SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional materials |

| ¨ | Soliciting Material Pursuant to §240.14a-11 or §240.14a-12 |

MEDICAL ACTION INDUSTRIES INC.

(Name of Registrant as Specified in its Charter)

RICHARD G. SATIN, ESQ.

VICE PRESIDENT & GENERAL COUNSEL

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or registration statement no.: |

Notice of

2007

Annual Meeting

and

Proxy Statement

WHETHER OR NOT YOU PRESENTLY PLAN TO ATTEND THE MEETING IN

PERSON, THE BOARD OF DIRECTORS URGES YOU TO VOTE.

Medical Action Industries Inc.

800 Prime Place

Hauppauge, New York 11788

Table of Contents

Proxy Statement

MEDICAL ACTION INDUSTRIES INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

August 16, 2007

To the Stockholders of

MEDICAL ACTION INDUSTRIES INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders ofMEDICAL ACTION INDUSTRIES INC. will be held on Thursday, August 16, 2007 at the Hyatt Regency Wind Watch, 1717 Motor Parkway, Hauppauge, New York 11788 at 9:00 a.m. (the “Annual Meeting”), for the following purposes:

| | 1. | To elect three directors to serve in Class II until the 2010 Annual Meeting of Stockholders; |

| | 2. | To consider and act upon the ratification of Grant Thornton LLP as independent certified registered public accountants of the Company for the fiscal year ending March 31, 2008; and |

| | 3. | To consider and act upon such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on Tuesday, June 19, 2007 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. All stockholders of the Company are cordially invited to attend the Annual Meeting in person. However, whether or not you plan to attend,please promptly sign, date and mail the enclosed proxy card in the enclosed return envelope, which requires no postage if mailed in the United States. Alternatively, you may vote electronically via the Internet or telephone as described in greater detail in the Proxy Statement. Returning your proxy card does not deprive you of your right to attend the Annual Meeting and vote your shares in person.

|

| By Order of the Board of Directors, |

|

| |

Richard G. Satin Vice President of Operations and General Counsel |

| Dated: | Hauppauge, New York |

EVEN THOUGH YOU MAY PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE VOTE BY TELEPHONE OR THE INTERNET, OR COMPLETE AND EXECUTE THE ENCLOSED PROXY CARD AND MAIL IT PROMPTLY. A RETURN ENVELOPE (WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR YOUR CONVENIENCE. TELEPHONE AND INTERNET VOTING INFORMATION IS PROVIDED ON YOUR PROXY CARD. SHOULD YOU ATTEND THE ANNUAL MEETING IN PERSON, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON.

MEDICAL ACTION INDUSTRIES INC.

800 Prime Place

Hauppauge, New York 11788

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

to be held August 16, 2007

This Proxy Statement is furnished to stockholders of MEDICAL ACTION INDUSTRIES INC., a Delaware corporation (the “Company” or “Medical Action”), in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Stockholders to be held at the Hyatt Regency Wind Watch, 1717 Motor Parkway, Hauppauge, New York 11788, on Thursday, August 16, 2007 at 9:00 a.m., New York time, including any adjournments thereof, for the purposes set forth in the accompanying Notice of Meeting. This Proxy Statement and the accompanying proxy are first being sent or given to stockholders on or about July 1, 2007.

Instead of submitting your proxy with the paper proxy card, you may be able to vote electronically by telephone or via the Internet. If you vote by telephone or Internet, it is not necessary to return your proxy card.See “Voting Via the Internet or By Telephone” on page 30 of this Proxy Statement, or the instructions on the proxy card, for further details. Please note that there are separate Internet and telephone voting arrangements depending upon whether your shares are registered in your name or in the name of a broker or bank.

A stockholder who returns the accompanying proxy may revoke it at any time before it is voted by giving notice in writing to the Company, by granting a subsequent proxy or by appearing in person and voting at the meeting. Any stockholder attending the Annual Meeting and entitled to vote may vote in person whether or not said stockholder has previously submitted a proxy. Where no instructions are indicated, proxies will be voted for the nominees for Directors set forth herein and in favor of the other proposals described herein. Those voting via the Internet, or by telephone may also revoke their proxy by attending the Annual Meeting or by voting again, at a later time, via the Internet, by telephone, or by submitting the proxy in accordance with the instructions thereon.

Voting Rights and Votes Required

At the close of business on June 19, 2007, the record date (the “Record Date”) for the determination of stockholders entitled to vote at the Annual Meeting, the Company had outstanding, approximately 15,863,411 shares of its Common Stock, par value $.001 per share (“Common Stock”). The holders of such Common Stock are entitled to one vote for each share held on the Record Date.

In order to carry on the business of the Annual Meeting, a quorum must be present. A quorum requires the presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the Annual Meeting. Abstention and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when the beneficial owner fails to provide voting instructions to the broker for shares held in “street name.” Under those circumstances, the broker may be authorized to vote on some routine items but is prohibited from voting on other items. Those items for which a broker cannot vote result in broker “non-votes.”

Directors will be elected by a plurality of the votes cast by the holders of the shares of Common Stock voting in person or by proxy at the Annual Meeting. Thus, abstentions will have no effect on the vote for election

1

of Directors. However, approval of the other matters to come before the Annual Meeting will require the affirmative vote of the holders of a majority of the shares of Common Stock of the Company present in person or by proxy at the Annual Meeting. Accordingly, abstentions will have the same effect as votes against these matters, while non-votes will not be included in vote totals and will have no effect on the outcome of these matters.

Management is not aware at the date hereof of any matter to be presented at the Annual Meeting other than the election of directors and the other proposals described in the attached Notice of Annual Meeting of Stockholders.

If your proxy is properly dated, executed and returned, your shares will be voted at the Annual Meeting in accordance with the instructions you indicate on the proxy card. If you submit the proxy card but do not indicate your voting instructions, your shares will be voted as follows:

| | • | | FOR the election of the three nominees to the Board of Directors; and |

| | • | | FOR the ratification of the appointment of Grant Thornton LLP as independent certified registered public accountants of the Company for the fiscal year ending March 31, 2008. |

The expense of soliciting proxies for the Annual Meeting, including the cost of preparing, assembling and mailing the notice, proxy and Proxy Statement, will be paid by the Company. The solicitation will be made by use of the mails, through brokers and banking institutions, and by officers and regular employees of the Company. Proxies may be solicited by personal interview, mail, telephone or facsimile transmission.

No person has been authorized to give any information or to make any representation other than those contained in this Proxy Statement and, if given or made, such information or representation must not be relied upon as having been authorized by the Company.

Deadline of Receipt of Stockholders Proposals for 2008 Annual Meeting

Under regulations of the Securities and Exchange Commission (“SEC”), any stockholder desiring to make a proposal to be acted upon at the 2008 annual meeting of stockholders must present such proposal to the Company’s Corporate Secretary at the Company’s principal office at 800 Prime Place, Hauppauge, New York 11788 not later than March 1, 2008, in order for the proposal to be considered for inclusion in the Company’s proxy statement. All stockholder proposals and director nominations must be submitted in accordance with and contain the information required by the Company’s Certificate of Incorporation, a copy of which may be obtained by contacting the Corporate Secretary at the address indicated above. The Company will determine whether to include properly submitted proposals in the proxy statement in accordance with regulations governing the solicitation of proxies.

The Company’s Certificate of Incorporation provides that a stockholder of the Company entitled to vote for the election of directors may nominate persons for election as directors only at an annual meeting and if written notice of such shareholder’s intent to make such nomination or nominations has been given to the Corporate Secretary of the Company not later than 90 days before the anniversary of the date of the first mailing of the Company’s proxy statement for the immediately preceding year’s annual meeting. The Corporate Secretary must receive written notice of a stockholder nomination to be acted upon at the 2008 annual meeting not later than the close of business on April 1, 2008. The stockholder’s notice must include the following information, including:

| | • | | the name and address of record of the stockholder intending to make the nomination, the beneficial owner, if any, on whose behalf the nomination is made and of the person or persons to be nominated; |

| | • | | a representation that such stockholder is a stockholder of record and intends to appear in person or by proxy at such meeting to nominate the director candidate; |

| | • | | the class and number of shares of Common Stock that are owned by such stockholder and such beneficial owners; |

2

| | • | | a description of all arrangements, understandings or relationships between such stockholder and each director nominee and any other person(s) (naming such person(s)) pursuant to which the nomination is to be made by such stockholder; |

| | • | | such other information regarding each nominee proposed by such stockholder as would be required to be disclosed in solicitations or proxies for election of directors in an election contest, or is otherwise required to be disclosed, pursuant to the proxy rules of the SEC, had the nominee been nominated, or intended to be nominated, by the Board of Directors; and |

| | • | | the written consent of the nominee to serve as a director if elected. |

The requirements found in the Company’s Certificate of Incorporation are separate from the requirements a stockholder must meet to have a proposal included in the Company’s proxy statement under the proxy rules.

The proxy grants the proxy holders discretionary authority to vote on any matter raised at the Annual Meeting. If you intend to submit a proposal for the 2007 Annual Meeting of Stockholders that is not eligible for inclusion in the Proxy Statement relating to that meeting, and you fail to give the Company notice in accordance with the requirements set out in the Securities Exchange Act of 1934 as amended, then the proxy holders will be allowed to use their discretionary voting authority when and if the proposal is raised at the Company’s 2007 Annual Meeting of Stockholders.

Corporate Governance Matters

Medical Action is committed to adhering to sound principles of corporate governance and has adopted corporate governance principles that the Board believes promote the effective functioning of the Board of Directors, its committees and the Company.

Director Independence

The Board of Directors has determined that each director is independent, as defined for purposes of the NASDAQ listing standards, other than Mr. Meringolo, who is Chairman, Chief Executive Officer and President of the Company, Richard G. Satin, who is Vice President of Operations, General Counsel and Corporate Secretary and Mr. Henry A. Berling, who until December 31, 2004 was Executive Vice President of Owens & Minor, Inc., and until April 28, 2005, was a member of the Owens & Minor, Inc. board of directors, one of the Company’s distributors. In making this determination, the Board affirmatively determined that each independent director had no relationship with the Company or management for more than the past three fiscal years.

Director Nominations

In obtaining the names of possible nominees, the Nominating and Governance Committee makes its own inquiries and will receive suggestions from other directors, management, stockholders and other sources, and its process for evaluating nominees identified in unsolicited recommendations from securities holders is the same as its process for unsolicited recommendations from other sources. All potential nominees must be considered by the Committee before being contacted by other Company directors or officers as possible nominees and before having their names formally considered by the full Board. The Nominating and Governance Committee will consider nominees recommended by securities holders who meet the eligibility requirements for submitting stockholder proposals for inclusion in the next proxy statement and submit their recommendations in writing to Chair, Nominating and Governance Committee, care of the Corporate Secretary, Medical Action Industries Inc, 800 Prime Place, Hauppauge, New York 11788 by the deadline for such stockholder proposals referred to at the end of this proxy statement. Unsolicited recommendations must contain all of the information that would be required in a proxy statement soliciting proxies for the election of the candidate as a director, a description of all direct or indirect arrangements or understandings between the recommending securities holder and the candidate,

3

all other companies to which the candidate is being recommended as a nominee for director, and a signed consent of the candidate to cooperate with reasonable background checks and personal interviews, and to serve as a director of the Company, if elected.

The Nominating and Governance Committee believes that nominees should, in the judgment of the Board, be persons of integrity and honesty, be able to exercise sound, mature and independent business judgment in the best interests of the Stockholders as a whole, be recognized leaders in business or professional activity, have background and experience that will complement those of other board members, be able to actively participate in Board and Committee meetings and related activities, be able to work professionally and effectively with other Board members and Company management, be available to remain on the Board long enough to make an effective contribution, and have no material relationship with competitors or other third parties that could present realistic possibilities of conflict of interest or legal issues. The Nominating and Governance Committee also believes that the Board membership should include appropriate expertise, and reflect gender, cultural and geographical diversity as well as an appropriate mix of inside and independent directors.

Stockholder Communication with Board Members

The Board has established a process for securities holders to send communications, other than sales-related communications, to one or more of its members. Any such communications should be sent by letter addressed to the member or members of the Board to whom the communication is directed, care of the Corporate Secretary, Medical Action Industries Inc., 800 Prime Place, Hauppauge, New York 11788. All such communication will be forwarded to the Board member or members specified.

Director Presiding at Executive Sessions

In fiscal 2007, the Board of Directors scheduled executive sessions without any management present prior to each Board Meeting. Mr. Burke, Chairman of the Audit Committee presided at these executive sessions of non-management directors.

Corporate Governance Guidelines and Code of Ethics

We have adopted a code of ethics that applies to our employees, officers and directors, including our Chief Executive Officer and Principal Financial Officer. Copies of the Company’s Corporate Governance Guidelines and Code of Ethics are available at the Company’s corporate governance website located atwww.medical-action.com. Any amendments to, or waivers from, our code of ethics as they relate to any executive officer or director must be approved by the Board of Directors or the Nominating and Governance Committee.

Complaint Procedures Regarding Accounting, Internal Control, Auditing and Financial Matters

In accordance with SEC Rules, the Audit Committee has established the following procedures for (i) the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls, or auditing matters and (ii) the confidential, anonymous submission by employees concerning questionable accounting or auditing matters.

Interested parties may report complaints regarding accounting, internal accounting controls, or auditing matters involving Medical Action by calling a toll free hotline which is available 24 hours a day, seven days a week. Complaints will be reviewed and investigated as appropriate. All calls regarding questionable accounting or auditing matters are confidential and anonymous.

Board of Directors Meetings and Committees

The Board of Directors held nine (9) meetings during the fiscal year ended March 31, 2007. The Company has an Audit, a Compensation, and a Nominating and Corporate Governance Committee. The members of the Audit Committee are William W. Burke (Chairman), Dr. Philip Corso, Kenneth R. Newsome and Bernard

4

Wengrover. The members of the Compensation Committee are Dr. Philip Corso (Chairman), William W. Burke, Kenneth R. Newsome and Bernard Wengrover. The members of the Nominating and Governance Committee are Bernard Wengrover (Chairman), William W. Burke, Dr. Philip Corso and Kenneth R. Newsome. During fiscal 2007, the Audit Committee met four (4) times; the Compensation Committee met six (6) times and the Nominating and Governance Committee met once. Except for Dr. Corso, who attended 75% or more of the meetings of the Board and committees of the Board on which he served, all of the remaining Directors attended 100% of the meetings of the Board and committees of the Board on which such directors served. Only independent non-employee Directors may serve on the Committees of the Board of Directors. The Company’s non-employee Directors are members of each of the Committees of the Board.

Audit Committee

The Audit Committee assists the Board in its oversight of the integrity of the Company’s financial statements, legal and regulatory compliance, the independent auditor’s qualifications and independence, and the performance of the Company’s internal audit function and of the independent auditors. The Audit Committee recommends for approval by the Stockholders, a firm of independent certified public accountants whose duty is to examine the Company’s financial statements. The Audit Committee has the sole authority and responsibility to appoint, subject to Stockholder approval, compensate and oversee the independent auditors, and to pre-approve all engagements, fees and terms for audit and other services provided by the Company’s independent auditors. The independent auditors are accountable to the Audit Committee. Mr. Burke is Chair of the Audit Committee and is the “audit committee financial expert” as defined by applicable SEC rules. The Audit Committee operates pursuant to a written charter. A copy of the Audit Committee Charter, which was revised in October 2005, is available on the Company’s website atwww.medical-action.com.

