As filed with the Securities and Exchange Commission |

on February 5, 2007 |

Registration No. ___________ |

| | (Investment Company Act Registration No. 811-04008) | | |

|

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

FORM N-14 |

REGISTRATION STATEMENT |

UNDER THE SECURITIES ACT OF 1933 |

|

| Pre-Effective Amendment No. | [ ] |

| Post-Effective Amendment No. ____ | [ ] |

|

Fidelity Investment Trust |

(Exact Name of Registrant as Specified in Charter) |

|

Registrant's Telephone Number (617) 563-7000 |

|

82 Devonshire St., Boston, MA 02109 |

(Address Of Principal Executive Offices) |

|

Eric D. Roiter, Secretary |

82 Devonshire Street |

Boston, MA 02109 |

(Name and Address of Agent for Service) |

|

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933. |

|

The Registrant has registered an indefinite amount of securities under the Securities Act of 1933 pursuant to Rule 24f-2 under the Investment Company Act of 1940; accordingly, no fee is payable herewith because of reliance upon such Rule. |

|

It is proposed that this filing will become effective on March 5, 2007, pursuant to Rule 488. |

Important Proxy Materials

PLEASE CAST YOUR VOTE NOW!

Fidelity® Nordic Fund

Dear Shareholder:

I am writing to let you know that a special meeting of shareholders of Fidelity® Nordic Fund will be held on May 16, 2007. The purpose of the meeting is to vote on an important proposal to merge Fidelity Nordic Fund into Fidelity Europe Fund. As a shareholder, you have the opportunity to voice your opinion on the matters that affect your fund. This package contains information about the proposal and the materials to use when casting your vote.

The fund's Board of Trustees has carefully reviewed the proposed merger and has unanimously recommended that the merger proposal be presented to shareholders. The Trustees, most of whom are not affiliated with Fidelity, are responsible for protecting your interests as a shareholder. The Trustees have determined that the proposed merger is in the best interests of shareholders; however the final decision is up to you.

The proposed merger would provide Nordic shareholders with the opportunity to invest in a larger, more diversified fund with the flexibility to invest across the entire European continent, including the Nordic region. As you know, in anticipation of the proposed merger, Fidelity Nordic Fund was closed to new investments at the close of business on March 14, 2007. We have attached a Q&A to assist you in understanding the proposal. The enclosed proxy statement includes a detailed description of the proposed merger.

Please read the enclosed materials and cast your vote on the proxy card(s). You are entitled to one vote for each dollar of net asset value you own of the fund on the record date (March 19, 2006). Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holding may be.

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) enclosed in this package. Be sure to sign the card(s) before mailing it in the postage-paid envelope. You may also vote your shares by touch--tone telephone or through the Internet. Simply call the toll--free number or visit the web site indicated on your proxy card(s), enter the control number found on the card(s), and follow the recorded or online instructions.

If you have any questions before you vote, please call Fidelity at 1-800-544-3198. We'll be glad to help you get your vote in quickly. Thank you for your participation in this important initiative.

Sincerely,

Edward C. Johnson 3d

Chairman and Chief Executive Officer

Important information to help you understand and vote on the proposal

Please read the full text of the proxy statement. Below is a brief overview of the proposal to be voted upon. Your vote is important. We appreciate you placing your trust in Fidelity and look forward to helping you achieve your financial goals.

What am I being asked to vote on?

You are being asked to vote on a merger between Fidelity Nordic Fund (Nordic Fund) and Fidelity Europe Fund (Europe Fund), another fund of the trust. Specifically, you are being asked to approve an Agreement and Plan of Reorganization (the Agreement) that provides for the transfer of all of the assets of Nordic Fund to Europe Fund in exchange solely for shares of beneficial interest of Europe Fund and the assumption by Europe Fund of Nordic Fund's liabilities. Europe Fund's shares then will be distributed to shareholders of Nordic Fund in liquidation of Nordic Fund.

Has the fund's Board of Trustees approved the merger?

Yes. The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

What are the reasons for and advantages of the proposed merger?

The Nordic market tends to be more volatile and less diversified than developed Europe as a whole, and Fidelity believes the region's characteristics have changed sufficiently to no longer warrant a separate fund focused on the region. The proposed merger would provide Nordic shareholders with a larger, more diversified fund that has the flexibility to invest broadly across the entire European continent, including the Nordic region.

Do the funds being merged have similar investment objectives and policies?

The funds have similar investment objectives. Nordic Fund seeks long term growth of capital. Europe Fund seeks growth of capital over the long term. Both funds invest in common stocks and use fundamental analysis as the primary means to select investments. However, Nordic Fund seeks to achieve its objective by normally investing at least 80% of its assets in securities of Danish, Finnish, Norwegian, and Swedish issuers and other investments that are tied economically to the Nordic region, while Europe Fund, by contrast, seeks to achieve its objective by normally investing at least 80% of its assets in securities of European (including Nordic) issuers and other investments that are tied economically to Europe as a whole. In addition, Europe Fund does not concentrate its investments in any industry, whereas Nordic Fund may invest up to 35% of its total assets in any industry that accounts for more than 20% of the Nordic market.

Will Europe Fund revise its investment policies if the merger is approved?

FMR does not expect Europe Fund to revise its investment policies as a result of the merger. In addition, FMR does not anticipate significant changes to the fund's management or to entities that provide the fund with services.

Who is the fund manager for the funds?

Both funds are currently managed by the same portfolio manager, Trygve Toraasen, who is expected to continue to manage Europe Fund (including its exposure to the Nordic region) after the merger.

Who bears the expenses associated with the merger?

The outcome of the shareholder vote will determine who pays the expenses related to the merger. If shareholders approve the merger, then the fund will pay all merger-related expenses up to the 1.25% voluntary cap set by FMR. FMR will pay expenses that exceed this voluntary cap. If shareholders do not approve the proposed merger, then all merger-related expenses will be borne by FMR.

How do the expense structures of the funds compare?

Each fund pays its management fee and other expenses separately. The management fees and other expenses of the funds vary from year to year, as a percentage of their respective average net assets. Unlike Nordic Fund, Europe Fund's management fee is subject to a performance adjustment, which either increases or decreases the management fee, depending on how well Europe Fund has performed relative to the MSCI Europe Index. The total operating expenses (the sum of their respective management fee and other expenses) of the funds for the 12 months ended October 31, 2006 were 1.16% for Europe Fund and 1.14% for Nordic Fund. Fidelity Management & Research Company (FMR) has voluntarily agreed to reimburse Nordic Fund to the extent that total operating expenses exceed 1.25%.

In addition, each fund has a redemption fee. Nordic Fund charges a redemption fee of 1.50% on shares held less than 90 days. Europe Fund charges a 1.00% redemption fee on shares held for less than 30 days.

If the merger is approved by shareholders, the combined fund will retain Europe Fund's expense structure, requiring payment of a management fee and other operating expenses, and applying a performance adjustment to the management fee. In addition, the combined fund will retain Europe Fund's 1.00% redemption fee on shares held for less than 30 days.

While Nordic Fund would have paid approximately 0.02% more in total operating expenses over the 12 months ended October 31, 2006 had the merger occurred at the beginning of the period, this difference was attributable primarily to the performance adjustment component of the Europe Fund's management fee. Going forward, Europe Fund may pay a higher or lower management fee than Nordic Fund pays depending on whether Europe Fund outperforms or underperforms, respectively, relative to the MSCI Europe Index. Excluding performance fees, Europe Fund's expense ratio was actually 0.11% lower than Nordic Fund's for the 12 months ended October 31, 2006, mainly due to lower transfer agent and other operating expenses.

How will you determine the number of shares of Europe Fund that I will receive?

As of the close of business of the New York Stock Exchange on the Closing Date of the merger, the number of shares to be issued will be based on the relative net asset values of each fund at the time of the exchange. The anticipated Closing Date is June 22, 2007.

Is the merger considered a taxable event for federal income tax purposes?

No. Typically the exchange of shares in a fund merger transaction does not result in a gain or loss for federal or state income tax purposes. In addition, the cost basis and holding period of your Nordic Fund shares are expected to carry over to your new shares in Europe Fund.

What if there are not enough votes to reach quorum by the scheduled shareholder meeting date?

To facilitate receiving a sufficient number of votes, we will need to take further action. D.F.King & Co., Inc., a proxy solicitation firm, or Fidelity, may contact you by mail or telephone. Therefore, we encourage shareholders to vote as soon as they review the enclosed proxy materials to avoid additional mailings or telephone calls.

If there are not sufficient votes to approve your fund's proposal by the time of your Shareholder Meeting (May 16, 2007), the meeting may be adjourned to permit further solicitation of proxy votes.

Who is D.F. King & Co., Inc.?

D.F. King is a third party proxy vendor that Fidelity hires to call shareholders and record proxy votes. In order to hold a shareholder meeting, quorum must be reached - which is a majority of the shares entitled to vote in person or by proxy at the shareholder meeting. If quorum is not attained, the meeting must adjourn to a future date. Fidelity attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be postponed.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to make a call to you to solicit your vote.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each dollar of net asset value you own of the fund on the record date. The record date is March 19, 2007.

