| | |

| OMB APPROVAL |

OMB Number: | | 3235-0059 |

Expires: | | January 31, 2008 |

Estimated average burden |

hours per response | | 14 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Cadmus Communications Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Dear Shareholder:

You are cordially invited to attend the 2006 Annual Meeting of Shareholders of Cadmus Communications Corporation (Cadmus or the Company). The meeting will be held on November 8, 2006, at 11:00 a.m., eastern time, at the Troutman Sanders Building, 15th Floor, Sanders Room, 1001 Haxall Point, Richmond, Virginia.

The primary business of the meeting will be the election of directors and ratification of the selection of independent auditors, as more fully explained in the enclosed proxy statement.

During the meeting, we also will report to you on the condition and performance of Cadmus and its subsidiaries, including developments during the past fiscal year. You will have an opportunity to question management on matters of interest to all shareholders.

We hope to see you on November 8. Whether you plan to attend or not, please complete, sign, date and return the enclosed proxy card as soon as possible in the postage-paid envelope provided. Your vote is important. If you receive more than one proxy card, it is an indication that your shares are registered in more than one account, and each proxy must be completed and returned if you wish to vote all of your shares eligible to be voted at the meeting.

We appreciate your continued interest in and support of Cadmus.

|

| Cordially, |

|

|

| Thomas C. Norris |

| Chairman of the Board |

October 2, 2006

CADMUS COMMUNICATIONS CORPORATION

1801 Bayberry Court, Suite 200, Richmond, Virginia 23226

NOTICE OF 2006 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 8, 2006

The 2006 Annual Meeting of Shareholders of Cadmus Communications Corporation will be held on November 8, 2006, at 11:00 a.m., eastern time, at theTroutman Sanders Building, 15th Floor, Sanders Room, 1001 Haxall Point, Richmond, Virginia, for the following purposes:

1. To elect three Class II directors to serve until the 2009 Annual Meeting of Shareholders;

2. To ratify the selection of BDO Seidman, LLP as independent auditors for the current fiscal year; and

3. To transact such other business as may properly come before the meeting or any adjournments thereof.

The Board of Directors has fixed the close of business on September 1, 2006, as the record date for determination of shareholders entitled to notice of and to vote at the meeting and any adjournments thereof.

|

By Order of the Board of Directors |

|

|

Bruce V. Thomas |

| President and Chief Executive Officer |

October 2, 2006

Please complete and return the enclosed proxy. If you attend the meeting in person, you may withdraw your proxy and vote your own shares.

CADMUS COMMUNICATIONS CORPORATION

1801 Bayberry Court, Suite 200, Richmond, Virginia 23226

PROXY STATEMENT

2006 ANNUAL MEETING OF SHAREHOLDERS

To Be Held on November 8, 2006

General

The enclosed proxy is solicited by the Board of Directors of Cadmus Communications Corporation for the 2006 Annual Meeting of Shareholders of Cadmus to be held November 8, 2006, at the time and place set forth in the accompanying Notice of 2006 Annual Meeting of Shareholders and for the following purposes: (i) to elect three Class II directors to serve until the 2009 Annual Meeting of Shareholders (see “Item 1. Election of Directors,” page 6; (ii) to ratify the selection of BDO Seidman, LLP as independent auditors for the current fiscal year (see “Item 2. Ratification of the Selection of Independent Auditors,” page 34), and (iii) to transact such other business as may properly come before the Annual Meeting or any adjournments thereof.

If a shareholder is a participant in the Cadmus Dividend Reinvestment Plan, the shareholder is being sent a proxy card representing the number of full shares in the participant’s dividend reinvestment plan account as well as shares registered in the participant’s name as of the record date for the Annual Meeting. If a shareholder is a participant in the Cadmus Thrift Savings Plan with shares of Cadmus common stock allocated to his or her account, the shareholder is being sent a separate proxy card representing the number of full shares allocated to his or her thrift savings plan account as of the record date for the Annual Meeting. A participant in the Cadmus Non-Qualified Savings Plan does not have voting rights with respect to his or her deemed investments, including those in Cadmus common stock, and will not be sent a proxy card reflecting Cadmus shares of common stock held through the Cadmus Non-Qualified Savings Plan.

Cadmus will pay all costs for this proxy solicitation. Proxies are being solicited by mail and may also be solicited in person, or by telephone, by directors, officers and employees of Cadmus. Cadmus may reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for their reasonable expenses in sending proxy materials to the beneficial owners of Cadmus common stock (Common Stock).

The approximate mailing date of this proxy statement and the accompanying proxy is October 2, 2006.

Revocation and Voting of Proxies

Submitting a proxy will not affect a shareholder’s right to attend the Annual Meeting and to vote in person. Any shareholder who has executed and returned a proxy may revoke it by attending the Annual Meeting and requesting to vote in person. A shareholder may also

1

revoke a proxy at any time before it is exercised by filing a written notice with the Company or by submitting a proxy bearing a later date. Proxies will extend to and will be voted at any properly adjourned session of the Annual Meeting. Each proxy will be voted as directed by the shareholder. If a shareholder returns a proxy but does not specify how to vote, the proxy will be voted for the director nominees and for ratification of the selection of the independent auditors.

Voting Rights

Only those shareholders of record at the close of business on September 1, 2006, are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. The number of shares of Common Stock outstanding and entitled to vote as of the record date was 9,530,631. A majority of those shares, represented in person or by proxy, will constitute a quorum for the transaction of business. If a share is represented for any purpose at the meeting, including any matter with respect to which the shareholder abstains from voting, it is deemed present for purposes of establishing a quorum for all matters considered at the meeting.

Each share outstanding on the record date will be entitled to one vote on each matter to be considered. With regard to the election of directors, votes may be cast in favor or withheld. If a quorum is present, the three nominees receiving the most votes will be elected. As a result, votes withheld will have no effect.

Ratification of the selection of BDO Seidman, LLP as independent auditors requires the favorable vote of a majority of the votes cast on the proposal. Thus, although abstentions and broker non-votes (shares held by customers which may not be voted on certain matters because the broker or plan administrator has not received specific instructions from the customer) are counted for purposes of determining the presence or absence of a quorum, they will not count as votes cast on a proposal, and therefore have no effect.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of August 31, 2006, the number and percentage of shares of Common Stock beneficially held by persons known by Cadmus to be the owners of more than 5% of the Company’s Common Stock, each of the Cadmus directors, nominees for director and executive officers named in the “Summary Compensation Table,” and all directors, nominees and executive officers as a group.

| | | | | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | | |

| | Shares(1)

| | | Exercisable Options(2)

| | Percent of Class

| |

Nathu R. Puri Nottingham, United Kingdom | | 1,771,369 | (3) | | 6,000 | | 18.64 | % |

| | | |

J. & W. Seligman & Co. Inc. New York, New York | | 1,488,370 | (4) | | — | | 15.62 | % |

2

| | | | | | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | | | |

| | Shares(1)

| | | Exercisable Options(2)

| | | Percent of Class

| |

Rutabaga Capital Management Boston, Massachusetts | | 770,662 | (5) | | — | | | 8.09 | % |

| | | |

Wachovia Corporation Charlotte, North Carolina | | 529,250 | (6) | | — | | | 5.55 | % |

| | | |

Martina L. Bradford Washington, D.C. | | 2,100 | | | 5,000 | | | * | |

| | | |

Thomas E. Costello Longboat Key, Florida | | 2,000 | | | 3,000 | | | * | |

| | | |

Robert E. Evanson Holmdel, New Jersey | | 1,000 | | | 2,000 | | | * | |

| | | |

G. Waddy Garrett Richmond, Virginia | | 12,100 | (7) | | 8,000 | | | * | |

| | | |

Keith Hamill Kent, England | | 3,120 | | | 2,000 | | | * | |

| | | |

Stephen E. Hare(8) Atlanta, Georgia | | 1,692 | | | — | | | * | |

| | | |

Edward B. Hutton, Jr.

