Exhibit 99.2

| | |

| | 888 SEVENTH AVENUE 29TH FLOOR NEW YORK, NY 10019 TEL: 212-265-4200 FAX: 212-265-4206 INFO@HPARTNERSLP.COM |

March 11, 2012

VIA EMAIL

Sealy Corporation

Attn: Nominating & Corporate Governance Committee

One Office Parkway

Trinity, NC 27370

Dear Messrs. Johnston, Morin, Replogle, and Roedel:

H Partners Management, LLC (“H Partners”) aims to invest in good businesses with capable, well-aligned fiduciaries focused on long-term value creation. We currently own approximately 14.5 percent of the outstanding shares of Sealy Corporation (“Sealy” or “the Company”), making H Partners the Company’s second largest shareholder. Over the past several months, we have contacted Sealy’s Board of Directors to express our concerns with the Company’s strategy and to discuss what we believe to be significant corporate governance deficiencies. Unfortunately, our efforts to engage with the board in a constructive and discreet manner have been ignored or met with roadblocks and delay tactics. Therefore, we have been compelled to set forth our concerns in this letter.

Since Sealy’s IPO in April 2006, shareholders have suffered a $1.3 billion, or an approximate 90 percent, loss of common equity value.1 In our view, this value destruction is due to the poor judgment, interference, and conflicts of interest of one shareholder: Kohlberg Kravis Roberts & Co. L.P. (“KKR”). Under KKR’s leadership, Sealy’s Boards have:

| | 1. | overloaded the Company with debt and taken a short-term approach; |

| | 2. | made numerous strategic errors resulting in a 50 percent earnings decline;2 |

| | 3. | repeatedly made poor CEO selections; |

| | 4. | allowed Dean Nelson, CEO of KKR’s in-house consulting firm and a Sealy Director, to exert excessive operational influence with no accountability for his poor performance; and |

| | 5. | sanctioned $20.9 million of payments to KKR since Sealy’s IPO in 2006, which represents a transfer of value from Sealy shareholders to KKR and its affiliates.3 |

Our goal is to resurrect this 100-year old iconic American manufacturer and to create long-term value forall shareholders. We believe in Sealy’s potential because of the Company’s enduring brands, legacy of innovation, and dedicated employees. One simple obstacle prevents Sealy from achieving its full potential:Sealy’s Board of Directors lacks broad shareholder representation. KKR, which owns 46.2 percent of Sealy’s outstanding common stock, receives a disproportionate representation of at least 78 percent on Sealy’s Board, including three direct representatives on the board.4 Meanwhile, the 53.8 percent non-KKR owners of the Company have no board representation.

In the following pages, we (i) assess Sealy’s current board composition, (ii) explain the five board failures described above, and (iii) recommend specific corporate governance improvements. Our recommendations include reconfiguring the board so that representation is proportionate to ownership interests, adding an H Partners representative to the board, and establishing a “Conflicts Committee.”

I. KKR’s Dominance of the Sealy Board

In our view, the current board composition advances the interests of minority shareholder KKR instead of, and often at the expense of, the interests of all shareholders.

From fiscal 2004 to 2008, KKR controlled Sealy by virtue of KKR owning over 50 percent of Sealy’s outstanding shares.5 On October 7, 2009, KKR’s ownership fell below 50 percent, and one year later, on October 7, 2010, Sealy claimed that it was “no longer a controlled company.”6 This statement is at odds with KKR’s 2011 investor presentation, which appears to claim that KKR maintains a “control position” in Sealy.7 Further, Sealy states that “a majority of our directors are independent,” even though four of five “independent” directors were added when KKR Capstone’s Dean Nelson was Chairman of the Nominating & Corporate Governance Committee (“N&G Committee”).8 We believe that Mr. Nelson has clear conflicts of interest as a director (see pages four and five).

Scrutiny of the current board shows that seven of the Company’s nine directors have strong current or previous affiliations with KKR:

| | • | | Three directors are employees of, or advisors to, KKR. |

| | • | | Dean Nelson is a “Member & Founder and Head of KKR Capstone,” KKR’s in-house consulting firm.9 |

| | • | | Simon Brown is a “Member & Head of Consumer Products” at KKR.10 |

| | • | | Paul Norris, current Chairman of Sealy, is a “Senior Advisor” to KKR.11 |

| | • | | A fourth director, James Johnston, previously served as Chairman and CEO of R.J. Reynolds Tobacco Co., a KKR-controlled company, and was Vice Chairman of RJR Nabisco, Inc.12 |

| | • | | A fifth director, Larry Rogers, is the Company’s current CEO. |

| | • | | Mr. Rogers was appointed CEO when Sealy was a KKR “controlled company” and he receives potential benefits assuming a “certain predetermined level of return has been achieved by KKR, Sealy’s major shareholder.”13 |

| | • | | Mr. Rogers endorses KKR Capstone on its website, even though Sealy shareholders have not seen the “better results” and “pools of profit” he attributes to KKR Capstone.14 |

| | • | | An additional two “independent” directors were appointed when Sealy was a KKR “controlled company”15 and when Mr. Nelson chaired the N&G Committee.16 Mr. Nelson was supported on this committee by a fellow KKR employee.17 |

We are also concerned about the independence of the last two directors. Both of these directors were added in September 2010 when Mr. Nelson was still Chairman of the N&G Committee.18 Mr. Nelson was supported on this committee by Mr. Johnston, the former Vice Chairman of RJR Nabisco, Inc.

