UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 0-14306

CHINA CRESCENT ENTERPRISES, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Nevada | 84-0928627 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

14860 Montfort Drive, Suite 210, Dallas, TX 75254

(Address of principal executive offices)

(214) 722-3040

(Registrant’s telephone number, including area code)

NEWMARKET CHINA, INC.

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes o No þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: Yes o No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | Large Accelerated Filer o | Accelerated Filer o | |

| | Non-Accelerated Filer þ | Smaller Reporting Company o | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant based on the closing price of the Registrant’s common stock on June 30, 2008: $1,195,472

China Crescent Enterprises, Inc.

ANNUAL REPORT ON FORM 10-

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2008

History of the Business

Intercell International Corporation (“Intercell”) was incorporated under the laws of Nevada in May 2000. Until October 2003, Intercell had no operations. In October 2003, Intercell acquired 60% membership interest in Brunetti DEC, LLC, a Colorado limited liability company (“Brunetti”) for a cash contribution. In January 2004, Intercell acquired the remaining 40% of Brunetti for and additional cash contribution. In October 2004, the operations of Brunetti were discontinued and in March 2005, Brunetti filed a voluntary petition for relief in the United States Bankruptcy Court, District of Colorado under Chapter 7 of Title 7 of the U.S. Bankruptcy Code.

On March 16, 2005, Intercell filed a voluntary petition for relief in the United States Bankruptcy Court, District of Colorado under Chapter 11 of Title 11 of the U.S. Bankruptcy Code. On April 5, 2006, the United States Bankruptcy Court, District of Colorado dismissed the Chapter 11 proceedings.

In October 2006, Intercell executed an Agreement and Plan of Reorganization (the “Agreement”) with NewMarket China, Inc. (“NewMarket China”) a wholly-owned subsidiary of NewMarket Technology, Inc. (“NewMarket Technology”). The Agreement provided for Intercell to acquire from NewMarket Technology its subsidiary, NewMarket China, through the exchange of all of the issued and outstanding stock of NewMarket China, one thousand (1,000) shares held by NewMarket Technology, for two million (2,000,000) common shares of Intercell. As a result of the Agreement, NewMarket China became the wholly-owned subsidiary of Intercell.

In a separate agreement, NewMarket Technology agreed to purchase 250,000 shares of Series A Preferred Stock from Intercell for a $250,000 cash payment. The shares have a par value of $0.001 per share and a purchase price of $1.00 per share and bear no dividend. The shares are convertible into 60% of the issued and outstanding common stock of Intercell, any time after August 31, 2006. The shares have a voting right equal to 60% of the issued and outstanding common stock of Intercell.

As part of the reorganization and acquisition of Intercell, on January 31, 2007, we changed the name of the company to NewMarket China, Inc. (the “Company”) and changed its trading symbol to “NMCH”. Additionally, we changed the Company’s fiscal year end from September 30th to December 31st. In June 2008, we changed the Company’s name to China Crescent Enterprises, Inc. and changed its trading symbol to “CCSE”.

As a result of the acquisition of NewMarket China and the change in control of Intercell, the following changes were made to our management:

| - | The Chief Executive Officer of the Company, Mr. Mark Richards, resigned on October 18, 2006. Mr. John T. Verges was appointed the Chief Executive Officer and President of the Company on October 18, 2006. |

| - | The Chief Financial Officer of the Company, Ms. Kristi J. Kampmann, resigned on October 18, 2006. Mr. Philip J. Rauch was appointed the Chief Financial Officer on October 18, 2006. |

| - | Messrs. Philip Verges, Bruce Noller and Philip J. Rauch were appointed Directors of the Company on October 18, 2006. |

| - | Messrs. Mark Richards and Mallory Smith resigned as Directors of the Company on February 15, 2007. |

| - | Mr. Paul Danner was appointed a Director of the Company on March 3, 2008. |

| - | Mr. Bruce Noller resigned as a Director of the Company on March 3, 2008. |

| - | Mr. John T. Verges resigned as Chief Executive Officer of the Company on June 2, 2008 and Mr. Paul Danner was appointed as Chief Executive Officer of the Company effective July 1, 2008. |

Business of China Crescent Enterprises

Our headquarters is located in Dallas, Texas but our primary operations are currently in The People’s Republic of China (“China”). To date, the majority of our sales have been information technology products and services sold within mainland China, however, the Company has also explored the possibility of establishing business relationships with U.S. based customers that may include:

| - | outsourcing of software development in China; |

| - | exploration of the Chinese marketplace; |

| - | localization of products and/or services; |

| - | identification of complimentary products in China; |

We provide these services through our subsidiaries, partnerships and relationships, as discussed below.

Clipper Technology, Inc. (“CLPTEC”). CLPTEC is one of our subsidiaries, and it is a Wholly Owned Foreign Entity (W.O.F.E.) registered in Shanghai, China. Chinese companies must be registered in the specific market space they intend to operate within. CLPTEC’s corporate charter in China allows it to provide consulting, development, implementation, and maintenance of technology systems which include both software and hardware peripherals for computing, communication, and data exchanges related to general business applications as well as the specialty fields of medical, security, military and homeland defense applications. CLPTEC may also engage in the prototype development of security systems as well as OEM sourcing for production of hardware related to the above business activities.

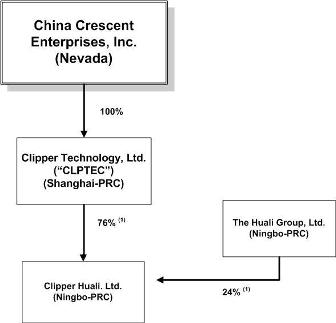

Clipper Huali Co., LTD (“Clipper Huali”). Clipper Huali was originally formed as a collaborative business enterprise between CLPTEC and a consortium of Chinese technology firms called The Huali Group, Ltd. (“Huali”). Such ventures in China are required to be registered companies. Clipper Huali is registered in the City of Ningbo, China, located just south of Shanghai on the opposite side of the Hangzhou Bay. By virtue of its registration as an independent firm, Clipper Huali is a now a majority-owned subsidiary of CLPTEC and is owned 51% by CLPTEC and 49% by Huali. Clipper Huali is engaged in the distribution of IT products including notebook & desktop computers, printers, servers, network equipment, LCD projectors and digital cameras from a number of global brand partners including Dell, HP, IBM, Cisco, Sony, Epson, Canon and Sanyo. The company is also an authorized reseller of operating system, database, middleware and application software from Microsoft, Red Hat, Oracle, Sybase, IBM, BEA, Veritas and others. In March 2009, we announced that CLPTEC acquired an additional 25% interest in Clipper Huali from Huali, bringing its total ownership in Clipper Huali to 76% and reducing Huali’s ownership interest to 24%.

