A SELF-CONTAINED APPRAISAL REPORT OF

The “As Is” Market Value of a

128-unit apartment complex

Known as Chimney Square

Located at 3201 South 23rd Street

Abilene, Texas

File No. 06-1385

PREPARED FOR

Mr. John Werra

Univesco

2800 North Dallas Parkway, Ste 100

Dallas, TX 75093

EFFECTIVE DATE OF APPRAISAL

January 2, 2007

PREPARED BY

Deverick & Associates, Inc.

5420 LBJ Freeway, Suite 1335

Dallas, Texas 75240

| DEVERICK & ASSOCIATES, INC AUSTIN • DALLAS • HOUSTON • OKLAHOMA CITY • SAN ANTONIO • TULSA WWW.DEVERICK.COM | |

| | |

| | |

| | | |

Mr. John Werra

Univesco

2800 North Dallas Parkway, Ste 100 Dallas, TX 75093

Re: An appraisal report, File No. 06-1385 of the "As Is" Fee Simple Estate Market Value of a 128-unit apartment complex, known as Chimney Square, located at 3201 South 23rd Street, Abilene, Texas.

Dear Mr. Werra:

Per your request, we have made an investigation and analysis of the following described property and the improvements associated with the site:

Two tracts of land totaling 7.589 acres with Tract I (7.194 acres) being described as all of Lot 2, Block A and Tract I (0.395 acres) being described as the easterly 50' of Lot 3, Block A, Chimney Square Addition, City of Abilene, Taylor County, Texas

The subject appraisal has been prepared in order to estimate the market value as defined subsequently in this report, where the value reported reflects a market value for the rights in realty. Information provided by Univesco or the property owner and used in this analysis includes a site plan, floor plans, current rent roll, historic operating statements and property specific data.

The subject property was physically inspected on January 2, 2007, and the value reported is based on the date of inspection. The reported value is based on the subject's "As Is" condition, as of the date reported.

This appraisal report has been prepared and reviewed by staff appraisers associated with Deverick & Associates, Inc., each of whom is recognized and acknowledged by individual resume and by signature on the Certificate following the Correlation and Final Value Estimate.

We are unbiased with respect to the parties involved and have no present nor contemplated future interest in the property appraised. Accordingly, statements of fact are to the best of our knowledge correct, and compensation for making the appraisal has in no manner been contingent upon the value conclusions reported herein.

The appraisal assignment was drafted under Standards Rule 2-2, as defined in the Uniform Standards of Professional Practice (USPAP), and performed under Standards Rule 1 of USPAP which satisfies the requirements of Title 12 of the Federal Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA), and the regulations promulgated thereunder. This report also complies with Univesco appraisal guidelines.

COMMERCIAL REAL ESTATE APPRAISAL, BROKERAGE & CONSULTING

Dallas Office 5420 LBJ Freeway, Suite 1335, Dallas, Texas 75240 (972) 458-0001 Fax (214) 550-2594

WWW. DEVERICK.COM

Mr. John Werra

January 4, 2007

Page Two

In the case of the subject property, it is our opinion that it would require under 12 months of marketing and exposure time to realize the total market value potential of the property. This report is prepared subject to the "Certification and Final Value Estimate" and certain assumptions and limiting conditions which are delineated within the text of this report. Any use of this study should be done only after thoroughly reviewing the summary of all such assumptions and limiting conditions. The property is being appraised assuming that there are no environmental conditions nor other hazards adversely affecting the subject.

Based on our investigation and analyses, it is our opinion that the "As Is" Market Value of the subject property’s Fee Simple Estate (subject to short-term leases), as of January 2, 2007, is:

FIVE MILLION TWO HUNDRED FIFTY THOUSAND DOLLARS

$5,250,000

The following report provides an analysis of the subject property and its relationship to the neighborhood and general market conditions. The report also sets forth the methodology utilized in our analysis.

Respectfully submitted, Deverick & Associates, Inc. | | |

John D. Jordan, MAI Principal/Appraiser State Certified Appraiser TX-1321 156-G | | Victor K. Thomas Inspecting Appraiser State Certified Appraiser TX-1335034-G |

