UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ____)

Filed by the Registrant /X/

Filed by a Party other than the Registrant / /

Check the appropriate box:

/X/ Preliminary Proxy Statement

/ / Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

/ / Definitive Proxy Statement

/ / Definitive Additional Materials

/ / Soliciting Materials Pursuant to Rule 14a-11(c) or Rule 14a-12

Maxus Realty Trust, Inc.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/X/ No Fee required

/ / Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

/ / Fee paid previously with preliminary materials.

/ / Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Maxus Realty Trust, Inc.

104 Armour Road

North Kansas City, Missouri 64116

April [___], 2006

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders to be held at 10:00 A.M. on May 9, 2006, in the 24th Floor Conference Room at 2345 Grand Boulevard, Suite 2400, Kansas City, Missouri. Information regarding business to be conducted at the meeting is set forth in the accompanying Notice of Annual Meeting and Proxy Statement.

The Board of Trustees of Maxus Realty Trust, Inc. (the “Trust”) is asking you to consider and vote on the proposals contained in the enclosed Proxy Statement. In addition to the election of trustees, the Board is recommending:

| · | an amendment to the Trust’s bylaws to not require that the annual meeting of shareholders be held on the second Tuesday in May of each year at 10:00 a.m., but to allow the Trust’s Board of Trustees the flexibility to determine such other date and time in May as may be determined in advance by the Board of Trustees |

| · | the Annual Meeting be adjourned to May [__], 2006 |

The accompanying Proxy Statement, which you are urged to read carefully, provides detailed information concerning the election of trustees.

We cannot stress enough the importance of the vote of every shareholder, regardless of the number of shares owned. Therefore, even if you are planning to attend the meeting, we urge you to complete and return the enclosed proxy to ensure that your shares will be represented. A postage-paid envelope is enclosed for your convenience. Should you later decide to attend the meeting, you may revoke your proxy at any time and vote your shares personally at the meeting.

We look forward to seeing many shareholders at the meeting.

Sincerely,

David L. Johnson

Chairman of the Board,

President and

Chief Executive Officer

MAXUS REALTY TRUST, INC.

104 ARMOUR ROAD

NORTH KANSAS CITY, MISSOURI 64116

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 9, 2006

To the Shareholders of

Maxus Realty Trust, Inc.:

You are hereby notified that the Annual Meeting of Shareholders of Maxus Realty Trust, Inc. (the “Trust”) will be held at 10:00 A.M. on May 9, 2006, in the 24th Floor Conference Room at 2345 Grand Boulevard, Suite 2400, Kansas City, Missouri, for the following purposes:

| | 1. | To elect seven trustees to hold office until the next Annual Meeting of Shareholders and until their successors are elected and qualify. |

| | 2. | To consider and vote on a proposal to amend Section 7.2(a) of the Trust's Bylaws to not require that the annual meeting of shareholders be held on the second Tuesday in May of each year at 10:00 o'clock a.m., but to allow the Trust's Board of Trustees the flexibility to determine such other date and time as may be determined in advance by the Board of Trustees. |

| | 3. | To consider and vote on a proposal to adjourn the Annual Meeting of Shareholders to May [__], 2006 to allow certain executive officers and members of the Board of Trustees to attend the Annual Meeting and to allow for additional solicitation of shareholder proxies or votes. If this proposal is approved, the other proposals will not be voted on until such later date. |

| | 4. | To consider and act on such other business as may properly come before the meeting or any adjournment thereof. |

The Trust’s Board of Trustees has fixed the close of business on March 20, 2006, as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting.

BY ORDER OF THE BOARD OF TRUSTEES

DeAnn Duffield, Secretary

April [__], 2006

North Kansas City, Missouri

MAXUS REALTY TRUST, INC.

104 ARMOUR ROAD

NORTH KANSAS CITY, MISSOURI 64116

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 9, 2006

The Board of Trustees of Maxus Realty Trust, Inc. (the “Trust”) is soliciting the enclosed proxy for its use at the Annual Meeting of Shareholders to be held at 10:00 A.M. on May 9, 2006, in the 24th Floor Conference Room at 2345 Grand Boulevard, Suite 2400, Kansas City, Missouri, or any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The Board is first mailing this Proxy Statement and the enclosed form of proxy on or about April [__], 2006.

Introduction

In addition to asking you to vote on nominees to the Board of Trustees, the Board of Trustees is proposing an amendment to the Trust’s Bylaws that will allow the Board of Trustees to designate the date and time of the annual meeting of shareholders. The Trust's Bylaws currently require that the annual meeting of the shareholders be held on the second Tuesday in May of each year at 10:00 a.m. These proposals are described in the accompanying Notice of Annual Meeting under Proposals 2 and 3. The Board of Trustees is also proposing that the Annual Meeting of Shareholders this year be adjourned until May [___], 2006 at 10:00 A.M. to allow certain executive officers and members of the Board of Trustees to attend the Annual Meeting.

If Proposal 2 is adopted, the Board of Trustees will have the flexibility to designate a date and time in May for the annual meeting of shareholders other than the second Tuesday in May of each year at 10:00 a.m. Currently, the Trust’s Bylaws require that the annual meeting of shareholders be held on the second Tuesday in May of each year at 10:00 a.m.

If Proposal 3 is adopted, the Board of Trustees will adjourn the 2006 Annual Meeting of Shareholders until May [___], 2006 and the other proposals will not be voted on until such later date.

Record Date

The Board of Trustees has fixed the close of business on March 20, 2006, as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting. On March 1, 2006, there were issued and outstanding and entitled to vote 1,401,680 shares of the Trust’s common stock, par value $1.00 per share. The presence in person or by proxy of the holders of record of a majority of the shares of Trust common stock entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business at the meeting.

Proxies

If you sign and return the enclosed proxy card, the proxies named therein will vote the shares which the proxy represents in accordance with the specifications thereon. If you do not indicate the manner in which you want your shares voted on the proxy card, the proxies will vote them for (i) the nominees for Trustees named herein, (ii) the proposed amendment to the Trust’s Bylaws and (iii) the adjournment of the Annual Meeting until May [___], 2006. If you are a participant in the Trust’s First Amended Optional Stock Dividend Plan (formerly the Dividend Reinvestment Plan), the proxy card represents the number of full shares in your optional stock dividend plan account, as well as shares registered in your name.

You may revoke your proxy at any time before it is voted by (i) delivering to the Secretary of the Trust written notice of revocation bearing a later date than the proxy, (ii) submitting a later dated proxy, or (iii) revoking the proxy and voting in person at the Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy. Any written notice revoking a proxy should be sent to DeAnn M. Duffield, Secretary, Maxus Realty Trust, Inc., 104 Armour, North Kansas City, Missouri 64116.

Voting

Shareholders are entitled to one vote per share on all matters, except for the election of Trustees, as to which cumulative voting applies. Under cumulative voting, each shareholder is entitled to cast that number of votes equal to the number of shares held by the shareholder multiplied by the number of Trustees to be elected, and all of such votes may be cast for a single Trustee or may be distributed among the nominees as the shareholder wishes. If you want to cumulate your votes, you should mark the accompanying proxy card to clearly indicate how you want to exercise the right to cumulate votes and specify how you want votes allocated among the nominees for Trustees. For example, you may write “cumulate” on the proxy card and write next to the name of the nominee or nominees for whom you desire to cast votes the number of votes to be cast for such nominee or nominees. Alternatively, without exercising your right to vote cumulatively, you may instruct the proxy holders not to vote for one or more of the nominees by marking on the proxy card “For All Except” and filling in the circle next to each nominee you wish to withhold your vote. By not marking the proxy card with respect to the election of Trustees to indicate how you want votes allocated among the nominees, you will be granting authority to the persons named in the proxy card to cumulate votes if they choose to do so and to allocate votes among the nominees in such a manner as they determine is necessary in order to elect all or as many of the nominees as possible.

Trustees must be elected by a plurality vote. To be elected, a nominee must be one of the seven candidates who receives the most votes out of all votes cast at the Annual Meeting. The affirmative vote of a majority of the issued and outstanding shares of the Trust is required to adopt the matter described in Proposal 2. The affirmative vote of the holders of a majority of the shares which are present in person or represented by proxy at the Annual Meeting is required to adjourn the Annual Meeting or to act on any other matters properly brought before the Meeting.

Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. If you indicate “abstain” or “withheld”

on a matter, your shares will be deemed present for that matter. In tabulating votes cast on the proposal to amend the Bylaws (Proposal 2), abstentions and broker non-votes will have the same effect as a negative vote. In tabulating votes cast on the election of Trustees, broker non-votes are not counted for purposes of determining the Trustees who have been elected. Shares withheld will have no impact on the election of Trustees except to the extent that (i) the failure to vote for an individual nominee results in another nominee receiving a larger proportion of the vote and (ii) withholding authority to vote for all nominees has the effect of abstaining from voting for any nominee. In tabulating votes on other matters, abstentions will have the effect of a negative vote and broker non-votes will not be counted for purposes of determining whether a proposal has been approved.

Discretionary Authority

By executing a proxy, you will be giving the proxies discretionary authority to vote your shares on any other business that may properly come before the meeting and any adjournment thereof as to which the Trust did not have notice a reasonable time prior to the date of mailing this proxy statement. The Board of Trustees is not aware of any such other business and does not itself intend to present any such other business. However, if such other business does come before the meeting, shares represented by proxies will be voted by the persons named in the proxy in accordance with their best judgment. A proxy also confers discretionary authority on the persons named therein to approve minutes of the last Annual Meeting of Shareholders, to vote on matters incident to the conduct of the meeting and to vote on the election of any person as a Trustee if a nominee herein named should decline or become unable to serve as a Trustee for any reason.

Costs of Solicitation

The Trust will pay all costs of preparing and soliciting proxies for the Annual Meeting. In addition to solicitation by mail, officers and Trustees of the Trust may solicit proxies from shareholders personally, or by telephone. The Trust will also reimburse brokerage firms, banks and other nominees for their reasonable costs incurred in forwarding proxy materials for shares held of record by them to the beneficial owners of such shares.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Proxy Statement constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this Proxy Statement, the words “estimate,” “project,” “anticipate,” “expect,” “intend,” “believe” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance and achievements of the Trust, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among other things, the following factors, as well as those factors discussed elsewhere in the Trust’s filings with the Commission: competition, inflation, the ability to retain tenants, general economic, business, market and social conditions, trends in the real estate investment market, projected leasing and sales, future prospects for the Trust and other factors referred to in this Proxy Statement.

PROPOSAL 1

ELECTION OF TRUSTEES

The Board of Trustees proposes the election of the seven nominees listed below to serve as Trustees of the Trust until the next Annual Meeting of Shareholders and until their successors have been elected and qualify, or until their earlier death, resignation or removal. If any vacancy in the list of nominees shall occur for any reason, the Board of Trustees will select a substitute nominee to be voted upon at the Annual Meeting.

The following is a brief summary of the business experience during the past five years of each of the nominees for election as Trustees of the Trust, including, where applicable, information regarding other directorships held by each nominee:

Mr. David L. Johnson, age 49, has served as a Trustee, Chairman of the Board, President and Chief Executive Officer of the Trust since May 11, 2004. He also served as Trustee from November 27, 1999 until May 13, 2003. He also served as Chief Executive Officer from November 27, 1999 until January 25, 2002. Mr. Johnson is also Chairman of Maxus Properties, Inc. (“Maxus”), a Missouri corporation located at 104 Armour Road, North Kansas City, Missouri 64116 that specializes in commercial property management for affiliated owners. Maxus employs more than 220 people to manage 43 commercial properties, including more than 7,000 apartment units and approximately 400,000 square feet of retail and office space. He has served as Chairman of Maxus since its inception in 1988. Mr. Johnson is also on the Board of Directors of Maxus Capital Corp.

