UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip Code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

Parnassus Value Equity Fund

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Value Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks that are attractively priced relative to their history or peers.

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $33 | 0.65% |

How did the fund perform?

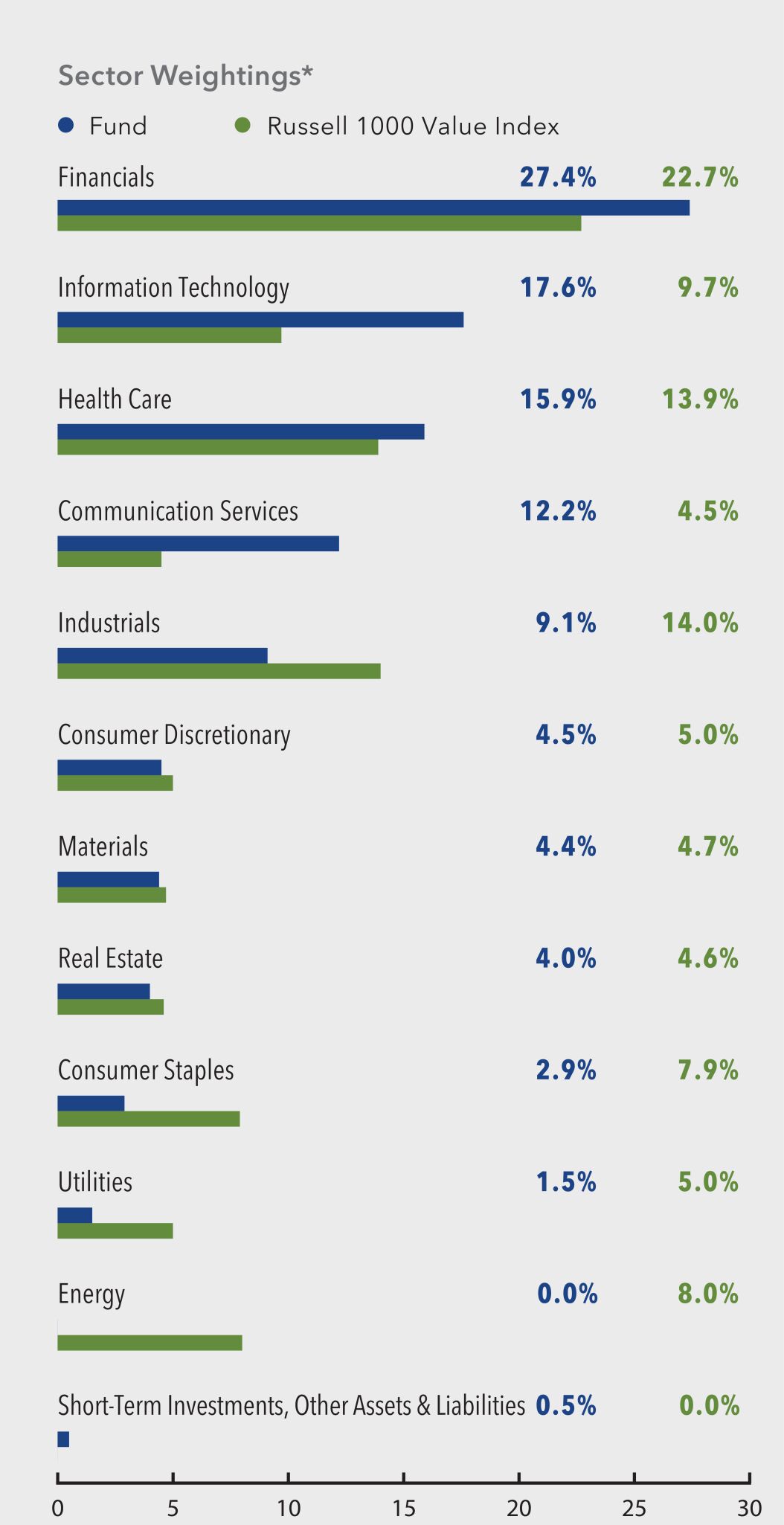

Parnassus Value Equity Fund (Institutional Shares) returned -3.74% (net of fees) for the quarter, underperforming the Russell 1000 Value Index. Stock selection in the Health Care sector drove most of the underperformance. Selection in the Consumer Staples and Industrials sectors detracted to a lesser degree.

The portfolio's positioning remained steady. The Fund maintained its overweights in Information Technology, Communication Services and Financials. We sold Cisco Systems and bought Broadcom for more attractive networking exposure, while adding to our existing cable positions.

We maintained diversification. Our artificial intelligence-related (AI-related) investments in information technology were complemented by holdings that provided exposure to other parts of the economy.

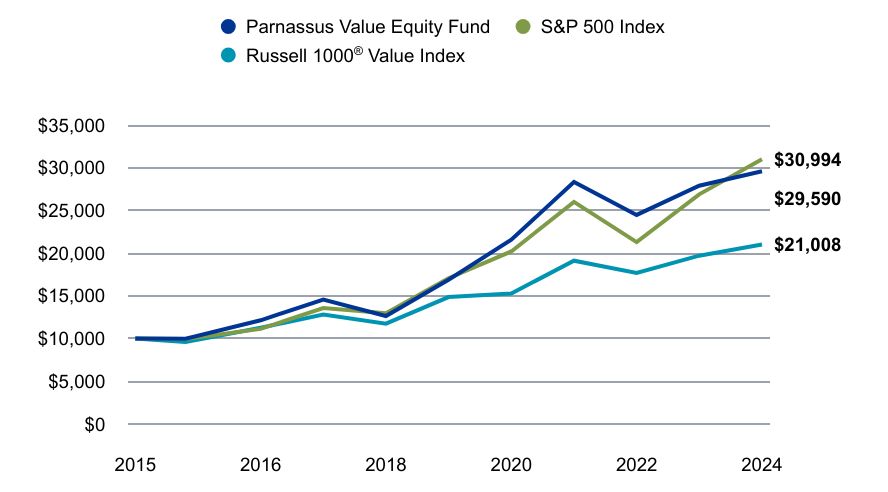

Value on June 30, 2024 of $10,000 invested on April 30, 2015.

| Parnassus Value Equity Fund | S&P 500 Index | Russell 1000® Value Index |

|---|

| | | |

|---|

| 2015 | $10,000 | $10,000 | $10,000 |

| 2015 | $9,978 | $9,947 | $9,597 |

| 2016 | $12,141 | $11,137 | $11,262 |

| 2017 | $14,573 | $13,569 | $12,801 |

| 2018 | $12,642 | $12,974 | $11,742 |

| 2019 | $16,885 | $17,059 | $14,859 |

| 2020 | $21,565 | $20,197 | $15,274 |

| 2021 | $28,330 | $25,995 | $19,117 |

| 2022 | $24,476 | $21,287 | $17,676 |

| 2023 | $27,888 | $26,883 | $19,703 |

| 2024 | $29,590 | $30,994 | $21,008 |

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The Fund commenced operations on April 30, 2015.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $4,902,949,310 |

| # of Portfolio Holdings | 44 |

| Portfolio Turnover Rate | 10% |

| Advisory Fees Paid | $15,609,747 |

Average Annual Total Returns (%)

| 1 Year | 5 years | Since Inception |

|---|

| Parnassus Value Equity Fund - Institutional Shares (Incp: April 30, 2015) | 15.38% | 14.59% | 12.56% |

