UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-04024 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 6 |

| |

| Address of principal executive offices: | | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6 th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | |

| |

| Date of fiscal year end: | | 8/31/2024 |

| |

| Date of reporting period: | | 8/31/ 2024 |

Item 1 – Reports to Stockholders

| | (a) | Report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

PGIM California Muni Income Fund

ANNUAL SHAREHOLDER REPORT – August 31,

2024

This annual shareholder report contains important information about the Class A shares of PGIM California Muni Income Fund (the “Fund”) for

the period of September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM California Muni Income Fund—Class A | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE

REPORTING

PERIOD?

■

During the reporting period, the US Federal Reserve held policy rates steady. Meanwhile,

issuance

picked up in the first half of 2024, due to

deferred maintenance and stabilizing project costs amid slowing inflation, moderating economic data, and upcoming elections. Despite

downgraded outlooks for California, strong fundamentals (e.g., healthy tax collections, robust rainy-day funds, and upgrades that outpaced

downgrades) provided a positive backdrop for demand, and spreads tightened.

■

The following contributed most to the Fund’s performance relative to the Index during the period: a significant overweight to the long end of the

yield curve (despite front-end rates rallying more than long-end rates and the portfolio’s yield curve flattener positioning); an underweight to San

Francisco airports subordinated credits; and overweight positioning in housing bonds, particularly Freddie Mac multifamily deals. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds. A yield curve flattener is an interest rate environment in which long-term rates are decreasing

more quickly than short-term rates.)

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: duration positioning as municipal

bond rates rallied, and positioning in specific senior San Francisco airport bonds and special tax assessment bonds. (Duration measures the

sensitivity of the price—the value of principal—of a bond to a change in interest rates.)

■

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used

futures to help manage duration positioning and yield curve exposure. The Fund’s

positions

in futures contributed to performance during the

reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class A shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense

reimbursements

, if any, the returns would

have been lower.

Cumulative Performance: August 31, 2014 to August 31, 2024 Initial Investment of $10,000 |

The line graph reflects the return on the Fund's Class A shares with sales charges.

Average Annual Total Returns as of 8/31/2024 |

| | | |

| Class A with sales charges | | | |

| Class A without sales charges | | | |

| Bloomberg California 1-15 Year Municipal Intermediate Index | | | |

Broad-Based Securities Market Index: Bloomberg Municipal Bond Index | | | |

The Fund’s total returns prior to April 1, 2020 as reflected in the line graph and the table are the returns of the Fund when it followed different investment strategies. The table

compares the Fund’s performance to the Bloomberg California 1-15 Year Municipal Intermediate Index, the Fund's benchmark. Since the Bloomberg California 1-15 Year Municipal

Intermediate Index inception date is October 31, 2016, the table also compares the Fund's performance to the Bloomberg Municipal Bond Index.

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE

FUND’S

HOLDINGS

AS OF 8/31/2024?

Credit Quality expressed as a percentage of total investments as of 8/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM California Muni Income Fund

PGIM California Muni Income Fund

ANNUAL SHAREHOLDER REPORT – August 31, 2024

This annual shareholder report contains important information about the Class C shares of PGIM California Muni Income Fund (the “Fund”) for

the period of September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM California Muni Income Fund—Class C | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, the US Federal Reserve held policy rates steady. Meanwhile, issuance picked up in the first half of 2024, due to

deferred maintenance and stabilizing project costs amid slowing inflation, moderating economic data, and upcoming elections. Despite

downgraded outlooks for California, strong fundamentals (e.g., healthy tax collections, robust rainy-day funds, and upgrades that outpaced

downgrades) provided a positive backdrop for demand, and spreads tightened.

■

The following contributed most to the Fund’s performance relative to the Index during the period: a significant overweight to the long end of the

yield curve (despite front-end rates rallying more than long-end rates and the portfolio’s yield curve flattener positioning); an underweight to San

Francisco airports subordinated credits; and overweight positioning in housing bonds, particularly Freddie Mac multifamily deals. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds. A yield curve flattener is an interest rate environment in which long-term rates are decreasing

more quickly than short-term rates.)

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: duration positioning as municipal

bond rates rallied, and positioning in specific senior San Francisco airport bonds and special tax assessment bonds. (

Duration

measures the

sensitivity of the price—the value of principal—of a bond to a change in interest rates.)

■

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used

futures to help manage duration positioning and yield curve exposure. The Fund’s positions in futures contributed to performance during the

reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class C shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: August 31, 2014 to August 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 8/31/2024 |

| | | |

Class C with sales charges | | | |

Class C without sales charges | | | |

Bloomberg California 1-15 Year Municipal Intermediate Index | | | |

Broad-Based Securities Market Index: Bloomberg Municipal Bond Index | | | |

The Fund’s total returns prior to April 1, 2020 as reflected in the line graph and the table are the returns of the Fund when it followed different investment strategies. The table

compares the Fund’s performance to the Bloomberg California 1-15 Year Municipal Intermediate Index, the Fund's benchmark. Since the Bloomberg California 1-15 Year Municipal

Intermediate Index inception date is October 31, 2016, the table also compares the Fund's performance to the Bloomberg Municipal Bond Index.

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2024?

Credit Quality expressed as a percentage of total investments as of 8/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM California Muni Income Fund

PGIM California Muni Income Fund

ANNUAL SHAREHOLDER REPORT – August 31, 2024

This annual shareholder report contains important information about the Class Z shares of PGIM California Muni Income Fund (the “Fund”) for

the period of September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM California Muni Income Fund—Class Z | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, the US Federal Reserve held policy rates steady. Meanwhile, issuance picked up in the first half of 2024, due to

deferred maintenance and stabilizing project costs amid slowing inflation, moderating economic data, and upcoming elections. Despite

downgraded outlooks for California, strong fundamentals (e.g., healthy tax collections, robust rainy-day funds, and upgrades that outpaced

downgrades) provided a positive backdrop for demand, and spreads tightened.

■

The following contributed most to the Fund’s performance relative to the Index during the period: a significant overweight to the long end of the

yield curve (despite front-end rates rallying more than long-end rates and the portfolio’s yield curve flattener positioning); an underweight to San

Francisco airports subordinated credits; and overweight positioning in housing bonds, particularly Freddie Mac multifamily deals. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds. A yield curve flattener is an interest rate environment in which long-term rates are decreasing

more quickly than short-term rates.)

■

The following detracted most from the Fund’s performance relative to the Index during the reporting

period

: duration positioning as municipal

bond rates rallied, and positioning in specific senior San Francisco airport bonds and special tax assessment bonds. (Duration measures the

sensitivity of the price—the value of principal—of a bond to a change in interest rates.)

■

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used

futures to help manage duration positioning and yield curve exposure. The Fund’s positions in futures contributed to performance during the

reporting period.

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class Z shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: August 31, 2014 to August 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 8/31/2024 |

| | | |

| | | |

Bloomberg California 1-15 Year Municipal Intermediate Index | | | |

Broad-Based Securities Market Index: Bloomberg Municipal Bond Index | | | |

The Fund’s total returns prior to April 1, 2020 as reflected in the line graph and the table are the returns of the Fund when it followed different investment strategies. The table

compares the Fund’s performance to the Bloomberg California 1-15 Year Municipal Intermediate Index, the Fund's benchmark. Since the Bloomberg California 1-15 Year Municipal

Intermediate Index inception date is October 31, 2016, the table also compares the Fund's performance to the Bloomberg Municipal Bond Index.

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2024?

Credit Quality expressed as a percentage of total investments as of 8/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM California Muni Income Fund

PGIM California Muni Income Fund

ANNUAL SHAREHOLDER REPORT – August 31, 2024

This annual shareholder report contains important information about the Class R6 shares of PGIM California Muni Income Fund (the “Fund”) for

the period of September 1, 2023 to August 31, 2024.

You can find additional information about the Fund at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

. You can also request

this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

PGIM California Muni Income Fund—Class R6 | | |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD?

■

During the reporting period, the US Federal Reserve held policy rates steady. Meanwhile, issuance picked up in the first half of 2024, due to

deferred maintenance and stabilizing project costs amid slowing inflation, moderating economic data, and upcoming elections. Despite

downgraded outlooks for California, strong fundamentals (e.g., healthy tax collections, robust rainy-day funds, and upgrades that outpaced

downgrades) provided a positive backdrop for demand, and spreads tightened.

■

The following contributed most to the Fund’s performance relative to the Index during the period: a significant overweight to the long end of the

yield curve (despite front-end rates rallying more than long-end rates and the portfolio’s yield

curve

flattener positioning); an underweight to San

Francisco airports subordinated credits; and overweight positioning in housing bonds, particularly Freddie Mac multifamily deals. (A yield curve

is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of

different maturities for the same type of bonds. A yield curve flattener is an interest rate environment in which long-term rates are decreasing

more quickly than short-term rates.)

■

The following detracted most from the Fund’s performance relative to the Index during the reporting period: duration positioning as municipal

bond rates rallied, and positioning in specific senior San Francisco airport bonds and special tax assessment bonds. (Duration measures the

sensitivity of the price—the value of principal—of a bond to a change in interest rates.)

■

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used

futures to help manage duration positioning and yield curve exposure. The Fund’s positions in futures contributed to performance during the

reporting period.

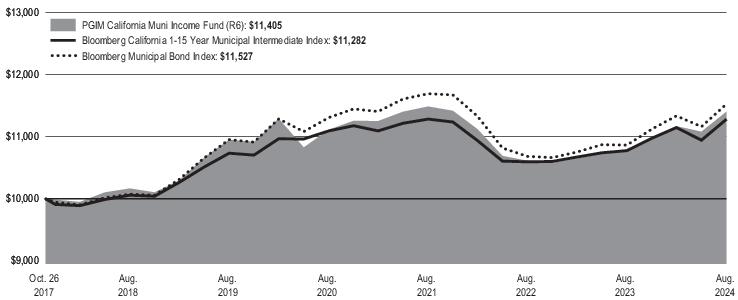

HOW HAS THE FUND PERFORMED OVER THE PAST 10 YEARS?

The Fund’s past performance is not a good predictor of the Fund’s future performance.

The returns do not reflect the deduction of

taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Visit

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

The line graph reflects a hypothetical $10,000 investment in Class R6 shares and assumes that all recurring fees (including management fees)

were deducted and dividend and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would

have been lower.

Cumulative Performance: October 26, 2017 to August 31, 2024 Initial Investment of $10,000 |

Average Annual Total Returns as of 8/31/2024 |

| | | |

| | | |

Bloomberg California 1-15 Year Municipal Intermediate Index | | | |

Broad-Based Securities Market Index: Bloomberg Municipal Bond | | | |

The Fund’s total returns prior to April 1, 2020 as reflected in the line graph and the table are the returns of the Fund when it followed different investment strategies.

Since Inception returns are provided for the share class since it has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest

month-end to the class’s inception date.

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2024?

| |

| |

Total advisory fees paid for the year | |

Portfolio turnover rate for the year | |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2024?

Credit Quality expressed as a percentage of total investments as of 8/31/2024 (%) |

| |

| |

| |

| |

| |

| |

| |

| |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global

Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable

S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

You can find additional information at

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

or by scanning the QR code below,

including the Fund’s prospectus, financial information, fund holdings, and proxy voting information. You can also request this information by

contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

To receive your fund documents online, go to

pgim.com/investments/resource/edelivery

and enroll.

PGIM California Muni Income Fund

| | (b) | Copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule – Not applicable. |

| Item 2 – | Code of Ethics – See Exhibit (a) |

As of the end of the period covered by this report, the registrant has adopted a code of ethics (the “Section 406 Standards for Investment Companies – Ethical Standards for Principal Executive and Financial Officers”) that applies to the registrant’s Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer.

The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant 800-225-1852, and ask for a copy of the Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers.

| Item 3 – | Audit Committee Financial Expert – |

The registrant’s Board has determined that Ms. Grace C. Torres, member of the Board’s Audit Committee is an “audit committee financial expert,” and that she is “independent,” for purposes of this item.

| Item 4 – | Principal Accountant Fees and Services – |

For the fiscal years ended August 31, 2024 and August 31, 2023, PricewaterhouseCoopers LLP (“PwC”), the Registrant’s principal accountant, billed the Registrant $41,499 and $39,150, respectively, for professional services rendered for the audit of the Registrant’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings.

For the fiscal years ended August 31, 2024 and August 31, 2023: none.

For the fiscal years ended August 31, 2024 and August 31, 2023: none.

For the fiscal years ended August 31, 2024 and August 31, 2023: none.

| | (e) | (1) Audit Committee Pre-Approval Policies and Procedures |

THE PGIM MUTUAL FUNDS

AUDIT COMMITTEE POLICY

on

Pre-Approval of Services Provided by the Independent

Accountants

The Audit Committee of each PGIM Mutual Fund is charged with the responsibility to monitor the independence of the Fund’s independent accountants. As part of this responsibility, the Audit Committee must pre-approve the independent accounting firm’s engagement to render audit and/or permissible non-audit services, as required by law. In evaluating a proposed engagement of the independent accountants, the Audit Committee will assess the effect that the engagement might reasonably be expected to have on the accountant’s independence. The Committee’s evaluation will be based on:

| | • | | a review of the nature of the professional services expected to be provided, |

| | • | | a review of the safeguards put into place by the accounting firm to safeguard independence, and |

| | • | | periodic meetings with the accounting firm. |

Policy for Audit and Non-Audit Services Provided to the Funds

On an annual basis, the scope of audits for each Fund, audit fees and expenses, and audit-related and non-audit services (and fees proposed in respect thereof) proposed to be performed by the Fund’s independent accountants will be presented by the Treasurer and the independent accountants to the Audit Committee for review and, as appropriate, approval prior to the initiation of such services.

Such presentation shall be accompanied by confirmation by both the Treasurer and the independent accountants that the proposed non-audit services will not adversely affect the independence of the independent accountants. Such proposed non-audit services shall be described in sufficient detail to enable the Audit Committee to assess the appropriateness of such services and fees, and the compatibility of the provision of such services with the auditor’s independence. The Committee shall receive periodic reports on the progress of the audit and other services which are approved by the Committee or by the Committee Chair pursuant to authority delegated in this Policy.

The categories of services enumerated under “Audit Services”, “Audit-related Services”, and “Tax Services” are intended to provide guidance to the Treasurer and the independent accountants as to those categories of services which the Committee believes are generally consistent with the independence of the independent accountants and which the Committee (or the Committee Chair) would expect upon the presentation of specific proposals to pre-approve. The enumerated categories are not intended as an exclusive list of audit, audit-related or tax services, which the Committee (or the Committee Chair) would consider for pre-approval.

Audit Services

The following categories of audit services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Annual Fund financial statement audits |

| | • | | Seed audits (related to new product filings, as required) |

| | • | | SEC and regulatory filings and consents |

Audit-related Services

The following categories of audit-related services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Accounting consultations |

| | • | | Fund merger support services |

| | • | | Agreed Upon Procedure Reports |

| | • | | Other Internal Control Reports |

| | |

Individual audit-related services that fall within one of these categories (except for fund merger support services) and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated). Fees related to fund merger support services are subject to a separate authorized pre-approval by the Audit Committee with fees determined on a per occurrence and merger complexity basis. | | |

Tax Services

The following categories of tax services are considered to be consistent with the role of the Fund’s independent accountants:

| | • | | Tax compliance services related to the filing or amendment of the following: |

| | • | | Federal, state and local income tax compliance; and, |

| | • | | Sales and use tax compliance |

| | • | | Timely RIC qualification reviews |

| | • | | Tax distribution analysis and planning |

| | • | | Tax authority examination services |

| | • | | Tax appeals support services |

| | • | | Accounting methods studies |

| | • | | Fund merger support services |

| | • | | Tax consulting services and related projects |

Individual tax services that fall within one of these categories and are not presented to the Audit Committee as part of the annual pre-approval process are subject to an authorized pre-approval by the Audit Committee so long as the estimated fee for those services does not exceed $30,000. Any services provided under such pre-approval will be reported to the Audit Committee at its next regular meeting. Should the amount of such services exceed $30,000 any additional fees will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated).

Other Non-Audit Services

Certain non-audit services that the independent accountants are legally permitted to render will be subject to pre-approval by the Committee or by one or more Committee members to whom the Committee has delegated this authority and who will report to the full Committee any pre-approval decisions made pursuant to this Policy. Non-audit services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Proscribed Services

The Fund’s independent accountants will not render services in the following categories of non-audit services:

| | • | | Bookkeeping or other services related to the accounting records or financial statements of the Fund |

| | • | | Financial information systems design and implementation |

| | • | | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports |

| | • | | Internal audit outsourcing services |

| | • | | Management functions or human resources |

| | • | | Broker or dealer, investment adviser, or investment banking services |

| | • | | Legal services and expert services unrelated to the audit |

| | • | | Any other service that the Public Company Accounting Oversight Board determines, by regulation, is impermissible. |

Pre-approval of Non-Audit Services Provided to Other Entities Within the PGIM Fund Complex

Certain non-audit services provided to PGIM Investments LLC or any of its affiliates that also provide ongoing services to the PGIM Mutual Funds will be subject to pre-approval by the Audit Committee. The only non-audit services provided to these entities that will require pre-approval are those related directly to the operations and financial reporting of the Funds. Individual projects that are not presented to the Audit Committee as part of the annual pre-approval process will be subject to pre-approval by the Committee Chair (or any other Committee member on whom this responsibility has been delegated) so long as the estimated fee for those services does not exceed $30,000. Services presented for pre-approval pursuant to this paragraph will be accompanied by a confirmation from both the Treasurer and the independent accountants that the proposed services will not adversely affect the independence of the independent accountants.

Although the Audit Committee will not pre-approve all services provided to PGIM Investments LLC and its affiliates, the Committee will receive an annual report from the Fund’s independent accounting firm showing the aggregate fees for all services provided to PGIM Investments and its affiliates.

(e) (2) Percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X –

| | | | | | | | | | | | |

| | | | | | Fiscal Year Ended August 31, 2024 | | | | Fiscal Year Ended August 31, 2023 | | |

| | 4(b) | | | | Not applicable. | | | | Not applicable. | | |

| | 4(c) | | | | Not applicable. | | | | Not applicable. | | |

| | 4(d) | | | | Not applicable. | | | | Not applicable. | | |

(f) Percentage of hours expended attributable to work performed by other than full time employees of principal accountant if greater than 50%.

The percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was 0%.

(g) Non-Audit Fees

The aggregate non-audit fees billed by the Registrant’s principal accountant for services rendered to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant for the fiscal years ended August 31, 2024 and August 31, 2023 was $0 and $0, respectively.

(h) Principal Accountant’s Independence

Not applicable as the Registrant’s principal accountant has not provided non-audit services to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X.

(i) Not applicable.

(j) Not applicable.

| Item 5 – | Audit Committee of Listed Registrants – Not applicable. |

| Item 6 – | Investments – The registrant’s Schedule of Investments is included in the financial statements filed under Item 7 of this Form. |

Items 7 – 11 (Refer to Report below)

PRUDENTIAL INVESTMENT PORTFOLIOS 6

PGIM California Muni Income Fund

FINANCIAL STATEMENTS AND OTHER INFORMATION

AUGUST 31, 2024

| | | | |

| Table of Contents | | Financial Statements and Other Information | | August 31, 2024 |

Form N-CSR Item 7 - Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Schedule of Investments

as of August 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

LONG-TERM INVESTMENTS 97.4% | | | | | | | | | | | | |

| | | | |

MUNICIPAL BONDS | | | | | | | | | | | | |

Alameda Corridor Trans. Auth. Rev.,

Sr. Lien, Series A, AGM | | 5.000% | | 10/01/43 | | | 1,000 | | | $ | 1,126,008 | |

Anaheim Pub. Fing. Auth. Rev., | | | | | | | | | | | | |

Cap. Apprec., Pub. Impts. Proj., Sub. Series C, AGM, ETM(ee) | | 3.226(t) | | 09/01/36 | | | 1,500 | | | | 1,021,608 | |

Bay Area Toll Auth. Rev., | | | | | | | | | | | | |

San Francisco Bay Area, Series B, Rfdg. (Mandatory put date 04/01/25) | | 2.850(cc) | | 04/01/47 | | | 1,000 | | | | 998,141 | |

Series A, Rfdg. (Mandatory put date 04/01/28) | | 2.000(cc) | | 04/01/56 | | | 750 | | | | 717,739 | |

Beaumont Unif. Sch. Dist., | | | | | | | | | | | | |

Cap. Apprec., Election 2008, Series C, GO, AGM | | 3.898(t) | | 08/01/40 | | | 2,365 | | | | 1,279,214 | |

California Cmnty. Choice Fing. Auth. Rev., | | | | | | | | | | | | |

Green Bond, Clean Energy Proj., Series A (Mandatory put date 12/01/27) | | 4.000(cc) | | 10/01/52 | | | 2,500 | | | | 2,543,465 | |

Green Bond, Clean Energy Proj., Series B-1 (Mandatory put date 08/01/29) | | 5.000(cc) | | 07/01/53 | | | 1,000 | | | | 1,062,308 | |

Green Bond, Series A-1 (Mandatory put date 08/01/28) | | 4.000(cc) | | 05/01/53 | | | 1,905 | | | | 1,929,187 | |

Green Bond, Series B-1 (Mandatory put date 08/01/31) | | 4.000(cc) | | 02/01/52 | | | 3,825 | | | | 3,885,973 | |

Green Bond, Series B-2 (Mandatory put date 08/01/31) | | 3.370(cc) | | 02/01/52 | | | 1,120 | | | | 1,049,305 | |

Green Bonds, Series C | | 5.000 | | 10/01/24 | | | 500 | | | | 500,368 | |

Green Bonds, Series D (Mandatory put date 11/01/28) | | 5.500(cc) | | 05/01/54 | | | 2,150 | | | | 2,315,469 | |

Sustainable Bonds, Clean Energy Proj., Series E-1 (Mandatory put date 03/01/31) | | 5.000(cc) | | 02/01/54 | | | 1,000 | | | | 1,077,619 | |

Sustainable Bonds, Clean Energy Proj., Series G-1 (Mandatory put date 04/01/30) | | 5.250(cc) | | 11/01/54 | | | 2,000 | | | | 2,167,356 | |

California Cnty. Tob. Secur. Agcy. Rev., | | | | | | | | | | | | |

Sonoma Cnty. Secur. Corp., Series A, Rfdg. | | 5.000 | | 06/01/28 | | | 635 | | | | 679,533 | |

Sr. Series A, Rfdg. | | 5.000 | | 06/01/25 | | | 875 | | | | 888,252 | |

Sr. Series A, Rfdg. | | 5.000 | | 06/01/26 | | | 1,220 | | | | 1,263,688 | |

Sr. Series A, Rfdg. | | 5.000 | | 06/01/29 | | | 1,475 | | | | 1,608,958 | |

Sr. Series A, Rfdg. | | 5.000 | | 06/01/31 | | | 1,885 | | | | 2,079,979 | |

California Edl. Facs. Auth. Rev., | | | | | | | | | | | | |

Pepperdine Univ., Rfdg. (Pre-refunded date 04/01/26)(ee) | | 5.000 | | 10/01/49 | | | 2,085 | | | | 2,168,655 | |

California Enterprise Dev. Auth. Rev., | | | | | | | | | | | | |

Pomona Properties LLC Proj., Series A, Rfdg. | | 5.000 | | 01/15/39 | | | 650 | | | | 712,268 | |

Pomona Properties LLC Proj., Series A, Rfdg. | | 5.000 | | 01/15/45 | | | 1,000 | | | | 1,059,959 | |

Riverside Cnty., Mead Valley Wellness Vlg. Proj., | | | | | | | | | | | | |

Series B | | 5.500 | | 11/01/59 | | | 1,000 | | | | 1,052,709 | |

California Hlth. Facs. Fing. Auth. Rev., | | | | | | | | | | | | |

Adventist Hlth. Sys. West, Series A | | 5.250 | | 12/01/42 | | | 1,000 | | | | 1,107,358 | |

Cedars Sinai Med. Ctr., Rfdg. | | 5.000 | | 11/15/25 | | | 1,565 | | | | 1,614,748 | |

Cedars Sinai Med. Ctr., Rfdg. | | 5.000 | | 11/15/33 | | | 1,115 | | | | 1,143,042 | |

Cedars Sinai Med. Ctr., Series A | | 5.000 | | 08/15/25 | | | 535 | | | | 548,431 | |

Children’s Hosp. of Orange Cnty., Series B (Mandatory put date 05/01/31) | | 5.000(cc) | | 11/01/54 | | | 1,500 | | | | 1,706,664 | |

See Notes to Financial Statements.

PGIM California Muni Income Fund 1

Schedule of Investments (continued)

as of August 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

MUNICIPAL BONDS (Continued) | | | | | | | | | | | | |

California Hlth. Facs. Fing. Auth. Rev., (cont’d.) | | | | | | | | | | | | |

Commonspirit Hlth., Series A, Rfdg. | | 5.000% | | 04/01/32 | | | 2,275 | | | $ | 2,499,047 | |

Initial Entrance Fees, Series A | | 3.850 | | 11/15/27 | | | 500 | | | | 505,077 | |

Kaiser Permanente, Series C (Mandatory put date 11/01/29) | | 5.000(cc) | | 06/01/41 | | | 4,365 | | | | 4,857,139 | |

Lucile Salter Packard Chil, Rfdg. | | 5.000 | | 05/15/25 | | | 1,000 | | | | 1,015,436 | |

Providence Hlth. Svcs., Series A, Rfdg. | | 5.000 | | 10/01/27 | | | 330 | | | | 330,418 | |

Rfdg. (Pre-refunded date 10/01/25)(ee) | | 5.000(cc) | | 10/01/39 | | | 1,225 | | | | 1,258,309 | |

Stanford Healthcare, Series A, Rfdg. | | 5.000 | | 11/15/24 | | | 2,140 | | | | 2,150,887 | |

Stanford Healthcare, Series A, Rfdg. (Mandatory put date 08/15/25) | | 3.000(cc) | | 08/15/54 | | | 3,150 | | | | 3,158,180 | |

Sutter Hlth., Series A | | 5.000 | | 11/15/30 | | | 500 | | | | 533,568 | |

Sutter Hlth., Series A | | 5.000 | | 11/15/36 | | | 2,085 | | | | 2,200,299 | |

Sutter Hlth., Series A, Rfdg. | | 5.000 | | 11/15/35 | | | 885 | | | | 935,925 | |

California Hsg. Fin. Agcy. Rev., | | | | | | | | | | | | |

Shoreview Apts., Series T | | 3.750 | | 07/01/34 | | | 1,000 | | | | 1,008,166 | |

Sustainable Bond, All Hallows Apts., Series U | | 3.650 | | 09/01/34 | | | 1,000 | | | | 1,003,844 | |

Sustainable Bond, LA Salle Apts., Series V | | 3.650 | | 09/01/34 | | | 1,000 | | | | 1,004,251 | |

California Infrast. & Econ. Dev. Bank Rev., | | | | | | | | | | | | |

Academy of Motion Picture Arts & Sciences Oblig., Series A, Rfdg. | | 4.000 | | 11/01/41 | | | 1,000 | | | | 1,034,210 | |

Sustainability Bonds, Calif. Academy of Sciences, Series A, Rfdg. | | 3.250 | | 08/01/29 | | | 2,000 | | | | 2,011,432 | |

California Muni. Fin. Auth. Rev., | | | | | | | | | | | | |

American Heritage Ed., Series A, Rfdg. | | 4.000 | | 06/01/26 | | | 270 | | | | 269,329 | |

Catalyst Impact Fund Hsg. Bonds, Class I, 144A | | 6.000 | | 01/01/39 | | | 1,000 | | | | 1,082,990 | |

CHF-Davis I, LLC, West Vlg. Student Hsg. Proj., BAM, TCRs | | 5.000 | | 05/15/29 | | | 760 | | | | 816,520 | |

Green Bond, Orchard Park Student Hsg. Proj., BAM | | 4.000 | | 05/15/46 | | | 1,045 | | | | 1,029,886 | |

Humangood Calif. Oblig. Grp. | | 4.000 | | 10/01/46 | | | 1,000 | | | | 961,956 | |

Humangood Calif. Oblig. Grp. | | 4.000 | | 10/01/49 | | | 1,000 | | | | 941,387 | |

Orange Cnty. Civic Ctr. Infrast. Program Phase 2 | | 5.000 | | 06/01/43 | | | 1,500 | | | | 1,582,971 | |

South Central Los Angeles Regl. Ctr. Proj., Rfdg. | | 4.000 | | 12/01/43 | | | 300 | | | | 297,786 | |

Sr. Lien, Linxs Apm Proj., Series A, P3 Proj., AMT | | 5.000 | | 12/31/25 | | | 285 | | | | 289,170 | |

Sr. Lien, Linxs Apm Proj., Series A, P3 Proj., AMT | | 5.000 | | 06/30/26 | | | 1,385 | | | | 1,410,029 | |

Sr. Lien, Linxs Apm Proj., Series A, P3 Proj., AMT | | 5.000 | | 06/30/31 | | | 320 | | | | 330,965 | |

St. Ignatius Clg. Prep. Sch., Series A | | 5.000 | | 09/01/49 | | | 1,000 | | | | 1,095,591 | |

Temps, 85 Aldersly Proj., Series B-1 | | 4.000 | | 11/15/28 | | | 595 | | | | 595,873 | |

Temps, St. Mary’s Sch., Aliso Viejo, Series B | | 4.650 | | 05/01/30 | | | 1,045 | | | | 1,061,074 | |

UCR North Dist. Phase 1 Student Hsg. Proj., BAM | | 5.000 | | 05/15/27 | | | 750 | | | | 789,883 | |

United Airlines, Inc. Proj., AMT | | 4.000 | | 07/15/29 | | | 2,000 | | | | 2,002,545 | |

Waste Mgmt. Inc. Proj., Rmkt., AMT (Mandatory put date 12/02/24)(hh) | | 3.950(cc) | | 10/01/45 | | | 1,000 | | | | 999,950 | |

California Poll. Ctrl. Fing. Auth. Wtr. Facs. Rev., | | | | | | | | | | | | |

American Wtr. Cap. Corp. Proj., Series 2020, Rmkt., Rfdg. (Mandatory put date 09/01/28) | | 3.700(cc) | | 08/01/40 | | | 1,000 | | | | 1,024,223 | |

Green Bond, Calplant I Proj., AMT, 144A^ | | 7.000 | | 07/01/22(d) | | | 250 | | | | 40,000 | |

Green Bond, Calplant I Proj., AMT, 144A^ | | 8.000 | | 07/01/39(d) | | | 500 | | | | 80,000 | |

California Pub. Fin. Auth. Rev., | | | | | | | | | | | | |

PIH Hlth., Series A, Rfdg. | | 5.000 | | 06/01/25 | | | 875 | | | | 888,179 | |

PIH Hlth., Series A, Rfdg. | | 5.000 | | 06/01/26 | | | 500 | | | | 517,950 | |

California Sch. Fin. Auth. Rev., | | | | | | | | | | | | |

Alliance CLG-Ready Pub. Schs., Series A, 144A | | 5.000 | | 07/01/45 | | | 1,000 | | | | 1,006,101 | |

Alliance CLG-Ready Pub. Schs., Series A, Rfdg., 144A | | 4.000 | | 07/01/26 | | | 300 | | | | 301,784 | |

Green Dot Pub. Sch. Proj., Series A, 144A | | 4.000 | | 08/01/25 | | | 150 | | | | 150,429 | |

See Notes to Financial Statements.

2

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

MUNICIPAL BONDS (Continued) | | | | | | | | | | | | |

California Sch. Fin. Auth. Rev., (cont’d.) | | | | | | | | | | | | |

Green Dot Pub. Sch. Proj., Series A, 144A | | 5.000% | | 08/01/45 | | | 685 | | | $ | 689,227 | |

Green Dot Pub. Schs. Calif. Proj., Series A, Rfdg., 144A | | 5.000 | | 08/01/32 | | | 650 | | | | 686,503 | |

KIPP Socal Pub. Schs., Series A, 144A | | 5.000 | | 07/01/39 | | | 1,000 | | | | 1,044,667 | |

KIPP Socal Pub. Schs., Series A, 144A | | 5.000 | | 07/01/49 | | | 1,500 | | | | 1,532,968 | |

Vista Charter Schs., Series A, 144A | | 4.000 | | 06/01/51 | | | 2,000 | | | | 1,692,922 | |

California St., | | | | | | | | | | | | |

Bid Grp. C, GO | | 4.000 | | 09/01/25 | | | 1,500 | | | | 1,520,789 | |

GO, Rfdg. | | 3.250 | | 04/01/45 | | | 1,000 | | | | 850,251 | |

GO, Rfdg. | | 4.000 | | 09/01/26 | | | 1,500 | | | | 1,543,005 | |

GO, Rfdg. | | 4.000 | | 09/01/34 | | | 1,000 | | | | 1,094,852 | |

GO, Rfdg. | | 5.000 | | 03/01/26 | | | 1,000 | | | | 1,010,410 | |

GO, Rfdg. | | 5.000 | | 11/01/26 | | | 2,075 | | | | 2,182,615 | |

GO, Rfdg. | | 5.000 | | 08/01/28 | | | 2,425 | | | | 2,577,906 | |

GO, Rfdg. | | 5.000 | | 09/01/28 | | | 2,005 | | | | 2,191,183 | |

GO, Rfdg. | | 5.000 | | 04/01/33 | | | 1,000 | | | | 1,094,014 | |

GO, Rfdg.(hh) | | 5.000 | | 08/01/34 | | | 500 | | | | 590,553 | |

GO, Rfdg.(hh) | | 5.000 | | 08/01/39 | | | 1,750 | | | | 2,022,537 | |

GO, Rfdg. | | 5.000 | | 10/01/42 | | | 1,000 | | | | 1,120,198 | |

GO, Rfdg. | | 5.000 | | 09/01/44 | | | 1,905 | | | | 2,152,345 | |

GO, Rfdg. | | 5.000 | | 08/01/46 | | | 2,000 | | | | 2,047,327 | |

GO, Rfdg., AGM | | 5.250 | | 08/01/32 | | | 1,500 | | | | 1,740,227 | |

Unrefunded Balance, GO, Rfdg. | | 5.500 | | 04/01/30 | | | 5 | | | | 5,009 | |

Var. Purp., GO | | 3.000 | | 03/01/28 | | | 2,000 | | | | 2,030,964 | |

Var. Purp., GO, Rfdg. | | 4.000 | | 09/01/34 | | | 1,580 | | | | 1,594,168 | |

Var. Purp., GO, Rfdg., BAM, TCRs | | 5.000 | | 09/01/35 | | | 1,000 | | | | 1,037,705 | |

California St. Pub. Wks. Brd. Lease Rev., | | | | | | | | | | | | |

May Lee St. Off. Complex, Series A | | 5.000 | | 04/01/34 | | | 800 | | | | 949,892 | |

Off. Emerg. Svcs., Series F, Rfdg. | | 5.000 | | 04/01/25 | | | 175 | | | | 177,453 | |

California Statewide Cmntys. Dev. Auth. Rev., | | | | | | | | | | | | |

899 Charleston Proj., Series A, Rfdg., 144A | | 5.250 | | 11/01/44 | | | 250 | | | | 241,668 | |

CHF Irvine LLC, Rfdg. | | 5.000 | | 05/15/27 | | | 685 | | | | 702,612 | |

CHF Irvine LLC, Rfdg. | | 5.000 | | 05/15/28 | | | 2,000 | | | | 2,050,340 | |

John Muir Hlth., Series A, Rfdg. | | 5.250 | | 12/01/42 | | | 1,250 | | | | 1,421,338 | |

Loma Linda Univ. Med. Ctr. Series A, Rfdg. | | 5.500 | | 12/01/54 | | | 1,585 | | | | 1,589,326 | |

Odd Fellows Home of Cali. Proj., Series A, Rfdg. | | 4.000 | | 04/01/43 | | | 1,000 | | | | 1,014,566 | |

Southern Calif. Edison Co., Series B, Rmkt., Rfdg. | | 1.450 | | 04/01/28 | | | 2,000 | | | | 1,826,040 | |

Southern Calif. Edison Co., Series D, Rmkt., Rfdg. | | 4.500 | | 11/01/33 | | | 1,100 | | | | 1,184,720 | |

Coast Cmnty. Clg. Dist.,

CABS, GO, Rfdg. (Pre-refunded date 08/15/25)(ee) | | 2.477(t) | | 08/01/35 | | | 1,600 | | | | 1,012,320 | |

Fontana,

Spl. Tax, Cmnty. Facs. Dist. No. 22 Sierra Hills, Rfdg. | | 5.000 | | 09/01/34 | | | 500 | | | | 503,348 | |

Freddie Mac Multifamily Cert. Rev.,

Series ML-18, Class XCA | | 1.506(cc) | | 09/25/37 | | | 9,841 | | | | 1,039,910 | |

Freddie Mac Multifamily Variable Rate Cert. Rev., | | | | | | | | | | | | |

Sustainability Bonds, Series ML-13, Class XCA | | 0.962(cc) | | 07/25/36 | | | 16,446 | | | | 888,247 | |

Golden St. Tob. Secur. Corp. Rev., | | | | | | | | | | | | |

Tob. Settlement Asset-Backed Bonds, Series A-1, Rfdg. | | 5.000 | | 06/01/51 | | | 1,100 | | | | 1,141,943 | |

Guam Govt. Waterworks Auth. Rev.,

Series A, Rfdg. | | 5.000 | | 07/01/43 | | | 650 | | | | 705,981 | |

Irvine Unif. Sch. Dist.,

Spl. Tax, Series A | | 4.000 | | 09/01/28 | | | 745 | | | | 786,527 | |

See Notes to Financial Statements.

PGIM California Muni Income Fund 3

Schedule of Investments (continued)

as of August 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

MUNICIPAL BONDS (Continued) | | | | | | | | | | | | |

Jurupa Pub. Fing. Auth., | | | | | | | | | | | | |

Spl. Tax, Series A, Rfdg. | | 5.000% | | 09/01/42 | | | 1,250 | | | $ | 1,250,000 | |

Lincoln Pub. Fing. Auth., | | | | | | | | | | | | |

Twelve Bridges, Tax Alloc., Sub. Series B, Rfdg. | | 6.000 | | 09/02/27 | | | 528 | | | | 529,241 | |

Long Beach Bond Fin. Auth. Nat. Gas Pur. Rev., | | | | | | | | | | | | |

Series A | | 5.000 | | 11/15/35 | | | 2,725 | | | | 3,022,804 | |

Series A | | 5.500 | | 11/15/30 | | | 1,475 | | | | 1,631,975 | |

Series A | | 5.500 | | 11/15/32 | | | 440 | | | | 496,548 | |

Los Angeles Calif. Dept. Arpts. Rev., | | | | | | | | | | | | |

Series B, Rfdg., AMT | | 5.000 | | 05/15/31 | | | 1,080 | | | | 1,147,147 | |

Series D, AMT | | 5.000 | | 05/15/26 | | | 1,100 | | | | 1,111,931 | |

Sr. Bonds, Private Activity, Series H, Rfdg., AMT | | 5.000 | | 05/15/29 | | | 1,000 | | | | 1,086,067 | |

Sub. Series A, Rfdg., AMT | | 4.000 | | 05/15/44 | | | 1,000 | | | | 964,974 | |

Sub-P3. Proj., Series A, Rfdg., AMT | | 5.000 | | 05/15/28 | | | 1,250 | | | | 1,332,891 | |

Unrefunded, Sub. Series D, Rfdg., AMT | | 5.000 | | 05/15/35 | | | 1,530 | | | | 1,658,509 | |

Los Angeles Cnty. Rev., | | | | | | | | | | | | |

TRANS | | 5.000 | | 06/30/25 | | | 2,000 | | | | 2,039,322 | |

Los Angeles Dept. Arpts. Rev., | | | | | | | | | | | | |

Series A, AMT | | 5.250 | | 05/15/48 | | | 1,000 | | | | 1,033,881 | |

Los Angeles Dept. of Wtr. & Pwr. Rev., | | | | | | | | | | | | |

Series D | | 5.250 | | 07/01/54 | | | 1,000 | | | | 1,132,837 | |

Los Angeles Dept. of Wtr. & Pwr. Wtr. Sys. Rev., | | | | | | | | | | | | |

Series B, Rfdg. | | 5.000 | | 07/01/43 | | | 1,115 | | | | 1,184,545 | |

Los Angeles Rev., | | | | | | | | | | | | |

TRANS | | 5.000 | | 06/26/25 | | | 3,000 | | | | 3,058,012 | |

Los Angeles Unif. Sch. Dist., | | | | | | | | | | | | |

Series A, GO, Rfdg. | | 5.000 | | 07/01/25 | | | 2,410 | | | | 2,461,437 | |

Series A, GO, Rfdg. | | 5.000 | | 07/01/34 | | | 1,000 | | | | 1,205,774 | |

Metro. Wtr. Dist. of Southern Calif. Rev., | | | | | | | | | | | | |

Series B, Rfdg. | | 3.000 | | 07/01/28 | | | 2,000 | | | | 2,025,659 | |

M-S-R Energy Auth. Rev., | | | | | | | | | | | | |

Series A | | 6.500 | | 11/01/39 | | | 1,000 | | | | 1,292,753 | |

Northern Calif. Tob. Secur. Auth. Rev., | | | | | | | | | | | | |

Sr. Bonds Sacramento Co. Tob. Secur. Corp., Series A, Class 1, Rfdg. | | 5.000 | | 06/01/29 | | | 1,225 | | | | 1,335,863 | |

Sr. Bonds, Series A, Rfdg. | | 5.000 | | 06/01/28 | | | 1,500 | | | | 1,609,305 | |

Northern Calif. Transmn. Agy. Rev., | | | | | | | | | | | | |

Calif.- Oregon Proj., Series A, Rfdg. | | 5.000 | | 05/01/39 | | | 980 | | | | 1,009,385 | |

Orange Cnty. Cmnty. Facs. Dist., | | | | | | | | | | | | |

Spl. Tax, No. 2015-1 Esencia Vlg., Series A | | 5.250 | | 08/15/45 | | | 2,150 | | | | 2,160,787 | |

Spl. Tax, No. 2017-1 Esencia Vlg., Series A | | 5.000 | | 08/15/47 | | | 1,500 | | | | 1,526,647 | |

Orange Cnty. Trans. Auth. Rev., | | | | | | | | | | | | |

I-405 Impt. Proj., BANS, ETM(ee) | | 5.000 | | 10/15/24 | | | 3,175 | | | | 3,181,865 | |

Oxnard Union High Sch. Dist., | | | | | | | | | | | | |

Election 2018, Series C, GO | | 3.500 | | 08/01/45 | | | 1,250 | | | | 1,143,245 | |

Patterson Pub. Fing. Auth., | | | | | | | | | | | | |

Spl. Tax, Rfdg., AGM | | 5.000 | | 09/01/39 | | | 750 | | | | 841,924 | |

Pittsburg Successor Agy. Redev. Agy., | | | | | | | | | | | | |

Los Medanos Cmnty. Dev. Proj., Tax Alloc., AMBAC, CABS | | 2.927(t) | | 08/01/26 | | | 1,585 | | | | 1,499,014 | |

Tax Alloc., Sub. Series A, Rfdg., AGM | | 5.000 | | 09/01/29 | | | 1,750 | | | | 1,818,379 | |

See Notes to Financial Statements.

4

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

MUNICIPAL BONDS (Continued) | | | | | | | | | | | | |

Port of Oakland Rev., | | | | | | | | | | | | |

Inter Lien, Series E, Rfdg. | | 5.000% | | 11/01/26 | | | 750 | | | $ | 789,054 | |

Intermediate Lien, Series H, Rfdg., AMT | | 5.000 | | 05/01/28 | | | 2,345 | | | | 2,495,131 | |

Intermediate Lien, Series H, Rfdg., AMT | | 5.000 | | 05/01/29 | | | 1,215 | | | | 1,306,456 | |

Intermediate Lien, Series H, Rfdg., AMT, ETM(ee) | | 5.000 | | 05/01/28 | | | 30 | | | | 31,970 | |

Intermediate Lien, Series H, Rfdg., AMT, ETM(ee) | | 5.000 | | 05/01/29 | | | 5 | | | | 5,403 | |

Poway Unif. Sch. Dist. Pub. Fing. Auth., | | | | | | | | | | | | |

Spl. Tax, Cmnty. Fasc. Dist. No. 14, Series A, Rfdg. | | 5.000 | | 09/01/35 | | | 1,000 | | | | 1,012,869 | |

Puerto Rico Ind. Tourist Edl. Med. & Envirml. Ctl. Facs. Fing. Auth. Rev., | | | | | | | | | | | | |

San Juan Cruise Terminal Proj., Series 2023, A-1, P3 Proj., AMT | | 6.750 | | 01/01/45 | | | 1,000 | | | | 1,187,771 | |

Puerto Rico Indl. Tourist Edl. Med. & Envirml. Ctl. Facs. Fing. Auth. Rev., | | | | | | | | | | | | |

Hosp. Auxilio Mutuo Oblig. Grp. Proj., Rfdg. | | 5.000 | | 07/01/32 | | | 2,100 | | | | 2,315,949 | |

Hosp. Auxilio Mutuo Oblig. Grp. Proj., Rfdg. | | 5.000 | | 07/01/33 | | | 1,335 | | | | 1,467,086 | |

Puerto Rico Sales Tax Fing. Corp. Sales Tax Rev., | | | | | | | | | | | | |

Restructured, Series A-1, CABS | | 3.899(t) | | 07/01/33 | | | 1,780 | | | | 1,265,375 | |

Series A-1, CABS | | 3.523(t) | | 07/01/27 | | | 2,645 | | | | 2,395,548 | |

Rancho Cucamonga Redev. Agy. Successor Agy., | | | | | | | | | | | | |

Rancho Redev. Proj. Area, Tax Alloc., Rfdg., AGM | | 5.000 | | 09/01/32 | | | 450 | | | | 450,611 | |

Riverside Cnty. Infrast. Fing. Auth. Rev., | | | | | | | | | | | | |

Series A, Rfdg. (Pre-refunded date 11/01/25)(ee) | | 4.000 | | 11/01/37 | | | 190 | | | | 193,411 | |

Riverside Cnty. Pub. Fing. Auth., | | | | | | | | | | | | |

Redev. Proj. Area No.1, Desert Cmntys., Tax Alloc., Series A, Rfdg. AGM | | 5.000 | | 10/01/34 | | | 1,000 | | | | 1,182,182 | |

Riverside Cnty. Pub. Fing. Auth. Rev., | | | | | | | | | | | | |

Cap. Facs. Proj. (Pre-refunded date 11/01/25)(ee) | | 5.250 | | 11/01/45 | | | 1,000 | | | | 1,032,212 | |

Riverside Cnty. Rev.,

TRANS | | 5.000 | | 06/30/25 | | | 2,000 | | | | 2,039,056 | |

Roseville, | | | | | | | | | | | | |

Spl. Tax, WestPark Cmnty. Facs. Dist. No. 1, Pub. Facs., Rfdg. | | 5.000 | | 09/01/28 | | | 300 | | | | 304,779 | |

Spl. Tax, WestPark Cmnty. Facs. Dist. No. 1, Pub. Facs., Rfdg. | | 5.000 | | 09/01/37 | | | 1,165 | | | | 1,178,002 | |

Sacramento Cnty., | | | | | | | | | | | | |

Spl. Tax, Cmnty. Facs. Dist. No. 2004-1, Mcclellan Park, Rfdg. | | 5.000 | | 09/01/40 | | | 1,085 | | | | 1,104,025 | |

San Diego Cnty. Regl. Arpt. Auth. Rev., | | | | | | | | | | | | |

Sub. Series B, AMT | | 5.000 | | 07/01/34 | | | 1,000 | | | | 1,080,509 | |

Sub. Series B, Rfdg., AMT | | 5.000 | | 07/01/28 | | | 1,000 | | | | 1,066,105 | |

Sub. Series B, Rfdg., AMT | | 5.000 | | 07/01/37 | | | 1,400 | | | | 1,478,672 | |

San Diego Pub. Facs. Fing. Auth. Rev., | | | | | | | | | | | | |

Cap. Impt. Projs., Series A | | 5.000 | | 10/15/44 | | | 1,000 | | | | 1,017,189 | |

San Diego Unif. Sch. Dist., | | | | | | | | | | | | |

Election of 2008, Series SR-4C, GO, Rfdg.(hh) | | 5.000 | | 07/01/34 | | | 1,000 | | | | 1,195,566 | |

Election of 2012, Series ZR-5C, GO, Rfdg.(hh) | | 5.000 | | 07/01/40 | | | 1,000 | | | | 1,155,913 | |

San Diego Unif. Sch. Dist. Rev., | | | | | | | | | | | | |

TRANS, Series A | | 5.000 | | 06/30/25 | | | 1,000 | | | | 1,019,544 | |

San Francisco City & Cnty. Arpt. Commn. Rev., | | | | | | | | | | | | |

2nd Series A, Rfdg. | | 5.000 | | 05/01/27 | | | 400 | | | | 414,271 | |

2nd Series A, Rfdg., AMT | | 5.250 | | 05/01/41 | | | 1,000 | | | | 1,116,699 | |

See Notes to Financial Statements.

PGIM California Muni Income Fund 5

Schedule of Investments (continued)

as of August 31, 2024

| | | | | | | | | | | | |

| | | | |

| Description | | Interest Rate | | Maturity Date | | Principal Amount (000)# | | | Value | |

| | | | |

MUNICIPAL BONDS (Continued) | | | | | | | | | | | | |

San Francisco City & Cnty. Arpt. Commn. Rev., (cont’d.) | | | | | | | | | | | | |

2nd Series C, Rfdg., AMT | | 5.500% | | 05/01/39 | | | 1,000 | | | $ | 1,133,809 | |

Series D, Rfdg., AMT | | 5.000 | | 05/01/26 | | | 1,980 | | | | 2,043,444 | |

Unrefunded, 2nd Series G, Rfdg., AMT | | 5.000 | | 05/01/27 | | | 2,330 | | | | 2,441,007 | |

San Leandro Cmnty. Facs. Dist. No. 1, | | | | | | | | | | | | |

Spl. Tax | | 6.500 | | 09/01/25 | | | 815 | | | | 816,862 | |

Sanger Unif. Sch. Dist., | | | | | | | | | | | | |

Unrefunded, COP, Cap. Proj., Rfdg., AGM | | 5.000 | | 06/01/52 | | | 85 | | | | 85,074 | |

Santa Maria Joint Union H.S. Dist., | | | | | | | | | | | | |

Elect. of 2004, CABS, GO, NATL | | 2.656(t) | | 08/01/29 | | | 1,250 | | | | 1,097,849 | |

Santa Monica Cmnty. Clg. Dist., | | | | | | | | | | | | |

Elect. of 2002, Series A, GO, NATL | | 2.594(t) | | 08/01/28 | | | 1,055 | | | | 953,631 | |

Southern Calif. Pub. Pwr. Auth. Rev., | | | | | | | | | | | | |

Clean Energy Proj., Series A (Mandatory put date 09/01/30) | | 5.000(cc) | | 04/01/55 | | | 2,000 | | | | 2,151,119 | |

Southern Calif. Tob. Secur. Auth. Rev., | | | | | | | | | | | | |

San Diego Co., Asset security, Rfdg. | | 5.000 | | 06/01/25 | | | 1,880 | | | | 1,907,124 | |

Territory of Guam. Rev., | | | | | | | | | | | | |

Series F, Rfdg. | | 5.000 | | 01/01/31 | | | 1,525 | | | | 1,656,492 | |

Univ. of California Reg. Med. Ctr. Rev., | | | | | | | | | | | | |

Series L, Rfdg. | | 5.000 | | 05/15/28 | | | 1,000 | | | | 1,040,733 | |

Series P | | 5.000 | | 05/15/36 | | | 1,725 | | | | 1,985,935 | |

Univ. of California Rev., | | | | | | | | | | | | |

Series BE, Rfdg. | | 5.000 | | 05/15/41 | | | 1,195 | | | | 1,312,016 | |

Series BS, Rfdg. | | 5.000 | | 05/15/43 | | | 1,000 | | | | 1,138,559 | |

Series BW, Rfdg. | | 5.000 | | 05/15/40 | | | 1,000 | | | | 1,155,372 | |

Vernon Elec. Sys. Rev., | | | | | | | | | | | | |

Series A | | 5.000 | | 04/01/28 | | | 2,150 | | | | 2,287,806 | |

Walnut Energy Ctr. Auth. Rev., | | | | | | | | | | | | |

Rfdg. | | 5.000 | | 01/01/34 | | | 1,000 | | | | 1,001,614 | |

| | | | | | | | | | | | |

| | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $237,489,292) | | | | | | | | | | | 236,971,864 | |

| | | | | | | | | | | | |

| | | | |

SHORT-TERM INVESTMENT 3.8% | | | | | | | | | | | | |

| | | | |

| | | | | | | Shares | | | | |

| | | | |

AFFILIATED MUTUAL FUND | | | | | | | | | | | | |

PGIM Core Ultra Short Bond Fund

(cost $9,300,840)(wb) | | | | | | | 9,300,840 | | | | 9,300,840 | |

| | | | | | | | | | | | |

| | | | |

TOTAL INVESTMENTS 101.2%

(cost $246,790,132) | | | | | | | | | | | 246,272,704 | |

Liabilities in excess of other assets(z) (1.2)% | | | | | | | | | | | (2,826,661 | ) |

| | | | | | | | | | | | |

| | | | |

NET ASSETS 100.0% | | | | | | | | | | $ | 243,446,043 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

6

Below is a list of the abbreviation(s) used in the annual report:

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

AGM—Assured Guaranty Municipal Corp.

AMBAC—American Municipal Bond Assurance Corp.

AMT—Alternative Minimum Tax

BAM—Build America Mutual

BANS—Bond Anticipation Notes

CABS—Capital Appreciation Bonds

CGM—Citigroup Global Markets, Inc.

COP—Certificates of Participation

ETM—Escrowed to Maturity

GO—General Obligation

IDB—Industrial Development Bond

NATL—National Public Finance Guarantee Corp.

OTC—Over-the-counter

PCR—Pollution Control Revenue

Rfdg—Refunding

SOFR—Secured Overnight Financing Rate

TCRs—Transferrable Custodial Receipts

TRANS—Tax and Revenue Anticipation Notes

| # | Principal amount is shown in U.S. dollars unless otherwise stated. |

| ^ | Indicates a Level 3 instrument. The aggregate value of Level 3 instruments is $120,000 and 0.0% of net assets. |

| (cc) | Variable rate instrument. The rate shown is based on the latest available information as of August 31, 2024. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description. |

| (d) | Represents issuer in default on interest payments and/or principal repayment. Non-income producing security. Such securities may be post-maturity. |

| (ee) | All or partial escrowed to maturity and pre-refunded issues are secured by escrowed cash, a guaranteed investment contract and /or U.S. guaranteed obligations. |

| (hh) | When-issued security. |

| (t) | Represents zero coupon. Rate quoted represents effective yield at August 31, 2024. |

| (wb) | Represents an investment in a Fund affiliated with the Manager. |

| (z) | Includes net unrealized appreciation/(depreciation) and/or market value of the below holdings which are excluded from the Schedule of Investments: |

Futures contracts outstanding at August 31, 2024:

| | | | | | | | | | | | | | | | | | | | |

Number of Contracts | | Type | | Expiration

Date | | | Current

Notional

Amount | | | Value /

Unrealized

Appreciation

(Depreciation) | |

Short Position: | | | | | | | | | | | | | | | |

9 | | 30 Year U.S. Ultra Treasury Bonds | | | Dec. 2024 | | | | $1,187,438 | | | | | | | $26,439 | | | | |

| | | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

PGIM California Muni Income Fund 7

Schedule of Investments (continued)

as of August 31, 2024

Summary of Collateral for Centrally Cleared/Exchange-traded Derivatives:

Cash and securities segregated as collateral, including pending settlement for closed positions, to cover requirements for centrally cleared/exchange-traded derivatives are listed by broker as follows:

| | | | | | | | | | |

Broker | | Cash and/or Foreign Currency | | Securities Market Value |

CGM | | | | $340,000 | | | | | $— | |

| | | | | | | | | | |

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of August 31, 2024 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

| | |

Investments in Securities | | | | | | | | |

Assets | | | | | | | | |

Long-Term Investments | | | | | | | | |

Municipal Bonds | | | | | | | | |

California | | $ | — | | | $ | 225,857,662 | | | $ | 120,000 | |

Guam | | | — | | | | 2,362,473 | | | | — | |

Puerto Rico | | | — | | | | 8,631,729 | | | | — | |

Short-Term Investment | | | | | | | | |

Affiliated Mutual Fund | | | 9,300,840 | | | | — | | | | — | |

| | | | | | | | | | | | |

| | | |

Total | | $ | 9,300,840 | | | $ | 236,851,864 | | | $ | 120,000 | |

| | | | | | | | | | | | |

| | |

Other Financial Instruments* | | | | | | | | |

Assets | | | | | | | | |

Futures Contracts | | $ | 26,439 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and centrally cleared swap contracts, which are recorded at unrealized appreciation (depreciation) on the instrument, and OTC swap contracts which are recorded at fair value. |

See Notes to Financial Statements.

8

Sector Classification:

The sector classification of investments and liabilities in excess of other assets shown as a percentage of net assets as of August 31, 2024 were as follows:

| | | | |

General Obligation | | | 16.4 | % |

Healthcare | | | 15.4 | |

Transportation | | | 13.6 | |

Pre-pay Gas | | | 10.3 | |

Special Tax/Assessment District | | | 9.2 | |

Development | | | 7.9 | |

Education | | | 7.5 | |

Tobacco Appropriated | | | 5.1 | |

Corporate Backed IDB &PCR | | | 4.2 | |

Affiliated Mutual Fund | | | 3.8 | |

| | | | |

Lease Backed Certificate of Participation | | | 2.5 | % |

Power | | | 2.2 | |

Water &Sewer | | | 1.6 | |

Pre-Refunded | | | 1.4 | |

Solid Waste/Resource Recovery | | | 0.1 | |

| | | | |

| |

| | | 101.2 | |

Liabilities in excess of other assets | | | (1.2 | ) |

| | | | |

| |

| | | 100.0 | % |

| | | | |

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Fund invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is interest rate risk. See the Notes to Financial Statements for additional detail regarding these derivative instruments and their risks. The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of August 31, 2024 as presented in the Statement of Assets and Liabilities:

| | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives |

Derivatives not accounted for as hedging instruments, carried at fair value | | Statement of Assets and Liabilities Location | | Fair

Value | | | Statement of Assets and Liabilities Location | | Fair

Value |

Interest rate contracts | | Due from/to broker-variation margin futures | | $ | 26,439 | * | | — | | $— |

| | | | | | | | | | |

| * | Includes cumulative appreciation (depreciation) as reported in the schedule of open futures and centrally cleared swap contracts. Only unsettled variation margin receivable (payable) is reported within the Statement of Assets and Liabilities. |

The effects of derivative instruments on the Statement of Operations for the year ended August 31, 2024 are as follows:

Amount of Realized Gain (Loss) on Derivatives Recognized in Income

| | | | | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Futures |

| | | |

| |

Interest rate contracts | | | $ | (3,006 | ) |

| | | | | |

See Notes to Financial Statements.

PGIM California Muni Income Fund 9

Schedule of Investments (continued)

as of August 31, 2024

Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income

| | | | | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Futures |

| |

Interest rate contracts | | | $ | 55,683 | |

| | | | | |

For the year ended August 31, 2024, the Fund’s average volume of derivative activities is as follows:

| | |

| |

| Derivative Contract Type | | Average Volume of Derivative Activities* |

| |

Futures Contracts - Short Positions (1) | | $1,323,188 |

| * | Average volume is based on average quarter end balances for the year ended August 31, 2024. |

| (1) | Notional Amount in USD. |

See Notes to Financial Statements.

10

Statement of Assets and Liabilities

as of August 31, 2024

| | | | |

|

Assets | |

| |

Investments at value: | | | | |

Unaffiliated investments (cost $237,489,292) | | $ | 236,971,864 | |

Affiliated investments (cost $9,300,840) | | | 9,300,840 | |

Interest receivable | | | 2,701,017 | |

Receivable for Fund shares sold | | | 556,290 | |

Deposit with broker for centrally cleared/exchange-traded derivatives | | | 340,000 | |

Due from broker—variation margin futures | | | 9,281 | |

Prepaid expenses and other assets | | | 2,743 | |

| | | | |

| |

Total Assets | | | 249,882,035 | |

| | | | |

| |

Liabilities | | | | |

| |

Payable for investments purchased | | | 5,874,693 | |

Payable for Fund shares purchased | | | 384,743 | |

Accrued expenses and other liabilities | | | 84,198 | |

Management fee payable | | | 46,282 | |

Distribution fee payable | | | 25,108 | |

Dividends payable | | | 16,462 | |

Affiliated transfer agent fee payable | | | 2,512 | |

Trustees’ fees payable | | | 1,994 | |

| | | | |

| |

Total Liabilities | | | 6,435,992 | |

| | | | |

| |

Net Assets | | $ | 243,446,043 | |

| | | | |

| | | | |

| |

Net assets were comprised of: | | | | |

Shares of beneficial interest, at par | | $ | 244,924 | |

Paid-in capital in excess of par | | | 247,125,773 | |

Total distributable earnings (loss) | | | (3,924,654 | ) |

| | | | |

| |

Net assets, August 31, 2024 | | $ | 243,446,043 | |

| | | | |

See Notes to Financial Statements.

PGIM California Muni Income Fund 11

Statement of Assets and Liabilities

as of August 31, 2024

| | | | |

| |

Class A | | | | |

| |

Net asset value and redemption price per share, | | | | |

($104,172,307 ÷ 10,481,033 shares of beneficial interest issued and outstanding) | | $ | 9.94 | |

Maximum sales charge (3.25% of offering price) | | | 0.33 | |

| | | | |

| |

Maximum offering price to public | | $ | 10.27 | |

| | | | |

| |

Class C | | | | |

| |

Net asset value, offering price and redemption price per share, | | | | |

($3,980,692 ÷ 400,581 shares of beneficial interest issued and outstanding) | | $ | 9.94 | |

| | | | |

| |

Class Z | | | | |

| |

Net asset value, offering price and redemption price per share, | | | | |

($109,102,287 ÷ 10,975,890 shares of beneficial interest issued and outstanding) | | $ | 9.94 | |

| | | | |

| |

Class R6 | | | | |

| |

Net asset value, offering price and redemption price per share, | | | | |

($26,190,757 ÷ 2,634,908 shares of beneficial interest issued and outstanding) | | $ | 9.94 | |

| | | | |

See Notes to Financial Statements.

12

Statement of Operations

Year Ended August 31, 2024

| | | | |

| |

Net Investment Income (Loss) | | | | |

| |

Income | | | | |

Interest income | | $ | 7,269,906 | |

Affiliated dividend income | | | 270,401 | |

| | | | |

| |

Total income | | | 7,540,307 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 867,173 | |

Distribution fee(a) | | | 312,811 | |

Transfer agent’s fees and expenses (including affiliated expense of $ 15,694)(a) | | | 138,987 | |

Custodian and accounting fees | | | 45,711 | |

Audit fee | | | 41,499 | |

Professional fees | | | 40,282 | |

Registration fees(a) | | | 35,251 | |

Shareholders’ reports | | | 24,970 | |

Trustees’ fees | | | 12,750 | |

Miscellaneous | | | 29,186 | |

| | | | |

| |

Total expenses | | | 1,548,620 | |

Less: Fee waiver and/or expense reimbursement(a) | | | (288,329 | ) |

Custodian fee credit | | | (4 | ) |

| | | | |

| |

Net expenses | | | 1,260,287 | |

| | | | |

| |

Net investment income (loss) | | | 6,280,020 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

| |

Net realized gain (loss) on: | | | | |

Investment transactions | | | (1,384,705 | ) |

Futures transactions | | | (3,006 | ) |

| | | | |

| |

| | | (1,387,711 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 6,743,723 | |

Futures | | | 55,683 | |

| | | | |

| |

| | | 6,799,406 | |

| | | | |

| |

Net gain (loss) on investment transactions | | | 5,411,695 | |

| | | | |

| |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 11,691,715 | |

| | | | |

| (a) | Class specific expenses and waivers were as follows: |

| | | | | | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class Z | | | Class R6 | |

Distribution fee | | | 261,258 | | | | 51,553 | | | | — | | | | — | |

Transfer agent’s fees and expenses | | | 45,538 | | | | 3,173 | | | | 89,289 | | | | 987 | |

Registration fees | | | 11,031 | | | | 7,307 | | | | 7,933 | | | | 8,980 | |

Fee waiver and/or expense reimbursement | | | (87,200 | ) | | | (4,302 | ) | | | (166,964 | ) | | | (29,863 | ) |

See Notes to Financial Statements.

PGIM California Muni Income Fund 13

Statements of Changes in Net Assets

| | | | | | | | |

| |

| | | Year Ended

August 31, | |

| | |

| | | 2024 | | | 2023 | |

| | |

Increase (Decrease) in Net Assets | | | | | | | | |

| | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 6,280,020 | | | $ | 5,352,424 | |

Net realized gain (loss) on investment transactions | | | (1,387,711 | ) | | | (37,721 | ) |

Net change .in unrealized appreciation (depreciation) on investments | | | 6,799,406 | | | | (1,938,421 | ) |

| | | | | | | | |

| | |

Net increase (decrease) in net assets resulting from operations | | | 11,691,715 | | | | 3,376,282 | |

| | | | | | | | |

| | |

Dividends and Distributions | | | | | | | | |

Distributions from distributable earnings | | | | | | | | |

Class A | | | (2,705,222 | ) | | | (2,702,719 | ) |