UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4061

Smith Barney Core Plus Bond Fund Inc.

(Exact name of registrant as specified in charter)

| | |

| 125 Broad Street, New York, NY | | 10004 |

| | |

| (Address of principal executive offices) | | (Zip code) |

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

300 First Stamford Place, 4th Floor

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 451-2010

Date of fiscal year end: July 31

Date of reporting period: January 31, 2006

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

SEMI-ANNUAL

REPORT

JANUARY 31, 2006

Smith Barney

Core Plus Bond Fund Inc.

INVESTMENT PRODUCTS: NOT FDIC INSURED Ÿ NO BANK GUARANTEE Ÿ MAY LOSE VALUE

Smith Barney

Core Plus Bond Fund Inc.

Semi-Annual Report • January 31, 2006

What’s

Inside

Fund Objective

The Fund seeks maximum total return consisting of capital appreciation and income, consistent with the preservation of capital.

Under a licensing agreement between Citigroup and Legg Mason, the names of funds, the names of any classes of shares of funds, and the names of investment managers of funds, as well as all logos, trademarks and service marks related to Citigroup or any of its affiliates (“Citi Marks”) are licensed for use by Legg Mason. Citi Marks include, but are not limited to, “Smith Barney,” “Salomon Brothers,” “Citi” and “Citigroup Asset Management”. Legg Mason and its affiliates, as well as the Fund’s investment manager, are not affiliated with Citigroup.

All Citi Marks are owned by Citigroup, and are licensed for use until no later than one year after the date of the licensing agreement.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

Despite numerous obstacles, including rising short-term interest rates, surging oil prices, a destructive hurricane season, and geopolitical issues, the U.S. economy continued to expand during the reporting period. After a 3.3% advance in the second quarter of 2005, gross domestic product (“GDP”)i growth was 4.1% in the third quarter. However, there were mixed economic signals in the fourth quarter. While the Labor Department announced that the unemployment rate fell to 4.7% in December, its lowest level in four years, fourth quarter GDP growth was 1.6%, lower than expected.

Given the overall strength of the economy and inflationary pressures, the Federal Reserve Board (“Fed”)ii continued to raise interest rates throughout the period. After raising rates nine times from June 2004 through July 2005, the Fed increased its target for the federal funds rateiii in 0.25% increments five additional times over the reporting period. This represents the longest sustained Fed tightening cycle since the 1970s. All told, the Fed’s fourteen rate hikes have brought the target for the federal funds rate from 1.00% to 4.50%.

Given the Fed’s actions and high oil prices fueling inflationary concerns, both short- and long-term yields rose over the reporting period. During the six months ended January 31, 2006, two-year Treasury yields rose from 4.04% to 4.54%. Over the same period, 10-year Treasury yields moved from 4.32% to 4.53%. At the end of the reporting period, the yield curve was slightly inverted, as the yield on two-year Treasuries surpassed that of 10-year Treasuries. This anomaly has historically foreshadowed an economic slowdown or recession. Looking at the six-month period as a whole, the overall bond market, as measured by the Lehman Brothers Aggregate Bond Indexiv returned 0.84%.

The high yield market generated a modest gain during the reporting period. While corporate balance sheets continued

Smith Barney Core Plus Bond Fund Inc. I

to strengthen and corporate profits were strong, these positive developments took a back seat to the highly publicized downgrades of General Motors Corporation and Ford Motor Company. During the six-month period ended January 31, 2006, the Citigroup High Yield Market Indexv returned 1.37%.

Emerging markets debt continued to produce strong results over the reporting period, as the JPMorgan Emerging Markets Bond Index Global (“EMBI Global”)vi returned 6.87%. Many emerging market countries have improved their balance sheets in recent years. In addition, strong domestic demand and high energy and commodity prices supported many emerging market countries. This more than offset the potential negatives associated with rising U.S. interest rates.

Performance Review

For the six months ended January 31, 2006, Class A shares of the Smith Barney Core Plus Bond Fund Inc., excluding sales charges, returned 0.53%. The Fund’s unmanaged benchmark, the Lehman Brothers Aggregate Bond Index, returned 0.84%, while its former benchmark, the Lehman Brothers Government Bond Indexvii returned 0.77% for the same period. These shares underperformed the Lipper

| | | | |

| Performance Snapshot as of January 31, 2006 (excluding sales charges) (unaudited) |

| | |

| | | 6 months | | |

Core Plus Bond Fund — Class A Shares | | 0.53% | | |

|

Lehman Brothers Aggregate Bond Index | | 0.84% | | |

|

Lehman Brothers Government Bond Index | | 0.77% | | |

|

Lipper Intermediate Investment Grade Debt Funds Category Average | | 0.63% | | |

|

| The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, please visit our website at www.citigroupam.com. |

| All share class returns assume the reinvestment of all distributions, including returns of capital, if any, at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include sales charges that may apply when shares are purchased or the deduction of taxes that a shareholder would pay on Fund distributions. Excluding sales charges, Class B shares returned 0.24%, Class C shares returned 0.28% and Class Y shares returned 0.74% over the six months ended January 31, 2006. |

II Smith Barney Core Plus Bond Fund Inc.

Intermediate Investment Grade Debt Funds Category Average,1 which increased 0.63%.

Special Shareholder Notices

On December 1, 2005, Citigroup Inc. (“Citigroup”) completed the sale of substantially all of its asset management business, Citigroup Asset Management (“CAM”), to Legg Mason, Inc. (“Legg Mason”). As a result, the Fund’s investment adviser (the “Manager”), previously an indirect wholly-owned subsidiary of Citigroup, has become a wholly-owned subsidiary of Legg Mason. Completion of the sale caused the Fund’s existing investment advisory contract and sub-advisory contract to terminate. The Fund’s shareholders previously approved a new investment management contract between the Fund and the Manager and a new sub-advisory contract, which became effective on December 1, 2005.

Effective February 1, 2006, Detlev Schlichter and Andres Sanchez-Balcazar, investment officers of Citigroup Asset Management Limited (the “sub-adviser”), the sub-adviser for investments in non-U.S. dollar-denominated securities of non-U.S. issuers and currency transactions, will assume portfolio management responsibility for the Fund’s investments in these areas.

Mr. Schlichter and Mr. Sanchez-Balcazar are each a portfolio manager of Western Asset Management Company Limited (“Western Asset Limited”), which, like the sub-adviser and Smith Barney Fund Management LLC, the Fund’s investment manager, is a subsidiary of Legg Mason. Mr. Schlichter joined Western Asset Limited in 2001 and has 16 years of investment experience. Mr. Sanchez-Balcazar joined Western Asset Limited in 2005 and has nine years of investment experience.

Effective February 10, 2006, the Manager has appointed the following individuals to assume the day-to-day portfolio management responsibilities for the Fund: S. Kenneth Leech, Stephen A. Walsh, Carl L. Eichstaedt, Edward A. Moody and Mark Lindbloom.

| 1 | | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the 6-month period ended January 31, 2006, including the reinvestment of distributions, including returns of capital, if any, calculated among the 479 funds in the Fund’s Lipper category, and excluding sales charges. |

Smith Barney Core Plus Bond Fund Inc. III

Each of the new portfolio managers is a portfolio manager of Western Asset Management Company (“Western Asset”), which, like the Manager, is a subsidiary of Legg Mason.

The Fund will be managed by a team of portfolio managers, sector specialists and other investment professionals. The portfolio managers lead the team, and their focus is on portfolio structure, including sector allocation, duration weighting and term structure decisions.

Messers Leech, Walsh, Eichstaedt and Moody have been employed by Western Asset for more than five years. Mr. Lindbloom joined Western Asset in 2006.

Effective April 7, 2006, the Smith Barney Core Plus Bond Fund Inc. will be renamed Legg Mason Partners Core Plus Bond Fund Inc.

Information About Your Fund

As you may be aware, several issues in the mutual fund industry have recently come under the scrutiny of federal and state regulators. The Fund’s Manager and some of its affiliates have received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the Fund’s response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to these subjects. The Fund has been informed that the Manager and its affiliates are responding to those information requests, but are not in a position to predict the outcome of these requests and investigations.

Important information concerning the Fund and its Manager with regard to recent regulatory developments is contained in Notes to Financial Statements included in this report.

IV Smith Barney Core Plus Bond Fund Inc.

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you continue to meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

President, Chairman and Chief Executive Officer

February 22, 2006

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: Interest rate increases, causing the prices of fixed income securities to decline, would reduce the value of the Fund’s share price. Investments in high yield securities and in foreign companies and governments, including emerging markets, involve risks beyond those inherent solely in higher-rated and domestic investments. The risks of high yield securities include, but are not limited to, price volatility and the possibility of default in the timely payment of interest and principal. Foreign securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Please see the Fund’s prospectus for more information on these and other risks.

All index performance reflects no deduction for fees, expenses or taxes. Please note an investor cannot invest directly in an index.

| i | | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| ii | | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| iv | | The Lehman Brothers Aggregate Bond Index is a broad-based bond index comprised of Government, Corporate, Mortgage and Asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| v | | The Citigroup High Yield Market Index is a broad-based unmanaged index of high yield securities. |

| vi | | JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Countries covered are Algeria, Argentina, Brazil, Bulgaria, Chile, China, Colombia, Cote d’Ivoire, Croatia, Ecuador, Greece, Hungary, Lebanon, Malaysia, Mexico, Morocco, Nigeria, Panama, Peru, the Philippines, Poland, Russia, South Africa, South Korea, Thailand, Turkey and Venezuela. |

| vii | | The Lehman Brothers Government Bond Index is a broad-based index of all public debt obligations of the U.S. government and its agencies that have an average maturity of roughly nine years. |

