UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM 10-K |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

| SECURITIES EXCHANGE ACT OF 1934 |

| |

For the fiscal year ended December 31, 2008 |

Commission File number 1-11826 |

|

| MIDSOUTH BANCORP, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Louisiana | 72-1020809 |

| (State of Incorporation) | (I.R.S. EIN Number) |

| |

| 102 Versailles Boulevard, Lafayette, LA 70501 |

| (Address of principal executive offices) |

| |

Registrant's telephone number, including area code: (337) 237-8343 |

| |

| Securities registered pursuant to Section 12(b) of the Act: |

| |

| Title of each class | Name of each exchange on which registered |

| Common Stock, $.10 par value | New York Stock Exchange Alternext |

| |

| Securities registered pursuant to Section 12(g) of the Act: none |

| |

| Indicate by check mark if this registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

Yes ¨ No þ |

| |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. |

Yes ¨ No þ |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨ |

| |

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ |

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. A large accelerated filer ¨An accelerated filer þA non-accelerated filer ¨ A smaller reporting company ¨ |

| |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) |

Yes ¨ No þ |

| |

| The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant at June 30, 2008 was approximately $68,042,660 based upon the closing market price on NYSE Alternext as of such date. As of February 27, 2009, there were 6,618,220 outstanding shares of MidSouth Bancorp, Inc. common stock. |

| |

DOCUMENTS INCORPORATED BY REFERENCE |

| Portions of the Company’s Proxy Statement for its 2009 Annual Meeting of Shareholders are incorporated by reference into Part III, Items 10-14 of this Form 10-K. |

| MIDSOUTH BANCORP, INC. |

| 2008 Annual Report on Form 10-K |

| TABLE OF CONTENTS |

| | Item 1B – Unresolved Staff Comments |

| | Item 3 - Legal Proceedings |

| | Item 4 - Submission of Matters to a Vote of Security Holders |

| | Item 4A - Executive Officers of the Registrant |

| | Item 5 - Market for Registrant's Common Stock, Related Shareholder Matters, and Issuer Purchases of Equity Securities |

| | Item 6 – Five Year Summary of Selected Consolidated Financial Data |

| | Item 7 – Management’s Discussion and Analysis of Financial Position and Results of Operations |

| | Item 7A – Quantitative and Qualitative Disclosures about Market Risk |

| | Item 8 – Financial Statements and Supplementary Data |

| | Notes to Consolidated Financial Statements |

| | Item 9 – Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

| | Item 9A – Controls and Procedures |

| | Item 9B – Other Information |

| | Item 10 - Directors, Executive Officers, Promoters, and Control Persons; Compliance with Section 16(a) of the Exchange Act |

| | Item 11 - Executive Compensation |

| | Item 12 - Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

| | Item 13 - Certain Relationships and Related Transactions |

| | Item 14 – Principal Accountant Fees and Services |

| | Item 15 - Exhibits and Financial Statement Schedules |

Part I

Item 1 - Business

MidSouth Bancorp, Inc. (the “Company”) is a Louisiana corporation registered as a bank holding company under the Bank Holding Company Act of 1956. Its operations are conducted primarily through a wholly-owned bank subsidiary, MidSouth Bank, N.A. (the “Bank”), chartered in February 1985. The Company merged its two wholly-owned banking subsidiaries, MidSouth Bank, N.A. (Louisiana) and MidSouth Bank Texas, N.A. into MidSouth Bank, N.A., at the end of the first quarter of 2008.

MidSouth Bank, N.A. is a national banking association domiciled in Lafayette, Louisiana. The Bank provides a broad range of commercial and retail community banking services primarily to professional, commercial, and industrial customers in their market areas. These services include, but are not limited to, interest-bearing and noninterest-bearing checking accounts, investment accounts, cash management services, electronic banking services, credit cards, and secured and unsecured loan products. The Bank is a U.S. government depository and a member of the Pulse network, which provides its customers with automatic teller machine services through the Pulse and Cirrus networks. Membership in the Community Cash Network provides the customers of the Bank with access to all ATMs operated by the Bank with no surcharge. The MidSouth franchise operates locations throughout south Louisiana and southeast Texas described below under Item 2 - Properties.

As of December 31, 2008, the Bank employed approximately 419 full-time equivalent employees. The Company has no employees who are not also employees of the Bank. Through the Bank, employees receive employee benefits, which include an employee stock ownership plan; a 401(K) plan; and life, health and disability insurance plans. The Company’s directors, officers, and employees are important to the success of the Company and play a key role in business development by actively participating in the communities served by the Company. The Company considers the relationship of the Bank with its employees to be excellent.

The Bank faces strong competition in its market areas from both traditional and nontraditional financial services providers, such as commercial banks; savings banks; credit unions; finance companies; mortgage, leasing, and insurance companies; money market mutual funds; brokerage houses; and branches that provide credit facilities. Several of the financial services competitors in the Company’s market areas are substantially larger and have far greater resources, but the Company has effectively competed by building long-term customer relationships. Customer loyalty has been built through a continued focus on quality customer service enhanced by current technology and effective delivery systems.

Other factors, including economic, legislative, and technological changes, also impact the Company’s competitive environment. The Company’s management continually evaluates competitive challenges in the financial services industry and develops appropriate responses consistent with its overall market strategy.

The Company opened a third branch in the Baton Rouge market in 2008, following the addition of four new branches and three replacement branches throughout the existing corporate footprint in 2007. In 2009, the Company plans to continue its focus in existing markets, solidifying and expanding its banking presence and commercial lending base throughout Houston and southeast Texas. The Company is continually receptive to new growth opportunities in both our existing markets and locations that are in accordance with our long-term strategic goal of building shareholder wealth.

| Supervision and Regulation |

Participants in the financial services industry are subject to varying degrees of regulation and government supervision. The following contains important aspects of the supervision and regulation of bank and bank holding companies. The current system of laws and regulations can change over time and it cannot be predicted whether these changes will be favorable or unfavorable to the Company or the Bank.

Current unfavorable economic conditions prompted government to pass the Emergency Economic Stabilization Act of 2008 (the “EESA”). Under the EESA, the Company issued $20.0 million in preferred stock to the United States Department of the Treasury (the “Treasury”) under the Capital Purchase Plan (“CPP”) in an effort to help stimulate the economy through increased lending efforts. Under the CPP, the Company is required to pay cumulative dividends on the senior preferred shares at an annual rate of 5% for the first five years and 9% thereafter, unless the Company redeems the shares earlier. Redemptions will be at 100% of issue price plus accrued dividends and are subject to prior regulatory approval. The Company may not declare or pay dividends on its common stock or repurchase common stock without first having paid all accrued cumulative preferred dividends that are due. For three years after Treasury’s investment in the senior preferred shares, the Company also may not increase its per share common stock dividend rate or repurchase its common shares without the Treasury’s consent, unless the Treasury has transferred all the senior preferred shares to third parties.

General

As a bank holding company, the Company is subject to the Bank Holding Company Act of 1956 (the “Act”) and to supervision by the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”). The Act requires the Company to file periodic reports with the Federal Reserve Board and subjects the Company to regulation and examination by the Federal Reserve Board. The Act also requires the Company to obtain the prior approval of the Federal Reserve Board for acquisitions of substantially all of the assets of any bank or bank holding company or more than 5% of the voting shares of any bank or bank holding company. The Act prohibits the Company from engaging in any business other than banking or bank-related activities specifically allowed by the Federal Reserve Board, including modifications to the Act brought about by the enactment of the Gramm-Leach-Bliley Act (“GLB”) of 1999.

Gramm-Leach-Bliley Act

This financial services reform legislation (1) permits commercial banks to affiliate with investment banks, (2) permits companies that own commercial banks to engage in any type of financial activity, and (3) allows subsidiaries of banks to engage in a broad range of financial activities beyond those permitted for banks themselves. As a result, banks, securities firms, and insurance companies are able to combine much more readily.

