1Q18 Update

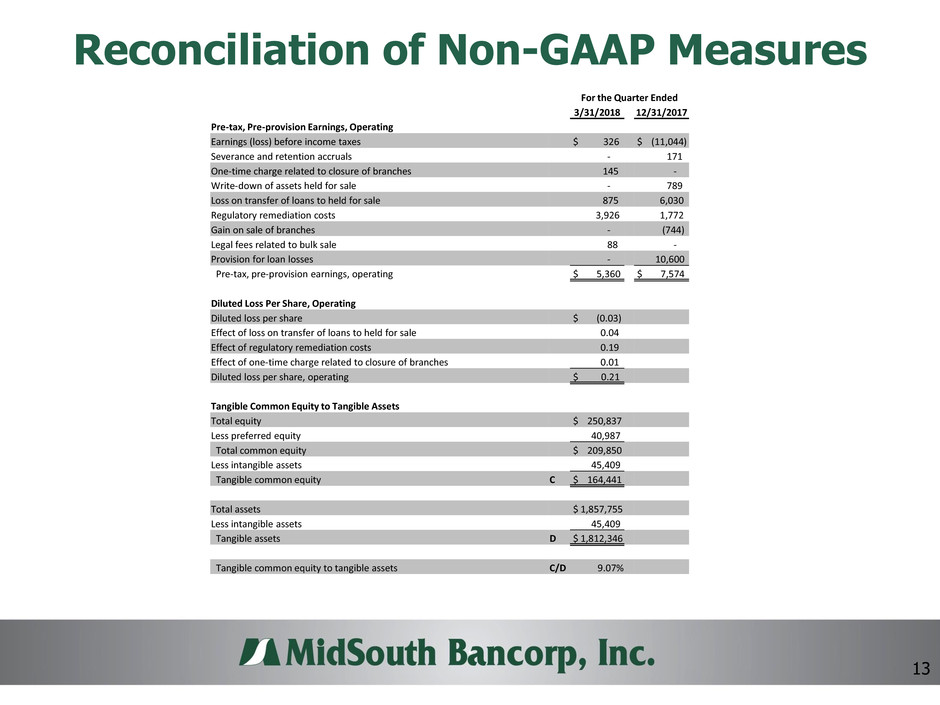

1Q18 Financial Update Quarterly loss of $450,000, $0.03 per diluted share Operating earnings was $0.21 per share excluding pre-tax loss on transfer of loans to held for sale of $875,000, pre-tax regulatory remediation costs of $3.9 million, pre-tax charge of $145,000 related to branch closures during the quarter and pre- tax charge of $88,000 of legal fees related to the bulk loan sale Reduced branch count to 42 with closure of 6 branches improving efficiencies Tangible Common Equity/Tangible Assets was 9.07% at 3/31/18 Classified assets to capital ratio for MidSouth Bank declined to 54.3%, down from 56.1% at 12/31/17 Loans declined $46.2 million Continued paydown of energy portfolio – decline of $6.9 million Core Deposits remain stable at 88% of deposit mix with low funding cost of 0.39% 1Q18 Pre-Tax, Pre-Provision earnings, operating $5.4 million vs. $7.6 million for 4Q17 2

1Q18 Financial Update (cont’d) Components of $3.9 million of regulatory remediation costs in 1Q18 $2.0 million – Compliance $652,000 – Enterprise Risk Management $584,000 – Operations $582,000 – Project Management Office $120,000 – Corporate Governance 3

1Q18 Asset Quality Summary Loan loss reserve/loans 2.23% at 3/31/18 vs. 2.27% at 12/31/17 No loan loss provision in the quarter due to a reduction in specific reserve allocations on impaired loans and a decrease in the overall loan portfolio Net charge-offs for quarter totaled $1.5 million Includes $554,000 of charge-offs on two collateral dependent loans on non- accrual Charge-offs on collateral dependent loans – more aggressive approach consistent with regulatory guidance Non-performing assets $85.1 million at 3/31/18 vs. $57.3 million at 12/31/17 Classified/Capital (Bank Level) was 54.3% vs. 56.1% at 12/31/17 Energy loans decreased $6.9 million to 15.2% of loans, unchanged from 15.2% at 12/31/17 4

1Q18 Energy Highlights Energy outstandings down $7 million in 1Q, or 3.8%, to $173 million Direct C&I – 81% of balances, Indirect – 19% (CRE and RRE) C&I Wtd Average Maturity – 1.9 years Seven energy-related C/Os during quarter totaling $972,000 and one energy- related recovery totaling $211,000 Three new energy-related impairments totaling $590,000 were identified during 1Q. One impairment charge of $268,000 and 7 reductions to impairments of $2.0 million were recorded related to existing impaired loans identified prior to 1Q18 Cycle to date NCO’s - $16.7 million or 6.30% of 12/31/14 energy loans To date, during the month of April, the Bank has had 4 rating related changes to its energy portfolio Two credits in the amount of $661,000 were downgraded to Classified from Pass Two credits in the amount of $2.6 million were downgraded to Special Mention from Pass 5