TABLE OF CONTENTS

PART I - INTRODUCTION | PAGE |

Letter of Transmittal | i |

Table of Contents | iii |

PART II - NATURE OF ASSIGNMENT | |

Summary of Salient Facts & Conclusions | 1 |

| Subject Photographs | 6 |

| Assumptions & Limiting Conditions | 8 |

| Property Identification | 14 |

| Purpose and Date of Appraisal | 14 |

| Property Rights Appraised | 14 |

| Definition of Market Value | 15 |

| Scope of The Assignment | 16 |

| History of Ownership | 17 |

| Real Estate/Business Tax Information | 18 |

PART III - REGIONAL AND NEIGHBORHOOD ANALYSIS |

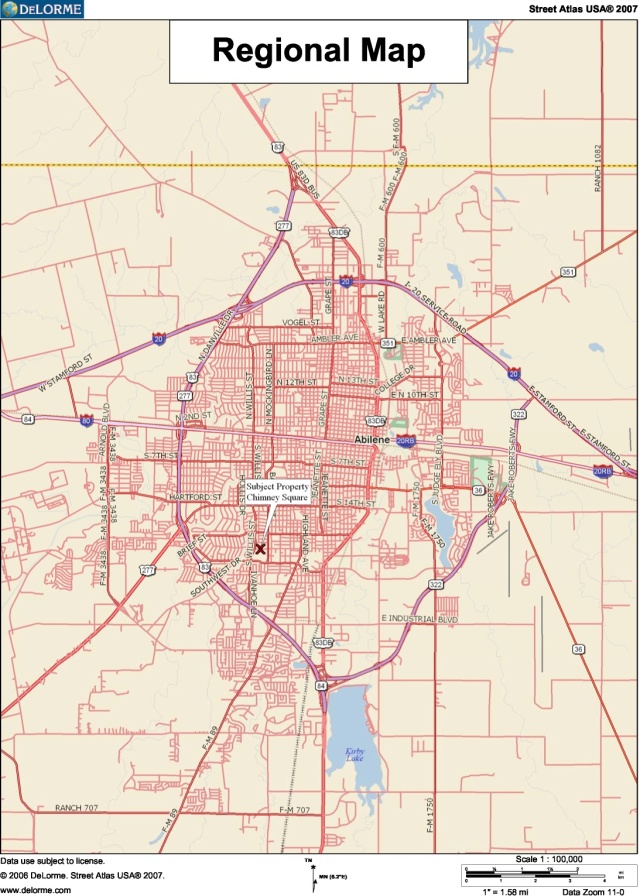

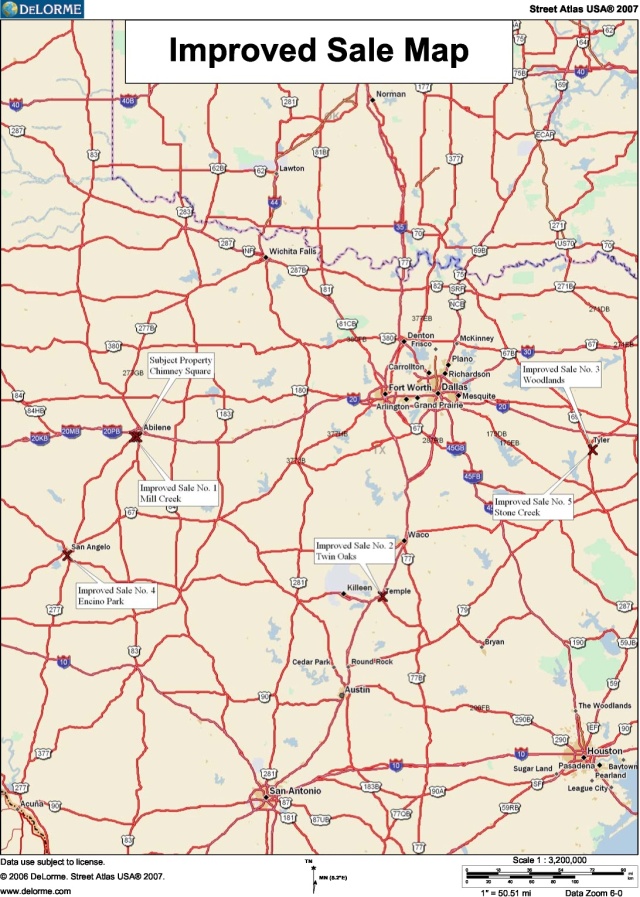

Regional Map | 23 |

| Regional Analysis | 24 |

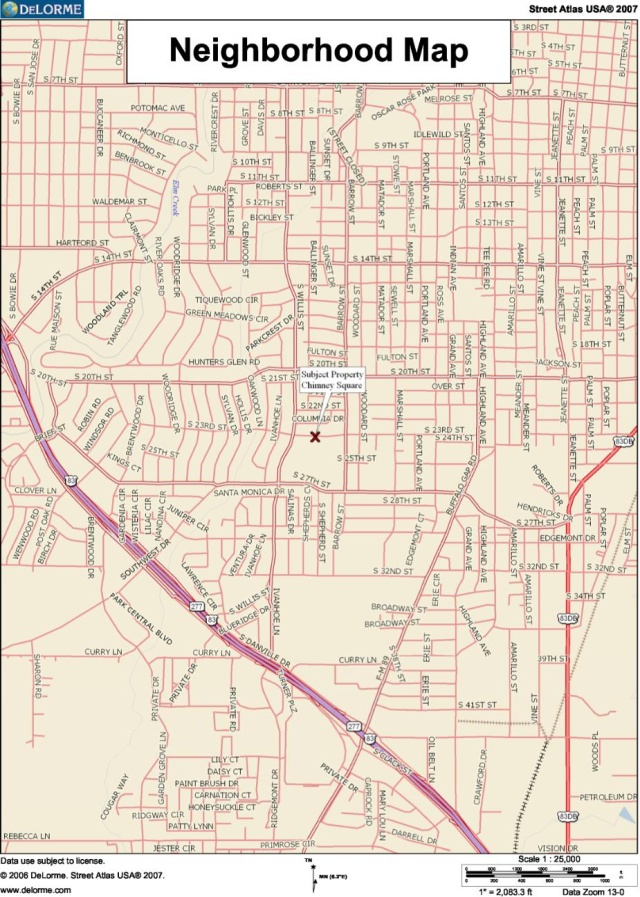

| Neighborhood Map | 31 |

| Neighborhood Analysis | 32 |

| Apartment Submarket Analysis | 36 |

PART IV - SUBJECT PROPERTY DATA | |

Site Analysis | 39 |

| Description of Improvements | 41 |

| Highest and Best Use Analysis | 44 |

PART V - VALUATION AND CONCLUSIONS | PAGE |

The Appraisal Process | 49 |

| Cost Approach | 51 |

Replacement Cost of Improvements | 51 |

Insurable Value | 55 |

| Sales Comparison Approach to Value | 56 |

Comparable Improved Sales | 58 |

Comparable Improved Sales Location Map | 68 |

Sales Comparison Approach Analysis | 69 |

NOI / Price Relationship | 75 |

EGIM | 77 |

Conclusion | 78 |

| Income Approach to Value | 80 |

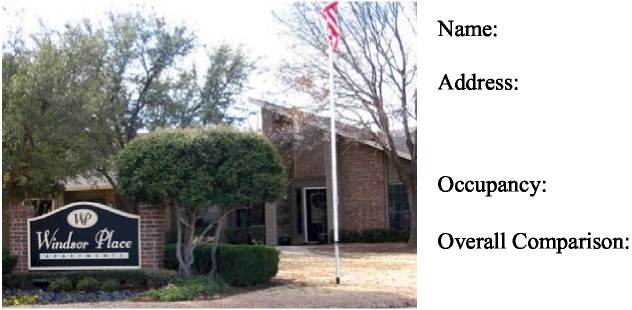

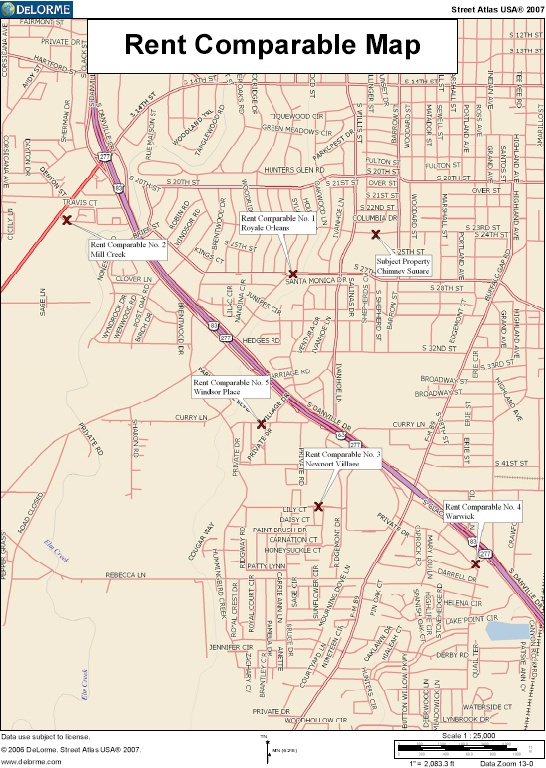

Comparable Rentals | 82 |

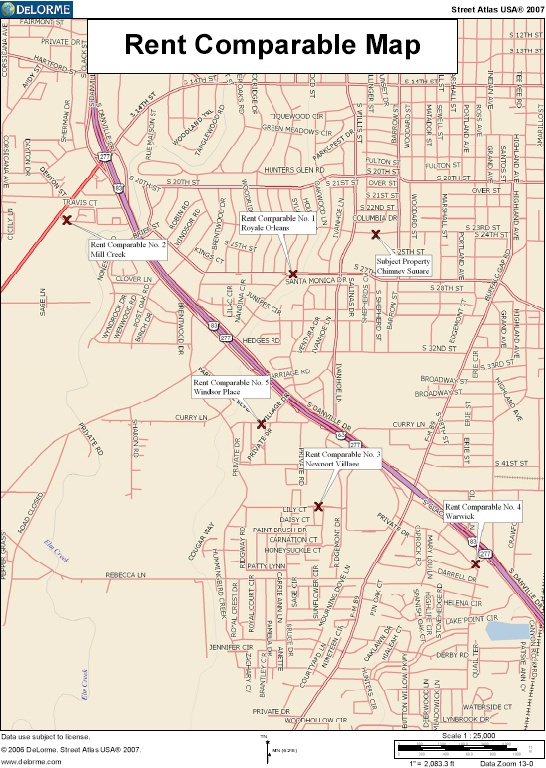

Comparable Rentals Location Map | 94 |

Income Analysis | 95 |

Expense Analysis | 102 |

Subject's Pro-Forma | 110 |

Direct Capitalization | 111 |

Conclusions | 114 |

| Reconciliation and Final Estimate of Value | 115 |

| Marketing/Exposure Time Period | 116 |

| Certification of Value | 117 |

Qualifications of Appraisers | 119 |

ADDENDA

Addendum A - Financial Exhibits

Addendum B - Site and Improvement Exhibits Addendum C - Fee Agreement

PART II NATURE OF THE ASSIGNMENT |

| Name: | Chimney Square |

| | |

| Legal Description: | Two tracts of land totaling 7.5 89 acres with Tract I (7.194 acres) being described as all of Lot 2, Block A and Tract II (0.395 acres) being described as the easterly 50' of Lot 3, Block A, Chimney Square Addition, City of Abilene, Taylor County, Texas |

| | |

| Property Type: | 128-unit apartment complex |

| | |

| Location: | The property is located along the south side of South 23rd Street, just east of South Willis Street in the south-central portion of the City of Abilene. |

| | |

| Address: | 3201 South 23rd Street |

| | |

| City: | Abilene |

| | |

| County: | Taylor |

| | |

| State: | Texas |

| | |

| Zip Code: | 79605 |

| | |

| Site Description: | The site reflects an irregular, but useable, shaped tract with level topography that appears adequate for drainage. |

| | |

| Land Area: | 7.589 acres or 330,577 square feet (per Survey) |

| | |

| Frontage/Access: | The site has adequate frontage and access with approximately 310 feet of frontage along the south side of South 23rd Street with one, double curb-cut allowing ingress and egress. The site also has a 50 foot wide exclusive easement at the southeast corner of the property that allows direct access to South 27th Street. Overall, access to the site is considered good. |

| | |

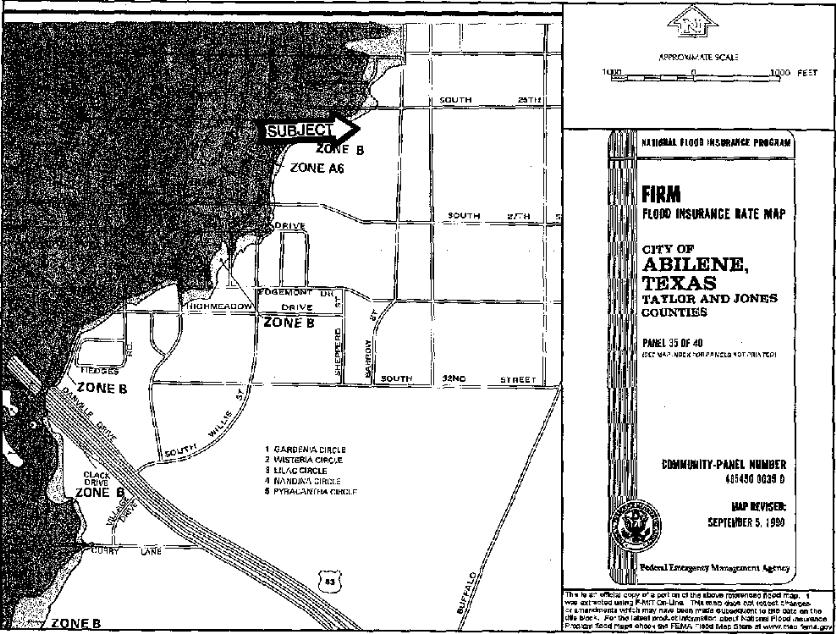

| Flood Hazard: | The site exhibits a level topography. According to FEMA Community Panel #4854500035D, dated September 5, 1990, a small portion of the site lies within Zone B and Zone A6, both of which are defined as flood hazard areas for which flood depths have been determined. Flood insurance is available and is recommended. The majority of the site is in Zone X, beyond the 100-year flood plain. We recommend that the services of a qualified professional surveyor be retained to make a determination of the impact of flood area designations. |

| | |

| Utilities: | All public utilities are available and with adequate capacity for the existing use. Electricity is individually or tenant metered and water/sewer is master-metered and paid by the property. |

| | |

| | Water/Sewer - City of Abilene |

| | |

| | Electric - Green Mountain |

| | |

| | Telephone - AT&T |

| | |

| Zoning: | RM-2 (Multi-family residential) |

| | |

| Permitted Uses: | The site is zoned RM-2, Multi-Family District by the City of Abilene. This district is intended for medium to high density development of multi-family residences. Based on the current zoning, it appears that the subject improvements represent a legal and conforming use. |

| | |

| Soil Conditions: | In the absence of a soil survey, it is assumed that the subject soils are capable of supporting a moderate scale development. |

| | |

| Easements/Encroachments: | Upon review of the survey provided, it appears the subject is not adversely affected by any detrimental easements or encroachments. It is assumed that there are no adverse easements or encroachments. |