Gaozhi Science and Technology Development, LTD. (“Gaozhi”). CLPTEC has formed a strategic partnership with Gaozhi to develop and distribute high technology products and services. Our primary office in mainland China is co-located within the same building as Gaozhi. Gaozhi is a well established and highly respected firm in China, particularly in the City of Shanghai. Gaozhi operates within many high technology market spaces including the manufacture of Mobile Communication Vehicles, Low Energy Intelligent Lighting Products, Satellite Data Communications, Telecommunications Software, and IP Television. By virtue of the opportunities in these market spaces, we have partnered with Gaozhi to develop foreign sales for several of Gaozhi’s products and services.

Shanghai Multimedia Industry Association (“SMIA”). We have formed a business development relationship with the SMIA. The SMIA is a municipal organization operated by the Shanghai City Government. Its mission is to develop the multimedia software industry in the City of Shanghai. The SMIA has formed an association comprised of approximately 148 Shanghai-based multimedia companies. These firms currently operate in China and are working to expand their businesses to include foreign customers in the United States, Western Europe and beyond. We have developed contractual working agreements with several of the SMIA member companies, and are jointly working with those companies to develop multimedia software sales in the United States.

The following chart reflects our current organizational structure as of the date of this report:

(1) These ownership percentages reflect the recent acquisition by CLPTEC of an additional 25% of Clipper Huali in March 2009.

Employees

As of December 31, 2008, we had approximately 250 employees, of which 240 employees work for Clipper Huali. Our employees are not represented by a labor union or subject to any collective bargaining agreement that may stem from such unions. Our Chinese subsidiaries are subject to Chinese labor laws that give labor a comparatively minor level of group power. We believe our relations with our employees are satisfactory and do not present any undue organizational risk.

Risks Related to Our Company

While we have been profitable for the year over the last three years, profits have been small and we have incurred monthly and quarterly operating losses from time to time in each of the last three years.

We cannot be certain that we can sustain or increase profitability on a quarterly or annual basis in the future. If we are unable to remain profitable, our liquidity could be materially harmed.

We cannot predict our future results because our business has a limited operating history, particularly in its current form.

Given our limited operating history, it will be difficult to predict our future results. You should consider the uncertainties that we may encounter as an early stage company in a new and rapidly evolving market. These uncertainties include:

o .......market acceptance of our products or services;

o .......consumer demand for, and acceptance of, our products, services and follow-on products;

o .......our ability to create user-friendly applications; and

o .......our unproven and evolving business model.

We have a limited operating history. We will need to achieve greater revenues to maintain profitability. There can be no assurance that we will be successful in increasing revenues, or generating acceptable margins, or, if we do, that operation of our business will be a profitable business enterprise. We may have to seek additional outside sources of capital for our business. There can be no assurance that we will be able to obtain such capital on favorable terms and conditions or at all. If this occurs the market price of our common stock could suffer.

Our quarterly and annual sales and financial results have varied significantly in the past, and we expect to experience fluctuations in the future, which mean that period-to-period comparisons are not necessarily meaningful or indicative of future performance.

Our sales and operating results have varied, and may continue to vary, significantly from year to year and from quarter to quarter as a result of a variety of factors, including the introduction of new products by competitors, pricing pressures, the timing of the completion or the cancellation of projects, the evolving and unpredictable nature of the markets in which our products and services are sold and economic conditions generally or in certain geographic areas in which our customers do business. Furthermore, we may be unable to control spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, we cannot assure you that sales and net income, if any, in any particular quarter will not be lower than sales and net income, if any, in a preceding or comparable quarter or quarters. In addition, sales and net income, if any, in any particular quarter are not likely to be indicative of the results of operations for any other quarter or for the full year. The trading prices of our securities may fluctuate significantly in response to variations in our quarterly or annual results of operations.

We may not be able to sustain or accelerate growth, or sustain or accelerate recurring revenue from our business.

There can be no assurance that demand for our services and products will increase or be sustained, or that our current or future products will have market acceptance in that product category. Our acquisition costs per customer are high due to the significant costs associated with sales, research and development and marketing. To the extent we do not achieve growth and this cost per customer is not reduced, it will be difficult for us to generate meaningful revenue at acceptable margins or achieve profitability. To the extent that our business model is not successful, because market acceptance does not develop as expected, or other competing technologies evolve in connection with the changing market or for any other reason, we might have future unexpected declines in revenue.

Rapid technological change could render our products and services obsolete.

The IT services industry is characterized by rapid technological innovation, sudden changes in user and customer requirements and preferences, frequent new product and service introductions and the emergence of new industry standards and practices. Each of these characteristics could render our services, products, intellectual property and systems obsolete. The rapid evolution of our market requires that we improve continually the performance, features and reliability of our products and services, particularly in response to competitive offerings. Our success also will depend, in part, on our ability:

| - | to develop or license new products, services and technology that address the varied needs of our customers and prospective customers |

| - | to respond to technological advances and emerging industry standards and practices on a cost-effective and timely basis |

If we are unable, for technical, financial, legal or other reasons, to adapt in a timely manner to changing market conditions or user preferences, we could lose customers, which would cause a decrease in our revenue.

We may be unable to obtain additional capital if needed to grow our business, which would adversely impact our business. If we raise additional financing, shareholders may suffer significant dilution.

Although we anticipate that our current cash and cash from operations will be sufficient to satisfy our working capital and ordinary course capital expenditure needs over the next 12 months, if our revenues do not continue to grow to cover our expenses, we will need to seek additional investment from our parent company or a third party to finance our growth plans as we have done in the past. We cannot be certain that financing from our parent company or third parties will be available on acceptable terms to us or at all. Our future capital requirements will depend upon several factors, including the rate of market acceptance of our products and services, our ability to expand our customer base and our level of expenditures for sales and marketing. If our capital requirements vary materially from those currently planned, we may require additional financing sooner than anticipated. If we cannot raise funds on acceptable terms, we may not be able to develop our products and services, take advantage of future opportunities or respond to competitive pressures or unanticipated requirements, any of which could have a material adverse effect on our ability to grow our business. Further, if we issue equity securities, shareholders will experience dilution of their ownership percentage, and the new equity securities may have rights, preferences or privileges senior to those of our common stock.

