UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

DETWILER, MITCHELL & CO.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

Reg. §240.14a-101.

SEC 1913 (3-99)

[LOGO]

DETWILER, MITCHELL & CO.

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To be held on May 19, 2003

To the Stockholders of Detwiler, Mitchell & Co.:

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of Detwiler, Mitchell & Co., a Delaware corporation, will be held at the Board Room, 225 Franklin Street, 33rd Floor, Boston, MA 02110 on Monday, May 19, 2003, at 10:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | | To approve an amendment to the 2000 Omnibus Equity Incentive Plan. |

| 2. | | To elect one Director of our company, to serve for three years and until his successor shall be duly appointed or elected. |

| 3. | | To ratify the selection of PricewaterhouseCoopers LLP as our company’s independent accountants for the year 2003. |

| 4. | | To transact such other business as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on April 2, 2003 will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you plan to attend in person, to assure your representation at the Annual Meeting, you are urged to mark, sign, date, and return the enclosed Proxy as promptly as possible in the postage-prepaid envelope provided for that purpose. Any stockholder attending the meeting may vote in person even if such stockholder returned a completed Proxy.

Requests for additional copies of proxy materials and other information should be addressed to Investor Relations at the executive offices of our company, 225 Franklin Street, 20th Floor, Boston, Massachusetts 02110, (617) 451-0100.

By Order of the Board of Directors

Boston, Massachusetts

April 17, 2003

[LOGO]

DETWILER, MITCHELL & CO.

225 Franklin Street, 20th Floor

Boston, MA 02110

Proxy Statement for

Annual Meeting of Stockholders

To Be Held on May 19, 2003

GENERAL

The enclosed Proxy is solicited by the Board of Directors of Detwiler, Mitchell & Co., a Delaware corporation, for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 19, 2003 at 10:00 a.m., Eastern Daylight Savings Time, or at any adjournment(s) or postponement(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Board Room, 225 Franklin Street, 33rd Floor, Boston, MA 02110.

Our company’s telephone number is (617) 451-0100. These proxy solicitation materials were first mailed on or about April 19, 2003 to all stockholders entitled to notice of and to vote at the Annual Meeting.

INFORMATION CONCERNING VOTING, SOLICITATION AND PROXIES

Record Date and Shares Outstanding

Stockholders of record at the close of business on April 2, 2003 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, our company had 3,202,356 shares of common stock, $0.01 par value (the “Common Stock”), and no shares of preferred stock, issued and outstanding.

Voting and Solicitation

Each stockholder is entitled to one vote for each share of Common Stock held of record on the record date.

Shares of Common Stock represented by properly executed proxies will, unless such proxies have been previously revoked, be voted in accordance with the instructions indicated thereon. In the absence of specific instructions to the contrary, properly executed proxies will be voted FOR the Amendment to the 2000 Omnibus Equity Incentive Plan,FOR the election of the person nominated by the Board of Directors for election as a Director andFOR ratification of the independent accountants. No business other than that set forth in the accompanying Notice of Annual Meeting of Stockholders is expected to come before the Annual Meeting. Should any other matter requiring a vote of stockholders properly come before the meeting, the persons named in the enclosed form of proxy (the “Proxy Holders”) will have discretionary authority to vote the shares represented by such proxy in accordance with their best judgment on such matter.

The cost of this proxy solicitation will be paid by our company. Our company will reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding soliciting materials to such beneficial owners. Proxies may be solicited by certain of our company’s Directors, officers, and employees, without additional compensation, personally or by telephone, telegram or electronic mail.

1

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to our company a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person. Attending the Annual Meeting in and of itself will not constitute a revocation of a proxy.

Deadlines for Receipt of Stockholder Nominations and Proposals for Inclusion in the Proxy Statement for the 2004 Annual Meeting

Section 2.5 of our company’s Bylaws provides that nominations may be made by the Board of Directors or by any stockholder entitled to vote in the election of Directors generally, provided that all stockholders intending to nominate Director candidates for election must deliver written notice thereof to the Secretary of our company, which notice must be received not less than sixty nor more than ninety days prior to the meeting or, if less than seventy days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, within ten days after the date on which notice of such meeting is first given to stockholders. Such notice must set forth certain information concerning such stockholder and his or her nominee(s), including their names and addresses, such other information as would be required to be in the proxy statement soliciting proxies for the election of the nominees of such stockholder and the consent of each nominee to serve as a Director of our company if so elected. The chairman of the Annual Meeting will refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

Our company’s Bylaws also require that stockholders give advance notice and follow certain other procedures with regard to business they wish to bring before an annual meeting of stockholders. Section 2.6 of our company’s Bylaws provides that all stockholders intending to bring business before the meeting deliver written notice thereof to the Secretary of our company in the same manner and within the same periods as required for stockholder nominees for the Board of Directors, as described in the preceding paragraph. Such notice shall set forth certain information concerning such stockholder and the proposed business, including any material interest of the stockholder in such business. The chairman of the Annual Meeting will refuse to permit business to be brought before the Annual Meeting if notice is not given in compliance with the foregoing procedure.

We intend to hold our next Annual Meeting of Stockholders on or about May 17, 2004. Stockholders seeking to include a proposal in the Proxy Statement for our company’s 2004 Annual Meeting must ensure that such proposal is received at the executive offices of our company on or before March 17, 2004. Inclusion of any such proposal is subject to certain other requirements.

Board Meetings and Committees

The business affairs of our company are managed by or under the direction of the Board of Directors, although it is not involved in day-to-day operations. During the year ended December 31, 2002, the Board of Directors met six times.

The Board of Directors of our company has standing Audit and Compensation Committees.

Audit Committee. The Audit Committee is responsible for the appointment of the firm selected to be independent public accountants for our company and monitors and evaluates the performance of such firm; reviews and approves the scope of the annual audit and evaluates with the independent public accountants our company’s annual audit and annual consolidated financial statements; reviews our company’s financial reporting policies and practices; reviews with management the status of internal control procedures, adequacy of financial staff and other matters and makes such recommendations to the Board of Directors as may be appropriate; evaluates matters having a potential financial impact on our company which may be brought to its attention by management, the independent public accountants or the Board of Directors; and reviews all public financial reporting documents of our company. The current members of the Audit Committee are Frank Jenkins (chairman), Edward Baran and Barton Beek, each of whom is “independent” as defined in the NASDAQ listing standards. The Audit Committee held eight meetings during the year ended December 31, 2002 and held two meetings in 2003 prior to release of our 2002 earnings report

2

and the filing of the Annual Report on Form 10-K for the year ended December 31, 2002. See “Audit Committee Report” below.

Compensation Committee.The Compensation Committee reviews and makes recommendations to the Board of Directors with respect to the specific compensation to be paid or provided to executive officers and also recommends grants of stock options including incentive stock options under our company’s 2000 Omnibus Equity Incentive Plan. The Compensation Committee also reviews the structure of salary, commissions, bonus and deferred bonus compensation for key employees. The current members of the Compensation Committee are Robert Sharp (chairman), Barton Beek and Frank Jenkins. The Compensation Committee held two meetings during fiscal 2002. See “Compensation Committee Report” below.

During the year ended December 31, 2002, each of the Directors of our company attended all of the meetings of the Board of Directors and all of the meetings of the committee(s) of the Board on which he served during the period he served in such capacities.

BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth names and certain other information concerning our company’s Board of Directors and executive officers, as of April 2, 2003:

Name

| | Age

| | Position

| | Term of Office as Director Will Expire

|

James Mitchell | | 64 | | Chairman, Chief Executive Officer and Director | | 2004 |

|

James Graves | | 54 | | Vice-Chairman and Director | | 2005 |

|

Robert Detwiler | | 73 | | President and Director | | 2005 |

|

Edward Baran | | 67 | | Director | | 2003 |

|

Barton Beek | | 79 | | Director | | 2005 |

|

Frank Jenkins | | 66 | | Director | | 2004 |

|

Robert Sharp | | 67 | | Director | | 2004 |

|

Stephen Martino | | 46 | | Chief Financial Officer | | |

|

Edward Hughes | | 62 | | Chief Operating Officer | | |

|

Stephen Frank | | 50 | | Chief Legal Officer and Secretary | | |

|

Peter Fenton | | 46 | | Executive Vice President of Fechtor, Detwiler & Co., Inc. | | |

Information with respect to the principal occupation during the past five years of each nominee, each current Director and each executive officer is set forth below. There currently are no family relationships among Directors or executive officers of our company.

James Mitchell became a Director in October 1988 and became Chairman of our company on January 1, 1993 and served as Chief Executive Officer between January 1, 1993 and August 30, 1999 and again, since May 22, 2000. He served as President of our company between January 1, 1997 and May 22, 2000. Mr. Mitchell is the founder of one of our operating subsidiaries, James Mitchell & Co. In 1973, Mr. Mitchell was a founding officer of

3

Security First Group, a financial services firm that pioneered the concept of marketing insurance and annuity products through stock brokerage firms. Before joining that firm, Mr. Mitchell served as Vice President of Marketing for the Variable Annuity Life Insurance Company of Houston, Texas. He attended Portland State University and is a registered General Securities Principal with the NASD.

James Graves became a director and Vice-Chairman of our company on February 27, 2002. Mr. Graves is a Managing Director and partner of Erwin, Graves & Associates, LP, a management consulting firm located in Dallas, Texas. Prior to starting that company, he was the Chief Operating Officer and head of Equity Capital Markets at J.C. Bradford & Co., an investment banking and brokerage firm located in Nashville, Tennessee, which was acquired by Paine Webber in 2000. Mr. Graves received a B.A. degree from Trinity College in Hartford, Connecticut. He is a member of the Board of Directors and Compensation Committee for Cash America International and Hallmark Financial Services, Inc. He is currently a registered NASD General Securities Principal.

Robert Detwiler is a Director and President of our company and one of our principal subsidiaries, Fechtor, Detwiler & Co., Inc. (“Fechtor, Detwiler”). Mr. Detwiler joined Fechtor, Detwiler in 1975. He owned one third of Fechtor, Detwiler until the merger between Fechtor Detwiler and our company in August 1999. He was named a Director of our company May 22, 2000. Mr. Detwiler has been in the securities industry since 1957 and has been with Smith Barney, Laird & Company and Wood, Struthers & Winthrop. He is a member of the Board of Directors of Friendship Home, a non-profit corporation. He is a registered General Securities Principal with the NASD.

Edward Baran became a Director in August 1992. Mr. Baran, has spent more than forty years in the insurance industry and recently retired as Chairman and Chief Executive Officer of BCS Financial Corporation, a financial services holding company. Prior to joining BCS in November 1987, Mr. Baran was Vice Chairman, President and Chief Executive Officer of Capitol Life Insurance Company of Denver, Colorado. He is a graduate of Georgetown University. He is a member of the Audit Committee of the Board of Directors.

Barton Beek became a Director in January 1984. Mr. Beek is a securities attorney specializing in mergers and acquisitions and a retired partner of, now of counsel to, O’Melveny & Myers LLP, a law firm that he joined in 1955, with offices worldwide. Mr. Beek is a graduate of the California Institute of Technology, the Stanford University Graduate School of Business and Loyola College of Law. He is a member of the Audit and Compensation Committees of the Board of Directors.

Frank Jenkins is an Associate Professor of Finance at RPI Lally School of Management in Hartford, Connecticut, and also provides ongoing financial, marketing and business strategy consulting to clients internationally. He was formerly the Chief Financial Officer, Vice President and Managing Partner of Harbridge House (which was purchased by Coopers & Lybrand in 1993) for 25 years until retiring as a Managing Director of Coopers & Lybrand in 1998. He graduated from North Carolina State University with a BSME and has a MBA from Wharton School, University of Pennsylvania. He is currently on the Board of Directors of Metro West Health, Inc., Metro West Community Healthcare Foundation, Inc., Clark, Cutler & McDermott, Inc. and the Boston Classical Orchestra. He is Chairman of the Audit Committee and a member of the Compensation Committee of the Board of Directors.

Robert Sharp became a Director of our Company in May 1995. Mr. Sharp retired from his position as President and Chief Executive Officer of Keyport Life Insurance Company in February 1992 after having served in that position since 1979. Mr. Sharp is the past chairman of the National Association for Variable Annuities and a former director of the National Association of Life Companies. Mr. Sharp is a graduate of the California State University at Sacramento and is a registered Principal with the NASD. He is also a director of Navallier Variable Funds, a mutual fund sponsor. He is Chairman of the Compensation Committee of the Board of Directors.

Edward Hughes has been employed by Fechtor, Detwiler for 16 years and served as a Director of our company from August 1999 to August 2002. He is currently Chief Operations Officer of our company. He holds a Bachelor of Science degree in Business Administration and an Associates Degree in Finance from Northeastern University. Mr. Hughes has served as a member and as Chairman of the 13th District Committee and the Small Firm Advisory Board of the NASD. He is a registered General Securities and Financial Principal with the NASD.

4

Stephen Martino became the Chief Financial Officer of our company in October 1999. Prior to joining us, Mr. Martino was Senior Vice President of Finance for Nvest, a New York Stock Exchange listed firm. Previously, he served in senior management positions with First Data Corporation and KPMG Peat Marwick. He received a BS in Business Administration, graduatingmagna cum laude, from Northeastern University. He is a member of the American Institute of CPAs and is Series 27 Financial and Operations Principal licensed with the NASD.

Stephen Frank has been the Chief Legal Officer, Chief Compliance Officer and Secretary of Fechtor, Detwiler & Co., Inc. since 1993 and the Chief Legal Officer and Secretary of our company since the merger. He has a BA in Psychology from C.W. Post College and a JD from New York Law School. Mr. Frank has served both as an arbitrator and as chairperson in NASD sponsored arbitrations and has been a member of the NYSE and NASD Content Committee for national continuing education. He is a registered General Securities, Financial Operations and Options Principal with the NASD.

Peter Fentonis Executive Vice President and Head of Capital Markets and a director of Fechtor Detwiler and has been with that firm since December 1992. He oversees the Capital Markets group, including Institutional Sales, Research and Trading. Before joining Fechtor Detwiler, he founded Plus Points Limited USA, a marketing company. He is a registered General Securities Principal with the NASD.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information regarding compensation paid during our company’s last three fiscal years to our Chief Executive Officer, Chief Operating Officer, Chief Financial Officer and the Executive Vice President of our subsidiary, Fechtor Detwiler (the “named executive officers”) (1):

| | | | | Annual Compensation

| | Long-Term Compensation Awards Securities Underlying Options/ | | All Other Compensation |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | SARs (#)(2)

| | ($)(3)

|

James Mitchell, Chairman and

Chief Executive Officer (5) | | 2002 2001 2000 | | $ $ $ | 190,400 275,769 225,000 | | $ $ $ | 0 0 105,000 | | | 355,000 0 0 | | $ $ $ | 9,929 9,929 9,929 |

|

Edward Hughes, Chief Operating Officer | | 2002 2001 2000 | | $ $ $ | 112,000 112,000 102,308 | | $ $ $ | 0 0 39,000 | | | 0 50,000 0 | | $ $ $ | 3,360 3,069 3,069 |

|

Stephen Martino, Chief Financial Officer | | 2002 2001 2000 | | $ $ $ | 168,704 182,692 161,637 | | $ $ $ | 0 0 39,000 | | | 13,750 50,000 0 | | $ $ $ | 4,947 4,099 4,099 |

|

Peter Fenton, Executive Vice President (4)(5) | | 2002 | | $ | 175,000 | | $ | 0 | | $ | 0 | | $ | 66,715 |

| (1) | | Mr. Fenton became a Named Executive Officer beginning in 2002 and compensation information is not required for prior years. No other executives qualify as Named Executive Officers requiring disclosure of compensation information under applicable Securities and Exchange Commission regulations. Mr. Graves, Vice Chairman, receives no compensation and Mr. Detwiler, President, receives minimal commissions on limited stock trading for clients and compensation information is not required. |

5

| (2) | | The 355,000 common shares listed under Long-Term Compensation for Mr. Mitchell are represented by Incentive Stock Options of which 55,000 shares were granted under the 2000 Omnibus Equity Incentive Plan and 300,000 shares were granted subject to stockholder approval and are included in the stock options of Proposal I herein. The options for 50,000 shares each to Messrs. Hughes and Martino were special stock options which received stockholder approval at the 2002 Annual Meeting. Our company does not have any outstanding Stock Appreciation Rights (“SARs”). |

| (3) | | Amounts reported for Messrs. Mitchell, Hughes, Martino and Fenton in the “All Other Compensation” column include $5,100, $3,360, $4,947 and $5,100 for 2002, and for Messrs. Mitchell, Hughes and Martino $5,100, $3,069 and $4,099 respectively for 2001 and $5,100, $3,069 and $4,099, respectively for 2000, representing our company’s contributions to its 401(k) Savings Plan on their behalf. Additionally, Mr. Mitchell received benefits of $4,829 for each of 2002, 2001 and 2000, representing life insurance premiums paid by our company pursuant to a split dollar insurance agreement. |

| (4) | | Amounts reported for Mr. Fenton for 2002 include $61,616 in commissions. |

| (5) | | Mr. Mitchell is party to an Employment Agreement, as described in the Compensation Committee Report. Mr. Fenton is party to an Employment Agreement, providing for a salary at an annual rate of $175,000, 35% of the Institutional Department’s annual and deferred bonus pools and 200,000 stock options at $1.01 per share with 66,667, 66,667 and 66,666 shares vested in 2001, 2002 and 2003, respectively. The term of his employment contract is on a month-to-month basis following the initial term which expired at the end of 2002. |

Option Grants

Options to purchase Common Stock to the named executive officers were granted during the 2002 fiscal year in the amounts of 355,000 and 13,750 shares each to Messrs. Mitchell and Martino. Included in Mr. Mitchell’s total options are options to purchase 300,000 shares which are subject to stockholder approval of the amendment to the 2000 Omnibus Equity Incentive Plan under Proposal I. The following table provides pro forma information related to such grants of options to Mr. Mitchell during the 2002 fiscal year assuming approval of the amendment to the 2000 Omnibus Equity Incentive Plan by the stockholders:

Stock Option Information

Individual Grants – 2002

| | |

Name

| | Number of Securities Underlying Options/SARs Granted (1)

| | Percent of Total Options/SARs Granted to All Employees During Fiscal Year (1)

| | | Exercise Price or Base Price ($/sh)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for Option Term (2)

|

| | | | | | 5% ($)

| | 10%($)

|

James Mitchell | | 355,000 | | 25.51 | % | | $ | 1.00 | | 11/06/07 | | $ | 98,080 | | $ | 216,731 |

Stephen Martino | | 13,750 | | 0.99 | % | | $ | 1.00 | | 11/06/07 | | $ | 3,799 | | $ | 8,395 |

| (1) | | The options listed above vest as follows: Options for 55,000 and 13,750 shares for Messrs. Mitchell and Martino, respectively, immediately vested on November 6, 2002. Mr. Mitchell’s remaining shares vest as follows: 50,000, 100,000, 100,000 and 50,000 shares on each of December 31, 2003, 2004, 2005 and 2006, respectively. |

| (2) | | The 5% and 10% assumed rates of appreciation are mandated by rules of the Securities and Exchange Commission and do not represent our company’s estimate or projection of the future Common Stock price. The potential realizable value for the above options were calculated using the exercise price of the options, set at the closing price of the Common Stock on November 6, 2002 (the date of grant) of $1.00 per share. |

6

Option Exercises and Fiscal Year-End Option Values

The following table provides information related to options exercised by the named executive officers during the 2002 fiscal year and the number and value of options held at fiscal year-end, assuming the amendment to the 2000 Omnibus Equity Incentive Plan is approved by stockholders.

| | | | | | | Number of Securities Underlying Unexercised Options/SARs at FY-End (#)(1)(2)

| | Value of Unexercised In-the-Money Options/ SARs at FY-End ($)(1)(2)

|

Name

| | Shares Acquired On Exercise (#)

| | Value Realized ($)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

James Mitchell | | 0 | | 0 | | 86,250 | | 300,000 | | $ | 2,750 | | $ | 15,000 |

Edward Hughes | | 0 | | 0 | | 87,500 | | 0 | | $ | 10,125 | | $ | 0 |

Stephen Martino | | 0 | | 0 | | 55,417 | | 33,333 | | $ | 1,354 | | $ | 1,333 |

Peter Fenton | | 0 | | 0 | | 156,084 | | 66,666 | | $ | 11,996 | | $ | 2,667 |

| (1) | | Our company does not have any outstanding SARs. |

| (2) | | The closing price for the Common Stock on December 31, 2002, as reported by the NASDAQ SmallCap Market, was $1.05 per share. Mssrs. Hughes’ and Fenton’s exercisable options include options to purchase 12,500 and 10,250 shares of Common Stock at a price of $0.40 per share granted under the 1999 Special Stock Option Plan. |

| (3) | | Unexercisable options listed for Mr. Mitchell include a grant of options to purchase 300,000 shares of Common Stock at a price of $1.00, the closing price on November 6, 2002. These options are subject to stockholder approval and are included in the options covered by Proposal I herein. The table assumes approval of the amendment to the 2000 Omnibus Equity Incentive Plan by stockholders. |

Compensation of Directors

The members of the Board of Directors who are not full-time employees of our company are entitled to receive reimbursement for out-of-pocket expenses they incur in attending Board of Directors’ meetings and otherwise performing their duties and receive fees of $1,000 for each meeting of the Board of Directors which they attend. Members of committees additionally receive $500 per committee meeting with the Chairman of each respective committee receiving an additional $500 per meeting. Non-employee Directors receive formula grants of non-qualified stock options under our company’s 2000 Omnibus Equity Incentive Plan. Options to acquire 6,000 shares of Common Stock are to be granted within six months after an individual takes office as a Director and options to acquire an additional 6,000 shares are to be granted within six months after every third anniversary of such Director’s taking office. If Proposal I is approved, the formula grants will increase to 30,000 shares.

Transactions Involving Directors

Effective as of October 1, 2001, Detwiler, Mitchell & Co. entered into a Letter of Engagement with Erwin, Graves & Associates, LP (“Erwin Graves”), a management consulting firm located in Dallas, Texas. James Graves is a partner of Erwin Graves with a 25% interest in Erwin Graves, and his spouse has an additional 25% interest. The arrangement with Erwin Graves allowed for two payments of $50,000 (or 50,000 shares of Common Stock in lieu of $50,000). One payment of 50,000 shares of Common Stock was made December 17, 2001 in lieu of $50,000 cash and a second payment of 50,000 shares in lieu of $50,000 cash was made on June 16, 2002. On November 12, 2001, the Compensation Committee and the Board authorized the grant of stock options to purchase 250,000 shares of Common Stock to Erwin Graves of $1.01 per share, the closing price on the Nasdaq SmallCap Market on November 14, 2001, which was approved by our stockholders at the 2002 Annual Meeting.

7

Effective March 22, 2002, the Company borrowed $300,000 from James H. Graves and delivered to Mr. Graves a 14 month promissory note (the “Note”) bearing interest at 10% per annum, secured by non-marketable securities. The Note was canceled in December 2002 by the issuance of 300,000 shares to James Graves and interest on the note through December 6, 2002.

Additionally, our company sold Mr. Graves 200,000 shares of Common Stock in a private transaction on January 16, 2003 for $1.13 per share, the closing market price on that date.

Compensation Committee Report

During 2002, executive compensation policy and practice were recommended to the Board by the Compensation Committee (the “Committee”). The Committee is composed of Robert Sharp, Chairman of the Committee, Frank Jenkins and Barton Beek. The Committee held two meetings during 2002.

No member of the Compensation Committee served as an officer or employee of our company or its subsidiaries. No executive officers of our company served during fiscal 2002 on the board of directors of any company which had a representative on our company’s Board of Directors. No member of our company’s Board of Directors served during 2002 as an executive officer of a company whose board of directors had a representative from our company on its Board of Directors.

The Committee’s compensation policy is to provide our company’s senior officers, including the executive officers named in this proxy statement, with base salaries commensurate with the base salaries of executives in our industry, augmented by (i) performance-based bonuses and (ii) stock incentives, primarily stock options. The objectives of the Committee’s policies are to attract and retain outstanding executives by providing compensation opportunities comparable to those offered by other companies in our industry, and to motivate and reward these executives with bonuses and stock awards which link their total compensation to the enhancement of stockholder value.

Mr. Mitchell has been party to an Employment Agreement for many years. Mr. Mitchell’s compensation was $190,400 for 2002, $276,000 for 2001 and $225,000 for 2000. At its November 6, 2002 meeting, the Committee unanimously approved that Mr. Mitchell’s employment contract be extended for two years (beyond its present expiration date at the end of 2003, which would give the amended agreement a 3-year term commencing January 1, 2003) at a salary of $175,000 plus 3-year deferred compensation of $110,000 per year.

Also at its November 6, 2002 meeting, the Committee considered the operating results for 2002 and determined that although all executives had been diligent in the performance of their duties, no cash bonuses should be awarded to the officers and employees of Detwiler, Mitchell & Co.

At the November 6, 2002 meeting, Messrs. Mitchell, Martino and Frank, executives who voluntarily reduced their salaries to help the company financially, were granted stock options under the 2000 Omnibus Equity Incentive Plan to purchase shares of stock at a price equal to $1.00 per share (the closing price on that date) in the amounts of 55,000, 13,750 and 3,375, respectively. Additionally, the Committee granted options to Mr. Mitchell to purchase 300,000 shares of stock at $1.00 per share, 150,000 of such options to be subject to the Company’s customary vesting terms and the other 150,000 to have vesting deferred one year beyond the customary terms. These options are included in the total subject to stockholder approval at the annual meeting under Proposal I. No other options were granted to officers.

At their April 2003 meeting, the Committee approved amendments to the 2000 Omnibus Equity Incentive Plan to increase the number of shares available for issuance and increase the number of shares automatically granted to independent directors, all subject to stockholder approval at the annual meeting of stockholders (see Proposal I herein). The Committee also granted Frank Jenkins 6,250 options and Robert Detwiler 50,000 options, and determined that these options together with the 300,000 options earlier granted to Mr. Mitchell, be subject to approval by the stockholders of Proposal I herein, thereby applying the total new grants against the increased available shares.

8

This report shall not be deemed incorporated by reference by any general statement incorporating this proxy statement by reference into any filing under the Securities Acts, except to the extent that our company specifically incorporates this information by reference, and shall not otherwise be deemed “filed” under such Acts.

Respectfully submitted:

The Compensation Committee

Robert Sharp, Chairman

Barton Beek

Frank Jenkins

Audit Committee Report

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to our company’s financial reporting process, its systems of internal accounting and financial controls, and the independent audit of its financial statements. See “Audit Committee” under “Board Meetings and Committees” above.

The Audit Committee has reviewed and discussed with management the audited financial statements of our company for the fiscal year ended December 31, 2002. The Audit Committee has reviewed and discussed with PricewaterhouseCoopers LLP, our company’s independent accountants who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgment as to the quality, not just the acceptability, of our company’s accounting practices and such other matters as are required to be discussed by the independent accountants with the Audit Committee under generally accepted auditing standards including the matters required to be discussed by Statement on Auditing Standards No. 61.

The Audit Committee has also received the written disclosures from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 and the Audit Committee has discussed the independence of PricewaterhouseCoopers LLP with that firm.

Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to the Board of Directors that our company’s audited financial statements be included in our company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2002 for filing with the Securities and Exchange Commission.

In accordance with the “Whistleblower” requirements of the Sarbanes-Oxley Act, the Audit Committee has approved a Disclosure Policy distributed to all employees, providing for confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Committee will establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters.

Respectfully Submitted: The Audit Committee

Frank Jenkins, Chairman

Edward Baran

Barton Beek

9

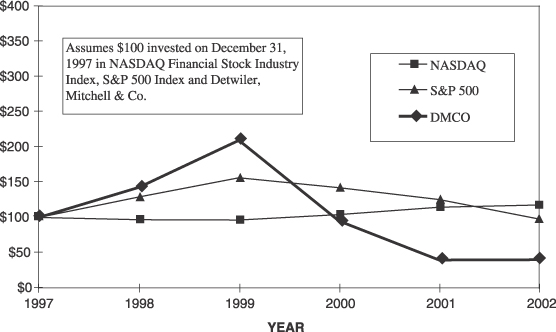

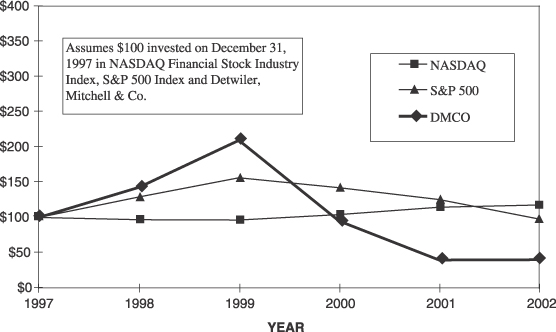

Performance Graph

The following chart compares the yearly percentage change in the cumulative total stockholder return on the Common Stock during the five fiscal years ended December 31, 2002 with the cumulative total return on the S&P 500 Index and the NASDAQ Financial Stocks Industry Index.

The foregoing information shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent our company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Unless otherwise noted below, the following table presents certain information with respect to the ownership of the Common Stock as of April 2, 2003 by each person known by our company to own beneficially more than 5% of the Common Stock, by each person who is a Director or nominee for Director of our company, by each named executive officer and by all executive officers and Directors of our company as a group:

| | | Shares of

Common Stock Beneficially Owned as of April 2, 2003 (1)

| |

Name

| | Number (2)(3)

| | %

| |

James Graves (6)(8) | | 947,666 | | 25.10 | % |

Robert Detwiler (4)(5)(8) | | 605,625 | | 16.04 | % |

James Mitchell (8) | | 306,167 | | 8.11 | % |

Peter Fenton (4)(8) | | 180,162 | | 4.77 | % |

Edward Hughes (4) | | 118,136 | | 3.13 | % |

Stephen Martino | | 74,577 | | 1.97 | % |

Frank Jenkins | | 45,500 | | 1.20 | % |

Barton Beek | | 45,000 | | 1.19 | % |

Robert Sharp | | 37,500 | | * | |

Edward Baran | | 14,250 | | * | |

Messrs. Graves, Detwiler, Mitchell and Fenton as a group (7) | | 2,039,620 | | 54.01 | % |

All Executive Officers and Directors as a group (10 persons)(8) | | 2,194,421 | | 58.11 | % |

Total outstanding shares (8) | | 3,776,274 | | | |

| (1) | | All beneficial ownership figures include options to purchase shares of Common Stock exercisable within 60 days of April 2, 2003, as set forth below. Except as otherwise noted below, each individual, directly or indirectly, has sole or shared voting and investment power with respect to the shares listed. |

| (2) | | Includes approximately 15,023, 9,078, 6,136, 9,160 and 30,319 vested shares of Common Stock contributed by our company to its 401(k) Savings Plan for Messrs. Mitchell, Fenton, Hughes and Martino and for all executive officers and Directors as a group. Outside Directors do not have 401(k) Plan holdings with our company. |

| (3) | | Includes options to purchase 166,667, 86,250, 156,084, 87,500, 55,417, 3,000, 15,250, 15,250, 11,250 and 563,335 shares of Common Stock for Messrs. Graves, Mitchell, Fenton, Hughes, Martino, Jenkins, Beek, Sharp, Baran and for all executive officers and Directors as a group, respectively. |

| (4) | | Includes 50,000 shares of Common Stock for Mr. Detwiler which represent a portion of 68,000 shares held in trust (“Trust Shares”) to reimburse our company for any shares issued by our company upon exercise of stock options under the 1999 Special Stock Option Plan (the “Special Plan”) assumed by our company after the |

11

merger. Reimbursed shares will be summarily canceled upon receipt by our company. Messrs. Hughes’s and Fenton’s ownership also include options to purchase 12,500 and 10,250 shares, respectively, which were granted under the Special Plan. There will be no dilution in issued and outstanding Common Stock of our company should Mr. Hughes and Mr. Fenton exercise their options due to the fact that all shares underlying these options will be reimbursed to the company as described above. Mr. Detwiler’s ownership will decrease by 7,583 shares upon exercise of those options.

| (5) | | Includes 2,500 shares owned by Mr. Robert Detwiler’s wife, as to which he disclaims beneficial ownership. |

| (6) | | Includes 241,000 shares owned by J&J Prairie Oaks Ranch, LP I, which is owned 50% by Mr. Graves and 50% by his spouse. His spouse also owns 40,000 shares of our company’s stock directly. This amount also includes 100,000 common shares owned by Erwin, Graves & Associates, LP as to which Mr. Graves has shared voting power. Erwin Graves also has options to purchase an additional 250,000 shares, 166,667 shares of which are exercisable. Mr. Graves and his spouse each have a 25% ownership interest in Erwin, Graves & Associates, LP. |

| (7) | | James Graves, Robert Detwiler, James Mitchell and Peter Fenton have signed a Stockholders Agreement effective April 15, 2003, in which the four members (including their families and other entities affiliated with them) have agreed to cross rights of first refusal in case a member wishes to sell shares, and to vote as a group on election of directors and other matters coming before the stockholders, with the exception of corporate governance matters such as amending the charter or by-laws, creating or modifying any class of securities, or any recapitalization, reorganization, business combination or sale of assets. The agreement is filed as an exhibit to a Form 13-D filed April 2003 with the Securities and Exchange Commission. Of the shares listed above for the group formed by this agreement, 1,606,518 have voting rights representing 50.16% of the current voting power of our company. The other shares represent exercisable options which do not have voting rights until exercised and 24,101 shares held in our company’s 401(k) Plan for group members under which voting rights are held by the Plan administrator. |

| (8) | | Includes stock options to purchase 596,668 shares of Common Stock. The stock options to purchase 12,500 and 10,250 shares of Common Stock for Messrs. Hughes and Fenton, respectively, under the 1999 Special Stock Option Plan are not included in this total as no dilution of outstanding shares will occur due to exercise of these options. |

The Stockholders Agreement described in footnote (7) above could, depending on circumstances, cause a change in control of our company or could, under other circumstances, prevent a change in control of our company.

COMPLIANCE WITH SECTION 16(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 requires our company’s Directors and executive officers, and persons who own more than 10% of a registered class of its equity securities, to file with the Securities and Exchange Commission, NASDAQ and the Pacific Stock Exchange initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of our company. Executive officers, Directors and greater than 10% stockholders are required by Securities and Exchange Commission regulations to furnish our company with copies of all Section 16(a) reports they file.

Specific due dates for these reports have been established and we are required to identify those persons who failed to timely file these reports. To our knowledge, based solely on review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2002, all Section 16(a) filing requirements applicable to its executive officers, Directors and greater than 10% beneficial owners were complied with except for the reporting of an automatic grant of an option to purchase 6,000 shares of Common Stock under the 2000 Omnibus Equity Incentive Plan to Frank Jenkins. Although the option was granted automatically on August 30, 1999, Mr. Jenkins was not notified of the grant until November 6, 2002 and it was subsequently reported on Form 4 on November 8, 2002. An amended report on Form 5 for 2001 was filed to disclose trades by Robert Sharp in 2001, which had not been reported on Form 4 or on the subsequent original Form 5. These trades were the sale of 14,250 shares of Common Stock held in a discretionary account to which Mr. Sharp’s broker had total discretion to

12

dispose of as he saw fit. Mr. Sharp was unaware of the trades at the time when a Form 4 would have been due and at the time when his subsequent Form 5 was originally filed.

I. PROPOSAL TO APPROVE AN AMENDMENT OF 2000 OMNIBUS EQUITY INCENTIVE PLAN

In April 2003, the Compensation Committee approved an amendment of the 2000 Omnibus Equity Incentive Plan to provide that the maximum number of shares that may be subject to grants made after January 1, 2003 shall be 1,000,000 shares, and awards made prior to that date shall be unaffected and provide that the initial grants to directors upon their taking office shall be 30,000 shares and the subsequent anniversary grants shall be 30,000 shares.

Summary of Basic Features

A general description of the basic features of the Omnibus Plan, as amended, is outlined below. This summary is qualified in its entirety by the terms of the Omnibus Plan, a copy of which was filed as Annex A to the 2000 Proxy Statement.

Stock Subject to the Plan. The Omnibus Plan sets the maximum number of shares that may be subject to grants after January 1, 2003 as 1,000,000 shares of authorized but unissued shares or treasury shares. The Omnibus Plan provides for an automatic increase each year by the lesser of 150,000 shares or ten percent (10%) of the outstanding shares on January 1st each year beginning in 2004. In the event of any reorganization, merger, recapitalization, stock dividend, stock split or similar change in the corporate structure or shares of our company, appropriate adjustments will be made to the number and kind of shares reserved under the Omnibus Plan and under outstanding stock options and to the exercise price of outstanding stock options.

Eligibility. Directors, officers, employees, and independent contractors, advisors and consultants providing services to our company, are eligible for the grant of Restricted Shares, Stock Units, NSOs or SARs. Further, only actual employees of our company are eligible for ISOs.

Administration. The Omnibus Plan shall be administered by the Board of Directors or the Committee, which shall consist of two or more Outside Directors (although Committee functions may be delegated to officers to the extent the Awards relate to persons who are not subject to the reporting requirements of Section 16 of the Exchange Act). If no Committee has been appointed, the entire Board of Directors shall constitute the Committee. The Committee shall select one of its members as Chairman and shall appoint a Secretary, who need not be a member of the Committee. The Committee shall hold meetings at such times and places as it may determine and minutes of such meetings shall be recorded. Acts by a majority of the members of the Committee in a meeting at which a quorum is present and acts approved in writing by a majority of the members of the Committee shall be valid acts of the Committee. Subject to the provisions of the Omnibus Plan, the Committee shall have full authority and discretion to take any and all allowable actions under the Omnibus Plan.

Committee for Non-Officer Grants. The Board of Directors may also appoint a secondary committee of the Board of Directors. Such secondary committee may administer the Omnibus Plan with respect to Employees and Consultants who are not considered officers or directors of our company under Section 16 of the Exchange Act, may grant Awards under the Omnibus Plan to such Employees and Consultants and may determine all features and conditions of such Awards. Any reference in the Omnibus Plan to the Committee shall include such secondary committee.

Option Grants. ISOs must be granted with an exercise price equal to at least the fair market value of the Common Stock on the date the stock options are granted, except that ISOs granted to persons owning stock possessing more than 10% of the total combined voting power of all classes of stock of our company or any subsidiary may not be granted at less than 110% of the fair market value of the Common Stock on the date of grant. NSOs may be granted at an exercise price equal to no less than 85% of the fair market value of the Common Stock on the date the stock options are granted. The Committee shall determine the exercisability of the Option as required by applicable law, but Options shall not vest in less than 20% per year from the date of grant. Regardless of the exercisability of the Option, the Option shall expire no more than ten years from the date of grant for Options and five years from the date of grant for Options to owners of 10% or more of our company. The Committee in its

13

discretion may accelerate any exercisability of any Option in case of death, disability, retirement or termination as well as extend, modify, renew or exchange outstanding Options.

Stock Appreciation Rights. SAR grants will be determined by the Committee and will be at a price specified in a Stock Appreciation Agreement or may vary by a predetermined formula in accordance with the SAR Agreement. The Committee will also determine the exercisability and term of the SAR and may, in its discretion, accelerate any exercisability of any SAR in case of death, disability, retirement or termination as well as extend, modify, renew or exchange outstanding SARs.

Stock Units. Stock Unit grants will be determined by the Committee as well as all vesting conditions. The holder of the Stock Units will have no voting or dividend rights. The Committee may determine whether Stock Units be settled in the form of cash or shares of Common Stock at the time of settlement of the Stock Units. The Committee in its discretion may accelerate any exercisability of any Stock Unit in case of death, disability, retirement or termination as well as extend, modify, renew or exchange outstanding Stock Unit awards.

Restricted Shares. Restricted Share awards will be determined by the Committee and will be considered compensation valued at price per share determined by the Committee but may not be less than 85% (100% for 10% owners) of the fair market value of the Common Stock at the time of the award. The Committee will also determine the vesting and term of the Restricted Shares but may not vest in less than 20% increments during the first five years. The Committee in its discretion may accelerate any vesting of any Restricted Share in case of death, disability, retirement or termination.

Manner of Exercise and Purchase. Options may be exercised by delivery of a Notice of Exercise and Common Stock Purchase Agreement in a form as provided with the optionee’s Stock Option Agreement, along with payment in full of the total Option exercise price for the shares to be purchased, subject to alternative methods of payment approved by the Committee in its sole discretion. Stock Units and Restricted Share awards shall be issued in accordance with the Stock Unit Agreement or Restricted Stock Agreement and any vesting requirements therein. SARs may be exercised in accordance with the terms of any underlying SAR Agreement.

Termination of Options. Upon the termination of an optionee’s employment or other service with our company, the optionee will have three months to exercise options vested as of the date of termination; provided that if the termination is due to the optionee’s death, the estate of the optionee will have six months to exercise. If the termination is due to disability of the optionee, which is expected to last for longer than twelve months, then the optionee shall have the right to exercise any vested options for six months after date of termination. The Committee, in its discretion, may extend such termination of option.

Plan Amendment and Termination. The Omnibus Plan may be amended from time to time by the Board of Directors without approval by the stockholders of our company unless required by applicable laws, regulations or rules. The Omnibus Plan will automatically expire on February 28, 2010, or on any earlier date by action of the Board of Directors. No grants of Options, Stock Units, SARs or Restricted Shares may be made after the Omnibus Plan is terminated and only those Options, Stock Units, SARs or Restricted Shares which are granted or awarded prior to the termination of the plan will be honored after the termination date of the Omnibus Plan.

Effect of Stock Issuance. The issuance of shares of Common Stock under the Omnibus Plan will dilute the voting power of current stockholders of our company. In the event of any reorganization, merger, recapitalization, stock dividend, stock split or similar change in the corporate structure or shares of our company, appropriate adjustments will be made to the number and kind of shares reserved under the Omnibus Plan and under outstanding stock options and to the exercise price of outstanding stock options. As of April 2, 2003, our company had 3,202,356 shares issued and outstanding. Our company plans to register under the Securities Act of 1933 the shares issuable upon exercise of Options or SARs granted or Stock Unit awards made under the Omnibus Plan, at the time of issuance, thereby making such shares immediately eligible for resale in the public market without restriction by non-affiliates of our company. However, affiliates of our company may generally only publicly resell shares of Common Stock, including shares issued in a registered transaction, under Rule 144, which limits the volume of such sales, requires that they be made in certain types of market transactions, requires that our company be current in its reports under the securities laws and requires that a specified notice of sale be filed.

14

Formula Grants to Non-Employee Directors. Options shall be granted to non-employee directors of our company as follows:

| | (1) | | Options to acquire 30,000 shares of stock shall be granted to each director of the Company upon taking office as a member of the Board of Directors of the Company; |

| | (2) | | Additional options to acquire 30,000 shares of Common Stock shall be granted to each director of our company every third anniversary of such director’s taking such office; |

| | (3) | | The exercise price for these options shall be the fair market value of the Common Stock on the date of grant, unless a higher price is required by applicable securities or tax laws; |

| | (4) | | This formula may be not modified more than once every six months, except as may be necessary or advisable to comport with the requirements of any applicable law or regulation; and |

| | (5) | | The formula in the Omnibus Plan is intended to incorporate and thereby supercede any other formula-based granting of options to non-employee directors of our company and, accordingly, (a) supplants the similar formula-based grant provisions of our company’s 1993 Plans, and (b) non-employee directors of our company shall be given credit for periods of service as a director for which options have not yet been awarded. |

Federal Income Tax Consequences

The following description of federal income tax consequences is based on current statutes, regulations and interpretations. There may however be, pending legislative proposals, which would affect the taxation of capital gains. The description does not include state or local income tax consequences. In addition, the description is not intended to address specific tax consequences applicable to an individual optionee who receives an Option or an individual who receives an SAR.

Initial Grant of Options and Stock Appreciation Rights.The grant of an option, whether a nonqualified stock option (“NSO”) or an incentive stock option (“ISO”), and the grant of a Stock Appreciation Right (“SAR”) are not taxable events for the optionee or recipient of an SAR. Accordingly, our company obtains no deduction from the grant of an NSO, ISO or SAR.

Nonqualified Stock Options.Upon the exercise of an NSO, the amount by which the fair market value of the shares on the date of exercise exceeds the exercise price will be treated as ordinary income (i.e., compensation) to the optionee. Our company will be entitled to a deduction in the same amount, provided it makes all required withholdings. In general, the optionee’s tax basis in the shares acquired by exercising an NSO is equal to the fair market value of such shares on the date of exercise. Upon a subsequent sale of any such shares in a taxable transaction, the optionee will realize capital gain or loss (long-term or short-term, depending on whether the shares were held for the required holding period before the sale) in an amount equal to the difference between his or her basis in the shares and the sale price. Our company is not entitled to any compensation expense deduction on the optionee’s sale of shares under these circumstances.

Incentive Stock Options. There will not be any federal income tax consequences to the optionee who holds an ISO or to our company as a result of the exercise of an ISO under the Omnibus Plan, provided that the optionee is still employed by our company at the time of exercise (or terminated employment no longer than three months before the exercise date). Additional exceptions to this exercise timing requirement apply upon the death or disability of an optionee. Notwithstanding the foregoing, an amount equal to the excess of the fair market value of the shares acquired upon exercise of the ISO, determined on the date of exercise, over the amount that the optionee paid for the shares will be includable in the optionee’s alternative minimum taxable income for purposes of the alternative minimum tax. Special rules will apply if previously acquired shares of Common Stock are permitted to be tendered in payment of an ISO exercise price.

An optionee who holds an ISO must hold the shares acquired upon exercise of the ISO for: (i) two years from the date that the ISO is granted to him or her, and (ii) one year from the date that he or she exercises the ISO.

15

A sale of the shares received upon the exercise of the ISO which meets the foregoing holding requirements will result in long-term capital gains or losses in the amount of the difference between the amount realized on the sale and the exercise price for such shares. Our company is not entitled to any compensation expense deduction under these circumstances.

If the optionee does not satisfy both of the foregoing holding requirements (a “disqualifying disposition”), then the optionee will be required to report as ordinary compensation income, in the year the optionee disposes of the shares, the amount which equals the lesser of (i) the excess of the fair market value of the shares on the date of the optionee’s exercise of the ISO over the exercise price, or (ii) the excess of the amount realized on the disposition of such shares over the exercise price. In these circumstances, our company will be entitled to a compensation expense deduction in an amount equal to the ordinary income includable in the taxable income of the optionee. This compensation income may be subject to withholding and employment-related taxes, and our company may be required to satisfy applicable withholding requirements in order to receive the deduction. The remainder of the gain or loss recognized on the disposition, if any, will be treated as a long-term or short-term capital gain or loss, depending on the length of time that the optionee held the shares subject to the option. Our company is not entitled to any compensation expense deduction with respect to any of the optionee’s capital gain or loss.

Stock Appreciation Rights.An SAR will result in ordinary compensation income for the person exercising the SAR equal to the amount of appreciation payable at the time of exercise. Our company is entitled to a deduction that corresponds with that amount included in the ordinary compensation income of the SAR recipient at the time that such SAR recipient exercises his or her SARs. In addition, so long as an SAR recipient exercises his or her SARs with money or employer stock, the exercise will trigger no recognized gain or loss to our company.

Stock Unit Awards.A Stock Unit Award (the “Award”) will result in ordinary compensation income for the person receiving the Award when the recipient of the Award receives a cash payment in the amount of the Award. The cash payment will generally equal the excess of the fair market value of the stock on the maturity date of the Award over the fair market value of the stock on the Award’s grant date. Our company is entitled to a deduction that corresponds with the amount included in the ordinary compensation income of the Award recipient in the same taxable year as such Award recipient receives cash payment.

Restricted Shares.An award of Restricted Shares will result in ordinary compensation income for the recipient of such Restricted Shares (the “Recipient”) when the Restricted Shares become unrestricted; i.e., the stock becomes transferable or is no longer subject to a substantial risk of forfeiture. The amount of ordinary compensation income equals the excess of the fair market value of the stock at the vesting date(s) over any amount that the Recipient paid for such Restricted Shares. However, the Recipient may make an “83(b) Election” whereby such Recipient would accelerate his or her taxable event to the year in which the 83(b) Election is made. Accordingly, the Recipient would be taxed on the full value of the shares at the time of the award of Restricted Shares less any amount paid for such Restricted Shares. Our company is entitled to a tax deduction in an amount that corresponds with the amount included in the Recipient’s ordinary compensation income during the same tax year; however, for our company to obtain this deduction, our company must properly and timely report the Recipient’s income and satisfy the requisite withholding requirements. Depending on the amount of time the Recipient holds the shares, he or she will incur a short-term or long-term capital gain or loss at the time he or she sells such shares. Our company is not entitled to any deduction upon such a sale.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL OF THE AMENDMENT OF THE 2000 OMNIBUS EQUITY INCENTIVE PLAN.

II. ELECTION OF DIRECTOR

Nominees

One of our company’s total of seven Directors is to be elected at the Annual Meeting. The Board of Directors of our company has authorized the nomination at the Annual Meeting of the person named below as a candidate. Unless otherwise directed, the Proxy Holders will vote the proxies received by them for the nominee named below. In the event that any nominee is unable or declines to serve as a Director at the time of the Annual

16

Meeting, the proxies will be voted for any nominee who shall be designated by the existing Board of Directors to fill the vacancy. It is not expected the nominee will be unable or will decline to serve as Director.

The Board of Directors intends to nominate incumbent Director Edward Baran for election as a Director to serve a three-year term, until the annual meeting of stockholders in 2006, and until his successor is duly elected. Information with respect to Mr. Baran is set forth above in “Directors and Executive Officers.”

Required Vote

The affirmative vote of a majority of the shares of Common Stock present and voting in person or by proxy is required for the election of the Director nominee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE PERSON NOMINATED FOR ELECTION AS DIRECTOR.

III. RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

The Board of Directors is recommending the ratification of its selection of PricewaterhouseCoopers LLP as independent accountants to audit our financial statements for the current fiscal year ending December 31, 2003. PricewaterhouseCoopers LLP has audited our financial statements for calendar year 2002.

PricewaterhouseCoopers LLP has advised our Audit Committee that it is “independent” of us within the rules and guidelines of the SEC, the American Institute of Certified Public Accountants and the Independence Standards Board.

Audit Fees:

Audit fees billed to our company by PricewaterhouseCoopers for the audit of our annual financial statements and review of our quarterly financial statements included in quarterly reports on Form 10-Q, for the year 2002, totaled $179,873.

We did not engage PricewaterhouseCoopers LLP to provide advice regarding financial information systems design and implementation during 2002.

Fees billed to our company by PricewaterhouseCoopers LLP with respect to the year 2002 for all other non-audit services rendered to our company including tax related services and regulatory advisory services totaled $55,213.

The Audit Committee has concluded that the provision of the other services including tax related services by PricewaterhouseCoopers LLP is compatible with maintaining their independence.

A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting, will have an opportunity to make a statement if desired, and will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF PRICEWATERHOUSECOOPERS LLP AS INDEPENDENT ACCOUNTANTS.

17

OTHER MATTERS

The Board of Directors knows of no other business which will be presented at the Annual Meeting. If any other business is properly brought before the Annual Meeting, it is intended that proxies in the enclosed form will be voted in respect thereof in accordance with the judgments of the persons voting the proxies. It is important that your shares be represented at the meeting, regardless of the number of shares which you hold. WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE ANNUAL MEETING, YOU ARE URGED TO COMPLETE, SIGN, AND RETURN YOUR PROXY PROMPTLY.

By Order of the Board of Directors

Dated: April 17, 2003

18

Please mark your votes as indicated | | x |

(1) | | Proposal to approve an amendment to the 2000 Omnibus Equity Incentive Plan. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ | | | | (3 | ) | | Proposal to ratify the selection of PricewaterhouseCoopers LLP as our company’s independent accountants for year 2003. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ |

|

(2)

| | Election of one director for three years and until his successor shall be duly appointed or elected. Nominees: (01) Edward Baran

| | FOR ¨

| | WITHHOLD ¨ | | | | | | (4 | ) | | In accordance with the discretion of the proxy holders, upon such other matters as may properly come before the Annual Meeting and at any and all adjournments thereof. | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ |

| | | | | | | | THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR EACH OF THE FOREGOING PROPOSALS. THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR EACH OF THE ABOVE PROPOSALS. |

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | Signature or signatures of Stockholders(s) |

|

| | | | | | | | | | | | | | | | | Dated: , 2003 |

|

| | | | | | | | | | | | | | | | | (Your signature should conform exactly to your name as printed hereon. Any co-owners may sign. Executors, administrators, trustees, etc. should give full title as such. If the stockholder is a corporation, a duly authorized officer should sign on behalf of the corporation and should indicate his or her title.) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

é FOLD AND DETACH HERE AND READ THE REVERSE SIDEé

PROXY

DETWILER, MITCHELL & CO.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned appoints James Mitchell and Stephen Frank, and each of them, proxies with full power of substitution, to vote all shares of Common Stock of Detwiler, Mitchell & Co. (the “Company”) held of record by the undersigned as of April 2, 2003 at the Annual Meeting of Stockholders of the Company, to be held at the Board Room, 225 Franklin Street, 33rd Floor, Boston, Massachusetts, 02110, on Monday, May 19, 2003, at 10:00 a.m., Eastern Daylight Savings Time, and at any and all adjournments thereof, upon the following matters:

ANNUAL MEETING OF STOCKHOLDERS

(continued and to be signed, on the reverse side)

é FOLD AND DETACH HEREé