UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2008

ZHAOHENG HYDROPOWER COMPANY

(Exact name of registrant as specified in its charter)

| Nevada | 000-52786 | 41-1484782 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

F/19, Unit A, JingFengCheng Building

5015 Shennan Road, Shenzhen PRC 518025

(Address of principal executive offices and Zip Code)

(011-86) 755-8207-0966

(Registrant’s Telephone Number, Including Area Code)

Certified Technologies Corporation

5353 Manhattan Circle

Suite 101

Boulder, CO 80303

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This current report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to anticipated future events, future results of operations or future financial performance, including statements regarding our expectations, hopes, intentions or strategies regarding the future. You should not place undue reliance on forward-looking statements. All forward-looking statements included in this current report are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. It is important to note that our actual results could differ materially from those in such forward-looking statements. Some of the factors that could cause results to differ materially from those in the forward-looking statements are set forth in the section “Risk Factors” beginning on page 31 of this current report.

The forward-looking statements included herein are necessarily based on various assumptions and estimates and are inherently subject to various risks and uncertainties, including risks and uncertainties relating to the possible invalidity of the underlying assumptions and estimates and possible changes or developments in economic, business, industry, market, legal and regulatory circumstances and conditions and actions taken or omitted to be taken by third parties, including customers, suppliers, business partners and competitors and legislative, judicial and other governmental authorities and officials. Assumptions related to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Any of such assumptions could be inaccurate.

EXPLANATORY NOTE

On May 14, 2008, we filed our original Current Report on Form 8-K with the U.S. Securities and Exchange Commission (the “Original Report”) disclosing, among other things, our entry into the share exchange agreement (the “Share Exchange Agreement”) with Guosheng Xu, the sole existing holder of all of the outstanding capital stock of Zhaoheng Investment Limited (BVI), a British Virgin Islands corporation (“Zhaoheng BVI”), as such Original Report is reproduced herein below. After we filed the Original Report, we learned that certain adjustments to our discussion in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”) section of the Original Report would have to be made in order to correspond to the adjustments made to the audited financial information filed with our Original Report. We are filing this Amendment No. 1 to the Original Report (this “Report”) in order to amend the MD&A section of the Original Report, to include as exhibits certain of our material agreements as required to be disclosed by us pursuant to Items 9.01(a) and (b) of Form 8-K, and to make other changes that we determined were necessary.

This current report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This current report responds to the following items on Form 8-K:

| | Item 1.01 | Entry into a Material Definitive Agreement. |

| | Item 2.01 | Completion of Acquisition or Disposition of Assets. |

| | Item 3.02 | Unregistered Sales of Equity Securities. |

| | Item 5.01 | Changes in Control of Registrant. |

| | Item 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers. |

| | Item 5.06 | Change in Shell Company Status. |

| | Item 9.01 | Financial Statements and Exhibits. |

As used in this current report and unless otherwise indicated, the terms the “Company,” “we,” “us,” and “our” refer to Certified Technologies Corporation after giving effect to our acquisition of Zhaoheng Investments Limited (BVI) and the related transactions described below, unless the context requires otherwise. Reference to “China” and “PRC” are references to the “People’s Republic of China.” References to “MW”, “GW”, “KW” and “KWH” mean megawatt, gigawatt, kilowatt, and kilowatt hour, respectively. References to “HK$” mean “Hong Kong dollar”.

| Item 1.01 | Entry into a Material Definitive Agreement. |

Share Exchange Agreement

On May 13, 2008, we entered into an share exchange agreement (the “Share Exchange Agreement”) with Guosheng Xu, the sole existing holder of all of the outstanding capital stock of Zhaoheng Investment Limited (BVI), a British Virgin Islands corporation (“Zhaoheng BVI”).

Pursuant to the Share Exchange Agreement, the Company issued an aggregate of 69,686,970 shares of common stock, par value $0.001 (the “Common Stock”) to Embedded Internet Solutions Limited, a Cayman Islands company wholly-owned by Guosheng Xu (“Embedded Internet”), in exchange for all of the shares of common stock of Zhaoheng BVI (the “Share Exchange”). Contemporaneously with the closing of the Share Exchange, certain holders of our Common Stock completed a sale of approximately 572,170 shares of Common Stock owned by them to Embedded Internet pursuant to a stock purchase agreement (the “Stock Purchase”). As a result of the completion of the Share Exchange and the Stock Purchase, Embedded Internet now owns shares of our Common Stock constituting approximately 98% of our outstanding capital stock.

Upon the consummation of the Share Exchange, the Company ceased being a shell company as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1932 (the “Exchange Act”), and Zhaoheng BVI is now a wholly-owned subsidiary of the Company, and Zhaoheng Hydropower (Hong Kong) Limited (“Zhaoheng HK”) is now the indirectly wholly-owned subsidiary of the Company in Hong Kong.

The foregoing description of the Share Exchange Agreement is qualified in its entirety, by the text of the agreement which is annexed hereto as Exhibit 10.1.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

As a result of the Share Exchange, the Company ceased being a shell company as such term is defined in Rule 12b-2. See Item 5.06 of this Current Report for more information.

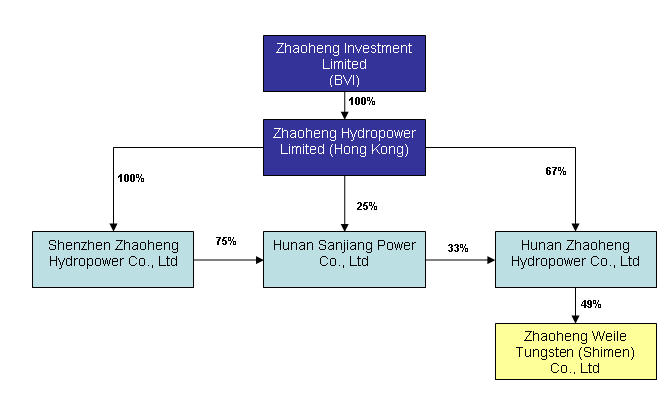

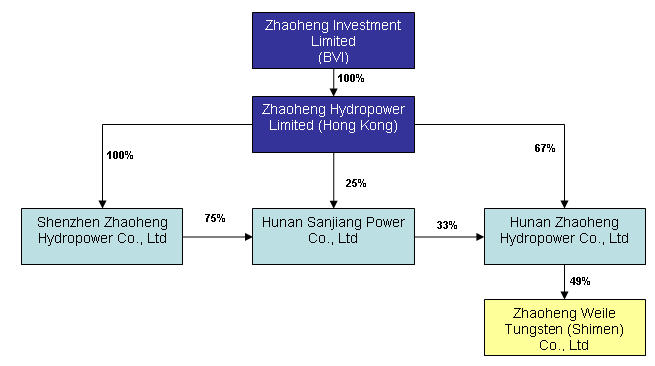

Our Corporate Structure

Our current corporate structure post reverse merger with the Zhaoheng BVI Investment Limited and its is set forth in diagram 1 below:

Organizational History of Certified Technologies Corporation

The Company was incorporated under the laws of the State of Minnesota in January 1984. The Company was formed to market a fire retardant chemical formulation to the commercial aviation and business furniture industries.

Since October 2000 to immediately before the completion of Share Exchange, the Company did not engage in any operations and was dormant. As such, the Company prior to the Share Exchange was defined as a “shell” company, whose sole purpose was to locate and consummate a merger or acquisition with a private entity.

On February 21, 2008, we reincorporated in the State of Nevada and completed a reverse split of our shares of common stock by entering into an Agreement and Plan of Merger with and into Certified Technologies Corporation, a Nevada corporation, with the Nevada corporation surviving the merger.

As a result of the consummation of the Share Exchange, we are now engaged in generating hydropower and supplying electricity to power grid companies and residents of small- and medium- sized cities in China. We will also provide other services such as hydropower device installation, equipment maintenance, construction, operation and management of hydropower stations in China.

