EXHIBIT (99.12)

2017 Ontario Economic Outlook and Fiscal Review

A STRONG AND FAIR

The Honourable

2017 ONTARIO

CHARLES SOUSA

ECONOMIC

Minister of Finance

OUTLOOK AND

BACKGROUND PAPERS

FISCAL REVIEW

For general inquiries regarding A Strong and Fair Ontario —

2017 Ontario Economic Outlook and Fiscal Review, Background Papers, please call:

| | |

| Toll-free English and French inquiries: | | 1-800-337-7222 |

| Teletypewriter (TTY): | | 1-800-263-7776 |

For electronic copies of this document, visit our website at ontario.ca/fallstatement

© Queen’s Printer for Ontario, 2017

ISSN 1483-5967 (Print)

ISSN 1496-2829 (PDF/HTML)

Ce document est disponible en français sous le titre :

Un Ontario fort et juste — Perspectives économiques et revue financière de

l’Ontario 2017, Documents d’information

FOREWORD

Introduction

Thanks to the hard work of the people of Ontario, our province has emerged from the global recession stronger.

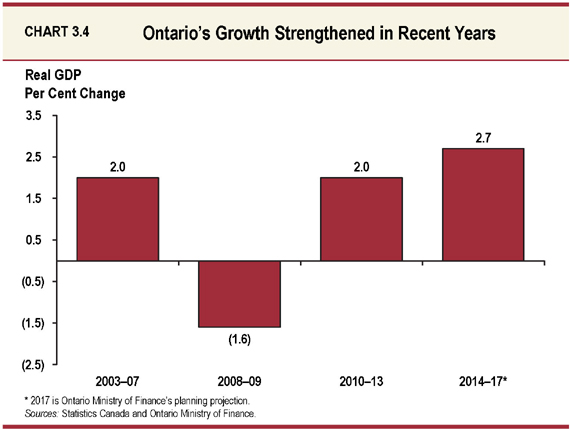

Over the past three years, Ontario’s economy has grown faster than Canada’s and those of all other G7 nations. Private-sector economists expect solid growth in Ontario to continue.

This economic growth has occurred while the Province has made significant investments to improve the lives of all Ontarians. We are undertaking the largest infrastructure investments in our history. Not only are these investments creating jobs for Ontarians, they are also improving their quality of life: better hospitals, improved schools, new roads and bridges, and expanded public transit to meet the needs of our growing population.

These investments have also been made in a responsible manner. Ontario remains the province with the lowest program spending per capita in Canada. This has been achieved by transforming our programs and services, finding efficiencies, and tackling the underground economy to ensure people pay their fair share.

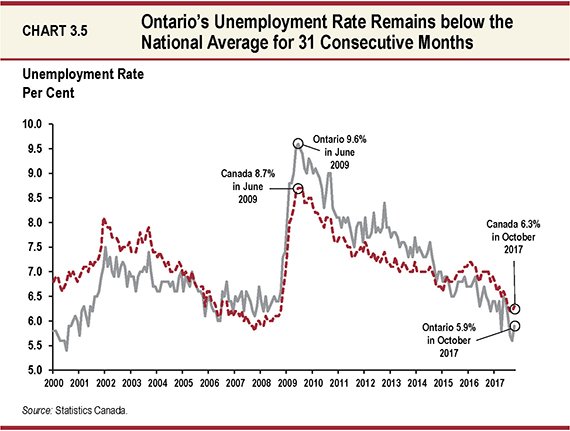

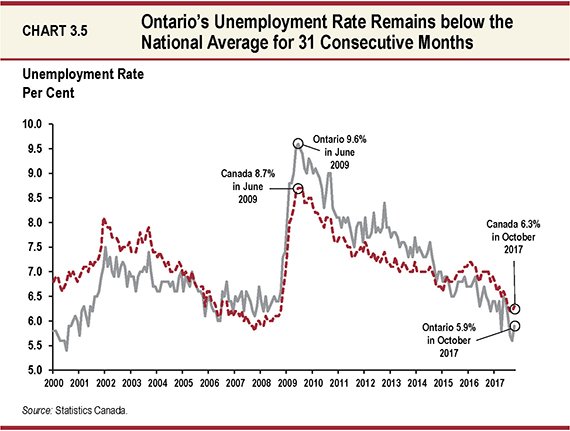

Our plan is working. There are now more jobs in Ontario than ever before — more than 800,000 net new jobs since the depth of the recession — and in October, our unemployment rate was 5.9 per cent, having remained below the national average for 31 consecutive months.

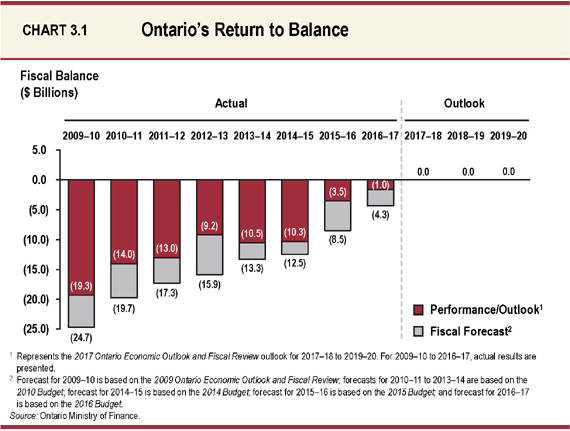

Given our prudent fiscal management and robust economic growth, we are delivering a balanced budget for the first time since the onset of the global recession in 2008. A balanced budget has been achieved only eight times in the last 40 years in Ontario. The 2017 Ontario Economic Outlook and Fiscal Review provides an update to the fiscal and economic plan presented in the 2017 Ontario Budget. It confirms that the government remains on track to balance the budget this fiscal year as well as in 2018–19 and 2019–20.

The question that confronts us now is: How do we apply the earned fiscal flexibility for the benefit of all Ontarians? The past few years have proven that we can embrace change by investing in our people, helping them get ahead today and preparing them for the challenges of tomorrow. Not only does that help grow our economy, but it ensures that the benefits of that growth will be shared fairly, and that opportunity will be available widely.

Yet, many people continue to feel a sense of unease about the economy. So, our government will continue to play an active role in creating fairness for Ontario families. Whether it’s ensuring everyone has access to quality health care, or to education that helps them get ahead, or the social services supports they need to be active members of our society, we will continue to remove barriers so that all Ontarians can reach their full potential.

Ontario is also committed to creating economic opportunities and providing the right conditions for businesses to succeed. Our government is proposing to lower taxes for small businesses, and is promoting international trade, assisting in job training, reducing red tape and helping our companies scale up, so that Ontario remains the best place in the world to live, work and raise a family.

Fairness for Ontario Families

Despite a strong economy, too many people are facing challenges with rising costs of living and feeling unsure about their economic future. With a balanced budget, the Ontario government is able to build greater fairness by increasing key public services that matter most.

Investing in Health Care

In Ontario, we are proud of our universal public health care system. It is an expression of our values of fairness, equality and compassion. In the 2017 Budget, our government took action by investing an additional $7 billion over three years to enhance primary care, increase access to specialists, ensure patients receive care closer to home, reduce wait times and provide more operating funding for hospitals.

People young and old, at hospitals across Ontario, are also benefiting from an additional $618 million investment — $100 million more than we announced in the 2017 Budget — to provide better and faster access to critical services and procedures. We have also added 1,200 new hospital beds to improve access to care.

There is no health without mental health. We know that mental health and addiction challenges affect nearly a third of the people in Ontario at some point in their lives, which is why we are expanding services and care for the many who need help. We are also focused on addressing mental health challenges that present in childhood and youth, to allow people to live healthy and meaningful lives in our communities.

Through a three-year, $100 million investment announced in spring 2017, our government will also ensure that everyone living with dementia in Ontario, as well as their families and caregivers, have the right supports in place to make informed decisions about their care, and continue to be treated with the dignity and respect that they deserve.

We are also continuing to expand Ontario’s interprofessional primary health care teams with an investment of $248.4 million over three years to benefit the growing number of people with complex health needs through faster access to the right care.

The government also continues to make targeted health investments to respond to the unique needs of our northern, French-speaking and Indigenous communities.

We are addressing the needs of our seniors and their families by providing more investments in home and community care this year, so people are able to access better health care, faster and closer to home.

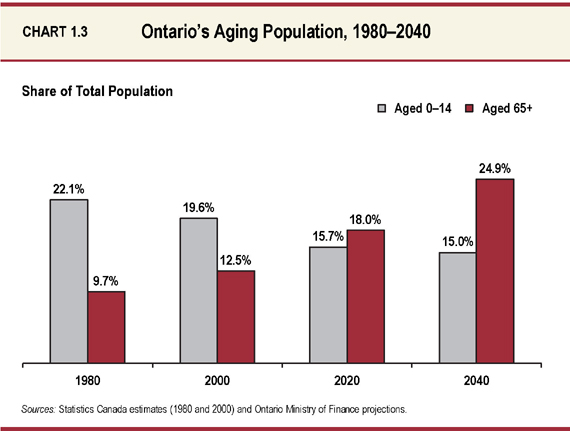

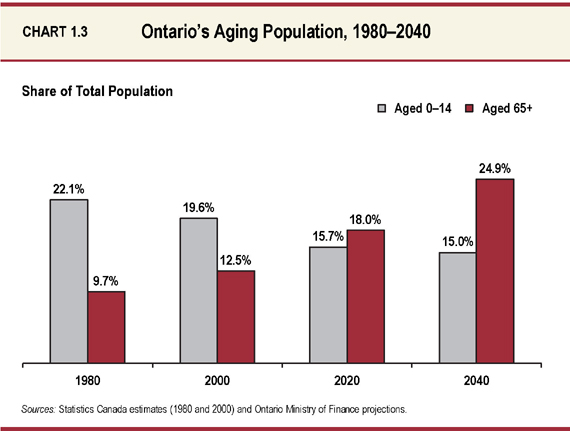

Supporting Our Seniors

As in many jurisdictions around the world, Ontario’s population is aging. The number of the province’s seniors is expected to grow from more than two million today to 4.5 million by 2040. In the 2017 Budget, the government introduced a suite of new initiatives to assist seniors and their families, including investing to promote health and active aging in communities throughout the province, lowering public transit costs, and increasing funding in long-term care.

This fall, our government introduced Aging with Confidence: Ontario’s Action Plan for Seniors, a strategy that will support seniors so they can live independent, healthy, active, safe and socially connected lives. The plan includes creating 5,000 more long-term care beds by 2022, as a first step towards creating 30,000 beds over the next decade to keep pace with the growing and changing needs of the aging population. We will also increase the provincial average to four hours of direct care per long-term care resident per day, once fully phased in, and are expanding compassionate end-of-life care for 2,000 more families.

Helping Parents

Everyone should have access to care to be healthy and to thrive. Starting January 2018, all children and youth aged 24 and under will receive free prescription medication through OHIP+, one of the most significant expansions of medicare in Ontario in a generation. We believe that parents should never be in a position where they need to choose between paying for their children’s medication or other essentials.

The government is committed to making sure that families are supported right from the start with quality child care that is affordable and accessible. In our province, no family should have to worry about finding an affordable place to care for their child.

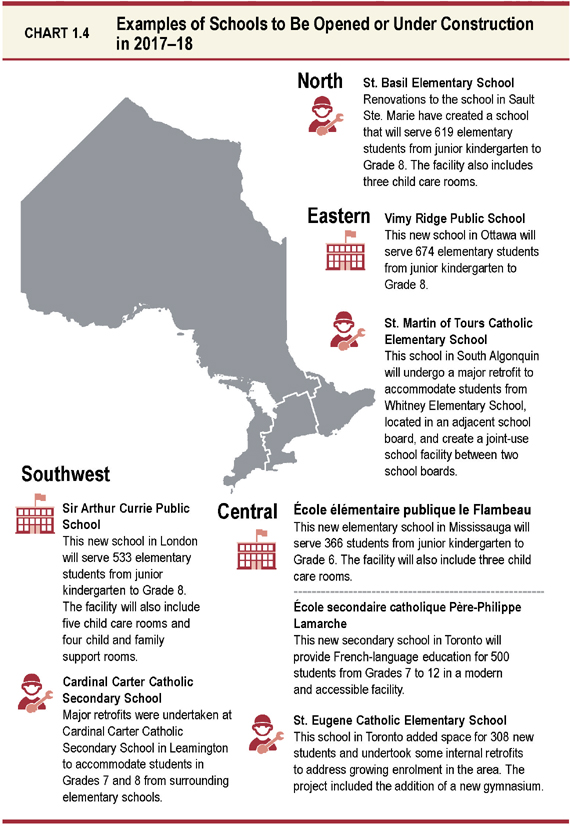

Ontario is helping 100,000 more children access affordable, high-quality licensed child care and is working to ensure universal accessibility for families all across the province — doubling current capacity. Sixty per cent of these spaces will be subsidized. In 2017–18 alone, the Province’s investments will help 24,000 additional children up to four years old access licensed child care. We want to remove barriers that hold our students back, by creating an environment in which school-age children feel safe, welcome and included. That is why we are investing in student achievement and well-being, with almost $16 billion in capital grants over 10 years for new and improved schools. This September, students returned to new or renovated learning spaces in more than 50 schools across the province.

Making Postsecondary Education More Affordable

Every student should have the opportunity to pursue a college or university education without worrying about how to cover tuition and repay student debt. To that end, we have transformed our Ontario Student Assistance Program (OSAP) to give every student the opportunity to reach their full potential. This year, more than 210,000 college and university students in Ontario are receiving free tuition. We are also making sure that mature students receive more OSAP support when they are raising children.

The government is also improving student assistance by ensuring that college and university students receive a reduced up-front bill, with OSAP already factored in.

Our government wants to create more opportunities for Indigenous students. We are working with our Indigenous partners to ensure diplomas and degrees can be granted by Indigenous Institutes across the province.

We are also proposing to establish a new French-language university, the first in Ontario, for our French-speaking learners.

Fairness for Workers

Even with a stronger economy and low unemployment, some Ontarians are struggling to get ahead. The nature of work has changed, and some are facing low pay and uncertain hours, with few benefits and protections.

Government has a responsibility to ensure fairness in the workplace and to help Ontario families get ahead. The Province plans to raise the minimum wage to $15 an hour by January 1, 2019. We will also ensure that part-time workers receive equal pay for equal work, and that all employees get paid sick days, minimum vacation entitlements and the right to emergency leave.

Many people are also worried about their retirement security. Two-thirds of workers do not have a workplace pension plan. Our government shares their concerns about how individuals and families will maintain their standard of living in retirement — after a lifetime of contribution to the workforce and our economy.

That is why Ontario urged the nation to address retirement security head on. Ontario’s leadership in proposing the Ontario Retirement Pension Plan was critical in driving negotiations that led to the historic agreement to enhance the Canada Pension Plan (CPP). The CPP enhancement will significantly improve the retirement security and quality of life of all workers.

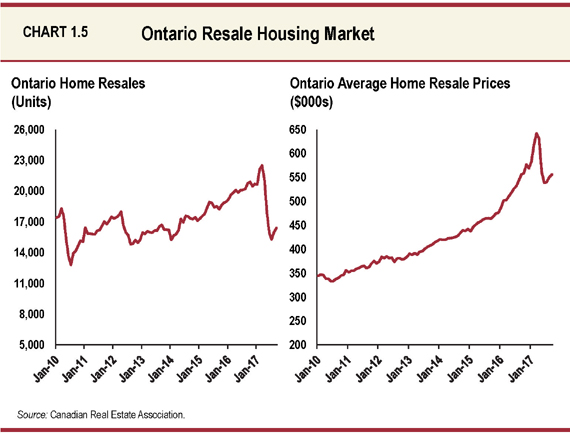

Addressing Home Prices

Earlier this year, rapidly rising real estate prices meant that the cost of buying or renting a home was becoming increasingly challenging for too many people and families. Our government took action last April, introducing the Fair Housing Plan to help more Ontarians find affordable homes by encouraging increased housing supply, expanding rent control, protecting buyers, and bringing stability to the real estate market. The latest numbers tell us that the plan is having its intended effect of allowing more people to buy or rent a home that they can afford.

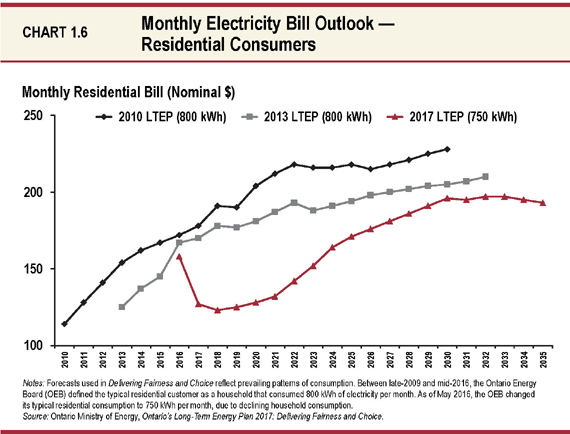

Making Electricity More Affordable

Ontario’s electricity sector has invested heavily since 2003 to make our electricity system cleaner, more modern and reliable. These important investments resulted in rapidly rising rates for people and small businesses across Ontario. This year, our government is delivering the single largest reduction to electricity rates in Ontario’s history. As of July 1, 2017, electricity bills have been reduced by 25 per cent on average for households. Approximately 500,000 small businesses and farms also receive a benefit. Some households in rural or remote communities are seeing their electricity bills reduced by as much as 40 per cent to 50 per cent. As part of this plan, any rate increases will be held to the rate of inflation for four years. With Ontario’s Fair Hydro Plan, as well as other government initiatives, we project lower monthly bills for residential consumers than previously forecast.

Creating Economic Opportunities

The government is committed to building a dynamic and competitive business environment and investing in people’s talents and skills. By creating opportunities for Ontario’s businesses and workers, we are helping ensure further economic growth and a greater quality of life for all.

Strengthening Small Business

About one third of the jobs in Ontario are in small businesses. While small businesses are significant contributors to the success of our economy, they have experienced slower growth since the recession, relative to larger firms.

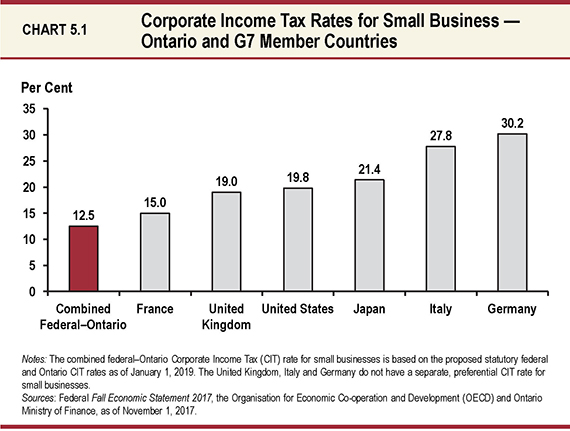

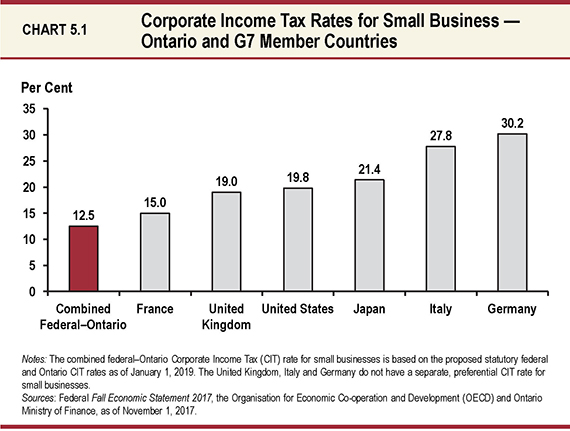

To strengthen Ontario small businesses, we are providing more than $500 million over three years in new initiatives that include proposing to lower the small business Corporate Income Tax rate, investing in youth employment, providing support for fruit and vegetable farmers, and reducing red tape. These new initiatives, combined with the Workplace Safety and Insurance Board’s reduction of average premium rates, and other recently announced measures, will result in $1.9 billion in provincial support for Ontario small businesses over the next three years.

Building Infrastructure

Modern, well-designed and maintained roads, bridges, transit, hospitals and schools improve quality of life and make Ontario more competitive in the long run.

Public infrastructure investment stimulates economic growth and attracts more business investment and talent. That is why we are making the largest infrastructure investment in our province’s history: Ontario is investing about $190 billion over 13 years, supporting 125,000 jobs per year. This year alone, we are allocating up to $400 million from the Trillium Trust to support priority projects such as Hurontario Light Rail Transit and investments across the province through the Ontario Community Infrastructure Fund.

Major transit investments and highway projects are underway to improve mobility and connectivity across the province. We are managing congestion, connecting communities, and providing people with more travel and commuting options by investing in regional and municipal public transit, roads and highways. We are taking steps towards regional fare integration, saving money for commuters. We are implementing GO Regional Express Rail, one of the largest transit infrastructure projects in North America.

Economic Outlook

Ontario’s economy continues to grow despite an uncertain global environment. Over the past three years, Ontario’s economy has grown faster than Canada’s and those of all other G7 countries. With a growing economy and a balanced budget, our government is creating more opportunities for people and businesses in Ontario.

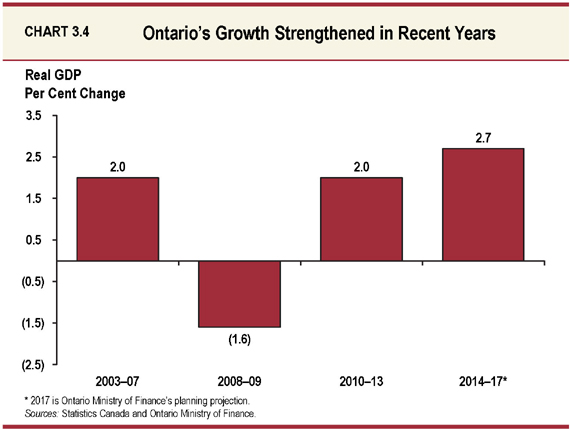

Our government’s plan is working. Ontario’s economy has continually performed well, with output and jobs rising. Exports are up, businesses are hiring more workers and household incomes are rising. In fact, Ontario’s real gross domestic product (GDP) is now 21.3 per cent above its recessionary low.

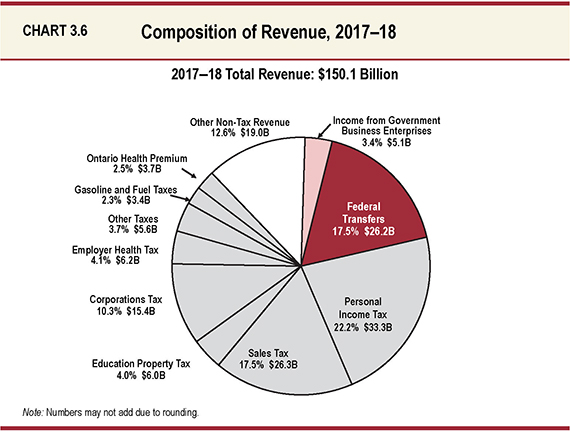

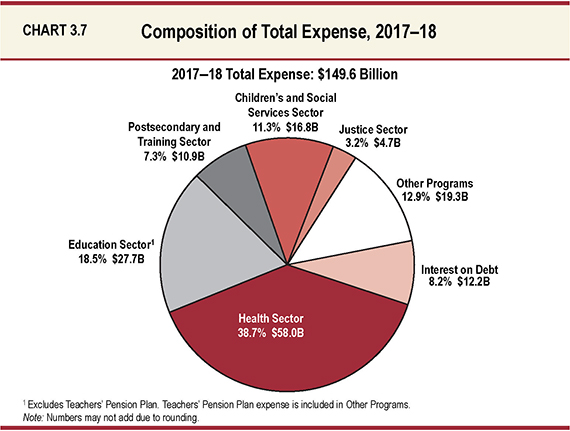

Our stronger economy has led to higher revenue, which is critical to maintaining a balanced budget. At the same time, we have managed growth in program spending, improving the efficiency and effectiveness of public services.

Independent economists project that Ontario’s economy will continue to grow over the next two years. The Ministry of Finance is forecasting growth of 2.8 per cent in Ontario’s real GDP in 2017, which is higher than the 2017 Budget assumption of 2.3 per cent.

Conclusion

Ontario’s balanced plan is helping to build a fairer and more inclusive province.

It allows us to make further investments to build up our infrastructure, improve our schools and hospitals, rebuild our roads, and expand our public transit systems.

It allows us to take greater action to provide everyone with more opportunities to help improve quality of life.

It allows us to continue to create the right economic environment, so that businesses can grow and people can get ahead.

It allows us to ensure fairness and opportunity for all.

Original signed by

The Honourable Charles Sousa

Minister of Finance

| | |

| | | 2018 Budget Talks and Pre-Budget Consultations |

2018 Budget Talks and Pre-Budget Consultations

For decades, the public has been invited to participate in pre-budget consultations, an essential tool in ensuring that the values and priorities of the people of Ontario are reflected in annual budgets.

Last year, 71,100 people from all walks of life helped shape the 2017 Ontario Budget’s policies and programs. Over 13 weeks, more than:

| | ➤ | 480 people attended pre-budget consultations in 11 cities, including Ottawa, Thunder Bay, Mississauga, Hamilton and Windsor; |

| | ➤ | 70,000 participated in four telephone townhalls; and |

| | ➤ | 680 written submissions were sent in to the government. |

To prepare the 2018 Ontario Budget, the Minister of Finance and the Parliamentary Assistant to the Minister of Finance will again meet — both in person and virtually — with communities across the province, beginning in December 2017.

Budget Talks

The public is invited to offer its great ideas on how to make everyday life easier for the people of Ontario through Budget Talks, an online platform.1 Last year, they submitted and voted on more than 400 ideas. The top three are being brought to life through a total of $2.6 million in provincial funding.

For the 2018 Budget Talks, the total funding has been increased to up to $5 million. This year’s program will also feature live events where people throughout the province can discuss the ideas and help determine the shortlist for public voting.

| 1 | http://Ontario.ca/BudgetTalks |

| | |

2018 Budget Talks and Pre-Budget Consultations | | |

Submissions

Individuals and organizations can submit ideas for the 2018 Budget online, or by mail, email or fax.

Online

Complete a submission form on the Ministry of Finance website at www.fin.gov.on.ca/en/consultations/prebud/

Mail

The Honourable Charles Sousa

Minister of Finance

c/o Budget Secretariat

Frost Building North, 3rd Floor

95 Grosvenor Street

Toronto, ON M7A 1Z1

Email

submissions@ontario.ca

Fax

416-325-0969

Contents

ChApter i Building FAirneSS For ontArio FAmilieS

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Introduction

Over the past three years, Ontario’s economy has grown faster than Canada’s and those of all other G7 countries. Today more Ontarians are working; the unemployment rate is 5.9 per cent and has been below the national average for 31 consecutive months. There have been 800,000 net new jobs added since the recession.

Too many hard-working people in Ontario are juggling responsibilities at school or work, while caring for children, parents and loved ones at home. The role of government is to create an environment where everyone can benefit from the growth the Province has created by delivering on a plan that has a positive impact on people’s everyday lives.

At its core, opportunity begins with good health. To ensure people in Ontario have the care they need, government is investing an additional $7 billion over three years in the health care system. Also, Ontario is making history as the first province in Canada to offer free prescription drug coverage for children and youth under age 25. This is one of the most significant expansions of medicare in a generation — and a major step towards universal drug coverage in this country.

A stable economy and good jobs are critical to improving people’s chances at success. The nature of work is changing, with more people retiring and an increasing demand for a highly skilled workforce. The government’s investment in child care and education positions Ontario to meet that challenge. Ontario is doubling the current capacity for licensed child care up to age four and providing free tuition to over 210,000 postsecondary students. The government is also making it more affordable for people to buy a home or rent an apartment.

The government will continue to make a difference in people’s lives by raising the minimum wage to $15 an hour by 2019 and delivering the single largest reduction to electricity rates in Ontario’s history.

Ontario is also committed to addressing the varying needs and the overall well-being of its rapidly growing seniors’ population by increasing services and supports, including improving access to more long-term care beds.

Through its plan, the government is committed to creating opportunity and ensuring fairness for those who need it most.

| | |

Chapter I: Building Fairness for Ontario Families | | |

Ensuring Fairness for Patients

Fair and timely access to health care services is essential for the functioning and well-being of a fair society. People in Ontario rely on universal access to health care services being available when they need it.

To meet the needs of patients today and in the future, in the 2017 Budget, Ontario announced that over the next three years, it would invest $7 billion more in health care than was set out in the 2016 Budget. These investments will improve access to care, reduce wait times, and enhance patients’ experiences and recoveries.

Increasing Provincewide Investments in Hospitals

Ontario’s hospitals are a central pillar of the health care system and have led the way in Canada with some of the shortest wait times for patients to access hip and knee replacement surgeries, MRIs and CT scans.1

Patients at hospitals across Ontario are benefiting from targeted investments that support better access to more procedures, new programs and digital technology advancements.

In 2017, Ontario is investing an additional $618 million in hospitals. To improve access to care for patients and families, and reduce wait times in hospitals, the government is making more than 1,200 additional hospital beds available across the province this year, with a $100 million investment. Ontario will also help patients continue to get the care they need as they transition from hospital to home by:

| | ➤ | Providing 207 affordable housing units for seniors who need additional community supports when they are discharged from hospital; |

| | ➤ | Creating 503 transitional care spaces outside of hospitals for up to 1,700 patients who do not require hospital care; and |

| | ➤ | Reopening 150 beds at Humber River Hospital’s former Finch site and 75 beds at University Health Network’s former Hillcrest site in Toronto to provide care for those transitioning out of hospital. |

| 1 | Canadian Institute for Health Information. Wait Times for Priority Procedures in Canada, 2017. |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

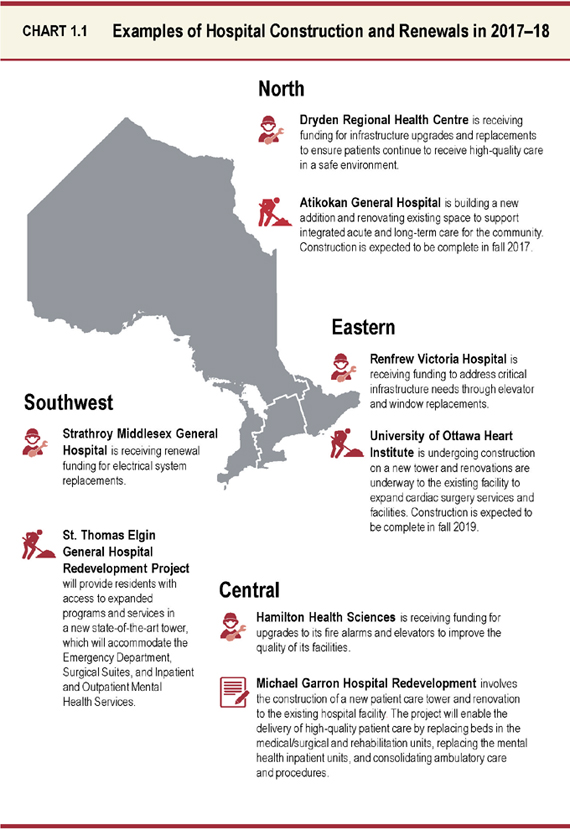

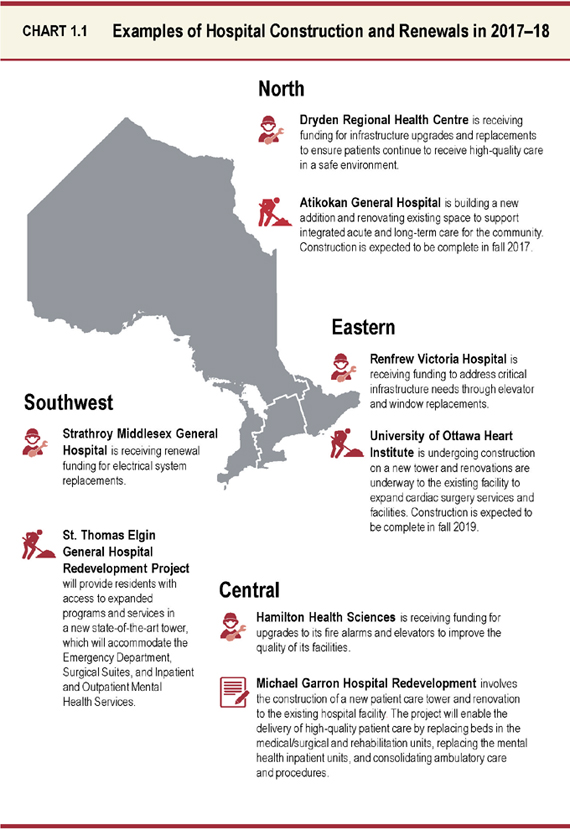

Building, Renovating and Expanding Hospitals

The Province is making investments in health infrastructure through new and redeveloped hospital facilities, helping to expand services and improve patient care in priority areas. Over the next 10 years, Ontario plans to provide more than $20 billion in capital grants to hospitals. This includes the 2017 Budget commitment of approximately $9 billion to support the construction of new major hospital projects across the province. In addition, the Province is providing patients with high-quality care in safe and healthy environments by investing $175 million in 2017–18 to repair and upgrade 131 hospitals this year through the Health Infrastructure Renewal Fund (HIRF).

| | |

Chapter I: Building Fairness for Ontario Families | | |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Improving Mental Health and Addictions Services

About 30 per cent of people in Ontario will experience mental illness or substance use disorder at some point in their lives. Recognizing that there is no health without mental health, the government is committed to ensuring that people living with mental illness or substance use disorder have access to the quality care and supports they need to live a healthy life, recover and thrive.

To improve services and care for anyone living with mental illness or addictions, and to support transitions between youth and adult services, the Province has been working with the Mental Health and Addictions Leadership Advisory Council on the implementation of Ontario’s Comprehensive Mental Health and Addictions Strategy.

Expanding Mental Health Services for Children and Youth

Approximately one in five children and youth in Ontario has a mental health challenge, and seven in 10 of all mental health challenges begin in childhood or adolescence. Early intervention can prevent or alleviate difficulties that can be associated with mental illness — homelessness, unemployment or incarceration — allowing people to live healthy and meaningful lives within their communities.

The government is committed to providing innovative, integrated approaches to identifying and intervening early in mental health and addiction issues among youth and young adults. This includes expanding and improving youth service hubs across the province, where young people aged 12 to 25 can receive walk-in, one-stop access to mental health and addictions services, as well as other health, social and employment supports under one roof.

| | |

Chapter I: Building Fairness for Ontario Families | | |

Expanding Mental Health Services for College and University Students

Ontario recognizes the ongoing and rising need for mental health supports and services among postsecondary students. A survey of over 25,000 Ontario postsecondary students reported a 50 per cent increase in anxiety and a 47 per cent increase in depression between 2013 and 2016.2 To help ensure college and university students have access to mental health services and supports when and where they need them, the government is investing a total of $45 million over three years. This includes additional funding of $6 million per year, as announced in the 2017 Budget, which will support development and/or expansion of mental health services on campus.

|

Carleton University continues to support From Intention to Action (FIT: Action), a peer-based counselling system supporting training and supervision of students and interns who provide counselling to more than 200 at-risk students. These students have benefited from improvements to their psychological well-being, as well as academic and study skills. Good2Talk/Allo J’écoute, a toll-free, confidential helpline, offers postsecondary students professional counselling, mental health and addictions information, and connections to local resources — available 24/7/365, in both English and French. |

Expanding Access to Publicly Funded Psychotherapy

Mild to moderate anxiety and depression disorders are among the most common mental health issues. Working in partnership with Health Quality Ontario, the government has found that structured psychotherapy reduces people’s symptoms, helps them with recovery and improves their quality of life.

To support more than 100,000 people with anxiety and/or depression, the government is investing close to $73 million over three years, as announced in the 2017 Budget, to expand structured psychotherapy programs. These investments make Ontario the first province to provide publicly funded structured psychotherapy, which includes group and individual therapy and online supports. Services will be provided by a range of regulated mental health professionals such as psychologists, psychotherapists, social workers, occupational therapists and nurses.

| 2 | American College Health Association – National College Health Assessment (Ontario Canada Reference Group), Spring 2016. |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Providing More Housing with Mental Health Supports

Estimates suggest that 25 to 50 per cent of homeless people live with a mental health condition. Research shows that having a stable, supportive place to live is essential for maintaining mental health and can improve involvement in the community. That is why Ontario is investing more than $45 million over three years to provide up to 1,150 additional supportive housing units for those with serious mental illness or addictions.

Addressing the Opioid Crisis

Opioid misuse is the third leading cause of accidental death in Ontario. To strengthen the Province’s coordinated response to this public health emergency, the government introduced an opioid strategy, which includes establishing an Opioid Emergency Task Force to support a coordinated response to the crisis. The government is also funding a number of supervised injection services.

Ontario is investing $222 million over three years to fight the opioid crisis through supports that include:

| | ➤ | Enhancing withdrawal management and rapid access to addiction services, as well as urgently needed community-level connections to longer term comprehensive care; |

| | ➤ | Immediate investments to help community-based addiction organizations, including hiring more front-line staff to provide counselling, case management and other wrap-around supports; |

| | ➤ | Creating new harm reduction and peer outreach worker positions to connect vulnerable populations with necessary harm reduction supports; and |

| | ➤ | Expanding the distribution of free naloxone kits. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

Boosting Access to Primary Health Care

A growing number of people in Ontario are suffering from complex health conditions. Ontario continues to invest in interprofessional primary health care teams to address these complex needs, as well as those of all people in Ontario. These teams bring together diverse health professionals, including doctors, nurse practitioners, registered nurses, mental health workers, pharmacists, physiotherapists and other allied health professionals. They can offer faster access to the right care by the right provider, significantly improving health outcomes for their patients. Timely access to health care and ongoing monitoring of patients’ health can reduce unnecessary emergency room visits or other hospitalizations.

The government recognizes the benefits that these interprofessional primary care teams currently deliver across the province to more than four million people. Ontario is investing $248.4 million over three years to enhance capacity and support the expansion of interprofessional primary care teams, helping even more people across the province access coordinated health care. A variety of health care teams now serve patients across Ontario, including 82 Health Links — teams of local health care providers who coordinate care for patients with multiple, complex conditions, often seniors; 184 Family Health Teams; 75 Community Health Centres; 25 Nurse Practitioner-Led Clinics; and 10 Aboriginal Health Access Centres.

|

Ottawa Inner City Health Inc., a Community Health Centre (CHC), operates special health care units within local shelters that provide homeless people with high-quality primary health care and other social supports. CHC programs include chronic disease management, mental health support and specific care plans for those with HIV. Programs are delivered in partnership with The Ottawa Hospital, The Ottawa Mission, University of Ottawa and other CHCs. The Centre for Family Medicine Family Health Team (FHT) in Kitchener-Waterloo maintains a significant outreach program serving refugees who are new to Canada. In partnership with Reception House, the FHT’s Refugee Health Clinic serves new government-assisted refugees coming to the Waterloo Wellington Local Health Integration Network (LHIN). |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Supporting Health Care for People in Northern Ontario

Over half the residents in northern Ontario live in communities of 2,500 people or fewer. Northern communities deserve the same access to quality health care as other communities in Ontario. When residents need to travel to access care, the Province helps offset these costs through the Northern Health Travel Grant Program, which more than 600,000 people have accessed over the last three years. The 2017 Budget announced a $10 million expansion of the program.

To further support health care in northern Ontario:

| | ➤ | The Northern Ontario School of Medicine has graduated a total of 526 new doctors since 2009; |

| | ➤ | Eight Nurse Practitioner-Led Clinics, 43 Family Health Teams, 11 Community Health Centres and six Aboriginal Health Access Centres serve patients across northern Ontario; and |

| | ➤ | Health care funding for northern Ontario includes $84.6 million for Public Health Units and $76 million for land ambulance services. |

|

Ontario is investing in a comprehensive cardiovascular surgery clinic at Thunder Bay Regional Health Sciences Centre — improving access to health care, shortening wait times and reducing travel for health care by people in the north. The program will care for approximately 1,000 patients each year, with a new surgical suite, advanced technology, new beds and a lab. |

Equitable Health Care for Indigenous Peoples

In 2016, the Province began implementing Ontario’s First Nations Health Action Plan (OFNHAP) with an investment of close to $222 million over three years to improve access to equitable, culturally appropriate health care services for Indigenous peoples. While the OFNHAP focuses on northern First Nations, it also invests in Indigenous health care across Ontario, including home and community care, primary care, and diabetes prevention and management, both on- and off-reserve.

| | |

Chapter I: Building Fairness for Ontario Families | | |

Meeting the Health Care Needs of the Francophone Community

The Province is improving access to quality French-language health services by fostering collaborative planning between Local Health Integration Networks, French language health planning entities and the community; improving data collection and monitoring; and strengthening accountability for the active offer of French-language health services.

Since October 2017, a new “health hub” in Limoges, Ontario, the Centre de santé communautaire de l’Estrie/Limoges Health Centre, has offered integrated physical, mental and community health care services to people in the rural communities of Stormont, Dundas, Glengarry, Prescott and Russell counties, which have large francophone populations. The centre focuses on high-quality preventive care, health promotion, chronic diseases, mental health and addictions, and diabetes education offered in both English and French.

Supporting Patients in Long-Term Care

Some seniors with complex needs caused by cognitive and physical decline, and conditions such as dementia, will require a higher level of support as they age. Many will require ongoing and intensive care that is currently provided in long-term care homes.

Recognizing that Ontario’s population is aging and creating more demand for long-term care, the Province will create 5,000 new long-term care beds by 2022. The government will prioritize these new beds for patients with the highest need, as well as those within hospitals who are ready to be discharged and require a long-term care home. New beds that serve specific cultural needs, including those of Indigenous populations, will also be prioritized. Over the next decade, the government will create over 30,000 new long-term care beds to keep pace with the growing and changing needs of the aging population.

The needs of long-term care residents are also becoming more complex, which is why the Province will increase the provincial average to four hours of direct care per resident per day. Once fully phased in, this will mean an additional 15 million hours of nursing, personal support and therapeutic care for long-term care residents across Ontario.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Further discussion and planning work is required on how best to staff the more diverse and complex needs of residents. The government intends to provide additional detail on the outcomes of these discussions as part of the 2018 Budget.

As announced in the 2017 Budget, Ontario also invested an additional $10 million in the Behavioural Supports Ontario (BSO) program to better meet the needs of residents with challenging and complex behaviours associated with dementia or other cognitive disorders. Through the program, specialized teams identify triggers that can lead to agitation or aggression, to better manage patient behaviours.

| | |

Chapter I: Building Fairness for Ontario Families | | |

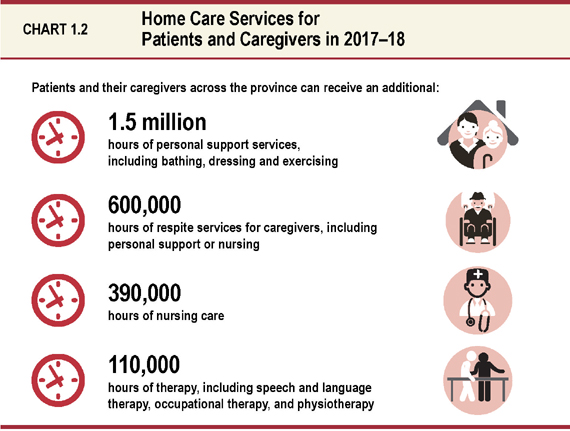

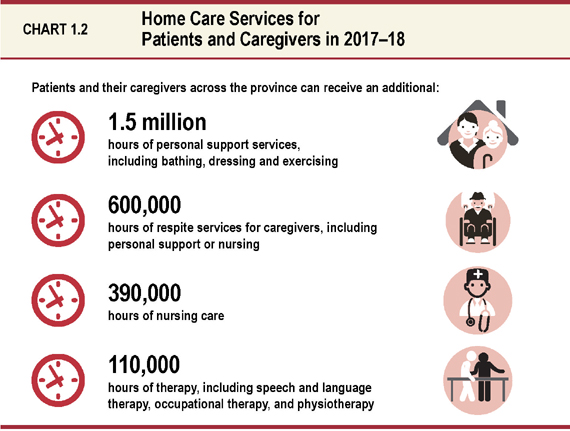

Expanding and Strengthening Home and Community Care

To ensure a smooth transition for patients who have been discharged from hospital and are returning home, the government is investing an additional $40 million in 2017 to help patients receive post-hospital and community care at home from registered nurses, care coordinators, personal support workers and other care providers.

Ontario has more than doubled funding for home and community care since 2003, to address increasing demographic pressures from an aging population and to help more people get the care they need, close to home and in the community. In addition to ongoing funding of more than $5 billion per year, the government has grown its investment in home and community care by about $250 million per year since 2013. These investments are providing the people of Ontario with greater access to nursing care, personal support and caregiver support at or close to home.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Supporting People Affected by Dementia

It is estimated that approximately 194,000 people in Ontario have been diagnosed with dementia. This number is expected to grow to 206,000 by 2020 and more than 300,000 by 2038. The impacts of dementia can be substantial, not only for those living with dementia, but also for their families, friends and caregivers.

In 2017, the government launched a new three-year, $100 million Dementia Strategy to ensure that everyone living with dementia in Ontario, their families and their care partners have the right supports, funding and tools in place to make informed decisions about patient care, and to ensure that they are treated with the dignity and respect that they deserve. These include:

| | ➤ | Access to the most appropriate health care, home care and other supports from as early as possible once a diagnosis is made, so that people living with dementia and their families can better plan and continue to experience meaningful, active lives; |

| | ➤ | Improved training and education in dementia care for personal support workers, physicians, nurses and other front-line workers to help coordinate appropriate, easy-to-use services that enable people to continue to live at home and participate in the community; |

| | ➤ | Increased access to adult day and evening programs for dementia patients; and |

| | ➤ | More public education campaigns to raise awareness of risk factors for dementia and to reduce stigma. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

Support for Caregivers

Caregivers — often unpaid family members, friends or neighbours — frequently report high levels of stress, sleep deprivation and depression. Additional responsibilities such as a job or a young family can further add to the physical, emotional and financial distress that caregivers experience.

Ontario is taking steps to make it easier for people who care for loved ones, through:

| | ➤ | Additional care hours and transportation to local programs; |

| | ➤ | Enhanced caregiver respite services, at home or overnight, so caregivers can take breaks; |

| | ➤ | Improved coordination of care with stronger links between primary, specialist and community care providers; |

| | ➤ | A proposed new, streamlined Ontario Caregiver Tax Credit; and |

| | ➤ | The launch of a new caregiver organization in spring 2018, which will provide support and resources across the province, including a single access point for information, resources and services to help caregivers in their roles. |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Supporting Compassionate End-of-Life Care

To provide compassionate palliative and end-of-life care for more patients and their families, Ontario is partnering with local communities to build hospice beds across the province. Through a new program announced in fall 2017, eligible hospices can apply for capital funding to supplement local fundraising efforts and support the creation of new and expanded hospices across Ontario. This funding will help with the construction or renovation costs of more than 190 beds that will allow over 2,000 additional clients to be served closer to their homes and families each year.

Residential hospices provide expert care in a home-like environment, giving families and friends the space and care they need to be with their loved ones at one of the most vulnerable times in their lives.

|

Hospice Vaughan, which currently offers a visiting volunteer program, will receive up to $2 million to help fund the costs of building a 10-bed hospice that will serve as a new Centre of Excellence for hospice palliative care. The centre will also provide counselling and day programs for families, as well as research and education on patient care. As a care services hub, the centre will support patients and families in the City of Vaughan and the surrounding area. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

Fairness for Seniors

As the baby boom generation ages and life expectancy continues to increase, the number of people in Ontario over age 65 will nearly double over the coming decades. In fact, Ontario’s and Canada’s seniors’ populations now outnumber those of their children for the first time in history.

Seniors are as diverse as any population in Ontario and have different requirements at different times of their lives. Half of Ontario’s seniors say they will require help over the next five to 10 years to access vital services such as transportation, and safe and affordable housing options; nearly half worry about social isolation; and over one-third have difficulty accessing information about community services. Also, as people grow older, disability can occur, health can decline, and functional capacity can decrease.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

The government’s recent investments in long-term care and home and community care, as well as supports for those affected by dementia or requiring compassionate end-of-life care, reflect these demographic challenges and diverse needs.

Aging with Confidence: Ontario’s Action Plan for Seniors

Ontario is committed to helping seniors across Ontario age well and confidently, recognizing their diversity and giving them choices, with a variety of new initiatives.

That is why the government has introduced Aging with Confidence: Ontario’s Action Plan for Seniors, an ongoing commitment to seniors that builds on successful initiatives launched through the 2013 Ontario’s Action Plan for Seniors. The plan will support seniors so they can live independent, healthy, active, safe and socially connected lives.

Supporting All Seniors, Regardless of their Needs

Ontario is introducing a number of initiatives that will support all seniors, including:

| | ➤ | Better community transportation in underserved communities, so seniors can connect with the services and supports they need; |

| | ➤ | A new “one-stop” website and a 24-hour phone line in over 150 languages with easy-to-find information about government services and supports for seniors; |

| | ➤ | Zero tolerance of elder abuse through strengthened prevention, awareness and response; and |

| | ➤ | A free high-dose flu vaccine, starting in fall 2018, that is more effective for older people. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

Helping Seniors Living Independently in the Community

Ontario is helping seniors remain active, healthy and socially connected in their communities through initiatives such as:

| | ➤ | Forty new Seniors Active Living Centres that will offer a wide variety of social, recreational and health programming, bringing the total number of such centres to more than 300 provincewide; |

|

The Thunder Bay 55 Plus Centre’s programs include fitness, visual arts workshops and general interest classes, as well as sessions to learn about technology and computers. Rendez-vous des aînés francophones d’Ottawa (RAFO) is a francophone centre with over 750 members and 230 volunteers. RAFO purchased a former elementary school to deliver its own programming, including a meal service and seasonal garden, while also renting out space to help support a wider range of programs and services. |

| | ➤ | A special project that will connect youth volunteers with seniors to help them build their understanding of technology; and |

| | ➤ | An expanded Seniors Community Grant Program, which will fund more innovative community projects that help seniors stay active, healthy and engaged in their communities. |

|

Using an $8,000 grant, Latin@s en Toronto Communication for social development created Let’s Connect, an e-learning program developed by and for Spanish-speaking seniors. Using the program, hundreds of seniors can access webinars on topics related to health care, human rights and preventing abuse, social participation, active aging, culture, and identity. |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Helping Seniors Requiring Enhanced Supports at Home

For seniors who may require some supports to help them remain safe and independent at home, the Province will provide:

| | ➤ | Increased access to both quality in-home health care and geriatric care; |

| | ➤ | Expanded home care through an estimated 2.6 million hours, including personal support services, nursing, physical and speech therapy, and respite services for caregivers; |

| | ➤ | Enhanced support for naturally occurring retirement communities, such as apartment buildings or housing developments, which will improve seniors’ access to coordinated home care based on local needs; and |

| | ➤ | A new organization for caregivers with easy-to-access supports and resources. |

Helping Seniors Requiring Intensive Supports

Some seniors with complex needs caused by cognitive and physical decline will require ongoing and intensive care as they age. The Province will support them by:

| | ➤ | Modernizing long-term care homes through redeveloping more than 30,000 long-term care beds in more than 300 long-term care homes by 2025; |

| | ➤ | Creating 5,000 new long-term care beds by 2022, as a first step towards creating over 30,000 beds over the next decade; |

| | ➤ | Undertaking planning work on approaches to increase the provincial average to four hours of direct care per resident per day, once fully phased in; and |

| | ➤ | Expanding compassionate palliative and end-of-life care. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

Supporting Families with Children

Investing in children’s health, well-being and education is vital to giving them the best start in life. That is why the government is making critical investments to support fairness for Ontario’s families.

Affordable, high-quality child care is essential for families. Parents need peace of mind, knowing that they will be able to access child care close to home, while also being able to afford it. Yet for too many, child care is unavailable or unaffordable, or has a significant wait time. Ontario is committed to ensuring that financial means are not the basis for access to reliable child care.

Parents should never have to choose between paying for their children’s prescription medications and other life essentials. The government remains committed to providing equitable access to health care for everyone in Ontario, including removing financial barriers for those who cannot afford prescription drugs.

The government is also committed to giving students not only the best education, but the best supports possible to improve well-being, ensure better equity for all students and advance student achievement even further.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Making Child Care More Accessible and Affordable

The Province is helping 100,000 more children access licensed child care and working towards universal accessibility for families all across the province. In 2017–18, Ontario is dedicating $200 million to help 24,000 additional children up to age four access licensed child care. This includes new fee subsidy spaces for 16,000 more children up to four years old, which will reduce waitlists for low- and middle-income families.

|

Helping Families across the Province In the Region of Waterloo, a boost of nearly $6 million will provide operating funding for new child care centres in four schools and help more than 400 children and their families by eliminating the current waitlist for subsidized spaces. In Ottawa, new and recent funding will significantly reduce the waitlist for subsidized child care spaces and increase the number of subsidies for low- and middle-income families. These measures will help 1,000 more children and their families access child care. In Hamilton, new child care funding will help 760 more children access licensed child care. |

Ontario continues to work with Indigenous partners to help provide access to culturally relevant child and family programs and licensed child care. This includes increasing the number of child care spaces off-reserve and expanding five existing child and family programs on-reserve.

Providing More Before- and After-School Programs

| | | | |

| Parents’ and caregivers’ schedules often differ from school hours, making access to before- and after-school programs essential for many families. The government recognizes this need and is committed to making sure that children up to age 12 can access safe, quality programming. | | | | This year, more than 80 per cent of schools in Ontario are now offering before- and after-school programs for children aged four to 12. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

OHIP+ — Ensuring Fairness for Parents, Children and Youth

Beginning January 1, 2018, OHIP+: Children and Youth Pharmacare will launch, making Ontario the first Province in Canada to provide prescription drug coverage for everyone under the age of 25, regardless of family income.

More than four million children and young people will be able to get their prescription medications for free by simply showing their Ontario health card number and a prescription. This includes over 4,400 medicines currently available through the Ontario Drug Benefit Program, including antibiotics for infections, asthma inhalers, insulins and other diabetes medications, as well as some drugs for cancer and rare diseases.

|

Through OHIP+, families with children with Type 1 diabetes can save approximately $8,600 on their medication costs. As of January 2018, this medication will be free. |

Improving Youth Well-Being and Achievement

| | | | |

| As Ontario continues to strive for excellence in the education system, there is more work to do to ensure that all students succeed. Children who have strong relationships and a positive sense of self are in a better position to reach their full potential. That is why the government is moving forward with an increased focus on student and youth well-being. | | | | Ontario students scored higher than those of any other jurisdiction in reading and were ranked among the top 10 in science, according to the 2015 Programme for International Student Assessment, an international ranking of student achievement among 15-year-olds, undertaken every three years. |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Focusing on Well-Being

The Province is committed to programs, both inside and outside the classroom, to help improve students’ well-being. The 2017 Budget committed to spending $49 million over three years to develop and strengthen programs that improve students’ cognitive, emotional, social and physical development. In September 2017, the Province announced investments in the following new and expanded programs:

| | ➤ | Funding for active transportation, including walking school buses and bike-to-school programs that create more physical activity opportunities for students; |

| | ➤ | Doubled funding for school boards to support local well-being priorities, including school breakfast programs, bullying prevention, recreational activities and staff professional development; and |

| | ➤ | Increased funding for School Mental Health ASSIST, a provincial support team that provides leadership, resources and other support to help boards promote student mental health and well-being across Ontario. |

Helping Student Achievement

Ontario’s school curriculum is being updated to improve student achievement in core skills and increase focus on transferable life skills. Provincial assessment practices will be reviewed to ensure that they are culturally relevant, measure a wider range of learning, and better reflect student well-being and equity. To better communicate all aspects of student achievement, new report cards are being developed and will be sent to parents starting in the next school year.

|

Reducing Class Sizes This year, full-day kindergarten classes, which are supported by a teacher and an early childhood educator, are capped at 30 students and average no more than 26 students per class within each school board. Support is also being provided to ensure that for students in Grades 4 to 8, all school boards have average class sizes of fewer than 25 students. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

Ensuring Equity and Inclusion

Ontario is making the education system fairer and more inclusive for all students by identifying and eliminating systemic barriers, as well as better supporting students in their future pathways. The Province committed over $7 million in 2017–18 for the implementation of Ontario’s Education Equity Action Plan, a roadmap to identifying and eliminating discriminatory and systemic practices, barriers and biases from schools and classrooms.

Key areas of action include:

| | ➤ | Introducing a renewed approach to Grade 9, enabling all students to better explore pathways to work, college, apprenticeship and university; |

| | ➤ | Identifying and addressing disparities in suspension, expulsion and exclusion rates among certain student populations; |

| | ➤ | Ensuring that school and classroom practices reflect and respond to the diversity of all students and staff, so that they reflect the needs and realities of all students; and |

| | ➤ | Ensuring that the diversity of the teachers, staff and school system leaders in Ontario schools reflects the diversity of their students through recruitment, hiring and promotion of educators and school and system leaders. |

Helping Parents and Children by Enhancing Autism Supports

Ontario has significantly expanded a range of dedicated supports in schools for students with Autism Spectrum Disorder (ASD), including:

| | ➤ | Specialized training of over 30,000 educators in applied behaviour analysis methods to support students with ASD; |

| | ➤ | Dedicated transition teams for students with ASD receiving intensive support transitioning from community services into full-time school; and |

| | ➤ | New after-school skills development programs. |

Through these investments, the number of students with ASD attending postsecondary has increased by four times since 2009. But more needs to be done to support students, families and educators.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

That is why Ontario is improving school-based supports for students with ASD by launching a new pilot project for the 2017–18 school year. The pilot is available in 18 school boards and aims to improve the experiences of children and their families. Through training and professional expertise, the pilot will also work to improve the capacity of school teams to provide skilled support to students with ASD.

Improving Access to Services for Children with Special Needs

Ontario is working to develop services and supports for children and youth with special needs to ensure they get timely and effective services as they transition to adulthood. This year, the Province announced an investment of up to $31 million to support the construction of a new facility for Grandview Children’s Centre in Durham Region. This new facility will create more treatment space, shorten wait times and help ensure families get access to the care they need sooner. The Province supports 21 Children’s Treatment Centres and helps more than 76,000 children and youth receive rehabilitation services such as physiotherapy, occupational therapy and speech language therapy.

Supporting Education in Rural and Northern Ontario

From April to June 2017, the government held provincewide consultations to seek input on how to strengthen education in rural and northern Ontario. In response to feedback from students, parents, educators and communities, the government took immediate action by boosting key supports, including a new $20 million Rural and Northern Education Fund. This fund will help students by enhancing programming such as French immersion, arts education and guidance counselling, and by improving student access through options such as late bus runs and mobile e-learning through tablets or Wi-Fi.

Additionally, the government is overhauling the process that school boards use to review schools for potential closure to allow for further community consultation. It will provide supplementary funding of $1.2 million to encourage school boards to share space with each other and community partners to maintain a presence in communities. For more information on community hubs, see Chapter II: Creating Opportunities for Everyone.

| | |

Chapter I: Building Fairness for Ontario Families | | |

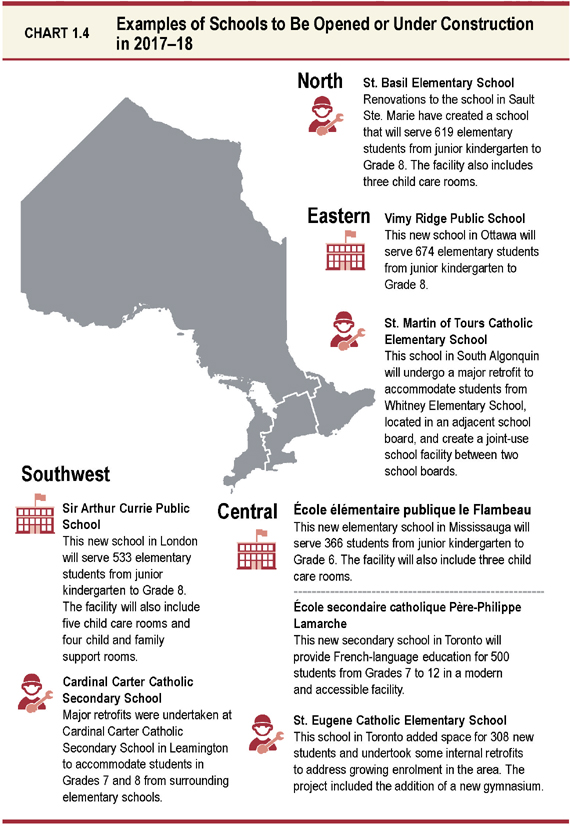

Investing In Education Infrastructure

Across the province, Ontario is investing almost $16 billion in capital grants over 10 years in new and improved schools, which will help deliver high-quality programs and increase student achievement and well-being. These capital investments are essential to address enrolment growth, renovate schools in poor condition and ensure students across the province have fair access to quality education infrastructure.

In September, students returned to class in new or renovated learning spaces in more than 50 schools in communities across the province. These investments will provide students with a better place to learn and grow for this school year and for years to come.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

| | |

Chapter I: Building Fairness for Ontario Families | | |

A Better Way Forward: Ontario’s Commitment to Fight Systemic Racism

Implementing the Ontario Black Youth Action Plan

In March 2017, the government introduced the Ontario Black Youth Action Plan, the first of its kind in Canada, which will support more than 10,000 Black youth and their families. Under the plan, the government recently announced the launch of new culturally focused programs for Black children and youth that will provide them with mentorship and career opportunities to build skills for school and work and create new pathways into the science, technology, engineering and math (STEM) professions. These programs will support up to 30 locally developed mentorship and training initiatives that are being designed with community partners and businesses in priority communities, including the Greater Toronto and Hamilton Area, Ottawa and Windsor.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Helping Students

Fairness for Postsecondary Students

Access to a postsecondary education should not be based on ability to pay — it should be based on desire to learn. It is important that everyone who wishes to pursue higher learning is able to do so in a way that is affordable. That is why Ontario is reducing financial barriers for students from low- and middle-income families.

This year, average tuition is free for more than 210,000 Ontario students, and costs have been reduced for many more. Most Ontario students are receiving more aid than they were eligible for previously.

In this school year so far, compared to the same time last year:

| | ➤ | The number of total OSAP awards increased by nearly 20 per cent; |

| | ➤ | The number of low-income OSAP recipients increased by about 20 per cent; |

| | ➤ | The number of OSAP recipients self-identifying as Indigenous increased by 35 per cent; and |

| | ➤ | The number of mature students receiving OSAP increased by 32 per cent. |

See Chapter II: Creating Opportunities for Everyone for more information on the changes to OSAP.

| | |

Chapter I: Building Fairness for Ontario Families | | |

Fairness for Workers

Over the past three years, Ontario’s economy has continued to grow, jobs are being created, incomes are rising and the unemployment rate has declined to 5.9 per cent in October. However, not everyone is benefiting. The workplace has changed and some workers are facing low pay, uncertain hours, and few benefits or protections. Some are struggling to support their families on part-time, contract or minimum-wage work.

The government has introduced the Fair Workplaces, Better Jobs Act, 2017, which builds on its 2017 Budget commitment to modernize Ontario’s employment and labour laws to help safeguard employees, ensure fairer workplaces and support better jobs. The Act, if passed, would:

| | ➤ | Raise the minimum wage to $14 on January 1, 2018 and to $15 on January 1, 2019, which will ensure that hundreds of thousands of workers will receive a raise; |

| | ➤ | Ensure part-time workers are paid the same hourly wage as full-time workers; |

| | ➤ | Introduce paid sick days for every worker; |

| | ➤ | Ensure all employees are entitled to 10 personal emergency leave days per year; |

| | ➤ | Ensure at least three weeks’ vacation after five years with the same employer; and |

| | ➤ | Step up enforcement of employment laws. |

The government appreciates that these significant benefits are also not without some associated costs. It is committed to working with its delivery partners such as those in the broader public sector and the not-for-profit sector, to help ensure they successfully manage the transition in the lead-up to January 1, 2018 and beyond.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Strengthening and Modernizing Retirement Security

With two-thirds of Ontario workers not participating in workplace pension plans and many families worried about how they will maintain their standard of living in retirement, strengthening and modernizing retirement security continues to be a priority for this government. As well, current economic realities are putting pressure on sponsors of existing defined benefit pension plans, highlighting a need to address plan sustainability and benefit security.

To modernize and strengthen retirement security, Ontario is undertaking key transformative changes that include the following initiatives:

| | ➤ | Ontario’s leadership in designing and developing the Ontario Retirement Pension Plan was instrumental in achieving the historic agreement to enhance the Canada Pension Plan (CPP). Once fully implemented, the CPP enhancement will improve the retirement security and future quality of life of many of today’s workers, particularly those without workplace pension plans, by providing them with a meaningful, lifelong increase in their retirement incomes. For example, individuals earning $40,000 annually over their working lives will contribute only an extra $1 per day, but receive an additional $3,222 annually in retirement as a result of the enhancement. These new benefits will be indexed annually to help retirees keep up with cost-of-living increases. |

| | ➤ | Ontario has announced a new framework for defined benefit pension plans that includes certain measures intended to help protect workers’ retirement benefits, while enabling businesses to grow and be more competitive. Similarly, a framework for target benefit multi-employer pension plans was announced to help ensure these plans are sustainable over the long term. |

The government is also exploring new approaches to help retirees draw down their savings in an efficient, cost-effective manner and help ensure their savings last throughout retirement.

| | |

Chapter I: Building Fairness for Ontario Families | | |

Improving Income Security and Mobilizing Community Solutions to Reduce Poverty

As part of building a fairer Ontario, the government is committed to providing effective social services and working to ensure that everyone shares in the province’s economic growth.

Launching a Basic Income Pilot

A wide range of research shows that living in poverty and working in precarious jobs can impact the health and well-being of individuals and their families. To develop evidence-based ways of supporting lower-income people in today’s changing economy, the Province launched a three-year Basic Income Pilot in spring 2017.

The pilot is testing whether a basic income could be a simpler and more effective way to provide income support, while improving food security, housing stability, physical and mental health, and access to health care. It is also exploring the effect of a basic income on participation in education and employment.

To reflect Ontario’s diverse communities, three pilot locations representative of the province’s socioeconomic and demographic profile were chosen.

Since the launch of the pilot, more than 500 participants in Hamilton, the Brantford and Brant County area, Thunder Bay and surrounding area, and Lindsay have started to receive a basic income, with more applications being processed.

Engagement will continue with First Nations and provincial and territorial organizations on a First Nations Basic Income Pilot.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Enhancing Social Assistance Benefits

Ontario’s social assistance programs are an important part of the income security system. Since 2013, the government has implemented improvements to Ontario Works and the Ontario Disability Support Program, including increasing rates, particularly for those with the lowest incomes and those living in higher-cost remote and northern communities. Other improvements have included:

| | ➤ | Making sure single-parent families benefit fully from the child support payments they may receive in addition to social assistance; |

| | ➤ | Increasing the income exemption for cash gifts, to recognize that people may also rely on the support of family or friends; and |

| | ➤ | Raising asset limits, so that individuals can avoid depleting all of their assets before getting help. |

Building on this progress, the 2017 Budget committed to investing more than $480 million over four years to further enhance benefits. This funding will help provide better supports for more than 900,000 people across Ontario.

In addition, Ontario has received the report from the Income Security Reform Working Group’s, Income Security: A Roadmap for Change. The government is reviewing the report and will use it, along with the public’s feedback, to help guide decisions on a multi-year path for reforming the income security system.

| | |

Chapter I: Building Fairness for Ontario Families | | |

Mobilizing Community Solutions through the Local Poverty Reduction Fund

Research has shown that food security improves mental health, reduces risks of chronic disease and lowers health care expenditure overall. Ontario is supporting an additional 48 community-led projects through the third round of the Local Poverty Reduction Fund with an investment of over $16 million. Announced this year, the fund is supporting 14 programs that will increase food security while improving livelihoods and social inclusion. These projects focus on local community partnerships, which will help communities develop better solutions to increasing food security, reducing child poverty and homelessness, and helping people prepare for employment opportunities.

|

Examples of initiatives being supported by the Local Poverty Reduction Fund: • Guelph Community Health Centre’s SEED program is a food-based social enterprise that aims to improve food access and food literacy, and support youth not in education, employment or training to move towards employment and income security. • Kasabonika Lake First Nation’s “Back to Our Roots” program is a multi-component project that aims to address economic and food security by revitalizing traditional harvesting of food as a means to subsidize income and provide nutrition to community members living in poverty. • Kingston Community Health Centres is partnering with Loving Spoonful to integrate healthy food programming with the evidence-based poverty reduction program Circles. |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Improving Housing Affordability

Implementing the Fair Housing Plan

The government strives to make it more affordable for the people of Ontario to buy or rent a home.

While rising housing prices reflect the strength of the economy and provide a net benefit to homeowners, they also create inequity as well as affordability challenges for individuals and families that are trying to buy a home or find rental accommodation.

In response to these challenges, on April 20, 2017, the government announced the Fair Housing Plan, a comprehensive package of measures to help more people find affordable homes, increase supply, protect buyers and renters, and bring stability to the real estate market.

The latest data show that the housing market is stabilizing and that the Fair Housing Plan measures are beginning to have the intended effect of making housing more affordable.

|

“In a word, the measures have accomplished almost exactly what the provincial government was hoping to achieve... a calmer market, without a collapse.” Douglas Porter, BMO Chief Economist |

| | |

Chapter I: Building Fairness for Ontario Families | | |

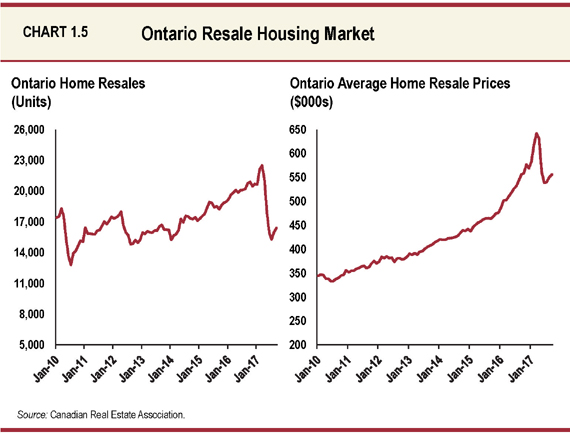

Since reaching a peak in March, the average resale price and number of Ontario home resales moved lower over the next few months before stabilizing shortly thereafter. Ontario’s average home resale price was $556,000 in September 2017, down from $642,000 in March. See Chapter III, Section B: Economic Outlook for further details.

The comprehensive package of measures announced as part of the Fair Housing Plan includes:

| | ➤ | Implementing the Non-Resident Speculation Tax to help make housing more affordable in the Greater Golden Horseshoe region; |

| | ➤ | Expanding rent control to all private market rental units across the province to protect tenants from unfair rent increases; |

| | ➤ | Improving fairness of property taxation for apartment buildings; |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

| | ➤ | Working with municipalities and stakeholders to provide municipalities with additional tools to increase housing supply, including new rental developments; |

| | ➤ | Unlocking surplus provincial land to create more than 2,000 new rental housing units with a mix of market-based and affordable units; |

|

Sites of Mixed-Income Housing Units Created in Ontario: • Two lots in the West Don Lands, one south of Front Street, between Trinity and Cherry Streets, and the other east of Cherry Street and north of the rail line. • Thistletown, located at Kipling and Finch Avenues in Toronto, will become home to a mix of affordable housing for rent or sale. • Development located at Lido Place at 129 Riverside Drive, London. • Developments in the north, including sites at 82 Gibson Street in Parry Sound and at 531 Trunk Road in Sault Ste. Marie. |

| | ➤ | Updating the Growth Plan for the Greater Golden Horseshoe, 2017, with new requirements for intensification, density targets and housing mix to support the supply of housing to meet the needs of people at any age; and |

| | ➤ | Enhancing consumer protections by proposing improvements to real estate practices. |

| | |

Chapter I: Building Fairness for Ontario Families | | |

As part of the Fair Housing Plan, the government has also established forums to identify opportunities for addressing key issues related to housing supply, including:

| | ➤ | A Housing Delivery Group — Working with developers and municipalities to cut red tape and bring specific housing projects to market faster; |

| | ➤ | A Development Approvals Roundtable — Working with senior representatives from the development and municipal sectors to identify opportunities to support more housing coming to market; releasing an action plan3 that focuses on modernizing and streamlining residential approval processes; developing new guidance materials; and promoting improved sharing of common, standardized housing-related data; and |

| | ➤ | A Housing Forum — Collaborating with housing partners to assess the impacts of the Fair Housing Plan and discuss potential additional steps. |

| 3 | http://www.mah.gov.on.ca/Page16623.aspx |

| | |

| | | Chapter I: Building Fairness for Ontario Families |

Ontario’s Fair Hydro Plan

Delivering the Single Largest Reduction to Electricity Rates in Ontario’s History

Electricity is an essential part of people’s daily lives. Following years of underinvestment, the system was due for major upgrades. Since 2003, almost $70 billion has been invested in electricity infrastructure across the province to ensure people and businesses benefit from a cleaner, more modern and more reliable system.

The much-needed rebuilding of an aging electricity system resulted in rapidly rising rates for people and businesses across Ontario. The government recognized that present-day consumers should not be burdened with paying for a disproportionate share of investments that can provide benefits for decades to come.

For this reason, the government announced Ontario’s Fair Hydro Plan in March 2017. A portion of the Global Adjustment, which helps pay for investments in electricity supply and conservation, is being refinanced and will be recovered from ratepayers over a longer period of time. The spreading of this refinancing and cost recovery from ratepayers in the future over a longer period reflects the expected longer life cycle of existing facilities and is providing significant and immediate rate relief, helping to ensure intergenerational fairness.

The average 25 per cent electricity bill reduction also reflects a number of other components that are government funded, including providing the eight per cent rebate on electricity bills, equal to the provincial portion of the Harmonized Sales Tax, which was effective January 1, 2017; and removing the cost of the Ontario Electricity Support Program and most of the Rural or Remote Rate Protection program from electricity consumers’ bills.

As of July 1, 2017, electricity bills have been reduced by 25 per cent on average, or about $41 per month, for eligible households. Approximately half a million eligible small businesses and farms are also receiving a benefit. As part of this plan, rate increases over four years will be held to the rate of inflation. While rates will rise gradually over time, the government remains committed to avoiding sharp increases.

| | |

Chapter I: Building Fairness for Ontario Families | | |

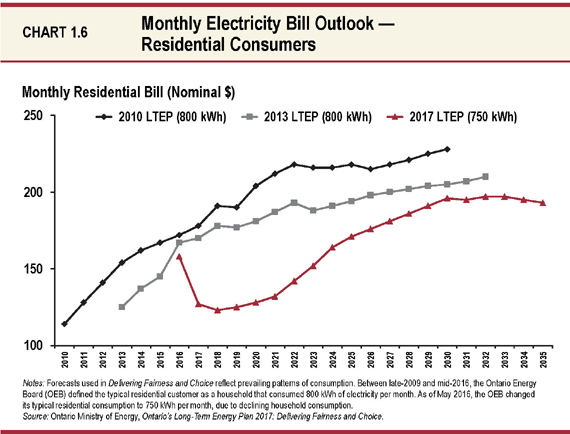

Due to a number of initiatives the government is implementing — including Ontario’s Fair Hydro Plan, the Independent Electricity System Operator’s market renewal initiative, and other efficiency and productivity improvements to the system — Ontario’s 2017 Long-Term Energy Plan (LTEP) projects lower monthly bills for residential consumers than previously forecasted.

| | |

| | | Chapter I: Building Fairness for Ontario Families |

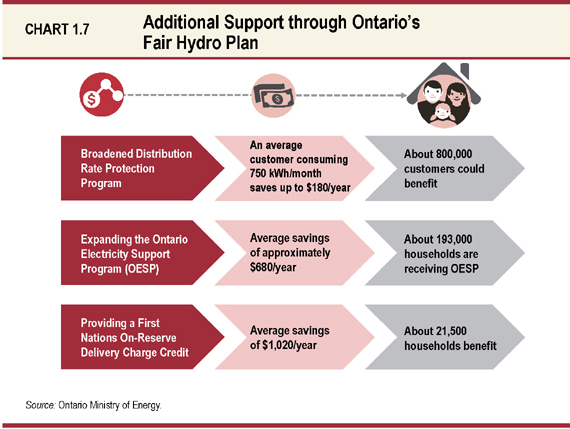

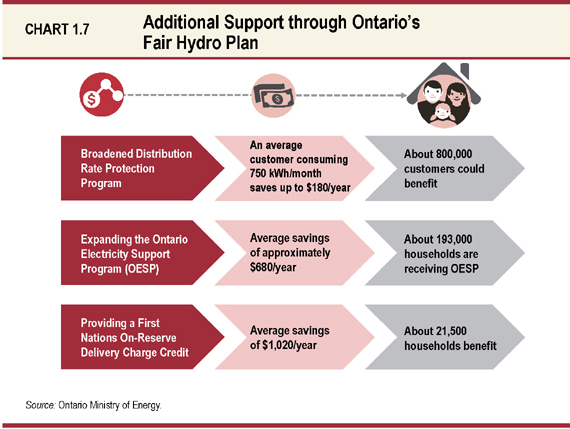

Providing Additional Support through Ontario’s Fair Hydro Plan

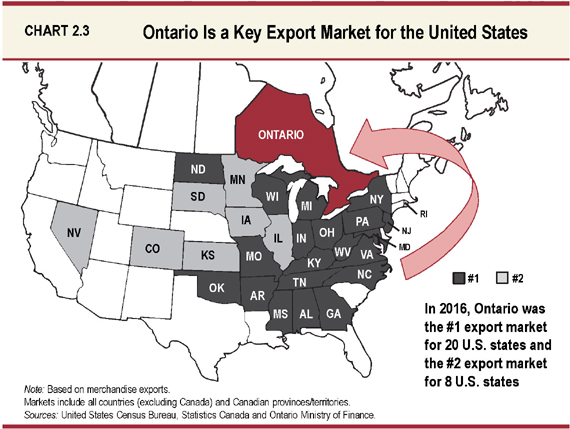

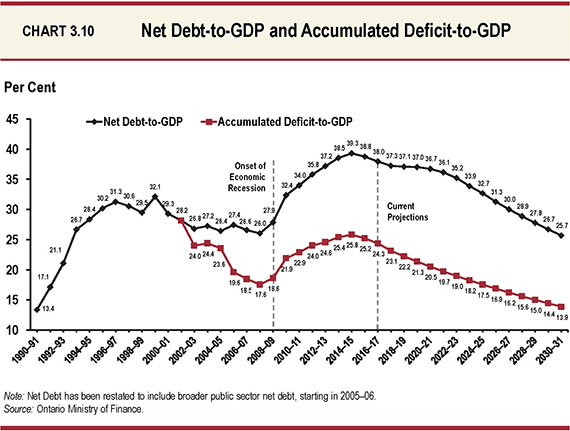

People with low incomes and those living in eligible rural or remote communities are receiving even greater reductions, as much as 40 to 50 per cent. On-reserve First Nation residential customers of licensed distributors are getting a 100 per cent credit on the delivery line of their bills.