As filed with the Securities and Exchange Commission on July 11, 2007

Registration No. 333-143628

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

x Pre-Effective Amendment No. ____1____ o Post-Effective Amendment No. ________

(Check appropriate box or boxes)

SIT MUTUAL FUNDS II, INC.

(Exact Name of Registrant as Specified in Charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, Minnesota 55402

(Address of Principal Executive Offices)

(612) 332-3223

(Registrant’s Area Code and Telephone Number)

Paul E. Rasmussen, Esq.

Sit Mutual Funds

3300 IDS Center

Minneapolis, Minnesota 55402

(Name and Address of Agent for Service)

Copy to:

Michael J. Radmer, Esq.

Dorsey & Whitney LLP

50 South Sixth Street, Suite 1500

Minneapolis, Minnesota 55402

Approximate Date of Proposed Public Offering:

As soon as possible following the effective date of this Registration Statement.

It is proposed that this filing become effective on:

July 11, 2007 pursuant to Rule 488.

The title of securities being registered is common stock, par value $0.001 per share.

No filing fee is required because of Registrant’s reliance on Section 24(f) of the Investment Company Act of 1940, as amended.

SIT MUTUAL FUNDS II, INC.

REGISTRATION STATEMENT ON FORM N-14

SIT MUTUAL FUNDS TRUST

3300 IDS Center

80 South Eighth Street

Minneapolis, Minnesota 55402

July 13, 2007

To the Shareholders of Sit Florida Tax-Free Income Fund:

I am writing to inform you of a Special Meeting of the shareholders of Sit Florida Tax-Free Income Fund (“Florida Fund”) to be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota. The purpose of this meeting is to vote on a proposal to combine Florida Fund into Sit Tax-Free Income Fund (“Tax-Free Fund”). If the proposed reorganization is approved, you will receive shares of Tax-Free Fund with a value equal to the value of your Florida Fund shares.

The attached Prospectus/Proxy Statement provides you with additional information about the proposed reorganization and a comparison of the Funds. There is also attached a “Q&A” which should provide answers to many of your questions. We urge you to read all of the enclosed materials carefully.

The board of directors for Sit Mutual Funds II, Inc., the issuer of Tax-Free Fund, and the board of trustees for Sit Mutual Funds Trust, the Trust consisting of one series of shares in the Florida Fund, have approved the proposed reorganization of the Funds. I encourage you to vote “FOR” the proposal, and ask that you please send your completed proxy ballot in as soon as possible to help save the cost of additional solicitations. As always, we thank you for your confidence and support.

| Sincerely, |

|

|

| /s/ Eugene C. Sit |

| Eugene C. Sit |

WHAT YOU SHOULD KNOW ABOUT

THIS PROPOSED FUND REORGANIZATION

The board of trustees of Sit Mutual Funds Trust, on behalf of Sit Florida Tax-Free Income Fund (“Florida Fund”) encourages you to read the attached Prospectus/Proxy Statement carefully. The following is a brief overview of the key issues.

Why is my Fund holding a special shareholder meeting on July 27, 2007?

The meeting is being called to ask you to approve the reorganization of Florida Fund into Sit Tax-Free Income Fund (“Tax-Free Fund”), a “tax-free” fund in the Sit fund family. If shareholders vote in favor of the reorganization, Tax-Free Fund will acquire all or substantially all of the assets and all of the liabilities of Florida Fund, and your shares of Florida Fund will be exchanged for shares of Tax-Free Fund with the same value.

The board of trustees of Sit Mutual Funds Trust, on behalf of Florida Fund, and the board of directors of Sit Mutual Funds II, Inc., on behalf of Tax-Free Fund have determined that the proposed reorganization is in the best interests of the shareholders of both Funds and that the interests of the existing shareholders of each Fund will not be diluted. Your board of trustees recommends that you vote “FOR” the reorganization. As explained below, the reorganization is expected to be tax-free.

Why has my board of trustees recommended that I vote in favor of the reorganization?

Based upon the recommendation of Sit Investment Associates, Inc. (the “Adviser”), the investment adviser to both Florida Fund and Tax-Free Fund, your board of trustees concluded that Florida Fund is unlikely to grow to a size that is as economically viable as Tax-Free Fund. While Florida Fund, at March 31, 2007, had net assets of $3.7 million, Tax-Free Fund had net assets of $377.5 million. Your board believes that the larger asset base of the combined Funds may provide several benefits to the shareholders of both Funds, including the creation of a larger and potentially more stable fund for investment management and economies of scale associated with higher asset levels. In addition, your board noted the tax-free nature of the proposed reorganization, as explained below. Additional information regarding the boards’ deliberations is described in the attached Prospectus/Proxy Statement under the heading “Information about the Reorganization – Reasons for the Reorganization.”

How are Florida Fund and Tax-Free Fund alike? How do they differ?

The investment objectives of these Funds are substantially similar. The Tax-Free Fund has an objective of seeking high current income that is exempt from federal income tax consistent with preservation of capital. The Florida Fund has an objective of seeking high current income that is exempt from federal regular income tax. In addition, The Tax-Free Fund seeks to achieve its investment objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Florida Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. The material differences in the Funds’ investment strategies are:

| • | Florida Fund substantially invests in municipal securities issued by the state of Florida and its political subdivisions. |

| • | Tax-Free Fund invests in municipal securities issued by U.S. states, territories, and possessions and their political subdivisions, agencies, and instrumentalities which includes the state of Florida. |

2

| • | Florida Fund may invest up to 30% of its net assets in securities rated below investment-grade. |

| • | Tax-Free Fund may invest up to 25% of its net assets in securities rated below investment-grade. |

| • | Florida Fund may invest up to 10% of its net assets in securities that generate interest income subject to federal alternative minimum tax. However, as of March 31, 2007, the Fund did not hold any such AMT securities. |

| • | Tax-Free Fund may invest up to 20% of its net assets in securities that generate interest income subject to federal alternative minimum tax. However, as of March 31, 2007, the Fund did not hold any such AMT securities. |

The investment risks associated with these Funds also are similar, except that investments in Florida Fund are subject to Florida state specific risk, which is not a primary risk of investing in Tax-Free Fund. The Funds’ principal risks are described and compared in the attached Prospectus/Proxy Statement under the heading “Risk Factors.”

Will Florida Fund’s expenses remain the same?

If the reorganization is approved, the contractual annual fund operating expenses paid by Florida Fund shareholders will remain the same at .80% (excluding fees and expenses of acquired funds). Due to the Adviser’s voluntary waiver of fees, Tax-Free Fund’s actual expenses (excluding fees and expenses of acquired funds) are lower; for the year ended March 31, 2007, Tax-Free Fund’s expenses (excluding fees and expenses of acquired funds) were equal to .77% of the Fund’s average daily net assets. After December 31, 2007, the voluntary fee waiver may be terminated at any time by the Adviser.

What happens if shareholders decide in favor of the reorganization?

If the reorganization is approved, Tax-Free Fund will acquire all or substantially all of the assets and all of the liabilities of Florida Fund, and the shareholders of Florida Fund will receive full and fractional shares of Tax-Free Fund equal in value to the shares of Florida Fund that they owned immediately prior to the reorganization. Following distribution of the shares of Tax-Free Fund, Florida Fund will liquidate and dissolve.

What happens if shareholders do not approve the reorganization?

If shareholders do not approve the reorganization, Florida Fund initially will continue to be managed as a separate fund in accordance with its current investment objective and investment strategies. However, the board of trustees of Florida Fund may consider other alternatives, such as re-submission of the reorganization proposal to shareholders, submission of a liquidation proposal to shareholders or changes in the investment strategies of Florida Fund.

If the Funds merge, will there be tax consequences for me?

Unlike a transaction where you sell shares of one fund in order to buy shares of another, the reorganization will not be considered a taxable event. The Funds themselves will recognize no gains or losses on assets as a result of the reorganization. Therefore, you will not have reportable capital gains or losses due to the reorganization, although you may receive a distribution, immediately prior to the reorganization, of all of current year net income and net realized capital gains, if any, not previously distributed by Florida Fund.