Mr. Danley K. Sheldon, age 47, has served as a Trustee since January 25, 2002. He was formerly the Trust's President and Chief Executive Officer from January 2002 until May 2004. Mr. Sheldon also was formerly the Chief Executive Officer of Maxus from May 2002 until September 2003. Prior to joining Maxus, Mr. Sheldon held various positions with Ferrellgas Partners, L.P., a New York Stock Exchange listed company (NYSE:FGP) including at various times the positions of Chief Financial Officer, President and Chief Executive Officer. Mr. Sheldon currently serves as a member of the board of directors of Blue Cross Blue Shield of Kansas City (where he chairs its audit committee) and the board of directors of The Greater Kansas City Community Foundation (where he chairs its finance committee, is a member of its management committee and is Treasurer). Mr. Sheldon is also on the Board of Directors of Maxus Capital Corp., the managing general partner of Maxus Real Property Investors-Four, L.P., a Missouri limited partnership that is a public reporting company. Mr. Sheldon is presently CEO of Briarcliff Investors, LLC, a private investment company.

Mr. Monte McDowell, age 48, has served as a Trustee since November 9, 1999. He is President, Chief Executive Officer and principal shareholder of McDowell Holdings, Inc., a Missouri corporation that is a diversified holding company with interests in the outdoor sports industry and wholesale pharmaceutical distribution. Previously, Mr. McDowell was President, Chief Executive Officer and principal shareholder of Home Medical Specialty Equipment, Inc., a Missouri corporation doing business as MED4HOME, involving capital equipment medical sales.

Mr. Christopher J. Garlich, age 48, has served as a Trustee since November 27, 1999. He is the Executive Vice President and member of Bancorp Services, LLC, a Missouri limited liability company, specializing in the development, administration and distribution of life insurance products to the corporate and high net worth market place. Mr. Garlich, through a wholly-owned trust, is also the majority shareholder of Maxus.

Mr. W. Robert Kohorst, age 53, has served as a Trustee since May 15, 2002. He is President, founding shareholder and majority owner of Everest Properties, LLC (“Everest”), which specializes in real estate and related investments, which operates through subsidiaries and affiliates.

Mr. Jose L. Evans, age 42, has served as a Trustee since May 13, 2003. He is President and sole owner of Assured Quality Title Trust, a real estate title insurance agency and escrow company.

Mr. Kevan D. Acord, age 47, has served as a Trustee since May 11, 2004. He is an attorney and certified public accountant in private practice in Lenexa, Kansas. He is the sole shareholder of Kevan D. Acord, P.A., a Lenexa, Kansas, based law firm specializing in the areas of federal and state income taxation, corporation law, and merger and acquisitions law. Mr. Acord is also the Managing Partner of Acord Cox & Trust, a full-service Lenexa, Kansas based certified public accounting firm. Prior to forming his own law and accounting firm in 1992, Mr. Acord was a Senior Tax Manager with the international accounting firm of Deloitte & Touche.

Each of Messrs. McDowell, Kohorst, Evans, Sheldon and Acord are Independent Trustees as defined in the Trust’s Bylaws. The Board has determined that each of the trustees currently slated for re-election is independent within the meaning of the National Association of Securities Dealers (“NASD”) listing standards, Rule 4200(a)(15), with the exception of (i) Mr. Sheldon, the former President and Chief Executive Officer of the Trust, (ii) Mr. Garlich, a majority shareholder of Maxus and (iii) Mr. Johnson, the Chairman of Maxus.

The Board of Trustees Recommends a Vote For The Above Nominees For Trustees of The Trust.

Communicating with the Board of Trustees

Shareholders may communicate with the Board of Trustees, its committees or any member of the Board of Trustees by sending a letter in care of the Trust’s Corporate Secretary at 104 Armour Boulevard, North Kansas City, Missouri 64116. The Board of Trustees’ policy is to have all shareholder communications compiled by the Corporate Secretary and forwarded directly to the Board, the committee or the trustee as indicated in the letter. All letters will be forwarded to the appropriate party. The Board of Trustees reserves the right to revise this policy in the event that this process is abused, becomes unworkable or otherwise does not efficiently serve the purpose of the policy.

Meetings and Committees of the Board

Among the standing committees of the Board of Trustees are the Executive Committee, the Audit Committee and the Nominating Committee. The Trust does not have a standing compensation committee.

The Executive Committee

The Executive Committee is comprised of David L. Johnson, W. Robert Kohorst, and Monte McDowell. The Executive Committee is empowered to exercise, between regular meetings of the Board of Trustees, all of the authority of the Board of Trustees in the management of the Trust.

The Audit Committee

The Audit Committee represents the Board of Trustees in overseeing the Trust’s accounting and financial reporting processes and financial statement audits. The Audit Committee also reviews the implementation of the Trust’s code of conduct. In this regard, the Audit Committee assists the Board of Trustees by reviewing the financial information disclosure, the internal controls established by management and the internal and external audit process. The Audit Committee currently consists of Messrs. Kohorst (Chairman), Acord and Evans. The Audit Committee has been established in accordance with Securities and Exchange Commission rules and regulations, and all the members of the Audit Committee are independent as independence for audit committee members is defined under Rule 4200(a)(15) of the NASD listing standards. The Board of Trustees has determined that Mr. W. Robert Kohorst, the Audit Committee Chairman, qualifies as an “audit committee financial expert” within the meaning of Securities and Exchange Commission rules and regulations. In February 2004, the Board amended the Audit Committee charter to include additional requirements related to the Sarbanes-Oxley Act of 2002 and NASD listing standards. The Audit Committee Charter as amended and adopted on February 11, 2004, was included as Appendix A to the Trust’s proxy statement for 2004 filed with the Securities and Exchange Commission on March 15, 2004.

