F’25 Q2 Financial Results Brady Corporation February 21, 2025

Forward-Looking Statements In this news release, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, income, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project,” “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: increased cost of raw materials and labor as well as raw material shortages and supply chain disruptions; decreased demand for our products; our ability to compete effectively or to successfully execute our strategy; our ability to develop technologically advanced products that meet customer demands; Brady’s ability to identify, integrate, and grow acquired companies, and to manage contingent liabilities from divested businesses; difficulties in protecting our websites, networks and systems against security breaches; risks associated with the loss of key employees; extensive regulations by U.S. and non-U.S. governmental and self-regulatory entities; global climate change and environmental regulations; litigation, including product liability claims; foreign currency fluctuations; potential write-offs of goodwill and other intangible assets; differing interests of voting and non-voting shareholders and changes in the regulatory and business environment around dual-class voting structures; changes in tax legislation and tax rates; numerous other matters of national, regional and global scale, including major public health crises and government responses thereto and those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2024. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward- looking statements. Brady does not undertake to update its forward-looking statements except as required by law. 2

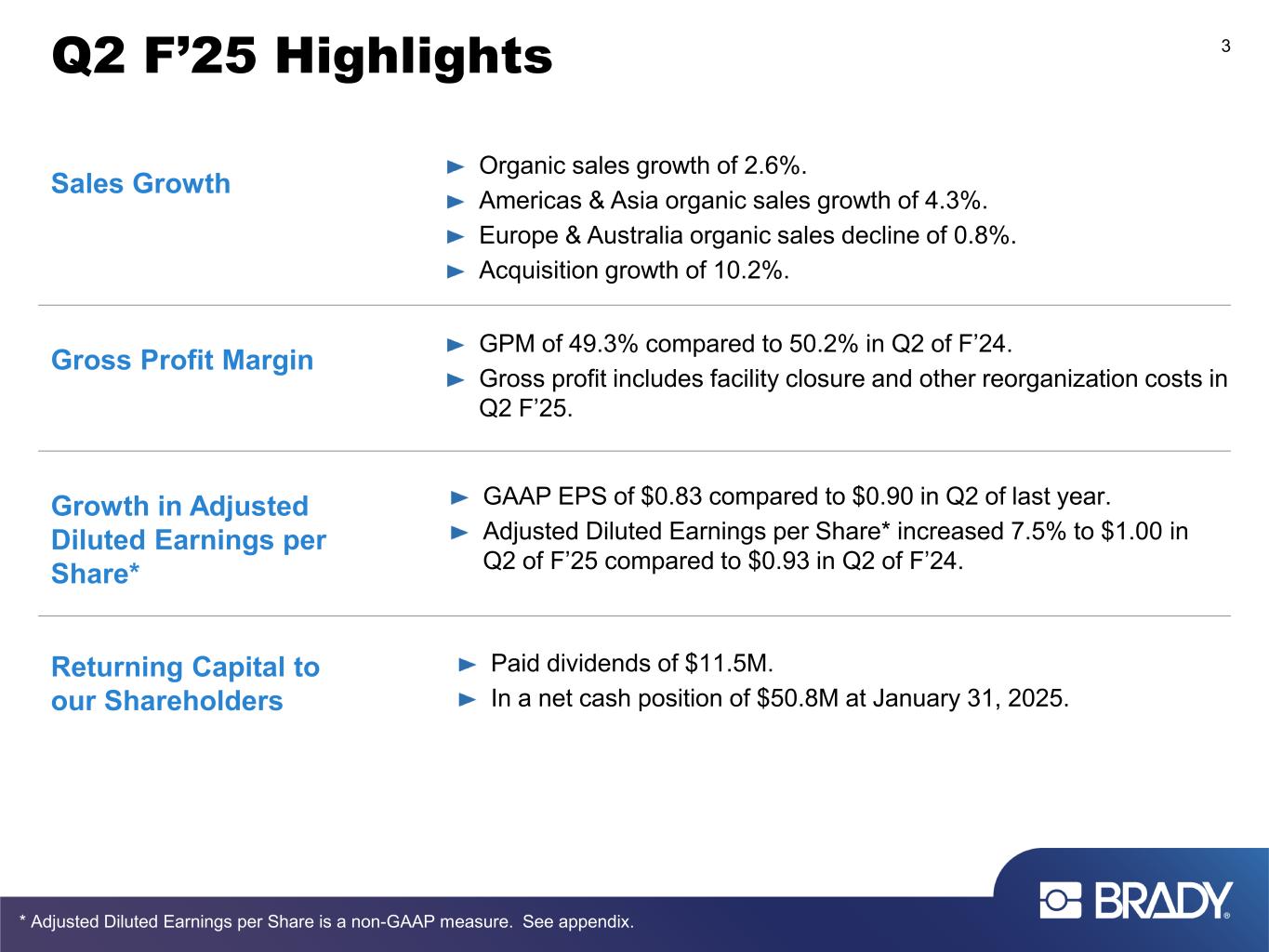

Q2 F’25 Highlights 3 * Adjusted Diluted Earnings per Share is a non-GAAP measure. See appendix. Organic sales growth of 2.6%. Americas & Asia organic sales growth of 4.3%. Europe & Australia organic sales decline of 0.8%. Acquisition growth of 10.2%. Sales Growth GPM of 49.3% compared to 50.2% in Q2 of F’24. Gross profit includes facility closure and other reorganization costs in Q2 F’25. Gross Profit Margin GAAP EPS of $0.83 compared to $0.90 in Q2 of last year. Adjusted Diluted Earnings per Share* increased 7.5% to $1.00 in Q2 of F’25 compared to $0.93 in Q2 of F’24. Growth in Adjusted Diluted Earnings per Share* Paid dividends of $11.5M. In a net cash position of $50.8M at January 31, 2025. Returning Capital to our Shareholders

