Ratchet Date Adjustments to the Benefit Base

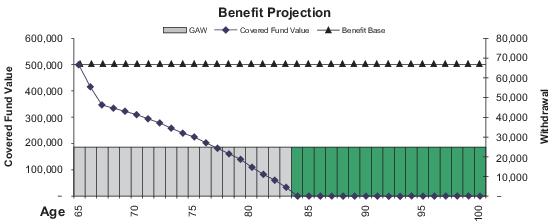

During the Accumulation Phase, a Ratchet Date is the anniversary of the GLWB Elector’s Certificate Election Date and each anniversary thereafter. On each Ratchet Date, we will evaluate your Benefit Base, and will adjust your Benefit Base to equal thegreater of:

| • | your current Benefit Base; or |

| • | your current Covered Fund Value. |

It is important to be aware that even though your Covered Fund Value may increase throughout the year due to dividends, capital gains, or settlements from the underlying Covered Fund, the Benefit Base will not similarly increase until the next Ratchet Date. Unlike Covered Fund Value, your Benefit Base will never decrease solely due to negative Covered Fund performance.

Example of Ratchet Date Adjustments during the Accumulation Period

Assume the following:

Benefit Base on Certificate Election Date (of January 2) = $100,000

Covered Fund Value on Certificate Election Date = $100,000

Increase in Covered Fund Value due to Dividends and Capital Gains paid July 1 = $5,000

Covered Fund Value on July 1 = $105,000

Benefit Base on July 1 = $100,000

No other Certificate Contributions, Dividends, or Capital Gains are paid to the Account for the rest of the year.

Covered Fund Value on January 2 of the following year = $105,000

So, because the Covered Fund Value is greater than the Benefit Base on the Ratchet Date (January 2 of the following year), the Benefit Base is adjusted to $105,000 effective January 2.

Excess Withdrawals During the Accumulation Phase

Because the Certificate is held in your Investment Portfolio, you may make withdrawals or change your investments at any time and in any amount that you wish, subject to any federal tax limitations. During the Accumulation Phase, however, any withdrawals or Transfers from your Covered Fund Value will be categorized as Excess Withdrawals. Any withdrawals to satisfy your required distribution obligations under the Code (IRA owners only) will be considered an Excess Withdrawal if taken during the Accumulation Phase. If you elect not to reinvest all dividends, any divided payments from your Covered Fund will be considered an Excess Withdrawal.

You should carefully consider the effect of an Excess Withdrawal on both the Benefit Base and the Covered Fund Value during the Accumulation Phase, as this may affect your future benefits under the Certificate. In the event you decide to take an Excess Withdrawal, as discussed below, your Covered Fund Value will be reduced dollar-for-dollar in the amount of the Excess Withdrawal. The Benefit Base will be reduced at the time the Excess Withdrawal is made by the ratio of the Covered Fund Value after the Excess Withdrawal reduction is applied.Accordingly, your Benefit Base will be reduced by more than the amount of the withdrawal when the Benefit Base is greater than the Covered Fund Value, which is likely to occur after periods of negative market performance.

Example of Effects of an Excess Withdrawal taken during the Accumulation Period

Assume the following:

Covered Fund Value before the Excess Withdrawal adjustment = $50,000

Benefit Base = $100,000

Excess Withdrawal amount: $10,000

So,

Covered Fund Value after adjustment = $50,000 - $10,000 = $40,000

Covered Fund Value adjustment = $40,000/$50,000 = 0.80

Adjusted Benefit Base = $100,000 x 0.80 = $80,000

Types of Excess Withdrawals

All Distributions and Transfers during the Accumulation Phase, including Transfers from one Covered Fund to another, are treated as Excess Withdrawals. If you elect not to reinvest all dividends, any divided payments from your Covered Fund will be considered an Excess Withdrawal. An Excess Withdrawal will reduce your Benefit Base and Covered Fund Value. A Distribution occurs when money is paid to you from the Covered Fund Value. A Transfer occurs when you transfer money to or from one