Under provisions of GLB, two types of regulated entities are authorized to engage in a broad range of financial activities much more extensive than those of standard holding companies. A “financial holding company” can engage in all authorized activities and is simply a bank holding company whose depository institutions are well-capitalized, well-managed, and has a Community Reinvestment Act (“CRA”) rating of “satisfactory” or better. The Company is not registered as a financial holding company. A “financial subsidiary” is a direct subsidiary of a bank that satisfies the same conditions as a “financial holding company,” plus several more. The “financial subsidiary” can engage in most of the authorized activities, which are defined as securities, insurance, merchant banking/equity investment, “financial in nature,” and “complementary” activities that do not pose a substantial risk to the safety and soundness of an institution or to the financial system generally.

GLB also defines the concept of “functional supervision” meaning similar activities should be regulated by the same regulator, with the Federal Reserve Board serving as an “umbrella” supervisory authority over bank and financial holding companies.

Support of Subsidiary Banks by Holding Companies

Under current Federal Reserve Board policy, the Company is expected to act as a source of financial strength for the Bank and to commit resources to support the Bank in circumstances where it might not do so absent such policy. In addition, any loans by a bank holding company to a subsidiary bank are subordinate in right of payment to deposits and certain other indebtedness of the subsidiary bank. In the event of a bank holding company's bankruptcy, any commitment by the bank holding company to a federal bank regulatory agency to maintain the capital of a subsidiary bank at a certain level would be assumed by the bankruptcy trustee and entitled to priority of payment.

Limitations on Acquisitions of Bank Holding Companies

As a general proposition, other companies seeking to acquire control of a bank holding company, such as the Company, would require the approval of the Federal Reserve Board under the Act. In addition, individuals or groups of individuals seeking to acquire control of a bank holding company would need to file a prior notice with the Federal Reserve Board (which the Federal Reserve Board may disapprove under certain circumstances) under the Change in Bank Control Act. Control is conclusively presumed to exist if an individual or company acquires 25% or more of any class of voting securities of the bank holding company. Control may exist under the Act or the Change in Bank Control Act if the individual or company acquires 10% or more of any class of voting securities of the bank holding company.

Sarbanes-Oxley Act of 2002

Signed into law on July 30, 2002, the Sarbanes-Oxley Act of 2002 (“SOX”) addresses many aspects of corporate governance and financial accounting and disclosure. Primarily, it provides a framework for the oversight of public company auditing and for insuring the independence of auditors and audit committees. Under SOX, audit committees are responsible for the appointment, compensation, and oversight of the work of external and internal auditors. SOX also provides for enhanced and accelerated financial disclosures, establishes certification requirements for a company’s chief executive and chief financial officers, and imposes new restrictions on and accelerated reporting of certain insider trading activities. Significant penalties for fraud and other violations are included in SOX.

Under Section 404 of SOX, the Company is required to include in its annual report a statement of management’s responsibility to establish and maintain adequate internal control over financial reporting and management’s conclusion on the effectiveness of internal controls at year-end.

Anti-Money Laundering

Financial institutions must maintain anti-money laundering programs that include established internal policies, procedures, and controls; a designated compliance officer; an ongoing employee training program; and testing of the program by an independent audit function. The Company and the Bank are also prohibited from entering into specified financial transactions and account relationships and must meet enhanced standards for due diligence and “knowing your customer” in their dealings with foreign financial institutions and foreign customers. Financial institutions must take reasonable steps to conduct enhanced scrutiny of account relationships to guard against money laundering and to report any suspicious transactions, and recent laws provide the law enforcement authorities with increased access to financial information maintained by banks. Anti-money laundering regulations have been substantially strengthened as a result of the USA PATRIOT Act, enacted in 2001. Bank regulators routinely examine institutions for compliance with these obligations and are required to consider compliance in connection with the regulatory review of applications. The regulatory authorities have been active in imposing “cease and desist” orders and money penalty sanctions against institutions found in violation of these obligations.

Capital Adequacy Requirements

The Federal Reserve Board and the Office of the Comptroller of Currency (the “OCC”) require that the Company and the Bank meet certain minimum ratios of capital to assets in order to conduct its activities. Two measures of regulatory capital are used in calculating these ratios: Tier 1 Capital and Total Capital. Tier 1 Capital generally includes common equity, retained earnings and a limited amount of qualifying preferred stock, reduced by goodwill and specific intangible assets, such as core deposit intangibles, and certain other assets. Total Capital generally consists of Tier 1 Capital plus the allowance for loan losses, preferred stock that did not qualify as Tier 1 Capital, particular types of subordinated debt, and a limited amount of other items.

The Tier 1 Capital ratio and the Total Capital ratio are calculated against an asset total weighted for risk. Certain assets, such as cash and U.S. Treasury securities, have a zero risk weighting. Others, such as commercial and consumer loans, often have a 100% risk weighting. Assets also include amounts that represent the potential funding of off-balance sheet obligations such as loan commitments and letters of credit. These potential assets are assigned to risk categories in the same manner as funded assets. The total assets in each category are multiplied by the appropriate risk weighting to determine risk-adjusted assets for the capital calculations.

The leverage ratio also provides a measure of the adequacy of Tier 1 Capital, but assets are not risk-weighted for this calculation. Assets deducted from regulatory capital, such as goodwill and other intangible assets, are excluded from the asset base used to calculate capital ratios. The minimum capital ratios for both the Company and the Bank are generally 8% for Total Capital, 4% for Tier 1 Capital and 4% for leverage.

At December 31, 2008, the Company's ratios of Tier 1 and total capital to risk-weighted assets were 11.04% and 12.16%, respectively. The Company's leverage ratio (Tier 1 capital to total average adjusted assets) was 8.38% at December 31, 2008. All three regulatory capital ratios for the Company exceeded regulatory minimums at December 31, 2008.

To be eligible to be classified as “well-capitalized,” the Bank must generally maintain a Total Capital ratio of 10% or greater, a Tier 1 Capital ratio of 6% or greater, and a leverage ratio of 6% or greater. If an institution fails to remain well-capitalized, it will be subject to a series of restrictions that increase as the capital condition worsens. For instance, federal law generally prohibits a depository institution from making any capital distributions, including the payment of a dividend, or paying any management fee to its holding company, if the depository institution would be undercapitalized as a result. Undercapitalized depository institutions may not accept brokered deposits absent a waiver from the Federal Deposit Insurance Corporation (the “FDIC”), are subject to growth limitations, and must submit a capital restoration plan that is guaranteed by the institution's parent holding company. Significantly undercapitalized depository institutions may be subject to a number of requirements and restrictions, including orders to sell sufficient voting stock to become adequately capitalized, requirements to reduce total assets, and cessation of receipt of deposits from correspondent banks. Critically undercapitalized institutions are subject to the appointment of a receiver or conservator.

As of December 31, 2008, the most recent notification from the FDIC placed the Bank in the “well capitalized” category under the regulatory framework for prompt corrective action. All three regulatory capital ratios for the Bank exceeded these minimums at December 31, 2008.

General

As a national banking association, the Bank is supervised and regulated by the OCC (its primary regulatory authority), the Federal Reserve Board, and the FDIC. Under Section 23A of the Federal Reserve Act, the Bank is restricted in its ability to extend credit to or make investments in the Company and other affiliates as that term is defined in that act. National banks are required by the National Bank Act to adhere to branch banking laws applicable to state banks in the states in which they are located and are limited as to powers, locations and other matters of applicable federal law.

Restrictions on loans to directors, executive officers, principal shareholders, and their related interests (collectively referred to herein as “insiders”) are contained in the Federal Reserve Act and Regulation O and apply to all insured institutions and its subsidiaries and holding companies. These restrictions include limits on loans to one borrower and conditions that must be met before such a loan can be made. There is also an aggregate limitation on all loans to insiders and their related interests. These loans cannot exceed the institution’s unimpaired capital and surplus, and the OCC may determine that a lesser amount is appropriate. Insiders are subject to enforcement actions for knowingly accepting loans in violation of applicable restrictions.

Deposit Insurance

The Bank’s deposits are insured by the FDIC up to the amount permitted by law. The Bank is thus subject to FDIC deposit insurance premium assessments. The FDIC uses a risk-based assessment system that assigns insured depository institutions to different premium categories based primarily on each institution's capital position and its overall risk rating as determined by its primary regulator. For several years, as a well-capitalized financial institution, the Company had not been required to pay FDIC insurance premiums, but had been required to pay the Financing Corporation (“FICO”) assessments that currently total approximately $21,000 a quarter, or $84,000 annually. FICO has assessment authority to collect funds from FDIC-insured institutions sufficient to pay interest on noncallable thrift bonds issued between 1987 and 1989, which expire with the bonds in 2019. In 2007, the FDIC resumed deposit insurance assessments and issued one-time credits against the assessments to qualifying institutions. The Company qualified for a one-time credit totaling approximately $240,000, which partially offset the new FDIC assessment and resulted in $157,000 in total assessments in 2007. FDIC assessments totaled $506,000 in 2008 and are expected to increase significantly in 2009 due to provisions of the EESA.

Emergency Economic Stabilization Act of 2008

On October 3, 2008, the EESA was signed into law by the President of the United States in response to a national economic and financial crisis. The EESA included a provision for an increase in the amount of deposits insured by the FDIC from $100,000 to $250,000 until December 2009. In addition, the FDIC announced a new program called the Temporary Liquidity Guarantee Program (“TLGP”) on October 14, 2008. The TLGP provided for a debt guarantee and increased deposit insurance coverage for certain noninterest-bearing accounts. The Bank opted into both programs. Neither the Bank nor the Company has issued debt under the TLGP. Under the new program, unlimited deposit insurance was provided on funds in noninterest-bearing transaction deposit accounts. Coverage under the program is available for a limited period of time without charge and, thereafter, at a cost of 10 basis points per annum for noninterest-bearing transaction accounts with balances above $250,000. Annual premium rates on deposit insurance ranges from 8 to 21 basis points per $100 of assessable deposits for institutions that are judged to pose the least risk to the insurance fund and up to 78 basis points per $100 of assessable deposits for the most risky institutions. The Company’s FDIC assessments for 2009, based on premium increases and current deposit growth projections, are expected to total approximately $306,000 per quarter, or $1,224,000 for the year.

On February 27, 2009, the FDIC approved an interim rule that would raise second quarter 2009 deposit insurance premiums for Risk Category I banks from 10 to 14 basis points to 12 to 16 basis points. Under the interim rule, the FDIC would also impose a 10 to 20 basis point special assessment as of June 30, 2009, payable on September 30, 2009 and provide the authorization to implement an additional 10 basis point premium increase in any quarter.

Financial Institutions Reform, Recovery and Enforcement Act

The Bank is held liable by the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (“FIRREA”) for any losses incurred by, or reasonably expected to be incurred by, the FDIC in connection with (1) the default of a commonly controlled FDIC-insured financial institution or (2) any assistance provided by the FDIC to a commonly controlled financial institution in danger of default.

Community Reinvestment Act

The Bank is subject to the provisions of the Community Reinvestment Act (“CRA”), as amended, and the related regulations issued by federal banking agencies. The CRA states that all banks have a continuing and affirmative obligation, consistent with safe and sound operation, to help meet the credit needs for its entire communities, including low- and moderate-income neighborhoods. The CRA also charges a bank's primary federal regulator, in connection with the examination of the institution or the evaluation of certain regulatory applications filed by the institution, with the responsibility to assess the institution's record in fulfilling its obligations under the CRA. The regulatory agency's assessment of the institution's record is made available to the public. The Bank received a satisfactory rating following its most recent CRA examination.

Consumer Regulation

Activities of the Bank are subject to a variety of statutes and regulations designed to protect consumers. These laws and regulations include provisions that:

| · | govern the Bank’s disclosures of credit terms to consumer borrowers; |

| · | limit the interest and other charges collected or contracted for by the Bank; |

| · | require the Bank to provide information to enable the public and public officials to determine whether it is fulfilling its obligation to help meet the housing needs of the community it serves; |

| · | prohibit the Bank from discriminating on the basis of race, creed, or other prohibited factors when it makes decisions to extend credit; |

| · | require that the Bank safeguard the personal nonpublic information of its customers, provide annual notices to consumers regarding the usage and sharing of such information, and limit disclosure of such information to third parties except under specific circumstances; and |

| · | govern the manner in which the Bank may collect consumer debts. |

The deposit operations of the Bank are also subject to laws and regulations that:

| · | require the Bank to adequately disclose the interest rates and other terms of consumer deposit accounts; |

| · | impose a duty on the Bank to maintain the confidentiality of consumer financial records and prescribe procedures for complying with administrative subpoenas of financial records; and |

| · | govern automatic deposits to and withdrawals from deposit accounts with the Bank and the rights and liabilities of customers who use automated teller machines and other electronic banking services. |

The operations of financial institutions may be affected by the policies of various regulatory authorities. In particular, bank holding companies and its subsidiaries are affected by the credit policies of the Federal Reserve Board. An important function of the Federal Reserve Board is to regulate the national supply of bank credit. Among the instruments of monetary policy used by the Federal Reserve Board to implement its objectives are open market operations in United States Government securities, changes in the discount rate on bank borrowings, and changes in reserve requirements on bank deposits. These policies have significant effects on the overall growth and profitability of the loan, investment, and deposit portfolios. The general effects of such policies upon future operations cannot be accurately predicted.

The Company files annual, quarterly, and current reports with the Securities and Exchange Commission (“SEC”). The public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The SEC’s website is www.sec.gov. The Company maintains a corporate website at www.midsouthbank.com. It provides public access free of charge to its annual reports on Form 10-K for the last two years, and its most recent quarterly report on Form 10-Q under the Corporate Relations section of the corporate website.

Item 1A – Risk Factors

An investment in the Company’s stock involves a number of risks. Investors should carefully consider the following risks as well as the other information in this Annual Report on Form 10-K and the documents incorporated by reference before making an investment decision. The realization of any of the risks described below could have a material adverse effect on the Company and the price of its common stock.

| Risks Relating to the Company’s Business |

The current economic environment poses significant challenges and could adversely affect the Company’s financial condition and results of operations.

Although the Company remains well capitalized and liquid, the current economic environment is challenging and uncertain. Recessionary conditions in the broader economy could adversely affect the financial capacity of businesses and individuals in the Company’s market area. This could increase the credit risk inherent in the loan portfolio, reduce loan demand from creditworthy borrowers, and prompt tightened underwriting criteria. The impact on the Company’s financial results could include continued high levels of nonperforming loans, provisions for loan losses, and expenses associated with loan collection efforts. Additionally, decreased demand for deposit products and services combined with a highly competitive rate environment could adversely affect the Company’s liquidity position. Decisions regarding credit risk involve a high degree of judgment. If the allowance for loan losses is not sufficient to cover actual losses, then earnings would decrease.

The loan and investment portfolio subjects the Company to credit risk. In-depth analysis is performed to maintain an appropriate allowance for probable loan losses inherent in the loan portfolio. During 2008, recorded provisions for loan losses totaled $4.6 million based on an overall evaluation of this risk. As of December 31, 2008, the allowance was $7.6 million, which is approximately 1.25% of total loans.

There is no precise method of predicting loan losses; therefore, the Company faces the risk that additional increases in the allowance for loan losses will be required. Additions to the allowance will result in a decrease in net earnings and capital and could hinder the Company’s ability to grow.

The Company has a concentration of exposure to a number of individual borrowers. Given the size of these loan relationships relative to capital levels and earnings, a significant loss on any one of these loans could materially and adversely affect the Company.

The Company has a high concentration of loans secured by real estate, and the current downturn in the real estate market could materially and adversely affect earnings.

A significant portion of our loan portfolio is dependent on real estate. At December 31, 2008, approximately 50% of the Company’s loans had real estate as a primary or secondary component of collateral. The collateral in each case provides an alternate source of repayment if the borrower defaults and may deteriorate in value during the time the credit is extended. An adverse change in the economy affecting values of real estate in the Company’s primary markets could significantly impair the value of collateral and the ability to sell the collateral upon foreclosure. Furthermore, it is likely that the Company would be required to increase the provision for loan losses. If the Company were required to liquidate the collateral securing a loan to satisfy the debt during a period of reduced real estate values or to increase the allowance for loan losses, the Company’s profitability and financial condition could be adversely impacted.

The Company may face risks with respect to future expansion and acquisition.

The Company has expanded its business in part through acquisitions and cannot assure the continuance of this trend or the profitability of future acquisitions. The Company’s ability to implement its strategy for continued growth depends on the ability to continue to identify and integrate profitable acquisition targets, to attract and retain customers in a highly competitive market, to increase the deposit base, and the growth of its customers’ businesses. Many of these growth prerequisites may be affected by circumstances that are beyond the control of the Company’s management and could have a material adverse effect on the size and quality of the Company’s assets. Current levels of market disruption and volatility have pressured stock prices and limited credit availability for issuers, seemingly without regard to the issuers’ financial stability, limiting issuers’ access to the capital markets.

The Company cannot predict the effect of recent legislative and regulatory initiatives.

Congress recently enacted the EESA in an effort to stabilize the financial markets. The initiative provided funding of up to $700 billion to purchase troubled assets and loans from financial institutions pursuant to the Troubled Asset Relief Program (“TARP”) and created the CPP directed by the Treasury. On January 9, 2009, the Company completed a CPP transaction and received $20 million in capital from the Treasury. Pursuant to terms and conditions of the CPP transaction, which is described in the Company’s 8-K filing dated January 14, 2009, the Company faces certain restrictions and limitations that could adversely affect its ability to support the value of the common stock.

A natural disaster, especially one affecting the Company’s market areas, could adversely affect the Company.

Since most of the Company’s business is conducted in Louisiana and Texas, most of its credit exposure is in those states; thus, the Company is at risk from natural hazards such as hurricanes, floods, and tornadoes that affect Louisiana and Texas. If the economies of Louisiana or Texas experience an overall decline as a result of these natural hazards, the rates of delinquencies, foreclosures, bankruptcies, and losses on loan portfolios would probably increase substantially and the value of real estate or other collateral could be adversely affected.

The Company faces substantial competition in originating loans and in attracting deposits. The competition in originating loans comes principally from other U.S. banks, mortgage banking companies, consumer finance companies, credit unions, insurance companies, and other institutional lenders and purchasers of loans. Many of the Company’s competitors are institutions that have significantly greater assets, capital, and other resources. Increased competition could require the Company to increase the rates paid on deposits or lower the rates offered on loans, which could adversely affect and also limit future growth and earnings prospects.

The Company’s profitability is vulnerable to interest rate fluctuations.

The Company’s profitability is dependent to a large extent on net interest income, which is the difference between its interest income on interest-earning assets, such as loans and investment securities, and interest expense on interest-bearing liabilities, such as deposits and borrowings. When interest-bearing liabilities mature or reprice more quickly than interest-earning assets in a given period, a significant increase in market rates of interest could adversely affect net interest income. Conversely, when interest-earning assets mature or reprice more quickly than interest-bearing liabilities, falling interest rates could result in a decrease in net interest income.

In periods of increasing interest rates, loan originations may decline, depending on the performance of the overall economy, which may adversely affect income from these lending activities. Also, increases in interest rates could adversely affect the market value of fixed income assets. In addition, an increase in the general level of interest rates may affect the ability of certain borrowers to pay the interest and principal on their obligations.

The Company relies heavily on its management team and the unexpected loss of key officers may adversely affect operations.

The Company’s success has been and will continue to be greatly influenced by the ability to retain existing senior management and, with expansion, to attract and retain qualified additional senior and middle management. C.R. Cloutier, President and Chief Executive Officer, and other executive officers have been instrumental in developing and managing the business. The loss of services of Mr. Cloutier or any other executive could have an adverse effect on the Company. While the Company has employment agreements with some of its executive officers, a formal management succession plan has been established. Accordingly, should the Company lose any member of senior management, there can be no assurance that the Company will be able to locate and hire a qualified replacement on a timely basis.

The Company’s management is required to report on, and the independent auditors to attest to, the effectiveness of internal controls over financial reporting as of December 31, 2008. The rules governing the standards that must be met for management to assess internal controls are complex, and require significant documentation, testing, and possible remediation. In connection with this effort, the Company has incurred increased expenses and diversion of management's time and other internal resources. In connection with the attestation process by the Company’s independent auditors, management may encounter problems or delays in completing the implementation of any requested improvements and receiving a favorable attestation. If the Company cannot make the required report, or if the Company’s external auditors are unable to provide an unqualified attestation, investor confidence and the Company’s common stock price could be adversely affected.

Monetary policy and other economic factors could affect profitability adversely.

Many factors affect the demand for loans and the ability to attract deposits, including:

| · | changes in governmental economic and monetary policies; |

| · | modifications to tax, banking, and credit laws and regulations; |

| · | national, state, and local economic growth rates; |

The Company’s success will depend in significant part upon the ability to maintain a sufficient interest margin between the rates of interest received on loans and other investments and the rates paid out on deposits and other liabilities. The monetary and economic factors listed above and the need to pay rates sufficient to attract deposits may adversely affect the Company’s ability to maintain a sufficient interest margin that results in operating profits.

The Company operates within a highly regulated environment. The regulations to which the Company is subject will continue to have a significant impact on its operations and the degree to which it can grow and be profitable. Certain regulators, to which the Company is subject, have significant power in reviewing the Company’s operations and approving its business practices. In recent years the Company’s bank, as well as other financial institutions, has experienced increased regulation and regulatory scrutiny, often requiring additional resources. In addition, investigations or proceedings brought by regulatory agencies may result in judgments, settlements, fines, penalties, or other results adverse to the Company. There is no assurance that any change to the regulatory requirements to which the Company is subject, or the way in which such regulatory requirements are interpreted or enforced, will not have a negative effect on the Company’s ability to conduct its business and its results of operations.

The Company relies heavily on technology and computer systems. The negative effects of computer system failures and unethical individuals with the technological ability to cause disruption of service could significantly affect the Company’s operations.

The Company’s ability to compete depends on the ability to continue to adapt and deliver technology on a timely and cost-effective basis to meet customers’ demands for financial services.

| Risks Relating to an Investment in the Company’s Common Stock |

Share ownership may be diluted by the issuance of additional shares of common stock in the future.

The Company’s stock incentive plan provides for the granting of stock incentives to directors, officers, and employees. As of December 31, 2008, there were 83,996 shares issued under options granted under that plan. Likewise, a number of shares equal to 8% of outstanding shares, including existing shares issuable under current options, are reserved for future issuance to directors, officers, and employees.

It is probable that options will be exercised during their respective terms if the stock price exceeds the exercise price of the particular option. The incentive plan also provides that all issued options automatically and fully vest upon a change in control. If the options are exercised, share ownership will be diluted.

In addition, the Company’s articles of incorporation authorize the issuance of up to 10,000,000 shares of common stock and 5,000,000 shares of preferred stock, but do not provide for preemptive rights to the shareholders. Authorized but unissued shares are available for issuance by the Company’s Board. Shareholders will not automatically have the right to subscribe for additional shares. As a result, if the Company issues additional shares to raise capital or for other corporate purposes, shareholders may be unable to maintain a pro rata ownership in the Company.

On January 9, 2009, the Company issued $20.0 million in preferred stock to the Treasury under the CPP. As part of the CPP transaction, the Company also issued the Treasury a 10-year warrant for the purchase of 208,768 shares of its common stock. The warrant has an aggregate market price equal to 15% of the amount of Treasury’s investment in the senior preferred stock and an initial exercise price of $14.37 per share.