Furthermore, we are alarmed by the fact that the Compensation Committee changed certain director and officer compensation arrangements in fiscal 2009 to be aligned with KKR’s interests, rather than those of all shareholders. In its March 4, 2011 proxy filing, Sealy states: “As a result of the 2009 Refinancing, the Compensation Committee believed that it was important to align the interest of management not only to those of current shareholders but also to those of Convertible Note holders.” KKR owned the majority of these Convertible Notes.19

| | |

| | 2 |

II. Major Board Failures

KKR-Dominated Boards Overloaded the Company with Debt and Adopted a Short-Term Approach

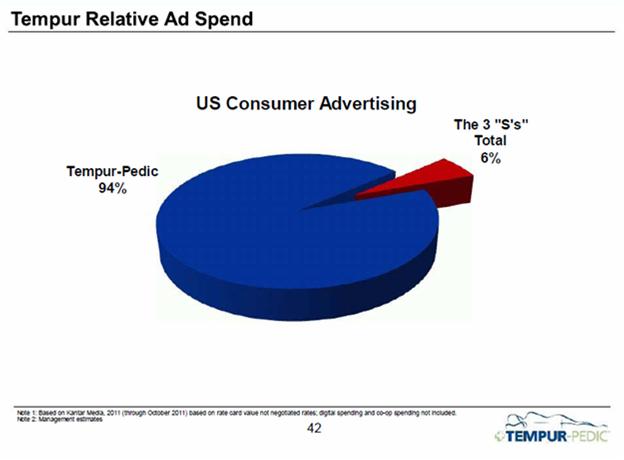

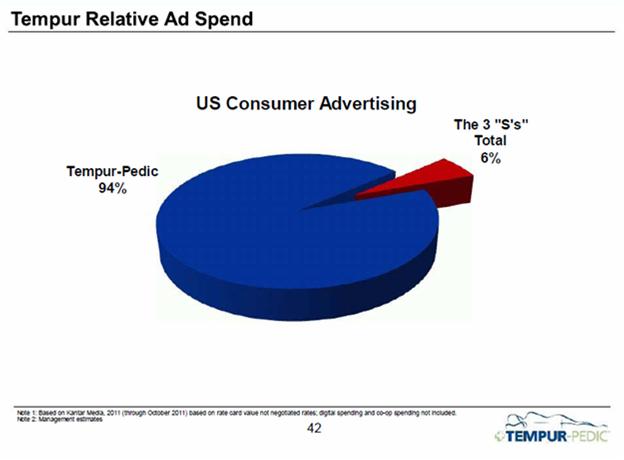

A company’s board is responsible for establishing an appropriate capital structure, annual budgets, and a capital allocation policy that create long-term value for shareholders. However, in Sealy’s case, we believe that KKR-dominated boards adopted a short-term approach. First, they put too much debt on the Company in an attempt to generate higher returns through financial engineering. Heading into the 2008 recession, Sealy’s $794 million total debt was almost five times its cash flow.20 This debt load almost bankrupted Sealy.21 Second, this excessive debt burden left little room to invest in projects that could drive long-term value. For example, in the eight fiscal years between 2004 and 2011, Sealy spent only $99 million on direct advertising.22 Over the same period, Tempur-Pedic, a comparable mattress manufacturer, invested over $750 million in direct advertising to build consumer awareness of its products. In a recent investor presentation, Tempur-Pedic highlights Sealy’s minimal investment in direct advertising (see Appendix A).

The two different approaches to long-term value creation have made a significant difference to shareholder returns. Since Sealy’s IPO, Tempur-Pedic’s common equity value has increased over 400 percent compared to an almost 90 percent decline in Sealy’s common equity value.23

Repeated Strategic Errors

Between 2000 and 2010, the United States mattress industry experienced tremendous growth, with total mattress sales rising 52 percent from $3.0 billion to $4.6 billion.24 Sales of non-innerspring, or “specialty,” mattresses were the largest contributor to this growth, increasing more than five-fold from an estimated $230 million in 2000 to almost $1.2 billion in 2010.25 These powerful tailwinds provided an ideal platform for value creation at Sealy, the market leader. But Sealy failed to capitalize on this opportunity, allowing two competitors to command an astounding 90 percent share of the lucrative specialty segment.26

Between 2004 and 2012, Sealy launched four different specialty brands, none of which gained meaningful traction with consumers because, in our view, Sealy did not provide adequate marketing support for these products.27 Despite over a decade of evidence of specialty’s growth, Sealy waited until September 2011 to establish a “new specialty bedding division.”28

The following table highlights the divergent performance of Sealy and three comparable public companies, each of which successfully executed on the specialty opportunity.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Sales | | | EBITDA | | | Enterprise Value | |

| | | 2006 | | | 2011 | | | % Change | | | 2006 | | | 2011 | | | % Change | | | 2006 | | | Current | | | % Change | |

Tempur-Pedic | | $ | 945 | | | $ | 1,418 | | | | 50 | % | | $ | 238 | | | $ | 392 | | | | 65 | % | | $ | 2,083 | | | $ | 5,637 | | | | 171 | % |

