Highlights

Section A: Jobs and Growth

Investing in People

þ | The government is committed to help Ontarians save for a strong and secure retirement and is leading the way by working to secure agreement among the provinces and the federal government on enhancing the Canada Pension Plan. If an agreement cannot be reached, the Province will move forward with a “made in Ontario” solution. |

| þ | Implementing the Ontario Youth Jobs Strategy will help 30,000 young people gain the benefit of on-the-job workplace experience, introduce them to employers and offer a head start on their future careers. |

þ | Changes will help protect consumers and make certain services, such as cell phone and wireless service contracts, the Drive Clean program and auto insurance, more affordable. |

þ | The government will provide support to Ontarians in greatest need and ensure that they can participate in the economy to their full potential by working to better match skilled workers with employment and releasing a second five-year Poverty Reduction Strategy that would focus on supporting attachment to the labour market. |

Investing in Modern Infrastructure

þ | The introduction of green bonds and Ontario’s new Trillium Trust, and support for increased investment by pension plans in public infrastructure projects, would help address congestion, increase private-sector productivity and improve the quality of life for Ontarians. |

þ | The government will introduce legislation that would require the Province to table a 10-year infrastructure plan in the legislature, supporting job creation, training opportunities and economic growth. |

þ | Building on Ontario’s status as a global leader for alternative financing and procurement (AFP) projects, the government will enhance its AFP approach to improve the delivery of large and complex infrastructure projects and increase the number of Ontario-based companies that participate in the construction of AFP projects. |

Supporting a Dynamic and Innovative Business Climate

þ | The government will build on Ontario’s strong fundamentals and encourage investment by partnering with industry and research organizations to help Ontario companies become more competitive and productive in order to create jobs, innovate and export. |

þ | Building partnerships among colleges, universities and industry leaders to connect Ontario’s highly skilled workforce with innovative businesses, facilitate learning and training, and encourage new investment, will support growth in key sectors such as aerospace and information and communications technologies. |

þ | The government is proposing to support small businesses by cutting the Employer Health Tax, helping 60,000 small employers save money, including 12,000 that would no longer pay this tax. |

Section B: Managing Responsibly

þ | Continuing global uncertainty is slowing Ontario’s economic and revenue growth, but the government will continue to protect investments in jobs, growth and families ahead of short-term targets. |

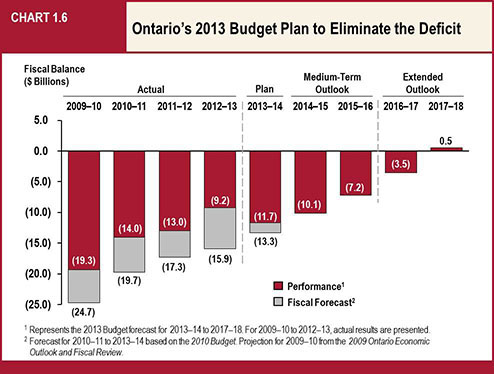

þ | The government has taken firm, effective measures to reduce spending growth, allowing the Province to overachieve on its deficit-reduction targets, and remains on track to balance the budget by 2017–18. |

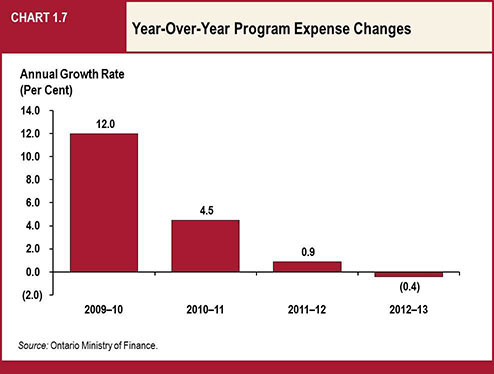

þ | Ontario has the lowest per-capita program spending in Canada and for the last two years has held growth in overall program spending below one per cent. The 2012–2013 Public Accounts of Ontario reported that program expense in 2012–13 was lower than the previous year for the first time in more than a decade. |

þ | To maintain the government’s approach to managing program spending growth, the government is moving forward with 60 per cent of the recommendations of the Commission on the Reform of Ontario’s Public Services and will analyze the remaining recommendations. |

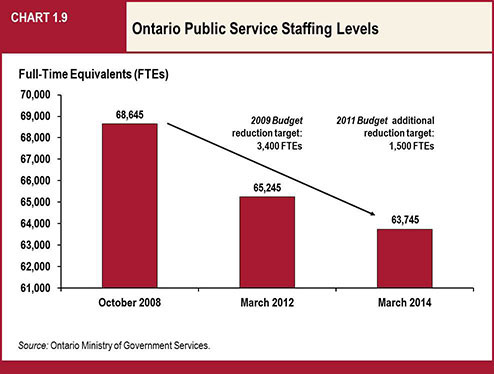

þ | The government has taken steps to make the Ontario Public Service (OPS) more efficient and reduce its size through attrition or other measures. By March 31, 2012, the government had achieved the objective announced in the 2009 Budget of a five per cent reduction of full-time equivalent staff and is well on its way towards a further reduction of 1,500 full-time equivalent staff by March 31, 2014. |

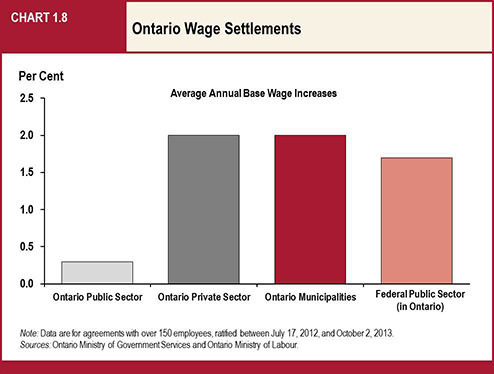

þ | With over half of all government spending going to salaries and benefits, the government has taken steps to manage public-sector compensation costs. Ontario public-sector wage settlements are below the growth of those in the private sector, municipal sector and federal public sector. The government is also reviewing executive compensation for the broader public sector. |

þ | The government has taken action to increase the accountability of government agencies by strengthening oversight and enhancing the governance of classified agencies, and will begin benchmarking government enterprises such as the LCBO, Ontario Lottery and Gaming Corporation, Ontario Power Generation, Hydro One and other agencies. |

þ | The establishment of the Financial Accountability Officer will ensure that the legislature and Ontarians have the financial information necessary to understand the state of the Province’s finances. |

| Section A: | Jobs and Growth |

Introduction

Ontario families have weathered the global economic recession with strength and resolve. As a result, Ontario is emerging stronger than ever. The recession has shown that government has an important role to play in creating a climate of economic growth and helping people in their everyday lives. To create jobs and protect key public services that Ontarians rely on, the government is implementing a plan that will drive economic growth by:

♦ | Investing in modern infrastructure; and |

♦ | Supporting a dynamic and innovative business climate. |

Ontario’s plan will build on its competitive strengths. It will increase job creation in high potential growth sectors while supporting mature sectors so that they can continue to be competitive. It will also help entrepreneurs to access the tools they need for success in order to create more innovative companies and will help give them access to emerging markets.

Responsible Management of Program Expense

The government remains on track to balance the budget by 2017–18 in a fair and responsible way. This will mean new strategic investments to spur growth, create jobs, strengthen services and help families. Fiscal discipline is fundamental to the government’s approach. The government is making responsible choices that reflect the state of the world around us. Across-the-board cuts would hurt Ontario families, impact economic growth, damage key public services and result in substantial job losses. On the other hand, reckless tax hikes would hurt job-creating businesses and, by direct extension, Ontario families. Instead, the government remains committed to controlling spending by transforming the delivery of services.

