Filed Pursuant to Rule 424(b)(3)

File No. 333-237640

GREAT-WEST SECUREFOUNDATION®

Group Fixed Deferred Annuity Contract

Issued by

Great-West Life & Annuity Insurance Company

Supplement dated October 30,

2020 to the Prospectus dated April

27, 2020

This Supplement amends certain information contained in the Prospectus dated April 27, 2020.

Background

Effective February 5, 2021, the Guarantee Benefit Fee is being increased from 0.90% to 1.20%.

Accordingly, effective February 5, 2021, the Prospectus is revised as follows:

How much will the GLWB cost?

While the Contract is in force, a Guarantee Benefit Fee will be calculated and deducted from the Covered Fund Value on a monthly basis. It will be paid by redeeming the number of fund shares of the Covered Fund equal to the Guarantee Benefit Fee. The Guarantee Benefit Fee is calculated as a specified percentage of the Covered Fund Value at the time the Guarantee Benefit Fee is calculated. If we do not receive the Guarantee Benefit Fee (except during the Settlement Phase), including as a result of the failure of the Retirement Plan’s custodian to submit it to us, the GLWB will terminate as of the date that the fee is due. We will not provide notice prior to termination of the Contract or GLWB and we will not refund the Guarantee Benefit Fee paid upon termination of the Contract or GLWB.

The Guarantee Benefit Fee pays for the insurance protections provided by the Contract.

The guaranteed maximum or minimum Guarantee Benefit Fee we can ever charge is shown below. The amount we currently charge is also shown below.

| | • | | The maximum Guarantee Benefit Fee, as a percentage of a GLWB Participant’s Covered Fund Value, on an annual basis, is 1.5%. |

| | • | | The minimum Guarantee Benefit Fee, as a percentage of a GLWB Participant’s Covered Fund Value, on an annual basis, is 0.70%. |

| | • | | The current Guarantee Benefit Fee, as a percentage of a GLWB Participant’s Covered Fund Value, on an annual basis, is 1.20%. |

We may change the current Guarantee Benefit Fee at any time within the minimum and maximum range described above upon thirty (30) days prior written notice to the GLWB Participant and the Plan Sponsor. We determine the Guarantee Benefit Fee based on observations of a number of experience factors, including, but not limited to, interest rates, volatility, investment returns, expenses, mortality, and lapse rates. As an example, if mortality experience improves faster than we have anticipated, and the population in general is expected to live longer than initially projected, we might increase the Guarantee Benefit Fee to reflect our increased probability of paying longevity benefits. However, improvements in mortality experience is provided as an example only, we reserve the right to change the Guarantee Benefit Fee at our discretion and for any reason, whether or not these experience factors change (although we will never increase the fee above the maximum or decrease the fee below the minimum). We do not need any particular event to occur before we may change the Guarantee Benefit Fee. Because the Covered Funds are offered by an affiliated company, we may benefit indirectly from the charges imposed by the Covered Funds.

The Guarantee Benefit Fee is in addition to any charges that are imposed in connection with advisory, custodial and other services, and charges imposed by the Covered Funds.

Premium taxes may be applicable in certain states. Premium tax applicability and rates vary by state and may change. We reserve the right to deduct any such tax from premium when received.

Page 1 of 6

EXAMPLES OF HOW THE CERTIFICATE WORKS

A note about the examples:

| | • | | All Contract Contributions are assumed to be at the end of the year and occur immediately before the next Ratchet Date. |

| | • | | All withdrawals are assumed to be at the beginning of the year and occur on the Ratchet Date. |

| | • | | All GLWB Participants are assumed to be fully vested. |

| | • | | All positive investment performance of the Covered Fund is assumed to be net of investment management fees. |

| | • | | In all of the examples, the GLWB Participant has access to his Covered Fund Value until it is depleted: |

| | • | | If the GLWB Participant dies before the Covered Fund Value is depleted, the remaining Covered Fund Value would be available to beneficiaries. |

| | • | | If the GLWB Participant needs to take a withdrawal in excess of the GLWB Participant’s GAW, the GLWB Participant may take up to the Covered Fund Value, which will be considered an Excess Withdrawal. |