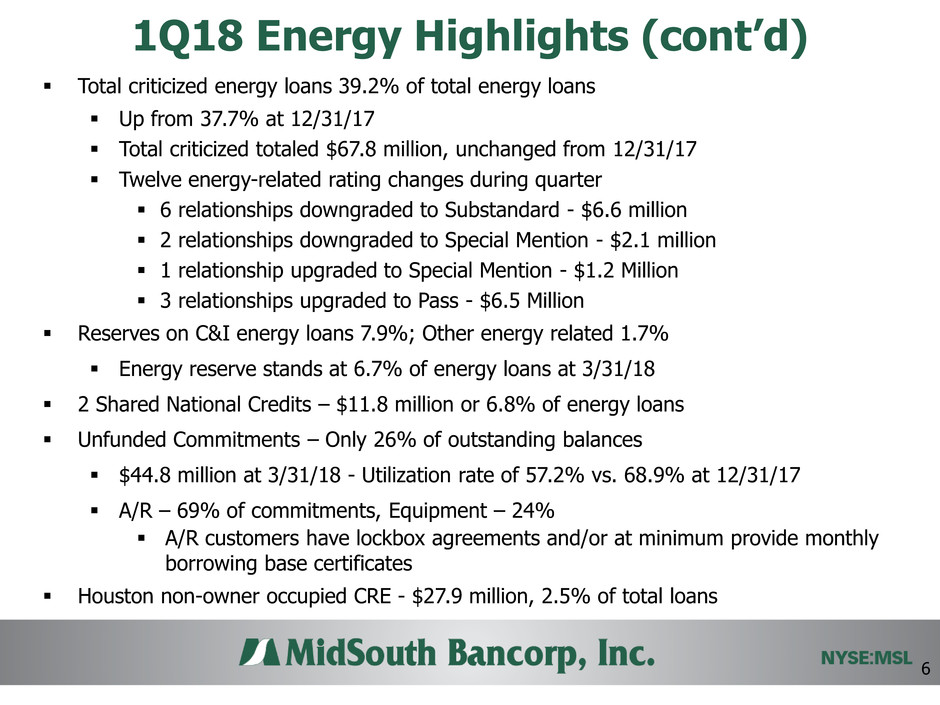

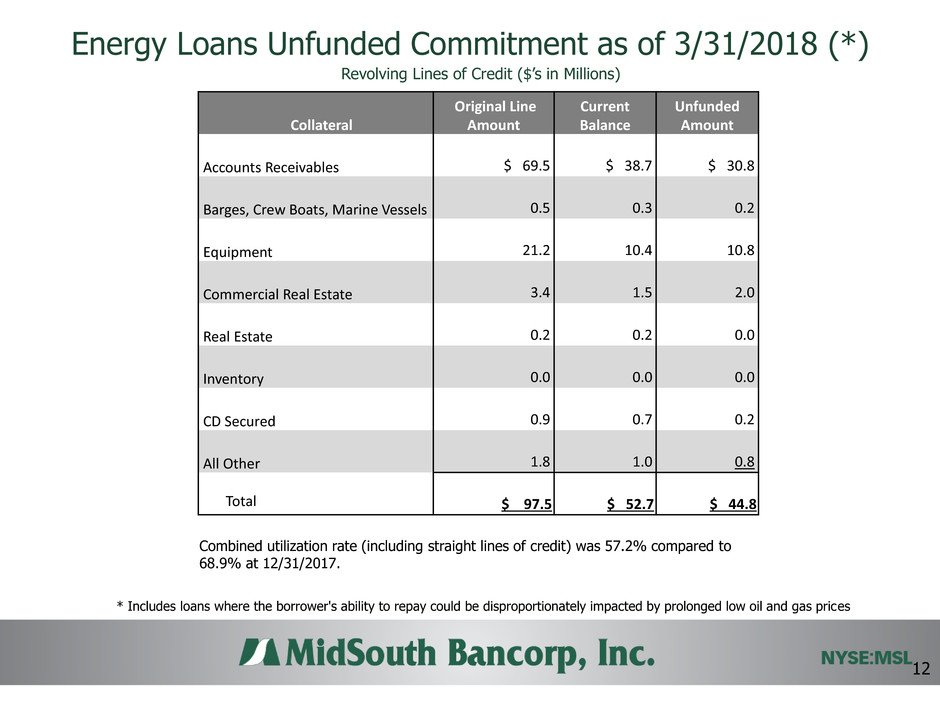

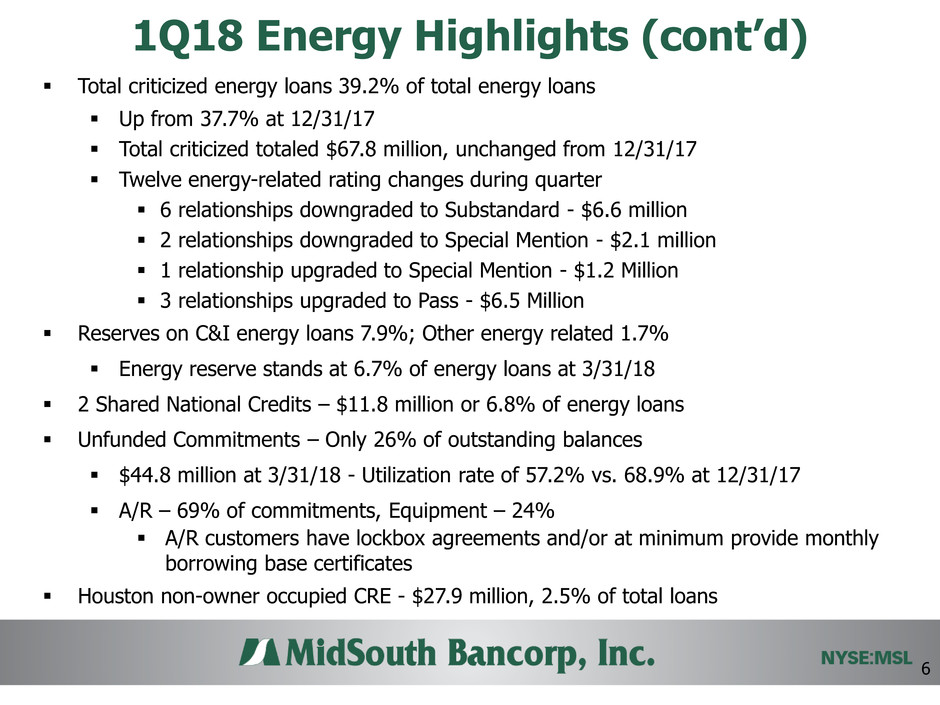

1Q18 Energy Highlights (cont’d) Total criticized energy loans 39.2% of total energy loans Up from 37.7% at 12/31/17 Total criticized totaled $67.8 million, unchanged from 12/31/17 Twelve energy-related rating changes during quarter 6 relationships downgraded to Substandard - $6.6 million 2 relationships downgraded to Special Mention - $2.1 million 1 relationship upgraded to Special Mention - $1.2 Million 3 relationships upgraded to Pass - $6.5 Million Reserves on C&I energy loans 7.9%; Other energy related 1.7% Energy reserve stands at 6.7% of energy loans at 3/31/18 2 Shared National Credits – $11.8 million or 6.8% of energy loans Unfunded Commitments – Only 26% of outstanding balances $44.8 million at 3/31/18 - Utilization rate of 57.2% vs. 68.9% at 12/31/17 A/R – 69% of commitments, Equipment – 24% A/R customers have lockbox agreements and/or at minimum provide monthly borrowing base certificates Houston non-owner occupied CRE - $27.9 million, 2.5% of total loans 6