| | |

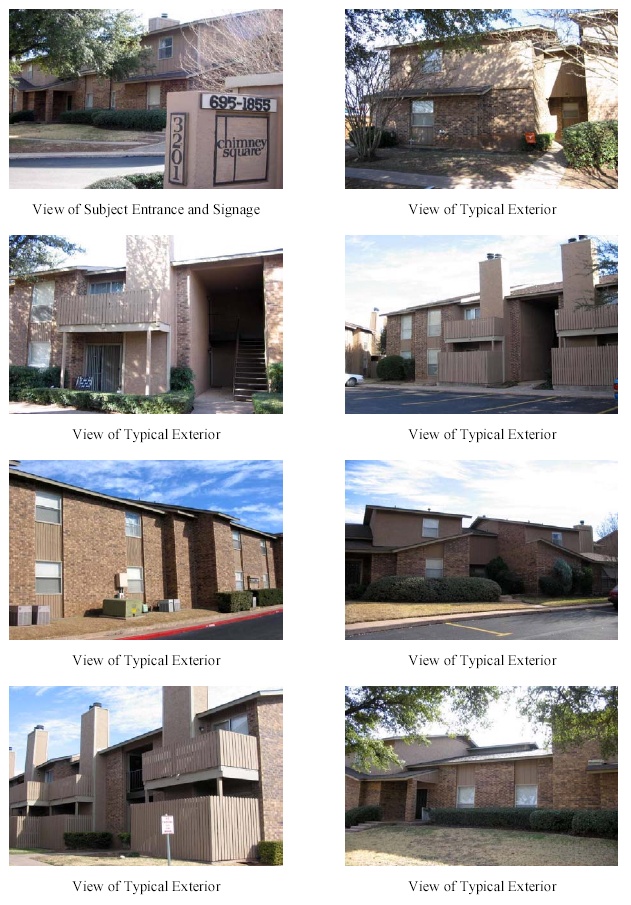

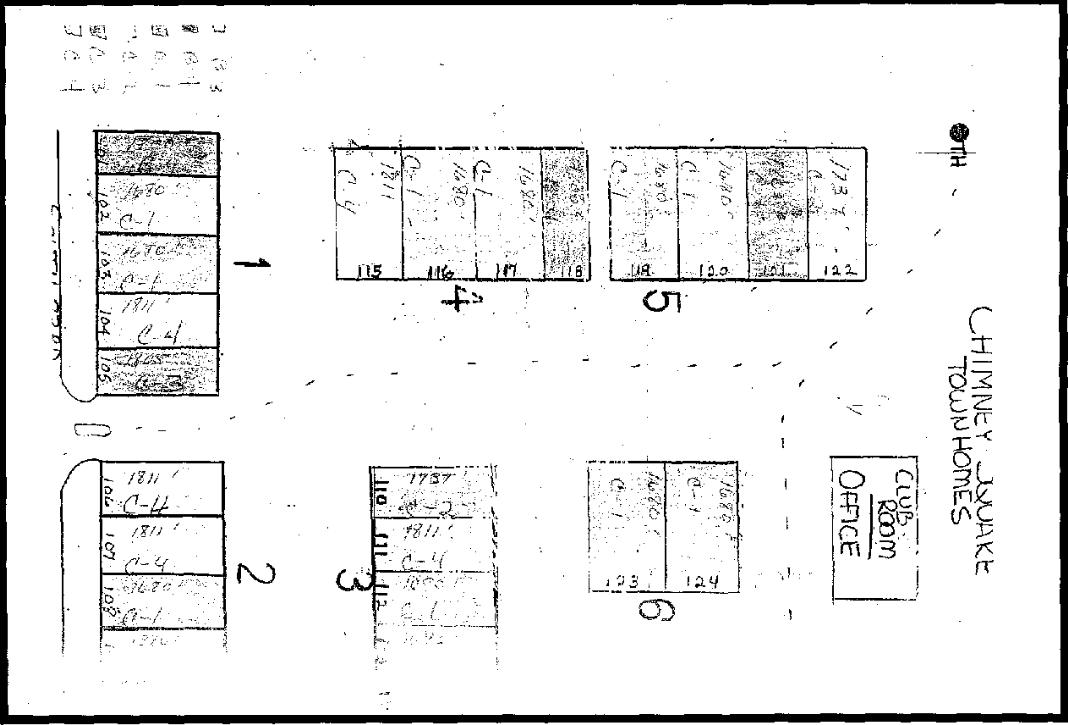

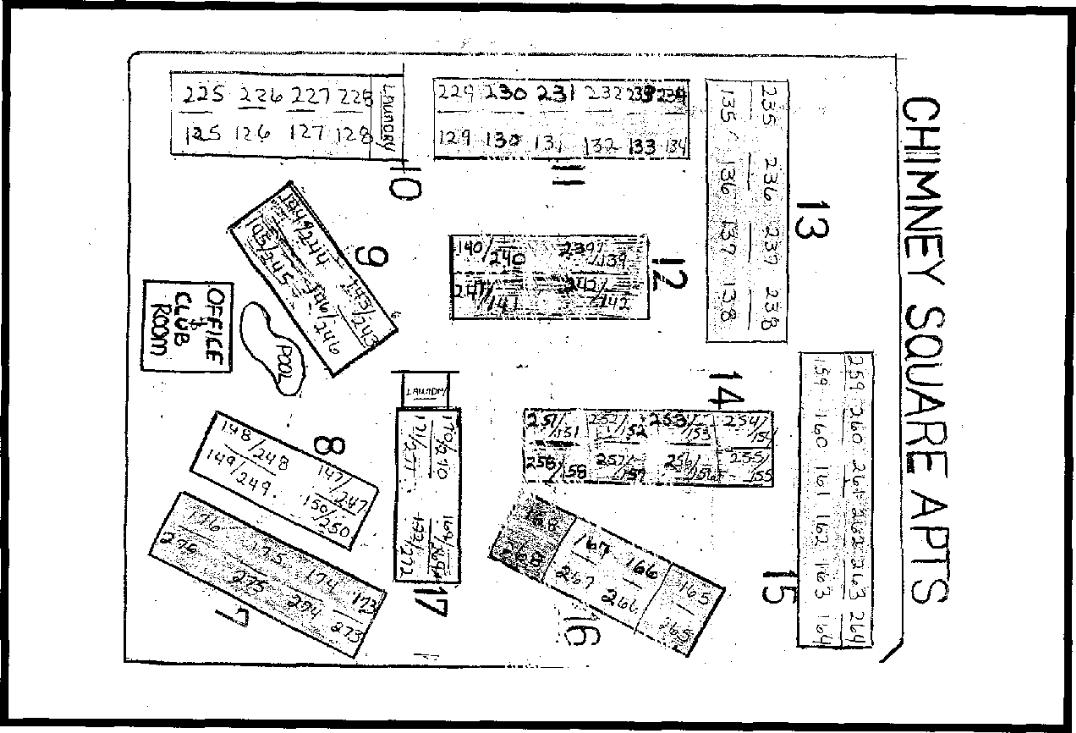

| Improvement Description: | The subject is a garden-style apartment project with 128 units contained within 17 buildings. The apartment buildings are two-story with brick veneer, stucco and wood siding exterior. Roofs are pitched with composition shingles and gutters. In addition, the property has a separate leasing office, which also includes a clubhouse and maintenance/storage area. The property appears reasonably well maintained with no apparent deferred maintenance. The parking areas are asphalt paved and in average condition. There are a total of 199 surface parking spaces, including 134 carports. In addition, each of the townhome units has double car garages with a total of 46 parking spaces. |

| | |

| Project Amenities: | Project amenities include a leasing office, clubhouse, swimming pool, two laundry facilities, 134 carports, attached garages and mature landscaping. |

| | |

| Unit Amenities: | Unit amenities consist of standard kitchen appliances, ceiling fans, pantries, linen closets, fireplaces, full sized washer/dryer connections in two and three bedroom units, fenced patios and double car garages in townhome units. |

| | |

| Condition: | Average |

| | |

| Total Parking: | 245 spaces or 1.91 spaces per unit |

| | |

| Covered Parking: | 177 |

| | |

| Year of Construction: | 1981 |

| | |

| Economic Life (Years): | 1981 |

| | |

| Overall Effective Age (Years): | 20 |

| | |

| Quality Class: | B+ |

| | |

| Average Unit Size: | 989 SF |

| | |

| Land to Building Ratio: | 2.58 :1 |

| | |

| Project Density: | 16.9 :units per acre |

Summary of Salient Facts

Unit Mix For Chimney Square

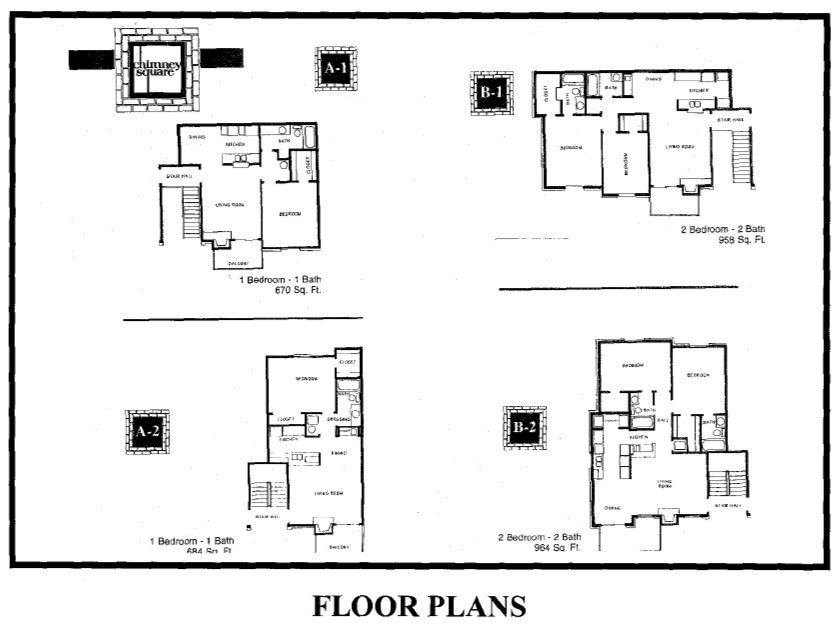

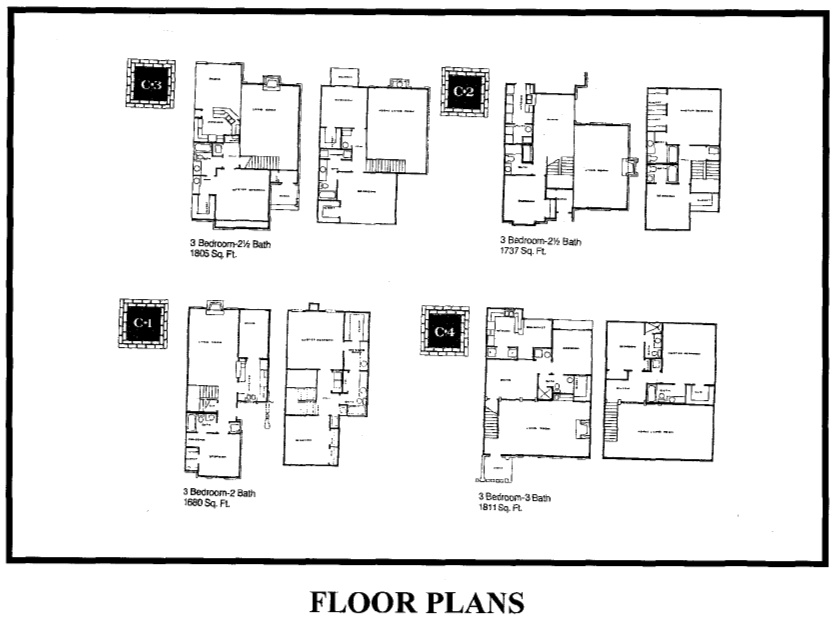

Floorplan | Units | SF | Total SF | Special Amenities/Comments |

| 1 Bd 1.0 Ba | 8 | 670 | 5,360 | Standard appliances, FP |

| 1 Bd 1.0 Ba | 44 | 684 | 30,096 | Standard appliances, FP |

| 2 Bd 1.0 Ba | 40 | 958 | 38,320 | Standard appliances, WDC, FP |

| 2 Bd 1.0 Ba | 12 | 964 | 11,568 | Standard appliances, WDC, FP |

| 2 Bd 2.0 Ba | 1 | 1,386 | 1,386 | Standard appliances, WDC, FP |

| 2 Bd 2.5 Ba, TH | 2 | 1,700 | 3,400 | Standard appliances, WDC, FP |

| 3 Bd 2.0 Ba, TH | 11 | 1,680 | 18,480 | Standard appliances, WDC, FP |

| 3 Bd 3.0 Ba, TH | 2 | 1,737 | 3,474 | Standard appliances, WDC, FP |

| 3 Bd 2.0 Ba, TH | 3 | 1,805 | 5,415 | Standard appliances, WDC, FP |

| 3 Bd 3.0 Ba, TH | 5 | 1,811 | 9,055 | Standard appliances, WDC, FP |

Total (Mean) | 128 | 989 | 126,554 | |

Net Rentable Area (SF): | 126,554 |

Leasing Office/Common Areas (SF): | 1,500 (Leasing, Clubhouse & Maintenance space included) |

Gross Building Area (SF): | 128,054 |

Current Occupancy: | 98% |

Percent Leased: | 98% |

Stabilized Vacancy & Collection Loss: | 5.0% (plus 1% loss-to-lease) |

Current Average Rent: | $0.65 /SF/month |

Quoted Street Rent: | $0.66 /SF/month |

Proposed Gross Potential Rent: | $0.66 /SF/month |

Highest and Best Use - If Vacant: | Future apartment development |

Highest and Best Use - As Improved: | Continued use as a 128-unit apartment project |

Purpose of the Report: | To estimate the “As Is” Market Value of the subject property subject to short-term leases |

Property Rights Appraised: | Fee Simple Estate |

Intended Use of the Appraisal: | This report is intended to serve as a basis for asset evaluation |

