Province of Ontario Green Bond Presentation NOVEMBER 2019 EXHIBIT (99.15)

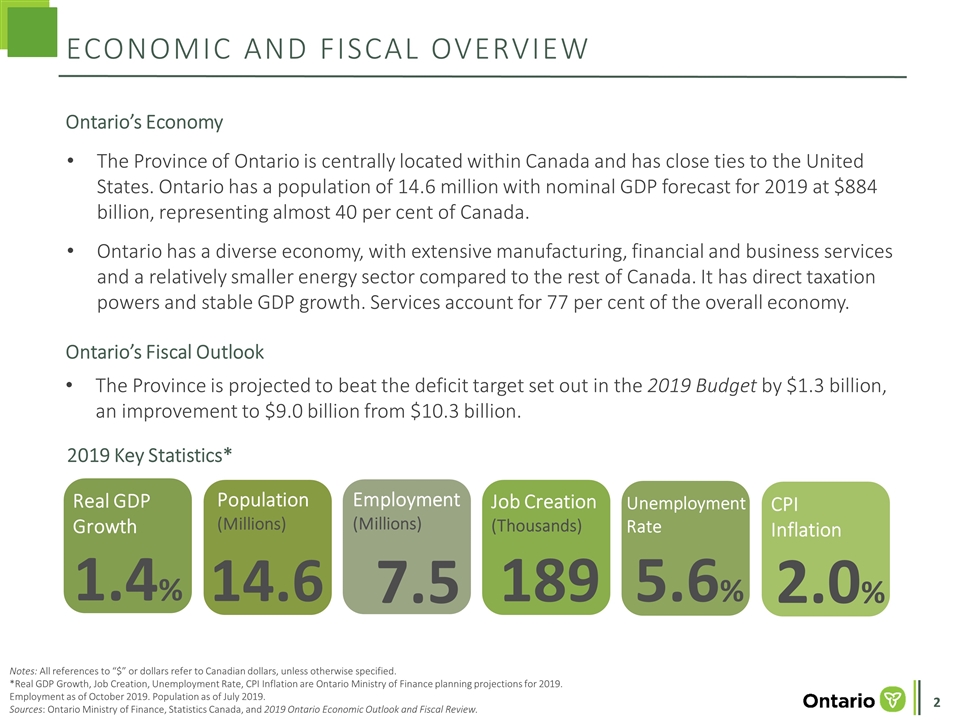

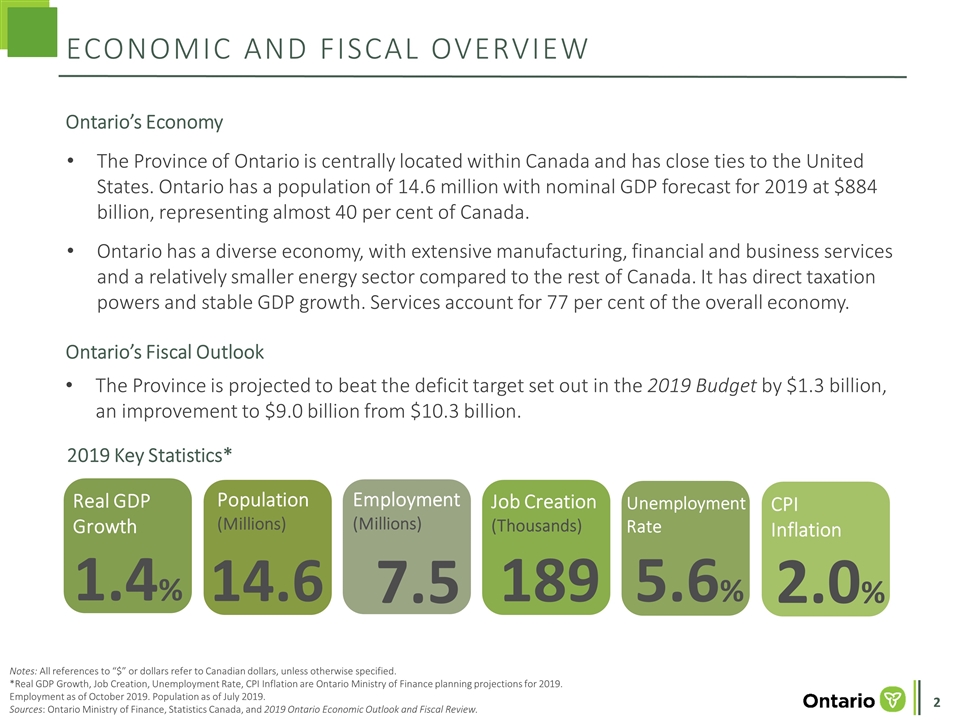

economic and fiscal Overview Ontario’s Economy The Province of Ontario is centrally located within Canada and has close ties to the United States. Ontario has a population of 14.6 million with nominal GDP forecast for 2019 at $884 billion, representing almost 40 per cent of Canada. Ontario has a diverse economy, with extensive manufacturing, financial and business services and a relatively smaller energy sector compared to the rest of Canada. It has direct taxation powers and stable GDP growth. Services account for 77 per cent of the overall economy. Ontario’s Fiscal Outlook The Province is projected to beat the deficit target set out in the 2019 Budget by $1.3 billion, an improvement to $9.0 billion from $10.3 billion. Notes: All references to “$” or dollars refer to Canadian dollars, unless otherwise specified. *Real GDP Growth, Job Creation, Unemployment Rate, CPI Inflation are Ontario Ministry of Finance planning projections for 2019. Employment as of October 2019. Population as of July 2019. Sources: Ontario Ministry of Finance, Statistics Canada, and 2019 Ontario Economic Outlook and Fiscal Review. 1.4% Real GDP Growth 2.0% CPI Inflation 5.6% Unemployment Rate Job Creation (Thousands) 189 Employment (Millions) 7.5 Population (Millions) 14.6 2019 Key Statistics*

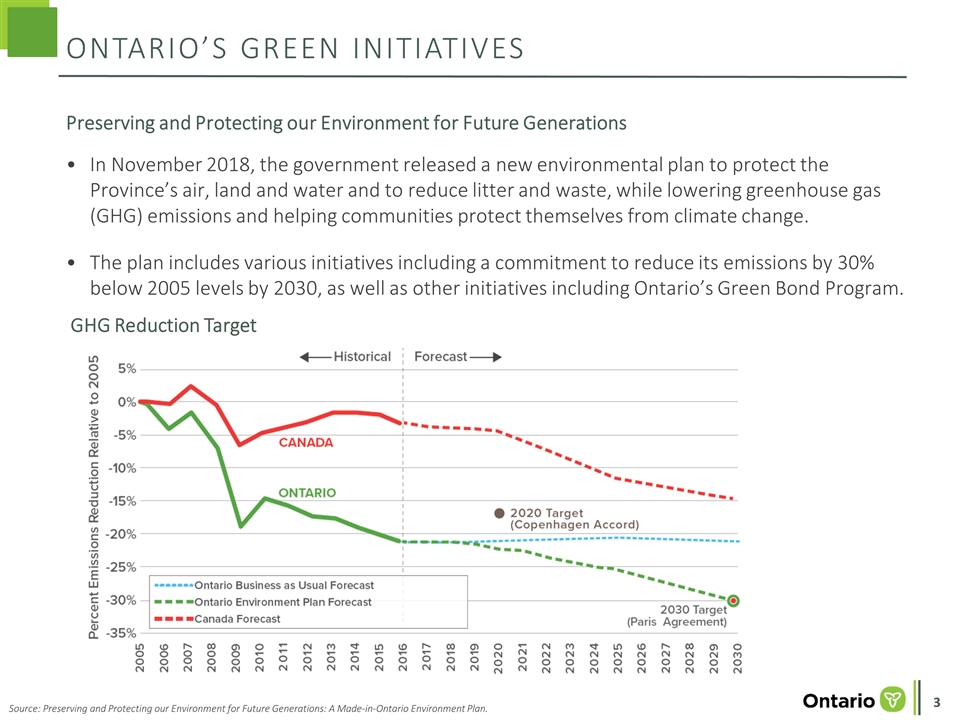

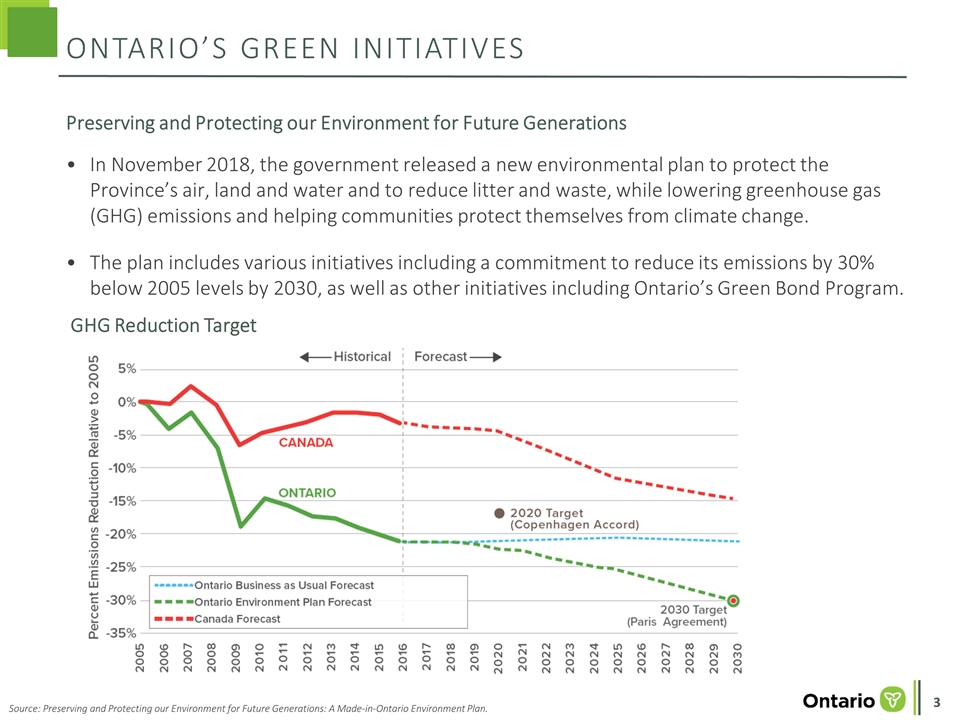

Preserving and Protecting our Environment for Future Generations In November 2018, the government released a new environmental plan to protect the Province’s air, land and water and to reduce litter and waste, while lowering greenhouse gas (GHG) emissions and helping communities protect themselves from climate change. The plan includes various initiatives including a commitment to reduce its emissions by 30% below 2005 levels by 2030, as well as other initiatives including Ontario’s Green Bond Program. Ontario’s Green Initiatives GHG Reduction Target Source: Preserving and Protecting our Environment for Future Generations: A Made-in-Ontario Environment Plan.

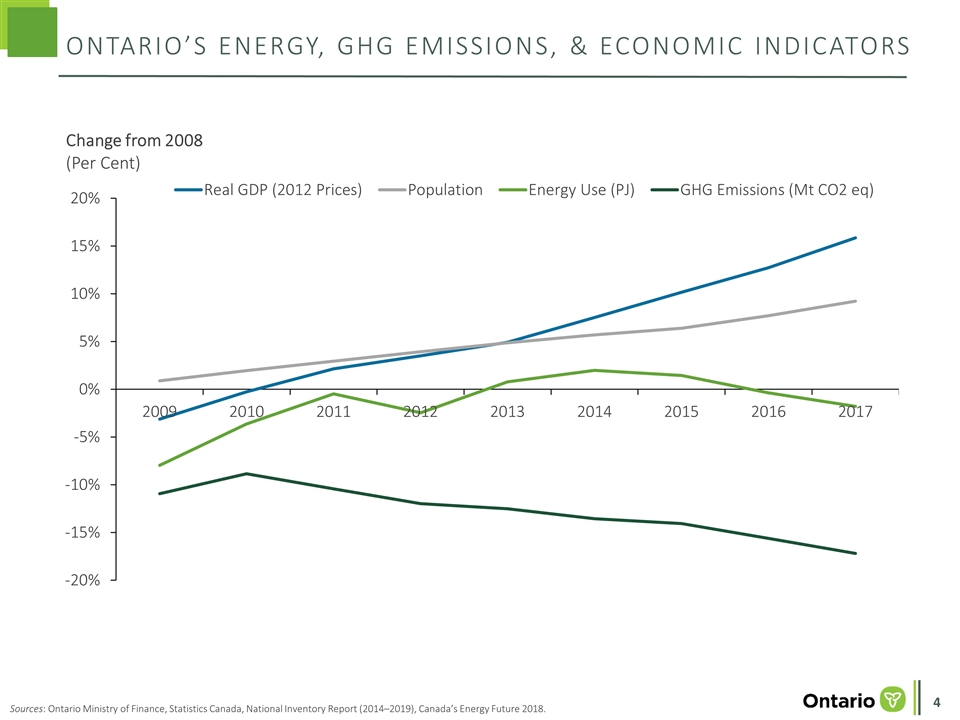

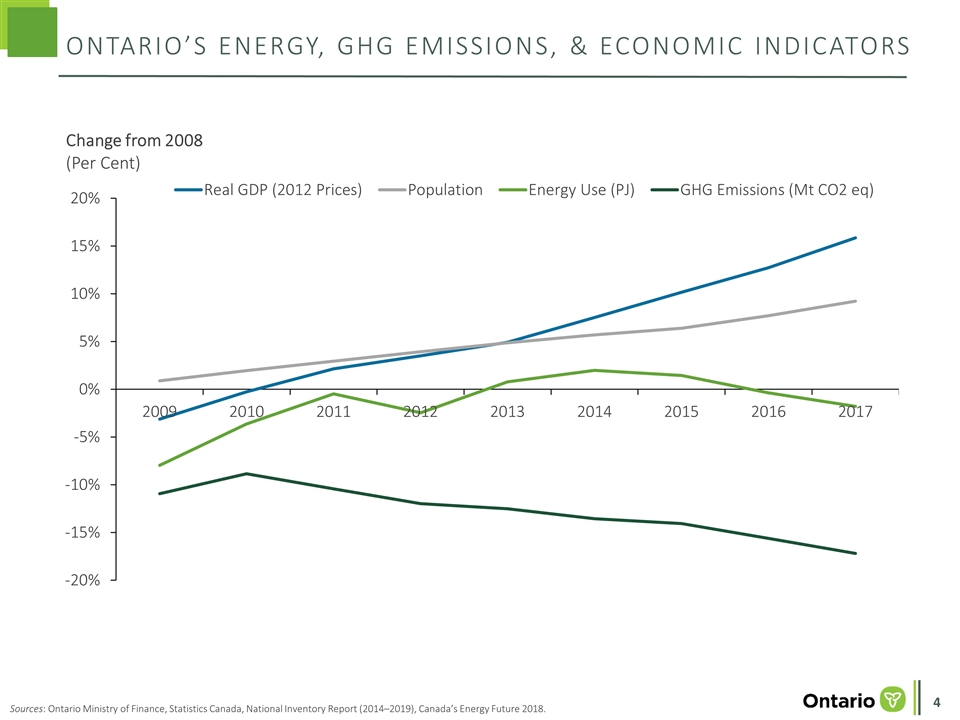

ONTARIO’S Energy, GHG Emissions, & Economic Indicators Sources: Ontario Ministry of Finance, Statistics Canada, National Inventory Report (2014–2019), Canada’s Energy Future 2018. Change from 2008 (Per Cent)

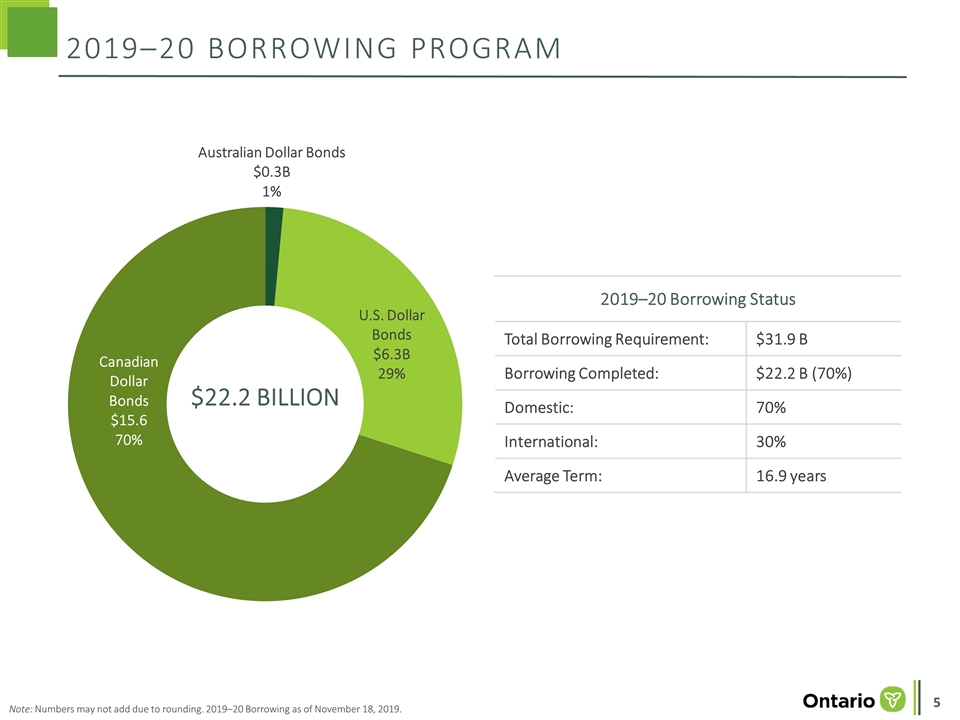

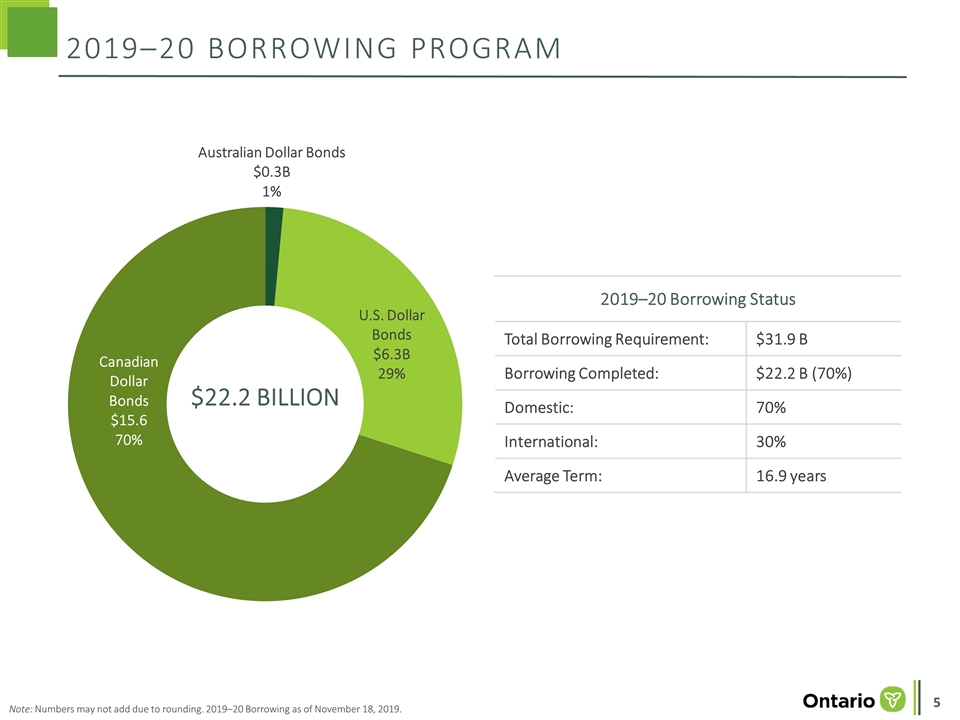

2019–20 Borrowing Program Note: Numbers may not add due to rounding. 2019–20 Borrowing as of November 18, 2019. $22.2 BILLION 2019–20 Borrowing Status Total Borrowing Requirement: $31.9 B Borrowing Completed: $22.2 B (70%) Domestic: 70% International: 30% Average Term: 16.9 years

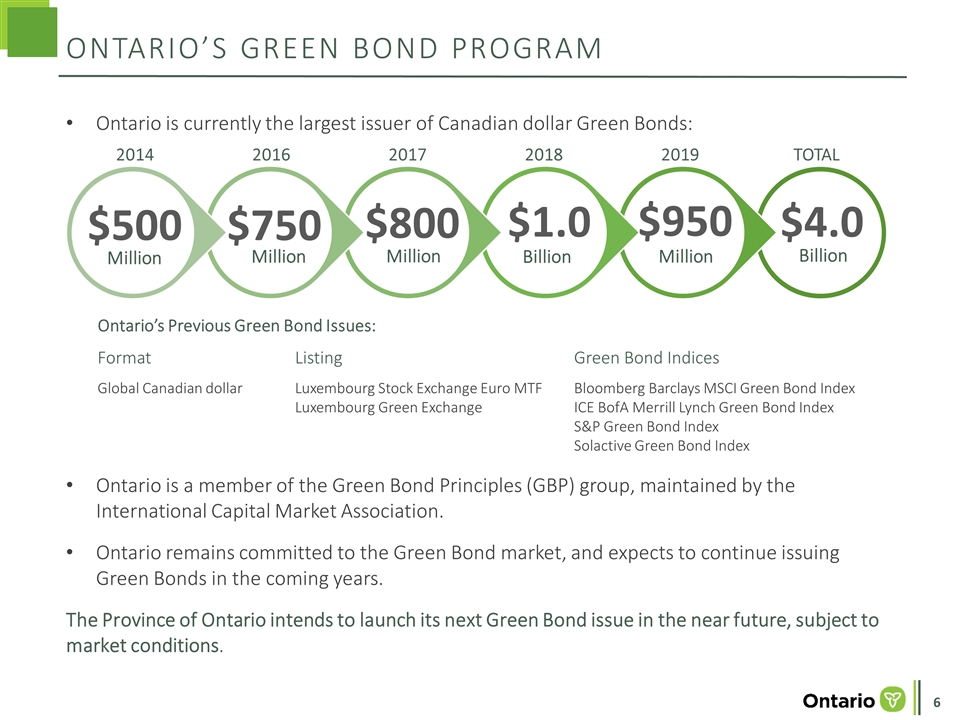

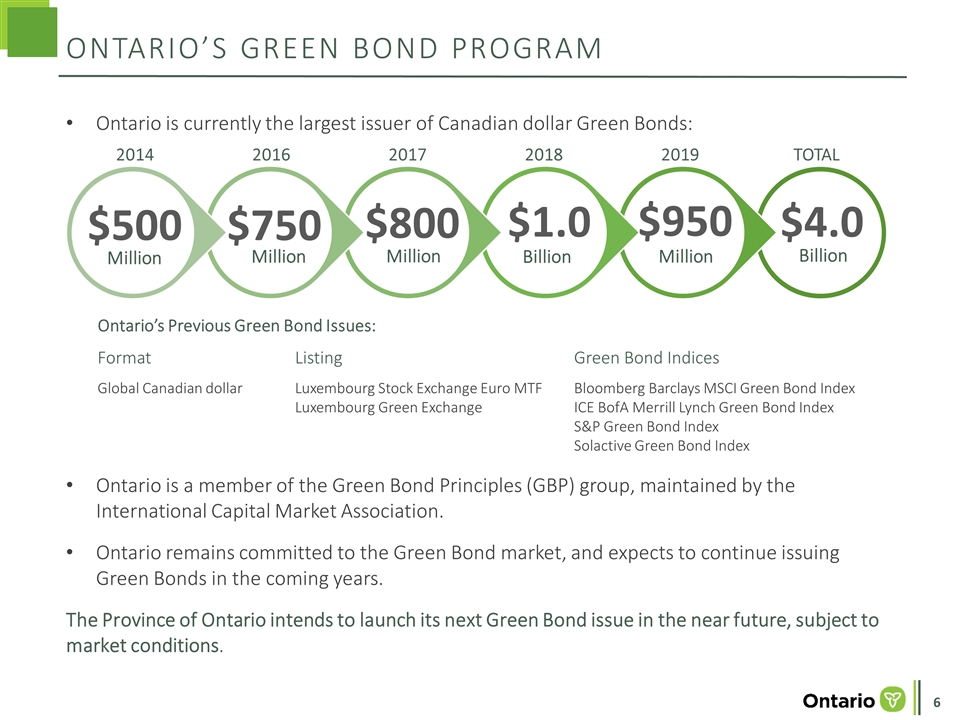

Ontario is currently the largest issuer of Canadian dollar Green Bonds: Ontario’s Green Bond Program Ontario’s Previous Green Bond Issues: Format Listing Green Bond Indices Global Canadian dollar Luxembourg Stock Exchange Euro MTF Luxembourg Green Exchange Bloomberg Barclays MSCI Green Bond Index ICE BofA Merrill Lynch Green Bond Index S&P Green Bond Index Solactive Green Bond Index $500 Million 2014 2016 2017 2018 2019 TOTAL $750 Million $800 Million $1.0 Billion $4.0 Billion Ontario is a member of the Green Bond Principles (GBP) group, maintained by the International Capital Market Association. Ontario remains committed to the Green Bond market, and expects to continue issuing Green Bonds in the coming years. The Province of Ontario intends to launch its next Green Bond issue in the near future, subject to market conditions. $950 Million 2 3 5 4 1

Green Bond proceeds are paid into the Consolidated Revenue Fund of Ontario. The proceeds are invested short-term in Government of Canada treasury bills. An amount equal to the net proceeds of each Green Bond issue is recorded in a designated account in the Province of Ontario’s financial records. These designated accounts are used to track the use and allocation of funds to eligible projects. Green Bond projects are expected to be funded within one year from the date of issue. Use and Management of Proceeds Assurance Audit An assurance audit is performed by the Auditor General of Ontario verifying amounts allocated to selected projects and tracking the amount of Green Bond proceeds. This assurance audit is expected within a year after the issue date. The most recent Assurance Audit was completed on November 22, 2018. External Review Ontario’s Green Bond Framework was developed in consultation with the Center for International Climate and Environmental Research — Oslo (CICERO) and is consistent with the Green Bond Principles.

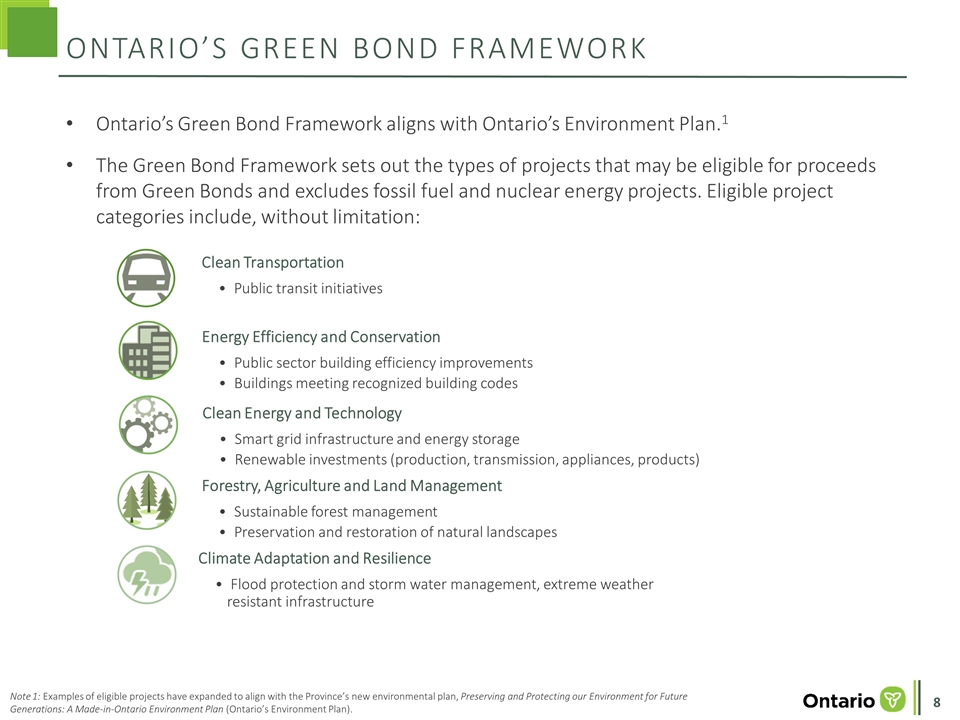

Ontario’s Green Bond Framework aligns with Ontario’s Environment Plan.1 The Green Bond Framework sets out the types of projects that may be eligible for proceeds from Green Bonds and excludes fossil fuel and nuclear energy projects. Eligible project categories include, without limitation: Ontario’s Green Bond Framework Note 1: Examples of eligible projects have expanded to align with the Province’s new environmental plan, Preserving and Protecting our Environment for Future Generations: A Made-in-Ontario Environment Plan (Ontario’s Environment Plan). Clean Transportation Public transit initiatives Energy Efficiency and Conservation Public sector building efficiency improvements Clean Energy and Technology Smart grid infrastructure and energy storage Forestry, Agriculture and Land Management Sustainable forest management Climate Adaptation and Resilience Flood protection and storm water management, extreme weather resistant infrastructure Preservation and restoration of natural landscapes Renewable investments (production, transmission, appliances, products) Buildings meeting recognized building codes

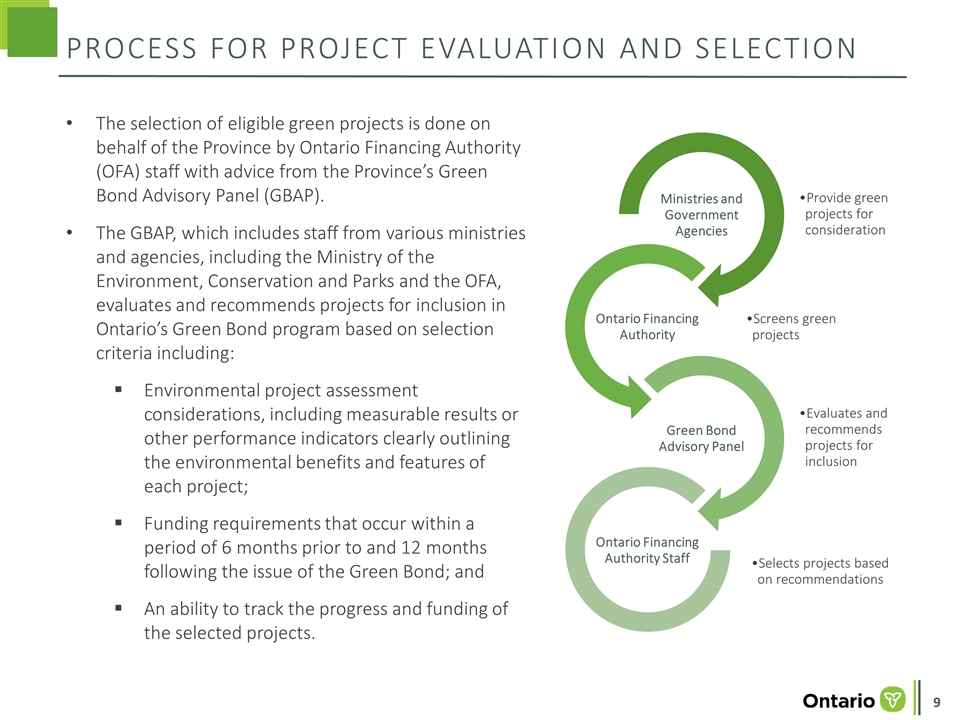

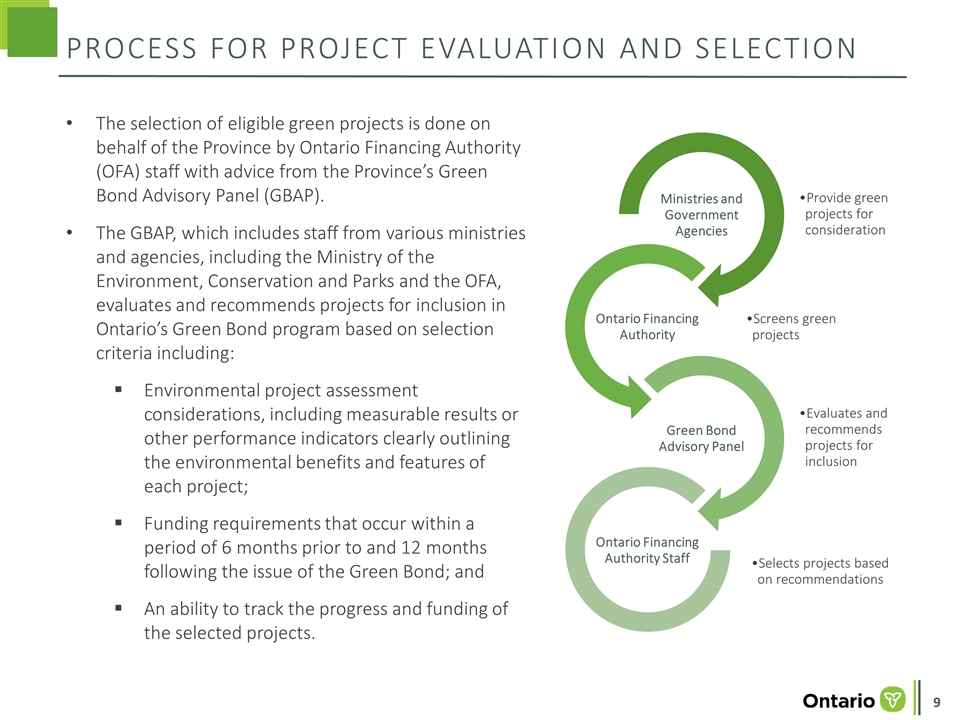

Process for Project Evaluation and Selection The selection of eligible green projects is done on behalf of the Province by Ontario Financing Authority (OFA) staff with advice from the Province’s Green Bond Advisory Panel (GBAP). The GBAP, which includes staff from various ministries and agencies, including the Ministry of the Environment, Conservation and Parks and the OFA, evaluates and recommends projects for inclusion in Ontario’s Green Bond program based on selection criteria including: Environmental project assessment considerations, including measurable results or other performance indicators clearly outlining the environmental benefits and features of each project; Funding requirements that occur within a period of 6 months prior to and 12 months following the issue of the Green Bond; and An ability to track the progress and funding of the selected projects. Ministries and Government Agencies Ontario Financing Authority Screens green projects Green Bond Advisory Panel Provide green projects for consideration Evaluates and recommends projects for inclusion Ontario Financing Authority Staff Selects projects based on recommendations

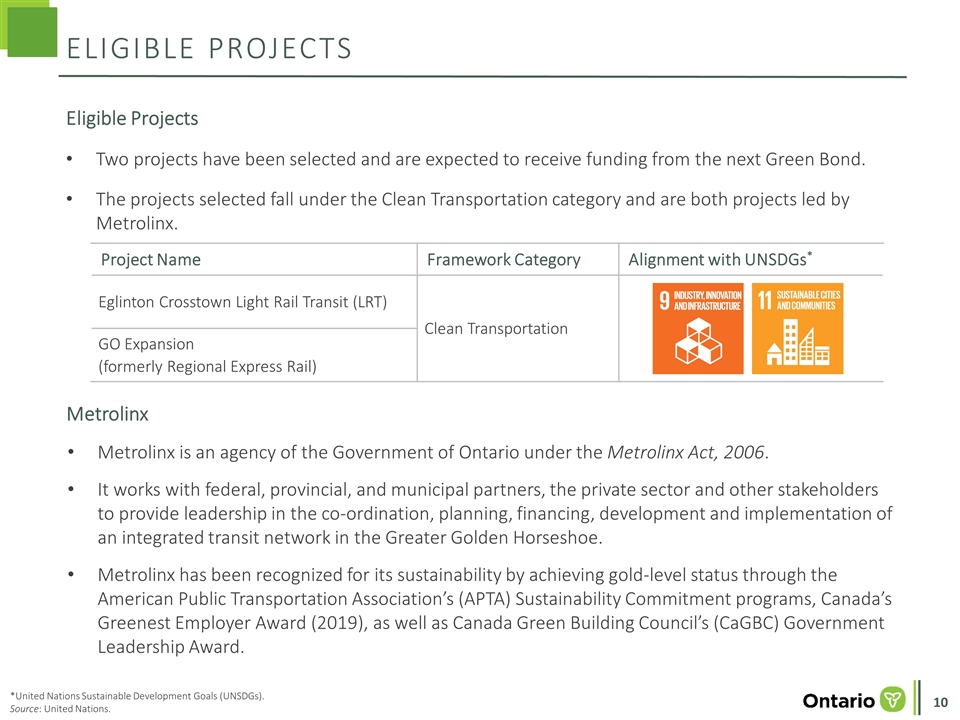

Eligible Projects Eligible Projects Two projects have been selected and are expected to receive funding from the next Green Bond. The projects selected fall under the Clean Transportation category and are both projects led by Metrolinx. *United Nations Sustainable Development Goals (UNSDGs). Source: United Nations. Metrolinx Metrolinx is an agency of the Government of Ontario under the Metrolinx Act, 2006. It works with federal, provincial, and municipal partners, the private sector and other stakeholders to provide leadership in the co-ordination, planning, financing, development and implementation of an integrated transit network in the Greater Golden Horseshoe. Metrolinx has been recognized for its sustainability by achieving gold-level status through the American Public Transportation Association’s (APTA) Sustainability Commitment programs, Canada’s Greenest Employer Award (2019), as well as Canada Green Building Council’s (CaGBC) Government Leadership Award. Project Name Framework Category Alignment with UNSDGs* Eglinton Crosstown Light Rail Transit (LRT) Clean Transportation GO Expansion (formerly Regional Express Rail)

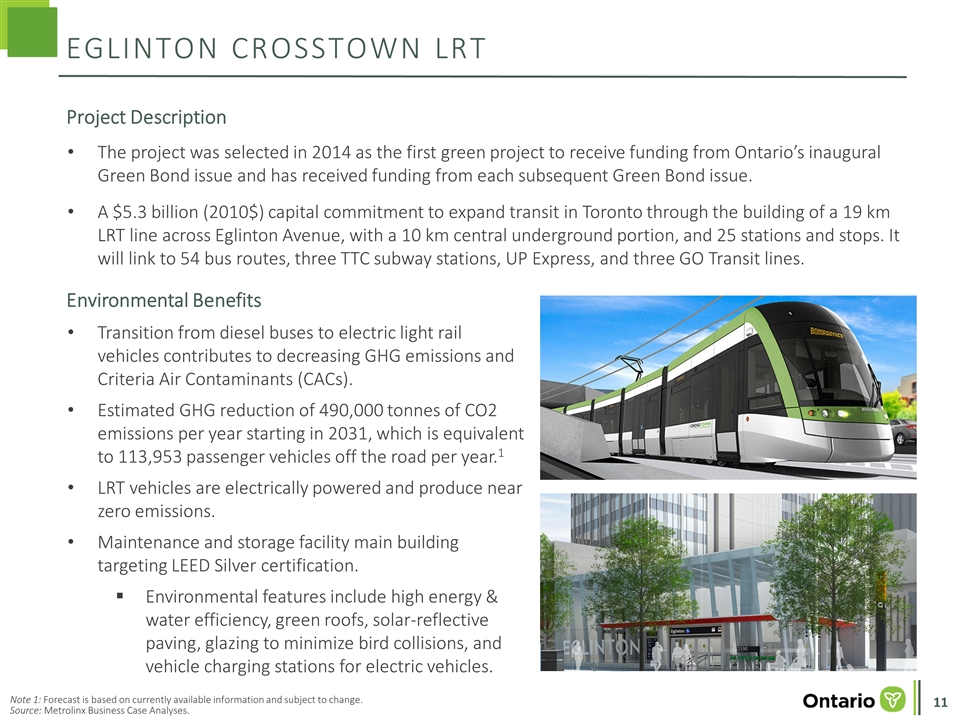

Eglinton crosstown lrt Project Description The project was selected in 2014 as the first green project to receive funding from Ontario’s inaugural Green Bond issue and has received funding from each subsequent Green Bond issue. A $5.3 billion (2010$) capital commitment to expand transit in Toronto through the building of a 19 km LRT line across Eglinton Avenue, with a 10 km central underground portion, and 25 stations and stops. It will link to 54 bus routes, three TTC subway stations, UP Express, and three GO Transit lines. Environmental Benefits Transition from diesel buses to electric light rail vehicles contributes to decreasing GHG emissions and Criteria Air Contaminants (CACs). Estimated GHG reduction of 490,000 tonnes of CO2 emissions per year starting in 2031, which is equivalent to 113,953 passenger vehicles off the road per year.1 LRT vehicles are electrically powered and produce near zero emissions. Maintenance and storage facility main building targeting LEED Silver certification. Environmental features include high energy & water efficiency, green roofs, solar-reflective paving, glazing to minimize bird collisions, and vehicle charging stations for electric vehicles. Note 1: Forecast is based on currently available information and subject to change. Source: Metrolinx Business Case Analyses.

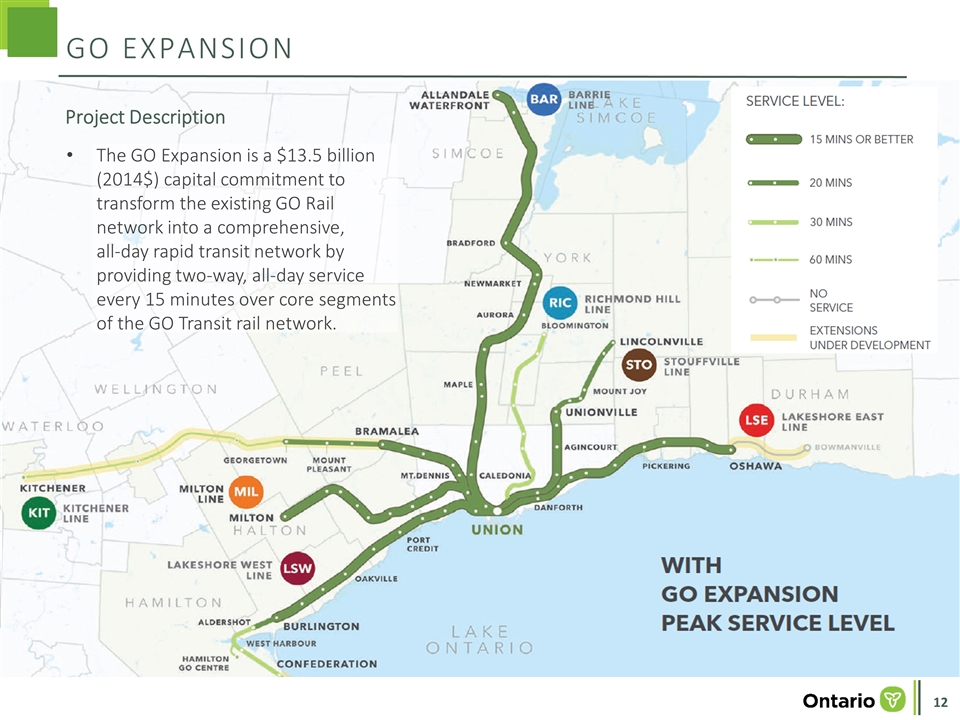

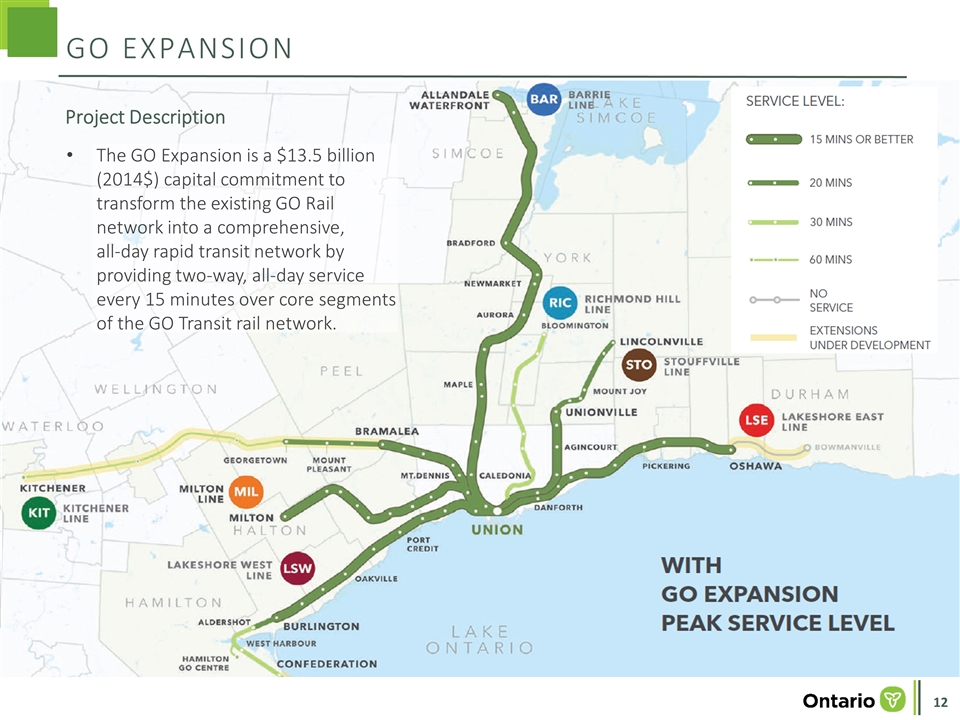

GO EXPANSION Project Description The GO Expansion is a $13.5 billion (2014$) capital commitment to transform the existing GO Rail network into a comprehensive, all-day rapid transit network by providing two-way, all-day service every 15 minutes over core segments of the GO Transit rail network.

GO EXPANSION Environmental Benefits GO Expansion will shift GO from a largely commuter system to a comprehensive regional rapid transit option, thereby contributing to mode shift and decreasing GHG emissions and CACs. Estimated GHG reduction of 480,000 tonnes of CO2 emissions per year starting in 2030, which is equivalent to 111,628 passenger vehicles off the road per year.1 New facilities will be minimum LEED Silver and are targeting LEED Gold certification where possible. Linear infrastructure through GO Expansion requires Envision Silver, with Gold credits being pursued where possible. The Province will look to the private sector to propose innovative approaches to meet future GO Transit rail service levels, including opportunities for technology that could be used to electrify core segments of the GO Transit rail network. Other Benefits The GO Expansion will also provide a range of improvements across the Greater Toronto and Hamilton Area: Note 1: The GO Expansion Full Business Case estimates emission reductions of 13,500,000 tonnes of CO2 by 2055 from reductions in auto use and the switch from diesel to electric locomotives, which is equivalent to about 480,000 tonnes per year, commencing in 2030. Forecast is based on currently available information and subject to change. Source: Metrolinx Business Case Analyses.

Impact Reporting Since 2015, Ontario has published an annual Green Bond Newsletter with its most recent released on December 4, 2018. The newsletter provides: An overview of the process for project evaluation and selection The total funds allocated to projects and amounts Updates on selected projects A link to the assurance audit performed by the Auditor General of Ontario Projected environmental benefits In developing the newsletter, the OFA works alongside other Ontario ministries and government agencies, with support from the Ministry of the Environment, Conservation and Parks providing expertise in the analysis of projected environmental benefits. Ontario uses widely recognized core indicators for its projects and expects to adopt any future impact reporting recommendations of the GBP.

Summary Ontario has a mature Green Bond program and expects Green Bonds to continue having an important role in the Province’s annual borrowing. Ontario strives to be a leader in its transparency and impact reporting efforts with the publication of its annual newsletter. Ontario is planning to launch its next Green Bond issue in the near future, subject to market conditions. Two Clean Transportation projects are expected to receive funding from the next issue, including the Eglinton Crosstown LRT and the GO Expansion.

Legal Notice This presentation was compiled by the Ontario Financing Authority. This information is intended for general information purposes only and does not constitute an offer to sell or a solicitation of offers to purchase securities. It has not been approved by any securities regulatory authority and it is not sufficient for the purpose of deciding to purchase securities. It may have errors or omissions resulting from electronic conversion, downloading or unauthorized modifications. Statements in this presentation may be “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve uncertainties, risks, and other factors which could cause the state of Ontario’s economy to differ materially from the forecasts and economic outlook contained expressly or implicitly in such statements. The province of Ontario undertakes no obligation to update forward-looking statements to reflect new information, future events or otherwise, except as may be required under applicable laws and regulations. No PRIIPs KID – No PRIIPs key information document (KID) has been or will be prepared as any bonds, if issued, will not be available to retail investors in the European Economic Area. This presentation has been prepared on the basis that any offer of bonds in any Member State of the European Economic Area will be made pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers of bonds. The expression "Prospectus Regulation" means Regulation (EU) 2017/1129 (as amended or superseded). This presentation is for distribution only to persons who (i) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Financial Promotion Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”) of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the FSMA) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). This presentation is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this presentation relates is available only to relevant persons and will be engaged in only with relevant persons. While the information in this presentation, when posted or released, was believed to be reliable as of its date, NO WARRANTY IS MADE AS TO THE ACCURACY OR COMPLETENESS OF THIS DOCUMENT OR THE INFORMATION IT CONTAINS. Investor Relations Ontario Financing Authority 1 Dundas Street West, Suite 1200 Toronto, Ontario M5G 1Z3 Canada