UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | | 811-04025 | | | | |

| | | | | | |

| AMERICAN CENTURY MUNICIPAL TRUST | | | | | | |

| (Exact name of registrant as specified in charter) | | | | | | |

| | | | | | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | | | | | | 64111 |

| (Address of principal executive offices) | | | | | | (Zip Code) |

| | | | | | |

CHARLES A. ETHERINGTON

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | | | | | | |

| (Name and address of agent for service) | | | | | | |

| | | | | | |

| Registrant’s telephone number, including area code: | | | | | 816-531-5575 | |

| | | | | | |

| Date of fiscal year end: | 05-31 | | | | | |

| | | | | | |

| Date of reporting period: | 05-31-2020 | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

| | | | | |

| |

| Annual Report |

| |

| May 31, 2020 |

| |

| High-Yield Municipal Fund |

| Investor Class (ABHYX) |

| I Class (AYMIX) |

| Y Class (AYMYX) |

| A Class (AYMAX) |

| C Class (AYMCX) |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the fund or your financial intermediary electronically by calling or sending an email request to your appropriate contacts as listed on the back cover of this report.

You may elect to receive all future reports in paper free of charge. You can inform the fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an email request to your appropriate contacts as listed on the back cover of this report. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| | | | | |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| |

| |

| Liquidity Risk Management Program | |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended May 31, 2020. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional investment insights, please visit americancentury.com.

Pandemic Rattled Markets, But Most Munis Persevered

Through the first several months of the reporting period, municipal bonds (munis) generally advanced, as U.S. bond yields declined amid dovish Federal Reserve (Fed) policy. In July 2019, growing concerns about global economic risks and U.S.-China trade disputes prompted the Fed to cut short-term interest rates for the first time in 10 years. The Fed followed up with additional rate cuts in September and October, driving bond yields lower. Munis also benefited from stable credit fundamentals and favorable supply/demand dynamics.

Market sentiment abruptly changed in late February. The COVID-19 outbreak rapidly spread throughout the world, triggering stay-at-home orders, business shutdowns and recession fears. Risk assets, including munis, sold off sharply in a global flight to the safest, highest-quality securities. The Fed and the U.S. federal government stepped in quickly and aggressively to provide financial relief to companies, municipalities and individuals. As part of its efforts to stabilize the financial system, the Fed relaunched quantitative easing and added munis to the bond-buying plan. This unprecedented move helped investment-grade munis generate their best monthly performance since January 2009. The May rally was enough to push the broad asset class back into positive-return territory for the 12-month period. High-yield munis, which suffered greater losses in the market sell-off, declined for the reporting period.

As COVID-19 infection rates are slowing, much of the U.S. economy is reopening. Nevertheless, the return to pre-pandemic life will take time and patience. In the meantime, investors likely will face periods of economic and political uncertainty and heightened market volatility. While these influences can be unsettling, they tend to be temporary.

We appreciate your confidence in us during these extraordinary times. We have a long history of helping clients weather unpredictable markets, and we’re confident we will meet today's challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

| | | | | | | | | | | | | | | | | | | | |

| Total Returns as of May 31, 2020 | | | | | | |

| | | | Average Annual Returns | | | |

| Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| Investor Class | ABHYX | -1.64% | 3.72% | 4.84% | — | 3/31/98 |

| S&P Municipal Bond 50% Investment Grade/50% High Yield Index | — | 1.30% | 4.32% | — | — | — |

| Bloomberg Barclays Municipal Bond Index | — | 3.98% | 3.74% | 4.13% | — | — |

| I Class | AYMIX | -1.45% | 3.93% | 5.05% | — | 3/1/10 |

| Y Class | AYMYX | -1.42% | — | — | 3.85% | 4/10/17 |

| A Class | AYMAX | | | | | 1/31/03 |

| No sales charge | | -1.89% | 3.46% | 4.58% | — | |

| With sales charge | | -6.26% | 2.52% | 4.09% | — | |

| C Class | AYMCX | -2.62% | 2.72% | 3.81% | — | 7/24/02 |

Average annual returns since inception are presented when ten years of performance history is not available.

Fund returns would have been lower if a portion of the fees had not been waived.

Because the S&P Municipal Bond 50% Investment Grade/50% High Yield Index total return data is first available as of November 30, 2011, returns for the Bloomberg Barclays Municipal Bond Index are also shown to cover the 10 year period.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 4.50% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

| | |

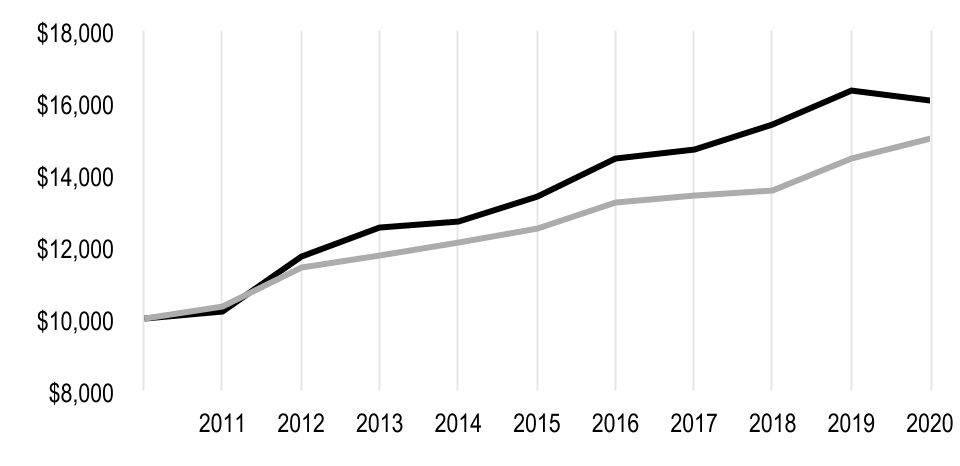

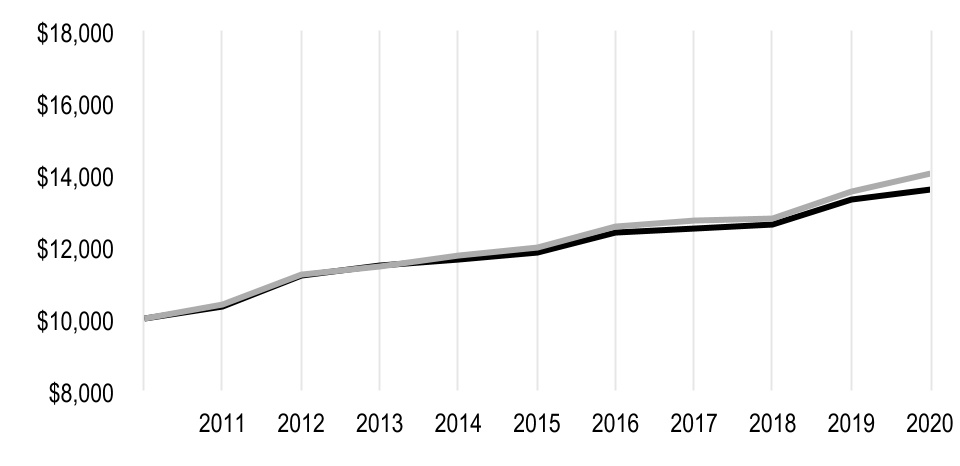

Growth of $10,000 Over 10 Years |

| $10,000 investment made May 31, 2010 |

| Performance for other share classes will vary due to differences in fee structure. |

| | | | | |

| Value on May 31, 2020 | |

| Investor Class — $16,045 |

| |

| Bloomberg Barclays Municipal Bond Index — $14,998 |

| |

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

Since S&P Municipal Bond 50% Investment Grade/50% High Yield Index total return data is only available from November 2011, it is not included in the line chart.

| | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | | | |

| Investor Class | I Class | Y Class | A Class | C Class |

| 0.60% | 0.40% | 0.37% | 0.85% | 1.60% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Steven Permut, Joseph Gotelli and Alan Kruss

Performance Summary

High-Yield Municipal returned -1.64%* for the 12 months ended May 31, 2020. By comparison, the S&P Municipal Bond 50% Investment Grade/50% High Yield Index returned 1.30%. Fund returns reflect operating expenses, while index returns do not.

Fund and index returns primarily reflect the wholesale aversion to riskier assets, including high-yield municipal bonds (munis), during March and April 2020, as the coronavirus pandemic abruptly halted economic activity. Through the first half of the period, the broad investment-grade muni market posted modest gains yet lagged U.S. Treasuries, which benefited from a dovish Federal Reserve (Fed). The central bank cut rates three times in 2019—in July, September and October—driving Treasury yields lower. High-yield munis generally outperformed, aided by investor demand for yield. Along with all but the safest-haven assets, investment-grade and high-yield munis plunged in early 2020 as the COVID-19 pandemic swept across the U.S. The market rebounded sharply in May, bolstered by monetary and fiscal responses to the crisis and a renewed risk-on mindset.

The steep sell-off in March reflected a global flight to quality, soaring volatility and sinking market liquidity. The Fed responded quickly by cutting short-term rates to near 0% and resurrecting a host of financial crisis-era programs to help boost liquidity and help stabilize the financial markets. These efforts, along with Congress’ $2 trillion fiscal rescue package, provided some relief to munis by the end of March. In early April, the Fed directly addressed muni market woes by establishing the $500 billion Municipal Liquidity Facility, which provides loans to states and municipalities. The Fed subsequently modified the program to expand eligibility and help ensure that municipalities are able to meet short-term borrowing needs. This unprecedented move provided additional support to the muni market, as it helped restore supply and demand for munis at the end of the reporting period.

Downgrades Likely, But Defaults Less So

State and local finances across the U.S. remained relatively healthy from the start of the reporting period through early 2020. However, costs related to the COVID-19 pandemic tapped states, counties and municipalities as they scrambled to secure medical equipment, medicine and support for first responders. The Coronavirus Aid, Relief and Economic Security Act, which President Donald Trump signed into law on March 27, earmarked funds to offset a large portion of those expenses. In the final days of the reporting period, demonstrations in response to the death of George Floyd occurred across the U.S. While the unrest likely will pressure local and state budgets, we believe the total financial impact will be fairly limited.

Although we believe downgrades will occur across credit markets in general, we don’t expect a wave of defaults as most state and local governments entered the crisis with record levels of reserves and available liquidity; state and local governments possess multiple levers to avoid default, including tax increases, spending reductions and the ability to shift funds; and support from the federal government remains likely given the essential services provided by states and municipalities. Ultimately, the biggest risks we see state and local governments facing are tied to

declining revenues causing budgetary stress, potentially leading to more downgrades. The extent of the challenges hinge on the duration of the economic downturn and the challenges involved in returning to normal.

*All fund returns referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the index, other share classes may not. See page 3 for returns for all share classes.

Sector Allocation, Security Selection Detracted

Sector allocation hindered relative performance over the 12-month period. Overweight allocations, relative to the index, to continuing care retirement communities weighed on results as the pandemic grew, as did investments in student housing and charter schools. Underweight exposure in higher-quality areas, such as prerefunded bonds and state general obligation (GO) bonds, also detracted. Allocations in multifamily housing and corporate muni sectors supplied a modest lift.

Security selection also detracted from results overall, largely due to lagging investments in special tax issues and private universities. Selections among high-quality state and local GO bonds also detracted from relative performance. Positive security selection among continuing care retirement communities and corporate munis helped mitigate these negative effects.

In addition, our bias toward lower-quality munis detracted from performance relative to the index, which contains an equal mix of investment-grade and high-yield munis. Lower-quality munis generally underperformed investment-grade securities for the 12-month period, largely due to the sharp sell-off of riskier securities in early 2020.

Yield Curve Approach Proved Advantageous

Our yield-curve positioning, featuring a longer duration than the index, provided a considerable relative lift through the second half of the period. The strategy paid off as longer-maturity yields declined sharply.

Portfolio Positioning

Given the steep sell-off of high-yield munis in March and April, we believe select sectors should continue to offer value. For example, late in the reporting period, we found opportunities to purchase what we believe are attractive credits that had been excessively punished during the market turmoil.

Although COVID-19 remains a concern and a key uncertainty, the stability that the Fed’s Municipal Liquidity Facility provides will likely support a broad spectrum of muni issues—either directly or indirectly. Additionally, municipal funding needs could contribute to increased supply in the coming months. We believe the recent recovery in demand and a recognition that defaults likely will remain few and fragmented should extend further support for munis. As always, fundamental credit research will drive our investment decisions.

| | | | | |

| MAY 31, 2020 | |

Portfolio at a Glance | |

| Weighted Average Life to Maturity | 18.2 years |

| Average Duration (Modified) | 7.3 years |

| |

Top Five States and Territories | % of net assets |

| New York | 10.7% |

| Illinois | 9.5% |

| Texas | 7.5% |

| Arizona | 6.3% |

| Florida | 6.3% |

| | |

Top Five Sectors | % of fund investments |

| Special Tax | 17% |

| Retirement Community | 15% |

| Charter School | 11% |

| General Obligation (GO) - Local | 9% |

| Hospital | 7% |

| | |

Types of Investments in Portfolio | % of net assets |

| Municipal Securities | 95.2% |

| Affiliated Funds | 1.5% |

| Exchange-Traded Funds | 1.0% |

| Other Assets and Liabilities | 2.3% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from December 1, 2019 to May 31, 2020.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | Beginning

Account Value

12/1/19 | Ending

Account Value

5/31/20 | Expenses Paid During Period(1) 12/1/19 - 5/31/20 | Annualized Expense Ratio(1) |

Actual | | | | |

| Investor Class | $1,000 | $953.30 | $2.93 | 0.60% |

| I Class | $1,000 | $954.20 | $1.95 | 0.40% |

| Y Class | $1,000 | $954.40 | $1.81 | 0.37% |

| A Class | $1,000 | $952.10 | $4.15 | 0.85% |

| C Class | $1,000 | $948.50 | $7.79 | 1.60% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.00 | $3.03 | 0.60% |

| I Class | $1,000 | $1,023.00 | $2.02 | 0.40% |

| Y Class | $1,000 | $1,023.15 | $1.87 | 0.37% |

| A Class | $1,000 | $1,020.75 | $4.29 | 0.85% |

| C Class | $1,000 | $1,017.00 | $8.07 | 1.60% |

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

MAY 31, 2020

| | | | | | | | |

| Principal Amount | Value |

| MUNICIPAL SECURITIES — 95.2% | | |

| Alabama — 1.1% | | |

| Jefferson County Sewer Rev., 6.50%, 10/1/53 | $ | 2,000,000 | | $ | 2,305,940 | |

| Southeast Alabama Gas Supply District Rev., VRN, 4.00%, 6/1/49 (GA: Morgan Stanley) | 5,000,000 | | 5,376,300 | |

| | 7,682,240 | |

| Alaska — 0.4% | | |

| Northern Tobacco Securitization Corp. Rev., 5.00%, 6/1/46 | 2,500,000 | | 2,500,075 | |

| Arizona — 6.3% | | |

Arizona Industrial Development Authority Rev., (BASIS Schools, Inc. Obligated Group), 5.00%, 7/1/51(1) | 2,065,000 | | 2,036,048 | |

Arizona Industrial Development Authority Rev., (Doral Academy of Nevada), 5.00%, 7/15/49(1) | 1,675,000 | | 1,612,774 | |

Arizona Industrial Development Authority Rev., (Kaizen Education Foundation), 5.70%, 7/1/47(1) | 2,000,000 | | 2,046,180 | |

Arizona Industrial Development Authority Rev., (Odyssey Preparatory Academy, Inc.), 5.50%, 7/1/52(1) | 5,000,000 | | 5,129,350 | |

Arizona Industrial Development Authority Rev., (Pinecrest Academy of Nevada), 4.00%, 7/15/50(1) | 1,600,000 | | 1,317,856 | |

| Florence Town, Inc. Industrial Development Authority Rev., (Legacy Traditional School Series 2013 Obligated Group), 6.00%, 7/1/43 | 1,000,000 | | 1,042,660 | |

| Industrial Development Authority of the City of Phoenix Rev., (AZ GFF Tiyan LLC), 5.375%, 2/1/41 | 840,000 | | 848,459 | |

Industrial Development Authority of the City of Phoenix Rev., (BASIS Schools, Inc. Obligated Group), 5.00%, 7/1/45(1) | 1,500,000 | | 1,493,565 | |

Industrial Development Authority of the City of Phoenix Rev., (BASIS Schools, Inc. Obligated Group), 5.00%, 7/1/46(1) | 1,500,000 | | 1,491,285 | |

Industrial Development Authority of the City of Phoenix Rev., (Legacy Traditional School Obligated Group), 6.75%, 7/1/44(1) | 2,000,000 | | 2,185,420 | |

Industrial Development Authority of the City of Phoenix Rev., (Legacy Traditional School Obligated Group), 5.00%, 7/1/46(1) | 500,000 | | 500,240 | |

Industrial Development Authority of the City of Phoenix Rev., (Leman Academy of Excellence Obligated Group), 5.25%, 7/1/48(1) | 1,000,000 | | 992,690 | |

Industrial Development Authority of the City of Phoenix Rev., (Leman Academy of Excellence Obligated Group), 5.25%, 7/1/53(1) | 1,000,000 | | 984,520 | |

Industrial Development Authority of the City of Phoenix Rev., (Leman Academy of Excellence, Inc.), 5.00%, 7/1/54(1) | 1,000,000 | | 943,860 | |

| Industrial Development Authority of the City of Phoenix Rev., (Villa Montessori, Inc.), 5.00%, 7/1/35 | 500,000 | | 533,155 | |

| Industrial Development Authority of the City of Phoenix Rev., (Villa Montessori, Inc.), 5.00%, 7/1/45 | 1,000,000 | | 1,047,030 | |

Industrial Development Authority of the County of Pima Rev., (American Leadership Academy, Inc.), 5.625%, 6/15/45(1) | 2,000,000 | | 1,998,620 | |

Industrial Development Authority of the County of Pima Rev., (American Leadership Academy, Inc.), 5.00%, 6/15/47(1) | 1,325,000 | | 1,201,232 | |

Industrial Development Authority of the County of Pima Rev., (American Leadership Academy, Inc.), 5.00%, 6/15/52(1) | 1,325,000 | | 1,183,795 | |

Maricopa County Industrial Development Authority Rev., (Benjamin Franklin Charter School Ltd.), 6.00%, 7/1/52(1) | 4,000,000 | | 4,224,920 | |

Maricopa County Industrial Development Authority Rev., (Legacy Traditional School Obligated Group), 5.00%, 7/1/49(1) | 2,450,000 | | 2,442,454 | |

Maricopa County Industrial Development Authority Rev., (Paragon Management, Inc.), 5.00%, 7/1/47(1) | 1,000,000 | | 970,650 | |

Sundance Community Facilities District Rev., 7.125%, 7/1/27(1) | 208,000 | | 207,979 | |

| | | | | | | | |

| Principal Amount | Value |

Sundance Community Facilities District Special Assessment,

6.50%, 7/1/29 | $ | 144,000 | | $ | 140,149 | |

Tempe Industrial Development Authority Rev., (Mirabella at ASU, Inc.), 5.35%, 10/1/25(1) | 1,000,000 | | 999,460 | |

Tempe Industrial Development Authority Rev., (Mirabella at ASU, Inc.), 6.00%, 10/1/37(1) | 500,000 | | 488,380 | |

Tempe Industrial Development Authority Rev., (Mirabella at ASU, Inc.), 6.125%, 10/1/47(1) | 4,500,000 | | 4,351,995 | |

| | 42,414,726 | |

| California — 1.9% | | |

California County Tobacco Securitization Agency Rev., (Alameda County Tobacco Securitization Corp.), 0.00%, 6/1/50(2) | 8,000,000 | | 1,281,360 | |

| California County Tobacco Securitization Agency Rev., (Los Angeles County Securitization Corp.), 5.45%, 6/1/28 | 2,000,000 | | 2,001,080 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/36(1) | 500,000 | | 516,465 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/41(1) | 500,000 | | 513,360 | |

California Statewide Communities Development Authority Rev., (Loma Linda University Medical Center Obligated Group), 5.00%, 12/1/46(1) | 1,000,000 | | 1,020,630 | |

Foothill-Eastern Transportation Corridor Agency Rev.,

6.50%, 1/15/43 | 500,000 | | 564,705 | |

| Foothill-Eastern Transportation Corridor Agency Rev., Capital Appreciation, VRN, 0.00%, 1/15/42 | 500,000 | | 524,180 | |

| Golden State Tobacco Securitization Corp. Rev., 5.30%, 6/1/37 | 1,000,000 | | 1,012,470 | |

Golden State Tobacco Securitization Corp. Rev., Capital Appreciation, 0.00%, 6/1/47(2) | 5,000,000 | | 987,300 | |

| River Islands Public Financing Authority Special Tax, 5.50%, 9/1/45 | 1,500,000 | | 1,594,650 | |

San Francisco City & County Redevelopment Agency Successor Agency Special Tax, Capital Appreciation, 0.00%, 8/1/43(2) | 3,500,000 | | 963,830 | |

| Sunnyvale Special Tax, 7.75%, 8/1/32 | 1,500,000 | | 1,504,455 | |

| | 12,484,485 | |

| Colorado — 3.6% | | |

| Belleview Station Metropolitan District No. 2 GO, 5.00%, 12/1/36 | 1,000,000 | | 968,150 | |

| Belleview Station Metropolitan District No. 2 GO, 5.125%, 12/1/46 | 2,000,000 | | 1,904,040 | |

| Brighton Crossing Metropolitan District No. 4 GO, 4.00%, 12/1/27 | 510,000 | | 504,145 | |

| Brighton Crossing Metropolitan District No. 4 GO, 5.00%, 12/1/37 | 525,000 | | 528,255 | |

| Brighton Crossing Metropolitan District No. 4 GO, 5.00%, 12/1/47 | 1,220,000 | | 1,189,744 | |

| Central Platte Valley Metropolitan District GO, 5.00%, 12/1/43 | 1,000,000 | | 1,013,110 | |

| Clear Creek Station Metropolitan District No. 2 GO, 5.00%, 12/1/47 | 1,000,000 | | 935,370 | |

Colorado Health Facilities Authority Rev., (Frasier Meadows

Manor, Inc.), 5.25%, 5/15/37 | 500,000 | | 480,985 | |

Colorado Health Facilities Authority Rev., (Frasier Meadows

Manor, Inc.), 5.25%, 5/15/47 | 2,000,000 | | 1,828,080 | |

| Copper Ridge Metropolitan District Rev., 5.00%, 12/1/39 | 2,500,000 | | 2,303,900 | |

| Copper Ridge Metropolitan District Rev., 5.00%, 12/1/43 | 1,000,000 | | 898,030 | |

| Cornerstar Metropolitan District GO, 4.50%, 12/1/27 | 500,000 | | 499,235 | |

| Denver International Business Center Metropolitan District No. 1 GO, 6.00%, 12/1/48 | 2,290,000 | | 2,239,895 | |

Denver Urban Renewal Authority Tax Allocation, 5.25%, 12/1/39(1) | 1,900,000 | | 1,836,996 | |

Gardens on Havana Metropolitan District No. 3 Rev.,

3.625%, 12/1/21 | 500,000 | | 500,200 | |

| Leyden Rock Metropolitan District No. 10 GO, 5.00%, 12/1/45 | 1,250,000 | | 1,248,462 | |

| One Horse Business Improvement District Rev., 6.00%, 6/1/24 | 750,000 | | 750,593 | |

| | | | | | | | |

| Principal Amount | Value |

| Regional Transportation District Rev., (Denver Transit Partners LLC), 6.00%, 1/15/41 | $ | 1,000,000 | | $ | 1,002,060 | |

| Southlands Metropolitan District No. 1 GO, 5.00%, 12/1/37 | 500,000 | | 512,285 | |

| Southlands Metropolitan District No. 1 GO, 5.00%, 12/1/47 | 1,000,000 | | 1,008,080 | |

Vauxmont Metropolitan District GO, 5.00%, 12/1/50 (AGM)(3) | 1,500,000 | | 1,798,170 | |

| Water Valley Metropolitan District No. 1 GO, 5.25%, 12/1/40 | 300,000 | | 302,298 | |

| | 24,252,083 | |

| Connecticut — 0.6% | | |

Connecticut State Health & Educational Facilities Authority Rev., (Griffin Health Obligated Group), 5.00%, 7/1/50(1) | 3,750,000 | | 3,920,700 | |

| Delaware — 0.7% | | |

| Delaware State Economic Development Authority Rev., (Delmarva Power & Light Co.), 5.40%, 2/1/31 | 1,500,000 | | 1,508,445 | |

Town of Millsboro Special Tax, 5.25%, 7/1/48(1) | 3,000,000 | | 2,835,930 | |

| | 4,344,375 | |

| District of Columbia — 0.7% | | |

District of Columbia Tobacco Settlement Financing Corp. Rev., Capital Appreciation, 0.00%, 6/15/46(2) | 15,000,000 | | 1,678,200 | |

| Metropolitan Washington Airports Authority Dulles Toll Road Rev., 4.00%, 10/1/44 | 3,000,000 | | 3,066,570 | |

| | 4,744,770 | |

| Florida — 6.3% | | |

| Atlantic Beach Health Care Facilities Rev., (Naval Continuing Care Retirement Foundation Obligated Group), 3.25%, 11/15/24 | 2,155,000 | | 2,089,639 | |

| Babcock Ranch Community Independent Special District Special Assessment, 5.25%, 11/1/46 | 250,000 | | 257,458 | |

Capital Trust Agency, Inc. Rev., (Franklin Academy - Cooper City Campus), 5.00%, 12/15/50(1) | 1,000,000 | | 984,580 | |

Capital Trust Agency, Inc. Rev., (Franklin Academy - Cooper City Campus), 5.00%, 12/15/55(1) | 1,005,000 | | 981,151 | |

| Celebration Pointe Community Development District Special Assessment, 5.125%, 5/1/45 | 720,000 | | 729,000 | |

Celebration Pointe Community Development District Special Assessment, 5.00%, 5/1/48(1) | 1,905,000 | | 1,908,562 | |

| Escambia County Health Facilities Authority Rev., (Baptist Health Care Corp. Obligated Group), 4.00%, 8/15/45 | 2,700,000 | | 2,792,232 | |

| Escambia County Health Facilities Authority Rev., (Baptist Health Care Corp. Obligated Group), 4.00%, 8/15/50 | 2,300,000 | | 2,363,733 | |

Lake County Rev., (Educational Charter Foundation of Florida, Inc.), 5.00%, 1/15/49(1) | 800,000 | | 776,264 | |

Lake County Rev., (Educational Charter Foundation of Florida, Inc.), 5.00%, 1/15/54(1) | 850,000 | | 816,561 | |

| Miami Beach Redevelopment Agency Tax Allocation, 5.00%, 2/1/27 | 1,000,000 | | 1,153,950 | |

| Miami-Dade County Educational Facilities Authority Rev., (University of Miami), 5.00%, 4/1/30 | 1,250,000 | | 1,402,587 | |

| Miami-Dade County Industrial Development Authority Rev., (Pinecrest Academy, Inc.), 5.25%, 9/15/44 | 950,000 | | 998,554 | |

| Northern Palm Beach County Improvement District Special Assessment, 5.00%, 8/1/46 | 2,000,000 | | 2,106,560 | |

| Pinellas County Industrial Development Authority Rev., (Drs. Kiran & Pallavi Patel 2017 Foundation for Global Understanding, Inc.), 5.00%, 7/1/29 | 3,150,000 | | 3,258,297 | |

| Seminole County Industrial Development Authority Rev., (CCRC Development Corp. Obligated Group), 3.75%, 11/15/25 | 2,000,000 | | 1,743,260 | |

| Seminole County Industrial Development Authority Rev., (CCRC Development Corp. Obligated Group), 4.25%, 11/15/26 | 3,000,000 | | 2,615,610 | |

| Seminole County Industrial Development Authority Rev., (CCRC Development Corp. Obligated Group), 5.75%, 11/15/54 | 2,000,000 | | 1,542,520 | |

| | | | | | | | |

| Principal Amount | Value |

Tallahassee Rev., (Tallahassee Memorial HealthCare, Inc.),

5.00%, 12/1/24 | $ | 1,225,000 | | $ | 1,394,491 | |

| Tomoka Community Development District Special Assessment, 5.50%, 5/1/35 | 2,500,000 | | 2,601,425 | |

| Village Community Development District No. 10 Special Assessment, 6.00%, 5/1/44 | 420,000 | | 458,249 | |

| Village Community Development District No. 12 Special Assessment, 3.625%, 5/1/31 | 1,940,000 | | 1,950,748 | |

Village Community Development District No. 12 Special Assessment, 4.375%, 5/1/50(1) | 2,710,000 | | 2,770,894 | |

| Village Community Development District No. 13 Special Assessment, 3.70%, 5/1/50 | 2,000,000 | | 1,902,520 | |

| Village Community Development District No. 8 Special Assessment, 6.125%, 5/1/39 | 715,000 | | 716,745 | |

| Winter Garden Village at Fowler Groves Community Development District Special Assessment, 4.125%, 5/1/37 | 1,995,000 | | 1,960,347 | |

| | 42,275,937 | |

| Georgia — 2.6% | | |

| Atlanta Department of Aviation Rev., (Atlanta Airport Passenger Facility Charge), 5.00%, 7/1/36 | 5,000,000 | | 6,141,750 | |

| Development Authority of White County Rev., (Truett-Mcconnell University, Inc. Obligated Group), 5.00%, 10/1/29 | 1,285,000 | | 1,260,521 | |

| Development Authority of White County Rev., (Truett-Mcconnell University, Inc. Obligated Group), 5.125%, 10/1/39 | 2,000,000 | | 1,826,800 | |

| Development Authority of White County Rev., (Truett-Mcconnell University, Inc. Obligated Group), 5.25%, 10/1/49 | 4,000,000 | | 3,528,040 | |

| Main Street Natural Gas, Inc. Rev., 5.00%, 5/15/49 (GA: Macquarie Group Ltd.) | 1,500,000 | | 1,902,975 | |

Marietta Development Authority Rev., (Life University, Inc.), 5.00%, 11/1/37(1) | 1,500,000 | | 1,503,615 | |

Rockdale County Development Authority Rev., (Pratt Paper LLC), 4.00%, 1/1/38 (GA: Pratt Industries, Inc.)(1) | 1,500,000 | | 1,475,655 | |

| | 17,639,356 | |

| Guam — 0.2% | | |

| Guam Government Department of Education COP, 6.625%, 12/1/30 | 1,000,000 | | 1,015,110 | |

| Idaho — 0.5% | | |

| Idaho Health Facilities Authority Rev., (Partners In Healthcare, Inc.), 5.50%, 11/1/45 | 3,250,000 | | 3,393,065 | |

| Illinois — 9.5% | | |

| Chicago GO, 5.00%, 1/1/27 | 1,265,000 | | 1,323,026 | |

| Chicago GO, 5.00%, 1/1/28 | 2,000,000 | | 2,094,760 | |

| Chicago GO, 5.00%, 1/1/29 | 2,000,000 | | 2,095,240 | |

| Chicago GO, 5.625%, 1/1/29 | 2,500,000 | | 2,683,700 | |

| Chicago GO, 5.50%, 1/1/39 | 2,000,000 | | 2,045,160 | |

| Chicago GO, 5.00%, 1/1/40 | 2,500,000 | | 2,486,700 | |

| Chicago Board of Education GO, 5.00%, 12/1/42 | 3,815,000 | | 3,668,771 | |

| Chicago Board of Education GO, 5.00%, 12/1/46 | 2,500,000 | | 2,365,000 | |

| Chicago Board of Education GO, 6.50%, 12/1/46 | 1,000,000 | | 1,070,720 | |

| Chicago Midway International Airport Rev., 5.00%, 1/1/26 | 2,200,000 | | 2,379,674 | |

| Cook County Community High School District No. 212 Leyden Rev., 5.00%, 12/1/28 (BAM) | 2,385,000 | | 2,834,191 | |

| Illinois Finance Authority Rev., 5.00%, 11/1/49 | 1,150,000 | | 1,000,488 | |

| Illinois Finance Authority Rev., (Ascension Health Credit Group), 4.00%, 2/15/36 | 2,400,000 | | 2,619,432 | |

| Illinois Finance Authority Rev., (Chicago Charter School Foundation), 5.00%, 12/1/47 | 3,500,000 | | 3,580,290 | |

Illinois Finance Authority Rev., (Intrinsic Schools), 6.00%, 12/1/45(1) | 2,000,000 | | 2,079,520 | |

| | | | | | | | |

| Principal Amount | Value |

Illinois Finance Authority Rev., (Plymouth Place, Inc.),

5.25%, 5/15/50 | $ | 2,000,000 | | $ | 1,782,360 | |

| Illinois Finance Authority Rev., (Westminster Village, Inc. Obligated Group), 5.50%, 5/1/53 | 2,500,000 | | 2,271,600 | |

| Northern Illinois University Rev., 4.00%, 4/1/38 (BAM) | 1,150,000 | | 1,207,316 | |

| Northern Illinois University Rev., 4.00%, 4/1/41 (BAM) | 750,000 | | 780,615 | |

| State of Illinois GO, 5.00%, 10/1/25 | 3,000,000 | | 3,063,090 | |

| State of Illinois GO, 5.00%, 12/1/25 | 3,000,000 | | 3,065,010 | |

| State of Illinois GO, 5.00%, 2/1/26 | 1,000,000 | | 1,017,190 | |

| State of Illinois GO, 5.125%, 12/1/29 | 3,000,000 | | 3,060,780 | |

| State of Illinois GO, 5.00%, 10/1/33 | 900,000 | | 912,177 | |

| State of Illinois GO, 5.00%, 3/1/36 | 2,100,000 | | 2,103,318 | |

| State of Illinois GO, 5.50%, 7/1/38 | 1,000,000 | | 1,020,850 | |

| State of Illinois GO, 5.00%, 2/1/39 | 3,000,000 | | 3,002,790 | |

| State of Illinois GO, 5.50%, 5/1/39 | 985,000 | | 1,034,880 | |

| State of Illinois GO, 5.75%, 5/1/45 | 2,400,000 | | 2,562,456 | |

| Western Illinois Economic Development Authority Rev., (Memorial Hospital Association), 4.00%, 6/1/36 | 2,000,000 | | 2,075,540 | |

| | 63,286,644 | |

| Iowa — 1.0% | | |

| Iowa Finance Authority Rev., (Lifespace Communities, Inc. Obligated Group), 5.00%, 5/15/48 | 4,720,000 | | 4,468,613 | |

| Iowa Finance Authority Rev., (Lifespace Communities, Inc. Obligated Group), 2.875%, 5/15/49 | 1,500,000 | | 1,443,090 | |

| Iowa Tobacco Settlement Authority Rev., 5.625%, 6/1/46 | 1,000,000 | | 1,013,200 | |

| | 6,924,903 | |

| Kansas — 1.4% | | |

| Kansas Development Finance Authority Rev., (Village Shalom Obligated Group), 4.00%, 11/15/25 | 9,500,000 | | 8,730,975 | |

| Wichita Rev., (K-96 Greenwich STAR Bond), 3.00%, 9/1/23 | 945,000 | | 950,264 | |

| | 9,681,239 | |

| Kentucky — 2.6% | | |

| Christian County Rev., (Jennie Stuart Medical Center Obligated Group), 5.50%, 2/1/44 | 1,335,000 | | 1,451,572 | |

Kentucky Public Energy Authority Rev., VRN, 4.00%, 12/1/49

(GA: Morgan Stanley) | 7,500,000 | | 8,182,050 | |

Kentucky Public Energy Authority Rev., VRN, 4.00%, 12/1/49

(GA: Morgan Stanley) | 3,000,000 | | 3,270,090 | |

| Paducah Electric Plant Board Rev., 5.00%, 10/1/30 (AGM) | 3,500,000 | | 4,342,555 | |

| | 17,246,267 | |

| Louisiana — 0.7% | | |

St. James Parish Rev., (NuStar Logistics LP), VRN, 6.10%, 12/1/40(1) | 1,250,000 | | 1,367,450 | |

St. James Parish Rev., (NuStar Logistics LP), VRN, 5.85%, 8/1/41(1) | 1,000,000 | | 1,056,150 | |

| St. John the Baptist Rev., (Marathon Oil Corp.), VRN, 2.00%, 6/1/37 | 1,125,000 | | 1,058,704 | |

| St. John the Baptist Rev., (Marathon Oil Corp.), VRN, 2.20%, 6/1/37 | 1,500,000 | | 1,317,480 | |

| | 4,799,784 | |

| Maryland — 1.5% | | |

| Baltimore Rev., 5.125%, 6/1/43 | 1,500,000 | | 1,442,220 | |

| Brunswick Special Tax, 5.00%, 7/1/36 | 1,450,000 | | 1,455,960 | |

| Maryland Economic Development Corp. Rev., (Ports America Chesapeake LLC), 5.00%, 6/1/25 | 1,000,000 | | 1,078,130 | |

| Maryland Economic Development Corp. Rev., (Ports America Chesapeake LLC), 5.00%, 6/1/27 | 1,000,000 | | 1,083,390 | |

| Prince George's County Rev., (Collington Episcopal Life Care Community, Inc.), 5.25%, 4/1/37 | 1,500,000 | | 1,399,755 | |

| | | | | | | | |

| Principal Amount | Value |

Prince George's County Tax Allocation, 5.25%, 7/1/48(1) | $ | 2,000,000 | | $ | 2,001,340 | |

Rockville Rev., (King Farm Presbyterian Retirement

Community, Inc.), 3.50%, 11/1/26 | 1,825,000 | | 1,716,467 | |

| | 10,177,262 | |

| Michigan — 2.8% | | |

| Calhoun County Hospital Finance Authority Rev., (Ella EM Brown Charitable Circle), 5.00%, 2/15/47 | 2,500,000 | | 2,710,700 | |

| Flint Hospital Building Authority Rev., (Hurley Medical Center), 4.00%, 7/1/41 | 2,500,000 | | 2,617,375 | |

| Kentwood Economic Development Corp. Rev., (Holland Home Obligated Group), 5.625%, 11/15/41 | 1,750,000 | | 1,779,488 | |

| Michigan Finance Authority Rev., (Lawrence Technological University), 5.00%, 2/1/47 | 2,195,000 | | 2,053,883 | |

Michigan Finance Authority Rev., (Thomas M Cooley Law School), 6.75%, 7/1/44(1) | 6,500,000 | | 6,529,315 | |

| Michigan Tobacco Settlement Finance Authority Rev., (Michigan Finance Authority), 6.00%, 6/1/48 | 3,000,000 | | 3,000,060 | |

| | 18,690,821 | |

| Minnesota — 0.6% | | |

| Crookston Rev., (Riverview Healthcare Association), 5.00%, 5/1/51 | 4,100,000 | | 4,017,754 | |

| Mississippi — 0.3% | | |

Mississippi Hospital Equipment & Facilities Authority Rev., (North Mississippi Medical Center Obligated Group), 5.00%, 10/1/38(3) | 800,000 | | 945,872 | |

Mississippi Hospital Equipment & Facilities Authority Rev., (North Mississippi Medical Center Obligated Group), 5.00%, 10/1/39(3) | 850,000 | | 1,002,388 | |

| | 1,948,260 | |

| Missouri — 3.1% | | |

| Health & Educational Facilities Authority of the State of Missouri Rev., (Lutheran Senior Services Obligated Group), 2.875%, 2/1/34 | 2,000,000 | | 1,936,580 | |

| Health & Educational Facilities Authority of the State of Missouri Rev., (Lutheran Senior Services Obligated Group), 6.00%, 2/1/41 | 1,250,000 | | 1,269,187 | |

| Industrial Development Authority of the City of St. Louis Missouri Rev., 4.75%, 11/15/47 | 2,500,000 | | 2,062,650 | |

| Kirkwood Industrial Development Authority Rev., (Ashfield Active Living and Wellness Communities, Inc.), 5.25%, 5/15/30 | 2,515,000 | | 2,522,193 | |

| Kirkwood Industrial Development Authority Rev., (Ashfield Active Living and Wellness Communities, Inc.), 5.25%, 5/15/37 | 1,000,000 | | 950,430 | |

Lees Summit Tax Allocation, 4.875%, 11/1/37(1) | 3,500,000 | | 3,051,160 | |

| St. Louis County Industrial Development Authority Rev., (Friendship Village St. Louis Obligated Group), 5.25%, 9/1/53 | 5,000,000 | | 4,508,300 | |

| St. Louis County Industrial Development Authority Rev., (Nazareth Living Center), 5.125%, 8/15/45 | 3,600,000 | | 3,293,208 | |

| St. Louis County Industrial Development Authority Rev., (Ranken-Jordan Pediatric Speciality Hospital), 5.00%, 11/15/46 | 1,000,000 | | 967,220 | |

| | 20,560,928 | |

| Nevada — 2.6% | | |

| Clark County Special Assessment, 5.00%, 8/1/30 | 1,385,000 | | 1,428,101 | |

| Clark County Special Assessment, 5.00%, 8/1/32 | 360,000 | | 368,359 | |

| Clark County Special Assessment, 5.00%, 8/1/35 | 660,000 | | 672,619 | |

Henderson Local Improvement Districts Special Assessment,

4.00%, 9/1/23 | 2,030,000 | | 2,047,763 | |

Henderson Local Improvement Districts Special Assessment,

6.10%, 3/1/24 | 660,000 | | 663,538 | |

| Las Vegas Special Improvement District No. 812 Special Assessment, 5.00%, 12/1/35 | 985,000 | | 1,007,409 | |

| Las Vegas Special Improvement District No. 814 Special Assessment, 4.00%, 6/1/49 | 850,000 | | 740,537 | |

| | | | | | | | |

| Principal Amount | Value |

Nevada Department of Business & Industry Rev., (Doral Academy of Nevada), 5.00%, 7/15/27(1) | $ | 335,000 | | $ | 347,683 | |

Nevada Department of Business & Industry Rev., (Doral Academy of Nevada), 5.00%, 7/15/37(1) | 1,000,000 | | 1,001,730 | |

Nevada Department of Business & Industry Rev., (Doral Academy of Nevada), 5.00%, 7/15/47(1) | 1,400,000 | | 1,353,534 | |

| North Las Vegas Special Assessment, (North Las Vegas Special Improvement District No. 64 Valley Vista), 4.25%, 6/1/34 | 600,000 | | 561,408 | |

| North Las Vegas Special Assessment, (North Las Vegas Special Improvement District No. 64 Valley Vista), 4.50%, 6/1/39 | 750,000 | | 707,865 | |

| North Las Vegas Special Assessment, (North Las Vegas Special Improvement District No. 64 Valley Vista), 4.625%, 6/1/43 | 600,000 | | 566,322 | |

| North Las Vegas Special Assessment, (North Las Vegas Special Improvement District No. 64 Valley Vista), 4.625%, 6/1/49 | 1,000,000 | | 925,640 | |

Reno Rev., (Washoe County Sales Tax Rev.), Capital Appreciation, 0.00%, 7/1/58(1)(2) | 9,500,000 | | 1,029,420 | |

Reno Rev., (Washoe County Sales Tax Rev.), Capital Appreciation, 0.00%, 7/1/58(1)(2) | 13,000,000 | | 1,149,200 | |

Sparks Rev., 2.75%, 6/15/28(1) | 3,000,000 | | 2,805,390 | |

| | 17,376,518 | |

| New Jersey — 3.5% | | |

| New Jersey Economic Development Authority Rev., 5.00%, 11/1/24 | 5,000,000 | | 5,295,900 | |

| New Jersey Economic Development Authority Rev., 5.00%, 6/15/40 | 1,625,000 | | 1,657,370 | |

New Jersey Economic Development Authority Rev., (Beloved Community Charter School, Inc.), 5.00%, 6/15/49(1) | 1,105,000 | | 1,107,254 | |

New Jersey Economic Development Authority Rev., (Beloved Community Charter School, Inc.), 5.00%, 6/15/54(1) | 725,000 | | 714,481 | |

| New Jersey Economic Development Authority Rev., (Port Newark Container Terminal LLC), 5.00%, 10/1/47 | 5,000,000 | | 5,224,200 | |

| New Jersey Educational Facilities Authority Rev., (College of Saint Elizabeth), 5.00%, 7/1/46 | 2,500,000 | | 2,292,250 | |

New Jersey Transportation Trust Fund Authority Rev.,

5.00%, 6/15/44 | 5,000,000 | | 5,154,900 | |

| Tobacco Settlement Financing Corp. Rev., 5.25%, 6/1/46 | 2,000,000 | | 2,234,920 | |

| | 23,681,275 | |

| New Mexico — 0.4% | | |

Lower Petroglyphs Public Improvement District Special Tax,

5.00%, 10/1/33 | 500,000 | | 508,250 | |

Lower Petroglyphs Public Improvement District Special Tax,

5.00%, 10/1/38 | 450,000 | | 452,093 | |

Lower Petroglyphs Public Improvement District Special Tax,

5.00%, 10/1/48 | 1,200,000 | | 1,195,272 | |

| Santa Fe Rev., (El Castillo Retirement Residences Obligated Group), 2.625%, 5/15/25 | 800,000 | | 726,072 | |

| | 2,881,687 | |

| New York — 10.7% | | |

| Buffalo & Erie County Industrial Land Development Corp. Rev., (Orchard Park CCRC, Inc.), 5.00%, 11/15/37 | 1,500,000 | | 1,502,085 | |

| Build NYC Resource Corp. Rev., (Metropolitan College of New York), 5.25%, 11/1/34 | 750,000 | | 778,035 | |

| Build NYC Resource Corp. Rev., (Metropolitan College of New York), 5.50%, 11/1/44 | 1,000,000 | | 1,031,110 | |

Build NYC Resource Corp. Rev., (Metropolitan Lighthouse Charter School), 5.00%, 6/1/32(1) | 625,000 | | 646,613 | |

Build NYC Resource Corp. Rev., (Metropolitan Lighthouse Charter School), 5.00%, 6/1/37(1) | 500,000 | | 506,180 | |

Build NYC Resource Corp. Rev., (Metropolitan Lighthouse Charter School), 5.00%, 6/1/47(1) | 1,000,000 | | 994,130 | |

| | | | | | | | |

| Principal Amount | Value |

Build NYC Resource Corp. Rev., (Metropolitan Lighthouse Charter School), 5.00%, 6/1/52(1) | $ | 1,000,000 | | $ | 985,860 | |

| Glen Cove Local Economic Assistance Corp. Rev., 5.00%, 1/1/56 | 1,500,000 | | 1,477,845 | |

| Metropolitan Transportation Authority Rev., 5.25%, 11/15/55 | 5,000,000 | | 5,508,900 | |

| New York City GO, 5.00%, 4/1/45 | 10,000,000 | | 11,953,400 | |

New York City GO, VRDN, 0.06%, 6/1/20 (SBBPA: Barclays

Bank plc) | 5,000,000 | | 5,000,000 | |

| New York City GO, VRDN, 0.07%, 6/1/20 (SBBPA: JPMorgan Chase Bank N.A.) | 2,500,000 | | 2,500,000 | |

| New York City Industrial Development Agency Rev., (TrIPs Obligated Group), 5.00%, 7/1/28 | 1,000,000 | | 1,025,130 | |

| New York City Transitional Finance Authority Future Tax Secured Rev., VRDN, 0.06%, 6/1/20 (SBBPA: Barclays Bank plc) | 2,070,000 | | 2,070,000 | |

| New York City Transitional Finance Authority Future Tax Secured Rev., VRDN, 0.07%, 6/1/20 (SBBPA: Bank of America N.A.) | 2,325,000 | | 2,325,000 | |

| New York City Water & Sewer System Rev., 5.00%, 6/15/49 | 5,000,000 | | 6,166,900 | |

| New York City Water & Sewer System Rev., VRDN, 0.06%, 6/1/20 (SBBPA: Barclays Bank plc) | 2,600,000 | | 2,600,000 | |

| New York Counties Tobacco Trust Rev., 4.00%, 6/1/51 | 1,500,000 | | 1,224,345 | |

| New York Counties Tobacco Trust Rev., 5.00%, 6/1/51 | 1,000,000 | | 989,120 | |

New York State Dormitory Authority Rev., 5.00%, 9/15/28, Prerefunded at 100% of Par(4) | 5,000 | | 6,819 | |

| New York State Dormitory Authority Rev., 5.00%, 3/15/48 | 9,995,000 | | 12,138,428 | |

New York State Dormitory Authority Rev., (Orange Regional Medical Center Obligated Group), 5.00%, 12/1/27(1) | 1,000,000 | | 1,183,690 | |

| New York State Urban Development Corp. Rev., (State of New York Personal Income Tax Rev.), 5.00%, 3/15/45 | 6,260,000 | | 7,595,508 | |

| Yonkers Economic Development Corp. Rev., (Charter School of Educational Excellence), 5.00%, 10/15/39 | 320,000 | | 321,408 | |

| Yonkers Economic Development Corp. Rev., (Charter School of Educational Excellence), 5.00%, 10/15/49 | 640,000 | | 622,675 | |

| Yonkers Economic Development Corp. Rev., (Charter School of Educational Excellence), 5.00%, 10/15/54 | 465,000 | | 447,990 | |

| | 71,601,171 | |

| North Carolina — 1.1% | | |

| North Carolina Medical Care Commission Rev., (Maryfield, Inc.), 5.00%, 10/1/35 | 1,000,000 | | 892,280 | |

North Carolina Medical Care Commission Rev., (Moravian

Home, Inc.), 5.00%, 10/1/48 | 3,000,000 | | 2,664,060 | |

| North Carolina Medical Care Commission Rev., (Presbyterian Home at Charlotte, Inc.), 5.00%, 7/1/49 | 1,500,000 | | 1,514,115 | |

| North Carolina Medical Care Commission Rev., (Southminster, Inc.), 5.00%, 10/1/37 | 1,500,000 | | 1,452,585 | |

| North Carolina Medical Care Commission Rev., (United Church Homes & Services Obligated Group), 5.00%, 9/1/23 | 610,000 | | 614,313 | |

| North Carolina Medical Care Commission Rev., (United Church Homes & Services Obligated Group), 5.00%, 9/1/24 | 280,000 | | 282,108 | |

| | 7,419,461 | |

| Ohio — 6.3% | | |

Buckeye Tobacco Settlement Financing Authority Rev.,

5.00%, 6/1/55 | 18,000,000 | | 18,192,060 | |

Buckeye Tobacco Settlement Financing Authority Rev., Capital Appreciation, 0.00%, 6/1/57(2) | 15,000,000 | | 1,940,400 | |

| Centerville Rev., (Graceworks Lutheran Services), 5.00%, 11/1/25 | 1,420,000 | | 1,446,895 | |

| Cleveland-Cuyahoga County Port Authority Rev., (Playhouse Square Foundation), 5.50%, 12/1/53 | 2,500,000 | | 2,487,475 | |

| Columbus-Franklin County Finance Authority Rev., (Ohio Dominican University), 6.50%, 3/1/48 | 6,000,000 | | 6,140,280 | |

| | | | | | | | |

| Principal Amount | Value |

| Cuyahoga County Rev., (MetroHealth System), 5.00%, 2/15/28 | $ | 1,250,000 | | $ | 1,403,187 | |

| Muskingum County Rev., (Genesis Healthcare System Obligated Group), 5.00%, 2/15/44 | 2,500,000 | | 2,545,725 | |

| Northeast Ohio Regional Sewer District Rev., 4.00%, 11/15/37 | 1,000,000 | | 1,202,680 | |

Ohio Air Quality Development Authority Rev., (AMG Vanadium LLC), 5.00%, 7/1/49 (GA: AMG Advanced Metallurgicl)(1) | 3,000,000 | | 2,875,740 | |

Ohio Air Quality Development Authority Rev., (Pratt Paper, Inc.), 4.25%, 1/15/38 (GA: Pratt Industries, Inc.)(1) | 1,000,000 | | 1,007,310 | |

Ohio Air Quality Development Authority Rev., (Pratt Paper, Inc.), 4.50%, 1/15/48 (GA: Pratt Industries, Inc.)(1) | 1,000,000 | | 1,007,150 | |

| Ohio Higher Educational Facility Commission Rev., (Cleveland Institute of Art), 5.50%, 12/1/53 | 1,900,000 | | 1,827,040 | |

| | 42,075,942 | |

| Oregon — 0.2% | | |

| Clackamas County Hospital Facility Authority Rev., (Mary's Woods at Marylhurst, Inc.), 2.80%, 5/15/24 | 555,000 | | 552,524 | |

| Clackamas County Hospital Facility Authority Rev., (Mary's Woods at Marylhurst, Inc.), 3.20%, 5/15/25 | 775,000 | | 770,079 | |

| | 1,322,603 | |

| Pennsylvania — 4.4% | | |

Berks County Municipal Authority Rev., (Alvernia University),

5.00%, 10/1/49 | 1,225,000 | | 1,165,281 | |

| Chester County Health & Education Facilities Authority Rev., (Simpson Senior Services Obligated Group), 5.25%, 12/1/45 | 1,400,000 | | 1,292,900 | |

| Chester County Health & Education Facilities Authority Rev., (Simpson Senior Services Obligated Group), 5.00%, 12/1/51 | 3,000,000 | | 2,600,370 | |

| Chester County Industrial Development Authority Rev., (Renaissance Academy Charter School), 5.00%, 10/1/44 | 1,215,000 | | 1,258,813 | |

Chester County Industrial Development Authority Special Assessment, (Woodlands at Greystone Neighborhood Improvement District), 5.00%, 3/1/38(1) | 525,000 | | 492,618 | |

Chester County Industrial Development Authority Special Assessment, (Woodlands at Greystone Neighborhood Improvement District), 5.125%, 3/1/48(1) | 1,050,000 | | 955,395 | |

| Crawford County Hospital Authority Rev., (Meadville Medical Center Obligated Group), 6.00%, 6/1/46 | 1,500,000 | | 1,603,395 | |

Dauphin County General Authority Rev., (Harrisburg University of Science & Technology), 5.125%, 10/15/41(1) | 3,000,000 | | 2,601,540 | |

| Franklin County Industrial Development Authority Rev., (Menno-Haven, Inc. Obligated Group), 5.00%, 12/1/48 | 1,170,000 | | 1,012,600 | |

Hospitals & Higher Education Facilities Authority of Philadelphia Rev., (Temple University Health System Obligated Group),

5.625%, 7/1/42 | 2,500,000 | | 2,604,925 | |

| Lancaster County Hospital Authority Rev., (Brethren Village Obligated Group), 5.125%, 7/1/37 | 1,000,000 | | 940,820 | |

| Montgomery County Industrial Development Authority Rev., (Albert Einstein Healthcare Network Obligated Group), 5.25%, 1/15/45 | 1,250,000 | | 1,319,650 | |

Pennsylvania Economic Development Financing Authority Rev., (Covanta Holding Corp.), 3.25%, 8/1/39(1) | 1,000,000 | | 834,880 | |

| Philadelphia GO, 5.00%, 7/15/38 | 1,500,000 | | 1,706,970 | |

| Philadelphia Authority for Industrial Development Rev., (First Philadelphia Preparatory Charter School), 7.25%, 6/15/43 | 1,500,000 | | 1,643,715 | |

| Philadelphia Authority for Industrial Development Rev., (KIPP Philadelphia Charter School), 4.00%, 4/1/26 | 405,000 | | 403,315 | |

| Philadelphia Authority for Industrial Development Rev., (KIPP Philadelphia Charter School), 5.00%, 4/1/46 | 2,000,000 | | 1,865,400 | |

| School District of Philadelphia GO, 5.00%, 9/1/25 | 2,500,000 | | 3,000,925 | |

| Scranton-Lackawanna Health & Welfare Authority Rev., (Marywood University), 5.00%, 6/1/36 | 1,000,000 | | 973,160 | |

| | | | | | | | |

| Principal Amount | Value |

| Scranton-Lackawanna Health & Welfare Authority Rev., (Marywood University), 5.00%, 6/1/46 | $ | 1,050,000 | | $ | 966,956 | |

| | 29,243,628 | |

| Rhode Island — 0.5% | | |

| Rhode Island Health & Educational Building Corp. Rev., (Care New England Health System Obligated Group), 5.00%, 9/1/36 | 2,125,000 | | 2,174,236 | |

| Tobacco Settlement Financing Corp. Rev., 5.00%, 6/1/50 | 1,000,000 | | 1,047,520 | |

| | 3,221,756 | |

| South Carolina — 0.5% | | |

| Berkeley County Special Assessment, (Berkeley County Nexton Improvement District), 4.375%, 11/1/49 | 1,500,000 | | 1,263,870 | |

South Carolina Jobs-Economic Development Authority Rev., (South Carolina Episcopal Home at Still Hopes Obligated Group),

5.00%, 4/1/48 | 1,000,000 | | 902,810 | |

| South Carolina Jobs-Economic Development Authority Rev., (Upstate Senior Living, Inc. Obligated Group), 5.00%, 11/15/42 | 585,000 | | 542,552 | |

| South Carolina Jobs-Economic Development Authority Rev., (Upstate Senior Living, Inc. Obligated Group), 5.00%, 11/15/54 | 1,000,000 | | 889,400 | |

| | 3,598,632 | |

| Tennessee — 1.3% | | |

| Metropolitan Nashville Airport Authority Rev., 5.00%, 7/1/49 | 2,000,000 | | 2,391,720 | |

Nashville Metropolitan Development & Housing Agency Tax Allocation, 5.125%, 6/1/36(1) | 500,000 | | 502,495 | |

| Tennessee Energy Acquisition Corp. Rev., VRN, 4.00%, 11/1/49 (GA: Goldman Sachs Group, Inc.) | 5,500,000 | | 6,112,095 | |

| | 9,006,310 | |

| Texas — 7.5% | | |

| Arlington Higher Education Finance Corp. Rev., (Leadership Prep School), 5.00%, 6/15/36 | 700,000 | | 689,367 | |

| Arlington Higher Education Finance Corp. Rev., (Leadership Prep School), 5.00%, 6/15/46 | 1,325,000 | | 1,240,796 | |

| Board of Managers Joint Guadalupe County-City of Seguin Hospital Rev., 5.00%, 12/1/40 | 1,000,000 | | 1,040,350 | |

| Board of Managers Joint Guadalupe County-City of Seguin Hospital Rev., 5.00%, 12/1/45 | 2,000,000 | | 2,042,060 | |

| Clifton Higher Education Finance Corp. Rev., (International American Education Federation, Inc.), 6.125%, 8/15/48 | 9,950,000 | | 10,638,142 | |

| Harris County Cultural Education Facilities Finance Corp. Rev., (Brazos Presbyterian Homes, Inc.), 5.00%, 1/1/37 | 1,750,000 | | 1,681,277 | |

Mission Economic Development Corp. Rev., (Natgasoline LLC), 4.625%, 10/1/31(1) | 2,500,000 | | 2,523,775 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Corpus Christi II LLC), 5.00%, 4/1/31 | 1,615,000 | | 1,562,432 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Corpus Christi II LLC), 5.00%, 4/1/48 | 1,850,000 | | 1,596,550 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Island Campus LLC), 5.00%, 4/1/24 | 1,385,000 | | 1,410,498 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Island Campus LLC), 5.00%, 4/1/25 | 1,505,000 | | 1,531,368 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Island Campus LLC), 5.00%, 4/1/26 | 1,000,000 | | 1,008,480 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Island Campus LLC), 5.00%, 4/1/27 | 1,260,000 | | 1,262,810 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Island Campus LLC), 5.00%, 4/1/28 | 1,120,000 | | 1,114,904 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Island Campus LLC), 5.00%, 4/1/29 | 570,000 | | 560,384 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing Island Campus LLC), 5.00%, 4/1/37 | 2,750,000 | | 2,479,785 | |

| | |

| | | | | | | | |

| Principal Amount | Value |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing San Antonio I LLC), 5.00%, 4/1/25 | $ | 290,000 | | $ | 298,436 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing San Antonio I LLC), 5.00%, 4/1/26 | 390,000 | | 400,768 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing San Antonio I LLC), 5.00%, 4/1/31 | 1,300,000 | | 1,314,235 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(CHF-Collegiate Housing San Antonio I LLC), 5.00%, 4/1/36 | 1,000,000 | | 979,420 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(MRC Crestview), 4.00%, 11/15/26 | 2,000,000 | | 1,858,380 | |

New Hope Cultural Education Facilities Finance Corp. Rev.,

(MRC Senior Living), 3.25%, 11/15/22 | 115,000 | | 106,452 | |

| North East Texas Regional Mobility Authority Rev., 5.00%, 1/1/31 | 1,805,000 | | 1,948,028 | |

| Pottsboro Higher Education Finance Corp. Rev., (Imagine International Academy of North Texas), 5.00%, 8/15/46 | 1,000,000 | | 968,700 | |

| Tarrant County Cultural Education Facilities Finance Corp. Rev., (Buckner Senior Living, Inc.), 6.75%, 11/15/47 | 5,095,000 | | 5,044,509 | |

Texas Private Activity Bond Surface Transportation Corp. Rev.,

(LBJ Infrastructure Group LLC), 7.00%, 6/30/40 | 3,000,000 | | 3,015,060 | |

| Texas Private Activity Bond Surface Transportation Corp. Rev., (NTE Mobility Partners Segments 3 LLC), 5.00%, 6/30/58 | 2,000,000 | | 2,202,120 | |

| | 50,519,086 | |

| Vermont — 0.2% | | |

| Vermont Educational & Health Buildings Financing Agency Rev., (Southwestern Vermont Medical Center, Inc.), VRDN, 0.13%, 6/1/20 (LOC: TD Bank N.A.) | 1,000,000 | | 1,000,000 | |

| Virginia — 2.8% | | |

Cherry Hill Community Development Authority Special Assessment, 5.40%, 3/1/45(1) | 1,000,000 | | 961,650 | |

| Danville Industrial Development Authority Rev., (Averett University Obligated Group), 5.00%, 10/1/47 | 2,500,000 | | 2,265,275 | |

| Dullles Town Center Community Development Authority Special Assessment, 4.25%, 3/1/26 | 1,750,000 | | 1,714,072 | |

| Henrico County Economic Development Authority Rev., (LifeSpire of Virginia Obligated Group), 5.00%, 12/1/37 | 765,000 | | 722,367 | |

| Henrico County Economic Development Authority Rev., (LifeSpire of Virginia Obligated Group), 5.00%, 12/1/47 | 2,200,000 | | 1,976,194 | |

Lower Magnolia Green Community Development Authority Special Assessment, 5.00%, 3/1/45(1) | 980,000 | | 895,740 | |

| Lynchburg Economic Development Authority Rev., (Centra Health Obligated Group), VRDN, 0.06%, 6/1/20 (LOC: Branch Banking & Trust) | 1,700,000 | | 1,700,000 | |

| Mosaic District Community Development Authority Tax Allocation, 6.875%, 3/1/36 | 1,000,000 | | 1,017,980 | |

Peninsula Town Center Community Development Authority Special Assessment, 5.00%, 9/1/37(1) | 2,000,000 | | 2,002,380 | |

Peninsula Town Center Community Development Authority Special Assessment, 5.00%, 9/1/45(1) | 2,250,000 | | 2,243,115 | |

Prince William County Industrial Development Authority Rev., (Westminster Presbyterian Retirement Community, Inc.),

5.00%, 1/1/26 | 1,165,000 | | 1,205,623 | |

| Tobacco Settlement Financing Corp. Rev., 5.00%, 6/1/47 | 1,000,000 | | 995,410 | |

Virginia Small Business Financing Authority Rev., (Covanta Holding Corp.), VRN, 5.00%, 1/1/48(1) | 1,000,000 | | 1,011,330 | |

| | 18,711,136 | |

| Washington — 2.5% | | |

Energy Northwest Electric Rev., (Bonneville Power Administration), 5.00%, 7/1/31(3) | 7,610,000 | | 10,457,129 | |

Washington State Housing Finance Commission Rev., (Bayview Manor Homes Obligated Group), 4.00%, 7/1/26(1) | 795,000 | | 756,936 | |

| | |

| | | | | | | | |

| Principal Amount/Shares | Value |

Washington State Housing Finance Commission Rev., (Lutheran Retirement Home of Greater Seattle Obligated Group), 3.125%, 7/1/23(1) | $ | 1,095,000 | | $ | 1,026,606 | |

Washington State Housing Finance Commission Rev., (Lutheran Retirement Home of Greater Seattle Obligated Group), 5.00%, 7/1/38(1) | 830,000 | | 734,940 | |

Washington State Housing Finance Commission Rev., (Lutheran Retirement Home of Greater Seattle Obligated Group), 5.00%, 7/1/48(1) | 1,900,000 | | 1,591,763 | |

Washington State Housing Finance Commission Rev., (Spokane United Methodist Homes Obligated Group), 7.50%, 1/1/49(1) | 2,000,000 | | 2,104,420 | |

| | 16,671,794 | |

| West Virginia — 0.2% | | |

Monongalia County Commission Special District Rev., 5.50%, 6/1/37(1) | 1,050,000 | | 1,058,484 | |

Monongalia County Commission Special District Rev., 5.75%, 6/1/43(1) | 500,000 | | 505,155 | |

| | 1,563,639 | |

| Wisconsin — 2.1% | | |

Public Finance Authority Rev., (Bancroft Neurohealth Obligated Group), 5.125%, 6/1/48(1) | 1,000,000 | | 944,020 | |

Public Finance Authority Rev., (Bancroft Neurohealth/Bancroft Rehabilitation Services Obligated Group), 5.00%, 6/1/24(1) | 1,575,000 | | 1,604,090 | |

Public Finance Authority Rev., (Beyond Boone LLC), 4.00%,

7/1/50 (AGM) | 700,000 | | 744,387 | |

Public Finance Authority Rev., (Beyond Boone LLC), 4.00%,

7/1/55 (AGM) | 1,000,000 | | 1,059,800 | |

Public Finance Authority Rev., (Beyond Boone LLC), 4.00%,

7/1/59 (AGM) | 1,350,000 | | 1,430,730 | |

Public Finance Authority Rev., (North Carolina Leadership Charter Academy, Inc.), 5.00%, 6/15/49(1) | 520,000 | | 492,581 | |

Public Finance Authority Rev., (North Carolina Leadership Charter Academy, Inc.), 5.00%, 6/15/54(1) | 455,000 | | 422,786 | |

| Public Finance Authority Rev., (Roseman University of Health Sciences), 5.50%, 4/1/32 | 2,000,000 | | 2,022,720 | |

Public Finance Authority Rev., (Roseman University of Health Sciences), 5.00%, 4/1/50(1) | 1,000,000 | | 931,180 | |

Public Finance Authority Rev., (Southminster, Inc.), 5.00%, 10/1/48(1) | 2,750,000 | | 2,542,430 | |

Wisconsin Health & Educational Facilities Authority Rev.,

(State Camillus Health System Obligated Group), 5.00%, 11/1/54 | 2,000,000 | | 1,770,680 | |

| | 13,965,404 | |

TOTAL MUNICIPAL SECURITIES

(Cost $646,100,019) | | 637,860,826 | |

AFFILIATED FUNDS(5) — 1.5% | | |

American Century Diversified Municipal Bond ETF

(Cost $10,134,293) | 196,300 | | 10,201,711 | |

| EXCHANGE-TRADED FUNDS — 1.0% | | |

VanEck Vectors High-Yield Municipal Index ETF

(Cost $6,699,154) | 116,400 | | 6,725,592 | |

TOTAL INVESTMENT SECURITIES — 97.7%

(Cost $662,933,466) | | 654,788,129 | |

| OTHER ASSETS AND LIABILITIES — 2.3% | | 15,110,928 | |

| TOTAL NET ASSETS — 100.0% | | $ | 669,899,057 | |

| | | | | | | | |

| NOTES TO SCHEDULE OF INVESTMENTS | | |

| AGM | - | Assured Guaranty Municipal Corporation |

| BAM | - | Build America Mutual Assurance Company |

| COP | - | Certificates of Participation |

| GA | - | Guaranty Agreement |

| GO | - | General Obligation |

| LOC | - | Letter of Credit |

| SBBPA | - | Standby Bond Purchase Agreement |

| VRDN | - | Variable Rate Demand Note. The instrument may be payable upon demand and adjusts periodically based upon the terms set forth in the security's offering documents. The rate shown is effective at the period end and the reference rate and spread, if any, is indicated. The date of the demand feature is disclosed. |

| VRN | - | Variable Rate Note. The rate adjusts periodically based upon the terms set forth in the security’s offering documents. The rate shown is effective at the period end and the reference rate and spread, if any, is indicated. The security's effective maturity date may be shorter than the final maturity date shown. |

(1)Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration, normally to qualified institutional investors. The aggregate value of these securities at the period end was $125,205,245, which represented 18.7% of total net assets.

(2)Security is a zero-coupon bond. Zero-coupon securities are issued at a substantial discount from their value at maturity.

(3)When-issued security. The issue price and yield are fixed on the date of the commitment, but payment and delivery are scheduled for a future date.

(4)Escrowed to maturity in U.S. government securities or state and local government securities.

(5)Investments are funds within the American Century Investments family of funds and are considered affiliated funds.

See Notes to Financial Statements.

| | |

| Statement of Assets and Liabilities |

| | | | | |

| MAY 31, 2020 | |

| Assets | |

| Investment securities - unaffiliated, at value (cost of $652,799,173) | $ | 644,586,418 | |

| Investment securities - affiliated, at value (cost of $10,134,293) | 10,201,711 | |

| Total investment securities, at value (cost of $662,933,466) | 654,788,129 | |

| Cash | 390,291 | |

| Receivable for investments sold | 27,104,286 | |

| Receivable for capital shares sold | 675,235 | |

| Interest receivable | 8,782,901 | |

| 691,740,842 | |

| |

| Liabilities | |

| Payable for investments purchased | 19,841,693 | |

| Payable for capital shares redeemed | 1,563,147 | |

| Accrued management fees | 263,476 | |

| Distribution and service fees payable | 16,035 | |

| Dividends payable | 157,434 | |

| 21,841,785 | |

| |

| Net Assets | $ | 669,899,057 | |

| |

| Net Assets Consist of: | |

| Capital paid in | $ | 679,376,993 | |

| Distributable earnings | (9,477,936) | |

| $ | 669,899,057 | |

| | | | | | | | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class | $268,023,412 | | 28,692,134 | | $9.34 |

| I Class | $320,784,618 | | 34,342,188 | | $9.34 |

| Y Class | $36,453,408 | | 3,904,011 | | $9.34 |

| A Class | $33,837,571 | | 3,622,777 | | $9.34* |

| C Class | $10,800,048 | | 1,156,724 | | $9.34 |

*Maximum offering price $9.78 (net asset value divided by 0.955).

See Notes to Financial Statements.

| | | | | |

| YEAR ENDED MAY 31, 2020 | |

| Investment Income (Loss) | |

| Income: | |

| Interest | $ | 29,281,031 | |

| Income distributions from affiliated funds | 235,251 | |

| 29,516,282 | |

| Expenses: | |

| Management fees | 3,559,185 | |

| Distribution and service fees: | |

| A Class | 92,442 | |

| C Class | 119,290 | |

| Trustees' fees and expenses | 55,483 | |

| Other expenses | 4,334 | |

| 3,830,734 | |

Fees waived(1) | (31,202) | |

| 3,799,532 | |

| |

| Net investment income (loss) | 25,716,750 | |

| |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) on investment transactions (including $(4,461)

from affiliated funds) | 1,699,477 | |

Change in net unrealized appreciation (depreciation) on investments

(including $(24,831) from affiliated funds) | (42,684,974) | |

| |

| Net realized and unrealized gain (loss) | (40,985,497) | |

| |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (15,268,747) | |

(1)Amount consists of $12,856, $14,678, $1,576, $1,582 and $510 for Investor Class, I Class, Y Class, A Class and C Class, respectively.

See Notes to Financial Statements.

| | |

| Statement of Changes in Net Assets |

| | | | | | | | |

| YEARS ENDED MAY 31, 2020 AND MAY 31, 2019 | | |

| Increase (Decrease) in Net Assets | May 31, 2020 | May 31, 2019 |

| Operations | | |

| Net investment income (loss) | $ | 25,716,750 | | $ | 24,716,679 | |

| Net realized gain (loss) | 1,699,477 | | (1,729,451) | |

| Change in net unrealized appreciation (depreciation) | (42,684,974) | | 17,390,514 | |

| Net increase (decrease) in net assets resulting from operations | (15,268,747) | | 40,377,742 | |

| | |

| Distributions to Shareholders | | |

| From earnings: | | |

| Investor Class | (11,338,625) | | (10,885,111) | |

| I Class | (13,589,468) | | (11,284,720) | |

| Y Class | (1,473,433) | | (1,026,866) | |

| A Class | (1,298,303) | | (1,233,647) | |

| C Class | (329,389) | | (366,041) | |

| Decrease in net assets from distributions | (28,029,218) | | (24,796,385) | |

| | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (2,268,280) | | 103,936,229 | |

| | |

| Net increase (decrease) in net assets | (45,566,245) | | 119,517,586 | |

| | |

| Net Assets | | |

| Beginning of period | 715,465,302 | | 595,947,716 | |

| End of period | $ | 669,899,057 | | $ | 715,465,302 | |

| | |

| | |

See Notes to Financial Statements.

| | |

| Notes to Financial Statements |

MAY 31, 2020

1. Organization

American Century Municipal Trust (the trust) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Massachusetts business trust. High-Yield Municipal Fund (the fund) is one fund in a series issued by the trust. The fund’s investment objective is to seek high current income that is exempt from federal income tax. The fund also seeks capital appreciation as a secondary objective.

The fund offers the Investor Class, I Class, Y Class, A Class and C Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Trustees has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Fixed income securities are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Municipal securities are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Open-end management investment companies are valued at the reported net asset value per share.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Trustees or its delegate, in accordance with policies and procedures adopted by the Board of Trustees. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.