3

However, you should consult your own tax adviser regarding any possible effect the proposed reorganization might have on you, given your personal circumstances – particularly regarding state and local taxes.

Who will pay the costs for the reorganization?

The expenses of the reorganization, including legal expenses, printing, packaging, and postage, plus the cost of any supplementary solicitations, will be borne by the Adviser.

What does the board of trustees recommend?

The board of trustees of Florida Fund recommends that you vote in favor of the reorganization. Before you do, however, be sure to study the issues involved and call us with any questions, then vote promptly to ensure that a quorum will be represented at the special shareholders meeting.

Where do I get more information about Florida Fund and Tax-Free Fund?

Please call the Funds at (800) 332-5580 or (612) 334-5888 or go online at www.sitfunds.com.

4

SIT FLORIDA TAX-FREE INCOME FUND

a series of

SIT MUTUAL FUNDS TRUST

3300 IDS Center

80 South Eighth Street

Minneapolis, Minnesota 55402

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD JULY 27, 2007

To the Shareholders of Sit Florida Tax-Free Income Fund: | July 13, 2007 |

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders of Sit Florida Tax-Free Income Fund (“Florida Fund”) will be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota. The purpose of the special meeting is as follows:

| 1. | To consider and vote on a proposed Agreement and Plan of Reorganization (the “Plan”) providing for (a) the acquisition of all or substantially all of the assets and the assumption of all of the liabilities of Florida Fund by Sit Tax-Free Income Fund (“Tax-Free Fund”) in exchange for full and fractional shares of common stock, of Tax-Free Fund having an aggregate net asset value equal to the aggregate value of the assets acquired (less liabilities assumed) from Florida Fund and (b) the distribution of Tax-Free Fund shares to the shareholders of Florida Fund in liquidation of Florida Fund. Under the Plan, each Florida Fund shareholder will receive Tax-Free Fund shares with a net asset value equal as of the effective time of the Plan to the net asset value of their Florida Fund shares. |

| 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Even if Florida Fund shareholders vote to approve the Plan, consummation of the Plan is subject to certain other conditions. See “Information about the Reorganization – Agreement and Plan of Reorganization” in the attached Prospectus/Proxy Statement.

THE BOARD OF TRUSTEES OF FLORIDA FUND RECOMMENDS APPROVAL OF THE PLAN.

The close of business on June 20, 2007 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any adjournments or postponements thereof.

5

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE. IN ORDER TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION, WE RESPECTFULLY ASK FOR YOUR COOPERATION IN MAILING IN YOUR PROXY PROMPTLY. If you are present at the meeting, you may then revoke your proxy and vote in person, as explained in the Prospectus/Proxy Statement in the section entitled “Voting Information – General.”

| By Order of the Board of Trustees |

|

|

| /s/ Eugene C. Sit |

| Eugene C. Sit |

6

PROSPECTUS/PROXY STATEMENT

dated July 9, 2007

SIT MUTUAL FUNDS II, INC.

SIT MUTUAL FUNDS TRUST

3300 IDS Center

80 South Eighth Street

Minneapolis, Minnesota 55402

(800) 332-5580 or (612) 334-5888

Acquisition of the Assets of Sit Florida Tax-Free Income Fund, a series of Sit Mutual Funds Trust

By and in Exchange for Shares of Sit Tax-Free Income Fund, a series of Sit Mutual Funds II, Inc.

We are furnishing this combined Prospectus/Proxy Statement to the shareholders of Sit Florida Tax-Free Income Fund (“Florida Fund”) in connection with the solicitation of proxies by Florida Fund’s board of trustees for use at a special meeting of the shareholders of Florida Fund to be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota, for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders. This Prospectus/Proxy Statement is first being mailed to Florida Fund shareholders on or about July 13, 2007.

This Prospectus/Proxy Statement relates to a proposed Agreement and Plan of Reorganization (the “Plan”) providing for (a) the acquisition of all or substantially all of the assets and the assumption of all of the liabilities of Florida Fund by Sit Tax-Free Income Fund (“Tax-Free Fund”) in exchange for full and fractional shares of common stock of Tax-Free Fund having an aggregate net asset value equal to the aggregate value of the assets acquired (less liabilities assumed) from Florida Fund and (b) the distribution of Tax-Free Fund shares to the shareholders of Florida Fund in liquidation of Florida Fund. Under the Plan, each Florida Fund shareholder will receive Tax-Free Fund shares with a net asset value equal to the net asset value of their Florida Fund shares.

Both Florida Fund and Tax-Free Fund are open-end funds with the investment objective to seek high current income that is exempt from federal regular income tax. The Funds’ investment objectives, principal investment strategies and principal risks are described and compared below under “Risk Factors” and “Information about Florida Fund and Tax-Free Fund – Comparison of Investment Objectives and Principal Investment Strategies.”

Because Florida Fund shareholders are being asked to approve a transaction that will result in their receiving shares of Tax-Free Fund, this documents also serves as a Prospectus for Tax-Free Fund shares. This Prospectus/Proxy Statement concisely sets forth information about Tax-Free Fund that shareholders of Florida Fund should know before voting on the Plan, and it should be retained for future reference.

Additional information about Florida Fund and Tax-Free Fund has been filed with the Securities and Exchange Commission and is available upon request and without charge by writing to the Funds at 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota 55402, by calling the Funds at (800) 332-5580 or (612) 334-5888, or by going online to www.sitfunds.com. You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s Internet site at www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549.

Information which has been filed with the Securities and Exchange Commission includes a Statement of Additional Information dated July 9, 2007 relating to this Prospectus/Proxy Statement, which is incorporated herein by reference. This Prospectus/Proxy Statement also includes the Agreement and Plan of Reorganization, a copy of which is attached as Exhibit A to this Prospectus/Proxy Statement. The Prospectus dated August 1, 2006 of Florida Fund and Tax-Free Fund also is incorporated into this Prospectus/Proxy Statement by reference, a copy of which is attached as Exhibit B to this Prospectus/Proxy Statement.

The documents listed below are incorporated by reference into the Statement of Additional Information relating to this Prospectus/Proxy Statement, and these items will be provided with any copy of the Statement of Additional Information which is requested. Any documents requested will be sent within one business day of receipt of the request by first class mail or other means designed to ensure equally prompt delivery.

| • | The financial statements of Florida Fund and Tax-Free Fund included as part of the Funds’ Annual Report to shareholders for fiscal year ended March 31, 2007 are incorporated by reference in the Statement of Additional Information relating to this Prospectus/Proxy Statement. |

| • | The Statement of Additional Information dated August 1, 2006 of Florida Fund and Tax-Free Fund is incorporated by reference in its entirety in the Statement of Additional Information relating to this Prospectus/Proxy Statement. |

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR

DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS

PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

2

TABLE OF CONTENTS

1 | ||

2 | ||

| 2 | |

| 2 | |

| 2 | |

| 3 | |

| Purchase, Exchange and Redemption Procedures; Distribution of Fund Shares | 3 |

| 4 | |

4 | ||

6 | ||

| 6 | |

| 8 | |

| 9 | |

| 9 | |

| 10 | |

11 | ||

| Comparison of Investment Objectives and Principal Investment Strategies | 11 |

14 | ||

| 14 | |

| 14 | |

| Security Ownership of Certain Beneficial Owners and Management | 15 |

| 15 | |

| 16 | |

16 | ||

16 | ||

16 | ||

A-1 | ||

B-1 | ||

i

This table describes the fees and expenses that:

| • | you currently bear as a Florida Fund shareholder (“Florida Fund” column); |

| • | shareholders of Tax-Free Fund currently bear (“Tax-Free Fund” column); and |

| • | you can expect to bear as a Tax-Free Fund shareholder after the proposed reorganization (“Pro Forma” column). |

Both Funds are no-load investments, so you will not pay sales charges (loads) or exchange fees when you buy or sell shares of either Fund. When you hold shares of either Fund, you indirectly pay a portion of that Fund’s operating expenses. These expenses are deducted from Fund assets.

| Florida Fund | Tax-Free Fund | Pro Forma |

Shareholder Fees (fees paid directly from your investment) | None | None | None |

|

|

|

|

Annual Fund Operating Expenses as a % of average net assets (expenses that are deducted from Fund assets) |

|

|

|

Management Fees | 0.80% | 0.80%1 | 0.80%1 |

Distribution (12b-1) Fees | None | None | None |

Other Expenses | None | None | None |

Acquired Fund Fees and Expenses 2 | None | 0.01% | 0.01% |

Total Annual Fund Operating Expenses | 0.80% | 0.81%1 | 0.81%1 |

___________________________

1 Management fee represents the contractual fee and does not reflect the Adviser’s voluntary waiver of fees. Actual expenses are lower than those shown in the table because of voluntary fee waivers by the Adviser. As a result of the fee waiver, actual management fees for the year ended March 31, 2007 for Tax-Free Fund and Pro Forma are 0.77% of the Fund’s average daily net assets, and actual total annual fund operating expenses which includes acquired fund fees and expenses for the year ended March 31, 2007 for Tax-Free Fund and Pro Forma are 0.78% of the Fund’s average daily net assets. After December 31, 2007, these voluntary fee waivers may be terminated at any time by the Adviser.

2 Reflects the pro-rata share of the fees and expenses of the acquired funds in which the Fund invests.

Example

This example is intended to help you compare the cost of investing in Florida Fund with the cost of investing in Tax-Free Fund (before any fee waiver), as well as other mutual funds. It assumes that you invest $10,000 for the time periods indicated (with reinvestment of all dividends and distributions), that your investment has a 5% return each year, that the Funds’ operating expenses remain the same, and that you redeem all of your shares at the end of those periods. Although your actual costs and returns may differ, based on these assumptions your costs would be:

| Florida Fund | Tax-Free Fund | Pro Forma |

1 year | $82 | $83 | $83 |

3 years | $256 | $260 | $260 |

5 years | $446 | $451 | $451 |

10 years | $993 | $1,005 | $1,005 |

1

SUMMARY

The following is a summary of certain information contained elsewhere in this Prospectus/Proxy Statement and in the documents incorporated by reference into this Prospectus/Proxy Statement, including the Plan, a copy of which is included with this Prospectus/Proxy Statement as Exhibit A. This summary may not contain all of the information that is important to you. Florida Fund shareholders should review the accompanying documents carefully in connection with their review of this Prospectus/Proxy Statement.

The Plan provides for (a) the acquisition of all or substantially all of the assets and the assumption of all of the liabilities of Florida Fund by Tax-Free Fund in exchange for full and fractional shares of common stock of Tax-Free Fund having an aggregate net asset value equal to the aggregate value of the assets acquired (less liabilities assumed) from Florida Fund and (b) the distribution of Tax-Free Fund shares to the shareholders of Florida Fund in liquidation of Florida Fund. Under the Plan, each Florida Fund shareholder will receive Tax-Free Fund shares with a net asset value equal to the net asset value of their Florida Fund shares.

For the reasons set forth below under “Information about the Reorganization – Reasons for the Reorganization,” the board of trustees of Florida Fund and the board of directors of Tax-Free Fund, including all of the “non-interested” members of the boards, as that term is defined in the Investment Company Act of 1940, as amended (the “Investment Company Act”), have concluded that the reorganization would be in the best interests of the shareholders of both Funds and that the interests of the Funds’ existing shareholders would not be diluted as a result of the transactions contemplated by the reorganization. Therefore, the boards have approved the reorganization on behalf of both Funds, and the board of trustees of Florida Fund has submitted the Plan for approval by Florida Fund shareholders.

Approval of the reorganization will require the affirmative vote of a majority of outstanding shares of Florida Fund as discussed in detail below under “Voting Information – General.”

Prior to completion of the reorganization Florida Fund will have received from counsel an opinion that, upon the reorganization, no gain or loss will be recognized by Florida Fund or its shareholders for federal income tax purposes. The holding period and aggregate tax basis of Tax-Free Fund shares that are received by each Florida Fund shareholder will be the same as the holding period and aggregate tax basis of Florida Fund shares previously held by those shareholders. In addition, the holding period and tax basis of the assets of Florida Fund in the hands of Tax-Free Fund as a result of the reorganization will be the same as in the hand of Florida Fund immediately prior to the reorganization. See “Information about the Reorganization – Federal Income Tax Consequences.”

Investment Objectives and Principal Investment Strategies

The investment objectives of the Funds are substantially similar. The Tax-Free Fund has an objective of seeking high current income that is exempt from federal income tax consistent with preservation of capital. The Florida Fund has an objective of seeking high current income that is exempt from federal regular income tax. In addition, The Tax-Free Fund seeks to achieve its investment objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Florida Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. The material differences in the Funds’ investment strategies are:

2

| • | Florida Fund substantially invests in municipal securities issued by the state of Florida and its political subdivisions. |

| • | Tax-Free Fund invests in municipal securities issued by U.S. states, territories, and possessions and their political subdivisions, agencies, and instrumentalities which includes the state of Florida. |

| • | Florida Fund may invest up to 30% of its net assets in securities rated below investment-grade. |

| • | Tax-Free Fund may invest up to 25% of its net assets in securities rated below investment-grade. |

| • | Florida Fund may invest up to 10% of its net assets in securities that generate interest income subject to federal alternative minimum tax. However, as of March 31, 2007, the Fund did not hold any such AMT securities. |

| • | Tax-Free Fund may invest up to 20% of its net assets in securities that generate interest income subject to federal alternative minimum tax. However, as of March 31, 2007, the Fund did not hold any such AMT securities. |

Each Fund is a party to a separate Investment Management Agreement with the Adviser under which the Adviser manages the Fund’s business and investment activities, subject to the authority of the board of directors or the board of trustees. The Agreements require the Adviser to bear each Fund’s expenses except interest, brokerage commission and transaction charges, acquired fund fees and expenses and certain extraordinary expenses. The investment advisory fees for the Funds, calculated as a percentage of Fund net assets, are .80% for Florida Fund and .80% for Tax-Free Fund (before voluntary fee waivers). Thus, if the reorganization is approved, Florida Fund shareholders will experience the same contractual advisory fees as shareholders of Tax-Free Fund. See “Fees and Expenses,” above. For the fiscal year ended March 31, 2007, the Adviser waived a portion of its fee for Tax-Free Fund, resulting in advisory fees equal to .77% of average daily net assets for the fiscal year. However, the Adviser may modify or discontinue voluntary waivers for Tax-Free Fund at any time after December 31, 2007, in its sole discretion.

Purchase, Exchange and Redemption Procedures; Distribution of Fund Shares

Shares of Tax-Free Fund received by Florida Fund shareholders in the reorganization will be subject to the same purchase, exchange and redemption procedures that currently apply to Florida Fund shares. Shares of both Funds are offered at net asset value, without any sales charges. Shares of the Funds may be purchased, exchanged or sold on any day the New York Stock Exchange is open. The minimum initial investment generally is $5,000 for each Fund ($2,000 for IRA accounts), with minimum additional investments of at least $100. For each Fund, shareholders may sell their shares and use the proceeds to buy shares of another Sit Mutual Fund at no cost. Purchase, exchange and redemption procedures are discussed in detail in the accompanying prospectus of Florida Fund and Tax-Free Fund under the caption “Shareholder Information.”