Capital Improvements and Rent Loss: | $0 |

Effective Date of Appraisal: | January 2, 2007 |

Date of Property Inspection: | January 2, 2007 |

Date of Report: | January 4, 2007 |

Proforma For Chimney Square

| | | Total | | $/SF | | $/Unit | | % of EGIM | |

| Potential Gross Rental Income | | $ | 1,002,504 | | $ | 7.92 | | $ | 7,832 | | | 103.5 | % |

| Plus: Other Income | | $ | 26,000 | | $ | 0.21 | | $ | 203 | | | 2.7 | % |

| Less: Vacancy/Collection Loss 5.0% | | | ($50,125 | ) | | ($0.40 | ) | | ($392 | ) | | (5.2 | )% |

| Less: Loss-to-Lease at 1.0% | | | ($10,025 | ) | | ($0.08 | ) | | ($78 | ) | | (1.0 | )% |

Effective Gross Income | | $ | 968,354 | | $ | 7.65 | | $ | 7,565 | | | 100.0 | % |

| Less: Operating Expenses | | | ($494,107 | ) | | ($3.90 | ) | | ($3,860 | ) | | (51.0 | )% |

| Less: Reserves for Replacement | | | ($38,400 | ) | | ($0.30 | ) | | ($300 | ) | | (4.0 | )% |

Net Operating Income | | $ | 435,846 | | $ | 3.44 | | $ | 3,405 | | | 45.0 | % |

Value Indications | | | As Is | | | | | | | | | | |

| Cost Approach: | | | N/A | | | | | | | | | | |

| Insurable Value: | | $ | 6,900,000 | | | | | | | | | | |

| Sales Comparison Approach: | | $ | 5,200,000 | | | | | | | | | | |

| Income Approach: | | $ | 5,300,000 | | | | | | | | | | |

Market Value Conclusion: | | $ | 5,250,000 | | | | | | | | | | |

“As Is” Value Indicators

| EGIM by Analysis: | 6.40 | Resulting: 5.42 |

| Stabilized OAR By Analysis: | 8.25% | Resulting: 8.30% |

| Value/SF: | $41.48 |

| Value/Unit: | $41,016 |

| Appraisers: | Deverick & Associates, Inc. |

| | John D. Jordan, MAI |

| | Victor K. Thomas |

| File Number: | 06-1385 |

Assumptions and Limiting Conditions

This appraisal report is subject to the following assumptions and limiting conditions. These assumptions are considered necessary by to make a proper estimate of value in accordance with the appraisal assignment. The first 21 categories reflect standard assumptions and limiting conditions that are applicable to all appraisals performed by Deverick & Associates. Category 22 details extraordinary conditions or assumptions that is uncertain information which is presumed as fact. Category 23 details hypothetical conditions or that which is contrary to what exists for the purposes of analysis. We may also cite specific assumptions and limiting conditions elsewhere throughout the appraisal report.

| 1. | COPIES, PUBLICATION, DISTRIBUTION, USE OF REPORT - Possession of this report or any copy thereof does not carry with it the right of publication, nor may it be used for other than its intended use; the physical reports remain the property of the appraiser for the use of the client, the fee being for the analytical services only. The report may not be used for any purpose by any person or corporation other than the client and or their assignee. Please be advised that you have the right to assign the appraisal to an investor, and an assignee may rely on the appraisal as though it were addressed to the assignee. |

Neither all nor any part of the contents of this report shall be conveyed to the public through advertising, public relations efforts, news, sales or other media, without the written consent and approval of Deverick & Associates, Inc., nor may any reference be made in such a public communication to the Appraisal Institute or the MAI designation.

This appraisal is to be used only in its entirety and no part is to be used without the whole report. All conclusions and opinions set forth in the report were prepared by the appraisers whose signatures appear on the appraisal report, unless indicated as "Review Appraiser". No change of any item in the report shall be made by anyone other than the appraisers, and the appraisers and firm shall have no responsibility if any unauthorized change is made.

| 2. | CONFIDENTIALITY - The appraisers may not give a copy of the report to anyone other than the client or his designee as specified in writing. Furthermore, the appraisers will not divulge the material contents of the report, either orally or in writing, to anyone other than the client or designee. Exceptions may be made if the report is subpoenaed by a court of law with proper authority, or if requested by the Appraisal Institute to assist in ethics enforcement. |

| 3. | EXHIBITS - The sketches and maps in this report are included to assist the reader in visualizing the property and are not necessarily to scale. Various photos, if any, are included for the same purpose and are not intended to represent the property in other than actual status, as of the date of the photos. |

| 4. | TRADE SECRETS - This appraisal consists of "trade secrets and commercial or financial information" which is privileged and confidential and exempt from disclosure under 5 U.S.C. 552 (b)(4). Notify Deverick & Associates, Inc., of any request to reproduce this appraisal in whole or in part. |

Assumptions and Limiting Conditions

| 5. | INFORMATION USED - No responsibility is assumed for accuracy of information furnished by others, including the client, his designees, public records, published data sources, or other real estate professionals. The comparable data relied upon in this report has been confirmed with one or more parties familiar with the transaction or from affidavit, and all are considered appropriate for inclusion to the best of our knowledge and judgment. In some instances, the data may have been verified by associates who may not have worked on this particular appraisal. |

| 6. | COMPONENT VALUES - The estimated values for the entire property applies only under the current or proposed utilization. The separate value estimates for land and improvements, if any, must not be used in conjunction with any other appraisal and are invalid if so used. |

| 7. | LIMITS OF EXPERTISE (LEGAL, ENGINEERING, HIDDEN COMPONENTS) - The appraisers assume no responsibility for matters beyond their personal expertise or the scope of the assignment, including all legal issues and items related to architecture, mechanics, engineering, or soil conditions. |

No opinion is rendered as to the title, which is presumed to be good and merchantable. The property is appraised as if free and clear of encumbrances, unless otherwise stated in this report. The legal description set forth in this report is assumed to be accurate, but the appraisers make no warranty.

The appraiser has inspected, by observation, the land and the improvements thereon; however, it is usually impractical and beyond the scope of this assignment to personally observe conditions beneath the soil, hidden structures, or mechanical components within the improvements. No representations are made herein as to these matters, and the value estimates specifically assume no adverse conditions exist, unless specifically identified in this report. The soils at the subject property appear reasonably firm to the untrained eye; however, the degree of subsidence in the area is not known. The appraisers do not warrant against problems that could arise from soil conditions. The appraisal is based on there being no hidden or unapparent conditions of the property site, subsoil, or structures that would render it more or less valuable. No responsibility is assumed for any such conditions or for any expertise or engineering required to discover or correct them.

All mechanical components are assumed to be in operable condition and typical of the market and property type. Unless otherwise stated, the condition of heating, cooling, ventilating, electrical and plumbing equipment is considered to be commensurate with the overall condition of the improvements.

| 8. | TESTIMONY, CONSULTATION, COMPLETION OF CONTRACT FOR APPRAISAL SERVICES - The contract for appraisal, consultation or analytical service is fulfilled and the total fee payable upon completion of the report. The fee for this appraisal or study is for the service rendered and not for the time spent on the physical report. Neither the appraisers nor any other employees of Deverick & Associates, Inc. will be asked or required to give testimony in court or hearing because of having made the appraisal, in full or in part. Nobody associated with Deverick & Associates, Inc. will engage in post-appraisal consultation with the client or third parties except under separate arrangement and at an additional fee. |

Assumptions and Limiting Conditions

| 9. | AUXILIARY AND RELATED STUDIES - Unless stated within the body of the report, the appraisers have neither prepared nor been provided with auxiliary studies related to the subject property, including an environmental impact study, special market study, highest and best use analysis, or feasibility study. If any such studies are subsequently made available to Deverick & Associates, Inc., the appraisers reserve the unlimited right to alter, amend, revise or rescind any of the statements, findings, opinions, value estimates, or conclusions set forth in this appraisal report. |

| 10. | DOLLAR VALUES, PURCHASING POWER - The Market Value estimated and the costs used are as of the date of the estimate of value. All dollar amounts are based on the purchasing power and price of the dollar as of the date of the value estimate. |

| 11. | THE EXISTENCE OF HAZARDOUS SUBSTANCES - Unless otherwise stated in this report, the appraiser(s) have no knowledge of the existence of hazardous waste products or any resultant contamination, including, without limitation, asbestos, polychlorinated biphenyl, petroleum leakage, or agricultural chemicals, which may or may not be present on the property. Furthermore, the appraisers are not qualified to test for such substances or conditions. The values derived herein specifically assume no such substances or conditions exist at the property. If evidence to the contrary is subsequently revealed, the appraisers reserve the right to alter any value estimates accordingly. No responsibility is assumed for any such conditions, nor for any expertise or studies required to discover or correct them. The client is urged to retain an expert in the field of environmental conditions and hazards. |

| 12. | LEGALITY OF USE - Unless otherwise stated in this report, the appraisal is based on the specific assumption that the property is in full compliance with all applicable regulations and laws regarding environmental conditions, zoning, building codes, and use regulations. It is further assumed that all required licenses, consents, or permits from any controlling authority have been or can be obtained or renewed for any use considered in the value estimate. |

| 13. | INCLUSIONS - The value estimates derived herein consider only the real estate component. Any business value, furnishings, and equipment, except as specifically indicated and typically considered as a part of real estate, have been disregarded. |

| 14. | PROPOSED IMPROVEMENTS, CONDITIONAL VALUES - Any proposed improvements or repairs are assumed to be completed in good and workmanlike manner according to information provided or adopted by the appraisers. In cases of proposed construction, any statements or conclusion are subject to modification upon inspection of the completed property. Any such inspections or modifications will only be performed at an additional fee, unless specifically delineated in the original letter of engagement. Any estimates of value are valid only for the effective dates shown, and subject to stated assumptions regarding the operating levels and extent of completion as of those dates. |

Assumptions and Limiting Conditions

| 15. | FACTORS EXCLUDED FROM CONSIDERATION - Any estimates of value or other conclusions derived by the appraisers are not based in whole or in part upon the race, color, national origin, sexual preference, or familial status of the current owner or occupants of the subject property or any properties in the vicinity of the subject. |

| 16. | VALUE CHANGES, DYNAMIC MARKET INFLUENCES - Any value estimates presented herein are effective only for the dates indicated and are based on information available at the time the appraisal was prepared. Values can change significantly over time due to a variety of market forces. Furthermore, the value estimates presented herein are no guarantee that the property can actually be sold for a specific amount. Sale prices can be influenced by numerous factors, including exposure, time, promotional effort, terms, motivation, and other conditions surrounding the offering. The value estimate considers the productivity and relative attractiveness of the property in the marketplace, both physically and economically. |

In cases of appraisals involving the capitalization of income benefits, the estimate of value is a reflection of the appraisers’ estimate of current and/or future income levels, coupled with investor yield requirements and other factors derived from general and specific market information. Such estimates are made as of the date of the estimate of value, and they are subject to change over time due to dynamic market influences.

| 17. | THE AMERICANS WITH DISABILITIES ACT (ADA) - ADA became effective January 26, 1992. The appraisers have not made a specific compliance survey and analysis of this property to determine whether or not it is in conformity with the various detailed requirements of the ADA. It is possible that a compliance survey of the property, together with a detailed analysis of the requirements of the ADA, could reveal that the property is not in compliance with one or more of the requirements of the act. If so, this fact could have a negative effect upon the value of the property. Unless stated elsewhere in this report, the appraisers have no direct evidence of noncompliance, and the value estimate specifically assumes no compliance issues. The client is advised to seek a qualified expert on ADA requirements. |

| 18. | MANAGEMENT OF THE PROPERTY - It is assumed that the property will be under prudent and competent ownership and management, neither inefficient nor super-efficient. |

| 19. | VALUE CONCLUSION - The final value conclusion is of the surface estate only. No consideration has been given to value, if any, of the subsurface rights of the subject property. |

| 20. | CONTINUING EDUCATION - As of the date of this report, John D. Jordan has completed the requirements under the continuing education program of the Appraisal Institute. All appraisers signing this appraisal are current with continuing education requirements of the various states in which they may be licensed. |

| 21. | ACCEPTANCE OF THE REPORT - Acceptance of and/or use of this appraisal report constitutes acceptance of all conditions set forth herein. |

