Semi-Annual Report

May 31, 2015

(Unaudited)

OCM GOLD FUND Shareholder Letter – May 31, 2015 |

Dear Fellow Shareholder:

Over the six month fiscal period ended May 31, 2015, the OCM Gold Fund Investor Class appreciated 4.42% (-0.32% after maximum sales load) while the Advisor Class gained 4.81% compared to a gain of 2.49% for the Philadelphia Gold and Silver Index (XAU)1 and 2.97% gain for the S&P 500 Index2. The price of gold bullion at May 31, 2015 was marginally higher at $1,191.40 based on the London PM fix, up 0.73% during the six month period. The larger cap major gold producers that dominate the weighting in the XAU index continued to underperform the broader portfolio of gold and silver mining shares held in your Fund over the period, which accounts for your Fund’s outperformance of the XAU during the six month period.

Market Commentary

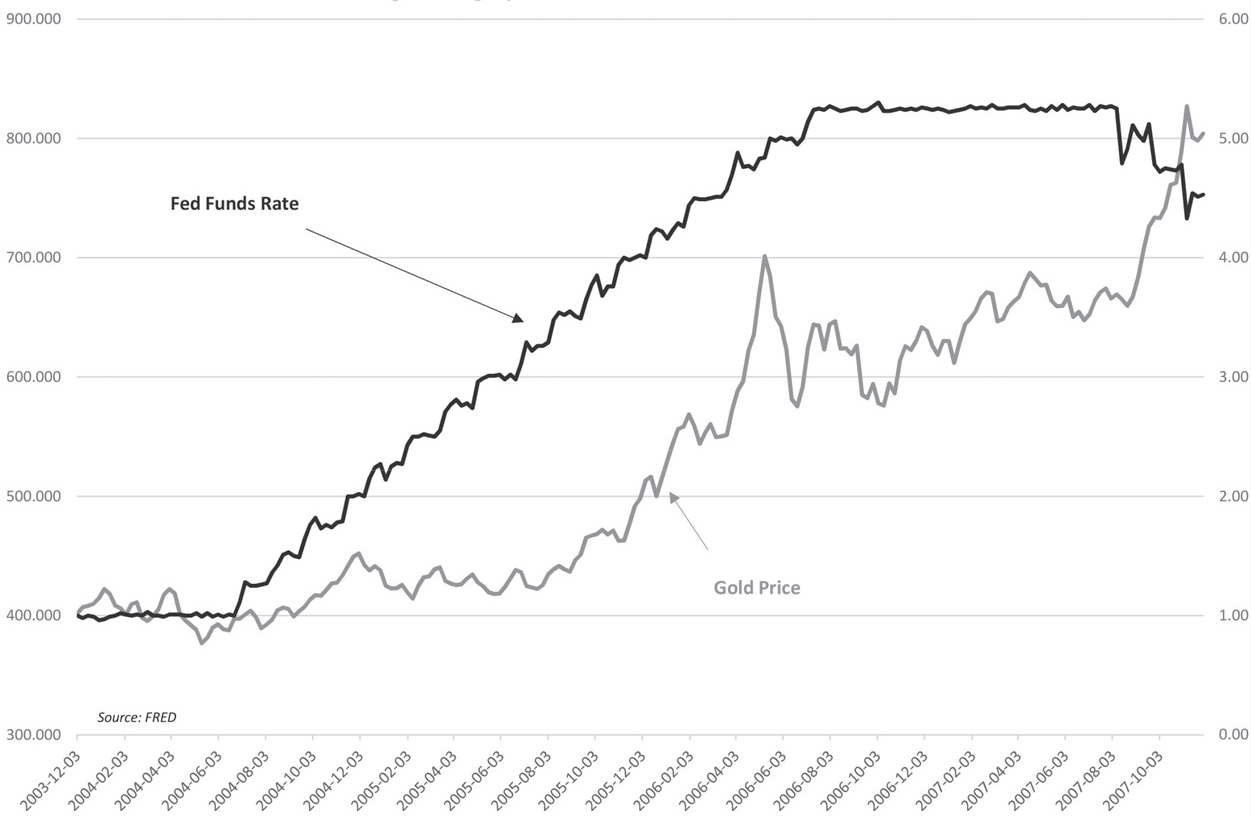

The gold market has been held captive by the threat of a Federal Reserve (FED) rate hike month after month over the past year. Traders in London and New York at bullion banks, hedge funds and commodity funds have aggressively sold gold short utilizing gold derivative contracts (paper gold) with the confidence investment flows into gold will be muted as markets await the signaled policy change by the Fed or a reversal in the strength of global equity markets. Short positions by speculators on the Commodity Exchange, Inc. (Comex) have consistently run 3 times the 20 year average number of contracts over the past two years. Despite the repeated mantra that rising rates are bad for gold prices put forward from the large investment banks keen to keep investment flows geared toward equity markets, a Fed rate tightening cycle may be the pivot point for gold prices to move higher as was the case in the 2004 to 2006 period, as illustrated in the chart below.

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis.

– 1 –

OCM GOLD FUND Shareholder Letter – May 31, 2015 (Continued) |

While removing the overhang of rate uncertainty clears a hurdle for the gold market, a more pronounced move in gold prices may materialize as the market comes to the realization that the Fed’s ability to “normalize” interest rates in a post-crisis global economy is essentially nonexistent without causing untenable economic upheaval. A seven year period of a zero interest rate policy has distorted capital allocations with central banks pushing capital into riskier assets in order to lift financial asset values as a means to stimulate global economic activity. Since 2007, McKinsey & Company estimates global debt at $200 trillion, up 40% versus global GDP of $75 trillion. The Bank for International Settlements pegs the current total global debt number at $250 trillion. In our opinion, the Fed and other central banks current policies are setting the stage for future financial boom-bust cycles with each bust bigger than the last. It is probably with this fear in mind the International Monetary Fund (IMF) recently implored the Fed to hold off on raising interest rates until 2016. The Bank for International Settlements (BIS) June annual report starts off with the candid statement, “Globally, interest rates have been extraordinarily low for an exceptionally long time in nominal and inflation-adjusted terms, against any benchmark. Such low rates are the most remarkable symptom of a broader malaise in the global economy: economic expansion is unbalanced, debt burdens and financial risks still too high, productivity growth too low and the room for manoevre in macroeconomic policy is too limited. The unthinkable risks becoming routine and being perceived as the new normal.”