Certain of our competitors have significantly greater financial, technical, marketing and other resources than we do and may be able to respond more quickly to new or emerging technologies and changes in customer requirements. Additional competition could result in price reductions, reduced margins and loss of market. We cannot guarantee that we will be able to compete successfully against future competitors or that future competitive pressures will not materially and adversely affect our business, financial condition and results of operations.

Our success depends in large part on the continued service of our management and other key personnel and our ability to continue to attract, motivate and retain highly qualified employees. If one or more of our key employees leaves the Company, we will have to find a replacement with the combination of skills and attributes necessary to execute our strategy. Because competition from other technology companies for skilled employees is intense, and the process of finding qualified individuals can be lengthy and expensive, we believe that the loss of services of key personnel could negatively affect our business, financial condition and results of operations.

The recent credit crisis and turmoil in the global financial system may have an adverse impact on our business and our financial condition, and we may face challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise capital, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, these economic conditions also impact levels of government and consumer spending, which have recently deteriorated significantly and may remain depressed for the foreseeable future. It is uncertain how long the global crisis in the financial services and credit markets will continue and how much of an impact it will have on the global economy in general or the Chinese economy in particular. If demand for our products and services fluctuates as a result of economic conditions or otherwise, our revenue and gross margin could be harmed.

In August 2006, six Chinese regulatory agencies promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective In September, 2006 (the “M&A Rule”). According to the M&A Rule, a “Round-trip Investment” is defined as having taken place when a Chinese business that is owned by Chinese individual(s) is sold to a non-Chinese entity that is established or controlled, directly or indirectly, by those same Chinese individual(s). Under the M&A Rules, any Round-trip Investment must be approved by China’s Ministry of Commerce (“MOFCOM”), and any indirect arrangement or series of arrangements which achieves the same end result without the approval of MOFCOM is a violation of Chinese law. The M&A Rule establishes additional procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that the MOFCOM be notified in advance of any change-of-control transaction and in some situations, require approval of the MOFCOM when a foreign investor takes control of a Chinese domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses. The M&A Rule also requires MOFCOM anti-trust review of any change-of-control transactions involving certain types of foreign acquirers. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from the MOFCOM, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

Risks Related to Doing Business in China

Changes in Chinese laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under our current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

Substantially all of our sales are generated from China. We anticipate that sales of our products in China will continue to represent a substantial majority of our total sales in the near future. Any significant decline in the condition of the Chinese economy could adversely affect demand for our products, among other things, which in turn would have a material adverse effect on our business and financial condition.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. If our new business ventures are unsuccessful, or other adverse circumstances arise from these transactions, we face the risk that the parties to these ventures may seek ways to terminate the transactions, or, may hinder or prevent us from accessing important information regarding the financial and business operations of these acquired companies. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under Chinese law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Substantially all of our revenues are generated from our Chinese subsidiary, CLPTEC. However, Chinese regulations restrict the ability of CLPTEC to make dividends and other payments to its parent company. Chinese legal restrictions permit payments of dividends by CLPTEC only out of its accumulated after-tax profits, if any, determined in accordance with Chinese accounting standards and regulations. Any limitations on the ability of CLPTEC to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time-to-time in mainland China. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new licenses, which would put us at a disadvantage. Although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other agents will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

China only recently has permitted provincial and local economic autonomy and private economic activities, and, as a result, we are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. During the past ten years, the rate of inflation in China has been as high as 20.7% and as low as (2.2)%. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. While inflation has been more moderate since 1995, high inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

China historically has been deficient in Western style management and financial reporting concepts and practices, as well as in modern banking, computer and other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in China. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards. We may have difficulty establishing adequate management, legal and financial controls in China.

Risks Related to Currency Exchange Between Chinese Renminbi and United States Dollars

It is possible that the Chinese government could adopt a more flexible currency policy, which could result in more significant fluctuation of RMB against the U.S. dollar. We can offer no assurance that RMB will be stable against the U.S. dollar or any other foreign currency.

The income statements appearing elsewhere herein are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions will result in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions will result in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of CLPTEC and Clipper Huali into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. In addition, we may have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss. We have not entered into agreements or purchased instruments to hedge our exchange rate risks, although we may do so in the future. The availability and effectiveness of any hedging transaction may be limited and we may not be able to successfully hedge our exchange rate risks.

Although Chinese governmental policies were introduced in 1996 to allow the convertibility of RMB into foreign currency for current account items, conversion of RMB into foreign exchange for capital items, such as foreign direct investment, loans or securities, requires the approval of the State Administration of Foreign Exchange, or SAFE, which is under the authority of the People’s Bank of China. These approvals, however, do not guarantee the availability of foreign currency conversion. We cannot be sure that we will be able to obtain all required conversion approvals for our operations or that Chinese regulatory authorities will not impose greater restrictions on the convertibility of RMB in the future. Because a significant amount of our future revenue may be in the form of RMB, our inability to obtain the requisite approvals or any future restrictions on currency exchanges could limit our ability to utilize revenue generated in RMB to fund potential business activities outside of China, or to repay foreign currency obligations, including our debt obligations, which would have a material adverse effect on our financial condition and results of operations.

Risks Related to Our Industry

Deterioration of the IT services industry could lead to further reductions in capital spending budgets by our customers, which could further adversely affect our revenues, gross margins and income.

Our revenues and gross margins will depend significantly on the overall demand for IT products and services. Reduced capital spending budgets by our customers caused by the ongoing industry downturn have led to continued soft demand for our products and services, which has resulted in, and may continue to result in, decreased revenues, earnings levels or growth rates. The global economy in general, and the technology market in particular, has weakened and market conditions continue to be challenging. As a result, individuals and companies are delaying or reducing expenditures. We have observed effects of the global economic downturn in many areas of our business. In addition, the technology industry has experienced significant consolidation, and this trend is expected to continue. It is possible that we and one or more of our competitors each supply products to the companies that have merged or will merge. This consolidation could result in further delays in purchasing decisions by merged companies or in us playing a decreased role in the supply of products to the merged companies. Further delays or reductions in spending could have a material adverse effect on demand for our products and services and, consequently, our results of operations, prospects and stock price.

Risks Related to Our Capital Stock

The public market for our common stock may be volatile.

There is currently only a limited public market for our common stock, which is listed on the OTC Bulletin Board under the symbol “CCSE”.

