0000074663eatonvance:EATONVANCEIndexICEBofAUSHighYieldConstrainedIndex19292AdditionalIndexMember2016-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02258

Eaton Vance Series Trust II

(Exact Name of Registrant as Specified in Charter)

One Post Office Square, Boston, Massachusetts 02109

(Address of Principal Executive Offices)

Deidre E. Walsh

One Post Office Square, Boston, Massachusetts 02109

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2024

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance Income Fund of Boston

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about the Eaton Vance Income Fund of Boston for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $105 | 0.98% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the ICE BofA U.S. High Yield Index (the Index):

↓ The Fund’s security selections by sector ― especially in the health care, gaming, and retail sectors ― detracted from Index-relative returns during the period

↓ Fund allocations by credit quality ― particularly a broad underweight exposure to distressed CCC-rated and lower-rated securities ― detracted from returns

↓ Security selections by credit quality ― especially selections in B-rated and CCC-rated securities ― detracted from Index-relative returns during the period

↓ Security selections by duration segment ― particularly selections in securities with durations of less than 5 years ― hampered returns relative to the Index

↑ An overweight exposure to the health care sector and an underweight allocation to the energy sector contributed to Index-relative returns during the period

↑ The Fund’s selections in lower-rated fixed-income investments contributed to performance relative to the Index during the period

↑ The Fund’s underweight exposure to BB-rated securities contributed to performance relative to the Index during the period

↑ The Fund’s overweight exposure to securities with durations between 5-10 years contributed to performance relative to the Index during the period

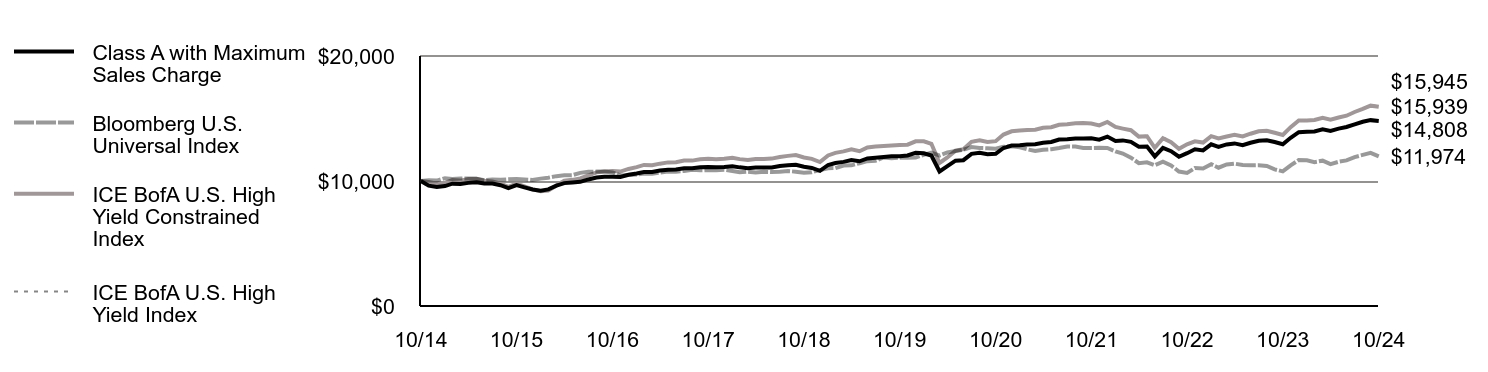

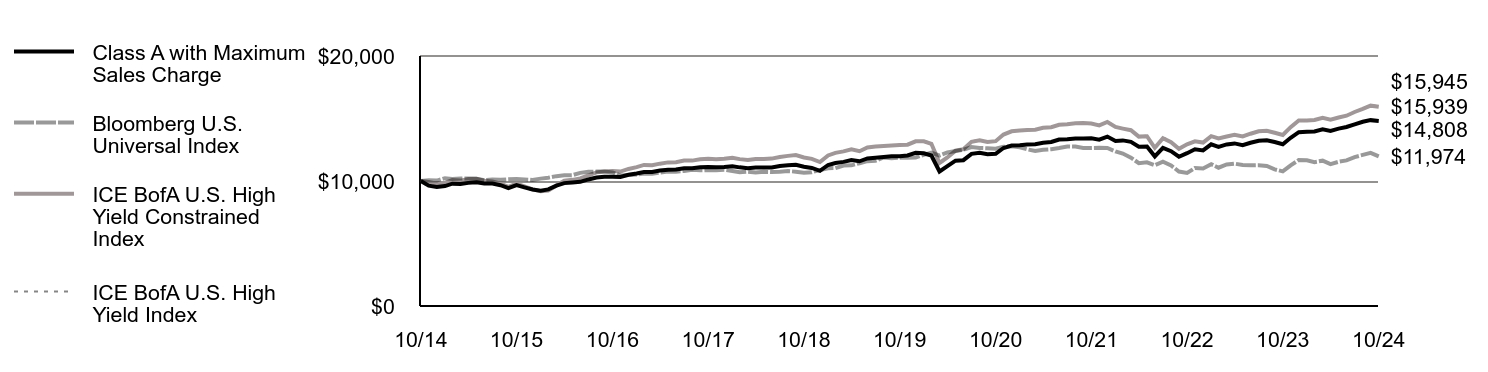

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class A with Maximum Sales Charge | Bloomberg U.S. Universal Index | ICE BofA U.S. High Yield Constrained Index | ICE BofA U.S. High Yield Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| 11/14 | $9,625 | $10,054 | $9,929 | $9,929 |

| 12/14 | $9,513 | $10,036 | $9,783 | $9,782 |

| 1/15 | $9,594 | $10,227 | $9,850 | $9,850 |

| 2/15 | $9,785 | $10,167 | $10,085 | $10,085 |

| 3/15 | $9,753 | $10,209 | $10,032 | $10,031 |

| 4/15 | $9,850 | $10,197 | $10,152 | $10,151 |

| 5/15 | $9,900 | $10,180 | $10,182 | $10,181 |

| 6/15 | $9,799 | $10,066 | $10,027 | $10,026 |

| 7/15 | $9,799 | $10,125 | $9,966 | $9,964 |

| 8/15 | $9,665 | $10,095 | $9,789 | $9,789 |

| 9/15 | $9,427 | $10,134 | $9,538 | $9,535 |

| 10/15 | $9,665 | $10,167 | $9,797 | $9,795 |

| 11/15 | $9,491 | $10,130 | $9,579 | $9,575 |

| 12/15 | $9,318 | $10,079 | $9,332 | $9,328 |

| 1/16 | $9,230 | $10,190 | $9,184 | $9,180 |

| 2/16 | $9,329 | $10,263 | $9,227 | $9,223 |

| 3/16 | $9,624 | $10,388 | $9,635 | $9,631 |

| 4/16 | $9,830 | $10,459 | $10,020 | $10,016 |

| 5/16 | $9,881 | $10,467 | $10,092 | $10,088 |

| 6/16 | $9,931 | $10,652 | $10,202 | $10,197 |

| 7/16 | $10,125 | $10,739 | $10,459 | $10,455 |

| 8/16 | $10,281 | $10,751 | $10,692 | $10,688 |

| 9/16 | $10,348 | $10,753 | $10,761 | $10,757 |

| 10/16 | $10,343 | $10,682 | $10,795 | $10,790 |

| 11/16 | $10,319 | $10,442 | $10,752 | $10,748 |

| 12/16 | $10,497 | $10,473 | $10,964 | $10,959 |

| 1/17 | $10,603 | $10,510 | $11,111 | $11,106 |

| 2/17 | $10,721 | $10,591 | $11,284 | $11,280 |

| 3/17 | $10,716 | $10,588 | $11,260 | $11,256 |

| 4/17 | $10,839 | $10,675 | $11,388 | $11,384 |

| 5/17 | $10,907 | $10,758 | $11,489 | $11,485 |

| 6/17 | $10,919 | $10,749 | $11,501 | $11,497 |

| 7/17 | $11,026 | $10,802 | $11,634 | $11,630 |

| 8/17 | $11,020 | $10,895 | $11,631 | $11,627 |

| 9/17 | $11,108 | $10,857 | $11,736 | $11,732 |

| 10/17 | $11,121 | $10,870 | $11,781 | $11,777 |

| 11/17 | $11,095 | $10,854 | $11,750 | $11,745 |

| 12/17 | $11,127 | $10,901 | $11,784 | $11,779 |

| 1/18 | $11,179 | $10,797 | $11,860 | $11,855 |

| 2/18 | $11,091 | $10,694 | $11,749 | $11,744 |

| 3/18 | $11,026 | $10,748 | $11,677 | $11,672 |

| 4/18 | $11,077 | $10,676 | $11,754 | $11,750 |

| 5/18 | $11,071 | $10,735 | $11,753 | $11,748 |

| 6/18 | $11,083 | $10,719 | $11,793 | $11,788 |

| 7/18 | $11,197 | $10,741 | $11,925 | $11,920 |

| 8/18 | $11,251 | $10,794 | $12,011 | $12,006 |

| 9/18 | $11,303 | $10,748 | $12,081 | $12,076 |

| 10/18 | $11,136 | $10,658 | $11,883 | $11,878 |

| 11/18 | $11,046 | $10,706 | $11,775 | $11,771 |

| 12/18 | $10,816 | $10,874 | $11,517 | $11,513 |

| 1/19 | $11,281 | $11,024 | $12,046 | $12,041 |

| 2/19 | $11,434 | $11,036 | $12,249 | $12,245 |

| 3/19 | $11,531 | $11,235 | $12,370 | $12,365 |

| 4/19 | $11,669 | $11,251 | $12,543 | $12,538 |

| 5/19 | $11,579 | $11,423 | $12,383 | $12,378 |

| 6/19 | $11,801 | $11,585 | $12,687 | $12,682 |

| 7/19 | $11,858 | $11,619 | $12,752 | $12,747 |

| 8/19 | $11,915 | $11,882 | $12,802 | $12,797 |

| 9/19 | $11,971 | $11,830 | $12,842 | $12,837 |

| 10/19 | $11,985 | $11,869 | $12,872 | $12,867 |

| 11/19 | $12,041 | $11,866 | $12,907 | $12,902 |

| 12/19 | $12,251 | $11,884 | $13,177 | $13,172 |

| 1/20 | $12,222 | $12,097 | $13,177 | $13,172 |

| 2/20 | $12,038 | $12,278 | $12,973 | $12,968 |

| 3/20 | $10,762 | $12,039 | $11,446 | $11,443 |

| 4/20 | $11,193 | $12,280 | $11,882 | $11,878 |

| 5/20 | $11,629 | $12,394 | $12,421 | $12,421 |

| 6/20 | $11,665 | $12,498 | $12,539 | $12,542 |

| 7/20 | $12,172 | $12,717 | $13,134 | $13,142 |

| 8/20 | $12,255 | $12,644 | $13,265 | $13,271 |

| 9/20 | $12,133 | $12,621 | $13,127 | $13,133 |

| 10/20 | $12,172 | $12,576 | $13,187 | $13,194 |

| 11/20 | $12,642 | $12,740 | $13,715 | $13,722 |

| 12/20 | $12,841 | $12,784 | $13,977 | $13,984 |

| 1/21 | $12,857 | $12,704 | $14,031 | $14,037 |

| 2/21 | $12,913 | $12,540 | $14,079 | $14,086 |

| 3/21 | $12,944 | $12,394 | $14,104 | $14,110 |

| 4/21 | $13,067 | $12,498 | $14,259 | $14,265 |

| 5/21 | $13,121 | $12,546 | $14,300 | $14,306 |

| 6/21 | $13,315 | $12,637 | $14,495 | $14,502 |

| 7/21 | $13,347 | $12,764 | $14,545 | $14,553 |

| 8/21 | $13,402 | $12,756 | $14,626 | $14,633 |

| 9/21 | $13,409 | $12,647 | $14,632 | $14,638 |

| 10/21 | $13,417 | $12,636 | $14,604 | $14,612 |

| 11/21 | $13,303 | $12,652 | $14,453 | $14,462 |

| 12/21 | $13,552 | $12,643 | $14,725 | $14,734 |

| 1/22 | $13,197 | $12,366 | $14,321 | $14,329 |

| 2/22 | $13,248 | $12,197 | $14,193 | $14,200 |

| 3/22 | $13,135 | $11,870 | $14,063 | $14,069 |

| 4/22 | $12,749 | $11,427 | $13,552 | $13,557 |

| 5/22 | $12,757 | $11,490 | $13,584 | $13,591 |

| 6/22 | $11,972 | $11,261 | $12,659 | $12,666 |

| 7/22 | $12,651 | $11,544 | $13,421 | $13,429 |

| 8/22 | $12,385 | $11,244 | $13,100 | $13,107 |

| 9/22 | $11,941 | $10,759 | $12,574 | $12,580 |

| 10/22 | $12,226 | $10,641 | $12,932 | $12,938 |

| 11/22 | $12,536 | $11,038 | $13,172 | $13,180 |

| 12/22 | $12,443 | $11,001 | $13,074 | $13,081 |

| 1/23 | $12,937 | $11,342 | $13,585 | $13,593 |

| 2/23 | $12,735 | $11,063 | $13,411 | $13,417 |

| 3/23 | $12,924 | $11,323 | $13,560 | $13,568 |

| 4/23 | $13,007 | $11,392 | $13,692 | $13,699 |

| 5/23 | $12,862 | $11,274 | $13,561 | $13,569 |

| 6/23 | $13,056 | $11,256 | $13,782 | $13,789 |

| 7/23 | $13,223 | $11,267 | $13,979 | $13,986 |

| 8/23 | $13,261 | $11,200 | $14,020 | $14,026 |

| 9/23 | $13,115 | $10,932 | $13,856 | $13,863 |

| 10/23 | $12,941 | $10,768 | $13,683 | $13,691 |

| 11/23 | $13,462 | $11,253 | $14,307 | $14,314 |

| 12/23 | $13,907 | $11,680 | $14,835 | $14,842 |

| 1/24 | $13,944 | $11,652 | $14,838 | $14,844 |

| 2/24 | $13,956 | $11,512 | $14,882 | $14,888 |

| 3/24 | $14,135 | $11,625 | $15,059 | $15,066 |

| 4/24 | $14,011 | $11,353 | $14,909 | $14,915 |

| 5/24 | $14,191 | $11,542 | $15,078 | $15,084 |

| 6/24 | $14,319 | $11,647 | $15,223 | $15,230 |

| 7/24 | $14,529 | $11,911 | $15,522 | $15,529 |

| 8/24 | $14,741 | $12,087 | $15,769 | $15,776 |

| 9/24 | $14,869 | $12,253 | $16,027 | $16,034 |

| 10/24 | $14,808 | $11,974 | $15,939 | $15,945 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class A | 14.38% | 4.31% | 4.34% |