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card(s) and mailing it in the enclosed postage-paid envelope. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. In addition, you may vote through the internet by visiting www.proxyweb.com/proxy and following the on-line instructions. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call Fidelity at 1-800-544-3198.

How do I sign the proxy card?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the card.

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name shown in the registration.

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, "Ann B. Collins, Trustee."

FIDELITY® NORDIC FUND

A FUND OF

FIDELITY INVESTMENT TRUST

82 DEVONSHIRE STREET, BOSTON, MASSACHUSETTS 02109

1-800-544-3198

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of Fidelity Nordic Fund:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of Fidelity Nordic Fund (Nordic Fund) will be held at the office of Fidelity Investment Trust (Investment Trust), 245 Summer Street, 14th Floor, Boston, Massachusetts 02110 on May 16, 2007, at 9:30 a.m. Eastern time (ET). The purpose of the Meeting is to consider and act upon the following proposal, and to transact such other business as may properly come before the Meeting or any adjournments thereof.

To approve an Agreement and Plan of Reorganization (the Agreement) between Nordic Fund and Fidelity Europe Fund (Europe Fund), another fund of the trust. The Agreement provides for the transfer of all of the assets of Nordic Fund to Europe Fund in exchange solely for shares of beneficial interest of Europe Fund and the assumption by Europe Fund of Nordic Fund's liabilities. Thereupon, Europe Fund's shares will be distributed to shareholders of Nordic Fund in liquidation of Nordic Fund.

The Board of Trustees has fixed the close of business on March 19, 2007 as the record date for the determination of the shareholders of Nordic Fund entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

ERIC D. ROITER, Secretary

March 19, 2007

YOUR VOTE IS IMPORTANT -

PLEASE VOTE YOUR SHARES PROMPTLY.

Shareholders are invited to attend the Meeting in person. Any shareholder who does not expect to attend the Meeting is urged to vote using the touch-tone telephone or internet voting instructions found below or indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

1. Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration.

3. All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card. For example:

REGISTRATION | VALID SIGNATURE |

A. 1) | ABC Corp. | John Smith, Treasurer |

2) | ABC Corp. | John Smith, Treasurer |

| c/o John Smith, Treasurer | |

B. 1) | ABC Corp. Profit Sharing Plan | Ann B. Collins, Trustee |

2) | ABC Trust | Ann B. Collins, Trustee |

3) | Ann B. Collins, Trustee | Ann B. Collins, Trustee |

| u/t/d 12/28/78 | |

C. 1) | Anthony B. Craft, Cust. | Anthony B. Craft |

| f/b/o Anthony B. Craft, Jr. | |

| UGMA | |

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE or through the internet

1. Read the proxy statement, and have your proxy card handy.

2. Call the toll-free number or visit the web site indicated on your proxy card.

3. Enter the control number found on your proxy card.

4. Follow the recorded or on-line instructions to cast your vote.

FIDELITY NORDIC FUND

A FUND OF

FIDELITY INVESTMENT TRUST

82 Devonshire Street, Boston, Massachusetts 02109

1-800-544-3198

PROXY STATEMENT AND PROSPECTUS

MARCH 19, 2007

This Proxy Statement and Prospectus (Proxy Statement) is being furnished to shareholders of Fidelity Nordic Fund (Nordic Fund), a fund of Fidelity Investment Trust (the trust), in connection with the solicitation of proxies by, and on behalf of, the trust's Board of Trustees for use at the Special Meeting of Shareholders of Nordic Fund and at any adjournments thereof (the Meeting). The Meeting will be held on May 16, 2007 at 9:30 a.m. Eastern time at 27 State Street, 10th Floor, Boston, Massachusetts 02109, a principal executive office of the trust and Fidelity Management & Research Company (FMR), the fund's investment adviser.

As more fully described in the Proxy Statement, the purpose of the Meeting is to vote on an Agreement and Plan of Reorganization (the Agreement) relating to the proposed acquisition of Nordic Fund by Fidelity Europe Fund (Europe Fund). The transaction contemplated by the Agreement is referred to as a Reorganization.

The Proposal in this Proxy Statement relates to the proposed acquisition of Nordic Fund by Europe Fund. If the Agreement is approved by fund shareholders and the Reorganization occurs, Nordic Fund will transfer all of its assets and liabilities to Europe Fund in exchange solely for shares of beneficial interest of Europe Fund and the assumption by Europe Fund of Nordic Fund's liabilities. The number of shares to be issued in the proposed Reorganization will be based upon the relative net asset value of the funds at the time of the exchange. As provided in the Agreement, Nordic Fund will distribute shares of Europe Fund to its shareholders in liquidation of Nordic Fund on June 22, 2007, or such other date as the parties may agree (the Closing Date).

Europe Fund, an international equity fund, is a diversified fund of the trust, an open-end management investment company organized as a Massachusetts business trust on April 20, 1984. Europe Fund's investment objective is to seek growth of capital over the long term. Europe Fund seeks to achieve its investment objective by normally investing at least 80% of the fund's assets in securities of European issuers and other investments that are tied economically to Europe.

This Proxy Statement, which should be retained for future reference, sets forth concisely the information about the Reorganization and Europe Fund that a shareholder should know before voting on the proposed Reorganization. The following documents have been filed with the Securities and Exchange Commission (SEC) and are incorporated herein by reference:

- Prospectus of Europe Fund and Nordic Fund dated December 30, 2006 and supplemented February 5, 2007.

- Statement of Additional Information of Europe Fund and Nordic Fund dated December 30, 2006 and supplemented January 19, 2007.

- The Report of Independent Registered Public Accounting Firm and the financial statements included in the Annual Report to Shareholders of Europe Fund and Nordic Fund dated December 21, 2006.

Nordic Fund has previously sent its Annual Report to its shareholders. Copies of current Prospectuses, Statements of Additional Information or Annual Reports of the funds may be obtained without charge by contacting the trust at Fidelity Distributors Corporation, 82 Devonshire Street, Boston, Massachusetts 02109 or by calling 1-800-544-8544. Text-only versions of each fund's documents can be viewed online or downloaded from the EDGAR database on the SEC's web site at www.sec.gov. You can review and copy information about the funds by visiting the Public Reference Room, U.S. Securities and Exchange Commission, Washington, DC 20546-0102 or the regional offices of the SEC located at 233 Broadway, New York, NY 10279 and 175 W. Jackson Boulevard, Suite 900, Chicago, IL 60604. You can obtain copies, upon payment of a duplication fee, by sending an e-mail request to publicinfo@sec.gov or by writing the Public Reference Room at its Washington, DC address above. Information on the operation of the Public Reference Room may be obtained by calling 202-942-8090.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT AND PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

An investment in the funds is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

TABLE OF CONTENTS

PROXY STATEMENT AND PROSPECTUS

SPECIAL MEETING OF SHAREHOLDERS OF

FIDELITY NORDIC FUND

A FUND OF

FIDELITY INVESTMENT TRUST

82 DEVONSHIRE STREET, BOSTON, MASSACHUSETTS 02109

1-800-544-3198

TO BE HELD ON MAY 16, 2007

_________________________________

VOTING INFORMATION

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of Fidelity Investment Trust (the trust) to be used at the Special Meeting of Shareholders of Nordic Fund and at any adjournments thereof (the Meeting), to be held on May 16, 2007 at 9:30 a.m. Eastern time at 245 Summer Street, 14th Floor, Boston, Massachusetts 02110, an office of the trust and Fidelity Management & Research Company (FMR), the fund's investment adviser.

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is made primarily by the mailing of this Proxy Statement and the accompanying proxy card on or about March 19, 2007. Supplementary solicitations may be made by mail, telephone, telegraph, facsimile, electronic means or by personal interview by representatives of the trust. In addition, D.F. King & Co., Inc. may be paid on a per-call basis to solicit shareholders by telephone on behalf of Nordic Fund at an anticipated cost of approximately $15,000. Nordic Fund may also arrange to have votes recorded by telephone. D.F. King & Co., Inc. may be paid on a per-call basis for vote-by-phone solicitations on behalf of Nordic Fund at an anticipated cost of approximately $5,000. If Nordic Fund records votes by telephone, it will use procedures designed to authenticate shareholders' identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted in the same manner that proxies voted by mail may be revoked.

The outcome of the shareholder vote will determine who pays the expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations. If shareholders approve the Reorganization, Nordic Fund will pay the expenses, provided that if expenses exceed Nordic Fund's existing voluntary expense cap of 1.25%, the expenses exceeding Nordic Fund's voluntary expense cap will be paid by FMR. If shareholders do not approve the Reorganization, all expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be paid by FMR. Brokerage firms and others will be reimbursed for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

The principal business address of FMR, the fund's investment adviser and administrator, is One Federal Street, Boston, Massachusetts 02110. The principal business address of Fidelity Distributors Corporation (FDC), the fund's principal underwriter and distribution agent, is 82 Devonshire Street, Boston, Massachusetts 02109. Fidelity Management & Research Company, Inc. (FMRC), located at 82 Devonshire Street, Boston, Massachusetts 02109; Fidelity Management & Research (U.K.) Inc., located at 25 Lovat Lane, London, EC3R 8LL, England; Fidelity Research & Analysis Company (FRAC) (formerly known as Fidelity Management & Research (Far East) Inc.), located at 82 Devonshire Street, Boston, Massachusetts 02109; Fidelity International Investment Advisors (FIIA), located at Pembroke Hall, 42 Crow Lane, Pembroke HM19, Bermuda; and Fidelity International Investment Advisors (U.K.) Limited (FIIA(U.K.)L), located at 25 Cannon Street, London, England EC4M5TA are also sub-advisers to the fund.

If the enclosed proxy card is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the trust, by the execution of a later-dated proxy card, by the trust's receipt of a subsequent valid telephonic or internet vote, or by attending the Meeting and voting in person.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and which are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy card, it will be voted FOR the matters specified on the proxy card. All shares that are voted and votes to ABSTAIN will be counted toward establishing a quorum, as will broker non-votes. (Broker non-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

With respect to fund shares held in Fidelity Individual retirement accounts (including Traditional, Rollover, SEP, SAR-SEP, Roth and SIMPLE IRAs), the IRA Custodian will vote those shares for which it has received instructions from shareholders only in accordance with such instructions. If Fidelity IRA shareholders do not vote their shares, the IRA Custodian will vote their shares for them, in the same proportion as other Fidelity IRA shareholders have voted.

If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve the proposal are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to each item, unless directed to vote AGAINST the item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. Please visit www.fidelity.com/goto/proxies to determine the status of this scheduled Shareholder Meeting.

On October 31, 2006 there were 9,525,813 and 95,319,221 shares issued and outstanding for Nordic Fund and Europe Fund, respectively.

As of October 31, 2006, 61.13% of Europe Fund's total outstanding shares was held by FMR affiliates. FMR Corp. is the ultimate parent company of FMR affiliates. By virtue of his ownership interest in FMR Corp., Mr. Edward C. Johnson 3d, Trustee, may be deemed to be a beneficial owner of these shares. As of the above date with the exception of Mr. Johnson 3d's deemed ownership of Europe Fund's shares, the Trustees, Member of the Advisory Board, and officers of Europe Fund and Nordic Fund owned, in the aggregate, less than 1% of each fund's total outstanding shares.

As of October 31, 2006, the following owned beneficially 5% or more of Europe Fund's outstanding shares:

Fidelity Freedom 2020 Fund, Boston, MA (18.91%); Fidelity Freedom 2030 Fund, Boston, MA (14.08%); Fidelity Freedom 2010 Fund, Boston, MA (9.98%); Fidelity Freedom 2040 Fund, Boston, MA (7.11%).

FMR has advised the trust that certain shares are registered to FMR or an FMR affiliate. To the extent that FMR or an FMR affiliate has discretion to vote, these shares will be voted at the Meeting FOR each proposal. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted.

Shareholders of record at the close of business on March 19, 2007 will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held on that date.

Only one copy of this Proxy Statement may be mailed to households, even if more than one person in a household is a fund shareholder of record. If you need additional copies of this Proxy Statement, please contact Fidelity at 1-800-544-3198. If you do not want the mailing of this Proxy Statement to be combined with those for other members of your household or do not want to receive multiple copies of future proxy statements, contact Fidelity in writing at P.O. Box 770001, Cincinnati, Ohio 45277-0002.

For a free copy of the annual report for the fiscal year ended October 31, 2006 and the semi-annual report for the fiscal period ended April 30, 2006, call 1-800-544-3198, log-on to www.fidelity.com, or write to FDC at 82 Devonshire Street, Boston, Massachusetts 02109.

VOTE REQUIRED: Approval of the Reorganization requires the affirmative vote of a "majority of the outstanding voting securities" of Nordic Fund. Under the Investment Company Act of 1940 (the 1940 Act), the vote of a "majority of the outstanding voting securities" means the affirmative vote of the lesser of (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (b) more than 50% of the outstanding voting securities. Votes to ABSTAIN and broker non-votes will have the same effect as votes cast AGAINST the proposal.

SYNOPSIS

The following is a summary of certain information contained elsewhere in this Proxy Statement, in the Agreement, and in the Prospectus of Nordic Fund and Europe Fund, which are incorporated herein by reference. Shareholders should read the entire Proxy Statement and the Prospectus of Europe Fund carefully for more complete information.

The Proposed Reorganization

The Board of Trustees of the trust is recommending that Nordic Fund merge with and into Europe Fund. Under the terms of the Agreement, Europe Fund would acquire all of the assets and liabilities of Nordic Fund in exchange for shares of Europe Fund. If the Reorganization is approved and consummated, Nordic Fund will cease to exist and current shareholders of the fund will receive shares of Europe Fund with an aggregate net asset value equal to the aggregate net asset value of their fund shares on the Closing Date (defined below). The Reorganization is currently scheduled to take place as of the close of business of the New York Stock Exchange (NYSE) on June 22, 2007, or such other time and date as the parties may agree.

Investment Objectives and Policies

The following summarizes the investment objective and policy differences of each fund:

The funds have similar investment objectives. Nordic Fund seeks long-term growth of capital. Europe Fund seeks growth of capital over the long-term.

Both funds have similar investment strategies. Each fund normally invests primarily in common stocks and uses fundamental analysis of each issuer's financial condition and industry position and market and economic conditions to select investments.

The main difference between Nordic Fund and Europe Fund is the number of countries in which each fund normally invests. Nordic Fund normally invests at least 80% of its assets in securities of Danish, Finnish, Norwegian, and Swedish issuers and other investments that are tied economically to the Nordic region. Europe Fund, by contrast, normally invests at least 80% of its assets in securities of European issuers and other investments that are tied economically to Europe as a whole. This includes all member countries of the European Union, Norway, Switzerland, and certain European countries with low to middle income economies as classified by the World Bank.

In addition, Europe Fund does not concentrate its assets (i.e., invest more than 25%) in any industry, while Nordic Fund may invest up to 35% of its total assets in any industry that accounts for more than 20% of the Nordic market.

Each fund uses a different benchmark index to measure performance. Nordic Fund uses the Financial Times-Stock Exchange (FTSE) World Nordic Index, whereas Europe Fund compares its performance against the Morgan Stanley Capital International (MSCI) Europe Index.

The following compares and contrasts certain investment policies of the funds:

Diversification. Each fund is a diversified fund. As a matter of fundamental policy, each fund may not with respect to 75% of the fund's total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, (a) more than 5% of the fund's total assets would be invested in the securities of that issuer, or (b) the fund would hold more than 10% of the outstanding voting securities of that issuer.

Borrowing. As a matter of fundamental policy, each fund may borrow money for temporary or emergency purposes (not for leveraging or investment) in an amount not exceeding 33 1/3% of the fund's total assets less liabilities. For these purposes, each fund may borrow money from banks or from other funds advised by FMR or an affiliate and may engage in reverse repurchase agreements.

Loans. Each fund does not currently intend to lend assets, other than securities, to other parties, except by lending money (up to 15% of the fund's net assets) to other funds advised by FMR or an affiliate. As a matter of fundamental policy, each fund may not lend more than 33 1/3% of its total assets to other parties. These limitations do not apply to purchases of debt securities or to repurchase agreements, or to acquisitions of loans, loan participations or other forms of debt instruments.

Concentration. The funds have different policies regarding concentration of investments. Nordic Fund may invest up to 35% of the fund's total assets in any industry that accounts for more than 20% of the Nordic market as a whole, as measured by an index determined by FMR to be an appropriate measure of the Nordic market. As a matter of fundamental policy, however, Europe Fund may not purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities) if, as a result, more than 25% of the fund's total assets would be invested in the securities of companies whose principal business activities are in the same industry.

Except as noted above, the funds are subject to substantially similar investment policies and restrictions, including fundamental investment restrictions. For more information about the risks and restrictions associated with these policies, see each fund's Prospectus, and for a more detailed discussion of the funds' investments, see their Statement of Additional Information, each of which is incorporated herein by reference.

Expense Structures and Investment Minimums

Operating Expenses.

The following summarizes the expense structures of Nordic Fund and Europe Fund:

Each fund pays its management fees and other expenses separately. Nordic Fund's management fee consists of a basic fee, but unlike Europe Fund, does not have a performance adjustment component. Nordic Fund's management fee is calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the fund's average net assets throughout the month. The group fee rate is based on the average net assets of all mutual funds managed by FMR. This rate cannot rise above 0.52% of its average net assets, and it drops as total assets under management increase. The individual fund fee rate for the fund is 0.45% of its average net assets.

Europe Fund pays a management fee which is determined by calculating a basic fee and then applying a performance adjustment. The performance adjustment either increases or decreases the management fee, depending on how well Europe Fund has performed relative to the MSCI Europe Index. The basic fee is calculated by adding a group fee rate to an individual fund fee rate, dividing by twelve, and multiplying the result by the fund's average net assets throughout the month. The group fee rate is based on the average net assets of all mutual funds managed by FMR. This rate cannot rise above 0.52% of its average net assets, and it drops as total assets under management increase. The individual fund fee rate for the fund is 0.45% of its average net assets.

Due to the performance adjustment component of its management fee, Europe Fund may pay higher or lower management fees to FMR than Nordic Fund. If Europe Fund outperforms the MSCI Europe Index over the relevant performance period, then Europe Fund will pay a higher management fee to FMR than Nordic Fund. In contrast, if Europe Fund underperforms the MSCI Europe Index, over the relevant performance period, then Europe Fund will pay a lower management fee to FMR than Nordic Fund.

