UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 18-K/A

For Foreign Governments and Political Subdivisions Thereof

AMENDMENT NO. 1 TO

ANNUAL REPORT

of

PROVINCE OF ONTARIO

(Canada)

(Name of Registrant)

Date of end of last fiscal year: March 31, 2014

___________________

SECURITIES REGISTERED*

(As of the close of the fiscal year)

| Title of Issue | Amounts as to which registration is effective | Names of exchanges on which registered |

| N/A | N/A | N/A |

Name and address of persons authorized to receive notices and

communications from the Securities and Exchange Commission:

Monique Smith

Ontario Representative

Canadian Embassy

501 Pennsylvania Avenue N.W.

Washington, D.C. 20001

Copies to:

Jason R. Lehner

Shearman & Sterling LLP

Commerce Court West, 199 Bay Street

Suite 4405, P.O. Box 247

Toronto, Ontario, Canada M5L IE8

* The Registrant is filing this annual report on a voluntary basis.

PROVINCE OF ONTARIO

The undersigned registrant hereby amends its Annual Report on Form 18-K for the fiscal year ended March 31, 2014 (the “Annual Report“) as follows:

The following additional exhibits are added to the Annual Report:

| Exhibit (99.3) | 2015 Ontario Budget: Budget Papers |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this amendment to the annual report to be signed on its behalf by the undersigned, thereunto duly authorized, at Toronto, Ontario.

PROVINCE OF ONTARIO

(Name of registrant)

| April 28, 2015 | By: /s/ Opallycia A. Kandelas | |

Name: Opallycia A. Kandelas

Title: Director, Capital Markets Operations

Capital Markets Division

Ontario Financing Authority

EXHIBIT INDEX

| Exhibit (99.3): | 2015 Ontario Budget: Budget Papers |

2015 Ontario Budget: Budget Papers

For general inquiries regarding the 2015 Ontario Budget:

Budget Papers, please call:

Toll-free English & French inquiries: 1-800-337-7222

Teletypewriter (TTY): 1-800-263-7776

For electronic copies of this document, visit our website at

www.ontario.ca/budget

A printed copy of this publication can be ordered:

Online at: www.serviceontario.ca/publications

By phone through the ServiceOntario Contact Centre

Monday to Friday, 8:30 AM to 5:00 PM

416 326-5300

416 325-3408 (TTY)

1 800 668-9938 Toll-free across Canada

1 800 268-7095 TTY Toll-free across Ontario

© Queen’s Printer for Ontario, 2015

ISBN 978-1-4606-5692-1 (Print)

ISBN 978-1-4606-5693-8 (HTML)

ISBN 978-1-4606-5694-5 (PDF)

Ce document est disponible en français sous le titre:

Budget de l’Ontario 2015 – Documents budgétaires

Contents

Foreword xvii

Chapter I: Implementing the Plan

Section A: Investing in People’s Talents and Skills

Supporting Every Child, Reaching Every Student 7

Modernizing Child Care and Early Learning 10

Building a Competitive Workforce 14

Experience Ontario 14

Ensuring an Accessible, High-Quality and Sustainable Postsecondary Education System 14

Matching Skilled Workers to the Right Jobs 21

Renewing the Ontario Youth Jobs Strategy 24

Supporting Ontario’s Skilled Tradespeople 29

Helping Newcomers Integrate Successfully into Their Communities and the Workplace 32

Section B: Building Modern Infrastructure and Transportation Networks

Building Together: Ontario’s Plan to Invest in Public Infrastructure 38

Ongoing Investments in Transportation 38

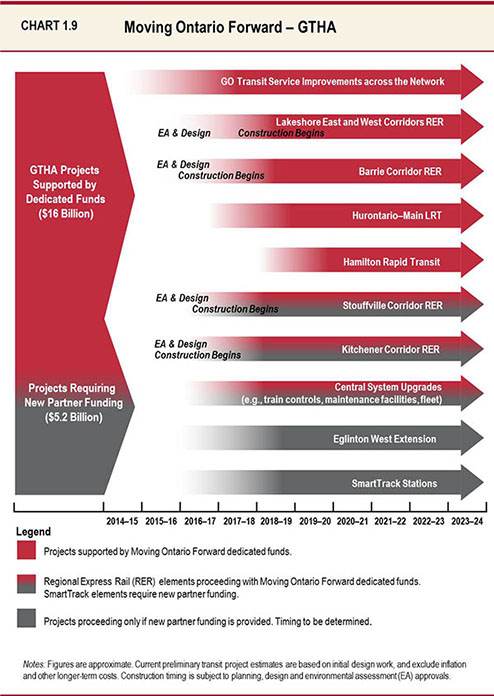

Moving Ontario Forward 42

Dedicated Funds to Support Moving Ontario Forward 42

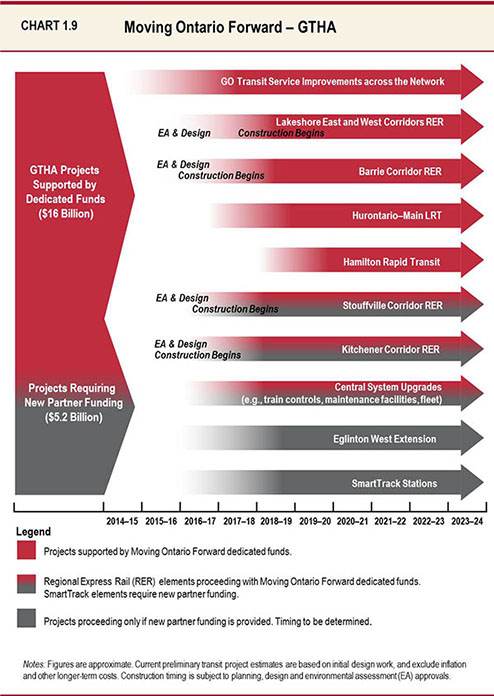

Investing in Transit Inside the GTHA 46

Investing in Transportation and Other Critical Infrastructure Outside the GTHA 53

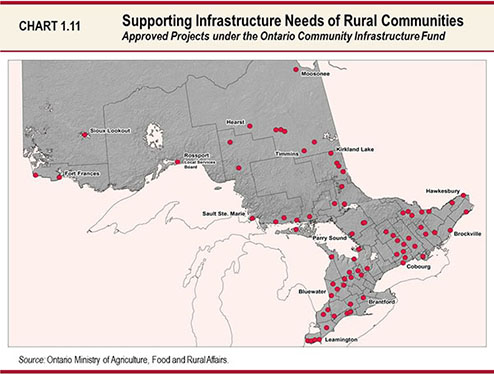

Building Together: Modernizing Infrastructure in Communities across Ontario 58

Education Infrastructure 58

Postsecondary Infrastructure 60

Health and Social Infrastructure 61

Justice Infrastructure 63

Energy Infrastructure 64

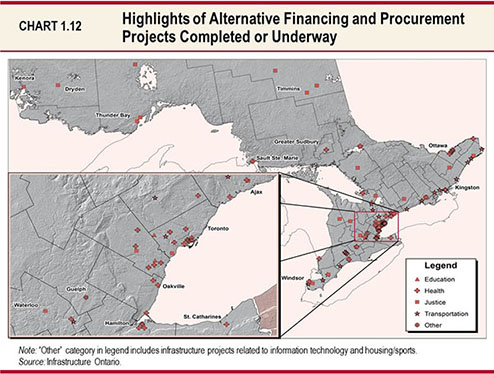

Cost-Effective Delivery of Infrastructure Projects 66

Federal Funding for Infrastructure 69

Progress on the Building Canada Plan 69

Strengthening Land Use Planning 71

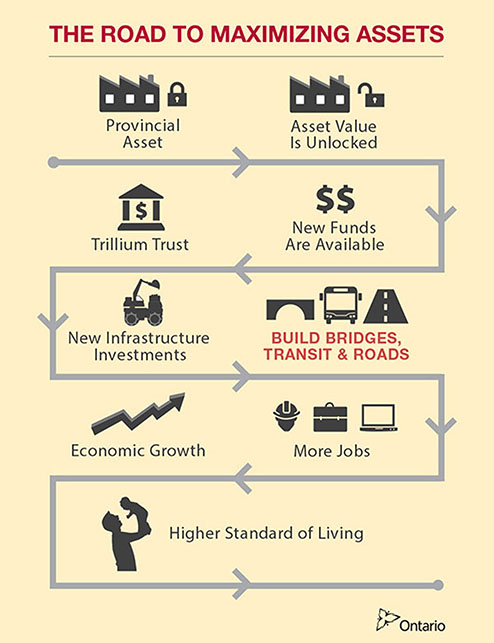

Section C: Unlocking the Value of Provincial Assets

Introduction 73

Trillium Trust 76

General Motors 76

Premier’s Advisory Council on Government Assets 77

Update on Council Progress and Recommendations 77

Recommendations for Hydro One 78

Recommendations for Beer Retailing and Distribution 82

Optimizing the Value of the Province’s Real Estate Assets 86

Section D: Creating an Innovative and Dynamic Business Environment

Supporting a Competitive Tax Environment 89

Making Strategic Investments 92

Jobs and Prosperity Fund 93

Regional and Community Partnerships 95

Access to Capital for Entrepreneurs 96

Attracting Foreign Direct Investment 97

Fostering an Innovation Ecosystem 98

Helping More Ontario Startups Scale Up 99

Supporting Excellence in Technology and Business Management 100

Supporting Health Innovation 100

Supporting the Sharing Economy 103

Strengthening International and Interprovincial Trade 104

Going Global Trade Strategy 104

Growing Opportunities Interprovincially 107

Creating a Supportive Business Environment 109

Helping Businesses Manage Electricity Costs 109

Effective Regulation 111

Managing Forfeited Corporate Property 112

Reviewing Labour Laws to Enhance Security and Competitiveness 112

Ensuring Workplace Stability During Transition 113

Modernizing Financial Services Regulation 114

Investments in Tourism and Culture 118

Enabling Long-Term Success for Ontario’s Horse Racing Industry 121

Supporting the Agriculture and Agri-Food Sector 123

Tackling Climate Change 124

Growing Businesses in the North 128

Renewing Ontario’s Mineral Development Strategy128

Forest Access Roads 129

Continued Electricity Support for Northern Industries 129

Supporting Northern Municipalities through the Ontario Municipal Partnership Fund 129

Section E: Strengthening Retirement Security

Introduction 131

The Need for Action to Enhance Retirement Savings 133

A Strategy to Enhance Retirement Savings 138

A New Ontario Pension Plan 138

The Proposed Ontario Retirement Pension Plan Act, 2014 139

Key Design Questions 139

Scope of the Plan 141

Minimum Earnings Threshold 143

Supporting the Self-Employed 146

Establishing the ORPP Administration Corporation 148

Ontarians with Self-Directed Retirement Savings 151

Strengthening Workplace Pension Plans 152

Target Benefit Pension Plans 152

Reforms to Pension Regulation 153

Sustainability and Affordability of Ontario’s Public-Sector Pension Plans 155

Section F: A Fair Society

Building a Fair Society for All Ontarians 159

Effective Health Care System for All 161

Patients First: Action Plan for Health Care 161

Providing Faster Access to the Right Care 162

Providing Better Coordinated and Integrated Care in the Community, Closer to Home 165

Providing Information to Help Ontarians Make the Right Decisions about their Health 169

Sustaining Ontario’s Universal Publicly Funded Health Care System for Generations to Come 170

Renewed Poverty Reduction Strategy 171

The Strategy’s Four Pillars 171

Assistance for the Vulnerable and Enhancing Safety 178

Supporting People with Developmental Disabilities 178

Ontario’s Youth Action Plan: Helping At-Risk Youth Succeed 180

An Action Plan to Stop Sexual Violence and Harassment 181

Increased Legal Aid Eligibility 183

Seniors Community Grant Program 183

Community Hubs 185

Fairness for Ontario Consumers 186

Taking Further Action to Protect Auto Insurance Consumers and Ensure Affordable Premiums 186

Keeping Electricity Cost-Effective and Efficient 191

Connecting Remote Communities to the Electricity Grid 193

Increasing Protection in the Condominium Market 193

Chapter II: Ontario’s Economic Outlook and Fiscal Plan

Section A: A Balanced Path to a Balanced Budget

Section B: Ontario’s Plan to Eliminate the Deficit

Program Review, Renewal and Transformation — Managing Spending while Transforming Programs and Services 203

Examples of Successful Transformation Initiatives 204

Transformation and Savings Initiatives in 2015–16 205

Moving Forward with PRRT 209

Success in Managing Compensation Costs 210

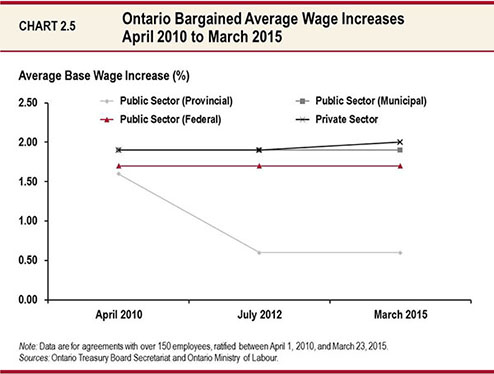

Overview 210

Public-Sector Bargaining Outcomes 210

Executive Compensation in the Broader Public Sector 212

Managing Public-Sector Pension Costs 213

Steps Taken to Maintain Tax Fairness and a Level Playing Field for Business 214

Combating the Underground Economy 215

Reducing Aggressive Corporate Tax Avoidance 219

Government Transparency, Financial Management and Fiscal Accountability 220

Government Transparency 220

Financial Management 221

Fiscal Accountability 222

Section C: 2014–15 Interim Fiscal Performance

In-Year Revenue Performance 227

Revenue Changes 228

In-Year Expense Performance 229

Expense Changes 231

Achieving the 2014–15 Savings Target 232

Section D: Ontario’s Economic Outlook

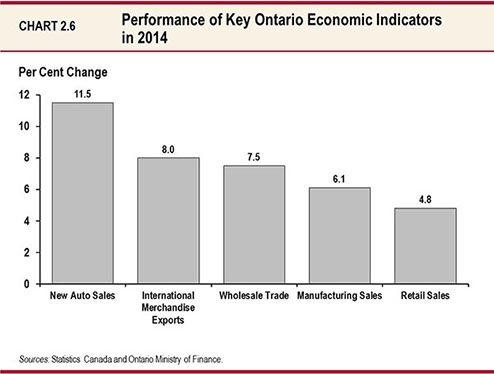

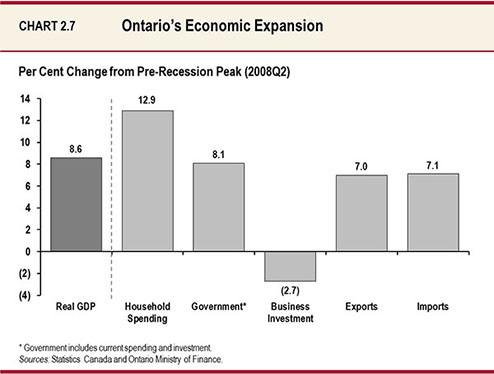

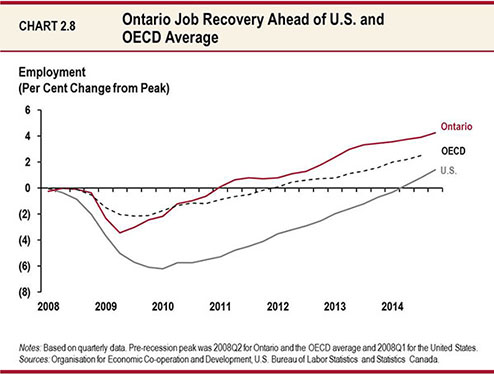

Ontario’s Economy Gaining Momentum 234

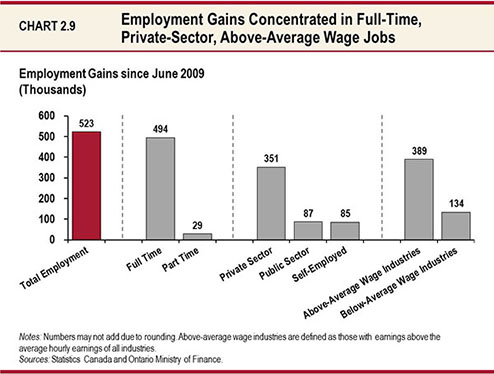

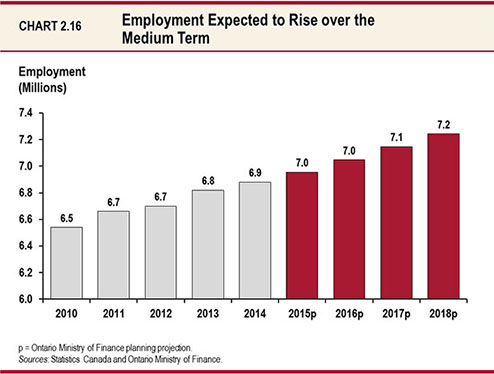

Employment Gains Continue 236

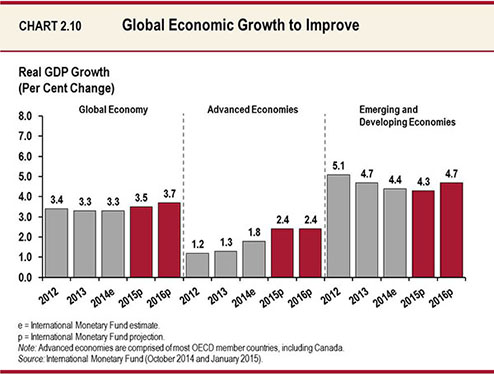

Global Economic Developments and Outlook 238

U.S. Economy 239

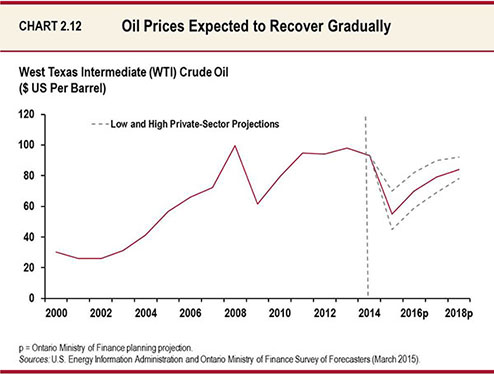

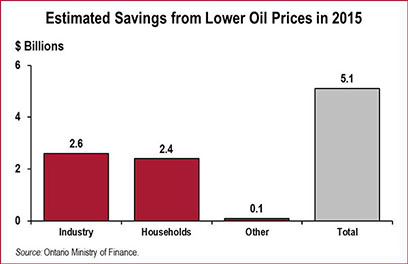

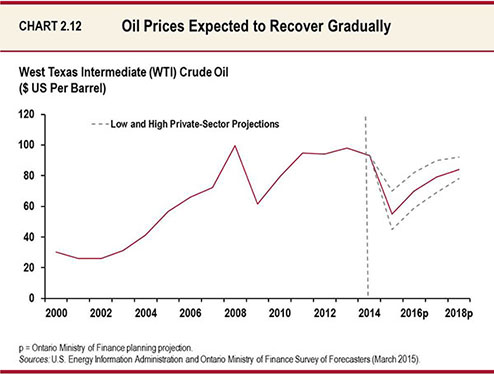

Oil Prices 241

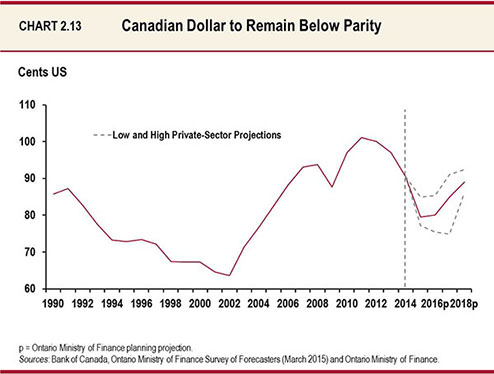

The Canadian Dollar 243

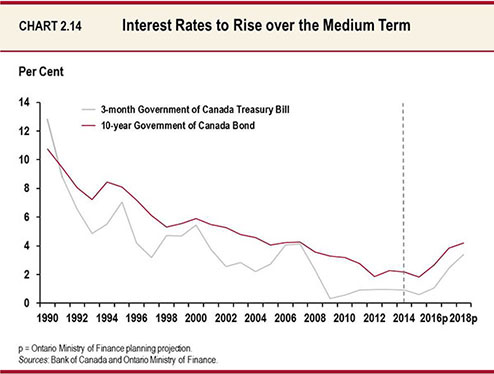

Financial Markets 244

Outlook for Ontario’s Economic Growth 248

Details of the Ontario Economic Outlook 256

Private-Sector Forecasts 257

Comparison to the 2014 Budget 259

Section E: Ontario’s Fiscal Plan

Ontario’s Recovery Plan 261

Key Changes since the 2014 Budget 262

Ontario’s Revenue Outlook 264

Medium-Term Revenue Outlook 265

Key Changes in the Medium-Term Revenue Outlook since the 2014 Budget 270

User Fees and Other Non-Tax Revenue 278

Medium-Term Expense Outlook 281

Risks to Expense Outlook 284

Contingent Liabilities 286

Fiscal Prudence 286

Section F: Details of Ontario’s Finances

Fiscal Tables and Charts 287

Support from Gaming 297

Chapter III: National Leadership — Strong Ontario, Strong Canada

Intergovernmental Partnerships that Address 21st Century Challenges 301

Need for Responsible Federal Action 302

The Fiscal Imbalance in the Federation 302

Fiscal Arrangements Need to Be Modernized 305

Building Blocks of a Strong Economic Union 306

Canadian Infrastructure Partnership 306

Ring of Fire 309

First Nation Communities 311

Support for Advanced Manufacturing 313

Labour Market Development Agreement 314

Canadian Energy Strategy 315

Support for Clean Energy 316

Support for Natural Disaster Response, Assistance and Mitigation 317

Chapter IV: A Fair and Sustainable Tax System

Introduction 321

Business Tax Supports 323

Apprenticeship Training Tax Credit 324

Ontario Interactive Digital Media Tax Credit 327

Film and Television Tax Credits 328

Ontario Sound Recording Tax Credit 331

Paralleling Federal Measures 332

Taxation of Trusts and Estates 332

Ontario Resource Tax Credit and the Additional Tax on Crown Royalties 333

Supporting Consolidation of the Electricity Distribution Sector 334

Other Measures 336

Registration Requirements for Certain Road-Building Machines 336

Property Tax Measures 336

Provincial Land Tax 336

Power Dam Special Payment Program 339

Strengthening the Property Assessment System 340

Summary of Measures 342

Technical Amendments 343

Chapter V: Borrowing and Debt Management

Introduction 347

Term of Borrowing 348

2014–15 Borrowing Details and Green Bonds 349

Borrowing Program Results 351

Borrowing Program Outlook 352

Interest on Debt Savings and Affordability 355

Ensuring Preferred Market Access 357

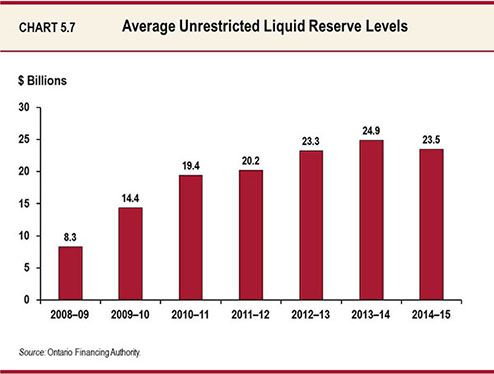

Ensuring Adequate Liquidity Levels 360

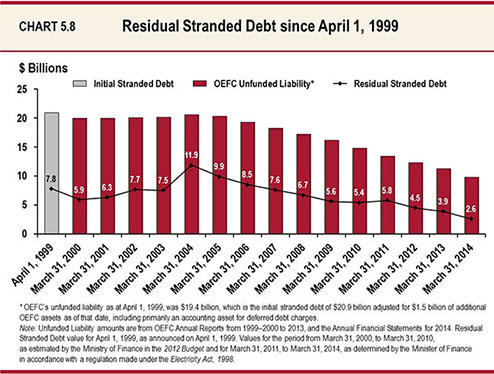

Reducing Ontario’s Stranded Debt 361

Impact of Proposed Hydro One Initial Public Offering on Residual Stranded Debt 362

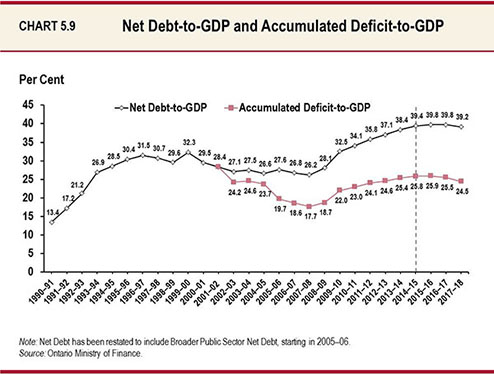

Net Debt 363

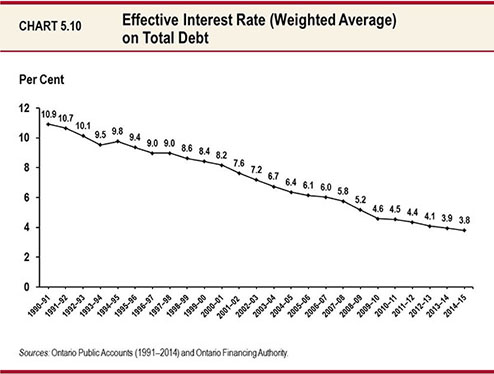

Cost of Debt 365

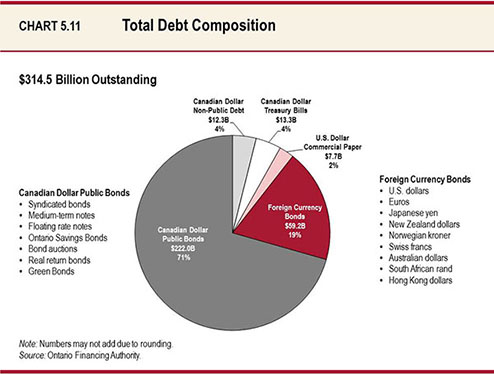

Total Debt Composition 366

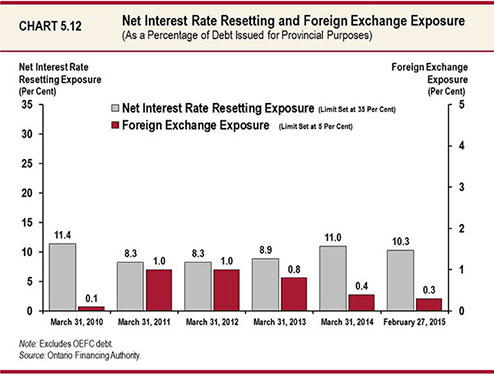

Limiting Risk Exposure 367

Consolidated Financial Tables 370

List of Tables

Chapter I: Implementing the Plan

| Table 1.1 | Dedicated Funds for Moving Ontario Forward 45 | |

| Table 1.2 | GO Transit Rail Service Improvements 50 | |

| Table 1.3 | Measures the Government Has Taken to Maintain a Competitive Business Tax System 89 |

| Table 1.4 | Recent Strategic Partnership Investments 94 |

| Table 1.5 | Recent Examples of Supporting Economic Development in Ontario’s Communities 95 |

Chapter II: Ontario’s Economic Outlook and Fiscal Plan

| Table 2.1 | Difference in Projected Pension Expense versus Commission on the Reform of Ontario’s Public Services’ Forecast 213 |

| Table 2.2 | 2014–15 In-Year Fiscal Performance 225 | |

| Table 2.3 | Summary of Revenue Changes since the 2014 Budget 227 | |

| Table 2.4 | Summary of Expense Changes since the 2014 Budget 230 | |

| Table 2.5 | Ontario Economic Outlook 233 | |

| Table 2.6 | Outlook for External Factors 246 | |

| Table 2.7 | Impacts of Sustained Changes in Key External Factors on Ontario’s Real GDP Growth 247 |

| Table 2.8 | The Ontario Economy, 2013 to 2018 256 | |

| Table 2.9 | Private-Sector Forecasts for Ontario Real GDP Growth 257 | |

| Table 2.10 | Changes in Ministry of Finance Key Economic Forecast Assumptions: 2014 Budget Compared to 2015 Budget 260 | |

| Table 2.11 | Ontario’s Recovery Plan 261 | |

| Table 2.12 | Change in Medium-Term Fiscal Outlook since the 2014 Budget 263 |

| Table 2.13 | Summary of Medium-Term Outlook 265 | |

| Table 2.14 | Personal Income Tax Revenue Outlook 266 | |

| Table 2.15 | Sales Tax Revenue Outlook 267 | |

| Table 2.16 | Corporations Tax Revenue Outlook 268 | |

| Table 2.17 | Summary of Medium-Term Revenue Changes since the 2014 Budget 270 |

| Table 2.18 | Selected Economic and Revenue Risks and Sensitivities 273 | |

| Table 2.19 | Summary of Medium-Term Expense Outlook 281 | |

| Table 2.20 | Selected Expense Sensitivities 285 | |

| Table 2.21 | Medium-Term Fiscal Plan and Outlook 287 | |

| Table 2.23 | Total Expense 289 | |

| Table 2.24 | Details of Other Expense 290 | |

| Table 2.25 | 2015–16 Infrastructure Expenditures 291 | |

| Table 2.26 | Ten-Year Review of Selected Financial and Economic Statistics 292 |

| Table 2.27 | Support for Health Care, Charities, Problem Gambling and Related Programs, Municipalities and Ontario First Nations 297 | |

Chapter III: National Leadership — Strong Ontario, Strong Canada

| Table 3.1 | Recent Examples of Investments in the Automotive Sector 313 | |

Chapter IV: A Fair and Sustainable Tax System

| Table 4.1 | 2015 Budget Tax Measures 342 | |

Chapter V: Borrowing and Debt Management

| Table 5.1 | 2014–15 Borrowing Program: Province and Ontario Electricity Financial Corporation 351 |

| Table 5.2 | Medium-Term Borrowing Outlook: Province and Ontario Electricity Financial Corporation 352 |

| Table 5.3 | Net Debt and Accumulated Deficit 370 | |

| Table 5.4 | Medium-Term Outlook: Net Debt and Accumulated Deficit 371 | |

| Table 5.5 | Debt Maturity Schedule 372 | |

List of Charts

Chapter I: Implementing the Plan

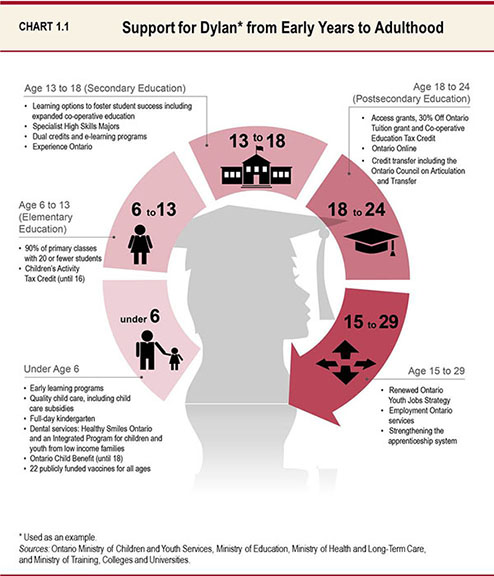

| Chart 1.1 | Support for Dylan from Early Years to Adulthood 6 | |

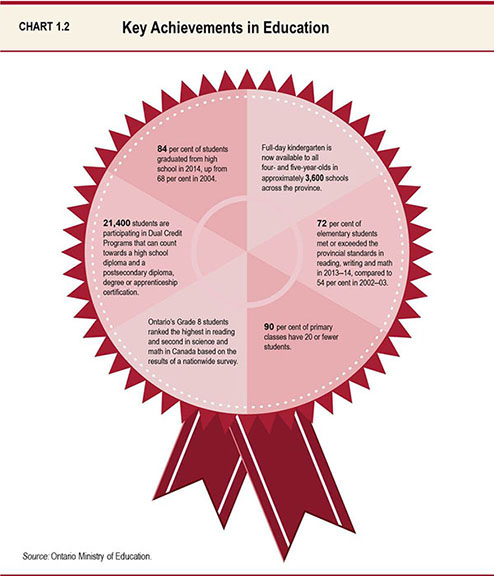

| Chart 1.2 | Key Achievements in Education 9 | |

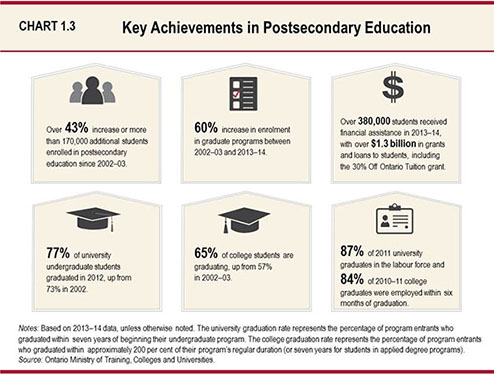

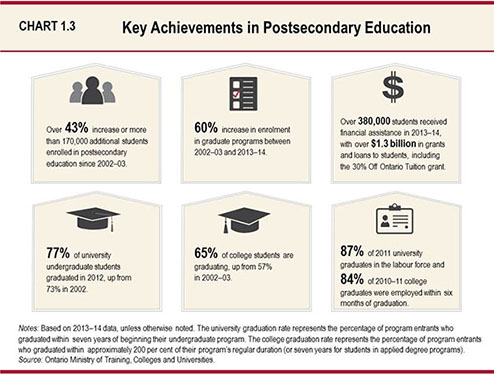

| Chart 1.3 | Key Achievements in Postsecondary Education 16 | |

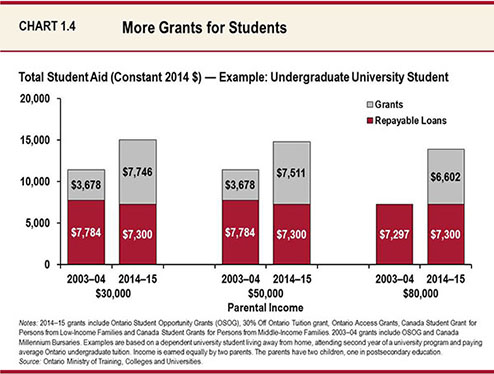

| Chart 1.4 | More Grants for Students 20 | |

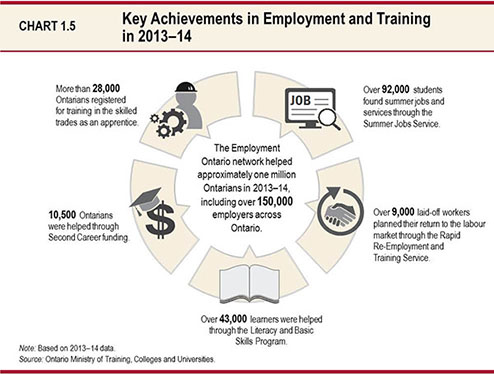

| Chart 1.5 | Key Achievements in Employment and Training in 2013–14 22 | |

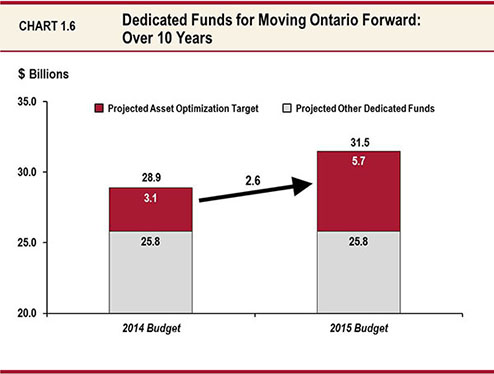

| Chart 1.6 | Dedicated Funds for Moving Ontario Forward: Over 10 Years 44 |

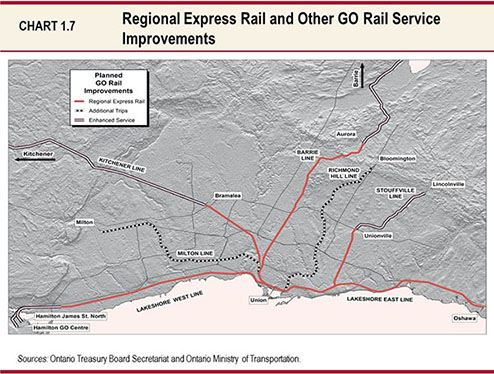

| Chart 1.7 | Regional Express Rail and Other GO Rail Service Improvements 47 |

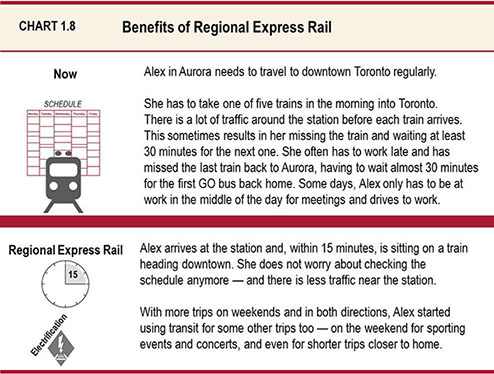

| Chart 1.8 | Benefits of Regional Express Rail 48 | |

| Chart 1.9 | Moving Ontario Forward – GTHA 52 | |

| Chart 1.10 | Moving Ontario Forward – Outside the GTHA 54 | |

| Chart 1.11 | Supporting Infrastructure Needs of Rural Communities 55 | |

| Chart 1.12 | Highlights of Alternative Financing and Procurement Projects Completed or Underway 67 |

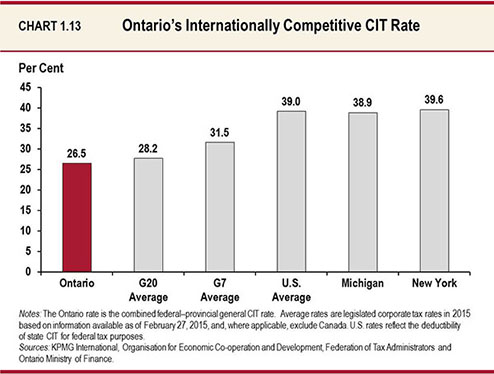

| Chart 1.13 | Ontario’s Internationally Competitive CIT Rate 90 | |

| Chart 1.14 | Ontario’s Marginal Effective Tax Rate on New Business Investment Has Been Cut in Half 91 |

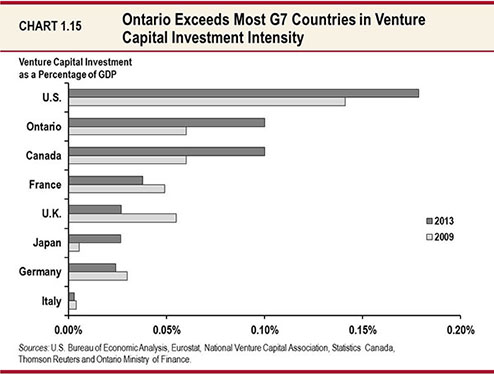

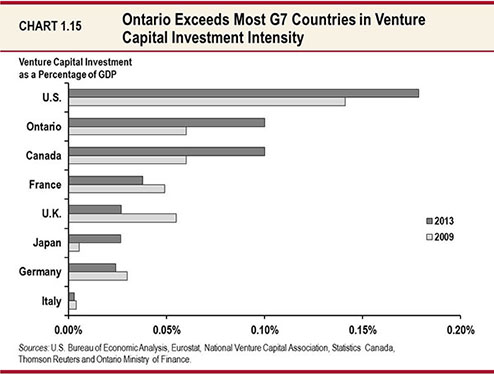

| Chart 1.15 | Ontario Exceeds Most G7 Countries in Venture Capital Investment Intensity 96 | |

| Chart 1.16 | Ontario’s Accident Benefits Claims Costs Decrease from Past Reforms but Remain Highest 188 |

Chapter II: Ontario’s Economic Outlook and Fiscal Plan

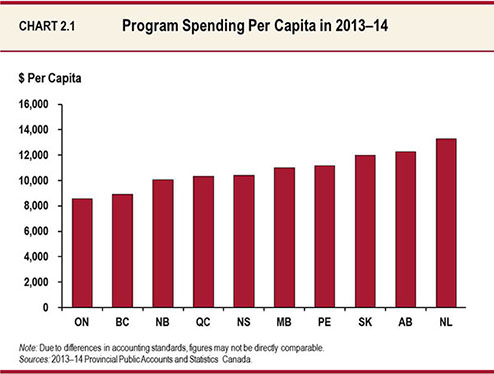

| Chart 2.1 | Program Spending Per Capita in 2013–14 198 |

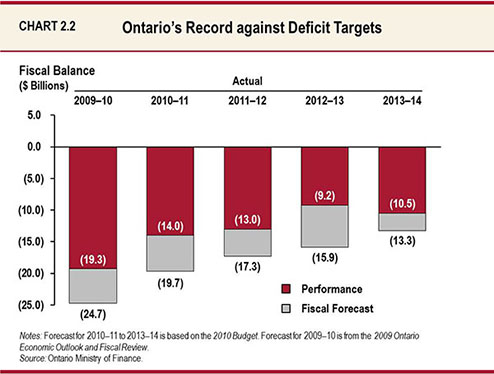

| Chart 2.2 | Ontario’s Record against Deficit Targets 199 | |

| Chart 2.3 | Ratio of Program Expense to GDP, 2009–10 to 2014–15 200 | |

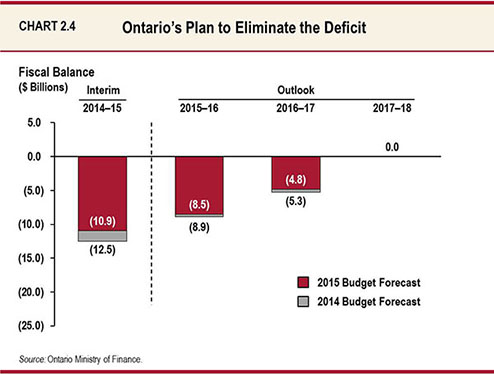

| Chart 2.4 | Ontario’s Plan to Eliminate the Deficit 201 | |

| Chart 2.5 | Ontario Bargained Average Wage Increases April 2010 to March 2015 211 |

| Chart 2.6 | Performance of Key Ontario Economic Indicators in 2014 234 | |

| Chart 2.7 | Ontario’s Economic Expansion 235 | |

| Chart 2.8 | Ontario Job Recovery Ahead of U.S. and OECD Average 236 | |

| Chart 2.9 | Employment Gains Concentrated in Full-Time, Private-Sector, Above-Average Wage Jobs 237 |

| Chart 2.10 | Global Economic Growth to Improve 239 | |

| Chart 2.11 | Strengthening U.S. Recovery 240 | |

| Chart 2.12 | Oil Prices Expected to Recover Gradually 241 |

| Chart 2.13 | Canadian Dollar to Remain Below Parity 243 | |

| Chart 2.14 | Interest Rates to Rise over the Medium Term 245 | |

| Chart 2.15 | Inflation Expected to Remain Moderate 249 | |

| Chart 2.16 | Employment Expected to Rise over the Medium Term 250 | |

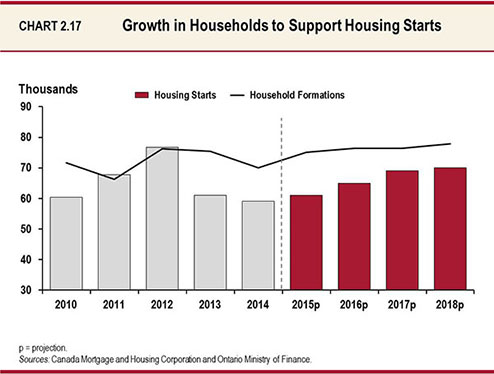

| Chart 2.17 | Growth in Households to Support Housing Starts 251 | |

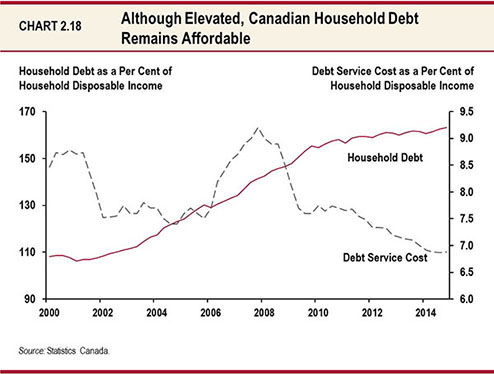

| Chart 2.18 | Although Elevated, Canadian Household Debt Remains Affordable 252 |

| Chart 2.19 | Ontario Business Machinery and Equipment Investment Expected to Rise in Line with Profits 253 | |

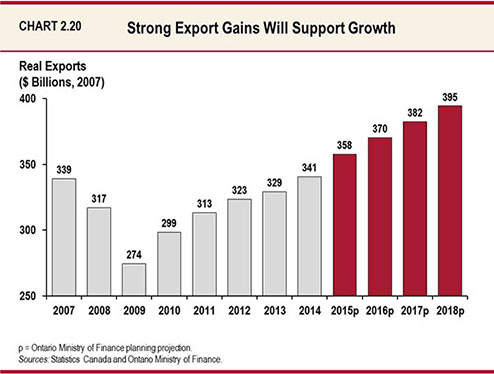

| Chart 2.20 | Strong Export Gains Will Support Growth 255 |

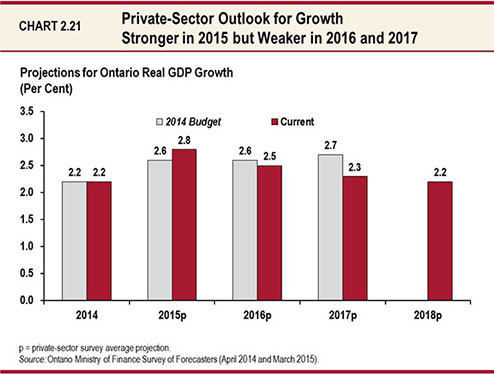

| Chart 2.21 | Private-Sector Outlook for Growth Stronger in 2015 but Weaker in 2016 and 2017 258 |

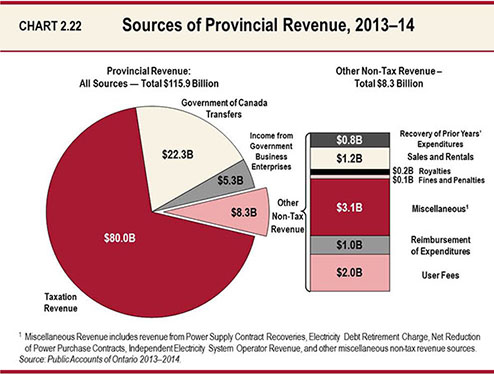

| Chart 2.22 | Sources of Provincial Revenue, 2013–14 280 |

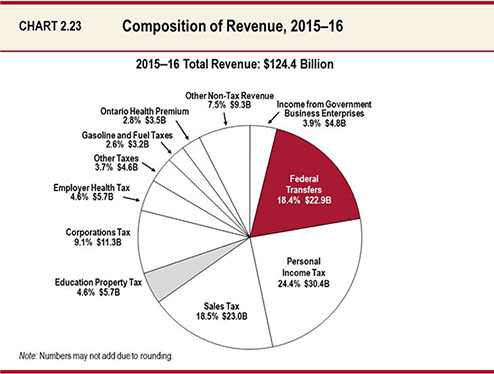

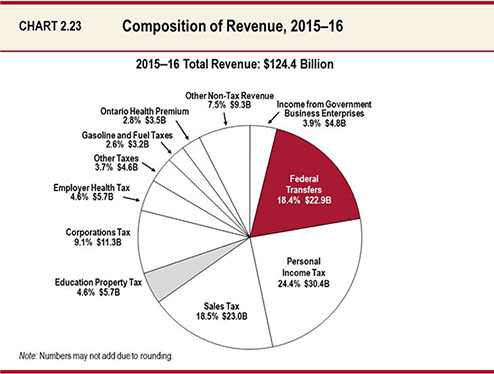

| Chart 2.23 | Composition of Revenue, 2015–16 294 | |

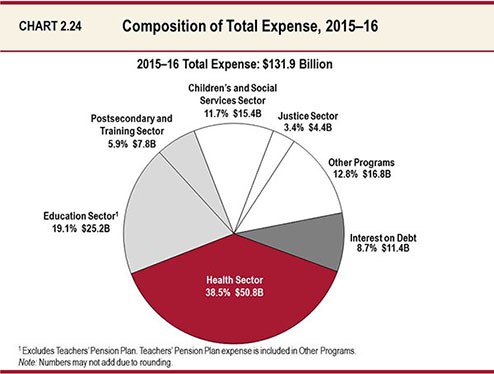

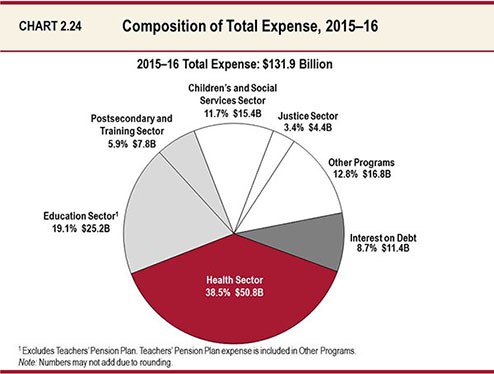

| Chart 2.24 | Composition of Total Expense, 2015–16 295 |

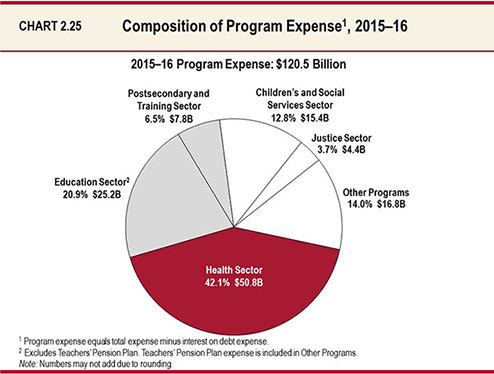

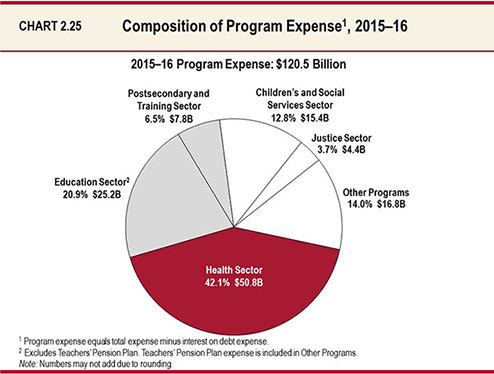

| Chart 2.25 | Composition of Program Expense, 2015–16 296 |

Chapter III: National Leadership — Strong Ontario, Strong Canada

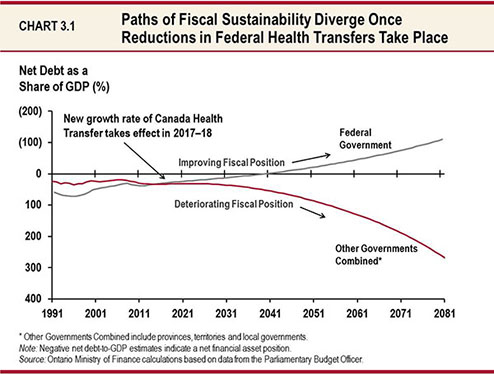

| Chart 3.1 | Paths of Fiscal Sustainability Diverge Once Reductions in Federal Health Transfers Take Place 303 |

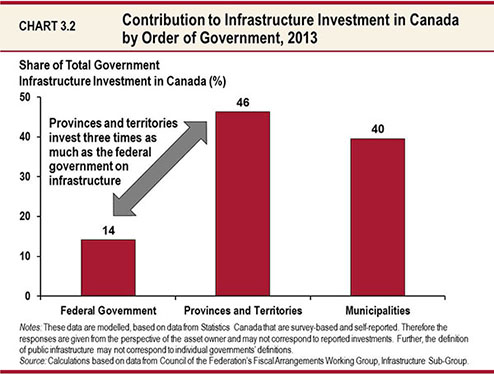

| Chart 3.2 | Contribution to Infrastructure Investment in Canada by Order of Government, 2013 307 |

Chapter IV: A Fair and Sustainable Tax System

| Chart 4.1 | New Apprenticeship Registrations in Trades Eligible for the ATTC, 2003–04 to 2013–14 325 |

Chapter V: Borrowing and Debt Management

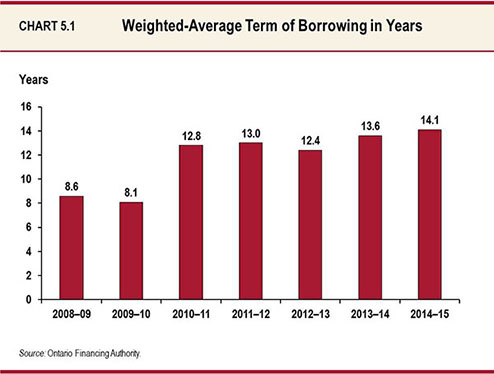

| Chart 5.1 | Weighted-Average Term of Borrowing in Years 348 | |

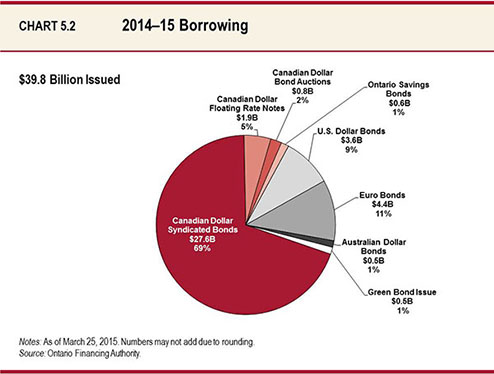

| Chart 5.2 | 2014–15 Borrowing 349 | |

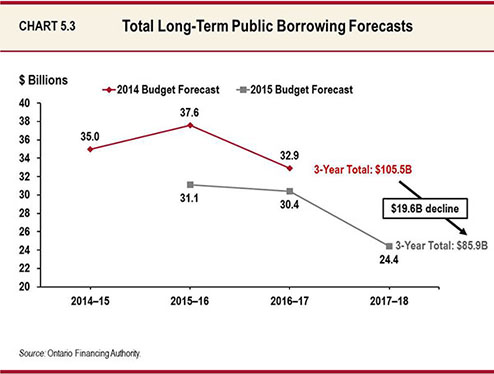

| Chart 5.3 | Total Long-Term Public Borrowing Forecasts 353 | |

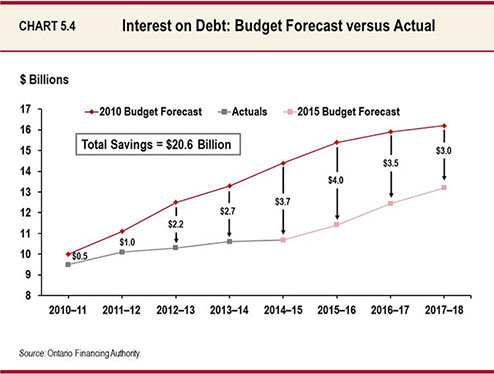

| Chart 5.4 | Interest on Debt: Budget Forecast versus Actual 355 | |

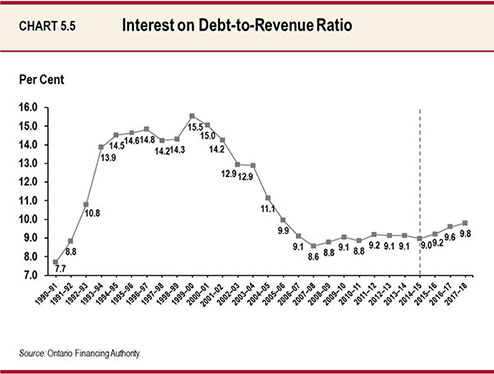

| Chart 5.5 | Interest on Debt-to-Revenue Ratio 356 | |

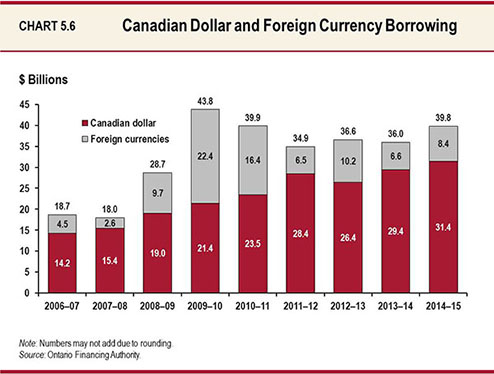

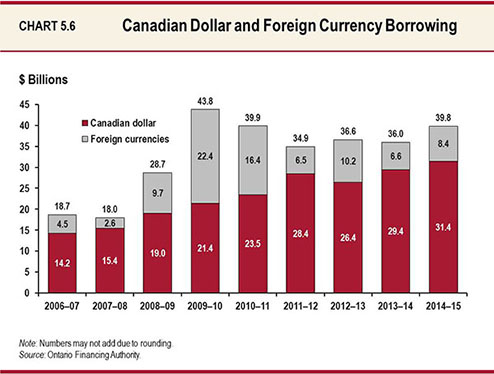

| Chart 5.6 | Canadian Dollar and Foreign Currency Borrowing 357 | |

| Chart 5.7 | Average Unrestricted Liquid Reserve Levels 360 |

| Chart 5.8 | Residual Stranded Debt since April 1, 1999 361 |

| Chart 5.9 | Net Debt-to-GDP and Accumulated Deficit-to-GDP 364 | |

| Chart 5.10 | Effective Interest Rate (Weighted Average) on Total Debt 365 | |

| Chart 5.11 | Total Debt Composition 366 | |

| Chart 5.12 | Net Interest Rate Resetting and Foreign Exchange Exposure (As a Percentage of Debt Issued for Provincial Purposes) 367 |

Foreword

Building Ontario Up

Ontario is moving forward with a plan for the economy focused on investing in modern public infrastructure such as roads, bridges and transit, creating an innovative and dynamic business environment, investing in people’s skills and talents, and building a strong and secure retirement income system.

We are building Ontario up by making investments that grow the economy and create jobs.

We are unlocking the value of Provincial assets in order to make unprecedented investments in modern infrastructure, which is essential to a 21st century economy.

The government’s plan is working. Performance indicators that measure economic progress prove this. Foreign direct investment remains strong, employment is up, youth employment is improving, graduation rates are up — and we are beating our deficit targets. The 2015 Ontario Budget builds on our plan by making key investments in priorities that matter to Ontarians.

Our plan rests on a foundation of fiscal responsibility. We are taking a deliberate and thoughtful approach to eliminating the deficit by 2017–18.

Ontario’s path to a balanced budget is focused on improving the quality of life of all Ontarians. As always, we must manage our limited resources in a way that is efficient and effective. As a government, this means doing some things differently. We will make the right investments to help grow the economy and to preserve and improve the vital services that our families and communities rely on.

That is why the government continues to invest in next-generation industries through, for example, our Jobs and Prosperity Fund.

We are investing in skills and training so we have the diverse workforce needed to take advantage of the job opportunities of tomorrow.

We are preparing youth for the jobs of today as well as for tomorrow’s opportunities.

We are also preserving and improving the programs and services that Ontarians expect and trust. At the same time, we are ensuring that people get the best possible value for every tax dollar spent.

Our society is compassionate and competitive. We will not let the vulnerable fall behind.

We have made significant progress. What comes next is further action on our plan to build Ontario up.

Maximizing the Value of Provincial Assets

A key part of strong fiscal management is making the most of the Province’s assets over the long term. Using them strategically is a cornerstone of good government. That is why Ontario is moving forward on a plan to unlock the value of certain Provincial assets, including the Liquor Control Board of Ontario (LCBO) head office lands, Ontario Power Generation’s head office building and Seaton and Lakeview lands.

In addition, the Premier’s Advisory Council on Government Assets has recommended ways to unlock the value of Provincial assets in a way that creates lasting public benefits. The Council recommended reforming Ontario’s beverage alcohol system, while maintaining a strong commitment to social responsibility. With respect to Hydro One, the Council recommended broadening ownership while ensuring ongoing consumer protection. It has done so in a way that is transparent, professional and independently validated.

Reforming Beverage Alcohol Sales

Ontario will permit the sale of beer in grocery stores for the first time in its history.

Ontario is also entering into a new agreement with the owners of the Beer Store that returns the framework closer to its original cooperative roots, opening up ownership to small and craft brewers.

At the same time, the LCBO will modernize its practices to improve the retail experience for all Ontarians.

The Premier’s Advisory Council on Government Assets will continue to refine its recommendations on how to maximize value in the wine retailing sector.

Selling alcohol is a public trust and the government will continue to adhere to the principle of social responsibility supporting the safe consumption of alcohol in light of the expansion of alcohol distribution channels in the province.

Broadening Ownership of Hydro One

The government intends to broaden ownership in Hydro One Inc., including through an initial public offering of approximately 15 per cent, in order to help strengthen its long-term performance.

The Province intends to ultimately retain 40 per cent of its Hydro One common shares and is proposing legislation so that no other shareholder or group of shareholders would be permitted to own more than 10 per cent.

The ability to set rates will continue to be at arm’s length from Hydro One management, with rates set by the independent regulator, the Ontario Energy Board (OEB).

Unlocked Value Placed in the Trillium Trust

Actions taken to unlock the value of Provincial assets will allow us to realize even more value than originally anticipated. An increased asset optimization target of $5.7 billion — a $2.6 billion increase over the 2014 Budget projection — will be reinvested to build bridges, transit, roads and other priority infrastructure throughout Ontario. This includes net proceeds from the sale of qualifying assets that will be placed in the Trillium Trust.

These projects will benefit Ontarians for years to come. The Trillium Trust has already received $1.35 billion from the sale of the Province’s shares in General Motors.

The Trillium Trust signifies the government’s commitment to building critically needed infrastructure.

Infrastructure: Building to Grow

Modern infrastructure is vital to Ontario’s growth and quality of life; it forms the backbone of a well-functioning economy and prosperous society. Infrastructure includes roads, bridges, public transit, water systems, hospitals and schools — in other words, important elements that help our economy grow and modern society thrive. We need efficient modes of transport to move goods to market, and to move commuters between their homes and workplaces.

That is why we are renewing and expanding Ontario’s infrastructure.

The government is investing more than $130 billion across the province over 10 years. These investments would support over 110,000 jobs per year on average. This investment will fund projects in public transit, highways, schools, health facilities, postsecondary institutions and other assets from Cornwall to Kenora and from Windsor to Moosonee.

Moving Ontario Forward is a plan to create jobs, boost productivity and revitalize communities. Unlocking the value of certain government assets will allow us to increase the dedicated funds available for Moving Ontario Forward by $2.6 billion, to $31.5 billion over 10 years. It will allow us to accelerate service enhancements on the GO Transit network, laying the foundation for Regional Express Rail. It will also allow us to enhance regional mobility by investing in new transit projects in Mississauga, Brampton and Hamilton. Outside the Greater Toronto and Hamilton Area (GTHA), it will allow us to invest in priority projects such as helping more communities gain access to natural gas, continuing to improve roads and highways and investing in the Ring of Fire in northern Ontario.

Infrastructure projects support jobs today while meeting our education, health care and transportation needs of the future. When Ontario invests in infrastructure, it is building — and when it is building, it is growing.

Creating an Innovative and Dynamic Business Environment

Through our four-part economic plan, we are supporting greater investment in productivity and innovation, providing a renewed focus on international exports, encouraging the transition to a low-carbon economy and creating more jobs for Ontarians.

These investments will help people achieve their full potential, so they can enjoy a better way of life, and help our province become an even better place to live.

The Jobs and Prosperity Fund allows us to partner with business to enhance productivity, increase innovation, grow exports and create jobs. We will enhance the Jobs and Prosperity Fund by an additional $200 million to attract more business investments and create jobs, and by making the forestry sector eligible.

We are ensuring that Ontario’s economy is resilient as we compete in the global environment by making strategic decisions to ensure our business supports are well targeted, effective and fiscally sustainable. The 2015 Budget highlights proposed measures to improve the effectiveness of supports to business and to achieve the best possible outcomes for every dollar we spend, while ensuring that Ontario remains one of the most attractive and competitive locations for business investment.

Improving Education and Skills Training Opportunities

We know that Ontario’s continued economic prosperity depends on a highly skilled workforce that is diverse, adaptable and innovative. That is how the Province attracts jobs and investments, which, in turn, improve our communities and the opportunities found in them. Studies suggest that seven of every 10 new jobs created are expected to require postsecondary education or training.

The success of Ontario’s workers is founded on a first-rate education system that starts in the earliest years. That is why the government is continuing to improve education and skills training, from preschool and full-day kindergarten through to postsecondary education and apprenticeship programs. We are building on past investments, including doubling child care funding since 2004 to more than $1 billion annually; continuously improving our education system with innovations such as experiential learning pilot programs; and providing more than $1.3 billion in grants and loans for student aid in 2013–14.

We are renewing the Ontario Youth Jobs Strategy by investing an additional $250 million over two years to provide employment and skills development opportunities for up to 150,000 youth. We are supporting the skilled trades by investing an additional $23 million over two years in the Apprenticeship Enhancement Fund for better equipment to help train more people.

A Fair Society: Living and Working in Ontario

Ontario’s most valuable resource is its people. Ontarians are the key to Ontario’s prosperity.

That is why the government is dedicated to ensuring all Ontarians can reach their full potential through access to high-quality education, excellent health care, rewarding employment opportunities and social services they can continue to rely on. We are also committed to ensuring that consumers are protected. Among other initiatives, Ontario is taking steps to keep auto insurance rates affordable and to assist low-income people with the cost of electricity.

Investments that focus on building a fair society for all Ontarians make economic sense. Focusing on early intervention programs supports good health, lifts people out of poverty, and enhances security for all Ontarians. This will, in turn, reduce government expenditures over the longer term.

National Leadership and a Strong Economic Union

Ontario will thrive when, working with other provinces and territories, as well as the federal government, we achieve a strong Canadian economic union.

As we adapt to the realities and challenges of the 21st century, we need stronger intergovernmental partnerships to create a stronger Canadian economic union. Ontarians, like all Canadians, expect their governments to work together to improve the economic well-being and quality of life of the people they serve.

Ontario is showing the necessary national leadership. Through the Council of the Federation, we are working with Canada’s premiers to promote international trade, reduce internal trade barriers, and develop a Canadian Energy Strategy. Ontario is a leader in helping to set up the Cooperative Capital Markets Regulatory System and to launch the renminbi trading hub in Toronto, serving all of North and South America. Ontario has also led the way in inviting the federal government to increase investment in public infrastructure and improve Canada’s economic competitiveness.

Ontario continues to be a strong voice at the national level — the challenges that Canada faces cannot be met by one order of government alone.

Retirement Security: Securing Our Future

The decisions we make today will help shape tomorrow.

Evidence shows that many Ontarians are not saving adequately for retirement. Unless action is taken now, the retirement undersaving challenge will worsen over time.

That is why the Province is leading the way to help Ontario workers secure the retirement future they deserve. Moving forward with strengthening workplace pension plans and introducing the Ontario Retirement Pension Plan by 2017 will ensure that today’s workers have a secure retirement income foundation.

Ontario’s retirement system should ensure that individual Ontarians can maintain their standard of living in retirement. For the economy as a whole, increased retirement savings will contribute to higher investment and strong economic growth over the long term. Higher incomes for retirees will lead to increased consumption, generating future economic growth and helping the Ontario economy better cope with an aging population.

Confronting Climate Change

Confronting climate change and protecting our environment will help ensure Ontario continues to be a great place to live. These actions will also help ensure that we have a strong economy.

The environmental, social and economic challenges of climate change are global issues. Ontario has been hit hard by the effects of climate change, including recent extreme weather events such as ice storms, severe thunderstorms and flash flooding. These events have caused unprecedented damage to the places Ontarians live, work and play, costing the government, businesses and families hundreds of millions of dollars. In the years to come, such damages and costs will likely be greater if current trends are left unchecked.

We will be moving ahead with a cap-and-trade system to protect the air we breathe, the water we drink, and the health of our children. We will take a balanced approach that protects both the environment and the economy. We will consult with experts, industry, environmental groups and the public, to determine what will work best for Ontario, with the intent to link with the cap-and-trade markets already in place in Quebec and California. This will be part of a comprehensive strategy to fight climate change.

Sound Fiscal Management

The government has a proven track record of strong fiscal management. We are not only meeting our deficit targets, but we are beating them. Our deficit for 2014–15 is projected to be $10.9 billion, an improvement of $1.6 billion, beating our deficit target set out in the 2014 Budget. For 2015–16, we are forecasting a deficit of $8.5 billion, which would be the lowest since the onset of the global recession.

We continue to overachieve on savings targets by managing expenses and making sure every dollar counts. The 2014 Budget outlined a plan to eliminate the deficit by 2017–18, and we remain committed to do so, based on managing growth in program spending while maintaining the integrity of Provincial revenues.

In fact, over the past four years, the Province has managed to hold average annual growth in program spending to 1.5 per cent, below inflation, without cutting vital services. Indeed, Ontario had the lowest per capita program spending of any province in 2013–14.

Achieving a balanced budget requires a disciplined focus on finding smarter, better ways to deliver the best possible value for every dollar spent, while continuing to make investments that create jobs, expand opportunities and secure prosperity for all Ontarians. To eliminate the deficit by 2017–18, the government will maintain a strong and unwavering commitment to fiscal discipline. Critical to this approach will be Program Review, Renewal and Transformation (PRRT). An internal process first discussed in the 2014 Ontario Economic Outlook and Fiscal Review, PRRT is focused on making smart and responsible choices while ensuring sustainable public services that serve Ontarians efficiently.

Program Review, Renewal and Transformation is a new approach to multi-year planning and budgeting. From an across-government perspective, ministries are working together to better deliver services to people. At the same time, the Province is making tough choices to transform or end programs that are not performing, do not link to government priorities or no longer clearly serve the public interest.

Making Progress

Most forecasters are predicting that Ontario will be among the provincial leaders in economic growth over the next two years, with growth outpacing the national average.

A combination of low oil prices, low interest rates, a lower Canadian dollar and the improving U.S. economy is giving Ontario’s economy new opportunities to grow. But we will not base our economic planning solely on these factors, which are volatile and difficult to predict. It is important to continue to build on our foundational strengths, rather than simply exploiting changes in circumstances.

Supported by the government’s sound fiscal management and favourable economic trends, Ontario continues to create jobs. Employment has rebounded strongly from the recessionary low in June 2009, with over half a million net new jobs created — the majority in industries paying above-average wages. These high-quality jobs provide opportunities for people to maximize their potential while also creating financial stability and securing prosperity for all Ontarians.

These conditions highlight Ontario’s advantage — its solid economic foundation.

What Is Important to Ontarians

The 2015 Budget sets out the government’s priorities for the coming year. But these are also Ontarians’ priorities. To make sure we have got it right, the Province undertook our most extensive budget consultation process to date. Through the new Budget Talks website, face-to-face sessions across the province and telephone town halls with tens of thousands of participants, we heard from more Ontarians than ever before.

For example, we heard that Ontarians want a world-class education and skills training system so that young people can compete for the jobs of tomorrow. We also heard that people are concerned about gridlock and want more public transit. People in northern and rural areas want better roads so they can more easily travel from community to community.

We listened to the views of Ontarians and their suggestions are reflected in the pages of this Budget.

Conclusion

Looking ahead, as we continue to invest in people’s talents and skills, build infrastructure, foster an innovative and dynamic business environment, and build retirement security, we are creating the conditions necessary for all Ontarians to succeed and enjoy a better life. At the same time, eliminating the deficit means securing the future of Ontario’s public services, such as health care and education, which make it possible for us to succeed.

Together, we are working hard to build Ontario up and help unlock the potential in our society and in each of us.

Originally signed by

The Honourable Charles Sousa

Minister of Finance

Chapter I

IMPLEMENTING THE PLAN

Section A: Investing in People’s Talents and Skills

Ontario’s greatest strength is its people. The Province’s highly skilled, diverse and adaptive workforce is a competitive advantage. That is a key reason why, despite global challenges and uncertain market conditions, Ontario continues to create jobs.

The Province has a world-class education and skills training system and is continually striving to improve it. By investing in people today and giving Ontarians the support they need to get the right skills and the right jobs, the Province is developing the strong economy of tomorrow. This principle is the foundation of the first pillar of the government’s four-point plan, outlined in the 2014 Budget. The plan provides a blueprint for excellence in education from early years to adulthood. Key elements include:

| › | Continuing to modernize and strengthen Ontario’s child care system; |

| › | Fully implementing full-day kindergarten; |

| › | Implementing Achieving Excellence, a new vision for education that prepares learners for a rapidly changing, technology-driven, globalized world; |

| › | Advancing postsecondary education and training by supporting programs that foster innovative, entrepreneurial and creative graduates; and |

| › | Renewing the Ontario Youth Jobs Strategy. |

The government is continuing to implement its plan by:

| › | Introducing and implementing the Child Care Modernization Act, 2014, which will strengthen oversight of the province’s child care sector; |

| › | Completing the implementation of full-day kindergarten across the province; |

| › | Implementing “Achieving Excellence” and successfully launching: |

| › | Over 40 experiential learning pilots across Ontario; |

| › | A Specialist High Skills Major certificate in Innovation, Creativity and Entrepreneurship in every school board in Ontario; and |

| › | A Math Action Plan to improve outcomes in math. |

| › | Completing Strategic Mandate Agreements with all 45 publicly supported colleges and universities to ensure postsecondary institutions focus on their areas of strength and avoid unnecessary duplication; and |

| › | Helping more than 29,000 young people access jobs, develop skills and gain valuable work experience through the Youth Employment Fund, part of the Ontario Youth Jobs Strategy. |

Ontario’s plan builds on the progress of successive investments in education and training over the past 12 years:

| › | 84 per cent of students graduated from high school in 2014, up from 68 per cent in 2004; |

| › | 66 per cent of adults in Ontario had a postsecondary credential in 2013, up from 56 per cent in 2002 and higher than any country in the Organisation for Economic Co-operation and Development; and |

| › | 84 per cent of 2010‒11 college graduates and 87 per cent of 2011 university graduates in the labour force were employed within six months of graduation. |

Despite these successes, more must be done to equip Ontarians to compete in a rapidly changing and highly competitive global economy. That is why the government is taking new measures, including:

| › | Renewing the Ontario Youth Jobs Strategy by investing an additional $250 million over two years in a suite of programs that will serve up to 150,000 clients and focus on skills development, labour market connections, entrepreneurship and innovation; |

| › | Modernizing the Ontario Student Assistance Program to strengthen financial assistance for students; and |

| › | Launching an Experience Ontario pilot that will help recent high school graduates pursue their passions and choose a postsecondary pathway. |

The government’s enduring commitment to improving education and training will help ensure Ontario has the best workforce and attracts the best jobs, leading to an even stronger economy and better way of life.

Supporting Every Child, Reaching Every Student

Ontario’s education system is recognized as one of the best in the world and the government is committed to making it even better. Through the implementation of Achieving Excellence: A Renewed Vision for Education in Ontario, the Province will continue its progress towards an increasingly responsive, high-quality and accessible system.

Ontario’s vision builds on the progress of the last 10 years and focuses on achieving tangible results for both students and educators through four key goals:

| › | Promoting well-being; and |

| › | Enhancing confidence in the publicly funded education system. |

The Province’s plan also includes a focus on 21st century teaching and learning skills, the modernization of early learning and child care, and improving math achievement.

Over the last year, the government has made significant progress towards implementing its vision for education, with the following results:

| › | Over 40 experiential learning pilots launched across Ontario in 2014‒15 to explore new ways to support the delivery of innovative, student-driven, hands-on learning experiences that are connected to the community; |

The Innovation, Creativity and Entrepreneurship (ICE) element of the Specialist High Skills Major (SHSM) program was delivered to 2,000 students in 2014‒15. The new program was a partnership between the government and the University of Toronto’s Rotman School of Management. The government is investing an additional $1 million in 2015‒16 to support expansion of the ICE component of the SHSM program. |

| › | Specialist High Skills Major (SHSM) in Innovation, Creativity and Entrepreneurship (ICE) launched in every school board in 2014‒15. SHSMs are bundles of 8 to 10 courses that allow students to focus on a specific economic sector while acquiring their high school diploma. Participants graduate with the 21st century skills of ICE to create the jobs of tomorrow; |

| › | Math Action Plan implemented, with emphasis on expanding opportunities for teacher and principal professional learning in math; and |

| › | 31 pilot programs launched in 2014‒15 to develop innovative strategies to improve educational outcomes for students in the care of children’s aid societies. |

Supporting Technology and Innovation in Classrooms In the first year of the Technology and Learning Fund, the government invested $40 million to support technology and pedagogy for classrooms of the future. Some successes to date include: ● Students in remote communities in the Keewatin-Patricia District School Board are using Skype technology in Grade 4 social studies classes to communicate with students in other parts of the world, and learn about geography and different communities; and ● In the Waterloo Region District School Board’s Futures Forum program, high school students blog about real-world issues and participate in book studies with one of 12 teachers across the region, using online discussion forums to collaborate with and learn from other students.

|

Modernizing Child Care and Early Learning

Safe, responsive and accessible child care, integrated with early learning programs, contributes to healthy child development and a stronger future.

Over the years, there has been little fundamental change to Ontario’s child care system. The government is committed to modernizing and building a child care and early years system that will enhance programs and supports for children under age 12 by:

| › | Modernizing the legislative and regulatory framework for child care. |

| › | Increasing transparency with a new funding formula for child care. |

| › | Enhancing program quality and consistency in child care and early years programs to reflect a focus on safe and healthy child development and well-being. |

› | Making full-day kindergarten available to every four- and five-year-old in Ontario. The rollout of this initiative was completed in September 2014. |

| › | Ensuring that before- and after-school programs are available to six- to twelve-year-olds, where there is sufficient demand. |

Legislative Framework

Through the Child Care Modernization Act, 2014, enacted in December 2014, the government introduced reforms that will strengthen oversight of the unlicensed child care sector and provide families with increased access to licensed child care options. The Act will also allow the Province to immediately shut down a child care provider when a child’s safety is at risk.

What People Are Saying about the Child Care Modernization Act, 2014 (Bill 10) “Bill 10 is a declaration that children in our province are valued and that our government cares about their well-being. Protection of our youngest citizens is long overdue and must be the foundation upon which we build our system of education and care. Bill 10 gives us this foundation.” Sheila Olan-MacLean, President of the Ontario Coalition for Better Child Care. |

The online registry of unlicensed child care violations can be found at www.earlyyears.edu.gov.on.ca/ Unlicenced CCRegistryWeb. |

This legislation builds on steps that Ontario has already taken to strengthen oversight of the unlicensed child care sector. They include the creation of a dedicated enforcement team to investigate complaints against unlicensed providers, as well as an online searchable registry — paired with a toll-free number — of unlicensed child care violations.

Investing in Results

Since 2004, the government has doubled child care funding to more than $1 billion annually. In 2013‒14, an estimated 447,472 children benefited from Ontario’s child care investments. In 2015, the Province is allocating an additional $44.5 million in child care funding through the funding formula, which will help stabilize fees, improve the reliability of child care, and better meet the needs of child care operators and parents — protecting the gains made through previously announced investments.

A community hub can be a school, a neighbourhood centre or another public space that offers coordinated services such as education, health care and social services. |

As part of the Province’s commitment to increase child care spaces, Ontario is investing $120 million over three years in capital funding to create thousands more child care spaces in schools. This investment is another important step towards achieving the full vision of a seamless and integrated early years system in Ontario. It also represents an important component of the government’s commitment to community hubs. See Chapter I, Section F: A Fair Society for more details on community hubs.

Ontario’s Investments Continue to Improve Access to Child Care ● Since 2003, licensed child care spaces have increased by 70 per cent to 317,868, providing more than 130,000 additional children with safe and reliable child care. ● In January 2015, Ontario implemented a wage increase of $1 per hour for eligible child care workers in the licensed child care sector. Another wage increase is set for next year. This investment enhances employers’ ability to recruit and retain highly qualified and talented educators. |

Full-Day Kindergarten

With more than $1.5 billion in funding, full-day kindergarten is one of the most significant investments Ontario has made in a generation. The program supports over 260,000 children in approximately 3,600 schools across the province, and saves families up to $6,500 a year per child on child care costs. Program benefits include improved social skills, language and cognitive development, as well as communication skills and general knowledge. Overall, students in full-day kindergarten are better prepared to enter Grade 1 and be more successful in school, compared with those in half-day programs.1

“Children’s early experiences have profound and long-lasting influences on their development and on the kind of learner they become.” “A Meta-Perspective on the Evaluation of Full-Day Kindergarten during the First Two Years of Implementation,” (October 2013). |

| 1 | “A Meta-Perspective on the Evaluation of Full-Day Kindergarten during the First Two Years of Implementation,” (October 2013). Report informed by the Social Program Evaluation Group — Queen’s University, “Final Report: Evaluation of the Implementation of the Ontario Full-Day Early Learning Kindergarten Program,” (Fall 2012); the Offord Centre for Child Studies — McMaster University, “The Full Day Kindergarten Early Learning Program Final Report,” (October 2012); and the Ontario Ministry of Education. |

Building a Competitive Workforce

Ontario’s students are key to the Province’s economic future. The government is building an education system that is innovative and responsive to labour market demands, producing graduates ready for today’s jobs and tomorrow’s opportunities. The Province is also building a modern and cohesive employment and training services network to help people find jobs and employers find workers.

Experience Ontario

The government is investing $20 million to launch Experience Ontario. This new pilot program will support graduating high school students to better identify future goals, choose the most appropriate postsecondary education and succeed once they enrol.

Ensuring an Accessible, High-Quality and Sustainable Postsecondary Education System

Ontario’s colleges and universities play an increasingly important role in preparing students to seize employment opportunities. Studies suggest that seven of every 10 new jobs are expected to require postsecondary education or training.

Building on one of the best public elementary and secondary education systems in the world, Ontario boasts a leading system of postsecondary education. With higher postsecondary attainment rates than any country in the Organisation for Economic Co-operation and Development, Ontario is already leading the world with a globally competitive, highly educated workforce. But there is more to do.

In 2013, 66 per cent of adults in Ontario had a postsecondary credential, up from 56 per cent in 2002 — higher than the rates for any country in the Organisation for Economic Co-operation and Development. |

As steward of the system, the government is continuing to invest in an accessible, affordable and student-centred system — one that supports innovative, creative and entrepreneurial graduates. To achieve this goal, the Province continues to transform postsecondary education based on the best evidence, investing in what works and focusing on outcomes.

The government has increased funding for postsecondary education by 83 per cent since 2002‒03. This has resulted in more Ontarians than ever participating in postsecondary education, with over 170,000 more students enrolled in colleges and universities since 2002‒03 and more students graduating every year. This puts Ontario in a position to meet, if not exceed, its target of a 70 per cent attainment rate by 2020.

As a step in the transformation of the postsecondary education system, Ontario is helping all 45 publicly supported colleges and universities build on their unique strengths and specializations to offer students the best possible learning experience. The Strategic Mandate Agreements now in place are helping guide further growth and avoid or limit expansion in academic areas where well-established programs already exist.

The Strategic Mandate Agreements will also ensure that students continue to gain hands-on experience through opportunities such as co-op programs and applied research. This approach helps students create new businesses or find highly skilled work that will benefit Ontario’s economy.

To ensure quality and sustainability, Ontario will be reforming the postsecondary education system funding model, starting with the university sector. This spring, the Province will begin open, formal and transparent engagement with the sector that will help shape a new model. The government will work with institutions to find ways to better align public funding with desired outcomes and to ensure that Ontarians receive the best possible value from investments made in postsecondary education. Among other things, the new funding model will also support greater differentiation in the university sector.

Differentiation within postsecondary education means focusing on institutional strengths while preserving and enhancing educational quality for students within a sustainable cost structure. Differentiation leads to more effective use of government and institutional resources to improve overall performance of the system, and to help Ontario compete internationally. |

Giving Students the Skills and Experience They Need to Get the Jobs They Want George Brown College focuses on its institutional strengths by providing applied research expertise that enhances student learning and supports industry innovation. It embeds applied research through a number of centres including the: ● Green Building Centre; ● Health Technology, Entrepreneurship and Commercialization Hub (HealthTech); ● Food Innovation and Research Studio (FIRSt); and ● Centre for Arts and Design, a digital media and gaming incubator. |

The government is also following through on its commitment to expand online learning opportunities. Ontario Online will give students the flexibility to receive world-class instruction wherever and whenever it works best for them. In 2014, Ontario Online was established as a collaborative Centre of Excellence in technology-enabled learning to give students across the province one-window access to transferable online courses. The government has invested $22.3 million over the past two years towards developing or redesigning 280 high-quality online courses and 56 online curricular content, learner support and credit recognition modules. With all of Ontario’s publicly assisted colleges and universities as members, Ontario Online will start offering state-of-the-art online courses in the 2015–16 academic year.

“Over its history, the University of Waterloo has been a leader in online education and, through the new Ontario Online initiative, we look forward to using this experience for the benefit of students throughout Ontario.” Feridun Hamdullahpur, President and Vice-Chancellor, University of Waterloo. |

The Province is also continuing to improve the credit transfer system to ensure students do not have to repeat relevant prior learning when moving between postsecondary institutions. Students will know in advance how many credits they can expect to receive before arriving at a new institution.

In partnership with colleges, universities and the Ontario Council on Articulation and Transfer (ONCAT), Ontario has created close to 800,000 transfer opportunities for students from the over 750 pathways now available — more than double the pathways that were offered in 2011.

“Transfer pathway” refers to a defined route from one program or institution to another that clearly sets out eligibility requirements and acceptable credits. |

The bilingual credit transfer website, ONTransfer.ca, was launched to make information on transfer opportunities and institutional transfer processes more publicly accessible. This will make it easier for students to navigate the postsecondary education system, reach their preferred credentials faster, and enter or re‐enter the labour market sooner.

Modernizing Student Financial Assistance

Ontario is helping students with the costs of postsecondary education so that every qualified Ontarian who wants to attend college or university can afford to do so.

Ontario Has Made Postsecondary Education More Affordable ● Provided more than $1.3 billion in grants and loans in 2013‒14 — 70 per cent of this aid was in the form of grants that students do not have to repay. ● Helped almost 230,000 college and university students in 2013‒14 save up to $1,780 in tuition through the 30% Off Ontario Tuition grant. ● Implemented a multi-year tuition framework that caps tuition fee increases at an average of three per cent per year. |

The government is also increasing support for students and modernizing the Ontario Student Assistance Program (OSAP) by:

| › | Indexing the Ontario maximum student aid levels annually to inflation, starting with the 2015–16 school year; |

Ontario is the first province to index maximum student aid levels to inflation. |

| › | Launching the Ontario Student Loan Rehabilitation Program, a new initiative that will allow past borrowers who defaulted on the Ontario portion of their student loan to bring their loan back into good standing through scheduled partial payments; |

| › | Indexing the debt cap — the level above which student loans are forgiven — to inflation, ensuring that OSAP remains sustainable in the long term. Repayable debt will remain at 60 per cent of the maximum amount of financial aid available to students; |

| › | Eliminating the requirement for students to report their vehicle as an asset for OSAP assessment and aligning with the 2014‒15 change in federal treatment of vehicles; and |

| › | Streamlining and simplifying the back-office administration of student loans by funding student loans directly through the Ministry of Training, Colleges and Universities and proposing to terminate the Ontario Student Loan Trust. The process of how students apply for and receive student loans will remain unchanged. |

Strengthening Financial Supports for Students ● In the 2015–16 school year, the Ontario student loan limit increases to $155 per week for single students and $355 per week for students who are married or have dependent children. ● By increasing the Ontario student loan limit with the rate of inflation each year, a student starting a four-year university degree in 2014–15 is eligible to receive about $1,000 more in financial aid over the four years. ● Student debt is capped at no more than $7,400 for a two-term academic year for the 2015–16 school year. |

Matching Skilled Workers to the Right Jobs

Ontario’s workers, employers and training service providers work better when they are working together. Once Ontarians have the right education and skills, they need to find the right job. Employers will also need the right employees to grow, innovate and take advantage of new opportunities.

The Province invests over $1 billion every year in employment and training programs and services through Employment Ontario that serve about one million Ontarians. These programs:

| › | Enable Ontarians to access the supports they need to succeed in today’s job market; |

| › | Deliver relevant skills training; and |

| › | Deliver employment and planning services to individuals and employers. |

Ontario is integrating employment and training programs and services across government. This will improve access and provide job seekers and employers with proven, coordinated and targeted services that meet their needs. The government is continuing to engage stakeholders on the design, development and implementation of new initiatives.

Employment and Training Services Integration The government is consulting on the design and implementation of five priority areas: ● Youth employment programming; ● Common assessment for employment-related needs; ● Pre-employment services; ● Employment supports for people with disabilities; and ● Local Employment Planning Council pilots to address local labour market needs and strengths. |

Canada–Ontario Job Grant

As part of the government’s commitment to create more on-the-job training opportunities, Ontario has placed a renewed focus on programs and services that better meet employers’ needs.

The Canada–Ontario Job Fund Agreement, signed by the governments of Ontario and Canada in March 2014, is a source of funding for employer-driven training initiatives such as the Canada–Ontario Job Grant.

By providing two-thirds of total eligible training costs up to $10,000, with additional flexibility for small employers, the Canada–Ontario Job Grant offers employers the opportunity to invest in their workforce. The new program began accepting employer applications in September 2014.

As part of the Canada–Ontario Job Grant, the Province also introduced two employer-driven skills training pilots. These pilots will investigate new ways of working with employers to provide flexible, short-term training. They include the:

| › | Customized Training pilot to help develop and deliver firm-specific training that meets employers’ workforce development needs; and |

| › | UpSkill pilot to support essential and technical skills training in specific sectors for potentially vulnerable workers in low- and medium-skilled occupations. |

While the Canada–Ontario Job Grant supports those who have a strong attachment to the workforce, there is a critical need for funding to support skills development for the most vulnerable job seekers. Federal collaboration to support skills training does not go far enough — far too many unemployed Ontarians are not eligible for skills training supported through Canada–Ontario labour market agreements. Federal investments in skills training for Canada’s unemployed must be increased. See Chapter III: National Leadership — Strong Ontario, Strong Canada.

Renewing the Ontario Youth Jobs Strategy

Young Ontarians face particular challenges in finding rewarding, permanent jobs. High unemployment has economic consequences for the province today, such as loss of revenue and increased cost of services but, more importantly, it can also lead to negative long-term consequences, such as lower wages and a higher likelihood of future unemployment. The Province has made progress in reducing youth unemployment from a high of 18.6 per cent to its current rate of 14.9 per cent; however, too many young people are still out of work. That is why the Province is renewing its Ontario Youth Jobs Strategy. The Province is working to ensure that every Ontarian is able to find the best employment opportunities that match their skills and passions.

Tackling youth unemployment was a key component of Ontario’s 2013 and 2014 budgets. Since launching the $295 million Ontario Youth Jobs Strategy, the government has made significant progress in advancing youth employment across the province.

Ontario Youth Jobs Strategy — Success Stories ● Having completed one year of a college diploma in interior design, Jenny went to an Employment Ontario service provider in St. Thomas for help obtaining work in her field. Through the Youth Employment Fund, she secured a job at a home decor store where she has been mentored in customer service, business, decorating and design. She is taking her skills to the next level by taking the lead on maintaining the online store and, with the support of her employer through the Canada–Ontario Job Grant, is continuing her diploma studies part time. ● With a Grade 12 education and part-time work experience in retail, Yousif went to an Employment Ontario service provider in Windsor for help finding full-time work. His winning attitude, combined with support from the Youth Employment Fund, helped him land a job at a masonry company, cutting and installing granite and stone finishes. His placement under the program has finished, but his company continues to employ him. |

However, overall youth unemployment remains unacceptably high. That is why the government is renewing the Ontario Youth Jobs Strategy by investing an additional $250 million over the next two years, bringing the total investment in youth employment programming to more than $565 million.

The renewed Strategy will build on successes to date and enhance a comprehensive suite of programs and services that are tailored to the individual needs of youth, including at-risk youth, Aboriginal youth, newcomers and youth with disabilities. The extension of the Strategy will serve up to 150,000 clients and focus on skills development, labour market connections, entrepreneurship and innovation.

Skills Development

Ontario has a world-class education system. However, many youth still lack the specific skills needed to get ahead in today’s competitive job market. Through targeted investments, the government will help enhance the skills of Ontario’s youth by:

| › | Creating Youth Job Connection, an intensive employment support program to help youth who experience multiple barriers to employment; |

The Aboriginal Institutes deliver a wide range of accredited postsecondary programs in partnership with colleges and universities. These institutions also develop curriculum to address the current and future human resource needs of Aboriginal communities. |

| › | Providing an additional $5 million in funding through the Postsecondary Education Fund for Aboriginal Learners (PEFAL) to ensure that high-quality postsecondary education and training remain accessible to Aboriginal youth through the Province’s nine Aboriginal Institutes; and |

| › | Supporting the creation of a Mechatronics Simulation and Demonstration Centre at Seneca College with an investment of $651,000. In partnership with Siemens Canada, the Centre will strengthen Ontario’s manufacturing skills and expertise and also support the modernization and regeneration of industries such as automotive manufacturing, plastics, and building technology province-wide. |

Labour Market Connections

The government recognizes that businesses all over the province are hungry for talent that will help them grow and thrive. That is why the Province is working hard to ensure the best fit between the skills youth have and the skills employers need. This improved alignment will help Ontario’s youth connect to the careers they are interested in and help businesses find the talent they need.

| › | Youth Job Link: For students and youth who do not face significant barriers to employment, access to job search resources and information to help transition to the labour market, including summer employment placement opportunities; and |

| › | Youth Skills Connections Fund: Funding for programs that bridge the gap between postsecondary training programs and the skills that businesses need today. |

Entrepreneurship

Programs under the Ontario Youth Jobs Strategy are based on the principle that Ontario’s economy needs a culture of startups to drive creativity and competitiveness in this new world economy. These programs also lead to measurable spinoff economic activity in regions across the province.

By expanding support to effective initiatives such as the Starter Company program and Summer Company program, the Province will continue to encourage the next generation of entrepreneurs. These programs provide mentorship, specialized training, individualized outreach, and startup capital to young Ontarians who want to start, grow or buy a small business. The government is also expanding its investment in:

| › | Campus-Linked Accelerators that are growing and expanding entrepreneurship programs at universities and colleges across the province. Students are getting the skills, tools, advice and support they need to start a business; and |

| › | On-Campus Entrepreneurship Activities programs that are helping to launch initiatives at universities and colleges across Ontario where they currently do not exist. |

Together, these two programs encourage the next generation of innovators by connecting them to training opportunities and regional business support services. They are giving students the chance to develop their ideas while at school and grow their entrepreneurial skills. The programs have been established at 42 out of the province’s 45 publicly funded postsecondary institutions and have helped create 1,749 companies.

Innovation

Businesses everywhere are seeking to locate in jurisdictions with workers who can drive innovation and productivity through their knowledge and skill. The Ontario Youth Jobs Strategy is designed in part to help Ontario support these workers, starting with young people. The Province is doing this through a number of funding initiatives, including the:

| › | TalentEdge Program, which has produced 328 internships for graduate and postgraduate students. These internships are integral to boosting campus-linked industrial research and development and commercializing the innovative ideas of young researchers; and |

| › | Youth Business Acceleration Program (Youth BAP), which has created 980 jobs by assisting youth-led, innovative companies with mentorship, startup funding and business development training. Thalmic Labs, a company that received Youth BAP services, was founded by three University of Waterloo engineering graduates. It raised $14.5 million in funding and made Forbes’ list of “Hottest Global Startups.” |

● TalentEdge Program provides the opportunity for postsecondary students and postdoctoral fellows to enhance their skills in industrial research, development and commercialization projects and enhance their technical problem-solving skills through joint industry–academia collaborations. ● Youth Business Acceleration Program provides training, mentorship and market intelligence for youth starting “technology enterprises” to help them develop and implement business models and address business challenges, such as marketing, human resources, product/service distribution or legal advice. |

Supporting Ontario’s Skilled Tradespeople

Skilled trades provide rewarding, well-paid work for many Ontarians and are a critical factor to Ontario’s continued prosperity.

The government has demonstrated a strong commitment to Ontario’s apprenticeship system by investing approximately $164.5 million in 2014–15 and by significantly increasing available opportunities since 2002. However, despite these investments, completion rates have remained stagnant, meaning many apprentices are not completing their trade certification. This has a negative impact, primarily on earning and future labour market success, because apprentices who receive certification in a trade receive higher hourly wages than those who do not. That is why Ontario will continue to provide supports for employers, apprenticeships and training institutions to promote access to and completion of apprenticeships, while raising the profile of the skilled trades as a career path on par with other forms of postsecondary education.

Ontario’s Investments Strengthen Its Apprenticeship System ● In 2014‒15, the government invested approximately $164.5 million in Ontario’s apprenticeship system, including: ● Over $146.5 million for 17 programs that offer support to both apprentices and employers; ● Nearly $16 million for colleges and other training delivery agents to make capital upgrades and purchase state-of-the-art equipment essential to the technical training of apprentices; and ● $2 million in loans to apprentices to buy the tools and equipment they need to begin their careers. ● The government is also helping apprentices complete their programs and obtain certification by providing: ● Completion bonuses for both apprentices and employers when training is successfully concluded; and ● Income supports to help apprentices with the costs associated with attending school. ● As a result of the government’s investments and support of the apprenticeship system, new annual apprenticeship registrations have grown from 17,100 in 2002‒03 to more than 28,000 in 2013‒14. |

Ontario will further support the apprenticeship system by:

| › | Investing an additional $13 million over two years for pre-apprenticeship programs; |

| › | Providing $19 million over three years to increase the per diem for apprenticeship classroom training; and |

| › | Investing an additional $23 million over two years in the Apprenticeship Enhancement Fund. |

Pre-Apprenticeship Programs

Programs that reach potential tradespeople early have proven to be highly effective in encouraging successful completion of apprenticeship programs. That is why the government is investing an additional $13 million over two years for pre-apprenticeship programs that help potential entrants to the system develop their job skills and readiness to find work as apprentices, through in-class training sessions and work placements. This additional funding will enrich the learning environment for all students, including those from underrepresented groups, such as women and Aboriginal peoples.

Increasing Per Diem Funding for Classroom Training Seats

One of the key ways that Ontario supports apprentices is by funding in-class training delivered by colleges and other training delivery agents across the province. Funding is provided on a per diem basis, linked to the training requirements of each trade. However, funding levels have not been adjusted since 2008–09, which has led to a decline in the resources available to ensure quality training for students.

The government is addressing this issue by investing more than $19 million over three years, increasing the per diem to $61.36 in 2015‒16 and to $63.09 in 2016‒17 and beyond. This increase will ensure that apprentices continue to receive the highest quality training, through support for equipment upgrades and more opportunities for lab time during their in-school training sessions.

Apprenticeship Enhancement Fund

As part of the Ontario Youth Jobs Strategy, Ontario is supporting young people by investing an additional $23 million over two years in the Apprenticeship Enhancement Fund. This Fund will help colleges and other delivery agents train more people and deliver relevant, high-quality apprenticeship programs by investing in equipment, technologies and space to meet the evolving needs of the workforce.

Ontario College of Trades

Trades play a vital role in Ontario’s infrastructure development and economic growth. In 2009, the Province created the Ontario College of Trades to regulate and promote skilled trades. Then, in October 2014, the government appointed Tony Dean to review issues related to the scope of practice and the process and criteria for the review of the classification of trades as compulsory or voluntary, to support the continued success of the College.

In January 2015, a consultation guide was released and stakeholders, including apprentices, tradespeople, employers, associations and training providers, were invited to provide written submissions. In-person consultations are currently taking place across various regions of the province. The final report will be submitted to the government in October 2015.

Helping Newcomers Integrate Successfully into Their Communities and the Workplace

Immigrants bring new skills to the Ontario economy, build businesses that employ Ontarians and open doors to global markets. Ontario remains the number one destination for newcomers in Canada. Nearly 40 per cent of Canada’s immigrants land in Ontario.