The holders of the Company’s preferred stock and trust preferred securities have rights that are senior to those of shareholders.

At December 31, 2008, the Company had outstanding $15.5 million of trust preferred securities. Payment of these securities is senior to shares of common stock. As a result, the Company must make payments on the trust preferred before any dividends can be paid on common stock; moreover, in the event of bankruptcy, dissolution, or liquidation, the holders of the trust preferred securities must be satisfied before any distributions can be made to shareholders. The Company has the right to defer distributions on the trust preferred for up to five years, and if such an election is made, no dividends may be paid to shareholders during that time.

On January 9, 2009, the Company issued $20.0 million in preferred stock to the Treasury under the CPP. Under the CPP, the Company is required to pay cumulative dividends on the senior preferred shares at an annual rate of 5% for the first five years and 9% thereafter, unless the Company redeems the shares earlier. Redemptions will be at 100% of issue price plus accrued dividends and are subject to prior regulatory approval. The Company may not declare or pay dividends on its common stock or repurchase common stock without first having paid all accrued cumulative preferred dividends that are due. For three years after the Treasury’s investment in the senior preferred shares, the Company also may not increase its per share common stock dividend rate or repurchase its common shares without the Treasury’s consent, unless the Treasury has transferred all the senior preferred shares to third parties.

The directors of the Company and executive management own a significant number of shares of stock, allowing further control over business and corporate affairs.

The Company’s directors and executive officers beneficially own approximately 2,519,403 shares, or 38.1%, of outstanding common stock. As a result, in addition to their day-to-day management roles, they will be able to exercise significant influence on the Company’s business as shareholders, including influence over election of the Board and the authorization of other corporate actions requiring shareholder approval.

Provisions of the Company’s articles of incorporation and bylaws, Louisiana law, and state and federal banking regulations, could delay or prevent a takeover by a third party.

The Company’s articles of incorporation and bylaws could delay, defer, or prevent a third party takeover, despite possible benefit to the shareholders, or otherwise adversely affect the price of the common stock. The Company’s governing documents:

| · | require Board action to be taken by a majority of the entire Board rather than a majority of a quorum; |

| · | permit shareholders to fill vacant Board seats only if the Board has not filled the vacancy within 90 days; |

| · | permit directors to be removed by shareholders only for cause and only upon an 80% vote; |

| · | require an 80% shareholder vote to amend the Bylaws (85% in the case of certain provisions), a 75% vote to approve amendments to the Articles (85% in the case of certain provisions) and a 66-2/3% vote for any other proposal, in each case if the proposed action was not approved by two-thirds of the entire Board; |

| · | require 80% of the voting power for shareholders to call a special meeting; |

| · | authorize a class of preferred stock that may be issued in series with terms, including voting rights, established by the Board without shareholder approval; |

| · | authorize approximately 10 million shares of common stock that may be issued by the Board without shareholder approval; |

| · | classify its Board with staggered three year terms, preventing a change in a majority of the Board at any annual meeting; |

| · | require advance notice of proposed nominations for election to the Board and business to be conducted at a shareholder meeting; and |

| · | require supermajority shareholder voting to approve business combinations not approved by the Board. |

These provisions would preclude a third party from removing incumbent directors and simultaneously gaining control of the board by filling the vacancies thus created with its own nominees. Under the classified Board provisions, it would take at least two elections of directors for any individual or group to gain control of the board. Accordingly, these provisions could discourage a third party from initiating a proxy contest, making a tender offer or otherwise attempting to gain control. These provisions may have the effect of delaying consideration of a shareholder proposal until the next annual meeting unless a special meeting is called by the Board or the chairman of the Board. Moreover, even in the absence of an attempted takeover, the provisions make it difficult for shareholders dissatisfied with the Board to effect a change in the Board’s composition, even at annual meetings.

Also, the Company is subject to the provisions of the Louisiana Business Corporation Law (“LBCL”), which provides that the Company may not engage in certain business combinations with an “interested shareholder” (generally defined as the holder of 10.0% or more of the voting shares) unless (1) the transaction was approved by the Board before the interested shareholder became an interested shareholder or (2) the transaction was approved by at least two-thirds of the outstanding voting shares not beneficially owned by the interested shareholder and 80% of the total voting power or (3) certain conditions relating to the price to be paid to the shareholders are met.

The LBCL also addresses certain transactions involving “control shares,” which are shares that would have voting power with respect to the Company within certain ranges of voting power. Control shares acquired in a control share acquisition have voting rights only to the extent granted by a resolution approved by the Company’s shareholders. If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of all voting power, shareholders of the issuing public corporation have dissenters’ rights as provided by the LBCL.

The Company’s future ability to pay dividends and repurchase stock is subject to restrictions.

Since the Company is a holding company with no significant assets other than the Bank, the Company has no material source of income other than dividends received from the Bank. Therefore, the ability to pay dividends to the shareholders will depend on the Bank’s ability to pay dividends to the Company. Moreover, banks and bank holding companies are both subject to certain federal and state regulatory restrictions on cash dividends. The Company is also restricted from paying dividends under the terms of its Series A Preferred Stock and if it has deferred payments of the interest on, or an event of default has occurred with respect to, its trust preferred securities. Additionally, terms and conditions of the CPP transaction place certain restrictions and limitations on common stock dividends and common stock repurchases.

A shareholder’s investment is not an insured deposit.

An investment in the Company’s common stock is not a bank deposit and is not insured or guaranteed by the FDIC or any other government agency. A shareholder’s investment will be subject to investment risk and the shareholder must be capable of affording the loss of the entire investment.

Item 1B – Unresolved Staff Comments

None.

Item 2 - Properties

The Company leases its principal executive and administrative offices and principal facility in Lafayette, Louisiana under a lease expiring March 31, 2017. The Company is granted two 5-year renewal options thereafter. Eight other branches are located in Lafayette, Louisiana, three in New Iberia, Louisiana, three in Baton Rouge, Louisiana, two in Lake Charles, Louisiana, and one banking office in each of the following Louisiana cities: Breaux Bridge, Cecilia, Larose, Jeanerette, Opelousas, Morgan City, Jennings, Sulphur, Thibodaux, and Houma. Seventeen of these offices are owned and nine are leased.

In the Company’s Texas region, three full service branches are located in Beaumont, Texas, two of which are owned and one leased. Additional full service branches are located in Vidor, College Station, Houston, and Conroe. The Company also operates a loan production office located in Conroe. Of these offices, three are owned and two are leased.

Item 3 - Legal Proceedings

The Bank has been named as a defendant in various legal actions arising from normal business activities in which damages of various amounts are claimed. While the amount, if any, of ultimate liability with respect to such matters cannot be currently determined, management believes, after consulting with legal counsel, that any such liability will not have a material adverse effect on the Company's consolidated financial position, results of operations, or cash flows.

Item 4 - Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of the Company's security holders in the fourth quarter of 2008.

Item 4A - Executive Officers of the Registrant

C. R. Cloutier, 61 – President, Chief Executive Officer and Director of the Company and the Bank since 1984.

J. Eustis Corrigan, Jr., 44 –Senior Executive Vice President and Chief Financial Officer for the Company and the Bank since 2006. Mr. Corrigan announced his resignation effective January 15, 2009 in an 8-K filed by the Company on December 4, 2008.

Karen L. Hail, 55 – Senior Executive Vice President and Chief Operations Officer of the Bank since 2002; Secretary and Treasurer of the Company since 1984; and Director of the Bank since 1988.

Donald R. Landry, 52 – Senior Executive Vice President and Chief Lending Officer of the Bank since 1995 and Executive Vice President since 2002.

Dwight Utz, 55 – Executive Vice President and Chief Retail Officer since 2001.

Teri S. Stelly, 49 – Senior Vice President and Controller of the Company since 1998; Interim Chief Financial Officer and Principal Accounting Officer since January 15, 2009.