Organizational History of Zhaoheng Investment Limited (BVI) and Zhaoheng Hydropower (Hong Kong) Limited

Zhaoheng BVI was incorporated on April 19, 2006 in the Territory of the British Virgin Islands with Guosheng Xu, a Hong Kong resident, as its sole stockholder. Zhaoheng BVI was formed for the purpose of raising funds from international investors.

In November 2007, Zhaoheng Hydropower (Hong Kong) Limited (“Zhaoheng HK”) was established in Hong Kong with Zhaoheng BVI as its sole stockholder. On December 31, 2007, the registered capital of the company was increased to $170,000,000 HKD by Mr. Guosheng Xu through a series of equity and capital infusion.

The following transactions were executed by Mr. Xu for the purpose :

| (i) | Mr. Guosheng Xu acquired 87.27% interest of Shenzhen Zhaoheng Hydropower Co., Ltd from Zhaoheng Holdings (Hong Kong) Limited (“Zhaoheng Holdings”) for 10,252,030 HKD; |

| (ii) | Mr. Guosheng Xu acquired 66.67% interest of Hunan Zhaoheng Hydropower Co., Ltd from Zhaoheng Holdings for 106,791,969.25 HKD; |

| (iii) | Mr. Guosheng Xu acquired 25% interest of Hunan Sanjiang Power Co., Ltd (“Sanjiang Power”) from Zhaoheng Holdings for 63,882,956 HKD; and |

| (iv) | Shenzhen Zhaoheng Industrial Co., Ltd entrusted its rights and obligation of12.73% interest of Shenzhen Zhaoheng Hydropower Co., Ltd to Mr. Guosheng Xu for the consideration of 1,495,087.57 HKD. |

The total consideration involved in the relevant equity transfers to Mr. Xu amounted to HKD 182,422,043. Subsequently, Mr. Xu contributed all these equity interests to Zhaoheng BVI. Of the total consideration, 93% (i.e., HKD170,000,000) represented the capital infusion by Mr. Xu. The remaining portion is accounted for as payables to Mr. Xu on the part of Zhaoheng BVI. Zhaoheng BVI then contributed all the equity interests into Zhaoheng (HK).

The purpose of the restructuring was to “spin off” hydropower assets from holding companies which are engaged in other industries such as software development.

As a result of the capital infusion and contribution of these equity interest by Zhaoheng BVI to Zhaoheng HK, Zhaoheng HK wholly and indirectly owns the four companies, which resulted in its ownership of the two stations (Hunan Sanjiang Hydropower Station and Hunan Sanjiang Left Bank Hydropower Station) and other relevant operating assets located in the PRC.

Overview of Our Business

As a result of the consummation of the Share Exchange, we are now engaged in generating hydropower and supplying electricity to power grid companies and residents of small- and medium- sized cities in China, as well as providing other services such as hydropower device installation, equipment maintenance, construction, operation and management of stations.

We own and operate two facilities in Hunan Province: Hunan Sanjiang Hydropower Station and Hunan Sanjiang Left Bank Hydropower Station, serving approximately 1,800 residential customers and 34 industrial customers, and Changde branch of State Grid Corporation of China, a state-owned power grid company. Hunan Sanjiang Hydropower Station has an installation capacity of 62.5MW. After a series of improvements, we were able to increase profitability by 20%. Hunan Sanjiang Left Bank Hydropower Station has an installation capacity of 50 MW. We acquired Hunan Sanjiang Left Bank Hydropower Station in 2003. The construction of Hunan Sanjiang Left Bank Hydropower Station started in November 2005 and was completed in October 2007. The first unit began generating electricity in April 2008. The total capital invested was $34 million, 20% less than original budget. Commencing April 2008, the Company will provide 90% of its generated power to Hunan Electrical Power Company, which is the parent company of Changde branch of State Grid Corporation of China, a state-owned power grid company and the largest client of the Company, and 10% to local industrial and residential clients.

| | | For the year ended December 31, | |

| | | 2007 | | | 2006 | |

| Total distributed and supplied | | 286 million KWH | | | 209.57 million KWH | |

| Distribution network | | | | | | |

| Number of industrial customers | | | 2 | | | | 2 | |

| Number of residential customers | | | 34 | | | | 34 | |

| | | | | | | | | |

| Customers | | | 1,800 | | | | 1,800 | |

We have two types of customers: (i) retail customers including local residents and industrial enterprises, and (ii) wholesale customers (e.g., local grid companies). The following table presents, for the periods indicated, the revenues generated from each of our activities:

| | At and for the year ended December 31, |

| | 2007 (in US$ millions) | 2006 (in US$ millions) |

Retail customers (as % of total Sales) | 2.30 (24.8%) | 1.79 (25.9%) |

| Grid company sales | 6.98 (75.2%) | 5.13 (75.1%) |

The following table presents Zhaoheng HK’s costs of sales for the periods indicated:

| | At and for the year ended December 31, |

| | 2007 (in US$ millions) | 2006 (in US$ millions) |

| | 1.873 | 1.835 |

| | | |

Seasonal Factors

Our business is generally affected by seasonal factors. The climate of China is influenced by the monsoons. As a result, the rainfall and runoffs distribute unevenly within any one-year period. The volume of runoff during the four or five months in the summer and autumn usually accounts for 60% to 70% of the annual volume of runoff. The volume of runoff in the winter is small. The quantity of seasonal electric energy of a hydropower station is consequently greater in the summer and autumn months than in the winter. However, we can offset this seasonality by using water collected in a reservoir to regulate the runoff and put water resources into more effective use.

Our Strategy

Our strategy involves a two-prong approach with a primary focus on small and medium-sized hydropower stations:

(i) Small and Medium-Sized Hydropower Stations. We will invest mainly through acquisition of over 51% stake of these small and medium-sized targets. At present, investments in small and medium hydropower stations are highly decentralized and are made mainly by local state-owned and private capital, leaving large substantial opportunities for expansion through mergers and acquisitions.

(ii) Construction of New Hydropower Resources. We will invest in new hydropower resources and construct quality power stations with high economic value and returns.

We believe that this two-prong approach will allow us to manage and develop profitable small and medium-sized hydropower stations and allow us to sustain our development by constructing new hydropower stations.

Strategic positioning

The Company has thoroughly analyzed the current situation of electric power industry and development trend in China and positions itself to develop small and medium hydropower stations with installed capacity of 10-100MW. Due to the capital and technology intensive nature of the hydropower industry, we have given priority to develop cascade stations in middle and west China’s Hunan, Hubei, and Sichuan provinces.

Our decision to focus on small and mid-sized hydropower stations in middle and west China is based mainly on the following factors:

| · | With regard to investment in small and medium hydropower stations, it requires a relatively small amount of capital and short construction period. |

| · | Hunan province is rich in small and medium hydropower resources and the local governments in Hunan province have invested heavily in the hydropower industry. |

| · | The Company has developed a good working relationship with local governments through years of local investment. |

| · | The Company has developed a good working relationship with grid companies and other retail clients through years of local investment. |

| · | Investments in small and medium hydropower stations are highly decentralized. Most of investors are small and lack of the financial resources and technical knowledge to make investments resulting in growth opportunities for acquisition and integration by the Company. |

| · | The investors in large and medium hydropower stations with installed capacity of over 100MW are usually state-owned large electric power enterprises. Because small hydropower stations with installed capacity of less than 10MW are usually distributed in remote and disperse areas, difficult in operation and management and with high costs, investors have less competition and pay lower prices for the hydropower services. |

Prospects

The Company will strengthen the operation and management of existing hydropower assets, bring in foreign capital and use multiple financing channels to acquire more projects, realize fast development in a relatively short time and achieve installed capacity of 500MW in two years and 1,200MW in five years. Our aim is to become an experienced and successful investor in small and medium hydropower stations in China with sizable operations, international capital investment and strong competitiveness.

| Year | Installed Capacity | Market Share in Small Hydropower |

| 2003-2007 | 0---112.5MW | 0.2% |

| 2008-2012 | 112.5---1GW | 0.2---2% |

| 2013-2017 | 1GW---2.5GW | 2---5% |

Chinese Hydropower Industry Overview

Hydropower is the most cost effective renewable clean energy. The generation of hydropower does not consume or pollute water and it does not produce greenhouse gases. At present, the total installed capacity of hydropower in the world is 800 GW, satisfying 20% of the globe’s power demand.

The Chinese government has issued many regulations to enhance the development of hydropower and has rated hydropower as a priority for creating energy. These regulations ensure that electricity generated by hydropower stations should be fully acquired by power grid companies, hydroelectricity tariff should progressively match thermal electricity tariff, and power grid employees will be prohibited from investment in hydropower generation industry. These regulations, combined with the huge demand of hydropower in China, create a favorable environment for the hydropower industry.

Electric Power

In 2007, China witnessed a huge imbalance of demand to supply in electric power. It is estimated that by 2020, China’s power consumption and installed capacity will both rank the first in the world. International analysis indicates that China’s GDP will continue to have sustained growth in the future. Compared with fast soaring electric power demand caused by sustained growth, the construction rate for energy sources seems relatively slow, creating potential for investment.

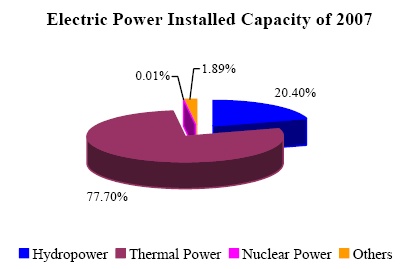

In 2007, China's total power output was 3.26 trillion KWH, a year-to-year increase of 14.4%. Of China’s total power output, hydropower output was 486.7 billion KWH, 14.95% of total output, a year-to-year increase of 7.6%, thermal power output was 2.70 trillion KWH, 82.86% of total output, a year-to-year increase of 13.8%; and nuclear power output was 62.6 billion KWH, 1.92% of total output, a year-to-year increase of 10.8%.

Source: www. caixun.com

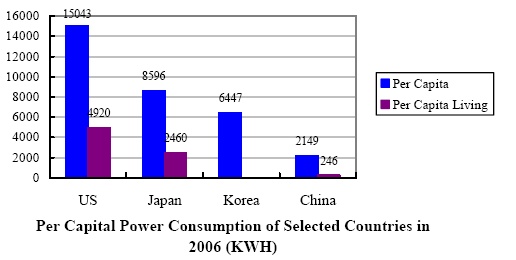

In 2006, China’s per capita power consumption reached 2,149 KWH, or 14.3% of that of the US, 25% of that of Japan and 33.3% of that of Korea; per capita living power consumption was only 246 KWH, or 5% of the US and 10% of Japan.

Source: www. reportbus.com

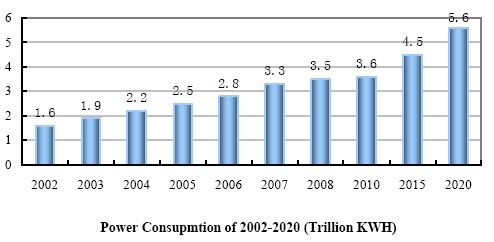

Power consumption in 2007 reached 3.25 trillion KWH, a year-to-year increase of 14.4% (www.caixun.com), and in 2008 it is expected to reach 3.46 trillion KWH, a year-to-year increase of 11.3%. During 2006-2010, average annual increase rate of power consumption is expected to be approximately 8.0%. By 2010 and 2020, power consumption of China is expected to be 3.6 trillion KWH and 5.6 trillion KWH, respectively.

Source: Zhongjing Communication Consultants

In 2002, China’s installed capacity was only 360 GW. In 2007, it reached 713 GW, a year-to-year increase of 14.36%, ranking second in the world after the US. Of the 713 GW, 554 GW or 77.7% was thermal power, a year-to-year increase of 14.59%, and 145 GW or 20.4% was hydropower, a year-to-year increase of 11.49%.

Source: www.caixun.com

By 2010, China’s installed capacity will be 850 GW, 190 GW of which will be hydropower. Most of newly constructed power stations will be located at Southwest area of China. By 2020, installed capacity of China will be 1,000 GW.

Source: Zhongjing Communication Consultants

Hydroelectric Power

Hydropower is a clean and renewable energy. Hydropower generation does not produce toxic gases, smoke, dust and ash or nuclear radiation. Hydropower reservoirs have many functions, including flood control, irrigation, shipping, tourism, and the supply of water for urban and rural residents and industries. Many countries have given priority to the development of hydropower resources.

Total installed capacity of hydropower generation in the world is 800 GW, satisfying 20% of globe’s power demand. China is rich in water energy resources, with a total reserve of 670 GW, accounting for 17% of world’s total. Developable installed capacity exceeds 400 GW and could generate 1.7 trillion KWH per year.

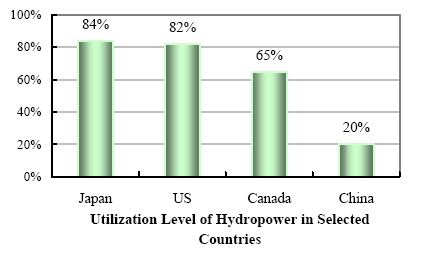

China’s hydropower installed capacity is 145 GW. The average level of hydropower development in developed countries exceeds 60%, with the United States about 82%, Japan about 84%, Canada about 65%, while in China it is only 26%. Compared with these countries, China's hydropower development is still at a relatively low level and has great potential for development. In 2007, hydropower accounted for 14.95% of China’s total electricity generation, representing an increase of 0.25% from 2006. Hydropower construction rate is far behind the nation’s average electricity construction rate.

Source: www. newenergy.org.cn

Based on the PRC’s “2006-2020 Plan” of electric power industry and 2020 development plan, by 2010 total installed capacity is projected to be 850 GW, of which 190 GW or 21.2% will be hydropower; by 2020, total installed capacity is projected to be 1,000 GW, of which 280 GW or 29% will be hydropower, and 70% of hydropower reserve will be developed. Therefore, during the next 10-15 years, 13 GW of

hydropower installed capacity will be newly constructed every year, which would save 420 million tons of standard coal, reduce emission of 1.17 billion tons of carbon dioxide and 7.5 million tons of sulfur dioxide as well as other toxic gases, largely decreasing pollution and the greenhouse effect.

Source: www. ica.gov.cn

According to “Industrial Guide Catalog for Foreign Investment (2007 Revision)” announced by National Development and Reform Commission and Ministry of Commerce on October 31, 2007, “Construction and operation of hydropower station” was categorized to “encouraging industry of foreign investment”.

Small Sized Hydropower

Small sized hydropower refers to the hydropower station with installed capacity of around 50 MW.

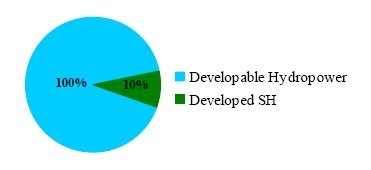

In China, total installed capacity of developable hydropower is 400 GW and total installed capacity of developable small hydropower is 87 GW, or 23% of total developable hydropower resource of China, ranking first in the world. Currently, there are over 45,000 small hydropower stations in China, with total installed capacity of over 38.5 GW, accounting for approximately 10% of total developable hydropower resource and 44% of total developable small hydropower resource.

Developed Small Hydropower Percentage

Hunan Province

During the first six months of 2007, Hunan province generated electricity of 38.4 billion KWH, up 11.1% over the same period of 2006. Of the 38.4 million KWH, hydropower was 15.1 million KWH, a decrease of 0.4%, and thermal power was 23.3 million KWH, an increase of 19.7%.

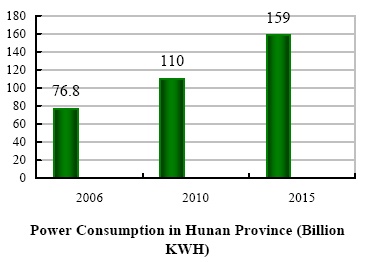

In 2006, GDP of Hunan province was $ 100 million, a 12.1% year-to-year increase, increasing the demand for electric power by 13.9% to 76.8 billion KWH. During the first six months of 2007, power

consumption of the province was 40.1 billion KWH, up 14.5%. By 2010 and 2015, power consumption of the province is projected to be 110 billion KWH and 159 billion KWH, respectively.

Source: www. china-cdt.com

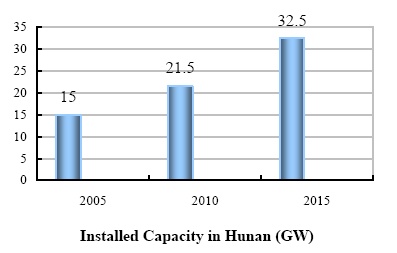

In 2005, Hunan province, installed capacity was 15 GW. During the first six months of 2007, installed capacity was 18.89 GW, up 21.7%, of which, hydropower was 8.90 GW, up 18.8%, and thermal power was 9.97 GW, up 2.6%. By 2010 and 2015, installed capacity is projected to be 21.5 GW and 32.5 GW, respectively.

Source: www. 86ne.com

Our Business Activities

Our business consists primarily of the following three activities:

1. Development – (i) identifying small and medium hydropower stations in China; (ii) investing in such small and medium hydropower stations; and (iii) securing sales contracts with local grid companies annually.

2. Operations – (i) operating hydropower stations; and (ii) generating hydropower and supplying electricity to power grid companies and residents, and providing related services to customers at the operating location.

3. Construction – constructing quality power stations with high economic value and substantial return on investment.

Development

(i) Identifying investment opportunities: Our business development team actively explores and identifies small and medium hydropower stations in China with great potential for a high return or investment. The energy industry is highly regulated in China. As a power generation company, we sell the electricity we generate to local grid companies. At the same time, according to relevant regulations, local grid companies have to fully acquire hydroelectricity as a priority over thermal electricity. Since the foundation of our relationship with these local grid companies is set by government regulations, we also receive invitations from local governmental to bid for new hydropower projects or take over existing hydropower projects.

The selection of new operational locations is determined after conducting preliminary evaluation and studies on the target locations, and return on investment. The criteria for any potential operational location that are investigated and documented by us are:

1. Size and density of population.

| 2. | Economic statistics of the targeted locations. |

| 3. | Extent and concentration of industrial and commercial activities. |

| 4. | Plentiful water resources with development potentials. |

| 5. | Extent of the local government’s commitment to environmental protection, environmental policies in place, and the location population’s awareness of environmental issues. |

| 6. | For an acquisition of existing hydropower projects, an installed capacity in the range of 10-100MW. |

| 7. | The acquisition targets should have profit increasing potential by way of downsizing, technology reform, efficiency improvement and capacity expansion. |

(ii) Investing in Hydropower Stations: Once we have identified a potential hydropower station for acquisition and/or investment, we make a proposal to the relevant parties that owns the hydropower station. We negotiate the terms of our investment in the hydropower station and the terms are evidenced in a sales and purchase agreement. At the closing, we pay the purchase price in cash or in stock according to the payment terms. We typically purchase a minimum of 51% of the equity in the small and medium-sized hydropower station.

(iii) Securing new operational locations: Once we have approved a potential hydropower distribution project in an operational location, we normally dispatch a team to administer the project for its lifetime. We then prepare and submit a detailed hydropower project proposal to the local government and commence negotiations on major issues such as the granting of exclusive rights or rights of first refusal to supply power to that location, proposed connection fees and usage charges and whether any tax and other concessions or favorable policies will be granted by the local government. Once established, the project company will conduct a series of marketing and promotional campaigns (which may include joint promotional campaigns with the local government) to increase public awareness of the benefits of hydropower in the operational location.

Operations

We take an active role in the operations of the hydropower stations. We provide senior management to operate each facility. In addition to supplying electricity to power grid companies and our industrial and residential customers, we provide other services such as hydropower device installation, maintenance, operation and management.

The workflow of hydropower generation is as follows:

| · | Hydrology analysis: We monitor and analyze real-time climate and water condition changes and estimate upstream water flow accordingly. |

| · | Production planning: We propose a daily production plan to grid companies by 9 a.m. according to the above analysis and receive approvals from grid companies by 4 p.m. |

| · | Power generation application: We apply for power generation approvals from grid companies. |

| · | Power generation: We conduct power generation and electricity output. |

| · | Equipment maintenance: We perform equipment maintenance and problem solving on a regular basis to improve equipment efficiency. |

Construction

We may acquire additional water resources development rights from the local Water Resource Bureau. After securing authorization from the state or local Development and Reform Commission and acquiring an approval from the Provincial Pricing Bureau, we hire a professional water resource institute to design a construction plan. We manage the construction work done by the general contractor or subcontractors. As part of the construction process, we obtain the approval of a quality control inspection performed by the grid companies. Finally, we hire operators to manage the new hydropower stations.

Sales and Marketing

With preferential policies requiring that grid companies fully acquire electricity generated by hydropower companies, the Company enjoys an advantage in sales and marketing. Each year, the Company signs a sales contract with Hunan Electric Power Company or its subsidiary company, Changde City Power Bureau. The contract stipulates amount of electricity to be generated and delivered, tariff and settlement terms. The Company’s subsidiary, Hunan Jiuli Hydropower Construction Company, signs sales contracts with local industrial clients and collects pre-payments from local residential clients.

The current price of the electricity sold to Hunan Electric Power Company and its subsidiary Changde City Power Bureau is $0.038/KWH, or $0.033/KWH, after value-added tax. The government has been and will be promoting price adjustment of hydroelectricity in response to 30% gap between the thermal and hydropower tariff.

Currently, we have approximately 1,800 residential customers and 34 industrial customers. Electricity is transmitted to these retail customers by our own grid. According to government regulations, power generation and power transmission should be separated progressively. As a result, in the future, our retail sales will be limited and we will be relying predominantly on our wholesale sales.

Historically, our grid network was built to provide electricity to local residents and enterprises as partial compensation for using their land to build the hydropower station. We still maintain this history as a way of giving back to local community. Currently, our retail price to local residents is ¥ 0.40/KWH while the retail price for other grid companies is ¥ 0.56/KWH. In addition, our retail price to local industrial enterprises in ¥ 0.35/KWH while the retail price from other grid companies is ¥ 0.70-0.80/KWH.

Materials and Suppliers

The principal supplies purchased for our business are parts for machinery and equipment which constitute approximately 25-35% of our construction costs. We purchase such supplies through a bidding process which is administered by our procurement committee. Potential suppliers are evaluated by their technical expertise, price, payment terms and post-sale maintenance services. Our procurement committee maintains a scoring system based on the terms offered by each supplier. After an evaluation of the each supplier’s ability to provide the supplies and services requested, we purchase the supplies from the supplier that provides us with the best terms and has the best reputation. Payments for equipment and machinery are purchased on payment terms ranging from 30 to 90 days.

Customers

We have two principal types of customers: (i) retail customers including local residents and industrial enterprises and (ii) wholesale customers, i.e., local grid companies. Our sales to residential customers and industrial customers represented 24.8% and 75.2% of our net sales, respectively, for the fiscal year ended 2007; 25.9% and 74.1% of our net sales, respectively, for the fiscal year ended 2006; sales to miscellaneous customers who are neither residential nor industrial or commercial customers accounted for the remainder of our sales.

Retail Customers.

Electricity is primarily used by our retail residential and commercial customers for lighting, air conditioning, water heating, cooking, and the operation of industrial equipment. Historically, we built a grid network to supply electricity to local retail customers as partial compensation for using their land to build the station. 60% of our retail customers make monthly advance payment to us; and the other 40% pay us by the end of each month according to their actual usage of electricity in the previous month. At present, we have approximately 1,800 residential customers and 34 industrial customers. Sales to retail customers accounted for 24.8% of our total sales for the fiscal year ended December 31, 2007.

Wholesale Customers.

Our wholesale customers are local grid companies including Hunan Electric Power Company and its subsidiaries. They acquire the electricity we generate and then retail to local residential and industrial customers. We are responsible for electricity transmission to the grid. According to relevant regulations in China, grid companies should fully acquire hydroelectricity which is clean and environmental friendly. Furthermore, grid companies are prohibited from getting involved in power generation to avoid any conflict of interest.

We collect 80% of receivables from our wholesale customers by the 20th of the following month and the other 20% by the end of January of the following fiscal year. Sales to local grid companies accounted for 75.2% of our total sales for the fiscal year ended December 31, 2007.

Historically, Changde Branch of State Grid Corporation of China, a state-owned power grid company, has been our principal client and has accounted for 75% of our sales for the fiscal year ended December 31, 2007. With the completion of our new hydropower station in Hunan province, we anticipate that 90% of its generated power will be delivered to Hunan Electrical Power Company, the parent company of Changde City Power Bureau and 10% of its power to other industrial and residential clients.

Pricing and Regulations

Electricity price is regulated by the Provincial Commodity Pricing Bureau. In determination electricity, the Bureau takes the following factors into consideration: (i) national energy policies; (ii) environmental impact; (iii) electricity supply and demand; and (iv) consumer price indexes (CPI). Currently, the electricity we sell to grid companies is $0.038/KWH, or $0.033/KWH after value-added tax. Future price increases are subject to annual pricing review. However, to promote the development of hydropower as a source of clean energy, the government has been and will be promoting price adjustment of hydroelectricity in response to the 30% gap between thermal electricity and hydroelectricity tariff.

Our current retail electricity price is ¥0.40/KWH to residential customers and ¥0.35/KWH to industrial customers. This price is determined by our management team and is not regulated by the Pricing Bureau. We give our local retail customers some discount as a way of giving back to local community. Currently, grid companies sell electricity to residential customers at ¥0.56/KWH and to industrial customers at ¥0.70-0.80.

Operational and Construction Permit

In the PRC, companies in the hydropower generation business must obtain an operational permit from the State Electricity Regulatory Commission and an electricity acceptance approval from grid companies to begin operation. In addition, to begin a construction project on a new hydropower station, we need to get: (i) a project approval from State Development and Reform Commission (SDRC); (ii) an environmental impact review and approval from local Environmental Protection Agency; (iii) a water resource development approval from Provincial Water Resources Bureau; and (iv) pricing approval from the Provincial Commodity Pricing Bureau.

As of the date of this Current Report, Zhaoheng Hydropower and all its subsidiaries have the necessary operational permits..

Safety Regulations

As a hydropower generation company, we are regulated by the relevant operation safety rules promulgated by grid companies. According to such rules, our daily operation should meet relevant safety requirements and qualifications.

Income Taxes

Pursuant to the tax laws of PRC, general enterprises are subject to income tax at an effective rate of 33% (according to a new tax bill, general enterprises will be taxed at 25% beginning from 2008). Our operating subsidiaries, Hunan Sanjiang Power Co., Ltd. and Hunan Zhaoheng Hydropower Co., Ltd., are in the hydropower industry whose development is encouraged by the government. According to the income tax regulation, any company engaged in the hydropower industry enjoys a favorable tax rate. In addition, our operating subsidiaries have been approved as Chinese-foreign joint venture companies and have been enjoying preferential income tax treatment under the PRC’s income tax policies that provide certain

preferential income tax treatment to entities qualified as Chinese Foreign joint venture entities. Under such policies, Hunan Sanjiang Power Co., Ltd. and Hunan Zhaoheng Hydropower Co., Ltd. are exempt from corporate income taxes for the first two years commencing from its first profitable year and thereafter, will be entitled to a 50% tax reduction for the succeeding three years. Accordingly, Hunan Sanjiang was exempt from income tax from 2005 to 2006 and is subject to a 7.5%-10% tax rate from 2007-2009. Hunan Zhaoheng Hydropower Co. is expected to be exempt from income tax from 2008-2013 due to tax credits from equipment purchase.

Safety and Quality Control

Safety Control

We are focused on safety. We have implemented a safety system and have designated an engineering department to oversee safety issues for all of our operations. We carry out routine inspection of our equipment every two hours and we conduct routine maintenance of our equipment every week or every other week depending on equipment type.

We believe in educating operational staff about safety procedures. Our operation employees have to take annual safety education and pass the annual safety exam. And while the equipment runs for 24 hours a day during peak seasons, our employees are divided into 3 shifts to oversee the operation.

In order for us to monitor the operations of our equipment, we also developed a micro processing unit that integrates measurement, control, communications, and other functions to achieve the goal of central control and management in a scientific manner.

Due to the strict implementation of safety control procedures, there have been no major accidents which have resulted in serious injury or death since our inception.

Quality Control

Quality control mainly stays in the design and construction phase of hydropower stations. The quality control team regularly makes inspection visits and conducts tests to ensure that the construction work meets our required standards as well as National and local regulations.

Unlike other industries, there is no quality control in the operation phase since all electricity is the same to end users.

Research and Development

Our research and development activities are carried out by our engineering department. Our research and development focuses on automation and improvement of hydropower generation. There are 30 employees in our engineering department that specialize in different areas such as safety control, automation, power generation planning and hydropower station construction. We also developed a micro-processing unit that integrates measurement, control, communications, and other functions to achieve the goal of central control and management in a scientific manner. Our research paper “Hydro Turbine Updating Technology for Small and Medium-sized Hydropower Stations” was included in the “2007 Annual Catalogue of Advanced Technologies in Hydropower Industry”.

Competition

Since 2002, our business has been concentrated in the generation and sales of hydroelectricity. With the increasing demand of electricity in China, industry competition focuses on the following two aspects:

1. Product competition: Currently, thermal power has 83% market share, hydropower has only 15%, and other energy sources have about 2%. Product competition mostly comes from thermal electricity. However, due to lower pricing, clean production and preferential policies, hydropower has an advantage over thermal power.

2. Hydropower resources competition: Currently, most hydropower resources are controlled by state-owned companies and local governments. With deepening reform of electricity industry, private capital and foreign capital are gradually coming to the industry due to its investment value and prospects, resulting in more intensive competition in the industry.

Further, the competition in our industry comes from the following sectors:

· Large state-owned companies. These large companies position themselves in large thermal power projects and large and medium hydropower projects, so there is no direct competition between them and the Company.

· Large local electric power companies: They are supported by local government, but have rigid management and low efficiency.

· Affiliates of grid companies: These companies possess many hydropower resources, but they will be the targets of next round of reform due to their conflicts with the electric reform policies. They will be our targets of cooperation or acquisition.

· Small and medium sized hydropower stations owned by local government: They are very inefficient in management and are the company’s acquisition targets.

· Private and foreign hydropower investment companies: These companies are more flexible in management, but are usually constrained by technological and capital requirements.

Intellectual Property

We do not hold have any registered trademark or patent.

Insurance

We currently purchase property insurance to cover our fixed asset from People’s Insurance Company of China (PICC).

In addition, we maintain the following insurances for our employees: (i) pension insurance, (ii) medical insurance; (iii) work-related injury insurance; (iv) employment insurance; and (v) parental insurance.

Employees

As of March 30, 2008, we had a total of 160 employees, including 30 engineers, 59 workers, 12 finance and accounting professionals, 8 sales and marketing staff, and 50 supporting staff.

Although each employee will enter into an employment contract with the respective company, each employee is an “at will” employee. The annual remuneration of each includes a fixed and bonus components plus contributions to the social insurances as well as stock incentives.

Government Regulation

The operation of hydropower stations is not subject to any regulation other than pricing regulation. Please see the discussion under “Pricing and Regulations; Regulatory Framework for Hydropower Companies”.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the consolidated financial condition and results of operations should be read in conjunction with the consolidated financial statements and related notes of Zhaoheng BVI, appearing elsewhere in this Current Report. This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. The actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, but not limited to, those set forth under “Risk Factors” and elsewhere in this Current Report.

Overview

As a result of the consummation of the Share Exchange, we are now engaged in generating hydropower and supplying electricity to power grid companies and residents of small- and medium- sized cities in China.

We own and operate two facilities in Hunan Province: Hunan Sanjiang Hydropower Station and Hunan Sanjiang Left Bank Hydropower Station, serving approximately 1800 residential customers and 34 industrial customers, including Changde branch of State Grid Corporation of China, a state-owned power grid company. Hunan Sanjiang Hydropower Station has an installation capacity of 62.5MW. Hunan Sanjiang Left Bank Hydropower Station has an installation capacity of 50MW.

Recent Trends and Developments

As a result of the combination of the business with Zhaoheng Group, the year end of the company’s fiscal year will change from March 31 to December 31.

As set forth in the following table, Zhaoheng BVI and its subsidiaries (the “Group”) has had an increase in both operating revenue and net income, as compared to the prior year ended December 31, 2006 (FY2006):

Recent Trends and Developments

As a result of the combination of the business with Zhaoheng Group, the year end of the company’s fiscal year will change from March 31 to December 31.

As set forth in the following table, Zhaoheng BVI and its subsidiaries (the “Group”), as combined, has had an increase in both operating revenue and net income, as compared to the prior year ended December 31, 2006 (FY2006):

| | | | |

| USD | | | | | | | |

| | | | | FY2007 | | | | | FY2006 | | |

Revenues | | | $ | 9,283,035 | | | | $ | 6,921,862 | | |

| | | | | |

| Cost of revenues | | | | (1,852,698 | ) | | | | (1,787,574 | ) | |

| | | | | |

| Gross profit | | | | 7,430,337 | | | | | 5,134,288 | | |

| | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | |

| Selling expenses | | | | (308,519 | ) | | | | (359,464 | ) | |

| Administrative expenses | | | | (961,362 | ) | | | | (1,100,142 | ) | |

| | | | | |

| Total expenses | | | | (1,269,881 | ) | | | | (1,459,606 | ) | |

| | | | | | | | | | | |

| Operating income | | | | 6,160,456 | | | | | 3,674,682 | | |

| | | | | | | | | | | |

| Other income (expenses): | | | | | | | |

| Interest income | | | | 35,541 | | | | | 5,850 | | |

| Interest expense | | | | (986,187 | ) | | | | (521,773 | ) | |

| Non-operating income | | | | 282,242 | | | | | 39,706 | | |

| Non-operating expense | | | | (3,165 | ) | | | | - | | |

| Other income | | | | 13,267 | | | | | 2,667 | | |

| Other expense | | | | (75,040 | ) | | | | (415,881 | ) | |

| Investment income | | | | 66,842 | | | | | 1,503,403 | | |

| | | | | |

| Total other income (expenses) | | | | (666,500 | ) | | | | 613,972 | | |

| | | | | | | | |

| Income before interest and tax | | | | 5,493,956 | | | | | 4,288,654 | | |

| | | | | |

| Income tax | | | | 412,959 | | | | | (2,551 | ) | |

| Minority interest | | | | - | | | | | (724,623 | ) | |

| | | | | |

| Net income | | | $ | 4,335,855 | | | | $ | 3,561,480 | | |

| | | | | | | | | | | | |

| Exchange rate (RMB/USD) | | | | 7.6172 | | | | | 7.9819 | | |

| | | | | |

| | | | | | | |

See Accompanying Notes to the Consolidated Financial Statements

The Group has continued to improve its financial performance over the years since 2003 mainly due to (1) acquisition of Hunan Sanjiang Hydropower Station; (2) improvement in the management of the operation; (3) establishment of employee’s incentive program; (4) price increase imposed by the government to promote the clean energy industry; and (5) tax reduction through preferential policies.

As an investment, development and management company in hydropower industry, the Group's financial performance in any given time period are also driven by several key factors, including installed capacity, utilization hours, and electricity tariff.

Fiscal Year Ended December 31, 2007 and December 31, 2006

Revenues

Our revenues for fiscal year ended December 31, 2007 (“FY 2007”) was $9,283,035, an increase of $2,361,173, by 34% from the previous year. This sales growth was primarily due to an increase in both electricity tariff and equipment utilization hours.

75% of the electricity generated was sold to state owned power grid companies. The table below presents information about our revenues for the periods indicated:

| Item | 2007 | 2006 | increase/decrease |

| Revenues | $9,283,035 | $6,921,862 | $2,361,173 | 34% |

Cost of Revenues

Our cost of revenues consists of fixed asset depreciation, equipment maintenance cost, wages, office expenses and state taxes (not including value-added tax and corporate income tax) attributable to the revenues.

| Item | 2007 | 2006 | increase/decrease |

| Cost of Revenues | $1,852,698 | $1,787,574 | $65,124 | 3.64% |

Cost of revenues for FY2007 was $1,852,698, representing 20.0% of the total revenues in 2007; cost of revenues for fiscal year ended December 31, 2006 (“FY 2006”) was $1,787,574, accounting for 25.8% of the total revenues of 2006. The cost of revenues as a percentage of total revenues decreased because total revenues increased while the cost of hydropower company is usually quite stable, as it mainly consists of fixed costs, such as fixed asset depreciation, equipment maintenance cost, wages and overhead.

Gross Profit

Gross profit margin of 80.0% for FY2007 was improved by almost 5.8% as compared to 74.2% in the prior year mainly due to a combined effect of (1) stable cost of sales; and (2) increase in electricity tariff and increase in utilization rate.

Operating Expenses

Total operating expenses decreased by $189,725 in FY2007 as compared to FY2006. This was mainly due to tightened control imposed by the Company.

| Item | | 2007 | | | 2006 | | | Increase/Decrease | |

| | | | | | | | | | | | | |

| Selling Expenses | | $ | 308,519 | | | $ | 359,464 | | | | -(50,945 | ) | | | -(14.2 | %) |

| Administrative Expenses | | $ | 961,362 | | | $ | 1,100,142 | | | | -(138,780 | ) | | | -(12.6 | %) |

| Total Expenses | | $ | 1,269,881 | | | $ | 1,459,606 | | | | -(189,725 | ) | | | -(13.0 | %) |

Operating Income

Operating income was $6,160,456 in FY2007 as compared to $3,674,682 in the prior fiscal year. Operating income margin increased from 53.1% in 2006 to 66.4% in FY2007, a change that was due to increased gross profit margin and decreased operating expenses margin.

Income Taxes

The Group did not carry on any business or maintain any branch office in the United States for FY2007 and FY2006. Therefore, no provision for U.S. federal income taxes or tax benefits on its undistributed earnings has been made.

For both FY2007 and FY2006, the Group's operations were solely in the PRC and governed by the PRC Enterprise Income Tax Laws. PRC enterprise income tax is calculated based on taxable income determined under PRC GAAP. In accordance with the Income Tax Laws, a PRC domestic company is subject to enterprise income tax (“EIT”) at the rate of 33%, value added tax (“VAT”) at the rate of 17% for most of the goods sold, and business tax (“BT”) on services at a rate ranging from 3% to 5% charged annually. A PRC domestic company is also subject to other local taxes. However, the Income Tax Laws provide certain favorable tax treatment to a foreign invested company in the energy industry. Additionally, the governments at the provincial, municipal and local levels can provide many tax incentives and abatements based on a number of programs at each level. As an incentive to hydropower industry, hydropower station owners are exempted from income tax for the first two profitable years and pay only half tax in the following three years.

As a result of these preferential tax treatments, the amount of income tax expenses of Zhaoheng BVI and his subsidiaries was $412,959 for the year ended December 31, 2007 and $2,551 for the year ended December 31, 2006. The income tax for fiscal year ended December 31, 2006 was nominal since our major subsidiary Hunan Sanjiang was exempted from income tax in year 2005 and 2006.

Investment Income

Investment income for FY2007 and FY2006 amounted to $66,842 and $1,503,403, respectively. Hunan Zhaoheng invested an amount of $535,951 in Zhaoheng Weile Tungsten (Shimen) Company limited (“Weile”) for 49% equity interests in January 2006. According to relevant agreements, Hunan Zhaoheng does not participate in the management of Weile but receives investment income at a fixed rate of 20% of the total contribution outstanding from the date the production line commenced operation. The production line commenced operation in May 2007. So the investment income for the year of 2007 represents the investment income from investment in Weile. The investment income for the year 2006 comes from a sale of investment in associate named Chongqing GuoNeng Investment Co. Ltd.

Net Income

Net income increased to approximately $4.336 million for FY2007 from approximately $3.561 million in the prior fiscal year. As a percentage of revenues, net income was approximately 46.7% for FY2007, as compared to approximately 51.5% for the prior year. There was an extra income of $1,503,403 from equity sales in fiscal year 2006. Excluding this income from equity sales, net income increased 110% from $2,058,077 in FY2007 to $4,335,855 in FY2007.

Liquidity and Capital Resources

Historically, the Group has financed its operations and capital expenditures with equity financing from existing stockholders, cash flows from operations and bank loans. Over the years, we developed good working relationship with the Bank of China, Industrial and Commercial Bank of China, China Construction Bank, and China Agriculture Bank. To keep pace with the rapid growth and expansion of our business, we may need additional capital, primarily to acquire developed hydropower stations or to construct new stations. As a result, we will seek to raise addition funds to finance our future growth.

Cash

Cash and cash equivalents decreased by $3,825,073 from $4,819,766 as of December 31, 2006 to $994,693 as of December 31, 2007.Operating activities generated cash of $11,086,168; investing activities used cash of $30,995,523; and financing activities generated cash of $15,919,190. The primary components of cash generated by operating activities were: (a) net income of $4,335,855; (b) a decrease in account receivables of $2,847,276; (c) an increase in other payables of $2,190,020; and (d) $992,996 depreciation and amortization offset by a decrease in accounts payables and accrued expensed of $394,987. The primary components of cash used in investing activities were: (i) an increase in due from related parties of $10,614,989 in connection with corporate restructuring; (ii) CAPEX of $14,057,951 in connection with the construction of hydropower plant in Hunan; and (iii) $6,095,140 purchase of minority interest. The primary components of cash generated by financing activities were proceeds from long term loans of $32,295,332 offset by (i) repayment of current portion of long term loans of $10,896,392 and (ii) dividend paid of $5,479,750..

Accounts Receivable

Accounts receivable was $1,915,471 at December 31, 2007, as compared to $4,557,342 at December 31, 2006. The decrease in accounts receivable was a result of our clients’ efforts to keep their accounts in good standing and our efforts in collecting overdue receivables.

Other assets

As a hydropower investment, development, and management company, our other assets are spare parts for equipment maintenance and deposit. Other assets as of December 31, 2007 were $175,886, as compared to $874,626 as of December 31, 2006.

Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses amounted to $130,299 and $942,946 as of December 31, 2007 and December 31, 2006, respectively. These amounts of accounts payable were primarily generated from the purchases of spare parts, which were disclosed in the account of other assets..

Construction in Progress

Construction in progress was $32,455,855 as of December 31, 2007, an increase of $18,679,565 or 135.6% as compared to $16,668,135 as of December 31, 2006. The increase was caused by the ongoing project of Sanjiang Left Bank Hydropower Station, which was expected to be completed in 2008. The first unit of the station was put into operation in April 2008.

Loans

As of December 31, 2007, we had outstanding loans in the amount of $60,567,944, as compared to $33,258,714 as of December 31, 2006. The loans were long term bank loans owed to three unrelated state owned banks as of December 31, 2007.

| Bank | | Amount ($) | | Interest Rate for the year of 2007 | |

| China Construction Bank | | | 5,879,055 | | 7.2 | % |

| | | | 2,734,444 | | 6.8 | % |

| | | | 8,203,333 | | 7.02 | % |

| Bank of China | | | 21,875,556 | | 6.84 | % |

| Industrial and Commercial Bank of China | | | 21,875,556 | | 7.11 | % |

Other Payables

Other payables decreased from $2,309,882 as of December 31, 2006 to $1,739,867 as of December 31, 2007. The other payables were mainly the security deposit placed for the ongoing construction of Sanjiang Left Bank Hydropower Station.

Off-balance Sheet Arrangement

1) On December 13, 1993, the State Council of China promulgated "The Provisional Regulation of the People's Republic of China on Value Added Tax" and put VAT into effect on January 1, 1994. In general, VAT was set at 17%.

In order to encourage the development of rural counties, the Ministry of Finance and State Administration of Taxation promulgated another notice on March 29, 1994 (No. 4, 1994) and lowered the VAT of certain businesses including small hydropower plants to 6%. Under the guidance of this notice, Hunan Sanjiang Power Co., Ltd. (“Hunan Sanjiang") has been paying VAT at 6% but received 17% VAT invoices from the tax authorities until 2004 because those are the only available invoices. Although this practice was allowed by the Tax Administration, it created a payable of 11% VAT on our books,with a total amount of $3,294,280 (RMB 24,094,690) by the end of 2004. As a result, these are not genuine payables. The balances

remain in the books because the tax authorities do not have the rights to issue a statement to clarify that are these conflicting policies.

With the implementation of Golden Tax Project and the establishment of online tax cross referencing network in 2005, local Tax Authorities can no longer collect VAT at an amount different from the VAT invoices. Consequently, the above mentioned preferential tax policy could not be executed in practice. Since January 2005, Hunan Sanjiang has been paying VAT at normal rate of 17%.

However, the Tax Administration has never questioned the historical tax payable of $3,294,280 arising from the 11% VAT discrepancy created under the different policies promulgated by the Ministry of Finance and State Administration of Taxation. Management believes that the existence of this payable was due to the unavailability of 6% VAT invoice from Tax Administration and this tax liability will never be collected by the related Tax Authorities as there is no record of such liabilities within the Tax Authorities.

In March 2005, Hunan Sanjiang transferred these payable and all related liabilities to its shareholder Shenzhen Zhaoheng Industrial Co., Ltd (“Zhaoheng Industrial”) According to an agreement signed between Hunan Sanjiang and Zhaoheng Industrial on March 31, 2005, Shenzhen Zhaoheng will assume all the liabilities if the related Tax Authorities come to collection of such payables.

2) Pursuant to an agreement between Zhaoheng Industrial and Jinjian Rice Co., Ltd. (“Jinjian Rice”), in July 2003, Hunan Sanjiang assumed three government loans in the aggregate amount of $4,451,595 (RMB 32,514,894.72). In the same year, Zhaoheng Industrial acquired 60% of equity interest in Hunan Sanjiang from Jinjian Rice. These three loans were granted by the State Ministry of Hydropower and Finance Bureau of Hunan Province to provide assistance in the construction of power plants during the years between 1985-1990. With government agency restructuring, the creditors are no longer in existence and have never claimed interest in the loans since 2003.

Critical Accounting Policies (please see accounting policies from auditing firm for more information)

Management's discussion and analysis of its financial condition and results of operations is based upon the Group's consolidated financial statements, which have been prepared in accordance with United States generally accepted accounting principles. The Group's financial statements reflect the selection and application of accounting policies which require management to make significant estimates and judgments. See note 1 to the Group's consolidated financial statements, “Organization and Summary of Significant Accounting Policies”. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. The Group believes that the following reflect the more critical accounting policies that currently affect the Group's financial condition and results of operations:

The consolidated financial statements include the accounts of the Company and its subsidiaries. Significant inter-company transactions have been eliminated in consolidation. Investments in which the company has a 20 percent to 50 percent voting interest and where the Company exercises significant influence over the entity in which it is invested are accounted for using the equity method.

As of December 31, 2007, the particulars of the subsidiaries are as follows:

Name of Company | Place of Incorporation | Date of Incorporation (M/D/Y) | Attributable Equity Interest | Registered Capital (RMB) |

| | | | | |

| Shenzhen Zhaoheng | PRC | 8/3/1999 | 100% | 11,000,000 |

| Hunan Sanjiang | PRC | 11/8/2001 | 100% | 199,400,000 |

| Hunan Zhaoheng | PRC | 6/25/2003 | 100% | 150,000,000 |

| Hunan Jiuli | PRC | 9/2/2002 | 100% | 13,038,000 |

| 2. | Economic and Political Risks |

The Company’s operations are conducted in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environment in the PRC, and by the general state of the PRC economy.