In addition, FMR has voluntarily agreed to limit Nordic Fund's total operating expenses to 1.25% of its average net assets. FMR may remove this expense limitation at any time. In contrast, FMR has not agreed to limit the total operating expenses of Europe Fund.

Nordic Fund imposes a redemption fee of 1.50% on shares held less than 90 days. Europe Fund imposes a redemption fee of 1.00% on shares held less than 30 days.

If shareholders approve the Reorganization, the combined fund will retain the expense structure of Europe Fund, including redemption fee rate and holding period, and the performance fee adjustment. The section below entitled "Annual Fund Operating Expenses" provides additional details on the expenses for each fund currently, and the estimated expenses for the combined fund, for the 12 months ended October 31, 2006.

Investment Minimums.

The fund's have identical investment minimums. Each fund requires a minimum initial investment of $2,500, a minimum additional investment of $250, and a minimum account balance of $2,000.

Annual Fund Operating Expenses

The following tables allow you to compare the management fees and expenses of each fund and to analyze the estimated expenses for the combined fund. Annual fund operating expenses are paid by each fund.

The tables show the historical fees and expenses of Nordic Fund and Europe Fund for the 12 months ended October 31, 2006 and pro forma fees for the combined fund based on the same time period after giving effect to the Reorganization.

Shareholder fees (paid by the investor directly)

| Nordic Fund | Europe Fund |

Sales charge (load) on purchases and reinvested distributions | None | None |

Deferred sales charge (load) on redemptions | None | None |

Redemption fee on shares held less than 90 days (as a % of amount redeemed)A | % | None |

Redemption fee on shares held less than 30 days (as a % of amount redeemed)A | None | 1.00% |

A A redemption fee may be charged when you sell your shares or if your shares are redeemed because your fund balance falls below the balance minimum for any reason, including solely due to declines in net asset value per share.

Combined Pro Forma Shareholder fees (paid by the investor directly)

| Europe Fund |

Sales charge (load) on purchases and reinvested distributions | None |

Deferred sales charge (load) on redemptions | None |

Redemption fee on shares held less than 30 days (as a % of amount redeemed)A | 1.00% |

A A redemption fee may be charged when you sell your shares or if your shares are redeemed because your fund balance falls below the balance minimum for any reason, including solely due to declines in net asset value per share.

Annual operating expenses (paid from fund assets)

| Nordic Fund | Europe Fund |

Management fee | 0.71% | 0.84%A |

Distribution and/or Service (12b-1) fees | None | None |

Other expenses | 0.43% | 0.32% |

Total annual fund operating expenses | 1.14%B | 1.16% |

A A portion of the fund's management fee is based on performance relative to a securities index. As a result, the current management fee rate and total expense ratio may be higher or lower than the rate disclosed above, which reflects the performance adjustments for the most recent fiscal period.

B Effective February 1, 2005, FMR has voluntarily agreed to reimburse Nordic Fund to the extent that total operating expenses (excluding interest, taxes, certain securities lending costs, brokerage commissions, and extraordinary expenses), as a percentage of its average net assets, exceed 1.25%. This arrangement may be discontinued by FMR at any time.

Combined Pro Forma Annual operating expenses (paid from fund assets)

| Europe Fund |

Management fee | 0.84%A |

Distribution and/or Service (12b-1) fees | None |

Other expenses | 0.32% |

Total annual fund operating expenses | 1.16% |

A A portion of the fund's management fee is based on performance relative to a securities index. As a result, the current management fee rate and total expense ratio may be higher or lower than the rate disclosed above, which reflects the performance adjustments for the most recent fiscal period.

Examples of Effect of Fund Expenses

The following table illustrates the expenses on a hypothetical $10,000 investment in each fund under the current and pro forma (combined fund) expenses calculated at the rates stated above, assuming a 5% annual return. These tables illustrate how much a shareholder would pay in total expenses if a shareholder sells all of his/her shares at the end of each time period indicated.

| Nordic Fund | Europe Fund |

1 year | $ 116 | $ 118 |

3 years | $ 362 | $ 368 |

5 years | $ 628 | $ 638 |

10 years | $ 1,386 | $ 1,409 |

Pro Forma Combined Fund

| Europe Fund |

1 year | $ 118 |

3 years | $ 368 |

5 years | $ 638 |

10 years | $ 1,409 |

These examples assume that all dividends and other distributions are reinvested and that the percentage amounts listed under Annual Fund Operating Expenses remain the same in the years shown. These examples illustrate the effect of expenses, but are not meant to suggest actual or expected expenses, which may vary. The assumed return of 5% is not a prediction of, and does not represent, actual or expected performance of any fund.

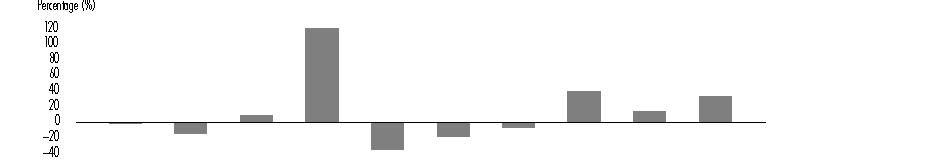

Performance Comparisons of the Funds

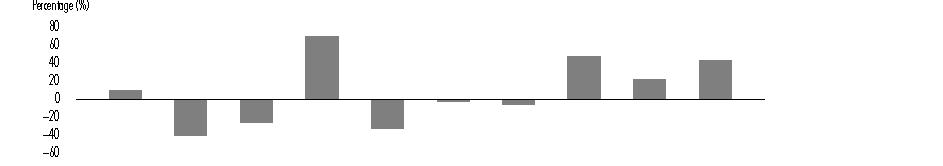

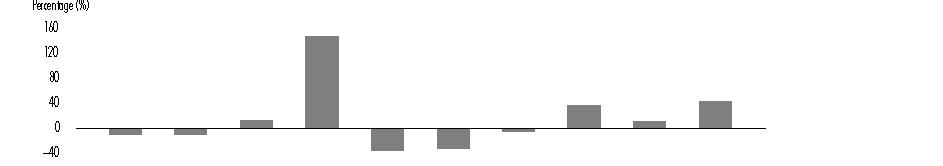

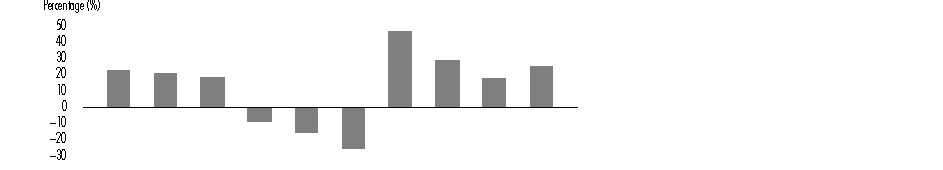

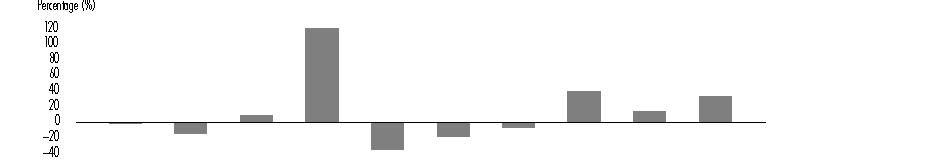

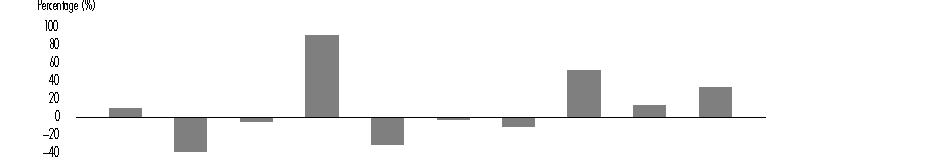

The following information illustrates the changes in each fund's performance from year to year. Please note that total returns are based on past results and are not an indication of future performance.

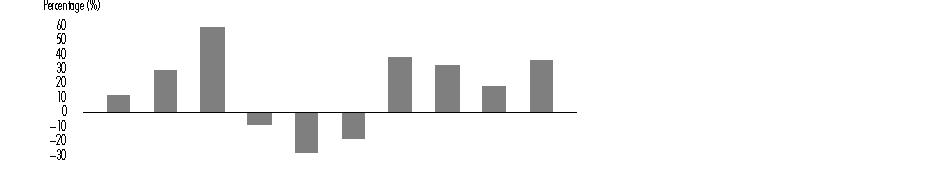

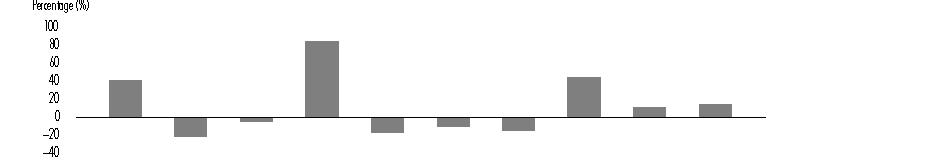

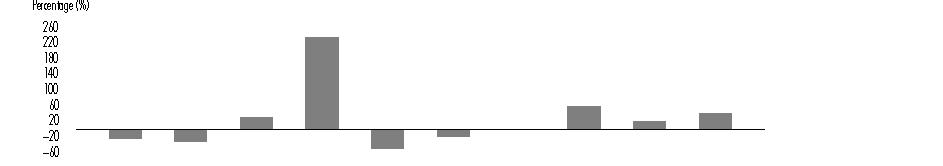

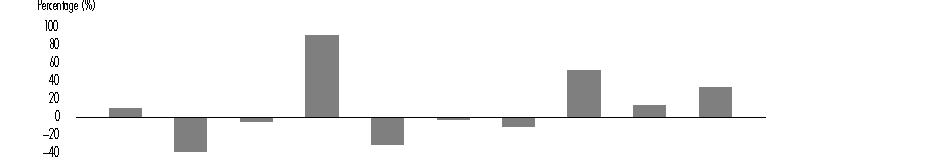

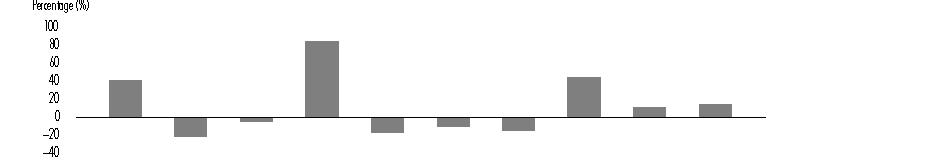

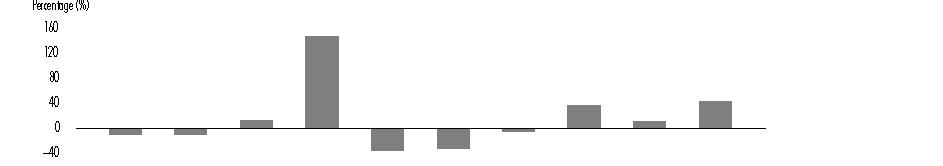

Nordic Fund |

Calendar Years | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 |

| 12.11% | 29.54% | 59.51% | -8.49% | -27.89% | -18.27% | 38.82% | 32.72% | 18.50% | 36.67% |

During the periods shown in the chart for Nordic: | Returns | Quarter ended |

<R>Highest Quarter Return</R> | <R> 39.05%</R> | <R>December 31, 1999</R> |

<R>Lowest Quarter Return</R> | <R> -24.79%</R> | <R>September 30, 2002</R> |

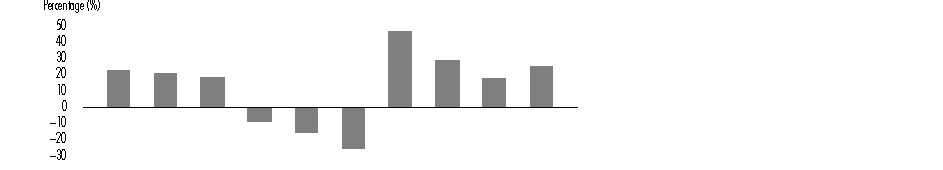

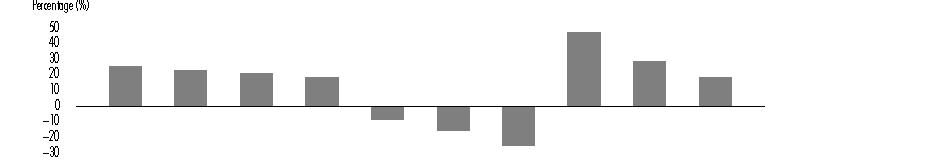

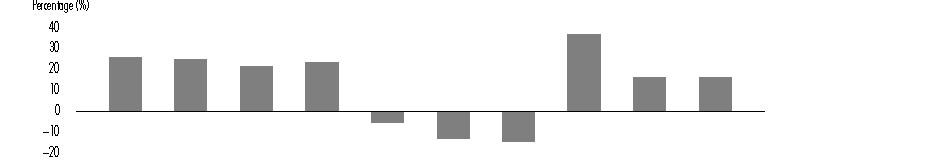

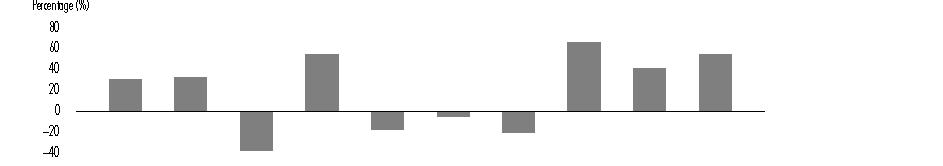

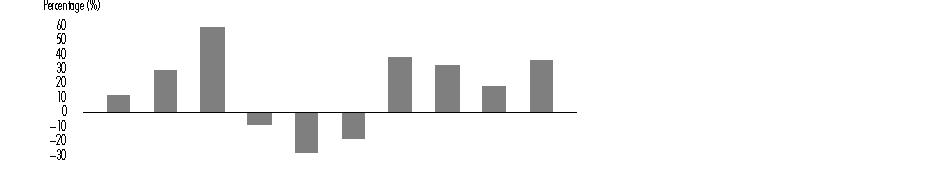

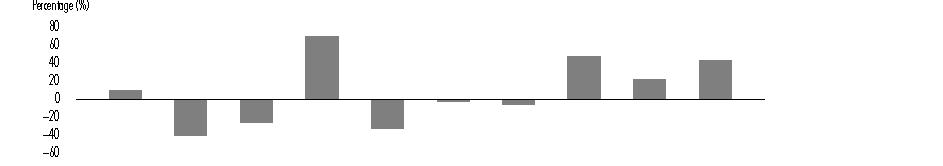

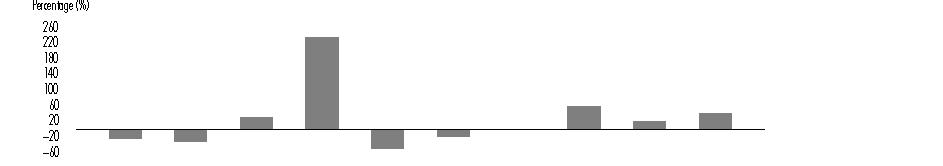

Europe Fund |

Calendar Years | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 |

| 22.89% | 20.77% | 18.69% | -9.14% | -16.03% | -25.46% | 46.91% | 28.95% | 18.17% | 25.18% |

During the periods shown in the chart for Europe: | Returns | Quarter ended |

<R>Highest Quarter Return</R> | <R> 29.36%</R> | <R>June 30, 2003</R> |

<R>Lowest Quarter Return</R> | <R> -28.01%</R> | <R>September 30, 2002</R> |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, but do not reflect the impact of state or local taxes. Return After Taxes on Distributions and Sale of Fund Shares may be higher than other returns for the same period due to a tax benefit of realizing a capital loss upon the sale of fund shares. Actual after-tax returns may differ depending on your individual circumstances. The after-tax returns shown are not relevant if you hold your shares in a retirement account or in another tax-deferred arrangement.

Average Annual Returns

(for the periods ending December 31, 2005)

| Past 1

year | Past 5

years | Past 10

years |

Nordic Fund | | | |

Return Before Taxes | 18.50% | 5.17% | 14.48% |

Return After Taxes on Distributions | 16.94% | 4.83% | 13.90% |

Return After Taxes on Distributions and Sale of Fund Shares | 14.07% | 4.45% | 12.85% |

FTSE World Nordic Index (reflects no deduction for fees, expenses, or taxes) | 15.69% | 2.64% | 13.11% |

Lipper European Region Funds Average (reflects no deduction for sales charges or taxes) | 12.29% | 5.66% | 10.90% |

Europe | | | |

Return Before Taxes | 18.17% | 6.98% | 10.91% |

Return After Taxes on Distributions | 15.47% | 6.36% | 9.56% |

Return After Taxes on Distributions and Sale of Fund Shares | 13.51% | 5.82% | 9.08% |

MSCI Europe Index (reflects no deduction for fees, expenses, or taxes) | 9.62% | 3.93% | 9.62% |

Lipper European Region Funds Average (reflects no deduction for sales charges or taxes) | 12.29% | 5.66% | 10.90% |

Forms of Organization

Nordic Fund and Europe Fund are diversified funds of the trust, an open-end management investment company organized as a Massachusetts business trust on April 20, 1984. The trust is authorized to issue an unlimited number of shares of beneficial interest. Because the funds are series of the same Massachusetts business trust, organized under the same Declaration of Trust, the rights of the security holders of Nordic Fund under state law and the governing documents are expected to remain unchanged after the Reorganization. For more information regarding shareholder rights, refer to the section of the funds' Statement of Additional Information called "Description of the Trust."

Operations of Europe Fund Following the Reorganization

FMR does not expect Europe Fund to revise its investment policies as a result of the Reorganization. In addition, FMR does not anticipate significant changes to the fund's management or to entities that provide the fund with services. Specifically, the Trustees and Officers, the investment adviser, distributor, and other entities will continue to serve Europe Fund in their current capacities. Trygve Toraasen, who is currently the portfolio manager of each fund, is expected to continue to be responsible for portfolio management of the surviving fund after the Reorganization.

All of the current investments of Nordic Fund are permissible investments for Europe Fund. Transaction costs associated with portfolio adjustments, if any, that occur between shareholder approval and the Closing Date will be borne by the fund that incurs them. Transaction costs associated with such adjustments that occur after the Closing Date will be borne by Europe Fund.

Purchases and Redemptions

The price to buy one share of each fund is the fund's net asset value (NAV). Each fund's shares are sold without a sales charge. Each fund's shares will be bought at the next NAV calculated after your investment is received in proper form. Each fund's NAV is calculated as of the close of business of the NYSE, normally 4:00 p.m. Eastern time.

To the extent that a fund's assets are traded in other markets on days when the fund is not open for business, the value of the fund's assets may be affected on those days. In addition, trading in some of a fund's assets may not occur on days when the fund is open for business.

The price to sell one share of each fund is the fund's NAV, minus the short-term redemption fee, if applicable.

For Nordic Fund, a 1.50% short-term redemption fee may be deducted from the redemption amount for shares held less than 90 days. For Europe Fund, a 1.00% short-term redemption fee may be deducted from the redemption amount for shares held less than 30 days.

On March 14, 2007, Nordic Fund closed to new accounts pending the Reorganization. Nordic Fund shareholders as of that date can continue to purchase shares of the fund. Shareholders of each fund may redeem shares through the Closing Date of the Reorganization. If the Reorganization is approved, the purchase and redemption policies of the combined fund will remain unchanged.

Refer to the funds' Prospectus for more information regarding how to buy and redeem shares.

Exchanges

An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund. The exchange privilege currently being offered by Nordic Fund and Europe Fund is the same and is not expected to change after the Reorganization.

For additional information regarding exchanges for a fund, see its Prospectus.

Management of the Funds

FMR is each fund's manager. The address of FMR is 82 Devonshire Street, Boston, Massachusetts 02109. As of March 29, 2006, FMR had approximately $9.8 billion in discretionary assets under management. As the manager, FMR has overall responsibility for directing each fund's investments and handling its business affairs.

Trygve Toraasen is vice president and manager of Europe Fund and Nordic Fund, which he has managed since January 2006 and June 1998, respectively. Since joining Fidelity Investments in 1994, Mr. Toraasen has worked as a research analyst and manager.

The funds' Statement of Additional Information, which is incorporated by reference herein, provides additional information about the compensation of, any other accounts managed by, and any fund shares held by Mr. Toraasen.

Dividends and Other Distributions

Each fund distributes substantially all of its investment company taxable income and net realized capital gains to shareholders each year. Each fund normally pays dividends and capital gain distributions in December. On or before the Closing Date, Nordic Fund may declare additional dividends or other distributions in order to distribute substantially all of its investment company taxable income and net realized capital gain.

Federal Income Tax Consequences of the Reorganization

Each fund will receive an opinion of its counsel, Dechert LLP, that the Reorganization will constitute a tax-free reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the Code). Accordingly, no gain or loss will be recognized by the funds or their shareholders as a result of the Reorganization. Please see the section entitled "Federal Income Tax Considerations" in the Proposal for more information.

THE PROPOSED TRANSACTION

TO APPROVE AN AGREEMENT AND PLAN OF REORGANIZATION BETWEEN NORDIC FUND AND EUROPE FUND.

The Proposal

Shareholders of Nordic Fund are being asked to approve the Agreement. By approving the Agreement, shareholders are approving the merger of Nordic Fund with and into Europe Fund.

Principal Investment Risks

Stock markets, especially foreign markets, are volatile, and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

Many factors can affect each fund's performance. Because FMR concentrates Nordic Fund's and Europe Fund's investments in the Nordic region and Europe, respectively, each fund's performance is expected to be closely tied to social, political, and economic conditions within the Nordic region and Europe, respectively, and to be more volatile than the performance of more geographically diversified funds. When shares are sold, they may be worth more or less than what was paid for them, which means that you could lose money.

The Nordic economies are dependent on the export of natural resources and natural resource products. Efforts to comply with the European Economic and Monetary Union (EMU) restrictions by Finland and Sweden may result in reduced government spending and higher unemployment. Denmark has elected not to join the final stage of the EMU and Norway has elected not to join both the European Union (EU) and the EMU and, as a result, these countries may have more flexibility to pursue different fiscal and economic goals.

Europe includes both developed and emerging markets. Most developed countries in Western Europe are members of the EU, and many are also members of the EMU. European countries can be significantly affected by the tight fiscal and monetary controls that the EMU imposes on its members or requires candidates for EMU membership to comply with. Unemployment in Europe has historically been higher than in the United States. Eastern European countries generally continue to move toward market economies.

For more information about the principal investment risks of Nordic Fund and Europe Fund, please see the funds' Prospectus.

Reorganization Plan

The terms and conditions under which the proposed transaction may be consummated are set forth in the Agreement. Significant provisions of the Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Agreement, a copy of which is attached as Exhibit 1 to this Proxy Statement.

The Agreement contemplates (a) Europe Fund acquiring as of the Closing Date all of the assets of Nordic Fund in exchange solely for shares of Europe Fund and the assumption by Europe Fund of Nordic Fund's liabilities; and (b) the distribution of shares of Europe Fund to the shareholders of Nordic Fund in complete liquidation and termination of Nordic Fund as provided for in the Agreement.

The value of Nordic Fund's assets to be acquired by Europe Fund and the amount of its liabilities to be assumed by Europe Fund will be determined as of the close of business of the NYSE on the Closing Date, using the valuation procedures set forth in Nordic Fund's then-current Prospectus and Statement of Additional Information. The NAV of a share of Europe Fund will be determined as of the same time using the valuation procedures set forth in its then-current Prospectus and Statement of Additional Information.

As of the Closing Date, Europe Fund will deliver to Nordic Fund, and Nordic Fund will distribute to its shareholders of record, shares of Europe Fund, so that each Nordic Fund shareholder will receive the number of full and fractional shares of Europe Fund equal in value to the aggregate NAV of shares of Nordic Fund held by such shareholder on the Closing Date; Nordic Fund will be liquidated as soon as practicable thereafter. Each Nordic Fund shareholder's account shall be credited with the respective pro rata number of full and fractional shares of Europe Fund due that shareholder.

Accordingly, immediately after the Reorganization, each former Nordic Fund shareholder will own shares of Europe Fund equal to the aggregate NAV of that shareholder's shares of Nordic Fund immediately prior to the Reorganization. The NAV per share of Europe Fund will be unchanged by the transaction. Thus, the Reorganization will not result in a dilution of any shareholder's interest.

Any transfer taxes payable upon issuance of shares of Europe Fund in a name other than that of the registered holder of the shares on the books of Nordic Fund as of that time shall be paid by the person to whom such shares are to be issued as a condition of such transfer. Any reporting responsibility of Nordic Fund is and will continue to be its responsibility up to and including the Closing Date and such later date on which Nordic Fund is liquidated.

The outcome of the shareholder vote will determine who pays the expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations. If shareholders approve the Reorganization, Nordic Fund will pay the expenses provided that if expenses exceed Nordic Fund's existing voluntary expense cap of 1.25%, the expenses exceeding Nordic Fund's voluntary expense cap will be paid by FMR. If shareholders do not approve the Reorganization, all expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be paid by FMR. Brokerage firms and others will be reimbursed for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

The consummation of the Reorganization is subject to a number of conditions set forth in the Agreement, some of which may be waived by a fund. In addition, the Agreement may be amended in any mutually agreeable manner, except that no amendment that may have a materially adverse effect on Nordic Fund's shareholders' interests may be made subsequent to the Meeting.

Reasons for the Reorganization

The Board of Trustees (the Board) of each fund has determined that the Reorganization is in the best interests of the shareholders of each fund and that the Reorganization will not result in a dilution of the interests of shareholders of either fund. The Board has unanimously approved the Agreement and the Reorganization and recommends that Nordic Fund shareholders vote in favor of the Reorganization by approving the Agreement.

In considering the Reorganization, the Board considered a number of factors, including the following:

(1) the compatibility of the funds' investment objectives and policies;

(2) various potential shareholder benefits of the Reorganization;

(3) the historical performance of the funds;

(4) the relative expense ratios of the funds;

(5) the costs to be incurred by each fund as a result of the Reorganization;

(6) the tax consequences of the Reorganization;

(7) the relative size of the funds;

(8) the elimination of duplicative funds; and

(9) the benefits to FMR and its affiliates.

FMR recommended the Reorganization to the Board at a meeting of the Board on December 14, 2006.

The Board noted that the funds already have the same manager (Trygve Toraasen) and have similar objectives.

In recommending the Reorganization, FMR advised the Board that the Reorganization would provide Nordic Fund shareholders with the opportunity to invest in a larger, more diversified fund, with a less volatile benchmark index. Nordic Fund's benchmark, the FTSE World Nordic Index, is a market capitalization-weighted index of stocks traded in various Scandinavian markets, designed to measure equity performance in the Scandinavian markets. Europe Fund's benchmark, MSCI Europe Index, is a market capitalization-weighted index of equity securities of companies domiciled in various European countries. As of November 30, 2006, the Nordic region made up approximately 8% of the European market, as represented by the MSCI Europe Index.

The Board considered that the Nordic market, as represented by the FTSE World Nordic Index, has exhibited greater volatility than Europe as a whole over the past 10 years. The Board also considered that the FTSE World Nordic Index tends to be highly concentrated, with the top ten constituents accounting for 50% to 60% of the total market capitalization over the past 10 years. The Nordic Fund's holdings have been similarly concentrated. In comparison, the top 10 constituents of the MSCI Europe Index have accounted for 20% to 27% over the same period.

In recommending the Reorganization, FMR acknowledged that Nordic Fund's performance has been strong, but also noted that the historical performance of the Europe and Nordic markets has been highly correlated. In FMR's view, the Nordic region has not provided significant diversification from developed Europe as a whole. The Board considered, too, that the Nordic region's relative outperformance (relative to Europe as a whole) has largely been attributable to securities of global technology and energy companies, whose economic fortunes are not closely related to the Nordic region. The Board determined that Nordic Fund shareholders would benefit from investing in the larger, more diversified Europe Fund.

While the pro forma expenses show that the Nordic Fund would have paid approximately 0.02% more in total operating expenses over the 12 months ended October 31, 2006 had the reorganization occurred at the beginning of the period, FMR advised the Board that this difference was attributable primarily to the performance adjustment component of the Europe Fund's management fee. While noting that the Europe Fund may pay a higher management fee to FMR than the Nordic Fund in times where the Europe Fund outperforms relative to the MSCI Europe Index, the Board considered that the Europe Fund may also pay a lower management fee to FMR than the Nordic Fund in times where the Europe Fund underperforms relative to the MSCI Europe Index. In addition, FMR advised the Board that Europe Fund's expense ratio, excluding performance fees, was actually 0.11% lower than Nordic Fund's for the 12 months ended October 31, 2006, mainly due to lower transfer agent and other operating expenses. The Board considered that the Nordic Fund's shareholders may benefit from the lower transfer agent and other operating expenses of the Europe Fund.

Expense Data

for the 12 months ended October 31, 2006

| | Management Fee | | | |

Fund | Average

Assets ($M) | Basic Fee | Performance Adjustment | Total

Management Fee | TA and

Other

Operating

Expenses* | Total

Expenses | Total

Expenses

Excluding Performance Fees |

Nordic Fund | $286 | 0.71% | -- | 0.71% | 0.43% | 1.14% | 1.14% |

Europe Fund | $3,261 | 0.71% | 0.13% | 0.84% | 0.32% | 1.16% | 1.03% |

Pro Forma: | | | | | | | |

Europe Fund | $3,529 | 0.71% | 0.13% | 0.84% | 0.32% | 1.16% | 1.03% |

*Excluding interest and brokerage credits.

The Board also considered the proposed Reorganization in the context of the general goal of offering funds that can be used to build a diversified portfolio in conjunction with effective asset allocation tools. The Board considered FMR's belief that Nordic Fund does not fit within the broader context of an investor's asset allocation. There is no category of single-country Europe mutual funds that complement the Nordic Fund in a "building block" context, nor is FMR aware of any regularly published, broadly accessible research on the expected returns and correlations of the Nordic region to other asset classes that would be useful in making an asset allocation to this region. In FMR's view, Nordic Fund represents too close a fit to Europe to offer any distinctive characteristics that would justify maintaining Nordic Fund in addition to Europe Fund.

Finally, the Board considered that if Nordic Fund shareholders do not approve the Reorganization, FMR will pay all costs associated with the Reorganization. If Nordic Fund shareholders vote in favor of the Reorganization, Nordic Fund will pay expenses (up to Nordic Fund's expense limitation) in connection with the Reorganization, including any expenses related to the Proxy Statement and any solicitation costs, with any Reorganization expenses in excess of that limitation to be paid by FMR.

The Reorganization is intended to permit Nordic Fund shareholders to exchange their investment for an investment in Europe Fund without recognizing gain or loss for federal income tax purposes. By contrast, if a Nordic Fund shareholder were to redeem his or her shares to invest in Europe Fund or another fund, the transaction would likely be a taxable event for the shareholder. After the Reorganization, shareholders may redeem any or all of their Europe Fund shares at net asset value at any time, at which point they would recognize a taxable gain or loss.

Description of the Securities to be Issued

The trust is registered with the SEC as an open-end management investment company. The Trustees of the trust are authorized to issue an unlimited number of shares of beneficial interest of separate series. Each share of Europe Fund represents an equal proportionate interest with each other share of the fund, and each such share of Europe Fund is entitled to equal voting, dividend, liquidation, and redemption rights. Each shareholder of the fund is entitled to one vote for each dollar value of net asset value of the fund that shareholder owns. Shares of Europe Fund have no preemptive or conversion rights. The voting and dividend rights, the right of redemption, and the privilege of exchange are described in the fund's Prospectus. Shares are fully paid and nonassessable, except as set forth in the fund's Statement of Additional Information under the heading "Shareholder Liability."

The trust is not required to hold annual meetings of shareholders, and the trust currently does not intend to hold regular shareholder meetings. The trust is required to call a meeting of shareholders for the purposes of electing Trustees if, at any time, less than a majority of the Trustees holding office have been elected by shareholders, at which time the Trustees then in office will call a shareholder meeting for the election of Trustees. Under the 1940 Act, shareholders of record of at least two-thirds of the outstanding shares of the trust may remove a Trustee by votes cast in person or by proxy at a meeting called for that purpose. The Trustees also are required to call a meeting of shareholders for the purpose of voting upon the question of removal of any Trustee when requested in writing to do so by the shareholders of record holding at least 10% of the trust's outstanding shares.

Federal Income Tax Considerations

The exchange of Nordic Fund's assets for Europe Fund's shares and the assumption of the liabilities of Nordic Fund by Europe Fund is intended to qualify for federal income tax purposes as a tax-free reorganization under the Code. With respect to the Reorganization, the participating funds will receive an opinion from Dechert LLP, counsel to Nordic Fund and Europe Fund, substantially to the effect that:

(i) The acquisition by Europe Fund of all of the assets of Nordic Fund solely in exchange for Europe Fund shares and the assumption by Europe Fund of Nordic Fund's liabilities, followed by the distribution by Nordic Fund of Europe Fund shares to the shareholders of Nordic Fund pursuant to the liquidation of Nordic Fund and constructively in exchange for their Nordic Fund shares, will constitute a reorganization within the meaning of section 368(a) of the Code;

(ii) No gain or loss will be recognized by Nordic Fund upon the transfer of all of its assets to Europe Fund in exchange solely for Europe Fund shares and Europe Fund's assumption of Nordic Fund's liabilities, followed by Nordic Fund's subsequent distribution of those shares to shareholders in liquidation of Nordic Fund;

(iii) No gain or loss will be recognized by Europe Fund upon the receipt of the assets of Nordic Fund in exchange solely for Europe Fund shares and its assumption of Nordic Fund's liabilities;

(iv) The shareholders of Nordic Fund will recognize no gain or loss upon the exchange of their Nordic Fund shares solely for Europe Fund shares;

(v) The basis of Nordic Fund's assets in the hands of Europe Fund will be the same as the basis of those assets in the hands of Nordic Fund immediately prior to the Reorganization, and the holding period of those assets in the hands of Europe Fund will include the holding period of those assets in the hands of Nordic Fund (except where investment activities of Europe Fund have the effect of reducing or eliminating a holding period with respect to an asset);

(vi) The basis of Nordic Fund shareholders in Europe Fund shares will be the same as their basis in Nordic Fund shares to be surrendered in exchange therefor; and

(vii) The holding period of the Europe Fund shares to be received by the Nordic Fund shareholders will include the period during which the Nordic Fund shares to be surrendered in exchange therefor were held, provided such Nordic Fund shares are held as capital assets by those shareholders on the date of the Reorganization.

Shareholders of Nordic Fund should consult their tax advisers regarding the effect, if any, of the Reorganization in light of their individual circumstances. Because the foregoing discussion only relates to the federal income tax consequences of the Reorganization, Nordic Fund's shareholders also should consult their tax advisers as to state and local tax consequences, if any, of the Reorganization.

Capitalization

The following table shows the capitalization of the funds as of October 31, 2006 and on a pro forma combined basis (unaudited) as of that date giving effect to the Reorganization.

| Net Assets | Net Asset Value Per Share | Shares Outstanding |

Nordic Fund | $ 348,482,355 | $ 36.58 | 9,525,813 |

Europe Fund | $ 4,033,263,044 | $ 42.31 | 95,319,221 |

Pro Forma Combined Fund | $ 4,381,745,399 | $ 42.31 | 103,555,627 |

The capitalization table above assumes that the Reorganization was consummated on October 31, 2006, and is for information purposes only. No assurance can be given as to how many shares of Europe Fund will be received by shareholders of Nordic Fund on the date the Reorganization takes place, and the foregoing should not be relied upon to reflect the number of shares of Europe Fund that actually will be received on or after such date.

Conclusion

The Agreement and the Reorganization were approved by the Board at a meeting held on December 14, 2006. The Board of Trustees of the trust determined that the proposed Reorganization is in the best interests of shareholders of each fund and that the interests of existing shareholders of Nordic Fund and Europe Fund would not be diluted as a result of the Reorganization. In the event that the Reorganization is not consummated, Nordic Fund will continue to engage in business as a fund of a registered investment company and the Board of Trustees of the trust will consider other proposals for the reorganization or liquidation of the fund.

The Trustees of Fidelity Investment Trust unanimously recommend approval of the Agreement and Plan of Reorganization.

ADDITIONAL INFORMATION ABOUT EUROPE FUND

Europe Fund's Prospectus dated December 30, 2006, is enclosed with this Proxy Statement and is incorporated herein by reference. The Prospectus contains additional information about the fund including its investment objective and policies, investment adviser, advisory fees and expenses, organization, and procedures for purchasing and redeeming shares. The prospectus also contains Europe Fund's financial highlights for the fiscal year ended October 31, 2006, as shown below:

Europe

Years ended October 31, | 2006 | 2005 | 2004 | 2003 | 2002 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 37.26 | $ 30.42 | $ 24.37 | $ 18.31 | $ 22.68 |

Income from Investment Operations | | | | | |

Net investment income (loss) D | .58 | .33 | .09 | .29 | .12 G |

Net realized and unrealized gain (loss) | 8.74 | 6.68 | 6.25 | 5.91 | (4.25) |

Total from investment operations | 9.32 | 7.01 | 6.34 | 6.20 | (4.13) |

Distributions from net investment income | (.30) | (.09) | (.29) | (.14) | (.24) |

Distributions from net realized gain | (3.97) | (.08) | - | - | - |

Total distributions | (4.27) | (.17) | (.29) | (.14) | (.24) |

Redemption fees added to paid in capital D, I | - | - | - | - | - |

Net asset value, end of period | $ 42.31 | $ 37.26 | $ 30.42 | $ 24.37 | $ 18.31 |

Total Return A, B, C | 27.40% | 23.12% | 26.20% | 34.09% | (18.49)% |

Ratios to Average Net Assets E, H | | | | | |

Expenses before reductions | 1.16% | 1.15% | 1.11% | 1.03% | 1.20% |

Expenses net of fee waivers, if any | 1.16% | 1.15% | 1.11% | 1.03% | 1.20% |

Expenses net of all reductions | 1.05% | 1.07% | 1.05% | .98% | 1.13% |

Net investment income (loss) | 1.48% | .95% | .32% | 1.44% | .52% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 4,033,263 | $ 2,547,812 | $ 1,845,440 | $ 1,283,191 | $ 875,995 |

Portfolio turnover rate F | 127% | 99% | 106% | 162% | 127% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the former sales charges.

C Total returns do not include the effect of the former contingent deferred sales charge.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expense of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Investment income per share reflects a special dividend which amounted to $.05 per share.

H Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

I Amount represents less than $.01 per share.

MISCELLANEOUS

Legal Matters. Certain legal matters in connection with the issuance of Europe Fund shares have been passed upon by Dechert LLP, counsel to the trust.

Experts. The audited financial statements of Nordic Fund and Europe Fund incorporated by reference into the Statement of Additional Information, have been examined by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose report thereon is included in the Annual Report to Shareholders for the fiscal year ended October 31, 2006. The financial statements audited by PricewaterhouseCoopers LLP have been incorporated by reference in reliance on their reports given on their authority as experts in auditing and accounting.

Available Information. Fidelity Investment Trust is subject to the informational requirements of the Securities and Exchange Act of 1934 and the 1940 Act, and in accordance therewith file reports, proxy material, and other information with the Commission. Such reports, proxy material, and other information can be inspected and copied at the SEC's Public Reference Room in Washington D.C. Copies of such material can also be obtained from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington D.C. 20549, at prescribed rates.

Notice to Banks, Broker-Dealers and Voting Trustees and Their Nominees. Please advise Fidelity Investment Trust, in care of Fidelity Service Company, Inc., P.O. Box 789, Boston, MA 02109, whether other persons are beneficial owners of shares for which proxies are being solicited and, if so, the number of copies of the Proxy Statement you wish to receive in order to supply copies to the beneficial owners of the respective shares.

Attachment 1

EXCERPTS FROM THE ANNUAL REPORT OF FIDELITY EUROPE FUND

DATED OCTOBER 31, 2006

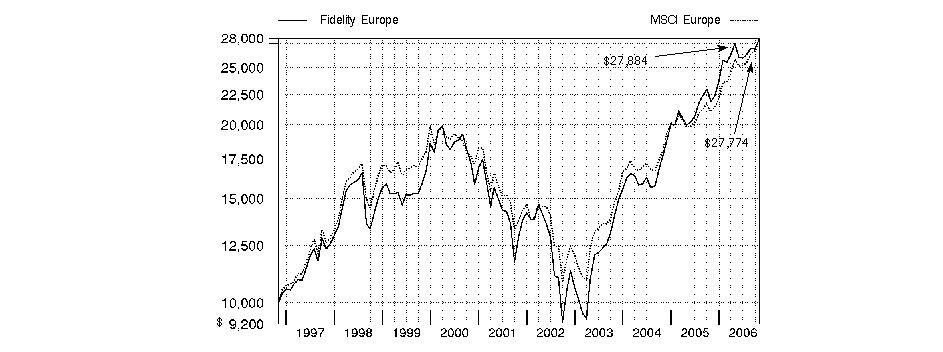

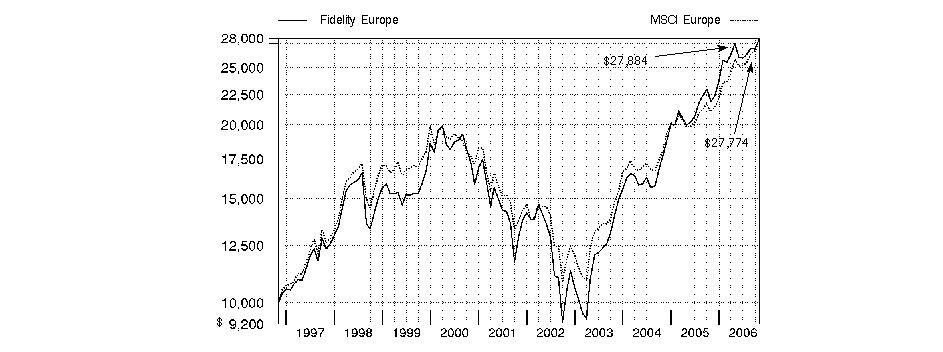

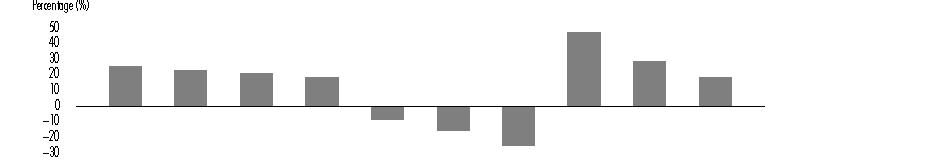

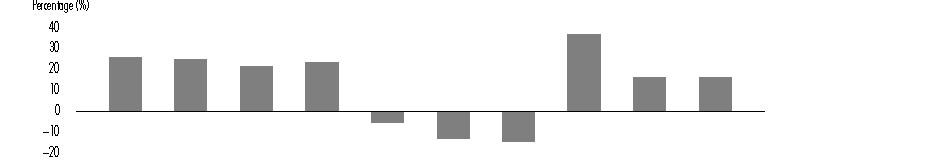

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended

October 31, 2006 | Past 1

year | Past 5

years | Past 10

years |

Fidelity Europe Fund | 27.40% | 16.69% | 10.80% |

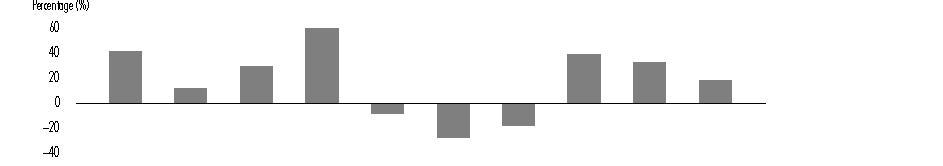

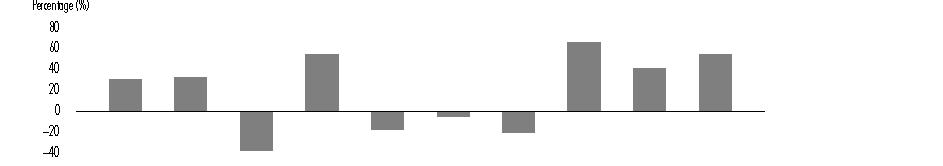

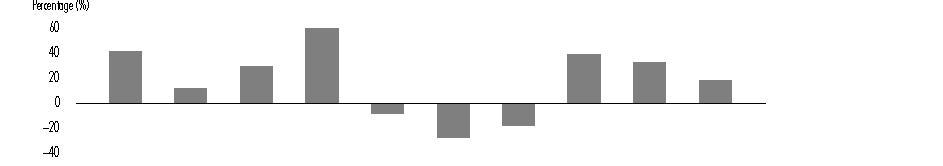

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Europe Fund on October 31, 1996. The chart shows how the value of your investment would have changed, and also shows how the MSCI Europe Index performed over the same period.

Comments from Trygve Toraasen, Portfolio Manager of Fidelity® Europe Fund