UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

| | For the quarterly period ended September 30, 2008 |

OR

| r | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

| | For the transition period from to |

Commission file number 000-52786

ZHAOHENG HYDROPOWER COMPANY

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | | 41-1484782 |

| (State or Other Jurisdiction of | | (I.R.S. Employer |

| Incorporation or Organization) | | Identification No.) |

F/19, Unit A, JingFengCheng Building 5015 Shennan Road, Shenzhen PRC | | 518025 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(011-86) 755-8207-0966

(Registrant’s Telephone Number, Including Area Code)

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o |

| | | |

Non-accelerated filer o (Do not check if a smaller reporting company.) | | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the last practicable date: As of August 11, 2008, there were 71,692,999 shares of the issuer’s common stock, $0.001 par value per share, outstanding.

INDEX

| | | Page |

| | | |

| | PART I FINANCIAL INFORMATION | |

| | | |

| Item 1. | Financial Statements | 1 |

| | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| | | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 29 |

| | | |

| Item 4. | Controls and Procedures | 29 |

| | | |

| | PART II OTHER INFORMATION | |

| | | |

| Item 1. | Legal Proceedings | 29 |

| | | |

| Item 1A. | Risk Factors | 29 |

| | | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 37 |

| | | |

| Item 3. | Defaults Upon Senior Securities | 37 |

| | | |

| Item 4. | Submission of Matters to a Vote of Security Holders | 37 |

| | | |

| Item 5. | Other Information | 37 |

| | | |

| Item 6. | Exhibits | 37 |

| | | |

| SIGNATURES | |

PART I — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| ZHAOHENG HYDROPOWER COMPANY AND SUBSIDIARIES | |

| CONSOLIDATED BALANCE SHEETS | |

| | | | | | | |

| | | | | | | |

| | | September 30, | | | December 31, | |

| | | 2008 | | | 2007 | |

| ASSETS | | (Unaudited) | | | | |

| Current Assets: | | | | | | |

| Cash | | $ | 3,114,904 | | | $ | 994,719 | |

| Notes receivable | | | - | | | | 202,349 | |

| Accounts receivable, net of allowance for doubtful accounts $327,652 | | | | | | | | |

| and $307,090 respectively | | | 2,430,558 | | | | 1,915,471 | |

| Dividend receivable | | | - | | | | 71,460 | |

| Other receivables | | | 117,498 | | | | 145,075 | |

| Prepaid expenses and other current assets | | | 67,541 | | | | 85,971 | |

Total current assets | | | 5,730,501 | | | | 3,415,045 | |

| | | | | | | | | |

| Investment in subsidiary | | | 571,837 | | | | 535,951 | |

| Property, plant and equipment, net of accumulated depreciation of | | | | | | | | |

| $40,254,091 and $34,380,646 respectively | | | 73,504,610 | | | | 30,634,626 | |

| Due from related parties | | | 16,369,507 | | | | 17,529,838 | |

| Other assets | | | 174,429 | | | | 175,886 | |

| Construction in progress | | | 2,553,107 | | | | 32,455,855 | |

| Property use rights, net | | | 1,227,057 | | | | 1,169,905 | |

| Goodwill | | | 401,122 | | | | - | |

Total assets | | $ | 100,532,170 | | | $ | 85,917,106 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| | | | | | | | | |

| Current Liabilities: | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 12,606 | | | $ | 133,163 | |

| Other payables | | | 962,224 | | | | 1,739,867 | |

| Salary payable and judgements payable | | | 31,032 | | | | 7,600 | |

| Taxes payable | | | 643,586 | | | | 157,525 | |

| Due to related parties | | | 3,581,833 | | | | 31,444 | |

| Advances from customers | | | 35,793 | | | | 34,021 | |

Total current liabilities | | | 5,267,074 | | | | 2,103,620 | |

| | | | | | | | | |

| Loans payable-long term | | | 64,623,419 | | | | 60,567,944 | |

| | | | | | | | | |

| Stockholders' Equity: | | | | | | | | |

| Preferred Stock: $.001 par value; 20,000,000 authorized, no shares issued and outstanding | | | | | |

| at September 30, 2008 and December 31, 2007, respectively | | | - | | | | - | |

| Common Stock: $.001 par value, 780,000,000 authorized, 71,692,943 and 2,005,973 issued | | | | | |

| and outstanding at September 30, 2008 and December 31, 2007, respectively | | | 71,693 | | | | 2,006 | |

| Additional paid-in capital | | | 19,336,244 | | | | 19,405,931 | |

| Statutory surplus reserve | | | 666,952 | | | | 666,952 | |

| Retained earnings | | | 6,357,052 | | | | 628,704 | |

| Accumulated other comprehensive income | | | 4,209,736 | | | | 2,541,949 | |

Total stockholders' equity | | | 30,641,677 | | | | 23,245,542 | |

Total liabilities and stockholders' equity | | $ | 100,532,170 | | | $ | 85,917,106 | |

| | | | | | | | | |

| | | | | | | | | |

| See notes to unaudited consolidated financial statements | | | | | | | | |

| ZHAOHENG HYDROPOWER COMPANY AND SUBSIDIARIES | |

| UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | For the Three Months Ended September 30, | | | For the Nine Months Ended September 30, | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Revenues | | $ | 5,156,207 | | | $ | 3,191,260 | | | $ | 9,789,788 | | | $ | 7,722,300 | |

| Cost of revenues | | | 722,820 | | | | 424,892 | | | | 1,942,789 | | | | 1,303,246 | |

| Gross profit | | | 4,433,387 | | | | 2,766,368 | | | | 7,846,999 | | | | 6,419,054 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Selling expense, General and administrative expenses | | | 400,003 | | | | 317,658 | | | | 934,438 | | | | 1,039,914 | |

| Operating income | | | 4,033,384 | | | | 2,448,710 | | | | 6,912,561 | | | | 5,379,140 | |

| | | | | | | | | | | | | | | | | |

| Other income (expenses): | | | | | | | | | | | | | | | | |

| Interest income | | | 677,264 | | | | 2,845 | | | | 1,642,276 | | | | 34,084 | |

| Interest expense | | | (1,223,717 | ) | | | (257,405 | ) | | | (2,686,779 | ) | | | (695,817 | ) |

| Nonoperating income | | | - | | | | (6,766 | ) | | | - | | | | 66,833 | |

| Nonoperating expense | | | (926 | ) | | | (13,789 | ) | | | (21,932 | ) | | | (37,333 | ) |

| Other income | | | 311 | | | | 109,800 | | | | 26,540 | | | | 109,800 | |

| Other expense | | | - | | | | (16,285 | ) | | | - | | | | (16,285 | ) |

| Investment income | | | 29,893 | | | | - | | | | 189,043 | | | | - | |

| Total other income (expenses) | | | (517,175 | ) | | | (181,600 | ) | | | (850,852 | ) | | | (538,718 | ) |

| | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 3,516,209 | | | | 2,267,110 | | | | 6,061,709 | | | | 4,840,422 | |

| Income taxes | | | 178,936 | | | | 196,289 | | | | 333,228 | | | | 366,742 | |

| Income before minority interest | | | 3,337,273 | | | | 2,070,821 | | | | 5,728,481 | | | | 4,473,680 | |

| Minority interest | | | - | | | | (278,937 | ) | | | - | | | | 976,781 | |

| Net income | | $ | 3,337,273 | | | $ | 1,791,884 | | | $ | 5,728,481 | | | $ | 3,496,899 | |

| Unrealized foreign currency translation gain | | | 42,977 | | | | 1,075,250 | | | | 1,667,787 | | | | 983,831 | |

| | | | | | | | | | | | | | | | | |

| Comprehensive income | | $ | 3,380,250 | | | $ | 2,867,134 | | | $ | 7,396,268 | | | $ | 4,480,730 | |

| | | | | | | | | | | | | | | | | |

| Net income per common share- basic and diluted | | $ | 0.05 | | | $ | 0.89 | | | $ | 0.15 | | | $ | 1.74 | |