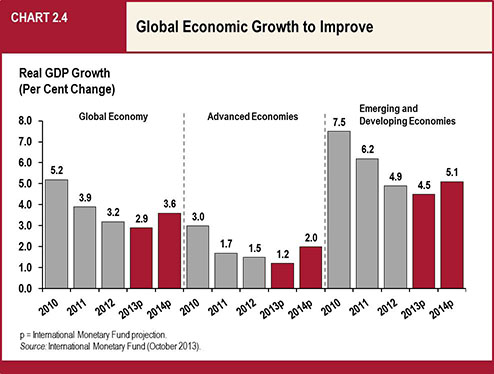

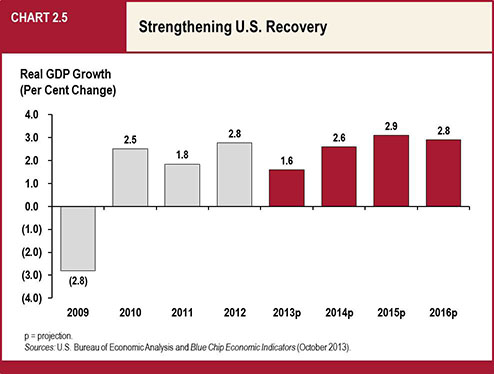

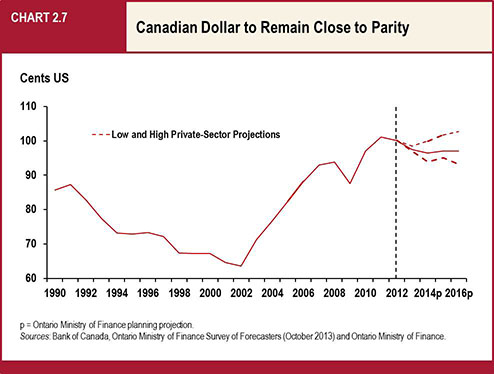

Economic Recovery

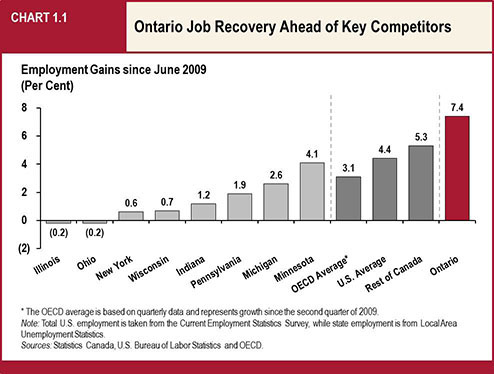

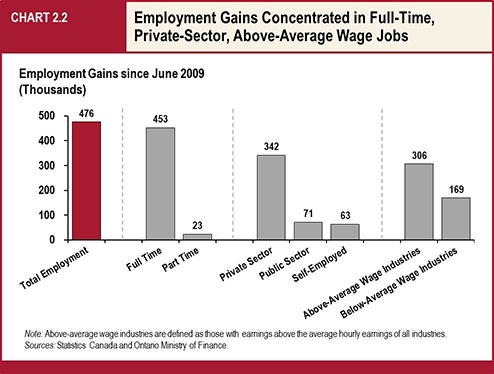

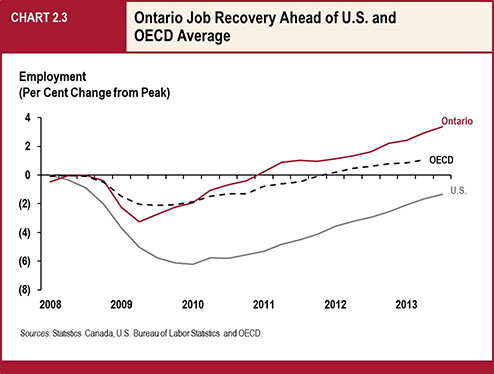

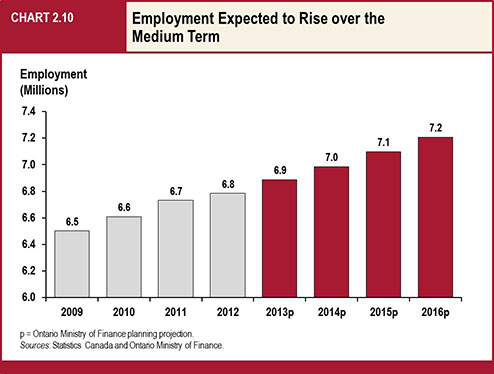

Ontario’s economic fundamentals remain strong. The economy continues to grow and create new jobs in the face of a challenging global environment. Ontario has recovered all of the jobs lost during the recession and employment is now above the pre-recession peak. More than 475,000 jobs have been created since the recessionary low in June 2009 and there are currently over 200,000 more jobs since the pre-recession peak. Job creation in Ontario has outpaced that of the rest of Canada, the United States and all of the Great Lake States.

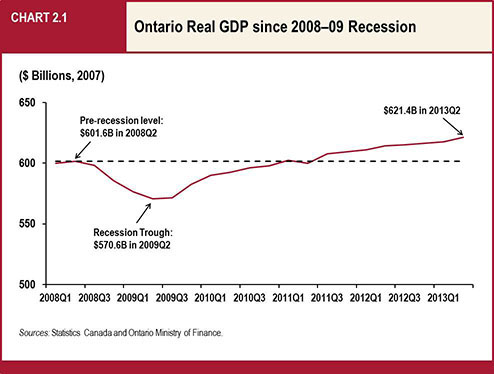

Real gross domestic product (GDP), an important measure of economic growth, has increased 8.9 per cent since the end of the recession and is more than three per cent higher than its pre-recession level. But given a fragile global recovery, many businesses, communities and people continue to feel vulnerable to economic change, and are uncertain about the future.

That is why the government has a bold plan to create jobs and grow the economy across the entire province. Through this approach, the government will help ensure that everyone has the opportunity to contribute to a stronger Ontario, One Ontario.

Ontario’s economic fundamentals are strong: Well-educated, highly skilled workforce — 65 per cent of Ontarians have a postsecondary education, among the highest rates in the world. Sound financial system — Ontario’s financial sector is one of the strongest in the world. Competitive tax system — Since 2009, the marginal effective tax rate on new business investment in Ontario has been cut in half. Fostering an environment of innovation — Leading universities and research centres support the commercialization of innovation. Effective public services — Strong universal health care and elementary and secondary education. |

Leading the Way to Secure Retirement

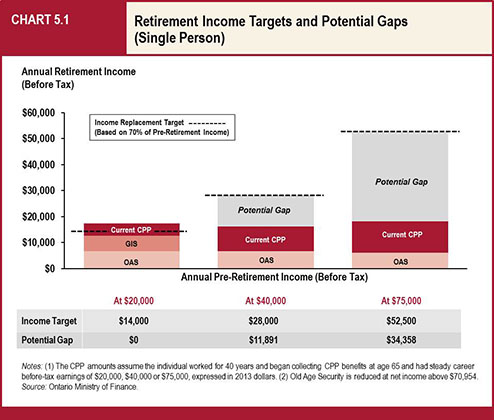

Long-term savings and investment are critical to ensuring Ontarians prepare financially for their retirement. Many Ontarians today are having difficulty putting aside sufficient savings for retirement and are worried about their future financial security.

The government is committed to help Ontarians save for a strong and secure retirement so they are able to enjoy their retirement years. It will assist working Ontarians in planning for their retirement, whether they rely on retirement income provided through the Canada Pension Plan (CPP), are accumulating retirement savings independently, or have access to a workplace pension plan. This commitment will ease the financial pressure on their children and grandchildren.

The CPP forms the foundation of the nation’s retirement income system. An enhancement to the CPP is critical to ensuring that Ontarians, particularly middle-income earners, have greater financial security in retirement.

The government is leading the way by working to secure agreement among provinces and the federal government on enhancing the CPP. If an agreement cannot be reached, Ontario will move forward with a “made in Ontario” solution.

The government will also implement innovative retirement savings models such as pooled registered pension plans (PRPPs) to promote increased retirement savings in the province. Before introducing legislation, it will consult on an Ontario framework for PRPPs to provide employees, particularly those working in small and medium-sized businesses, with a simplified, low-cost retirement savings vehicle.

For Ontarians with self-directed retirement savings, such as registered retirement savings plans (RRSPs), Ontario will work to reduce the cost of investing and provide individuals with the help they need to make informed decisions about financial savings. The government will examine recommendations by the Ontario Securities Commission (OSC), which is looking at the structure of mutual fund fees, and consider more tailored regulation of financial advisers and planners.

Recognizing recent funding challenges, the government will also help those with defined benefit (DB) pension plans by implementing new and revised rules to ensure Ontario’s private-sector DB plans remain financially sound and public-sector DB plans remain affordable and sustainable. (See Chapter V: Retirement Income Security for more details.)

Connecting People to Tomorrow’s Jobs

To ensure all Ontarians can participate in the economy to their full potential, Ontario is continuing to take action by helping youth and workers needing additional training and support, and providing additional support for those in greatest need.

Implementation of the Ontario Youth Jobs Strategy

The government created the Ontario Youth Jobs Strategy to help young people find jobs, start their own businesses and gain valuable skills. A key element of the strategy, the Youth Employment Fund, was launched in September 2013 through the Province’s network of employment services across Ontario. The program gives employers incentives to offer four- to six-month job and training placements for young people of up to $6,800 to help cover wage and training costs, and up to $1,000 to help young workers pay for job-related costs like tools and transportation to work, with 2,000 jobs already created.

This initiative builds on Ontario’s investments totalling over $1 billion per year in employment and training services under Employment Ontario. Youth aged 15 to 29 accounted for 35 per cent of Employment Ontario participants in 2012.

TABLE 1.1 Ontario Youth Jobs Strategy — $295 Million over Two Years |

| Youth Employment | Ontario Youth Employment Fund | ● Launched in September, this fund will provide employment opportunities for about 25,000 youth across Ontario. ● The fund helps employers offer four- to six-month job training placements for youth. |

Ontario Youth Skills Connections Fund | ● Will partner about 3,000 young people with industry, not-for-profit and academic leaders to help them build career skills and secure jobs. |

| Youth Entrepreneurship | Ontario Youth Innovation Fund | ● Will provide about 2,000 training and employment opportunities for graduate students and postgraduate students, and help up to 1,000 postsecondary students launch startups by funding campus-linked business accelerators. |

| Ontario Youth Entrepreneurship Fund | ● Will generate about 6,000 mentorship and job opportunities by increasing funding for existing programs, such as Summer Company, and new programs to support the growth of youth-led companies with training, mentorship and seed financing. |

Connecting Companies to Workers

The Ministry of Training, Colleges and Universities’ Rapid Re-employment and Training Service (RRTS) currently provides immediate response to announced layoffs, by connecting individuals with the relevant and appropriate Employment Ontario services that will help them regain employment. This response is always adapted to meet the unique circumstances of each situation.

The capacity will be expanded to better match skilled workers seeking employment with either existing employers expanding or new companies investing in Ontario. This would contribute to Ontario’s renewed focus on engaging employers across all regions.

Reducing Poverty Helps Strengthen the Economy

Ontario’s economy is strengthened when everyone has the opportunity to achieve their full potential. Strategic investments in education, health and income support help reduce reliance on social services, build the workforce and strengthen Ontario’s economy. That is why the government introduced the first Poverty Reduction Strategy, Breaking the Cycle, in 2008.

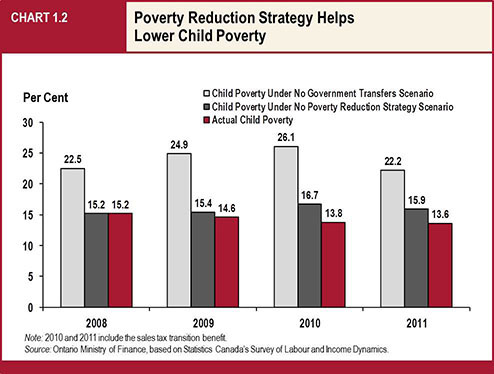

Ontario is making progress on its Poverty Reduction Strategy. The number of children living in poverty in Ontario has dropped 47,000 since 2008, a decline of 11.4 per cent. This reduction in poverty happened as Ontario’s economy was battered by the global financial crisis and ensuing recession. Without the Poverty Reduction Strategy, an estimated 15.9 per cent of Ontario children would have been living in low-income families in 2011. As a result of the Strategy, the actual child poverty rate was 13.6 per cent.

Building on this success, Ontario will release its second five-year plan in the coming months, with a focus on helping support attachment to the labour market.

While the minimum wage was frozen for a nine-year period, before 2003, the government has since increased it by 50 per cent to $10.25 per hour. The Province has also struck a Panel that will provide recommendations on the appropriate timing and scale of future minimum-wage increases.

Social assistance reform that helps remove barriers to employment can make a meaningful and lasting improvement in economic well-being. The 2013 Budget announced a new $200 monthly earnings exemption for those receiving Ontario Works (OW) and Ontario Disability Support Program (ODSP) supports to encourage employment. In addition, OW and ODSP recipients are able to keep 50 cents for every $1 of employment earnings above $200.

The government will continue to help people get back into the workforce by removing barriers faced by social assistance recipients.

21st-Century Learning

Creative, Innovative and Entrepreneurial Learning

Ontario students continue to lead the way in educational excellence, supported by the province’s world‐class schools. Investments in education will continue to build on student achievement, support innovative, technology-enabled teaching and learning practices, and integrate the higher-order skills such as critical thinking, communication, collaboration and entrepreneurship that young students need to succeed in the 21st-century global labour market.

McKinsey & Company Cites Ontario’s Education System as One of the Best in the World In the 2010 McKinsey report “How the World’s Most Improved School Systems Keep Getting Better,” Ontario was recognized as being near the top among 20 school systems that “have registered significant, sustained, and widespread student outcome gains.” It was rated as “great” and on a trajectory to “excellent.” Then, in a subsequent McKinsey report titled “Capturing the Leadership Premium” (2010), Ontario was one of eight systems selected for review as a result of strong performance on international assessments and “good practices in school leadership.” |

Ontario remains committed to preparing its youngest students for a productive future. Full-day kindergarten gives children a better start in school and prepares them for success in Grade 1 and beyond.

This school year, full-day kindergarten is available to about 184,000 four- and five-year-olds in approximately 2,600 schools. When the program is fully implemented in September 2014, all four- and five-year-olds will have access, benefiting approximately 265,000 children and saving families up to $6,500 per child per year on child care costs.

In October 2013, the Ministry of Education released the findings of a study conducted in partnership with Queen’s and McMaster universities. The evaluation provides preliminary evidence that full-day kindergarten is having a favourable impact on four- and five-year-olds in Ontario. The study showed that children with two years of full-day kindergarten instruction had reduced risks in social competence development, in language and cognitive development, and in communication skills and general knowledge development as compared to children with no full-day kindergarten instruction.

To remain competitive in the global economy, the government’s commitment and investments must continue to foster innovation in the education sector to drive towards even higher levels of student achievement. The government continues to consult with the public on moving Ontario’s education system from “great to excellent.” This vision will guide the next phase of Ontario’s education strategy.

Ontario continues to make significant improvements in student achievement. ● In 2011–12, the high school graduation rate increased to 83 per cent, an increase of 15 percentage points over the 2003–04 level of 68 per cent. This means 115,500 more students graduated than had the rate remained at the 2003–04 level. ● In 2002–03, only 54 per cent of children in Grades 3 and 6 were meeting the provincial standard in literacy and numeracy. Today, that number is 71 per cent, an increase of 17 percentage points. This means over 150,000 more elementary students are reaching the standard than would have in 2002–03. ● The government expects to conclude formal consultations on Building the Next Phase in Ontario’s Education Strategy in November 2013 and anticipates launching an updated vision in early 2014. |

Postsecondary Education Transformation and Training

Education is the cornerstone of the government’s economic plan. Ontario colleges and universities prepare the next generation for good jobs. Recognizing these benefits, Ontario has introduced a number of initiatives resulting in significant achievements to boost higher education.

The government has improved access for low- and middle-income families with the introduction of the 30% Off Ontario Tuition grant in 2011–12. About 230,000 students received this grant in 2012–13, up from 207,000 the previous year.

Further proposed enhancements include better alignment of tuition fee deadlines with Ontario Student Assistance Program (OSAP) payments, so that students do not face penalties for late payment while they are waiting for their student assistance to arrive.

The 2013 Ontario Budget reaffirmed the government’s commitment to integrate employment and training services across government with Employment Ontario. This will give individuals and employers improved access to the services they need — whether it is training to improve skills, opportunities to gain work experience, or strategies and tools to recruit local talent.

The Ministry of Training, Colleges and Universities continues to develop options on how best to implement this initiative. The government is also engaging key stakeholders to better integrate the programs.

Over 120,000 apprentices are learning a trade today — more than double the number in 2002–03. The Ontario government continues to invest in the apprenticeship system to ensure that the province has the skilled workers it needs, including supports and incentives to increase apprenticeship completions.

The Ontario government is working with colleges, universities, students and other stakeholders to build a sustainable postsecondary education system that supports job creation, enhanced productivity and better collaboration with regional communities.

Key government priorities in creating a sustainable postsecondary education system include:

♦ | Improved collaboration with industry on program development and applied research; |

♦ | A differentiated postsecondary education system that will place a premium on collaboration between institutions to support the government’s vision and priorities for postsecondary education, and support institutions to build on their distinctive strengths; and |

♦ | Improved credit transfers between institutions so students have more options. |

Expanding French Postsecondary Education

Ontario recently announced more opportunities to study in French and prepare for future jobs. The province’s Action Plan for French-language Postsecondary Education will increase access to French-language postsecondary education and services in central and southwestern Ontario. Ontario is providing $16.5 million to help universities and colleges expand their French-language programs and services, including expansions already underway at York University's Glendon College, College Boréal and La Cité collégiale in the Greater Toronto Area. The government has increased funding to French-language postsecondary education by more than 62 per cent since 2003–04.

Supporting Northern Ontario Students

Ontario is committed to making smart investments that will help northern Ontario’s economy grow and create more jobs. The Ontario government has invested $1.5 million in Lakehead University’s new Faculty of Law and $21 million in Laurentian University’s new School of Architecture, northern Ontario’s first law and architecture schools. Lakehead’s law school welcomed its inaugural class in September 2013. The first phase of the new School of Architecture at Laurentian was completed in 2013.

These schools will help northern Ontario students enter the law and architecture professions, and study closer to their families and the communities where they grew up.

Increasing Access to Health Care

A healthy, well-educated population leads to a stronger economy. More doctors and nurses mean more people can access family health care when they need it. The government has made significant investments to increase the number and availability of primary care providers in the province, including initiatives to support the training and employment of physicians and nurses, such as:

♦ | Creating four new medical education campuses in St. Catharines, Kitchener-Waterloo, Windsor and Mississauga, which are successfully training doctors; |

♦ | Opening the Northern Ontario School of Medicine in 2005 — the first new medical school in Canada in over 30 years. As of 2012, the school was training a total of 249 undergraduate medical students; |

| ♦ | Expanding opportunities for International Medical Graduates (IMGs) to practise in the province. Ontario currently offers more training positions and assessments for IMGs than all other provinces combined. IMGs account for approximately 25 per cent of the province’s physician workforce; |

♦ | Continuing to support nurses to work to their full scope of practice so patients can get the services they need; and |

♦ | Creating the Nursing Career OrIENtation Initiative, an employment initiative to help internationally educated nurses transition to practise full time in Ontario. |

Keeping Seniors Active

Seniors helped build this province. Through Ontario’s Action Plan for Seniors, released earlier this year, the government is helping seniors stay active, healthy and connected to the community. It is building on this commitment by announcing Ontario’s first-ever grants program solely dedicated to seniors. This $500,000 program will help seniors participate in more community activities, continue their learning in areas like technology and financial literacy, and develop a strong sense of social inclusion and community participation. This grant program is another step towards making Ontario the best place to age, to live longer and to live well.

Protecting Consumers

The government has recently introduced changes that will help protect consumers and make certain services more affordable.

Stronger Rights for Wireless Consumers

Cell phones are the new utilities. They are not luxuries, they are necessities of modern life. Wireless costs are too high in Ontario. Ontario is committed to providing consumers with clear information and fewer surprises when they enter into cell phone and wireless services contracts.

Ontario is moving forward to protect wireless and cell phone customers with the passage of the Wireless Services Agreements Act, 2013. The new legislation will benefit wireless consumers by:

♦ | Limiting the cost associated with cancelling a contract; |

♦ | Requiring contracts to be written in plain, easy-to-understand language; |

♦ | Ensuring contracts clearly spell out which services come with the basic fee, and which would result in a higher bill; and |

♦ | Showing all-inclusive prices in wireless services pricing and advertisements. |

These reforms will protect the rights of consumers while furthering the government’s commitment to building a strong economy and a fair, safe and informed marketplace.

Stronger Rights and More Protection for Consumers

Educating and protecting Ontario consumers is part of the government’s plan to ensure a fair marketplace and help people in their everyday lives. If passed, the government’s proposed Bill 55, Stronger Protection for Ontario Consumers Act, 2013, would:

♦ | Curb aggressive door-to-door sales tactics on the sale of water heaters; |

♦ | Protect vulnerable, indebted consumers against the abusive practices of some companies offering debt settlement services; |

♦ | Help protect home buyers and sellers in real estate bidding; and |

♦ | Give home buyers and sellers more power to negotiate both fees and commissions when working with a real estate professional. |

Protecting Ontario’s Consumers and Investors

Ontario’s capital markets are well regulated and foster safe, stable and attractive investment opportunities. The government remains committed to modernizing securities laws and the regulatory framework to ensure sound and efficient markets that help investors and savers work towards their financial objectives.

Financial literacy helps Ontarians make informed investment decisions. The government encourages individuals of all ages to plan for their economic future and will continue to work with its partners, including the Ontario Securities Commission (OSC), to promote the financial literacy of all Ontarians. The Investor Education Fund, which is funded through monetary settlements and fines resulting from OSC enforcement proceedings, has created and maintains a website with the most popular financial material of its kind in Canada.

The OSC is currently engaged in a number of high profile consultations affecting investors and capital markets. One such OSC consultation relates to the examination of the structure of mutual fund fees (including trailer fees) in Canada to see whether there are investor protection or fairness issues, and to determine whether any regulatory responses are needed.

Financial advisers, including financial planners, also play a significant role in the savings and investment decisions of many individuals and provide a broad range of available financial planning services. People who seek the assistance of financial planners expect access to sound, professional advice to ensure that their investment decisions best serve their financial goals. The government will investigate the merits of proceeding with more tailored regulation of financial planners. It will consider the appropriate regulatory framework for doing so, including possible reforms put forward by industry organizations.

Renewing the Drive Clean Program

In the coming months, the Ministry of the Environment will announce a reduction in Drive Clean fees paid by consumers to ensure the program remains revenue neutral over its lifetime. The Drive Clean program protects public health by reducing smog-causing emissions by more than a third every year, removing 335,000 tonnes of smog-causing pollutants from the air since 1999.

Cutting Auto Insurance Rates

As part of the government’s plan to make everyday life more affordable, the government announced a multi-faceted plan, in August 2013, to reduce Ontario auto insurance rates by 15 per cent on average within the next two years — with an overall average eight per cent reduction target by August 2014.

Ontario’s Auto Insurance Cost and Rate Reduction Strategy

To help achieve the average rate reduction, the government gave the Financial Services Commission of Ontario (FSCO) the authority to require insurers to re-file new rates for FSCO approval. Insurers have started to file new rates with FSCO as a result of this new authority. The government also made the Superintendent of FSCO’s guidelines binding to help reduce unexpected costs.

The government expects that the January 2014 report on approved rates from FSCO will provide the first evidence that its strategy to reduce costs and rates is working.

Transforming the auto insurance dispute resolution system is another key element of the government’s Cost and Rate Reduction Strategy. The Province appointed former Associate Chief Justice of the Superior Court of Justice, the Honourable J. Douglas Cunningham, to lead a review and make recommendations on how to make this a more efficient and effective system. An interim report is expected in the fall, in which the Honourable J.D. Cunningham will outline preliminary recommendations as well as a framework for possible legislation towards a new auto insurance dispute resolution system. Stakeholder consultations on the recommended legislative direction will be held in the coming months in preparation for the final report.

The government also committed to protecting consumers by continuing to ensure that insurer rate filings include rates that reward safe drivers and by helping to ensure that all regions of Ontario benefit fairly from cost savings.

Tackling Fraud

The Ontario government is also continuing to crack down on auto insurance fraud to further benefit consumers. The government has already taken a number of actions to address key recommendations made by the Auto Insurance Anti-Fraud Task Force, such as a framework for licensing health clinics in the auto insurance system, and expanding the regulator’s investigation and enforcement authority.

The Task Force identified consumer engagement and education as an important part of the fight against fraud. FSCO has launched an Anti-Fraud Hotline at 1-855-5TIP-NOW that will allow the public to play a greater role in combating fraud. Ontario has also added important information to the Ministry of Transportation’s Driver’s Handbook to help new drivers understand and prevent auto insurance fraud.

The government is also actively working to develop a province-wide system to oversee the towing industry. In the winter of 2014, the government will work closely with the sector, the Association of Municipalities of Ontario, the City of Toronto and other key stakeholders on the development of a proposed model. As part of this work, the government will also look at the issues of vehicle storage and collision repair practices.

In addition, the insurance industry is working to fight fraud. It recently announced the creation of Canadian National Insurance Crime Services (CANATICS), a new not-for-profit organization that will use data analytics to identify suspicious claims. The Task Force supported the use of data analytics to combat auto insurance fraud and recommended the creation of such an organization in its final report.

Increasing Transparency and Accountability

To increase the transparency and accountability of the system, the government will provide independent annual public reports on progress made on the Cost and Rate Reduction Strategy.

The government is taking strong action to make auto insurance more affordable for the province’s over nine million drivers. However, the insurance industry must also do more. For example, the industry needs to review its claims management practices regularly to ensure that it is operating as effectively and efficiently as possible.

Ensuring market competition in the provision of auto insurance will continue to play an important role in keeping auto insurance rates down.

The government will continue to consult with stakeholders on any possible new measures that can work to reduce costs and lower auto insurance rates for consumers.

| 2. | Investing in Modern Infrastructure |

Building modern public infrastructure is a key driver of economic growth, prosperity and job creation.

Infrastructure investments help address congestion, increase private-sector productivity, and improve the quality of life for Ontarians. Public transit and integrated transportation networks support economic growth by giving Ontarians better access to jobs, attracting business investment, helping to prevent bottlenecks and expanding access to suppliers, buyers and skilled workers. Investments in health infrastructure, schools and postsecondary facilities support the delivery of high quality health care and provide better places to learn.

The government is introducing three new initiatives to further invest in infrastructure priorities such as public transit, highways, hospitals and schools:

♦ | Ontario’s New Trillium Trust: The government would create the Trillium Trust where revenue gains from asset sales would be placed in a consolidated trust and used to finance key public infrastructure priorities. |

♦ | Green Bonds: The government would make Ontario the first province in Canada to develop and sell green bonds. Green bonds are a tool to raise capital for projects with specific environmental benefits. The proceeds from green bonds would be invested in transit and other environmentally friendly infrastructure projects across the province and allow Ontarians to directly invest in the future of their province. |

♦ | Pension Plan Investment in Ontario Infrastructure: The government will propose regulations that would allow pension plans to further invest in local infrastructure by exempting plans’ investments in certain Ontario public infrastructure projects from the “30 per cent” pension investment rule. This rule prohibits Ontario pension plans from owning more than 30 per cent of the voting shares of a single corporation, restricting pension plans from taking an active role in infrastructure and other investments. The government is proposing to remove this obstacle to investments in Ontario public infrastructure projects, which could represent a significant new source of capital to support economic growth and job creation in Ontario. |

Public Infrastructure Benefits Ontario’s Economy

Economic Impacts of Public Infrastructure in Ontario A growing body of research demonstrates the significant economic benefits of public infrastructure. ● A 2013 Conference Board of Canada report cited Ontario’s current and planned real infrastructure investments from 2006 to 2014, and reported that: ● each $100 million of public infrastructure investment in Ontario boosts gross domestic product by $114 million, particularly in the construction and manufacturing sectors; and ● public infrastructure adds over $1,000 to the average annual income of Ontarians by 2014 and lowers the unemployment rate by about one percentage point compared to what it would have been in the absence of these investments. ● A 2009 Statistics Canada report estimated that roughly 50 per cent of Canada’s growth in productivity from 1962 to 2006 was the result of public infrastructure. ● A 2008 Statistics Canada report stated that public infrastructure spending decreases business costs by 11 cents on the dollar and manufacturing costs specifically by 27 cents on average. |

The Province has invested more than $85 billion in public infrastructure since 2003 to reverse the underinvestment that had accumulated over several previous decades. All regions of Ontario have benefited from these investments, which have resulted in:

♦ | more than 7,900 kilometres of provincial highways built or repaired in Ontario, including over 4,000 kilometres in northern Ontario; |

♦ | more than 950 bridges constructed or repaired on provincial highways; |

♦ ♦ | over 100 major hospital projects initiated, including 40 under construction or in planning; and 610 new schools opened, planned, or under construction. |

The Province will continue to make significant investments in infrastructure of more than $35 billion over the next three years, including about $13.5 billion in 2013–14. Planned infrastructure investments over the next three years would support well over 100,000 jobs on average each year in construction and related industries across the province.

Given the importance of Ontario’s economy to Canada, Ontario believes the federal government needs to be a full partner in strategic infrastructure investments through adequate and predictable funding that is coordinated and consistent with provincial infrastructure plans. (See Chapter IV: The Need for a Committed Federal Partner for more details.)

Introducing Ontario’s First Long-Term Infrastructure Legislation

Building on the government’s commitment to support the economy through infrastructure investments, the Province will introduce legislation that, if passed, would require the government to table a 10-year infrastructure plan in the legislature. This would support job creation and training opportunities, economic growth and protection of the environment.

Making Strategic Investments in Infrastructure

Building Public Transit

Investments in public transit help manage congestion, reduce transportation costs, and improve the livability of cities. The Province is investing over $3 billion in transit infrastructure in 2013–14.

This year, Ontario enacted legislation to make the Dedicated Gas Tax Program permanent. This program provides two cents per litre of gas tax revenue to help municipalities improve public transit. These revenues will support 96 municipal transit systems serving 130 communities, and represent an investment of $2.6 billion since 2004. This funding is helping municipalities expand and improve public transit infrastructure, increase accessibility, buy more conventional and specialized transit vehicles, add more routes and extend hours of service.

The 2013 Budget also announced increasing investments in GO Transit over the next 10 years to address underserviced areas, meet projected demand for peak-hour service, and help lay the foundation for major initiatives included in Metrolinx’s regional transportation plan, The Big Move. In June, the Province announced that GO Train service along the Lakeshore line between Aldershot and Oshawa will run every 30 minutes, seven days a week. This adds 263 new train trips in total every week along the line, offering greater flexibility to commuters in the Greater Toronto and Hamilton Area (GTHA).

In May 2013, Metrolinx made recommendations to support the funding and implementation of projects under The Big Move, estimated at a capital cost of $50 billion. There will also be associated financing costs and, as these projects come into service, they will require ongoing funding to maintain and operate these new assets over their lifetime.

Given the importance of transit funding in Ontario, the government has established a 13-member panel to evaluate dedicated sources of revenue to fund further investments in public transit infrastructure. Throughout November, these experts will engage the public on the recommendations presented by Metrolinx and other potential options to support ongoing investment in transportation.

At the same time, the Province is committed to introducing high-occupancy toll (HOV/HOT) lanes in the GTHA, in which carpooling drivers would continue to drive for free, but individual drivers would be able to choose to drive in the HOT lane for a toll. Toll-free options would exist on all highways that have HOV/HOT lanes.

Congestion Is Hurting Ontario’s Economy “In the Greater Toronto and Hamilton Area, the commonly used estimate is that congestion costs the economy about $6 billion per year … this report estimates the additional costs [above the $6 billion] to be at least $1.5 billion and as much as $5 billion per year [in lost wages].” C.D. Howe Institute, “Cars, Congestion and Costs: A New Approach to Evaluating Government Infrastructure Investment,” July 2013, p. 1. |

Building Highways

As important as public transit is, a modern, efficient highway network plays an important role in helping address traffic congestion. Investments in the provincial highway network support the movement of goods to market and commuters between their homes and workplaces. Ontario is making strategic investments to expand provincial highways, including widening Highway 417 in Ottawa and Highway 11/17 between Thunder Bay and Nipigon, and extending Highway 407 east through Durham Region.

Building Municipal Infrastructure

To build stronger communities, support jobs and grow local businesses, the Province announced as part of the 2013 Budget a new $100 million infrastructure fund to help small, rural and northern municipalities undertake critical infrastructure projects.

Over the summer, the Province heard from more than 500 municipal delegates on the design of the program. Informed by these consultations, the new Small, Rural and Northern Municipal Infrastructure Fund has three parts:

♦ | $71 million for road, bridge, water and wastewater projects that are identified as priorities in municipal asset management plans; |

♦ | $25 million to fund 20 previously submitted critical project proposals; and |

♦ | $4 million to help municipalities with populations under 5,000 complete asset management plans to ensure that the highest-priority projects are built. |

The Province is continuing to take consultation feedback into account as it considers options to make the Fund permanent through the 2014 Budget.

Investing in Health Infrastructure

The Province continues to make significant progress in ensuring the provision of the right care, at the right time, in the right place. This includes initiating over 100 major hospital projects that are complete or underway. For example, the new Humber River Regional Hospital, once complete, will provide for increased patient capacity and expanded emergency services for the surrounding community in north Toronto. Another example is the provincial investment to expand the dialysis facility at Renfrew Victoria Hospital, which will reduce the need for patients to commute to Ottawa to meet their dialysis needs.

In Cornwall, the Province is supporting the construction of a new hospital that would consolidate all acute and rehabilitation hospital services from two sites into one. The redevelopment project at Atikokan General Hospital will give families access to quality health care services in state-of-the-art inpatient facilities.

In addition, the Ministry of Health and Long-Term Care is developing a long-term solution to address the capital investment needs of the community health care sector.

Investing in Education and Postsecondary Infrastructure

Investments in schools and postsecondary facilities provide better places to learn and train the highly educated workforce that Ontario’s economy needs. Across Ontario, 610 new schools have been opened, planned, or are under construction. In January 2013, the Province also announced the retrofit of another 48 schools to help meet the needs of the province’s growing communities, revitalize older schools and improve the efficiency of education infrastructure.

The increase in college and university enrolment in Ontario over the past decade has put pressure on postsecondary infrastructure. The government is investing in 20 capital projects throughout the province to support postsecondary education.

Additionally, the Province recognizes that despite recent growth in enrolment capacity, many of the largest and fastest growing communities in Ontario do not have postsecondary campuses or have campuses that provide limited local options for students. The government remains committed to improving the alignment of future capacity with long-term demand growth to ensure more students have quality learning closer to home. This fall, the government will release a policy framework to govern future expansion in the postsecondary sector either through creation of three new campuses or through major expansion at existing campuses. The Province will also initiate a call for proposals with an announcement of potential locations in early 2014.

Innovative Approaches to Infrastructure Investment

Alternative Financing and Procurement

Ontario is a global leader for alternative financing and procurement (AFP) projects. Infrastructure Ontario (IO) and its private-sector partners are consistently delivering valuable public infrastructure assets on time and on budget. The Ontario government, through IO, is delivering over 80 projects using the AFP model, valued at about $35 billion. This includes over 50 projects completed or under construction, with an estimated $3 billion in value-for-money savings. A recent review of the 30 completed projects found that 29 were completed at or below budget and 28 were completed on or ahead of schedule, or within three months of schedule.

Leading the Way “Infrastructure Ontario is recognized as an international leader in leveraging private-sector expertise to deliver projects on time and on budget.” Her Majesty’s Treasury (United Kingdom), December 2012. |

Building on this success, each year IO will continue to release a market update that identifies upcoming projects, estimated project sizes and procurement timelines, to allow firms to better organize their resources.

With its partners, IO will play a critical role in delivering important infrastructure projects including:

♦ | Burlington’s Joseph Brant Hospital; |

♦ | Cambridge Memorial Hospital; |

♦ | University of Ottawa Heart Institute; and |

♦ | St. Joseph’s Health Care – West 5th Campus in Hamilton. |

Further, based on progress on the Humber and Sheridan College projects, IO will move forward in partnership with the Ministry of Training, Colleges and Universities and Seneca College to expand learning facilities using the AFP delivery model.

The government is taking action to enhance the AFP approach to improve the delivery of large and complex projects, particularly integrated transit systems with significant risk and scope. These enhancements would enable companies of various sizes to compete and participate while maintaining the commitment to on-time and on-budget delivery. Pilot AFP initiatives are also anticipated to increase opportunities for apprentices.

The Conference Board of Canada’s August 2013 report and the December 2012 report from the U.K. Treasury cite IO as a global leader in delivering public investment with the private sector. Infrastructure Ontario will work with Ontario’s international trade offices to create export opportunities for Ontario’s construction companies, engineers, architects and financial services. Recently, IO was invited to be an expert adviser to the National Governors Association in the United States to assist with their delivery of public infrastructure with private-sector partners. This is an example of how the government can help Ontario-based companies do more business abroad.

Maximizing the Value of Government Assets

The government’s priority is to invest in jobs, not real estate. That is why the government continues to reduce its real estate footprint to achieve greater value from its existing assets.

The government is moving forward with the sale of the LCBO head office located on Lake Shore Boulevard in Toronto. The one-time proceeds from this sale would be placed into the new Trillium Trust to fund priority infrastructure projects.

Additionally, the government is reviewing options for the Ontario Power Generation (OPG) head office building located at 700 University Avenue in Toronto. OPG already leases out a majority of the building, and the Province and OPG will explore opportunities to unlock value associated with this property for the benefit of Ontarians.

The government will also continue to evaluate its assets in conjunction with IO, in order to support jobs, protect public services and grow the economy.

On September 10, 2013, Ontario, along with the federal government, sold its interest in 10 million shares of General Motors (GM) Company, resulting in a revenue gain to the Province of $249 million. The Province continues to hold an interest in approximately 36.7 million GM shares, and will continue to monitor the value of these remaining shares to assess the appropriate timing for share divestiture. Revenue gains from this divestiture would be placed into the new Trillium Trust and used to finance key public infrastructure priorities.

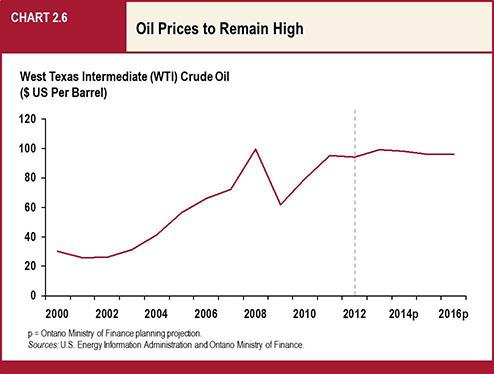

Ontario’s Long-Term Energy Plan and Clean Energy

In 2003, Ontario’s electricity system had no long-term plan and for the previous decade, little investment had been made in the province’s electricity infrastructure. There was not enough generation to reliably meet demand and transmission lines were aging.

Over the last 10 years, over 7,500 kilometres of transmission and distribution lines have been upgraded in the province, representing an investment of more than $10 billion, including the Bruce-to-Milton transmission reinforcement project. As well, about 12,000 megawatts (MW) of new and refurbished generating capacity have been added, representing investments of over $21 billion. Today, Ontarians can feel secure that the lights will come on when they flip the switch.

The government has been regularly updating a 20-year, long-term energy plan to forecast energy needs and plan for conservation and new supply to meet the province’s electricity needs. The government initiated a consultation process this summer as part of its review process for an updated Long-Term Energy Plan (LTEP).

Eliminating Coal-Fired Generation The Province is eliminating coal-fired generation, and has moved forward the 2014 closure date for the Lambton and Nanticoke coal-powered generating stations to before the end of 2013. On October 23, 2013, the Province marked the end of burning coal at the Lambton Generating Station. Ontario’s elimination of coal-fired electricity generation is the single largest greenhouse-gas reduction measure being undertaken in North America in this timeframe — the equivalent of taking seven million cars off the road. Since 2005, various initiatives have helped Ontario families and businesses conserve more than 1,900 megawatts of electricity — the equivalent of taking more than 600,000 homes off the power grid. Conserving energy not only saves money for families and businesses, but also lowers demand on the electricity system and helps reduce greenhouse gas emissions. |

The key principles of an updated LTEP are expected to include a focus on conservation, a clean and reliable electricity system, cost effectiveness and community engagement. The updated LTEP will have a renewed focus on facilitating the transition from planning to siting for new electricity infrastructure projects as well as minimizing costs to ratepayers.

The timing and amount of new resources to be procured will be informed by the updated LTEP. By putting conservation first, the updated LTEP will be able to avoid generation costs. Updated projections on demand, conservation and supply enable deferring the construction of two new reactors at Darlington. As a result, billions of dollars of costs will be avoided. The government has also taken action in a number of areas:

♦ | In May 2013, the Ministry of Energy made changes to the Feed-in Tariff (FIT) Program, including removing from the program the future procurement of large renewable projects (greater than 500 kilowatts) and developing with the Ontario Power Authority (OPA) a new competitive process that will consider input from stakeholders and communities. |

♦ | In October 2013, the government announced its plan to improve the siting of large energy infrastructure projects by implementing the recommendations made by the OPA and Independent Electricity System Operator (IESO). The new rules will ensure infrastructure is located in the right place from the start, improve municipal engagement and public consultation, and ensure greater predictability for the energy sector. |

The government has also taken action to mitigate electricity rates for Ontario families and businesses.

♦ | In June 2013, the government announced an update to the Green Energy Investment Agreement (GEIA) with the Korean Consortium, reducing the contracted capacity from 2,500 MW to 1,369 MW, and reducing the total contract commitment of the project by $3.7 billion. |

♦ | Through changes to the FIT program, from FIT 2.0 to FIT 3.0, the Ministry of Energy has estimated a cost reduction from lower FIT prices of approximately $1.9 billion. |

♦ | As Ontario negotiates new power purchase agreements with existing Non-Utility Generators (NUGs), it will be done with an eye to ensuring maximum value to ratepayers. If a NUG is not required for power system needs, then a new contract will not be executed. |

Competitive and Innovative Climate for Transmission

As part of the government’s upcoming LTEP, the Ministry of Energy will work with IO and Hydro One to explore ways to apply IO’s proven alternative financing and procurement (AFP) model for competitive procurement, to new large-scale transmission grid projects. This would allow these projects to take advantage of private-sector expertise and innovation to drive construction costs down and further mitigate future rate pressures for Ontario electricity consumers.

Electricity Cost-Containment Measures The government has taken significant actions to reduce ratepayer impacts and contain electricity costs through the following measures: ● Reducing the amount of capacity contracted with the Korean Consortium from 2,500 megawatts to 1,369 megawatts, reducing the total contract commitment by $3.7 billion. ● Changing the Feed-in Tariff (FIT) program, with lower FIT prices, resulting in an estimated cost reduction of approximately $1.9 billion. ● Negotiating new power purchase agreements with existing Non-Utility Generators, only to meet system needs and ensure maximum value to ratepayers. ● Deferring the construction of two new nuclear reactors at Darlington and avoiding billions of dollars of costs. |

Supporting Aboriginal Participation in Energy Infrastructure

The government announced in the 2009 Budget the Aboriginal Loan Guarantee Program (ALGP) to provide loan guarantees to support Aboriginal investment in renewable energy generation and transmission infrastructure projects. In 2012, the Province increased the program’s envelope from $250 million to $400 million.

The government continues to be committed to supporting Aboriginal communities’ equity investments in electricity generation and transmission infrastructure projects in Ontario. The ALGP is well suited to support significant Aboriginal investments in larger projects. To date, applications have been received representing planned Aboriginal participation in projects totalling over 1,250 MW of new renewable energy supply. Three loan guarantees have been approved so far, including the recently approved loan guarantee supporting a portion of the investment by the six First Nation members of United Chiefs and Councils of Mnidoo Mnising in the McLean’s Mountain Wind Project.

| 3. | Supporting a Dynamic and Innovative Business Climate |

The fundamentals of Ontario’s economy are solid and its industries are well positioned to take advantage of growing opportunities in the global economy. Ontario has a well-diversified economy with key industries such as agriculture, forestry, mining, manufacturing and services. These industries represent opportunities for growth and increased business investment to improve their competitiveness.

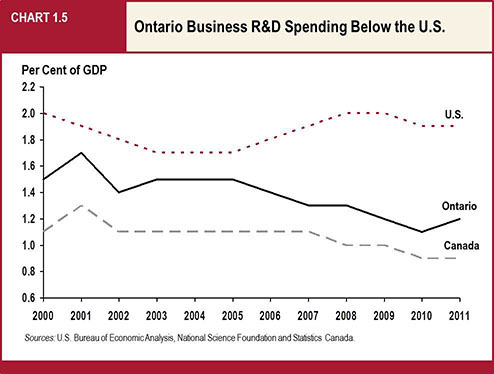

The government has put in place a competitive tax system for business, made regulations less burdensome, and enhanced the safety and efficiency of capital markets, while delivering lower-than-forecasted deficits. In addition, the marginal effective tax rate, which is a key determinant of business investment, has been cut in half. Nevertheless, many firms continue to underinvest in innovation and productivity-enhancing technologies such as R&D, new equipment and computer software.

Ontario’s Businesses Could Be Investing More

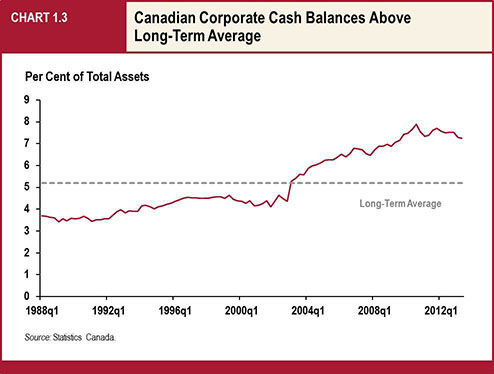

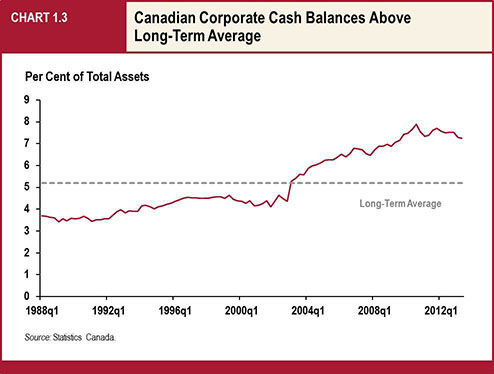

Ontario’s businesses have strengthened their financial positions despite a challenging global economic backdrop. Many analysts and the Bank of Canada have pointed to the generally strong balance sheets of Canadian businesses and concluded that the business sector is now well positioned to make increased investments to improve innovation and productivity.

Increasing Opportunities for Businesses to Invest A recent report by CIBC Economics suggests that Canadian businesses are extremely well positioned to increase investment. CIBC Economics’ composite indicator of corporate strength — which includes nine key measures of corporate performance — is close to an all-time high. The improvement in these key indicators includes historically low debt-to-equity ratios, strong cash positions and record low business bankruptcies. In particular, the corporate cash position of Canadian corporations is at a near record high relative to assets. CIBC Economics, “Why Corporate Canada Will Surprise on the Upside in 2014,” October 2013. “Previous studies have shown that despite a strong dollar, low interest rates and a stable investment environment, many of our businesses invest materially less in the research and development (R&D) and machinery and equipment (M&E) (including information and communication technology (ICT)) that are vital to improving productivity. Our new research suggests that a significant portion of Canadian firms mistakenly believe they are making competitive levels of investment when they are not — causing them to slip behind their peers.” Deloitte Canada, “The Future of Productivity: A Wake-Up Call for Canadian Companies,” 2013, p. 1. |

Healthy corporate balance sheets provide businesses with flexibility to expand operations. However, Ontario lags the United States and the rest of Canada when it comes to business investment as a share of GDP. Ontario’s businesses have the potential to invest more and create more good, well-paying jobs. The government is committed to working with industry to help it activate this capital to stimulate economic growth.

Strong business investment matters critically for labour productivity growth, both because it increases the amount of capital per worker, but most importantly because it brings new technology to the workplace. New technologies spur innovation, efficiency gains, higher output and increased competitiveness.

Encouraging More Business Investment Activity

The government will work with industry and research organizations to find solutions to help more Ontario companies become more competitive and productive in order to create jobs, innovate and export.

In addition, the government will partner with industry on measuring and reporting investment in innovation, training and technology, and showcasing top performers according to international benchmarks. To demonstrate the government’s commitment, it will begin to benchmark government enterprises such as the LCBO, Ontario Lottery and Gaming Corporation, Ontario Power Generation, Hydro One and other agencies. The responsible ministries will report annually on the performance of these enterprises.

