UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | | |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the fiscal year ended December 31, 2008 |

| OR |

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file no. 000-52786

ZHAOHENG HYDROPOWER COMPANY

(Exact name of registrant as specified in its charter)

Nevada (State or other jurisdiction of incorporation or organization) | 41-1484782 (IRS Employer Identification No.) 518025 |

F/19, Unit A, JingFengCheng Building 5015 Shennan Road, Shenzhen PRC (Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (011-86) 755-8207-0966

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

Title of class:

Common stock, $0.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | Large accelerated filer | ¨ | Accelerated filer | ¨ |

| | Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting common stock held by non-affiliates of the registrant based upon the closing sale price of the common stock on December 31, 2008 was approximately $1,448,198 based on the average closing price of the registrant’s common stock as reported by the OTC Bulletin Board on that day. Solely for purposes of the foregoing calculation all of the registrant’s directors and officers are deemed to be affiliates. The registrant does not have outstanding any non-voting common stock.

As of March 31, 2009, 71,692,999 shares of the registrant’s common stock were outstanding.

TABLE OF CONTENTS

| | | | | Pages |

| Part I | | | | |

| | Item 1 | Business | | 1 |

| | Item 1A | Risk Factors | | 16 |

| | Item 1B | Unresolved Staff Comments | | 25 |

| | Item 2 | Description of Properties | | 25 |

| | Item 3 | Legal Proceedings | | 26 |

| | Item 4 | Submission of Matters To a Vote of Security Holders | | 26 |

| | | | | |

| Part II | | | | |

| | Item 5 | Market for Registrant’s Common Equity and Related Stockholder Matters | | 27 |

| | Item 6 | Selected Financial Data | | 27 |

| | Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 28 |

| | Item 7A | Quantitative and Qualitative Disclosures About Market Risk | | 47 |

| | Item 8 | Financial Statements and Supplementary Data | | 47 |

| | Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 47 |

| | Item 9A(T) | Controls and Procedures | | 47 |

| | Item 9B | Other Information | | 50 |

| | | | | |

| Part III | | | |

| | Item 10 | Directors, Executive Officers and Corporate Governance | | 51 |

| | Item 11 | Executive Compensation | | 54 |

| | Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 56 |

| | Item 13 | Certain Relationships and Related Transactions, and Director Independence | | 57 |

| | Item 14 | Principal Accounting Fees and Services | | 58 |

| | Item 15 | Exhibits, Financial Statement Schedules | | 59 |

CONVENTIONS

Except as otherwise indicated by context, references in this report to the “Company,” “Zhaoheng,” “we,” “us” and “our” are to Zhaoheng Hydropower Company, a Nevada corporation, and its subsidiaries. References to “China” and “PRC” are to the People’s Republic of China. References to “U.S.” are to the United States of America. References to “RMB” are to Renminbi, the legal currency of China, and references to “$” are to U.S. dollars, the legal currency of the United States. References to “MW” are to megawatts, one million watts, references to “GW” are to gigawatts, one million kilowatts, references to “kWh” are to kilowatt-hour, the standard unit of energy used in the electric power industry, and references to “TWh” are to terawatt hour, a unit of energy used for expressing the amount of produced energy, electricity and heat.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements include statements regarding, among other things, (a) our future financial performance, (b) our growth strategies, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for working capital. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “estimate,” “believe,” “intend,” “objective,” “predict,” “potential,” “project” or “continue,” or the negative of these words or other variations on these words or comparable terminology. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by forward-looking statements. These statements are only predictions and actual events or results may differ materially.

Readers are urged to carefully review and consider the various disclosures made by us in this Annual Report on Form 10-K and our other public filings with the United States Securities and Exchange Commission (the “SEC”). You should not place undue reliance on any forward-looking statement as a prediction of actual results or developments. We undertake no duty to update or revise any forward-looking statement after the date of this report to reflect actual results or to changes in our expectations or future events.

PART I

OVERVIEW

We are engaged in the generation and supply of hydropower in Southwestern and Midwestern China. We focus on small- to medium-sized hydropower plants and aim to become a leader in our industry.

We entered the hydropower industry in 2002. After two years of exploring the available opportunities in the industry, we acquired Hunan Sanjiang Hydropower Station with an installed capacity of 62.5MW, from a state-owned company in 2003.

In 2007, we completed the construction of the Hunan Zhaoheng Hydropower Station (also known as “Hunan Sanjiang Left Bank Hydropower Station”), which provides an additional 50MW capacity. Hunan Zhaoheng Hydropower Station is the expansion project of Hunan Sanjiang Hydropower Station. They share the same dam and are located on the left and right banks of the river, respectively. In June 2008, we acquired Jingrong Industrial Development Co., Ltd. (“Jingrong”, also known as “Guizhou Jingrong Industrial Development Co., Ltd.”), which operates Guizhou Yongfu Hydropower Station (“Guizhou Yongfu”). In November 2008, we acquired 88% equity interest of Hubei Minyuan Huohe Hydropower Development Co., Ltd. (“Hubei Huohe”), which operates Huohe Cascade II and Huohe Cascade III hydropower stations. As of December 31, 2008, our portfolio consisted of five hydropower stations with an aggregate installed capacity of 132.85MW:

Profiles of our Existing Hydropower Stations

| Name | | Location | | Year of Acquisition by our Company | | | Current Installed Capacity (MW) | | | Tariff(1) as of December 31, 2008 (RMB) | | | Equity Interest (%) | |

| Hunan Sanjiang | | Shimen, Hunan | | 2003 | | | | 62.50 | | | | 0.295 | | | | 100 | |

| Hunan Zhaoheng | | Shimen, Hunan | | — (2) | | | | 50.00 | | | | 0.295 | | | | 100 | |

| Guizhou Yongfu | | Rongjiang, Guizhou | | 2008 | | | | 7.50 | | | | 0.2374 | | | | 100 | |

| Hubei Huohe Cascade II | | Zhushan, Hubei | | 2008 | | | | 9.10 | | | | 0.280 | | | | 88 | |

| Hubei Huohe Cascade III | | Zhushan, Hubei | | 2008 | | | | 3.75 | | | | 0.280 | | | | 88 | |

Hubei Shunshuiping(3) | | Zhushan, Hubei | | 2009 | | | | 2.50 | | | | 0.35 | | | | 85 | |

Hubei Huangjiawang(3) | | Zhushan, Hubei | | 2009 | | | | 3.75 | | | | 0.35 | | | | 85 | |

Hubei Qiujiabang(3) | | Zhushan, Hubei | | 2009 | | | | 10.20 | | | | 0.35 | | | | 85 | |

| Total | | | | | | | | | 149.30 | | | | | | | | | |

| (1) | Tariff is VAT inclusive. |

| (2) | We developed and constructed Hunan Zhaoheng Hydropower Station. We completed construction in 2007 and commenced operation in 2008. |

| (3) | We acquired Hubei Shunshuiping, Hubei Huanjiawang and Hubei Qiujiabang in January 2009. |

Our business consists primarily of the following three activities:

1. Development –

| | (i) | identifying and investing in small- and medium-sized hydropower stations in China; and |

| | (ii) | securing annual sales contracts with the State Grid Corporation of China (“SGCC”) and the China Southern Power Grid Co., Ltd. (“CSPGC”). |

2. Operation –

| | (i) | managing hydropower stations and improving operational and technical efficiency; and |

| | (ii) | generating hydropower and supplying electricity to power grid companies. |

3. Construction –

| | (i) | developing new hydropower resources with substantial return on investment; and |

| | (ii) | upgrading capacities of existing facilities at minimal incremental cost. |

Currently, our operations are located in the Hunan, Hubei and Guizhou Provinces. Our existing hydropower stations, including Hunan Sanjiang Hydropower Station, Hunan Zhaoheng Hydropower Station, Guizhou Yongfu Hydropower Station, Huohe Cascade II Hydropower Station, Huohe Cascade III Hydropower Station, Qiujiabang Hydropower Station, Shunshuiping Hydropower Station and Huangjiawang Hydropower Station primarily service the SGCC and the CSPGC, two state-owned power grid companies.

Approximately 14% of the electricity we generated was sold to Hunan Jiuli Hydropower Construction Co., Ltd. (“Hunan Jiuli”), a related party, during the year ended December 31, 2008, which was in turn distributed to local residential and industrial customers.

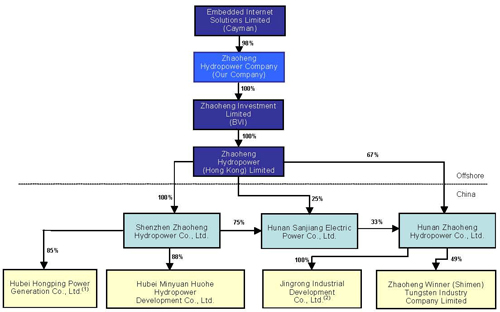

Our Corporate Structure

As a result of a share exchange or “reverse acquisition” transaction consummated on May 13, 2008, we became a holding company conducting operations through an indirect operating subsidiary: Zhaoheng Hydropower (Hong Kong) Limited (“Zhaoheng HK”), a company operating in China. As our wholly owned subsidiary, Zhaoheng Investment Limited (BVI), a British Virgin Islands corporation (“Zhaoheng BVI”), owns 100% of the capital stock of Zhaoheng HK.

Our current corporate structure post reverse merger with Zhaoheng BVI and its subsidiaries is set forth in the chart below:

| (1) | We acquired Hubei Hongping Power Generation Co., Ltd. in January 2009. |

| (2) | In April 2009, Hunan Zhaoheng transferred its 100% equity interest in Jingrong to Shenzhen Zhaoheng. |

Our Organizational History

We were incorporated under the laws of the State of Minnesota in January 1984 with registered name of “Certified Technologies Corporation” (“Certified”). We were formed to market a fire retardant chemical formulation to the commercial aviation and business furniture industries. Certified filed for Chapter 11 bankruptcy on July 11, 2000, which was converted to a Chapter 7 on October 23, 2000. The bankruptcy closed on November 4, 2004.

On February 21, 2008, we reincorporated in the State of Nevada and on May 13, 2008, Zhaoheng BVI entered into a share exchange agreement (the “Share Exchange Agreement”) with Certified resulting in a change of control of Certified. Pursuant to the Share Exchange Agreement, Certified issued an aggregate of 69,686,970 shares of common stock, par value $0.001 (the “Common Stock”), to Embedded Internet Solutions Limited (“Embedded Internet”), a Cayman Islands company wholly owned by Guosheng Xu, our current Chief Executive Officer and Chairman, in exchange for all of the shares of common stock of Zhaoheng BVI (the “Share Exchange”). Contemporaneously with the closing of the Share Exchange, certain holders of Certified’s Common Stock completed a sale of approximately 572,170 shares of Common Stock owned by them to Embedded Internet pursuant to a stock purchase agreement (the “Stock Purchase”). As a result of the completion of the Share Exchange and the Stock Purchase, Embedded Internet now owns shares of our Common Stock constituting approximately 98% of our outstanding capital stock.

On July 17, 2008, Certified changed its corporate name from “Certified Technologies Corporation” to our current corporate name, “Zhaoheng Hydropower Company”.

As a result of the consummation of the Share Exchange, we are now engaged in the investment, operation, and development of environmentally friendly small- to medium-sized hydropower plants in China.

In November 2007, Zhaoheng BVI’s wholly-owned subsidiary, Zhaoheng HK, was established in Hong Kong. Guosheng Xu, the sole shareholder of Zhaoheng BVI, combined his equity interests in the following four operating companies (collectively, the “Operating Entities”): (i) Shenzhen Zhaoheng Hydropower Co., Ltd. (“Shenzhen Zhaoheng”); (ii) Hunan Zhaoheng Hydropower Co., Ltd. (“Hunan Zhaoheng”); (iii) Hunan Sanjiang Electric Power Co., Ltd. (“Hunan Sanjiang”); and (iv) Hunan Jiuli. All of these four companies are incorporated under the laws of the PRC, and were injected into our Company in December 2007.

We originally acquired Hunan Jiuli at the request of the local government to provide electricity to local users as part of the transaction involving our acquisition of Hunan Sanjiang, one of our subsidiaries. In December 2007, Hunan Sanjiang entered into an equity transfer agreement to transfer its 100% interest in Hunan Jiuli to Shenzhen Zhaoheng Industrial Co., Ltd. (“Zhaoheng Industrial”). All relevant procedures were completed in April 2008. As a result, Hunan Jiuli was not our subsidiary as of June 30, 2008.

In April 2008, Zhaoheng Holdings Limited (“Zhaoheng Holdings”), a related party, entered into an equity transfer agreement with Zhaoheng HK, in accordance with which 66.67% of shares of Hunan Zhaoheng were transferred to Zhaoheng HK. As a result, Zhaoheng Holdings is no longer the shareholder of Hunan Zhaoheng.

In April 2008, Zhaoheng Industrial, a related party, entered into an equity transfer agreement with Shenzhen Zhaoheng, in accordance with which 65% of shares of Hunan Sanjiang were transferred to Shenzhen Zhaoheng. As a result, Zhaoheng Industrial is no longer the shareholder of Hunan Sanjiang.

In April 2008, Zhaoheng Holdings entered into an equity transfer agreement with Zhaoheng HK, in accordance with which 25% of shares of Hunan Sanjiang were transferred to Zhaoheng HK. As a result, Zhaoheng Holdings is no longer the shareholder of Hunan Sanjiang.

On June 15, 2008, Hunan Zhaoheng completed the acquisition of Jingrong in Rongjiang County of Guizhou Province, China, which operates Guizhou Yongfu Hydropower Station. The acquisition was undertaken to allow us to diversify our operations, to improve our financial condition and increase shareholder value.

On November 25, 2008, we acquired an 88% equity interest in Hubei Minyuan Huohe Hydropower Development Co., Ltd. (“Huohe”), which operates the Huohe Cascade II Hydropower Station and the Huohe Cascade III Hydropower Station.

On January 12, 2009, we acquired an 85% equity interest in Hubei Hongping Power Generation Co., Ltd. (“Hongping”), which operates the Qiujiabang Hydropower Station, the Shunshuiping Hydropower Station and the Huangjiawang Hydropower Station.

In April 2009, Hunan Zhaoheng, one of our subsidiaries, entered into an equity transfer agreement to transfer its 100% equity interest in Jingrong to Shenzhen Zhaoheng, also one of our subsidiaries.

CHINA’S HYDROPOWER INDUSTRY

China’s Electric Power Industry

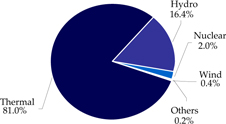

In 2008, China had a total installed capacity of 793GW and total electricity consumption of 3,433TWh. In line with historical trends, the majority of China’s energy requirements were met by thermal power generation, which accounted for 81% of the nation’s total energy demand in 2008.

| Power Generation 2008 | | Installed Capacity 2008 |

| | | |

| | |

| Sources: | China Electricity Council, 2008 |

China’s over-dependence on coal has raised significant concerns over the sustainability to the environment, fuel supply security and fuel cost fluctuations. The issues in China’s existing power sector have forced the PRC government to implement supportive measures for the development of alternative energy sources. Renewable energy has been actively promoted in recent years to address these issues, such as fostering a greener environment and promoting the accessibility of electricity in rural areas.

