0000745463eatonvance:C000014488Membereatonvance:SectorCommunicationServicesSectorMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

December 31, 2024

Date of Reporting Period

| Item 1. | Reports to Stockholders |

Parametric Commodity Strategy Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Parametric Commodity Strategy Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/parametric-fund-documents.php. You can also request this information by contacting us at 1-800-260-0761.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $95 | 0.91% |

|---|

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Commodity Index Total Return (the Index):

↑ The Fund’s exposure to cocoa helped Index-relative returns amid adverse weather conditions in the Ivory Coast and Ghana that sent commodity prices soaring during the period

↑ The Fund’s exposure to Robusta coffee contributed to Index-relative performance, as poor weather conditions in key growing regions generated crop shortages

↑ Contract selections in natural gas contributed to Fund performance relative to the Index ― primarily the result of a significant drop in natural gas spot prices during the first quarter of 2024

↓ The Fund’s underweight exposure to gold detracted from Index-relative returns, as the U.S. Federal Reserve’s easing monetary policy helped lift gold prices

↓ An underweight exposure to crude oil hurt Index-relative returns, as oil prices increased due, in part, to escalating geopolitical tensions in the Middle East

↓ The Fund’s exposure to palladium hampered Index-relative returns, partially due to the market’s expectation of a 2025 inventory surplus of the precious metal

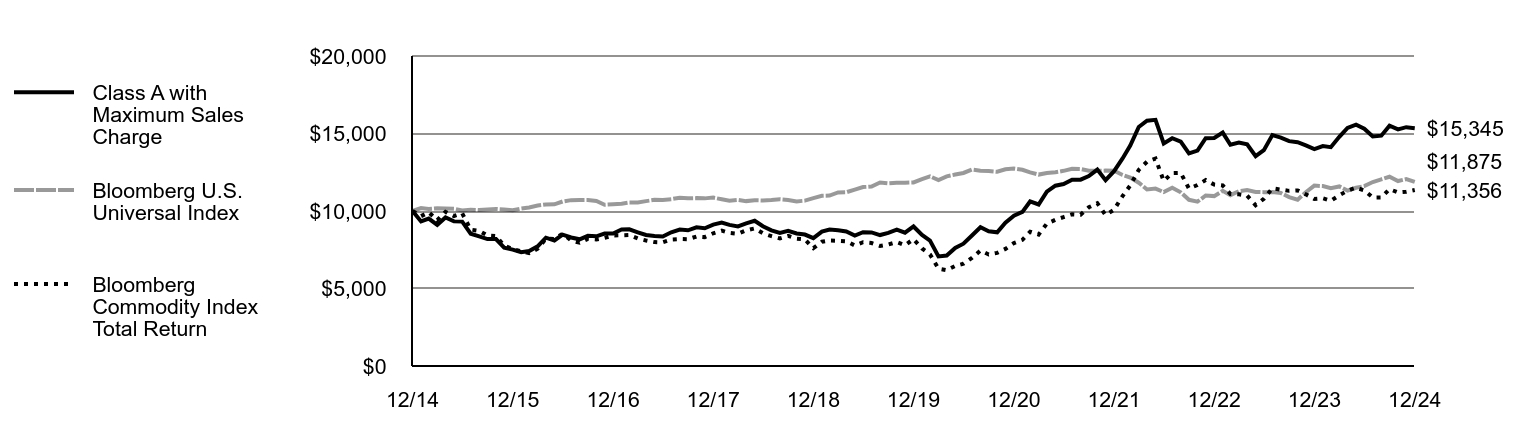

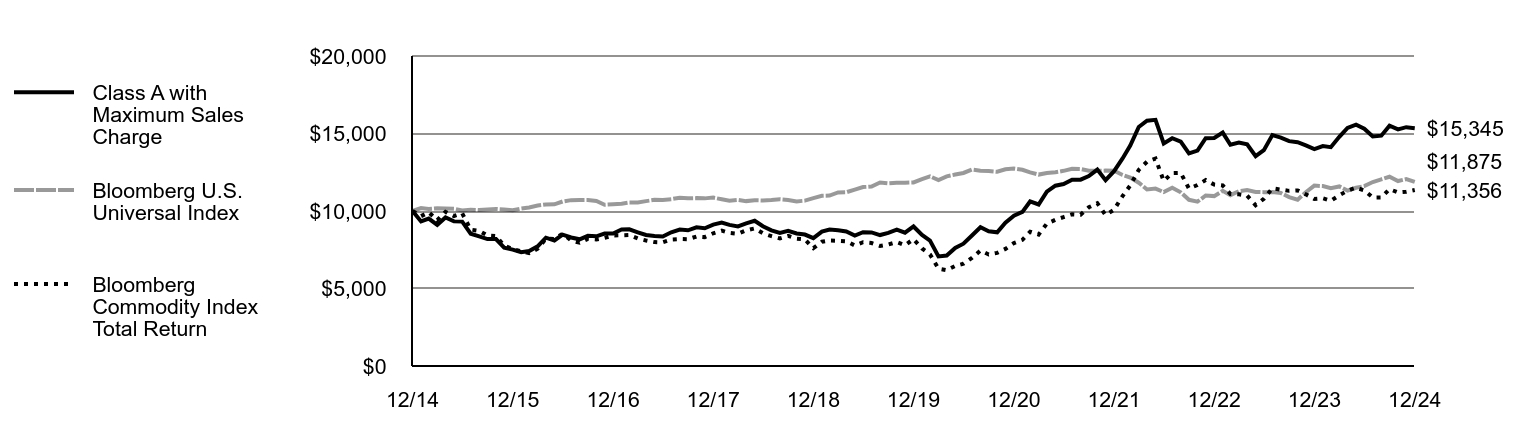

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg U.S. Universal Index | Bloomberg Commodity Index Total Return |

|---|

| 12/14 | $10,000 | $10,000 | $10,000 |

|---|

| 1/15 | $9,329 | $10,190 | $9,666 |

|---|

| 2/15 | $9,510 | $10,131 | $9,915 |

|---|

| 3/15 | $9,104 | $10,173 | $9,406 |

|---|

| 4/15 | $9,585 | $10,161 | $9,945 |

|---|

| 5/15 | $9,330 | $10,143 | $9,677 |

|---|

| 6/15 | $9,315 | $10,030 | $9,844 |

|---|

| 7/15 | $8,533 | $10,088 | $8,799 |

|---|

| 8/15 | $8,368 | $10,059 | $8,718 |

|---|

| 9/15 | $8,188 | $10,098 | $8,420 |

|---|

| 10/15 | $8,188 | $10,130 | $8,382 |

|---|

| 11/15 | $7,632 | $10,093 | $7,774 |

|---|

| 12/15 | $7,512 | $10,043 | $7,534 |

|---|

| 1/16 | $7,346 | $10,154 | $7,408 |

|---|

| 2/16 | $7,422 | $10,226 | $7,287 |

|---|

| 3/16 | $7,722 | $10,351 | $7,566 |

|---|

| 4/16 | $8,278 | $10,422 | $8,210 |

|---|

| 5/16 | $8,098 | $10,430 | $8,194 |

|---|

| 6/16 | $8,473 | $10,614 | $8,533 |

|---|

| 7/16 | $8,293 | $10,701 | $8,096 |

|---|

| 8/16 | $8,173 | $10,713 | $7,954 |

|---|

| 9/16 | $8,398 | $10,715 | $8,203 |

|---|

| 10/16 | $8,368 | $10,644 | $8,163 |

|---|

| 11/16 | $8,548 | $10,405 | $8,272 |

|---|

| 12/16 | $8,547 | $10,436 | $8,421 |

|---|

| 1/17 | $8,803 | $10,473 | $8,432 |

|---|

| 2/17 | $8,819 | $10,553 | $8,450 |

|---|

| 3/17 | $8,627 | $10,550 | $8,225 |

|---|

| 4/17 | $8,451 | $10,637 | $8,101 |

|---|

| 5/17 | $8,387 | $10,719 | $7,994 |

|---|

| 6/17 | $8,355 | $10,710 | $7,978 |

|---|

| 7/17 | $8,627 | $10,764 | $8,159 |

|---|

| 8/17 | $8,803 | $10,856 | $8,191 |

|---|

| 9/17 | $8,755 | $10,818 | $8,179 |

|---|

| 10/17 | $8,947 | $10,831 | $8,355 |

|---|

| 11/17 | $8,883 | $10,815 | $8,316 |

|---|

| 12/17 | $9,120 | $10,863 | $8,564 |

|---|

| 1/18 | $9,254 | $10,758 | $8,734 |

|---|

| 2/18 | $9,103 | $10,656 | $8,583 |

|---|

| 3/18 | $9,002 | $10,710 | $8,530 |

|---|

| 4/18 | $9,204 | $10,638 | $8,750 |

|---|

| 5/18 | $9,372 | $10,696 | $8,874 |

|---|

| 6/18 | $9,019 | $10,681 | $8,564 |

|---|

| 7/18 | $8,750 | $10,703 | $8,381 |

|---|

| 8/18 | $8,581 | $10,756 | $8,233 |

|---|

| 9/18 | $8,716 | $10,710 | $8,391 |

|---|

| 10/18 | $8,548 | $10,620 | $8,210 |

|---|

| 11/18 | $8,480 | $10,668 | $8,164 |

|---|

| 12/18 | $8,245 | $10,835 | $7,601 |

|---|

| 1/19 | $8,667 | $10,984 | $8,015 |

|---|

| 2/19 | $8,802 | $10,996 | $8,096 |

|---|

| 3/19 | $8,752 | $11,195 | $8,082 |

|---|

| 4/19 | $8,684 | $11,210 | $8,048 |

|---|

| 5/19 | $8,414 | $11,382 | $7,777 |

|---|

| 6/19 | $8,633 | $11,543 | $7,986 |

|---|

| 7/19 | $8,616 | $11,578 | $7,932 |

|---|

| 8/19 | $8,448 | $11,840 | $7,748 |

|---|

| 9/19 | $8,583 | $11,788 | $7,839 |

|---|

| 10/19 | $8,802 | $11,826 | $7,998 |

|---|

| 11/19 | $8,600 | $11,824 | $7,793 |

|---|

| 12/19 | $9,002 | $11,842 | $8,186 |

|---|

| 1/20 | $8,455 | $12,054 | $7,584 |

|---|

| 2/20 | $8,097 | $12,235 | $7,201 |

|---|

| 3/20 | $7,072 | $11,996 | $6,279 |

|---|

| 4/20 | $7,123 | $12,236 | $6,182 |

|---|

| 5/20 | $7,618 | $12,350 | $6,451 |

|---|

| 6/20 | $7,892 | $12,453 | $6,598 |

|---|

| 7/20 | $8,421 | $12,672 | $6,974 |

|---|

| 8/20 | $8,951 | $12,599 | $7,446 |

|---|

| 9/20 | $8,694 | $12,576 | $7,197 |

|---|

| 10/20 | $8,626 | $12,531 | $7,298 |

|---|

| 11/20 | $9,241 | $12,695 | $7,554 |

|---|

| 12/20 | $9,698 | $12,739 | $7,930 |

|---|

| 1/21 | $9,945 | $12,659 | $8,138 |

|---|

| 2/21 | $10,614 | $12,495 | $8,665 |

|---|

| 3/21 | $10,420 | $12,350 | $8,479 |

|---|

| 4/21 | $11,247 | $12,454 | $9,182 |

|---|

| 5/21 | $11,634 | $12,501 | $9,432 |

|---|

| 6/21 | $11,740 | $12,592 | $9,607 |

|---|

| 7/21 | $12,022 | $12,719 | $9,784 |

|---|

| 8/21 | $12,022 | $12,710 | $9,755 |

|---|

| 9/21 | $12,250 | $12,602 | $10,240 |

|---|

| 10/21 | $12,673 | $12,591 | $10,505 |

|---|

| 11/21 | $11,986 | $12,607 | $9,737 |

|---|

| 12/21 | $12,569 | $12,598 | $10,080 |

|---|

| 1/22 | $13,392 | $12,322 | $10,965 |

|---|

| 2/22 | $14,216 | $12,154 | $11,648 |

|---|

| 3/22 | $15,420 | $11,828 | $12,655 |

|---|

| 4/22 | $15,822 | $11,387 | $13,179 |

|---|

| 5/22 | $15,882 | $11,449 | $13,380 |

|---|

| 6/22 | $14,356 | $11,221 | $11,938 |

|---|

| 7/22 | $14,698 | $11,503 | $12,447 |

|---|

| 8/22 | $14,477 | $11,204 | $12,458 |

|---|

| 9/22 | $13,714 | $10,721 | $11,448 |

|---|

| 10/22 | $13,894 | $10,603 | $11,676 |

|---|

| 11/22 | $14,698 | $10,999 | $11,996 |

|---|

| 12/22 | $14,713 | $10,961 | $11,702 |

|---|

| 1/23 | $15,059 | $11,301 | $11,645 |

|---|

| 2/23 | $14,274 | $11,024 | $11,098 |

|---|

| 3/23 | $14,413 | $11,282 | $11,075 |

|---|

| 4/23 | $14,297 | $11,351 | $10,991 |

|---|

| 5/23 | $13,535 | $11,233 | $10,372 |

|---|

| 6/23 | $13,928 | $11,216 | $10,791 |

|---|

| 7/23 | $14,898 | $11,227 | $11,466 |

|---|

| 8/23 | $14,736 | $11,160 | $11,378 |

|---|

| 9/23 | $14,505 | $10,893 | $11,299 |

|---|

| 10/23 | $14,436 | $10,730 | $11,329 |

|---|

| 11/23 | $14,228 | $11,213 | $11,074 |

|---|

| 12/23 | $13,998 | $11,638 | $10,776 |

|---|

| 1/24 | $14,189 | $11,610 | $10,819 |

|---|

| 2/24 | $14,117 | $11,471 | $10,660 |

|---|

| 3/24 | $14,786 | $11,584 | $11,013 |

|---|

| 4/24 | $15,359 | $11,313 | $11,309 |

|---|

| 5/24 | $15,574 | $11,500 | $11,507 |

|---|

| 6/24 | $15,311 | $11,606 | $11,330 |

|---|

| 7/24 | $14,810 | $11,869 | $10,873 |

|---|

| 8/24 | $14,858 | $12,044 | $10,878 |

|---|

| 9/24 | $15,502 | $12,209 | $11,407 |

|---|

| 10/24 | $15,264 | $11,932 | $11,196 |

|---|

| 11/24 | $15,407 | $12,057 | $11,241 |

|---|

| 12/24 | $15,345 | $11,875 | $11,356 |

|---|

Average Annual Total Returns (%)Footnote Reference1

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 9.69% | 11.26% | 4.72% |

|---|

| Class A with 3.25% Maximum Sales Charge | 6.07% | 10.51% | 4.37% |

|---|

| Bloomberg U.S. Universal Index | 2.04% | 0.06% | 1.73% |

|---|

| Bloomberg Commodity Index Total Return | 5.38% | 6.76% | 1.28% |

|---|

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the Bloomberg U.S. Universal Index effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $1,430,233,441 |

|---|

| # of Portfolio Holdings (including derivatives) | 88 |

|---|

| Portfolio Turnover Rate | 0% |

|---|

| Total Advisory Fees Paid | $7,020,256 |

|---|

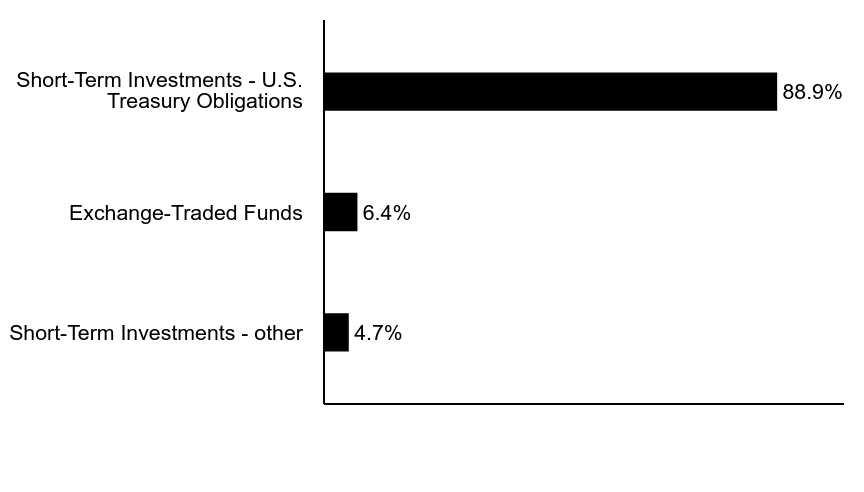

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments - other | 4.7% |

| Exchange-Traded Funds | 6.4% |

| Short-Term Investments - U.S. Treasury Obligations | 88.9% |

Commodity Exposure (% of net assets)

| Agriculture | 26.6% |

| Energy | 25.7% |

| Industrial Metals | 23.8% |

| Precious Metals | 17.5% |

| Livestock | 6.3% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/parametric-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-260-0761 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Parametric Commodity Strategy Fund

