UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2011 |

Item 1. Reports to Stockholders

Fidelity's

Broadly Diversified International Equity

Funds

Fidelity® Diversified International Fund

Fidelity International Capital Appreciation Fund

Fidelity Overseas Fund

Fidelity Worldwide Fund

Semiannual Report

April 30, 2011

(2_fidelity_logos) (Registered_Trademark)

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

(photo_of_James_C_Curvey)

Dear Shareholder:

Amid indications the U.S. economy had turned a corner, U.S. equities continued their generally upward trend in early 2011, overcoming bouts of short-term volatility following unrest in North Africa and the disaster in Japan. Still, questions remained about the longer-term outlook, most notably persistently high unemployment. Financial markets are always unpredictable, of course, but there also are several time-tested investment principles that can help put the odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There can be tax advantages and cost benefits to consider as well. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or by phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

(The acting chairman's signature appears here.)

James C. Curvey

Acting Chairman

Semiannual Report

Fidelity Diversified International Fund

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2010 to April 30, 2011).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized Expense Ratio | Beginning

Account Value

November 1, 2010 | Ending

Account Value

April 30, 2011 | Expenses Paid

During Period*

November 1, 2010

to April 30, 2011 |

Diversified International | .91% | | | |

Actual | | $ 1,000.00 | $ 1,134.40 | $ 4.82 |

HypotheticalA | | $ 1,000.00 | $ 1,020.28 | $ 4.56 |

Class K | .74% | | | |

Actual | | $ 1,000.00 | $ 1,135.60 | $ 3.92 |

HypotheticalA | | $ 1,000.00 | $ 1,021.12 | $ 3.71 |

Class F | .69% | | | |

Actual | | $ 1,000.00 | $ 1,135.40 | $ 3.65 |

HypotheticalA | | $ 1,000.00 | $ 1,021.37 | $ 3.46 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Semiannual Report

Fidelity Diversified International Fund

Investment Changes (Unaudited)

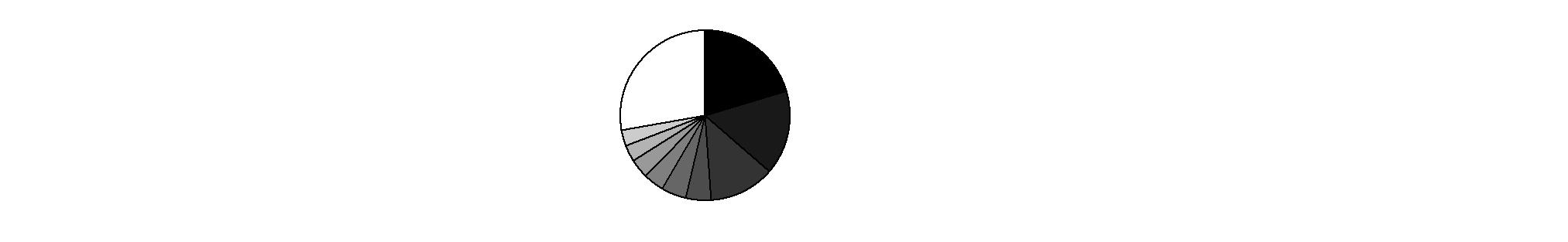

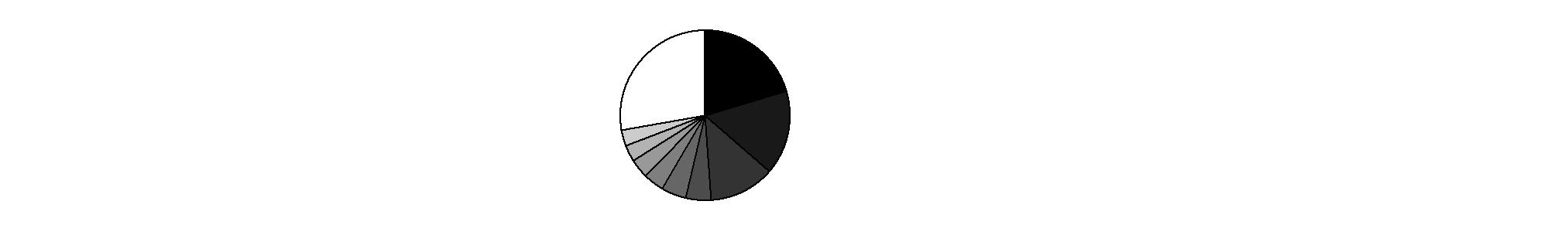

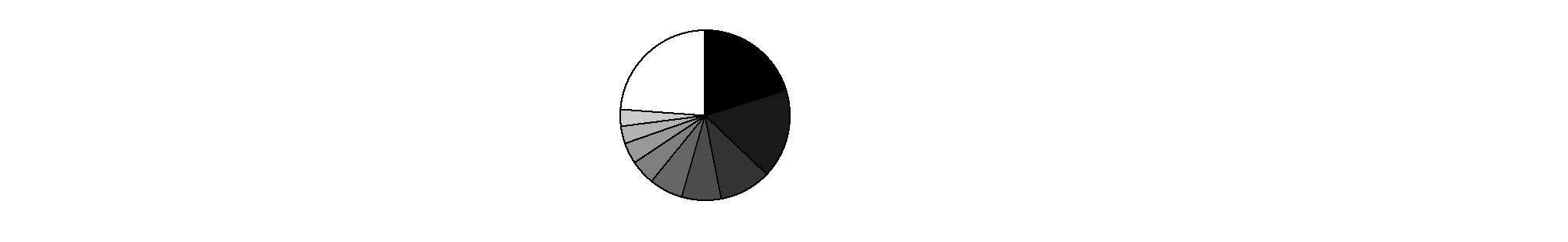

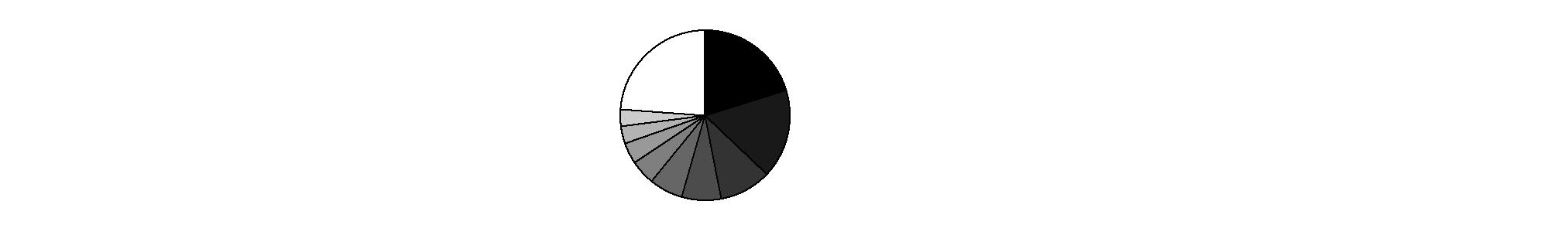

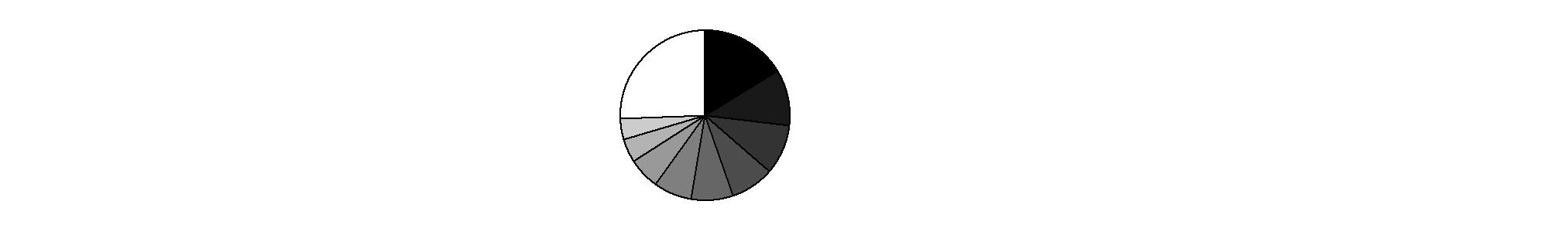

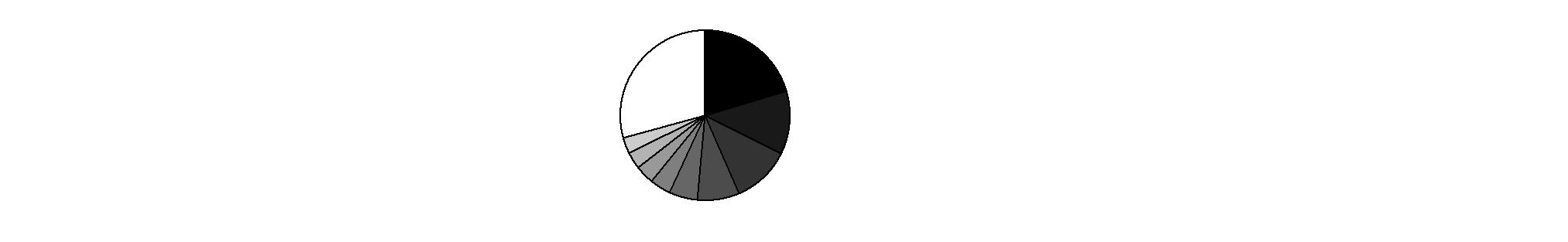

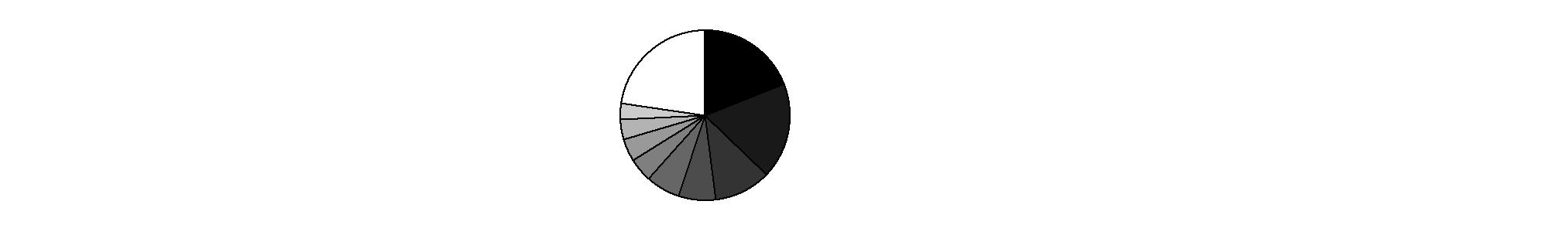

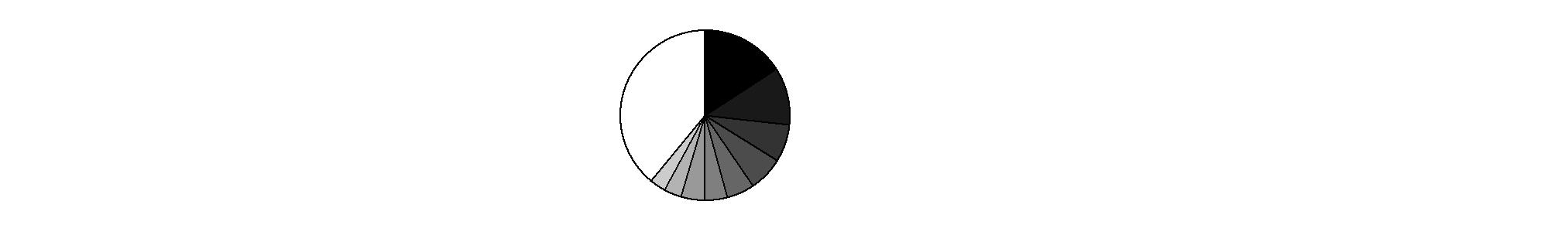

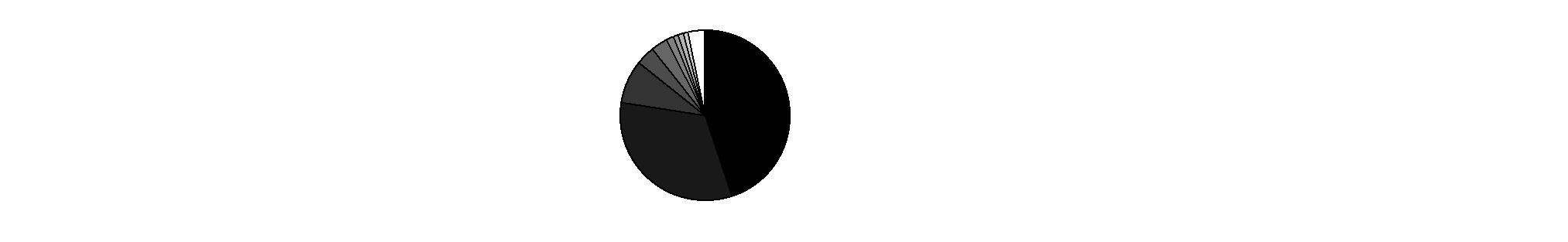

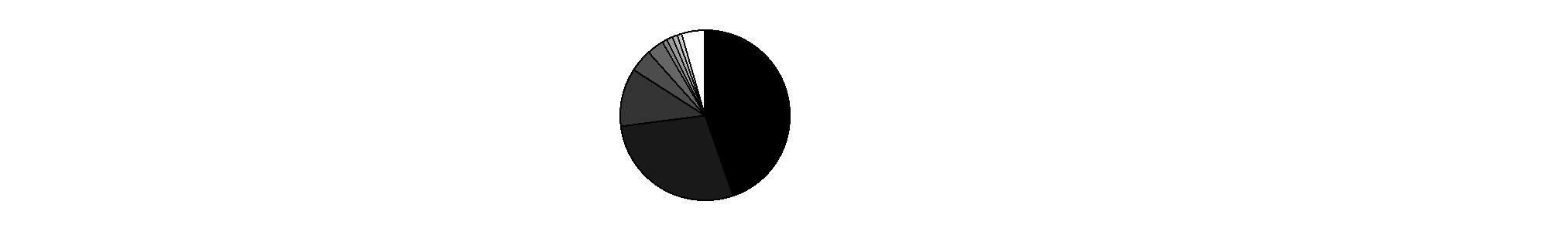

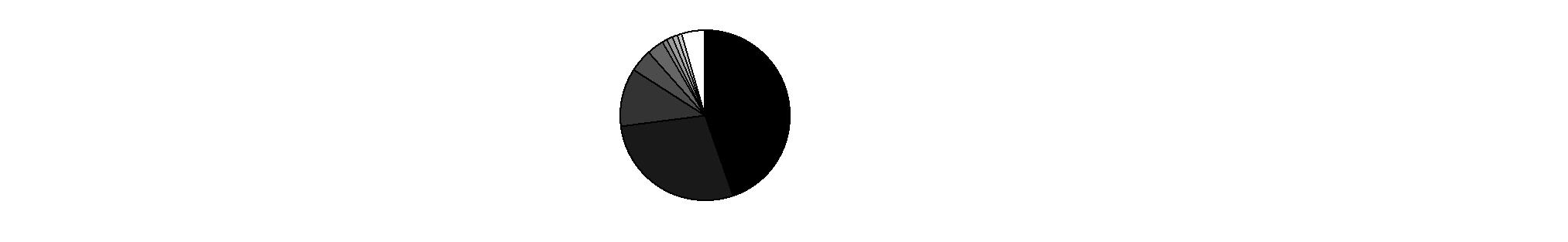

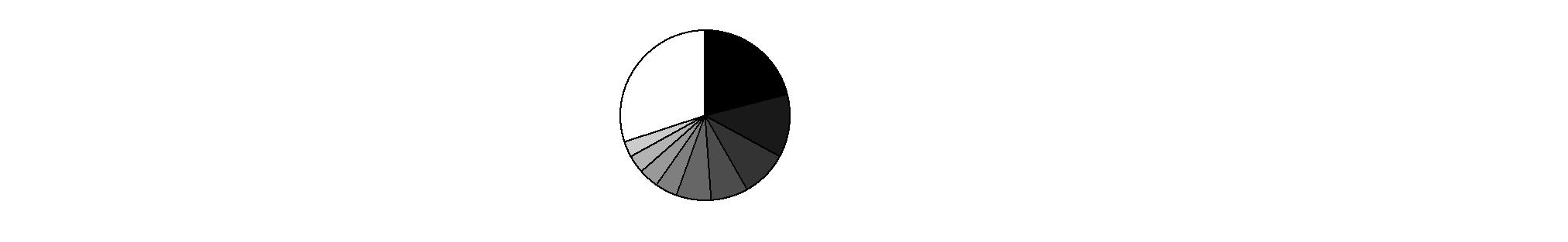

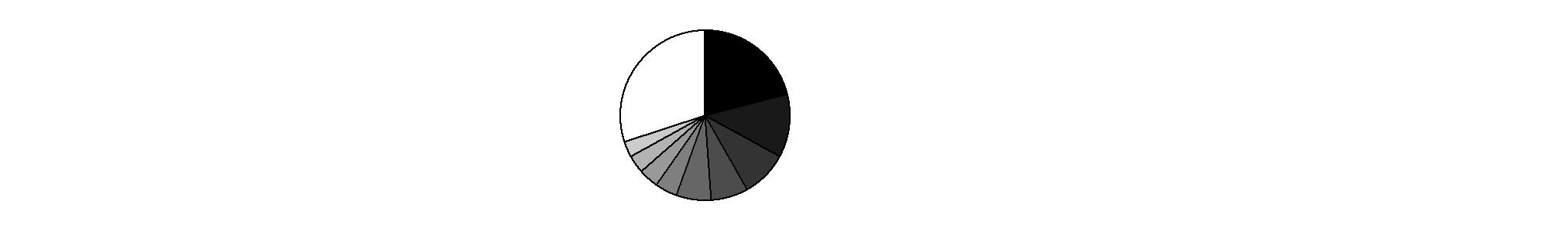

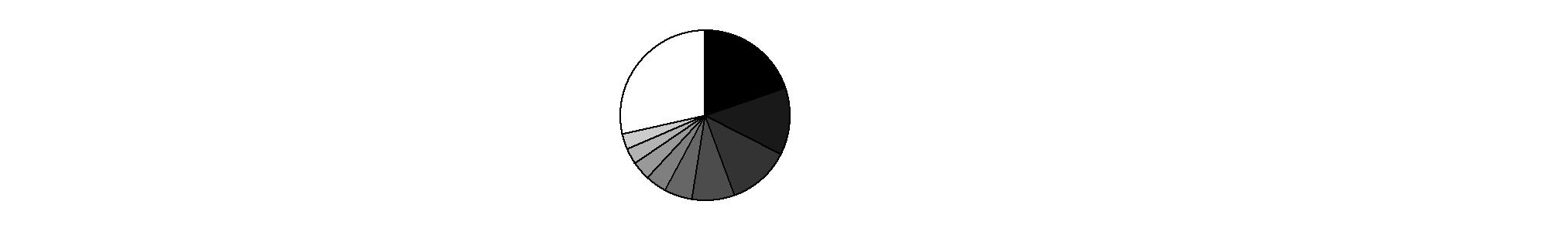

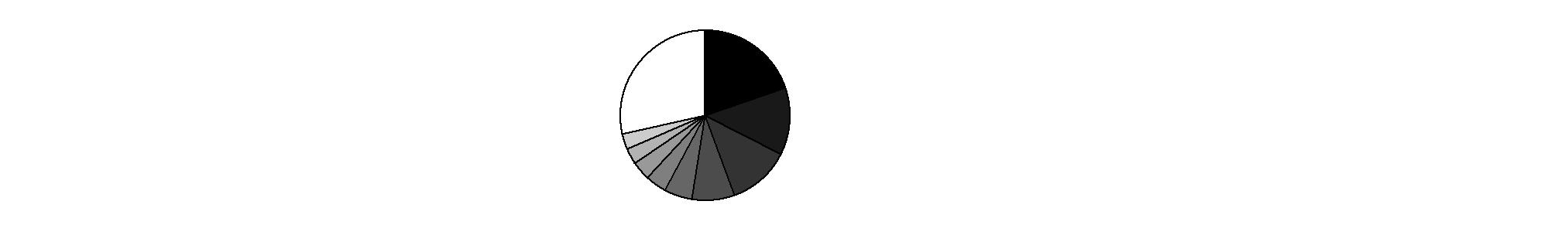

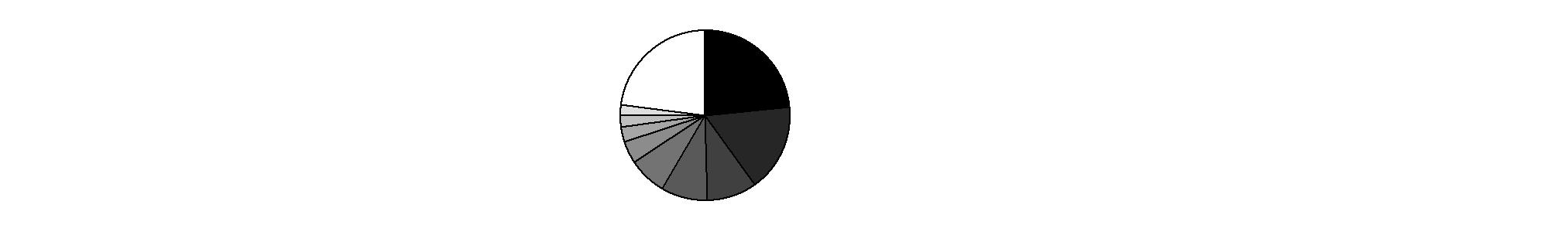

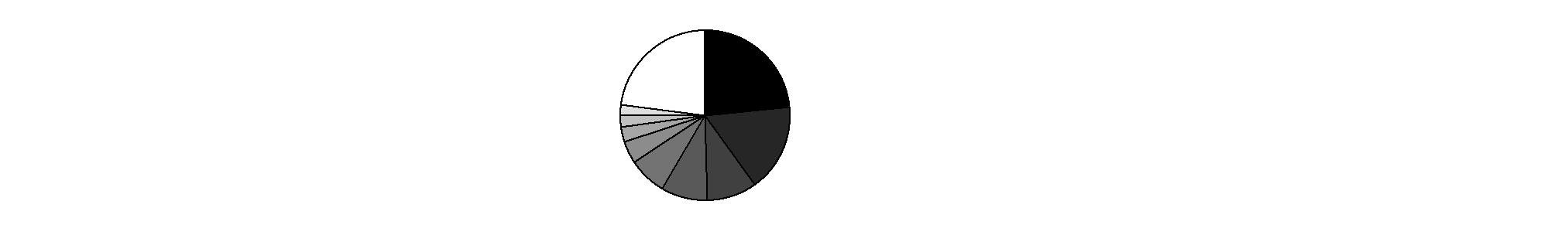

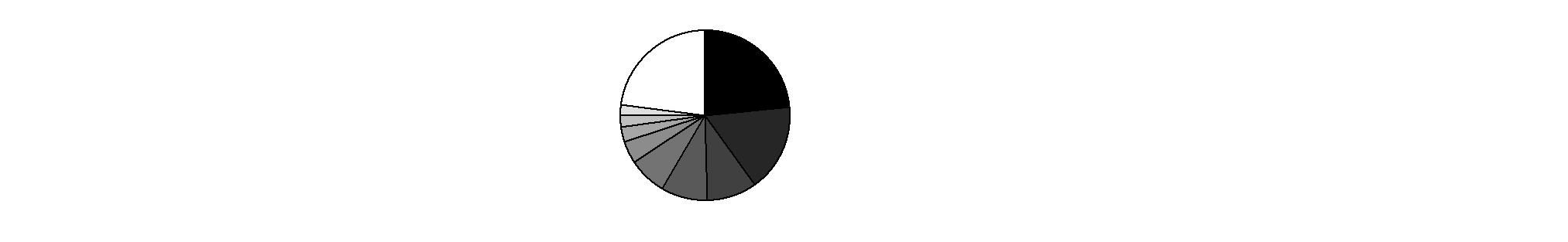

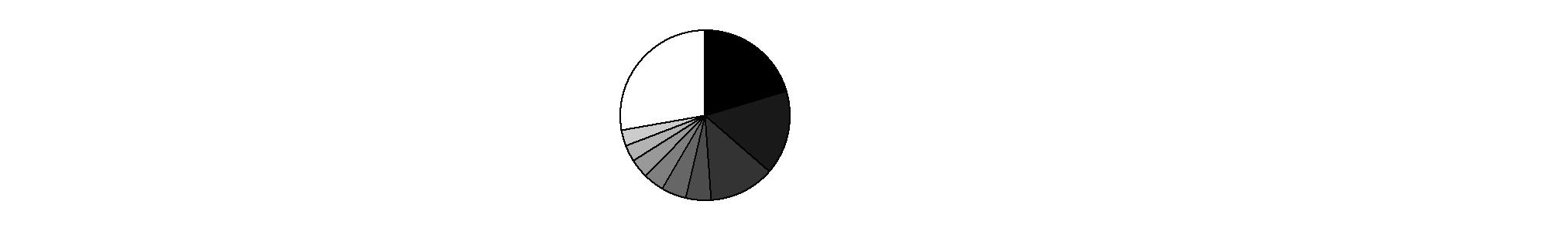

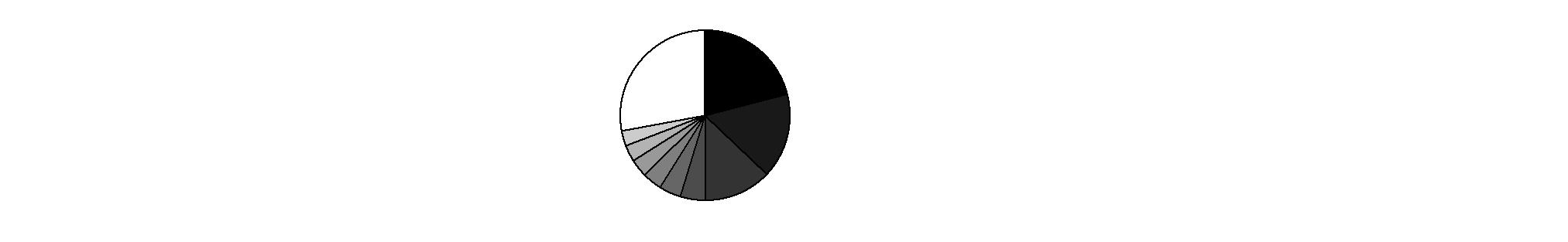

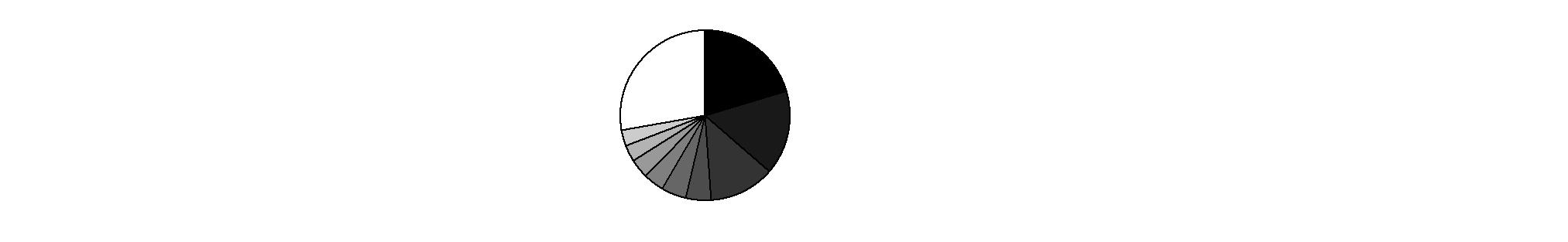

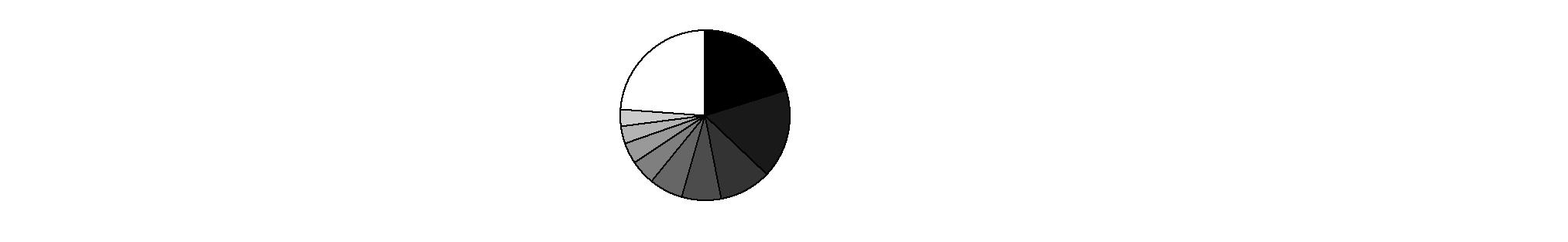

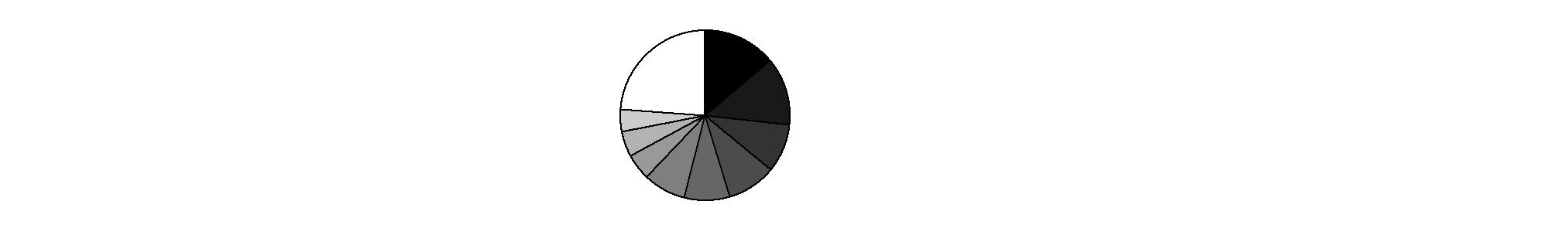

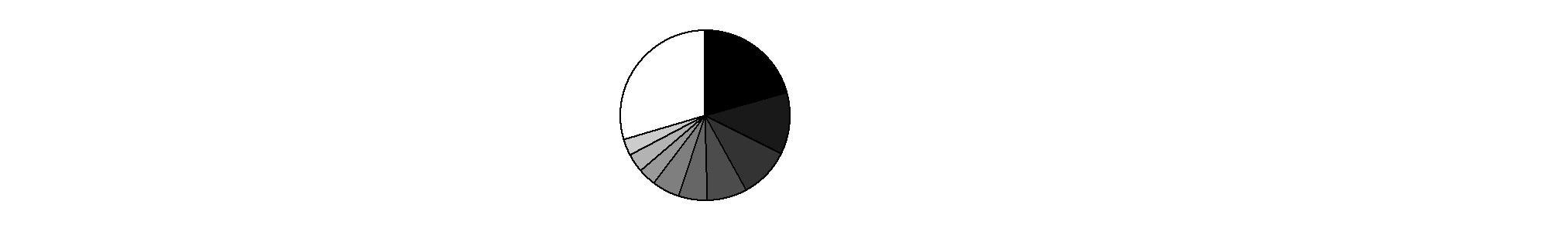

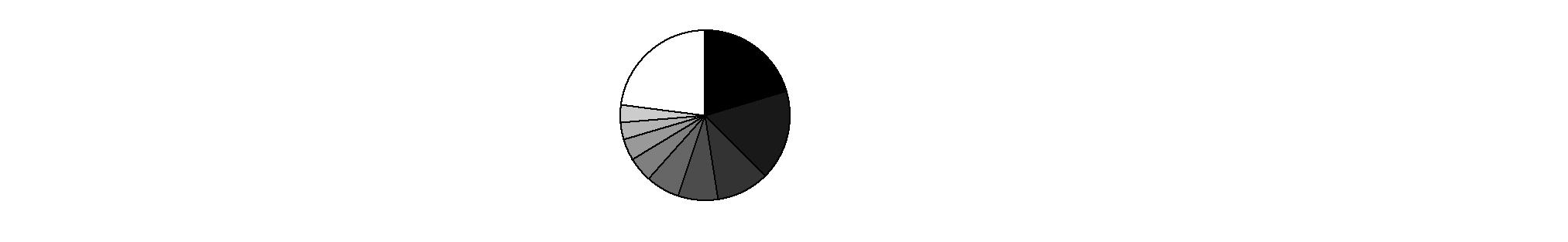

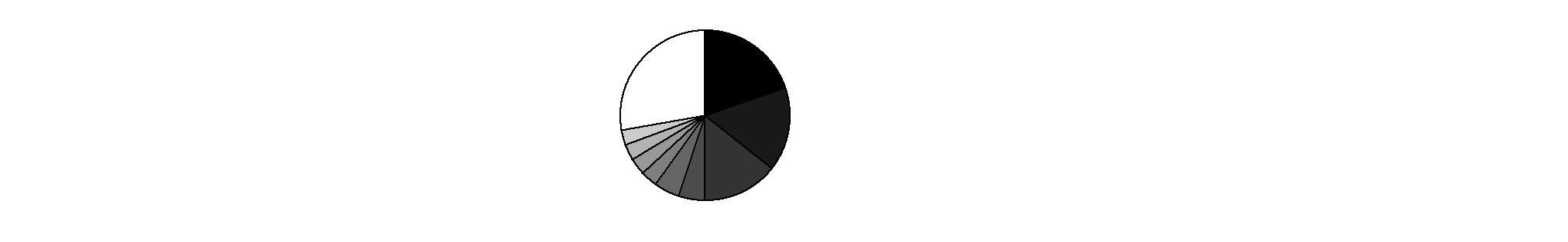

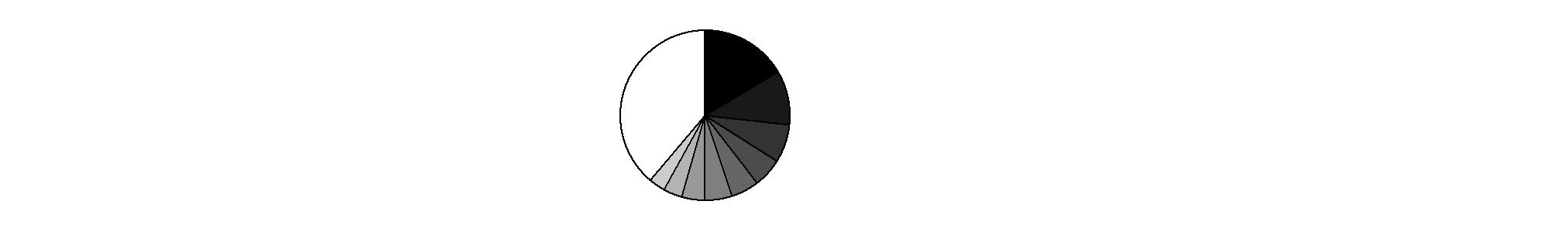

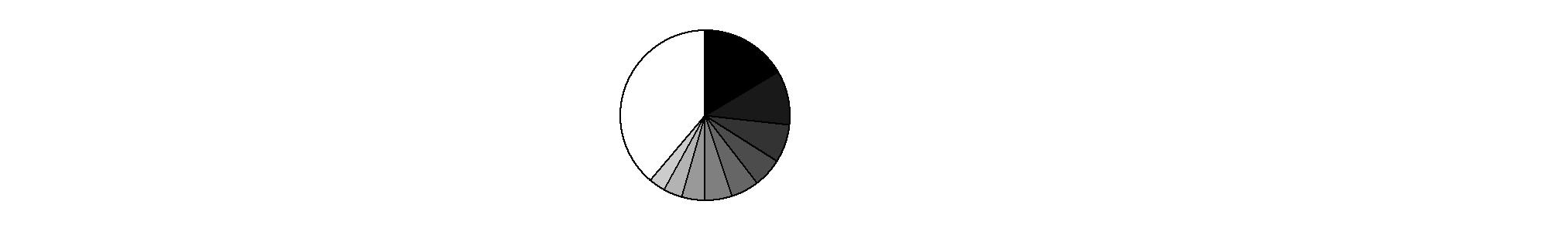

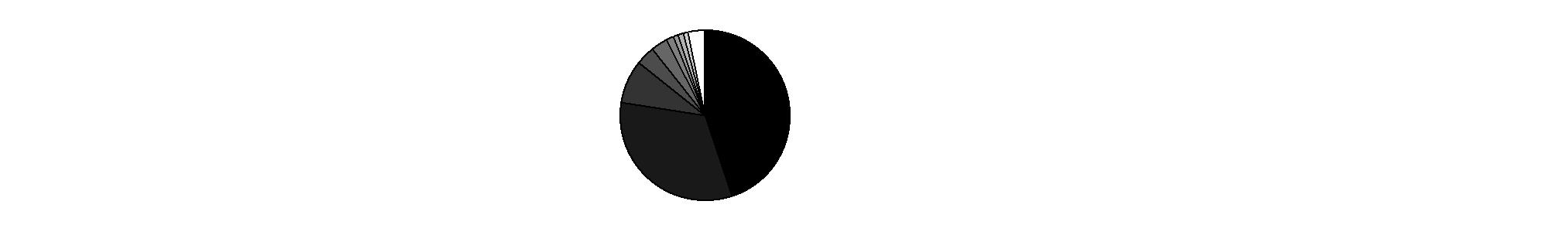

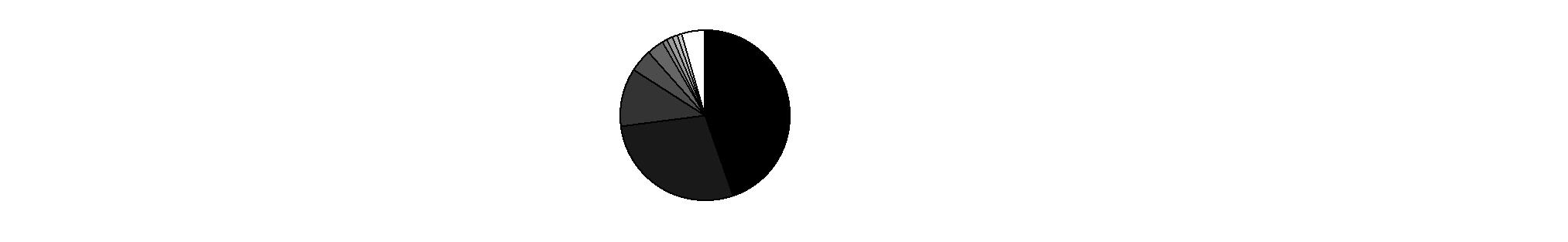

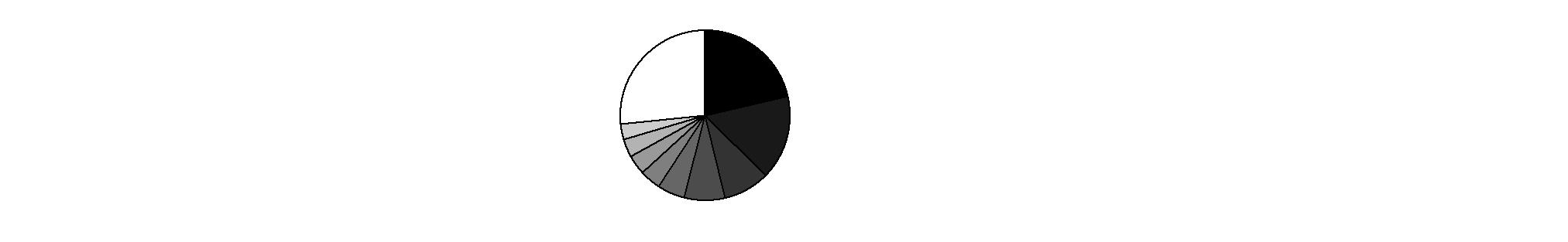

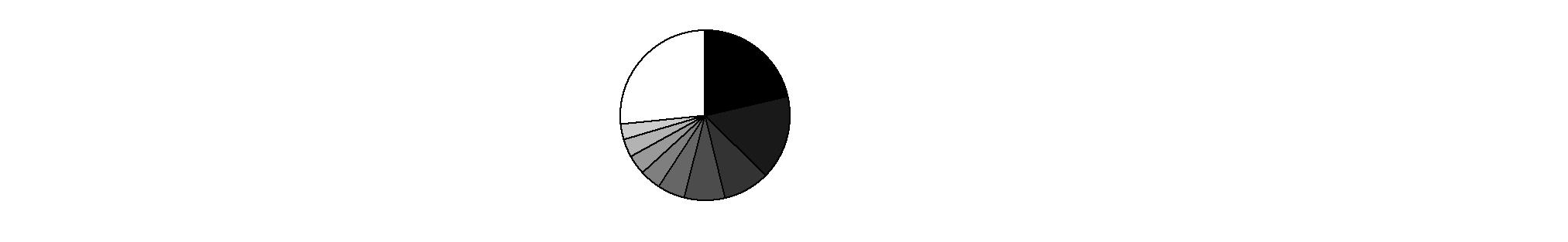

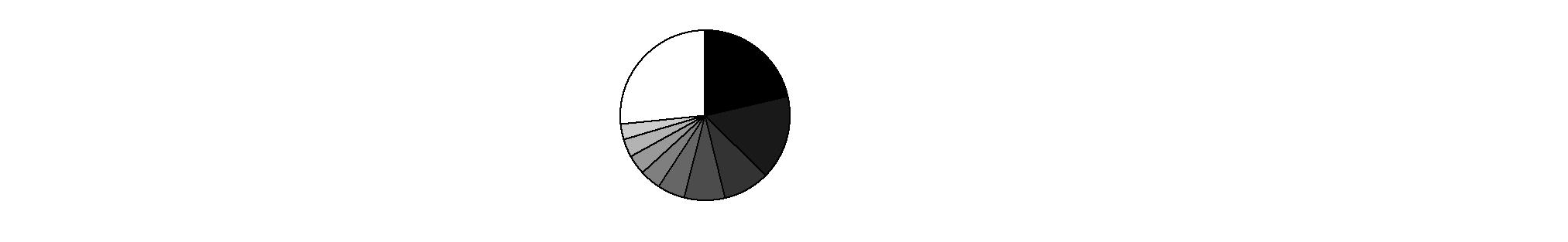

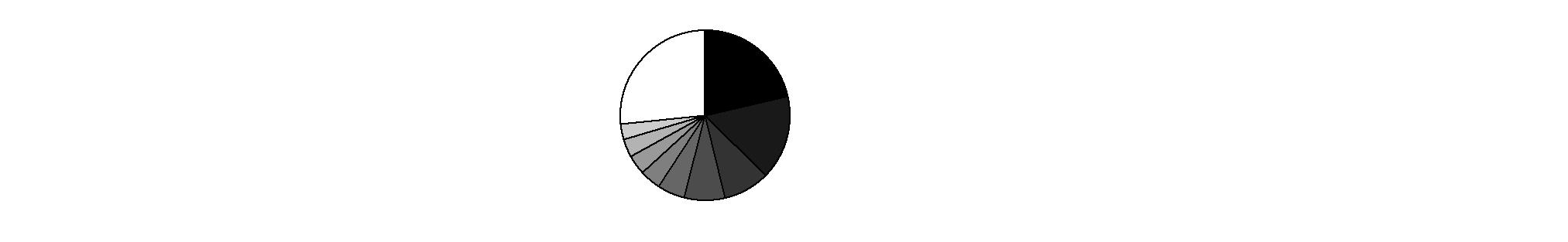

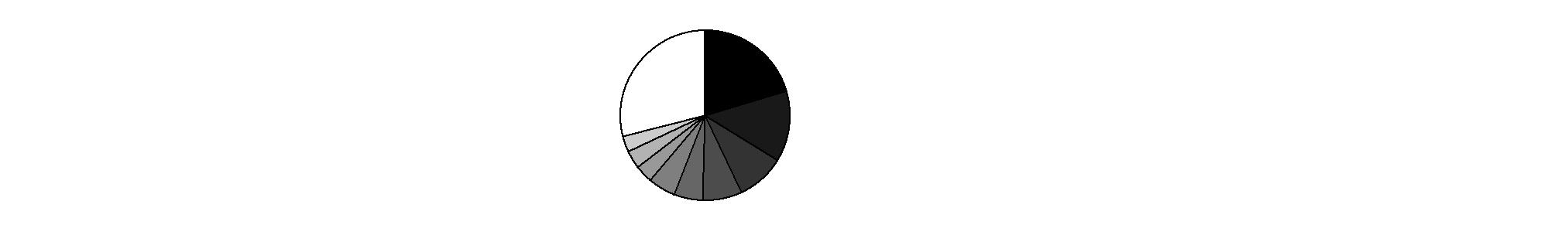

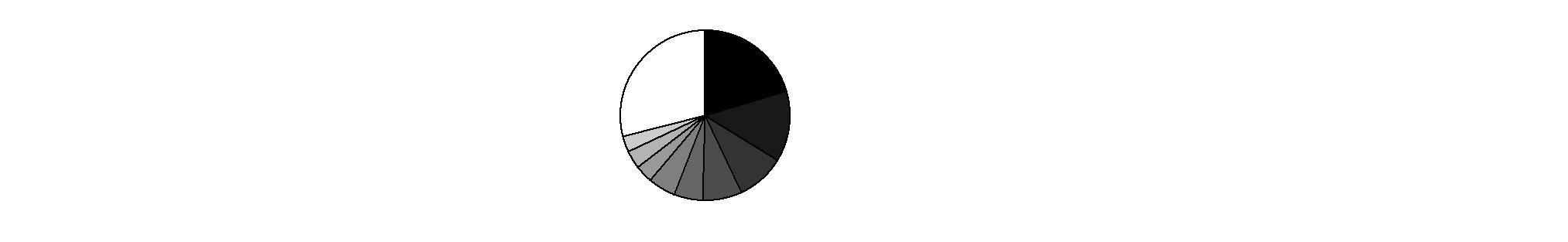

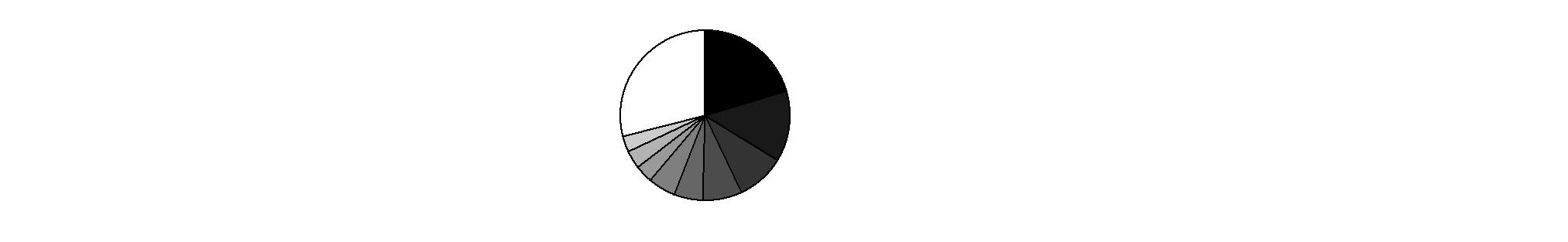

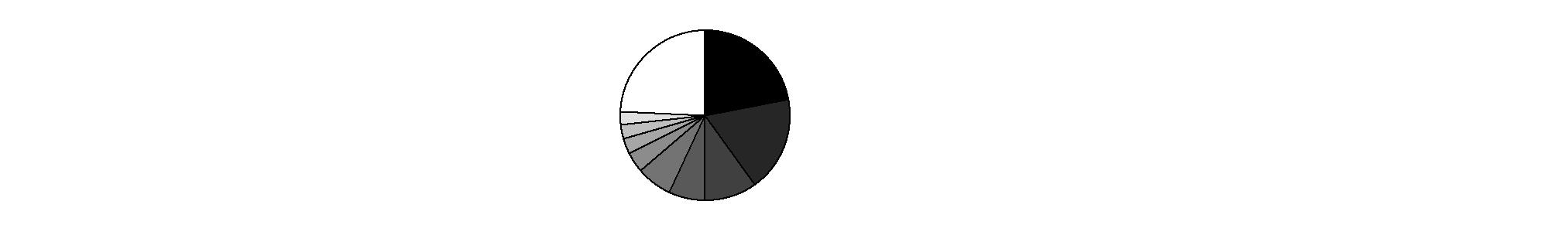

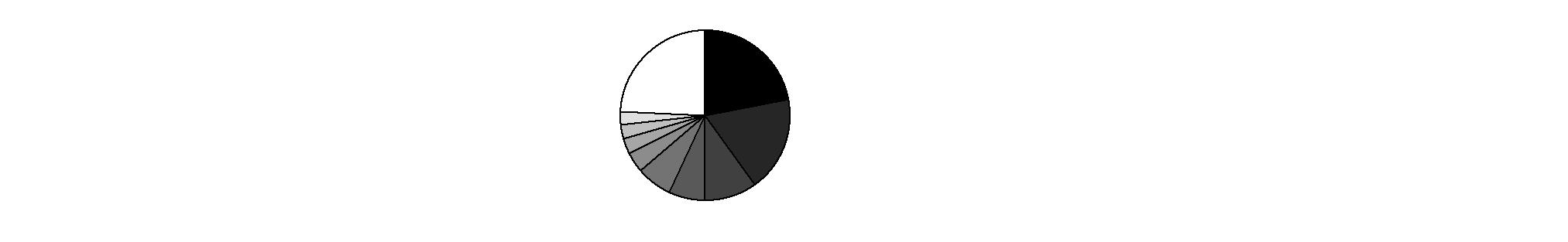

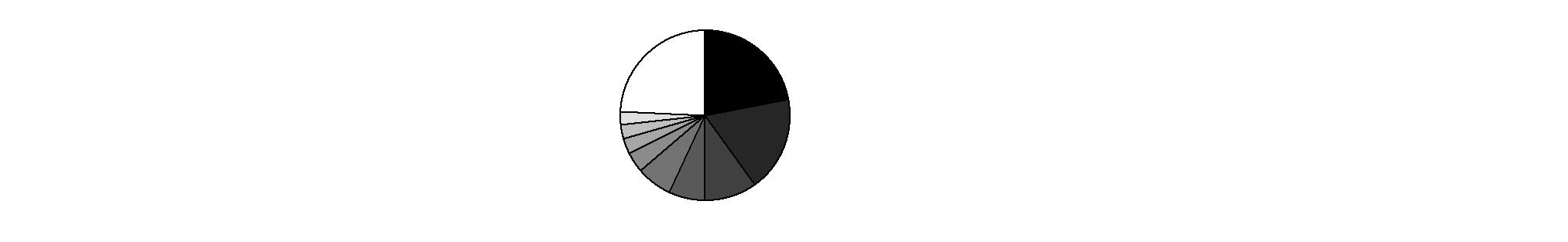

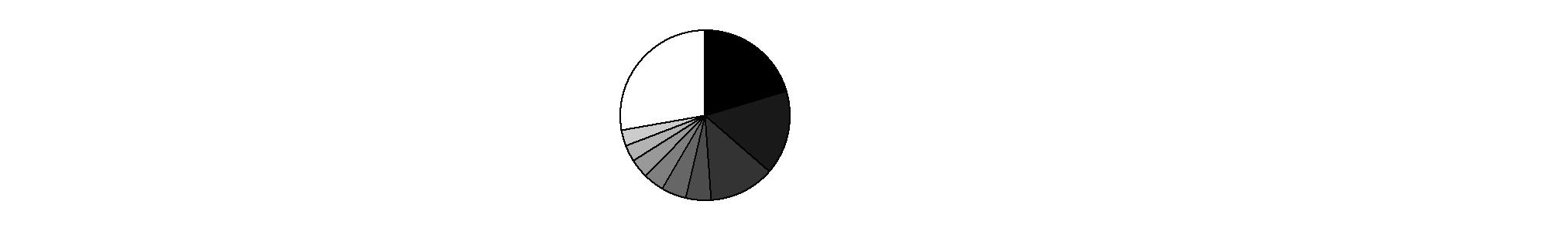

Geographic Diversification (% of fund's net assets) |

As of April 30, 2011 |

| United Kingdom | 17.6% | |

| Japan | 13.0% | |

| Germany | 8.4% | |

| France | 6.4% | |

| United States of America | 6.2% | |

| Switzerland | 5.4% | |

| Canada | 5.0% | |

| Australia | 3.8% | |

| Spain | 3.4% | |

| Other | 30.8% | |

Percentages are adjusted for the effect of futures contracts, if applicable. |

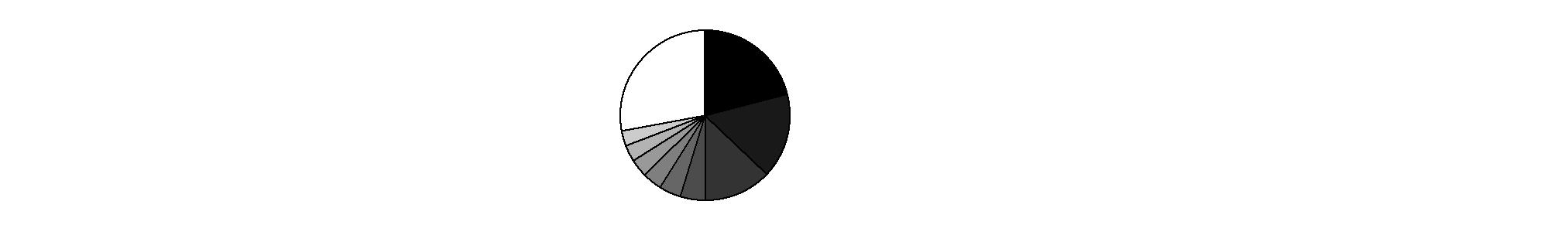

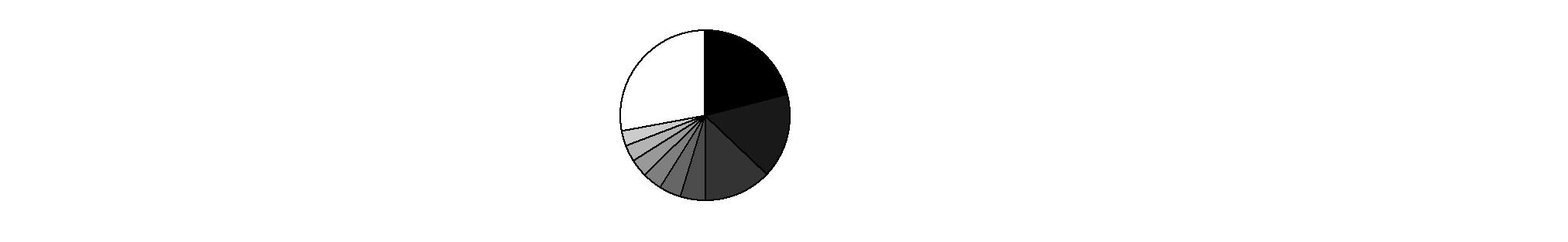

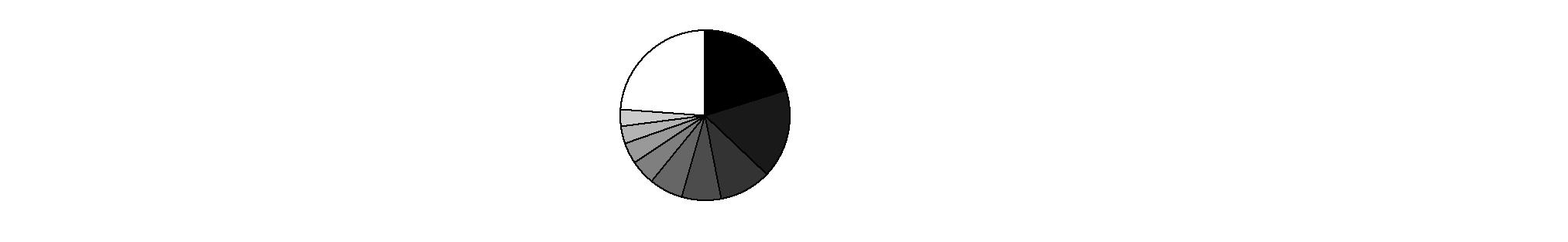

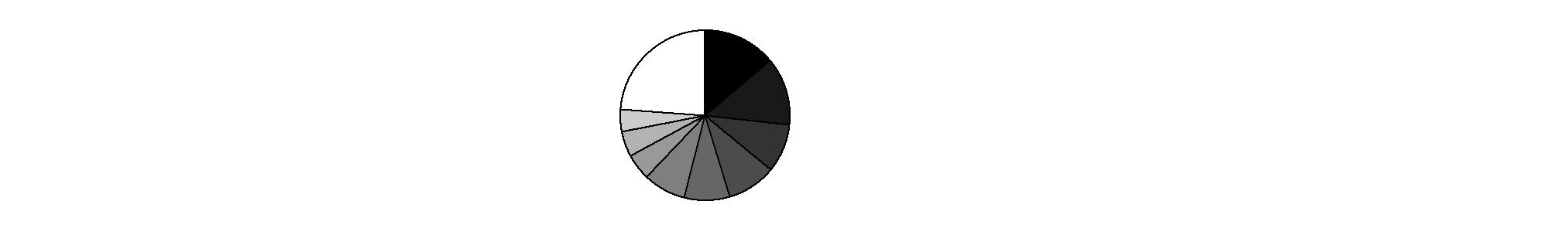

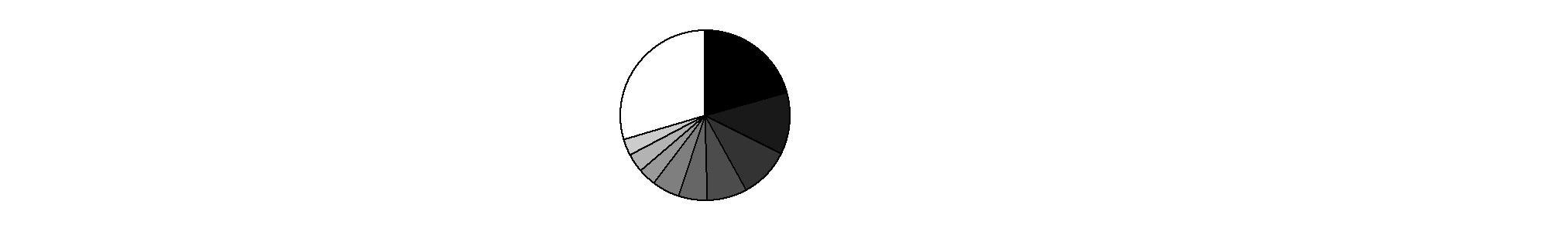

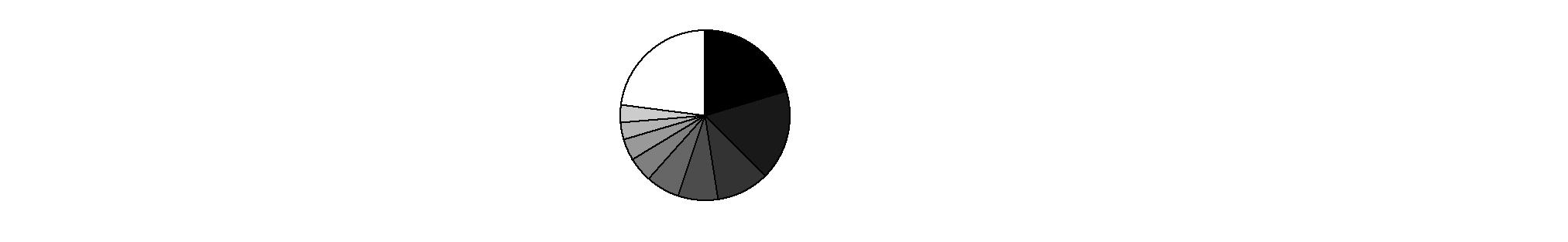

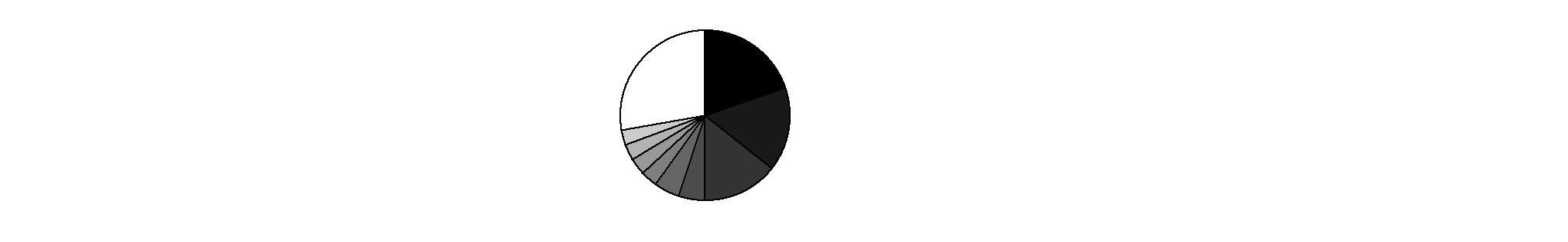

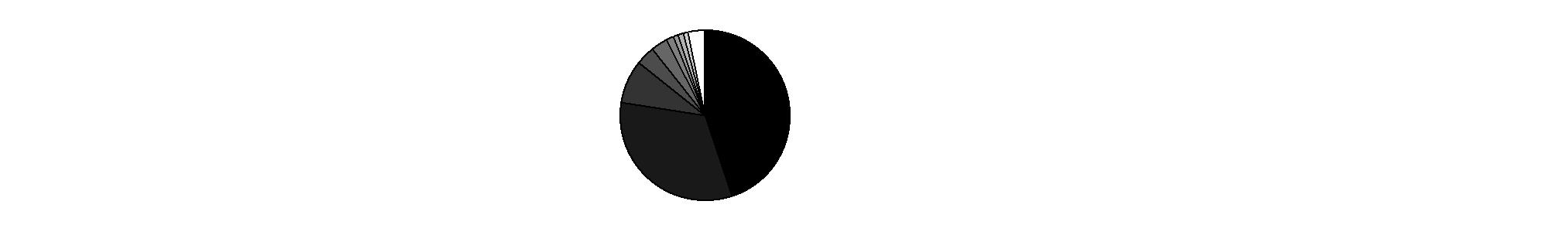

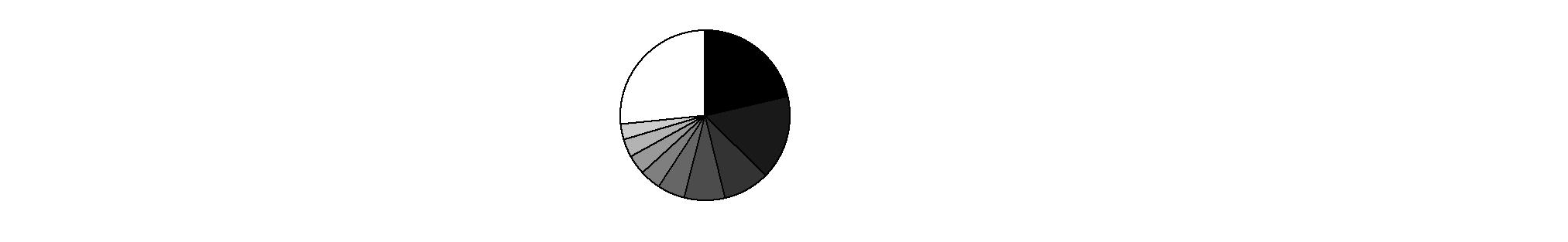

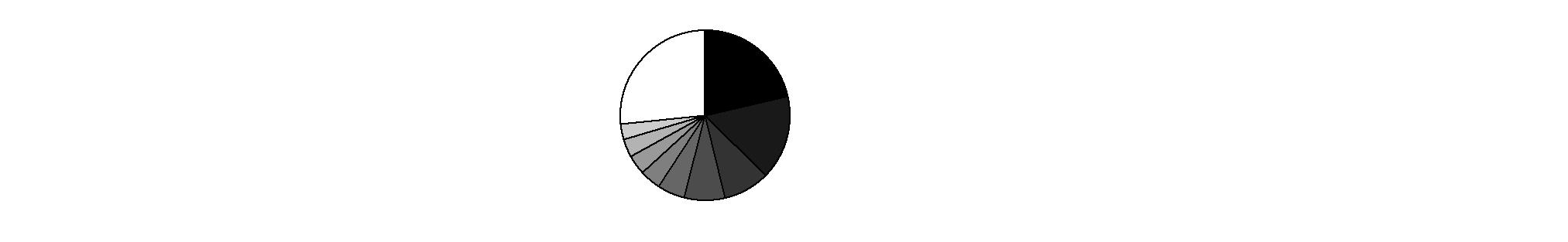

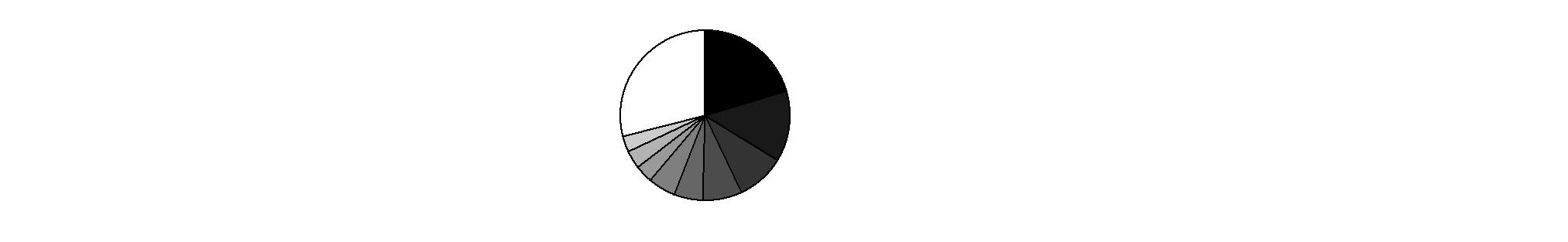

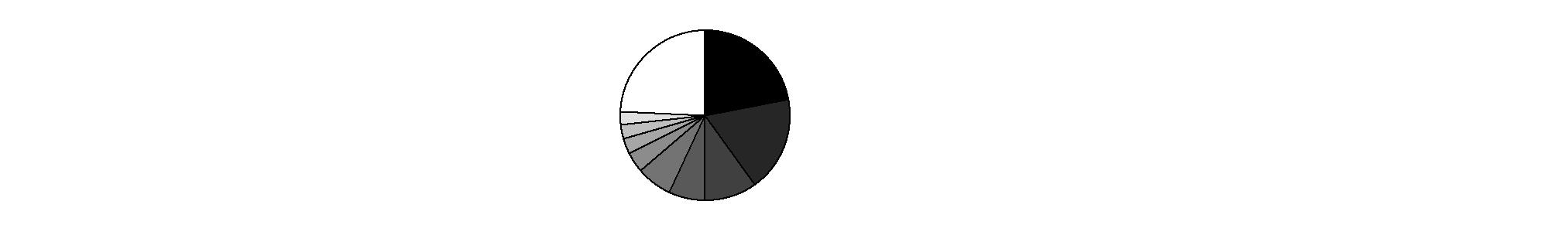

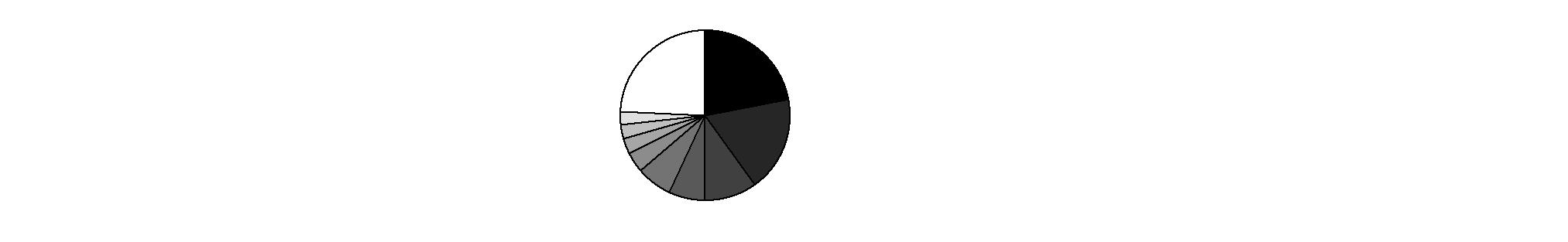

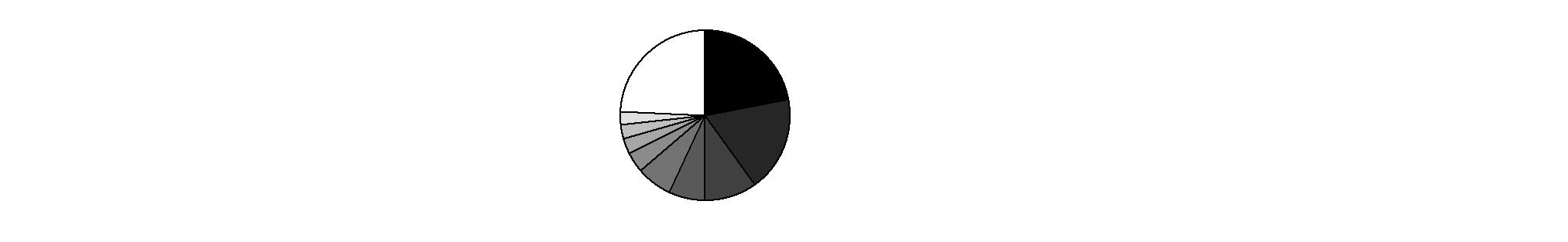

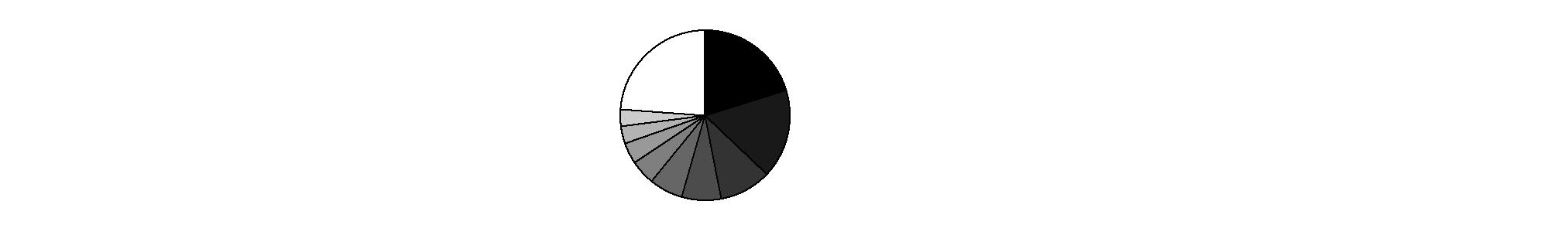

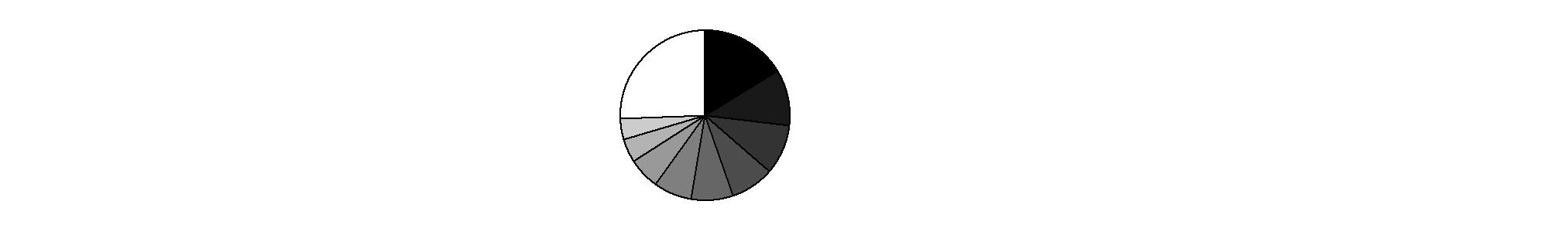

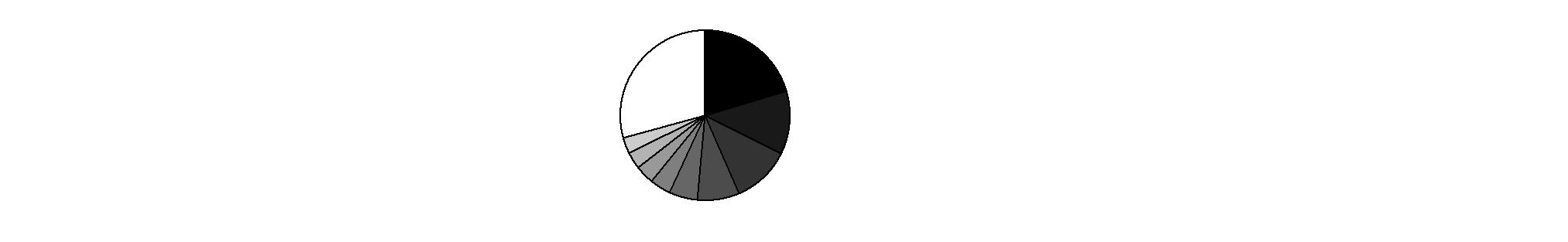

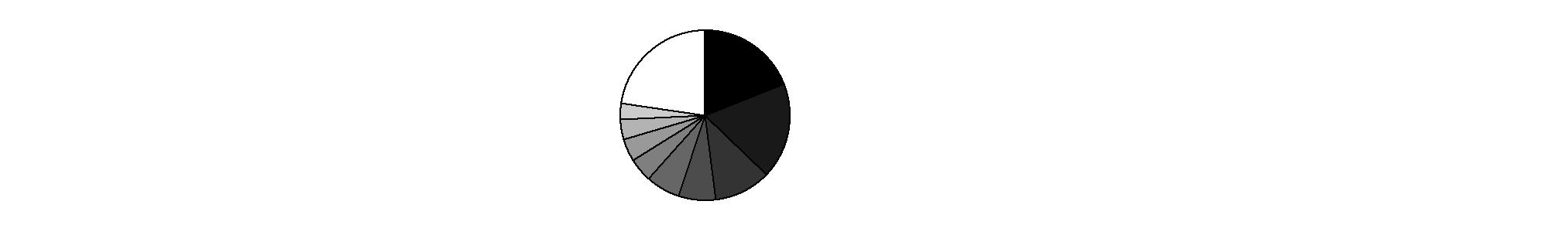

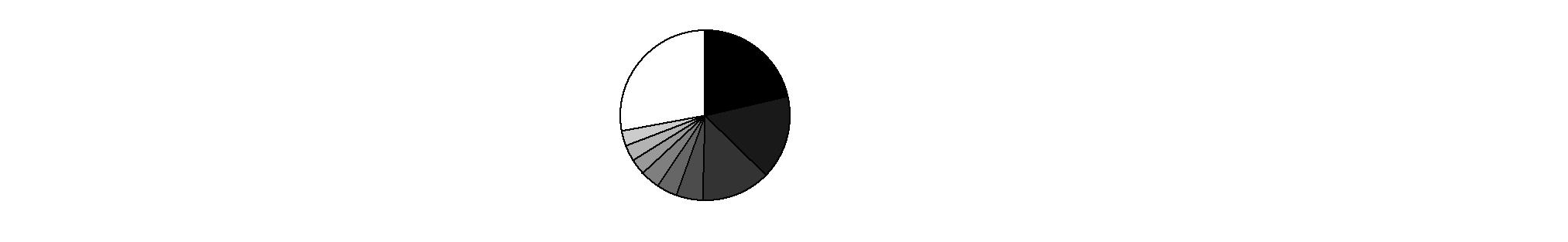

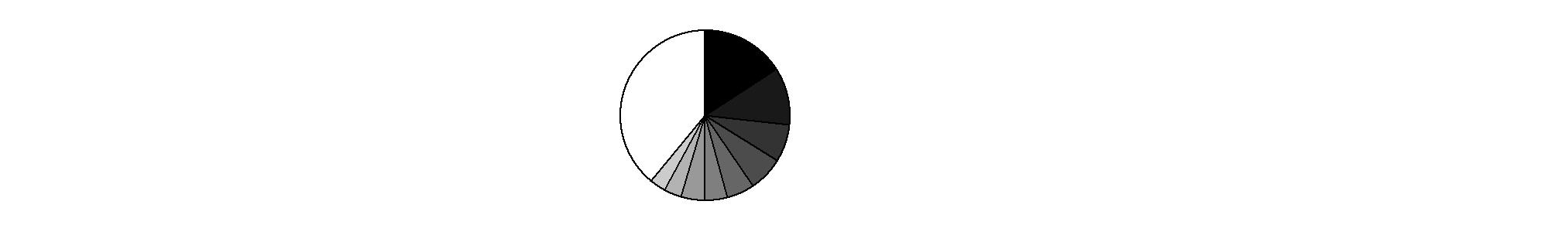

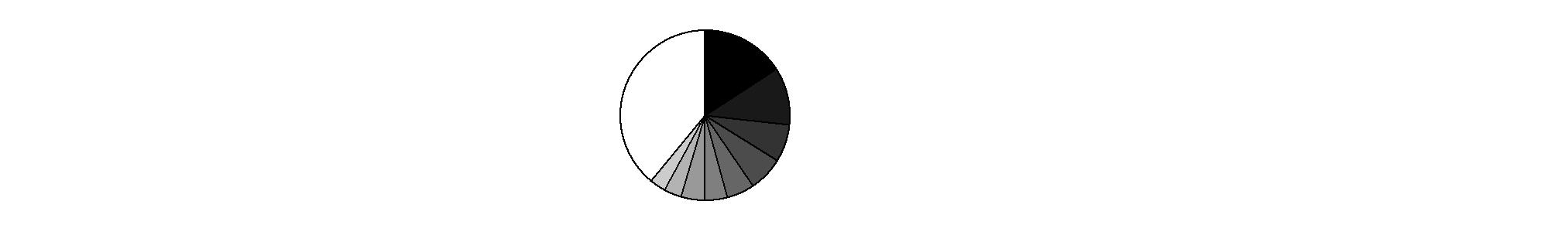

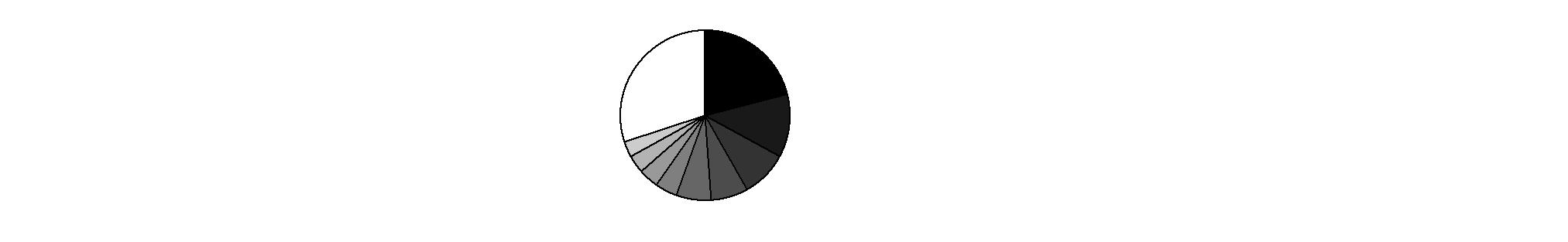

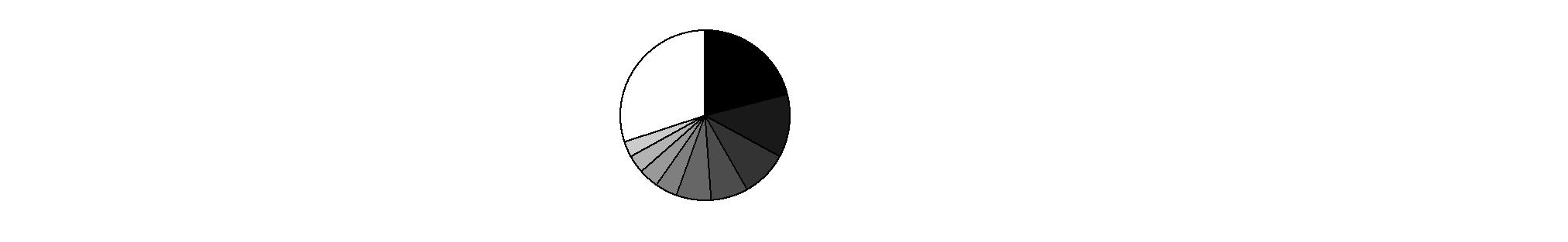

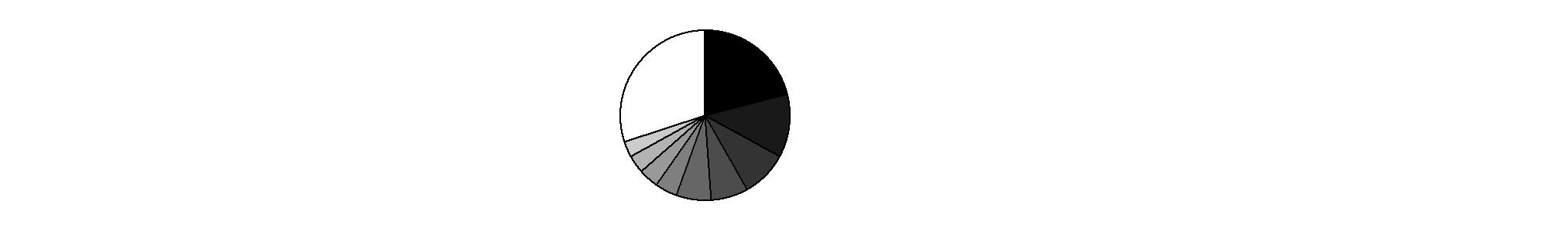

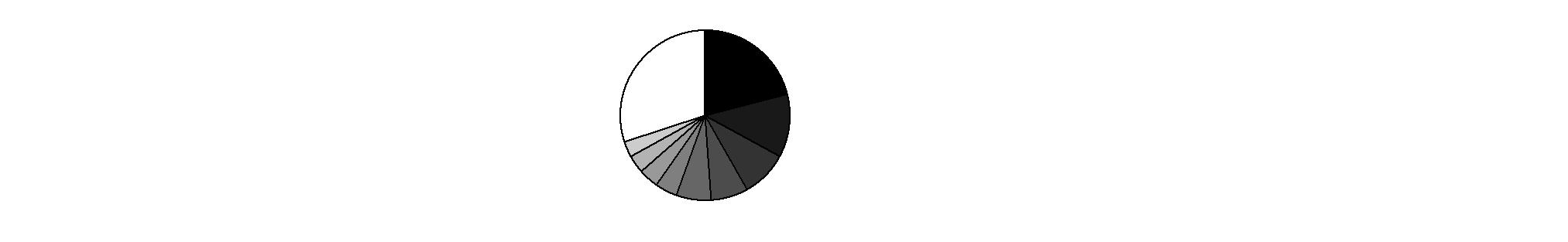

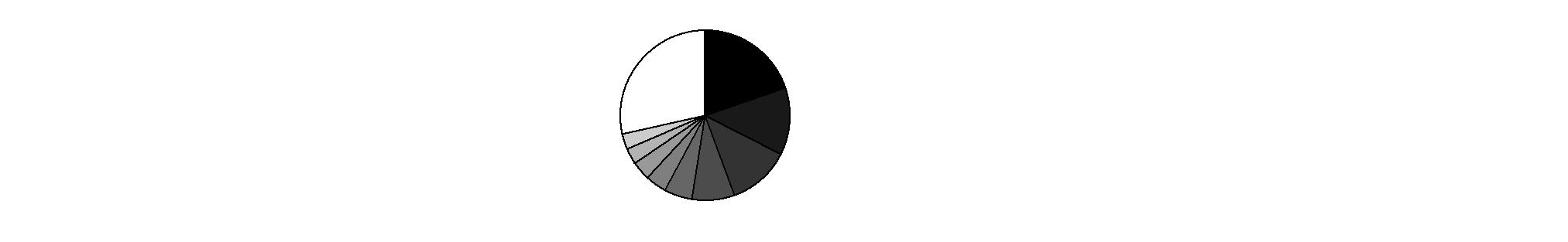

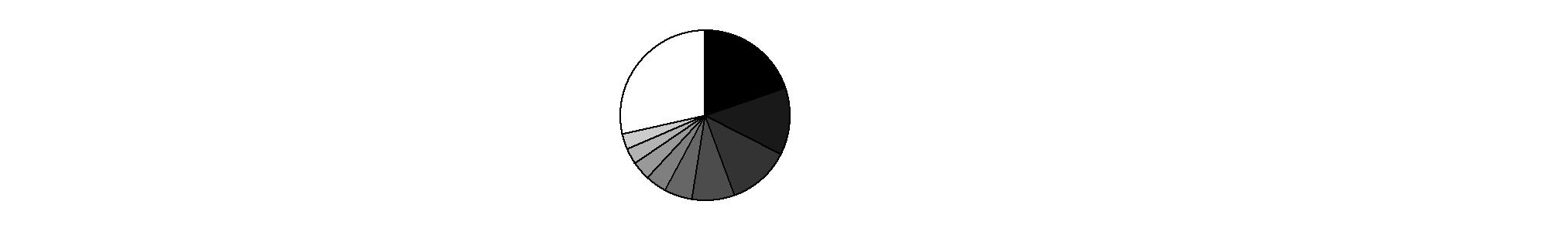

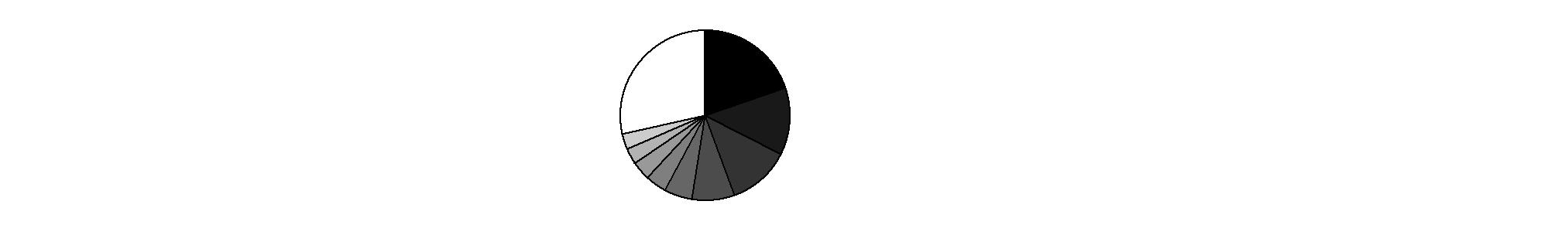

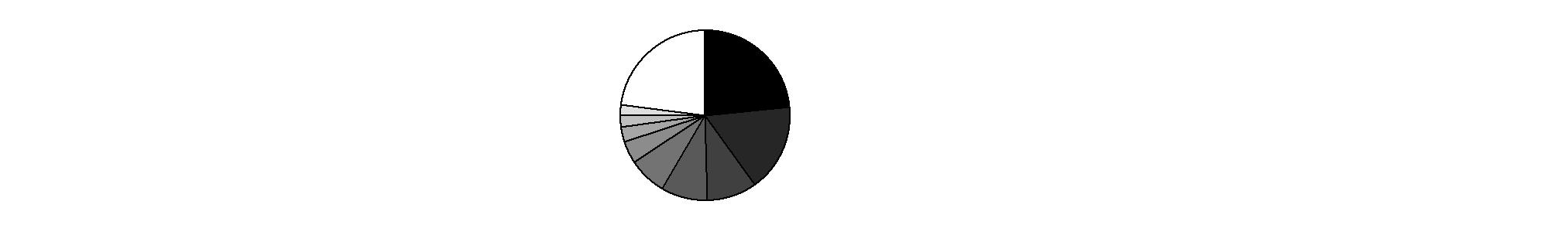

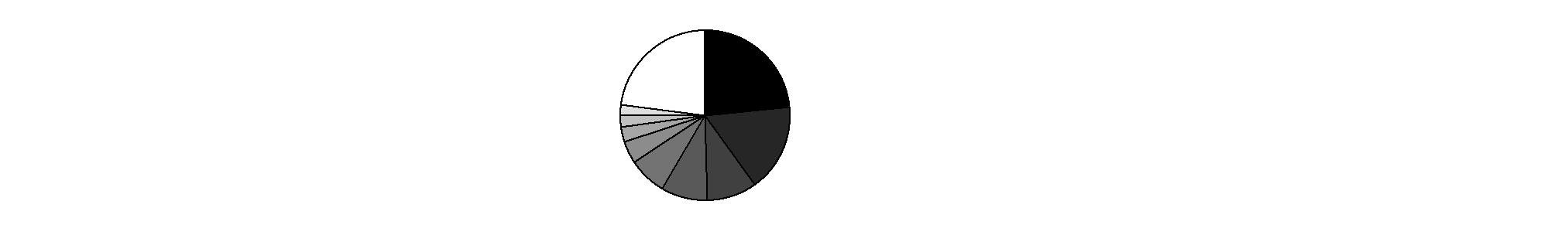

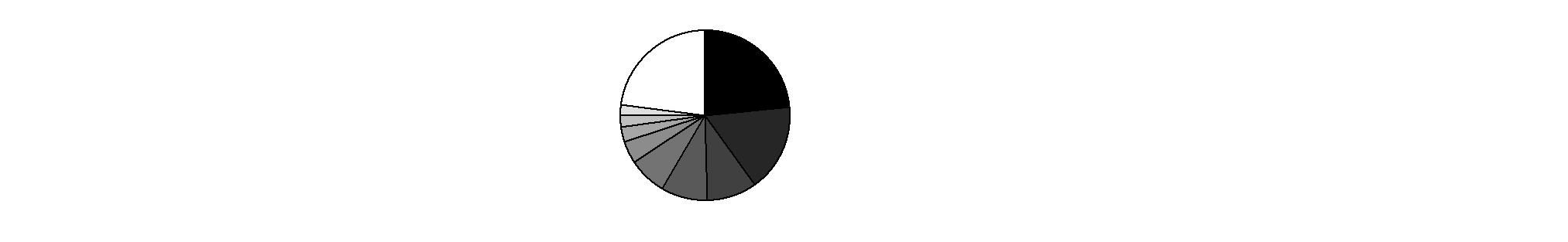

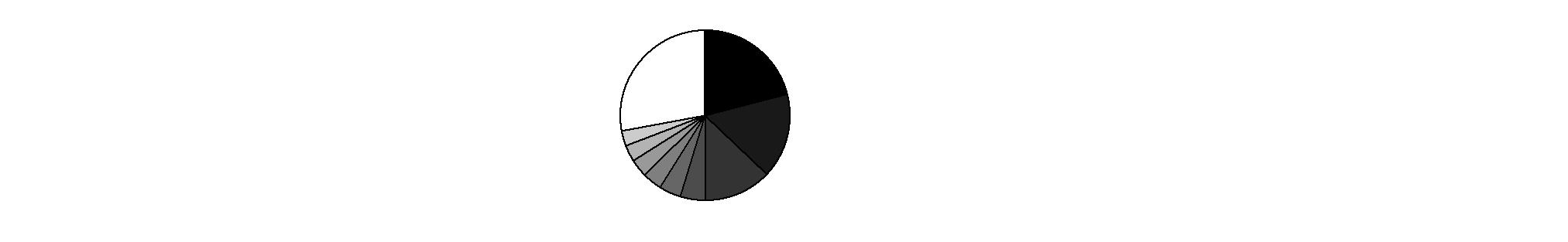

As of October 31, 2010 |

| United Kingdom | 18.4% | |

| Japan | 11.8% | |

| United States of America | 10.4% | |

| Germany | 8.1% | |

| Switzerland | 7.7% | |

| France | 7.0% | |

| Canada | 4.3% | |

| Spain | 3.9% | |

| Netherlands | 3.2% | |

| Other | 25.2% | |

Percentages are adjusted for the effect of futures contracts, if applicable. |

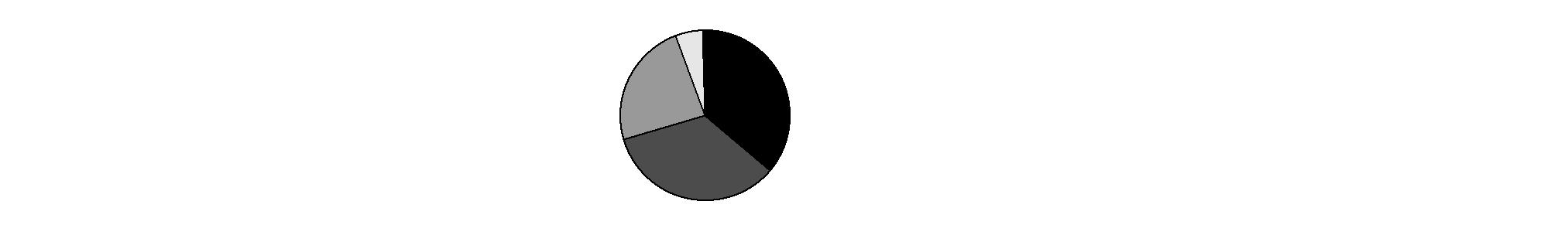

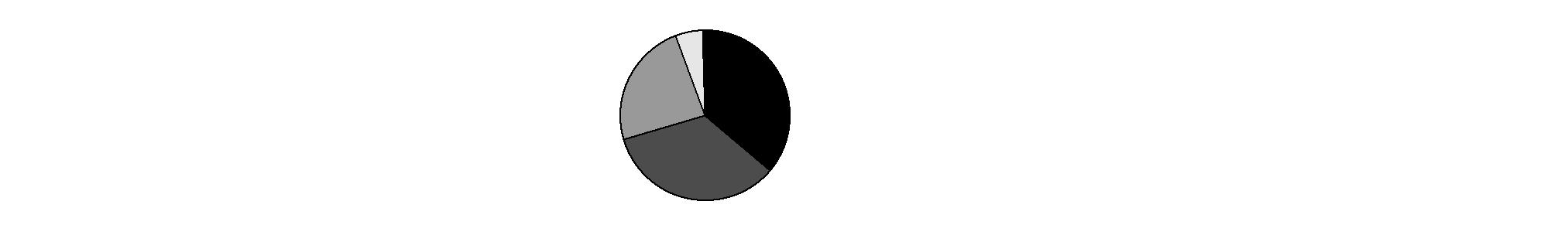

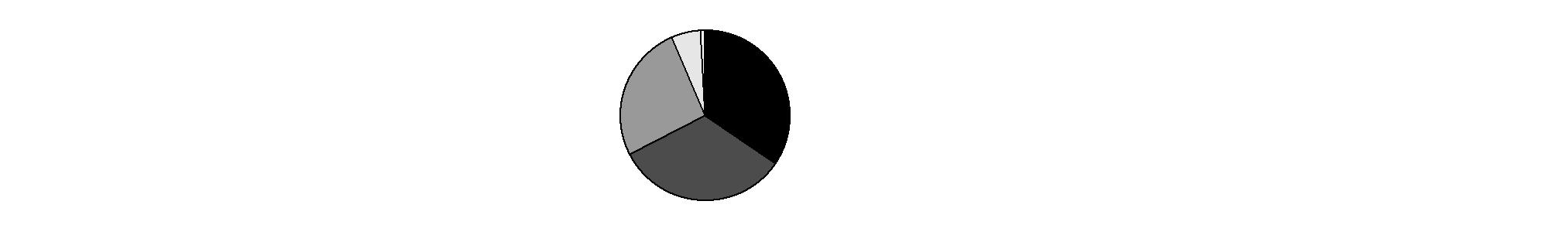

Asset Allocation |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Stocks | 98.1 | 95.9 |

Short-Term Investments and Net Other Assets | 1.9 | 4.1 |

Top Ten Stocks as of April 30, 2011 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Royal Dutch Shell PLC Class B sponsored ADR (United Kingdom, Oil, Gas & Consumable Fuels) | 2.4 | 2.0 |

BHP Billiton Ltd. sponsored ADR (Australia, Metals & Mining) | 2.0 | 1.7 |

Novo Nordisk A/S Series B (Denmark, Pharmaceuticals) | 1.7 | 1.4 |

HTC Corp. (Taiwan, Communications Equipment) | 1.6 | 0.9 |

HSBC Holdings PLC (United Kingdom, Commercial Banks) | 1.6 | 1.5 |

SOFTBANK CORP. (Japan, Wireless Telecommunication Services) | 1.5 | 1.0 |

Banco Santander SA sponsored ADR (Spain, Commercial Banks) | 1.4 | 1.5 |

Siemens AG (Germany, Industrial Conglomerates) | 1.3 | 1.1 |

Reckitt Benckiser Group PLC (United Kingdom, Household Products) | 1.3 | 0.8 |

Vodafone Group PLC (United Kingdom, Wireless Telecommunication Services) | 1.2 | 1.9 |

| 16.0 | |

Market Sectors as of April 30, 2011 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 20.5 | 20.5 |

Consumer Discretionary | 14.8 | 13.8 |

Energy | 11.3 | 11.4 |

Materials | 11.2 | 10.2 |

Industrials | 10.8 | 8.2 |

Information Technology | 10.3 | 9.5 |

Consumer Staples | 6.7 | 9.2 |

Health Care | 6.2 | 7.3 |

Telecommunication Services | 6.0 | 5.4 |

Utilities | 0.3 | 0.4 |

Semiannual Report

Fidelity Diversified International Fund

Investments April 30, 2011

Showing Percentage of Net Assets

Common Stocks - 96.5% |

| Shares | | Value |

Argentina - 0.0% |

Banco Macro SA sponsored ADR | 268,529 | | $ 9,932,888 |

Australia - 3.8% |

AMP Ltd. | 14,831,137 | | 89,117,633 |

BHP Billiton Ltd. sponsored ADR (d) | 7,059,600 | | 714,713,904 |

CSL Ltd. | 1,944,269 | | 73,230,455 |

Newcrest Mining Ltd. | 7,469,169 | | 339,473,172 |

Paladin Energy Ltd. (Australia) (a) | 167,540 | | 606,235 |

QBE Insurance Group Ltd. | 4,150,000 | | 85,139,388 |

Westfield Group unit | 4,650,000 | | 45,990,500 |

TOTAL AUSTRALIA | | 1,348,271,287 |

Bailiwick of Guernsey - 0.9% |

Ashmore Global Opportunities Ltd. (e) | 1,245,000 | | 10,022,250 |

Resolution Ltd. | 60,665,000 | | 306,740,490 |

TOTAL BAILIWICK OF GUERNSEY | | 316,762,740 |

Bailiwick of Jersey - 1.4% |

Experian PLC | 16,227,900 | | 218,618,635 |

Randgold Resources Ltd. sponsored ADR | 855,700 | | 74,077,949 |

WPP PLC | 15,115,311 | | 197,993,213 |

TOTAL BAILIWICK OF JERSEY | | 490,689,797 |

Belgium - 0.8% |

Anheuser-Busch InBev SA NV (d) | 4,274,775 | | 272,816,556 |

Anheuser-Busch InBev SA NV (strip VVPR) (a) | 5,339,200 | | 23,725 |

KBC Groupe SA (d) | 30,000 | | 1,222,879 |

Telenet Group Holding NV | 24,500 | | 1,218,054 |

TOTAL BELGIUM | | 275,281,214 |

Bermuda - 1.1% |

Assured Guaranty Ltd. | 3,106,200 | | 52,805,400 |

Cafe de Coral Holdings Ltd. | 264,000 | | 613,914 |

China Foods Ltd. | 1,336,000 | | 934,097 |

CNPC (Hong Kong) Ltd. | 10,904,000 | | 19,319,243 |

Credicorp Ltd. (NY Shares) | 9,200 | | 887,984 |

Huabao International Holdings Ltd. | 77,697,000 | | 115,250,434 |

Li & Fung Ltd. | 28,626,000 | | 146,331,226 |

Noble Group Ltd. | 31,012,000 | | 56,498,313 |

Vostok Nafta Investment Ltd. SDR (a) | 83,500 | | 552,660 |

Vtech Holdings Ltd. | 108,100 | | 1,231,841 |

Yue Yuen Industrial (Holdings) Ltd. | 187,500 | | 648,233 |

TOTAL BERMUDA | | 395,073,345 |

Brazil - 2.1% |

All America Latina Logistica SA | 87,300 | | 721,350 |

Anhanguera Educacional Participacoes SA | 1,038,700 | | 23,107,163 |

Banco Bradesco SA | 123,700 | | 2,083,551 |

Banco Bradesco SA (PN) sponsored ADR | 4,550,000 | | 92,046,500 |

Banco Santander (Brasil) SA ADR | 5,000,000 | | 58,050,000 |

BM&F Bovespa SA | 9,123,200 | | 68,483,437 |

|

| Shares | | Value |

Droga Raia SA | 386,000 | | $ 5,937,329 |

Drogasil SA | 6,198,300 | | 44,518,394 |

Estacio Participacoes SA | 1,989,165 | | 29,079,511 |

Itau Unibanco Banco Multiplo SA sponsored ADR | 5,904,200 | | 140,224,750 |

Klabin SA (PN) (non-vtg.) | 163,000 | | 634,056 |

Lojas Renner SA | 19,300 | | 712,111 |

Mills Estruturas e Servicos de Engenharia SA | 1,727,100 | | 23,601,761 |

Multiplus SA | 55,000 | | 1,129,155 |

Petroleo Brasileiro SA - Petrobras (ON) sponsored ADR | 845,000 | | 31,543,850 |

Souza Cruz Industria Comerico | 4,375,000 | | 49,191,985 |

T4F Entretenimento SA | 2,091,900 | | 19,944,384 |

TIM Participacoes SA sponsored ADR (non-vtg.) | 1,353,300 | | 63,848,694 |

Tractebel Energia SA | 105,200 | | 1,842,822 |

Usinas Siderurgicas de Minas Gerais SA - Usiminas (PN-A) (non-vtg.) | 80,000 | | 821,204 |

Valid Solucoes SA | 51,600 | | 705,142 |

Vivo Participacoes SA sponsored ADR | 1,898,100 | | 79,359,561 |

Wilson Sons Ltd. unit | 57,500 | | 1,077,417 |

TOTAL BRAZIL | | 738,664,127 |

British Virgin Islands - 0.2% |

Arcos Dorados Holdings, Inc. | 1,737,100 | | 38,268,313 |

Camelot Information Systems, Inc. ADR | 915,603 | | 17,671,138 |

TOTAL BRITISH VIRGIN ISLANDS | | 55,939,451 |

Canada - 5.0% |

Agnico-Eagle Mines Ltd. (Canada) | 1,250,000 | | 87,094,387 |

Barrick Gold Corp. | 800,000 | | 40,858,260 |

Canadian Natural Resources Ltd. | 4,175,000 | | 196,416,077 |

Fairfax Financial Holdings Ltd. (sub. vtg.) | 170,000 | | 68,657,647 |

Goldcorp, Inc. | 1,859,800 | | 103,968,737 |

InterOil Corp. (a)(d) | 991,400 | | 63,053,040 |

Ivanhoe Mines Ltd. (a) | 2,538,160 | | 66,559,296 |

Niko Resources Ltd. | 2,237,500 | | 189,079,511 |

Open Text Corp. (a) | 1,445,400 | | 88,548,128 |

Osisko Mining Corp. (a) | 4,000,000 | | 58,556,178 |

Painted Pony Petroleum Ltd. (a)(f)(e) | 2,139,100 | | 22,519,222 |

Painted Pony Petroleum Ltd. Class A (a)(e) | 3,535,700 | | 37,221,829 |

Petrobank Energy & Resources Ltd. (e) | 5,625,000 | | 119,028,115 |

Petrominerales Ltd. | 3,121,175 | | 119,456,449 |

Silver Wheaton Corp. | 2,126,900 | | 86,550,735 |

Suncor Energy, Inc. | 3,100,000 | | 142,892,929 |

Talisman Energy, Inc. | 8,400,000 | | 202,874,960 |

Tourmaline Oil Corp. (a) | 1,200,000 | | 34,271,219 |

Tourmaline Oil Corp. (a)(f)(g) | 644,200 | | 18,397,933 |

Uranium One, Inc. | 4,137,000 | | 17,228,390 |

TOTAL CANADA | | 1,763,233,042 |

Cayman Islands - 0.8% |

Central China Real Estate Ltd. | 1,860,000 | | 514,917 |

Common Stocks - continued |

| Shares | | Value |

Cayman Islands - continued |

China Automation Group Ltd. | 16,640,000 | | $ 14,569,615 |

China Kanghui Holdings sponsored ADR (a) | 32,500 | | 624,000 |

China ZhengTong Auto Services Holdings Ltd. | 24,761,500 | | 28,025,390 |

Geely Automobile Holdings Ltd. | 46,000,000 | | 18,420,612 |

Hengan International Group Co. Ltd. | 7,325,500 | | 57,160,463 |

Hengdeli Holdings Ltd. | 68,972,000 | | 41,296,345 |

hiSoft Technology International Ltd. ADR (a) | 1,726,400 | | 32,214,624 |

Kingboard Chemical Holdings Ltd. | 142,000 | | 777,990 |

Mindray Medical International Ltd. sponsored ADR (d) | 31,200 | | 833,976 |

Minth Group Ltd. | 7,436,000 | | 11,432,193 |

Samson Holding Ltd. | 3,220,000 | | 721,425 |

Shenguan Holdings Group Ltd. | 4,304,000 | | 5,719,233 |

Silver Base Group Holdings Ltd. | 26,592,000 | | 21,879,515 |

Want Want China Holdings Ltd. | 36,665,000 | | 32,905,637 |

TOTAL CAYMAN ISLANDS | | 267,095,935 |

Chile - 0.0% |

Compania Cervecerias Unidas SA sponsored ADR | 22,000 | | 1,320,000 |

Embotelladora Andina SA sponsored ADR | 35,100 | | 1,012,284 |

Inversiones Aguas Metropolitanas SA | 647,863 | | 1,060,894 |

TOTAL CHILE | | 3,393,178 |

China - 2.5% |

Agricultural Bank China Ltd. (H Shares) | 278,924,000 | | 164,848,276 |

Baidu.com, Inc. sponsored ADR (a) | 1,382,000 | | 205,254,640 |

Bank of China Ltd. (H Shares) | 158,346,000 | | 87,468,208 |

Changsha Zoomlion Heavy Industry Science & Technology Development Co. Ltd. (H Shares) | 19,359,600 | | 51,351,063 |

China Bluechemical Ltd. (H shares) | 624,000 | | 507,794 |

China Communications Services Corp. Ltd. (H Shares) | 878,000 | | 535,869 |

China Construction Bank Corp.

(H Shares) | 121,885,000 | | 115,194,610 |

China Merchants Bank Co. Ltd.

(H Shares) | 77,890,500 | | 200,585,865 |

Dalian Port (PDA) Co. Ltd. (H Shares) | 1,542,000 | | 603,592 |

Nine Dragons Paper (Holdings) Ltd. | 559,000 | | 638,442 |

Shandong Weigao Group Medical Polymer Co. Ltd. (H Shares) | 14,588,000 | | 40,009,322 |

TOTAL CHINA | | 866,997,681 |

Colombia - 0.0% |

Ecopetrol SA ADR (d) | 16,200 | | 710,694 |

Czech Republic - 0.0% |

Philip Morris CR AS | 1,900 | | 1,080,194 |

|

| Shares | | Value |

Denmark - 2.8% |

Carlsberg A/S Series B | 1,980,600 | | $ 235,237,801 |

Novo Nordisk A/S Series B | 4,892,689 | | 619,406,452 |

Pandora A/S (d) | 599,100 | | 26,986,808 |

William Demant Holding A/S (a) | 1,250,000 | | 116,536,575 |

TOTAL DENMARK | | 998,167,636 |

Egypt - 0.0% |

Commercial International Bank Ltd. | 152,800 | | 707,089 |

JUHAYNA Food Industries | 571,200 | | 518,662 |

TOTAL EGYPT | | 1,225,751 |

Finland - 0.1% |

Fortum Corp. | 50,000 | | 1,722,636 |

Nokian Tyres PLC | 439,253 | | 22,771,754 |

TOTAL FINLAND | | 24,494,390 |

France - 6.4% |

Alstom SA | 2,918,413 | | 194,070,012 |

Atos Origin SA (a) | 1,149,659 | | 70,848,111 |

AXA SA sponsored ADR (d) | 6,572,200 | | 147,348,724 |

BNP Paribas SA | 2,507,000 | | 198,405,275 |

Carrefour SA | 48,700 | | 2,309,023 |

Club Mediterranee SA (a) | 635,000 | | 14,799,743 |

Danone | 1,330,850 | | 97,488,418 |

Dassault Aviation SA | 36,265 | | 34,915,217 |

Essilor International SA | 1,868,672 | | 156,440,407 |

Euler Hermes SA | 200,000 | | 21,320,393 |

Iliad Group SA | 617,692 | | 79,406,375 |

L'Oreal SA | 431,800 | | 54,754,629 |

LVMH Moet Hennessy - Louis Vuitton | 1,868,701 | | 335,610,293 |

PPR SA | 2,062,000 | | 368,798,806 |

Publicis Groupe SA | 1,225,000 | | 69,421,623 |

Safran SA (d) | 477,000 | | 18,511,149 |

Sanofi-Aventis | 1,006,453 | | 79,630,250 |

Schneider Electric SA (d) | 762,142 | | 134,675,949 |

Societe Generale Series A | 2,052,100 | | 137,267,006 |

Vallourec SA | 13,850 | | 1,727,126 |

VINCI SA | 588,200 | | 39,293,007 |

TOTAL FRANCE | | 2,257,041,536 |

Germany - 6.8% |

adidas AG | 1,380,730 | | 102,788,600 |

BASF AG (d) | 2,297,237 | | 236,145,122 |

Bayer AG (d) | 46,750 | | 4,109,756 |

Bayerische Motoren Werke AG (BMW) | 3,000,500 | | 282,971,168 |

Commerzbank AG (a) | 3,300,000 | | 20,578,312 |

Deutsche Boerse AG | 1,228,500 | | 102,082,601 |

ElringKlinger AG | 310,500 | | 10,893,030 |

Fresenius Medical Care AG & Co. KGaA | 3,194,050 | | 251,028,287 |

Fresenius SE | 2,319,000 | | 243,397,214 |

GFK AG | 1,600,000 | | 90,767,937 |

Common Stocks - continued |

| Shares | | Value |

Germany - continued |

HeidelbergCement AG (d) | 1,474,200 | | $ 112,738,496 |

Kabel Deutschland Holding AG (a) | 681,800 | | 42,611,978 |

Linde AG | 1,427,462 | | 257,105,778 |

MTU Aero Engines Holdings AG (d) | 513,600 | | 39,368,519 |

Rheinmetall AG (d) | 547,250 | | 49,089,131 |

SAP AG | 1,643,285 | | 105,880,468 |

Siemens AG | 23,266 | | 3,384,818 |

Siemens AG sponsored ADR (d) | 3,053,100 | | 445,569,414 |

Symrise AG | 70,000 | | 2,309,043 |

TOTAL GERMANY | | 2,402,819,672 |

Hong Kong - 0.9% |

AIA Group Ltd. | 18,365,200 | | 61,837,681 |

China Insurance International Holdings Co. Ltd. (a) | 200,400 | | 550,911 |

China Mobile (Hong Kong) Ltd. | 221,500 | | 2,037,451 |

China Resources Enterprise Ltd. | 266,000 | | 1,072,042 |

China Resources Power Holdings Co. Ltd. | 578,000 | | 1,064,265 |

Henderson Land Development Co. Ltd. | 9,664,155 | | 66,138,295 |

Henderson Land Development Co. Ltd. warrants 6/1/11 (a) | 2,171,600 | | 60,118 |

Hopewell Holdings Ltd. | 367,500 | | 1,109,650 |

Swire Pacific Ltd. (A Shares) | 4,577,000 | | 69,895,858 |

Television Broadcasts Ltd. | 184,000 | | 1,077,991 |

Wharf Holdings Ltd. | 15,247,000 | | 111,511,222 |

TOTAL HONG KONG | | 316,355,484 |

India - 1.7% |

Axis Bank Ltd. | 1,472,751 | | 42,816,438 |

Bajaj Auto Ltd. | 597,383 | | 19,897,018 |

Bharti Airtel Ltd. | 4,465,580 | | 38,349,197 |

CESC Ltd. GDR | 162,621 | | 1,132,523 |

Cipla Ltd. | 109,853 | | 768,264 |

CMC Ltd. | 18,189 | | 837,010 |

HDFC Bank Ltd. | 2,599,139 | | 134,826,293 |

Housing Development Finance Corp. Ltd. | 6,533,960 | | 104,354,377 |

India Cements Ltd. | 236,719 | | 531,153 |

Indian Bank | 117,015 | | 637,494 |

Infrastructure Development Finance Co. Ltd. | 11,565,310 | | 37,971,745 |

ITC Ltd. | 4,346,226 | | 18,890,444 |

Mahindra & Mahindra Financial Services Ltd. | 2,226,876 | | 36,826,104 |

Max India Ltd. (a) | 304,943 | | 1,154,863 |

Provogue (India) Ltd. | 527,589 | | 510,839 |

Punjab National Bank | 83,060 | | 2,377,729 |

Redington India Ltd. | 316,091 | | 630,325 |

Satyam Computer Services Ltd. (a) | 652,716 | | 1,112,810 |

Shriram Transport Finance Co. Ltd. | 2,327,613 | | 40,756,238 |

Sobha Developers Ltd. | 85,897 | | 554,240 |

SREI Infrastructure Finance Ltd. | 522,125 | | 609,962 |

|

| Shares | | Value |

State Bank of India | 1,677,783 | | $ 106,327,200 |

Tulip Telecom Ltd. | 182,655 | | 645,308 |

TOTAL INDIA | | 592,517,574 |

Indonesia - 0.1% |

PT Bank Rakyat Indonesia Tbk | 1,446,500 | | 1,089,437 |

PT Panin Life Tbk (a) | 24,842,000 | | 559,845 |

PT Perusahaan Gas Negara Tbk

Series B | 80,497,000 | | 37,597,895 |

TOTAL INDONESIA | | 39,247,177 |

Ireland - 0.3% |

CRH PLC | 4,099,800 | | 101,774,183 |

Italy - 2.5% |

Enel SpA | 470,000 | | 3,351,334 |

ENI SpA | 2,725,300 | | 72,968,652 |

Fiat Industrial SpA (a) | 22,427,792 | | 333,197,059 |

Fiat SpA (d) | 9,726,500 | | 103,801,656 |

Intesa Sanpaolo SpA | 18,977,983 | | 63,023,043 |

Saipem SpA | 4,983,203 | | 282,918,342 |

TOTAL ITALY | | 859,260,086 |

Japan - 13.0% |

ABC-Mart, Inc. | 298,700 | | 11,190,294 |

Aozora Bank Ltd. | 6,702,000 | | 14,515,615 |

Canon, Inc. sponsored ADR (d) | 3,533,300 | | 166,665,761 |

Chiyoda Corp. | 3,789,000 | | 37,713,704 |

Denso Corp. | 4,779,700 | | 159,939,898 |

Dentsu, Inc. | 1,677,800 | | 44,615,171 |

eAccess Ltd. (d) | 57,960 | | 27,363,763 |

Elpida Memory, Inc. (a)(d) | 5,270,900 | | 78,969,242 |

Fanuc Ltd. | 885,100 | | 148,146,983 |

Fast Retailing Co. Ltd. | 154,000 | | 24,279,144 |

Hitachi Ltd. | 26,083,000 | | 141,554,001 |

Honda Motor Co. Ltd. | 5,597,400 | | 215,160,601 |

Hoya Corp. | 2,000,000 | | 43,069,905 |

Itochu Corp. | 6,178,000 | | 64,349,037 |

Japan Tobacco, Inc. | 53,692 | | 208,637,366 |

JSR Corp. | 4,543,500 | | 95,574,548 |

KDDI Corp. | 18,982 | | 126,709,692 |

Keyence Corp. | 731,100 | | 193,175,047 |

Komatsu Ltd. | 7,736,200 | | 272,740,118 |

Makita Corp. | 738,600 | | 33,957,266 |

Mazda Motor Corp. | 13,813,000 | | 31,714,725 |

Mitsubishi Corp. | 5,819,600 | | 157,852,740 |

Mitsubishi Electric Corp. | 1,454,000 | | 16,185,804 |

Mitsubishi UFJ Financial Group, Inc. | 24,770,300 | | 118,872,592 |

Mitsui & Co. Ltd. | 7,619,800 | | 135,578,305 |

Nintendo Co. Ltd. | 357,600 | | 84,602,784 |

Nitori Holdings Co. Ltd. | 441,400 | | 38,164,088 |

NSK Ltd. | 7,385,000 | | 65,527,431 |

NTT DoCoMo, Inc. | 64,435 | | 119,536,349 |

ORIX Corp. | 4,020,290 | | 394,925,274 |

Rakuten, Inc. | 217,002 | | 201,472,475 |

Common Stocks - continued |

| Shares | | Value |

Japan - continued |

ROHM Co. Ltd. | 514,600 | | $ 30,988,515 |

Shimadzu Corp. | 3,803,000 | | 33,035,826 |

Shinsei Bank Ltd. (a) | 6,126,000 | | 7,366,060 |

SOFTBANK CORP. | 12,900,100 | | 544,276,104 |

Sumitomo Corp. | 2,944,600 | | 40,615,277 |

Sumitomo Mitsui Financial Group, Inc. | 2,810,400 | | 87,285,521 |

TDK Corp. | 579,400 | | 29,890,404 |

Tokyo Electron Ltd. | 2,698,100 | | 156,184,678 |

Yahoo! Japan Corp. | 437,883 | | 161,053,840 |

TOTAL JAPAN | | 4,563,455,948 |

Korea (South) - 1.8% |

Amorepacific Corp. | 106,907 | | 108,057,563 |

Daegu Bank Co. Ltd. | 40,960 | | 686,180 |

Korea Plant Service & Engineering Co. Ltd. | 20,480 | | 628,679 |

KT Corp. | 47,400 | | 1,706,816 |

LG Corp. | 23,274 | | 2,145,520 |

LIG Non-Life Insurance Co. Ltd. | 26,720 | | 661,435 |

NHN Corp. (a) | 572,776 | | 113,911,879 |

Orion Corp. | 20,563 | | 7,996,184 |

S1 Corp. | 20,993 | | 1,027,546 |

Samsung Electronics Co. Ltd. | 345,597 | | 288,832,922 |

Shinhan Financial Group Co. Ltd. | 2,186,480 | | 107,431,115 |

Shinsegae Co. Ltd. | 4,723 | | 1,193,458 |

Sindoh Co. Ltd. | 10,885 | | 537,883 |

TOTAL KOREA (SOUTH) | | 634,817,180 |

Luxembourg - 0.1% |

Millicom International Cellular SA | 12,600 | | 1,365,084 |

Ternium SA sponsored ADR | 1,411,261 | | 47,446,595 |

TOTAL LUXEMBOURG | | 48,811,679 |

Malaysia - 0.2% |

Genting Bhd | 17,806,800 | | 69,724,517 |

Parkson Holdings Bhd | 563,574 | | 1,088,150 |

TOTAL MALAYSIA | | 70,812,667 |

Mexico - 0.8% |

America Movil SAB de CV Series L sponsored ADR | 2,173,700 | | 124,335,640 |

Grupo Televisa SA de CV (CPO) sponsored ADR (a) | 2,214,800 | | 52,535,056 |

Urbi, Desarrollos Urbanos, SA de CV (a) | 444,900 | | 1,065,994 |

Wal-Mart de Mexico SA de CV

Series V | 34,518,200 | | 108,136,455 |

TOTAL MEXICO | | 286,073,145 |

Netherlands - 2.8% |

AEGON NV (a) | 24,716,400 | | 196,463,173 |

Gemalto NV | 1,700,000 | | 87,136,775 |

ING Groep NV: | | | |

(Certificaten Van Aandelen) (a) | 149,000 | | 1,963,027 |

sponsored ADR (a)(d) | 18,160,800 | | 239,540,952 |

|

| Shares | | Value |

Koninklijke KPN NV | 7,336,331 | | $ 116,435,336 |

Koninklijke Philips Electronics NV | 55,250 | | 1,636,451 |

Koninklijke Philips Electronics NV unit | 5,773,400 | | 170,257,566 |

LyondellBasell Industries NV Class A | 1,366,500 | | 60,809,250 |

Randstad Holdings NV | 934,994 | | 52,599,000 |

Wolters Kluwer NV (Certificaten Van Aandelen) | 2,168,800 | | 50,531,470 |

TOTAL NETHERLANDS | | 977,373,000 |

Netherlands Antilles - 0.5% |

Schlumberger Ltd. | 2,062,900 | | 185,145,275 |

Nigeria - 0.0% |

Guaranty Trust Bank PLC GDR (Reg. S) | 85,500 | | 538,650 |

Norway - 1.3% |

DnB NOR ASA (d) | 12,195,600 | | 198,287,320 |

Storebrand ASA (A Shares) (d) | 4,980,000 | | 51,733,110 |

Telenor ASA | 11,802,200 | | 203,926,431 |

TOTAL NORWAY | | 453,946,861 |

Papua New Guinea - 0.0% |

Oil Search Ltd. | 111,150 | | 859,226 |

Philippines - 0.0% |

Banco de Oro Universal Bank | 677,000 | | 858,804 |

Manila Water Co., Inc. | 2,331,300 | | 980,339 |

Universal Robina Corp. | 899,000 | | 783,383 |

TOTAL PHILIPPINES | | 2,622,526 |

Poland - 0.0% |

Warsaw Stock Exchange | 44,200 | | 836,695 |

Qatar - 0.1% |

Commercial Bank of Qatar GDR

(Reg. S) | 9,940,628 | | 39,963,970 |

Russia - 1.0% |

JSC TransContainer ADR unit | 50,300 | | 603,600 |

Lukoil Oil Co. sponsored ADR | 550,000 | | 38,335,000 |

OAO Gazprom sponsored ADR | 8,486,800 | | 144,784,808 |

Sberbank (Savings Bank of the Russian Federation) | 19,725,000 | | 71,950,431 |

Sberbank (Savings Bank of the Russian Federation) GDR | 1,800 | | 717,864 |

Uralkali JSC GDR (Reg. S) | 2,019,600 | | 84,762,612 |

TOTAL RUSSIA | | 341,154,315 |

South Africa - 0.9% |

African Bank Investments Ltd. | 146,200 | | 852,439 |

AngloGold Ashanti Ltd. | 43,600 | | 2,219,063 |

AngloGold Ashanti Ltd. sponsored ADR | 1,750,000 | | 89,215,000 |

Aveng Ltd. | 129,400 | | 686,916 |

Foschini Ltd. | 905,000 | | 12,482,284 |

Impala Platinum Holdings Ltd. | 1,232,700 | | 38,476,191 |

Naspers Ltd. Class N | 2,050,600 | | 123,309,153 |

Sasol Ltd. | 23,900 | | 1,380,295 |

Shoprite Holdings Ltd. | 844,000 | | 13,298,421 |

Common Stocks - continued |

| Shares | | Value |

South Africa - continued |

Tiger Brands Ltd. | 25,400 | | $ 744,358 |

Vodacom Group (Pty) Ltd. | 3,340,800 | | 40,839,770 |

TOTAL SOUTH AFRICA | | 323,503,890 |

Spain - 3.4% |

Banco Bilbao Vizcaya Argentaria SA | 229,000 | | 2,933,480 |

Banco Santander SA sponsored ADR | 38,778,700 | | 480,855,880 |

Gestevision Telecinco SA | 5,277,300 | | 59,305,582 |

Inditex SA | 3,264,772 | | 292,758,141 |

Prosegur Compania de Seguridad SA (Reg.) | 1,734,500 | | 105,977,083 |

Red Electrica Corporacion SA | 1,068,600 | | 68,187,469 |

Telefonica SA | 6,157,000 | | 165,414,372 |

TOTAL SPAIN | | 1,175,432,007 |

Sweden - 1.1% |

H&M Hennes & Mauritz AB

(B Shares) (d) | 5,753,543 | | 203,256,628 |

Sandvik AB (d) | 974,900 | | 20,680,430 |

Swedbank AB (A Shares) | 8,303,300 | | 157,451,507 |

TOTAL SWEDEN | | 381,388,565 |

Switzerland - 5.4% |

Adecco SA (Reg.) | 23,500 | | 1,677,310 |

Clariant AG (Reg.) (a) | 6,401,457 | | 132,816,452 |

Kuehne & Nagel International AG | 1,576,550 | | 251,839,808 |

Nestle SA | 6,049,792 | | 375,511,565 |

Noble Corp. | 1,200,000 | | 51,612,000 |

Schindler Holding AG: | | | |

(participation certificate) | 13,050 | | 1,687,910 |

(Reg.) | 1,278,570 | | 164,485,743 |

Syngenta AG (Switzerland) | 95,717 | | 33,845,149 |

The Swatch Group AG (Bearer) | 84,750 | | 41,681,934 |

Transocean Ltd. (United States) (a) | 2,150,000 | | 156,412,500 |

Transocean Ltd. (Switzerland) | 22,910 | | 1,678,893 |

UBS AG (a) | 16,391,005 | | 327,969,219 |

Zurich Financial Services AG | 1,320,056 | | 370,772,245 |

TOTAL SWITZERLAND | | 1,911,990,728 |

Taiwan - 2.0% |

Advantech Co. Ltd. | 195,000 | | 644,448 |

Chroma ATE, Inc. | 329,000 | | 1,083,859 |

CTCI Corp. | 784,000 | | 989,395 |

Giant Manufacturing Co. Ltd. | 261,000 | | 1,041,816 |

Hon Hai Precision Industry Co. Ltd. (Foxconn) | 19,141,040 | | 72,400,309 |

HTC Corp. | 12,293,000 | | 557,116,963 |

Pacific Hospital Supply Co. Ltd. | 152,000 | | 680,913 |

Powertech Technology, Inc. | 316,000 | | 1,145,686 |

President Chain Store Corp. | 235,000 | | 1,286,212 |

SIMPLO Technology Co. Ltd. | 122,000 | | 825,100 |

Ta Chong Bank (a) | 3,076,000 | | 1,233,188 |

|

| Shares | | Value |

Taiwan Fertilizer Co. Ltd. | 22,351,000 | | $ 75,269,535 |

Taiwan Semiconductor Manufacturing Co. Ltd. | 909,000 | | 2,347,305 |

TOTAL TAIWAN | | 716,064,729 |

Thailand - 0.0% |

Banpu PCL (For. Reg.) | 20,200 | | 504,662 |

Charoen Pokphand Foods PCL (For. Reg.) | 1,156,400 | | 1,142,458 |

Indorama Ventures PCL | 428,800 | | 764,689 |

Quality Houses PCL | 15,762,600 | | 1,235,247 |

TOTAL THAILAND | | 3,647,056 |

Turkey - 0.0% |

Turkiye Is Bankasi AS Series C | 307,000 | | 1,085,904 |

United Kingdom - 17.6% |

Anglo American PLC (United Kingdom) | 3,869,200 | | 201,681,401 |

Aviva PLC | 5,008,200 | | 37,482,448 |

Barclays PLC | 3,866,165 | | 18,380,356 |

BG Group PLC | 11,041,979 | | 282,846,742 |

BHP Billiton PLC | 4,671,680 | | 197,524,765 |

BP PLC | 449,500 | | 3,455,536 |

BP PLC sponsored ADR | 7,449,700 | | 343,729,158 |

British American Tobacco PLC: | | | |

(United Kingdom) | 62,500 | | 2,731,151 |

sponsored ADR | 1,773,400 | | 156,413,880 |

British Land Co. PLC | 4,410,000 | | 44,235,617 |

Britvic PLC | 7,141,500 | | 48,849,917 |

Burberry Group PLC | 6,263,800 | | 135,496,518 |

Capita Group PLC | 13,338,500 | | 163,985,441 |

Carphone Warehouse Group PLC (a) | 16,014,300 | | 106,399,266 |

Centrica PLC | 539,000 | | 2,889,209 |

GlaxoSmithKline PLC | 18,204,100 | | 397,681,210 |

HSBC Holdings PLC: | | | |

(United Kingdom) | 421,871 | | 4,601,866 |

sponsored ADR (d) | 9,939,900 | | 541,426,353 |

Imperial Tobacco Group PLC | 100,050 | | 3,521,293 |

Inchcape PLC | 17,442,619 | | 106,172,134 |

ITV PLC (a) | 94,319,000 | | 119,817,124 |

Johnson Matthey PLC | 1,813,800 | | 60,686,324 |

Lloyds Banking Group PLC (a) | 316,953,400 | | 314,699,155 |

Misys PLC | 13,125,310 | | 69,193,779 |

Next PLC | 2,865,200 | | 107,063,494 |

Ocado Group PLC (a) | 9,816,418 | | 37,123,588 |

Pearson PLC | 10,425,200 | | 199,814,282 |

Prudential PLC | 241,500 | | 3,124,480 |

Pz Cussons PLC Class L | 149,300 | | 817,503 |

QinetiQ Group PLC (a) | 16,755,100 | | 33,837,153 |

Reckitt Benckiser Group PLC | 7,905,900 | | 438,967,953 |

Rio Tinto PLC | 47,350 | | 3,455,011 |

Rio Tinto PLC sponsored ADR | 3,501,000 | | 256,308,210 |

Rolls-Royce Group PLC | 5,014,400 | | 53,732,385 |

Rolls-Royce Group PLC (C shares) | 481,382,400 | | 804,101 |

Common Stocks - continued |

| Shares | | Value |

United Kingdom - continued |

Royal Dutch Shell PLC: | | | |

Class A (United Kingdom) | 154,000 | | $ 5,974,436 |

Class A sponsored ADR | 4,900,000 | | 379,652,000 |

Class B sponsored ADR (d) | 10,800,000 | | 846,287,998 |

Standard Chartered PLC (United Kingdom) | 91,587 | | 2,538,053 |

SuperGroup PLC (a) | 1,516,200 | | 40,167,996 |

Vodafone Group PLC | 1,664,000 | | 4,810,441 |

Vodafone Group PLC sponsored ADR | 14,606,100 | | 425,329,632 |

Xstrata PLC | 140,000 | | 3,558,119 |

TOTAL UNITED KINGDOM | | 6,207,267,478 |

United States of America - 4.3% |

Agilent Technologies, Inc. (a) | 756,000 | | 37,731,960 |

Alliance Data Systems Corp. (a) | 233,800 | | 22,211,000 |

Anadarko Petroleum Corp. | 7,800 | | 615,732 |

Apple, Inc. (a) | 699,200 | | 243,482,416 |

C. R. Bard, Inc. | 864,700 | | 92,306,725 |

Citigroup, Inc. (a) | 22,936,500 | | 105,278,535 |

Cognizant Technology Solutions Corp. Class A (a) | 456,800 | | 37,868,720 |

eBay, Inc. (a) | 2,154,400 | | 74,111,360 |

Facebook, Inc. Class B (a)(h) | 1,288,142 | | 32,203,550 |

Google, Inc. Class A (a) | 263,608 | | 143,429,113 |

Hasbro, Inc. | 155,200 | | 7,269,568 |

Intuit, Inc. (a) | 321,900 | | 17,884,764 |

Jacobs Engineering Group, Inc. (a) | 1,186,800 | | 58,877,148 |

JPMorgan Chase & Co. | 1,903,200 | | 86,843,016 |

Medco Health Solutions, Inc. (a) | 2,286,700 | | 135,669,911 |

MEMC Electronic Materials, Inc. (a) | 1,228,400 | | 14,531,972 |

Newmont Mining Corp. | 1,000,000 | | 58,610,000 |

QUALCOMM, Inc. | 12,700 | | 721,868 |

SanDisk Corp. (a) | 1,411,800 | | 69,375,852 |

Schweitzer-Mauduit International, Inc. (e) | 1,584,655 | | 82,148,515 |

The Pep Boys - Manny, Moe & Jack | 980,514 | | 13,433,042 |

The Walt Disney Co. | 1,423,200 | | 61,339,920 |

Unisys Corp. (a) | 1,537,730 | | 45,639,826 |

Wells Fargo & Co. | 2,840,200 | | 82,678,222 |

TOTAL UNITED STATES OF AMERICA | | 1,524,262,735 |

TOTAL COMMON STOCKS (Cost $25,068,585,082) | 33,977,083,291 |

Nonconvertible Preferred Stocks - 1.6% |

| Shares | | Value |

Germany - 1.6% |

MAN SE | 8,000 | | $ 824,732 |

ProSiebenSat.1 Media AG | 4,370,100 | | 125,155,303 |

Volkswagen AG (d) | 2,175,300 | | 428,533,233 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS (Cost $268,609,934) | 554,513,268 |

Master Notes - 0.0% |

| Principal Amount | | |

Canada - 0.0% |

OZ Optics Ltd. 5% 11/5/14 (h)

(Cost $369,425) | | $ 361,325 | | 361,325 |

Money Market Funds - 8.9% |

| Shares | | |

Fidelity Cash Central Fund, 0.13% (b) | 526,644,900 | | 526,644,900 |

Fidelity Securities Lending Cash Central Fund, 0.12% (b)(c) | 2,604,453,237 | | 2,604,453,237 |

TOTAL MONEY MARKET FUNDS (Cost $3,131,098,137) | 3,131,098,137 |

TOTAL INVESTMENT PORTFOLIO - 107.0% (Cost $28,468,662,578) | 37,663,056,021 |

NET OTHER ASSETS (LIABILITIES) - (7.0)% | (2,460,481,035) |

NET ASSETS - 100% | $ 35,202,574,986 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Affiliated company |

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $40,917,155 or 0.1% of net assets. |

(g) Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

(h) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $32,564,875 or 0.1% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost |

Facebook, Inc Class B | 3/31/11 | $ 32,203,550 |

OZ Optics Ltd. 5% 11/5/14 | 11/5/10 | 370,453 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 889,351 |

Fidelity Securities Lending Cash Central Fund | 7,012,533 |

Total | $ 7,901,884 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliate | Value, beginning of period | Purchases | Sales

Proceeds | Dividend

Income | Value, end of period |

Ashmore Global Opportunities Ltd. | $ - | $ 9,748,350 | $ - | $ - | $ 10,022,250 |

Painted Pony Petroleum Ltd. | 9,544,006 | 7,892,568 | - | - | 22,519,222 |

Painted Pony Petroleum Ltd. Class A | 21,509,462 | 3,954,028 | - | - | 37,221,829 |

Petrobank Energy & Resources Ltd. | 223,863,859 | - | - | 108,873,999 | 119,028,115 |

Schweitzer-Mauduit International, Inc. | 83,300,121 | 15,918,255 | - | 432,385 | 82,148,515 |

Total | $ 338,217,448 | $ 37,513,201 | $ - | $ 109,306,384 | $ 270,939,931 |

Other Information |

The following is a summary of the inputs used, as of April 30, 2011, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

United Kingdom | $ 6,207,267,478 | $ 5,019,506,777 | $ 1,187,760,701 | $ - |

Japan | 4,563,455,948 | 166,665,761 | 4,396,790,187 | - |

Germany | 2,957,332,940 | 2,957,332,940 | - | - |

France | 2,257,041,536 | 2,177,411,286 | 79,630,250 | - |

Switzerland | 1,911,990,728 | 1,550,176,360 | 361,814,368 | - |

Canada | 1,763,233,042 | 1,763,233,042 | - | - |

United States of America | 1,524,262,735 | 1,492,059,185 | - | 32,203,550 |

Australia | 1,348,271,287 | 1,348,271,287 | - | - |

Spain | 1,175,432,007 | 1,007,084,155 | 168,347,852 | - |

Korea (South) | 634,817,180 | 631,916,906 | 1,706,816 | 1,193,458 |

Other | 10,188,491,678 | 8,578,281,835 | 1,610,209,843 | - |

Master Notes | 361,325 | - | - | 361,325 |

Money Market Funds | 3,131,098,137 | 3,131,098,137 | - | - |

Total Investments in Securities: | $ 37,663,056,021 | $ 29,823,037,671 | $ 7,806,260,017 | $ 33,758,333 |

The following is a reconciliation of Investments in Securities for which Level 3 inputs were used in determining value: |

Investments in Securities: | |

Beginning Balance | $ 451,860 |

Total Realized Gain (Loss) | (1,056,146) |

Total Unrealized Gain (Loss) | 1,163,507 |

Cost of Purchases | 33,742,128 |

Proceeds of Sales | (541,987) |

Amortization/Accretion | (1,029) |

Transfers in to Level 3 | - |

Transfers out of Level 3 | - |

Ending Balance | $ 33,758,333 |

The change in unrealized gain (loss) for the period attributable to Level 3 securities held at April 30, 2011 | $ 109,846 |

The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. |

Income Tax Information |

At October 31, 2010, the Fund had a capital loss carryforward of approximately $5,177,653,127 of which $956,598,602, $3,601,913,096 and $619,141,429 will expire in fiscal 2016, 2017 and 2018, respectively. Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Diversified International Fund

Statement of Assets and Liabilities

| April 30, 2011 |

Assets | | |

Investment in securities, at value (including securities loaned of $2,490,341,329) - See accompanying schedule: Unaffiliated issuers (cost $24,964,128,672) | $ 34,261,017,953 | |

Fidelity Central Funds (cost $3,131,098,137) | 3,131,098,137 | |

Other affiliated issuers (cost $373,435,769) | 270,939,931 | |

Total Investments (cost $28,468,662,578) | | $ 37,663,056,021 |

Foreign currency held at value (cost $774,453) | | 774,454 |

Receivable for investments sold | | 4,039,937 |

Receivable for fund shares sold | | 32,072,831 |

Dividends receivable | | 174,226,437 |

Interest receivable | | 8,712 |

Distributions receivable from Fidelity Central Funds | | 2,908,342 |

Prepaid expenses | | 34,918 |

Other receivables | | 3,478,401 |

Total assets | | 37,880,600,053 |

Liabilities | | |

Payable to custodian bank | $ 210 | |

Payable for investments purchased

Regular delivery | 1,647,040 | |

Delayed delivery | 17,362,964 | |

Payable for fund shares redeemed | 25,129,232 | |

Accrued management fee | 19,104,240 | |

Other affiliated payables | 5,083,505 | |

Other payables and accrued expenses | 5,244,639 | |

Collateral on securities loaned, at value | 2,604,453,237 | |

Total liabilities | | 2,678,025,067 |

Net Assets | | $ 35,202,574,986 |

Net Assets consist of: | | |

Paid in capital | | $ 30,032,156,924 |

Undistributed net investment income | | 205,624,708 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (4,233,336,918) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 9,198,130,272 |

Net Assets | | $ 35,202,574,986 |

Diversified International: Net Asset Value, offering price and redemption price per share ($25,442,563,880 ÷ 774,460,433 shares) | | $ 32.85 |

Class K:

Net Asset Value, offering price and redemption price per share ($9,129,951,822 ÷ 278,030,353 shares) | | $ 32.84 |

Class F:

Net Asset Value, offering price and redemption price per share ($630,059,284 ÷ 19,188,988 shares) | | $ 32.83 |

Statement of Operations

| Six months ended April 30, 2011 |

| | |

Investment Income | | |

Dividends (including $432,385 earned from other affiliated issuers) | | $ 394,179,694 |

Special dividend (earned from other affiliated issuer) | | 108,873,999 |

Interest | | 13,488 |

Income from Fidelity Central Funds | | 7,901,884 |

Income before foreign taxes withheld | | 510,969,065 |

Less foreign taxes withheld | | (28,800,330) |

Total income | | 482,168,735 |

| | |

Expenses | | |

Management fee

Basic fee | $ 122,312,121 | |

Performance adjustment | (6,299,168) | |

Transfer agent fees | 30,388,403 | |

Accounting and security lending fees | 1,334,831 | |

Custodian fees and expenses | 3,621,408 | |

Independent trustees' compensation | 88,530 | |

Appreciation in deferred trustee compensation account | 26 | |

Registration fees | 125,429 | |

Audit | 113,704 | |

Legal | 67,844 | |

Miscellaneous | 178,245 | |

Total expenses before reductions | 151,931,373 | |

Expense reductions | (5,535,619) | 146,395,754 |

Net investment income (loss) | | 335,772,981 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 1,111,263,521 | |

Foreign currency transactions | 55,780 | |

Total net realized gain (loss) | | 1,111,319,301 |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of decrease in deferred foreign taxes of $2,512,882) | 2,938,106,796 | |

Assets and liabilities in foreign currencies | 385,938 | |

Total change in net unrealized appreciation (depreciation) | | 2,938,492,734 |

Net gain (loss) | | 4,049,812,035 |

Net increase (decrease) in net assets resulting from operations | | $ 4,385,585,016 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Diversified International Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Six months ended April 30,

2011 | Year ended

October 31,

2010 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 335,772,981 | $ 486,439,991 |

Net realized gain (loss) | 1,111,319,301 | (561,752,757) |

Change in net unrealized appreciation (depreciation) | 2,938,492,734 | 3,614,151,999 |

Net increase (decrease) in net assets resulting from operations | 4,385,585,016 | 3,538,839,233 |

Distributions to shareholders from net investment income | (554,170,946) | (474,506,693) |

Distributions to shareholders from net realized gain | (93,780,296) | - |

Total distributions | (647,951,242) | (474,506,693) |

Share transactions - net increase (decrease) | (3,354,636,247) | (3,995,252,806) |

Redemption fees | 342,341 | 822,251 |

Total increase (decrease) in net assets | 383,339,868 | (930,098,015) |

| | |

Net Assets | | |

Beginning of period | 34,819,235,118 | 35,749,333,133 |

End of period (including undistributed net investment income of $205,624,708 and undistributed net investment income of $424,022,673, respectively) | $ 35,202,574,986 | $ 34,819,235,118 |

Financial Highlights - Diversified International

| Six months ended

April 30, | Years ended October 31, |

| 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 29.49 | $ 26.86 | $ 21.96 | $ 45.41 | $ 37.58 | $ 30.80 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .29 I | .37 | .35 | .55 | .47 | .46 |

Net realized and unrealized gain (loss) | 3.61 | 2.61 | 4.86 | (20.96) | 10.23 | 7.33 |

Total from investment operations | 3.90 | 2.98 | 5.21 | (20.41) | 10.70 | 7.79 |

Distributions from net investment income | (.46) | (.35) | (.31) | (.47) | (.36) | (.28) |

Distributions from net realized gain | (.08) | - | - | (2.57) | (2.51) | (.73) |

Total distributions | (.54) | (.35) | (.31) | (3.04) | (2.87) | (1.01) |

Redemption fees added to paid in capital D, H | - | - | - | - | - | - |

Net asset value, end of period | $ 32.85 | $ 29.49 | $ 26.86 | $ 21.96 | $ 45.41 | $ 37.58 |

Total Return B, C | 13.44% | 11.15% | 24.32% | (48.04)% | 30.37% | 25.89% |

Ratios to Average Net Assets E, G | | | | | | |

Expenses before reductions | .92% A | .98% | 1.01% | 1.04% | .93% | 1.01% |

Expenses net of fee waivers, if any | .91% A | .98% | 1.01% | 1.04% | .93% | 1.01% |

Expenses net of all reductions | .89% A | .96% | .99% | 1.02% | .91% | .97% |

Net investment income (loss) | 1.90% A, I | 1.34% | 1.58% | 1.53% | 1.20% | 1.32% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 25,442,564 | $ 26,527,229 | $ 30,998,270 | $ 28,274,961 | $ 59,929,942 | $ 43,965,189 |

Portfolio turnover rate F | 44% A | 57% | 54% | 49% | 51% | 59% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Calculated based on average shares outstanding during the period. E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. F Amount does not include the portfolio activity of any underlying Fidelity Central Funds. G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. H Amount represents less than $.01 per share. I Investment income per share reflects a special dividend which amounted to $.10 per share. Excluding the special dividends, the ratio of net investment income (loss) to average net assets would have been 1.27%. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class K

| Six months ended

April 30, | Years ended October 31, |

| 2011 | 2010 | 2009 | 2008 G |

Selected Per-Share Data | | | | |

Net asset value, beginning of period | $ 29.51 | $ 26.89 | $ 21.98 | $ 38.39 |

Income from Investment Operations | | | | |

Net investment income (loss) D | .32 J | .42 | .42 | .16 |

Net realized and unrealized gain (loss) | 3.62 | 2.61 | 4.85 | (16.57) |

Total from investment operations | 3.94 | 3.03 | 5.27 | (16.41) |

Distributions from net investment income | (.53) | (.41) | (.36) | - |

Distributions from net realized gain | (.08) | - | - | - |

Total distributions | (.61) | (.41) | (.36) | - |

Redemption fees added to paid in capital D, I | - | - | - | - |

Net asset value, end of period | $ 32.84 | $ 29.51 | $ 26.89 | $ 21.98 |

Total Return B, C | 13.56% | 11.33% | 24.64% | (42.75)% |

Ratios to Average Net Assets E, H | | | | |

Expenses before reductions | .75% A | .79% | .77% | .88% A |

Expenses net of fee waivers, if any | .74% A | .79% | .77% | .88% A |

Expenses net of all reductions | .72% A | .77% | .76% | .87% A |

Net investment income (loss) | 2.06% A, J | 1.54% | 1.81% | 1.45% A |

Supplemental Data | | | | |

Net assets, end of period (000 omitted) | $ 9,129,952 | $ 7,697,405 | $ 4,713,909 | $ 932,275 |

Portfolio turnover rate F | 44% A | 57% | 54% | 49% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Calculated based on average shares outstanding during the period. E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. F Amount does not include the portfolio activity of any underlying Fidelity Central Funds. G For the period May 9, 2008 (commencement of sale of shares) to October 31, 2008. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for startup periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. I Amount represents less than $.01 per share. JInvestment income per share reflects a special dividend which amounted to $.10 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been 1.43%. |

Financial Highlights - Class F

| Six months ended

April 30, | Years ended October 31, |

| 2011 | 2010 | 2009 G |

Selected Per-Share Data | | | |

Net asset value, beginning of period | $ 29.52 | $ 26.89 | $ 23.29 |

Income from Investment Operations | | | |

Net investment income (loss) D | .32 J | .43 | (.02) |

Net realized and unrealized gain (loss) | 3.61 | 2.62 | 3.62 |

Total from investment operations | 3.93 | 3.05 | 3.60 |

Distributions from net investment income | (.54) | (.42) | - |

Distributions from net realized gain | (.08) | - | - |

Total distributions | (.62) | (.42) | - |

Redemption fees added to paid in capital D, I | - | - | - |

Net asset value, end of period | $ 32.83 | $ 29.52 | $ 26.89 |

Total Return B, C | 13.54% | 11.41% | 15.46% |

Ratios to Average Net Assets E, H | | | |

Expenses before reductions | .70% A | .73% | .71% A |

Expenses net of fee waivers, if any | .69% A | .73% | .71% A |

Expenses net of all reductions | .67% A | .72% | .70% A |

Net investment income (loss) | 2.12% A, J | 1.59% | (.19)% A |

Supplemental Data | | | |

Net assets, end of period (000 omitted) | $ 630,059 | $ 594,602 | $ 37,155 |

Portfolio turnover rate F | 44% A | 57% | 54% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Calculated based on average shares outstanding during the period. E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. F Amount does not include the portfolio activity of any underlying Fidelity Central Funds. G For the period June 26, 2009 (commencement of sale of shares) to October 31, 2009. H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. I Amount represents less than $.01 per share. J Investment income per share reflects a special dividend which amounted to $.10 per share. Excluding the special dividend, the ratio of net investment income (loss) to average net assets would have been 1.49%. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended April 30, 2011

1. Organization.

Fidelity Diversified International Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Diversified International, Class K and Class F shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class F shares of the Fund are only available for purchase by mutual funds for which Fidelity Management & Research Company (FMR) or an affiliate serves as investment manager. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by FMR and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Fund uses independent pricing services approved by the Board of Trustees to value its investments. When current market prices or quotations are not readily available or reliable, valuations may be determined in good faith in accordance with procedures adopted by the Board of Trustees. Factors used in determining value may include market or security specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The value used for net asset value (NAV) calculation under these procedures may differ from published prices for the same securities.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below.

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of April 30, 2011, as well as a roll forward of Level 3 securities, is included at the end of the Fund's Schedule of Investments. Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when significant market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-traded funds (ETFs) and certain indexes as well as quoted prices for similar securities are used and are categorized as Level 2 in the hierarchy in these circumstances. Utilizing these techniques may result in transfers between Level 1 and Level 2. For restricted equity securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Semiannual Report

3. Significant Accounting Policies - continued

Security Valuation - continued

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities. For master notes, pricing services utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices and are generally categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds,including the Fidelity Central Funds, are valued at their closing net asset value each business day and are categorized as Level 1 in the hierarchy.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Large, non-recurring dividends recognized by the Fund are presented separately on the Statement of Operations as "Special Dividends" and the impact of these dividends is presented in the Financial Highlights. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company, including distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. A fund's federal tax return is subject to examination by the Internal Revenue Service (IRS) for a period of three years. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on realized short term capital gains on securities of certain issuers domiciled in India. An estimated deferred tax liability for net unrealized gains on these securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to the short-term gain distributions from the Fidelity Central Funds, foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), deferred trustees compensation, capital loss carryforwards and losses deferred due to wash sales.

Semiannual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 9,591,579,161 |

Gross unrealized depreciation | (543,667,844) |

Net unrealized appreciation (depreciation) on securities and other investments | $ 9,047,911,317 |

| |

Tax cost | $ 28,615,144,704 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days are subject to a redemption fee equal to 1.00% of the net asset value of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

New Accounting Pronouncement. In May 2011, the Financial Accounting Standards Board issued Accounting Standard Update No. 2011-04, Fair Value Measurement (Topic 820) - Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The update changes the wording used to describe the requirements in GAAP for measuring fair value and for disclosing information about fair value measurements. The update is effective during interim and annual periods beginning after December 15, 2011. Management is currently evaluating the impact of the update's adoption on the Fund's financial statement disclosures.

4. Operating Policies.

Delayed Delivery Transactions and When-Issued Securities. The Fund may purchase or sell securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. During the time a delayed delivery sell is outstanding, the contract is marked-to-market daily and equivalent deliverable securities are held for the transaction. The securities purchased on a delayed delivery or when-issued basis are identified as such in the Fund's Schedule of Investments. The Fund may receive compensation for interest forgone in the purchase of a delayed delivery or when-issued security. With respect to purchase commitments, the Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $7,320,651,579 and $10,224,002,231, respectively.

6. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and a group fee rate that averaged .26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of ± .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Diversified International as compared to an appropriate benchmark index. For the period, the total annualized management fee rate, including the performance adjustment, was .67% of the Fund's average net assets.

Semiannual Report

6. Fees and Other Transactions with Affiliates - continued