UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:

Parnassus Funds (811-04044) and Parnassus Income Funds (811-06673)

Parnassus Funds

Parnassus Income Funds

(Exact name of registrant as specified in charter)

1 Market Street, Suite 1600, San Francisco, California 94105

(Address of principal executive offices) (Zip Code)

Marc C. Mahon

Parnassus Funds

Parnassus Income Funds

1 Market Street, Suite 1600, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 778-0200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

| | (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). |

| | (b) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Parnassus Growth Equity Fund

Annual Shareholder Report - December 31, 2024

Parnassus Growth Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks with the potential to benefit from secular trends at attractive valuations.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $95 | 0.84% |

|---|

How did the fund perform?

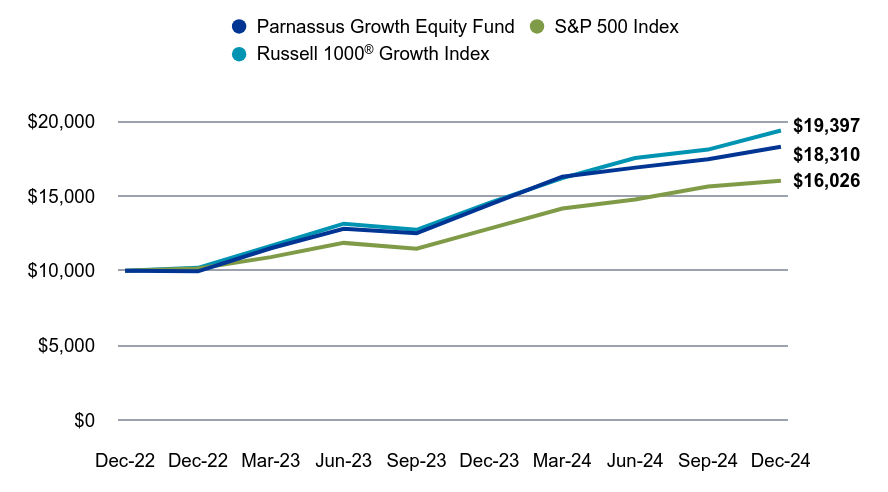

Parnassus Growth Equity Fund (Investor Shares) returned 26.85%, (net of fees) for the year, underperforming the Russell 1000 Growth Index’s 33.36%. Stock selection in the Information Technology, Consumer Discretionary and Communication Services sectors held back relative returns. Conversely, stock selection in the Health Care sector and both stock selection and an underweight in the Consumer Staples sector buoyed relative performance.

We continue to maintain balanced portfolio positioning in favor of increasingly relevant, competitively advantaged businesses that are trading at attractive valuations.

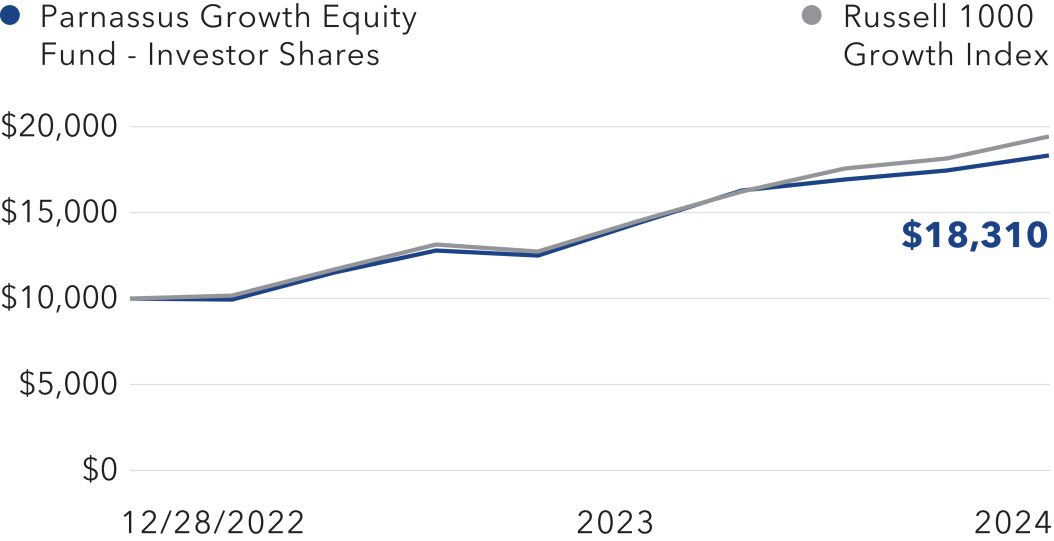

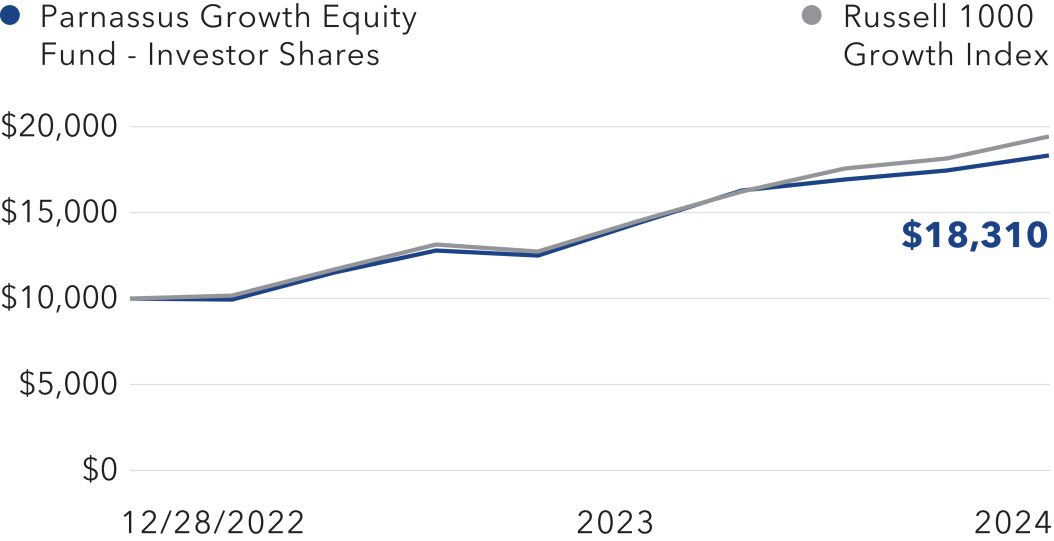

Value on December 31, 2024 of $10,000 invested on December 28, 2022.

| Parnassus Growth Equity Fund | S&P 500 Index | Russell 1000® Growth Index |

|---|

| | | |

|---|

| Dec-22 | $10,000 | $10,000 | $10,000 |

|---|

| Dec-22 | $9,960 | $10,151 | $10,194 |

|---|

| Mar-23 | $11,507 | $10,912 | $11,659 |

|---|

| Jun-23 | $12,813 | $11,866 | $13,152 |

|---|

| Sep-23 | $12,507 | $11,477 | $12,741 |

|---|

| Dec-23 | $14,434 | $12,819 | $14,545 |

|---|

| Mar-24 | $16,298 | $14,172 | $16,205 |

|---|

| Jun-24 | $16,908 | $14,779 | $17,556 |

|---|

| Sep-24 | $17,463 | $15,649 | $18,116 |

|---|

| Dec-24 | $18,310 | $16,026 | $19,397 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The Fund commenced operations on December 28, 2022.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $63,702,581 |

|---|

| # of Portfolio Holdings | 42 |

|---|

| Portfolio Turnover Rate | 34.89% |

|---|

| Advisory Fees Paid | $85,796 |

|---|

Average Annual Total Returns (%)

| 1 Year | Since Inception |

|---|

| Parnassus Growth Equity Fund - Investor Shares (Incp: December 28, 2022) | 26.85% | 35.15% |

|---|

| S&P 500 Index | 25.02% | 26.47% |

|---|

Russell 1000® Growth Index | 33.36% | 39.08% |

|---|

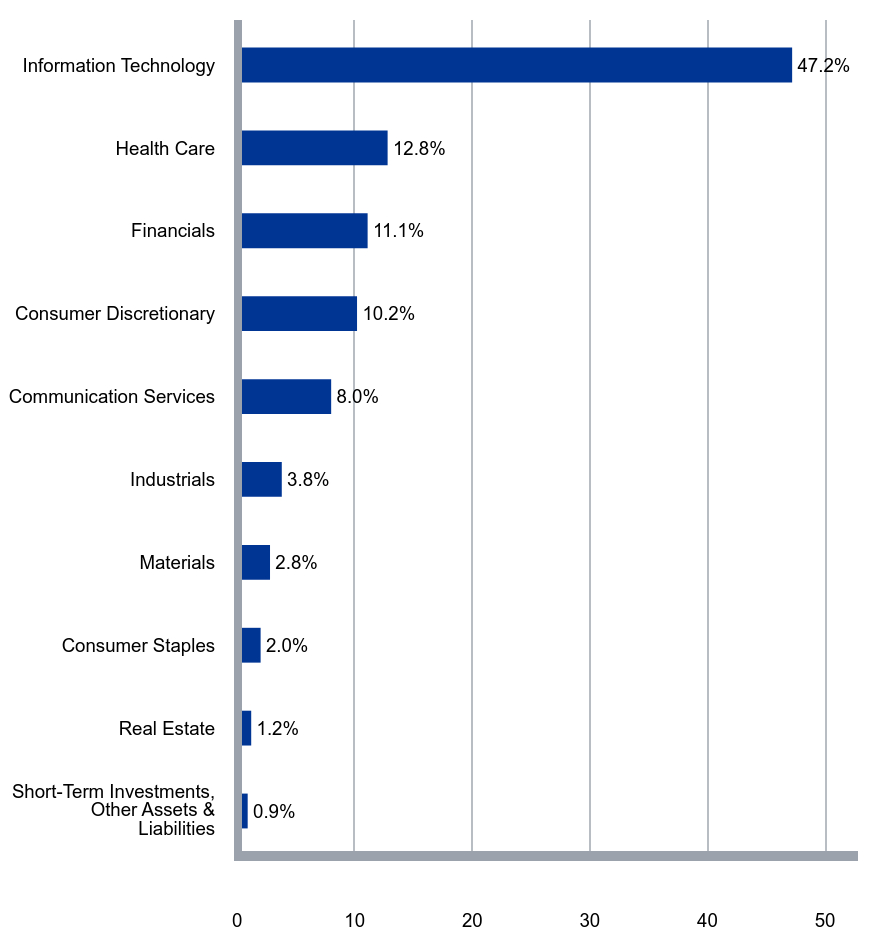

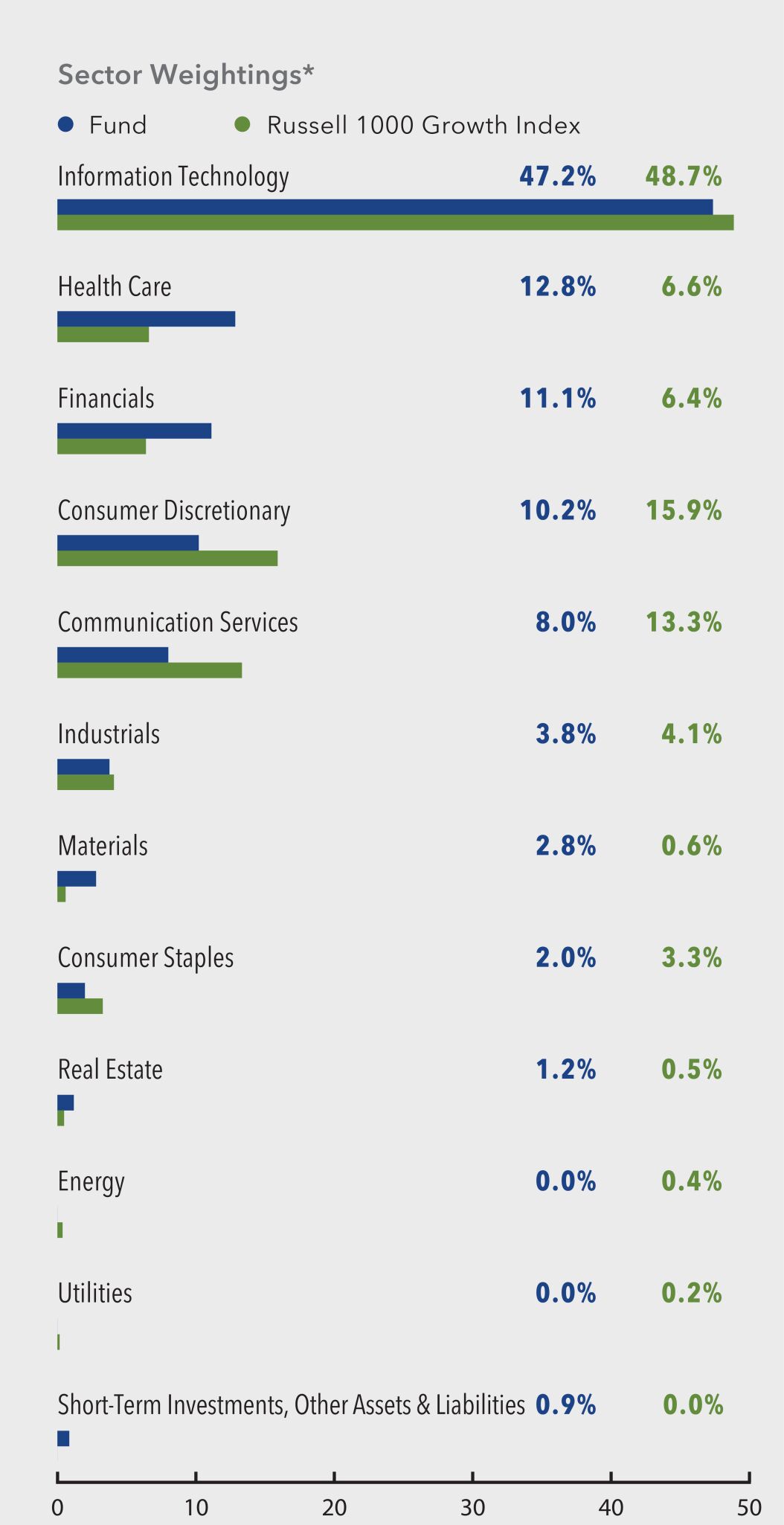

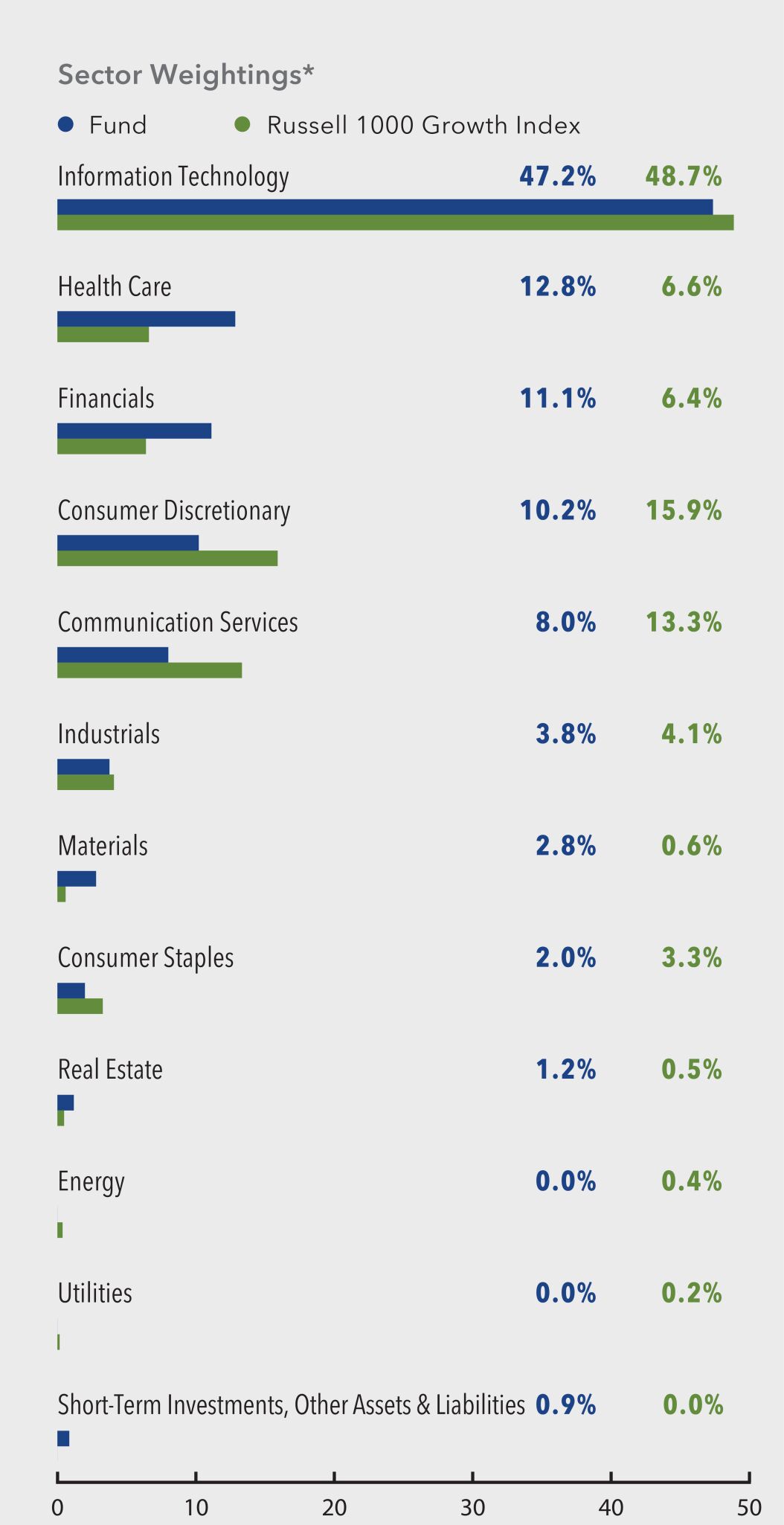

What did the Fund invest in?

Parnassus Growth Equity Fund invests selectively in about 40 U.S. large-cap equity securities. The Fund pursues high quality companies with increasing relevancy, durable competitive advantages, strong management teams and sustainable business practices. It favors leading, innovative companies positioned to capitalize on secular trends.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.9% |

| Real Estate | 1.2% |

| Consumer Staples | 2.0% |

| Materials | 2.8% |

| Industrials | 3.8% |

| Communication Services | 8.0% |

| Consumer Discretionary | 10.2% |

| Financials | 11.1% |

| Health Care | 12.8% |

| Information Technology | 47.2% |

| Microsoft Corp. | 9.0% |

| NVIDIA Corp. | 8.9% |

| Alphabet Inc., Class A | 6.4% |

| Amazon.com Inc. | 4.8% |

| Apple Inc. | 4.8% |

| Broadcom Inc. | 4.8% |

| Visa Inc., Class A | 4.6% |

| Salesforce Inc. | 3.2% |

| Eli Lilly & Co. | 2.9% |

| Natera Inc. | 2.4% |

Parnassus Growth Equity Fund

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Growth Equity Fund

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

Parnassus Growth Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks with the potential to benefit from secular trends at attractive valuations.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $72 | 0.63% |

|---|

How did the fund perform?

