SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material under Rule 14a-12 |

Parnassus Funds

(Name of Registrant as Specified in its Charter)

Parnassus Income Funds

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | 5. | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1. | | Amount Previously Paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

| | 3. | | Filing Party: |

| | 4. | | Date Filed: |

PARNASSUS FUNDS

PARNASSUS INCOME FUNDS

1 Market Street, Suite 1600

San Francisco, California 94105

July 19, 2021

Dear Valued Shareholders:

We need your help. Please take a minute to vote on a very important matter for the shareholders of the Parnassus Funds and Parnassus Investments, the Funds’ investment adviser.

Parnassus Investments has entered into an agreement to partner with Affiliated Managers Group, Inc. (AMG). We believe this partnership will support the sustainability and success of our firm and the Parnassus Funds for many years to come.

Most importantly, I want you to know that the way we invest your assets will not change with this agreement because AMG maintains the independence of each of its investment partners (its “Affiliates”). AMG’s partnership approach preserves each Affiliate’s unique entrepreneurial culture and fully independent investment decision-making process, and does not involve any integration of Affiliate firms or their operational or investment functions. Our commitment to investing for Principles and Performance® will carry forward, and our investment team will be making the same types of investment decisions in the future that we make today.

Under the law, the Parnassus Funds’ existing investment advisory agreements with Parnassus Investments will automatically terminate upon completion of the transaction with AMG. In order for Parnassus Investments to continue to manage the Parnassus Funds, shareholders must approve new investment advisory agreements.

If you have any questions after reviewing the enclosed materials, please call us at (888) 541-9895. Representatives are available Monday through Friday 9 a.m. to 10 p.m. Eastern time.

If you do not vote, you may receive a call from our proxy solicitation firm, AST Fund Solutions, LLC.

In closing, I would like to sincerely thank each and every one of you for investing in the Parnassus Funds and again encourage you to exercise your vote.

|

PARNASSUS FUNDS PARNASSUS INCOME FUNDS

Benjamin E. Allen President and Chief Executive Officer |

PARNASSUS FUNDS

PARNASSUS INCOME FUNDS

1 Market Street, Suite 1600

San Francisco, California 94105

Notice of Special Meeting of Shareholders

Parnassus Core Equity FundSM

Parnassus Mid Cap Growth FundSM

Parnassus Fixed Income FundSM

To be Held August 30, 2021

Dear Shareholders:

We invite you to attend a special meeting of shareholders of the Parnassus Core Equity Fund, the Parnassus Mid Cap Growth Fund and the Parnassus Fixed Income Fund (collectively, the “Funds”), which is being convened by the Parnassus Funds trust and the Parnassus Income Funds trust. The Funds are managed by Parnassus Investments.

The special meeting will be held on August 30, 2021, at 10:00 a.m., Pacific time, in a virtual meeting format only. As we describe in the accompanying proxy statement, the shareholders will vote on (1) a proposal to approve a new investment advisory agreement for each of the Funds; (2) a proposal to elect seven Trustees; and (3) any other business that properly comes before the special meeting.

Due to the public health and safety concerns of COVID-19, and to support the health and well-being of our shareholders and officers, and other attendees, the meeting will be held in a virtual meeting format only. You will not be able to attend the meeting in person.

IF YOU WOULD LIKE TO ATTEND THE VIRTUAL SHAREHOLDER MEETING, please send an email to attendameeting@astfinancial.com. Please use the email subject line “Parnassus Special Meeting”, and include in your email your full name along with your request for a meeting registration link. That information will be sent back to you, allowing you to register to attend the meeting. Requests to attend the meeting via conference call must be received no later than 1:00 p.m. Eastern time on August 27, 2021.

We have enclosed a proxy card with this proxy statement. Your vote is important, no matter how many shares you own. Even if you plan to attend the special meeting, please complete, date and sign the proxy card and mail it as soon as you can in the envelope we have provided, or complete your proxy by following the instructions supplied on the proxy card for voting by telephone or via the Internet. You retain the right to revoke the proxy at any time before it is actually voted by giving another proxy by mail, by calling the toll-free telephone number on the proxy card or through the Internet (including during the meeting). To be effective, such revocation must be received before your prior proxy is exercised at the meeting.

We look forward to your attendance at the special meeting.

|

PARNASSUS FUNDS PARNASSUS INCOME FUNDS

Benjamin E. Allen President and Chief Executive Officer |

San Francisco, California

July 19, 2021

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on August 30, 2021

The Proxy Statement and copies of the Funds’ most recent annual and semi-annual reports to shareholders are available at https://vote.proxyonline.com/ParnassusFunds/docs/2021.pdf.

PARNASSUS FUNDS

1 Market Street, Suite 1600

San Francisco, California 94105

Notice of Special Meeting of Shareholders

Parnassus Mid Cap FundSM

Parnassus Endeavor FundSM

To be Held August 30, 2021

Dear Shareholders:

We invite you to attend a special meeting of shareholders of the Parnassus Mid Cap Fund and the Parnassus Endeavor Fund (collectively, the “Funds”), which is being convened by the Parnassus Funds trust. The Funds are managed by Parnassus Investments.

The special meeting will be held on August 30, 2021, at 10:30 a.m., Pacific time, in a virtual meeting format only. As we describe in the accompanying proxy statement, the shareholders will vote on (1) a proposal to approve a new investment advisory agreement for each of the Funds and (2) any other business that properly comes before the special meeting.

Due to the public health and safety concerns of COVID-19, and to support the health and well-being of our shareholders and officers, and other attendees, the meeting will be held in a virtual meeting format only. You will not be able to attend the meeting in person.

IF YOU WOULD LIKE TO ATTEND THE VIRTUAL SHAREHOLDER MEETING, please send an email to attendameeting@astfinancial.com. Please use the email subject line “Parnassus Special Meeting”, and include in your email your full name along with your request for a meeting registration link. That information will be sent back to you, allowing you to register to attend the meeting. Requests to attend the meeting via conference call must be received no later than 1:00 p.m. Eastern time on August 27, 2021.

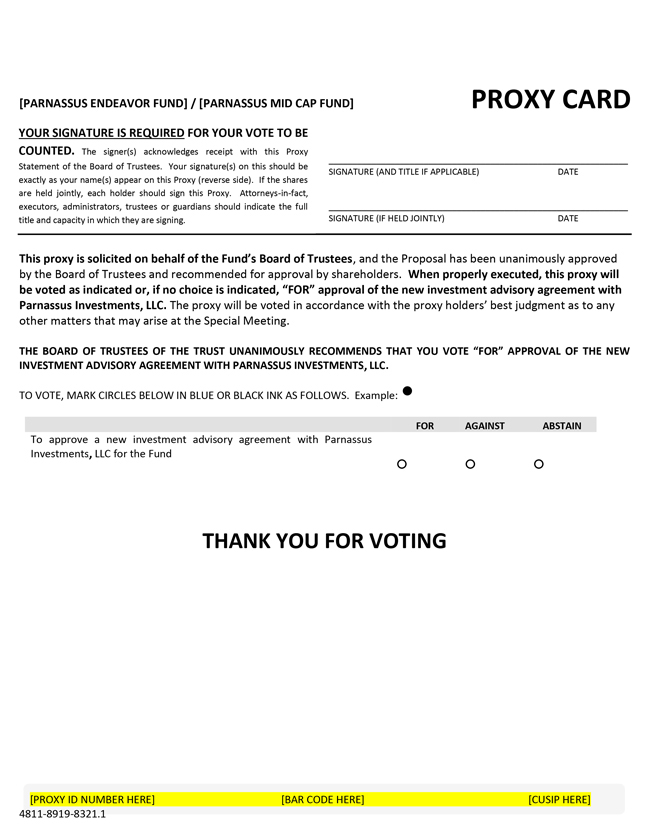

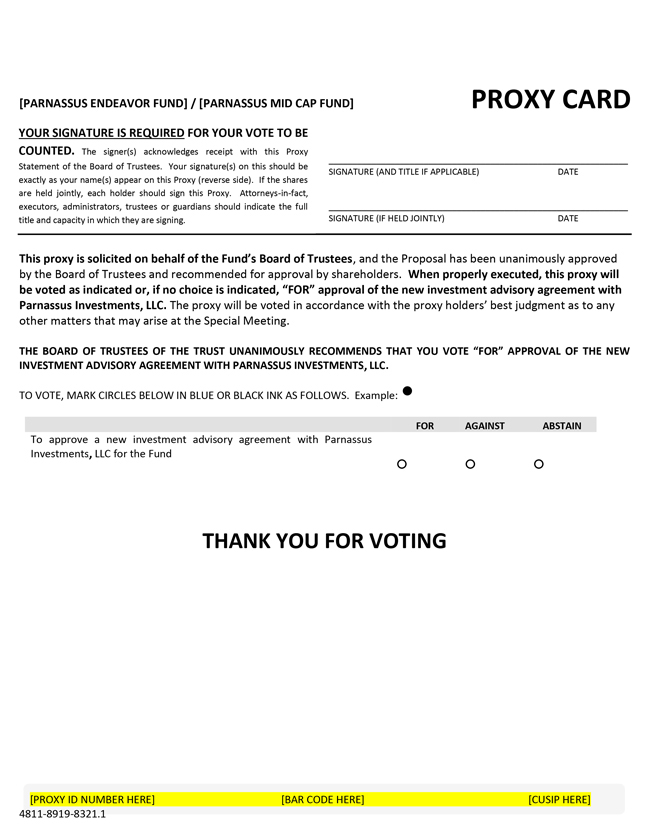

We have enclosed a proxy card with this proxy statement. Your vote is important, no matter how many shares you own. Even if you plan to attend the special meeting, please complete, date and sign the proxy card and mail it as soon as you can in the envelope we have provided, or complete your proxy by following the instructions supplied on the proxy card for voting by telephone or via the Internet. You retain the right to revoke the proxy at any time before it is actually voted by giving another proxy by mail, by calling the toll-free telephone number on the proxy card or through the Internet (including during the meeting). To be effective, such revocation must be received before your prior proxy is exercised at the meeting.

We look forward to your attendance at the special meeting.

|

PARNASSUS FUNDS

Benjamin E. Allen President and Chief Executive Officer |

San Francisco, California

July 19, 2021

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on August 30, 2021

The Proxy Statement and copies of the Funds’ most recent annual and semi-annual reports to shareholders are available at https://vote.proxyonline.com/ParnassusFunds/docs/2021.pdf.

PARNASSUS FUNDS

1 Market Street, Suite 1600

San Francisco, California 94105

Notice of Special Meeting of Shareholders

Parnassus Mid Cap FundSM

Parnassus Endeavor FundSM

To be Held August 30, 2021

Dear Shareholders:

We invite you to attend a special meeting of shareholders of the Parnassus Mid Cap Fund and the Parnassus Endeavor Fund (collectively, the “Funds”), which is being convened by the Parnassus Funds trust. The Funds are managed by Parnassus Investments.

The special meeting will be held on August 30, 2021, at 11:00 a.m., Pacific time, in a virtual meeting format only. As we describe in the accompanying proxy statement, the shareholders will vote on (1) a proposal to elect seven Trustees and (2) any other business that properly comes before the special meeting.

Due to the public health and safety concerns of COVID-19, and to support the health and well-being of our shareholders and officers, and other attendees, the meeting will be held in a virtual meeting format only. You will not be able to attend the meeting in person.

IF YOU WOULD LIKE TO ATTEND THE VIRTUAL SHAREHOLDER MEETING, please send an email to attendameeting@astfinancial.com. Please use the email subject line “Parnassus Special Meeting”, and include in your email your full name along with your request for a meeting registration link. That information will be sent back to you, allowing you to register to attend the meeting. Requests to attend the meeting via conference call must be received no later than 1:00 p.m. Eastern time on August 27, 2021.

We have enclosed a proxy card with this proxy statement. Your vote is important, no matter how many shares you own. Even if you plan to attend the special meeting, please complete, date and sign the proxy card and mail it as soon as you can in the envelope we have provided, or complete your proxy by following the instructions supplied on the proxy card for voting by telephone or via the Internet. You retain the right to revoke the proxy at any time before it is actually voted by giving another proxy by mail, by calling the toll-free telephone number on the proxy card or through the Internet (including during the meeting). To be effective, such revocation must be received before your prior proxy is exercised at the meeting.

We look forward to your attendance at the special meeting.

|

PARNASSUS FUNDS

Benjamin E. Allen President and Chief Executive Officer |

San Francisco, California

July 19, 2021

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on August 30, 2021

The Proxy Statement and copies of the Funds’ most recent annual and semi-annual reports to shareholders are available at https://vote.proxyonline.com/ParnassusFunds/docs/2021.pdf.

PARNASSUS FUNDS

PARNASSUS INCOME FUNDS

1 Market Street, Suite 1600

San Francisco, California 94105

PROXY STATEMENT

July 19, 2021

Dear Shareholders:

We are furnishing you with this proxy statement in connection with the solicitation of proxies by the Boards of Trustees of Parnassus Funds and Parnassus Income Funds (each referred to herein as a “Trust” and, collectively, as the “Trusts”), to be used at the special meetings of shareholders, which will be held virtually on Monday, August 30, at the times specified below, and at any adjournments, postponements, reschedulings or continuations thereof. We commenced distribution of this proxy statement and accompanying form of proxy on or about July 19, 2021.

| | | | |

Name of Funds Holding Special

Meeting | | Date and Time of Special Meeting | | Proposals Voted on at Special Meeting |

| | |

Parnassus Core Equity FundSM Parnassus Mid Cap Growth FundSM Parnassus Fixed Income FundSM | | August 30, 2021 10:00 a.m., Pacific time | | • Approval of a new investment advisory agreement among the Trusts, on behalf of each of the Funds, and Parnassus Investments, the investment adviser to the Funds. • Election of seven Trustees. |

| | |

Parnassus Mid Cap FundSM Parnassus Endeavor FundSM | | August 30, 2021 10:30 a.m., Pacific time | | • Approval of a new investment advisory agreement among the Trust, on behalf of each of the Funds, and Parnassus Investments, the investment adviser to the Funds. |

| | |

Parnassus Mid Cap FundSM Parnassus Endeavor FundSM | | August 30, 2021 11:00 a.m., Pacific time | | • Election of seven Trustees. |

1

IF YOU WOULD LIKE TO ATTEND THE VIRTUAL SHAREHOLDER MEETINGS, please send an email to attendameeting@astfinancial.com. Please use the email subject line “Parnassus Special Meeting”, and include in your email your full name along with your request for a meeting registration link. That information will be sent back to you, allowing you to register to attend the Meetings. Requests to attend the Meeting via conference call must be received no later than 1:00 p.m. Eastern time on August 27, 2021.

FREQUENTLY ASKED QUESTIONS

| Q: | Why have I received this proxy statement? |

Our Trustees have sent you this proxy statement to ask for your vote as a shareholder of one or more of the following funds: the Parnassus Mid Cap Fund, the Parnassus Mid Cap Growth Fund and the Parnassus Endeavor Fund, each a series of Parnassus Funds, and the Parnassus Core Equity Fund and the Parnassus Fixed Income Fund, each a series of Parnassus Income Funds. Each of the mutual funds referenced above is referred to herein, as a “Fund” and, collectively, as the “Funds”. The proxy statement is mailed by various vendors, depending upon where the shareholder��s account is serviced (direct with the Funds, at a broker or bank, etc.).

The Funds are soliciting your vote on the following proposals, if you owned shares of one or more of the Funds on the record date, July 2, 2021, for the special meetings. Shareholders will not be able to attend the meetings in person.

Proposals and Description

| | • | | Approval of a new investment advisory agreement among the Trusts, on behalf of each of the Funds, and Parnassus Investments, the investment adviser to the Funds. |

| | • | | Election of seven Trustees. |

Our Trustees are not aware of any other matter that will be presented to you at the special meetings.

| Q: | How may I vote my shares? |

By mail. You may vote by completing, dating and signing a proxy card and mailing it as soon as you can. The shares of shareholders who complete and properly sign a proxy card and return it before the special meetings will be voted as directed by such shareholder at the special meetings and any adjournments, postponements, reschedulings or continuations of the special

2

meetings. The shares of a shareholder who properly signs and returns a proxy card, but does not specify how to vote, will be voted for approval of the new investment advisory agreement and for the election of the nominees listed below, except that proxy cards returned by a broker to indicate a broker non-vote will not be so voted and will not constitute a vote “for” or “against” the proposals.