The information in or referred to in the foregoing paragraph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Trust specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The Nominating Committee

The Board of Trustees established a nominating committee and adopted a charter for the committee at its annual meeting on May 11, 2004, after the Annual Meeting of the Shareholders. The Nominating Committee Charter as adopted on May 11, 2004 was included as Appendix A to the Trust’s proxy statement for 2005 filed with the Securities and Exchange Commission on March 11, 2005. The Nominating Committee consists of Messrs. Acord, Evans and McDowell, each of whom is independent within the meaning of NASD’s listing standards. The Nominating Committee’s purpose is to identify and recommend individuals to the Board for nomination as members of the Board.

Trustee Nomination Process

Effective January 11, 2005, the Nominating Committee adopted certain policies and procedures applicable to the nominating committee process. The policies and procedures provide that the Nominating Committee should consider the following criteria in selecting nominees:

| · | financial, regulatory and business experience; |

| · | familiarity with and participation in the local community; |

| · | integrity, honesty and reputation; |

| · | dedication to the Trust and its shareholders; independence; and |

| · | any other factors the Nominating Committee deems relevant, including diversity, size of the Board of Trustees and regulatory disclosure obligations. |

The policies and procedures adopted by the Nominating Committee include the process for identifying and evaluating nominees. For purposes of identifying nominees for the Board of Trustees, the Nominating Committee should rely on their personal contacts and other members of the Board of Trustees. The Nominating Committee will also consider trustee candidates recommended by shareholders as described below.

In evaluating potential nominees, the Nominating Committee is to determine whether the nominee is eligible and qualified for service on the Board of Trustees by evaluating the candidate under the selection criteria set forth above. In addition, the Nominating Committee is to conduct a check of the individual’s background and interview the candidate. The Nominating Committee may in its sole discretion require candidates (including a shareholder recommended candidate) to complete a form of questionnaire similar to questionnaires completed by trustee nominees prior to filing the Trust’s proxy statement.

The trustee nominees named in this proxy statement were recommended to the Board by the Nominating Committee.

Procedures Regarding Trustee Candidates Recommended By Shareholders

Under the policies and procedures adopted by the Nominating Committee, the Nominating Committee will also consider shareholder recommendations of qualified nominees when such recommendations are submitted in accordance with the procedures below. In order to have a nominee considered by the Nominating Committee for election at the 2007 annual meeting, a shareholder must submit its recommendation in writing to the attention of the Trust’s Corporate Secretary at 104 Armour Boulevard, North Kansas City 64116 not later than November [___] 2006. Any such recommendation must include:

| · | the name of the person recommended as a trustee candidate; |

| · | all information relating to such person that is required to be disclosed in solicitations of proxies for election of trustees pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| · | the written consent of the person being recommended as a trustee candidate to being named in the proxy statement as a nominee and to serving as a trustee if elected; |

| · | with regard to the shareholder making the recommendation, the shareholder’s name and address as they appear on the Trust’s records; provided, however, that if the shareholder is not a registered holder of the Trust’s common stock, the shareholder must submit his or her name and address along with a current written statement from the record holder of the shares that reflects such shareholder’s beneficial ownership of the Trust’s common stock and the record holder’s name and address as they appear on the Trust’s records; and |

| · | a statement disclosing whether such shareholder is acting with or on behalf of any other person, entity or group and, if applicable, the identity of such person, entity or group. |

Once the Nominating Committee receives the recommendation, the Nominating Committee will deliver to the candidate a questionnaire that requests additional information about the candidate’s independence, qualifications and other matters that will assist the Nominating Committee in evaluating the candidate, as well as certain information that must be disclosed about the candidate in our proxy statement or other regulatory filings, if nominated. Candidates must complete and return the questionnaire within the time frame provided to be considered for nomination by the Nominating Committee.

Attendance at Meetings

From January 1, 2005 to December 31, 2005, the Board of Trustees met nine (9) times, the Audit Committee met six (6) times and the Nominating Committee met one (1) time. All of the incumbent Trustees attended seventy-five percent or more of all of the meetings of the Board of Trustees and meetings held by those committees of the Board on which they served, except Monte McDowell who attended fewer than seventy-five percent of the Board of Trustee meetings. The Executive Committee did not meet during 2005.

Each year the Annual Meeting of Shareholders is held on the same day as the Annual Meeting of the Board of Trustees. Although there is no policy requiring Board members to attend the Annual Meeting of the Shareholders, all Board members usually attend both the Annual Meeting of Shareholders and the Annual Meeting of the Board of Trustees. All Board members attended the 2005 Annual Meeting of Shareholders either in person or by telephone.

Audit Committee Report

The Audit Committee has reviewed and discussed with management the audited financial statements for the year ended December 31, 2005; has discussed with the independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU § 380), as modified or supplemented; has received the written disclosures and letter from the independent auditors required by Independence Standards Board Standard No. 1, as may be modified or supplemented; and has discussed with the independent auditors the auditors’ independence. Based on such review and discussions, the Audit Committee has recommended to the Board of Trustees that the audited financial statements for the year ended

December 31, 2005, be included in the Trust’s Annual Report on Form 10-KSB for filing with the Securities and Exchange Commission.

This report was made over the name of each member of the Audit Committee on March 23, 2006, namely Jose L. Evans, Kevan D. Acord and W. Robert Kohorst.

The information in the foregoing two paragraphs shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Trust specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Audit Fees

The aggregate fees billed the Trust by KPMG LLP for professional services rendered for the audit of the Trust’s annual financial statements for the years ended December 31, 2004 and December 31, 2005, and the review of the financial statements included in the Trust’s reports on Form 8-K and Form 10-QSB during the years 2004 and 2005 were $70,350 and $114,800, respectively.

Audit-Related Fees

KPMG LLP did not bill any fees to the Trust for assurance and related services that are reasonably related to the performance of the audit or review of the Trust’s financial statements and that are not reported under the preceding caption for the years ended December 31, 2004 and December 31, 2005.