The Province will also study various approaches, including those taken in other jurisdictions, to encourage higher levels of business investment, such as:

♦ | Replacing existing research and development (R&D) tax credits with an incentive that would reward incremental R&D spending. The new credit would redirect support to incremental R&D expenditure growth, to provide an incentive for businesses to increase R&D and/or expand research operations in Ontario. The majority of U.S. states provide R&D tax credits based on incremental R&D expenditures. Ontario’s and Canada’s business R&D investment as a proportion of GDP remains significantly lower than that of the United States. |

♦ | “Pay or play” tax incentives, such as: |

| | s | a special corporate tax that could be eliminated or reduced through investments in new equipment or other eligible investment expenses; and |

| | s | a payroll tax that could be eliminated or reduced by employer investments in employee training and/or by funding training programs. Quebec, France and a number of U.S. states have payroll taxes that encourage or support training expenditures. |

Investment Ready Program

In a highly competitive global economy, businesses need to move fast when making investment decisions. To build on Ontario’s success in attracting new business investment, the government has introduced a program to pre-certify industrial sites that are investment ready. This ensures that sites have the proper services a business needs to start up its operations.

Open for Business

The government is continuing to work on the Open for Business initiative, to help make Ontario more attractive for business development while protecting the public interest.

It has reduced regulations, which has resulted in a reduced burden on business and stakeholders of over 17 per cent (or over 80,000 regulatory requirements).

Building Sector Partnerships for Success

Leveraging Partnerships with Ontario’s Diverse Industries

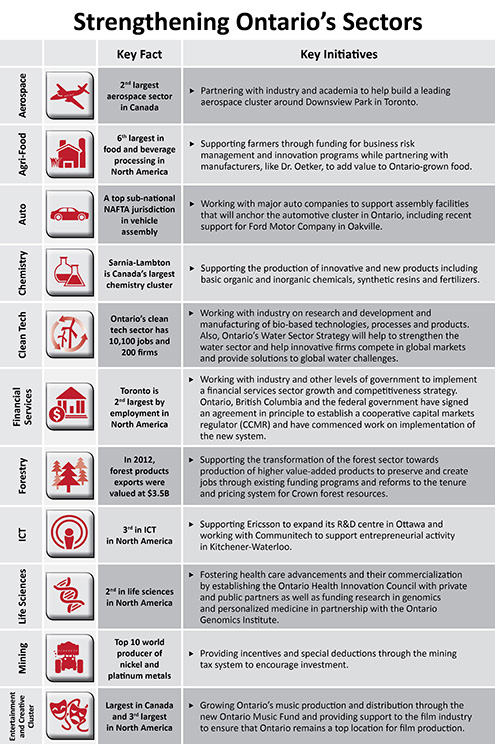

Industrial diversity is an important contributor to economic strength and resilience. Ontario’s economy is well diversified with many industries, some mature and some emerging rapidly and poised for future growth.

The government is partnering with all key sectors of the economy, identifying opportunities and offering solutions to challenges. It will build on its competitive strengths to drive jobs and growth.

Growing Ontario’s Agri-Food Industry

Ontario’s innovative agri-food industry, including its large and diverse farming sector, competitive food processing industry and large food services sector, supports more than 740,000 jobs across the province. Ontario has the sixth largest food processing sector in North America, and a strong food safety culture that is in high demand in world markets, including fast-growing emerging economies.

Premier Kathleen Wynne recently issued a challenge to the agri-food industry to double its exports and create 120,000 jobs by 2020. The government will work in greater partnership with key industry sectors to identify opportunities for increased trade, investment in innovation, training and productivity, and cooperation within the sectors. The Jobs and Prosperity Council has identified these as key success factors for future economic growth. For its part, the government will maintain a competitive tax system for business, make regulations smarter and less burdensome, and enhance the safety and efficiency of capital markets.

The government has proposed a Local Food Act that, if passed, would celebrate and support the good things grown, harvested and made in Ontario. The legislation is one part of the Local Food Strategy, which aims to increase local food awareness, access and sales in Ontario, as well as help farmers and create jobs.

Agri-Food Firms Are Investing in Ontario Conestoga Meat Packers Ontario is helping Conestoga Meat Packers increase capacity while creating 100 new jobs and retaining 425 existing jobs in Breslau, in the Kitchener-Waterloo region. The pork processor is owned and supplied by a cooperative of 120 southern Ontario hog farms. With support from the Southwestern Ontario Development Fund, Conestoga Meat Packers is investing more than $10 million in new cooler space and refrigeration equipment that will increase the plant’s capacity by about one-third. Dr. Oetker Canada In 2011, Dr. Oetker announced expansion into southwestern Ontario in order to build its first North American frozen pizza production facility in London that will create over 125 jobs. This will enable the company to produce 50 million frozen pizzas a year for the Canadian and U.S. markets by sourcing over 24 million pounds of high quality ingredients from Ontario farmers and food processors. |

The government is committed to modernizing the regulatory environment for Ontario’s wine, beer and spirits sector, ensuring that it maintains the highest standards of responsible consumption while finding opportunities to create jobs and improve customer experience. Over the coming months, the Province will work with its industry partners to bring forward measures that achieve these objectives in a fair and balanced way.

Building Ontario’s Auto Sector

The auto industry, including motor vehicle assembly and parts production, is a cornerstone of Ontario’s manufacturing sector, directly accounting for over 14 per cent of Ontario’s manufacturing jobs. The government is committed to working with major auto companies to help ensure a strong future for the industry in Ontario.

Building Ontario’s Auto Sector Ford Motor Company recently announced an investment of more than $700 million in its Oakville facility to upgrade the assembly plant with global manufacturing processes, making it more efficient and competitive. The investment, supported by a grant of up to $70.9 million from the government, will help to secure more than 2,800 jobs and will anchor new research and development activities. General Motors (GM) announced that it is keeping its Consolidated Line assembly plant in Oshawa open until 2016. The plant is helping GM meet resurgent demand for its vehicles in the North American market. The plant also won the second highest rating among North and South American assembly plants in this year’s J.D. Power Awards for Assembly Line Quality. |

Increasing the Competitiveness of the Aerospace and Manufacturing Sectors

The government supports partnerships among colleges, universities and industry leaders to help ensure there is on-the-ground, hands-on learning and training available to train students for next-generation advanced manufacturing jobs. Ontario has established an aerospace engineering and manufacturing sector with 13 of the top global aerospace companies operating in the province. The government will support the relocation of Centennial College’s aerospace training programs to Downsview Park, providing opportunities for future expansion in the aerospace industry, including by Bombardier. This will support projected demand for skilled aerospace workers in Ontario, improve the future competitiveness of Ontario’s aerospace industry, and establish a solid foundation for collaboration across industry partners and among colleges and universities.

The Province will also support a permanent Industry Innovation Centre at Niagara College. Since 2011, Niagara College’s research and innovation branch has provided assistance to small and medium-sized manufacturers that do not have the in-house capacity or equipment needed to undertake research and development. A permanent, state-of-the-art facility in the Niagara region will allow Ontario-based manufacturers to access business services, equipment, research and expertise provided by the faculty and students at Niagara College.

The government continues to encourage partnerships between business, colleges and universities to facilitate industry-relevant training. For example, the Ontario Network of Entrepreneurs (ONE) is a coordinated series of innovation and small business centres across the province that has supported the skills development of more than 48,000 students, researchers, entrepreneurs and private-sector employees since 2007. The ONE also administers the recently launched Collaboration Voucher Program, which will allow eligible companies to access the expertise and knowledge available at Ontario universities, colleges and research hospitals.

Growing the Financial Services Sector

The financial services sector remains an engine of growth for Ontario — the economy’s second-largest major sector after manufacturing based on output. It has continued to create jobs this year at a rate faster than the overall economy. It is also enabling economic growth in the rest of the economy by supporting ancillary jobs in business services industries, as well as savings, access to capital and investment. The financial services sector is a leader behind the outward orientation of the Ontario economy, trading and investing globally with the rest of the world. Financial services exports from Canada grew strongly by six per cent in the first half of 2013 from the previous year. Financial services foreign direct investment (FDI) to other countries grew by five per cent in 2012, remaining the largest sector for outward FDI in Canada, with 40 per cent of the total, followed by mining and manufacturing.

Toronto is the financial capital of Canada and a global financial centre — home to many leading banks, securities dealers, insurers and pension funds. As a global financial centre, Toronto ranks strongly in the world — number seven on The Banker magazine ranking and number eleven on the U.K.-based Global Financial Centres Index. The government is continuing to work with the financial services sector, Toronto Financial Services Alliance and other orders of government in implementing a financial services sector growth and competitiveness strategy.

Ontario has long been a leader in advocating for the creation of a common securities regulator. It sees a cooperative securities regulator as key to the country’s ability to sustain and grow its financial services industry. Moving to a cooperative securities regulator would foster more efficient and globally competitive capital markets in Canada through streamlined, less burdensome regulation for market participants. It would strengthen Canada’s capacity to identify and manage risks to its financial system on a national basis. It would provide better protection for investors through more integrated compliance and enforcement activities to allow households to save and invest with confidence. Ontario’s perseverance and outreach to other governments in pursuit of this goal culminated with the recent announcement that British Columbia, Ontario and Canada have reached an agreement in principle to establish a cooperative capital markets regulatory system.

Strengthening the Mining Sector

The mining sector plays an important role in Ontario’s economy. The province ranks among the top 10 world producers of platinum, nickel and cobalt, and is a significant producer of gold, silver, copper and zinc. Ontario also produces, processes and markets diamonds. The sector is well positioned to respond to the growing global demand for metals and minerals driven mainly by economic growth in emerging economies such as China, India and Brazil.

Ring of Fire Ontario’s Ring of Fire area, located about 535 kilometres northeast of Thunder Bay, holds significant mineral deposits. Recent estimates suggest that the value of mineral resources in the Ring of Fire area could be up to $50 billion, for known chromite and nickel deposits. Potential development of the Ring of Fire represents tremendous economic development opportunities that will generate new wealth, social benefits and employment for Ontario’s North, including First Nation communities. Ontario has appointed former Supreme Court of Canada Justice Frank Iacobucci as lead negotiator on behalf of Ontario in discussions with Chiefs of the Matawa Tribal Council on resource developments in the Ring of Fire. Ontario has taken a leadership role in planning for development in partnership with commercial proponents and First Nations. The federal government must come to the table as a partner to fund the regional infrastructure necessary to develop the Ring of Fire. |

Growing Ontario’s Film and Music Sector

Ontario’s film and TV industry recorded its best year ever in 2012, contributing $1.28 billion to the provincial economy. For the second consecutive year, Ontario ranked first in Canada for production expenditures and third in North America, just after California and New York.

The province offers a complete range of advantages including top-notch technical and creative crews, world-class studios and post-production facilities, a dynamic talent pool, a variety of locations, and financial support. The government remains committed to ensuring that Ontario remains a top location for film production.

As announced in the 2013 Budget, the government will provide funding of $9 million over three years, starting in 2013–14, to support the Canadian Film Centre’s educational programs for advanced film, television and new media.

The 2013 Budget announced a new Ontario Music Fund, with funding of $45 million in grants over three years, which launched in October. The province-wide fund will support Ontario-based music companies and boost music production and distribution through four streams: music company development, music industry development, music futures and live music. Grants from the fund will help the industry to innovate, invest and take advantage of opportunities in the global music marketplace, bringing more recording activity to the province. The fund will capitalize on Ontario’s infrastructure, critical mass and competitive edge to drive economic growth and jobs.

Supporting the Information and Communications Technologies Sector

Clusters, which are associated with innovation and positive economic outcomes, are concentrations of related businesses, academic institutions and entrepreneurs. Clusters exist across the province, from the mining and forestry clusters in northern Ontario, to the financial services cluster in Toronto, and the information and communications technologies (ICT) clusters in Ottawa, Toronto and Kitchener-Waterloo.

Ontario’s Information and Communications Technologies (ICT) Corridor Ontario’s ICT sector is concentrated in three clusters — Toronto, Ottawa and Kitchener-Waterloo. This corridor accounted for almost 80 per cent of Ontario’s ICT employment in 2012, and has strong concentrations of research and development activity and venture capital investment. The government is committed to supporting its continued growth. ● In January 2013, the Province announced $15 million in funding to establish a new innovation complex in Ottawa to support the city’s ICT cluster and its broader knowledge economy. ● In partnership with Communitech, Waterloo Region’s innovation hub, the government is contributing $15 million over three years to accelerate entrepreneurial activity in the region through access to seed investment, mentoring and business advice. ● Working with the federal government, Ontario’s new venture capital fund of up to $300 million will support investment in innovative new firms, including firms in the ICT sector. ● The government is developing a new big data strategy that will produce the high quality talent that industry needs to accelerate the adoption of advanced computing and build strong collaborations between public institutions and critical industries that rely on big data, including advanced manufacturing. ● The government is offering supports for recently laid-off workers so they can continue to contribute to Ontario’s productivity and innovation. In addition, significant anchor investments by business are being encouraged by the government to further develop Ontario’s ICT clusters. |

Ontario is a global ICT leader and will continue to support a world-class environment and a highly skilled workforce that attracts new investments. In September 2013, Ericsson, a Swedish-based multinational corporation, opened a new research and development lab in Ottawa with provincial support. The new facility will leverage the Ottawa area’s expertise in wireless communications.

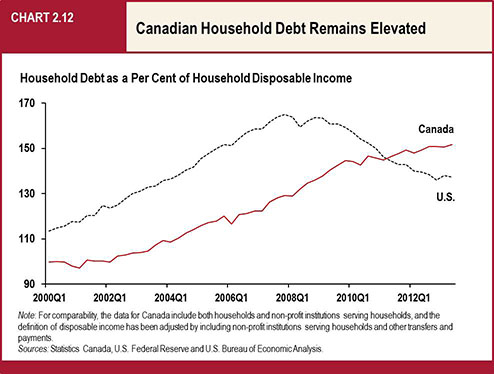

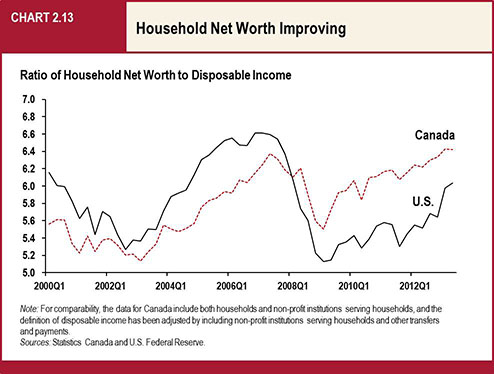

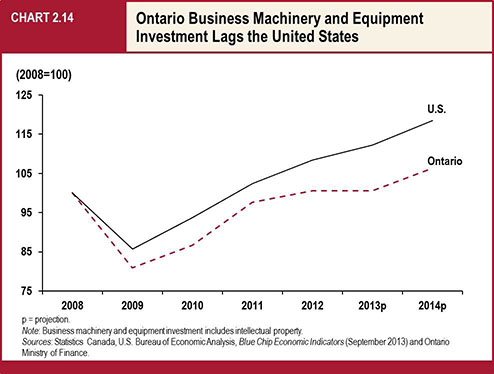

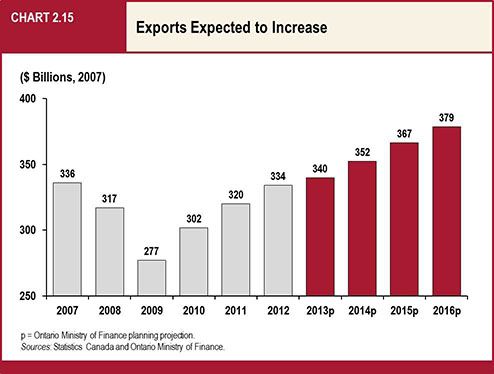

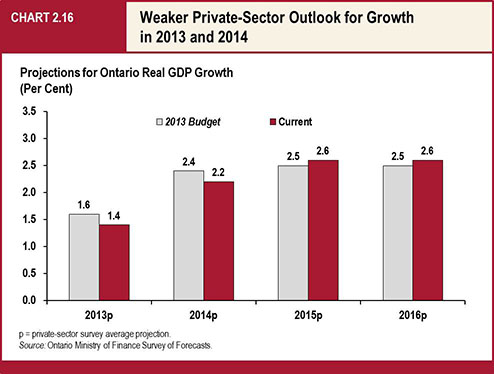

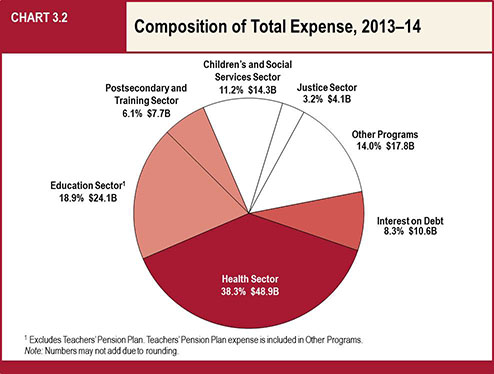

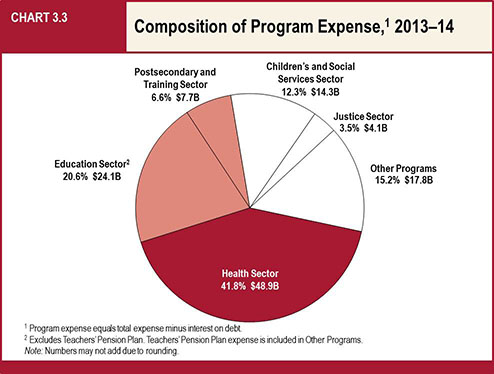

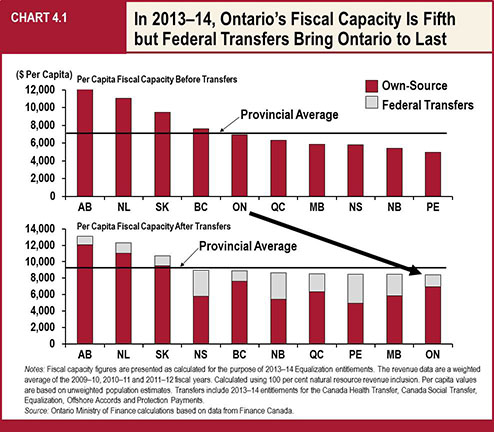

Successful Innovation in Ontario ● Polar (formerly Polar Mobile), based in Toronto, is a world leader in the development of mobile applications for media companies such as CBS, Sports Illustrated, Bloomberg BusinessWeek and many others. Polar has received support from the MaRS Centre and Ontario Venture Capital Fund. ● Waterloo-based OpenText is Canada’s largest software company and is at the forefront of enterprise content management (ECM) for firms such as Unilever and Siemens. Provincial funding is supporting OpenText’s expanded workforce in Waterloo, Richmond Hill and Ottawa. ● Intel opened the Intel Developer Zone in June 2013, located in Waterloo’s Communitech Hub. The Developer Zone will give local entrepreneurs access to technology mentorship in order to support the development of new products and services. |