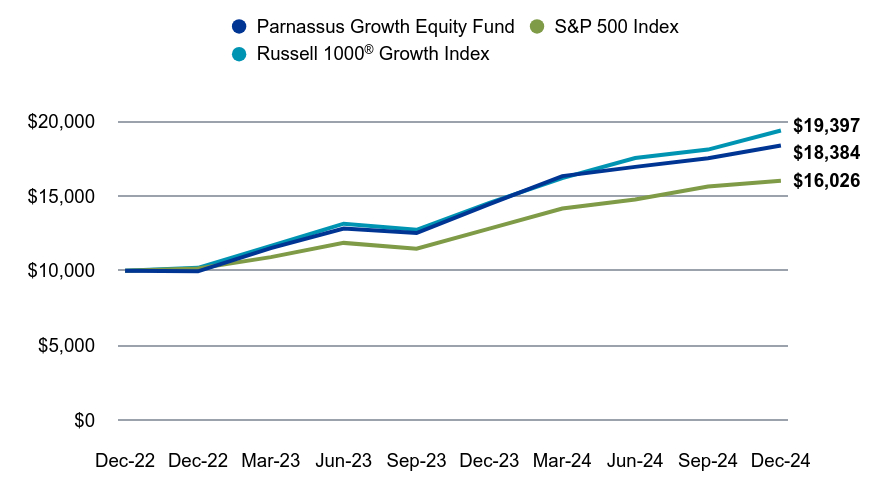

Parnassus Growth Equity Fund (Institutional Shares) returned 27.13%, (net of fees) for the year, underperforming the Russell 1000 Growth Index’s 33.36%. Stock selection in the Information Technology, Consumer Discretionary and Communication Services sectors held back relative returns. Conversely, stock selection in the Health Care sector and both stock selection and an underweight in the Consumer Staples sector buoyed relative performance.

We continue to maintain balanced portfolio positioning in favor of increasingly relevant, competitively advantaged businesses that are trading at attractive valuations.

Value on December 31, 2024 of $10,000 invested on December 28, 2022.

| Parnassus Growth Equity Fund | S&P 500 Index | Russell 1000® Growth Index |

|---|

| | | |

|---|

| Dec-22 | $10,000 | $10,000 | $10,000 |

|---|

| Dec-22 | $9,960 | $10,151 | $10,194 |

|---|

| Mar-23 | $11,513 | $10,912 | $11,659 |

|---|

| Jun-23 | $12,827 | $11,866 | $13,152 |

|---|

| Sep-23 | $12,527 | $11,477 | $12,741 |

|---|

| Dec-23 | $14,460 | $12,819 | $14,545 |

|---|

| Mar-24 | $16,341 | $14,172 | $16,205 |

|---|

| Jun-24 | $16,959 | $14,779 | $17,556 |

|---|

| Sep-24 | $17,536 | $15,649 | $18,116 |

|---|

| Dec-24 | $18,384 | $16,026 | $19,397 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The Fund commenced operations on December 28, 2022.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $63,702,581 |

|---|

| # of Portfolio Holdings | 42 |

|---|

| Portfolio Turnover Rate | 34.89% |

|---|

| Advisory Fees Paid | $85,796 |

|---|

Average Annual Total Returns (%)

| 1 Year | Since Inception |

|---|

| Parnassus Growth Equity Fund - Institutional Shares (Incp: December 28, 2022) | 27.13% | 35.42% |

|---|

| S&P 500 Index | 25.02% | 26.47% |

|---|

Russell 1000® Growth Index | 33.36% | 39.08% |

|---|

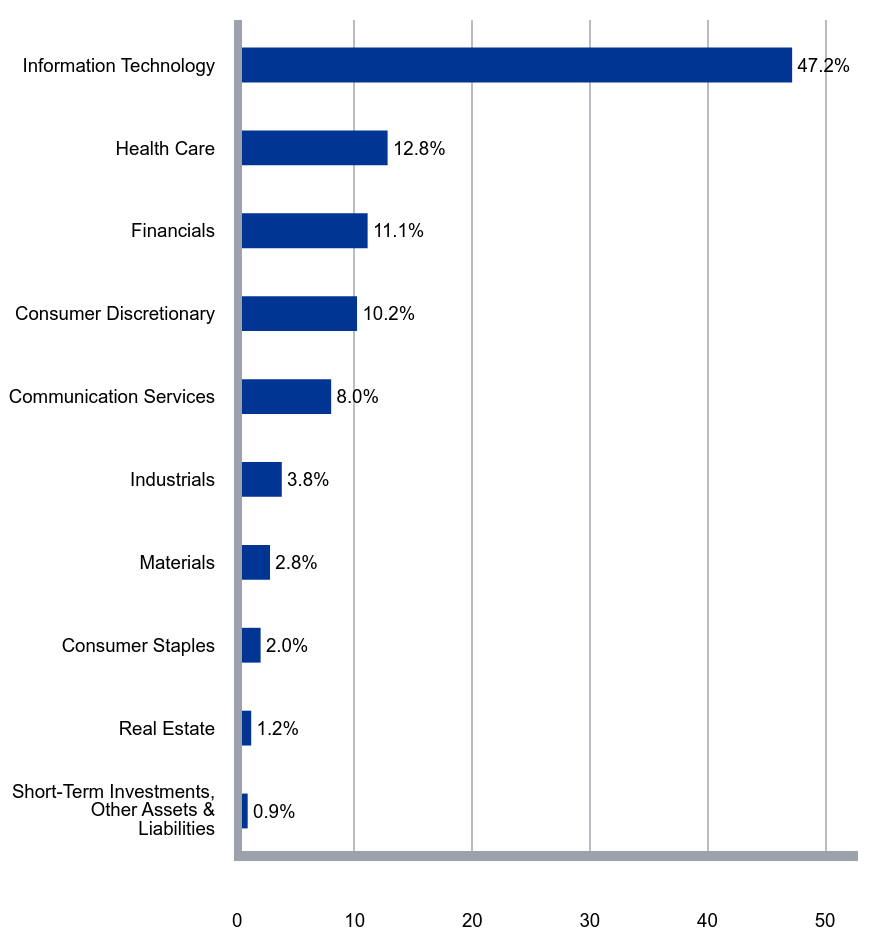

What did the Fund invest in?

Parnassus Growth Equity Fund invests selectively in about 40 U.S. large-cap equity securities. The Fund pursues high quality companies with increasing relevancy, durable competitive advantages, strong management teams and sustainable business practices. It favors leading, innovative companies positioned to capitalize on secular trends.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.9% |

| Real Estate | 1.2% |

| Consumer Staples | 2.0% |

| Materials | 2.8% |

| Industrials | 3.8% |

| Communication Services | 8.0% |

| Consumer Discretionary | 10.2% |

| Financials | 11.1% |

| Health Care | 12.8% |

| Information Technology | 47.2% |

| Microsoft Corp. | 9.0% |

| NVIDIA Corp. | 8.9% |

| Alphabet Inc., Class A | 6.4% |

| Amazon.com Inc. | 4.8% |

| Apple Inc. | 4.8% |

| Broadcom Inc. | 4.8% |

| Visa Inc., Class A | 4.6% |

| Salesforce Inc. | 3.2% |

| Eli Lilly & Co. | 2.9% |

| Natera Inc. | 2.4% |

Parnassus Growth Equity Fund

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Value Equity Fund

Annual Shareholder Report - December 31, 2024

Parnassus Value Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks that are attractively priced relative to their history or peers.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $93 | 0.88% |

|---|

How did the fund perform?

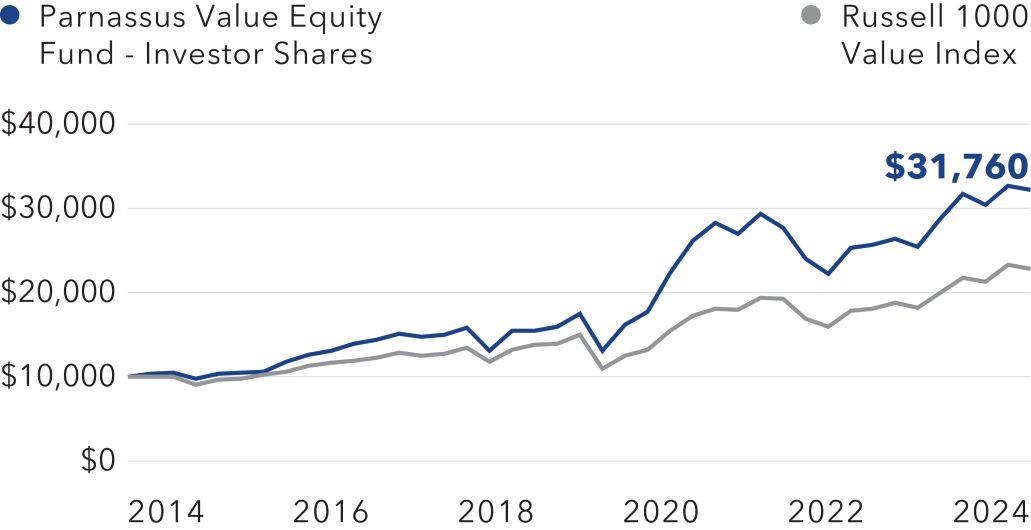

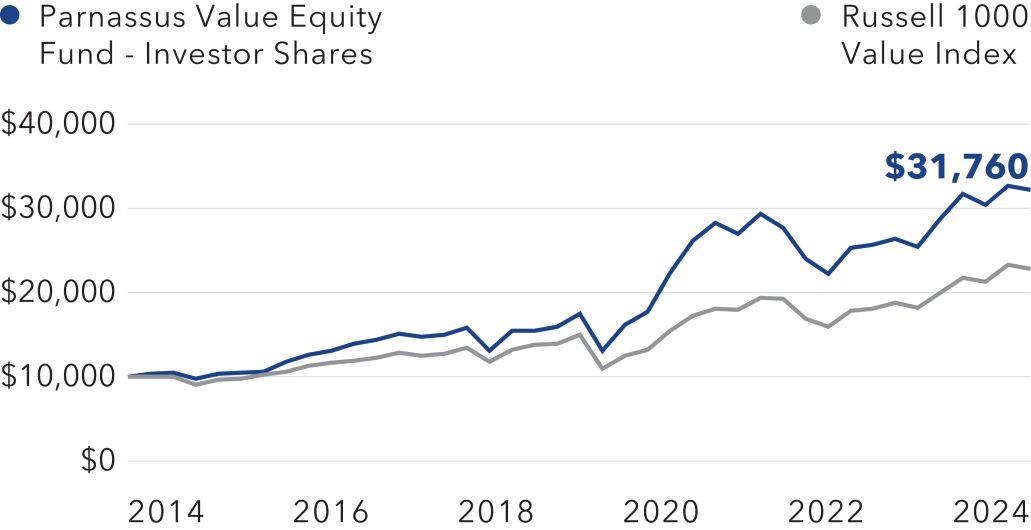

Parnassus Value Equity Fund (Investor Shares) returned 12.01% (net of fees), trailing the Russell 1000 Value Index’s 14.37% for the year. Stock selection in the Health Care sector notably weighed on relative performance. In contrast, strong stock selection in Real Estate boosted relative returns.

A continuation of the shift in investor sentiment toward more economically sensitive sectors could support a broadening of the stock market rally, especially in value stocks.

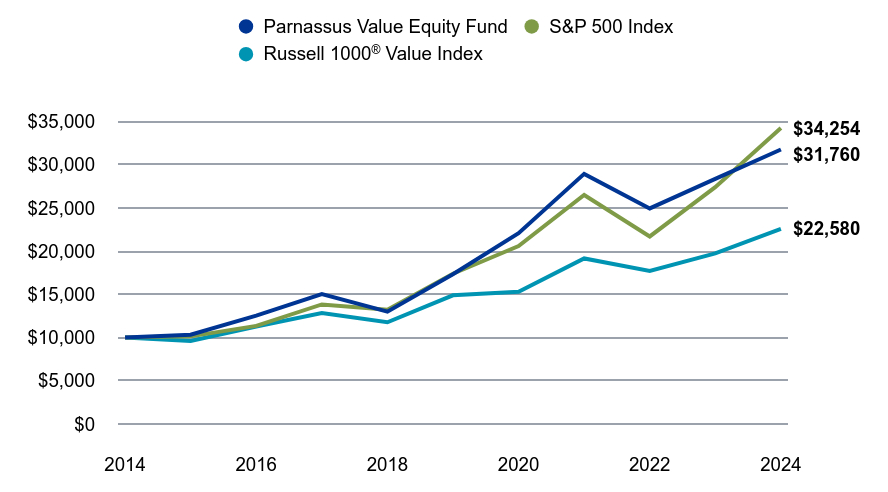

Value on December 31, 2024 of $10,000 invested on December 31, 2014.

| Parnassus Value Equity Fund | S&P 500 Index | Russell 1000® Value Index |

|---|

| | | |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

|---|

| 2015 | $10,325 | $10,138 | $9,617 |

|---|

| 2016 | $12,536 | $11,351 | $11,285 |

|---|

| 2017 | $15,019 | $13,829 | $12,827 |

|---|

| 2018 | $12,994 | $13,223 | $11,767 |

|---|

| 2019 | $17,319 | $17,386 | $14,890 |

|---|

| 2020 | $22,068 | $20,585 | $15,306 |

|---|

| 2021 | $28,936 | $26,494 | $19,157 |

|---|

| 2022 | $24,939 | $21,696 | $17,713 |

|---|

| 2023 | $28,355 | $27,399 | $19,743 |

|---|

| 2024 | $31,760 | $34,254 | $22,580 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $4,825,190,926 |

|---|

| # of Portfolio Holdings | 45 |

|---|

| Portfolio Turnover Rate | 24.08% |

|---|

| Advisory Fees Paid | $31,176,918 |

|---|

Average Annual Total Returns (%)

| 1 Year | 5 years | 10 Years |

|---|

| Parnassus Value Equity Fund - Investor Shares | 12.01% | 12.89% | 12.25% |

|---|

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Value Index | 14.37% | 8.68% | 8.49% |

