F’23 Q1 Financial Results Brady Corporation November 17, 2022

Forward-Looking Statements In this news release, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project,” “continue” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: increased cost of raw materials, labor and freight as well as material shortages and supply chain disruptions; adverse impacts of the novel coronavirus (“COVID-19”) pandemic or other pandemics; decreased demand for our products; our ability to compete effectively or to successfully execute our strategy; Brady’s ability to identify, integrate, and grow acquired companies, and to manage contingent liabilities from divested businesses; difficulties in protecting our websites, networks, and systems against security breaches; risks associated with the loss of key employees; extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities; litigation, including product liability claims; foreign currency fluctuations; potential write-offs of goodwill and other intangible assets; changes in tax legislation and tax rates; differing interests of voting and non-voting shareholders; numerous other matters of national, regional and global scale, including major public health crises and government responses thereto and those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2022. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward- looking statements. Brady does not undertake to update its forward-looking statements except as required by law. 2

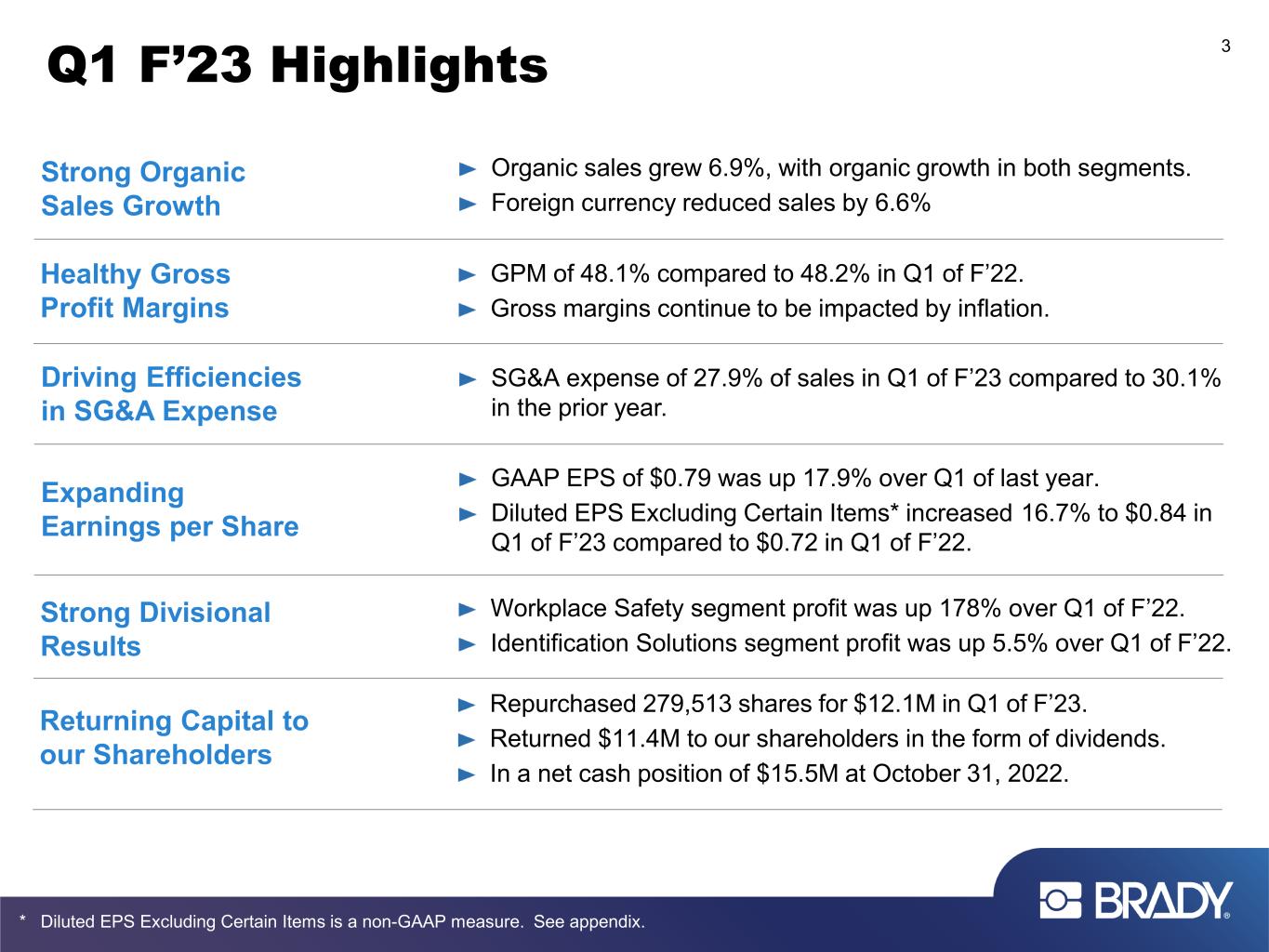

3 * Diluted EPS Excluding Certain Items is a non-GAAP measure. See appendix. Organic sales grew 6.9%, with organic growth in both segments. Foreign currency reduced sales by 6.6% Strong Organic Sales Growth GPM of 48.1% compared to 48.2% in Q1 of F’22. Gross margins continue to be impacted by inflation. Healthy Gross Profit Margins GAAP EPS of $0.79 was up 17.9% over Q1 of last year. Diluted EPS Excluding Certain Items* increased 16.7% to $0.84 in Q1 of F’23 compared to $0.72 in Q1 of F’22. Expanding Earnings per Share Workplace Safety segment profit was up 178% over Q1 of F’22. Identification Solutions segment profit was up 5.5% over Q1 of F’22. Strong Divisional Results Repurchased 279,513 shares for $12.1M in Q1 of F’23. Returned $11.4M to our shareholders in the form of dividends. In a net cash position of $15.5M at October 31, 2022. Returning Capital to our Shareholders Q1 F’23 Highlights SG&A expense of 27.9% of sales in Q1 of F’23 compared to 30.1% in the prior year. Driving Efficiencies in SG&A Expense

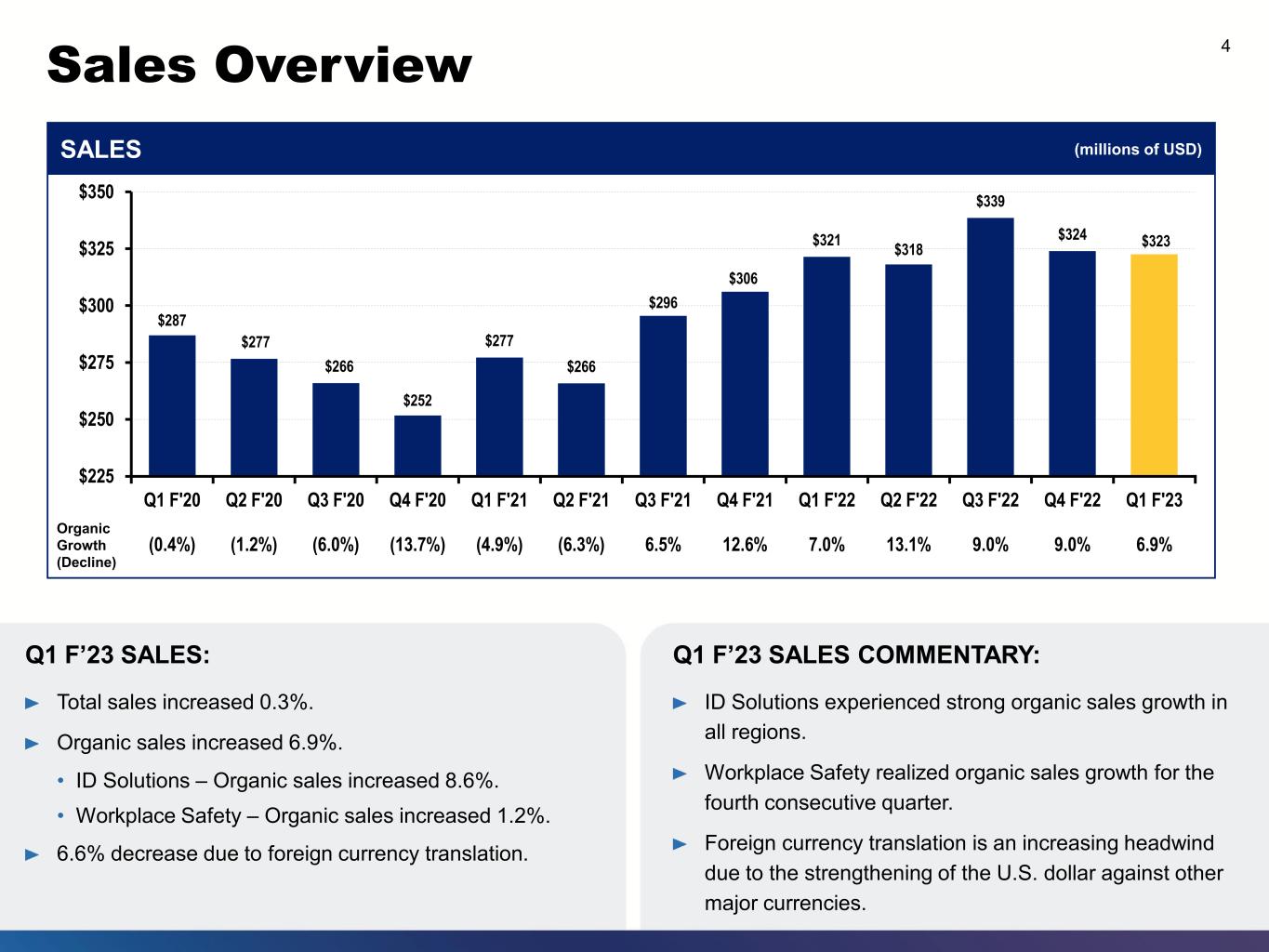

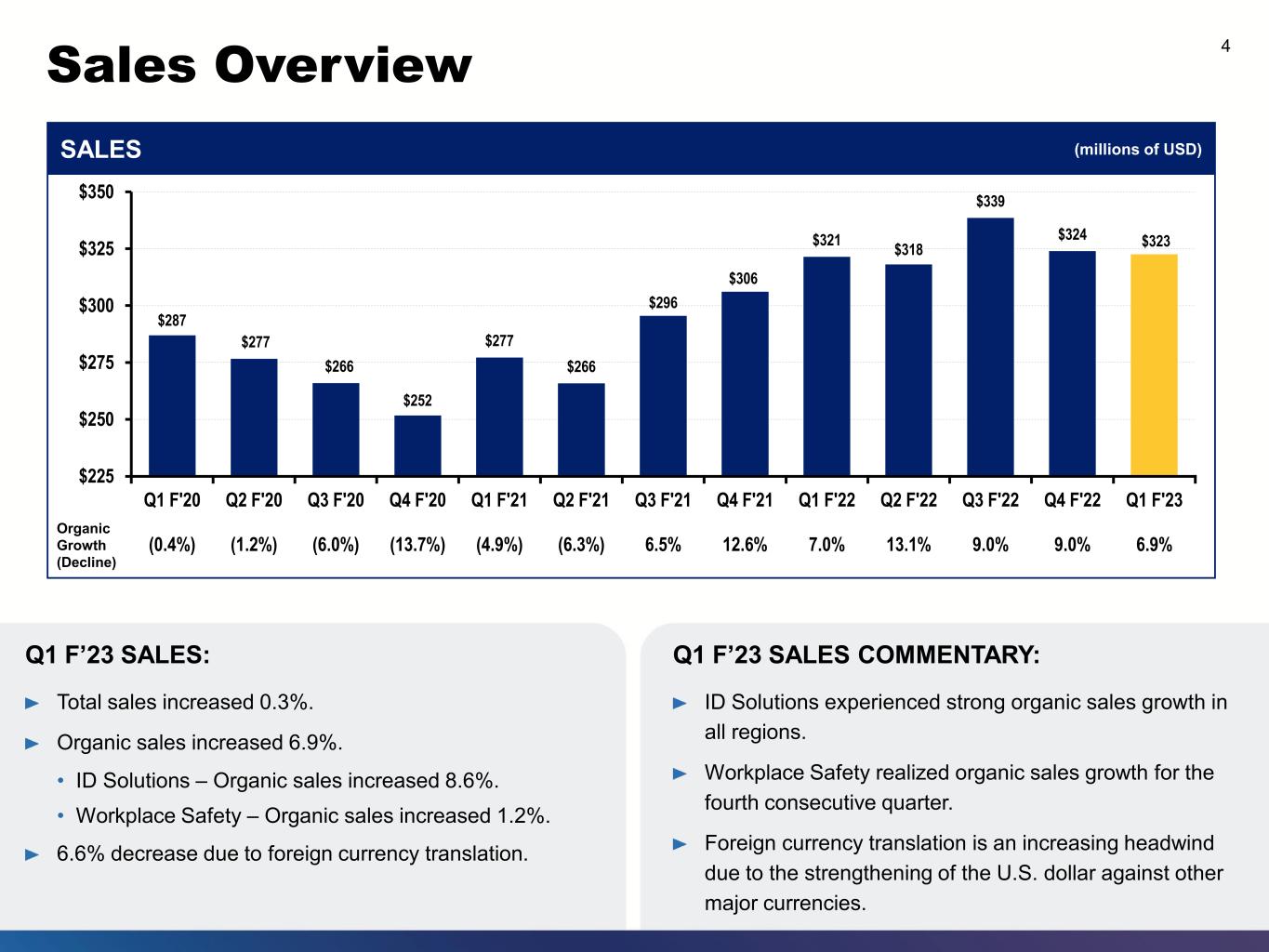

Sales Overview 4 Q1 F’23 SALES: Total sales increased 0.3%. Organic sales increased 6.9%. • ID Solutions – Organic sales increased 8.6%. • Workplace Safety – Organic sales increased 1.2%. 6.6% decrease due to foreign currency translation. $287 $277 $266 $252 $277 $266 $296 $306 $321 $318 $339 $324 $323 $225 $250 $275 $300 $325 $350 Q1 F'20 (0.4%) Q2 F'20 (1.2%) Q3 F'20 (6.0%) Q4 F'20 (13.7%) Q1 F'21 (4.9%) Q2 F'21 (6.3%) Q3 F'21 6.5% Q4 F'21 12.6% Q1 F'22 7.0% Q2 F'22 13.1% Q3 F'22 9.0% Q4 F'22 9.0% Q1 F'23 6.9% Organic Growth (Decline) SALES (millions of USD) Q1 F’23 SALES COMMENTARY: ID Solutions experienced strong organic sales growth in all regions. Workplace Safety realized organic sales growth for the fourth consecutive quarter. Foreign currency translation is an increasing headwind due to the strengthening of the U.S. dollar against other major currencies.