Assumptions and Limiting Conditions

| 22. | EXTRAORDINARY ASSUMPTIONS - An extraordinary assumption is defined as an assumption, directly related to a specific assignment, which, if found to be false, could alter the appraiser’s opinions or conclusions. This appraisal employs no extraordinary assumptions. |

| 23. | HYPOTHETICAL CONDITIONS - A hypothetical condition is defined as that which is contrary to what exists, but is supposed for the purpose of analysis. Hypothetical conditions assume conditions contrary to known facts about physical, legal, or economic characteristics of the subject property or about conditions external to the property, such as market conditions or trends, or the integrity of data used in an analysis. This appraisal employs the following hypothetical condition: |

Tax Burden - As of May 18, 2006, Governor Rick Perry signed into law House Bill 3, a legislation that provides a comprehensive business tax reform. This and other additional tax laws have been passed that will likewise change the Texas ad valorem taxing structure. As the appraisers are aware of this change, we are unaware of the direct implication resulting from this legislation. However, after reviewing the established laws, we conclude that there should be no adverse detriment from this new act. With the decrease in ad valorem property taxes, the net effect with a franchise tax should, in essence, balance out. Therefore, the appraiser assumes that the change in the taxing structure should positively impact property value after consideration of the ad valorem tax decrease and gross receipts tax increase, assuming a 70% revenue basis is utilized. The full implementation of these changes will be in effect as of January 1, 2007. For the purposes of our analysis, we will assume that full implementation of these tax changes are in effect. Please note that we are not licensed attorneys, and therefore, all new tax legislation information provided herein is for informational purposes only. We suggest that the client contact a tax attorney on the subject if additional information is needed.

PART II NATURE OF ASSIGNMENT |

Nature of the Assignment

Property Identification

The subject property consists of a 7.589-acre site improved with a 128-unit apartment complex known as Chimney Square. The property is located along the south side of South 23rd Street, just east of South Willis Street in the south-central portion of the City of Abilene. The address is 3201 South 23rd Street, Abilene, Texas 79605.

The subject is a garden-style apartment project with 128 units contained within 17 buildings. The apartment buildings are two-story with brick veneer, stucco and wood siding exterior. Roofs are pitched with composition shingles and gutters. In addition, the property has a separate leasing office, which also includes a clubhouse and maintenance/storage area. The property appears reasonably well maintained with no apparent deferred maintenance. The parking areas are asphalt paved and in average condition. There are a total of 199 surface parking spaces, including 134 carports. In addition, each of the townhome units has double car garages with a total of 46 parking spaces. The property has an estimated net rentable area (NRA) of 126,554 SF and a gross building area (GBA) of 128,054 SF.

Legal Description

The subject property is legally described as follows:

Two tracts of land totaling 7.589 acres with Tract I (7.194 acres) being described as all of Lot 2, Block A and Tract I (0.395 acres) being described as the easterly 50' of Lot 3, Block A, Chimney Square Addition, City of Abilene, Taylor County, Texas

We have not commissioned a survey or had one verified by legal counsel. It is recommended that the legal description be verified before being used in a legal document or conveyance.

Purpose of The Appraisal/Intended Use

The purpose of this appraisal is to estimate the “As Is” Market Value of the subject property’s Fee Simple Estate, as of the effective date reported, subject to short term leases. The interest appraised represents the Market Value interest directed by The Appraisal Institute & The Appraisal Foundation. This report is intended to serve as a basis for asset evaluation.

Effective Date of Appraisal

The effective date of valuation is January 2, 2007, the date of a full physical inspection by the appraiser.

Property Rights Appraised

This report addresses the subject property’s Fee Simple Estate. According to the Dictionary of Real Estate Appraisal (Third Edition, 1993), published by the Appraisal Institute, Fee Simple Estate is defined as follows:

Absolute ownership unencumbered by any other interest or estate, subject only to the limitations imposed by the governmental powers of taxation, eminent domain, police power, and escheat.

Nature of the Assignment

Client and Intended Users of the Appraisal

Univesco, its officers, administrators, employees, and lending participants (if any).

Definition of Market Value

Market Value is the major focus of most real estate appraisal assignments. Both economic and legal definitions of Market Value have been developed and refined. Continual refinement is essential to the growth of the appraisal profession.

Market Value - is defined as the most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently, knowledgeably and assuming the price is not affected by undue stimuli. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under the conditions whereby:

| | a. | buyer and seller are typically motivated; |

| | b. | both parties are well informed or well advised, and each acting in what they consider their own best interest; |

| | c. | a reasonable time is allowed for exposure in the open market; |

| | d. | payment is made in terms of cash in U.S. Dollars or in terms of financial arrangements comparable thereto; and |

| | e. | the price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.1 |

"As Is" Market Value - is defined as an estimate of the market value of a property in the condition observed upon inspection and as it physically and legally exists without hypothetical conditions, assumptions, or qualifications as of the date the appraisal is prepared.2

Competency Provision

The appraiser(s), reviewer(s), and principal of Deverick and Associates have performed numerous appraisals of similar properties in the past. The appraiser(s) possess the knowledge and experience to conduct the inspection, analysis, and reasoning necessary to accurately estimate the value of the subject property.

1 Federal Regulation, 12 CFR 564, as promulgated by the OTC, effective August 23, 1990

2 Statement of Policy 12 CFR 571.27

Nature of the Assignment

Scope of The Assignment:

The scope of the appraisal report, as stipulated by the terms of the assignment, is to prepare the appraisal in a format which complies with the Appraisal Foundation and the Appraisal Institute. Pursuant to this goal, the property rights appraised are those of Fee Simple Estate ownership. In valuing the subject, we have narratively evaluated and described the general area, neighborhood area, site, zoning, and improvement data, if any, impacting the subject in order to analyze the highest and best use of the site as vacant. Further, we have utilized the standard appraisal methods to estimate the market value and have not omitted any of our conclusions herein.

The following Scope of Investigation more specifically describes the procedures followed in the reporting and the documentation of the collected data.

Scope of Investigation:

The following addresses the scope of the investigation inclusive of what was performed to complete the assignment.

Area and Neighborhood Analysis

For the Area and Neighborhood Analysis, the appraiser personally inspected the surrounding area and utilized published and non-published data to help draw conclusions about the affect of the area and neighborhood data impacting the subject. Information for this section of the report was published by various private and public entities. Non-published, yet public information, was obtained from the various state and other government related entities. Area real estate brokers, agents, and appraisers were also consulted for their opinions of the aforementioned.

Site Description and Analysis

The site was visually examined (including a full physical inspection) by the appraiser on January 2, 2007. Local governmental bodies and utility suppliers were consulted to secure information regarding utility availability, plat maps, zoning, flood hazards, and tax information.

Highest And Best Use

In determining the Highest and Best Use of the subject property as though vacant and/or improved, the appraiser utilized information obtained for, and reported in, the Area and Neighborhood Analyses, and the remaining sections of this appraisal. This information revealed the historic and future significance of the area to the subject, as well as the contribution of the area development in designating a proposed use for the subject.

The four criteria examined to establish the Highest and Best Use were: 1) Physically Possible, 2) Legally Permissible, 3) Financially Feasible, and 4) Maximally Productive.

Nature of the Assignment

Valuation Analysis

The Valuation section was performed with sales and rent comparables which were considered most similar to the subject. For the most part, the sales and rental data were of properties located within the boundaries of the subject neighborhood or alternate comparable areas. The sources of information utilized to obtain sales included local, county and state agencies, local real estate brokers/agents, local investors, and/or other appraisers. The comparable data relied upon in this report has been confirmed with one or more parties involved in or familiar with the given transaction. However, in some cases, the sales have been confirmed by appraisers other than the person who performed this report. Each party is considered reliable and the information received is considered true and factual to the best of the appraisers’ knowledge and judgment.

Marketing Time Analysis

The marketing time of the subject property is based on the length of time similar type properties were on the market before they sold. A history of any known offers for the subject was also considered, as well as opinions of area real estate brokers, agents, investors, and appraisers.

History of Ownership

According to local tax records, the subject property is owned by Chimney Square, LP (Univesco, Inc.), who has owned the complex for more than 10 years. According to the property manager, a new privacy fence was installed along the perimeter of the property in the first quarter of 2004. In addition, new flooring has been installed in several units during the current year. The parking lot was reportedly resurfaced in 2002. The roof was replaced and the entire property exterior was re-painted in early 2005. The property is currently considered to be in adequate condition with no major visible items of deferred maintenance. We are not aware of any recent offers or contracts to purchase the property, and the project is not listed for sale as of the appraisal date.

Encumbrances

Based on the personal inspection of the subject tract, there were no visible easements that would adversely affect the development of the subject property assuming a vacant tract. No study concerning deed restrictions has been conducted by the appraisers. Only a detailed search by a title company or attorney can provide positive assurance of the existence or absence of deed restrictions. This analysis specifically assumes there are no deed restrictions or liens which adversely affect the subject site.

Real Estate Taxes

Real estate taxes are based on the assessed value of real property, hence, the term ad valorem (according to value). For the subject property, the assessed value is calculated at 100% of the market value, as estimated by the Central Appraisal District of Taylor County. The 2006 assessment and applicable account number(s) are shown below:

Summary of 2006 Tax Assessment

ID Number | | Component | | Assessed Value | | Ratio | | Assessed Value | |

| 75761 | | | Land | | $ | 545,213 | | | 100.0 | % | $ | 545,213 | |

Improvements | | $ | 4,087,787 | | | 100.0 | % | $ | 4,087,787 | |

Total | | | Chimney Square | | $ | 4,633,000 | | | 100.0 | % | $ | 4,633,000 | |

To determine the reasonableness of the assessment and estimate the future tax burden, we have researched assessments (real estate only) for the following tax comparables, each of which is presented later as a comparable rental property.