Tax Fees

The aggregate fees billed to the Trust for professional services rendered by KPMG LLP for tax compliance, tax advice and tax planning for the year ended December 31, 2004 were $30,335. These fees for the year ended December 31, 2004 relate to services performed with regard to federal and state tax compliance, fixed asset depreciation analysis, information reporting consultation, distribution characterization analysis and general miscellaneous tax consulting. KPMG LLP did not bill any fees to the Trust for any tax compliance, tax advice or tax planning during the year ended December 31, 2005.

All Other Fees

KPMG LLP did not bill any fees to the Trust for any services other than those described under the preceding three captions during the years ended December 31, 2004 and December 31, 2005.

Audit Committee’s Pre-Approval Policies

The Audit Committee’s policy is to pre-approve all audit services and all permitted non-audit services (including the fees and terms thereof) to be provided by the Trust’s independent auditor; provided, however, pre-approval requirements for non-audit services are not required if

all such services (1) do not aggregate to more than five percent of total revenues paid by the Trust to its accountant in the fiscal year when services are provided; (2) were not recognized as non-audit services at the time of the engagement; and (3) are promptly brought to the attention of the Audit Committee and approved prior to the completion of the audit by the Audit Committee.

All of KPMG’s fees in 2004 and 2005 described above were approved in advance by the Audit Committee except for the fees associated with the accounting of the impairment due to the destruction caused by Hurricane Katrina, which represented 17% of KPMG's aggregate fees.

Trustees’ Compensation

Pursuant to the Trust’s Bylaws, the Trust’s officers who serve as Trustees do not receive compensation for their services as Trustees.

The Trust pays Independent Trustees the following fees: (a) $900 annual fee, (b) $450 for each meeting attended in person and (c) $225 for each meeting attended by telephone conference at which a vote was taken. In addition, the Trust reimburses the Independent Trustees for their travel expenses and other out-of-pocket expenses incurred in connection with attending meetings and carrying on the Trust’s business.

There are no family relationships between any of the Trustees or executive officers.

Executive Officers

| | | | | | POSITIONS OR OFFICES |

| | NAME | | AGE | | WITH THE TRUST |

| | | | | | |

| | David L. Johnson(1) | | 49 | | Chairman of the Board, President, |

| | | | | | Chief Executive Officer and Trustee |

| | | | | | |

| | John W. Alvey | | 47 | | Vice President and Chief Financial |

| | | | | | and Accounting Officer |

Mr. John W. Alvey has served as Vice President and Chief Financial and Accounting Officer since November 1999. He served as a Trustee from September 19, 2000 until May 15, 2002. He is also Executive Vice President and Chief Financial Officer of Maxus. He has served in these capacities since 1988. Mr. Alvey is also on the Board of Directors of Maxus Capital Corp., the managing general partner of Maxus Real Property Investors-Four, L.P., a Missouri limited partnership that is a public reporting company.

(1) Mr. Johnson became Chairman of the Board, President and Chief Executive Officer on May 11, 2004. Prior to such date, Mr. Danley K. Sheldon served in such capacities. For biographical information on Messrs. Johnson and Sheldon, see “ELECTION OF TRUSTEES.”

Executive Compensation

No person serving as executive officer as of the end of or during 2005 or 2004 received salary and bonuses exceeding $100,000. None of the Trust’s executive officers are compensated by the Trust for their services.

Related Transactions

The Trust has entered into an agreement with Maxus to manage the Trust’s properties. David L. Johnson, Chairman, President, Chief Executive Officer and a Trustee of the Trust, is the Chairman of Maxus. Christopher J. Garlich, a current Trustee, through a wholly-owned trust, is the majority shareholder of Maxus, and Mr. Johnson and his wife own approximately 13.7% of the outstanding stock of Maxus. John W. Alvey is also an executive officer of Maxus. Management fees of $317,000 and $391,000 payable to Maxus have been incurred for the years ended December 31, 2004 and December 31, 2005, respectively. The management fees the Trust pays Maxus for the management of the properties held by the Trust range from 4.5% to 5% of the monthly gross receipts from the operation of each of the properties held by the Trust. In addition, certain Maxus employees are located at the Trust’s properties and perform leasing, maintenance, office management and other related services for these properties. The Trust recognized $891,000 and $978,000 of such payroll costs for the years ended December 31, 2004 and December 31, 2005, respectively, that have been or will be reimbursed to Maxus by the Trust.

On July 1, 2005, the Trust, through one of the Trust’s subsidiaries, acquired The Bicycle Club Apartments pursuant to a merger transaction with Secured Investment Resources Fund, L.P. III (“SIR III”). David L. Johnson, Chairman, Chief Executive Officer and President of the Trust, is also the beneficial owner of more than 10% of the Trust’s issued and outstanding common stock, and the principal owner and President of Nichols Resources, Ltd., the general partner of SIR III. Mr. Johnson, together with his wife, jointly own approximately 85% of Bond Purchase, L.L.C. (“Bond Purchase”), a 7.81% limited partner in SIR III and the sole owner of SIR III’s general partner. Mr. Johnson is also an affiliate of Paco Development, L.L.C. (“Paco”), which was a 2.43% limited partner in SIR III. Monte McDowell, Bob Kohorst and Chris Carlich, each of whom are trustees of the Trust, were the beneficial owners of 20.3%, 8.0% and 6.5%, respectively, of SIR III’s limited partnership units. The total consideration paid by the Trust to acquire the property was $3,267,000. In connection with the merger, the Trust issued 35,884 of operating units of Maxus Operating Limited Partnership (“MOLP”), the Trust’s operating limited partnership, valued at $502,000 and made cash payments totaling $2,765,000. The operating units are convertible into shares of the Trust’s common stock (currently on a one unit for one share basis) or cash, at the Trust’s election. Bond Purchase and Paco received approximately 30,811 operating units of MOLP in connection with the consummation of the merger transaction.