SIA Securities Corp. (the “Distributor”), an affiliate of the Adviser, is the distributor for the Funds. The Distributor markets the Funds’ shares only to certain institutional and individual investors, and all other sales of the Funds’ shares are made by each Fund. The Distributor or the Adviser may enter into agreements under which various financial institutions and brokerage firms provide administrative services for customers who are beneficial owners of shares of the Funds. The Distributor or Adviser may compensate these firms for the services provided, with compensation based on the aggregate assets of customers that are invested in the Funds.

3

Dividends and Distributions

Each Fund distributes an annual dividend from its net investment income. Capital gains, if any, are distributed at least once a year by each Fund. Dividend and capital gain distributions are automatically reinvested in additional shares of the Fund paying the distribution at the net asset value per share on the distribution date. However, for each Fund, shareholders may request that distributions be automatically reinvested in another Sit Mutual Fund, or paid in cash. Florida Fund anticipates that it will make a distribution, immediately prior to the combination with Tax-Free Fund, of all of its current year net income and net realized capital gains, if any, not previously distributed. This distribution of realized capital gains, if any, will be taxable to Florida Fund shareholders subject to taxation.

Because both Funds invest primarily in municipal securities that generate interest income that is exempt from regular federal income tax, the risks of the two Funds are similar. Principal risks that apply to both Funds are interest rate risk, credit risk, income risk, management risk, prepayment risk, call risk, political, economic and tax risk, revenue bond risk, housing authority bonds risk, health care facility revenue obligations risk, and high-yield risk. Because Florida Fund invests primarily in Florida municipal securities, which Tax-Free Fund does not, Florida Fund also is subject to risk of nondiversification and Florida state specific risk. Each of these risks is discussed below. All investments carry some degree of risk which will affect the value of each Fund’s investments and investment performance and the price of its shares. It is possible to lose money by investing in either Fund.

Both Funds are subject to the following risks:

| • | Interest Rate Risk: An increase in interest rates may lower a Fund’s value and the overall return on your investment. The magnitude of this decrease is often greater for longer-term fixed income securities than shorter-term securities. |

| • | Credit Risk: the issuers or guarantors of securities (including U.S. government agencies and instrumentalities issuing securities that are not guaranteed by the full faith and credit of the U.S. government) owned by a Fund may default on the payment of principal or interest, or the other party to a contract may default on its obligations to a Fund, causing the value of the Fund to decrease. |

| • | Income Risk: The income you earn from a Fund may decline due to declining interest rates. |

| • | Management Risk: A strategy used by the investment management team may not produce the intended results. |

| • | Prepayment Risk: Declining interest rates may compel borrowers to prepay mortgages and debt obligations underlying the mortgage-backed securities and manufactured home loan pass-through securities owned by a Fund. The proceeds received by a Fund from prepayments will likely be reinvested at interest rates lower than the original investment, thus resulting in a reduction of income to a Fund. Likewise, rising interest rates could reduce prepayments and extend the life of securities with lower interest rates, which may increase the sensitivity of a Fund’s value to rising interest rates. |

4

| • | Call Risk: Many bonds may be redeemed (“called”) at the option of the issuer before their stated maturity date. In general, an issuer will call its bonds if they can be refinanced by issuing new bonds which bear a lower interest rate. A Fund would then be forced to invest the unanticipated proceeds at lower interest rates, resulting in a decline in a Fund’s income. |

| • | Political, Economic and Tax Risk: Because the Funds invest primarily in municipal securities issued by states and their political subdivisions (specifically, the state of Florida for the Florida Fund), the Funds may be particularly affected by the political and economic conditions and developments in those states. Since each Fund primarily invests in municipal securities, the value of each Fund may be more adversely affected than other funds by future changes in federal or state income tax laws. |

| • | Revenue Bond Risk: The revenue bonds in which the Funds may invest entail greater credit risk than the Funds’ investments in general obligation bonds. In particular, weaknesses in federal housing subsidy programs and their administration may result in a decrease of subsidies available for the payment of principal and interest on certain multi-family housing authority bonds. |

| • | Housing Authority Bonds Risk: Because the Funds may invest a significant portion of their assets in housing authority bonds, the Funds may be more affected by events influencing the housing sector than a fund that is more diversified across numerous sectors. A housing authority’s gross receipts and net income available for debt service may be affected by future events and conditions, including, among other things, economic developments such as fluctuations in interest rates, construction costs and operating costs; and changes in federal housing subsidy programs. A housing authority’s inability to obtain additional financial could also reduce revenues available to pay existing obligations. |

| • | Health Care Facility Revenue Obligations Risk: Because the Funds may invest a significant portion of their assets in health care facility bonds, the Funds may be more affected by events influencing the health care sector than a fund that is more diversified across numerous sectors. A health care facility’s gross receipts and net income available for debt service may be affected by future events and conditions including, among other things, demand for services, efforts by insurers and governmental agencies to limit rates, legislation and changes in Medicare, Medicaid and other similar third-party payor programs. |

| • | High-Yield Risk: The Florida Fund may invest up to 30% of its assets in municipal securities rated below investment grade. The Tax-Free Fund may invest up to 25% of its assets in municipal securities rated below investment grade. Debt securities rated below investment grade are commonly known as junk bonds. Junk bonds are considered predominately speculative and involve greater risk of default or price changes due to changes in the issuer’s creditworthiness. |

Florida Fund is subject to the following additional risks:

| • | Risk of Nondiversification: The Florida Fund is nondiversified, as is typical of a single-state fund. This means that the Fund may invest a larger portion of its assets in a limited number of issuers than a diversified fund. Because a relatively high percentage of the Fund’s assets may be invested in the securities of a limited number of issuers, the Fund may be more susceptible to any single economic, political or regulatory occurrence than a diversified fund. |

5

| • | Florida State Specific Risk: Because the Florida Fund invests primarily in Florida municipal securities it will be more exposed to negative political or economic factors in Florida than a fund that invests more widely. Florida’s economy is largely composed of services, trade, construction, agriculture, manufacturing and tourism. The exposure to these industries, particularly tourism, leaves Florida vulnerable to an economic slowdown associated with business cycles. When compared with other states, Florida has a proportionately greater retirement age population, and property income (dividends, interest and rent) and transfer payments (including social security and pension benefits) are a relatively more important source of income. Proportionately greater dependency on these revenues leaves the state vulnerable to a decline in these revenues. Furthermore, because of Florida’s rapidly growing population, corresponding increases in state revenue will be necessary during the next decade to meet increased burdens on the various public and social services provided by the state. From time to time, Florida and its political subdivisions have encountered financial difficulties. |

The investment securities and techniques of the Funds, and the risks associated therewith, are described in more detail in the Statement of the Additional Information for Florida Fund and Tax-Free Fund.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

The board of trustees of Florida Fund and the board of directors of Tax-Free Fund are comprised of the same individuals, and the boards, including all of the “non-interested” directors and trustees, have determined that it is advantageous to the respective Funds to combine Florida Fund with Tax-Free Fund. As discussed in detail below under “Information About Florida Fund and Tax-Free Fund,” the Funds have substantially similar investment objectives and similar investment strategies. The Funds also have the same investment adviser and the same distributor, auditors, legal counsel, custodian and transfer agent.

The board of directors and trustees for each Fund have determined that the reorganization is expected to provide certain benefits to each Fund, that the reorganization would be in the best interests of the shareholders of both Funds and that the interests of the Funds’ existing shareholders would not be diluted as a result of the transactions contemplated by the reorganization. The board of trustees of Florida Fund has submitted the Plan for approval by Florida Fund shareholders.

In approving the reorganization, the board of trustees of Florida Fund and the board of directors of Tax-Free Fund considered several factors, including the following:

| • | The compatibility of the Funds’ investment objectives, policies, and restrictions: The boards noted that the Funds’ investment objectives are substantially similar and that both Funds seek to meet this objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. Although Florida Fund primarily limits its investments to municipal securities issued from the state of Florida and the Tax-Free Fund has no such state limitations, the boards concluded that the investment strategies were sufficiently similar to warrant combination of the Funds. |

| • | The Funds’ relative risks: The boards noted that the risks associated with investing in the two Funds are identical, except that Florida Fund is subject to Florida state specific risk and risk of nondiversification that the Tax-Free Fund is not. |

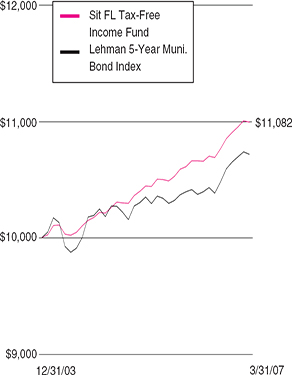

| • | The Funds’ investment performance: The boards noted that returns before taxes for the 1-year, 3-year and since inception periods ended March 31, 2007 were 3.97%, 3.12% and 3.21%, respectively, for Florida Fund and 4.00%, 3.30% and 5.85%, respectively, for Tax-Free Fund. The boards considered this information and noted that the returns were better in each period for Tax-Free Fund than for Florida Fund. |

6

| • | The Funds’ relative sizes: The boards noted that Florida Fund’s net assets were $3.2 million at March 31, 2005, $3.8 million at March 31, 2006, and $3.7 million at March 31, 2007. In contrast, Tax-Free Fund had net assets of $377.5 million at March 31, 2007. Given the small and stagnant asset base of Florida Fund, and the much larger size of Tax-Free Fund’s asset base, the boards believed that the reorganization may provide several benefits to the shareholders of both Funds, including the creation of a larger and potentially more stable fund for investment management and economies of scale associated with higher asset levels. |

| • | The Funds’ relative expenses: The boards noted that the contractual investment advisory fee for Tax-Free Fund and Florida Fund is identical: 0.80%. The boards also noted that as a result of the Adviser’s voluntary waiver of fees through at least December 31, 2007, the net effective advisory fee rate for Tax-Free Fund is lower: 0.77% for the year ended March 31, 2007. |

| • | The repeal of the Florida intangible personal property tax: Effective January 1, 2007, the Florida Legislature repealed the Florida intangible personal property tax which was an annual tax based on the fair market value of intangible personal property including securities such as shares of mutual funds. The Florida Fund’s shares were exempt from the Florida intangible personal property tax. The boards noted that the exemption from the Florida intangible personal property tax was a distinguishing aspect of the Florida Fund’s shares which was eliminated by the repeal of the tax. |

| • | The portfolio composition of the Funds: The boards noted that the two Funds’ investment portfolios are expected to be compatible, so that the Adviser anticipates little or no rebalancing in connection with the reorganization. |

| • | The tax consequences of the Reorganization: The boards noted that the reorganization is expected to be tax-free to shareholders of both Funds, which the boards believe is in best interests of the shareholders. |

| • | The investment experience, expertise, and results of each Fund’s portfolio managers: The boards noted that both Funds are managed by the same senior portfolio managers. The boards considered the investment experience, expertise, and results of this team, and concluded that it is comfortable with the team. |

| • | The effect of the Reorganization on each Fund’s shareholders’ rights: The boards noted that the rights of the shareholders of both Funds are substantially similar. |

| • | Expenses of the Reorganization: The boards noted that the Adviser has agreed to pay the expenses associated with the reorganization, including the expenses of preparing, filing, printing, and mailing this Prospectus/Proxy Statement and of holding the special meeting, so that no shareholders of either Fund will effectively bear these expenses. |

| • | The alternatives to the Reorganization: The board of directors of Florida Fund could have decided to continue Florida Fund in its present form, but believed this was not in shareholders’ best interests given the small, stagnant asset base and in light of the benefits expected to be derived by Florida Fund from the reorganization, including the creation of a larger and potentially more stable fund for investment management and economies of scale associated with higher asset levels. |

7

| • | The potential benefits of the Reorganization to the Adviser and its affiliates: The boards recognized that the Adviser may benefit from the reorganization. The Adviser might be able to reduce its expenditures for investment advisory and marketing services following the discontinuation of Florida Fund. While the boards recognized that the Adviser and its affiliates, as well as Fund shareholders, might benefit from the proposed reorganization, it did not view this as a reason not to approve the transaction. |

The boards of the Funds did not assign specific weights to any or all of these factors but did consider all of them in determining, in their business judgment, to approve the reorganization and, with respect to the board of trustees of Florida Fund, to recommend its approval by Florida Fund’s shareholders.

Agreement and Plan of Reorganization

The following summary of the proposed Plan and reorganization is qualified in its entirety by reference to the Plan, which is included with this Prospectus/Proxy Statement as Exhibit A. The Plan provides that, as of the Effective Time (as defined in the Plan), Tax-Free Fund will acquire all or substantially all of the assets and assume all of the liabilities of Florida Fund in exchange for full and fractional shares of common stock, par value $0.001 per share, of Tax-Free Fund having an aggregate net asset value equal to the aggregate value of the assets acquired (less liabilities assumed) from Florida Fund. For corporate law purposes, the transaction is structured as a sale of the assets and assumption of the liabilities of Florida Fund in exchange for the issuance of Tax-Free Fund shares to Florida Fund, followed immediately by the distribution of such Tax-Free Fund shares to Florida Fund shareholders and the cancellation and retirement of outstanding Florida Fund shares.

Under the Plan, each holder of Florida Fund shares will receive, at the Effective Time, Tax-Free Fund shares with an aggregate net asset value equal to the aggregate net asset value of Florida Fund shares owned by that shareholder immediately prior to the Effective Time. The net asset value per share of each Fund’s shares will be computed as of the Effective Time using the valuation procedures set forth in the respective Funds’ articles of incorporation and bylaws and in the Funds’ then-current Prospectus and Statement of Additional Information and as may be required by the Investment Company Act.

At the Effective Time, Tax-Free Fund will issue to Florida Fund, and Florida Fund will distribute to Florida Fund’s shareholders of record, determined as of the Effective Time, the Tax-Free Fund shares issued in exchange for Florida Fund’s assets as described above. All outstanding shares of Florida Fund will then be canceled and retired and no additional shares representing interests in Florida Fund will be issued thereafter, and Florida Fund will be deemed to be liquidated. The distribution of Tax-Free Fund shares to former Florida Fund shareholders will be accomplished by the transfer of the Tax-Free Fund shares then credited to the account of Florida Fund on the books of Tax-Free Fund to open accounts on the share records of Tax-Free Fund in the names of Florida Fund shareholders representing the full and fractional Tax-Free Fund shares due each such shareholder.

Florida Fund anticipates that it will make a distribution, immediately prior to the Effective Time, of all of its current year net income and net realized capital gains, if any, not previously distributed. This distribution will be taxable to Florida Fund shareholders subject to taxation.

The consummation of the reorganization is subject to the conditions set forth in the Plan, including, among others:

| • | approval of the Plan by the shareholders of Florida Fund; |

| • | the delivery of the opinion of counsel described below under “Federal Income Tax Consequences”; |

8

| • | the accuracy as of the Effective Time of the representations and warranties made by Florida Fund and Tax-Free Fund in the Plan; and |

| • | the delivery of customary closing certificates. |

See the Plan included with this Prospectus/Proxy Statement as Exhibit A for a complete listing of the conditions to the consummation of the reorganization. The Plan may be terminated and the reorganization abandoned at any time prior to the Effective Time, before or after approval by shareholders of Florida Fund, by resolution of the board of trustees of Florida Fund or the board of directors of Tax-Free Fund, if circumstances should develop that, in the opinion of either board, make proceeding with the consummation of the Plan and reorganization not in the best interests of the respective Funds’ shareholders.

The Plan provides that the Adviser will bear the entire cost of the reorganization, including professional fees and the cost of soliciting proxies for the special meeting, which principally consists of printing and mailing expenses, and the cost of any supplementary solicitation. Neither Florida Fund nor Tax-Free Fund will pay any of these expenses.

Approval of the Plan will require the affirmative vote of a majority of the outstanding shares of Florida Fund as discussed in detail below under “Voting Information – General.” If the Plan is not approved, Florida Fund initially will continue to be managed as a separate fund in accordance with its current investment objective and investment strategies. However, the board of trustees of Florida Fund may consider other possible courses of action, such as re-submission of the reorganization proposal to shareholders, submission of a liquidation proposal to shareholders or changes in the investment strategies of Florida Fund. Florida Fund shareholders are not entitled to assert dissenters’ rights of appraisal in connection with the Plan or reorganization. See “Voting Information – No Dissenters’ Rights of Appraisal,” below.

Description of Florida Fund and Tax-Free Fund Shares

Sit Mutual Funds II, Inc. is the corporate issuer of the Tax-Free Fund which is designated as series A. Sit Mutual Funds Trust is a Delaware statutory trust and issuer of the Florida Fund. Florida Fund and Tax-Free Fund each offers a single class of shares, and each share of the Funds has one vote, with proportionate voting for fractional shares. All Tax-Free Fund shares issued in the reorganization will be fully paid and non-assessable and will not be entitled to pre-emptive or cumulative voting rights.

Federal Income Tax Consequences

It is intended that the exchange of Tax-Free Fund shares for Florida Fund’s net assets and the distribution of those shares to Florida Fund’s shareholders upon liquidation of Florida Fund will be treated as a tax-free reorganization under the Internal Revenue Code of 1986, as amended (the “Code”), and that consequently for federal income tax purposes, no income, gain or loss will be recognized by Florida Fund’s shareholders (except that Florida Fund anticipates that it will make a distribution, immediately prior to the Effective Time, of all of its current year net income and net realized capital gains, if any, not previously distributed, and this distribution will be taxable to Florida Fund shareholders subject to taxation). Florida Fund has not asked, nor does it plan to ask, the Internal Revenue Service to rule on the tax consequences of the reorganization.

As a condition to the closing of the reorganization, the two Funds will receive an opinion from Dorsey & Whitney LLP, counsel to the Funds, based in part on certain representations to be furnished by each Fund, substantially to the effect that the federal income tax consequences of the reorganization will be as follows:

9

| • | the reorganization will constitute a reorganization within the meaning of Section 368(a)(1)(C) of the Code, and Florida Fund and Tax-Free Fund each will qualify as a party to the reorganization under Section 368(b) of the Code; |

| • | Florida Fund shareholders will recognize no income, gain or loss upon receipt, pursuant to the reorganization, of Tax-Free Fund shares. Florida Fund shareholders subject to taxation will recognize income upon receipt of any net investment income or net capital gains of Florida Fund which are distributed by Florida Fund prior to the Effective Time; |

| • | the tax basis of Tax-Free Fund shares received by each Florida Fund shareholder pursuant to the reorganization will be equal to the tax basis of Florida Fund shares exchanged therefor; |

| • | the holding period of Tax-Free Fund shares received by each Florida Fund shareholder pursuant to the reorganization will include the period during which each Florida Fund shareholder held the Florida Fund shares exchanged therefor, provided that the Florida Fund shares were held as a capital asset at the Effective Time; |

| • | Florida Fund will recognize no income, gain or loss by reason of the reorganization; |

| • | Tax-Free Fund will recognize no income, gain or loss by reason of the reorganization; |

| • | the tax basis of the assets received by Tax-Free Fund pursuant to the reorganization will be the same as the basis of those assets in the hands of Florida Fund as of the Effective Time; |

| • | the holding period of the assets received by Tax-Free Fund pursuant to the reorganization will include the period during which such assets were held by Florida Fund, provided that such assets were held as capital assets at the Effective Time; and |

| • | Tax-Free Fund will succeed to and take into account the earnings and profits, or deficit in earnings and profits, of Florida Fund as of the Effective Time. |

The tax opinion will state that no opinion is expressed as to the effect of the reorganization on the Funds or any shareholder with respect to any asset as to which any unrealized gain or loss is required to be recognized for federal income tax purposes at the end of a taxable year (or on the termination or transfer thereof) under a mark-to-market system of accounting.

Florida Fund shareholders should consult their tax advisors regarding the effect, if any, of the reorganization in light of their individual circumstances. Because the foregoing discussion only relates to the federal income tax consequences of the reorganization, those shareholders also should consult their tax advisors about state and local tax consequences, if any, of the reorganization.

Existing and Pro Forma Capitalization

The table below reflects the existing capitalization of each Fund as of March 31, 2007 and pro forma capitalization for the combined Funds as of the same date:

10

| Florida Fund | Adjustment | Tax-Free Fund | Pro Forma |

Net assets | $3,734,161 | - | $377,549,145 | $381,283,306 |

Net asset value per share | $9.99 | - | $9.72 | $9.72 |

Shares Outstanding | 373,841 | 10,186 | 38,827,764 | 39,211,791 |

INFORMATION ABOUT FLORIDA FUND AND TAX-FREE FUND

Information concerning Florida Fund and Tax-Free Fund is incorporated into this Prospectus/Proxy Statement by reference to the Funds’ current Prospectus dated August 1, 2006. That Prospectus accompanies this Prospectus/Proxy Statement and forms part of the Registration Statements of Florida Fund and Tax-Free Fund on Form N-1A which have been filed with the Securities and Exchange Commission.

Florida Fund and Tax-Free Fund are subject to the informational requirements of the Securities and Exchange Act of 1934 and in accordance with those requirements file reports and other information, including proxy materials, reports and charter documents. These items can be inspected and copied at the Public Reference Facilities maintained by the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549, and at the SEC’s Regional Offices located at 75 West Jackson Boulevard, Chicago, Illinois 60604 and at 233 Broadway, New York, New York 10279. Copies of such materials can also be obtained at prescribed rates from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. Further information on the operations of the public reference facilities may be obtained by calling (800) SEC-0330. In addition, the SEC maintains an Internet site that contains copies of the information. The address of the site is http://www.sec.gov.

Comparison of Investment Objectives and Principal Investment Strategies

The investment objectives of the Funds are substantially similar. The Tax-Free Fund has an objective of seeking high current income that is exempt from federal income tax consistent with preservation of capital. The Florida Fund has an objective of seeking high current income that is exempt from federal regular income tax. In addition, The Tax-Free Fund seeks to achieve its investment objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Florida Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. The material differences in the Funds’ investment strategies are:

| • | Florida Fund substantially invests in municipal securities issued by the state of Florida and its political subdivisions. |

| • | Tax-Free Fund invests in municipal securities issued by U.S. states, territories, and possessions and their political subdivisions, agencies, and instrumentalities which includes the state of Florida. |

11

| • | Florida Fund may invest up to 30% of its net assets in securities rated below investment-grade. |

| • | Tax-Free Fund may invest up to 25% of its net assets in securities rated below investment-grade. |

| • | Florida Fund may invest up to 10% of its net assets in securities that generate interest income subject to federal alternative minimum tax. |

| • | Tax-Free Fund may invest up to 20% of its net assets in securities that generate interest income subject to federal alternative minimum tax. However, as of March 31, 2007, the Fund did not hold any such AMT securities. |

The following table compares the current investment objectives and principal investment strategies of Florida Fund and of Tax-Free Fund with the post-reorganization investment objectives and principal investment strategies of Tax-Free Fund.

| Florida Fund | Tax-Free Fund | Tax-Free Fund |

Investment Objective: | Seeks high current income that is exempt from federal regular income tax. | Seeks high current income that is exempt from federal income tax consistent with preservation of capital. | Seeks high current income that is exempt from federal income tax consistent with preservation of capital. |

12

| Florida Fund | Tax-Free Fund | Tax-Free Fund |

Principal Investment Strategies: | The Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from regular federal income tax. The Fund invests, under normal market conditions, 100% (and, as fundamental policy, no less than 80%) of its net assets in such tax-exempt municipal securities. The Fund may invest up to 10% of its assets in securities that generate interest income subject to federal alternative minimum tax (“AMT”). However, as of March 31, 2007, the Fund did not hold any such AMT securities. The Fund substantially invests in municipal securities issued by the state of Florida and its political subdivisions. The Fund invests in both general obligation bonds and in revenue bonds. The Fund generally invests a significant portion of its assets in obligations of municipal housing authorities. The Fund primarily invests in securities rated investment-grade at the time of purchase, or if unrated, determined to be of comparable quality by the Fund’s adviser. However, the Fund may invest up to 30% of its net assets in securities rated below investment-grade (commonly referred to as junk bonds), but the Fund may not invest in securities rated lower than B3 by Moody’s Investors Service, or B- by Standard and Poor’s or Fitch Ratings, or if unrated, determined by the Fund’s investment adviser to be of comparable quality. Fund managers seek securities providing high current tax-exempt income. In making purchase and sales decisions for the Fund, Fund managers consider several factors, including: their economic outlook and interest rate forecast, the security’s structure, credit quality, yield, maturity, liquidity, and portfolio diversification. Fund managers attempt to maintain an average effective duration for the portfolio of approximately 2.5 to 8 years. | The Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Fund invests, under normal market conditions, 100% (and, as fundamental policy, no less than 80%) of its net assets in such tax-exempt municipal securities. The Fund may invest up to 20% of its assets in securities that generate interest income subject to federal alternative minimum tax (“AMT”). However, as of March 31, 2007, the Fund did not hold any such AMT securities. The Fund invests both in revenue bonds and in general obligation bonds. The Fund generally invests a significant portion of its assets in obligations of municipal housing authorities. The Fund primarily invests in securities rated investment-grade at the time of purchase, or if unrated, determined to be of comparable quality by the Fund’s adviser. However, the Fund may invest up to 25% of its assets in municipal securities rated below investment-grade (commonly referred to as junk bonds), but the Fund may not invest in securities rated lower than B3 by Moody’s Investors Service, or B- by Standard and Poor’s or Fitch Ratings, or if unrated, determined by the Fund’s investment adviser to be of comparable quality. Fund managers seek securities providing high current tax-exempt income. Fund managers attempt to maintain an average effective duration for the portfolio of approximately 2.5 to 8 years. The Fund managers’ economic outlook and interest rate forecast, as well as their evaluation of a security’s structure, credit quality, yield, maturity, and liquidity, are all factors considered when making investment decisions.

| The Fund seeks to achieve its objective by investing primarily in municipal securities that generate interest income that is exempt from both regular federal income tax and federal alternative minimum tax. The Fund invests, under normal market conditions, 100% (and, as fundamental policy, no less than 80%) of its net assets in such tax-exempt municipal securities. The Fund may invest up to 20% of its assets in securities that generate interest income subject to federal alternative minimum tax (“AMT”). However, as of March 31, 2007, the Fund did not hold any such AMT securities. The Fund invests both in revenue bonds and in general obligation bonds. The Fund generally invests a significant portion of its assets in obligations of municipal housing authorities. The Fund primarily invests in securities rated investment-grade at the time of purchase, or if unrated, determined to be of comparable quality by the Fund’s adviser. However, the Fund may invest up to 25% of its assets in municipal securities rated below investment-grade (commonly referred to as junk bonds), but the Fund may not invest in securities rated lower than B3 by Moody’s Investors Service, or B- by Standard and Poor’s or Fitch Ratings, or if unrated, determined by the Fund’s investment adviser to be of comparable quality. Fund managers seek securities providing high current tax-exempt income. Fund managers attempt to maintain an average effective duration for the portfolio of approximately 2.5 to 8 years. The Fund managers’ economic outlook and interest rate forecast, as well as their evaluation of a security’s structure, credit quality, yield, maturity, and liquidity, are all factors considered when making investment decisions. |

13

The principal investment strategies discussed above are the strategies which the Adviser believes are most likely to be important in trying to achieve the Funds’ objectives. You should be aware that each Fund may also use non-principal strategies and invest in securities that are not described in this Prospectus/Proxy Statement, but that are described in Funds’ Statement of Additional Information. For a copy of the Funds’ Statement of Additional Information, write to the Funds at 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota 55402, calls the Funds at (800) 332-5580 or (612) 334-5888, or go online to www.sitfunds.com.

VOTING INFORMATION

This Prospectus/Proxy Statement is furnished in connection with the solicitation of proxies by the board of trustees of Florida Fund to be used at a special meeting of shareholders of Florida Fund to be held at 9:00 a.m., Central time, on July 27, 2007, at the offices of Sit Investment Associates, Inc., 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota, and at any adjournments or postponements thereof.

Only shareholders of record as of the close of business on June 20, 2007 (the “Record Date”) will be entitled to notice of, and to vote at, the special meeting or any adjournment or postponement thereof. If the enclosed form of proxy is properly executed and returned on time to be voted at the special meeting, the proxies named in the form of proxy will vote the shares represented by the proxy in accordance with the instructions marked thereon. Unmarked proxies will be voted “FOR” the proposed Plan and reorganization. A proxy may be revoked by giving written notice, in person or by mail, of revocation before the special meeting to Florida Fund at its principal offices, 3300 IDS Center, 80 South Eighth Street, Minneapolis, Minnesota 55402, or by properly executing and submitting a later-dated proxy, or by voting in person at the special meeting.

If a shareholder executes and returns a proxy but abstains from voting, the shares held by that shareholder will be deemed present at the special meeting for purposes of determining a quorum and will be included in determining the total number of votes cast. If a proxy is received from a broker or nominee indicating that such person has not received instructions from the beneficial owner or other person entitled to vote Florida Fund shares (i.e., a broker “non-vote”), the shares represented by that proxy will not be considered present at the special meeting for purposes of determining a quorum and will not be included in determining the number of votes cast. Brokers and nominees will not have discretionary authority to vote shares for which instructions are not received from the beneficial owner.

Approval of the Plan and reorganization will require the affirmative vote of a majority of the outstanding shares of Florida Fund.

Outstanding Shares Entitled to Vote

As of the Record Date, Florida Fund had 291,790.045 shares outstanding and entitled to vote at the special meeting.

14

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of the Record Date, (i) shares of the Funds owned by all officers, directors and members of the board of Tax-Free Fund as a group, without naming them, and (ii) the name, address and percentage of ownership of each person who is known by Florida Fund to own of record or beneficially 5 percent or more of either Fund:

Florida Fund Record or Beneficial Owner | Shares Owned | Percentage Ownership | |

All officers, directors and members of the board of Tax-Free Fund as a group | None | 0.0% | |

Sit Investment Associates, Inc. | 163,223,623 | 55.9% | |

Sit Fixed Income Advisors II, LLC | 94,855.384 | 32.5% | |

Josephine K. Trippe Rev. Trust, | 14,792.056 | 5.1% |

Proxy solicitations will be made primarily by mail but may also be made by telephone, through the Internet or personal solicitations conducted by officers and employees of the Adviser, its affiliates or other representatives of Florida Fund (who will not be paid for their soliciting activities). The costs of solicitation and the expenses incurred in connection with preparing this Prospectus/Proxy Statement and its enclosures will be paid by the Adviser. Neither Florida Fund nor Tax-Free Fund will bear any costs associated with the special meeting, this proxy solicitation or any adjourned session.

In the event that sufficient votes to approve the Plan and reorganization are not received by the date set for the special meeting, the persons named as proxies may propose one or more adjournments of the special meeting to permit further solicitation of proxies. In determining whether to adjourn the special meeting, the following factors may be considered: the percentage of votes actually cast, the percentage of negative votes actually cast, the nature of any further solicitation and the information to be provided to shareholders with respect to the reasons for the solicitation. Any such adjournment will require the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the special meeting. The persons named as proxies will vote upon such adjournment after consideration of the best interests of all shareholders.

Florida Fund does not hold annual shareholder meetings. Shareholders wishing to submit proposals to be considered for inclusion in a proxy statement for a subsequent shareholder meeting should send their written proposals to the Secretary of Florida Fund at the address set forth on the cover of this Prospectus/Proxy Statement so that they will be received by Florida Fund in a reasonable period of time prior to that meeting.

The following person affiliated with the Funds receives payments from Florida Fund and Tax-Free Fund for services rendered pursuant to contractual arrangements with the Funds: Sit Investment Associates, Inc., as the investment adviser to each Fund, receives payments for its investment advisory and management services.

15

No Dissenters’ Rights of Appraisal

Under the Investment Company Act, Florida Fund shareholders are not entitled to assert dissenters’ rights of appraisal in connection with the Plan and reorganization.

FINANCIAL STATEMENTS AND EXPERTS

The audited financial statements for the Funds, which are incorporated by reference into the Statement of Additional Information relating to this Prospectus/Proxy Statement, have been audited by KPMG LLP, an independent registered public accounting firm, as set forth in their report appearing in the Annual Report for the fiscal year ended March 31, 2007. The financial statements audited by KPMG LLP have been incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Certain legal matters concerning the issuance of Tax-Free Fund shares as part of the reorganization will be passed on by Dorsey & Whitney LLP, 50 South Sixth Street, Suite 1500, Minneapolis, MN 55402.

The board of trustees of Florida Fund does not intend to present any other business at the special meeting. If, however, any other matters are properly brought before the special meeting, the persons named in the accompanying form of proxy will vote thereon in accordance with their judgment.

16

Exhibit A

AGREEMENT AND PLAN OF REORGANIZATION

Sit Florida Tax-Free Income Fund and Sit Tax-Free Income Fund

EXHIBIT A

AGREEMENT AND PLAN OF REORGANIZATION

SIT FLORIDA TAX-FREE INCOME FUND AND SIT TAX-FREE INCOME FUND

THIS AGREEMENT AND PLAN OF REORGANIZATION (the "Agreement") is made as

of this 23rd day of April, 2007, by and between Sit Mutual Funds Trust ("Sit

Trust"), a Delaware Statutory Trust, on behalf of its series Sit Florida

Tax-Free Income Fund ("Florida Fund"), and Sit Mutual Funds II, Inc. ("Sit Funds

II"), a Minnesota corporation, on behalf of its series Sit Tax-Free Income Fund

(" Tax-Free Fund"). As used in this Agreement, the term, "Florida Fund" and the

term "Tax-Free Fund" shall be construed to mean "Sit Trust on behalf of Florida

Fund" and "Sit Funds II on behalf of Tax-Free Fund", respectively, to reflect

the fact that a series is generally considered the beneficiary of corporate

level actions taken with respect to the series and is not itself recognized as a

person under law.

This Agreement is intended to be and is adopted as a plan of

reorganization and liquidation pursuant to Sections 368(a)(1)(C) and

368(a)(2)(G) of the United States Internal Revenue Code of 1986, as amended (the

"Code"). The reorganization (the "Reorganization") will consist of the transfer

of all or substantially all of the assets of Florida Fund to Tax-Free Fund and

the assumption by Tax-Free Fund of all of the liabilities of Florida Fund in

exchange solely for full and fractional shares of common stock, par value $.01

per share, of Tax-Free Fund (the "Tax-Free Fund Shares"), having an aggregate

net asset value equal to the aggregate value of the assets acquired (less

liabilities assumed) of Florida Fund, and the distribution of Tax-Free Fund

Shares to the shareholders of Florida Fund in liquidation of Florida Fund as

provided herein, all upon the terms and conditions hereinafter set forth.

WITNESSETH:

WHEREAS, Sit Trust is a Delaware statutory trust with one series of

shares of common stock, that series being Florida Fund; and Sit Funds II is a

registered, open-end management investment company, offering its shares of

common stock in multiple series (each of which series represents a separate and

distinct portfolio of assets and liabilities), one of those series being

Tax-Free Fund;

WHEREAS, Florida Fund owns securities which generally are assets of the

character in which Tax-Free Fund is permitted to invest; and

WHEREAS, the Board of Trustees and Board of Directors of each of Sit

Trust and Sit Funds II, including a majority of the trustees and directors who

are not "interested persons" (as defined in Section 2(a)(19) of the Investment

Company Act of 1940, as amended (the "1940 Act"), has determined that the

exchange of all or substantially all of the assets of Florida Fund for Tax-Free

Fund Shares and the assumption of all of the liabilities of Florida Fund by

Tax-Free Fund is in the best interests of the shareholders of Florida Fund and

Tax-Free Fund, respectively.

NOW, THEREFORE, in consideration of the premises and of the

representations, warranties, covenants and agreements hereinafter set forth, the

parties hereto covenant and agree as follows:

1. TRANSFER OF ALL OR SUBSTANTIALLY ALL OF THE ASSETS OF FLORIDA FUND TO

TAX-FREE FUND SOLELY IN EXCHANGE FOR TAX-FREE FUND SHARES, THE

ASSUMPTION OF ALL FLORIDA FUND LIABILITIES AND THE LIQUIDATION OF

FLORIDA FUND

Part A

A-1

1.1 In accordance with Title 12 of the Delaware Code (the "Delaware

Law") and Sections 302A.601 to 302A.651 of the Minnesota Business Corporation

Act (the "Minnesota Law"), and subject to the requisite approval by Florida Fund

shareholders and to the other terms and conditions set forth herein and on the

basis of the representations and warranties contained herein, Florida Fund

agrees to transfer all or substantially all of Florida Fund's assets as set

forth in Section 1.2 to Tax-Free Fund, and Tax-Free Fund agrees in exchange

therefor (a) to deliver to Florida Fund that number of full and fractional

Tax-Free Fund Shares determined in accordance with Article 2, and (b) to assume

all of the liabilities of Florida Fund, as set forth in Section 1.3. Such

transactions shall take place as of the effective time provided for in Section

3.1 (the "Effective Time").

1.2 (a) The assets of Florida Fund to be acquired by Tax-Free Fund

shall consist of all or substantially all of Florida Fund's property, including,

but not limited to, all cash, securities, commodities, futures, and interest and

dividends receivable which are owned by Florida Fund as of the Effective Time.

All of said assets shall be set forth in detail in an unaudited statement of

assets and liabilities of Florida Fund as of the Effective Time (the "Effective

Time Statement"). The Effective Time Statement shall, with respect to the

listing of Florida Fund's portfolio securities, detail the adjusted tax basis of

such securities by lot, the respective holding periods of such securities and

the current and accumulated earnings and profits of Florida Fund. The Effective

Time Statement shall be prepared in accordance with generally accepted

accounting principles (except for footnotes) consistently applied from the prior

audited period.

(b) Florida Fund has provided Tax-Free Fund with a list of all of

Florida Fund's assets as of the date of execution of this Agreement. Florida

Fund reserves the right to sell any of these securities in the ordinary course

of its business and, subject to Section 5.1, to acquire additional securities in

the ordinary course of its business.

1.3 Tax-Free Fund shall assume all of the liabilities, expenses, costs,

charges and reserves (including, but not limited to, expenses incurred in the

ordinary course of Florida Fund's operations, such as accounts payable relating

to custodian fees, investment management and administrative fees, legal and

audit fees, and expenses of state securities registration of Florida Fund's

shares), including those reflected in the Effective Time Statement.

1.4 Immediately after the transfer of assets provided for in Section

1.1 and the assumption of liabilities provided for in Section 1.3, and pursuant

to the plan of reorganization adopted herein, Florida Fund will distribute pro

rata (as provided in Article 2) to Florida Fund's shareholders of record,

determined as of the Effective Time (the "Florida Fund Shareholders"), the

Tax-Free Fund Shares received by Florida Fund pursuant to Section 1.1, and all

other assets of Florida Fund, if any. Thereafter, no additional shares

representing interests in Florida Fund shall be issued. Such distribution will