EATON VANCE GROUP OF FUNDS

| The Eaton Vance Building 255 State Street Boston, Massachusetts 02109 |

| September 26, 2008 |

Dear Shareholder:

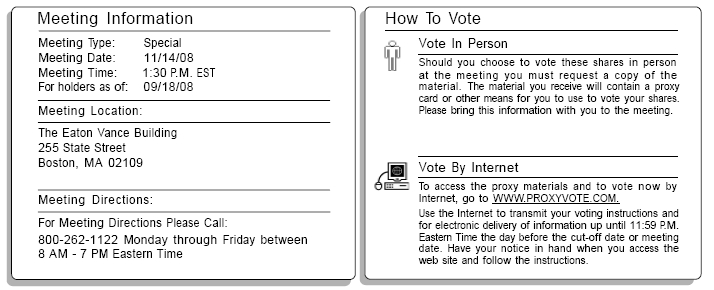

We cordially invite you to attend a Special Meeting of Shareholders of the Eaton Vance Group of Funds on Friday, November 14, 2008. There is only one item on the agenda, but it is an important one — the election of Trustees. We ask you to read the enclosed information carefully and to submit your vote promptly.

In the proxy statement that follows this letter, the current Trustees are asking shareholders to elect a slate of Trustees that includes all of the existing Trustees and one new Trustee. The current Trustees serve on the Boards of multiple Eaton Vance funds. If the entire slate is elected, at least two-thirds of each Board will continue to be composed of Trustees who are independent of Fund management.

Since the Trustee proposal is common to the Funds, we have combined our discussion into a single proxy statement, which will reduce Fund expenses. Please note that we are required to provide you with one proxy card (or other means to vote) for each account that you own.

We realize that most of our shareholders will not be able to attend the meeting and vote their shares in person. However, your Fund does need your vote. You can vote bymail, telephone,or over theInternet,as explained in the enclosed material. If you later decide to attend the meeting, you may revoke your proxy and vote your shares in person.By voting promptly, you can help your Fund avoid the expense of additional mailings.

If you would like additional information concerning the election of Trustees, please call one of our service representatives at 1-800-262-1122 Monday through Friday between 8:00 A.M. - 7:00 P.M. (Eastern Time). Your participation in this vote is extremely important.

| YOUR VOTE IS IMPORTANT — PLEASE VOTE PROMPTLY. |

| SHAREHOLDERS ARE URGED TO SIGN AND MAIL THE ENCLOSED PROXY IN THE |

| ENCLOSED POSTAGE PREPAID ENVELOPE OR VOTE BY TELEPHONE OR OVER |

| THE INTERNET BY FOLLOWING THE ENCLOSED INSTRUCTIONS. YOUR VOTE IS |

| IMPORTANT WHETHER YOU OWN A FEW SHARES OR MANY SHARES. |

EATON VANCE GROUP OF FUNDS

| The Eaton Vance Building 255 State Street Boston, Massachusetts 02109 |

| Notice of Special Meeting of Shareholders To Be Held November 14, 2008 |

A Special Meeting of Shareholders of each Eaton Vance Fund listed on the following pages will be held at the principal office of the Funds, The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109, on Friday, November 14, 2008 at 1:30 P.M. (Eastern Time), for the following purposes:

| 1. | To consider and act upon a proposal to elect a Board of Trustees. |

| 2. | To consider and act upon any other matters which may properly come before the meeting and any adjourned or postponed session thereof. |

The proposal to elect Trustees is discussed in greater detail in the following pages.

The meeting is called pursuant to the By-Laws of each Fund. The Boards of Trustees of the Funds have fixed the close of business on September 18, 2008 as the record date for the determination of the shareholders of each Fund entitled to notice of and to vote at the meeting and any adjournments or postponements thereof. The Proxy Statement and accompanying material, or a Notice of Internet Availability of Proxy Materials are being mailed to shareholders on or about September 26, 2008.

| September 26, 2008 Boston, Massachusetts |

| IMPORTANT |

| SHAREHOLDERS CAN HELP THE BOARD OF TRUSTEES OF EACH FUND AVOID |

| THE NECESSITY AND ADDITIONAL EXPENSE OF FURTHER SOLICITATIONS, |

| WHICH MAY BE NECESSARY TO OBTAIN A QUORUM BY PROMPTLY RETURNING |

| THE ENCLOSED PROXY OR VOTING BY TELEPHONE OR OVER THE INTERNET. |

| THE ENCLOSED ADDRESSED ENVELOPE REQUIRES NO POSTAGE IF MAILED IN |

| THE UNITED STATES AND IS INTENDED FOR YOUR CONVENIENCE. |

Special Meeting of Shareholders — November 14, 2008

EATON VANCE GROUP OF FUNDS

The Funds in the Eaton Vance Group of Funds are part of various trusts. Each Trust listed below is a “Trust” and collectively, the “Trusts”. The Funds listed below are each a “Fund” and collectively, the “Funds”. Many of the Eaton Vance Funds are in the master-feeder structure and invest their assets in a corresponding portfolio. Each portfolio listed below is a “Portfolio” and collectively, the “Portfolios”. The list below contains all the Funds and their corresponding Portfolios.

| Trust Names | Fund Names | Corresponding Portfolio | ||

| Eaton Vance Growth Trust | Eaton Vance Asian Small Companies Fund | Asian Small Companies Portfolio | ||

| (7 Funds) | Eaton Vance-Atlanta Capital Large-Cap Growth Fund | Large-Cap Portfolio | ||

| Eaton Vance-Atlanta Capital SMID-Cap Fund | SMID-Cap Portfolio | |||

| Eaton Vance Global Growth Fund | Global Growth Portfolio | |||

| Eaton Vance Greater China Growth Fund | Greater China Growth Portfolio | |||

| Eaton Vance Multi-Cap Growth Fund | Multi-Cap Growth Portfolio | |||

| Eaton Vance Worldwide Health Sciences Fund | Worldwide Health Sciences Portfolio | |||

| Eaton Vance Investment Trust | Eaton Vance AMT-Free Limited Maturity Municipals Fund | N/A | ||

| (8 Funds) | Eaton Vance California Limited Maturity Municipals Fund | N/A | ||

| Eaton Vance Massachusetts Limited Maturity Municipals Fund | N/A | |||

| Eaton Vance National Limited Maturity Municipals Fund | N/A | |||

| Eaton Vance New Jersey Limited Maturity Municipals Fund | N/A | |||

| Eaton Vance New York Limited Maturity Municipals Fund | N/A | |||

| Eaton Vance Ohio Limited Maturity Municipals Fund | N/A | |||

| Eaton Vance Pennsylvania Limited Maturity Municipals Fund | N/A | |||

| Eaton Vance Municipals Trust | Eaton Vance Alabama Municipals Fund | N/A | ||

| (28 Funds) | Eaton Vance Arizona Municipals Fund | N/A | ||

| Eaton Vance Arkansas Municipals Fund | N/A | |||

| Eaton Vance California Municipals Fund | N/A | |||

| Eaton Vance Colorado Municipals Fund | N/A | |||

| Eaton Vance Connecticut Municipals Fund | N/A | |||

| Eaton Vance Florida Plus Municipals Fund | N/A | |||

| Eaton Vance Georgia Municipals Fund | N/A | |||

| Eaton Vance Kentucky Municipals Fund | N/A | |||

| Eaton Vance Louisiana Municipals Fund | N/A | |||

| Eaton Vance Maryland Municipals Fund | N/A | |||

| Eaton Vance Massachusetts Municipals Fund | N/A | |||

| Eaton Vance Michigan Municipals Fund | N/A | |||

| Eaton Vance Minnesota Municipals Fund | N/A | |||

| Eaton Vance Mississippi Municipals Fund | N/A | |||

| Eaton Vance Missouri Municipals Fund | N/A | |||

| Eaton Vance National Municipals Fund | N/A | |||

| Eaton Vance New Jersey Municipals Fund | N/A | |||

| Eaton Vance New York Municipals Fund | N/A | |||

| Eaton Vance North Carolina Municipals Fund | N/A | |||

| Eaton Vance Ohio Municipals Fund | N/A | |||

| Eaton Vance Oregon Municipals Fund | N/A | |||

| Eaton Vance Pennsylvania Municipals Fund | N/A | |||

| Eaton Vance Rhode Island Municipals Fund | N/A | |||

| Eaton Vance South Carolina Municipals Fund | N/A | |||

| Eaton Vance Tennessee Municipals Fund | N/A | |||

| Eaton Vance Virginia Municipals Fund | N/A | |||

| Eaton Vance West Virginia Municipals Fund | N/A | |||

| Eaton Vance Municipals | Eaton Vance Insured Municipals Fund | N/A | ||

| Trust II(4 Funds) | Eaton Vance Hawaii Municipals Fund | N/A | ||

| Eaton Vance High Yield Municipals Fund | N/A | |||

| Eaton Vance Kansas Municipals Fund | N/A | |||

| Eaton Vance Mutual Funds | Eaton Vance AMT-Free Municipal Bond Fund | N/A | ||

| Trust(29 Funds) | Eaton Vance Cash Management Fund | Cash Management Portfolio | ||

| Eaton Vance Diversified Income Fund | Boston Income Portfolio/Floating Rate | |||

| Portfolio/Government Obligations | ||||

| Portfolio |

| Trust Names | Fund Names | Corresponding Portfolio | ||

| Eaton Vance Mutual Funds | Eaton Vance Dividend Income Fund | Dividend Income Portfolio | ||

| Trust(cont.) | Eaton Vance Emerging Markets Local Income Fund | Emerging Markets Local Income | ||