Compensation Committee

The Compensation Committee has responsibility for establishing and monitoring the executive compensation programs of the Company and for making decisions regarding the compensation of the Named Executive Officers. The agenda for meetings of the Compensation Committee is determined by the Chairman of the Compensation Committee, in consultation with the Chief Executive Officer and General Counsel of the Company. Compensation Committee meetings are often attended by the Chief Executive Officer and the General Counsel. The Compensation Committee also meets in executive session. In determining compensation of the Named Executive Officers, the Compensation Committee reviews data which it believes is representative of the medical products industry, primarily by reviewing public disclosure of other public companies, as filed with the U.S. Securities and Exchange Commission. The Compensation Committee considers, among other factors, the Company’s performance and relative shareholder return, the value of similar incentive awards to Chief Executive Officers at comparable companies, the awards given to the Chief Executive Officer in past years, and other factors considered relevant by the Committee. The Compensation Committee attempts to benchmark companies in the medical device or medical products industries with similar annual revenue, size and other factors. The Compensation Committee also administers the Company’s stock option plans. Dr. Corso is Chair of the Compensation Committee. The Compensation Committee Charter is available on the Company’s website atwww.medical-action.com.

Nominating and Governance Committee

The Nominating and Governance Committee assists the Board in identifying individuals qualified to become directors under criteria approved by the Board. The committee recommends to the Board the number and names of persons to be proposed by the Board for election as directors at the annual general meeting of stockholders and may also recommend to the Board persons to be appointed by the Board or to be elected by the stockholders to fill any vacancies which occur on the Board. The Nominating and Governance Committee is responsible for periodically reviewing director compensation and benefits, reviewing corporate governance trends, and recommending to the Board any improvements to the Company’s corporate governance guidelines as it deems appropriate. The Nominating and Governance Committee also recommends directors to serve on and to

5

chair the Board Committees and leads the Board’s appraisal process. Mr. Wengrover is Chair of the Nominating and Governance Committee. The Nominating and Governance Committee operates pursuant to a written charter. A copy of the Nominating and Governance Committee Charter is available on the Company’s website atwww.medical-action.com.

Director Compensation

The Company uses a combination of cash and equity compensation to attract and retain qualified candidates to serve on its Board of Directors. In setting director compensation, the Company considers the commitment of time directors must make in performing their duties, the level of skills required by the Company of its Board members and the market competitiveness of its director compensation levels. The table below sets forth the schedule of fees paid to non-employee directors in fiscal 2007 for their service in various capacities on Board committees and in Board leadership roles. Employee directors do not receive any additional compensation other than their normal salary for serving on the Board.

| | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash ($)(1) | | Stock

Awards

($) | | Stock

Option

Awards

($)(2)(3) | | All Other

Compensation

($) | | Total

($) |

Henry A. Berling | | 25,000 | | — | | 22,425 | | — | | 47,425 |

William W. Burke | | 26,000 | | — | | 22,425 | | — | | 48,425 |

Dr. Philip F. Corso | | 21,500 | | — | | 22,425 | | — | | 43,925 |

Kenneth R. Newsome | | 14,000 | | — | | 22,425 | | — | | 36,425 |

Bernard Wengrover | | 25,500 | | — | | 22,425 | | — | | 47,925 |

| (1) | Non-employee Directors receive a $1,000 monthly retainer, a $1,000 fee for each board meeting they attend, and a $500 fee for each telephonic Board Meeting they attend. Non-employee Directors also receive a $500 fee for each Committee Meeting they attend that is on the same day as a regular Board meeting (with the exception of the Chairman of each Committee who receives $1,000). For such Committee meetings that non-employee Directors attend that are not on the same day as a regular Board meeting, they receive a $1,000 fee for each meeting (with the exception of the Chairman of each Committee who receives $2,000). For telephonic Committee meetings that non-employee Directors attend, they receive a $500 fee for each meeting (with the exception of the Chairman of each Committee who receives $1,000). |

| (2) | Dollar values represent the expense recognized for financial statement purposes for the year ended March 31, 2007, in accordance with SFAS 123(R). The compensation expense reflected in the table above is the same as the grant-date fair value pursuant to SFAS 123(R) because all of the option awards vested during fiscal 2007. Refer to Note 10 to the Consolidated Financial Statements included in our Annual Report to Stockholders for the year ended March 31, 2007, for a discussion of the relevant assumptions used in calculating the recognized compensation expense and grant-date fair value pursuant to SFAS 123(R). The recognized compensation expense and grant-date fair value of the stock option awards for financial reporting purposes will likely vary from the actual amount ultimately realized by the Director based on a number of factors. These factors include our actual operating performance, stock price fluctuations, differences from the valuation assumptions used and the timing of exercise. As of March 31, 2007, the following Directors had the following stock options outstanding: Henry A. Berling, 7,500 options; William W. Burke, 11,250 options; Dr. Philip F. Corso, 11,250 options; Kenneth R. Newsome, 3,750 options and Bernard Wengrover, 11,250 options. The number of stock options held by our non-employee Directors is a function of years of Board service and their decisions as to the timing of exercise. All share amounts have been adjusted to reflect the Company’s 3-for-2 stock split paid on February 9, 2007. |

| (3) | In August 1996, stockholders approved the 1996 Non-Employee Directors Stock Option Plan, under which all Directors who are not also employees of the Company are automatically granted each year at the Annual Meeting of Stockholders options to purchase 2,500 shares at the closing price of the Company’s Common Stock on the date of grant. All options are exercisable from the date of grant. |

6

PROPOSAL 1 – ELECTION OF DIRECTORS

The Company’s Certificate of Incorporation provides that the Board of Directors shall consist of between three and eleven members, as determined from time to time by the Board, divided into three classes as nearly equal in number as possible. The size of the Board has currently been set at seven. Directors are to be re-elected at the 2007 Annual Meeting to serve for a term ending at the 2010 Annual Meeting of Stockholders. Shares represented by executed proxies in the form enclosed will be voted, unless otherwise indicated, for the election as Directors of the nominees, unless one shall be unavailable, in which event such shares may be voted for a substitute nominee(s) designated by the Board of Directors. The Board of Directors has no reason to believe that any of the nominees will be unavailable or, if elected, will decline to serve.

Nominees for Election for a Three-Year Term Expiring at the 2010 Annual Meeting

Mr. Paul D. Meringolo, a director and Chairman of the Board and Chief Executive Officer of the Company since October 1997, has been employed by the Company for more than the past twenty years in various executive positions. He also serves the Company as President (since November 1992), and previously held the position of Vice President of Operations from March 1989 to October 1991 and Senior Vice President (Chief Operating Officer) from October 1991 to November 1992.

Mr. Kenneth R. Newsome, 47 years of age, a director of the Company since August 2006, has been President and CEO of AMF Automation Technologies, Inc., a privately held manufacturer of wholesale bread and baking equipment since 1996. With approximately 300 employees worldwide, AMF has completed seven acquisitions to date. For more than the four years prior thereto, Mr. Newsome held various executive positions, including Chief Operating Officer of MedSurg Industries, which was acquired by Isolyser Healthcare, which is now known as Microtek Medical Inc., a publicly traded medical products company. Mr. Newsome holds a Bachelors of Science degree in Finance from the University of Virginia – McIntire School of Commerce and a Masters of Business Administration degree from the University of Virginia – Darden School of Graduate Business Administration.