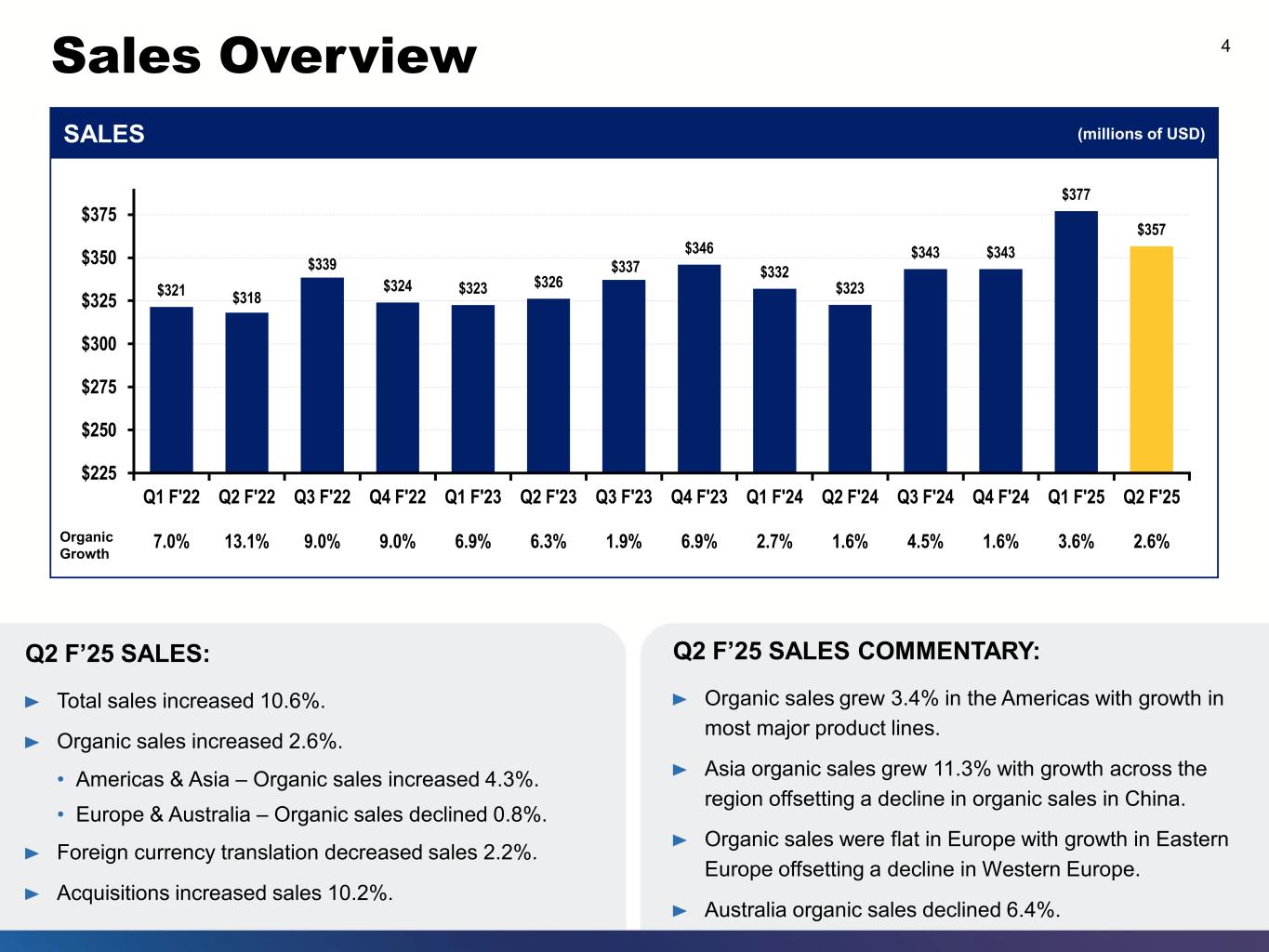

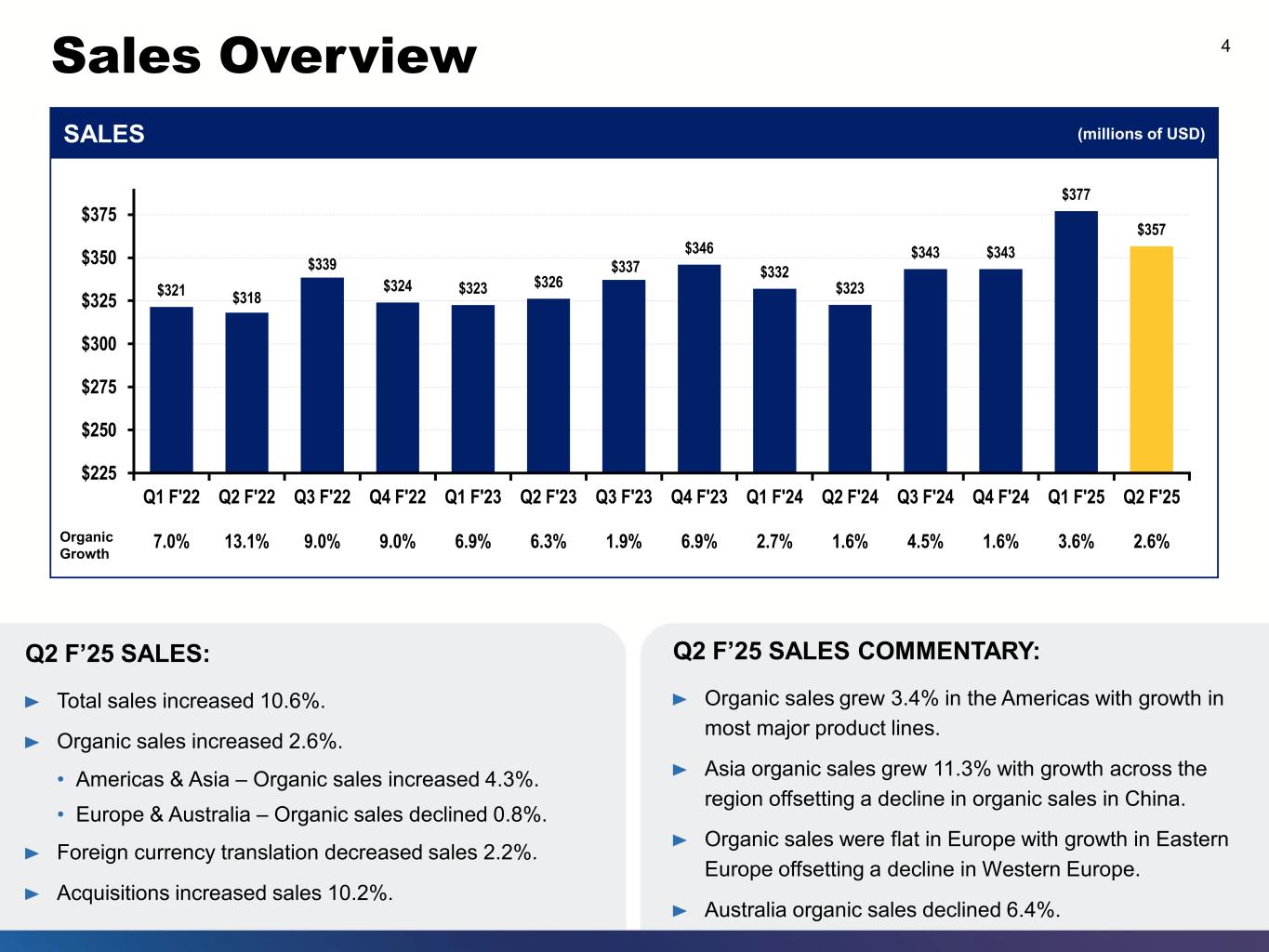

Sales Overview 4 Q2 F’25 SALES: Total sales increased 10.6%. Organic sales increased 2.6%. • Americas & Asia – Organic sales increased 4.3%. • Europe & Australia – Organic sales declined 0.8%. Foreign currency translation decreased sales 2.2%. Acquisitions increased sales 10.2%. $321 $318 $339 $324 $323 $326 $337 $346 $332 $323 $343 $343 $377 $357 $225 $250 $275 $300 $325 $350 $375 Q1 F'22 7.0% Q2 F'22 13.1% Q3 F'22 9.0% Q4 F'22 9.0% Q1 F'23 6.9% Q2 F'23 6.3% Q3 F'23 1.9% Q4 F'23 6.9% Q1 F'24 2.7% Q2 F'24 1.6% Q3 F'24 4.5% Q4 F'24 1.6% Q1 F'25 3.6% Q2 F'25 2.6%Organic Growth SALES (millions of USD) Q2 F’25 SALES COMMENTARY: Organic sales grew 3.4% in the Americas with growth in most major product lines. Asia organic sales grew 11.3% with growth across the region offsetting a decline in organic sales in China. Organic sales were flat in Europe with growth in Eastern Europe offsetting a decline in Western Europe. Australia organic sales declined 6.4%.

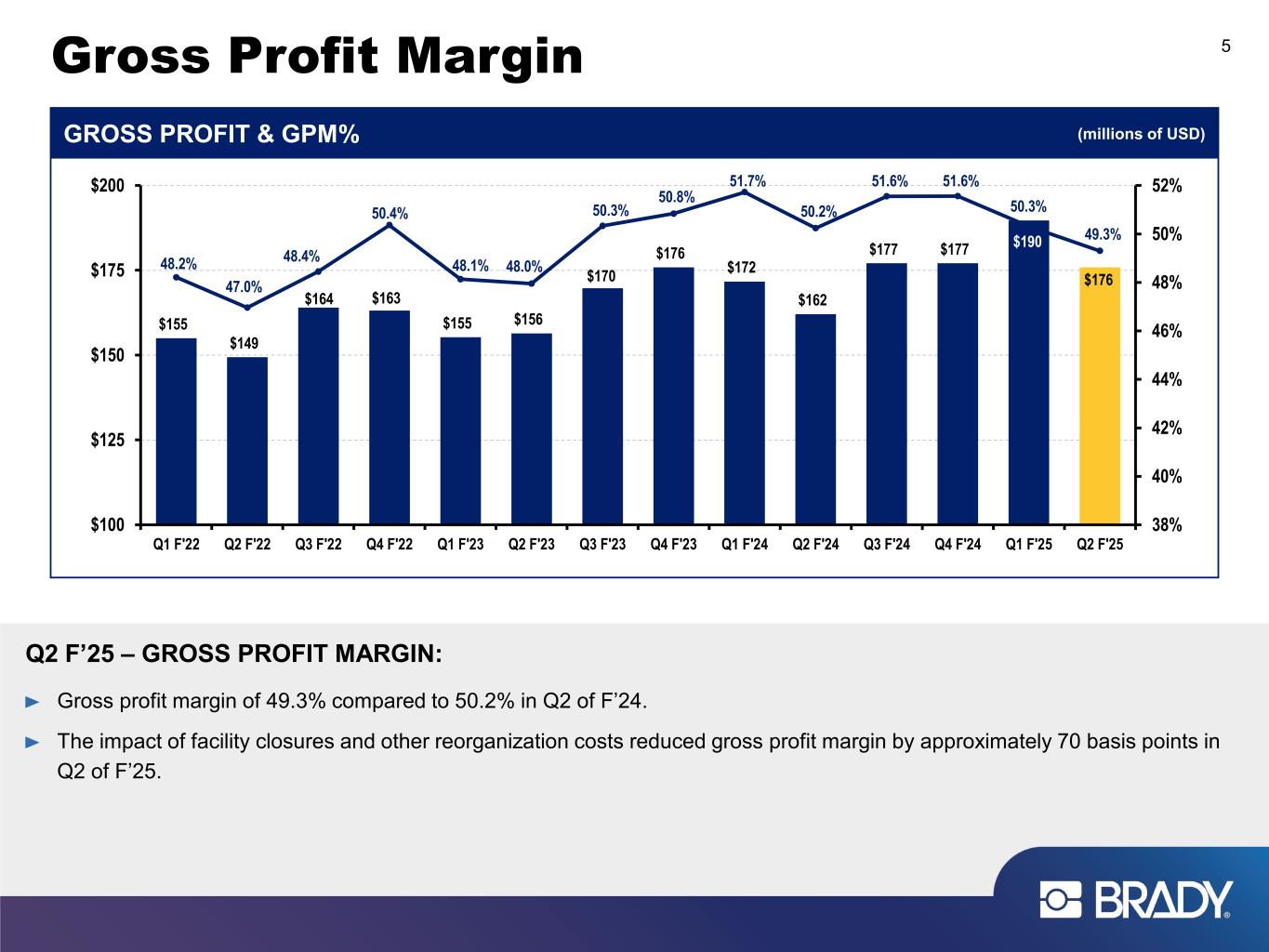

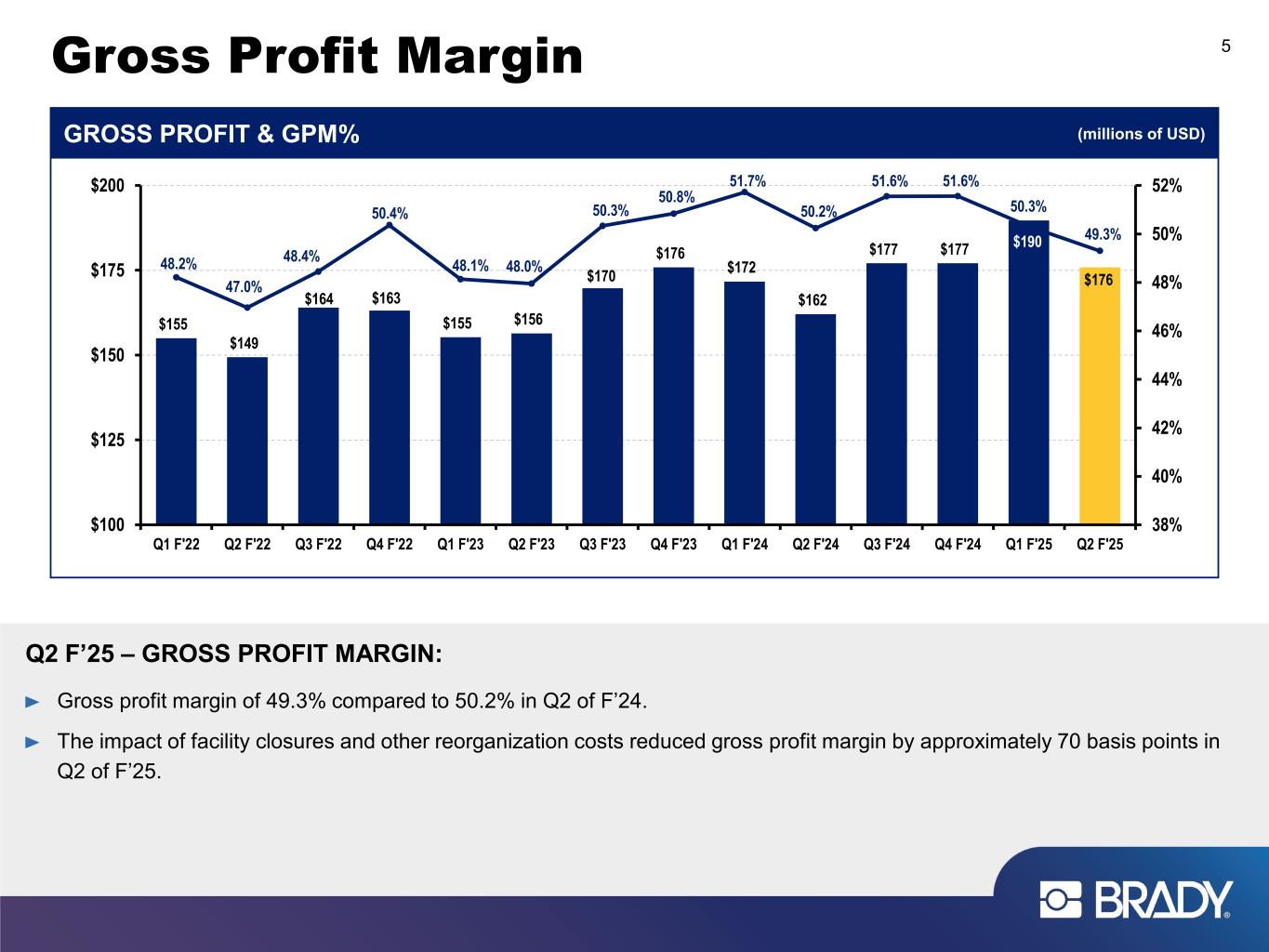

Gross Profit Margin 5 $155 $149 $164 $163 $155 $156 $170 $176 $172 $162 $177 $177 $190 $176 48.2% 47.0% 48.4% 50.4% 48.1% 48.0% 50.3% 50.8% 51.7% 50.2% 51.6% 51.6% 50.3% 49.3% 38% 40% 42% 44% 46% 48% 50% 52% $100 $125 $150 $175 $200 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 Q1 F'24 Q2 F'24 Q3 F'24 Q4 F'24 Q1 F'25 Q2 F'25 GROSS PROFIT & GPM% (millions of USD) Q2 F’25 – GROSS PROFIT MARGIN: Gross profit margin of 49.3% compared to 50.2% in Q2 of F’24. The impact of facility closures and other reorganization costs reduced gross profit margin by approximately 70 basis points in Q2 of F’25.

SG&A Expense 6 Q2 F’25 – SG&A EXPENSE: SG&A expense increased as a percent of sales when compared to Q2 last year primarily due to increased amortization and facility closure and other reorganization costs. Amortization expense was $4.7M in Q2 of F’25 and $2.4M in Q2 of F’24, and facility closure and other reorganization costs were $3.4M in Q2 of F’25. We continue to drive efficiencies in SG&A expenses while investing in sales-generating resources. $97 $93 $96 $95 $90 $92 $91 $97 $96 $91 $96 $93 $112 $106 30.1% 29.1% 28.4% 29.2% 27.9% 28.3% 27.0% 28.2% 29.0% 28.3% 27.9% 27.2% 29.7% 29.7% 10% 15% 20% 25% 30% 35% $60 $70 $80 $90 $100 $110 $120 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 Q1 F'24 Q2 F'24 Q3 F'24 Q4 F'24 Q1 F'25 Q2 F'25 SG&A EXPENSE AND SG&A EXPENSE AS A % OF SALES (millions of USD)

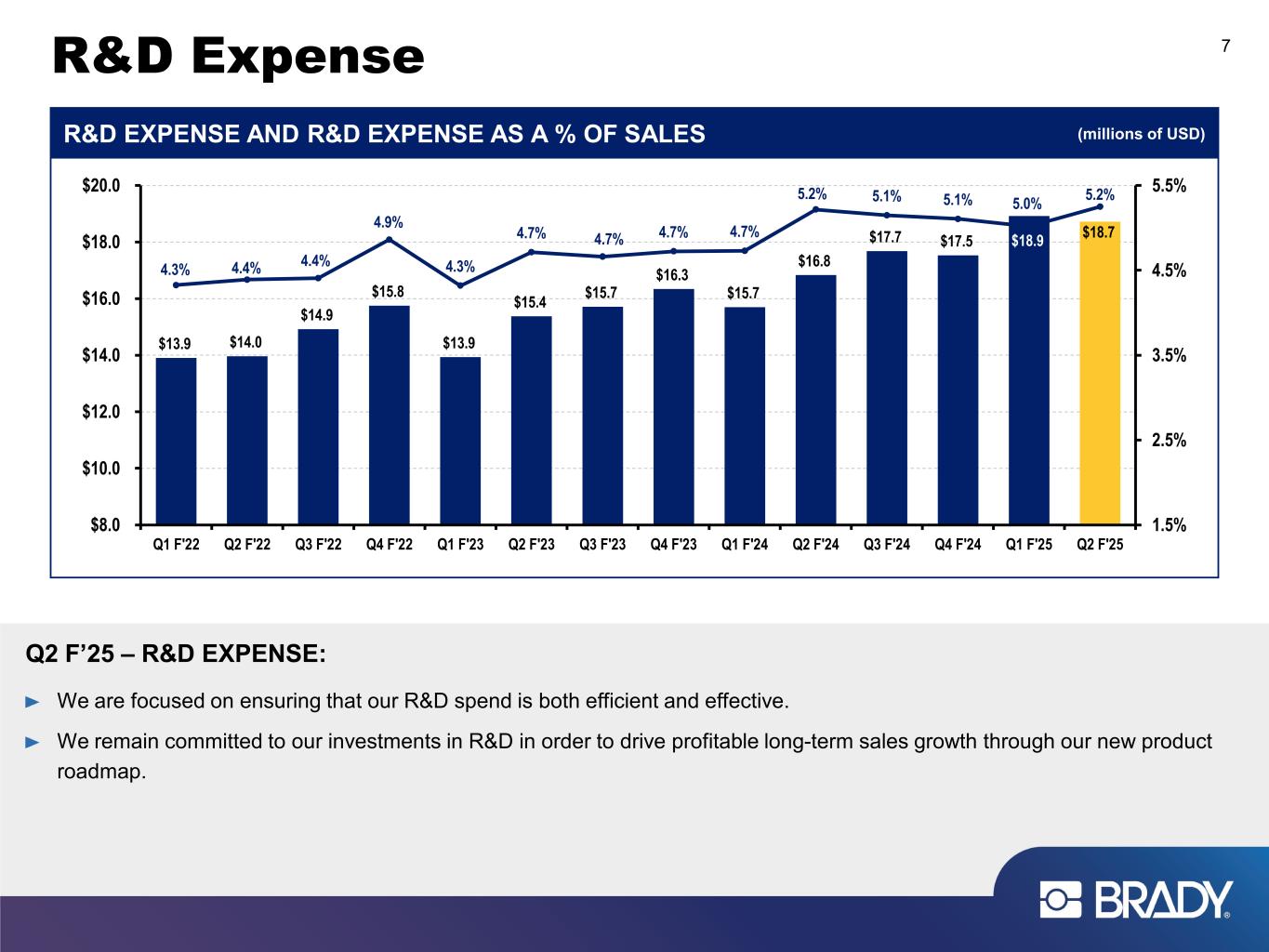

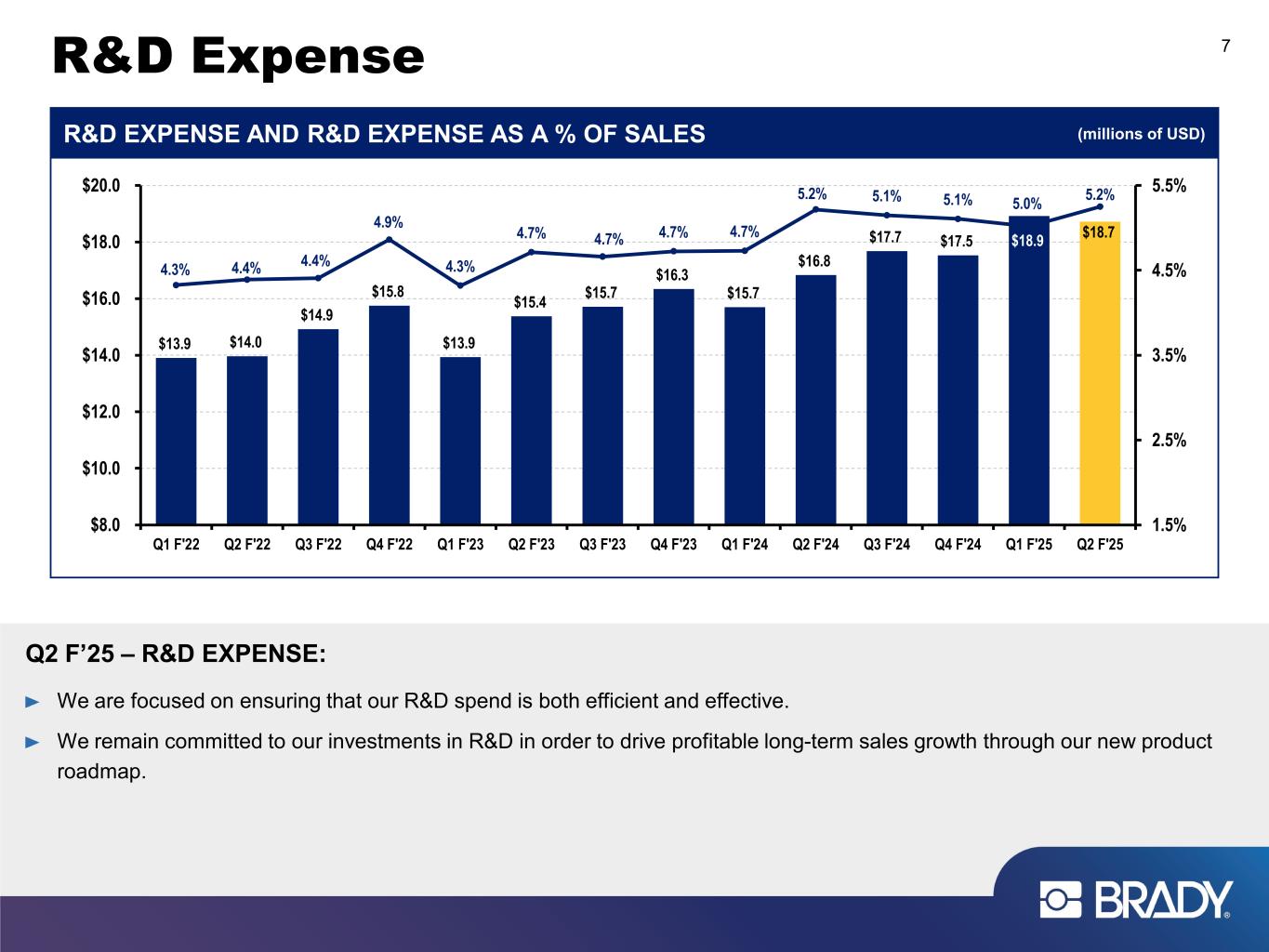

R&D Expense 7 Q2 F’25 – R&D EXPENSE: We are focused on ensuring that our R&D spend is both efficient and effective. We remain committed to our investments in R&D in order to drive profitable long-term sales growth through our new product roadmap. $13.9 $14.0 $14.9 $15.8 $13.9 $15.4 $15.7 $16.3 $15.7 $16.8 $17.7 $17.5 $18.9 $18.7 4.3% 4.4% 4.4% 4.9% 4.3% 4.7% 4.7% 4.7% 4.7% 5.2% 5.1% 5.1% 5.0% 5.2% 1.5% 2.5% 3.5% 4.5% 5.5% $8.0 $10.0 $12.0 $14.0 $16.0 $18.0 $20.0 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 Q1 F'24 Q2 F'24 Q3 F'24 Q4 F'24 Q1 F'25 Q2 F'25 R&D EXPENSE AND R&D EXPENSE AS A % OF SALES (millions of USD)

Income Before Income Taxes 8 $44.7 $42.0 $51.3 $54.0 $50.3 $48.5 $63.0 $63.8 $59.4 $55.8 $64.4 $68.2 $58.8 $52.0 $10 $20 $30 $40 $50 $60 $70 Q1 F'22 5.8% Q2 F'22 6.7% Q3 F'22 7.3% Q4 F'22 29.7% Q1 F'23 12.6% Q2 F'23 15.4% Q3 F'23 23.0% Q4 F'23 18.2% Q1 F'24 18.0% Q2 F'24 15.1% Q3 F'24 2.2% Q4 F'24 6.9% Q1 F'25 (1.0%) Q2 F'25 (6.8%) * Adjusted Income Before Income Taxes is a non-GAAP measure. See appendix. (millions of USD)INCOME BEFORE INCOME TAXES (GAAP) Q2 F’25 – INCOME BEFORE INCOME TAXES: GAAP Income before income taxes was down 6.8% to $52.0M in Q2 of F’25 compared to $55.8M in Q2 of F’24. Excluding adjusted* items from both periods, income before income taxes was up 7.2% to $62.4M in Q2 of F’25 compared to $58.2M in Q2 of F’24. Year-on-Year Growth (Decline)

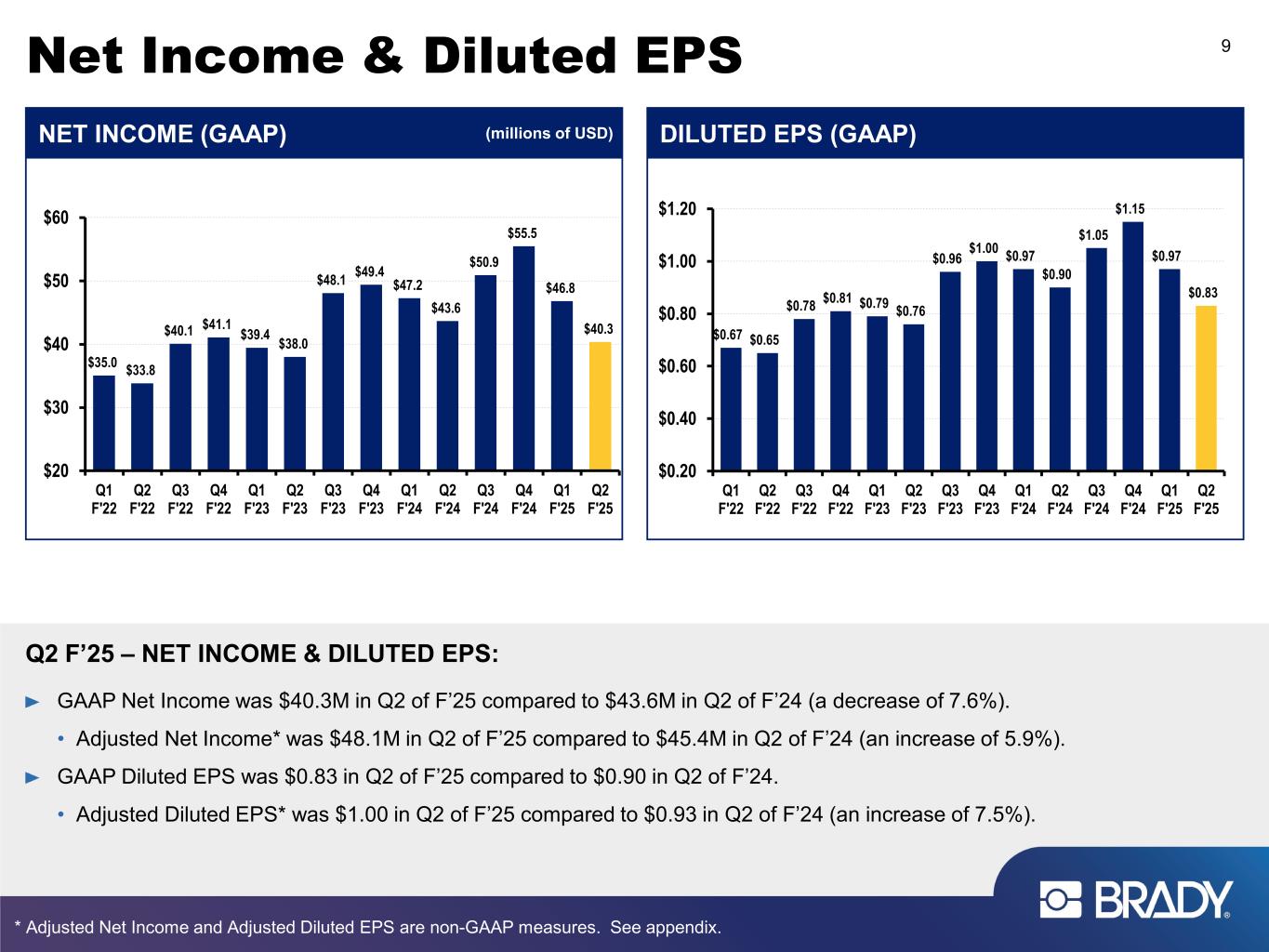

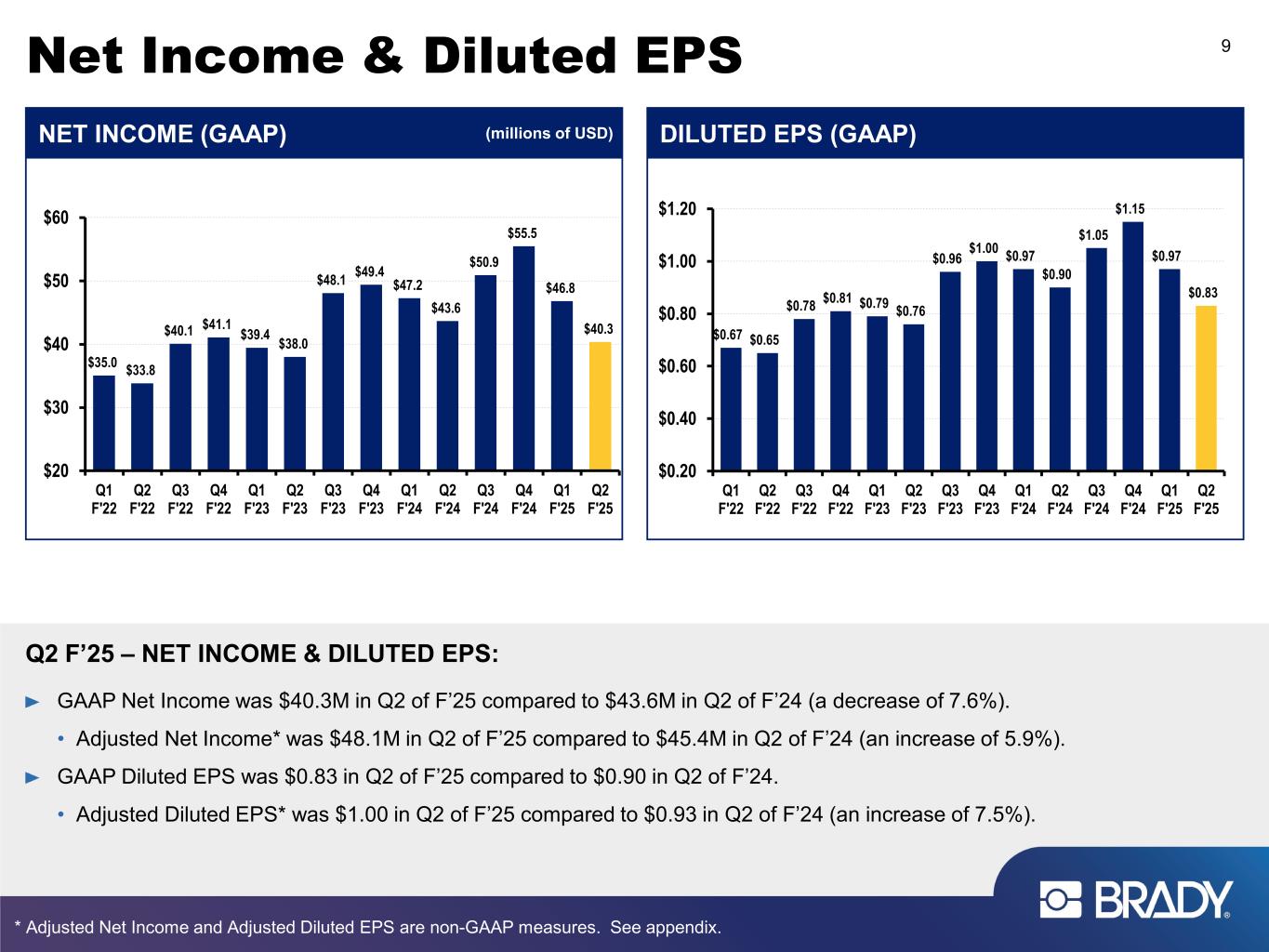

Net Income & Diluted EPS 9 Q2 F’25 – NET INCOME & DILUTED EPS: GAAP Net Income was $40.3M in Q2 of F’25 compared to $43.6M in Q2 of F’24 (a decrease of 7.6%). • Adjusted Net Income* was $48.1M in Q2 of F’25 compared to $45.4M in Q2 of F’24 (an increase of 5.9%). GAAP Diluted EPS was $0.83 in Q2 of F’25 compared to $0.90 in Q2 of F’24. • Adjusted Diluted EPS* was $1.00 in Q2 of F’25 compared to $0.93 in Q2 of F’24 (an increase of 7.5%). * Adjusted Net Income and Adjusted Diluted EPS are non-GAAP measures. See appendix. $35.0 $33.8 $40.1 $41.1 $39.4 $38.0 $48.1 $49.4 $47.2 $43.6 $50.9 $55.5 $46.8 $40.3 $20 $30 $40 $50 $60 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 Q1 F'24 Q2 F'24 Q3 F'24 Q4 F'24 Q1 F'25 Q2 F'25 NET INCOME (GAAP) (millions of USD) $0.67 $0.65 $0.78 $0.81 $0.79 $0.76 $0.96 $1.00 $0.97 $0.90 $1.05 $1.15 $0.97 $0.83 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 Q1 F'24 Q2 F'24 Q3 F'24 Q4 F'24 Q1 F'25 Q2 F'25 DILUTED EPS (GAAP)

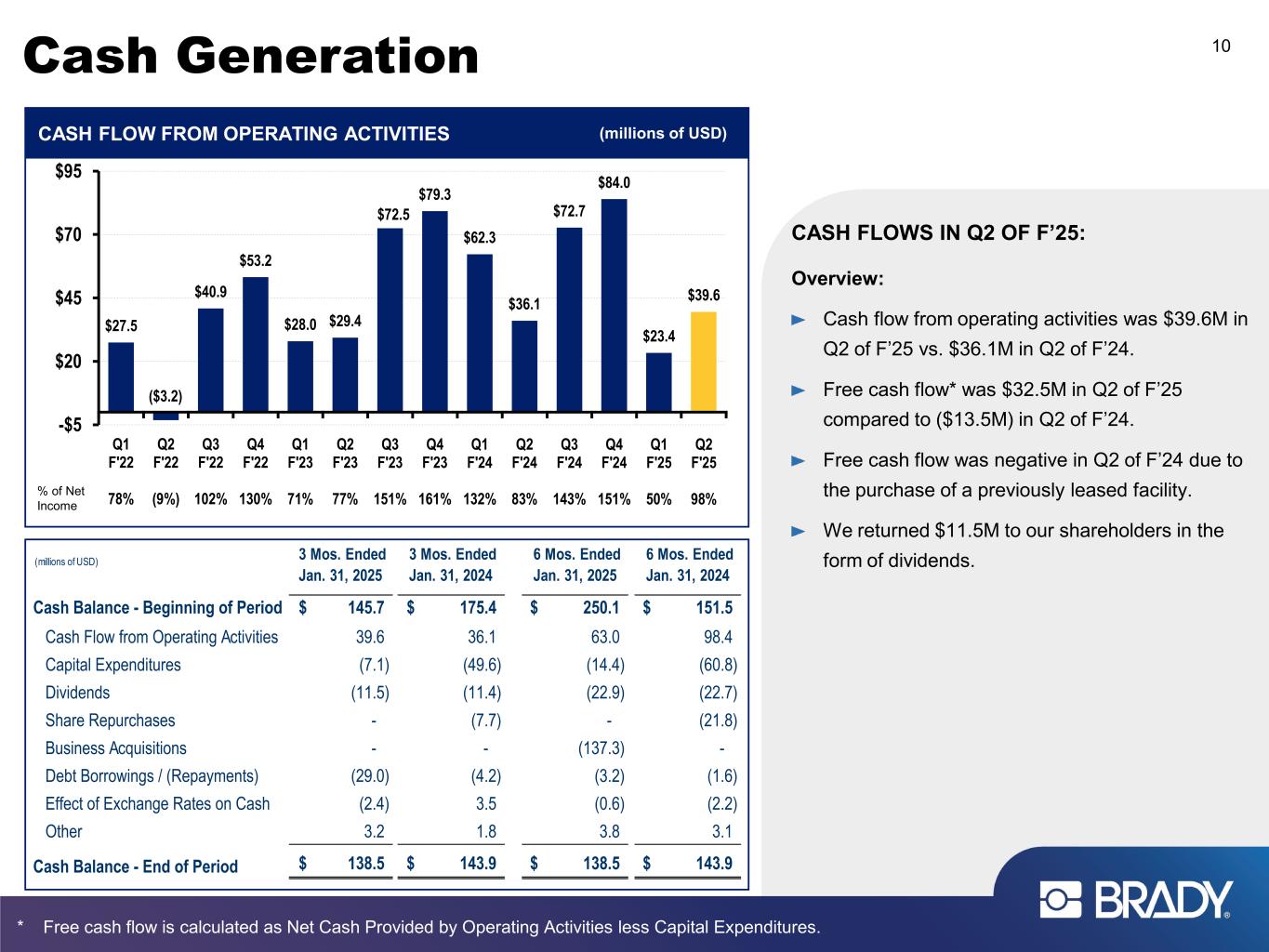

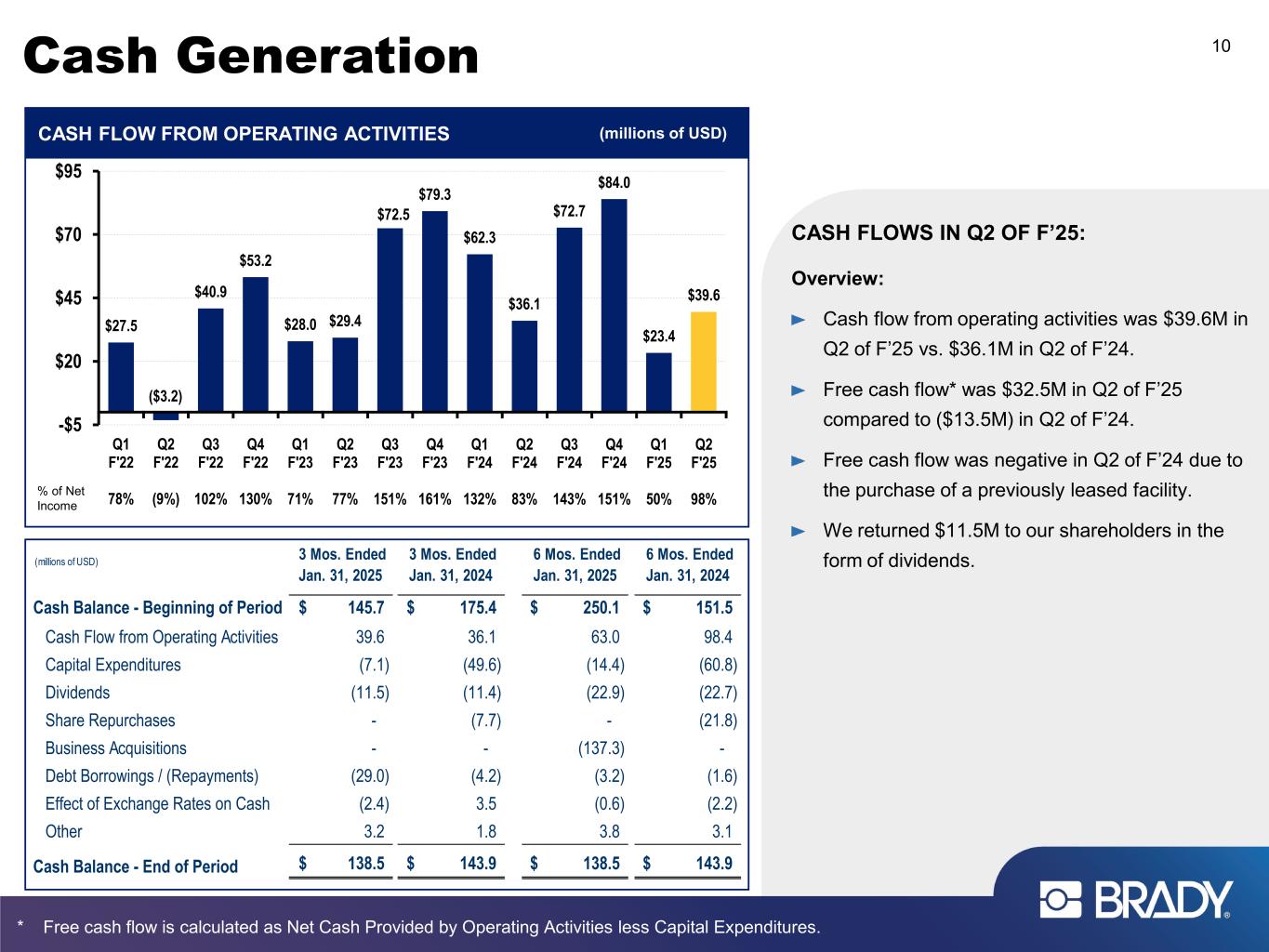

Cash Generation 10 CASH FLOW FROM OPERATING ACTIVITIES $27.5 ($3.2) $40.9 $53.2 $28.0 $29.4 $72.5 $79.3 $62.3 $36.1 $72.7 $84.0 $23.4 $39.6 -$5 $20 $45 $70 $95 Q1 F'22 78% Q2 F'22 (9%) Q3 F'22 102% Q4 F'22 130% Q1 F'23 71% Q2 F'23 77% Q3 F'23 151% Q4 F'23 161% Q1 F'24 132% Q2 F'24 83% Q3 F'24 143% Q4 F'24 151% Q1 F'25 50% Q2 F'25 98%% of Net Income CASH FLOWS IN Q2 OF F’25: Overview: Cash flow from operating activities was $39.6M in Q2 of F’25 vs. $36.1M in Q2 of F’24. Free cash flow* was $32.5M in Q2 of F’25 compared to ($13.5M) in Q2 of F’24. Free cash flow was negative in Q2 of F’24 due to the purchase of a previously leased facility. We returned $11.5M to our shareholders in the form of dividends. * Free cash flow is calculated as Net Cash Provided by Operating Activities less Capital Expenditures. (millions of USD) (millions of USD) 3 Mos. Ended Jan. 31, 2025 3 Mos. Ended Jan. 31, 2024 6 Mos. Ended Jan. 31, 2025 6 Mos. Ended Jan. 31, 2024 Cash Balance - Beginning of Period 145.7$ 175.4$ 250.1$ 151.5$ Cash Flow from Operating Activities 39.6 36.1 63.0 98.4 Capital Expenditures (7.1) (49.6) (14.4) (60.8) Dividends (11.5) (11.4) (22.9) (22.7) Share Repurchases - (7.7) - (21.8) Business Acquisitions - - (137.3) - Debt Borrowings / (Repayments) (29.0) (4.2) (3.2) (1.6) Effect of Exchange Rates on Cash (2.4) 3.5 (0.6) (2.2) Other 3.2 1.8 3.8 3.1 Cash Balance - End of Period 138.5$ 143.9$ 138.5$ 143.9$

Net Cash 11 STRONG BALANCE SHEET: January 31, 2025 cash = $138.5M. January 31, 2025 debt = $87.7M. Balance sheet provides flexibility for future organic and inorganic investments. $91 $64 $26 $19 $15 $31 $84 $102 $123 $96 $97 $159 $29 $51 $0 $50 $100 $150 $200 $250 $300 $350 Q1 F'22 Q2 F'22 Q3 F'22 Q4 F'22 Q1 F'23 Q2 F'23 Q3 F'23 Q4 F'23 Q1 F'24 Q2 F'24 Q3 F'24 Q4 F'24 Q1 F'25 Q2 F'25 NET CASH (millions of USD)

F’25 Diluted EPS Guidance GAAP Diluted EPS $3.99 to $4.24 F’25 Adjusted Diluted EPS* $4.45 to $4.70 Guidance Assumptions: Organic sales growth in the low-single digit percentages. Full-year income tax rate of approximately 21%. Foreign currency exchange rates as of January 31, 2025. Depreciation and amortization expense of approximately $40M. Capital expenditures of approximately $35M. Adjusted Diluted EPS guidance represents a range of 5.5% growth to 11.4% growth vs. F’24. 12 * Adjusted Diluted EPS is a non-GAAP measure. See appendix.

Americas & Asia 13 • Revenues increased 10.5% in Q2 of F’25: • Organic growth = + 4.3%. • Fx decrease = (1.4%). • Acquisition = + 7.6%. • Organic sales grew 3.4% in the Americas with growth in most major product lines. • Organic sales grew 11.3% in Asia; growth throughout the region more than offset an organic sales decline in China. • Growth in segment profit due to organic sales growth in higher gross margin product lines, which was partially offset by increased amortization from acquisitions and facility closure and other reorganization costs. Excluding these increased costs, segment profit increased 12.0%. Q2 F’25 SUMMARY:Q2 F’25 vs. Q2 F’24 (millions of USD) $218 $220 $223 $227 $222 $212 $225 $228 $245 $234 19% 18% 22% 22% 23% 21% 22% 23% 22% 20% 0% 5% 10% 15% 20% 25% $100 $150 $200 $250 $300 Q1 F'23 4.0% (1.4%) - Q2 F'23 6.9% (1.0%) - Q3 F'23 1.2% (0.8%) (0.3%) Q4 F'23 5.6% (0.2%) (1.0%) Q1 F'24 3.3% - (1.9%) Q2 F'24 1.2% 0.1% (5.1%) Q3 F'24 4.5% (0.1%) (3.5%) Q4 F'24 3.4% (0.8%) (2.2%) Q1 F'25 5.1% (0.2%) 5.8% Q2 F'25 4.3% (1.4%) 7.6% SALES & SEGMENT PROFIT % (millions of USD) Q2 F’25 Q2 F’24 Change Sales $ 233.8 $ 211.6 10.5% Segment Profit 46.0 43.9 + 4.8% Segment Profit % 19.7% 20.7% - 100 bps • Organic sales growth of approximately 4% in F’25. • Growth in segment profit excluding amortization and facility closure and other reorganization costs. OUTLOOK: Organic For. Curr. Acq. & Div.

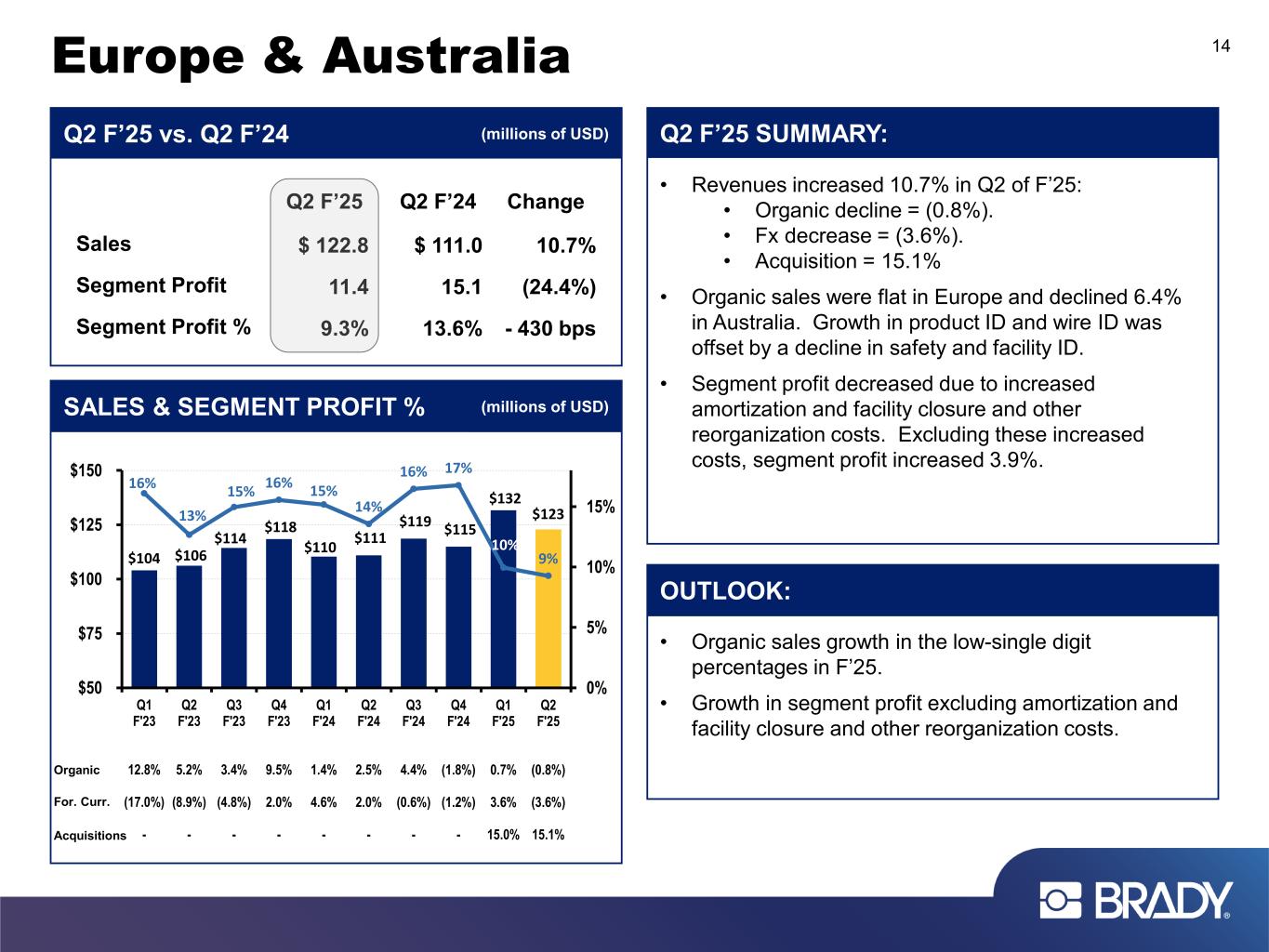

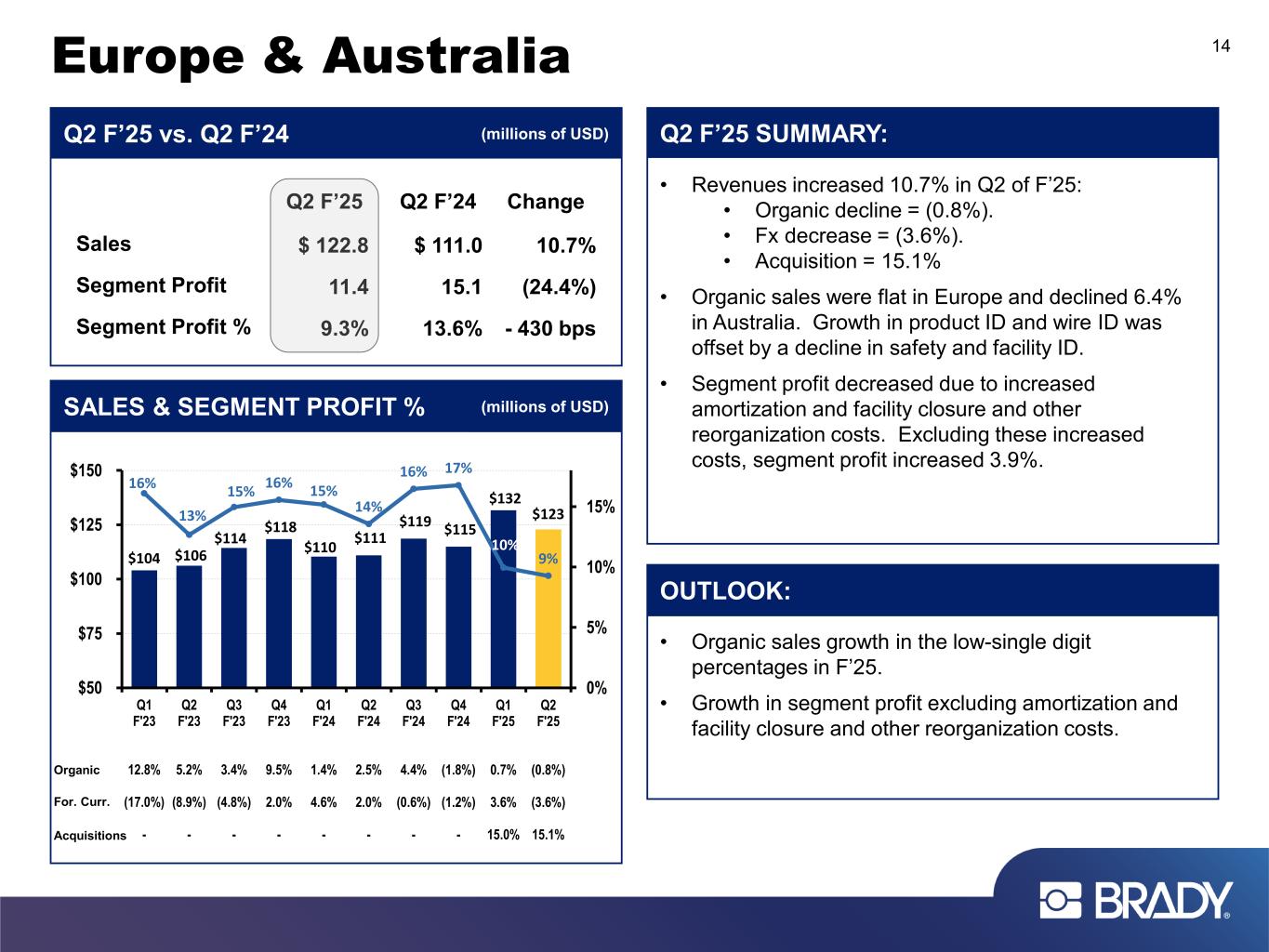

Europe & Australia 14 • Revenues increased 10.7% in Q2 of F’25: • Organic decline = (0.8%). • Fx decrease = (3.6%). • Acquisition = 15.1% • Organic sales were flat in Europe and declined 6.4% in Australia. Growth in product ID and wire ID was offset by a decline in safety and facility ID. • Segment profit decreased due to increased amortization and facility closure and other reorganization costs. Excluding these increased costs, segment profit increased 3.9%. Q2 F’25 SUMMARY:Q2 F’25 vs. Q2 F’24 (millions of USD) $104 $106 $114 $118 $110 $111 $119 $115 $132 $123 16% 13% 15% 16% 15% 14% 16% 17% 10% 9% 0% 5% 10% 15% $50 $75 $100 $125 $150 Q1 F'23 12.8% (17.0%) - Q2 F'23 5.2% (8.9%) - Q3 F'23 3.4% (4.8%) - Q4 F'23 9.5% 2.0% - Q1 F'24 1.4% 4.6% - Q2 F'24 2.5% 2.0% - Q3 F'24 4.4% (0.6%) - Q4 F'24 (1.8%) (1.2%) - Q1 F'25 0.7% 3.6% 15.0% Q2 F'25 (0.8%) (3.6%) 15.1% SALES & SEGMENT PROFIT % Q2 F’25 Q2 F’24 Change Sales $ 122.8 $ 111.0 10.7% Segment Profit 11.4 15.1 (24.4%) Segment Profit % 9.3% 13.6% - 430 bps Organic For. Curr. Acquisitions • Organic sales growth in the low-single digit percentages in F’25. • Growth in segment profit excluding amortization and facility closure and other reorganization costs. OUTLOOK: (millions of USD)

Investor Relations Brady Contact: Ann Thornton Investor Relations 414-438-6887 Ann_Thornton@bradycorp.com See our website at www.bradycorp.com/investors 15

Appendix GAAP to Non-GAAP Reconciliations

Non-GAAP Reconciliations 17 2025 2024 2025 2024 52,047$ 55,820$ 110,847$ 115,222$ Amortization expense 4,671 2,364 9,384 4,719 Facility closure and other reorganization costs 5,654 - 5,654 - Non-recurring acquisition-related costs and other expenses - - 5,059 - 62,372$ 58,184$ 130,944$ 119,941$ 2025 2024 2025 2024 11,713$ 12,192$ 23,730$ 24,353$ Amortization expense 1,125 548 2,258 1,094 Facility closure and other reorganization costs 1,413 - 1,413 - Non-recurring acquisition-related costs and other expenses - - 1,265 - 14,251$ 12,740$ 28,666$ 25,447$ GAAP to NON-GAAP MEASURES (Unaudited; Dollars in Thousands, Except Per Share Amounts) In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure. Three months ended January 31, Three months ended January 31, Adjusted Income Tax Expense (non-GAAP measure) Income before income taxes Adjusted Income Before Income Taxes (non-GAAP measure) Brady is presenting the non-GAAP measure, "Adjusted Income Tax Expense." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income tax expense to the non-GAAP measure of Adjusted Income Tax Expense: Six months ended January 31, Adjusted Income Before Income Taxes: Brady is presenting the non-GAAP measure, "Adjusted Income Before Income Taxes." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this profit measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income before income taxes to the non-GAAP measure of Adjusted Income Before Income Taxes: Adjusted Income Tax Expense: Six months ended January 31, Income tax expense (GAAP measure)