The unthinkable risks referred to by the BIS reached epic proportions this past spring as €1.5 trillion of Eurozone debt with maturities over a year had a negative yield – you pay them, so they can owe you. Quantitative Easing (QE) is to blame as the European Central Bank (ECB) steps up purchases of sovereign debt to debase the euro and spur growth in the Eurozone. We can understand gold has a negative carry because of the cost to store and it is not subject to default because it is not someone else’s liability. A negative carry on government debt with a history of default and debasement seems incongruent with common sense. Given this, in our view, there would seem to be a point of rising risk that may lead to an “Aha! moment” that tilts in the favor of owning gold as the preferred alternative to owning government debt.

The recent Greek financial crisis may prove to be a dress rehearsal for larger scale sovereign debt crises to come. Greece is symbolic of the pervasive global issue of excessive money printing and credit extension employed to fund political promises to the populace. There is an ancient Greek saying “As Greece goes, so goes the world.” Leftist factions in Spain, Italy, France and Portugal may find it is time to follow the lead of Greek voters and attempt to break away from German dictated austerity in order to solve high unemployment and economic stagnation in those countries.

The path of least resistance for policy makers has been to utilize monetary policies rather than enact necessary structural reforms to promote long-term economic growth solutions. Having exhausted conventional policy tools of lowering interest rates, central banks have embarked on competitive devaluations. The country debasing marginally more than the other tends to lead the growth parade until displaced by a more aggressive currency devaluation. In our opinion, with S&P 500 earnings feeling the pressure of currency weakness having declined two quarters in a row and with equity valuations at elevated levels on a number of metrics, it may be just a matter of time before the

– 2 –

OCM GOLD FUND Shareholder Letter – May 31, 2015 (Continued) |

jig is up and the one way ticket for equities reverses sending panic into policy makers banking on the wealth effect for growth. If that occurs, the question then must be asked just how long does the Fed wait to re-join the race to debase through a quick about face on an interest rate increase and another round of QE?

We believe outwardly devaluing the U.S. dollar will once again bring calls for lessening the dollar’s reserve currency role. China, Russia and a host of emerging market countries have openly pushed for an end to U.S. dollar hegemony and have gone so far as to create a competing development bank to the U.S. led IMF and World Bank. The ongoing purchases of gold by both China and Russia fit with the theme of moving away from U.S. dollar influence and carving out independent trade away from the dollar. Any chipping away of the U.S. dollar’s reserve status opens up a slew of issues for the U.S. and its ability to finance its budget and trade deficits at favorable interest rates.

Turning to the gold market, physical demand continues to outpace newly mined gold according to the World Gold Council. Asian demand remains robust with gold continuing to move from Western vaults to Asia where it is more likely to be treated as a strategic asset versus an asset to rent. In a research piece published earlier this year by ANZ Research entitled “East to El Dorado,” Australian bank ANZ forecast Asian gold demand doubling to 5,000 tons annually over the next 15 years with the gold price trending to $2,400 per ounce as Asian per capita demand moves closer to Western per capita numbers. ANZ claims to handle 20 percent of China’s gold imports and 12% of global mine production. In our opinion, forecasting 15 years out is very difficult, but assuming Asian demand growth put forward by ANZ, gold prices will have to be substantially higher to allow for lower grade deposits to become economic in order to meet the higher levels of demand.

Shares of Gold Mining Companies

The pendulum of negative sentiment toward the precious metals mining companies has reached extreme levels as represented by the S&P 500/Philadelphia Gold and Silver Mining Index (XAU) ratio matching November 2000 levels when the gold price was $250 per ounce (see chart). The market capitalization of the entire global precious metals mining industry is now approximately $100 billion, approximately half the amount needed to replace existing mining infrastructure by our estimates. By comparison, Facebook has a market capitalization of approximately $275 billion. Share prices of gold mining companies that exhibited poor capital discipline in the rising gold price environment continue to underperform and remain in the penalty box until managements can exhibit an ability to generate free cash flow either through a return to higher gold prices or though operating efficiencies. The pockets of strength in the sector over the past six months have been in a number of emerging producers with new lower cost mines coming on stream along with a select group of Canadian and Australian junior gold producers that have seen the benefits of local currency weakness.

– 3 –

OCM GOLD FUND Shareholder Letter – May 31, 2015 (Continued) |

With lower gold bullion prices and access to capital constrained as investors remain disenchanted with the sector, gold mining companies have shifted focus to maintaining and increasing margins rather than attempting to grow production ounces for the sake of putting forth a growth profile. For those gold mining companies with the flexibility and the deposits to mine higher grade ore, raising cut-off off grades should result in better cash flow, earnings and return on capital going forward. The flip side for the gold mining industry is that it means declining production profiles and reserves for a number of miners and reinforces our belief that global gold production is set to decline by approximately 30% over the next ten years unless gold prices appreciate 100% in real terms. We believe our experience and knowledge of the industry allow your Fund to capitalize on those companies that exhibit free cash flow generation while maintaining quality gold reserve bases.

Conclusion

While we cannot predict the inflexion point of when confidence in central banking breaks, we believe the ingredients are at hand for the Fed’s integrity to be tested. Should monetary debasement lead to accelerated visible inflation, especially as politicians push for lower and middle class wage growth in an attempt for wealth equalization, the Fed will find itself boxed-in and forever behind the inflation curve for fear of unwinding financial asset values and setting off another financial crisis. It is our opinion, moreover, with economic weakness starting to appear in the U.S.

– 4 –

OCM GOLD FUND Shareholder Letter – May 31, 2015 (Continued) |

economy, as exhibited by declining discretionary spending, the Fed may be forced to put off a rate hike altogether with its only policy move being another round of QE. We believe the continuum of money printing will expose the Fed as a serial currency debaser with the Fed’s ultimate intention coming into view to debase the high government liabilities down to a manageable level. In our opinion, the resumption of the secular bull market in gold which we feel began in 2000 will resume when cracks in Fed’s veneer become more apparent to a wider audience. Gold’s monetary attributes will once again become appreciated, in our opinion, by dollar holders looking for protection against the over issuance of paper money.

We appreciate your shareholding and confidence in the OCM Gold Fund and we look forward to trying to meet the goal of preserving your purchasing power. Should you have any questions regarding the Fund or gold, please contact your financial adviser or you may contact us directly at 1-800-779-4681. For question regarding your account, please contact Shareholder Service at 1-800-628-9403.

Sincerely,

Gregory M. Orrell

Portfolio Manager

July 23, 2015

Investing in the OCM Gold Fund involves risks including the loss of principal. Many of the companies in which the Fund invests are smaller capitalization companies which may subject the fund to greater risk than securities of larger, more-established companies, as they often have limited product lines, markets or financial resources and may be subject to more-abrupt market movements. The Fund also invests in securities of gold and precious metals which may be subject to greater price fluctuations over short periods of time. The Fund is a non-diversified investment company meaning it will invest in fewer securities than diversified investment companies and its performance may be more volatile. The Fund contains international securities that may provide the opportunity for greater return but also have special risks associated with foreign investing including fluctuations in currency, government regulation, differences in accounting standards and liquidity.

– 5 –

OCM GOLD FUND Shareholder Letter – May 31, 2015 (Continued) |

Investor Class Performance as of May 31, 2015

OCMGX | OCMGX | Philadelphia Index (XAU) | S&P 500 | ||

Six Months | 4.42% | (0.32)% | 2.49% | 2.97% | |

One Year | (12.41)% | (16.35)% | (17.14)% | 11.81% | |

3 Year Annualized | (18.26)% | (19.51)% | (21.93)% | 19.67% | |

5 Year Annualized | (13.36)% | (14.16)% | (15.42)% | 16.54% | |

10 Year Annualized | 3.94% | 3.46% | (0.87)% | 8.12% |

Advisor Class Performance as of May 31, 2015

OCMAX | Philadelphia Index (XAU) | S&P 500 | ||

Six Months | 4.81% | 2.49% | 2.97% | |

One Year | (11.74)% | (17.14)% | 11.81% | |

3 Year Annualized | (17.72)% | (21.93)% | 19.67% | |

5 Year Annualized | (12.84)% | (15.42)% | 16.54% | |

Since Inception Annualized* | (10.54)% | (14.09)% | 14.46% |

* | Inception: April 1, 2010 |

The performance data quoted above represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s Total Annual Operating Expenses for the OCM Gold Fund Investor Class and Advisor Class are 2.39% and 1.79% respectively. Please review the Fund’s prospectus for more information regarding the Fund’s fees and expenses. For performance information current to the most recent month-end, please call toll-free 800-628-9403. The returns shown include the reinvestment of all dividends but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 | The Philadelphia Gold and Silver Index (XAU Index) is a market capitalization index of precious metal mining company stocks. |

2 | The S&P 500 is an index of 500 widely held common stocks that measures the general performance of the market. |

– 6 –

OCM GOLD FUND Schedule of Investments – May 31, 2015 |

Shares |

| Value | |||||

COMMON STOCKS 92.5% | |||||||

Major Gold Producers 36.4% | |||||||

127,250 | Agnico-Eagle Mines Ltd. | $ | 4,093,633 | ||||

225,000 | AngloGold Ashanti Ltd. ADR* | 2,155,500 | |||||

400,000 | Gold Fields Ltd. ADR | 1,364,000 | |||||

430,000 | Goldcorp, Inc. | 7,636,800 | |||||

358,200 | Kinross Gold Corp.* | 841,770 | |||||

100,000 | Newmont Mining Corp. | 2,724,000 | |||||

249,750 | Sibanye Gold Ltd. ADR | 1,773,225 | |||||

250,000 | Yamana Gold, Inc. | 897,500 | |||||

21,486,428 | |||||||

Intermediate/Mid-Tier Gold Producers 25.9% | |||||||

100,000 | Alacer Gold Corp.* | 227,565 | |||||

145,200 | AuRico Gold, Inc. | 479,160 | |||||

500,000 | B2Gold Corp.* | 848,343 | |||||

200,000 | Centerra Gold, Inc. | 1,235,124 | |||||

360,833 | Eldorado Gold Corp. | 1,742,823 | |||||

1,200,000 | Endeavour Mining Corp.* | 588,614 | |||||

300,000 | IAMGOLD Corp.* | 609,000 | |||||

122,500 | Randgold Resources Ltd. ADR | 8,848,175 | |||||

113,500 | Silver Standard Resources, Inc.* | 705,970 | |||||

15,284,774 | |||||||

Junior Gold Producers 6.9% | |||||||

100,000 | Alamos Gold, Inc. | 652,000 | |||||

240,000 | Argonaut Gold Ltd.* | 335,799 | |||||

300,000 | Dundee Precious Metals, Inc.* | 629,623 | |||||

32,500 | Guyana Goldfields, Inc.* | 96,434 | |||||

100,000 | Klondex Mines Ltd.* | 266,163 | |||||

1,100,000 | Mandalay Resources Corp. | 840,302 | |||||

1,000,000 | Perseus Mining Ltd.* | 341,750 | |||||

1,000,000 | Wesdome Gold Mines Ltd.* | 884,529 | |||||

4,046,600 | |||||||

Exploration and Development Companies 3.6% | |||||||

500,000 | Amarillo Gold Corp.* | $ | 32,165 | ||||

138,500 | Asanko Gold, Inc.* | 231,295 | |||||

73,000 | Avala Resources Ltd.* | 2,348 | |||||

150,000 | MAG Silver Corp.* | 1,120,537 | |||||

500,000 | Roxgold, Inc.* | 301,544 | |||||

6,000,040 | Sutter Gold Mining, Inc.* | 313,608 | |||||

2,500,000 | West Kirkland Mining, Inc.* | 120,617 | |||||

2,122,114 | |||||||

Primary Silver Producers 10.9% | |||||||

200,000 | Fortuna Silver Mines, Inc.* | 767,128 | |||||

210,000 | Silver Wheaton Corp. | 4,010,534 | |||||

100,000 | Tahoe Resources, Inc. | 1,389,514 | |||||

20,000 | Tahoe Resources, Inc.^ | 278,600 | |||||

6,445,776 | |||||||

Other 8.8% | |||||||

14,800 | Franco-Nevada Corp. | 761,184 | |||||

10,200 | Franco-Nevada Corp.^ | 525,096 | |||||

60,000 | Royal Gold, Inc. | 3,886,200 | |||||

5,172,480 | |||||||

Total Common Stocks | |||||||

(Cost $30,446,673) | 54,558,172 | ||||||

EXCHANGE TRADED FUND 6.7% | |||||||

34,500 | SPDR Gold Trust* | 3,936,450 | |||||

Total Exchange Traded Fund | |||||||

(Cost $1,525,245) | 3,936,450 | ||||||

WARRANTS 0.0% | |||||||

75,000 | Veris Gold Corp.*# | — | |||||

Total Warrants | |||||||

(Cost $0) | — | ||||||

See notes to financial statements.