The market price of our common stock has been and is likely to continue to be significantly affected by various factors, including:

| - | general market conditions and market conditions affecting technology stocks in particular |

| - | actual or anticipated fluctuations in our quarterly or annual operating results |

| - | announcements relating to contracts, investments, acquisitions, divestitures |

| - | discontinued operations, layoffs or corporate actions |

| - | industry conditions or trends |

| - | limited public float, market making activity and research coverage |

The stock markets, especially the over-the-counter markets, have experienced significant price and volume fluctuations that have affected the market prices of many technology companies' stocks. These fluctuations have often been unrelated or disproportionate to operating performance. These broad market or technology sector fluctuations may adversely affect the market price of our common stock. General economic, political and market conditions such as recessions and interest rate fluctuations may also have an adverse effect on the market price of our common stock. In addition, the market price of our common stock has also been and is likely to continue to be affected by expectations of analysts and investors.

The U.S. Securities and Exchange Commission (the ‘SEC”) has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share, subject to specific exemptions. The market price of our Common Stock is less than $5.00 per share and therefore is a “penny stock.” Brokers and dealers effecting transactions in “penny stock” must disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell our Common Stock and may affect your ability to sell shares.

Our stock is controlled by a single majority shareholder for the foreseeable future and as a result, will be able to control our overall direction. This majority shareholder could conceivably control the outcome of matters requiring stockholder approval and could be able to elect all of our directors. Such control, which may have the effect of delaying, deferring or preventing a change of control, is likely to continue for the foreseeable future and significantly diminishes control and influence which future stockholders may have in the Company.

We may be the subject of securities class action litigation due to future stock price volatility.

Shareholder interest in the Company may be substantially diluted as a result of the sale of additional securities to fund our plan of operation.

Our preferred stock has certain preferences over our common stock with regard to liquidation, dividends and election of directors.

Our issued and outstanding preferred stock holds a preference in liquidation over our common stock. All of our outstanding Preferred Stock is subject to conversion into common stock upon the occurrence of certain enumerated events and contain provisions that may limit our ability to raise additional capital if needed. In addition, any such conversion will dilute our existing common stockholders.

Our ability to issue additional preferred stock or other convertible securities may adversely affect the rights of our common stockholders and may make takeovers more difficult, possibly preventing you from obtaining optimal share price.

Our Articles of Incorporation authorize the issuance of shares of "blank check" preferred stock, which would have the designations, rights and preferences as may be determined from time to time by the board of directors. Accordingly, the board of directors is empowered, without shareholder approval (but subject to applicable government regulatory restrictions), to issue additional preferred stock with dividend, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of the common stock. In the event of an issuance, the preferred stock could be used, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company. We have also historically used securities that are convertible into common stock as a currency to finance acquisitions and may continue to do so in the future.

Not applicable.

Principal Executive Offices

Our principal executive offices are located at 14860 Montfort Drive, Suite 210, Dallas, Texas 75254. We moved to these offices during the fall of 2006. NewMarket Technology, our majority stockholder, leases the space.

CLPTEC’s offices are located at No. 123 Qinjiang Road, Shanghai, 200233, People’s Republic of China. The offices are leased from Gaozhi, a strategic partner, on a month-to-month basis. Rent payments for the Shanghai office totaled approximately $6,335 in 2008.

On March 1, 2005, Brunetti filed a voluntary petition for relief in the United States Bankruptcy Court, District of Colorado under Chapter 7 of Title 7 of the U.S. Bankruptcy Code.

On March 16, 2005, the Company filed a voluntary petition for relief in the United States Bankruptcy Court, District of Colorado under Chapter 11 of Title 11 of the U.S. Bankruptcy Code. On April 5, 2006, the United States Bankruptcy Court, District of Colorado dismissed the Chapter 11 proceedings.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

There were no meetings of the security holders during the period covered by this report.

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

Price Range of Common Stock

Our common stock is presently traded on the over-the-counter market on the OTC Bulletin Board maintained by the National Association of Securities Dealers, Inc. (the “NASD") The NASD symbol for our common stock is “CCSE”. The following table sets forth the range of high and low bid quotations for our common stock of each full quarterly period during the fiscal year or equivalent period for the fiscal periods indicated below. The quotations were obtained from information published by the NASD and reflect interdealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| 2007 Fiscal Year | | |

| | | |

| First Quarter | 0.24 | 0.16 |

| Second Quarter | 0.29 | 0.12 |

| Third Quarter | 0.26 | 0.12 |

| Fourth Quarter | 0.20 | 0.10 |

| 2008 Fiscal Year | | |

| | | |

| First Quarter | 0.15 | 0.057 |

| Second Quarter | 0.113 | 0.03 |

| Third Quarter | 0.039 | 0.014 |

| Fourth Quarter | 0.017 | 0.004 |

Number of Shareholders

As of December 31, 2008, there were approximately 615 stockholders of record of our common stock. Based upon information provided to us by persons holding securities for the benefit of others, it is estimated that we have in excess of 3,600 beneficial owners of our common stock as of that date.

Dividend Policy

While there currently are no restrictions prohibiting us from paying dividends to our shareholders, we have not paid any cash dividends on our common stock in the past and do not anticipate paying any dividends in the foreseeable future. Earnings, if any, are expected to be retained to fund future operations of the Company. There can be no assurance that we will pay dividends at any time in the future.

The following selected financial data is derived from the consolidated financial statements of the Company. The data should be read in conjunction with the consolidated financial statements, related notes, and other financial information included herein. The information presented below is in thousands, except per share amounts.

| | | Year ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | |

| | | | | | | | | | |

| SELECTED STATEMENT OF OPERATIONS DATA | | | | | | | | | |

| Revenues | | $ | 41,878 | | | $ | 40,007 | | | $ | 29,510 | |

| Income from operations | | | | | | | | | | | | |

| Net income | | | 638 | | | | 438 | | | | 245 | |

| Net income per weighted avg. common share-basic | | $ | 0.02 | | | $ | 0.02 | | | $ | 0.01 | |

| | | | | | | | | | | | | |

| SELECTED BALANCE SHEET DATA | | | | | | | | | | | | |

| Cash | | $ | 2,600 | | | $ | 1,489 | | | $ | 1,168 | |

| Working capital | | | 6,124 | | | | 3,461 | | | | 1,833 | |

| Total assets | | | 10,346 | | | | 7,209 | | | | 4,724 | |

| Total liabilities | | | 4,277 | | | | 3,650 | | | | 2,495 | |

| Stockholders' equity | | | 4,456 | | | | 2,560 | | | | 1,650 | |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements:

Some statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include the words “may,” “estimate,” “intend,” “continue,” “believe,” “expect,” or “anticipate” and other similar words. These forward-looking statements generally relate to plans and objectives for future operations and are based upon management’s reasonable estimates of future results or trends. Although we believe that the plans and objectives reflected in or suggested by such forward-looking statements are reasonable, such plans or objectives may not be achieved. Actual results could differ materially from those projected in the forward-looking statements as a result of a number of risks and uncertainties, including: (a) lack of demand for our products and services; (b) competitive products and pricing; (c) limited amount of resources devoted to advertising; (d) lack of demand for our products and services being purchased via the Internet; and (e) other factors that may negatively affect our operating results. Statements made herein are as of the date of the filing of this Form 10-K with the Securities and Exchange Commission and should not be relied upon as of any subsequent date. We expressly disclaim any obligation to update any information or forward-looking statements contained in this Form 10-K, except as may otherwise be required by applicable law.

