Exhibit 99.2

NORSAT INTERNATIONAL INC.

2017 NOTICE OF ANNUAL GENERAL AND SPECIAL

MEETING OF SECURITYHOLDERS AND INFORMATION

CIRCULAR

including with respect to a proposed

ARRANGEMENT

involving

HYTERA COMMUNICATIONS CO., LTD.

and

HYTERA PROJECT CORP.

and

NORSAT INTERNATIONAL INC.

APRIL 28, 2017

|

| |

| These materials are important and require your immediate attention. |

| They request Norsat International Inc. securityholders to make important decisions. |

| If you have questions, you may contact the proxy solicitation agent: |

| |

| Evolution Proxy, Inc. |

| 1-844-226-3222 (North American Toll Free Number) |

| 1-416-855-0238 (Outside North America) |

| info@evolutionproxy.com |

| |

April 28, 2017

Dear Fellow Securityholders:

It is my pleasure to invite you to the upcoming Annual General and Special Meeting of Norsat International Inc. (“Norsat”) securityholders on Monday, May 29, 2017, at 2:00 pm (Pacific time) at the offices of Norsat International Inc. at Suite 110-4020 Viking Way, Richmond, B.C., V6V 2L4 (the “Meeting”).

As securityholders are aware, after discussions with multiple parties and a comprehensive review of several indications of interest with respect to a strategic transaction, on March 27, 2017 Norsat announced that it had entered into an Arrangement Agreement (the “Arrangement Agreement”) with Hytera Communications Co., Ltd. (“Hytera”) and Hytera Project Corp., pursuant to which, and subject to the terms and conditions of the Arrangement Agreement, Hytera agreed to indirectly acquire all of the issued and outstanding shares of Norsat in accordance with a plan of arrangement to be completed under theBritish Columbia Business Corporations Act(the “Arrangement”).

Pursuant to the terms of the Arrangement Agreement, Hytera will indirectly acquire each outstanding common share of Norsat (each a “Norsat Share”) in exchange for cash payment of US$10.25 per share. The Arrangement provides shareholders of Norsat (the “Norsat Shareholders”) with a 62% premium over the unaffected trading price of the Norsat Shares on September 16, 2016 (the date before which a shareholder of Norsat publicly expressed an interest in acquiring control of Norsat), and 66% over the 20-day volume weighted average price ending on September 16, 2016.

The independent directors of Norsat have unanimously determined that the Arrangement is in the best interests of Norsat and its securityholders. The Board of Directors received opinions from its financial advisor, Raymond James Ltd., and from KPMG LLP, an independent advisor, that as of March 24, 2017 and subject to the assumptions, limitations and qualifications set forth herein, the consideration to be received by the Norsat Shareholders of Norsat pursuant to the Arrangement Agreement is fair, from a financial point of view, to the Norsat Shareholders.

On April 17, 2017, Norsat announced that it had received an unsolicited, conditional, non-binding proposal from Privet Fund Management LLC (“Privet”) to acquire Norsat for cash consideration of US$11.00 per Norsat Share. The non-binding proposal is subject to conditions relating to due diligence and financing. Since Norsat received the proposal Norsat has allowed Privet access to conduct due diligence. However, as of the date of this letter Privet had neither removed the conditions to its proposal nor tendered an amended proposal. As of the date hereof, the Board of Directors has not changed its assessment regarding the pending transaction with Hytera.

At the Meeting, securityholders of Norsat will be asked to consider a resolution to approve the Arrangement (the “Arrangement Resolution”). The Arrangement Resolution must be approved by not less than 66⅔% of the votes cast by the Norsat Shareholders, either in person or by proxy, at the Meeting.

After careful consideration of the Arrangement, the Board of Directors hasrecommendedthat the securityholders of Norsatvote in favourof the Arrangement Resolution.

The accompanying notice of meeting (the “Notice of Meeting”) and management information circular (the “Circular”) contain a detailed description of the Arrangement and set forth the actions to be taken by you at the Meeting. You should carefully consider all of the information in the Notice of Meeting and Circular and consult your financial, legal or other professional advisors if you require assistance.

The Arrangement is also subject to court approval. Assuming that all of the conditions to the Arrangement are satisfied, Norsat expects the Arrangement to become effective in the second quarter of 2017.

Your vote is important regardless of how many Norsat Shares you own. To ensure that your Norsat Shares will be represented at the Meeting, whether or not you are personally able to attend, registered holders of Norsat Shares are asked to return the enclosed form of proxy, properly completed and signed, prior to 2:00 p.m. (Pacific time) on May 25, 2017(or a day, other than a Saturday, Sunday or holiday which is at least two business days prior to any adjournment or postponement of the Meeting).

If you are a beneficial Norsat Shareholder, meaning your Norsat Shares are not registered in your own name but are registered in the name of a broker, bank or other intermediary, follow the instructions provided on your voting instruction form.

If you have questions, you may contact the proxy solicitation agent, Evolution Proxy, Inc., by telephone at: 1-844-226-3222 (North American Toll Free Number) or 1-416-855-0238 (Outside North America); or by email at:info@evolutionproxy.com.

On behalf of the Board of Directors, I would like to express our gratitude for the ongoing support our shareholders have demonstrated with respect to our decision to take part in this important event in the history of Norsat. We would also like to thank our employees who have worked very hard assisting us with this task and for providing their support for the Arrangement in addition to their on-going responsibilities executing on Norsat’s business objectives.

Sincerely,

“Fabio Doninelli”

Fabio Doninelli

Chairman

| | | | |

| FREQUENTLY ASKED QUESTIONS | | Q. | Who can attend and vote at the Meeting? |

| | | | |

| The following is a summary of certain information | | A. | Securityholders of record at the close of business |

| contained elsewhere in this Circular, including the | | | on April 24, 2017 will be entitled to receive notice of |

| Appendices hereto. Terms with initial capital letters | | | and vote at the Meeting, or any adjournment or |

| used in this summary are defined in the “Glossary of | | | postponement thereof. |

| Terms”. | | | |

| | Q. | How many Norsat Shares are entitled to vote? |

| About the Meeting | | | |

| | | A. | As of April 24, 2017, the Record Date for the |

| Q. | Why is the Meeting being held? What am I being | | | Meeting, there were 5,848,808 Norsat Shares |

| | asked to vote on? | | | outstanding with each Norsat Share carrying the |

| | | | | right to one vote. |

| A. | In addition to the matters customarily considered at | | | |

| an annual general meeting, at the Meeting the | | Q. | What if I acquire ownership of Norsat Shares |

| | Securityholders will also consider a resolution to | | | after the Record Date of April 24, 2017? |

| | approve the acquisition by Hytera of all of the | | | |

| | issued and outstanding Norsat Shares. The | | A. | Only the Securityholders as of the close of business |

| | acquisition will be completed by way of a plan of | | | (Pacific Time) on the Record Date (being April 24, |

| | arrangement to be completed under theBritish | | | 2017) are entitled to receive notice of, attend, be |

| | Columbia Business Corporations Act. and to | | | heard and vote at the Meeting. The Securityholders |

| | complete the acquisition you will be asked to vote | | | at the time of the Arrangement becomes effective |

| | on the Arrangement Resolution. | | | will be entitled to receive the consideration paid |

| | | | | under the Arrangement whether or not they were |

| | | | securityholders on the Record Date. |

| Q. | What will I receive for my Norsat shares if the | | | |

| | Arrangement is completed? | | Q. | What is the Requisite Securityholder Approval? |

| | | | |

| A. | Under the terms of the Arrangement, the Norsat | | A. | The approval of the Arrangement Resolution will |

| | Shareholders will receive, in exchange, for each | | | require the approval of: |

| | Norsat Share, US$10.25, less any applicable | | | |

| | withholdings. | | | a) two-thirds of the votes cast on the |

| | | | Arrangement Resolution by the |

| Q. | How are Norsat Options and Norsat RSUs being | | | Securityholders present in person or |

| | treated? | | | represented by proxy at the Meeting and |

| | | | | voting as a single class; |

| A. | Under the terms of the Plan of Arrangement, Norsat | | | |

| | will be acquiring all outstanding Norsat Options and | | | b) two-thirds of the votes cast on the |

| | Norsat RSUs at the same time that Hytera acquires | | | Arrangement Resolution by the Norsat |

| | all outstanding Norsat Shares. The price paid for | | | Shareholders present in person or |