| Class A with 3.25% Maximum Sales Charge | 10.71% | 3.61% | 4.00% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 11.20% | 0.18% | 1.82% |

| ICE BofA U.S. High Yield Index | 16.47% | 4.38% | 4.77% |

| ICE BofA U.S. High Yield Constrained Index | 16.49% | 4.36% | 4.77% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $5,663,132,601 |

| # of Portfolio Holdings | 432 |

| Portfolio Turnover Rate | 45% |

| Total Advisory Fees Paid | $30,275,138 |

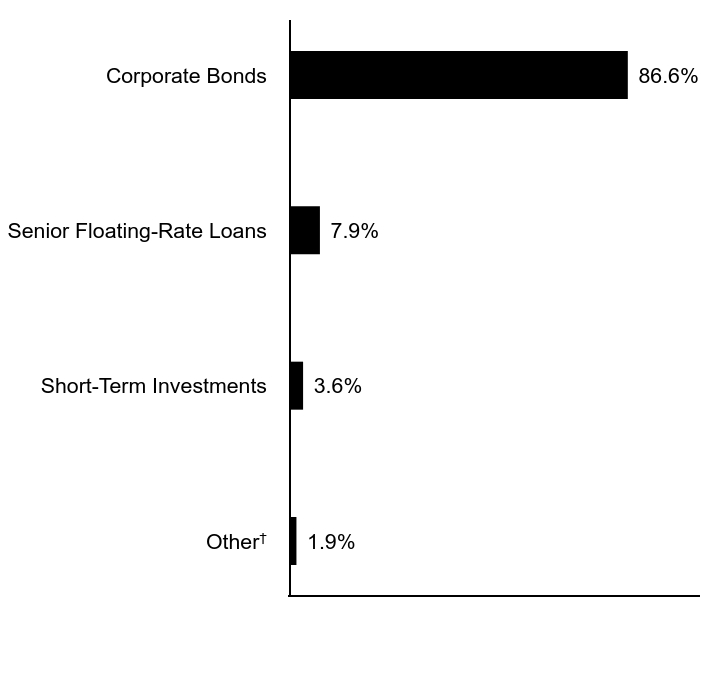

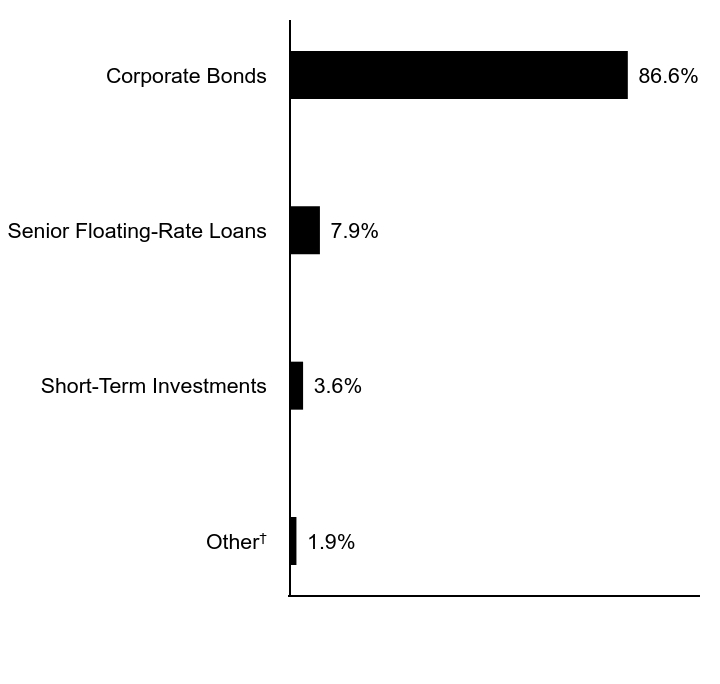

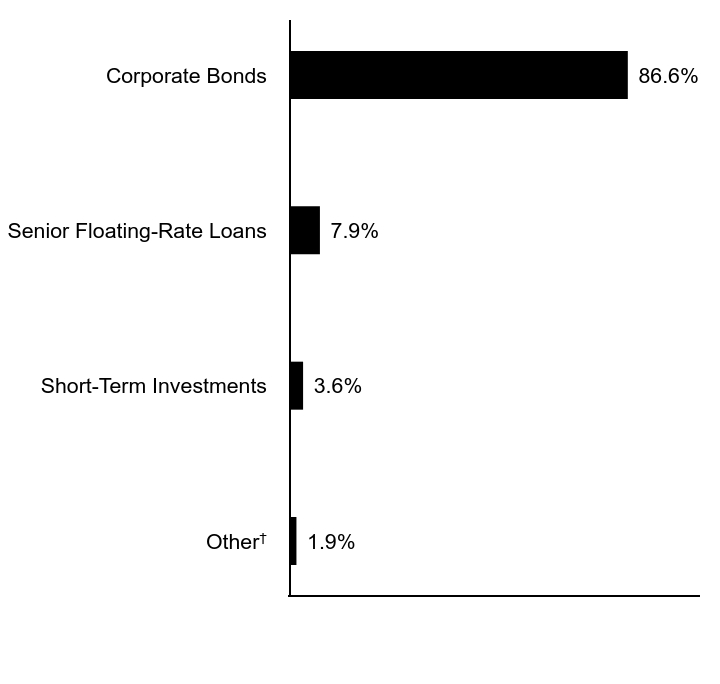

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.9% |

| Short-Term Investments | 3.6% |

| Senior Floating-Rate Loans | 7.9% |

| Corporate Bonds | 86.6% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

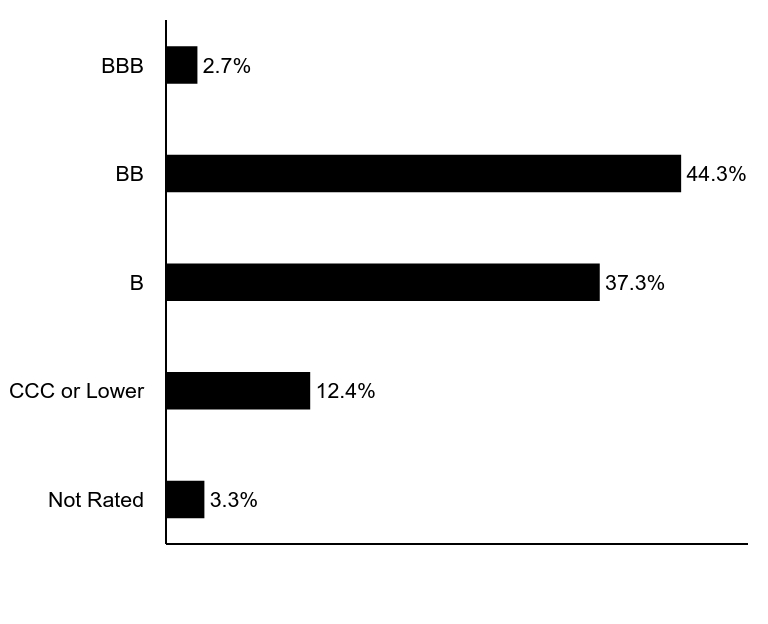

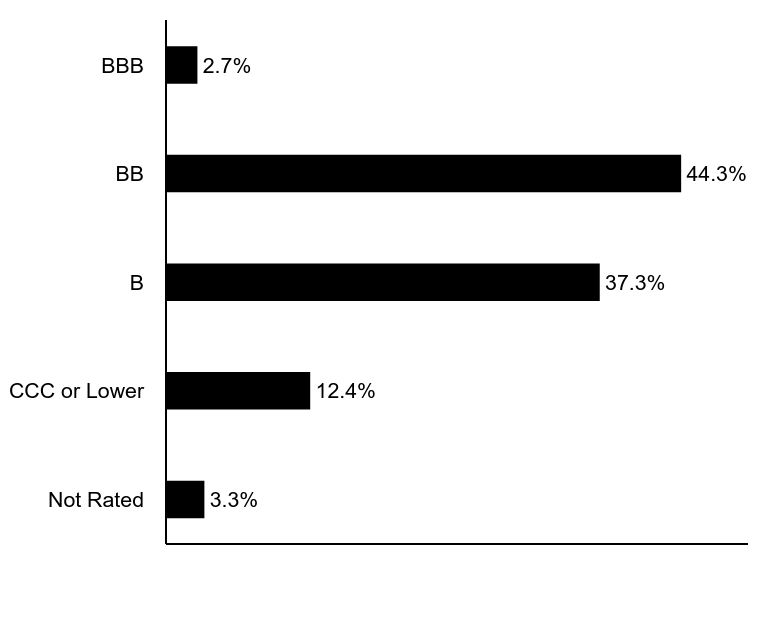

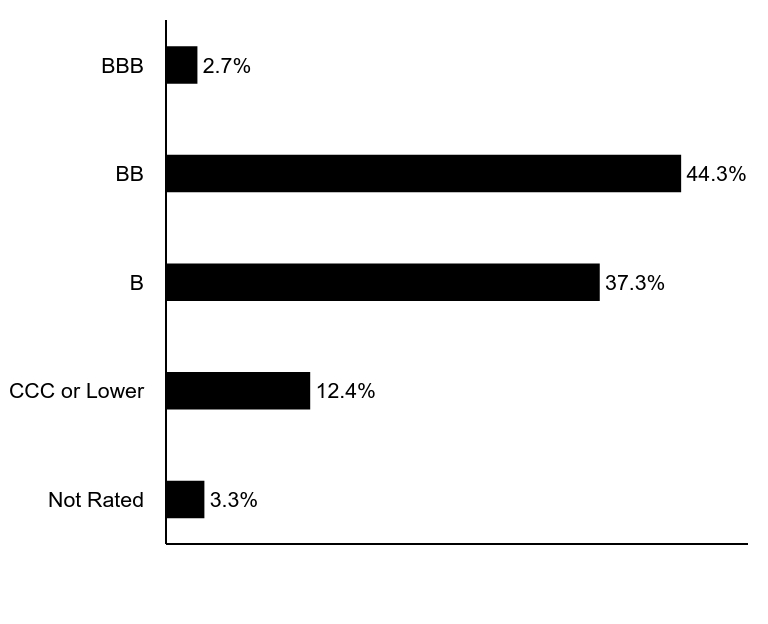

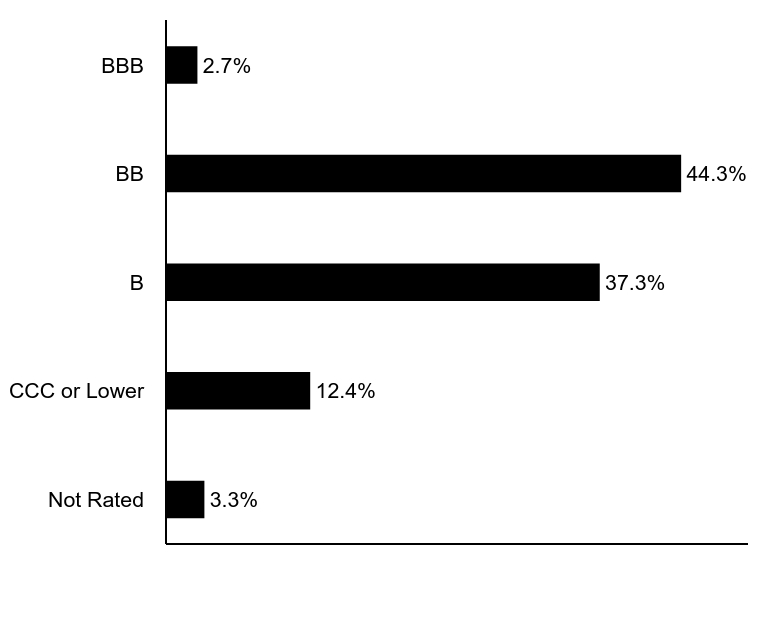

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 3.3% |

| CCC or Lower | 12.4% |

| B | 37.3% |

| BB | 44.3% |

| BBB | 2.7% |

| Footnote | Description |

Footnotea | Excludes Short-Term Investments. Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). This breakdown assigns a numeric equivalent to the ratings from the aforementioned agencies and the mean is rounded to the nearest integer and converted to an equivalent S&P rating ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Eaton Vance Income Fund of Boston

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about the Eaton Vance Income Fund of Boston for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $184 | 1.73% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the ICE BofA U.S. High Yield Index (the Index):

↓ The Fund’s security selections by sector ― especially in the health care, gaming, and retail sectors ― detracted from Index-relative returns during the period

↓ Fund allocations by credit quality ― particularly a broad underweight exposure to distressed CCC-rated and lower-rated securities ― detracted from returns

↓ Security selections by credit quality ― especially selections in B-rated and CCC-rated securities ― detracted from Index-relative returns during the period

↓ Security selections by duration segment ― particularly selections in securities with durations of less than 5 years ― hampered returns relative to the Index

↑ An overweight exposure to the health care sector and an underweight allocation to the energy sector contributed to Index-relative returns during the period

↑ The Fund’s selections in lower-rated fixed-income investments contributed to performance relative to the Index during the period

↑ The Fund’s underweight exposure to BB-rated securities contributed to performance relative to the Index during the period

↑ The Fund’s overweight exposure to securities with durations between 5-10 years contributed to performance relative to the Index during the period