All executive officers of the Company are appointed for one year terms expiring at the first meeting of the Board of Directors after the annual shareholders meeting next succeeding his or her election and until his or her successor is elected and qualified.

PART II

Item 5 - Market for Registrant's Common Equity, Related Shareholder Matters, and Issuer Purchases of Equity Securities

As of February 27, 2009, there were 864 common shareholders of record. The Company’s common stock trades on the NYSE Alternext under the symbol “MSL.” The high and low sales price for the past eight quarters has been provided in the Selected Quarterly Financial Data tables that are included with this filing under Item 8 and is incorporated herein by reference.

Cash dividends totaling $2.1 million were declared to common shareholders during 2008. The regular quarterly dividend of $0.07 per share was paid for each quarter of 2008. A special dividend of $0.04 per share was declared in addition to the $0.07 per share for the fourth quarter of 2008. Cash dividends paid in 2008 totaled $0.32 per share. It is the intention of the Board of Directors of the Company to continue paying quarterly dividends on the common stock at a rate of $0.07 per share. Cash dividends totaling $1.9 million were declared to common shareholders during 2007. A quarterly dividend of $0.06 per share was paid for the first two quarters of 2007 and $0.07 per share was paid for the last two quarters of 2007. A special dividend of $0.04 per share was declared in addition to the $0.07 per share for the fourth quarter of 2007. As adjusted for a 5% stock dividend in 2007, cash dividends paid in 2007 totaled $0.29 per share. Restrictions on the Company's ability to pay dividends are described in Item 7 below under the heading “Liquidity - Dividends” and in Note 15 to the Company's consolidated financial statements.

The following table provides information with respect to purchases made by or on behalf of the Company or any “affiliated purchaser,” as defined in Securities Exchange Act Rule 10b-8(a)(3), of equity securities during the fourth quarter ended December 31, 2008. The CPP contains limitations on the payment of dividends on the common stock, including cash dividends in excess of $0.32 per share and on the Company’s ability to repurchase its common stock.

| | | Total Number of Shares Purchased | | | Average Price Paid per Share | | | Total Number of Shares Purchased as Part of a Publicly Announced Plan1 | | | Maximum Number of Shares That May Yet be Purchased Under the Plan1 | |

| October 2008 | | | 197 | | | $ | 16.02 | | | | 197 | | | | 168,941 | |

| November 2008 | | | 142 | | | $ | 16.30 | | | | 142 | | | | 168,799 | |

| December 2008 | | | - | | | | - | | | | - | | | | 168,799 | |

1 Under a share repurchase program approved by the Company’s Board of Directors on November 13, 2002, the Company can repurchase up to 5% of its common stock outstanding through open market or privately negotiated transactions. The repurchase program does not have an expiration date.

| Securities Authorized for Issuance under Equity Compensation Plans |

As of December 31, 2008, the Company had outstanding stock options granted under the 2007 Omnibus Incentive Compensation Plan, which was approved by the Company’s shareholders. Provided below is information regarding the Company’s equity compensation plans under which the Company’s equity securities are authorized for issuance as of December 31, 2008.

| | Number of securities to be issued upon exercise of outstanding options, warrants, and rights (a) | | | Weighted-average exercise price of outstanding options (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| Equity compensation plans approved by security holders | | | 83,996 | | | $ | 14.93 | | | | 445,462 | |

| Equity compensation plans not approved by security holders | | | - | | | | - | | | | - | |

| Total | | | 83,996 | | | $ | 14.93 | | | | 445,462 | |

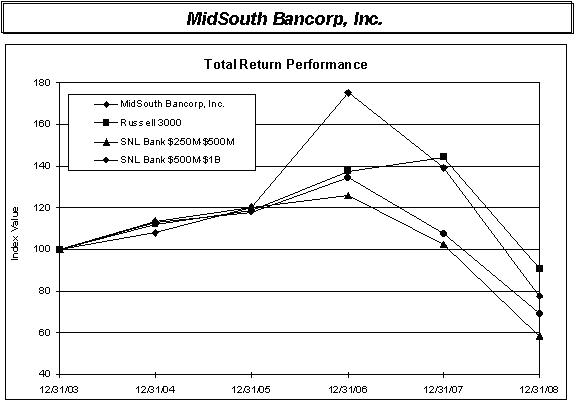

The following graph, which was prepared by SNL Securities, LC (“SNL”), compares the cumulative total return on the Company’s common stock over a period beginning December 31, 2003 with (1) the cumulative total return on the stocks included in the Russell 3000 and (2) the cumulative total return on the stocks included in the SNL $250M - $500M and the SNL $500M - $1B Bank Index. All of these cumulative returns are computed assuming the quarterly reinvestment of dividends paid during the applicable period.

| | | Period Ending | |

| | | | | | | | | | | | | | | | | | |

| MidSouth Bancorp, Inc. | | | 100.00 | | | | 108.16 | | | | 120.26 | | | | 175.17 | | | | 139.20 | | | | 77.68 | |

| Russell 3000 | | | 100.00 | | | | 111.95 | | | | 118.80 | | | | 137.47 | | | | 144.54 | | | | 90.61 | |

| SNL Bank $250M-$500M | | �� | 100.00 | | | | 113.50 | | | | 120.50 | | | | 125.91 | | | | 102.33 | | | | 58.44 | |

| SNL Bank $500M-$1B | | | 100.00 | | | | 113.32 | | | | 118.18 | | | | 134.41 | | | | 107.71 | | | | 69.02 | |

The stock price information shown above is not necessarily indicative of future price performance. Information used was obtained from SNL from sources believed to be reliable. The Company assumes no responsibility for any errors or omissions in such information.

Item 6 – Five Year Summary of Selected Financial Data

| | | At and For the Year Ended December 31, | |

| | | | | | | | | | | | | | | | |

| | | (dollars in thousands, except per share data) | |

| | | | | | | | | | | | | | | | |

| Interest income | | $ | 55,472 | | | $ | 57,139 | | | $ | 50,235 | | | $ | 38,556 | | | $ | 27,745 | |

| Interest expense | | | (16,085 | ) | | | (20,534 | ) | | | (17,692 | ) | | | (10,824 | ) | | | (5,718 | ) |

| Net interest income | | | 39,387 | | | | 36,605 | | | | 32,543 | | | | 27,732 | | | | 22,027 | |

| Provision for loan losses | | | (4,555 | ) | | | (1,175 | ) | | | (850 | ) | | | (980 | ) | | | (991 | ) |

| Noninterest income | | | 15,128 | | | | 14,259 | | | | 12,379 | | | | 12,286 | | | | 9,246 | |

| Noninterest expenses | | | (43,974 | ) | | | (38,634 | ) | | | (33,124 | ) | | | (29,326 | ) | | | (20,861 | ) |

| Earnings before income taxes | | | 5,986 | | | | 11,055 | | | | 10,948 | | | | 9,712 | | | | 9,421 | |

| Income tax expense | | | (449 | ) | | | (2,279 | ) | | | (2,728 | ) | | | (2,438 | ) | | | (2,442 | ) |

| Net income | | $ | 5,537 | | | $ | 8,776 | | | $ | 8,220 | | | $ | 7,274 | | | $ | 6,979 | |

| | | | | | | | | | | | | | | | | | | | | |

Basic earnings per share1 | | $ | 0.84 | | | $ | 1.34 | | | $ | 1.26 | | | $ | 1.13 | | | $ | 1.18 | |

Diluted earnings per share1 | | $ | 0.83 | | | $ | 1.32 | | | $ | 1.24 | | | $ | 1.10 | | | $ | 1.12 | |

Dividends per share1 | | $ | 0.32 | | | $ | 0.29 | | | $ | 0.22 | | | $ | 0.22 | | | $ | 0.18 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total loans | | $ | 608,955 | | | $ | 569,505 | | | $ | 499,046 | | | $ | 442,794 | | | $ | 386,471 | |

| Total assets | | | 936,815 | | | | 854,056 | | | | 805,022 | | | | 698,814 | | | | 610,088 | |

| Total deposits | | | 766,704 | | | | 733,517 | | | | 716,180 | | | | 624,938 | | | | 530,383 | |

| Cash dividends on common stock | | | 2,120 | | | | 1,920 | | | | 1,463 | | | | 1,425 | | | | 1,112 | |