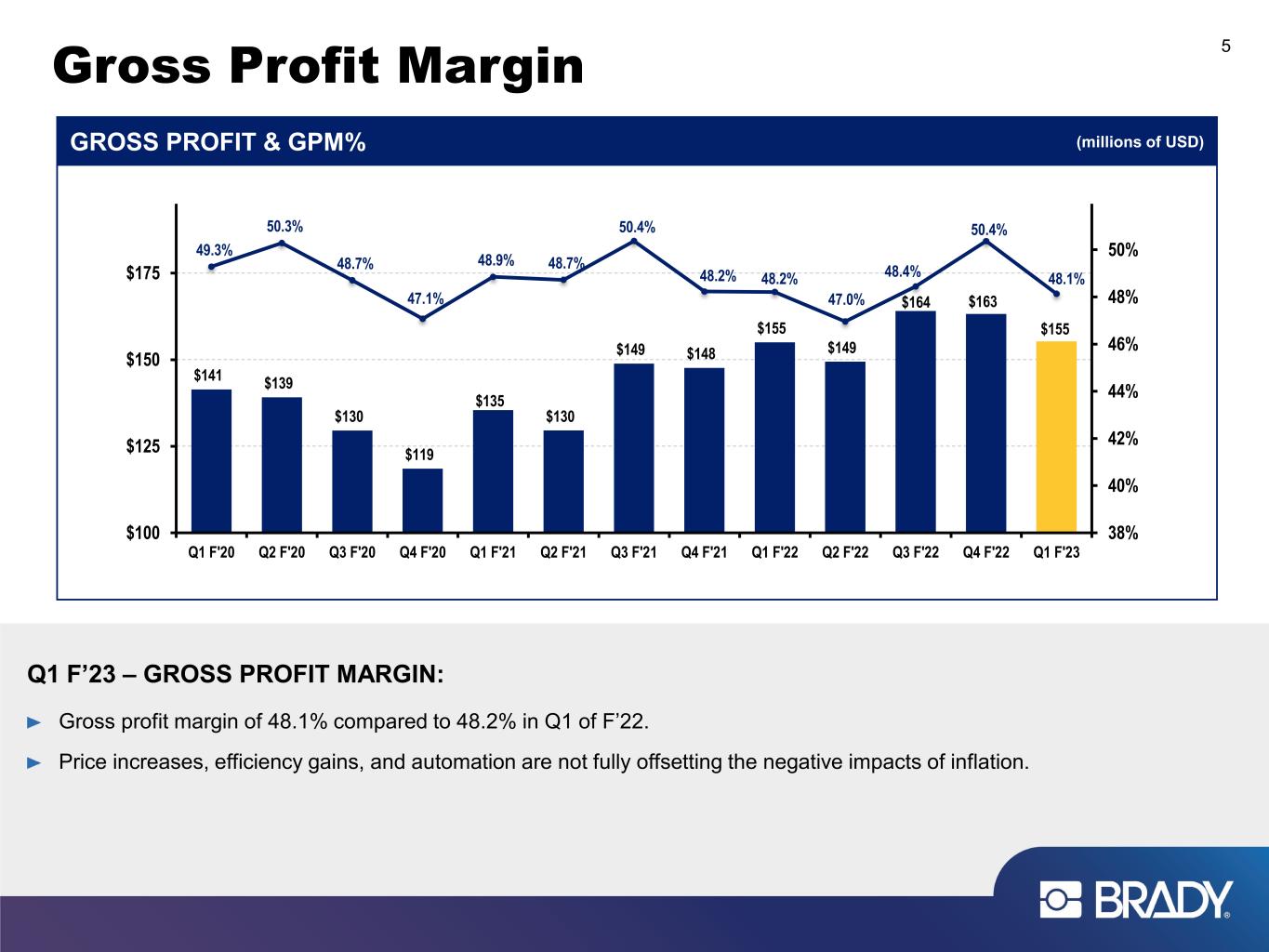

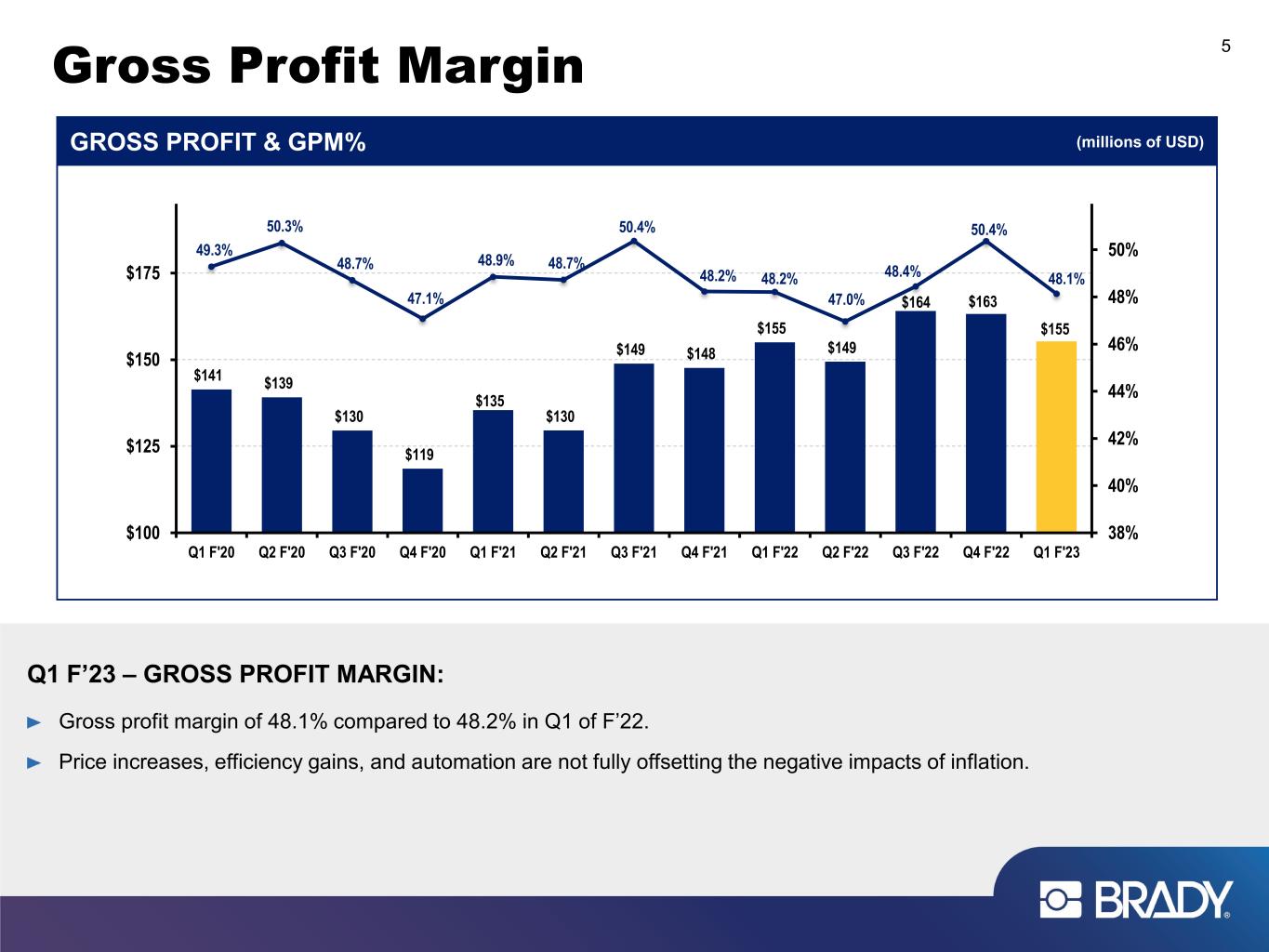

Gross Profit Margin 5 $141 $139 $130 $119 $135 $130 $149 $148 $155 $149 $164 $163 $155 49.3% 50.3% 48.7% 47.1% 48.9% 48.7% 50.4% 48.2% 48.2% 47.0% 48.4% 50.4% 48.1% 38% 40% 42% 44% 46% 48% 50% $100 $125 $150 $175 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 GROSS PROFIT & GPM% (millions of USD) Q1 F’23 – GROSS PROFIT MARGIN: Gross profit margin of 48.1% compared to 48.2% in Q1 of F’22. Price increases, efficiency gains, and automation are not fully offsetting the negative impacts of inflation.