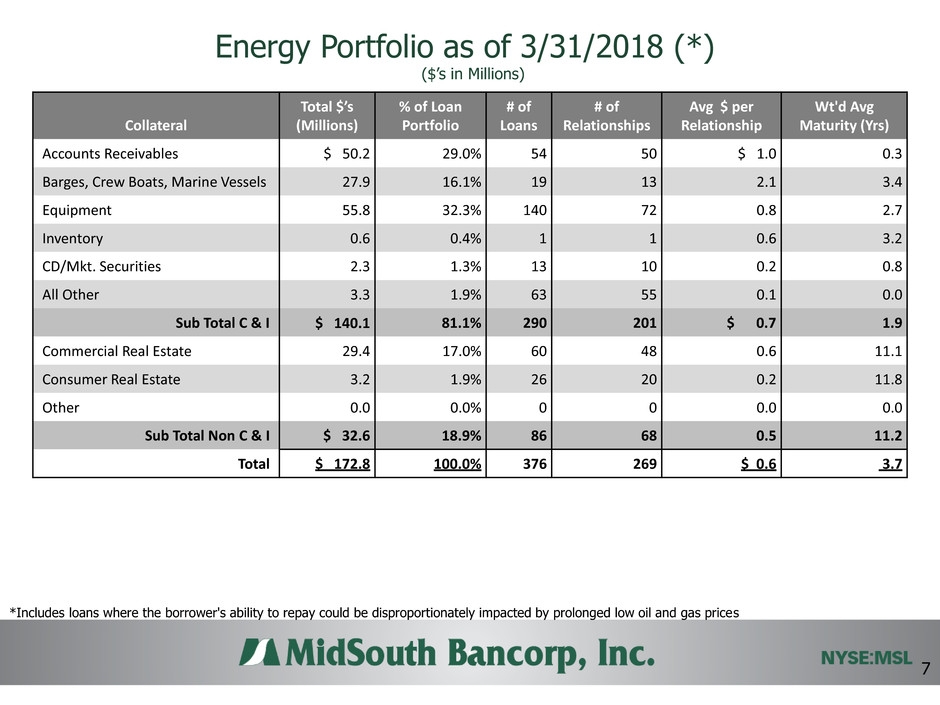

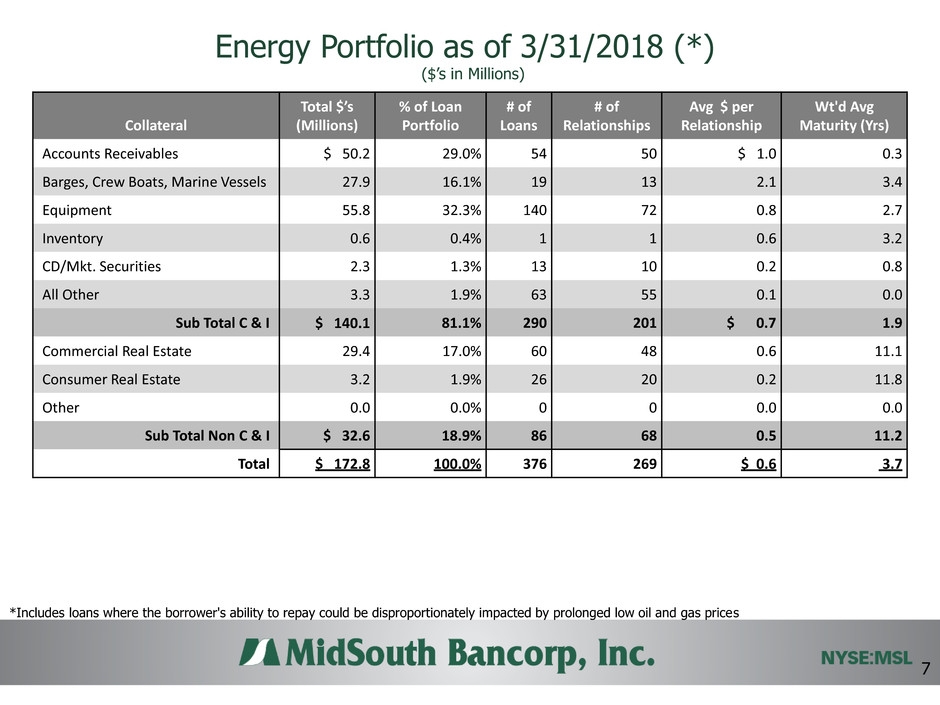

Energy Portfolio as of 3/31/2018 (*) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices ($’s in Millions) 7 Collateral Total $’s (Millions) % of Loan Portfolio # of Loans # of Relationships Avg $ per Relationship Wt'd Avg Maturity (Yrs) Accounts Receivables $ 50.2 29.0% 54 50 $ 1.0 0.3 Barges, Crew Boats, Marine Vessels 27.9 16.1% 19 13 2.1 3.4 Equipment 55.8 32.3% 140 72 0.8 2.7 Inventory 0.6 0.4% 1 1 0.6 3.2 CD/Mkt. Securities 2.3 1.3% 13 10 0.2 0.8 All Other 3.3 1.9% 63 55 0.1 0.0 Sub Total C & I $ 140.1 81.1% 290 201 $ 0.7 1.9 Commercial Real Estate 29.4 17.0% 60 48 0.6 11.1 Consumer Real Estate 3.2 1.9% 26 20 0.2 11.8 Other 0.0 0.0% 0 0 0.0 0.0 Sub Total Non C & I $ 32.6 18.9% 86 68 0.5 11.2 Total $ 172.8 100.0% 376 269 $ 0.6 3.7

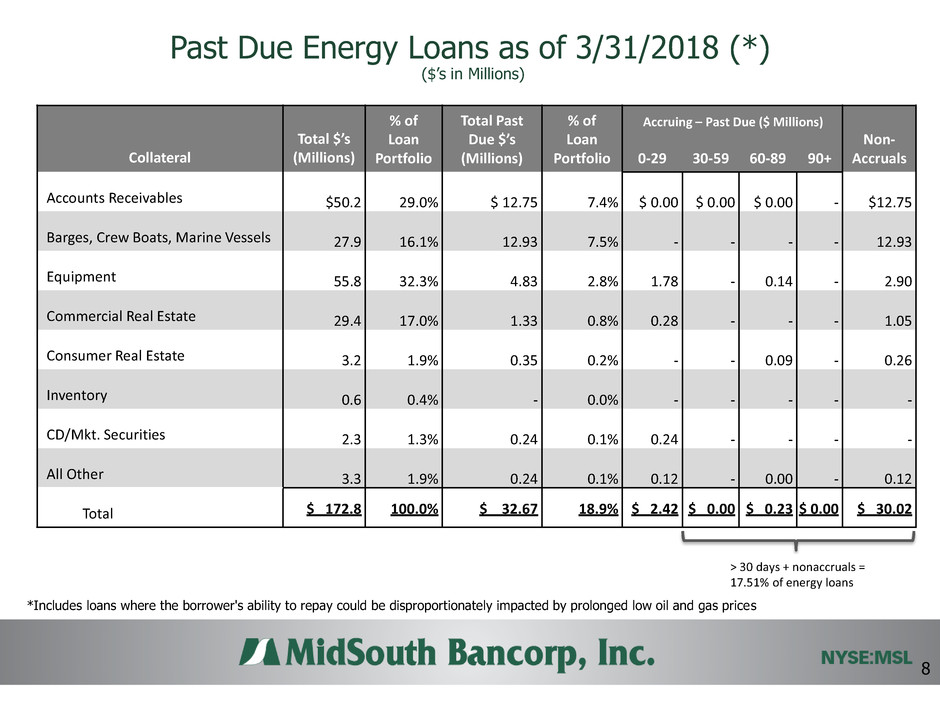

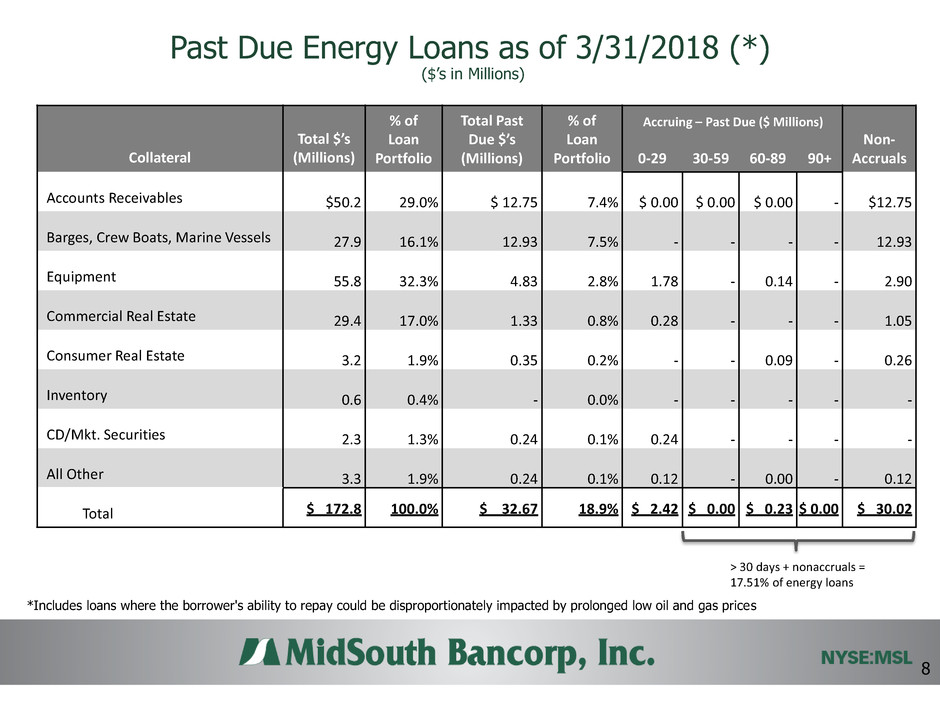

Past Due Energy Loans as of 3/31/2018 (*) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices > 30 days + nonaccruals = 17.51% of energy loans ($’s in Millions) 8 Collateral Total $’s (Millions) % of Loan Portfolio Total Past Due $’s (Millions) % of Loan Portfolio 0-29 30-59 60-89 90+ Non- Accruals Accounts Receivables $50.2 29.0% $ 12.75 7.4% $ 0.00 $ 0.00 $ 0.00 - $12.75 Barges, Crew Boats, Marine Vessels 27.9 16.1% 12.93 7.5% - - - - 12.93 Equipment 55.8 32.3% 4.83 2.8% 1.78 - 0.14 - 2.90 Commercial Real Estate 29.4 17.0% 1.33 0.8% 0.28 - - - 1.05 Consumer Real Estate 3.2 1.9% 0.35 0.2% - - 0.09 - 0.26 Inventory 0.6 0.4% - 0.0% - - - - - CD/Mkt. Securities 2.3 1.3% 0.24 0.1% 0.24 - - - - All Other 3.3 1.9% 0.24 0.1% 0.12 - 0.00 - 0.12 Total $ 172.8 100.0% $ 32.67 18.9% $ 2.42 $ 0.00 $ 0.23 $ 0.00 $ 30.02 Accruing – Past Due ($ Millions)

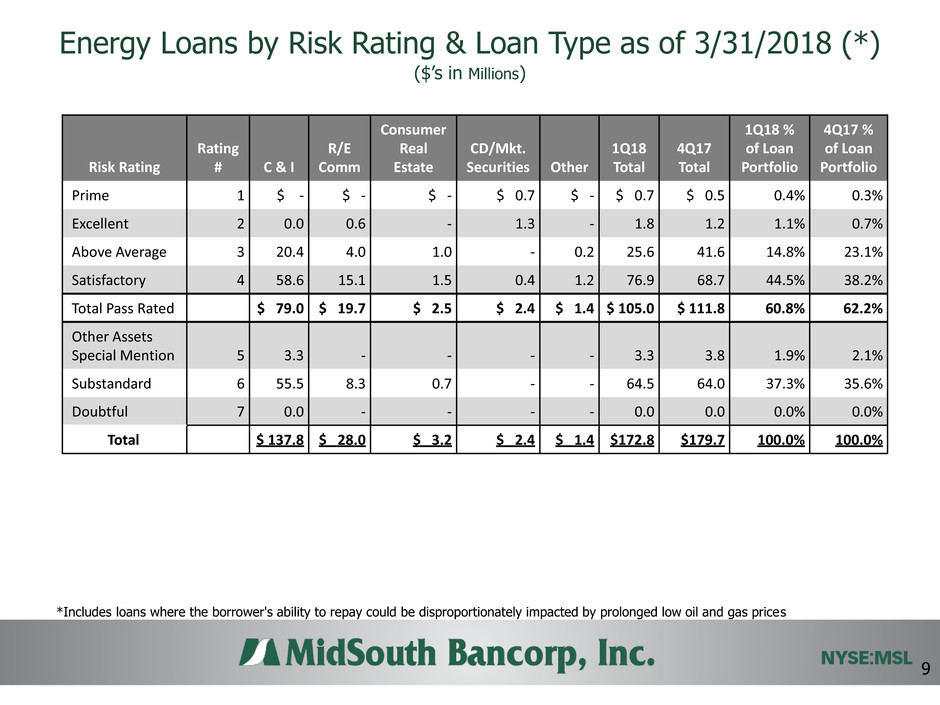

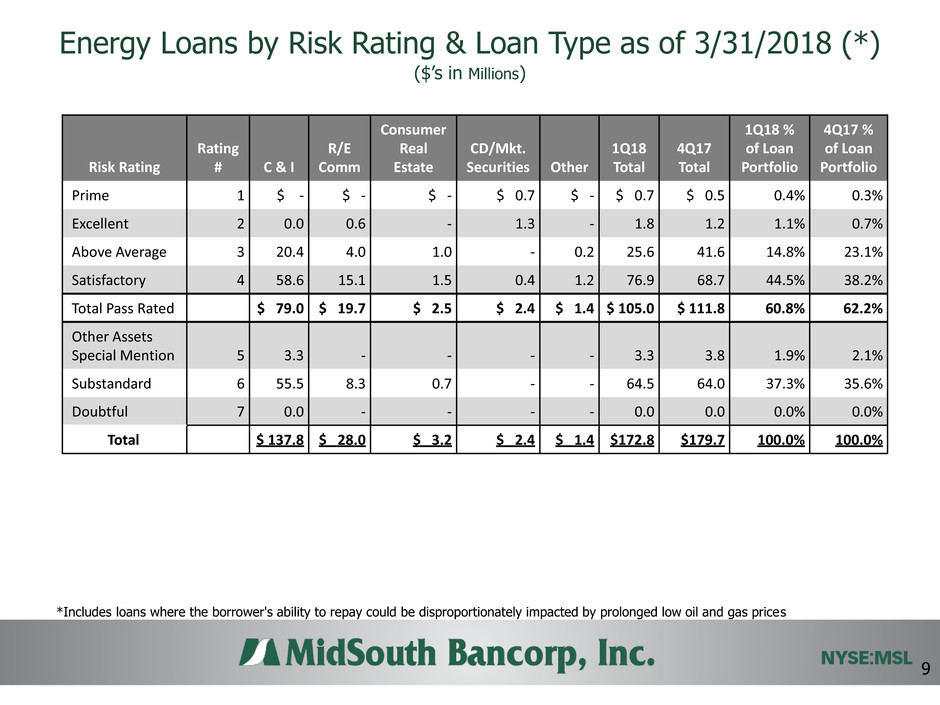

Energy Loans by Risk Rating & Loan Type as of 3/31/2018 (*) ($’s in Millions) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 9 Risk Rating Rating # C & I R/E Comm Consumer Real Estate CD/Mkt. Securities Other 1Q18 Total 4Q17 Total 1Q18 % of Loan Portfolio 4Q17 % of Loan Portfolio Prime 1 $ - $ - $ - $ 0.7 $ - $ 0.7 $ 0.5 0.4% 0.3% Excellent 2 0.0 0.6 - 1.3 - 1.8 1.2 1.1% 0.7% Above Average 3 20.4 4.0 1.0 - 0.2 25.6 41.6 14.8% 23.1% Satisfactory 4 58.6 15.1 1.5 0.4 1.2 76.9 68.7 44.5% 38.2% Total Pass Rated $ 79.0 $ 19.7 $ 2.5 $ 2.4 $ 1.4 $ 105.0 $ 111.8 60.8% 62.2% Other Assets Special Mention 5 3.3 - - - - 3.3 3.8 1.9% 2.1% Substandard 6 55.5 8.3 0.7 - - 64.5 64.0 37.3% 35.6% Doubtful 7 0.0 - - - - 0.0 0.0 0.0% 0.0% Total $ 137.8 $ 28.0 $ 3.2 $ 2.4 $ 1.4 $172.8 $179.7 100.0% 100.0%