Smith Barney Core Plus Bond Fund Inc. V

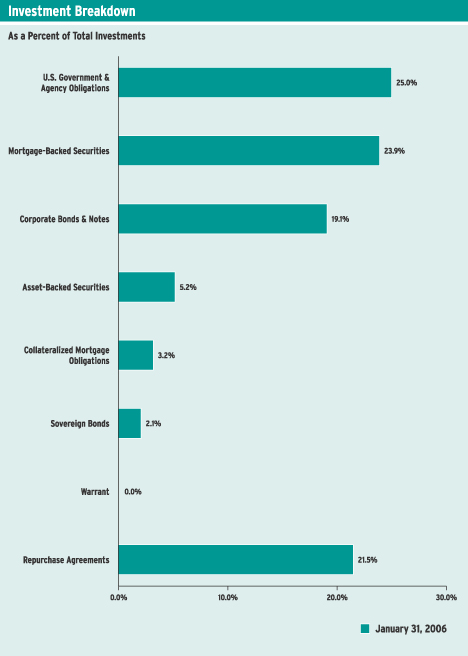

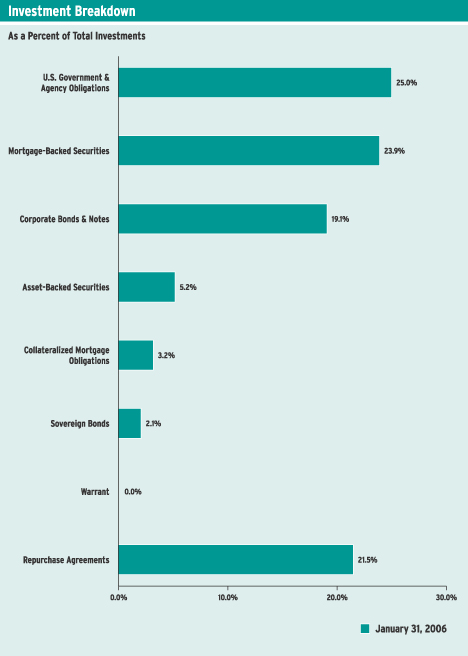

Fund at a Glance (unaudited)

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 1

Fund Expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end and back-end sales charges (loads) on purchase payments and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on August 1, 2005 and held for the six months ended January 31, 2006.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

| | | | | | | | | | | | | | | |

| Based on Actual Total Return(1) | | | | | | |

| | | | | |

| | | Actual Total Return Without Sales Charges(2) | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses Paid During the Period(3) |

Class A | | 0.53 | % | | $ | 1,000.00 | | $ | 1,005.30 | | 1.07 | % | | $ | 5.41 |

|

Class B | | 0.24 | | | | 1,000.00 | | | 1,002.40 | | 1.65 | | | | 8.33 |

|

Class C | | 0.28 | | | | 1,000.00 | | | 1,002.80 | | 1.56 | | | | 7.88 |

|

Class Y | | 0.74 | | | | 1,000.00 | | | 1,007.40 | | 0.66 | | | | 3.34 |

|

| (1) | | For the six months ended January 31, 2006. |

| (2) | | Assumes reinvestment of all distributions, including returns of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class B and C shares. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect voluntary fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of voluntary fee waivers and/or expense reimbursements, the total return would have been lower. |

| (3) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

2 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Fund Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or back-end sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| Based on Hypothetical Total Return(1) | | | | | | |

| | | | | |

| | | Hypothetical

Annualized

Total Return | | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | | Expenses Paid During the Period(2) |

Class A | | 5.00 | % | | $ | 1,000.00 | | $ | 1,019.81 | | 1.07 | % | | $ | 5.45 |

|

Class B | | 5.00 | | | | 1,000.00 | | | 1,016.89 | | 1.65 | | | | 8.39 |

|

Class C | | 5.00 | | | | 1,000.00 | | | 1,017.34 | | 1.56 | | | | 7.93 |

|

Class Y | | 5.00 | | | | 1,000.00 | | | 1,021.88 | | 0.66 | | | | 3.36 |

|

| (1) | | For the six months ended January 31, 2006. |

| (2) | | Expenses are equal to each class’ respective annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 3

Schedule of Investments (January 31, 2006) (unaudited)

SMITH BARNEY CORE PLUS BOND FUND INC.

| | | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value | |

| | | | | | | | | |

| CORPORATE BONDS & NOTES — 23.6% | |

| Aerospace & Defense — 0.4% | |

| 250,000 | | B | | DRS Technologies Inc., Senior Subordinated Notes, 6.875% due 11/1/13 | | $ | 249,375 | |

| 2,990,000 | | BBB- | | Goodrich Corp., Notes, 7.500% due 4/15/08 | | | 3,130,198 | |

| | | | | L-3 Communications Corp., Senior Subordinated Notes: | | | | |

| 100,000 | | BB+ | | 7.625% due 6/15/12 | | | 105,250 | |

| 275,000 | | BB+ | | Series B, 6.375% due 10/15/15 | | | 275,000 | |

| 125,000 | | B+ | | Moog Inc., Senior Subordinated Notes, 6.250% due 1/15/15 | | | 123,438 | |

| | | | | Sequa Corp., Senior Notes: | | | | |

| 175,000 | | BB- | | 9.000% due 8/1/09 | | | 190,750 | |

| 175,000 | | BB- | | Series B, 8.875% due 4/1/08 | | | 186,375 | |

|

|

| | | | | Total Aerospace & Defense | | | 4,260,386 | |

|

|

| Auto Components — 0.0% | |

| 121,000 | | B- | | Dura Operating Corp., Senior Unsecured Notes, Series B, 8.625% due 4/15/12 | | | 99,825 | |

| 50,000 | | B- | | Keystone Automotive Operations Inc., Senior Subordinated Notes, 9.750% due 11/1/13 | | | 43,500 | |

| 100,000 | | BB- | | TRW Automotive Inc., Senior Subordinated Notes, 9.375% due 2/15/13 | | | 109,250 | |

|

|

| | | | | Total Auto Components | | | 252,575 | |

|

|

| Automobiles — 0.6% | |

| 4,350,000 | | BBB | | DaimlerChrysler North America Holding Corp., 4.050% due 6/4/08 | | | 4,230,971 | |

| | | | | Ford Motor Co.: | | | | |

| | | | | Debentures: | | | | |

| 25,000 | | BB- | | 6.625% due 10/1/28 | | | 17,375 | |

| 30,000 | | BB- | | 8.900% due 1/15/32 | | | 23,400 | |

| 950,000 | | BB- | | Notes, 7.450% due 7/16/31 | | | 705,375 | |

| 500,000 | | BB- | | Senior Notes, 4.950% due 1/15/08 | | | 461,409 | |

| | | | | General Motors Corp., Senior Debentures: | | | | |

| 50,000 | | B | | 8.250% due 7/15/23 | | | 36,750 | |

| 265,000 | | B | | 8.375% due 7/15/33 | | | 197,425 | |

|

|

| | | | | Total Automobiles | | | 5,672,705 | |

|

|

| Beverages — 0.0% | |

| 100,000 | | B+ | | Constellation Brands Inc., Senior Subordinated Notes, Series B, 8.125% due 1/15/12 | | | 105,250 | |

|

|

| Building Products — 0.0% | |

| 125,000 | | CCC | | Associated Materials Inc., Senior Subordinated Notes, 9.750% due 4/15/12 | | | 121,875 | |

| 125,000 | | CCC+ | | Nortek Inc., Senior Subordinated Notes, 8.500% due 9/1/14 | | | 122,188 | |

|

|

| | | | | Total Building Products | | | 244,063 | |

|

|

See Notes to Financial Statements.

4 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value | |

| | | | | | | | | |

| Capital Markets — 1.3% | |

| 125,000 | | B- | | BCP Crystal U.S. Holdings Corp., Senior Subordinated Notes, 9.625% due 6/15/14 | | $ | 139,375 | |

| 5,225,000 | | A+ | | Lehman Brothers Holdings Inc., Medium-Term Notes, Series H, 4.500% due 7/26/10 | | | 5,102,761 | |

| 6,800,000 | | A | | Morgan Stanley, Subordinated Notes, 4.750% due 4/1/14 | | | 6,481,475 | |

| 250,000 | | BB+ | | Morgan Stanley Bank AG for OAO Gazprom, Notes, 9.625% due 3/1/13 | | | 301,250 | |

|

|

| | | | | Total Capital Markets | | | 12,024,861 | |

|

|

| Chemicals — 0.2% | |

| 100,000 | | BB- | | Arco Chemical Co., Debentures, 9.800% due 2/1/20 | | | 112,250 | |

| 150,000 | | B- | | Borden U.S. Finance Corp./Nova Scotia Finance ULC, Second Priority Senior Secured Notes, 9.000% due 7/15/14 (a) | | | 153,000 | |

| 100,000 | | BB- | | Equistar Chemicals LP, Senior Notes, 10.625% due 5/1/11 | | | 110,500 | |

| 75,000 | | BB- | | Ethyl Corp., Senior Notes, 8.875% due 5/1/10 | | | 79,125 | |

| | | | | Huntsman International LLC: | | | | |

| 50,000 | | B | | Senior Notes, 9.875% due 3/1/09 | | | 52,750 | |

| 75,000 | | B | | Senior Subordinated Notes, 7.875% due 1/1/15 (a) | | | 76,312 | |

| 25,000 | | BB | | IMC Global Inc., Senior Notes, 10.875% due 8/1/13 | | | 28,875 | |

| 105,000 | | B+ | | ISP Chemco Inc., Senior Subordinated Notes, Series B,

10.250% due 7/1/11 | | | 112,875 | |

| 50,000 | | BB- | | Lyondell Chemical Co., Senior Secured Notes, 11.125% due 7/15/12 | | | 56,375 | |

| 50,000 | | B- | | Nalco Co., Senior Subordinated Notes, 8.875% due 11/15/13 | | | 52,500 | |

| 175,000 | | BB+ | | NOVA Chemicals Corp., Senior Notes, 6.500% due 1/15/12 | | | 168,875 | |

| 50,000 | | B- | | OM Group Inc., Senior Subordinated Notes, 9.250% due 12/15/11 | | | 50,250 | |

| 250,000 | | B- | | PQ Corp., 7.500% due 2/15/13 (a) | | | 236,875 | |

| 100,000 | | B- | | Resolution Performance Products LLC, Senior Subordinated Notes, 13.500% due 11/15/10 | | | 107,250 | |

| 125,000 | | CCC+ | | Rhodia SA, Senior Notes, 7.625% due 6/1/10 | | | 126,250 | |

| 200,000 | | BB- | | Westlake Chemical Corp., Senior Notes, 8.750% due 7/15/11 | | | 219,500 | |

|

|

| | | | | Total Chemicals | | | 1,743,562 | |

|

|

| Commercial Banks — 2.0% | | | | |

| 5,500,000 | | A+ | | Bank of America Corp., Subordinated Notes, 7.400% due 1/15/11 | | | 6,038,296 | |

| 6,800,000 | | BBB+ | | HSBC Finance Capital Trust IX, 5.911% due 11/30/35 (b) | | | 6,827,996 | |

| 4,975,000 | | A- | | Standard Chartered Bank PLC, Subordinated Notes, 8.000% due 5/30/31 (a) | | | 6,327,299 | |

|

|

| | | | | Total Commercial Banks | | | 19,193,591 | |

|

|

| Commercial Services & Supplies — 0.1% | | | | |

| | | | | Allied Waste North America Inc., Senior Notes: | | | | |

| 150,000 | | BB- | | 7.875% due 4/15/13 | | | 156,375 | |

| 200,000 | | BB- | | 7.250% due 3/15/15 | | | 203,000 | |

| 100,000 | | B- | | Cardtronics Inc., Senior Subordinated Notes, 9.250% due 8/15/13 (a) | | | 100,750 | |