Long-term obligations2 | | | 15,465 | | | | 15,465 | | | | 15,465 | | | | 15,465 | | | | 15,465 | |

| | | | | | | | | | | | | | | | | | | | | |

| Selected ratios: | | | | | | | | | | | | | | | | | | | | |

| Loans to assets | | | 65.00 | % | | | 66.68 | % | | | 61.99 | % | | | 63.36 | % | | | 63.35 | % |

| Loans to deposits | | | 79.43 | % | | | 77.64 | % | | | 69.68 | % | | | 70.85 | % | | | 72.87 | % |

| Deposits to assets | | | 81.84 | % | | | 85.89 | % | | | 88.96 | % | | | 89.43 | % | | | 86.94 | % |

| Return on average assets | | | 0.60 | % | | | 1.06 | % | | | 1.08 | % | | | 1.13 | % | | | 1.39 | % |

Return on average common equity3 | | | 7.79 | % | | | 13.83 | % | | | 14.68 | % | | | 14.24 | % | | | 18.73 | % |

1 On October 23, 2007, the Company paid a 5% stock dividend to shareholders of record on September 21, 2007. On October 23, 2006, the Company paid a 25% stock dividend on its common stock to holders of record on September 29, 2006. On August 19, 2005, a 10% stock dividend was paid to holders of record on July 29, 2005. On November 30, 2004, a 25% stock dividend was paid to holders of record on October 29, 2004. Per common share data has been adjusted accordingly.

2On September 20, 2004, the Company issued $8,248,000 of junior subordinated debentures to partially fund the acquisition of Lamar Bancshares, Inc. (MidSouth TX) on October 1, 2004. On February 21, 2001, the Company completed the issuance of $7,217,000 of junior subordinated debentures. For regulatory purposes, these funds qualify as Tier 1 Capital. For financial reporting purposes, these funds are included as a liability under generally accepted accounting principles.

3 In 2004, the return on average common equity ratio reflected the impact of approximately $9 million in goodwill added as a result of the Lamar Bancshares, Inc. acquisition.

Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations

MidSouth Bancorp, Inc. (the “Company”) is a single-bank holding company that conducts substantially all of its business through its wholly-owned subsidiary bank, MidSouth Bank, N. A. (the “Bank”), headquartered in Lafayette, Louisiana. The Company merged its two wholly-owned banking subsidiaries, MidSouth Bank, N.A. (Louisiana) and MidSouth Bank Texas, N.A. into MidSouth Bank, N.A., at the end of the first quarter of 2008. The purpose of this discussion and analysis is to focus on significant changes in the financial condition of the Company and on its results of operations during 2008, 2007, and 2006. This discussion and analysis is intended to highlight and supplement information presented elsewhere in this annual report on Form 10-K, particularly the consolidated financial statements and related notes appearing in Item 8.

| Forward Looking Statements |

The Private Securities Litigation Act of 1995 provides a safe harbor for disclosure of information about a company’s anticipated future financial performance. This act protects a company from unwarranted litigation if actual results differ from management expectations. This management’s discussion and analysis reflects management’s current views and estimates of future economic circumstances, industry conditions, and the Company’s performance and financial results based on reasonable assumptions. A number of factors and uncertainties could cause actual results to differ materially from the anticipated results and expectations expressed in the discussion. These factors and uncertainties include, but are not limited to:

| · | changes in interest rates and market prices that could affect the net interest margin, asset valuation, and expense levels; |

| · | changes in local economic and business conditions that could adversely affect customers and their ability to repay borrowings under agreed upon terms and/or adversely affect the value of the underlying collateral related to the borrowings; |

| · | increased competition for deposits and loans which could affect rates and terms; |

| · | changes in the levels of prepayments received on loans and investment securities that adversely affect the yield and value of the earning assets; |

| · | a deviation in actual experience from the underlying assumptions used to determine and establish the Allowance for Loan Losses (“ALL”); |

| · | changes in the availability of funds resulting from reduced liquidity or increased costs; |

| · | the timing and impact of future acquisitions, the success or failure of integrating operations, and the ability to capitalize on growth opportunities upon entering new markets; |

| · | the ability to acquire, operate, and maintain effective and efficient operating systems; |

| · | increased asset levels and changes in the composition of assets which would impact capital levels and regulatory capital ratios; |

| · | loss of critical personnel and the challenge of hiring qualified personnel at reasonable compensation levels; |

| · | changes in government regulations applicable to financial holding companies and banking; and |

| · | acts of terrorism, weather, or other events beyond the Company’s control. |

| Critical Accounting Policies |

Certain critical accounting policies affect the more significant judgments and estimates used in the preparation of the consolidated financial statements. The Company’s significant accounting policies are described in the notes to the consolidated financial statements included in this report. The accounting principles followed by the Company and the methods of applying these principles conform with accounting principles generally accepted in the United States of America (“GAAP”) and general banking practices. The Company’s most critical accounting policy relates to its allowance for loan losses, which reflects the estimated losses resulting from the inability of its borrowers to make loan payments. If the financial condition of its borrowers were to deteriorate, resulting in an impairment of their ability to make payments, the Company’s estimates would be updated and additional provisions for loan losses may be required. See Asset Quality – Allowance for Loan Losses.

Another of the Company’s critical accounting policies relates to its goodwill and intangible assets. Goodwill represents the excess of the purchase price over the fair value of net assets acquired. In accordance with SFAS No. 142, Goodwill and Other Intangible Assets, goodwill is not amortized, but is evaluated for impairment annually. If the fair value of an asset exceeds the carrying amount of the asset, no charge to goodwill is made. If the carrying amount exceeds the fair value of the asset, goodwill will be adjusted through a charge to earnings.

Compliance with accounting for stock-based compensation requires that management make assumptions including stock price volatility and employee turnover that are utilized to measure compensation expense. The fair value of stock options granted is estimated at the date of grant using the Black-Scholes option-pricing model. This model requires the input of highly subjective assumptions.

Given the current instability of the economic environment, it is reasonably possible that the methodology of the assessment of potential loan losses, goodwill impairment, and other fair value measurements could change in the near-term or could result in impairment going forward.

The Company’s growth strategy is focused on three principal components: internal growth through strategic de novo branching, technological upgrades, and continual staff development. The Company focuses on internal growth and identification of de novo branch opportunities that enhance franchise value. Each retail region operates with a regional president accountable for the Company’s performance in their market. The Company will also continue its focus on attracting key new hires and on ongoing development of existing staff.

On January 2, 2009, the Company paid its regular quarterly dividend of $0.07 per share and an additional $0.04 special dividend to its common shareholders of record as of December 14, 2008.

On January 9, 2009, the Company’s participation in the CPP of the Treasury offered under the EESA added $20.0 million in liquidity and capital for the purpose of funding loans.

The Company’s net income for the year ended December 31, 2008 totaled $5.5 million compared to $8.8 million for the year ended December 31, 2007, a decrease of $3.3 million, or 36.9%. Basic earnings per share were $0.84 and $1.34 for the years ended December 31, 2008 and 2007, respectively. Diluted earnings per share were $0.83 for the year ended December 31, 2008 compared to $1.32 per share earned for the year ended December 31, 2007. Total provision for loan loss increased $3.4 million in year-to-date comparison. The increase in provision expense was primarily driven by an increase of $1.9 million in net charge-offs, credit downgrades identified in the loan portfolio during the year, and an increase in average loan volume of $39.6 million (see Asset Quality). Net interest income increased $2.8 million, or 7.6%, in 2008, primarily attributable to the lower cost of interest-bearing liabilities. Interest expense decreased $4.4 million for the year ended December 31, 2008, as compared to the same period ended December 31, 2007, as the Company adjusted deposit rates in response to the 400 basis point drop in interest rates by the Federal Open Market Committee (“FOMC”) during 2008. Total interest income decreased $1.7 million, despite an $83.8 million increase in average earning assets, primarily due to a 104 basis points decrease in the average loan yield.