Mr. Bernard Wengrover, 82 years of age, a director of the Company since October 1990, has been a certified public accountant in the State of New York for more than the past forty years. Mr. Wengrover was the Company’s independent auditor from 1977 until March 31, 1989.

Continuing Directors to serve until the 2008 Annual Meeting

Mr. William W. Burke, 48 years of age, a director since August 2004, has served as Executive Vice President and Chief Financial Officer of ReAble Therapeutics, Inc. (formerly known as Encore Medical Corporation), a diversified orthopedic device company since August 2004. Mr. Burke served as Chief Financial Officer, Treasurer and Secretary of Cholestech Corporation, a publicly traded medical products company from March 2001 to August 2004. For more than fifteen years prior thereto, Mr. Burke was a senior investment banker with such firms as Bear, Stearns & Co., Inc., Everen Securities, Inc. and Principal Financial Securities, where he provided financing and advisory services to companies in healthcare and other industry sectors. Mr. Burke holds a Bachelors of Business Administration degree in Finance from the University of Texas at Austin and a Masters of Business Administration degree from University of Pennsylvania’s Wharton Graduate Business School.

Dr. Philip F. Corso, 79 years of age, a director of the Company since March 1984, has been associated with the Yale University School of Medicine for more than the past ten years and is presently an Assistant Clinical Professor of Surgery Emeritus. In addition, Dr. Corso is Senior Attending and Emeritus Chief of Plastic Surgery at Bridgeport and Norwalk Hospitals in Connecticut. Dr. Corso has also published numerous articles in professional journals on plastic and reconstructive surgery. He is a member of numerous national and international plastic surgery societies.

7

Continuing Directors to Serve until the 2009 Annual Meeting

Mr. Henry A. Berling, 64 years of age, a director since August 2005, retired on December 31, 2004 as Executive Vice President after 38 years with Owens & Minor, Inc., a publicly traded Fortune 500 supply-chain solutions company and a leading distributor of name-brand medical and surgical supplies. From 1995 to 2002 Mr. Berling served as Executive Vice President, Partnership Development. Prior to 1995, he served Owens & Minor, Inc. in various positions, including Executive Vice President, Sales and Customer Development and Senior Vice President, Sales and Marketing. Mr. Berling was a member of the Owens & Minor Board of Directors from 1998 to 2005. For more than the past three years, Owens & Minor, Inc. has been the Company’s largest distributor.

Mr. Richard G. Satin, previously a director of the Company from October 1987 to February 1992, was reappointed to the Board of Directors in February 1993. Mr. Satin has been employed by the Company as Vice President and General Counsel since January 1993 and has been Corporate Secretary of the Company since October 1991. In February 1994, Mr. Satin was appointed Vice President of Operations. Mr. Satin, a practicing attorney in the State of New York for more than the past twenty years, was associated with the law firm of Blau, Kramer, Wactlar, Lieberman & Satin, P.C. from May 1983 to January 1993.

The Board of Directors of the Company recommends a vote FOR Paul D. Meringolo, Kenneth R. Newsome and Bernard Wengrover as Class II Directors. Each nominee was proposed for re-election by the Nominating and Governance Committee for consideration by the Board.

8

PROPOSAL 2 – RATIFICATION OF INDEPENDENT CERTIFIED REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected Grant Thornton LLP, independent certified registered public accounting firm, to examine financial statements of the Company for the fiscal year ending March 31, 2008. In the absence of contrary specifications, the shares represented by the proxies will be voted FOR the ratification of this appointment. If the stockholders fail to ratify this appointment, the Board of Directors will reconsider its selection.

Grant Thornton LLP has been our independent accountants since 1998. A representative of Grant Thornton LLP will be present at the annual meeting, will have the opportunity to make a statement if he or she desires to do so and will be available to answer any appropriate questions.

Principal Accounting Firm Fees

The following table sets forth the aggregate fees billed to the Company for the fiscal years ended March 31, 2007 and 2006 by the Company’s principal accounting firm, Grant Thornton LLP.

| | | | | | |

| | | March 31, |

Description | | 2007 | | 2006 |

Audit fees | | $ | 486,100 | | $ | 283,496 |

Tax fees | | | 63,782 | | | 50,262 |

All other fees | | | — | | | — |

| | | | | | |

Total | | $ | 549,882 | | $ | 333,758 |

| | | | | | |

Audit Fees

In fiscal 2007 and 2006, these services consisted of fees billed for professional services rendered for the audit of our financial statements, review of the interim financial statements included in quarterly reports, review of the Company’s proxy statement and Sarbanes-Oxley Section 404 audit procedures. Additionally, services included the review and research of accounting issues associated with the Company’s acquisition of Medegen Medical Products, LLC on October 17, 2006 and related Current Report on Form 8-K filing.

Tax Fees

Consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include tax planning and the preparation of various tax returns and advice on other tax related matters. Additionally, services included research of tax issues associated with the Company’s acquisition of Medegen Medical Products, LLC on October 17, 2006.

The Audit Committee has established policies and procedures for the approval and pre-approval of audit services and permitted non-audit services. The Audit Committee has the responsibility to engage and terminate the engagement of the Company’s independent registered public accountants, to pre-approve their performance of audit services and permitted non-audit services and to renew with the Company’s independent registered public accountants their fees and plans for all auditing services. All services provided by and fees paid to Grant Thornton LLP in fiscal 2007 were pre-approved by the Audit Committee and there were no instances of waiver of approval requirements or guidelines during this period.

Vote Required and Board Recommendation

If a quorum is present, the affirmative vote of the holders of a majority of the shares to be voted will be required to approve this proposal. Abstentions will have the same effect as a vote against this proposal and broker non-votes will have no effect on the outcome of the vote with respect to this proposal.

The Board of Directors recommends that stockholders vote FOR ratification of the appointment of Grant Thornton LLP as our independent certified registered public accountants for Fiscal 2008.

9

REPORT OF THE AUDIT COMMITTEE

As its charter reflects, the Audit Committee has a broad array of duties and responsibilities. With respect to financial reporting and the financial reporting process, management, the Company’s independent registered public accountants and the Audit Committee have the following respective responsibilities:

Management is responsible for

| | • | | Establishing and maintaining the Company’s internal control over financial reporting; |

| | • | | Assessing the effectiveness of the Company’s internal control over financial reporting as of the end of each year; and |

| | • | | Preparation, presentation and integrity of the Company’s consolidated financial statements. |

The Company’s independent registered public accountants are responsible for

| | • | | Performing an independent audit of the Company’s consolidated financial statements and the Company’s internal control over financial reporting; |

| | • | | Expressing an opinion as to the conformity of the Company’s consolidated financial statements with U.S. generally accepted accounting principles; and |

| | • | | Expressing an opinion as to management’s assessment of the effectiveness of the Company’s internal control over financial reporting. |

The Audit Committee is responsible for

| | • | | Selecting the Company’s independent registered public accountants, subject to stockholder ratification; |

| | • | | Overseeing and reviewing the financial statements and the accounting and financial reporting processes of the Company; and |

| | • | | Overseeing and reviewing management’s evaluation of the effectiveness of internal control over financial reporting. |

In this context, the Audit Committee has met and held discussions with management and Grant Thornton LLP, the Company’s independent registered public accountants. Management represented to the Audit Committee that the Company’s consolidated financial statements for the year ended March 31, 2007 were prepared in accordance with U.S. generally accepted accounting principles. The Audit Committee has reviewed and discussed these consolidated financial statements with management and Grant Thornton LLP, including the scope of the independent registered public accountants’ responsibilities, critical accounting policies and practices used and significant financial reporting issues and judgments made in connection with the preparation of such financial statements.

The Audit Committee has discussed with Grant Thornton LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee has also received the written disclosures and the letter from Grant Thornton LLP relating to the independence of that firm as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with Grant Thornton LLP the firm’s independence from the Company.

In addition, the Audit Committee has discussed with management its assessment of the effectiveness of internal control over financial reporting and has discussed with Grant Thornton LLP its opinion as to both the effectiveness of the Company’s internal control over financial reporting and management’s assessment thereof.

10

Based upon its discussions with management and Grant Thornton LLP and its review of the representations of management and the report of Grant Thornton LLP to the Audit Committee, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2007 for filing with the SEC.

The Audit Committee

William W. Burke, Chairman

Dr. Philip F. Corso

Kenneth R. Newsome

Bernard Wengrover

11

STOCK OWNERSHIP INFORMATION

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, directors, certain officers, and beneficial owners of 10% or more of the Company’s Common Stock (“reporting persons”) are required from time to time to file with the Securities and Exchange Commission (the “Commission”) reports on Forms 3, 4 or 5, relating principally to transactions in Company securities by such persons. Based solely upon its review of the copies of such reports furnished to the Company, or written representations received by the Company that no other reports were required, the Company believes during fiscal 2006 that the reporting persons filed on a timely basis the reports required by Section 16(a) of the Securities Exchange Act of 1934.

Stock Ownership by Management and the Board of Directors.The following table shows the number of shares of Medical Action common stock beneficially owned as of the Record Date (i) by each non-employee Director (ii) the Named Executives of the Company (hereafter defined in the Summary Compensation Table) and (iii) all Directors and executive officers as a group.

| | | | | |

Name and Address of Beneficial Ownership | | Amount at Nature

of Beneficial

Ownership (1) (2)

Common Stock | | Percent of Class

if more than

1.0%

Common Stock | |

Non-Employee Directors | | | | | |

Henry A. Berling 3803 Exeter Road Richmond, Virginia 23221 | | 15,000 | | — | |

| | |

William W. Burke 9800 Metric Blvd. Austin, Texas 78758 | | 11,250 | | — | |

| | |

Dr. Philip F. Corso 475 Algonquin Road Fairfield, Connecticut 06432 | | 34,500 | | — | |

| | |

Kenneth R. Newsome 2115 W. Laburnum Avenue Richmond, Virginia 23227 | | 4,750 | | — | |

| | |

Bernard Wengrover 100 Jericho Quadrangle Jericho, New York 11753 | | 46,250 | | — | |

| | |

Named Executive Officers | | | | | |

| | |

Eric Liu (3) 800 Prime Place Hauppauge, New York 11788 | | 500,250 | | 3.1 | % |

| | |

Manuel B. Losada 800 Prime Place Hauppauge, New York 11788 | | 110,625 | | — | |

| | |

Paul D. Meringolo (3)(4) 800 Prime Place Hauppauge, New York 11788 | | 823,690 | | 5.2 | % |

| | |

Richard G. Satin (3) 800 Prime Place Hauppauge, New York 11788 | | 340,282 | | 2.1 | % |

| | |

All Directors and executive officers as a group (9 persons)(3)(4) | | 1,886,597 | | 11.5 | % |

| (1) | Unless otherwise indicated, the stockholders identified in this table have sole voting and investment power with respect to the shares beneficially owned by them. |

12

| (2) | Each named person and all executive officers and Directors as a group are deemed to be the beneficial owners of securities that may be acquired within 60 days through the exercise of options. Accordingly, the number of shares and percentage set forth opposite each stockholder’s name in the above table include the shares of Common Stock issuable upon exercise of presently exercisable stock options under the Company’s stock option plans, both with respect to the number of shares of Common Stock deemed to be beneficially owned and the adjusted percentage of outstanding Common Stock resulting from such right of exercise. However, the shares of Common Stock so issuable on such exercise by any stockholder are not included in calculating the number of shares or percentage of Common Stock beneficially owned by any other stockholder. |

| (3) | Does not include 88,503 shares, 41,576 shares and 16,662 shares acquired by Paul D. Meringolo, Richard G. Satin and Eric Liu, respectively, pursuant to the Medical Action Industries Inc. 401(k) Retirement Plan as of March 31, 2007. |

| (4) | Includes 42,270 shares owned by Mr. Meringolo’s children, as to which he disclaims beneficial ownership. |

MANAGEMENT

Officers of the Company

The Company’s executive officers are as follows:

| | | | |

Name | | Age | | Position Held with the Company |

| Paul D. Meringolo | | 49 | | Chairman of the Board (Chief Executive Officer) and President |

| | |

| Richard G. Satin | | 52 | | Vice President of Operations, General Counsel and Corporate Secretary |

| | |

| Manuel B. Losada | | 43 | | Vice President of Sales and Marketing |

| | |

| Eric Liu | | 47 | | Vice President of International Operations and Global Development |

All of the executive officers of the Company hold office at the pleasure of the Board of Directors.

Mr. Manuel B. Losada, has been an executive officer of the Company since August 2004 as Vice President of Sales and Marketing. For the year prior thereto, Mr. Losada was Senior Vice President – Chief Sales Officer of B. Braun Medical U.S.A., a global organization offering products in IV therapy, pain control, vascular interventional, dialysis and nutrition. For the four years prior thereto, Mr. Losada was Vice President – Corporate Business Management for Henry Schein, Inc., a distributor of healthcare products and services primarily to office-based healthcare practitioners in the North America and European markets.

Mr. Eric Liu, has been employed by the Company for more than the past ten years in various positions relating to the international procurement of raw materials and the manufacture of certain of the Company’s products. Mr. Liu was appointed Vice President of International Operations and Global Development in May 2005. For more than the five years prior thereto Mr. Liu was Vice President of International Operations. Mr. Liu received a Bachelor of Science degree from The National Taiwan Marine University and a Master of Science degree in Transportation Management from the State University of New York.

13

STOCK OWNERSHIP BY CERTAIN STOCKHOLDERS

The following table shows each person who, based upon their most recent filings with the Securities and Exchange Commission, beneficially owns more than 5% of the Company’s Common Stock.

| | | | | | |

Name and Address of Beneficial Owner | | Shares Beneficially Owned | | | Percentage

Owned | |

FMR Corp 82 Devonshire Street Boston, Massachusetts 02109 | | 2,371,926 shares | (1) | | 15.0 | % |

| | |

Barclays Global Investments, N.A. 45 Fremont Street San Francisco, California 94105 | | 1,155,478 shares | (2) | | 7.3 | % |

| | |

Vaughan Nelson Investment Management, LP 600 Travis, Ste. 6300 Houston, Texas 77002 | | 1,008,882 shares | (3) | | 6.4 | % |

| | |

Royce & Associates, LLC 1414 Avenue of the Americas New York, NY 10019 | | 851,250 shares | (4) | | 5.4 | % |

| (1) | According to Schedule 13G/A, dated February 14, 2007, filed with the Securities and Exchange Commission jointly by FMR Corp. and Edward C. Johnson 3d, Mr. Johnson is chairman of FMR Corp. and may be deemed to be a member of a controlling group with respect to FMR Corp. The Schedule 13G indicates that at December 31, 2006 Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR Corp. was the beneficial owner of 2,371,926 shares of Common Stock in its capacity as investment advisor to various registered investment companies (the “Fidelity Funds”) (the power to vote such shares resides solely with the boards of trustees of the Fidelity Funds, while the power to dispose of such shares resides with Mr. Johnson, FMR Corp., Fidelity and the Fidelity Funds. |

| (2) | According to Schedule 13G/A, dated January 31, 2007, filed with the Securities and Exchange Commission, Barclays Global Investors, N.A. and Barclays Global Fund Advisors (“Barclays”), as of December 31, 2006, Barclays was the beneficial owner of 1,155,478 shares of Common Stock. |

| (3) | According to Schedule 13G/A, dated February 13, 2007, filed with the Securities and Exchange Commission by Vaughan Nelson Investment Management, LP (“Vaughan Nelson”), as of December 31, 2006, Vaughan Nelson was the beneficial owner of 1,008,882 shares of Common Stock of the Company. By reason of investment advisory relationships with the person who owns such Common Stock, Vaughan Nelson may be deemed to be the beneficial owner of the reported shares. Vaughan Nelson Investment Management, Inc. as General Partner of Vaughan Nelson, may be deemed the indirect beneficial owner of such shares. Both Vaughan Nelson and Vaughan Nelson Investment Management, Inc. disclaim beneficial ownership of such shares. |

| (4) | According to Schedule 13G/A, dated January 23, 2007, filed with the Securities and Exchange Commission by Royce & Associates, LLC (“Royce”), as of December 31, 2006, Royce was the beneficial owner of 851,250 shares of Common Stock with sole voting and dispositive power. |

14

Equity Compensation Plan Information

The following table shows, as of March 31, 2007, information with respect to compensation plans under which shares of Common Stock are authorized for issuance.

| | | | | | | |

Plan Category | | Number of securities to be

issued upon exercise of

outstanding options (1) | | Weighted-average

exercise price of

outstanding options | | Number of securities remaining

available for future issuance under

equity compensation plans (4) |

Equity compensation plans approved by stockholders (2) | | 1,418,562 | | $ | 10.20 | | 1,979,689 |

Equity compensation plans not approved by stockholders (3) | | 0 | | | 0 | | 0 |

| | | | | | | |

Total | | 1,418,562 | | $ | 10.20 | | 1,979,689 |

| | | | | | | |

| (1) | All share amounts and exercise prices have been adjusted to reflect the Company’s 3-for-2 stock split paid on February 9, 2007. |

| (2) | These equity compensation plans are the 1994 Stock Incentive Plan, 1989 Non-Qualified Stock Option Plan and 1996 Non-Employee Stock Option Plan, all of which have been approved by our stockholders. |

| (3) | The Company does not have any equity compensation plans that have not been approved by our stockholders. |

| (4) | Excludes securities to be issued upon exercise of outstanding options. |

Compensation Discussion and Analysis

Overview

The goal of our named executive officer compensation program is the same as our goal for operating the Company-to create long-term value for our stockholders. Toward this goal, we have designed and implemented our compensation programs for our Named Executive Officers to reward them for sustained financial and operating performance and leadership excellence, to align their interests with those of our stockholders and to encourage them to remain with the Company for long and productive careers. Most of our compensation elements simultaneously fulfill one or more of our performance, alignment and retention objectives. These elements consist of salary and annual bonus, equity incentive compensation, a long-term performance program driven by the achievement of objective financial performance criteria and other benefits. In deciding on the type and amount of compensation for each executive, we focus on both current pay and the opportunity for future compensation. We combine the compensation elements for each executive in a manner we believe optimizes the executive’s contribution to the Company.

This year’s overview of Medical Action’s executive compensation policy has been significantly expanded to provide a more comprehensive picture to you, the stockholder, of both the rationale behind executive compensation decisions and the manner in which those decisions are made. In developing our enhanced disclosure, the Committee relied upon the principles contained in the newly adopted regulations governing public company executive compensation disclosure that were recently approved by the SEC.

Compensation Objectives

Performance.Executives who are identified in the Summary Compensation Table on page 24 (whom we refer to as our “Named Executive Officers”) have a combined total of 64 years with Medical Action. The amount of compensation for each Named Executive Officer reflect his superior management experience, continued high performance and exceptional career of service to the Company for over a long period of time. Key elements of compensation that depend upon the Named Executive Officers performance include:

| | • | | a necessary cash bonus that is based on an assessment of his performance against pre-determined quantitative and qualitative measures within the context of the Company’s overall performance; |

15

| | • | | equity incentive compensation in the form of stock options and restricted stock, the value of which is contingent upon the performance of the Medical Action share price and subject to vesting schedules that require continued service with the Company; and |

| | • | | a long-term performance award program (“LTPA”) that is contingent upon achieving four specific financial goals for the overall Company, over a three-year period. |

Base salary and bonus are designed to reward annual achievements and be commensurate with the executive’s scope of responsibilities, demonstrated leadership abilities, and management experience and effectiveness. Our other elements of compensation focus on motivating and challenging the executive to achieve superior, long-term, sustained results.

Alignment. We seek to align the interests of the Named Executives with those of our investors by evaluating executive performance on the basis of key financial measurements which we believe closely correlate to long-term stockholder value, including revenue, organic revenue, operating profit, earnings per share, operating margins, return on total equity or total capital, cash flow from operating activities and total stockholder return. Key elements of compensation that align the interests of the Named Executive Officers with stockholders include:

| | • | | equity incentive compensation, which links a significant portion of compensation to stockholder value because the total value of those awards corresponds to stock price appreciation and dividend rate, if any; and |

| | • | | the LTPA, which focuses on the growth of earnings per share, revenue, return on total capital and cash generated as key financial measurements and goals that drive long-term stockholder value. |

Retention. Due to the exceptional management training and experience offered by careers with Medical Action, our senior executives are often presented with other professional opportunities, including ones at potentially higher compensation levels. We attempt to retain our executives by using continued service as a determinant of total pay opportunity. Key elements of compensation that require continued service to receive any, or maximum, payout include:

| | • | | the extended vesting terms on elements of equity incentive compensation, including stock options and restricted stock; and |

| | • | | the LTPA, which pays out only if the executive remains with the Company for the entire three-year performance period. |

Implementing Our Objectives

Determining Compensation.We rely upon our judgment in making compensation decisions, after reviewing the performance of the Company and carefully evaluating an executive’s performance during the year against established goals, leadership qualities, operational performance, business responsibilities, career with the Company, current compensation arrangements and long-term potential to enhance stockholder value. Specific factors affecting compensation decisions for the Named Executive Officers include:

| | • | | key financial measurements such as revenue, organic revenue, operating profit, earnings per share, operating margins, return on total equity or total capital, cash flow from operating activities and total stockholder return; |

| | • | | strategic objectives such as acquisitions, dispositions or joint ventures, technological innovation and globalization; |

| | • | | promoting commercial excellence by launching new or continuously improving products or services, being a leading market player and attracting and retaining customers; |

| | • | | achieving specific operational goals for the Company, including improved productivity, risk management, and management; and |

| | • | | supporting Medical Action values by promoting a culture of unyielding integrity through compliance with law and our ethics policies, as well as commitment to community leadership and diversity. |

16

We generally do not adhere to rigid formulas or necessarily react to short-term changes in business performance in determining the amount and mix of compensation elements. We rely on the formulaic achievement of financial goals in only one instance: the four specific measurements that form the basis for payments under the LTPA. We consider competitive market compensation paid by other companies, but we do not attempt to maintain a certain target percentile within a peer group or otherwise rely on those data to determine executive compensation. We incorporate flexibility into our compensation programs and in the assessment process to respond to and adjust for the evolving business environment.

We strive to achieve an appropriate mix between equity incentive awards and cash payments in order to meet our objectives. Any apportionment goal is not applied rigidly and does not control our compensation decisions; we use it as another tool to assess an executive’s total pay opportunities and whether we have provided the appropriate incentives to accomplish our compensation objectives. Our mix of compensation elements is designed to reward recent results and motivate long-term performance through a combination of cash and equity incentive awards. We also seek to balance compensation elements that are based on financial, operational and strategic metrics with others that are based on the performance of Medical Action shares. We believe the most important indicator of whether our compensation objectives are being met is our ability to motivate our Named Executive Officers to deliver superior performance and retain them to continue their careers with Medical Action on a cost-effective basis.

No Employment and Severance Agreements. None of the Named Executive Officers have employment or severance agreements. Mr. Meringolo terminated his Employment Agreement in April 2007 with the mutual consent of the Company. In February 1993, the Company entered into an Employment Agreement with Paul D. Meringolo which, as amended, covered the five years ending March 31, 2008 and provided for a salary at an annual rate of $250,000, together with cost of living increments, reimbursement of medical expenses not otherwise covered by the Company’s medical plans, up to a maximum of $5,000 and the use of a Company automobile and is included in the Summary Compensation Table on page 24. Our Named Executives serve at the will of the Board, which enables the Company to terminate their employment with discretion as to the terms of any severance arrangement. This is consistent with the Company’s performance-based employment and compensation philosophy.

In lieu of his Employment Agreement, Mr. Meringolo will receive in fiscal 2008, an annual salary of $500,000 in addition to the reimbursement of medical expenses not otherwise covered by the Company’s medical plans, up to a maximum of $5,000, and the use of a Company automobile, together with a bonus of 80% of base salary subject to the achievement of the Company’s performance targets and certain individual/team goals, which will be determined by the Compensation Committee.

The Company has entered into agreements with three of its executive officers, Messrs. Paul D. Meringolo, Satin and Losada, which provide certain benefits in the event of a change in control of the Company. A “change in control” of the Company is defined as, in general, the acquisition by any person of beneficial ownership of 20% or more of the voting stock of the Company, certain business combinations involving the Company or a change in a majority of the incumbent members of the Board of Directors, except for changes in the majority of such members approved by such members. If, within two years after a change in control, the Company or, in certain circumstances, the executive, terminates his employment, the executive is entitled to a severance payment equal to three times (i) such executive’s highest annual salary within the five-year period preceding termination plus (ii) a bonus increment equal to the average of the two highest of the last five bonuses paid to such executive. In addition, the executive is entitled to the continuation of all employment benefits for a three-year period, the vesting of all stock options and certain other benefits, including payment of an amount sufficient to offset any “excess parachute payment” excise tax payable by the executive pursuant to the provisions of the Internal Revenue Code or any comparable provision of state law.

Prior to a change in control, the rights and obligations of the executive with regard to his employment by the Company shall be determined in accordance with the policies and procedures adopted from time to time by the Company. The agreements deal only with certain rights and obligations of the executive subsequent to a change in control, and the existence of the agreement shall not be treated as raising any inference with respect to what rights and obligations exist prior to a change in control.

17

Role of Compensation Committee and CEO. The Compensation Committee of our Board has primary responsibility for developing and evaluating potential candidates for executive positions, including the CEO. As part of this responsibility, the Compensation Committee oversees the design, development and implementation of the compensation program for the CEO and the other Named Executives. The Compensation Committee evaluates the performance of the CEO and determines CEO compensation in light of the goals and objectives of the compensation program. The CEO and the Compensation Committee together assess the performance of the other Named Executives and determine their compensation, based on initial recommendations from the CEO.

The other Named Executives do not play a role in their own compensation determination, other than discussing individual performance objectives with the CEO.

Role of Compensation Consultant. In fiscal 2007, the Company and the Compensation Committee utilized Compensation Resources, Inc., a compensation consultant in the design of programs that affect senior executive officer compensation, including the CEO. The Company’s Named Executives did not participate in the selection of the consultant. The Company has not used the services of any other compensation consultant in matters affecting senior executive or director compensation. In the future, either the Company or the Compensation Committee may engage or seek the advice of other compensation consultants.

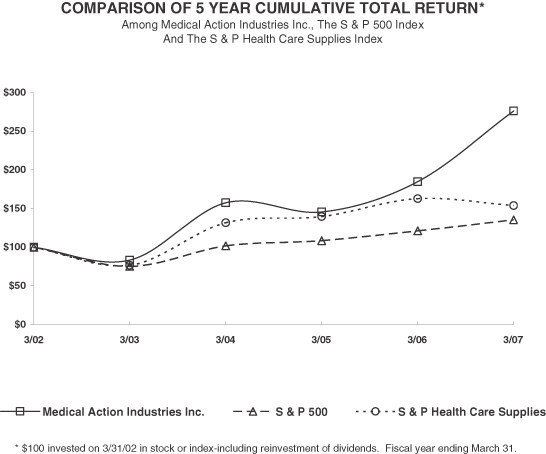

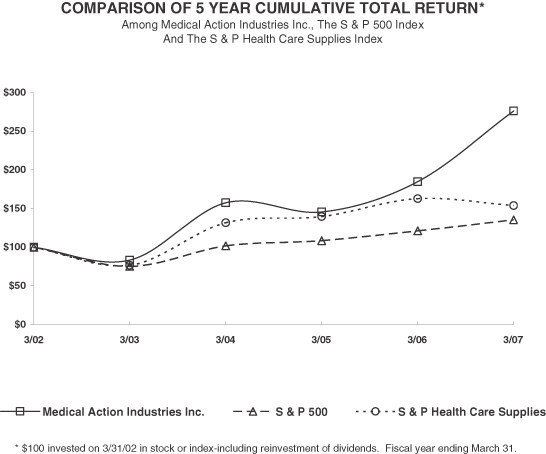

Compensation Resources, Inc. looked at a number of companies of comparative size, similar businesses, similar financial strength and geographic scope. Additionally, the positions were compared to published survey data from nationally recognized sources to ensure the accuracy and validity of the group. The comparator group was chosen to include companies with similar market capitalization, similar revenue size and some direct competitors. The comparator group is different from the companies used to create the five year cumulative return graph on page 23 of this Annual Report, because the Company has business competitors with whom we benchmark against for financial performance, but we also have business and talent competitors against whom we benchmark for pay purposes.

Equity Grant Practices. The exercise price of each stock option awarded to our senior executives is the closing price of Medical Action common stock on the date of grant. Scheduling decisions are made without regard to anticipated earnings of other major announcements by the Company. We prohibit the repricing of stock options. Medical Action executives do not have any role in the selection of the grant date. The exercise price or number of options or grant of restricted stock is always as of the date of issuance of the agreement for the grant. Stock awards for the Company’s Named Executive Officers are promptly announced on a Form 4 filing.

Tax Deductibility of Compensation. Section 162(m) of the Internal Revenue Code of 1986, as amended, imposes a $1 million limit on the amount that a public Company may deduct for compensation paid to the Company’s CEO or any of the Company’s four other most highly compensated executive officers who are employed as of the end of the year. This limitation does not apply to compensation that meets the requirements under Section 162(m) for “qualifying performance-based” compensation (established objective goals based on performance criteria approved by stockholders). For fiscal 2007, the grants of stock options, restricted stock and the payments of annual bonuses and long-term performance awards were designed to satisfy the requirements for deductible compensation.

Elements Used to Achieve Compensation Objectives

Annual cash compensation

Base salary.Base salaries for our Named Executives depend on the scope of their responsibilities, their performance, and the period over which they have performed those responsibilities. Decisions regarding salary increases take into account the executive’s current salary and the amounts paid to the executive’s peers within and outside the Company. Base salaries are reviewed every year, but are not automatically increased if the Compensation Committee believes that other elements of compensation are more appropriate in light of our stated objectives. This strategy is consistent with the Company’s primary intent of offering compensation that is contingent on the achievement of performance objectives.

18

Bonus.Each May the CEO reviews with the Compensation Committee the Company’s estimated full-year financial results against the financial, strategic and operational goals established for the year, and the Company’s financial performance in prior periods. Based on that review, the Compensation Committee determines on a preliminary basis, and as compared to the prior year, an estimated appropriation to provide for the payment of cash bonuses to employees.

The Compensation Committee, with input from the CEO with respect to the other Named Executive Officers, uses discretion in determining for each individual executive the current year’s bonus and the percent change from the prior year’s bonus. They evaluate the overall performance of the Company, the performance of the business or function that the named executive leads and an assessment of each executive’s performance against expectations, which were established at the beginning of the year. The bonuses also reflect (and are proportionate to) the consistently increasing and sustained annual financial results of the Company. We believe that the annual bonus rewards the high-performing executives who drive these results and incents them to sustain this performance over a long Medical Action career.

The annual bonuses for fiscal 2007 set targets of 80% of base salary for the Chief Executive Officer and 40% of base salary for each of the other Named Executive Officers (“Target Payout Amount”), subject to the achievement of the Company’s performance target performance objectives. The Target Payout Amount was based on achievement of financial and other performance targets (“Performance Targets”) established in the Company’s annual bonuses plan as follows:

| | | |

Performance Target | | Weight | |

Company Net Sales | | 35 | % |

Company Net Income | | 40 | % |

Individual/Team Goals | | 25 | % |

The Compensation Committee selected and the Board of Directors approved the Performance Targets, the weights assigned to them and the target achievement levels based on discussion with and recommendations by the Company’s senior management and the objectives of the Company’s business plan for fiscal 2007.

The specific Performance Targets to achieve the Target Payout Amounts were selected because they represented growth and improvement parameters that the Compensation Committee believed would lead to achievement of the Company’s earnings per share objectives for the year. The individual/team goals for each executive were selected with input from the executive on tangible improvements in processes, systems and procedures that would contribute to specific or general reductions in expenses or increases in operating margin for the Company. In several instances, these individual goals were modified in mid-year as tasks and energies were redirected to the Company’s purchase of the patient bedside utensil business of Medegen Medical Products LLC (“MMP”).

The Performance Targets (other than the individual goals) were structured as a range in which different levels of achievement resulted in decreased or increased incentive payouts relative to the Target Payout Amount; provided that the maximum payout could be no greater than the Target Payout Amount, a minimum threshold equal to 25% of the Target Payout Amount had to be achieved for a partial payout, and no incentive at all would be payable if the Company’s net income for fiscal 2007 did not exceed net income for fiscal 2006. The table below sets forth the net income and net sales target levels for 2007, without giving effect to the acquisition of MMP completed in October 2006.

| | | | |

Achievement vs. Target | | Company Net

Sales (millions) | | Company Net

Income (millions) |

100% (Maximum) | | 168.0 | | 12.5 |

75% | | 162.25 | | 12.3 |

50% | | 158.5 | | 12.0 |

25% (Threshold) | | 155.0 | | 11.75 |

19

Based on these financial and operational results, the Company achieved both its net income Performance Target and net sales Performance Target at the 100% level. Accordingly, all of the Named Executive Officers received their annual bonus award for fiscal 2007.

In addition, the Compensation Committee has the authority to award discretionary bonus amounts to executive officers when Performance Targets are not achieved and to increase or decrease the size of earned payouts. The salaries paid and the annual bonuses awarded to the Named Executive Officers in fiscal 2007 are shown in the Summary Compensation Table on page 24.

Equity awards

Stock options and Restricted Stock. The Company’s equity incentive compensation program is designed to recognize scope of responsibilities, reward demonstrated performance and leadership, motivate future superior performance, align the interests of the executive with our stockholders and retain the executives through the term of the awards. We consider the grant size and the appropriate combination of stock options and restricted stock when making award decisions. The amount of equity incentive compensation granted is based upon the strategic, operational and financial performance of the Company overall and reflects the executive’s expected contributions to the Company’s future success. Existing ownership levels are not a factor in award determination, as we do not want to discourage executives from holding significant amounts of Medical Action stock.

We have expensed stock option grants under Statement of Financial Accounting Standards 123R, Share-Based Payment (SFAS 123R), beginning in fiscal 2007. When determining the appropriate combination of stock options and restricted stock, our goal is to weigh the cost of these grants with their potential benefits as a compensation tool. We believe that providing combined grants of stock options and restricted stock effectively balances our objective of focusing the Named Executives on delivering long-term value to our stockholders, with our objective of providing value to the executives with the equity awards. Stock options only have value to the extent the price of Medical Action stock on the date of the exercise exceeds the exercise price on grant date, and thus are an effective compensation element only if the stock price grows over the term of the award. In this sense, stock options are a motivational tool. Unlike stock options, restricted stock offer executives the opportunity to receive shares of Medical Action stock on the date the restriction lapses. In this regard, restricted stock serve both to reward and retain executives, as the value of the restricted stock is linked to the price of Medical Action stock on the date the restricted stock vests. In order to better balance upside potential with volatility, we have determined that the total number of shares of Medical Action stock awarded should be divided equally between stock options and restricted stock, with stock options converting to restricted stock on a 4-to-1 basis.

Other then Mr. Losada, none of the Named Executive Officers received grants of restricted stock awards in fiscal 2007. Mr. Losada’s grant was in accordance with his offer letter of employment in August 2004. The restricted stock granted to Mr. Losada becomes exercisable in four equal annual installments beginning two years after the grant date. We believe that this vesting schedule aids the Company in retaining executives and motivating longer-term performance. Under the terms of the Company’s long-term incentive plan, unvested stock options and restrict stock are forfeited if the executive voluntarily leaves Medical Action.

Other elements

LTPA. Beginning in fiscal 2008, contingent long-term performance awards will be granted every three years to our senior executive officers and other select leaders. These awards provide a strong incentive for achieving specified financial performance goals that the Company considers to be consistent with our business strategy and important contributors to long-term shareholder value. While the plan under which these awards are granted allows for them to be settled in stock, we believe paying these awards in cash appropriately balances the cash and equity components of long-term compensation opportunities and is an excellent way to reward the attainment of these performance objectives. These long-term performance awards also encourage retention as they are subject to forfeiture if the executive’s employment terminates for any reason other than death, disability or retirement before the end of the performance period.

20

Contingent long-term performance awards will be payable in 2010 if the Company achieves, on an overall basis for the three fiscal years ending 2008-2010, specified goals based on four equally weighted business measurements. These business measurements are: (a) average earnings per share growth rate; (b) average revenue growth rate; (c) cumulative return on total capital; and (d) cumulative cash flow from operating activities. The Compensation Committee adopted these performance goals because we believe they are key indicators of our financial and operational success and are key drivers of long-term stockholder value. Measurement of business results against the goals is adjusted to exclude the effect of pension costs on income as well as to account for the effects of unusual events.

Awards will be paid based on achieving threshold, target or maximum levels for any of the four measurements. For example, the Named Executives will receive only one-quarter of the threshold payment if the Company, at the end of the three-year period, satisfies only a single threshold goal for a single measurement. We set the goals at levels that reflected our internal, confidential business plan at the time the awards were established. The awards will be based on a multiple of the Name Executive Officers base salary in effect in April 2008. The potential payment in 2010 as a multiple of salary and bonus, for each Named Executive Officer, will be .50X at threshold, .75X at target and 1.00X at maximum.

Deferred Compensation. Beginning in fiscal 2009, the Company will allow executives to defer up to 100% of their annual bonus. Under this plan, payouts will commence following termination of employment. As no “above-market” rates are earned on any of the deferred bonus, earnings on those deferrals are not shown in the Summary Compensation Table. The amounts deferred will be unfunded and unsecured obligations of the Company, receive no preferential standing, and are subject to the same risks as any of the Company’s other general obligations.