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 5

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value | |

| | | | | | | | | |

| Commercial Services & Supplies — 0.1% (continued) | | | | |

| 125,000 | | B+ | | Cenveo Corp., Senior Notes, 9.625% due 3/15/12 | | $ | 134,688 | |

| 200,000 | | BB- | | Corrections Corporation of America, Senior Subordinated Notes, 6.250% due 3/15/13 | | | 198,000 | |

|

|

| | | | | Total Commercial Services & Supplies | | | 792,813 | |

|

|

| Communications Equipment — 0.1% | | | | |

| 550,000 | | B | | Lucent Technologies Inc., Debentures, 6.450% due 3/15/29 | | | 464,750 | |

|

|

| Computers & Peripherals — 0.0% | | | | |

| 50,000 | | B- | | SunGard Data Systems Inc., Senior Notes, 9.125% due 8/15/13 (a) | | | 52,250 | |

|

|

| Construction Materials — 0.0% | | | | |

| 75,000 | | BB- | | Texas Industries Inc., Senior Notes, 7.250% due 7/15/13 | | | 77,813 | |

|

|

| Consumer Finance — 0.4% | | | | |

| | | | | MBNA Corp.: | | | | |

| 3,150,000 | | AA- | | Medium-Term Notes, 6.250% due 1/17/07 | | | 3,188,968 | |

| 750,000 | | AA- | | Notes, 4.625% due 9/15/08 | | | 744,091 | |

|

|

| | | | | Total Consumer Finance | | | 3,933,059 | |

|

|

| Containers & Packaging — 0.1% | | | | |

| 100,000 | | B- | | Berry Plastics Corp., Senior Subordinated Notes, 10.750% due 7/15/12 | | | 109,000 | |

| | | | | Graphic Packaging International Corp.: | | | | |

| 50,000 | | B- | | Senior Notes, 8.500% due 8/15/11 | | | 50,250 | |

| 175,000 | | B- | | Senior Subordinated Notes, 9.500% due 8/15/13 | | | 165,375 | |

| 401,000 | | CCC+ | | Jefferson Smurfit Corp., Senior Notes, 8.250% due 10/1/12 | | | 382,955 | |

| 125,000 | | B- | | JSG Funding PLC, Senior Notes, 9.625% due 10/1/12 | | | 129,687 | |

| | | | | Owens-Brockway Glass Container Inc., Senior Notes: | | | | |

| 150,000 | | B | | 8.250% due 5/15/13 | | | 158,625 | |

| 50,000 | | B | | 6.750% due 12/1/14 | | | 48,625 | |

| 25,000 | | B | | Owens-Illinois Inc., Debentures, 7.500% due 5/15/10 | | | 25,500 | |

| 100,000 | | CCC+ | | Smurfit-Stone Container Enterprises Inc., Senior Notes, 8.375% due 7/1/12 | | | 96,250 | |

|

|

| | | | | Total Containers & Packaging | | | 1,166,267 | |

|

|

| Diversified Financial Services — 6.0% | |

| 400,000 | | CCC+ | | Alamosa Delaware Inc., Senior Notes, 11.000% due 7/31/10 | | | 450,000 | |

| 3,225,000 | | BBB | | Capital One Bank, Notes, 5.750% due 9/15/10 | | | 3,294,167 | |

| 100,000 | | B- | | CCM Merger Inc., Notes, 8.000% due 8/1/13 (a) | | | 98,000 | |

| 5,725,000 | | A | | CIT Group Inc., Senior Notes, 7.750% due 4/2/12 (c) | | | 6,447,821 | |

| 6,925,000 | | A | | Countrywide Home Loans Inc., Unsubordinated Medium-Term Notes, Series L, 4.000% due 3/22/11 | | | 6,501,792 | |

| 4,175,000 | | A- | | EnCana Holdings Finance Corp., Notes, 5.800% due 5/1/14 | | | 4,317,088 | |

| | | | | Ford Motor Credit Co., Notes: | | | | |

| 50,000 | | BB- | | 6.625% due 6/16/08 | | | 47,074 | |

| 4,875,000 | | BB- | | 7.875% due 6/15/10 | | | 4,591,397 | |

See Notes to Financial Statements.

6 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | | |

| | | |

Face

Amount† | | | Rating‡ | | Security | | Value |

| Diversified Financial Services — 6.0% (continued) |

| | | | | | General Motors Acceptance Corp.: | | | |

| 540,000 | | | BB | | Bonds, 8.000% due 11/1/31 | | $ | 552,115 |

| | | | | | Notes: | | | |

| 45,000 | | | BB | | 7.250% due 3/2/11 | | | 43,461 |

| 3,575,000 | | | BB | | 6.875% due 9/15/11 | | | 3,417,049 |

| 210,000 | | | BB | | 6.750% due 12/1/14 | | | 199,349 |

| 162,000 | | | B- | | Global Cash Access LLC/Global Cash Finance Corp., Senior Subordinated Notes, 8.750% due 3/15/12 | | | 174,150 |

| 6,325,000 | | | AA- | | International Lease Finance Corp., Notes, 5.875% due 5/1/13 | | | 6,495,889 |

| 4,350,000 | | | A- | | John Deere Capital Corp., Medium-Term Notes, Series D, 4.125% due 1/15/10 | | | 4,210,148 |

| 6,050,000 | | | A | | JPMorgan Chase & Co., Subordinated Notes, 6.625% due 3/15/12 | | | 6,490,246 |

| 100,000 | | | B- | | Nell AF SARL, Senior Notes, 8.375% due 8/15/15 (a) | | | 100,375 |

| 250,000 | | | BB | | Omega Healthcare Investors Inc., 7.000% due 1/15/16 (a) | | | 252,500 |

| 9,109,755 | | | BB- | | Targeted Return Index Securities (TRAINS), Secured Notes, Series HY-2005-1, 7.562% due 6/15/15 (a)(b) | | | 9,307,091 |

| 150,000 | | | CCC+ | | Vanguard Health Holdings Co. I LLC,

Senior Discount Notes, step bond to yield 9.885% due 10/1/15 | | | 110,250 |

| 75,000 | | | CCC+ | | Vanguard Health Holding Co. II LLC,

Senior Subordinated Notes, 9.000% due 10/1/14 | | | 79,500 |

|

| | | | | | Total Diversified Financial Services | | | 57,179,462 |

|

| Diversified Telecommunication Services — 1.4% |

| 150,000 | | | A | | AT&T Corp., Senior Notes, 9.750% due 11/15/31 | | | 186,028 |

| 350,000 | | | B | | Intelsat Ltd., Senior Discount Notes, step bond to yield 9.232% due 2/1/15 (a) | | | 232,750 |

| 425,000 | | | A | | MCI Inc., Senior Notes, 8.735% due 5/1/14 | | | 480,250 |

| 300,000 | | | B- | | NTL Cable PLC, Senior Notes, 8.750% due 4/15/14 | | | 309,000 |

| 50,000 | | | B+ | | PanAmSat Corp., Senior Notes, 9.000% due 8/15/14 | | | 52,812 |

| | | | | | Qwest Corp.: | | | |

| 200,000 | | | BB | | Debentures, 6.875% due 9/15/33 | | | 185,500 |

| 550,000 | | | BB | | Notes, 8.875% due 3/15/12 | | | 611,875 |

| 4,500,000 | | | BBB+ | | Telecom Italia Capital SA, 5.250% due 10/1/15 | | | 4,323,663 |

| 2,000,000 | MXN | | BBB+ | | Telefonos de Mexico S.A. de C.V., 8.750% due 1/31/16 | | | 189,812 |

| 6,305,000 | | | A | | Verizon Florida Inc., Senior Unsecured Notes, Series F, 6.125% due 1/15/13 | | | 6,365,383 |

|

| | | | | | Total Diversified Telecommunication Services | | | 12,937,073 |

|

| Electric Utilities — 1.0% |

| 100,000 | | | BB- | | Allegheny Energy Supply Co. LLC, 8.250% due 4/15/12 (a) | | | 111,500 |

| 3,625,000 | | | BBB | | Appalachian Power Co., Bonds, Series H, 5.950% due 5/15/33 | | | 3,575,997 |

| 200,000 | | | B+ | | Edison Mission Energy, Senior Notes, 9.875% due 4/15/11 | | | 233,000 |

| 4,679,000 | | | A | | Florida Power & Light Co., First Mortgage Bonds, 5.625% due 4/1/34 | | | 4,655,020 |

| 250,000 | | | B | | Inergy L.P./Inergy Finance Corp., 6.875% due 12/15/14 | | | 236,875 |

| 375,000 | | | B+ | | Reliant Energy Inc., Senior Secured Notes, 9.500% due 7/15/13 | | | 373,125 |

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 7

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Electric Utilities — 1.0% (continued) |

| 175,000 | | B | | Texas Genco LLC/Texas Genco Financing Corp., Senior Notes,

6.875% due 12/15/14 (a) | | $ | 190,313 |

|

| | | | | Total Electric Utilities | | | 9,375,830 |

|

| Energy Equipment & Services — 0.1% | | | |

| 88,000 | | B- | | Dresser-Rand Group Inc., Senior Subordinated Notes,

7.625% due 11/1/14 (a) | | | 91,520 |

| 25,000 | | BB | | Grant Prideco Inc., Senior Unsecured Notes, 6.125% due 8/15/15 (a) | | | 25,313 |

| 125,000 | | B | | Hanover Compressor Co., Senior Notes, 8.625% due 12/15/10 | | | 133,437 |

| 125,000 | | B- | | Targa Resources Inc., Senior Notes, 8.500% due 11/1/13 (a) | | | 130,625 |

| 125,000 | | B | | Universal Compression Inc., Senior Notes, 7.250% due 5/15/10 | | | 129,375 |

|

| | | | | Total Energy Equipment & Services | | | 510,270 |

|

| Food & Staples Retailing — 0.4% | | | |

| 175,000 | | B- | | Jean Coutu Group Inc., Senior Subordinated Notes, 8.500% due 8/1/14 | | | 167,562 |

| | | | | Rite Aid Corp.: | | | |

| | | | | Notes: | | | |

| 50,000 | | B- | | 7.125% due 1/15/07 | | | 50,375 |

| 25,000 | | B- | | 6.125% due 12/15/08 (a) | | | 24,000 |

| 50,000 | | B+ | | Senior Secured Notes, 7.500% due 1/15/15 | | | 48,125 |

| 75,000 | | B+ | | Senior Secured Second Lien Notes, 8.125% due 5/1/10 | | | 76,875 |

| 2,825,000 | | BBB- | | Safeway Inc., Senior Debentures, 7.250% due 2/1/31 | | | 3,057,433 |

|

| | | | | Total Food & Staples Retailing | | | 3,424,370 |

|

| Food Products — 0.6% | | | |

| 200,000 | | B | | Del Monte Corp., Senior Subordinated Notes, 8.625% due 12/15/12 | | | 213,000 |

| 125,000 | | B- | | Doane Pet Care Co., Senior Notes, 10.750% due 3/1/10 | | | 135,625 |

| 225,000 | | B+ | | Dole Food Co. Inc., Debentures, 8.750% due 7/15/13 | | | 228,094 |

| 5,475,000 | | BBB+ | | Kraft Foods Inc., Senior Notes, 5.625% due 11/1/11 | | | 5,552,175 |

|

| | | | | Total Food Products | | | 6,128,894 |

|

| Health Care Providers & Services — 1.1% | | | |

| 125,000 | | B | | Community Health Systems Inc., Senior Subordinated Notes,

6.500% due 12/15/12 | | | 123,125 |

| 225,000 | | B | | DaVita Inc., Senior Subordinated Notes, 7.250% due 3/15/15 | | | 227,531 |

| | | | | Extendicare Health Services Inc., Senior Subordinated Notes: | | | |

| 75,000 | | B+ | | 9.500% due 7/1/10 | | | 79,969 |

| 75,000 | | B | | 6.875% due 5/1/14 | | | 73,688 |

| | | | | HCA Inc.: | | | |

| 75,000 | | BB+ | | 7.500% due 12/15/23 | | | 75,467 |

| 225,000 | | BB+ | | Debentures, 7.050% due 12/1/27 | | | 213,324 |

| | | | | Notes: | | | |

| 100,000 | | BB+ | | 6.375% due 1/15/15 | | | 100,334 |

| 25,000 | | BB+ | | 7.690% due 6/15/25 | | | 25,587 |

| 4,125,000 | | BBB | | Humana Inc., Senior Notes, 6.300% due 8/1/18 | | | 4,323,351 |

| 200,000 | | B- | | IASIS Healthcare LLC/IASIS Capital Corp., Senior Subordinated Notes, 8.750% due 6/15/14 | | | 205,750 |

See Notes to Financial Statements.

8 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Health Care Providers & Services — 1.1% (continued) | | | |

| 100,000 | | B | | InSight Health Services Corp., Senior Subordinated Notes,

9.174% due 11/1/11 (b) | | $ | 93,500 |

| 150,000 | | B- | | Psychiatric Solutions Inc., Senior Subordinated Notes,

7.750% due 7/15/15 | | | 156,000 |

| 4,425,000 | | BBB+ | | Quest Diagnostics Inc., 5.450% due 11/1/15 (a) | | | 4,419,632 |

| 175,000 | | B | | Tenet Healthcare Corp., Senior Notes, 9.875% due 7/1/14 | | | 175,875 |

| 300,000 | | B+ | | Triad Hospitals Inc., Senior Subordinated Notes, 7.000% due 11/15/13 | | | 304,125 |

|

| | | | | Total Health Care Providers & Services | | | 10,597,258 |

|

| Hotels, Restaurants & Leisure — 0.4% | | | |

| | | | | Boyd Gaming Corp., Senior Subordinated Notes: | | | |

| 100,000 | | B+ | | 7.750% due 12/15/12 | | | 104,750 |

| 100,000 | | B+ | | 6.750% due 4/15/14 | | | 98,750 |

| 400,000 | | BB+ | | Caesars Entertainment Inc., Senior Subordinated Notes, 8.125% due 5/15/11 | | | 443,000 |

| 100,000 | | B- | | Carrols Corp., Senior Subordinated Notes, 9.000% due 1/15/13 | | | 98,000 |

| 150,000 | | B- | | Cinemark Inc., Senior Discount Notes, step bond to yield 9.031% due 3/15/14 | | | 110,250 |

| 75,000 | | B- | | Equinox Holdings Inc., Senior Notes, 9.000% due 12/15/09 | | | 80,250 |

| | | | | Gaylord Entertainment Co., Senior Notes: | | | |

| 75,000 | | B- | | 8.000% due 11/15/13 | | | 78,375 |

| 100,000 | | B- | | 6.750% due 11/15/14 | | | 98,000 |

| 50,000 | | B- | | Herbst Gaming Inc., Senior Subordinated Notes, 7.000% due 11/15/14 | | | 50,125 |

| 275,000 | | BBB- | | Hilton Hotels Corp., Notes, 7.625% due 12/1/12 | | | 297,623 |

| 190,000 | | B | | Isle of Capri Casinos Inc., Senior Subordinated Notes, 7.000% due 3/1/14 | | | 187,387 |

| 175,000 | | B | | Kerzner International Ltd., Senior Subordinated Notes, 6.750% due 10/1/15 | | | 171,500 |

| 225,000 | | B | | Las Vegas Sands Corp., Senior Notes, 6.375% due 2/15/15 | | | 215,719 |

| | | | | MGM MIRAGE Inc., Senior Notes: | | | |

| 250,000 | | BB | | 6.750% due 9/1/12 | | | 255,625 |

| 125,000 | | BB | | 6.625% due 7/15/15 | | | 126,250 |

| 100,000 | | BB | | Mirage Resorts Inc., Debentures, 7.250% due 8/1/17 | | | 104,750 |

| 125,000 | | B+ | | Mohegan Tribal Gaming Authority, Senior Subordinated Notes, 6.875% due 2/15/15 | | | 127,344 |

| 150,000 | | B+ | | Penn National Gaming Inc., Senior Subordinated Notes, 6.750% due 3/1/15 | | | 150,375 |

| | | | | Pinnacle Entertainment Inc., Senior Subordinated Notes: | | | |

| 75,000 | | B- | | 8.250% due 3/15/12 | | | 78,000 |

| 50,000 | | B- | | 8.750% due 10/1/13 | | | 53,500 |

| 75,000 | | B- | | Riddell Bell Holdings Inc., Senior Subordinated Notes, 8.375% due 10/1/12 | | | 70,688 |

| 125,000 | | B+ | | Scientific Games Corp., Senior Subordinated Notes, 6.250% due 12/15/12 | | | 123,125 |

| 125,000 | | BB- | | Seneca Gaming Corp., Senior Notes, 7.250% due 5/1/12 (a) | | | 127,187 |

| 150,000 | | CCC | | Six Flags Inc., Senior Notes, 9.750% due 4/15/13 | | | 154,312 |

| 225,000 | | BB+ | | Starwood Hotels & Resorts Worldwide Inc., Senior Notes,

7.875% due 5/1/12 | | | 247,500 |

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 9

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Hotels, Restaurants & Leisure — 0.4% (continued) | | | |

| 275,000 | | B+ | | Station Casinos Inc., Senior Subordinated Notes, 6.875% due 3/1/16 | | $ | 280,844 |

| 125,000 | | B+ | | Tunica-Biloxi Gaming Authority, Senior Notes, 9.000% due 11/15/15 (a) | | | 127,344 |

| 50,000 | | B+ | | Turning Stone Casino Resort Enterprise, Senior Notes, 9.125% due 12/15/10 (a) | | | 52,250 |

|

| | | | | Total Hotels, Restaurants & Leisure | | | 4,112,823 |

|

| Household Durables — 0.0% |

| 100,000 | | B- | | Norcraft Cos. LP/Norcraft Finance Corp., Senior Subordinated Notes, 9.000% due 11/1/11 | | | 103,625 |

| 75,000 | | B- | | Sealy Mattress Co., Senior Subordinated Notes, 8.250% due 6/15/14 | | | 77,813 |

|

| | | | | Total Household Durables | | | 181,438 |

|

| Household Products — 0.0% |

| 125,000 | | CCC+ | | Spectrum Brands Inc., Senior Subordinated Notes, 8.500% due 10/1/13 | | | 107,813 |

|

| Independent Power Producers & Energy Traders — 0.4% |

| | | | | AES Corp., Senior Notes: | | | |

| 275,000 | | B- | | 8.875% due 2/15/11 | | | 298,375 |

| 125,000 | | B- | | 7.750% due 3/1/14 | | | 132,500 |

| 300,000 | | D | | Calpine Corp., Second Priority Senior Secured Notes, 8.500% due 7/15/10 (a)(d) | | | 269,625 |

| 100,000 | | D | | Calpine Generating Co. LLC, Senior Secured Notes,

13.216% due 4/1/11 (d) | | | 106,750 |

| 1,500,000 | | BBB | | Duke Energy Corp., Senior Notes, 4.200% due 10/1/08 | | | 1,464,457 |

| 450,000 | | CCC+ | | Dynegy Holdings Inc., Senior Debentures, 7.625% due 10/15/26 | | | 436,500 |

| 175,000 | | B- | | Mirant North America LLC, Senior Notes, 7.375% due 12/31/13 (a) | | | 178,938 |

| | | | | NRG Energy Inc.: | | | |

| 315,000 | | B | | Second Priority Senior Secured Notes, 8.000% due 12/15/13 | | | 352,800 |

| | | | | Senior Notes: | | | |

| 85,000 | | B- | | 7.250% due 2/1/14 | | | 86,594 |

| 250,000 | | B- | | 7.375% due 2/1/16 | | | 255,625 |

|

| | | | | Total Independent Power Producers & Energy Traders | | | 3,582,164 |

|

| Industrial Conglomerates — 0.5% | | | |

| 75,000 | | B | | Blount Inc., Senior Subordinated Notes, 8.875% due 8/1/12 | | | 79,125 |

| 100,000 | | B- | | KI Holdings Inc., Senior Discount Notes, step bond to yield

10.284% due 11/15/14 | | | 67,500 |

| 100,000 | | B | | Koppers Inc., Senior Notes, 9.875% due 10/15/13 | | | 109,000 |

| 4,200,000 | | BBB+ | | Tyco International Group SA, 6.125% due 11/1/08 | | | 4,290,800 |

|

| | | | | Total Industrial Conglomerates | | | 4,546,425 |

|

| Internet & Catalog Retail — 0.0% | | | |

| 100,000 | | B- | | FTD Inc., Senior Unsecured Notes, 7.750% due 2/15/14 | | | 100,250 |

|

| IT Services — 0.0% | | | |

| 250,000 | | B | | Iron Mountain Inc., Senior Subordinated Notes, 8.625% due 4/1/13 | | | 261,875 |

| | | | | Unisys Corp., Senior Notes: | | | |

| 100,000 | | BB- | | 6.875% due 3/15/10 | | | 95,750 |

| 50,000 | | BB- | | 8.000% due 10/15/12 | | | 47,875 |

|

| | | | | Total IT Services | | | 405,500 |

|

See Notes to Financial Statements.

10 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Machinery — 0.0% | | | |

| 75,000 | | B- | | Mueller Group Inc., Senior Subordinated Notes, 10.000% due 5/1/12 | | $ | 79,875 |

| 296,000 | | B | | Terex Corp., Senior Subordinated Notes, 7.375% due 1/15/14 | | | 298,960 |

|

| | | | | Total Machinery | | | 378,835 |

|

| Media — 1.6% | | | |

| 75,000 | | CCC+ | | AMC Entertainment Inc., Senior Subordinated Notes,

11.000% due 2/1/16 (a) | | | 75,375 |

| 100,000 | | B | | Cadmus Communications Corp., Senior Subordinated Notes,

8.375% due 6/15/14 | | | 101,500 |

| 214,000 | | CCC- | | CCH I Holdings LLC, Senior Secured Notes, 11.000% due 10/1/15 (a) | | | 177,085 |

| 375,000 | | CCC- | | CCO Holdings LLC/CCO Holdings Capital Corp., Senior Notes,

8.750% due 11/15/13 (a) | | | 361,875 |

| 200,000 | | CCC- | | Charter Communications Holdings II LLC/Charter Communications Holdings II Capital Corp., Senior Notes, 10.250% due 9/15/10 | | | 197,750 |

| 175,000 | | B- | | Charter Communications Operating LLC, Second Lien Senior Notes,

8.375% due 4/30/14 (a) | | | 175,656 |

| 50,000 | | BB- | | Chukchansi Economic Development Authority, Senior Notes,

8.000% due 11/15/13 (a) | | | 51,750 |

| 3,725,000 | | BBB+ | | Comcast Cable Communications Holdings Inc., Notes, 8.375% due 3/15/13 | | | 4,269,487 |

| | | | | CSC Holdings Inc.: | | | |

| 125,000 | | B+ | | Senior Debentures, 7.625% due 7/15/18 | | | 120,000 |

| | | | | Senior Notes: | | | |

| 100,000 | | B+ | | 7.000% due 4/15/12 (a) | | | 96,000 |

| | | | | Series B: | | | |

| 125,000 | | B+ | | 8.125% due 7/15/09 | | | 127,500 |

| 250,000 | | B+ | | 7.625% due 4/1/11 | | | 251,562 |

| 350,000 | | B | | Dex Media Inc., Discount Notes, step bond to yield 7.913% due 11/15/13 | | | 290,500 |

| 81,000 | | BB- | | DIRECTV Holdings LLC/DIRECTV Financing Co. Inc., Senior Notes,

8.375% due 3/15/13 | | | 87,278 |

| 270,000 | | BB- | | DIRECTV Holdings LLC Finance, Senior Notes, 6.375% due 6/15/15 | | | 265,950 |

| | | | | EchoStar DBS Corp., Senior Notes: | | | |

| 475,000 | | BB- | | 6.625% due 10/1/14 | | | 463,125 |

| 15,000 | | BB- | | 7.125% due 2/1/16 (a) | | | 14,869 |

| 51,429 | | B- | | Emmis Communications Corp., Senior Notes, 10.366% due 6/15/12 (b) | | | 51,750 |

| 200,000 | | B | | Lamar Media Corp., Senior Subordinated Nates, 6.625% due 8/15/15 | | | 202,000 |

| 125,000 | | B- | | LIN Television Corp., Series B, 6.500% due 5/15/13 | | | 118,750 |

| 50,000 | | B | | LodgeNet Entertainment Corp., Senior Subordinated Debentures,

9.500% due 6/15/13 | | | 54,250 |

| | | | | Mediacom Broadband LLC: | | | |

| 125,000 | | B | | 8.500% due 10/15/15 (a) | | | 118,750 |

| 100,000 | | B | | Senior Notes, 11.000% due 7/15/13 | | | 108,000 |

| 3,325,000 | | BBB | | News America, Inc., Notes, 5.300% due 12/15/14 | | | 3,273,250 |

| 50,000 | | CCC+ | | Nexstar Finance Inc., Senior Subordinated Notes, 7.000% due 1/15/14 | | | 46,563 |

| | | | | R.H. Donnelley Corp.: | | | |

| | | | | Senior Discount Notes: | | | |

| 125,000 | | B+ | | Series A-1, 6.875% due 1/15/13 (a) | | | 115,000 |

| 200,000 | | B+ | | Series A-2, 6.875% due 1/15/13 (a) | | | 184,500 |

| 300,000 | | B+ | | Senior Notes, Series A-3, 8.875% due 1/15/16 (a) | | | 304,875 |

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 11

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Media — 1.6% (continued) | | | |

| 50,000 | | BB+ | | Rogers Cable Inc., Senior Secured Notes, 6.250% due 6/15/13 | | $ | 49,625 |

| 125,000 | | B- | | Salem Communications Holding Corp., Series B, 9.000% due 7/1/11 | | | 132,656 |

| | | | | Sinclair Broadcast Group Inc., Senior Subordinated Notes: | | | |

| 125,000 | | B | | 8.750% due 12/15/11 | | | 130,781 |

| 125,000 | | B | | 8.000% due 3/15/12 | | | 127,187 |

| 2,875,000 | | BBB+ | | Time Warner Inc., Senior Notes, 7.625% due 4/15/31 | | | 3,203,253 |

| 50,000 | | CCC | | Vertis Inc., Senior Second Lien Secured Notes, 9.750% due 4/1/09 | | | 52,000 |

| 150,000 | | B+ | | Videotron Ltd., Senior Notes, 6.375% due 12/15/15 (a) | | | 149,250 |

| 100,000 | | B+ | | Yell Finance BV, Senior Notes, 10.750% due 8/1/11 | | | 108,125 |

|

| | | | | Total Media | | | 15,657,827 |

|

| Metals & Mining — 0.0% | | | |

| 50,000 | | B+ | | Aleris International Inc., Senior Secured Notes, 10.375% due 10/15/10 | | | 55,250 |

| 250,000 | | B | | Novelis Inc., Senior Notes, 7.500% due 2/15/15 (a) | | | 237,500 |

|

| | | | | Total Metals & Mining | | | 292,750 |

|

| Multiline Retail — 0.0% | | | |

| 100,000 | | B- | | Harry & David Operations, Senior Notes, 9.000% due 3/1/13 | | | 102,000 |

| 75,000 | | B- | | Neiman Marcus Group Inc., Senior Subordinated Notes,

10.375% due 10/15/15 (a) | | | 77,719 |

|

| | | | | Total Multiline Retail | | | 179,719 |

|

| Office Electronics — 0.0% | | | |

| 75,000 | | BB | | IKON Office Solutions Inc., Senior Notes, 7.750% due 9/15/15 (a) | | | 76,125 |

| 225,000 | | B- | | Xerox Capital Trust I, 8.000% due 2/1/27 | | | 233,156 |

|

| | | | | Total Office Electronics | | | 309,281 |

|

| Oil, Gas & Consumable Fuels — 1.7% | | | |

| 4,250,000 | | BBB+ | | Burlington Resources Finance Corp., Senior Notes, 5.600% due 12/1/06 | | | 4,270,621 |

| | | | | Chesapeake Energy Corp., Senior Notes: | | | |

| 125,000 | | BB | | 6.375% due 6/15/15 | | | 125,313 |

| 225,000 | | BB | | 6.625% due 1/15/16 | | | 228,375 |

| 100,000 | | BB | | 6.250% due 1/15/18 | | | 99,250 |

| 25,000 | | BB | | 6.875% due 11/15/20 (a) | | | 25,625 |

| 3,950,000 | | BBB | | Devon Financing Corp. ULC, 6.875% due 9/30/11 | | | 4,288,187 |

| | | | | El Paso Corp., Medium-Term Notes: | | | |

| 200,000 | | B- | | 7.800% due 8/1/31 | | | 211,000 |

| 225,000 | | B- | | 7.750% due 1/15/32 | | | 239,063 |

| 200,000 | | B | | EXCO Resources Inc., Senior Notes, 7.250% due 1/15/11 | | | 204,000 |

| 550,000 | | BB | | Gaz Capital SA, 8.625% due 4/28/34 | | | 697,840 |

| 150,000 | | B+ | | Holly Energy Partners, L.P., Senior Notes, 6.250% due 3/1/15 | | | 145,500 |

| 275,000 | | BB+ | | Kerr-McGee Corp., Senior Secured Notes, 7.000% due 11/1/11 | | | 275,687 |

| 100,000 | | BB- | | Massey Energy Co., Senior Notes, 6.625% due 11/15/10 | | | 102,000 |

| | | | | Pemex Project Funding Master Trust, Notes: | | | |

| 225,000 | | BBB | | 5.750% due 12/15/15 (a) | | | 222,694 |

| 100,000 | | BBB | | 6.625% due 6/15/35 (a) | | | 100,225 |

| 100,000 | | B+ | | Pogo Producing Co., Senior Subordinated Notes, 6.875% due 10/1/17 (a) | | | 100,500 |

See Notes to Financial Statements.

12 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Oil, Gas & Consumable Fuels — 1.7% (continued) | | | |

| | | | | Stone Energy Corp., Senior Subordinated Notes: | | | |

| 50,000 | | B- | | 8.250% due 12/15/11 | | $ | 51,750 |

| 50,000 | | B- | | 6.750% due 12/15/14 | | | 48,500 |

| 200,000 | | BB- | | Swift Energy Co., Senior Notes, 7.625% due 7/15/11 | | | 208,000 |

| 4,225,000 | | BBB- | | Valero Energy Corp., Notes, 4.750% due 6/15/13 | | | 4,075,245 |

| 100,000 | | B | | Vintage Petroleum Inc., Senior Subordinated Notes, 7.875% due 5/15/11 | | | 105,000 |

| | | | | Whiting Petroleum Corp.: | | | |

| 125,000 | | B- | | 7.250% due 5/1/13 | | | 127,656 |

| 100,000 | | B- | | Senior Subordinated Notes, 7.000% due 2/1/14 (a) | | | 101,000 |

| 350,000 | | B+ | | Williams Cos. Inc., Notes, 8.750% due 3/15/32 | | | 418,250 |

|

| | | | | Total Oil, Gas & Consumable Fuels | | | 16,471,281 |

|

| Paper & Forest Products — 0.1% |

| | | | | Abitibi-Consolidated Inc.: | | | |

| 125,000 | | B+ | | Debentures, 8.850% due 8/1/30 | | | 107,500 |

| 100,000 | | B+ | | Notes, 7.750% due 6/15/11 | | | 94,250 |

| 50,000 | | B+ | | Senior Notes, 8.375% due 4/1/15 | | | 47,250 |

| 125,000 | | BB- | | Appleton Papers Inc., Senior Notes, 8.125% due 6/15/11 | | | 124,062 |

| 300,000 | | B+ | | Boise Cascade, LLC, Senior Subordinated Notes, Series B, 7.125% due 10/15/14 | | | 278,250 |

| | | | | Buckeye Technologies Inc.: | | | |

| 150,000 | | B+ | | Senior Notes, 8.500% due 10/1/13 | | | 151,500 |

| 50,000 | | B | | Senior Subordinated Notes, 8.000% due 10/15/10 | | | 48,500 |

| 100,000 | | B+ | | Catalyst Paper Corp., Senior Notes, Series D, 8.625% due 6/15/11 | | | 96,500 |

|

| | | | | Total Paper & Forest Products | | | 947,812 |

|

| Personal Products — 0.0% |

| 125,000 | | B | | DEL Laboratories Inc., 9.230% due 11/1/11 (a)(b) | | | 128,125 |

| 175,000 | | CCC+ | | Playtex Products Inc., Senior Subordinated Notes, 9.375% due 6/1/11 | | | 184,844 |

|

| | | | | Total Personal Products | | | 312,969 |

|

| Pharmaceuticals — 0.5% |

| 180,000 | | BB- | | Valeant Pharmaceuticals International, Senior Notes, 7.000% due 12/15/11 | | | 177,300 |

| 75,000 | | CCC+ | | Warner Chilcott Corp., 8.750% due 2/1/15 (a) | | | 73,875 |

| 4,650,000 | | A | | Wyeth, Unsubordinated Notes, 5.500% due 3/15/13 | | | 4,686,428 |

|

| | | | | Total Pharmaceuticals | | | 4,937,603 |

|

| Real Estate — 0.9% |

| 625,000 | | BBB | | Boston Properties LP, Senior Notes, 6.250% due 1/15/13 | | | 652,217 |

| 3,500,000 | | A- | | ERP Operating LP, Notes, 5.250% due 9/15/14 | | | 3,467,292 |

| 200,000 | | B | | Felcor Lodging LP, Senior Notes, 9.000% due 6/1/11 | | | 221,250 |

| | | | | Host Marriott LP, Senior Notes: | | | |

| 325,000 | | BB- | | 7.125% due 11/1/13 | | | 335,969 |

| 125,000 | | BB- | | Series O, 6.375% due 3/15/15 | | | 124,063 |

| 3,300,000 | | BBB- | | iStar Financial Inc., Senior Notes, 5.150% due 3/1/12 | | | 3,202,109 |

| 175,000 | | CCC+ | | MeriStar Hospitality Corp., Senior Notes, 9.125% due 1/15/11 | | | 190,313 |

|

| | | | | Total Real Estate | | | 8,193,213 |

|

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 13

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Road & Rail — 0.5% |

| 4,600,000 | | BBB | | Union Pacific Corp., Notes, 3.625% due 6/1/10 | | $ | 4,331,539 |

|

| Semiconductors & Semiconductor Equipment — 0.0% |

| | | | | Amkor Technology Inc.: | | | |

| | | | | Senior Notes: | | | |

| 175,000 | | CCC+ | | 9.250% due 2/15/08 | | | 172,375 |

| 121,000 | | CCC+ | | 7.750% due 5/15/13 | | | 107,085 |

| 50,000 | | CCC | | Senior Subordinated Notes, 10.500% due 5/1/09 | | | 47,250 |

|

| | | | | Total Semiconductors & Semiconductor Equipment | | | 326,710 |

|

| Specialty Retail — 0.4% |

| 125,000 | | B- | | CSK Auto Inc., Senior Notes, 7.000% due 1/15/14 | | | 114,687 |

| 125,000 | | B- | | Jafra Cosmetics International Inc., Senior Subordinated Notes, 10.750% due 5/15/11 | | | 136,875 |

| 3,200,000 | | BBB | | Limited Brands Inc., Debentures, 6.950% due 3/1/33 | | | 3,193,936 |

|

| | | | | Total Specialty Retail | | | 3,445,498 |

|

| Textiles, Apparel & Luxury Goods — 0.1% |

| 125,000 | | B- | | Collins & Aikman Floor Covering Inc., Senior Subordinated Notes, Series B, 9.750% due 2/15/10 | | | 115,625 |

| 300,000 | | B- | | Levi Strauss & Co., Senior Notes, 9.750% due 1/15/15 | | | 317,625 |

| 75,000 | | BB- | | Quiksilver Inc., Senior Notes, 6.875% due 4/15/15 | | | 72,375 |

| 75,000 | | B- | | Simmons Bedding Co., Senior Subordinated Notes, 7.875% due 1/15/14 | | | 70,875 |

|

| | | | | Total Textiles, Apparel & Luxury Goods | | | 576,500 |

|

| Wireless Telecommunication Services — 0.7% |

| 100,000 | | BB- | | American Tower Corp., Senior Notes, 7.125% due 10/15/12 | | | 104,250 |

| | | | | Centennial Communications Corp., Senior Notes: | | | |

| 100,000 | | CCC | | 10.250% due 1/1/13 (a)(b) | | | 102,750 |

| 175,000 | | CCC | | 10.125% due 6/15/13 | | | 192,500 |

| 125,000 | | CCC | | 8.125% due 2/1/14 | | | 127,812 |

| 50,000 | | CCC | | iPCS Inc., Senior Notes, 11.500% due 5/1/12 | | | 57,875 |

| 2,850,000 | | A | | New Cingular Wireless Services Inc., Unsubordinated Senior Notes, 8.750% due 3/1/31 | | | 3,745,732 |

| 675,000 | | A- | | Nextel Communications Inc., Senior Notes, Series D, 7.375% due 8/1/15 | | | 713,904 |

| | | | | SBA Communications Corp.: | | | |

| 49,000 | | B- | | Senior Discount Notes, step bond to yield 7.843% due 12/15/11 | | | 46,305 |

| 32,000 | | B- | | Senior Notes, 8.500% due 12/1/12 | | | 35,520 |

| 1,250,000 | | A- | | Sprint Capital Corp., Notes, 8.375% due 3/15/12 | | | 1,443,949 |

| 100,000 | | BBB- | | US Unwired Inc., Second Priority Secured Notes, Series B, 10.000% due 6/15/12 | | | 113,750 |

|

| | | | | Total Wireless Telecommunication Services | | | 6,684,347 |

|

| | | | | TOTAL CORPORATE BONDS & NOTES

(Cost — $228,969,655) | | | 226,219,399 |

|

See Notes to Financial Statements.

14 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| ASSET-BACKED SECURITIES — 6.4% |

| Automobiles — 2.0% |

| 6,500,000 | | AAA | | AmeriCredit Automobile Receivables Trust, Series 2004-AF, Class A4, 2.870% due 2/7/11 | | $ | 6,380,226 |

| 6,500,000 | | AAA | | Ford Credit Auto Owner Trust, Series 2005-B, Class A4, 4.380% due 1/15/10 | | | 6,430,473 |

| 2,750,000 | | AAA | | Franklin Auto Trust, Series 2004-1, Class A2, 3.570% due 3/16/09 | | | 2,723,326 |

| 3,950,000 | | AAA | | Susquehanna Auto Lease Trust, Series 2005-1, Class A3, 4.430% due 6/16/08 (a) | | | 3,917,906 |

|

| | | | | Total Automobiles | | | 19,451,931 |

|

| Automotive — 1.5% |

| 6,000,000 | | AAA | | E-Trade RV and Marine Trust, Series 2004-1, Class A3,

3.620% due 10/8/18 | | | 5,755,939 |

| 8,800,000 | | AAA | | Long Beach Auto Receivables Trust, Series 2005-A, Class A4, 4.250% due 4/15/12 | | | 8,646,985 |

|

| | | | | Total Automotive | | | 14,402,924 |

|

| Credit Card — 0.6% |

| 5,800,000 | | AAA | | Nordstrom Private Label Credit Card Master Note Trust, Series 2001-A, 4.820% due 4/15/10 (a) | | | 5,796,803 |

|

| Home Equity — 2.3% |

| 2,345,437 | | AAA | | Centex Home Equity Loan Trust, Series 2003-B, Class AF4, 3.235% due 2/25/32 | | | 2,317,757 |

| 4,475,241 | | AAA | | CIT Group Home Equity Loan Trust, 3.930% due 3/20/32 | | | 4,402,048 |

| 8,350,000 | | Aaa(e) | | Irwin Home Equity, Series 2005-1, Class 2A2, 4.720% due 6/25/35 | | | 8,210,776 |

| 6,675,000 | | AAA | | Structured Asset Securities Corp., Series 2005-7XS, Class 1A2B, 5.270% due 4/25/35 | | | 6,650,455 |

|

| | | | | Total Home Equity | | | 21,581,036 |

|

| | | | | TOTAL ASSET-BACKED SECURITIES

(Cost — $61,669,912) | | | 61,232,694 |

|

| MORTGAGE-BACKED SECURITIES — 29.5% |

| FHLMC — 7.9% |

| | | | | FHLMC: | | | |

| | | | | Gold: | | | |

| 462 | | | | 5.500% due 5/1/13 | | | 466 |

| 2,538,729 | | | | 6.500% due 9/1/14-1/1/32 | | | 2,608,333 |

| 3,615,286 | | | | 6.000% due 3/1/17 | | | 3,685,785 |

| 17,500,000 | | | | 4.500% due 2/1/21 (f)(g) | | | 16,975,000 |

| 3,496,305 | | | | 5.000% due 8/1/33-9/1/33 | | | 3,389,684 |

| 20,900,000 | | | | 5.000% due 2/1/36 (f)(g) | | | 20,181,562 |

| 29,000,000 | | | | 5.500% due 2/1/36-3/1/36 (f)(g) | | | 28,830,000 |

|

| | | | | Total FHLMC | | | 75,670,830 |

|

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 15

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| FNMA — 21.0% |

| | | | | FNMA: | | | |

| 3,487,844 | | | | 6.500% due 2/1/14-1/1/33 | | $ | 3,583,616 |

| 22,134,206 | | | | 5.500% due 11/1/16-4/1/35 | | | 21,933,775 |

| 10,621,835 | | | | 6.000% due 5/1/17-6/1/32 | | | 10,759,645 |

| 70,600,000 | | | | 5.000% due 2/1/21-2/1/36 (f)(g) | | | 68,648,490 |

| 55,010,000 | | | | 5.500% due 2/1/21-2/1/36 (f)(g) | | | 54,543,812 |

| 7,000,000 | | | | 4.500% due 2/1/36 (f)(g) | | | 6,564,684 |

| 32,000,000 | | | | 6.000% due 2/1/36 (f)(g) | | | 32,403,125 |

| 3,000,000 | | | | 6.500% due 2/1/36 (f)(g) | | | 3,075,936 |

|

| | | | | Total FNMA | | | 201,513,083 |

|

| GNMA — 0.6% |

| | | | | GNMA: | | | |

| 19,438 | | | | 8.500% due 11/15/27 | | | 21,037 |

| 5,994,040 | | | | 6.500% due 8/15/31-3/15/32 | | | 6,276,043 |

|

| | | | | Total GNMA | | | 6,297,080 |

|

| | | | | TOTAL MORTGAGE-BACKED SECURITIES

(Cost — $287,624,482) | | | 283,480,993 |

|

| COLLATERALIZED MORTGAGE OBLIGATIONS — 4.0% |

| 8,586,850 | | AAA | | Countrywide Alternative Loan Trust, Series 2004-14T2, Class A6, 5.500% due 8/25/34 (c) | | | 8,537,148 |

| 4,019,464 | | AAA | | FHLMC, Series 2687, Class IA, PAC IO, 5.500% due 9/15/22 | | | 191,153 |

| 2,982,886 | | AAA | | FNMA, Series 2003-111, Class HR, PAC, 3.750% due 5/25/30 | | | 2,893,895 |

| 2,487,584 | | AAA | | MASTR Adjustable Rate Mortgages Trust, Series 2004-6, Class 5A1, 4.743% due 7/25/34 (b) | | | 2,458,972 |

| 2,843,770 | | AAA | | Merrill Lynch Mortgage Investors Inc., Series 2005-A2, Class A4, 4.497% due 2/25/35 (b) | | | 2,794,322 |

| 5,965,806 | | AAA | | Residential Accredit Loans, Inc., Series 2005-QA7, Class A21,

4.854% due 7/25/35 (b) | | | 5,882,868 |

| 7,660,000 | | AAA | | Structured Adjustable Rate Mortgage Loan, Series 2005-20, Class 3A2, 5.250% due 10/25/35 (b) | | | 7,488,143 |

| | | | | Wells Fargo Mortgage Backed Securities Trust: | | | |

| 5,635,115 | | AAA | | Series 2004-N, Class A2, 3.599% due 8/25/34 (b) | | | 5,620,395 |

| 2,777,551 | | Aaa(e) | | Series 2005-AR4, Class 2A2, 4.531% due 4/25/35 (b) | | | 2,721,719 |

|

| | | | | TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost — $38,835,166) | | | 38,588,615 |

|

| U.S. GOVERNMENT & AGENCY OBLIGATIONS — 30.9% | | | |

| U.S. Government Agencies — 6.0% | | | |

| | | | | FHLMC: | | | |

| 10,000,000 | | | | 6.875% due 9/15/10 | | | 10,849,800 |

| 10,000,000 | | | | 5.125% due 7/15/12 | | | 10,156,420 |

| | | | | FNMA: | | | |

| 1,500,000 | | | | 3.625% due 3/15/07 | | | 1,480,494 |

| 10,000,000 | | | | 6.625% due 9/15/09 | | | 10,608,840 |

| 15,000,000 | | | | 6.000% due 5/15/11 | | | 15,833,340 |

| 8,000,000 | | | | 6.125% due 3/15/12 | | | 8,544,592 |

|

| | | | | Total U.S. Government Agencies | | | 57,473,486 |

|

See Notes to Financial Statements.

16 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| U.S. Government Obligations — 24.9% | | | |

| | | | | U.S. Treasury Bonds: | | | |

| 17,000,000 | | | | 8.750% due 5/15/17 | | $ | 23,082,158 |

| 13,200,000 | | | | 5.375% due 2/15/31 | | | 14,535,470 |

| | | | | U.S. Treasury Notes: | | | |

| 36,000,000 | | | | 3.500% due 5/31/07 (h) | | | 35,520,480 |

| 18,000,000 | | | | 4.375% due 12/31/07 | | | 17,953,596 |

| 43,300,000 | | | | 6.500% due 2/15/10 | | | 46,449,425 |

| 8,420,000 | | | | 4.000% due 3/15/10 | | | 8,261,797 |

| 18,800,000 | | | | 4.000% due 4/15/10 | | | 18,439,435 |

| 8,000,000 | | | | 5.000% due 2/15/11 | | | 8,185,008 |

| 40,000,000 | | | | 4.000% due 2/15/15 | | | 38,412,520 |

| 20,000,000 | | | | 4.125% due 5/15/15 | | | 19,377,360 |

| 9,000,000 | | | | 4.500% due 11/15/15 | | | 8,982,072 |

|

| | | | | Total U.S. Government Obligations | | | 239,199,321 |

|

| | | | | TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS

(Cost — $302,556,313) | | | 296,672,807 |

|

| SOVEREIGN BONDS — 2.6% | | | |

| Argentina — 0.1% | | | |

| | | | | Republic of Argentina: | | | |

| 849,761ARS | | B- | | 5.830% due 12/31/33 (b) | | | 327,616 |

| 381,159 | | B- | | Discount Notes, 8.280% due 12/31/33 | | | 340,566 |

| 2,373,887ARS | | NR | | Series PGDP, zero coupon due 12/15/35 (b) | | | 42,616 |

|

| | | | | Total Argentina | | | 710,798 |

|

| Brazil — 0.4% | | | | | |

| | | | | Federative Republic of Brazil: | | | |

| 525,000 | | BB- | | 7.875% due 3/7/15 | | | 568,575 |

| 250,000 | | BB- | | 8.750% due 2/4/25 | | | 286,250 |

| 1,626,000 | | BB- | | Collective Action Securities, 8.000% due 1/15/18 | | | 1,777,624 |

| 1,185,316 | | BB- | | DCB, Series L, 5.250% due 4/15/12 (b) | | | 1,182,353 |

|

| | | | | Total Brazil | | | 3,814,802 |

|

| Bulgaria — 0.0% | | | | | |

| 100,000 | | BBB | | Republic of Bulgaria, 8.250% due 1/15/15 | | | 120,000 |

|

| Canada — 0.5% | | | | | |

| 4,825,000 | | A+ | | Province of Quebec, 4.600% due 5/26/15 | | | 4,680,964 |

|

| Chile — 0.0% | | | | | |

| 225,000 | | A | | Republic of Chile, 5.500% due 1/15/13 | | | 229,847 |

|

| Colombia —0.1% | | | |

| | | | | Republic of Colombia: | | | |

| 300,000 | | BB | | 10.000% due 1/23/12 | | | 359,625 |

| 325,000 | | BB | | 11.750% due 2/25/20 | | | 464,750 |

| 175,000 | | BB | | 10.375% due 1/28/33 | | | 239,487 |

|

| | | | | Total Colombia | | | 1,063,862 |

|

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 17

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| Dominican Republic — 0.0% | | | |

| 235,288 | | B | | Dominican Republic, 9.040% due 1/23/18 (a) | | $ | 254,699 |

|

| Ecuador — 0.0% | | | | | |

| 350,000 | | CCC+ | | Republic of Ecuador, step bond to yield 10.486% due 8/15/30 | | | 341,250 |

|

| Malaysia — 0.1% | | | | | |

| 350,000 | | A- | | Federation of Malaysia, 7.500% due 7/15/11 | | | 390,106 |

|

| Mexico — 0.6% | | | | | |

| 2,500,000 | | A | | Corporacion Andina de Fomento, Notes, 6.875% due 3/15/12 | | | 2,700,657 |

| | | | | United Mexican States: | | | |

| 475,000 | | BBB | | 8.125% due 12/30/19 | | | 581,875 |

| 650,000 | | BBB | | Medium-Term Notes, Series A, 8.000% due 9/24/22 | | | 793,975 |

| | | | | Series A, Notes: | | | |

| 1,150,000 | | BBB | | 6.375% due 1/16/13 | | | 1,219,575 |

| 630,000 | | BBB | | 5.875% due 1/15/14 | | | 649,688 |

|

| | | | | Total Mexico | | | 5,945,770 |

|

| Panama — 0.1% | | | | | |

| | | | | Republic of Panama: | | | |

| 350,000 | | BB | | 9.375% due 7/23/12 | | | 414,750 |

| 275,000 | | BB | | 8.875% due 9/30/27 | | | 341,000 |

| 163,000 | | BB | | 6.700% due 1/26/36 | | | 162,633 |

|

| | | | | Total Panama | | | 918,383 |

|

| Peru — 0.1% | | | | | |

| | | | | Republic of Peru: | | | |

| 175,000 | | BB | | 9.125% due 2/21/12 | | | 203,000 |

| 150,000 | | BB | | 9.875% due 2/6/15 | | | 186,375 |

| 75,000 | | BB | | 8.750% due 11/21/33 | | | 88,500 |

| 451,000 | | BB | | PDI, 5.000% due 3/7/17 (b) | | | 438,598 |

|

| | | | | Total Peru | | | 916,473 |

|

| Philippines — 0.1% | | | |

| | | | | Republic of the Philippines: | | | |

| 400,000 | | BB- | | 9.000% due 2/15/13 | | | 446,740 |

| 200,000 | | BB- | | 8.250% due 1/15/14 | | | 214,370 |

| 100,000 | | BB- | | 8.875% due 3/17/15 | | | 111,313 |

| 125,000 | | BB- | | 9.875% due 1/15/19 | | | 149,059 |

| 300,000 | | BB- | | 9.500% due 2/2/30 | | | 351,735 |

|

| | | | | Total Philippines | | | 1,273,217 |

|

| Russia — 0.1% | | | |

| | | | | Russian Federation: | | | |

| 350,000 | | BBB | | 8.250% due 3/31/10 | | | 372,750 |

| 200,000 | | BBB | | 11.000% due 7/24/18 | | | 294,000 |

|

| | | | | Total Russia | | | 666,750 |

|

See Notes to Financial Statements.

18 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | |

| | | |

Face

Amount† | | Rating‡ | | Security | | Value |

| South Africa — 0.0% | | | |

| 200,000 | | BBB+ | | Republic of South Africa, 6.500% due 6/2/14 | | $ | 216,000 |

|

| Turkey — 0.2% | | | |

| | | | | Republic of Turkey: | | | |

| 300,000 | | BB- | | 11.500% due 1/23/12 | | | 380,625 |

| 150,000 | | BB- | | 11.000% due 1/14/13 | | | 190,688 |

| 175,000 | | BB- | | 7.250% due 3/15/15 | | | 183,750 |

| 200,000 | | BB- | | 7.000% due 6/5/20 | | | 202,750 |

| 450,000 | | BB- | | 7.375% due 2/5/25 | | | 465,187 |

|

| | | | | Total Turkey | | | 1,423,000 |

|

| Ukraine — 0.0% | | | |

| | | | | Republic of Ukraine: | | | |

| 100,000 | | BB- | | 6.875% due 3/4/11 | | | 102,125 |

| 200,000 | | BB- | | 7.650% due 6/11/13 | | | 212,500 |

|

| | | | | Total Ukraine | | | 314,625 |

|

| Uruguay — 0.1% | | | |

| | | | | Republic of Uruguay, Benchmark Bonds: | | | |

| 200,000 | | B | | 7.500% due 3/15/15 | | | 211,000 |

| 128,144 | | B | | 7.875% due 1/15/33 (i) | | | 134,071 |

|

| | | | | Total Uruguay | | | 345,071 |

|

| Venezuela — 0.1% | | | |

| | | | | Bolivarian Republic of Venezuela: | | | |

| 425,000 | | B+ | | 8.500% due 10/8/14 | | | 477,487 |

| | | | | Collective Action Security: | | | |

| 275,000 | | B+ | | 10.750% due 9/19/13 | | | 343,750 |

| 275,000 | | B+ | | 9.375% due 1/13/34 | | | 343,750 |

|

| | | | | Total Venezuela | | | 1,164,987 |

|

| | | | | TOTAL SOVEREIGN BONDS

(Cost — $24,532,769) | | | 24,790,604 |

|

| | | |

| Warrant | | | | | | |

| WARRANT — 0.0% | | | |

| 4,250 | | | | United Mexican States, Series XW10, Expires 10/10/06*

(Cost — $10,625) | | | 18,063 |

|

| | | | | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS

(Cost — $944,198,922) | | | 931,003,175 |

|

See Notes to Financial Statements.

Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report 19

Schedule of Investments (January 31, 2006) (unaudited) (continued)

| | | | | | | | | |

| | | |

Face

Amount | | | | Security | | Value | |

| | SHORT-TERM INVESTMENTS(c) — 26.7% | |

| | Repurchase Agreements — 26.7% | |

| $ | 100,000,000 | | | | Interest in $588,238,000 joint tri-party repurchase agreement dated 1/31/06 with Deutsche Bank Securities Inc., 4.450% due 2/1/06; Proceeds at maturity — $100,012,361; (Fully collateralized by various U.S. government agency obligations, 0.000% to 5.365% due 2/13/06 to 9/9/24; Market value —$102,000,409) | �� | $ | 100,000,000 | |

| | 55,568,000 | | | | Interest in $930,833,000 joint tri-party repurchase agreement dated 1/31/06 with Goldman, Sachs & Co., 4.440% due 2/1/06; Proceeds at maturity — $55,574,853; (Fully collateralized by various U.S. Treasury obligations, 0.875% to 4.250%, due 1/15/07 to 4/15/32; Market value — $56,688,684) | | | 55,568,000 | |

| | 100,000,000 | | | | Interest in $479,208,000 joint tri-party repurchase agreement dated 1/31/06 with Morgan Stanley, 4.450% due 2/1/06; Proceeds at maturity — $100,012,361; (Fully collateralized by various U.S. government agency obligations, 0.000% to 6.300% due 8/17/07 to 9/19/25; Market value —$103,217,088) | | | 100,000,000 | |

|

|

|

| | | | | | TOTAL SHORT-TERM INVESTMENTS

(Cost — $255,568,000) | | | 255,568,000 | |

|

|

|

| | | | | | TOTAL INVESTMENTS — 123.7% (Cost — $1,199,766,922#) | | | 1,186,571,175 | |

| | | | | | Liabilities in Excess of Other Assets — (23.7)% | | | (227,108,822 | ) |

|

|

|

| | | | | | TOTAL NET ASSETS — 100.0% | | $ | 959,462,353 | |

|

|

|

| * | | Non-income producing security. |

| † | | Face amount denominated in U.S. dollars, unless otherwise indicated. |

| ‡ | | All ratings are by Standard & Poor’s Ratings Service, unless otherwise noted. |

| (a) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

| (b) | | Variable rate security. Interest rate disclosed is that which is in effect at January 31, 2006. |

| (c) | | All or a portion of this security is segregated for open futures contracts, extended settlements, TBA’s and mortgage dollar rolls. |

| (d) | | Security is currently in default. |

| (e) | | Rating by Moody’s Investors Service. |

| (f) | | This security is traded on a “to-be-announced” basis (See Note 1). |

| (g) | | All or a portion of this security is acquired under mortgage dollar roll agreement (See Notes 1 and 3). |

| (h) | | All or a portion of this security is held at the broker as collateral for open futures contracts. |

| (i) | | Payment-in-kind security for which part of the income earned may be paid as additional principal. |

| # | | Aggregate cost for federal income tax purposes is substantially the same. |

See page 21 for definitions of ratings.

| | |

Abbreviations used in this schedule:

|

| ARS | | — Argentine Peso |

| DCB | | — Debt Conversion Bond |

| FHLMC | | — Federal Home Loan Mortgage Corp. |

| FNMA | | — Federal National Mortgage Association |

| GNMA | | — Government National Mortgage Association |

| IO | | — Interest Only |

| MASTR | | — Mortgage Asset Securitization Transactions Inc. |

| MXN | | — Mexican Peso |

| PAC | | — Planned Amortization Cost |

| PDI | | — Past Due Interest |

See Notes to Financial Statements.

20 Smith Barney Core Plus Bond Fund Inc. 2006 Semi-Annual Report

Bond Ratings (unaudited)

The definitions of the applicable rating symbols are set forth below:

Standard & Poor’s Ratings Service (“Standard & Poor’s”) — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (–) sign to show relative standings within the major rating categories.

AAA | — Bonds rated “AAA” have the highest rating assigned by Standard & Poor’s. Capacity to pay interest and repay principal is extremely strong. |

AA | — Bonds rated “AA” have a very strong capacity to pay interest and repay principal and differ from the highest rated issues only in a small degree. |

A | — Bonds rated “A” have a strong capacity to pay interest and repay principal although they are somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher rated categories. |

BBB | — Bonds rated “BBB” are regarded as having an adequate capacity to pay interest and repay principal. Whereas they normally exhibit adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for bonds in this category than in higher rated categories. |

BB, B, CCC, CC and C | — Bonds rated “BB”, “B”, “CCC”, “CC” and “C” are regarded, on balance, as predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. “BB” represents a lower degree of speculation than “B”, and “C” the highest degree of speculation. While such bonds will likely have some quality and protective characteristics, these are outweighed by large uncertainties or major risk exposures to adverse conditions. |

D | — Bonds rated “D” are in default and payment of interest and/or repayment of principal is in arrears. |

Moody’s Investors Service (“Moody’s”) — Numerical modifiers 1, 2 and 3 may be applied to each generic rating from “Aa” to “Caa,” where 1 is the highest and 3 the lowest ranking within its generic category.

Aaa | — Bonds rated “Aaa” are judged to be of the best quality. They carry the smallest degree of investment risk and are generally referred to as “gilt edge.” Interest payments are protected by a large or by an exceptionally stable margin and principal is secure. While the various protective elements are likely to change, such changes as can be visualized are most unlikely to impair the fundamentally strong position of such issues. |

Aa | — Bonds rated “Aa” are judged to be of high quality by all standards. Together with the “Aaa” group they comprise what are generally known as high grade bonds. They are rated lower than the best bonds because margins of protection may not be as large as in “Aaa” securities or fluctuation of protective elements may be of greater amplitude or there may be other elements present which make the long-term risks appear somewhat larger than in “Aaa” securities. |

A | — Bonds rated “A” possess many favorable investment attributes and are to be considered as upper medium grade obligations. Factors giving security to principal and interest are considered adequate but elements may be present which suggest a susceptibility to impairment some time in the future. |