Other noninterest income increased $869,000, or 6.1%, primarily due to increases of $384,000 in service charges on deposit accounts, $635,000 in debit card and ATM transaction fee income, and a $131,000 one-time payment recorded in other noninterest income in the first quarter of 2008 related to VISA’s mandatory redemption of a portion of its Class B shares outstanding in connection with an initial public offering. These increases were partially offset by a decrease of $205,000 in mortgage processing fee income. Noninterest expense increased $5,340,000 due to increases in salaries and benefits costs ($1,005,000), occupancy expenses ($1,810,000), professional fees ($410,000), marketing expenses ($414,000), FDIC insurance premiums ($349,000), data processing expenses ($287,000), ATM and debit card processing fees ($268,000), corporate development expenses ($283,000), and losses on other assets repossessed ($299,000).

The results for the year ended December 31, 2008 were positively impacted by a lower effective tax rate of 7.50% for 2008 as compared to 20.62% in 2007 that reduced income tax expense by $1.8 million. The lower effective tax rate resulted from decreased pretax earnings due to the $3.4 million increase in the provision for loan losses combined with sustained interest income from tax exempt municipal securities within the investment portfolio. Additionally, the Work Opportunity Tax Credit was applied to the tax expense for the years ended December 31, 2008 and 2007, which reduced the expense by $149,000 and $99,000, respectively.

The Company’s total consolidated assets increased $82.8 million, or 9.7%, from $854.0 million at December 31, 2007, to $936.8 million at December 31, 2008. Total loans grew $39.5 million, or 6.9%, from $569.5 million at December 31, 2007 to $609.0 million at December 31, 2008, primarily in commercial credits and real estate mortgage loans. Total deposits grew $33.2 million, or 4.5%, from $733.5 million at December 31, 2007, to $766.7 million at December 31, 2008. The Company maintained a strong noninterest-bearing deposit portfolio of $199.9 million, or 26.1% of total deposits, and grew interest-bearing deposits primarily in consumer Platinum checking and business checking accounts.

Nonperforming assets, including loans 90 days or more past due and still accruing (“loans past due”), totaled $11.0 million at December 31, 2008 compared to $3.0 million at December 31, 2007. Nonaccrual loans increased $7.8 million from 2007 to 2008, primarily attributable to one loan relationship totaling $7.4 million in the Baton Rouge market secured by commercial real estate. Loans past due increased $25,000 in annual comparison, from $980,000 at December 31, 2007 to $1,005,000 at December 31, 2008. As a percentage of total assets, nonperforming assets increased from 0.35% at December of 2007 to 1.17% at December of 2008.

Net loan charge-offs for 2008 were $2.4 million, or 0.40% of average loans, compared to $540,000, or 0.10% of average loans, recorded a year earlier. The Company provided $4.6 million for loan losses in 2008 compared to $1.2 million in 2007 to bring the ALL as a percentage of total loans to 1.25% at year-end 2008 compared to 0.99% at year-end 2007. The increase in provision expense was primarily driven by an increase of $1.9 million in net charge-offs, credit downgrades identified in the loan portfolio, and an increase in average loan volume of $39.6 million during the year ending December 31, 2008.

The Company’s leverage ratio was 8.38% at December 31, 2008, compared to 8.67% at December 31, 2007. Return on average common equity was 7.79% for 2008 compared to 13.83% for 2007. Return on average assets was 0.60% compared to 1.06% for the same periods, respectively.

| | |

| Table 1 | |

| Summary of Return on Equity and Assets | |

| | | | | | | | | | |

| Return on average assets | | | 0.60 | % | | | 1.06 | % | | | 1.08 | % |

| Return on average common equity | | | 7.79 | % | | | 13.83 | % | | | 14.68 | % |

| Dividend payout ratio on common stock | | | 38.14 | % | | | 19.97 | % | | | 18.14 | % |

| Average equity to average assets | | | 7.75 | % | | | 7.69 | % | | | 7.35 | % |

Net Interest Income

The primary source of earnings for the Company is net interest income, which is the difference between interest earned on loans and investments and interest paid on deposits and other interest-bearing liabilities. Changes in the volume and mix of earning assets and interest-bearing liabilities combined with changes in market rates of interest greatly affect net interest income. The Company’s net interest margin on a taxable equivalent basis, which is net interest income as a percentage of average earning assets, was 4.93%, 5.10%, and 4.90% for the years ended December 31, 2008, 2007, and 2006, respectively. Tables 2 and 3 analyze the changes in net interest income for each of the three year periods ended December 31, 2008, 2007, and 2006.

| Table 2 | |

Consolidated Average Balances, Interest, and Rates (in thousands) | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment securities1 | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Taxable | | $ | 97,363 | | | $ | 4,381 | | | | 4.50 | % | | $ | 85,999 | | | $ | 4,089 | | | | 4.75 | % | | $ | 98,173 | | | $ | 4,459 | | | | 4.54 | % |

Tax-exempt2 | | | 112,801 | | | | 6,100 | | | | 5.41 | % | | | 110,256 | | | | 5,846 | | | | 5.30 | % | | | 93,918 | | | | 4,803 | | | | 5.11 | % |

| Other investments | | | 4,172 | | | | 136 | | | | 3.26 | % | | | 3,533 | | | | 156 | | | | 4.42 | % | | | 2,377 | | | | 80 | | | | 3.37 | % |

| Total investments | | | 214,336 | | | | 10,617 | | | | 4.95 | % | | | 199,788 | | | | 10,091 | | | | 5.05 | % | | | 194,468 | | | | 9,342 | | | | 4.80 | % |

| Federal funds sold | | | 29,406 | | | | 669 | | | | 2.24 | % | | | 15,554 | | | | 788 | | | | 5.00 | % | | | 23,528 | | | | 1,134 | | | | 4.75 | % |

| Loans | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial and real estate | | | 461,382 | | | | 35,404 | | | | 7.67 | % | | | 426,038 | | | | 38,314 | | | | 8.99 | % | | | 376,827 | | | | 32,894 | | | | 8.73 | % |

| Installment | | | 113,973 | | | | 10,128 | | | | 8.89 | % | | | 109,688 | | | | 9,651 | | | | 8.80 | % | | | 97,693 | | | | 8,251 | | | | 8.45 | % |

Total loans3 | | | 575,355 | | | | 45,532 | | | | 7.91 | % | | | 535,726 | | | | 47,965 | | | | 8.95 | % | | | 474,520 | | | | 41,145 | | | | 8.67 | % |

| Other earning assets | | | 15,892 | | | | 447 | | | | 2.81 | % | | | 118 | | | | 7 | | | | 5.93 | % | | | 205 | | | | 12 | | | | 5.85 | % |

| Total earning assets | | | 834,989 | | | | 57,265 | | | | 6.86 | % | | | 751,186 | | | | 58,851 | | | | 7.83 | % | | | 692,721 | | | | 51,633 | | | | 7.45 | % |

| Allowance for loan losses | | | (5,910 | ) | | | | | | | | | | | (5,079 | ) | | | | | | | | | | | (4,686 | ) | | | | | | | | |

| Nonearning assets | | | 88,808 | | | | | | | | | | | | 79,327 | | | | | | | | | | | | 73,568 | | | | | | | | | |

| Total assets | | $ | 917,887 | | | | | | | | | | | $ | 825,434 | | | | | | | | | | | $ | 761,603 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities and shareholders’ equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NOW, money market, and savings | | $ | 453,531 | | | $ | 7,958 | | | | 1.75 | % | | $ | 419,983 | | | $ | 13,017 | | | | 3.10 | % | | $ | 388,880 | | | $ | 12,084 | | | | 3.11 | % |