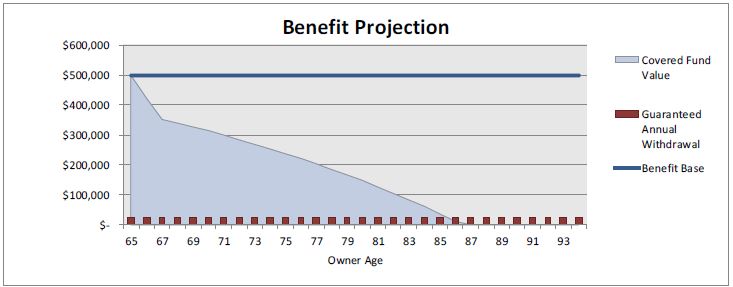

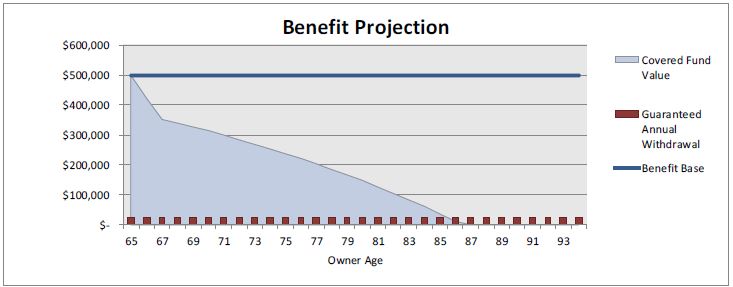

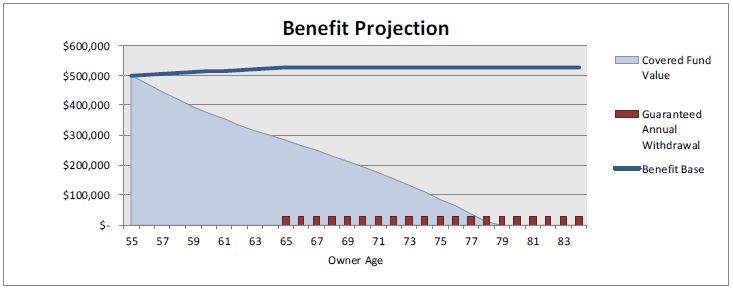

Example 1 – Basic: Assume the GLWB Participant buys the GLWB at age 65 and starts taking GAWs in annual Installments immediately. Also, assume that the Covered Fund Value (net of investment management fees) decreases by 10% in the first two years and increases by 5% every year thereafter.

Details:

| | • | | Initial Covered Fund Value: $500,000 |

| | • | | GAW Amount: $500,000 x 5% = $25,000 |

| | • | | Guarantee Benefit Fee: 1.20% |

| | • | | Changes in Covered Fund Value (net of investment management fees): |

| | • | | Year 1: -10%, Year 2: -10%, Years 3+: 5% |

Result:

| | • | | The GLWB Participant annually withdraw $25,000 from the GLWB Participant’s Covered Fund until about age 87 when the Covered Fund is depleted: |

| | • | | At age 87 GLWB Participant’s Covered Fund Value is $11,514. |

| | • | | The GLWB Participant withdraws the $11,514, which depletes the Covered Fund and the GLWB Participant is now in Settlement Phase. |

| | • | | We provide the remaining $13,486 necessary to make the Installment of $25,000. |

| | • | | We continue to pay Installments of $25,000 each year for the GLWB Participant’s life. |

Illustration:

Page 2 of 6

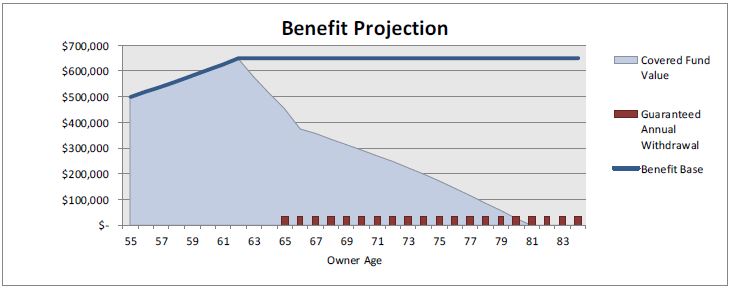

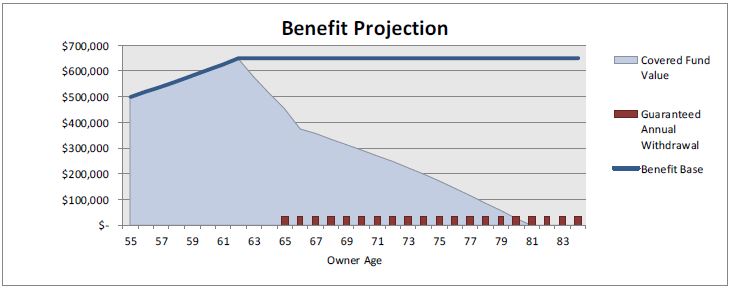

Example 2 – Ratchet: Assume the GLWB Participant buys the GLWB at age 55 and starts taking GAWs in annual Installments at age 65. Also, assume that the Covered Fund Value (net of investment management fees) increases by 5% in years 1 through 7, decreases by 10% in years 8 through 11, and increases by 5% thereafter.