– 7 –

OCM GOLD FUND Schedule of Investments – May 31, 2015 (Continued) |

Shares | Value | ||||||

SHORT-TERM INVESTMENT 1.0% | |||||||

590,210 | UMB Money Market Fiduciary, 0.01% | $ | 590,210 | ||||

Total Short-Term Investment | |||||||

(Cost $590,210) | 590,210 | ||||||

Total Investments | |||||||

(Cost $32,562,128) 100.2% | 59,084,832 | ||||||

Liabilities less Other Assets (0.2)% | (98,953 | ) | |||||

TOTAL NET ASSETS 100.0% | $ | 58,985,879 | |||||

CAD – Canadian Dollars.

* | Non-income producing security. |

^ | Denoted investment is a Canadian security traded on U.S. stock exchange. |

# | The security is valued at fair value in accordance with procedures established by the Fund’s Board of Trustees. |

See notes to financial statements.

– 8 –

OCM GOLD FUND Schedule of Investments – May 31, 2015 (Continued) |

SUMMARY OF INVESTMENTS BY COUNTRY

Country | Value | Percent of | ||||||

Australia | $ | 341,750 | 0.6 | % | ||||

Canada | 32,876,708 | 55.6 | ||||||

Cayman Islands | 588,614 | 1.0 | ||||||

Jersey | 8,848,175 | 15.0 | ||||||

South Africa | 5,292,725 | 9.0 | ||||||

United States1 | 11,136,860 | 18.8 | ||||||

Total | $ | 59,084,832 | 100.0 | % | ||||

1 | Includes short-term investments. |

See notes to financial statements.

– 9 –

OCM GOLD FUND Statement of Assets and Liabilities – May 31, 2015 |

Assets: | ||||

Investments in unaffiliated issuers, at value (cost $32,562,128) | $ | 59,084,832 | ||

Interest and dividends receivable | 105,104 | |||

Receivable for fund shares sold | 18,386 | |||

Prepaid expenses and other assets | 45,203 | |||

Total assets | 59,253,525 | |||

Liabilities: | ||||

Payable for fund shares redeemed | 42,070 | |||

Investment adviser fees | 49,126 | |||

Accrued distribution fees | 109,895 | |||

Accrued Trustees' fees | 2,487 | |||

Accrued audit fees | 21,226 | |||

Accrued expenses and other liabilities | 42,842 | |||

Total liabilities | 267,646 | |||

Net Assets | $ | 58,985,879 | ||

Net Assets Consist of: | ||||

Shares of beneficial interest, no par value: unlimited shares authorized | $ | 34,610,360 | ||

Undistributed net investment loss | (2,338,072 | ) | ||

Accumulated net realized gain on investments and foreign currency transactions | 191,450 | |||

Net unrealized appreciation on investments and foreign currency translations | 26,522,141 | |||

Net Assets | $ | 58,985,879 | ||

Calculation of Maximum Offering Price: | ||||

Investor Class: | ||||

Net asset value and redemption price per share | $ | 9.72 | ||

Maximum sales charge (4.50% of offering price) | 0.46 | |||

Offering price to public | $ | 10.18 | ||

Shares outstanding | 3,763,100 | |||

Advisor Class: | ||||

Net asset value and redemption price per share | $ | 10.06 | ||

Shares outstanding | 2,227,194 | |||

Total shares outstanding | 5,990,294 | |||

See notes to financial statements.

– 10 –

OCM GOLD FUND Statement of Operations - Six Months Ended May 31, 2015 |

Investment Income | ||||

Interest | $ | 90 | ||

Dividend (net of foreign withholding taxes of $45,638) | 360,678 | |||

Total investment income | 360,768 | |||

Expenses | ||||

Investment advisory fees | 292,214 | |||

Distribution fees - Investor Class | 167,251 | |||

Fund administration and accounting fees | 64,581 | |||

Transfer agent fees and expenses | 54,369 | |||

Professional fees | 32,059 | |||

Distribution fees - Advisor Class | 27,707 | |||

Federal and state registration fees | 19,858 | |||

Chief Compliance Officer fees | 13,161 | |||

Custody fees | 10,062 | |||

Reports to shareholders | 9,010 | |||

Trustees' fees | 4,986 | |||

Other expenses | 4,713 | |||

Total expenses | 699,971 | |||

Net investment loss | (339,203 | ) | ||

Realized and Unrealized Gain on Investments: | ||||

Net realized gain on investments and foreign currency transactions | 1,382,533 | |||

Net change in unrealized appreciation on investments and foreign currency translations | 1,104,571 | |||

Net gain on investments | 2,487,104 | |||

Net increase in net assets from operations | $ | 2,147,901 | ||

See notes to financial statements.

– 11 –

OCM GOLD FUND Statements of Changes in Net Assets |

Six Months Ended May 31, 2015 | Year Ended November 30, | |||||||

Operations: | ||||||||

Net investment loss | $ | (339,203 | ) | $ | (852,951 | ) | ||

Net realized gain/(loss) on investments and foreign currency transactions | 1,382,533 | (296,278 | ) | |||||

Net change in unrealized appreciation/depreciation on investments and | 1,104,571 | (6,550,961 | ) | |||||

Net increase (decrease) in net assets resulting from operations | 2,147,901 | (7,700,190 | ) | |||||

Distributions Paid to Shareholders | ||||||||

Investor Class: | ||||||||

Distributions paid from net realized gains | (615,794 | ) | (1,759,477 | ) | ||||

Total distributions from Investor Class | (615,794 | ) | (1,759,477 | ) | ||||

Advisor Class: | ||||||||

Distributions paid from net realized gains | (291,493 | ) | (749,894 | ) | ||||

Total distributions from Advisor Class | (291,493 | ) | (749,894 | ) | ||||

Total distributions | (907,287 | ) | (2,509,371 | ) | ||||

Fund Share Transactions | ||||||||

Investor Class: | ||||||||

Net proceeds from shares sold | 872,648 | 1,857,972 | ||||||

Distributions reinvested | 543,376 | 1,647,220 | ||||||

Payment of shares redeemed1 | (4,146,970 | ) | (10,915,835 | ) | ||||

Net decrease in net assets from Investor Class share transactions | (2,730,946 | ) | (7,410,643 | ) | ||||

Advisor Class: | ||||||||

Net proceeds from shares sold | 12,071,174 | 12,167,338 | ||||||

Distributions reinvested | 275,664 | 717,716 | ||||||

Payment of shares redeemed2 | (7,017,446 | ) | (4,353,883 | ) | ||||

Net increase in net assets from Advisor Class share transactions | 5,329,392 | 8,531,171 | ||||||

Net increase in net assets from Fund share transactions | 2,598,446 | 1,120,528 | ||||||

Total increase (decrease) in net assets | 3,839,060 | (9,089,033 | ) | |||||

Net Assets, Beginning of Period | 55,146,819 | 64,235,852 | ||||||

Net Assets, End of Period | 58,985,879 | 55,146,819 | ||||||

Accumulated Net Investment Loss | $ | (2,338,072 | ) | $ | (1,998,869 | ) | ||

See notes to financial statements.

– 12 –

OCM GOLD FUND Statements of Changes in Net Assets (Continued) |

Six Months Ended May 31, 2015 | Year Ended November 30, | |||||||

Transactions in shares | ||||||||

Investor Class: | ||||||||

Shares sold | 78,311 | 145,125 | ||||||

Shares issued on reinvestment of distributions | 60,713 | 190,210 | ||||||

Shares redeemed | (407,276 | ) | (942,822 | ) | ||||

Net decrease in Investor Class shares outstanding | (268,252 | ) | (607,487 | ) | ||||

Advisor Class: | ||||||||

Shares sold | 1,143,695 | 952,396 | ||||||

Shares issued on reinvestment of distributions | 29,896 | 80,522 | ||||||

Shares redeemed | (685,457 | ) | (338,760 | ) | ||||

Net increase in Advisor Class shares outstanding | 488,134 | 694,158 | ||||||

Net increase in Fund shares outstanding | 219,882 | 86,671 | ||||||

1 | Net of redemption fees of $0 for the six months ended May 31, 2015 and $79 for the year ended November 30, 2014, respectively. |

2 | Net of redemption fees of $10,405 for the six months ended May 31, 2015 and $14,467 for the year ended November 30, 2014, respectively. |

See notes to financial statements.

– 13 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 |

Note 1. Organization

OCM Mutual Fund (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust was organized as a Massachusetts business trust on January 6, 1984 and consists of the OCM Gold Fund (the “Fund”). The investment objective for the Fund is long-term growth of capital through investing primarily in equity securities of domestic and foreign companies engaged in activities related to gold and precious metals.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

Note 2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Security Valuation – Portfolio securities that are listed on national securities exchanges, other than the NASDAQ Stock Market LLC, are valued at the last sale price as of the close of business of such securities exchanges, or, in the absence of recorded sales, at the average of readily available closing bid and ask prices on such exchanges. NASDAQ Global Select Market, Global Market and Capital Market securities are valued at the NASDAQ Official Closing Price (“NOCP”). If a NOCP is not issued for a given day, these securities are valued at the average of readily available closing bid and asked prices. Unlisted securities are valued at the average of the quoted bid and ask prices in the over-the-counter market. Short-term investments which mature in less than 60 days are valued at amortized cost (unless the Trust’s Board of Trustees determines that this method does not represent fair value). Short-term investments which mature after 60 days are valued at market. Securities and other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the investment adviser under procedures established by and under the general supervision and responsibility of the Trust’s Board of Trustees. For each investment that is fair valued, the investment adviser considers, to the extent applicable, various factors including, but not limited to, the type of security, the financial condition of the company, comparable companies in the public market, the nature and duration of the cause for a quotation not being readily available and other relevant factors.

Under Fair Value Measurements and Disclosures, various inputs are used in determining the value of the Fund’s investments. These inputs are summarized into three broad levels as described below:

● | Level 1 – quoted prices in active markets for identical securities |

– 14 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 (Continued) |

● | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, and evaluated quotation obtained from pricing services) |

● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used, as of May 31, 2015, in valuing the Fund’s assets:

Sector | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks |

|

|

|

| ||||||||||||

Major Gold Producers | $ | 21,486,428 | $ | — | $ | — | $ | 21,486,428 | ||||||||

Intermediate/Mid-Tier Gold Producers | 15,284,774 | — | — | 15,284,774 | ||||||||||||

Junior Gold Producers | 4,046,600 | — | — | 4,046,600 | ||||||||||||

Exploration and Development Companies | 2,122,114 | — | — | 2,122,114 | ||||||||||||

Primary Silver Producers | 6,445,776 | — | — | 6,445,776 | ||||||||||||

Other | 5,172,480 | — | — | 5,172,480 | ||||||||||||

Exchange Traded Fund | 3,936,450 | — | — | 3,936,450 | ||||||||||||

Short-Term Investment | 590,210 | — | — | 590,210 | ||||||||||||

Warrants | ||||||||||||||||

Junior Gold Producers | — | — | — | — | ||||||||||||

Total | $ | 59,084,832 | $ | — | $ | — | $ | 59,084,832 | ||||||||

As of May 31, 2015 the Fund held Level 3 investments in Veris Gold Corp. warrants, which were fair valued in accordance with procedures established by and under the general supervision of the Trust’s Board of Trustees. Veris Gold Corp. filed for bankruptcy after Deutsche Bank declared it in default and the company was unable to refinance debt; the warrants, therefore, were fair valued at $0. There were no Level 2 securities as of May 31, 2015. The Fund recognizes transfers between levels at the end of the reporting period. There were no transfers at period end.

– 15 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 (Continued) |

Foreign Currency – Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations for the six months ended May 31, 2015 are included within the realized and unrealized gain/loss on investments section of the Statement of Operations.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. Such fluctuations for the six months ended May 31, 2015 are included within the realized and unrealized gain/loss on investments section of the Statement of Operations.

Federal Income Taxes – The Fund complies with and intends to comply with the requirements of the Internal Revenue Code necessary to qualify as a regulated investment company and to make the requisite distributions of income to its shareholders to relieve it from all or substantially all federal income taxes. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding on the applicable county’s tax rules and rate.

Accounting for Uncertainty in Income Taxes (“Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing a Fund’s tax returns to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on the Statement of Operations. As of May 31, 2015, the Fund did not have any interest or penalties associated with the underpayment of any income taxes.

The Income Tax Statement requires management of the Fund to analyze all open tax years, fiscal years 2011-2015 as defined by IRS statute of limitations for all major jurisdictions, including federal tax authorities and certain state tax authorities. As of and during the six months ended May 31, 2015, the Fund did not have a liability for any unrecognized tax benefits. The Fund has no examinations in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

– 16 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 (Continued) |

Share Classes – The Fund offers two classes of shares, Investor Class and Advisor Class. The outstanding shares of the Fund on April 1, 2010 were renamed “Investor Class shares.” The Advisor Class shares commenced operations on April 1, 2010. The two classes represent interests in the same portfolio of investments and have the same rights. Investor Class shares are subject to an annual 12b-1 fee of up to 0.99% of the Fund’s average daily net assets allocable to Investor Class shares, whereas Advisor Class shares are subject to an annual 12b-1 fee of up to 0.25% of the Fund’s average daily net assets allocable to Advisor Class shares. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains and losses on investments are allocated to each class of shares in proportion to their relative shares outstanding.

Securities Transactions and Investment Income – Securities transactions are accounted for on a trade date basis. Realized gains and losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis.

Distributions to Shareholders – The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial statement and tax purposes. To the extent that these differences are attributable to permanent book and tax accounting differences, the components of net assets have been adjusted.

Redemption Fee – A 1.50% redemption fee is retained by the Fund to offset transaction costs and other expenses associated with short-term investing. The fee is imposed on redemptions or exchanges of shares held less than three months from their purchase date. The Fund records the fee as a reduction of shares redeemed and as a credit to shares of beneficial interest. For the six months ended May 31, 2015, the Investor Class and the Advisor Class received $0 and $10,405 in redemption fees, respectively.

Guarantees and Indemnifications – In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Derivative Instruments – Equity securities in the gold mining industry, particularly the smaller companies, may occasionally issue warrants as part of their capital structure. A warrant gives the holder the right to purchase the underlying equity at the exercise price until the expiration date of the warrant. The Fund may hold such warrants

– 17 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 (Continued) |

for exposure to smaller companies in the portfolio or other reasons associated with the Fund’s overall objective of long-term growth, though warrants will typically not be a significant part of the Fund’s portfolio. The Fund’s maximum risk in holding warrants is the loss of the entire amount paid for the warrants. The Fund did not acquire or sell any warrants during the six months ended May 31, 2015. The limited use of warrants by the Fund involved holding one set of warrants for Veris Gold Corp. which filed for bankruptcy, and as such were fair valued at $0 throughout the reporting period. The Veris Gold Corp. warrants had no impact on the Fund’s Statement of Operations or performance during the reporting period.

Subsequent Events – Management has evaluated subsequent events and determined there were no subsequent events that require recognition or disclosure in the financial statements.

Note 3. Investment Advisory Agreement and Affiliated Parties

The Fund has an investment advisory agreement with Orrell Capital Management, Inc. (“OCM”). Under the agreement, the Fund pays OCM a fee computed daily and payable monthly, at the following annual rates based upon average daily net assets:

Assets | Fee Rate | |||

$0 to $250 million | 0.950 | % | ||

$250 million to $500 million | 0.800 | % | ||

$500 million to $1 billion | 0.700 | % | ||

Over $1 billion | 0.600 | % | ||

The Fund does not compensate Trustees and Officers affiliated with OCM. For the six months ended May 31, 2015, the expenses accrued for Trustees who are not affiliated with OCM are reported on the Statement of Operations. The Fund pays the salary and related expenses of the Fund’s Chief Compliance Officer. The expenses incurred for the Chief Compliance Officer are reported on the Statement of Operations.

Note 4. Distribution Agreement and Plan

The Trust has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended. The Plan authorizes the Fund to reimburse the distributor for marketing expenses incurred in distributing shares of the Fund, including the cost of printing sales material and making payments to dealers of

– 18 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 (Continued) |

the Fund’s Investor Class and Advisor Class, in any fiscal year, subject to limits of 0.99% and 0.25%, respectively, of the average daily net assets of each respective class. For the six months ended May 31, 2015, the Investor Class and the Advisor Class incurred $167,251 and $27,707, respectively, in expenses under the Plan.

Note 5. Purchases and Sales of Securities

Purchases and sales of investment securities (excluding short-term securities and U.S. government obligations) for the six months ended May 31, 2015 were $3,131,263 and $2,364,255, respectively. There were no purchases or sales of U.S. government obligations.

Note 6. Federal Income Tax Information

At May 31, 2015, gross unrealized appreciation and depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

Cost of investments | $ | 33,865,507 | ||

Unrealized appreciation | $ | 30,800,325 | ||

Unrealized depreciation | (5,581,000 | ) | ||

Unrealized appreciation on foreign currency | (563 | ) | ||

Net unrealized appreciation on investments | $ | 25,218,762 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to investments in passive foreign investment companies (“PFICs”).

– 19 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 (Continued) |

The tax character of distributions paid during the fiscal years ended November 30, 2014 and 2013 was as follows:

2014 | 2013 | |||||||

Ordinary income | $ | — | $ | — | ||||

Net long-term capital gains | 2,509,371 | 2,593,300 | ||||||

Total distributions | $ | 2,509,371 | $ | 2,593,300 | ||||

As of November 30, 2014 the components of accumulated earnings on a tax basis were as follows:

Undistributed ordinary income | $ | — | ||

Undistributed long-term gains | — | |||

Tax accumulated earnings | — | |||

Accumulated capital and other losses | (1,089,208 | ) | ||

Unrealized appreciation on investments | 24,224,113 | |||

Total accumulated earnings | $ | 23,134,905 |

The Fund has $757,628 in qualified late-year losses, which are deferred until fiscal year 2015 for tax purposes. Net late-year ordinary losses incurred after December 31 and within the taxable year and net late-year specified losses incurred after October 31 and within the taxable year are deemed to arise on the first day of the Fund’s next taxable year.

As of November 30, 2014, the Fund had $134,210 of post-October capital losses, which are deferred until December 1, 2014. Net capital losses incurred after October 31 and within the taxable year are deemed to arise on the first day of the Fund’s next taxable year.

Under the Regulated Investment Company Modernization Act of 2010 (the “Act”), the Fund will be permitted to carryforward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those post-enactment years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

– 20 –

OCM GOLD FUND Notes to Financial Statements – May 31, 2015 (Continued) |

As of November 30, 2014, the Fund had $7,040 of accumulated short-term capital loss carryforward and $190,330 of accumulated long-term capital loss carryforward which are not subject to expiration. Capital loss carryovers are available to offset future realized capital gains and thereby reduce further taxable gain distributions.

Note 7. Concentration of Risk

Investing in foreign securities involves certain risks not necessarily found in U.S. markets. These include risks associated with adverse changes in economic, political, regulatory and other conditions, changes in currency exchange rates, exchange control regulations, expropriation of assets or nationalization, imposition of withholding taxes on dividend or interest payments or capital gains, and possible difficulty in obtaining and enforcing judgments against foreign entities. Further, issuers of foreign securities are subject to different, and often less comprehensive, accounting, reporting, and disclosure requirements than domestic issuers.

As the Fund concentrates its investments in the gold mining industry, a development adversely affecting the industry (for example, changes in the mining laws which increases production costs or a significant decrease in the market price of gold) would have a greater adverse effect on the Fund than it would if the Fund invested in a number of different industries.

Note 8. Illiquid Securities

The Fund may invest up to 15% of net assets in securities for which there is no readily available market (“illiquid securities”). The 15% limitation includes securities whose disposition would be subject to legal restrictions (“restricted securities”). Illiquid and restricted securities often have a market value lower than the market price of unrestricted securities of the same issuer and are not readily marketable without some time delay. This could result in the Fund being unable to realize a favorable price upon disposition of such securities and in some cases might make disposition of such securities at the time desired by the Fund impossible.

– 21 –

OCM GOLD FUND Financial Highlights Investor Class |

Six Months Ended | Year | Year | Year | Year | Year | |||||||||||||||||||

Per Share Operating Performance | ||||||||||||||||||||||||

(For a share outstanding throughout each period) | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 9.47 | $ | 11.26 | $ | 21.68 | $ | 28.49 | $ | 30.53 | $ | 24.68 | ||||||||||||

Income from Investment Operations: | ||||||||||||||||||||||||

Net investment loss | (0.07 | )1 | (0.17 | )1 | (0.27 | ) | (0.25 | ) | (0.29 | ) | (0.43 | ) | ||||||||||||

Net realized and unrealized gain/(loss) on investments and foreign currency transactions | 0.48 | (1.17 | ) | (9.75 | ) | (5.48 | ) | 0.76 | 6.81 | |||||||||||||||

Total from investment operations | 0.41 | (1.34 | ) | (10.02 | ) | (5.73 | ) | 0.47 | 6.38 | |||||||||||||||

Less Distributions: | ||||||||||||||||||||||||

Dividends from net investment income | — | — | — | — | — | — | ||||||||||||||||||

Distribution from net realized gains | (0.16 | ) | (0.45 | ) | (0.40 | ) | (1.08 | ) | (2.51 | ) | (0.53 | ) | ||||||||||||

Total distributions | (0.16 | ) | (0.45 | ) | (0.40 | ) | (1.08 | ) | (2.51 | ) | (0.53 | ) | ||||||||||||

Redemption fee proceeds | — | — | 2 | — | 2 | — | 2 | — | 2 | — | 2 | |||||||||||||

Net asset value, end of period | $ | 9.72 | $ | 9.47 | $ | 11.26 | $ | 21.68 | $ | 28.49 | $ | 30.53 | ||||||||||||

Total return* | 4.42 | %3 | (11.49 | )% | (47.03 | )% | (20.27 | )% | 1.70 | % | 26.70 | % | ||||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||||||

Net assets, end of year (in 000's) | $ | 36,586 | $ | 38,177 | $ | 52,231 | $ | 125,286 | $ | 168,305 | $ | 175,802 | ||||||||||||

Ratio of expenses to average net assets | 2.49 | %4 | 2.39 | % | 2.22 | % | 1.99 | % | 1.73 | % | 1.93 | % | ||||||||||||

Ratio of net investment loss to average net assets | (1.32 | )%4 | (1.34 | )% | (0.85 | )% | (1.04 | )% | (1.03 | )% | (1.57 | )% | ||||||||||||

Portfolio turnover rate | 4 | %3 | 5 | % | 8 | % | 1 | % | 5 | % | 12 | % | ||||||||||||

* | Assumes no sales charge |

1 | Based on average shares method. |

2 | Amount represents less than $0.01 per share. |

3 | Not annualized. |

4 | Annualized. |

See notes to financial statements.

– 22 –

OCM GOLD FUND Financial Highlights Advisor Class |

Six Months Ended | Year | Year | Year | Year | For the Period April 1, 2010# - | |||||||||||||||||||

Per Share Operating Performance | ||||||||||||||||||||||||

(For a share outstanding throughout each period) | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 9.76 | $ | 11.49 | $ | 22.00 | $ | 28.74 | $ | 30.65 | $ | 22.24 | ||||||||||||

Income from Investment Operations: | ||||||||||||||||||||||||

Net investment income loss | (0.04 | )1 | (0.09 | )1 | (0.08 | ) | (0.12 | ) | (0.18 | ) | (0.13 | ) | ||||||||||||

Net realized and unrealized gain/(loss) on investments and foreign currency transactions | 0.50 | (1.20 | ) | (10.03 | ) | (5.54 | ) | 0.78 | 8.54 | |||||||||||||||

Total from investment operations | 0.46 | (1.29 | ) | (10.11 | ) | (5.66 | ) | 0.60 | 8.41 | |||||||||||||||

Less Distributions: | ||||||||||||||||||||||||

Dividends from net investment income | — | — | — | — | — | — | ||||||||||||||||||

Distribution from net realized gains | (0.16 | ) | (0.45 | ) | (0.40 | ) | (1.08 | ) | (2.51 | ) | — | |||||||||||||

Total distributions | (0.16 | ) | (0.45 | ) | (0.40 | ) | (1.08 | ) | (2.51 | ) | — | |||||||||||||

Redemption fee proceeds | — | 2 | 0.01 | — | 2 | — | 2 | — | 2 | — | 2 | |||||||||||||

Net asset value, end of period | $ | 10.06 | $ | 9.76 | $ | 11.49 | $ | 22.00 | $ | 28.74 | $ | 30.65 | ||||||||||||

Total return | 4.81 | %3 | (10.74 | )% | (46.75 | )% | (19.83 | )% | 2.15 | % | 37.81 | %3 | ||||||||||||

Ratios/Supplemental Data: | ||||||||||||||||||||||||

Net assets, end of year (in 000's) | $ | 22,400 | $ | 16,970 | $ | 12,005 | $ | 17,322 | $ | 20,328 | $ | 20,386 | ||||||||||||

Ratio of expenses to average net assets | 1.89 | %4 | 1.79 | % | 1.69 | % | 1.48 | % | 1.30 | % | 1.34 | %4 | ||||||||||||

Ratio of net investment loss to average net assets | (0.72 | )%4 | (0.74 | )% | (0.31 | )% | (0.52 | )% | (0.60 | )% | (0.98 | )%4 | ||||||||||||

Portfolio turnover rate | 4 | %3 | 5 | % | 8 | % | 1 | % | 5 | % | 12 | %3 | ||||||||||||

# | Inception date of Advisor Class. |

1 | Based on average shares method. |

2 | Amount represents less than $0.01 per share. |

3 | Not annualized. |

4 | Annualized. |

See notes to financial statements.

– 23 –

OCM GOLD FUND Expense Example – For the Period Ended May 31, 2015 |

As a shareholder of the OCM Gold Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees on certain redemptions; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 1, 2014 to May 31, 2015 (the “period”).

Actual Expenses

The row titled “Actual” in the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the appropriate line for your share class under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the periods.

Hypothetical Example for Comparison Purposes

The row titled “Hypothetical” in the table below provides information about hypothetical account values and hypothetical expenses based on each class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the classes of the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the hypothetical lines of the table are useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

– 24 –

OCM GOLD FUND Expense Example – For the Period Ended May 31, 2015 (Continued) |

Expenses Paid During the Period

Beginning | Ending | Expenses Paid | ||||||||||

Investor Class | ||||||||||||

Actual | $ | 1,000.00 | $ | 1,044.20 | $ | 12.70 | ||||||

Hypothetical (5% return before expenses) | 1,000.00 | 1,012.57 | 12.51 | |||||||||

Advisor Class | ||||||||||||

Actual | 1,000.00 | 1,048.10 | 9.65 | |||||||||

Hypothetical (5% return before expenses) | 1,000.00 | 1,015.57 | 9.50 | |||||||||

* | Expenses are equal to the Investor Class’ and Advisor Class’ annualized expense ratios of 2.49% and 1.89%, respectively, for the period, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

– 25 –

OCM GOLD FUND Other Information |

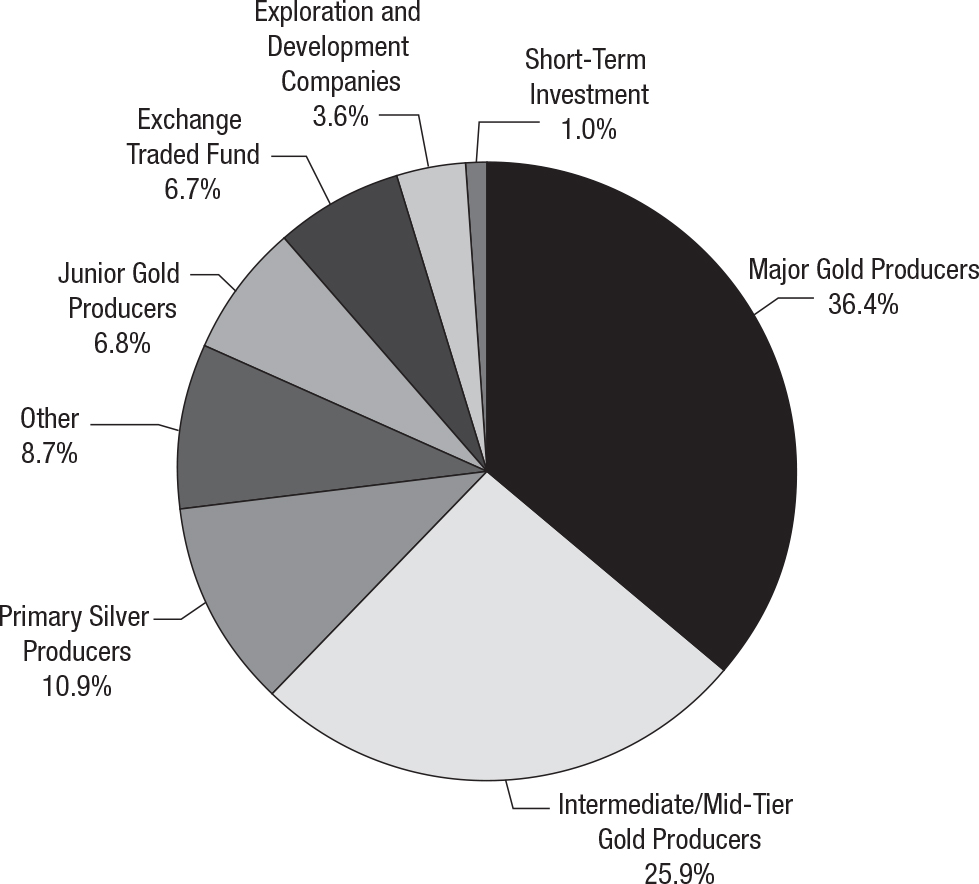

Investments by Sector – As of May 31, 2015

As a Percentage of Total Investments

Proxy Voting Information

A description of the Fund’s proxy voting policies and procedures and a record of the Fund’s proxy votes for the year ended June 30, 2014 are available without charge, upon request by calling toll free 1-800-779-4681 and on the Securities and Exchange Commission’s (SEC) website at http://www.sec.gov.

Quarterly Filings of Portfolio Holdings

The Fund will file its complete schedule of investments with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q will be available on the EDGAR database on the SEC’s website at http://www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

– 26 –

THIS PAGE INTENTIONALLY LEFT BLANK

THIS PAGE INTENTIONALLY LEFT BLANK

THIS PAGE INTENTIONALLY LEFT BLANK

OCM Gold Fund

Distributed by:

Northern Lights Distributors, LLC

17605 Wright Street

Omaha, NE 68130

2415-NLD-7/28/2015

Item 2. Code of Ethics.

| (a) | The registrant's certifying officer has concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-2 under the Investment Company Act of 1940 (the "Act")) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-2 under the Act, based on their evaluation of these disclosure controls and procedures within 90 days of the filing date of this report on Form N-CSR. |

| (b) | Not applicable. |

| (a)(1) | Code of Ethics – Not applicable. |

| (a)(2) | Certification for each principal executive and principal financial officer of the registrant as required by Rule 30a-2 under the Act (17 CFR 270.30a-2(a)) – Filed as an attachment to this filing. |

| (b) | Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)), Rule 13a-14(b) or Rule 15d-14(b) under the Exchange Act (17 CFR 240.13a-14(b) or 240.15d-14(b)), and Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) – Filed as an attachment to this filing. |

| By: | /s/ Gregory M. Orrell | |

| Gregory M. Orrell | ||

| President | ||

| Date: July 22, 2015 | ||

| By: | /s/ Gregory M. Orrell | |

| Gregory M. Orrell | ||

| President and Treasurer | ||

| Date: July 22, 2015 | ||