By telephone or via the Internet. Shareholders who hold their shares directly in their own names may vote by telephone or via the Internet by following the instructions supplied on the proxy card supplied by us. Shareholders who hold their shares in “street name” through a bank, broker, nominee, fiduciary or other holder of record may also be able to vote their shares by telephone or via the Internet, as a large number of banks and brokerage firms are participating in programs that allow such methods of voting. If a shareholder’s bank or brokerage firm is participating in programs that allow voting by telephone or via the Internet, then such bank or brokerage firm will provide the shareholder with instructions for voting by telephone or via the Internet. If a shareholder votes by telephone or via the Internet, then such shareholder does not need to return the proxy card by mail.

Telephone and Internet voting procedures are designed to authenticate shareholders’ identities to allow shareholders to give their voting instructions and to confirm that their instructions have been properly recorded.

| Q: | Who is entitled to vote? |

If you owned shares of the Funds as of the close of business on the record date, July 2, 2021, then you are entitled to vote. You will be entitled to one vote for each Fund share you hold, and fractional votes for each fractional Fund share you hold, as of the record date.

| Q: | Do I need to attend the special meeting in order to vote? |

No. You can vote by completing and mailing the enclosed proxy card, and by telephone and Internet, as explained herein and as provided on the proxy card.

| Q: | How will proxies be solicited? |

We will solicit proxies primarily by mail. In addition, certain of our officers and employees may solicit by telephone and personally. We will not pay these officers and employees specifically for soliciting proxies. Parnassus Investments and Affiliated Managers Group, Inc. will bear the out-of-pocket costs and expenses related to the special shareholder meetings, which include costs and expenses related to legal representation, a proxy solicitation firm, and the preparation, printing, mailing, filing and distribution of all proxy solicitation materials. We will reimburse brokers and other nominees for their reasonable expenses in communicating with the persons for whom they hold shares of the Funds.

3

We have engaged AST Fund Solutions, LLC, at AST Fund Solutions, 55 Challenger Road, Suite 201, Ridgefield Park, New Jersey 07660 for inquiries, to provide project management services, including the distribution of this proxy statement and related materials to shareholders as well as assisting us in soliciting proxies for the special meetings at an approximate cost of up to $3,609,880. As noted above, Parnassus Investments and Affiliated Managers Group, Inc. will bear this cost.

| Q: | How many shares of the Funds’ stock are entitled to vote? |

As of the July 2, 2021 record date, the number of shares of the Funds that were entitled to vote at the special meetings were: 462,736,364.321 shares of the Parnassus Core Equity Fund; 179,005,822.493 shares of the Parnassus Mid Cap Fund; 81,176,097.486 shares of the Parnassus Endeavor Fund; 17,323,858.292 shares of the Parnassus Mid Cap Growth Fund; and 26,116,958.223 shares of the Parnassus Fixed Income Fund.

| Q: | What happens if a special meeting is adjourned? |

Any one of the special meetings could be adjourned if, for example, a quorum does not exist or if sufficient votes to approve a proposal at that particular meeting are not received. If a special meeting is adjourned, then it will be reconvened at the same or some other place, to be announced at the meeting at which the adjournment is taken. At the adjourned special meeting, any business may be transacted that might have been transacted at the original special meeting. All proxies will be voted in the same manner as they would have been voted at the original convening of the special meeting, except for any proxies that have been effectively revoked or withdrawn prior to the time the proxy is voted at the reconvened meeting. For purposes of any adjournment, proxies will be voted “for” adjournment unless you direct otherwise by writing anywhere on the enclosed proxy that you will vote against any adjournments.

If the shareholders fail to elect one or more of the Trustees, then the applicable Board of Trustees will take such further action as it deems to be in the best interests of the Funds’ shareholders, which may include reducing the size of the Board in such a manner that a majority of the Trustees of the Funds consist of Trustees previously elected by shareholders, or reproposing the election of any Trustees who are not elected.

| Q: | What constitutes a quorum? |

A “quorum” refers to the number of shares that must be in attendance, in person or by proxy, at a meeting to lawfully conduct business. Virtual attendance at the meetings shall constitute in person attendance for purposes of calculating a quorum. A quorum is present with respect to the Funds if one-third of the shares entitled to be cast are present in person or by proxy.

4

| Q: | What happens if I sign and return my proxy card but do not mark my vote? |

Benjamin E. Allen, Marc C. Mahon and John V. Skidmore II, as proxies, will vote your shares to approve the new investment advisory agreement and to elect the nominees for Trustee.

Any shareholder giving a proxy may revoke it at any time before it is exercised by giving another proxy by mail, by calling the toll-free telephone number on the proxy card or through the Internet (including during the applicable special meeting). Presence at the special meeting by a shareholder who has signed a proxy does not itself revoke the proxy.

| Q: | Who will count the votes? |

A representative of AST Fund Solutions will tabulate the votes and John V. Skidmore II will act as inspector of election.

| Q: | What if I need technical assistance accessing or participating in the virtual shareholder meetings? |

If you encounter any difficulties accessing the virtual shareholder meetings, or during the meetings, please call (888) 541-9895.

| Q: | How can I obtain a copy of the annual report? |

You may request a copy of the latest annual report and the latest semi-annual report for the Funds by writing to Parnassus Funds, Attention: Secretary, 1 Market Street, Suite 1600, San Francisco, California 94105, by calling 1-800-999-3505, or you may view the reports at www.parnassus.com. We will furnish these copies free of charge.

5

PROPOSAL ON APPROVAL OF NEW INVESTMENT ADVISORY AGREEMENT

Introduction

Pursuant to investment advisory agreements between Parnassus Investments, a California corporation (together with the Company (as defined below), “Parnassus Investments” or the “Adviser”), and the Trusts on behalf of each Fund (each a “Current Investment Advisory Agreement” and collectively, the “Current Investment Advisory Agreements”), Parnassus Investments currently serves as the investment adviser to each of the Funds and is responsible for each Fund’s overall investment strategy and its implementation. Each Current Investment Advisory Agreement was amended and restated as of March 24, 2020 to reflect changes to the names of certain Funds and the reduction of certain advisory fees, which were immaterial changes not requiring shareholder approval. The Current Investment Advisory Agreements were last approved by the initial shareholder of each Fund immediately prior to the commencement of operations of such Fund (the Parnassus Mid Cap Growth Fund commenced operations on December 27, 1984; the Parnassus Endeavor Fund and the Parnassus Mid Cap Fund both commenced operations on April 29, 2005; the Parnassus Core Equity Fund and the Parnassus Fixed Income Fund both commenced operations on August 31, 1992). The continuation of the Current Investment Advisory Agreements was last approved by the Boards of Trustees of the Trusts (collectively, the “Board”) on March 26, 2021.

On July 2, 2021, Parnassus Investments entered into a purchase agreement with Affiliated Managers Group, Inc. (“AMG”) pursuant to which AMG agreed to purchase a majority interest in Parnassus Investments, LLC, a Delaware limited liability company wholly-owned by Parnassus Investments (the “Company”) (collectively, the “Transaction”). As part of the Transaction, Parnassus Investments will contribute substantially all of its assets and liabilities to the Company. AMG is a publicly traded Delaware corporation listed on the New York Stock Exchange, and whose affiliated investment management firms managed approximately $738 billion in assets as of March 31, 2021. Consummation of the Transaction would constitute an “assignment,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of each Fund’s Current Investment Advisory Agreement with Parnassus Investments. As required by the 1940 Act, each Current Investment Advisory Agreement provides for its automatic termination in the event of its assignment. In anticipation of the Transaction, shareholders of each Fund must approve a new investment advisory agreement (the “New Investment Advisory Agreement” and, collectively, the “New Investment Advisory Agreements”) between the applicable Trust, on behalf of its series, and Parnassus Investments to be effective upon the consummation of the Transaction. A Form of New Investment Advisory Agreement for each Trust, which contains the fee schedule for each Fund, is attached hereto as Exhibit A. THE NEW INVESTMENT ADVISORY AGREEMENTS FOR THE FUNDS WILL BE SUBSTANTIALLY SIMILAR

6

IN ALL MATERIAL RESPECTS TO EACH FUND’S CURRENT INVESTMENT ADVISORY AGREEMENT.

The Transaction is not expected to change in any way Parnassus Investments’ Fund management team, other personnel, day-to-day operations, or the services that Parnassus Investments provides to its clients, including the Funds. The current Fund managers of the Funds are expected to continue to manage the Funds following the consummation of the Transaction. The investment goals of the Funds will remain the same. The Transaction will have no effect on the number of shares you own or the value of those shares. The advisory fees payable by the Funds will not increase as a result of this Transaction.

The material terms of the Current Investment Advisory Agreements and the New Investment Advisory Agreements are described under “Description of the Current and New Investment Advisory Agreements” below.

Information Concerning the Transaction

The Transaction is expected to close during the second half of 2021 and is subject to the satisfaction or waiver of certain conditions, including, among others: (1) any applicable waiting period (and extension thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 relating to the Transaction having expired or been terminated, (2) Parnassus Investments maintaining a specified percentage of its revenues between signing and closing, and (3) certain key employees remaining employed with Parnassus Investments at and after the closing.

As part of the Transaction, certain key employees of Parnassus Investments have entered into employment agreements, to be effective at the closing of the Transaction, that provide for the continued service of each of them to Parnassus Investments for at least ten years after the closing. These employment agreements and related agreements provide for these individuals to be subject to long-term non-competition and non-solicitation provisions following the closing of the Transaction. As a key component of AMG’s approach, it is anticipated that subsequent generations of management will also own significant equity in the firm.

Upon the closing of the Transaction, Parnassus Investments expects to have the same personnel with the same responsibilities as before, including Fund management personnel of each Fund. In addition, senior principals of Parnassus Investments will continue to own direct equity in the firm, and additional principals will own equity. It is the shared view of AMG and Parnassus Investments that ongoing direct equity ownership in the business by a broad group of senior leaders will ensure a long-term orientation by leadership, and maintain Parnassus Investments’ unique and investment-centric entrepreneurial culture.

7

Board of Trustees Recommendation

On June 28, 2021, the Board, including the Trustees who are not “interested persons” (as defined under the 1940 Act) (the “Independent Trustees”), voted to approve the New Investment Advisory Agreements and to recommend their approval to Shareholders.

For information about the Board’s deliberations and the reasons for its recommendation, please see “Board of Trustees Evaluation” below.

THE TRUSTEES RECOMMEND THAT SHAREHOLDERS OF EACH FUND VOTE IN FAVOR OF THE APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENT APPLICABLE TO THEIR FUND.

Board of Trustees Evaluation

On June 28, 2021, the Board held a meeting at which it reviewed information about the Transaction and its potential impact on the Funds, considered the terms of the New Investment Advisory Agreements and approved the New Investment Advisory Agreements. Then on July 1, 2021, the Board approved the call of the special meetings to, among other things, submit the New Investment Advisory Agreements to shareholders for their approval. These meetings culminated a process that included: requesting and holding a meeting (which took place on May 26, 2021) with senior representatives of AMG and Parnassus Investments, and subsequently interviewing proposed nominees for Independent Trustees of the Funds, including those named in this Proxy Statement. The purpose of this process was to understand whether, after the Transaction, Parnassus Investments would remain able to perform its advisory and other services at least at the level to which Fund shareholders have become accustomed, which includes having access to funds sufficient to retain and enhance personnel and plan for their orderly succession over time (there being no material personnel changes contemplated as a consequence of the Transaction).

The Board also considered the approval of the New Investment Advisory Agreements, employing a process typically employed annually when the Board considers reapproving its investment advisory agreement with Parnassus Investments. Thus, as is the case typically, the Board and counsel to the Independent Trustees had an opportunity to review the information provided in advance of the meeting by Parnassus Investments and counsel to the Fund in response to a detailed series of questions submitted by counsel to the Fund before the meeting.

This information, in part, brought current the detailed information provided to the Board by Parnassus Investments with respect to the Board meeting held on March 26, 2021, in connection with the Board’s annual evaluation and approval of the continuance of the Current Investment Advisory Agreements. In evaluating the New Investment Advisory Agreements, the Board conducted a review that relied

8

upon this information, advice provided by Fund counsel and by counsel to the Independent Trustees, including advice provided in written memoranda outlining their legal duties, the due diligence review described above and the Board’s knowledge, resulting from its meetings throughout the year, of Parnassus Investments, its services and the Funds.

In approving the New Investment Advisory Agreements and determining to submit them to shareholders for approval, the Trustees considered several factors discussed below. The Board was advised by legal counsel to the Fund and legal counsel to the Independent Trustees with respect to their deliberations regarding the approval of the New Investment Advisory Agreements. The discussion below is not intended to be all-inclusive. The Board reviewed a variety of factors and considered a significant amount of information. The approval determinations were made on the basis of each Trustee’s business judgment after consideration of all the information presented. Individual Trustees may have given different weights to certain factors and assigned various degrees of materiality to information received in connection with the approval process.

Beneficial Consequences of the Transaction

The Board considered that the Transaction is expected to (i) provide for the operational independence of Parnassus Investments by allowing management to continue to run the day-to-day business of the Funds, (ii) preserve the Funds’ character, (iii) promote the long-term continuity of existing personnel, and (iv) allow for the ability to attract new personnel through substantial permanent management ownership participation. The Board considered that the Transaction would provide a framework and financing for generational succession, and it would eliminate the long-term risk of a disruptive “strategic” sale upon any major owners’ retirement. Finally, the Board noted that following the Transaction, the Funds will have the ability to access AMG’s substantial distribution resources for mutual funds, as well as to access other AMG strategic capabilities, including business and strategic consultation (for example, incentive alignment and long-term succession planning, legal and compliance resources, and information security consultation, among others).

Other Considerations

The Trustees, including all of the Independent Trustees, then reviewed the factors considered by the Trustees and their conclusions regarding the factors. So, prior to approving the New Investment Advisory Agreements, the Trustees, including the Independent Trustees meeting in executive session, considered, among other items:

| | • | | The nature and quality of the investment advisory services provided by the Adviser, including the Adviser’s organization and operations, financial condition and stability, and ownership structure; |

9

| | • | | The terms of the New Investment Advisory Agreements as compared to the terms of the Current Investment Advisory Agreements, and how the services to be performed by the Adviser under the New Investment Advisory Agreements compare to those performed under the Current Investment Advisory Agreements and to those performed for other accounts. |

| | • | | A comparison of the fees and expenses of the Funds to other similar funds, including a comparison of the Funds’ total expenses and the total expense ratios. |

| | • | | A comparison of the fee structures of other accounts managed by the Adviser. |

| | • | | Whether economies of scale are recognized by the Funds, and whether existing breakpoints are appropriate. |

| | • | | The costs and profitability of the Funds to the Adviser. |

| | • | | The independence, expertise, care, and conscientiousness of the Board of Trustees. |

| | • | | Short-term and long-term investment performance of the Funds. |

| | • | | The other benefits to the Adviser from serving as investment adviser to the Funds (in addition to the advisory fee). |

The material considerations and determinations of the Trustees, including all of the Independent Trustees, are as follows:

Nature and Quality of Investment Advisory Services

The Trustees noted that Parnassus Investments supervises the investment portfolios of the Funds, directing the day-to-day management of the Funds’ portfolios, including the purchase and sale of investment securities and the monitoring of the environmental, social and governance (ESG) aspects of the Funds. The Trustees then discussed with management the nature of the investment process employed by Parnassus Investments, including the interplay of the ESG research in the process of selecting investments. They determined that, as the Adviser’s processes are team-based and research intensive, it is important to have knowledgeable personnel and sufficient personnel to effectively manage the Funds.

This led to a discussion with the Adviser on the personnel and other resources at Parnassus Investments, including the experience of senior management; the qualifications, tenure, background and responsibilities of the portfolio managers primarily responsible for the day-to-day portfolio management of the Funds; and the personnel that manage the ESG aspect of the Funds. Based on this discussion, the Trustees concluded that Parnassus Investments is well staffed to conduct the research needed to meet the investment objectives of the Funds, as Parnassus Investments

10

regularly reviews its staffing levels and has regularly added staff and resources to ensure the Funds are properly serviced.

The Trustees noted that the material terms of the Current Investment Advisory Agreements and the New Investment Advisory Agreements are substantially the same.

In considering the nature, extent and quality of the services provided by Parnassus Investments, the Trustees reviewed written and oral reports prepared by Parnassus Investments describing the portfolio management, shareholder communication and servicing, prospective shareholder assistance and regulatory compliance services provided by Parnassus Investments to the Funds. The Trustees also considered a written report prepared by Broadridge, an independent provider of investment company data, comparing aspects of the portfolio management services provided by Parnassus Investments to similar services provided to a universe of comparable mutual funds (each a “Universe”). The Trustees also considered the quality of the material service providers to the Funds, who provide administrative and distribution services on behalf of the Funds and are overseen by Parnassus Investments, and the overall reputation and capabilities of Parnassus Investments. Based on this review, the Trustees believe that Parnassus Investments provides high quality services to the Funds, as the Funds generally compare favorably to the Universe and have generally performed well.

The Trustees also assessed the resources and personnel assigned to the administrator, which is affiliated with Parnassus Investments, and the Trustees concluded that the administrator has sufficient personnel and resources to service the Funds, and that the quality of the services they provide to the Funds are comparable to the quality of services that would be provided to a third party service provider.

The Independent Trustees evaluated the ability of Parnassus Investments, based on its financial condition, resources, reputation and other attributes to attract and retain qualified investment professionals, including research, advisory and supervisory personnel. They concluded that Parnassus Investments is a well-respected firm that is able to attract qualified professionals. The Independent Trustees further considered the compliance programs and compliance records of Parnassus Investments, noting that the Funds have a robust compliance program and that Parnassus Investments regularly uses its own resources to help enhance the Funds compliance program. In addition, the Independent Trustees took into account the administrative services provided to the Funds by Parnassus Investments, noting that the Funds filings are timely filed and that board materials are provided well in advance of meetings. Overall, the Trustees concluded that they were satisfied with the nature, extent and quality of the investment advisory services provided to the Funds by Parnassus Investments, and that the nature and extent of the services to be provided by Parnassus Investments are appropriate to assure that each Fund’s operations are conducted in compliance with applicable laws, rules and regulations.

11

Comparative Fees and Expenses

The Trustees then discussed with management the variables, in addition to the management fees, such as administrative and transaction fees, that impact costs to the shareholders of the Funds. They also reviewed reports comparing each Fund’s expense ratio to that of the applicable Universe and concluded overall that each Fund’s expense ratio was within the range of its respective Universe. The Trustees also reviewed reports comparing the advisory fees paid by each Fund to that of the applicable Universe and concluded overall that the advisory fee paid by each Fund was within the range of its respective Universe.

As part of the discussion with management, the Trustees ensured that they understood and were comfortable with the criteria used by Parnassus Investments to determine the mutual funds that make up each Universe for purposes of the materials provided at the meeting. Overall, the Trustees concluded that the Funds’ fees are reasonable in relation to the nature and quality of the services provided, and are reasonable when compared to the applicable Universe.

Comparison of Fee Structures of Other Accounts

The Trustees then inquired of management regarding the distinction between the services performed by Parnassus Investments for institutional separate accounts and those performed by Parnassus Investments for the Funds. Parnassus Investments noted that the management of the Funds involves more comprehensive and substantive duties than the management of institutional separate accounts. Specifically, Parnassus Investments noted the following:

| | • | | Parnassus Investments provides tailored investment advisory services to the Funds in order to accommodate the cash flow volatility presented by the purchases and redemptions of shareholders. |

| | • | | With regard to the Funds, Parnassus Investments attempts to serve the needs of thousands of accounts, ranging from direct accounts holding a few thousand dollars to the large omnibus accounts of intermediaries who in turn service thousands of large and small accounts. |

| | • | | Parnassus Investments maintains a robust shareholder communication effort for the Funds to reach shareholders through direct contact, through intermediaries, or via the financial press. |

| | • | | Parnassus Investments coordinates with the Funds’ Chief Compliance Officer and other service providers to ensure compliance with regulatory regimens imposed by Federal law and the Internal Revenue Code. |

| | • | | Parnassus Investments faces substantially greater litigation risk than other accounts Parnassus Investments manages due in part to the large number of retail shareholders. |

| | • | | Separate accounts do not require the same level of services and oversight, nor do they present the same compliance or litigation risk. |

12

The Trustees concluded that the services performed by Parnassus Investments for the Funds require a higher level of service and oversight than the services performed by Parnassus Investments for institutional separate accounts, and that the services performed by Parnassus Investments for the Funds present a higher level of compliance and litigation risk to Parnassus Investments. Based on this determination, the Trustees believe that the differential in advisory fees between the Funds and the institutional separate accounts are reasonable, and concluded that the fee rates charged to the Funds in comparison to those charged to Parnassus Investments’ other clients are reasonable.

In addition to the above, the Trustees discussed with management the fact that increasingly investors in the Funds invest through brokerage platforms (intermediaries), with fewer investors going directly to the Funds’ transfer agent. The Trustees noted that in connection with the intermediaries, Parnassus Investments absorbs all costs in excess of the fees paid by the Funds for sub-transfer agent services performed by the intermediaries. As result, the cost of obtaining, retaining and servicing shareholders for the Funds is significantly higher than the costs for separately managed accounts. The Trustees concluded that the payment of the intermediary service fees by Parnassus Investments further justify the differential in advisory fees between the Funds and the institutional separate accounts.

Economies of Scale

The Trustees noted that the investment advisory fee for each Fund contains a number of breakpoints in an effort to reflect economies of scale that might be realized as each Fund grows. The Independent Trustees also noted that actual or potential economies of scale will be reasonably shared with the Fund shareholders through these breakpoints, fee waivers and expense reimbursement arrangements applicable to the Funds. The Trustees concluded that the current fees and breakpoints were appropriate. They also concluded that the Adviser’s ongoing and significant investments into the Funds’ portfolio management, research and ESG teams results in a sharing of economies of scale that benefits the Funds and their shareholders.

Costs and Profitability

The Trustees reviewed a report of the costs of services provided, and the profits realized, by Parnassus Investments from its relationship with each Fund, and concluded, on a Fund-by-Fund basis, that such profits were reasonable and not excessive when compared to profitability guidelines set forth in relevant court cases. The Trustees also considered the impact of the intermediary service fees on the profitability of Parnassus Investments, and the resources and revenues that Parnassus Investments has put into managing and distributing the Funds, and concluded that this further supported the conclusion that the level of profitability realized by Parnassus Investments from its provision of services to the Funds is reasonable.

13

Performance

The Trustees compared the performance of each of the Funds to benchmark indices over various periods of time ended December 31, 2020 and to the Universe of comparable mutual funds as determined by Broadridge. They noted, on a comparative basis, that the overall, long-term performance of the Funds other than the Parnassus Fixed Income Fund has been strong. The Trustees noted that while the Parnassus Fixed Income Fund has slightly underperformed on a comparative basis, it has been within a reasonable range, and the Fund has had positive absolute performance.

The Trustees discussed how the Funds’ performance compares when the ESG component is factored into the analysis, and determined that the Funds’ performance is very strong. Based on the Trustees’ review of the Funds’ comparative performance, the Trustees concluded that the overall performance of the Funds warranted the continuation of the investment advisory agreements.

The Trustees noted that at each quarterly meeting, the Trustees review reports comparing the investment performance of the Funds to various indices. Based on the information provided at this meeting and the information and quarterly discussions regarding the Funds’ investment performance, the Trustees believe that Parnassus Investments manages the Funds in a manner that is materially consistent with their stated investment objective and style. The Trustees concluded that the Funds’ investment performance had generally been strong, particularly when factoring in the ESG component, and had confidence in the investment personnel of Parnassus Investments managing the Funds.

Fall-Out Benefits

The Trustees then considered other benefits to Parnassus Investments from serving as adviser to the Funds (in addition to the advisory fee). The Trustees noted that Parnassus Investments derives ancillary benefits from its association with the Funds in the form of proprietary and third party research products and services received from broker dealers that execute portfolio trades for the Funds. The Trustees determined such products and services have been used for legitimate purposes relating to the Funds by providing assistance in the investment decision-making process. The Trustees concluded that the other benefits realized by Parnassus Investments from its relationship with the Funds were reasonable.

Conclusion

After reviewing the materials provided for the meeting, management’s presentation, as well as other information regularly provided at the Board’s quarterly meetings throughout the year regarding the quality of services provided by Parnassus Investments, the performance of the Funds, expense information, regulatory compliance issues, trading information and related matters and other factors deemed

14

relevant by the Board, the Trustees, including all of the Independent Trustees, approved the New Investment Advisory Agreements.

Description of the Current and New Investment Advisory Agreements

The Forms of New Investment Advisory Agreements are attached as Exhibit A. The description of the terms of the New Investment Advisory Agreements that follows is qualified in its entirety by reference to that Exhibit.

The New Investment Advisory Agreements will be substantially similar in all material respects to each of the Current Investment Advisory Agreements. Under both the Current Investment Advisory Agreements and the New Investment Advisory Agreements, Parnassus Investments will continue to serve as attorney-in-fact to invest and reinvest the assets of the Funds. These duties of Parnassus Investments will be identical in all material respects to the duties provided under the Current Investment Advisory Agreements and Parnassus Investments’ fees for these services will remain unchanged under the New Investment Advisory Agreements. Under both the Current Investment Advisory Agreements and the New Investment Advisory Agreements, Parnassus Investments is responsible for managing the investments of each Fund, including, without limitation, providing investment research, advice and supervision, determining which Fund securities shall be purchased or sold by the Funds, purchasing and selling securities on behalf of the Funds and determining how voting and other rights with respect to Fund securities of the Funds shall be exercised, subject in each case to the control of the Board and in accordance with the objective, policies and principles of each Fund set forth in the Registration Statement, as amended, of the Fund, the requirements of the 1940 Act and other applicable law.

Under both the Current Investment Advisory Agreements and the New Investment Advisory Agreements, Parnassus Investments pays all of its expenses arising from the performance of its obligations under the agreements. The Funds are responsible for their operating expenses, including: (i) interest and taxes; (ii) brokerage commissions; (iii) insurance premiums; (iv) compensation and expenses of their Trustees other than those affiliated with the Adviser; (v) legal and audit expenses; (vi) fees and expenses related to the preparation of tax returns for the Funds; (vii) fees and expenses of the Funds’ custodian, transfer agent and accounting services agent; (viii) expenses incident to the issuance of their shares, including issuance on the payment of or reinvestment of dividends; (ix) fees and expenses incident to the registration under federal or state securities laws of the Funds or their shares; (x) expenses of preparing, printing and mailing reports and notices and proxy material to shareholders of the Funds; (xi) all other expenses incidental to holding meetings of the Funds’ shareholders; (xii) security pricing services of third-party vendors; (xiii) the cost of providing the record of proxy votes on the website; (xiv) dues or assessments of or contributions to the Investment Company Institute, the Social Investment Forum or any successor; and (xv) such nonrecurring expenses

15

as may arise, including litigation affecting the Funds and the legal obligations for which the Funds may have to indemnify their Officers and Trustees with respect thereto. In allocating brokerage transactions, the Adviser may consider research provided by brokerage firms.

Each of the Funds, under both the Current Investment Advisory Agreements and the New Investment Advisory Agreements, pays the Adviser a fee. The fee is computed and payable at the end of each month. The following annual percentages of each Fund’s average daily net assets are used:

| | • | | Parnassus Core Equity Fund: 0.75% of the first $30 million in assets; 0.70% of the next $70 million; 0.65% of the next $400 million; 0.60% of the next $9.5 billion; and 0.55% of the amount above $10 billion. |

| | • | | Parnassus Mid Cap Fund: 0.85% of the first $100 million in assets; 0.80% of the next $100 million; 0.75% of the next $300 million; and 0.70% of the amount above $500 million. |

| | • | | Parnassus Endeavor Fund: 0.85% of the first $100 million in assets; 0.80% of the next $100 million; 0.75% of the next $300 million; and 0.65% of the amount above $500 million. |

| | • | | Parnassus Mid Cap Growth Fund: 0.70% of the first $100 million in assets; 0.65% of the next $100 million; and 0.60% of the amount above $200 million. |

| | • | | Parnassus Fixed Income Fund: 0.50% of the first $200 million in assets; 0.45% of the next $200 million; and 0.40% of the amount above $400 million. |

For the fiscal year ended December 31, 2020, the Parnassus Core Equity Fund paid to Parnassus Investments aggregate advisory fees of $110,353,220; the Parnassus Mid Cap Fund paid to Parnassus Investments aggregate advisory fees of $38,541,003, and Parnassus Investments waived $278,485 of the fees; the Parnassus Endeavor Fund paid to Parnassus Investments aggregate advisory fees of $20,281,925, and Parnassus Investments waived $148,628 of the fees; the Parnassus Mid Cap Growth Fund paid to Parnassus Investments aggregate advisory fees of $5,772,003; and the Parnassus Fixed Income Fund paid to Parnassus Investments aggregate advisory fees of $1,509,642, and Parnassus Investments waived $232,872 of the fees. There were no affiliated brokerage transactions in the most recently completed fiscal year.

Under both the Current Investment Advisory Agreements and the New Investment Advisory Agreements, Parnassus Investments will be not liable to the Funds for any error of judgment or mistake of law or for any loss arising out of any investment or for any act or omission in the management of the Funds and the performance of its duties under the agreement except for losses arising out of Parnassus Investments’ willful misfeasance, bad faith, or gross negligence in the

16

performance of its duties or by reason of its reckless disregard of its obligations and duties under the agreement.

Under both the Current Investment Advisory Agreements and the New Investment Advisory Agreements, the term of the agreements shall continue in full force and effect for two years, and will continue in effect from year to year thereafter if such continuance is approved in the manner required by the 1940 Act, provided that the agreement is not otherwise terminated. Parnassus Investments may terminate the agreement at any time, without the payment of any penalty, upon 60 days’ written notice to the Funds. A Fund may terminate the agreement with respect to the Fund at any time, without the payment of any penalty, on 60 days’ written notice to Parnassus Investments by vote of either the majority of the Independent Trustees or a majority of the outstanding voting securities (as defined in Section 2(a)(42) of the 1940 Act) of the Fund. The agreements will automatically terminate in the event of their assignment (the term “assignment” for this purpose having the meaning defined in Section 2(a)(4) of the 1940 Act).

Reliance on Section 15(f) of the 1940 Act

The Board has been advised that, in connection with carrying out the Transaction, parties to the purchase agreement intend to rely on Section 15(f) of the 1940 Act which provides a non-exclusive safe harbor for an investment adviser to an investment company, and any of the investment adviser’s affiliated persons (as that term is defined in the 1940 Act) to receive any amount or benefit in connection with a change in control of the investment adviser so long as two conditions are met.

First, for a period of three years after the closing of the Transaction, at least 75% of the Board must be comprised of persons who are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the predecessor or successor adviser. The Fund intends to comply with this 75% requirement with respect to the Board for the three-year period following the closing of the Transaction.

The second condition of Section 15(f) is that, for a period of two years following the closing of the Transaction, there must not be imposed on the Funds any “unfair burden” as a result of the Transaction or any express or implied terms, conditions or understandings related to it. An “unfair burden” would include any arrangement whereby an adviser, or any “interested person” of the adviser, would receive or be entitled to receive any compensation, directly or indirectly, from the Funds or their shareholders (other than fees for bona fide investment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the Funds (other than bona fide ordinary compensation as principal underwriter for a Fund).

Each party to the purchase agreement has agreed to use its commercially reasonable efforts not to cause a Fund to take any action that would result in an

17

“unfair burden,” as defined above, for a period of not less than two years following the closing of the Transaction.

Information Regarding Parnassus Investments

Parnassus Investments, 1 Market Street, Suite 1600, San Francisco, California 94105, acts as investment adviser to the Funds, subject to the oversight of the Funds’ Boards of Trustees, and as such, supervises and arranges the purchase and sale of securities held in the Funds’ portfolios. The Adviser has been the investment manager of the Parnassus Funds trust since 1984 and of the Parnassus Income Funds trust since 1992. As of the date of this proxy statement, Jerome L. Dodson, the Chairperson of Parnassus Investments and former Chairperson of the Board of the Parnassus Funds trust and the Parnassus Income Funds trust, owns and controls the majority of the stock of the Adviser via his living trust and trusts for his children; therefore, Mr. Dodson can be considered a “control person” of the Adviser. Upon closing of the Transaction, Mr. Dodson will no longer own and control a majority of the stock of the Adviser and will not be a “control person” of the Adviser. The directors of Parnassus Investments are Jerome L. Dodson, retired; Thao N. Dodson, retired; Todd C. Ahlsten, Vice President and Chief Investment Officer of Parnassus Investments; Marc C. Mahon, Chief Financial Officer and Chief Operating Officer of Parnassus Investments; and Benjamin E. Allen, President and Chief Executive Officer of Parnassus Investments. The address of the executive officers and directors of the Adviser is 1 Market Street, Suite 1600, San Francisco, California 94105.

Parnassus Investments serves as the fund accounting and fund administration agent for the Funds, pursuant to the Amended and Restated Agreement for Fund Accounting and Fund Administration Services, dated May 1, 2021. Brown Brothers Harriman was appointed as sub-administrator, effective as of May 1, 2020, and assumed the fund accounting duties when it entered into an Administrative Agency Agreement, dated April 28, 2020, with Parnassus Investments. In this capacity, Brown Brothers Harriman handles all fund accounting services, including calculating the daily net asset values and is paid a fee for these Services by Parnassus Investments. As fund accountant and fund administrator, Parnassus Investments received the amounts detailed below for the fiscal year ended December 31, 2020: the Parnassus Core Equity Fund, the Parnassus Mid Cap Fund, the Parnassus Endeavor Fund, the Parnassus Mid Cap Growth Fund and the Parnassus Fixed Income Fund paid accounting and administrative fees of $5,953,474, $1,697,397, $942,929, $292,326 and $97,598, respectively. Following the Transaction, Parnassus Investments will continue to serve as the fund accounting and fund administration agent for the Funds, with Brown Brothers Harriman acting as sub-administrator.

Information Regarding AMG

AMG, a Delaware corporation with a principal place of business at 600 Hale Street, Prides Crossing, Massachusetts 01965, is a leading partner to independent

18

active investment management firms globally. AMG’s strategy is to generate long-term value by investing in a diverse array of excellent independent partner-owned firms, through a proven partnership approach, and allocating resources across AMG’s unique opportunity set to the areas of highest growth and return. AMG’s innovative partnership approach enables each Affiliate’s management team to own significant equity in their firm while maintaining operational and investment autonomy. In addition, AMG offers its Affiliates growth capital, global distribution, and other strategic value-added capabilities, which enhance the long-term growth of these independent businesses, and enable them to align equity incentives across generations of principals to build enduring franchises. As of March 31, 2021, AMG’s aggregate assets under management were approximately $738 billion across a broad range of active, return-oriented strategies. For more information, please visit the Company’s website at www.amg.com.

Shareholder Approval

Assuming a quorum is present, approval of each of the New Investment Advisory Agreements requires the affirmative vote of a “majority of the outstanding voting securities” (as defined in the 1940 Act) of the Fund entitled to vote on the New Investment Advisory Agreement, with all classes of that particular Fund voting together and not by class. Virtual attendance at the meetings shall constitute in person attendance for purposes of calculating a quorum. Shareholders are entitled to one vote for each Fund share they hold, and fractional votes for each fractional Fund share they hold, as of the record date. A “majority of the outstanding voting securities” of a Fund is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the special meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon.

In tallying shareholder votes for the meetings, abstentions (namely, shares for which a proxy is presented that abstains from voting) and “broker non-votes” (namely, shares held by brokers or nominees for which proxies are presented but as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote; and (ii) the broker or nominee does not have discretionary voting power on a particular matter) will be counted for purposes of determining whether a quorum is present at the meetings. With regard to the approval of the New Investment Advisory Agreements, abstentions and broker non-votes will have the same effect as a vote “against” the New Investment Advisory Agreements.

THE BOARD OF TRUSTEES, INCLUDING THE NON-INTERESTED TRUSTEES, UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE NEW INVESTMENT ADVISORY AGREEMENTS

19

PROPOSAL ON ELECTION OF TRUSTEES

Trustee Nominees

At the special meeting, shareholders are being asked to elect seven Trustees. Each Trustee will hold office during the lifetime of the Funds until the election of his or her successor, or until he or she sooner dies, resigns or is removed in accordance with the Funds’ charter documents.

Four of the nominees, Donald J. Boteler, Alecia A. DeCoudreaux, Kay Yun, and Benjamin E. Allen, are current Trustees. Roy Swan, Jr., Rajesh Atluru, and Eric P. Rakowski have not previously served on the Funds’ Boards of Trustees. Each nominee has consented to being named as a nominee and to serve if elected. As proxies, Benjamin E. Allen, Marc C. Mahon and John V. Skidmore II intend to vote for the election of all of the Trustees nominees. Should the Funds lawfully identify or nominate substitute nominees before the special meeting, the Funds will file supplemental proxy material that identifies such nominee(s), discloses whether such nominee(s) has (have) consented to being named in the proxy material and to serve if elected and includes the relevant required disclosures with respect to such nominee(s).

Certain important information regarding each of the nominees (including their principal occupations for at least the last five years) is set forth below. The Funds currently form a “Fund Complex” as defined in the Investment Company Act of 1940.

The Trustees and Officers of the Funds are as set forth on the following pages (ages and employment tenures listed are as of June 30, 2021).

| | | | | | | | | | | | |

Name, Age and Address | | Position with Funds | | Term of Office and Length of Time Served | | Principal Occupation During Past Five Years | | Directorships Outside the Parnassus Complex | | Number of

Funds in

Parnassus

Complex

Overseen by

Trustee | |

INDEPENDENT TRUSTEES (Trustees who are not deemed to be “interested persons” of the Funds as defined in the 1940 Act) | |

| | | | | |

Donald J. Boteler, 73 Parnassus

Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Trustee, Chair of Audit Committee | | Indefinite* Since May 2012 for Parnassus Income Funds and Parnassus Funds | | Retired. Trustee

of FAM Funds since 2012. Since 2016, has served as a member of the Town Council of South Bethany, Delaware and Chairman of the town’s Budget and Finance Committee. | | FAM Funds | | | 5 | |

| * | Subject to the mandatory retirement age |

20

| | | | | | | | | | | | |

Name, Age and Address | | Position with Funds | | Term of Office and Length of Time Served | | Principal Occupation During Past Five Years | | Directorships Outside the Parnassus Complex | | Number of

Funds in

Parnassus

Complex

Overseen by

Trustee | |

INDEPENDENT TRUSTEES (Trustees who are not deemed to be “interested persons” of the Funds as defined in the 1940 Act) | |

| | | | | |

Alecia A. DeCoudreaux, 66 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Trustee, Chairperson of Board | | Indefinite* Since December 2013 for Parnassus Income Funds and Parnassus Funds | | Director of CVS Health Corporation since 2015. President of Mills College from 2011 to 2016. Trustee Emerita of Wellesley College, Honorary Director of the Indiana University Foundation and Emerita Board Member of the Indiana University School of Law Board of Visitors. | | CVS Health Corporation | | | 5 | |

| | | | | |

Kay Yun, 58 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Trustee | | Indefinite* Since July 2017 for Parnassus Income Funds and Parnassus Funds | | Partner and Chief

Financial Officer at Health Evolution Partners in San Francisco since 2007. Currently a trustee at both the American Conservatory Theater and the San Francisco University High School. | | None | | | 5 | |

| | | | | |

Roy Swan, Jr., 57 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Nominee | | Indefinite* | | Head of The Ford Foundation’s Mission

Investments program, managing the foundation’s portfolio of mission-related investments, program-related investments, and grants dedicated to the impact investing field since 2018. Before joining the Ford Foundation in 2018, Mr. Swan was a managing director at Morgan Stanley, where he held roles including co-head of Global Sustainable Finance, President & COO of Morgan Stanley Trust, and founding CEO and Managing Member of Morgan Stanley Impact Small Business Investment Company LLC, where he remains a Managing Member. | | Aequi Acquisition Corp. | | | 5 | |

| * | Subject to the mandatory retirement age |

21

| | | | | | | | | | | | |

Name, Age and Address | | Position with Funds | | Term of Office and Length of Time Served | | Principal Occupation During Past Five Years | | Directorships Outside the Parnassus Complex | | Number of

Funds in

Parnassus

Complex

Overseen by

Trustee | |

INDEPENDENT TRUSTEES (Trustees who are not deemed to be “interested persons” of the Funds as defined in the 1940 Act) | |

| | | | | |

Rajesh Atluru, 52 Parnassus

Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Nominee | | Indefinite* | | Founder and Managing Director of Activate Capital, a private equity/venture capital investment firm focusing on sustainable investments in energy, mobility and industrial ecosystems. | | None | | | 5 | |

| | | | | |

Eric P. Rakowski, 63 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Nominee | | Indefinite* | | Professor of Law, University of California at Berkeley School of Law since 1990. | | AMG Funds (43 portfolios); AMG Pantheon Fund, LLC (1 portfolio); AMG Pantheon Master Fund, LLC (1 portfolio); AMG Pantheon Subsidiary Fund, LLC (1 portfolio); AMG Pantheon Lead Fund, LLC (1 portfolio); Harding, Loevner Funds, Inc. (10 portfolios); Third Avenue Trust (3 portfolios) (2002-2019); and Third Avenue Variable Trust (1 portfolio) (2002-2019) | | | 5 | |

| * | Subject to the mandatory retirement age |

22

| | | | | | | | | | |

Name, Age and Address | | Position with Funds | | Term of Office and Length of Time Served | | Principal Occupation During Past Five Years | | Directorships Outside the Parnassus Complex | | Number of Funds in Parnassus Complex Overseen by Trustee |

INTERESTED TRUSTEE (Mr. Allen is an “interested person” of the Funds as defined in the 1940 Act because of his ownership in the Adviser) |

| | | | | |

Benjamin E. Allen,

43 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | President and Chief Executive Officer and Trustee | | Indefinite Since 2017 | | Chief Executive Officer of Parnassus Investments since 2018. President of Parnassus Investments since 2017. Vice President of Parnassus Investments from 2008 to 2017; employed by Parnassus Investments since 2005. Portfolio Manager of the Parnassus Core Equity Fund since 2012. Vice President of Parnassus Funds and Parnassus Income Funds from 2015 to 2017. | | None | | 5 |

| | | | | | |

Name, Age and Address | | Positions with Funds | | Term of Office and Length of Time Served | | Principal Occupation During Past Five Years |

OFFICERS (other than Benjamin E. Allen) |

| | | |

Todd C. Ahlsten, 48 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Vice President | | Indefinite Since 2001 | | Chief Investment Officer and Vice President of Parnassus Investments since 2007; employed by Parnassus Investments since 1995. Portfolio Manager of the Parnassus Core Equity Fund since 2001. Vice President of Parnassus Funds and Parnassus Income Funds since 2001. |

| | | |

Marc C. Mahon, 44 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Executive Vice President, Principal Accounting Officer and Treasurer | | Indefinite As Principal Accounting Officer and Treasurer, since 2007 As Executive Vice President, since July 2017 | | Chief Financial Officer of Parnassus Investments since 2007. Chief Operating Officer of Parnassus Investments since 2018. Executive Vice President of Parnassus Investments since 2017. |

23

| | | | | | |

Name, Age and Address | | Positions with Funds | | Term of Office and Length of Time Served | | Principal Occupation During Past Five Years |

OFFICERS (other than Benjamin E. Allen) |

| | | |

John V. Skidmore II, 55 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Chief Compliance Officer, Fidelity Bond Officer and Secretary | | Indefinite Since 2008 | | Chief Compliance Officer of Parnassus Funds, Parnassus Income Funds and Parnassus Investments since 2008. |

| | | |

Downey H. Blount, 50 Parnassus Investments 1 Market Street, Ste. 1600 San Francisco, CA 94105 | | Assistant Secretary | | Indefinite Since 2015 | | Deputy Chief Compliance Officer of Parnassus Investments since January 1, 2019. Chief Compliance Officer of Parnassus Funds Distributor from 2015 to April 30, 2019. Senior Compliance Officer of Parnassus Investments from 2014 to 2018. |

Benjamin E. Allen was appointed as a Trustee effective as of January 1, 2021, replacing Jerome L. Dodson, who retired as a Trustee. Mr. Allen is President and Chief Executive Officer of Parnassus Investments, where he has worked since 2005. He is a portfolio manager of the Core Equity Fund and has been a portfolio manager since 2012. Mr. Allen has been President of the Funds since 2017 and Chief Executive of the Funds since 2017. His experience and skills as a portfolio manager, as well as his familiarity with the investment strategies utilized by Parnassus Investments for the Funds, led to the conclusion that he should serve as a Trustee.

Donald J. Boteler and Alecia A. DeCoudreaux have served as Trustees from 2012 and 2013, respectively, and Kay Yun was appointed as a Trustee in 2017. Mr. Boteler’s knowledge of the investment advisory industry and the regulatory framework that governs mutual funds are beneficial to the Funds’ operations. Ms. DeCoudreaux’s management and corporate governance experience help ensure that the Funds adhere to best practices in their governance. Ms. Yun’s broad experience with investments and issuers allows her to provide insight on industry and regulatory developments that benefit the Funds. Also, as reflected in the information provided in the table above, they are all experienced business persons and consultants, familiar with financial statements and responsible investing. We believe each takes a constructive and thoughtful approach to addressing issues facing the Funds, and are well qualified to serve as Trustees.

Roy Swan, Jr. is well qualified to serve as a Trustee due to his significant experience in impact investment, finance, and public company management. Rajesh Atluru is well qualified to serve as a Trustee due to his subject matter expertise in sustainability and technology, and his investment experience. Eric P. Rakowski is well qualified to serve as a Trustee due to his knowledge about the investment advisory business, including mutual fund distribution, portfolio valuation,

24

compliance, and auditing, and his governance experience serving as a mutual fund director.

As discussed above, the combination of skills and attributes of all of the nominees led to the conclusion that each should serve as a Trustee. The mandatory retirement age for Independent Trustees is 75.

The Funds’ Boards of Trustees decide matters of general policy and supervise the activities of the Adviser. All Trustees serve indefinite terms (subject to the mandatory retirement age for Independent Trustees), and they each oversee five Funds in the Fund Complex. Each of the Trusts has its own Board of Trustees. The same individuals serve as Trustees and Officers of each Trust. The Funds’ Officers conduct and supervise the daily business operations of the Funds. Alecia A. DeCoudreaux serves as the Chairperson of the Board, and is the presiding officer at all meetings of the Boards of Trustees.

The Trustees have determined that the leadership structure is appropriate as they believe they have ample input into their meetings, ample access to information about the Funds, and effective communications with management of the Adviser. Also, having an Independent Trustee serves as the Chairperson and a supermajority of Independent Trustees (75% of the Board is comprised of Independent Trustees) allows the Board and management to have proper alignment and dialogue on all matters within the authority of the Board, including those related to risk oversight.

Trustee Compensation

For the fiscal year ended December 31, 2020, the Trusts paid each of their Trustees who is not affiliated with the Adviser an aggregate annual fee of $150,000 in addition to reimbursement for certain out-of-pocket expenses. For the fiscal year ending December 31, 2021, the Trusts will pay each of their Trustees who is not affiliated with the Adviser an aggregate annual fee of $175,000, in addition to reimbursement for certain out-of-pocket expenses. The Funds comprise a “family of investment companies.” The Trusts have no retirement or pension plans for their Trustees.

The following table sets forth the aggregate compensation paid by the Trusts and the Boards of any other investment companies managed by Parnassus Investments to the Trustees who are not affiliated with the Adviser for the fiscal year

25

ended December 31, 2020. Roy Swan, Jr., Rajesh Atluru, and Eric P. Rakowski have not previously served on the Fund’s Board of Trustees.

| | | | | | | | | | | | |

Name and

Position(1) | | Aggregate

Compensation

From Funds | | | Pension or Retirement

Benefits Accrued as

Part of Fund Expenses | | | Total Compensation from

Fund and Fund Complex

Paid to Trustees | |

Donald J. Boteler | | $ | 150,000 | | | | None | | | $ | 150,000 | |

Alecia A. DeCoudreaux | | $ | 150,000 | | | | None | | | $ | 150,000 | |