Details:

| | • | | Initial Covered Fund Value: $500,000 |

| | • | | Guarantee Benefit Fee: 1.20% |

| | • | | Changes in Covered Fund Value (net of investment management fees): |

| | • | | Years 1 through 7: 5%, Years 8 through 11: -10%, Years 12+: 5% |

Result:

| | • | | Positive Covered Fund performance through year 7 results in a Covered Fund Value of $662,407 on your Ratchet Date. |

| | • | | The GLWB Participant’s Benefit Base Ratchets to $649,160 |

| | • | | Covered Fund Value at the end of year 10 is $ 454,559, but GAWs are based on the Benefit Base, which is $662,407. |

| | • | | GAWs are $649,160x 5% = $ 32,458 |

| | • | | The GLWB Participant annually withdraws $32,458 from the GLWB Participant’s Covered Fund until about age 80 when the Covered Fund is depleted: |

| | • | | At age 80, the GLWB Participant Covered Fund Value is $23,926 |

| | • | | The GLWB Participant withdraws the $23,926, which depletes the Covered Fund and the GLWB Participant is now in Settlement Phase. We provide the remaining $8,532 necessary to make the Installment of $32,458. |

| | • | | We continue to pay Installments of $ 32,458 each year for the GLWB Participant’s life. |

Illustration:

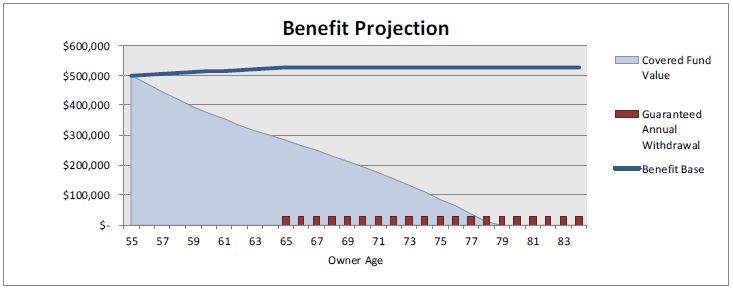

Example 3 – Additional Contract Contributions: Assume the GLWB Participant buys the GLWB at age 55 and the GLWB Participant makes annual Contributions of $2,500 until the GLWB Participant starts taking GAWs in annual Installments at age 65. Also, assume that the Covered Fund Value (net of investment management fees) decreases by 5% in years 1 through 10 and increases by 5% thereafter.

Details:

| | • | | Initial Covered Fund Value: $500,000 |

| | • | | Additional Annual Contract Contributions until GAWs Begin: $2,500 |

Page 3 of 6

| | • | | Guarantee Benefit Fee: 1.20% |

| | • | | Changes in Covered Fund Value (net of investment management fees): |

| | • | | Years 1 through 10: -5%, Years 11+: 5% |

Result:

| | • | | Poor Covered Fund performance in years 1 through 10 results in a Covered Fund Value of $282,593 at the end of year 10. |

| | • | | The GLWB Participant’s Benefit Base at the end of year 10 is $525,000 as a result of the additional Contract Contributions in years 1 through 10. |

| | • | | GAWs are $525,000 x 5% = $26,250. |

| | • | | The GLWB Participant annually withdraws $26,250 from the GLWB Participant’s Covered Fund until about age 78 when the Covered Fund is depleted: |

| | • | | At age 78, the GLWB Participant’s Covered Fund Value is $11,531. The GLWB Participant withdraws the remaining $11,531, which depletes the Covered Fund and the GLWB Participant are now in Settlement Phase. We provide the remaining $14,719 necessary to make the Installment of $26,250. |

| | • | | We continue to pay Installments of $26,250 each year for the GLWB Participant’s life. |

Illustration:

GUARANTEE BENEFIT FEE

After the GLWB Participant purchases the GLWB, the GLWB Participant is required to pay the Guarantee Benefit Fee. The Guarantee Benefit Fee is set forth in the Contract, and is based on the dollar amount of the GLWB Participant’s Covered Fund Value (which may be the same as, higher than, or lower than, the Benefit Base due to factors that affect the Covered Fund Value between Ratchet Dates, such as Covered Fund performance). The Guarantee Benefit Fee will be deducted monthly as a separate charge from the GLWB Participant’s Covered Fund and will be paid by redeeming the number of fund shares of the GLWB Participant’s Covered Fund(s) equal to the Guarantee Benefit Fee.

Pursuant to the terms of the GLWB, we will collect the fee from the custodian on a monthly basis in arrears. We reserve the right to change the frequency of the deduction, but will notify the Plan Sponsor and the GLWB Participant in writing at least thirty (30) days prior to the change. Because the Benefit Base may not exceed $5,000,000, we will not charge the Guarantee Benefit Fee on an amount of the GLWB Participant’s Covered Fund Value that exceeds $5,000,000.

Currently the Guarantee Benefit Fee is 1.20% and is subject to a minimum of 0.70% and a maximum of 1.50%. This is the guaranteed maximum or minimum Guarantee Benefit Fee we can ever charge for the GLWB. We may change the current fee within this minimum and maximum range at any time upon thirty (30) days written notice to the Plan Sponsor and the GLWB Participant. We determine the Guarantee Benefit Fee based on observations of a number of experience factors, including, but not limited to, interest rates, volatility, investment returns, expenses, mortality, and lapse rates. We reserve the right to change the Guarantee Benefit Fee at our discretion and for

Page 4 of 6

any reason, whether or not these experience factors change (although we will never increase the fee above the maximum or decrease the fee below the minimum). We do not need any particular event to occur before we may change the Guarantee Benefit Fee.

The Guarantee Benefit Fee is in addition to any charges that are imposed in connection with advisory, custodial, and other services, and charges imposed by the mutual funds in which the GLWB Participant invests.

At the time we calculate the Guarantee Benefit Fee, the Covered Fund Value may be less than the Benefit Base:

Example of how the Guarantee Benefit Fee is Computed (Covered Fund Value is Less Than Benefit Base)

Date: 1/31

Covered Fund Value = $100,000

Benefit Base = $125,000

Guarantee Benefit Fee = 1.20% x Covered Fund Value / 12

Guarantee Benefit Fee = 1.20% x $100,000 / 12 = $100.00

At the time we calculate the Guarantee Benefit Fee, the Covered Fund Value may be greater than the Benefit Base:

Example of how the Guarantee Benefit Fee is Computed (Covered Fund Value is Greater Than Benefit Base)

Date: 1/31

Covered Fund Value = $130,000

Benefit Base = $125,000

Guarantee Benefit Fee = 1.20% x Covered Fund Value / 12

Guarantee Benefit Fee = 1.20% x $130,000 / 12 = $130.00

The Guarantee Benefit Fee compensates us for the costs and risks we assume for providing the GLWB (including marketing, administration, and profit).

If we do not receive the Guarantee Benefit Fee (except during Settlement Phase), including as a result of the failure of the Retirement Plan custodian to submit it to us, the Contract will terminate as of the date that the fee is due.

Will a GLWB Participant pay the same amount (in dollars) for the Withdrawal Guarantee every month?

Example 1: Declining Covered Fund Value results in declining Guarantee Benefit Fee

Date: 1/31

Covered Fund Value = $100,000

Benefit Base = $125,000

Guarantee Benefit Fee = 1.20% x Covered Fund Value / 12

Guarantee Benefit Fee = 1.20% x $100,000 / 12 = $100.00

Date: 2/28

Covered Fund Value = $90,000

Benefit Base = $125,000

Guarantee Benefit Fee = 1.20% x Covered Fund Value / 12

Guarantee Benefit Fee = 1.20% x $90,000 / 12 = $90.00

Note: in this example, the Guarantee Benefit Fee declined because the Covered Fund Value declined. This could be the result of negative Covered Fund performance.

Example 2: Increasing Covered Fund Value results in increasing Guarantee Benefit Fee

Date: 1/31

Covered Fund Value = $100,000

Benefit Base = $125,000

Guarantee Benefit Fee = 1.20% x Covered Fund Value / 12

Guarantee Benefit Fee = 1.20% x $100,000 / 12 = $100.00

Date: 2/28

Covered Fund Value = $120,000

Benefit Base = $125,000

Page 5 of 6

Guarantee Benefit Fee = 1.20% x Covered Fund Value / 12

Guarantee Benefit Fee = 1.20% x $120,000 / 12 = $120.00

Note: in this example, the Guarantee Benefit Fee increased because the Covered Fund Value increased. This could be the result of several factors including positive Covered Fund performance, Transfers, or Contract Contributions.

If you have any questions regarding this Supplement, please call Great-West toll-free at (800) 537-2033.

This Supplement must be accompanied by, and read in conjunction with, the current Prospectus

dated April 27, 2020.

Please read this Supplement carefully and retain it for future reference.

Page 6 of 6