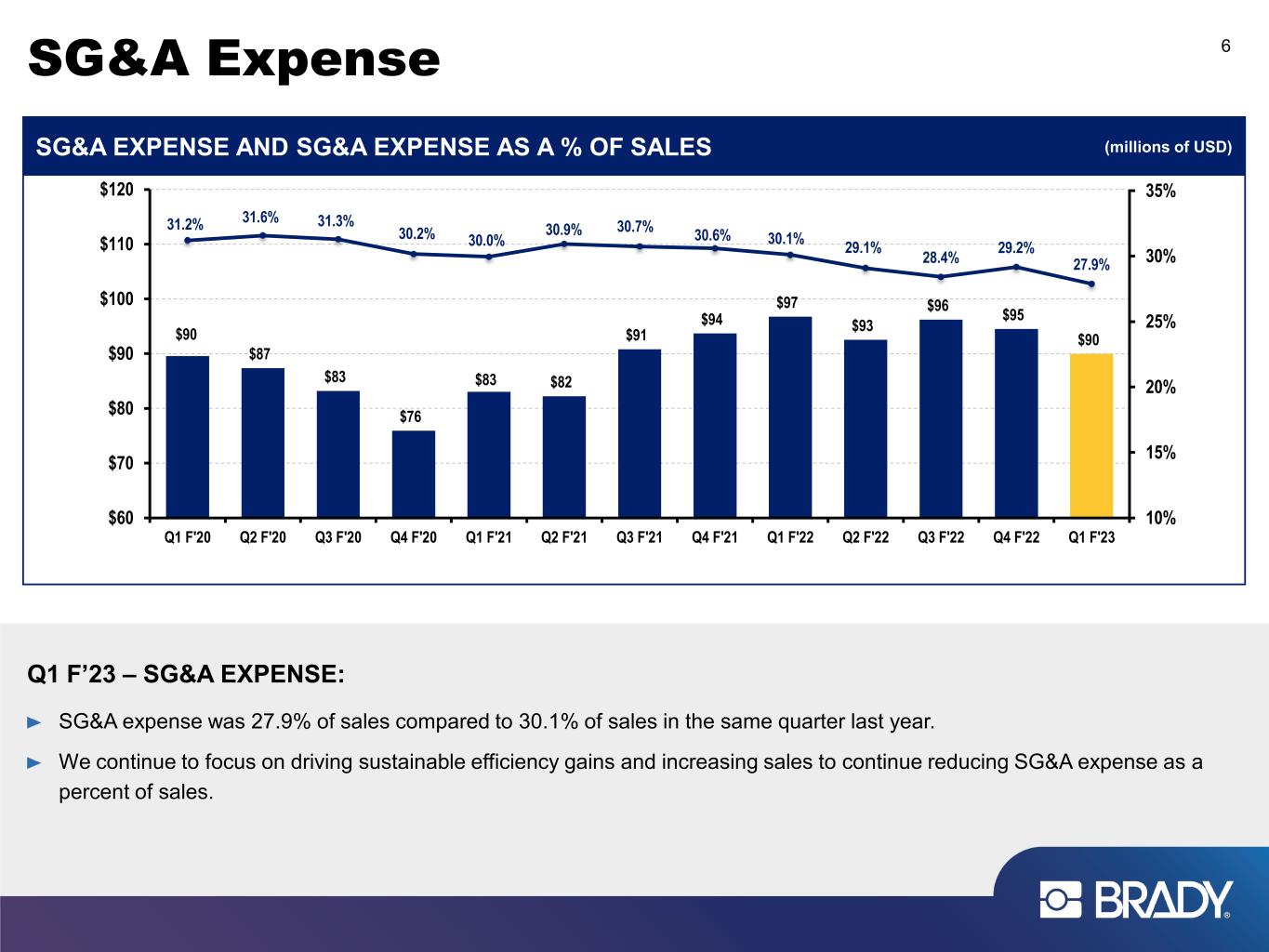

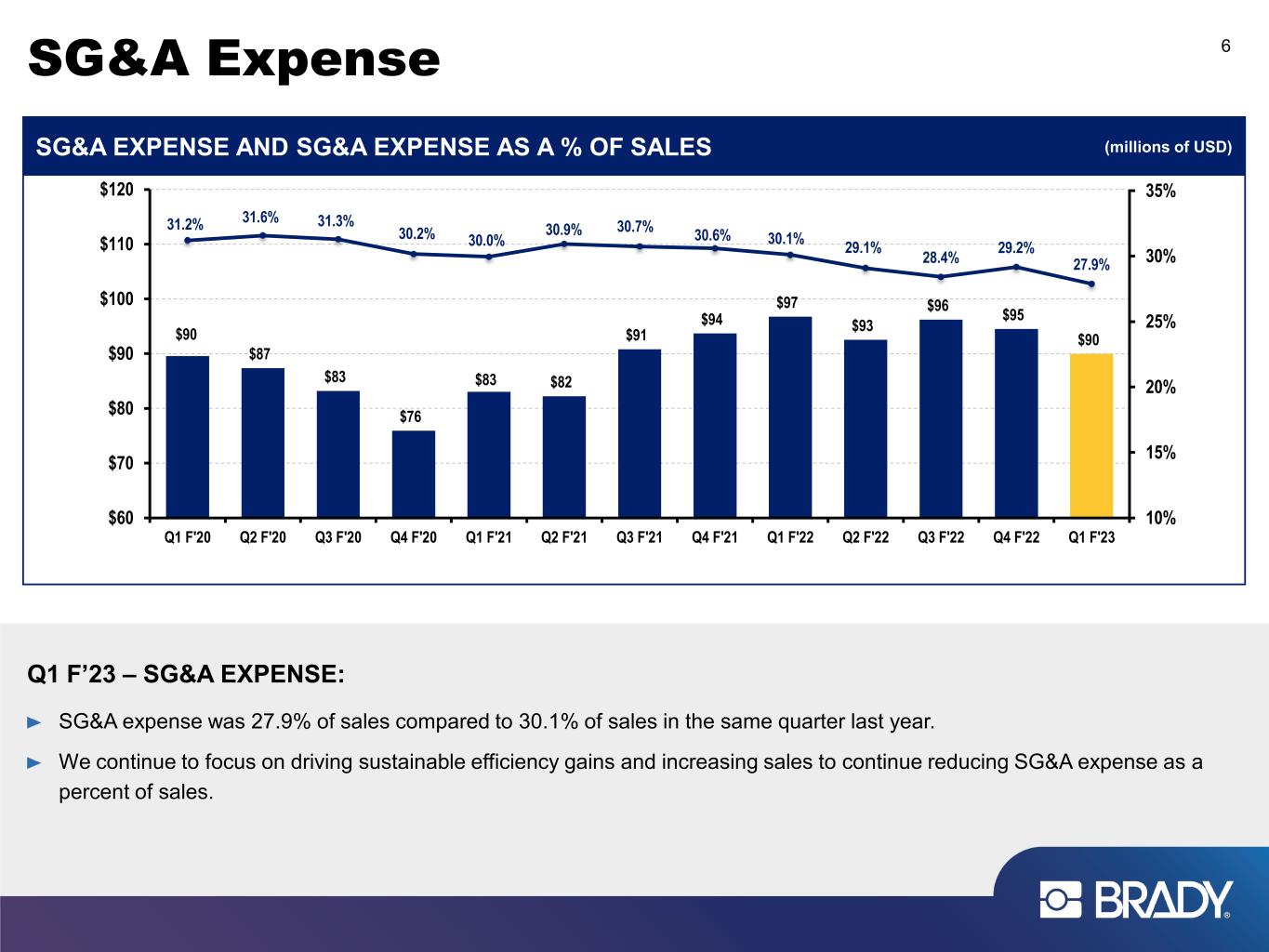

SG&A Expense 6 Q1 F’23 – SG&A EXPENSE: SG&A expense was 27.9% of sales compared to 30.1% of sales in the same quarter last year. We continue to focus on driving sustainable efficiency gains and increasing sales to continue reducing SG&A expense as a percent of sales. $90 $87 $83 $76 $83 $82 $91 $94 $97 $93 $96 $95 $90 31.2% 31.6% 31.3% 30.2% 30.0% 30.9% 30.7% 30.6% 30.1% 29.1% 28.4% 29.2% 27.9% 10% 15% 20% 25% 30% 35% $60 $70 $80 $90 $100 $110 $120 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 SG&A EXPENSE AND SG&A EXPENSE AS A % OF SALES (millions of USD)

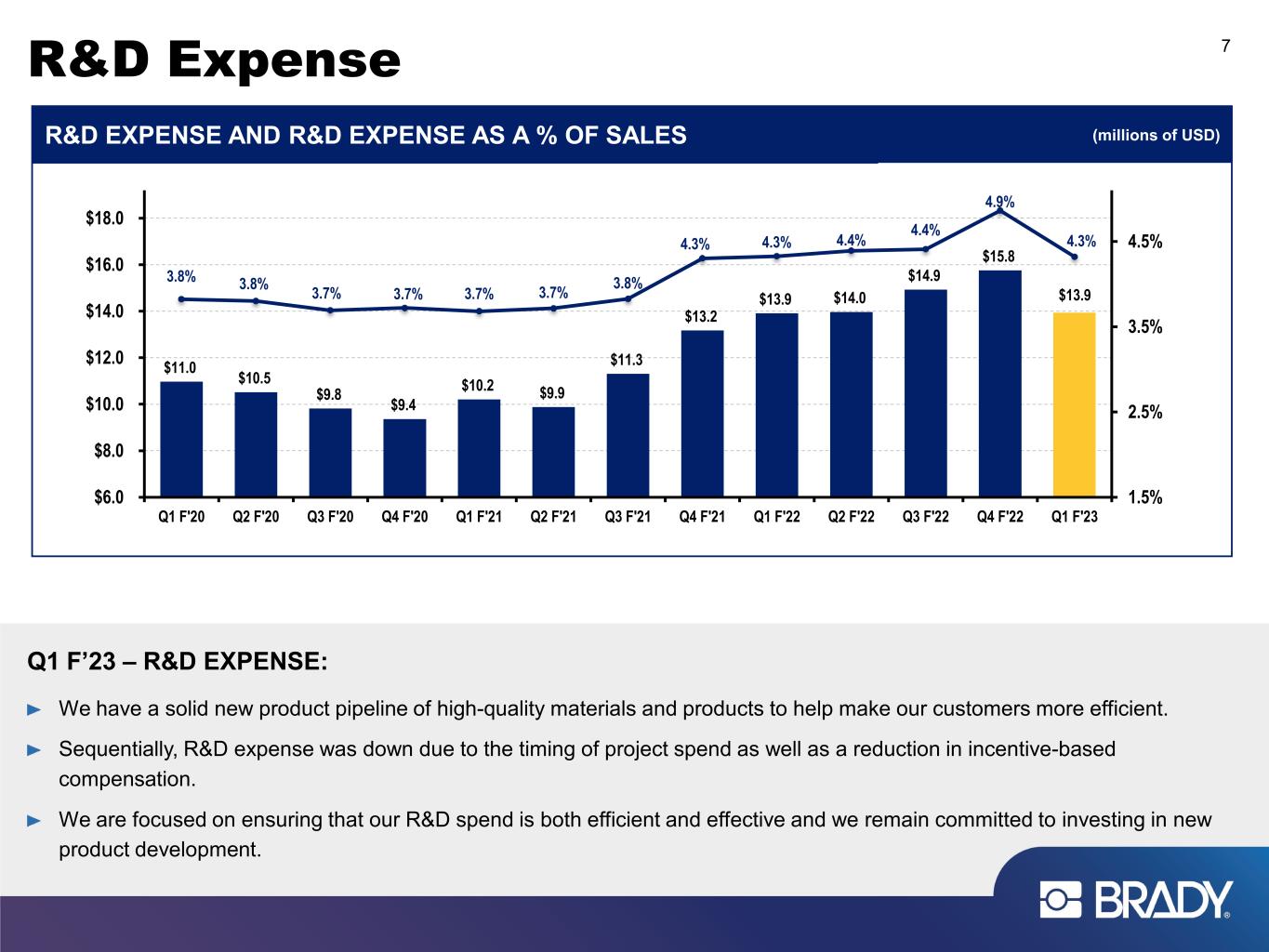

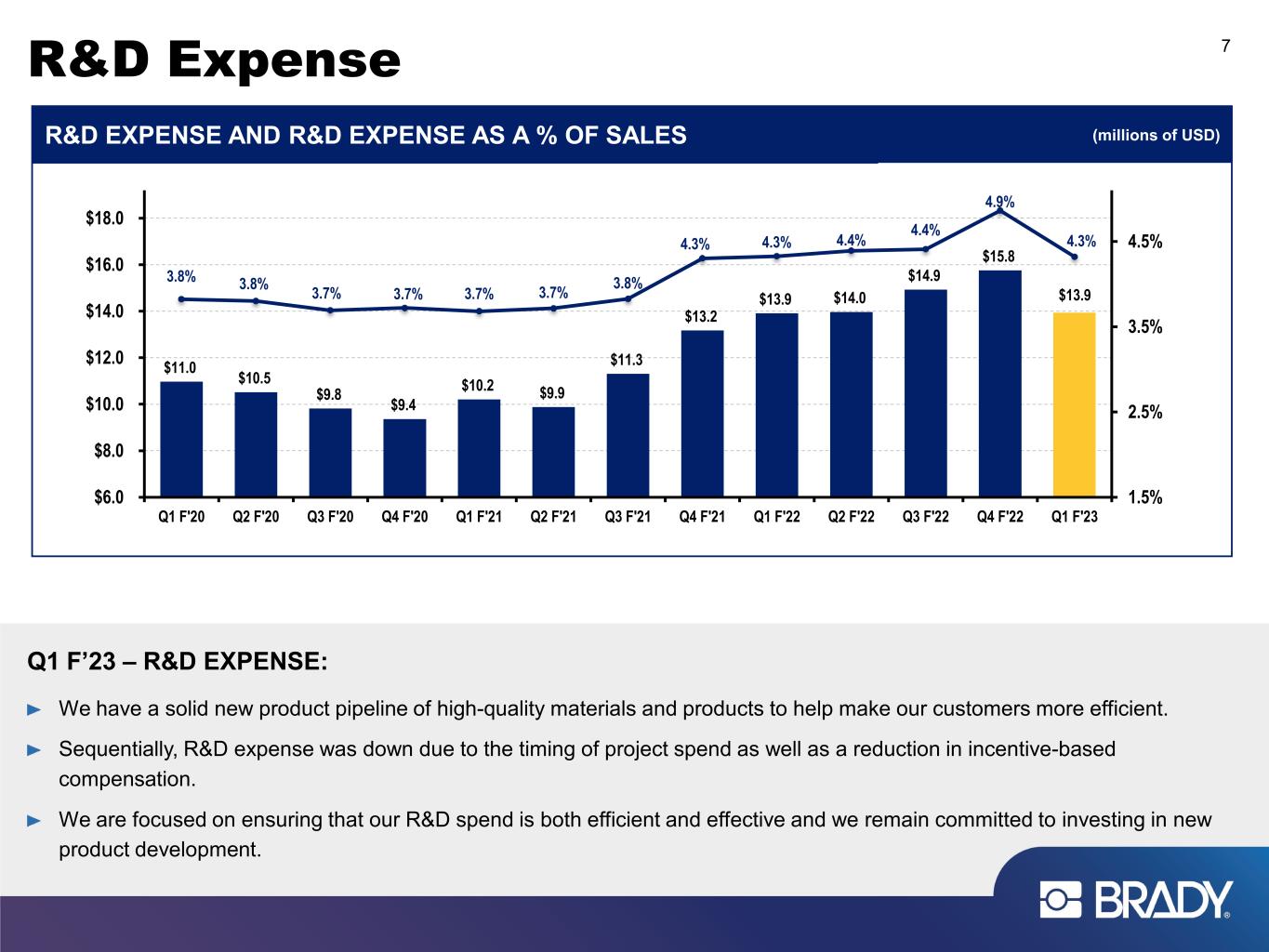

R&D Expense 7 Q1 F’23 – R&D EXPENSE: We have a solid new product pipeline of high-quality materials and products to help make our customers more efficient. Sequentially, R&D expense was down due to the timing of project spend as well as a reduction in incentive-based compensation. We are focused on ensuring that our R&D spend is both efficient and effective and we remain committed to investing in new product development. $11.0 $10.5 $9.8 $9.4 $10.2 $9.9 $11.3 $13.2 $13.9 $14.0 $14.9 $15.8 $13.9 3.8% 3.8% 3.7% 3.7% 3.7% 3.7% 3.8% 4.3% 4.3% 4.4% 4.4% 4.9% 4.3% 1.5% 2.5% 3.5% 4.5% $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 R&D EXPENSE AND R&D EXPENSE AS A % OF SALES (millions of USD)

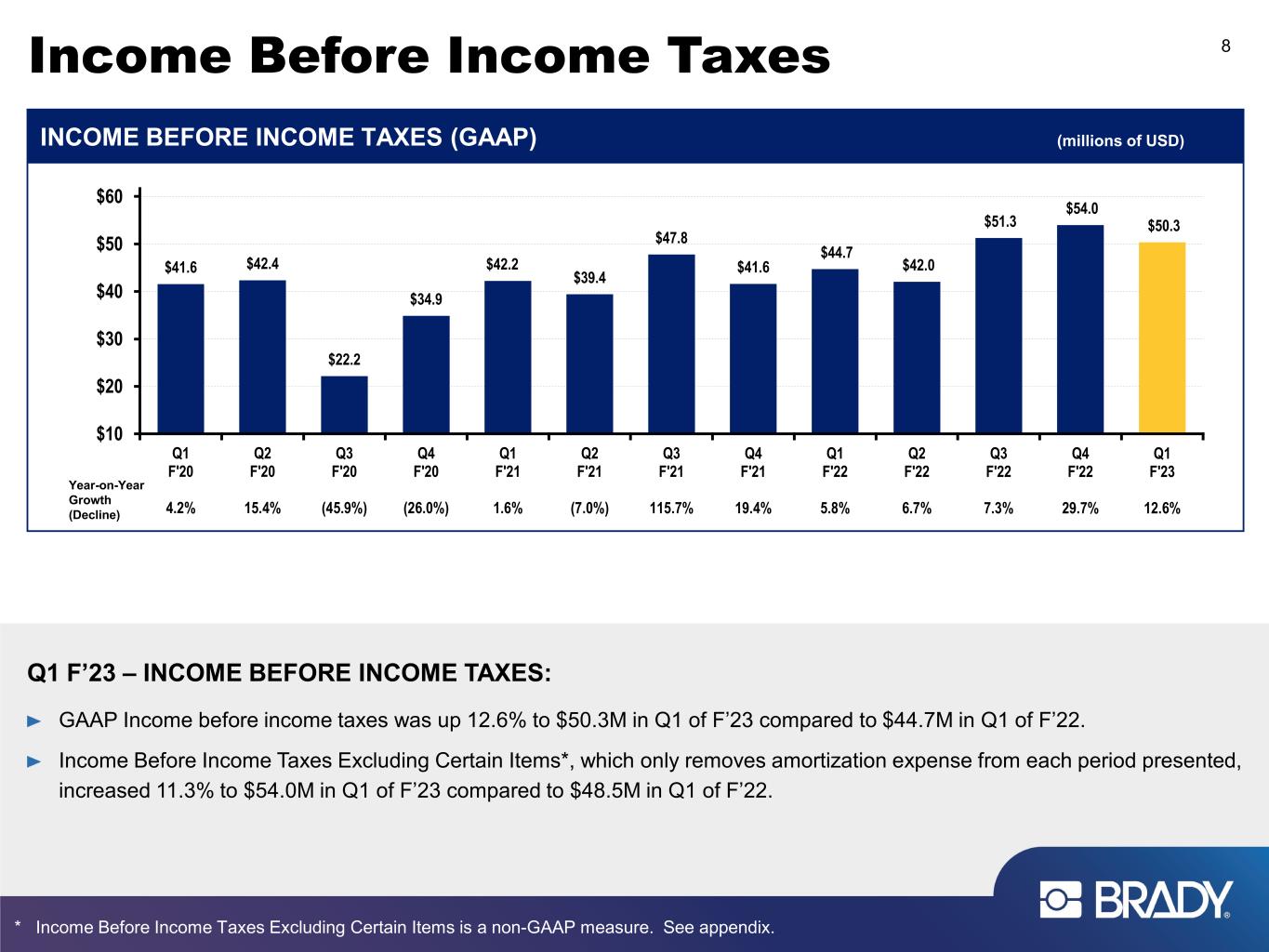

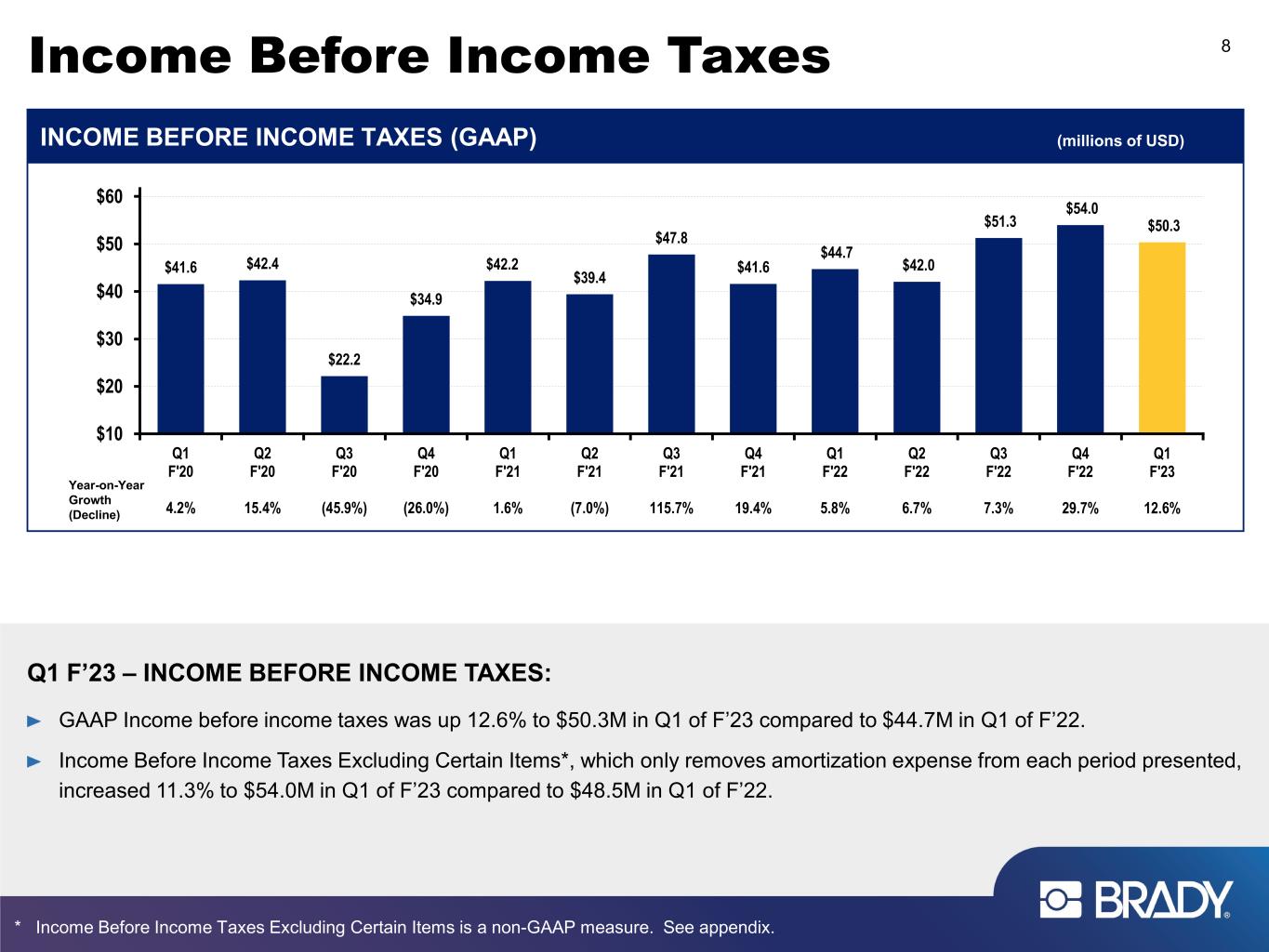

Income Before Income Taxes 8 Q1 F’23 – INCOME BEFORE INCOME TAXES: GAAP Income before income taxes was up 12.6% to $50.3M in Q1 of F’23 compared to $44.7M in Q1 of F’22. Income Before Income Taxes Excluding Certain Items*, which only removes amortization expense from each period presented, increased 11.3% to $54.0M in Q1 of F’23 compared to $48.5M in Q1 of F’22. INCOME BEFORE INCOME TAXES (GAAP) (millions of USD) $41.6 $42.4 $22.2 $34.9 $42.2 $39.4 $47.8 $41.6 $44.7 $42.0 $51.3 $54.0 $50.3 $10 $20 $30 $40 $50 $60 Q1 F'20 4.2% Q2 F'20 15.4% Q3 F'20 (45.9%) Q4 F'20 (26.0%) Q1 F'21 1.6% Q2 F'21 (7.0%) Q3 F'21 115.7% Q4 F'21 19.4% Q1 F'22 5.8% Q2 F'22 6.7% Q3 F'22 7.3% Q4 F'22 29.7% Q1 F'23 12.6% Year-on-Year Growth (Decline) * Income Before Income Taxes Excluding Certain Items is a non-GAAP measure. See appendix.

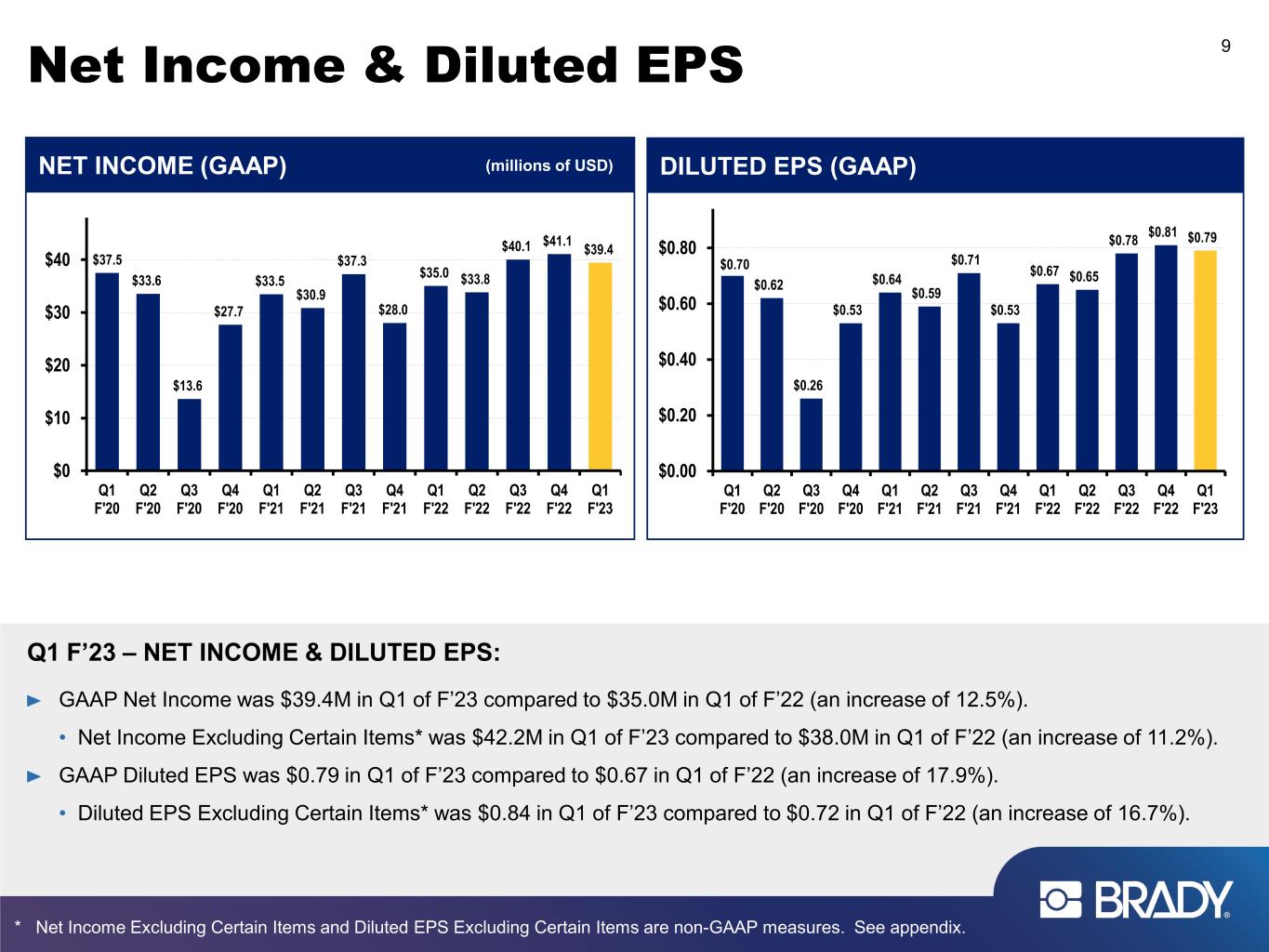

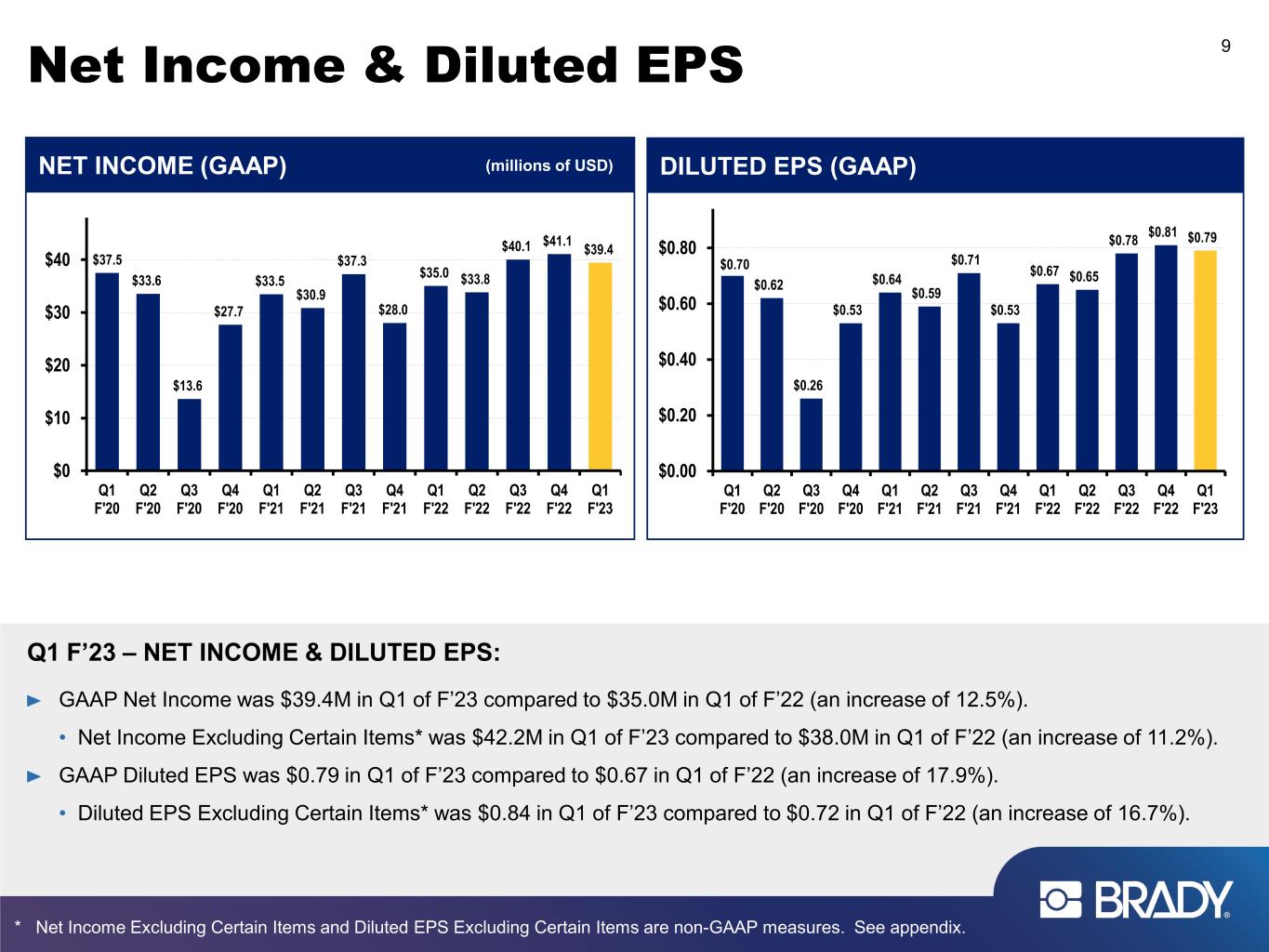

Net Income & Diluted EPS 9 Q1 F’23 – NET INCOME & DILUTED EPS: GAAP Net Income was $39.4M in Q1 of F’23 compared to $35.0M in Q1 of F’22 (an increase of 12.5%). • Net Income Excluding Certain Items* was $42.2M in Q1 of F’23 compared to $38.0M in Q1 of F’22 (an increase of 11.2%). GAAP Diluted EPS was $0.79 in Q1 of F’23 compared to $0.67 in Q1 of F’22 (an increase of 17.9%). • Diluted EPS Excluding Certain Items* was $0.84 in Q1 of F’23 compared to $0.72 in Q1 of F’22 (an increase of 16.7%). * Net Income Excluding Certain Items and Diluted EPS Excluding Certain Items are non-GAAP measures. See appendix. $37.5 $33.6 $13.6 $27.7 $33.5 $30.9 $37.3 $28.0 $35.0 $33.8 $40.1 $41.1 $39.4 $0 $10 $20 $30 $40 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 NET INCOME (GAAP) (millions of USD) $0.70 $0.62 $0.26 $0.53 $0.64 $0.59 $0.71 $0.53 $0.67 $0.65 $0.78 $0.81 $0.79 $0.00 $0.20 $0.40 $0.60 $0.80 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 DILUTED EPS (GAAP)

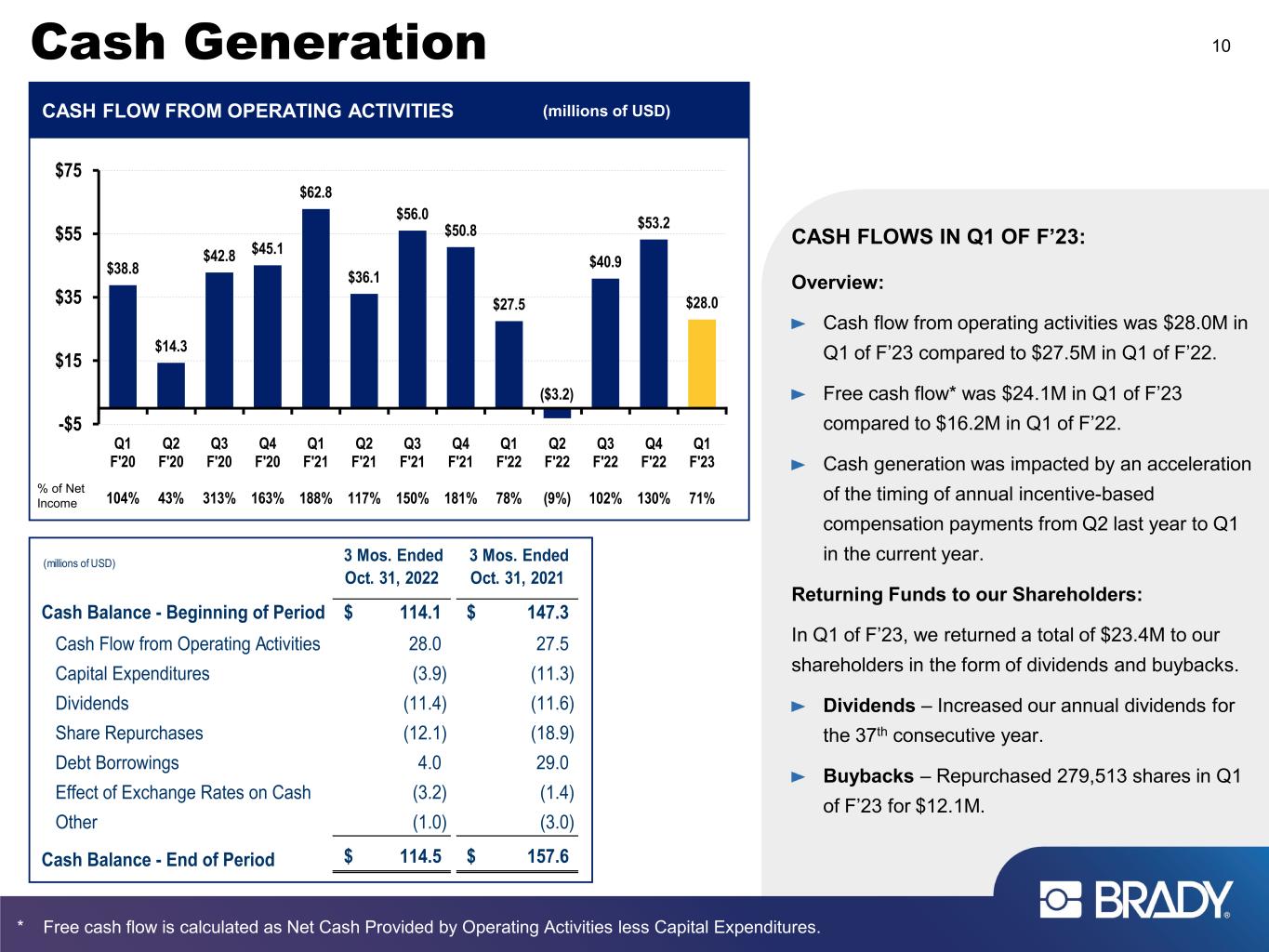

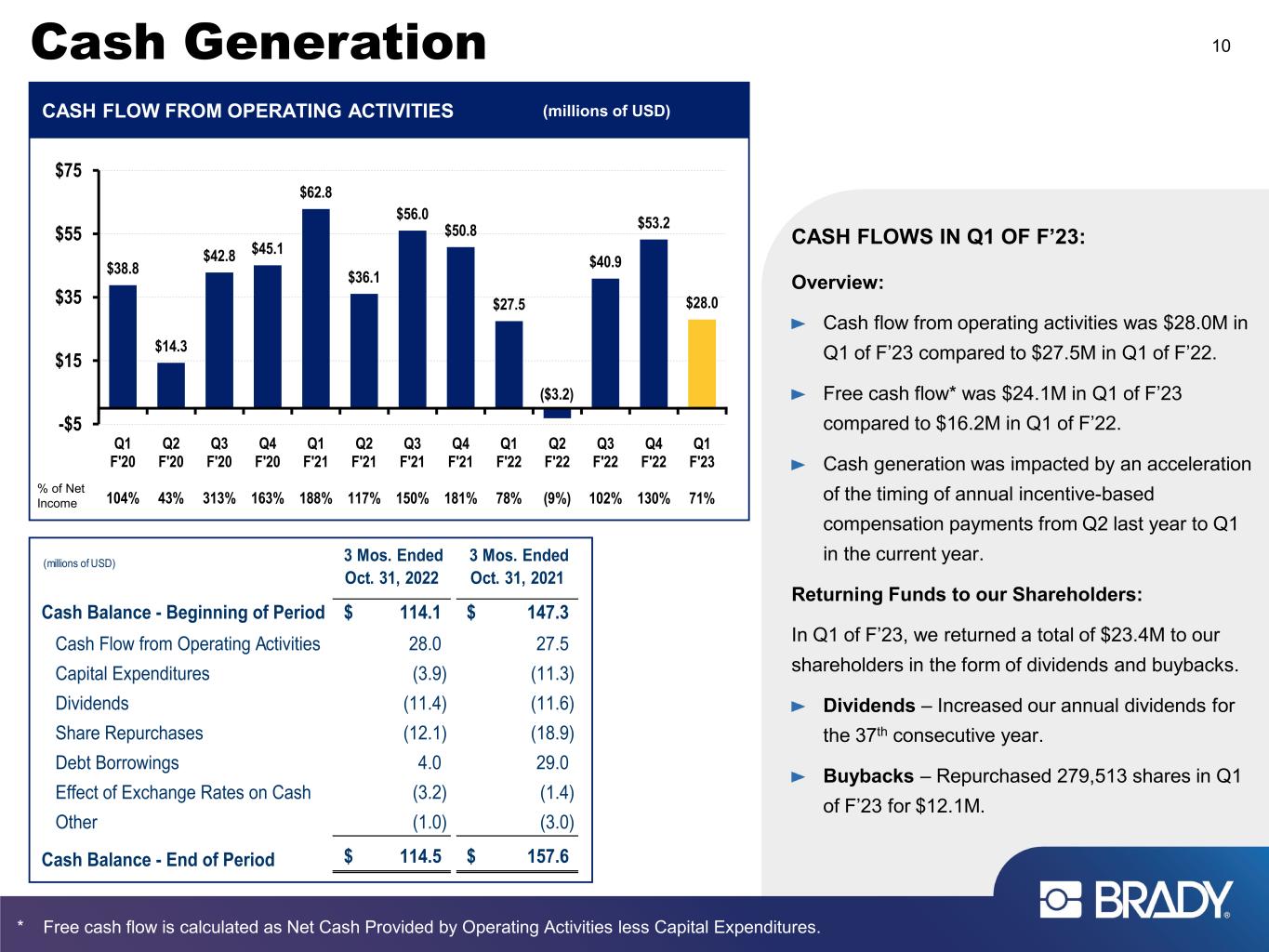

Cash Generation 10 CASH FLOW FROM OPERATING ACTIVITIES (millions of USD) $38.8 $14.3 $42.8 $45.1 $62.8 $36.1 $56.0 $50.8 $27.5 ($3.2) $40.9 $53.2 $28.0 -$5 $15 $35 $55 $75 Q1 F'20 104% Q2 F'20 43% Q3 F'20 313% Q4 F'20 163% Q1 F'21 188% Q2 F'21 117% Q3 F'21 150% Q4 F'21 181% Q1 F'22 78% Q2 F'22 (9%) Q3 F'22 102% Q4 F'22 130% Q1 F'23 71%% of Net Income CASH FLOWS IN Q1 OF F’23: Overview: Cash flow from operating activities was $28.0M in Q1 of F’23 compared to $27.5M in Q1 of F’22. Free cash flow* was $24.1M in Q1 of F’23 compared to $16.2M in Q1 of F’22. Cash generation was impacted by an acceleration of the timing of annual incentive-based compensation payments from Q2 last year to Q1 in the current year. Returning Funds to our Shareholders: In Q1 of F’23, we returned a total of $23.4M to our shareholders in the form of dividends and buybacks. Dividends – Increased our annual dividends for the 37th consecutive year. Buybacks – Repurchased 279,513 shares in Q1 of F’23 for $12.1M. * Free cash flow is calculated as Net Cash Provided by Operating Activities less Capital Expenditures. (millions of USD) 3 Mos. Ended Oct. 31, 2022 3 Mos. Ended Oct. 31, 2021 Cash Balance - Beginning of Period 114.1$ 147.3$ Cash Flow from Operating Activities 28.0 27.5 Capital Expenditures (3.9) (11.3) Dividends (11.4) (11.6) Share Repurchases (12.1) (18.9) Debt Borrowings 4.0 29.0 Effect of Exchange Rates on Cash (3.2) (1.4) Other (1.0) (3.0) Cash Balance - End of Period 114.5$ 157.6$

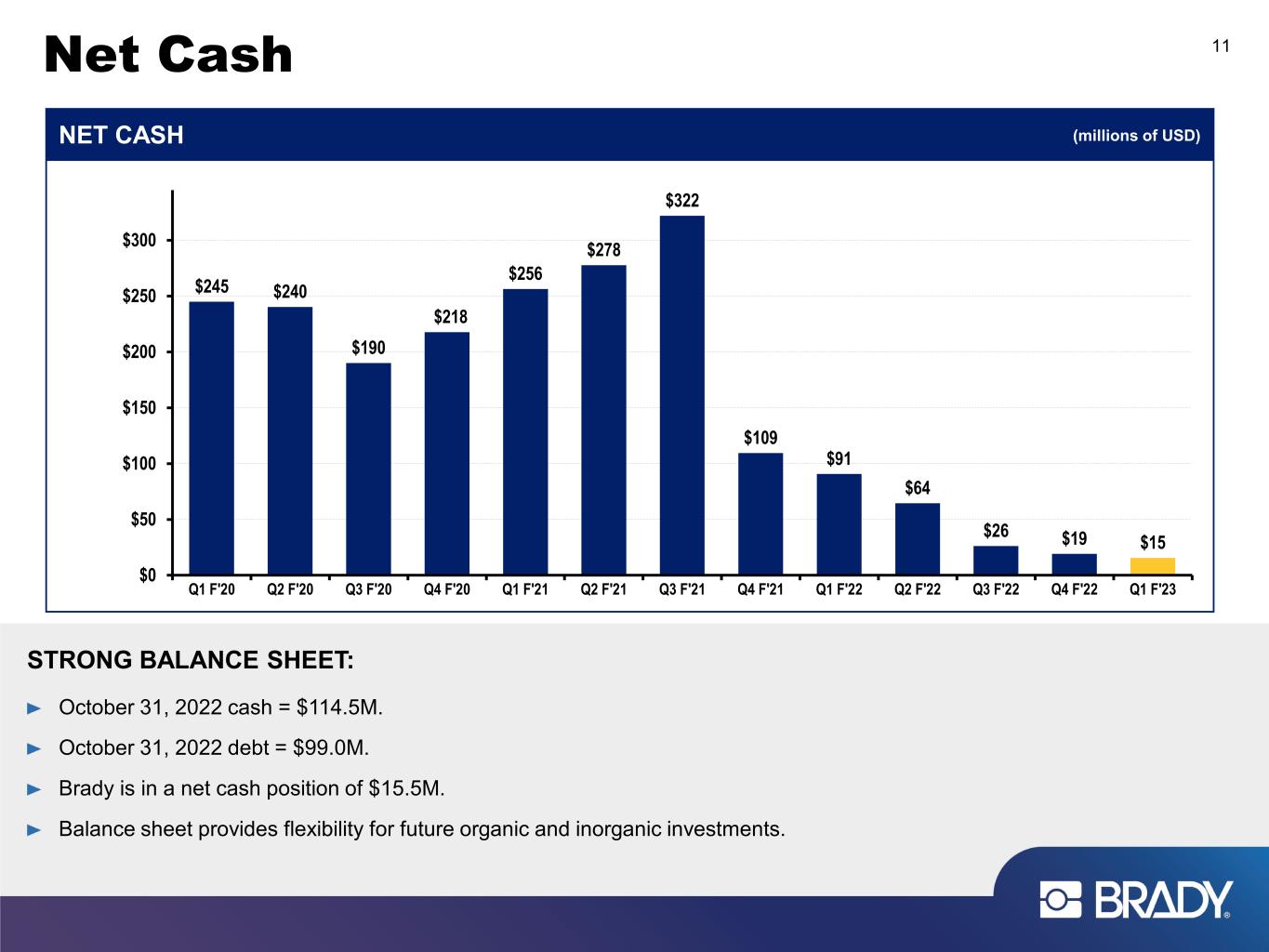

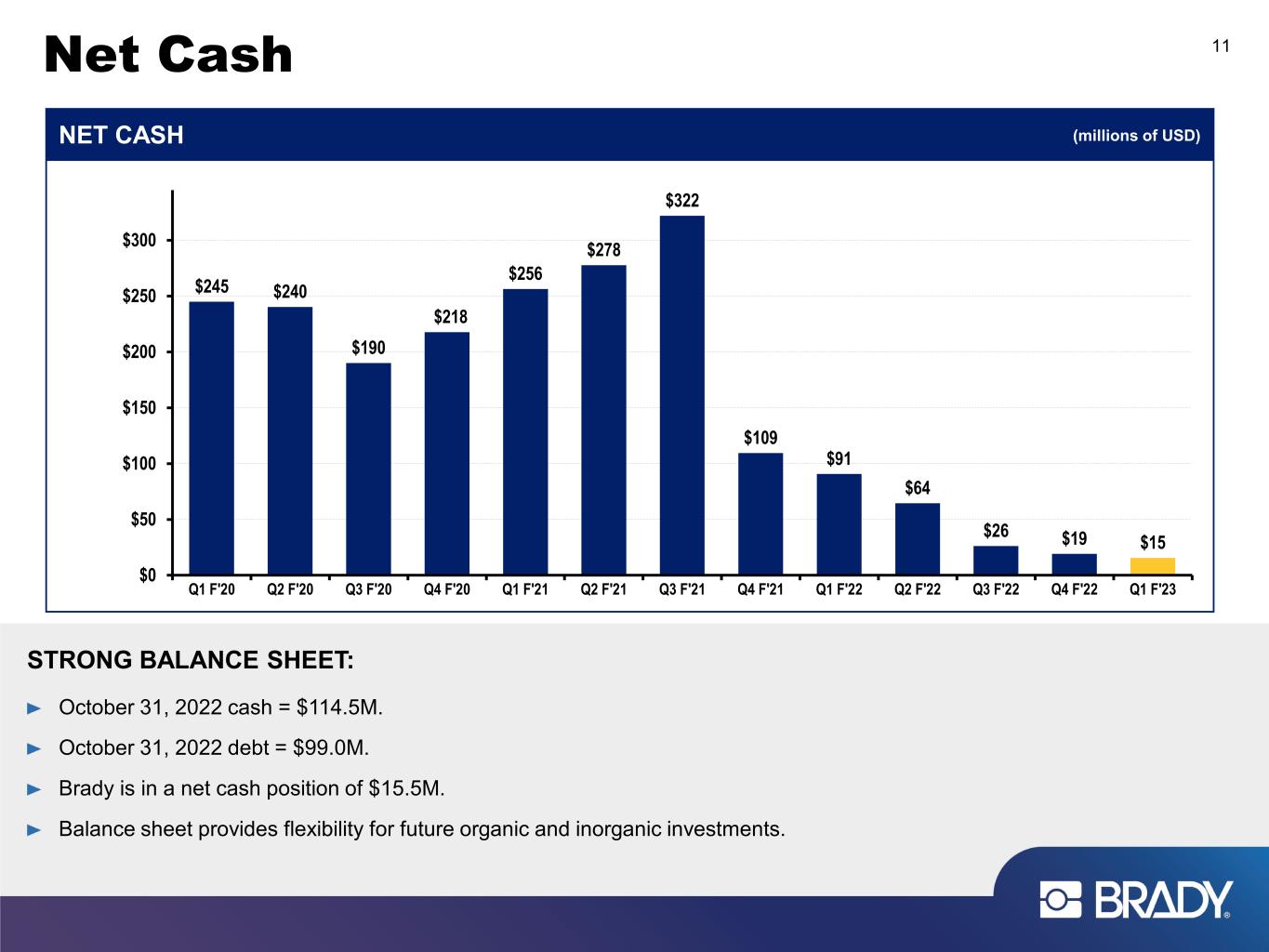

Net Cash 11 STRONG BALANCE SHEET: October 31, 2022 cash = $114.5M. October 31, 2022 debt = $99.0M. Brady is in a net cash position of $15.5M. Balance sheet provides flexibility for future organic and inorganic investments. $245 $240 $190 $218 $256 $278 $322 $109 $91 $64 $26 $19 $15 $0 $50 $100 $150 $200 $250 $300 Q1 F'20 Q2 F'20 Q3 F'20 Q4 F'20 Q1 F'21 Q2 F'21 Q3 F'21 Q4 F'21 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 NET CASH (millions of USD)

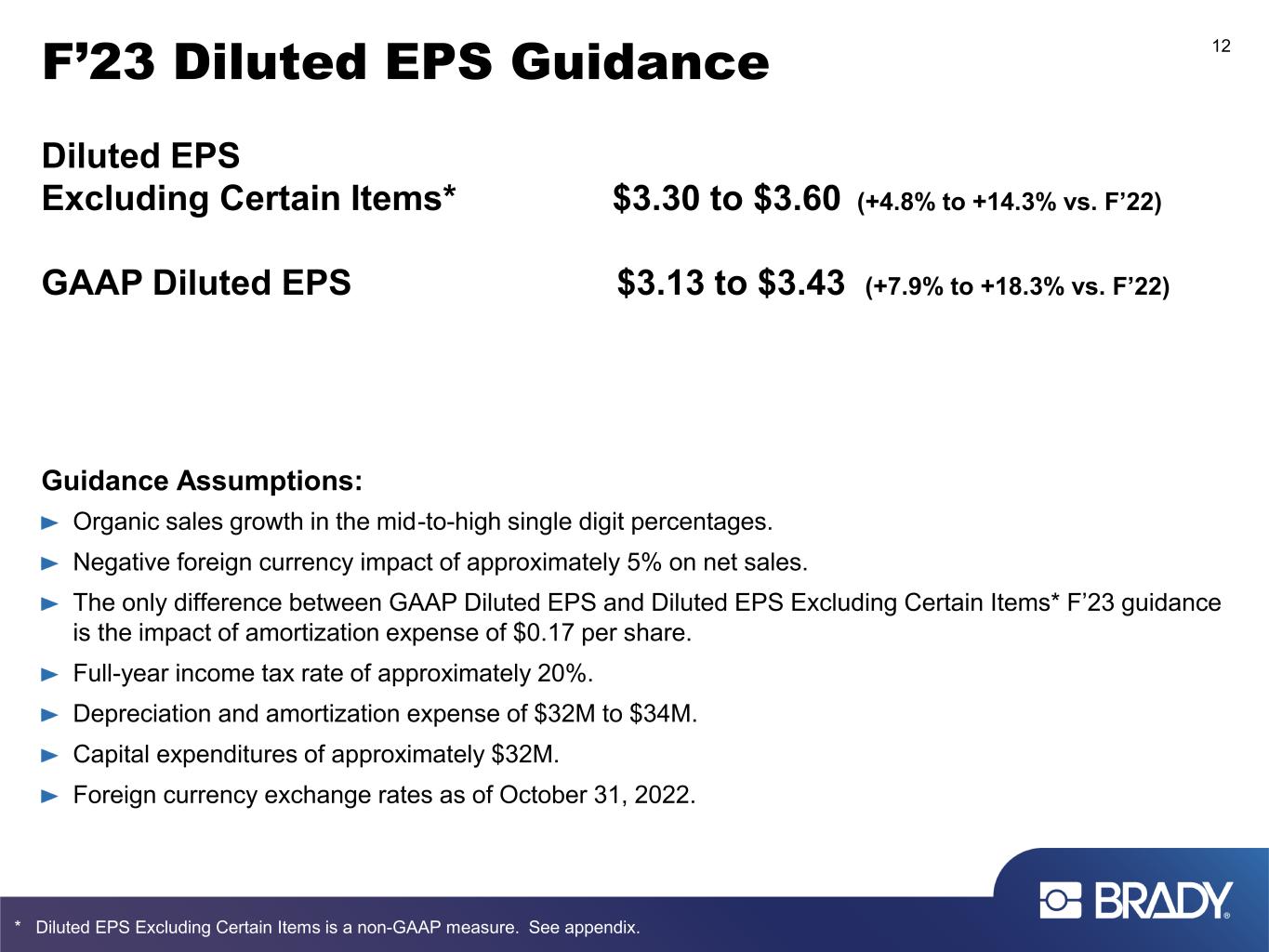

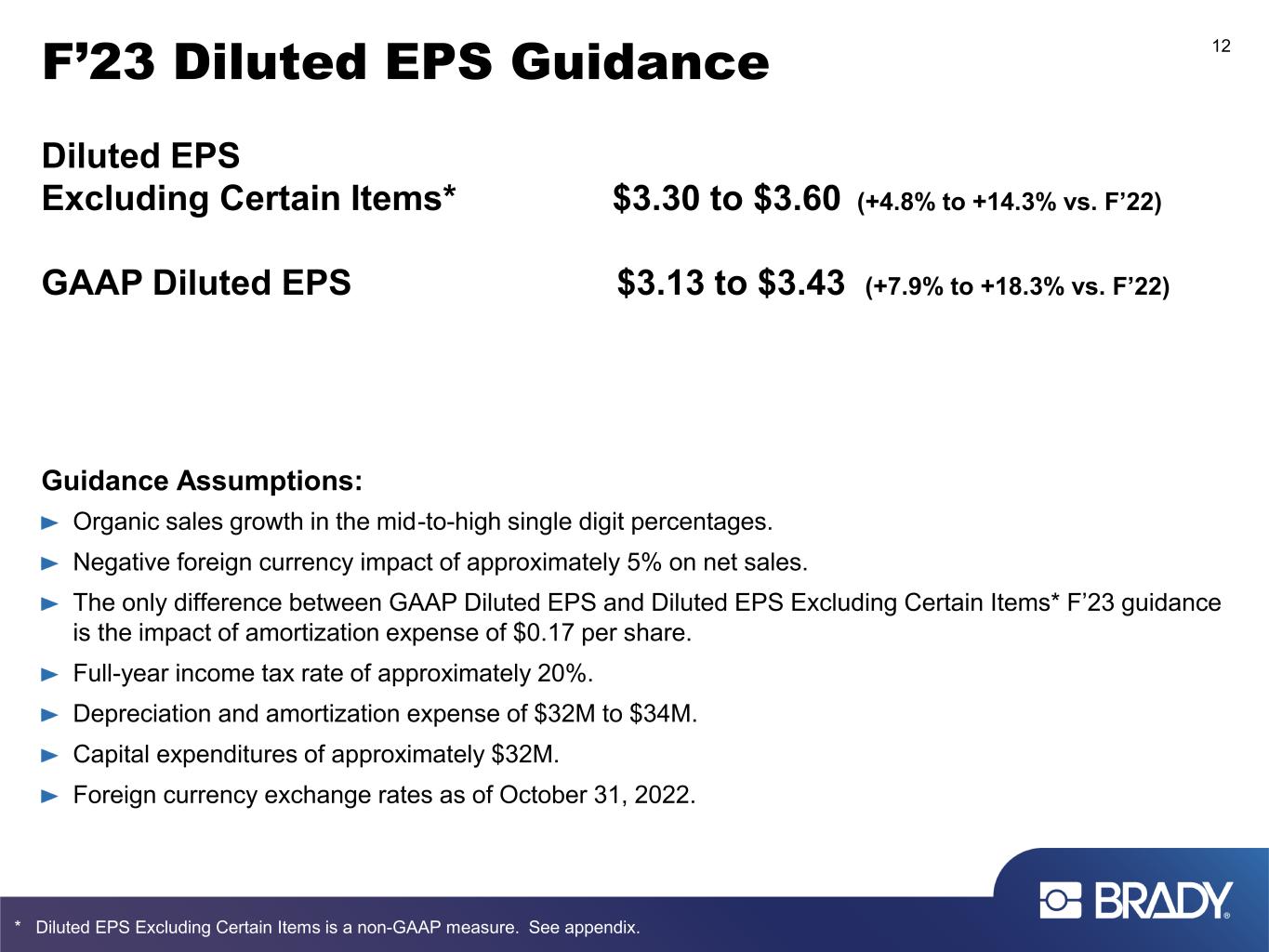

F’23 Diluted EPS Guidance Diluted EPS Excluding Certain Items* $3.30 to $3.60 (+4.8% to +14.3% vs. F’22) GAAP Diluted EPS $3.13 to $3.43 (+7.9% to +18.3% vs. F’22) Guidance Assumptions: Organic sales growth in the mid-to-high single digit percentages. Negative foreign currency impact of approximately 5% on net sales. The only difference between GAAP Diluted EPS and Diluted EPS Excluding Certain Items* F’23 guidance is the impact of amortization expense of $0.17 per share. Full-year income tax rate of approximately 20%. Depreciation and amortization expense of $32M to $34M. Capital expenditures of approximately $32M. Foreign currency exchange rates as of October 31, 2022. 12 * Diluted EPS Excluding Certain Items is a non-GAAP measure. See appendix.

Identification Solutions 13 • Revenues increased 3.1%: • Organic growth = + 8.6%. • Fx reduction = (5.5%). • Organic sales growth remains strong in all regions. The strongest organic sales growth was in Europe. • We are investing in geographic expansion, innovation and sales-generating resources. • Increased segment profit as a percent of sales versus the prior year was partially driven by reduced incentive-based compensation as well as benefits from pricing actions. Q1 F’23 SUMMARY:Q1 F’23 vs. Q1 F’22 (millions of USD) $198 $194 $218 $231 $249 $245 $264 $253 $256 20% 20% 22% 18% 20% 18% 20% 20% 20% 0% 5% 10% 15% 20% $150 $175 $200 $225 $250 $275 $300 $325 Q1 F'21 (8.4%) Q2 F'21 (6.9%) Q3 F'21 9.8% Q4 F'21 24.5% Q1 F'22 13.2% Q2 F'22 16.0% Q3 F'22 11.8% Q4 F'22 10.8% Q1 F'23 8.6% SALES & SEGMENT PROFIT % (millions of USD) • Organic sales growth in the mid-to-high single-digit percentages in F’23. • Continued profit growth, partially offset by increasing foreign currency headwinds as well as the negative impact of inflation on gross profit margins. OUTLOOK: Q1 F’23 Q1 F’22 Change Sales $ 256.4 $ 248.6 + 3.1% Segment Profit 51.5 48.8 + 5.5% Segment Profit % 20.1% 19.6% + 50 bps Organic Growth

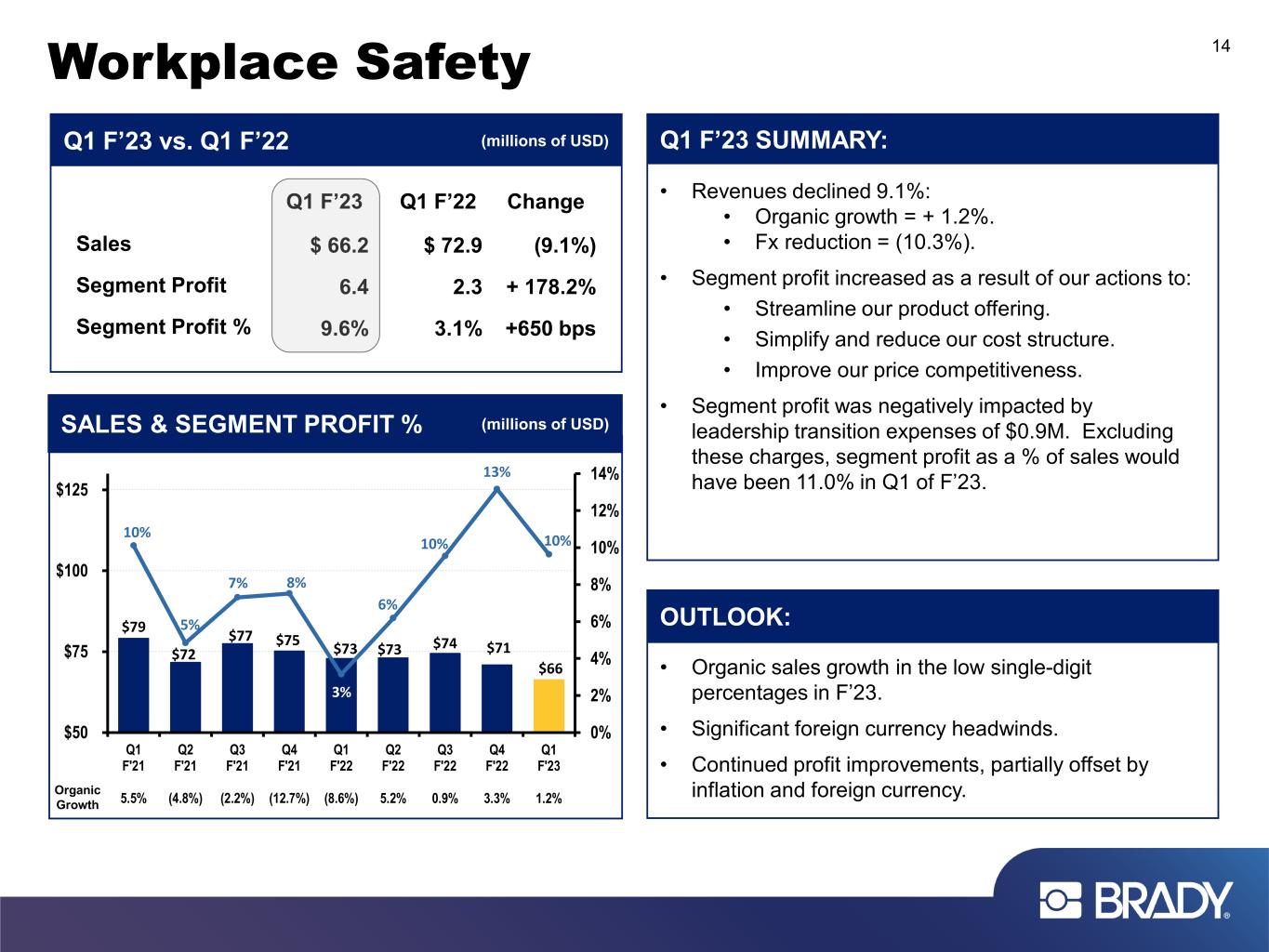

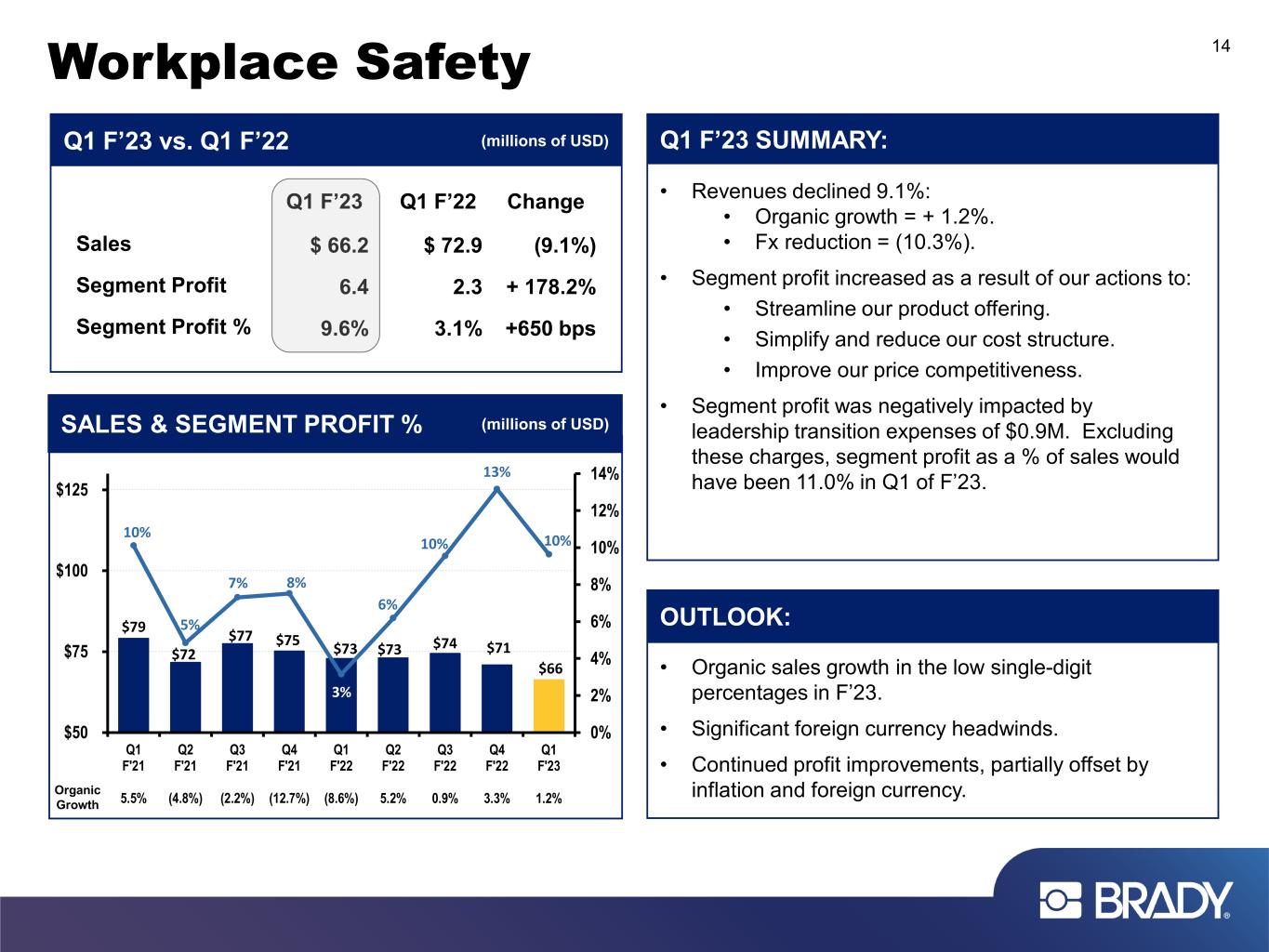

Workplace Safety 14 • Revenues declined 9.1%: • Organic growth = + 1.2%. • Fx reduction = (10.3%). • Segment profit increased as a result of our actions to: • Streamline our product offering. • Simplify and reduce our cost structure. • Improve our price competitiveness. • Segment profit was negatively impacted by leadership transition expenses of $0.9M. Excluding these charges, segment profit as a % of sales would have been 11.0% in Q1 of F’23. Q1 F’23 SUMMARY:Q1 F’23 vs. Q1 F’22 (millions of USD) • Organic sales growth in the low single-digit percentages in F’23. • Significant foreign currency headwinds. • Continued profit improvements, partially offset by inflation and foreign currency. OUTLOOK: Q1 F’23 Q1 F’22 Change Sales $ 66.2 $ 72.9 (9.1%) Segment Profit 6.4 2.3 + 178.2% Segment Profit % 9.6% 3.1% +650 bps $79 $72 $77 $75 $73 $73 $74 $71 $66 10% 5% 7% 8% 3% 6% 10% 13% 10% 0% 2% 4% 6% 8% 10% 12% 14% $50 $75 $100 $125 Q1 F'21 5.5% Q2 F'21 (4.8%) Q3 F'21 (2.2%) Q4 F'21 (12.7%) Q1 F'22 (8.6%) Q2 F'22 5.2% Q3 F'22 0.9% Q4 F'22 3.3% Q1 F'23 1.2% SALES & SEGMENT PROFIT % (millions of USD) Organic Growth

Investor Relations Brady Contact: Ann Thornton Investor Relations 414-438-6887 Ann_Thornton@bradycorp.com See our website at www.bradycorp.com/investors 15

Appendix GAAP to Non-GAAP Reconciliations

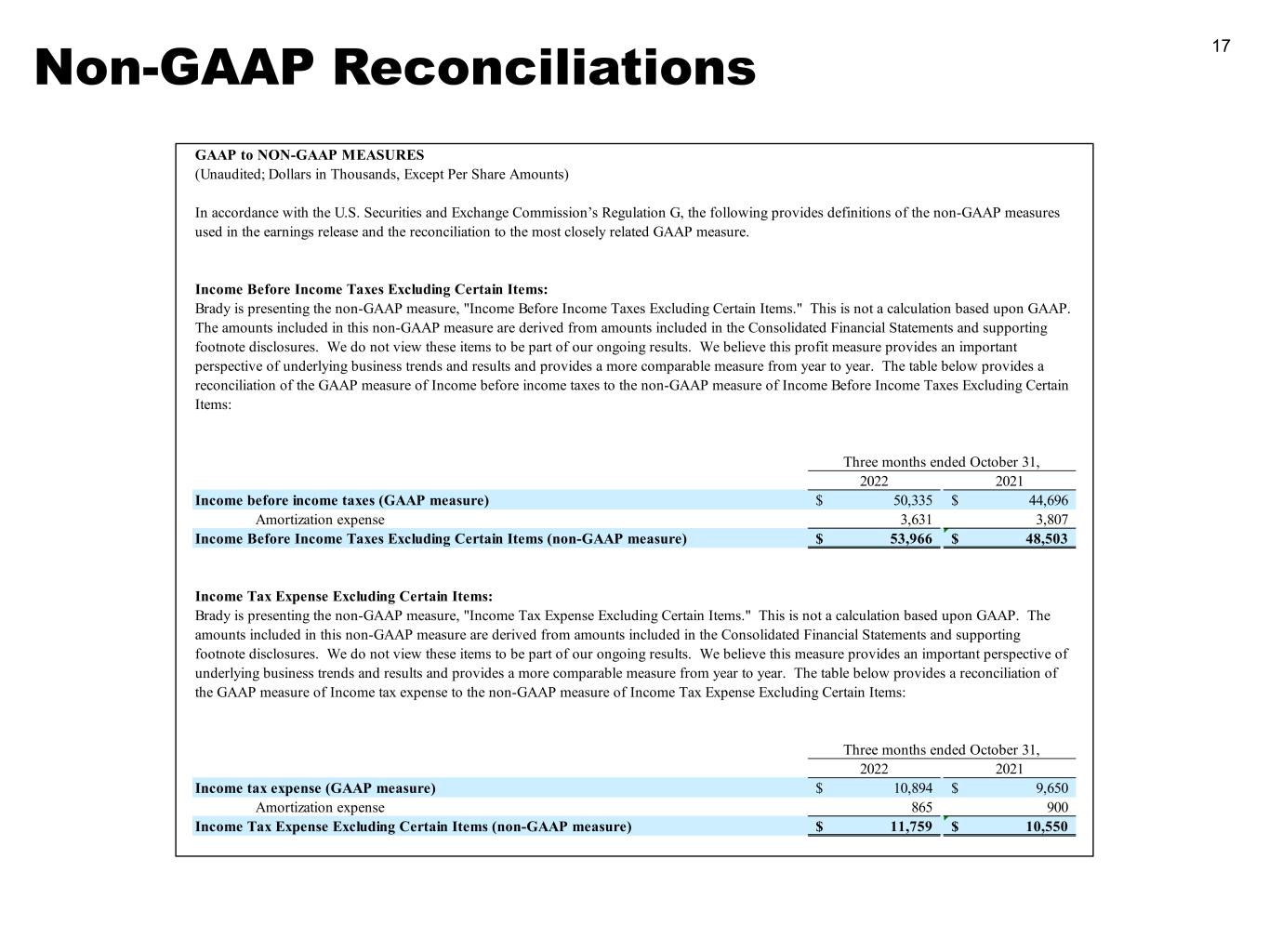

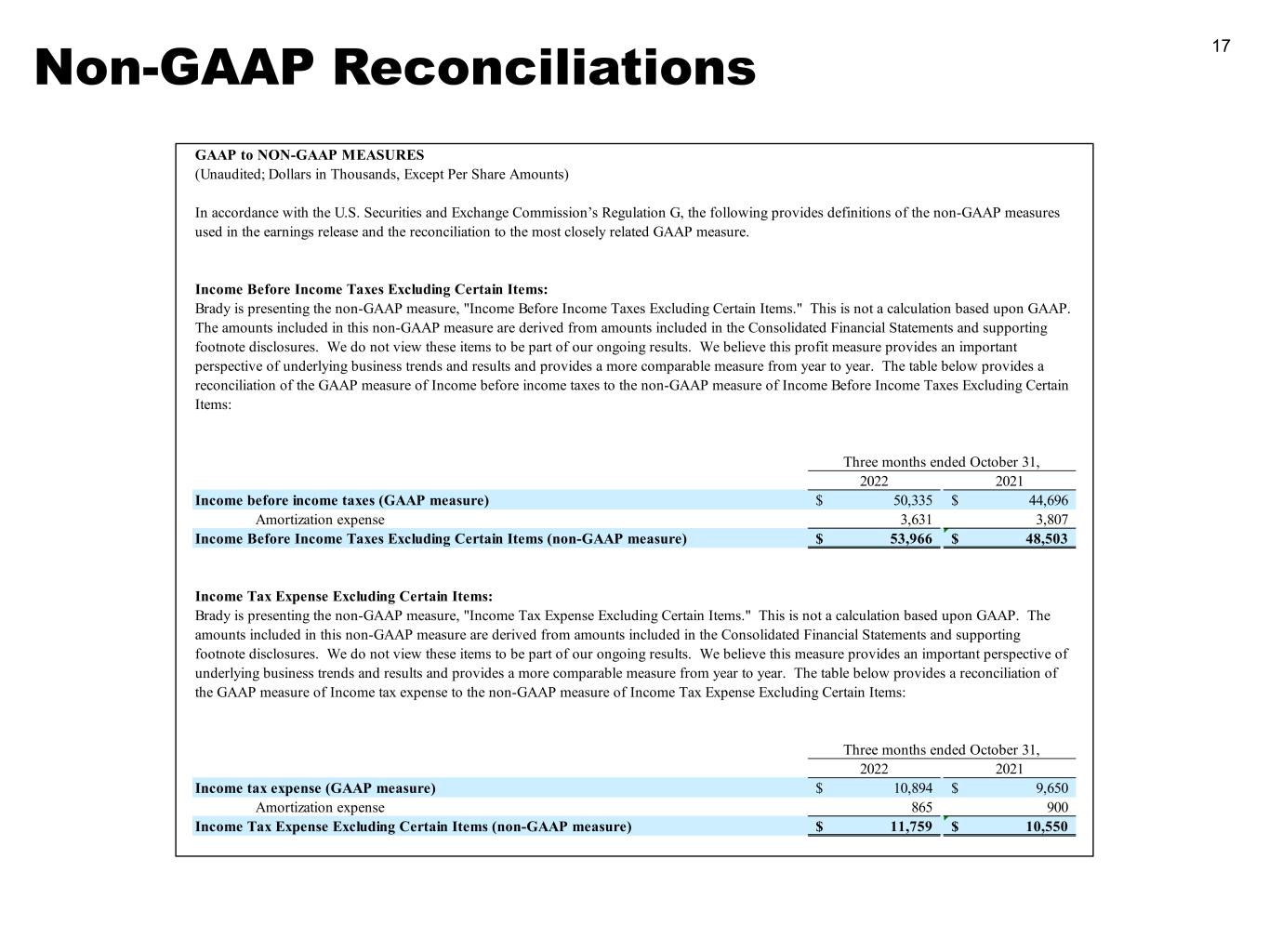

Non-GAAP Reconciliations 17 2022 2021 50,335$ 44,696$ Amortization expense 3,631 3,807 53,966$ 48,503$ 2022 2021 10,894$ 9,650$ Amortization expense 865 900 11,759$ 10,550$ Income Tax Expense Excluding Certain Items (non-GAAP measure) Income Before Income Taxes Excluding Certain Items (non-GAAP measure) Income tax expense (GAAP measure) Income Tax Expense Excluding Certain Items: Brady is presenting the non-GAAP measure, "Income Tax Expense Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income tax expense to the non-GAAP measure of Income Tax Expense Excluding Certain Items: Three months ended October 31, GAAP to NON-GAAP MEASURES Income Before Income Taxes Excluding Certain Items: (Unaudited; Dollars in Thousands, Except Per Share Amounts) In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure. Brady is presenting the non-GAAP measure, "Income Before Income Taxes Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this profit measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income before income taxes to the non-GAAP measure of Income Before Income Taxes Excluding Certain Items: Three months ended October 31, Income before income taxes (GAAP measure)

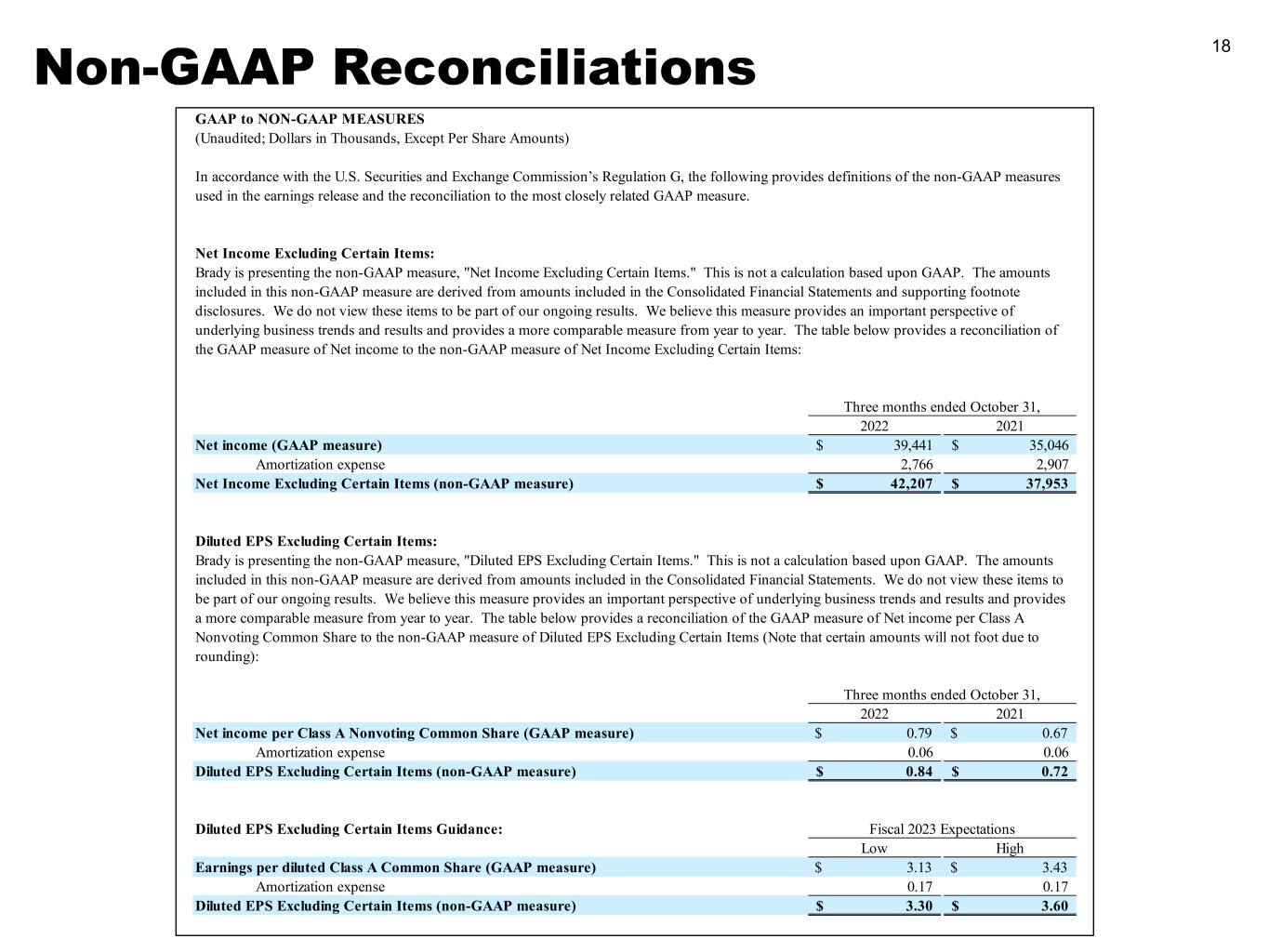

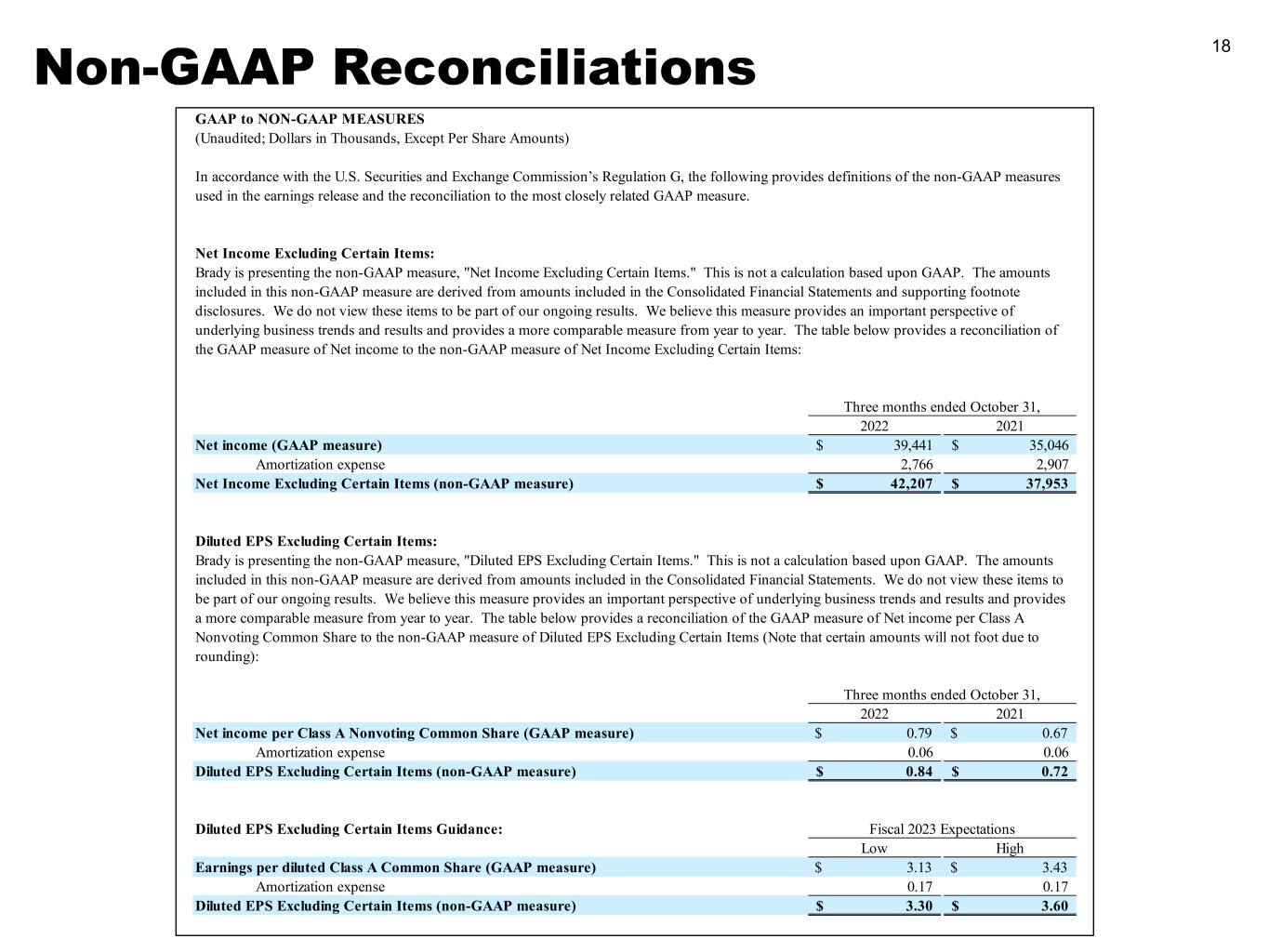

Non-GAAP Reconciliations 18 2022 2021 39,441$ 35,046$ Amortization expense 2,766 2,907 42,207$ 37,953$ 2022 2021 $ 0.79 $ 0.67 Amortization expense 0.06 0.06 0.84$ 0.72$ Diluted EPS Excluding Certain Items Guidance: Low High Earnings per diluted Class A Common Share (GAAP measure) $ 3.13 $ 3.43 Amortization expense 0.17 0.17 Diluted EPS Excluding Certain Items (non-GAAP measure) 3.30$ 3.60$ Fiscal 2023 Expectations Diluted EPS Excluding Certain Items (non-GAAP measure) Net Income Excluding Certain Items (non-GAAP measure) Net income (GAAP measure) Diluted EPS Excluding Certain Items: Brady is presenting the non-GAAP measure, "Diluted EPS Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income per Class A Nonvoting Common Share to the non-GAAP measure of Diluted EPS Excluding Certain Items (Note that certain amounts will not foot due to rounding): Three months ended October 31, Net income per Class A Nonvoting Common Share (GAAP measure) Three months ended October 31, GAAP to NON-GAAP MEASURES (Unaudited; Dollars in Thousands, Except Per Share Amounts) In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure. Brady is presenting the non-GAAP measure, "Net Income Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income to the non-GAAP measure of Net Income Excluding Certain Items: Net Income Excluding Certain Items: