Registration No. 2-91312

As soon as possible following the effective date of this Registration Statement.

July 9, 2007 (30 days after filing) pursuant to Rule 488.

The title of securities being registered is common stock, par value $0.001 per share.

No filing fee is required because of Registrant’s reliance on Section 24(f) of the Investment Company Act of 1940, as amended.

I am writing to inform you of a Special Meeting of the shareholders of Sit Florida Tax-Free Income Fund (“Florida Fund”) to be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota. The purpose of this meeting is to vote on a proposal to combine Florida Fund into Sit Tax-Free Income Fund (“Tax-Free Fund”). If the proposed reorganization is approved, you will receive shares of Tax-Free Fund with a value equal to the value of your Florida Fund shares.

The attached Prospectus/Proxy Statement provides you with additional information about the proposed reorganization and a comparison of the Funds. There is also attached a “Q&A” which should provide answers to many of your questions. We urge you to read all of the enclosed materials carefully.

The board of directors for Sit Mutual Funds II, Inc., the issuer of Tax-Free Fund, and the board of trustees for Sit Mutual Funds Trust, the Trust consisting of one series of shares in the Florida Fund, have approved the proposed reorganization of the Funds. I encourage you to vote “FOR” the proposal, and ask that you please send your completed proxy ballot in as soon as possible to help save the cost of additional solicitations. As always, we thank you for your confidence and support.

The meeting is being called to ask you to approve the reorganization of Florida Fund into Sit Tax-Free Income Fund (“Tax-Free Fund”), a “tax-free” fund in the Sit fund family. If shareholders vote in favor of the reorganization, Tax-Free Fund will acquire all or substantially all of the assets and all of the liabilities of Florida Fund, and your shares of Florida Fund will be exchanged for shares of Tax-Free Fund with the same value.

Based upon the recommendation of Sit Investment Associates, Inc. (the “Adviser”), the investment adviser to both Florida Fund and Tax-Free Fund, your board of trustees concluded that Florida Fund is unlikely to grow to a size that is as economically viable as Tax-Free Fund. While Florida Fund, at March 31, 2007, had net assets of $3.7 million, Tax-Free Fund had net assets of $377.5 million. Your board believes that the larger asset base of the combined Funds may provide several benefits to the shareholders of both Funds, including the creation of a larger and potentially more stable fund for investment management and economies of scale associated with higher asset levels. In addition, your board noted the tax-free nature of the proposed reorganization, as explained below. Additional information regarding the boards’ deliberations is described in the attached Prospectus/Proxy Statement under the heading “Information about the Reorganization – Reasons for the Reorganization.”

The investment objectives of these Funds are substantially similar. The Tax-Free Fund has an objective of seeking high current income that is exempt from federal income tax consistent with preservation of capital. The Florida Fund has an objective of seeking high current income that is exempt from federal regular income tax. In addition, The Tax-Free Fund seeks to achieve its investment objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Florida Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. The material differences in the Funds’ investment strategies are:

The investment risks associated with these Funds also are similar, except that investments in Florida Fund are subject to Florida state specific risk, which is not a primary risk of investing in Tax-Free Fund. The Funds’ principal risks are described and compared in the attached Prospectus/Proxy Statement under the heading “Risk Factors.”

If the reorganization is approved, the contractual annual fund operating expenses paid by Florida Fund shareholders will remain the same at .80% (excluding fees and expenses of acquired funds). Due to the Adviser’s voluntary waiver of fees, Tax-Free Fund’s actual expenses (excluding fees and expenses of acquired funds) are lower; for the year ended March 31, 2007, Tax-Free Fund’s expenses (excluding fees and expenses of acquired funds) were equal to .77% of the Fund’s average daily net assets. After December 31, 2007, the voluntary fee waiver may be terminated at any time by the Adviser.

If the reorganization is approved, Tax-Free Fund will acquire all or substantially all of the assets and all of the liabilities of Florida Fund, and the shareholders of Florida Fund will receive full and fractional shares of Tax-Free Fund equal in value to the shares of Florida Fund that they owned immediately prior to the reorganization. Following distribution of the shares of Tax-Free Fund, Florida Fund will liquidate and dissolve.

If shareholders do not approve the reorganization, Florida Fund initially will continue to be managed as a separate fund in accordance with its current investment objective and investment strategies. However, the board of trustees of Florida Fund may consider other alternatives, such as re-submission of the reorganization proposal to shareholders, submission of a liquidation proposal to shareholders or changes in the investment strategies of Florida Fund.

Unlike a transaction where you sell shares of one fund in order to buy shares of another, the reorganization will not be considered a taxable event. The Funds themselves will recognize no gains or losses on assets as a result of the reorganization. Therefore, you will not have reportable capital gains or losses due to the reorganization, although you may receive a distribution, immediately prior to the reorganization, of all of current year net income and net realized capital gains, if any, not previously distributed by Florida Fund.

However, you should consult your own tax adviser regarding any possible effect the proposed reorganization might have on you, given your personal circumstances – particularly regarding state and local taxes.

The expenses of the reorganization, including legal expenses, printing, packaging, and postage, plus the cost of any supplementary solicitations, will be borne by the Adviser.

The board of trustees of Florida Fund recommends that you vote in favor of the reorganization. Before you do, however, be sure to study the issues involved and call us with any questions, then vote promptly to ensure that a quorum will be represented at the special shareholders meeting.

Please call the Funds at (800) 332-5580 or (612) 334-5888 or go online at www.sitfunds.com.

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders of Sit Florida Tax-Free Income Fund (“Florida Fund”) will be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota. The purpose of the special meeting is as follows:

Even if Florida Fund shareholders vote to approve the Plan, consummation of the Plan is subject to certain other conditions. See “Information about the Reorganization – Agreement and Plan of Reorganization” in the attached Prospectus/Proxy Statement.

The close of business on June 20, 2007 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any adjournments or postponements thereof.

We are furnishing this combined Prospectus/Proxy Statement to the shareholders of Sit Florida Tax-Free Income Fund (“Florida Fund”) in connection with the solicitation of proxies by Florida Fund’s board of trustees for use at a special meeting of the shareholders of Florida Fund to be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota, for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders. This Prospectus/Proxy Statement is first being mailed to Florida Fund shareholders on or about July 13, 2007.

This Prospectus/Proxy Statement relates to a proposed Agreement and Plan of Reorganization (the “Plan”) providing for (a) the acquisition of all or substantially all of the assets and the assumption of all of the liabilities of Florida Fund by Sit Tax-Free Income Fund (“Tax-Free Fund”) in exchange for full and fractional shares of common stock of Tax-Free Fund having an aggregate net asset value equal to the aggregate value of the assets acquired (less liabilities assumed) from Florida Fund and (b) the distribution of Tax-Free Fund shares to the shareholders of Florida Fund in liquidation of Florida Fund. Under the Plan, each Florida Fund shareholder will receive Tax-Free Fund shares with a net asset value equal to the net asset value of their Florida Fund shares.

Both Florida Fund and Tax-Free Fund are open-end funds with the investment objective to seek high current income that is exempt from federal regular income tax. The Funds’ investment objectives, principal investment strategies and principal risks are described and compared below under “Risk Factors” and “Information about Florida Fund and Tax-Free Fund – Comparison of Investment Objectives and Principal Investment Strategies.”

Because Florida Fund shareholders are being asked to approve a transaction that will result in their receiving shares of Tax-Free Fund, this documents also serves as a Prospectus for Tax-Free Fund shares. This Prospectus/Proxy Statement concisely sets forth information about Tax-Free Fund that shareholders of Florida Fund should know before voting on the Plan, and it should be retained for future reference.

Additional information about Florida Fund and Tax-Free Fund has been filed with the Securities and Exchange Commission and is available upon request and without charge by writing to the Funds at 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota 55402, by calling the Funds at (800) 332-5580 or (612) 334-5888, or by going online to www.sitfunds.com. You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s Internet site at www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549.

Information which has been filed with the Securities and Exchange Commission includes a Statement of Additional Information dated July 9, 2007 relating to this Prospectus/Proxy Statement, which is incorporated herein by reference. This Prospectus/Proxy Statement also includes the Agreement and Plan of Reorganization, a copy of which is attached as Exhibit A to this Prospectus/Proxy Statement. The Prospectus dated August 1, 2006 of Florida Fund and Tax-Free Fund also is incorporated into this Prospectus/Proxy Statement by reference, a copy of which is attached as Exhibit B to this Prospectus/Proxy Statement.

The documents listed below are incorporated by reference into the Statement of Additional Information relating to this Prospectus/Proxy Statement, and these items will be provided with any copy of the Statement of Additional Information which is requested. Any documents requested will be sent within one business day of receipt of the request by first class mail or other means designed to ensure equally prompt delivery.

Both Funds are no-load investments, so you will not pay sales charges (loads) or exchange fees when you buy or sell shares of either Fund. When you hold shares of either Fund, you indirectly pay a portion of that Fund’s operating expenses. These expenses are deducted from Fund assets.

This example is intended to help you compare the cost of investing in Florida Fund with the cost of investing in Tax-Free Fund (before any fee waiver), as well as other mutual funds. It assumes that you invest $10,000 for the time periods indicated (with reinvestment of all dividends and distributions), that your investment has a 5% return each year, that the Funds’ operating expenses remain the same, and that you redeem all of your shares at the end of those periods. Although your actual costs and returns may differ, based on these assumptions your costs would be:

The following is a summary of certain information contained elsewhere in this Prospectus/Proxy Statement and in the documents incorporated by reference into this Prospectus/Proxy Statement, including the Plan, a copy of which is included with this Prospectus/Proxy Statement as Exhibit A. This summary may not contain all of the information that is important to you. Florida Fund shareholders should review the accompanying documents carefully in connection with their review of this Prospectus/Proxy Statement.

The Plan provides for (a) the acquisition of all or substantially all of the assets and the assumption of all of the liabilities of Florida Fund by Tax-Free Fund in exchange for full and fractional shares of common stock of Tax-Free Fund having an aggregate net asset value equal to the aggregate value of the assets acquired (less liabilities assumed) from Florida Fund and (b) the distribution of Tax-Free Fund shares to the shareholders of Florida Fund in liquidation of Florida Fund. Under the Plan, each Florida Fund shareholder will receive Tax-Free Fund shares with a net asset value equal to the net asset value of their Florida Fund shares.

For the reasons set forth below under “Information about the Reorganization – Reasons for the Reorganization,” the board of trustees of Florida Fund and the board of directors of Tax-Free Fund, including all of the “non-interested” members of the boards, as that term is defined in the Investment Company Act of 1940, as amended (the “Investment Company Act”), have concluded that the reorganization would be in the best interests of the shareholders of both Funds and that the interests of the Funds’ existing shareholders would not be diluted as a result of the transactions contemplated by the reorganization. Therefore, the boards have approved the reorganization on behalf of both Funds, and the board of trustees of Florida Fund has submitted the Plan for approval by Florida Fund shareholders.

Approval of the reorganization will require the affirmative vote of a majority of outstanding shares of Florida Fund as discussed in detail below under “Voting Information – General.”

Prior to completion of the reorganization Florida Fund will have received from counsel an opinion that, upon the reorganization, no gain or loss will be recognized by Florida Fund or its shareholders for federal income tax purposes. The holding period and aggregate tax basis of Tax-Free Fund shares that are received by each Florida Fund shareholder will be the same as the holding period and aggregate tax basis of Florida Fund shares previously held by those shareholders. In addition, the holding period and tax basis of the assets of Florida Fund in the hands of Tax-Free Fund as a result of the reorganization will be the same as in the hand of Florida Fund immediately prior to the reorganization. See “Information about the Reorganization – Federal Income Tax Consequences.”

The investment objectives of the Funds are substantially similar. The Tax-Free Fund has an objective of seeking high current income that is exempt from federal income tax consistent with preservation of capital. The Florida Fund has an objective of seeking high current income that is exempt from federal regular income tax. In addition, The Tax-Free Fund seeks to achieve its investment objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Florida Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. The material differences in the Funds’ investment strategies are:

Each Fund is a party to a separate Investment Management Agreement with the Adviser under which the Adviser manages the Fund’s business and investment activities, subject to the authority of the board of directors or the board of trustees. The Agreements require the Adviser to bear each Fund’s expenses except interest, brokerage commission and transaction charges, acquired fund fees and expenses and certain extraordinary expenses. The investment advisory fees for the Funds, calculated as a percentage of Fund net assets, are .80% for Florida Fund and .80% for Tax-Free Fund (before voluntary fee waivers). Thus, if the reorganization is approved, Florida Fund shareholders will experience the same contractual advisory fees as shareholders of Tax-Free Fund. See “Fees and Expenses,” above. For the fiscal year ended March 31, 2007, the Adviser waived a portion of its fee for Tax-Free Fund, resulting in advisory fees equal to .77% of average daily net assets for the fiscal year. However, the Adviser may modify or discontinue voluntary waivers for Tax-Free Fund at any time after December 31, 2007, in its sole discretion.

Shares of Tax-Free Fund received by Florida Fund shareholders in the reorganization will be subject to the same purchase, exchange and redemption procedures that currently apply to Florida Fund shares. Shares of both Funds are offered at net asset value, without any sales charges. Shares of the Funds may be purchased, exchanged or sold on any day the New York Stock Exchange is open. The minimum initial investment generally is $5,000 for each Fund ($2,000 for IRA accounts), with minimum additional investments of at least $100. For each Fund, shareholders may sell their shares and use the proceeds to buy shares of another Sit Mutual Fund at no cost. Purchase, exchange and redemption procedures are discussed in detail in the accompanying prospectus of Florida Fund and Tax-Free Fund under the caption “Shareholder Information.”

SIA Securities Corp. (the “Distributor”), an affiliate of the Adviser, is the distributor for the Funds. The Distributor markets the Funds’ shares only to certain institutional and individual investors, and all other sales of the Funds’ shares are made by each Fund. The Distributor or the Adviser may enter into agreements under which various financial institutions and brokerage firms provide administrative services for customers who are beneficial owners of shares of the Funds. The Distributor or Adviser may compensate these firms for the services provided, with compensation based on the aggregate assets of customers that are invested in the Funds.

Each Fund distributes an annual dividend from its net investment income. Capital gains, if any, are distributed at least once a year by each Fund. Dividend and capital gain distributions are automatically reinvested in additional shares of the Fund paying the distribution at the net asset value per share on the distribution date. However, for each Fund, shareholders may request that distributions be automatically reinvested in another Sit Mutual Fund, or paid in cash. Florida Fund anticipates that it will make a distribution, immediately prior to the combination with Tax-Free Fund, of all of its current year net income and net realized capital gains, if any, not previously distributed. This distribution of realized capital gains, if any, will be taxable to Florida Fund shareholders subject to taxation.

The investment securities and techniques of the Funds, and the risks associated therewith, are described in more detail in the Statement of the Additional Information for Florida Fund and Tax-Free Fund.

The board of trustees of Florida Fund and the board of directors of Tax-Free Fund are comprised of the same individuals, and the boards, including all of the “non-interested” directors and trustees, have determined that it is advantageous to the respective Funds to combine Florida Fund with Tax-Free Fund. As discussed in detail below under “Information About Florida Fund and Tax-Free Fund,” the Funds have substantially similar investment objectives and similar investment strategies. The Funds also have the same investment adviser and the same distributor, auditors, legal counsel, custodian and transfer agent.

The board of directors and trustees for each Fund have determined that the reorganization is expected to provide certain benefits to each Fund, that the reorganization would be in the best interests of the shareholders of both Funds and that the interests of the Funds’ existing shareholders would not be diluted as a result of the transactions contemplated by the reorganization. The board of trustees of Florida Fund has submitted the Plan for approval by Florida Fund shareholders.

In approving the reorganization, the board of trustees of Florida Fund and the board of directors of Tax-Free Fund considered several factors, including the following:

The boards of the Funds did not assign specific weights to any or all of these factors but did consider all of them in determining, in their business judgment, to approve the reorganization and, with respect to the board of trustees of Florida Fund, to recommend its approval by Florida Fund’s shareholders.

The following summary of the proposed Plan and reorganization is qualified in its entirety by reference to the Plan, which is included with this Prospectus/Proxy Statement as Exhibit A. The Plan provides that, as of the Effective Time (as defined in the Plan), Tax-Free Fund will acquire all or substantially all of the assets and assume all of the liabilities of Florida Fund in exchange for full and fractional shares of common stock, par value $0.001 per share, of Tax-Free Fund having an aggregate net asset value equal to the aggregate value of the assets acquired (less liabilities assumed) from Florida Fund. For corporate law purposes, the transaction is structured as a sale of the assets and assumption of the liabilities of Florida Fund in exchange for the issuance of Tax-Free Fund shares to Florida Fund, followed immediately by the distribution of such Tax-Free Fund shares to Florida Fund shareholders and the cancellation and retirement of outstanding Florida Fund shares.

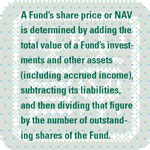

Under the Plan, each holder of Florida Fund shares will receive, at the Effective Time, Tax-Free Fund shares with an aggregate net asset value equal to the aggregate net asset value of Florida Fund shares owned by that shareholder immediately prior to the Effective Time. The net asset value per share of each Fund’s shares will be computed as of the Effective Time using the valuation procedures set forth in the respective Funds’ articles of incorporation and bylaws and in the Funds’ then-current Prospectus and Statement of Additional Information and as may be required by the Investment Company Act.

At the Effective Time, Tax-Free Fund will issue to Florida Fund, and Florida Fund will distribute to Florida Fund’s shareholders of record, determined as of the Effective Time, the Tax-Free Fund shares issued in exchange for Florida Fund’s assets as described above. All outstanding shares of Florida Fund will then be canceled and retired and no additional shares representing interests in Florida Fund will be issued thereafter, and Florida Fund will be deemed to be liquidated. The distribution of Tax-Free Fund shares to former Florida Fund shareholders will be accomplished by the transfer of the Tax-Free Fund shares then credited to the account of Florida Fund on the books of Tax-Free Fund to open accounts on the share records of Tax-Free Fund in the names of Florida Fund shareholders representing the full and fractional Tax-Free Fund shares due each such shareholder.

Florida Fund anticipates that it will make a distribution, immediately prior to the Effective Time, of all of its current year net income and net realized capital gains, if any, not previously distributed. This distribution will be taxable to Florida Fund shareholders subject to taxation.

The consummation of the reorganization is subject to the conditions set forth in the Plan, including, among others:

See the Plan included with this Prospectus/Proxy Statement as Exhibit A for a complete listing of the conditions to the consummation of the reorganization. The Plan may be terminated and the reorganization abandoned at any time prior to the Effective Time, before or after approval by shareholders of Florida Fund, by resolution of the board of trustees of Florida Fund or the board of directors of Tax-Free Fund, if circumstances should develop that, in the opinion of either board, make proceeding with the consummation of the Plan and reorganization not in the best interests of the respective Funds’ shareholders.

The Plan provides that the Adviser will bear the entire cost of the reorganization, including professional fees and the cost of soliciting proxies for the special meeting, which principally consists of printing and mailing expenses, and the cost of any supplementary solicitation. Neither Florida Fund nor Tax-Free Fund will pay any of these expenses.

Approval of the Plan will require the affirmative vote of a majority of the outstanding shares of Florida Fund as discussed in detail below under “Voting Information – General.” If the Plan is not approved, Florida Fund initially will continue to be managed as a separate fund in accordance with its current investment objective and investment strategies. However, the board of trustees of Florida Fund may consider other possible courses of action, such as re-submission of the reorganization proposal to shareholders, submission of a liquidation proposal to shareholders or changes in the investment strategies of Florida Fund. Florida Fund shareholders are not entitled to assert dissenters’ rights of appraisal in connection with the Plan or reorganization. See “Voting Information – No Dissenters’ Rights of Appraisal,” below.

Sit Mutual Funds II, Inc. is the corporate issuer of the Tax-Free Fund which is designated as series A. Sit Mutual Funds Trust is a Delaware statutory trust and issuer of the Florida Fund. Florida Fund and Tax-Free Fund each offers a single class of shares, and each share of the Funds has one vote, with proportionate voting for fractional shares. All Tax-Free Fund shares issued in the reorganization will be fully paid and non-assessable and will not be entitled to pre-emptive or cumulative voting rights.

It is intended that the exchange of Tax-Free Fund shares for Florida Fund’s net assets and the distribution of those shares to Florida Fund’s shareholders upon liquidation of Florida Fund will be treated as a tax-free reorganization under the Internal Revenue Code of 1986, as amended (the “Code”), and that consequently for federal income tax purposes, no income, gain or loss will be recognized by Florida Fund’s shareholders (except that Florida Fund anticipates that it will make a distribution, immediately prior to the Effective Time, of all of its current year net income and net realized capital gains, if any, not previously distributed, and this distribution will be taxable to Florida Fund shareholders subject to taxation). Florida Fund has not asked, nor does it plan to ask, the Internal Revenue Service to rule on the tax consequences of the reorganization.

As a condition to the closing of the reorganization, the two Funds will receive an opinion from Dorsey & Whitney LLP, counsel to the Funds, based in part on certain representations to be furnished by each Fund, substantially to the effect that the federal income tax consequences of the reorganization will be as follows:

The tax opinion will state that no opinion is expressed as to the effect of the reorganization on the Funds or any shareholder with respect to any asset as to which any unrealized gain or loss is required to be recognized for federal income tax purposes at the end of a taxable year (or on the termination or transfer thereof) under a mark-to-market system of accounting.

Florida Fund shareholders should consult their tax advisors regarding the effect, if any, of the reorganization in light of their individual circumstances. Because the foregoing discussion only relates to the federal income tax consequences of the reorganization, those shareholders also should consult their tax advisors about state and local tax consequences, if any, of the reorganization.

The table below reflects the existing capitalization of each Fund as of March 31, 2007 and pro forma capitalization for the combined Funds as of the same date:

Information concerning Florida Fund and Tax-Free Fund is incorporated into this Prospectus/Proxy Statement by reference to the Funds’ current Prospectus dated August 1, 2006. That Prospectus accompanies this Prospectus/Proxy Statement and forms part of the Registration Statements of Florida Fund and Tax-Free Fund on Form N-1A which have been filed with the Securities and Exchange Commission.

Florida Fund and Tax-Free Fund are subject to the informational requirements of the Securities and Exchange Act of 1934 and in accordance with those requirements file reports and other information, including proxy materials, reports and charter documents. These items can be inspected and copied at the Public Reference Facilities maintained by the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549, and at the SEC’s Regional Offices located at 75 West Jackson Boulevard, Chicago, Illinois 60604 and at 233 Broadway, New York, New York 10279. Copies of such materials can also be obtained at prescribed rates from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. Further information on the operations of the public reference facilities may be obtained by calling (800) SEC-0330. In addition, the SEC maintains an Internet site that contains copies of the information. The address of the site is http://www.sec.gov.

The investment objectives of the Funds are substantially similar. The Tax-Free Fund has an objective of seeking high current income that is exempt from federal income tax consistent with preservation of capital. The Florida Fund has an objective of seeking high current income that is exempt from federal regular income tax. In addition, The Tax-Free Fund seeks to achieve its investment objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Florida Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. The material differences in the Funds’ investment strategies are:

The following table compares the current investment objectives and principal investment strategies of Florida Fund and of Tax-Free Fund with the post-reorganization investment objectives and principal investment strategies of Tax-Free Fund.

The principal investment strategies discussed above are the strategies which the Adviser believes are most likely to be important in trying to achieve the Funds’ objectives. You should be aware that each Fund may also use non-principal strategies and invest in securities that are not described in this Prospectus/Proxy Statement, but that are described in Funds’ Statement of Additional Information. For a copy of the Funds’ Statement of Additional Information, write to the Funds at 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota 55402, calls the Funds at (800) 332-5580 or (612) 334-5888, or go online to www.sitfunds.com.

This Prospectus/Proxy Statement is furnished in connection with the solicitation of proxies by the board of trustees of Florida Fund to be used at a special meeting of shareholders of Florida Fund to be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota, and at any adjournments or postponements thereof.

Only shareholders of record as of the close of business on June 20, 2007 (the “Record Date”) will be entitled to notice of, and to vote at, the special meeting or any adjournment or postponement thereof. If the enclosed form of proxy is properly executed and returned on time to be voted at the special meeting, the proxies named in the form of proxy will vote the shares represented by the proxy in accordance with the instructions marked thereon. Unmarked proxies will be voted “FOR” the proposed Plan and reorganization. A proxy may be revoked by giving written notice, in person or by mail, of revocation before the special meeting to Florida Fund at its principal offices, 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota 55402, or by properly executing and submitting a later-dated proxy, or by voting in person at the special meeting.

Approval of the Plan and reorganization will require the affirmative vote of a majority of the outstanding shares of Florida Fund.

As of the Record Date, Florida Fund had 291,790.045 shares outstanding and entitled to vote at the special meeting.

The following table sets forth, as of the Record Date, (i) shares of the Funds owned by all officers, directors and members of the board of Tax-Free Fund as a group, without naming them, and (ii) the name, address and percentage of ownership of each person who is known by Florida Fund to own of record or beneficially 5 percent or more of either Fund:

Proxy solicitations will be made primarily by mail but may also be made by telephone, through the Internet or personal solicitations conducted by officers and employees of the Adviser, its affiliates or other representatives of Florida Fund (who will not be paid for their soliciting activities). The costs of solicitation and the expenses incurred in connection with preparing this Prospectus/Proxy Statement and its enclosures will be paid by the Adviser. Neither Florida Fund nor Tax-Free Fund will bear any costs associated with the special meeting, this proxy solicitation or any adjourned session.

In the event that sufficient votes to approve the Plan and reorganization are not received by the date set for the special meeting, the persons named as proxies may propose one or more adjournments of the special meeting to permit further solicitation of proxies. In determining whether to adjourn the special meeting, the following factors may be considered: the percentage of votes actually cast, the percentage of negative votes actually cast, the nature of any further solicitation and the information to be provided to shareholders with respect to the reasons for the solicitation. Any such adjournment will require the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the special meeting. The persons named as proxies will vote upon such adjournment after consideration of the best interests of all shareholders.

Florida Fund does not hold annual shareholder meetings. Shareholders wishing to submit proposals to be considered for inclusion in a proxy statement for a subsequent shareholder meeting should send their written proposals to the Secretary of Florida Fund at the address set forth on the cover of this Prospectus/Proxy Statement so that they will be received by Florida Fund in a reasonable period of time prior to that meeting.

The following person affiliated with the Funds receives payments from Florida Fund and Tax-Free Fund for services rendered pursuant to contractual arrangements with the Funds: Sit Investment Associates, Inc., as the investment adviser to each Fund, receives payments for its investment advisory and management services.

Under the Investment Company Act, Florida Fund shareholders are not entitled to assert dissenters’ rights of appraisal in connection with the Plan and reorganization.

The audited financial statements for the Funds, which are incorporated by reference into the Statement of Additional Information relating to this Prospectus/Proxy Statement, have been audited by KPMG LLP, an independent registered public accounting firm, as set forth in their report appearing in the Annual Report for the fiscal year ended March 31, 2007. The financial statements audited by KPMG LLP have been incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Certain legal matters concerning the issuance of Tax-Free Fund shares as part of the reorganization will be passed on by Dorsey & Whitney LLP, 50 South Sixth Street, Suite 1500, Minneapolis, MN 55402.

The board of trustees of Florida Fund does not intend to present any other business at the special meeting. If, however, any other matters are properly brought before the special meeting, the persons named in the accompanying form of proxy will vote thereon in accordance with their judgment.

Exhibit B

BOND FUNDS PROSPECTUS

Dated August 1, 2006

EXHIBIT B

Bond Funds Prospectus

August 1, 2006

Bond Funds Prospectus

August 1, 2006

Money Market Fund

U.S. Government Securities Fund

Tax-Free Income Fund

Minnesota Tax-Free Income Fund

Florida Tax-Free Income Fund

Sit Mutual Funds

Part A

B-1

A Family of No-Load Funds

Each Sit Fund is no-load, which means that you pay no sales charges.

Be sure to read this Prospectus before you invest and keep it on file for future reference. If you have a question about any part of the Prospectus, please call 1-800-332-5580 or visit our website at www.sitfunds.com.

Part A

B-2

Sit Mutual Funds

Bond Funds Prospectus

A U G U S T 1 , 2 0 0 6

M O N E Y M A R K E T F U N D

U. S. G O V E R N M E N T S E C U R I T I E S F U N D

T A X - F R E E I N C O M E F U N D

M I N N E S O T A T A X - F R E E I N C O M E F U N D

F L O R I D A T A X - F R E E I N C O M E F U N D

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Part A

B-3

Part A

B-4

Part A

B-5

Introduction

Sit Mutual Funds are a family of no-load mutual funds offering a selection of Funds to investors. Each Fund has a distinctive investment objective and risk/reward profile.

T H E S I T B O N D F U N D S C O N S I S T O F :

| |

> | Money Market Fund |

| |

> | U.S. Government Securities Fund |

| |

> | Tax-Free Income Fund |

| |

> | Minnesota Tax-Free Income Fund |

| |

> | Florida Tax-Free Income Fund |

This Prospectus describes the five bond funds that are a part of the Sit Mutual Fund family. The descriptions on the following pages may help you choose the Fund or Funds that best fit your investment goals. Keep in mind, however, that no Fund can guarantee it will meet its investment objective, and no Fund should be relied upon as a complete investment program.

The Fund Summaries section describes the principal strategies used by the Funds in trying to achieve these objectives, and highlights the risks involved with these strategies. It also provides you with information about the performance, fees and expenses of the Funds.

1

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-6

Fund Summaries

MONEY MARKET FUND

I N V E S T M E N T O B J E C T I V E

The Fund seeks maximum current income to the extent consistent with preserving capital and maintaining liquidity.

P R I N C I P A L I N V E S T M E N T S T R A T E G I E S

The Fund seeks to achieve its objective by investing in a diversified portfolio of high-quality short-term debt securities, which may include:

| |

> | Corporate debt securities, such as commercial paper; |

| |

> | Obligations of the U.S. government, its agencies and instrumentalities; and |

| |

> | Bank instruments, such as certificates of deposit, time deposits and bankers’ acceptances. |

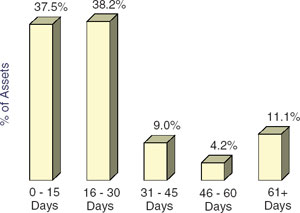

The Fund complies with Securities and Exchange Commission regulations that apply to money market funds. These regulations require that:

| |

> | the Fund seeks to maintain a stable asset value of $1.00 per share; |

| |

> | the Fund’s investments mature within 397 days of purchase; |

| |

> | the Fund maintain an average dollar-weighted portfolio maturity of 90 days or less; |

| |

> | all of the Fund’s investments be denominated in U.S. dollars; and |

| |

> | all of the Fund’s investments be high-quality securities that have been determined by the Fund’s investment adviser to present minimal credit risk. |

R I S K S

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. The principal risks of investing in the Fund are Interest Rate Risk, Credit Risk and Income Risk. See page 11 for a discussion of these risks.

2

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-7

U.S. GOVERNMENT SECURITIES FUND

I N V E S T M E N T O B J E C T I V E

The Fund seeks high current income and safety of principal.

P R I N C I P A L I N V E S T M E N T S T R A T E G I E S

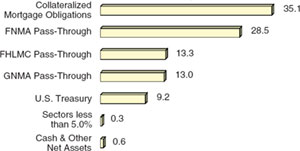

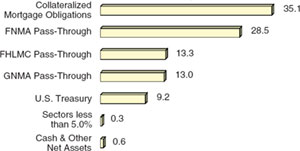

The Fund seeks to achieve its objective by investing exclusively in U.S. government securities, which are securities issued, guaranteed or insured by the U.S. government, its agencies or instrumentalities.

The Fund invests a substantial portion of its assets in pass-through securities. Pass-through securities are formed when mortgages or other debt instruments are pooled together and undivided interests in the pool are sold to investors, such as the Fund. The cash flow from the underlying debt instruments is “passed through” to the holders of the securities in the form of periodic (generally monthly) payments of interest and principal, and any prepayments.

Pass-through securities in which the Fund invests include mortgage-backed securities such as those issued by Government National Mortgage Association (GNMA), Federal National Mortgage Association (FNMA) and Federal Home Loan Mortgage Corporation (FHLMC). GNMA is an agency of the U.S. government and its securities are backed by the full faith and credit of the U.S. government. FNMA and FHLMC are U.S. government sponsored enterprises and their securities are backed by their credit. In addition, a portion of the Fund’s pass-through security investments may be GNMA manufactured home loan pass-through securities. Manufactured home loans are fixed-rate loans secured by a manufactured home unit.

Other types of U.S. government securities in which the Fund may invest include U.S. Treasury securities, U.S. government agency collateralized mortgage obligations and other U.S. government agency securities.

In selecting securities for the Fund, Fund managers seek securities providing high current income relative to yields currently available in the market. In making purchase and sales decisions for the Fund, the Fund managers consider their economic outlook and interest rate

3

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-8

forecast, as well as their evaluation of a security’s prepayment risk, yield, maturity, and liquidity. Fund managers attempt to maintain an average effective duration for the portfolio of approximately 2 to 5 years.

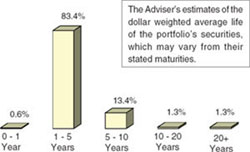

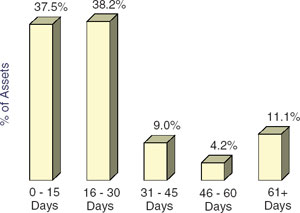

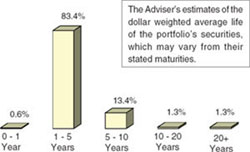

The Fund’s dollar-weighted average maturity will, under normal market conditions, range between 15 and 25 years. However, since the Fund’s securities are subject to various types of call provisions which make their expected average lives shorter than their stated maturity dates, the Fund managers believe that the Fund’s average effective duration is a more accurate measure of the Fund’s price sensitivity to changes in interest rates than the Fund’s dollar-weighted average maturity.

R I S K S

As with all mutual funds investing in bonds, the price and yield of the Fund may change daily due to interest rate changes and other factors. You could lose money by investing in the Fund. The principal risks of investing in the Fund are Interest Rate Risk, Credit Risk, Income Risk, Prepayment Risk and Management Risk. See page 11 for a discussion of these risks.

4

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-9

TAX-FREE INCOME FUND

I N V E S T M E N T O B J E C T I V E

The Fund seeks high current income that is exempt from federal income tax consistent with preservation of capital.

P R I N C I P A L I N V E S T M E N T S T R A T E G I E S

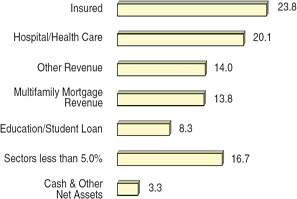

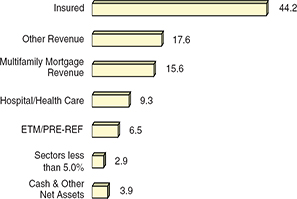

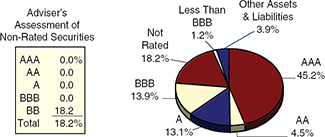

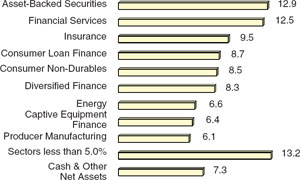

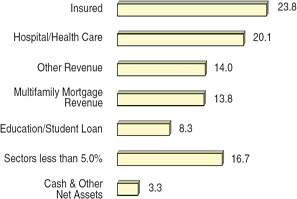

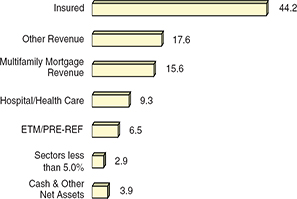

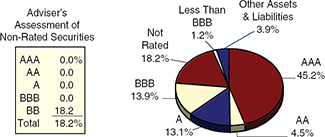

The Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. During normal market conditions, the Fund invests 100% (and, as a fundamental policy, no less than 80%) of its net assets in such tax-exempt municipal securities. Municipal securities are debt obligations issued by or for U.S. states, territories, and possessions and the District of Columbia and their political subdivisions, agencies, and instrumentalities.

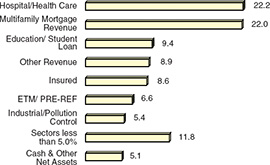

The Fund invests both in revenue bonds, which are backed by and payable only from the revenues derived from a specific facility or specific revenue source, and in general obligation bonds, which are secured by the full faith, credit and taxation power of the issuing municipality. The Fund generally invests a significant portion of its assets in obligations of municipal housing authorities, which include single family and multi-family mortgage revenue bonds, and in revenue bonds of health care related facilities.

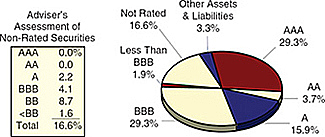

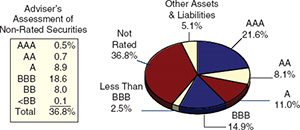

The Fund primarily invests in securities rated investment-grade at the time of purchase or, if unrated, determined to be of comparable quality by the Fund’s investment adviser. Investment-grade securities are rated within the four highest grades by the major rating agencies. However, the Fund may invest up to 25% of its assets in municipal securities rated below investment grade (commonly refered to as junk bonds) or determined to be of comparable quality by the Fund’s investment adviser, but the Fund may not invest in securities rated lower than B3 by Moody’s Investors Service, or B- by Standard and Poor’s or Fitch Ratings, or, if unrated, determined by the Fund’s investment adviser to be of comparable quality.

5

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-10

In selecting securities for the Fund, Fund managers seek securities providing high tax-exempt income. Fund managers attempt to maintain an average effective duration for the portfolio of approximately 2.5 to 8 years. The Fund managers’ economic outlook and interest rate forecast, as well as their evaluation of a security’s structure, credit quality, yield, maturity, and liquidity, are all factors considered when making investment decisions.

The Fund’s dollar-weighted average maturity will, under normal market conditions, range between 10 and 20 years. However, since the Fund’s securities are subject to various types of call provisions which make their expected average lives shorter than their stated maturity dates, the Fund managers believe that the Fund’s average effective duration is a more accurate measure of the Fund’s price sensitivity to changes in interest rates than the Fund’s dollar-weighted average maturity.

R I S K S

As with all mutual funds investing in bonds, the price and yield of the Fund may change daily due to interest rate changes and other factors. You could lose money by investing in the Fund. The principal risks of investing in the Fund are Interest Rate Risk, Credit Risk, Income Risk, Prepayment Risk, Management Risk, Call Risk, Political, Economic and Tax Risk, Revenue Bond Risk, Housing Authority Bonds Risk, Health Care Facility Revenue Obligations Risk and High-Yield Risk. See pages 11 through 13 for a discussion of these risks.

6

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-11

MINNESOTA TAX-FREE INCOME FUND

I N V E S T M E N T O B J E C T I V E

The Fund seeks high current income that is exempt from federal regular income tax and Minnesota regular personal income tax consistent with preservation of capital.

P R I N C I P A L I N V E S T M E N T S T R A T E G I E S

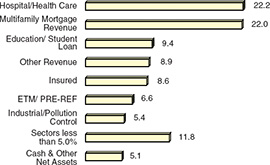

The Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax and Minnesota regular personal income tax. During normal market conditions, the Fund invests 100% (and, as a fundamental policy, no less than 80%) of its net assets in such tax-exempt municipal securities. The Fund may invest up to 20% of its assets in securities that generate interest income subject to both Minnesota and federal alternative minimum tax (“AMT”). Investors subject to AMT treat the Fund’s income subject to AMT as an item of tax preference in computing their alternative minimum taxable income.

The Fund substantially invests in municipal securities issued by the state of Minnesota and its political subdivisions. The Fund invests in both general obligation bonds, which are secured by the full faith, credit and taxation power of the issuing municipality, and in revenue bonds, which are backed by and payable only from the revenues derived from a specific facility or specific revenue source. The Fund generally invests a significant portion of its assets in obligations of municipal housing authorities which include single family and multi-family mortgage revenue bonds, and in revenue bonds of health care related facilities.

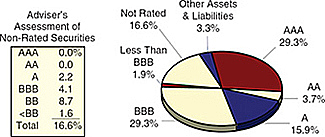

The Fund primarily invests in securities rated investment-grade at the time of purchase or, if unrated, determined to be of comparable quality by the Fund’s adviser. Investment-grade securities are rated within the four highest grades by the major rating agencies. However, the Fund may invest up to 30% of its assets in municipal securities rated below investment-grade (commonly referred to as junk bonds) or determined to be of comparable quality by the Fund’s investment adviser, but the Fund may not invest in securities rated lower than B3 by Moody’s Investors Service, or B- by Standard and Poor’s or Fitch Ratings or, if unrated, determined by the Fund’s investment adviser to be of comparable quality.

7

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-12

In selecting securities for the Fund, Fund managers seek securities providing high current tax-exempt income. In making purchase and sales decisions for the Fund, the Fund managers consider their economic outlook and interest rate forecast, as well as their evaluation of a security’s structure, credit quality, yield, maturity, and liquidity. Fund managers attempt to maintain an average effective duration for the portfolio of approximately 3 to 8 years.

The Fund’s dollar-weighted average maturity will, under normal market conditions, range between 10 and 20 years. However, since the Fund’s securities are subject to various types of call provisions which make their expected average lives shorter than their stated maturity dates, the Fund managers believe that the Fund’s average effective duration is a more accurate measure of the Fund’s price sensitivity to changes in interest rates than the Fund’s dollar-weighted average maturity.

R I S K S

As with all mutual funds investing in bonds, the price and yield of the Fund may change daily due to interest rate changes and other factors. You could lose money by investing in the Fund. The principal risks of investing in the Fund are Interest Rate Risk, Credit Risk, Income Risk, Prepayment Risk, Management Risk, Call Risk, Political, Economic and Tax Risk, Revenue Bond Risk, Housing Authority Bonds Risk, Health Care Facility Revenue Obligations Risk, Risk of Non-Diversification, High-Yield Risk and Minnesota State Specific Risk. See pages 11 through 14 for a discussion of these risks.

8

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-13

FLORIDA TAX-FREE INCOME FUND

I N V E S T M E N T O B J E C T I V E

The Fund seeks high current income that is exempt from federal regular income tax.

P R I N C I P A L I N V E S T M E N T S T R A T E G I E S

The Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. Florida does not impose an individual income tax. Dividends paid by the Fund to corporate shareholders will be subject to Florida corporate income tax.

During normal market conditions, the Fund invests 100% (and, as a fundamental policy, no less than 80%) of its net assets in such tax-exempt municipal securities. The Fund may invest up to 10% of its assets in securities that generate interest income subject to federal alternative minimum tax (“AMT”). Investors subject to AMT treat the Fund’s income subject to AMT as an item of tax preference in computing their alternative minimum taxable income.

The Fund substantially invests in municipal securities issued by the state of Florida and its political subdivisions. The Fund invests in both general obligation bonds, which are secured by the full faith, credit and taxation power of the issuing municipality, and in revenue bonds, which are backed by and payable only from the revenues derived from a specific facility or specific revenue source. The Fund generally invests a significant portion of its assets in obligations of municipal housing authorities which include single family and multi-family mortgage revenue bonds, and in revenue bonds of health care related facilities. The Fund also invests in community development district bonds. Community development districts are special purpose taxing and development districts that issue special assessment and revenue bonds to fund infrastructure projects within the development district.

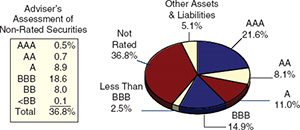

The Fund primarily invests in securities rated investment-grade at the time of purchase or, if unrated, determined to be of comparable quality by the Fund’s adviser. Investment-grade securities are rated within the four highest grades by the major rating agencies. Currently, the Fund’s adviser intends to invest less than 20% of the Fund’s assets in municipal securities rated below investment-grade (commonly referred to as junk bonds) or determined to be of comparable quality by the Fund’s investment adviser. However, the Fund may invest up to 30% of its net assets in securities rated below investment-grade, but the Fund may not invest

9

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-14

in securities rated lower than B3 by Moody’s Investors Service, or B- by Standard and Poor’s or Fitch Ratings or, if unrated, determined by the Fund’s investment adviser to be of comparable quality.

In selecting securities for the Fund, Fund managers seek securities providing high current tax-exempt income. In making purchase and sales decisions for the Fund, the Fund managers consider their economic outlook and interest rate forecast, as well as their evaluation of a security’s structure, credit quality, yield, maturity, liquidity and portfolio diversification. Fund managers attempt to maintain an average effective duration for the portfolio of approximately 2.5 to 8 years based on the managers’ economic outlook and the direction in which inflation and interest rates are expected to move. The Fund’s dollar-weighted average maturity will, under normal market conditions, range between 10 and 20 years. However, since the Fund’s securities are subject to various types of call provisions which make their expected average lives shorter than their stated maturity dates, the Fund managers believe that the Fund’s average effective duration is a more accurate measure of the Fund’s price sensitivity to changes in interest rates than the Fund’s dollar-weighted average maturity.

R I S K S

As with all mutual funds investing in bonds, the price and yield of the Fund may change daily due to interest rate changes and other factors. You could lose money by investing in the Fund. The principal risks of investing in the Fund are Interest Rate Risk, Credit Risk, Income Risk, Prepayment Risk, Management Risk, Call Risk, Political, Economic and Tax Risk, Revenue Bond Risk, Housing Authority Bonds Risk, Health Care Facility Revenue Obligations Risk, Risk of Non-Diversification, High-Yield Risk and Florida State Specific Risk. See pages 11 through 14 for a discussion of these risks.

10

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-15

PRINCIPAL INVESTMENT RISKS

All investments carry some degree of risk which will affect the value of a Fund’s investments, investment performance and price of its shares. It is possible to lose money by investing in the Funds.

The principal risks of investing in the Funds include:

R I S K S T H A T A P P L Y T O A L L F U N D S

| |

> | Interest Rate Risk: An increase in interest rates may lower a Fund’s value and the overall return on your investment. The magnitude of this decrease is often greater for longer-term fixed income securities than shorter-term securities. |

| |

> | Credit Risk: The issuers or guarantors of securities (including U.S. government agencies and instrumentalities issuing securities that are not guaranteed by the full faith and credit of the U.S. government) owned by a Fund may default on the payment of principal or interest, or the other party to a contract may default on its obligations to a Fund, causing the value of the Fund to decrease. |

| |

> | Income Risk: The income you earn from a Fund may decline due to declining interest rates. |

| |

> | Management Risk: A strategy used by the investment management team may not produce the intended results. |

R I S K T H A T A P P L I E S P R I M A R I L Y T O T H E U . S ..

G O V E R N M E N T S E C U R I T I E S , T A X - F R E E I N C O M E ,

M I N N E S O T A T A X - F R E E I N C O M E A N D F L O R I D A

T A X - F R E E I N C O M E F U N D S

| |

> | Prepayment Risk: Declining interest rates may compel borrowers to prepay mortgages and debt obligations underlying the mortgage-backed securities and manufactured home loan pass-through securities owned by a Fund. The proceeds received by a Fund from prepayments will likely be reinvested at interest rates lower than the original investment, thus resulting in a reduction of income to a Fund. Likewise, rising interest rates could reduce prepayments and extend the life of securities with lower interest rates, which may increase the sensitivity of a Fund’s value to rising interest rates. |

11

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-16

R I S K S T H A T A P P L Y P R I M A R I L Y T O T H E T A X - F R E E

I N C O M E , M I N N E S O T A T A X - F R E E I N C O M E , A N D

F L O R I D A T A X - F R E E I N C O M E F U N D S

| |

> | Call Risk: Many bonds may be redeemed (“called”) at the option of the issuer before their stated maturity date. In general, an issuer will call its bonds if they can be refinanced by issuing new bonds which bear a lower interest rate. A Fund would then be forced to invest the unanticipated proceeds at lower interest rates, resulting in a decline in a Fund’s income. |

| |

> | Political, Economic and Tax Risk: Because the Funds invest primarily in municipal securities issued by states and their political subdivisions (specifically, the state of Minnesota for the Minnesota Tax-Free Income Fund and the state of Florida for the Florida Tax-Free Income Fund), the Funds may be particularly affected by the political and economic conditions and developments in those states. Since each Fund primarily invests in municipal securities, the value of each Fund may be more adversely affected than other funds by future changes in federal or state income tax laws. |

| |

> | Revenue Bond Risk: The revenue bonds in which the Funds invest may entail greater credit risk than the Funds’ investments in general obligation bonds. In particular, weaknesses in federal housing subsidy programs and their administration may result in a decrease of subsidies available for the payment of principal and interest on certain multi-family housing authority bonds. |

| |

> | Housing Authority Bonds Risk: Because the Funds may invest a significant portion of their assets in housing authority bonds, the Funds may be more affected by events influencing the housing sector than a fund that is more diversified across numerous sectors. A housing authority’s gross receipts and net income available for debt service may be affected by future events and conditions including, among other things, economic developments such as fluctuations in interest rates, construction costs and operating costs; and changes in federal housing subsidy programs. A housing authority’s inability to obtain additional financing could also reduce revenues available to pay existing obligations. |

| |

> | Health Care Facility Revenue Obligations Risk: Because the Funds may invest a significant portion of their assets in health care facility bonds, the Funds may be more affected by events influencing the health care sector than a fund that is more diversified across numerous sectors. A health care facility’s gross receipts and net income |

12

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-17

| |

| available for debt service may be affected by future events and conditions including, among other things, demand for services, efforts by insurers and governmental agencies to limit rates, legislation and changes in Medicare, Medicaid and other similar third-party payor programs. |

| |

> | High-Yield Risk: The Minnesota Tax-Free Income and Florida Tax-Free Income Funds may invest up to 30% of its assets in municipal securities rated below investment-grade. The Tax-Free Income Fund may invest up to 25% of its assets in municipal securities rated below investment-grade. Debt securities rated below investment-grade are commonly known as junk bonds. Junk bonds are considered predominately speculative and involve greater risk of default or price changes due to changes in the issuer’s creditworthiness. |

R I S K T H A T A P P L I E S P R I M A R I L Y T O T H E

M I N N E S O T A T A X - F R E E I N C O M E F U N D A N D T H E

F L O R I D A T A X - F R E E I N C O M E F U N D

| |

> | Risk of Nondiversification: The Funds are nondiversified, as is typical of single-state funds. This means that each may invest in a larger portion of its assets in a limited number of issuers than a diversified fund. Because a relatively high percentage of each Fund’s assets may be invested in the securities of a limited number of issuers, the Funds may be more susceptible to any single economic, political or regulatory occurrence than a diversified fund. |

R I S K T H A T A P P L I E S O N L Y T O T H E M I N N E S O T A

T A X - F R E E I N C O M E F U N D

| |

> | Minnesota State Specific Risk: The State relies heavily on a progressive individual income tax and a retail sales tax for revenue, which results in a fiscal system that is sensitive to economic conditions. Diversity and a significant natural resource base are two important characteristics of the Minnesota economy. Generally, the structure of the State’s economy parallels the structure of the United States economy as a whole. There are, however, employment concentrations in the manufacturing categories of fabricated metals, machinery, computers and electronics, food, and printing and related. The concentration in these industries leaves Minnesota vulnerable to an economic slowdown associated with business cycles in these industries. The ability of Minnesota or its municipalities to meet their obligations depends on the availability of tax and other revenues, the economic, political and demographic conditions within the state, ecological |

13

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-18

| |

| or environmental concerns, and the underlying fiscal condition of the state, its counties and its municipalities. In recent years, the State addressed recurring projected budget deficits by substantially reducing or deferring projected spending, including aid to local government and higher education, transferring funds from other accounts, and increasing revenues. |

R I S K T H A T A P P L I E S O N L Y T O T H E F L O R I D A

T A X - - F R E E I N C O M E F U N D

| |

> | Florida State Specific Risk: Because the Fund invests primarily in Florida municipal securities it will be more exposed to negative political or economic factors in Florida than a fund that invests more widely. Florida’s economy is largely composed of services, trade, construction, agriculture, manufacturing and tourism. The exposure to these industries, particularly tourism, leaves Florida vulnerable to an economic slowdown associated with business cycles. When compared with other states, Florida has a proportionately greater retirement age population, and property income (dividends, interest and rent) and transfer payments (including social security and pension benefits) are a relatively more important source of income. Proportionately greater dependency on these revenues leaves the state vulnerable to a decline in these revenues. Furthermore, because of Florida’s rapidly growing population, corresponding increases in state revenue will be necessary during the next decade to meet increased burdens on the various public and social services provided by the state. From time to time, Florida and its political subdivisions have encountered financial difficulties. |

PORTFOLIO HOLDINGS

Each Funds’ portfolio holdings are included in that Fund’s annual and semi-annual financial reports that are mailed to shareholders of record. Additionally, a complete portfolio holdings report is filed quarterly with the SEC on Form N-Q and is available on the SEC website at www.sec.gov or upon request from a Sit Investor Service Representative. A complete description of the Funds’ portfolio holdings disclosure policies is available in the Funds’ Statement of Additional Information.

14

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-19

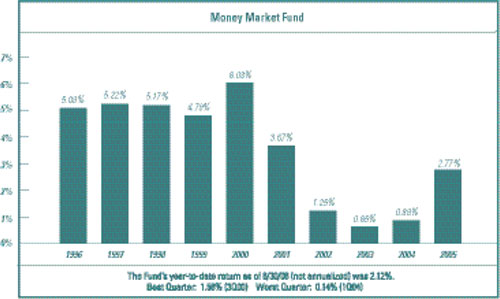

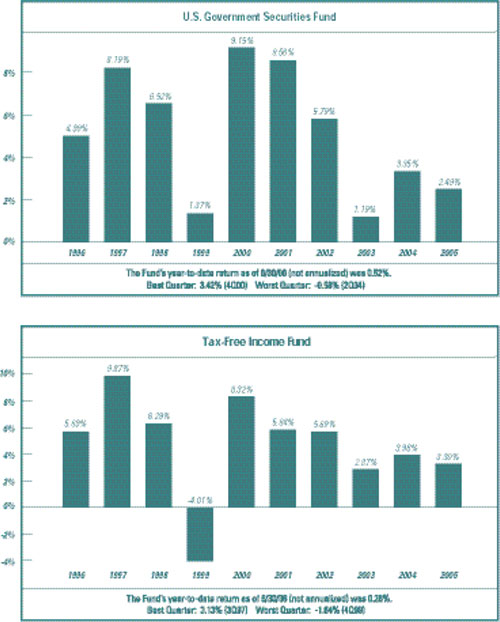

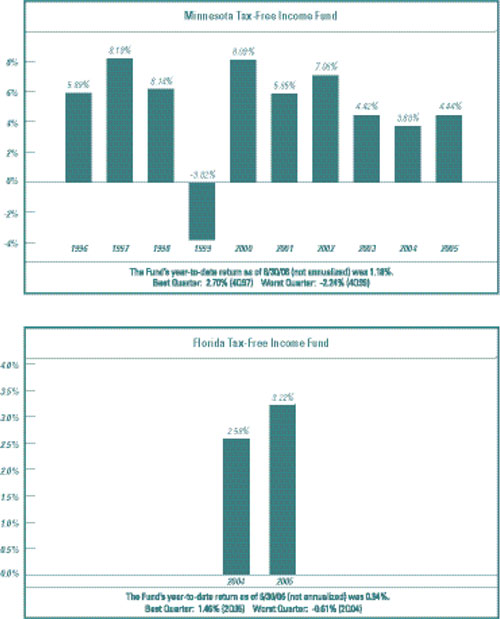

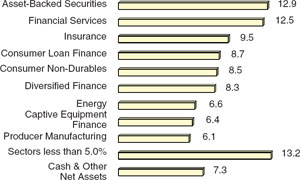

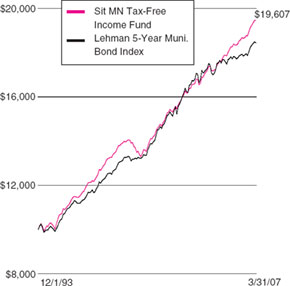

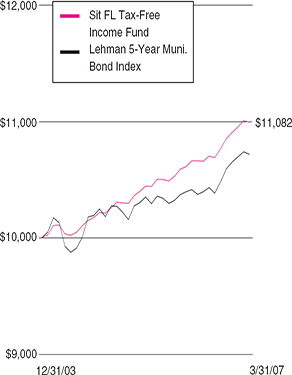

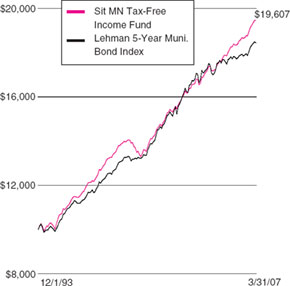

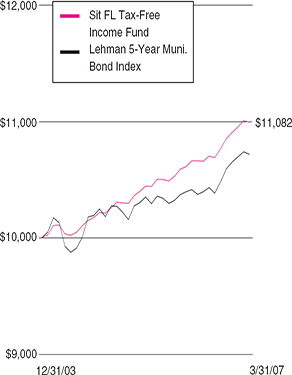

PERFORMANCE

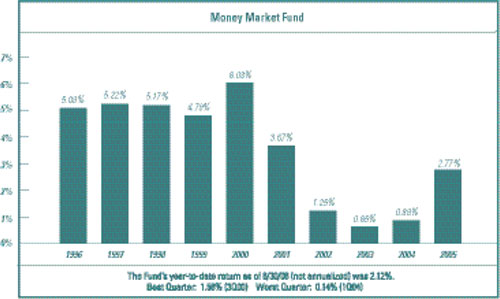

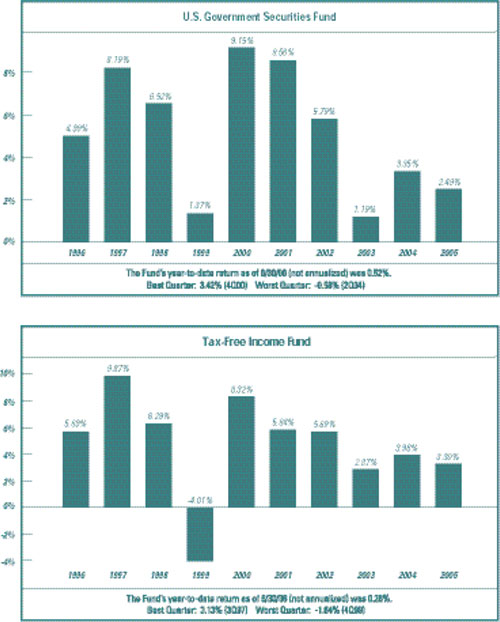

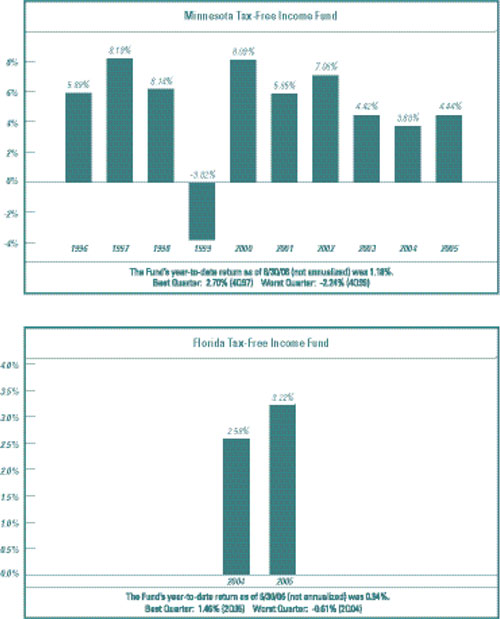

The following bar charts show the Funds’ annual total returns for calendar years ended 12/31. This information illustrates how each Fund’s performance has varied over time, which is one indication of the risks of investing in a Fund. A Fund’s past performance does not necessarily indicate how it will perform in the future. The bar charts assume that all distributions have been reinvested.

A N N U A L T O T A L R E T U R N S for calendar years ended 12/31

15

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-20

16

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-21

A N N U A L T O T A L R E T U R N S (continued)

17

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-22

A V E R A G E A N N U A L T O T A L R E T U R N S for periods ended 12/31/05

The following tables show the Funds’ average annual total returns before taxes over various periods ended December 31, 2005. The tables also show, for each Fund other than Money Market Fund, the Fund’s average total returns after taxes and the change in value of a broad-based market index. The index information is intended to permit you to compare each Fund’s performance to a broad measure of market performance. The after-tax returns are intended to show the impact of federal income taxes on an investment in a Fund. The highest individual federal marginal income tax rate in effect during the specified period is assumed, and the state and local tax impact is not reflected.

A Fund’s “Return After Taxes on Distributions” shows the effect of taxable distributions (dividends and capital gain distributions), but assumes that you still hold the fund shares at the end of the period and so do not have any taxable gain or loss on your investment in the Fund.

A Fund’s “Return After Taxes on Distributions and Sale of Fund Shares” shows the effect of both taxable distributions and any taxable gain or loss that would be realized if the Fund shares were purchased at the beginning and sold at the end of the specified period.

The Funds’ past performance, before and after taxes, is not an indication of how the Funds will perform in the future. Your actual after-tax returns depend on your own tax situation and may differ from those shown. After-tax returns reflect past tax effects and are not predictive of future tax effects. After-tax returns are not relevant to investors who hold their Fund shares in a tax-deferred account (including a 401(k) or IRA account).

| | | | | | | | | | | | | |

Money Market Fund | | 1 Year | | 5 Years | | 10 Years | |

| | | | | | | | |

|

Return before taxes | | | 2.77 | % | | | 1.84 | % | | | 3.53 | % | |

| | | | | | | | | | | | | |

U.S. Government Securities Fund | | 1 Year | | 5 Years | | 10 Years | |

| | | | | | | | | | | | | | |

|

Return before taxes | | | 2.49 | % | | | 4.25 | % | | | 5.12 | % | |

| | | | | | | | | | | | | |

Return after taxes on distributions | | | 1.11 | | | | 2.71 | | | | 3.12 | | |

| | | | | | | | | | | | | |

Return after taxes on distributions and sale of Fund shares | | | 1.33 | | | | 2.70 | | | | 3.12 | | |

| | | | | | | | | | | | | |

Lehman Intermediate Gov’t Bond Index (1) (2) | | | 1.68 | | | | 4.82 | | | | 5.50 | | |

| |

(1) | Reflects no deduction for fees, expenses or taxes |

| |

(2) | An unmanaged index composed of government fixed-rate securities with maturities of 1 to 10 years. |

18

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-23

| | | | | | | | | | | | | |

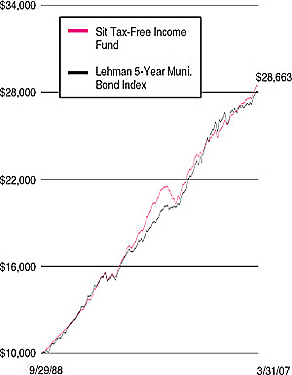

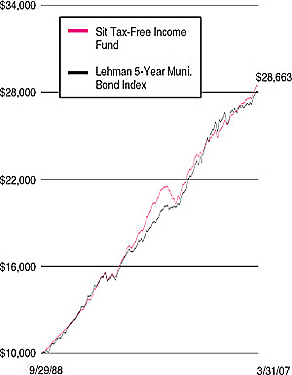

Tax-Free Income Fund | | 1 Year | | 5 Years | | 10 Years | |

| | | | | | | | | | | | | | |

|

Return before taxes | | | 3.30 | % | | | 4.33 | % | | | 4.72 | % | |

| | | | | | | | | | | | | |

Return after taxes on distributions | | | 3.30 | | | | 4.33 | | | | 4.70 | | |

| | | | | | | | | | | | | |

Return after taxes on distributions and sale of Fund shares | | | 3.38 | | | | 4.34 | | | | 4.73 | | |

| | | | | | | | | | | | | |

Lehman 5-Year Municipal Bond Index (1) (2) | | | 0.95 | | | | 4.62 | | | | 4.78 | | |

| |

(1) | Reflects no deduction for fees, expenses or taxes |

| |

(2) | An unmanaged index composed of municipal securities with maturities of 4 to 6 years. It is a subset of the Lehman Municipal Bond Index, an unmanaged index of investment-grade tax-exempt bonds. |

| | | | | | | | | | | | | |

Minnesota Tax-Free Income Fund | | 1 Year | | 5 Years | | 10 Years | |

| | | | | | | | | | | | | | |

|

Return before taxes | | | 4.44 | % | | | 5.08 | % | | | 4.94 | % | |

| | | | | | | | | | | | | |

Return after taxes on distributions | | | 4.44 | | | | 5.08 | | | | 4.94 | | |

| | | | | | | | | | | | | |

Return after taxes on distributions and sale of Fund shares | | | 4.41 | | | | 5.02 | | | | 4.95 | | |

| | | | | | | | | | | | | |

Lehman 5-Year Municipal Bond Index (1) (2) | | | 0.95 | | | | 4.62 | | | | 4.78 | | |

| |

(1) | Reflects no deduction for fees, expenses or taxes |

| |

(2) | An unmanaged index composed of municipal securities with maturities of 4 to 6 years. It is a subset of the Lehman Municipal Bond Index, an unmanaged index of investment-grade tax-exempt bonds. |

| | | | | | | | | | | | | |

Florida Tax-Free Income Fund | | 1 Year | | 5 Years | | Since

Inception

(12/31/03) | |

| | | | | | | | |

|

Return Before Taxes | | | 3.22 | % | | | n/a | | | | 2.89 | % | |

| | | | | | | | | | | | | |

Return After Taxes on Distributions | | | 3.22 | | | | n/a | | | | 2.89 | | |

| | | | | | | | | | | | | |

Return After Taxes on Distributions and Sale of Fund Shares | | | 3.22 | | | | n/a | | | | 2.87 | | |

| | | | | | | | | | | | | |

Lehman 5-Year Municipal Bond Index (1)(2) | | | 0.95 | | | | n/a | | | | 1.83 | | |

| |

(1) | Reflects no deduction for fees, expenses or taxes |

| |

(2) | An unmanaged index composed of municipal securities with maturities of 4 to 6 years. It is a subset of the Lehman Municipal Bond Index, an unmanaged index of investment-grade tax-exempt bonds. |

19

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-24

FEESAND EXPENSES

This table shows fees and expenses that you may pay if you buy and hold shares of the Funds. All Sit Mutual Funds are no-load investments, so you will not pay any shareholder fees such as sales loads or exchange fees when you buy or sell shares of the Funds. However, when you hold shares of a Fund, you indirectly pay a portion of the Fund’s operating expenses. These expenses are deducted from Fund assets.

| | | | | | | | | |

Shareholder Fees (fees paid directly from your investment) | | | | None | |

| | | | | | | | | | |

| | | | | | | | | |

Annual Fund Operating Expenses as a % of average net assets | | | | | |

| | | | | | | | | | |

| | | | | | | | | |

| | Management

Fees | | Distribution

(12b-1) Fees | | Other

Expenses | | Total Annual

Fund Operating

Expenses | |

| | | | | | | | | |

Money Market | | .80% | (1) | None | | None | | .80% | (1) |

| | | | | | | | | |

U.S. Government Securities | | 1.00% | (1) | None | | None | | 1.00% | (1) |

| | | | | | | | | |

Tax-Free Income | | .80% | (1) | None | | None | | .80% | (1) |

| | | | | | | | | |

Minnesota Tax-Free Income | | .80% | | None | | None | | .80% | |

| | | | | | | | | |

Florida Tax-Free Income | | .80% | | None | | None | | .80% | |

| | | | | | | | | |

| | | | | | | | | | |

| |

(1) | Management fee represents contractual fee and does not reflect the Adviser’s voluntary waiver of fees. Actual expenses are lower than those shown in the table because of voluntary fee waivers by the Adviser. As a result of the fee waiver, the actual management fee paid for the year ended 3/31/06 by the Money Market Fund was .50% of the Fund’s average daily net assets; U.S. Government Securities Fund was .80% of the Fund’s average daily net assets; Tax-Free Income Fund was .77% of the Fund’s average daily net assets. After December 31, 2007, the voluntary fee waivers may be terminated at any time by the Adviser. |

20

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-25

E X A M P L E

This example is intended to help you compare the cost of investing in each Fund (before the fee waiver) with the cost of investing in other mutual funds. It assumes that you invest $10,000 in a Fund for the time periods indicated (with reinvestment of all dividends and distributions), that your investment has a 5% return each year, that the Fund’s operating expenses remain the same, and that you redeem all of your shares at the end of those periods. Although your actual costs and returns may differ, based on these assumptions your costs would be:

| | | | | | | | | | | | | |

| | 1-Year | | 3-Years | | 5-Years | | 10-Years | |

| | | | | | | | | | | | | | |

|

Money Market | | $ | 82 | | $ | 256 | | $ | 446 | | $ | 993 | |

| | | | | | | | | | | | | |

U.S. Government Securities | | $ | 102 | | $ | 320 | | $ | 555 | | $ | 1,229 | |

| | | | | | | | | | | | | |

Tax-Free Income | | $ | 82 | | $ | 256 | | $ | 446 | | $ | 993 | |

| | | | | | | | | | | | | |

Minnesota Tax-Free Income | | $ | 82 | | $ | 256 | | $ | 446 | | $ | 993 | |

| | | | | | | | | | | | | |

Florida Tax-Free Income | | $ | 82 | | $ | 256 | | $ | 446 | | $ | 993 | |

21

| | | |

FUND SUMMARIES | FUND MANAGEMENT | SHAREHOLDER INFORMATION | ADDITIONAL INFORMATION |

Part A

B-26

Fund Management

INVESTMENT ADVISER

Sit Investment Associates, Inc. (the “Adviser”), 3300 IDS Center, 80 S. Eighth Street, Minneapolis, Minnesota 55402, is the Funds’ investment adviser. The Adviser was founded in 1981 and provides investment management services for both public and private clients. As of June 30, 2006, the Adviser had approximately $6.6 billion in assets under management, including approximately $1.4 billion for the 13 Sit Mutual Funds.