| | | | | | | | | | | | | | | | | |

| Weighted average number of shares | | | | | | | | | | | | | | | | |

| outstanding-basic and diluted | | | 71,692,943 | | | | 2,005,973 | | | | 37,742,881 | | | | 2,005,973 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | |

| See notes to unaudited consolidated financial statements. | |

| ZHAOHENG HYDROPOWER COMPANY AND SUBSIDIARIES | | | | |

| UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | |

| | | | | | | |

| | | | | | | |

| | | For the Nine Months Ended September 30, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net income | | $ | 5,728,481 | | | $ | 3,496,899 | |

| Adjustments to reconcile net income to net cash | | | | | | | | |

| provided by operating activities: | | | | | | | | |

| Depreciation and amortization expenses | | | 1,215,494 | | | | 799,182 | |

| Minority interest | | | - | | | | 997,331 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Notes receivable | | | 211,463 | | | | 9,311 | |

| Accounts receivable | | | (378,887 | ) | | | 1,299,999 | |

| Dividend receivable | | | 74,679 | | | | - | |

| Other receivables | | | 36,526 | | | | (839,843 | ) |

| Prepaid expense | | | (34,631 | ) | | | (124,431 | ) |

| Other assets | | | (321,600 | ) | | | (90,861 | ) |

| Accounts payable and accrued expenses | | | 102 | | | | (949,940 | ) |

| Other payables | | | (976,945 | ) | | | (1,030,490 | ) |

| Advances from customers | | | (35,554 | ) | | | 88,390 | |

| Taxes payable | | | 465,943 | | | | 329,730 | |

| Net cash provided by operating activities | | | 5,985,071 | | | | 3,985,277 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Due from related parties | | | 5,868,204 | | | | (12,894,046 | ) |

| Purchase of equity investment | | | (2,626,077 | ) | | | - | |

| Purchase of property, plant and equipment | | | (7,131,947 | ) | | | (107,213 | ) |

| Investment in construction of hydropower station | | | - | | | | (11,486,794 | ) |

Net cash used in investing activities | | | (3,889,820 | ) | | | (24,488,053 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Dividend paid | | | - | | | | (3,158,772 | ) |

| Proceeds from long-term loans | | | - | | | | 21,682,452 | |

Net cash provided by financing activities | | | - | | | | 18,523,680 | |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH | | | 2,095,251 | | | | (1,979,096 | ) |

| | | | | | | | | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | | | 24,934 | | | | 265,845 | |

| | | | | | | | | |

| CASH, BEGINNING OF YEAR | | | 994,719 | | | | 4,819,766 | |

| | | | | | | | | |

| CASH, ENDING OF PERIOD | | $ | 3,114,904 | | | $ | 3,106,514 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES: | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Interest paid | | $ | 2,686,779 | | | $ | 2,551,175 | |

| Income tax paid | | $ | 239,804 | | | $ | 173,430 | |

| | | | | | | | | |

| | | | | | | | | |

| See notes to unaudited consolidated financial statements | |

| ZHAOHENG HYDROPOWER COMPANY AND SUBSIDIARIES |

| CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY | |

| (Unaudited) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Preferred Stock | | | Common Stock | | | | | | | | | | | | | | | | |

| | | Shares | | | Amount | | | Shares | | | Amount | | | Additional Paid-in Capital | | | Statutory Surplus Reserve | | | Retained Earnings | | | Accumulated Other Comprehensive Income | | | Total | |

| Balance, January 1, 2008 | | | - | | | $ | - | | | | 2,005,973 | | | $ | 2,006 | | | $ | 5,470,767 | | | $ | - | | | $ | (5,514,655 | ) | | $ | 2,541,949 | | | $ | 2,500,067 | |

| Recapitalization of reverse acquisition | | | - | | | | - | | | | 69,686,970 | | | | 69,687 | | | | 13,865,477 | | | | 666,952 | | | | 6,143,226 | | | | - | | | | 20,745,342 | |

| Commprehensive income: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 5,728,481 | | | | - | | | | 5,728,481 | |

| Unrealized foreign currency translation | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,667,787 | | | | 1,667,787 | |

| Subtotal | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 7,396,268 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, September 30, 2008 | | | - | | | $ | - | | | | 71,692,943 | | | $ | 71,693 | | | $ | 19,336,244 | | | $ | 666,952 | | | $ | 6,357,052 | | | $ | 4,209,736 | | | $ | 30,641,677 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| See notes to unaudited consolidated financial statements | |

ZHAOHENG HYDROPOWER COMPANY AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED

FINANCIAL STATEMENTS

Note 1 – ORGANIZATION AND BUSINESS OPERATIONS

Certified Technologies Corporation ("Certified") was incorporated under the laws of the State of Minnesota in January, 1984. Certified was formed to market a fire retardant chemical formulation to the commercial aviation and business furniture industries. Certified filed for a Chapter 11 bankruptcy on July 11, 2000, which was converted to a Chapter 7 on October 23, 2000. The bankruptcy closed on November 4, 2004.

On May 13, 2008, Zhaoheng Investment Limited, a British Virgin Island Corporation ("Zhaoheng BVI") entered into a share exchange agreement (the “Share Exchange Agreement”) with Certified resulting in a change of control of Certified. Pursuant to the Share Exchange Agreement, Certified issued an aggregate of 69,686,970 shares of common stock, par value $0.001 (the “Common Stock”), to Embedded Internet Solutions Limited (“Embedded Internet”), a Cayman Islands company wholly owned by Guosheng Xu, our current Chief Executive Officer and Chairman, in exchange for all of the shares of common stock of Zhaoheng BVI (the “Share Exchange”). Contemporaneously with the closing of the Share Exchange, certain holders of our Common Stock completed a sale of approximately 572,170 shares of Common Stock owned by them to Embedded Internet pursuant to a stock purchase agreement (the “Stock Purchase”). As a result of the completion of the Share Exchange and the Stock Purchase, Embedded Internet now owns shares of our Common Stock constituting approximately 98% of our outstanding capital stock.

Upon the consummation of the Share Exchange, Certified ceased being a shell company and is now engaged in the investment and operation of small and medium sized hydropower stations in the People’s Republic of China (“PRC”).

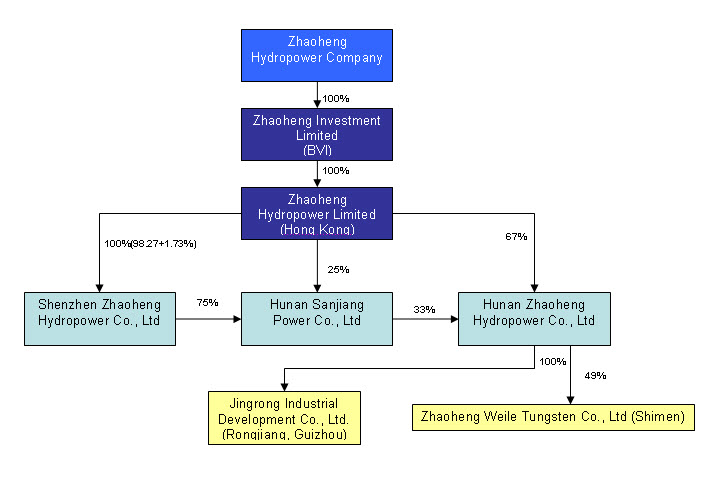

In November 2007, Zhaoheng BVI’s wholly-owned subsidiary, Zhaoheng Hydropower (Hong Kong) Limited (“Zhaoheng HK”), was established in Hong Kong. Guosheng Xu, the sole shareholder of Zhaoheng BVI, combined his equity interests in the following four operating companies (collectively, the “Operating Entities”): (1) Shenzhen Zhaoheng Hydropower Co., Ltd., ("Shenzhen Zhaoheng") (2) Hunan Zhaoheng Hydropower Co., Ltd. (“Hunan Zhaoheng”), (3) Hunan Sanjiang Power Co., Ltd., (“Hunan Sanjiang”) and (4) Hunan Jiuli Hydropower Construction Co., Ltd. (“Hunan Juili”), each incorporated under laws of the PRC, and injected them into the Company in December 2007. This combination of ownership is collectively referred to as “Capital Injection”.

On February 27, 2008, Certified reincorporated in the State of Nevada and on July 17, 2008, Certified changed its corporate name from “Certified Technologies Corporation” to “Zhaoheng Hydropower Company”.

Hereafter, Zhaoheng BVI, Zhaoheng HK, the Operating Entities that consolidated their equity interest into Zhaoheng BVI, Zhaoheng Hydropower Company, and any subsequent acquisition to the Capital Injection are referred to as the “Company”, unless specific reference is given to a specific company. All assets and liabilities are recorded at their historical costs.

In December 2007, one of the Company’s subsidiaries Hunan Sanjiang entered into a letter of intent to transfer its 100% interest in Hunan Juili to its related party, Shenzhen Zhaoheng Industrial Co., Ltd., for a consideration of RMB 13,038,000. All relevant procedures were completed in April 2008. As a result, Hunan Jiuli is not a subsidiary of the Company as of June 30, 2008.

On June 15, 2008, Hunan Zhaoheng succeeded in the buyout of Guizhou Jingrong Industrial Development Co., Ltd (“Guizhou Jingrong”) in Rongjiang County of the Guizhou Province. The acquisition was undertaken to allow the Company to diversify its operations, to improve its financial condition and increase shareholder value.

The Company uses the purchase method of accounting for qualifying business combinations. Under the purchase method of accounting, the assets and liabilities of acquired companies are recorded at their estimated fair values at the date of acquisition. The excess of cost over their fair values is recognized as an intangible asset. In accordance with SFAS No. 142, “Goodwill and Other Intangible Assets”, identified intangible assets are amortized over their estimated useful lives. The equity consideration for Guizhou Jingrong was initially estimated at $2,332,668 and the

amount was paid on June 30, 2008. After final adjustment pursuant to the acquisition agreement, the final cost was set at $2,681,150. The Company had paid the difference by September 30, 2008.

The Company, by virtue of their ownership structure, owns three hydropower stations (Hunan Sanjiang Hydropower Station, Hunan Sanjiang Left Bank Hydropower Station and Guizhou Jingrong Industrial Development Station) and other relevant operating assets located in the People’s Republic of China (“PRC”).

The financial statements as presented hereby consolidated for the nine months ended September 30, 2008 and 2007. The accompanying unaudited financial statements of the Company as of September 30, 2008 and 2007 had been prepared in accordance with generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X, as promulgated by the US Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. The financial statements for the nine months ended September 30, 2008 and 2007 are unaudited and include all adjustments considered necessary for a fair presentation of the results of operations for the nine month periods ended September 30, 2008 and 2007. All such adjustments are of a normal recurring nature. The results of the Company's operations for any interim period are not necessarily indicative of the results of the Company's operations for a full fiscal year.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation

The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. The consolidated financial statements include the accounts of the Company’s four Operating Entities. Inter-company items and transactions have been eliminated in combination.

Estimates

In preparing financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates. Significant estimates include the allowance for doubtful accounts of accounts receivable, and the useful life of property, plant and equipment.

Cash and Cash Equivalents

For purposes of the consolidated cash flow statements, the Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents.

Cash includes cash on hand and demand deposits in accounts maintained with state-owned banks within the PRC. Total cash in state-owned banks at September 30, 2008 and December 31, 2007 amounted to $3,111,092 and $994,693 respectively, of which no deposits are covered by insurance. The Company has not experienced any losses in such accounts and believes it is not exposed to any risks on its cash in bank accounts.

Accounts Receivable

The Company conducts its business operations in the PRC. Accounts receivables are reported at net realizable value. Management reviews its accounts receivable on a regular basis. Delinquent accounts are written off when it’s determined that the amounts are uncollectible. Accounts receivable, net of the allowance for doubtful accounts, as of September 30, 2008 and December 31, 2007 were $2,430,558 and $1,915,471 respectively.

Investments in Subsidiary

We use the cost method to account for investments in common stock of entities in which we have a minority voting interest or in which we otherwise have the ability to exercise significant influence or the right to share any net earnings or losses of the entity. Under the cost method, the investment is originally recorded at cost. We are

recording the investment in Zhaoheng Weile Tungsten (Shimen), Ltd. (“Weile”) as an investment under the cost method of accounting.

Property, Plant and Equipment

| | Property, plant and equipment are stated at the actual cost on acquisition less accumulated depreciation. Depreciation is provided for in amounts sufficient to relate the cost of depreciation assets to operations over their estimated service lives, principally on a straight-line basis. Property and equipment have a residual value of 10% of actual cost. The estimated lives used in determining depreciation are: |

| Classification | Useful Years |

| Dams | 50 years |

| Buildings | 20 -50 years |

| Machine equipment | 10-30 years |

| Electronic and other equipment | 3-10 years |

Maintenance and repairs are charged to expense as incurred. Significant renewals and improvements are capitalized.

Construction in Progress

As of September 30, 2008, "construction in progress" refers to the auxiliary project of Hunan Sanjiang Left Bank Hydropower Station and Guizhou Jingrong’s expansion project which amounted to $2,553,107. As of December 31, 2007, it refers to Hunan Sanjiang Left Bank Station, which amounted to $32,455,855. We started to test operations in April 2008. The amounts allocated to "construction in progress" was transferred to property, plant and equipment in July 2008. The carryover amount is $34,909,173.

Intangible Assets

Intangible assets represent the excess of cost over fair value of non-contractual relationships. In accordance with SFAS No. 142, “Goodwill and Other Intangible Assets”, intangible assets are amortized over their useful lives. The useful life for the intangible assets is 20 years since July 2008.

Acquisitions

The Company accounts for acquisitions using the purchase method of accounting in accordance with SFAS No. 141. In each of our acquisitions we determined that fair values were equivalent to the acquired historical carrying costs. The estimated purchase price and the preliminary adjustments to historical book value of business entities acquired were recorded by the Company at the pre-acquisition carrying amount.

Revenue Recognition

The Company follows the guidance of the Securities and Exchange Commission’s Staff Accounting Bulletin No. 104 for revenue recognition. In general, the Company records revenue when persuasive evidence of an arrangement exists, power have been delivered , the sales price to the customer is fixed or determinable, and collectability is reasonably assured.

Sales revenue represents the invoiced value of goods or service, net of a value-added tax (“VAT”). All of the Company’s products that are sold in the PRC are subject to a Chinese value-added tax at a rate of 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on raw materials and other materials included in the cost of production.

Major Suppliers

The Company’s supplies are mainly related to spare parts of low value that are used for maintenance of the hydropower factories. As the Company could source the supplies from various suppliers on comparable terms, no concentration risk is perceived.

Major Customers

For the nine months ended September 30, 2008 and 2007, the major five customers accounted for approximately 100% and 90.71%, respectively, of the Company’s total sales. As at September 30, 2008 and December 31, 2007, accounts receivables from these customers were 100% and 94% of the Company’s total outstanding balance.

Foreign Currency Translation

The functional currency of the Company is the Chinese Renminbi (“RMB”). The financial statements of the Company are translated to United Stated dollars using year-end exchange rates as to assets and liabilities and average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when the capital transaction occurred. Net gains and losses resulting from foreign exchange translations are included in the statements of operations and stockholders' equity as other comprehensive income. The cumulative translation adjustment and effect of exchange rate changes at September 30, 2008 and December 31, 2007 was $4,209,736 and $2,541,949, respectively.

This quotation of the exchange rates does not imply free convertibility of RMB to other foreign currencies. All foreign exchange transactions continue to take place either through the People’s Bank of China or other banks authorized to buy and sell foreign currencies at the exchange rate quoted by the People’s Bank of China.

Capital accounts of the consolidated financial statements are translated into United States dollars from RMB at their historical exchange rates when the capital transactions occurred. Assets and liabilities are translated at the exchange rates as of the balance sheet date. Income and expenditures are translated at the average exchange rates during the nine months ended September 30, 2008 and 2007.

| | | For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| | | 2008 | | 2007 | | 2008 | | 2007 |

| Period end RMB : U.S. Dollar exchange rate | | 6.8551 | | 7.5176 | | 6.8551 | | 7.5176 |

| Average year-to-date RMB : U.S. Dollar exchange rate | | 6.8529 | | 7.5691 | | 6.9989 | | 7.6758 |

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through PRC authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into United States dollars at the rates applied in the translation.

Comprehensive Income (Loss)

The Company uses Statement of Financial Accounting Standards No. 130 (“SFAS 130”) "Reporting Comprehensive Income". Comprehensive income is comprised of net income and all changes to the statements of stockholders' equity, except those due to investments by stockholders', changes in paid-in capital and distributions to stockholders. Comprehensive income for the nine months ended September 30, 2008 and the year ended December 31, 2007 included net income and foreign currency translation adjustments.

Impairment of Long-lived Assets

In accordance with SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets", the Company periodically reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the estimated fair value and the book value of the underlying asset. The Company did not incur any impairment charges during the nine months ended September 30, 2008 and 2007.

Minority Interest

Under generally accepted accounting principles when losses applicable to the minority interest in a subsidiary exceed the minority interest in the equity capital of the subsidiary, the excess is not charged to the majority interest since there is no obligation of the minority interest to assume liability on such losses. The Company, therefore, has absorbed all losses applicable to a minority interest where applicable. If future earnings do materialize, minority interest shall be credited to the extent of such losses previously absorbed.

Income Taxes

The Company accounts for income taxes under the Statement of Financial Accounting Standards No. 109, "Accounting for Income Taxes" ("Statement 109").

Under Statement 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under Statement 109, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Value Added Taxes (VAT)

The Company is required to charge and to collect for value added taxes on their sales. In addition, the Company pays value added taxes on their primary purchases, recorded as a receivable. These amounts are netted for financial statement purposes.

Basic and Diluted Earnings per Share

Basic income per common share is computed by dividing income available to common shareholders by the weighted average number of shares of common stock outstanding for the periods presented. Diluted income per share reflects the potential dilution that could occur if securities were exercised or converted into common stock or other contracts to issue common stock resulted in the issuance of common stock that would then share in the income of the Company, subject to anti-dilution limitations.

Fair Value of Financial Instruments

The carrying amounts of the Company's financial instruments (including accounts receivable, due from/to related parties, account payable, bank loans and notes receivable) approximate fair value due to either the relatively short period to maturity or float market interest rate of those instruments.

Concentrations and Credit Risks

For the nine months ended September 30, 2008 and 2007, all of the Company’s sales came from companies located in the PRC. As of September 30, 2008 and December 31, 2007, all of the Company’s assets were located in the PRC.

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”). SFAS No. 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles, and expands disclosures about fair value measurements. This statement does not require any new fair value measurements; rather, it applies under other accounting pronouncements that require or permit fair value measurements. The provisions of this statement are to be applied prospectively as of the beginning of the fiscal year in which this statement is initially applied, with any transition adjustment recognized as a cumulative-effect adjustment to the opening balance of retained earnings. The provisions of SFAS 157 are effective for the fiscal years beginning after November 15, 2007. Therefore, the Company adopted this standard on January 1, 2008, and the adoption of this statement did not have a material impact to the Company’s financial condition or results of operations.

In September 2006, the FASB issued Statement No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans” (“SFAS 158”), amendment of FASB Statements No. 87, 88, 106 and 132(R). SFAS No. 158 requires (a) recognition of the funded status (measured as the difference between the fair value of the plan assets and the benefit obligation) of a benefit plan as an asset or liability in the employer’s statement of financial position, (b) measurement of the funded status as of the employer’s fiscal year-end with limited exceptions, and (c) recognition of changes in the funded status in the year in which the changes occur through comprehensive income. The requirement to recognize the funded status of a benefit plan and the disclosure requirements are effective as of the end of the fiscal year ending after December 15, 2006. The requirement to measure the plan assets and benefit obligations as of the date of the employer’s fiscal year-end statement of financial position is effective for fiscal years ending after December 15, 2008. This Statement has no current applicability to the Company’s financial statements. Management adopted this Statement on January 1, 2007, and the adoption of SFAS 158 did not have a material impact to the Company’s financial position, results of operations, or cash flows.

In February 2007, the FASB issued Statement No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities” (“SFAS 159”). This statement permits companies to choose to measure many financial assets and liabilities at fair value. Unrealized gains and losses on items for which the fair value option has been elected are reported in earnings. SFAS 159 is effective for fiscal years beginning after November 15, 2007. The Company adopted this standard on January 1, 2008, and the adoption of this statement did not have a material impact on the Company’s financial condition or results of operations.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS 141(R)”). SFAS 141(R) will change the accounting for business combination. Under SFAS No. 141(R), an acquiring entity will be required to recognize all the assets acquired and liabilities assumed in a transaction at the acquisition-date fair value with limited exceptions. SFAS 141(R) will change the accounting treatment and disclosure for certain specific items in a business combination. SFAS 141(R) applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008.

In December 2007, the FASB issued SFAS No. 160, “Non-controlling Interests in Consolidated Financial Statements—an amendment of Accounting Research Bulletin No. 51” (“SFAS 160”). SFAS 160 establishes new accounting and reporting standards for the non-controlling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS No. 160 is effective for fiscal years beginning on or after December 15, 2008. The Company does not believe that SFAS 160 will have a material impact on its consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities—an amendment of FASB Statement No. 133” (“SFAS 161”). SFAS 161 changes the disclosure requirements for derivative instruments and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under Statement 133 and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. The guidance in SFAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. This Statement encourages, but does not require, comparative disclosures for earlier periods at initial adoption. The Company is currently assessing the impact of SFAS 161.

Other accounting standards that have been issued or proposed by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the financial statements upon adoption.

Note 3 – NOTES RECEIVABLE

The Company, on occasion, allows their customers to satisfy the payment of their trade debt to the Company, through the issuance of notes receivable with the Company as the beneficiary. These notes receivable are usually of a short term nature, approximately three to six months in length. These notes do not bear interest and are paid by the customer’s bank to the Company’s bank upon presentation to the customer’s bank on the date of maturity. In the event of insufficient funds to repay these notes, the company's bank can proceed with bankruptcy proceedings

against the customer in China. Total notes receivable as of September 30, 2008 and December 31, 2007 were $0 and $202,349 respectively.

Note 4 – DIVIDEND RECEIVABLE

Dividend receivable at September 30, 2008 and December 31, 2007 amounted to $0 and $71,460, respectively. Dividend receivable is investment income receivable on the investment in Zhaoheng Weile Tungsten (Shimen), Ltd. (see Note 7).

Note 5 – OTHER RECEIVABLES

Other receivables at September 30, 2008 and December 31, 2007 amounted to $117,498 and $145,075 respectively. Other receivables are primarily advance travel expenses to employees.

Note 6 – PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets consist of advances to suppliers and tax refund. Prepaid expenses and other current assets at September 30, 2008 and December 31, 2007 amounted to $67,541 and $85,971 respectively.

Note 7 – INVESTMENT IN SUBSIDIARY

As of September 30, 2008 and December 31, 2007, Hunan Zhaoheng invested $571,837 and $535,951, respectively, for a 49% equity interests in Zhaoheng Weile Tungsten (Shimen), Ltd. (“Weile”). For this investment, Hunan Zhaoheng will not participate in the management of Weile, but receive annual dividend at a fixed rate of 20% of its original capital contribution to Weile as long as the production line is put into operation. Weile had started its production line since October 2007. The investment was accounted for historical cost. The dividend generated from this investment was presented as investment income in our unaudited consolidated financial statements. The investment income was then calculated based on the above investment term. Total investment incomes for the three months ended September 30, 2008 and 2007 were $29,893 and $0. For the nine months ended September 30, 2008 and 2007, the investment incomes were $189,043 and $0, respectively.

Note 8 – PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment as of September 30, 2008 and December 31, 2007 are summarized as follows:

| Items | | September 30, 2008 | | | December 31, 2007 | |

| | | (Unaudited) | | | | |

| | | | | | | | | |

| Dams | | $ | 72,105,460 | | | $ | 42,467,137 | |

| | | | | | | | | |

| Buildings | | | 1,953,900 | | | | 8,278,953 | |

| | | | | | | | | |

| Machine equipment | | | 38,827,851 | | | | 13,434,886 | |

| | | | | | | | | |

| Electronic and other equipment | | | 871,490 | | | | 834,296 | |

| | | | | | | | | |

| Total | | | 113,758,701 | | | | 65,015,272 | |

| | | | | | | | | |

| Less: Accumulated Depreciation | | | (40,254,091 | ) | | | (34,380,646 | ) |

| | | | | | | | | |

| | | $ | 73,504,610 | | | $ | 30,634,626 | |

Depreciation expenses for the nine months ended September 30, 2008 and 2007 was $1,194,311 and $760,039, respectively.

Note 9 – OTHER ASSETS

Other assets consisted of the following:

| Items | | September 30, 2008 | | | December 31, 2007 | |

| | | (Unaudited) | | | | |

| | | | | | | | | |

| Spare parts | | $ | 167,607 | | | $ | 175,886 | |

| | | | | | | | | |

| Deposit | | | 6,822 | | | | - | |

| | | | | | | | | |

| | | $ | 174,429 | | | $ | 175,886 | |

Note 10 – CONSTRUCTION IN PROGRESS

As of September 30, 2008, "construction in progress" refers to the Auxiliary project of Hunan Sanjiang Left Bank Hydropower Station and Guizhou Jingrong’s expansion project at which amounted to $2,553,107. As of December 31, 2007, it refers to Hunan Sanjiang Left Bank Station, which amounted to $32,455,855, we started to test operations in April 2008. The amount allocated to "construction in progress" was transferred to property, plant and equipment in July 2008. The carryover amount is $34,909,173.

Note 11 – PROPERTY USE RIGHT

Property use right consists of the following as of September 30, 2008 and December 31, 2007

| Items | | September 30, 2008 | | | December 31, 2007 | |

| | | (Unaudited) | | | | |

| | | | | | | | | |

| Property use right | | $ | 1,412,087 | | | $ | 1,321,471 | |

| | | | | | | | | |

| Less: Accumulated amortization | | | (185,030 | ) | | | (153,566 | ) |

| | | | | | | | | |

| | | $ | 1,227,057 | | | $ | 1,169,905 | |

Amortization expenses for the nine months ended September 30, 2008 and 2007 amounted to $21,183 and $39,143 respectively.

Note 12 – TAXES PAYABLE

Taxes payable at September 30, 2008 and December 31, 2007 amounted to $643,586 and $157,525 respectively. Taxes payable are summarized below:

| | | | | | | |

| Items | | September 30, 2008 | | | December 31, 2007 | |

| | | (Unaudited) | | | | |

| | | | | | | | | |

| Business tax payable | | $ | 129,208 | | | $ | 33,680 | |

| | | | | | | | | |

| Value added tax payable | | | 252,097 | | | | 34,309 | |

| | | | | | | | | |

| Property tax payable | | | 22,087 | | | | 42,470 | |

| | | | | | | | | |

| Income tax payable | | | 211,434 | | | | 45,196 | |

| | | | | | | | | |

| Other taxes and government fees | | | 28,760 | | | | 1,870 | |

| | | | | | | | | |

| | | $ | 643,586 | | | $ | 157,525 | |

Note 13 – OTHER PAYABLES

Other payables at September 30, 2008 and December 31, 2007 amounted to $962,224 and $1,739,867, respectively. Other payables were the final payment withheld from the construction contractors until occupancy of the ongoing construction of Sanjiang Left Bank Hydropower Station (details please refer to Note 10).

Note 14 – LONG-TERM LOANS

The Company was obligated for the following long-term loans as of September 30, 2008 and December 31, 2007:

| Lenders | | September 30, 2008 | | December 31, 2007 | |

| | | (Unaudited) | | | |

| Due to Construction Bank of China on April 30, 2010. Interest rate is adjusted every 12 months based on the bench mark rate set by the People’s Bank of China. For the year of 2007, the average interest rate was 7.2%. Pledged with property, plant and equipment. | | $ | 6,272,701 | | $ | 5,879,055 | |

| Due to Construction Bank of China on July 30, 2011. Interest rate is adjusted every 12 months based on the bench mark rate set by the People’s Bank of China. For the years of 2007 and 2006, the average interest rate was 6.8% and 6.3%, respectively Pledged with property, plant and equipment and guaranteed by Shenzhen Zhaoheng Industrial Ltd. | | | 2,917,536 | | | 2,734,444 | |

| Due to Construction Bank of China on August 30, 2011. Interest rate is adjusted every 12 months based on the bench mark rate set by the People’s Bank of China. For the years of 2007 and 2006, the average interest rate was 7.02% and 6.3%, respectively Pledged with property, plant and equipment and guaranteed by Shenzhen Zhaoheng Industry Ltd. | | | 8,752,608 | | | 8,203,333 | |

| Due to Bank of China on March 3, 2012. Interest rate is Floated based on the prime rate set by the People’s Bank of China. For the years of 2007 and 2006 the average interest rate are 6.84% and 6.72%, respectively. Pledged with 66.7% equity of Hunan Zhaoheng Hydropower Ltd. and guaranteed by Shenzhen Zhaoheng Industry Ltd. | | | 23,340,287 | | | 21,875,556 | |

| Due to Industrial & Commerce Bank of China on March 23, 2022. Fixed interest rate of 7.11%. Guaranteed by Shenzhen Zhaoheng Industry Ltd. | | | 23,340,287 | | | 21,875,556 | |

| Total | | | 64,623,419 | | | 60,567,944 | |

| Less: short-term loans | | | – | | | – | |

| Long-term loans | | $ | 64,623,419 | | $ | 60,567,944 | |

The future payments of loan principles for the next 5 years are as below:

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 and after | |

| Projected payment of loan principle | | $ | - | | | $ | - | | | $ | 6,272,701 | | | $ | 11,670,143 | | | $ | 46,680,575 | |

Note 15 – STOCKHOLDERS’ EQUITY

Reverse Merger

On May 13, 2008, the shareholder (Guoheng Xu) of the Company entered into a share exchange agreement with those of Certified. Pursuant to the agreement, Certified issued an aggregate of

69,686,970 shares of common stock, par value $0.001 (the “Common Stock”) to Embedded Internet, in exchange for all of the shares of common stock of Embedded Internet. Contemporaneously with the closing of the Share Exchange, certain holders of Certified's Common Stock completed a sale of approximately 572,170 shares of Common Stock owned by them to Embedded Internet pursuant to a stock purchase agreement. As a result of the completion of the Share Exchange and the Stock Purchase, Embedded Internet former shareholders own shares of Certified’s Common Stock constituting approximately 98% of Certified’s total outstanding capital stock.

Statutory Reserve

Shenzhen Zhaoheng, Hunan Zhaoheng and Hunan Sanjiang are foreign-invested companies in PRC, according to relevant laws and regulations in China, the companies reserve some profit as reserve fund, enterprise development fund with the exact amount decided by the board of directors. As of September 30, 2008 and December 31, 2007, the Company had a statutory surplus reserve of $666,952.

Domestic companies located in the PRC are required to make appropriations to statutory surplus reserve and discretionary surplus reserve, based on after-tax net income determined in accordance with law of the PRC. Appropriation to the statutory surplus reserve should be 10% of the after tax net income determined in accordance with the generally accepted accounting principles of the PRC (“PRC GAAP”) until the reserve is equal to 50% of the entities’ registered capital or members’ equity. Guizhou Jinrong, as a domestic company, did not provide any reserves because of net loss incurred for the quarterly period ended September 30, 2008.

The Company, is an entity registered in the British Virgin Islands and is, as a result, not required to provide statutory reserves.

Retained Earnings

As of September 30, 2008 and December 31, 2007, the details of retained earnings are listed as below:

| Items | | September 30, 2008 | | | December 31, 2007 | |

| | | (Unaudited) | | | | |

| Retained earnings | | $ | 6,357,052 | | | $ | 628,704 | |

| Statutory surplus reserve | | | 666,952 | | | | 666,952 | |

| | | $ | 7,024,004 | | | $ | 1,295,656 | |

Note 16 – INCOME TAXES

Refer to the table below for general description of tax treatments for each of the four major operating entities as mentioned.

| Entity | | | Tax treatments |

| | | | |

| Hunan Zhaoheng | | - | | Preferential rate of 15% (income tax), and will increase to 25% progressively within the next five years from January 1, 2008 onwards. |

| | | - | | 40% reduction of income tax for the purchase of locally manufactured equipments. |

| | | - | | Based on related regulation of PRC, this company fulfills the condition of applying 2 years tax exemption and subsequently 3 years 50% reduction in income tax from January 1, 2008 onwards, related application is now processing. |

| | | | | |

| Guizhou Jinrong | | - | | Preferential rate of 15% (income tax), and will increase to 25% progressively within the next five years from January 1, 2008 onwards. |

| | | - | | Based on related regulation of the PRC, this company fulfills the condition of applying 2 years tax exemption and subsequently 3 years 50% reduction in income tax from January 1, 2008 onwards, related application is now processing. |

| | | | | |

| Hunan Sanjiang | | - | | Preferential rate of 15% (income tax), and will increase to 25% progressively within the next five years from January 1, 2008 onwards. |

| | | - | | Two years tax exemption from the first profit year (2005) and subsequently 50% reduction in income tax for the next 3 years including years ended December 31, 2007, 2008 and 2009. |

| | | | | |

| Shenzhen Zhaoheng | | - | | 15% of income tax rate for the years ended December 31, 2007 and 2006 and will increase to - 25% progressively within the next five years from January 1, 2008 onwards. |

| | | | | |

Note 17 – RELATED PARTY TRANSACTIONS

For the quarterly period ended September 30, 2008 and for the year ended December 31, 2007, the Company distributed power to its long-term invested company, Weile, limited at market price. For the nine months ended September 30, 2008 and 2007, the total sales amounted to $204,899 and $164,813, respectively.

The Company leases its warehouse, plant and operating space to its related party, Weile, for 5 years as of June 1, 2006 under an operating lease agreement. The rent is $1,312 per month with an exemption period of 5 months.

As of September 30, 2008 and December 31, 2007, the amounts due from related parties were $16,369,507 and $17,529,838, respectively. All amounts are due on demand, and all advances are without security. The details of payments owed by related parties are listed as below:

| | | | | | | | | | | |

| Related party | Relationship | | | September 30, 2008 | | | | December 31, 2007 | | Interest rate |

| | | | | (Unaudited) | | | | | | |

| Weile | Long-term investment | | $ | 1,234,312 | | | $ | 931,169 | | 12% annual; without security |

Hunan Jiuli Hydropower Construction Co., Ltd. | The same major shareholder | | | 1,493,637 | | | | - | | Interest free; without security |

| Zhaoheng Industrial | The same major shareholder | | | 13,641,558 | | | | 16,598,669 | | 120% of the bench mark rate set the People’s Bank of China annual; without security |

| Total | | | $ | 16,369,507 | | | $ | 17,529,838 | | |

Starting from January 1, 2008, we started charging interest on the loans to our related party Shenzhen Zhaoheng Industrial Co., Ltd. (“Zhaoheng Industrial”) whose major shareholders are also the majority shareholders fo the Company. For the nine months ended September 30, 2008 and 2007, the interest incomes were $2,505,385 and $0, respectively. Interest rates charged on these loans are 120% of the bench mark rate as set by the People’s Bank of China. The bench mark rate as of September 30, 2008 was 7.47%. Accordingly, the Company charged 8.96% interest on this related party loan receivable as of September 30, 2008. As of September 30, 2008 and December 31, 2007, the loans to Zhaoheng Industrial amounted to $13,641,558 and $16,598,669.

As of September 30, 2008 and December 31, 2007, the amounts due to related parties were $3,581,833 and $31,444, respectively and due on demand. The details of due to related parties are listed as below:

| Related party | Relationship | | September 30, 2008 | | | December 31, 2007 | | Interest rate |

| | | | (Unaudited) | | | | | |

Original shareholders of Certified Technologies Corp. | Original shareholders of the Company | | $ | - | | | $ | 31,444 | | Interest free without security |

| Zhaoheng holdings limited. | The same major shareholder | | | 3,581,833 | | | | - | | Interest free without security |

| Total | | | $ | 3581,833 | | | $ | 31,444 | | |

Note 18 – OPERATING RISKS

Currently, the Company's revenues are derived fully from distribution of power in the PRC. A change in relevant regulations or downturn in the economic environment of the PRC could have a material adverse effect on the Company's financial condition.

The Company competes with larger companies, who have greater funds available for expansion, marketing, research and development and the ability to attract more qualified personnel. There can be no assurance that the Company will remain competitive with larger competitors.

The Company generates and distributes power locally in the PRC. All transactions are settled in local currency. Therefore, the Company believes that the relevant exchange risk exposure should not be significant.

Currently, the PRC is in a period of growth and is openly promoting business development in order to bring more business into the PRC. Additionally, the PRC allows a Chinese corporation to be owned by a United States corporation. If the laws or regulations are changed by the PRC government, the Company's ability to operate in the PRC could be affected.

The Company's future success depends on the continued services of executive management in China. The loss of any of their services would be detrimental to the Company and could have an adverse effect on business development. The Company does not currently maintain key-man insurance on their lives. Future success is also dependent on the ability to identify, hire, train and retain other qualified managerial and other employees. Competition for these individuals is intense and increasing.

Note 19 – SUBSEQUENT EVENTS

In China, electricity tariff is regulated by Provincial Price Bureau and reevaluated on a periodic basis as market conditions dictate. Such conditions can be consumer demand and inflation, among others. On September 24, 2008, Price Bureau of Hunan Province promulgated a document to increase the benchmark electricity rate of Hunan Sanjiang and Hunan Zhaoheng from RMB 0.28/KWH to RMB 0.295/KWH. As such, the Company will record additional revenue of approximately $240,000 in October 2008 based on the new electricity rate for the electricity sold to Changde Branch of State Grid Corporation of China (“SGCC”) based on revenue generated from July 1 to September 30, 2008.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cautionary Statement Regarding Forward-Looking Statements

The information contained in this report include statements that are not purely historical facts and that are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements regarding our management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition, results of operations, growth of our blower business and establishment of our turbine business. The words “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “projects,” “should,” and similar expressions, or the negatives of such terms, identify forward-looking statements.

The forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments. There can be no assurance that future developments actually affecting us will be those anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results to be materially different from those expressed or implied by these forward-looking statements, including the following:

• vulnerability of our business to general economic downturn;

• operating in the PRC generally and the potential for changes in the laws of the PRC that affect our operations;

• failure to meet or timely meet contractual performance standards and schedules;

• dependence on the steel and iron markets;

• exposure to product liability and defect claims;

• ability to obtain all necessary government certifications and/or licenses to conduct our business;

• cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; and

• other factors referenced in this report.

These risks and uncertainties, along with others, are also described in the Risk Factors section in Part I, Item 1A of this Form 10-Q. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Company Overview

As a result of the share exchange or “reverse acquisition” transaction consummated on May 13, 2008, Zhaoheng Hydropower Company became a holding company conducting operations through an indirect operating subsidiary: Zhaoheng Hydropower (Hong Kong) Limited (“Zhaoheng HK”), a company operating in China. As a wholly owned subsidiary of the Company, Zhaoheng Investment Limited (BVI), a British Virgin Islands corporation, owns 100% of the capital stock of Zhaoheng HK.

Zhaoheng Hydropower Company and its subsidiaries (collectively, “Zhaoheng”, “we”, “us”, “our” and “the Company”) are engaged in generating and supplying hydropower in Midwest China. We focus on small to medium sized hydropower stations and aim to become a leader in our industry.

The Company entered the hydropower industry in 2002. After 2 years of exploring the available opportunities in the industry, the Company acquired Hunan Sanjiang Hydropower Station with an installed capacity of 62.5MW, from a state-owned company in 2003.

In April 2008, the Company completed the construction of the Hunan Zhaoheng Hydropower Station (also called “Hunan Sanjiang Left Bank Hydropower Station”), which provides an additional 50MW capacity. Hunan Zhaoheng Hydropower Station is the expansion project of Hunan Sanjiang Hydropower Station. They share the same dam and are located on the left and right bank of the river respectively. In June 2008, the Company acquired the Guizhou Yongfu Hydropower station. Currently, Zhaoheng’s portfolio consists of three hydropower stations with an aggregate installed capacity of 120MW:

| · | Hunan Sanjiang Hydropower Station : 62.5MW |

| · | Hunan Zhaoheng Hydropower Station: 50MW |

| · | Guizhou Yongfu Hydropower Station: 7.5MW |

Zhaoheng’s business consists primarily of the following three activities:

| (i) | identify and invest in small and medium hydropower stations in China; and |

| (ii) | secure sales contracts with the State Grid Corporation of China and the China Southern Power Grid Corporation annually. |

| (i) | operate hydropower stations; and |

| (ii) | generate hydropower and supply electricity to power grid companies. |

| (i) | construct quality power stations with high economic value and substantial return on investment. |

Zhaoheng’s current operations are in the Hunan and Guizhou Provinces. The Hunan Sanjiang Hydropower Station, Hunan Zhaoheng Hydropower Station and Guizhou Yongfu Hydropower Station primarily service the Changde Branch of State Grid Corporation of China and China Southern Power Grid Corporation, two state-owned power grid companies.

Hydropower Industry

The various policies issued by the central government in the past 2 years are testament to the government’s intention to encourage and support the small – medium hydropower stations in the country. For example, the government offers tax incentives for hydropower companies and guarantees 100% purchase of the electricity generated by hydropower stations. The government is also gradually implementing the “Same Price for Same Power” policy, giving hydropower producers substantial room for revenue increase.

On January 28, 2008, the State Development and Reform Commission (“SDRC”) promulgated the “Opinions on Regulating the Investment into the Power Generation Enterprises by the Employees in Power System”, stipulating that leaders of grid enterprises at the level of prefecture city or the power dispatching personnel, financial personnel, and managers cannot invest in power generation companies within the coverage of their power grid. Those who already invested in power generation companies are required to sell their shares within one year. This will reduce competition in our industry and create many acquisition opportunities for us.

For the nine months ended September 30, 2008, total power output in China amounted to 2.61 trillion KWH, an increase of 9.9% from the same period in the prior year. Output of hydropower and thermal power increased 17.0% and 8.2%, respectively, from the same period in the prior year. With the rapid growth of China’s economy, power generation cannot meet power demand and the power industry in China is now growing at a fast space.

One of the biggest uncertainties in our business is the unpredictability of rainfall. In a particular year, the amount of rainfall may be significantly less than the average for prior years. In the event this decrease in rainfall levels takes place in the regions where our hydropower stations are located, the ability of our stations to generate power will be hampered. Therefore, our revenue will also be impacted. In order to mitigate this risk, the Company has been adopting certain strategies such as diversifying the locations of our future stations, both acquired and self-constructed. We believe that this is a sound and effective strategy to stabilize the impact of uneven and unpredictable rainfall levels.

Results of Operations

The following table sets forth runoff and output of our Hunan facilities from January to September in 2008 and 2007, respectively.

| | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

| | | | | | | | | | |

Runoff (million m3), 2008 | 397 | 360 | 527 | 1,036 | 1,415 | 878 | 1656 | 3655 | 1243 |

| | | | | | | | | | |

| Output (million KWH), 2008 | 8.29 | 11.93 | 13.7 | 32.13 | 29.83 | 29.2 | 22.57 | 55.9 | 41.33 |

| | | | | | | | | | |

Runoff (million m3), 2007 | 500 | 656 | 919 | 907 | 627 | 1,286 | 4361 | 1300 | 802 |

| | | | | | | | | | |

| Output (million KWH), 2007 | 16.72 | 19.14 | 28.51 | 28.93 | 21 | 30.94 | 36.69 | 39.01 | 26.84 |

*In the event the runoff exceeds the maximum diversion discharge of turbines, the excessive amount of water is wasted.

With the usage of two new generating units at our subsidiary, Hunan Zhaoheng Hydropower Co., Ltd., in April and the acquisition of Guizhou Jingrong Industrial Development Co., Ltd. in June 2008, the Company now owns 9 generating units with total installed capacity of 120 MW and annual potential output capacity of 430 million KWH. The potential output capacity has increased by 60% from September 30, 2007. Currently, all generating units are in good working condition.

The following table sets forth certain operating data for the periods indicated:

| | | For Three Months Ended September 30, | | | For Nine Months Ended September 30, | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

| Revenues | | $ | 5,156,207 | | | $ | 3,191,260 | | | $ | 9,789,788 | | | $ | 7,722,300 | |

| Cost of revenues | | | 722,820 | | | | 424,892 | | | | 1,942,789 | | | | 1,303,246 | |

| Gross profit | | | 4,433,387 | | | | 2,766,368 | | | | 7,846,999 | | | | 6,419,054 | |

| Operating Expenses | | | 400,003 | | | | 317,658 | | | | 934,438 | | | | 1,039,914 | |

| Operating income | | | 4,033,384 | | | | 2,448,710 | | | | 6,912,561 | | | | 5,379,140 | |

| Interest Income | | | 677,264 | | | | 2,845 | | | | 1,642,276 | | | | 34,084 | |

| Interest Expense | | | (1,223,717 | ) | | | (257,405 | ) | | | (2,686,779 | ) | | | (695,817 | ) |

| Net Income | | $ | 3,337,273 | | | $ | 1,791,884 | | | $ | 5,728,481 | | | $ | 3,496,899 | |

| Gross Margin | | | 86.0 | % | | | 86.7 | % | | | 81.2 | % | | | 83.1 | % |

| Operating Margin | | | 78.2 | % | | | 76.7 | % | | | 70.6 | % | | | 69.7 | % |

| Net Income Margin | | $ | 64.7 | % | | $ | 56.1 | % | | $ | 58.5 | % | | $ | 45.3 | % |

Revenues

Revenues for the three months ended September 30, 2008 were $5,156,207, an increase of $1,964,947 or 61.6% from $3,191,260 during the three months ended September 30, 2007. For the nine months period ended September 30, 2008, revenues were $9,789,788, an increase of $2,067,488 or 26.8% from total revenues of $7,722,300 reported during the nine months ended September 30, 2007. This growth was due primarily to an increase in installed capacity and power output. Two new generating units with total installed capacity of 50MW were put into use in April 2008 and another hydropower station was acquired in June 2008, bringing the total installed capacity of the Company to 120MW by September 30, 2008. Electricity tariff varies in different seasons and different hours. The following table sets fort electricity tariff in the nine months ended September 30, 2008 for Hunan Sanjiang and Hunan Zhaoheng (Except for Hunan Zhaoheng during its trial run in April 2008). In the dry season of January and February of 2008, when electricity tariff was highest, rainfall in Lishui Basin where our Sanjiang Hydropower Plants are located was much less compared to the same period of 2007. Also, the electricity tariff for Hunan Zhaoheng Hydropower Co. Ltd during its trial run in April 2008 was only RMB 0.08/K WH. As a result, average electricity tariff for our Hunan facilities was RMB 0.2773/KWH for the three months ended September 30, 2008, higher than the RMB 0.2744/KWH for the three months ended September 30, 2007. Average electricity tariff for our Hunan facilities was RMB 0.2698/KWH for the nine months ended September 30, 2008, lower than the RMB 0.2774/KWH for the nine months ended September 30, 2007.

| Season | Month | Tariff(RMB/KWH) |

| Peak | High | Low | Valley |

| Dry | 1, 2 | 0.3744 | 0.3744 | 0.32 | 0.2208 |

| Ordinary | 3, 7, 8, 9 | 0.3276 | 0.3276 | 0.28 | 0.1932 |

| Rainy | 4, 5, 6, | 0.2925 | 0.2925 | 0.25 | 0.1725 |

Cost of Revenues

Cost of revenues consists of depreciation expense of property, plant and equipment, equipment maintenance cost, direct labor, overhead and state taxes (not including value-added tax, price exclusive tax and corporate income tax).

Cost of revenues for the three months ended September 30, 2008 was $722,820 or 14.0% of revenues. For the same period one year ago, cost of revenues was $424,892 or 13.3% of revenues. Cost of revenues for the nine months ended September 30, 2008 was $1,942,789, or 19.8% of our revenues. This represents an increase from $1,303,246 or 16.9% of our revenues from the nine months ended September 30, 2007. Our Hunan Zhaoheng Hydropower Station is an expansion project of the existing Hunan Sanjiang Hydropower Station and the annual average utilization hour of expansion project usually can not match the existing facility. As a result, cost of revenues, which largely consists of depreciation expense, increased slightly as a percentage of revenues for the nine months ended September 30, 2008 compared with the same period in 2007.

Operating Expenses

Total operating expenses, which include selling, general and administrative expenses increased to $400,003 for the three months ended September 30, 2008, as compared to $317,658 for the three months ended September 30, 2007. Comparing the nine months periods ended September 30, 2008 and September 30, 2007, operating expenses were $934,438, or 9.54% of revenues in 2008 and $1,039,914, or 13.46% of revenues in 2007. The decrease in operating expenses for the nine months period was mainly due to savings from 1) a discontinued leather trading business operated by one of our subsidiaries, Shenzhen Zhaoheng Hydropower Co., Ltd. (“Shenzhen Zhaoheng”) in December 2007; and 2) sales of Hunan Jiuli Hydropower Construction Co. Ltd to our related company Shenzhen Zhaoheng Industrial Co., Ltd in April 2008.

Interest Income

For the nine months ended September 30, 2008, we realized interest income of $1,642,276, compared with interest income of $34,084 for the nine months ended September 30, 2007. Starting from January 1, 2008, two of our

subsidiaries, Hunan Sanjiang Power Co., Ltd. (“Hunan Sanjiang”) and Hunan Zhaoheng Hydropower Co., Ltd. (“Hunan Zhaoheng”), started charging interest on the loans to Shenzhen Zhaoheng Industrial Co., Ltd. (“Shenzhen Zhaoheng Industrial”), a related party with a common controlling shareholder. Interest rates charged on loans to related parties are 120% of the bench mark rate set by the People’s Bank of China. As of September 30, 2008, the loans to Shenzhen Zhaoheng Industrial amounted to $13,641,558, compared to $16,598,669 as of December 31, 2007.

Interest Expense

Interest expense was $1,223,717 for the nine months ended September 30, 2008, compared with $257,405 for the same period in 2007. This increase was due to 1) the capitalization of interest expense incurred during the construction period of the new hydropower plant established by one of our subsidiaries, Hunan Zhaoheng; and 2) incurring a new loan in the amount of RMB 43 millions from China Construction Bank in July 2007.

Investment Income

Total investment income for the three months ended September. 30, 2008 and September 30, 2007 was $29,893 and $0 respectively. For the nine months ended September 30, 2008 and September 30, 2007, the investment income was $189,043 and $0, respectively. The investment income was generated from the long-term investment at Zhaoheng Weile Tungsten (Shimen), Ltd. (“Weile”). As of September 30, 2008 and December 31, 2007, we invested $571,837 and $535,951 respectively for a 49% equity interests in Weile. For this investment, we will not participate in the management of Weile, but will receive an annual dividend at a fixed rate of 20% of the original capital contribution to Weile as long as the production line is put into operation. Weile started its production line in October 2007. The investment was accounted for at cost basis. Dividends generated from this investment are presented as investment income in our unaudited consolidated financial statements and the investment income was calculated based on the above investment term.

Net Income

Net income increased to $3,337,273 for the three months ended September 30, 2008 from $1,791,884 for the period ended September 30, 2007. As a percentage of revenue, net income was approximately 64.7% for the three months ended September 30, 2008, as compared to approximately 56.1% for the same period ended September 30, 2007.

For the nine months ended September 30, 2008 and September 30, 2007, net income increased to $5,728,481 in 2008 from $3,496,899 in 2007. As a percentage of net sales, net income was approximately 58.5% for the nine months ended September 30, 2008, compared to approximately 45.3% for the nine months ended September 30, 2007.

The increase in net income as a percentage of revenue was mainly due to reduced operating expenses and increased interest income. In addition, we realized investment income of $189,043 in Zhaoheng (Shimen) Weile Tungsten Co., Ltd. for the nine months ended September 30, 2008.

Liquidity and Capital Resources

Historically, we financed our operations and capital expenditures with equity financing from our stockholders, cash flows from operations and bank loans. Over the years, we developed good working relationships with the Bank of China, Industrial and Commercial Bank of China, China Construction Bank and China Agriculture Bank. To keep pace with the rapid growth and expansion of our business, we may need to raise additional capital, primarily to acquire developed hydropower stations or to construct new stations. As a result, we will seek to raise additional funds to finance our future growth.

Cash Flows

For the nine months ended September 30, 2008, we had a net increase in cash and cash equivalents of $2,095,251. Cash flow from operating activities was $5,985,071, cash outflow from investing activities was $43,889,820 and we did not have any financing activities this quarter. The primary components of cash generated by operating activities were: (a) net income of $5,728,481; (b) a $1,215,494 increase in depreciation and amortization; (c) a decrease of $211,463 in notes receivable and (d) an increase of $465,943 in taxes payable offset by: a) an increase in accounts receivable of $378,887; b) an increase of $321,600 in other assets; and c) a decrease of $976,945 in other payables.

The primary components of cash used in investing activities were: (i) $7,131,947 in connection with the construction of hydropower plant in Hunan offset by (i) $2,626,077 in connection with the adjustment of the acquisition of Jingrong Industrial Development Co., Ltd. in Rongjiang County of Guizhou Province; and (ii) a decrease in due from related parties of $5,916,147.

Critical Accounting Policies

Management's discussion and analysis of its financial condition and results of operations is based upon our unaudited consolidated financial statements, which have been prepared in accordance with United States generally accepted accounting principles. Our financial statements reflect the selection and application of accounting policies which require management to make significant estimates and judgments. In Note 2 to the unaudited consolidated financial statements, “Summary of Significant Accounting Policies”. Management makes its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. Management believes that the following reflects the most critical accounting policies that currently affect our financial condition and results of operations:

The unaudited consolidated financial statements include the accounts of the Company and its subsidiaries (“the Group”). Significant intercompany transactions have been eliminated in consolidation. Investments in which the company has a 20 percent to 50 percent voting interest and where the company exercises significant influence over the investee are accounted for using the equity method.

As of September 30, 2008, the particulars of the subsidiaries are as follows:

| | | | | |

| Name of Company | Place of Incorporation | Date of Incorporation | Attributable Equity Interest | Registered Capital |

| Shenzhen Zhaoheng Hydropower Co., Ltd. | PRC | 8/3/1999 | 100 | RMB 11,000,000 |

| Hunan Sanjiang Power Co., Ltd | PRC | 11/8/2001 | 100 | RMB 199,400,000 |

| Hunan Zhaoheng Hydropower Co., Ltd | PRC | 6/25/2003 | 100 | RMB 150,000,000 |

| Jingrong Industrial Development Co., Ltd | PRC | 1/24/2002 | 100 | RMB 1,000,000 |

| 2. | Economic and Political Risks |

Our operations are conducted in the PRC. Accordingly, our business, financial condition, and results of operations may be influenced by the political, economic and legal environment in the PRC.

The operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The operating results may be adversely affected by changes in the political and social conditions in the PRC, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the consolidated financial statements, as well as the reported amounts of revenues and expenses during the reporting year. These accounts and estimates include, but are not limited to, the valuation of accounts receivable, inventories, deferred income taxes and the estimation on useful lives of plant and machinery. Actual results could differ from those estimates.

| 4. | Cash and Cash Equivalents |

For purposes of the consolidated cash flow statements, the Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents.