UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2013 |

This report on Form N-CSR relates solely to the Registrant's Fidelity Diversified International Fund, Fidelity Emerging Europe, Middle East, Africa (EMEA) Fund, Fidelity Global Commodity Stock Fund, Fidelity Global Equity Income Fund, Fidelity International Capital Appreciation Fund, Fidelity International Discovery Fund, Fidelity International Growth Fund, Fidelity International Small Cap Fund, Fidelity International Small Cap Opportunities Fund, Fidelity International Value Fund, Fidelity Overseas Fund, Fidelity Series Emerging Markets Fund, Fidelity Series International Growth Fund, Fidelity Series International Small Cap Fund, Fidelity Series International Value Fund, Fidelity Total International Equity Fund, and Fidelity Worldwide series (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

Fidelity®

Total International Equity

Fund

Semiannual Report

April 30, 2013

(Fidelity Cover Art)

Contents

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2013 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2012 to April 30, 2013).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Shareholder Expense Example - continued

| Annualized Expense RatioB | Beginning

Account Value

November 1, 2012 | Ending

Account Value

April 30, 2013 | Expenses Paid

During Period*

November 1, 2012

to April 30, 2013 |

Class A | 1.45% | | | |

Actual | | $ 1,000.00 | $ 1,135.30 | $ 7.68 |

HypotheticalA | | $ 1,000.00 | $ 1,017.60 | $ 7.25 |

Class T | 1.69% | | | |

Actual | | $ 1,000.00 | $ 1,133.10 | $ 8.94 |

HypotheticalA | | $ 1,000.00 | $ 1,016.41 | $ 8.45 |

Class B | 2.20% | | | |

Actual | | $ 1,000.00 | $ 1,130.80 | $ 11.62 |

HypotheticalA | | $ 1,000.00 | $ 1,013.88 | $ 10.99 |

Class C | 2.20% | | | |

Actual | | $ 1,000.00 | $ 1,131.60 | $ 11.63 |

HypotheticalA | | $ 1,000.00 | $ 1,013.88 | $ 10.99 |

Total International Equity | 1.08% | | | |

Actual | | $ 1,000.00 | $ 1,137.10 | $ 5.72 |

HypotheticalA | | $ 1,000.00 | $ 1,019.44 | $ 5.41 |

Institutional Class | 1.20% | | | |

Actual | | $ 1,000.00 | $ 1,136.10 | $ 6.36 |

HypotheticalA | | $ 1,000.00 | $ 1,018.84 | $ 6.01 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Semiannual Report

Investment Changes (Unaudited)

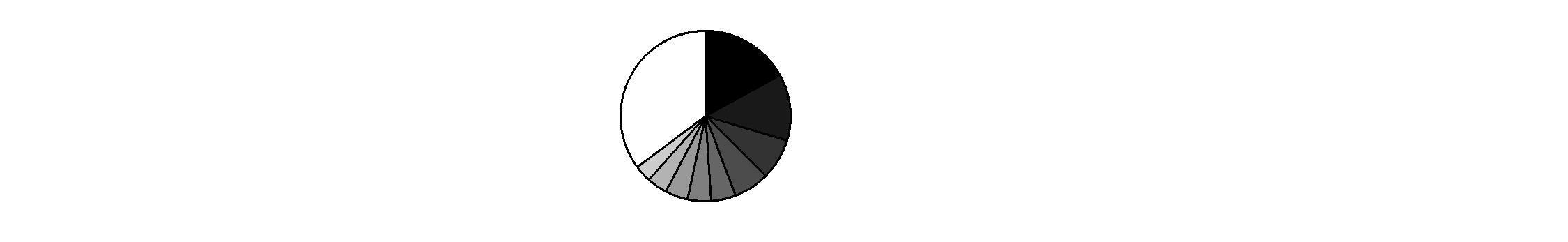

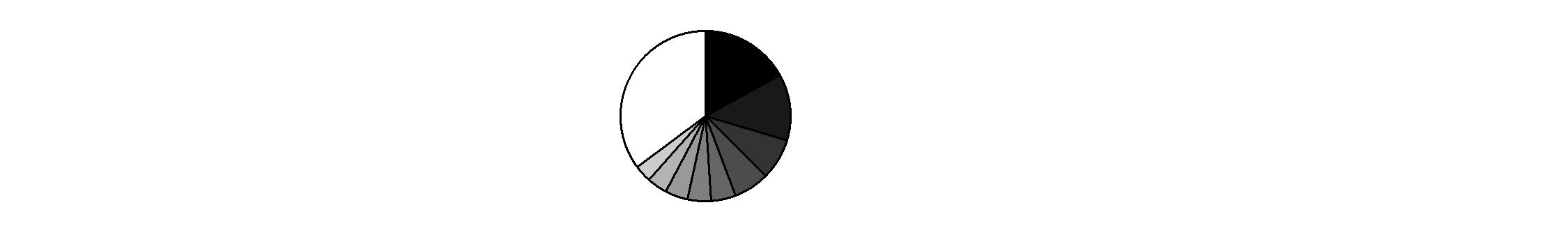

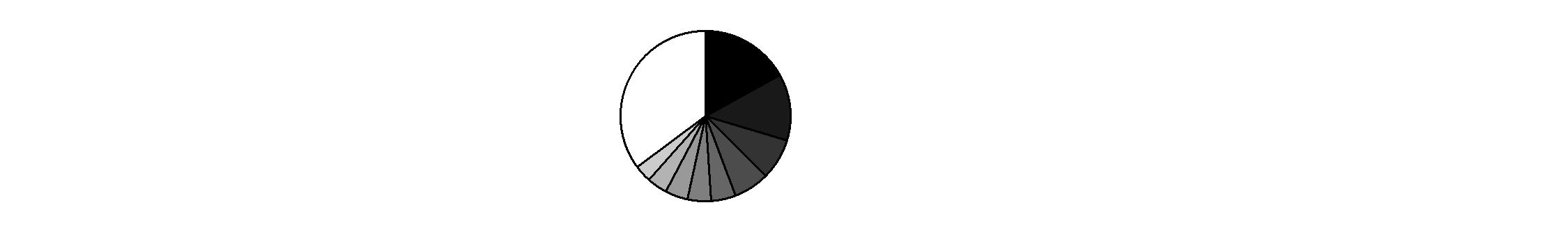

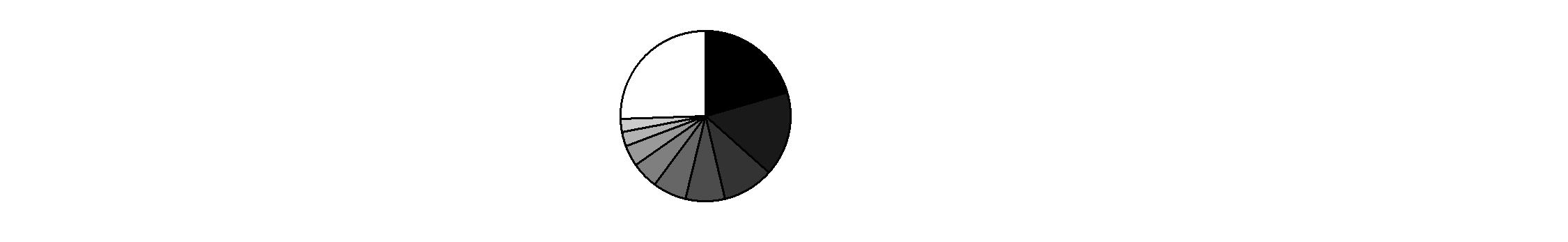

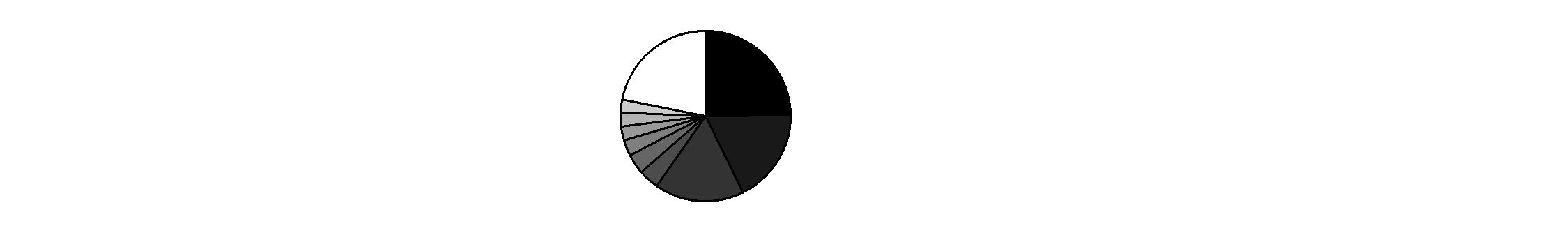

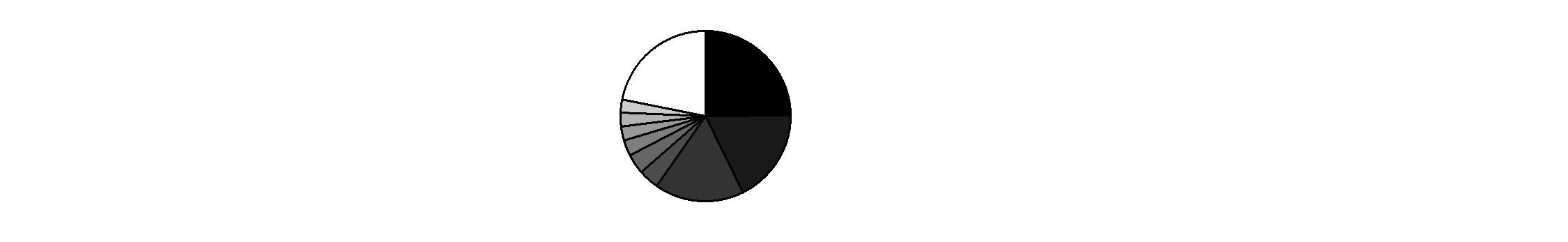

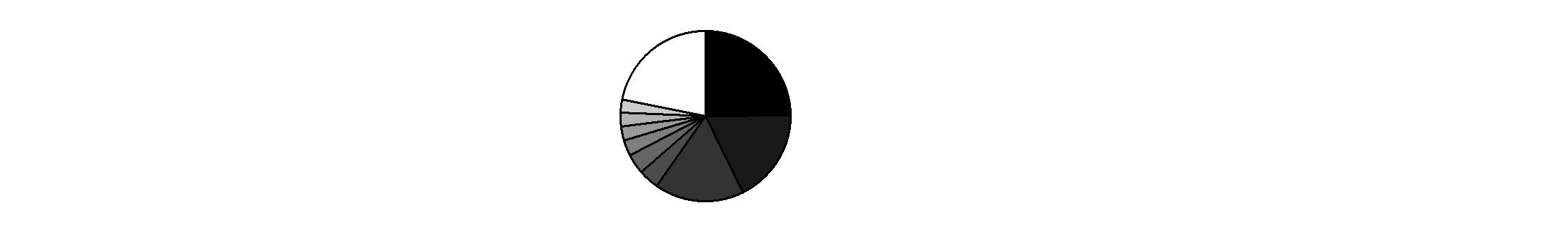

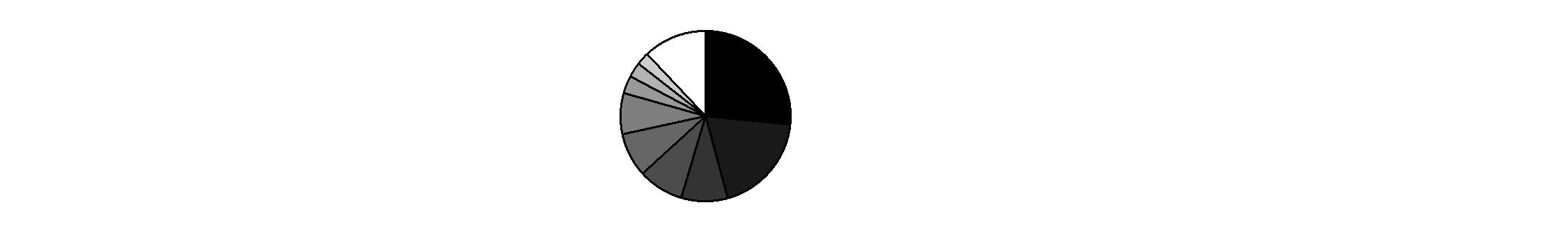

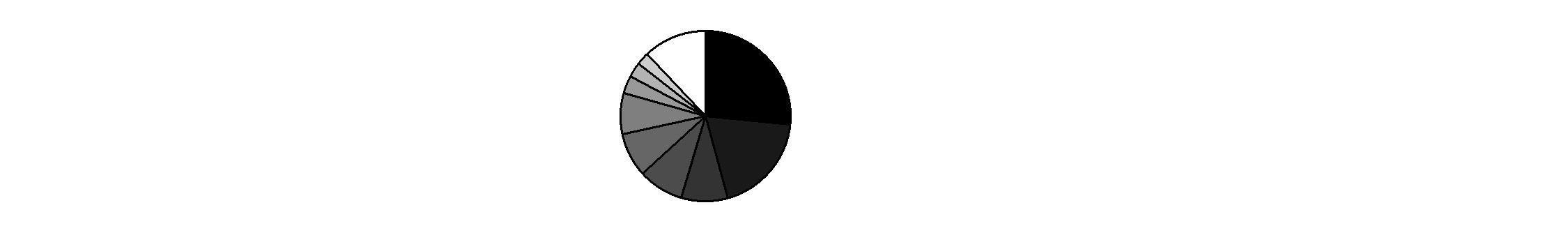

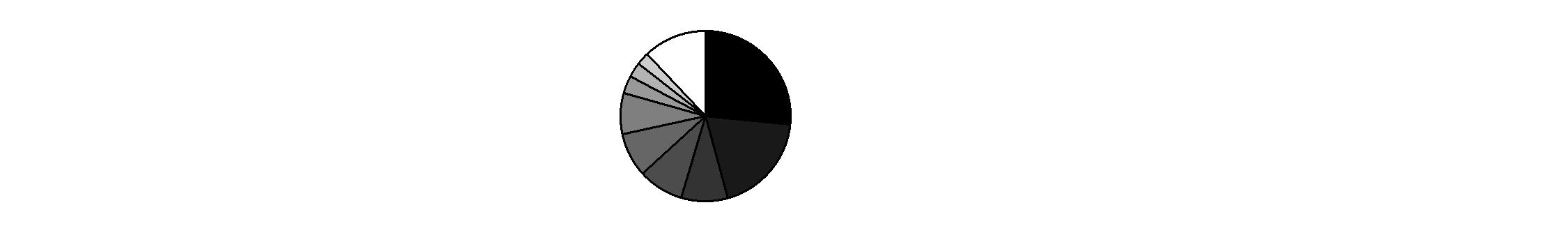

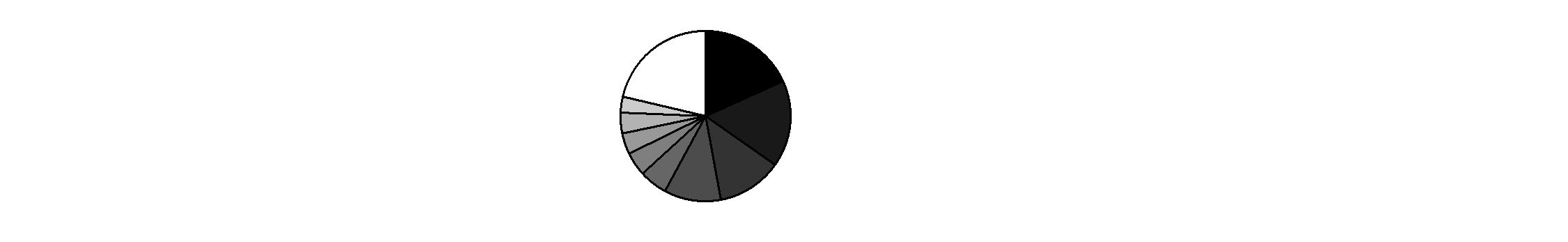

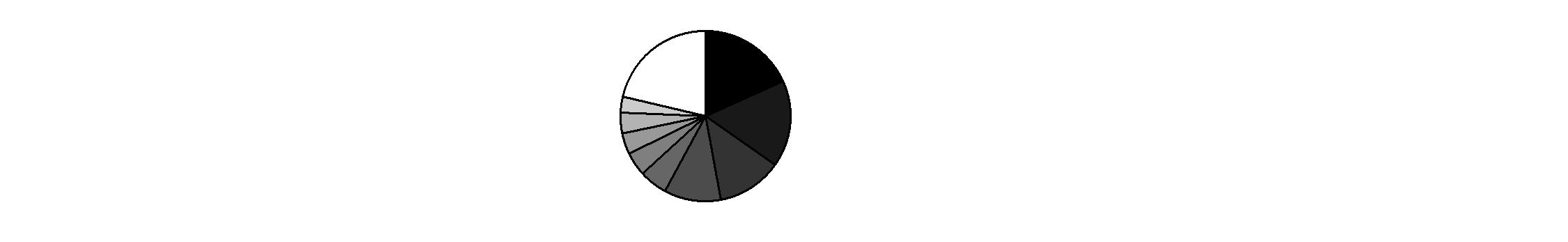

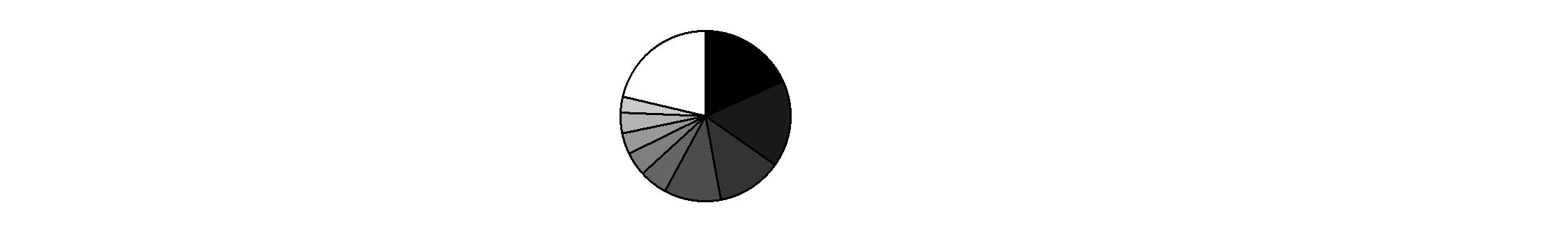

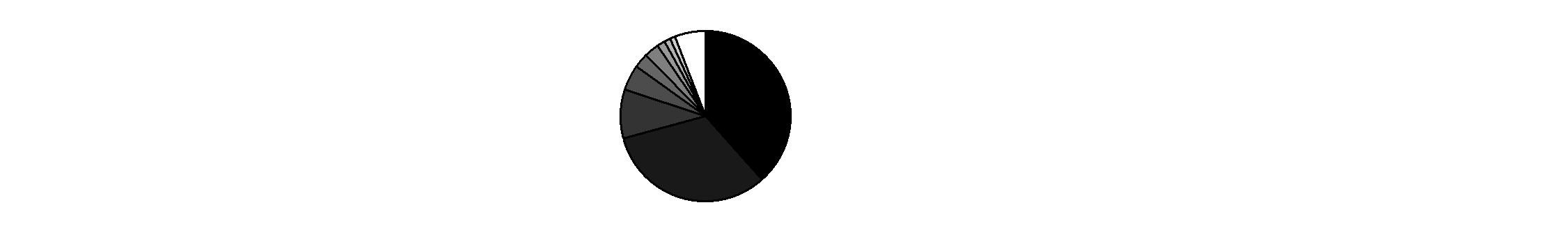

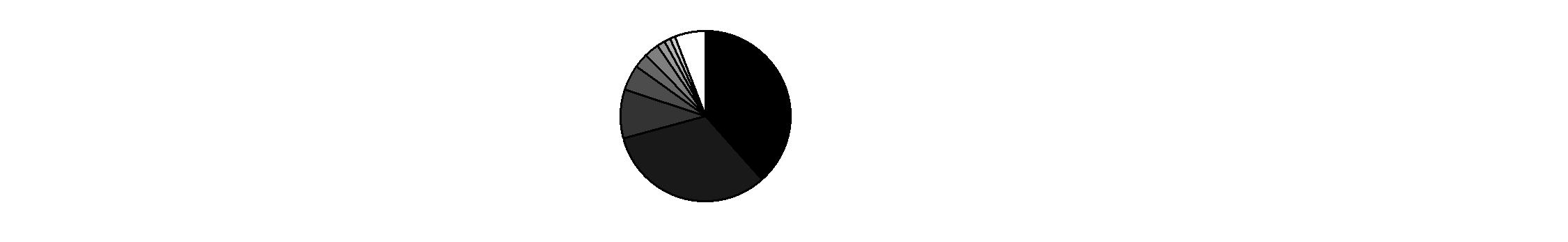

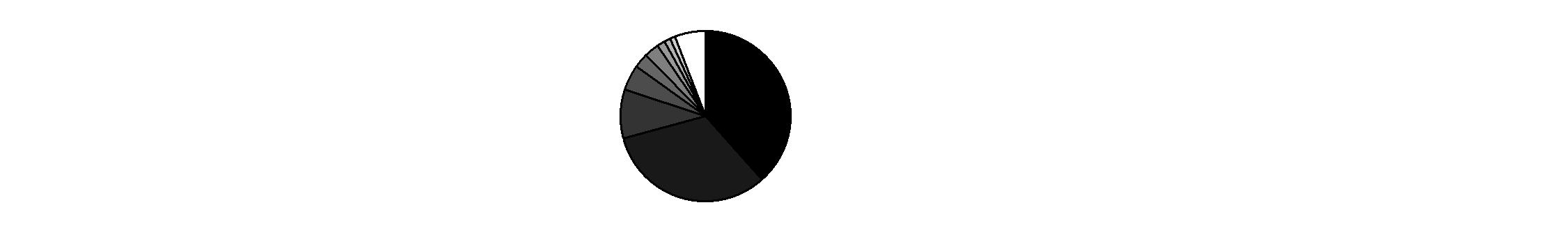

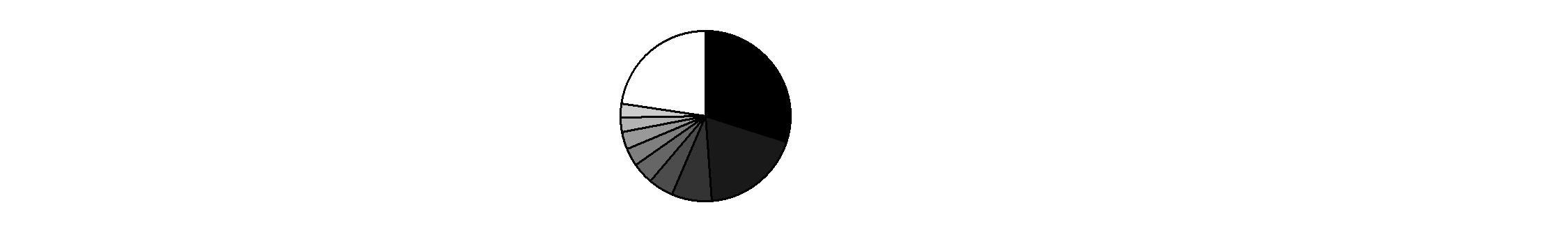

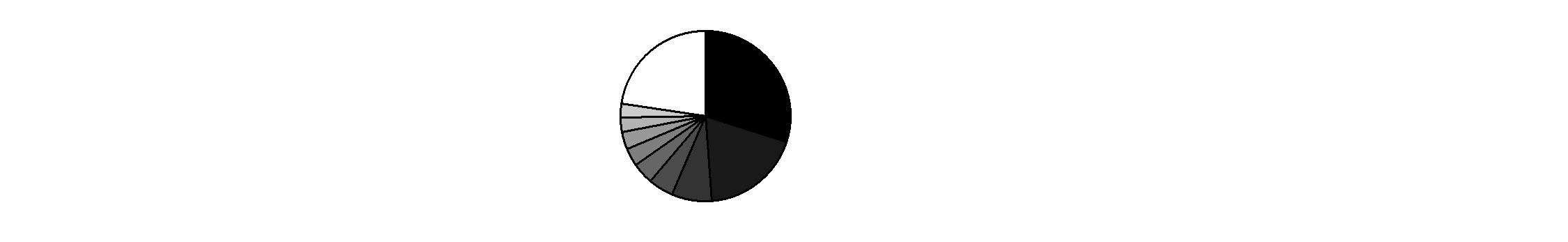

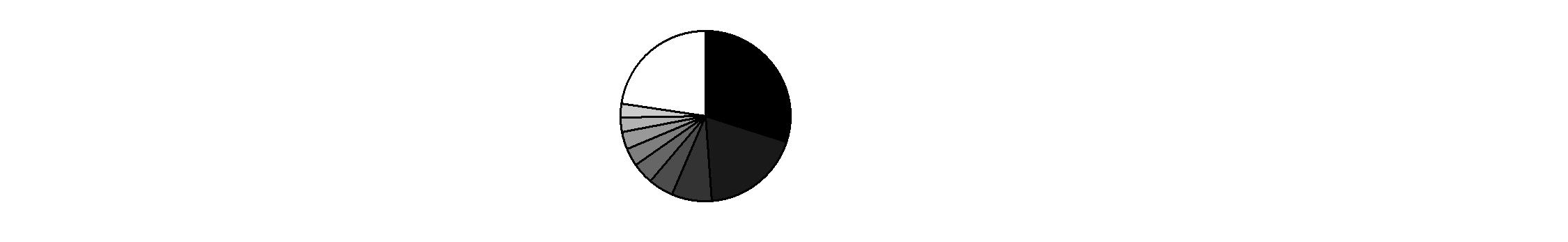

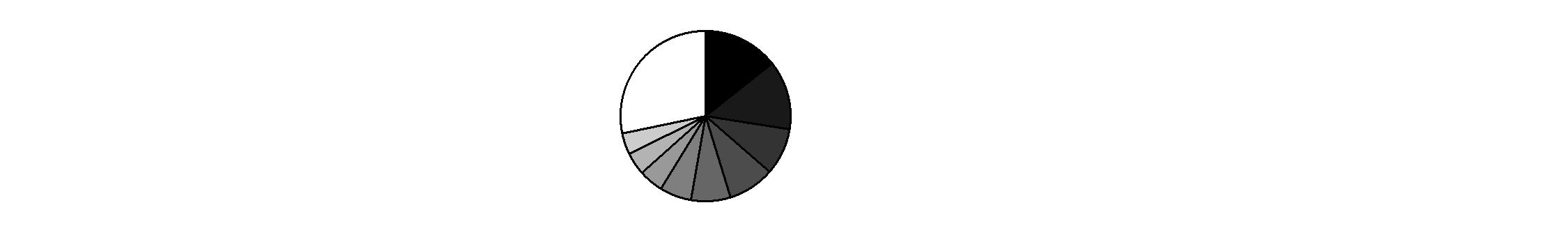

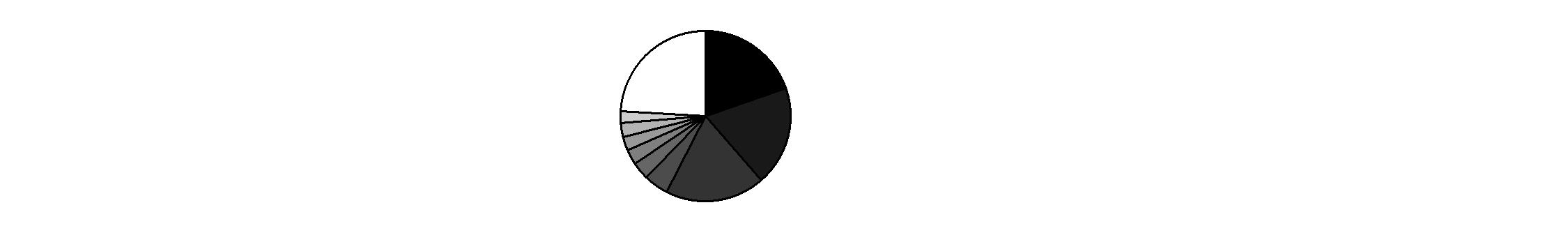

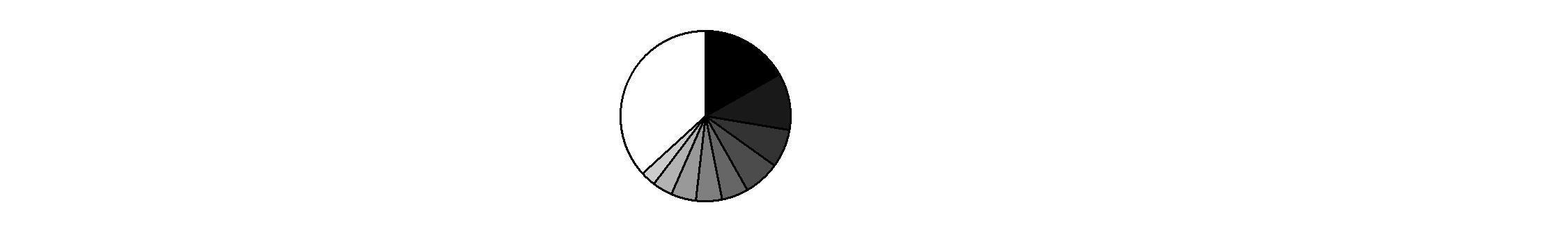

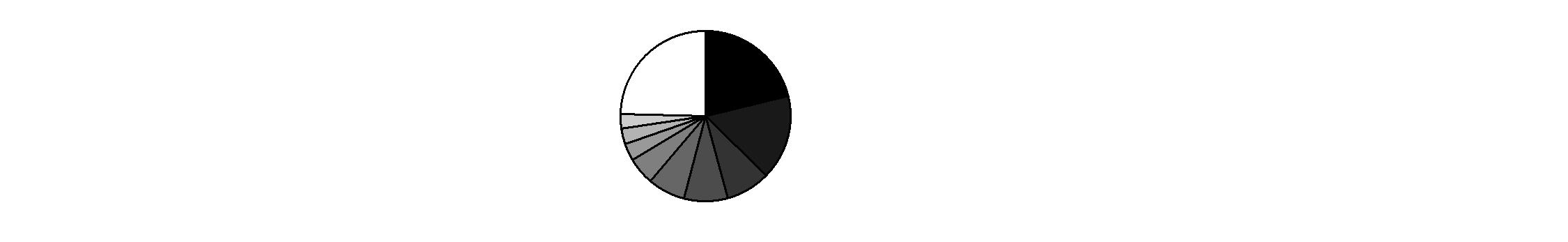

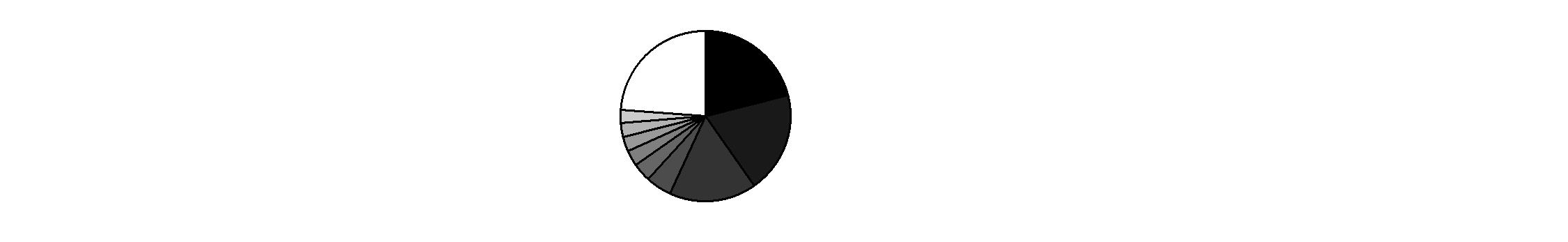

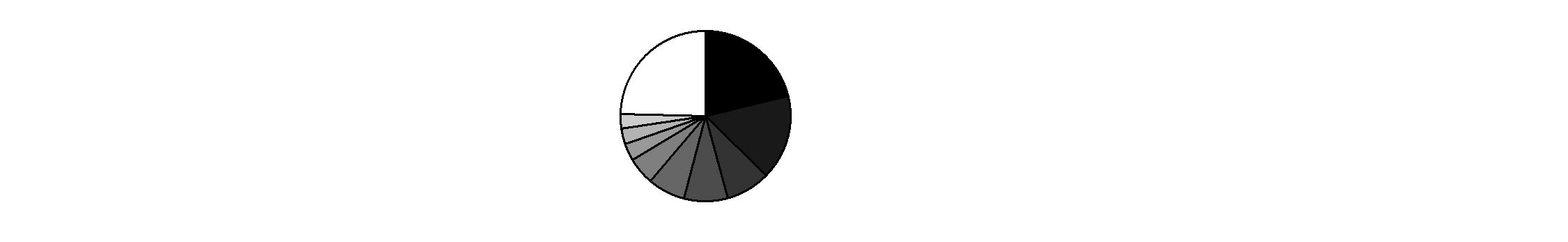

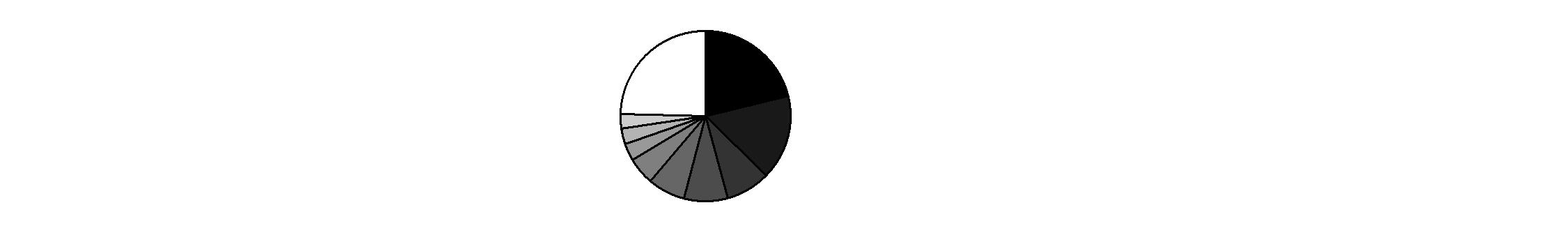

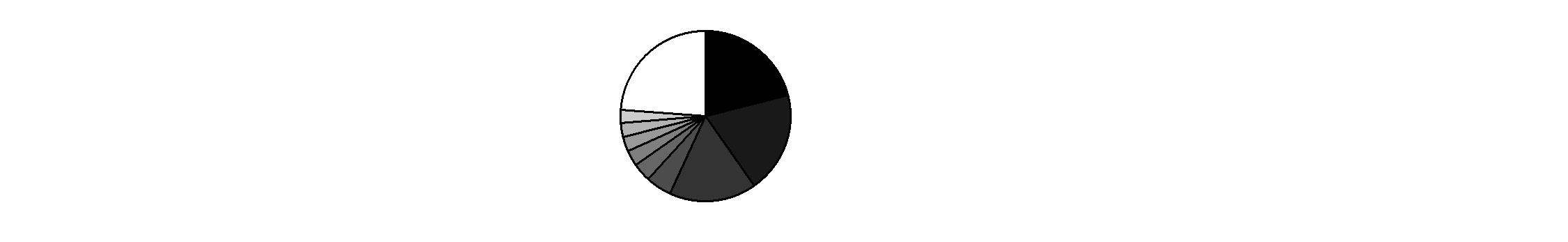

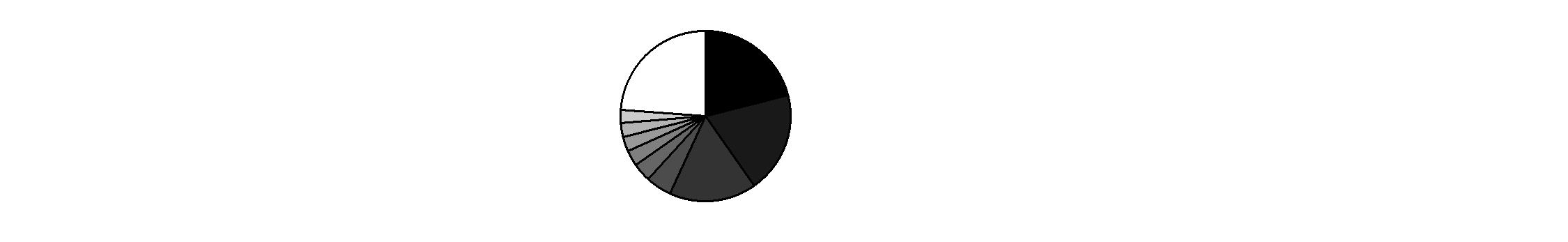

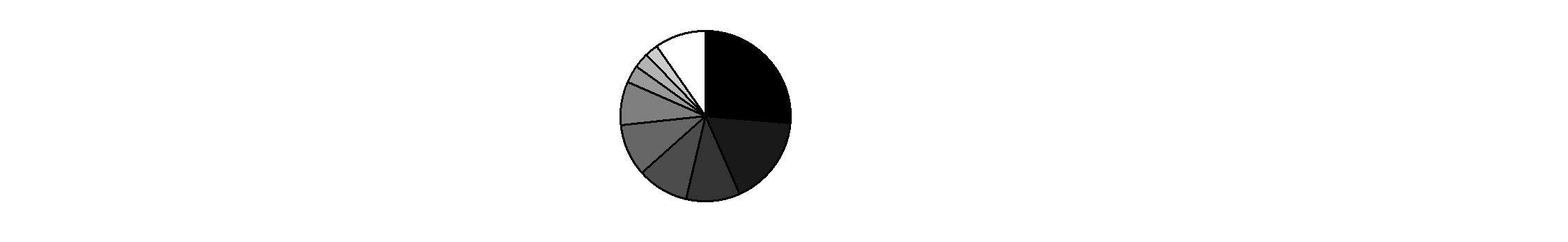

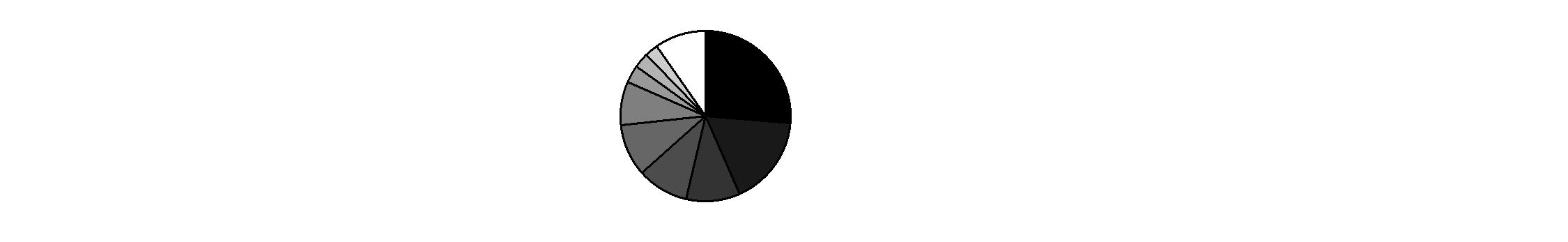

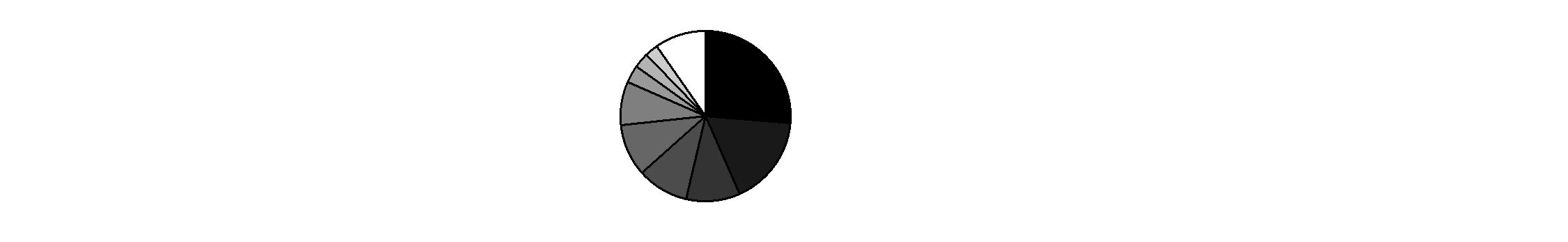

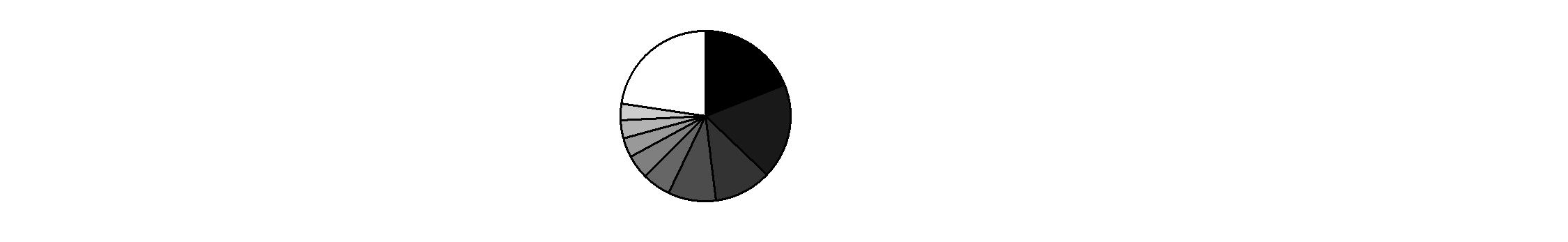

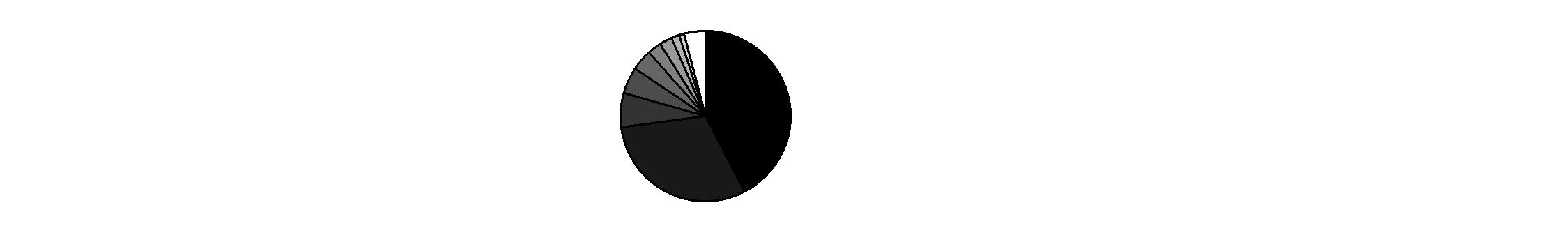

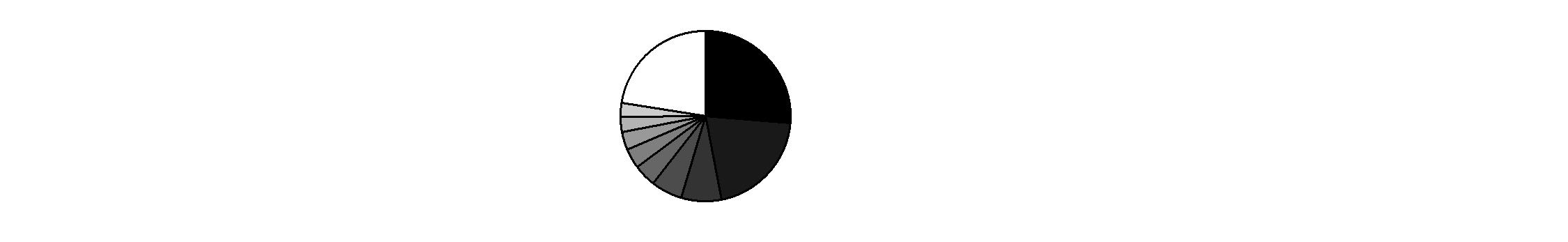

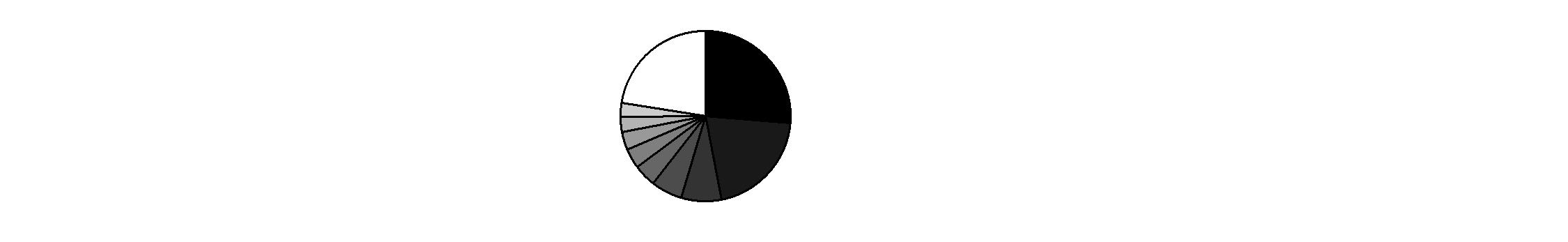

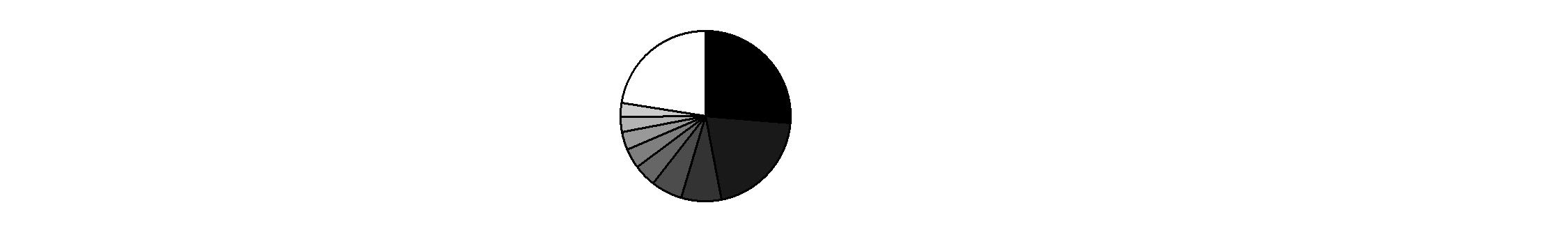

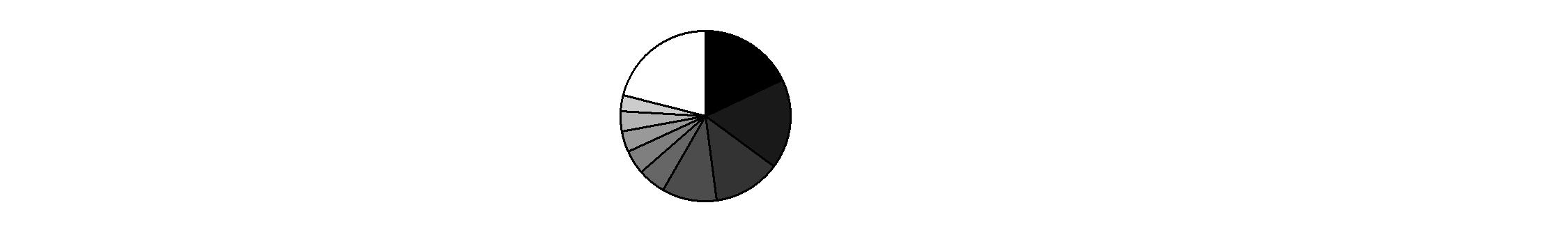

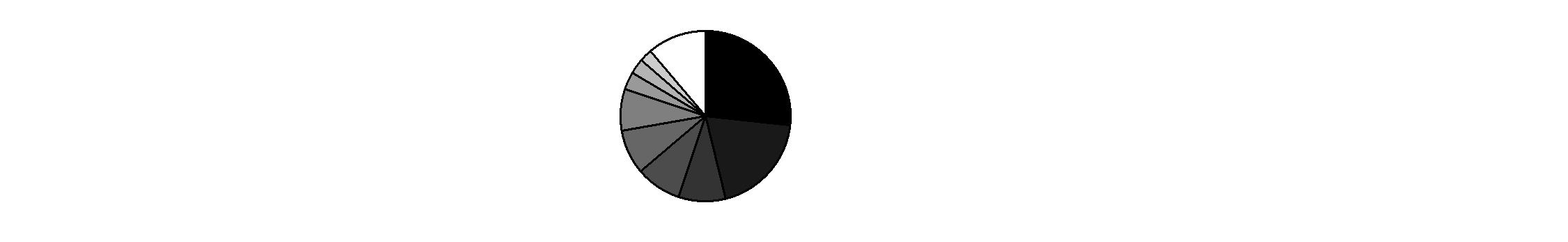

Geographic Diversification (% of fund's net assets) |

As of April 30, 2013 |

| United Kingdom 17.0% | |

| Japan 12.6% | |

| United States of America 7.8% | |

| Switzerland 6.9% | |

| Germany 4.6% | |

| Australia 4.5% | |

| France 4.3% | |

| Taiwan 3.9% | |

| India 3.1% | |

| Other 35.3% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

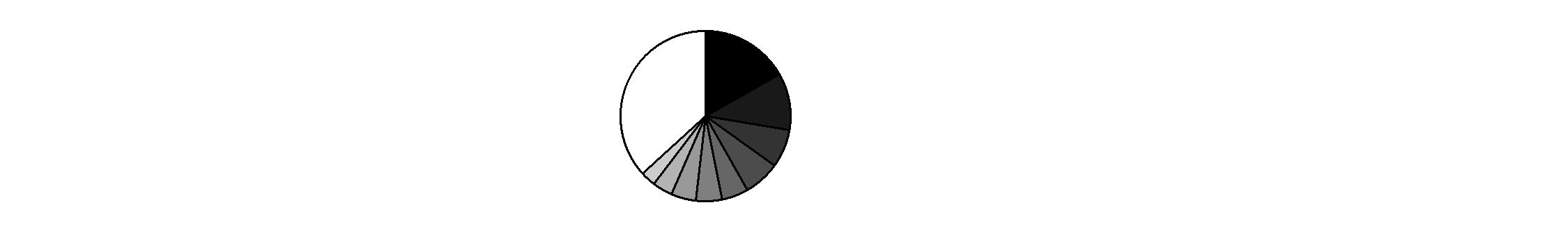

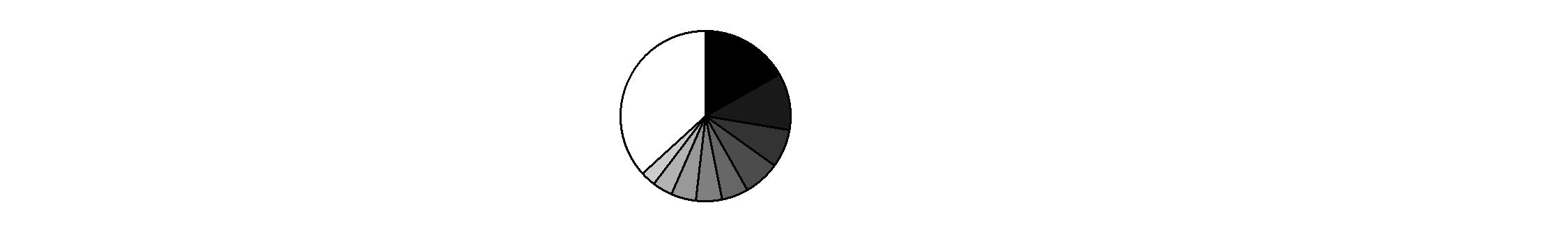

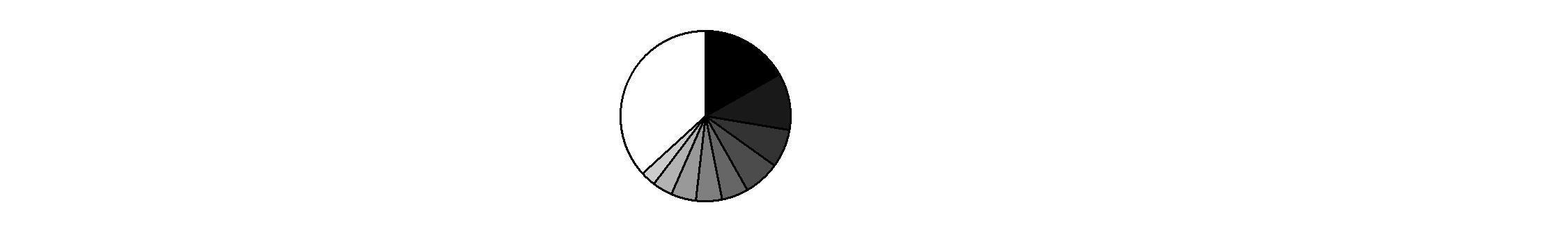

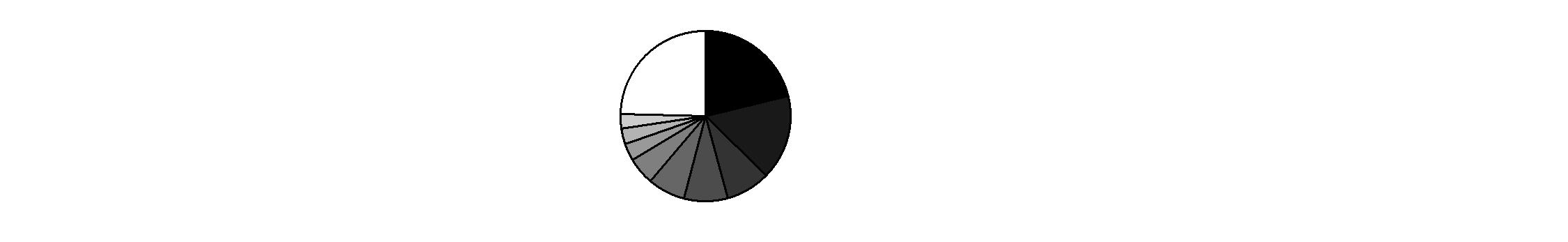

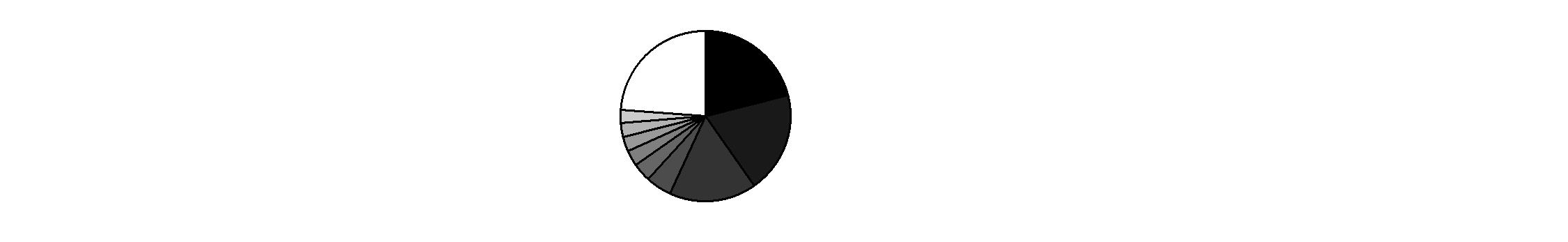

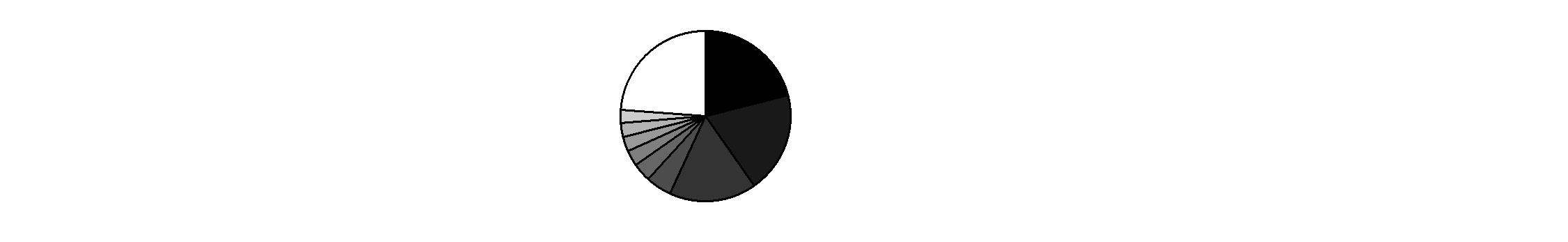

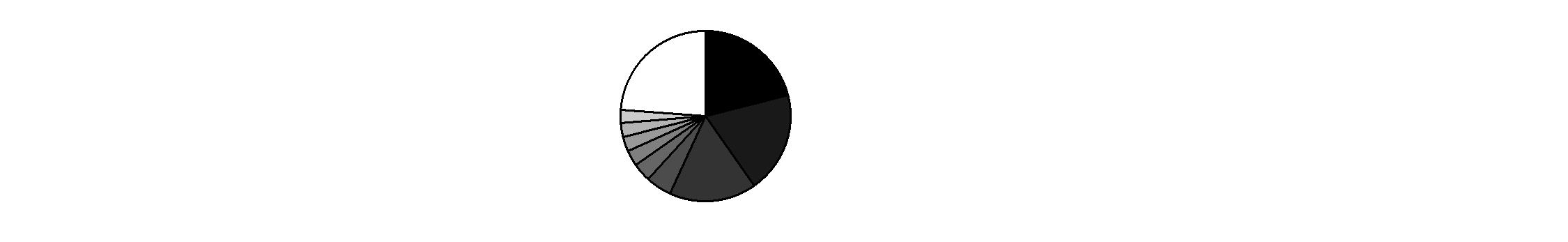

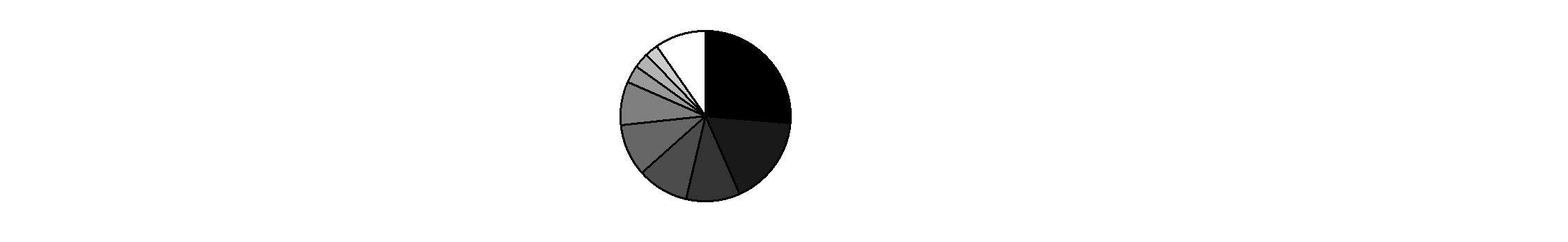

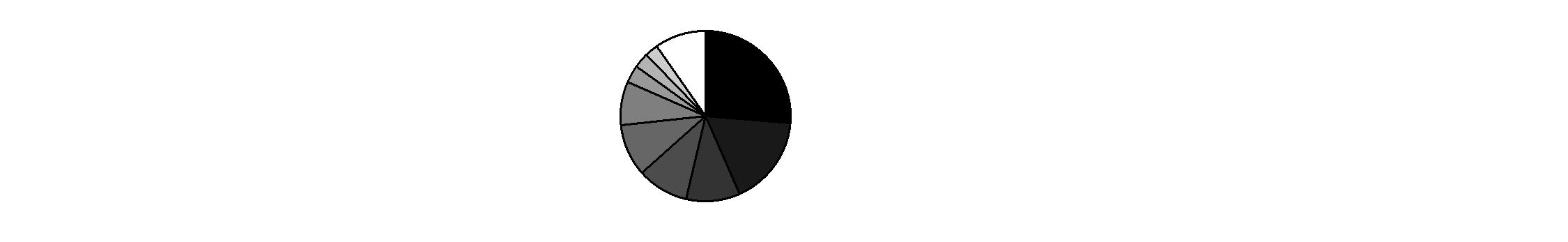

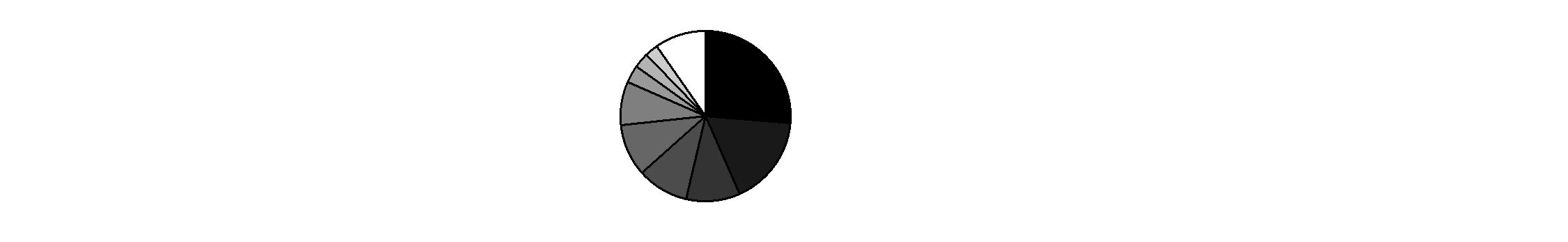

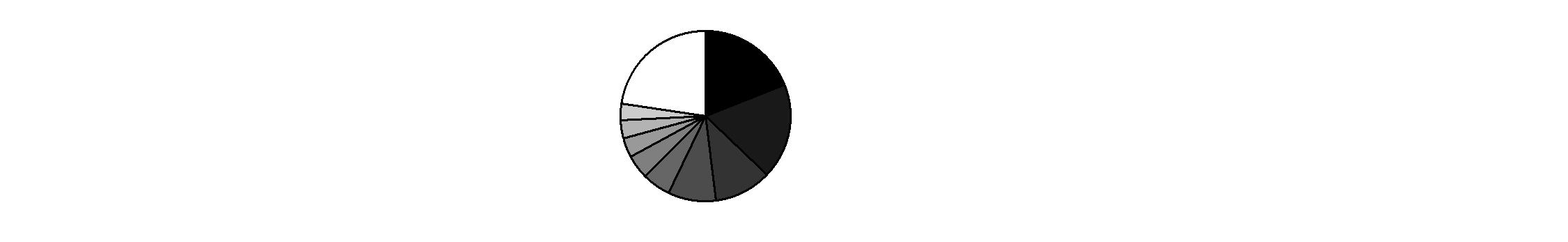

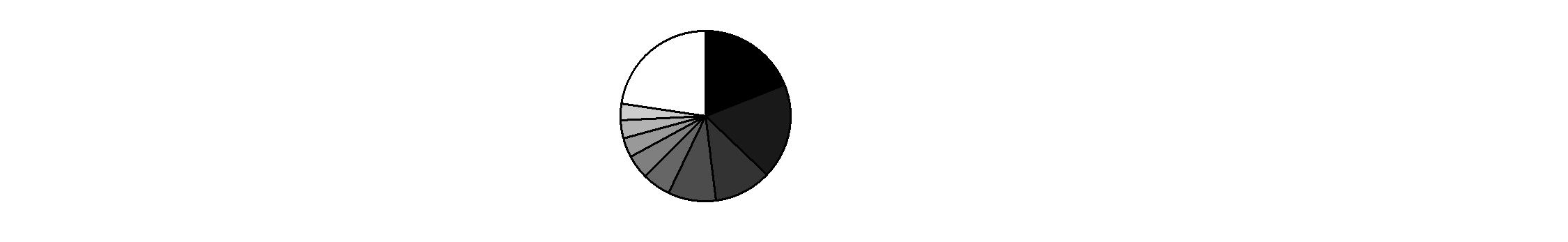

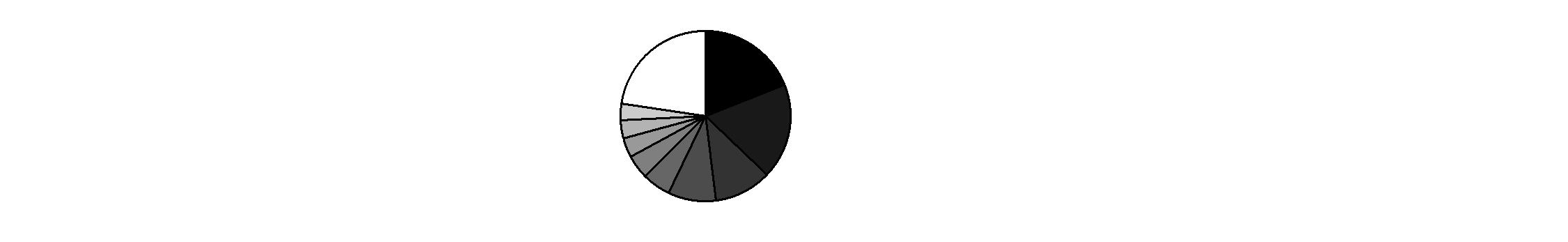

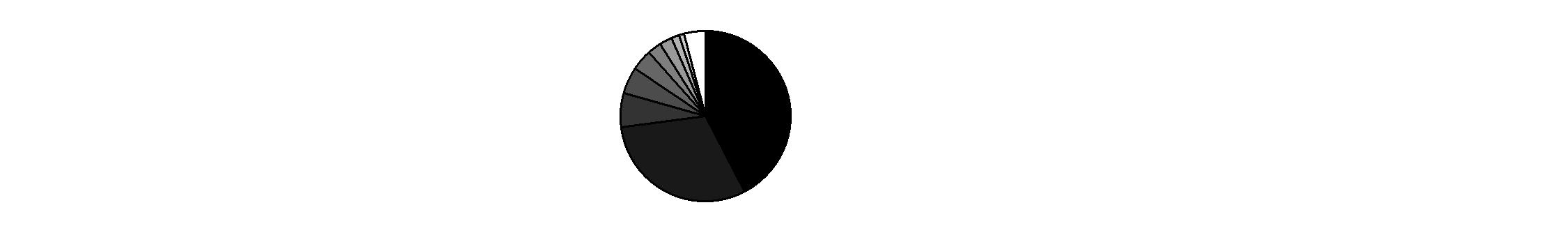

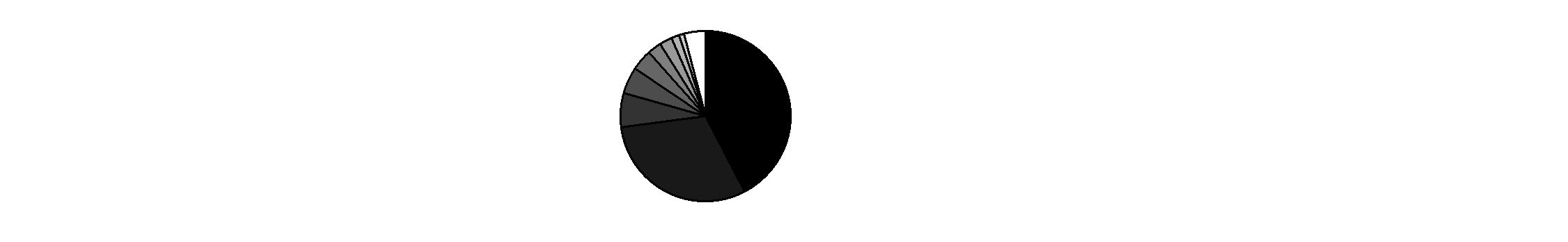

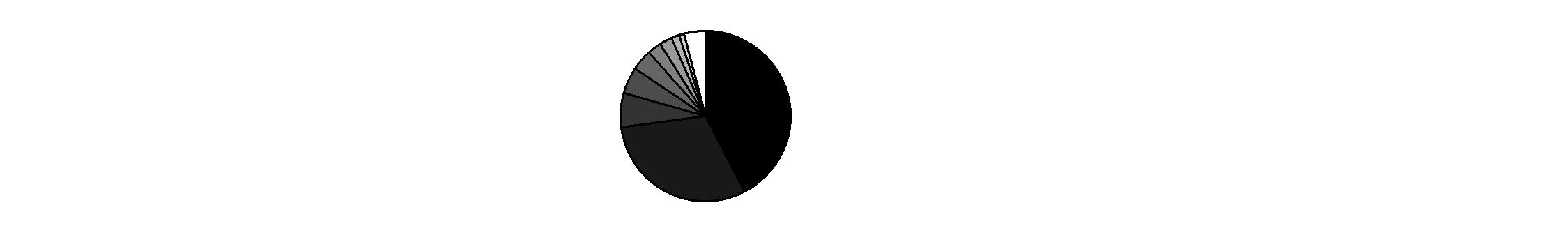

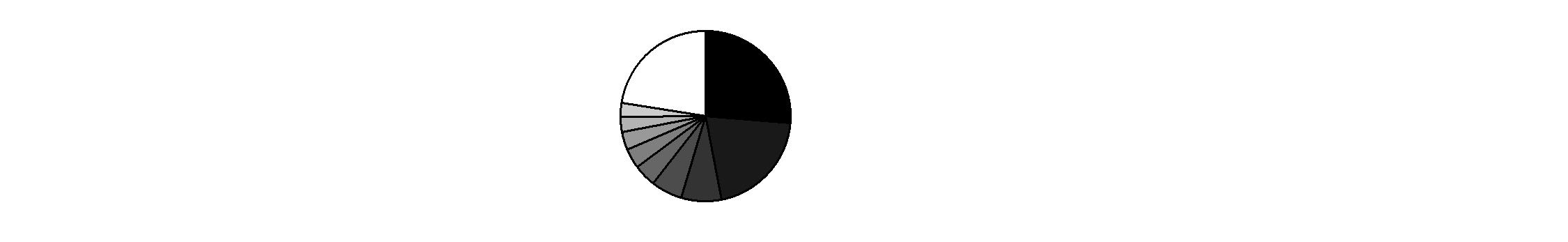

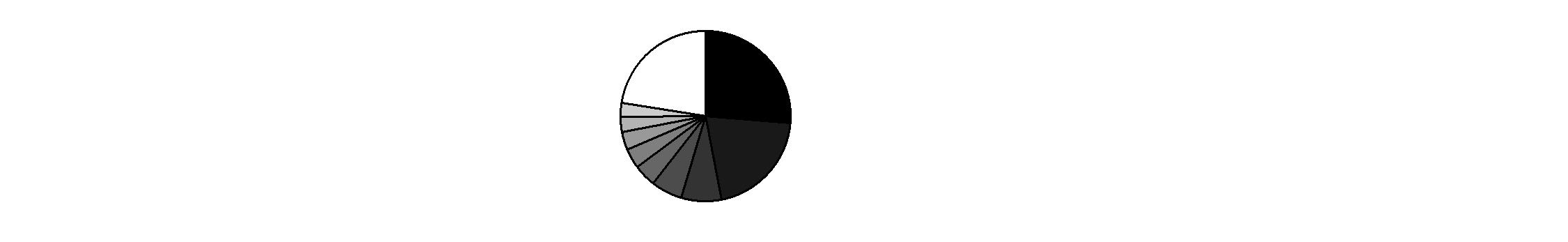

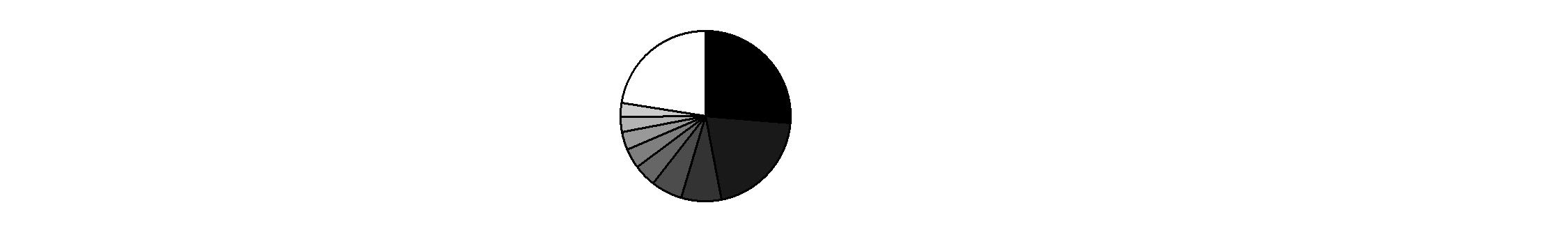

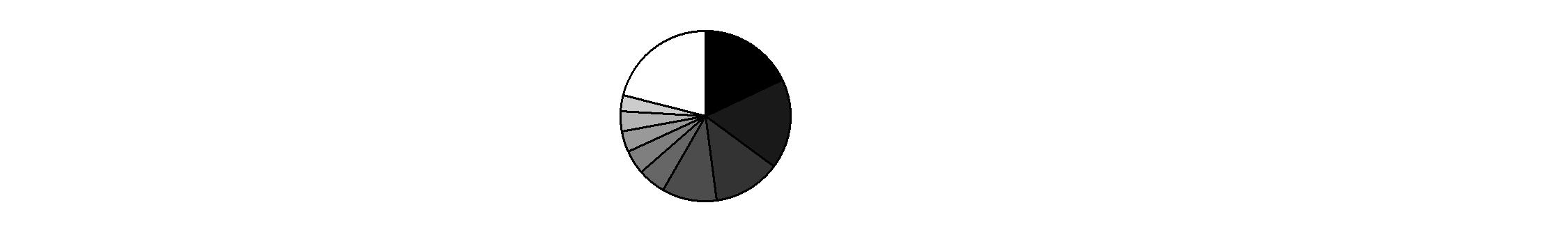

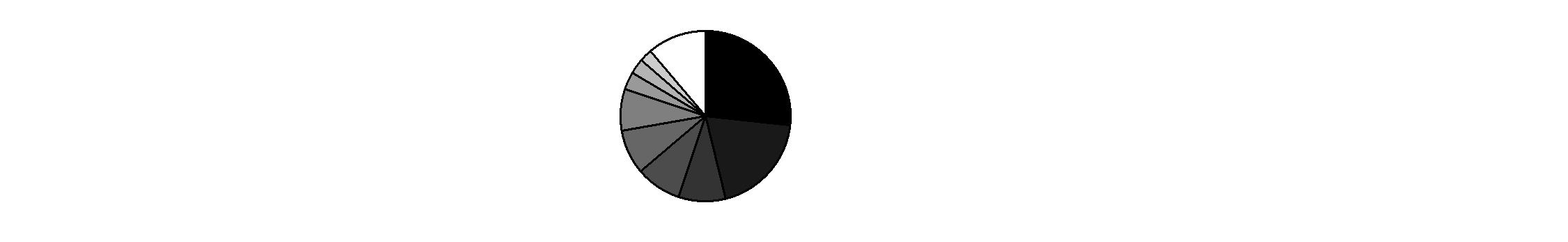

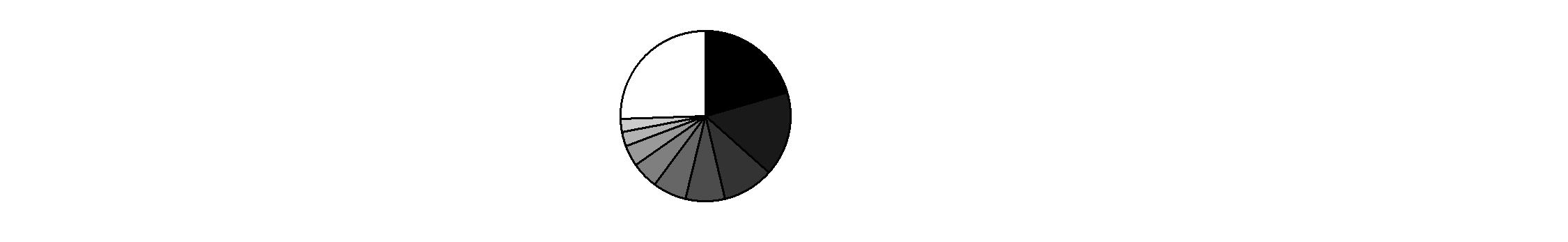

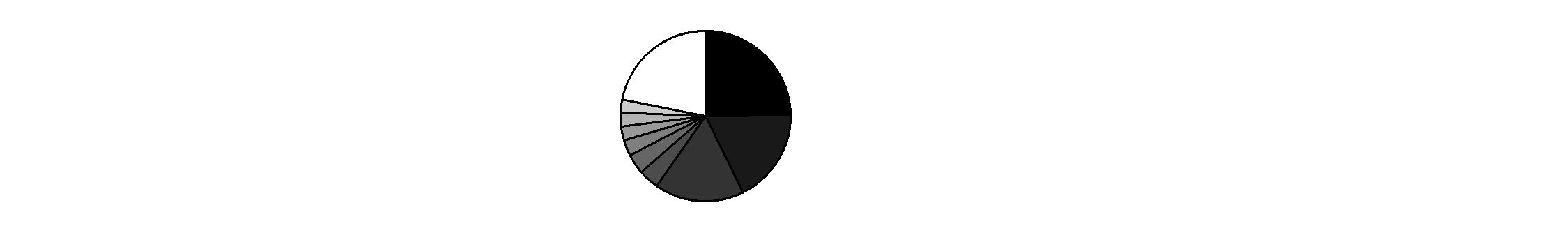

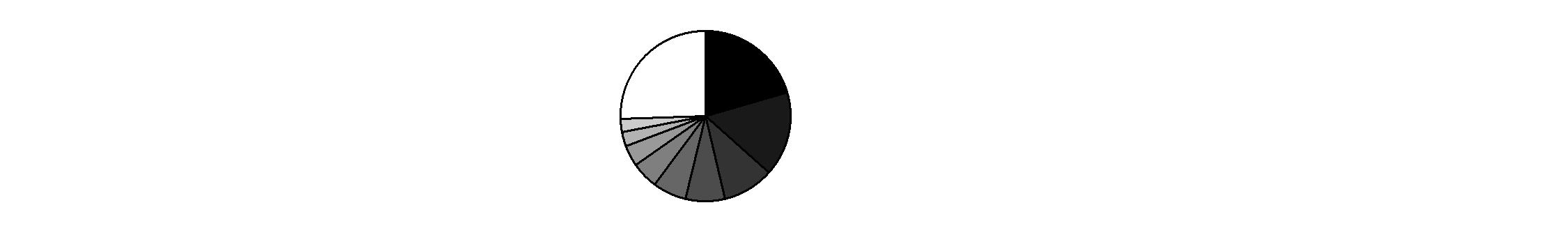

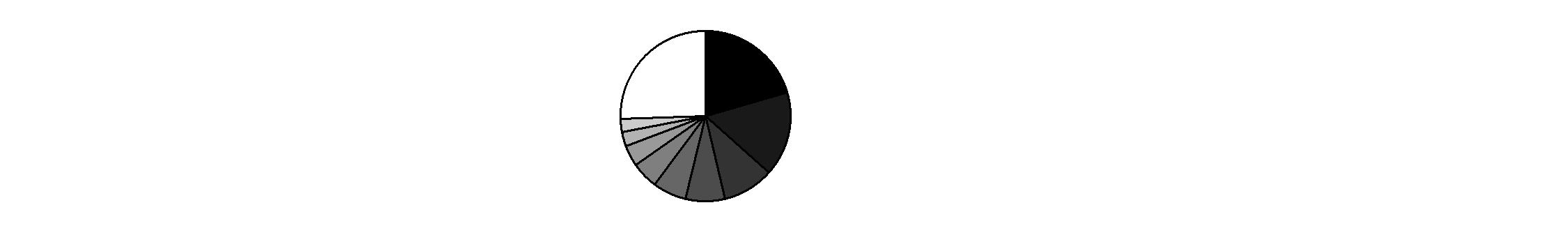

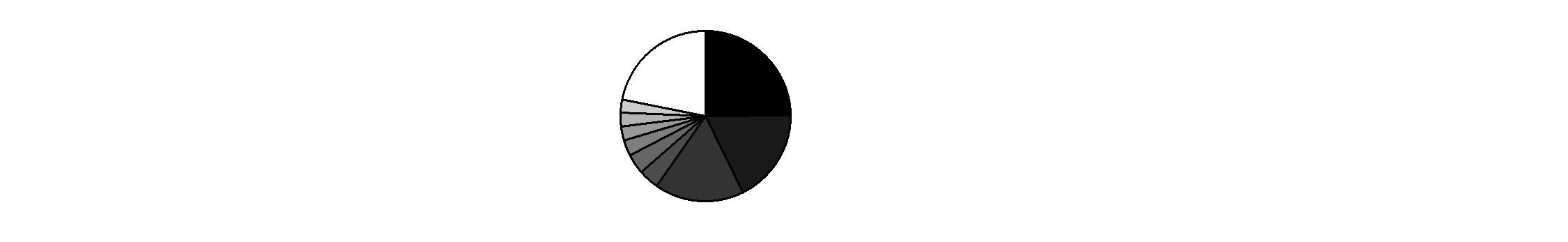

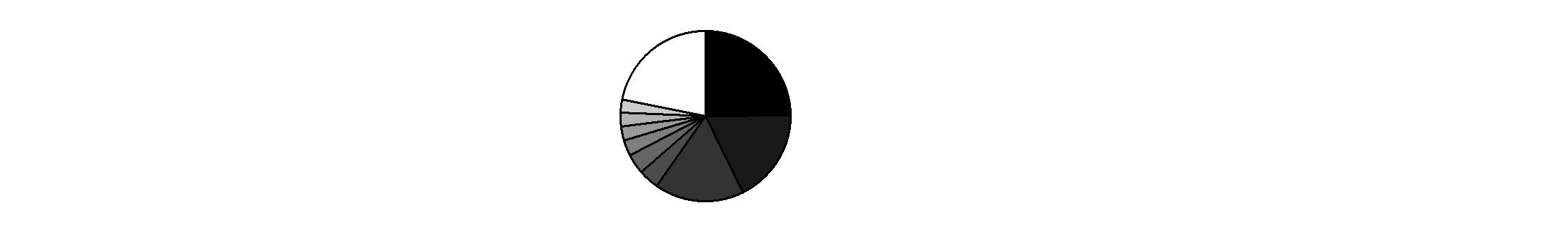

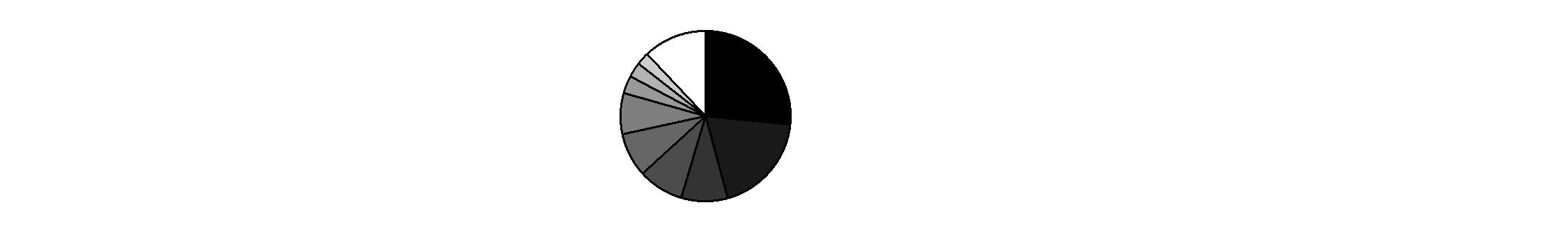

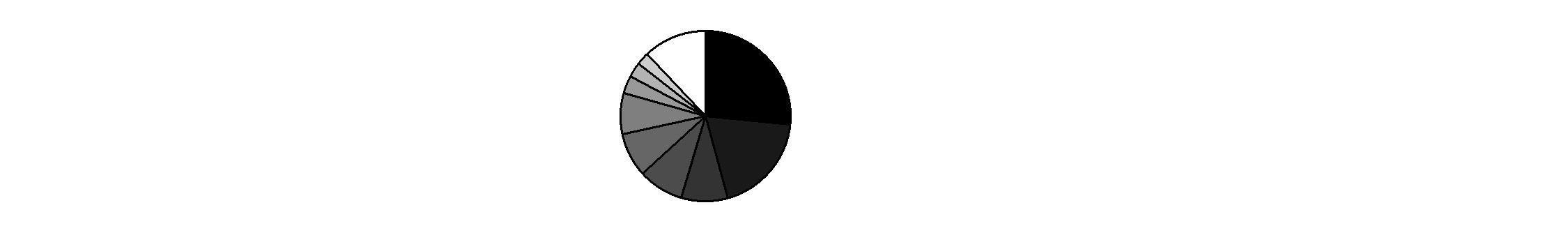

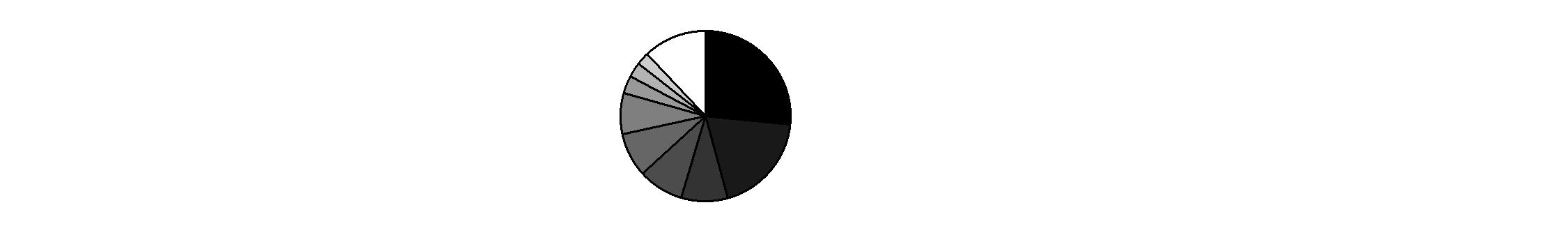

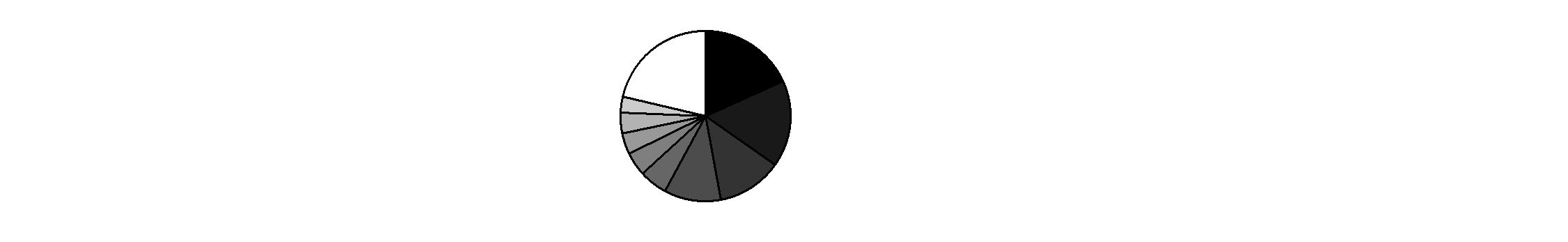

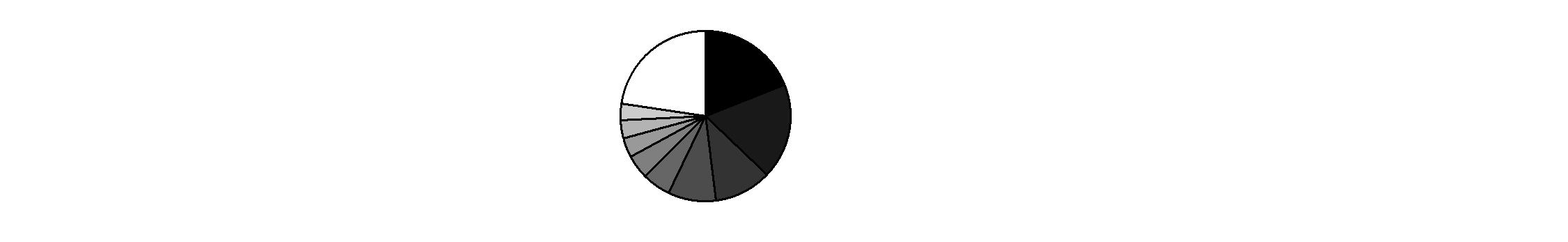

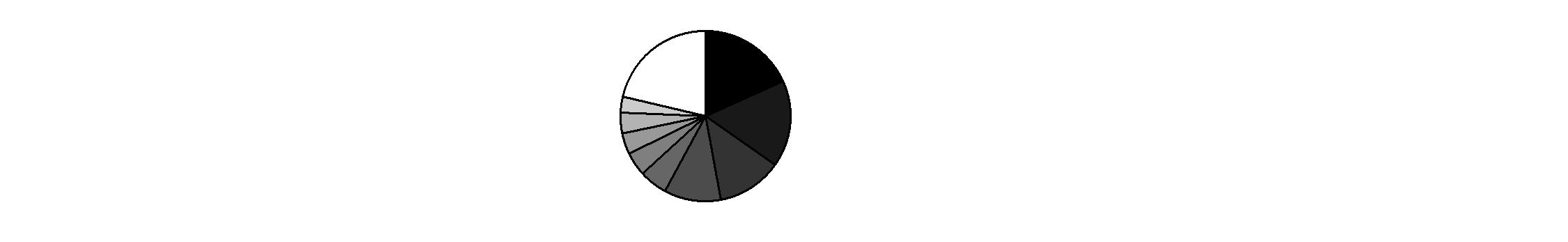

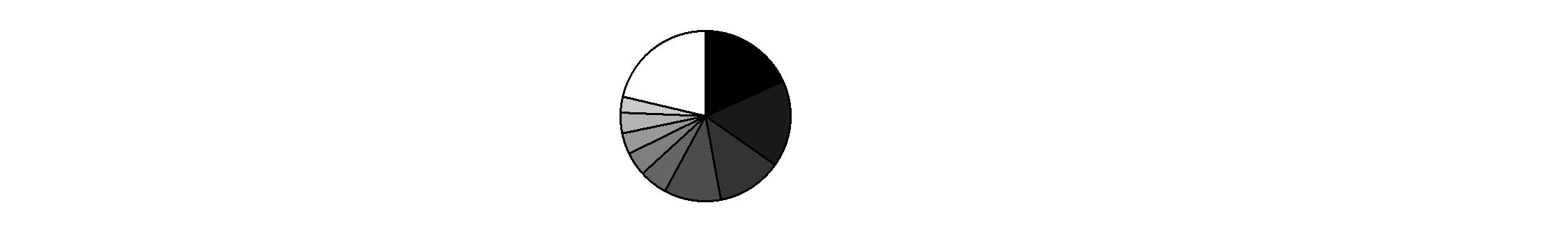

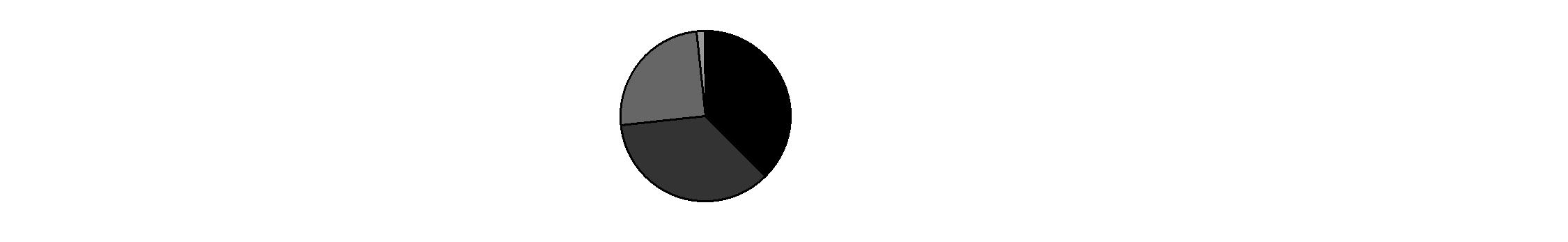

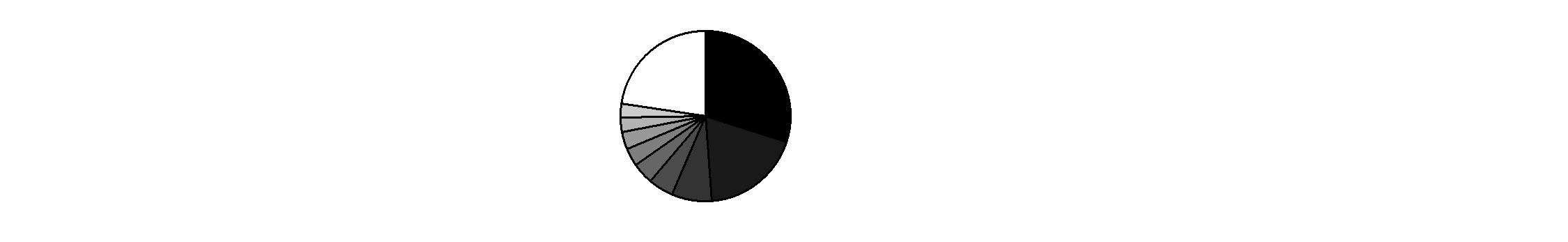

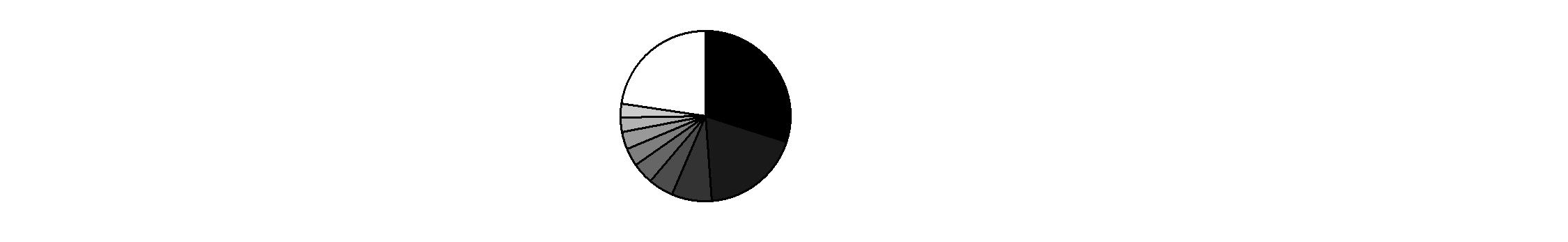

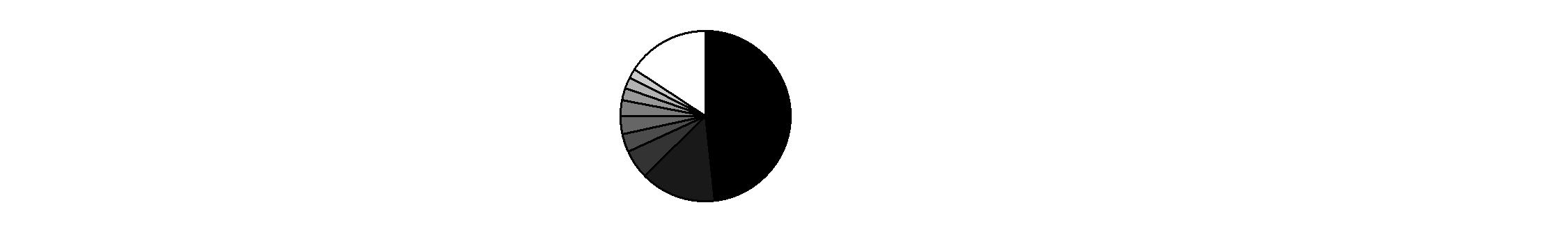

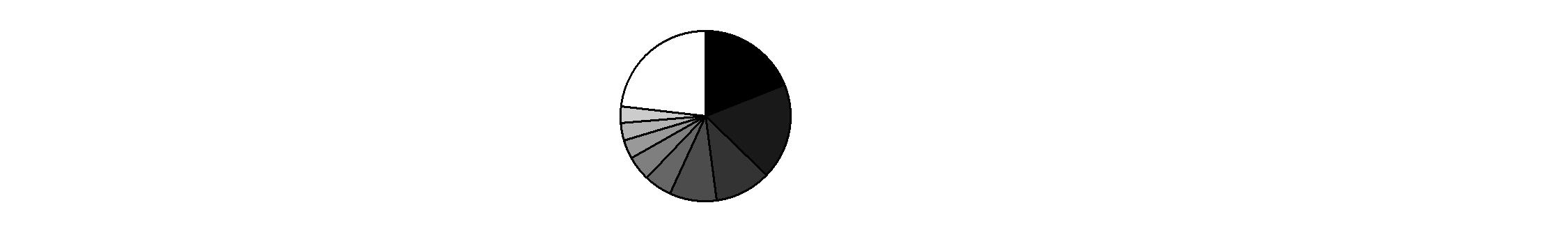

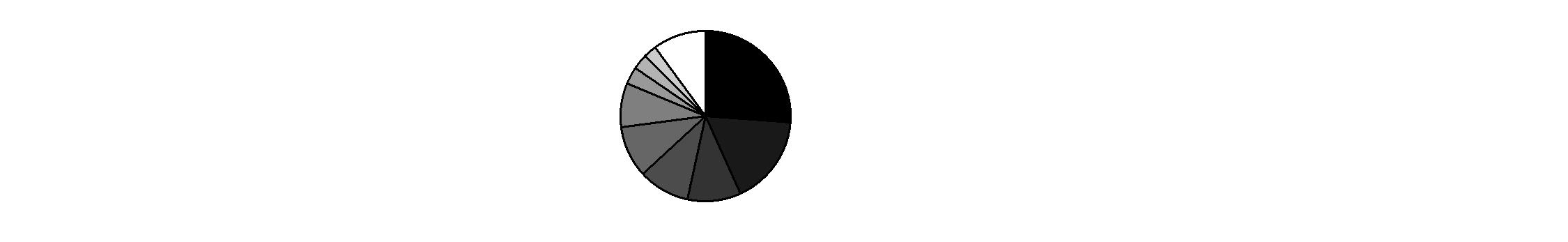

As of October 31, 2012 |

| United Kingdom 16.8% | |

| Japan 10.8% | |

| United States of America 7.2% | |

| Switzerland 6.9% | |

| Germany 5.1% | |

| France 5.0% | |

| Australia 4.8% | |

| Taiwan 3.7% | |

| Korea (South) 2.9% | |

| Other 36.8% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

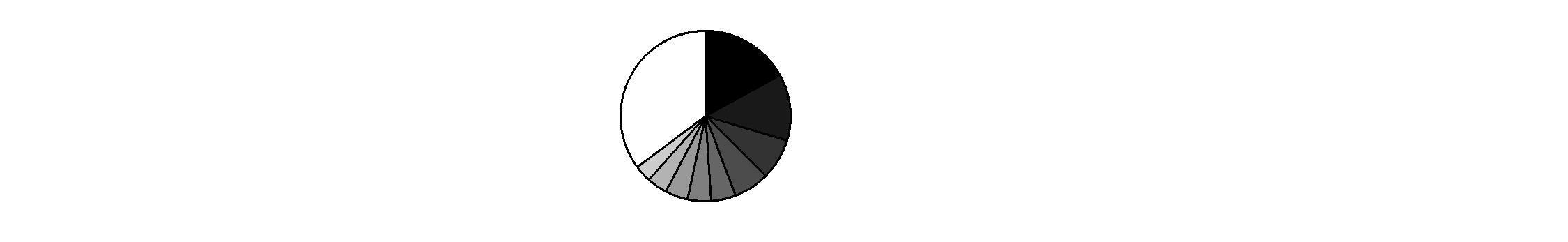

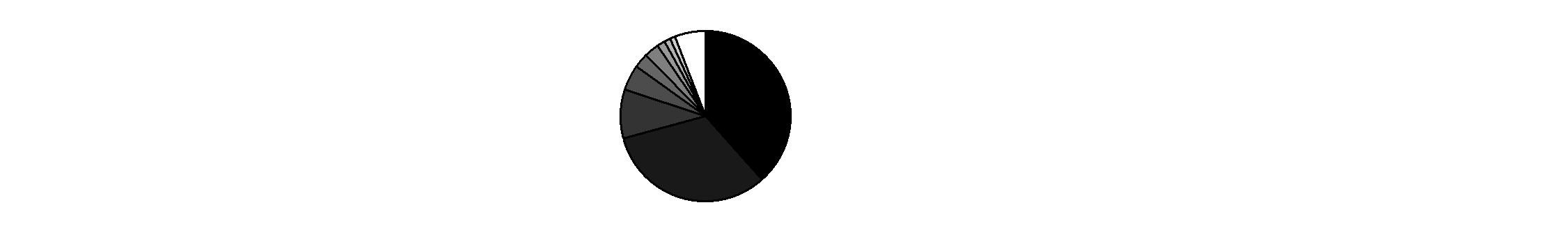

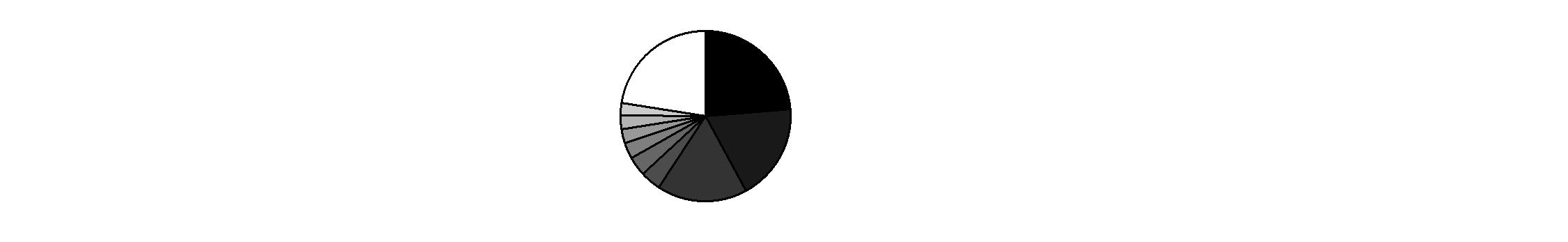

Asset Allocation as of April 30, 2013 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Stocks | 97.7 | 98.4 |

Short-Term Investments and Net Other Assets (Liabilities) | 2.3 | 1.6 |

Top Ten Stocks as of April 30, 2013 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Nestle SA (Switzerland, Food Products) | 1.9 | 2.3 |

Sanofi SA (France, Pharmaceuticals) | 1.6 | 1.4 |

Royal Dutch Shell PLC Class A sponsored ADR (United Kingdom, Oil, Gas & Consumable Fuels) | 1.5 | 1.8 |

HSBC Holdings PLC sponsored ADR (United Kingdom, Commercial Banks) | 1.4 | 1.0 |

Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 1.3 | 1.8 |

Anheuser-Busch InBev SA NV (Belgium, Beverages) | 1.2 | 1.2 |

Vodafone Group PLC sponsored ADR (United Kingdom, Wireless Telecommunication Services) | 1.2 | 1.2 |

GlaxoSmithKline PLC sponsored ADR (United Kingdom, Pharmaceuticals) | 1.1 | 1.2 |

DENSO Corp. (Japan, Auto Components) | 1.1 | 0.7 |

Novartis AG (Switzerland, Pharmaceuticals) | 1.1 | 0.0 |

| 13.4 | |

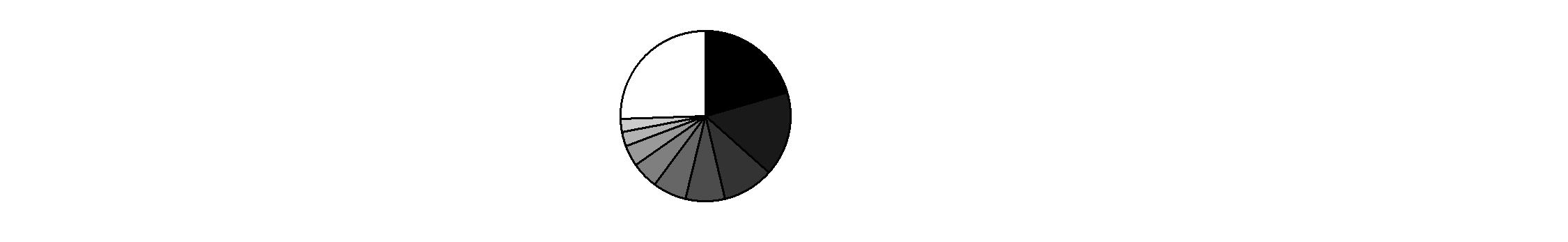

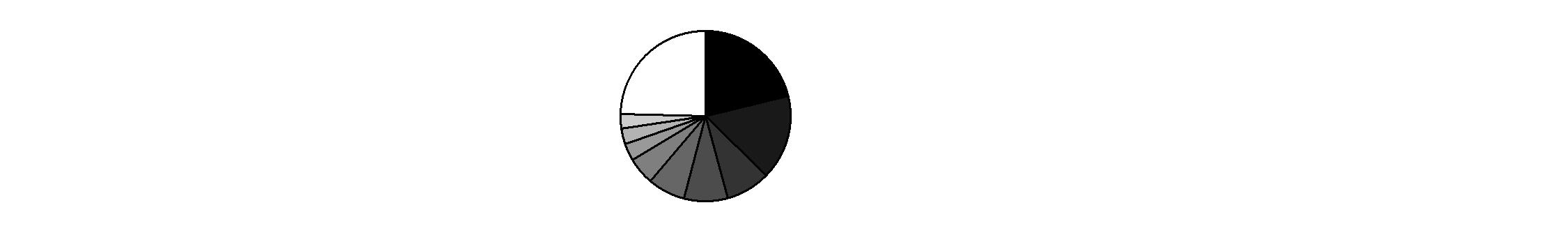

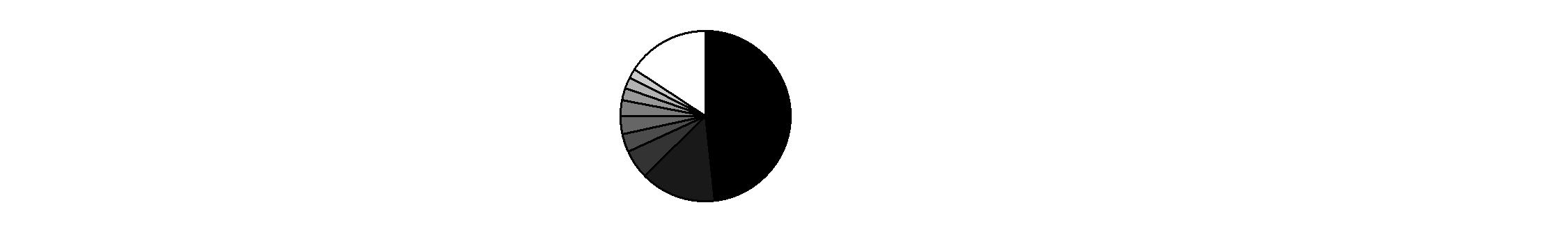

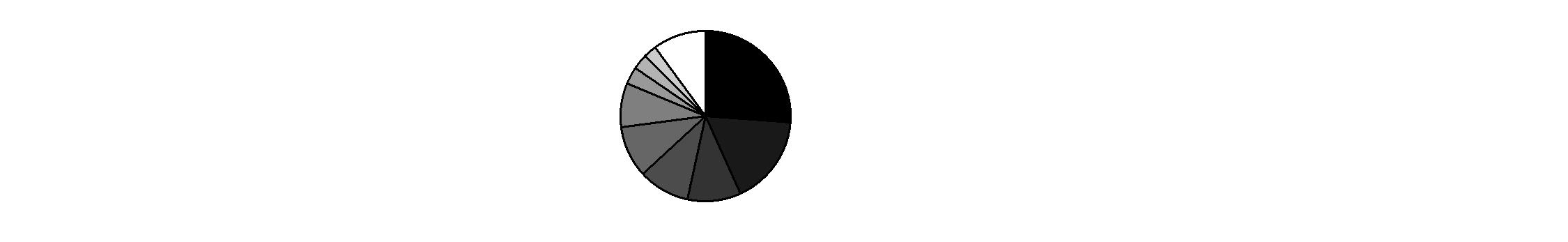

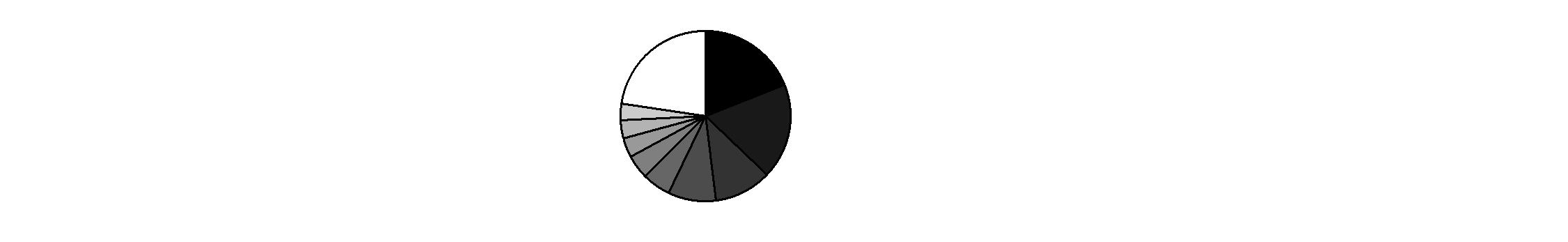

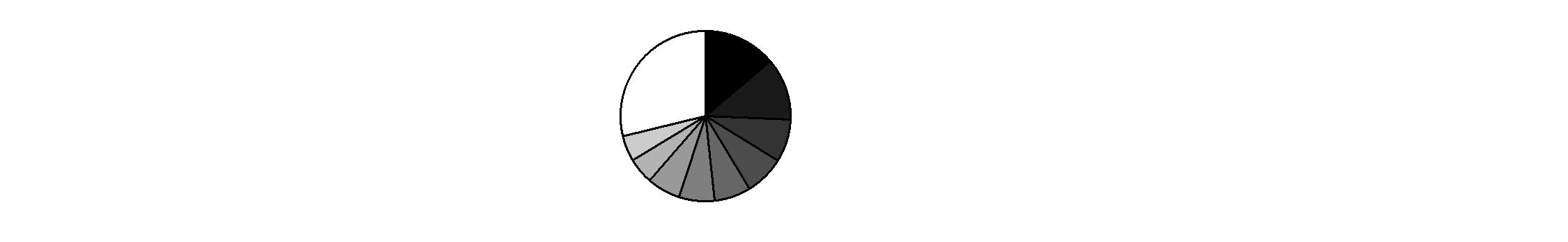

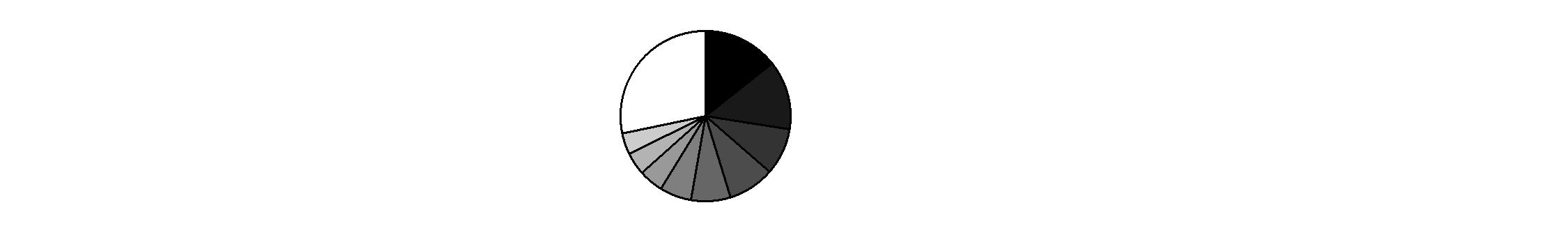

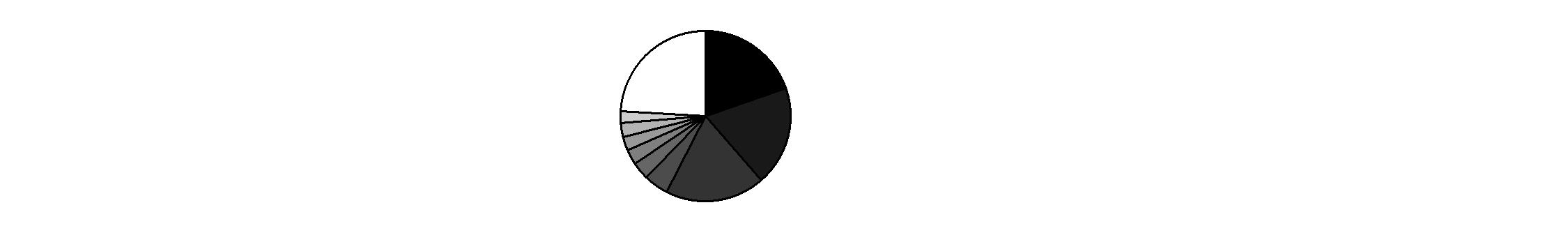

Market Sectors as of April 30, 2013 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 22.5 | 21.4 |

Consumer Staples | 14.8 | 14.4 |

Industrials | 12.6 | 12.2 |

Consumer Discretionary | 11.9 | 10.2 |

Health Care | 9.3 | 9.8 |

Materials | 7.6 | 8.7 |

Information Technology | 6.3 | 6.3 |

Energy | 5.1 | 7.4 |

Telecommunication Services | 4.4 | 4.1 |

Utilities | 3.2 | 3.9 |

Semiannual Report

Investments April 30, 2013 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 97.4% |

| Shares | | Value |

Australia - 4.5% |

Ansell Ltd. | 28,912 | | $ 473,575 |

Australia & New Zealand Banking Group Ltd. | 97,820 | | 3,228,894 |

Coca-Cola Amatil Ltd. | 86,696 | | 1,360,749 |

CSL Ltd. | 38,167 | | 2,491,184 |

Imdex Ltd. | 29,418 | | 30,040 |

Newcrest Mining Ltd. | 24,416 | | 425,496 |

Ramsay Health Care Ltd. | 2,307 | | 76,509 |

Sydney Airport unit | 151,947 | | 545,031 |

Telstra Corp. Ltd. | 233,537 | | 1,205,697 |

Transurban Group unit | 103,132 | | 729,174 |

Westfield Group unit | 123,734 | | 1,494,404 |

Westpac Banking Corp. | 102,286 | | 3,584,148 |

Woolworths Ltd. | 14,158 | | 534,411 |

TOTAL AUSTRALIA | | 16,179,312 |

Austria - 0.6% |

Andritz AG | 23,458 | | 1,528,586 |

Vienna Insurance Group AG | 13,400 | | 710,121 |

Zumtobel AG | 5,300 | | 59,350 |

TOTAL AUSTRIA | | 2,298,057 |

Bailiwick of Jersey - 0.9% |

Glencore International PLC | 173,874 | | 856,041 |

Informa PLC | 156,650 | | 1,163,128 |

Randgold Resources Ltd. sponsored ADR | 5,960 | | 487,409 |

Wolseley PLC | 16,091 | | 795,589 |

TOTAL BAILIWICK OF JERSEY | | 3,302,167 |

Belgium - 1.8% |

Anheuser-Busch InBev SA NV (d) | 45,471 | | 4,368,425 |

Gimv NV | 2,103 | | 108,234 |

KBC Groupe SA | 22,512 | | 883,486 |

Umicore SA | 26,783 | | 1,239,806 |

TOTAL BELGIUM | | 6,599,951 |

Bermuda - 2.2% |

China Foods Ltd. | 1,562,000 | | 797,088 |

Credicorp Ltd. (NY Shares) | 3,772 | | 568,025 |

First Pacific Co. Ltd. | 712,000 | | 985,404 |

GP Investments Ltd. Class A (depositary receipt) (a) | 13,900 | | 32,792 |

Hongkong Land Holdings Ltd. | 89,000 | | 646,140 |

Jardine Strategic Holdings Ltd. | 24,500 | | 955,500 |

Lazard Ltd. Class A | 17,100 | | 579,690 |

Common Stocks - continued |

| Shares | | Value |

Bermuda - continued |

Pacific Basin Shipping Ltd. | 1,143,000 | | $ 652,499 |

Texwinca Holdings Ltd. | 736,000 | | 859,282 |

Vtech Holdings Ltd. | 75,000 | | 956,811 |

Yue Yuen Industrial (Holdings) Ltd. | 264,000 | | 913,436 |

TOTAL BERMUDA | | 7,946,667 |

Brazil - 2.6% |

Arezzo Industria e Comercio SA | 19,300 | | 406,692 |

Banco Bradesco SA | 119,710 | | 2,048,667 |

BM&F Bovespa SA | 150,800 | | 1,046,913 |

Companhia de Bebidas das Americas (AmBev) | 22,000 | | 902,432 |

Duratex SA | 74,800 | | 561,911 |

Fleury SA | 59,700 | | 568,429 |

Iguatemi Empresa de Shopping Centers SA | 23,400 | | 279,642 |

LPS Brasil Consultoria de Imoveis SA | 51,200 | | 527,162 |

Porto Seguro SA | 53,300 | | 661,205 |

Tegma Gestao Logistica SA | 40,100 | | 538,742 |

Tractebel Energia SA | 60,500 | | 1,076,194 |

Weg SA | 54,400 | | 719,986 |

TOTAL BRAZIL | | 9,337,975 |

British Virgin Islands - 0.0% |

Gem Diamonds Ltd. (a) | 18,223 | | 37,011 |

Canada - 0.3% |

Agnico Eagle Mines Ltd. (Canada) | 8,840 | | 285,351 |

Baytex Energy Corp. | 900 | | 35,564 |

Copper Mountain Mining Corp. (a) | 12,900 | | 25,865 |

Eldorado Gold Corp. | 4,800 | | 37,973 |

Goldcorp, Inc. | 9,494 | | 281,018 |

Painted Pony Petroleum Ltd. Class A (a) | 6,300 | | 61,158 |

Pason Systems, Inc. | 5,400 | | 92,461 |

Petrominerales Ltd. | 5,525 | | 30,492 |

TAG Oil Ltd. (a) | 9,000 | | 49,134 |

TOTAL CANADA | | 899,016 |

Cayman Islands - 1.6% |

Baidu.com, Inc. sponsored ADR (a) | 7,000 | | 600,950 |

China Mengniu Dairy Co. Ltd. | 265,000 | | 746,152 |

ENN Energy Holdings Ltd. | 148,000 | | 856,324 |

Mindray Medical International Ltd. sponsored ADR | 15,300 | | 604,197 |

Sands China Ltd. | 346,600 | | 1,817,828 |

Common Stocks - continued |

| Shares | | Value |

Cayman Islands - continued |

Vantage Drilling Co. (a) | 23,300 | | $ 39,377 |

Wynn Macau Ltd. | 308,000 | | 934,698 |

TOTAL CAYMAN ISLANDS | | 5,599,526 |

Chile - 1.7% |

Cencosud SA | 137,136 | | 774,449 |

Compania Cervecerias Unidas SA sponsored ADR | 21,500 | | 742,395 |

Embotelladora Andina SA sponsored ADR | 16,600 | | 678,110 |

Empresa Nacional de Telecomunicaciones SA (ENTEL) | 45,527 | | 877,769 |

Inversiones Aguas Metropolitanas SA | 516,177 | | 1,095,924 |

Parque Arauco SA | 300,738 | | 777,723 |

Quinenco SA | 209,098 | | 685,968 |

Sociedad Matriz SAAM SA | 5,534,577 | | 634,605 |

TOTAL CHILE | | 6,266,943 |

China - 0.4% |

China Oilfield Services Ltd. (H Shares) | 340,000 | | 670,348 |

Dongfeng Motor Group Co. Ltd. (H Shares) | 482,000 | | 718,017 |

TOTAL CHINA | | 1,388,365 |

Colombia - 0.2% |

Grupo de Inversiones Suramerica | 27,440 | | 578,845 |

Czech Republic - 0.2% |

Komercni Banka A/S | 4,300 | | 821,935 |

Denmark - 1.1% |

Novo Nordisk A/S Series B sponsored ADR | 17,600 | | 3,108,688 |

Spar Nord Bank A/S (a) | 100 | | 643 |

TDC A/S | 94,443 | | 766,074 |

TOTAL DENMARK | | 3,875,405 |

Finland - 0.7% |

Nokian Tyres PLC | 33,858 | | 1,467,880 |

Outotec Oyj | 2,425 | | 35,385 |

Sampo Oyj (A Shares) | 29,699 | | 1,185,097 |

TOTAL FINLAND | | 2,688,362 |

France - 4.3% |

Alstom SA | 16,937 | | 695,029 |

Arkema SA | 7,160 | | 670,805 |

Atos Origin SA | 11,152 | | 776,188 |

BNP Paribas SA | 40,079 | | 2,233,208 |

Danone SA | 20,180 | | 1,541,677 |

Common Stocks - continued |

| Shares | | Value |

France - continued |

Laurent-Perrier Group SA | 1,059 | | $ 85,771 |

Pernod Ricard SA | 4,843 | | 599,531 |

PPR SA | 3,513 | | 772,848 |

Remy Cointreau SA | 5,681 | | 661,448 |

Safran SA | 19,314 | | 948,493 |

Saft Groupe SA | 2,329 | | 57,326 |

Sanofi SA | 53,201 | | 5,751,857 |

Schneider Electric SA (d) | 7,545 | | 575,317 |

Vetoquinol SA | 1,300 | | 45,797 |

Virbac SA | 560 | | 114,311 |

TOTAL FRANCE | | 15,529,606 |

Germany - 4.3% |

Allianz AG | 17,657 | | 2,605,542 |

alstria office REIT-AG | 5,900 | | 71,484 |

BASF AG (d) | 7,303 | | 682,086 |

Bayer AG | 14,893 | | 1,553,769 |

Bayerische Motoren Werke AG (BMW) | 12,951 | | 1,194,760 |

Bilfinger Berger AG | 1,345 | | 134,796 |

CompuGROUP Holding AG | 3,546 | | 81,770 |

CTS Eventim AG | 4,783 | | 184,717 |

Deutsche Bank AG | 27,500 | | 1,265,908 |

Deutsche Post AG | 31,383 | | 744,764 |

Fielmann AG | 1,379 | | 133,046 |

Fresenius SE & Co. KGaA | 6,100 | | 764,940 |

HeidelbergCement Finance AG | 8,743 | | 629,476 |

Lanxess AG | 4,700 | | 342,288 |

Linde AG | 15,649 | | 2,959,445 |

Siemens AG | 11,551 | | 1,206,929 |

Siemens AG sponsored ADR | 6,169 | | 644,722 |

Telefonica Deutschland Holding AG | 46,707 | | 370,664 |

TOTAL GERMANY | | 15,571,106 |

Greece - 0.0% |

Titan Cement Co. SA (Reg.) (a) | 2,750 | | 51,065 |

Hong Kong - 1.6% |

Cathay Pacific Airways Ltd. | 339,000 | | 595,860 |

China Insurance International Holdings Co. Ltd. (a) | 388,200 | | 661,328 |

China Merchant Holdings International Co. Ltd. | 224,000 | | 708,646 |

China Resources Enterprise Ltd. | 272,000 | | 932,353 |

Dah Chong Hong Holdings Ltd. | 789,000 | | 726,964 |

Hysan Development Co. Ltd. | 141,000 | | 698,627 |

Common Stocks - continued |

| Shares | | Value |

Hong Kong - continued |

Television Broadcasts Ltd. | 119,300 | | $ 898,576 |

Wing Hang Bank Ltd. | 47,000 | | 493,914 |

TOTAL HONG KONG | | 5,716,268 |

Hungary - 0.2% |

Richter Gedeon PLC | 4,700 | | 697,978 |

India - 3.1% |

Aditya Birla Nuvo Ltd. | 46,535 | | 908,813 |

Bharat Heavy Electricals Ltd. | 197,584 | | 709,403 |

Bharti Airtel Ltd. (a) | 172,037 | | 1,021,455 |

Cipla Ltd. | 115,612 | | 872,824 |

Colgate-Palmolive (India) | 1,585 | | 43,443 |

Container Corp. of India Ltd. | 40,019 | | 838,323 |

Housing Development Finance Corp. Ltd. (a) | 122,570 | | 1,935,184 |

Infosys Ltd. | 15,425 | | 641,179 |

Jyothy Laboratories Ltd. | 27,018 | | 88,978 |

Max India Ltd. | 176,888 | | 714,669 |

NTPC Ltd. | 324,351 | | 950,668 |

Piramal Enterprises Ltd. | 9,656 | | 100,913 |

Satyam Computer Services Ltd. (a) | 282,634 | | 580,693 |

Tata Power Co. Ltd. | 506,446 | | 893,368 |

Titan Industries Ltd. (a) | 165,961 | | 836,838 |

TOTAL INDIA | | 11,136,751 |

Ireland - 0.6% |

CRH PLC sponsored ADR | 36,000 | | 774,360 |

FBD Holdings PLC | 5,072 | | 82,393 |

James Hardie Industries PLC: | | | |

CDI | 1,130 | | 11,879 |

sponsored ADR | 22,955 | | 1,203,990 |

TOTAL IRELAND | | 2,072,622 |

Israel - 0.1% |

Azrieli Group | 13,296 | | 384,230 |

Ituran Location & Control Ltd. | 4,561 | | 72,794 |

Strauss Group Ltd. | 2,259 | | 33,239 |

TOTAL ISRAEL | | 490,263 |

Italy - 1.1% |

Azimut Holding SpA | 8,614 | | 160,180 |

Beni Stabili SpA SIIQ | 105,412 | | 74,270 |

Enel SpA | 214,767 | | 830,411 |

Common Stocks - continued |

| Shares | | Value |

Italy - continued |

ENI SpA | 85,400 | | $ 2,038,191 |

Interpump Group SpA | 55,091 | | 484,648 |

Prada SpA | 55,100 | | 496,671 |

TOTAL ITALY | | 4,084,371 |

Japan - 12.6% |

AEON Financial Service Co. Ltd. | 25,100 | | 752,523 |

Air Water, Inc. | 59,000 | | 955,344 |

Aozora Bank Ltd. | 227,000 | | 711,214 |

Artnature, Inc. | 2,000 | | 37,571 |

Asahi Co. Ltd. | 3,900 | | 65,629 |

Astellas Pharma, Inc. | 16,900 | | 985,018 |

Autobacs Seven Co. Ltd. | 26,900 | | 453,306 |

Azbil Corp. | 3,600 | | 77,735 |

Cosmos Pharmaceutical Corp. | 300 | | 33,455 |

Credit Saison Co. Ltd. | 18,000 | | 526,529 |

Daiichi Sankyo Kabushiki Kaisha | 32,500 | | 635,918 |

Daikokutenbussan Co. Ltd. | 5,000 | | 137,474 |

DENSO Corp. | 85,900 | | 3,851,812 |

Fanuc Corp. | 5,800 | | 875,523 |

Fast Retailing Co. Ltd. | 3,600 | | 1,320,171 |

FCC Co. Ltd. | 6,700 | | 169,854 |

Fields Corp. | 2,200 | | 44,617 |

GCA Savvian Group Corp. | 5,800 | | 73,015 |

Glory Ltd. | 2,200 | | 60,455 |

Goldcrest Co. Ltd. | 5,460 | | 179,605 |

Harmonic Drive Systems, Inc. | 2,000 | | 41,104 |

Hitachi Ltd. | 112,000 | | 715,775 |

Hoya Corp. | 31,000 | | 621,127 |

Itochu Corp. | 85,100 | | 1,055,193 |

Iwatsuka Confectionary Co. Ltd. | 1,200 | | 56,933 |

Japan Retail Fund Investment Corp. | 255 | | 604,472 |

Japan Tobacco, Inc. | 54,100 | | 2,045,047 |

JSR Corp. | 41,300 | | 950,728 |

Kamigumi Co. Ltd. | 6,000 | | 56,260 |

Kansai Electric Power Co., Inc. | 58,700 | | 717,158 |

KDDI Corp. | 4,200 | | 201,967 |

Keyence Corp. | 4,821 | | 1,529,925 |

Kobayashi Pharmaceutical Co. Ltd. | 8,600 | | 469,861 |

Kyoto Kimono Yuzen Co. Ltd. | 2,800 | | 30,656 |

Lasertec Corp. | 2,000 | | 48,816 |

Meiko Network Japan Co. Ltd. | 3,700 | | 51,323 |

Common Stocks - continued |

| Shares | | Value |

Japan - continued |

Miraial Co. Ltd. | 2,400 | | $ 49,807 |

Mitsubishi Corp. | 46,800 | | 842,506 |

Mitsui Fudosan Co. Ltd. | 54,000 | | 1,837,783 |

Nabtesco Corp. | 2,900 | | 63,995 |

Nagaileben Co. Ltd. | 5,100 | | 87,279 |

Nihon M&A Center, Inc. | 4,200 | | 221,550 |

Nihon Parkerizing Co. Ltd. | 7,000 | | 142,584 |

Nippon Seiki Co. Ltd. | 7,000 | | 92,397 |

Nippon Thompson Co. Ltd. | 15,000 | | 74,889 |

Nissan Motor Co. Ltd. | 133,600 | | 1,393,756 |

Nitto Denko Corp. | 11,700 | | 768,685 |

NS Tool Co. Ltd. | 1,900 | | 37,815 |

Obic Co. Ltd. | 350 | | 92,343 |

ORIX Corp. | 70,700 | | 1,084,843 |

OSG Corp. | 10,300 | | 156,713 |

Santen Pharmaceutical Co. Ltd. | 16,900 | | 848,295 |

Sekisui House Ltd. | 58,000 | | 869,382 |

Seven & i Holdings Co. Ltd. | 32,600 | | 1,253,997 |

Seven Bank Ltd. | 403,700 | | 1,433,509 |

Shinsei Bank Ltd. | 332,000 | | 931,825 |

SHO-BOND Holdings Co. Ltd. | 17,200 | | 725,952 |

Shoei Co. Ltd. | 5,900 | | 57,176 |

SMC Corp. | 4,200 | | 841,985 |

Softbank Corp. | 17,500 | | 867,894 |

Sparx Group Co. Ltd. (a) | 210 | | 70,547 |

Sumitomo Mitsui Financial Group, Inc. | 69,700 | | 3,294,535 |

Sumitomo Realty & Development Co. Ltd. | 11,000 | | 519,875 |

The Nippon Synthetic Chemical Industry Co. Ltd. | 13,000 | | 124,515 |

Tocalo Co. Ltd. | 2,700 | | 39,539 |

Toshiba Corp. | 179,000 | | 987,037 |

Tsutsumi Jewelry Co. Ltd. | 2,100 | | 65,576 |

Unicharm Corp. | 15,000 | | 969,921 |

USS Co. Ltd. | 18,450 | | 2,366,849 |

Workman Co. Ltd. | 2,000 | | 65,722 |

Yamato Kogyo Co. Ltd. | 24,200 | | 800,404 |

TOTAL JAPAN | | 45,224,593 |

Korea (South) - 2.9% |

AMOREPACIFIC Corp. | 706 | | 576,792 |

BS Financial Group, Inc. | 54,970 | | 723,545 |

Coway Co. Ltd. | 2,580 | | 130,685 |

E-Mart Co. Ltd. | 3,957 | | 772,283 |

Common Stocks - continued |

| Shares | | Value |

Korea (South) - continued |

Kiwoom Securities Co. Ltd. | 13,190 | | $ 808,203 |

Korea Plant Service & Engineering Co. Ltd. | 14,148 | | 730,768 |

LG Chemical Ltd. | 3,069 | | 724,340 |

LG Corp. | 23,877 | | 1,421,856 |

LG Electronics, Inc. | 8,852 | | 707,928 |

LG Household & Health Care Ltd. | 1,518 | | 852,971 |

NICE Holdings Co. Ltd. | 600 | | 45,152 |

NICE Information Service Co. Ltd. | 7,500 | | 36,288 |

Samsung Fire & Marine Insurance Co. Ltd. | 4,873 | | 1,001,928 |

Shinsegae Co. Ltd. | 5,059 | | 1,086,095 |

TK Corp. (a) | 33,687 | | 672,755 |

TOTAL KOREA (SOUTH) | | 10,291,589 |

Malaysia - 0.4% |

Axiata Group Bhd | 448,500 | | 997,977 |

Top Glove Corp. Bhd | 222,300 | | 461,770 |

TOTAL MALAYSIA | | 1,459,747 |

Mexico - 0.8% |

America Movil S.A.B. de CV Series L | 827,200 | | 890,400 |

Consorcio ARA SA de CV (a) | 1,857,300 | | 613,374 |

Fomento Economico Mexicano S.A.B. de CV sponsored ADR | 5,620 | | 637,252 |

Grupo Televisa SA de CV | 169,500 | | 860,601 |

TOTAL MEXICO | | 3,001,627 |

Netherlands - 1.8% |

Aalberts Industries NV | 7,400 | | 165,818 |

ASM International NV (depositary receipt) | 3,050 | | 102,114 |

ASML Holding NV (d) | 30,876 | | 2,296,248 |

D.E. Master Blenders 1753 NV (a) | 19,200 | | 304,437 |

Heijmans NV (Certificaten Van Aandelen) | 6,581 | | 60,408 |

ING Groep NV (Certificaten Van Aandelen) (a) | 112,078 | | 923,281 |

Koninklijke Philips Electronics NV | 40,639 | | 1,124,808 |

QIAGEN NV (a) | 2,980 | | 59,242 |

Unilever NV (Certificaten Van Aandelen) (Bearer) | 28,500 | | 1,214,423 |

VastNed Retail NV | 1,503 | | 67,091 |

TOTAL NETHERLANDS | | 6,317,870 |

Norway - 0.4% |

DnB ASA | 8,000 | | 130,755 |

Telenor ASA | 60,408 | | 1,357,648 |

TOTAL NORWAY | | 1,488,403 |

Common Stocks - continued |

| Shares | | Value |

Papua New Guinea - 0.2% |

Oil Search Ltd. ADR | 87,795 | | $ 676,257 |

Philippines - 0.2% |

BDO Unibank, Inc. | 278,762 | | 620,825 |

Jollibee Food Corp. | 29,770 | | 92,907 |

TOTAL PHILIPPINES | | 713,732 |

Poland - 0.2% |

Warsaw Stock Exchange | 63,638 | | 761,276 |

Portugal - 0.4% |

Jeronimo Martins SGPS SA | 54,969 | | 1,309,199 |

Russia - 0.3% |

Sberbank (Savings Bank of the Russian Federation) (a) | 289,400 | | 920,414 |

Singapore - 1.3% |

Ascendas Real Estate Investment Trust | 297,000 | | 663,108 |

ComfortDelgro Corp. Ltd. | 349,000 | | 562,446 |

Singapore Telecommunications Ltd. | 467,000 | | 1,490,062 |

United Overseas Bank Ltd. | 82,746 | | 1,434,300 |

UOL Group Ltd. | 58,000 | | 335,747 |

TOTAL SINGAPORE | | 4,485,663 |

South Africa - 2.7% |

African Bank Investments Ltd. | 201,400 | | 639,426 |

AngloGold Ashanti Ltd. | 39,300 | | 758,243 |

Bidvest Group Ltd. | 32,600 | | 847,778 |

City Lodge Hotels Ltd. | 4,700 | | 67,094 |

Clicks Group Ltd. | 105,320 | | 671,344 |

Impala Platinum Holdings Ltd. | 54,100 | | 738,295 |

Mr Price Group Ltd. | 2,700 | | 38,808 |

Nampak Ltd. | 18,930 | | 69,573 |

Naspers Ltd. Class N | 19,800 | | 1,325,001 |

Reunert Ltd. | 18,100 | | 157,310 |

Sasol Ltd. | 30,300 | | 1,312,491 |

Shoprite Holdings Ltd. | 40,700 | | 771,456 |

Standard Bank Group Ltd. | 113,971 | | 1,423,764 |

Tiger Brands Ltd. | 28,300 | | 880,238 |

TOTAL SOUTH AFRICA | | 9,700,821 |

Spain - 1.7% |

Banco Bilbao Vizcaya Argentaria SA sponsored ADR | 204,628 | | 2,005,354 |

Grifols SA | 1,546 | | 62,037 |

Iberdrola SA | 187,617 | | 1,010,566 |

Inditex SA | 11,699 | | 1,572,284 |

Common Stocks - continued |

| Shares | | Value |

Spain - continued |

Prosegur Compania de Seguridad SA (Reg.) | 122,476 | | $ 683,890 |

Repsol YPF SA | 33,751 | | 791,181 |

TOTAL SPAIN | | 6,125,312 |

Sweden - 2.5% |

ASSA ABLOY AB (B Shares) (d) | 30,400 | | 1,210,643 |

Atlas Copco AB (A Shares) | 49,659 | | 1,307,169 |

Fagerhult AB | 12,985 | | 344,608 |

H&M Hennes & Mauritz AB (B Shares) | 44,986 | | 1,591,608 |

Intrum Justitia AB | 26,363 | | 543,039 |

SKF AB (B Shares) | 29,400 | | 684,074 |

Svenska Cellulosa AB (SCA) (B Shares) | 26,876 | | 697,916 |

Svenska Handelsbanken AB (A Shares) | 43,531 | | 1,977,384 |

Swedish Match Co. AB (d) | 22,450 | | 778,695 |

TOTAL SWEDEN | | 9,135,136 |

Switzerland - 6.9% |

Nestle SA | 97,646 | | 6,963,379 |

Novartis AG | 51,283 | | 3,796,357 |

Roche Holding AG (participation certificate) | 18,027 | | 4,505,781 |

Schindler Holding AG: | | | |

(participation certificate) | 5,270 | | 790,103 |

(Reg.) | 1,620 | | 237,128 |

Swatch Group AG (Bearer) | 940 | | 538,342 |

Swisscom AG | 1,888 | | 888,972 |

Syngenta AG (Switzerland) | 3,096 | | 1,323,600 |

UBS AG (NY Shares) | 205,697 | | 3,659,350 |

Zehnder Group AG | 1,363 | | 60,249 |

Zurich Insurance Group AG | 6,639 | | 1,853,608 |

TOTAL SWITZERLAND | | 24,616,869 |

Taiwan - 3.9% |

China Steel Chemical Corp. | 153,000 | | 744,507 |

Chroma ATE, Inc. | 345,116 | | 740,788 |

CTCI Corp. | 373,000 | | 746,253 |

Delta Electronics, Inc. | 180,000 | | 863,683 |

E.SUN Financial Holdings Co. Ltd. | 1,411,350 | | 851,883 |

Powertech Technology, Inc. | 434,000 | | 777,050 |

President Chain Store Corp. | 156,000 | | 962,767 |

Standard Foods Corp. | 243,000 | | 832,248 |

Synnex Technology International Corp. | 341,000 | | 577,006 |

Taiwan Hon Chuan Enterprise Co. Ltd. | 311,000 | | 864,768 |

Taiwan Mobile Co. Ltd. | 265,000 | | 966,005 |

Common Stocks - continued |

| Shares | | Value |

Taiwan - continued |

Taiwan Semiconductor Manufacturing Co. Ltd. | 769,035 | | $ 2,856,350 |

TXC Corp. | 420,000 | | 655,137 |

Unified-President Enterprises Corp. | 506,800 | | 998,477 |

Wistron Corp. | 636,000 | | 645,921 |

Wowprime Corp. | 4,000 | | 56,494 |

TOTAL TAIWAN | | 14,139,337 |

Thailand - 0.2% |

PTT Exploration and Production PCL (For. Reg.) | 143,300 | | 751,898 |

Turkey - 1.4% |

Albaraka Turk Katilim Bankasi A/S | 107,303 | | 116,116 |

Anadolu Efes Biracilik Ve Malt Sanayii A/S | 36,000 | | 598,410 |

Asya Katilim Bankasi A/S (a) | 29,000 | | 35,102 |

Boyner Buyuk Magazacilik A/S (a) | 42,049 | | 160,432 |

Coca-Cola Icecek A/S | 54,989 | | 1,533,649 |

Enka Insaat ve Sanayi A/S | 225,680 | | 697,402 |

Tupras Turkiye Petrol Rafinelleri A/S | 18,313 | | 510,752 |

Turkiye Garanti Bankasi A/S | 257,143 | | 1,420,006 |

TOTAL TURKEY | | 5,071,869 |

United Kingdom - 17.0% |

Babcock International Group PLC | 46,400 | | 771,207 |

Barclays PLC | 408,229 | | 1,821,713 |

Barclays PLC sponsored ADR | 35,867 | | 644,889 |

Bellway PLC | 6,928 | | 144,744 |

Berendsen PLC | 6,746 | | 81,054 |

BG Group PLC | 124,227 | | 2,092,738 |

BHP Billiton PLC | 69,296 | | 1,949,490 |

BHP Billiton PLC ADR | 24,100 | | 1,362,373 |

BP PLC sponsored ADR | 49,445 | | 2,155,802 |

British American Tobacco PLC (United Kingdom) | 19,040 | | 1,055,487 |

British Land Co. PLC | 102,450 | | 946,092 |

Britvic PLC | 11,917 | | 81,450 |

Bunzl PLC | 44,457 | | 883,243 |

Centrica PLC | 188,275 | | 1,085,015 |

Compass Group PLC | 70,814 | | 931,691 |

Dechra Pharmaceuticals PLC | 9,800 | | 109,300 |

Derwent London PLC | 1,900 | | 68,147 |

Elementis PLC | 30,508 | | 124,872 |

Fenner PLC | 8,453 | | 46,167 |

GlaxoSmithKline PLC sponsored ADR | 77,797 | | 4,017,437 |

Great Portland Estates PLC | 17,772 | | 146,865 |

Common Stocks - continued |

| Shares | | Value |

United Kingdom - continued |

H&T Group PLC | 7,114 | | $ 29,712 |

HSBC Holdings PLC sponsored ADR | 88,890 | | 4,876,505 |

Imperial Tobacco Group PLC | 13,103 | | 468,132 |

InterContinental Hotel Group PLC ADR | 51,747 | | 1,529,124 |

ITV PLC | 373,419 | | 730,283 |

Johnson Matthey PLC | 33,377 | | 1,256,751 |

Kingfisher PLC | 165,227 | | 803,588 |

Legal & General Group PLC | 460,214 | | 1,211,710 |

Meggitt PLC | 23,598 | | 171,770 |

National Grid PLC | 151,091 | | 1,925,989 |

Next PLC | 9,500 | | 643,250 |

Persimmon PLC | 6,537 | | 109,666 |

Prudential PLC | 67,755 | | 1,165,019 |

PZ Cussons PLC Class L | 86,619 | | 537,122 |

Reckitt Benckiser Group PLC | 27,551 | | 2,009,716 |

Reed Elsevier PLC | 88,134 | | 1,029,510 |

Rexam PLC | 74,788 | | 600,028 |

Rolls-Royce Group PLC | 96,852 | | 1,700,029 |

Rolls-Royce Group PLC (C Shares) (a) | 5,126,352 | | 7,963 |

Rotork PLC | 25,703 | | 1,161,440 |

Royal Dutch Shell PLC Class A sponsored ADR | 78,230 | | 5,317,293 |

SABMiller PLC | 55,054 | | 2,966,196 |

Scottish & Southern Energy PLC | 46,824 | | 1,132,469 |

Serco Group PLC | 92,608 | | 889,729 |

Shaftesbury PLC | 49,537 | | 467,461 |

Spectris PLC | 4,570 | | 149,785 |

Spirax-Sarco Engineering PLC | 5,304 | | 216,108 |

Standard Chartered PLC (United Kingdom) | 99,344 | | 2,495,290 |

Ted Baker PLC | 3,975 | | 83,604 |

Ultra Electronics Holdings PLC | 4,801 | | 123,051 |

Unite Group PLC | 90,502 | | 488,942 |

Victrex PLC | 2,318 | | 57,791 |

Vodafone Group PLC sponsored ADR | 141,932 | | 4,341,700 |

TOTAL UNITED KINGDOM | | 61,216,502 |

United States of America - 5.5% |

Albemarle Corp. | 5,263 | | 322,359 |

Allergan, Inc. | 3,900 | | 442,845 |

Amazon.com, Inc. (a) | 1,976 | | 501,529 |

ANSYS, Inc. (a) | 500 | | 40,430 |

Autoliv, Inc. | 16,650 | | 1,272,393 |

Berkshire Hathaway, Inc. Class B (a) | 7,411 | | 787,938 |

Common Stocks - continued |

| Shares | | Value |

United States of America - continued |

BorgWarner, Inc. (a) | 12,897 | | $ 1,008,158 |

BPZ Energy, Inc. (a) | 14,847 | | 31,773 |

Broadridge Financial Solutions, Inc. | 2,340 | | 58,921 |

Cummins, Inc. | 5,691 | | 605,465 |

Cymer, Inc. (a) | 622 | | 65,161 |

Dril-Quip, Inc. (a) | 1,270 | | 106,312 |

Evercore Partners, Inc. Class A | 2,260 | | 85,315 |

FMC Technologies, Inc. (a) | 9,903 | | 537,733 |

Greenhill & Co., Inc. | 1,420 | | 65,590 |

Kansas City Southern | 1,117 | | 121,831 |

Kennedy-Wilson Holdings, Inc. | 3,383 | | 56,259 |

KLA-Tencor Corp. | 10,800 | | 585,900 |

Martin Marietta Materials, Inc. | 7,680 | | 775,603 |

MasterCard, Inc. Class A | 2,509 | | 1,387,301 |

Mead Johnson Nutrition Co. Class A | 18,500 | | 1,500,165 |

Mohawk Industries, Inc. (a) | 7,135 | | 791,129 |

National Oilwell Varco, Inc. | 11,700 | | 763,074 |

Oceaneering International, Inc. | 1,550 | | 108,764 |

Philip Morris International, Inc. | 23,600 | | 2,255,924 |

PriceSmart, Inc. | 8,950 | | 798,609 |

ResMed, Inc. | 17,020 | | 817,300 |

Solera Holdings, Inc. | 11,152 | | 642,132 |

SS&C Technologies Holdings, Inc. (a) | 15,854 | | 486,559 |

Union Pacific Corp. | 7,600 | | 1,124,496 |

Universal Display Corp. (a) | 2,014 | | 63,320 |

Visa, Inc. Class A | 8,401 | | 1,415,232 |

TOTAL UNITED STATES OF AMERICA | | 19,625,520 |

TOTAL COMMON STOCKS (Cost $302,905,438) |

350,203,201

|

Nonconvertible Preferred Stocks - 0.3% |

| | | |

Brazil - 0.0% |

Banco ABC Brasil SA | 13,994 | | 109,952 |

Banco Pine SA | 9,306 | | 64,373 |

TOTAL BRAZIL | | 174,325 |

Germany - 0.3% |

Volkswagen AG | 4,816 | | 976,100 |

Nonconvertible Preferred Stocks - continued |

| Shares | | Value |

United Kingdom - 0.0% |

Rolls-Royce Group PLC Class C | 11,168,388 | | $ 17,348 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS (Cost $1,040,130) |

1,167,773

|

Money Market Funds - 3.6% |

| | | |

Fidelity Cash Central Fund, 0.13% (b) | 3,921,327 | | 3,921,327 |

Fidelity Securities Lending Cash Central Fund, 0.12% (b)(c) | 8,841,080 | | 8,841,080 |

TOTAL MONEY MARKET FUNDS (Cost $12,762,407) |

12,762,407

|

TOTAL INVESTMENT PORTFOLIO - 101.3% (Cost $316,707,975) | 364,133,381 |

NET OTHER ASSETS (LIABILITIES) - (1.3)% | (4,674,660) |

NET ASSETS - 100% | $ 359,458,721 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 5,668 |

Fidelity Securities Lending Cash Central Fund | 50,887 |

Total | $ 56,555 |

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of April 30, 2013, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 43,820,029 | $ 32,921,803 | $ 10,898,226 | $ - |

Consumer Staples | 52,923,647 | 34,317,674 | 18,605,973 | - |

Energy | 18,172,793 | 14,822,111 | 3,350,682 | - |

Financials | 81,421,391 | 64,143,755 | 17,241,348 | 36,288 |

Health Care | 34,135,320 | 22,030,596 | 12,104,724 | - |

Industrials | 43,911,038 | 36,485,822 | 7,425,216 | - |

Information Technology | 22,160,218 | 14,540,124 | 7,620,094 | - |

Materials | 27,008,168 | 19,234,575 | 7,773,593 | - |

Telecommunication Services | 16,244,284 | 15,174,423 | 1,069,861 | - |

Utilities | 11,574,086 | 8,930,939 | 2,643,147 | - |

Money Market Funds | 12,762,407 | 12,762,407 | - | - |

Total Investments in Securities: | $ 364,133,381 | $ 275,364,229 | $ 88,732,864 | $ 36,288 |

The following is a summary of transfers between Level 1 and Level 2 for the period ended April 30, 2013. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements: |

Transfers | Total |

Level 1 to Level 2 | $ 31,519,838 |

Level 2 to Level 1 | $ 0 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

| April 30, 2013 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $8,472,738) - See accompanying schedule: Unaffiliated issuers (cost $303,945,568) | $ 351,370,974 | |

Fidelity Central Funds (cost $12,762,407) | 12,762,407 | |

Total Investments (cost $316,707,975) | | $ 364,133,381 |

Cash | | 922,749 |

Foreign currency held at value (cost $77,379) | | 77,545 |

Receivable for investments sold | | 6,094,947 |

Receivable for fund shares sold | | 77,925 |

Dividends receivable | | 1,601,546 |

Distributions receivable from Fidelity Central Funds | | 24,199 |

Prepaid expenses | | 357 |

Receivable from investment adviser for expense reductions | | 2,641 |

Other receivables | | 31,722 |

Total assets | | 372,967,012 |

| | |

Liabilities | | |

Payable for investments purchased | $ 4,132,951 | |

Payable for fund shares redeemed | 140,966 | |

Accrued management fee | 228,792 | |

Distribution and service plan fees payable | 6,689 | |

Other affiliated payables | 57,721 | |

Other payables and accrued expenses | 100,092 | |

Collateral on securities loaned, at value | 8,841,080 | |

Total liabilities | | 13,508,291 |

| | |

Net Assets | | $ 359,458,721 |

Net Assets consist of: | | |

Paid in capital | | $ 335,779,505 |

Undistributed net investment income | | 1,930,563 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (25,674,097) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 47,422,750 |

Net Assets | | $ 359,458,721 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities - continued

| April 30, 2013 (Unaudited) |

| | |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($8,389,249 ÷ 1,063,539 shares) | | $ 7.89 |

| | |

Maximum offering price per share (100/94.25 of $7.89) | | $ 8.37 |

Class T:

Net Asset Value and redemption price per share ($5,451,344 ÷ 686,353 shares) | | $ 7.94 |

| | |

Maximum offering price per share (100/96.50 of $7.94) | | $ 8.23 |

Class B:

Net Asset Value and offering price per share ($219,099 ÷ 27,538 shares)A | | $ 7.96 |

| | |

Class C:

Net Asset Value and offering price per share ($3,284,575 ÷ 414,734 shares)A | | $ 7.92 |

| | |

Total International Equity:

Net Asset Value, offering price and redemption price per share ($339,928,338 ÷ 43,078,787 shares) | | $ 7.89 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($2,186,116 ÷ 278,025 shares) | | $ 7.86 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

Six months ended April 30, 2013 (Unaudited) |

| | |

Investment Income | | |

Dividends | | $ 4,567,566 |

Interest | | 288 |

Income from Fidelity Central Funds | | 56,555 |

Income before foreign taxes withheld | | 4,624,409 |

Less foreign taxes withheld | | (352,097) |

Total income | | 4,272,312 |

| | |

Expenses | | |

Management fee

Basic fee | $ 1,170,672 | |

Performance adjustment | 106,650 | |

Transfer agent fees | 242,699 | |

Distribution and service plan fees | 34,902 | |

Accounting and security lending fees | 86,064 | |

Custodian fees and expenses | 131,175 | |

Independent trustees' compensation | 1,025 | |

Registration fees | 34,002 | |

Audit | 38,271 | |

Legal | 649 | |

Miscellaneous | 1,451 | |

Total expenses before reductions | 1,847,560 | |

Expense reductions | (50,381) | 1,797,179 |

Net investment income (loss) | | 2,475,133 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 7,570,702 | |

Foreign currency transactions | (45,222) | |

Total net realized gain (loss) | | 7,525,480 |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of decrease in deferred foreign taxes of $35,138) | 32,112,075 | |

Assets and liabilities in foreign currencies | 9,693 | |

Total change in net unrealized appreciation (depreciation) | | 32,121,768 |

Net gain (loss) | | 39,647,248 |

Net increase (decrease) in net assets resulting from operations | | $ 42,122,381 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended April 30, 2013

(Unaudited) | Year ended

October 31,

2012 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 2,475,133 | $ 5,615,371 |

Net realized gain (loss) | 7,525,480 | 9,140,393 |

Change in net unrealized appreciation (depreciation) | 32,121,768 | 20,537,189 |

Net increase (decrease) in net assets resulting

from operations | 42,122,381 | 35,292,953 |

Distributions to shareholders from net investment income | (5,845,552) | (1,867,192) |

Distributions to shareholders from net realized gain | (9,769,201) | - |

Total distributions | (15,614,753) | (1,867,192) |

Share transactions - net increase (decrease) | 38,384,113 | 122,647,348 |

Redemption fees | 1,183 | 3,128 |

Total increase (decrease) in net assets | 64,892,924 | 156,076,237 |

| | |

Net Assets | | |

Beginning of period | 294,565,797 | 138,489,560 |

End of period (including undistributed net investment income of $1,930,563 and undistributed net investment income of $5,300,982, respectively) | $ 359,458,721 | $ 294,565,797 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

| Six months ended

April 30, 2013 | Years ended October 31, |

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 H |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 7.31 | $ 6.67 | $ 7.36 | $ 6.40 | $ 4.90 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .04 | .13 | .11 | .08 | .06 | .11 |

Net realized and unrealized gain (loss) | .91 | .59 | (.69) | .95 | 1.55 | (5.21) |

Total from investment operations | .95 | .72 | (.58) | 1.03 | 1.61 | (5.10) |

Distributions from net investment income | (.13) | (.08) | (.09) | (.04) | (.11) | - |

Distributions from net realized gain | (.25) | - | (.02) | (.03) | - | - |

Total distributions | (.37) K | (.08) | (.11) | (.07) | (.11) | - |

Redemption fees added to paid in capital E,J | - | - | - | - | - | - |

Net asset value, end of period | $ 7.89 | $ 7.31 | $ 6.67 | $ 7.36 | $ 6.40 | $ 4.90 |

Total Return B,C,D | 13.53% | 10.88% | (8.03)% | 16.17% | 33.87% | (51.00)% |

Ratios to Average Net Assets F,I | | | | | |

Expenses before reductions | 1.49% A | 1.57% | 1.73% | 2.02% | 2.09% | 2.00% |

Expenses net of fee waivers, if any | 1.45% A | 1.45% | 1.45% | 1.50% | 1.50% | 1.50% |

Expenses net of all reductions | 1.42% A | 1.42% | 1.42% | 1.47% | 1.47% | 1.48% |

Net investment income (loss) | 1.15% A | 1.88% | 1.44% | 1.15% | 1.13% | 1.35% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 8,389 | $ 5,767 | $ 4,307 | $ 5,029 | $ 3,727 | $ 5,944 |

Portfolio turnover rate G | 74% A | 110% | 75% | 67% | 98% | 91% |

AAnnualized BTotal returns for periods of less than one year are not annualized. CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. DTotal returns do not include the effect of the sales charges. ECalculated based on average shares outstanding during the period. FFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. GAmount does not include the portfolio activity of any underlying Fidelity Central Funds. HFor the period November 1, 2007 (commencement of operations) to October 31, 2008. IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. JAmount represents less than $.01 per share. KTotal distributions of $.37 per share is comprised of distributions from net investment income of $.126 and distributions from net realized gain of $.245 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class T

| Six months ended

April 30, 2013 | Years ended October 31, |

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 H |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.37 | $ 6.73 | $ 7.41 | $ 6.40 | $ 4.88 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .03 | .11 | .09 | .06 | .04 | .09 |

Net realized and unrealized gain (loss) | .91 | .59 | (.68) | .95 | 1.57 | (5.21) |

Total from investment operations | .94 | .70 | (.59) | 1.01 | 1.61 | (5.12) |

Distributions from net investment income | (.13) | (.06) | (.07) | - | (.09) | - |

Distributions from net realized gain | (.25) | - | (.02) | - | - | - |

Total distributions | (.37) K | (.06) | (.09) | - | (.09) | - |

Redemption fees added to paid in capital E,J | - | - | - | - | - | - |

Net asset value, end of period | $ 7.94 | $ 7.37 | $ 6.73 | $ 7.41 | $ 6.40 | $ 4.88 |

Total Return B,C,D | 13.31% | 10.52% | (8.08)% | 15.78% | 33.74% | (51.20)% |

Ratios to Average Net Assets F,I | | | | | |

Expenses before reductions | 1.76% A | 1.84% | 2.02% | 2.31% | 2.34% | 2.42% |

Expenses net of fee waivers, if any | 1.69% A | 1.70% | 1.70% | 1.75% | 1.75% | 1.75% |

Expenses net of all reductions | 1.67% A | 1.67% | 1.67% | 1.72% | 1.72% | 1.73% |

Net investment income (loss) | .91% A | 1.63% | 1.19% | .90% | .88% | 1.10% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 5,451 | $ 2,348 | $ 997 | $ 1,004 | $ 1,526 | $ 2,567 |

Portfolio turnover rate G | 74% A | 110% | 75% | 67% | 98% | 91% |

AAnnualized BTotal returns for periods of less than one year are not annualized. CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. DTotal returns do not include the effect of the sales charges. ECalculated based on average shares outstanding during the period. FFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. GAmount does not include the portfolio activity of any underlying Fidelity Central Funds. HFor the period November 1, 2007 (commencement of operations) to October 31, 2008. IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. JAmount represents less than $.01 per share. KTotal distributions of $.37 per share is comprised of distributions from net investment income of $.128 and distributions from net realized gain of $.245 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class B

| Six months ended

April 30, 2013 | Years ended October 31, |

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 H |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.33 | $ 6.68 | $ 7.37 | $ 6.39 | $ 4.86 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .02 | .08 | .05 | .03 | .02 | .05 |

Net realized and unrealized gain (loss) | .91 | .59 | (.68) | .95 | 1.56 | (5.19) |

Total from investment operations | .93 | .67 | (.63) | .98 | 1.58 | (5.14) |

Distributions from net investment income | (.05) | (.02) | (.04) | - | (.05) | - |

Distributions from net realized gain | (.25) | - | (.02) | - | - | - |

Total distributions | (.30) | (.02) | (.06) | - | (.05) | - |

Redemption fees added to paid in capital E,J | - | - | - | - | - | - |

Net asset value, end of period | $ 7.96 | $ 7.33 | $ 6.68 | $ 7.37 | $ 6.39 | $ 4.86 |

Total Return B,C,D | 13.08% | 10.05% | (8.66)% | 15.34% | 32.95% | (51.40)% |

Ratios to Average Net Assets F,I | | | | | |

Expenses before reductions | 2.24% A | 2.34% | 2.51% | 2.81% | 2.82% | 2.92% |

Expenses net of fee waivers, if any | 2.20% A | 2.20% | 2.20% | 2.25% | 2.25% | 2.25% |

Expenses net of all reductions | 2.17% A | 2.17% | 2.17% | 2.22% | 2.22% | 2.24% |

Net investment income (loss) | .40% A | 1.13% | .69% | .40% | .38% | .60% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 219 | $ 220 | $ 254 | $ 327 | $ 1,337 | $ 2,505 |

Portfolio turnover rate G | 74% A | 110% | 75% | 67% | 98% | 91% |

AAnnualized BTotal returns for periods of less than one year are not annualized. CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. DTotal returns do not include the effect of the contingent deferred sales charge. ECalculated based on average shares outstanding during the period. FFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. GAmount does not include the portfolio activity of any underlying Fidelity Central Funds. HFor the period November 1, 2007 (commencement of operations) to October 31, 2008. IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. JAmount represents less than $.01 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class C

| Six months ended

April 30, 2013 | Years ended October 31, |

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 H |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.31 | $ 6.67 | $ 7.36 | $ 6.39 | $ 4.86 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .02 | .08 | .05 | .03 | .02 | .05 |

Net realized and unrealized gain (loss) | .91 | .58 | (.69) | .94 | 1.56 | (5.19) |

Total from investment operations | .93 | .66 | (.64) | .97 | 1.58 | (5.14) |

Distributions from net investment income | (.08) | (.02) | (.03) | - | (.05) | - |

Distributions from net realized gain | (.25) | - | (.02) | - | - | - |

Total distributions | (.32) K | (.02) | (.05) | - | (.05) | - |

Redemption fees added to paid in capital E,J | - | - | - | - | - | - |

Net asset value, end of period | $ 7.92 | $ 7.31 | $ 6.67 | $ 7.36 | $ 6.39 | $ 4.86 |

Total Return B,C,D | 13.16% | 9.98% | (8.72)% | 15.18% | 33.10% | (51.40)% |

Ratios to Average Net Assets F,I | | | | | |

Expenses before reductions | 2.25% A | 2.31% | 2.51% | 2.80% | 2.85% | 2.92% |

Expenses net of fee waivers, if any | 2.20% A | 2.20% | 2.20% | 2.25% | 2.25% | 2.25% |

Expenses net of all reductions | 2.17% A | 2.17% | 2.17% | 2.22% | 2.22% | 2.23% |

Net investment income (loss) | .40% A | 1.13% | .69% | .40% | .38% | .60% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 3,285 | $ 2,737 | $ 1,396 | $ 1,423 | $ 1,714 | $ 2,787 |

Portfolio turnover rate G | 74% A | 110% | 75% | 67% | 98% | 91% |

AAnnualized BTotal returns for periods of less than one year are not annualized. CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. DTotal returns do not include the effect of the contingent deferred sales charge. ECalculated based on average shares outstanding during the period. FFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. GAmount does not include the portfolio activity of any underlying Fidelity Central Funds. HFor the period November 1, 2007 (commencement of operations) to October 31, 2008. IExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. JAmount represents less than $.01 per share. KTotal distributions of $.32 per share is comprised of distributions from net investment income of $.075 and distributions from net realized gain of $.245 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Total International Equity

| Six months ended

April 30, 2013 | Years ended October 31, |

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.32 | $ 6.69 | $ 7.37 | $ 6.41 | $ 4.91 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .06 | .15 | .12 | .09 | .07 | .13 |

Net realized and unrealized gain (loss) | .90 | .58 | (.68) | .96 | 1.55 | (5.21) |

Total from investment operations | .96 | .73 | (.56) | 1.05 | 1.62 | (5.08) |

Distributions from net investment income | (.15) | (.10) | (.10) | (.06) | (.12) | (.01) |

Distributions from net realized gain | (.25) | - | (.02) | (.03) | - | - |

Total distributions | (.39) J | (.10) | (.12) | (.09) | (.12) | (.01) |

Redemption fees added to paid in capital D,I | - | - | - | - | - | - |

Net asset value, end of period | $ 7.89 | $ 7.32 | $ 6.69 | $ 7.37 | $ 6.41 | $ 4.91 |

Total Return B,C | 13.71% | 11.03% | (7.70)% | 16.45% | 34.23% | (50.87)% |

Ratios to Average Net Assets E,H | | | | | |

Expenses before reductions | 1.08% A | 1.16% | 1.42% | 1.79% | 1.87% | 1.89% |

Expenses net of fee waivers, if any | 1.08% A | 1.16% | 1.20% | 1.25% | 1.25% | 1.25% |

Expenses net of all reductions | 1.06% A | 1.13% | 1.17% | 1.22% | 1.22% | 1.23% |

Net investment income (loss) | 1.52% A | 2.16% | 1.69% | 1.40% | 1.38% | 1.60% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 339,928 | $ 281,979 | $ 131,338 | $ 60,826 | $ 33,061 | $ 23,226 |

Portfolio turnover rate F | 74% A | 110% | 75% | 67% | 98% | 91% |

AAnnualized BTotal returns for periods of less than one year are not annualized. CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. DCalculated based on average shares outstanding during the period. EFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. FAmount does not include the portfolio activity of any underlying Fidelity Central Funds. GFor the period November 1, 2007 (commencement of operations) to October 31, 2008. HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. IAmount represents less than $.01 per share. JTotal distributions of $.39 per share is comprised of distributions from net investment income of $.148 and distributions from net realized gain of $.245 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Institutional Class

| Six months ended

April 30, 2013 | Years ended October 31, |

| (Unaudited) | 2012 | 2011 | 2010 | 2009 | 2008 G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 7.30 | $ 6.67 | $ 7.35 | $ 6.41 | $ 4.91 | $ 10.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .05 | .14 | .12 | .10 | .07 | .13 |

Net realized and unrealized gain (loss) | .90 | .59 | (.68) | .95 | 1.55 | (5.21) |

Total from investment operations | .95 | .73 | (.56) | 1.05 | 1.62 | (5.08) |

Distributions from net investment income | (.15) | (.10) | (.10) | (.08) | (.12) | (.01) |

Distributions from net realized gain | (.25) | - | (.02) | (.03) | - | - |

Total distributions | (.39) J | (.10) | (.12) | (.11) | (.12) | (.01) |

Redemption fees added to paid in capital D,I | - | - | - | - | - | - |

Net asset value, end of period | $ 7.86 | $ 7.30 | $ 6.67 | $ 7.35 | $ 6.41 | $ 4.91 |

Total Return B,C | 13.61% | 11.06% | (7.72)% | 16.48% | 34.23% | (50.87)% |

Ratios to Average Net Assets E,H | | | | | |

Expenses before reductions | 1.22% A | 1.27% | 1.48% | 1.82% | 1.80% | 1.91% |

Expenses net of fee waivers, if any | 1.20% A | 1.20% | 1.20% | 1.25% | 1.25% | 1.25% |

Expenses net of all reductions | 1.17% A | 1.17% | 1.17% | 1.23% | 1.22% | 1.23% |

Net investment income (loss) | 1.40% A | 2.13% | 1.69% | 1.40% | 1.38% | 1.60% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 2,186 | $ 1,514 | $ 197 | $ 28 | $ 1,308 | $ 2,733 |

Portfolio turnover rate F | 74% A | 110% | 75% | 67% | 98% | 91% |

AAnnualized BTotal returns for periods of less than one year are not annualized. CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. DCalculated based on average shares outstanding during the period. EFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. FAmount does not include the portfolio activity of any underlying Fidelity Central Funds. GFor the period November 1, 2007 (commencement of operations) to October 31, 2008. HExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. IAmount represents less than $.01 per share. JTotal distributions of $.39 per share is comprised of distributions from net investment income of $.148 and distributions from net realized gain of $.245 per share. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended April 30, 2013 (Unaudited)

1. Organization.

Fidelity® Total International Equity Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C, Total International Equity and Institutional Class shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Significant Accounting Policies - continued

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the FMR Fair Value Committee (the Committee), in accordance with procedures adopted by the Fund's Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Semiannual Report

3. Significant Accounting Policies - continued

Investment Valuation - continued

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of April 30, 2013, including information on transfers between Levels 1 and 2 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Significant Accounting Policies - continued

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. A fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), partnerships, capital loss carryforwards and losses deferred due to wash sales.

Semiannual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 55,673,111 |

Gross unrealized depreciation | (9,356,334) |