- MGA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Magna International (MGA) 6-KCurrent report (foreign)

Filed: 5 May 23, 7:11am

Exhibit 99.2

Magna International Inc.

First Quarter Report

2023

MAGNA INTERNATIONAL INC.

Management’s Discussion and Analysis of Results of Operations and Financial Position

Unless otherwise noted, all amounts in this Management’s Discussion and Analysis of Results of Operations and Financial Position [“MD&A”] are in U.S. dollars and all tabular amounts are in millions of U.S. dollars, except per share figures, which are in U.S. dollars. When we use the terms “we”, “us”, “our” or “Magna”, we are referring to Magna International Inc. and its subsidiaries and jointly controlled entities, unless the context otherwise requires.

This MD&A should be read in conjunction with the unaudited interim consolidated financial statements for the three months ended March 31, 2023 included in this Quarterly Report, and the audited consolidated financial statements and MD&A for the year ended December 31, 2022 included in our 2022 Annual Report to Shareholders.

This MD&A may contain statements that are forward looking. Refer to the “Forward-Looking Statements” section in this MD&A for a more detailed discussion of our use of forward-looking statements.

This MD&A has been prepared as at May 4, 2023.

USE OF NON-GAAP FINANCIAL MEASURES

In addition to results presented in accordance with accounting principles generally accepted in the United States of America [“U.S. GAAP”], this report includes the use of Adjusted earnings before interest and taxes [“Adjusted EBIT”], Adjusted EBIT as a percentage of sales, Adjusted diluted earnings per share, Return on Invested Capital and Adjusted Return on Invested Capital [collectively, the “Non-GAAP Measures”]. We believe these non-GAAP financial measures provide additional information that is useful to investors in understanding our underlying performance and trends through the same financial measures employed by our management for this purpose. Readers should be aware that Non-GAAP Measures have no standardized meaning under U.S. GAAP and accordingly may not be comparable to the calculation of similar measures by other companies. We believe that Return on Invested Capital is useful to both management and investors in their analysis of our results of operations and reflect our ability to generate returns. Similarly, we believe that Adjusted EBIT, Adjusted EBIT as a percentage of sales, Adjusted diluted earnings per share and Adjusted Return on Invested Capital provide useful information to our investors for measuring our operational performance as they exclude certain items that are not reflective of ongoing operating profit or loss and facilitate a comparison with prior periods. The presentation of any Non-GAAP Measures should not be considered in isolation or as a substitute for our related financial results prepared in accordance with U.S. GAAP. Non-GAAP financial measures are presented together with the most directly comparable U.S. GAAP financial measure, and a reconciliation to the most directly comparable U.S. GAAP financial measure, can be found in the “Non-GAAP Financial Measures Reconciliation” section of this MD&A.

HIGHLIGHTS

Comparing the first quarter of 2023 to the first quarter of 2022:

| · | Global light vehicle production increased 3%, including 8% and 7% higher production in our two largest markets, North America and Europe, respectively. |

| · | Total sales increased 11% to $10.7 billion, largely reflecting higher global light vehicle production, the launch of new programs and higher complete vehicle assembly volumes. These were partially offset by the net weakening of foreign currencies against the U.S. dollar. |

| · | Diluted earnings per share were $0.73 and adjusted diluted earnings per share decreased $0.17 to $1.11 primarily as a result of higher production input costs, net of customer recoveries, partially offset by earnings on higher sales. |

| · | Cash from operating activities increased $47 million to $227 million. |

In addition, in the first quarter of 2023:

| · | We raised debt of $1.6 billion in the form of Senior Notes. |

| · | We announced the awards of significant new business including: |

| · | battery enclosures for General Motors’ full-size electric pick-up trucks and SUVs; |

| · | eDrive systems for a Europe-based global premium OEM; |

| · | complete seat assemblies for General Motors’ electric pick up-trucks to be produced at their Orion Assembly Plant; and |

| · | complete vehicle engineering and contract manufacturing for INEOS Automotive’s off-road electric vehicle. |

Magna International Inc. First Quarter Report 2023 1

OVERVIEW

OUR BUSINESS(1)

Magna is more than one of the world’s largest suppliers in the automotive space. We are a mobility technology company with a global, entrepreneurial-minded team of over 171,000(2) employees and an organizational structure designed to innovate like a startup. With 65+ years of expertise, and a systems approach to design, engineering and manufacturing that touches nearly every aspect of the vehicle, we are positioned to support advancing mobility in a transforming industry. Our global network includes 341 manufacturing operations and 88 product development, engineering and sales centres spanning 29 countries. Our common shares trade on the Toronto Stock Exchange (MG) and the New York Stock Exchange (MGA).

INDUSTRY TRENDS & RISKS

Our operating results are primarily dependent on the levels of North American, European and Chinese car and light truck production by our customers. While we supply systems and components to every major original equipment manufacturer [“OEM”], we do not supply systems and components for every vehicle, nor is the value of our content consistent from one vehicle to the next. As a result, customer and program mix relative to market trends, as well as the value of our content on specific vehicle production programs, are also important drivers of our results.

Ordinarily, OEM production volumes are aligned with vehicle sales levels and thus affected by changes in such levels. Aside from vehicle sales levels, production volumes are typically impacted by a range of factors, including: general economic and political conditions; labour disruptions; free trade arrangements; tariffs; relative currency values; commodities prices; supply chains and infrastructure; availability and relative cost of skilled labour; regulatory considerations, including those related to environmental emissions and safety standards; and other factors.

Overall vehicle sales levels are significantly affected by changes in consumer confidence levels, which may in turn be impacted by consumer perceptions and general trends related to the job, housing and stock markets, as well as other macroeconomic and political factors. Other factors which typically impact vehicle sales levels and thus production volumes include: interest rates and/or availability of credit; fuel and energy prices; relative currency values; regulatory restrictions on use of vehicles in certain megacities; and other factors.

While the foregoing economic, political and other factors are part of the general context in which the global automotive industry operates, there have been a number of significant industry trends that are shaping the future of the industry and creating opportunities and risks for automotive suppliers. We continue to implement a business strategy which is rooted in our best assessment as to the rate and direction of change in the automotive industry, including with respect to trends related to vehicle electrification and advanced driver assistance systems, as well as new mobility business models/“mobility-as-a-service” [“MaaS”]. Our short- and medium-term operational success, as well as our ability to create long-term value through our business strategy, are subject to a number of risks and uncertainties. Significant industry trends, our business strategy and the major risks we face, are discussed in our revised Annual Information Form [“AIF”] and Annual Report on Form 40-F / 40-F/A [“Form 40-F”] in respect of the year ended December 31, 2022, together with subsequent filings. Those industry trends and risk factors remain substantially unchanged in respect of the first quarter ended March 31, 2023.

1 Manufacturing operations, product development, engineering and sales centres include certain operations accounted for under the equity method.

2 Number of employees includes over 160,000 employees at our wholly owned or controlled entities and approximately 11,000 employees at certain operations accounted for under the equity method.

2 Magna International Inc. First Quarter Report 2023

RESULTS OF OPERATIONS

AVERAGE FOREIGN EXCHANGE

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| 1 Canadian dollar equals U.S. dollars | 0.740 | 0.790 | - | 6 | % | |||||||

| 1 euro equals U.S. dollars | 1.073 | 1.123 | - | 4 | % | |||||||

| 1 Chinese renminbi equals U.S. dollars | 0.146 | 0.158 | - | 8 | % | |||||||

The preceding table reflects the average foreign exchange rates between the most common currencies in which we conduct business and our U.S. dollar reporting currency.

The results of operations for which the functional currency is not the U.S. dollar are translated into U.S. dollars using the average exchange rates for the relevant period. Throughout this MD&A, reference is made to the impact of translation of foreign operations on reported U.S. dollar amounts where relevant.

Our results can also be affected by the impact of movements in exchange rates on foreign currency transactions (such as raw material purchases or sales denominated in foreign currencies). However, as a result of hedging programs employed by us, foreign currency transactions in the current period have not been fully impacted by movements in exchange rates. We record foreign currency transactions at the hedged rate where applicable.

Finally, foreign exchange gains and losses on revaluation and/or settlement of monetary items denominated in a currency other than an operation’s functional currency impact reported results. These gains and losses are recorded in selling, general and administrative expense.

LIGHT VEHICLE PRODUCTION VOLUMES

Our operating results are mostly dependent on light vehicle production in the regions reflected in the table below:

Light Vehicle Production Volumes (thousands of units)

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| North America | 3,909 | 3,621 | + | 8 | % | |||||||

| Europe | 4,270 | 4,002 | + | 7 | % | |||||||

| China | 6,077 | 6,388 | - | 5 | % | |||||||

| Other | 6,610 | 6,327 | + | 4 | % | |||||||

| Global | 20,866 | 20,338 | + | 3 | % | |||||||

Overall, global light vehicle production increased 3% over the first quarter of 2022, largely reflecting the significant industry production disruptions during the first quarter of 2022 caused by global semiconductor chip shortages and the Russian invasion of Ukraine. The industry disruption caused by global semiconductor chip shortages continued in the first quarter of 2023, but to a lesser extent than we experienced in the first quarter of 2022.

North America and Europe light vehicle production volumes benefited from improved semiconductor chip availability. However, Europe light vehicle production volumes were unfavourably impacted by lost production due to the Russian invasion of Ukraine while China volumes were unfavourably impacted by cautious consumer confidence levels.

Magna International Inc. First Quarter Report 2023 3

RESULTS OF OPERATIONS – FOR THE THREE MONTHS ENDED MARCH 31, 2023

SALES

Sales increased 11% or $1.03 billion to $10.67 billion for the first quarter of 2023 compared to $9.64 billion for the first quarter of 2022 primarily due to:

| · | higher global light vehicle production and assembly volumes; |

| · | the launch of new programs during or subsequent to the first quarter of 2022; and |

| · | customer price increases to recover certain higher production input costs. |

These factors were partially offset by:

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $370 million; |

| · | lower sales as a result of the substantial idling of our Russian facilities; |

| · | divestitures, net of acquisitions subsequent to the first quarter of 2022, which decreased sales by $17 million; and |

| · | net customer price concessions subsequent to the first quarter of 2022. |

COST OF GOODS SOLD

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| Material | $ | 6,703 | $ | 5,937 | $ | 766 | ||||||

| Direct labour | 809 | 726 | 83 | |||||||||

| Overhead | 1,904 | 1,737 | 167 | |||||||||

| Cost of goods sold | $ | 9,416 | $ | 8,400 | $ | 1,016 | ||||||

Cost of goods sold increased $1.02 billion to $9.42 billion for the first quarter of 2023 compared to $8.40 billion for the first quarter of 2022, primarily due to:

| · | higher material, direct labour and overhead associated with higher sales; |

| · | higher net production input costs, including for labour, energy and commodities; |

| · | operating inefficiencies at a facility in Europe; |

| · | an increase in material and direct labour costs associated with higher sales in our Complete Vehicles segment, which has a higher material content compared to our consolidated average; |

| · | higher net engineering costs including spending related to our electrification and advanced driver assistance systems [“ADAS”] businesses; |

| · | an increase in net warranty costs of $28 million; and |

| · | higher launch costs. |

These factors were partially offset by:

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar cost of goods sold by $325 million; |

| · | lower material, direct labour and overhead costs as a result of the substantial idling of our Russian facilities; |

| · | lower employee profit sharing and incentive compensation; |

| · | productivity and efficiency improvements, including lower costs at certain previously underperforming facilities; and |

| · | divestitures, net of acquisitions subsequent to the first quarter of 2022. |

DEPRECIATION AND AMORTIZATION

Depreciation and amortization decreased $4 million to $365 million for the first quarter of 2023 compared to $369 million for the first quarter of 2022 primarily due to the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar depreciation and amortization by $13 million partially offset by increased capital deployed at new and existing facilities to support the launch of programs subsequent to the first quarter of 2022.

4 Magna International Inc. First Quarter Report 2023

SELLING, GENERAL AND ADMINISTRATIVE [“SG&A”]

SG&A expense increased $102 million to $488 million for the first quarter of 2023 compared to $386 million for the first quarter of 2022, primarily as a result of:

| · | commercial items in the first quarter of 2023 and 2022, which had a net unfavourable impact on a year over year basis; |

| · | higher labour and benefit costs; |

| · | costs incurred at new facilities; |

| · | costs incurred relating to the pending acquisition of the Veoneer Active Safety business; and |

| · | higher costs to accelerate our operational excellence initiatives. |

These factors were partially offset by the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar SG&A expense by $16 million.

INTEREST EXPENSE, NET

During the first quarter of 2023, we recorded net interest expense of $20 million compared to $26 million for the first quarter of 2022. The $6 million decrease is primarily a result of a $4 million make-whole payment in February 2022, and higher interest income earned on cash and investments due to higher interest rates. These were partially offset by higher interest expense due to an increase in borrowings and higher interest rates.

EQUITY INCOME

Equity income increased $13 million to $33 million for the first quarter of 2023 compared to $20 million for the first quarter of 2022, primarily as a result of earnings on higher sales at certain equity-accounted entities and acquisitions subsequent to the first quarter of 2022 partially offset by the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar equity income by $2 million.

OTHER EXPENSE, NET

| For the three months | ||||||||

| ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Restructuring and impairments (1) | $ | 118 | $ | — | ||||

| Net losses on investments (2) | 24 | 61 | ||||||

| $ | 142 | $ | 61 | |||||

| (1) | Restructuring and impairments |

During the first quarter of 2023, we initiated restructuring plans to right-size our business in an effort to optimize our footprint. These restructuring plans include plant closures and workforce reductions in the amount of $118 million [$92 million after tax]. Of the total charges, $105 million [$82 million after tax] was recorded in our Power & Vision segment, and $13 million [$10 million after tax] in our Body Exteriors & Structures segment.

| (2) | Net losses on investments |

| For the three months | ||||||||

| ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Revaluation of public company warrants | $ | 22 | $ | 38 | ||||

| Revaluation of public and private equity investments | 2 | 21 | ||||||

| Net loss on sale of public equity investments | — | 2 | ||||||

| Other expense, net | 24 | 61 | ||||||

| Tax effect | (6 | ) | (13 | ) | ||||

| Net loss attributable to Magna | $ | 18 | $ | 48 | ||||

Magna International Inc. First Quarter Report 2023 5

INCOME FROM OPERATIONS BEFORE INCOME TAXES

Income from operations before income taxes was $275 million for the first quarter of 2023 compared to a $420 million for the first quarter of 2022. This $145 million decrease is a result of the following changes, each as discussed above:

| For the three months | ||||||||||||

| ended March 31, | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| Sales | $ | 10,673 | $ | 9,642 | $ | 1,031 | ||||||

| Costs and expenses | ||||||||||||

| Cost of goods sold | 9,416 | 8,400 | 1,016 | |||||||||

| Depreciation and amortization | 365 | 369 | (4 | ) | ||||||||

| Selling, general & administrative | 488 | 386 | 102 | |||||||||

| Interest expense, net | 20 | 26 | (6 | ) | ||||||||

| Equity income | (33 | ) | (20 | ) | (13 | ) | ||||||

| Other expense, net | 142 | 61 | 81 | |||||||||

| Income from operations before income taxes | $ | 275 | $ | 420 | $ | (145 | ) | |||||

INCOME TAXES

| For the three months ended March 31, | ||||||||||||||||

| 2023 | 2022 | |||||||||||||||

| Income Taxes as reported | $ | 58 | 21.1 | % | $ | 41 | 9.8 | % | ||||||||

| Tax effect on Other Expense, net | 32 | 0.5 | 13 | 1.5 | ||||||||||||

| Adjustments to Deferred Tax Valuation Allowances | — | — | 29 | 6.0 | ||||||||||||

| $ | 90 | 21.6 | % | $ | 83 | 17.3 | % | |||||||||

During the first quarter of 2022 we recorded a partial release of valuation allowances against certain deferred tax assets as a result of a tax reorganization [“Adjustments to Deferred Tax Valuation Allowances”].

Excluding the tax effect on Other expense, net, and the Adjustments to Deferred Tax Valuation Allowances our effective income tax rate increased to 21.6% for the first quarter of 2023 compared to 17.3% for the first quarter of 2022 primarily due to higher losses not benefited in Europe and lower net favourable adjustments related to changes in tax laws. These factors were partially offset by a lower accrued tax on undistributed foreign earnings.

6 Magna International Inc. First Quarter Report 2023

INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS

Income attributable to non-controlling interests was $8 million for the first quarter of 2023 compared to $15 million for the first quarter of 2022. This $7 million change was primarily due to lower net income at our non-wholly owned operations in China.

NET INCOME ATTRIBUTABLE TO MAGNA INTERNATIONAL INC.

Net income attributable to Magna International Inc. was $209 million for the first quarter of 2023 compared to $364 million for the first quarter of 2022. This $155 million decrease was as a result of: a decrease in income from operations before income taxes of $145 million; and a $17 million increase in income taxes; partially offset by a $7 million decrease in income attributable to non-controlling interests.

EARNINGS PER SHARE

| For the three months | |||||||||||||

| ended March 31, | |||||||||||||

| 2023 | 2022 | Change | |||||||||||

| Earnings per Common Share | |||||||||||||

| Basic | $ | 0.73 | $ | 1.23 | - | 41 | % | ||||||

| Diluted | $ | 0.73 | $ | 1.22 | - | 40 | % | ||||||

| Weighted average number of Common Shares outstanding (millions) | |||||||||||||

| Basic | 286.1 | 296.6 | - | 4 | % | ||||||||

| Diluted | 286.6 | 298.1 | - | 4 | % | ||||||||

| Adjusted diluted earnings per share | $ | 1.11 | $ | 1.28 | - | 13 | % | ||||||

Diluted earnings per share was $0.73 for the first quarter of 2023 compared to diluted earnings per share of $1.22 for the first quarter of 2022. The $0.49 decrease was as a result of lower net income attributable to Magna International Inc., as discussed above, partially offset by a decrease in the weighted average number of diluted shares outstanding during the first quarter of 2023. The decrease in the weighted average number of diluted shares outstanding was primarily due to the purchase and cancellation of Common Shares, during or subsequent to the first quarter of 2022, pursuant to our normal course issuer bids and a decrease in diluted shares relating to outstanding stock options as a result of the decrease in our share price.

Other expense, net, after tax, and Adjustments to Deferred Tax Valuation Allowances negatively impacted diluted earnings per share by $0.38 in the first quarter of 2023 and $0.06 in the first quarter of 2022, respectively, as discussed in the “Other expense, net” and “Income Taxes” sections above.

Adjusted diluted earnings per share, as reconciled in the “Non-GAAP Financial Measures Reconciliation” section, was $1.11 for the first quarter of 2023 compared to $1.28 in the first quarter of 2022.

Magna International Inc. First Quarter Report 2023 7

NON-GAAP PERFORMANCE MEASURES – FOR THE THREE MONTHS ENDED MARCH 31, 2023

ADJUSTED EBIT AS A PERCENTAGE OF SALES

The table below shows the change in Magna’s Sales and Adjusted EBIT by segment and the impact each segment’s changes had on Magna’s Adjusted EBIT as a percentage of sales for the first quarter of 2023 compared to the first quarter of 2022:

| Sales | Adjusted EBIT | Adjusted EBIT as a percentage of sales | ||||||||||

| First quarter of 2022 | $ | 9,642 | $ | 507 | 5.3 | % | ||||||

| Increase (decrease) related to: | ||||||||||||

| Body Exteriors & Structures | 362 | 41 | + | 0.2 | % | |||||||

| Power & Vision | 277 | (70 | ) | - | 0.8 | % | ||||||

| Seating Systems | 110 | (13 | ) | - | 0.2 | % | ||||||

| Complete Vehicles | 351 | 2 | - | 0.2 | % | |||||||

| Corporate and Other | (69 | ) | (30 | ) | - | 0.2 | % | |||||

| First quarter of 2023 | $ | 10,673 | $ | 437 | 4.1 | % | ||||||

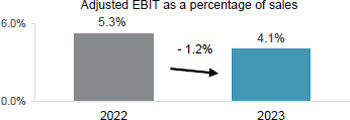

Adjusted EBIT as a percentage of sales decreased to 4.1% for the first quarter of 2023 compared to 5.3% for the first quarter of 2022 primarily due to:

| · | higher net production input costs, including for labour, energy and commodities; |

| · | lower net favourable commercial items; |

| · | operating inefficiencies at a facility in Europe; |

| · | higher net engineering costs including spending related to our electrification and ADAS businesses; |

| · | higher net warranty costs of $28 million; |

| · | higher launch costs; |

| · | lower amortization related to the initial value of public company securities; |

| · | higher costs to accelerate our operational excellence initiatives; and |

| · | reduced earnings as a result of the substantial idling of our Russian facilities. |

These factors were partially offset by:

| · | earnings on higher sales; |

| · | lower employee profit sharing and incentive compensation; |

| · | productivity and efficiency improvements, including lower costs at certain previously underperforming facilities; and |

| · | higher equity income. |

8 Magna International Inc. First Quarter Report 2023

ADJUSTED RETURN ON INVESTED CAPITAL AND RETURN ON INVESTED CAPITAL

Adjusted Return on Invested Capital decreased to 8.4% for the first quarter of 2023 compared to 10.4% for the first quarter of 2022 as a result of a decrease in Adjusted After-tax operating profits and higher Average Invested Capital. Other expense, net, after tax and Adjustments to Deferred Tax Valuation Allowances negatively impacted Return on Invested Capital by 2.7% in the first quarter of 2023 and by 0.5% in the first quarter of 2022.

Average Invested Capital increased $133 million to $16.32 billion for the first quarter of 2023 compared to $16.19 billion for the first quarter of 2022, primarily due to:

| · | average investment in fixed assets in excess of our average depreciation expense on fixed assets; |

| · | an increase in average changes in operating assets and liabilities; and |

| · | acquisitions, net of divestitures during and subsequent to the first quarter of 2022. |

These factors were partially offset by:

| · | the net weakening of foreign currencies against the U.S. dollar; |

| · | the impairment of our Russian assets recorded during the second quarter of 2022; and |

| · | lower net investments. |

Magna International Inc. First Quarter Report 2023 9

SEGMENT ANALYSIS

We are a global automotive supplier that has complete vehicle engineering and contract manufacturing expertise, as well as product capabilities which include body, chassis, exterior, seating, powertrain, active driver assistance, electronics, mechatronics, mirrors, lighting and roof systems. We also have electronic and software capabilities across many of these areas.

Our reporting segments are: Body Exteriors & Structures; Power & Vision; Seating Systems; and Complete Vehicles.

| For the three months ended March 31, | ||||||||||||||||||||||||

| Sales | Adjusted EBIT | |||||||||||||||||||||||

| 2023 | 2022 | Change | 2023 | 2022 | Change | |||||||||||||||||||

| Body Exteriors & Structures | $ | 4,439 | $ | 4,077 | $ | 362 | $ | 270 | $ | 229 | $ | 41 | ||||||||||||

| Power & Vision | 3,323 | 3,046 | 277 | 84 | 154 | (70 | ) | |||||||||||||||||

| Seating Systems | 1,486 | 1,376 | 110 | 36 | 49 | (13 | ) | |||||||||||||||||

| Complete Vehicles | 1,626 | 1,275 | 351 | 52 | 50 | 2 | ||||||||||||||||||

| Corporate and Other | (201 | ) | (132 | ) | (69 | ) | (5 | ) | 25 | (30 | ) | |||||||||||||

| Total reportable segments | $ | 10,673 | $ | 9,642 | $ | 1,031 | $ | 437 | $ | 507 | $ | (70 | ) | |||||||||||

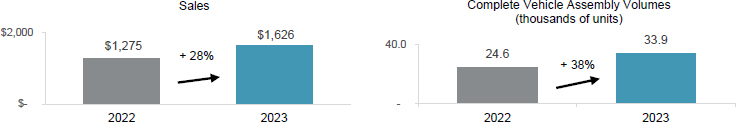

BODY EXTERIORS & STRUCTURES

| For the three months ended March 31, | ||||||||||||||||

| 2023 | 2022 | Change | ||||||||||||||

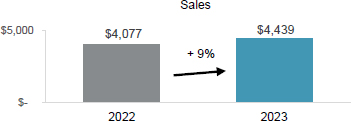

| Sales | $ | 4,439 | $ | 4,077 | $ | 362 | + | 9 | % | |||||||

| Adjusted EBIT | $ | 270 | $ | 229 | $ | 41 | + | 18 | % | |||||||

| Adjusted EBIT as a percentage of sales | 6.1 | % | 5.6 | % | + | 0.5 | % | |||||||||

Sales – Body Exteriors & Structures

Sales increased 9% or $362 million to $4.44 billion for the first quarter of 2023 compared to $4.08 billion for the first quarter of 2022 primarily due to:

| · | the launch of programs during or subsequent to the first quarter of 2022, including the: |

| · | Chevrolet Silverado; |

| · | Honda CR-V; |

| · | Rivian R1T and R1S; and |

| · | Mercedes Benz EQE; |

| · | higher global light vehicle production; and |

| · | customer price increases to recover certain higher production input costs. |

These factors were partially offset by:

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $136 million; |

| · | lower sales as a result of the substantial idling of our Russian facilities; and |

| · | net customer price concessions subsequent to the first quarter of 2022. |

10 Magna International Inc. First Quarter Report 2023

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Body Exteriors & Structures

Adjusted EBIT increased $41 million to $270 million for the first quarter of 2023 compared to $229 million for the first quarter of 2022 and Adjusted EBIT as a percentage of sales increased to 6.1% from 5.6%. These increases were primarily due to:

| · | earnings on higher sales; |

| · | productivity and efficiency improvements, including lower costs at certain previously underperforming facilities; |

| · | higher favourable commercial settlements; and |

| · | lower employee profit sharing and incentive compensation. |

These factors were partially offset by:

| · | operating inefficiencies at a facility in Europe; |

| · | higher net production input costs, including for labour, commodities, energy and freight; |

| · | reduced earnings as a result of the substantial idling of our Russian facilities; and |

| · | the net weakening of foreign currencies against the U.S. dollar, which had a $7 million unfavourable impact on reported U.S. dollar Adjusted EBIT. |

POWER & VISION

| For the three months ended March 31, | ||||||||||||||||

| 2023 | 2022 | Change | ||||||||||||||

| Sales | $ | 3,323 | $ | 3,046 | $ | 277 | + | 9 | % | |||||||

| Adjusted EBIT | $ | 84 | $ | 154 | $ | (70 | ) | - | 45 | % | ||||||

| Adjusted EBIT as a percentage of sales | 2.5 | % | 5.1 | % | - | 2.6 | % | |||||||||

Sales – Power & Vision

Sales increased 9% or $277 million to $3.32 billion for the first quarter of 2023 compared to $3.05 billion for the first quarter of 2022 primarily due to:

| · | the launch of programs during or subsequent to the first quarter of 2022, including the: |

| · | Chery Arrizo 8; |

| · | Chery Tiggo 9; |

| · | Alfa Romeo Tonale; and |

| · | Cadillac Lyriq; |

| · | higher global light vehicle production; and |

| · | customer price increases to recover certain higher production input costs. |

These factors were partially offset by:

| · | the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $125 million; |

| · | a divestiture subsequent to the first quarter of 2022, which decreased sales by $17 million; and |

Magna International Inc. First Quarter Report 2023 11

| · | net customer price concessions subsequent to the first quarter of 2022. |

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Power & Vision

Adjusted EBIT decreased $70 million to $84 million for the first quarter of 2023 compared to $154 million for the first quarter of 2022 and Adjusted EBIT as a percentage of sales decreased to 2.5% from 5.1%. These decreases were primarily due to:

| · | commercial items in the first quarter of 2023 and 2022, which had a net unfavourable impact on a year over year basis; |

| · | higher net warranty costs of $32 million; |

| · | higher net engineering costs including spending related to our electrification and ADAS businesses; |

| · | higher net production input costs, including for labour, partially offset by lower prices for commodities; |

| · | costs incurred relating to the pending acquisition of the Veoneer Active Safety business; and |

| · | the net weakening of foreign currencies against the U.S. dollar, which had an $8 million unfavourable impact on reported U.S. dollar Adjusted EBIT. |

These factors were partially offset by:

| · | earnings on higher sales; |

| · | higher equity income; and |

| · | lower employee profit sharing and incentive compensation. |

SEATING SYSTEMS

| For the three months ended March 31, | ||||||||||||||||

| 2023 | 2022 | Change | ||||||||||||||

| Sales | $ | 1,486 | $ | 1,376 | $ | 110 | + | 8 | % | |||||||

| Adjusted EBIT | $ | 36 | $ | 49 | $ | (13 | ) | - | 27 | % | ||||||

| Adjusted EBIT as a percentage of sales | 2.4 | % | 3.6 | % | - | 1.2 | % | |||||||||

Sales – Seating Systems

Sales increased 8% or $110 million to $1.49 billion for the first quarter of 2023 compared to $1.38 billion for the first quarter of 2022 primarily due to:

| · | higher global light vehicle production; and |

| · | the launch of programs during or subsequent to the first quarter of 2022, including the: |

| · | Nissan Frontier; |

| · | Changan Shenlan SL03; |

| · | Changan Oshan Z6; and |

| · | BMW XM. |

These factors were partially offset by the net weakening of foreign currencies against the U.S. dollar, which decreased reported U.S. dollar sales by $42 million and net customer price concessions subsequent to the first quarter of 2022.

12 Magna International Inc. First Quarter Report 2023

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Seating Systems

Adjusted EBIT decreased $13 million to $36 million for the first quarter of 2023 compared to $49 million for the first quarter of 2022 and Adjusted EBIT as a percentage of sales decreased to 2.4% from 3.6%. These decreases were primarily due to:

| · | inefficiencies including at certain underperforming facilities; |

| · | net favourable commercial settlements during the first quarter of 2022; |

| · | higher launch costs; and |

| · | higher net production input costs, including for labour and freight. |

These factors were partially offset by earnings on higher sales.

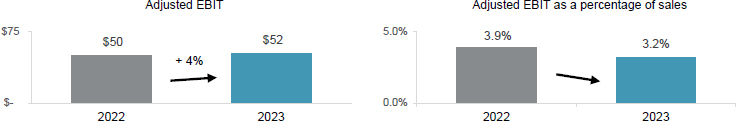

COMPLETE VEHICLES

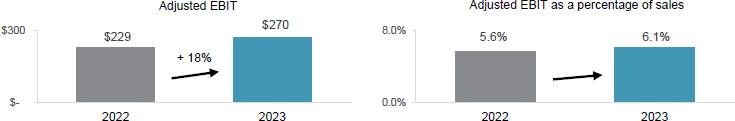

| For the three months ended March 31, | ||||||||||||||||

| 2023 | 2022 | Change | ||||||||||||||

| Complete Vehicle Assembly Volumes (thousands of units)(i) | 33.9 | 24.6 | + | 9.3 | + | 38 | % | |||||||||

| Sales | $ | 1,626 | $ | 1,275 | $ | 351 | + | 28 | % | |||||||

| Adjusted EBIT | $ | 52 | $ | 50 | $ | 2 | + | 4 | % | |||||||

| Adjusted EBIT as a percentage of sales | 3.2 | % | 3.9 | % | - | 0.7 | % | |||||||||

(i) Vehicles produced at our Complete Vehicle operations are included in Europe Light Vehicle Production volumes.

Sales – Complete Vehicles

Sales increased 28% or $351 million to $1.63 billion for the first quarter of 2023 compared to $1.28 billion for the first quarter of 2022 and assembly volumes increased 38%. The increase in sales is primarily a result of higher assembly volumes partially offset by a $75 million decrease in reported U.S. dollar sales as a result of the weakening of the euro against the U.S. dollar.

Magna International Inc. First Quarter Report 2023 13

Adjusted EBIT and Adjusted EBIT as a percentage of sales – Complete Vehicles

Adjusted EBIT increased $2 million to $52 million for the first quarter of 2023 compared to $50 million for the first quarter of 2022 while Adjusted EBIT as a percentage of sales decreased to 3.2% from 3.9%. Adjusted EBIT was higher primarily as a result of higher earnings due to higher assembly volumes, net of contractual fixed cost recoveries on certain programs. Excluding this factor, Adjusted EBIT and Adjusted EBIT as a percentage of sales were lower primarily due to:

| · | commercial items in the first quarter of 2023 and 2022, which had a net unfavourable impact on a year over year basis; |

| · | higher net production input costs, including for labour, freight and energy; and |

| · | higher engineering and other costs to launch upcoming assembly programs. |

These factors were partially offset by lower employee profit sharing.

CORPORATE AND OTHER

Adjusted EBIT was a loss of $5 million for the first quarter of 2023 compared to earnings of $25 million for the first quarter of 2022. The $30 million decrease was primarily the result of:

| · | lower amortization related to the initial value of public company securities; |

| · | higher costs to accelerate our operational excellence initiatives; |

| · | lower equity income; |

| · | higher incentive compensation and employee profit sharing; and |

| · | higher labour and benefit costs. |

These factors were partially offset by an increase in fees received from our divisions.

14 Magna International Inc. First Quarter Report 2023

FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES

OPERATING ACTIVITIES

| For the three months ended March 31, | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| Net income | $ | 217 | $ | 379 | ||||||||

| Items not involving current cash flows | 351 | 370 | ||||||||||

| 568 | 749 | $ | (181 | ) | ||||||||

| Changes in operating assets and liabilities | (341 | ) | (569 | ) | 228 | |||||||

| Cash provided from operating activities | $ | 227 | $ | 180 | $ | 47 | ||||||

Cash provided from operating activities

Comparing the first quarter of 2023 to 2022, cash generated from operating activities increased $47 million primarily as a result of a $607 million increase in cash received from customers.

This factor was partially offset by:

| · | a $306 million increase in cash paid for labour; |

| · | a $188 million increase in cash paid for materials and overhead; |

| · | a $43 million increase in cash paid for taxes; and |

| · | lower dividends received from equity method investments of $14 million. |

Changes in operating assets and liabilities

Consistent with the seasonality of our business, we invested in operating assets and liabilities during the first quarter of 2023. During the first quarter of 2023, we used $341 million for operating assets and liabilities primarily as a result of higher operating activity in the month of March 2023 compared to the month of December 2022. Specifically, we used cash for operating assets and liabilities for:

| · | an increase in production accounts receivables due to higher sales in the first quarter of 2023 compared to the fourth quarter of 2022; |

| · | an increase in tooling investment related to timing of program launches; and |

| · | an increase in prepaid expenses. |

These uses of cash were partially offset by an increase in accounts payable.

Magna International Inc. First Quarter Report 2023 15

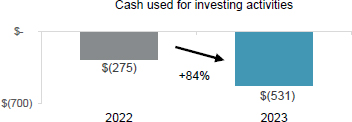

INVESTING ACTIVITIES

| For the three months ended March 31, | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| Fixed asset additions | $ | (424 | ) | $ | (238 | ) | ||||||

| Increase in investments, other assets and intangible assets | (101 | ) | (64 | ) | ||||||||

| Increase in public and private equity investments | — | (2 | ) | |||||||||

| Fixed assets, investments, other assets and intangible assets additions | (525 | ) | (304 | ) | ||||||||

| Proceeds from dispositions | 19 | 23 | ||||||||||

| Disposal of facilities | (25 | ) | 6 | |||||||||

| Cash used for investing activities | $ | (531 | ) | $ | (275 | ) | $ | (256 | ) | |||

Cash used for investing activities in the first quarter of 2023 was $256 million higher compared to the first quarter of 2022. The change between the first quarter of 2023 and the first quarter of 2022 was primarily due to a $223 million increase of cash used for fixed assets, investments, other assets, and intangible assets.

In addition, during the fourth quarter of 2022, we entered into an agreement to sell a European Power & Vision operation in early 2023. Under the terms of the arrangement, we are contractually obligated to provide the buyer with up to $42 million of funding, resulting in a loss of $58 million [$57 million after tax] recognized in 2022. During the first quarter of 2023, we completed the sale of this operation which resulted in a net cash outflow of $25 million.

FINANCING ACTIVITIES

| For the three months ended March 31, | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| Issues of debt | $ | 1,641 | $ | 28 | ||||||||

| Repayments of debt | (2 | ) | (357 | ) | ||||||||

| (Decrease) increase in short-term borrowings | (3 | ) | 1 | |||||||||

| Issue of Common Shares on exercise of stock options | 6 | 4 | ||||||||||

| Repurchase of Common Shares | (9 | ) | (383 | ) | ||||||||

| Tax withholdings on vesting of equity awards | (9 | ) | (14 | ) | ||||||||

| Dividends paid to non-controlling interests | (7 | ) | — | |||||||||

| Dividends | (132 | ) | (133 | ) | ||||||||

| Cash provided from (used for) financing activities | $ | 1,485 | $ | (854 | ) | $ | 2,339 | |||||

During the first quarter of 2023, we issued the following Senior Notes [the “Senior Notes”]:

| Issuance Date | Amount in USD at Issuance Date | Maturity Date | |||||

| Cdn$350 million Senior Notes at 4.950% | March 10, 2023 | $ | 258 million | January 31, 2031 | |||

| €550 million Senior Notes at 4.375% | March 17, 2023 | $ | 591 million | March 17, 2032 | |||

| $300 million Senior Notes at 5.980% | March 21, 2023 | $ | 300 million | March 21, 2026 | |||

| $500 million Senior Notes at 5.500% | March 21, 2023 | $ | 500 million | March 21, 2033 | |||

The total cash proceeds received from the Senior Note issuances was $1,637 million, which consists of $1,649 million of Senior Notes less debt issuance costs of $12 million.

The Senior Notes are unsecured obligations and do not include any financial covenants. We may redeem the Senior Notes in whole or in part at any time, and from time to time, at specified redemption prices determined in accordance with the terms of the indenture governing the Senior Notes. Refer to Note 9, “Debt” of our unaudited interim consolidated financial statements for the three months ended March 31, 2023.

16 Magna International Inc. First Quarter Report 2023

During the first quarter of 2023 we repurchased 0.1 million Common Shares under normal course issuer bids for aggregate cash consideration of $9 million.

Cash dividends paid per Common Share were $0.46 for the first quarter of 2023 compared to $0.45 for the first quarter of 2022.

FINANCING RESOURCES

| As at March 31, 2023 | As at December 31, 2022 | Change | ||||||||||

| Liabilities | ||||||||||||

| Short-term borrowings | $ | 4 | $ | 8 | ||||||||

| Long-term debt due within one year | 668 | 654 | ||||||||||

| Current portion of operating lease liabilities | 285 | 276 | ||||||||||

| Long-term debt | 4,500 | 2,847 | ||||||||||

| Operating lease liabilities | 1,318 | 1,288 | ||||||||||

| $ | 6,775 | $ | 5,073 | $ | 1,702 | |||||||

Financial liabilities increased $1.70 billion to $6.78 billion as at March 31, 2023 primarily as a result the issuance of the Senior Notes during the first quarter of 2023.

CASH RESOURCES

In the first quarter of 2023, our cash resources increased by $1.2 billion to $2.4 billion, primarily as a result of cash provided from financing and operating activities partially offset by cash used for investing activities, as discussed above. In addition to our cash resources at March 31, 2023, we had term and operating lines of credit totaling $5.1 billion, of which $4.9 billion was unused and available.

On March 6, 2023, we entered into a syndicated, unsecured, delayed draw term loan (the “Term Loan”) with a 3-year tranche of $800 million and a 5-year tranche of $600 million. The purpose of the Term Loan was to back stop our access to Debt Capital Markets in the event of disruptions that could restrict access to markets and to finance a portion of the pending acquisition of the Veoneer Active Safety Business and pay related fees and expenses. On April 21, 2023, we reduced the 3-year tranche amount to $300 million and the 5-year tranche amount to $400 million. Refer to the “Subsequent Events” section in this MD&A.

MAXIMUM NUMBER OF SHARES ISSUABLE

The following table presents the maximum number of shares that would be outstanding if all of the outstanding options at May 4, 2023 were exercised:

| Common Shares | 286,121,944 | |||

| Stock options (i) | 6,320,552 | |||

| 292,442,496 |

| (i) | Options to purchase Common Shares are exercisable by the holder in accordance with the vesting provisions and upon payment of the exercise price as may be determined from time to time pursuant to our stock option plans. |

CONTRACTUAL OBLIGATIONS

There have been no material changes with respect to the contractual obligations requiring annual payments during the first quarter of 2023 that are outside the ordinary course of our business. Refer to our MD&A included in our 2022 Annual Report.

SUBSEQUENT EVENTS

Reduction of term loan facility

Refer to the “Cash Resources” section in this MD&A.

AMENDMENT TO CREDIT FACILITY

On April 27, 2023 we amended our $2.7 billion syndicated revolving credit facility, including to: (i) extend the maturity date from June 24, 2027 to June 24, 2028, and (ii) cancel the $150 million Asian tranche and allocate the equivalent amount to the Canadian dollar tranche.

Magna International Inc. First Quarter Report 2023 17

COMMITMENTS AND CONTINGENCIES

From time to time, we may be contingently liable for litigation, legal and/or regulatory actions and proceedings and other claims. Refer to Note 13, “Contingencies” of our unaudited interim consolidated financial statements for the three months ended March 31, 2023, which describes these claims.

For a discussion of risk factors relating to legal and other claims/actions against us, refer to “Item 5. Risk Factors” in our AIF and Form 40-F, each in respect of the year ended December 31, 2022.

CONTROLS AND PROCEDURES

There have been no changes in our internal controls over financial reporting that occurred during the three months ended March 31, 2023 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

NON-GAAP FINANCIAL MEASURES RECONCILIATION

The reconciliation of Non-GAAP financial measures is as follows:

ADJUSTED EBIT

| For the three months ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Net Income | $ | 217 | $ | 379 | ||||

| Add: | ||||||||

| Interest expense, net | 20 | 26 | ||||||

| Other expense, net | 142 | 61 | ||||||

| Income taxes | 58 | 41 | ||||||

| Adjusted EBIT | $ | 437 | $ | 507 | ||||

ADJUSTED EBIT AS A PERCENTAGE OF SALES

| For the three months ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Sales | $ | 10,673 | $ | 9,642 | ||||

| Adjusted EBIT | $ | 437 | $ | 507 | ||||

| Adjusted EBIT as a percentage of sales | 4.1 | % | 5.3 | % | ||||

ADJUSTED DILUTED EARNINGS PER SHARE

| For the three months ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Net income attributable to Magna International Inc. | $ | 209 | $ | 364 | ||||

| Add (deduct): | ||||||||

| Other expense, net | 142 | 61 | ||||||

| Tax effect on Other expense, net | (32 | ) | (13 | ) | ||||

| Adjustments to Deferred Tax Valuation Allowances | — | (29 | ) | |||||

| Adjusted net income attributable to Magna International Inc. | 319 | 383 | ||||||

| Diluted weighted average number of Common Shares outstanding during the period (millions) | 286.6 | 298.1 | ||||||

| Adjusted diluted earnings per share | $ | 1.11 | $ | 1.28 | ||||

18 Magna International Inc. First Quarter Report 2023

RETURN ON INVESTED CAPITAL AND ADJUSTED RETURN ON INVESTED CAPITAL

Return on Invested Capital is calculated as After-tax operating profits divided by Average Invested Capital for the period. Adjusted Return on Invested Capital is calculated as Adjusted After-tax operating profits divided by Average Invested Capital for the period. Average Invested Capital for the three month period is averaged on a two-fiscal quarter basis.

| For the three months ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Net Income | $ | 217 | $ | 379 | ||||

| Add (deduct): | ||||||||

| Interest expense, net | 20 | 26 | ||||||

| Income taxes on Interest expense, net at Magna’s effective income tax rate: | (4 | ) | (4 | ) | ||||

| After-tax operating profits | 233 | 401 | ||||||

| Other expense, net | 142 | 61 | ||||||

| Tax effect on Other expense, net | (32 | ) | (13 | ) | ||||

| Adjustments to Deferred Tax Valuation Allowances | — | (29 | ) | |||||

| Adjusted After-tax operating profits | $ | 343 | $ | 420 | ||||

| As at March 31, | ||||||||

| 2023 | 2022 | |||||||

| Total Assets | $ | 30,654 | $ | 28,822 | ||||

| Excluding: | ||||||||

| Cash and cash equivalents | (2,429 | ) | (1,996 | ) | ||||

| Deferred tax assets | (506 | ) | (464 | ) | ||||

| Less Current Liabilities | (12,045 | ) | (10,440 | ) | ||||

| Excluding: | ||||||||

| Short-term borrowing | 4 | — | ||||||

| Long-term debt due within one year | 668 | 127 | ||||||

| Current portion of operating lease liabilities | 285 | 276 | ||||||

| Invested Capital | $ | 16,631 | $ | 16,325 | ||||

| For the three months ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| After-tax operating profits | $ | 233 | $ | 401 | ||||

| Average Invested Capital | $ | 16,318 | $ | 16,185 | ||||

| Return on Invested Capital | 5.7 | % | 9.9 | % | ||||

| For the three months ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Adjusted After-tax operating profits | $ | 343 | $ | 420 | ||||

| Average Invested Capital | $ | 16,318 | $ | 16,185 | ||||

| Adjusted Return on Invested Capital | 8.4 | % | 10.4 | % | ||||

Magna International Inc. First Quarter Report 2023 19

FORWARD-LOOKING STATEMENTS

Certain statements in this MD&A may constitute “forward-looking information” or “forward-looking statements” (collectively, “forward-looking statements”). Any such forward-looking statements are intended to provide information about management’s current expectations and plans and may not be appropriate for other purposes. Forward-looking statements may include financial and other projections, as well as statements regarding our future plans, strategic objectives or economic performance, or the assumptions underlying any of the foregoing, and other statements that are not recitations of historical fact. We use words such as “may”, “would”, “could”, “should”, “will”, “likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “aim”, “forecast”, “outlook”, “project”, “estimate”, “target” and similar expressions suggesting future outcomes or events to identify forward-looking statements.

Forward-looking statements are based on information currently available to us, and are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. While we believe we have a reasonable basis for making any such forward-looking statements, they are not a guarantee of future performance or outcomes. Whether actual results and developments conform to our expectations and predictions is subject to a number of risks, assumptions and uncertainties, many of which are beyond our control, and the effects of which can be difficult to predict, including, without limitation:

Macroeconomic, Geopolitical and Other Risks

· impact of the Russian invasion of Ukraine; · inflationary pressures; · interest rate levels; · risks related to COVID-19;

Risks Related to the Automotive Industry

· economic cyclicality; · regional production volume declines; · deteriorating vehicle affordability; · potential consumer hesitancy with respect to Electric Vehicles (“EVs”); · intense competition;

Strategic Risks

· alignment of our product mix with the “Car of the Future”; · our ability to consistently develop and commercialize innovative products or processes; · our investments in mobility and technology companies; · our changing business risk profile as a result of increased investment in electrification and autonomous/assisted driving, including: higher R&D and engineering costs, and challenges in quoting for profitable returns on products for which we may not have significant quoting experience;

Customer-Related Risks

· concentration of sales with six customers; · inability to significantly grow our business with Asian customers; · emergence of potentially disruptive EV OEMs, including risks related to limited revenues/operating history of new OEM entrants; · evolving counterparty risk profile; · dependence on outsourcing; · OEM consolidation and cooperation; · shifts in market shares among vehicles or vehicle segments; · shifts in consumer “take rates” for products we sell; · quarterly sales fluctuations; · potential loss of any material purchase orders; · potential OEM production-related disruptions;

Supply Chain Risks

· semiconductor chip supply disruptions and price increases, and the impact on customer production volumes and on the efficiency of our operations; · supply disruptions and applicable costs related to supply disruption mitigation initiatives; · regional energy shortages/disruptions and pricing; · a deterioration of the financial condition of our supply base; | IT Security/Cybersecurity Risks

· IT/Cybersecurity breach; · Product cybersecurity breach;

Pricing Risks

· pricing risks following time of quote or award of new business; · price concessions; · commodity cost volatility; · declines in scrap steel/aluminum prices;

Warranty / Recall Risks

· costs related to repair or replace defective products, including due to a recall; · warranty or recall costs that exceed warranty provisions or insurance coverage limits; · product liability claims;

Climate Change Risks

· transition risks and physical risks; · strategic and other risks related to the transition to electromobility;

Acquisition Risks

· competition for strategic acquisition targets; · inherent merger and acquisition risks; · acquisition integration risk;

Other Business Risks

· risks related to conducting business through joint ventures; · intellectual property risks; · risks of conducting business in foreign markets; · fluctuations in relative currency values; · an increase in pension funding obligations; · tax risks; · reduced financial flexibility as a result of an economic shock; · inability to achieve future investment returns that equal or exceed past returns; · changes in credit ratings assigned to us; · the unpredictability of, and fluctuation in, the trading price of our Common Shares; · a reduction of suspension of our dividend; |

20 Magna International Inc. First Quarter Report 2023

Manufacturing Operational Risks

· product and new facility launch risks; · operational underperformance; · restructuring costs; · impairment charges; · labour disruptions; · skilled labour attraction/retention; · leadership expertise and succession; | Legal, Regulatory and Other Risks

· antitrust risk; · legal claims and/or regulatory actions against us; · changes in laws and regulations, including those related to vehicle emissions, taxation or made as a result of the COVID-19 pandemic · potential restrictions on free trade; · trade disputes/tariffs; and · environmental compliance costs. |

In evaluating forward-looking statements, we caution readers not to place undue reliance on any forward-looking statement. Additionally, readers should specifically consider the various factors which could cause actual events or results to differ materially from those indicated by such forward-looking statements, including the risks, assumptions and uncertainties above which are:

| · | discussed under the “Industry Trends and Risks” heading of our Management’s Discussion and Analysis; and |

| · | set out in our revised Annual Information Form filed with securities commissions in Canada, our annual report on Form 40-F / 40-F/A filed with the United States Securities and Exchange Commission, and subsequent filings. |

Readers should also consider discussion of our risk mitigation activities with respect to certain risk factors, which can also be found in our Annual Information Form.

Magna International Inc. First Quarter Report 2023 21

MAGNA INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF INCOME

[Unaudited]

[U.S. dollars in millions, except per share figures]

| Three months ended | |||||||||||

| March 31, | |||||||||||

| Note | 2023 | 2022 | |||||||||

| Sales | 14 | $ | 10,673 | $ | 9,642 | ||||||

| Costs and expenses | |||||||||||

| Cost of goods sold | 9,416 | 8,400 | |||||||||

| Depreciation and amortization | 365 | 369 | |||||||||

| Selling, general and administrative | 488 | 386 | |||||||||

| Interest expense, net | 20 | 26 | |||||||||

| Equity income | (33 | ) | (20 | ) | |||||||

| Other expense, net | 2 | 142 | 61 | ||||||||

| Income from operations before income taxes | 275 | 420 | |||||||||

| Income taxes | 58 | 41 | |||||||||

| Net income | 217 | 379 | |||||||||

| Income attributable to non-controlling interests | (8 | ) | (15 | ) | |||||||

| Net income attributable to Magna International Inc. | $ | 209 | $ | 364 | |||||||

| Earnings per Common Share: | 3 | ||||||||||

| Basic | $ | 0.73 | $ | 1.23 | |||||||

| Diluted | $ | 0.73 | $ | 1.22 | |||||||

| Cash dividends paid per Common Share | $ | 0.46 | $ | 0.45 | |||||||

| Weighted average number of Common Shares outstanding during the period [in millions]: | 3 | ||||||||||

| Basic | 286.1 | 296.6 | |||||||||

| Diluted | 286.6 | 298.1 | |||||||||

See accompanying notes

22 Magna International Inc. First Quarter Report 2023

MAGNA INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

[Unaudited]

[U.S. dollars in millions]

| Three months ended | |||||||||||

| March 31, | |||||||||||

| Note | 2023 | 2022 | |||||||||

| Net income | $ | 217 | $ | 379 | |||||||

| Other comprehensive income (loss), net of tax: | 11 | ||||||||||

| Net unrealized gain (loss) on translation of net investment in foreign operations | 45 | (98 | ) | ||||||||

| Net unrealized gain on cash flow hedges | 41 | 55 | |||||||||

| Reclassification of net gain on cash flow hedges to net income | (3 | ) | (6 | ) | |||||||

| Pension and post retirement benefits | (5 | ) | 1 | ||||||||

| Reclassification of net loss on pensions to net income | 1 | 1 | |||||||||

| Other comprehensive income (loss) | 79 | (47 | ) | ||||||||

| Comprehensive income | 296 | 332 | |||||||||

| Comprehensive income attributable to non-controlling interests | (10 | ) | (13 | ) | |||||||

| Comprehensive income attributable to Magna International Inc. | $ | 286 | $ | 319 | |||||||

See accompanying notes

Magna International Inc. First Quarter Report 2023 23

MAGNA INTERNATIONAL INC.

CONSOLIDATED BALANCE SHEETS

[Unaudited]

[U.S. dollars in millions]

| As at | As at | |||||||||||

| March 31, | December 31, | |||||||||||

| Note | 2023 | 2022 | ||||||||||

| ASSETS | ||||||||||||

| Current assets | ||||||||||||

| Cash and cash equivalents | 4 | $ | 2,429 | $ | 1,234 | |||||||

| Accounts receivable | 7,959 | 6,791 | ||||||||||

| Inventories | 5 | 4,421 | 4,180 | |||||||||

| Prepaid expenses and other | 367 | 320 | ||||||||||

| 15,176 | 12,525 | |||||||||||

| Investments | 6 | 1,390 | 1,429 | |||||||||

| Fixed assets, net | 8,304 | 8,173 | ||||||||||

| Operating lease right-of-use assets | 1,638 | 1,595 | ||||||||||

| Intangible assets, net | 441 | 452 | ||||||||||

| Goodwill | 2,049 | 2,031 | ||||||||||

| Deferred tax assets | 506 | 491 | ||||||||||

| Other assets | 7 | 1,150 | 1,093 | |||||||||

| $ | 30,654 | $ | 27,789 | |||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||

| Current liabilities | ||||||||||||

| Short-term borrowing | $ | 4 | $ | 8 | ||||||||

| Accounts payable | 7,731 | 6,999 | ||||||||||

| Other accrued liabilities | 8 | 2,526 | 2,118 | |||||||||

| Accrued salaries and wages | 822 | 850 | ||||||||||

| Income taxes payable | 9 | 93 | ||||||||||

| Long-term debt due within one year | 668 | 654 | ||||||||||

| Current portion of operating lease liabilities | 285 | 276 | ||||||||||

| 12,045 | 10,998 | |||||||||||

| Long-term debt | 9 | 4,500 | 2,847 | |||||||||

| Operating lease liabilities | 1,318 | 1,288 | ||||||||||

| Long-term employee benefit liabilities | 563 | 548 | ||||||||||

| Other long-term liabilities | 451 | 461 | ||||||||||

| Deferred tax liabilities | 288 | 312 | ||||||||||

| 19,165 | 16,454 | |||||||||||

| Shareholders’ equity | ||||||||||||

| Capital stock | ||||||||||||

| Common Shares | ||||||||||||

| [issued: 286,095,777; December 31, 2022 – 285,931,816] | 10 | 3,319 | 3,299 | |||||||||

| Contributed surplus | 104 | 111 | ||||||||||

| Retained earnings | 8,699 | 8,639 | ||||||||||

| Accumulated other comprehensive loss | 11 | (1,036 | ) | (1,114 | ) | |||||||

| 11,086 | 10,935 | |||||||||||

| Non-controlling interests | 403 | 400 | ||||||||||

| 11,489 | 11,335 | |||||||||||

| $ | 30,654 | $ | 27,789 | |||||||||

See accompanying notes

24 Magna International Inc. First Quarter Report 2023

MAGNA INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

[Unaudited]

[U.S. dollars in millions]

| Three months ended | |||||||||||

| March 31, | |||||||||||

| Note | 2023 | 2022 | |||||||||

| Cash provided from (used for): | |||||||||||

| OPERATING ACTIVITIES | |||||||||||

| Net income | $ | 217 | $ | 379 | |||||||

| Items not involving current cash flows | 4 | 351 | 370 | ||||||||

| 568 | 749 | ||||||||||

| Changes in operating assets and liabilities | 4 | (341 | ) | (569 | ) | ||||||

| Cash provided from operating activities | 227 | 180 | |||||||||

| INVESTMENT ACTIVITIES | |||||||||||

| Fixed asset additions | (424 | ) | (238 | ) | |||||||

| Increase in investments, other assets and intangible assets | (101 | ) | (64 | ) | |||||||

| Proceeds from dispositions | 19 | 23 | |||||||||

| Increase in public and private equity investments | — | (2 | ) | ||||||||

| Disposal of facilities | 4 | (25 | ) | 6 | |||||||

| Cash used for investing activities | (531 | ) | (275 | ) | |||||||

| FINANCING ACTIVITIES | |||||||||||

| Issues of debt | 9 | 1,641 | 28 | ||||||||

| Repayments of debt | (2 | ) | (357 | ) | |||||||

| (Decrease) increase in short-term borrowings | (3 | ) | 1 | ||||||||

| Issues of Common Shares on exercise of stock options | 6 | 4 | |||||||||

| Repurchase of Common Shares | 10 | (9 | ) | (383 | ) | ||||||

| Tax withholdings on vesting of equity awards | (9 | ) | (14 | ) | |||||||

| Dividends paid to non-controlling interests | (7 | ) | — | ||||||||

| Dividends | (132 | ) | (133 | ) | |||||||

| Cash provided by (used for) financing activities | 1,485 | (854 | ) | ||||||||

| Effect of exchange rate changes on cash and cash equivalents | 14 | (3 | ) | ||||||||

| Net increase (decrease) in cash and cash equivalents during the period | 1,195 | (952 | ) | ||||||||

| Cash and cash equivalents, beginning of period | 1,234 | 2,948 | |||||||||

| Cash and cash equivalents, end of period | 4 | $ | 2,429 | $ | 1,996 | ||||||

See accompanying notes

Magna International Inc. First Quarter Report 2023 25

MAGNA INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

[Unaudited]

[U.S. dollars in millions]

| Common Shares | Non- | ||||||||||||||||||||||||||||||

| Stated | Contributed | Retained | controlling | Total | |||||||||||||||||||||||||||

| Note | Number | Value | Surplus | Earnings | AOCL (i) | Interest | Equity | ||||||||||||||||||||||||

| [in millions] | |||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | 285.9 | $ | 3,299 | $ | 111 | $ | 8,639 | $ | (1,114 | ) | $ | 400 | $ | 11,335 | |||||||||||||||||

| Net income | 209 | 8 | 217 | ||||||||||||||||||||||||||||

| Other comprehensive income | 77 | 2 | 79 | ||||||||||||||||||||||||||||

| Shares issued on exercise of stock options | 0.1 | 7 | (1 | ) | 6 | ||||||||||||||||||||||||||

| Release of stock and stock units | 0.3 | 15 | (15 | ) | — | ||||||||||||||||||||||||||

| Tax withholdings on vesting of Equity awards | (0.1 | ) | (2 | ) | (7 | ) | (9 | ) | |||||||||||||||||||||||

| Repurchase and cancellation under normal course issuer bid | 10 | (0.1 | ) | (2 | ) | (8 | ) | 1 | (9 | ) | |||||||||||||||||||||

| Stock-based compensation expense | 9 | 9 | |||||||||||||||||||||||||||||

| Dividends paid | 2 | (134 | ) | (132 | ) | ||||||||||||||||||||||||||

| Dividends paid to non-controlling interests | (7 | ) | (7 | ) | |||||||||||||||||||||||||||

| Balance, March 31, 2023 | 286.1 | $ | 3,319 | $ | 104 | $ | 8,699 | $ | (1,036 | ) | $ | 403 | $ | 11,489 | |||||||||||||||||

| Common Shares | Non- | ||||||||||||||||||||||||||||||

| Stated | Contributed | Retained | controlling | Total | |||||||||||||||||||||||||||

| Note | Number | Value | Surplus | Earnings | AOCL (i) | Interest | Equity | ||||||||||||||||||||||||

| [in millions] | |||||||||||||||||||||||||||||||

| Balance, December 31, 2021 | 297.9 | $ | 3,403 | $ | 102 | $ | 9,231 | $ | (900 | ) | $ | 389 | $ | 12,225 | |||||||||||||||||

| Net income | 364 | 15 | 379 | ||||||||||||||||||||||||||||

| Other comprehensive loss | (45 | ) | (2 | ) | (47 | ) | |||||||||||||||||||||||||

| Shares issued on exercise of stock options | 0.1 | 5 | (1 | ) | 4 | ||||||||||||||||||||||||||

| Release of stock and stock units | 0.3 | 14 | (14 | ) | — | ||||||||||||||||||||||||||

| Tax withholdings on vesting of Equity awards | (0.2 | ) | (2 | ) | (12 | ) | (14 | ) | |||||||||||||||||||||||

| Repurchase and cancellation under normal course issuer bid | 10 | (5.8 | ) | (64 | ) | (322 | ) | 3 | (383 | ) | |||||||||||||||||||||

| Stock-based compensation expense | 8 | 8 | |||||||||||||||||||||||||||||

| Dividends paid | 2 | (135 | ) | (133 | ) | ||||||||||||||||||||||||||

| Balance, March 31, 2022 | 292.3 | $ | 3,358 | $ | 95 | $ | 9,126 | $ | (942 | ) | $ | 402 | $ | 12,039 | |||||||||||||||||

| (i) | AOCL is Accumulated Other Comprehensive Loss. |

See accompanying notes

26 Magna International Inc. First Quarter Report 2023

MAGNA INTERNATIONAL INC.

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

[Unaudited]

[All amounts in U.S. dollars and all tabular amounts in millions unless otherwise noted]

| 1. | SIGNIFICANT ACCOUNTING POLICIES |

| [a] | Basis of presentation |

The unaudited interim consolidated financial statements of Magna International Inc. and its subsidiaries [collectively “Magna” or the “Company”] have been prepared in U.S. dollars following accounting principles generally accepted in the United States of America [“GAAP”]. The unaudited interim consolidated financial statements do not conform in all respects to the requirements of GAAP for annual financial statements. Accordingly, these unaudited interim consolidated financial statements should be read in conjunction with the December 31, 2022 audited consolidated financial statements and notes thereto included in the Company’s 2022 Annual Report.

The unaudited interim consolidated financial statements reflect all adjustments, which consist only of normal and recurring adjustments, necessary to present fairly the financial position as at March 31, 2023 and the results of operations, changes in equity, and cash flows for the three-month periods ended March 31, 2023 and 2022.

| [b] | Use of Estimates |

The preparation of the unaudited interim consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported and disclosed in the interim consolidated financial statements and accompanying notes. Due to the inherent uncertainty involved in making estimates, actual results could ultimately differ from those estimates.

| 2. | OTHER EXPENSE, NET |

| Three months ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Restructuring and impairments | [a] | $ | 118 | $ | — | ||||||

| Net losses on investments | [b] | 24 | 61 | ||||||||

| $ | 142 | $ | 61 | ||||||||

| [a] | Restructuring and impairments |

In the first quarter of 2023, the Company initiated restructuring plans to right-size its business in an effort to optimize its footprint. These restructuring plans include plant closures and workforce reductions in the amount of $118 million [$92 million after tax]. Of the total charges, $105 million [$82 million after tax] was recorded in its Power & Vision segment, and $13 million [$10 million after tax] in its Body Exteriors & Structures segment.

| [b] | Net losses on investments |

| Three months ended | ||||||||

| March 31, | ||||||||

| 2023 | 2022 | |||||||

| Revaluation of public company warrants | $ | 22 | $ | 38 | ||||

| Revaluation of public and private equity investments | 2 | 21 | ||||||

| Net loss on sale of public equity investments | — | 2 | ||||||

| Other expense, net | 24 | 61 | ||||||

| Tax effect | (6 | ) | (13 | ) | ||||

| Net loss attributable to Magna | $ | 18 | $ | 48 | ||||

Magna International Inc. First Quarter Report 2023 27

MAGNA INTERNATIONAL INC.

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

[Unaudited]

[All amounts in U.S. dollars and all tabular amounts in millions unless otherwise noted]

| 3. | EARNINGS PER SHARE |

| Three months ended | ||||||||

| March 31, | ||||||||

| 2023 | 2022 | |||||||

| Basic earnings per Common Share: | ||||||||

| Net income attributable to Magna International Inc. | $ | 209 | $ | 364 | ||||

| Weighted average number of Common Shares outstanding | 286.1 | 296.6 | ||||||

| Basic earnings per Common Share | $ | 0.73 | $ | 1.23 | ||||

| Diluted earnings per Common Share [a]: | ||||||||

| Net income attributable to Magna International Inc. | $ | 209 | $ | 364 | ||||

| Weighted average number of Common Shares outstanding | 286.1 | 296.6 | ||||||

| Stock options and restricted stock | 0.5 | 1.5 | ||||||

| 286.6 | 298.1 | |||||||

| Diluted earnings per Common Share | $ | 0.73 | $ | 1.22 | ||||

| [a] | For the three months ended March 31, 2023, diluted earnings per Common Share excluded 1.4 million [2022 – 1.0 million] Common Shares issuable under the Company’s Incentive Stock Option Plan because these options were not “in-the-money”. The dilutive effect of participating securities using the two-class method was excluded from the calculation of earnings per share because the effect would be immaterial. |

28 Magna International Inc. First Quarter Report 2023

MAGNA INTERNATIONAL INC.

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

[Unaudited]

[All amounts in U.S. dollars and all tabular amounts in millions unless otherwise noted]

| 4. | DETAILS OF CASH FLOWS |

Cash from operating activities

| [a] | Cash and cash equivalents: |

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Bank term deposits and bankers’ acceptances | $ | 1,750 | $ | 720 | ||||

| Cash | 679 | 514 | ||||||

| $ | 2,429 | $ | 1,234 | |||||

| [b] | Items not involving current cash flows: |

| Three months ended | ||||||||

| March 31, | ||||||||

| 2023 | 2022 | |||||||

| Depreciation and amortization | $ | 365 | $ | 369 | ||||

| Amortization of other assets included in cost of goods sold | 65 | 47 | ||||||

| Deferred revenue amortization | (75 | ) | (59 | ) | ||||

| Dividends received in excess of equity income | 8 | 35 | ||||||

| Deferred tax recovery | (37 | ) | (90 | ) | ||||

| Other non-cash charges | 1 | 7 | ||||||

| Non-cash portion of Other expense, net [note 2] | 24 | 61 | ||||||

| $ | 351 | $ | 370 | |||||

| [c] | Changes in operating assets and liabilities: |

| Three months ended | ||||||||

| March 31, | ||||||||

| 2023 | 2022 | |||||||

| Accounts receivable | $ | (1,170 | ) | $ | (762 | ) | ||

| Inventories | (235 | ) | (350 | ) | ||||

| Prepaid expenses and other | (4 | ) | (5 | ) | ||||

| Accounts payable | 693 | 441 | ||||||

| Accrued salaries and wages | (21 | ) | 38 | |||||

| Other accrued liabilities | 491 | 85 | ||||||

| Income taxes payable | (95 | ) | (16 | ) | ||||

| $ | (341 | ) | $ | (569 | ) | |||

Cash from investment activities

During the fourth quarter of 2022, the Company entered into an agreement to sell a European Power & Vision operation in early 2023. Under the terms of the arrangement, the Company is contractually obligated to provide the buyer with up to $42 million of funding, resulting in a loss of $58 million [$57 million after tax] recognized in 2022. During the first quarter of 2023, the Company completed the sale of this operation which resulted in a net cash outflow of $25 million.

Magna International Inc. First Quarter Report 2023 29

MAGNA INTERNATIONAL INC.

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

[Unaudited]

[All amounts in U.S. dollars and all tabular amounts in millions unless otherwise noted]

| 5. | INVENTORIES |

Inventories consist of:

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Raw materials and supplies | $ | 1,641 | $ | 1,640 | ||||

| Work-in-process | 431 | 427 | ||||||

| Finished goods | 523 | 537 | ||||||

| Tooling and engineering | 1,826 | 1,576 | ||||||

| $ | 4,421 | $ | 4,180 | |||||

Tooling and engineering inventory represents costs incurred on tooling and engineering services contracts in excess of billed and unbilled amounts included in accounts receivable.

| 6. | INVESTMENTS |

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Equity method investments | $ | 982 | $ | 997 | ||||

| Public and private equity investments | 288 | 290 | ||||||

| Warrants | 120 | 142 | ||||||

| $ | 1,390 | $ | 1,429 | |||||

Cumulative unrealized gains and losses on equity securities held as at March 31, 2023 were $73 million and $228 million [$74 million and $205 million as at December 31, 2022], respectively.

| 7. | OTHER ASSETS |

Other assets consist of:

| March 31, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Preproduction costs related to long-term supply agreements | $ | 700 | $ | 679 | ||||

| Long-term receivables | 284 | 262 | ||||||

| Pension overfunded status | 40 | 41 | ||||||

| Unrealized gain on cash flow hedges | 22 | 26 | ||||||

| Other, net | 104 | 85 | ||||||

| $ | 1,150 | $ | 1,093 | |||||

| 8. | WARRANTY |

The following is a continuity of the Company’s warranty accruals:

| 2023 | 2022 | |||||||

| Balance, beginning of period | $ | 257 | $ | 247 | ||||

| Expense, net | 49 | 17 | ||||||

| Settlements | (23 | ) | (4 | ) | ||||

| Foreign exchange and other | 1 | (5 | ) | |||||

| Balance, March 31 | $ | 284 | $ | 255 | ||||

30 Magna International Inc. First Quarter Report 2023

MAGNA INTERNATIONAL INC.

NOTES TO INTERIM CONSOLIDATED FINANCIAL STATEMENTS

[Unaudited]

[All amounts in U.S. dollars and all tabular amounts in millions unless otherwise noted]

| 9. | DEBT |

| [a] | Senior notes |

During the first quarter of 2023, the Company issued the following Senior Notes:

| Issuance Date | Amount in USD at Issuance Date | Maturity Date | ||||

| Cdn$350 million Senior Notes at 4.950% [i] | March 10, 2023 | $258 million | January 31, 2031 | |||

| €550 million Senior Notes at 4.375% [ii] | March 17, 2023 | $591 million | March 17, 2032 | |||

| $300 million Senior Notes at 5.980% [i] | March 21, 2023 | $300 million | March 21, 2026 | |||

| $500 million Senior Notes at 5.500% [i] | March 21, 2023 | $500 million | March 21, 2033 |

The total cash proceeds received from the Senior Note issuances was $1,637 million, which consists of $1,649 million of Senior Notes less debt issuance costs of $12 million.

The Senior Notes are unsecured obligations and do not include any financial covenants. The Company may redeem the notes in whole or in part at any time, and from time to time, at specified redemption prices determined in accordance with the terms of the indenture governing the Senior Notes.