|---|

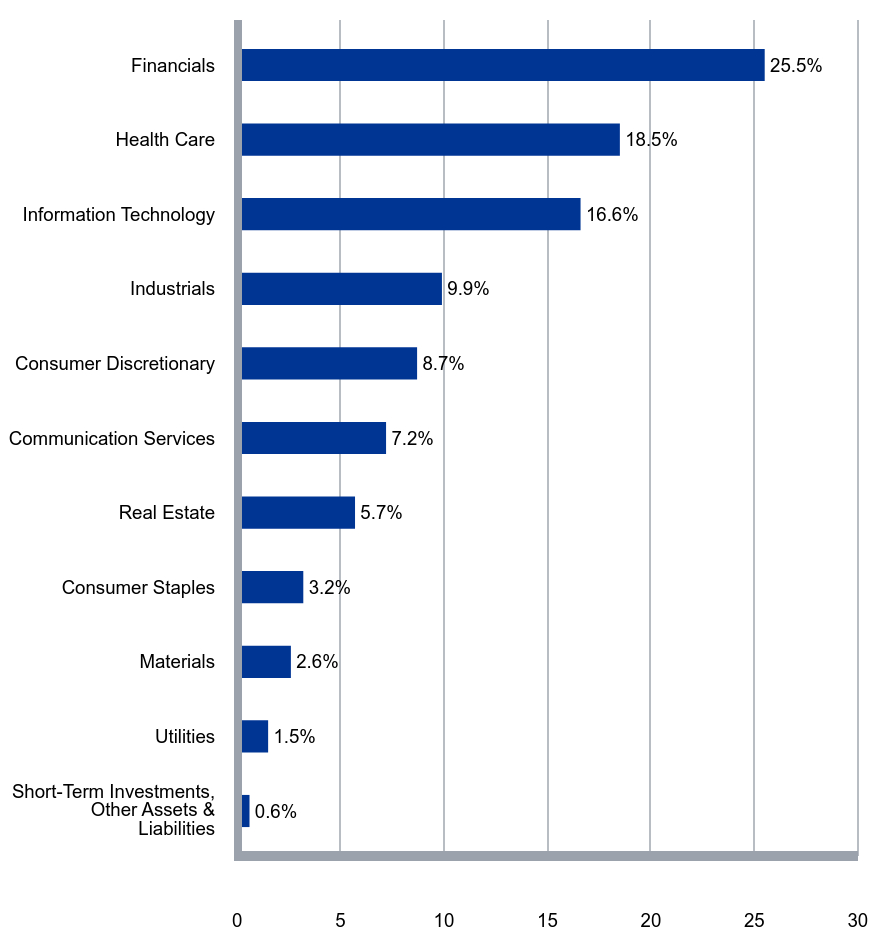

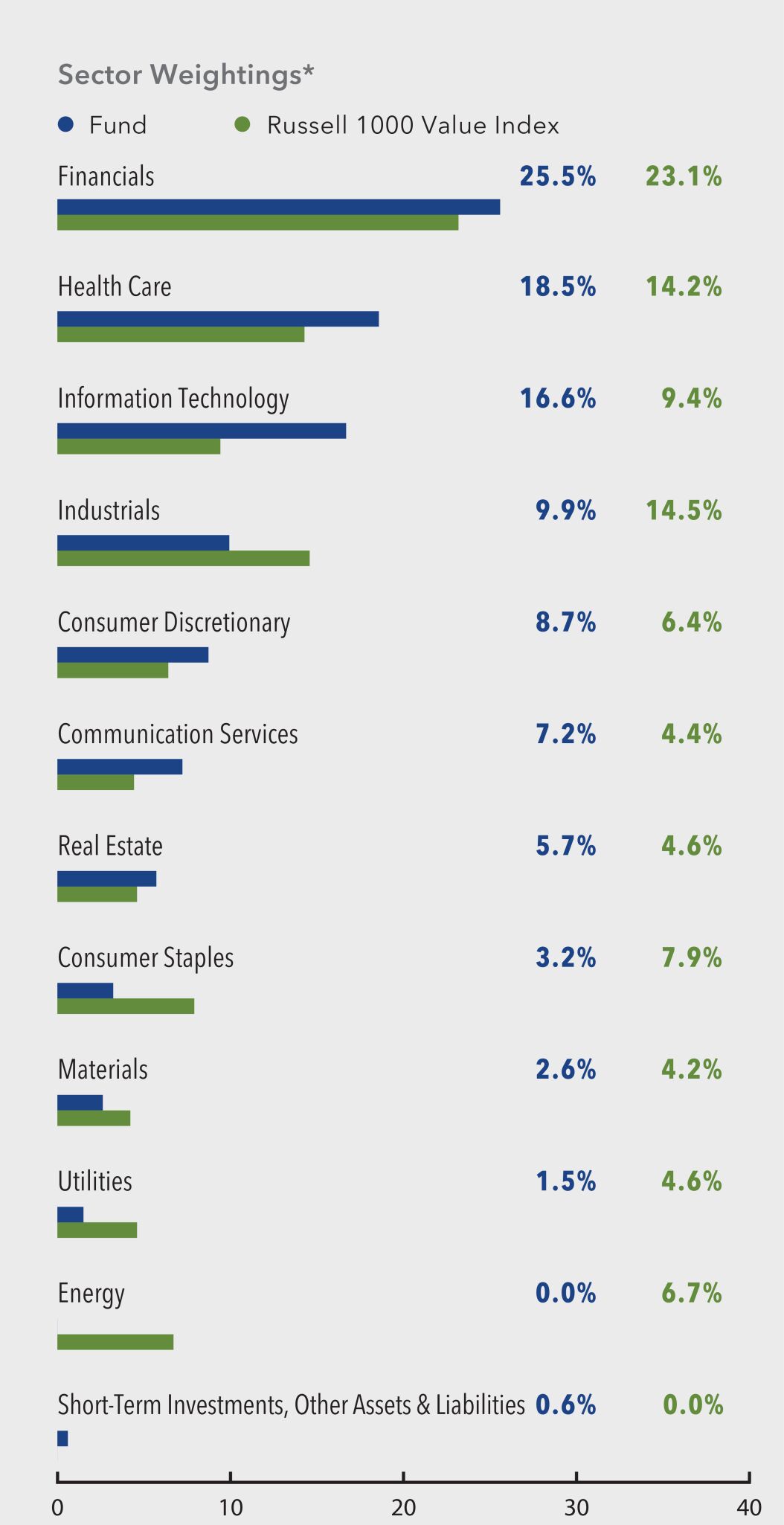

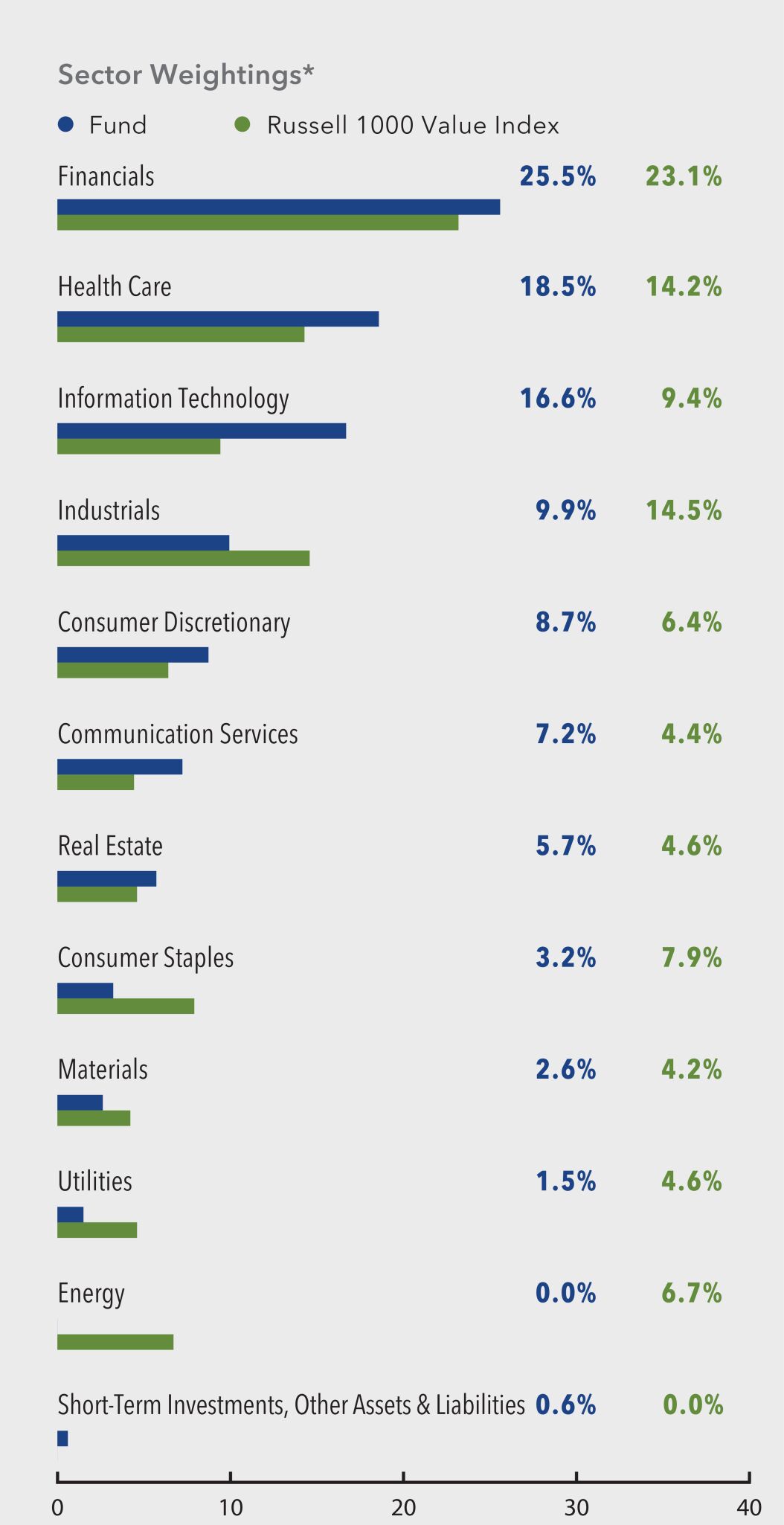

What did the Fund invest in?

Parnassus Value Equity Fund invests selectively in about 40-45 U.S. large-cap equity securities trading at a discount. The Fund pursues companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.6% |

| Utilities | 1.5% |

| Materials | 2.6% |

| Consumer Staples | 3.2% |

| Real Estate | 5.7% |

| Communication Services | 7.2% |

| Consumer Discretionary | 8.7% |

| Industrials | 9.9% |

| Information Technology | 16.6% |

| Health Care | 18.5% |

| Financials | 25.5% |

| S&P Global Inc. | 3.5% |

| Bank of America Corp. | 3.3% |

| Sysco Corp. | 3.2% |

| CBRE Group Inc., Class A | 3.2% |

| Deere & Co. | 3.1% |

| Verizon Communications Inc. | 2.9% |

| Mastercard Inc., Class A | 2.9% |

| Broadcom Inc. | 2.8% |

| Alphabet Inc., Class A | 2.8% |

| Cummins Inc. | 2.7% |

Parnassus Value Equity Fund

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Value Equity Fund

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

Parnassus Value Equity Fund (the "Fund") offers a concentrated portfolio of U.S. large-cap stocks that are attractively priced relative to their history or peers.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $69 | 0.65% |

|---|

How did the fund perform?

Parnassus Value Equity Fund (Institutional Shares) returned 12.27% (net of fees), trailing the Russell 1000 Value Index’s 14.37% for the year. Stock selection in the Health Care sector notably weighed on relative performance. In contrast, strong stock selection in Real Estate boosted relative returns.

A continuation of the shift in investor sentiment toward more economically sensitive sectors could support a broadening of the stock market rally, especially in value stocks.

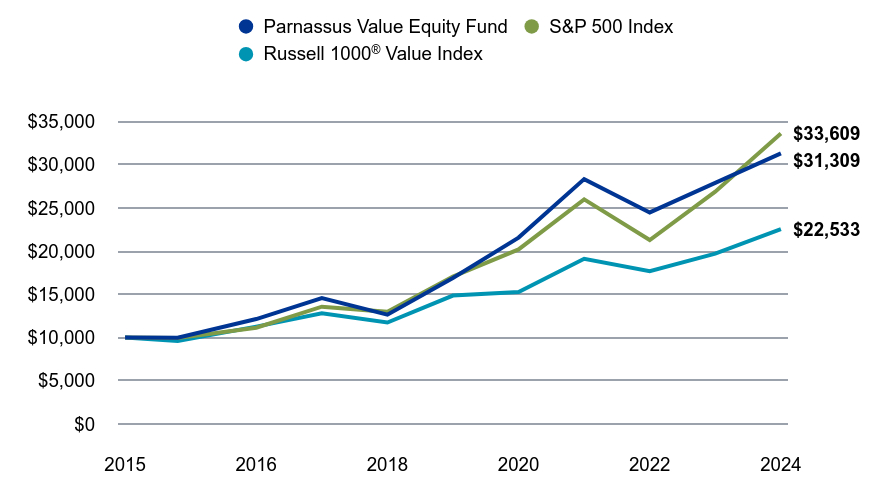

Value on December 31, 2024 of $10,000 invested on April 30, 2015.

| Parnassus Value Equity Fund | S&P 500 Index | Russell 1000® Value Index |

|---|

| | | |

|---|

| 2015 | $10,000 | $10,000 | $10,000 |

|---|

| 2015 | $9,978 | $9,947 | $9,597 |

|---|

| 2016 | $12,141 | $11,137 | $11,262 |

|---|

| 2017 | $14,573 | $13,569 | $12,801 |

|---|

| 2018 | $12,642 | $12,974 | $11,742 |

|---|

| 2019 | $16,885 | $17,059 | $14,859 |

|---|

| 2020 | $21,565 | $20,197 | $15,274 |

|---|

| 2021 | $28,330 | $25,995 | $19,117 |

|---|

| 2022 | $24,476 | $21,287 | $17,676 |

|---|

| 2023 | $27,888 | $26,883 | $19,703 |

|---|

| 2024 | $31,309 | $33,609 | $22,533 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The share class commenced operations on April 30, 2015.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $4,825,190,926 |

|---|

| # of Portfolio Holdings | 45 |

|---|

| Portfolio Turnover Rate | 24.08% |

|---|

| Advisory Fees Paid | $31,176,918 |

|---|

Average Annual Total Returns (%)

| 1 Year | 5 years | Since Inception |

|---|

| Parnassus Value Equity Fund - Institutional Shares (Incp: April 30, 2015) | 12.27% | 13.14% | 12.53% |

|---|

| S&P 500 Index | 25.02% | 14.53% | 13.36% |

|---|

Russell 1000® Value Index | 14.37% | 8.68% | 8.76% |

|---|

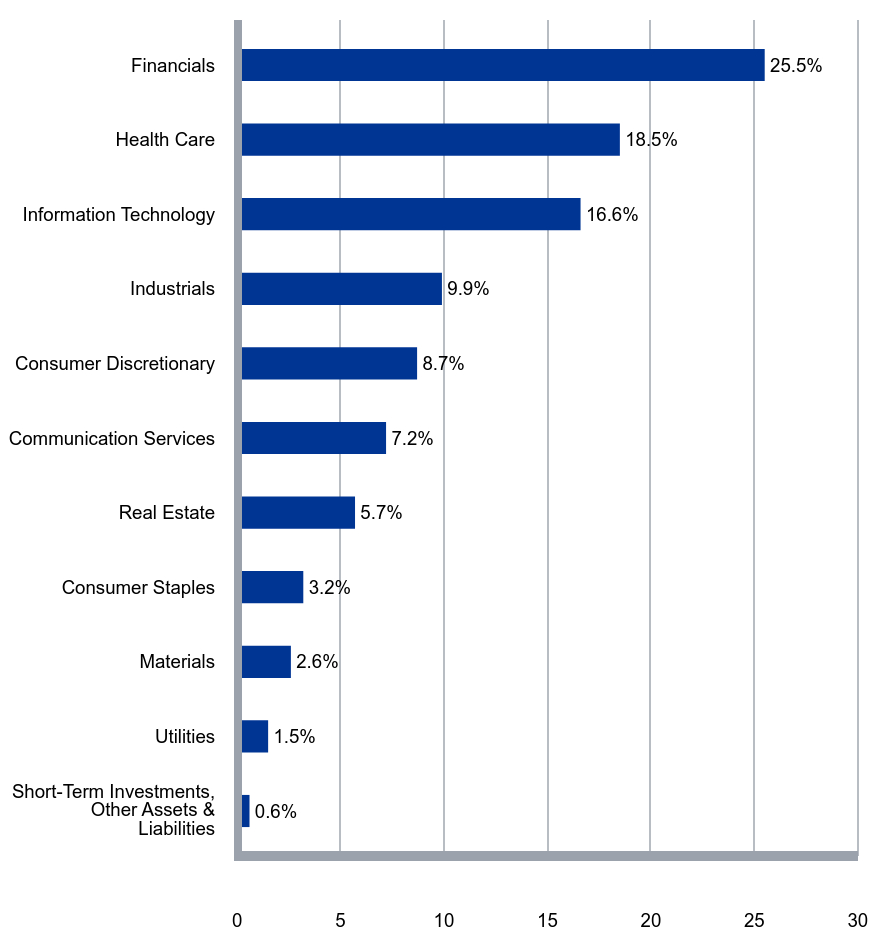

What did the Fund invest in?

Parnassus Value Equity Fund invests selectively in about 40-45 U.S. large-cap equity securities trading at a discount. The Fund pursues companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.6% |

| Utilities | 1.5% |

| Materials | 2.6% |

| Consumer Staples | 3.2% |

| Real Estate | 5.7% |

| Communication Services | 7.2% |

| Consumer Discretionary | 8.7% |

| Industrials | 9.9% |

| Information Technology | 16.6% |

| Health Care | 18.5% |

| Financials | 25.5% |

| S&P Global Inc. | 3.5% |

| Bank of America Corp. | 3.3% |

| Sysco Corp. | 3.2% |

| CBRE Group Inc., Class A | 3.2% |

| Deere & Co. | 3.1% |

| Verizon Communications Inc. | 2.9% |

| Mastercard Inc., Class A | 2.9% |

| Broadcom Inc. | 2.8% |

| Alphabet Inc., Class A | 2.8% |

| Cummins Inc. | 2.7% |

Parnassus Value Equity Fund

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Annual Shareholder Report - December 31, 2024

Parnassus Mid Cap Fund (the "Fund") offers a concentrated portfolio U.S. mid-cap stocks with the potential for long-term growth and business resiliency.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $100 | 0.95% |

|---|

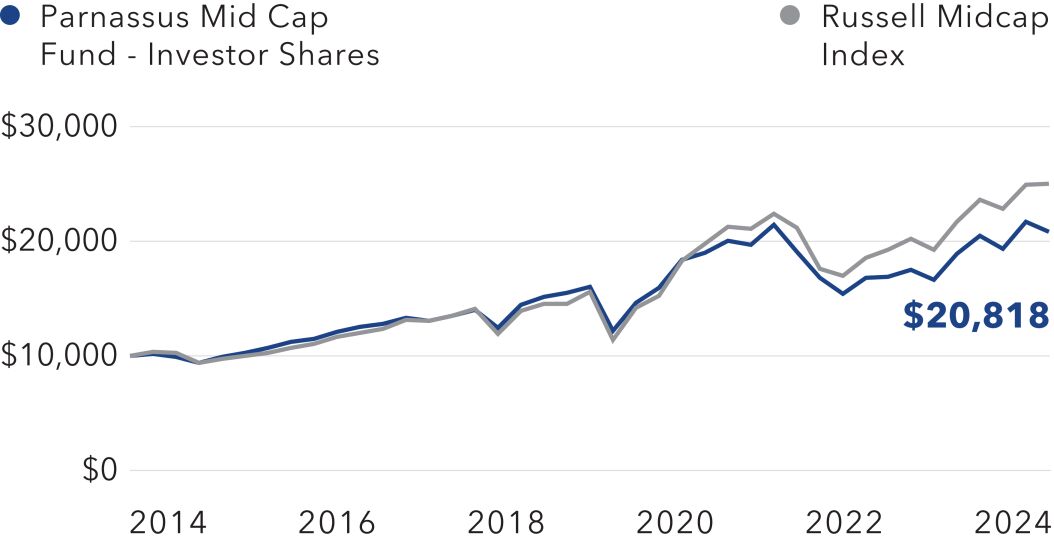

How did the fund perform?

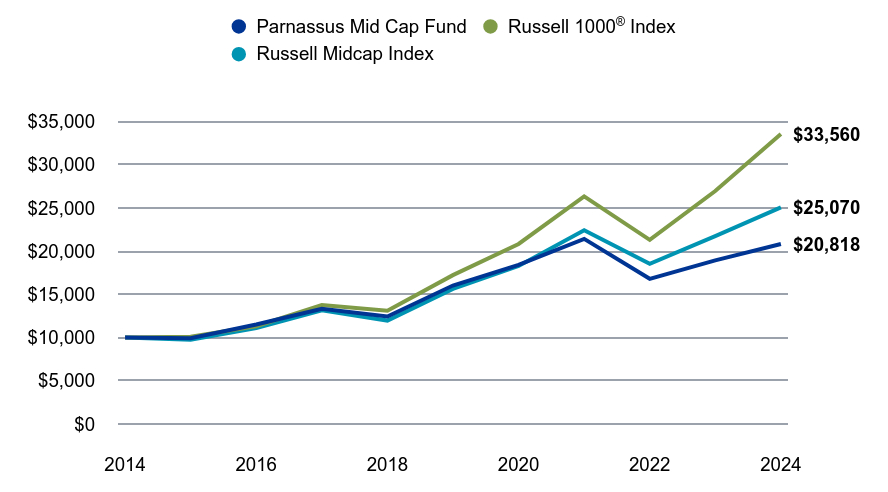

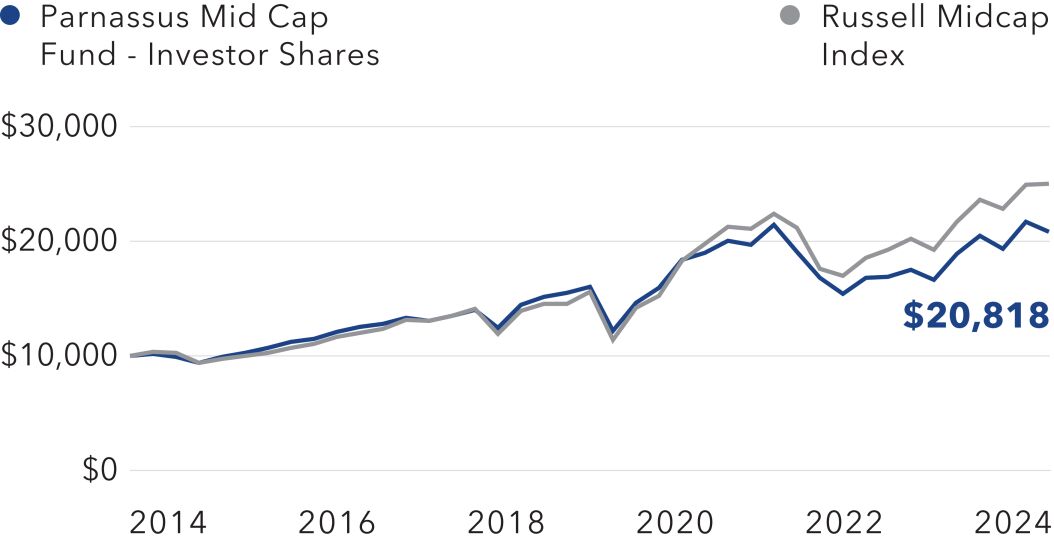

The Parnassus Mid Cap Fund (Investor shares) returned 9.99% (net of fees) in 2024, underperforming the Russell Midcap Index’s 15.34% return. Stock selection within Communication Services and Real Estate contributed to relative performance, while selection within Industrials and Information Technology detracted.

