UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2012

Date of Reporting Period

Item 1. Reports to Stockholders

| | |

Eaton Vance Multi-Strategy Absolute Return Fund Annual Report October 31, 2012 | |

|

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report October 31, 2012

Eaton Vance

Multi-Strategy Absolute Return Fund

Table of Contents

| | | | |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Fund Expenses | | | 6 | |

| |

Financial Statements | | | 7 | |

| |

Report of Independent Registered Public Accounting Firm | | | 21 | |

| |

Federal Tax Information | | | 22 | |

| |

Management and Organization | | | 23 | |

| |

Important Notices | | | 25 | |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Management’s Discussion of Fund Performance1

Economic and Market Conditions

During the 12 months ended October 31, 2012, financial markets worldwide climbed, despite a less-than-ideal global economic backdrop. In the United States, the economy grew at a disappointing annual pace of 2.7% or less, and unemployment remained stubbornly high — dropping below 8% in September 2012 for the first time in more than three years. A pickup in the U.S. housing market and improved consumer sentiment, however, offered some encouragement. By contrast, economies in the U.K., European Union and many emerging markets weakened, pressured by the sovereign debt crisis in Europe and signs of slowing growth in China.

Financial markets responded positively, as central banks in the United States and Europe undertook stimulus measures aimed at averting further economic deterioration. Last fall, the U.S. Federal Reserve (the Fed) initiated “Operation Twist,” a program aimed at lowering borrowing costs for consumers and businesses, while the European Central Bank (ECB) put in place a long-term refinancing operation giving struggling eurozone banks access to very low interest-rate, three-year loans. By the New Year, the U.S. economy was showing signs of improvement and the fiscal situation in Europe was starting to stabilize, buoying the financial markets. However, investors grew risk-averse in the second quarter, as U.S. economic momentum faded and the sovereign debt crisis in Europe deepened. In the summer, markets benefited, as investors correctly anticipated more monetary stimulus measures in the United States and additional efforts in Europe to address the sovereign debt crisis. The ECB subsequently pledged to do whatever was necessary to save the euro and outlined an aggressive government bond repurchase program to help fiscally strapped eurozone countries. In the United States, the Fed announced a third round of U.S. quantitative easing — involving the open-ended purchase of agency mortgage-backed securities — along with plans to keep short-term interest rates near zero through mid-2015. Markets retreated late in the period amid mounting worries over the U.S. presidential election and looming fiscal cliff.

A combination of declining interest rates and central bank intervention helped bond prices move higher, with the Barclays Capital U.S. Aggregate Index2 returning 5.25% for the year. Within the fixed-income market, the biggest gains came from higher-risk, lower credit quality bonds. Longer-maturity assets also did well, benefiting as yields fell more on longer-maturity than shorter-term issues.

Fund Performance

For the fiscal year ended October 31, 2012, Eaton Vance Multi-Strategy Absolute Return Fund’s (the Fund) Class A shares had a total return of 1.97% at net asset value (NAV), outperforming the 0.08% gain of its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index (the Index).

Nearly all of the Fund’s underlying Portfolios contributed positively to performance.

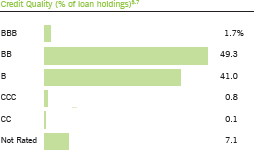

Some of the biggest contributions to performance versus the Index came from the Floating Rate Portfolio and the option absolute return strategy employed within the MSAR Completion Portfolio. The Floating Rate Portfolio benefited, as investors flocked to the higher-yields offered by floating-rate loans, which are typically issued by below-investment-grade companies. In addition, the prices on the securities appreciated, as credit spreads–the difference between the yields on lower- and higher-quality issues–tightened. The option absolute return strategy–which involves a series of put and call option spread combinations on the S&P 500 Index–performed well during a period of relatively low market volatility.

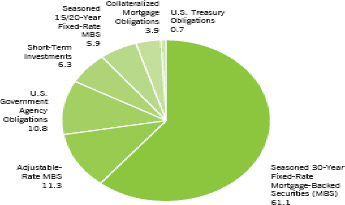

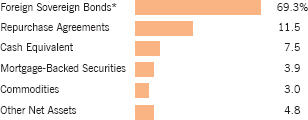

Elsewhere, foreign exposure through the Global Macro Portfolio and Global Macro Absolute Return Advantage Portfolio aided results versus the Index. These Portfolios, which focus on long and short positions in sovereign debt and currencies, gained due in part to foreign currencies appreciating against the U.S. dollar. To a lesser extent, a stake in commercial mortgage-backed securities (CMBS) within the MSAR Completion Portfolio contributed to performance versus the Index. The Fund’s focus during the period was on high-quality, short-maturity, low-volatility issues that generated higher income rather than similar-maturity U.S. Treasuries. On the margin, a small increase in the Fund’s overall duration–a measure of interest-rate sensitivity–aided performance versus the Index.

The Fund’s conservative positioning relative to its targeted volatility range muted results versus the Index, as higher-risk assets outperformed. The Fund’s stake in the Global Macro Absolute Return Advantage Portfolio and its exposure to the option absolute return strategy was reduced during the period. At the same time, the Fund increased its weighting in the Parametric Structured Absolute Return Portfolio, which is a lower-risk, more market-neutral portfolio. Small stakes in U.S. government agency mortgage-backed securities (through the Short-Term U.S. Government and Government Obligations Portfolios) and investment-grade corporate bonds had minimal impact on overall performance versus the Index. Some of the hedging strategies within the MSAR Completion Portfolio detracted from performance versus the Index. The Fund had some S&P 500 Index put options to manage the risk of owning the floating-rate loans and risk, in general. As the markets went up, the cost of owning these contracts dragged on performance versus the Index.

|

See Endnotes and Additional Disclosures in this report. Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month end, please refer to www.eatonvance.com. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Performance2,3

Portfolio Managers Jeffrey A. Rawlins, CFA, Dan R. Strelow, CFA, Justin H. Bourgette, CFA and Thomas A. Shively

| | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Inception Date | | | One Year | | | Five Years | | | Since

Inception | |

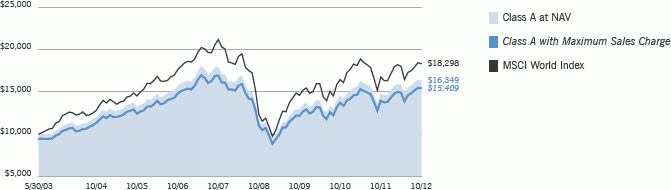

Class A at NAV | | | 12/07/2004 | | | | 1.97 | % | | | 3.43 | % | | | 4.11 | % |

Class A with 4.75% Maximum Sales Charge | | | — | | | | –2.90 | | | | 2.43 | | | | 3.47 | |

Class B at NAV | | | 12/07/2004 | | | | 1.21 | | | | 2.66 | | | | 3.32 | |

Class B with 5% Maximum Sales Charge | | | — | | | | –3.75 | | | | 2.32 | | | | 3.32 | |

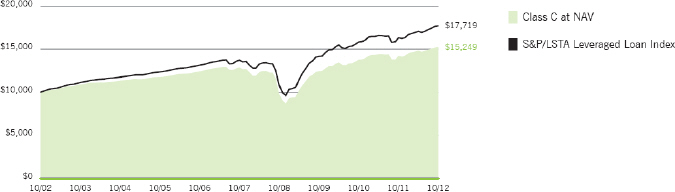

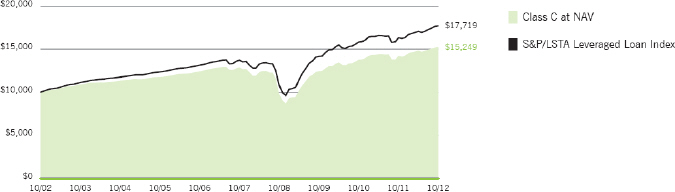

Class C at NAV | | | 12/07/2004 | | | | 1.32 | | | | 2.69 | | | | 3.34 | |

Class C with 1% Maximum Sales Charge | | | — | | | | 0.33 | | | | 2.69 | | | | 3.34 | |

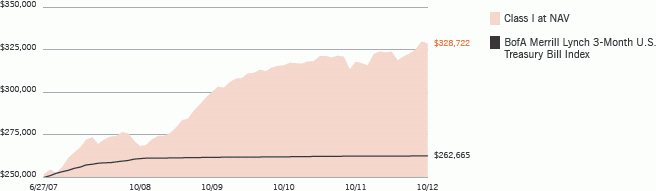

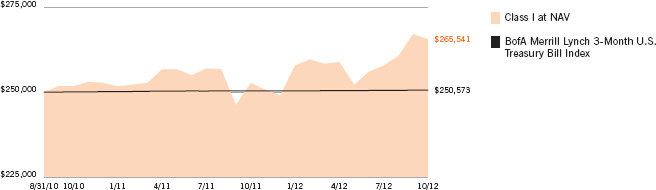

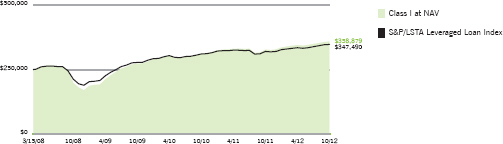

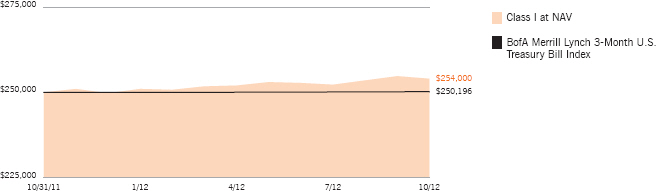

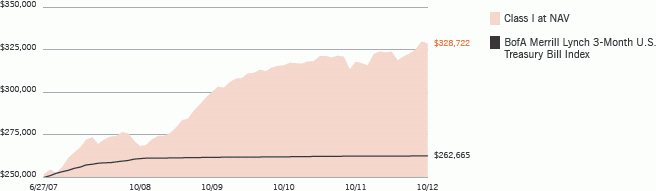

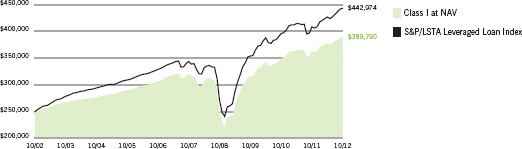

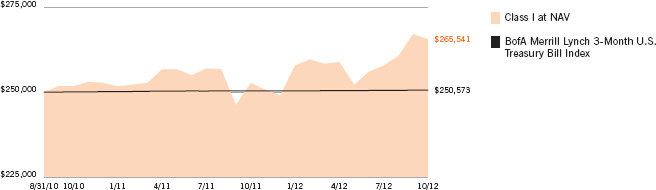

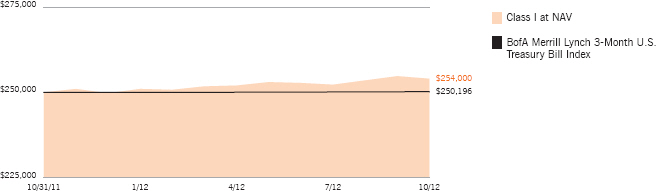

Class I at NAV | | | 10/01/2009 | | | | 2.33 | | | | — | | | | 4.39 | |

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 12/07/2004 | | | | 0.08 | % | | | 0.66 | % | | | 1.96 | % |

| | | | |

| | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios4 | | Class A | | | Class B | | | Class C | | | Class I | |

| | | 1.22 | % | | | 1.96 | % | | | 1.96 | % | | | 0.98 | % |

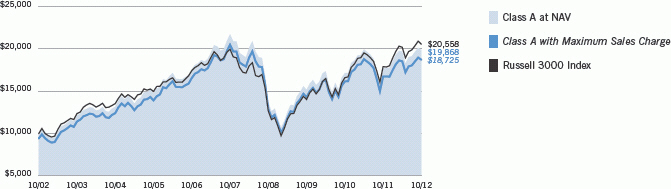

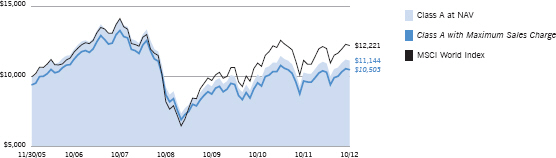

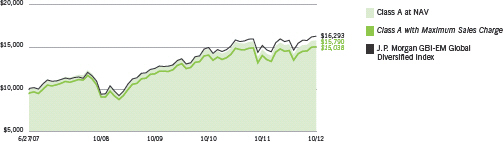

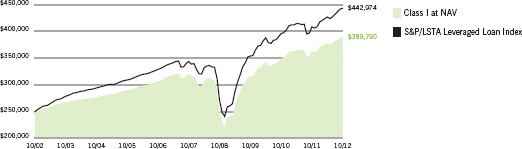

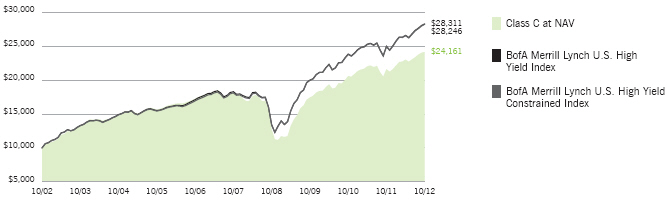

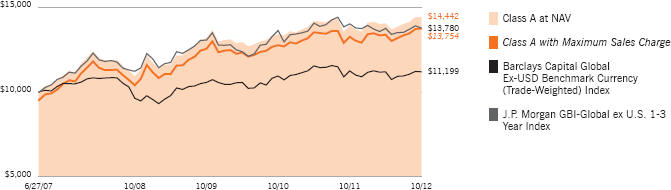

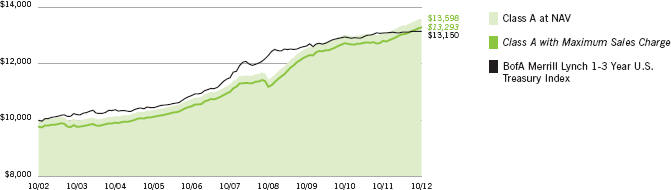

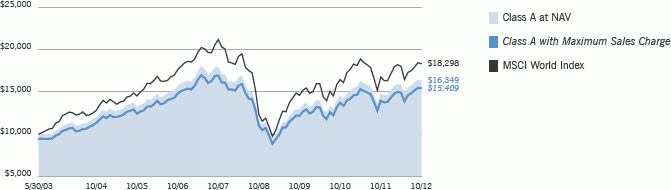

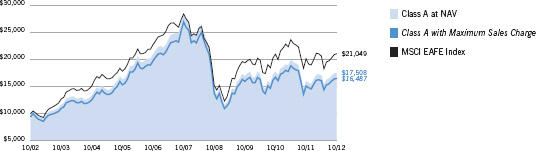

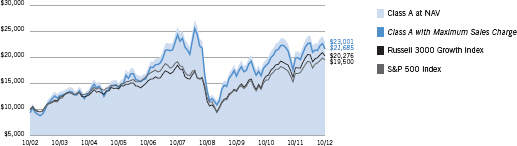

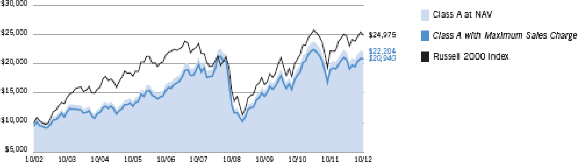

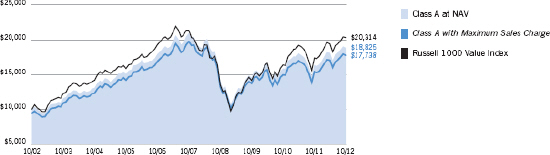

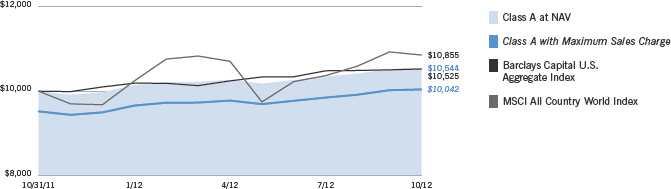

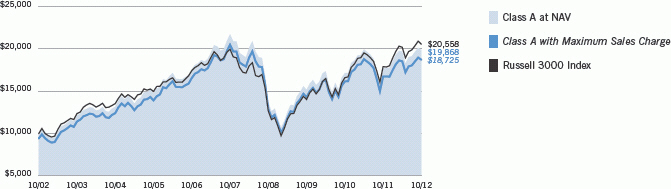

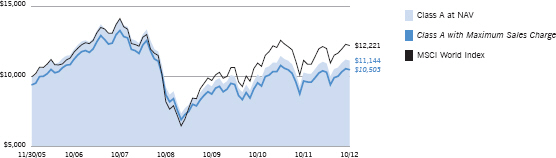

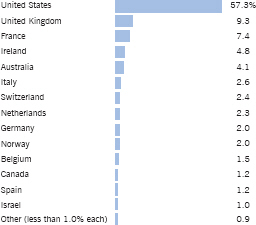

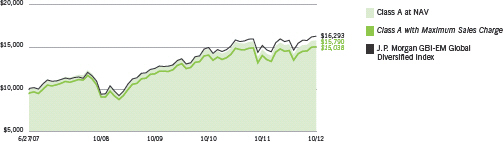

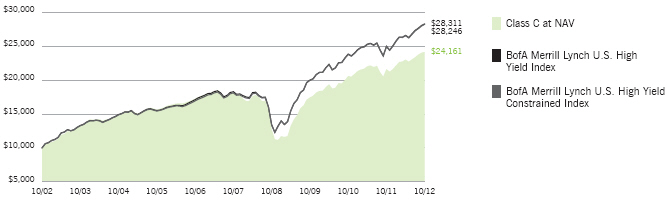

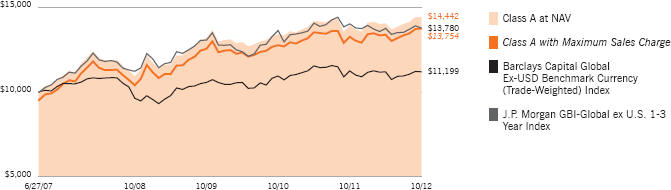

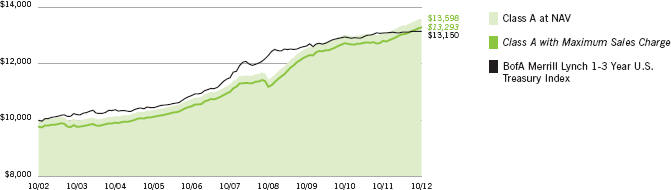

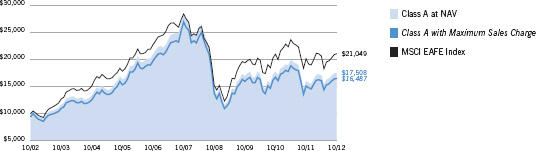

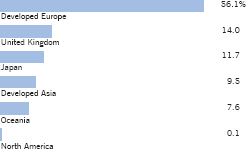

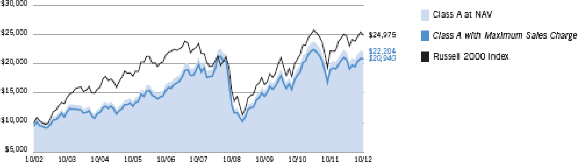

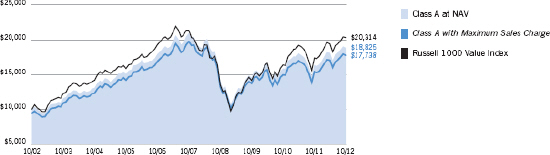

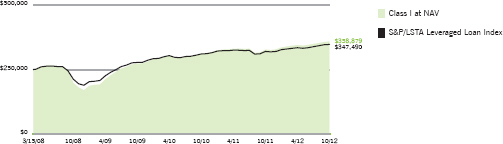

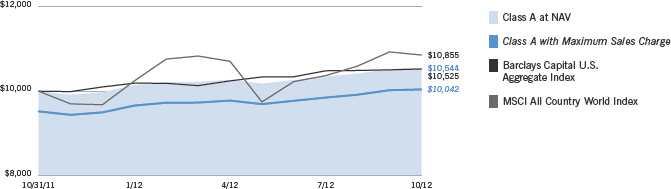

Performance of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| | | | | | | | |

| Performance of Investment | | Amount Invested | | Period Beginning | | At NAV | | With Maximum

Sales Charge |

Class B | | $ 10,000 | | 12/07/2004 | | $ 12,948 | | N.A. |

Class C | | $ 10,000 | | 12/07/2004 | | $ 12,962 | | N.A. |

Class I | | $ 250,000 | | 10/01/2009 | | $ 285,475 | | N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month end, please refer to www.eatonvance.com.

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

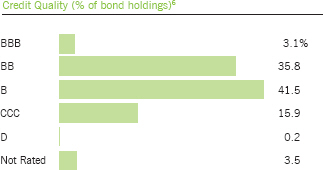

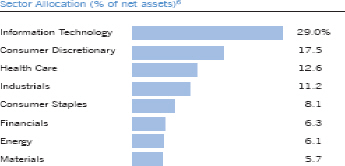

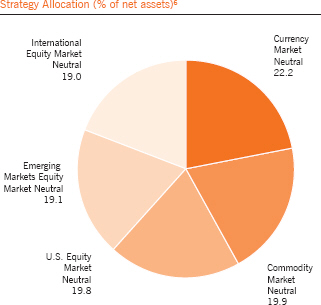

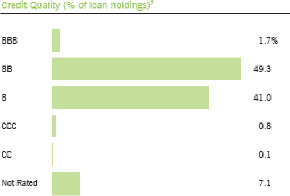

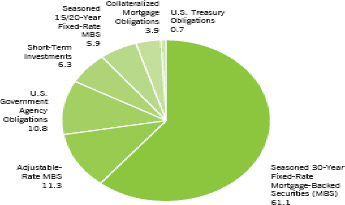

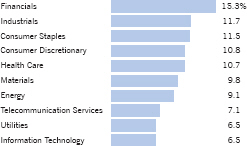

Fund Profile5

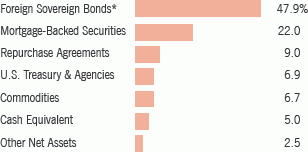

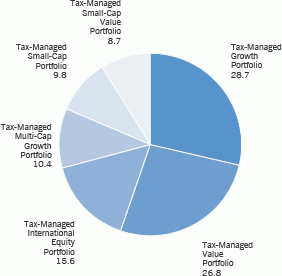

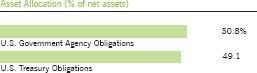

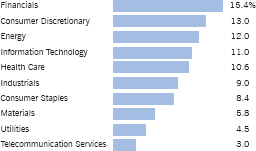

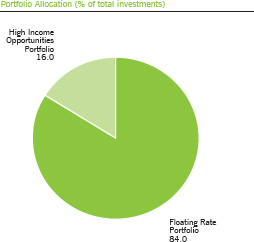

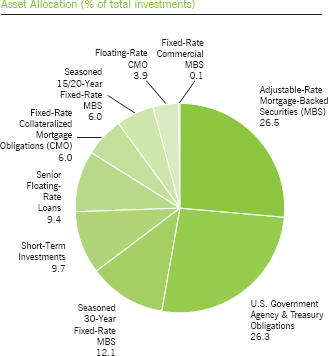

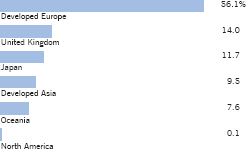

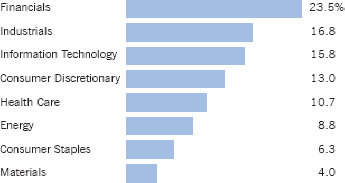

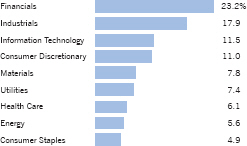

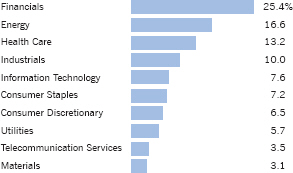

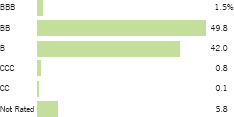

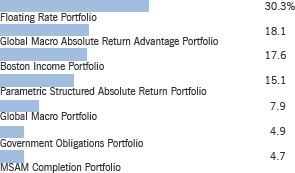

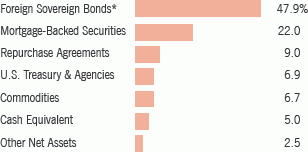

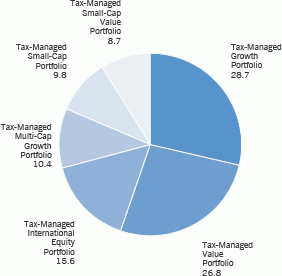

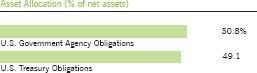

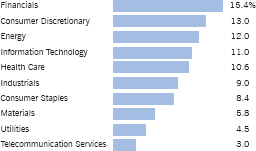

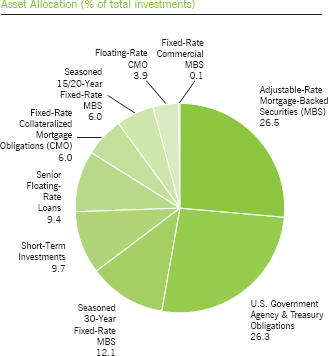

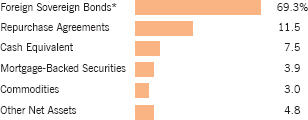

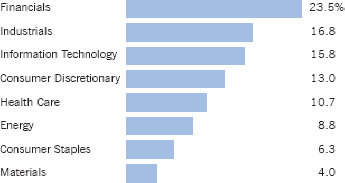

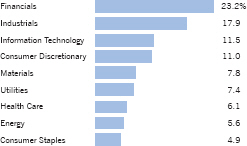

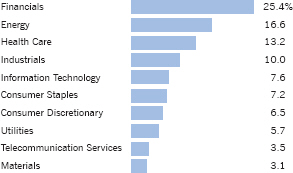

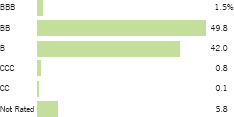

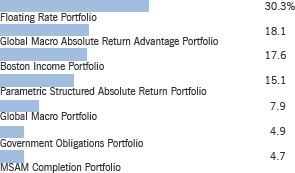

Portfolio Allocation (% of net assets)

Fund Weightings (% of net assets)6

| | | | |

Absolute Return Strategies | | | 52.0 | % |

Global Macro Portfolio | | | 14.9 | |

Global Macro Absolute Return Advantage Portfolio | | | 7.4 | |

Parametric Structured Absolute Return Portfolio | | | 24.8 | |

Option Absolute Return Strategy* | | | 4.9 | |

Income Strategies | | | 40.5 | % |

Short-Term U.S. Government Portfolio | | | 5.1 | |

Government Obligations Portfolio | | | 10.0 | |

CMBS* | | | 11.1 | |

Investment-Grade Corporate Bonds* | | | 1.6 | |

Floating Rate Portfolio | | | 12.7 | |

Other | | | 0.3 | |

Equity Options* | | | -2.4 | |

U.S. Treasury Futures* | | | 2.7 | |

Cash & Cash Equivalents* | | | 12.3 | |

| * | Held in MSAR Completion Portfolio. |

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | Barclays Capital U.S. Aggregate Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities. BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index of U.S. Treasury securities maturing in 90 days. BofA Merrill Lynch® indices not for redistribution or other uses; provided “as is”, without warranties, and with no liability. Eaton Vance has prepared this report, BofAML does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. S&P 500 Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. |

| 4 | Source: Fund prospectus. |

| 5 | Fund primarily invests in one or more affiliated investment companies (Portfolios) and may also invest directly. Unless otherwise noted, references to investments are to the aggregate holdings of the Fund and the Portfolios. |

| 6 | Economic value is shown for derivatives holdings and, thus, total will not add to 100%. If applicable, CMBS refers to commercial mortgage-backed securities. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2012 – October 31, 2012).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(5/1/12) | | | Ending

Account Value

(10/31/12) | | | Expenses Paid

During Period*

(5/1/12 – 10/31/12) | | | Annualized

Expense

Ratio | |

| | | | |

| | | | | | | | | | | | | | | | |

Actual | |

Class A | | $ | 1,000.00 | | | $ | 1,009.60 | | | $ | 6.26 | | | | 1.24 | % |

Class B | | $ | 1,000.00 | | | $ | 1,005.80 | | | $ | 10.08 | | | | 2.00 | % |

Class C | | $ | 1,000.00 | | | $ | 1,006.90 | | | $ | 10.09 | | | | 2.00 | % |

Class I | | $ | 1,000.00 | | | $ | 1,010.80 | | | $ | 5.00 | | | | 0.99 | % |

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

Hypothetical | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 6.29 | | | | 1.24 | % |

Class B | | $ | 1,000.00 | | | $ | 1,015.10 | | | $ | 10.13 | | | | 2.00 | % |

Class C | | $ | 1,000.00 | | | $ | 1,015.10 | | | $ | 10.13 | | | | 2.00 | % |

Class I | | $ | 1,000.00 | | | $ | 1,020.20 | | | $ | 5.03 | | | | 0.99 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on April 30, 2012. The Example reflects the expenses of both the Fund and the Portfolios. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Portfolio of Investments

| | | | | | | | |

| Investments in Affiliated Portfolios | | Value | | | % of Net

Assets | |

Floating Rate Portfolio

(identified cost, $94,164,468) | | $ | 91,694,121 | | | | 12.7 | % |

Global Macro Absolute Return Advantage Portfolio

(identified cost, $53,718,604) | | | 53,204,507 | | | | 7.4 | |

Global Macro Portfolio

(identified cost, $104,108,670) | | | 106,949,270 | | | | 14.9 | |

Government Obligations Portfolio

(identified cost, $66,487,647) | | | 71,726,848 | | | | 10.0 | |

MSAR Completion Portfolio

(identified cost, $180,376,806) | | | 182,337,525 | | | | 25.3 | |

Parametric Structured Absolute Return Portfolio

(identified cost, $172,021,820) | | | 178,543,498 | | | | 24.8 | |

Short-Term U.S. Government Portfolio

(identified cost, $34,910,641) | | | 36,575,713 | | | | 5.1 | |

| | | | | | | | | |

| | |

Total Investments in Affiliated Portfolios

(identified cost $705,788,656) | | | $721,031,482 | | | | 100.2 | % |

| | | | | | | | | |

| | |

Other Assets, Less Liabilities | | | $(1,230,369) | | | | (0.2 | )% |

| | | | | | | | | |

| | |

Net Assets | | $ | 719,801,113 | | | | 100.0 | % |

| | | | | | | | | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Statement of Assets and Liabilities

| | | | |

| Assets | | October 31, 2012 | |

Affiliated investments, at value (identified cost, $705,788,656) | | $ | 721,031,482 | |

Receivable for Fund shares sold | | | 2,265,352 | |

Total assets | | $ | 723,296,834 | |

| |

| Liabilities | | | | |

Payable for Fund shares redeemed | | $ | 2,955,230 | |

Distributions payable | | | 241,934 | |

Payable to affiliates: | | | | |

Distribution and service fees | | | 167,745 | |

Trustees’ fees | | | 42 | |

Accrued expenses | | | 130,770 | |

Total liabilities | | $ | 3,495,721 | |

Net Assets | | $ | 719,801,113 | |

| |

| Sources of Net Assets | | | | |

Paid-in capital | | $ | 762,809,947 | |

Accumulated net realized loss | | | (56,765,149 | ) |

Accumulated distributions in excess of net investment income | | | (1,486,511 | ) |

Net unrealized appreciation | | | 15,242,826 | |

Total | | $ | 719,801,113 | |

| |

| Class A Shares | | | | |

Net Assets | | $ | 338,113,840 | |

Shares Outstanding | | | 37,182,065 | |

Net Asset Value and Redemption Price Per Share | | | | |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 9.09 | |

Maximum Offering Price Per Share | | | | |

(100 ÷ 95.25 of net asset value per share) | | $ | 9.54 | |

| |

| Class B Shares | | | | |

Net Assets | | $ | 16,540,682 | |

Shares Outstanding | | | 1,820,710 | |

Net Asset Value and Offering Price Per Share* | | | | |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 9.08 | |

| |

| Class C Shares | | | | |

Net Assets | | $ | 91,682,316 | |

Shares Outstanding | | | 10,090,133 | |

Net Asset Value and Offering Price Per Share* | | | | |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 9.09 | |

| |

| Class I Shares | | | | |

Net Assets | | $ | 273,464,275 | |

Shares Outstanding | | | 30,083,196 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 9.09 | |

On sales of $50,000 or more, the offering price of Class A shares is reduced.

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Statement of Operations

| | | | |

| Investment Income | | Year Ended

October 31, 2012 | |

Interest and other income allocated from affiliated Portfolios (net of foreign taxes, $34,584) | | $ | 22,240,276 | |

Dividends allocated from affiliated Portfolios (net of foreign taxes, $158,816) | | | 2,241,973 | |

Expenses allocated from affiliated Portfolios | | | (7,247,489 | ) |

Total investment income from Portfolios | | $ | 17,234,760 | |

| |

| Expenses | | | | |

Distribution and service fees | | | | |

Class A | | $ | 991,508 | |

Class B | | | 195,161 | |

Class C | | | 1,261,985 | |

Trustees’ fees and expenses | | | 500 | |

Custodian fee | | | 48,143 | |

Transfer and dividend disbursing agent fees | | | 409,871 | |

Legal and accounting services | | | 48,383 | |

Printing and postage | | | 54,290 | |

Registration fees | | | 78,494 | |

Miscellaneous | | | 16,344 | |

Total expenses | | $ | 3,104,679 | |

| |

Net investment income | | $ | 14,130,081 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) — | | | | |

Investment transactions | | $ | (1,148,974 | ) |

Net realized gain (loss) allocated from affiliated Portfolios — | | | | |

Investment transactions (including a gain of $6,112 from precious metals) | | | (22,694,589 | ) |

Written options | | | 9,038,220 | |

Securities sold short | | | 264,714 | |

Futures contracts | | | (5,927,963 | ) |

Swap contracts | | | (2,018,777 | ) |

Forward commodity contracts | | | (81,486 | ) |

Foreign currency and forward foreign currency exchange contract transactions | | | 8,194,225 | |

Net realized loss | | $ | (14,374,630 | ) |

Change in unrealized appreciation (depreciation) — | | | | |

Investments | | $ | 1,148,974 | |

Change in unrealized appreciation (depreciation) allocated from affiliated Portfolios — | | | | |

Investments (including net decrease of $76,230 from precious metals) and (net of decrease in accrued foreign capital gains taxes of $1,097) | | | 18,526,682 | |

Written options | | | 452,404 | |

Securities sold short | | | (1,164,055 | ) |

Futures contracts | | | 1,882,261 | |

Swap contracts | | | (2,432,987 | ) |

Forward commodity contracts | | | 84,904 | |

Foreign currency and forward foreign currency exchange contracts | | | (2,982,021 | ) |

Net change in unrealized appreciation (depreciation) | | $ | 15,516,162 | |

| |

Net realized and unrealized gain | | $ | 1,141,532 | |

| |

Net increase in net assets from operations | | $ | 15,271,613 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| Increase (Decrease) in Net Assets | | 2012 | | | 2011 | |

From operations — | | | | | | | | |

Net investment income | | $ | 14,130,081 | | | $ | 9,230,376 | |

Net realized loss from investment transactions, written options, securities sold short, futures contracts, swap contracts, forward commodity contracts, and foreign currency and forward foreign currency exchange contract transactions | | | (14,374,630 | ) | | | (3,831,907 | ) |

Net change in unrealized appreciation (depreciation) from investments, written options, securities sold short, futures contracts, swap contracts, forward commodity contracts, foreign currency and forward foreign currency exchange contracts | | | 15,516,162 | | | | (1,633,329 | ) |

Net increase in net assets from operations | | $ | 15,271,613 | | | $ | 3,765,140 | |

Distributions to shareholders — | | | | | | | | |

From net investment income | | | | | | | | |

Class A | | $ | (8,239,928 | ) | | $ | (5,488,871 | ) |

Class B | | | (294,032 | ) | | | (340,723 | ) |

Class C | | | (1,909,176 | ) | | | (1,713,171 | ) |

Class I | | | (5,268,497 | ) | | | (2,097,769 | ) |

Tax return of capital | | | | | | | | |

Class A | | | (2,631,821 | ) | | | — | |

Class B | | | (93,913 | ) | | | — | |

Class C | | | (609,788 | ) | | | — | |

Class I | | | (1,682,750 | ) | | | — | |

Total distributions to shareholders | | $ | (20,729,905 | ) | | $ | (9,640,534 | ) |

Transactions in shares of beneficial interest — | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Class A | | $ | 200,287,569 | | | $ | 379,976,539 | |

Class B | | | 301,830 | | | | 2,668,301 | |

Class C | | | 15,887,489 | | | | 58,882,498 | |

Class I | | | 226,884,615 | | | | 257,347,130 | |

Net asset value of shares issued to shareholders in payment of distributions declared | | | | | | | | |

Class A | | | 10,473,233 | | | | 4,942,008 | |

Class B | | | 333,604 | | | | 251,430 | |

Class C | | | 2,132,149 | | | | 1,373,441 | |

Class I | | | 4,420,408 | | | | 1,230,201 | |

Cost of shares redeemed | | | | | | | | |

Class A | | | (284,458,290 | ) | | | (115,312,350 | ) |

Class B | | | (5,634,199 | ) | | | (7,365,582 | ) |

Class C | | | (69,144,751 | ) | | | (39,239,467 | ) |

Class I | | | (144,431,760 | ) | | | (72,667,527 | ) |

Net asset value of shares exchanged | | | | | | | | |

Class A | | | 779,900 | | | | 1,203,178 | |

Class B | | | (779,900 | ) | | | (1,203,178 | ) |

Net increase (decrease) in net assets from Fund share transactions | | $ | (42,948,103 | ) | | $ | 472,086,622 | |

| | |

Net increase (decrease) in net assets | | $ | (48,406,395 | ) | | $ | 466,211,228 | |

| | |

| Net Assets | | | | | | | | |

At beginning of year | | $ | 768,207,508 | | | $ | 301,996,280 | |

At end of year | | $ | 719,801,113 | | | $ | 768,207,508 | |

| | |

Accumulated undistributed (distributions in excess of) net investment income

included in net assets | | | | | | | | |

At end of year | | $ | (1,486,511 | ) | | $ | 913,668 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A | |

| | | Year Ended October 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Net asset value — Beginning of year | | $ | 9.160 | | | $ | 9.200 | | | $ | 8.890 | | | $ | 7.600 | | | $ | 9.630 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | $ | 0.171 | | | $ | 0.172 | | | $ | 0.350 | | | $ | 0.485 | | | $ | 0.568 | |

Net realized and unrealized gain (loss) | | | 0.007 | | | | (0.023 | ) | | | 0.362 | | | | 1.328 | | | | (1.977 | ) |

| | | | | |

Total income (loss) from operations | | $ | 0.178 | | | $ | 0.149 | | | $ | 0.712 | | | $ | 1.813 | | | $ | (1.409 | ) |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

From net investment income | | $ | (0.188 | ) | | $ | (0.189 | ) | | $ | (0.296 | ) | | $ | (0.523 | ) | | $ | (0.588 | ) |

Tax return of capital | | | (0.060 | ) | | | — | | | | (0.106 | ) | | | — | | | | (0.033 | ) |

| | | | | |

Total distributions | | $ | (0.248 | ) | | $ | (0.189 | ) | | $ | (0.402 | ) | | $ | (0.523 | ) | | $ | (0.621 | ) |

| | | | | |

Net asset value — End of year | | $ | 9.090 | | | $ | 9.160 | | | $ | 9.200 | | | $ | 8.890 | | | $ | 7.600 | |

| | | | | |

Total Return(2) | | | 1.97 | % | | | 1.62 | % | | | 8.18 | % | | | 24.98 | % | | | (15.48 | )% |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | $ | 338,114 | | | $ | 413,764 | | | $ | 146,073 | | | $ | 139,217 | | | $ | 128,030 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | |

Expenses(3)(4) | | | 1.27 | % | | | 1.22 | % | | | 1.10 | % | | | 1.17 | % | | | 1.14 | % |

Net investment income | | | 1.88 | % | | | 1.86 | % | | | 3.85 | % | | | 6.12 | % | | | 6.22 | % |

Portfolio Turnover of the Fund(5) | | | 68 | % | | | 26 | % | | | 60 | % | | | 61 | % | | | 19 | % |

Portfolio Turnover of Boston Income Portfolio | | | N.A. | | | | 70 | % | | | 75 | % | | | 74 | % | | | 54 | % |

Portfolio Turnover of Floating Rate Portfolio | | | 42 | % | | | 56 | % | | | 39 | % | | | 35 | % | | | 7 | % |

Portfolio Turnover of Global Macro Absolute Return Advantage Portfolio | | | 91 | % | | | 50 | % | | | N.A. | | | | N.A. | | | | N.A. | |

Portfolio Turnover of Global Macro Portfolio | | | 39 | % | | | 33 | % | | | 19 | % | | | 25 | % | | | N.A. | |

Portfolio Turnover of Government Obligations Portfolio | | | 26 | % | | | 19 | % | | | 22 | % | | | 28 | % | | | 19 | % |

Portfolio Turnover of Large-Cap Core Research Portfolio | | | N.A. | | | | 64 | % | | | 51 | % | | | N.A. | | | | N.A. | |

Portfolio Turnover of MSAR Completion Portfolio | | | 37 | % | | | 32 | % | | | 2 | %(6) | | | N.A. | | | | N.A. | |

Portfolio Turnover of Multi-Sector Portfolio | | | N.A. | | | | N.A. | | | | N.A. | | | | 31 | %(7) | | | N.A. | |

Portfolio Turnover of Parametric Structured Absolute Return Portfolio | | | 22 | % | | | N.A. | | | | N.A. | | | | N.A. | | | | N.A. | |

Portfolio Turnover of Short-Term U.S. Government Portfolio | | | 15 | % | | | 6 | % | | | 26 | % | | | N.A. | | | | N.A. | |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Includes the Fund’s share of the Portfolios’ allocated expenses. |

| (4) | Excludes the effect of custody fee credits, if any, of less than 0.005%. |

| (5) | Percentage includes both the Fund’s contributions to and withdrawals from the Portfolios and purchases and sales of securities held directly by the Fund, if any. |

| (6) | For the period from the Portfolio’s start of business, August 24, 2010, to October 31, 2010. |

| (7) | For the period from the Portfolio’s start of business, July 16, 2009, to October 31, 2009. |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Financial Highlights — continued

| | | | | | | | | | | | | | | | | | | | |

| | | Class B | |

| | | Year Ended October 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Net asset value — Beginning of year | | $ | 9.150 | | | $ | 9.200 | | | $ | 8.890 | | | $ | 7.590 | | | $ | 9.620 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | $ | 0.103 | | | $ | 0.115 | | | $ | 0.283 | | | $ | 0.426 | | | $ | 0.500 | |

Net realized and unrealized gain (loss) | | | 0.006 | | | | (0.045 | ) | | | 0.361 | | | | 1.337 | | | | (1.977 | ) |

| | | | | |

Total income (loss) from operations | | $ | 0.109 | | | $ | 0.070 | | | $ | 0.644 | | | $ | 1.763 | | | $ | (1.477 | ) |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

From net investment income | | $ | (0.136 | ) | | $ | (0.120 | ) | | $ | (0.246 | ) | | $ | (0.463 | ) | | $ | (0.524 | ) |

Tax return of capital | | | (0.043 | ) | | | — | | | | (0.088 | ) | | | — | | | | (0.029 | ) |

| | | | | |

Total distributions | | $ | (0.179 | ) | | $ | (0.120 | ) | | $ | (0.334 | ) | | $ | (0.463 | ) | | $ | (0.553 | ) |

| | | | | |

Net asset value — End of year | | $ | 9.080 | | | $ | 9.150 | | | $ | 9.200 | | | $ | 8.890 | | | $ | 7.590 | |

| | | | | |

Total Return(2) | | | 1.21 | % | | | 0.75 | % | | | 7.37 | % | | | 24.22 | % | | | (16.13 | )% |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | $ | 16,541 | | | $ | 22,469 | | | $ | 28,217 | | | $ | 31,637 | | | $ | 28,616 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | |

Expenses(3)(4) | | | 2.02 | % | | | 1.96 | % | | | 1.85 | % | | | 1.93 | % | | | 1.88 | % |

Net investment income | | | 1.13 | % | | | 1.25 | % | | | 3.12 | % | | | 5.38 | % | | | 5.48 | % |

Portfolio Turnover of the Fund(5) | | | 68 | % | | | 26 | % | | | 60 | % | | | 61 | % | | | 19 | % |

Portfolio Turnover of Boston Income Portfolio | | | N.A. | | | | 70 | % | | | 75 | % | | | 74 | % | | | 54 | % |

Portfolio Turnover of Floating Rate Portfolio | | | 42 | % | | | 56 | % | | | 39 | % | | | 35 | % | | | 7 | % |

Portfolio Turnover of Global Macro Absolute Return Advantage Portfolio | | | 91 | % | | | 50 | % | | | N.A. | | | | N.A. | | | | N.A. | |

Portfolio Turnover of Global Macro Portfolio | | | 39 | % | | | 33 | % | | | 19 | % | | | 25 | % | | | N.A. | |

Portfolio Turnover of Government Obligations Portfolio | | | 26 | % | | | 19 | % | | | 22 | % | | | 28 | % | | | 19 | % |

Portfolio Turnover of Large-Cap Core Research Portfolio | | | N.A. | | | | 64 | % | | | 51 | % | | | N.A. | | | | N.A. | |

Portfolio Turnover of MSAR Completion Portfolio | | | 37 | % | | | 32 | % | | | 2 | %(6) | | | N.A. | | | | N.A. | |

Portfolio Turnover of Multi-Sector Portfolio | | | N.A. | | | | N.A. | | | | N.A. | | | | 31 | %(7) | | | N.A. | |

Portfolio Turnover of Parametric Structured Absolute Return Portfolio | | | 22 | % | | | N.A. | | | | N.A. | | | | N.A. | | | | N.A. | |

Portfolio Turnover of Short-Term U.S. Government Portfolio | | | 15 | % | | | 6 | % | | | 26 | % | | | N.A. | | | | N.A. | |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Includes the Fund’s share of the Portfolios’ allocated expenses. |

| (4) | Excludes the effect of custody fee credits, if any, of less than 0.005%. |

| (5) | Percentage includes both the Fund’s contributions to and withdrawals from the Portfolios and purchases and sales of securities held directly by the Fund, if any. |

| (6) | For the period from the Portfolio’s start of business, August 24, 2010, to October 31, 2010. |

| (7) | For the period from the Portfolio’s start of business, July 16, 2009, to October 31, 2009. |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Financial Highlights — continued

| | | | | | | | | | | | | | | | | | | | |

| | | Class C | |

| | | Year Ended October 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Net asset value — Beginning of year | | $ | 9.150 | | | $ | 9.200 | | | $ | 8.890 | | | $ | 7.590 | | | $ | 9.620 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) | | $ | 0.103 | | | $ | 0.111 | | | $ | 0.282 | | | $ | 0.426 | | | $ | 0.500 | |

Net realized and unrealized gain (loss) | | | 0.016 | | | | (0.041 | ) | | | 0.362 | | | | 1.337 | | | | (1.978 | ) |

| | | | | |

Total income (loss) from operations | | $ | 0.119 | | | $ | 0.070 | | | $ | 0.644 | | | $ | 1.763 | | | $ | (1.478 | ) |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

From net investment income | | $ | (0.136 | ) | | $ | (0.120 | ) | | $ | (0.246 | ) | | $ | (0.463 | ) | | $ | (0.523 | ) |

Tax return of capital | | | (0.043 | ) | | | — | | | | (0.088 | ) | | | — | | | | (0.029 | ) |

| | | | | |

Total distributions | | $ | (0.179 | ) | | $ | (0.120 | ) | | $ | (0.334 | ) | | $ | (0.463 | ) | | $ | (0.552 | ) |

| | | | | |

Net asset value — End of year | | $ | 9.090 | | | $ | 9.150 | | | $ | 9.200 | | | $ | 8.890 | | | $ | 7.590 | |

| | | | | |

Total Return(2) | | | 1.32 | % | | | 0.75 | % | | | 7.37 | % | | | 24.21 | % | | | (16.13 | )% |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | $ | 91,682 | | | $ | 143,809 | | | $ | 123,689 | | | $ | 133,596 | | | $ | 120,654 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | |

Expenses(3)(4) | | | 2.02 | % | | | 1.96 | % | | | 1.85 | % | | | 1.93 | % | | | 1.88 | % |

Net investment income | | | 1.13 | % | | | 1.20 | % | | | 3.12 | % | | | 5.37 | % | | | 5.48 | % |

Portfolio Turnover of the Fund(5) | | | 68 | % | | | 26 | % | | | 60 | % | | | 61 | % | | | 19 | % |

Portfolio Turnover of Boston Income Portfolio | | | N.A. | | | | 70 | % | | | 75 | % | | | 74 | % | | | 54 | % |

Portfolio Turnover of Floating Rate Portfolio | | | 42 | % | | | 56 | % | | | 39 | % | | | 35 | % | | | 7 | % |

Portfolio Turnover of Global Macro Absolute Return Advantage Portfolio | | | 91 | % | | | 50 | % | | | N.A. | | | | N.A. | | | | N.A. | |

Portfolio Turnover of Global Macro Portfolio | | | 39 | % | | | 33 | % | | | 19 | % | | | 25 | % | | | N.A. | |

Portfolio Turnover of Government Obligations Portfolio | | | 26 | % | | | 19 | % | | | 22 | % | | | 28 | % | | | 19 | % |

Portfolio Turnover of Large-Cap Core Research Portfolio | | | N.A. | | | | 64 | % | | | 51 | % | | | N.A. | | | | N.A. | |

Portfolio Turnover of MSAR Completion Portfolio | | | 37 | % | | | 32 | % | | | 2 | %(6) | | | N.A. | | | | N.A. | |

Portfolio Turnover of Multi-Sector Portfolio | | | N.A. | | | | N.A. | | | | N.A. | | | | 31 | %(7) | | | N.A. | |

Portfolio Turnover of Parametric Structured Absolute Return Portfolio | | | 22 | % | | | N.A. | | | | N.A. | | | | N.A. | | | | N.A. | |

Portfolio Turnover of Short-Term U.S. Government Portfolio | | | 15 | % | | | 6 | % | | | 26 | % | | | N.A. | | | | N.A. | |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Includes the Fund’s share of the Portfolios’ allocated expenses. |

| (4) | Excludes the effect of custody fee credits, if any, of less than 0.005%. |

| (5) | Percentage includes both the Fund’s contributions to and withdrawals from the Portfolios and purchases and sales of securities held directly by the Fund, if any. |

| (6) | For the period from the Portfolio’s start of business, August 24, 2010, to October 31, 2010. |

| (7) | For the period from the Portfolio’s start of business, July 16, 2009, to October 31, 2009. |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Financial Highlights — continued

| | | | | | | | | | | | | | | | |

| | | Class I | |

| | | Year Ended October 31, | | | Period Ended

October 31, 2009(1) | |

| | | 2012 | | | 2011 | | | 2010 | | |

Net asset value — Beginning of period | | $ | 9.150 | | | $ | 9.200 | | | $ | 8.890 | | | $ | 8.830 | |

| | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | |

Net investment income(2) | | $ | 0.196 | | | $ | 0.185 | | | $ | 0.353 | | | $ | 0.027 | |

Net realized and unrealized gain (loss) | | | 0.014 | | | | (0.023 | ) | | | 0.381 | | | | 0.071 | |

| | | | |

Total income from operations | | $ | 0.210 | | | $ | 0.162 | | | $ | 0.734 | | | $ | 0.098 | |

| | | | |

| Less Distributions | | | | | | | | | | | | | | | | |

From net investment income | | $ | (0.205 | ) | | $ | (0.212 | ) | | $ | (0.313 | ) | | $ | (0.038 | ) |

Tax return of capital | | | (0.065 | ) | | | — | | | | (0.111 | ) | | | — | |

| | | | |

Total distributions | | $ | (0.270 | ) | | $ | (0.212 | ) | | $ | (0.424 | ) | | $ | (0.038 | ) |

| | | | |

Net asset value — End of period | | $ | 9.090 | | | $ | 9.150 | | | $ | 9.200 | | | $ | 8.890 | |

| | | | |

Total Return(3) | | | 2.33 | % | | | 1.76 | % | | | 8.45 | % | | | 1.12 | %(4) |

| | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s omitted) | | $ | 273,464 | | | $ | 188,165 | | | $ | 4,018 | | | $ | 1,253 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | | | | | |

Expenses(5)(6) | | | 1.01 | % | | | 0.98 | % | | | 0.85 | % | | | 0.99 | %(7) |

Net investment income | | | 2.15 | % | | | 2.00 | % | | | 3.86 | % | | | 7.29 | %(7) |

Portfolio Turnover of the Fund(8) | | | 68 | % | | | 26 | % | | | 60 | % | | | 61 | %(9) |

Portfolio Turnover of Boston Income Portfolio | | | N.A. | | | | 70 | % | | | 75 | % | | | 74 | %(10) |

Portfolio Turnover of Floating Rate Portfolio | | | 42 | % | | | 56 | % | | | 39 | % | | | 35 | %(10) |

Portfolio Turnover of Global Macro Absolute Return Advantage Portfolio | | | 91 | % | | | 50 | % | | | N.A. | | | | N.A. | |

Portfolio Turnover of Global Macro Portfolio | | | 39 | % | | | 33 | % | | | 19 | % | | | 25 | %(10) |

Portfolio Turnover of Government Obligations Portfolio | | | 26 | % | | | 19 | % | | | 22 | % | | | 28 | %(10) |

Portfolio Turnover of Large-Cap Core Research Portfolio | | | N.A. | | | | 64 | % | | | 51 | % | | | N.A. | |

Portfolio Turnover of MSAR Completion Portfolio | | | 37 | % | | | 32 | % | | | 2 | %(11) | | | N.A. | |

Portfolio Turnover of Multi-Sector Portfolio | | | N.A. | | | | N.A. | | | | N.A. | | | | 31 | %(12) |

Portfolio Turnover of Parametric Structured Absolute Return Portfolio | | | 22 | % | | | N.A. | | | | N.A. | | | | N.A. | |

Portfolio Turnover of Short-Term U.S. Government Portfolio | | | 15 | % | | | 6 | % | | | 26 | % | | | N.A. | |

| (1) | For the period from commencement of operations on October 1, 2009 to October 31, 2009. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (5) | Includes the Fund’s share of the Portfolios’ allocated expenses. |

| (6) | Excludes the effect of custody fee credits, if any, of less than 0.005%. |

| (8) | Percentage includes both the Fund’s contributions to and withdrawals from the Portfolios and purchases and sales of securities held directly by the Fund, if any. |

| (9) | For the Fund’s year ended October 31, 2009. |

| (10) | For the Portfolio’s year ended October 31, 2009. |

| (11) | For the period from the Portfolio’s start of business, August 24, 2010, to October 31, 2010. |

| (12) | For the period from the Portfolio’s start of business, July 16, 2009, to October 31, 2009. |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Multi-Strategy Absolute Return Fund (the Fund) is a diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund offers four classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. Class B and Class C shares are sold at net asset value and are generally subject to a contingent deferred sales charge (see Note 5). Class I shares are sold at net asset value and are not subject to a sales charge. Class B shares automatically convert to Class A shares eight years after their purchase as described in the Fund’s prospectus. Beginning January 1, 2012, Class B shares are only available for purchase upon exchange from another Eaton Vance fund or through reinvestment of distributions. Each class represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Net investment income, other than class-specific expenses, is allocated daily to each class of shares based upon the ratio of the value of each class’s paid shares to the total value of all paid shares. Each class of shares differs in its distribution plan and certain other class-specific expenses. The Fund’s investment objective is to seek total return. The Fund currently pursues its objective by investing all of its investable assets in interests in the following seven portfolios managed by Eaton Vance Management (EVM) or its affiliates: Floating Rate Portfolio, Global Macro Absolute Return Advantage Portfolio, Global Macro Portfolio, Government Obligations Portfolio, MSAR Completion Portfolio, Parametric Structured Absolute Return Portfolio and Short-Term U.S. Government Portfolio (the Portfolios), which are Massachusetts business trusts. The value of the Fund’s investments in the Portfolios reflects the Fund’s proportionate interest in the net assets of Floating Rate Portfolio, Global Macro Absolute Return Advantage Portfolio, Global Macro Portfolio, Government Obligations Portfolio, MSAR Completion Portfolio, Parametric Structured Absolute Return Portfolio and Short-Term U.S. Government Portfolio (1.0%, 4.5%, 1.5%, 5.6%, 99.7%, 67.7% and 9.1%, respectively, at October 31, 2012). The performance of the Fund is directly affected by the performance of the Portfolios. A copy of each Portfolio’s financial statements is available on the EDGAR database on the Securities and Exchange Commission’s website (www.sec.gov), at the Commission’s public reference room in Washington, DC or upon request from the Fund’s principal underwriter, Eaton Vance Distributors, Inc. (EVD), by calling 1-800-262-1122.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — The valuation policies common to the Portfolios are as follows:

Debt obligations (including short-term obligations with a remaining maturity of more than sixty days and excluding most seasoned, fixed rate 30-year mortgage-backed securities as noted below) are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and asked prices, broker/dealer quotations, prices or yields of securities with similar characteristics, benchmark curves or information pertaining to the issuer, as well as industry and economic events. The pricing services may use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security. Short-term obligations purchased with a remaining maturity of sixty days or less (excluding those that are non-U.S. dollar denominated, which typically are valued by a pricing service or dealer quotes) are generally valued at amortized cost, which approximates market value. Equity securities (including common shares of closed-end investment companies) listed on a U.S. securities exchange generally are valued at the last sale or closing price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ Global or Global Select Market generally are valued at the NASDAQ official closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices or, in the case of preferred equity securities that are not listed or traded in the over-the-counter market, by a third party pricing service that will use various techniques that consider factors including, but not limited to, prices or yields of securities with similar characteristics, benchmark yields, broker/dealer quotes, quotes of underlying common stock, issuer spreads, as well as industry and economic events. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Portfolios’ Trustees have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities. Precious metals are valued at the New York composite mean quotation reported by Bloomberg at the valuation time. Exchange-traded options (other than FLexible EXchange traded options) are valued at the mean between the bid and asked prices at valuation time as reported by the Options Price Reporting Authority for U.S. listed options or by the relevant exchange or board of trade for non-U.S. listed options. Over-the-counter options (including options on securities, indices and foreign currencies) and FLexible EXchange traded options traded at the Chicago Board Options Exchange are valued by a third party pricing service using techniques that consider factors including the value of the underlying instrument, the volatility of the underlying instrument and the period of time until option expiration. Financial and commodities futures contracts are valued at the closing settlement price established by the board of trade or exchange on which they are traded. Forward foreign currency exchange contracts are generally valued at the mean of the average bid and average asked prices that are reported by currency dealers to a third party pricing service at the valuation time. Such third party pricing service valuations are supplied for specific settlement periods and the Portfolios’ forward foreign currency exchange contracts are valued at an interpolated rate between the closest preceding and subsequent settlement period reported by the third party pricing service. Forward commodity contracts are generally valued based on the price of the underlying futures or forward contract provided by the exchange on which the underlying instruments are traded or if unavailable, based on forward rates provided by broker/dealers. Interest rate swaps, cross-currency swaps and options on interest rate swaps (“swaptions”) are normally valued using

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Notes to Financial Statements — continued

valuations provided by a third party pricing service. Such pricing service valuations are based on the present value of fixed and projected floating rate cash flows over the term of the swap contract. Future cash flows are discounted to their present value using swap rates provided by electronic data services or by broker/dealers. Alternatively, swaptions may be valued at the valuation provided by the counterparty, so determined using the same techniques as those employed by the pricing service. Credit default swaps are normally valued using valuations provided by a third party pricing service. The pricing services employ electronic data processing techniques to determine the present value based on credit spread quotations obtained from broker/dealers and expected default recovery rates determined by the pricing service using proprietary models. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Portfolios in a manner that fairly reflects the security’s value, or the amount that the Portfolios might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

Additional valuation policies for Global Macro Absolute Return Advantage Portfolio, Global Macro Portfolio, Government Obligations Portfolio and Short-Term U.S. Government Portfolio are as follows: Most seasoned, fixed-rate 30-year mortgage-backed securities are valued through the use of the investment adviser’s matrix pricing system, which takes into account bond prices, yield differentials, anticipated prepayments and interest rates provided by dealers.

Additional valuation policies for Floating Rate Portfolio (the Portfolio) are as follows: Interests in senior floating-rate loans (Senior Loans) for which reliable market quotations are readily available are valued generally at the average mean of bid and ask quotations obtained from a third party pricing service. Other Senior Loans are valued at fair value by the investment adviser under procedures approved by the Trustees. In fair valuing a Senior Loan, the investment adviser utilizes one or more of the valuation techniques described in (i) through (iii) below to assess the likelihood that the borrower will make a full repayment of the loan underlying such Senior Loan relative to yields on other Senior Loans issued by companies of comparable credit quality. If the investment adviser believes that there is a reasonable likelihood of full repayment, the investment adviser will determine fair value using a matrix pricing approach that considers the yield on the Senior Loan. If the investment adviser believes there is not a reasonable likelihood of full repayment, the investment adviser will determine fair value using analyses that include, but are not limited to: (i) a comparison of the value of the borrower’s outstanding equity and debt to that of comparable public companies; (ii) a discounted cash flow analysis; or (iii) when the investment adviser believes it is likely that a borrower will be liquidated or sold, an analysis of the terms of such liquidation or sale. In certain cases, the investment adviser will use a combination of analytical methods to determine fair value, such as when only a portion of a borrower’s assets are likely to be sold. In conducting its assessment and analyses for purposes of determining fair value of a Senior Loan, the investment adviser will use its discretion and judgment in considering and appraising relevant factors. Fair value determinations are made by the portfolio managers of the Portfolio based on information available to such managers. The portfolio managers of other funds managed by the investment adviser that invest in Senior Loans may not possess the same information about a Senior Loan borrower as the portfolio managers of the Portfolio. At times, the fair value of a Senior Loan determined by the portfolio managers of other funds managed by the investment adviser that invest in Senior Loans may vary from the fair value of the same Senior Loan determined by the portfolio managers of the Portfolio. The fair value of each Senior Loan is periodically reviewed and approved by the investment adviser’s Valuation Committee and by the Trustees based upon procedures approved by the Trustees. Junior Loans (i.e., subordinated loans and second lien loans) are valued in the same manner as Senior Loans.

The Portfolios may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by EVM. Cash Reserves Fund generally values its investment securities utilizing the amortized cost valuation technique in accordance with Rule 2a-7 under the 1940 Act. This technique involves initially valuing a portfolio security at its cost and thereafter assuming a constant amortization to maturity of any discount or premium. If amortized cost is determined not to approximate fair value, Cash Reserves Fund may value its investment securities in the same manner as debt obligations described above.

B Income — The Fund’s net investment income or loss consists of the Fund’s pro-rata share of the net investment income or loss of the Portfolios less all actual and accrued expenses of the Fund.

C Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

At October 31, 2012, the Fund, for federal income tax purposes, had a capital loss carryforward of $31,834,307 and current year deferred capital losses of $16,497,310 which will reduce its taxable income arising from future net realized gains on investment transactions, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of distributions to shareholders, which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax. Such capital loss carryforward will expire on October 31, 2013 ($1,057,658), October 31, 2014 ($1,054,697), October 31, 2015 ($1,377,385), October 31, 2016 ($15,304,398), October 31, 2017 ($9,100,702) and October 31, 2018 ($3,939,467). The current year deferred capital losses are treated as arising on the first day of the Fund’s next taxable year and are treated as realized prior to the utilization of the capital loss carryforward.

Additionally, at October 31, 2012, the Fund had a net investment loss of $2,265,508 incurred after December 31, 2011. This net investment loss is treated as arising on the first day of the Fund’s taxable year ending October 31, 2013.

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Notes to Financial Statements — continued

As of October 31, 2012, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

D Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

E Expense Reduction — State Street Bank and Trust Company (SSBT) serves as custodian of the Fund. Pursuant to the custodian agreement, SSBT receives a fee reduced by credits, which are determined based on the average daily cash balance the Fund maintains with SSBT. All credit balances, if any, used to reduce the Fund’s custodian fees are reported as a reduction of expenses in the Statement of Operations.

F Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

G Indemnifications — Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Trust shall assume the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

H Other — Investment transactions are accounted for on a trade date basis. Dividends to shareholders are recorded on the ex-dividend date.

2 Distributions to Shareholders

The Fund declares dividends daily to shareholders of record at the time of declaration. Distributions are generally paid monthly. Distributions of realized capital gains (reduced by available capital loss carryforwards from prior years, if any) are made at least annually. Distributions are declared separately for each class of shares. Shareholders may reinvest income and capital gain distributions in additional shares of the same class of the Fund at the net asset value as of the reinvestment date or, at the election of the shareholder, receive distributions in cash. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

The tax character of distributions declared for the years ended October 31, 2012 and October 31, 2011 was as follows:

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2012 | | | 2011 | |

|

Distributions declared from: | |

Ordinary income | | $ | 15,711,633 | | | $ | 9,640,534 | |

Tax return of capital | | $ | 5,018,272 | | | | — | |

During the year ended October 31, 2012, accumulated distributions in excess of net investment income was increased by $818,627, accumulated net realized loss was increased by $4,993,975 and paid-in capital was increased by $5,812,602 due to differences between book and tax accounting, primarily for swap contracts, premium amortization, tax accounting for straddle transactions, foreign currency gain (loss), futures contracts, options contracts, investments in passive foreign investment companies (PFICs), investment in partnerships, a Portfolio’s investment in a subsidiary and paydown gain (loss). These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of October 31, 2012, the components of distributable earnings (accumulated losses) and unrealized appreciation (depreciation) on a tax basis were as follows:

| | | | |

Capital loss carryforward and deferred capital losses | | $ | (48,331,617 | ) |

Late year ordinary losses | | $ | (2,265,508 | ) |

Net unrealized appreciation | | $ | 7,830,225 | |

Other temporary differences | | $ | (241,934 | ) |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Notes to Financial Statements — continued

The differences between components of distributable earnings (accumulated losses) on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales, tax accounting for straddle transactions, defaulted bond interest, foreign currency transactions, premium amortization, swap contracts, futures contracts, investment in partnerships, options contracts, partnership allocations, PFICs and the timing of recognizing distributions to shareholders.

3 Transactions with Affiliates

EVM serves as the investment adviser and administrator of the Fund, providing investment advisory services (relating to the investment of the Fund’s assets in the Portfolios) and administering the business affairs of the Fund. EVM does not receive a fee for serving as the Fund’s investment adviser and administrator. The Portfolios have engaged Boston Management and Research (BMR), a subsidiary of EVM, to render investment advisory services. For the year ended October 31, 2012, the Fund’s allocated portion of the investment adviser fees paid by the Portfolios amounted to $5,540,428 or 0.71% of the Fund’s average daily net assets.

EVM serves as the sub-transfer agent of the Fund and receives from the transfer agent an aggregate fee based upon the actual expenses incurred by EVM in the performance of these services. For the year ended October 31, 2012, EVM earned $15,406 in sub-transfer agent fees. The Fund was informed that EVD, an affiliate of EVM, received $19,809 as its portion of the sales charge on sales of Class A shares for the year ended October 31, 2012. EVD also received distribution and service fees from Class A, Class B and Class C shares (see Note 4) and contingent deferred sales charges (see Note 5).

Trustees and officers of the Fund and the Portfolios who are members of EVM’s or BMR’s organizations receive remuneration for their services to the Fund out of the investment adviser fee. Certain officers and Trustees of the Fund and the Portfolios are officers of the above organizations.

4 Distribution Plans

The Fund has in effect a distribution plan for Class A shares (Class A Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class A Plan, the Fund pays EVD a distribution and service fee of 0.25% per annum of its average daily net assets attributable to Class A shares for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued to EVD for the year ended October 31, 2012 amounted to $991,508 for Class A shares.

The Fund also has in effect distribution plans for Class B shares (Class B Plan) and Class C shares (Class C Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class B and Class C Plans, the Fund pays EVD amounts equal to 0.75% per annum of its average daily net assets attributable to Class B and Class C shares for providing ongoing distribution services and facilities to the Fund. The Fund will automatically discontinue payments to EVD during any period in which there are no outstanding Uncovered Distribution Charges, which are equivalent to the sum of (i) 6.25% of the aggregate amount received by the Fund for Class B and Class C shares sold, plus (ii) interest calculated by applying the rate of 1% over the prevailing prime rate to the outstanding balance of Uncovered Distribution Charges of EVD of each respective class, reduced by the aggregate amount of contingent deferred sales charges (see Note 5) and amounts theretofore paid or payable to EVD by each respective class. For the year ended October 31, 2012, the Fund paid or accrued to EVD $146,371 and $946,489 for Class B and Class C shares, respectively, representing 0.75% of the average daily net assets of Class B and Class C shares. At October 31, 2012, the amounts of Uncovered Distribution Charges of EVD calculated under the Class B and Class C Plans were approximately $970,000 and $14,835,000, respectively.

Pursuant to the Class B and Class C Plans, the Fund also makes payments of service fees to EVD, financial intermediaries and other persons in amounts equal to 0.25% per annum of its average daily net assets attributable to that class. Service fees paid or accrued are for personal services and/or the maintenance of shareholder accounts. They are separate and distinct from the sales commissions and distribution fees payable to EVD and, as such, are not subject to automatic discontinuance when there are no outstanding Uncovered Distribution Charges of EVD. Service fees paid or accrued for the year ended October 31, 2012 amounted to $48,790 and $315,496 for Class B and Class C shares, respectively.

5 Contingent Deferred Sales Charges

A contingent deferred sales charge (CDSC) generally is imposed on redemptions of Class B shares made within six years of purchase and on redemptions of Class C shares made within one year of purchase. Class A shares may be subject to a 1% CDSC if redeemed within 18 months of purchase (depending on the circumstances of purchase). Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gain distributions. The CDSC for Class B shares is imposed at declining rates that begin at 5% in the case of redemptions in the first and second year after purchase, declining one percentage point each subsequent year. Class C shares are subject to a 1% CDSC if redeemed within one year of purchase. No CDSC is levied on shares which have been sold to EVM or its affiliates or to their respective employees or clients and may be waived under certain other limited conditions. CDSCs received on Class B and Class C redemptions are paid to EVD to reduce the amount of Uncovered Distribution Charges calculated under the Fund’s Class B and Class C Plans. CDSCs received on Class B and Class C redemptions when no Uncovered Distribution Charges exist are credited to the Fund. For the year ended October 31, 2012, the Fund was informed that EVD received approximately $26,000, $33,000 and $36,000 of CDSCs paid by Class A, Class B and Class C shareholders, respectively.

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Notes to Financial Statements — continued

6 Investment Transactions

For the year ended October 31, 2012, increases and decreases in the Fund’s investments in the Portfolios were as follows:

| | | | | | | | |

| Portfolio | | Contributions | | | Withdrawals | |

| | |

Boston Income Portfolio | | $ | — | | | $ | 1 | |

Floating Rate Portfolio | | | 15,561,816 | | | | 68,090,141 | |

Global Macro Absolute Return Advantage Portfolio | | | 7,693,775 | | | | 55,306,238 | |

Global Macro Portfolio | | | 42,746,709 | | | | 36,488,798 | |

Government Obligations Portfolio | | | 82,505,165 | | | | 24,078,703 | |

Large-Cap Core Research Portfolio | | | — | | | | 15,606,868 | |

MSAR Completion Portfolio | | | 160,802,586 | | | | 358,147,502 | |

Parametric Structured Absolute Return Portfolio | | | 196,256,868 | | | | 19,005,394 | |

Short-Term U.S. Government Portfolio | | | 18,846,528 | | | | 12,159,676 | |

7 Shares of Beneficial Interest

The Fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Such shares may be issued in a number of different series (such as the Fund) and classes. Transactions in Fund shares were as follows:

| | | | | | | | |

| | | Year Ended October 31, | |

| Class A | | 2012 | | | 2011 | |

| | |

Sales | | | 21,974,238 | | | | 41,159,963 | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 1,151,032 | | | | 535,404 | |

Redemptions | | | (31,214,623 | ) | | | (12,509,560 | ) |

Exchange from Class B shares | | | 85,585 | | | | 130,037 | |

| | |

Net increase (decrease) | | | (8,003,768 | ) | | | 29,315,844 | |

| | |

| | | | | | | | |

| | | Year Ended October 31, | |

| Class B | | 2012 | | | 2011 | |

| | |

Sales | | | 33,120 | | | | 289,391 | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 36,702 | | | | 27,223 | |

Redemptions | | | (619,253 | ) | | | (798,568 | ) |

Exchange to Class A shares | | | (85,623 | ) | | | (130,084 | ) |

| | |

Net decrease | | | (635,054 | ) | | | (612,038 | ) |

| | |

| | | | | | | | |

| | | Year Ended October 31, | |

| Class C | | 2012 | | | 2011 | |

| | |

Sales | | | 1,744,238 | | | | 6,372,782 | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 234,563 | | | | 148,719 | |

Redemptions | | | (7,603,790 | ) | | | (4,253,172 | ) |

| | |

Net increase (decrease) | | | (5,624,989 | ) | | | 2,268,329 | |

| | |

| | | | | | | | |

Eaton Vance

Multi-Strategy Absolute Return Fund

October 31, 2012

Notes to Financial Statements — continued

| | | | | | | | |

| | | Year Ended October 31, | |

| Class I | | 2012 | | | 2011 | |

| | |

Sales | | | 24,905,523 | | | | 27,890,271 | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 485,942 | | | | 133,437 | |

Redemptions | | | (15,862,419 | ) | | | (7,906,247 | ) |

| | |

Net increase | | | 9,529,046 | | | | 20,117,461 | |

At October 31, 2012, accounts advised by EVM owned 14.5% of the value of the outstanding shares of the Fund.

8 Fair Value Measurements

Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| Ÿ | | Level 1 – quoted prices in active markets for identical investments |