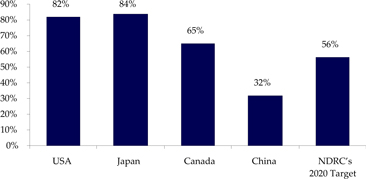

China’s Hydropower Industry

Hydropower is the cheapest form of large-scaled clean energy and can be highly utilized in China with its vast amount of water resources. The generation of hydropower does not consume or pollute water nor does it produce greenhouse gases. At the same time, China is rich in hydropower resources. With a technically exploitable capacity of 542GW and annual potential output capacity of 2.47 trillion kWh, China ranks number one in the world in potential hydraulic resources. However, by the end of 2008, the installed capacity of hydropower only amounted to 171.52GW and the utilization level in China is only 31.6%, much lower than the 65% to 85% range in developed countries such as the United States, Japan, and European countries. In 2007, the National Development and Reform Commission (“NDRC”) released the Medium to Long-Term Developmental Plan for Renewable Energy. The plan gives priority to the development of small- to medium-sized hydropower plants in rural regions rich in hydropower resources and sets an installed capacity target for hydropower of 190GW by 2010 and 300GW by 2020, from 172GW as of the end of 2008. This includes the installed capacity target of 50GW and 75GW by 2010 and 2020, respectively, for small- to medium-sized hydropower plants from the current level of 35GW.

| Utilization Rate of China’s Exploitable Hydro Resources |

| |

|

| Source: Report on the Survey and the Forecast of Investment Prospect of Industries in China during 2007 and 2008, China Electricity Council 2008 Electricity Report, NDRC 2007 |

The various policies issued by the PRC government in the past few years are testament to the PRC government’s intention to encourage and support the small – medium hydropower stations in the country. For example, the PRC government offers tax incentives for hydropower companies and requires grid companies to accept full output from hydropower stations. The PRC government is also gradually implementing the “Same Price for Same Power” policy, giving hydropower producers substantial room for revenue increase. In addition, hydropower stations also benefit from dispatch priority ahead of most other energy sources. The State Council has announced a priority dispatch order based on the power generation fuel source:

| | 1. | Wind power, solar power and “run-of-river” hydropower |

| | 2. | Hydropower plants with reservoirs and waste-to-energy |

| | 4. | Co-generation (combined heat and electricity) |

| | 5. | Natural gas and coal gas |

| | 6. | Coal-fired generation (High efficiency coal plants have priority over other coal-fired generators) |

Small- to Medium-sized Hydropower Plants

In China, small-sized hydropower plants refer to plants with a total installed capacity of less than 50MW. Compared to large hydropower plants, small- to medium-sized hydropower plants have shorter construction periods and lower investment risks.

Small-sized hydropower plants are predominantly located in rural regions. 60% of China’s existing small-sized hydropower plants is located in Sichuan, Guangdong, Fujian, Yunnan, Hubei, Hunan and Zhejiang Province. Future developments of small-sized hydropower plants are expected to be focused on the Sichuan, Yunnan, Guizhou, Hubei, Hunan, Xinjiang and Tibet Province.

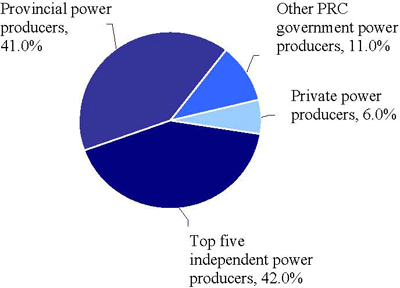

The power sector is dominated by the country’s state-owned enterprises including the top five independent power producers, and other central or provincial government-owned entities. Private operators demonstrate tremendous growth potential as they are more operationally and cost-efficient than state-owned enterprises. In addition, there are no existing dominant players in China’s small- to medium-sized hydropower plants sector. The fragmented market structure with various small and sometimes inefficient players provides significant consolidation opportunities.

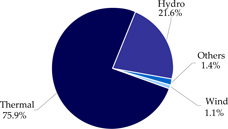

Ownership Breakdown by Installed Capacity (2007) |

| |

|

Source: China Electricity Council

BUSINESS STRATEGY

Our strategy involves a three-pronged approach with a primary focus on small- and medium-sized hydropower stations:

| | · | Acquisitions of Small- and Medium-Sized Hydropower Stations. We will expand mainly through acquisitions of over 51% stake of these small- and medium-sized targets. Currently, investments in small- and medium-sized hydropower stations are highly decentralized and are made mainly by local state-owned and private capital, leaving large substantial opportunities for expansion through mergers and acquisitions. In particular, we favor purchasing operating hydropower stations with solid financial and operational track records that can provide immediate contributions to earnings and cash flow. |

| | · | Greenfield Development and Capacity Upgrades. In 2005, we undertook the development of Hunan Zhaoheng, an expansion of the existing Hunan Sanjiang plant, at a total construction cost of approximately RMB220 million ($0.63 million/MW) compared to the current average replacement cost of $1.0 – $1.4 million/MW for a Chinese small- to medium-sized hydropower plants, enabling us to increase our capacity and cash flow at minimal incremental costs. As a result of the potentially attractive returns offered by upgrading existing plants, we have also placed great emphasis on targeting hydropower plants with future capacity expansion potential. We are currently evaluating the feasibility to increase Guizhou Yongfu’s installed capacity. On the Greenfield development front, we have already secured the exclusive rights to develop two new hydropower stations with a total installed capacity of 65MW in Hunan Province. |

| | · | Operation and Technical Improvements. We also focus on enhancing profitability and shareholder returns of our hydropower plants by improving operational and technical efficiencies. Many of our acquired hydropower plants were previously state-owned enterprises with redundant structures, excess labor, outdated technologies and suboptimal operational system. We have a remarkable track record in creating value by eliminating redundancies and streamlining operations to increase output. |

We believe that this three-pronged approach will allow us to manage and develop profitable small- and medium-sized hydropower stations and allow us to sustain our development by constructing new hydropower stations.

We have thoroughly analyzed the current situation of electric power industry and development trend in China and are positioned to develop small- and medium-sized hydropower stations with installed capacities of between 10MW and 100MW. Due to the capital and technology intensive nature of the hydropower industry, we have given priority to develop cascade hydropower stations in Southwestern and Midwestern China, including Hunan, Hubei, Yunnan, Guizhou and Sichuan provinces.

Our decision to focus on small- and medium-sized hydropower stations in Southwestern and Midwestern China is based mainly on the following factors:

| | · | Hydropower is a clean energy source that is environmentally friendly. Hydropower generation does not create carbon emissions or water or air pollution and does not discharge any toxic chemicals or radioactive residuals that damage the environment; |

| | · | Hydropower development receives substantial support from the PRC government, which encourages investments in the sector through preferential tax policies, preferential land-use policies and favorable terms to private and foreign investors; |

| | · | Investments in small- and medium-sized hydropower stations involve relatively small amounts of capital, short construction periods and lower risks; |

| | · | In Southwestern and Midwestern China, small- and medium-sized hydropower resources are abundant and local governments have invested heavily in the hydropower industry; |

| | · | Investments in small- and medium-sized hydropower stations are highly decentralized. There are no existing dominant players in China’s small- and medium-sized hydropower sector. The fragmented market structure with various small and sometimes inefficient players provides significant consolidation opportunities; and |

| | · | We have developed a good working relationship with local governments and grid companies through years of local investment. |

Our business consists primarily of the following three activities:

1. Development –

| | (i) | identifying and investing in small- and medium-sized hydropower stations in China; and |

| | (ii) | securing annual sales contracts with the SGCC and the CSPGC. |

2. Operation –

| | (i) | managing hydropower stations and improving operational and technical efficiency; and |

| | (ii) | generating hydropower and supplying electricity to power grid companies. |

3. Construction –

| | (i) | developing new hydropower resources with substantial return on investment; and |

| | (ii) | upgrading capacities of existing facilities at minimal incremental cost. |

Development

(i) Identifying investment opportunities: Our business development team actively explores and identifies small- and medium-sized hydropower stations in China that we believe have great potential for a high return or investment. As one of the early players in the industry, we have established a strong brand name and a strong connection with local governments, state-owned enterprises and other private operators. We will continue to leverage these relationships to secure high-quality projects to enhance shareholder value.

We favor the acquisition of operating hydropower plants that can provide immediate contributions to earnings and cash flow. In particular, we seek acquisition targets that:

| | · | have solid operational and financial track records; |

| | · | have a high likelihood of on-grid tariff increases; |

| | · | have a long history of reliable hydrology; |

| | · | have potential to increase existing installed capacity through upgrades; |

| | · | qualify for the Clean Development Mechanism program or the Verified Emission Reduction program; |

| | · | provide an opportunity to achieve cost-savings through clustering of hydropower plants; |

| | · | have potential for operational and technical improvements; and |

| | · | enhance the geographic diversification of our hydropower plant portfolio. |

(ii) Acquisition of hydropower stations: After we identify a potential hydropower station for acquisition and/or investment, we submit a proposal to the relevant parties that own the hydropower station. We then negotiate the terms of our purchase of the hydropower station and the terms are evidenced in a sales and purchase agreement. At the closing, we pay the purchase price in cash or in stock according to the payment terms. We typically purchase a minimum of 51% of the equity interest in small- and medium-sized hydropower stations.

(iii) Securing new operational locations: After we purchase a hydropower station, we usually retain the existing management team to operate the project. However, we implement a uniform management system to improve management and operational efficiency of acquired stations. For greenfield development, we typically set up a new office in the operational location and dispatch a team to manage the project for its lifetime.

Operations

We take an active role in the operation of our hydropower stations. We assign senior management to operate each facility.

Operating a hydropower station involves:

| | · | Hydrology analysis: We monitor and analyze changes in climate and water conditions on a real-time basis and estimate upstream water flow accordingly. |

| | · | Production planning: According to forecasts determined based on the above analysis, we propose a daily production plan to grid companies by 9 a.m. for the following day and we receive approvals from grid companies by 4 p.m. |

| | · | Power generation application: We apply for power generation approvals from grid companies. |

| | · | Power generation: We conduct power generation and electricity output. |

| | · | Equipment maintenance: We perform equipment maintenance and problem solving on a regular basis to improve equipment efficiency. |

We also focus on enhancing profitability and shareholder returns of our hydropower plants by improving operating and technological efficiencies. Many of our acquired hydropower plants were previously state-owned enterprises with redundant structures, excess labor, outdated technologies and suboptimal operating system. We have an excellent track record in creating value by eliminating redundancies and streamlining operations to increase efficiency and output.

Construction

We may acquire additional water resource development rights from local governments. After securing authorization from the state or local Development and Reform Commission and acquiring an approval from the Provincial Pricing Bureau, we hire a professional water resource institute to design a construction plan. We manage the construction work of a project performed by subcontractors. As part of the construction process, we obtain the approval of a quality control inspection performed by the grid companies. Finally, we dispatch or hire operators to manage the new hydropower stations.

Sales and Marketing

With preferential policies requiring that grid companies fully acquire electricity generated by hydropower companies, we enjoy an advantage in sales and marketing. Each year, we sign a sales contract with subsidiaries of the SGCC and the CSPGC, two dominant state grid companies. The contracts stipulate an estimated amount of electricity to be generated and delivered, the on-grid tariff and settlement terms. We also sell approximately 14% of electricity to Hunan Jiuli, which is distributed to local industrial and residential clients.

On December 31, 2008, the benchmark electricity tariff was RMB0.295/kWh for Hunan Sanjiang and Hunan Zhaoheng, RMB0.2374/kWh for Guizhou Yongfu, and RMB0.280/kWh for Hubei Huohe. Our Hunan Sanjiang and Hunan Zhaoheng hydropower stations enjoy differential on-grid tariffs during different seasons and different hours. The following table sets forth Hunan Sanjiang and Hunan Zhaoheng’s on-grid tariff scheme, which was effective from July 1, 2008.

Pricing and Regulations

Electricity prices are regulated by the Provincial Commodity Pricing Bureau. In determining the electricity on-grid tariffs, the Provincial Commodity Pricing Bureau considers the following factors: (i) national energy policies; (ii) environmental impact; (iii) electricity supply and demand; and (iv) consumer price indexes (CPI). As of December 31, 2008, the benchmark electricity on-grid tariff was RMB0.295/kWh for Hunan Sanjiang and Hunan Zhaoheng, RMB0.2374/kWh for Guizhou Yongfu and RMB0.280/kWh for Hubei Huohe. In addition, our Hunan Sanjiang and Hunan Zhaoheng hydropower stations enjoy differential on-grid tariff during different seasons and different hours. The following table sets forth Hunan Sanjiang and Hunan Zhaoheng’s on-grid tariff scheme, which was effective from July 1, 2008.

| | | | | Electricity On-grid Tariff |

| Season | | Month | | | | | | | | |

| | | | | | | | | | | |

| Dry | | 1, 2, 11, 12 | | 0.3919 | | 0.3919 | | 0.335 | | 0.2311 |

| Normal | | 3, 7, 8, 9 | | 0.3451 | | 0.3451 | | 0.295 | | 0.2035 |

| Wet | | 4, 5, 6, 10 | | 0.3100 | | 0.3100 | | 0.265 | | 0.1828 |

Future price increases are subject to annual pricing reviews.

The on-grid tariff for the electricity we sold to Hunan Jiuli is RMB0.35/kWh. This price is negotiated between Zhaoheng and Hunan Jiuli.

Materials and Suppliers

The principal supplies purchased for our business are parts for machinery and equipment for our Hunan Zhaoheng Hydropower Station Project, machinery and equipments constitute approximately 25% to 35% of our total construction costs. We purchase such supplies through a bidding process which is administered by our procurement committee. Potential suppliers are evaluated by their technical expertise, price, payment terms and post-sales maintenance services. Our procurement committee maintains a scoring system based on the terms offered by each supplier. After an evaluation of each supplier’s ability to provide the supplies and services requested, we purchase the supplies from the supplier that provides us with the best terms and has the best reputation. We purchase equipment and machinery on payment terms ranging from 30 to 90 days and generally receive one-year repair or replacement warranties on certain major equipment.

Customers

Most of our electricity was sold to local subsidiaries of the SGCC and the CSPGC, which are two state-owned grid companies that control the electricity transmission sector in China. Approximately 14% of the electricity we generated in the fiscal year ended December 31, 2008 was sold to Hunan Jiuli, a related party, which was distributed to local industrial and residential customers.

Under the Law of the People’s Republic of China on Regenerable Energies, we enjoy priority dispatch and guaranteed full purchase from the two state-owned grid companies, which significantly reduce both operational and financial risks. In addition, grid companies are prohibited from becoming involved in power generation to avoid any conflict of interest. For the fiscal year ended December 31, 2008, sales to the SGCC, CSPGC and Hunan Jiuli accounted for approximately 81%, 5% and 14% of our total sales. The following table sets forth operating data of our four subsidiaries:

| | | | | | | Percentage of Total Sales | |

| Hunan Sanjiang | | Jiuli | | | 1,895,407.2 | | | | 14.1 | % |

| | | SGCC | | | | | | | | |

| Hunan Zhaoheng | | SGCC | | | 10,928,390.2 | | | | 81.0 | % |

| Hubei Huohe | | SGCC | | | | | | | | |

| Jingrong | | CSGC | | | 661,699.5 | | | | 4.9 | % |

Competition

Since 2002, our business has been concentrated in the generation and sale of hydroelectricity. With the increasing demand for electricity in China, competition in the industry has the following two aspects:

Product competition: Currently, thermal power occupies an 81% market share while hydropower occupies only a 16.4% market share, and other energy sources occupy approximately 2.6% of the market share. Product competition comes mostly from thermal electricity. However, due to lower pricing, clean production and preferential policies, hydropower has an advantage over thermal power.

Hydropower resources competition: Currently, most hydropower resources are controlled by state-owned companies and local governments. With increasing reform of the electric power industry, private capital and foreign capital are gradually being injected into the industry due to the industry’s investment value and prospects, resulting in more intensive industry competition.

In addition, competition in our industry comes from the following sectors:

| | · | Large state-owned companies. These large state-owned companies generally operate large thermal power projects and large and medium-sized hydropower projects. As such, there is no direct competition between these large state-owned companies and us. |

| | · | Large local electric power companies. These companies are supported by local governments, and generally have rigid management and low operating efficiency. |

| | · | Affiliates of grid companies. Historically, most power grids and power generation plants were owned by the same state-owned entities. Under the reform policy introduced in 2002 by the Power Industry Reform Plan and issued by the State Council, however, the government restructured the power industry by separating power plants from power grids. The purpose behind the reform is to deregulate and introduce competition into the power generation business through the privatization of power plants, while still maintaining the monopoly of power grids by state-owned companies. These power plants, which are affiliates of grid companies, possess many hydropower resources and will be our targets of cooperation or acquisition. |

| | · | Small- and medium-sized hydropower stations owned by local governments. These generally have inefficient management and are our acquisition targets. |

| | · | Private and foreign hydropower investment companies. These companies are more flexible in management, but are often inhibited by technological and capital deficiencies. |

Insurance

Currently, our fixed assets at different operating facilities are insured through the following insurance companies:

| | · | Hunan Sanjiang: People’s Insurance Company of China & Tianan Insurance Company Limited of China, covering damage to fixed assets and other equipment. |

| | · | Hunan Zhaoheng: China Pacific Property Insurance Co., Ltd., covering damage to dams, roads and equipment as well as construction-related damage. |

| | · | Guizhou Yongfu: China Pacific Property Insurance Co., Ltd., covering damage to fixed assets. |

| | · | Hubei Huohe: People’s Insurance Company of China, covering damage to fixed assets and other equipment. |

In addition, we maintain the following types of insurance for our employees: (i) pension insurance; (ii) medical insurance; (iii) work-related injury insurance; (iv) employment insurance; and (v) prenatal insurance.

PRC Government Regulation

In China, the development, operation and construction of hydropower stations are subject to extensive PRC government regulations including pricing, water use, land use, environmental protection, soil and water conservation, project construction and safety. A company engaged in the development of a hydropower station must first obtain approvals from the relevant governmental agencies, such as the Administration of Water Resources, Environment Protection Bureau, Land and Resources Bureau, Labor and Social Security Bureau and Development and Reform Commission. A company in the hydropower generation business must obtain an operational permit from the State Electricity Regulatory Commission and an electricity acceptance approval from grid companies prior to commencing operation. In addition, in order to commence construction of a new hydropower station, a company must first obtain several approvals including: (i) approval of the construction project from the State Development and Reform Commission; (ii) an environmental impact review and approval from the local Environmental Protection Agency; (iii) a water resource development approval from the Provincial Water Resources Bureau; and (iv) pricing approval from the Provincial Commodity Pricing Bureau.

According to Article 4 of the Provisions on the Administration of Electric Power Business Licenses, promulgated on December 1, 2005 by the State Electricity Regulatory Commission of the PRC, an electric power production enterprise must obtain an Electric Power Business License to sell electricity to electricity suppliers. In addition, according to Article 25 of the Electric Power Law of the People's Republic of China implemented on April 1, 1996, electricity suppliers, such as grid companies, must obtain an Electricity Supply Business Permit issued by the relevant electric power administration in order to supply users with electricity. In China, grid companies are generally state-owned entities that possess the Electricity Supply Business Permit which enables them to supply users with electricity.

During the year ended December 31, 2008, we sold approximately 14% of the electricity generated by Hunan Sanjiang, our operating subsidiary, to Hunan Jiuli. As of December 31, 2008, we had obtained an Electric Power Business License to sell electricity to grid companies but had not obtained an Electricity Supply Business Permit to supply electricity to users such as Hunan Jiuli, a related party. As such, our supply of electricity to Hunan Jiuli may not be in compliance with Article 25. However, we continue to supply Hunan Jiuli with electricity in reliance on a contract for the supply and consumption of electricity entered into between Hunan Sanjiang and Hunan Jiuli (the “Electricity Supply and Consumption Contract”), as well as the minutes of a meeting among Hunan Zhaoheng, Hunan Sanjiang and the Changde Branch of Hunan Electric Power Company, a subsidiary of the SGCC and a state-owned entity (the “Meeting Minutes”), in which the Changde Branch of Hunan Electric Power Company has granted us a three-year grace period to gradually reduce the amount of electricity supplied without the Electricity Supply Business Permit, and to stop supplying electricity to users by 2010. However, according to Article 6 of the Electric Power Law, the electric power administration department is the legitimate government agency responsible for the supervision and control of China’s electric power industry and, as such, we cannot assure you that the electric power administration department will not challenge the validity of the Electricity Supply and Consumption Contract and the Meeting Minutes. In the event that the electric power administration determines that these two documents are not legally valid, we may be required to stop supplying electricity to Hunan Jiuli with immediate effect and surrender all income generated from supplying electricity to Hunan Jiuli. In addition, according to Article 63 of the Electric Power Law, we may be subject to a fine of up to five times the income generated from such non-compliant supply of electricity. See “Item 1A. Risk Factors – Risks Related to Our Business – Our supply of electricity to Hunan Jiuli may not be in compliance with the relevant PRC laws and regulations.”

According to Article 14 of the Law of the People’s Republic of China on Regenerable Energies, adopted by the Standing Committee of the Tenth National People’s Congress and effective as of January 1, 2006, grid companies are required to purchase the full amount of electricity generated from regenerable energies, which includes hydro energy. Given that grid companies are required to acquire all of the output that we sell them, and the fact that the amount of electricity we supply to Hunan Jiuli accounted for only 14% of the electricity we generated in 2008 (which amount is being gradually reduced every year), our management believes that our business operations and financial condition will not be materially adversely affected if we were required to stop supplying electricity to Hunan Jiuli.

Safety and Quality Control

Safety Control

We are focused on safety. We have implemented a safety system and have designated an engineering department to oversee safety issues for all of our operations. We carry out routine inspection of our equipment every two hours and we conduct routine maintenance of our equipment every week or every other week depending on equipment type.

We believe in educating operational staff about safety procedures. Our operation employees are required to undergo annual safety training and pass an annual safety exam. Our employees are divided into three shifts to oversee the operation of our equipment, which runs for 24 hours a day during peak seasons.

In order to monitor the operation of our equipment, we developed a micro processing unit that integrates measurement, control, communications and other functions to achieve centralized control and management.

As a result of our strict adherence to safety control procedures, we have not experienced any major accidents which have resulted in serious injury or death since our inception.

Quality Control

Quality control procedures are typically implemented in the design and construction phase of hydropower stations. Our technical experts in our construction management department perform regular inspections and tests to ensure that the construction work meets our required standards as well as national and local regulations. Currently, our construction management department consists of six experienced and knowledgeable technical experts.

Unlike in other industries, there is no quality control in the operation phase because all electricity is the same to end users.

Safety Regulations

As a hydropower generation company, we are regulated by the relevant operation safety rules promulgated by grid companies and PRC government agencies such as the Administration of Work Safety, Administration of Quality and Technology, State Electricity Regulatory Commission, Administration of Water Resources, Fire Department, Labor and Social Security Bureau. According to such rules, our daily operation must meet relevant safety requirements and qualifications. Grid companies and each of the PRC government agencies conduct inspections at our hydropower stations at least once a year. If we fail any of these inspections, we are given a grace period of 15 to 30 days to rectify any safety violations. If we are unable to rectify any safety violations during the grace period, we face significant fines, suspension of our operations or a shut-down of the relevant non-compliant facility.

According to the Safety Management Regulation for Dam Operation of Hydropower Stations issued by the State Electricity Regulatory Commission on December 1, 2004, we are required to obtain a Safety Registration Certificate of Hydropower Station’s Dam from the Large Dam Supervision Centre of the State Electricity Regulatory Commission to operate our hydropower stations. As of the date of this Annual Report, our subsidiaries have not obtained these certificates. We are currently in the process of preparing the application for the Safety Registration Certificates for these three subsidiaries. See “Item 1A. Risk Factors – Risks Related to Our Business – Our operations are subject to PRC government review and approvals, as well as extensive PRC government regulations.”

Environmental Matters

We are subjected to state and local regulations, such as regulations related to the environment, land use, public utility utilization and the fire code, in connection with our daily operation activities. We believe that our activities comply with current PRC government regulations that are applicable to our operations and current facilities.

Taxes

We are subject to the following taxes:

Enterprise Income Tax (“EIT”): According to the latest PRC Enterprise Income Tax Law, the enterprise income tax rate is 25%. However, different operating entities for our hydropower plants may be eligible for tax reductions or exemptions pursuant to various tax incentives granted by the PRC government. Relevant tax incentives applicable to us include:

| | · | “Notice Regarding the Transition of the Implementation of Enterprise Income Tax” issued by the State Council. According to this policy, the preferential EIT rate of 15% enjoyed by our subsidiaries will be progressively increased to a uniform rate of 25% by 2012. However, the Tax Incentives for Developing Western Regions is still effective. This policy became effective on January 1, 2008. |

| | · | “Notice Regarding Tax Incentives for Developing Western Regions” issued by the Ministry of Finance, State Administration of Taxation and General Administration of Customs. According to this policy, business entities in western regions enjoy a preferential tax rate of 15% from 2001 to 2010. In addition, business entities with more than 70% revenue from hydropower sales enjoy a two-year income tax exemption followed by a three-year 50% income tax rate reduction. This policy became effective on January 1, 2001. |

| | · | “Notice Regarding the Extension of Applicable Scope of Tax Incentives Granted to Foreign Invested Enterprises Investing in Energy and Transport Infrastructure Projects” issued by the State Council. According to this policy, foreign-invested energy corporations enjoy a preferential EIT rate of 15%. This policy became effective on January 1, 1999. |

| Applicable EIT Rate for 2008 | |

| | | EIT Rate | |

| | | | |

| Shenzhen Zhaoheng | | | 25.0 | % |

| Hunan Sanjiang | | | 9.0 | % |

| Hunan Zhaoheng | | | 0 | |

| Jingrong | | | 25.0 | % |

| Hubei Huohe | | | 25.0 | % |

Value Added Tax (“VAT”): Value added tax applies to the revenue received from the sale of electricity by the hydropower plants. The VAT rate varies in each province and with each hydropower plant.

| Applicable VAT Rate for 2008 | |

| | | VAT Rate | |

| | | | |

| Shenzhen Zhaoheng | | | 17.0 | % |

| Hunan Sanjiang | | | 17.0 | % |

| Hunan Zhaoheng | | | 17.0 | % |

| Jingrong | | | 6.0 | % |

| Hubei Huohe | | | 17.0 | % |

The VAT rules and regulations applicable to us include:

| | · | “Provisional Rules and Regulations Regarding Value Added Tax” issued by the State Council. According to this policy, the purchase of certain fixed assets, including machinery and equipment, is deductible from VAT. This policy became effective on January 1, 2009. |

| | · | “Notice Regarding the Adjustment of Value Added Tax for Agricultural Products and Exemption of Value Added Tax for Various Other Projects” issued by the Ministry of Finance and State Administration and Taxation. According to this policy, small hydropower operators enjoy a preferential VAT rate of 6%. This policy became effective on May 1, 1994. On January 19, 2009, the Ministry of Finance and State Administration and Taxation issued “Notice Regarding the Application of Lower VAT Rate and Simplified Way to Impose Capital Gain Tax on Certain Goods” to replace the May 1, 1994 policy. However, the preferential VAT rate granted to small hydropower operators remains the same under the new policy. |

Other Taxes, Fees and Surcharges: We are subject to several other types of taxes, fees and surcharges, which include the Municipal Development and Maintenance Fee, Educational Surcharge, Local Education Fee, Land Use Right Fee, Property Tax and Stamp Duty. The sum of these amounts is included in our cost of revenues. On April 17, 2007, the Ministry of Finance of the PRC issued the “Assessment of Reservoir Area Fund for Large and Medium-sized Reservoirs”, which require hydropower companies to pay an assessment of reservoir area fund based on certain rates multiplied by electricity sold during the year. The assessment rate of the reservoir area fund for 2008 was approximately $0.0012/kWh (RMB0.008/kWh).

Foreign Currency Control

Under certain regulations in the form of public notices issued by the PRC State Administration of Foreign Exchange, or SAFE, our shareholders who are PRC resident entities or individuals are subject to certain registration requirements because of Zhaoheng BVI’s status under PRC law as an offshore special purpose company, or SPC. These regulations would prohibit Zhaoheng HK from distributing dividends or profits to Zhaoheng BVI and/or us as SPCs unless we comply with the registration requirements set forth by SAFE. Guosheng Xu, our Chief Executive Officer and Chairman of the Board, has completed the registration with the SAFE and has been issued a SAFE certificate on August 22, 2008. We are in the process of determining whether there are additional shareholders who are subject to the SAFE regulations and whose compliance status will have a material effect on our ability to remit any of our profits out of China in the form of dividends or otherwise.

Employees

As of December 31, 2008, we had a total of 136 full-time employees. Of these, 30 are managers, finance and accounting professionals, and other supporting staff. The remaining 106 employees are frontline workers.

Although each employee has entered into an employment contract with us, each employee is an “at will” employee. The annual remuneration of each employee includes a fixed wage and bonus, as well as contributions to social insurance and stock incentives. We have not in the past experienced any material labor disputes, work stoppages or difficulty recruiting staff.

Web site Access to our Periodic SEC Reports

You may read and copy any public reports that we have filed with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site at http://www.sec.gov that contains reports, information statements, and other information that we have filed electronically.

An investment in our common stock or other securities involves a number of risks. You should carefully consider each of the risks described below, as well as the other information contained in this Annual Report, before deciding to invest in our common stock. If any of the following risks develops into actual events, our business, financial condition or results of operations could be negatively affected, the market price of our common stock or other securities could decline and you may lose all or part of your investment. You should refer to the other information set forth or referred to in this Annual Report, including our consolidated financial statements and the related notes incorporated by reference herein.

The risk factors presented below are all of the ones that we currently consider material. However, they are not the only ones facing our company. Additional risks not presently known to us, or which we currently consider immaterial, may also adversely affect us. There may be risks that a particular investor views differently from us, and our analysis might be wrong. If any of the risks that we face actually occur, our business, financial condition and operating results could be materially adversely affected and could differ materially from any possible results suggested by any forward-looking statements that we have made or might make. In such case, the trading price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business

Our inability to fund our capital expenditure requirements may adversely affect our growth and profitability.

Our continued growth is dependent upon our ability to generate more revenue from our existing distribution systems and raise capital from outside sources. We believe that in order to continue to capture additional market share, we will have to raise more capital to fund the construction and installation of the hydropower distribution network for our customers under existing contracts and for additional customers. In the event that we are unable to obtain the necessary financing on a timely basis and on acceptable terms, our financial position, competitive position, growth and profitability may be adversely affected. Our ability to obtain acceptable financing at any time may depend on a number of factors, including:

| | · | our financial condition and results of operations; |

| | · | the condition of the PRC economy and the PRC hydropower industry, and |

| | · | conditions in relevant financial markets in the United States, China and elsewhere in the world. |

Our success depends on our ability to identify and acquire additional hydropower stations or exclusive rights to develop water resources.

Our success depends on our ability to identify and acquire additional hydropower stations and water resource development rights. Our failure to identify acquisition targets and obtain the exclusive rights to be the developer of hydropower stations and distribute hydropower in such operational locations would curb our revenue growth and thus have an adverse impact on our financial condition and operating results.

We may not be able to effectively control and manage our growth.

If our business and markets grow and develop, it will be necessary for us to finance and manage our expansion in an orderly fashion. We may face challenges in managing and expanding our hydropower stations and service offerings and in integrating acquired businesses with our own. Growth in our business may place increased demands on our existing management, workforce and facilities as well as a significant strain on our financial systems and other resources. Failure to meet such increased demands could interrupt or adversely affect our operations, cause delay in construction and/or acquisition of hydropower stations, or result in longer operation location completion cycles and administrative inefficiencies.

If we are unable to successfully complete and integrate new operational locations in a timely manner, our growth strategy could be adversely impacted.

An important element of our growth strategy has been and is expected to continue to develop additional hydropower stations in small- and medium-sized cities. However, integrating businesses involves a number of special risks, including the possibility that management may be distracted from regular business concerns by the need to integrate operations, unforeseen difficulties in integrating operations and systems, problems relating to assimilating and retaining the employees of the acquired business, accounting issues that may arise in connection with the acquisition, challenges in retaining customers, and potential adverse short-term effects on operating results. If we are unable to successfully complete and integrate new operations in a timely manner, our growth strategy could be adversely impacted.

Our hydropower business is affected by seasonal factors.

Our business is generally affected by seasonal factors. Our hydropower generation stations rely on rainfall and snowfall to provide water flow for hydropower production. In many parts of the country, including our service areas, demand for power peaks during the hot summer months, with market prices also peaking at that time. As a result, our operating results in the future will likely fluctuate substantially on a seasonal basis. In addition, because the climate of China is influenced by monsoons, rainfall and runoffs are distributed unevenly within any one-year period. As each hydropower station is heavily dependent on the volume of water that flows through its location, any extended period of below-normal rainfall may significantly reduce our revenue.

We have in the past entered into inter-company loan agreements, which may be deemed legally invalid under PRC law.

According to Article 73 of the Lending General Provision issued by the People’s Bank of China, a company may not enter into any loan agreement with a non-financial institution. Historically, Hunan Sanjiang, Hunan Zhaoheng and Shenzhen Zhaoheng have entered into various loan agreements with our related parties, none of which are financial institutions, whereby Hunan Sanjiang, Hunan Zhaoheng and Shenzhen Zhaoheng gave loans to these related parties at negotiated interest rates. As of June 1, 2008, we ceased entering into inter-company loan agreements. However, we cannot assure you that our historical inter-company loan agreements, which are in violation of Article 73, will not be deemed legally invalid by the People’s Bank of China. In the event that such loan agreements are deemed to be invalid, we may be subject to penalties of up to five times the interest income derived from such invalid loans. In addition, we may be required to surrender any past and future interest income generated from such loans.

Operation of our hydropower plants involves significant risks and our insurance policies may not be adequate to cover economic losses if our operations are interrupted.

Our hydropower projects depend on the near-continuous operation of our equipment and are therefore subject to many risks and hazards, including but not limited to breakdowns, mechanical failures or substandard performance of equipment, improper installation or operation of equipment, labor or third party demonstrations, protests or disputes, natural disasters, environmental hazards and industrial accidents. If such events were to occur at any of our stations, our operations could be disrupted or interrupted for considerable periods of time and our business, financial condition and results of operations could be adversely affected. In addition, any failures of electricity grids near one or all of our projects could prevent the relevant projects from delivering electricity.

We currently maintain insurance coverage that is typical in the hydropower industry in China and in amounts that we believe to be adequate. In accordance with general industry practice, we are required to obtain fire, liability or other property insurance for the property and equipment in relation to our hydropower operations, and are required to obtain construction all-risks insurance for the construction projects we undertake. However, there may be circumstances where we are not fully covered or covered at all by insurance policies for business interruption, environmental liability, third-party liability, or loss of profit arising from disruptions in our operations. Failure to effectively cover ourselves against these risks could expose us to substantial costs and potentially lead to significant losses.

Our operations are subject to PRC government review and approvals, as well as extensive PRC government regulations.

Construction of new hydropower project is subject to special sessions of governmental review and approval. These reviews include an analysis of the impact on the environment and environmental protection, water use, feasibility studies, soil and water conservation programs. These reviews could delay the completion of each hydropower project which would hinder our expansion plans, which could have a material adverse effect on our financial condition and results of operation. In addition, we are regulated by relevant operation safety rules promulgated by grid companies and PRC government agencies such as the Administration of Work Safety, Administration of Quality and Technology, State Electricity Regulatory Commission, Administration of Water Resources, Fire Department, Labor and Social Security Bureau. According to such rules, our daily operation must meet relevant safety requirements and qualifications. Grid companies and each of the PRC government agencies conduct inspections at our hydropower stations at least once a year. We are given a grace period of 15 to 30 days to rectify any safety violations. In the event that we fail any inspection and are unable to rectify the safety violation during the grace period, we may face significant fines, suspension of our operations or even a shut-down of the relevant non-compliant facility.

In addition, according to the Safety Management Regulation for Dam Operation of Hydropower Stations issued by the State Electricity Regulatory Commission on December 1, 2004, we are required to obtain a Safety Registration Certificate of Hydropower Station’s Dam from the Large Dam Supervision Centre of the State Electricity Regulatory Commission to operate our hydropower stations. As of the date of this Annual Report, our subsidiaries have not obtained these certificates. We are currently in the process of preparing the application for the Safety Registration Certificates for these three subsidiaries. However, we cannot guarantee that the Large Dam Supervision Centre will grant the Safety Registration Certificates to us. In the event that we are unable to obtain such certificates, our directors may be subject to civil liabilities and we may face fines of up to RMB10,000.

Our supply of electricity to Hunan Jiuli may not be in compliance with the relevant PRC laws and regulations.

According to Article 4 of the Provisions on the Administration of Electric Power Business Licenses, promulgated on December 1, 2005 by the State Electricity Regulatory Commission of the PRC, an electric power production enterprise must obtain an Electric Power Business License to sell electricity to electricity suppliers. In addition, according to Article 25 of the Electric Power Law of the People's Republic of China implemented on April 1, 1996, electricity suppliers, such as grid companies, must obtain an Electricity Supply Business Permit issued by the relevant electric power administration in order to supply users with electricity. In China, grid companies are generally state-owned entities that possess the Electricity Supply Business Permit which enables them to supply users with electricity.

During the year ended December 31, 2008, we sold approximately 14% of the electricity generated by Hunan Sanjiang, our operating subsidiary, to Hunan Jiuli, a related party. As of December 31, 2008, we had obtained an Electric Power Business License to sell electricity to grid companies, such as the SGCC and the CSPGC, but had not obtained an Electricity Supply Business Permit to supply electricity to users such as Hunan Jiuli. As such, our supply of electricity to Hunan Jiuli may not be in compliance with Article 25. However, we continue to supply Hunan Jiuli with electricity in reliance on a contract for the supply and consumption of electricity entered into between Hunan Sanjiang and Hunan Jiuli (the “Electricity Supply and Consumption Contract”) and the minutes of a meeting among Hunan Zhaoheng, Hunan Sanjiang and the Changde Branch of Hunan Electric Power Company, a subsidiary of the SGCC and a state-owned entity (the “Meeting Minutes”). According to the Meeting Minutes, prior to our acquisition of it in 2003, Hunan Sanjiang historically supplied electricity without the Electricity Supply Business Permit. Pursuant to the Meeting Minutes, we have been granted a three-year grace period by the Changde Branch of Hunan Electric Power Company to gradually reduce the amount of electricity supplied without the Electricity Supply Business Permit, and to stop supplying electricity to users by 2010.

According to Article 6 of the Electric Power Law, the electric power administration department is the legitimate government agency responsible for the supervision and control of China’s electric power industry. As such, the Changde Branch of Hunan Electric Power Company, a party to the Meeting Minutes, may not be the appropriate authority to grant us the three-year grace period which allows us to continue supplying electricity without the necessary permit. We cannot give any assurance that the electric power administration department will not challenge the validity of the Electricity Supply and Consumption Contract and the Meeting Minutes. In the event that the electric power administration determines that these two documents are not legally valid, we may be required to stop supplying electricity to Hunan Jiuli with immediate effect and surrender all income generated from supplying electricity to Hunan Jiuli. In addition, according to Article 63 of the Electric Power Law, we may be subject to a fine of up to five times the income generated from such non-compliant supply of electricity.

Since a majority of small hydropower stations are located in rural and mountainous areas, the cost of construction may be high and operation of the stations may be difficult.

The majority of hydropower stations are built in remote mountain villages and townships. The construction of hydropower projects in such remote and mountainous locations will increase the cost of each project and require us to raise additional capital. In addition, the remote locations of the hydropower stations will result in increased costs of managing and operating such projects.

We cannot assure you that we will continue to benefit from preferential tax treatment.

Under the PRC Income Tax Law for Foreign Invested Enterprises and Foreign Enterprises and its implementing rules, an income tax rate of 33% was generally imposed on foreign-invested enterprises prior to January 1, 2008. However, we enjoyed substantial income tax reductions under various tax incentive programs for foreign-invested enterprises. A two-year income tax exemption followed by a three-year 50% income tax rate reduction based on an income tax rate of 15% commencing from the first profitable year is generally applicable to Hunan Sanjiang and Hunan Zhaoheng, both of which qualify and are approved as foreign-invested enterprises according to the State Tax Bureau of Shimen County.

On March 16, 2007, the National People’s Congress approved and promulgated the new PRC Enterprise Income Tax Law (“new EIT law”). The new EIT law, which went into effect on January 1, 2008, imposes a uniform tax rate of 25% on both foreign-invested enterprises and domestic companies. Preferential tax treatment will continue to be given to enterprises that previously enjoyed the preferential tax rate of 15% as well as enterprises that previously enjoyed the “two-year income tax exemption followed by a three-year 50% income tax rate reduction”. As a result of the new EIT Law, we expect our effective tax rate to increase to 25% within a five-year transition period commencing on January 1, 2008, unless we are otherwise eligible for preferential tax treatment. Hunan Sanjiang is entitled to a three-year 50% tax rate reduction beginning in 2007 and was taxed at a rate of 9% in 2008. After the expiration of its preferential tax treatment in 2010, it may be taxed at a rate of 25%. Hunan Zhaoheng is still within the two-year income tax exemption period and may be subject to EIT at a rate of 25% after its preferential tax treatment expires.

We cannot guarantee that we will continue to be eligible for any preferential tax treatment in the future. Moreover, we cannot assure you that our interpretation of the new EIT Law will be adopted by the local tax authorities or that the existing PRC income tax law or its interpretation and application will not continue to change. Moreover, our historical operating results may not be indicative of our operating results for future periods after expiration of the tax benefits currently available to us.

We may not be able to hire and retain qualified personnel to support our growth and if we are unable to retain or hire such personnel in the future, our ability to improve our products and implement our business objectives could be adversely affected.

Our future success depends heavily upon the continuing services of the members of our senior management team, in particular our Chief Executive Officer, Mr. Guosheng Xu. If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions and we are unable to replace them easily or at all, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. Because competition for senior management and senior technology personnel is intense and the pool of qualified candidates is very limited, we may not be able to retain the services of our senior executives or senior technology personnel or attract and retain high-quality senior executives or senior technology personnel in the future. Such failure could materially and adversely affect our future growth and financial condition.

Risks Related to Doing Business in the PRC

We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in China and the profitability of such business.

China’s economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the PRC government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of China. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that China will continue to strengthen its economic and trading relationships with foreign countries and business development in China will follow market forces. While we believe that this trend will continue, we cannot assure you that this will be the case. A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, we cannot assure you that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC’s political, economic and social life.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on our business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. We and any future subsidiaries are considered foreign persons or foreign funded enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations. These laws and regulations are sometimes vague and may be subject to future changes, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses.

Our PRC operating subsidiaries are subject to restrictions on paying dividends and making other payments to us.

We are a holding company incorporated in the State of Nevada and do not have any assets or conduct any business operations other than our investments in our subsidiaries. As a result of our holding company structure, we rely primarily on dividends payments from our subsidiaries in China. However, PRC regulations currently permit payment of dividends only out of accumulated profits, as determined in accordance with PRC accounting standards and regulations. Our subsidiary and affiliated entity in China are also required to set aside a portion of their after-tax profits according to PRC accounting standards and regulations to fund certain reserve funds. The PRC government also imposes controls on the conversion of Renminbi and the remittance of currencies out of China. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency. See “Government control of currency conversion may affect the value of your investment.” Furthermore, if our subsidiaries or affiliated entity in China incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our common stock.

PRC State Administration of Foreign Exchange (“SAFE”) Regulations regarding offshore financing activities by PRC residents, have undertaken continuous changes which may increase the administrative burden we face and create regulatory uncertainties that could adversely affect the implementation of our acquisition strategy, and a failure by our stockholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident stockholders to liability under PRC law.