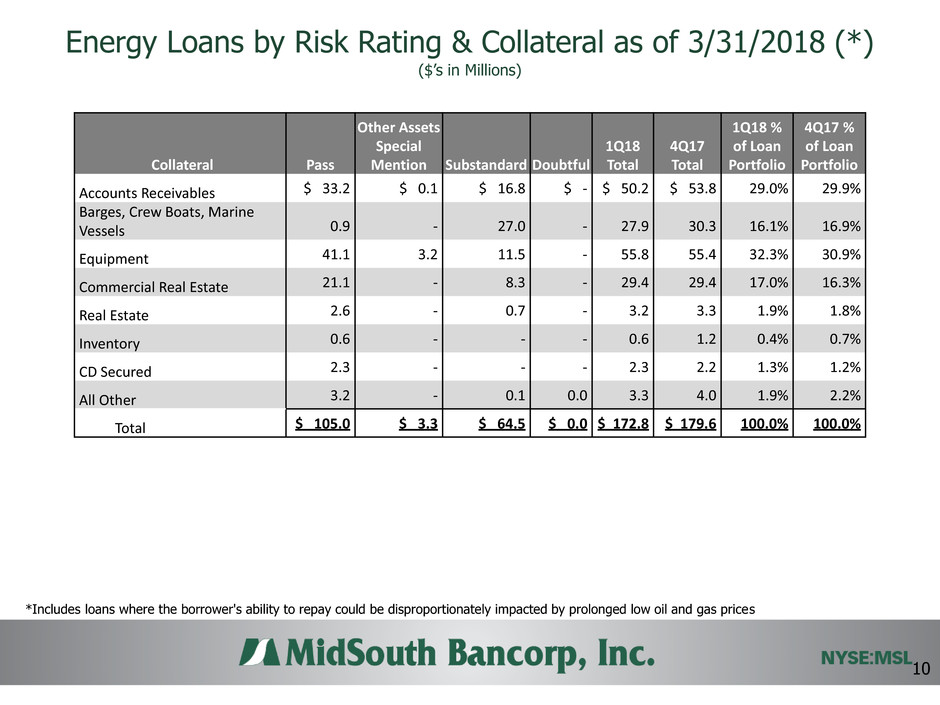

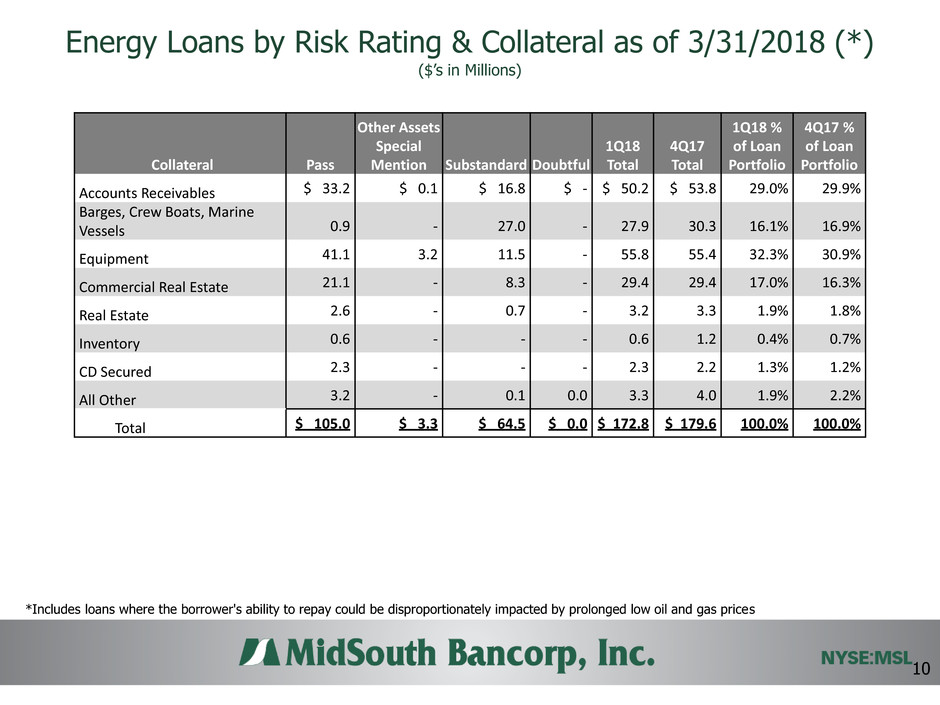

Energy Loans by Risk Rating & Collateral as of 3/31/2018 (*) ($’s in Millions) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 10 Collateral Pass Other Assets Special Mention Substandard Doubtful 1Q18 Total 4Q17 Total 1Q18 % of Loan Portfolio 4Q17 % of Loan Portfolio Accounts Receivables $ 33.2 $ 0.1 $ 16.8 $ - $ 50.2 $ 53.8 29.0% 29.9% Barges, Crew Boats, Marine Vessels 0.9 - 27.0 - 27.9 30.3 16.1% 16.9% Equipment 41.1 3.2 11.5 - 55.8 55.4 32.3% 30.9% Commercial Real Estate 21.1 - 8.3 - 29.4 29.4 17.0% 16.3% Real Estate 2.6 - 0.7 - 3.2 3.3 1.9% 1.8% Inventory 0.6 - - - 0.6 1.2 0.4% 0.7% CD Secured 2.3 - - - 2.3 2.2 1.3% 1.2% All Other 3.2 - 0.1 0.0 3.3 4.0 1.9% 2.2% Total $ 105.0 $ 3.3 $ 64.5 $ 0.0 $ 172.8 $ 179.6 100.0% 100.0%