Select Comfort | | | 806 | | | | 743 | | | | (8 | %) | | | 107 | | | | 109 | | | | 2 | % | | | 779 | | | | 1,605 | | | | 106 | % |

Mattress Firm | | | 365 | | | | 693 | | | | 90 | % | | | 48 | | | | 77 | | | | 62 | % | | | 450 | | | | 1,391 | | | | 209 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

All Comparables | | | 2,116 | | | | 2,854 | | | | 35 | % | | | 393 | | | | 578 | | | | 47 | % | | | 3,312 | | | | 8,632 | | | | 161 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sealy | | | 1,448 | | | | 1,230 | | | | (15 | %) | | | 250 | | | | 125 | | | | (50 | %) | | | 2,136 | | | | 1,022 | | | | (52 | %) |

Whereas Sealy’s earnings declined 50 percent between 2006 and 2011, comparable companies’ earnings grew by an average of 47 percent.29 Tempur-Pedic, Select Comfort and Mattress Firm have added over $5 billion in enterprise value over the past five years, while Sealy’s enterprise value has been cut by more than half.30

| | |

| | 3 |

Poor CEO Selections

When it acquired Sealy in 2004, KKR decided to retain incumbent CEO, David McIlquham. Four years later, Mr. McIlquham was replaced by the President of Sealy North America, Larry Rogers. The board approved $900,000 in payments to KKR for “executive search costs” in fiscal 2008 and 2009, presumably related to Mr. Rogers’ promotion.31 We are puzzled to see a “global alternative asset manager” retained for an executive search, and wonder what process the board followed to retain KKR for this search.32 In December 2011, only three years after Mr. Rogers’ appointment, the board commenced yet another CEO search. This will be Sealy’s third CEO since KKR acquired the Company in 2004.

In contrast, the boards of Tempur-Pedic and Select Comfort conducted broad and effective CEO searches. In 2008, when Sealy promoted Mr. Rogers to CEO, Tempur-Pedic recruited a CEO who previously worked at the Campbell Soup Company, J. Crew and Nestle. Tempur-Pedic’s head of North America previously worked at Duracell and Gillette. Select Comfort’s CEO previously held senior leadership roles at PepsiCo. These managers’ strong consumer and general management backgrounds have enabled Tempur-Pedic and Select Comfort to succeed.

KKR Capstone’s Dean Nelson has Exerted Excessive Operating Influence with No Accountability for his Poor Performance

Mr. Nelson is the only KKR director representative who has been on Sealy’s Board continuously since 2004.A Four of five “independent” directors were appointed to the board when Mr. Nelson was Chairman of the N&G Committee, a post he held from fiscal 2006 to October 7, 2010.33

The Nelson-led KKR Capstone team was paid for “consulting services” in six out of the past eight years.34 During Sealy’s IPO in 2006, the Company paid $11 million to terminate KKR’s consulting services agreement. Accordingly, KKR Capstone received no payments in fiscal 2006 and 2007.35 However, Sealy’s Board authorized the resumption of payments to KKR Capstone in 2008, just two years after the $11 million payment to halt such services. Sealy has paid KKR and its affiliates $20.9 million since Sealy’s 2006 IPO.36

We do not understand why Sealy has paid millions of dollars to the Company’s largest shareholder for “consulting services.”

| | • | | First, KKR itself says that KKR Capstone provides consulting services to portfolio companies in which KKR has a “control position,” but according to Sealy, KKR does not have a control position in the Company.37 KKR Capstone appears to have no history of providing consulting services to any third party companies. |

| | • | | Second, in fiscal 2006 through 2008, the Company stated that “the ongoing provision to us of consulting services by Capstone remains at our discretion. We believe that the terms of these arrangements to date have been no less favorable to us than those that we could have obtained from unaffiliated third parties.”38 We are puzzled by the absence of this statement from fiscal 2009 and 2010 proxy filings. |

| | • | | Third, Sealy is well-staffed with 4,276 qualified full-time employees. We are not aware of any period in which Sealy lacked interim or full-time senior executives. Sealy’s financial |

| A | Eight different KKR employees or advisors have served as Sealy Directors since 2004: Dean Nelson (2004 – Present), Simon Brown (first term 2004 – 2005, second term 2010 – Present), Brian Carroll (2004 – 2010), Scott Stuart (2004 – 2009), Paul Norris (2006 – Present), Andrew Bellas (April 22, 2009 – August 28, 2009), Matthew King (August 28, 2009 – September 28, 2010), and Stephen Ko (April 14, 2010 – September 28, 2010). |

| | |

| | 4 |

| | statements confirm the Company’s more than adequate staffing levels. Sealy’s general and administrative expense in fiscal 2011 was $185 million, and has averaged approximately 15.6 percent of net sales in fiscal 2009, 2010 and 2011, all years in which KKR Capstone was employed by Sealy.39 This is considerably higher than comparable ratios of 9.9 percent, 8.5 percent, and 7.1 percent for Tempur-Pedic, Select Comfort, and Mattress Firm, respectively.40 |

Appendix B shows a letter dated January 8, 2011 from Mr. Nelson to Sealy’s CEO. In this letter, Mr. Nelson describes the “support” KKR Capstone provided to Sealy in fiscal 2010, and he states that the Company is making “good progress on a number of dimensions” ahead of fiscal 2011. The results tell a different story:Adjusted EBITDA declined 29 percent in fiscal 2011 and the stock fell 41 percent in calendar 2011.

The following table lists some of KKR Capstone’s 2010 initiatives, all of which appear redundant with routine executive officer responsibilities. The table also shows KKR Capstone’s poor results in sales and marketing, organizational design and budgeting, culminating in an alarming 62% decline in fourth quarter 2011 earnings.41

| | |

KKR Capstone Project | | Result |

| |

2011 Posturepedic Development and Launch | | Posturepedic - half of Sealy’s product portfolio - lost innerspring market share in Q4 2011 |

| |

Embody Performance In-Field | | Embody product line is being replaced |

| |

Fiscal 2011 Budget Process | | Fiscal 2011 Adjusted EBITDA of $125 million was 34% below the $190 million budget; only $15 million was allocated to direct advertising |

| |

Sales Force Compensation Model Redesign | | Sales force compensation model had to be redesignedagain for fiscal 2012 |

| |

Canadian Business Support | | Q4 2011 Canadian revenue declined 17% |

Despite KKR Capstone’s repeated failures, Mr. Nelson continues to be retained as a consultant. In fact, Mr. Nelson looks “forward to continuing our support of the Sealy team across a broad range of initiatives,” and views himself as a permanent fixture whose “mandate will shift with the needs of the business.” Per Sealy’s proxy statement filed last week, KKR Capstone has once again been retained in fiscal 2012.42

In our experience, a service provider who consistently fails to deliver on key objectives is terminated. Therefore, we ask ourselves how and why Mr. Nelson and KKR Capstone are still involved in any capacity at Sealy.

| | |

| | 5 |

Payments of $20.9 Million from Sealy to KKR have Transferred Value from Sealy Shareholders to KKR and its Affiliates KKR and its affiliates have received approximately $52.1 million in fees from Sealy since 2004, including $20.9 million since Sealy’s April 2006 IPO.43 The following table details these fees.

| | | | | | |

| | | Amount | | | |

Fiscal Year | | ($ millions) | | | Transaction, as disclosed in proxy filing |

| 2004 | | | 25.0 | | | Transaction Fee |

| 2004 | | | 2.0 | | | Consulting Services Provided by Capstone Consulting LLC |

| 2005 | | | 2.1 | | | Advisory Fees |

| 2005 | | | 1.4 | | | Consulting Services Provided by Capstone Consulting LLC |

| 2006 | | | 0.7 | | | Advisory Fees |

| 2006 | | | 11.0 | | | Termination of Management Services Agreement |

| 2007 | | | 0.1 | | | Excess D&O Liability Insurance and Excess Liability Insurance to KKR |

| 2008 | | | 2.3 | | | Consulting Services Provided by KKR |

| 2008 | | | 0.6 | | | Recruiting Fees Paid by KKR for Sealy |

| 2008 | | | 0.4 | | | Consulting Services Provided by Capstone Consulting LLC |

| 2008 | | | 0.1 | | | Excess Insurance Coverage Paid by KKR for Sealy |

| 2009 | | | 2.9 | | | Consulting Services Rendered by KKR and Capstone Consulting LLC |

| 2009 | | | 0.3 | | | Executive Search Costs Incurred by KKR on the Company’s Behalf |

| 2010 | | | 1.9 | | | Consulting Services Rendered by KKR and Capstone Consulting LLC |

| 2011 | | | 1.3 | | | Consulting Services Rendered by KKR and Capstone Consulting LLC |

| | | | | | |

| Total KKR Payments | | | 52.1 | | | |

We believe that KKR has a conflict with respect to fees. KKR itself explains: “It has been and remains a key objective of our firm to maximize our fee related earnings.”44 Henry Kravis, co-founder of KKR, stated that “you can take anywhere from 12 to 15 times on the fee-related earnings. You can take a discount to our balance sheet earnings if you want to do that, and they – that’s pretty much the value of the stock.”45 Since the IPO, Sealy’s $3.5 million average annual payments to KKR have been costly to shareholders. Assuming Sealy stock is also valued at 12 to 15 times earnings, the value transferred from Sealy shareholders to KKR and its affiliates ranges from $42 million to $52 million.

Numerous related party transactions indicate a troubling relationship between KKR and Sealy’s Board. In our view, Sealy’s Board has not fully considered the conflicts and value leakage described above.

In contrast, other companies have enforced clear policies to protect shareholders from conflicts of interest. For example, Tempur-Pedic was 65.3 percent owned by two private equity firms after the company was publicly listed in December 2003.46 Since Tempur-Pedic’s IPO, we observed no reported related party transactions between Tempur-Pedic and the two private equity firms. In fact, Tempur-Pedic’s proxy filings disclose a Related Party Transactions Policy which states that Tempur-Pedic’s Nominating and Corporate Governance Committee will examine whether a potential transaction “is on terms no more favorable than to an unaffiliated third party under similar circumstances,as well as the extent of the related party’s interest in the transaction” (emphasis added).47

A review of Sealy’s proxy filings reveals that Sealy’s Nominating and Corporate Governance Committee, of which Mr. Nelson of KKR Capstone was Chairman from fiscal 2006 through October 7, 2010, has no such Related Party Transactions Policy.

| | |

| | 6 |

III. H Partners’ Recommendations

To address the Company’s deficient strategies and corporate governance, we recommend the following changes:

| | 1. | H Partners will appoint one representative to the board, proportionate to H Partners’ 14.5 percent stake. H Partners’ representative will waive any board fees so that H Partners is fully aligned with shareholders. In addition, H Partners will certify that it will not seek fees or reimbursement for consulting services, executive recruitment, investment banking advice, or monitoring its own investment in Sealy. |

| | 2. | As discussed, KKR’s board representation must be proportionate with its ownership. Currently, at least seven out of nine, or 78 percent, of Sealy’s directors are employed by KKR or have strong affiliations with KKR.48 Therefore, three KKR-affiliated directors will be replaced with independent directors to bring KKR’s representation in line with its ownership interest. |

| | 3. | We believe it is a conflict of interest for a provider of consulting services to remain on the board. Therefore, Dean Nelson, CEO of KKR Capstone, will resign as a director. |

| | 4. | H Partners will assist the N&G Committee in appointing two additional qualified, independent directors. The N&G Committee will solicit recommendations and feedback solely from non-KKR shareholders. |

| | 5. | H Partners’ representative will be added to the CEO Search Committee. H Partners has experience identifying, recruiting and incentivizing proven managers. A KKR employee currently serves on the CEO Search Committee. Non-KKR owners of Sealy must be included in this critical decision. |

| | 6. | H Partners’ representative and one of the new independent directors will be added to the N&G Committee. Currently, three out of four members of this committee have strong KKR affiliations.49 Two of these three directors will resign from this committee. |

| | 7. | The N&G Committee will create a “Conflicts Committee” comprised of three independent directors. This committee will be tasked with approving all transactions with related parties. This committee will establish a Related Party Transactions Policy which will examine, among other things, the extent of a related party’s interest in a transaction. In addition, the Conflicts Committee will provide specific details of any related party transaction in the Company’s annual report and proxy statement. |

| | |

| | 7 |

Despite our disappointing experience with Sealy’s Board, H Partners remains open to working constructively with the board and its N&G Committee to restore Sealy to its former greatness. Our team at H Partners has experience collaborating with boards and management teams to achieve strong results for all stakeholders. Further, as an experienced investor in mattress companies, we have deep knowledge of how value is created within the industry.

At this critical juncture, Sealy’s Board should acknowledge the failures of the past and implement the governance changes we have recommended. If the board does not implement our recommendations, we will be forced to pursue other avenues to protect the value of our investment. These avenues may include, but are not limited to, (i) a potential campaign to withhold votes from KKR-affiliated directors, and (ii) remedies to protect ourselves and fellow shareholders from any abuses and self-interested transactions perpetrated by KKR and its affiliates, the Company, the Company’s Board and all other relevant parties.

| | |

| Sincerely, | | |

/s/ Usman Nabi | | /s/ Arik Ruchim |

| |

Partner | | Partner |

| | |

| | 8 |

| 1 | The loss in common equity value is calculated by using the $16 IPO stock price and 90.7 million shares outstanding on April 6, 2006, which implies an initial equity value of $1.45 billion. The current common equity value of $176 million is calculated by using a $1.74 stock price on March 8, 2012 and outstanding shares of 100.9 million as of January 10, 2012. |

| 2 | The earnings decline is calculated by comparing Sealy’s fiscal 2006 Adjusted EBITDA of $250 million and fiscal 2011 Adjusted EBITDA of $125 million. Because of the recurring nature of KKR fees, we reduce the Company’s reported Adjusted EBITDA by $0.7 million and $1.3 million in fiscal 2006 and 2011, respectively. The stock price decline is calculated by comparing Sealy’s $16 stock price at IPO on April 6, 2006 with a $1.74 stock price on March 8, 2012. Strategic errors include a failure to invest in the growing specialty segment. As a result, the Company achieved only 9% of domestic net sales from non-innerspring products in fiscal 2011. |

| 3 | See page 6 for a detailed list of fees paid to KKR and KKR-affiliated companies. Fees since Sealy’s IPO include an $11.0 million termination payment in fiscal 2006 and all payments to KKR between fiscal 2007 and 2011. When calculating fees since the IPO, we have excluded the $0.7 million “advisory fees” paid to KKR in fiscal 2006 because of conflicting disclosures by the Company. In a proxy filing dated March 26, 2007, the Company states “In 2006 we paid $0.7 million in advisory fees to KKR.” However, in a proxy filing dated March 23, 2009, the Company states “In fiscal year 2006, we did not pay any advisory fees to KKR.” |

| 4 | Seven out of nine directors are employees of KKR, or have strong affiliations with KKR. Simon Brown and Dean Nelson are employed by KKR. Paul Norris is a “Senior Advisor” to KKR. James Johnston was the CEO of a KKR-controlled company. Richard Roedel and Gary Morin joined the board when the Company characterized itself as a KKR-controlled company, and when Mr. Nelson chaired the N&G Committee. Larry Rogers became CEO when the Company characterized itself as a KKR-controlled company. Larry Rogers may receive certain benefits tied to the performance of KKR’s investment in the Company. |

| 5 | In fiscal 2004 and 2005 KKR owned over 50% of Sealy shares. Each proxy statement for fiscal 2006, 2007, and 2008 states that Sealy is a “controlled company” because KKR owned over 50% of outstanding shares. |

| 6 | Source: March 4, 2011 proxy filing. |

| 7 | In an investor presentation by KKR dated March 15, 2011 KKR includes Sealy in a list of “portfolio companies.” These “portfolio companies” are defined as those companies “with greater than $100mm in revenue at close and where KKR holds acontrol position, either alone or with other partners” (emphasis added). |

| 8 | Source: March 4, 2011 proxy filing. |

| 9 | Source: www.kkr.com/leadership/team |

| 10 | Source: www.kkr.com/leadership/team |

| 11 | Source: www.kkr.com/leadership/senior-advisors |

| 12 | Source: March 9, 2012 proxy filing. “Mr. Johnston was Vice Chairman of RJR Nabisco, Inc., a diversified manufacturer of consumer products, from 1995 to 1996. He also served as Chairman and CEO of R. J. Reynolds Tobacco Co. from 1989 to 1995, Chairman of Reynolds from 1995 to 1996 and Chairman of R. J. Reynolds Tobacco International from 1993 to 1996. Mr. Johnston served on the board of RJR Nabisco, Inc. and RJR Nabisco Holdings Corp. from 1989 to 1996.” Mr. Johnston was a speaker at KKR’s Annual Meeting on May 23, 1994. |

| 13 | Source: March 4, 2011 proxy filing. |

| 14 | Mr. Rogers’s quote reads as follows: “KKR Capstone really differentiates KKR from its competitors. Through our partnership, we’ve achieved better results more quickly than we could have on our own. KKR Capstone not only unlocks pools of profit but also teaches our people how to identify and analyze future opportunities.” http://www.kkr.com/businesses/private-markets/kkr-capstone.php |

| 15 | Source: March 4, 2011 proxy filing. |

| 16 | In its March 27, 2007 proxy filing, Sealy states: “Mr. Nelson is the chairperson of the nominating/corporate governance committee.” It further states: “Our nominating/corporate governance committee met only one time in fiscal 2006.” |

| 17 | In its March 27, 2007 proxy filing, Sealy states: “Our nominating/corporate governance committee consists of Brian F. Carroll, Dean B. Nelson and David J. McIlquham, none of whom are independent, as permitted by the “controlled company” exception.” Brian F. Carroll was a KKR employee. |

| 18 | In its March 4, 2011 proxy filing, Sealy states: “During fiscal 2010 prior to October 7, 2010 Mr. Nelson, who is not an independent director, was a member and chairman of the [nominating/corporate governance] committee.” |

| 19 | Per the proxy filing dated March 5, 2010, KKR owned approximately $93.8 million or 53% of the Convertible Notes. |

| 20 | Cash flow is calculated as Adjusted EBITDA of $216.8 million less Capital Expenditures of $42.4 million in fiscal 2007. Total debt of $794 million is as of December 2, 2007. |

| 21 | In March 2009, Sealy’s 8.25% Senior Subordinated Notes traded at 35% of face value, implying a risk of default. |

| 22 | Direct advertising is calculated as total advertising expenses less cooperative advertising. |

| 23 | Based on Sealy’s $16.00 IPO stock price and $1.74 stock price on March 8, 2012 and Tempur-Pedic’s stock price of $15.89 on April 6, 2006 and $80.93 stock price on March 8, 2012. |

| 24 | Source: International Sleep Products Association report titled “2010 Mattress Industry Report of Sales and Trends.” |

| | |

| | 9 |

| 25 | Source for non-innerspring sales in 2010: International Sleep Products Association report titled “2010 Mattress Industry Report of Sales and Trends.” 2000 non-innerspring mattress sales of $230 million is an estimate based upon publicly disclosed data by Tempur-Pedic and Furniture Today. |

| 26 | Estimate based on 2010 International Sleep Products Association data and public disclosures by Tempur-Pedic and Select Comfort. |

| 27 | Specialty product launches include: True Form (2005), Right Touch (2006), Embody (2010), and Optimum (2012). |

| 28 | Source: Sealy press release “Sealy Announces Increased Commitment to Specialty Bedding” dated September 27, 2011. |

| 29 | Comparable company earnings is the sum of Tempur-Pedic, Select Comfort, and Mattress Firm EBITDA in each reference period. Mattress Firm’s 2011 EBITDA is an estimate based on consensus analyst expectations for the fiscal year ending January 2012. The earnings decline is calculated by comparing Sealy’s fiscal 2006 Adjusted EBITDA of $250 million and fiscal 2011 Adjusted EBITDA of $125 million. Because of the recurring nature of KKR fees, we reduce the Company’s reported Adjusted EBITDA by $0.7 million and $1.3 million in fiscal 2006 and 2011, respectively. |

| 30 | Mattress Firm’s 2006 Enterprise Value of $450 million is an estimate based on J.W. Child’s January 2007 announced acquisition of the company. |

| 31 | As shown on page 6, the Company paid KKR $600,000 in fiscal 2008 and $300,000 in fiscal 2009 for executive search costs. |

| 32 | Per KKR’s S-1 filing on July 3, 2007, KKR is “a leading global alternative asset manager.” |

| 33 | Source: Proxy filing dated March 4, 2011. |

| 34 | From fiscal 2004 through 2005 and 2008 through 2011, Sealy names Capstone Consulting LLC as a recipient of fees. |

| 35 | There is some ambiguity surrounding 2006 payments to KKR. In a proxy filing dated March 27, 2007, the Company states: “In 2006 we paid $0.7 million in advisory fees to KKR.” However, in a proxy filing dated March 23, 2009, the Company states: “In fiscal year 2006, we did not pay any advisory fees to KKR.” |

| 36 | See page 6 for a detailed list of fees paid to KKR and KKR-affiliated companies. |

| 37 | In an investor presentation by KKR dated March 15, 2011, KKR includes Sealy in a list of “portfolio companies.” These “portfolio companies” are defined as those companies “with greater than $100mm in revenue at close and where KKR holds acontrol position, either alone or with other partners” (emphasis added). |

| 38 | From proxy filings dated March 27, 2007, March 31, 2008, and March 23, 2009. |

| 39 | Sealy’s reported selling, general & administrative expenses for fiscal 2009, 2010, and 2011 are adjusted to exclude marketing and shipping & handling expenses. |

| 40 | Tempur-Pedic and Select Comfort ratios calculated from 2009 through 2011 public disclosures. Mattress Firm ratio is for fiscal 2009 through the first nine months of fiscal 2011. |

| 41 | Fourth quarter 2011 earnings calculated as reported Adjusted EBITDA of $15.1 million less $322,000 of KKR consulting fees. Fourth quarter 2010 earnings calculated as reported Adjusted EBITDA of $39.9 million less $456,000 of KKR consulting fees. |

| 42 | In its March 9, 2012 proxy filing, Sealy states: “For Fiscal 2012 our audit committee has approved specific consulting services from KKR and KKR Capstone for a combined amount of less than $0.6 million.” |

| 43 | Fees since IPO include an $11.0 million termination payment in fiscal 2006 and all payments to KKR between fiscal 2007 and 2011. When calculating fees since the IPO, we have excluded the $0.7 million “advisory fees” paid to KKR in fiscal 2006 because of conflicting disclosures by the Company. In a proxy filing dated March 27, 2007, the Company states: “In 2006 we paid $0.7 million in advisory fees to KKR.” However, in a proxy filing dated March 23, 2009, the Company states: “In fiscal year 2006, we did not pay any advisory fees to KKR.” |

| 44 | Source: KKR’s S-1 filing dated July 3, 2007. |

| 45 | KKR presentation teleconference at the Bank of America Merrill Lynch Conference, November 15, 2011. |

| 46 | Tempur-Pedic’s proxy filing dated April 28, 2004 shows that TA Associates Funds and Friedman Fleischer & Lowe Funds owned 43.8% and 21.5%, respectively, as of March 31, 2004. |

| 47 | Tempur-Pedic’s proxy filing dated March 24, 2008 states: “In reviewing a transaction or relationship, the Nominating and Corporate Governance Committee will take into account, among other factors it deems appropriate, whether it is on terms no more favorable than to an unaffiliated third party under similar circumstances, as well as the extent of the related party’s interest in the transaction.” |

| 48 | Seven out of nine directors are employees of KKR, or have strong affiliations with KKR. Simon Brown and Dean Nelson are employed by KKR. Paul Norris is a “Senior Advisor” to KKR. James Johnston was the CEO of a KKR-controlled company. Richard Roedel and Gary Morin joined the board when the Company characterized itself as a KKR-controlled company, and when Mr. Nelson chaired the N&G Committee. Larry Rogers became CEO when the Company characterized itself as a KKR-controlled company. Larry Rogers may receive certain benefits tied to the performance of KKR’s investment in the Company. |

| 49 | The N&G Committee includes the former CEO of a KKR-controlled company as well as two directors who were added when Sealy was controlled by KKR and when Mr. Nelson chaired the N&G Committee. |

| | |

| | 10 |

Appendix A: Mattress Industry Relative Ad Spend

Appendix B: KKR Capstone Letter Dated January 8, 2011

KKR CAPSTONE

January 8, 2011

Mr. Larry Rogers

Sealy Corporation

One Office Parkway

Trinity, NC, 27370

Dear Larry:

We are delighted to provide you with a review of the work that KKR Capstone completed in partnership with the Sealy team in 2010. We believe that despite a difficult domestic sales environment, Sealy continued to make good progress on a number of dimensions and we are proud to continue to have had the opportunity to work alongside the management team.