| Portfolio | ||||

| Eaton Vance Floating-Rate Advantage Fund | Senior Debt Portfolio | |||

| Eaton Vance Floating-Rate Fund | Floating Rate Portfolio | |||

| Eaton Vance Floating-Rate & High Income Fund | Floating Rate Portfolio/High Income | |||

| Opportunities Portfolio | ||||

| Eaton Vance Global Macro Fund | Global Macro Portfolio | |||

| Eaton Vance Government Obligations Fund | Government Obligations Portfolio | |||

| Eaton Vance High Income Opportunities Fund | High Income Opportunities Portfolio | |||

| Eaton Vance International Equity Fund | International Equity Portfolio | |||

| Eaton Vance International Income Fund | International Income Portfolio | |||

| Eaton Vance Large-Cap Core Research Fund | N/A | |||

| Eaton Vance Low Duration Fund | Floating Rate Portfolio/Government | |||

| Obligations Portfolio/Investment | ||||

| Portfolio | ||||

| Eaton Vance Money Market Fund | Cash Management Portfolio | |||

| Eaton Vance Strategic Income Fund | Boston Income Portfolio/Emerging | |||

| Markets Local Income Portfolio/ | ||||

| Floating Rate Portfolio/Global Macro | ||||

| Portfolio/High Income Opportunities | ||||

| Portfolio/International Income | ||||

| Portfolio/Investment Grade Income | ||||

| Portfolio/Investment Portfolio | ||||

| Eaton Vance Structured Emerging Markets Fund | N/A | |||

| Eaton Vance Tax Free Reserves | N/A | |||

| Eaton Vance Tax-Managed Dividend Income Fund | N/A | |||

| Eaton Vance Tax-Managed Equity Asset Allocation Fund | All Tax-Managed Portfolios | |||

| Eaton Vance Tax-Managed Growth Fund 1.1 | Tax-Managed Growth Portfolio | |||

| Eaton Vance Tax-Managed Growth Fund 1.2 | Tax-Managed Growth Portfolio | |||

| Eaton Vance Tax-Managed International Equity Fund | Tax-Managed International Equity | |||

| Portfolio | ||||

| Eaton Vance Tax-Managed Mid-Cap Core Fund | Tax-Managed Mid-Cap Core Portfolio | |||

| Eaton Vance Tax-Managed Multi-Cap Growth Fund | Tax-Managed Multi-Cap Growth | |||

| Portfolio | ||||

| Eaton Vance Tax-Managed Small-Cap Fund | Tax-Managed Small-Cap Portfolio | |||

| Eaton Vance Tax-Managed Small-Cap Value Fund | Tax-Managed Small-Cap Value | |||

| Portfolio | ||||

| Eaton Vance Tax-Managed Value Fund | Tax-Managed Value Portfolio | |||

| Eaton Vance Series Trust | Eaton Vance Tax-Managed Growth Fund 1.0 | Tax-Managed Growth Portfolio | ||

| (1 Fund) | ||||

| Eaton Vance Series Trust II | Eaton Vance Income Fund of Boston | Boston Income Portfolio | ||

| (2 Funds) | Eaton Vance Tax-Managed Emerging Markets Fund | N/A | ||

| Eaton Vance Special Investment | Eaton Vance Balanced Fund | Capital Growth Portfolio/Investment | ||

| Trust(17 Funds) | Grade Income Portfolio/Large-Cap | |||

| Value Portfolio | ||||

| Eaton Vance Capital & Income Strategies Fund | Boston Income Portfolio/Dividend | |||

| Builder Portfolio/Large-Cap Value | ||||

| Portfolio | ||||

| Eaton Vance Dividend Builder Fund | Dividend Builder Portfolio | |||

| Eaton Vance Emerging Markets Fund | Emerging Markets Portfolio | |||

| Eaton Vance Enhanced Equity Option Income Fund | N/A | |||

| Eaton Vance Equity Asset Allocation Fund | International Equity Portfolio/Large- | |||

| Cap Growth Portfolio/Large-Cap | ||||

| Value Portfolio/Multi-Cap Growth | ||||

| Portfolio/Small-Cap Portfolio/ | ||||

| SMID-Cap Portfolio | ||||

| Eaton Vance Greater India Fund | Greater India Portfolio | |||

| Eaton Vance Institutional Short Term Income Fund | N/A | |||

| Eaton Vance Institutional Short Term Treasury Fund | N/A | |||

| Eaton Vance Investment Grade Income Fund | Investment Grade Income Portfolio | |||

| Eaton Vance Large-Cap Growth Fund | Large-Cap Growth Portfolio | |||

| Eaton Vance Large-Cap Value Fund | Large-Cap Value Portfolio |

| Trust Names | Fund Names | Corresponding Portfolio | ||

| Eaton Vance Special Investment | Eaton Vance Real Estate Fund | N/A | ||

| Trust(cont.) | Eaton Vance Risk-Managed Equity Option Income Fund | N/A | ||

| Eaton Vance Small-Cap Fund | Small-Cap Portfolio | |||

| Eaton Vance Small-Cap Value Fund | N/A | |||

| Eaton Vance Special Equities Fund | Special Equities Portfolio | |||

| Eaton Vance Variable Trust | Eaton Vance VT Floating-Rate Income Fund | N/A | ||

| (3 Funds) | Eaton Vance VT Large-Cap Value Fund | N/A | ||

| Eaton Vance VT Worldwide Health Sciences Fund | N/A |

| Eaton Vance Group of Funds The Eaton Vance Building 255 State Street Boston, Massachusetts 02109 PROXY STATEMENT |

A proxy is enclosed with the foregoing Notice of a Special Meeting of the Funds to be held on November 14, 2008 at 1:30 P.M. (Eastern Time) at the Eaton Vance Building, 255 State Street, Boston, MA 02109 for the benefit of shareholders who wish to vote, but do not expect to be present at the meeting. Shareholders may also vote by telephone or over the Internet. All proxies are solicited on behalf of the Board of Trustees. A written proxy is revocable by the person giving it prior to exercise by a signed writing filed with the Funds’ proxy tabulator, Broadridge Investor Communication Solutions, MIS, 60 Research Road, Hingham, MA, 02043 or by executing and delivering a later dated proxy, or by attending the meeting and voting the shares in person. Proxies voted by telephone or over the Internet may be revoked at any time in the same manner that proxies voted by mail may be revoked. Each proxy will be voted in accordance with its instructions; if no instruction is given, an executed proxy will authorize the persons named as attorneys, or any of them, to vote in favor of each matter. This proxy and accompanying material, or a Notice of Internet Availability of Proxy Materials are initially being mailed to shareholders on or about September 26, 2008. Supplementary solicitations may be made by mail, telephone, facsimile or electronic means.

The Trustees have fixed the close of business on September 18, 2008 as the record date for the determination of the shareholders entitled to notice of and to vote at the meeting and any adjournments or postponements thereof. Shareholders at the close of business on the record date will be entitled to one vote for each share held. The number of shares of beneficial interest (excluding fractions thereof) of each Fund outstanding as of September 18, 2008 is set forth in Exhibit A.

The persons who held of record more than 5% of the outstanding shares of any class of shares of a Fund as of August 29, 2008 are set forth in Exhibit B. To the knowledge of the Fund, no other person owns (of record or beneficially) 5% or more of the outstanding shares of any class of shares of a Fund. The Trustees, nominee for Trustee, and executive officers of each Fund individually and as a group own beneficially less than 1% of the outstanding shares of each Fund, except as disclosed in Exhibit B. Shareholders of all classes of shares of a Fund will vote jointly on all items. Each Trust’s Board of Trustees shall be elected by a plurality of the shares of the entire Trust voted in person or by proxy. Election of Trustees is non-cumulative.

The Trustees know of no business other than the business mentioned in Proposal 1 of the Notice of Meeting that will be presented for consideration. If any other matters are properly presented, it is the intention of the persons named as attorneys in the enclosed proxy to vote the proxies in accordance with their judgment on such matters.

Each Fund has previously sent its Annual Report and Semiannual Report to its shareholders. Each Fund will furnish without charge a copy of the Fund’s most recent Annual Report and its Semiannual Report to any shareholder upon request. Shareholders desiring to obtain a copy of such reports should: (i) access them on Eaton Vance’s website atwww.eatonvance.com; (ii) write to the Fund c/o Eaton Vance Management, The Eaton Vance Building, 255 State Street, Boston, MA 02109, Attn: Proxy Coordinator, Mutual Fund Operations, or (iii) call 1-800-262-1122 Monday through Friday between 8:00 A.M. - 7:00 P.M. (Eastern Time).

| PROPOSAL 1. ELECTION OF TRUSTEES |

The Boards of Trustees of the Trusts and Portfolios have proposed that the slate of persons listed in the table set forth below be elected as Trustees of each Trust and Portfolio. Each nominee, with the exception of Helen Frame Peters, is currently serving as a Trustee for multiple funds in the Eaton Vance Group of Funds.

Trustee Nominations

Messrs. Esty, Faust, Freedman, Park, Pearlman and Verni and Mmes. Steiger and Stout currently serve as Trustees of each Trust and Portfolio. Ms. Peters was approved to serve as a Trustee of all Trusts and Portfolios by the Boards of Trustees, including a majority of the Independent Trustees, based upon a recommendation of each Trust and Portfolio’s Governance Committee.

The nominees for Trustee and their principal occupations for at least the last five years are set forth in the table below. Unless otherwise indicated, the position listed under “Position(s) Held with the Fund and/or Portfolio” are held with all Funds and Portfolios. Each Trustee holds office until his or her successor is elected and qualified. Information about Trust and Portfolio officers appears in Exhibit C.

Interested Trustee

Thomas E. Faust Jr. is an “interested person” as defined in the Investment Company Act of 1940 (the “1940 Act”) by reason of his affiliations with certain of the Funds; Eaton Vance Management (“EVM” or “Eaton Vance”); Boston Management and Research (“BMR”); and Eaton Vance Distributors, Inc. (“EVD”). Eaton Vance, Inc. (“EV”) serves as the Trustee of EVM and BMR. EV, EVM and EVD are wholly-owned subsidiaries of Eaton Vance Corp. (“EVC”), a publicly-held holding company. BMR is an indirect subsidiary of EVC. (EVM, EVD, EVC, BMR and their affiliates are sometimes referred to collectively as the “Eaton Vance Organization”).

| Number of | ||||||||||

| Portfolios | ||||||||||

| in Fund | ||||||||||

| Complex | ||||||||||

| Position(s) | Term of | Overseen by | ||||||||

| Held with the | Office(2)and | Trustee or | Other Directorships | |||||||

| Name, Address and | Fund and/or | Length of | Principal Occupation(s) During | Nominee for | Held by Trustee or | |||||

| Date of Birth(1) | Portfolio | Time Served | Past Five Years | Trustee(3) | Nominee for Trustee | |||||

| Interested Trustee | ||||||||||

| Thomas E. Faust Jr. | Trustee and | See Exhibit D | Chairman, Chief Executive | 177 | Director of EVC | |||||

| DOB: 5/31/58 | President or | Officer and President of | ||||||||

| Vice | EVC, President of EV, Chief | |||||||||

| President(4) | Executive Officer and | |||||||||

| President of EVM and BMR | ||||||||||

| and Director of EVD. Trustee | ||||||||||

| and/or officer of 177 | ||||||||||

| registered investment | ||||||||||

| companies and 5 private | ||||||||||

| investment companies | ||||||||||

| managed by Eaton Vance or | ||||||||||

| BMR. | ||||||||||

| Noninterested Trustees | ||||||||||

| Benjamin C. Esty | Trustee | See Exhibit D | Roy and Elizabeth Simmons | 177 | None | |||||

| DOB: 1/2/63 | Professor of Business | |||||||||

| Administration, Harvard | ||||||||||

| University Graduate School | ||||||||||

| of Business Administration. | ||||||||||

2

| Number of | ||||||||||

| Portfolios | ||||||||||

| in Fund | ||||||||||

| Complex | ||||||||||

| Position(s) | Term of | Overseen by | ||||||||

| Held with the | Office(2)and | Trustee or | Other Directorships | |||||||

| Name, Address and | Fund and/or | Length of | Principal Occupation(s) During | Nominee for | Held by Trustee or | |||||

| Date of Birth(1) | Portfolio | Time Served | Past Five Years | Trustee(3) | Nominee for Trustee | |||||

| Allen R. Freedman | Trustee | See Exhibit D | Former Chairman | 177 | Director of Assurant, | |||||

| DOB: 4/3/40 | (2002-2004) and a Director | Inc. (insurance | ||||||||

| (1983-2004) of Systems & | provider) and | |||||||||

| Computer Technology Corp. | Stonemor Partners | |||||||||

| (provider of software to | L.P. (owner and | |||||||||

| higher education). Formerly, | operator of cemeteries) | |||||||||

| a Director of Loring Ward | ||||||||||

| International (fund | ||||||||||

| distributor) (2005-2007). | ||||||||||

| Formerly, Chairman and a | ||||||||||

| Director of Indus | ||||||||||

| International Inc. (provider of | ||||||||||

| enterprise management | ||||||||||

| software to the power | ||||||||||

| generating industry) | ||||||||||

| (2005-2007). | ||||||||||

| William H. Park | Trustee | See Exhibit D | Vice Chairman, Commercial | 177 | None | |||||

| DOB: 9/19/47 | Industrial Finance Corp. | |||||||||

| (specialty finance company) | ||||||||||

| (since 2006). Formerly, | ||||||||||

| President and Chief | ||||||||||

| Executive Officer, Prizm | ||||||||||

| Capital Management, LLC | ||||||||||

| (investment management | ||||||||||

| firm) (2002-2005). | ||||||||||

| Ronald A. Pearlman | Trustee | See Exhibit D | Professor of Law, | 177 | None | |||||

| DOB: 7/10/40 | Georgetown University Law | |||||||||

| Center. | ||||||||||

| Helen Frame Peters(5) | Current | — | Professor of Finance, Carroll | 0 | Director of Federal | |||||

| DOB: 3/22/48 | Nominee for | School of Management, | Home Loan Bank of | |||||||

| Trustee | Boston College (2003- | Boston (a bank for | ||||||||

| present). Adjunct Professor | banks) and BJ’s | |||||||||

| of Finance, Peking | Wholesale Clubs | |||||||||

| University, Beijing, China | (wholesale club | |||||||||

| (2005-present). Formerly, | retailer); Trustee of | |||||||||

| Dean, Boston College | SPDR Index Shares | |||||||||

| (August 2000-2003). | Funds and SPDR | |||||||||

| Series Trust (exchange | ||||||||||

| traded funds) | ||||||||||

3

| Number of | ||||||||||

| Portfolios | ||||||||||

| in Fund | ||||||||||

| Complex | ||||||||||

| Position(s) | Term of | Overseen by | ||||||||

| Held with the | Office(2)and | Trustee or | Other Directorships | |||||||

| Name, Address and | Fund and/or | Length of | Principal Occupation(s) During | Nominee for | Held by Trustee or | |||||

| Date of Birth(1) | Portfolio | Time Served | Past Five Years | Trustee(3) | Nominee for Trustee | |||||

| Heidi L. Steiger | Trustee | See Exhibit D | Managing Partner, Topridge | 177 | Director of Nuclear | |||||

| DOB: 7/8/53 | Associates LLC (global | Electric Insurance Ltd. | ||||||||

| wealth management firm) | (nuclear insurance | |||||||||

| (since 2008). Senior Adviser | provider) and Aviva | |||||||||

| (since 2008), President | USA (insurance | |||||||||

| (2005-2008), Lowenhaupt | provider) | |||||||||

| Global Advisors, LLC | ||||||||||

| (global wealth management | ||||||||||

| firm). Formerly, President | ||||||||||

| and Contributing Editor, | ||||||||||

| Worth Magazine | ||||||||||

| (2004-2005). Formerly, | ||||||||||

| Executive Vice President and | ||||||||||

| Global Head of Private Asset | ||||||||||

| Management (and various | ||||||||||

| other positions), Neuberger | ||||||||||

| Berman (investment firm) | ||||||||||

| (1986-2004). | ||||||||||

| Lynn A. Stout | Trustee | See Exhibit D | Paul Hastings Professor of | 177 | None | |||||

| DOB: 9/14/57 | Corporate and Securities Law | |||||||||

| (since 2006) and Professor of | ||||||||||

| Law (2001-2006), University | ||||||||||

| of California at Los Angeles | ||||||||||

| School of Law. | ||||||||||

| Ralph F. Verni | Chairman of | See Exhibit D | Consultant and private | 177 | None | |||||

| DOB: 1/26/43 | the Board | investor. | ||||||||

| and Trustee | ||||||||||

| (1) | The business address of each Trustee and nominee for Trustee is The Eaton Vance Building, 255 State Street, Boston, MA 02109. |

| (2) | As noted under “Trustee Nominations,” each Trustee holds office until his or her successor is elected and qualified. |

| (3) | Includes both master and feeder funds in master-feeder structure. |

| (4) | Mr. Faust is President of the following Trusts: Eaton Vance Growth Trust, Eaton Vance Mutual Funds Trust, Eaton Vance Special Investment Trust and Eaton Vance Variable Trust. Mr. Faust is Vice President of Eaton Vance Series Trust. Mr. Faust is Vice President of the following Portfolios: Large-Cap Portfolio, SMID-Cap Portfolio, Tax-Managed Growth Portfolio, Tax-Managed Mid-Cap Core Portfolio and Tax-Managed Small-Cap Value Portfolio. |

| (5) | Nominated for election as a Trustee of all Trusts and Portfolios at the November 14, 2008 Special Meeting of Shareholders. |

For the dollar range of equity securities beneficially owned by each Trustee and nominee in each Fund and in all Eaton Vance Funds overseen by the Trustee as of August 29, 2008, see Exhibit E.

Unless authority to vote for election of one or more of the nominees is specifically withheld by executing the proxy in the manner stated thereon, it is the present intention that the enclosed proxy will be used for the purpose of voting in favor of the election of all nominees as Trustees as described above to hold office in accordance with the By-Laws. Each Trustee nominee has consented to stand for election and to serve as a Trustee

4

if elected. If any nominee should be unable to serve, an event not now anticipated, the discretionary power given in the proxy may be used to vote for a substitute nominee as designated by the Board of Trustees to replace such person (unless authority to vote for election of all nominees is specifically withheld by executing the proxy in the manner stated thereon).

Board Meetings and Committees

During the calendar year ended December 31, 2007, the Trustees met twelve times (the Board of Trustees of Eaton Vance Variable Trust and Floating Rate Portfolio met thirteen times). Each Board has the following formal standing committees: an Audit Committee, a Contract Review Committee (formerly, the Special Committee), a Governance Committee, a Portfolio Management Committee and a Compliance Reports and Regulatory Matters Committee. During the calendar year ended December 31, 2007, the Audit Committee met six times, the Contract Review Committee met eleven times and the Governance Committee met three times. The Portfolio Management Committee and the Compliance Reports and Regulatory Matters Committee were recently formed, so they did not convene during the year ended December 31, 2007. Each Trustee currently serving on the Boards listed above attended at least 75% of such Board and Committee meetings on which he or she serves. The Portfolios have the same Trustee committee and compensation structure and committee composition as the Funds.

Each Committee of the Board of Trustees of each Fund is comprised only of Trustees who are not “interested persons” as that term is defined under the 1940 Act (“Independent Trustees”). The respective duties and responsibilities of these Committees remain under the continuing review of the Governance Committee and the Board.

Messrs. Park (Chair) and Verni and Mmes. Steiger and Stout serve on the Audit Committee of the Board of Trustees of each Fund and Portfolio, such Audit Committee being established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The purposes of the Audit Committee are to (i) oversee each Fund’s accounting and financial reporting processes, its internal control over financial reporting, and, as appropriate, the internal control over financial reporting of certain service providers; (ii) oversee or, as appropriate, assist Board oversight of the quality and integrity of each Fund’s financial statements and the independent audit thereof; (iii) oversee, or, as appropriate, assist Board oversight of, each Fund’s compliance with legal and regulatory requirements that relate to the Fund’s accounting and financial reporting, internal control over financial reporting and independent audits; (iv) approve, prior to appointment, the engagement and, when appropriate, replacement of the independent auditors, and, if applicable, nominate independent auditors to be proposed for shareholder ratification in any proxy statement of each Fund; (v) evaluate the qualifications, independence and performance of the independent auditors and the audit partner in charge of leading the audit; and (vi) prepare, as necessary, such Audit Committee reports consistent with the requirements of applicable Securities and Exchange Commission (“SEC”), American Stock Exchange and New York Stock Exchange rules for inclusion in the proxy statement for a Fund. Each Fund’s Board of Trustees has adopted a written charter for its Audit Committee, a copy of which is available on the Eaton Vance website, www.eatonvance.com. Each Board designated Mr. Park as the Audit Committee financial expert.

Messrs. Verni (Chair), Esty, Freedman, Park and Pearlman serve on the Contract Review Committee of the Board of Trustees of each Fund and Portfolio. The purposes of the Contract Review Committee are to consider, evaluate and make recommendations to the Boards of Trustees concerning the following matters: (i) contractual arrangements with each service provider to a Fund, including advisory, sub-advisory, transfer agency, custodial and fund accounting, distribution services and administrative services; (ii) any and all other matters in which any of a Fund’s service providers (including Eaton Vance or any affiliated entity thereof) has any actual or potential conflict of interest with the interests of a Fund or its shareholders; and (iii) any other matter appropriate for review by the Independent Trustees, unless the matter is within the responsibilities of the Audit Committee or the Governance Committee of the Fund.

5

Messrs. Esty (Chair), Freedman and Park are currently members of the Portfolio Management Committee of the Board of Trustees of each Fund and Portfolio. The purposes of the Portfolio Management Committee are to: (i) assist the Board of Trustees in its oversight of the portfolio management process employed by each Fund and Portfolio and its investment adviser and sub-adviser(s), if applicable, relative to a Fund’s or Portfolio’s stated objective(s), strategies and restrictions; (ii) assist the Board of Trustees in its oversight of the trading policies and procedures and risk management techniques applicable to each Fund and Portfolio; and (iii) assist the Board of Trustees in its monitoring of the performance results of all funds, giving special attention to the performance of certain funds that it or the Board of Trustees identifies from time to time.

Mr. Pearlman (Chair) and Mmes. Steiger and Stout are currently members of the Compliance Reports and Regulatory Matters Committee of the Board of Trustees of each Fund and Portfolio. The purposes of the Compliance Reports and Regulatory Matters Committee are to: (i) assist the Board of Trustees in its oversight role with respect to compliance issues and certain other regulatory matters affecting a Fund; (ii) serve as a liaison between the Board of Trustees and a Fund’s or Portfolio’s Chief Compliance Officer; and (iii) serve as a “qualified legal compliance committee” within the rules promulgated by the SEC.

Mmes. Stout (Chair) and Steiger, and Messrs. Esty, Freedman, Park, Pearlman and Verni serve on the Governance Committee of the Board of Trustees of each Fund and Portfolio. The purpose of the Governance Committee is to consider, evaluate and make recommendations to the Boards of Trustees with respect to the structure, membership and operation of the Boards of Trustees and the Committees thereof, including the nomination and selection of Independent Trustees and a Chairperson of the Boards and the compensation of Independent Trustees.

Each Fund’s and Portfolio’s Board of Trustees has adopted a written charter for its Governance Committee, a copy of which is available on the Eaton Vance website, www.eatonvance.com. The Governance Committee identifies candidates by obtaining referrals from such sources as it deems appropriate, which may include current Trustees, management of the Funds, counsel and other advisors to the Trustees, and shareholders of a Fund who submit recommendations in accordance with the procedures described in the Committee’s charter. In no event shall the Governance Committee consider as a candidate to fill any vacancy an individual recommended by management of the Funds, unless the Governance Committee has invited management to make such a recommendation. The Governance Committee will, when a vacancy exists or is anticipated, consider any nominee for Independent Trustee recommended by a shareholder if such recommendation is submitted in writing to t he Governance Committee, contains sufficient background information concerning the candidate, including evidence the candidate is willing to serve as an Independent Trustee if selected for the position, and is received in a sufficiently timely manner. The Governance Committee’s procedures for identifying and evaluating candidates for the position of Independent Trustee, including the procedures to be followed by shareholders of a Fund wishing to recommend such candidates for consideration by the Governance Committee and the qualifications the Governance Committee will consider, are set forth in an appendix to the Committee’s charter.

Communication with the Board

Shareholders wishing to communicate with the Board may do so by sending a written communication to the Chairperson of the Boards of Trustees, the Chairperson of any of the Committees of the Boards of Trustees or to the Independent Trustees as a group, at the following address: The Eaton Vance Building, 255 State Street, Boston, MA 02109, c/o the Secretary of the applicable Fund.

Remuneration of Trustees

Trustees of each Trust and Portfolio who are not affiliated with EVM or BMR may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of a Trustees Deferred Compensation Plan (a “Trustees’ Plan”). Under each Trustees’ Plan, an eligible Trustee may elect to have his deferred fees invested in the shares of one or more funds in the Eaton Vance Group of Funds, and the amount paid to the Trustees under

6

each Trustees’ Plan will be determined based upon the performance of such investments. Deferral of Trustees’ fees in accordance with each Trustees’ Plan will have a negligible effect on a Fund’s or Portfolio’s assets, liabilities, and net income per share, and will not obligate a Trust or Portfolio to retain the services of any Trustee or obligate a Trust or Portfolio to pay any particular level of compensation to the Trustee. None of the Trusts or the Portfolios has a retirement plan for Trustees. The fees and expenses of those Trustees who are not members of the Eaton Vance Organization are paid by the Trusts and Portfolios. Exhibit F sets forth (i) the compensation earned by the Trustees who are not members of the Eaton Vance Organization in their capacities as Trustees of each Trust and Portfolio as of the Fund’s most recent fiscal year end, and (ii) the compensation earned in their capacities as Trustees of the registered investment companies in t he Eaton Vance Group of Funds for the year ended December 31, 2007.

Election of Portfolio Trustees

As described above, each nominee for Trustee of a Fund is also nominated to serve as Trustee of the Fund’s corresponding Portfolio or Portfolios. For those Funds in a “master-feeder structure” that invest in a single Portfolio, each such Fund will vote its interest in its corresponding Portfolio for or against a Portfolio Trustee nominee in the same proportion as the instructions received from the Fund’s shareholders. For those Funds that invest in multiple Portfolios, each such Fund will vote its respective interests in its Portfolios for or against a Portfolio Trustee nominee in accordance with applicable law.

Voting at the Meeting

Unless authority to vote for election of one or more nominees is specifically withheld by executing the proxy in the manner stated thereon, it is the present intention that the enclosed proxy will be used for the purpose of authorizing each Fund to vote in favor of the election of the nominees set forth in Proposal 1 to be Trustees of the respective Trusts and Portfolios, to hold office until their successors are elected and qualified.

Vote Required to Approve Proposal 1

Each Trust’s Board of Trustees shall be elected by a plurality of the shares of the entire Trust voted in person or by proxy.

The Board of Trustees recommends that the shareholders of each Fund vote to elect each nominee of its respective Trust as a Trustee of the Trust.

| NOTICE TO BANKS AND BROKER/DEALERS |

The Funds have previously solicited all Nominee and Broker/Dealer accounts as to the number of additional proxy statements or Notice of Internet Availability of Proxy Materials required to supply owners of shares. Should additional proxy material be required for beneficial owners, please forward such requests to Eaton Vance Management, The Eaton Vance Building, 255 State Street, Boston, MA 02109, Attn: Proxy Coordinator.

| ADDITIONAL INFORMATION |

Auditors, Audit Fees and All Other Fees

Deloitte & Touche LLP (“Deloitte”), 200 Berkeley Street, Boston, MA 02116 serves as the independent registered public accounting firm of the Funds and Portfolios. Certain Funds and Portfolios had a change in their Independent Registered Public Accounting firm in 2007. Please see Exhibit G for additional information. Deloitte is expected to be represented at the Special Meeting, but if not, a representative will be available by

7

telephone should the need for consultation arise. Representatives of Deloitte will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions. A list of the Funds and the aggregate audit, audit-related, tax, and other fees billed for services rendered to each Fund by the Fund’s independent registered public accounting firm for the relevant periods are set forth on Exhibit G hereto. Aggregate non-audit fees (i.e., fees for audit-related, tax, and other services) billed for services rendered for the relevant periods to (i) each Fund by the Fund’s independent registered public accounting firm; and (ii) the Eaton Vance Organization by each Fund’s independent registered public accounting firm are also set forth on Exhibit G hereto.

Each Fund’s Audit Committee has adopted policies and procedures relating to the pre-approval of services provided by the Fund’s independent registered public accounting firm (the “Pre-Approval Policies”). The Pre-Approval Policies establish a framework intended to assist the Audit Committee in the proper discharge of its pre-approval responsibilities. As a general matter, the Pre-Approval Policies (i) specify certain types of audit, audit-related, tax, and other services determined to be pre-approved by the Audit Committee; and (ii) delineate specific procedures governing the mechanics of the pre-approval process, including the approval and monitoring of audit and non-audit service fees. Unless a service is specifically pre-approved under the Pre-Approval Policies, it must be separately pre-approved by the Audit Committee. The Pre-Approval Policies and the types of audit and non-audit services pre-approved therein must be reviewed a nd ratified by each Fund’s Audit Committee at least annually. The Fund’s Audit Committee maintains full responsibility for the appointment, compensation, and oversight of the work of each Fund’s independent registered public accounting firm.

Each Fund’s Audit Committee has considered whether the provision by the Fund’s principal accountant of non-audit services to the Fund’s investment adviser, as well as any of its affiliates that provide ongoing services to the Fund, that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X is compatible with maintaining the independent registered public accounting firm’s independence.

Officers of the Funds and Portfolios

The officers of the Funds, their corresponding Portfolios and length of service are set forth in Exhibits C and D. Because of their positions with Eaton Vance and their ownership of EVC stock, the officers of each Fund and each Portfolio will benefit from the advisory fees and/or administration fees paid by a Fund or Portfolio to Eaton Vance or BMR.

Investment Adviser, Administrator and Underwriter

Eaton Vance and BMR serve as investment adviser to many of the Funds and Portfolios in the Eaton Vance Group of Funds. In addition, where applicable, Eaton Vance serves as administrator and sub-transfer agent to the Funds. Lloyd George Investment Management (Bermuda) Limited, 3808 One Exchange Square, Central, Hong Kong serves as the investment adviser to certain Funds and Portfolios. OrbiMed Advisors, LLC, 767 3rd Avenue, New York, NY 10017, is the investment adviser to Worldwide Health Sciences Portfolio and VT Worldwide Health Sciences Fund. Eagle Global Advisors, L.L.C., 5847 San Felipe, Suite 930, Houston, TX 77057, acts as the sub-adviser to certain Funds and Portfolios. Atlanta Capital Management Company, LLC, Fox Asset Management LLC and Parametric Portfolio Associates LLC, each an indirect majority owned subsidiary of Eaton Vance, act as sub-advisers to certain Funds and Portfolios. Parametric Risk Advisors LLC, a subsidiary of Parametric Port folio Associates LLC, acts as sub-adviser to certain Funds. EVD acts as the principal underwriter for all Funds and as placement agent for all the Portfolios. The business address of Eaton Vance, BMR, EVD, Atlanta Capital Management, LLC, Fox Asset Management LLC and Parametric Portfolio Associates LLC is The Eaton Vance Building, 255 State Street, Boston, MA 02109. The business address of Parametric Risk Advisors LLC is 274 Riverside Avenue, Westport, CT 06880.

8

Proxy Solicitation and Tabulation

The expense of preparing, printing and mailing this Proxy Statement and enclosures and the costs of soliciting proxies on behalf of each Trust’s Board of Trustees will be borne ratably by its Funds. Proxies will be solicited by mail and may be solicited in person or by telephone, facsimile or other electronic means by officers of the Trust, by personnel of Eaton Vance, by the Funds’ transfer agent, PNC Global Investment Servicing (“PNC”) (or State Street Bank and Trust Company in the case of Eaton Vance Variable Trust), or by broker-dealer firms. The expenses connected with the solicitation of these proxies and with any further proxies which may be solicited by a Fund’s officers, by Eaton Vance personnel, by the transfer agent, PNC (or State Street Bank and Trust Company in the case of Eaton Vance Variable Trust), by broker-dealer firms, in person, or by telephone, by facsimile or other electronic means will be borne pro rata b y each Fund based on the number of that Fund’s shareholder accounts. A written proxy may be delivered to a Fund or its transfer agent prior to the meeting by facsimile machine, graphic communication equipment or other electronic transmission. A Fund will reimburse banks, broker-dealer firms, and other entities or persons holding shares registered in their names or in the names of their nominees, for their expenses incurred in sending proxy material to and obtaining proxies from the beneficial owners of such shares. Total aggregate proxy costs for all the Trusts are estimated to be $1,985,000. As mentioned, such costs will be borne ratably by all of the Funds.

Shareholders may also choose to give their proxy votes through the Internet or by telephone using automated telephonic voting rather than return their proxy cards. Please see the proxy card or Notice of Internet Availability of Proxy Materials for details. A Fund may arrange for Eaton Vance, its affiliates or agents to contact shareholders who have not returned their proxy cards and offer to have votes recorded by telephone. If a Fund records votes over the Internet or by telephone, it will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. If the enclosed proxy card is executed and returned, or an Internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the Fund, by the execution of a later-dated proxy card, by the Fund’s receipt of a subsequent valid Internet or telephonic vote, or by attending the meeting and voting in person.

All proxy cards solicited by the Boards of Trustees that are properly executed and telephone and Internet votes that are properly delivered and received by the Secretary prior to the meeting, and which are not revoked, will be voted at the meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on the proxy card with respect to Proposal 1, it will be voted FOR the matters specified on the proxy card. With respect to fund shares held in Eaton Vance individual retirement accounts, undirected shares will be voted by Eaton Vance or an affiliate in the same proportion as shares of that Fund for which instructions were received. For purposes of determining the presence or absence of a quorum and for determining whether sufficient votes have been received for approval of any matter to be acted upon at the meeting, abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other person entitled to vote shares on a particular matter with respect to which the brokers or nominees do not have discretionary power) will be treated as shares that are present at the meeting, but which have not been voted. Accordingly, abstentions and broker non-votes will assist a Fund in obtaining a quorum, but will have no effect on the outcome of the Proposal.

For a Trust to have a quorum to transact business at the Special Meeting of Shareholders, there must be present, in person or by proxy the holders of a majority of the then issued and outstanding shares of that Trust, except for Eaton Vance Variable Trust where one-third (1/3) of the then issued and outstanding shares must be present. In the event that a quorum is not present at the meeting, or if a quorum is present at the meeting but sufficient votes by the shareholders of the Trusts in favor of Proposal 1 set forth in the Notice of this meeting are not received by the meeting date, the persons named as attorneys in the enclosed proxy may propose one or more adjournments of the meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of the shares of that Trust present in person or by proxy at the

9

session of the meeting to be adjourned. The persons named as attorneys in the enclosed proxy will vote in favor of such adjournment those proxies that they are entitled to vote in favor of the Proposal for which further solicitation of proxies is to be made. They will vote against any such adjournment those proxies required to be voted against such Proposal. The costs of any such additional solicitation and of any adjourned session will be borne by the Funds as described above.

Shareholder Proposals

Shareholders wishing to submit proposals for consideration at a subsequent shareholders’ meeting should send their written proposals to: Secretary, Eaton Vance Group of Funds, The Eaton Vance Building, 255 State Street, Boston, MA 02109. Proposals must be received in advance of a proxy solicitation to be considered and the mere submission of a proposal does not guarantee inclusion in the proxy statement or consideration at the meeting. The Funds do not conduct annual meetings.

September 26, 2008

10

| & nbsp; Exhibit A |

| The outstanding shares of beneficial interest of each Fund may consist of Class A, Advisers Class, Class B, Class C, Class I, Class R or Class S shares as indicated below. |

| No. of Shares | ||

| Outstanding on | ||

| September 18, | ||

| Fund Name and Class | 2008 | |

| Eaton Vance Growth Trust | ||

| Eaton Vance Asian Small Companies Fund(Class A and B) | 4,371,118.367 | |

| Eaton Vance-Atlanta Capital Large-Cap Growth Fund(Class A and I) | 2,480,700.902 | |

| Eaton Vance-Atlanta Capital SMID-Cap Fund(Class A and I) | 3,400,958.112 | |

| Eaton Vance Global Growth Fund(Class A, B and C) | 4,604,581.204 | |

| Eaton Vance Greater China Growth Fund(Class A, B and C) | 11,599,038.409 | |

| Eaton Vance Multi-Cap Growth Fund(Class A, B and C) | 33,963,059.934 | |

| Eaton Vance Worldwide Health Sciences Fund(Class A, B, C and R) | 149,956,485.628 | |

| Eaton Vance Investment Trust | ||

| Eaton Vance AMT-Free Limited Maturity Municipals Fund(Class A, B and C) | 4,040,622.402 | |

| Eaton Vance California Limited Maturity Municipals Fund(Class A, B and C) | 3,633,717.912 | |

| Eaton Vance Massachusetts Limited Maturity Municipals Fund(Class A, B and C) | 6,549,140.849 | |

| Eaton Vance National Limited Maturity Municipals Fund(Class A, B and C) | 68,964,416.393 | |

| Eaton Vance New Jersey Limited Maturity Municipals Fund(Class A, B and C) | 4,174,285.327 | |

| Eaton Vance New York Limited Maturity Municipals Fund(Class A, B and C) | 9,823,849.824 | |

| Eaton Vance Ohio Limited Maturity Municipals Fund(Class A, B and C) | 2,103,912.299 | |

| Eaton Vance Pennsylvania Limited Maturity Municipals Fund(Class A, B and C) | 5,366,909.929 | |

| Eaton Vance Municipals Trust | ||

| Eaton Vance Alabama Municipals Fund(Class A, B, C and I) | 6,625,046.684 | |

| Eaton Vance Arizona Municipals Fund(Class A, B and C) | 11,648,239.871 | |

| Eaton Vance Arkansas Municipals Fund(Class A, B and C) | 6,881,651.837 | |

| Eaton Vance California Municipals Fund(Class A, B, C and I) | 27,615,832.876 | |

| Eaton Vance Colorado Municipals Fund(Class A, B and C) | 4,299,360.387 | |

| Eaton Vance Connecticut Municipals Fund(Class A, B, C and I) | 12,129,038.083 | |

| Eaton Vance Florida Plus Municipals Fund(Class A, B and C) | 19,523,235.592 | |

| Eaton Vance Georgia Municipals Fund(Class A, B, C and I) | 10,161,767.121 | |

| Eaton Vance Kentucky Municipals Fund(Class A, B and C) | 6,690,231.418 | |

| Eaton Vance Louisiana Municipals Fund(Class A, B and C) | 4,934,886.029 | |

| Eaton Vance Maryland Municipals Fund(Class A, B, C and I) | 11,253,258.169 | |

| Eaton Vance Massachusetts Municipals Fund(Class A, B, C and I) | 33,698,880.714 | |

| Eaton Vance Michigan Municipals Fund(Class A and C) | 7,018,371.498 | |

| Eaton Vance Minnesota Municipals Fund(Class A, B and C) | 9,594,424.149 | |

| Eaton Vance Mississippi Municipals Fund(Class A, B and C) | 1,852,627.527 | |

| Eaton Vance Missouri Municipals Fund(Class A, B and C) | 11,285,608.968 | |

| Eaton Vance National Municipals Fund(Class A, B, C and I) | 601,714,108.709 | |

| Eaton Vance New Jersey Municipals Fund(Class A, C and I) | 30,058,120.955 | |

| Eaton Vance New York Municipals Fund(Class A, B, C and I) | 41,565,281.891 | |

| Eaton Vance North Carolina Municipals Fund(Class A, B, C and I) | 11,428,310.431 | |

| Eaton Vance Ohio Municipals Fund(Class A, B and C) | 37,594,951.174 | |

| Eaton Vance Oregon Municipals Fund(Class A, B and C) | 17,416,960.756 | |

| Eaton Vance Pennsylvania Municipals Fund(Class A, B, C and I) | 31,346,095.689 | |

| Eaton Vance Rhode Island Municipals Fund(Class A, B and C) | 6,075,211.727 | |

| Eaton Vance South Carolina Municipals Fund(Class A, B, C and I) | 18,171,108.100 | |

| Eaton Vance Tennessee Municipals Fund(Class A, B and C) | 6,398,675.131 | |

A-1

| No. of Shares | ||

| Outstanding on | ||

| September 18, | ||

| Fund Name and Class | 2008 | |

| Eaton Vance Municipals Trust (cont.) | ||

| Eaton Vance Virginia Municipals Fund(Class A, B, C and I) | 15,090,356.218 | |

| Eaton Vance West Virginia Municipals Fund(Class A, B and C) | 3,596,336.071 | |

| Eaton Vance Municipals Trust II | ||

| Eaton Vance Insured Municipals Fund(Class A, B and C) | 3,838,038.352 | |

| Eaton Vance Hawaii Municipals Fund(Class A, B and C) | 2,035,460.629 | |

| Eaton Vance High Yield Municipals Fund(Class A, B, C and I) | 106,068,829.571 | |

| Eaton Vance Kansas Municipals Fund(Class A, B and C) | 3,854,658.387 | |

| Eaton Vance Mutual Funds Trust | ||

| Eaton Vance AMT-Free Municipal Bond Fund(Class A, B, C and I) | 93,404,695.033 | |

| Eaton Vance Cash Management Fund | 548,908,950.170 | |

| Eaton Vance Diversified Income Fund(Class A, B and C) | 39,873,722.068 | |

| Eaton Vance Dividend Income Fund(Class A, C, I and R) | 33,830,335.451 | |

| Eaton Vance Emerging Markets Local Income Fund(Class A) | 854,437.379 | |

| Eaton Vance Floating-Rate Advantage Fund(Advisers Class, Class A, B, C, and I) | 156,558,626.077 | |

| Eaton Vance Floating-Rate Fund(Advisers Class, Class A, B, C and I) | 306,699,472.153 | |

| Eaton Vance Floating-Rate & High Income Fund(Advisers Class, Class A, B, C and I) | 89,922,342.383 | |

| Eaton Vance Global Macro Fund(Class A and I) | 4,684,520.236 | |

| Eaton Vance Government Obligations Fund(Class A, B, C and R) | 85,493,800.867 | |

| Eaton Vance High Income Opportunities Fund(Class A, B and C) | 106,960,484.621 | |

| Eaton Vance International Equity Fund(Class A, C and I) | 2,358,454.387 | |

| Eaton Vance International Income Fund(Class A) | 576,880.499 | |

| Eaton Vance Large-Cap Core Research Fund(Class A and I) | 798,873.005 | |

| Eaton Vance Low Duration Fund(Class A, B and C) | 11,351,013.643 | |

| Eaton Vance Money Market Fund | 112,996,970.060 | |

| Eaton Vance Strategic Income Fund(Class A, B and C) | 198,268,865.629 | |

| Eaton Vance Structured Emerging Markets Fund(Class A, C and I) | 40,054,635.511 | |

| Eaton Vance Tax Free Reserves | 83,499,183.230 | |

| Eaton Vance Tax-Managed Dividend Income Fund(Class A, B, C and I) | 146,507,734.453 | |

| Eaton Vance Tax-Managed Equity Asset Allocation Fund(Class A, B and C) | 56,952,956.692 | |

| Eaton Vance Tax-Managed Growth Fund 1.1(Class A, B, C, I and S) | 88,490,590.095 | |

| Eaton Vance Tax-Managed Growth Fund 1.2(Class A, B, C and I) | 91,212,053.434 | |

| Eaton Vance Tax-Managed International Equity Fund(Class A, B, C and I) | 18,880,055.545 | |

| Eaton Vance Tax-Managed Mid-Cap Core Fund(Class A, B and C) | 2,604,126.451 | |

| Eaton Vance Tax-Managed Multi-Cap Growth Fund(Class A, B, and C) | 10,069,722.084 | |

| Eaton Vance Tax-Managed Small-Cap Fund(Class A, B and C) | 10,846,020.475 | |

| Eaton Vance Tax-Managed Small-Cap Value Fund(Class A, B and C) | 2,287,890.765 | |

| Eaton Vance Tax-Managed Value Fund(Class A, B, C and I) | 86,881,622.822 | |

| Eaton Vance Series Trust | ||

| Eaton Vance Tax-Managed Growth Fund 1.0 | 1,514,387.926 | |

| Eaton Vance Series Trust II | ||

| Eaton Vance Income Fund of Boston(Class A, B, C, I and R) | 326,056,567.984 | |

| Eaton Vance Tax-Managed Emerging Markets Fund(Class I) | 32,029,455.121 | |

| Eaton Vance Special Investment Trust | ||

| Eaton Vance Balanced Fund(Class A, B and C) | 44,023,734.059 | |

| Eaton Vance Capital & Income Strategies Fund(Class A, C and I) | 1,757,975.360 | |

| Eaton Vance Dividend Builder Fund(Class A, B, C, and I) | 165,004,834.417 | |

| Eaton Vance Emerging Markets Fund(Class A and B) | 4,651,793.585 | |

| Eaton Vance Enhanced Equity Option Income Fund(Class A, C and I) | 304,964.150 | |

A-2

| No. of Shares | ||

| Outstanding on | ||

| September 18, | ||

| Fund Name and Class | 2008 | |

| Eaton Vance Special Investment Trust (cont.) | ||

| Eaton Vance Equity Asset Allocation Fund(Class A, C, and I) | 1,749,589.804 | |

| Eaton Vance Greater India Fund(Class A, B and C) | 42,195,225.325 | |

| Eaton Vance Institutional Short Term Income Fund | 1,119,336.044 | |

| Eaton Vance Institutional Short Term Treasury Fund | 1,285,643.243 | |

| Eaton Vance Investment Grade Income Fund(Class I) | 559,094.352 | |

| Eaton Vance Large-Cap Growth Fund(Class A, B, C and I) | 6,716,447.729 | |

| Eaton Vance Large-Cap Value Fund(Class A, B, C, I and R) | 553,166,386.325 | |

| Eaton Vance Real Estate Fund(Class I) | 62,656.506 | |

| Eaton Vance Risk-Managed Equity Option Income Fund(Class A, C and I) | 410,314.289 | |

| Eaton Vance Small-Cap Fund(Class A, B, C and I) | 5,326,502.400 | |

| Eaton Vance Small-Cap Value Fund(Class A, B and C) | 1,679,411.395 | |

| Eaton Vance Special Equities Fund(Class A, B and C) | 6,674,278.267 | |

| Eaton Vance Variable Trust | ||

| Eaton Vance VT Floating-Rate Income Fund | 92,140,504.982 | |

| Eaton Vance VT Large-Cap Value Fund | 2,595,966.071 | |

| Eaton Vance VT Worldwide Health Sciences Fund | 2,009,942.664 | |

A-3

| Exhibit B |

As of August 29, 2008, the following record owner(s) of the specified Fund and class held the share percentages indicated below, which was owned either (i) beneficially by such person(s) or (ii) of record by such person(s) on behalf of customers who are the beneficial owners of such shares and as to which such record owner(s) may exercise voting rights under certain limited circumstances. Beneficial owners of 25% or more of a class of a Fund are presumed to be in control of the class for purposes of voting on certain matters submitted to shareholders. Beneficial share ownership by a Fund Trustee or officer, as the case may be, is noted.

| Amount of Securities | ||||||

| Address | and (% Owned) | |||||

| Eaton Vance Growth Trust | ||||||

| Eaton Vance-Atlanta Capital Large-Cap Growth Fund | ||||||

| Class A Shares | ||||||

| NFSC FEBO GBA Retirement Services Inc., GBA Retirement | ||||||

| Services Inc. TTEE | Atlanta, GA | 241,138 (25.9%) | ||||

| NFSC FEBO GBA Capital Plans, GBA Retirement Services I | ||||||

| TTEE | Atlanta, GA | 219,582 (23.6%) | ||||

| NFSC FEBO GBA Retirement Services Inc., GBA Retirement | ||||||

| Services Inc. TTEE | Atlanta, GA | 136,312 (14.6%) | ||||

| NFSC FEBO GBA Retirement Services Inc., GBA Retirement | ||||||

| Services Inc. TTEE | Atlanta, GA | 55,839 | (6.0%) | |||

| Class I Shares | ||||||

| Patterson & Co FBO Eaton Vance Master Trust for Retirement | ||||||

| Plans — Eaton Vance Management Profit Sharing Plan** | Charlotte, NC | 549,128 (35.4%) | ||||

| Patterson & Co | Charlotte, NC | 251,397 (16.2%) | ||||

| Patterson & Co | Charlotte, NC | 228,525 (14.7%) | ||||

| Patterson & Co. FBO Eaton Vance Master Trust for Retirement | ||||||

| Plans — Eaton Vance Management Savings Plan** | Charlotte, NC | 151,768 | (9.8%) | |||

| Eaton Vance-Atlanta Capital SMID-Cap Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 712,724 (35.4%) | ||||

| Reliance Trust Company Citistreet Retirement Trust | Somerset, NJ | 359,923 (17.9%) | ||||

| NFSC FEBO GBA Capital Plans, GBA Retirement Services I | ||||||

| TTEE | Atlanta, GA | 164,632 | (8.2%) | |||

| NFSC FEBO GBA Retirement Services Inc., GBA Retirement | ||||||

| Services Inc. TTEE | Atlanta, GA | 129,194 | (6.4%) | |||

| Class I Shares | ||||||

| Patterson & Co. Eaton Vance Master Trust for Retirement Plans | ||||||

| — Eaton Vance Management Profit Sharing Plan** | Charlotte, NC | 294,782 (21.6%) | ||||

| Patterson & Co. FBO Eaton Vance Master Tr for Ret Plan — | ||||||

| Eaton Vance Management Savings Plan** | Charlotte, NC | 266,995 (19.6%) | ||||

| Dingle & Co | Detroit, MI | 224,365 (16.4%) | ||||

| SEI Private Trust c/o Suntrust | Oaks, PA | 126,847 | (9.3%) | |||

| Patterson & Co. FBO Eaton Vance Management | ||||||

| PS/MP Self-Directed** | Charlotte, NC | 96,625 | (7.1%) | |||

| Charles Schwab & Co., Inc | San Francisco, CA | 83,457 | (6.1%) | |||

| Eaton Vance Asian Small Companies Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 590,762 (16.9%) | ||||

| Citigroup Global Markets, Inc | New York, NY | 187,447 | (5.3%) | |||

B-1

| Amount of Securities | ||||||

| Address | and (% Owned) | |||||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 285,769 | (26.2%) | |||

| Eaton Vance Global Growth Fund | ||||||

| Class A Shares | ||||||

| Patterson & Co. FBO Eaton Vance Master Trust for | ||||||

| Retirement Plans — Eaton Vance Management Profit | ||||||

| Sharing Plan** | Charlotte, NC | 529,404 | (15.6%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 180,883 | (5.3%) | |||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 64,713 | (10.6%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 81,870 | (13.0%) | |||

| Citigroup Global Markets, Inc | New York, NY | 36,042 | (5.7%) | |||

| Eaton Vance Greater China Growth Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 984,229 | (12.2%) | |||

| Citigroup Global Markets, Inc | New York, NY | 782,090 | (9.7%) | |||

| Class B Shares | ||||||

| Citigroup Global Markets, Inc | New York, NY | 384,612 | (26.2%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 149,495 | (10.2%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 495,506 | (21.2%) | |||

| Citigroup Global Markets, Inc | New York, NY | 492,194 | (21.0%) | |||

| Eaton Vance Multi-Cap Growth Fund | ||||||

| Class A Shares | ||||||

| None | ||||||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 199,622 | (11.2%) | |||

| Citigroup Global Markets, Inc | New York, NY | 143,794 | (8.1%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 704,807 | (19.4%) | |||

| Citigroup Global Markets, Inc | New York, NY | 528,360 | (14.6%) | |||

| Eaton Vance Worldwide Health Sciences Fund | ||||||

| Class A Shares | ||||||

| Bill & Melinda Gates Foundation | Kirkland, WA | 17,765,451 | (18.8%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 5,865,035 | (6.2%) | |||

| Charles Schwab & Co., Inc | San Francisco, CA | 4,919,548 | (5.2%) | |||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 2,970,405 | (10.5%) | |||

| Citigroup Global Markets, Inc | New York, NY | 1,767,355 | (6.2%) | |||

| Morgan Stanley | Jersey City, NJ | 1,761,245 | (6.2%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 6,435,024 | (24.4%) | |||

| Citigroup Global Markets, Inc | New York, NY | 2,169,497 | (8.2%) | |||

| Morgan Stanley | Jersey City, NJ | 1,705,490 | (6.5%) | |||

| Class R Shares | ||||||

| Hartford Life Insurance Company, Separate Account, Attn | ||||||

| Justin Smith | Simsbury, CT | 472,378 | (51.6%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 96,165 | (10.5%) | |||

B-2

| Amount of Securities | ||||||

| Address | and (% Owned) | |||||

| Eaton Vance Investment Trust | ||||||

| Eaton Vance AMT-Free Limited Maturity Municipals Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 422,006 | (14.4%) | |||

| Citigroup Global Markets, Inc | New York, NY | 289,471 | (9.9%) | |||

| Northern Trust as Custodian FBO Julia Menard Marital Trust | Chicago, IL | 174,502 | (6.0%) | |||

| Class B Shares | ||||||

| Morgan Stanley | Jersey City, NJ | 45,628 | (47.8%) | |||

| Citigroup Global Markets, Inc | New York, NY | 13,387 | (14.0%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 8,804 | (9.2%) | |||

| Raymond James & Associates, Inc. FBO Margaret E. Pierce | ||||||

| TTEE | Marathon, FL | 8,049 | (8.4%) | |||

| First Clearing, LLC A/C Allen C. Bennett | Greenbush, MI | 7,264 | (7.6%) | |||

| First Clearing, LLC A/C Rita J. Selvage | Lakeland, FL | 6,212 | (6.5%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 282,706 | (32.4%) | |||

| Citigroup Global Markets, Inc | New York, NY | 136,034 | (15.6%) | |||

| Morgan Stanley | Jersey City, NJ | 48,452 | (5.5%) | |||

| Eaton Vance California Limited Maturity Municipals Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 934,879 | (27.2%) | |||

| NFS LLC FEBO Bacciocco Family Trust, Joseph J. & Warren | ||||||

| W. Bacciocco | San Francisco, CA | 370,592 | (10.8%) | |||

| Class B Shares | ||||||

| Oppenheimer & Co. Inc. FBO Gina Seamon | Lake Forest, CA | 9,169 | (18.1%) | |||

| NFS LLC, Ann C. McMahon TTEE, Charles Durose III | Redlands, CA | 7,508 | (14.8%) | |||

| �� Morgan Stanley | Jersey City, NJ | 6,499 | (12.8%) | |||

| First Clearing, LLC Diane Lane Revocable Trust, Diane Lane | ||||||

| TTEE | Beverly Hills, CA | 5,149 | (10.2%) | |||

| First Clearing, LLC WBNA Collateral Account FBO Hischier | ||||||

| Living Trust | San Luis Obisp, CA | 5,145 | (10.1%) | |||

| Pershing LLC | Jersey City, NJ | 4,756 | (9.4%) | |||

| LPL Financial | San Diego, CA | 4,040 | (8.0%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 3,755 | (7.4%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 113,063 | (60.7%) | |||

| Morgan Stanley | Jersey City, NJ | 13,981 | (7.5%) | |||

| First Clearing, LLC The Hatambeiki and Khatiblou Living | ||||||

| Trust | Walnut Creek, CA | 9,401 | (5.0%) | |||

| Eaton Vance Massachusetts Limited Maturity Municipals | ||||||

| Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 448,960 | (9.0%) | |||

| Citigroup Global Markets, Inc | New York, NY | 427,304 | (8.6%) | |||

| Class B Shares | ||||||

| Morgan Stanley | Jersey City, NJ | 16,036 | (12.4%) | |||

| Citigroup Global Markets, Inc | New York, NY | 11,468 | (8.9%) | |||

| RBC Capital Markets Corp. FBO Sylvia D. Robichaud TTEE, | ||||||

| Sylvia D. Robichaud Living Trust | Methuen, MA | 8,775 | (6.8%) | |||

B-3

| Amount of Securities | ||||||

| Address | and (% Owned) | |||||

| Pershing LLC | Jersey City, NJ | 8,645 | (6.7%) | |||

| NFS LLC FEBO Paula J. Malzone, Michael Quinn | Braintree, MA | 7,373 | (5.7%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 183,578 | (12.9%) | |||

| Morgan Stanley | Jersey City, NJ | 106,029 | (7.5%) | |||

| Pershing LLC | Jersey City, NJ | 90,085 | (6.4%) | |||

| Eaton Vance National Limited Maturity Municipals Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 6,776,042 | (12.1%) | |||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 78,587 | (14.9%) | |||

| UBS Financial Services Inc. FBO Melba L. Baehr | Eau Claire, WI | 35,475 | (6.7%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 4,578,346 | (40.9%) | |||

| Eaton Vance New Jersey Limited Maturity Municipals Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 894,176 | (21.8%) | |||

| Citigroup Global Markets, Inc | New York, NY | 338,073 | (8.2%) | |||

| Class B Shares | ||||||

| Elizabeth Chirichiello, Michele Chirichiello | Pequannock, NJ | 10,575 | (15.0%) | |||

| RBC Capital Markets Corp. FBO Mr. Robert D. Rento | Little Falls, NJ | 9,005 | (12.8%) | |||

| Morgan Stanley | Jersey City, NJ | 6,381 | (9.1%) | |||

| First Clearing, LLC Helen V. Widmer Revoc Liv Trust | Paramus, NJ | 4,912 | (7.0%) | |||

| First Clearing, LLC Jillian Spatz | North Bergen, NJ | 4,420 | (6.3%) | |||

| LPL Financial Services | San Diego, CA | 3,849 | (5.5%) | |||

| First Clearing, LLC Virginia Howedel | Brant Beach, NJ | 3,816 | (5.4%) | |||

| Class C Shares | ||||||

| Pershing LLC | Jersey City, NJ | 9,759 | (26.4%) | |||

| Pershing LLC | Jersey City, NJ | 9,661 | (26.2%) | |||

| Pershing LLC | Jersey City, NJ | 6,313 | (17.1%) | |||

| American Enterprise Investment SVCS | Minneapolis, MN | 4,008 | (10.8%) | |||

| Pershing LLC | Jersey City, NJ | 3,313 | (9.0%) | |||

| NFS LLC FEBO Elizabeth Carbone | Jersey City, NJ | 1,883 | (5.1%) | |||

| Eaton Vance New York Limited Maturity Municipals Fund | ||||||

| Class A Shares | ||||||

| Citigroup Global Markets, Inc | New York, NY | 1,060,198 | (15.1%) | |||

| Morgan Stanley | Jersey City, NJ | 788,459 | (11.2%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 627,811 | (8.9%) | |||

| UBS Financial Services Inc. FBO William M. Birch | New York, NY | 521,537 | (7.4%) | |||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 19,890 | (12.5%) | |||

| UBS Financial Services Inc. FBO Carole Weiss | Ardsley, NY | 12,780 | (8.1%) | |||

| NFS LLC FEBO Aldona M. Fogarascher, Tod William | ||||||

| M. Fogarascher | East Meadow, NY | 9,057 | (5.7%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 705,890 | (28.0%) | |||

| Citigroup Global Markets, Inc | New York, NY | 128,869 | (5.1%) | |||

| Eaton Vance Ohio Limited Maturity Municipals Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 262,735 | (12.8%) | |||

B-4

| Amount of Securities | ||||||

| Address | and (% Owned) | |||||

| UBS Financial Services Inc. FBO A&F Machine Products | ||||||

| Co. Inc. ATTN Fred Helwig | Berea, OH | 243,390 | (11.8%) | |||

| NFS LLC FEBO Donald C. Brown | Akron, OH | 119,450 | (5.8%) | |||

| Citigroup Global Markets, Inc | New York, NY | 106,318 | (5.2%) | |||

| Class B Shares | ||||||

| Paul Gregory Farkas | Columbus, OH | 5,293 | (26.4%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 4,046 | (20.2%) | |||

| UBS Financial Services Inc. FBO Sherri I. Manson & | ||||||

| William D. Manson JTTEN | University Heights, OH | 3,989 | (19.9%) | |||

| Robert W. Baird & Co. Inc | Milwaukee, WI | 3,923 | (19.6%) | |||

| Pershing LLC | Jersey City, NJ | 1,379 | (6.9%) | |||

| NFS LLC FEBO Hollace Dunn, TOD Irene Haus | Cleveland, OH | 1,186 | (5.9%) | |||

| Class C Shares | ||||||

| NFSC FEBO John F. Wolber TTEE, John F. Wolber | ||||||

| Trust | Cincinnati, OH | 12,160 | (57.1%) | |||

| Pershing LLC | Jersey City, NJ | 5,330 | (25.0%) | |||

| Pershing LLC | Jersey City, NJ | 2,137 | (10.0%) | |||

| Pershing LLC | Jersey City, NJ | 1,557 | (7.3%) | |||

| Eaton Vance Pennsylvania Limited Maturity Municipals | ||||||

| Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 598,971 | (14.4%) | |||

| FNB Nominee Co. c/o 1st Commonwealth Trust Co | Indiana, PA | 484,489 | (11.6%) | |||

| Citigroup Global Markets, Inc | New York, NY | 372,715 | (9.0%) | |||

| SEI Private Trust Company | Oaks, PA | 214,562 | (5.2%) | |||

| Class B Shares | ||||||

| Pershing LLC | Jersey City, NJ | 9,242 | (11.1%) | |||

| Anna Marie Kuhns | Whitehall, PA | 6,835 | (8.2%) | |||

| Citigroup Global Markets, Inc | New York, NY | 5,919 | (7.1%) | |||

| NFS LLC FEBO Constance E. West | Bryn Mawr, PA | 5,005 | (6.0%) | |||

| Pershing LLC | Jersey City, NJ | 4,953 | (6.0%) | |||

| Pershing LLC | Jersey City, NJ | 4,707 | (5.7%) | |||

| NFS LLC Theodore H. Rupp, Earla R. Rupp | Lancaster, PA | 4,314 | (5.2%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 711,683 | (53.1%) | |||

| Citigroup Global Markets, Inc | New York, NY | 66,628 | (5.0%) | |||

| Eaton Vance Municipals Trust | ||||||

| Eaton Vance Alabama Municipals Fund | ||||||

| Class A Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 997,916 | (19.0%) | |||

| Citigroup Global Markets, Inc | New York, NY | 597,043 | (11.3%) | |||

| Morgan Stanley | Jersey City, NJ | 284,740 | (5.4%) | |||

| Class B Shares | ||||||

| Morgan Stanley | Jersey City, NJ | 73,160 | (8.7%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 64,569 | (7.7%) | |||

| Citigroup Global Markets, Inc | New York, NY | 50,959 | (6.1%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 44,960 | (48.3%) | |||

| NFS LLC FEBO Robert W. Grubb | Birmingham, AL | 8,130 | (8.7%) | |||

| Citigroup Global Markets, Inc | New York, NY | 6,255 | (6.7%) | |||

B-5

| Amount of Securities | ||||||

| Address | and (% Owned) | |||||

| Pershing LLC | Jersey City, NJ | 5,831 | (6.3%) | |||

| Richard M. Russell and Eileen C. Russell, JTWROS | Glencoe, AL | 5,807 | (6.2%) | |||

| Vivian E. King | Birmingham, AL | 4,926 | (5.3%) | |||

| Class I Shares | ||||||

| Patterson & Co | Charlotte, NC | 422,602 | (99.7%) | |||

| Eaton Vance Arizona Municipals Fund | ||||||

| Class A Shares | ||||||

| Citigroup Global Markets, Inc | New York, NY | 858,395 | (8.5%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 745,934 | (7.4%) | |||

| U.S. Bancorp Investments Inc | St. Paul, MN | 585,372 | (5.8%) | |||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 128,224 | (18.6%) | |||

| Morgan Stanley | Jersey City, NJ | 74,468 | (10.8%) | |||

| Citigroup Global Markets, Inc | New York, NY | 60,970 | (8.9%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 87,867 | (10.9%) | |||

| Morgan Stanley | Jersey City, NJ | 39,924 | (5.0%) | |||

| Eaton Vance Arkansas Municipals Fund | ||||||

| Class A Shares | ||||||

| Citigroup Global Markets, Inc | New York, NY | 340,556 | (5.5%) | |||

| Morgan Stanley | Jersey City, NJ | 338,345 | (5.5%) | |||

| Class B Shares | ||||||

| Morgan Stanley | Jersey City, NJ | 38,813 | (9.2%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 31,140 | (7.4%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 120,314 | (39.7%) | |||

| A.G. Edwards & Sons Inc. Elizabeth M. Kranzush TOD | ||||||

| Account | St. Louis, MO | 38,070 | (12.5%) | |||

| LPL Financial Services | San Diego, CA | 20,507 | (6.8%) | |||

| Eaton Vance California Municipals Fund | ||||||

| Class A Shares | ||||||

| Morgan Stanley | Jersey City, NJ | 2,759,138 | (10.9%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 2,651,556 | (10.5%) | |||

| Citigroup Global Markets, Inc | New York, NY | 2,088,641 | (8.2%) | |||

| Class B Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 74,770 | (19.1%) | |||

| RBC Capital Markets Corp | Beverly Hills, CA | 27,968 | (7.1%) | |||

| Citigroup Global Markets, Inc | New York, NY | 27,835 | (7.1%) | |||

| Charles Schwab & Co., Inc | San Francisco, CA | 23,353 | (6.0%) | |||

| Class C Shares | ||||||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 602,825 | (33.5%) | |||

| Citigroup Global Markets, Inc | New York, NY | 154,663 | (8.6%) | |||

| Morgan Stanley | Jersey City, NJ | 90,016 | (5.0%) | |||

| Class I Shares | ||||||

| Patterson & Co | Charlotte, NC | 10,905 | (91.2%) | |||

| Eaton Vance Management* | Boston, MA | 1,049 | (8.8%) | |||

| Eaton Vance Colorado Municipals Fund | ||||||

| Class A Shares | ||||||

| Citigroup Global Markets, Inc | New York, NY | 283,249 | (7.3%) | |||

| Merrill Lynch, Pierce, Fenner & Smith, Inc | Jacksonville, FL | 282,802 | (7.3%) | |||

B-6

| Amount of Securities | ||||||

| Address | and (% Owned) | |||||

| Morgan Stanley | Jersey City, NJ | 230,385 | (5.9%) | |||

| UBS Financial Services, Inc. FBO Philip J. Sevier and | ||||||