The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

In preparing financial statements in conformity with generally accepted accounting principles in the United States of America,, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements reported period. Actual results could differ from those estimates.

| 4. | Cash and Cash Equivalents |

The Company considers all cash and other highly liquid investments with maturities of 90 days or less at the time of investment to be cash equivalents.

| 5. | Investments in Equity Securities |

In the consolidated balance sheet, investments in equity securities are stated at the Group's share of the net assets of its associates plus the premium paid less any discount on acquisition in so far as it has not already been amortized to the statement of income, less any identified impairment loss.

Hunan Zhaoheng invested an amount of $535,951 for 49% equity interests in Zhaoheng Weile Tungsten (Shimen) Company limited (“Weile”) in January 2006. However, Hunan Zhaoheng will not participate in the management of Weile but will receive investment income at a fixed rate of 20% of the total contribution outstanding from the time of the production line put into operation. The other parties to Weile committed to purchase the equity interests held by Hunan Zhaoheng at historical cost. The investment income was then calculated based on the above arrangement. The investment was accounted for at cost.

| 6. | Accounts and Other Receivable |

Accounts and other receivable are reported at net realizable value. Management reviews its accounts

receivable on a regular basis. Delinquent accounts are written off when it is determined that the amounts are uncollectible. Delinquent accounts are written off when it’s determined that the amounts are uncollectible.

Our revenue recognition policies are structured to comply with Staff Accounting Bulletin (SAB) 104 and SFAS 48. SAB 104 requires that revenue can only be recognized when it is realized or realizable and earned. Revenue generally is realized or realizable and earned when all four of the following criteria have been met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services rendered; (3) the price is fixed and determinable; and (4) collectibility is reasonably assured. In general, the Company records revenue when persuasive evidence of an arrangement exists, power have been delivered, the sales price to the customer is fixed or determinable, and collectibility is reasonably assured.

Determination of criterion (4) is based on our judgments regarding the collectibility of those amounts. Historically, we have not encountered any significant problems with collectibility and thus have determined that it is not necessary to defer revenue recognition on that basis. Should changes in conditions cause us to determine this criterion is not met for certain future transactions, revenues for any reporting period could be adversely affected by delaying recognition of such revenues.

| 8. | Property, Plant and Equipment |

Property and equipment are stated at the actual cost on acquisition less accumulated depreciation and amortization. Depreciation and amortization are provided for in amounts sufficient to relate the cost of depreciation assets to operations over their estimated service lives, principally on a straight-line basis. Property and equipment have a residual value of 10% of actual cost. The estimated lives used in determining depreciation are:

| Classification | Useful years |

Dams | 50 years |

| Buildings | 20 -50 years |

| Machine Equipment | 10-30 years |

| Electronic and other equipment | 3-10 years |

In accordance with Statement of Financial Accounting Standards (SFAS) No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”, the Company examines the possibility of decreases in the value of fixed assets when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

Intangible assets are stated at cost less amortization and accumulated impairment loss. Amortization is provided over their estimated useful lives, using the straight-line method. All intangible assets of the Company are land use right and amortized in the useful life (generally 50 years).

| 10. | Construction in Progress |

Construction in progress is booked as its historical cost. Construction in progress refers to the Hunan Sanjiang Left Bank Hydropower Station which was expected to be completed in 2008. The first unit of the station was put into operation in April 2008.

Completed items are transferred from construction in progress to fixed assets when they are ready for their intended use.

| 11. | Foreign Currency Translation |

The functional currency of the Company is the Chinese Renminbi (“RMB”). The financial statements of the Company are translated to United Stated dollars using year-end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transaction occurred. Net gains and losses resulting from foreign exchange translations are included in the statements of operations and stockholders' equity as other comprehensive income. The cumulative translation adjustment and effect of exchange rate changes at December 31, 2007 and 2006 was $4,542,712and $1,933,598 respectively.

This quotation of the exchange rates does not imply free convertibility of RMB to other foreign currencies. All foreign exchange transactions continue to take place either through the People’s Bank of China or other banks authorized to buy and sell foreign currencies at the exchange rate quoted by the People’s Bank of China.

The Company accounts for income taxes under the Statement of Financial Accounting Standards No. 109, "Accounting for Income Taxes" ("Statement 109").

Under Statement 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under Statement 109, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this Current Report before deciding to invest in our common stock.

Risks Related to Our Business

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We commenced our current line of business operations in 2002. Our limited operating history may not provide a meaningful basis on which to evaluate our business. Although our revenues have grown rapidly since inception, we cannot assure you that we will maintain our profitability or that we will not incur net losses in the future. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in significant operating losses. We will continue to encounter risks and difficulties frequently experienced by companies at a similar stage of development, including our potential failure to:

| | - | raise adequate capital for expansion and operations; |

| | - | implement our business model and strategy and adapt and modify them as needed; |

| | - | increase awareness of our brands, protect our reputation and develop customer loyalty; |

| | - | manage our expanding operations and service offerings, including the integration of any future acquisitions; |

| | - | maintain adequate control of our expenses; |

| | - | anticipate and adapt to changing conditions in the hydropower utility market in which we operate as well as the impact of any changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

If we are not successful in addressing any or all of these risks, our business may be materially and adversely affected.

Our failure to compete effectively may adversely affect our ability to generate revenue.

We compete primarily on the basis of our ability to secure sales contracts with local government entities in small- and medium-sized cities that allow us the exclusive rights to develop hydropower distribution networks and supply hydropower in these cities. There can be no assurance that such contracts will be available to us in new areas as we attempt to expand or that our competitors will negotiate more favorable arrangements. We expect that we will be required to continue to invest in building hydropower distribution infrastructure. Our business requires large amounts of working capital to fund our operations. Our competitors may have better resources and better strategies to raise capital which could have a material adverse effect on our business, results of operations or financial condition.

Our inability to fund our capital expenditure requirements may adversely affect our growth and profitability.

Our continued growth is dependent upon our ability to generate more revenue from our existing distribution systems and raise capital from outside sources. We believe that in order to continue to capture additional market share, we will have to raise more capital to fund the construction and installation of the

hydropower distribution network for our customers under existing contracts and for additional customers. In the future we may be unable to obtain the necessary financing on a timely basis and on acceptable terms, and our failure to do so may adversely affect our financial position, competitive position, growth and profitability. Our ability to obtain acceptable financing at any time may depend on a number of factors, including:

| | - | our financial condition and results of operations, |

| | - | the condition of the PRC economy and the hydropower industry in the PRC, and |

| | - | conditions in relevant financial markets in the United States, the PRC and elsewhere in the world. |

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. In addition, we may face challenges in managing and expanding hydropower stations and service offerings and in integrating acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect our operations and cause delay in construction and/or acquisition of hydropower stations, longer operation location completion cycle, and administrative inefficiencies.

If we are unable to successfully complete and integrate new operational locations in a timely manner, our growth strategy could be adversely impacted.

An important element of our growth strategy has been and is expected to continue to develop additional hydropower stations in small- and medium-sized cities. However, integrating businesses involves a number of special risks, including the possibility that management may be distracted from regular business concerns by the need to integrate operations, unforeseen difficulties in integrating operations and systems, problems relating to assimilating and retaining the employees of the acquired business, accounting issues that arise in connection with the acquisition, challenges in retaining customers, and potential adverse short-term effects on operating results. In addition, we may incur debt to finance future operation locations, and we may issue securities in connection with future operation locations that may dilute the holdings of our current or future stockholders. If we are unable to successfully complete and integrate new operations in a timely manner, our growth strategy could be adversely impacted.

Our success depends on our ability to identify and develop additional hydropower stations and negotiate and enter into favorable franchise agreements with local governments of the operation locations.