Overview

We sell information technology products and services and provide systems integration services in mainland China through our wholly-owned foreign entity, Clipper Technology, Ltd. The majority of our sales are concentrated in and around the cities of Shanghai, Ningbo and Hangzhou in China. In June 2008, we changed the Company name from NewMarket China, Inc. to China Crescent Enterprises, Inc. In July 2008, Paul K. Danner was appointed President and Chief Executive Officer of the Company.

2008 Compared to 2007

Revenue increased 5% from $40,007,006 for the year ended December 31, 2007 to $41,877,584 for the year ended December 31, 2008. This was due to increased sales of computer hardware in the Hangzhou region. Year over year sales in the Ningbo and Shanghai regions were essentially even. Cost of sales increased 3% from $38,211,067 for the year ended December 31, 2007 to $39,538,508 for the year ended December 31, 2008. This increase was primarily due to the corresponding increase in sales volume. Cost of sales as a percentage of sales was approximately 94% and 96% for the years ended December 31, 2008 and 2007, respectively. We plan to continue to pursue strategies to reduce the overall cost of sales as a percentage of sales as the Company grows. Management intends to leverage the increased purchasing volume to improve purchasing contracts and reduce overall cost of sales.

General and administrative expenses for the year ended December 31, 2008 were $1,064,491 compared to $1,085,982 for the year ended December 31, 2007, a decrease of 2%. The decrease is primarily attributable to decreased administrative headcount in the Shanghai region.

For the year ended December 31, 2008, we recognized net income of $638,319 after accounting for the minority interest in a consolidated subsidiary, compared to net income of $437,824 for the year ended December 31, 2007, a 46% increase. The increase in net income is attributable to (i) an increase in overall sales; (ii) a decrease in general and administrative expenses for the year; and (iii) a decrease in cost of sales as a percentage of sales. Comprehensive income for the year ended December 31, 2008 was $1,131,931 compared to comprehensive income of $909,771 for the year ended December 31, 2007, a 24% increase. Comprehensive income includes foreign currency translation adjustments and gains or losses on investment securities held.

2007 Compared to 2006

In October 2006, the Company executed an Agreement and Plan of Reorganization (“the Agreement”) with NewMarket China, Inc. (“NewMarket China” or “the Company”), a wholly-owned subsidiary of NewMarket Technology, Inc. (“NewMarket Technology”). The Agreement, provided for Intercell to acquire from NewMarket Technology its subsidiary, NewMarket China through the exchange of all of the issued and outstanding stock of NewMarket China, one thousand (1,000) shares held by NewMarket Technology for two million (2,000,000) restricted common shares of Intercell. As a result of the Agreement, NewMarket China became the wholly-owned subsidiary of Intercell.

As a result of the Agreement and subsequent reorganization, we had revenue of $40,007,006 and $29,509,968 for the years ended December 31, 2007 and 2006, respectively. Cost of sales was $38,211,067 and $28,237,125 years ended December 31, 2007 and 2006, respectively. The gross margin was $1,795,939 and $1,272,843 for the years ended December 31, 2007 and 2006, respectively. Gross margin as a percentage of sales was 4.5% for the year ended December 31, 2007. The increase in revenue and corresponding increase in cost of sales from 2006 to 2007 was attributable to the expansion of our sales efforts into the city of Hangzhou, China. Hangzhou is capital of Zhejiang province with a population of approximately 6.4 million.

Liquidity and Capital Resources

Cash Flow Activities

Our cash balance at December 31, 2008 increased $1,111,724, from $1,488,774 as of December 31, 2007, to $2,600,498. The increase was the result of cash used in operating activities of $729,881, offset by cash provided by financing activities of $1,301,615 and the effect of exchange rates on cash of $539,990. Operating activities for the year ended December 31, 2008 exclusive of changes in operating assets and liabilities provided $1,267,937, as well as an increase in accrued expenses $81,226, offset by an increase in inventory of $161,810, an increase in accounts receivable and other assets of $1,425,883 and a decrease in accounts payable of $491,351.

Liquidity

As of December 31, 2008, we own 23,245 shares of common stock of Vyta Corp (“Vyta”). We have classified our investment in Vyta as available for sale securities in which unrealized gains (losses) are recorded to shareholders’ equity. At December 31, 2008, 2008, all 23,245 shares of Vyta Corp common stock are tradable, and based upon the closing price of $0.05 per share, the market value of the Vyta common shares at December 31, 2008 was $1,162.

To the extent our operations are not sufficient to fund our capital requirements, we may enter into a revolving loan agreement with a financial institution, or attempt to raise additional capital through the sale of additional common or preferred stock or through the issuance of additional debt.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported in the financial statements, including the notes thereto, and related disclosures of commitments and contingencies, if any. We consider our critical accounting policies to be those that require the more significant judgments and estimates in the preparation of financial statements, including the following:

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, it's wholly-owned subsidiary Clipper Technology, Ltd. (“CLPTEC”) and it’s indirectly owned subsidiary Clipper-Huali, Ltd. (“Clipper Huali”). All material intercompany accounts, transactions and profits have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Property and Equipment

Property and equipment are recorded at cost, less accumulated depreciation. Depreciation is provided for using straight-line methods over the estimated useful lives of the respective assets, usually three to seven years.

Stock-Based Compensation

SFAS No. 123, “Accounting for Stock Based Compensation”, defines a fair-value-based method of accounting for stock-based employee compensation plans and transactions in which an entity issues its equity instruments to acquire goods or services from non-employees, and encourages but does not require companies to record compensation cost for stock-based employee compensation plans at fair value.

The Company has chosen to account for employee stock-based compensation using the intrinsic value method prescribed in Accounting Principles Board Opinion No. 25 (“APB No. 25”), Accounting for Stock Issued to Employees, and related interpretations. Accordingly, employee compensation cost for stock options is measured as the excess, if any, of the estimated fair value of the Company’s stock at the date of the grant over the amount an employee must pay to acquire the stock.