Report of the Independent Trustees

The Trust does not have a compensation committee responsible for establishing an executive compensation policy and plan for the Trust. In the place of such a compensation committee, the Independent Trustees are responsible for establishing the executive compensation

policies. The Independent Trustees review and approve all compensation plans, benefit programs and perquisites for executives.

The Independent Trustees have determined not to pay the executive officers a salary or enter into employment agreements with the executive officers because the executive officers (i) are already significant shareholders of the Trust and (ii) are affiliates of the management company hired by the Trust to manage the properties held by the Trust. The Independent Trustees review this compensation policy on an annual basis.

This report was made over the name of each of the Independent Trustees: Monte McDowell, Kevan D. Acord, W. Robert Kohorst, Danley K. Sheldon and Jose L. Evans.

Performance Graph

The following performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Trust specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The following performance graph shows a five-year comparison of cumulative total returns (change in stock price plus reinvested dividends) for Maxus Realty Trust, Inc. (“MRTI”), the Total Return Index for The NASDAQ Stock Market (U.S.) (“NASDAQ”) and the National Association of Real Estate Investment Trusts (“NAREIT”) Total Return Index.

Comparison Of Five-Year Cumulative Total Return Among

Maxus Realty Trust, the Total Return Index for The Nasdaq Stock Market (U.S.) and NAREIT

Composite Return Index

Assumes $100 invested on December 31, 2000 in Maxus Realty Trust, Inc.

Common Stock, NASDAQ Stock Market (U.S.) and NAREIT Composite Index

| | December 31, |

| | 2001 | 2002 | 2003 | 2004 | 2005 |

| NASDAQ | 79.32 | 54.84 | 81.99 | 89.22 | 91.12 |

| NAREIT | 115.50 | 121.53 | 168.27 | 219.44 | 237.63 |

| MRTI | 185.80 | 168.45 | 194.28 | 278.92 | 294.64 |

PROPOSAL 2

PROPOSAL TO ALLOW THE TRUST'S BOARD OF TRUSTEES

TO DESIGNATE A DATE AND TIME OTHER THAN THE

SECOND TUESDAY IN MAY AT 10:00 A.M. AS THE

ANNUAL MEETING OF SHAREHOLDERS

The proposed amendment to Section 7.2(a) of the Trust’s Bylaws attached as Appendix B to this proxy statement will allow the Board of Trustees to designate a date and time in May other than the second Tuesday in May at 10:00 a.m. as the annual meeting of the shareholders. The following summary does not purport to be complete and is qualified in its entirety by reference to the proposed amendment to Section 7.2(a) of the Bylaws as set forth in Appendix B.

Section 7.2(a) of the Trust’s Bylaws currently require that the annual meeting of the shareholders be held on the second Tuesday in May each year at 10:00 a.m. The Board of Trustees would like the flexibility to designate in advance another date and time in May as the annual meeting of the shareholders. If the amendment is adopted, the Trust's Board of Trustees may determine each year to designate another date and time in May to hold the annual meeting of shareholders. The Board believes that this amendment is in the best interests of the Trust because it will give the Trust flexibility in determining the date and time of the annual meeting.

The Board of Trustees Recommends a Vote for the above described Amendment to the Trust’s Bylaws.

PROPOSAL 3

PROPOSAL TO APPROVE ANY ADJOURNMENT

OF THE ANNUAL MEETING

A vote (i) in person by a shareholder for adjournment of the Annual Meeting of Shareholders or (ii) for Proposal 3 on the proxy card authorizing the named proxies on the proxy card to vote the shares covered by such proxy to adjourn the Annual Meeting of Shareholders until May [___], 2006 at 10:00 A.M. to allow certain executive officers and members of the Board of Trustees to attend the Annual Meeting and to allow for additional solicitation of shareholder proxies or votes. Consequently, it is not likely to be in the interest of shareholders who intend to vote against Proposal 2 to vote in person to adjourn the Annual Meeting of Shareholders or to vote for Proposal 3 on the proxy card.

The Board of Trustees Recommends a Vote For the Proposal to Adjourn The Annual Meeting until May [__], 2006 at 10:00 A.M.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth information as of March 1, 2006, regarding the number of shares of the Trust beneficially owned by each of the Trustees, nominees for Trustee and executive officers of the Trust, by any other person, if any, known to own 5% or more of the Trust’s outstanding shares and by all current Trustees, nominees for Trustees and executive officers as a group:

Name of Beneficial Owner(1) | Number of Shares Beneficially Owned (2) | Percent of Class (3) |

| David L. Johnson | 192,373 (4) | 13.7 | |

| John W. Alvey | 55,881 (5) | 4.0 | |

| Christopher J. Garlich | 77,482 (6) | 5.5 | |

| Monte McDowell | 22,584 (7) | 1.6 | |

| Danley K. Sheldon | 20,000 (8) | 1.4 | |

| W. Robert Kohorst | 38,811 (9) | 2.7 | |

| Kevan D. Acord | 58,505 (10) | 4.2 | |

| Jose L. Evans | 29,676 | 2.1 | |

| | | | |

Mercury Real Estate Advisors LLC 100 Field Point Road Greenwich, CT 06830 | 97,998 (11) | 7.0 | |

| | | | |

Mercury Special Situations Fund LP 100 Field Point Road Greenwich, CT 06830 | 80,656 (11) | 5.8 | |

| | | | |

Malcolm F. MacLean IV 100 Field Point Road Greenwich, CT 06830 | 97,998 (11) | 7.0 | |

| | | | |

David R. Jarvis 100 Field Point Road Greenwich, CT 06830 | 97,998 (11) | 7.0 | |

| | | | |

MacKenzie Patterson Fuller, Inc. (12) 1640 School Street Moraga, CA 94556 | 100,000 (12) | 7.1 | |