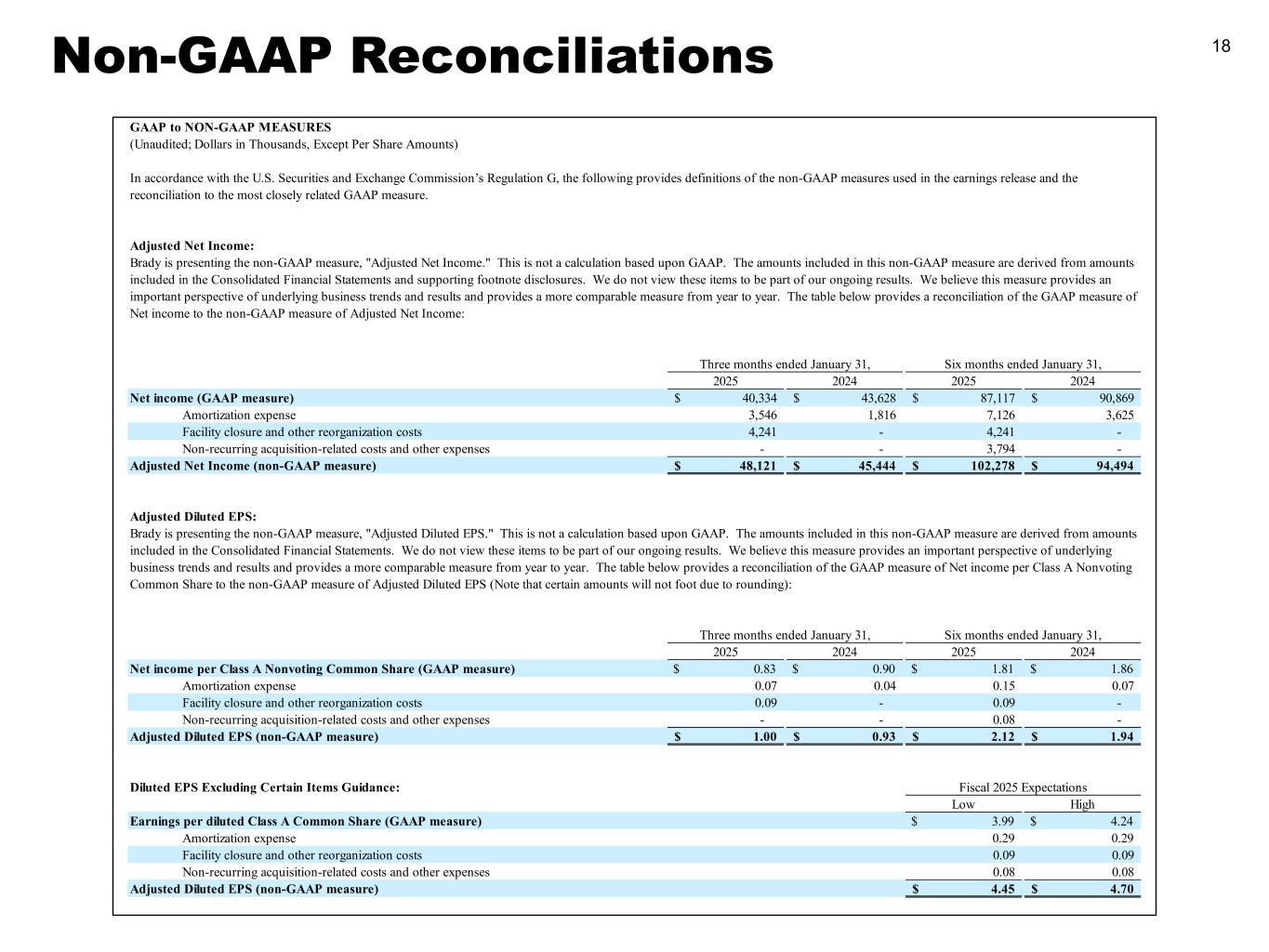

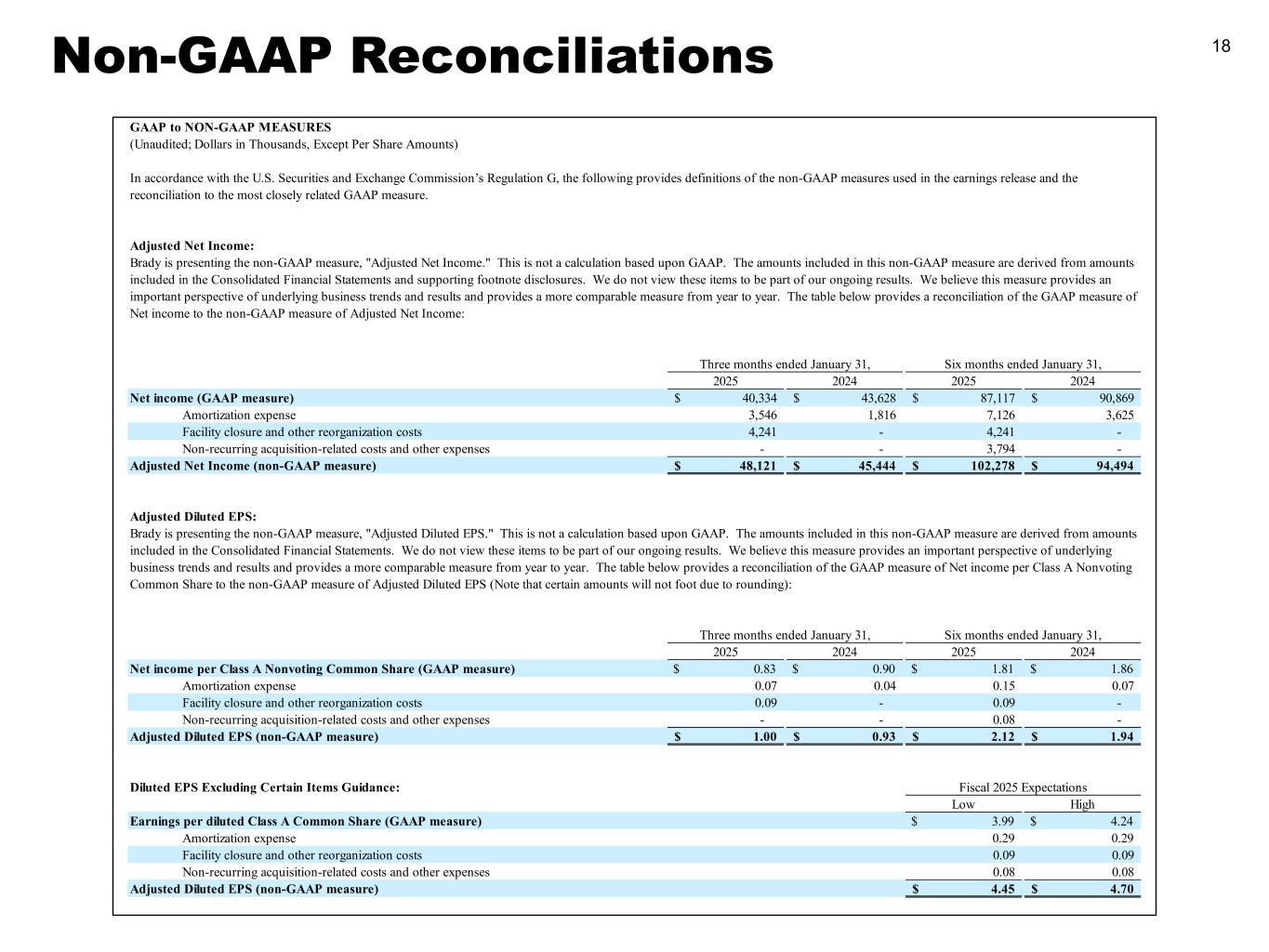

Non-GAAP Reconciliations 18 2025 2024 2025 2024 40,334$ 43,628$ 87,117$ 90,869$ Amortization expense 3,546 1,816 7,126 3,625 Facility closure and other reorganization costs 4,241 - 4,241 - Non-recurring acquisition-related costs and other expenses - - 3,794 - 48,121$ 45,444$ 102,278$ 94,494$ 2025 2024 2025 2024 $ 0.83 $ 0.90 $ 1.81 $ 1.86 Amortization expense 0.07 0.04 0.15 0.07 Facility closure and other reorganization costs 0.09 - 0.09 - Non-recurring acquisition-related costs and other expenses - - 0.08 - 1.00$ 0.93$ 2.12$ 1.94$ Diluted EPS Excluding Certain Items Guidance: Low High Earnings per diluted Class A Common Share (GAAP measure) $ 3.99 $ 4.24 Amortization expense 0.29 0.29 Facility closure and other reorganization costs 0.09 0.09 Non-recurring acquisition-related costs and other expenses 0.08 0.08 Adjusted Diluted EPS (non-GAAP measure) 4.45$ 4.70$ GAAP to NON-GAAP MEASURES (Unaudited; Dollars in Thousands, Except Per Share Amounts) In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure. Adjusted Diluted EPS (non-GAAP measure) Three months ended January 31, Brady is presenting the non-GAAP measure, "Adjusted Net Income." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income to the non-GAAP measure of Adjusted Net Income: Six months ended January 31, Net income (GAAP measure) Adjusted Net Income (non-GAAP measure) Adjusted Net Income: Fiscal 2025 Expectations Three months ended January 31, Brady is presenting the non-GAAP measure, "Adjusted Diluted EPS." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income per Class A Nonvoting Common Share to the non-GAAP measure of Adjusted Diluted EPS (Note that certain amounts will not foot due to rounding): Six months ended January 31, Net income per Class A Nonvoting Common Share (GAAP measure) Adjusted Diluted EPS: