Exhibit 99.13

Treasury Board Secretariat PUBLIC ACCOUNTS OF ONTARIO Annual Report and Consolidated Financial Statements 2015-2016

Treasury Board Secretariat

PUBLIC ACCOUNTS OF ONTARIO

| | |

Annual Report and Consolidated Financial Statements 2015-2016 | |  |

| | | | | | | | |

Treasury Board Secretariat Office of the Minister | | Ministry of Finance Office of the Minister | | Secrétariat du Conseil du

Trésor Bureau du ministre | | Ministère des Finances Bureau du ministre | |

|

| 99 Wellesley Street West | | 7th Floor, Frost Building South | | 99, rue Wellesley Ouest | | 7 étage, Édifice Frost Sud | |

| Room 4320, Whitney Block | | 7 Queen’s Park Crescent | | Édifice Whitney, bureau 4320 | | 7 Queen’s Park Crescent | |

| Toronto, ON M7A 1W3 | | Toronto ON M7A 1Y7 | | Toronto (Ontario) M7A 1W3 | | Toronto ON M7A 1Y7 | |

| Tel.: 416-327-2333 | | Telephone: 416-325-0400 | | Tél. : 416 327-2333 | | Téléphone: 416-325-0400 | |

| Fax: 416-327-3790 | | Facsimile: 416-325-0374 | | Téléc. : 416 327-3790 | | Télécopieur: 416-325-0374 | |

The Honourable Elizabeth Dowdeswell, OC, OOnt

Lieutenant Governor of Ontario

Legislative Building

Queen’s Park

Toronto, ON M7A 1A1

May It Please Your Honour:

The undersigned have the privilege to present the Public Accounts of the Province of Ontario for the fiscal year ended March 31, 2016, in accordance with the requirements of the Financial Administration Act.

Respectfully submitted,

| | |

| Original signed by | | Original signed by |

| |

| The Honourable Liz Sandals | | The Honourable Charles Sousa |

| President of the Treasury Board | | Minister of Finance |

| Toronto, October 2016 | | Toronto, October 2016 |

Contents

| | | | |

Foreword | | | iii | |

Introduction | | | 1 | |

Guide to the Public Accounts | | | 2 | |

Financial Statement Discussion and Analysis | | | 2 | |

The Consolidated Financial Statements | | | 2 | |

Other elements of the Annual Report | | | 4 | |

Supporting volumes | | | 4 | |

Statement of Responsibility | | | 5 | |

| |

FINANCIAL STATEMENT DISCUSSION AND ANALYSIS | | | | |

Highlights | | | 9 | |

Analysis of 2015–16 Results | | | 12 | |

Revenue | | | 12 | |

Expense | | | 17 | |

Statement of Financial Position analysis | | | 23 | |

Infrastructure expenditures | | | 26 | |

Liabilities | | | 27 | |

Risks and risk management | | | 29 | |

Key Financial Ratios | | | 31 | |

Responsible Fiscal Management | | | 34 | |

Non-Financial Activities | | | 37 | |

Health care | | | 37 | |

Education | | | 38 | |

Post-secondary education and training | | | 38 | |

Condition of provincial tangible capital assets | | | 38 | |

Transparency and Accountability | | | 40 | |

Recent developments in public sector accounting standards | | | 40 | |

The C.D. Howe Institute Fiscal Accountability Report | | | 40 | |

Trillium Trust | | | 41 | |

Data visualization | | | 41 | |

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | i | |

| | | | |

CONSOLIDATED FINANCIAL STATEMENTS | | | | |

| |

Auditor’s Report | | | 45 | |

Consolidated Statement of Operations | | | 47 | |

Consolidated Statement of Financial Position | | | 48 | |

Consolidated Statement of Change in Net Debt | | | 49 | |

Consolidated Statement of Change in Accumulated Deficit | | | 50 | |

Consolidated Statement of Cash Flow | | | 51 | |

Notes to the Consolidated Financial Statements | | | 52 | |

Schedules to the Consolidated Financial Statements | | | 87 | |

Glossary | | | 106 | |

Sources of Additional Information | | | 112 | |

| | |

| ii | | Financial Statement Discussion and Analysis, 2015–2016 |

Foreword

Each year, the Province releases the Public Accounts to update Ontarians on our end-of-year financial position. The Annual Report that accompanies the financial statements provides transparency and accountability for the dollars we spend. Ontario is a recognized leader in financial reporting. The C.D. Howe Institute, an independent research organization that focuses on support for economically sound public policy practices, has acknowledged the consistent basis used by Ontario for our Budget, Estimates and Public Accounts as a best practice for supporting transparency and accountability.

I am pleased to present the Public Accounts for the year 2015–16, which confirm that our government’s plan to achieve fiscal balance by 2017–18 is working.

At $5.0 billion, Ontario’s deficit is $3.5 billion lower than projected in the 2015 Budget. This marks the seventh year in a row that Ontario has beaten its deficit target.

When the global economic recession hit, our government made a deliberate choice to invest in our economy and stimulate growth. Since then, Ontario has created almost 600,000 net new jobs and the unemployment rate declined to an eight-year low of 6.4 per cent in July 2016. Ontario’s economy continues to grow and is expected to remain one of the fastest growing in Canada over the next two years.

Although we have made considerable progress since the recession, there is still hard work ahead to eliminate the deficit. Our government will make the tough but necessary decisions needed to ensure our province continues to grow. As President of the Treasury Board, it is my role to lead this effort and to help create a modern and open government — one that is fiscally responsible, uses evidence to track performance and is focused on results.

In the spirit of openness and increased transparency, this year we have created new visualization tools to help Ontarians understand the Province’s finances. To access these new tools, and to see the full Public Accounts online, visit Ontario.ca/publicaccounts.

Making every dollar count

In 2014, we implemented a new fiscal planning and expenditure management approach. Through the Program Review, Renewal, and Transformation (PRRT) process, we are looking across ministries to achieve better value for money.

We have deliberately taken a fair and equitable approach, allowing us to continue to make strategic investments in physical infrastructure such as roads and transit, as well as in social capital through the talents and skills of Ontarians, all while protecting the services on which Ontarians rely.

By prioritizing cross-ministry collaboration in our planning and policy development, we are undertaking major transformation and efficiency initiatives that will help free up resources and allow us to invest in key priorities. This means asking tough questions and making tough choices about services that are not linked to government priorities, serve no clear public interest or fail to achieve their desired outcomes.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | iii | |

For example, transfer payments to organizations including consolidated broader public sector organizations account for approximately 82 per cent of the government’s expenditures. The Transfer Payment Administration Modernization (TPAM) project will streamline government transfers to hospitals, school boards, municipalities, non-profits and all other transfer payment recipients. It will not only improve the way we work with these organizations, but will also make their jobs easier by reducing their administrative burdens. TPAM will also help us get better value for our money by emphasizing data and evidence when making funding decisions.

Making services simpler, faster and easier

Through Ontario’s Digital Government strategy, we are modernizing government for the digital age, using technology to make services simpler, easier and more convenient for people. This work will improve citizens’ online experience with government and deliver better value for public money.

We are also finding innovative ways to support how we drive change across the government. In 2015, we established the Centre of Excellence for Evidence-Based Decision Making. The centre is setting standards for the use of evidence. Its mandate is to build capacity to assess program performance, using evidence to inform choices and lead change in critical public services.

Modern infrastructure and a dynamic business climate

Ontario must build and maintain its infrastructure to remain economically strong and competitive.

The Province is continuing to pursue opportunities to unlock economic value from its assets. Unlocking value from provincial assets is providing resources to invest in new transit and transportation infrastructure, and is helping to expand the economy and improve competitiveness and productivity. In short, it will help to create jobs for Ontarians.

We’re investing more than $137 billion over the next 10 years in public infrastructure such as roads, bridges, public transit, hospitals and schools. This investment builds on previous commitments, resulting in a total of approximately $160 billion in public infrastructure investments over 12 years, starting in 2014–15. This is the largest investment in public infrastructure in the Province’s history. Planned investments will support more than 110,000 jobs, on average, each year.

The government is building the infrastructure that is needed today and tomorrow. These investments will help manage congestion, connect people, and improve the economy and Ontarians’ quality of life.

In addition, our government continues to create a dynamic and innovative business climate. As of August 31, 2016, the 10-year, $2.7 billion Jobs and Prosperity Fund is helping to create and retain more than 22,000 jobs and is attracting more than $2.2 billion in investments. Our government is reducing business costs, keeping tax rates competitive, building strategic partnerships, helping businesses go global, strengthening the financial services sector and investing in training and education.

| | |

| iv | | Financial Statement Discussion and Analysis, 2015–2016 |

We have an ambitious agenda to Build Ontario Up. Our balanced budget plan is vitally important, and Public Accounts is the tool by which we report our progress. Working to eliminate the deficit and taking a balanced and disciplined approach to our fiscal plan over the last three and a half years has allowed us to deliver better services and outcomes to Ontarians, and help people in their everyday lives. We are striving to build a province that is the best place to live, from childhood to retirement — a place where everyone has the opportunity to realize their full potential.

Original signed by

The Honourable Liz Sandals

President of the Treasury Board

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | v | |

| | |

| vi | | Financial Statement Discussion and Analysis, 2015–2016 |

Introduction

The Annual Report is a key element of the Public Accounts of the Province of Ontario and is central to demonstrating the Province’s transparency in reporting its financial activities and position as well as its accountability for financial resources.

This Annual Report presents Ontario’s financial results and position for the year ending March 31, 2016, against the approved 2015 Budget. Specifically, it compares the Province’s actual financial results for the 2015–16 fiscal year to the Budget plan presented in April 2015 and explains major variances.

This year, in addition to providing a comparison of actual to planned results, the Annual Report has been enhanced in several areas to further support transparency and accountability for readers:

| | • | | It expands the comparison of the current year’s results to those of the prior year, and includes analysis of the trends over a five-year period as related to several financial items, including an expanded discussion on balance sheet items. |

| | • | | It provides a description of the Province’s capital assets, reflecting their importance in service delivery and their impact on the Province’s financial condition. |

| | • | | It includes a discussion of key risks that could impact the Province’s financial results. |

As in previous years, the Annual Report sets out and analyzes trends in a number of key financial ratios over the past several years.

The additional discussion and analysis included in this year’s Annual Report will help users of the Consolidated Financial Statements better understand the impacts of economic conditions and government decisions on the Province’s financial results and position.

Producing the Public Accounts of Ontario requires the teamwork and collaboration of many stakeholders across Ontario’s public sector. The Office of the Auditor General plays a critical role in auditing and reporting on the Province’s financial statements, and the Standing Committee on the Public Accounts also plays an important role in providing legislative oversight and guidance. I would like to thank everyone for their contributions.

We welcome your comments on the Public Accounts. Please share your thoughts by email at infoTBS@ontario.ca, or by writing to the Office of the Provincial Controller, Re: Annual Report, Treasury Board Secretariat, Second Floor, Frost Building South, 7 Queen’s Park Crescent, Toronto, Ontario M7A 1Y7.

Original signed by

Nadine Petsche, MBA, CPA, CA

Director, Accounting Policy and Financial Reporting

Treasury Board Secretariat

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 1 | |

Guide to the Public Accounts

The Public Accounts of the Province of Ontario comprise this Annual Report and three supporting volumes.

The Annual Report includes a Financial Statement Discussion and Analysis, the Consolidated Financial Statements of the Province and other supporting schedules and disclosures.

Financial Statement Discussion and Analysis

The first section of the Annual Report is the Financial Statement Discussion and Analysis section, which:

| | • | | Compares the Province’s financial results to both the approved Budget for the year and results for the previous year; |

| | • | | Shows trends in key financial items and indicators of financial condition; |

| | • | | Sets out key potential risks to financial results and explains how the government manages them; |

| | • | | Includes descriptions of various assets and liabilities on the statement of financial position; and |

| | • | | Presents non-financial activities results and discusses important initiatives related to enhancing transparency and accountability. |

The Consolidated Financial Statements

The Consolidated Financial Statements show the Province’s financial position at the end of the previous fiscal year, its financial activities during the reporting period and its financial position at the end of the fiscal year. The statements are linked, and figures that appear in one statement may affect another.

The Province’s financial statements are presented on a consolidated basis, meaning that the Province’s statement of financial position and statement of operations reflect the combination of ministry results as well as financial results for entities that are controlled by the government. Therefore, reported revenues and expenses of the Province can be affected directly by the activities of ministries as well as the performance of controlled entities such as government business enterprises (GBEs) and broader public sector (BPS) organizations such as hospitals, school boards and colleges. In addition, the Province’s results are also affected by transfer payments made to non-consolidated entities, such as municipalities and universities.

| | |

| 2 | | Financial Statement Discussion and Analysis, 2015–2016 |

The financial statements comprise:

| | • | | The Consolidated Statement of Operations, which provides a summary of the government’s revenue for the period less its expenses, and shows whether the government incurred an operating deficit or surplus for the year, in comparison to its approved Budget plan as presented on April 23, 2015, as well as the financial results for the prior fiscal period. The annual surplus/deficit has an impact on the Province’s financial position. |

| | • | | The Consolidated Statement of Financial Position, which reports the Province’s assets and liabilities and is also known as the balance sheet. The Province’s total liabilities include debt and other long-term financing. Financial assets include cash, short-term investments and investment in GBEs. The difference between total liabilities and financial assets is the Province’s net debt, which provides a measure of the future government revenues that will be required to pay for the government’s past transactions. Non-financial assets, mainly tangible capital assets such as highways, bridges and buildings, are subtracted from net debt to arrive at the accumulated deficit. An operating deficit in the year increases the accumulated deficit. |

| | • | | The Consolidated Statement of Change in Net Debt, which shows how the Province’s net debt position changed during the year. The main factors increasing net debt are the annual deficit and additions to tangible capital assets, which increase liabilities. |

| | • | | The Consolidated Statement of Change in Accumulated Deficit, which is a cumulative total of all the Province’s annual deficits and surpluses to date. It is mainly impacted by the annual surplus or deficit in a year. |

| | • | | The Consolidated Statement of Cash Flow, which shows the sources and uses of cash and cash equivalents over the year. Two major sources of cash are revenues and borrowings. Uses of cash include funding for operating costs, investments in capital assets and debt repayment. The statement is presented in what is referred to as the indirect method, meaning that it starts with the annual surplus or deficit and reconciles that to the cash flow from operations by adding or subtracting non-cash items, such as amortization of tangible capital assets. As well, it also shows cash used to acquire tangible capital assets and investments, as well as cash generated from financing activities. |

When reading the Consolidated Financial Statements, it is essential to also read the accompanying notes and schedules, which summarize the Province’s significant accounting policies and give more information on underlying financial activities, market value of investments, contractual obligations and risks. Commentary is also provided on possible future changes to accounting standards.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 3 | |

Other elements of the Annual Report

| | • | | In management’s Statement of Responsibility, the government acknowledges its responsibility for the Consolidated Financial Statements and the Financial Statement Discussion and Analysis. The Statement, which appears on page 5, outlines the accounting policies and practices used in preparing the financial statements and acknowledges the government’s responsibility for financial management systems and controls. |

| | • | | For the 2015–16 Public Accounts, the government legislated the accounting treatment for pension assets of its jointly sponsored pension plans. Note 18 to the Consolidated Financial Statements includes additional information about this change. |

| | • | | The Auditor General’s Report, which appears on page 45, expresses an opinion under the Auditor General Act as to whether the statements present fairly the annual financial results and financial position of the government in accordance with Canadian Public Sector Accounting Standards. |

Supporting volumes

Volume 1 contains ministry statements and detailed schedules of debt and other items. Individual ministry statements compare actual expenses to the amounts appropriated by the Legislative Assembly. Appropriations are made through the Estimates, Supplementary Estimates and annual Supply Act (as modified by any Treasury Board Orders), other statutes and any special warrants. The ministry statements include amounts appropriated to fund certain provincial organizations, including hospitals, school boards and colleges. The financial results of all provincial organizations included in the government reporting entity in accordance with Public Sector Accounting Standards are consolidated with those of the Province to produce the Consolidated Financial Statements in accordance with the accounting policies described in Note 1 to the statements.

Volume 2 contains the individual financial statements of significant provincial corporations, boards and commissions that are part of the government’s reporting entity, as well as other miscellaneous financial statements.

Volume 3 contains the details of payments made by ministries to vendors (including sales tax) and transfer payment recipients that exceed certain thresholds, including payments to suppliers of temporary help services; payments made directly to a supplier by the ministry for employee benefits; travel payments for employees; total payments for grants, subsidies or assistance to persons, businesses, non-commercial institutions and other government bodies; other payments to suppliers of goods and services; and statutory payments.

| | |

| 4 | | Financial Statement Discussion and Analysis, 2015–2016 |

Statement of Responsibility

The Consolidated Financial Statements are prepared by the Government of Ontario in accordance with legislation and the accounting principles for governments recommended by the Public Sector Accounting Board (PSAB) of the Chartered Professional Accountants of Canada (CPA Canada).

The government accepts responsibility for the objectivity and integrity of these Consolidated Financial Statements and the Financial Statement Discussion and Analysis.

The government is also responsible for maintaining systems of financial management and internal control to provide reasonable assurance that transactions recorded in the Consolidated Financial Statements are within statutory authority, assets are properly safeguarded and reliable financial information is available for preparation of these Consolidated Financial Statements.

The Consolidated Financial Statements have been audited by the Auditor General of Ontario in accordance with the Auditor General Act and Canadian Auditing Standards. Her report appears on page 45 of this document.

| | | | |

Original signed by | | Original signed by | | Original signed by |

| Scott Thompson | | Greg Orencsak | | Nadine Petsche |

| Deputy Minister | | Deputy Minister, Treasury | | Director, Accounting |

| Ministry of Finance | | Board Secretariat and | | Policy and Financial |

| | Secretary of Treasury | | Reporting |

| | Board and Management | | Treasury Board |

| | Board of Cabinet | | Secretariat |

| | |

| October 5, 2016 | | October 5, 2016 | | October 5, 2016 |

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 5 | |

| | |

| 6 | | Financial Statement Discussion and Analysis, 2015–2016 |

FINANCIAL STATEMENT DISCUSSION AND ANALYSIS

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 7 | |

| | |

| 8 | | Financial Statement Discussion and Analysis, 2015–2016 |

Highlights

| | |

| 2015–16 Financial Highlights | | Table 1 |

| ($ Billions) | | |

Consolidated Statement of Operations

For the fiscal year ended March 31

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Change from | |

| | | 2015 | | | 2015–16 | | | 2014–15 | | | 2015 | | | 2014–15 | |

| | | Budget | | | Actual | | | Actual | | | Budget | | | Actual | |

Total Revenue | | | 124.4 | | | | 128.4 | | | | 118.5 | | | | 4.0 | | | | 9.8 | |

Expense | | | | | | | | | | | | | | | | | | | | |

Programs | | | 120.5 | | | | 122.4 | | | | 118.2 | | | | 1.9 | | | | 4.2 | |

Interest on debt | | | 11.4 | | | | 11.0 | | | | 10.6 | | | | (0.4 | ) | | | 0.4 | |

| | | | | | | | | | | | | | | | | | | | |

Total Expense | | | 131.9 | | | | 133.4 | | | | 128.8 | | | | 1.5 | | | | 4.6 | |

Reserve | | | 1.0 | | | | — | | | | — | | | | (1.0 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Annual Deficit | | | (8.5 | ) | | | (5.0 | ) | | | (10.3 | ) | | | (3.5 | ) | | | (5.3 | ) |

| | | | | | | | | | | | | | | | | | | | |

Consolidated Statement of Financial Position | | | | | | | | | | | | | | | | | | | | |

As at March 31 | | | | | | | | | | | | | | | | | | | | |

Financial Assets | | | | | | | 83.5 | | | | 82.5 | | | | | | | | 1.0 | |

Liabilities | | | | | | | 388.7 | | | | 367.1 | | | | | | | | 21.6 | |

| | | | | | | | | | | | | | | | | | | | |

Net Debt | | | | | | | (305.2 | ) | | | (284.6 | ) | | | | | | | 20.6 | |

Non-Financial Assets | | | | | | | 102.5 | | | | 97.1 | | | | | | | | 5.4 | |

| | | | | | | | | | | | | | | | | | | | |

Accumulated Deficit | | | | | | | (202.7 | ) | | | (187.5 | ) | | | | | | | 15.2 | |

| | | | | | | | | | | | | | | | | | | | |

Note: Numbers may not add due to rounding. | | | | | | | | | | | | | | | | | | | | |

Comparison to the 2015 Budget plan

The Province of Ontario recorded a deficit of $5.0 billion for the 2015–16 fiscal year, an improvement of $3.5 billion from the $8.5 billion projected in the 2015 Budget plan (see Table 1).

The improvement over plan was due to revenues that were $4.0 billion above forecast, at $128.4 billion. This was largely due to higher-than-expected taxation revenues and net revenues from the first phase of broadening Hydro One ownership.

Despite the challenges stemming from an uncertain global economic setting, Ontario’s economy grew, with real gross domestic product (GDP) increasing by 2.6 per cent in 2015, slightly below the forecast of 2.7 per cent in the 2015 Budget.

Total spending for 2015–16 came in at $133.4 billion, which was $1.5 billion higher than forecast in the 2015 Budget plan. This increase from plan was due mainly to the change in the Province’s accounting treatment for pension assets of jointly sponsored pension plans.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 9 | |

The government identified and acted on a number of initiatives in the 2015 Budget to modernize public services, improve outcomes for Ontarians and support the Province’s fiscal objectives. Savings from these and other initiatives identified through Program Review, Renewal and Transformation (PRRT) are reflected in all of the program expense lines in the 2015–16 results.

Comparison to the 2014–15 fiscal year

Provincial revenues were up $9.8 billion, or 8.3 per cent, from the previous year (see Table 1). This increase was due in part to nominal GDP growth of 3.5 per cent, which contributed to higher taxation revenues. Higher transfers from the federal government, particularly Canada Health Transfer, Canada Social Transfer and Equalization payments, also increased revenues.

Also contributing to year-over-year revenue growth was the completion of the first phase of Hydro One share sales in 2015–16 through an initial public offering (IPO). This transaction and its fiscal impacts are discussed in more detail in “Broadening Hydro One ownership” on page 14.

Year-over-year, total spending rose by $4.6 billion, or 3.5 per cent, going from $128.8 billion to $133.4 billion. Increases in the health care, children’s and social services, and justice sectors, as well as other program areas, accounted for most of the increase. Interest on debt rose by 3.1 per cent, from $10.6 billion to $11.0 billion, reflecting financing costs for the Province’s debt. In addition, the change in the Province’s accounting treatment for pension assets accounted for $1.5 billion of the year-over-year variance.

As a result of stronger relative growth in revenue than in spending, the annual deficit fell from $10.3 billion in 2014–15 to $5.0 billion in 2015–16, reflecting an improvement of 51.2 per cent.

For the 2015-16 Public Accounts, the Province’s opening pension asset balance was adjusted to reflect a legislated change in accounting treatment for pension assets of jointly sponsored pension plans1. As a result, net debt — the difference between the Province’s liabilities and financial assets — grew by $20.6 billion during the year. Excluding the $10.7 billion impact of this change in accounting treatment for pension assets related to jointly sponsored pension plans, total liabilities increased by $10.9 billion which was partially offset by a $1.0 billion increase in financial assets.

The net book value of capital assets such as roads and bridges owned by the Province grew by $5.4 billion during the year, reflecting new capital investments. The accumulated deficit rose by $6.1 billion, mainly as a result of the annual deficit of $5.0 billion and other adjustments.

| 1 | See Note 18 to the Consolidate Financial Statement. |

| | |

| 10 | | Financial Statement Discussion and Analysis, 2015–2016 |

Cash flow during the year was used to fund the annual deficit of $5.0 billion, provide $10.9 billion for investment in capital assets, repay maturing debt of $21.9 billion and cover other cash items. These needs were partially covered with funds borrowed before the end of 2014–15, including pre-borrowing for 2015–16, for a total of $12.4 billion in new financing.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 11 | |

Analysis of 2015–16 Results

| | |

| Details of 2015–16 Actual Results1 | | Table 2 |

| ($ Billions) | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Change from | |

| | | 2015 | | | 2015–16 | | | 2014–15 | | | 2015 | | | 2014–15 | |

| | | Budget | | | Actual | | | Actual | | | Budget | | | Actual | |

Revenue | | | | | | | | | | | | | | | | | | | | |

Taxation | | | 87.4 | | | | 91.8 | | | | 82.3 | | | | 4.4 | | | | 9.5 | |

Government of Canada | | | 22.9 | | | | 22.9 | | | | 21.6 | | | | — | | | | 1.2 | |

Income from government business enterprises | | | 4.8 | | | | 4.9 | | | | 5.6 | | | | 0.1 | | | | (0.7 | ) |

Other non-tax revenue | | | 9.3 | | | | 8.8 | | | | 9.0 | | | | (0.5 | ) | | | (0.2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Revenue | | | 124.4 | | | | 128.4 | | | | 118.5 | | | | 4.0 | | | | 9.8 | |

| | | | | | | | | | | | | | | | | | | | |

Expense | | | | | | | | | | | | | | | | | | | | |

Health sector | | | 50.8 | | | | 51.1 | | | | 50.0 | | | | 0.3 | | | | 1.1 | |

Education sector2 | | | 25.2 | | | | 25.0 | | | | 24.6 | | | | (0.2 | ) | | | 0.4 | |

Post-secondary and training sector | | | 7.8 | | | | 7.6 | | | | 7.7 | | | | (0.2 | ) | | | (0.1 | ) |

Children’s and social services sector | | | 15.4 | | | | 15.6 | | | | 14.7 | | | | 0.1 | | | | 0.9 | |

Justice | | | 4.4 | | | | 4.5 | | | | 4.3 | | | | 0.1 | | | | 0.2 | |

Other programs3 | | | 16.8 | | | | 18.6 | | | | 16.9 | | | | 1.8 | | | | 1.7 | |

| | | | | | | | | | | | | | | | | | | | |

Total Program Expense | | | 120.5 | | | | 122.4 | | | | 118.2 | | | | 1.9 | | | | 4.2 | |

Interest on debt | | | 11.4 | | | | 11.0 | | | | 10.6 | | | | (0.4 | ) | | | 0.4 | |

| | | | | | | | | | | | | | | | | | | | |

Total Expense | | | 131.9 | | | | 133.4 | | | | 128.8 | | | | 1.5 | | | | 4.6 | |

| | | | | | | | | | | | | | | | | | | | |

Reserve | | | 1.0 | | | | — | | | | — | | | | (1.0 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Annual Deficit | | | (8.5 | ) | | | (5.0 | ) | | | (10.3 | ) | | | (3.5 | ) | | | (5.3 | ) |

| | | | | | | | | | | | | | | | | | | | |

Notes:

| 1 | Numbers may not add due to rounding. |

| 2 | Teachers’ Pension Plan expense is included in Other programs. In the Consolidated Financial Statements, this expense item appears under the Ministry of Education. Schedule 4 to the financial statements provides details. |

| 3 | The 2015 Budget included a Program Review Savings Target of $490 million and Year End Savings of $1.0 billion. |

Revenue

Comparison to the 2015 Budget plan

In the 2015 calendar year, Ontario’s real GDP grew by a solid 2.6 per cent, driven by a boost from exports, business investments and sustained growth in household spending. Growth was very close to the 2.7 per cent forecast in the 2015 Budget.

The robust growth was supported by solid economic expansion in the United States and favourable shifts in key external factors, including reduced oil prices, a more competitive Canadian dollar and low interest rates.

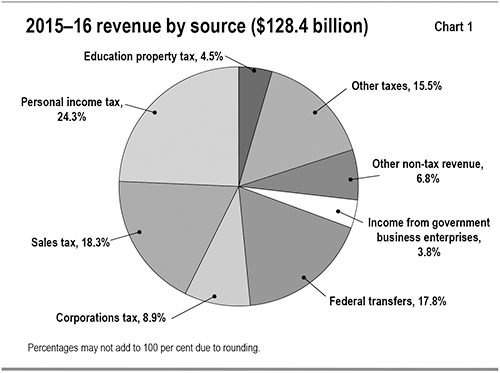

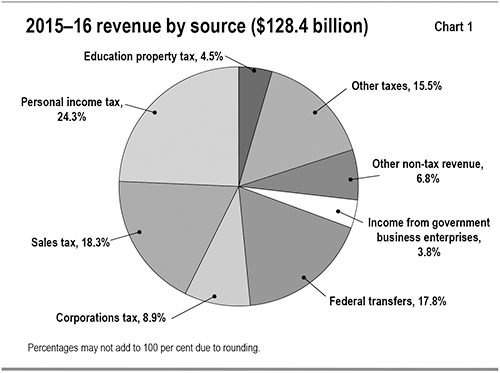

Revenues for 2015–16 came in at $128.4 billion, or 3.2 per cent higher than forecast in the 2015 Budget. See Chart 1 for a breakdown of revenues by source.

| | |

| 12 | | Financial Statement Discussion and Analysis, 2015–2016 |

Excluding the impacts of the sale of Hydro One shares, as discussed on page 14:

| | • | | Taxation revenues were $1.7 billion, or 2.0 per cent higher than projected in the 2015 Budget. Personal income tax revenues were $0.8 billion higher, reflecting stronger-than-projected 2015 tax assessments. The strong housing market in 2015 contributed to a $0.8 billion increase in combined sales tax and land transfer tax revenues. |

| | • | | Income from GBEs was $0.6 billion higher, reflecting higher-than-projected returns from Ontario Power Generation Inc., the Ontario Lottery and Gaming Corporation and the Liquor Control Board of Ontario. |

| | • | | Other non-tax revenues were $0.3 billion higher on a net basis, mainly reflecting higher recoveries of prior year expenditures and higher fiscally neutral Power Supply Contract Recoveries. |

Another factor was an increase from plan of $1.5 billion in net revenues arising from the completion of the first phase of broadening Hydro One ownership.

Transfers from the Government of Canada were close to the 2015 Budget estimate.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 13 | |

Comparison to prior year and earlier years

Total revenues were up $9.8 billion, or 8.3 per cent, from the previous year.

Excluding the impacts of the sale of Hydro One shares, as discussed below:

| | • | | Taxation revenues grew by $6.8 billion, or 8.3 per cent, reflecting economic growth, including a strong 2015 housing market. Prior year adjustments that lowered 2014–15 corporations tax revenues and boosted 2015–16 Harmonized Sales Tax (HST) revenues also contributed to stronger year-over-year growth. |

| | • | | Net income from GBEs declined in 2015–16 by $0.2 billion, mainly due to lower net income from Ontario Power Generation after a one-time gain from 2014–15. This was partially offset by higher net income growth from the Ontario Lottery and Gaming Corporation and the Liquor Control Board of Ontario. |

Higher net revenues from asset optimization arising from the first phase of broadening Hydro One ownership accounted for $2.0 billion of the increase in Provincial revenues.

Higher transfers under the Canada Health Transfer, Canada Social Transfer and Equalization programs accounted for most of the $1.2 billion year-over-year increase in Government of Canada transfers.

Broadening Hydro One ownership

In November 2015, the Province completed the first phase of its plan to broaden Hydro One ownership. It sold approximately 16 per cent of the Province’s outstanding Hydro One common shares at a price of $20.50 per share through an IPO and through related share sales to electricity sector union trusts. As a result, as at March 31, 2016, the Province owned about 84 per cent of the outstanding common shares in Hydro One.

The Province reported a gain of $0.8 billion from the sale of Hydro One shares as well as a deferred gain of $48 million in connection with sales to electricity sector union trusts.

The Hydro One IPO had additional impacts. Prior to the IPO, Hydro One was exempt from taxation under the federal Income Tax Act and the provincial Taxation Act, 2007, and instead made payments in lieu of corporate taxes (corporate PILs) to the Province.

Hydro One’s tax-exempt status ended as a result of the IPO, and it exited the corporate PILs regime to become subject to federal and provincial taxes. Immediately before that occurred, the entity was deemed to have disposed of its assets for proceeds equal to the assets’ fair market value.

| | |

| 14 | | Financial Statement Discussion and Analysis, 2015–2016 |

As a result of this deemed disposition, before exiting the corporate PILs regime Hydro One had to make a payment to the Province through the Ontario Electricity Financial Corporation under the Electricity Act, 1998, related to the income and capital gains arising from the difference between the assets’ fair value and tax value. This one-time payment to the Province, referred to as the departure tax, was $2.6 billion. Hydro One also paid the Province $0.2 billion in additional corporate PILs in connection with leaving the corporate PILs regime.

These one-time payments did not affect the Province’s annual deficit, as the additional revenue was offset by an equal reduction in Hydro One’s net income, which is consolidated in the Province’s financial statements. The Province continues to consolidate Hydro One according to its proportionate share ownership.

Hydro One is now subject to corporate income taxes. The transition into the corporate income tax regime also resulted in Hydro One recognizing a deferred tax recovery based on the fair market value of its assets that increased the Province’s reported revenues by $2.4 billion. The deferred tax asset reflects the fact that cash taxes payable by Hydro One, including those payable to the Province, will be reduced for some period into the future.

Under the Trillium Trust Act, 2014, net revenue gains from the disposition of Hydro One shares are allocated to the Trillium Trust. See “Transparency and Accountability” on page 40, and Volume 1 of the Public Accounts for more details.

Revenue trend

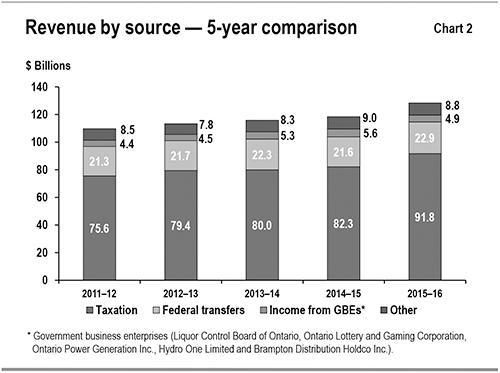

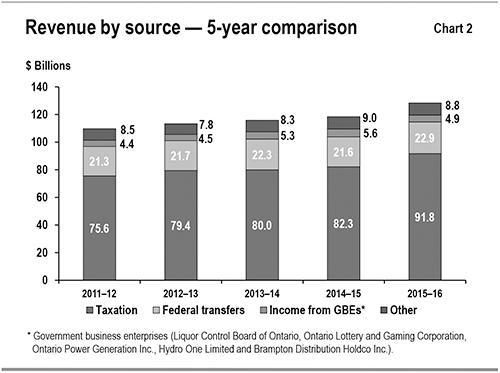

Chart 2 shows the recent trends in revenue for the Province’s major revenue sources.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 15 | |

Taxation revenue

Between 2011–12 and 2015–16, taxation revenue grew at an annual average rate of 5.0 per cent, higher than the average annual nominal GDP growth of 3.2 per cent over the same period.

Although economic growth and increases in taxation revenue are clearly linked, the relationship is affected by several factors. Growth in some revenue sources, such as corporations tax and mining tax, can diverge significantly from economic growth in any given year, due to the inherent volatility of business profits as well as the use of tax provisions such as the option to carry losses forward or backward. The impact of housing completions and re-sales on HST and Land Transfer Tax revenue is proportionately greater than their contribution to GDP. As well, changes in such sources as volume-based gasoline and fuel taxes are more closely aligned to growth in real as opposed to nominal GDP, as these revenue sources are less influenced by price changes.

Much of the rising trend in taxation revenues between 2011–12 and 2015–16 reflects a growing economy and the impact of tax measures, as well as measures aimed at tax fairness and addressing the underground economy.

Other taxation revenues increased significantly in 2015–16 compared to the prior year. The increase largely reflects one-time payments in lieu of taxes from Hydro One associated with the Hydro One IPO. This transition resulted in a one-time $2.6 billion departure tax payment, in addition to $0.2 billion in one-time payments in lieu of taxes from Hydro One to the Province. These one-time payments were revenue neutral to the Province, as they also reduced the Province’s revenues from Hydro One’s net income by an equal amount. The Province’s relative share of Hydro One’s net income is reported in the Consolidated Financial Statements as income from GBEs.

Federal government transfers

Government of Canada transfers are based on existing federal–provincial funding arrangements and formulas. These include major federal transfer programs such as the Canada Health Transfer, Canada Social Transfer and Equalization programs, as well as transfers for social housing, infrastructure and labour market programs. There are also a number of smaller federal transfers to the Province, which are largely program-specific. Some transfers are ongoing, while others are time-limited.

Between 2011–12 and 2015–16, Government of Canada transfers grew at an annual average rate of 1.8 per cent. Higher entitlements under the Canada Health Transfer, Canada Social Transfer and Equalization payments were partially offset by several time-limited transfers that wound down over that time period.

| | |

| 16 | | Financial Statement Discussion and Analysis, 2015–2016 |

Income from government business enterprises

Revenues for the Province include the net income of five GBEs: the Ontario Lottery and Gaming Corporation, the Liquor Control Board of Ontario, Ontario Power Generation Inc., Hydro One Limited and Brampton Distribution Holdco Inc. (Before August 31, 2015, Hydro One Brampton Networks Inc., a subsidiary of Brampton Distribution Holdco Inc., was a subsidiary of Hydro One and its results were included in those of Hydro One on the Province’s financial reports.)

After growing between 2011–12 and 2014–15, net income from GBEs declined in 2015–16. This was mainly due to the impact on Hydro One’s net income from the one-time, final payments in lieu of taxes to the Province triggered by the Hydro One IPO.

Other non-tax revenues

Other non-tax revenues arise from a number of sources, including vehicle and driver registration fees; sales and rentals of goods and services; other fees, licences and permits; reimbursements of provincial expenditures in delivering certain services; royalties for the use of Crown resources; and such revenue sources from the electricity sector as the Debt Retirement Charge, Power Supply Contract Recoveries and Net Reduction of Power Purchase Contract Liability.

Other non-tax revenues grew moderately, at an annual average rate of 1.0 per cent, between 2011–12 and 2015–16. Two major factors were responsible for most of the growth in revenues:

| | • | | Increases in licensing and vehicle validation fees to maintain and expand provincial roads and highways; and |

| | • | | The Province’s asset-optimization strategy, particularly the gain on the sale and redemption of General Motors shares in 2013–14 and 2014–15 and the gain on the sale of Hydro One common shares in 2015–16. |

These gains were partially offset by lower non-tax revenues from the electricity sector.

Expense

Comparison to the 2015 Budget plan

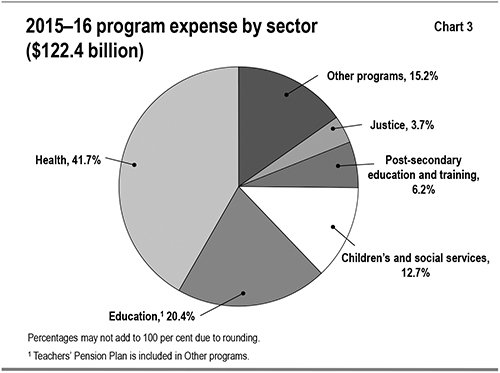

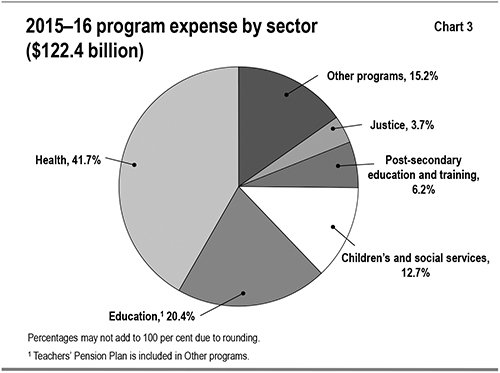

Total expense in 2015–16 was $133.4 billion, which was higher than forecast in the 2015 Budget plan. Program spending was $122.4 billion, up $1.9 billion from a planned spending of $120.5 billion. Spending in the health, children’s and social services, and justice sectors, as well as in other programs, was higher than planned (see Table 2). See Chart 3 for a breakdown of program expense by sector.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 17 | |

Total program spending was $1.9 billion higher than the Budget plan, resulting in actual program expense of $122.4 billion. The increases were attributable to:

| | • | | Health sector expense that was $294 million, or about 0.6 per cent, above plan. Higher spending resulted from increased drug costs as well as higher hospital sector expense, which was partially offset by underspending in agencies. |

| | • | | Children’s and social services sector expense that was $124 million higher than planned, due mainly to additional spending to address demand for the Ontario Disability Support Program, and the cost of prescription drugs for social assistance recipients. |

| | • | | Justice sector expense increases of $120 million, mainly due to settlements under the Proceedings Against the Crown Act and higher-than-expected bad debt provisions related to unpaid fines. |

| | • | | Other programs expense was $1.8 billion higher than expected, mainly due to a change in the accounting treatment for pension assets of jointly sponsored pension plans, higher-than-anticipated expense for the Ontario Production Services Tax Credit and costs related to the Hydro One IPO. |

Increases in these sectors and programs were partially offset by:

| | • | | Education sector expense that was $233 million lower than expected, due in part to a higher share of funding spent on capital projects that are capitalized and amortized instead of expensed, higher-than-forecasted revenues from education development charges and slightly lower-than-projected enrolment. |

| | |

| 18 | | Financial Statement Discussion and Analysis, 2015–2016 |

| | • | | Post-secondary and training sector expense that was $176 million lower than expected, mainly due to lower spending on post-secondary operating grants and lower student financial assistance as a result of lower-than-forecast enrolment. As well, spending on employment and training programs was below plan, partially offset by higher expense on tax credits to employers to support training. |

As noted in the footnote to Table 2, the 2015 Budget included two savings targets that together totalled $1.49 billion as part of other programs expense. Ministries achieved $1.1 billion in savings against these targets which were reallocated to the ministries that achieved savings — notably in both the education and post-secondary and training sectors, as highlighted above. Program expense was $1.9 billion higher than planned as a result of $0.4 billion higher ministry spending and the impact of the change in accounting treatment for pension assets in jointly sponsored pension plans, which increased other program expense by $1.5 billion for the year.

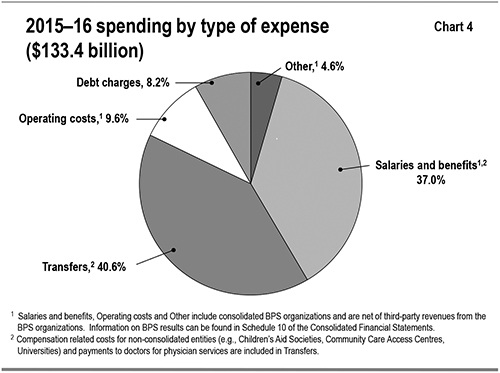

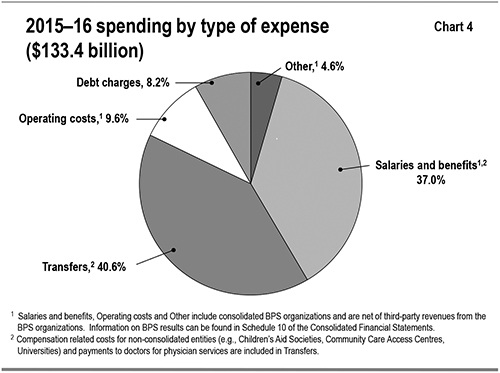

Chart 4 shows spending by type of expense instead of spending by sector. A significant share of government spending goes directly to salaries and benefits across ministries in the Ontario Public Service and BPS organizations, including hospitals, school boards and colleges that are consolidated in its accounts. Note that the share labelled “Transfers” in Chart 4 includes payments to doctors for physician services, but does not include transfers to consolidated BPS organizations; these are reflected in the other expense types.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 19 | |

The transfers category reflects payments to a variety of third parties, mainly in the public sector, to support the delivery of public services. These third parties include, for example, child care providers, social service agencies and health care professionals. As service providers, a large share of the spending of these third parties typically goes to salaries and benefits.

Comparison to prior year and earlier years

Year-over-year, program spending grew by 3.6 per cent in 2015–16.

Health care represents the largest share of government program spending. Transformation efforts to make the sector more effective and sustainable are vital to managing overall spending growth and to achieving better outcomes for patients in a better integrated system. These continuing efforts moderated the year-over-year growth in health sector spending to 2.1 per cent in 2015–16. Prior to this transformation, the sector had been experiencing an average annual growth rate of over 6.0 per cent.

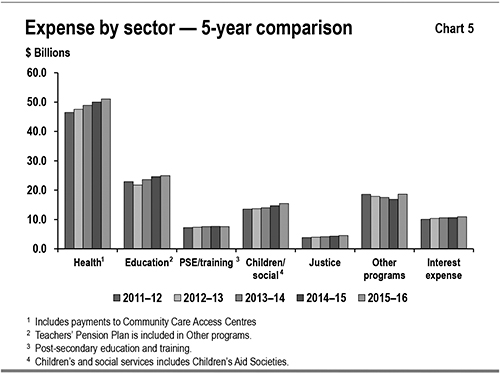

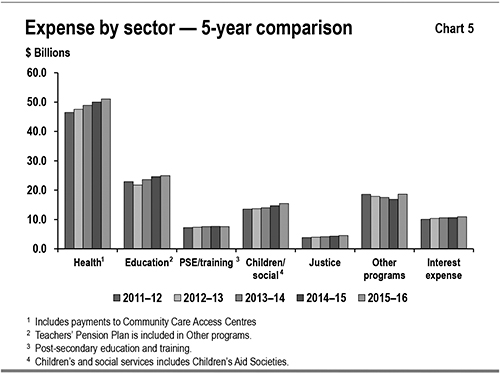

Chart 5 shows the recent trends in spending for major program areas.

| | • | | Health sector expense increased from $46.5 billion in 2011–12 to $51.1 billion in 2015–16, or on average by 2.4 per cent per year between 2011–12 and 2015–16. These increases are due in part to increasing demands for health care services from an aging and growing population, along with other factors. Increases also include new investments in home and community care as well as specialized services such as cancer care. Expense increases in the health sector have been moderated by ongoing transformation of the sector to focus on patients while reducing costs such as the prices of generic prescription drugs. |

| | |

| 20 | | Financial Statement Discussion and Analysis, 2015–2016 |

| | • | | Education sector expense increased from $22.9 billion in 2011–12 to $25.0 billion in 2015–16, or on average by 2.2 per cent per year between 2011–12 and 2015–16. The increase is mainly due to the introduction of full-day kindergarten, which has been made available to every four- and five-year-old in Ontario since September 2014. Expense was lower in 2012–13 due to the impact of $1.3 billion in one-time savings from reducing liabilities carried by school boards for sick-day banking and retirement gratuities. |

| | • | | Post-secondary education and training sector expense increased from $7.3 billion in 2011–12 to $7.6 billion in 2015–16, or on average by 1.3 per cent per year between 2011–12 and 2015–16. The increase is mainly due to continued funding to support enrolment growth in post-secondary institutions, growth in student financial assistance programs and support for employment and training programs. |

| | • | | Children’s and social services sector expense increased from $13.5 billion in 2011–12 to $15.6 billion in 2015–16, or on average by 3.5 per cent per year between 2011–12 and 2015–16. This increase reflects annual social assistance rate increases, caseload growth in the Ontario Disability Support Program and investments in developmental services and the Ontario Child Benefit. |

| | • | | Justice sector expense increased from $3.9 billion in 2011–12 to $4.5 billion in 2015–16, or on average by 4.1 per cent per year between 2011–12 and 2015–16. These increases are mainly due to the provincial upload of court security costs from municipalities, costs incurred mainly in 2015–16 for the security services for the 2015 Pan/Parapan American Games and improved access to legal aid for low-income Ontarians. |

| | • | | Other programs expense was $18.6 billion in 2015–16, including a $1.5 billion increase in pension expense. This brought other programs expense back to about where it was in 2011–12. Excluding the increase in pension expense, other programs expense for 2015–16 would have been $17.1 billion, contributing to an average decrease of 2.0 per cent per year between 2011–12 and 2015–16. |

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 21 | |

Interest costs

Interest on debt expense was $0.4 billion below plan in 2015–16, as a result mainly of lower-than-forecast interest rates, the lower-than-planned deficit and cost-effective borrowing and debt management.

Interest expense grew from $10.6 billion in 2014–15 to $11.0 billion in 2015–16 (see Table 2).

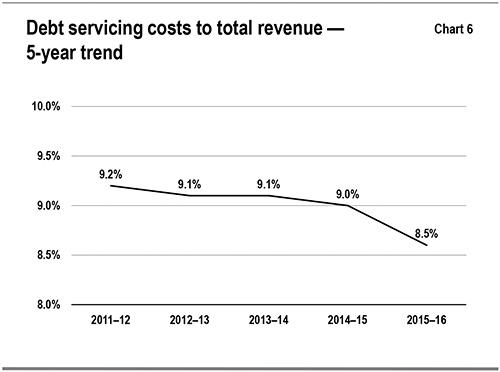

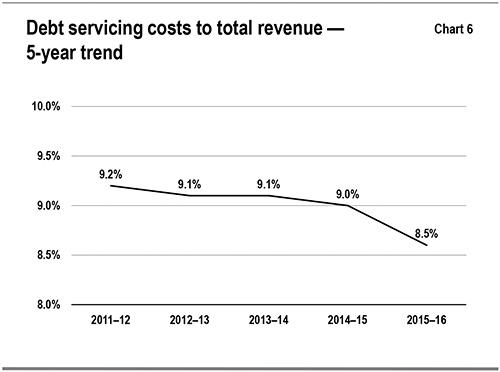

Between 2011–12 and 2015–16, interest expense has trended upward, reflecting higher borrowings required to fund the deficit and investments in infrastructure. Chart 6 shows that although interest costs have grown in absolute terms, they have steadily fallen as a percentage of the Province’s revenues. The interest on debt-to-revenue ratio is now at its lowest level since 1990–91. This is mainly due to historically low interest rates, coupled with cost-effective debt management.

| | |

| 22 | | Financial Statement Discussion and Analysis, 2015–2016 |

Statement of Financial Position analysis

Financial assets

| | | | |

| Financial Assets | | | Table 3 | |

($ Billions) | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2015–16

Actual | | | % of Total | | | 2014–15

Actual | | | % of Total | | | Variance

Increase

(Decrease) | |

Cash and cash equivalents | | | 13.6 | | | | 16.3 | % | | | 15.2 | | | | 18.4 | % | | | (1.6 | ) |

Investments | | | 21.8 | | | | 26.1 | % | | | 20.4 | | | | 24.7 | % | | | 1.4 | |

Accounts receivable | | | 11.1 | | | | 13.3 | % | | | 10.3 | | | | 12.5 | % | | | 0.8 | |

Loans receivable | | | 11.5 | | | | 13.8 | % | | | 11.1 | | | | 13.5 | % | | | 0.4 | |

Other assets | | | 1.9 | | | | 2.3 | % | | | 2.0 | | | | 2.4 | % | | | (0.1 | ) |

Investment in government business enterprises | | | 23.6 | | | | 28.2 | % | | | 23.5 | | | | 28.5 | % | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | | |

Total Financial Assets | | | 83.5 | | | | 100.0 | % | | | 82.5 | | | | 100.0 | % | | | 1.0 | |

| | | | | | | | | | | | | | | | | | | | |

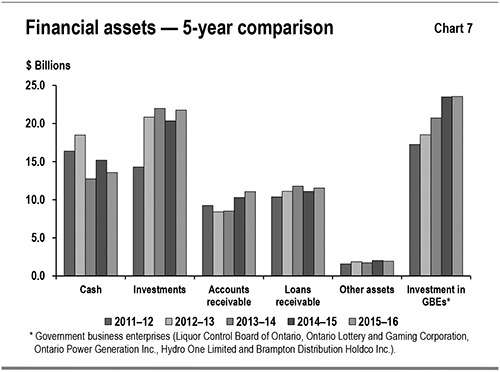

Financial assets consist of items such as cash and cash equivalents, and investments that are available to the Province to meet its expenditure needs; accounts and loans receivable, which are amounts it expects to receive from third parties; and other items, including investment in GBEs.

The Province’s financial assets increased by $1.0 billion in 2015–16 over the prior year to $83.5 billion. This increase was mainly due to a $1.4 billion increase in investments and a $0.8 billion increase in accounts receivable, which was offset by a $1.6 billion decrease in cash and cash equivalents (see Table 3):

| | • | | Investments went up by $1.4 billion, mainly due to the pre-borrowing at year-end for 2016–17 spending requirements. |

| | • | | Accounts receivable, which shows amounts owing to the Province by third parties, increased by $0.8 billion, mainly due to an increase in tax receivable at year-end. |

| | • | | Cash and cash equivalents, which are financial instruments that can be easily converted to cash, decreased by $1.6 billion as a result of operating, investing, capital and financing activities. |

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 23 | |

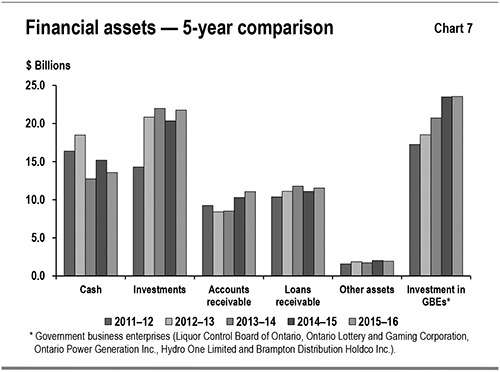

Chart 7 shows the recent trends in financial assets for the Province.

The five-year trend shows a steady gain in investment in GBEs from 2011–12 to 2014–15, reflecting an increase in net assets reported for these entities. The same upward trend did not continue in 2015–16, mainly due to the Province’s decreased ownership interest in Hydro One.

The level of other financial assets, including cash, accounts receivable and investments, tends to be more variable, since these assets often reflect specific circumstances at year-end, such as pre-borrowing for the following period’s needs.

Tangible capital assets

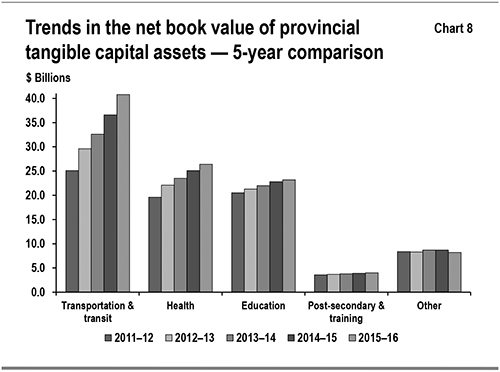

The government is responsible for a large portfolio of non-financial assets, which is almost entirely made up of tangible capital assets.

Tangible capital assets owned by the Province and its consolidated entities represent the largest component of the Province’s infrastructure investments. These assets include those it owns directly, such as provincial highways, as well as the assets of school boards, hospitals, colleges and agencies that are consolidated in its financial statements. The assets of GBEs are reflected in the Province’s statement of financial position as an investment in government business enterprises.

| | |

| 24 | | Financial Statement Discussion and Analysis, 2015–2016 |

The reported net book value of Ontario’s tangible capital assets exceeded $102.5 billion in 2015–16, increasing by $5.4 billion over the prior year. Buildings, including schools, hospitals and college facilities, made up the single largest share, at $53.4 billion. The total also includes assets under construction, whether these are being built using the Alternative Financing Procurement (AFP) model, which the private sector finances during construction, or by other means. The balance sheet includes AFP assets under construction in accordance with the Province’s accounting policy. The impacts of AFPs on balance sheet liabilities are discussed in “Other long-term financing” on page 28.

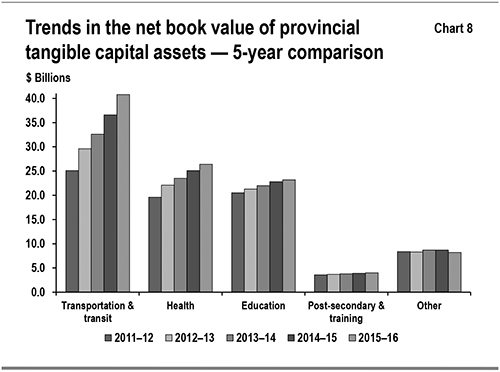

Growth in the net book value of capital assets has averaged 7.4 per cent annually over the past five years. Most of the growth has been in new and renewed buildings and in transportation infrastructure, including provincial highways, bridges and the transit network owned by Metrolinx, an agency of the Government of Ontario. See Chart 8 for the recent trends in provincial tangible capital assets.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 25 | |

Infrastructure expenditures

One of the goals of investing in capital is to improve the economic growth of the province. A 2015 report from The Centre for Spatial Economics, entitled The Economic Benefits of Public Infrastructure Spending in Canada, found that, on average, investing $1.00 in public infrastructure in Canada raises GDP by $1.43 in the short term and up to $3.83 in the long term. The full report is available at www.broadbentinstitute.ca/infrastructure.

The Province’s infrastructure spending in 2015–16 was $12.8 billion (see Table 4). This included $10.4 billion invested in assets owned by the Province and its consolidated entities, as discussed in “Tangible capital assets” on page 24 and $2.4 billion provided to non-consolidated partners such as universities and municipalities, and other infrastructure expenditures. The total was slightly less than the $13.9 billion set out in the 2015 Budget plan because of lower-than-forecast construction activity for the period.

| | |

| Infrastructure expenditures, 2015–161 | | Table 4 |

| ($ Billions) | | |

| | | | | | | | | | | | |

Sector | | Investment in Capital

Assets2 | | | Transfers and Other

Infrastructure

Expenditures3 | | | Total Infrastructure

Expenditures | |

Transportation and transit | | | 5.7 | | | | 0.6 | | | | 6.3 | |

Health | | | 2.8 | | | | 0.4 | | | | 3.2 | |

Education | | | 1.5 | | | | 0.0 | | | | 1.6 | |

Post-secondary and training | | | 0.4 | | | | 0.2 | | | | 0.6 | |

Other sectors4 | | | (0.1 | ) | | | 1.1 | | | | 1.0 | |

| | | | | | | | | | | | |

Totals5 | | | 10.4 | | | | 2.4 | | | | 12.8 | |

| | | | | | | | | | | | |

Notes:

| | 1 | Numbers may not add due to rounding. |

| | 2 | Includes adjustments for the net book value of assets disposed during the year, as well as changes in valuation. |

| | 3 | Mainly transfers for capital purposes to municipalities and universities and expenditure for capital repairs. Transfers for capital-related purposes and other infrastructure expenditures are recorded as expenses in the Province’s Consolidated Statement of Operations. |

| | 4 | Includes government administration, natural resources, and culture and tourism sectors. A negative investment in capital assets is due to the transfer of Pan/Parapan American Games assets to third parties. |

| | 5 | Includes third-party investments in consolidated entities such as hospitals, colleges and schools. |

| | |

| 26 | | Financial Statement Discussion and Analysis, 2015–2016 |

Liabilities

The Province’s liabilities consist of debt and other financial obligations, including accounts payable, funds it has received from the federal government but not yet spent and the estimated cost of future payments, including net pension liabilities, owing to current and former employees (see Table 5).

| | |

| Liabilities | | Table 5 |

| ($ Billions) | | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2015–16

Actual | | | % of

Total | | | 2014–15

Actual | | | % of

Total | | | Variance

Increase

(Decrease) | |

Accounts payable and accrued liabilities | | | 19.4 | | | | 5.0 | % | | | 20.1 | | | | 5.5 | % | | | (0.7 | ) |

Debt | | | 327.4 | | | | 84.2 | % | | | 315.0 | | | | 85.8 | % | | | 12.4 | |

Other long-term financing | | | 14.1 | | | | 3.6 | % | | | 13.9 | | | | 3.8 | % | | | 0.2 | |

Deferred revenue and capital contributions | | | 10.8 | | | | 2.8 | % | | | 10.1 | | | | 2.8 | % | | | 0.7 | |

Pensions and other employee future benefits liability | | | 12.1 | | | | 3.1 | % | | | 3.2 | | | | 0.9 | % | | | 9.0 | |

Other liabilities | | | 4.9 | | | | 1.3 | % | | | 4.9 | | | | 1.3 | % | | | 0.0 | |

| | | | | | | | | | | | | | | | | | | | |

Total Liabilities | | | 388.7 | | | | 100.0 | % | | | 367.1 | | | | 100.0 | % | | | 21.6 | |

| | | | | | | | | | | | | | | | | | | | |

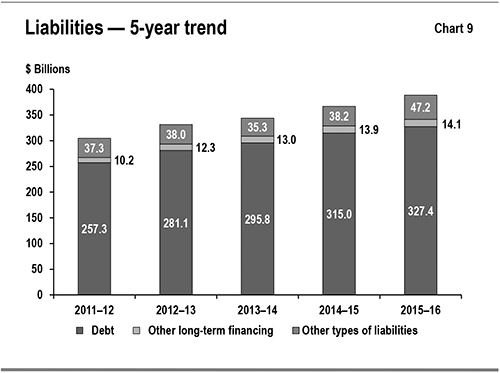

Debt

Debt and other long-term financing make up the largest share of liabilities. Debt grew by $12.4 billion in 2015–16 to $327.4 billion by year-end, primarily to finance the operating deficit and to invest in infrastructure. The change in Province’s accounting treatment for pensions, while increasing net debt, had no impact on the Province’s borrowing requirements. Hence total debt remained unchanged by this adjustment.

Net debt as at March 31, 2016, was $305.2 billion, $6.3 billion higher than forecast in the 2015 Budget. Table 6 summarizes how the Province used its net new financing in 2015–16.

| | |

| Use of new financing by the Province, 2015–16 | | Table 6 |

| ($ Billions) | | |

| | | | |

Operating deficit and other transactions1 | | | 1.4 | |

Cash invested in capital assets owned by the Province and its consolidated organizations,including hospitals, school boards and colleges2 | | | 10.7 | |

Increase in the Province’s cash and investments | | | 0.5 | |

| | | | |

| | | 12.6 | |

Increase in other long-term financing3 | | | (0.2 | ) |

| | | | |

Net new financing | | | 12.4 | |

| | | | |

| 1 | The Province’s operating deficit of $5.0 billion was offset by a net $3.6 billion in changes to assets and liabilities that provided cash for operating purposes. See the Consolidated Statement of Cash Flow. |

| 2 | New investments of $10.9 billion less proceeds of $0.2 billion from the sale of tangible capital assets. |

| 3 | Including net increase in financing of capital projects through AFP. See Note 4 to the Consolidated Financial Statements. |

The government completed an annual borrowing program of $32.1 billion in 2015–16. This yielded net new financing of $12.4 billion after adjustments and repayment of $21.9 billion in existing debt that matured.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 27 | |

Other long-term financing

This category includes debt incurred to finance construction for public assets, including those procured through the AFP model and other means. All assets that are owned by the Province and its consolidated entities, and the associated financing liabilities, are reflected on the Province’s balance sheet as the assets are constructed and the liabilities incurred. For information on asset investments, refer to “Tangible capital assets” on page 24.

Other types of liabilities

Other types of liabilities include accounts payable, pensions and other employee future benefits, transfers received from the federal government representing deferred revenues, and other liabilities. This category increased by $9.0 billion in 2015–16 over the prior year, mainly due to an adjustment to the opening pension asset balance.

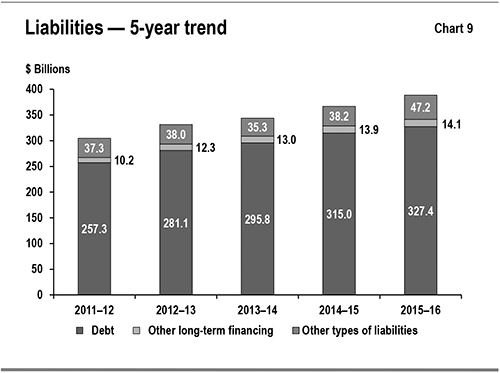

Chart 9 shows the recent trends in liabilities for the Province. This trend over the period between 2011–12 and 2015–16 shows public debt rising, mainly to fund capital investments and the annual deficit, as well as the impact in 2015-16 of the change in accounting treatment for pension assets of jointly sponsored pension plans. The upward trend in other long-term financing indicates increased capital related activities through AFPs. Other types of liabilities, including accounts payable and deferred revenue, tend to be more variable, since they often reflect specific circumstances at year-end, such as accrued liabilities for goods and services.

| | |

| 28 | | Financial Statement Discussion and Analysis, 2015–2016 |

Risks and risk management

The Province’s financial results and financial reporting are subject to risks and uncertainties over which the government has limited or no control. These include:

| | • | | Actual economic and/or revenue growth that differs from forecast; |

| | • | | Significant changes in financial statement items, especially taxation revenues, arising from actual results that differ from accounting estimates; |

| | • | | Unforeseen changes in transfer payments from the federal government; |

| | • | | Demand for entitlement-based public services or a change in other expense, including pension expense, that reflects actual experience that is significantly different than forecast; |

| | • | | Unusual weather patterns, extreme weather events and natural disasters with major financial impacts; |

| | • | | Security breaches or other malicious behaviour that could interrupt services, result in loss of information, compromise privacy and/or damage equipment or facilities; |

| | • | | The outcomes of legal settlements, arbitration and negotiations, and possible defaults on projects and potential defaults affecting loan and funding guarantees; |

| | • | | Financial market conditions, including access to capital markets, currency exchange rates and interest rates, that differ from expectations; and |

| | • | | Changes in accounting standards. |

Ontario manages risks to the revenue forecast by consulting with private sector economists and tracking their forecasts to inform the government’s planning assumptions. For prudent fiscal planning, the Ministry of Finance’s real GDP growth projections are slightly below the average private sector forecast.

The Province monitors information flows about revenues on an ongoing basis to assess potential risks to its finances. It also works constantly to enhance information flows for the same purpose. Collaboration with the Canada Revenue Agency, which administers roughly 75 per cent of Ontario’s taxation revenues, is essential to achieving this. As well, Ontario is currently leading a federal, provincial and territorial working group that is exploring ways to enhance corporate income tax revenue forecasting and monitoring.

The possible impacts on tax revenue of actual growth in the economy and other parameters differing from the assumptions used in the Budget is disclosed on pages 273–277 of the 2015 Budget, which is available at: http://www.fin.gov.on.ca/en/budget/ontariobudgets/2015/papers_all.pdf.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 29 | |

There are also risks arising from other sources of revenue, such as federal transfers and income from GBEs. Because these represent a smaller share of total revenue, the risks they present are generally less material to the revenue forecast and, in any event, are difficult or impossible to predict or quantify. Note 1 to the Consolidated Financial Statements provides additional details on measurement uncertainty.

On the expense side, the fiscal plan includes contingency funds to help mitigate risks. In the 2015 Budget, these totalled $650 million: $550 million for operating risks and $100 million for capital. Funds were used to support initiatives such as emergency forest firefighting and supporting social assistance recipients.

Provisions for losses that are likely to occur as a result of contingent liabilities, such as ongoing litigation, and that can be reasonably estimated, are expensed and reported as liabilities. Note 13 to the Consolidated Financial Statements provide further details.

Note 3 to the Consolidated Financial Statements explains the Province’s risk management strategies, which are intended to ensure that exposure to borrowing-related risk is managed in a prudent and cost-effective manner.

Changes in Canadian generally accepted accounting principles for the public sector made by the Public Sector Accounting Board (PSAB) can have an impact on the Province’s budgets, estimates and actual results. Treasury Board Secretariat actively monitors proposed changes and provides input to standard setters to support development of standards that support sound public policy decision-making and transparency and accountability in reporting.

As required under the Fiscal Transparency and Accountability Act, 2004, a reserve is included in the projected surplus/deficit each year to guard against unforeseen revenue and expense changes that could have a negative impact on the Province’s fiscal performance. The 2015 Budget plan included a $1.0 billion reserve for 2015–16. Excluding this reserve, the 2015 Budget projected a deficit of $7.5 billion. Because the reserve is a forecast provision, and the fiscal results for 2015–16 are now finalized, a reserve is not reflected in the Province’s financial statements. The final deficit for the 2015–16 fiscal year is $5.0 billion, a $3.5 billion improvement compared with the 2015 Budget projection of $8.5 billion, which included the reserve.

| | |

| 30 | | Financial Statement Discussion and Analysis, 2015–2016 |

Key Financial Ratios

The use of key measures of financial position helps readers of the Annual Report assess the financial position of the Province. Through the levels and trends of these measures, readers are able to gauge the impacts of economic and other events on the Province’s finances, as well as how the government has responded.

The Public Sector Accounting Board recommends a series of ratios that help financial statement users better understand the sustainability, flexibility and vulnerability of a reporting entity.

For greater transparency and accountability, the Province has expanded the number of ratios on which it reports. The ratio, and the level of each, over the past five years are outlined in Table 7.

| | |

| Key Financial Ratios | | Table 7 |

| as at the end of the fiscal period | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | 2011–12 | | | 2012–13 | | | 2013–14 | | | 2014–15 | | | 2015–16 | |

| | Net Debt to GDP (%) | | | 35.7 | % | | | 37.1 | % | | | 38.5 | % | | | 39.4 | % | | | 40.9 | % |

Sustainability | | Net Debt to Total Revenue (%) | | | 214.6 | % | | | 222.4 | % | | | 230.5 | % | | | 240.1 | % | | | 237.8 | % |

| | Net Debt per Capita ($) | | $ | 17,626 | | | $ | 18,667 | | | $ | 19,591 | | | $ | 20,693 | | | $ | 21,926 | |

Flexibility | | Debt Charges to Total Revenue (%) | | | 9.2 | % | | | 9.1 | % | | | 9.1 | % | | | 9.0 | % | | | 8.5 | % |

| | Own-Source Revenue to GDP (%) | | | 13.4 | % | | | 13.5 | % | | | 13.5 | % | | | 13.4 | % | | | 14.1 | % |

| | Federal Transfers to Total Revenue (%) | | | 19.4 | % | | | 19.1 | % | | | 19.2 | % | | | 18.2 | % | | | 17.8 | % |

Vulnerability | | Foreign Currency Debt to Total Debt (%) | | | 25.4 | % | | | 24.3 | % | | | 22.9 | % | | | 20.9 | % | | | 18.8 | % |

| | Unhedged Foreign Currency Debt (%) | | | 0.9 | % | | | 0.7 | % | | | 0.5 | % | | | 0.3 | % | | | 0.3 | % |

Measures of sustainability

Net debt provides a measure of the future government revenues that will be required to pay for the government’s past transactions. Net debt as a percentage of the Province’s GDP shows the financial demands on the economy resulting from the government’s spending and taxation policies. A lower ratio of net debt-to-GDP indicates higher sustainability.

The Province’s net debt-to-GDP ratio was 40.9 per cent at the end of fiscal year 2015–16. In 2011–12, it was 35.7 per cent. Over this period, the deficit and other adjustments, including the 2015–16 legislated change in the Province’s accounting treatment for pension assets of jointly sponsored pension plans, contributed to 64 per cent of the increase in net debt, with investments in capital assets accounting for the balance. Between 2011–12 and 2014–15, because net debt grew more quickly than GDP, the ratio increased from 35.7 per cent to 39.4 per cent. The ratio increased to 40.9 per cent in 2015–16, mainly as a result of the change in accounting treatment for pension assets of jointly sponsored pension plans. If not for this change, this ratio would have remained level.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 31 | |

The government continues to maintain a target of returning net debt to GDP to the pre-recession level of 27 per cent. The first key step in achieving this is to balance the budget. Debt is incurred for two main reasons: to finance deficits and to invest in capital assets. The government plans to invest $137 billion in capital over 10 years. These capital investments will be amortized over a period of time that corresponds to the useful life of the assets. After balancing the budget, increases in debt will be limited to the difference between the cash investment to build the assets and the amortization, which is a non-cash amount.

The government’s plan to reduce the ratio of net debt to GDP therefore hinges on both balancing the budget and investing in capital assets to help the economy grow, both of which will help achieve the 27 per cent target.

The ratio of net debt to total revenue is another measure of sustainability, since it shows the future revenue that is required to pay for past transactions and events. A lower net debt-to-revenue ratio indicates higher sustainability. In 2011–12, the ratio was 214.6 per cent. It rose to 240.1 per cent in 2014–15, as net debt grew more quickly than revenue. Even with the change in the accounting treatment for pension assets, the ratio fell to 237.8 per cent in 2015–16, indicating that total revenues increased at a greater rate than did net debt.

Measures of flexibility

The ratio of interest on debt to total revenue shows the share of provincial revenue that is being used to pay borrowing costs and is thus not available for programs. A lower ratio indicates that a government has more flexibility to direct its revenues to programs. The ratio has steadily fallen for Ontario over the past five years, from a high of 9.2 per cent in 2011–12 to the current level of 8.5 per cent. The Province’s strategy of extending the term of its borrowing program and locking in low interest rates for a longer period has also contributed to lower interest costs. This strategy has extended the weighted average term to maturity of provincially issued debt from approximately 8 years in 2009–10 to 14 years in 2015–16.

Own-source revenue as a share of the provincial GDP shows the extent to which the government is using funds from the provincial economy collected through taxation, user fees and other revenue sources it controls. Too high a taxation burden makes a jurisdiction uncompetitive, so increases in the ratio can reduce future revenue flexibility. Ontario’s ratio was stable between 2011–12 and 2014–15. The increase from 13.4 per cent in 2014–15 to 14.1 per cent in 2015–16 was largely due to the strong growth in tax and other revenues. This caused own-source revenues to increase more sharply than GDP.

| | |

| 32 | | Financial Statement Discussion and Analysis, 2015–2016 |

Measures of vulnerability

Transfers from the federal government as a percentage of total revenue are an indicator of the degree to which the Province relies on the federal government for revenue. A very high ratio shows that a provincial government is very reliant on federal transfers, a source of revenue over which it has limited or no control, and therefore vulnerable to shifts in federal policy on transfers. Ontario’s highest share of revenue from federal transfers in the past five years was 19.4 per cent, in 2011–12. The lowest was 17.8 per cent, in 2015–16. The gradual decline largely represents the expiration of time-limited federal transfers, including the HST transition payment, and the maturing of federal stimulus programs put in place following the global economic crisis in 2008.

Foreign currency debt to total debt is a measure of vulnerability to changes in foreign currency exchange rates. Accessing borrowing opportunities in foreign currencies allows Ontario to diversify its investor base and take advantage of lower borrowing costs. It also ensures that the Province will continue to have access to capital in the event that domestic market conditions become more challenging. Ontario manages foreign currency risk by hedging its exposure to Canadian dollars through the use of financial instruments, which is called hedging. Effective hedging has allowed the Province to consistently limit its exposure to foreign currency fluctuations to 0.9 per cent of debt issued for provincial purposes in 2011–12, declining to 0.3 per cent in 2015–16.

| | | | |

| Financial Statement Discussion and Analysis, 2015–2016 | | | 33 | |

Responsible Fiscal Management

The 2015–16 annual deficit of $5.0 billion was an improvement of $3.5 billion from the $8.5 billion deficit target laid out in the 2015 Budget. As a result, Ontario has achieved better-than-planned results in each of the last seven years.

The government’s record of strong fiscal management is due to an ongoing focus on managing growth in spending, as well as stimulating the economy and protecting revenue.

After declines in revenue in 2008–09 and 2009–10, paralleled by poor economic conditions in those years, Ontario’s economic and revenue performance have shown steady gains. Ontario’s economic recovery from the global recession has been driven by solid economic fundamentals, supported by long-term job recovery efforts such as significant infrastructure investments. Over the past four years, revenue has grown at an average annual rate of 4.0 per cent, while nominal GDP has grown at an average annual rate of 3.2 per cent.

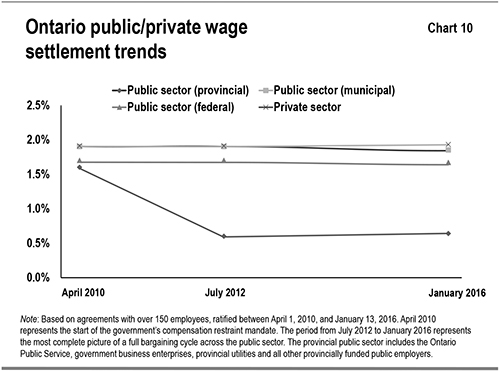

To protect provincial revenues, better support consumer and work safety, and provide a level playing field for legitimate businesses, the government has focused on fighting underground economic activities. As noted in the 2016 Budget, Ontario has generated over $930 million since 2013–14 through ongoing enhanced compliance-focused measures.