Summary of Tax Comparables

Name | | | Units | | | Rentable Area | | | Avg Unit SF | | | YOC | | | 2006 Assessment | | $ | /Unit | | $ | /SF | |

| Warwick | | | 152 | | | 143,104 | | | 941 | | | 1981 | | $ | 5,466,000 | | $ | 35,961 | | $ | 38.20 | |

| Mill Creek | | | 176 | | | 167,880 | | | 954 | | | 1982 | | $ | 6,132,278 | | $ | 34,842 | | $ | 36.53 | |

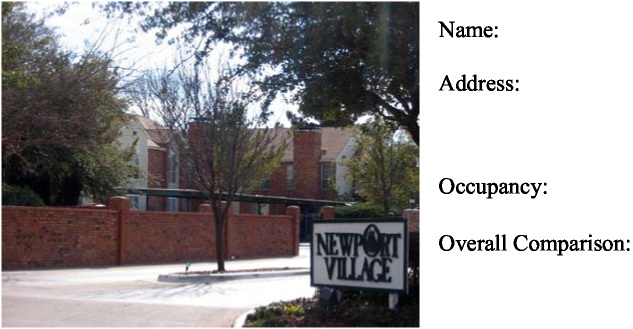

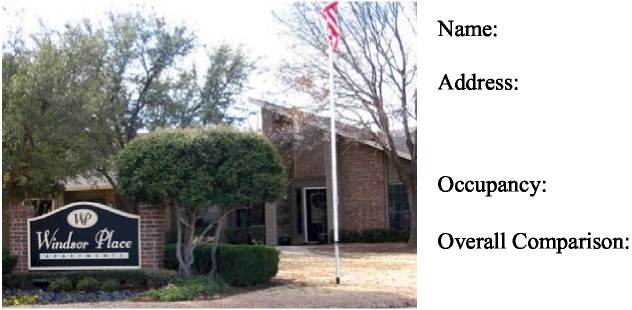

| Newport Village | | | 216 | | | 186,592 | | | 864 | | | 1984 | | $ | 7,543,000 | | $ | 34,921 | | $ | 40.43 | |

| Windsor Place | | | 228 | | | 195,544 | | | 858 | | | 1982 | | $ | 6,992,000 | | $ | 30,667 | | $ | 35.76 | |

Average/Mean | | | 193 | | | 173,280 | | | 904 | | | 1982 | | $ | 6,533,320 | | $ | 34,098 | | $ | 37.73 | |

| Chimney Square | | | 128 | | | 126,554 | | | 989 | | | 1981 | | $ | 4,633,000 | | $ | 36,195 | | $ | 36.61 | |

: * Based upon building area reported by the property Management.

The previous tax comparables were constructed from 1981 through 1984, while the subject property was completed in 1981. Assessments per unit vary from $30,667 to $35,961 for the comparables with a mean of $34,098. The subject’s assessment is $36,195 per unit. Furthermore, the assessments for the comparables on a per square foot basis range from $35.76 to $40.43 with a mean of $37.73. The subject’s assessment is $36.61 per square foot. The subject’s assessment is within the range and reflective of the mean on both a per unit and per square foot basis. Overall, we conclude that the subject’s recently certified assessment is supported by the comparables.

Base on recent trends in the market and considering the rate of increase at the subject and the comparables over the last two years, we conclude that some level of increase is most likely forthcoming for the next year. A majority of the commercial and multi-family residential property values in Taylor County have been increase slightly in each of the last few years. Below is the subject’s assessment value over the last five years

Real Estate Taxes

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

Market Value | | $ | 4,633,000 | | $ | 4,569,000 | | $ | 4,213,000 | | $ | 4,213,000 | | $ | 4,336,000 | |

Increase/Decrease | | $ | 64,000 | | $ | 356,000 | | $ | 0 | | | ($123,000 | ) | | N/A | |

% of Increase | | | 1.4 | % | | 8.5 | % | | 0.0 | % | | -2.8 | % | | N/A | |

Based on recent trends and changes in the tax rate, we estimate that the subject’s assessment value will be increased on the order of 2-8% over the next year and conclude that a reasonable estimate of the rate increase is 5%. Therefore, for our analysis will increase the current stabilized assessment value by roughly 5% to reflect market conditions.

The subject property lies within the taxing jurisdiction of Taylor County, Abilene I.S.D. and the City of Abilene. The 2006 applicable tax rate was set in September, 2006 and will be utilized to estimate the stabilized tax burden of the subject. Based on the preceding information, the subject’s stabilized taxes are estimated as follows:

Estimated Stabilized Property Taxes

Jurisdiction | | Estimated Assessment | | 2006 Tax Rate/$ 100 | | Estimated Stabilized Taxes | |

| Taylor County | | $ | 4,865,000 | | $ | 0.498000 | | $ | 24,228 | |

| Abilene I.S.D. | | $ | 4,865,000 | | $ | 1.486700 | | $ | 72,328 | |

| City of Abilene | | $ | 4,865,000 | | $ | 0.667800 | | $ | 32,488 | |

ACTUAL TOTAL | | $ | 4,865,000 | | $ | 2.652500 | | $ | 129,044 | |

House Bill 3

As of May 18, 2006, Governor Rick Perry signed into law House Bill 3, a legislation that provides a comprehensive business tax reform; with this new legislation (and other House Bills, such as House Bill 1, which provides for the property tax cut; House Bill 2, which mandates that all taxes raised from the five bills be used to reduce property taxes; House Bill 4, which raises money from sales tax on pre-owned cars; and, House Bill 5, which calls for a $1 tax increase on each pack of cigarettes), the largest property tax cut in the State of Texas will take place. According to the Texas Tax Reform Commission’s “Section By Section Bill Analysis,” the School District Property Tax Relief will require school districts, through tax rate calculation rollbacks, to reduce their property tax rate for maintenance and operations from $1.50 to $1.00 per $100 of valuation by the 2007 tax year; the tax reduction was phased in at 17 cents in the 2006 tax year and an additional 33 cents in the 2007 tax year. Therefore, property tax burdens should significantly decrease with the enacting of this legislation.

For the purposes of our analysis we have utilized the 2006 ISD tax rate and will further reduce this rate by $0.3 3/$ 100 to reflect the approximate stabilized tax rate that will be in effect as of January 1, 2007.

Real Estate Taxes

Although many taxing entities throughout the Permian Basin area have increased tax rates over the last few years as property values have remained flat or declined, we anticipate that with many property values increasing the need to increase tax rates will be diminished and many authorities may actually decrease their rate. Please note that we have increased the tax burden by $1,000 to account for personal property taxes. Based on an analysis of the historical and comparable data, we conclude the annual stabilized tax payment (based on current tax rates) is estimated as follows:

Stabilized Tax Burden

Projected Assessed Value $4,865,000 | Tax Rate / $100* 2.3225 | Total Taxes $116,990 |

*Tax rate accounts for $0.33 reduction in 2007

Gross Receipts Tax

Article 2, Franchise Tax, is being reformed by broadening the base, lowering the rate, and extending coverage to all active businesses receiving state law liability protection. A taxable entity, under the new franchise tax, is defined as, “those with state law liability protection.” Such entities include corporations, limited liability companies, partnerships, limited partnerships, limited-liability partnerships, professional and business associations, joint ventures, joint stock companies, and holding companies. There are some entities that will not be held responsible for the tax; those taxable entities that are excluded from the franchise tax include sole proprietorships, general partnerships owned entirely by natural persons, certain unincorporated passive entities, and non-profit and other organizations currently exempt from the franchise tax. Taxable entities also do not include grantor trusts, estates of natural persons, escrows, passive investment partnerships, family limited partnerships where at least 80% of the interests are held by members of the same family and that are passive investment partnerships, certain non-business passive entity trusts, real estate investment trusts (REITs) but only if the REIT does not own real estate directly (other than real estate occupied for business purposes), and real estate mortgage investment conduits (REMICs).

The main part of the act comes by increasing the number of businesses subject to the tax. In determining the tax amount, the underlying base is changed to “total revenues minus certain deductions,” rather than net income. As a result of the increased taxable entities, the primary tax rate is lowered from 4.5% to 1%. However, small businesses are exempt from paying the tax if they have $300,000 or less in total revenue. The exemption will be indexed to inflation every two years beginning on January 1, 2009 and continuing each odd-numbered year.

Real Estate Taxes

To calculate the new tax base, a taxable entity would start with its total revenue and choose to deduct one of the following two: 1) Employee compensation (employee compensation summarized by the act includes the deduction for wages and cash compensation, excluding benefits which is capped at $300,000 per employee [including officers, directors, owners, and partners] and includes wages, salaries, stock options, and net distributive income from entities treated as partnerships for federal income tax purposes, but only if the person receiving the distribution is a natural person. The $300,000 cap would be indexed to inflation every two years in the same manner used for the small business exemption. The compensation deduction also includes the actual cost of health coverage, retirement benefits, and workers’ compensation benefits, which is not capped); or 2) Cost of Goods Sold (COGS summarized by the act includes all direct costs of acquiring or producing goods, including the cost of labor and materials. It also includes indirect overhead costs related to the goods, but not to exceed 4% of the taxable entity’s total indirect overhead costs. Cost of goods sold does not include selling, distribution, outbound transportation costs, advertising costs, etc., nor does it include interest, income taxes, or officers’’ compensations. If the taxable entity is a lending institution, the cost of goods sold is equal to interest expense.). An entity’s taxable margin can not be greater than 70% of its total revenue. Certain exclusions from total revenue would be allowed such as for bad debt, foreign royalties and dividends, and net distributive income from certain entities treated as partnerships for federal income tax purposes.

The first annual return and payment under the reformed franchise tax would be due on May 15, 2008 for the reporting period beginning on January 1, 2007 and ending on December 31, 2007. As a result, the first revenue the State of Texas will collect under the reformed franchise tax will be in fiscal year 2008. However, certain exceptions for reporting periods are allowed for taxpayers that have accounting periods that do not correspond to the calendar year.

For the subject property we will calculate the gross receipts tax utilizing our stabilized EGI and assuming that the property will be subject to the maximum rate because the cost of goods sold is typically less than 30%. The following is our estimate of the Gross receipts tax burden for the subject:

Estimated Gross Receipts | Taxable Percentage | Tax Rate | Tax Burden |

| $968,354 | 70% | 1.0% | $6,778 |

After reviewing the established laws, we conclude that there should be no adverse detriment for the subject from the new acts. With the decrease in ad valorem property taxes, the net effect with a franchise tax should, in essence, balance out. Therefore, the appraiser assumes that the change in the taxing structure should positively impact property value after consideration of the ad valorem tax decrease and gross receipts tax increase, assuming a 70% revenue basis is utilized. For purposes of our analysis, we will consider the decrease in ad valorem taxes in our Proforma, but only present the Gross Receipts Tax calculation for informational purposes as this expense is consider a partnership expense. However, we are not licensed attorneys, and therefore, all new tax legislation information provided herein is for informational purposes only. We suggest that the client contact a tax attorney if a further assessment is needed. See Hypothetical Assumption # 23 for further clarification.

PART III REGIONAL & NEIGHBORHOOD ANALYSES |

Street Atlas USA® 2007

Regional Map

Regional Analysis

Real estate values reflect the influence of four primary forces that motivate human activity: environmental factors, social trends, economic conditions, and governmental policies. The purpose of this Regional Analysis is to describe and analyze the area within which the interactions of the four major forces influence properties similar to the subject. This section will further analyze past trends for insight into possible future trends affecting the value of real estate.

Abilene is located in central west Texas approximately 100 miles from the geographic center of the state. Interstate 20, the major highway system serving Abilene, runs east to west through north central Texas. Interstate 20 links Abilene with the Dallas-Fort Worth Metroplex (170 miles east) and Midland (150 miles west). The state capital, Austin, lies 225 miles southeast of Abilene. The Abilene Metropolitan Statistical Area (MSA) encompasses all of Taylor County. Abilene was founded in 1881 as a direct result of the building of the Texas and Pacific Railroad and was incorporated in 1882. Abilene is the county seat of Taylor County and is the center of a 22-county trade area referred to as the "Big Country.”

Overview of the Abilene Economy

Abilene's economy, like that of many West Texas cities, has long been tied to the oil and gas, agricultural and military industries. During the late 1970s and early 1980s oil prices were escalating at a rapid rate. By the end of 1982 the average price of oil was just less than $40.00 per barrel. As a result Abilene experienced unprecedented economic growth. All segments of the real estate market were booming and banks were heavily committed in real estate and energy related loans. In 1983 and again in 1986-1987, the world oil market collapsed. The collapse of the oil industry had a detrimental effect on the Abilene economy. Beginning in 1986 Abilene entered into a recession that lasted four years. This recession was compounded by a three year agricultural drought that began in 1985 and continued through 1987. During this time Abilene had a net loss in both the population and civilian labor force and experienced the collapse of both the real estate and banking industries.

By 1990 the economy reached a level of stability. Losses in both population and civilian labor force leveled-off and the unemployment rate became stable. Since 1990, population has slowly decreased and the unemployment rate has averaged approximately 4.1% for year end 2002 in comparison to the state of Texas’ unemployment rate of 6.7% for the same year. In 1990, the real estate market reached a level of stability, but real estate values remained flat with minimal appreciation until 1992 when the city experienced an increase in new home construction spurred by low interest rates. Vacancy levels in office and retail properties were atypically high in the early 1990's, but have recovered gradually since approximately 1993. Vacancy levels in multi-family and light industrial have improved over the past two to three years; However, the prevailing market rental rates remain below the level necessary to justify new multi family construction.

There has been some new construction in the light industrial and retail segments. There has been increased demand for unimproved land sites. Values of well located sites have increased significantly and values of secondary sites have increased more slowly, with retail zoning the prevalent use in demand . In the following discussions, the four forces that influence value; social, economic, governmental and environmental will be examined. An understanding of the four forces is fundamental to appraising because the interaction of these forces creates the climate in which property values increase, decrease, or remain stable.

Regional Analysis

Social Forces

Population Profile: The following chart summarizes population trends for the Abilene CBSA, as well as comparative data for the State of Texas and the United States.

Historical and Projected Population Trends

| | | | | | | Growth Rate | | | | Growth Rate | |

Region | | 1990 | | 2006 | | 1990-2006 | | 2011 | | 2006-2011 | |

| Abilene | | | 148,010 | | | 158,539 | | | 0.43 | % | | 157,168 | | | (0.17 | )% |

| Texas | | | 16,986,524 | | | 23,278.274 | | | 1.99 | % | | 25,219,040 | | | 1.61 | % |

| United States | | | 248,710,012 | | | 299,088112 | | | 1.16 | % | | 313,518,258 | | | 0.95 | % |

Source: SRC LLC (www.demographicsnow.com)

Over the past 16 years, the population of the CBSA has increased at a compounded annual rate of 0.43%. During the same period, the Texas growth rate was 1.99% and the national growth rate was 1.16%. Over the next five years, the CBSA population is projected to decrease at a compounded annual rate of -0. 17%, while the State of the Texas is projected to grow at a rate of 1.61% and the nation is projected to grow at a rate of 0.95%.

Abilene experienced a large increase in population from 1950 to 1960. However, from 1960 to 1970 there was a loss in population as a result of the closure of several intercontinental ballistic missile installations and the departure of the B-47 Bomber Wing from Dyess Air Force Base. The city population increased by about 10% from 1970 to 1980. From 1980 through 1986 Abilene experienced an atypical increase in population brought about by an expanding oil and gas industry and a boom in the real estate market. The population, based on estimates prepared by the City Planning and Zoning Department, peaked in 1986 at 110,906. From 1987 through 1992, Abilene experienced a net decrease in population. The increase from 1992 to 1993 is misleading. The primary cause of the increase during this time period is the prison population at the French Robertson and John Middleton Prison Units located north of Abilene. If these inmates are not counted, there is a minimal decrease in population. From 1992 through 1994 there was an increase in population which leveled out in 1995. Over the last five years population has been trending downward very slowly and is projected to continue this trend over the next five years.

Households: The following chart summarizes trends in household growth for the region.

Historical and Projected Household Trends

| | | | | | | | | Growth Rate | | | | | | Growth Rate | |

Region | | | 1990 | | | 2006 | | | 1990-2006 | | | 2011 | | | 2006-2011 | |

| Abilene | | | 54,044 | | | 53,547 | | | (0.06 | )% | | 49,723 | | | (1.47 | )% |

| Texas | | | 6,070,907 | | | 7,977,911 | | | 1.72 | % | | 8,445,557 | | | 1.15 | % |

| United States | | | 91,947,641 | | | 111,826,380 | | | 1.23 | % | | 117,033,680 | | | 0.91 | % |

Source: SRC LLC (www.demographicsnow.com)

Regional Analysis

Over the past 15 years, the number of households in the CBSA has decreased at a compounded annual rate of -0.06%. During the same period, the Texas growth rate was 1.72% and the national growth rate was 1.23%. Over the next five years, the number of households in the CBSA is projected to decrease at a compounded annual rate of -1.47%, while the State of the Texas is projected to grow at a rate of 1.15% and the nation is projected to grow at a rate of 0.91%.

Income Levels: The following chart summarizes trends in median household income levels.

Historical and Projected Trends in Household Income

Region | | | 1990 | | | 2006 | | | Growth Rate 1990-2006 | | | | 2011 | | | Growth Rate 2006-2011 | |

Abilene | | $ | 23,690 | | $ | 37,406 | | | 2.90 | % | | $ | 40,556 | | | 1.63 | % |

Texas | | $ | 27,038 | | $ | 45,956 | | | 3.37 | % | | $ | 50,789 | | | 2.02 | % |

| United States | | $ | 30,102 | | $ | 48,271 | | | 3.00 | % | | $ | 52,655 | | | 1.75 | % |

Source: SRC LLC (www.demographicsnow.com)

As of 2006, the average median household income in the CBSA was $37,406, which is 18.60% lower than the statewide average of $45,956 and 22.51% lower than the national average of $48,271. Over the past 16 years, the median income for the CBSA has grown at an annual compounded rate of 2.90%, compared to 3.37% for the State of Texas and 3.00% for the nation. Over the next 5 years, the median income for the CMSA is projected to grow at a slower rate of 1.63%, compared to 2.02% for the State of Texas and 1.75% for the nation. By 2011, the MSA median income is projected to reach $40,556, which would be 20.15% lower than the projected statewide average of $50,789 and 22.95% lower than the projected national average of $52,633.

Education:

The following chart shows the breakdown, by city, county and state of education levels.

Education Level, Persons Age 25 and Older (Percentage of Population) | |

Level of Education | | | Abilene | | | Taylor County | | | Texas | |

| Highschool Graduate | | | 30.84 | % | | 29.00 | % | | 27.20 | % |

| Some College, No Degree | | | 23.89 | % | | 24.87 | % | | 20.26 | % |

| Associate’s Degree | | | 5.72 | % | | 5.99 | % | | 6.29 | % |

| Bachelor’s Degree | | | 13.65 | % | | 15.40 | % | | 16.87 | % |

| Graduate or Professional Degree | | | 6.68 | % | | 7.75 | % | | 8.34 | % |

| Source: SRC LLC (www.demographicsnow.com) |

Regional Analysis

A well-educated workforce is essential in a competitive global environment, and workers must be able to update and expand their knowledge as new technology and ways of working evolve. Post-secondary and higher education resources are readily available within the Abilene area to serve area residents and businesses.

Abilene has a public school system that is administered by a local board of trustees. The 2005 total enrollment for public schools was 19,804 with an average of 13 to 1 teacher/pupil ratio. In 1990 the citizens approved a bond election to construct additional facilities to meet the long term educational needs of the city. One middle school and four elementary schools were constructed and opened in the fall of 1992. In May of 2001 two-elementary schools were closed due to school district budget problems. There are three private colleges in Abilene; Abilene Christian University, Hardin-Simmons University and McMurry University, in addition to three public colleges; Cisco Junior College, Texas Tech University-Abilene and Texas State Technical College. Public parks, community theaters, a symphonic orchestra, and fine arts museums are available for public participation and enjoyment. Also, a wide variety of cultural and entertainment functions are presented each year at Abilene Civic Center and the Taylor County Expo Center.

Recreation & Cultural Attractions

Most communities in the region have staffed recreation programs. Abilene has an adequate number of parks and ample open space. Facilities offered include 29 city parks, public and private golf courses, tennis courts, hiking, jogging, bike and nature trails. Abilene a public Zoo and Expo Center.

Cost of Living

As a smaller city in a very remote location, it is not surprising that Abilene has a relatively low cost of living. In fact, the appraisers were unable to identify very few metropolitan areas in Texas with a lower cost of living, even among similarly sized cities.

Hospitals

The City of Abilene is served by two regional hospitals and an array of medical support facilities. Abilene Regional Medical Center (ARMC), provides a complete range of medical services to the community, including advanced cancer therapy and emergency/trauma treatment. In addition, Hendrick Health system operates a regional medical facility and numerous support facilities. There are also numerous small medical clinics and nursing homes throughout the area.

Transportation

Abilene is served by one railroad line, four bus lines, two airlines, and nineteen motor freight carriers. Abilene has access to one Interstate Highway and 5 major state highways. Abilene's ground transportation is considered above average compared with other West Texas cities. Air service is provided by two commuter airlines, American Eagle Airlines and Conquest Airlines. These airlines provide 10 daily flights to and from Dallas-Ft. Worth, and 2 daily flights to and from Austin. In June 2006, air service began with two direct flights per week between Abilene and Las Vegas, Nevada as provided by Allegiant Air. This new service provides the only direct connection to western destinations from the Abilene area.

Regional Analysis

Employment

Abilene serves as an employment and commercial hub for many west-Texas towns. Many regional area jobs are directly related to oil and gas production. The fate of this region is closely tied to oil prices. The statistics presented only reflect non-farm employment. It is noted that cattle ranching is also big business in the region.

While the importance of the petroleum industry to Abilene, the City also serves as a center for other services for much of West Texas. The area has experienced slow, but steady, growth in construction of residential and retail/commercial properties since early 2005, with the area drawing workers from all of the surrounding communities. Although the Census figures report a drop in population over the last six years, we conclude that based on employment and construction figures the area population has actually increased in 2005 and 2006.

Unemployment: The following chart summarizes recent unemployment trends for the MSA, the state, and the nation, as reported by the U.S. Bureau of Labor Statistics.

Actual Unemployment Information

| | Abilene MSA | Texas | United States |

| | Employed | % Rate | Employed | % Rate | Employed | % Rate |

| | | | | | |

Nov-06 | 80.7 | 3.9% | 11,102 | 4.6% | 146,014 | 4.3% |

Oct-06 | 80.5 | 3.9% | 11,088 | 4.6% | 146,125 | 4.1% |

Nov-05 | 78.6 | 3.9% | 10,755 | 5.1% | 142,968 | 4.8% |

Source: Texas Labor Market Information, Nov 2006, Texas Workforce Commission (http://www.tracer2.com)

Total Nonagricultural Employment in the Abilene MSA increased by 400 jobs in November and has added 1,100 positions since November 2005. Natural Resources, Mining and Construction employment showed no change in November 2006, but added 400 positions since November 2005. Retail Trade employment showed an increase of 200 jobs in November 2006 due to the start of holiday season. Education and Health Services employment showed no change in November 2006, but add 400 positions since November 2005. Leisure and Hospitality posted a small increase over the month. The annual growth rate for this group remained positive at 3.1 percent, an increase of 200 jobs since November 2005. Local Government employment increased slightly over the month. The annual growth rate rose from 1.2 percent in October, to 2.4 percent in November.