Vero Beach, Florida | | 32,700 | | | 3,000 | | | * | |

| | | |

Lisa S. Licata Richmond, Virginia | | 38,933 | (9) | | 15,000 | | | * | |

| | | |

Wayne B. Luck Richmond, Virginia | | 51,573 | (10) | | 21,000 | | | * | |

| | | |

Gerard P. Lux, Jr. Charlotte, North Carolina | | 76,371 | (11) | | 40,067 | | | 1.22 | % |

| | | |

Thomas C. Norris York, Pennsylvania | | 10,000 | | | 2,000 | | | * | |

| | | |

James E. Rogers Richmond, Virginia | | 4,292 | | | 4,000 | | | * | |

| | | |

Paul K. Suijk Richmond, Virginia | | 56,378 | (12) | | — | | | * | |

| | | |

Bruce V. Thomas Richmond, Virginia | | 145,512 | (13) | | 98,000 | | | 2.53 | % |

| | | |

All Directors, Nominees and

Executive Officers as a Group

(18 persons)(14) | | 2,256,684 | | | 244,177 | (15) | | 25.58 | % |

| * | Indicates that percent of the Company’s Common Stock does not exceed one percent. |

| (1) | Except as otherwise indicated and except to the extent that in certain cases shares may be held in joint tenancy with a spouse, each nominee, director, or executive officer has sole voting and investment power with respect to the shares shown. |

3

| (2) | Includes options that will become exercisable within 60 days of August 31, 2006. |

| (3) | Includes 128,045 shares held by Melham US Inc. (Melham), of which Mr. Puri is the controlling shareholder, 1,143,324 shares held by Purico (IOM) Limited (Purico), of which Mr. Puri is the controlling shareholder, and 500,000 shares held by Clary Limited (Clary), of which Mr. Puri is the controlling shareholder. According to information provided by Mr. Puri, he has no voting or investment power with respect to any of the shares held by Melham, Purico or Clary. In the case of each of Melham, Purico and Clary, all voting and investment power with respect to these shares is controlled by the respective company’s board of directors. |

| (4) | Based on a listing of institutional holders of the Company’s Common Stock provided to the Company by NASDAQ OnlineSM, reflecting beneficial ownership as of June 30, 2006. According to Amendment No. 12 to Schedule 13G filed with the Securities and Exchange Commission on February 13, 2006 by J. & W. Seligman & Co. Incorporated (J. & W. Seligman), as of December 31, 2005, J. & W. Seligman was the beneficial owner of 1,668,815 shares of Company Common Stock and had shared voting power with respect to 1,311,495 of the reported shares and shared investment power with respect to all 1,668,815 shares. |

| (5) | Based on a listing of institutional holders of the Company’s Common Stock provided to the Company by NASDAQ OnlineSM, reflecting beneficial ownership as of June 30, 2006. According to Amendment No. 6 to Schedule 13G filed with the Securities and Exchange Commission on February 16, 2006 by Rutabaga Capital Management (Rutabaga), as of December 31, 2005, Rutabaga was the beneficial owner of 772,077 shares of Company Common Stock and had sole voting power with respect to 318,471 of the reported shares, shared voting power with respect to 453,606 of the reported shares and sole investment power with respect to all 772,077 shares. |

| (6) | Based on a listing of institutional holders of the Company’s Common Stock provided to the Company by NASDAQ OnlineSM, reflecting beneficial ownership as of June 30, 2006. According to Amendment No. 1 to Schedule 13G filed with the Securities and Exchange Commission on February 10, 2006 by Wachovia Corporation (Wachovia), as of December 31, 2005, Wachovia was the beneficial owner of 530,466 shares of Company Common Stock and had sole voting power with respect to all 530,466 shares and sole investment power with respect to 520,700 of the reported shares. As the holding company of Evergreen Investment Management Company, J.L. Kaplan Associates, LLC and Wachovia Bank, N.A, Wachovia Corporation reports the number of shares of Company Common Stock beneficially owned by these subsidiaries. Evergreen Investment Management Company and J.L. Kaplan Associates, LLC are investment advisors for mutual funds and/or other clients; the Company Common Stock reported by these subsidiaries is beneficially owned by such mutual funds or other clients. Wachovia Bank, N.A. holds the Company Common Stock in a fiduciary capacity for its respective customers. |

| (7) | Includes 600 shares held by Mr. Garrett’s wife, as to which shares Mr. Garrett disclaims beneficial ownership. |

4

| (8) | Mr. Hare ceased active employment with the Company effective March 15, 2006. |

| (9) | Includes 308 shares held for Ms. Licata’s account in the Cadmus account under the Cadmus Non-Qualified Savings Plan and 30,381 shares of performance-vesting restricted stock over which Ms. Licata does not have investment power until such shares vest and are distributed. See Note (4) to the Summary Compensation Table on page 16 for a discussion of the vesting conditions relating to the performance-vesting restricted stock. |

| (10) | Includes 8,229 shares held for Mr. Luck’s account in the Cadmus account under the Cadmus Thrift Savings Plan and 30,835 shares of performance-vesting restricted stock over which Mr. Luck does not have investment power until such shares vest and are distributed. See Note (4) to the Summary Compensation Table on page 16 for a discussion of the vesting conditions relating to the performance-vesting restricted stock. |

| (11) | Includes 2,342 shares held for Mr. Lux’s account in the Cadmus account under the Cadmus Thrift Savings Plan, 4,963 shares held for Mr. Lux’s account in the Cadmus account under the Cadmus Non-Qualified Savings Plan and 64,748 shares of performance-vesting restricted stock over which Mr. Lux does not have investment power until such shares vest and are distributed. See Note (4) to the Summary Compensation Table on page 16 for a discussion of the vesting conditions relating to the performance-vesting restricted stock. |

| (12) | Includes 3,573 shares held for Mr. Suijk’s account in the Cadmus account under the Cadmus Thrift Savings Plan and 46,682 shares of performance-vesting restricted stock over which Mr. Suijk does not have investment power until such shares vest and are distributed. See Note (4) to the Summary Compensation Table on page 16 for a discussion of the vesting conditions relating to the performance-vesting restricted stock. |

| (13) | Includes 6,795 shares held for Mr. Thomas’ account in the Cadmus account under the Cadmus Thrift Savings Plan and 118,975 shares of performance-vesting restricted stock over which Mr. Thomas does not have investment power until such shares vest and are distributed. See Note (4) to the Summary Compensation Table on page 16 for a discussion of the vesting conditions relating to the performance-vesting restricted stock. |

| (14) | In addition to the executive officers named in the Summary Compensation Table, the beneficial ownership shown for executive officers of Cadmus reflects shares beneficially owned by Peter R. Hanson, Chief Operating Officer, Publisher Services Group, Christopher T. Schools, Vice President and Treasurer, and Bruce G. Willis, Executive Vice President, Finance and Administration, Publisher Services Group, and Senior Vice President of Procurement, Cadmus. |

| (15) | Includes zero options exercisable by Mr. Hanson, zero options exercisable by Mr. Schools and 35,110 options exercisable by Mr. Willis. |

5

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Cadmus’ directors and certain of its officers to file reports with the Securities and Exchange Commission indicating their holdings of, or transactions in, Cadmus’ equity securities. Based on a review of these reports and written representations furnished to Cadmus, Cadmus believes that, during fiscal year 2006, its directors and officers complied with all Section 16(a) filing requirements.

Item 1. Election of Directors

The Board of Directors is divided into three classes (I, II and III), with one class being elected each year for a term of three years. G. Waddy Garrett, Thomas C. Norris and Bruce V. Thomas currently serve as Class II directors, with terms expiring at the 2006 Annual Meeting. The Board of Directors has nominated Messrs. Garrett, Norris and Thomas to serve as Class II directors for terms of three years expiring at the 2009 Annual Meeting of Shareholders.

Your proxy will be voted to elect the nominees unless you instruct us otherwise. If, for any reason, any of the persons nominated should become unavailable to serve, an event which management does not anticipate, proxies will be voted for the remaining nominees and such other person or persons as the Board of Directors may designate. In the alternative, the Board may reduce the size of any class to reflect the number of remaining nominees, if any, for whom the proxies will be voted.

Certain information concerning the three nominees for election at the Annual Meeting is set forth below, as well as certain information about the Class III and Class I directors, who will continue in office after the Annual Meeting until the 2007 and 2008 Annual Meetings of Shareholders, respectively.