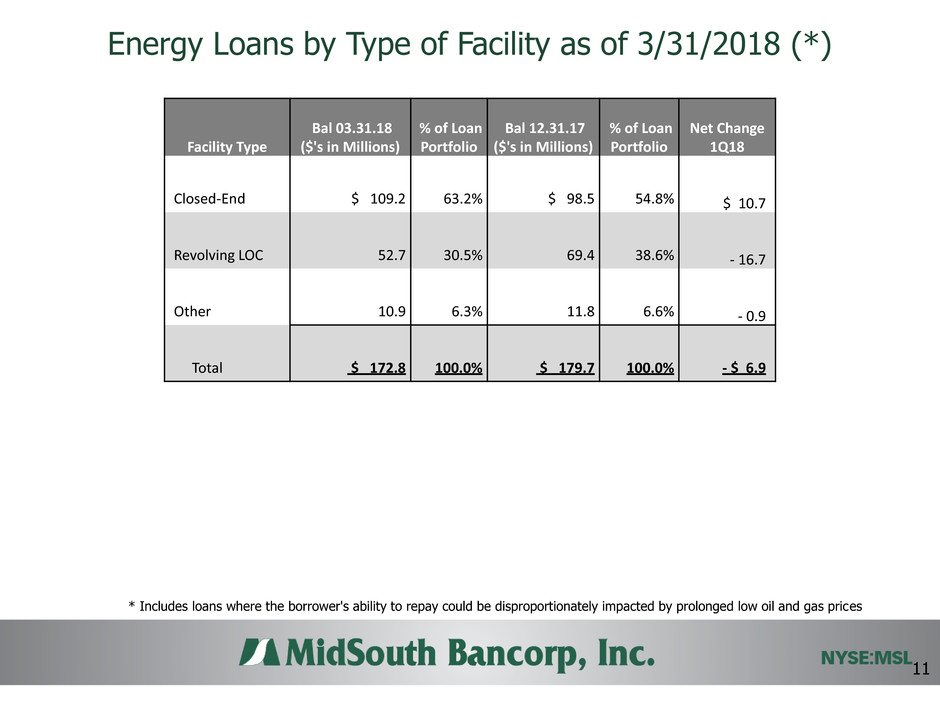

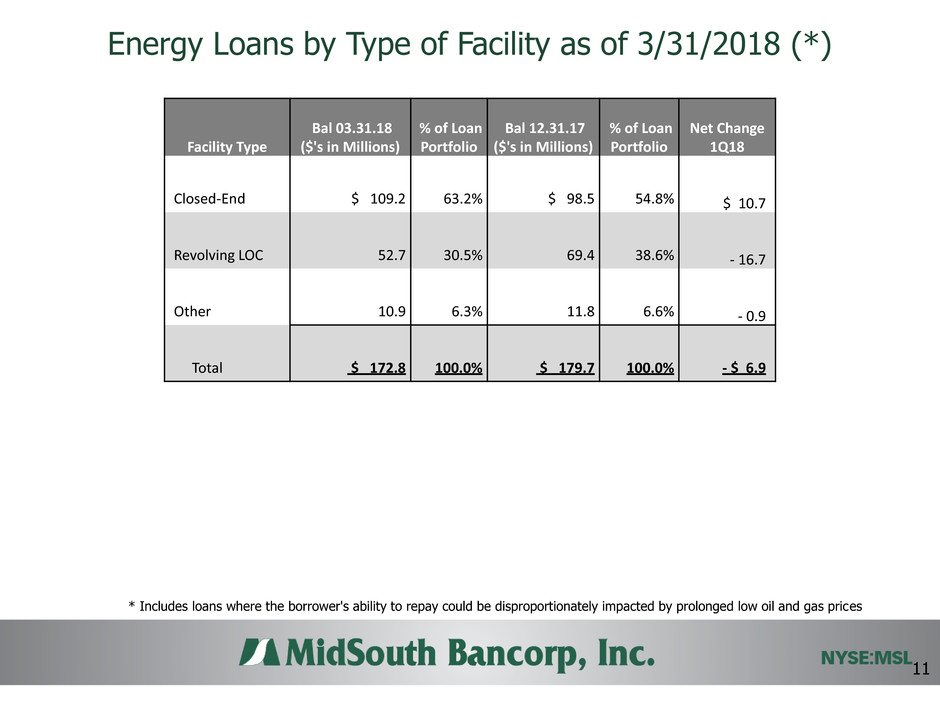

Energy Loans by Type of Facility as of 3/31/2018 (*) * Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 11 Facility Type Bal 03.31.18 ($'s in Millions) % of Loan Portfolio Bal 12.31.17 ($'s in Millions) % of Loan Portfolio Net Change 1Q18 Closed-End $ 109.2 63.2% $ 98.5 54.8% $ 10.7 Revolving LOC 52.7 30.5% 69.4 38.6% - 16.7 Other 10.9 6.3% 11.8 6.6% - 0.9 Total $ 172.8 100.0% $ 179.7 100.0% - $ 6.9

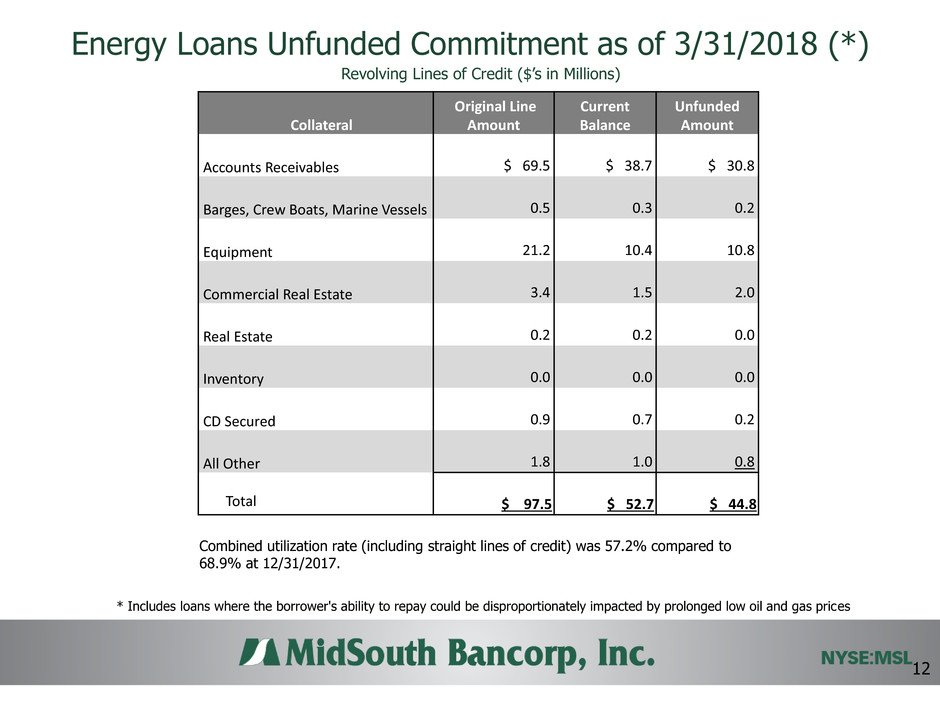

Energy Loans Unfunded Commitment as of 3/31/2018 (*) * Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices Combined utilization rate (including straight lines of credit) was 57.2% compared to 68.9% at 12/31/2017. Revolving Lines of Credit ($’s in Millions) 12 Collateral Original Line Amount Current Balance Unfunded Amount Accounts Receivables $ 69.5 $ 38.7 $ 30.8 Barges, Crew Boats, Marine Vessels 0.5 0.3 0.2 Equipment 21.2 10.4 10.8 Commercial Real Estate 3.4 1.5 2.0 Real Estate 0.2 0.2 0.0 Inventory 0.0 0.0 0.0 CD Secured 0.9 0.7 0.2 All Other 1.8 1.0 0.8 Total $ 97.5 $ 52.7 $ 44.8

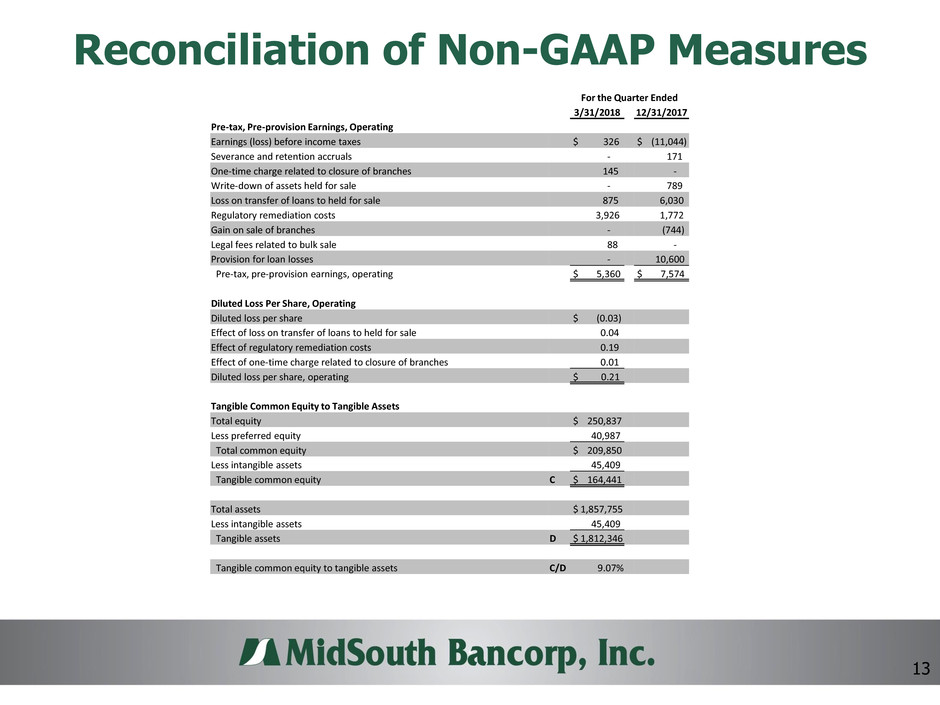

Reconciliation of Non-GAAP Measures 13 For the Quarter Ended 3/31/2018 12/31/2017 Pre-tax, Pre-provision Earnings, Operating Earnings (loss) before income taxes $ 326 $ (11,044) Severance and retention accruals - 171 One-time charge related to closure of branches 145 - Write-down of assets held for sale - 789 Loss on transfer of loans to held for sale 875 6,030 Regulatory remediation costs 3,926 1,772 Gain on sale of branches - (744) Legal fees related to bulk sale 88 - Provision for loan losses - 10,600 Pre-tax, pre-provision earnings, operating $ 5,360 $ 7,574 Diluted Loss Per Share, Operating Diluted loss per share $ (0.03) Effect of loss on transfer of loans to held for sale 0.04 Effect of regulatory remediation costs 0.19 Effect of one-time charge related to closure of branches 0.01 Diluted loss per share, operating $ 0.21 Tangible Common Equity to Tangible Assets Total equity $ 250,837 Less preferred equity 40,987 Total common equity $ 209,850 Less intangible assets 45,409 Tangible common equity C $ 164,441 Total assets $ 1,857,755 Less intangible assets 45,409 Tangible assets D $ 1,812,346 Tangible common equity to tangible assets C/D 9.07%