Washington, D.C. 20549

IMPORTANT NOTICES

As used in this Current Report of Foreign Private Issuer on Form 6-K and unless otherwise indicated, “the Company” refers to Zhaoheng Hydropower Limited, a British Virgin Islands corporation. References to “China” mean the “People’s Republic of China”.

This Current Report, including the exhibits contained herein, contains forward-looking statements that involve substantial risks and uncertainties. Other than statements of historical facts, all statements included in this report regarding the strategy, future operations, future financial position, prospects, plans and objectives of management of the Company, as well as statements, other than statements of historical facts, regarding the hydropower industry, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements, and investors should not place undue reliance on the forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements made by the Company. Important factors that could cause actual results or events to differ materially from the forward-looking statements, include among others: changing principles of generally accepted accounting principles; outcomes of government reviews, inquiries, investigations and related litigation; compliance with government regulations; legislation or regulatory environments, requirements or changes adversely affecting the hydropower business in China; fluctuations in customer demand; management of rapid growth; changes in government policy; China’s overall economic conditions and local market economic conditions; the Company’s ability to expand through strategic acquisitions and establishment of new locations; and geopolitical events.

Further, the forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, collaborations or investments made by the Company. The Company does not assume any obligation to update any forward-looking statements.

The information in this Current Report, including all exhibits, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. It shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

The 2009 Restructuring

The following series of events describe the Company’s recent corporate restructuring (collectively, the “2009 Restructuring”):

On May 13, 2009 and May 14, 2009, respectively, Zhaoheng Investment Limited established two separate entities, namely, Zhaoheng Hydropower Holdings Limited, a Cayman Islands exempted company (“ZHHL”), and Zhaoheng (BVI) Limited, a British Virgin Islands business company (“Zhaoheng BVI”). Pursuant to a resolution passed by the board of directors of Zhaoheng Investment Limited, 100% of the shares in ZHHL held by Zhaoheng Investment Limited were transferred to Zhaoheng BVI on June 11, 2009, thereby making ZHHL a wholly owned subsidiary of Zhaoheng BVI and an indirect subsidiary of Zhaoheng Investment Limited.

On June 29, 2009, Zhaoheng Investment Limited entered into a share swap arrangement with ZHHL whereby 100% of the shares in Zhaoheng Hydropower (Hong Kong) Limited, then a wholly owned subsidiary of Zhaoheng Investment Limited, were transferred to ZHHL. In exchange, ZHHL issued 8,199,999 shares to Zhaoheng BVI, a wholly owned subsidiary of Zhaoheng Investment Limited, and as a result, Zhaoheng Hydropower (Hong Kong) Limited became a wholly owned subsidiary of ZHHL and an indirect subsidiary of Zhaoheng Investment Limited. On June 24, 2009, pursuant to a resolution passed by its board of directors, Zhaoheng BVI issued 8,945,859 ordinary shares to Zhaoheng Investment Limited.

On July 1, 2009, Zhaoheng Investment Limited completed a merger with its parent company, Zhaoheng Hydropower Company, a Nevada corporation (“ZHC”), pursuant to a plan of merger and the articles of merger between Zhaoheng Investment Limited and ZHC, both dated May 13, 2009, and became the successor issuer to ZHC for reporting purposes under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Upon the consummation of the merger, Zhaoheng Investment Limited became a foreign private issuer and changed its corporate name to “Zhaoheng Hydropower Limited”, its current name. Please see Form 8-K filed on July 8, 2009 for details.

Completion of Acquisition or Disposition of Assets

On June 19, 2009, Zhaoheng BVI and ZHHL entered into the Parent Preference Share Purchase Agreement (as defined below) and the Company Common Share Purchase Agreement (as defined below), respectively (collectively, the “Share Purchase Agreements”). Both transactions closed on July 14, 2009 (the “Closing”). The following are summaries of the material terms of each of the Share Purchase Agreements.

Parent Preference Share Purchase Agreement

This Share Purchase Agreement was entered into by and among AEP China Hydro Ltd., a Mauritius company (“AEP”), Olympus Capital Asia Mauritius, Ltd., a Mauritius company (“Olympus” and, together with AEP, the “Investors”), Zhaoheng BVI and Guosheng Xu, a citizen of the PRC and a resident of Hong Kong and the founder of the Company (the “Parent Preference Share Purchase Agreement”). Pursuant to the Parent Preference Share Purchase Agreement, the Investors subscribed for and purchased from Zhaoheng BVI 3,750,000 preference shares (the “Parent Preference Shares”) for an aggregate cash consideration of US$37,500,000, payment of which is to be made in two instalments: the Investors shall receive from Zhaoheng BVI 2,368,421 Parent Preference Shares against the first payment to be made upon the Closing (the “Closing Preference Shares”), and shall receive the remaining 1,381,579 Parent Preference Shares against the second payment, which is to occur when at least seventy-five percent (75%) of the proceeds from the sale of the Closing Preference Shares have been used for the purposes of acquiring small and medium hydropower projects and assets in China, subject to approval by the Investors in their reasonable discretion (the “Second Payment Preference Shares”).

Company Common Share Purchase Agreement

This Share Purchase Agreement was entered into by and among the Investors, Zhaoheng BVI, ZHHL and Guosheng Xu (the “Company Common Share Purchase Agreement”). Pursuant to the Company Common Share Purchase Agreement, the Investors subscribed for and purchased from ZHHL a total of 1,000,000 common shares (the “Company Common Shares”) for an aggregate cash consideration of US$10,000,000, payment of which is to be made in two instalments: the Investors shall receive from ZHHL 631,579 common shares against the first payment to be made upon the Closing (the “Closing Common Shares”), and shall receive the remaining 368,421 Company Common Shares against the second payment, which is to occur when at least seventy-five percent (75%) of the proceeds from the sale of the Closing Common Shares have been used for the purposes of acquiring small and medium hydropower projects and assets in China, subject to approval by the Investors in their reasonable discretion (the “Second Payment Common Shares”). As a condition precedent to the Investors’ obligations at the Closing, Zhaoheng International Limited, a Hong Kong company and the Company’s related party (“Zhaoheng International”), purchased 1,000,000 common shares of ZHHL for the purchase price of US$10,000,000. Such proceeds shall be used for investment in small and medium hydropower projects and assets in China approved by the Investors.

Shareholders Agreement of Zhaoheng BVI

This Shareholders Agreement was entered into by and among the Investors, the Company, Zhaoheng BVI and Guosheng Xu (the “Zhaoheng BVI Shareholders Agreement”). Pursuant to the Zhaoheng BVI Shareholders Agreement, the shareholders of Zhaoheng BVI agreed that the Investors shall have the right to veto certain major actions taken by any of Zhaoheng BVI and its subsidiaries, as defined in the Zhaoheng BVI Shareholders Agreement. For so long as the Investors hold shares in Zhaoheng BVI, the Company shall not, directly or indirectly, transfer any equity securities in Zhaoheng BVI, except for any transfer of equity securities in Zhaoheng BVI held by the Company to the Company’s affiliate(s) who has executed and delivered to Zhaoheng BVI a deed of adherence substantially in the form attached to the Zhaoheng BVI Shareholders Agreement (“Deed of Adherence”). On the other hand, until the earlier of (i) the second (2nd) anniversary of the date of the Zhaoheng BVI Shareholders Agreement and (ii) the occurrence of an event of default by, among others, any of Guosheng Xu, Zhaoheng International, Zhaoheng BVI and ZHHL (collectively, the "Founder Parties") under the terms and conditions of the preference shares issued to the Investors, attached as Exhibit A to the Parent Preference Share Purchase Agreement (“Preference Share Conditions”), the Investors shall not, directly or indirectly, transfer any equity securities in Zhaoheng BVI, except for between Investors and to an affiliate(s) who has executed and delivered a Deed of Adherence.

Shareholders Agreement of ZHHL

This Shareholders Agreement was entered into by and among the Investors, Zhaoheng International, Zhaoheng BVI, ZHHL and Guosheng Xu (the “ZHHL Shareholders Agreement”). Similarly, pursuant to the ZHHL Shareholders Agreement, the shareholders of ZHHL agreed that the Investors shall have the right to veto certain major actions taken by any of ZHHL and its subsidiaries, as defined in the ZHHL Shareholders Agreement. Until the earlier of (i) the third (3rd) anniversary of the date of the ZHHL Shareholders Agreement and (ii) the date which is eighteen (18) months following the expiration of the period following the initial public offering of ZHHL, Zhaoheng International, Zhaoheng BVI and Guosheng Xu shall not, directly or indirectly, transfer any equity securities in ZHHL, except for a number of permitted transfers stipulated in the ZHHL Shareholders Agreement. On the other hand, until the earlier of (i) the second (2nd) anniversary of the date of the ZHHL Shareholders Agreement and (ii) the occurrence of an event of default by, among others, any of the Founder Parties under the Preference Share Conditions, the Investors shall not, directly or indirectly, transfer any equity securities in ZHHL, except for between Investors and to an affiliate(s) who has executed and delivered a Deed of Adherence.

Lock-Up Agreement

This Lock-Up Agreement was entered into by and among the Investors, Embedded Internet Solutions Limited (“EISL”), the Company and Guosheng Xu (the “Lock-Up Agreement”). Pursuant to the Lock-Up Agreement, EISL, the Company and Guosheng Xu shall not, directly or indirectly, transfer any equity securities in ZHHL until the earlier of (i) the third (3rd) anniversary of the date of the Lock-Up Agreement and (ii) the date which is eighteen (18) months following the expiration of the period following the initial public offering, except for a number of permitted transfers stipulated in the Lock-Up Agreement.

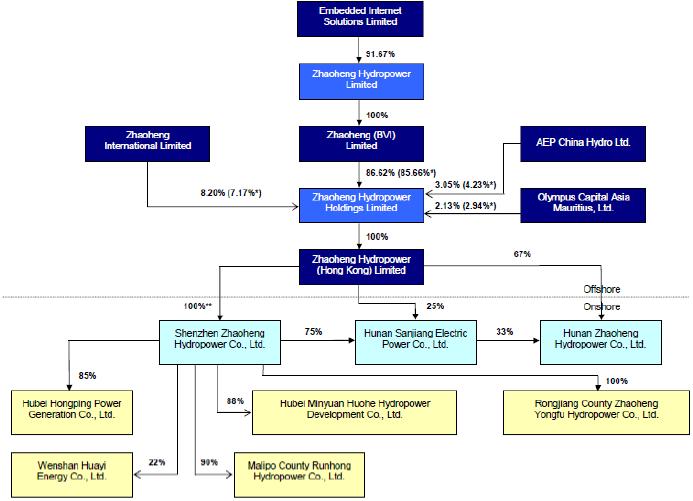

Current Corporate Structure

The following chart sets forth the Company’s current corporate structure:

| * | Percentage of ownership after the second payment for the aggregate of the remaining Parent Preference Shares and Company Common Shares has been made by the Investors without taking into account the conversion of the Parent Preference Shares into common shares. |

| ** | 1.73% of the equity interest in Shenzhen Zhaoheng Hydropower Co., Ltd. held by Shenzhen Zhaoheng Industrial Co., Ltd. was entrusted to Zhaoheng Hydropower Hong Kong Limited on December 31, 2007. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ZHAOHENG HYDROPOWER LIMITED (Registrant) | |

| | | |

| | | | |

Date July 23, 2009 | By | /s/ Guosheng Xu | |

| | | Name: Guosheng Xu | |

| | | Title: Chief Executive Officer | |