| | each Norsat Option will be the Canadian dollar | | | represented by proxy at the Meeting and |

| | equivalent of US$10.25 (calculated as provided for | | | voting as a single class; and |

| | in the Arrangement Agreement) less the exercise | | | |

| | price of the Norsat Option and less any applicable | | | c) a simple majority of the votes cast on the |

| | withholdings. The price paid for each Norsat RSU | | | Arrangement Resolution by the Norsat |

| | will be US$10.25, less any applicable withholdings. | | | Shareholders present in person or presented |

| | | | by proxy at the Meeting, excluding the votes |

| Q. | What is this document? | | | by the Norsat Shareholders that are required |

| | | | to be excluded pursuant to Multilateral |

| A. | This document is a management information | | | Instrument 61-101 –Protection of Minority |

| | circular furnished to the Securityholders in | | | Security Holders in Special Transactions. To |

| | connection with the solicitations of proxies by and | | | the knowledge of Norsat, only the votes |

| | on behalf of the Board and management of Norsat | | | attached to the Norsat Shares, Norsat RSUs |

| | for use at the Meeting or at any adjournment(s) or | | | and the Norsat Shares underlying the Norsat |

| | postponement(s) thereof. This Circular provides | | | Options owned by Fabio Doninelli, Amiee |

| | additional information regarding the Arrangement. | | | Chan and Arthur Chin will be excluded from |

| | | | | the “majority of the minority” vote mandated |

| Q. | When and where is the Meeting? | | | by Multilateral Instrument 61-101 –Protection |

| | | | | of MinoritySecurity Holdersin Special |

| A. | The Meeting will be held on Monday, May 29, 2017, | | | Transactions. |

| | at 2:00 pm (Pacific time) at the offices of Norsat | | | |

| | International Inc. at Suite 110-4020 Viking Way, | | | |

| | Richmond, B.C., V6V 2L4. | | | |

|

| |

|

| | | | |

| Q. | How can I vote? | | Q. | Has a fairness opinion been provided in |

| | | | | connection with the Arrangement? |

| A. | If you are a registered shareholder or a Canadian | | | |

| | Non-Objecting Beneficial Owner you should | | A. | Yes. The Board has received opinions from its |

| | complete, date, sign and return the accompanying | | | financial advisor, Raymond James Ltd., and from |

| | form of proxy or voting instruction form for use at | | | KPMG LLP, an independent advisor, that as of |

| | the Meeting. To be effective, forms of proxy and | | | March 24, 2017 and subject to the assumptions, |

| | voting instruction forms must be received by | | | limitations and qualifications set forth herein, the |

| | Computershare Investor Services Inc., Attention | | | consideration to be received by the Norsat |

| | Proxy Department, 100 University Avenue, 8th | | | Shareholders pursuant to the Arrangement |

| | Floor, Toronto, Ontario, M5J 2Y1, before 2:00 pm | | | Agreement is fair, from a financial point of view, to |

| | (Pacific time) on May 25, 2017 or no less than 48 | | | the Norsat Shareholders. The full text of the |

| | hours (excluding Saturdays, Sundays and holidays) | | | Fairness Opinions can be found at Appendix B and |

| | before the time of any adjournment thereof. To vote | | | C to this Circular. |

| | by internet, please go to www.investorvote.com and | | | |

| | follow the instructions. | | Q | What other conditions must be satisfied to |

| | | | | complete the Arrangement? |

| | All other non-registered shareholders who receive | | | |

| | these materials through a broker or other | | A. | The Arrangement will be subject to a number of |

| | intermediary should complete and return the | | | customary conditions, including the Final Order |

| | materials in accordance with the instructions | | | from the Court and certain regulatory approvals |

| | provided to them by such broker or intermediary. | | | including under the Investment Canada Act. See |

| | | | | section See “The Arrangement – The Arrangement |

| | See “Information Circular – Appointment and | | | Agreement – Conditions”. |

| | Revocation of Proxies”. | | | |

| | | | Q. | When will the Arrangement become effective? |

| Q. | If I change my mind, can I revoke my proxy? | | | |

| | | A. | Assuming that all of the conditions to the |

| A. | A Securityholder who has given a proxy may revoke | | | Arrangement are satisfied, Norsat expects the |

| | it by an instrument in writing executed by the | | | Arrangement to become effective in the second |

| | Securityholder or by his attorney authorized in | | | quarter of 2017. |

| | writing or, where the Securityholder is a company, | | | |

| | by a duly authorized officer or attorney of such | | | |

| | company, and delivered to the registered office of | | | |

| | the Company, Suite 110 - 4020 Viking Way, | | | |

| | Richmond, British Columbia, V6V 2L4 at any time | | | |

| | up to and including the last business day preceding | | | |

| | the day of the Meeting, or if adjourned, any | | | |

| | reconvening thereof, or to the Chairman of the | | | |

| | Meeting on the day of the Meeting or, if adjourned, | | | |

| | any reconvening thereof or in any other manner | | | |

| | provided by law. A revocation of a proxy does not | | | |

| | affect any matter on which a vote has been taken | | | |

| | prior to the revocation. | | | |

| | | | |

| | In addition, a proxy may be revoked by the | | | |

| | Securityholder executing another form of proxy | | | |

| | bearing a later date and depositing it at the offices | | | |

| | of Computershare Investor Services before 2:00 pm | | | |

| | (Pacific time) on May 25, 2017 or no less than 48 | | | |

| | hours (excluding Saturdays, Sundays and holidays) | | | |

| | before the time of any adjournment thereof. | | | |

| | | | |

| Q. | Does the Independent Directors support the | | | |

| | Arrangement? | | | |

| | | | |

| A. | After receiving financial and legal advice, the | | | |

| | Independent Directors have unanimously | | | |

| | determined that the consideration to be received by | | | |

| | the Norsat Shareholders pursuant to the | | | |

| | Arrangement is fair and that the Arrangement is in | | | |

| | the best interests of the Company and the | | | |

| | Independent Directors have unanimously | | | |

| | recommended that the Securityholdersvote in | | | |

| | favourof the Arrangement Resolution. | | | |

|

| |

|

| Q. | Am I entitled to Dissent Rights? | | Q. | When must I be a Norsat Shareholder, RSU |

| | | | | holder or Option holder in order to receive the |

| A. | Pursuant to the Interim Order, registered Norsat | | | consideration? |

| | Shareholders as of the Record Date have been | | | |

| granted the right to dissent in respect of the | | A. | In order to receive consideration under the |

| | Arrangement Resolution. If the Arrangement | | | Arrangement, you need to be a Norsat Shareholder, |

| | becomes effective, a Dissenting Shareholder is | | | RSU Holder or Option Holder at 12:01 a.m. (Pacific |

| | entitled to be paid the fair value of such Dissenting | | | Time) on the date that the Arrangement is |

| | Shareholder’s Norsat Shares, provided that such | | | completed. |

| | Dissenting Shareholder has sent a written notice of | | | |

| | dissent to the Arrangement Resolution to Norsat | | Q. | How does the Share Consideration compare to |

| | International Inc., 110-4020 Viking Way, Richmond, | | | the market price of the Norsat Shares? |

| | British Columbia, V6V 2L4, Attention: Arthur Chin | | | |

| | not later than 10:00 a.m. (Pacific Time) on Monday, | | A. | The consideration offered under the Arrangement |

| | May 29, 2017, (or, if the Meeting is postponed or | | | represents a 62% premium over the unaffected |

| | adjourned, two days preceding the date of the | | | trading price of the Norsat Shares on September |

| | postponed or adjourned Meeting) and has | | | 16, 2016 (the date before which a shareholder of |

| | otherwise complied strictly with the dissent | | | Norsat publicly expressed an interest in acquiring |

| | procedures described in this Information Circular, | | | control of Norsat), and 66% over the 20-day volume |

| | including the relevant provisions of the BCBCA, as | | | weighted average price ending on September 16, |

| | modified by the Interim Order and the Plan of | | | 2016. |

| | Arrangement. Beneficial owners of Norsat Shares | | | |

| registered in the name of a broker, investment | | Q. | When will the Arrangement be completed? |

| | dealer or other intermediary who wish to dissent | | | |

| | should be aware that only registered owners of | | A. | It is presently anticipated that the Arrangement will |

| | Norsat Shares as of the Record Date are entitled to | | | be completed in the second quarter of 2017. |