| | | | |

Trustees and Executive Officers as a Group | 490,437 | 35.0 | |

| (1) | Each of the named beneficial owners other than Mercury Real Estate Advisors LLC may be reached at the Trust’s executive offices: c/o Maxus Realty Trust, 104 Armour Boulevard, North Kansas City, Missouri 64116. |

| (2) | Under the rules of the Securities and Exchange Commission, persons who have power to vote or dispose of securities, either alone or jointly with others, are deemed to be the beneficial owners of such securities. Except as described in the footnotes below, the Trustee has both sole voting power and sole investment power with respect to the shares set forth in the table. |

| (3) | An asterisk indicates that the number of shares beneficially owned do not exceed one percent of the number of shares of common stock issued and outstanding. |

| (4) | Includes: (i) 151,491 shares held by Mr. Johnson and his wife as joint tenants with right of survivorship, (ii) 150 shares held in an individual retirement account for Mr. Johnson’s benefit, (iii) 300 shares held by his minor son and daughter and (iv) 40,432 units of Maxus Operating Limited Partnership (“MOLP”), the Trust’s operating limited partnership, which are currently convertible into 40,432 shares of the Trust’s common stock. Does not include (i) 49,946 shares pledged as collateral to Sunset Plaza Realty Partners, L.P. (“Sunset”), a limited partnership in which Mr. Johnson and his wife indirectly are the principal equity interest holders, to secure loans made by Sunset and (ii) 37,881 shares pledged as collateral to Bond Purchase, L.L.C. (“Bond Purchase”), a limited liability company in which Mr. Johnson and his wife are the majority equity interest holders, to secure a loan to NKC Associates, L.L.C. (as described in note (5) below). |

| (5) | Includes shared voting and dispositive power of the 37,881 shares held by NKC Associates, L.L.C., a Missouri limited liability company (“NKC”), in which Mr. Alvey holds a 22.5% equity interest. NKC acquired these shares with funds from a demand loan made by Bond Purchase, L.L.C., a Missouri limited liability company and affiliate of David L. Johnson. The demand loan is secured by the 37,881 shares of the Trust acquired by NKC, with interest accruing on the unpaid balance at a rate of eight percent per annum. Substantially all of the shares purchased by Mr. Alvey other than the shares acquired by NKC Associates, L.L.C. were purchased with funds loaned to Mr. Alvey by David L. Johnson and his wife and his affiliates. These loans are unsecured. |

| (6) | Includes 50,982 shares held by a trust in which Mr. Garlich is the grantor and trustee and 26,500 shares held by Mr. Garlich’s wife. |

| (7) | Includes: (i) 11,000 shares held by a revocable trust for the benefit of Mr. McDowell’s minor son, (ii) 4,875 shares held by McDowell Investments, L.P., a Missouri limited partnership in which Mr. McDowell is the 100% equity owner (“McDowell Investments”), (iii) 2,500 shares held by McDowell Foods, Inc., a Missouri corporation in which Mr. McDowell is the 100% equity owner, (iv) 4,009 shares held by his minor son in a custodial account in which Mr. McDowell is the custodian, and (v) 200 shares held by his wife. |

| (8) | These shares have been pledged as collateral to Sunset to secure loans made by Sunset to Mr. Sheldon. |

| (9) | Includes (i) 36,111 shares held by Everest Management, LLC, of which Mr. Kohorst is a 50% beneficial owner through his pension plan, (ii) 700 shares held in Mr. Kohorst’s individual retirement account and (iii) 2,000 shares held in Mr. Kohorst’s wife’s individual retirement account. |

| (10) | Includes (i) 2,130 held by Mr. Acord’s wife, (ii) 4,875 shares held by McDowell Investments (“McDowell Investments”), of which shares Mr. Acord does not have beneficial ownership but has the power to direct the voting or disposition and (iii) 51,500 shares held by Maxus Holdings, LLC, of which shares Mr. Acord does not have beneficial ownership but has the power to direct the voting or disposition. |

| (11) | Pursuant to Amendment No. 1 to the Schedule 13D jointly filed by Mercury Real Estate Advisors LLC, Mercury Special Situations Fund LP, Malcolm F. MacLean IV and David R. Jarvis on December 22, 2004. Each of these reporting persons reported beneficial ownership of all or a certain portion of the 97,998 shares acquired by the reporting persons. |

| (12) | Based on information provided on Schedule 13G filed with the SEC on November 18, 2005. The Trust's shares are owned by affiliated funds managed by MacKenzie Patterson Fuller, Inc. (“MPF”). MPF and each of the affiliated funds disclaim beneficial ownership of each other’s shares. MPF has the power to direct the voting or disposition of all of the shares. |

OTHER MATTERS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Trust’s officers and Trustees, and persons who own more than ten percent of the Trust’s common stock, to file reports of ownership and changes in ownership with the SEC. Officers, Trustees and greater than ten percent shareholders are required by SEC regulation to furnish the Trust with copies of all Section 16(a) forms they file.

Based primarily on its review of the copies of such reports received by it, or written representations from certain reporting persons that no Form 5s were required for those persons, the Trust believes that, during fiscal 2005, all filing requirements applicable to its officers, Trustees, and greater than ten-percent beneficial owners were complied with, except that (i) David L. Johnson did not timely file a Form 4 to report his receipt of MOLP units that are currently convertible into 30,811 shares of the Trust’s common stock in connection with the consummation of a transaction on July 1, 2005 and (ii) Monte McDowell did not timely file a Form 4 to report his acquisition of the beneficial ownership on February 1, 2000 of 2,500 shares of the Trust’s common stock held by McDowell Foods, Inc. and his acquisition of the beneficial ownership of 200 shares held by his wife upon their marriage.

Independent Auditors

The Audit Committee selected KPMG LLP to serve as the Trust’s independent auditor for the current year. KPMG LLP also served as the Trust’s independent auditor for the fiscal year ended December 31, 2005. Representatives of KPMG LLP will be present at the Annual Meeting, will have an opportunity to make a statement if they desire to do so, and will be available to answer questions for the shareholders.