In December 2004, the FASB issued SFAS No. 123(R), “Share-Based Payment”, which addresses the accounting for share-based payment transactions. SFAS No. 123(R) eliminates the ability to account for share-based compensation transactions using APB 25, and generally requires instead that such transactions be accounted and recognized in the statement of operations based on their fair value. SFAS No. 123(R) will be effective for the Company beginning with the first fiscal quarter of the fiscal year ended June 30, 2007. Depending upon the number of and terms of options that may be granted in future periods, the implementation of this standard could have a significant impact on the Company’s financial position and results of operations in future periods.

Valuation of Long-Lived Assets

In accordance with SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets", we periodically evaluate long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. If the estimated future cash flows (undiscounted and without interest charges) from the use of an asset were less than the carrying value, a write-down would be recorded to reduce the related asset to its estimated fair value. We do not believe that there has been any impairment to long-lived assets as of December 31, 2008.

Statement of Cash Flows

In accordance with SFAS No. 95, "Statement of Cash Flows", cash flows from our operations are based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheet.

Translation Adjustment

The Chinese Renminbi ("RMB"), the national currency of the China, is the primary currency of the economic environment in which our operations are conducted. We use the United States dollar ("U.S. dollars") for financial reporting purposes.

In accordance with SFAS No. 52, “Foreign Currency Translation,” our results of operations and cash flows are translated at the average exchange rates during the period, assets and liabilities are translated at the exchange rates at the balance sheet dates, and equity is translated at the historical exchange rates. As a result, amounts related to assets and liabilities reported on the consolidated statements of cash flows will not necessarily agree with changes in the corresponding balances on the consolidated balance sheets.

Comprehensive Income

Comprehensive income includes accumulated foreign currency translation gains and losses and any accumulated gains or losses attributable to securities held for investment purposes. We have reported the components of comprehensive income on our statements of stockholders’ equity.

Effects of Inflation

Inflation and changing prices have not had a material effect on our business and we do not expect that inflation or changing prices will materially affect our business in the foreseeable future. However, our management will closely monitor the price change and continually maintain effective cost control in operations

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements as defined in Regulation S-K Item 303(a)(4).

Recent Accounting Pronouncements

(See “Recently Issued Accounting Pronouncements” in Note 2 of Notes to the Consolidated Financial Statements.)

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Exchange Rate Risk

While our reporting currency is the U.S. dollar, the majority of our consolidated revenues and consolidated costs and expenses are denominated in foreign currency, specifically the Chinese Renminbi (“RMB”). The majority of our assets are denominated in RMB. As a result, we are exposed to foreign exchange risk as our revenues and results of operations may be affected by fluctuations in the exchange rate between U.S. dollars and the Chinese currencies. If the Chinese currency depreciates against the U.S. dollar, the value of a portion of our revenues, earnings and assets as expressed in our U.S. dollar financial statements will decline. We have not entered into any hedging transactions in an effort to reduce our exposure to foreign exchange risk.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The full text of our audited consolidated financial statements as of December 31, 2008 and 2007 begins on page F-1 of this annual report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISLCOSURE

None.

Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in the reports that we file or submit under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

We carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of our most recent fiscal year. Based upon this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective as of December 31, 2008.

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Exchange Act Rule 13a-15(f). Our management conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, our management concluded that our internal control over financial reporting was effective as of December 31, 2008. This Annual Report on Form 10-K does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our independent registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only management’s report in this Annual Report on Form 10-K.

Changes in Internal Control Over Financial Reporting

No change in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) occurred during the fourth quarter of 2008 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

None.

ITEM 10. DIRECTORS AND OFFICERS OF THE COMPANY

The following table sets forth information with respect to the sole executive officers and directors of the Company as of March 31, 2009:

| Name and Age | Position | Date of Appointment |

| | | |

| John T. Verges (40) | President & Chief Executive Officer | October 18, 2006 to June 1, 2008 |

| | | |

| Paul K. Danner (51) | President & Chief Executive Officer, Director | June 1, 2008 |

| | | |

| Philip J. Rauch (48) | Chief Financial Officer, Director | October 18, 2006 |

| | | |

| Philip Verges (43) | Director | October 18, 2006 |

| | | |

| Bruce Noller (51) | Director | October 18, 2006 to March 3, 2008 |

Committees of the Board of Directors

We presently do not have an audit committee, compensation committee, nominating committee, an executive committee of its board of directors, stock plan committee or any other committees.

Biographical Information on Officers and Directors

John T. Verges. Mr. Verges was the Chief Executive Officer and President of the Company from October 2006 through June 2008. Mr. Verges holds a Bachelor of Science in Management Information Systems from the University of Texas at Dallas where he graduated Summa Cum Laude. In addition, he later earned a Masters of Business Administration in Finance from the University of Texas at Dallas, graduating with high honors. Mr. Verges served on active duty in the United States Navy for five years as a Naval Officer and Aviator. After completing his active duty commitment, Mr. Verges remained on reserve status for ten additional years and worked in the private sector with several large and small emerging technology firms.

Paul K. Danner. On March 3, 2008, Mr. Danner was appointed to the Board of Directors of the Company. He was elected President & Chief Executive Officer of the Company by the Board of Directors effective July 1, 2008. Mr. Danner previously served as the Chairman and Chief Executive Officer of Paragon Financial Corporation., a financial services firm, from 2001 to 2007 From 1998 to 2000 Mr. Danner was employed in various roles at MyTurn.com, Inc., including as Chief Executive Officer. From 1985 to 1997 he held various executive-level and sales & marketing positions with a number of technology companies including NEC Technologies and Control Data Corporation. Mr. Danner previously served on active duty with the United States Navy where he flew the F-14 Tomcat. He is currently affiliated with the United States Navy Reserve where he holds the rank of Captain and serves as the Director, Strategic Communications for the Naval Air Systems Command Reserve Program. Mr. Danner earned a Bachelor of Science degree in Business Finance from Colorado State University in 1979, and a Master of Business Administration degree from Old Dominion University in 1996.

Philip J. Rauch. On October 18, 2006, Mr. Rauch was appointed the Chief Financial Officer and a Director of the Company. Mr. Rauch is the Chief Financial Officer and a Director of NewMarket Technology, Inc., a majority stockholder of the Company. Mr. Rauch holds a Bachelor of Science in Economics degree with honors from the University of Pennsylvania Wharton School of Business, with a concentration in finance and accounting. From February 2004 to February 2007, Mr. Rauch served as the Chief Operating and Financial Officer of Defense Technology Systems, Inc. Beginning in 1997, Mr. Rauch served in a senior capacity at AboveNet, Inc. (formerly Metromedia Fiber Network, Inc.) as Vice President, Business Operations, and later as Controller. From 1993 to 1997, Mr. Rauch was Vice President and Chief Financial Officer of Columbus Construction. From 1989 to 1993, he was Vice President and Chief Financial Officer of F. Garofalo Electric Co., an engineering and construction company.

Philip Verges. On October 18, 2006, Mr. Verges was appointed to the Board of Directors of the Company. Mr. Verges is the Chief Executive Officer and Chairman of NewMarket Technology, Inc. Mr. Verges is a 1988 graduate of the United States Military Academy. His studies at West Point centered on national security. Mr. Verges served with distinction as a U.S. Army Captain in a wide variety of important engagements to include research and development of counterterrorism communication technologies and practices. Mr. Verges' early career after the Army includes time in the Computer Sciences Research and Development Department of General Motors as well as experience teaching systems engineering methodology and programming to Electronic Data Systems ("EDS") employees from 1991 to 1995. Mr. Verges' first business start-up experience was at EDS in a new division concentrating on call center technology in financial institutions. Later in 1995, he added to his start-up experience at a $30 million technology services business with the responsibility to open a new geographic region with a Greenfield operation. Mr. Verges founded NewMarket Technology in 1997.

Bruce Noller. Mr. Bruce Noller served as a director of the Company from October 18, 2006 through March 3, 2008. Mr. Noller is currently the President of Managed Services at NewMarket Technology, Inc. Prior to becoming part of NewMarket Technology senior management, Mr. Noller was the President of Noller & Associates, Inc., Mr. Noller brings to the Board over 25 years of Financial, Operational and Marketing experience. Before he founded his own firm in 1994, he served as Vice President for Integrated Control Systems, a worldwide management consulting firm. During that time, Mr. Noller proposed and oversaw engagements with a variety of industries including healthcare, distribution, manufacturing, retail, banking, insurance, mining and telecommunications. Mr. Noller has International management consulting experience in Singapore, Malaysia, China, Canada, Latin America and Europe.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that our executive officers, directors and 10% stockholders file reports of securities ownership and changes in ownership with the Securities and Exchange Commission. Officers, directors and 10% owners also are required to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of the Section 16(a) forms received by us, or written representations from certain reporting persons, we believe that, during the last fiscal year, all Section 16(a) filing requirements applicable our officers, directors and greater than 10%, beneficial owners were complied with.

Code of Ethics

We have adopted a corporate code of ethics that applies to our chief executive officer and our chief financial officer. A copy of the code of ethics is filed as an exhibit to this Form 10-K. We believe our code of ethics is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability for adherence to the code.

This table summarizes the before-tax compensation for the Chief Executive Officer and Chief Financial Officer who were our only executive officers during fiscal 2008.

| | | Annual Compensation Long Term Compensation | | |

| | | | Awards Payouts | | | |

| | | | | | | |

Name & Principal Position | Year | Salary ($) | Bonus ($) | Other Annual Compensation ($) | Restricted Stock Awards ($) | Securities Underlying Options (#) | LTIP Payouts ($) | All Other Compensation ($) |

John T. Verges President & CEO(1) | 2007 2008 | $100,000 $50,000 | $-0- $-0- | $-0- $-0- | -0- -0- | -0- -0- | -0- -0- | -0- -0- |

| | | | | | | | | |

Paul K. Danner President & CEO(2) | 2007 2008 | $ -0- $ 87,500 | $-0- $-0- | $-0- $-0- | -0- -0- | -0- -0- | -0- -0- | -0- -0- |

| | | | | | | | | |

Philip J. Rauch CFO | 2007 2008 | $ 50,000 $ 50,000 | $-0- $-0- | $-0- $-0- | -0- -0- | -0- -0- | -0- -0- | -0- -0- |

(1) Mr. Verges resigned as President and Chief Executive Officer in June 2008.

(2) Mr. Danner was appointed President and Chief Executive Officer effective July 1, 2008.

The foregoing compensation table does not include certain fringe benefits made available on a nondiscriminatory basis to all our employees such as group health insurance, dental insurance, long-term disability insurance, vacation and sick leave. In addition, we make available certain non-monetary benefits to our executive officers with a view to acquiring and retaining qualified personnel and facilitating job performance. We consider such benefits to be ordinary and incidental business costs and expenses. The aggregate value of such benefits in the case of each executive officer listed in the above table, which cannot be precisely ascertained but which is less than 10% of the cash compensation paid to each such executive officer, is not included in such table.

Option/SAR Grants

No options were granted during the fiscal years ended December 31, 2008 and 2007.

Aggregated Option/SAR Exercises in Last Fiscal Year

No options were exercised during the fiscal years ended December 31, 2008 and 2007.

Employment Agreements

We do not have any employment agreements in place with our officers at this time.

Director Compensation

We do not provide for any compensation to members of our Board of Directors.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of December 31, 2008, certain information regarding beneficial ownership of the common stock held by each person known by us to own beneficially more than 5% of the common stock, each of our directors, each of the executive officers named in the Summary Compensation Table, and all of our executive officers and directors as a group.

| Name and Address of Beneficial Owner | | Number of Shares | | % of Outstanding(3) |

| | | | | | | |

NewMarket Technology, Inc. 14860 Montfort Drive, Suite 210 Dallas, TX 75254 | | | 106,481,993 | (1) | | | 61.1 | % |

| | | | | | | | | |

All officers and directors as a group (4 persons) | | | 0 | (2) | | | 0.0 | % |

(1) Includes 250,000 shares of our Series A Preferred Stock. The shares have a par value of $0.001 per share and a purchase price of $1.00 per share and bear no dividend. The shares are convertible into 60% of the issued and outstanding common stock of the Company, any time after August 31, 2007. At December 31, 2008, these shares would be convertible into 104,481,993 common shares.

(2) Messrs. Danner, Rauch and Verges, our officers and directors, do not own any common stock, options or warrants exercisable into the common stock of the Company on December 31, 2008. This does not include shares of the Company held by NewMarket Technology, Inc., which Messrs. Verges and Rauch are officers of.

(3) Based on 69,654,662 shares of common stock issued and outstanding on December 31, 2008 and assuming the conversion of the 250,000 shares of Series A Preferred Stock into 104,481,993 shares of common stock, there would be 174,136,655 shares outstanding.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In October 2006, NewMarket China, Inc. at the time a wholly-owned subsidiary of NewMarket Technology, Inc. executed an Agreement and Plan of Reorganization (“the Agreement”) with the Intercell International (“Intercell”). The Agreement provided for all of the issued and outstanding stock of NewMarket China, Inc., one thousand (1,000) shares held by NewMarket Technology, to be exchanged for two million (2,000,000) restricted common shares of Intercell. As a result of the Agreement, NewMarket China became the wholly-owned subsidiary of Intercell.

In a separate agreement, NewMarket Technology agreed to purchase 250,000 shares of a Series A Preferred Stock from Intercell for $250,000. The shares have a par value of $0.001 per share and a purchase price of $1.00 per share and bear no dividend. The shares are convertible into 60% of the issued and outstanding common stock of the Company, any time after August 31, 2007. The shares have a voting right equal to 60% of our issued and outstanding common stock.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Summarized below is the aggregate amount of various professional fees billed by our principal accountants, Pollard-Kelley Auditing Services Inc. (“PKASI”) in 2008 and 2007:

| | | | | | | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| | | | | | | |

| Audit fees | | $ | 31,796 | | | $ | 18,000 | |

| Tax fees | | | 0 | | | | 0 | |

| | | | | | | | | |

| Total: | | $ | 31,796 | | | $ | 18,000 | |

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a) Financial Statements

The following financial statements of the Company and the related report of Independent Registered Public Accounting Firm thereon are set forth immediately following the Index of Financial Statements which appears on page F-1 of this report:

Independent Registered Public Accounting Firm Report

Consolidated Balance Sheets as of December 31, 2008 and 2007

Consolidated Statements of Operations for the years ended December 31, 2008, 2007 and 2006

Consolidated Statements of Stockholders' Equity for the years ended December 31, 2008, 2007 and 2006

Consolidated Statements of Cash Flows for the years ended December 31, 2008, 2007 and 2006

Notes to Consolidated Financial Statements

(b) Financial Statement Schedules

All schedules are omitted as the required information is inapplicable or the information is presented in the consolidated financial statements or related notes.

(c) Exhibits

| Exhibit No. | Description |

| | |

22 | Agreement for Purchase of Ownership Interest, dated October 20, 2003, by and between Brunetti DEC, LLC and the Company. |

4.15 | Certificate of Designation of Series A Convertible Preferred Stock |

10.11 | 1995 Compensatory Stock Option Plan. |

10.43 | Code of Ethics |

10.54 | Agreement and Plan or Reorganization between Intercell International Corp., NewMarket China, Inc. and NewMarket Technology, Inc., dated August 7, 2007. |

10.65 | Stock Purchase Agreement between Intercell International Corp. and NewMarket Technology, Inc. dated August 21, 2007. |

216 | List of Subsidiaries of Intercell International Corporation |

| 31* | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act |

| 32* | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act |

| | |

*Filed herewith. |

| |

1. Incorporated by reference to the Company's Registration Statement on Form S-8, Registration No. 333-67742, and effective August 16, 2001. |

2. Current Report on Form 8-K, dated October 20, 2003. |

3. Form 10-KSB for the fiscal year ended September 30, 2003. |

4. Current Report on Form 8-K, dated August 11, 2007. |

5. Current Report on Form 8-K, dated August 24, 2007. |

6. Form 10-KSB for the fiscal year ended December 31, 2006. |

In accordance with Section 13 or Section 15(d) of the Exchange Act, the Registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

China Crescent Enterprises, Inc.

(Registrant)

| Date: March 31, 2009 | |

| | | |

| | | |

| | By: /s/ Paul K. Danner | |

| | Paul K. Danner | |

| | President and Chief Executive Officer | |

| | | |

| | | |

| Date: March 31, 2009 | |

| | | |

| | | |

| | By: /s/ Philip J. Rauch | |

| | Philip J. Rauch | |

| | Chief Financial Officer | |

In accordance with the Exchange Act this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| /s/ Paul K. Danner | President and | March 31, 2009 |

| Paul K. Danner | | |

| | | |

| /s/ Philip J. Rauch | Chief Financial Officer and | March 31, 2009 |

| Philip J. Rauch | | |

| | | |

| /s/ Philip M. Verges | Director | March 31, 2009 |

| Philip M. Verges | | |

INDEX TO FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

China Crescent Enterprises, Inc.

Dallas, Texas

We have audited the accompanying consolidated balance sheet of China Crescent Enterprises, Inc. and subsidiaries as of December 31, 2008 and 2007, and the related consolidated statements of operations and comprehensive income, stockholders’ equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of China Crescent Enterprises, Inc. and subsidiaries as of December 31, 2008 and 2007, and the results of operations and cash flows for each of the years then ended, in conformity with accounting principles generally accepted in the United States of America.

| | /s/ Pollard-Kelley Auditing Services, Inc. |

| | Pollard-Kelley Auditing Services, Inc. |

Independence, Ohio

March 30, 2009

|

| Consolidated Balance Sheet |

| | | | | | | |

| ASSETS | | December 31, 2008 | | | December 31, 2007 | |

| CURRENT ASSETS | | | | | | |

| Cash and cash equivalents | | $ | 2,600,498 | | | $ | 1,488,774 | |

| Accounts receivable | | | 4,238,294 | | | | 3,674,523 | |

| Inventory | | | 1,858,233 | | | | 1,582,734 | |

| Supplier advances and prepaid expenses | | | 787,149 | | | | 305,723 | |

| Advances to affiliate | | | 687,567 | | | | - | |

| Assets of discontinued operations | | | 9,377 | | | | 9,377 | |

| Other current assets | | | 68,840 | | | | 49,804 | |

| Total current assets | | | 10,249,958 | | | | 7,110,935 | |

| | | | | | | | | |

| PROPERTY AND EQUIPMENT, NET | | | 93,185 | | | | 95,171 | |

| INTANGIBLE ASSETS | | | 2,993 | | | | 3,167 | |

| | | | | | | | | |

| Total assets | | $ | 10,346,136 | | | $ | 7,209,273 | |

| | | | | | | | | |

| | | | | | | | | |

| LIABILITIES, STOCKHOLDERS' EQUITY AND MINORITY INTEREST | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 1,573,643 | | | $ | 2,057,733 | |

| Short-term borrowing | | | 1,798,542 | | | | 584,046 | |

| Accrued expenses and other liabilities | | | 445,258 | | | | 365,468 | |

| Advances from affiliate | | | - | | | | 334,124 | |

| Liabilities of discontinued operations | | | 308,683 | | | | 308,683 | |

| Total current liabilities | | | 4,126,126 | | | | 3,650,054 | |

| | | | | | | | | |

| Long-term debt | | | 151,041 | | | | 0 | |