SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ X ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12

Federated Equity Funds

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary proxy materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

____________________________________________________________

2) Form, Schedule or Registration Statement No.:

____________________________________________________________

3) Filing Party:

____________________________________________________________

4) Date Filed:

____________________________________________________________

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

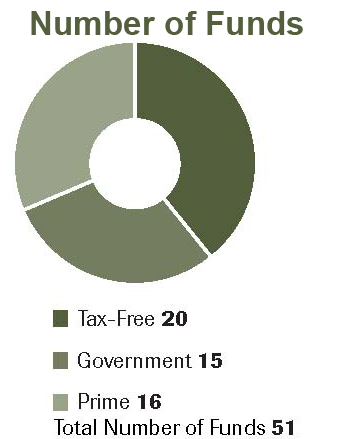

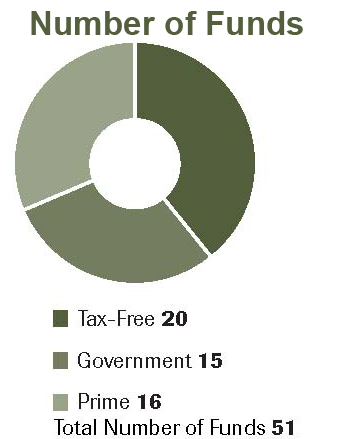

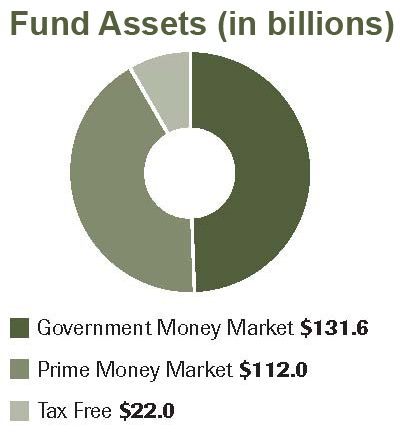

Nearly $3 trillion is currently invested in money market funds, according to the Investment Company Institute. When you consider the expanding cash needs of corporations, businesses, government entities, highnet-worth individuals and the largest generation of retirees in history, expect the demand for money funds to grow.

For more than three decades, Federated has been an industry leader when it comes to money fund management. Federated’s strong presence within the industry enables us to provide one of the largest product menus among money market managers and targeted solutions that are among the most innovative in the industry.

Plus, Federated has relationships with hundreds of securities dealers, ranging from the largest names on Wall Street to regional firms across the country. Our broad network of counterparties also enables us to access a range of primary and secondary market deals around the country.

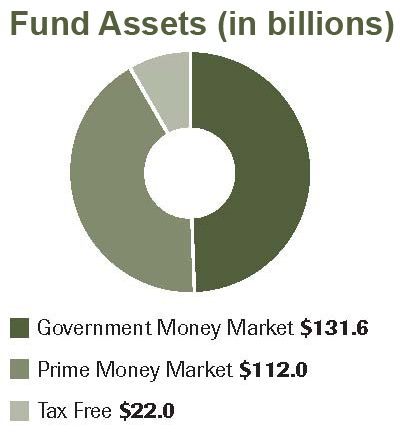

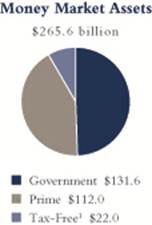

Federated Investors is one of the largest institutional investment managers in the United States with approximately $355 billion in assets, $265.5 billion of which is in money market products.

Our Investment Philosophy

- Highly defined and disciplined process of portfolio construction

- Intensive credit review

- Barbell structure consisting primarily of securities with maturities above and below the average portfolio maturity

- Managers seek competitive yields while avoiding the more speculative issues

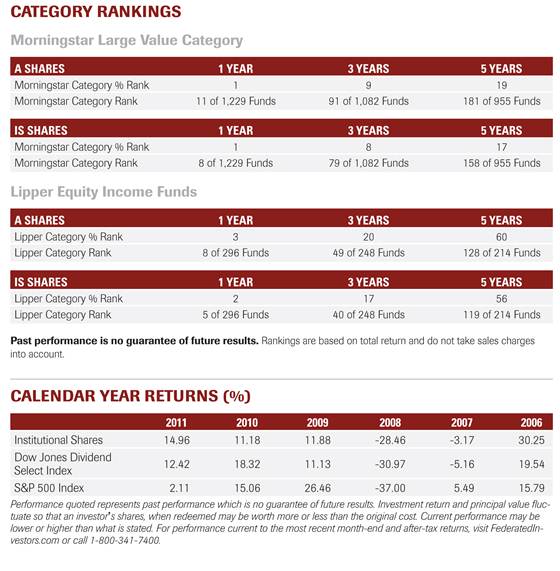

Industry Standings

- Fifty-seven years managing money

- Top 3% of all money market managers1

- One of the largest institutional money market fund managers2

- One of the largest selections of state-specific, tax-free money market funds2,3

- One of the largest managers of AAA-rated money market portfolios2

Industry Leadership

- Introduced one of the first institutional and retail money market funds.

- Helped pioneer the use of the amortized cost accounting method for valuing shares of money market funds at $1.00 — now common practice by all money market fund managers.

- Launched one of the first money market funds holding tax-free variable rate demand notes.

- Was the first U.S. mutual fund company to register in Dublin, Ireland for distribution of offshore money market funds to the European community.4

Federated knows...

Stability

Ranks as a leading global investment manager, managing approximately $355 billion in assets,* delivering competitive and consistent results since 1955 and fostering growth by reinvesting in the company

Offers broad product lines spanning domestic and international equity, fixed income, alternative and money market strategies with the goal of long-term, consistent, competitive performance

Takes the long view, believing that doing business the right way over time will present opportunity for future growth

* As of 6/30/2012.

An investment in money market funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds.1Strategic Insight, 5/31/12, based on assets under management in open-ended funds.

2iMoneyNet, Inc. 5/31/12. For more information on credit ratings, visit standardandpoors.com.

3Income may be subject to the federal alternative minimum tax and state and local taxes.

4Offshore money funds are available to qualified investors. Please contact your Federated representative for more information.

Current and future portfolio holdings are subject to risk.

For more complete information, visit FederatedInvestors.com or call 1-800-341-7400 for summary prospectuses or prospectuses. You should consider the fund’s investment objectives, risks, charges and expenses carefully before you invest. Information about these and other important subjects is in the fund’s summary prospectus or prospectus which you should read carefully before investing.

Not FDIC Insured • May Lose Value • No Bank Guarantee

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

Experience

Federated has earned a well-deserved reputation as a strong fixed income manager.1Our track record in fixed income spans decades, and includes the development of several milestone funds: one of the first government bond funds in 1969; one of the first high yield bond funds in 1972; one of the first tax-free2municipal bond funds in 1976; and one of the first high yield municipal bond funds in 1996.We’ve been managing fixed income portfolios for more than 40 years. Our senior fixed income management team averages 24 years of experience; team members have worked together at Federated for 22 years.

Philosophy

Federated believes that optimum results in fixed income products are best achieved through a traditional value-based approach, using fundamental analysis with teams focused by sector to extract value from each step of the process. Our fixed income management combines top-down decision making with bottom-up security selection to build diversified, risk-managed portfolios.