Other Business

Other than those items set forth herein, the Board of Trustees knows of no other business to be presented for consideration at the Annual Meeting. Should any other matters properly come before the Annual Meeting or any adjournment thereof, it is the intention of the persons named in the proxies to vote such proxies in accordance with their best judgment on such matters.

Shareholder Proposals for the 2007 Annual Meeting of Shareholders

Shareholders who wish to present proposals for action at the Annual Meeting of Shareholders to be held in 2007 should submit their proposals to the Trust at the address of the Trust set forth on the first page of this Proxy Statement. Proposals must be received by the Trust no later than November [__], 2006, for consideration for inclusion in the next year’s Proxy Statement and proxy. In addition, proxies solicited by management may confer discretionary authority to vote on matters which are not included in the proxy statement but which are raised at the Annual Meeting by shareholders, unless the Trust receives written notice at such address of such matters on or before February [__], 2007.

Householding

Only one copy of the Trust’s Annual Report and the Proxy Statement is being delivered to multiple security holders sharing an address unless the Trust has received contrary instructions from one or more of the shareholders. This procedure is referred to as “householding.” In addition, the Trust has been notified that certain intermediaries, i.e., brokers or banks, will household proxy materials. The Trust will promptly deliver upon written or oral request a separate copy of the Annual Report and/or the Proxy Statement to a shareholder at a shared address to which a single copy of the document was delivered if a separate copy of the Annual Report and/or Proxy Statement is desired. A shareholder should notify the Trust (i) if a shareholder wishes to receive a separate Annual Report and/or Proxy Statement in the future or (ii) if a shareholder is receiving multiple copies of the Annual Report and/or the Proxy Statement, but wishes to receive a single copy of the Annual Report and/or the Proxy Statement in the future. Requests should be made to Maxus Realty Trust, Inc., Attention: Diana Graves-Six, 104 Armour Road, North Kansas City, Missouri 64116, (816) 303-4500. A shareholder can contact his broker or bank to make a similar request, provided the broker or bank has determined to household proxy materials.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

A copy of the Trust’s Annual Report to Shareholders is being furnished with this Proxy Statement. The following portions of the Annual Report are incorporated herein by reference:

(i) “Management’s Discussion and Analysis,” at pages 3 to 13.

(ii) “Consolidated Financial Statements” with the independent auditors report therein, at pages F-1 to F-18. Any statement contained in a document incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Proxy Statement to the extent that a statement contained herein or in any other subsequently filed document that is incorporated by reference herein modifies or supersedes such earlier statement. Any such statements modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Proxy Statement.

BY ORDER OF THE BOARD OF TRUSTEES

DeAnn Duffield

Secretary

April [__], 2006

North Kansas City, Missouri

Requests for Annual Report

A copy of the Trust’s Annual Report on Form 10-KSB as filed with the Securities and Exchange Commission for fiscal 2005 will be sent to shareholders upon request without charge. Requests should be made to Maxus Realty Trust, Inc., Attention: Diana Graves-Six, 104 Armour Road, North Kansas City, Missouri 64116.

APPENDIX A

PRELIMINARY COPY

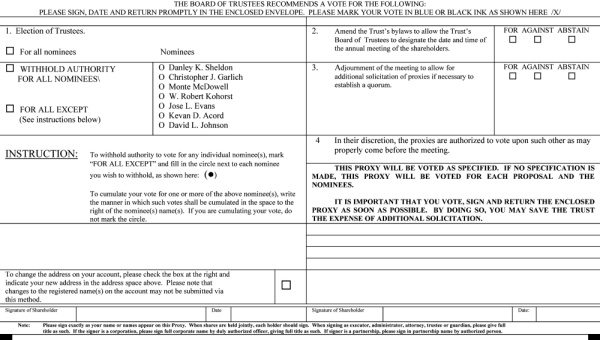

FORM OF PROXY

PROXY

MAXUS REALTY TRUST, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES

The undersigned does hereby appoint David L. Johnson and DeAnn Duffield and each of them, the true and lawful attorneys-in-fact and proxies of the undersigned (acting by a majority hereunder), each with full power of substitution, to vote all common shares of the undersigned in Maxus Realty Trust, Inc. at the Annual Meeting of Shareholders to be held on May 9, 2006, commencing at 10:00 A.M. in the 24th Floor Conference Room at 2345 Grand Boulevard, Suite 2400, Kansas City, Missouri, and at any adjournment thereof, upon all matters described in the Proxy Statement furnished herewith, subject to any directions indicated on the reverse side of this proxy. This proxy revokes all prior proxies given by the undersigned.

With respect to the election of Trustees (Proposal 1), where no vote is specified or where a vote for all nominees is marked, the cumulative votes represented by a proxy will be cast, unless contrary instructions are given, at the discretion of the proxies named herein in order to elect as many nominees as believed possible under the then prevailing circumstances. Unless contrary instructions are given, if the undersigned withholds the undersigned’s vote for a nominee, all of the undersigned’s cumulative votes will be distributed among the remaining nominees at the discretion of the proxies.

(Please sign and date on the reverse side)

ANNUAL MEETING OF SHAREHOLDERS OF

MAXUS REALTY TRUST, INC.

May 9, 2006

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

Please detach along perforated line and mail in the envelope provided.

APPENDIX B

PROPOSED AMENDMENT TO

SECTION 7.2(a)

TO the

BYLAWS

RESOLVED, that the Trust’s Bylaws be amended by replacing Section 7.2(a), in its entirety, with the following:

“7.2 Annual Meetings.

(a) Time of Holding. The Annual Meeting of Shareholders shall be held on the second Tuesday in May of each year, commencing in May of 1987, at 10:00 o’clock a.m. or on such other date and time in May of each year as may be determined in advance by the Board of Trustees. At such Annual Meeting, Trustees shall be elected by the cumulative voting procedures prescribed by the Missouri statutes, and such other business shall be transacted as may properly be brought before the Annual Meeting.