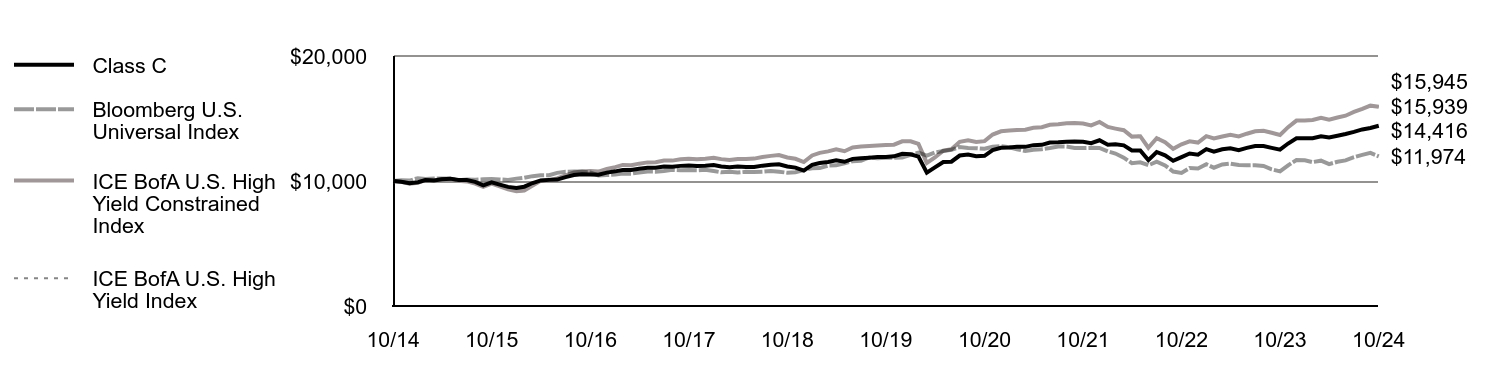

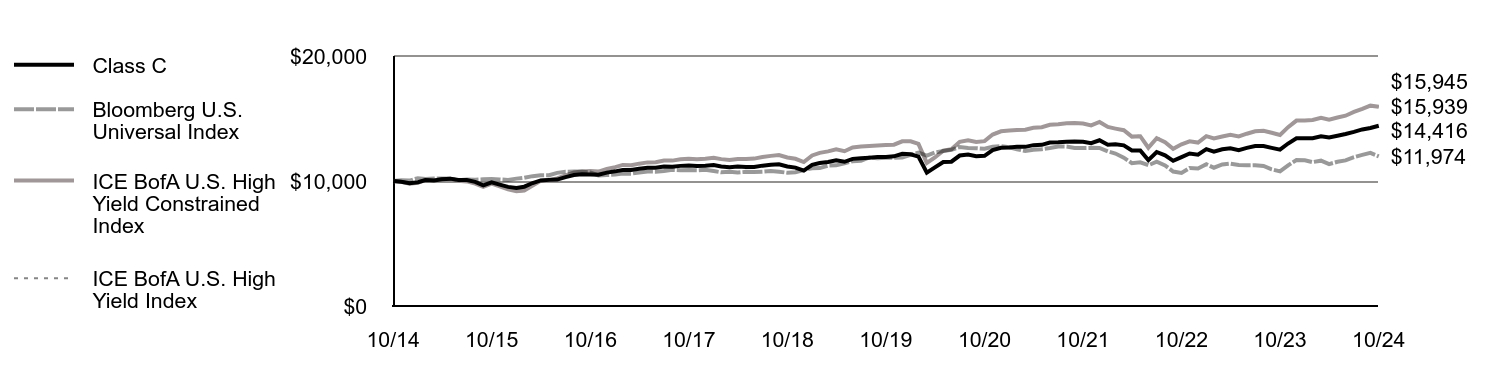

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class C | Bloomberg U.S. Universal Index | ICE BofA U.S. High Yield Constrained Index | ICE BofA U.S. High Yield Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| 11/14 | $9,943 | $10,054 | $9,929 | $9,929 |

| 12/14 | $9,820 | $10,036 | $9,783 | $9,782 |

| 1/15 | $9,898 | $10,227 | $9,850 | $9,850 |

| 2/15 | $10,072 | $10,167 | $10,085 | $10,085 |

| 3/15 | $10,049 | $10,209 | $10,032 | $10,031 |

| 4/15 | $10,143 | $10,197 | $10,152 | $10,151 |

| 5/15 | $10,188 | $10,180 | $10,182 | $10,181 |

| 6/15 | $10,077 | $10,066 | $10,027 | $10,026 |

| 7/15 | $10,071 | $10,125 | $9,966 | $9,964 |

| 8/15 | $9,927 | $10,095 | $9,789 | $9,789 |

| 9/15 | $9,659 | $10,134 | $9,538 | $9,535 |

| 10/15 | $9,896 | $10,167 | $9,797 | $9,795 |

| 11/15 | $9,712 | $10,130 | $9,579 | $9,575 |

| 12/15 | $9,529 | $10,079 | $9,332 | $9,328 |

| 1/16 | $9,450 | $10,190 | $9,184 | $9,180 |

| 2/16 | $9,545 | $10,263 | $9,227 | $9,223 |

| 3/16 | $9,839 | $10,388 | $9,635 | $9,631 |

| 4/16 | $10,044 | $10,459 | $10,020 | $10,016 |

| 5/16 | $10,090 | $10,467 | $10,092 | $10,088 |

| 6/16 | $10,116 | $10,652 | $10,202 | $10,197 |

| 7/16 | $10,307 | $10,739 | $10,459 | $10,455 |

| 8/16 | $10,478 | $10,751 | $10,692 | $10,688 |

| 9/16 | $10,539 | $10,753 | $10,761 | $10,757 |

| 10/16 | $10,528 | $10,682 | $10,795 | $10,790 |

| 11/16 | $10,497 | $10,442 | $10,752 | $10,748 |

| 12/16 | $10,671 | $10,473 | $10,964 | $10,959 |

| 1/17 | $10,772 | $10,510 | $11,111 | $11,106 |

| 2/17 | $10,886 | $10,591 | $11,284 | $11,280 |

| 3/17 | $10,874 | $10,588 | $11,260 | $11,256 |

| 4/17 | $10,972 | $10,675 | $11,388 | $11,384 |

| 5/17 | $11,054 | $10,758 | $11,489 | $11,485 |

| 6/17 | $11,059 | $10,749 | $11,501 | $11,497 |

| 7/17 | $11,160 | $10,802 | $11,634 | $11,630 |

| 8/17 | $11,148 | $10,895 | $11,631 | $11,627 |

| 9/17 | $11,210 | $10,857 | $11,736 | $11,732 |

| 10/17 | $11,236 | $10,870 | $11,781 | $11,777 |

| 11/17 | $11,202 | $10,854 | $11,750 | $11,745 |

| 12/17 | $11,228 | $10,901 | $11,784 | $11,779 |

| 1/18 | $11,273 | $10,797 | $11,860 | $11,855 |

| 2/18 | $11,158 | $10,694 | $11,749 | $11,744 |

| 3/18 | $11,106 | $10,748 | $11,677 | $11,672 |

| 4/18 | $11,150 | $10,676 | $11,754 | $11,750 |

| 5/18 | $11,117 | $10,735 | $11,753 | $11,748 |

| 6/18 | $11,122 | $10,719 | $11,793 | $11,788 |

| 7/18 | $11,229 | $10,741 | $11,925 | $11,920 |

| 8/18 | $11,295 | $10,794 | $12,011 | $12,006 |

| 9/18 | $11,341 | $10,748 | $12,081 | $12,076 |

| 10/18 | $11,166 | $10,658 | $11,883 | $11,878 |

| 11/18 | $11,069 | $10,706 | $11,775 | $11,771 |

| 12/18 | $10,831 | $10,874 | $11,517 | $11,513 |

| 1/19 | $11,289 | $11,024 | $12,046 | $12,041 |

| 2/19 | $11,435 | $11,036 | $12,249 | $12,245 |

| 3/19 | $11,524 | $11,235 | $12,370 | $12,365 |

| 4/19 | $11,654 | $11,251 | $12,543 | $12,538 |

| 5/19 | $11,536 | $11,423 | $12,383 | $12,378 |

| 6/19 | $11,771 | $11,585 | $12,687 | $12,682 |

| 7/19 | $11,820 | $11,619 | $12,752 | $12,747 |

| 8/19 | $11,869 | $11,882 | $12,802 | $12,797 |

| 9/19 | $11,917 | $11,830 | $12,842 | $12,837 |

| 10/19 | $11,924 | $11,869 | $12,872 | $12,867 |

| 11/19 | $11,972 | $11,866 | $12,907 | $12,902 |

| 12/19 | $12,172 | $11,884 | $13,177 | $13,172 |

| 1/20 | $12,136 | $12,097 | $13,177 | $13,172 |

| 2/20 | $11,945 | $12,278 | $12,973 | $12,968 |

| 3/20 | $10,673 | $12,039 | $11,446 | $11,443 |

| 4/20 | $11,093 | $12,280 | $11,882 | $11,878 |

| 5/20 | $11,516 | $12,394 | $12,421 | $12,421 |

| 6/20 | $11,544 | $12,498 | $12,539 | $12,542 |

| 7/20 | $12,036 | $12,717 | $13,134 | $13,142 |

| 8/20 | $12,110 | $12,644 | $13,265 | $13,271 |

| 9/20 | $11,982 | $12,621 | $13,127 | $13,133 |

| 10/20 | $12,012 | $12,576 | $13,187 | $13,194 |

| 11/20 | $12,467 | $12,740 | $13,715 | $13,722 |

| 12/20 | $12,655 | $12,784 | $13,977 | $13,984 |

| 1/21 | $12,685 | $12,704 | $14,031 | $14,037 |

| 2/21 | $12,733 | $12,540 | $14,079 | $14,086 |

| 3/21 | $12,733 | $12,394 | $14,104 | $14,110 |

| 4/21 | $12,868 | $12,498 | $14,259 | $14,265 |

| 5/21 | $12,891 | $12,546 | $14,300 | $14,306 |

| 6/21 | $13,074 | $12,637 | $14,495 | $14,502 |

| 7/21 | $13,096 | $12,764 | $14,545 | $14,553 |

| 8/21 | $13,143 | $12,756 | $14,626 | $14,633 |

| 9/21 | $13,164 | $12,647 | $14,632 | $14,638 |

| 10/21 | $13,140 | $12,636 | $14,604 | $14,612 |

| 11/21 | $13,021 | $12,652 | $14,453 | $14,462 |

| 12/21 | $13,257 | $12,643 | $14,725 | $14,734 |

| 1/22 | $12,902 | $12,366 | $14,321 | $14,329 |

| 2/22 | $12,944 | $12,197 | $14,193 | $14,200 |

| 3/22 | $12,849 | $11,870 | $14,063 | $14,069 |

| 4/22 | $12,441 | $11,427 | $13,552 | $13,557 |

| 5/22 | $12,441 | $11,490 | $13,584 | $13,591 |

| 6/22 | $11,669 | $11,261 | $12,659 | $12,666 |

| 7/22 | $12,321 | $11,544 | $13,421 | $13,429 |

| 8/22 | $12,054 | $11,244 | $13,100 | $13,107 |

| 9/22 | $11,614 | $10,759 | $12,574 | $12,580 |

| 10/22 | $11,907 | $10,641 | $12,932 | $12,938 |

| 11/22 | $12,199 | $11,038 | $13,172 | $13,180 |

| 12/22 | $12,100 | $11,001 | $13,074 | $13,081 |

| 1/23 | $12,546 | $11,342 | $13,585 | $13,593 |

| 2/23 | $12,342 | $11,063 | $13,411 | $13,417 |

| 3/23 | $12,541 | $11,323 | $13,560 | $13,568 |

| 4/23 | $12,614 | $11,392 | $13,692 | $13,699 |

| 5/23 | $12,466 | $11,274 | $13,561 | $13,569 |

| 6/23 | $12,646 | $11,256 | $13,782 | $13,789 |

| 7/23 | $12,799 | $11,267 | $13,979 | $13,986 |

| 8/23 | $12,802 | $11,200 | $14,020 | $14,026 |

| 9/23 | $12,654 | $10,932 | $13,856 | $13,863 |

| 10/23 | $12,504 | $10,768 | $13,683 | $13,691 |

| 11/23 | $12,998 | $11,253 | $14,307 | $14,314 |

| 12/23 | $13,418 | $11,680 | $14,835 | $14,842 |

| 1/24 | $13,419 | $11,652 | $14,838 | $14,844 |

| 2/24 | $13,423 | $11,512 | $14,882 | $14,888 |

| 3/24 | $13,585 | $11,625 | $15,059 | $15,066 |

| 4/24 | $13,486 | $11,353 | $14,909 | $14,915 |

| 5/24 | $13,623 | $11,542 | $15,078 | $15,084 |

| 6/24 | $13,764 | $11,647 | $15,223 | $15,230 |

| 7/24 | $13,930 | $11,911 | $15,522 | $15,529 |

| 8/24 | $14,124 | $12,087 | $15,769 | $15,776 |

| 9/24 | $14,238 | $12,253 | $16,027 | $16,034 |

| 10/24 | $14,416 | $11,974 | $15,939 | $15,945 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class C, with conversion to Class A after 8 years | 13.28% | 3.50% | 3.72% |

| Class C, with 1% Maximum Deferred Sales Charge and conversion to Class A after 8 years | 12.28% | 3.50% | 3.72% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 11.20% | 0.18% | 1.82% |

| ICE BofA U.S. High Yield Index | 16.47% | 4.38% | 4.77% |

| ICE BofA U.S. High Yield Constrained Index | 16.49% | 4.36% | 4.77% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $5,663,132,601 |

| # of Portfolio Holdings | 432 |

| Portfolio Turnover Rate | 45% |

| Total Advisory Fees Paid | $30,275,138 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.9% |

| Short-Term Investments | 3.6% |

| Senior Floating-Rate Loans | 7.9% |

| Corporate Bonds | 86.6% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 3.3% |

| CCC or Lower | 12.4% |

| B | 37.3% |

| BB | 44.3% |

| BBB | 2.7% |

| Footnote | Description |

Footnotea | Excludes Short-Term Investments. Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). This breakdown assigns a numeric equivalent to the ratings from the aforementioned agencies and the mean is rounded to the nearest integer and converted to an equivalent S&P rating ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Eaton Vance Income Fund of Boston

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about the Eaton Vance Income Fund of Boston for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $78 | 0.73% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the ICE BofA U.S. High Yield Index (the Index):

↓ The Fund’s security selections by sector ― especially in the health care, gaming, and retail sectors ― detracted from Index-relative returns during the period

↓ Fund allocations by credit quality ― particularly a broad underweight exposure to distressed CCC-rated and lower-rated securities ― detracted from returns

↓ Security selections by credit quality ― especially selections in B-rated and CCC-rated securities ― detracted from Index-relative returns during the period

↓ Security selections by duration segment ― particularly selections in securities with durations of less than 5 years ― hampered returns relative to the Index

↑ An overweight exposure to the health care sector and an underweight allocation to the energy sector contributed to Index-relative returns during the period

↑ The Fund’s selections in lower-rated fixed-income investments contributed to performance relative to the Index during the period

↑ The Fund’s underweight exposure to BB-rated securities contributed to performance relative to the Index during the period

↑ The Fund’s overweight exposure to securities with durations between 5-10 years contributed to performance relative to the Index during the period

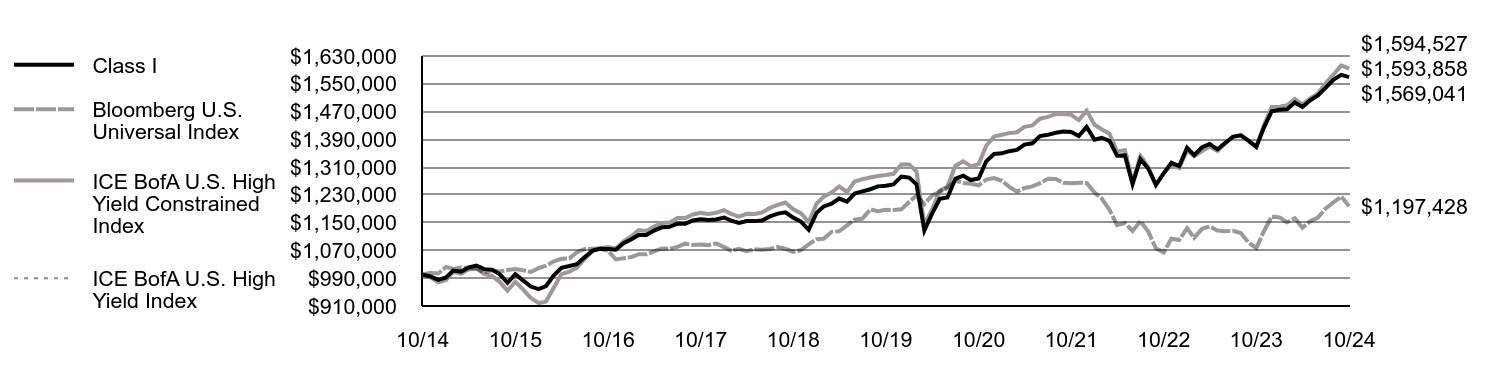

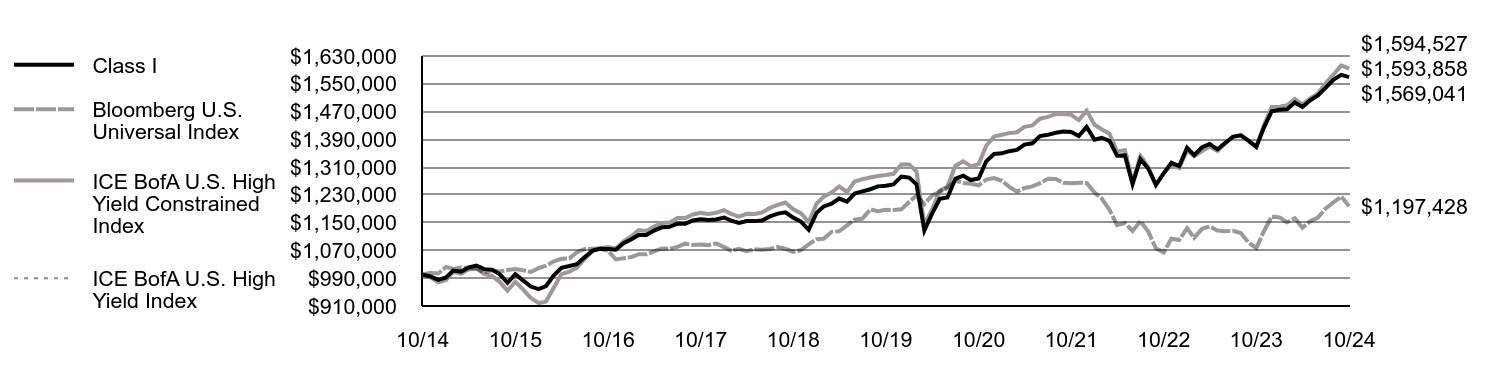

Comparison of the change in value of a $1,000,000 investment for the period indicated.

| Class I | Bloomberg U.S. Universal Index | ICE BofA U.S. High Yield Constrained Index | ICE BofA U.S. High Yield Index |

|---|

| 10/14 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| 11/14 | $995,085 | $1,005,397 | $992,901 | $992,852 |

| 12/14 | $985,305 | $1,003,580 | $978,297 | $978,214 |

| 1/15 | $992,258 | $1,022,684 | $985,015 | $984,961 |

| 2/15 | $1,012,236 | $1,016,723 | $1,008,512 | $1,008,460 |

| 3/15 | $1,009,086 | $1,020,920 | $1,003,166 | $1,003,103 |

| 4/15 | $1,021,089 | $1,019,735 | $1,015,225 | $1,015,130 |

| 5/15 | $1,026,474 | $1,017,951 | $1,018,213 | $1,018,137 |

| 6/15 | $1,016,208 | $1,006,590 | $1,002,703 | $1,002,607 |

| 7/15 | $1,014,723 | $1,012,452 | $996,552 | $996,434 |

| 8/15 | $1,001,047 | $1,009,468 | $978,915 | $978,885 |

| 9/15 | $976,618 | $1,013,420 | $953,818 | $953,492 |

| 10/15 | $1,001,501 | $1,016,659 | $979,742 | $979,484 |

| 11/15 | $983,701 | $1,012,952 | $957,889 | $957,494 |

| 12/15 | $965,948 | $1,007,891 | $933,190 | $932,796 |

| 1/16 | $958,811 | $1,019,017 | $918,428 | $918,042 |

| 2/16 | $967,475 | $1,026,256 | $922,700 | $922,312 |

| 3/16 | $998,237 | $1,038,833 | $963,487 | $963,082 |

| 4/16 | $1,019,897 | $1,045,911 | $1,001,986 | $1,001,564 |

| 5/16 | $1,025,397 | $1,046,728 | $1,009,215 | $1,008,791 |

| 6/16 | $1,030,750 | $1,065,155 | $1,020,157 | $1,019,725 |

| 7/16 | $1,051,085 | $1,073,933 | $1,045,923 | $1,045,481 |

| 8/16 | $1,069,436 | $1,075,091 | $1,069,220 | $1,068,768 |

| 9/16 | $1,074,644 | $1,075,347 | $1,076,135 | $1,075,683 |

| 10/16 | $1,074,426 | $1,068,213 | $1,079,498 | $1,079,044 |

| 11/16 | $1,072,149 | $1,044,202 | $1,075,241 | $1,074,789 |

| 12/16 | $1,090,868 | $1,047,304 | $1,096,382 | $1,095,929 |

| 1/17 | $1,102,070 | $1,050,999 | $1,111,096 | $1,110,646 |

| 2/17 | $1,114,587 | $1,059,108 | $1,128,417 | $1,127,977 |

| 3/17 | $1,114,232 | $1,058,753 | $1,126,047 | $1,125,610 |

| 4/17 | $1,127,218 | $1,067,538 | $1,138,792 | $1,138,364 |

| 5/17 | $1,136,559 | $1,075,775 | $1,148,921 | $1,148,532 |

| 6/17 | $1,137,972 | $1,074,863 | $1,150,140 | $1,149,744 |

| 7/17 | $1,147,402 | $1,080,216 | $1,163,435 | $1,163,006 |

| 8/17 | $1,147,044 | $1,089,536 | $1,163,121 | $1,162,704 |

| 9/17 | $1,156,388 | $1,085,702 | $1,173,558 | $1,173,150 |

| 10/17 | $1,159,996 | $1,087,005 | $1,178,137 | $1,177,677 |

| 11/17 | $1,157,451 | $1,085,360 | $1,174,994 | $1,174,517 |

| 12/17 | $1,159,088 | $1,090,145 | $1,178,420 | $1,177,940 |

| 1/18 | $1,164,766 | $1,079,655 | $1,185,976 | $1,185,493 |

| 2/18 | $1,155,739 | $1,069,417 | $1,174,918 | $1,174,441 |

| 3/18 | $1,149,258 | $1,074,811 | $1,167,664 | $1,167,190 |

| 4/18 | $1,154,832 | $1,067,639 | $1,175,432 | $1,174,954 |

| 5/18 | $1,154,452 | $1,073,462 | $1,175,265 | $1,174,777 |

| 6/18 | $1,155,949 | $1,071,905 | $1,179,325 | $1,178,833 |

| 7/18 | $1,168,019 | $1,074,148 | $1,192,502 | $1,192,006 |

| 8/18 | $1,175,973 | $1,079,440 | $1,201,138 | $1,200,639 |

| 9/18 | $1,179,585 | $1,074,815 | $1,208,119 | $1,207,616 |

| 10/18 | $1,164,448 | $1,065,824 | $1,188,326 | $1,187,839 |

| 11/18 | $1,153,278 | $1,070,617 | $1,177,539 | $1,177,060 |

| 12/18 | $1,129,482 | $1,087,367 | $1,151,717 | $1,151,261 |

| 1/19 | $1,178,288 | $1,102,360 | $1,204,609 | $1,204,137 |

| 2/19 | $1,196,661 | $1,103,561 | $1,224,949 | $1,224,469 |

| 3/19 | $1,204,901 | $1,123,489 | $1,236,951 | $1,236,467 |

| 4/19 | $1,219,498 | $1,125,062 | $1,254,258 | $1,253,766 |

| 5/19 | $1,210,367 | $1,142,296 | $1,238,314 | $1,237,830 |

| 6/19 | $1,233,877 | $1,158,453 | $1,268,679 | $1,268,182 |

| 7/19 | $1,240,079 | $1,161,901 | $1,275,177 | $1,274,676 |

| 8/19 | $1,246,312 | $1,188,192 | $1,280,151 | $1,279,650 |

| 9/19 | $1,254,597 | $1,183,044 | $1,284,211 | $1,283,707 |

| 10/19 | $1,256,421 | $1,186,867 | $1,287,194 | $1,286,688 |

| 11/19 | $1,260,302 | $1,186,629 | $1,290,709 | $1,290,201 |

| 12/19 | $1,282,467 | $1,188,398 | $1,317,688 | $1,317,172 |

| 1/20 | $1,279,776 | $1,209,727 | $1,317,745 | $1,317,228 |

| 2/20 | $1,260,692 | $1,227,840 | $1,297,320 | $1,296,813 |

| 3/20 | $1,127,324 | $1,203,856 | $1,144,644 | $1,144,323 |

| 4/20 | $1,175,102 | $1,227,971 | $1,188,162 | $1,187,811 |

| 5/20 | $1,218,715 | $1,239,440 | $1,242,061 | $1,242,137 |

| 6/20 | $1,222,736 | $1,249,782 | $1,253,861 | $1,254,244 |

| 7/20 | $1,276,179 | $1,271,736 | $1,313,363 | $1,314,173 |

| 8/20 | $1,285,166 | $1,264,402 | $1,326,491 | $1,327,105 |

| 9/20 | $1,272,681 | $1,262,124 | $1,312,742 | $1,313,270 |

| 10/20 | $1,277,004 | $1,257,613 | $1,318,664 | $1,319,411 |

| 11/20 | $1,326,563 | $1,274,024 | $1,371,522 | $1,372,224 |

| 12/20 | $1,347,744 | $1,278,423 | $1,397,714 | $1,398,397 |

| 1/21 | $1,349,707 | $1,270,388 | $1,403,106 | $1,403,749 |

| 2/21 | $1,355,882 | $1,253,996 | $1,407,942 | $1,408,640 |

| 3/21 | $1,359,425 | $1,239,403 | $1,410,439 | $1,411,038 |

| 4/21 | $1,375,042 | $1,249,825 | $1,425,870 | $1,426,516 |

| 5/21 | $1,378,622 | $1,254,592 | $1,429,986 | $1,430,634 |

| 6/21 | $1,399,313 | $1,263,738 | $1,449,454 | $1,450,180 |

| 7/21 | $1,402,922 | $1,276,427 | $1,454,542 | $1,455,342 |

| 8/21 | $1,409,038 | $1,275,575 | $1,462,569 | $1,463,280 |

| 9/21 | $1,412,480 | $1,264,683 | $1,463,164 | $1,463,770 |

| 10/21 | $1,411,109 | $1,263,649 | $1,460,410 | $1,461,167 |

| 11/21 | $1,399,435 | $1,265,175 | $1,445,270 | $1,446,193 |

| 12/21 | $1,425,939 | $1,264,322 | $1,472,450 | $1,473,401 |

| 1/22 | $1,388,902 | $1,236,603 | $1,432,083 | $1,432,898 |

| 2/22 | $1,394,573 | $1,219,743 | $1,419,259 | $1,420,032 |

| 3/22 | $1,385,467 | $1,187,019 | $1,406,266 | $1,406,893 |

| 4/22 | $1,342,575 | $1,142,746 | $1,355,183 | $1,355,715 |

| 5/22 | $1,343,753 | $1,149,034 | $1,358,425 | $1,359,110 |

| 6/22 | $1,261,397 | $1,126,073 | $1,265,874 | $1,266,600 |

| 7/22 | $1,333,246 | $1,154,385 | $1,342,055 | $1,342,886 |

| 8/22 | $1,305,514 | $1,124,375 | $1,309,991 | $1,310,727 |

| 9/22 | $1,258,937 | $1,075,933 | $1,257,382 | $1,258,012 |

| 10/22 | $1,292,016 | $1,064,128 | $1,293,158 | $1,293,823 |

| 11/22 | $1,322,382 | $1,103,805 | $1,317,209 | $1,318,043 |

| 12/22 | $1,312,872 | $1,100,056 | $1,307,381 | $1,308,116 |

| 1/23 | $1,365,318 | $1,134,180 | $1,358,481 | $1,359,258 |

| 2/23 | $1,344,234 | $1,106,311 | $1,341,056 | $1,341,668 |

| 3/23 | $1,367,240 | $1,132,265 | $1,355,956 | $1,356,771 |

| 4/23 | $1,376,317 | $1,139,182 | $1,369,169 | $1,369,866 |

| 5/23 | $1,361,261 | $1,127,371 | $1,356,128 | $1,356,860 |

| 6/23 | $1,379,331 | $1,125,619 | $1,378,187 | $1,378,946 |

| 7/23 | $1,397,237 | $1,126,738 | $1,397,883 | $1,398,582 |

| 8/23 | $1,401,496 | $1,119,953 | $1,402,042 | $1,402,573 |

| 9/23 | $1,386,397 | $1,093,247 | $1,385,568 | $1,386,261 |

| 10/23 | $1,368,288 | $1,076,807 | $1,368,266 | $1,369,103 |

| 11/23 | $1,423,714 | $1,125,268 | $1,430,728 | $1,431,373 |

| 12/23 | $1,471,071 | $1,167,966 | $1,483,527 | $1,484,159 |

| 1/24 | $1,475,284 | $1,165,171 | $1,483,812 | $1,484,434 |

| 2/24 | $1,476,835 | $1,151,201 | $1,488,205 | $1,488,830 |

| 3/24 | $1,496,030 | $1,162,504 | $1,505,932 | $1,506,565 |

| 4/24 | $1,483,305 | $1,135,338 | $1,490,874 | $1,491,499 |

| 5/24 | $1,502,682 | $1,154,158 | $1,507,792 | $1,508,423 |

| 6/24 | $1,516,486 | $1,164,708 | $1,522,345 | $1,522,984 |

| 7/24 | $1,539,065 | $1,191,145 | $1,552,219 | $1,552,870 |

| 8/24 | $1,561,896 | $1,208,679 | $1,576,910 | $1,577,571 |

| 9/24 | $1,575,784 | $1,225,257 | $1,602,678 | $1,603,351 |

| 10/24 | $1,569,041 | $1,197,428 | $1,593,858 | $1,594,527 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 14.67% | 4.54% | 4.60% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 11.20% | 0.18% | 1.82% |

| ICE BofA U.S. High Yield Index | 16.47% | 4.38% | 4.77% |

| ICE BofA U.S. High Yield Constrained Index | 16.49% | 4.36% | 4.77% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $5,663,132,601 |

| # of Portfolio Holdings | 432 |

| Portfolio Turnover Rate | 45% |

| Total Advisory Fees Paid | $30,275,138 |

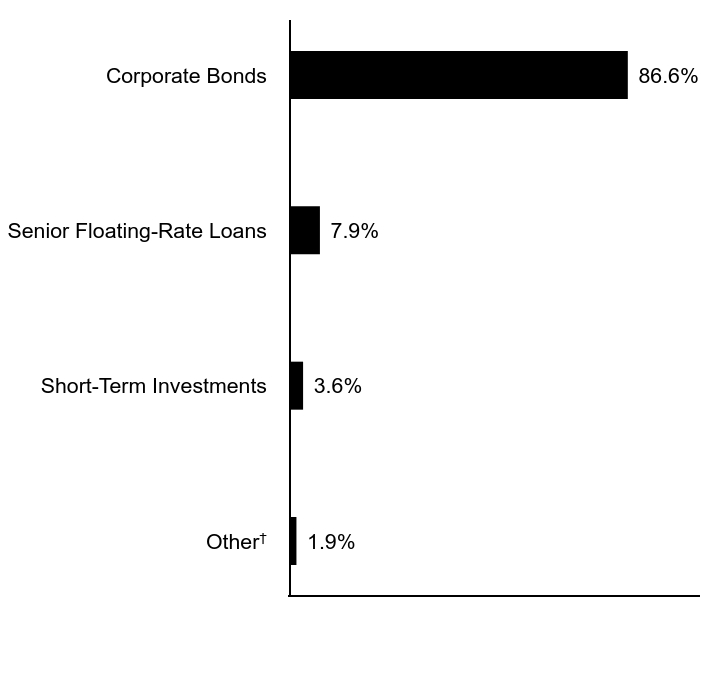

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.9% |

| Short-Term Investments | 3.6% |

| Senior Floating-Rate Loans | 7.9% |

| Corporate Bonds | 86.6% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 3.3% |

| CCC or Lower | 12.4% |

| B | 37.3% |

| BB | 44.3% |

| BBB | 2.7% |

| Footnote | Description |

Footnotea | Excludes Short-Term Investments. Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). This breakdown assigns a numeric equivalent to the ratings from the aforementioned agencies and the mean is rounded to the nearest integer and converted to an equivalent S&P rating ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Eaton Vance Income Fund of Boston

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about the Eaton Vance Income Fund of Boston for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R | $132 | 1.23% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the ICE BofA U.S. High Yield Index (the Index):

↓ The Fund’s security selections by sector ― especially in the health care, gaming, and retail sectors ― detracted from Index-relative returns during the period

↓ Fund allocations by credit quality ― particularly a broad underweight exposure to distressed CCC-rated and lower-rated securities ― detracted from returns

↓ Security selections by credit quality ― especially selections in B-rated and CCC-rated securities ― detracted from Index-relative returns during the period

↓ Security selections by duration segment ― particularly selections in securities with durations of less than 5 years ― hampered returns relative to the Index

↑ An overweight exposure to the health care sector and an underweight allocation to the energy sector contributed to Index-relative returns during the period

↑ The Fund’s selections in lower-rated fixed-income investments contributed to performance relative to the Index during the period

↑ The Fund’s underweight exposure to BB-rated securities contributed to performance relative to the Index during the period

↑ The Fund’s overweight exposure to securities with durations between 5-10 years contributed to performance relative to the Index during the period

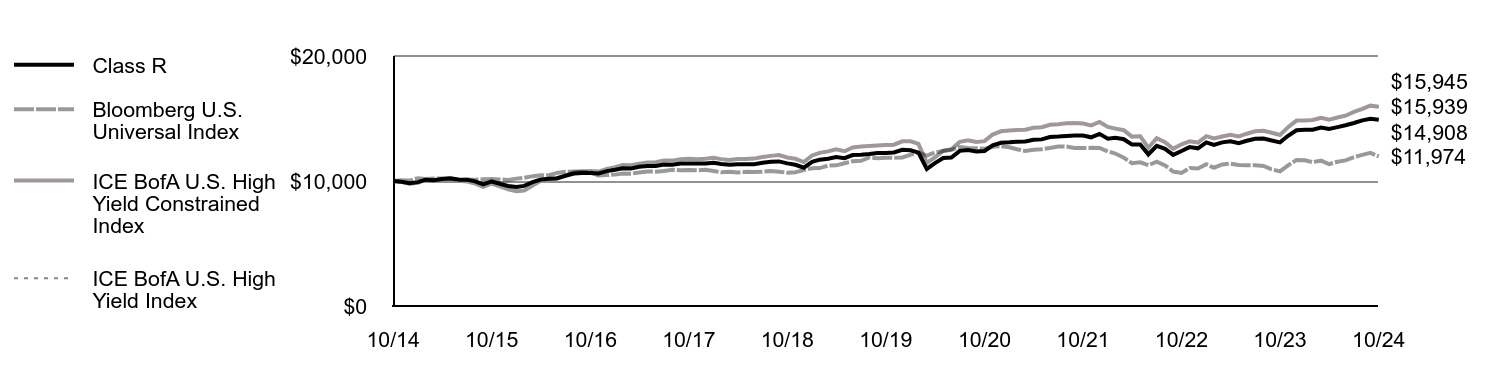

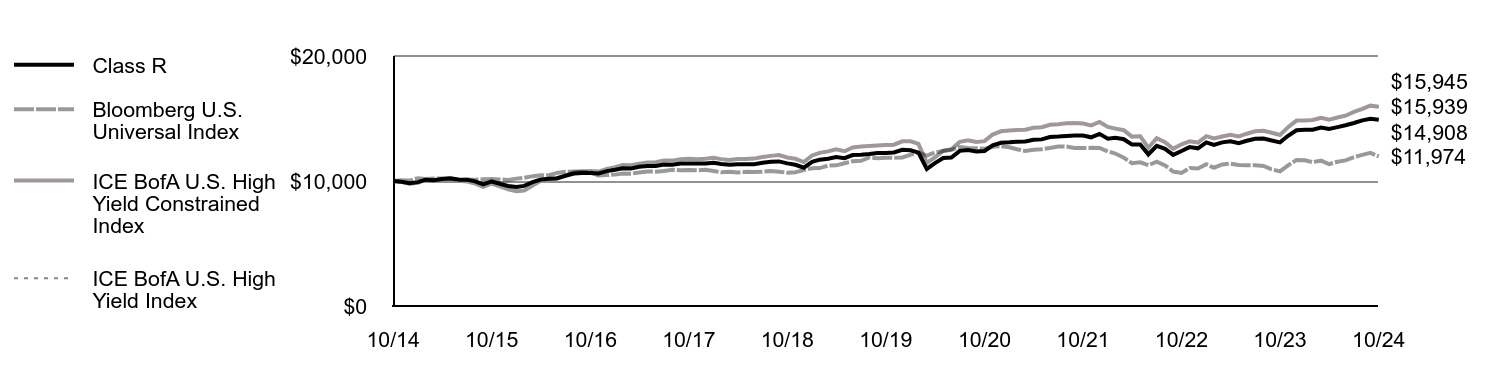

Comparison of the change in value of a $10,000 investment for the period indicated.

| Class R | Bloomberg U.S. Universal Index | ICE BofA U.S. High Yield Constrained Index | ICE BofA U.S. High Yield Index |

|---|

| 10/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| 11/14 | $9,947 | $10,054 | $9,929 | $9,929 |

| 12/14 | $9,828 | $10,036 | $9,783 | $9,782 |

| 1/15 | $9,910 | $10,227 | $9,850 | $9,850 |

| 2/15 | $10,106 | $10,167 | $10,085 | $10,085 |

| 3/15 | $10,070 | $10,209 | $10,032 | $10,031 |

| 4/15 | $10,168 | $10,197 | $10,152 | $10,151 |

| 5/15 | $10,218 | $10,180 | $10,182 | $10,181 |

| 6/15 | $10,128 | $10,066 | $10,027 | $10,026 |

| 7/15 | $10,109 | $10,125 | $9,966 | $9,964 |

| 8/15 | $9,969 | $10,095 | $9,789 | $9,789 |

| 9/15 | $9,721 | $10,134 | $9,538 | $9,535 |

| 10/15 | $9,964 | $10,167 | $9,797 | $9,795 |

| 11/15 | $9,783 | $10,130 | $9,579 | $9,575 |

| 12/15 | $9,602 | $10,079 | $9,332 | $9,328 |

| 1/16 | $9,527 | $10,190 | $9,184 | $9,180 |

| 2/16 | $9,609 | $10,263 | $9,227 | $9,223 |

| 3/16 | $9,910 | $10,388 | $9,635 | $9,631 |

| 4/16 | $10,121 | $10,459 | $10,020 | $10,016 |

| 5/16 | $10,172 | $10,467 | $10,092 | $10,088 |

| 6/16 | $10,221 | $10,652 | $10,202 | $10,197 |

| 7/16 | $10,418 | $10,739 | $10,459 | $10,455 |

| 8/16 | $10,595 | $10,751 | $10,692 | $10,688 |

| 9/16 | $10,643 | $10,753 | $10,761 | $10,757 |

| 10/16 | $10,636 | $10,682 | $10,795 | $10,790 |

| 11/16 | $10,609 | $10,442 | $10,752 | $10,748 |

| 12/16 | $10,790 | $10,473 | $10,964 | $10,959 |

| 1/17 | $10,896 | $10,510 | $11,111 | $11,106 |

| 2/17 | $11,016 | $10,591 | $11,284 | $11,280 |

| 3/17 | $11,008 | $10,588 | $11,260 | $11,256 |

| 4/17 | $11,132 | $10,675 | $11,388 | $11,384 |

| 5/17 | $11,200 | $10,758 | $11,489 | $11,485 |

| 6/17 | $11,209 | $10,749 | $11,501 | $11,497 |

| 7/17 | $11,317 | $10,802 | $11,634 | $11,630 |

| 8/17 | $11,309 | $10,895 | $11,631 | $11,627 |

| 9/17 | $11,396 | $10,857 | $11,736 | $11,732 |

| 10/17 | $11,407 | $10,870 | $11,781 | $11,777 |

| 11/17 | $11,397 | $10,854 | $11,750 | $11,745 |

| 12/17 | $11,408 | $10,901 | $11,784 | $11,779 |

| 1/18 | $11,459 | $10,797 | $11,860 | $11,855 |

| 2/18 | $11,366 | $10,694 | $11,749 | $11,744 |

| 3/18 | $11,298 | $10,748 | $11,677 | $11,672 |

| 4/18 | $11,348 | $10,676 | $11,754 | $11,750 |

| 5/18 | $11,339 | $10,735 | $11,753 | $11,748 |

| 6/18 | $11,349 | $10,719 | $11,793 | $11,788 |

| 7/18 | $11,462 | $10,741 | $11,925 | $11,920 |

| 8/18 | $11,535 | $10,794 | $12,011 | $12,006 |

| 9/18 | $11,566 | $10,748 | $12,081 | $12,076 |

| 10/18 | $11,412 | $10,658 | $11,883 | $11,878 |

| 11/18 | $11,298 | $10,706 | $11,775 | $11,771 |

| 12/18 | $11,060 | $10,874 | $11,517 | $11,513 |

| 1/19 | $11,532 | $11,024 | $12,046 | $12,041 |

| 2/19 | $11,707 | $11,036 | $12,249 | $12,245 |

| 3/19 | $11,783 | $11,235 | $12,370 | $12,365 |

| 4/19 | $11,921 | $11,251 | $12,543 | $12,538 |

| 5/19 | $11,826 | $11,423 | $12,383 | $12,378 |

| 6/19 | $12,072 | $11,585 | $12,687 | $12,682 |

| 7/19 | $12,106 | $11,619 | $12,752 | $12,747 |

| 8/19 | $12,161 | $11,882 | $12,802 | $12,797 |

| 9/19 | $12,237 | $11,830 | $12,842 | $12,837 |

| 10/19 | $12,249 | $11,869 | $12,872 | $12,867 |

| 11/19 | $12,282 | $11,866 | $12,907 | $12,902 |

| 12/19 | $12,493 | $11,884 | $13,177 | $13,172 |

| 1/20 | $12,461 | $12,097 | $13,177 | $13,172 |

| 2/20 | $12,270 | $12,278 | $12,973 | $12,968 |

| 3/20 | $10,966 | $12,039 | $11,446 | $11,443 |

| 4/20 | $11,426 | $12,280 | $11,882 | $11,878 |

| 5/20 | $11,844 | $12,394 | $12,421 | $12,421 |

| 6/20 | $11,878 | $12,498 | $12,539 | $12,542 |

| 7/20 | $12,414 | $12,717 | $13,134 | $13,142 |

| 8/20 | $12,473 | $12,644 | $13,265 | $13,271 |

| 9/20 | $12,369 | $12,621 | $13,127 | $13,133 |

| 10/20 | $12,406 | $12,576 | $13,187 | $13,194 |

| 11/20 | $12,858 | $12,740 | $13,715 | $13,722 |

| 12/20 | $13,057 | $12,784 | $13,977 | $13,984 |

| 1/21 | $13,094 | $12,704 | $14,031 | $14,037 |

| 2/21 | $13,148 | $12,540 | $14,079 | $14,086 |

| 3/21 | $13,154 | $12,394 | $14,104 | $14,110 |

| 4/21 | $13,299 | $12,498 | $14,259 | $14,265 |

| 5/21 | $13,329 | $12,546 | $14,300 | $14,306 |

| 6/21 | $13,523 | $12,637 | $14,495 | $14,502 |

| 7/21 | $13,553 | $12,764 | $14,545 | $14,553 |

| 8/21 | $13,606 | $12,756 | $14,626 | $14,633 |

| 9/21 | $13,634 | $12,647 | $14,632 | $14,638 |

| 10/21 | $13,640 | $12,636 | $14,604 | $14,612 |

| 11/21 | $13,497 | $12,652 | $14,453 | $14,462 |

| 12/21 | $13,772 | $12,643 | $14,725 | $14,734 |

| 1/22 | $13,384 | $12,366 | $14,321 | $14,329 |

| 2/22 | $13,459 | $12,197 | $14,193 | $14,200 |

| 3/22 | $13,340 | $11,870 | $14,063 | $14,069 |

| 4/22 | $12,922 | $11,427 | $13,552 | $13,557 |

| 5/22 | $12,928 | $11,490 | $13,584 | $13,591 |

| 6/22 | $12,130 | $11,261 | $12,659 | $12,666 |

| 7/22 | $12,815 | $11,544 | $13,421 | $13,429 |

| 8/22 | $12,568 | $11,244 | $13,100 | $13,107 |

| 9/22 | $12,089 | $10,759 | $12,574 | $12,580 |

| 10/22 | $12,401 | $10,641 | $12,932 | $12,938 |

| 11/22 | $12,712 | $11,038 | $13,172 | $13,180 |

| 12/22 | $12,615 | $11,001 | $13,074 | $13,081 |

| 1/23 | $13,086 | $11,342 | $13,585 | $13,593 |

| 2/23 | $12,879 | $11,063 | $13,411 | $13,417 |

| 3/23 | $13,093 | $11,323 | $13,560 | $13,568 |

| 4/23 | $13,175 | $11,392 | $13,692 | $13,699 |

| 5/23 | $13,025 | $11,274 | $13,561 | $13,569 |

| 6/23 | $13,219 | $11,256 | $13,782 | $13,789 |

| 7/23 | $13,385 | $11,267 | $13,979 | $13,986 |

| 8/23 | $13,394 | $11,200 | $14,020 | $14,026 |

| 9/23 | $13,244 | $10,932 | $13,856 | $13,863 |

| 10/23 | $13,092 | $10,768 | $13,683 | $13,691 |

| 11/23 | $13,616 | $11,253 | $14,307 | $14,314 |

| 12/23 | $14,063 | $11,680 | $14,835 | $14,842 |

| 1/24 | $14,097 | $11,652 | $14,838 | $14,844 |

| 2/24 | $14,106 | $11,512 | $14,882 | $14,888 |

| 3/24 | $14,283 | $11,625 | $15,059 | $15,066 |

| 4/24 | $14,156 | $11,353 | $14,909 | $14,915 |

| 5/24 | $14,307 | $11,542 | $15,078 | $15,084 |

| 6/24 | $14,461 | $11,647 | $15,223 | $15,230 |

| 7/24 | $14,641 | $11,911 | $15,522 | $15,529 |

| 8/24 | $14,852 | $12,087 | $15,769 | $15,776 |

| 9/24 | $14,978 | $12,253 | $16,027 | $16,034 |

| 10/24 | $14,908 | $11,974 | $15,939 | $15,945 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class R | 13.86% | 4.00% | 4.07% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 11.20% | 0.18% | 1.82% |

| ICE BofA U.S. High Yield Index | 16.47% | 4.38% | 4.77% |

| ICE BofA U.S. High Yield Constrained Index | 16.49% | 4.36% | 4.77% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $5,663,132,601 |

| # of Portfolio Holdings | 432 |

| Portfolio Turnover Rate | 45% |

| Total Advisory Fees Paid | $30,275,138 |

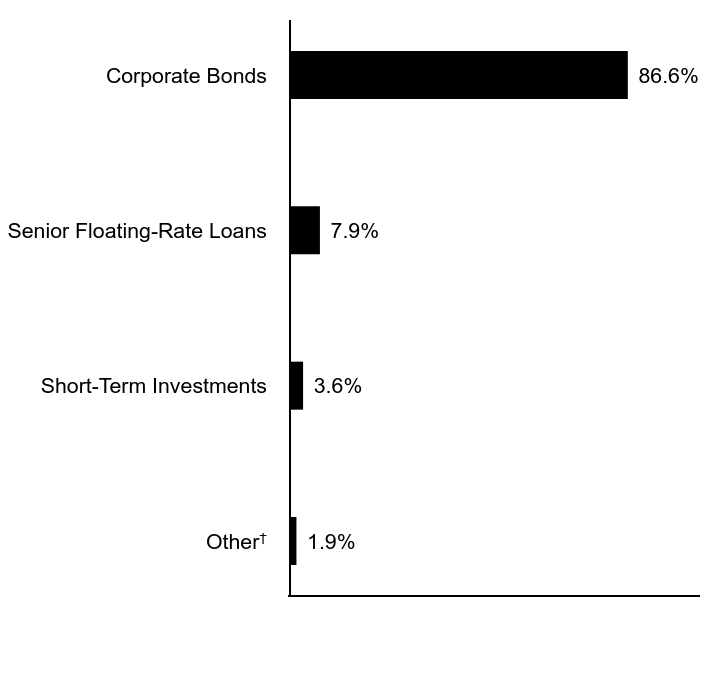

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.9% |

| Short-Term Investments | 3.6% |

| Senior Floating-Rate Loans | 7.9% |

| Corporate Bonds | 86.6% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

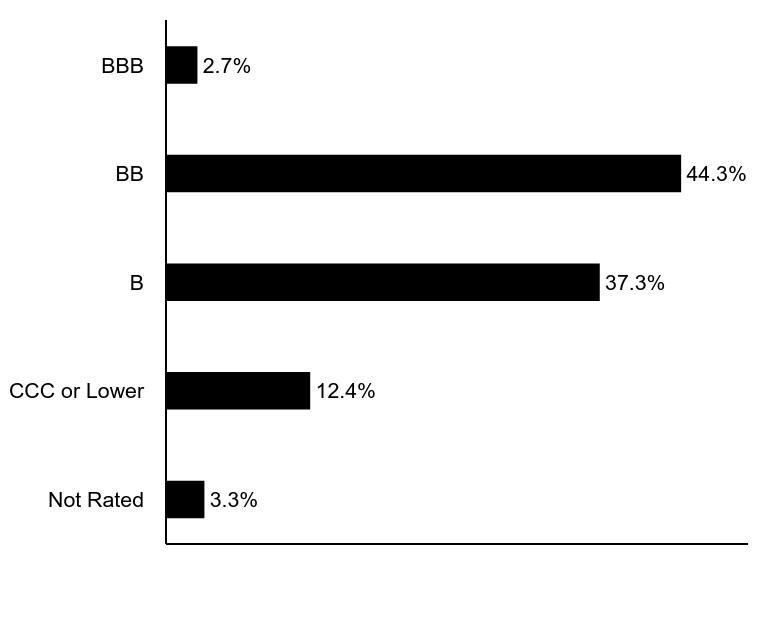

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 3.3% |

| CCC or Lower | 12.4% |

| B | 37.3% |

| BB | 44.3% |

| BBB | 2.7% |

| Footnote | Description |

Footnotea | Excludes Short-Term Investments. Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). This breakdown assigns a numeric equivalent to the ratings from the aforementioned agencies and the mean is rounded to the nearest integer and converted to an equivalent S&P rating ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Eaton Vance Income Fund of Boston

Annual Shareholder Report October 31, 2024

This annual shareholder report contains important information about the Eaton Vance Income Fund of Boston for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.eatonvance.com/open-end-mutual-fund-documents.php. You can also request this information by contacting us at 1-800-262-1122.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class R6 | $69 | 0.64% |

How did the Fund perform last year and what affected its performance?

Key contributors to (↑) and detractors from (↓) performance, relative to the ICE BofA U.S. High Yield Index (the Index):

↓ The Fund’s security selections by sector ― especially in the health care, gaming, and retail sectors ― detracted from Index-relative returns during the period

↓ Fund allocations by credit quality ― particularly a broad underweight exposure to distressed CCC-rated and lower-rated securities ― detracted from returns

↓ Security selections by credit quality ― especially selections in B-rated and CCC-rated securities ― detracted from Index-relative returns during the period

↓ Security selections by duration segment ― particularly selections in securities with durations of less than 5 years ― hampered returns relative to the Index

↑ An overweight exposure to the health care sector and an underweight allocation to the energy sector contributed to Index-relative returns during the period

↑ The Fund’s selections in lower-rated fixed-income investments contributed to performance relative to the Index during the period

↑ The Fund’s underweight exposure to BB-rated securities contributed to performance relative to the Index during the period

↑ The Fund’s overweight exposure to securities with durations between 5-10 years contributed to performance relative to the Index during the period

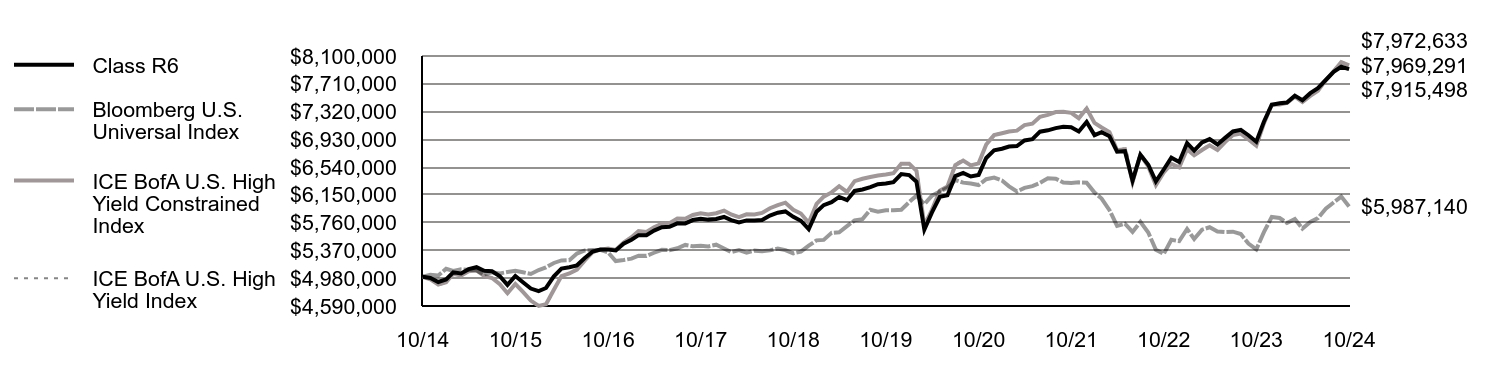

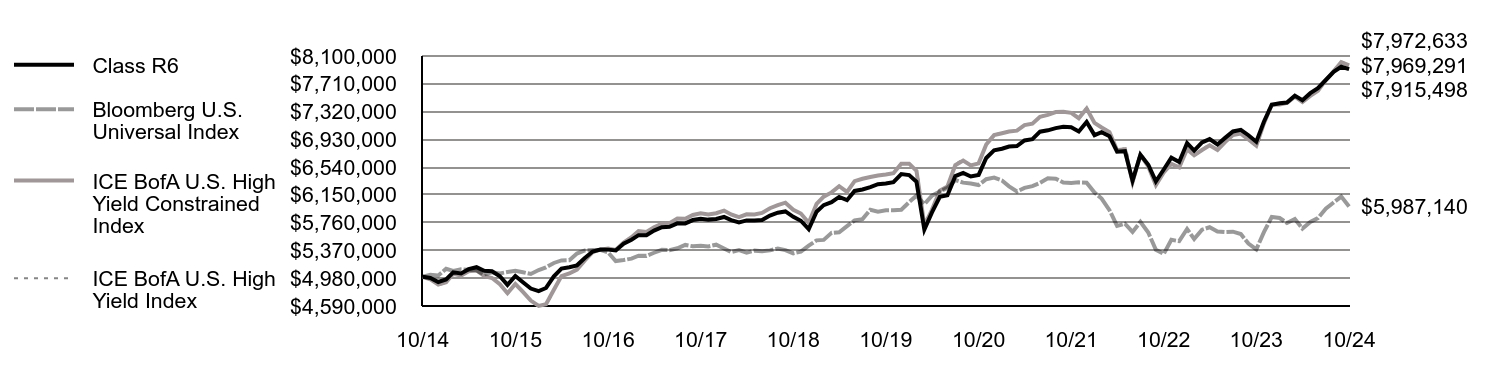

Comparison of the change in value of a $5,000,000 investment for the period indicated.

| Class R6 | Bloomberg U.S. Universal Index | ICE BofA U.S. High Yield Constrained Index | ICE BofA U.S. High Yield Index |

|---|

| 10/14 | $5,000,000 | $5,000,000 | $5,000,000 | $5,000,000 |

| 11/14 | $4,984,071 | $5,026,983 | $4,964,506 | $4,964,261 |

| 12/14 | $4,927,176 | $5,017,901 | $4,891,486 | $4,891,071 |

| 1/15 | $4,962,303 | $5,113,418 | $4,925,075 | $4,924,804 |

| 2/15 | $5,062,534 | $5,083,617 | $5,042,562 | $5,042,299 |

| 3/15 | $5,047,143 | $5,104,598 | $5,015,829 | $5,015,515 |

| 4/15 | $5,107,538 | $5,098,676 | $5,076,124 | $5,075,649 |

| 5/15 | $5,134,836 | $5,089,756 | $5,091,064 | $5,090,684 |

| 6/15 | $5,083,845 | $5,032,951 | $5,013,515 | $5,013,033 |

| 7/15 | $5,076,803 | $5,062,258 | $4,982,761 | $4,982,170 |

| 8/15 | $5,008,759 | $5,047,342 | $4,894,575 | $4,894,426 |

| 9/15 | $4,886,884 | $5,067,099 | $4,769,089 | $4,767,458 |

| 10/15 | $5,011,784 | $5,083,296 | $4,898,709 | $4,897,418 |

| 11/15 | $4,923,072 | $5,064,759 | $4,789,447 | $4,787,472 |

| 12/15 | $4,834,594 | $5,039,457 | $4,665,950 | $4,663,980 |

| 1/16 | $4,799,259 | $5,095,087 | $4,592,140 | $4,590,211 |

| 2/16 | $4,842,988 | $5,131,280 | $4,613,499 | $4,611,559 |

| 3/16 | $5,006,424 | $5,194,166 | $4,817,436 | $4,815,408 |

| 4/16 | $5,115,237 | $5,229,555 | $5,009,932 | $5,007,821 |

| 5/16 | $5,134,033 | $5,233,640 | $5,046,075 | $5,043,956 |

| 6/16 | $5,161,207 | $5,325,777 | $5,100,784 | $5,098,626 |

| 7/16 | $5,263,437 | $5,369,663 | $5,229,613 | $5,227,404 |

| 8/16 | $5,355,723 | $5,375,456 | $5,346,098 | $5,343,841 |

| 9/16 | $5,382,205 | $5,376,733 | $5,380,675 | $5,378,413 |

| 10/16 | $5,381,512 | $5,341,063 | $5,397,491 | $5,395,221 |

| 11/16 | $5,370,502 | $5,221,011 | $5,376,203 | $5,373,943 |

| 12/16 | $5,464,665 | $5,236,520 | $5,481,910 | $5,479,647 |

| 1/17 | $5,521,194 | $5,254,995 | $5,555,480 | $5,553,229 |

| 2/17 | $5,584,286 | $5,295,541 | $5,642,086 | $5,639,885 |

| 3/17 | $5,582,925 | $5,293,767 | $5,630,236 | $5,628,052 |

| 4/17 | $5,648,381 | $5,337,691 | $5,693,959 | $5,691,820 |

| 5/17 | $5,695,616 | $5,378,873 | $5,744,605 | $5,742,659 |

| 6/17 | $5,703,127 | $5,374,313 | $5,750,699 | $5,748,721 |

| 7/17 | $5,750,820 | $5,401,082 | $5,817,173 | $5,815,028 |

| 8/17 | $5,749,426 | $5,447,680 | $5,815,607 | $5,813,521 |

| 9/17 | $5,796,664 | $5,428,508 | $5,867,791 | $5,865,750 |

| 10/17 | $5,815,152 | $5,435,026 | $5,890,687 | $5,888,386 |

| 11/17 | $5,802,797 | $5,426,801 | $5,874,971 | $5,872,586 |

| 12/17 | $5,811,404 | $5,450,725 | $5,892,098 | $5,889,701 |

| 1/18 | $5,840,273 | $5,398,274 | $5,929,878 | $5,927,465 |

| 2/18 | $5,795,379 | $5,347,087 | $5,874,591 | $5,872,203 |

| 3/18 | $5,763,300 | $5,374,056 | $5,838,320 | $5,835,951 |

| 4/18 | $5,791,675 | $5,338,197 | $5,877,158 | $5,874,769 |

| 5/18 | $5,790,222 | $5,367,309 | $5,876,326 | $5,873,883 |

| 6/18 | $5,798,149 | $5,359,525 | $5,896,626 | $5,894,167 |

| 7/18 | $5,859,113 | $5,370,741 | $5,962,508 | $5,960,031 |

| 8/18 | $5,899,473 | $5,397,201 | $6,005,691 | $6,003,194 |

| 9/18 | $5,918,026 | $5,374,074 | $6,040,593 | $6,038,078 |

| 10/18 | $5,842,538 | $5,329,118 | $5,941,629 | $5,939,196 |

| 11/18 | $5,786,937 | $5,353,085 | $5,887,696 | $5,885,301 |

| 12/18 | $5,667,988 | $5,436,837 | $5,758,585 | $5,756,303 |

| 1/19 | $5,913,374 | $5,511,800 | $6,023,043 | $6,020,687 |

| 2/19 | $6,005,973 | $5,517,807 | $6,124,744 | $6,122,346 |

| 3/19 | $6,047,800 | $5,617,446 | $6,184,757 | $6,182,335 |

| 4/19 | $6,121,504 | $5,625,309 | $6,271,292 | $6,268,828 |

| 5/19 | $6,076,143 | $5,711,481 | $6,191,571 | $6,189,148 |

| 6/19 | $6,205,636 | $5,792,265 | $6,343,395 | $6,340,912 |

| 7/19 | $6,226,194 | $5,809,507 | $6,375,884 | $6,373,380 |

| 8/19 | $6,257,943 | $5,940,961 | $6,400,756 | $6,398,251 |

| 9/19 | $6,299,997 | $5,915,222 | $6,421,056 | $6,418,535 |

| 10/19 | $6,309,615 | $5,934,333 | $6,435,968 | $6,433,439 |

| 11/19 | $6,329,562 | $5,933,147 | $6,453,546 | $6,451,007 |

| 12/19 | $6,441,384 | $5,941,988 | $6,588,441 | $6,585,862 |

| 1/20 | $6,428,371 | $6,048,634 | $6,588,723 | $6,586,141 |

| 2/20 | $6,332,938 | $6,139,202 | $6,486,599 | $6,484,063 |

| 3/20 | $5,663,471 | $6,019,281 | $5,723,218 | $5,721,614 |

| 4/20 | $5,903,988 | $6,139,856 | $5,940,811 | $5,939,056 |

| 5/20 | $6,123,604 | $6,197,201 | $6,210,305 | $6,210,687 |

| 6/20 | $6,144,289 | $6,248,911 | $6,269,303 | $6,271,222 |

| 7/20 | $6,413,342 | $6,358,678 | $6,566,814 | $6,570,864 |

| 8/20 | $6,458,994 | $6,322,012 | $6,632,456 | $6,635,524 |

| 9/20 | $6,408,616 | $6,310,618 | $6,563,711 | $6,566,352 |

| 10/20 | $6,430,837 | $6,288,063 | $6,593,322 | $6,597,056 |

| 11/20 | $6,668,448 | $6,370,118 | $6,857,611 | $6,861,118 |

| 12/20 | $6,775,446 | $6,392,115 | $6,988,570 | $6,991,982 |

| 1/21 | $6,798,006 | $6,351,938 | $7,015,529 | $7,018,743 |

| 2/21 | $6,829,501 | $6,269,979 | $7,039,710 | $7,043,199 |

| 3/21 | $6,835,597 | $6,197,013 | $7,052,195 | $7,055,191 |

| 4/21 | $6,914,622 | $6,249,123 | $7,129,348 | $7,132,581 |

| 5/21 | $6,933,163 | $6,272,959 | $7,149,931 | $7,153,168 |

| 6/21 | $7,037,726 | $6,318,690 | $7,247,272 | $7,250,902 |

| 7/21 | $7,056,392 | $6,382,137 | $7,272,708 | $7,276,711 |

| 8/21 | $7,087,688 | $6,377,877 | $7,312,844 | $7,316,398 |

| 9/21 | $7,105,520 | $6,323,413 | $7,315,820 | $7,318,852 |

| 10/21 | $7,099,160 | $6,318,245 | $7,302,052 | $7,305,833 |

| 11/21 | $7,040,950 | $6,325,877 | $7,226,351 | $7,230,964 |

| 12/21 | $7,174,843 | $6,321,611 | $7,362,248 | $7,367,003 |

| 1/22 | $6,989,027 | $6,183,015 | $7,160,413 | $7,164,488 |

| 2/22 | $7,030,927 | $6,098,716 | $7,096,295 | $7,100,160 |

| 3/22 | $6,972,728 | $5,935,095 | $7,031,330 | $7,034,464 |

| 4/22 | $6,757,397 | $5,713,731 | $6,775,915 | $6,778,577 |

| 5/22 | $6,763,880 | $5,745,169 | $6,792,124 | $6,795,548 |

| 6/22 | $6,349,873 | $5,630,366 | $6,329,372 | $6,332,998 |

| 7/22 | $6,712,119 | $5,771,925 | $6,710,273 | $6,714,430 |

| 8/22 | $6,573,071 | $5,621,876 | $6,549,956 | $6,553,636 |

| 9/22 | $6,339,107 | $5,379,665 | $6,286,909 | $6,290,060 |

| 10/22 | $6,506,237 | $5,320,638 | $6,465,791 | $6,469,117 |

| 11/22 | $6,673,147 | $5,519,025 | $6,586,043 | $6,590,215 |

| 12/22 | $6,612,318 | $5,500,280 | $6,536,906 | $6,540,580 |

| 1/23 | $6,877,042 | $5,670,901 | $6,792,406 | $6,796,290 |

| 2/23 | $6,771,366 | $5,531,557 | $6,705,279 | $6,708,341 |

| 3/23 | $6,887,837 | $5,661,324 | $6,779,780 | $6,783,854 |

| 4/23 | $6,934,095 | $5,695,908 | $6,845,845 | $6,849,331 |

| 5/23 | $6,858,776 | $5,636,854 | $6,780,641 | $6,784,298 |

| 6/23 | $6,950,343 | $5,628,094 | $6,890,933 | $6,894,729 |

| 7/23 | $7,041,117 | $5,633,689 | $6,989,417 | $6,992,911 |

| 8/23 | $7,063,119 | $5,599,763 | $7,010,211 | $7,012,864 |

| 9/23 | $6,987,548 | $5,466,236 | $6,927,838 | $6,931,303 |

| 10/23 | $6,896,821 | $5,384,034 | $6,841,331 | $6,845,514 |

| 11/23 | $7,176,725 | $5,626,342 | $7,153,641 | $7,156,864 |

| 12/23 | $7,416,009 | $5,839,829 | $7,417,634 | $7,420,795 |

| 1/24 | $7,437,831 | $5,825,853 | $7,419,059 | $7,422,172 |

| 2/24 | $7,446,188 | $5,756,004 | $7,441,024 | $7,444,150 |

| 3/24 | $7,543,548 | $5,812,519 | $7,529,661 | $7,532,827 |

| 4/24 | $7,480,007 | $5,676,689 | $7,454,370 | $7,457,495 |

| 5/24 | $7,578,300 | $5,770,788 | $7,538,958 | $7,542,113 |

| 6/24 | $7,648,491 | $5,823,542 | $7,611,724 | $7,614,920 |

| 7/24 | $7,762,961 | $5,955,723 | $7,761,093 | $7,764,351 |

| 8/24 | $7,878,576 | $6,043,397 | $7,884,548 | $7,887,853 |

| 9/24 | $7,949,157 | $6,126,285 | $8,013,391 | $8,016,753 |

| 10/24 | $7,915,498 | $5,987,140 | $7,969,291 | $7,972,633 |

Average Annual Total Returns (%)

| Fund | 1 Year | 5 Years | 10 Years |

|---|

| Class R6 | 14.77% | 4.63% | 4.70% |

Bloomberg U.S. Universal IndexFootnote Reference1 | 11.20% | 0.18% | 1.82% |

| ICE BofA U.S. High Yield Index | 16.47% | 4.38% | 4.77% |

| ICE BofA U.S. High Yield Constrained Index | 16.49% | 4.36% | 4.77% |

| Footnote | Description |

Footnote1 | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective May 1, 2024. |

Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance assumes that all dividends and distributions, if any, were reinvested. For more recent performance information, visit www.eatonvance.com/performance.php.

THE FUND'S PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

| Total Net Assets | $5,663,132,601 |

| # of Portfolio Holdings | 432 |

| Portfolio Turnover Rate | 45% |

| Total Advisory Fees Paid | $30,275,138 |

What did the Fund invest in?

The following tables reflect what the Fund invested in as of the report date.

Asset Allocation (% of total investments)

| Value | Value |

|---|

OtherFootnote Reference† | 1.9% |

| Short-Term Investments | 3.6% |

| Senior Floating-Rate Loans | 7.9% |

| Corporate Bonds | 86.6% |

| Footnote | Description |

Footnote† | Investment types less than 1% each |

Credit Quality (% of total investments)Footnote Referencea

| Value | Value |

|---|

| Not Rated | 3.3% |

| CCC or Lower | 12.4% |

| B | 37.3% |

| BB | 44.3% |

| BBB | 2.7% |

| Footnote | Description |

Footnotea | Excludes Short-Term Investments. Ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”). This breakdown assigns a numeric equivalent to the ratings from the aforementioned agencies and the mean is rounded to the nearest integer and converted to an equivalent S&P rating ranging from AAA, being the highest, to D, being the lowest. Ratings of BBB or higher are considered to be investment-grade quality. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

If you wish to view additional information about the Fund, including the prospectus, statement of additional information, financial statements and holdings, please scan the QR code or visit www.eatonvance.com/open-end-mutual-fund-documents.php. For proxy information, please visit www.eatonvance.com/proxyvoting.

The Funds may deliver a single copy of certain required shareholder documents (including prospectuses, shareholder reports, and proxy materials) to investors with the same last name and the same address. Your participation will continue indefinitely unless you instruct otherwise by calling 1-800-262-1122 or by contacting your financial intermediary. Your instruction will typically be effective within 30 days of receipt.

Not FDIC Insured | May Lose Value | No Bank Guarantee

Annual Shareholder Report October 31, 2024

Item 2. Code of Ethics

The registrant (sometimes referred to as the “Fund”) has adopted a code of ethics applicable to its Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer. The registrant undertakes to provide a copy of such code of ethics to any person upon request, without charge, by calling 1-800-262-1122. The registrant has not amended the code of ethics as described in Form N-CSR during the period covered by this report. The registrant has not granted any waiver, including an implicit waiver, from a provision of the code of ethics as described in Form N-CSR during the period covered by this report.

Item 3. Audit Committee Financial Expert

The registrant’s Board of Trustees (the “Board”) has designated George J. Gorman and Scott E. Wennerholm, each an independent trustee, as audit committee financial experts. Mr. Gorman is a certified public accountant who is the Principal at George J. Gorman LLC (a consulting firm). Previously, Mr. Gorman served in various capacities at Ernst & Young LLP (a registered public accounting firm), including as Senior Partner. Mr. Gorman also has experience serving as an independent trustee and audit committee financial expert of other mutual fund complexes. Mr. Wennerholm is a private investor. Previously, Mr. Wennerholm served as a Trustee at Wheelock College (postsecondary institution), as a Consultant at GF Parish Group (executive recruiting firm), Chief Operating Officer and Executive Vice President at BNY Mellon Asset Management (investment management firm), Chief Operating Officer and Chief Financial Officer at Natixis Global Asset Management (investment management firm), and Vice President at Fidelity Investments Institutional Services (investment management firm).

Item 4. Principal Accountant Fees and Services

Eaton Vance Income Fund of Boston (the “Fund”) is a series of Eaton Vance Series Trust II (the “Trust”), a Massachusetts business trust, which, including the Fund, contains a total of 2 series (the “Series”). The Trust is registered under the Investment Company Act of 1940 as an open-end management investment company. This Form N-CSR relates to the Fund’s annual report.

(a)-(d)

The following table presents the aggregate fees billed to the fund for the fund’s fiscal years ended October 31, 2023 and October 31, 2024 by the registrant’s principal accountant, Deloitte & Touche LLP (“D&T”), for professional services rendered for the audit of the fund’s annual financial statements and fees billed for other services rendered by D&T during such periods.

Eaton Vance Income Fund of Boston

| | | | | | | | |

Fiscal Years Ended | | 10/31/23 | | | 10/31/24 | |

Audit Fees | | $ | 98,600 | | | $ | 96,200 | |

Audit-Related Fees(1) | | $ | 0 | | | $ | 0 | |

Tax Fees(2) | | $ | 0 | | | $ | 0 | |

All Other Fees(3) | | $ | 833 | | | $ | 0 | |

| | | | | | | | |

Total | | $ | 99,433 | | | $ | 96,200 | |

| | | | | | | | |

| (1) | Audit-related fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit of financial statements and are not reported under the category of audit fees. |

| (2) | Tax fees consist of the aggregate fees billed for professional services rendered by the principal accountant relating to tax compliance, tax advice, and tax planning and specifically include fees for tax return preparation and other tax related compliance/planning matters. |

| (3) | All other fees consist of the aggregate fees billed for products and services provided by the principal accountant other than audit, audit-related, and tax services. |

The various Series comprising the Trust have differing fiscal year ends (October 31 or June 30). The following table presents the aggregate audit, audit-related, tax, and other fees billed to all of the Series in the Trust by D&T for the last two fiscal years of each Series.

| | | | | | | | | | | | | | | | |

Fiscal Years Ended | | 6/30/23 | | | 10/31/23 | | | 6/30/24 | | | 10/31/24 | |

Audit Fees | | $ | 86,700 | | | $ | 98,600 | | | $ | 80,600 | | | $ | 96,200 | |

Audit-Related Fees(1) | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

Tax Fees(2) | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

All Other Fees(3) | | $ | 38 | | | $ | 833 | | | $ | 0 | | | $ | 0 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 86,738 | | | $ | 99,433 | | | $ | 80,600 | | | $ | 96,200 | |

| | | | | | | | | | | | | | | | |

| (1) | Audit-related fees consist of the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit of financial statements and are not reported under the category of audit fees. |

| (2) | Tax fees consist of the aggregate fees billed for professional services rendered by the principal accountant relating to tax compliance, tax advice, and tax planning and specifically include fees for tax return preparation and other tax related compliance/planning matters. |

| (3) | All other fees consist of the aggregate fees billed for products and services provided by the principal accountant other than audit, audit-related, and tax services. |

(e)(1) The registrant’s audit committee has adopted policies and procedures relating to the pre-approval of services provided by the registrant’s principal accountant (the “Pre-Approval Policies”). The Pre-Approval Policies establish a framework intended to assist the audit committee in the proper discharge of its pre-approval responsibilities. As a general matter, the Pre-Approval Policies (i) specify certain types of audit, audit-related, tax, and other services determined to be pre-approved by the audit committee; and (ii) delineate specific procedures governing the mechanics of the pre-approval process, including the approval and monitoring of audit and non-audit service fees. Unless a service is specifically pre-approved under the Pre-Approval Policies, it must be separately pre-approved by the audit committee.

The Pre-Approval Policies and the types of audit and non-audit services pre-approved therein must be reviewed and ratified by the registrant’s audit committee at least annually. The registrant’s audit committee maintains full responsibility for the appointment, compensation, and oversight of the work of the registrant’s principal accountant.

(e)(2) No services described in paragraphs (b)-(d) above were approved by the registrant’s audit committee pursuant to the “de minimis exception” set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X.

(f) Not applicable.

(g) The following table presents (i) the aggregate non-audit fees (i.e., fees for audit-related, tax, and other services) billed for services rendered to all of the Series in the Trust by D&T for the last two fiscal years of each series; and (ii) the aggregate non-audit fees (i.e., fees for audit-related, tax, and other services) billed to the Eaton Vance organization by D&T for the last two fiscal years of each Series.

| | | | | | | | | | | | | | | | |

Fiscal Years Ended | | 6/30/23 | | | 10/31/23 | | | 6/30/24 | | | 10/31/24 | |

Registrant(1) | | $ | 38 | | | $ | 833 | | | $ | 0 | | | $ | 0 | |

Eaton Vance(2) | | $ | 0 | | | $ | 0 | | | $ | 18,490 | | | $ | 18,490 | |

| (1) | Includes all of the Series of the Trust. During the fiscal years reported above, certain of the Funds were “feeder” funds in a “master-feeder” fund structure or funds of funds. |

| (2) | Various subsidiaries of Morgan Stanley act in either an investment advisory and/or service provider capacity with respect to the Series and/or their respective “master” funds (if applicable). |

(h) The registrant’s audit committee has considered whether the provision by the registrant’s principal accountant of non-audit services to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant that were not pre-approved pursuant to Rule 2-01(c)(7)(ii) of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

| (a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

Eaton Vance

Income Fund of Boston

Annual Financial Statements and

Additional Information

October 31, 2024

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the prospectus and/or statement of additional information, which can be obtained by calling 1-800-262-1122 or from a financial intermediary. Prospective investors should read the prospectus carefully before investing.

Annual Financial Statements and Additional Information October 31, 2024

Eaton Vance

Income Fund of Boston

Eaton Vance

Income Fund of Boston

October 31, 2024

| Security | Shares | Value |

| Energy — 0.2% |

| Ascent CNR Corp., Class A(1)(2) | | 32,029,863 | $ 8,968,362 |

| | | | $ 8,968,362 |

| Environmental — 0.2% |

| GFL Environmental, Inc. | | 300,300 | $ 12,552,540 |

| | | | $ 12,552,540 |

| Gaming — 0.0% |

| New Cotai Participation Corp., Class B(1)(2)(3) | | 36 | $ 0 |

| | | | $ 0 |

| Healthcare — 0.1% |

| Endo, Inc.(3) | | 218,020 | $ 5,561,690 |

| | | | $ 5,561,690 |

| Leisure — 0.0% |

| iFIT Health and Fitness, Inc.(1)(2)(3) | | 128,520 | $ 0 |

| | | | $ 0 |

Total Common Stocks

(identified cost $11,918,741) | | | $ 27,082,592 |

| Security | Principal

Amount

(000's omitted) | Value |

| Homebuilders & Real Estate — 0.2% |

| Pebblebrook Hotel Trust, 1.75%, 12/15/26 | $ | 8,290 | $ 7,566,283 |

| | | | $ 7,566,283 |

| Utility — 0.3% |

| NextEra Energy Partners LP, 2.50%, 6/15/26(4) | $ | 19,038 | $ 17,901,280 |

| | | | $ 17,901,280 |

Total Convertible Bonds

(identified cost $25,230,216) | | | $ 25,467,563 |

| Security | Principal

Amount*

(000's omitted) | Value |

| Aerospace — 3.2% |

| Amentum Holdings, Inc., 7.25%, 8/1/32(4) | | 5,485 | $ 5,686,036 |

| Bombardier, Inc.: | | | |

| 7.00%, 6/1/32(4) | | 7,225 | 7,405,989 |

| 7.25%, 7/1/31(4) | | 8,710 | 9,009,694 |

| 7.875%, 4/15/27(4) | | 4,027 | 4,037,455 |

| 8.75%, 11/15/30(4) | | 11,185 | 12,133,108 |

| BWX Technologies, Inc.: | | | |

| 4.125%, 6/30/28(4) | | 9,145 | 8,736,176 |

| 4.125%, 4/15/29(4) | | 7,743 | 7,341,826 |

| Moog, Inc., 4.25%, 12/15/27(4) | | 11,173 | 10,661,486 |

| Rolls-Royce PLC: | | | |

| 3.625%, 10/14/25(4) | | 200 | 197,822 |

| 5.75%, 10/15/27(4) | | 32,331 | 33,013,604 |

| Science Applications International Corp., 4.875%, 4/1/28(4) | | 17,035 | 16,724,985 |

| TransDigm, Inc.: | | | |

| 4.625%, 1/15/29 | | 12,870 | 12,233,921 |

| 5.50%, 11/15/27 | | 20,169 | 20,008,394 |

| 6.375%, 3/1/29(4) | | 6,785 | 6,895,524 |

| 6.625%, 3/1/32(4) | | 10,835 | 11,031,972 |

| 6.75%, 8/15/28(4) | | 17,349 | 17,743,013 |

| | | | $ 182,861,005 |

| Air Transportation — 0.5% |

| VistaJet Malta Finance PLC/Vista Management Holding, Inc.: | | | |

| 6.375%, 2/1/30(4) | | 26,948 | $ 23,096,592 |

| 9.50%, 6/1/28(4) | | 4,439 | 4,365,542 |

| | | | $ 27,462,134 |

| Automotive & Auto Parts — 2.2% |

| Belron U.K. Finance PLC, 5.75%, 10/15/29(4) | | 18,960 | $ 19,011,382 |

| Clarios Global LP/Clarios U.S. Finance Co.: | | | |

| 4.375%, 5/15/26(5) | EUR | 23,968 | 26,073,470 |

| 8.50%, 5/15/27(4) | | 16,507 | 16,626,147 |

| Ford Motor Co., 4.75%, 1/15/43 | | 17,531 | 14,224,116 |

| Goodyear Tire & Rubber Co., 5.00%, 7/15/29 | | 13,448 | 12,187,208 |

| Real Hero Merger Sub 2, Inc., 6.25%, 2/1/29(4) | | 22,690 | 19,839,984 |

| Wand NewCo 3, Inc., 7.625%, 1/30/32(4) | | 17,454 | 18,053,346 |

| | | | $ 126,015,653 |

1

See Notes to Financial Statements.

Eaton Vance

Income Fund of Boston

October 31, 2024

Portfolio of Investments — continued

| Security | Principal

Amount*

(000's omitted) | Value |

| Broadcasting — 0.4% |

| Playtika Holding Corp., 4.25%, 3/15/29(4) | | 14,461 | $ 13,060,786 |

| Townsquare Media, Inc., 6.875%, 2/1/26(4) | | 11,647 | 11,614,319 |

| | | | $ 24,675,105 |

| Building Materials — 2.6% |

| Builders FirstSource, Inc.: | | | |

| 4.25%, 2/1/32(4) | | 26,747 | $ 23,948,408 |

| 5.00%, 3/1/30(4) | | 8,286 | 7,923,911 |

| CP Atlas Buyer, Inc., 7.00%, 12/1/28(4) | | 21,533 | 19,731,655 |

| MIWD Holdco II LLC/MIWD Finance Corp., 5.50%, 2/1/30(4) | | 7,025 | 6,729,449 |

| Smyrna Ready Mix Concrete LLC, 6.00%, 11/1/28(4) | | 27,640 | 27,438,675 |

| Standard Industries, Inc.: | | | |

| 2.25%, 11/21/26(5) | EUR | 2,250 | 2,369,774 |

| 3.375%, 1/15/31(4) | | 15,417 | 13,397,524 |

| 4.375%, 7/15/30(4) | | 21,439 | 19,717,296 |

| 4.75%, 1/15/28(4) | | 5,450 | 5,261,435 |

| 6.50%, 8/15/32(4) | | 7,140 | 7,191,022 |

| Summit Materials LLC/Summit Materials Finance Corp., 7.25%, 1/15/31(4) | | 13,383 | 13,918,521 |

| | | | $ 147,627,670 |

| Cable & Satellite TV — 1.9% |