| | dissent.Failure to comply strictly with the | | | However, completion of the Arrangement is |

| | dissent procedures described in this Circular | | | dependent on many factors outside Norsat’s or |

| | will result in the loss of any right of dissent. | | | Hytera’s control and it is not possible at this time to |

| | These rights are described in detail in this Circular | | | determine precisely when or if the Arrangement will |

| | under the heading “The Arrangement – Dissenting | | | become effective. In addition, the Arrangement |

| | Shareholder Rights”. It is recommended that you | | | Agreement may be terminated at any time before |

| | seek legal advice if you wish to exercise your right | | | the Effective Time in the circumstances specified in |

| | to dissent. | | | the Arrangement Agreement, including if the |

| | | | | Arrangement is not completed prior to the Outside |

| About the Arrangement | | | Date (being September 30, 2017). Further, |

| | | | | depending on the circumstances in which |

| Q. | Who is acquiring the Norsat Shares? | | | termination of the Arrangement Agreement occurs, |

| | | | | Norsat may have to pay the Company Termination |

| A. | The Norsat Shares are being acquired by Hytera | | | Payment. See “The Arrangement – The |

| | Project Corp., an indirect wholly owned subsidiary | | | Arrangement Agreement – Termination”. |

| | of Hytera Communications Co., Ltd. Hytera | | | |

| Communications Co., Ltd. is a manufacturer of | | Q. | When will I receive the Share Consideration for |

| | radio transceivers and radio systems based in | | | my Norsat Shares? |

| | Shenzhen, China. | | | |

| | | | A. | You will receive the Share Consideration for your |

| | | | Norsat Shares as soon as practicable after the |

| Q. | What is a plan of arrangement? | | | Effective Time provided you have sent all of the |

| | | | | necessary documents to the Depositary. |

| A. | A plan of arrangement is a statutory procedure | | | |

| | under British Columbia corporate law that allows a | | | |

| | company to carry out transactions with the approval | | Q. | Should I send my Norsat Share certificate(s) to |

| | of its securityholders and the Court. The Plan of | | | the Depositary now? |

| | Arrangement that you are being asked to consider | | | |

| will provide for, among other things, the acquisition | | A. | Yes. A Letter of Transmittal has been mailed, |

| | by Hytera of all of the issued and outstanding | | | together with this Circular, to each person who was |

| | Norsat Shares, Norsat Options and Norsat RSUs in | | | a registered Norsat Shareholder on the Record |

| | exchange for the consideration as set out in the | | | Date. It is recommended that you complete, sign |

| | Arrangement Agreement. | | | and return the Letter of Transmittal with |

| | | | | accompanying Norsat Share certificate(s) to the |

| | | | | Depositary as soon as possible. See “The |

| | | | | Arrangement – Letter of Transmittal”. |

| | | | |

| | | | | The Letter of Transmittal will also be available |

| | | | | under Norsat’s SEDAR profile at www.sedar.com or |

| | | | | by contacting the Depositary. |

|

| |

|

| |

| Q. | What happens if the Norsat Shareholders and |

| | Securityholders do not approve the |

| | Arrangement? |

| |

| A. | If the Arrangement Resolution does not receive the |

| | Requisite Securityholder Approval at the Meeting, |

| | the Arrangement will not become effective. |

| | Additionally, Hytera is not required to complete the |

| | Arrangement if the Norsat Shareholders have |

| | exercised their Dissent Rights in connection with |

| | the Arrangement with respect to more than 33⅓ of |

| | the outstanding Norsat Shares. Failure to complete |

| | the Arrangement could have a material negative |

| | effect on the market price of the Norsat Shares. |

| | See “Risk Factors – Risk Factors Relating to the |

| | Arrangement” and “The Arrangement – The |

| | Arrangement Agreement – Termination”. Subject to |

| | the risks referenced above, Norsat would otherwise |

| | continue as a standalone company. |

| | |

| Q. | What are the tax consequences of the |

| | Arrangement? |

| |

| A. | This Circular contains a summary of the principal |

| | Canadian federal and certain United States federal |

| | income tax considerations relevant to the Norsat |

| | Shareholders. Please see the discussions under |

| | the headings “Certain Canadian Federal Income |

| | Tax Considerations” and “Certain U.S. Federal |

| | Income Tax Considerations”. These summaries are |

| | of a general nature only and are not, and are not |

| | intended to be, nor should they be construed to be, |

| | legal or tax advice or representations to any |

| | particular Norsat Shareholder. These summaries |

| | are not an exhaustive discussion of all income tax |

| | considerations. The Norsat Shareholders, as well |

| | as Option Holders and RSU Holders are urged to |

| | consult their own legal and tax advisors with |

| | respect to the tax consequences to them of the |

| | Arrangement having regard to their particular |

| | circumstances, including the application and effect |

| | of the income and other tax laws of any country, |

| | province or other jurisdiction that may be |

| | applicable. |

| |

| Q. | What if I have other questions? |

| |

| A. | If you have questions, you may contact the proxy |

| | solicitation agent, Evolution Proxy, Inc., by |

| | telephone at:1-844-226-3222(North American Toll |

| | Free Number) or1-416-855-0238(Outside North |

| | America); or by email at:info@evolutionproxy.com. |

|

| |

|

TABLE OF CONTENTS

| |

| NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SECURITYHOLDERS | 1 |

| | |

| INFORMATION CIRCULAR | 3 |

FORWARD LOOKING INFORMATION | 3 |

GLOSSARY OF TERMS | 5 |

NOTICE TO SECURITYHOLDERS IN THE UNITED STATES | 13 |

SUMMARY | 14 |

SOLICITATION OF PROXIES | 21 |

APPOINTMENT AND REVOCATION OF PROXIES | 21 |

VALIDITY OF PROXIES | 21 |

VOTING OF PROXIES | 22 |

ADVICE TO NON-REGISTERED SHAREHOLDERS | 22 |

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF | 22 |

| | |

| MATTERS TO BE ACTED UPON | 23 |

FINANCIAL STATEMENTS | 23 |

ELECTION OF DIRECTORS | 23 |

APPOINTMENT OF AUDITOR | 26 |

THE ARRANGEMENT | 26 |

PLAN OF ARRANGEMENT | 27 |

BACKGROUND TO THE ARRANGEMENT | 29 |

RECOMMENDATION OF THE INDEPENDENT DIRECTORS | 33 |

REASONS FOR THE ARRANGEMENT | 33 |

RAYMOND JAMES FAIRNESS OPINION | 36 |

KPMG FAIRNESS OPINION | 37 |

SUPPORT AND VOTING AGREEMENTS | 38 |

REGULATORY MATTERS | 40 |

APPROVALS | 41 |

INTERESTS OF DIRECTORS AND EXECUTIVE OFFICERS OF NORSAT IN THE ARRANGEMENT | 42 |

LETTER OF TRANSMITTAL | 45 |

DISSENTING SHAREHOLDER RIGHTS | 46 |

THE ARRANGEMENT AGREEMENT | 48 |

RISK FACTORS | 60 |

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | 62 |

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS | 65 |

ANY OTHER MATTERS | 69 |

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 69 |

INTEREST OF INFORMED PERSON IN MATERIAL TRANSACTIONS | 69 |

| | |

| OTHER INFORMATION REGARDING THE COMPANY | 69 |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 69 |

MANDATE AND REPORT OF THE BOARD | 69 |

MANDATE AND REPORT OF THE COMPENSATION COMMITTEE | 72 |

DIRECTORS’ COMPENSATION | 73 |

EXECUTIVE COMPENSATION | 81 |

MANDATE AND REPORT OF THE AUDIT COMMITTEE | 83 |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 86 |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 89 |