| S&P 500 Index | 24.56% | 15.05% | 13.13% |

Russell 1000® Value Index | 13.06% | 9.01% | 8.43% |

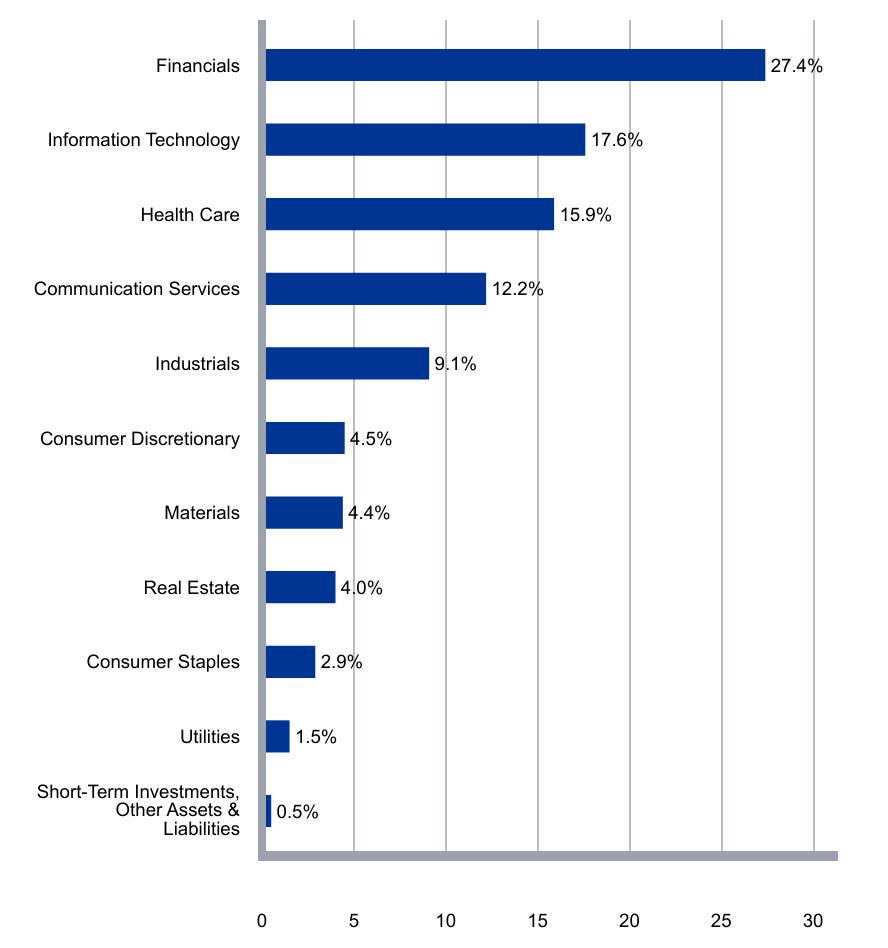

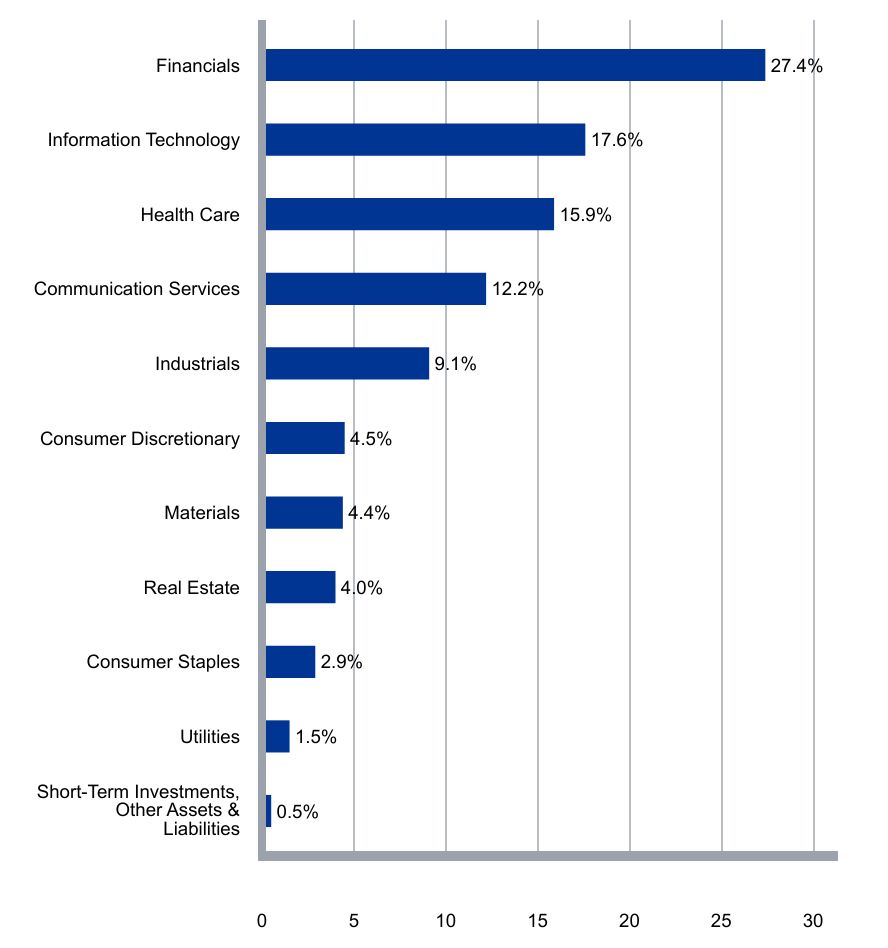

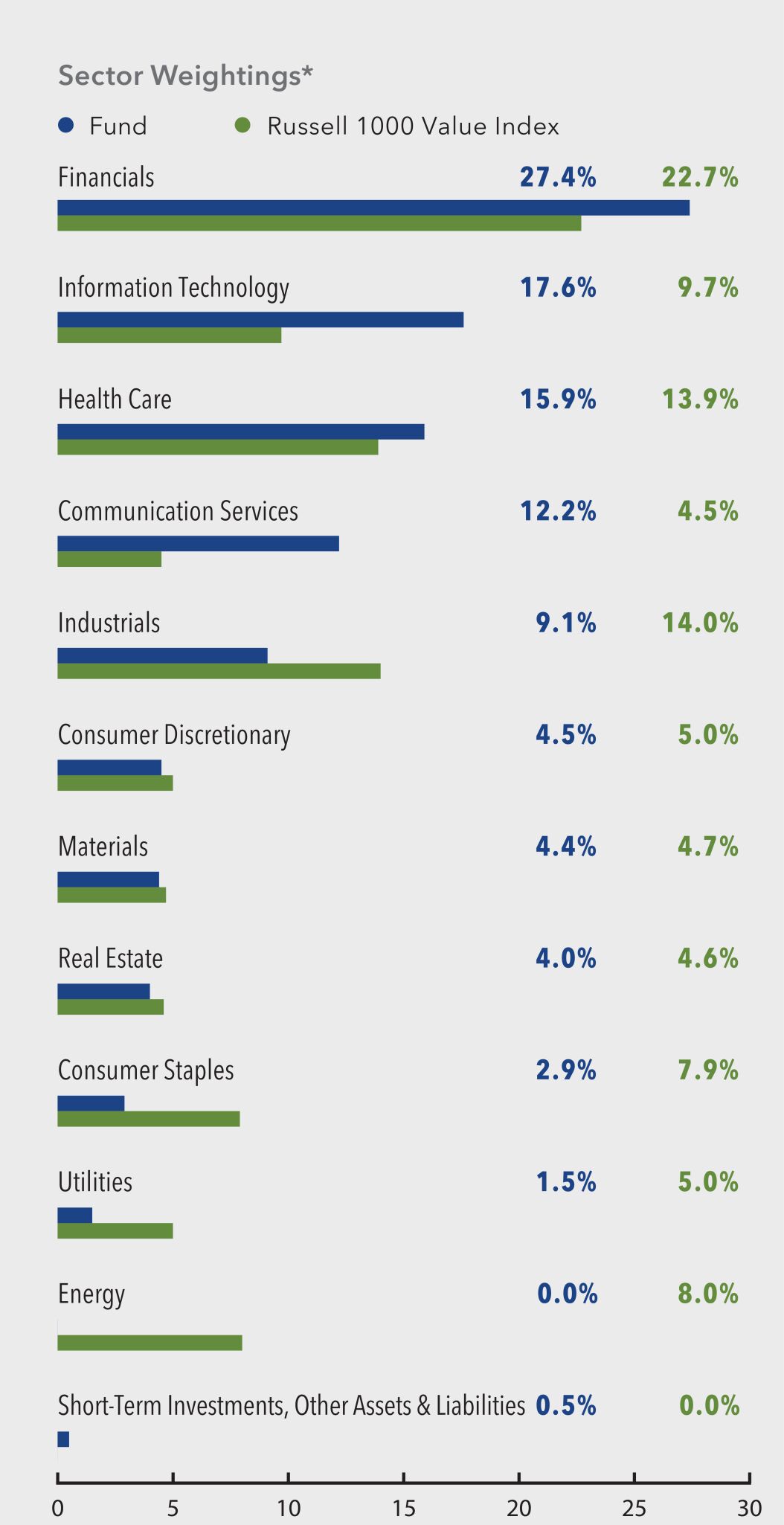

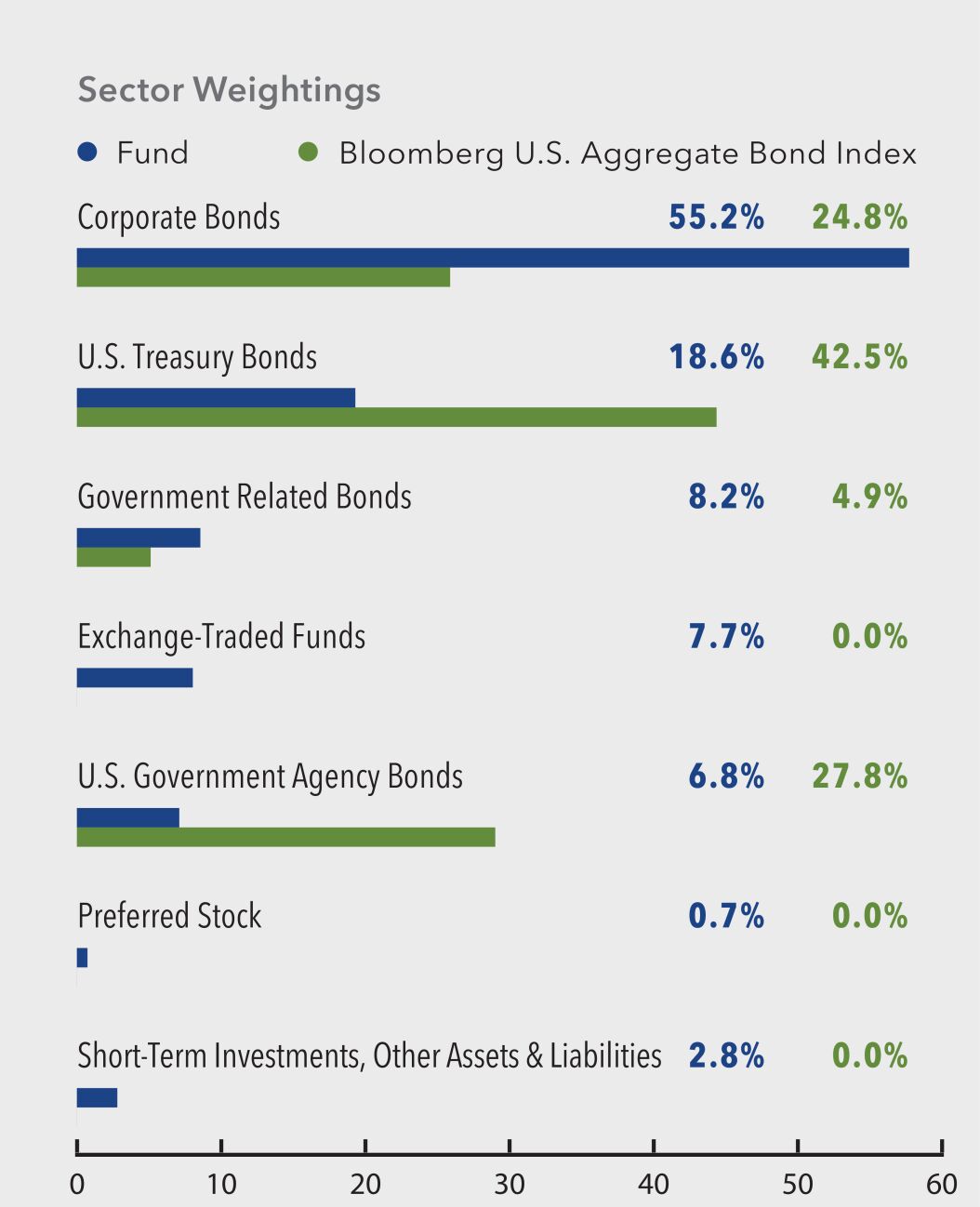

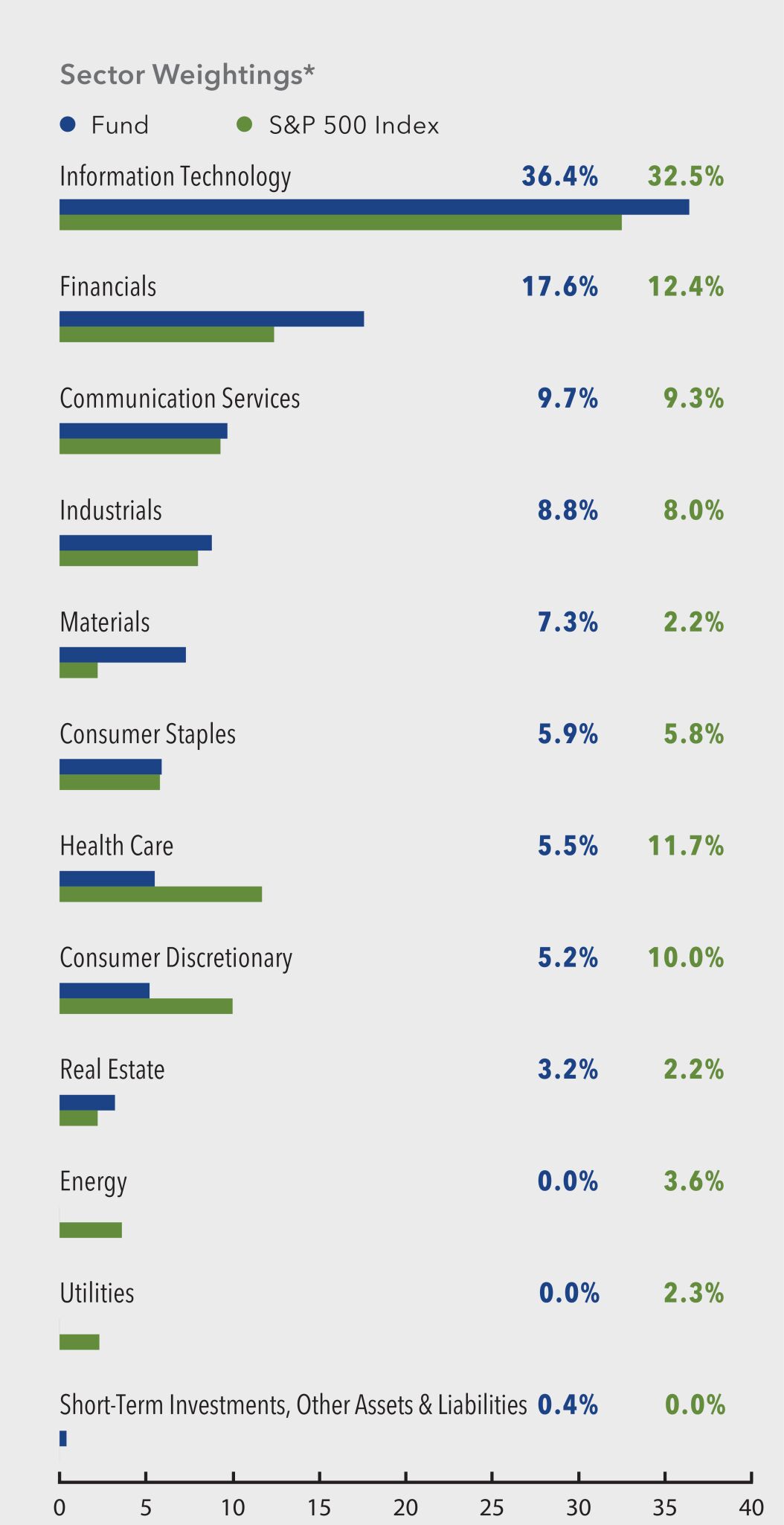

What did the Fund invest in?

Parnassus Value Equity Fund invests selectively in about 40-45 U.S. large-cap equity securities trading at a discount. The Fund pursues companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.5% |

| Utilities | 1.5% |

| Consumer Staples | 2.9% |

| Real Estate | 4.0% |

| Materials | 4.4% |

| Consumer Discretionary | 4.5% |

| Industrials | 9.1% |

| Communication Services | 12.2% |

| Health Care | 15.9% |

| Information Technology | 17.6% |

| Financials | 27.4% |

| Verizon Communications Inc. | 4.2% |

| Bank of America Corp. | 3.5% |

| Oracle Corp. | 3.3% |

| S&P Global Inc. | 3.0% |

| Alphabet Inc., Class A | 3.0% |

| Sysco Corp. | 2.9% |

| Ball Corp. | 2.8% |

| The Bank of New York Mellon Corp. | 2.8% |

| Micron Technology Inc. | 2.7% |

| Microsoft Corp. | 2.7% |

Parnassus Value Equity Fund

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Growth Equity Fund

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Growth Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks with the potential to benefit from secular trends at attractive valuations.

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $34 | 0.63% |

How did the fund perform?

The Parnassus Growth Equity Fund (Institutional Shares) returned 3.78% (net of fees) for the quarter, underperforming the Russell 1000 Growth Index. The underperformance was primarily driven by our stock selection in the Information Technology sector. An overweight position and stock selection in the Financials sector also detracted.

We took advantage of recent sell-offs to add two new positions in Financials and Information Technology: MSCI and Workday, respectively. We offset these new holdings by trimming our existing positions and selling Palo Alto Networks within Information Technology.

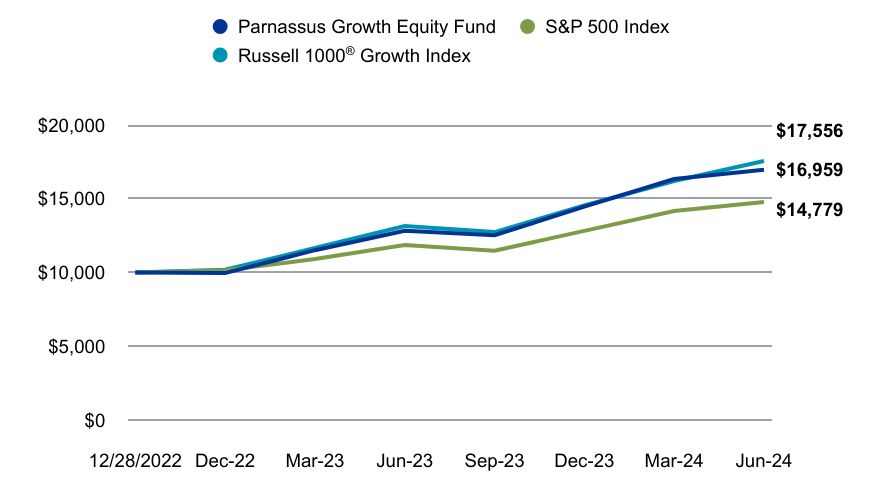

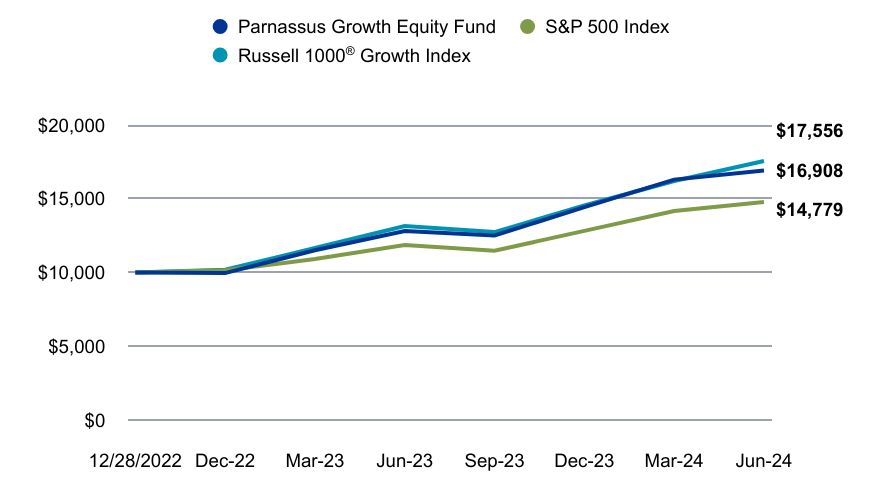

Value on June 30, 2024 of $10,000 invested on December 28, 2022.

| Parnassus Growth Equity Fund | S&P 500 Index | Russell 1000® Growth Index |

|---|

| | | |

|---|

| 12/28/2022 | $10,000 | $10,000 | $10,000 |

| Dec-22 | $9,960 | $10,151 | $10,194 |

| Mar-23 | $11,513 | $10,912 | $11,659 |

| Jun-23 | $12,827 | $11,866 | $13,152 |

| Sep-23 | $12,527 | $11,477 | $12,741 |

| Dec-23 | $14,460 | $12,819 | $14,545 |

| Mar-24 | $16,341 | $14,172 | $16,205 |

| Jun-24 | $16,959 | $14,779 | $17,556 |

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The Fund commenced operations on December 28, 2022.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $49,937,183 |

| # of Portfolio Holdings | 41 |

| Portfolio Turnover Rate | 15% |

| Advisory Fees Paid | $21,511 |

Average Annual Total Returns (%)

| 1 Year | Since Inception |

|---|

| Parnassus Growth Equity Fund - Institutional Shares (Incp: December 28, 2022) | 32.21% | 42.03% |

| S&P 500 Index | 24.56% | 29.63% |

Russell 1000® Growth Index | 33.48% | 45.33% |

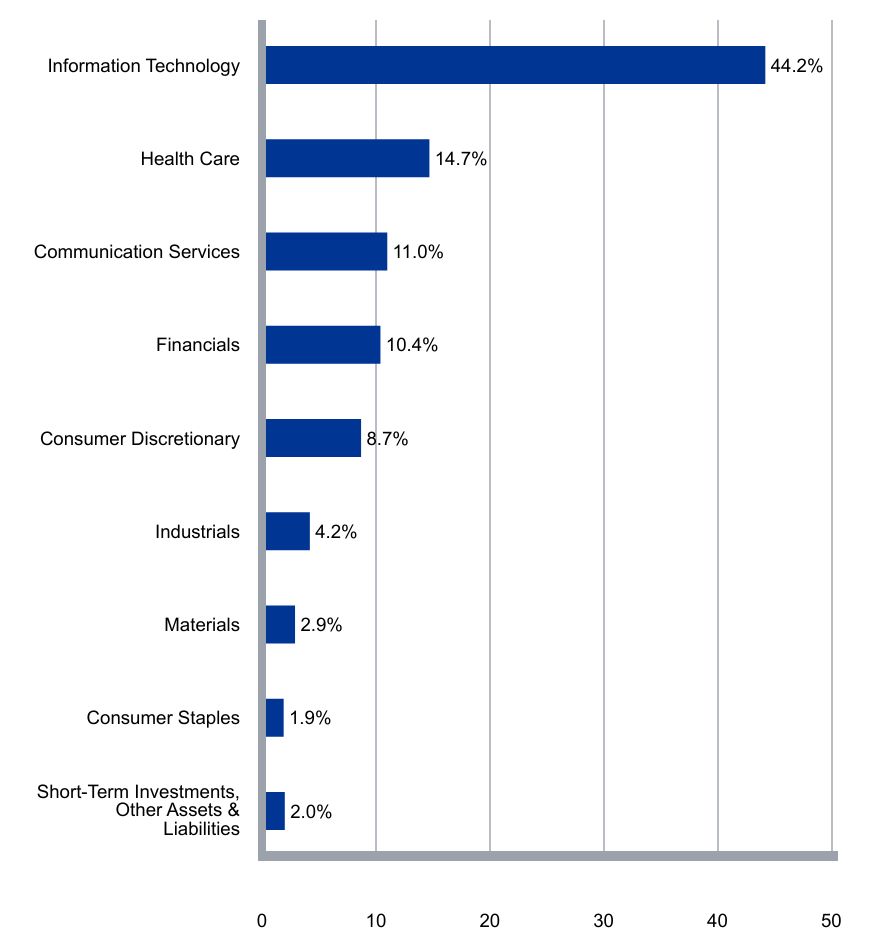

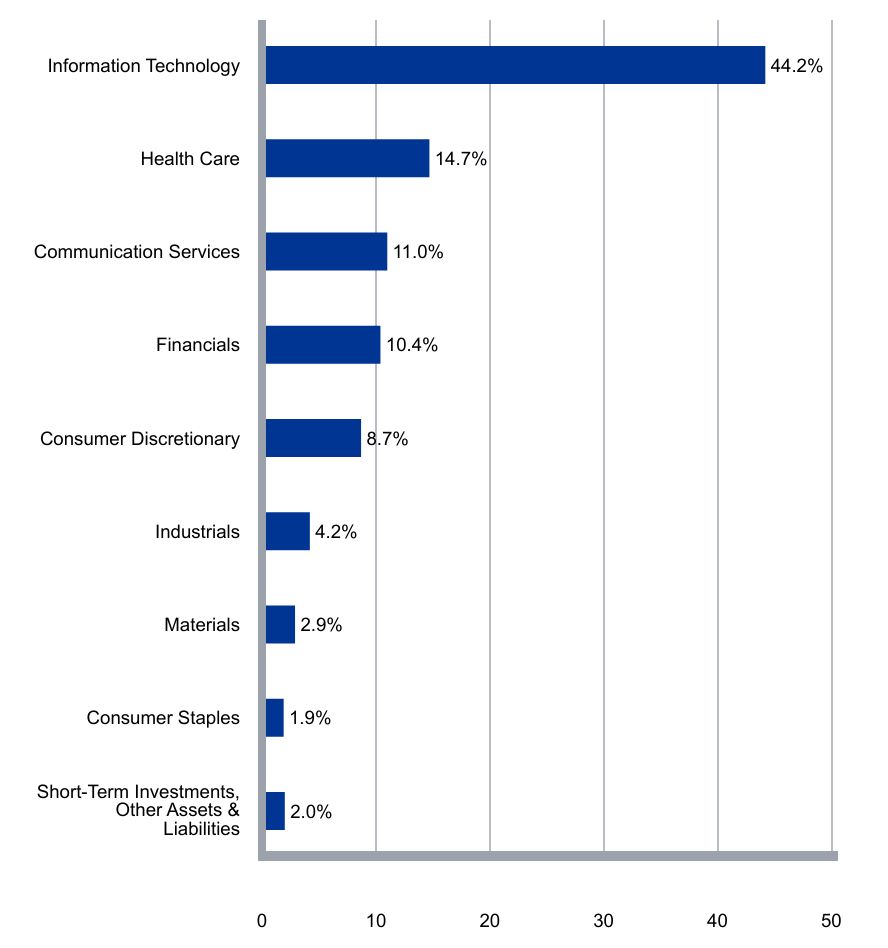

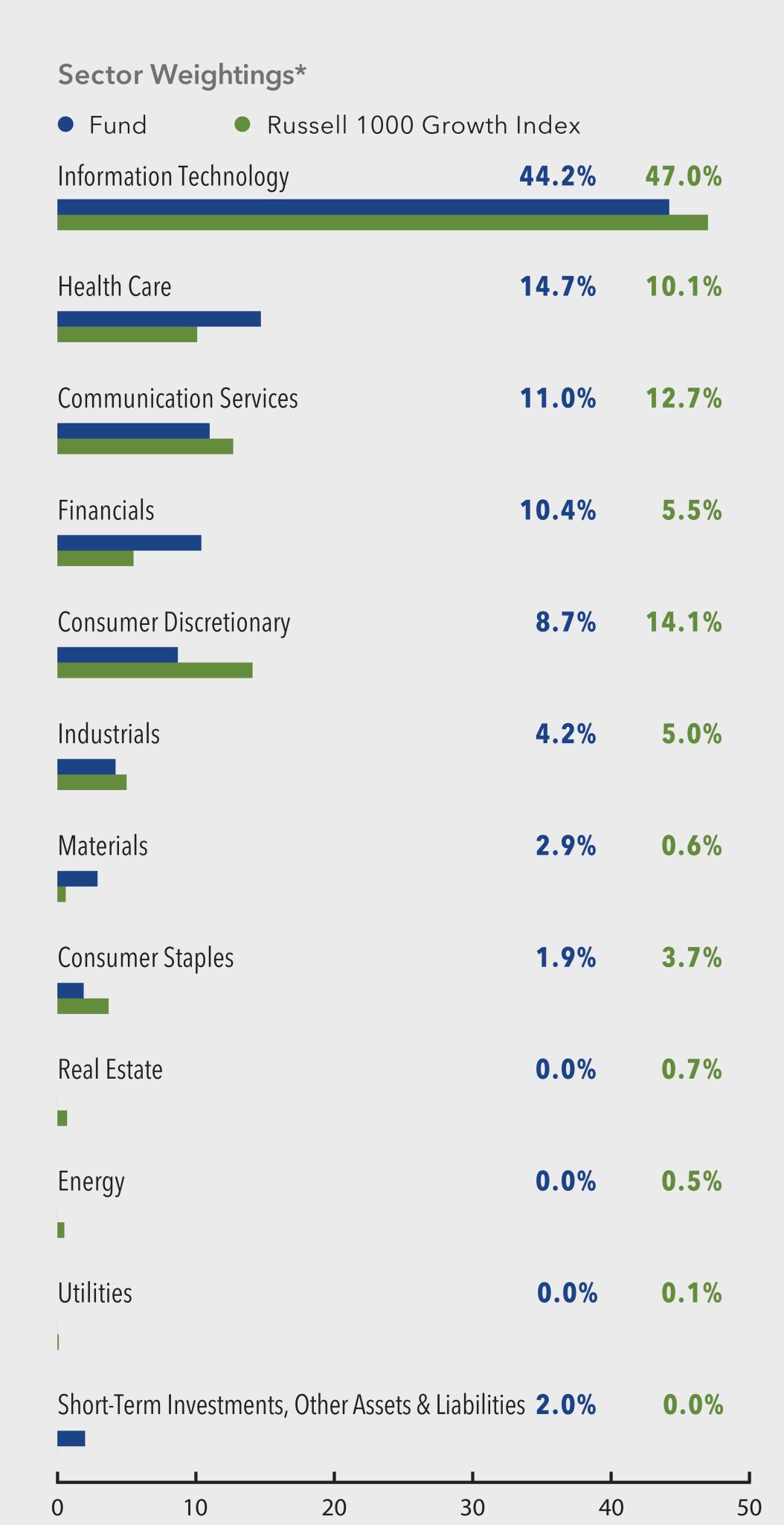

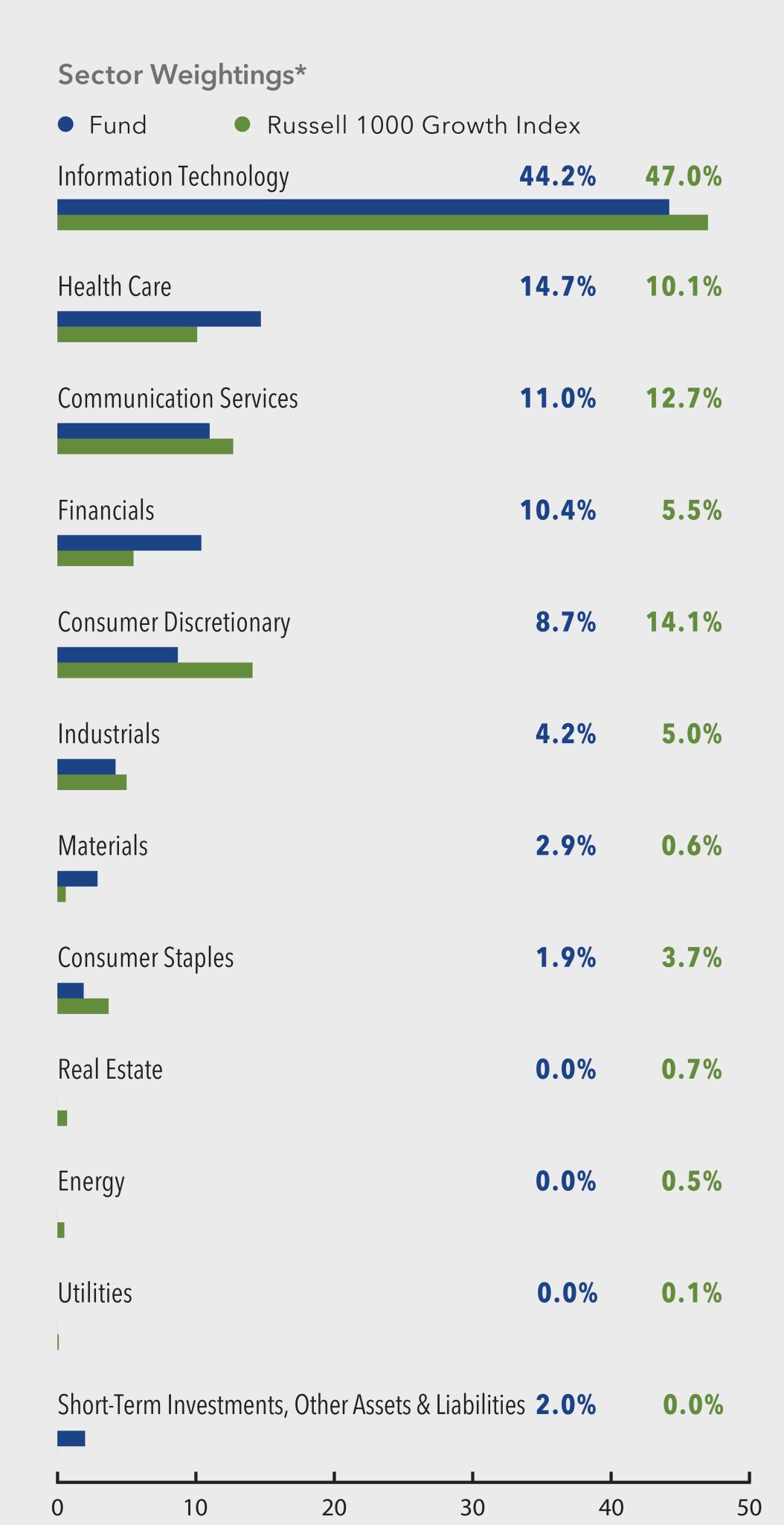

What did the Fund invest in?

Parnassus Growth Equity Fund invests selectively in about 40 U.S. large-cap equity securities. The Fund pursues high quality companies with increasing relevancy, durable competitive advantages, strong management teams and sustainable business practices. It favors leading, innovative companies positioned to capitalize on secular trends.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 2.0% |

| Consumer Staples | 1.9% |

| Materials | 2.9% |

| Industrials | 4.2% |

| Consumer Discretionary | 8.7% |

| Financials | 10.4% |

| Communication Services | 11.0% |

| Health Care | 14.7% |

| Information Technology | 44.2% |

| Microsoft Corp. | 8.4% |

| Alphabet Inc., Class A | 8.1% |

| NVIDIA Corp. | 7.7% |

| Amazon.com Inc. | 4.9% |

| Apple Inc. | 4.5% |

| Visa Inc., Class A | 4.1% |

| Eli Lilly & Co. | 3.4% |

| Salesforce Inc. | 3.3% |

| Broadcom Inc. | 2.9% |

| Intuit Inc. | 2.4% |

Parnassus Growth Equity Fund

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Mid Cap Fund (the "Fund") offers a concentrated portfolio U.S. mid-cap stocks with the potential for long-term growth and business resiliency.

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $48 | 0.96% |

How did the fund perform?

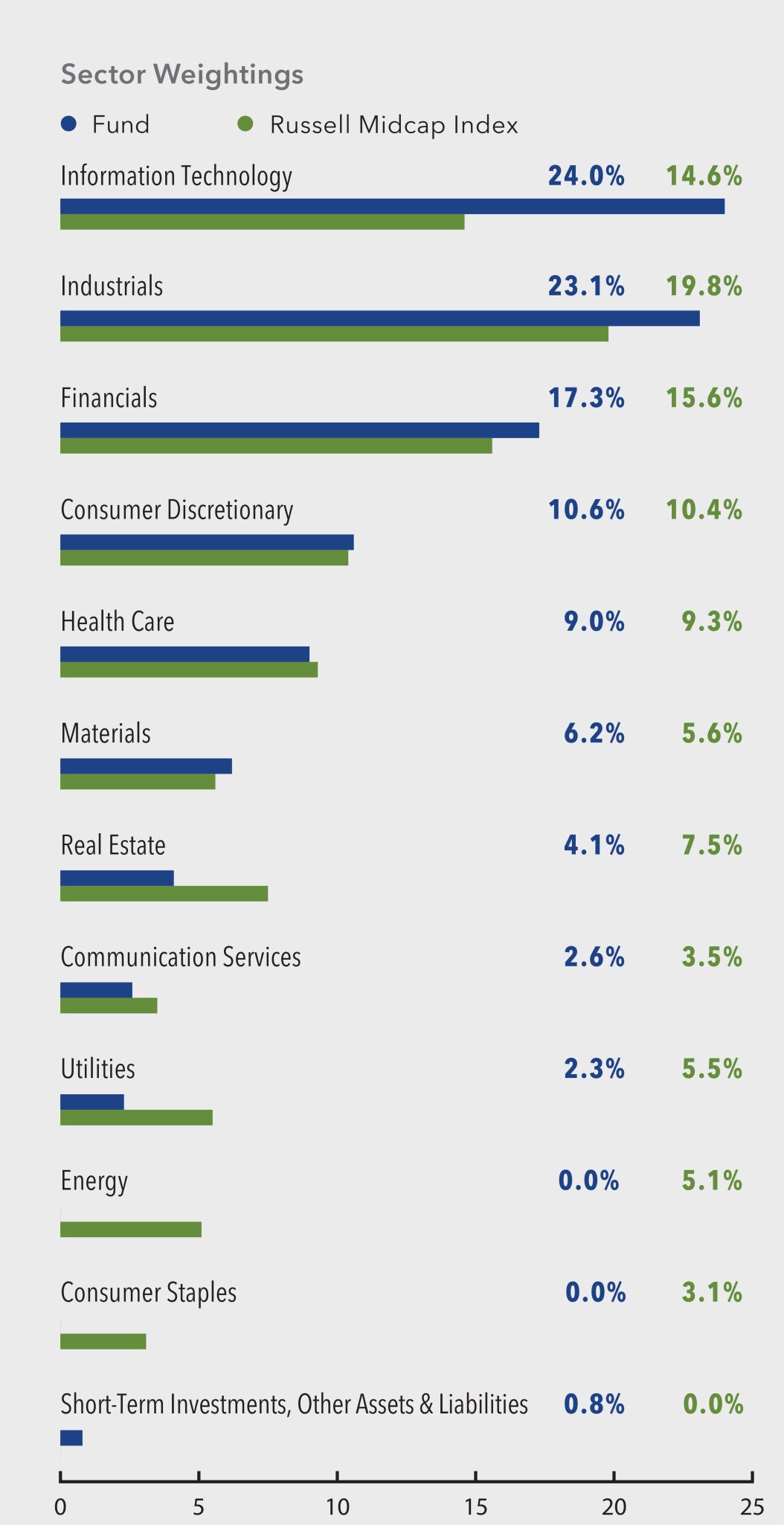

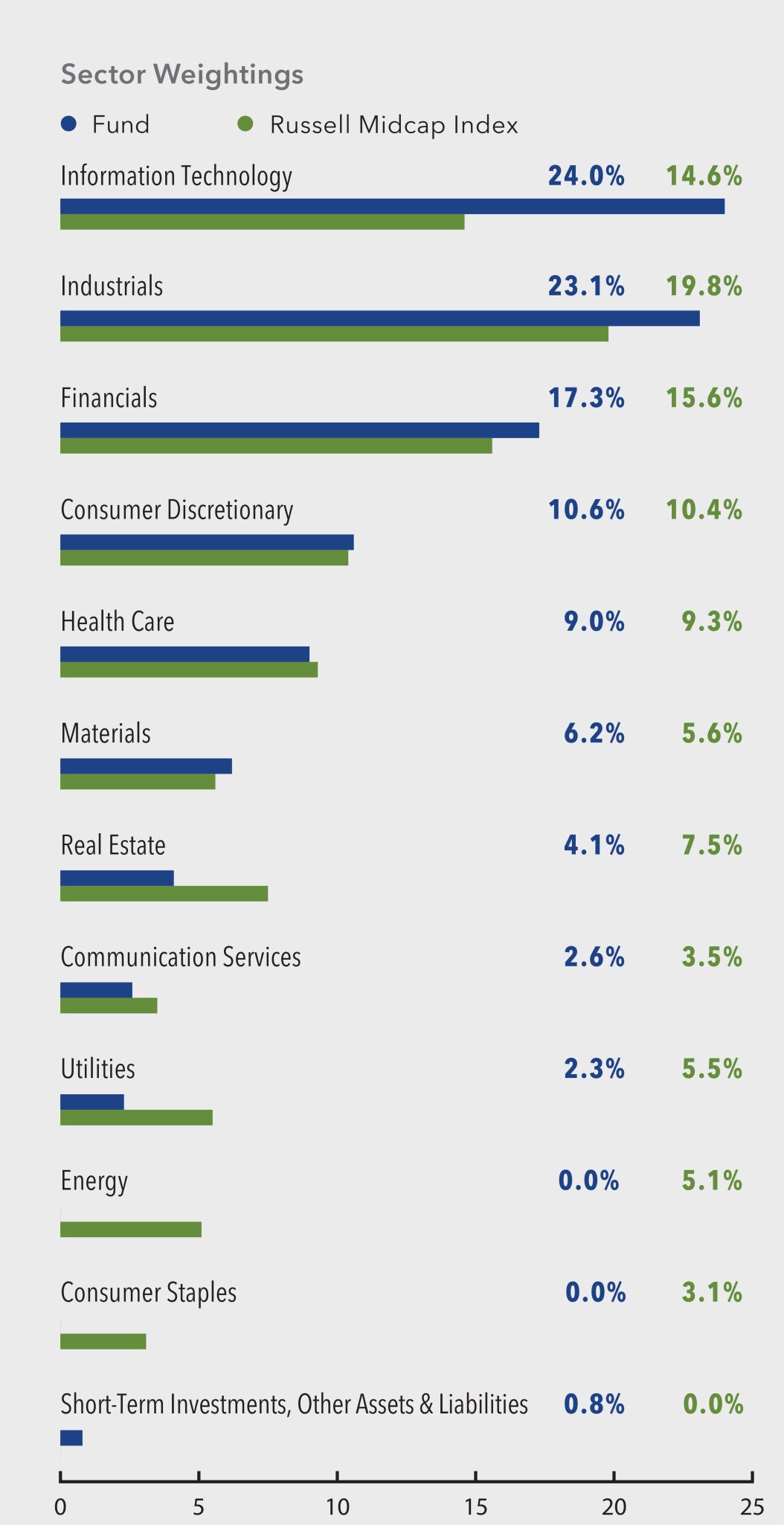

The Parnassus Mid Fund (Investor Shares) returned -5.80% (net of fees) for the quarter, underperforming the Russell Midcap Index. The portfolio's underperformance was primarily driven by stock selection. The Health Care and Industrials sectors were the biggest detractors, due in part to our overweight positioning in life sciences tools and freight transportation stocks.

We shifted the portfolio position in the Consumer Staples sector from a modest underweight to a significant underweight during the quarter and increased the overweight position in the Information Technology sector.

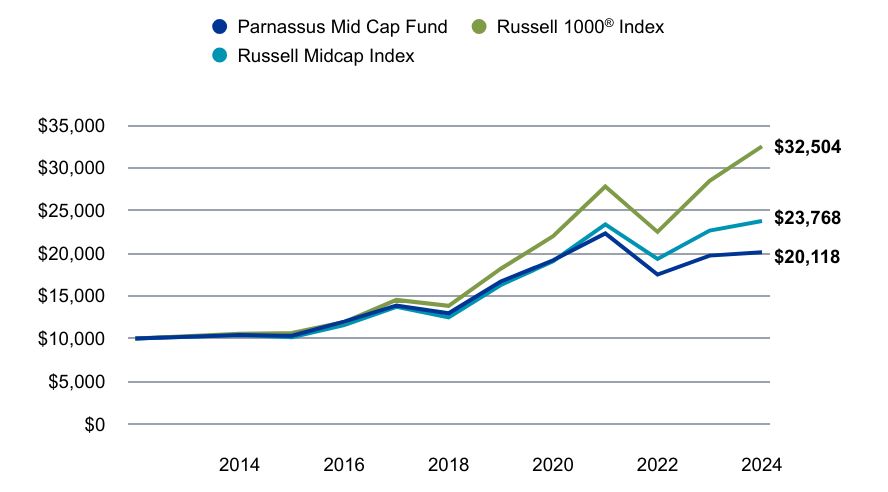

Value on June 30, 2024 of $10,000 invested on June 30, 2014.

| Parnassus Mid Cap Fund | Russell 1000® Index | Russell Midcap Index |

|---|

| | | |

|---|

| 2013 | $10,000 | $10,000 | $10,000 |

| 2014 | $10,414 | $10,557 | $10,418 |

| 2015 | $10,324 | $10,653 | $10,164 |

| 2016 | $11,984 | $11,938 | $11,567 |

| 2017 | $13,876 | $14,526 | $13,708 |

| 2018 | $12,955 | $13,831 | $12,467 |

| 2019 | $16,680 | $18,178 | $16,274 |

| 2020 | $19,162 | $21,989 | $19,057 |

| 2021 | $22,303 | $27,806 | $23,361 |

| 2022 | $17,494 | $22,488 | $19,316 |

| 2023 | $19,711 | $28,453 | $22,644 |

| 2024 | $20,118 | $32,504 | $23,768 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $3,037,798,726 |

| # of Portfolio Holdings | 40 |

| Portfolio Turnover Rate | 33% |

| Advisory Fees Paid | $12,512,960 |

Average Annual Total Returns (%)

| 1 Year | 5 years | 10 Years |

|---|

| Parnassus Mid Cap Fund - Investor Shares | 10.06% | 4.98% | 7.24% |

Russell 1000® Index | 23.88% | 14.61% | 12.51% |

| Russell Midcap Index | 12.88% | 9.46% | 9.04% |

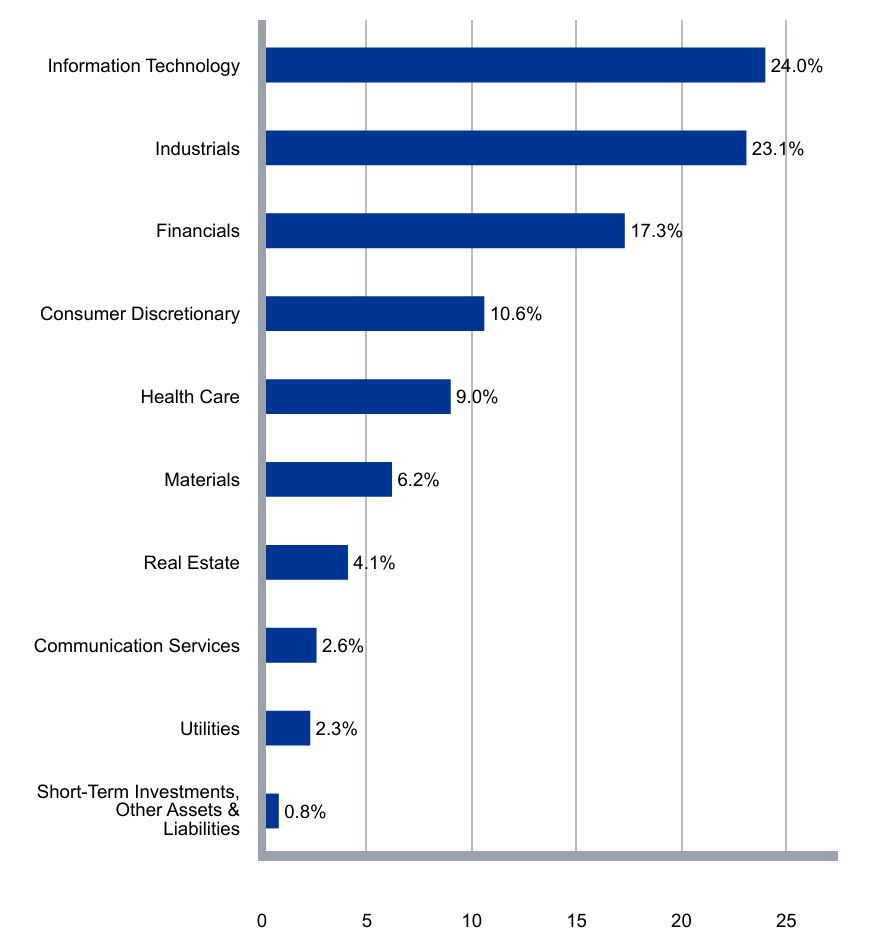

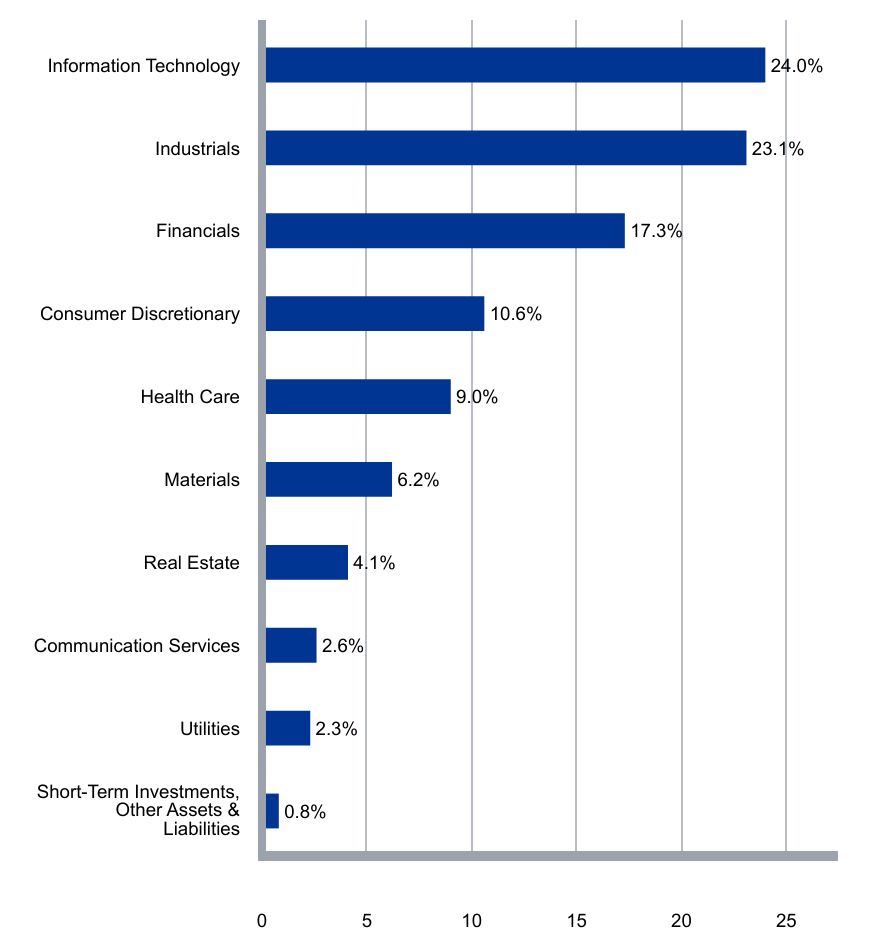

What did the Fund invest in?

Parnassus Mid Cap Fund invests selectively in about 35-45 U.S. mid-cap equity securities. The Fund pursues high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.8% |

| Utilities | 2.3% |

| Communication Services | 2.6% |

| Real Estate | 4.1% |

| Materials | 6.2% |

| Health Care | 9.0% |

| Consumer Discretionary | 10.6% |

| Financials | 17.3% |

| Industrials | 23.1% |

| Information Technology | 24.0% |

| Fidelity National Information Services | 3.9% |

| Guidewire Software Inc. | 3.7% |

| Roper Technologies Inc. | 3.6% |

| J.B. Hunt Transport Services Inc. | 3.5% |

| Cboe Global Markets Inc. | 3.5% |

| KLA Corp. | 3.2% |

| TransUnion | 3.2% |

| Republic Services Inc., Class A | 3.1% |

| Hologic Inc. | 3.1% |

| Ross Stores Inc. | 2.9% |

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Mid Cap Growth Fund

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Mid Cap Growth Fund (the "Fund") offers a concentrated portfolio of U.S. mid-cap, fast-growing companies with healthy balance sheets and proven financial models

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $41 | 0.80% |

How did the fund perform?

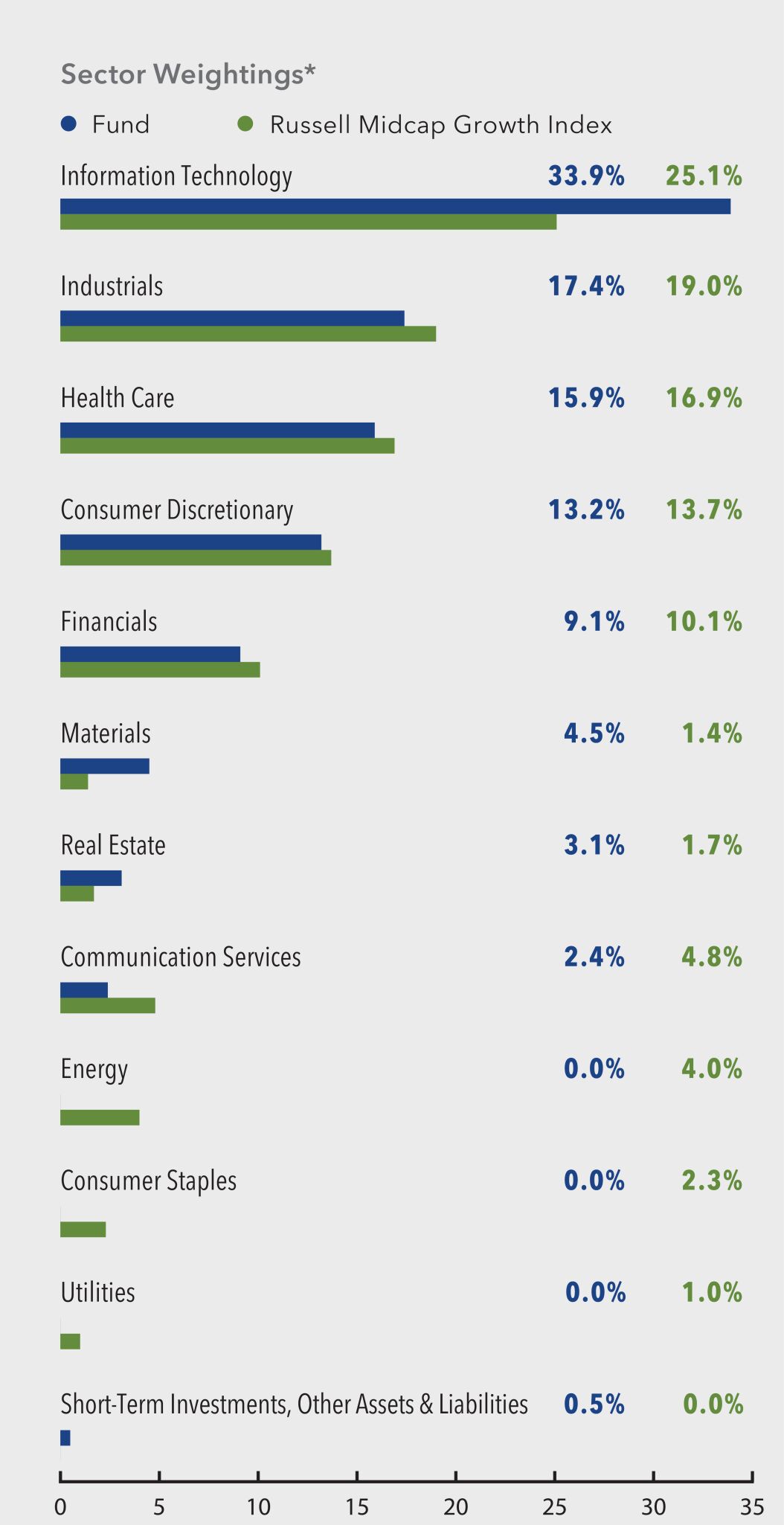

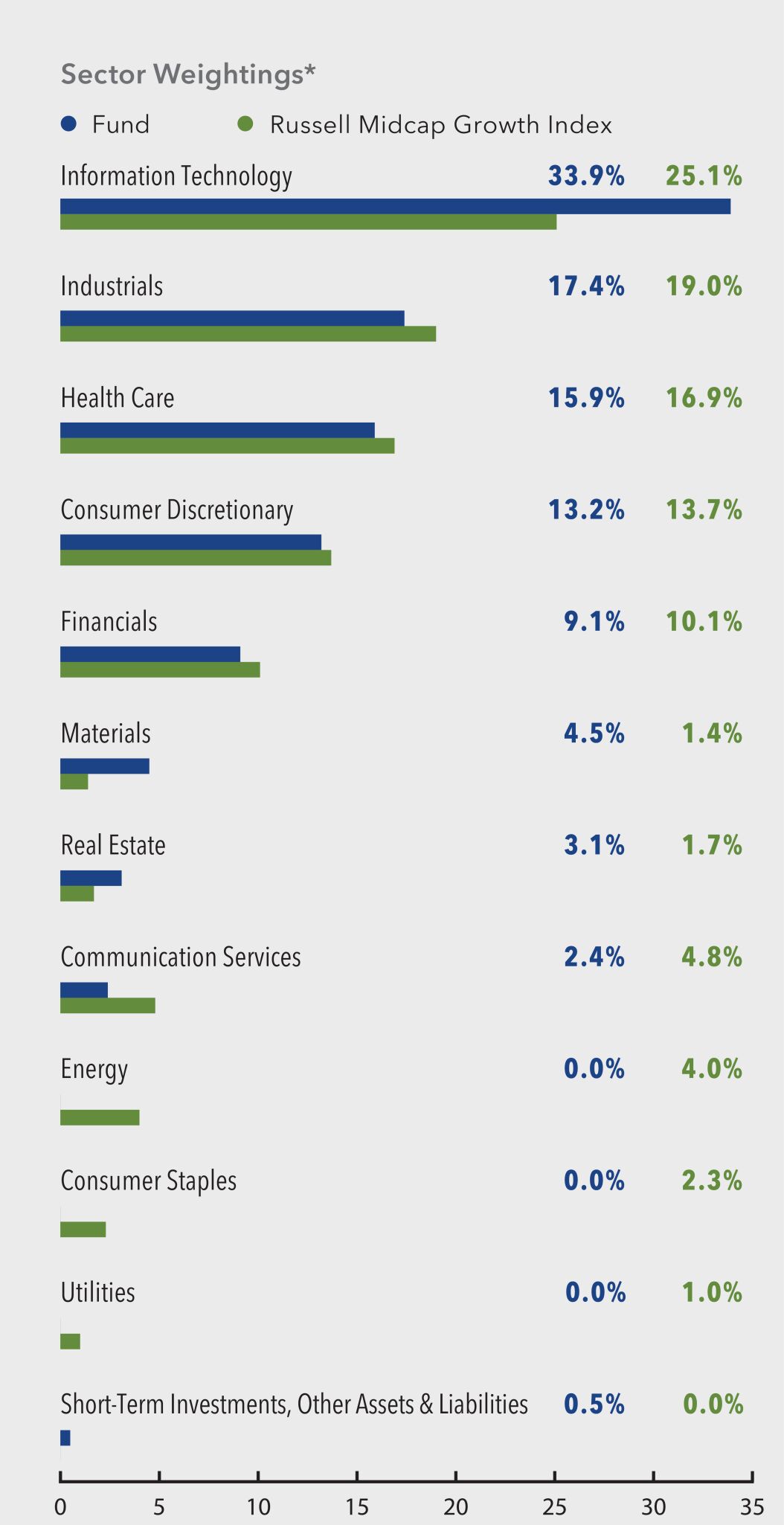

The Parnassus Mid Cap Growth Fund (Investor Shares) returned -3.20% (net of fees) for the second quarter of 2024, approximately in line with the Russell Midcap Growth Index's -3.21% return. Stock selection in the Information Technology and Industrials sectors contributed to relative results, while selection within Real Estate and Health Care detracted.

The portfolio position in Consumer Discretionary shifted from an overweight to an underweight during the quarter, while the overweight position in Information Technology increased.

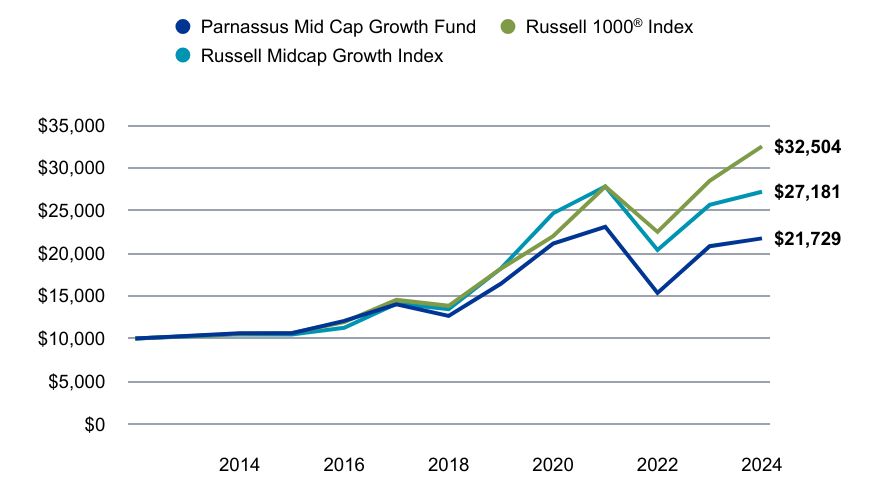

Value on June 30, 2024 of $10,000 invested on June 30, 2014.

| Parnassus Mid Cap Growth Fund | Russell 1000® Index | Russell Midcap Growth Index |

|---|

| | | |

|---|

| 2013 | $10,000 | $10,000 | $10,000 |

| 2014 | $10,609 | $10,557 | $10,507 |

| 2015 | $10,637 | $10,653 | $10,486 |

| 2016 | $12,068 | $11,938 | $11,254 |

| 2017 | $14,008 | $14,526 | $14,097 |

| 2018 | $12,645 | $13,831 | $13,427 |

| 2019 | $16,416 | $18,178 | $18,189 |

| 2020 | $21,112 | $21,989 | $24,662 |

| 2021 | $23,090 | $27,806 | $27,801 |

| 2022 | $15,350 | $22,488 | $20,372 |

| 2023 | $20,815 | $28,453 | $25,648 |

| 2024 | $21,729 | $32,504 | $27,181 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $831,325,790 |

| # of Portfolio Holdings | 40 |

| Portfolio Turnover Rate | 20% |

| Advisory Fees Paid | $2,519,872 |

Average Annual Total Returns (%)

| 1 Year | 5 years | 10 Years |

|---|

| Parnassus Mid Cap Growth Fund - Investor Shares | 19.29% | 7.43% | 8.07% |

Russell 1000® Index | 23.88% | 14.61% | 12.51% |

| Russell Midcap Growth Index | 15.05% | 9.93% | 10.52% |

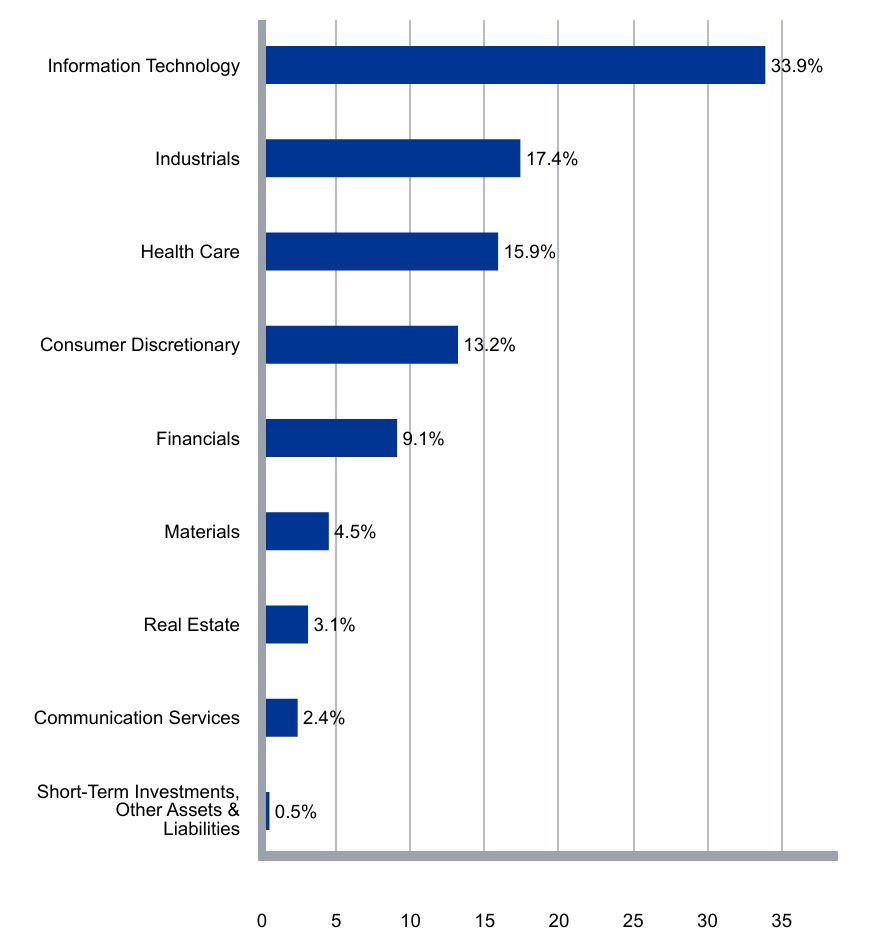

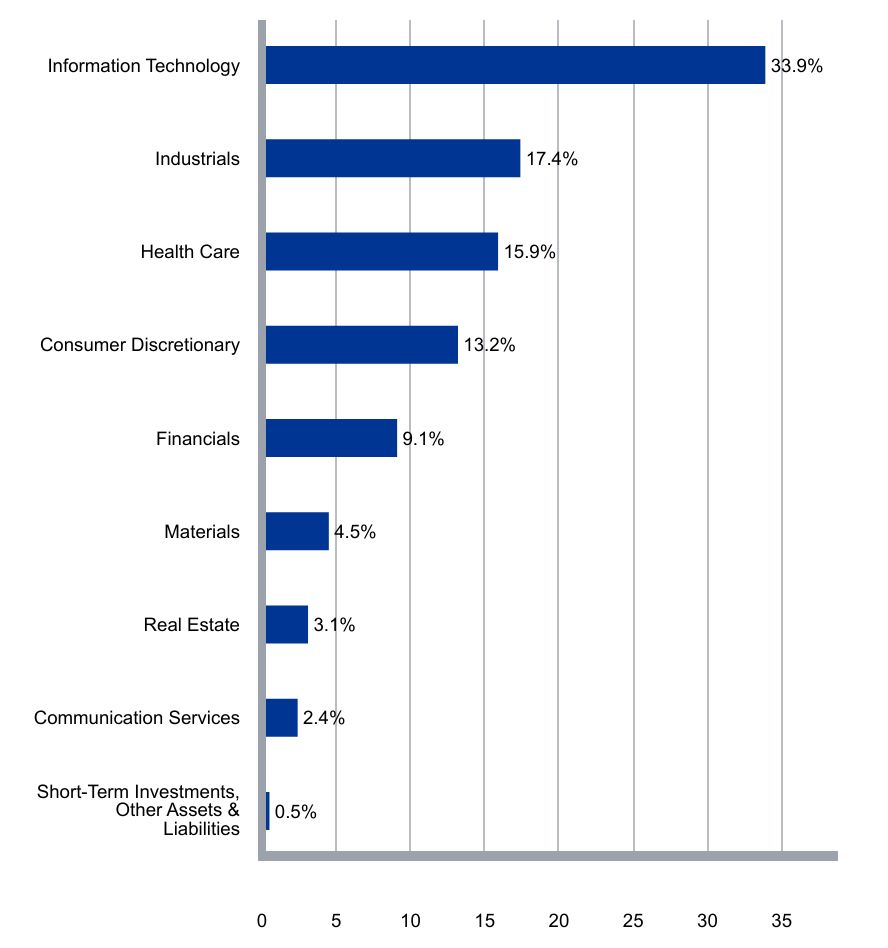

What did the Fund invest in?

Parnassus Mid Cap Growth Fund invests selectively in about 35-45 U.S. mid-cap growth equity securities. The Fund pursues best-in-class, high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in a downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.5% |

| Communication Services | 2.4% |

| Real Estate | 3.1% |

| Materials | 4.5% |

| Financials | 9.1% |

| Consumer Discretionary | 13.2% |

| Health Care | 15.9% |

| Industrials | 17.4% |

| Information Technology | 33.9% |

| Guidewire Software Inc. | 5.5% |

| Teradyne Inc. | 4.9% |

| Equifax Inc. | 4.3% |

| Trane Technologies plc | 3.6% |

| KLA Corp. | 3.6% |

| Agilent Technologies Inc. | 3.4% |

| Ross Stores Inc. | 3.4% |

| CoStar Group Inc. | 3.1% |

| Monolithic Power Systems Inc. | 3.0% |

| Mettler-Toledo International Inc. | 3.0% |

Parnassus Mid Cap Growth Fund

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Value Equity Fund

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Value Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks that are attractively priced relative to their history or peers.

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $45 | 0.88% |

How did the fund perform?

Parnassus Value Equity Fund (Investor Shares) returned -3.81% (net of fees) for the quarter, underperforming the Russell 1000 Value Index. Stock selection in the Health Care sector drove most of the underperformance. Selection in the Consumer Staples and Industrials sectors detracted to a lesser degree.

The portfolio's positioning remained steady. The Fund maintained its overweights in Information Technology, Communication Services and Financials. We sold Cisco Systems and bought Broadcom for more attractive networking exposure, while adding to our existing cable positions.

We maintained diversification. Our artificial intelligence-related (AI-related) investments in information technology were complemented by holdings that provided exposure to other parts of the economy.

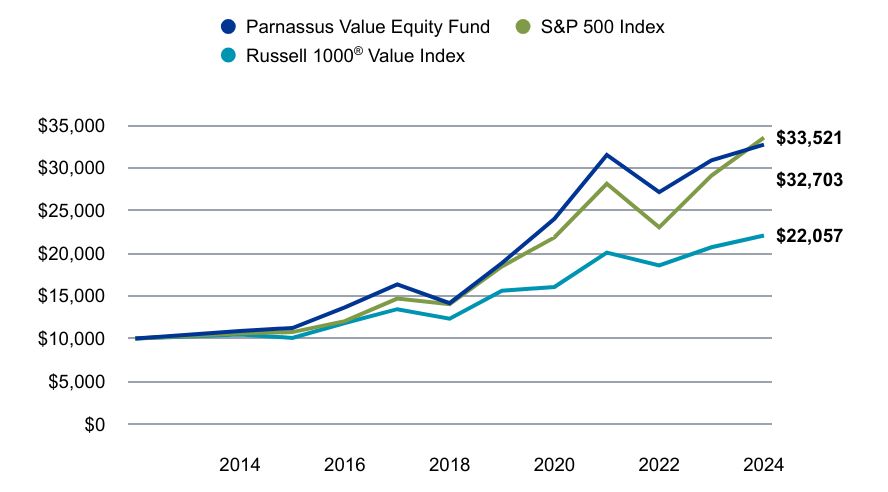

Value on June 30, 2024 of $10,000 invested on June 30, 2014.

| Parnassus Value Equity Fund | S&P 500 Index | Russell 1000® Value Index |

|---|

| | | |

|---|

| 2013 | $10,000 | $10,000 | $10,000 |

| 2014 | $10,883 | $10,612 | $10,478 |

| 2015 | $11,237 | $10,758 | $10,077 |

| 2016 | $13,643 | $12,045 | $11,824 |

| 2017 | $16,346 | $14,675 | $13,440 |

| 2018 | $14,141 | $14,031 | $12,329 |

| 2019 | $18,849 | $18,449 | $15,601 |

| 2020 | $24,017 | $21,844 | $16,037 |

| 2021 | $31,491 | $28,114 | $20,072 |

| 2022 | $27,141 | $23,023 | $18,559 |

| 2023 | $30,859 | $29,075 | $20,686 |

| 2024 | $32,703 | $33,521 | $22,057 |

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $4,902,949,310 |

| # of Portfolio Holdings | 44 |

| Portfolio Turnover Rate | 10% |

| Advisory Fees Paid | $15,609,747 |

Average Annual Total Returns (%)

| 1 Year | 5 years | 10 Years |

|---|

| Parnassus Value Equity Fund - Investor Shares | 15.13% | 14.34% | 12.58% |

| S&P 500 Index | 24.56% | 15.05% | 12.86% |

Russell 1000® Value Index | 13.06% | 9.01% | 8.23% |

What did the Fund invest in?

Parnassus Value Equity Fund invests selectively in about 40-45 U.S. large-cap equity securities trading at a discount. The Fund pursues companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.5% |

| Utilities | 1.5% |

| Consumer Staples | 2.9% |

| Real Estate | 4.0% |

| Materials | 4.4% |

| Consumer Discretionary | 4.5% |

| Industrials | 9.1% |

| Communication Services | 12.2% |

| Health Care | 15.9% |

| Information Technology | 17.6% |

| Financials | 27.4% |

| Verizon Communications Inc. | 4.2% |

| Bank of America Corp. | 3.5% |

| Oracle Corp. | 3.3% |

| S&P Global Inc. | 3.0% |

| Alphabet Inc., Class A | 3.0% |

| Sysco Corp. | 2.9% |

| Ball Corp. | 2.8% |

| The Bank of New York Mellon Corp. | 2.8% |

| Micron Technology Inc. | 2.7% |

| Microsoft Corp. | 2.7% |

Parnassus Value Equity Fund

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Mid Cap Fund (the "Fund") offers a concentrated portfolio U.S. mid-cap stocks with the potential for long-term growth and business resiliency.

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $38 | 0.75% |

How did the fund perform?

The Parnassus Mid Cap Fund (Institutional Shares) returned -5.77% (net of fees) for the quarter, underperforming the Russell Midcap Index. The portfolio's underperformance was primarily driven by stock selection. The Health Care and Industrials sectors were the biggest detractors, due in part to our overweight positioning in life sciences tools and freight transportation stocks.

We shifted the portfolio position in the Consumer Staples sector from a modest underweight to a significant underweight during the quarter and increased the overweight position in the Information Technology sector.

Value on June 30, 2024 of $10,000 invested on April 30, 2015.

| Parnassus Mid Cap Fund | Russell 1000® Index | Russell Midcap Index |

|---|

| | | |

|---|

| 2015 | $10,000 | $10,000 | $10,000 |

| 2015 | $9,870 | $9,864 | $9,471 |

| 2016 | $11,477 | $11,053 | $10,778 |

| 2017 | $13,318 | $13,450 | $12,774 |

| 2018 | $12,467 | $12,806 | $11,617 |

| 2019 | $16,084 | $16,831 | $15,165 |

| 2020 | $18,524 | $20,359 | $17,758 |

| 2021 | $21,605 | $25,745 | $21,769 |

| 2022 | $16,979 | $20,821 | $18,000 |

| 2023 | $19,172 | $26,344 | $21,100 |

| 2024 | $19,587 | $30,094 | $22,148 |

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The Fund commenced operations on April 30, 2015.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $3,037,798,726 |

| # of Portfolio Holdings | 40 |

| Portfolio Turnover Rate | 33% |

| Advisory Fees Paid | $12,512,960 |

Average Annual Total Returns (%)

| 1 Year | 5 years | Since Inception |

|---|

| Parnassus Mid Cap Fund - Institutional Shares (Incp: April 30, 2015) | 10.27% | 5.21% | 7.61% |

Russell 1000® Index | 23.88% | 14.61% | 12.77% |

| Russell Midcap Index | 12.88% | 9.46% | 9.06% |

What did the Fund invest in?

Parnassus Mid Cap Fund invests selectively in about 35-45 U.S. mid-cap equity securities. The Fund pursues high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.8% |

| Utilities | 2.3% |

| Communication Services | 2.6% |

| Real Estate | 4.1% |

| Materials | 6.2% |

| Health Care | 9.0% |

| Consumer Discretionary | 10.6% |

| Financials | 17.3% |

| Industrials | 23.1% |

| Information Technology | 24.0% |

| Fidelity National Information Services | 3.9% |

| Guidewire Software Inc. | 3.7% |

| Roper Technologies Inc. | 3.6% |

| J.B. Hunt Transport Services Inc. | 3.5% |

| Cboe Global Markets Inc. | 3.5% |

| KLA Corp. | 3.2% |

| TransUnion | 3.2% |

| Republic Services Inc., Class A | 3.1% |

| Hologic Inc. | 3.1% |

| Ross Stores Inc. | 2.9% |

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Mid Cap Growth Fund

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Mid Cap Growth Fund (the "Fund") offers a concentrated portfolio of U.S. mid-cap, fast-growing companies with healthy balance sheets and proven financial models

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $35 | 0.68% |

How did the fund perform?

The Parnassus Mid Cap Growth Fund (Institutional Shares) returned -3.17% (net of fees) for the second quarter of 2024, mostly outperforming the Russell Midcap Growth Index's -3.21% return. Stock selection in the Information Technology and Industrials sectors contributed to relative results, while selection within Real Estate and Health Care detracted.

The portfolio position in Consumer Discretionary shifted from an overweight to an underweight during the quarter, while the overweight position in Information Technology increased.

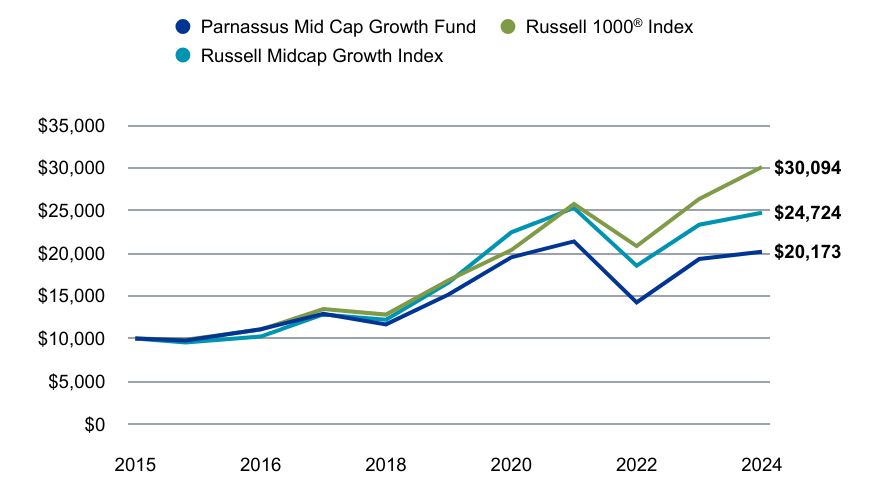

Value on June 30, 2024 of $10,000 invested on April 30, 2015.

| Parnassus Mid Cap Growth Fund | Russell 1000® Index | Russell Midcap Growth Index |

|---|

| | | |

|---|

| 2015 | $10,000 | $10,000 | $10,000 |

| 2015 | $9,763 | $9,864 | $9,538 |

| 2016 | $11,089 | $11,053 | $10,237 |

| 2017 | $12,891 | $13,450 | $12,823 |

| 2018 | $11,658 | $12,806 | $12,213 |

| 2019 | $15,152 | $16,831 | $16,545 |

| 2020 | $19,517 | $20,359 | $22,432 |

| 2021 | $21,373 | $25,745 | $25,288 |

| 2022 | $14,224 | $20,821 | $18,531 |

| 2023 | $19,311 | $26,344 | $23,329 |

| 2024 | $20,173 | $30,094 | $24,724 |

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The Fund commenced operations on April 30, 2015.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $831,325,790 |

| # of Portfolio Holdings | 40 |

| Portfolio Turnover Rate | 20% |

| Advisory Fees Paid | $2,519,872 |

Average Annual Total Returns (%)

| 1 Year | 5 years | Since Inception |

|---|

| Parnassus Mid Cap Growth Fund - Institutional Shares (Incp: April 30, 2015) | 19.44% | 7.57% | 7.96% |

Russell 1000® Index | 23.88% | 14.61% | 12.77% |

| Russell Midcap Growth Index | 15.05% | 9.93% | 10.38% |

What did the Fund invest in?

Parnassus Mid Cap Growth Fund invests selectively in about 35-45 U.S. mid-cap growth equity securities. The Fund pursues best-in-class, high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in a downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.5% |

| Communication Services | 2.4% |

| Real Estate | 3.1% |

| Materials | 4.5% |

| Financials | 9.1% |

| Consumer Discretionary | 13.2% |

| Health Care | 15.9% |

| Industrials | 17.4% |

| Information Technology | 33.9% |

| Guidewire Software Inc. | 5.5% |

| Teradyne Inc. | 4.9% |

| Equifax Inc. | 4.3% |

| Trane Technologies plc | 3.6% |

| KLA Corp. | 3.6% |

| Agilent Technologies Inc. | 3.4% |

| Ross Stores Inc. | 3.4% |

| CoStar Group Inc. | 3.1% |

| Monolithic Power Systems Inc. | 3.0% |

| Mettler-Toledo International Inc. | 3.0% |

Parnassus Mid Cap Growth Fund

Class - Institutional Shares

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Growth Equity Fund

Semi-Annual Shareholder Report - June 30, 2024

Parnassus Growth Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks with the potential to benefit from secular trends at attractive valuations.

This semi-annual shareholder report contains important information about the Fund for the period of January 1, 2024 to June 30, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the period?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $45 | 0.84% |

How did the fund perform?

The Parnassus Growth Equity Fund (Investor Shares) returned 3.74% (net of fees) for the quarter, underperforming the Russell 1000 Growth Index. The underperformance was primarily driven by our stock selection in the Information Technology sector. An overweight position and stock selection in the Financials sector also detracted.

We took advantage of recent sell-offs to add two new positions in Financials and Information Technology: MSCI and Workday, respectively. We offset these new holdings by trimming our existing positions and selling Palo Alto Networks within Information Technology.

Value on June 30, 2024 of $10,000 invested on December 28, 2022.

| Parnassus Growth Equity Fund | S&P 500 Index | Russell 1000® Growth Index |

|---|

| | | |

|---|

| 12/28/2022 | $10,000 | $10,000 | $10,000 |

| Dec-22 | $9,960 | $10,151 | $10,194 |

| Mar-23 | $11,507 | $10,912 | $11,659 |

| Jun-23 | $12,813 | $11,866 | $13,152 |

| Sep-23 | $12,507 | $11,477 | $12,741 |

| Dec-23 | $14,434 | $12,819 | $14,545 |

| Mar-24 | $16,298 | $14,172 | $16,205 |

| Jun-24 | $16,908 | $14,779 | $17,556 |

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The Fund commenced operations on December 28, 2022.

The fund's past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $49,937,183 |

| # of Portfolio Holdings | 41 |

| Portfolio Turnover Rate | 15% |

| Advisory Fees Paid | $21,511 |

Average Annual Total Returns (%)

| 1 Year | Since Inception |

|---|

| Parnassus Growth Equity Fund - Investor Shares (Incp: December 28, 2022) | 31.95% | 41.74% |

| S&P 500 Index | 24.56% | 29.63% |

Russell 1000® Growth Index | 33.48% | 45.33% |

What did the Fund invest in?

Parnassus Growth Equity Fund invests selectively in about 40 U.S. large-cap equity securities. The Fund pursues high quality companies with increasing relevancy, durable competitive advantages, strong management teams and sustainable business practices. It favors leading, innovative companies positioned to capitalize on secular trends.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 2.0% |

| Consumer Staples | 1.9% |

| Materials | 2.9% |

| Industrials | 4.2% |

| Consumer Discretionary | 8.7% |

| Financials | 10.4% |

| Communication Services | 11.0% |

| Health Care | 14.7% |

| Information Technology | 44.2% |

| Microsoft Corp. | 8.4% |

| Alphabet Inc., Class A | 8.1% |

| NVIDIA Corp. | 7.7% |

| Amazon.com Inc. | 4.9% |

| Apple Inc. | 4.5% |

| Visa Inc., Class A | 4.1% |

| Eli Lilly & Co. | 3.4% |

| Salesforce Inc. | 3.3% |

| Broadcom Inc. | 2.9% |

| Intuit Inc. | 2.4% |

Parnassus Growth Equity Fund

Semi-Annual Shareholder Report - June 30, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com

No material changes to the Fund in the last reporting period.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting period.

© 2024 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC. The Parnassus Funds are distributed by Parnassus Funds Distributor, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Item 2. Code of Ethics.

Not applicable for semi-annual reports. The information required by this Item is only required in an annual report on Form N-CSR.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports. The information required by this Item is only required in an annual report on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports. The information required by this Item is only required in an annual report on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports. The information required by this Item is only required in an annual report on Form N-CSR.

Item 6. Investments.

| (a) | Included as part of the report to shareholders filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Parnassus Funds Semiannual Report

June 30, 2024

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Growth Equity FundSM

Investor Shares: PFGEX | Institutional Shares: PFPGX

Parnassus Value Equity FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

3

| | | | |

| | |

| | | | Semiannual Report • 2024 |

August 9, 2024

Dear Shareholder,

The narrow market, driven largely by Nvidia, the highflying semiconductor company, has been challenging to navigate as an active manager. The positive returns for equities have been dominated by a very small number of large technology companies, which makes it very difficult to outperform the benchmark.

Given that backdrop, I’m pleased that all of the Parnassus Equity Funds delivered healthy positive returns for the first half of 2024. Our best-performing fund this year has been the Parnassus Growth Equity Fund, up 17% in the first half of the year, followed by the Parnassus Core Equity Fund with a 12% gain. The Parnassus Value Equity Fund, the Parnassus Mid Cap Fund and the Parnassus Mid Cap Growth Fund delivered returns between 2% and 6%, which is respectable on a historical basis. The Parnassus Fixed Income Fund, meanwhile, saw a 0.3% decline, slightly ahead of its benchmark. In the pages that follow, you can read about what the portfolio managers of these funds think about the current market environment, including retrospectives on the past quarter’s performance, as well as outlooks for the second half of the year.

Interns and Anniversaries

2024 is a big year for Parnassus as we celebrate our 40th anniversary. On a more personal note, this year also marks a milestone in my career: I joined Parnassus 20 years ago as an intern. Today, our internship program remains close to my heart, and so I’m proud to welcome five interns to Parnassus this summer.

Xiling Chen joins us as a Research Analyst intern while pursuing an MBA at Harvard Business School. Previously, Xiling received a dual major in math and arts at Tufts University and worked for five years in equity research at JP Morgan, covering U.S. pharmaceutical and Chinese healthcare companies in New York and Hong Kong. In her free time, she loves reading, sketching, film photography, hiking and wakesurfing.

Jade Mon joined our Software Engineering program after achieving a double major at University of California, Berkeley, in computer and data science. Jade previously conducted research at the university’s Space Science Laboratory as well as cybersecurity research with Proofpoint, creating machine learning models to detect potentially malicious emails. Her interests include reading, biking, playing the piano and hanging out with friends.

Terry Park also joins our Research Analyst Internship program as a first-year MBA student at Stanford University. He previously worked at EQT Group, focusing on advanced industrials and financial services, and later as an analyst in Morgan Stanley’s investment banking division in Hong Kong. He graduated summa cum laude from the Wharton School at the University of Pennsylvania with a degree in statistics and finance. He also served two years in the Korean army, becoming a top rifle marksman.

4

| | | | |

| | |

| Semiannual Report • 2024 | | | |  |

Craig Wong is a summer intern on our Software Engineering team, having recently graduated from the University of California, Davis, with a degree in computer science. Craig spends his free time enjoying new restaurants, playing basketball and meeting new people.

Hanna Zhang enters our ESG Internship program while studying business administration and cognitive science at the University of California, Berkeley. Hanna’s interest include exploring the financial world and its intersection with technology, healthcare and global climate issues. She can play five musical instruments and has 11 years of experience in ballet and other dance.

New Team Members

We continued to invest in expanding the Parnassus team to better serve shareholders. Cristian Bayer joined Parnassus as Senior Manager, Software Engineering. Cristian has 23 years of fintech development experience, with a focus on technology management and application development. A San Francisco native, Cristian enjoys games, painting models and spending time with his family, friends and puppy dog.

Alyssa McShane is a new Executive Assistant at Parnassus. Alyssa moved to the Bay Area after attending school at Chico State in Northern California. Before Parnassus, she spent 12 years at the Boston Consulting Group, managing a team of three executive assistants for the past three years. She loves attending concerts with her wife Annie and bringing their spoiled-rotten rescue pup Mazzy to local breweries and wineries, and she recently enjoyed a goat-yoga retreat with friends to celebrate her birthday.

Finally, please take note that there is a new shareholder report rolling out this quarter. We will no longer be sending reports on a quarterly schedule, but you can continue to expect this new report on a semiannual basis, for the June and December reporting periods. Our website, www.parnassus.com, has the most current information for portfolio performance, holdings and commentary. We encourage you to check it out and subscribe to receive updates by email.

Thank you for your investment in the Parnassus Funds.

Sincerely,

Benjamin E. Allen

CEO and Portfolio Manager

5

| | | | |

| | |

| | | | Semiannual Report • 2024 |

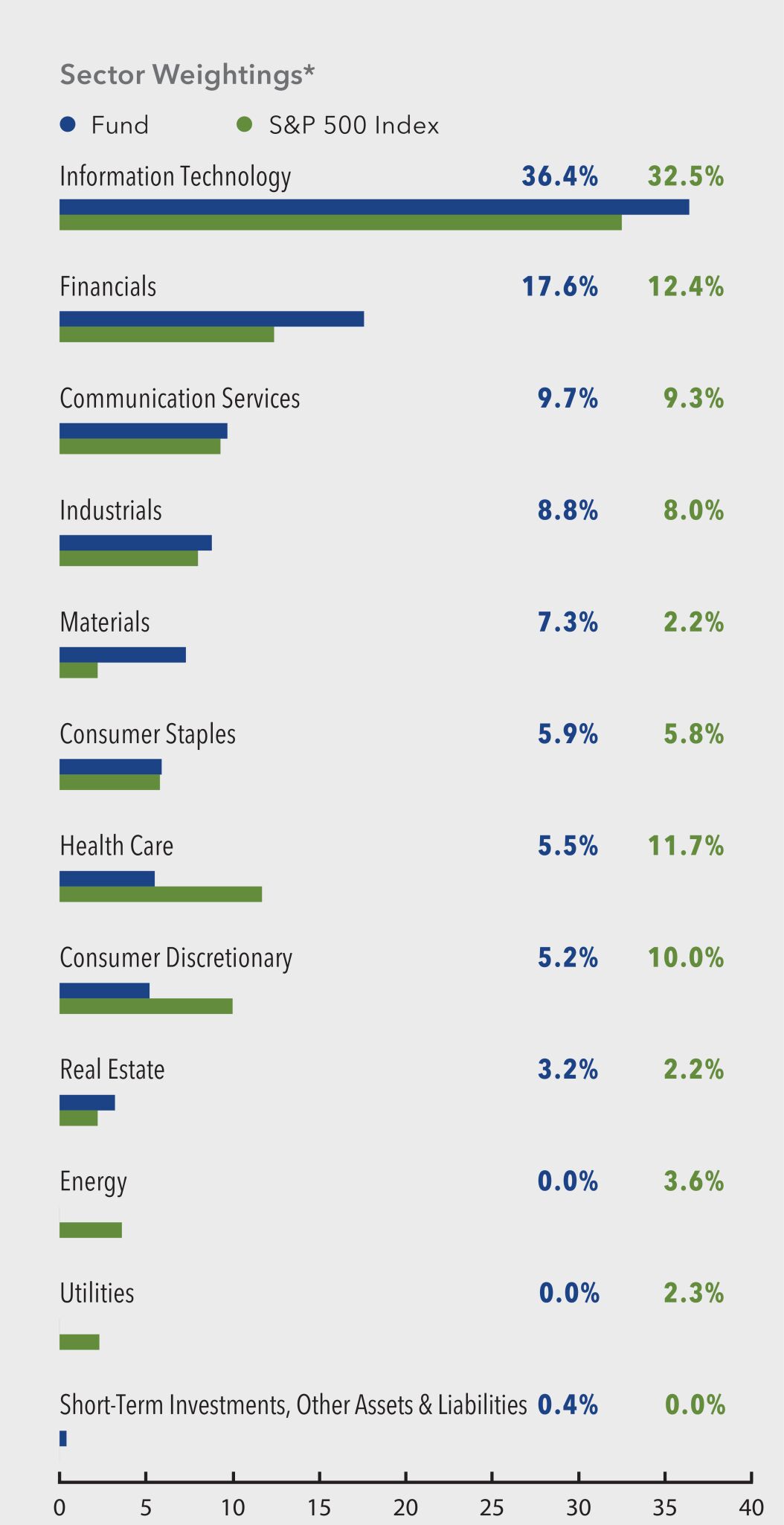

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

As of June 30, 2024, after taking dividends into account, the Parnassus Core Equity Fund – Investor Shares (“the Fund”) returned 1.86% (net of fees) for the quarter, underperforming the S&P 500 Index’s (“S&P 500”) 4.28%.

Below is a table that summarizes the performances of the Parnassus Core Equity Fund and the S&P 500. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2024 | |

| | | | | | |

| | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Gross Expense Ratio | | | Net Expense Ratio | |

| | | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | 21.10 | | | | 8.10 | | | | 13.87 | | | | 12.01 | | | | 0.82 | | | | 0.82 | |

| | | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 21.34 | | | | 8.32 | | | | 14.11 | | | | 12.24 | | | | 0.62 | | | | 0.61 | |

| | | | | | |

| S&P 500 Index | | | 24.56 | | | | 10.01 | | | | 15.05 | | | | 12.86 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2024, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.82% of net assets for the Parnassus Core Equity Fund – Investor Shares and to 0.61% of net assets for the Parnassus Core Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2025, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

The Fund (Investor Shares) returned 1.86%, (net of fees), underperforming the S&P 500 Index’s 4.28% during the quarter. From the sector perspective, positive stock selection in Communication Services boosted relative performance. An underweight in Health Care and a lack of Energy exposure also had positive impacts. Conversely, stock selection in the Information Technology, Consumer Discretionary and Materials sectors hindered relative results.

The Fund’s strongest relative contributors—Alphabet, Applied Materials and Oracle—rose because investors felt confident about their prospects as the artificial intelligence (AI) infrastructure build-out and adoption continues. The top two detractors, Salesforce and Intel, lagged due to disappointing near-term results. We believe the current valuations of these stocks do not reflect the long-term opportunity for these advantaged businesses.

Alphabet’s stock rose on the strength of robust first-quarter revenue growth underpinned by noteworthy gains in search advertising, YouTube advertising and the cloud business. Signs that the company is accelerating its development of AI solutions buoyed investor optimism.

Applied Materials is the world’s largest supplier of wafer fabrication technologies used in semiconductor manufacturing. The company reported solid earnings for the quarter, and investors believe Applied Materials should continue to benefit from accelerated industry spend due to AI and share gains.

Oracle stock surged in June after management forecasted double-digit revenue growth for fiscal year 2025, powered in part by growth in the company’s cloud infrastructure business. Investor sentiment was further bolstered by Oracle’s announcement of a new

6

| | | | |

| | |

| Semiannual Report • 2024 | | | |  |

partnership with ChatGPT maker OpenAI and Microsoft, and another with Google Cloud.

Salesforce’s growth continues to moderate, and investors question its prospect as it relates to AI. We remain confident that the company, which developed the original salesforce automation product and pioneered the SaaS (software as a service) delivery model, is well positioned to capitalize on emerging AI opportunities.

Intel reported first-quarter results largely in line with expectations, but its moderate second-quarter forecast weighed on the stock. Intel continues to show progress on its technology roadmaps, albeit at a slower-than-expected pace.

Ball saw its shares decline despite reporting a largely positive financial report for the first quarter. The company continues to capitalize on a global shift toward eco-friendly packaging. After the sale of its aerospace operations, we expect management’s focus on capital allocation to significantly benefit shareholders.

Parnassus Core Equity Fund

As of June 30, 2024

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

7

| | | | |

| | |

| | | | Semiannual Report • 2024 |

| | | | |

| |

Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 6.9% | |

| |

| NVIDIA Corp. | | | 6.6% | |

| |

| Alphabet Inc., Class A | | | 6.5% | |

| |

| Apple Inc. | | | 4.6% | |

| |

| Salesforce Inc. | | | 4.2% | |

| |

| Deere & Co. | | | 3.4% | |

| |

| Realty Income Corp. | | | 3.2% | |

| |

| Mastercard Inc., Class A | | | 3.2% | |

| |

| Ball Corp. | | | 2.8% | |

| |

| Linde plc | | | 2.8% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

As of June 30, 2024, the Fund’s most significant sector weights relative to the benchmark did not change significantly from the previous quarter-end. The Fund’s largest overweights are in Financials, Materials and Information Technology, while its largest underweights are in Health Care and Consumer Discretionary.

The Financials sector continues to be our largest sector overweight position. Our exposure decreased as we trimmed several holdings, including Bank of America, Fiserv and Mastercard. Our Materials exposure also declined with the sale of Nutrien, a distributor of agricultural products.

Our underweight position in the Health Care sector widened as we exited the pharmaceutical industry by closing our position in Switzerland-based drugmaker Roche Holding. We redeployed a portion of the proceeds to increase our existing position in Realty Income, a real estate investment trust that owns commercial properties. We consider Realty Income a more appealing defensive holding in the current environment. This move changed our Real Estate sector exposure from an underweight to an overweight.

Within the Information Technology sector, we trimmed certain positions, including Micron Technology and Applied Materials, while increasing our exposure to Salesforce, Adobe, Broadcom and Alphabet. The net effect of these changes was to moderately grow our overweight in the sector.

We continue to look through the near-term noise and seek to own competitively advantaged, attractively priced businesses that we believe are positioned to outperform over the long term.

We have maintained our balanced approach to portfolio positioning. The investment landscape remains favorable for stocks and risk assets, given moderating inflation, robust consumer demand, resilient wages and strong corporate earnings growth. In this environment, investor optimism has led to an elevated overall market valuation.

We continue to focus on companies that, in our view, are well positioned from a long-term secular perspective, and we are taking advantage of volatility to add to what we believe are high-quality businesses with strong growth potential.

Further, we have repositioned the defensive portion of the portfolio to emphasize areas where we are seeing attractively priced exposure, including Real Estate.

As always, we are honored to have your trust as we continue pursuing Principles and Performance®.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

Andrew S. Choi

Portfolio Manager

8

| | | | |

| | |

| Semiannual Report • 2024 | | | |  |

Parnassus Growth Equity Fund

Ticker: Investor Shares - PFGEX

Ticker: Institutional Shares - PFPGX

As of June 30, 2024, the Parnassus Growth Equity Fund – Investor Shares (“the Fund”) returned 3.74% (net of fees) for the quarter, underperforming the Russell 1000 Growth Index’s (“Russell 1000 Growth”) 8.33%.

Below is a table that summarizes the performances of the Parnassus Growth Equity Fund and the Russell 1000 Growth. The returns are for the one-year and since inception periods.

Parnassus Growth Equity Fund

| | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2024 | |

| | | | |

| | | One

Year | | | Since

Inception* | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | |

| Parnassus Growth Equity Fund – Investor Shares | | | 31.95 | | | | 41.74 | | | | 2.89 | | | | 0.84 | |

| | | | |

| Parnassus Growth Equity Fund – Institutional Shares | | | 32.21 | | | | 42.03 | | | | 1.86 | | | | 0.63 | |

| | | | |

| Russell 1000 Growth Index | | | 33.48 | | | | 45.33 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Growth is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

* Since Inception, December 28, 2022 (commencement of operations) through December 31, 2023.

As described in the Fund’s current prospectus dated May 1, 2024, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.84% of net assets for the Parnassus Growth Equity Fund – Investor Shares and to 0.63% of net assets for the Parnassus Growth Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2025, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

The Fund (Investor Shares) returned 3.74% (net of fees), trailing the Russell 1000 Growth Index’s 8.33%, with underperformance driven primarily by our stock selection in the Information Technology sector, where a select few companies outgained most of the market. An overweight position and stock selection in the Financials sector and an overweight in the Materials sector also curbed results. Conversely, our stock selection in the Health Care, Consumer Staples and Communication Services sectors contributed to performance.

The Fund’s top relative contributors included companies benefiting from the surge in AI investment (Alphabet, Taiwan Semiconductor Manufacturing Company (TSMC) and Applied Materials). Among our largest detractors were our underweight positions in Apple and NVIDIA, two companies that gained largely on investor confidence in their AI-related growth prospects.

Alphabet’s stock rose on the strength of robust first-quarter revenue growth underpinned by noteworthy gains in search advertising, YouTube advertising and the cloud business. Signs that the company is accelerating its development of AI solutions buoyed investor optimism.

Taiwan Semiconductor Manufacturing Company’s leading position in AI chip production continued to boost investor sentiment on the stock. During the quarter, announcements by several large technology companies to expand their AI investments signaled insatiable demand for TSMC’s chips and contributed to the stock’s rise.

Natera, an industry leader in genetic testing, reported favorable financial results for the first quarter of 2024. The company reached cash flow breakeven early and raised full-year guidance. We are optimistic that

9

| | | | |

| | |

| | | | Semiannual Report • 2024 |

upcoming catalysts will continue to fuel growth in its women’s health and oncology businesses.

Adyen shares tumbled during the quarter as investors were disappointed that the payments processor met but did not exceed revenue expectations. Encouragingly, the company reported an expansion of its relationship with a key digital customer and reiterated optimistic medium-term guidance.

Apple gained but detracted from relative performance due to our underweight. While the company’s overall and iPhone revenues declined year over year, the unveiling of an upgraded iPad Pro and iPad Air boosted investor sentiment. In particular, the introduction of generative AI features allayed concerns that Apple was not keeping pace with competitors.

NVIDIA rallied but detracted from relative returns due to our underweight. The maker of generative AI chips once again reported exceptional quarterly results and increased its guidance for the upcoming quarter.

Parnassus Growth Equity Fund

As of June 30, 2024

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

10

| | | | |

| | |

| Semiannual Report • 2024 | | | |  |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 8.4% | |

| |

| Alphabet Inc., Class A | | | 8.1% | |

| |

| NVIDIA Corp. | | | 7.7% | |

| |

| Amazon.com Inc. | | | 4.9% | |

| |

| Apple Inc. | | | 4.5% | |

| |

| Visa Inc., Class A | | | 4.1% | |

| |

| Eli Lilly & Co. | | | 3.4% | |

| |

| Salesforce Inc. | | | 3.3% | |

| |

| Broadcom Inc. | | | 2.9% | |

| |

| Intuit Inc. | | | 2.4% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

As of June 30, 2024, the Fund’s most significant sector weights relative to the benchmark remain the same. The Fund’s largest overweight positions are in the Financials and Health Care sectors, while its largest underweight positions are in the Information Technology and Consumer Discretionary sectors.

The Financials sector continues to be our largest sector overweight position. We opportunistically added market index provider MSCI during the quarter. We believe MSCI complements our existing names as a must-have data provider to the asset management industry. Like our other holdings, MSCI has unique end-market exposure, high operating leverage and limited balance sheet risk. To fund MSCI, we trimmed some of our existing positions and sold Old Dominion Freight Line. This sale turned our overweight to an underweight in Industrials, which continues to face cyclical demand risk.

Our relative Health Care exposure increased slightly. We continue to favor our catalyst-rich names across subsectors, including medical devices, biopharma, life science tools and payors. We prefer the relatively defensive and idiosyncratic growth opportunities in Health Care to the businesses and valuations in Consumer Staples, where we remain underweight.

Our underweight positions in the Information Technology and Consumer Discretionary sectors were primarily driven by our limited exposure to large benchmark constituents Apple, NVIDIA, Tesla and Amazon. Our underweights in Apple and NVIDIA were

both negative relative contributors for the quarter. To help offset this underweight, we continued to add to our overall semiconductor exposure. Within Information Technology, we added Workday and funded it with the sale of Palo Alto Networks.

We made no material changes to our positions in the Consumer Staples, Communication Services or Materials sectors. We do not own any Energy, Real Estate or Utilities stocks.

We have maintained our balanced approach to portfolio positioning. The investment landscape remains favorable for stocks and risk assets, given moderating inflation, robust consumer demand, resilient wages and strong corporate earnings growth. In this environment, investor optimism has led to an elevated overall market valuation.

We remain focused on companies that have dominant market positions and growth supported by long-term secular trends. We are taking advantage of volatility to add to what we believe are high-quality businesses with strong growth potential at reasonable valuations.

We continue to anchor the Fund’s defensive exposure in Health Care, where we invest in businesses with cash flow that is less macro sensitive and in companies with strong catalysts. We are trimming some of our exposure to payments processors and Industrials companies with cyclical sensitivity in favor of those with more recurring revenue and must-have products within the Financials and Industrials sectors.

As always, we are honored to have your trust as we continue pursuing Principles and Performance®.

Sincerely,

Andrew S. Choi

Lead Portfolio Manager

Shivani R. Vohra

Portfolio Manager

11

| | | | |

| | |

| | | | Semiannual Report • 2024 |

Parnassus Value Equity Fund

Ticker: Investor Shares - PARWX

Ticker: Institutional Shares - PFPWX

As of June 30, 2024, the Parnassus Value Equity Fund – Investor Shares (“the Fund”) returned -3.81% (net of fees) for the quarter, underperforming the Russell 1000 Value Index’s (“Russell 1000 Value”) -2.17%.

Below is a table that summarizes the performances of the Parnassus Value Equity Fund and the Russell 1000 Value. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Value Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended June 30, 2024 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Value Equity Fund – Investor Shares | | | 15.13 | | | | 2.56 | | | | 14.34 | | | | 12.58 | | | | 0.93 | | | | 0.88 | |

| | | | | | |

| Parnassus Value Equity Fund – Institutional Shares | | | 15.38 | | | | 2.79 | | | | 14.59 | | | | 12.81 | | | | 0.72 | | | | 0.65 | |

| | | | | | |

| Russell 1000 Value Index | | | 13.06 | | | | 5.52 | | | | 9.01 | | | | 8.23 | | | | NA | | | | NA | |

The average annual total return for the Parnassus Value Equity Fund – Institutional Shares from commencement (April 30, 2015) was 12.56%. Performance shown prior to the inception of the Institutional Shares reflects the performance of the Parnassus Value Equity Fund – Investor Shares and includes expenses that are not applicable to and are higher than those of the Institutional Shares. The performance of the Institutional Shares differs from that shown for the Investor Shares to the extent that the classes do not have the same expenses.

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Value is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

As described in the Fund’s current prospectus dated May 1, 2024, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.88% of net assets for the Parnassus Value Equity Fund – Investor Shares and to 0.65% of net assets for the Parnassus Value Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2025, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Second Quarter Review

The Fund returned -3.81% (net of fees), trailing the Russell 1000 Value’s -2.17%. From a sector perspective, stock selection in the Communication Services sector contributed the most to relative performance, followed by selection in the Information Technology and Utilities sectors. The Fund’s overweight in Financials also aided results. Stock selection in Health Care, Consumer Staples and Industrials, on the other hand, hindered relative return.

The Fund’s top contributors were Alphabet, Micron Technology and Taiwan Semiconductor Manufacturing Company (TSMC), while the bottom contributors were Global Payments, Intel and NICE.

Alphabet’s stock rose on the strength of robust first-quarter revenue growth underpinned by noteworthy gains in search advertising, YouTube advertising and the cloud business. Signs that the company is accelerating its development of AI solutions sparked investor optimism.

Micron Technology posted fiscal-third-quarter results that met expectations. Micron’s DRAM (dynamic random access memory) and NAND (non-volatile storage technology) segments grew revenue strongly, continuing the company’s recovery from a cyclical downturn last year. We believe Micron is well positioned to capitalize on AI-driven demand for greater memory.

Taiwan Semiconductor Manufacturing Company’s leading position in AI chip production continued to boost investor sentiment on the stock. During the quarter, announcements by several large technology companies to expand their AI investments signaled insatiable demand for TSMC’s chips and contributed to the stock’s rise.

12

| | | | |

| | |

| Semiannual Report • 2024 | | | |  |

Global Payments’ stock fell on investor fears that a slowing economy could weigh on payment processing companies. The company will host an investor day focused on improving efficiencies and strategic redeployment of assets in the fall, which we believe will unlock hidden value in the undervalued shares.

Intel disappointed investors with a less-than-stellar second-quarter forecast, driving shares lower despite first-quarter results that largely met expectations. Additionally, the company revealed greater losses than anticipated in its foundry operations during the quarter.

NICE reported first-quarter earnings that exceeded consensus estimates. However, the stock fell on news that the company’s CEO plans to leave at the end of the year and on concerns that its contact-center software would be replaced by generative AI. We believe the concerns are overblown and anticipate that the firm will integrate AI features successfully.

Parnassus Value Equity Fund

As of June 30, 2024

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

13

| | | | |

| | |

| | | | Semiannual Report • 2024 |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Verizon Communications Inc. | | | 4.2% | |

| |

| Bank of America Corp. | | | 3.5% | |

| |

| Oracle Corp. | | | 3.3% | |

| |

| S&P Global Inc. | | | 3.0% | |

| |

| Alphabet Inc., Class A | | | 3.0% | |

| |

| Sysco Corp. | | | 2.9% | |

| |

| Ball Corp. | | | 2.8% | |

| |

| The Bank of New York Mellon Corp. | | | 2.8% | |

| |

| Micron Technology Inc. | | | 2.7% | |

| |

| Microsoft Corp. | | | 2.7% | |

Portfolio characteristics and holdings are subject to change periodically.

Outlook and Strategy

The Fund’s largest overweights relative to the benchmark as of June 30, 2024, were in the Information Technology, Communication Services and Financials sectors, while the Fund’s three largest underweights were in the Energy, Consumer Staples and Industrials sectors.

During the second quarter, the Fund’s overweight position in the Information Technology sector decreased slightly as we sold our position in Cisco Systems and used most of the proceeds to buy Broadcom, a leading semiconductor company and provider of custom silicon products. Both stocks provide similar exposure to networking technology, but we believe Broadcom offers more upside from AI infrastructure spend and defensiveness due to its software assets.

The Fund’s exposure to the Communication Services sector increased slightly as we used proceeds from the Cisco exit to increase our existing exposure to Comcast and Charter Communications. We consider both Comcast and Charter to be trading at attractive valuations following a period of soft performance. These moves increased the Fund’s overweight position in the Communication Services sector.

In the Financials sector, we tapered our positions across multiple holdings, including Bank of America, Bank of New York Mellon, Fidelity National Information Services, Charles Schwab, Progressive and American

Express. After more than a year of uncertainty, investors now accept the idea that the U.S. economy could experience a soft landing, which has driven these stocks higher. While there is room to run if capital markets continue to recover, we reduced the Fund’s overweight in Financials slightly to add to our existing positions in cable and other stocks with more upside potential.

With stocks pushing multiple record highs, there are fewer bargains in the market. We therefore made fewer new purchases this quarter, consistent with our disciplined investment process. Our bottom-up approach allows us to uncover quality businesses and invest only when they are trading at attractive valuations.

We continue to maintain the Fund’s balanced positioning between offensive and defensive sectors, given that available economic data suggests a balanced mix of risks and opportunities. After peaking at over 9% in 2022, headline inflation is trending lower in response to restrictive monetary policy by the Fed. However, the unpredictable timing of Fed rate cuts, concerns that economic growth could stall and tensions over the upcoming presidential election are all expected to increase investor uncertainty. Our strategy is to capitalize on this volatility by investing in quality businesses when they reach attractive valuations.