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Parametric Commodity Strategy Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/parametric-fund-documents.php. You can also request this information by contacting us at 1-800-260-0761.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $69 | 0.66% |

|---|

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the Bloomberg Commodity Index Total Return (the Index):

↑ The Fund’s exposure to cocoa helped Index-relative returns amid adverse weather conditions in the Ivory Coast and Ghana that sent commodity prices soaring during the period

↑ The Fund’s exposure to Robusta coffee contributed to Index-relative performance, as poor weather conditions in key growing regions generated crop shortages

↑ Contract selections in natural gas contributed to Fund performance relative to the Index ― primarily the result of a significant drop in natural gas spot prices during the first quarter of 2024

↓ The Fund’s underweight exposure to gold detracted from Index-relative returns, as the U.S. Federal Reserve’s easing monetary policy helped lift gold prices

↓ An underweight exposure to crude oil hurt Index-relative returns, as oil prices increased due, in part, to escalating geopolitical tensions in the Middle East

↓ The Fund’s exposure to palladium hampered Index-relative returns, partially due to the market’s expectation of a 2025 inventory surplus of the precious metal

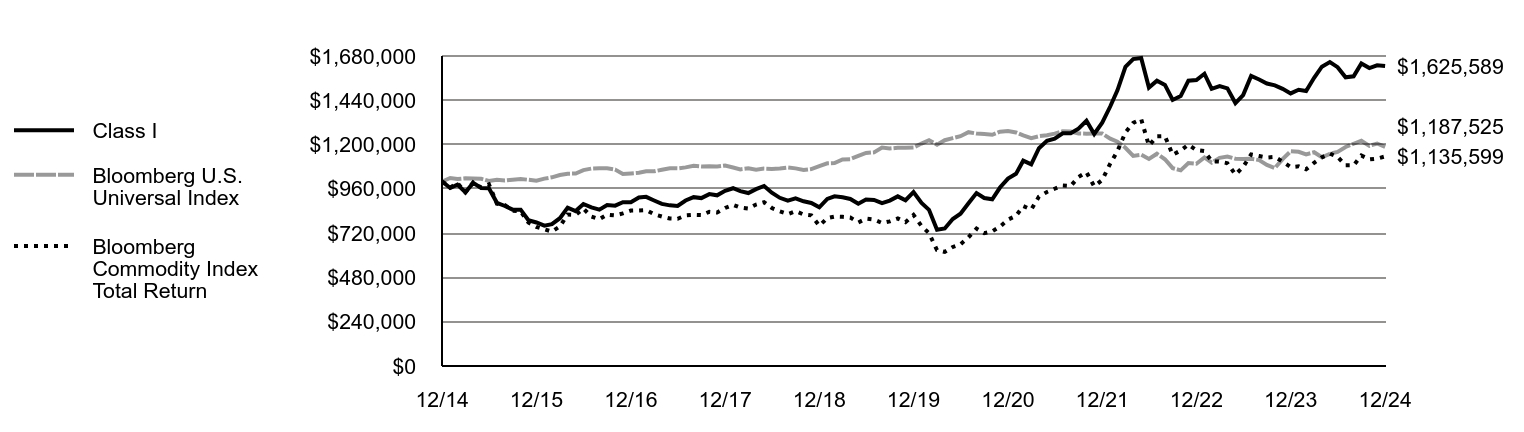

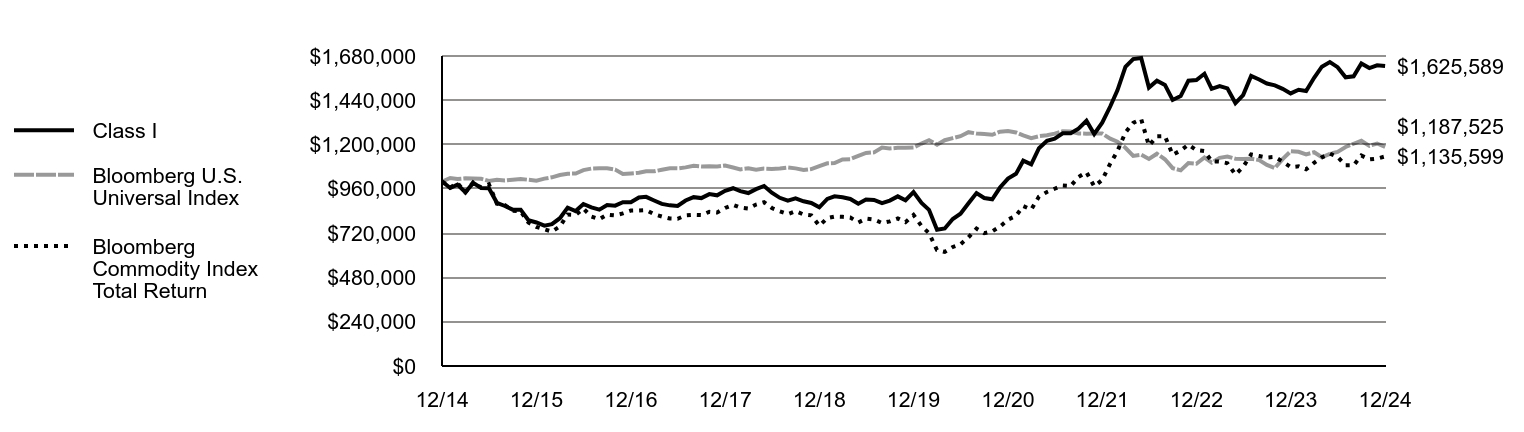

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg U.S. Universal Index | Bloomberg Commodity Index Total Return |

|---|

| 12/14 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| 1/15 | $964,506 | $1,019,035 | $966,598 |

|---|

| 2/15 | $983,025 | $1,013,096 | $991,500 |

|---|

| 3/15 | $941,359 | $1,017,278 | $940,574 |

|---|

| 4/15 | $992,282 | $1,016,097 | $994,505 |

|---|

| 5/15 | $964,505 | $1,014,320 | $967,672 |

|---|

| 6/15 | $962,961 | $1,002,999 | $984,387 |

|---|

| 7/15 | $884,256 | $1,008,840 | $879,855 |

|---|

| 8/15 | $867,280 | $1,005,867 | $871,771 |

|---|

| 9/15 | $847,219 | $1,009,805 | $841,981 |

|---|

| 10/15 | $847,217 | $1,013,032 | $838,224 |

|---|

| 11/15 | $790,117 | $1,009,338 | $777,417 |

|---|

| 12/15 | $777,773 | $1,004,296 | $753,428 |

|---|

| 1/16 | $760,799 | $1,015,382 | $740,766 |

|---|

| 2/16 | $768,516 | $1,022,595 | $728,717 |

|---|

| 3/16 | $800,923 | $1,035,127 | $756,566 |

|---|

| 4/16 | $858,020 | $1,042,180 | $820,966 |

|---|

| 5/16 | $839,501 | $1,042,994 | $819,415 |

|---|

| 6/16 | $878,084 | $1,061,356 | $853,263 |

|---|

| 7/16 | $859,565 | $1,070,102 | $809,649 |

|---|

| 8/16 | $847,219 | $1,071,256 | $795,382 |

|---|

| 9/16 | $871,908 | $1,071,510 | $820,293 |

|---|

| 10/16 | $868,821 | $1,064,402 | $816,286 |

|---|

| 11/16 | $887,340 | $1,040,477 | $827,172 |

|---|

| 12/16 | $886,978 | $1,043,568 | $842,081 |

|---|

| 1/17 | $913,309 | $1,047,250 | $843,222 |

|---|

| 2/17 | $916,599 | $1,055,330 | $844,983 |

|---|

| 3/17 | $896,851 | $1,054,976 | $822,494 |

|---|

| 4/17 | $878,748 | $1,063,730 | $810,110 |

|---|

| 5/17 | $870,520 | $1,071,937 | $799,350 |

|---|

| 6/17 | $867,229 | $1,071,028 | $797,813 |

|---|

| 7/17 | $896,849 | $1,076,363 | $815,853 |

|---|

| 8/17 | $914,949 | $1,085,649 | $819,141 |

|---|

| 9/17 | $910,012 | $1,081,828 | $817,920 |

|---|

| 10/17 | $931,405 | $1,083,127 | $835,459 |

|---|

| 11/17 | $924,821 | $1,081,488 | $831,605 |

|---|

| 12/17 | $949,589 | $1,086,256 | $856,433 |

|---|

| 1/18 | $963,453 | $1,075,803 | $873,441 |

|---|

| 2/18 | $947,857 | $1,065,602 | $858,335 |

|---|

| 3/18 | $937,458 | $1,070,977 | $853,000 |

|---|

| 4/18 | $958,253 | $1,063,831 | $875,046 |

|---|

| 5/18 | $975,582 | $1,069,632 | $887,442 |

|---|

| 6/18 | $939,193 | $1,068,081 | $856,417 |

|---|

| 7/18 | $911,469 | $1,070,316 | $838,139 |

|---|

| 8/18 | $895,873 | $1,075,589 | $823,299 |

|---|

| 9/18 | $908,005 | $1,070,981 | $839,087 |

|---|

| 10/18 | $892,410 | $1,062,021 | $820,973 |

|---|

| 11/18 | $883,747 | $1,066,798 | $816,350 |

|---|

| 12/18 | $859,929 | $1,083,488 | $760,123 |

|---|

| 1/19 | $905,372 | $1,098,427 | $801,523 |

|---|

| 2/19 | $919,354 | $1,099,625 | $809,637 |

|---|

| 3/19 | $914,110 | $1,119,481 | $808,192 |

|---|

| 4/19 | $905,373 | $1,121,048 | $804,785 |

|---|

| 5/19 | $879,154 | $1,138,221 | $777,708 |

|---|

| 6/19 | $901,875 | $1,154,320 | $798,593 |

|---|

| 7/19 | $900,125 | $1,157,756 | $793,222 |

|---|

| 8/19 | $882,648 | $1,183,953 | $774,823 |

|---|

| 9/19 | $896,632 | $1,178,824 | $783,924 |

|---|

| 10/19 | $919,355 | $1,182,633 | $799,775 |

|---|

| 11/19 | $898,380 | $1,182,396 | $779,296 |

|---|

| 12/19 | $942,321 | $1,184,158 | $818,583 |

|---|

| 1/20 | $883,759 | $1,205,411 | $758,361 |

|---|

| 2/20 | $846,491 | $1,223,460 | $720,138 |

|---|

| 3/20 | $738,241 | $1,199,562 | $627,895 |

|---|

| 4/20 | $745,341 | $1,223,591 | $618,235 |

|---|

| 5/20 | $796,804 | $1,235,019 | $645,069 |

|---|

| 6/20 | $825,197 | $1,245,324 | $659,792 |

|---|

| 7/20 | $881,986 | $1,267,199 | $697,449 |

|---|

| 8/20 | $936,998 | $1,259,892 | $744,619 |

|---|

| 9/20 | $910,379 | $1,257,621 | $719,664 |

|---|

| 10/20 | $903,282 | $1,253,126 | $729,802 |

|---|

| 11/20 | $967,170 | $1,269,479 | $755,436 |

|---|

| 12/20 | $1,015,753 | $1,273,862 | $793,012 |

|---|

| 1/21 | $1,041,374 | $1,265,856 | $813,834 |

|---|

| 2/21 | $1,112,752 | $1,249,522 | $866,493 |

|---|

| 3/21 | $1,092,622 | $1,234,981 | $847,890 |

|---|

| 4/21 | $1,180,470 | $1,245,366 | $918,186 |

|---|

| 5/21 | $1,220,736 | $1,250,116 | $943,237 |

|---|

| 6/21 | $1,231,716 | $1,259,230 | $960,699 |

|---|

| 7/21 | $1,260,996 | $1,271,874 | $978,362 |

|---|

| 8/21 | $1,260,996 | $1,271,025 | $975,469 |

|---|

| 9/21 | $1,286,618 | $1,260,171 | $1,024,001 |

|---|

| 10/21 | $1,328,713 | $1,259,141 | $1,050,462 |

|---|

| 11/21 | $1,257,336 | $1,260,662 | $973,667 |

|---|

| 12/21 | $1,318,492 | $1,259,812 | $1,007,991 |

|---|

| 1/22 | $1,406,252 | $1,232,192 | $1,096,480 |

|---|

| 2/22 | $1,494,012 | $1,215,392 | $1,164,788 |

|---|

| 3/22 | $1,621,474 | $1,182,784 | $1,265,507 |

|---|

| 4/22 | $1,663,264 | $1,138,670 | $1,317,908 |

|---|

| 5/22 | $1,669,533 | $1,144,935 | $1,338,005 |

|---|

| 6/22 | $1,508,639 | $1,122,056 | $1,193,841 |

|---|

| 7/22 | $1,546,251 | $1,150,267 | $1,244,729 |

|---|

| 8/22 | $1,523,266 | $1,120,364 | $1,245,825 |

|---|

| 9/22 | $1,441,774 | $1,072,095 | $1,144,808 |

|---|

| 10/22 | $1,462,670 | $1,060,331 | $1,167,603 |

|---|

| 11/22 | $1,546,251 | $1,099,867 | $1,199,573 |

|---|

| 12/22 | $1,550,055 | $1,096,132 | $1,170,209 |

|---|

| 1/23 | $1,583,752 | $1,130,134 | $1,164,475 |

|---|

| 2/23 | $1,501,917 | $1,102,365 | $1,109,757 |

|---|

| 3/23 | $1,516,359 | $1,128,225 | $1,107,471 |

|---|

| 4/23 | $1,504,324 | $1,135,118 | $1,099,149 |

|---|

| 5/23 | $1,424,896 | $1,123,349 | $1,037,198 |

|---|

| 6/23 | $1,468,220 | $1,121,603 | $1,079,093 |

|---|

| 7/23 | $1,571,718 | $1,122,718 | $1,146,605 |

|---|

| 8/23 | $1,552,462 | $1,115,957 | $1,137,820 |

|---|

| 9/23 | $1,530,800 | $1,089,347 | $1,129,920 |

|---|

| 10/23 | $1,521,172 | $1,072,965 | $1,132,921 |

|---|

| 11/23 | $1,501,917 | $1,121,254 | $1,107,400 |

|---|

| 12/23 | $1,477,358 | $1,163,799 | $1,077,615 |

|---|

| 1/24 | $1,497,322 | $1,161,014 | $1,081,903 |

|---|

| 2/24 | $1,489,835 | $1,147,094 | $1,065,988 |

|---|

| 3/24 | $1,562,206 | $1,158,357 | $1,101,253 |

|---|

| 4/24 | $1,622,099 | $1,131,288 | $1,130,887 |

|---|

| 5/24 | $1,647,054 | $1,150,040 | $1,150,741 |

|---|

| 6/24 | $1,619,603 | $1,160,553 | $1,133,042 |

|---|

| 7/24 | $1,564,701 | $1,186,895 | $1,087,312 |

|---|

| 8/24 | $1,569,693 | $1,204,368 | $1,087,841 |

|---|

| 9/24 | $1,639,568 | $1,220,886 | $1,140,727 |

|---|

| 10/24 | $1,614,612 | $1,193,156 | $1,119,587 |

|---|

| 11/24 | $1,629,585 | $1,205,735 | $1,124,141 |

|---|

| 12/24 | $1,625,589 | $1,187,525 | $1,135,599 |

|---|

Average Annual Total Returns (%)Footnote Reference1

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 10.03% | 11.51% | 4.97% |

|---|

| Bloomberg U.S. Universal Index | 2.04% | 0.06% | 1.73% |

|---|

| Bloomberg Commodity Index Total Return | 5.38% | 6.76% | 1.28% |

|---|

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund's primary benchmark to represent the overall applicable market, the Fund's primary prospectus benchmark changed to the Bloomberg U.S. Universal Index effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $1,430,233,441 |

|---|

| # of Portfolio Holdings (including derivatives) | 88 |

|---|

| Portfolio Turnover Rate | 0% |

|---|

| Total Advisory Fees Paid | $7,020,256 |

|---|

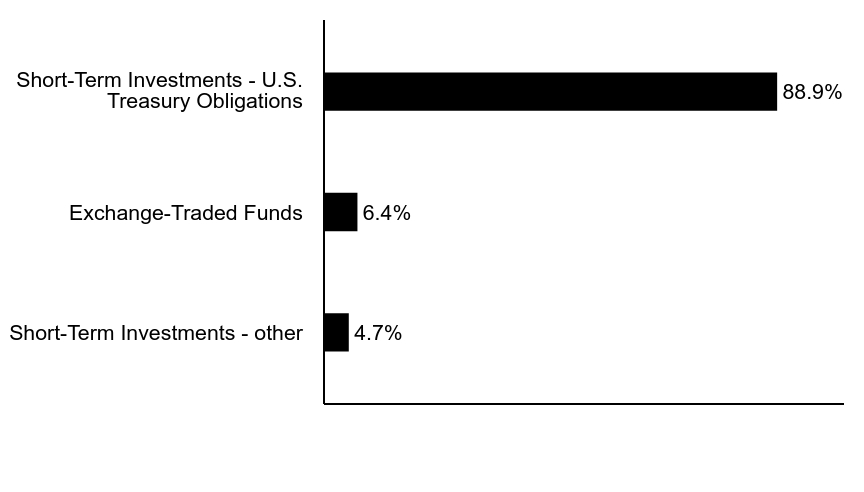

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments - other | 4.7% |

| Exchange-Traded Funds | 6.4% |

| Short-Term Investments - U.S. Treasury Obligations | 88.9% |

Commodity Exposure (% of net assets)

| Agriculture | 26.6% |

| Energy | 25.7% |

| Industrial Metals | 23.8% |

| Precious Metals | 17.5% |

| Livestock | 6.3% |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/parametric-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-260-0761 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Stock Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $113 | 0.98% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio, the Portfolio in which it invests. |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index):

↑ An overweight position in NVIDIA Corp., a major microchip supplier for artificial intelligence (AI) applications, helped returns as NVIDIA’s stock price soared

↑ An overweight position in Broadcom, Inc. aided relative returns as its stock price doubled on AI-driven demand for its semiconductor and software products

↑ An overweight position in global retail and grocery giant Walmart, Inc. rose in value as its core U.S. retail business gained market share during the period

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ An overweight position in managed care company Elevance Health, Inc. — sold during the period — hurt returns as rising Medicaid costs depressed its stock price

↓ An underweight position in electric car maker Tesla Inc. hurt relative returns as its stock rose on optimism over the potential launch of an autonomous vehicle

↓ Among sectors, stock selections in energy and real estate detracted from Fund performance relative to the Index during the period

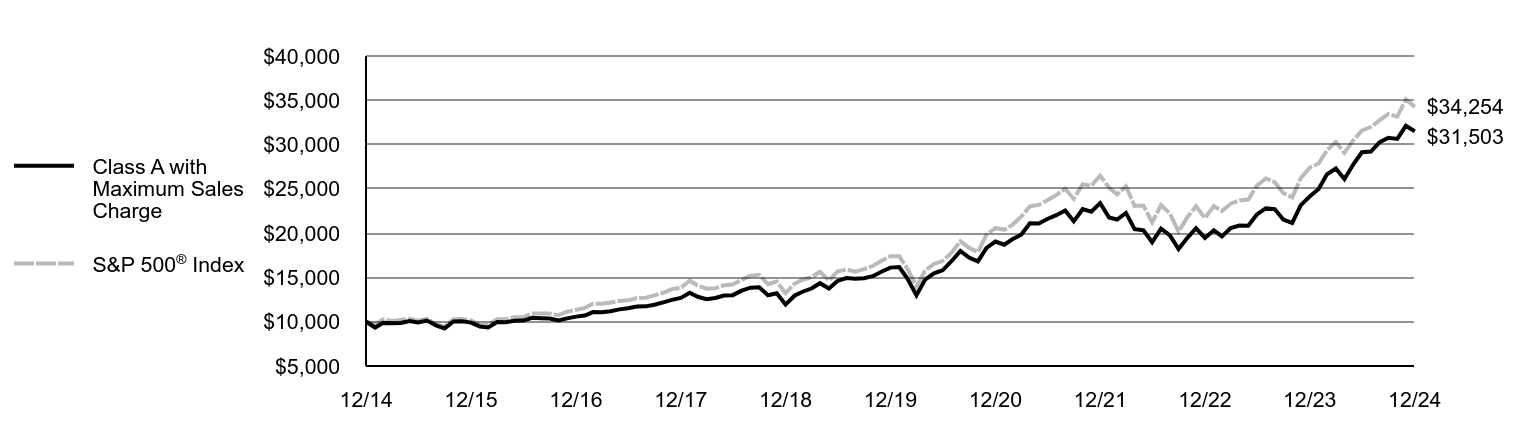

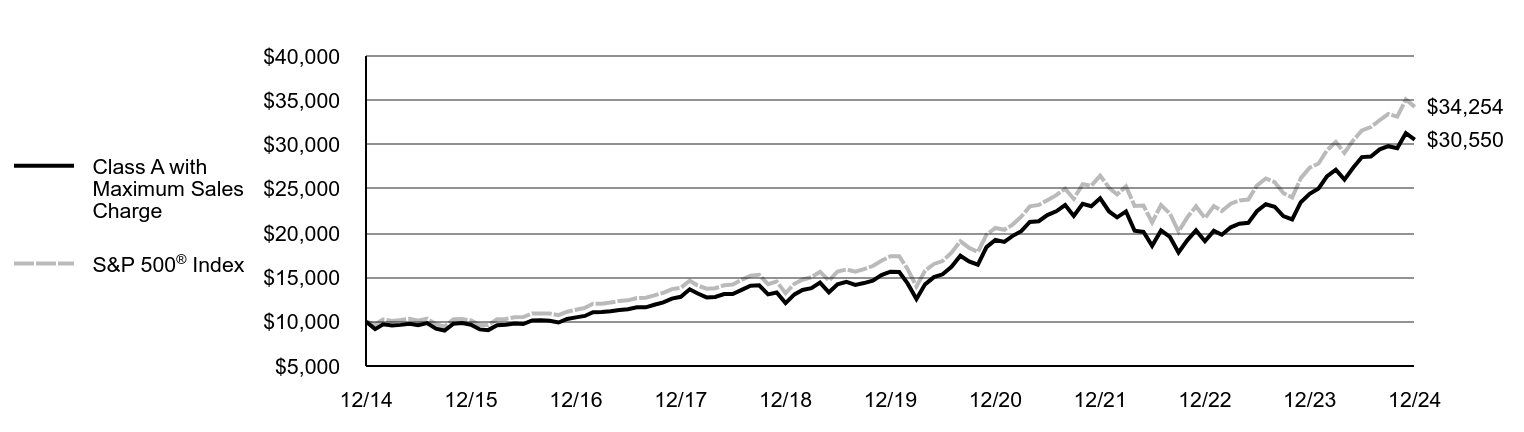

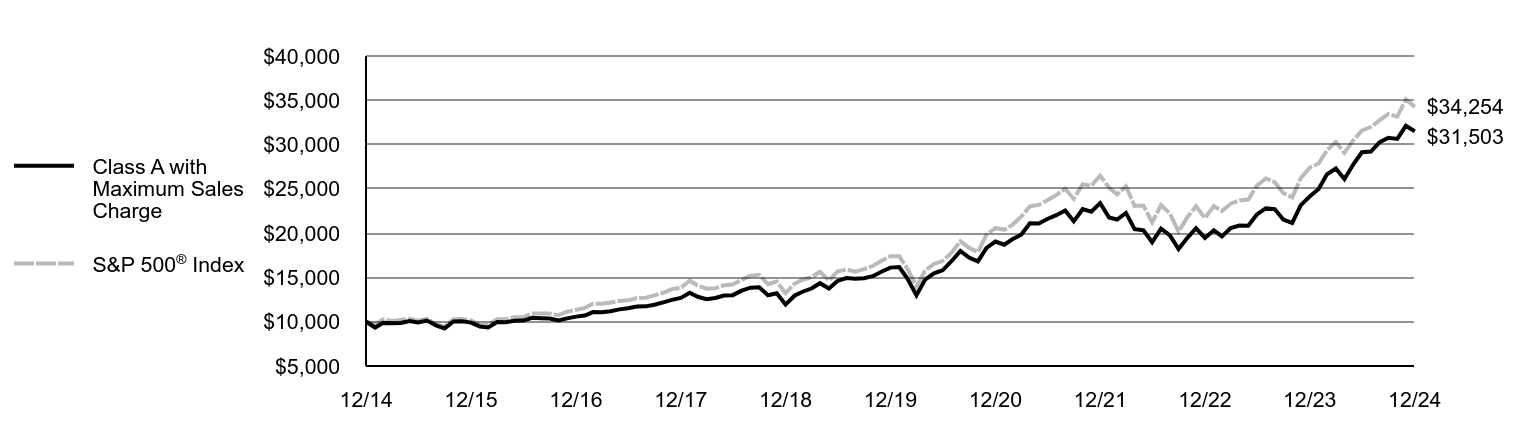

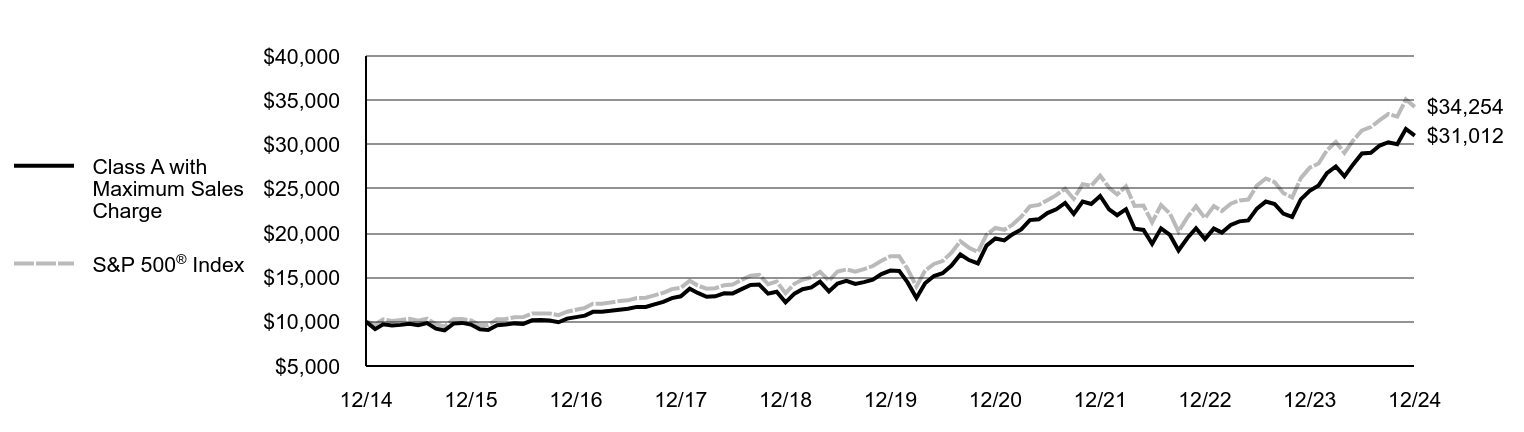

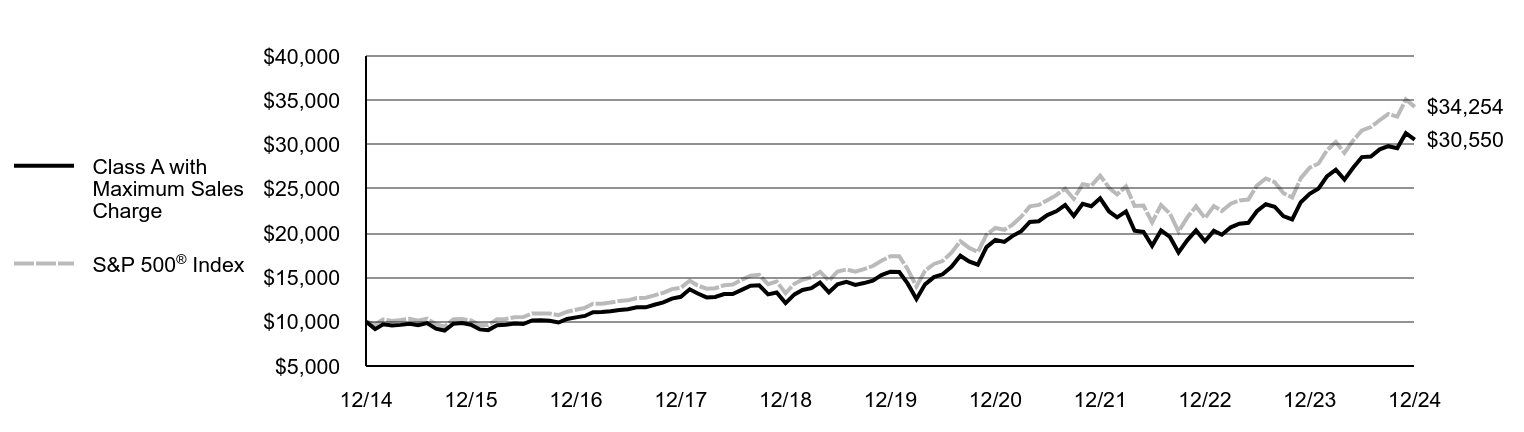

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | S&P 500® Index |

|---|

| 12/14 | $10,000 | $10,000 |

|---|

| 1/15 | $9,342 | $9,700 |

|---|

| 2/15 | $9,868 | $10,257 |

|---|

| 3/15 | $9,832 | $10,095 |

|---|

| 4/15 | $9,868 | $10,192 |

|---|

| 5/15 | $10,071 | $10,323 |

|---|

| 6/15 | $9,922 | $10,123 |

|---|

| 7/15 | $10,133 | $10,335 |

|---|

| 8/15 | $9,582 | $9,712 |

|---|

| 9/15 | $9,247 | $9,471 |

|---|

| 10/15 | $10,021 | $10,270 |

|---|

| 11/15 | $10,052 | $10,301 |

|---|

| 12/15 | $9,902 | $10,138 |

|---|

| 1/16 | $9,465 | $9,635 |

|---|

| 2/16 | $9,354 | $9,622 |

|---|

| 3/16 | $9,968 | $10,275 |

|---|

| 4/16 | $9,929 | $10,315 |

|---|

| 5/16 | $10,098 | $10,500 |

|---|

| 6/16 | $10,132 | $10,527 |

|---|

| 7/16 | $10,447 | $10,915 |

|---|

| 8/16 | $10,401 | $10,931 |

|---|

| 9/16 | $10,355 | $10,933 |

|---|

| 10/16 | $10,152 | $10,733 |

|---|

| 11/16 | $10,375 | $11,131 |

|---|

| 12/16 | $10,575 | $11,351 |

|---|

| 1/17 | $10,703 | $11,566 |

|---|

| 2/17 | $11,086 | $12,025 |

|---|

| 3/17 | $11,079 | $12,039 |

|---|

| 4/17 | $11,180 | $12,163 |

|---|

| 5/17 | $11,395 | $12,334 |

|---|

| 6/17 | $11,529 | $12,411 |

|---|

| 7/17 | $11,726 | $12,667 |

|---|

| 8/17 | $11,733 | $12,705 |

|---|

| 9/17 | $11,918 | $12,967 |

|---|

| 10/17 | $12,191 | $13,270 |

|---|

| 11/17 | $12,472 | $13,677 |

|---|

| 12/17 | $12,680 | $13,829 |

|---|

| 1/18 | $13,275 | $14,621 |

|---|

| 2/18 | $12,818 | $14,082 |

|---|

| 3/18 | $12,550 | $13,724 |

|---|

| 4/18 | $12,673 | $13,777 |

|---|

| 5/18 | $12,963 | $14,108 |

|---|

| 6/18 | $12,999 | $14,195 |

|---|

| 7/18 | $13,499 | $14,724 |

|---|

| 8/18 | $13,846 | $15,203 |

|---|

| 9/18 | $13,890 | $15,290 |

|---|

| 10/18 | $12,985 | $14,245 |

|---|

| 11/18 | $13,211 | $14,535 |

|---|

| 12/18 | $11,933 | $13,223 |

|---|

| 1/19 | $12,930 | $14,282 |

|---|

| 2/19 | $13,384 | $14,741 |

|---|

| 3/19 | $13,749 | $15,027 |

|---|

| 4/19 | $14,349 | $15,636 |

|---|

| 5/19 | $13,757 | $14,642 |

|---|

| 6/19 | $14,600 | $15,674 |

|---|

| 7/19 | $14,925 | $15,899 |

|---|

| 8/19 | $14,852 | $15,648 |

|---|

| 9/19 | $14,908 | $15,940 |

|---|

| 10/19 | $15,143 | $16,286 |

|---|

| 11/19 | $15,638 | $16,877 |

|---|

| 12/19 | $16,110 | $17,386 |

|---|

| 1/20 | $16,178 | $17,379 |

|---|

| 2/20 | $14,837 | $15,949 |

|---|

| 3/20 | $12,974 | $13,979 |

|---|

| 4/20 | $14,753 | $15,771 |

|---|

| 5/20 | $15,470 | $16,522 |

|---|

| 6/20 | $15,798 | $16,850 |

|---|

| 7/20 | $16,827 | $17,801 |

|---|

| 8/20 | $17,985 | $19,080 |

|---|

| 9/20 | $17,237 | $18,355 |

|---|

| 10/20 | $16,807 | $17,867 |

|---|

| 11/20 | $18,329 | $19,823 |

|---|

| 12/20 | $19,045 | $20,585 |

|---|

| 1/21 | $18,692 | $20,377 |

|---|

| 2/21 | $19,312 | $20,939 |

|---|

| 3/21 | $19,820 | $21,856 |

|---|

| 4/21 | $21,111 | $23,022 |

|---|

| 5/21 | $21,086 | $23,183 |

|---|

| 6/21 | $21,602 | $23,724 |

|---|

| 7/21 | $22,024 | $24,288 |

|---|

| 8/21 | $22,558 | $25,026 |

|---|

| 9/21 | $21,335 | $23,863 |

|---|

| 10/21 | $22,704 | $25,534 |

|---|

| 11/21 | $22,412 | $25,357 |

|---|

| 12/21 | $23,384 | $26,494 |

|---|

| 1/22 | $21,765 | $25,123 |

|---|

| 2/22 | $21,542 | $24,371 |

|---|

| 3/22 | $22,288 | $25,276 |

|---|

| 4/22 | $20,456 | $23,071 |

|---|

| 5/22 | $20,311 | $23,114 |

|---|

| 6/22 | $18,973 | $21,206 |

|---|

| 7/22 | $20,514 | $23,161 |

|---|

| 8/22 | $19,748 | $22,217 |

|---|

| 9/22 | $18,197 | $20,170 |

|---|

| 10/22 | $19,467 | $21,804 |

|---|

| 11/22 | $20,553 | $23,022 |

|---|

| 12/22 | $19,460 | $21,696 |

|---|

| 1/23 | $20,326 | $23,059 |

|---|

| 2/23 | $19,637 | $22,496 |

|---|

| 3/23 | $20,570 | $23,322 |

|---|

| 4/23 | $20,859 | $23,686 |

|---|

| 5/23 | $20,848 | $23,789 |

|---|

| 6/23 | $22,114 | $25,361 |

|---|

| 7/23 | $22,792 | $26,176 |

|---|

| 8/23 | $22,714 | $25,759 |

|---|

| 9/23 | $21,526 | $24,531 |

|---|

| 10/23 | $21,159 | $24,015 |

|---|

| 11/23 | $23,158 | $26,208 |

|---|

| 12/23 | $24,133 | $27,399 |

|---|

| 1/24 | $24,981 | $27,859 |

|---|

| 2/24 | $26,638 | $29,347 |

|---|

| 3/24 | $27,303 | $30,291 |

|---|

| 4/24 | $26,116 | $29,054 |

|---|

| 5/24 | $27,773 | $30,494 |

|---|

| 6/24 | $29,130 | $31,589 |

|---|

| 7/24 | $29,208 | $31,973 |

|---|

| 8/24 | $30,278 | $32,749 |

|---|

| 9/24 | $30,773 | $33,448 |

|---|

| 10/24 | $30,643 | $33,145 |

|---|

| 11/24 | $32,117 | $35,090 |

|---|

| 12/24 | $31,503 | $34,254 |

|---|

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 30.54% | 14.34% | 12.76% |

|---|

| Class A with 5.25% Maximum Sales Charge | 23.65% | 13.11% | 12.15% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $98,539,271 |

|---|

| # of Portfolio Holdings (for Stock Portfolio) | 56 |

|---|

| Portfolio Turnover Rate (for Stock Portfolio) | 44% |

|---|

| Total Advisory Fees Paid | $464,616 |

|---|

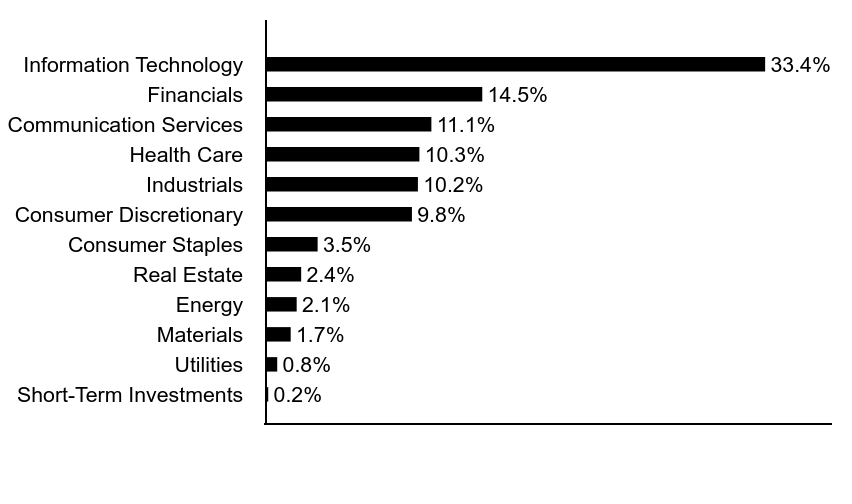

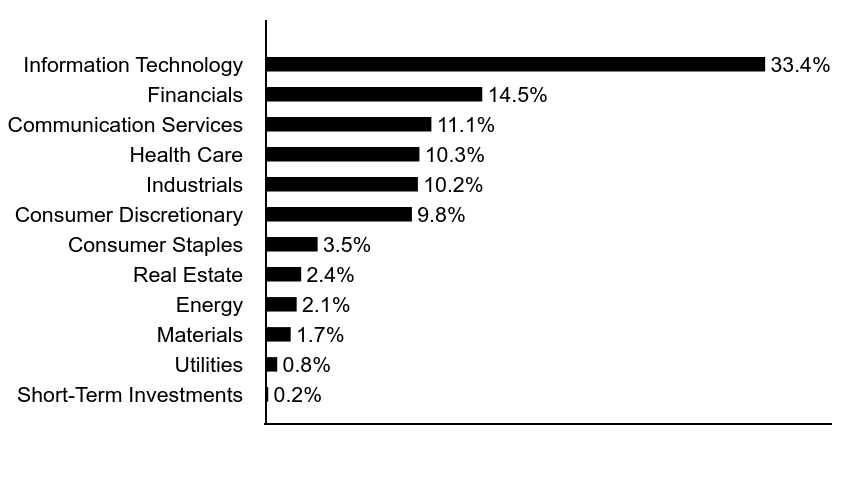

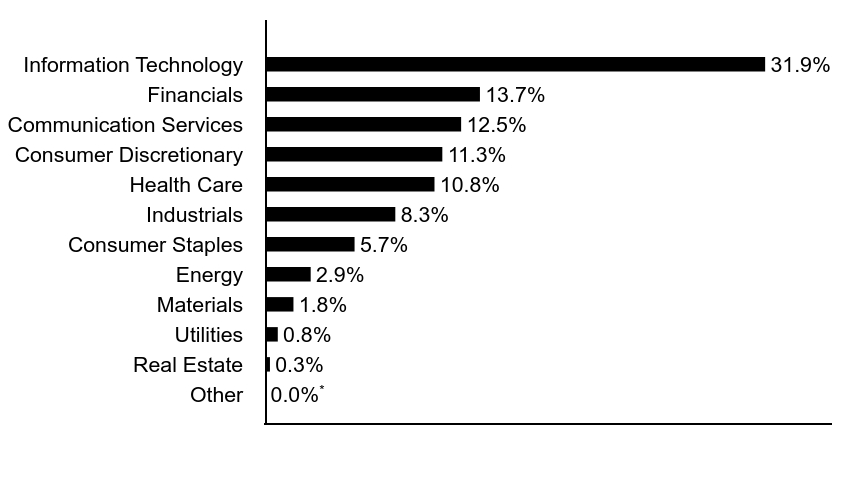

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio, an affiliated investment company in which the Fund invests substantially all of its assets.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 0.2% |

| Utilities | 0.8% |

| Materials | 1.7% |

| Energy | 2.1% |

| Real Estate | 2.4% |

| Consumer Staples | 3.5% |

| Consumer Discretionary | 9.8% |

| Industrials | 10.2% |

| Health Care | 10.3% |

| Communication Services | 11.1% |

| Financials | 14.5% |

| Information Technology | 33.4% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Apple, Inc. | 7.7% |

| Microsoft Corp. | 7.6% |

| NVIDIA Corp. | 7.4% |

| Amazon.com, Inc. | 5.4% |

| Alphabet, Inc., Class C | 4.5% |

| Broadcom, Inc. | 3.6% |

| Meta Platforms, Inc., Class A | 3.1% |

| Eli Lilly & Co. | 2.3% |

| Visa, Inc., Class A | 2.2% |

| ConocoPhillips | 2.1% |

| Total | 45.9% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Stock Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $199 | 1.73% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio, the Portfolio in which it invests. |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index):

↑ An overweight position in NVIDIA Corp., a major microchip supplier for artificial intelligence (AI) applications, helped returns as NVIDIA’s stock price soared

↑ An overweight position in Broadcom, Inc. aided relative returns as its stock price doubled on AI-driven demand for its semiconductor and software products

↑ An overweight position in global retail and grocery giant Walmart, Inc. rose in value as its core U.S. retail business gained market share during the period

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ An overweight position in managed care company Elevance Health, Inc. — sold during the period — hurt returns as rising Medicaid costs depressed its stock price

↓ An underweight position in electric car maker Tesla Inc. hurt relative returns as its stock rose on optimism over the potential launch of an autonomous vehicle

↓ Among sectors, stock selections in energy and real estate detracted from Fund performance relative to the Index during the period

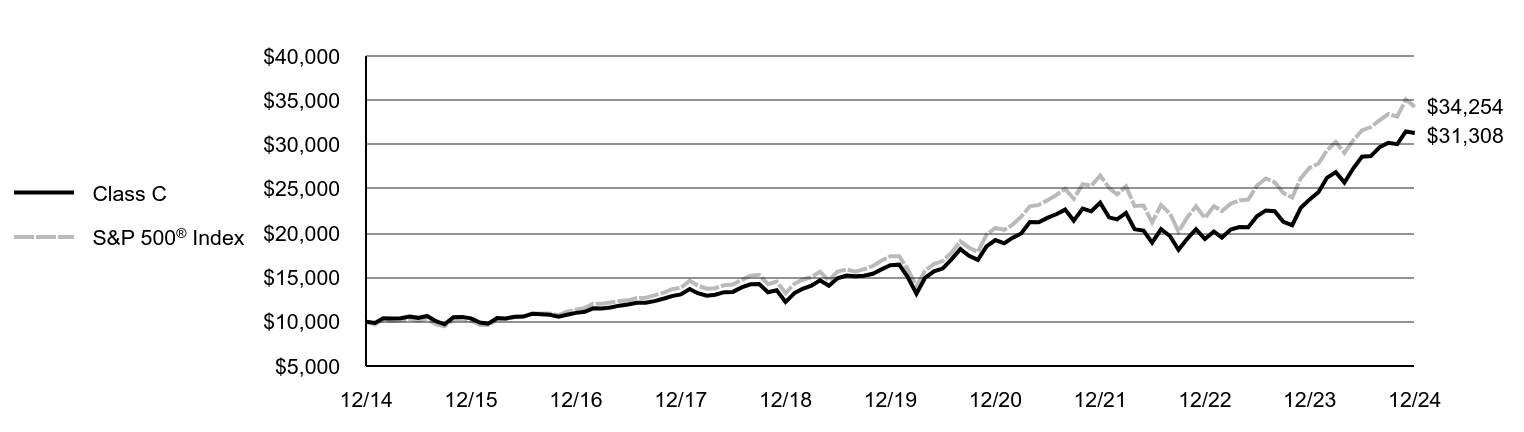

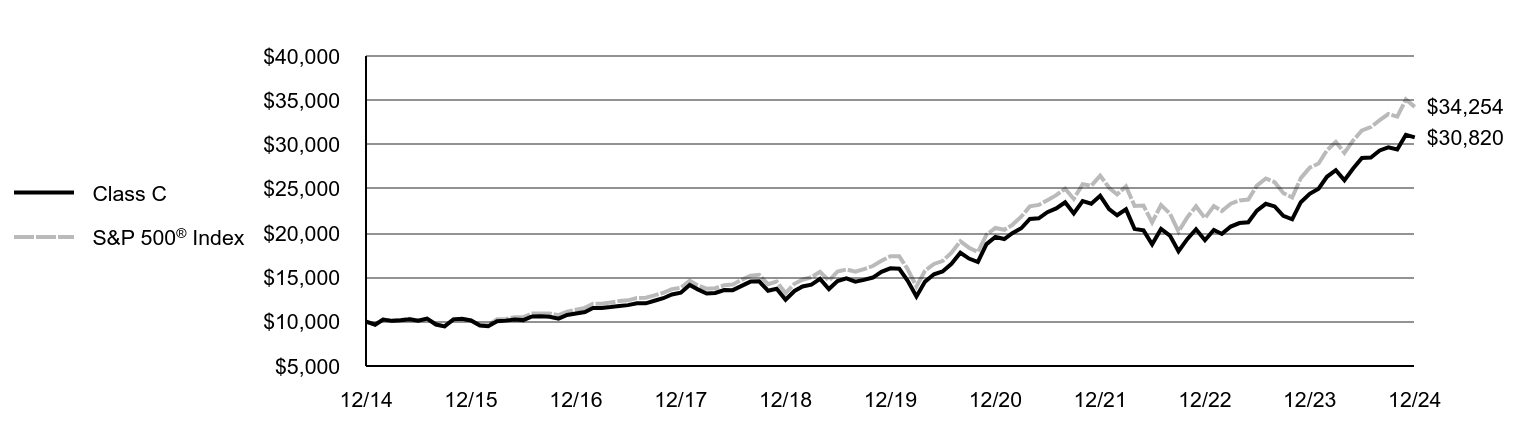

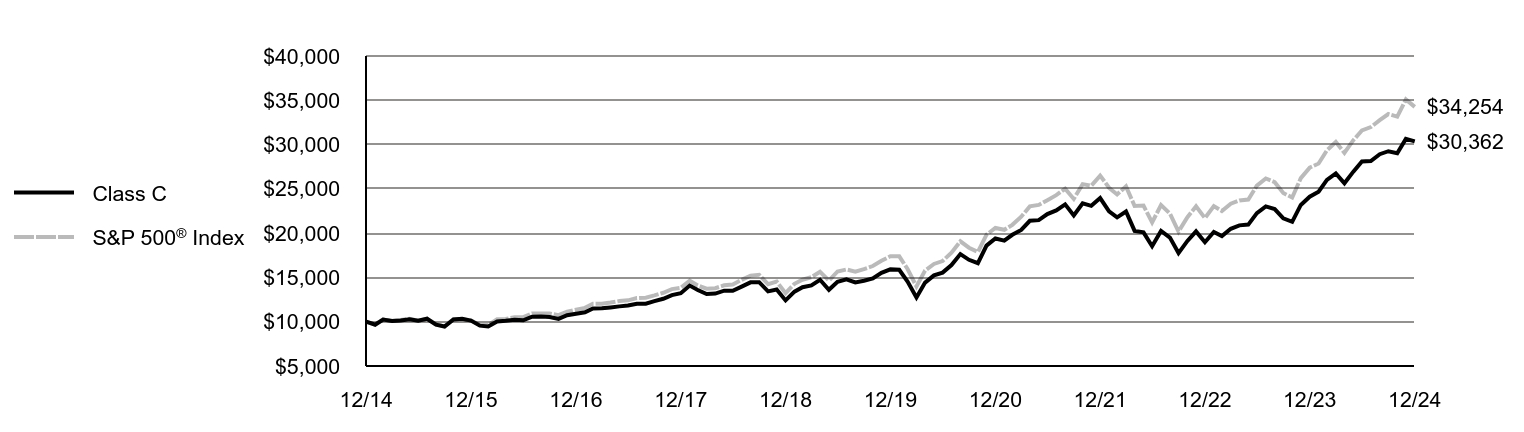

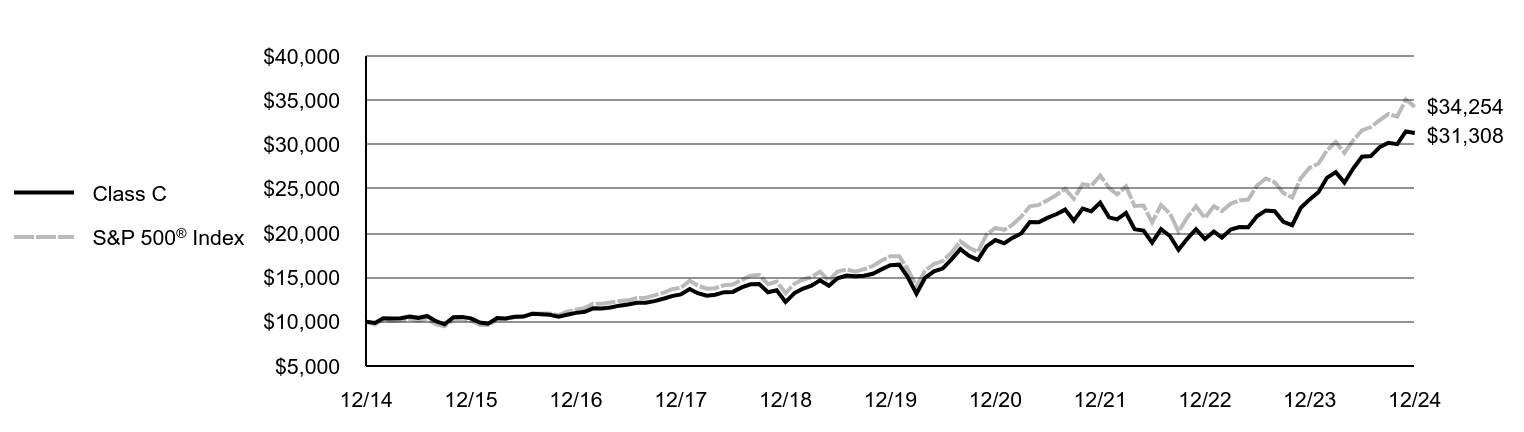

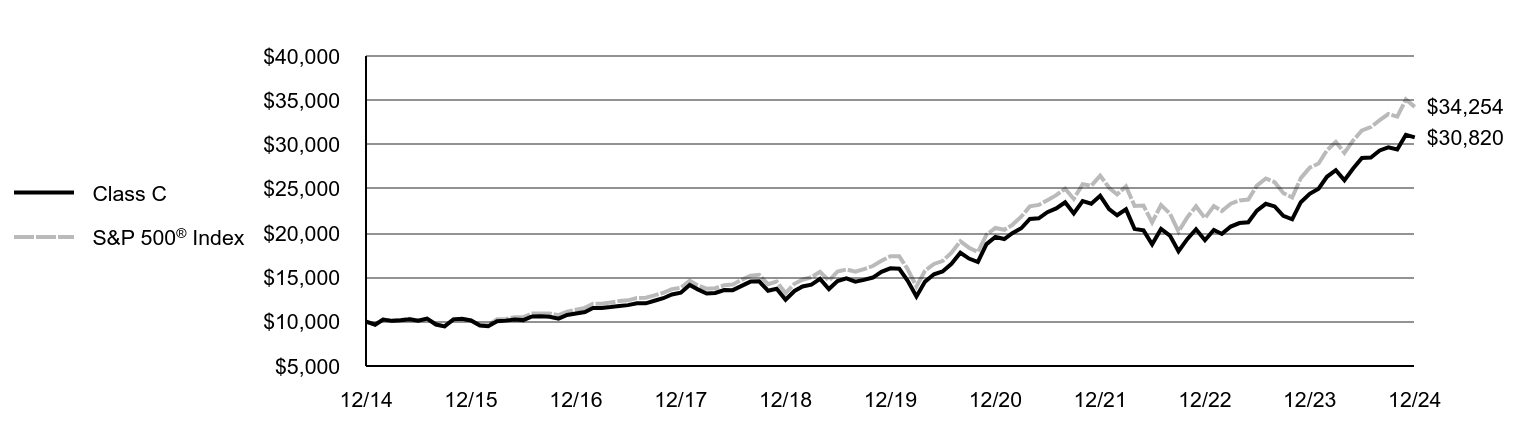

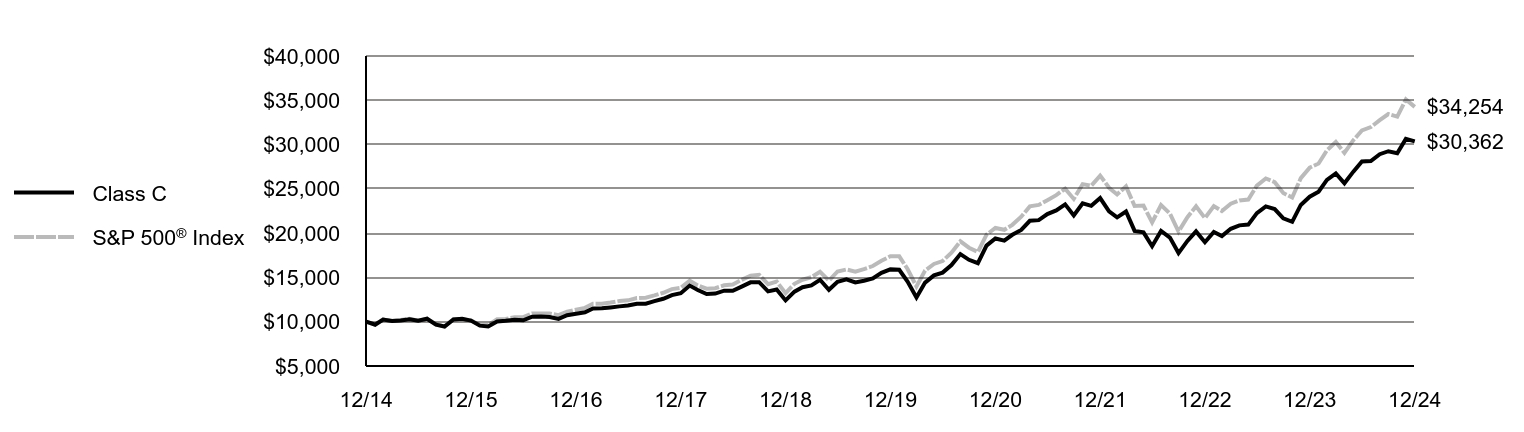

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | S&P 500® Index |

|---|

| 12/14 | $10,000 | $10,000 |

|---|

| 1/15 | $9,857 | $9,700 |

|---|

| 2/15 | $10,402 | $10,257 |

|---|

| 3/15 | $10,357 | $10,095 |

|---|

| 4/15 | $10,389 | $10,192 |

|---|

| 5/15 | $10,597 | $10,323 |

|---|

| 6/15 | $10,437 | $10,123 |

|---|

| 7/15 | $10,650 | $10,335 |

|---|

| 8/15 | $10,065 | $9,712 |

|---|

| 9/15 | $9,706 | $9,471 |

|---|

| 10/15 | $10,517 | $10,270 |

|---|

| 11/15 | $10,544 | $10,301 |

|---|

| 12/15 | $10,377 | $10,138 |

|---|

| 1/16 | $9,916 | $9,635 |

|---|

| 2/16 | $9,790 | $9,622 |

|---|

| 3/16 | $10,425 | $10,275 |

|---|

| 4/16 | $10,377 | $10,315 |

|---|

| 5/16 | $10,551 | $10,500 |

|---|

| 6/16 | $10,576 | $10,527 |

|---|

| 7/16 | $10,899 | $10,915 |

|---|

| 8/16 | $10,843 | $10,931 |

|---|

| 9/16 | $10,794 | $10,933 |

|---|

| 10/16 | $10,576 | $10,733 |

|---|

| 11/16 | $10,794 | $11,131 |

|---|

| 12/16 | $10,999 | $11,351 |

|---|

| 1/17 | $11,128 | $11,566 |

|---|

| 2/17 | $11,513 | $12,025 |

|---|

| 3/17 | $11,499 | $12,039 |

|---|

| 4/17 | $11,599 | $12,163 |

|---|

| 5/17 | $11,813 | $12,334 |

|---|

| 6/17 | $11,941 | $12,411 |

|---|

| 7/17 | $12,146 | $12,667 |

|---|

| 8/17 | $12,146 | $12,705 |

|---|

| 9/17 | $12,320 | $12,967 |

|---|

| 10/17 | $12,596 | $13,270 |

|---|

| 11/17 | $12,887 | $13,677 |

|---|

| 12/17 | $13,083 | $13,829 |

|---|

| 1/18 | $13,695 | $14,621 |

|---|

| 2/18 | $13,213 | $14,082 |

|---|

| 3/18 | $12,930 | $13,724 |

|---|

| 4/18 | $13,045 | $13,777 |

|---|

| 5/18 | $13,336 | $14,108 |

|---|

| 6/18 | $13,366 | $14,195 |

|---|

| 7/18 | $13,871 | $14,724 |

|---|

| 8/18 | $14,221 | $15,203 |

|---|

| 9/18 | $14,260 | $15,290 |

|---|

| 10/18 | $13,321 | $14,245 |

|---|

| 11/18 | $13,544 | $14,535 |

|---|

| 12/18 | $12,220 | $13,223 |

|---|

| 1/19 | $13,240 | $14,282 |

|---|

| 2/19 | $13,698 | $14,741 |

|---|

| 3/19 | $14,064 | $15,027 |

|---|

| 4/19 | $14,667 | $15,636 |

|---|

| 5/19 | $14,055 | $14,642 |

|---|

| 6/19 | $14,896 | $15,674 |

|---|

| 7/19 | $15,219 | $15,899 |

|---|

| 8/19 | $15,143 | $15,648 |

|---|

| 9/19 | $15,185 | $15,940 |

|---|

| 10/19 | $15,415 | $16,286 |

|---|

| 11/19 | $15,908 | $16,877 |

|---|

| 12/19 | $16,380 | $17,386 |

|---|

| 1/20 | $16,442 | $17,379 |

|---|

| 2/20 | $15,069 | $15,949 |

|---|

| 3/20 | $13,167 | $13,979 |

|---|

| 4/20 | $14,963 | $15,771 |

|---|

| 5/20 | $15,685 | $16,522 |

|---|

| 6/20 | $16,002 | $16,850 |

|---|

| 7/20 | $17,041 | $17,801 |

|---|

| 8/20 | $18,197 | $19,080 |

|---|

| 9/20 | $17,433 | $18,355 |

|---|

| 10/20 | $16,984 | $17,867 |

|---|

| 11/20 | $18,511 | $19,823 |

|---|

| 12/20 | $19,224 | $20,585 |

|---|

| 1/21 | $18,856 | $20,377 |

|---|

| 2/21 | $19,467 | $20,939 |

|---|

| 3/21 | $19,961 | $21,856 |

|---|

| 4/21 | $21,255 | $23,022 |

|---|

| 5/21 | $21,219 | $23,183 |

|---|

| 6/21 | $21,722 | $23,724 |

|---|

| 7/21 | $22,135 | $24,288 |

|---|

| 8/21 | $22,656 | $25,026 |

|---|

| 9/21 | $21,416 | $23,863 |

|---|

| 10/21 | $22,773 | $25,534 |

|---|

| 11/21 | $22,467 | $25,357 |

|---|

| 12/21 | $23,430 | $26,494 |

|---|

| 1/22 | $21,786 | $25,123 |

|---|

| 2/22 | $21,554 | $24,371 |

|---|

| 3/22 | $22,280 | $25,276 |

|---|

| 4/22 | $20,444 | $23,071 |

|---|

| 5/22 | $20,283 | $23,114 |

|---|

| 6/22 | $18,931 | $21,206 |

|---|

| 7/22 | $20,454 | $23,161 |

|---|

| 8/22 | $19,678 | $22,217 |

|---|

| 9/22 | $18,124 | $20,170 |

|---|

| 10/22 | $19,385 | $21,804 |

|---|

| 11/22 | $20,454 | $23,022 |

|---|

| 12/22 | $19,339 | $21,696 |

|---|

| 1/23 | $20,191 | $23,059 |

|---|

| 2/23 | $19,500 | $22,496 |

|---|

| 3/23 | $20,410 | $23,322 |

|---|

| 4/23 | $20,687 | $23,686 |

|---|

| 5/23 | $20,664 | $23,789 |

|---|

| 6/23 | $21,896 | $25,361 |

|---|

| 7/23 | $22,564 | $26,176 |

|---|

| 8/23 | $22,472 | $25,759 |

|---|

| 9/23 | $21,286 | $24,531 |

|---|

| 10/23 | $20,905 | $24,015 |

|---|

| 11/23 | $22,864 | $26,208 |

|---|

| 12/23 | $23,811 | $27,399 |

|---|

| 1/24 | $24,642 | $27,859 |

|---|

| 2/24 | $26,248 | $29,347 |

|---|

| 3/24 | $26,888 | $30,291 |

|---|

| 4/24 | $25,704 | $29,054 |

|---|

| 5/24 | $27,324 | $30,494 |

|---|

| 6/24 | $28,631 | $31,589 |

|---|

| 7/24 | $28,699 | $31,973 |

|---|

| 8/24 | $29,720 | $32,749 |

|---|

| 9/24 | $30,196 | $33,448 |

|---|

| 10/24 | $30,047 | $33,145 |

|---|

| 11/24 | $31,476 | $35,090 |

|---|

| 12/24 | $31,308 | $34,254 |

|---|

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class C, with conversion to Class A after 8 years | 29.61% | 13.49% | 12.08% |

|---|

| Class C, with 1% Maximum Deferred Sales Charge and conversion to Class A after 8 years | 28.61% | 13.49% | 12.08% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $98,539,271 |

|---|

| # of Portfolio Holdings (for Stock Portfolio) | 56 |

|---|

| Portfolio Turnover Rate (for Stock Portfolio) | 44% |

|---|

| Total Advisory Fees Paid | $464,616 |

|---|

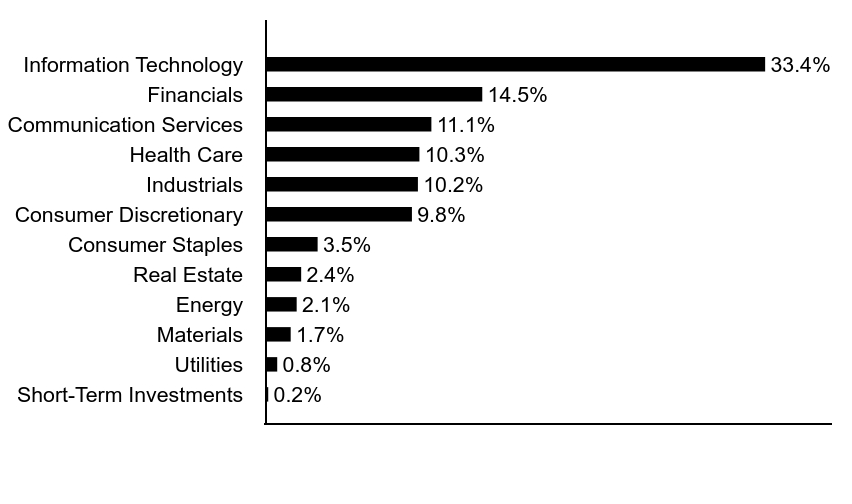

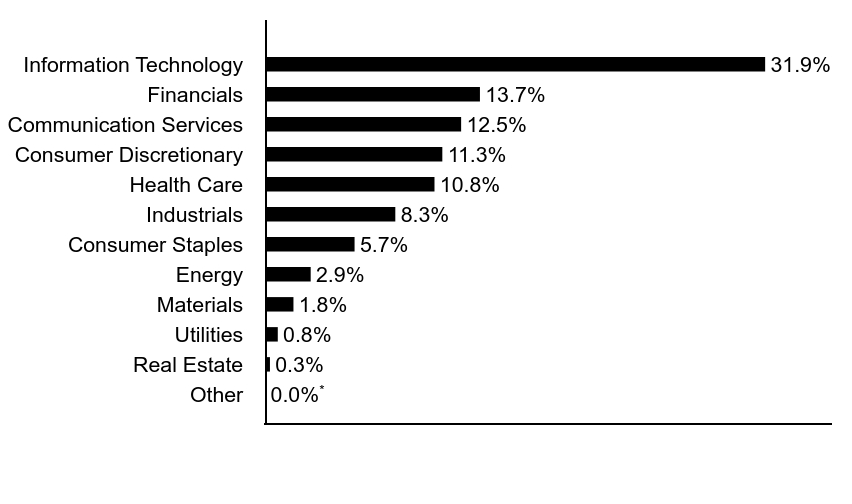

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio, an affiliated investment company in which the Fund invests substantially all of its assets.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 0.2% |

| Utilities | 0.8% |

| Materials | 1.7% |

| Energy | 2.1% |

| Real Estate | 2.4% |

| Consumer Staples | 3.5% |

| Consumer Discretionary | 9.8% |

| Industrials | 10.2% |

| Health Care | 10.3% |

| Communication Services | 11.1% |

| Financials | 14.5% |

| Information Technology | 33.4% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Apple, Inc. | 7.7% |

| Microsoft Corp. | 7.6% |

| NVIDIA Corp. | 7.4% |

| Amazon.com, Inc. | 5.4% |

| Alphabet, Inc., Class C | 4.5% |

| Broadcom, Inc. | 3.6% |

| Meta Platforms, Inc., Class A | 3.1% |

| Eli Lilly & Co. | 2.3% |

| Visa, Inc., Class A | 2.2% |

| ConocoPhillips | 2.1% |

| Total | 45.9% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Stock Fund for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $84 | 0.73% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and Stock Portfolio, the Portfolio in which it invests. |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index):

↑ An overweight position in NVIDIA Corp., a major microchip supplier for artificial intelligence (AI) applications, helped returns as NVIDIA’s stock price soared

↑ An overweight position in Broadcom, Inc. aided relative returns as its stock price doubled on AI-driven demand for its semiconductor and software products

↑ An overweight position in global retail and grocery giant Walmart, Inc. rose in value as its core U.S. retail business gained market share during the period

↑ Among sectors, stock selections and underweight exposures to health care and consumer staples, and stock selections in information technology, helped returns

↓ An overweight position in energy exploration and production firm ConocoPhillips fell in value as global energy demand and oil prices weakened during the period

↓ An overweight position in managed care company Elevance Health, Inc. — sold during the period — hurt returns as rising Medicaid costs depressed its stock price

↓ An underweight position in electric car maker Tesla Inc. hurt relative returns as its stock rose on optimism over the potential launch of an autonomous vehicle

↓ Among sectors, stock selections in energy and real estate detracted from Fund performance relative to the Index during the period

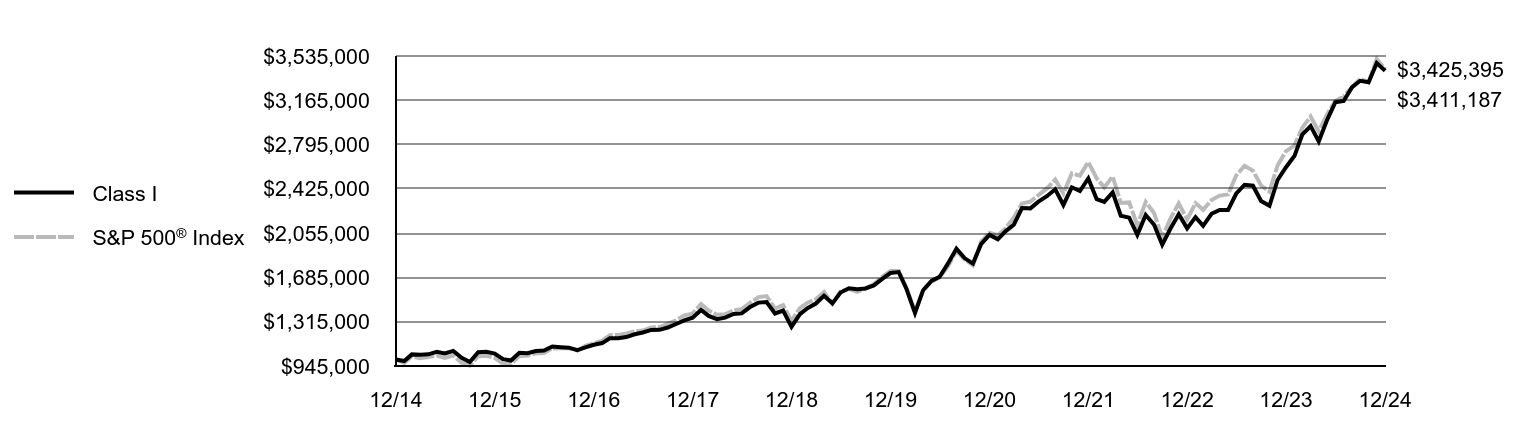

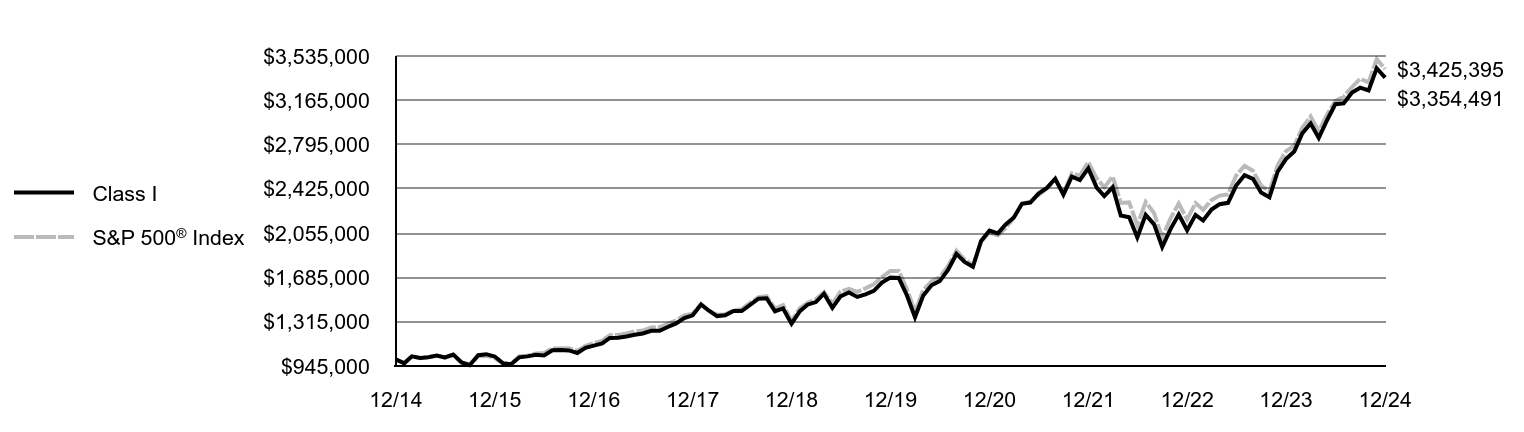

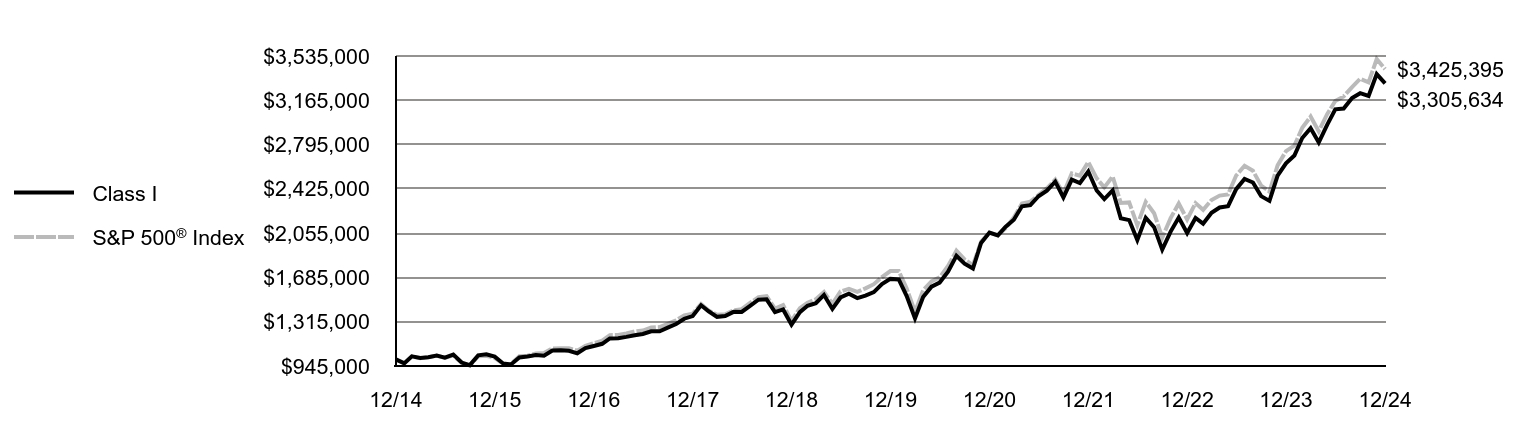

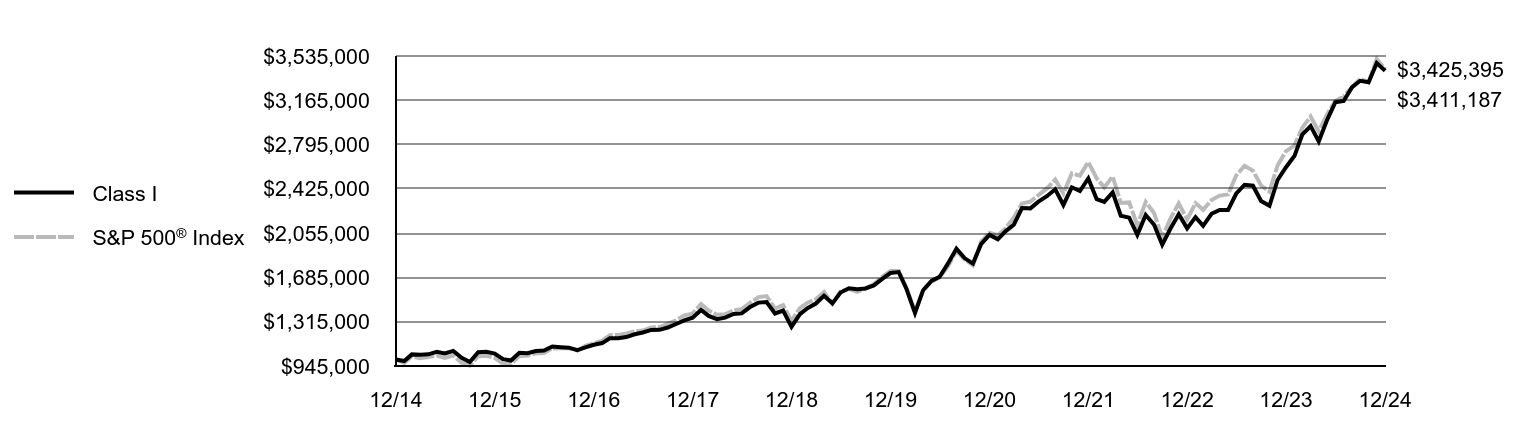

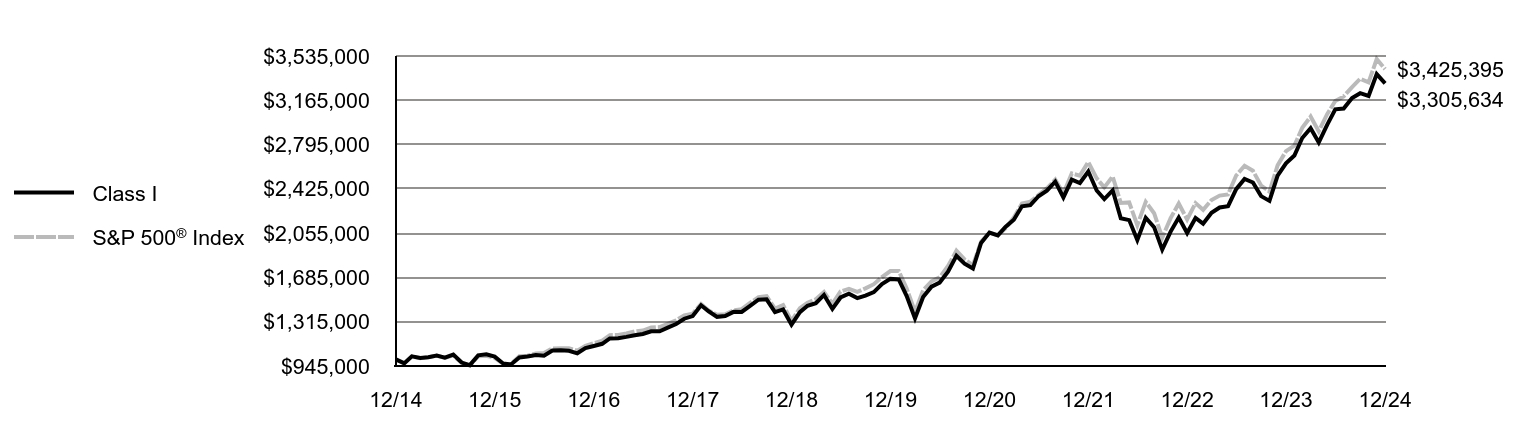

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | S&P 500® Index |

|---|

| 12/14 | $1,000,000 | $1,000,000 |

|---|

| 1/15 | $986,615 | $969,981 |

|---|

| 2/15 | $1,042,096 | $1,025,727 |

|---|

| 3/15 | $1,038,278 | $1,009,506 |

|---|

| 4/15 | $1,042,741 | $1,019,190 |

|---|

| 5/15 | $1,064,265 | $1,032,296 |

|---|

| 6/15 | $1,049,229 | $1,012,313 |

|---|

| 7/15 | $1,071,450 | $1,033,522 |

|---|

| 8/15 | $1,013,926 | $971,166 |

|---|

| 9/15 | $977,978 | $947,136 |

|---|

| 10/15 | $1,060,349 | $1,027,030 |

|---|

| 11/15 | $1,064,267 | $1,030,085 |

|---|

| 12/15 | $1,048,290 | $1,013,838 |

|---|

| 1/16 | $1,001,997 | $963,527 |

|---|

| 2/16 | $990,257 | $962,227 |

|---|

| 3/16 | $1,055,910 | $1,027,503 |

|---|

| 4/16 | $1,051,764 | $1,031,487 |

|---|

| 5/16 | $1,069,730 | $1,050,010 |

|---|

| 6/16 | $1,074,128 | $1,052,731 |

|---|

| 7/16 | $1,107,452 | $1,091,544 |

|---|

| 8/16 | $1,102,593 | $1,093,076 |

|---|

| 9/16 | $1,098,422 | $1,093,283 |

|---|

| 10/16 | $1,076,896 | $1,073,340 |

|---|

| 11/16 | $1,100,511 | $1,113,091 |

|---|

| 12/16 | $1,122,228 | $1,135,093 |

|---|

| 1/17 | $1,136,477 | $1,156,621 |

|---|

| 2/17 | $1,176,380 | $1,202,546 |

|---|

| 3/17 | $1,176,373 | $1,203,949 |

|---|

| 4/17 | $1,187,054 | $1,216,313 |

|---|

| 5/17 | $1,209,855 | $1,233,430 |

|---|

| 6/17 | $1,224,821 | $1,241,129 |

|---|

| 7/17 | $1,246,659 | $1,266,650 |

|---|

| 8/17 | $1,247,380 | $1,270,527 |

|---|

| 9/17 | $1,266,239 | $1,296,736 |

|---|

| 10/17 | $1,295,999 | $1,326,995 |

|---|

| 11/17 | $1,326,475 | $1,367,694 |

|---|

| 12/17 | $1,348,248 | $1,382,901 |

|---|

| 1/18 | $1,413,012 | $1,462,078 |

|---|

| 2/18 | $1,363,667 | $1,408,190 |

|---|

| 3/18 | $1,335,913 | $1,372,403 |

|---|

| 4/18 | $1,349,008 | $1,377,669 |

|---|

| 5/18 | $1,379,846 | $1,410,846 |

|---|

| 6/18 | $1,384,474 | $1,419,530 |

|---|

| 7/18 | $1,437,656 | $1,472,355 |

|---|

| 8/18 | $1,474,482 | $1,520,333 |

|---|

| 9/18 | $1,479,902 | $1,528,986 |

|---|

| 10/18 | $1,383,762 | $1,424,480 |

|---|

| 11/18 | $1,408,559 | $1,453,508 |

|---|

| 12/18 | $1,272,362 | $1,322,270 |

|---|

| 1/19 | $1,378,685 | $1,428,231 |

|---|

| 2/19 | $1,427,956 | $1,474,089 |

|---|

| 3/19 | $1,466,861 | $1,502,733 |

|---|

| 4/19 | $1,531,702 | $1,563,578 |

|---|

| 5/19 | $1,468,591 | $1,464,216 |

|---|

| 6/19 | $1,558,483 | $1,567,408 |

|---|

| 7/19 | $1,593,919 | $1,589,935 |

|---|

| 8/19 | $1,587,006 | $1,564,750 |

|---|

| 9/19 | $1,593,050 | $1,594,027 |

|---|

| 10/19 | $1,618,106 | $1,628,553 |

|---|

| 11/19 | $1,670,839 | $1,687,668 |

|---|

| 12/19 | $1,721,683 | $1,738,605 |

|---|

| 1/20 | $1,729,804 | $1,737,924 |

|---|

| 2/20 | $1,586,545 | $1,594,859 |

|---|

| 3/20 | $1,387,440 | $1,397,874 |

|---|

| 4/20 | $1,578,437 | $1,577,072 |

|---|

| 5/20 | $1,655,928 | $1,652,185 |

|---|

| 6/20 | $1,691,066 | $1,685,042 |

|---|

| 7/20 | $1,801,898 | $1,780,054 |

|---|

| 8/20 | $1,925,704 | $1,908,005 |

|---|

| 9/20 | $1,846,694 | $1,835,507 |

|---|

| 10/20 | $1,800,748 | $1,786,694 |

|---|

| 11/20 | $1,963,351 | $1,982,273 |

|---|

| 12/20 | $2,040,667 | $2,058,487 |

|---|

| 1/21 | $2,003,803 | $2,037,705 |

|---|

| 2/21 | $2,070,182 | $2,093,895 |

|---|

| 3/21 | $2,125,489 | $2,185,598 |

|---|

| 4/21 | $2,264,732 | $2,302,241 |

|---|

| 5/21 | $2,261,987 | $2,318,321 |

|---|

| 6/21 | $2,318,214 | $2,372,442 |

|---|

| 7/21 | $2,363,383 | $2,428,799 |

|---|

| 8/21 | $2,421,477 | $2,502,648 |

|---|

| 9/21 | $2,290,536 | $2,386,250 |

|---|

| 10/21 | $2,438,075 | $2,553,435 |

|---|

| 11/21 | $2,406,723 | $2,535,743 |

|---|

| 12/21 | $2,512,397 | $2,649,385 |

|---|

| 1/22 | $2,338,590 | $2,512,287 |

|---|

| 2/22 | $2,315,693 | $2,437,066 |

|---|

| 3/22 | $2,395,831 | $2,527,553 |

|---|

| 4/22 | $2,200,168 | $2,307,145 |

|---|

| 5/22 | $2,184,557 | $2,311,378 |

|---|

| 6/22 | $2,040,932 | $2,120,588 |

|---|

| 7/22 | $2,207,454 | $2,316,116 |

|---|

| 8/22 | $2,125,234 | $2,221,660 |

|---|

| 9/22 | $1,958,712 | $2,017,049 |

|---|

| 10/22 | $2,096,092 | $2,180,352 |

|---|

| 11/22 | $2,213,698 | $2,302,198 |

|---|

| 12/22 | $2,094,783 | $2,169,558 |

|---|

| 1/23 | $2,189,239 | $2,305,880 |

|---|

| 2/23 | $2,116,305 | $2,249,619 |

|---|

| 3/23 | $2,216,739 | $2,332,212 |

|---|

| 4/23 | $2,249,022 | $2,368,614 |

|---|

| 5/23 | $2,247,826 | $2,378,910 |

|---|

| 6/23 | $2,384,131 | $2,536,097 |

|---|

| 7/23 | $2,459,457 | $2,617,569 |

|---|

| 8/23 | $2,451,087 | $2,575,893 |

|---|

| 9/23 | $2,323,152 | $2,453,080 |

|---|

| 10/23 | $2,283,696 | $2,401,500 |

|---|

| 11/23 | $2,498,913 | $2,620,818 |

|---|

| 12/23 | $2,606,015 | $2,739,884 |

|---|

| 1/24 | $2,698,886 | $2,785,925 |

|---|

| 2/24 | $2,877,593 | $2,934,682 |

|---|

| 3/24 | $2,949,356 | $3,029,104 |

|---|

| 4/24 | $2,821,307 | $2,905,381 |

|---|

| 5/24 | $3,001,420 | $3,049,444 |

|---|

| 6/24 | $3,147,763 | $3,158,864 |

|---|

| 7/24 | $3,159,020 | $3,197,315 |

|---|

| 8/24 | $3,274,405 | $3,274,872 |

|---|

| 9/24 | $3,327,876 | $3,344,813 |

|---|

| 10/24 | $3,315,212 | $3,314,481 |

|---|

| 11/24 | $3,475,625 | $3,509,044 |

|---|

| 12/24 | $3,411,187 | $3,425,395 |

|---|

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 30.89% | 14.64% | 13.04% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $98,539,271 |

|---|

| # of Portfolio Holdings (for Stock Portfolio) | 56 |

|---|

| Portfolio Turnover Rate (for Stock Portfolio) | 44% |

|---|

| Total Advisory Fees Paid | $464,616 |

|---|

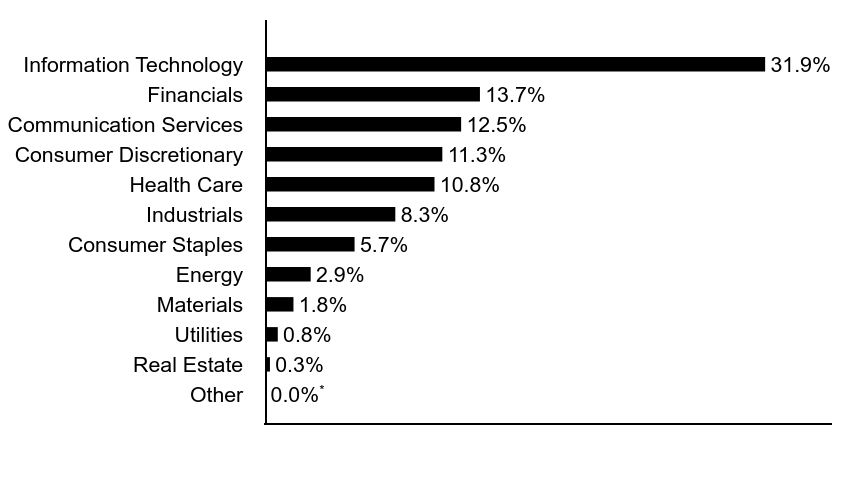

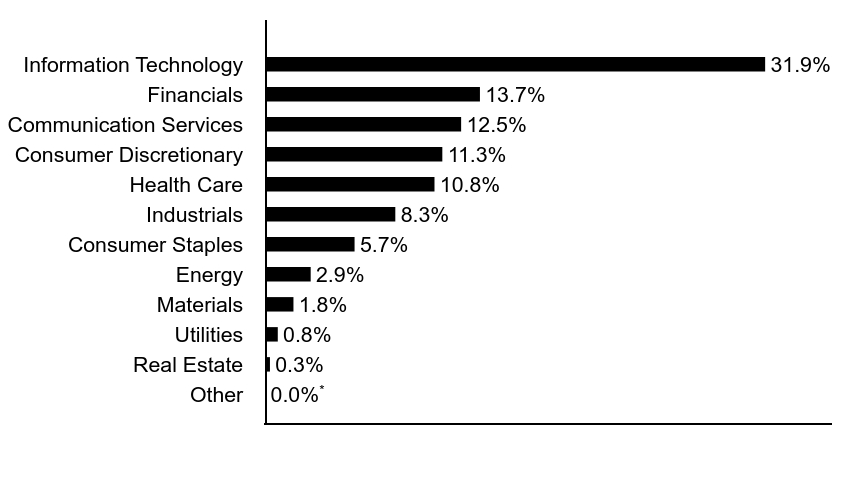

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of the investments of Stock Portfolio, an affiliated investment company in which the Fund invests substantially all of its assets.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Short-Term Investments | 0.2% |

| Utilities | 0.8% |

| Materials | 1.7% |

| Energy | 2.1% |

| Real Estate | 2.4% |

| Consumer Staples | 3.5% |

| Consumer Discretionary | 9.8% |

| Industrials | 10.2% |

| Health Care | 10.3% |

| Communication Services | 11.1% |

| Financials | 14.5% |

| Information Technology | 33.4% |

Top Ten Holdings (% of total investments)Footnote Referencea

| Apple, Inc. | 7.7% |

| Microsoft Corp. | 7.6% |

| NVIDIA Corp. | 7.4% |

| Amazon.com, Inc. | 5.4% |

| Alphabet, Inc., Class C | 4.5% |

| Broadcom, Inc. | 3.6% |

| Meta Platforms, Inc., Class A | 3.1% |

| Eli Lilly & Co. | 2.3% |

| Visa, Inc., Class A | 2.2% |

| ConocoPhillips | 2.1% |

| Total | 45.9% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Eaton Vance Tax-Managed Growth Fund 1.1

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Tax-Managed Growth Fund 1.1 for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $81 | 0.72% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and the Tax-Managed Growth Portfolio, the Portfolio in which it invests. |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index):

↑ An overweight position in online streaming service Netflix Inc. rose in value, driven by better-than-expected subscriber and revenue growth, and higher profits ↑ An overweight position in Meta Platforms Inc. — parent of Facebook and Instagram — grew in value as artificial intelligence (AI) investments drove revenue growth ↑ An overweight position in cloud-networking firm Arista Networks Inc. rose in value as data centers raised spending to meet computing demand from AI applications ↑ Among sectors, stock selections and an overweight exposure to communication services, and stock selections in health care and consumer staples helped returns ↓ An underweight position in electric car maker Tesla Inc. — sold by period-end — hurt returns as its stock price rose over optimism about autonomous vehicles ↓ An underweight position in Broadcom Inc. detracted from returns as its stock price doubled on AI-driven demand for its semiconductor and software products ↓ An overweight position in athletic apparel giant Nike Inc. lost value as the firm had trouble with increased competition and its shift to more wholesale sales ↓ Among sectors, stock selections in industrials, consumer discretionary, and information technology hurt Fund returns relative to the Index during the period