As has been our practice for the last several years, please find below a recap of the various projects the KKR Capstone team was involved with in 2010. In addition to the projects specifically listed below, KKR Capstone provided on-going, ad-hoc support for the executive team.

| | • | | SAPSA Restructuring and Sale (January ’09 to November ’10) - In FY10, KKR Capstone continued its support of the restructuring of the European ( SAPSA) business which ultimately culminated with the sale of the business. Through June of FY10, KKR Capstone worked closely with the European management team to execute the transition of the business away from the Pirelli brand to the Sealy brand following Sealy’s decision not to renew the license agreement. Upon completion of the transition, KKR Capstone worked with the European management team to develop the workplan and assess the impact for “Project Drake”, the shutdown of the Italian facility. This workplan ultimately served as the baseline against which the full sale of the business was compared against. Beginning in August, KKR Capstone initiated conversations with a prospective buyer of SAPSA and led the negotiation of the letter of intent. Through the fall, KKR Capstone worked with Michael Murray to support the buyer’s diligence effort and negotiate the definitive share purchase agreement.***** |

9West 57 Street, New York, New York 10019

Telephone (212) 326-9600 Fax (212)230-9795

| | • | | Returns Reduction Initiative (October ’09 to October ’10) — ***** KKR Capstone supported Jeff Ackerman’s cross-functional returns-reduction program. The initiative focused on a number of fronts: (1) assessing foam supplier quality and variability, (2) identifying specific design criteria and decisions leading to poor returns performance, (3) uncovering and codifying dealer best practices on returns and (4) working directly with ***** to lower their returns. The output from the analysis on supplier quality and design criteria was directly incorporated into the 2011 Posturepedic product development process. The work on dealer practices was presented to the entire sales force and a concentrated effort on applying these practices to 25 of the highest opportunity dealers ***** |

| | • | | 2011 Posturepedic Development (January ’10 to Present)—As with prior product development cycles, KKR Capstone supported a number of executives with the development of the 2011 Posturepedic line. Our involvement has included providing on going input on merchandising and branding strategy as well as analysis on margin trends and target. As the line begins to move into rollout / commercialization, KKR Capstone is working closely with ***** to ensure a seamless launch. |

| | • | | Recapitalization Assessment (January ’10 to April ’10) —The KKR Capstone team supported Jeff Ackerman and Larry Rogers in developing a perspective on capital structure options. This assistance included refreshing the market models, developing management presentations and financial projections to assist ***** an ***** reviewing capital structure options. |

| | • | | S&F Cost Reduction Actions (February ’10 to March ’10)— ***** the KKR Capstone team worked with a cross-functional team led by ***** to identify and asses value engineering opportunities on the S&F product line. In total, initiatives with annualized savings of ***** were implemented ***** |

| | • | | Manufacturing Fixed Cost Benchmarking (February ’10 to March ’10)—Working with Mike Hofmann’s organization, KKR Capstone assisted in conducting a benchmarking of fixed cost spend items across Sealy manufacturing facilities. The analysis highlighted a ***** cost reduction opportunity on spend items, approximately half of which was realized in FY10 and the other half of which was included in the FY11 budget. |

| | • | | Sales Force Compensation Model Redesign (March ’10 to April ’10)—KKR Capstone worked closely with ***** on the redesign of the sales force compensation. |

| | • | | Contract Sales ***** (March ’10 to August ’10)—KKR Capstone worked closely with ***** on assessing changes required to restore Sealy’s Contract channel business. We were involved in meeting with suppliers, creating a sales pipeline reporting and supporting ***** transition. ***** |

| | • | | Mexico Components (May ’10 to June ’10)—KKR Capstone worked with ***** and ***** to assess the opportunity associated with moving innerspring production equipment to the Mexican Assembly Plant to service the Mexican marketplace. The analysis highlighted ***** in annualized cost savings once the transition was completed, a nearly 100% IRR on the invested capital. The machines were subsequently moved and the transition is underway. ***** |

| | • | | Embody performance in-field (September ’10 to November ’10)—KKR Capstone worked closely with Louis Bachicha’s team to identify the key drivers required for sell-through success on the Embody product line: (1) ***** (2) ***** (3) ***** and (4) ***** These learnings were embedded in the Embody training materials, implemented as targeted countermeasures at key accounts and were incorporated as clear components of the ***** agreements. |

| | • | | FY11 Budget Process (September ’10 to November ’10)—KKR Capstone team supported Jeff Ackerman and the finance team in developing run-rate projections and assessing impacts of key initiatives on revenue, gross margin and EBITDA. This support assisted management in accomplishing their goal of delivering the FY11 budget to the organization at the start of the fiscal year. |

| | • | | Canadian Business Support (Ongoing)—Beginning in May 2009, KKR Capstone began to work with Larry Rogers to provide regular on-going support to ***** and the Canadian leadership team. Our involvement has included participation on weekly update calls and analysis of merchandising, promotions and strategy. |

| | • | | KKR Cross-Portfolio Savings Programs (Ongoing)—KKR Capstone assisted a number of Sealy executives in the assessment and implementation of savings opportunities associated with KKR cross-portfolio programs. Programs with cumulative annualized savings of ***** were implemented in FY10 in the areas of Corporate insurance, Small Parcel, Pharmacy Benefits Management and ASO fees. Additionally, KKR Capstone assisted ***** benefits plan benchmarking review which identified ***** in opportunity; however, given regulatory changes, we do not expect all of these savings to be realized. |

In FY11, we look forward to continuing our support of the Sealy team across a broad range of initiatives. While we anticipate that our mandate will shift with the needs of the business, we are currently focused on a number of key topics: supporting a seamless 2011 Posturepedic Launch; ***** and facilitating execution of the National Advertising Campaign.

Please do not hesitate to contact us should you require any additional information.

|

| Sincerely, |

|

| /s/ Dean Nelson |

|

| The KKR Capstone team |