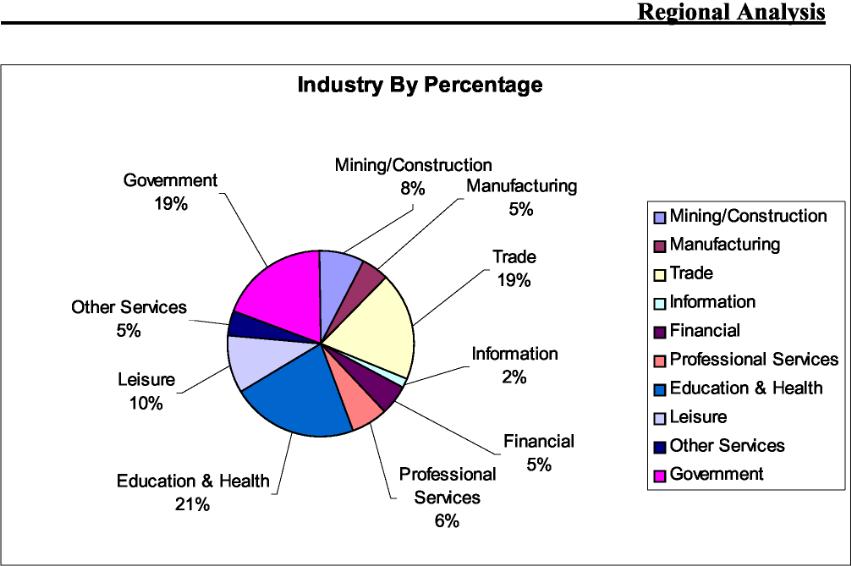

Employment by Industry: Abilene has a diverse economic bases, including large components in government, education, Trade, Transportation & Utilities, and Natural Resources. The following table identifies the number of employees by industry type.

In addition to numerous energy related and health-service employers, various government entities provide a very stable base for the local economy. The area also has a higher education industry and notable employment sectors of manufacturing and natural resources and construction.

Major Employers: Following is a listing of the largest private employers in the Abilene area.

Abilene

Largest Private Employers

| Abilene Christian University |

| Abilene Regional Medical Center |

| AMS Bus Solutions & Sterling Personnel |

| Bronco Drilling, Co. Inc. |

| Health Care Service Corp. |

| Hendrick Medical Center |

| Sears Methodist Centers Inc. |

| Teleperformance USA |

| United Spermarkets Ltd. |

| Wal-Mart Associates, Inc. |

Source: Texas Workforce Commission, Nov 2006 |

Regional Analysis

From a political standpoint, city affairs are controlled by a home rule type of government with a city manager-council form of local government. Land use and development is controlled with a master land use plan and a comprehensive zoning ordinance. Growth within the city limits is encouraged as long as the development plans conform to city requirements and zoning limitations. All structural improvements built within the city boundaries follow local and national codes. The city provides all essential services and has adequate facilities to meet the needs of the residents. The city maintains an adequate fire and police force. The city also provides water and sewer service. Electric, natural gas and telephone are supplied by private industry. Water is supplied to the city from three area lakes and two nearby reservoirs. There are two general hospitals, one state facility and a rehabilitation center. Abilene has adequate health care services and facilities.

Conclusions

The combination of the mild climatic conditions, low cost of living, recreational amenities, healthcare facilities and ample supplies of vacant land are positive factors that will contribute toward the long term stability of the area. Abilene's economy stabilized in 1990 after several years of decline. It now appears to be growing slowly, but steadily. The Comptroller's office is estimating Abilene to exhibit a population growth of 0.5% to 1% per year. The labor force has also stabilized and become more diversified. Overall, the Abilene economy can be characterized as stable with expectation of moderate growth during the next three to five years.

For the next three to five years, nonresidential rental rates and property values are expected to appreciate slightly. Values of well located sites are expected to remain stable to increasing, and values of secondary sites are expected to increase slightly.

A neighborhood is generally considered to be an area with conforming characteristics. It is defined as “a group of complementary land uses.” 3 A neighborhood can be a portion of a city, a community or an entire town. It is usually considered to be an area which exhibits a fairly high degree of homogeneity as to use, tenancy and certain other characteristics. Homogeneity is a state of uniform structure or composition throughout. The value of a property is not found exclusively in its physical characteristics. Physical, economic, political and sociological forces found in the area interact to influence real estate values. In order to determine the degree of influence extended by these forces on a property, their past, present and probable future trends must be analyzed in depth. The subject’s neighborhood is determined to be the south half of the city of Abilene. The following information is presented in summary chart form to give the reader a quick overview of the subject neighborhood.

GENERAL NEIGHBORHOOD CHARACTERISTICS

LOCATION | ___ | URBAN | X | SUBURBAN | ___ | RURAL |

% DEVELOPED | X | OVER 75% | ___ | 25%-75% | ___ | UNDER 25% |

GROWTH RATE | ___ | RAPID | X | STABLE | ___ | SLOW |

SUPPLY | ___ | SHORTAGE | X | IN BALANCE | ___ | OVERSUPPLY |

MARKETING TIME | ___ | < 6 MONTHS | ___ | 6-12 MONTHS | ___ | OVER 1 YEAR |

% RETAIL | ___ | OVER 75% | ___ | 25%-75% | ___ | UNDER 25% |

VALUES | ___ | INCREASING | X | STABLE | ___ | DECLINING |

STAGE OF LIFE CYCLE

GROWTH | |

STABILITY | X |

DECLINE | |

REVITALIZATION | |

The neighborhood is located in the south portion of the city of Abilene. Being a mature and established area, there have been few new commercial and residential development projects in recent years. The majority of new residential and commercial/retail development in the Abilene area has generally been located in the proximity of the Mall of Abilene, which provides the highest concentration of shopping facilities in the local area. The Mall is generally located at the intersection of Buffalo Gap Road and Highway 83, approximately three miles southeast of the subject property. A large portion of the neighborhood consists of single-family residences, with several multi-family residences as well. Much of the commercial and retail development is positioned along the major transportation routes and near the Mall of Abilene. The single-family residences in the nearby area were generally built 20 to 40 years prior to the appraisal date, and typically range between $80,000 and $130,000 in price. These homes have generally been well maintained, and thus this area remains a desirable market for single-family dwellings due to the overall upkeep and appeal.

3 Appraisal Institute, The Appraisal of Real Estate, 11th edition (Chicago: Appraisal Institute, 1996), p. 171.

Access throughout the subject neighborhood is good with several major transportation routes. Overall, the subject property is considered to have an adequate location with convenient access to several nearby major traffic carriers.

Governmental and Environmental Forces: Governmental forces consist of zoning regulations, building codes and prevailing property tax levels within a district. The subject neighborhood is zoned mixed use with moderate commercial and residential zoning with some local and area retail, as well as limited office zoning. Existing uses in the area appear to conform to the provisions of these classifications. Furthermore, these zoning ordinances have not been a deterrent to development in the neighborhood. The quality of police and fire protection provided by the City of Abilene has been satisfactory and the property tax burden is reasonable.

Environmental forces consist of physical features that are contained in or affect the neighborhood. The majority of improvements within the neighborhood are residential subdivisions and mixed use commercial properties. The maintenance of these properties is average as exhibited by adequate upkeep. No hazards or nuisances were noted such as litter, dust, odors or smog with the exception of vehicular and air traffic. The subject neighborhood does have some designated HUD flood hazard areas, but the area is generally well drained by a network of creeks and drainage channels.

All public utilities are readily available to the neighborhood and include municipal water, sanitary sewer, storm sewer, natural gas, telephone service and electricity. These utilities have reportedly been adequate for past needs and it should be noted there appears to be no shortages.

Trends and Development: The subject neighborhood is located within an area which is experiencing stabilization with minimal new construction taking place. The neighborhood at present, is approximately 80% to 85% developed with several vacant tracts of land available for development of new residential or commercial projects. At the present time, rent levels are not quite high enough in most instances to justify new construction of most commercial, office and multi-family investment properties. As a result, the recent stabilized growth trend is anticipated to continue in the near term.

Neighborhood Apartment Overview: There are numerous nearby apartment complexes that directly compete with the subject property. Many of these complexes were built at least 20 to 40 years prior to the appraisal date. Some of these properties exhibit the effects of older age in terms of design and overall amenities; however, the majority of these complexes are fairly well maintained and exhibit steady demand with occupancies generally averaging at least 93% or more. Additional information can be found in the Apartment Market Analysis that follows this analysis.

Demographics

The following chart summarizes population trends within 1-, 3-, and 5-mile radii of the subject, as well as comparative figures for the MSA:

Neighborhood Population Trends

| | 1 Mile | 3 Mile | 5 Mile | MSA |

| 1990 Census | 10,918 | 62,228 | 104,080 | 148,010 |

| 2006 Estimate | 10,087 | 60,686 | 105,728 | 158,539 |

| 2011 Projection | 9,573 | 58,795 | 103,750 | 157,168 |

| 1990-2006 Growth Rate | (0.49)% | (0.16)% | 0.10% | 0.43% |

| 2006-2011 Growth Rate | (1.04)% | (0.63)% | (0.38)% | (0.17)% |

Source: SRC, LLC

The current year population in this selected geography is 105,728. The 2000 Census revealed a population of 108,363, and in 1990 it was 104,080 representing a 4.1% change. It is estimated that the population in this area will be 103,750 in 2011, representing a change of -1.9% from 2006. The current population is 48.4% male and 51.6% female. In 2006, the median age of the population in this area was 31.6, compared to the US median age which was 36.5. The population density in your area is 1,346.2 people per square mile.

Neighborhood Household Trends

| | 1 Mile | 3 Mile | 5 Mile | MSA |

| 1990 Census | 4,464 | 23,845 | 37,381 | 54,044 |

| 2006 Estimate | 3,871 | 22,152 | 36,554 | 53,547 |

| 2011 Projection | 3,438 | 20,158 | 33,639 | 49,723 |

| 1990-2006 Growth Rate | (0.89)% | (0.46)% | 0.14% | 0.06% |

| 2006-2011 Growth Rate | (2.34)% | (1.87)% | (1.65)% | (1.47)% |

Source: SRC, LLC

There are currently 36,554 households in this selected geography. The Census revealed household counts of 40,410 in 2000, up from 37,381 in 1990, representing a change of 8.1%. It is estimated that the number of households in this area will be 33,639 in 2011, representing a change of -8.0% from the current year. For the current year, the average household size in this area is 2.89 persons.

In 2006, the median number of years in residence in this geography's population is 3.21. The average household size in this geography was 2.72 people and the average family size was 3.40 people. The average number of vehicles per household in this geography was 1.8.

The median housing value in this area was $45,981 in 1990, compare this to the US median of $78,382 for the same year. The 2000 Census median housing value was $61,266, which is a 33.2% change from 1990. In 1990, there were 22,124 owner occupied housing units in this area vs. 23,468 in 2000. Also in 1990, there were 15,256 renter occupied housing units in this area vs. 16,943 in 2000. The average rent in 1990 was $292 vs. $416 in 2000.

Neighborhood Analysis

The following chart summarizes income trends for the neighborhood.

Median Household Income Levels

| | 1 Mile | 3 Mile | 5 Mile | MSA |

| 1990 Census | $31,288 | $25,595 | $24,954 | $23,690 |