UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04995

Sit U.S. Government Securities Fund, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: March 31, 2006

Date of reporting period: September 30, 2005

Item 1: Reports to Stockholders

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04032

Sit Money Market Fund, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: March 31, 2006

Date of reporting period: September 30, 2005

Item 1: Reports to Stockholders

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04033

Sit Mutual Funds II, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: March 31, 2006

Date of reporting period: September 30, 2005

Item 1: Reports to Stockholders

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21447

Sit Mutual Funds Trust

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: March 31, 2006

Date of reporting period: September 30, 2005

Item 1: Reports to Stockholders

Sit Mutual Funds

Bond Funds

Semi-Annual Report

September 30, 2005

Money Market Fund

U.S. Government Securities Fund

Tax-Free Income Fund

Minnesota Tax-Free Income Fund

Florida Tax-Free Income Fund

| Sit Mutual Funds |

| | BOND FUNDS SEMI-ANNUAL REPORT |

| TABLE OF CONTENTS |

| | Page

|

| Chairman’s Letter | 2 |

| Performance Summary | 4 |

| Average Annual Total Returns | 6 |

| Fund Reviews and Portfolios of Investments |

| Money Market Fund | 8 |

| U.S. Government Securities Fund | 12 |

| Tax-Free Income Fund | 24 |

| Minnesota Tax-Free Income Fund | 42 |

| Florida Tax-Free Income Fund | 58 |

| Notes to Portfolios of Investments | 62 |

| Statements of Assets and Liabilities | 64 |

| Statements of Operations | 66 |

| Statements of Changes in Net Assets | 68 |

| Notes to Financial Statements | 70 |

| Financial Highlights | 75 |

| Expense Example | 80 |

| Additional Information | 84 |

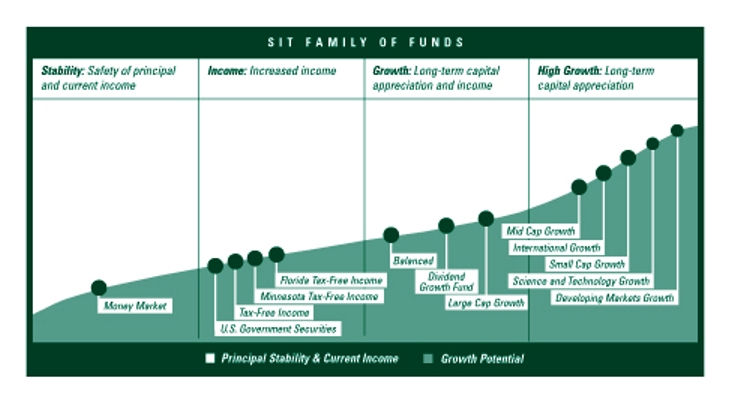

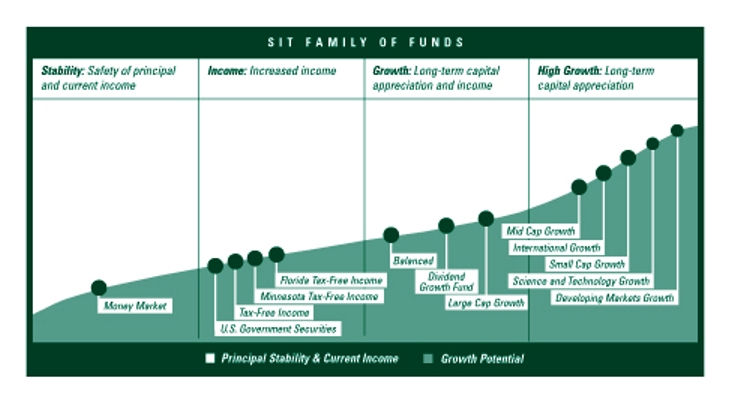

| A Look at Sit Mutual Funds | 85 |

This document must be preceded or accompanied by a Prospectus.

1

Dear fellow shareholders:

Short and intermediate interest rates rose, and longer-term rates fell during the 6 months ended September 30, 2005. The Federal Reserve raised the federal funds rate by 0.25% at each of its four meetings over the period, which left the rate target at 3.75% at the end of September. Market participants thought that the Fed might refrain from raising rates at its September 20th meeting, so it could assess the impact of the hurricanes. However, the Fed demonstrated its conviction to contain inflation by raising rates another 0.25% at that meeting. The Fed also indicated that it will continue to raise rates at a “measured pace”.

Recent economic data have begun to show the effects of Hurricane Katrina. High energy costs are having an impact on consumer spending, particularly at lower income levels. Personal consumption expenditures dropped in the month of August, but the decline was mostly the result of a reduction in durable goods spending, which was boosted in July by vehicle sales incentives. The consumer will continue to play a large role in the economy, as two-thirds of GDP is comprised by the consumer sector. Real personal consumption for August was still up +3.5% year over year, but down from +4.5% in June.

Employment, another determinant of future consumer spending, has remained healthy. Reported payrolls declined 8,000 in September, but would have increased around 200,000 after adjusting for hurricane-related payroll losses, in line with the prior twelve months’ average. Job creation has averaged 196,000 per month this year, on top of a strong 183,000 per month rate in 2004. In addition to strong employment, the latest measures of manufacturing activity have also been remarkably strong.

With respect to pricing trends, as expected, higher energy prices are making their way into inflation measures. The Consumer Price Index (CPI) rose +0.5% for the second consecutive month in August as gasoline prices jumped +7.7%. Year over year the CPI is up +3.6%. There may be more to come in terms of higher energy prices, as the CPI and PPI inflation measures have not yet captured much of the effects of Hurricane Katrina. The Bureau of Labor Statistics stated that, “Over 90% of the prices for August were collected prior to August 29th, the date when Hurricane Katrina struck the Gulf Coast.” An early warning sign may be the ISM prices paid index, which surged again in September to 78.0 from 62.5 in August and 48.5 in July, as 60 percent of supply executives reported paying higher prices.

The Congressional Budget Office (CBO) estimates that real GDP will grow about 0.5 percentage points slower over the second half of 2005 due to the hurricanes, with most of that slowing occurring in the third quarter. The CBO also anticipates that with private and government support for recovery and rebuilding, GDP growth will not be much affected in the fourth quarter. The CBO expects GDP to return to its previous trend by early 2006 and to accelerate subsequently as rebuilding raises overall economic activity.

The cumulative budget deficit has been $352.6 billion through eleven months of fiscal year 2005, an $84.9 billion improvement over last year. However this year’s budget deficit improvement will likely be short lived. Congress has already approved more than $60 billion in emergency spending related to Hurricane Katrina, which could ultimately increase to $150 billion to $200 billion.

In summary, based on a slightly weaker outlook for consumer spending in the third quarter, but a more optimistic viewpoint regarding other effects of the hurricanes on second half growth, we now expect +3.5% real GDP growth in the third quarter and +3.8% growth in the fourth quarter. Depending on the speed of the

2

rebuilding process, we forecast stronger growth will emerge in 2006. Our full-year 2005 real GDP growth forecast remains approximately +3.6%, which compares with +4.2% in 2004.

Strategy Summary

We expect the yield curve to continue to flatten, with short rates rising more than rates for longer maturities. It appears likely that the Fed will maintain its tightening stance as long as economic growth is solidly above +3.0% and signs of inflation are evident. It seems the Fed has discounted the effects of Hurricane Katrina as having a short-term impact and that it will continue its course of increasing rates at a “measured pace.” Fed policy is complicated by higher energy costs acting both as a drag on the economy, and a source of inflationary pressure. Because the CPI has edged higher to +3.6% year over year, we expect the Fed will raise its rate target a further +0.25% at two of the next three meetings (meetings in November, December and the end of January) to bring the Fed Funds target to 4.25%. By the March 28th, 2006 meeting, there should be more clarity on the direction of the economy, inflation, and the recovery efforts following the hurricanes. Long-term rates will likely move inversely with the direction of oil prices for the near term. Another factor weighing on the market is the uncertainty surrounding the appointment of Ben Bernanke, who will replace longtime Fed Chairman Alan Greenspan in early 2006.

We continue to monitor these issues and invest accordingly. We are focusing on securities whose structures offer higher current yields at the expense of reduced price appreciation potential. The rise in interest rates should help slow refinancing activity in the mortgage sector, and the expectation of more stable prepayment rates should result in increased investor demand.

Municipal portfolios also remain focused on securities that provide incremental yield, and remain defensively positioned with durations shorter than their benchmarks. We believe our focus on income will contribute to attractive relative returns, and as interest rates move higher, our short durations will allow us to reinvest at higher levels.

Fixed income investments are an important component of a well-diversified long-term portfolio. We believe that the Sit bond funds, with their dual objectives of high income and stability of principal, offer an attractive risk/reward profile to complement equity holdings. We appreciate your continued interest and investment in Sit Mutual Funds and look forward to assisting you in achieving your long-term investment goals.

With best wishes,

Eugene C. Sit, CFA

Chairman and Chief Investment Officer

3

| Sit Mutual Funds

Six Months Ended September 30, 2005

Performance Summary – Bond Funds

|  |

The U.S. Treasury yield curve continued to flatten during the six-month period as shorter maturity yields rose and longer maturity yields declined. The Federal Reserve increased its rate target by 25 basis points at each of its four meetings during the period, bringing the federal funds rate to 3.75%. Treasury bill yields rose more than 75 basis points during the period while 2-year Treasury yields rose only 39 basis points. 10-year and 30-year yields fell 16 and 19 basis points, respectively, as investors continued to react to long-term inflation expectations. As short-term rates and oil prices have continued to rise, long-term bondholders have reduced economic growth and long-term inflation expectations, leading to the decrease in long-term yields over the period.

The flattening yield curve caused intermediate maturity taxable bonds to perform worse than longer maturity bonds. With regard to taxable market sectors, asset backed securities provided the worst returns, reflecting concerns about how a weaker economy and high energy costs could impact consumers and lead to higher delinquencies. There was little dispersion in returns among other sectors as Treasuries and corporates posted similar returns for the six-month period.

The municipal yield curve flattened somewhat during the period as short yields increased only slightly and intermediate term and longer term yields dropped. Despite the flattening yield curve environment over the last year, the municipal yield curve remains quite positively sloped, with approximately 125 basis points greater yield differential between 2-year and 30-year maturity AAA general obligation issues than between comparable maturity Treasuries. Investors have continued to seek out yield, which drove demand for tobacco settlement revenue bonds, and other high yield bonds, making industrial development bonds the best performing sector over the past six months. The hospital sector was the next best performing sector, and housing bonds lagged.

Fixed income funds remain defensively positioned, with durations shorter than respective benchmarks in anticipation of more attractive, higher-yielding reinvestment opportunities as interest rates move higher. Our focus on securities that provide high levels of income and relative price stability should continue to provide attractive relative returns in the months ahead.

| TOTAL RETURNS – CALENDAR YEAR | | |

|---|

| 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | YTD

2005 | | 30-Day

SEC Yield

as of

9/30/05 | Distribution

Rate (2) |

|---|

|

|

| Sit Money Market Fund | | | | 5.08 | % | | 5.22 | % | | 5.17 | % | | 4.79 | % | | 6.03 | % | | 3.67 | % | | 1.25 | % | | 0.65 | % | | 0.88 | % | | 1.87 | % | | 3.26 | %(3) | | | |

|

| Sit U.S. Gov’t. Securities Fund | | | | 4.99 | | | 8.19 | | | 6.52 | | | 1.37 | | | 9.15 | | | 8.56 | | | 5.79 | | | 1.19 | | | 3.35 | | | 1.93 | | | 4.07 | | | 3.74 | % |

|

| Sit Tax-Free Income Fund | | | | 5.69 | | | 9.87 | | | 6.29 | | | -4.01 | | | 8.32 | | | 5.84 | | | 5.69 | | | 2.87 | | | 3.96 | | | 2.44 | | | 4.36 | (4) | | 3.75 | |

|

Sit Minnesota Tax-Free

Income Fund | | | | 5.89 | | | 8.19 | | | 6.14 | | | -3.82 | | | 8.09 | | | 5.85 | | | 7.06 | | | 4.42 | | | 3.68 | | | 3.40 | | | 4.31 | (5) | | 4.21 | |

|

Sit Florida Tax-Free

Income Fund | | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2.58 | | | 2.36 | | | 4.18 | (6) | | 3.06 | |

|

| 3-Month U.S. Treasury Bill | | | | 5.27 | | | 5.32 | | | 5.01 | | | 4.88 | | | 6.16 | | | 3.50 | | | 1.67 | | | 1.03 | | | 1.41 | | | 2.26 | |

| Lehman Inter. Government Bond Index | | | | 4.06 | | | 7.72 | | | 8.49 | | | 0.49 | | | 10.47 | | | 8.42 | | | 9.64 | | | 2.29 | | | 2.33 | | | 1.08 | |

| Lehman 5-Year Municipal Bond Index | | | | 4.22 | | | 6.38 | | | 5.84 | | | 0.74 | | | 7.72 | | | 6.21 | | | 9.27 | | | 4.13 | | | 2.72 | | | 0.64 | |

| | | Total Returns | | Average Annual Total Returns for the

Periods Ended September 30, 2005 |

|---|

| NASDAQ

Symbol | | Inception | | Quarter

Ended

9/30/05 | | Six Months

Ended

9/30/05 | | 1 Year | | 5 Years | | 10 Years | | Since

Inception |

|---|

|

|

| Sit Money Market Fund(1) | | | SNIXX | | | 11/01/93 | | | | 0.75 | % | | 1.37 | % | | 2.25 | % | | 1.97 | % | | 3.58 | % | | 3.72 | % |

|

| Sit U.S. Gov’t. Securities Fund | | | SNGVX | | | 06/02/87 | | | | -0.17 | | | 1.80 | | | 2.45 | | | 4.83 | | | 5.37 | | | 6.81 | |

|

| Sit Tax-Free Income Fund | | | SNTIX | | | 09/29/88 | | | | 0.54 | | | 2.12 | | | 3.18 | | | 4.73 | | | 4.98 | | | 6.07 | |

|

| Sit Minnesota Tax-Free Income Fund | | | SMTFX | | | 12/01/93 | | | | 0.51 | | | 2.78 | | | 4.80 | | | 5.42 | | | 5.16 | | | 5.26 | |

|

| Sit Florida Tax-Free Income Fund | | | SFLIX | | | 12/31/03 | | | | 0.53 | | | 2.00 | | | 3.21 | | | — | | | — | | | 2.83 | |

|

| 3-Month U.S. Treasury Bill | | | | | | 11/01/93 | | | | 0.86 | | | 1.60 | | | 2.78 | | | 2.28 | | | 3.77 | | | 3.95 | |

| Lehman Inter. Government Bond Index | | | | | | 05/31/87 | | | | -0.52 | | | 1.77 | | | 1.31 | | | 5.51 | | | 5.78 | | | 6.99 | |

| Lehman 5-Year Municipal Bond Index | | | | | | 09/30/88 | | | | -0.10 | | | 1.81 | | | 1.45 | | | 5.13 | | | 4.96 | | | 6.02 | |

| (1) | Converted from Sit Investment Reserve Fund to Sit Money Market Fund on 11/1/93. |

| (2) | Based on the last 12 monthly distributions of net investment income and average NAV as of 9/30/05. |

| (3) | Figure represents 7-day compound effective yield. The 7-day simple yield as of 9/30/05 was 3.21%. |

| (4) | For individuals in the 25%, 28%, 33%, and 35% federal tax brackets, the federal tax equivalent yields are 5.81%, 6.06%, 6.51% and 6.71%, respectively (income subject to state tax, if any). |

| (5) | For Minnesota residents in the 25%, 28%, 33% and 35% federal tax brackets, the double exempt tax equivalent yields are 6.24%, 6.50%, 6.98% and 7.20%, respectively (assumes the maximum Minnesota tax bracket of 7.85%). |

| (6) | For individuals in the 25%, 28%, 33%, and 35% federal tax brackets, the tax equivalent yields are 5.57%, 5.81%, 6.24% and 6.43%, respectively (income subject to state tax, if any). |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Average annual total returns include changes in share price as well as reinvestment of all dividends and capital gains.

| Sit Mutual Funds

Average Annual Total Returns for Periods Ended December 31, 2004

|

The tables on the next page show the Funds’ average annual total returns (before and after taxes) and the change in value of a broad-based market index over various periods ended December 31, 2004. The index information is intended to permit you to compare each Fund’s performance to a broad measure of market performance. The after-tax returns are intended to show the impact of federal income taxes on an investment in a Fund. The highest individual federal marginal income tax rate in effect during the specified period is assumed, and the state and local tax impact is not reflected.

A Fund’s “Return After Taxes on Distributions” shows the effect of taxable distributions (dividends and capital gain distributions), but assumes that you still hold the fund shares at the end of the period and so do not have any taxable gain or loss on your investment in the Fund.

A Fund’s “Return After Taxes on Distributions and Sale of Fund Shares” shows the effect of both taxable distributions and any taxable gain or loss that would be realized if the Fund shares were purchased at the beginning and sold at the end of the specified period.

The Funds’ past performance, before and after taxes, is not an indication of how the Funds will perform in the future. Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund shares in a tax-deferred account (including a 401(k) or IRA account).

6

|

|  |

|

| Sit U. S. Government Securities Fund | | | 1 Year | | | 5 Years | | | 10 Years | | |

| Return Before Taxes | | | 3.4% | | | 5.6% | | | 6.0% | | |

| Return After Taxes on Distributions | | | 2.1% | | | 3.8% | | | 3.9% | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | | 2.2% | | | 2.9% | | | 3.4% | | |

| Lehman Intermediate Government Bond Index | | | 2.3% | | | 6.6% | | | 6.8% | | |

|

| |

| |

|

| Sit Tax-Free Income Fund | | | 1 Year | | | 5 Years | | | 10 Years | | |

| Return Before Taxes | | | 4.0% | | | 5.3% | | | 5.6% | | |

| Return After Taxes on Distributions | | | 4.0% | | | 5.3% | | | 5.6% | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | | 4.0% | | | 5.2% | | | 5.6% | | |

| Lehman 5-Year Municipal Bond Index | | | 2.7% | | | 6.0% | | | 5.8% | | |

|

| |

| |

|

| Sit Minnesota Tax-Free Income Fund | | | 1 Year | | | 5 Years | | | 10 Years | | |

| Return Before Taxes | | | 3.7% | | | 5.8% | | | 5.7% | | |

| Return After Taxes on Distributions | | | 3.7% | | | 5.8% | | | 5.7% | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | | 3.9% | | | 5.7% | | | 5.6% | | |

| Lehman 5-Year Municipal Bond Index | | | 2.7% | | | 6.0% | | | 5.8% | | |

|

| |

| |

|

| Sit Florida Tax-Free Income Fund | | | 1 Year | | | 5 Years | | | Since Inception* | | |

| Return Before Taxes | | | 2.6% | | | n/a | | | 2.6% | | |

| Return After Taxes on Distributions | | | 2.6% | | | n/a | | | 2.6% | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | | 2.6% | | | n/a | | | 2.6% | | |

| Lehman 5-Year Municipal Bond Index | | | 2.7% | | | n/a | | | 2.7% | | |

|

*Inception date 12/31/03.

| Notes: |

| (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. |

| (2) | Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

| (3) | Indices reflect no deduction for fees, expenses, or taxes. |

7

| Sit Money Market Fund

Six Months Ended September 30, 2005

Michael C. Brilley, Senior Portfolio Manager

Mark H. Book, CFA, Portfolio Manager

|

The Sit Money Market Fund returned +1.37% for the six months ended September 30, 2005 compared to +1.60% for the 3-month U.S. Treasury Bill. As of September 30th, the Fund’s 7-day compound yield was 3.26% and its average maturity was 24 days.

The Federal Reserve increased its rate target by 25 basis points at each of its four meetings during the period, bringing the federal funds rate to 3.75%. Market participants thought that the Fed might refrain from raising rates at its September 20th meeting, so it could assess the impact of the hurricanes. However, the Fed demonstrated its conviction to contain inflation by raising rates another 0.25% at that meeting. The Fed also indicated that it will continue to raise rates at a “measured pace.” Because inflation has begun to edge higher, we expect that the Federal Reserve will continue on the path of raising interest rates. We believe the Fed will most likely increase the federal funds target by 25 basis points at two of the next three FOMC meetings (meetings in November, December, and late January) to bring the target rate to 4.25%. By the March 28th, 2006 meeting, there should be more clarity on the direction of the economy, inflation, and the recovery efforts following the hurricanes.

The Fund has maintained its average maturity near the short end of its customary 20-40 day range as the 3-Month Treasury Bill yield increased 77 basis points over the past six months. The Fund will maintain its rather short average maturity in anticipation of earning higher yields as the Fed continues to raise short-term rates. If the pace of tightening slows or ceases, we expect to extend the average maturity to the middle or longer end of its customary range. The Fund continues to invest in companies with top-tier credit quality.

| INVESTMENT OBJECTIVE AND STRATEGY |

|---|

The objective of the Fund is to achieve maximum current income to the extent consistent with the preservation of capital and maintenance of liquidity. The Fund pursues this objective by investing in short-term debt instruments which mature in 397 days or less and by maintaining a dollar-weighted portfolio maturity of 90 days or less.

An investment in the Fund is neither insured nor guaranteed by the U.S. Government and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share.

| | Net Asset Value 9/30/05: | | $1.00 Per Share | | |

| | 3/31/05: | | $1.00 Per Share | | |

| |

| | Total Net Assets: | | $58.6 Million | | |

PORTFOLIO STRUCTURE

(% OF TOTAL NET ASSETS) |

|---|

8

| AVERAGE ANNUAL TOTAL RETURNS* |

|---|

| Sit Money

Market

Fund

| | 3-Month

U.S. Treasury

Bill

| | Lipper

Money

Market Index

|

|---|

| 3 Month** | | | 0.75% | | | 0.86% | | | 0.73% | | |

| 6 Month** | | | 1.37 | | | 1.60 | | | n/a | | |

| 1 Year | | | 2.25 | | | 2.78 | | | 2.11 | | |

| 5 Years | | | 1.97 | | | 2.28 | | | 1.96 | | |

| 10 Years | | | 3.58 | | | 3.77 | | | 3.54 | | |

| Inception | | | 3.72 | | | 3.95 | | | 3.67 | | |

| (11/1/93) | | |

| CUMULATIVE TOTAL RETURNS* |

|---|

| Sit Money

Market

Fund

| | 3-Month

U.S. Treasury

Bill

| | Lipper

Money

Market Index

|

|---|

| 1 Year | | | 2.25% | | | 2.78% | | | 2.11% | | |

| 5 Year | | | 10.23 | | | 11.93 | | | 10.18 | | |

| 10 Year | | | 42.14 | | | 44.82 | | | 41.61 | | |

| Inception | | | 54.49 | | | 58.78 | | | 53.70 | | |

| (11/1/93) | | |

*As of 9/30/05 | **Not annualized. |

Performance is historical and assumes reinvestment of all dividends and capital gains. Money funds are neither insured nor guaranteed by the U.S. Government. There is no assurance that a fund will maintain a $1 share value. Yield fluctuates. Past performance is not a guarantee of future results. Management fees and administrative expenses are included in the Fund’s performance; however, fees and expenses are not incorporated in the 3-Month U.S. Treasury Bill. The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

The sum of $10,000 invested at inception (11/1/93) and held until 9/30/05 would have grown to $15,449 in the Fund or $15,878 in the 3-Month U.S. Treasury Bill assuming reinvestment of all dividends and capital gains.

| Sit Money Market Maturity Ranges |

|---|

9

| Sit Money Market Fund

September 30, 2005

Portfolio of Investments (Unaudited)

|

|

| Quantity ($) | | Name of Issuer | Market Value ($)(1) |

|---|

|

Commercial Paper (95.8%)(2)

Asset-Backed (16.6%) |

| | | | Daimler-Chrysler Auto Conduit: | | | | | |

| | 1,163,000 | | 3.62%, 10/11/2005 | | | | 1,161,831 | |

| | 1,400,000 | | 3.78%, 10/19/2005 | | | | 1,397,354 | |

| | 2,500,000 | | FCAR Owner Trust Series I, | | |

| | | | 3.79%, 11/9/2005 | | | | 2,489,735 | |

| | 2,200,000 | | Mortgage Interest Networking Trust, | | |

| | | | 3.67%, 10/18/2005 | | | | 2,196,187 | |

| | | | New Center Asset Trust: | | |

| | 1,100,000 | | 3.73%, 10/17/2005 | | | | 1,098,176 | |

| | 1,405,000 | | 3.73%, 10/20/2005 | | | | 1,402,234 | |

| |

| |

| | | | | | | | 9,745,517 | |

| |

| |

| Captive Auto Finance (4.2%) |

| | 2,500,000 | | Toyota Motor Credit Corp., | | |

| | | | 3.77%, 11/14/2005 | | | | 2,488,481 | |

| |

| |

| Captive Equipment Finance (4.3%) |

| | 2,500,000 | | Caterpillar Financial Services Corp., | | |

| | | | 3.70%, 10/11/2005 | | | | 2,497,431 | |

| |

| |

| Communications (7.3%) |

| | 2,200,000 | | Bellsouth Corp., | | |

| | | | 3.56%, 10/7/2005 | | | | 2,198,695 | |

| | 2,100,000 | | Verizon Global Funding Corp., | | |

| | | | 3.64%, 10/12/2005 (5) | | | | 2,097,664 | |

| |

| |

| | | | | | | | 4,296,359 | |

| |

| |

| Consumer Durables (3.8%) |

| | | | American Honda Finance: | | |

| | 1,100,000 | | 3.56%, 10/5/2005 | | | | 1,099,565 | |

| | 1,100,000 | | 3.61%, 10/25/2005 | | | | 1,097,353 | |

| |

| |

| | | | | | | | 2,196,918 | |

| |

| |

| Consumer Loan Finance (7.3%) |

| | 2,100,000 | | American Express Credit Corp., | | |

| | | | 3.67%, 10/31/2005 | | | | 2,093,577 | |

| | 2,200,000 | | American General Financial Corp., | | |

| | | | 3.64%, 10/24/2005 | | | | 2,194,884 | |

| |

| |

| | | | | | | | 4,288,461 | |

| |

| |

| Consumer Non-Durables (12.3%) |

| | | | Coca Cola Co.: | | |

| | 1,350,000 | | 3.56%, 10/17/2005 | | | | 1,347,864 | |

| | 850,000 | | 3.58%, 11/1/2005 | | | | 847,380 | |

| | 2,500,000 | | Coca Cola Enterprises, | | |

| | | | 3.75%, 10/5/2005 (5) | | | | 2,498,958 | |

|

| Quantity ($) | | Name of Issuer | Market Value ($)(1) |

|---|

|

| | | | Procter & Gamble: | | | | | |

| | 1,200,000 | | 3.49%, 10/19/2005 | | | | 1,197,906 | |

| | 1,300,000 | | 3.72%, 11/16/2005 | | | | 1,293,821 | |

| |

| |

| | | | | | | | 7,185,929 | |

| |

| |

| Consumer Servives (3.2%) |

| | 1,891,000 | | United Parcel Service, | | |

| | | | 3.50%, 10/3/2005 | | | | 1,890,632 | |

| |

| |

| Diversified Finance (12.2%) |

| | 2,500,000 | | CIT Group Holdings, | | |

| | | | 3.83%, 12/7/2005 | | | | 2,482,180 | |

| | 2,500,000 | | GE Capital Corp., | | |

| | | | 3.73%, 11/14/2005 | | | | 2,488,603 | |

| | 2,200,000 | | GE Capital Services, | | |

| | | | 3.66%, 10/26/2005 | | | | 2,194,408 | |

| |

| |

| | | | | | | | 7,165,191 | |

| |

| |

| Energy (4.3%) |

| | 2,500,000 | | Chevron Texaco Funding Corp., | | |

| | | | 3.70%, 10/28/2005 | | | | 2,493,063 | |

| |

| |

| Financial Services (7.2%) |

| | 2,500,000 | | Citigroup, Inc., | | |

| | | | 3.70%, 10/21/2005 | | | | 2,494,861 | |

| | | | UBS Finance Corp.: | | |

| | 1,200,000 | | 3.61%, 10/14/2005 | | | | 1,198,436 | |

| | 556,000 | | 3.70%, 10/19/2005 | | | | 554,971 | |

| |

| |

| | | | | | | | 4,248,268 | |

| |

| |

| Health Technology (3.8%) |

| | 2,200,000 | | Pfizer, Inc., | | |

| | | | 3.56%, 10/6/2005 (5) | | | | 2,198,912 | |

| |

| |

| Insurance (1.4%) |

| | 800,000 | | American Family Financial, | | |

| | | | 3.72%, 11/23/2005 | | | | 795,619 | |

| |

| |

| Producer Manuafactoring (4.2%) |

| | | | Siemens Capital: | | |

| | 1,100,000 | | 3.58%, 10/13/2005 | | | | 1,098,687 | |

| | 1,400,000 | | 3.80%, 11/28/2005 | | | | 1,391,429 | |

| |

| |

| | | | | | | | 2,490,116 | |

| |

| |

| Retail Trade (3.7%) |

| | 2,200,000 | | Wal-Mart Stores, Inc., | | |

| | | | 3.65%, 11/10/2005 | | | | 2,191,078 | |

| |

| |

See accompanying notes to portfolios of investments on page 62.

10

|

| Quantity ($) | | Name of Issuer | Market Value ($)(1) |

|---|

|

Total Commercial Paper

(cost: $56,171,975) | | | 56,171,975 | |

| |

| |

| |

| U.S. Government Securities (4.5%)(2) | |

| | 2,613,000 | | FHLMC Discount Note, 3.2%, 10/3/05 | | | | 2,612,535 | |

| |

| |

| |

Total U.S. Government Securities

(cost: $2,612,535) | | | 2,612,535 | |

| |

| |

| |

Total investments in securities

(cost:$58,784,510)(7) | | $ | 58,784,510 | |

| |

| |

11

| Sit U.S. Government Securities Fund

Six Months Ended September 30, 2005

Senior Portfolio Managers, Michael C. Brilley and Bryce A. Doty, CFA

Portfolio Manager, Mark H. Book, CFA

|

The Sit U.S. Government Securities Fund provided investors with a +1.80% return during the past six months while the Lehman Intermediate Government Bond Index returned +1.77%. The Fund’s 30-day SEC yield was 4.07% and its 12-month distribution rate was 3.74%.

The yield curve flattened during the period as the Federal Reserve continued raising short-term interest rates. The Fed increased its federal funds target level 0.25% to 3.75% on September 20, 2005. This was the eleventh consecutive 0.25% increase since June of last year, when the Fed began raising its target rate. Despite the higher short-term rates, longer maturity U.S. Treasury yields declined, reflecting the market’s belief that the Fed’s actions will be successful in containing inflation. As a result, longer maturity securities performed better than shorter maturity securities. The Fund’s allocation to U.S. Treasuries was the strongest performing sector, as it had a longer average maturity than the other sectors. The Fund’s collateralized mortgage obligations (CMO’s) also outperformed the benchmark as this sector generated higher levels of income than the benchmark. Despite the high levels of income generated by the agency mortgage pass-throughs, the returns from this sector just matched that of the benchmark.

The bond market has recently been driven by oil prices and the Fed. While higher energy costs resulting from the recent hurricanes have produced significant inflationary pressures, data suggests that the economy continues to grow at relatively strong levels. We expect that this combination of economic growth and higher inflation will result in higher interest rates overall, with shorter term rates rising faster than longer term rates. Within this interest rate environment, we continue to emphasize securities that provide both high levels of income and low levels of price sensitivity to changes in interest rates. Within the Fund, we accomplish this focus through ownership of high coupon mortgage pass-through securities, as has consistently been the case since the Fund’s inception. These securities continue to provide a strong track record of providing attractive income return regardless of changes in underlying interest rates.

| INVESTMENT OBJECTIVE AND STRATEGY |

|---|

The objective of the U.S. Government Securities Fund is to provide high current income and safety of principal, which it seeks to attain by investing solely in debt obligations issues, guaranteed or insured by the U.S. government or its agencies or its instrumentalities.

Agency mortgage securities and U.S. Treasury securities will be the principal holdings in the Fund. The mortgage securities that the Fund will purchase consist of pass-through securities including those issued by Government National Mortgage Association (GNMA), Federal National Mortgage Asociation (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC).

| | Net Asset Value 9/30/05: | | $10.61 Per Share | | |

| | 3/31/05: | | $10.62 Per Share | | |

| | Total Net Assets: | | $262.9 Million | | |

| | 30-day SEC Yield: | | 4.07% | | |

| | 12-Month Distribution Rate: | | 3.74% | | |

| | Average Maturity: | | 20.7 Years | | |

| | Effective Duration: | | 2.9 Years(1) | | |

| |

| (1) Effective duration is a measure which reflects estimated price sensitivity to a given change in interest rates. For example, for an interest rate change of 1.0%, a portfolio with a duration of 5 years would be expected to experience a price change of 5%. Effective duration is based on current interest rates and the Adviser’s assumptions regarding the expected average life of individual securities held in the portfolio. |

PORTFOLIO STRUCTURE

(% OF TOTAL NET ASSETS) |

|---|

12

| AVERAGE ANNUAL TOTAL RETURNS* |

|---|

| Sit

U.S. Gov’t.

Securities

Fund

| | Lehman

Inter. Gov’t.

Bond Index

| | Lipper

U.S. Gov’t.

Fund Index

|

|---|

| 3 Month** | | | -0.17% | | | -0.52% | | | -0.63% | | |

| 6 Month** | | | 1.80 | | | 1.77 | | | n/a | | |

| 1 Year | | | 2.45 | | | 1.31 | | | 2.72 | | |

| 5 Year | | | 4.83 | | | 5.51 | | | 5.66 | | |

| 10 Year | | | 5.37 | | | 5.78 | | | 5.55 | | |

| Inception | | | 6.81 | | | 6.99 | | | 6.59 | | |

| (6/2/87) | | |

| CUMULATIVE TOTAL RETURNS* |

|---|

| Sit

U.S. Gov't.

Securities

Fund

| | Lehman

Inter. Gov't.

Bond Index

| | Lipper

U.S. Gov't.

Fund Index

|

|---|

| 1 Year | | | 2.45% | | | 1.31% | | | 2.72% | | |

| 5 Year | | | 26.63 | | | 30.76 | | | 31.71 | | |

| 10 Year | | | 68.74 | | | 75.46 | | | 71.59 | | |

| Inception | | | 234.84 | | | 245.70 | | | 222.60 | | |

| (6/2/87) | | |

*As of 9/30/05 | **Not annualized. |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Average annual total returns include changes in share price as well as reinvestment of all dividends and capital gains. Management fees and administrative expenses are included in the Fund’s performance; however, fees and expenses are not incorporated in the Lehman Intermediate Government Bond Index. The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

The sum of $10,000 invested at inception (6/2/87) and held until 9/30/05 would have grown to $33,484 in the Fund or $34,570 in the Lehman Intermediate Government Bond Index assuming reinvestment of all dividends and capital gains.

| ESTIMATED AVERAGE LIFE PROFILE |

|---|

13

| Sit U.S. Government Securities Fund

September 30, 2005

Portfolio of Investments (Unaudited)

|

Mortgage Pass-Through Securities (62.7%) (2)

Federal Home Loan Mortgage Corporation (17.6%):

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 2,322,357 | 3.08% | 5/1/2034 | 2,277,312 |

| 65,889 | 5.50% | 8/1/2017 | 67,445 |

| 283,288 | 6.38% | 12/1/2026 | 289,667 |

| 79,215 | 6.38% | 8/1/2027 | 81,536 |

| 137,994 | 6.38% | 12/1/2027 | 142,037 |

| 739,830 | 6.50% | 8/1/2029 | 760,822 |

| 128,033 | 7.00% | 7/1/2024 | 134,409 |

| 85,570 | 7.00% | 2/1/2029 | 89,800 |

| 1,927,495 | 7.00% | 10/1/2031 | 2,014,433 |

| 4,627,207 | 7.00% | 7/1/2032 | 4,834,561 |

| 438,683 | 7.38% | 12/17/2024 | 468,916 |

| 101,102 | 7.50% | 10/1/2012 | 105,811 |

| 67,210 | 7.50% | 4/1/2021 | 71,322 |

| 214,679 | 7.50% | 5/1/2026 | 227,587 |

| 38,986 | 7.50% | 2/1/2027 | 41,414 |

| 193,614 | 7.50% | 4/1/2027 | 205,672 |

| 1,483,523 | 7.50% | 7/1/2029 | 1,572,720 |

| 210,764 | 7.50% | 3/1/2030 | 223,436 |

| 1,664,363 | 7.50% | 1/1/2031 | 1,764,606 |

| 1,894,225 | 7.50% | 10/1/2031 | 2,017,941 |

| 214,812 | 7.50% | 2/1/2032 | 227,728 |

| 3,348,374 | 7.50% | 4/1/2032 | 3,549,695 |

| 2,283,610 | 7.50% | 7/1/2032 | 2,421,219 |

| 97,042 | 8.00% | 10/1/2016 | 103,787 |

| 742,579 | 8.00% | 12/1/2016 | 793,427 |

| 43,837 | 8.00% | 5/1/2017 | 46,683 |

| 545,876 | 8.00% | 12/1/2023 | 579,574 |

| 229,809 | 8.00% | 7/1/2024 | 245,790 |

| 261,942 | 8.00% | 9/1/2024 | 280,159 |

| 452,754 | 8.00% | 9/15/2024 | 481,739 |

| 163,711 | 8.00% | 11/1/2025 | 174,982 |

| 91,940 | 8.00% | 12/1/2026 | 98,187 |

| 119,895 | 8.00% | 1/1/2027 | 128,161 |

| 138,855 | 8.00% | 10/1/2027 | 148,435 |

| 1,618,252 | 8.00% | 10/17/2027 | 1,723,236 |

| 147,924 | 8.00% | 1/1/2028 | 158,123 |

| 75,738 | 8.00% | 7/1/2028 | 80,765 |

| 293,117 | 8.00% | 6/1/2030 | 313,061 |

| 130,948 | 8.00% | 11/1/2030 | 139,696 |

| 172,456 | 8.00% | 11/1/2030 | 183,976 |

| 153,414 | 8.00% | 2/1/2032 | 163,593 |

| 35,458 | 8.25% | 12/1/2008 | 36,544 |

| 52,736 | 8.25% | 12/1/2017 | 56,732 |

| 351,555 | 8.50% | 1/1/2016 | 377,145 |

| 662,023 | 8.50% | 5/1/2016 | 710,737 |

| 7,574 | 8.50% | 1/1/2017 | 8,194 |

| 83,393 | 8.50% | 5/1/2017 | 90,218 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 160,693 | 8.50% | 10/1/2019 | 174,520 |

| 189,838 | 8.50% | 8/1/2023 | 205,455 |

| 21,296 | 8.50% | 7/1/2024 | 23,200 |

| 92,623 | 8.50% | 1/1/2025 | 100,395 |

| 130,015 | 8.50% | 4/1/2025 | 140,924 |

| 91,194 | 8.50% | 5/1/2025 | 98,846 |

| 40,768 | 8.50% | 6/1/2025 | 44,188 |

| 58,088 | 8.50% | 10/1/2026 | 63,288 |

| 616,778 | 8.50% | 12/1/2029 | 668,531 |

| 521,900 | 8.50% | 8/1/2030 | 568,592 |

| 23,360 | 8.50% | 12/1/2030 | 25,402 |

| 852,360 | 8.50% | 2/1/2031 | 923,880 |

| 162,340 | 8.50% | 4/1/2031 | 176,320 |

| 24,840 | 8.50% | 8/1/2031 | 26,979 |

| 33,660 | 8.75% | 1/1/2017 | 35,698 |

| 16,917 | 9.00% | 5/1/2009 | 17,654 |

| 7,136 | 9.00% | 6/1/2009 | 7,810 |

| 25,353 | 9.00% | 7/1/2009 | 26,458 |

| 30,072 | 9.00% | 7/1/2009 | 31,414 |

| 84,864 | 9.00% | 12/1/2009 | 88,564 |

| 18,666 | 9.00% | 10/1/2013 | 20,072 |

| 163,646 | 9.00% | 11/1/2015 | 179,175 |

| 13,484 | 9.00% | 5/1/2016 | 14,622 |

| 320,457 | 9.00% | 5/1/2016 | 350,867 |

| 99,265 | 9.00% | 7/1/2016 | 107,643 |

| 91,858 | 9.00% | 10/1/2016 | 98,947 |

| 22,019 | 9.00% | 11/1/2016 | 23,878 |

| 15,575 | 9.00% | 1/1/2017 | 16,867 |

| 10,485 | 9.00% | 1/1/2017 | 11,370 |

| 172,160 | 9.00% | 2/1/2017 | 186,690 |

| 20,292 | 9.00% | 2/1/2017 | 22,004 |

| 51,964 | 9.00% | 2/1/2017 | 54,665 |

| 7,095 | 9.00% | 4/1/2017 | 7,616 |

| 63,752 | 9.00% | 4/1/2017 | 64,908 |

| 36,046 | 9.00% | 6/1/2017 | 39,176 |

| 30,772 | 9.00% | 6/1/2017 | 33,400 |

| 7,847 | 9.00% | 9/1/2017 | 8,528 |

| 92,884 | 9.00% | 10/1/2017 | 100,949 |

| 60,644 | 9.00% | 6/1/2018 | 65,213 |

| 194,044 | 9.00% | 6/1/2019 | 209,927 |

| 22,445 | 9.00% | 10/1/2019 | 24,271 |

| 86,927 | 9.00% | 10/1/2019 | 94,844 |

| 97,132 | 9.00% | 10/1/2019 | 105,980 |

| 404,377 | 9.00% | 3/1/2020 | 439,515 |

| 207,035 | 9.00% | 9/1/2020 | 216,796 |

| 505,297 | 9.00% | 6/1/2021 | 535,265 |

| 28,465 | 9.00% | 7/1/2021 | 31,182 |

| 84,835 | 9.00% | 7/1/2021 | 92,774 |

| 55,185 | 9.00% | 10/1/2021 | 58,311 |

14

|

|  |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 33,391 | 9.00% | 3/1/2022 | 36,374 |

| 71,346 | 9.00% | 4/1/2025 | 77,364 |

| 241,353 | 9.00% | 11/1/2025 | 265,863 |

| 1,268,612 | 9.00% | 5/1/2031 | 1,400,067 |

| 10,769 | 9.25% | 7/1/2008 | 11,301 |

| 26,325 | 9.25% | 8/1/2008 | 27,626 |

| 14,725 | 9.25% | 8/1/2009 | 15,304 |

| 63,764 | 9.25% | 7/1/2010 | 64,989 |

| 25,697 | 9.25% | 3/1/2011 | 26,680 |

| 42,051 | 9.25% | 6/1/2016 | 45,918 |

| 20,939 | 9.25% | 3/1/2017 | 22,864 |

| 367,778 | 9.25% | 2/1/2018 | 394,129 |

| 16,397 | 9.25% | 1/1/2019 | 17,023 |

| 94,517 | 9.25% | 3/1/2019 | 101,800 |

| 165,281 | 9.25% | 3/1/2019 | 175,365 |

| 1,550 | 9.50% | 10/1/2005 | 1,550 |

| 37,349 | 9.50% | 10/1/2008 | 39,301 |

| 60,533 | 9.50% | 2/1/2010 | 63,622 |

| 25,358 | 9.50% | 5/1/2010 | 25,509 |

| 21,672 | 9.50% | 6/1/2010 | 22,778 |

| 21,672 | 9.50% | 1/1/2011 | 23,323 |

| 135,676 | 9.50% | 6/1/2011 | 141,481 |

| 37,861 | 9.50% | 6/1/2016 | 41,569 |

| 10,300 | 9.50% | 7/1/2016 | 11,309 |

| 14,748 | 9.50% | 9/1/2016 | 15,700 |

| 46,720 | 9.50% | 10/1/2016 | 51,296 |

| 80,148 | 9.50% | 6/1/2017 | 88,258 |

| 41,323 | 9.50% | 9/1/2017 | 45,444 |

| 49,276 | 9.50% | 4/1/2018 | 54,393 |

| 13,519 | 9.50% | 10/1/2018 | 14,887 |

| 132,091 | 9.50% | 12/1/2018 | 144,937 |

| 11,554 | 9.50% | 6/1/2019 | 12,300 |

| 424,663 | 9.50% | 6/17/2019 | 465,382 |

| 110,606 | 9.50% | 7/1/2020 | 119,312 |

| 50,901 | 9.50% | 8/1/2020 | 55,851 |

| 3,283 | 9.50% | 9/1/2020 | 3,612 |

| 242,877 | 9.50% | 8/1/2021 | 266,937 |

| 1,590,620 | 9.50% | 12/17/2021 | 1,750,064 |

| 11,886 | 9.75% | 12/1/2008 | 12,495 |

| 40,950 | 9.75% | 12/1/2008 | 43,049 |

| 51,052 | 9.75% | 11/1/2009 | 53,669 |

| 15,793 | 9.75% | 6/1/2011 | 16,603 |

| 288,880 | 9.75% | 12/1/2016 | 312,737 |

| 43,584 | 9.75% | 6/1/2017 | 48,150 |

| 263,154 | 9.75% | 12/1/2017 | 288,899 |

| 16,000 | 9.85% | 5/1/2016 | 17,660 |

| 67,043 | 10.00% | 11/1/2010 | 70,671 |

| 65,254 | 10.00% | 11/1/2011 | 72,953 |

| 240,645 | 10.00% | 6/1/2020 | 271,203 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 206,628 | 10.00% | 9/1/2020 | 230,535 |

| 142,213 | 10.00% | 3/1/2021 | 156,919 |

| 66,536 | 10.00% | 10/1/2021 | 73,113 |

| 24,483 | 10.25% | 6/1/2010 | 26,131 |

| 36,216 | 10.25% | 2/1/2017 | 38,654 |

| 61,293 | 10.29% | 9/1/2016 | 66,053 |

| 62,222 | 10.50% | 10/1/2013 | 68,382 |

| 109,637 | 10.50% | 5/1/2014 | 117,404 |

| 28,794 | 10.50% | 9/1/2015 | 32,012 |

| 24,425 | 10.50% | 1/1/2019 | 27,535 |

| 466,569 | 10.50% | 6/1/2019 | 520,345 |

| 868 | 10.50% | 7/1/2020 | 979 |

| 9,368 | 11.00% | 12/1/2011 | 10,316 |

| 42,916 | 11.00% | 6/1/2015 | 46,846 |

| 42,578 | 11.00% | 2/1/2016 | 46,997 |

| 20,567 | 11.00% | 5/1/2019 | 22,381 |

| 48,337 | 11.00% | 7/1/2019 | 53,820 |

| 13,105 | 11.25% | 10/1/2009 | 14,146 |

| 45,843 | 11.25% | 8/1/2011 | 50,258 |

| 27,852 | 13.00% | 5/1/2017 | 31,195 |

| | |

|

| 46,360,198 |

| | |

|

Federal National Mortgage Association (30.9%):

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 2,252,962 | 4.03% | 4/1/2033 | 2,229,680 |

| 4,680,872 | 5.00% | 11/1/2010 | 4,705,606 |

| 78,490 | 5.76% | 3/1/2033 | 79,268 |

| 858,788 | 6.00% | 9/1/2017 | 886,756 |

| 31,963 | 6.49% | 3/1/2019 | 32,310 |

| 91,853 | 6.49% | 2/1/2032 | 94,620 |

| 74,279 | 6.49% | 4/1/2032 | 76,516 |

| 65,202 | 6.91% | 11/1/2026 | 68,657 |

| 218,497 | 6.91% | 8/1/2027 | 230,076 |

| 504,746 | 6.95% | 8/1/2021 | 521,788 |

| 270,064 | 7.00% | 7/1/2026 | 282,673 |

| 127,778 | 7.00% | 3/1/2027 | 134,004 |

| 24,963 | 7.00% | 4/1/2027 | 26,403 |

| 501,769 | 7.00% | 5/1/2028 | 525,195 |

| 862,195 | 7.00% | 1/1/2029 | 902,448 |

| 2,617,777 | 7.00% | 11/1/2029 | 2,741,107 |

| 493,309 | 7.00% | 2/1/2032 | 516,340 |

| 103,762 | 7.00% | 5/1/2032 | 108,614 |

| 489,267 | 7.00% | 6/1/2032 | 514,459 |

| 1,897,284 | 7.00% | 6/1/2032 | 1,986,009 |

| 192,320 | 7.00% | 7/1/2032 | 201,314 |

| 688,446 | 7.00% | 9/1/2032 | 720,641 |

| 344,768 | 7.00% | 10/1/2032 | 360,904 |

| 492,912 | 7.00% | 11/1/2032 | 515,924 |

| 329,584 | 7.00% | 11/1/2032 | 344,971 |

See accompanying notes to portfolios of investments on page 62.

15

| Sit U.S. Government Securities Fund

September 30, 2005

Portfolio of Investments (Unaudited)

|

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 1,406,244 | 7.00% | 4/1/2034 | 1,471,897 |

| 576,575 | 7.50% | 11/1/2012 | 584,900 |

| 741,937 | 7.50% | 3/1/2016 | 787,992 |

| 1,215,517 | 7.50% | 6/1/2022 | 1,287,481 |

| 1,680,094 | 7.50% | 10/1/2022 | 1,777,959 |

| 461,713 | 7.50% | 9/1/2023 | 488,608 |

| 1,186,353 | 7.50% | 5/1/2024 | 1,255,458 |

| 431,460 | 7.50% | 6/1/2025 | 457,730 |

| 4,977 | 7.50% | 3/1/2027 | 5,278 |

| 16,663 | 7.50% | 9/1/2027 | 17,839 |

| 1,217,013 | 7.50% | 5/1/2029 | 1,287,904 |

| 86,979 | 7.50% | 11/1/2029 | 92,296 |

| 32,324 | 7.50% | 1/1/2030 | 34,213 |

| 355,211 | 7.50% | 1/1/2031 | 375,902 |

| 979,686 | 7.50% | 1/1/2031 | 1,037,613 |

| 303,545 | 7.50% | 10/1/2031 | 321,255 |

| 236,550 | 7.50% | 3/1/2032 | 250,339 |

| 695,230 | 7.50% | 6/1/2032 | 738,397 |

| 966,352 | 7.50% | 12/1/2034 | 1,022,642 |

| 1,209,205 | 7.54% | 6/1/2016 | 1,311,987 |

| 1,302,703 | 7.87% | 12/15/2025 | 1,391,206 |

| 64,867 | 8.00% | 8/1/2009 | 67,682 |

| 281,190 | 8.00% | 4/1/2016 | 301,466 |

| 76,290 | 8.00% | 11/1/2016 | 81,804 |

| 64,447 | 8.00% | 6/1/2018 | 67,420 |

| 615,786 | 8.00% | 7/1/2021 | 659,998 |

| 215,509 | 8.00% | 1/1/2022 | 230,917 |

| 24,978 | 8.00% | 2/1/2023 | 26,727 |

| 124,211 | 8.00% | 5/1/2023 | 132,695 |

| 80,028 | 8.00% | 9/1/2023 | 85,583 |

| 522,000 | 8.00% | 7/1/2024 | 558,372 |

| 189,837 | 8.00% | 8/1/2024 | 203,488 |

| 24,269 | 8.00% | 4/1/2025 | 26,009 |

| 151,735 | 8.00% | 6/1/2027 | 162,617 |

| 97,968 | 8.00% | 7/1/2027 | 104,971 |

| 489,050 | 8.00% | 9/1/2027 | 523,893 |

| 160,536 | 8.00% | 9/1/2027 | 172,540 |

| 52,879 | 8.00% | 10/1/2027 | 56,681 |

| 251,322 | 8.00% | 6/1/2028 | 268,906 |

| 217,602 | 8.00% | 9/1/2028 | 232,827 |

| 971,169 | 8.00% | 5/1/2029 | 1,038,058 |

| 207,709 | 8.00% | 9/1/2029 | 223,034 |

| 67,088 | 8.00% | 12/1/2029 | 71,547 |

| 18,650 | 8.00% | 2/1/2030 | 19,979 |

| 271,626 | 8.00% | 2/1/2031 | 290,418 |

| 561,493 | 8.00% | 2/1/2031 | 600,166 |

| 280,173 | 8.00% | 3/1/2031 | 301,918 |

| 758,433 | 8.00% | 12/1/2031 | 810,670 |

| 141,536 | 8.00% | 3/1/2032 | 150,488 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 1,098,847 | 8.00% | 9/1/2032 | 1,177,385 |

| 474,078 | 8.00% | 8/1/2034 | 506,730 |

| 54,793 | 8.25% | 4/1/2022 | 58,688 |

| 974,246 | 8.29% | 7/20/2030 | 1,060,528 |

| 778,852 | 8.33% | 7/15/2020 | 863,208 |

| 400,109 | 8.38% | 7/20/2028 | 435,155 |

| 3,959,015 | 8.45% | 5/31/2035 | 4,324,356 |

| 6,755 | 8.50% | 8/1/2006 | 6,872 |

| 69,146 | 8.50% | 11/1/2010 | 72,738 |

| 545,903 | 8.50% | 9/1/2013 | 556,529 |

| 722,400 | 8.50% | 2/1/2016 | 774,077 |

| 38,020 | 8.50% | 4/1/2017 | 41,041 |

| 133,096 | 8.50% | 6/1/2017 | 135,893 |

| 38,916 | 8.50% | 9/1/2017 | 41,524 |

| 141,085 | 8.50% | 8/1/2018 | 153,489 |

| 410,656 | 8.50% | 5/1/2022 | 444,106 |

| 145,064 | 8.50% | 7/1/2022 | 158,577 |

| 81,149 | 8.50% | 11/1/2023 | 88,336 |

| 19,655 | 8.50% | 5/1/2024 | 21,527 |

| 217,317 | 8.50% | 2/1/2025 | 235,018 |

| 64,950 | 8.50% | 9/1/2025 | 70,603 |

| 477,828 | 8.50% | 12/1/2025 | 520,269 |

| 317,201 | 8.50% | 1/1/2026 | 345,424 |

| 479,845 | 8.50% | 1/1/2026 | 522,539 |

| 236,499 | 8.50% | 7/1/2026 | 254,828 |

| 459,473 | 8.50% | 9/1/2026 | 500,284 |

| 1,173,983 | 8.50% | 11/1/2026 | 1,278,580 |

| 42,993 | 8.50% | 12/1/2026 | 46,824 |

| 247,390 | 8.50% | 5/1/2027 | 269,363 |

| 340,665 | 8.50% | 6/1/2027 | 370,975 |

| 774,725 | 8.50% | 11/1/2028 | 843,781 |

| 1,358,499 | 8.50% | 12/1/2028 | 1,479,535 |

| 265,454 | 8.50% | 12/1/2029 | 289,033 |

| 393,522 | 8.50% | 1/1/2030 | 424,028 |

| 73,190 | 8.50% | 8/1/2030 | 78,863 |

| 28,580 | 8.50% | 11/1/2030 | 31,075 |

| 174,843 | 8.50% | 11/1/2030 | 188,169 |

| 87,169 | 8.50% | 12/1/2030 | 94,778 |

| 22,197 | 8.50% | 1/1/2031 | 23,906 |

| 164,682 | 8.50% | 6/1/2032 | 179,334 |

| 463,851 | 8.52% | 9/15/2030 | 503,277 |

| 158,412 | 8.87% | 12/15/2025 | 176,452 |

| 128,614 | 9.00% | 1/1/2009 | 135,109 |

| 49,882 | 9.00% | 5/1/2009 | 51,821 |

| 25,502 | 9.00% | 5/1/2009 | 26,633 |

| 89,506 | 9.00% | 5/1/2009 | 92,671 |

| 59,269 | 9.00% | 5/1/2009 | 61,899 |

| 17,347 | 9.00% | 4/1/2010 | 18,278 |

| 69,286 | 9.00% | 3/1/2011 | 73,365 |

16

|

|  |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 170,834 | 9.00% | 8/1/2016 | 185,378 |

| 180,595 | 9.00% | 11/1/2016 | 195,970 |

| 15,250 | 9.00% | 6/1/2017 | 15,547 |

| 71,807 | 9.00% | 6/1/2017 | 77,722 |

| 17,328 | 9.00% | 7/1/2017 | 18,755 |

| 38,841 | 9.00% | 9/1/2017 | 42,331 |

| 65,603 | 9.00% | 12/1/2017 | 71,008 |

| 42,665 | 9.00% | 2/1/2018 | 46,499 |

| 12,881 | 9.00% | 9/1/2019 | 13,572 |

| 24,411 | 9.00% | 10/1/2019 | 25,366 |

| 80,630 | 9.00% | 12/15/2019 | 87,337 |

| 74,288 | 9.00% | 3/1/2021 | 80,408 |

| 3,797 | 9.00% | 9/1/2021 | 4,158 |

| 65,607 | 9.00% | 4/1/2025 | 72,133 |

| 353,882 | 9.00% | 6/15/2025 | 387,501 |

| 499,939 | 9.00% | 11/1/2025 | 544,689 |

| 39,512 | 9.00% | 12/1/2026 | 42,503 |

| 269,933 | 9.00% | 5/1/2027 | 293,501 |

| 68,488 | 9.00% | 5/1/2030 | 75,357 |

| 146,318 | 9.00% | 8/15/2030 | 160,589 |

| 48,403 | 9.00% | 11/1/2030 | 53,367 |

| 95,195 | 9.00% | 4/1/2031 | 104,877 |

| 87,578 | 9.00% | 6/1/2031 | 96,528 |

| 29,894 | 9.00% | 7/1/2031 | 32,480 |

| 65,970 | 9.25% | 10/1/2009 | 69,294 |

| 29,869 | 9.25% | 7/1/2010 | 31,648 |

| 3,633 | 9.25% | 4/1/2012 | 3,659 |

| 56,773 | 9.25% | 10/1/2016 | 62,021 |

| 64,769 | 9.25% | 12/1/2016 | 70,757 |

| 187,900 | 9.25% | 2/1/2017 | 204,713 |

| 6,766 | 9.25% | 3/1/2017 | 7,392 |

| 347,482 | 9.34% | 8/20/2027 | 395,492 |

| 21,730 | 9.50% | 9/1/2008 | 22,201 |

| 69,082 | 9.50% | 12/1/2009 | 73,344 |

| 16,480 | 9.50% | 1/1/2011 | 17,358 |

| 15,015 | 9.50% | 10/1/2013 | 16,074 |

| 21,944 | 9.50% | 5/1/2014 | 22,419 |

| 6,600 | 9.50% | 4/1/2016 | 7,066 |

| 80,967 | 9.50% | 4/1/2016 | 87,189 |

| 32,339 | 9.50% | 9/1/2016 | 35,522 |

| 35,175 | 9.50% | 9/1/2017 | 36,981 |

| 90,779 | 9.50% | 11/1/2018 | 100,868 |

| 64,166 | 9.50% | 12/1/2018 | 70,689 |

| 49,605 | 9.50% | 5/1/2019 | 55,255 |

| 78,101 | 9.50% | 10/1/2019 | 86,014 |

| 58,123 | 9.50% | 12/1/2019 | 64,342 |

| 1,050,929 | 9.50% | 3/1/2020 | 1,145,512 |

| 27,622 | 9.50% | 3/1/2020 | 29,909 |

| 91,830 | 9.50% | 6/1/2020 | 102,036 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

|---|

| 176,164 | 9.50% | 9/1/2020 | 195,010 |

| 186,816 | 9.50% | 9/1/2020 | 205,860 |

| 205,039 | 9.50% | 10/15/2020 | 224,486 |

| 185,586 | 9.50% | 12/15/2020 | 204,255 |

| 38,558 | 9.50% | 12/15/2020 | 42,306 |

| 63,189 | 9.50% | 3/1/2021 | 70,004 |

| 50,454 | 9.50% | 4/15/2021 | 55,741 |

| 207,216 | 9.50% | 7/1/2021 | 226,955 |

| 218,290 | 9.50% | 4/1/2025 | 240,481 |

| 296,226 | 9.50% | 4/1/2025 | 330,317 |

| 561,654 | 9.50% | 11/1/2025 | 624,809 |

| 365,722 | 9.50% | 3/1/2026 | 407,812 |

| 446,794 | 9.50% | 9/1/2026 | 498,213 |

| 344,264 | 9.50% | 10/1/2026 | 384,262 |

| 102,579 | 9.50% | 8/1/2030 | 113,946 |

| 1,765,205 | 9.55% | 8/20/2025 | 1,945,866 |

| 158,806 | 9.75% | 1/15/2013 | 173,589 |

| 124,211 | 9.75% | 1/1/2021 | 137,991 |

| 317,876 | 9.75% | 10/1/2021 | 355,654 |

| 327,873 | 9.75% | 4/1/2025 | 366,839 |

| 8,468 | 10.00% | 3/1/2011 | 8,936 |

| 67,570 | 10.00% | 5/1/2011 | 71,992 |

| 113,573 | 10.00% | 7/1/2013 | 121,379 |

| 84,971 | 10.00% | 6/1/2014 | 88,530 |

| 730,477 | 10.00% | 2/1/2015 | 803,451 |

| 888,300 | 10.00% | 3/1/2015 | 992,616 |

| 75,892 | 10.00% | 11/1/2016 | 83,792 |

| 43,708 | 10.00% | 3/1/2018 | 48,367 |

| 468,319 | 10.00% | 7/1/2019 | 515,104 |

| 63,545 | 10.00% | 9/1/2019 | 70,676 |

| 92,132 | 10.00% | 12/1/2019 | 100,015 |

| 209,797 | 10.00% | 6/1/2020 | 234,442 |

| 16,753 | 10.00% | 11/1/2020 | 18,805 |

| 37,089 | 10.00% | 1/1/2021 | 41,802 |

| 26,641 | 10.00% | 2/1/2021 | 29,564 |

| 189,535 | 10.00% | 10/1/2021 | 211,225 |

| 96,018 | 10.00% | 5/1/2022 | 108,219 |

| 159,638 | 10.00% | 5/1/2022 | 177,152 |

| 121,246 | 10.00% | 1/1/2024 | 135,121 |

| 653,859 | 10.00% | 2/1/2028 | 733,382 |

| 171,426 | 10.00% | 7/1/2028 | 192,444 |

| 338,989 | 10.25% | 8/15/2013 | 371,518 |

| 11,803 | 10.50% | 5/1/2009 | 12,512 |

| 45,525 | 10.50% | 5/1/2015 | 49,057 |

| 287,778 | 10.50% | 1/1/2016 | 323,403 |

| 91,344 | 10.50% | 12/1/2017 | 102,587 |

| 16,690 | 10.75% | 11/1/2010 | 17,764 |

| 5,714 | 11.00% | 4/1/2014 | 6,353 |

| 41,282 | 11.00% | 8/1/2015 | 44,592 |

See accompanying notes to portfolios of investments on page 62.

17

| Sit U.S. Government Securities Fund

September 30, 2005

Portfolio of Investments (Unaudited)

|

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| | | |

|---|

| 20,548 | 11.00% | 4/1/2017 | 22,323 |

| 472,241 | 11.27% | 8/15/2020 | 524,612 |

| 295,485 | 11.75% | 10/20/2022 | 336,849 |

| | |

|

| 81,331,837 |

| | |

|

| |

| Government National Mortgage Association (14.2%) (3): |

| |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 242,837 | 5.76% | 3/20/2033 | 246,234 |

| 112,570 | 5.76% | 3/20/2033 | 114,145 |

| 84,041 | 5.76% | 3/20/2033 | 85,217 |

| 117,677 | 5.76% | 5/20/2033 | 119,324 |

| 447,431 | 5.76% | 5/20/2033 | 453,691 |

| 109,935 | 5.76% | 6/20/2033 | 111,473 |

| 96,195 | 5.76% | 6/20/2033 | 97,541 |

| 75,375 | 6.00% | 9/15/2018 | 77,233 |

| 84,176 | 6.05% | 3/20/2033 | 86,040 |

| 340,083 | 6.25% | 5/15/2013 | 352,088 |

| 236,660 | 6.38% | 12/15/2027 | 246,014 |

| 307,443 | 6.38% | 4/15/2028 | 319,533 |

| 165,448 | 6.49% | 9/20/2031 | 171,319 |

| 345,030 | 6.49% | 11/20/2031 | 357,273 |

| 49,854 | 6.49% | 12/20/2031 | 51,623 |

| 360,121 | 6.49% | 4/20/2032 | 372,790 |

| 75,941 | 6.49% | 6/20/2032 | 78,612 |

| 56,303 | 6.49% | 6/20/2032 | 58,284 |

| 89,802 | 6.49% | 12/20/2032 | 92,962 |

| 2,732,342 | 6.50% | 5/15/2023 | 2,843,018 |

| 40,624 | 6.57% | 9/20/2032 | 42,054 |

| 116,731 | 6.57% | 11/20/2032 | 120,840 |

| 84,944 | 6.57% | 12/20/2032 | 87,934 |

| 179,884 | 6.57% | 1/20/2033 | 186,188 |

| 85,514 | 6.57% | 3/20/2033 | 88,511 |

| 131,524 | 6.75% | 9/15/2015 | 138,732 |

| 68,243 | 6.75% | 8/15/2028 | 71,407 |

| 465,137 | 6.75% | 8/15/2028 | 486,704 |

| 227,710 | 6.75% | 6/15/2029 | 238,123 |

| 135,956 | 6.75% | 6/15/2029 | 142,173 |

| 618,025 | 6.91% | 7/20/2026 | 647,260 |

| 38,998 | 7.00% | 9/20/2016 | 40,954 |

| 513,061 | 7.00% | 2/15/2028 | 539,455 |

| 396,822 | 7.00% | 1/15/2030 | 417,402 |

| 400,022 | 7.00% | 1/15/2031 | 420,717 |

| 417,519 | 7.00% | 10/15/2031 | 438,998 |

| 788,808 | 7.00% | 11/15/2032 | 829,546 |

| 29,067 | 7.05% | 2/15/2023 | 30,748 |

| 45,359 | 7.25% | 8/15/2010 | 47,303 |

| 107,205 | 7.25% | 10/15/2028 | 113,297 |

| 67,994 | 7.27% | 7/20/2022 | 71,950 |

| 461,140 | 7.38% | 3/15/2031 | 463,183 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 8,712 | 7.50% | 3/15/2007 | 8,926 |

| 130,502 | 7.50% | 5/15/2016 | 139,946 |

| 396,300 | 7.50% | 12/15/2022 | 423,684 |

| 831,117 | 7.50% | 2/15/2027 | 883,983 |

| 73,369 | 7.55% | 7/20/2022 | 77,344 |

| 168,216 | 7.55% | 10/20/2022 | 177,329 |

| 110,083 | 7.65% | 10/20/2021 | 116,335 |

| 107,252 | 7.65% | 7/20/2022 | 113,341 |

| 212,719 | 7.75% | 6/15/2020 | 226,407 |

| 271,369 | 7.75% | 7/15/2020 | 288,831 |

| 297,173 | 7.75% | 8/15/2020 | 316,295 |

| 217,759 | 7.75% | 8/15/2020 | 231,771 |

| 112,393 | 7.75% | 11/15/2020 | 119,625 |

| 601,618 | 7.75% | 10/15/2022 | 646,063 |

| 2,735 | 7.90% | 11/20/2020 | 2,908 |

| 46,600 | 7.90% | 1/20/2021 | 49,548 |

| 38,627 | 7.90% | 1/20/2021 | 41,070 |

| 31,043 | 7.90% | 4/20/2021 | 33,007 |

| 224,125 | 7.95% | 2/15/2020 | 239,691 |

| 91,031 | 7.99% | 2/20/2021 | 97,002 |

| 63,401 | 7.99% | 4/20/2021 | 67,559 |

| 161,834 | 7.99% | 7/20/2021 | 172,449 |

| 164,331 | 7.99% | 9/20/2021 | 175,109 |

| 108,854 | 7.99% | 10/20/2021 | 115,994 |

| 247,320 | 7.99% | 1/20/2022 | 263,562 |

| 458,620 | 7.99% | 6/20/2022 | 488,739 |

| 37,327 | 8.00% | 10/15/2012 | 39,721 |

| 783,679 | 8.00% | 10/15/2014 | 840,016 |

| 91,584 | 8.00% | 5/15/2016 | 98,709 |

| 285,030 | 8.00% | 6/15/2016 | 307,205 |

| 143,621 | 8.00% | 9/15/2016 | 154,794 |

| 138,124 | 8.00% | 11/20/2016 | 146,867 |

| 99,345 | 8.00% | 7/15/2017 | 106,370 |

| 48,330 | 8.00% | 7/20/2023 | 51,516 |

| 24,412 | 8.00% | 8/15/2023 | 26,143 |

| 48,227 | 8.00% | 12/20/2023 | 51,405 |

| 18,335 | 8.00% | 2/20/2024 | 19,546 |

| 173,916 | 8.00% | 2/20/2026 | 185,592 |

| 37,330 | 8.00% | 12/15/2026 | 40,022 |

| 34,069 | 8.00% | 12/20/2026 | 36,356 |

| 284,601 | 8.00% | 4/15/2028 | 304,620 |

| 53,159 | 8.00% | 4/15/2028 | 56,959 |

| 53,690 | 8.00% | 9/15/2029 | 57,515 |

| 279,416 | 8.10% | 5/20/2019 | 301,161 |

| 68,167 | 8.10% | 6/20/2019 | 73,472 |

| 134,079 | 8.10% | 7/20/2019 | 144,513 |

| 86,737 | 8.10% | 9/20/2019 | 93,487 |

| 177,835 | 8.10% | 9/20/2019 | 191,675 |

| 87,171 | 8.10% | 10/20/2019 | 93,955 |

| | | |

18

|

|  |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 122,671 | 8.10% | 1/20/2020 | 132,417 |

| 79,804 | 8.10% | 4/20/2020 | 86,144 |

| 136,039 | 8.10% | 7/20/2020 | 146,846 |

| 152,750 | 8.25% | 12/15/2011 | 163,358 |

| 36,386 | 8.25% | 1/15/2012 | 39,095 |

| 60,728 | 8.25% | 8/15/2015 | 65,943 |

| 533,827 | 8.25% | 4/15/2019 | 579,588 |

| 187,064 | 8.25% | 2/15/2020 | 203,414 |

| 20,150 | 8.25% | 4/15/2027 | 21,783 |

| 87,018 | 8.25% | 6/15/2027 | 94,069 |

| 93,098 | 8.38% | 10/15/2019 | 101,370 |

| 157,415 | 8.40% | 2/15/2019 | 171,525 |

| 33,615 | 8.40% | 4/15/2019 | 36,628 |

| 125,795 | 8.40% | 6/15/2019 | 137,071 |

| 43,259 | 8.40% | 9/15/2019 | 47,137 |

| 58,951 | 8.40% | 9/15/2019 | 64,235 |

| 58,595 | 8.40% | 2/15/2020 | 63,950 |

| 46,361 | 8.50% | 12/15/2011 | 49,793 |

| 168,701 | 8.50% | 1/15/2012 | 182,098 |

| 35,249 | 8.50% | 4/15/2015 | 38,482 |

| 72,744 | 8.50% | 4/15/2015 | 79,416 |

| 215,953 | 8.50% | 9/15/2016 | 236,450 |

| 186,838 | 8.50% | 1/15/2017 | 205,097 |

| 143,380 | 8.50% | 12/15/2021 | 157,112 |

| 18,746 | 8.50% | 7/20/2022 | 20,489 |

| 130,922 | 8.50% | 10/20/2022 | 143,094 |

| 61,363 | 8.50% | 9/20/2024 | 67,208 |

| 132,730 | 8.50% | 3/20/2025 | 145,340 |

| 311,813 | 8.50% | 12/20/2026 | 338,118 |

| 26,934 | 8.50% | 8/15/2030 | 29,261 |

| 59,013 | 8.60% | 5/15/2018 | 63,811 |

| 98,083 | 8.60% | 6/15/2018 | 106,058 |

| 78,113 | 8.63% | 10/15/2018 | 84,391 |

| 3,819 | 8.75% | 5/15/2006 | 3,889 |

| 4,038 | 8.75% | 5/15/2006 | 4,112 |

| 7,536 | 8.75% | 10/15/2006 | 7,674 |

| 12,612 | 8.75% | 11/15/2006 | 12,843 |

| 9,064 | 8.75% | 2/15/2007 | 9,543 |

| 3,961 | 8.75% | 3/15/2007 | 4,170 |

| 39,633 | 8.75% | 11/15/2009 | 42,461 |

| 49,253 | 8.75% | 6/15/2011 | 53,315 |

| 208,186 | 8.75% | 11/15/2011 | 225,357 |

| 44,760 | 8.75% | 12/15/2011 | 48,452 |

| 8,825 | 9.00% | 4/15/2006 | 8,995 |

| 12,320 | 9.00% | 4/15/2006 | 12,558 |

| 7,938 | 9.00% | 5/15/2006 | 8,092 |

| 15,346 | 9.00% | 5/15/2006 | 15,643 |

| 5,958 | 9.00% | 6/15/2006 | 6,073 |

| 50,775 | 9.00% | 6/15/2006 | 51,758 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 30,024 | 9.00% | 7/15/2006 | 30,605 |

| 5,719 | 9.00% | 10/15/2006 | 5,830 |

| 28,033 | 9.00% | 10/15/2006 | 28,576 |

| 7,055 | 9.00% | 6/15/2007 | 7,442 |

| 25,200 | 9.00% | 10/15/2007 | 26,583 |

| 22,891 | 9.00% | 9/15/2008 | 23,978 |

| 8,986 | 9.00% | 9/15/2008 | 9,413 |

| 3,201 | 9.00% | 10/15/2008 | 3,353 |

| 12,038 | 9.00% | 11/15/2008 | 12,610 |

| 27,293 | 9.00% | 12/15/2008 | 28,590 |

| 3,271 | 9.00% | 2/15/2009 | 3,454 |

| 1,463 | 9.00% | 3/15/2009 | 1,545 |

| 13,390 | 9.00% | 4/15/2009 | 14,138 |

| 15,109 | 9.00% | 4/15/2009 | 15,997 |

| 5,058 | 9.00% | 5/15/2009 | 5,340 |

| 21,706 | 9.00% | 8/15/2009 | 22,981 |

| 18,300 | 9.00% | 9/15/2009 | 19,376 |

| 11,377 | 9.00% | 10/15/2009 | 12,013 |

| 26,548 | 9.00% | 11/15/2009 | 28,535 |

| 7,092 | 9.00% | 12/15/2009 | 7,509 |

| 103,252 | 9.00% | 7/15/2010 | 109,707 |

| 115,880 | 9.00% | 5/15/2011 | 125,964 |

| 42,541 | 9.00% | 5/15/2011 | 46,243 |

| 73,780 | 9.00% | 6/15/2011 | 80,200 |

| 97,026 | 9.00% | 7/15/2011 | 105,470 |

| 57,555 | 9.00% | 8/15/2011 | 61,844 |

| 100,470 | 9.00% | 8/15/2011 | 109,213 |

| 63,452 | 9.00% | 9/15/2011 | 68,974 |

| 98,126 | 9.00% | 9/15/2011 | 106,665 |

| 106,563 | 9.00% | 9/15/2011 | 115,836 |

| 64,152 | 9.00% | 10/15/2011 | 69,734 |

| 40,675 | 9.00% | 1/15/2012 | 44,422 |

| 49,950 | 9.00% | 5/20/2015 | 53,960 |

| 181,957 | 9.00% | 7/15/2015 | 197,295 |

| 37,051 | 9.00% | 8/15/2015 | 40,174 |

| 103,765 | 9.00% | 12/20/2015 | 112,097 |

| 20,277 | 9.00% | 5/20/2016 | 21,957 |

| 27,834 | 9.00% | 7/20/2016 | 30,140 |

| 139,943 | 9.00% | 1/15/2017 | 155,099 |

| 15,108 | 9.00% | 3/20/2017 | 16,397 |

| 533,462 | 9.00% | 6/15/2017 | 591,234 |

| 421,214 | 9.00% | 7/15/2017 | 466,830 |

| 270,657 | 9.00% | 8/20/2017 | 293,745 |

| 18,653 | 9.00% | 5/15/2018 | 20,596 |

| 288,774 | 9.00% | 12/15/2019 | 315,763 |

| 6,598 | 9.00% | 12/15/2019 | 7,215 |

| 212,658 | 9.00% | 6/15/2021 | 233,269 |

| 3,204 | 9.00% | 7/20/2021 | 3,501 |

| 3,125 | 9.00% | 10/20/2021 | 3,416 |

See accompanying notes to portfolios of investments on page 62.

19

| Sit U.S. Government Securities Fund

September 30, 2005

Portfolio of Investments (Unaudited)

|

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 364,928 | 9.00% | 11/15/2024 | 399,341 |

| 48,070 | 9.00% | 7/20/2025 | 52,754 |

| 178,472 | 9.00% | 4/15/2026 | 196,458 |

| 24,484 | 9.10% | 5/15/2018 | 26,838 |

| 94,588 | 9.25% | 11/15/2009 | 102,689 |

| 43,848 | 9.25% | 1/15/2010 | 47,918 |

| 38,868 | 9.25% | 4/15/2010 | 42,476 |

| 44,702 | 9.25% | 11/15/2010 | 48,851 |

| 72,451 | 9.25% | 11/15/2011 | 79,600 |

| 16,342 | 9.25% | 4/15/2012 | 18,047 |

| 1,518 | 9.50% | 1/15/2006 | 1,551 |

| 9,688 | 9.50% | 7/15/2009 | 10,315 |

| 35,999 | 9.50% | 8/15/2009 | 38,328 |

| 12,468 | 9.50% | 8/15/2009 | 13,275 |

| 16,929 | 9.50% | 9/15/2009 | 17,971 |

| 24,945 | 9.50% | 9/15/2009 | 26,559 |

| 5,074 | 9.50% | 9/15/2009 | 5,402 |

| 43,764 | 9.50% | 10/15/2009 | 46,459 |

| 7,452 | 9.50% | 10/15/2009 | 7,911 |

| 116,685 | 9.50% | 10/15/2009 | 123,872 |

| 12,203 | 9.50% | 10/15/2009 | 12,993 |

| 3,454 | 9.50% | 10/15/2009 | 3,677 |

| 9,755 | 9.50% | 10/15/2009 | 10,386 |

| 9,055 | 9.50% | 10/15/2009 | 9,641 |

| 9,663 | 9.50% | 10/15/2009 | 10,288 |

| 32,278 | 9.50% | 11/15/2009 | 35,157 |

| 94,931 | 9.50% | 1/15/2010 | 104,133 |

| 36,760 | 9.50% | 2/15/2010 | 39,309 |

| 89,598 | 9.50% | 4/15/2010 | 96,121 |

| 29,017 | 9.50% | 8/15/2010 | 31,830 |

| 39,983 | 9.50% | 11/15/2010 | 43,859 |

| 24,771 | 9.50% | 1/15/2011 | 27,329 |

| 111,321 | 9.50% | 3/15/2011 | 122,813 |

| 16,237 | 9.50% | 3/20/2016 | 17,802 |

| 14,801 | 9.50% | 6/15/2016 | 16,286 |

| 45,690 | 9.50% | 10/15/2016 | 50,275 |

| 44,274 | 9.50% | 10/15/2016 | 48,717 |

| 38,270 | 9.50% | 11/15/2016 | 42,111 |

| 46,678 | 9.50% | 11/20/2016 | 51,176 |

| 16,339 | 9.50% | 1/15/2017 | 18,032 |

| 38,288 | 9.50% | 8/15/2017 | 42,256 |

| 4,031 | 9.50% | 8/20/2017 | 4,433 |

| 30,075 | 9.50% | 9/15/2017 | 33,193 |

| 17,594 | 9.50% | 9/15/2017 | 19,418 |

| 186,393 | 9.50% | 12/15/2017 | 204,964 |

| 25,021 | 9.50% | 12/15/2017 | 27,532 |

| 82,748 | 9.50% | 12/15/2017 | 91,033 |

| 76,807 | 9.50% | 12/15/2017 | 84,382 |

| 6,497 | 9.50% | 12/20/2017 | 7,145 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 6,267 | 9.50% | 4/15/2018 | 6,933 |

| 7,752 | 9.50% | 4/20/2018 | 8,546 |

| 3,153 | 9.50% | 5/20/2018 | 3,476 |

| 93,679 | 9.50% | 6/15/2018 | 103,646 |

| 68,231 | 9.50% | 6/20/2018 | 75,218 |

| 32,665 | 9.50% | 7/20/2018 | 36,010 |

| 13,213 | 9.50% | 8/15/2018 | 14,619 |

| 25,376 | 9.50% | 8/20/2018 | 27,975 |

| 47,347 | 9.50% | 9/15/2018 | 52,385 |

| 68,794 | 9.50% | 9/15/2018 | 76,114 |

| 122,797 | 9.50% | 9/20/2018 | 135,371 |

| 13,170 | 9.50% | 9/20/2018 | 14,518 |

| 45,643 | 9.50% | 9/20/2018 | 50,316 |

| 37,076 | 9.50% | 10/15/2018 | 40,850 |

| 18,153 | 9.50% | 1/15/2019 | 20,130 |

| 28,189 | 9.50% | 4/15/2019 | 31,258 |

| 6,090 | 9.50% | 8/15/2019 | 6,753 |

| 92,868 | 9.50% | 8/20/2019 | 102,610 |

| 30,727 | 9.50% | 9/15/2019 | 34,073 |

| 4,929 | 9.50% | 10/20/2019 | 5,446 |

| 9,031 | 9.50% | 12/15/2019 | 10,014 |

| 3,280 | 9.50% | 1/15/2020 | 3,645 |

| 8,401 | 9.50% | 10/15/2020 | 9,333 |

| 14,965 | 9.50% | 1/15/2021 | 16,653 |

| 41,215 | 9.50% | 8/15/2021 | 45,865 |

| 275,590 | 9.50% | 8/15/2022 | 307,116 |

| 1,927 | 9.75% | 1/15/2006 | 1,971 |

| 1,821 | 9.75% | 2/15/2006 | 1,862 |

| 94,199 | 9.75% | 8/15/2009 | 102,814 |

| 54,384 | 9.75% | 9/15/2009 | 59,357 |

| 158,711 | 9.75% | 8/15/2010 | 174,676 |

| 37,968 | 9.75% | 11/15/2010 | 41,788 |

| 224,703 | 9.75% | 12/15/2010 | 247,307 |

| 192,975 | 9.75% | 1/15/2011 | 214,089 |

| 105,963 | 9.75% | 1/15/2011 | 117,557 |

| 17,394 | 9.75% | 10/15/2012 | 19,427 |

| 29,263 | 9.75% | 10/15/2012 | 32,683 |

| 17,925 | 9.75% | 10/15/2012 | 20,019 |

| 40,535 | 9.75% | 11/15/2012 | 45,272 |

| 29,116 | 9.75% | 11/15/2012 | 32,518 |

| 19,800 | 9.75% | 11/15/2012 | 22,114 |

| 44,759 | 9.75% | 11/15/2012 | 49,990 |

| 35,899 | 10.00% | 11/15/2008 | 38,906 |

| 1,804 | 10.00% | 11/15/2009 | 1,931 |

| 87,516 | 10.00% | 6/15/2010 | 96,681 |

| 5,509 | 10.00% | 6/15/2010 | 6,086 |

| 25,374 | 10.00% | 7/15/2010 | 28,031 |

| 10,929 | 10.00% | 7/15/2010 | 12,074 |

| 14,071 | 10.00% | 10/15/2010 | 15,544 |

20

|

|  |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 81,915 | 10.00% | 11/15/2010 | 90,493 |

| 6,579 | 10.00% | 1/15/2011 | 7,329 |

| 34,030 | 10.00% | 3/20/2016 | 37,888 |

| 19,143 | 10.00% | 11/15/2017 | 21,391 |

| 33,445 | 10.00% | 2/15/2019 | 37,393 |

| 26,711 | 10.00% | 2/20/2019 | 29,758 |

| 43,784 | 10.00% | 3/20/2019 | 48,778 |

| 23,902 | 10.00% | 5/15/2019 | 26,724 |

| 30,454 | 10.00% | 5/20/2019 | 33,927 |

| 279,337 | 10.00% | 10/15/2019 | 319,130 |

| 43,740 | 10.00% | 11/15/2019 | 48,904 |

| 8,293 | 10.00% | 7/15/2020 | 9,285 |

| 32,948 | 10.00% | 12/15/2020 | 36,888 |

| 115,063 | 10.00% | 6/15/2021 | 128,968 |

| 11,895 | 10.00% | 10/15/2030 | 13,408 |

| 36,937 | 10.25% | 5/15/2009 | 39,976 |

| 28,440 | 10.25% | 11/15/2011 | 31,313 |

| 31,035 | 10.25% | 1/15/2012 | 34,418 |

| 33,844 | 10.25% | 2/15/2012 | 37,534 |

| 3,086 | 10.25% | 2/15/2012 | 3,423 |

| 18,325 | 10.25% | 7/15/2012 | 20,323 |

| 36,859 | 10.50% | 6/15/2009 | 40,023 |

| 7,705 | 10.50% | 7/15/2010 | 8,446 |

| 10,324 | 10.50% | 9/15/2015 | 11,533 |

| 13,457 | 10.50% | 11/15/2015 | 15,033 |

| 21,197 | 10.50% | 8/20/2017 | 23,719 |

| 52,975 | 10.50% | 11/15/2018 | 59,610 |

| 62,355 | 10.50% | 6/15/2019 | 70,286 |

| 305,504 | 10.50% | 2/15/2020 | 343,376 |

| 241,600 | 10.50% | 8/15/2021 | 276,060 |

| 3,877 | 10.75% | 1/15/2010 | 4,248 |

| 1,638 | 10.75% | 7/15/2011 | 1,800 |

| 67,544 | 11.00% | 1/15/2010 | 73,438 |

| 42,488 | 11.00% | 1/15/2010 | 46,195 |

| 78,815 | 11.00% | 1/15/2010 | 85,691 |

| 36,139 | 11.00% | 3/15/2010 | 39,292 |

| 11,516 | 11.00% | 6/15/2010 | 12,520 |

| 28,179 | 11.00% | 9/15/2010 | 30,638 |

| 39,661 | 11.25% | 6/15/2010 | 43,809 |

| 46,589 | 11.25% | 9/15/2010 | 51,461 |

| 5,709 | 11.25% | 9/15/2010 | 6,306 |

| 8,003 | 11.25% | 2/15/2011 | 8,875 |

| 2,688 | 11.25% | 2/15/2011 | 2,981 |

| 21,229 | 11.25% | 3/15/2011 | 23,543 |

| 11,837 | 11.25% | 3/15/2011 | 13,126 |

| 47,933 | 11.25% | 4/15/2011 | 53,156 |

| 11,434 | 11.25% | 5/15/2011 | 12,680 |

| 35,214 | 11.25% | 7/15/2011 | 39,051 |

| 16,974 | 11.25% | 7/15/2011 | 18,823 |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 7,709 | 11.25% | 7/15/2011 | 8,549 |

| 33,822 | 11.25% | 9/15/2011 | 37,507 |

| 15,549 | 11.25% | 10/15/2011 | 17,243 |

| 4,141 | 11.25% | 11/15/2011 | 4,593 |

| | |

|

| 37,241,922 |

| | |

|

| |

| Total mortgage pass-through securities | 164,933,957 |

| (cost: $164,964,400) |

|

|

| Quantity ($) | | Name of Issuer | Market Value ($)(1) |

|---|

|

| |

| Taxable Municipal Securities (0.3%) (2) |

| | 229,000 | | Bernalillo Multifamily Rev. Series | | | | | |

| | | | 1998A, 7.50%, 9/20/20 | | | | 247,757 | |

| | 55,000 | | Cuyahoga County Multifamily Rev. | | | | | |

| | | | Series 2000B, 7.00%, 1/20/08 | | | | 57,186 | |

| | 5,000 | | Dakota Multifamily Rev. Series | | | | | |

| | | | 1999A, 6.50%, 12/20/05 | | | | 5,021 | |

| | 95,000 | | Louisiana Comm. Dev. Auth Rev. | | | | | |

| | | | Series 2002B, 5.25%, 12/20/07 | | | | 95,044 | |

| | 415,000 | | Maplewood Multifamily Rev. | | | | | |

| | | | Series 1998B, 6.75%, 7/20/15 | | | | 424,495 | |

| | 27,000 | | Nortex Multifamily Rev. Series | | | | | |

| | | | 1999T, 6.50%, 3/20/06 | | | | 27,255 | |

| |

| |

| |

| Total taxable municipal securities | 856,758 |

| (cost: $826,000) |

|

| |

| U.S. Treasury / Federal Agency Securities (9.6%) (2) |

| | | | Federal Home Loan Bank: | | | | | |

| | 5,000,000 | | 2.50%, 6/30/09 | | | | 4,891,425 | |

| | 2,170,000 | | 5.62%, 8/6/18 | | | | 2,141,319 | |

| | 5,000,000 | | FNMA Strip, zero coupon, | | | | | |

| | | | 4.88% effective yield, 11/15/30 | | | | 1,449,900 | |

| | | | U.S. Treasury Strips, zero coupon: | | | | | |

| | 9,800,000 | | 3.80% effective yield, 8/15/11 | | | | 7,674,929 | |

| | 25,000,000 | | 4.80% effective yield, 11/15/27 | | | | 8,986,650 | |

| |

| |

| |

| Total U.S. Treasury / Federal Agency securities | 25,144,223 |

| (cost: $25,060,889) |

|

See accompanying notes to portfolios of investments on page 62.

21

| Sit U.S. Government Securities Fund

September 30, 2005

Portfolio of Investments (Unaudited)

|

| Collateralized Mortgage Obligations (25.1%) (2) |

| |

| Federal Home Loan Mortgage Corp.: |

| |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 754,621 | 3.00% | 2/15/2023 | 705,119 |

| 4,598,510 | 3.25% | 4/15/2032 | 4,303,168 |

| 897,871 | 3.50% | 5/15/2029 | 868,864 |

| 716,480 | 4.00% | 11/15/2014 | 700,352 |

| 3,000,000 | 4.00% | 5/31/2025 | 2,757,136 |

| 491,814 | 4.00% | 12/15/2032 | 474,640 |

| 2,147,215 | 4.25% | 11/15/2017 | 2,101,968 |

| 2,890,125 | 6.50% | 5/15/2029 | 2,959,665 |

| 702,349 | 7.50% | 6/15/2017 | 744,539 |

| 423,899 | 7.50% | 9/15/2030 | 438,003 |

| 28,708 | 7.75% | 3/18/2025 | 29,559 |

| 52,173 | 9.15% | 10/15/2020 | 54,377 |

| 2,000,476 | 9.50% | 2/15/2020 | 2,145,954 |

| |

| Federal National Mortgage Association: |

| |

| Par ($) | Coupon | Maturity | Market Value ($)(1) |

| 4,226,189 | 3.50% | 2/25/2033 | 3,967,465 |

| 1,254,707 | 3.50% | 3/25/2033 | 1,215,097 |

| 1,304,112 | 3.75% | 5/25/2033 | 1,224,440 |

| 1,727,766 | 4.00% | 11/25/2032 | 1,690,661 |

| 501,533 | 4.00% | 1/25/2033 | 473,863 |

| 2,031,671 | 4.00% | 3/25/2033 | 1,938,107 |

| 304,429 | 5.00% | 8/25/2022 | 303,528 |

| 125,567 | 6.85% | 12/18/2027 | 130,181 |

| 137,942 | 7.00% | 1/25/2021 | 141,804 |

| 744,147 | 7.00% | 1/25/2022 | 763,738 |

| 66,046 | 7.70% | 3/25/2023 | 69,485 |

| 383,032 | 8.00% | 7/25/2022 | 396,550 |

| 663,458 | 8.00% | 7/25/2044 | 702,229 |

| 154,942 | 8.20% | 4/25/2025 | 164,260 |

| 54,562 | 8.50% | 1/25/2021 | 58,232 |

| 82,949 | 8.50% | 4/25/2021 | 86,802 |

| 397,332 | 8.50% | 9/25/2021 | 424,177 |

| 141,693 | 8.50% | 1/25/2025 | 150,621 |