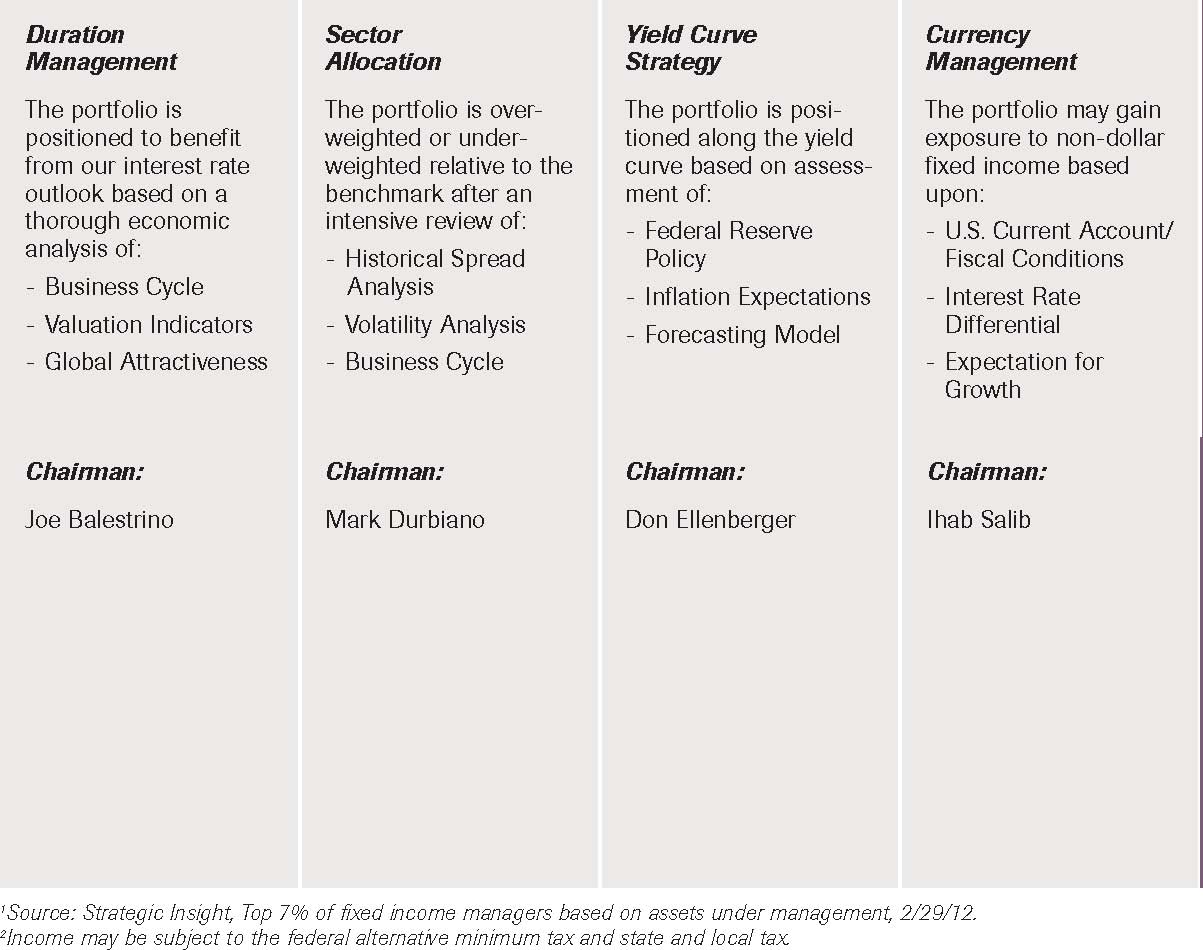

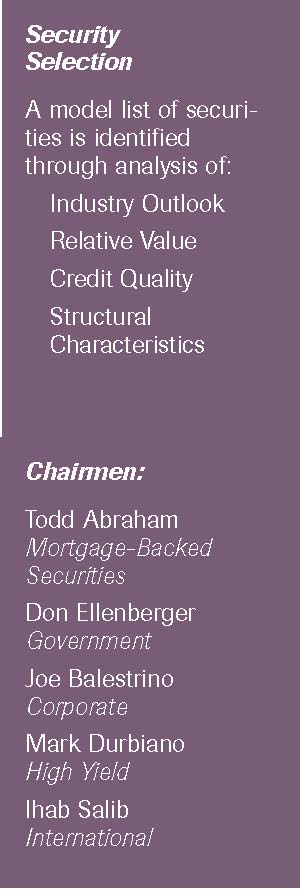

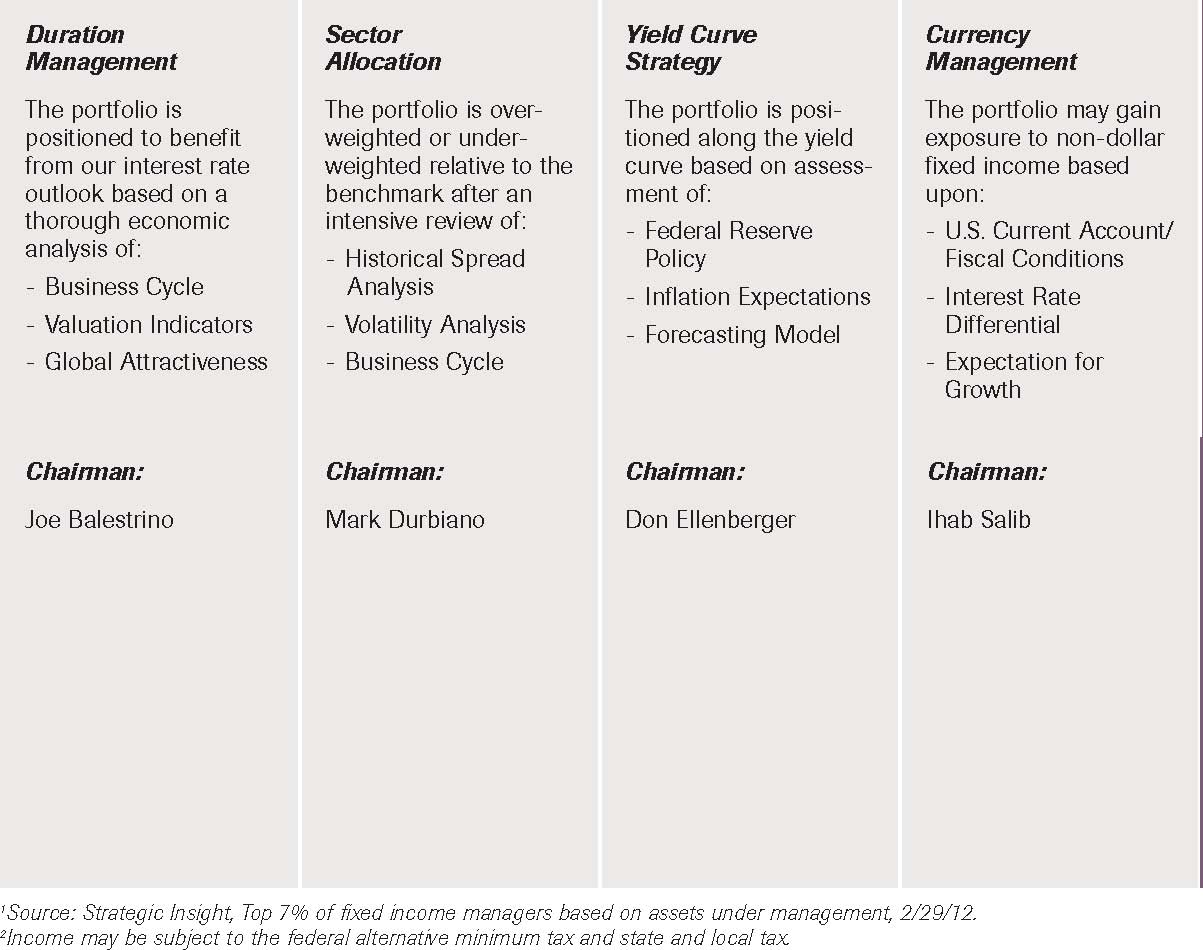

Multiple Alpha Sources: The Alpha Pod Process

Federated fixed income teams make key decisions on various fixed income factors referred to as alpha pods.The alpha pod process consists of duration management, sector allocation, yield curve strategy and currency management.The culmination of this process occurs at the security selection level.

Federated knows...

Stability

Ranks as a leading global investment manager, managing approximately $360 billion1in assets, delivering competitive and consistent results since 1955 and fostering growth by reinvesting in the company

Offers broad product lines spanning domestic and international equity, fixed income, alternative and money market strategies with the goal of long-term, consistent, competitive performance

Takes the long view, believing that doing business the right way over time will present opportunity for future growth

1Assets under management as of 3/31/2012.Mutual funds are subject to risks and fluctuate in value.

International investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards.

High yield, lower-rated securities generally entail greater market, credit/default and liquidity risks, and may be more volatile than investment grade securities.

Alpha measures a fund’s risk-adjusted performance. It represents the difference between a fund’s actual returns and its expected performance, given its level of risk as measured by beta. A positive value for alpha implies that the fund has performed better than would have been expected given its volatility. The higher the alpha, the better the fund’s risk-adjusted performance.

Duration is a measure of a security’s price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations.

Yield Curve: Graph showing the comparative yields of securities in a particular class according to maturity. Securities on the long end of the yield curve have longer maturities.

Investors should carefully consider the fund’s investment objectives, risks, charges, and expenses before investing. To obtain a summary prospectus or prospectus containing this and other information contact us or visit FederatedInvestors.com. Please carefully read the summary prospectus or prospectus before investing.

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices.

Diversification does not assure a profit nor protect against loss.

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

Experience

For more than three decades, Federated has been dedicated to delivering disciplined equity management to a wide variety of institutional and retail clients. Our diverse equity fund lineup includes domestic, international, global and alternative investment strategies, a result of both carefully cultivated homegrown initiatives as well as key strategic acquisitions.The stability of our investment teams allows us to deliver consistency in strategy and management, and to continue exploring new opportunities to meet the ever-changing and diverse needs of our clients.

Philosophy

Federated’s equity management philosophy is based on the belief that research discipline, dedicated risk management and a long-term outlook have the greatest potential to weather market movements and maximize each fund’s ability to reach its investment objective. For each fund, Federated’s experienced specialized investment teams seek to establish clear guidelines for portfolio management and to be systematic about making decisions. This approach is designed to provide each fund with a distinct, stable identity in its pursuit of superior and sustainable investment performance.

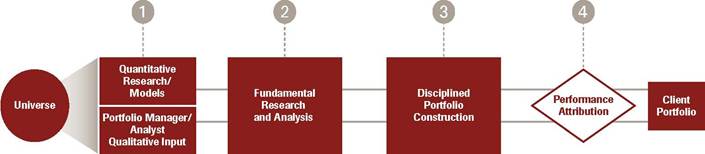

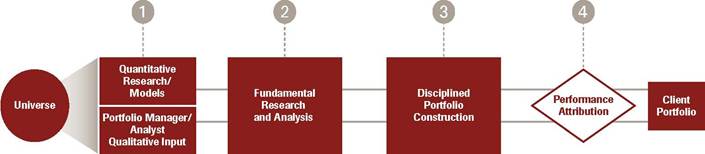

Process

Federated’s equity investment process originates with its commitment to proprietary research—both fundamental and quantitative. Using that information advantage, investment teams construct their portfolios using strict constraints specific to each fund’s investment style. Performance attribution is then used to review the portfolio’s performance and positioning.

Federated knows...

Stability

Ranks as a leading global investment manager, managing approximately $360 billion1in assets, delivering competitive and consistent results since 1955 and fostering growth by reinvesting in the company

Investment Solutions

Offers broad product lines spanning domestic and international equity, fixed income, alternative and money market strategies with the goal of long-term, consistent, competitive performance

Diligence

Takes the long view, believing that doing business the right way over time will present opportunity for future growth

1Assets under management as of 3/31/2012.Mutual funds are subject to risks and fluctuate in value.

International investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards.

Investors should carefully consider the fund’s investment objectives, risks, charges, and expenses before investing. To obtain a summary prospectus or prospectus containing this and other information contact us or visit FederatedInvestors.com. Please carefully read the summary prospectus or prospectus before investing.

Diversification does not assure profit nor protect against loss.

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

All information as of 6/30/2012 unless otherwise noted.

2ndQuarter2012

ProductProfile

FUNDFACTS

Inception Date

3/30/2005

Benchmark

Dow Jones Select Dividend Index

Morningstar Category

LargeValue

Lipper Category

Equity IncomeFunds

Fund Assets

$6.4 billion

Ticker Symbols

Institutional Shares –SVAIX

Class A Shares –SVAAX

Class C Shares –SVACX

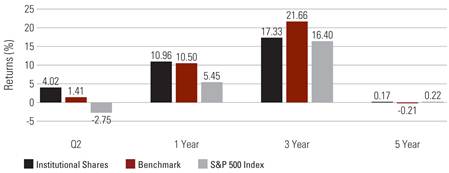

Morningstar Style Box™

Foreign Holdings

28.44%

Portfolio Statistics

| Weighted Median P/E (LTM) | 17.4x |

| Weighted Median P/E (NTM) | 14.4x |

| Number of Securities | 39 |

| Weighted Median Market Cap | $60.7 b |

| Weighted MedianPrice/Book | 3.0x |

| AnnualPortfolioTurnover | 13.3% |

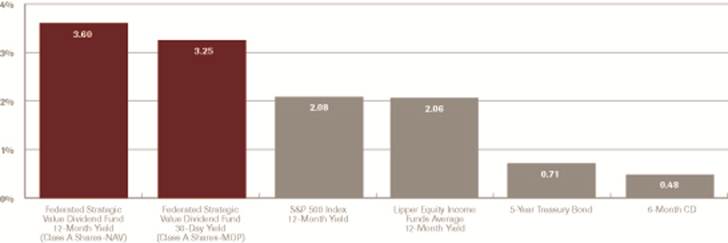

| 30-DayYield1 | 3.25% |

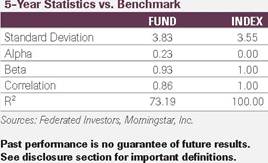

5-Year Statistics vs. S&P 500 Index

| | FUND | INDEX |

| Standard Deviation | 14.60 | 19.21 |

| Beta | 0.65 | 1.00 |

| Correlation | 0.85 | 1.00 |

| R2 | 71.61 | 100.00 |

Sources: Federated Investors, Morningstar, Inc.

Past performance is no guarantee of future results.

See disclosure sectionfor important definitions.

PRODUCTHIGHLIGHTS

| · | Pursues income and long-term capital appreciation. |

| · | Invests primarily in high-yielding stocks of undervalued companies positioned to increase their dividends over time. |

| · | Seeks a substantially higher-than-market dividend yield and a growing stream of income to offset inflation. |

Investment Approach

The fund’s investment approach is bottom-up, striving to emphasize high-yielding dividend- growing stocks. The fund aims to participate in high-yielding market sectors, industries and companies in an effort to produce diversified portfolios. The approach seeks reliable dividend income growth and capital appreciation.

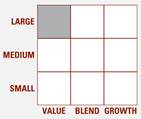

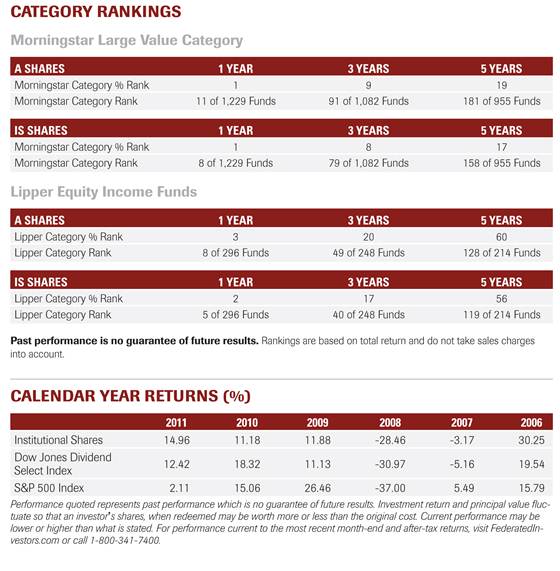

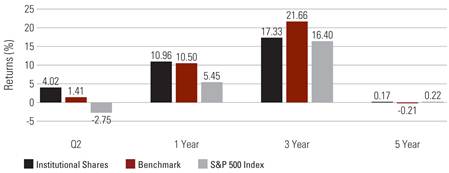

PERFORMANCE

Average Annual Total Returns (%)

| | | | | | | | Expense Ratio* |

| | Q2 | YTD | 1 Year | 3 Year | 5 Year | Since Inception | Before Waivers | After Waivers |

| Class A Shares (NAV) | 3.98 | 5.11 | 10.73 | 17.01 | -0.10 | 5.12 | 1.25 | 1.06 |

| Class A Shares (MOP) | -1.70 | -0.64 | 4.69 | 14.86 | -1.22 | 4.31 | 1.25 | 1.06 |

| Institutional Shares | 4.02 | 5.22 | 10.96 | 17.33 | 0.17 | 5.41 | 0.95 | 0.81 |

| Benchmark | 1.41 | 6.54 | 10.50 | 21.66 | -0.21 | N/A | -- | -- |

Performance quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than what is stated. To view performance current to the most recent month-end, and for after-tax returns, contact us or visit FederatedInvestors.com. Maximum Offering Price figures reflect the maximum sales charge of 5.5% for Class A Shares. See the prospectus for other fees and expenses that apply to a continued investment in the fund.

*The Adviser and its affiliates havevoluntarily agreed towaive theirfees and/orreimburse expenses so that total annual fund operating expenses (excluding acquired fundfees and expenses of 0.01%) paid by Class A andIS Shares (after thevoluntarywaivers and/orreimbursements) will not exceed 1.05% and 0.80%respectively, up to but not including the later of 1/1/13 or the date of the fund’s next effective prospectus.

Not FDIC Insured • May LoseValue • No Bank Guarantee

KEYINVESTMENT TEAMMEMBERS

| Walter Bean, CFA

Senior Vice President

Senior Portfolio Manager

Head of Income

Management Team |  | Daniel Peris,

PhD, CFA

Vice President

Senior Portfolio Manager |  | Deborah Bickerstaff

Vice President

Associate Portfolio Manager |

INVESTMENTPROCESS

• All common stocks in developed markets, with a minimum market cap of $3.0 billion and yield greater than 3.0% • Rank stocks based on: - Dividend yield - Dividend growth - Valuation - Strong financial condition - Performance during periods of market weakness | • Focus on high-yielding stocks • Conduct fundamental risk/reward analysis at industry and company level • Evaluate management concern for shareholder value • Prepare cash flow and dividend forecasts • Construct disciplined valuation framework | • 40-50 stocks • Fully invested • Diversified across income producing sectors • Portfolio yield significantly higher than market average yield • Risk management • 5% maximum position size • Sell discipline | • Multi-factor analysis attributes style and characteristic exposures • Examine sector and stock selection impact • Rigorous and continuous feedback loop helps ensure all elements of process are adding value as expected |

INVESTMENT REVIEW

Market Overview

A strong June rally wasn’t enough to save the second quarter of 2012 from May’s ugly sell-off, but the major indices posted their best June returns in more than a decade, fueled by late-breaking events in Europe that sent equities soaring on the last trading day. European Union leaders defied expectations at their 20th summit since the eurozone crisis broke by agreeing to the immediate and direct use of bailout funds to aid struggling European banks, as well as to treat rescue funds for banks equally to funds used to support sovereign debts and to create a central eurozone authority over banks. These moves were viewed for the most part as concessions to the more growth-first forces led by the European Union’s southern-tier countries, by the austerity-first forces led by Germany. While details about how all the measures would work remained sketchy, the outcome was enough to give the markets hope that the agreement bought Europe more time to get its house in order.

Back in the U.S., the news wasn’t as favorable. The economic soft patch continued into June, with sluggish retail sales and nonfarm payroll growth, a significant slowdown in manufacturing activity—the Institute for Supply Management’s gauge for the month actually fell into contraction territory for the first time in three years—and a spate of downward revisions to forecasted second-quarter corporate profits that will start appearing soon. Housing continued to be a bright spot, with sales, construction and prices all tilting to increases, indicating an industry that has been a drag on GDP likely may be a contributor this year.

On the political front, the U.S. Supreme Court surprised by essentially upholding the Patient Protection and Affordable Care Act, commonly known as Obamacare—though not for reasons most thought it would. The court upheld the mandate as a tax and, in so doing, effectively let Obamacare stand. The decision promises to sharpen the debate between President Obama and Republican challenger Mitt Romney in this fall’s presidential campaign, as well as to further the divisiveness between the two parties.

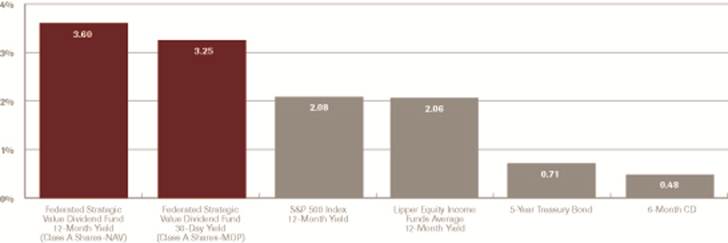

Performance and Strategy

Amidst the recent commotion in the markets, Federated Strategic Value Dividend Fund has remained focused, as always, on achieving its core objectives: to provide investors with income and long-term capital appreciation. The portfolio finished the quarter with a 30-day yield of 3.4% for Class A Shares and a weighted average stock dividend yield of 4.7%, maintaining its historically high yield. The portfolio’s dividend yield was not only greater than that of the Dow Jones Select Dividend Index (4.0%), a proxy of the domestic dividend-paying universe, but it has continued to be well above that of the 10-Year U.S. Treasury Bond (1.7%) and the broad market, represented by the S&P 500 Index (2.2%). Complementing its high yield, the fund also saw dividend growth within the second quarter of 2012. This dividend growth, which may provide investors with a hedge against inflation and may help the portfolio to sustain its high yield, came courtesy of 11 dividend increases announced by holdings within the portfolio. Among those 11 were an 11.1% increase from Chevron Corp., its 25th consecutive yearly dividend bump, and a 7.0% increase from Johnson & Johnson, its 50th consecutive yearly increase. Such milestones are not unexpected given the fund’s holdings and the solid foundations of their dividend histories. Year-to-date, the portfolio has now experienced 19 dividend increases, along with a special dividend from GlaxoSmithKline PLC, which was announced in February.

Providing investors with lower downside risk is an important goal for the fund. In a market where volatility has been an all-too-common occurrence, the portfolio aims to stay above the fray and short-term noise of the markets. Since its inception, the fund has consistently done just that, demonstrated by its low beta of 0.55 (Wilshire 3-year beta versus S&P 500 calculated using monthly return). By keeping the volatility of the portfolio low, the fund pursues lower downside risk in an environment of falling prices. Dividend stocks not only anchor a large portion of total return to their dividend distributions, but they also are commonly held by income investors. These income investors tend not to trade as frequently as other investors, since they buy stocks to collect the dividends that they generate. As a result, when the market rises and falls, the income investor is less likely to buy/sell due to their focus on the stock’s dividend distribution, not its price. Further, stocks that are dividend stalwarts are generally less sensitive to downward swings in the economy, since these companies are typically large, well-established global firms with diverse revenue streams and geographies. This, combined with the large portion of total return tied to the dividend and the less-frequent trading habits of income investors, results in the low volatility of dividend stocks.

During the second quarter of 2012, Federated Strategic Value Dividend Fund produced a total return of 4.0% (Class A Shares at net asset value). The Dow Jones Select Dividend Index and S&P 500 Index had returns of 1.4% and -2.8% respectively over the same time period.

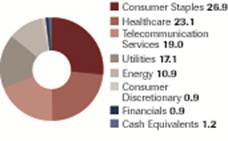

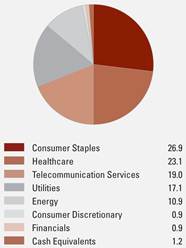

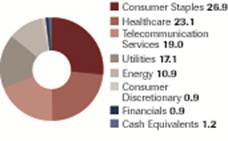

Defensive stocks were in favor and consequently, the Utilities, Health Care, and Consumer Staples sectors produced attractive returns of 6.1%, 5.3%, and 4.3% for the portfolio. Telecom Services, another defensive sector, was the best performing sector for the fund, returning 7.4%.

Returns were led by Verizon Communications (17.8%) and AT&T, Inc. (15.8%). Additionally benefiting the portfolio was its avoidance of the cyclical and dividend-unfriendly Information Technology, Materials, and Industrials sectors which experienced losses of -6.7%, -4.2%, and -3.6%, respectively. A sector that did post a loss to the detriment of the fund was the Energy sector. The portfolio’s Energy holdings fell -3.2% on the quarter, driven by the fall in oil prices which have retreated -17.5% since the end of the first quarter.

Federated Strategic Value Dividend Fund’s objectives to provide investors with income and long-term capital appreciation and its goal of lower downside risk all contribute to the portfolio’s long-term goal to produce superior long-term total returns. While all of these are critical to the fund, the lower downside risk characteristics of the fund were in evidence in the second quarter as the markets gyrated. As Baby Boomers retire in larger and larger numbers, the need for lower downside risk is as great as ever.

Performance quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than what is stated. To view performance current to the most recent month-end, and for after-tax returns, contact us or visit FederatedInvestors.com.

See disclosure section for important disclosures and definitions.

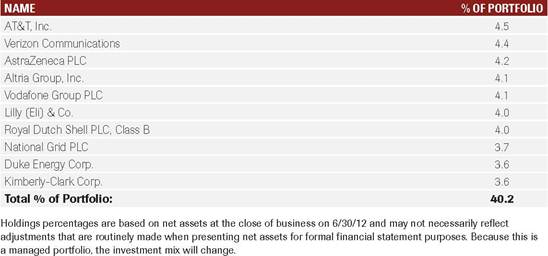

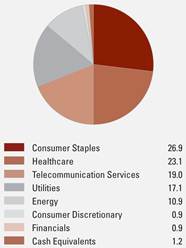

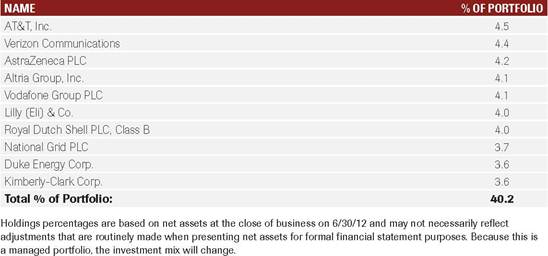

TOPHOLDINGSSectorWeightings(%)

Sector Weightings (%)

Portfolio composition is based on net assets at the close of business on 6/30/12 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement purposes. Because this is a managed portfolio, the investment mix will change.

ReasonstoOwnthisFund

The High-Dividend Advantage

An important potential benefit of dividend investing is that returns are linked tocash payments. Dividend income may provide a distinct advantage when fixed-income yields are low, the outlook for inflation is uncertain and the broader market is volatile.

APortfolio Built One Dividend-Paying Stock at aTime

Fund managersWalter C. Bean and DanielPeris bring 55 years of collective experience to building a portfolio of 40-50 stocks ranked according to their dividend yield, dividend growth, valuation, strong financials and performance regardless of market conditions.

A Balance of Risk and Reward

Dividend-paying companies:

| § | Tend to be solid and wellestablished |

| § | Issue stock whose prices have typically been less volatile than non-dividend- paying companies |

| § | Have historically paid a sizeable portion of their returns incash and, as a result, may help cushion a portfolio’s downside |

FEDERATEDKNOWS...

Stability

Ranks as a leading global investment manager, managing approximately $355 billion* in assets, delivering competitive and consistent results since 1955 and fostering growth by reinvesting in the company

Investment Solutions

Offers broad product lines spanning domestic and international equity, fixed income, alternative and money market strategies with the goal of long-term, consistent, competitive performance

Diligence

Takes the long view, believing that doing business the right way over time will present opportunity for future growth

* As of 6/30/2012

Past performance is no guarantee of futureresults.

| 1 | The 30-day SEC yield for Class A Shares is calculated by dividing the net investment income per share for the 30 days ended on the date of calculation by the maximum offering price per share on that date. The figure is compounded and annualized. For an indefinite period of time, the investment adviser is waiving all or part of its fee and, in addition, may reimburse the fund for some of its expenses. Otherwise, the yield would have been 3.09%. |

A WORD ABOUT RISK

Mutual funds are subject to risks and fluctuate in value.

Asset allocation does not assure a profit nor protect against loss.

International investing involves special risks, including currency risk, increased volatility, political risks, and differences in auditing and other financial standards.

There are no guarantees that dividend-paying stocks will continue to pay dividends. In addition, dividend paying stocks may not experience the same capital appreciation potential as non-dividend paying stocks.

Funds whose investments are concentrated in a specific industry, sector or geographic area may be subject to a higher degree of market risk than funds whose investments are diversified.

DEFINITIONS

Current Dividend Yield is based on the current yields of the individual securities within the portfolio, weighted for their respective share of the overall portfolio.

Dow Jones Select Dividend Index universe is defined as all dividend-paying companies in the Dow Jones U.S. Total Market Index that have a non-negative historical five-year dividend-per-share growth rate, a five-year average dividend earnings-per-share ratio of less than or equal to 60%, and three-month average daily trading volume of 200,000 shares. Current index components are included in the universe regardless of their dividend payout ratio. The Dow Jones U.S. Total Market Index is a rule-governed, broad-market benchmark that represents approximately 95% of the U.S market capitalization.

S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Indexes are unmanaged and cannot be invested in directly.

Betameasures a portfolio’s volatility relative to the market. A Beta greater than 1.00 suggests the portfolio has historically been more volatile than the market as measured by the funds’ benchmark. A Beta less than 1.00 suggests the portfolio has historically had less volatility relative to the market.

Correlation is the degree to which one variable (here, the fund’s returns) fluctuates relative to another (the returns of the fund’s benchmark). Correlation ranges from 1.0 when two variables move identically in the same direction, to -1.0 when two variables move identically in the opposite direction.

R-Squared indicates what percentage of a portfolio’s movement in performance is explained by movement in performance of the market. R-squared ranges from 0 to 100, and a score of 100 suggests that all movements of a portfolio’s performance are completely explained by movements in the market as measured by the fund’s benchmark.

Standard Deviation is a historical measure of the variability of returns relative to the average annual return. A higher number indicates higher overall volatility.

Weighted Median P/E (LTM - Latest Twelve Months) is a ratio comparing share price to earnings per share using data from the previous twelve months.

Weighted Median P/E (NTM - Next Twelve Months) is a ratio comparing share price to earnings per share using estimated data for the next twelve months.

Weighted Median Price/Book is a ratio comparing share price to book value or assets minus liabilities.

Weighted Median Dividend Yield is a weighted average of the dividends of all the stocks in a portfolio.

RATINGS ANDRATING AGENCIES

Lipper Categories: Data Source: Lipper, A Reuters Company. Copyright 2012© Reuters. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Morningstar Style Box™ reveals a fund’s investment strategy. For equity funds, the vertical axis shows the market capitalization of the long stocks owned, and the horizontal axis shows investment style (value, blend or growth).

Morningstar Category identifies funds based on their actual investment styles as measured by their underlying portfolio holdings over the past three years. If the fund is less than three years old, the category is based on the life of the fund. ©2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Federated Investors, Inc.

Federated Investors Tower

1001LibertyAvenue

Pittsburgh, PA 15222-3779

1-800-341-7400

FederatedInvestors.com

G42142-02 (7/12)

Federated Securities Corp., Distributor

This must be preceded or accompanied by a prospectus.

Federated is a registered trademark ofFederated Investors, Inc. 2012 ©Federated Investors, Inc.

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

In Need of Dividends?

FederatedStrategicValueDividendFund

FederatedStrategicValueDividendFundoffersinvestorsaportfolioofquality,dividend-payingcompanieswithstrong

dividendgrowthpotential.

| | Ticker | Security | DividendsPaid | 2012DividendStatus: |

| Holding | Symbol | Yield | ConsecutivelySince | Month/Increase% |

| ConsumerDiscretionary | | | | |

| McDonald'sCorp. | MCD | 3.16 | 1976 | |

| ConsumerStaples | | | | |

| AltriaGroup,Inc. | MO | 4.75 | 1928 | |

| Coca-ColaCo. | KO | 2.61 | 1920 | Feb./8.5% |

| GeneralMills,Inc. | GIS | 3.43 | 1899 | Jun./8.2% |

| H.J.HeinzCo. | HNZ | 3.79 | 1946 | May/7.3% |

| KelloggCo. | K | 3.57 | 1925 | Apr./2.3% |

| Kimberly-ClarkCorp. | KMB | 3.53 | 1935 | Feb./5.7% |

| Lorillard,Inc. | LO | 4.70 | 2008 | Feb./19.2% |

| PepsiCo,Inc. | PEP | 3.04 | 1952 | Feb./4.4% |

| PhilipMorrisInternationalInc. | PM | 3.53 | 1928 | |

| Procter&GambleCo. | PG | 3.67 | 1890 | Apr./7.0% |

| ReynoldsAmerican,Inc. | RAI | 5.26 | 1999 | May/5.4% |

| UnileverPLC | ULVR | 3.61 | 1949 | Apr./5.9% |

| Energy | | | | |

| ChevronCorp. | CVX | 3.41 | 1912 | Apr./11.1% |

| ConocoPhillips | COP | 4.72 | 1934 | |

| RoyalDutchShellPLC | RDSB | 4.83 | 1943 | Feb./2.4% |

| TotalSA | TOT | 5.46 | 1945 | |

| Financials | | | | |

| Ventas,Inc. | VTR | 3.93 | 1999 | |

| Healthcare | | | | |

| AbbottLaboratories | ABT | 3.16 | 1924 | Feb./6.3% |

| AstraZenecaPLC | AZN | 6.17 | 1999 | |

| Bristol-MyersSquibbCo. | BMY | 3.78 | 1933 | |

| EliLilly&Co. | LLY | 4.57 | 1955 | |

| GlaxoSmithKlinePLC | GSK | 4.91 | 1889 | Feb.1&Apr./15.2%2 |

| Johnson&Johnson | JNJ | 3.61 | 1944 | Apr./7.0% |

| Merck&Co.,Inc. | MRK | 4.02 | 1932 | |

| TelecommunicationServices | | | | |

| AT&T,Inc. | T | 4.94 | 1893 | |

| BCE,Inc. | BCE | 4.39 | 1949 | |

| CenturyLink,Inc. | CTL | 7.34 | 1978 | |

| VerizonCommunications | VZ | 4.50 | 1893 | |

| VodafoneGroupPLC | VOD | 5.31 | 1999 | |

| WindstreamCorp. | WIN | 10.35 | 2006 | |

| Utilities | | | | |

| AmericanElectricPowerCo.,Inc. | AEP | 4.71 | 1910 | |

| DominionResources,Inc. | D | 3.91 | 1925 | Jan./7.1% |

| DukeEnergyCorp. | DUK | 4.42 | 1926 | Jun./2.0% |

| NationalGridPLC | NGG | 5.81 | 1996 | |

| PepcoHoldings,Inc. | POM | 5.52 | 1904 | |

| PPLCorp. | PPL | 5.18 | 1946 | Feb./2.9% |

| SouthernCo. | SO | 4.23 | 1948 | Apr./3.7% |

| SSEPLC | SSE | 5.76 | 1992 | |

Holdingsareasof6/30/2012.TheFundisamanagedportfolioandholdingsaresubjecttochange.

Pastperformanceisnoguaranteeoffutureresults.Forcurrentfundperformance,visitFederatedInvestors.com.

NOTFDICINSURED • MAYLOSEVALUE •NOBANKGUARANTEE

AverageAnnualTotalReturn(%)asof6/30/12

TickerSymbol | Since

Inception 1Year 5Year (3/30/2005) | Expenses * BeforeWaivers AfterWaivers | 30-DayYield |

| ClassAShares(NAV)SVAAX | 10.73 -0.10 5.12 | 1.25 1.06 | 3.44 |

| ClassAShares(MOP)SVAAX | 4.69 -1.22 4.31 | 1.25 1.06 | 3.25 |

| ClassCShares(NAV)SVACX | 9.91 -0.83 4.38 | 1.95 1.81 | 2.71 |

| ClassCShares(MOP)SVACX | 8.91 -0.83 4.38 | 1.95 1.81 | N/A |

| InstitutionalSharesSVAIX | 10.96 0.17 5.41 | 0.95 0.81 | 3.68 |

Performance quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than what is stated. To view performance current to the most recent month-end, and for after-tax returns, contact us or visit FederatedInvestors.com. Maximum Offering Price figures reflect the maximum sales charge of 5.5% for Class A Shares and the maximum contingent deferred sales charge of 1% for Class C Shares. See the prospectus for other fees and expenses that apply to a continued investment in the fund.

*TheAdviseranditsaffiliateshavevoluntarilyagreedtowaivetheirfeesand/orreimburseexpensessothatthetotalannualfundoperatingexpenses(excluding acquiredfundfeesandexpensesof0.01%)paidbythefund’sClassA,ClassCandInstitutionalShares(afterthevoluntarywaiversand/orreimbursements)will notexceed1.05%,1.80%and0.80%,respectively,throughthelaterofJanuary1,2013orthedateofthefund’snexteffectiveprospectus.

The30-dayyieldiscalculatedbydividingthenetinvestmentincomepershareforthe30daysendedonthedateofcalculationbythemaximumofferingprice (SECyield)ornetassetvaluepershareonthatdate.Thefigureiscompoundedandannualized.Intheabsenceoftemporaryexpensewaiversorreimbursements, the30-dayyieldwouldhavebeen3.09%atmaximumofferingpriceand3.28%atnetassetvalueforClassAShares,2.55%forClassCSharesand3.52%for InstitutionalShares.

Investorsshouldcarefullyconsiderthefund’sinvestmentobjectives,risks,chargesandexpensesbeforeinvesting.Toobtain asummaryprospectusorprospectuscontainingthisandotherinformation,contactusorvisitFederatedInvestors.com.Please carefullyreadthesummaryprospectusorprospectusbeforeinvesting.

Therearenoguaranteesthatdividend-payingstockswillcontinuetopaydividends.Inaddition,dividend-payingstocksmaynot experiencethesamecapitalappreciationpotentialasnon-dividendpayingstocks.

1 GlaxoSmithKlinePLCdeclaredaspecialdividendof5GBppershareon2/7/12.Thisspecialdividendisnotincludedinanyyieldcalculations.

2 Equalsthe6/30/12trailing12month(TTM)dividends,includingthespecialdividend,comparedtothe6/30/11TTMdividends.

Fundswhoseinvestmentsareconcentratedinaspecificindustry,sectororgeographicareamaybesubjecttoahigherdegreeofmarketriskthanfundswhose investmentsarediversified.

Internationalinvestinginvolvesspecialrisksincludingcurrencyrisk,increasedvolatility,politicalrisksanddifferencesinauditingandotherfinancialstandards.

43145(7/12)FederatedisaregisteredtrademarkofFederatedInvestors,Inc.FederatedSecuritiesCorp.,Distributor 2012©FederatedInvestors,Inc.

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

August 2012 Money Market Commentary

| FundName | Ratings | ShareClass | NASDAQ |

| PRIME |

FederatedPrimeCashObligationsFund | AAAmS&P Aaa-mfMoody’s AAAmmfFitch NAICList*, | IS | PCOXX |

| CAP | PCCXX |

| SS | PRCXX |

FederatedPrimeManagementObligationsFund | N/A | IS | PMOXX |

| CAP | PICXX |

| SS | PSSXX |

FederatedPrimeObligationsFund | AAAmS&P Aaa-mfMoody’s AAAmmfFitch NAICList*, | IS | POIXX |

| CAP | POPXX |

| SS | PRSXX |

| TR | POLXX |

FederatedPrimeValueObligationsFund | A-mfMoody’s NAICList*, | IS | PVOXX |

| CAP | PVCXX |

| SS | PVSXX |

| GOVERNMENT |

FederatedGovernmentObligationsFund | AAAmS&P Aaa-mfMoody’s AAAmmfFitch NAICList** | IS | GOIXX |

| CAP | GOCXX |

| SS | GOSXX |

| TR | GORXX |

FederatedGovernmentObligations Tax-ManagedFund | AAAmS&P Aaa-mfMoody’s NAICList**, | IS | GOTXX |

| SS | GTSXX |

| TREASURY |

FederatedTreasuryObligationsFund | AAAmS&P Aaa-mfMoody’s NAICList**, | IS | TOIXX |

| CAP | TOCXX |

| SS | TOSXX |

| TR | TOTXX |

FederatedU.S.TreasuryCashReserves | AAAmS&P Aaa-mfMoody’s NAICList** | IS | UTIXX |

| SS | TISXX |

| MUNICIPAL |

FederatedMunicipalObligationsFund | AmmfFitch NAICList* | IS | MOFXX |

| CAP | MFCXX |

| SS | MOSXX |

FederatedTax-FreeObligationsFund | Aaa-mfMoody’s AAAmmfFitch NAICList* | IS | TBIXX |

| SS | TBSXX |

| Treasury Yields as of 7/31/12 | 3-Month | 6-Month | 2-Year | 5-Year |

| 0.11% | 0.14% | 0.23% | 0.60% |

| Libor Rates as of 7/31/12 | 1-Month | 3-Month | 6-Year | 1-Year |

| 0.25% | 0.44% | 0.73% | 1.05% |

Pastperformanceisnoguaranteeoffutureresults.

Month in Cash: What might the Fed have in reserve?

August1,2012

TheFederalReserve’sJuneannouncementofanextensionof“OperationTwist”,underwhich theFedpurchaseslonger-termTreasurysecuritieswiththeproceedsfromthe saleofshort-termTreasuries,wasprobablythemostbenignchoiceforadditionalstimulusaftercomingunderintense pressureasaresultofsluggishdomesticeconomicgrowthandcontinuedconcernsoverEurope. Sincethen,ofcourse,speculationhasgrownthattheFedmight takefurtherstepsbeforelongto shoreuptheeconomy.FedChairmanBenBernankecontinuestoindicatethatwhiletheFedremains inwatchfulwaitingmode,itisofcoursepreparedtoacttoprovidemoreaccommodation—itsimply hasn’tdecidedtodosoyet,norhasitdeterminedwhatstepswouldbeappropriate,shoulditdecide togodownthatpath.

Bernankeidentifiedassetpurchasesandcommunicationsastheprimarytoolsunderconsideration, butthereareanumberofdifferentoptionstheFedmightpursue.ThecurrentOperationTwistfocusesonthree-yearandunderTreasurysecurities.TheFedcouldexpandthattoincludelonger-datedTreasuries,mortgage-backedsecurities,oragencies.Judgingfromtheirdiscussions,theyseemmost interestedinmortgages.Thatmightnot causemanyproblemsforthemoneymarketworld–we’dsee thebizarreeffectofaneasingthatwouldactuallyhelpstabilizerates,ifnotpushthemupafewbasis points,ifonlybecauseitwould takeidlesupplyjustsittingontheFed’sbalancesheetandputitback outintothemarketsforuse—maybenotbymoneyfundsdirectly,butinthe caseofmortgages,as collateralforrepo.AnotherideawouldbetoinitiateafullQuantitativeEasingIII,andresumepurchasingsecurities.Thatoptionmightbeapossibility,butitseemsitwouldbeadistantsecond.

Thereisathirdoption—loweringoreliminatingtheInterest RateonExcessReserves,or IOER, fromitscurrent25basispointlevel.Bernankebroughtupthisoptiononlyafterasecondwaveof questioningbycongressmen.Theseeminglyreluctantmentionof IOERwasabitofarelief,as speculationhadmountedinthepastseveraldaysthattheFedmightgothere.Thespeculation waspromptedbytherecentaction takenbytheEuropeanCentralBanktoloweritsdepositrate from25basispointstozero,whichwasaccompaniedbyareductioninitslendingratefrom1.0% to0.75%.TheFedhasprobablyobserved,however,thattheECB’scurrentzero-rateenvironment isn’tworkingoutinthewaythattheyhadhoped,pushingthisoptiontoanunlikelythird.

Atlanticcrossing?

There are, of course, concerns about European credit markets slowing down—they’re a major trade partner. But the slowdown on the European continent has already happened. It’s one of the reasons the U.S. pace has slowed. And it’s not as important of a sector for us as some other areas, such as Canada and Mexico, which are more significant trading partners. While there’s a good deal of headline risk concerning the potential for Europe’s economic problems to bleed into our markets, from a money markets perspective, we don’t see that happening just yet. They don’t have much supply – European rates are at such low levels, if not negative, that few are buying there. Europe does have the potential to impact demand. Buyers who are turned off by euro investments could swap those investments for there’s a finite supply – obviously rates would go down, as demand could outstrip supply. We haven’t seen that play out yet, but we’re keeping our own watchful, waiting eye on Europe.

Federated knows...

Stability

Ranksasaleadingglobalinvestmentmanagerwithapproximately$355billioninassetsundermanagement,1deliveringcompetitiveandconsistentresultssince1955andfostering growthbyreinvestinginthecompany

Investment Solutions

Offersbroadproductlinesspanningdomesticandinternationalequity,fixedincome,alternativeand moneymarketstrategieswiththegoaloflong-term,consistent,competitiveperformance

Diligence

Takesthelongview,believingthatdoingbusinesstherightwayovertimewillpresentopportunity forfuture growth

Views are subject to change based on market conditions and other factors. These views should not be construed as a recommendation for any specific security or sector.

London Interbank Offered Rate (Libor): The rate at which banks can borrow funds from other banks in the London interbank market. The Libor is fixed on a daily basis by the British Bankers Association and acts as a benchmark for other short-term interest rates.

Securities are considered to be “first tier” as follows: Standard & Poor’s: A-1+ and A-1, based on the obligor’s capacity to meet its financial commitment on the obligation; Moody’s: P-1, based on the issuer’s ability to repay short-term obligations; Fitch: F-1+ and F-1, based on the issuer’s liquidity necessary to meet financial commitments in a timely manner. Similarly, securities are considered to be “second tier” as follows: Standard & Poor’s: A-2; Moody’s: P-2 and Fitch: F-2.

*This fund is on the National Association of Insurance Commissioner’s list as a Class 1 listing. This designation denotes that the fund meets certain quality and pricing guidelines such as: a rating of A or better by a Nationally Recognized Statistical Rating Organization (NRSRO), maintains a constant NAV $1.00 at all times, allows a maximum seven-day redemption of proceeds, invests 95% in U.S. government securities or securities rated in the highestshort-term rating category by anNRSRO, or unrated securities determined by the fund’s board to be of comparable quality or other registered money market fundsor collateralized repurchase agreements with the remaining 5% in Second Tier securities from Rule 2a-7. This is subject to an annual review.

**This fund is on the National Association of Insurance Commissioner’s list as a U.S. Direct Obligations/Full Faith & Credit listing. This designation denotes that the fund meets certain quality and pricing guidelines such as: a rating of AAA or Aaa by a Nationally Recognized Statistical Rating Organization (NRSRO), maintains a constant NAV $1.00 at all times, allows a maximum seven-day redemption of proceeds, invests 100% in U.S. government securities. This is subject to an annual review.

1 As of 6/30/12.

An AAAm rating by Standard & Poor’s is obtained after S&P evaluates a number of factors, including credit quality,market price exposure, and management.

Money market funds rated Aaa-mf by Moody’s are judged to be of an investment quality similar to Aaa-rated fixed income obligations, that is, they are judged to be of the best quality. Money funds rated A-mf by Moody’s are judged to be of an investment quality similar to A-rated fixed income obligations; that is, they are judged to possess many favorable investment attributes and are considered as upper-medium-grade investment vehicles. Fitch’s money market ratings are an assessment of the safety of invested principal and the ability to maintain a stable value of the fund’s shares. Ratings are based on an evaluation of several factors, including credit quality,diversification, and maturity of assets in the portfolio, as well as management and operation capabilities. Ratings are subject to change and do not remove market risk. For more information on credit ratings, visit standardandpoors.com, v3.moodys.com and fitchratings.com.

AninvestmentinmoneymarketfundsisneitherinsurednorguaranteedbytheFederalDepositInsuranceCorporationoranyothergovernment agency.Althoughmoneymarketfundsseektopreservethevalueofyourinvestmentat$1.00pershare,itispossibletolosemoney byinvestingin thesefunds.

This must be preceded or accompanied by a prospectus for the funds named. Income from municipal funds may be subject to the federal alternative minimum tax and state and local taxes.

ForInstitutional/InvestmentProfessionalUseOnly.NotforDistributiontothePublic.

Federated Investors, Inc.

Federated InvestorsTower

1001LibertyAvenue

Pittsburgh,PA 15222-3779

Contact us atFederatedInvestors.com orcall 1-800-341-7400.

41805 ( 8/12)

Federated Securities Corp., Distributor

Federated is a registered trademark ofFederated Investors, Inc.

2012 ©Federated Investors, Inc.

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

An Investor’s Guide to Understanding

Federated’s MoneyFund Management

It’sachallengingtimetobeaninvestor,soit’snaturalthatyoumaybeconcernedabout thesecurityofyourinvestments.BeassuredthatFederatedmoneymarketfundsare amongthemostconservativeofinvestments.

Formorethan38years,thenameFederatedhasbeensynonymouswithexperienceand integrityinmoneyfundmanagement.Duringatimeofhistoricvolatilityforthemoney markets,investorscanturntoFederatedfordiligentcreditanalysis,broaddiversification andtimetestedcashmanagementservices.

LeadingFromaPositionofStrengthandExperience

Specifically,Federatedmoneymarketfunds:

- Havealwayssoldandredeemedtheirsharesata$1.00netassetvalue(NAV).Federated hasneverinfusedcapitaltomaintainastable$1.00NAV.(Notethat,whileFederated moneymarketfundshaveneverbrokenthe$1.00statedprice,thereisnoguaranteethat suchpricestabilitywillbemaintainedinthefuture.)

- HoldonlythosesecuritiesthatmeasureuptoFederated’sintensiveinternalrating standards.Ourintensivecreditanalysisconsidersbutdoesnotrelyontheratingsgivenbynationallyrecognizedratingorganizationsortheirequivalents.

- StrictlycomplywithRule2a-7oftheInvestmentCompanyActof1940,which seekstolimittheexposurethatafundwouldhavetoanyoneissuerorguarantor ofsecurities.1

- Aremanagedbyseasonedprofessionalswhohaveworkedtogetherfornearly25years andoverseenourfundsthroughavarietyofbusinessandeconomiccycles.

AtFederated,weunderstandtheimportanceofprotectingwhatisimportanttoyouwhileyouinvesttowardyourfinancialgoals. Weinviteyoutolearnmoreaboutourstructured, transparentanddisciplinedinvestmentprocess.

SeekingtoOptimizePerformanceWithoutCompromisingLiquidity andStability

FewmanagerscanmatchFederated’scombinationofassetsize,breadthofexperienceand depthofstaff.Withnearly$275billion2 inmoneymarketassetsundermanagement,we bringkeyadvantagesinpricingandmarketaccesstoourclients.

NotFDIC Insured • May LoseValue • No Bank Guarantee

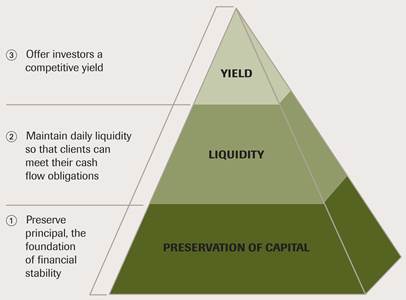

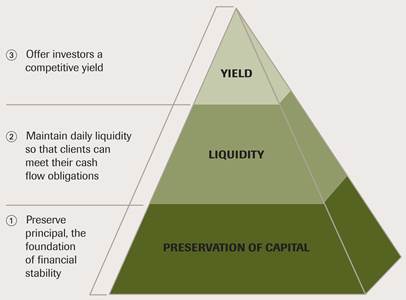

Ourobjectivesinmanagingcasharethreefold: topreserveprincipal,thefoundationoffinancial stability;tomaintaindailyliquiditysoclients canmeettheircashflowobligations;andto offerinvestors acompetitiveyield.

Wepursuetheseobjectivesthroughanunwavering adherenceto astringentcredit reviewprocess,the experienceofourlong-tenuredteamofmoneyfundmanagersandcontinuedinvestmentin technologythatsupportsourdecisionmaking.

A ProcessBuiltonIntensiveCreditAnalysis

Managingmoneymarketfundsrequiresattentivenessto many factors, includingdailycashflows, longer-termcash flowtrendsinvariousrateenvironments, andoverallmarket dynamics. Westrivetoaddvalueinavarietyofwaysand havebuiltourreputationonsoundportfoliostructureand athoroughcreditreviewprocess.

Asillustratedbelow,everyissuerconsideredforFederated’s approved issuer list is subject to stringent creditreview, includingtheassignmentofacreditratingbyFederated,in additionto,andindependentof,third-partyevaluations.In additiontoqualityconsiderations,ourintensivesecurity selectionprocessinvolvescarefulevaluationofinterestrate trendsanddeterminationofmaturitystructures.

Federated’s Credit ReviewProcess

Credit ratings pertain only to the securities in the portfolio and do not protect fund shares against market risk.

Wemanageourmoneymarketfundsin accordancetoSECRule2a-7

- Quality

- <3% of total assets in second-tier securities

- <0.5% of total assets in second-tier securities of a single issuer

- <45 days to maturity for any single second-tier security

- Liquidity

- Know your client

- <5% of total assets in illiquid securities

- >10% of total assets with daily liquidity

- >30% of total assets in weekly liquidity

- Stresstesting

- Repurchaseagreement

- Weightedaveragematurity(WAM)reduced from 90daysto 60days

- Weightedaveragelife(WAL)mustbe amaximumof120days

- Monthlyportfoliowebsitedisclosure

- RequiredMonthlyreportingto SEC

ThePeopleBehindtheProcess

ThededicatedresearchteamssupportingFederated’staxable andtax-freesectorscomprisesomeofthemostexperienced andknowledgeablepeopleinthebusiness.

EachFederatedanalystisassignedtoaparticularsector orproductarea, suchasBanks, ConsumerProducts, Government Agencies, Asset-BackedCreditProgramsand Manufacturingonthetaxableside, and VariableRate DemandNotes, MunicipalCommercialPaperandother typesofmunicipalsecuritiesonthetax-freeside, aswellas specifictypesofcreditorindustriesavailablewithinthat sector/area. Thisstructuregiveseveryanalystanin-depth understandingofthecompaniesinagivensector, the impactofmonetaryandfiscalpolicyonanindustry, andthe behaviorofeachsectorwithinacreditcycle. Italsoallows teammemberstodeveloprelationshipswithintheindustry that facilitateanunderstanding of company management.

The combination of the analysts’ focus on sector with theoverarchingwork of the credit committee creates an environment in which analysts have the freedom to do theirownresearch,but are compelled to present only their best ideas to their peers and to senior management. This ensures the integrity and quality of theresearch process.

Rounding out the taxable and tax-free teams are dedicated, experienced traders. Working closely together,Federated’s team of managers, analysts and traders support and implementFederated’s intensive creditresearch process with an objective to successfully manage cash across all market cycles.

TechnologyDeliversAddedSupport

AlthoughFederated’screditresearchteamprovidesthe foundationofourfundselectionandmanagementprocess, theirworkisthoroughlyintegratedandsupportedthroughFedPorts,Federated’sproprietarytradingandportfolio managementsystem.FedPortsisavitaltooltotheportfolio managerandprovidesapowerfulcompliancescreenand audittrail.

AnyportfolioconstraintsareprogrammedintoFedPortsbyproductandportfolio. Thesystemflagsallquestionable tradesrelativetoinvestmentpolicyandpreventstradesthatwouldrendertheportfoliooutofcompliance. This approachfocusesnotonlyongeneratingcompetitivereturns,butalsoonmanagingriskandprovidingtransparencytotheentireinvestmentprocess.

ComprehensiveCashManagementSolutions

Federated’s money market funds allowyou to pursuerelative safety, liquidity and competitive income across money market sectors.

- Taxablemoneymarketfunds—prime,government andtreasury.

- Municipal money market funds —various national and 14 state-specific funds. Income may be subject to federal alternative minimum tax and state and local taxes (AMT). Some funds are managed to avoid AMT.

In addition, we offer qualified clients a variety of taxable money market funds, other types of mutual funds, separate accounts3 and offshore funds (not available in all countries and not available for sale either to U.S. citizens or to persons in any other jurisdiction in which such offer is unlawful).

CountonFederatedforTotalSupport

Whetherit’sourbroadselectionofproducts,unwavering creditstandards,experiencedfundmanagement,state-of- the-arttechnologyortheefficienciesandpricingadvantage thataccompaniesourscale,Federatedcontinuallystrives toprovideadditionalvaluetoinvestors. Welookforwardto sharingthebenefitofourexperiencewithyou.

FederatedKnows...

Stability

Ranksasaleadingglobalinvestmentmanager, managingapproximately$360billioninassets,2delivering competitiveandconsistentresultssince1955andfostering growthbyreinvestinginthecompany

InvestmentSolutions

Offersbroadproductlinesspanningdomesticandinternationalequity, fixedincome, alternativeand moneymarketstrategieswiththegoaloflong-termconsistent, competitiveperformance

Diligence

Takesthelongview, believingthatdoingbusinesstherightwayovertimewillpresentopportunity forfuture growth

Federated Investors, Inc.

Federated InvestorsTower

1001LibertyAvenue Pittsburgh, PA

15222-3779

Contact us atFederatedInvestors.com or call 1-800-341-7400.

39049 (7/12)

Federated Securities Corp., Distributor

Federated is a registered trademark ofFederated Investors, Inc.

2012 ©Federated Investors, Inc.

For more information about Federated’s cash management solutions and how they can help you pursue your financial goals, please contact your investment advisor.

For more complete information, visit FederatedInvestors.com or contact your Federated representative by calling 1-800-341-7400 for a summary prospectus or prospectus.You should consider the fund's investment objectives, risks, charges and expenses carefully before you invest. Information about these and other important subjects is in the fund's summary prospectus or prospectus which you should read carefully before investing.

Aninvestmentinmoneymarketfundsisneitherinsurednor guaranteedbytheFederalDepositInsuranceCorporationorany othergovernmentagency.Althoughmoneymarketfundsseekto preservethevalueofyourinvestmentat$1.00pershare,itis possibletolosemoneybyinvestinginthesefunds.

Diversificationdoesnotassureaprofitnorprotectagainstaloss.

Securitiesareconsideredtobe“firsttier”asfollows:Standard&Poor’s:A-1+andA-1,basedon theobligor’scapacitytomeetitsfinancialcommitmentontheobligation;Moody’s:P-1,based ontheissuer’sabilitytorepayshort-termobligations;Fitch:F-1+andF-1,basedontheissuer’s liquiditynecessarytomeetfinancialcommitmentsinatimelymanner.

| 1 | Rule2a-7isaruleundertheInvestmentCompanyActof1940whichpermitsamoneymarket fundtouseamortizedcosttostabilizethevalueofitssharesat$1.00.Rule2a-7imposesvarious restrictionsonthemoneymarketfund'sportfolio,includingrestrictionsrelatedtodiversification, andcreditqualityandmaturityofportfoliosecurities. |

| 3 | SeparatelymanagedaccountsareavailablethroughFederatedInvestmentCounseling,aregistered investmentadvisor. |

Current and future portfolio holdings are subject to risk.

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

Corporate Overview

June30,2012

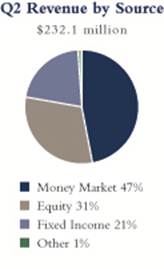

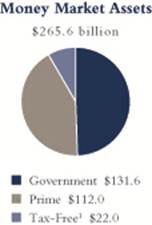

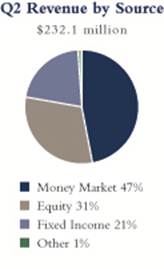

QuarterlyHighlights

| • | Increasedequityandfixed-incomeassetsby$1.4billionduring Q22012toarecord$90billion |

| • | Producedrecordgrosssalesinequityandfixed-incomefundsof$7.2billion inQ22012 |

| • | Reached$355.9billioninmanagedassetsat6/30/12,up$6.5billion or2percentfrom$349.4billionreportedat6/30/11 |

| • | Continuedtoseedemandforhigh-quality,income-orientedinvestmentstrategies |

| • | Generated52percentofQ22012revenuefromequityandfixed-incomeassets |

| • | Declared a quarterly dividend of $0.24 per share |

Federatedknows

Stability

| • | Ranksasaleadingglobalinvestmentmanager,managing$355.9billioninassets,deliveringcompetitiveandconsistentresultssince1955andfosteringgrowthby reinvestinginthecompany |

InvestmentSolutions

| • | Offersbroadproductlinesspanningdomesticandinternationalequity,fixed-income,alternativeandmoneymarketstrategieswiththegoalof long-term,consistent,competitiveperformanceovertime |

Diligence

| • | Takesthelongview,believingthatdoingbusinesstherightwayovertimewill presentopportunityforfuturegrowth |

Federated managed $8.1 billion of fixed-income assets in liquidation portfolios as of June 30, 2012.

InvestorInformation

NYSE:FII

Q22012high/lowstockprice: $22.89/$18.75

Shares Outstanding:104.1 million

Market Capitalization: $2.3 billion

IndexListing: S&P500

CompanyContact

Investor Relations

(412) 288-1934

(800) 245-0242 x 1934

investors@federatedinv.com

FederatedInvestors.com

1 Income may be subject to the federal alternative minimum tax and state and local taxes.

Separately managed accounts are made available through Federated Global Investment Management Corp., Federated Investment Counseling and Federated MDTA LLC, each a registered investment advisor.

For complete financial results please see Federated’s Second Quarter Earnings Press Release dated July 26, 2012 and SEC Filings on Form 8-K, 10-Q and 10-K for further information. Links to each document are available on the About Federated section ofFederatedInvestors.com.

Investors should carefully consider the fund’s investment objectives, risks, charges and expenses before investing. To obtain a summary prospectus or prospectus containing this and other information, contact us or visit FederatedInvestors.com. Please carefully read the summary prospectus or the prospectus before investing.

Past performance is no guarantee of future results.

An investment in money market funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds.

Mutual funds are subject to risks and fluctuate in value.

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

Reasons to Own

Capturing Opportunities Across the Bond Market

For more than two decades, Federated Total Return Bond Fund has helped investors fortify their portfolios with an authentic core bond holding. Its diversified, disciplined and flexible approach seeks total return in ever-changing market environments.

Broad Bond Market Exposure

Fluctuating market conditions affect different bond market sectors differently. Federated Total Return Bond Fund offers a multi-sector approach and the versatility to quickly pursue opportunities by making security and sector selections in sync with a changing investment climate.

Well-Equipped to Seek Opportunities

| · | The fund represents the best thinking of Federated’s fixed-income managers, analysts and traders who work collectively to arrive at an optimum combination of bonds for the portfolio. |

| · | Fund management has a decades-long track record navigating through numerous market and economic cycles. |

Pursues Higher Total Return with Less Risk

The fund’s risk management process combines top-down evaluation of macroeconomic events with intensive bottom-up monitoring of individual securities and sectors. The continuous assessment of risk versus return at each decision point seeks to ensure that consistent value is added while managing performance volatility.

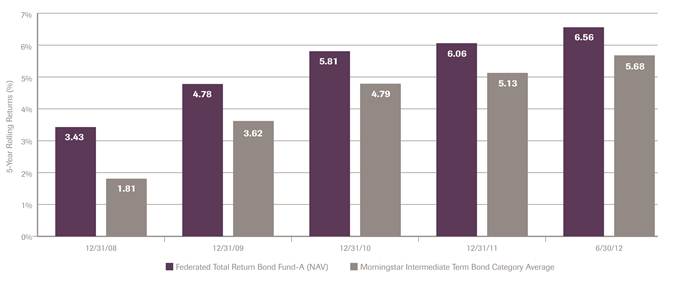

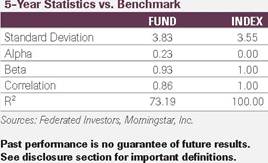

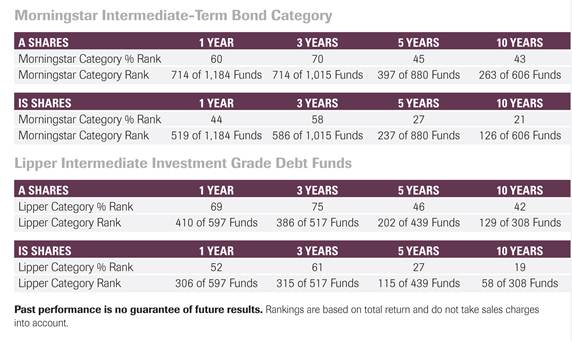

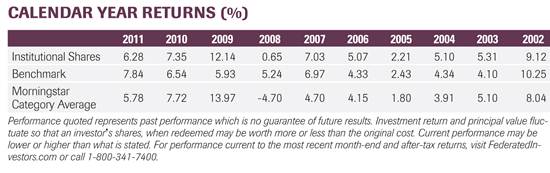

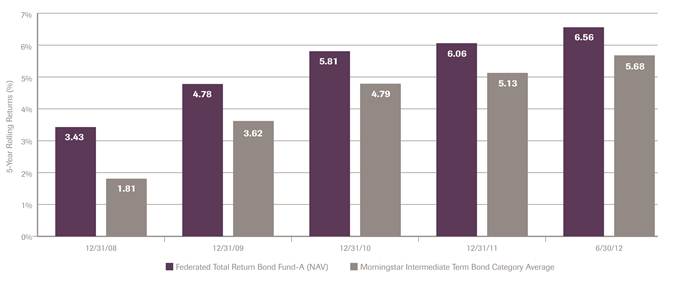

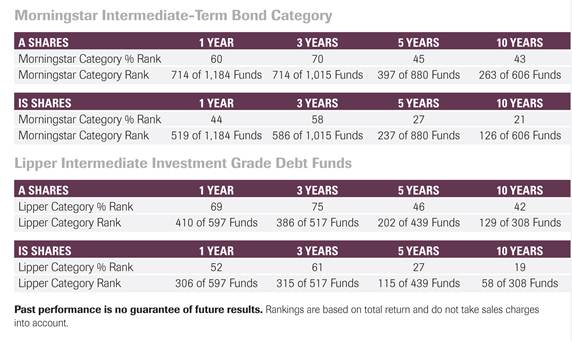

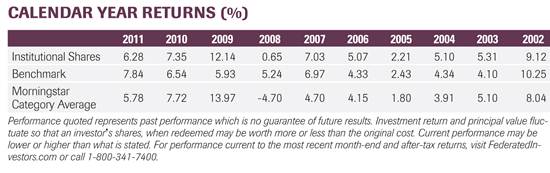

During Challenging Markets, the Fund Has Consistently Outperformed Its Peers

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than what is stated. To view performance current to the most recent month-end, and for after-tax returns, contact us or visit FederatedInvestors.com. Performance for the fund does not reflect the maximum sales charge of 5.5% for Class A Shares. If reflected, such charges would reduce the performance quoted. See the prospectus for other fees and expenses that apply to a continued investment in the fund.

Source: Morningstar Direct

Investors should carefully consider the fund’s investment objectives, risks, charges and expenses before investing. To obtain a summary prospectus or prospectus containing this and other information, contact us or visit FederatedInvestors.com. Please carefully read the summary prospectus or the prospectus before investing.

Indexes are unmanaged, and it is not possible to invest directly into an index.

Not FDIC Insured • May Lose Value • No Bank Guarantee

All information as of 6/30/2012 unless otherwise noted.

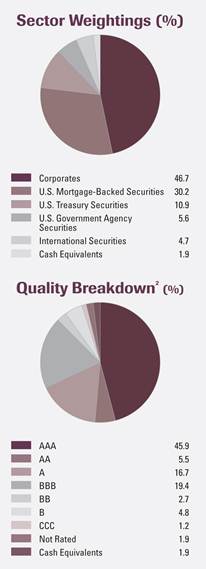

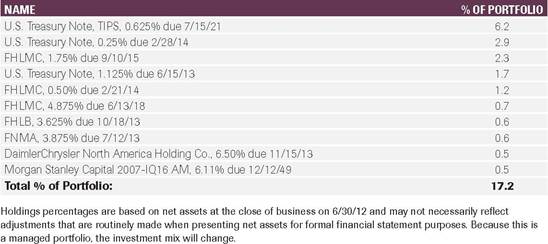

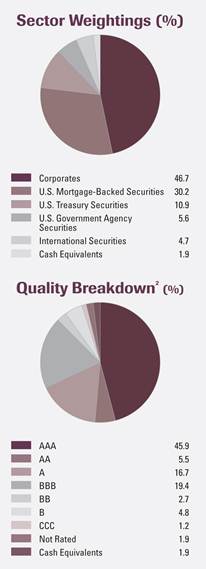

Sector Weightings (%)

Quality Breakdown (%)*

Key Investment Team Members

Experienced, tenured fixed-income management team averages more than 20 years of industry experience; over 15 years together at Federated.

Nasdaq Symbols:

Class A Shares (A):TLRAX

Class C Shares (C):TLRCX

Institutional Shares (IS):FTRBX

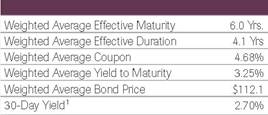

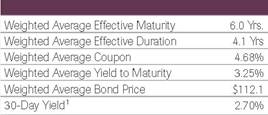

Fund Characteristics:

Portfolio Assets:$7.4 billion

Benchmark:Barclays U.S. Aggregate Index

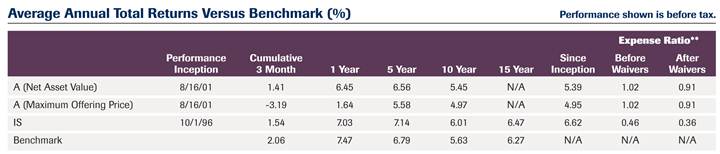

Weighted Average Effective Maturity:6.0 years

Weighted Average Effective Duration:4.1 years

Performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than what is stated. To view performance current to the most recent month-end, and for after-tax returns, contact us or visit FederatedInvestors.com. Maximum Offering Price figures reflect the maximum sales charge of 4.5% for Class A Shares. See the prospectus for other fees and expenses that apply to a continued investment in the fund. Total return would have been lower in the absence of expense waivers or reimbursements.

* The ratings agencies that provided the ratings are Standard and Poor’s, Moody’s and Fitch. When ratings vary, the highest rating is used. Credit ratings of A or better are considered to be high credit quality; credit ratings of BBB are good credit quality and the lowest category of investment grade; credit ratings BB and below are lower-rated securities (“junk bonds”); and credit ratings of CCC or below have high default risk. The credit quality breakdown does not give effect to the impact of any credit derivative investments made by the fund.

** The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that total annual fund operating expenses (excluding acquired fund fees and expenses of 0.01% and expenses allocated from affiliated partnerships, if any) paid by Class A, B, C, R, IS and SS Shares (after the voluntary waivers and/or reimbursements) will not exceed 0.90%, 1.45%, 1.45%, 1.10%, 0.35% and 0.65% respectively, up to but not including the later of 2/1/13 or the date of the fund’s next effective prospectus.

A Word About Risk

High-yield, lower-rated securities generally entail greater market, credit/default and liquidity risks, and may be more volatile than investment-grade securities.

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices.

The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some form of government or private insurance, there is no assurance that private guarantors or insurers will meet their obligations.

International investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards.

Definitions

Weighted average effective maturity is the average time to maturity of debt securities held in the fund.

Weighted average effective duration is a measure of security’s price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities of shorter durations.

Barclays U.S. Aggregate Bond Index is an unmanaged index composed of securities from the Barclays Government/Corporate Bond Index, Mortgage-Backed Securities Index and the Asset-Backed Securities Index. Total return comprises price appreciation/depreciation and income as a percentage of the original investment. Indices are rebalanced monthly by market capitalization. Indexes are unmanaged and cannot be invested in directly.

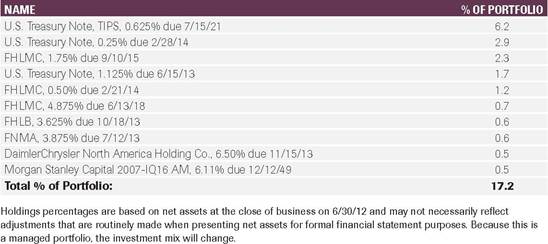

Holdings percentages are based on net assets at the close of business on 6/30/12 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement purposes. Because this is a managed portfolio, the investment mix will change.

Morningstar Category identifies funds based on their actual investment styles as measured by their underlying portfolio holdings over the past three years. If the fund is less than three years old, the category is based on the life of the fund. ©2012 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Federated Investors Tower, 1001 Liberty Avenue, Pittsburgh, PA 15222-3779, 1-800-341-7400, FederatedInvestors.com

Federated Securities Corp., Distributor

Federated is a registered trademark of Federated Investors, Inc. 2012 ©Federated Investors, Inc.

G42880-03 (7/12)

A prospectus/proxy statement with respect to the proposed transaction has been mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Investors are urged to read the prospectus/proxy statement because it contains important information. The prospectus/proxy statement and other relevant documents are available free of charge on the SEC’s Web site atwww.sec.gov or by calling 1-800-341-7400.

Filed by: Federated Equity Funds

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Strategic Dividend Fund, Large Cap Equity Fund, Leaders Equity Fund, Mid Cap Equity Fund, each a portfolio of the Performance Funds Trust

Subject Company Commission File No. 811-0660

2nd Quarter 2012

Product Profile

FUND FACTS

Inception Date

Class A Shares: 8/16/2001

Institutional Shares: 10/1/1996

Benchmark

Barclays U.S. Aggregate Bond Index

Morningstar Category

Intermediate-Term Bond

Lipper Category

Intermediate Investment Grade Debt Funds

Fund Assets

$7.4 billion

Ticker Symbols

Institutional Shares – FTRBX

Service Shares – FTRFX

Class A Shares – TLRAX

Class B Shares – TLRBX

Class C Shares – TLRCX

Class R Shares – FTRKX

Portfolio Statistics

All information as of 6/30/2012 unless otherwise noted.

PRODUCT HIGHLIGHTS

| • | Invests in a broad, strategic mix of bond sectors: primarily U.S. government and investment-grade corporate; high-yield allocation limited to 25%. |

| • | Focuses on sectors management believes will benefit from anticipated changes in economic and market conditions. |

| • | Serves as a core multisector bond holding. |

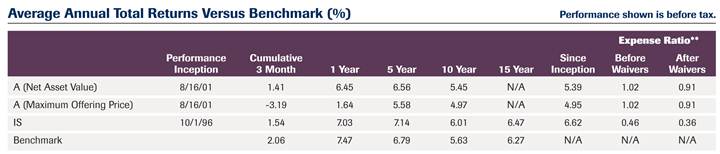

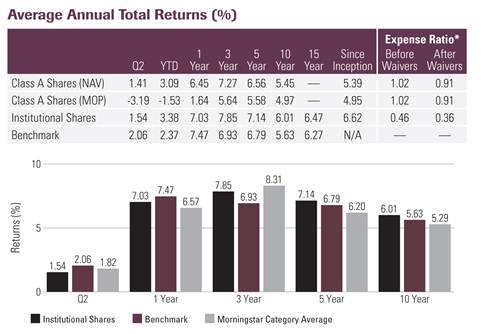

PERFORMANCE

Performance quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than what is stated. To view performance current to the most recent month-end, and for after-tax returns, contact us or visit FederatedInvestors.com. Maximum Offering Price figures reflect the maximum sales charge of 4.5% for Class A Shares.See the prospectus for other fees and expenses that apply to a continued investment in the fund.

* The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that total annual fund operating expenses (excluding acquired fund fees and expenses of 0.01% and expenses allocated from affiliated partnerships, if any) paid by Class A, B, C, R, IS and SS Shares (after the voluntary waivers and/or reimbursements) will not exceed 0.90%, 1.45%, 1.45%, 1.10%, 0.35% and 0.65% respectively, up to but not including the later of 2/1/13 or the date of the fund’s next effective prospectus.

Federated Total Return Bond Fund

Not FDIC Insured • May Lose Value • No Bank Guarantee

INVESTMENT PROCESS

A proven investment process featuring multiple sources of alpha and broad bond market access

Federated’s belief is that optimum results in fixed income products are best achieved through traditional value-based approach, using fundamental analysis with teams focused by sector to extract value from each step of the process.