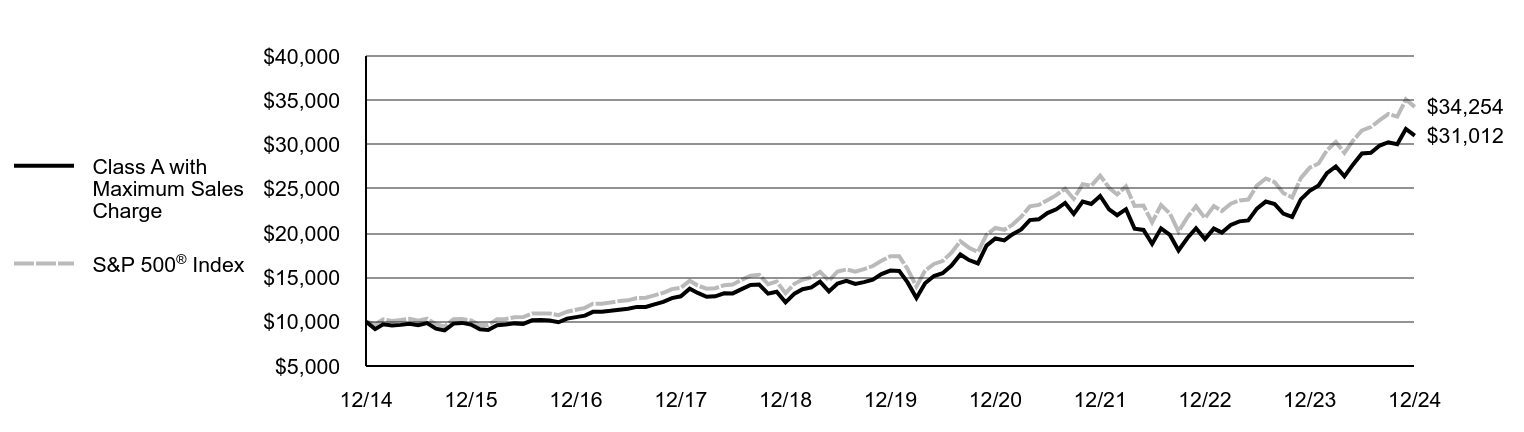

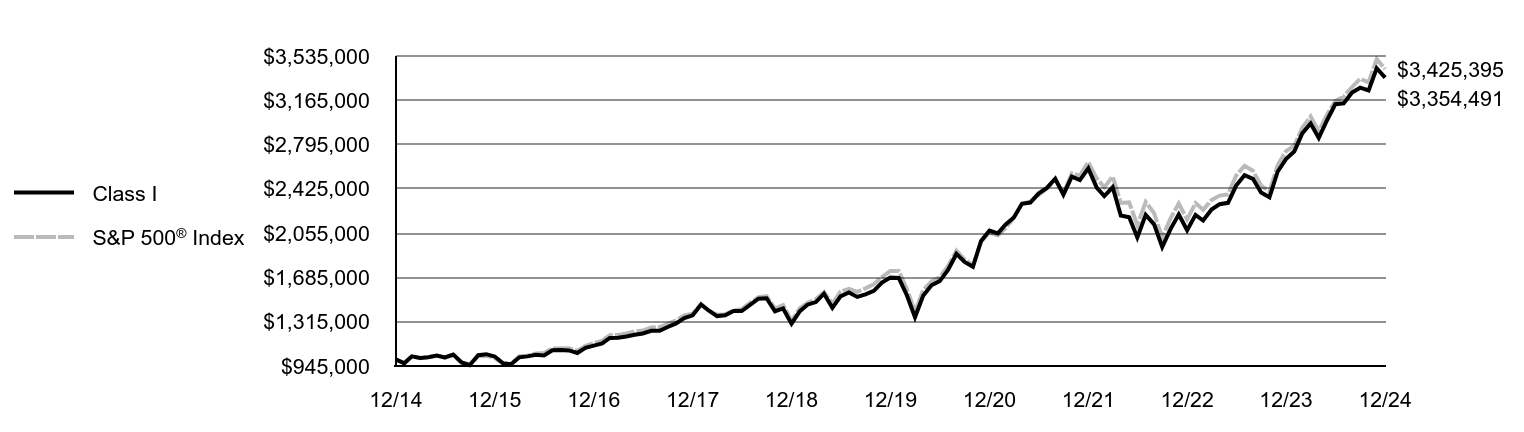

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | S&P 500® Index |

|---|

| 12/14 | $10,000 | $10,000 |

|---|

| 1/15 | $9,163 | $9,700 |

|---|

| 2/15 | $9,714 | $10,257 |

|---|

| 3/15 | $9,582 | $10,095 |

|---|

| 4/15 | $9,643 | $10,192 |

|---|

| 5/15 | $9,772 | $10,323 |

|---|

| 6/15 | $9,616 | $10,123 |

|---|

| 7/15 | $9,845 | $10,335 |

|---|

| 8/15 | $9,222 | $9,712 |

|---|

| 9/15 | $9,020 | $9,471 |

|---|

| 10/15 | $9,789 | $10,270 |

|---|

| 11/15 | $9,867 | $10,301 |

|---|

| 12/15 | $9,679 | $10,138 |

|---|

| 1/16 | $9,145 | $9,635 |

|---|

| 2/16 | $9,064 | $9,622 |

|---|

| 3/16 | $9,613 | $10,275 |

|---|

| 4/16 | $9,687 | $10,315 |

|---|

| 5/16 | $9,812 | $10,500 |

|---|

| 6/16 | $9,758 | $10,527 |

|---|

| 7/16 | $10,160 | $10,915 |

|---|

| 8/16 | $10,184 | $10,931 |

|---|

| 9/16 | $10,145 | $10,933 |

|---|

| 10/16 | $9,941 | $10,733 |

|---|

| 11/16 | $10,347 | $11,131 |

|---|

| 12/16 | $10,520 | $11,351 |

|---|

| 1/17 | $10,687 | $11,566 |

|---|

| 2/17 | $11,114 | $12,025 |

|---|

| 3/17 | $11,132 | $12,039 |

|---|

| 4/17 | $11,233 | $12,163 |

|---|

| 5/17 | $11,363 | $12,334 |

|---|

| 6/17 | $11,465 | $12,411 |

|---|

| 7/17 | $11,674 | $12,667 |

|---|

| 8/17 | $11,674 | $12,705 |

|---|

| 9/17 | $11,965 | $12,967 |

|---|

| 10/17 | $12,246 | $13,270 |

|---|

| 11/17 | $12,662 | $13,677 |

|---|

| 12/17 | $12,872 | $13,829 |

|---|

| 1/18 | $13,723 | $14,621 |

|---|

| 2/18 | $13,251 | $14,082 |

|---|

| 3/18 | $12,810 | $13,724 |

|---|

| 4/18 | $12,868 | $13,777 |

|---|

| 5/18 | $13,202 | $14,108 |

|---|

| 6/18 | $13,194 | $14,195 |

|---|

| 7/18 | $13,674 | $14,724 |

|---|

| 8/18 | $14,156 | $15,203 |

|---|

| 9/18 | $14,188 | $15,290 |

|---|

| 10/18 | $13,172 | $14,245 |

|---|

| 11/18 | $13,388 | $14,535 |

|---|

| 12/18 | $12,183 | $13,223 |

|---|

| 1/19 | $13,171 | $14,282 |

|---|

| 2/19 | $13,670 | $14,741 |

|---|

| 3/19 | $13,876 | $15,027 |

|---|

| 4/19 | $14,524 | $15,636 |

|---|

| 5/19 | $13,415 | $14,642 |

|---|

| 6/19 | $14,317 | $15,674 |

|---|

| 7/19 | $14,608 | $15,899 |

|---|

| 8/19 | $14,263 | $15,648 |

|---|

| 9/19 | $14,466 | $15,940 |

|---|

| 10/19 | $14,735 | $16,286 |

|---|

| 11/19 | $15,373 | $16,877 |

|---|

| 12/19 | $15,771 | $17,386 |

|---|

| 1/20 | $15,738 | $17,379 |

|---|

| 2/20 | $14,437 | $15,949 |

|---|

| 3/20 | $12,665 | $13,979 |

|---|

| 4/20 | $14,335 | $15,771 |

|---|

| 5/20 | $15,160 | $16,522 |

|---|

| 6/20 | $15,479 | $16,850 |

|---|

| 7/20 | $16,342 | $17,801 |

|---|

| 8/20 | $17,593 | $19,080 |

|---|

| 9/20 | $16,960 | $18,355 |

|---|

| 10/20 | $16,582 | $17,867 |

|---|

| 11/20 | $18,594 | $19,823 |

|---|

| 12/20 | $19,404 | $20,585 |

|---|

| 1/21 | $19,183 | $20,377 |

|---|

| 2/21 | $19,854 | $20,939 |

|---|

| 3/21 | $20,416 | $21,856 |

|---|

| 4/21 | $21,470 | $23,022 |

|---|

| 5/21 | $21,561 | $23,183 |

|---|

| 6/21 | $22,262 | $23,724 |

|---|

| 7/21 | $22,696 | $24,288 |

|---|

| 8/21 | $23,405 | $25,026 |

|---|

| 9/21 | $22,164 | $23,863 |

|---|

| 10/21 | $23,559 | $25,534 |

|---|

| 11/21 | $23,287 | $25,357 |

|---|

| 12/21 | $24,193 | $26,494 |

|---|

| 1/22 | $22,695 | $25,123 |

|---|

| 2/22 | $22,024 | $24,371 |

|---|

| 3/22 | $22,705 | $25,276 |

|---|

| 4/22 | $20,503 | $23,071 |

|---|

| 5/22 | $20,361 | $23,114 |

|---|

| 6/22 | $18,788 | $21,206 |

|---|

| 7/22 | $20,544 | $23,161 |

|---|

| 8/22 | $19,799 | $22,217 |

|---|

| 9/22 | $18,037 | $20,170 |

|---|

| 10/22 | $19,448 | $21,804 |

|---|

| 11/22 | $20,554 | $23,022 |

|---|

| 12/22 | $19,327 | $21,696 |

|---|

| 1/23 | $20,513 | $23,059 |

|---|

| 2/23 | $20,069 | $22,496 |

|---|

| 3/23 | $20,920 | $23,322 |

|---|

| 4/23 | $21,333 | $23,686 |

|---|

| 5/23 | $21,434 | $23,789 |

|---|

| 6/23 | $22,769 | $25,361 |

|---|

| 7/23 | $23,565 | $26,176 |

|---|

| 8/23 | $23,282 | $25,759 |

|---|

| 9/23 | $22,216 | $24,531 |

|---|

| 10/23 | $21,837 | $24,015 |

|---|

| 11/23 | $23,812 | $26,208 |

|---|

| 12/23 | $24,785 | $27,399 |

|---|

| 1/24 | $25,388 | $27,859 |

|---|

| 2/24 | $26,766 | $29,347 |

|---|

| 3/24 | $27,534 | $30,291 |

|---|

| 4/24 | $26,406 | $29,054 |

|---|

| 5/24 | $27,789 | $30,494 |

|---|

| 6/24 | $29,003 | $31,589 |

|---|

| 7/24 | $29,074 | $31,973 |

|---|

| 8/24 | $29,894 | $32,749 |

|---|

| 9/24 | $30,264 | $33,448 |

|---|

| 10/24 | $30,042 | $33,145 |

|---|

| 11/24 | $31,757 | $35,090 |

|---|

| 12/24 | $31,012 | $34,254 |

|---|

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 25.16% | 14.47% | 12.58% |

|---|

| Class A with 5.25% Maximum Sales Charge | 18.59% | 13.25% | 11.97% |

|---|

S&P 500® Index | 25.02% | 14.51% | 13.09% |

|---|

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $2,683,337,864 |

|---|

| # of Portfolio Holdings (for Tax-Managed Growth Portfolio) | 143 |

|---|

| Portfolio Turnover Rate (for Tax-Managed Growth Portfolio) | 7% |

|---|

| Total Advisory Fees Paid | $10,204,484 |

|---|

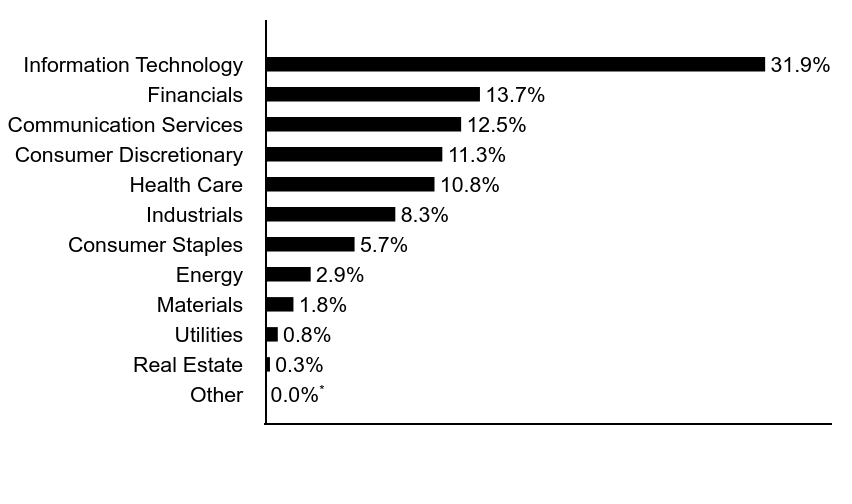

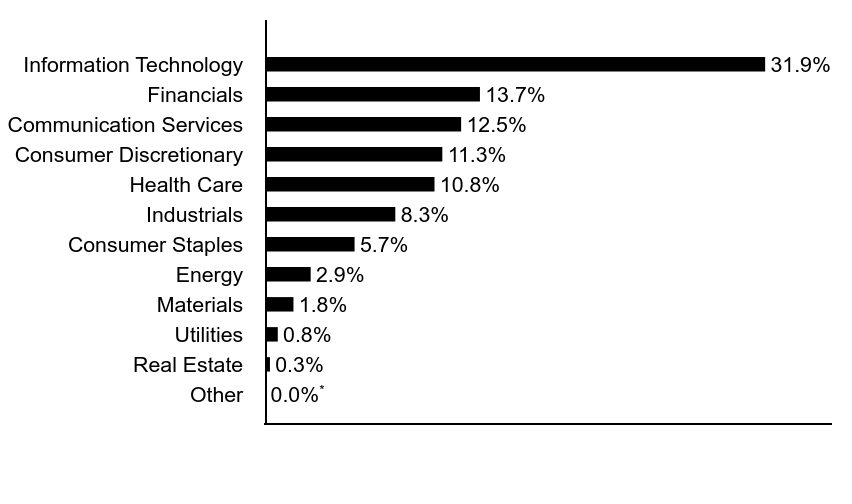

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

References to the Fund's investments are to the Fund's pro rata share of Tax-Managed Growth Portfolio, an affiliated investment company in which the Fund invests substantially all of its assests.

Sector Allocation (% of total investments)

| Value | Value |

|---|

| Other | 0.0%Footnote Reference* |

| Real Estate | 0.3% |

| Utilities | 0.8% |

| Materials | 1.8% |

| Energy | 2.9% |

| Consumer Staples | 5.7% |

| Industrials | 8.3% |

| Health Care | 10.8% |

| Consumer Discretionary | 11.3% |

| Communication Services | 12.5% |

| Financials | 13.7% |

| Information Technology | 31.9% |

| Footnote | Description |

Footnote* | Amount is less than 0.05%. |

Top Ten Holdings (% of total investments)Footnote Referencea

| Apple, Inc. | 8.3% |

| NVIDIA Corp. | 6.4% |

| Microsoft Corp. | 6.4% |

| Amazon.com, Inc. | 5.5% |

| Meta Platforms, Inc., Class A | 3.8% |

| Alphabet, Inc., Class A | 2.8% |

| Alphabet, Inc., Class C | 2.8% |

| JPMorgan Chase & Co. | 2.1% |

| Netflix, Inc. | 1.7% |

| Berkshire Hathaway, Inc., Class B | 1.7% |

| Total | 41.5% |

| Footnote | Description |

Footnotea | Excluding cash equivalents |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report December 31, 2024

Eaton Vance Tax-Managed Growth Fund 1.1

Annual Shareholder Report December 31, 2024

This annual shareholder report contains important information about the Eaton Vance Tax-Managed Growth Fund 1.1 for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?Footnote Reference*

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $165 | 1.47% |

|---|

| Footnote | Description |

Footnote* | Expenses in the table reflect the expenses of both the Fund and the Tax-Managed Growth Portfolio, the Portfolio in which it invests. |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the S&P 500® Index (the Index):

↓ An underweight position in electric car maker Tesla Inc. — sold by period-end — hurt returns as its stock price rose over optimism about autonomous vehicles ↓ An underweight position in Broadcom Inc. detracted from returns as its stock price doubled on AI-driven demand for its semiconductor and software products ↓ An overweight position in athletic apparel giant Nike Inc. lost value as the firm had trouble with increased competition and its shift to more wholesale sales ↓ Among sectors, stock selections in industrials, consumer discretionary, and information technology hurt Fund returns relative to the Index during the period ↑ An overweight position in online streaming service Netflix Inc. rose in value, driven by better-than-expected subscriber and revenue growth, and higher profits ↑ An overweight position in Meta Platforms Inc. — parent of Facebook and Instagram — grew in value as artificial intelligence (AI) investments drove revenue growth ↑ An overweight position in cloud-networking firm Arista Networks Inc. rose in value as data centers raised spending to meet computing demand from AI applications ↑ Among sectors, stock selections and an overweight exposure to communication services, and stock selections in health care and consumer staples helped returns

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | S&P 500® Index |

|---|

| 12/14 | $10,000 | $10,000 |

|---|

| 1/15 | $9,664 | $9,700 |

|---|

| 2/15 | $10,242 | $10,257 |

|---|

| 3/15 | $10,097 | $10,095 |

|---|

| 4/15 | $10,154 | $10,192 |

|---|

| 5/15 | $10,282 | $10,323 |

|---|

| 6/15 | $10,114 | $10,123 |

|---|

| 7/15 | $10,348 | $10,335 |

|---|

| 8/15 | $9,684 | $9,712 |

|---|

| 9/15 | $9,467 | $9,471 |

|---|

| 10/15 | $10,267 | $10,270 |

|---|

| 11/15 | $10,342 | $10,301 |

|---|

| 12/15 | $10,139 | $10,138 |

|---|

| 1/16 | $9,573 | $9,635 |

|---|

| 2/16 | $9,484 | $9,622 |

|---|

| 3/16 | $10,051 | $10,275 |

|---|

| 4/16 | $10,122 | $10,315 |

|---|

| 5/16 | $10,246 | $10,500 |

|---|

| 6/16 | $10,182 | $10,527 |

|---|

| 7/16 | $10,595 | $10,915 |

|---|

| 8/16 | $10,615 | $10,931 |

|---|

| 9/16 | $10,566 | $10,933 |

|---|

| 10/16 | $10,348 | $10,733 |

|---|

| 11/16 | $10,763 | $11,131 |

|---|

| 12/16 | $10,935 | $11,351 |

|---|

| 1/17 | $11,102 | $11,566 |

|---|

| 2/17 | $11,542 | $12,025 |

|---|

| 3/17 | $11,551 | $12,039 |

|---|

| 4/17 | $11,651 | $12,163 |

|---|

| 5/17 | $11,778 | $12,334 |

|---|

| 6/17 | $11,872 | $12,411 |

|---|

| 7/17 | $12,082 | $12,667 |

|---|

| 8/17 | $12,077 | $12,705 |

|---|

| 9/17 | $12,367 | $12,967 |

|---|

| 10/17 | $12,652 | $13,270 |

|---|

| 11/17 | $13,071 | $13,677 |

|---|

| 12/17 | $13,282 | $13,829 |

|---|

| 1/18 | $14,149 | $14,621 |

|---|

| 2/18 | $13,653 | $14,082 |

|---|

| 3/18 | $13,189 | $13,724 |

|---|

| 4/18 | $13,241 | $13,777 |

|---|

| 5/18 | $13,575 | $14,108 |

|---|

| 6/18 | $13,561 | $14,195 |

|---|

| 7/18 | $14,045 | $14,724 |

|---|

| 8/18 | $14,529 | $15,203 |

|---|

| 9/18 | $14,554 | $15,290 |

|---|

| 10/18 | $13,503 | $14,245 |

|---|

| 11/18 | $13,716 | $14,535 |

|---|

| 12/18 | $12,486 | $13,223 |

|---|

| 1/19 | $13,473 | $14,282 |

|---|

| 2/19 | $13,978 | $14,741 |

|---|

| 3/19 | $14,177 | $15,027 |

|---|

| 4/19 | $14,832 | $15,636 |

|---|

| 5/19 | $13,686 | $14,642 |

|---|

| 6/19 | $14,598 | $15,674 |

|---|

| 7/19 | $14,887 | $15,899 |

|---|

| 8/19 | $14,527 | $15,648 |

|---|

| 9/19 | $14,726 | $15,940 |

|---|

| 10/19 | $14,985 | $16,286 |

|---|

| 11/19 | $15,629 | $16,877 |

|---|

| 12/19 | $16,025 | $17,386 |

|---|

| 1/20 | $15,978 | $17,379 |

|---|

| 2/20 | $14,650 | $15,949 |

|---|

| 3/20 | $12,841 | $13,979 |

|---|

| 4/20 | $14,530 | $15,771 |

|---|

| 5/20 | $15,355 | $16,522 |

|---|

| 6/20 | $15,669 | $16,850 |

|---|

| 7/20 | $16,532 | $17,801 |

|---|

| 8/20 | $17,784 | $19,080 |

|---|

| 9/20 | $17,132 | $18,355 |

|---|

| 10/20 | $16,743 | $17,867 |

|---|

| 11/20 | $18,762 | $19,823 |

|---|

| 12/20 | $19,568 | $20,585 |

|---|

| 1/21 | $19,331 | $20,377 |

|---|

| 2/21 | $19,998 | $20,939 |

|---|

| 3/21 | $20,552 | $21,856 |

|---|

| 4/21 | $21,597 | $23,022 |

|---|

| 5/21 | $21,675 | $23,183 |

|---|

| 6/21 | $22,368 | $23,724 |

|---|

| 7/21 | $22,790 | $24,288 |

|---|

| 8/21 | $23,488 | $25,026 |

|---|

| 9/21 | $22,227 | $23,863 |

|---|

| 10/21 | $23,612 | $25,534 |

|---|

| 11/21 | $23,324 | $25,357 |

|---|

| 12/21 | $24,218 | $26,494 |

|---|

| 1/22 | $22,703 | $25,123 |

|---|

| 2/22 | $22,019 | $24,371 |

|---|

| 3/22 | $22,686 | $25,276 |

|---|

| 4/22 | $20,473 | $23,071 |

|---|

| 5/22 | $20,317 | $23,114 |

|---|

| 6/22 | $18,738 | $21,206 |

|---|

| 7/22 | $20,475 | $23,161 |

|---|

| 8/22 | $19,719 | $22,217 |

|---|

| 9/22 | $17,956 | $20,170 |

|---|

| 10/22 | $19,347 | $21,804 |

|---|

| 11/22 | $20,435 | $23,022 |

|---|

| 12/22 | $19,203 | $21,696 |

|---|

| 1/23 | $20,369 | $23,059 |

|---|

| 2/23 | $19,913 | $22,496 |

|---|

| 3/23 | $20,747 | $23,322 |

|---|

| 4/23 | $21,142 | $23,686 |

|---|

| 5/23 | $21,229 | $23,789 |

|---|

| 6/23 | $22,539 | $25,361 |

|---|

| 7/23 | $23,312 | $26,176 |

|---|

| 8/23 | $23,018 | $25,759 |

|---|

| 9/23 | $21,950 | $24,531 |

|---|

| 10/23 | $21,561 | $24,015 |

|---|

| 11/23 | $23,497 | $26,208 |

|---|

| 12/23 | $24,441 | $27,399 |

|---|

| 1/24 | $25,021 | $27,859 |

|---|

| 2/24 | $26,363 | $29,347 |

|---|