ADDITIONAL INFORMATION | 89 |

APPROVAL OF CIRCULAR | 89 |

CONSENT OF RAYMOND JAMES LTD | 90 |

CONSENT OF KPMG LLP | 90 |

APPENDIX A – ARRANGEMENT RESOLUTION | A-1 |

APPENDIX B – FAIRNESS OPINION OF RAYMOND JAMES LTD | B-1 |

APPENDIX C – FAIRNESS OPINION OF KPMG LLP | C-1 |

APPENDIX D – INTERIM ORDER | D-1 |

APPENDIX E – NOTICE OF APPLICATION | E-1 |

APPENDIX F – FINAL ORDER | F-1 |

APPENDIX G – AUDIT COMMITTEE CHARTER | G-1 |

|

| i |

|

NORSAT INTERNATIONAL INC.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SECURITYHOLDERS

NOTICE IS HEREBY GIVENthat the Annual General and Special Meeting (the “Meeting”) of holders (the “Norsat Shareholders”) of common shares (“Norsat Shares”), holders (“Option Holders”) of options (“Norsat Options”) and holders (“RSU Holders” and, together with the Norsat Shareholders and Option Holders, the “Securityholders”) of restricted share units (“Norsat RSUs”) ofNORSAT INTERNATIONAL INC.(the “Company” or “Norsat”) will be held at the offices of Norsat International Inc. at Suite 110-4020 Viking Way, Richmond, B.C., V6V 2L4 on Monday May 29, 2017 at 2:00 pm (Pacific time), for the following purposes:

| 1. | To receive the audited consolidated financial statements of the Company for the fiscal year ended December 31, 2016, together with the report of the auditors thereon; |

| | |

| 2. | To re-elect the directors of the Company for the ensuing year; |

| | |

| 3. | To reappoint PricewaterhouseCoopers LLP as the auditors of the Company for the ensuing year and to authorize the Directors to fix their remuneration; |

| | |

| 4. | To consider and if thought advisable, to pass, with or without variation, a special resolution (the “Arrangement Resolution”, the full text of which is set forth in Appendix A to the accompanying Management Information Circular, approving a plan of arrangement involving Hytera Communications Co., Ltd., Hytera Project Corp. and the Company under Division 5 of Part 9 of theBusiness Corporations Act(British Columbia) (the “BCBCA”); and |

| | |

| 5. | To transact such other business as may properly be brought before the Meeting. |

Further information regarding the matters to be considered at the Meeting is set out in the accompanying Circular.

The Directors of the Company have fixed the close of business on April 24, 2017 as the record date for determining Securityholders entitled to receive notice of and to vote at the Meeting. Only Norsat Shareholders whose names have been entered into the register of the holders of Norsat Shares as at April 24, 2017, and Option Holders and RSU Holders as at April 24, 2017, will be entitled to receive notice of and to vote at the Meeting in respect of such Norsat Shares, Norsat Options or Norsat RSUs, as applicable.

Securityholders are requested to date, sign and return the accompanying form of proxy for use at the Meeting whether or not they are able to attend personally. To be effective, forms of proxy must be received by Computershare Investor Services Inc., Attention Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, before 2:00 pm (Pacific time) on May 25, 2017 or no less than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjournment thereof.

All non-registered shareholders who receive these materials through a broker or other intermediary should complete and return the materials in accordance with the instructions provided to them by such broker or intermediary.

|

| 1 |

|

Dissent Rights

Pursuant to the provisions of Section 242 of the BCBCA, if you are a registered holder of Norsat Shares, you have the right to dissent in respect of the Arrangement Resolution approving the Arrangement and, if the Arrangement becomes effective and upon strict compliance with the dissent procedures, to be paid the fair value of your Norsat Shares.There can be no assurance that a dissenting Norsat Shareholder will receive consideration for his or her Norsat Shares of equal or greater value to the consideration that such dissenting Norsat Shareholder will receive consideration for his or her Norsat Shares of equal or greater value to the consideration that such dissenting Norsat Shareholder would have received under the Arrangement.This right of dissent is described in the accompanying Circular. If you fail to strictly comply with the dissent procedures set out in the accompanying Circular, you may not be able to exercise your right of dissent. If you are a beneficial owner of Norsat Shares registered in the name of a broker, investment dealer, bank, trust company, custodian or other intermediary and wish to dissent, you should be aware thatONLY REGISTERED HOLDERS OF NORSAT SHARES ARE ENTITLED TO EXERCISE RIGHTS OF DISSENT.A dissenting Norsat Shareholder may only dissent with respect to all Norsat Shares held on behalf of any one beneficial owner and registered in the name of such dissenting Norsat Shareholder. Options Holders or RSU Holders, and Norsat Shareholders who vote in favour of the Arrangement Resolution, are not entitled to any rights to dissent.

Persons who are beneficial owners of Norsat Shares registered in the name of a broker, custodian, nominee or other intermediary who wish to dissent should be aware that only registered holders of Norsat Shares are entitled to dissent. Accordingly, a beneficial owner of Norsat Shares who desires to exercise the right of dissent must make arrangements for the Norsat Shares who desires to exercise the right of dissent must make arrangements for the Norsat Shares beneficially owned by such holder to be registered in the holder’s name prior to the time written objection to the Arrangement Resolution is required to be received by Norsat or, alternatively, make arrangements for the registered holder of such Norsat Shares to dissent on the holder’s behalf.

DATED at Richmond, British Columbia, as of this 28thday of April, 2017.

By order of the Board of Directors

“Arthur Chin”

Arthur Chin

Chief Financial Officer

|

| 2 |

|

NORSAT INTERNATIONAL INC.

INFORMATION CIRCULAR

This Information Circular (“Circular”) is furnished to the securityholders of Norsat International Inc. (the “Company” or “Norsat”) by management for use at the Annual General and Special Meeting (the “Meeting”) of the Securityholders (and any adjournment thereof) to be held on May 29, 2017 at the time and place and for the purposes set forth in the accompanying Notice of Annual General and Special Meeting.

In this Circular, references to “we” and “our” refer to Norsat. The “Board of Directors” or the “Board” refers to the board of directors of Norsat. “Norsat Shares” means common shares without par value in the capital of Norsat. “Norsat Shareholders” refers to shareholders of Norsat. “Beneficial Shareholders” means Norsat Shareholders who do not hold Norsat Shares in their own name and “intermediaries” refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders.

The information contained in this Circular is given as at April 27, 2017, except where otherwise noted and except that information in documents incorporated by reference is given as of the dates noted therein. No person has been authorized to give any information or to make any representation in connection with the Arrangement and other matters described herein other than those contained in this Circular and, if given or made, any such information or representation should be considered not to have been authorized by Norsat.

This Circular does not constitute the solicitation of an offer to purchase, or the making of an offer to sell, any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation or offer is not authorized or in which the person making such solicitation or offer is not qualified to do so or to any person to whom it is unlawful to make such solicitation or offer.

Information contained in this Circular should not be construed as legal, tax or financial advice and Securityholders are urged to consult their own professional advisors in connection therewith.

Descriptions in this Circular of the terms of the Arrangement Agreement and the Plan of Arrangement are summaries of the terms of those documents. Securityholders should refer to the full text of each of the Arrangement Agreement and the Plan of Arrangement for complete details of those documents. The full text of the Arrangement Agreement and the Plan of Arrangement can be obtained through Norsat’s profile on the SEDAR website at www.sedar.com.

FORWARD LOOKING INFORMATION

This Circular and some of the material incorporated by reference into this Circular, contain “forward-looking information”, as such term is defined in applicable Securities Laws. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, “expected”, “scheduled”, “estimates”, “forecasts”, “targets”, “anticipates” or “believes”, “intends”, “to create”, “to diversify”, “to invest”, “enabling”, “upon”, “further”, “proposed”, “opportunities”, “potentially”, “increases”, “adds” “improves”, “continuing” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could” or “might”, “occur” and similar expressions.

Forward-looking statements in this Circular and the documents incorporated by reference herein include, without limitation, those that relate to:

the perceived benefits of the Arrangement;

the timing of the Meeting and the Final Order;

the treatment of the Norsat Shareholders under tax laws;

the anticipated closing date of the Arrangement;

|

| 3 |

|

Forward-looking information is based on a number of factors, assumptions and estimates that, while considered reasonable by management based on the business and markets in which Norsat operates, are inherently subject to significant operational, economic and competitive uncertainties and contingencies. The estimates and assumptions of Norsat contained or incorporated by reference in the Circular, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein and incorporated by reference, as well as:

the perceived benefits of the Arrangement, which are based upon a number of factors, including the terms and conditions of the Arrangement Agreement and current industry, economic and market conditions (see “The Arrangement – Reasons for the Arrangement”);

certain steps in, and timing of, the Arrangement and the Effective Date of the Arrangement, which are based upon the terms of the Arrangement Agreement and advice received from counsel to Norsat relating to timing expectations (see “The Arrangement”);

that Norsat will complete the Arrangement in accordance with the terms and conditions of the Arrangement Agreement;

that the required approvals will be obtained from the Securityholders;

that all required third party, regulatory, and government approvals and Court orders will be obtained;

that the Arrangement will proceed in accordance with the anticipated timeline and close in the second quarter of 2017;

the treatment of the Norsat Shareholders under tax laws, which is subject to the statements under “Certain Canadian Federal Income Tax Considerations” and “Certain U.S. Federal Income Tax Considerations”; and

the effects of the Arrangement on Norsat, Hytera and Hytera Sub, which are based on Norsat management’s current expectations regarding the intentions of Hytera and Hytera Sub.

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. No assurance can be given that these assumptions will prove to be correct. These assumptions should be considered carefully by readers. Readers are cautioned not to place undue reliance on the forward-looking information and statements or the assumptions on which Norsat’s forward-looking information and statements are based.

Norsat cautions that forward-looking information involves known and unknown risks, uncertainties and other factors that may cause Norsat’s actual results, performance or achievements to be materially different from those expressed or implied by such information, including, but not limited to:

the Arrangement is subject to satisfaction or waiver of several conditions;

there may be potential undisclosed liabilities associated with the Arrangement;

the Arrangement Agreement may be terminated by Hytera Communications Co., Ltd. and Hytera Project Corp. in certain circumstances;

Norsat will incur costs and may have to pay a termination fee;

the Norsat Termination Fee may discourage other parties from proposing a significant business transaction with Norsat;

Norsat’s business relationships may be subject to disruption due to uncertainty associated with the Arrangement; and

the market price of the Norsat Shares may decline.

|

| 4 |

|

Although Norsat has attempted to identify important factors that could cause actual results, performance or achievements to differ materially from those contained in forward-looking information, there can be other factors that cause results, performance or achievements not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. All of the forward-looking information in this Circular is qualified by these cautionary statements and those made in each of Norsat’s filings with Canadian and United States securities regulatory authorities expressly incorporated by reference into this Circular. These factors are not intended to represent a complete list of the factors that could affect Norsat. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information in this Circular is made as of the date of this Circular, and Norsat disclaims any intention or obligation to update or revise such information, except as required by applicable law.

CURRENCY AND CURRENCY EXCHANGE RATE INFORMATION

Unless otherwise indicated, all references to “$” or “dollars” in the Circular refer to United States dollars (US$) and all references to “CDN$” in the Circular refer to Canadian dollars. Norsat’s financial statements included herein and incorporated by reference are reported in U.S. dollars and are prepared in accordance with International Financial Reporting Standards.

The following table sets forth, for each period indicated, exchange rates for one Canadian dollar expressed in U.S. dollars:

| | | |

| | | Years ended | |

| | | December 31 | |

| | 2016 | 2015 | 2014 |

| December 31 | 0.7448 | 0.7225 | 0.8620 |

| Annual average | 0.7552 | 0.7832 | 0.9055 |

On April 27, 2017, the exchange rate for one Canadian dollar expressed in U.S. dollars was 0.7340.

GLOSSARY OF TERMS

“1933 Act” means the United States Securities Act of 1933, as amended, including the rules and regulations promulgated thereunder; “1934 Act” means the United States Securities Exchange Act of 1934, as amended, including the rules and regulations promulgated thereunder; “Acquisition Proposal” means, excluding the Arrangement, any offer, proposal or inquiry, whether written or oral, made after the date of the Arrangement Agreement, from any person or group of persons acting jointly or in concert relating to, in each case whether in a single transaction or a series of related transactions:

| (i) | any takeover bid, tender offer or exchange offer that, if consummated, would result in a person or group of persons beneficially owning 20% or more of any class of voting or equity securities of Norsat and/or one or more subsidiaries of Norsat whose assets, revenues or earnings constitute, individually or in the aggregate, 20% or more of the consolidated assets, revenues or earnings of Norsat; |

| | |

| (ii) | any amalgamation, plan of arrangement, share exchange, business combination, merger, consolidation, recapitalization, reorganization or other similar transaction involving Norsat and/or one or more subsidiaries of Norsat whose assets, revenues or earnings constitute, individually or in the aggregate, 20% or more of the consolidated assets, revenues or earnings of Norsat, or any liquidation, dissolution or winding-up of Norsat and/or one or more subsidiaries of Norsat whose assets, revenues or earnings constitute, individually |

| | | |

|

| 5 |

|

| | or in the aggregate, 20% or more of the consolidated assets, revenues or earnings of Norsat; |

| | |

| (iii) | any direct or indirect acquisition or sale of assets (or any lease, long-term supply arrangement, license, technology partnering agreement or other arrangement having the same economic effect as a sale of assets) of Norsat and/or one or more subsidiaries of Norsat which represents, individually or in the aggregate, 20% or more of the consolidated assets or contributed 20% or more of the consolidated revenues or earnings of Norsat; |

| | |

| (iv) | any direct or indirect sale, issuance or acquisition of Norsat Shares or any other voting or equity interests (or securities convertible into or exercisable for such Norsat Shares or other voting or equity interests) of Norsat representing 20% or more of the issued and outstanding voting or equity interests (or rights or interests therein or thereto) of Norsat or any subsidiary of Norsat; or |

| | |

| (v) | any proposal or offer to do, proposed amendment of, or public announcement of an intention to do, any of the foregoing, |

excluding the Transactions and the Plan of Arrangement and any transaction to which Hytera, Hytera Sub or a subsidiary of Hytera is a party and any transaction involving only Norsat and/or one or more of its subsidiaries;

“affiliate” has the meaning ascribed thereto in the BCBCA;

“Applicable Securities Laws” means the Securities Act, the 1933 Act, the 1934 Act, and all other applicable Canadian and United States securities Laws, rules and regulations and published policies thereunder and the rules of the Exchanges applicable to companies listed thereon;

“Arrangement” means an arrangement pursuant to Division 5 of Part 9 of the BCBCA on the terms and subject to the conditions set out in the Plan of Arrangement, subject to any amendments or variations to the Plan of Arrangement made in accordance with the terms of the Arrangement Agreement or made at the direction of the Court in the Final Order with the consent of the Parties, each acting reasonably;

“Arrangement Agreement” means the arrangement agreement dated March 24, 2017, entered into among Norsat, Hytera and Hytera Sub, as the same may be amended, supplemented or otherwise modified in accordance with the terms therein, a copy of which is available under Norsat’s profile on SEDAR;

“Arrangement Resolution” means the special resolution of the Norsat Shareholders approving the Plan of Arrangement to be considered at the Meeting, and, if thought fit, passed by the Securityholders at the Meeting;

“BCBCA” means theBusiness Corporations Act(British Columbia), and the regulations promulgated thereunder, as amended;

“Beneficial Shareholders” means a Norsat Shareholder whose Norsat Shares are registered in the name of a broker, bank or other nominee;

“Board” or “Board of Directors” means the board of directors of Norsat as the same is constituted from time to time;

“Broadridge” means Broadridge Financial Solutions, Inc.;

“business day” means any day (other than a Saturday, a Sunday, a statutory or civic holiday or, for the purpose of the Final Order, a date the courts in Vancouver, British Columbia would not hear the application for the Final Order) on which commercial banks located in Vancouver, British Columbia and Toronto, Ontario are open for the conduct of business;

|

| 6 |

|

“Canadian Equivalent of the Share Consideration” means the amount in Canadian dollars of the Share Consideration on the basis of the noon United States to Canadian dollar exchange rate on the date that is three business days immediately preceding the Effective Date as reported by the Bank of Canada;

“CGP Approval” means a statement or other indication from the Controlled Goods Directorate of Public Works and Government Services Canada affirming that the Company’s registration under the Controlled Goods Program will not be revoked, suspended or otherwise jeopardized by Hytera Sub’s acquisition of the Company;

“Change of Recommendation” by the Board of Directors means:

| (i) | any withholding, amendment, withdrawal, modification or qualification in any manner adverse to the Hytera and/or the consummation of the Arrangement of the Norsat Recommendation, including any failure to include the Norsat Recommendation in the Circular; |

| | |

| (ii) | any approval, acceptance, recommendation or endorsement by the Board of Directors of, or public proposal by the Board of Directors to approve, accept, recommend or endorse, or publicly taking no position or a neutral position with respect to, any Acquisition Proposal (it being understood that publicly taking a neutral position or no position with respect to an Acquisition Proposal until the earlier to occur of ten business days following the earlier of the receipt, and the public announcement of such Acquisition Proposal and two business days prior to the Meeting shall not constitute a Change in Recommendation); |

| | |

| (iii) | Norsat enters into a written agreement in respect of an Acquisition Proposal (other than a confidentiality agreement permitted by the Arrangement Agreement); or |

| | |

| (iv) | Norsat shall have publicly announced the intention to, or the Board of Directors shall have resolved to, do any of the foregoing; |

except that a determination by Norsat that it shall make or the making by Norsat of a submission for SADI Approval of an Acquisition Proposal shall not be considered a Change in Recommendation without also the matter in (iii) above having occurred;

“Circular” means this management information circular dated April 28, 2017;

“Commissioner” means the Commissioner of Competition appointed under the Competition Act or his or her designee;

“Company” or “Norsat” means Norsat International Inc.;

“Company Disclosure Letter” means the disclosure letter dated the date of the Arrangement Agreement that has been provided by Norsat to Hytera and Hytera Sub;

“Competition Act” means theCompetition Act, R.S.C. 1985, c. C-34, as amended, including the regulations promulgated thereunder;

“Competition Act Approval” means either (i) the relevant waiting period under Section 123 of the Competition Act will have expired or been terminated by the Commissioner, (ii) the Commissioner will have issued a No-Action Letter on terms and conditions, if any, acceptable to Norsat, acting reasonably, or (iii) the Commissioner will have issued an advance ruling certificate in respect of the Arrangement;

“Contracts” means any lease, sublease, license, sublicense, contract, subcontract, commitment, note, bond, mortgage, indenture, or other agreement, instrument, obligation or binding arrangement or understanding of any kind or character, whether oral or in writing;

“Confidentiality Agreement” means the confidentiality and personal information protection agreement dated June 7, 2016, as amended, between the Hytera and Norsat;

“Consenting Securityholder” means the director and/or executive officer of Norsat who is a party to the Support and Voting Agreement;

|

| 7 |

|

“Convertible Securities” means, collectively, the Norsat Options, Norsat RSUs and any other securities of Norsat that are convertible into or exchangeable or exercisable for Norsat Shares;

“Court” means the Supreme Court of British Columbia;

“Depositary” means Computershare Investor Services Inc., as depositary;

“Dissenting Shareholder” means a registered Norsat Shareholder who properly dissents from the Arrangement Resolution in accordance with the BCBCA, and “Dissenting Shareholders” means more than one Dissenting Shareholder;

“Dissent Rights” means the rights of dissent in respect of the Arrangement described in the Plan of Arrangement;

“Effective Date” has the meaning ascribed thereto in the Plan of Arrangement;

“Effective Time” has the meaning ascribed thereto in the Plan of Arrangement;

“Exchanges” means the TSX and NYSE;

“Fairness Opinions” means the fairness opinions rendered to the Board of Directors, in respect of the Arrangement by Raymond James, the financial advisor to Norsat, and KPMG an independent financial advisor to Norsat;

“Final Order” means the final order of the Court, after a hearing upon the fairness of the terms and conditions of the Arrangement, approving the Arrangement as such order may be amended by the Court (with the consent of both Norsat and Hytera Sub, each acting reasonably) at any time prior to the Effective Date or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended (provided that any such amendment is acceptable to both Norsat and Hytera Sub, each acting reasonably) on appeal;

“GAAP” means Canadian generally accepted accounting principles as set out in the Handbook of the Canadian Institute of Chartered Accountants, as amended from time to time, consistently applied, which, for greater certainty, includes International Financial Reporting Standards consistently applied, as applicable;

“Governmental Entity” means any (i) supranational, multinational, federal, territorial, provincial, state, regional, municipal, local or other government or public ministry, department, authority, body, armed forces, central bank, court, commission, tribunal, board, bureau or agency, domestic or foreign, (ii) subdivision, agent or authority of any of the above, (iii) quasi-governmental or private body, including any tribunal, commission, regulatory agency or self-regulatory organization, exercising any regulatory, expropriation or taxing authority under or for the account of any of the above, or (iv) stock exchange (including the Exchanges), and “Governmental Entities” means more than one Governmental Entity;

“Hytera Termination Payment” means $2.0 million;

“ICA Approval” has the meaning ascribed thereto in “The Arrangement Agreement – Conditions”;

“ICA Notification” means a notification under Part III of the Investment Canada Act;

“Independent Directors” means the independent (non-management) directors of Norsat, namely Fabio Doninelli, Joseph Caprio, James Topham and Peter Ciceri;

“Interim Order” means the interim order of the Court in a form acceptable to Norsat and Hytera Sub, acting reasonably, providing for, among other things, the calling and holding of the Meeting, as the same may be amended by the Court with the consent of Norsat and Hytera Sub, each acting reasonably;

“Investment Canada Act” means theInvestment Canada Act(Canada), as amended, including the regulations promulgated thereunder;

“KPMG” means KPMG LLP;

“KPMG Fairness Opinion” means the fairness opinion dated March 24, 2017 rendered to the Board of Directors, in respect of the Arrangement by KPMG;

|

| 8 |

|

“Law” or “Laws” means any applicable laws, including international, multinational, federal, national, provincial, state, municipal and local laws (statutory, common or otherwise), constitutions, treaties, conventions, statutes, principles of law and equity, rulings, ordinances, judgments, determinations, awards, decrees, injunctions, writs, certificates and orders, notices, bylaws, rules, regulations, ordinances, or other requirements, policies, guidelines, standards or instruments, whether domestic or foreign, and the terms and conditions of any grant of approval, permission, authority or licence or other similar requirement enacted, adopted, promulgated, or applied by any Governmental Entity (including the Exchanges) having the force of law, and the term “applicable” with respect to such Laws and in a context that refers to one or more persons, means such Laws as are binding upon or applicable to such person or its assets;

“Lien” means any mortgage, hypothec, pledge, assignment, charge, lien, prior claim, security interest, encroachment, option, right of first refusal or first offer, occupancy rights, covenants, restriction adverse interest, adverse claim, other third person interest or encumbrance of any kind, whether contingent or absolute, and any agreement, option, right or privilege (whether by Law, contract or otherwise) capable of becoming any of the foregoing;

“Material Contracts” has the meaning ascribed thereto in Section 13(a) of Schedule C of the Arrangement Agreement;

“Meeting” means the meeting of Securityholders, to be held at the offices of Norsat International Inc. at Suite 110-4020 Viking Way, Richmond, B.C., V6V 2L4 on Monday May 29, 2017 at 2:00 pm (Pacific time);

“MI 61-101” means Multilateral Instrument 61-101 –Protection of Minority Security Holders in Special Transactionsof the securities regulatory authorities of Ontario and Quebec;

“Minister” means the Minister of Innovation, Science and Economic Development Canada;

“Norsat Material Adverse Change” means any event, change, effect, development, state of facts, condition, circumstance or occurrence that, individually or in the aggregate with other events, effects, developments, state of facts, conditions, circumstances or occurrences would or would reasonably be expected to have a material adverse effect on the business, results of operations, assets, liabilities or financial condition of Norsat and its subsidiaries, taken as a whole; except to the extent that such material adverse effect results from any of the following:

| (i) | any changes in Law or interpretations thereof by any Governmental Entity or Regulatory Authority, except to the extent that such changes have a materially disproportionate adverse effect on Norsat and its subsidiaries, taken as a whole, relative to the adverse effect that such changes have on other companies in Norsat’s industry; |

| | |

| (ii) | any changes in general Canadian, United States or global economic conditions or in national or global financial or capital markets, except to the extent such changes have a materially disproportionate adverse effect on Norsat and its subsidiaries, taken as a whole, relative to the adverse effect that such changes have on other companies in Norsat’s industry; |

| | |

| (iii) | any changes in conditions generally affecting Norsat’s industry, except to the extent such changes in conditions have a materially disproportionate adverse effect on Norsat and its subsidiaries, taken as a whole, relative to the adverse effect that such changes have on other companies in Norsat’s industry; |

| | |

| (iv) | changes or proposed changes in GAAP applicable to Norsat or the enforcement or interpretation thereof; |

| | |

| (v) | any natural disaster, act of terrorism or outbreak of war, except to the extent that such event has a materially disproportionate adverse effect on Norsat and its subsidiaries, taken as a whole, relative to the adverse effect that such changes have on other companies in Norsat’s industry; |

| | |

| (vi) | any change in the market price or trading volume of the securities of Norsat, including after announcement of the entering into of the Arrangement Agreement (it being |

| | |

|

| 9 |

|

| | understood that the causes underlying such change may be taken into account in determining whether a Norsat Material Adverse Change has occurred); |

| | |

| (vii) | the failure of Norsat in and of itself to meet any internal or public projections, forecasts or estimates of revenues or earnings (it being understood that the causes underlying such change or failure may be taken into account in determining whether a Norsat Material Adverse Change has occurred); or |

| | |

| (viii) | except for any requirement to operate in the ordinary course of business, any action taken (or refrained from being taken) specifically and expressly required by the Arrangement Agreement or at the written request of Hytera or Hytera Sub; |

“Norsat Option” means an option to purchase Norsat Shares granted by Norsat under the Stock Option Plan or otherwise;

“Norsat Recommendation” has the meaning ascribed thereto in Section 4(b) of Schedule C of the Arrangement Agreement;

“Norsat Reports” has the meaning ascribed thereto in Section 6(a) of Schedule C of the Arrangement Agreement;

“Norsat RSU Plan” means the Restricted Share Unit Plan of Norsat dated May 9, 2012, as may be amended, restated and/or supplemented;

“Norsat RSUs” means the restricted share units granted by Norsat under the Norsat RSU Plan or otherwise;

“Norsat Securities” means the Norsat Shares, Norsat Options and Norsat RSUs;

“Norsat Shareholders” means the holders of Norsat Shares;

“Norsat Termination Payment” means $2.0 million;

“Norsat Shares” means common shares in the capital of Norsat, including common shares issued on the conversion, exchange or exercise of Convertible Securities;

“NYSE” means the New York Stock Exchange;

“NYSE MKT” means the NYSE MKT LLC;

“Order” means, with respect to any person, any order, judgment, decision, decree, injunction, ruling, writ, assessment or other similar requirement issued, enacted, adopted, promulgated or applied by, or agreed to with, any Governmental Entity or arbitrator that is binding on or applicable to such person or its property;

“Outside Date” means September 30, 2017 or such later date as Hytera Sub and Norsat may agree in writing;

“Parties” means Norsat, Hytera and Hytera Sub;

“Permits” means any permit, license, certifications, registrations, security clearances, variances, exemptions, Orders, authorization, consent, or approval from any Governmental Entity;

“Person” includes an individual, general partnership, limited partnership, corporation, company, limited liability, company, body corporate, joint venture, unincorporated organization, other form of business organization, trust, trustee, executor, administrator or other legal representative, government (including any Governmental Entity) or any other entity, whether or not having legal status;

“Plan of Arrangement” means the plan of arrangement of Norsat, substantially in the form of Schedule B of the Arrangement Agreement, and any amendments or variations thereto made in accordance with the Arrangement Agreement or the Plan of Arrangement or made at the direction of the Court in the Final Order with the written consent of Norsat and Hytera Sub, each acting reasonably;

|

| 10 |

|

“PRC Approvals” means the approval of the National Development and Reform Commission of the People’s Republic of China, the Ministry of Commerce of the People’s Republic of China and the State Administration of Foreign Exchange of the People’s Republic of China to the payment of the Share Consideration;

“Proxy” means the proxy to be sent to Securityholders for use in connection with the Meeting;

“Raymond James” means Raymond James Ltd.;

“Raymond James Fairness Opinion” means the fairness opinion dated March 24, 2017 rendered to the Board of Directors, in respect of the Arrangement by Raymond James;

“Record Date” means April 24, 2017;

“Regulatory Authorities” means the applicable Governmental Entity who requires the Permits that are necessary for the Company and its subsidiaries to conduct its business;

“Regulatory Clearances” means those sanctions, rulings, consents, orders, exemptions, permits and other approvals (including the lapse, without objection, of a prescribed time under a statute or regulation that states that a transaction may be implemented if a prescribed time lapses following the giving of notice without an objection being made) of Governmental Entities necessary to implement the Arrangement and includes the (i) ICA Approval; (ii) CGP Approval; (iii) SADI Approval and (iv) PRC Approvals;

“Requisite Securityholder Approval” means (i) two-thirds of the votes cast on the Arrangement Resolution by the Norsat Shareholders present in person or represented by proxy at the Meeting; (ii) two-thirds of the votes cast by Securityholders present in person or represented by proxy at the Meeting and entitled to vote thereat, voting together as a single class, with each Norsat Share, each Norsat RSU and each Norsat Share underlying a Norsat Option entitling the holder thereof to one vote; and (iii) a simple majority of the votes cast by the Norsat Shareholders present in person or represented by proxy at the Meeting and entitled to vote thereat, excluding the votes cast by such Norsat Shareholders that are required to be excluded pursuant to MI 61-101.

“Right to Match Period” has the meaning ascribed thereto in “The Arrangement Agreement –Norsat’s Right to Accept a Superior Proposal”;

“SADI” means the Strategic Aerospace & Defence Initiative, designed by Industry Canada to encourage strategic research and development in aerospace, defence, space or security;

“SADI Approval” means the prior written consent of the Minister of Industrial Technology Office of Innovation, Science and Economic Development Canada to enter into an agreement resulting in a Change in Control as defined in the Schedule 1 – SADI General Conditions attached to SADI Agreement No. 780-502886 and to SADI Agreement No. 70-510309, each between Norsat and Her Majesty the Queen in Right of Canada;

“SEC” means the United States Securities and Exchange Commission;

“Securities Act” means theSecurities Act(British Columbia) and the rules and regulations promulgated thereunder, as amended;

“Securities Authorities” means the British Columbia Securities Commission, the SEC and the applicable securities commissions and other securities regulatory authorities in each of the other provinces of Canada and the states of the United States;

“Securityholders” means the Norsat Shareholders, Option Holders and RSU Holders;

“SEDAR” means the System for Electronic Document Analysis and Retrieval described in National Instrument 13-101 –System for Electronic Document Analysis and Retrievaland available for public view at www.sedar.com;

“Share Consideration” means $10.25 in cash per Norsat Share, subject to adjustment pursuant to the terms of the Arrangement Agreement and in accordance with the Plan of Arrangement;

“Stock Option Plan” means the Stock Option Plan of Norsat dated May 9, 2012, as may be amended, restated or supplemented

“subsidiary” means a “subsidiary” as defined in the BCBCA;

|

| 11 |

|

“Superior Proposal” means any unsolicitedbona fideAcquisition Proposal to purchase or otherwise acquire directly or indirectly, including by means of a merger, takeover bid, amalgamation, plan of arrangement, business combination or similar transaction, (i) not less than all of the Norsat Shares (other than Norsat Shares beneficially owned by the party making such Acquisition Proposal), or (ii) not less than all or substantially all of the assets of Norsat and its subsidiaries taken as a whole, that in either case:

| (a) | did not result from a beach of Section 7.2 of the Arrangement Agreement; |

| | |

| (b) | complies with Applicable Securities Laws; |

| | |

| (c) | is not subject to any due diligence or financing condition; and |

| | | |

| (d) | the Board has determined in good faith (after consultation with its financial advisors and outside legal counsel) (A) is reasonably capable of being completed in accordance with its terms without undue delay taking into account, to the extent considered appropriate by the Board of Directors, all legal, financial, regulatory and other aspects of such Acquisition Proposal and the person or persons making such Acquisition Proposal, including that shareholder approval and SADI Approval may be required, and (B) would, if consummated in accordance with its terms (but expressly taking into account any risk of non-completion), result in a transaction more favourable to the Norsat Shareholders from a financial point of view to the Norsat Shareholders than the Arrangement (taking into consideration any adjustment to the terms and conditions of the Arrangement proposed by Hytera and Hytera Sub; |

“Superior Proposal Notice” has the meaning ascribed thereto in “The Arrangement Agreement – Norsat’s Right to Accept a Superior Proposal”;

“Support and Voting Agreement” means the voting support agreements prepared by Hytera Sub and entered into contemporaneously, or as soon or practicable after the date of the Arrangement Agreement, between Hytera Sub and (i) each member of the Board of Directors and (ii) each executive officer of Norsat;

“Tax Act” means theIncome Tax Act(Canada) and the regulations made thereunder, as now in effect and as they may be promulgated or amended from time to time;

“Termination Payment Event” has the meaning ascribed thereto in “The Arrangement Agreement - Termination”;

“Third Party Consents” means those consents and approvals described in Section 1.1 of the Company Disclosure Letter;

“Transactions” has the meaning ascribed thereto in Section 4(a) of Schedule C of the Arrangement Agreement;

“TSX” means the Toronto Stock Exchange; and

“United States” or “U.S.” means the United States of America, its territories and possessions, any State of the United States and the District of Columbia.

|

| 12 |

|

NOTICE TO SECURITYHOLDERS IN THE UNITED STATES

THE ARRANGEMENT HAS NOT AND WILL NOT BE APPROVED OR DISAPPROVED BY SEC OR THE SECURITIES REGULATORY AUTHORITIES IN ANY STATE OF THE UNITED STATES; NOR HAS THE SEC OR THE SECURITIES REGULATORY AUTHORITIES IN ANY STATE OF THE UNITED STATES PASSED UPON THE FAIRNESS OR MERITS OF THE ARRANGEMENT OR UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS CIRCULAR.

Norsat is a corporation existing under the laws of the Province of British Columbia. The solicitation of proxies and the Arrangement contemplated in this Circular involve securities of a Canadian issuer that are being effected in accordance with Canadian corporate and securities laws. This solicitation of proxies is not subject to the requirements of Section 14(a) of the 1934 Act by virtue of an exemption applicable to proxy solicitations by “foreign private issuers” as defined in Rule 3b-4 under the 1934 Act. Accordingly, the proxy solicitation rules under the 1934 Act are not applicable to Norsat or this solicitation, and, accordingly, this solicitation is not being effected in accordance with such rules. Securityholders should be aware that disclosure requirements under Canadian securities laws may be different from requirements under the 1934 Act.

Financial statements included or incorporated by reference in this Circular have been prepared in accordance with International Financial Reporting Standards, which differ from United States generally accepted accounting principles in certain material respects, and thus they may not be comparable to financial statements of United States companies.

Norsat Shareholders that are United States Holders are advised to consult their own tax advisors regarding the United States federal, state, local and foreign tax consequences to them of participating in the Arrangement and should carefully read the information under “Certain United States Federal Income Tax Considerations”.

The enforcement by Norsat Shareholders of civil liabilities under U.S. securities laws may be affected adversely by the fact that: (i) Norsat is a corporation existing and governed under the laws of the Province of British Columbia; (ii) certain of the directors, officers and the experts named in this Circular are not residents of the United States; and (iii) a substantial portion of Norsat’s and such officer’s and director’s respective assets may be located outside the United States. As a result, it may be difficult or impossible for U.S. securityholders to effect service of process within the United States upon Norsat, its officers and directors or the experts named herein, or to realize against them upon judgments of courts of the United States predicated upon civil liabilities under U.S. securities laws or “blue sky” law of any state within the United States. In addition, U.S. securityholders should not assume that the courts of Canada: (a) would enforce judgments of United States courts obtained in actions against such persons predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the Unites States; or (b) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the United States.

|

| 13 |

|

SUMMARY

The following is a summary of certain information contained in this Circular, including its appendices. This summary is not intended to be complete and is qualified in its entirety by the more detailed information contained elsewhere in this Circular, including its appendices. Certain capitalized terms used in this summary are defined in the Glossary of Terms of this Circular. Securityholders are urged to read this Circular and its appendices carefully and in their entirety.

Annual General and Special Meeting

Purpose of the Meeting and Record Date

The Meeting will be held at the offices of Norsat International Inc. at Suite 110-4020 Viking Way, Richmond, B.C. V6V 2L4 on Monday May 29, 2017 at 2:00 pm (Pacific time), for the following purposes:

| a) | attend to annual general meeting matters, such as (i) receiving the consolidated financial statements of the Company for the fiscal year ended December 31, 2016, together with the auditor’s report thereon; (ii) electing directors to the Board for the ensuing year; (iii) appointing auditors for the ensuing year and authorizing the directors to fix their remuneration; and |

| |

| b) | to consider, and if deemed advisable, pass a special resolution approving a Plan of Arrangement that, if implemented, will result in all Norsat Shares being acquired by Hytera Sub. |

The Directors of the Company have fixed the close of business on April 24, 2017 as the record date for determining Securityholders entitled to receive notice of and to vote at the Meeting. Only Shareholders whose names have been entered into the register of the holders of Norsat Shares as at April 24, 2017, and Option Holders and RSU Holders as at April 24, 2017, will be entitled to receive notice of and to vote at the Meeting in respect of such Norsat Shares, Norsat Options or Norsat RSUs, as applicable.

The Arrangement

The Arrangement and Plan of Arrangement are being proposed pursuant to the terms of the Arrangement Agreement. On implementation of the Plan of Arrangement, Hytera Sub will acquire all outstanding Norsat Shares and Norsat will become a wholly-owned subsidiary of Hytera Sub. Under the Plan of Arrangement, each holder of Norsat Shares (other than Dissenting Shareholders) will receive US$10.25 per Norsat Share.

At the Meeting, Securityholders will be asked to consider and, if deemed advisable, to pass the Arrangement Resolution, a copy of which is attached as Appendix A to this Circular. The Arrangement Resolution will, subject to the terms and conditions of the Arrangement Agreement, authorize Norsat to implement the Plan of Arrangement.

Particulars of the Arrangement

Under the terms of the Arrangement, Norsat Shareholders and RSU holders will receive, in exchange for their Norsat Shares or Norsat RSUs, as applicable, the Share Consideration pursuant to a series of transactions as set out in the Plan of Arrangement, which includes the following steps:

| a) | each outstanding Norsat Share (other than Norsat Shares held by Dissenting Shareholders) will, be irrevocably assigned and transferred by the holder thereof to Hytera Sub (free and clear of all Liens) in exchange for a cash payment of US$10.25 for each Norsat Share held; and |

| |

| b) | each outstanding Norsat RSU (whether vested or unvested) shall be transferred by the holder |

| |

| |

| 14 |

|

thereof to Norsat in exchange for a cash payment by or on behalf of Norsat equal to US$10.25 for each Norsat RSU held.

Each outstanding Norsat Option (whether vested or unvested) will be transferred by the holder thereof to Norsat (free and clear of all Liens) in exchange for a cash payment by or on behalf of Norsat equal to the amount, if any, by which the Canadian Equivalent of the Share Consideration exceeds the exercise price per Norsat Share of such Norsat Option.

The Norsat Shares held by Dissenting Shareholders in respect of which Dissent Rights have been validly exercised will be deemed to be transferred to Norsat (free and clear of all Liens), without any further act or formality, and such Dissenting Shareholders will cease to have any rights as holders of such Norsat Shares other than the right to be paid fair value for such Norsat Shares by Norsat as set out in the Plan of Arrangement, attached as Schedule B to the Arrangement Agreement, and the Norsat Shares so transferred will be cancelled.

Background to the Arrangement

The provisions of the Arrangement Agreement are the result of arm’s length negotiations conducted among representatives of Norsat and Hytera, and their respective legal and financial advisors, as applicable. See “The Arrangement – Background to the Arrangement” for a description of the background to the Arrangement.

Recommendation of the Independent Directors

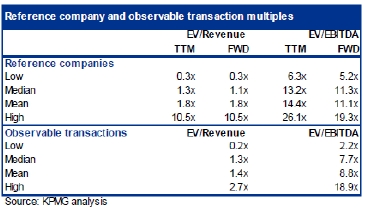

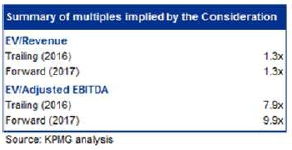

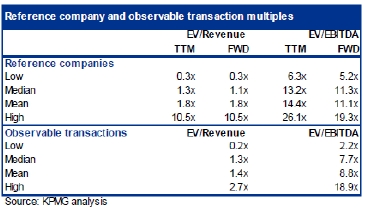

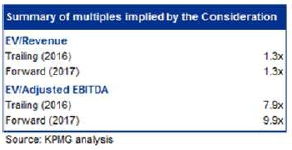

The Independent Directors, having taken into account such matters they considered relevant, including certain fairness opinions discussed below, unanimously determined that the consideration to be paid by Hytera under the Arrangement is fair to the securityholders of Norsat and that the Arrangement is in the best interests of Norsat.Accordingly, the Independent Directors unanimously recommend that the Securityholders vote FOR the Arrangement Resolution.See “The Arrangement – Recommendation of the Independent Directors”.