6

NOMINEES FOR ELECTION AS

CLASS II DIRECTORS

(To Serve Until 2009 Annual Meeting)

| | | | |

Name (Age)

| | Director

Since

| | Principal Occupation During

Past Five Years and Directorships

in Other Public Companies

|

| | |

G. Waddy Garrett (65) | | 1997 | | President, GWG Financial, LLC. Retired Chairman and Chief Executive Officer of Alliance Agronomics, Inc., a Mechanicsville, Virginia based fertilizer and distribution company. Director, Bank of Virginia and Reeds Jewelers, Inc. |

|

| | |

Thomas C. Norris (68) | | 2000 | | Non-Executive Chairman of Cadmus. Retired Chairman of the Board of P. H. Glatfelter Company (now Glatfelter Co.), headquartered in York, Pennsylvania, a multi-national manufacturer of engineered and specialized printing papers. Formerly, Chairman, President and CEO of P. H. Glatfelter Company (now Glatfelter Co.). Director, York Water Company. |

|

| | |

Bruce V. Thomas (50) | | 2000 | | President and Chief Executive Officer of Cadmus since July 2000. Formerly, Senior Vice President and Chief Operating Officer of Cadmus. |

|

The Board of Directors recommends that you voteFOR

the foregoing nominees to the Board of Directors in Item 1.

7

CLASS III DIRECTORS

(Serving Until 2007 Annual Meeting)

| | | | |

Name (Age)

| | Director

Since

| | Principal Occupation During

Past Five Years and Directorships

in Other Public Companies

|

| | |

Martina L. Bradford (54) | | 2000 | | Partner, Akin Gump Strauss Hauer & Feld, LLP, Washington, D.C. Former Corporate Vice President, Global Public Affairs of Lucent Technologies, a global provider of communication systems, software and services. Formerly, Corporate Vice President, Federal Government Affairs for AT&T. |

|

| | |

Robert E. Evanson (69) | | 2004 | | Senior Advisor to Leveraged Transaction Group of Apax Partners, Inc., a private equity company based in New York, New York, from May 2003 through March 2005. Retired President, McGraw-Hill Education from 2000 through 2002; Executive Vice President and Chief Operating Officer, McGraw-Hill Education from 1998 through 1999. Retired, certified public accountant. Director, The Princeton Review, Inc. |

|

| | |

James E. Rogers (61) | | 2000 | | President, SCI Investors, Inc., a Richmond, Virginia private equity firm. Chairman, Caraustar Industries, Inc. Director, New Market Corp., Owens & Minor, Inc. and Wellman, Inc. |

|

8

CLASS I DIRECTORS

(Serving Until 2008 Annual Meeting)

| | | | |

Name (Age)

| | Director

Since

| | Principal Occupation During Past Five Years and Directorships

in Other Public Companies

|

| | |

Thomas E. Costello (67) | | 2002 | | Retired Chief Executive Officer,xpedx, a division of International Paper Company, specializing in the distribution of commercial printing paper, graphics and packaging solutions. |

|

| | |

Keith Hamill (53) | | 2002 | | Chairman, Bertram Books Ltd. Chairman of several United Kingdom listed companies, including Luminar plc (leisure), Collins Stewart Tullett plc (financial services), Moss Bros Group PLC (retailer) and Alterian plc (software provider). Chairman of United Kingdom private equity-backed companies Travelodge (hotels) and Health Lambert Group Limited (insurance, brokering). Director of United Kingdom listed company Electrocomponents plc (electronic equipment and supplies). Formerly, Chief Financial Officer of international retailer and publisher WH Smith PLC, Chairman of WH Smith USA and Chief Financial Officer of Forte PLC, international hotel and leisure group, and partner of PricewaterhouseCoopers. Fellow, Institute of Chartered Accountants for England. Former member, Urgent Issues Task Force of the United Kingdom Accounting Standards Board. Deputy Chancellor, University of Nottingham. |

|

9

| | | | |

Name (Age)

| | Director

Since

| | Principal Occupation During Past Five Years and Directorships

in Other Public Companies

|

| | |

Edward B. Hutton, Jr. (61) | | 2002 | | President, Hutton Broadcasting, LLC, Vero Beach, Florida. Formerly, Chief Executive Officer, Lippincott Williams & Wilkins, a publishing company. |

|

| | |

Nathu R. Puri (66) | | 1999 | | Former Chairman and controlling shareholder, Melton Medes Group and Melham Holdings Limited. Controlling shareholder, Clary Limited, Condor Structure Limited and Purico (IOM) Limited. |

|

10

Cadmus Board and Committee Meetings and Attendance

The Board of Directors of Cadmus held seven meetings during the fiscal year ended June 30, 2006. Each director attended at least 75% of all meetings of the Board and the committees on which he or she served, except for Messrs. Hamill and Puri who attended 67% and 71% of all such meetings, respectively. The Board believes that each director of Cadmus should attend each annual meeting of shareholders in its entirety and in person. All directors attended the 2005 Annual Meeting.

Cadmus’ Board of Directors is composed of a majority of directors who qualify as “independent” as defined by the rules of the NASDAQ Stock Market. To be considered independent, the Board of Directors must determine each year that a director does not have any direct or indirect material relationship with Cadmus that would impair the director’s independence. When assessing the “materiality” of any relationship a director has with Cadmus, the Board of Directors reviews all relevant facts and circumstances of the relationship to assure itself that no commercial, charitable or family relationship of a director impairs such director’s independence. The Board of Directors has affirmatively determined that each of the following directors qualifies as independent: Ms. Bradford and Messrs. Costello, Evanson, Garrett, Hamill, Hutton, Norris and Rogers.

The Board has five standing committees: the Executive Committee, the Planning and Risk Management Committee, the Human Resources and Compensation Committee, the Audit Committee and the Nominating and Governance Committee. Each committee operates pursuant to a written charter adopted by the Board, which sets forth in more specific detail the duties and responsibilities of the committee. These charters are available at the Company’s website atwww.cadmus.com, under “Investors — Governance.”

The Executive Committee has a wide range of powers, but its primary duty is to act if necessary between scheduled Board meetings. For such purpose, the Executive Committee possesses all the powers of the Board in management of the business and affairs of Cadmus except as otherwise limited by Virginia law. The Executive Committee met four times during the fiscal year ended June 30, 2006. Members of the Committee are Ms. Bradford and Messrs. Costello, Hutton, Norris (Chairman), Rogers and Thomas.

The Nominating and Governance Committee assists the Board of Directors in reviewing the qualifications of director candidates (including candidates suggested by shareholders) and identifying qualified candidates to serve on the Board of Directors, in reviewing and evaluating the Board’s committee structure, responsibilities and membership, in reviewing and developing corporate governance and board governance practices and procedures and in evaluating the Board’s performance. The Board has determined that all three members of the Committee are independent in accordance with the rules of the NASDAQ Stock Market. The Committee met two times during the fiscal year ended June 30, 2006. Members of the Committee are Ms. Bradford (Chairman) and Messrs. Hamill and Hutton.

The Nominating and Governance Committee is responsible for evaluating the size and composition of the Board of Directors and approving the criteria used for board

11

membership. It is also responsible for identifying and recommending to the Board of Directors specific nominees for board membership. As a general matter, candidates for nomination to the Board of Directors are recommended to the Committee by individual members of the Committee, by other Board members or by officers or employees of Cadmus. The evaluation of board nominee candidates normally involves a review of the candidate’s background, experience and expertise, a series of internal discussions and one or more interviews and meetings between selected candidates and members of the Committee and other board members.

In evaluating board nominee candidates, the Committee’s goal is to identify the available candidates with the greatest potential to make a significant contribution to the Board and the Company. While the Committee has not established any specific minimum qualifications that a nominee must possess, it has identified the following characteristics as factors to be considered in evaluating potential new Board members: transactional expertise; new media expertise; operational expertise; diversity; strategic expertise; financial expertise; marketing expertise; corporate governance expertise; and industry expertise, especially in new markets targeted by the Company. The Committee’s emphasis and priorities in evaluating Board candidates and the relative weight which it attaches to each of these characteristics will vary from time to time based on the particular needs of the Board and the Company at the time and based on the expertise of the incumbent members of the Board of Directors.

The Committee will consider candidates for Board membership recommended by shareholders, and those candidates will be reviewed and evaluated by the Committee using the same process and the same criteria then being applied to other candidates. A shareholder desiring to recommend a candidate for Board membership to the Committee must make the recommendation in writing and forward it to the Nominating and Governance Committee, c/o Corporate Secretary, Cadmus Communications Corporation, 1801 Bayberry Court, Suite 200, Richmond, Virginia 23226. To give the Committee sufficient time to review and evaluate the recommendation, it must be delivered not later than 120 days prior to the anniversary date of the mailing of the proxy statement for the prior year’s annual meeting of shareholders. The recommendation must include the name and contact information of the recommending shareholder, the name and contact information of the candidate recommended for board membership, a resume of the Board candidate containing relevant biographical information, a description of the Board candidate’s experience, expertise and other qualifications relevant to service on the Board, a statement that the candidate has agreed to serve on the Board of Directors if nominated and elected, and any other information which the recommending shareholder believes that the Committee should consider.

The primary function of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities by reviewing the financial information which will be provided to the shareholders and others, the systems of internal controls which management has established, and the audit process. The Board has determined that all four members of the Committee satisfy the financial literacy and independence requirements of the Securities

12

and Exchange Commission and the rules of the NASDAQ Stock Market with respect to Audit Committee membership. The Audit Committee met four times during the fiscal year ended June 30, 2006. Members of the Committee are Messrs. Evanson, Garrett, Norris and Rogers (Chairman). The Board has determined that Mr. Evanson is an Audit Committee financial expert as defined by Securities and Exchange Commission regulations.

The primary function of the Human Resources and Compensation Committee is to assist the Board in carrying out the responsibilities of the Board of Directors relating to executive compensation, associate benefits and human resources policies and procedures. The Board has determined that all five members of the Committee are independent in accordance with the rules of the NASDAQ Stock Market. The Committee met eight times during the fiscal year ended June 30, 2006. Members of the Committee are Ms. Bradford and Messrs. Costello (Chairman), Evanson, Garrett and Hamill.

The primary function of the Planning and Risk Management Committee is to review, evaluate and make recommendations to the Board of Directors regarding the Company’s strategic and operational planning and budgeting process, operation and financial performance, proposed acquisitions, divestitures and other material transactions, capital and debt structure and insurance and risk management programs. The Planning and Risk Management Committee met four times during the fiscal year ended June 30, 2006. Members of the Committee are Messrs. Costello, Hamill, Hutton (Chairman), Puri and Rogers.

Compensation Committee Interlocks and Insider Participation

Members of the Human Resources and Compensation Committee are Ms. Bradford and Messrs. Costello (Chairman), Evanson, Garrett and Hamill. No member of this committee is or has ever been an employee of Cadmus. Furthermore, none of Cadmus’ executive officers has served on the board of directors of any company of which a Human Resources and Compensation Committee member is an employee.

Directors’ Compensation

Cash Compensation. For the fiscal year ended June 30, 2006, each director of Cadmus who was not also an executive officer of Cadmus received: (a) an annual retainer of $13,750; (b) $1,250 for each Board meeting attended; (c) $800 for each committee meeting attended; (d) $800 for each committee or Board meeting conference call attended; and (e) $400 for each quarterly earnings conference call attended. The Chairman of the Board of Directors received an additional annual payment of $50,000. Thomas C. Norris served as Chairman of the Board of Directors for the fiscal year ended June 30, 2006 and continues to serve as Chairman of the Board in the current fiscal year. The Chairman of each committee other than the Executive Committee also received an additional annual payment of $2,000. The Company previously disclosed that the annual retainer for each director who was not also an executive officer of Cadmus would increase to $15,000 for the fiscal year ended June 30, 2006. The increased annual retainer began being paid with the

13

second quarter of fiscal 2006, with a resulting annual retainer of $13,750 for each non-executive director for the fiscal year ended June 30, 2006. All Board retainer and meeting attendance fees remain the same for the fiscal year ending June 30, 2007, except that the annual retainer for each director who is not also an executive officer of Cadmus is $15,000.

Each director also is reimbursed for usual and ordinary expenses of meeting attendance. A director who also is an employee of Cadmus or its subsidiaries receives no additional compensation for serving as a director.

Cadmus has in effect a plan under which directors may elect to defer their annual retainers and attendance fees generally until after the termination of their service on the Board.

Non-Employee Director Stock Compensation Plan. The 2004 Non-Employee Director Stock Compensation Plan, which was approved by shareholders at the 2004 Annual Meeting, provides for annual grants of options for 1,000 shares of Cadmus stock on each November 15 from November 15, 2004 through November 15, 2008 to each non-employee serving as a member of the Board on each such November 15.

Certain Relationships and Other Transactions with Management

Pursuant to a lease agreement entered into in August 1998, Cadmus’ Port City Press subsidiary (which operates within the Publisher Services segment) leases its manufacturing and distribution facility in Baltimore, Maryland from an indirect subsidiary of a company whose majority shareholder is Nathu R. Puri, a Class I director. The initial term of the lease agreement is 20 years, with options available to the tenant to extend the lease for four additional terms of five years each. For the first five years of the lease, the annual rent was $977,407, with the rent increasing approximately 14.5% every fifth year. The annual rent for fiscal years 2005 and 2006 was $1,119,129. The annual rent increases to $1,281,403 for years eleven through fifteen and to $1,467,207 for years sixteen through twenty of the lease. The annual rent for the first extension term is $1,613,928. The annual rent for subsequent extension terms is to be based on fair market rent not less than $1,467,207.

From time to time, Cadmus and its subsidiaries may purchase products from or utilize services of other corporations of which a Cadmus director is a director, officer or employee. Such transactions occur in the ordinary course of business and are not deemed material.

Communications with the Board of Directors

Cadmus provides an informal process for its shareholders to send communications to its Board of Directors, to any committee of the Board, or to one or more individual directors. Such communications should be in writing and sent by mail to Cadmus Communications Corporation, Attention: Corporate Secretary, 1801 Bayberry Court, Suite 200, Richmond, Virginia 23226. The Corporate Secretary will transmit all such communications to the person or persons to whom they are directed.

14

Executive Compensation

The following table shows, for the fiscal years ended June 30, 2006, 2005 and 2004, the total salary and compensation awarded to or earned by the Company’s Chief Executive Officer and the other most highly compensated executive officers as of June 30, 2006.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long-Term Compensation

| | |

Name (Age) and

Principal Position

| | Year

| | Salary ($)(1)

| | Bonus($)(2)

| | | Other Annual Compen- sation

($)(3)

| | Restricted Stock Awards ($)(4)

| | | Securities Underlying Options/ SARs (#)

| | All Other Compen- sation ($)(5)

|

Bruce V. Thomas (50) | | FY06 | | $ | 474,317 | | | — | | | | — | | | — | | | — | | $ | 4,666 |

President and Chief | | FY05 | | | 459,346 | | $ | 69,500 | (6) | | | — | | $ | 1,653,753 | (7) | | — | | | 4,018 |

Executive Officer | | FY04 | | | 446,538 | | | 225,000 | | | | — | | | — | | | — | | | 3,907 |

| | | | | | | |

Lisa S. Licata (45) | | FY06 | | $ | 211,962 | | | — | | | | — | | | — | | | — | | $ | 3,402 |

Senior Vice President | | FY05 | | | 207,545 | | $ | 22,163 | | | | — | | $ | 422,296 | (7) | | — | | | 2,674 |

of Human Resources and | | FY04 | | | 204,407 | | | 65,000 | | | | — | | | — | | | — | | | 3,431 |

Corporate Secretary | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Wayne B. Luck (50) | | FY06 | | $ | 215,126 | | | — | | | | — | | | — | | | — | | $ | 3,678 |

Senior Vice President and | | FY05 | | | 211,571 | | $ | 22,502 | (6) | | | — | | $ | 428,607 | (7) | | — | | | 2,912 |

Chief Information Officer | | FY04 | | | 209,011 | | | 60,000 | | | | — | | | — | | | — | | | 3,665 |

| | | | | | | |

Gerard P. Lux, Jr. (48) | | FY06 | | $ | 301,154 | | $ | 156,000 | | | | — | | | — | | | — | | $ | 2,593 |

President, Cadmus | | FY05 | | | 301,154 | | | 269,250 | (6) | | | — | | $ | 899,997 | (7) | | — | | | 2,382 |

Specialty Packaging | | FY04 | | | 282,698 | | | 275,000 | | | | — | | | — | | | — | | | 3,418 |

| | | | | | | |

Paul K. Suijk (49) | | FY06 | | $ | 261,933 | | $ | 165,000 | (8) | | | — | | | — | | | — | | $ | 2,877 |

Senior Vice President and | | FY05 | | | 253,394 | | | 27,169 | (6) | | | — | | $ | 648,880 | (7) | | — | | | 2,573 |

Chief Financial Officer | | FY04 | | | 239,279 | | | 82,500 | | | $ | 136,676 | | | — | | | — | | | 4,930 |

| | | | | | | |

Stephen E. Hare (53) | | FY06 | | $ | 301,538 | | | — | | | $ | 30,154 | | | — | | | — | | $ | 302,350 |

Former Executive Vice | | FY05 | | | 396,923 | | | — | (10) | | | 57,131 | | $ | 1,200,001 | (7) | | — | | | 4,320 |

President and President, | | FY04 | | | 382,085 | | $ | 100,000 | | | | 40,924 | | | — | | | — | | | 4,815 |

Cadmus Publisher Services(9) | | | | | | | | | | | | | | | | | | | | | �� |

| (1) | Reflects salary before pretax contributions under the Cadmus Thrift Savings Plan and non-qualified plans. |

| (2) | Except where otherwise noted, reflects short-term incentive awards accrued for each of the three fiscal years ended June 30, 2006 under the Cadmus Incentive Plan described in the Report of the Human Resources and Compensation Committee on Executive Compensation beginning on page 24. |

| (3) | Mr. Suijk’s “Other Annual Compensation” in fiscal 2004 consisted of a relocation allowance of $128,276 and an $8,400 automobile allowance. For the fiscal years ended June 30, 2006, 2005 and 2004, none of the named executive officers received perquisites or other personal benefits in excess of $50,000 or 10% of their total cash compensation. Mr. Hare’s “Other Annual Compensation” included: in fiscal 2006, |

15

| | $30,154 in tax reimbursement payments in connection with taxes he incurred upon the vesting of a portion of his restricted Cadmus stock; in fiscal 2005, $57,131 in tax reimbursement payments in connection with taxes he incurred upon the vesting of a portion of his restricted Cadmus stock; and in fiscal 2004, $40,924 in tax reimbursement payments in connection with taxes he incurred upon the vesting of a portion of his restricted Cadmus stock. |

| (4) | Reflects the market value on the date of grant of performance-vesting restricted stock awards made on November 10, 2004 under the 2005-2007 executive long term incentive subplan (LTIP) established pursuant to the 2004 Key Employee Stock Compensation Plan. Performance-vesting LTIP restricted stock generally tentatively vests annually based on satisfaction of earnings per share and share price targets, subject to divestment and forfeiture upon non-covered termination of employment prior to the Human Resources and Compensation Committee’s final determination of vesting and awards in the first four months of fiscal year 2008.However, if the specified performance targets ultimately are not achieved through the end of fiscal 2007, the LTIP restricted stock will be forfeited back to the Company. The LTIP restricted stock for fiscal years 2005 and 2006 did not vest as specified performance targets were not achieved as of June 30, 2006.LTIP restricted stock also may vest in whole or in part upon satisfaction of certain performance criteria in case of death, disability, retirement, termination by Cadmus without cause, termination by an employee for good reason under an employment agreement, or change in control. Dividends on unvested LTIP restricted stock are accumulated at the same rate and to the same extent as dividends paid on the Company’s outstanding stock generally, and will be paid out only if and when the underlying shares are distributed free of restrictions. |

| (5) | Fiscal year 2006 includes: (i) matching contributions by Cadmus or its subsidiaries under the Cadmus Thrift Savings Plan in the amounts of $3,300 for Mr. Thomas, $3,291 for Ms. Licata, $3,290 for Mr. Luck, $2,461 for Mr. Lux, $2,483 for Mr. Suijk and $1,759 for Mr. Hare, and (ii) life insurance premiums paid by Cadmus in the amounts of $1,366 for Mr. Thomas, $111 for Ms. Licata, $388 for Mr. Luck, $132 for Mr. Lux, $394 for Mr. Suijk and $1,608 for Mr. Hare. Fiscal year 2006 for Mr. Hare also includes: (i) a payment of $177,450 for the cancellation of 23,200 stock options, (ii) $108,333 paid pursuant to his Change in Status Agreement, and (iii) $13,200 in consulting fees paid after his change in status. |

| (6) | In support of cost-reduction steps taken by the Company during the first quarter of fiscal 2006, the bonus amounts paid for the fiscal year ended June 30, 2005 and reported in this table were reduced from the amounts previously reported for Messrs. Thomas, Luck, Lux and Suijk from $94,500, $27,589, $270,000 and $33,638, respectively. |

| (7) | All of Mr. Hare’s performance-vesting LTIP restricted stock was forfeited as of June 30, 2006 in connection with his resignation. At June 30, 2006, Mr. Thomas, Ms. Licata, and Messrs. Luck, Lux, and Suijk held 118,975, 30,381, 30,835, 64,748 and 46,682 shares, respectively, of performance-vesting LTIP restricted stock, having |

16

| | an aggregate value of $2,079,683, $531,060, $538,996, $1,131,795, and $816,001, respectively, based on a closing price of $17.48 per share. However, if the specified performance targets ultimately are not achieved through the end of fiscal 2007, the LTIP restricted stock will be forfeited back to the Company. The LTIP restricted stock for fiscal years 2005 and 2006 did not vest as specified performance targets were not achieved as of June 30, 2006. |

| (8) | A special bonus of $165,000 was awarded to Mr. Suijk on August 9, 2006 in recognition of his significant efforts during fiscal year 2006 in helping the Company reach a resolution with the Internal Revenue Service (IRS) on the tax treatment of a fiscal 2005 transaction related to the Company’s Mack Printing Company subsidiary. As a result of the resolution with the IRS, the Company expects to realize a total cash benefit of $37.4 million. The Company has received $14.4 million and expects to utilize the balance in future years as a reduction to income taxes otherwise payable on future income earned. |

| (9) | Mr. Hare ceased active employment with the Company effective March 15, 2006. |

| (10) | Mr. Hare was not paid a bonus for fiscal 2005 because the Publisher Services segment did not satisfy certain performance goals for the first quarter of fiscal 2006. |

Stock Options

No stock options were granted to any of the named executive officers during the fiscal year ended June 30, 2006.

The following table reflects certain information regarding the exercise of stock options during the fiscal year ended June 30, 2006, as well as information with respect to unexercised options held at such date by each of the named executive officers.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END OPTION VALUES

| | | | | | | | | | |

| | | Shares

Acquired on Exercise (#)

| | | Value Realized ($)

| | Number of Securities

Underlying Unexercised Options at Fiscal Year End (#)

Exercisable/Unexercisable

| | Value of Unexercised “In the Money” Options at

Fiscal Year End ($) Exercisable/Unexercisable(1)

|

Bruce V. Thomas | | 8,000 | | | $ | 2,616 | | 98,000/— | | $657,903/— |

Lisa S. Licata | | — | | | | — | | 15,000/— | | $ 89,200/— |

Wayne B. Luck | | 6,000 | | | $ | 45,825 | | 21,000/— | | $150,605/— |

Gerard P. Lux, Jr. | | 32,400 | | | $ | 191,629 | | 40,067/— | | $172,094/— |

Paul K. Suijk | | 15,000 | | | $ | 126,424 | | —/— | | —/— |

Stephen E. Hare | | 24,300 | (2) | | $ | 252,426 | | —/— | | —/— |

| (1) | Value of unexercised options is based on difference between the exercise price and the closing market price of Cadmus stock on June 30, 2006. |

17

| (2) | On April 6, 2006 the Company entered into a Stock Option Cancellation Agreement with Mr. Hare pursuant to which the Company paid Mr. Hare $177,450 in consideration of the cancellation of 23,200 stock options. These options and the amount received in consideration of their cancellation are not included in the numbers reported for options exercised and value received. The value received is reflected under the “All Other Compensation” column of the Summary Compensation Table on page 15. |

Employment Agreement

Cadmus has in place an amended and restated employment agreement with Bruce V. Thomas which provides for a three-year term initially expiring June 30, 2006, and which also provides for successive, automatic one-year extensions which began on July 1, 2004, and which continue on each July 1 thereafter, unless the Company gives notice that the term of the contract will not be further extended. Mr. Thomas’ employment agreement is currently scheduled to expire on June 30, 2009. Under the agreement, Mr. Thomas serves as the President and Chief Executive Officer of the Company during the term of the contract at an annual base salary of not less than $450,000 per year. The agreement also provides that Mr. Thomas will be eligible for incentive compensation awards based on performance, stock option awards and benefits under all other employee benefit and incentive plans provided by the Company to its senior management.

Mr. Thomas may be terminated as an officer and employee of the Company at any time, with or without “cause.” Termination without cause is subject to 30 days’ written notice by the Company. Termination for cause may be effected without prior notice. Mr. Thomas also may resign at any time upon 30 days’ written notice to the Company. Generally speaking, “cause” is defined to mean (1) fraud, dishonesty or moral turpitude, (2) material dereliction in the performance of duties, (3) willful misconduct or gross negligence, (4) fraudulent or dishonest behavior, or (5) other egregious conduct in violation of the Cadmus Code of Conduct.

In the event of termination by the Company without cause, or a termination by Mr. Thomas for “employee cause,” (1) Mr. Thomas will receive an annual severance benefit (prorated for any partial year) for the succeeding 30 months equal to the sum of his base salary for the two most recently ended fiscal years of the Company and his average annual target bonus under the Company’s Incentive Plan, described below in the Report of the Human Resources and Compensation Committee on Executive Compensation beginning on page 24, for the two most recently ended fiscal years of the Company, as well as certain supplemental pension payments and “SERP equivalent” payments, (2) all stock options granted to Mr. Thomas will be fully vested and exercisable for an 18-month period (but not beyond the maximum term specified in the applicable option agreement), and Mr. Thomas will have the right to require the Company to purchase his outstanding options during that 18-month period and (3) Mr. Thomas (and his eligible family members) will be entitled to participate during the 30-month severance period in the Company’s welfare benefit plans subject to certain exceptions. Generally speaking, “employee cause” means (1) a material

18

uncured breach of the agreement by the Company, (2) a material change in Mr. Thomas’ duties, status, title, responsibilities or authority, (3) failure of the Company to allow participation by Mr. Thomas in Company benefit plans, (4) receipt by Mr. Thomas of notice that the Company will not agree to any further automatic one-year extensions of the agreement, (5) relocation of the Company’s headquarters more than 25 miles from Richmond, Virginia, or (6) termination of the Company’s business.

In the event of termination by the Company with cause, or in the event Mr. Thomas resigns his position, Mr. Thomas will not be entitled to any compensation, bonus or benefits under the agreement other than his earned and unpaid base salary and any other payments or benefits payable as a matter of law.

Under the agreement, Mr. Thomas agrees that during the 30-month period following termination he will not compete against Cadmus, solicit employees from Cadmus, or interfere with Cadmus’ vendor relationships. The agreement also provides that in the event of a “change in control,” Mr. Thomas’ entitlements will be governed by the employee retention agreement he has with the Company as described below under “Change in Control Agreements.”

Change in Control Agreements

Cadmus has entered into agreements with Mr. Thomas, Ms. Licata, Messrs. Luck, Lux and Suijk and two other officers that provide for severance payments and certain other benefits if their employment terminates after a “change in control” (as defined therein) of Cadmus. Mr. Hare had a change in control agreement with the Company, but this agreement was terminated in connection with his resignation with no payment obligation for the Company. Payments and benefits will be paid under these change in control agreements only if, within three years for Mr. Thomas and two years for other officers following a change in control (the guaranteed employment period), the employee (i) is terminated involuntarily without “cause” (as defined therein) and not as a result of death, disability or normal retirement, or (ii) terminates his or her employment voluntarily for “good reason” (as defined therein, which includes for Mr. Thomas only the right to voluntarily resign for any reason during the 60 day period following the first anniversary of a change in control). “Change in control” is defined generally to include (i) an acquisition of 20% or more of Cadmus’ voting stock, (ii) certain changes in the composition of the Cadmus Board of Directors, (iii) shareholder approval of certain business combinations or asset sales in which Cadmus’ historic shareholders hold less than 60% of the resulting or purchasing company, or (iv) shareholder approval of the liquidation or dissolution of Cadmus. No amendment or modification to an employee’s change in control agreement may be made by the Company within six months before a change in control without the employee’s consent.

In the event of such termination following a change in control, the employee will be entitled to receive a lump sum severance payment, certain other retirement benefits and continuation of certain welfare benefits. Severance payments under these agreements are determined by a formula (or a fixed 2.99 annual payment multiple for Mr. Thomas) that

19

takes into account base salary, annual bonus and years of employment and produces an annual payment multiple, are subject to certain minimums and maximums, and are limited to the amount of base salary and applicable defined target bonus (described below) which would have been payable for the period from the date of a change in control to the date for normal retirement. Under the severance formula, an employee will be entitled to the severance payment, which will be an amount equal to the product of the annual payment multiple times the sum of his or her base salary and the greater of his or her target annual bonus (exclusive of any long-term incentive compensation) for the fiscal year in which the termination occurs, or for the fiscal year in which the employee’s change in control agreement was executed. The other retirement benefits include certain enhanced benefits under the Supplemental Executive Retirement Plan and the Pension Plan. Under certain of the agreements, if the total amount payable to the employee exceeds the maximum amount that may be paid without the imposition of a federal excise tax on the employee, and if excise tax is due, the employee will receive an additional payment in an amount sufficient to pay the excise tax and the additional taxes due with respect to such additional payment (calculated assuming no portion of any award under the Company’s FY 2005-2007 Executive Long-Term Incentive Plan (LTIP) is part of the additional payment and thus assuming no excise tax or additional taxes will be due with respect to an award under the LTIP).

The LTIP established pursuant to the 2004 Key Employee Stock Compensation Plan contains a change in control feature. The LTIP’s change in control provisions override the earnings per share and share price performance-vesting earning and vesting provisions of the LTIP for any awardee, including Mr. Thomas, Ms. Licata, Messrs. Luck, Lux, and Suijk, who is employed on the date of a covered change in control (as defined in the LTIP). In the event a covered change in control occurs prior to the date the Human Resources and Compensation Committee finally determines earned awards during the first four months of fiscal year 2008, 20% of each outstanding award to any covered awardee will automatically vest at the date of the change in control. In addition, none, part or all of the remaining 80% of each outstanding award may vest depending on the market value of Company stock on the date of the change in control. Payment and release of restrictions on LTIP restricted stock to any covered awardee will be accelerated to not later than 90 days after the covered change in control occurs.

Termination of Employment Agreement

On April 6, 2006, the Company entered into a Stock Option Cancellation Agreement and on April 8, 2006, the Company entered into a Change in Status Agreement with Stephen E. Hare. Pursuant to the Change in Status Agreement, effective March 15, 2006, Mr. Hare resigned as Executive Vice President of the Company and President of the Publisher Services Group, but remained an employee of the Company on inactive status until June 12, 2006 (the Termination Date). Under the Change in Status Agreement, Mr. Hare is entitled to receive $415,384.62 for the period beginning March 15, 2006, and ending March 15, 2007, and to continue to receive certain welfare benefits until he accepted other full-time employment.

20

Under the Change in Status Agreement, with limited exceptions, for one year after the Termination Date, Mr. Hare agreed not to (i) solicit for employment, recruit, provide information on any personnel of the Company or assist another employer in the recruitment of any employee of the Company, or (ii) without the prior written approval of the Company, solicit any customer (as defined in the Change in Status Agreement) on his behalf or on behalf of any other person, entity or firm for the purpose of selling to the customer any product or service that is competitive with any product or service offered for sale by the Company during the last twelve months of Mr. Hare’s employment by the Company. Under the Change in Status Agreement, Mr. Hare also agreed not to disclose any proprietary, confidential or trade secret document or information of the Company. In addition, under the Change in Status Agreement, with limited exceptions, Mr. Hare agreed not to compete or engage in activities competitive with the business in which the Company is engaged for one year after March 15, 2006, unless otherwise agreed to in writing by the Company.

Under the Stock Option Cancellation Agreement, the Company paid $177,450 to Mr. Hare as consideration for the cancellation of 23,200 stock options for shares of common stock of the Company held by Mr. Hare.

21

Equity Compensation Plan Information

The following table sets forth information as of June 30, 2006 with respect to certain compensation plans under which equity securities of Cadmus are authorized for issuance.

| | | | | | |

Plan Category

| | Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights (a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights (b)

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a)) (c)

|

Equity compensation plans approved by shareholders(1) | | 831,795(2) | | $12.29(3) | | 311,215(4) |

Equity compensation plans not approved by shareholders | | — | | n/a | | 25,000(5) |

| | | |

Total | | 831,795(2) | | $12.29(3) | | 336,215 |

| (1) | These plans consist of: (a) the 1990 Long Term Incentive Stock Plan, (b) the 1992 Non-Employee Director Stock Compensation Plan, (c) the 1997 Non-Employee Director Stock Compensation Plan, (d) the 2004 Key Employee Stock Compensation Plan and (e) 2004 Non-Employee Director Stock Compensation Plan. |

| (2) | Includes 380,785 shares of performance-vesting restricted stock awarded pursuant to the 2005-2007 executive long term incentive subplan (LTIP) established under the 2004 Key Employee Stock Compensation Plan. LTIP restricted stock generally vests annually based on satisfaction of earnings per share and share price targets, subject to divestment and forfeiture upon non-covered termination of employment prior to the Human Resources and Compensation Committee’s final determination of vesting and awards in the first four months of fiscal year 2008. LTIP restricted stock also may vest in whole or in part upon satisfaction of certain performance criteria in case of death, disability, retirement, termination by Cadmus without cause, termination by an employee for good reason under an employment agreement, or change in control. Of the shares of performance-vesting LTIP restricted stock reflected in the above table, 26,392 shares were forfeited as of August 9, 2006, and 18,323 shares were forfeited as of August 16, 2006. These forfeited shares are eligible for re-issuance under the 2004 Key Employee Stock Compensation Plan. |

| (3) | Weighted-average exercise price does not take into account the performance-vesting LTIP restricted stock awards discussed in Note (2) above. |

| (4) | The 1992 Non-Employee Director Stock Compensation Plan expired August 15, 1997, the 1997 Non-Employee Director Stock Compensation Plan expired November 15, 2002, and the 1990 Long Term Incentive Stock Plan expired June 30, 2003. |

| (5) | All 25,000 shares are available to be issued under the Non-Qualified Savings Plan. |

Non-Qualified Savings Plan. Cadmus’ Deferred Compensation Plan and Non-Qualified Thrift Plan were merged into a new Non-Qualified Savings Plan in 2002.

22

Under the current plan, eligible employees can defer portions of their base salary and incentive pay under the executive compensation program to purchase shares of various mutual funds or Cadmus common stock. Eligible employees generally are vice president-level employees, or above, and designated senior sales leaders. All deferrals are 100% vested immediately. Cadmus makes no matching or other contributions to the plan. Distribution of deferrals is normally made after a participant’s cessation of employment in a lump sum or in periodic installments. The plan is administered by Cadmus with oversight responsibility by the Human Resources and Compensation Committee. Cadmus has authorized up to 25,000 shares of Cadmus common stock for issuance under the Non-Qualified Savings Plan, subject to an increase to 100,000 shares with shareholder approval. As of June 30, 2006, no shares authorized under this plan had been issued.

Retirement Benefits

Pension Plan. Prior to July 31, 2003, substantially all non-union employees of Cadmus and its participating subsidiaries (other than former Mack Printing Company employees not employed in the Easton, Pennsylvania facility) who were 21 years of age or older and who were credited with at least one year of service with Cadmus or a participating subsidiary were covered by the Cadmus Pension Plan (the Pension Plan). As of July 31, 2003, all participation and benefit accrual was frozen for current employees. The Pension Plan is a non-contributory defined benefit pension plan under which retirement benefits are generally based on periods of active participation. A non-union participant earned a retirement benefit expressed as an annuity for life equal to 1.6% of his or her base compensation through July 31, 2003 (exclusive of non-guaranteed commissions, bonuses, overtime pay and similar payments; but with a transition rule including commissions and the straight time portion of overtime for non-highly compensated employees participating in the Mack Pension Plan on December 31, 2000) for each year of service. Different benefit formulas applied prior to July 1, 1985, and a special transition rule applied through December 31, 1991.

Because retirement benefits for non-union participants under the Pension Plan are based on career average compensation, a table showing annual retirement benefits based upon final average compensation and years of service is inappropriate and has been omitted. Based on the benefit formula in effect on and after July 1, 1985, and the freezing of benefit accrual as of July 31, 2003, the estimated annual benefits at age 65 (which are not subject to any deduction for Social Security or other offset amount) payable for the named executive officers are $27,796 for Mr. Thomas, $264 for Ms. Licata, $5,102 for Mr. Luck, $33,283 for Mr. Lux and $0 for Mr. Hare and Mr. Suijk. Prior to his cessation of active employment effective March 15, 2006, Mr. Hare had accrued a $3,200 annual benefit under the Pension Plan, but that benefit is not payable since Mr. Hare was not vested when he ceased active employment; and Mr. Suijk did not meet the one year eligibility requirements to join the plan prior to the plan freeze on July 31, 2003.

Cadmus Supplemental Executive Retirement Plan. Cadmus maintains the Cadmus Supplemental Executive Retirement Plan (the SERP) to provide supplemental retirement benefits for certain key employees of Cadmus and its participating subsidiaries who are

23

credited with at least five years of service and who are selected by the Board of Directors of Cadmus for participation in the SERP. The Board may waive all or any part of the five year service requirement. The SERP is a non-qualified unfunded plan which covers nine active key employees of Cadmus and its participating subsidiaries. The retirement or death benefit payable under the SERP is a 15-year term certain annuity equal to 30% of the participant’s final average (highest three years out of last ten) base compensation (exclusive of non-guaranteed commissions, bonuses, overtime pay or similar payments) generally commencing at the participant’s normal retirement age (which is age 65 for employees last hired prior to age 60 or otherwise is the fifth anniversary of commencement of participation). Benefits are not subject to any reduction for Social Security or other offset amount.

The following table shows the estimated annual retirement benefits payable to SERP participants in the following average final compensation and years of service classifications assuming retirement at age 65. Average compensation under the SERP includes only the amounts set forth under “Salary” in the Summary Compensation Table on page 15.

SUPPLEMENTAL EXECUTIVE RETIREMENT PLAN TABLE

| | | | | | | | | | | | |

Highest 3-Year Average Compensation

| | Years of Service

|

| | 5

| | 10

| | 15

| | 20 and over

|

| $125,000 | | $ | 9,375 | | $ | 18,750 | | $ | 28,125 | | $ | 37,500 |

| 150,000 | | | 11,250 | | | 22,500 | | | 33,750 | | | 45,000 |

| 175,000 | | | 13,125 | | | 26,250 | | | 39,375 | | | 52,500 |

| 200,000 | | | 15,000 | | | 30,000 | | | 45,000 | | | 60,000 |

| 250,000 | | | 18,750 | | | 37,500 | | | 56,250 | | | 75,000 |

| 300,000 | | | 22,500 | | | 45,000 | | | 67,500 | | | 90,000 |

| 350,000 | | | 26,250 | | | 52,500 | | | 78,750 | | | 105,000 |

| 400,000 | | | 30,000 | | | 60,000 | | | 90,000 | | | 120,000 |

| 450,000 | | | 33,750 | | | 67,500 | | | 101,250 | | | 135,000 |

| 500,000 | | | 37,500 | | | 75,000 | | | 112,500 | | | 150,000 |

| 550,000 | | | 41,250 | | | 82,500 | | | 123,750 | | | 165,000 |

| 600,000 | | | 45,000 | | | 90,000 | | | 135,000 | | | 180,000 |

Credited years of service under the SERP as of the fiscal year ended June 30, 2006 are: Mr. Thomas -14; Ms. Licata -4, Mr. Luck -5; Mr. Lux -23 and Mr. Suijk -3. Mr. Hare is not eligible for benefits under the SERP since he ceased to be a covered employee for SERP purposes effective March 15, 2006 and his benefits had not vested.

Report of the Human Resources and Compensation Committee on Executive Compensation

The Human Resources and Compensation Committee has responsibility for all aspects of the compensation program for Cadmus’ executive officers. The Committee is made up of only non-employee directors who do not participate in any of the executive compensation

24

plans they administer. Working in collaboration with Cadmus senior management and outside consultants, the Committee administers this executive compensation program to fulfill the objectives outlined below.

Principal Objectives. The principal objectives of the executive compensation program are: (i) to attract and retain a highly-qualified management team; (ii) to motivate this team to achieve corporate objectives; (iii) to ensure that executive compensation is integral to, and supportive of, the Cadmus strategy and other Cadmus management benefits, systems and processes; and (iv) to link pay with performance in a number of respects, most notably linking executive compensation and long-term shareholder value so that increases in executive compensation are directly related to the creation and maintenance of value for the Company’s shareholders.

The primary components of the Company’s executive compensation program are:

| | • | | competitive base salaries, |

| | • | | short-term incentive payments, |

| | • | | long-term incentive awards, and |

| | • | | the Supplemental Executive Retirement Plan. |

In addition to the Company’s basic benefits package provided to substantially all employees, the Company also provides certain enhanced benefits and rights for select executives through a Non- Qualified Savings Plan. The Non-Qualified Savings Plan is employee funded only and generally allows eligible employees to defer salary and bonuses on a pre-tax basis in addition to any contributions they make under the Company’s Thrift Savings Plan. The Company also provides employee retention (change in control) agreements to select executives. The Committee is responsible for substantially all aspects of these enhanced benefits and rights provided to Cadmus’ executive officers.

U.S. Income Tax Limits on Deductibility. The Committee considers the deductibility of executive compensation under Section 162(m) of the Internal Revenue Code that was enacted in 1993. Under this provision, beginning in 1994 a publicly-held corporation is not permitted to deduct compensation in excess of one million dollars per year paid to the chief executive officer or any one of the other named executive officers except to the extent the compensation was paid under compensation plans meeting certain tax code requirements. The Committee noted that the Company does not currently face the loss of this deduction for compensation. The Committee nevertheless determined that, in reviewing the design of and administering the executive compensation program, the Committee will continue in the future to preserve the Company’s tax deductions for executive compensation unless this goal conflicts with the primary objectives of the Company’s compensation program.

Competitive Base Salaries. In keeping with the long-term and highly technical nature of Cadmus’ business, the Committee takes a long-term approach to executive compensation. This career-oriented philosophy requires a competitive base salary. Salaries for Cadmus

25

executive officers are established and administered by means of salary grades and salary ranges. All Cadmus executive officers are assigned a base salary grade that is reviewed annually to ensure that base salaries are generally competitive with the market based on the periodic input of independent compensation consultants retained by the Committee and comparisons to general industry companies located in the United States with annual sales of approximately $500 million. These general industry companies are not necessarily the same companies included in the Peer Group used to create the Performance Graph presented later in this proxy statement. The peer companies against which compensation is compared is a broader group than the Performance Graph peer group. The Committee believes that general industry is the appropriate comparison category in determining competitive compensation because Cadmus’ executive officers can be recruited from, and by, businesses outside Cadmus’ industry peer group.

For determining fiscal 2006 base salaries for the Company’s executive officers, the Committee assessed these factors and considered how the base salaries of Cadmus’ executive officers compared to the market. The Committee deferred any decisions regarding base salary adjustments until corporate performance meets expectations, with the result that there were no base salary increases for executive officers for fiscal 2006. Exceptions were made during fiscal 2006, however, for the Company’s Chief Financial Officer and the Company’s Vice President and Treasurer, who were awarded base salary increases based on their individual performance and the gap between their base salary and the market.

Short-Term Incentive Payments. The Company utilizes an Incentive Plan under which its executive officers and certain other employees may earn annual incentive payments based on their business unit’s performance as well as the overall financial performance of Cadmus. A grid based primarily upon operating profits and earnings improvements for each Cadmus business unit generates a variable “pool” from which the short-term incentives are paid. As operating profits increase, the pool grows. The pool earned by a business unit may be increased or decreased, but not eliminated, by the corporate earnings per share for the year.

At the beginning of each fiscal year, senior management presents for consideration and approval by the Committee the recommended short-term incentive curves for Cadmus and for each Cadmus business unit. At the conclusion of the fiscal year, senior management recommends to the Committee specific short-term awards to be made under the Incentive Plan. Those recommendations are based, among other factors, on individual performance, as well as the performance and profitability of the applicable business unit and the financial performance of Cadmus as a whole. The Committee then considers and approves, to the extent it believes appropriate, the incentive pools generated by the incentive curves and the specific incentive award recommendations of senior management. For executive officers, at budgeted performance levels the Incentive Plan generally should have the potential to generate awards in the range of 25-60% of base salary. Under the Incentive Plan, the Committee reserves the right to adjust the incentive pool and/or individual awards for Cadmus to meet minimally acceptable earnings per share requirements, for individual or

26

division performance that falls below the plan threshold or above the plan maximum, and for any individual performance determined to require either a positive or negative adjustment.

Based on relevant business unit performance as well as Cadmus’ overall financial performance in fiscal 2006, the incentive curves for the Incentive Plan generated a short-term incentive award to only one executive officer for fiscal 2006. However, two other executive officers were awarded special cash bonuses outside of the Incentive Plan for fiscal 2006 in recognition of their significant efforts during fiscal 2006 in helping Cadmus reach a resolution with the Internal Revenue Service regarding the tax treatment of a transaction related to Cadmus’ Mack Printing Company subsidiary.

Long-Term Incentive Awards. Long-term incentive awards are intended to develop and retain strong management through share ownership and incentive awards that recognize future performance. The long-term incentive component of executive compensation for Cadmus’ executive officers has most recently been provided under the 2004 Key Employee Stock Compensation Plan, which was approved by shareholders on November 10, 2004. Previously, long term incentive awards were provided under the 1990 Long Term Incentive Stock Plan, which expired in June 2003 (the 1990 Plan).

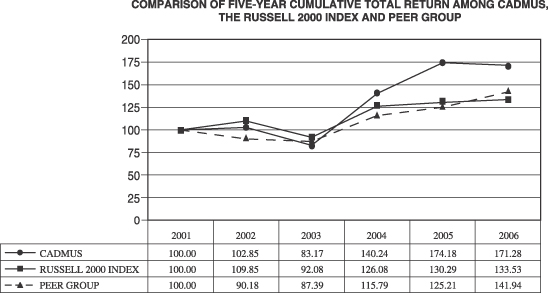

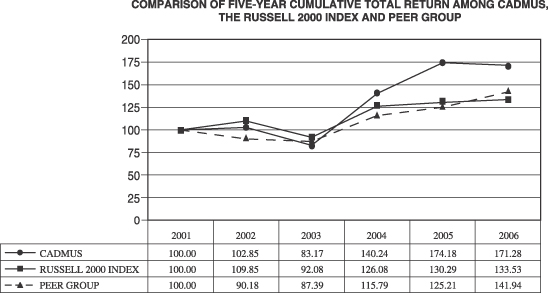

The 1990 Plan was an omnibus plan that provided for awards of incentive and non-qualified stock options, SARs, restricted stock grants, performance units or shares, as well as “other stock-unit” awards. Options issued prior to fiscal year 1998 became exercisable over 5 years with accelerated performance vesting criteria. Other options issued in fiscal year 1999, primarily to executives and managers who were not executive officers of the Company, vested immediately. Options issued in fiscal years 2000, 2001, 2002 and 2003 under the 1990 Plan generally become exercisable over a period of 3 years (normally, one-third of each award becomes vested and exercisable at the end of each of the second, third and fourth calendar years following the calendar year in which the award was made) with earlier vesting if the Company’s performance exceeds specific standards established by the Committee. Under the performance criteria, vesting for a year’s grants normally is accelerated if Cadmus’ cumulative total return reported in its annual proxy statement as of the end of any fiscal year beginning after the award date exceeds its peer group’s cumulative total return for the same period. Variations in the specifics of the vesting and performance dates occur in some grants depending on the circumstances and the time of year at which the grant was made. In fiscal 2004, Cadmus’ cumulative total return exceeded its peer group’s cumulative total return for the five years ended June 30, 2004. As a result, all unvested options under the 1990 Plan vested as of July 1, 2004. Options under the 1990 Plan generally have a ten-year term subject to early termination under certain circumstances and typically have an option exercise price equal to the market value of the Common Stock at the date of grant. Thus, the Common Stock must appreciate before an executive officer receives any benefit from an option grant.

The 2004 Key Employee Stock Compensation Plan (the 2004 Plan), approved by shareholders at the 2004 Annual Meeting, is an omnibus plan that provides for awards of incentive and non-qualified stock options, SARs, restricted stock grants, performance units

27