Our disciplined approach—emphasizing quality, financial strength, and attractive valuations—positions the Fund to help protect capital during downturns while capturing upside in favorable markets.

Value on December 31, 2024 of $10,000 invested on December 31, 2014.

| Parnassus Mid Cap Fund | Russell 1000® Index | Russell Midcap Index |

|---|

| | | |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

|---|

| 2015 | $9,913 | $10,092 | $9,756 |

|---|

| 2016 | $11,507 | $11,308 | $11,102 |

|---|

| 2017 | $13,324 | $13,761 | $13,158 |

|---|

| 2018 | $12,440 | $13,102 | $11,966 |

|---|

| 2019 | $16,016 | $17,220 | $15,621 |

|---|

| 2020 | $18,399 | $20,830 | $18,292 |

|---|

| 2021 | $21,416 | $26,340 | $22,424 |

|---|

| 2022 | $16,798 | $21,302 | $18,541 |

|---|

| 2023 | $18,927 | $26,953 | $21,735 |

|---|

| 2024 | $20,818 | $33,560 | $25,070 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $2,842,441,773 |

|---|

| # of Portfolio Holdings | 38 |

|---|

| Portfolio Turnover Rate | 43.55% |

|---|

| Advisory Fees Paid | $23,536,822 |

|---|

Average Annual Total Returns (%)

| 1 Year | 5 years | 10 Years |

|---|

| Parnassus Mid Cap Fund - Investor Shares | 9.99% | 5.38% | 7.61% |

|---|

Russell 1000® Index | 24.51% | 14.28% | 12.87% |

|---|

| Russell Midcap Index | 15.34% | 9.92% | 9.63% |

|---|

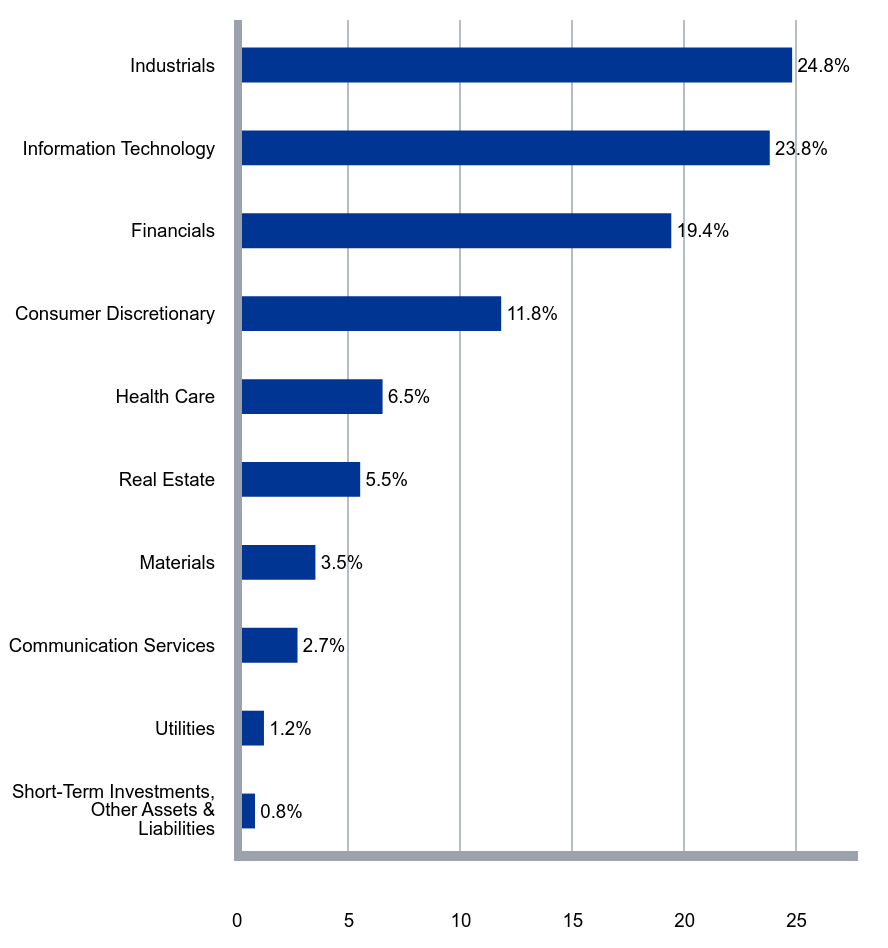

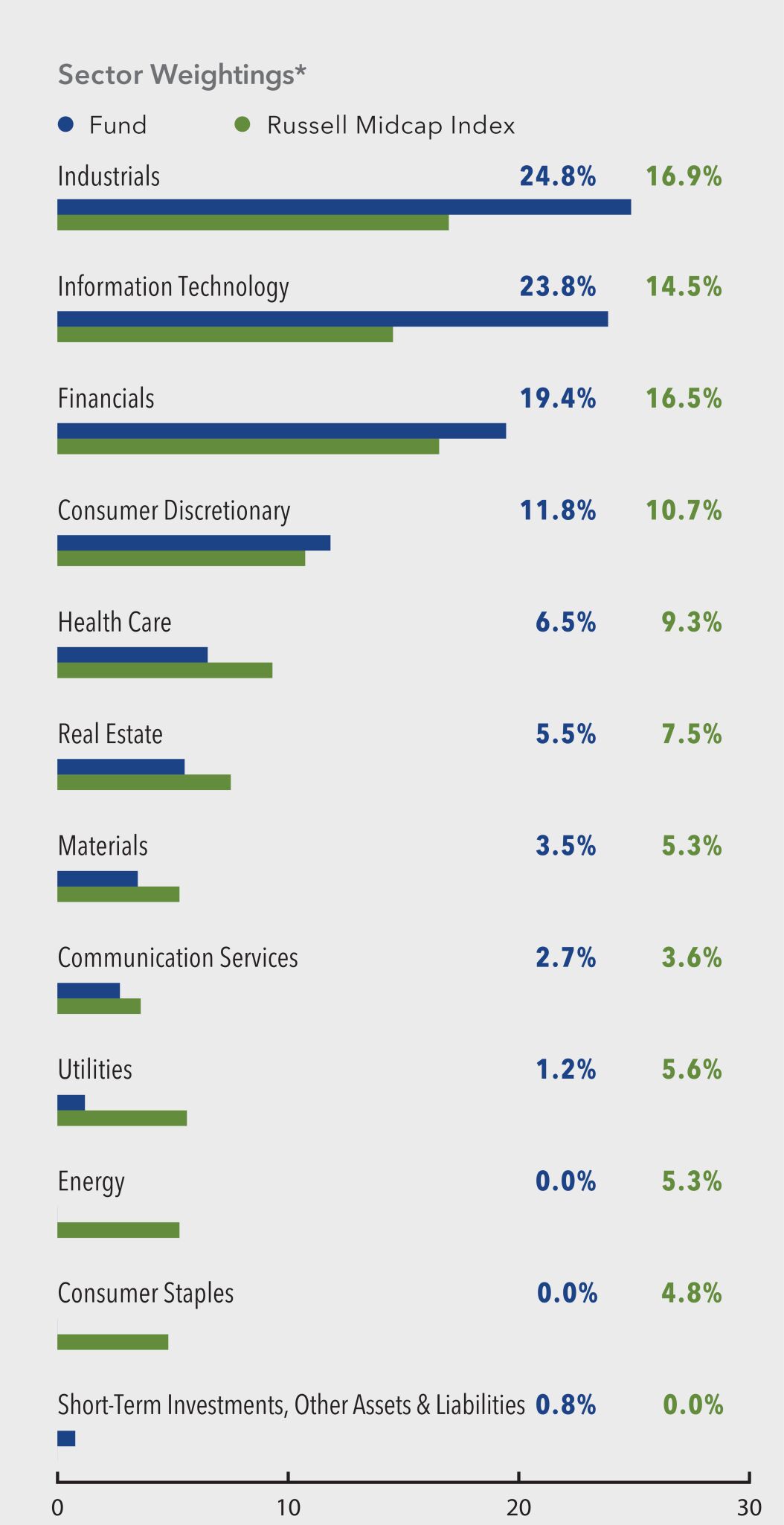

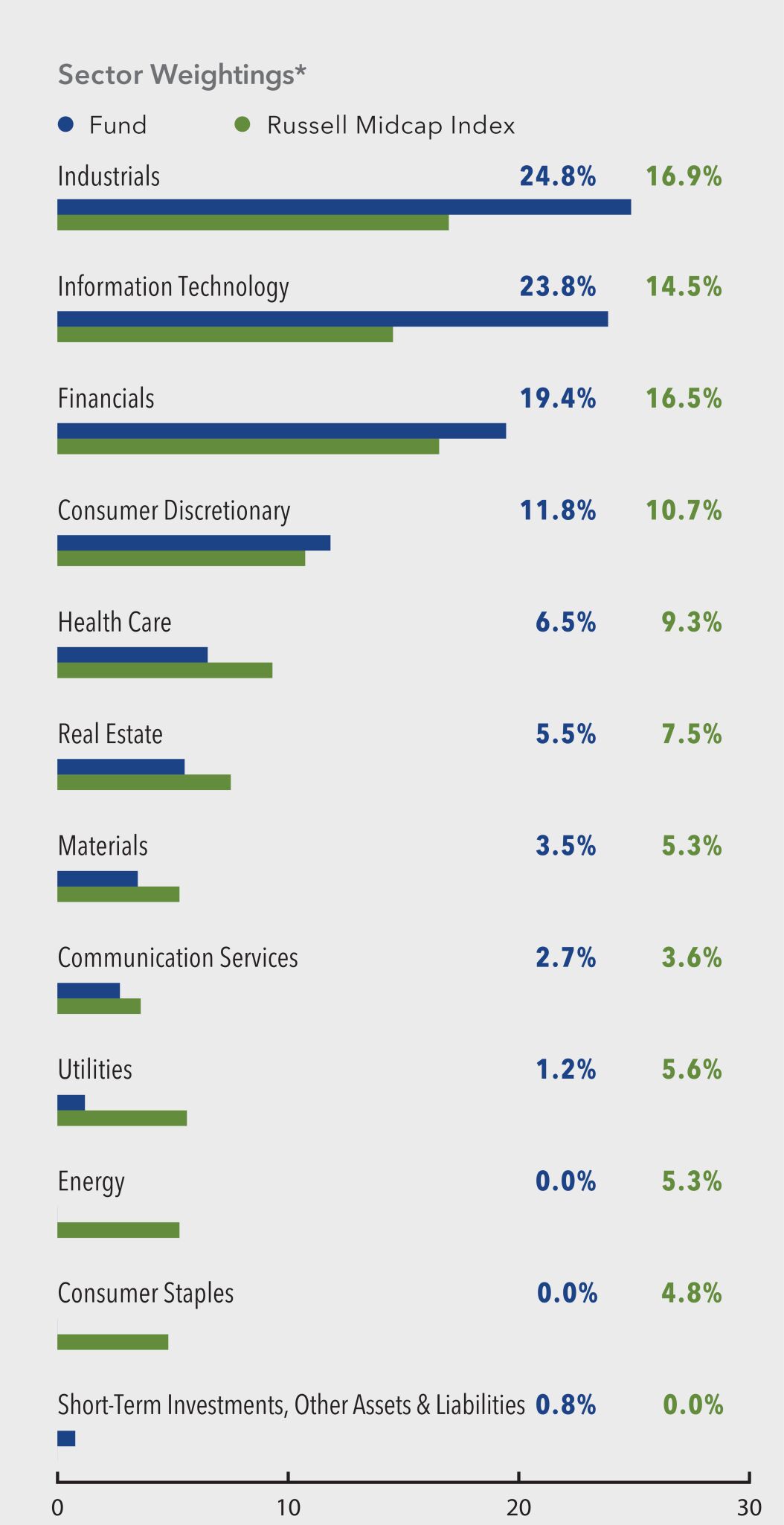

What did the Fund invest in?

Parnassus Mid Cap Fund invests selectively in about 35-45 U.S. mid-cap equity securities. The Fund pursues high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.8% |

| Utilities | 1.2% |

| Communication Services | 2.7% |

| Materials | 3.5% |

| Real Estate | 5.5% |

| Health Care | 6.5% |

| Consumer Discretionary | 11.8% |

| Financials | 19.4% |

| Information Technology | 23.8% |

| Industrials | 24.8% |

| Fidelity National Information Services | 4.0% |

| TransUnion | 3.8% |

| CBRE Group Inc., Class A | 3.7% |

| Fortinet Inc. | 3.7% |

| J.B. Hunt Transport Services Inc. | 3.6% |

| Cboe Global Markets Inc. | 3.5% |

| The Bank of New York Mellon Corp. | 3.4% |

| Roper Technologies Inc. | 3.3% |

| Truist Financial Corp. | 3.3% |

| Republic Services Inc. | 3.1% |

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

Parnassus Mid Cap Fund (the "Fund") offers a concentrated portfolio U.S. mid-cap stocks with the potential for long-term growth and business resiliency.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $79 | 0.75% |

|---|

How did the fund perform?

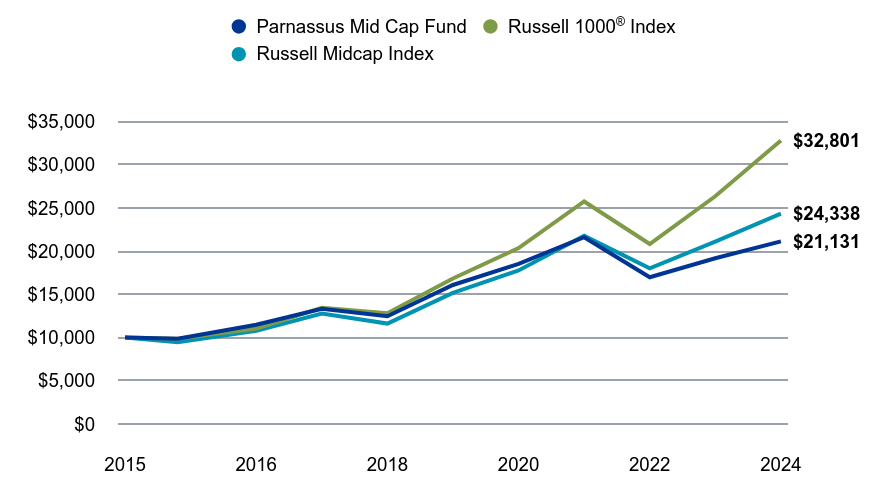

The Parnassus Mid Cap Fund (Institutional shares) returned 10.21% (net of fees) in 2024, underperforming the Russell Midcap Index’s 15.34% return. Stock selection within Communication Services and Real Estate contributed to relative performance, while selection within Industrials and Information Technology detracted.

Our disciplined approach—emphasizing quality, financial strength, and attractive valuations—positions the Fund to help protect capital during downturns while capturing upside in favorable markets.

Value on December 31, 2024 of $10,000 invested on April 30, 2015.

| Parnassus Mid Cap Fund | Russell 1000® Index | Russell Midcap Index |

|---|

| | | |

|---|

| 2015 | $10,000 | $10,000 | $10,000 |

|---|

| 2015 | $9,870 | $9,864 | $9,471 |

|---|

| 2016 | $11,477 | $11,053 | $10,778 |

|---|

| 2017 | $13,318 | $13,450 | $12,774 |

|---|

| 2018 | $12,467 | $12,806 | $11,617 |

|---|

| 2019 | $16,084 | $16,831 | $15,165 |

|---|

| 2020 | $18,523 | $20,359 | $17,758 |

|---|

| 2021 | $21,605 | $25,745 | $21,769 |

|---|

| 2022 | $16,979 | $20,821 | $18,000 |

|---|

| 2023 | $19,172 | $26,344 | $21,100 |

|---|

| 2024 | $21,131 | $32,801 | $24,338 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The share class commenced operations on April 30, 2015.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $2,842,441,773 |

|---|

| # of Portfolio Holdings | 38 |

|---|

| Portfolio Turnover Rate | 43.55% |

|---|

| Advisory Fees Paid | $23,536,822 |

|---|

Average Annual Total Returns (%)

| 1 Year | 5 years | Since Inception |

|---|

| Parnassus Mid Cap Fund - Institutional Shares (Incp: April 30, 2015) | 10.21% | 5.61% | 8.04% |

|---|

Russell 1000® Index | 24.51% | 14.28% | 13.07% |

|---|

| Russell Midcap Index | 15.34% | 9.92% | 9.64% |

|---|

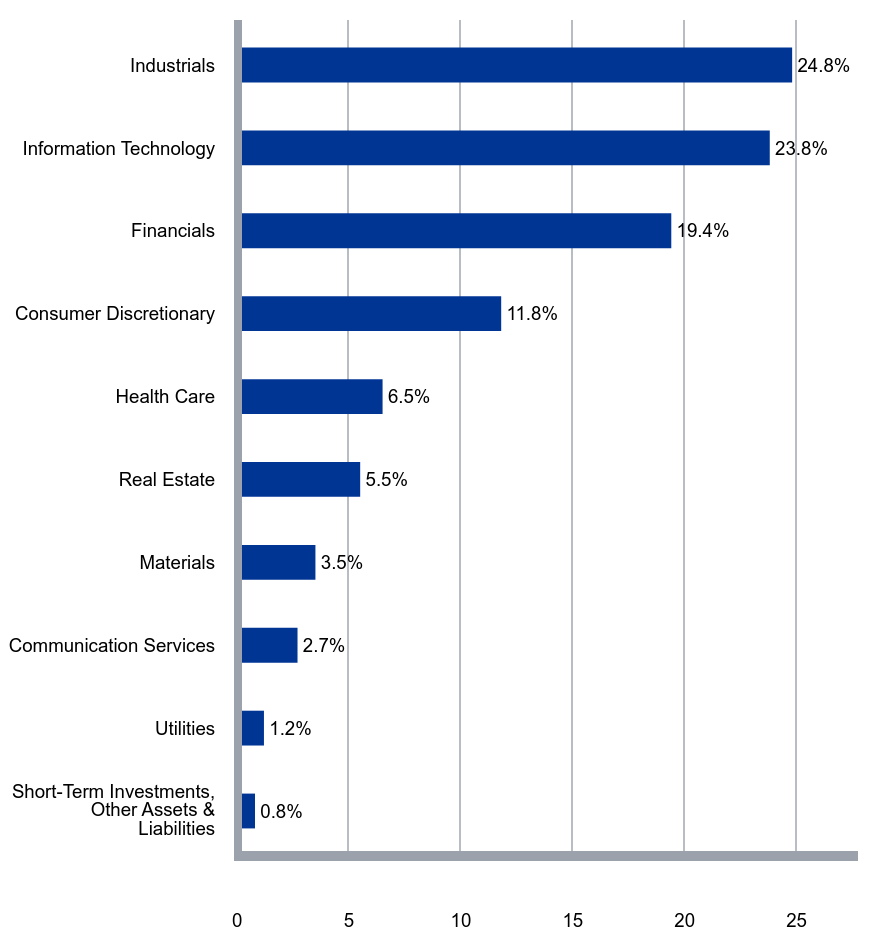

What did the Fund invest in?

Parnassus Mid Cap Fund invests selectively in about 35-45 U.S. mid-cap equity securities. The Fund pursues high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in an economic downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.8% |

| Utilities | 1.2% |

| Communication Services | 2.7% |

| Materials | 3.5% |

| Real Estate | 5.5% |

| Health Care | 6.5% |

| Consumer Discretionary | 11.8% |

| Financials | 19.4% |

| Information Technology | 23.8% |

| Industrials | 24.8% |

| Fidelity National Information Services | 4.0% |

| TransUnion | 3.8% |

| CBRE Group Inc., Class A | 3.7% |

| Fortinet Inc. | 3.7% |

| J.B. Hunt Transport Services Inc. | 3.6% |

| Cboe Global Markets Inc. | 3.5% |

| The Bank of New York Mellon Corp. | 3.4% |

| Roper Technologies Inc. | 3.3% |

| Truist Financial Corp. | 3.3% |

| Republic Services Inc. | 3.1% |

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

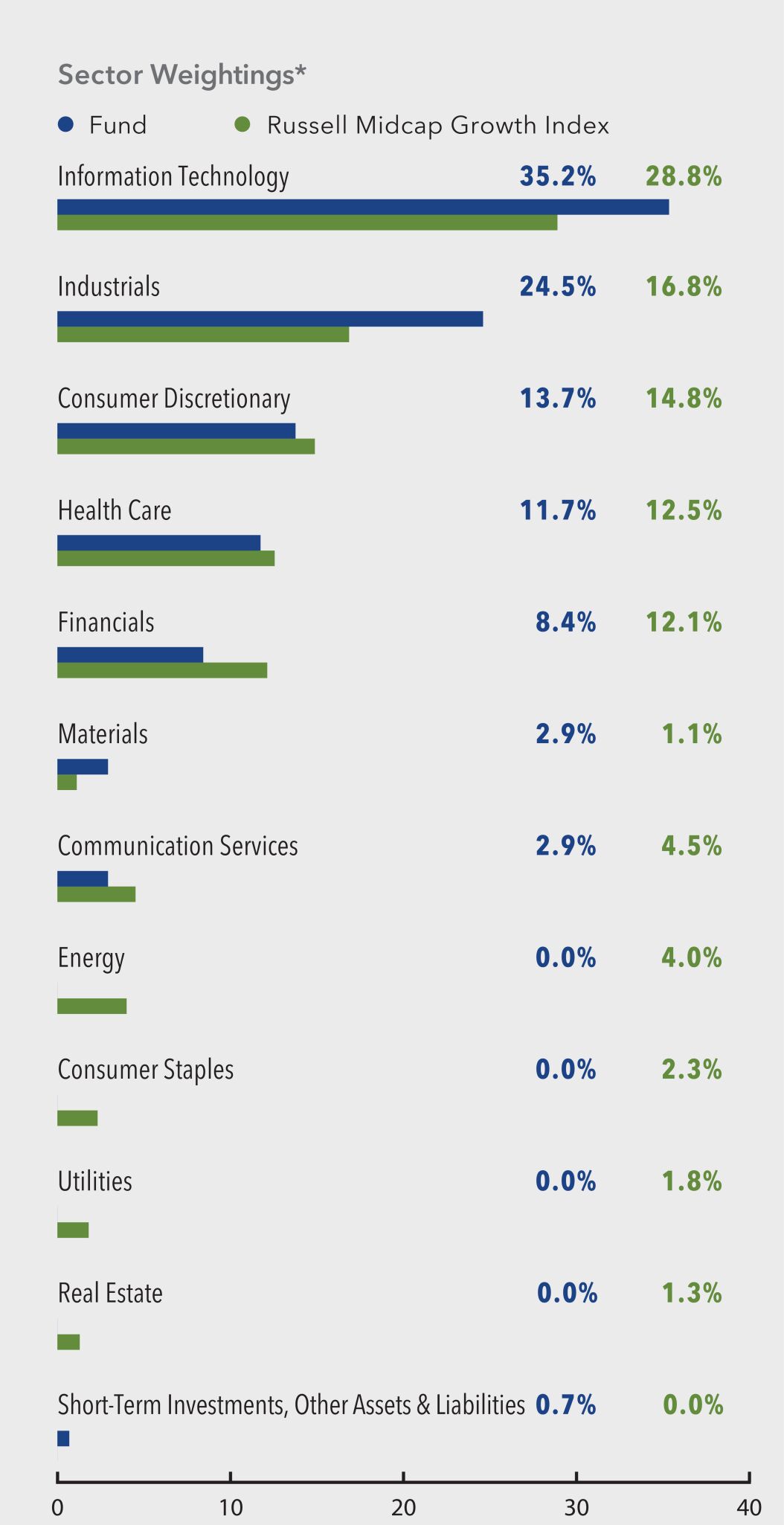

Parnassus Mid Cap Growth Fund

Annual Shareholder Report - December 31, 2024

Parnassus Mid Cap Growth Fund (the "Fund") offers a concentrated portfolio of U.S. mid-cap, fast-growing companies with healthy balance sheets and proven financial models.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Investor Shares | $84 | 0.80% |

|---|

How did the fund perform?

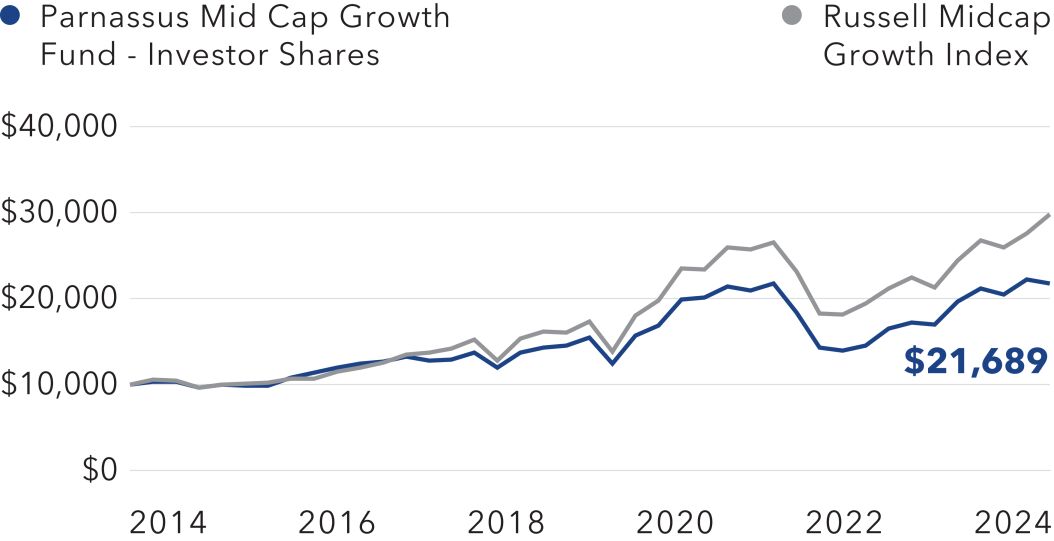

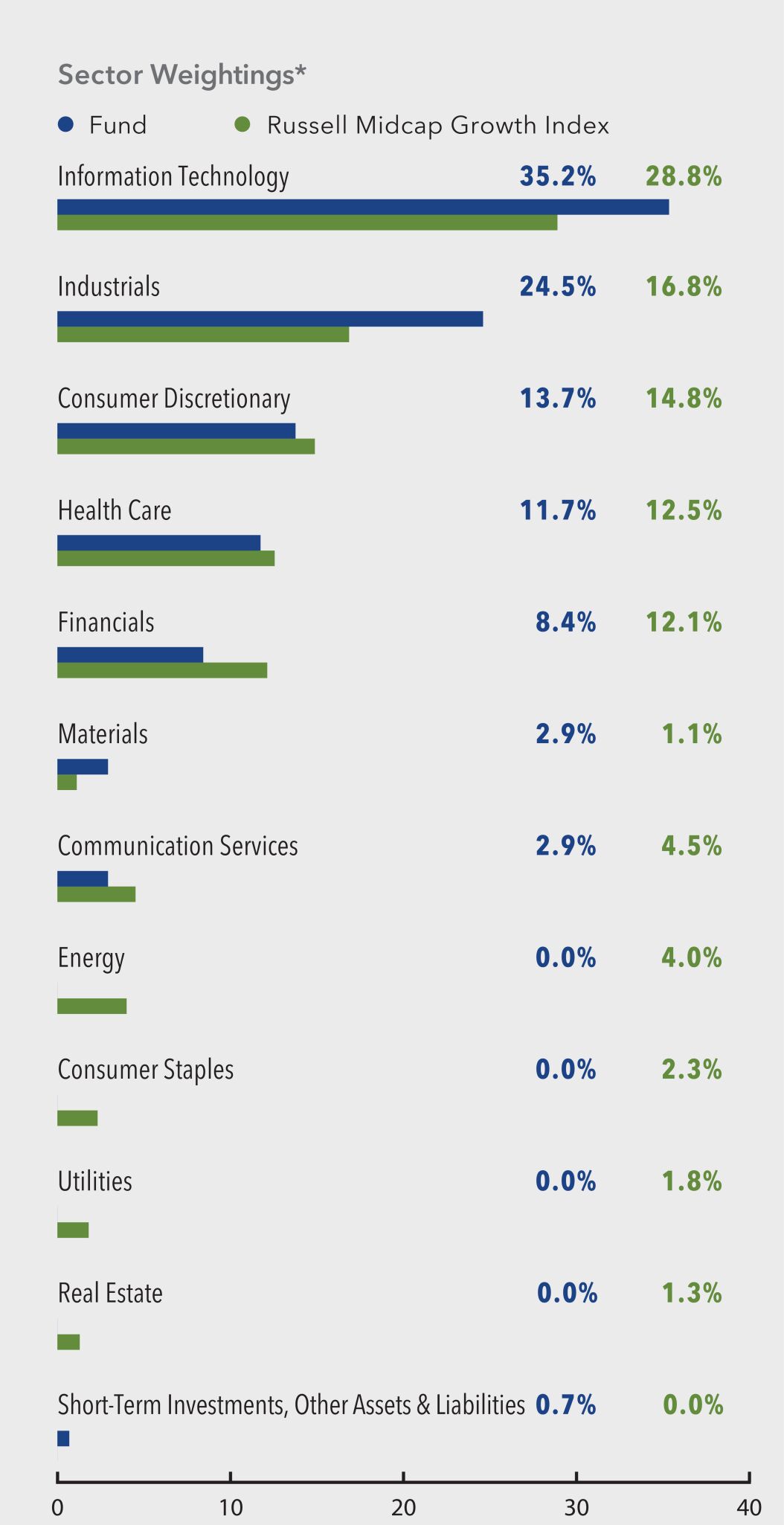

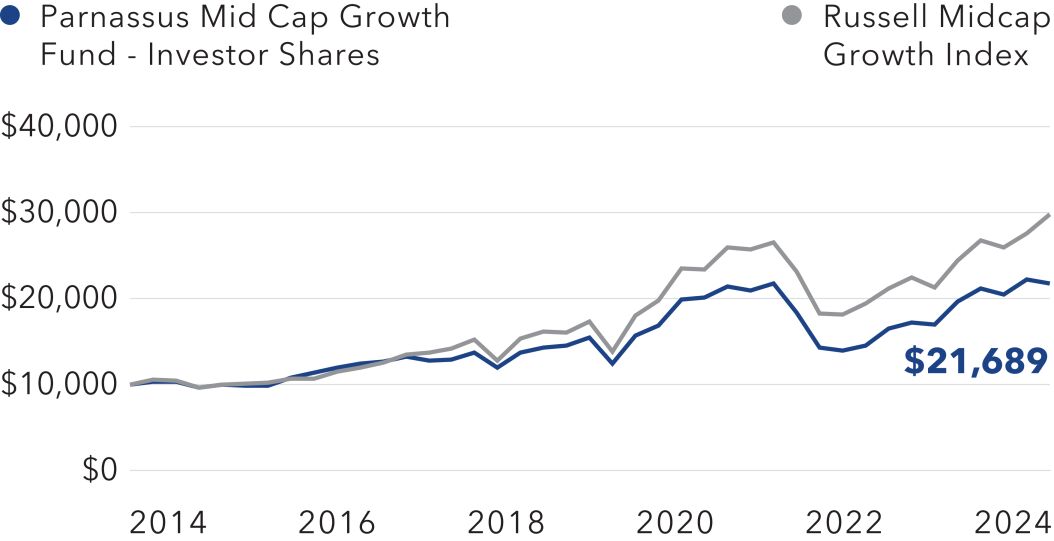

The Parnassus Mid Cap Growth Fund (Investor shares) returned 10.55% (net of fees) in 2024, underperforming the Russell Midcap Growth Index’s 22.10% return. A lack of exposure to Consumer Staples and stock selection within Communication Services contributed while stock selection within Information Technology and Consumer Discretionary detracted.

Our disciplined approach—emphasizing quality, financial strength, and attractive valuations—positions the Fund to help protect capital during downturns while capturing upside in favorable markets.

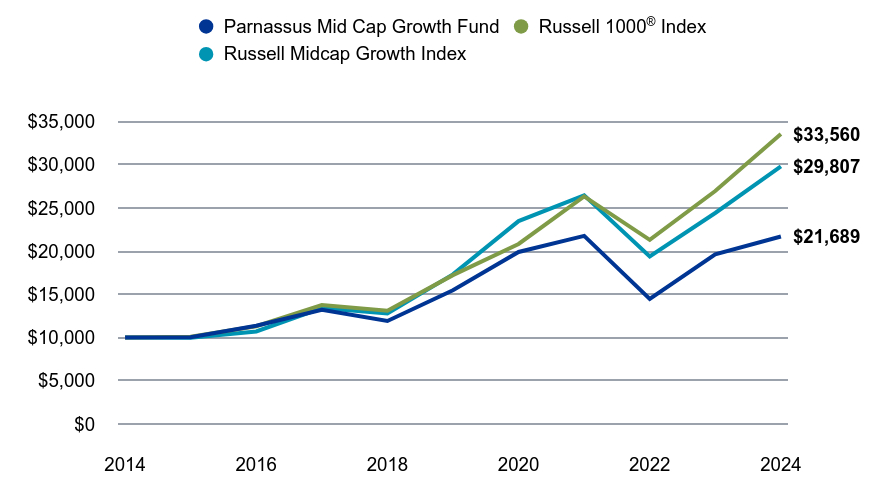

Value on December 31, 2024 of $10,000 invested on December 31, 2014.

| Parnassus Mid Cap Growth Fund | Russell 1000® Index | Russell Midcap Growth Index |

|---|

| | | |

|---|

| 2014 | $10,000 | $10,000 | $10,000 |

|---|

| 2015 | $10,026 | $10,092 | $9,980 |

|---|

| 2016 | $11,375 | $11,308 | $10,711 |

|---|

| 2017 | $13,204 | $13,761 | $13,418 |

|---|

| 2018 | $11,919 | $13,102 | $12,780 |

|---|

| 2019 | $15,474 | $17,220 | $17,312 |

|---|

| 2020 | $19,900 | $20,830 | $23,473 |

|---|

| 2021 | $21,764 | $26,340 | $26,461 |

|---|

| 2022 | $14,468 | $21,302 | $19,390 |

|---|

| 2023 | $19,620 | $26,953 | $24,411 |

|---|

| 2024 | $21,689 | $33,560 | $29,807 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $841,960,290 |

|---|

| # of Portfolio Holdings | 37 |

|---|

| Portfolio Turnover Rate | 41.45% |

|---|

| Advisory Fees Paid | $5,159,334 |

|---|

Average Annual Total Returns (%)

| 1 Year | 5 years | 10 Years |

|---|

| Parnassus Mid Cap Growth Fund - Investor Shares | 10.55% | 6.99% | 8.05% |

|---|

Russell 1000® Index | 24.51% | 14.28% | 12.87% |

|---|

| Russell Midcap Growth Index | 22.10% | 11.48% | 11.54% |

|---|

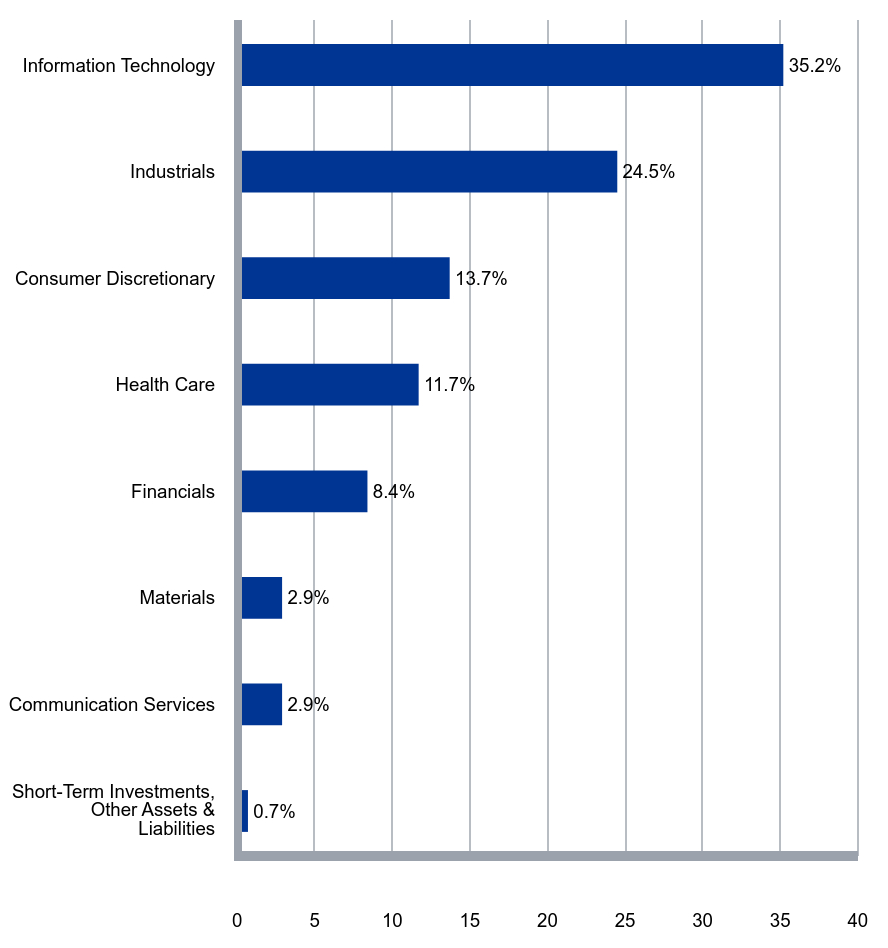

What did the Fund invest in?

Parnassus Mid Cap Growth Fund invests selectively in about 35-45 U.S. mid-cap growth equity securities. The Fund pursues best-in-class, high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in a downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.7% |

| Communication Services | 2.9% |

| Materials | 2.9% |

| Financials | 8.4% |

| Health Care | 11.7% |

| Consumer Discretionary | 13.7% |

| Industrials | 24.5% |

| Information Technology | 35.2% |

| Equifax Inc. | 4.4% |

| Old Dominion Freight Line Inc. | 4.0% |

| J.B. Hunt Transport Services Inc. | 4.0% |

| Trane Technologies plc | 3.9% |

| Atlassian Corp., Class A | 3.7% |

| Teradyne Inc. | 3.6% |

| MercadoLibre Inc. | 3.4% |

| Block Inc., Class A | 3.2% |

| Workday Inc., Class A | 3.2% |

| Hilton Worldwide Holdings Inc. | 3.1% |

Parnassus Mid Cap Growth Fund

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Parnassus Mid Cap Growth Fund

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

Parnassus Mid Cap Growth Fund (the "Fund") offers a concentrated portfolio of U.S. mid-cap, fast-growing companies with healthy balance sheets and proven financial models.

This annual shareholder report contains important information about the Fund for the period of January 1, 2024 to December 31, 2024.

You can find additional information about the fund at www.parnassus.com. You can also request this information by contacting us at 800-999-3505.

What was the Fund's cost for the year?

(based on hypothetical $10,000 investment)

| Class name | Cost of a $10,000 investment | Cost paid as a % of a $10,000 investment |

|---|

| Institutional Shares | $72 | 0.68% |

|---|

How did the fund perform?

The Parnassus Mid Cap Growth Fund (Institutional shares) returned 10.68% (net of fees) in 2024, underperforming the Russell Midcap Growth Index’s 22.10% return. A lack of exposure to Consumer Staples and stock selection within Communication Services contributed while stock selection within Information Technology and Consumer Discretionary detracted.

Our disciplined approach—emphasizing quality, financial strength, and attractive valuations—positions the Fund to help protect capital during downturns while capturing upside in favorable markets.

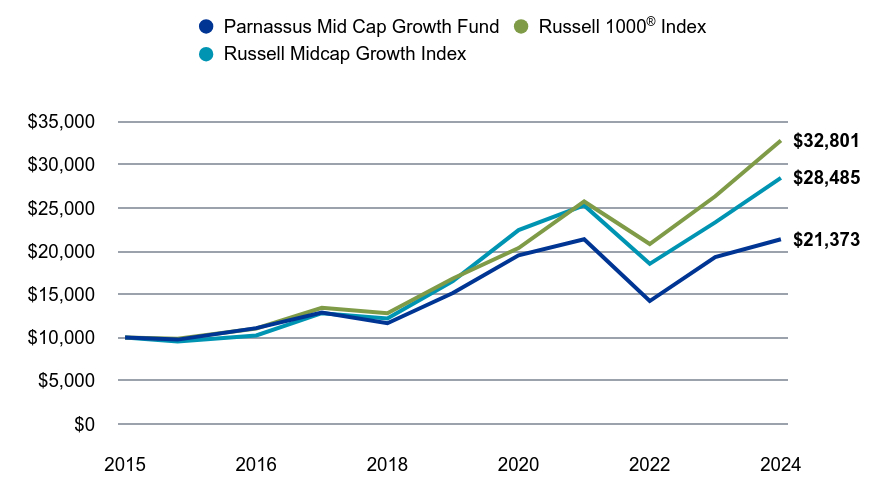

Value on December 31, 2024 of $10,000 invested on April 30, 2015.

| Parnassus Mid Cap Growth Fund | Russell 1000® Index | Russell Midcap Growth Index |

|---|

| | | |

|---|

| 2015 | $10,000 | $10,000 | $10,000 |

|---|

| 2015 | $9,763 | $9,864 | $9,538 |

|---|

| 2016 | $11,089 | $11,053 | $10,237 |

|---|

| 2017 | $12,891 | $13,450 | $12,823 |

|---|

| 2018 | $11,658 | $12,806 | $12,213 |

|---|

| 2019 | $15,152 | $16,831 | $16,545 |

|---|

| 2020 | $19,517 | $20,359 | $22,432 |

|---|

| 2021 | $21,373 | $25,745 | $25,288 |

|---|

| 2022 | $14,224 | $20,821 | $18,531 |

|---|

| 2023 | $19,311 | $26,344 | $23,329 |

|---|

| 2024 | $21,373 | $32,801 | $28,485 |

|---|

The chart shows the growth in value of a hypothetical $10,000 investment since inception and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. The share class commenced operations on April 30, 2015.

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Total Net Assets | $841,960,290 |

|---|

| # of Portfolio Holdings | 37 |

|---|

| Portfolio Turnover Rate | 41.45% |

|---|

| Advisory Fees Paid | $5,159,334 |

|---|

Average Annual Total Returns (%)

| 1 Year | 5 years | Since Inception |

|---|

| Parnassus Mid Cap Growth Fund - Institutional Shares (Incp: April 30, 2015) | 10.68% | 7.12% | 8.17% |

|---|

Russell 1000® Index | 24.51% | 14.28% | 13.07% |

|---|

| Russell Midcap Growth Index | 22.10% | 11.48% | 11.43% |

|---|

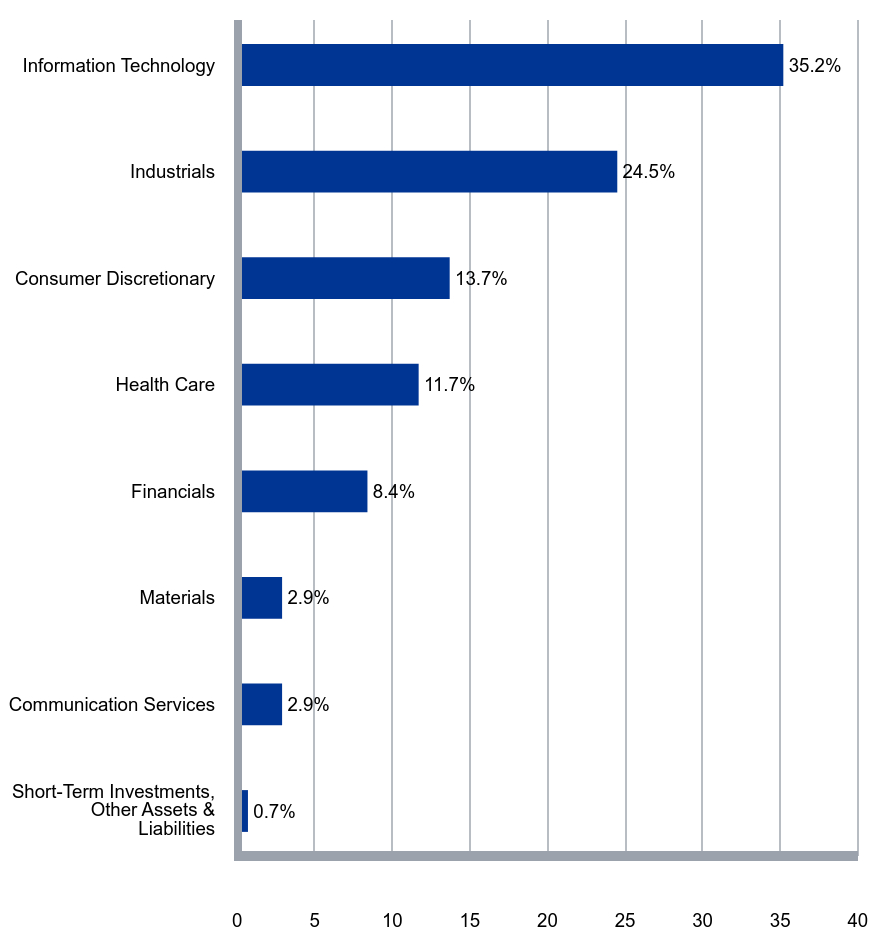

What did the Fund invest in?

Parnassus Mid Cap Growth Fund invests selectively in about 35-45 U.S. mid-cap growth equity securities. The Fund pursues best-in-class, high quality companies with increasingly relevant products and services, durable competitive advantages, strong management teams and sustainable business practices that are likely to thrive in a healthy economy and be resilient in a downturn.

| Value | Value |

|---|

| Short-Term Investments, Other Assets & Liabilities | 0.7% |

| Communication Services | 2.9% |

| Materials | 2.9% |

| Financials | 8.4% |

| Health Care | 11.7% |

| Consumer Discretionary | 13.7% |

| Industrials | 24.5% |

| Information Technology | 35.2% |

| Equifax Inc. | 4.4% |

| Old Dominion Freight Line Inc. | 4.0% |

| J.B. Hunt Transport Services Inc. | 4.0% |

| Trane Technologies plc | 3.9% |

| Atlassian Corp., Class A | 3.7% |

| Teradyne Inc. | 3.6% |

| MercadoLibre Inc. | 3.4% |

| Block Inc., Class A | 3.2% |

| Workday Inc., Class A | 3.2% |

| Hilton Worldwide Holdings Inc. | 3.1% |

Parnassus Mid Cap Growth Fund

Class - Institutional Shares

Annual Shareholder Report - December 31, 2024

If you wish to view additional information about the Fund; including, but not limited to, financial statements or holdings, please call us or visit our website:

Phone: 800-999-3505

Website: www.parnassus.com/literature-and-forms/fund-information

For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

* The holding tables and charts above represent percentage based on Total Net Assets.

No material changes to the Fund in the last reporting year.

Change in or Disagreements with Accountants

There have been no changes to or disagreements with the accountants in the last reporting year.

© 2025 Parnassus Investments, LLC. All rights reserved. PARNASSUS, PARNASSUS INVESTMENTS, and PARNASSUS FUNDS are federally registered trademarks of Parnassus Investments, LLC.

If you wish to receive a copy of this document at a new address, contact 800-999-3505.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics dated July 22, 2003 that applies to the registrant’s principal executive officer (President) and principal financial officer (Treasurer) for the fiscal year ending December 31, 2024. During the fiscal year ending December 31, 2024 there were no amendments to any provisions of this code of ethics.

Item 3. Audit Committee Financial Expert.

The Boards of Trustees of the Parnassus Funds and the Parnassus Income Funds determined that Kay Yun, Chair of the Boards’ Audit Committee, qualified as an “independent audit committee financial expert” as defined by Form N-CSR. The Trustees’ decision was based on Ms. Yun’s understanding of generally accepted accounting principles (GAAP); her ability to assess the general application of such principles in connection with the accounting for estimates, accruals, and reserves; her experience preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrants’ financial statements; an understanding of internal controls and procedures for financial reporting; and understanding of audit committee functions.

Kay Yun is a Partner and the Chief Financial Officer of Health Evolution Partners, a healthcare-focused private equity firm in San Francisco. Before this, Kay was Co-Founder and Chief Executive Officer of YuniNetworks, a technology start-up, through its sale in 2001. Before YuniNetworks, she was an investment banker with Goldman Sachs for almost ten years. Kay serves as the Board President at the American Conservatory Theater and co-chair of the $18 million Next ACT capital campaign. She is also the fundraising chair for The Wharton MBA class of 1990. Kay received her B.S. in Business Administration from the Leeds School of Business at the University of Colorado, Boulder, in 1985 and an MBA from The Wharton School at the University of Pennsylvania in 1990.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees

The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the Parnassus Funds fiscal years ended December 31, 2023 and 2024 were $297,550 and $95,000 respectively and the Parnassus Income Funds fiscal year ended December 31, 2023 and 2024 were $234,950 and $78,000 respectively.

(b) Audit-Related Fees

There were no aggregate fees billed for assurance and related services rendered by the principal accountants that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item.

(c) Tax Fees

The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning for the Parnassus Funds fiscal years ended December 31, 2023 and 2024 were $33,955 and $15,412 respectively and the Parnassus Income Funds fiscal years ended December 31, 2023 and 2024 were $26,365 and $7,706 respectively.

(d) All Other Fees

There were no fees billed in each of the last two fiscal years for products and services by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item.

(e)(1) The Audit Committee’s pre-approval policies and procedures are as follows: The audit committee is required to pre-approve all audit services and permitted non-audit services provided by the independent accountants for the Parnassus Funds, affiliated funds, and other service affiliates. Explicit pre-approval by the Audit Committee Chair shall be required for any individual non-audit engagement to be performed by the independent accountants with estimated fees of $10,000 or less and the Audit Committee Chair shall report such approval to the full audit committee at the next regularly scheduled meeting. Explicit pre-approval by the full Audit Committee shall be required for any individual non-audit engagement to be performed by the independent accountants with estimated fees in excess of $10,000. Officers of the Funds shall furnish the audit committee at least annually with a listing of all fees paid to the independent accountants including non-audit services performed. For certain non-audit services which are no more than five percent of the total fees paid by the Trust, such fees may be exempted from the required pre-approval process specified above subject to limitations and prompt disclosure of such services are identified, and in all cases approval is required prior to completion.

(e)(2) None.

(f) Not applicable.

(g) The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser forth in 4(b) and (c) of this Item of $— and $— for the Parnassus Funds fiscal years ended December 31, 2023 and 2024, respectively and $— and $— for the Parnassus Income Funds fiscal years ended December 31, 2023 and 2024, respectively.

Item 5. Audit Committee of Listed Registrants.

(a) The Registrant is an issuer as defined in Section 10A-3 of the Securities Exchange Act of 1934 and has a separately-designated standing Audit Committee in accordance with Section 3(a)(58)(A) of such Act. All of the Board’s independent Trustees are members of the Audit Committee.

(b) Not applicable.

Item 6. Investments.

| (a) | Included as part of the report to shareholders filed under Item 7 of this form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| (a) | The Registrant’s Financial Statements are attached herewith. |

| (b) | The Registrant’s Financial Highlights are included as part of the Financial Statements filed under Item 7(a) of this Form. |

Parnassus Funds Annual Report

December 31, 2024

Parnassus Core Equity FundSM

Investor Shares: PRBLX | Institutional Shares: PRILX

Parnassus Growth Equity FundSM

Investor Shares: PFGEX | Institutional Shares: PFPGX

Parnassus Value Equity FundSM

Investor Shares: PARWX | Institutional Shares: PFPWX

Parnassus Mid Cap FundSM

Investor Shares: PARMX | Institutional Shares: PFPMX

Parnassus Mid Cap Growth FundSM

Investor Shares: PARNX | Institutional Shares: PFPRX

Parnassus Fixed Income FundSM

Investor Shares: PRFIX | Institutional Shares: PFPLX

Table of Contents

3

| | | | |

| | |

| | | | Annual Report • 2024 |

February 14, 2025

Dear Shareholder,

2024 was another great year to be invested in stocks and bonds. Our five equity strategies saw impressive double-digit gains in 2024 this year, with our flagship Core Equity Fund advancing 19% on the year and our Growth Equity Fund finishing the year with a 27% gain. Our Value Equity, Mid Cap and Mid Cap Growth Funds also delivered compelling absolute performance with gains of 12%, 10% and 11% respectively. Throughout the year, however, the stock market’s strong performance was narrowly driven by a handful of tech companies, presenting challenges to active managers and leading our equity strategies to lag their benchmarks.

Actively managed funds can be helpful in navigating this kind of market because that narrowness eventually widens out. In past market cycles, we’ve seen a handful of companies dominate for several years, but it always changes. Other companies take up the mantle of market leadership. Some sectors that have been overlooked can become the leaders of the next three to five years. So we’re focused on the dynamics of the overall stock market and staying nimble. We aim to position our portfolios to be resilient, capturing market upside while protecting our portfolios from market pullbacks to deliver enduring value.

As a firm, we haven’t been standing still. Our clients expressed interest in Parnassus investment strategies in an exchange-traded fund (ETF) vehicle. And we delivered. I’m very proud that we launched the Parnassus Core Select ETF (NYSE: PRCS) and the Parnassus Value Select ETF (NYSE: PRVS) in December. These innovative products give investors new ways to access the strengths of our investment approach. Our active ETFs offer highly concentrated portfolios that represent our portfolio managers’ convictions for the highest quality, most attractively valued companies in a cost-efficient, convenient product. The new ETFs reaffirm our focus on doing what we do best by offering investors building blocks for a diversified equity allocation that is poised to outperform. I invite you to check out the new ETFs at www.parnassus.com/etfs.

In the pages that follow, you can find detailed commentary from our portfolio managers on market conditions as well as their outlooks for the coming year. You can always also find the most current information on our portfolio performance, holdings and commentary at www.parnassus.com. We encourage you to visit our website and subscribe to receive updates by email.

Strengthening Our Team

In pursuit of our mission of building wealth responsibly, I want to acknowledge our team, and the hard work our entire staff has put in this year. Our team has grown to support and enhance our capabilities. We welcomed nine new employees to Parnassus in the second half of 2024.

| | • | | Weston Cooper joined our firm as an Equity Trader on the Research team after spending the last 10 years of his career with Fisher Investments in a senior role responsible for firmwide trade execution. Weston loves spending time outdoors and traveling. |

ETFs are subject to additional risks that do not apply to conventional funds, including the risks that the market price of an ETF’s shares may trade at a premium or discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact an ETF’s ability to sell its shares. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. Brokerage commissions will reduce returns.

4

| | | | |

| | |

| Annual Report • 2024 | | | |  |

| | • | | Sophie Haywood is a new analyst on the Sustainability and Stewardship team, supporting company engagement programs, client communications, proxy voting activities and sustainability-related integration. Previously, Sophie was with Environmental Resources Management. Sophie is happiest when taking art classes, baking, skiing or training to run a marathon. |

| | • | | Ethan Hejna joined our Investment Operations team as an Associate. Ethan came from Citigroup’s credit trading middle office team, where he worked with various corporate debt and securitized trading desks. In his free time, he enjoys skiing, golfing and hanging out with friends and family. |

| | • | | Karen Huynh is a Senior Manager specializing in ETF operations. Karen previously served as a Senior Manager and Fund Accountant at Matthews Asia. During her free time, Karen loves to travel, having visited many countries where she enjoyed local cultures and foods. |

| | • | | Paulyne Keefe also joined us as a Manager on our Corporate Accounting team, with more than seven years of experience in financial reporting, accounting systems implementation and compliance. Outside of work, Paulyne enjoys spending time with her husband and their two kids and experiencing different cultures. |

| | • | | Chris Kelser is a new analyst on our Research team, responsible for supporting firmwide investment research. Chris worked at Fidelity Investments as an Equity Research Associate on the healthcare team covering medical device stocks. In his free time, he enjoys running and is an avid reader and writer. |

| | • | | Marcy McCullaugh is a new director on our Sustainability and Stewardship team. She leads impact engagements with portfolio companies and serves as a member of our Proxy Committee. Previously, Marcy was Director of Investment Stewardship at Schwab Asset Management and was a senior advisor on the sustainability and public policy team at Chevron. She enjoys running, hiking and traveling to new destinations. |

| | • | | Ken Ryan joined us as a Senior Analyst on our Research team. He previously worked in equity research for WCM Investment Management, Dodge & Cox and Credit Suisse. Ken is a CFA charterholder. He enjoys traveling both personally and professionally, having visited 35 countries and counting. |

| | • | | Peter Valencia is a Manager on our Compliance team. He previously worked at Mission Creek Capital Partners and Matthews Asia. In his free time, Peter enjoys spending time with his son and cooking, and is an avid longboarder. |

Thank you for your investment in the Parnassus Funds. May 2025 bring peace, prosperity and good health for us all.

Sincerely,

Benjamin E. Allen

CEO and Portfolio Manager

5

| | | | |

| | |

| | | | Annual Report • 2024 |

Parnassus Core Equity Fund

Ticker: Investor Shares - PRBLX

Ticker: Institutional Shares - PRILX

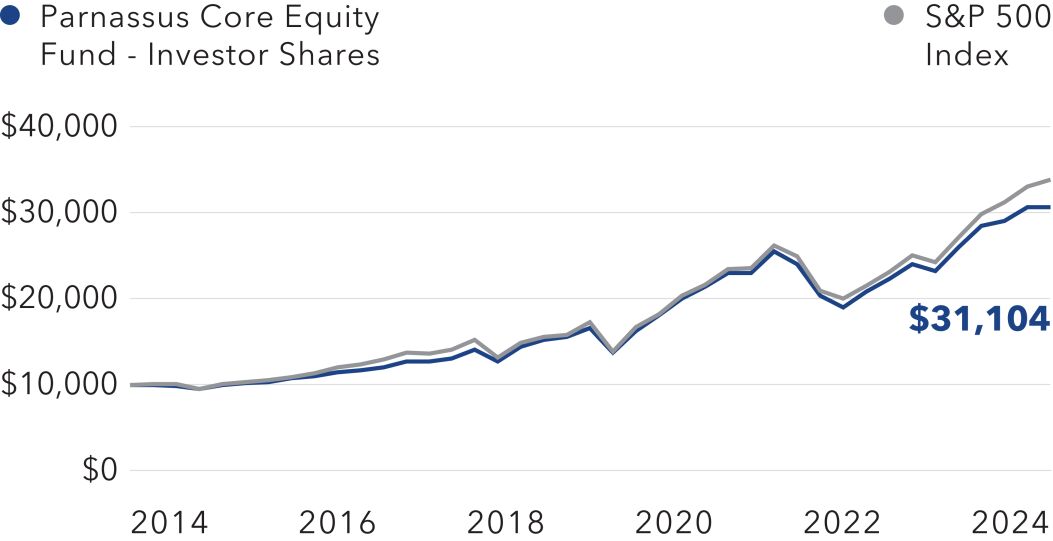

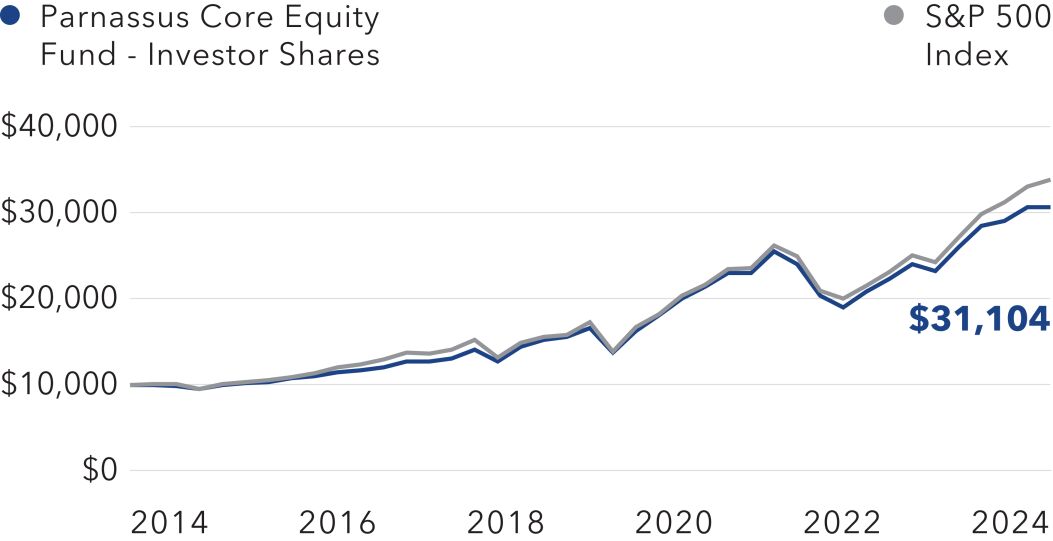

As of December 31, 2024, after taking dividends into account, the Parnassus Core Equity Fund – Investor Shares (the “Fund”) returned 18.52% (net of fees) for the year, underperforming the S&P 500 Index’s 25.02%.

Below is a table that summarizes the performances of the Parnassus Core Equity Fund and the S&P 500. The returns are for the one-, three-, five- and ten-year periods.

Parnassus Core Equity Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2024 | |

| | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | | | |

| Parnassus Core Equity Fund – Investor Shares | | | 18.52 | | | | 6.42 | | | | 13.25 | | | | 12.02 | | | | 0.82 | | | | 0.82 | |

| | | | | | |

| Parnassus Core Equity Fund – Institutional Shares | | | 18.75 | | | | 6.64 | | | | 13.49 | | | | 12.25 | | | | 0.62 | | | | 0.61 | |

| | | | | | |

| S&P 500 Index | | | 25.02 | | | | 8.94 | | | | 14.53 | | | | 13.10 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted, and current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The S&P 500 is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Contributions to returns quoted for individual stocks are their returns relative to the Fund’s index.

As described in the Fund’s current prospectus dated May 1, 2024, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.82% of net assets for the Parnassus Core Equity Fund – Investor Shares and to 0.61% of net assets for the Parnassus Core Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2025, and may be continued indefinitely by the investment adviser on a year-to-year basis.

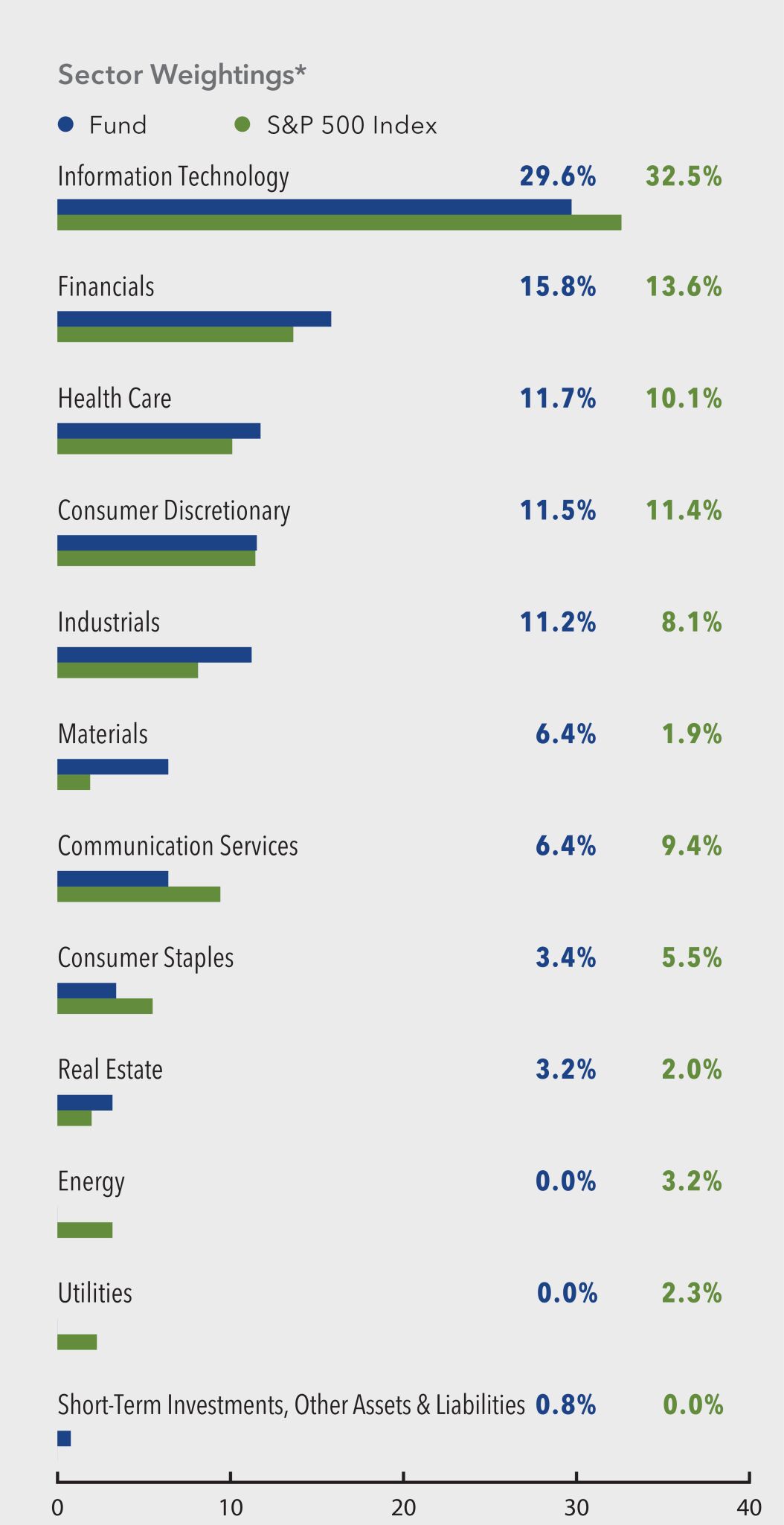

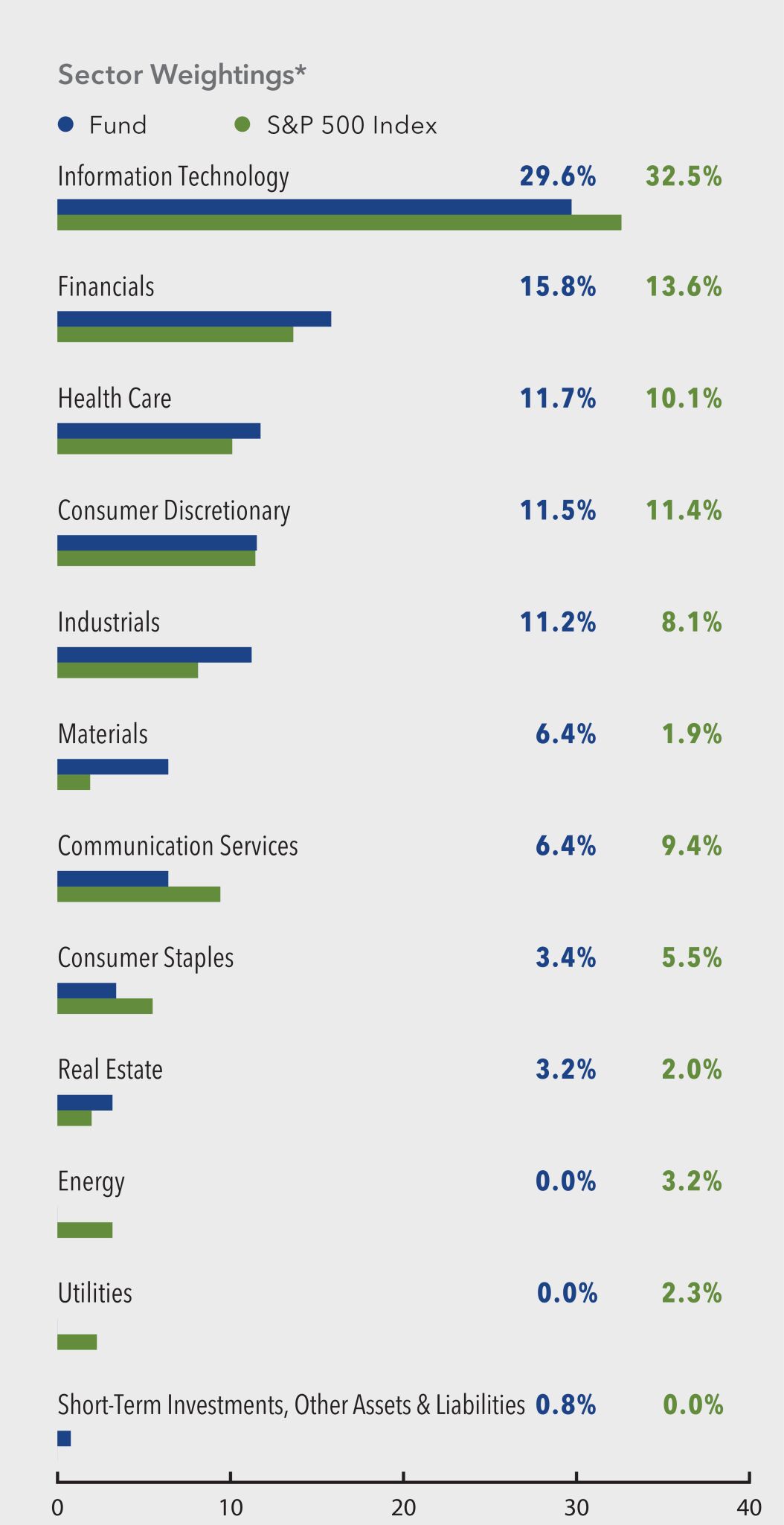

Year In Review

The Fund (Investor Shares) returned 18.52%, (net of fees) for the year, underperforming the S&P 500 Index’s 25.02%. Stock selection in the Financials and Communication Services sector held back relative returns, as did an overweight to Materials. Conversely, a lack of exposure to the Energy sector and underweights in the Consumer Discretionary and Health Care sectors buoyed relative performance.

Oracle stock posted its best annual performance since 1999 as the software giant gained market share in cloud-based training of generative artificial intelligence (AI) models. Oracle Cloud Infrastructure is helping to reaccelerate growth as the company continues to execute well in capturing new deals.

Fiserv benefited in 2024 from growing demand for payments processing and fintech intermediaries, gaining traction with both merchants and financial institutions. Its quarterly results throughout the year reflected strong competitive positioning.

Amazon’s shares experienced volatility throughout the year as IT spending and the company’s margin structure came under scrutiny. Despite this, the stock outperformed as sentiment and results improved across both the overall environment for Amazon Web Services and the company’s ability to show margin.

Intel shares declined as the chipmaker announced a major cost-cutting plan and reported disappointing financial results. We exited our position in the stock.

Ball, the global leader in aluminum packaging, experienced lackluster results as consumer spending on beverages tightened across key regions globally.

Cigna Group shares declined along with those of several other large health care providers and insurers amid

6

| | | | |

| | |

| Annual Report • 2024 | | | |  |

speculation that the incoming Trump administration could implement reforms to pharmacy benefit managers, along with heightened public scrutiny over the sector’s business practices.

Parnassus Core Equity Fund

As of December 31, 2024

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 6.5% | |

| |

| Amazon.com Inc. | | | 6.3% | |

| |

| NVIDIA Corp. | | | 5.9% | |

| |

| Alphabet Inc., Class A | | | 5.0% | |

| |

| Deere & Co. | | | 3.6% | |

| |

| Waste Management Inc. | | | 3.4% | |

| |

| Mastercard Inc., Class A | | | 3.4% | |

| |

| Realty Income Corp. | | | 3.2% | |

| |

| Broadcom Inc. | | | 3.0% | |

| |

| Intercontinental Exchange Inc. | | | 3.0% | |

Portfolio characteristics and holdings are subject to change periodically.

Value on December 31, 2024

of $10,000 invested on December 31, 2014

The chart shows the growth in value of a hypothetical $10,000 investment over the last 10 years and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

The portfolio’s largest overweights are in Materials and Industrials, while its largest underweights are in Energy and Communication Services.

We continue to maintain a portfolio positioning balanced between offense and defense. Real rates moved higher in the fourth quarter as the 10-year Treasury yield increased by almost 0.80%. Despite this, the market’s valuation is largely unchanged, as are earnings expectations for 2025. The market continues to anticipate a favorable environment for risk and economic growth, a backdrop that we believe warrants our balanced portfolio positioning.

We sold two positions in the Consumer Staples sector during the quarter, Sysco and Mondelez International. Sysco has not responded convincingly to its industry’s

7

| | | | |

| | |

| | | | Annual Report • 2024 |

competitive dynamics, while Mondelez faces idiosyncratic challenges to its financial outlook. In Financials, we sold CME Group, an operator of futures and derivatives exchanges that faces slowing growth and rising competition.

We also added several new positions, including two in Information Technology: Workday, a category leader for enterprise cloud applications for finance and human resources, and KLA, a leader in semiconductor process control.

In the Health Care sector, we added drugmaker Eli Lilly, which has an exceptional GLP-1 franchise and a strong track record of innovation, and Vertex Pharmaceuticals, a high-quality biotech company run by a strong management team. We also added Industrials sector holding Ferguson Enterprises, a leading distributor of plumbing supplies and construction equipment.

The market has begun to grapple with policy expectations from a new presidential administration. We expect the debate between expected and realized policy to be a persistent theme in 2025.

As we look into the year ahead, we expect the following factors, some of which carry forward from 2024, to be notable drivers of investment returns:

| | • | | The path and continuation of frontier AI model scaling, which expands the capabilities and complexity of AI applications |

| | • | | Greater AI usage and workflow integration across consumer and enterprise businesses |

| | • | | Fiscal policy moves (e.g., tariffs, immigration) by the new administration and Congress and the combined impact on inflation, economic growth and interest rates |

| | • | | International markets experiencing growth recoveries (e.g., China, Europe, South America) |

We remain focused on executing our investment process and maintaining exposure to increasingly relevant, competitively advantaged businesses at attractive valuations. We continue to see attractive opportunities across the Materials and Financials sectors while opportunistically taking advantage of volatility in Information Technology in our pursuit of strong long-term returns.

As always, we are honored to have your trust as we continue pursuing Principles and Performance®.

Sincerely,

Todd C. Ahlsten

Lead Portfolio Manager

Benjamin E. Allen

Portfolio Manager

Andrew S. Choi

Portfolio Manager

8

| | | | |

| | |

| Annual Report • 2024 | | | |  |

Parnassus Growth Equity Fund

Ticker: Investor Shares - PFGEX

Ticker: Institutional Shares - PFPGX

As of December 31, 2024, after taking dividends into account, Parnassus Growth Equity Fund – Investor Shares (the “Fund”) returned 26.85%, (net of fees) for the year, underperforming the Russell 1000 Growth’s 33.36%.

Below is a table that summarizes the performances of the Parnassus Growth Equity Fund and the Russell 1000 Growth. The returns are for the one-year and since inception periods.

Parnassus Growth Equity Fund

| | | | | | | | | | | | | | | | |

| |

| | | Average Annual Total Returns (%) | |

| |

| | | for period ended December 31, 2024 | |

| | | | |

| | | One

Year | | | Since

Inception* | | | Gross

Expense

Ratio | | | Net

Expense

Ratio | |

| | | | |

| Parnassus Growth Equity Fund – Investor Shares | | | 26.85 | | | | 35.15 | | | | 2.89 | | | | 0.84 | |

| | | | |

| Parnassus Growth Equity Fund – Institutional Shares | | | 27.13 | | | | 35.42 | | | | 1.86 | | | | 0.63 | |

| | | | |

| Russell 1000 Growth Index | | | 33.36 | | | | 39.02 | | | | NA | | | | NA | |

Performance data quoted represent past performance and are no guarantee of future returns. Current performance may be lower or higher than the performance data quoted. Current performance information to the most recent month end is available on the Parnassus website (www.parnassus.com). Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than their original principal cost. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived.

Returns shown in the table do not reflect the deduction of taxes a shareholder may pay on fund distributions or redemption of shares. The Russell 1000 Growth is an unmanaged index of common stocks, and it is not possible to invest directly in an index. Index figures do not take any expenses, fees or taxes into account, but mutual fund returns do.

The estimated impact of individual stocks on the Fund’s performance is provided by FactSet.

Contributions to returns quoted for individual stocks are their returns relative to the Fund’s index.

* Since Inception, December 28, 2022 (commencement of operations) through December 31, 2024.

As described in the Fund’s current prospectus dated May 1, 2024, Parnassus Investments, LLC has contractually agreed to reduce its investment advisory fee to the extent necessary to limit total annual fund operating expenses to 0.84% of net assets for the Parnassus Growth Equity Fund – Investor Shares and to 0.63% of net assets for the Parnassus Growth Equity Fund – Institutional Shares. This agreement will not be terminated prior to May 1, 2025, and may be continued indefinitely by the investment adviser on a year-to-year basis.

Year In Review

The Fund (Investor Shares) returned 26.85%, (net of fees) for the year, underperforming the Russell 1000 Growth’s 33.36%. Stock selection in the Information Technology, Consumer Discretionary and Communication Services sectors held back relative returns. Conversely, stock selection in the Health Care sector and both stock selection and an underweight in the Consumer Staples sector buoyed relative performance.

Natera shares rose throughout the year, as the genetic testing company gained market share, improved reimbursement and continued to publish data and gain traction for its cancer recurrence monitoring tests. More than 50% of oncologists in the U.S. have now used the Natera test.

Taiwan Semiconductor Manufacturing Co.’s leading position in AI chip production continued to boost investor sentiment on the stock. During the year, moves by several large technology companies to increase their AI investments underscored demand for TSMC’s chips and supported the stock’s rise.

Microsoft’s focus on AI investment provided a boost to the company’s revenue streams and its share price. Azure, Microsoft’s cloud computing business that integrates AI tools, drove significant growth during the year.

NVIDIA continued to lead the market for graphics processing units and semiconductor chips needed to power AI applications. Because our position in the stock is an underweight relative to the nearly 12% of the benchmark it now represents, it was a relative detractor for the year.

9

| | | | |

| | |

| | | | Annual Report • 2024 |

Intuit shares ended the year slightly higher but lagged the broader market and the Information Technology sector. However, we continue to believe Intuit’s customer growth and relevant platform will sustain its wide moat and long growth runway.

Akamai Technologies suffered an unexpected deterioration in its underlying business, notably on the content delivery side, in an intensely competitive industry. We exited the position.

Parnassus Growth Equity Fund

As of December 31, 2024

(percentage of net assets)

* For purposes of categorizing securities for diversification requirements under the Investment Company Act, the Fund uses industry classifications that are more specific than those used for the chart.

Portfolio characteristics and holdings are subject to change periodically.

10

| | | | |

| | |

| Annual Report • 2024 | | | |  |

| | | | |

| |

| Top 10 Equity Holdings | | | | |

| (percentage of net assets) | | | | |

| |

| Microsoft Corp. | | | 9.0% | |

| |

| NVIDIA Corp. | | | 8.9% | |

| |

| Alphabet Inc., Class A | | | 6.4% | |

| |

| Amazon.com Inc. | | | 4.8% | |

| |

| Apple Inc. | | | 4.8% | |

| |

| Broadcom Inc. | | | 4.8% | |

| |

| Visa Inc., Class A | | | 4.6% | |

| |

| Salesforce Inc. | | | 3.2% | |

| |

| Eli Lilly & Co. | | | 2.9% | |

| |

| Natera Inc. | | | 2.4% | |

Portfolio characteristics and holdings are subject to change periodically.

Value on December 31, 2024

of $10,000 invested on December 28, 2022

The chart shows the growth in value of a hypothetical $10,000 investment since inception (December 28, 2022) and does not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Outlook and Strategy

The portfolio’s largest overweights are in Health Care and Financials, while its largest underweights are in Consumer Discretionary and Communication Services. These underweights are partially driven by large benchmark constituents we do not own, such as Meta Platforms and Tesla.

We continue to maintain a portfolio positioning balanced between offense and defense. While there is some uncertainty particularly around a new administration, the market continues to anticipate a favorable environment for risk and economic growth. We believe this backdrop warrants a continued, balanced portfolio positioning.

We sold two Health Care positions during the quarter, pharmaceutical company AstraZeneca and insurer UnitedHealth Group. AstraZeneca is under investigation concerning the company’s leadership in China, which increases the range of expected outcomes for the stock. UnitedHealth’s business model is becoming higher-risk, which coupled with slowing Medicare Advantage growth and regulatory uncertainty led to us exiting the position. With these proceeds, we bought two new positions in biotechnology company Vertex Pharmaceuticals and genetic-testing company Exact Sciences.

In Consumer Discretionary, we sold LVMH Moet Hennessy Louis Vuitton, which faces a potentially prolonged economic recovery in China, one of its major markets. With the proceeds, we bought food delivery company DoorDash.

We also added several new positions, including two in Information Technology: Atlassian, a maker of innovative software that allows IT developers and other employees to seamlessly collaborate on complex projects, and Datadog, a dominant cloud monitoring platform.

The market has begun to grapple with policy expectations from a new presidential administration. We expect the debate between expected and realized policy to be a persistent theme in 2025.

As we look into the year ahead, we expect the following factors, some of which carry forward from 2024, to be notable drivers of investment returns:

| | • | | The path and continuation of frontier AI model scaling, which expands the capabilities and complexity of AI applications |

| | • | | Greater AI usage and workflow integration across consumer and enterprise businesses |

| | • | | Fiscal policy moves (e.g., tariffs, immigration) by the new administration and Congress and the combined impact on inflation, economic growth and interest rates |

| | • | | International markets experiencing growth recoveries (e.g., China, Europe, South America) |

We remain focused on executing our investment process and maintaining exposure to increasingly relevant, competitively advantaged businesses at

11

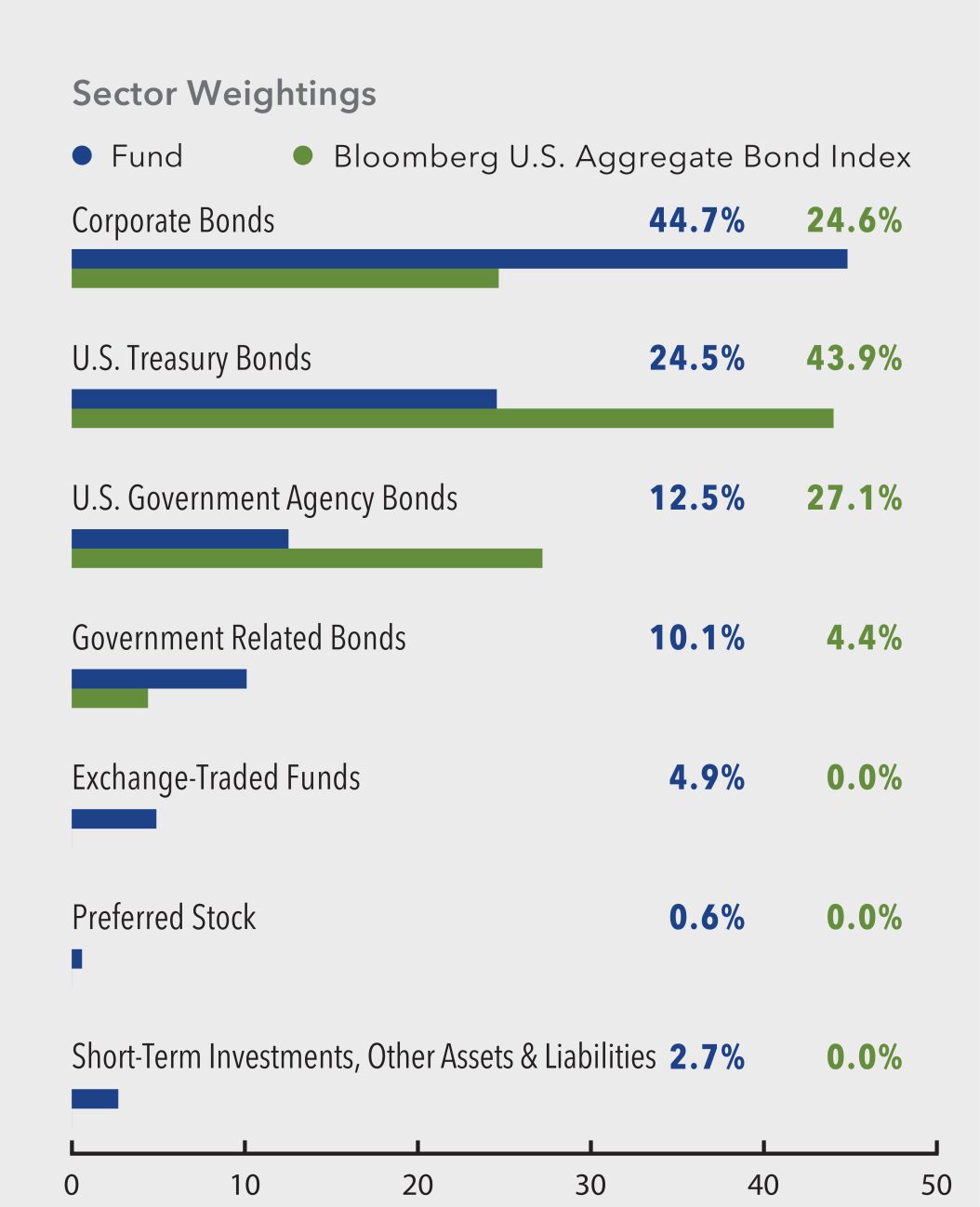

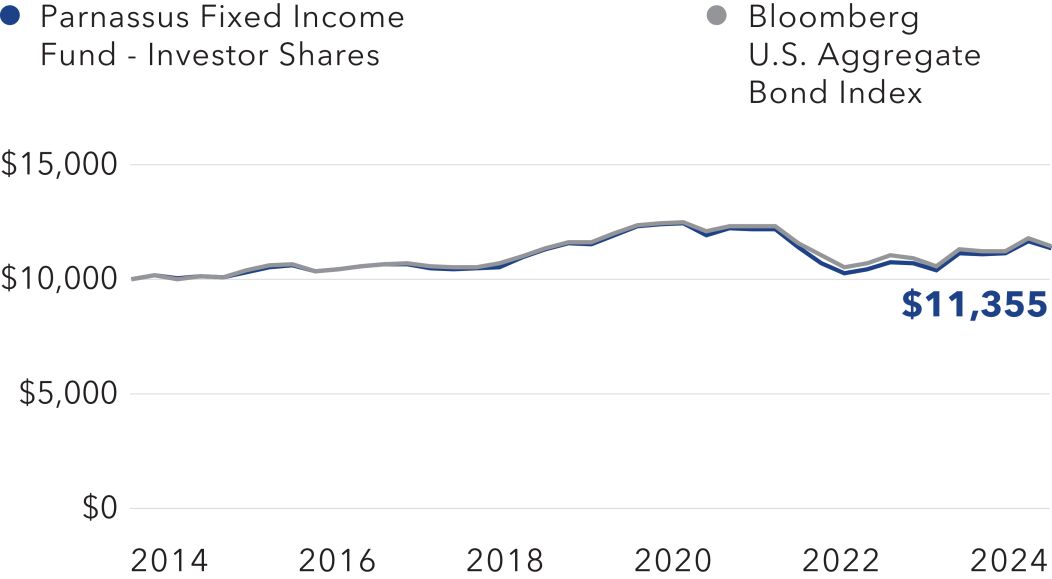

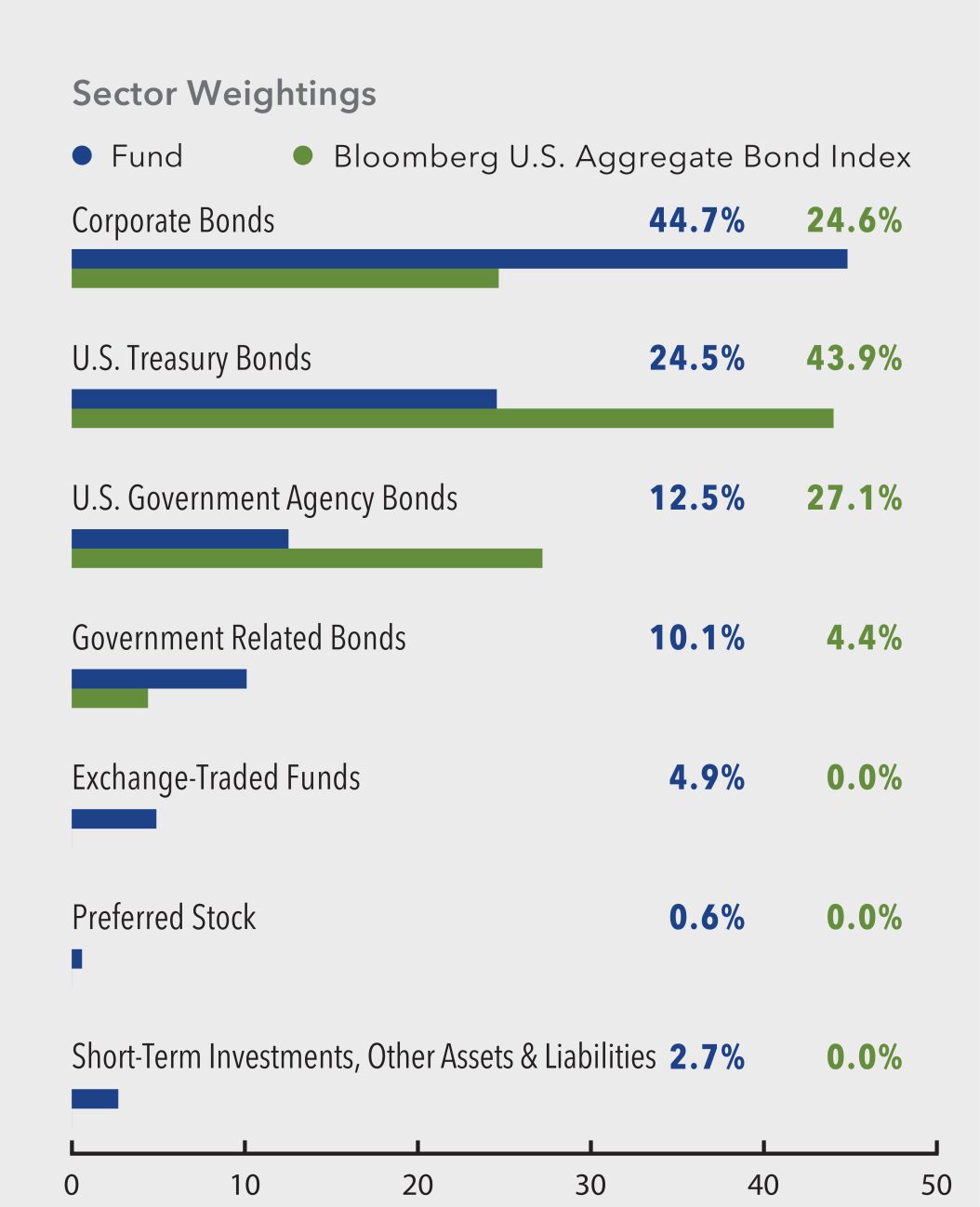

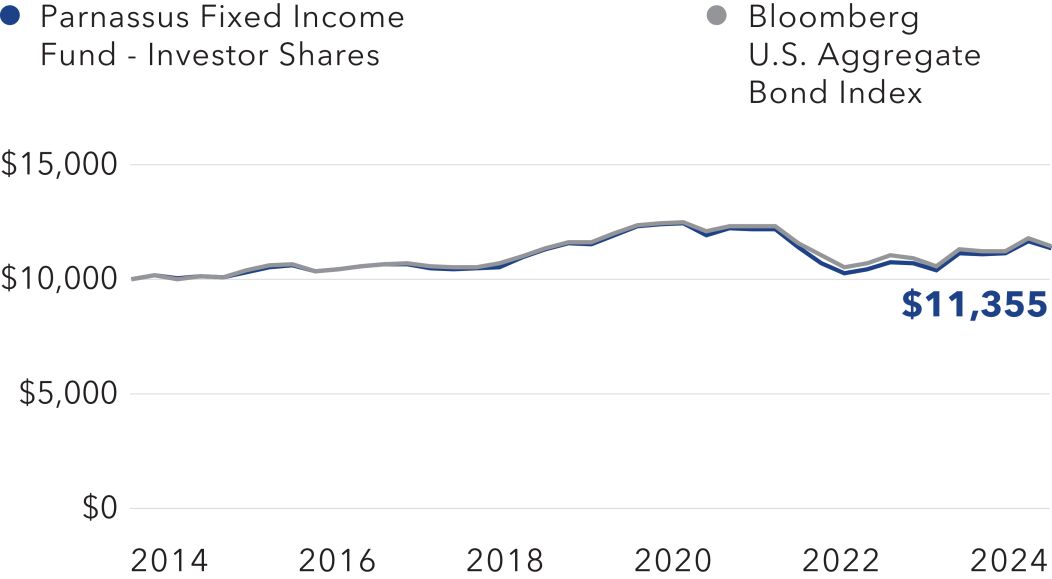

| | | | |