QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

| ý | | Filed by the Registrant |

o |

|

Filed by a Party other than the Registrant |

|

|

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

TRM CORPORATION |

(Name of Registrant as Specified in its Charter) |

|

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: Set forth the amount on which the filing fee is calculated and state how it was determined.

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Notice of Annual Meeting of Shareholders

May 18, 2004

To Our Shareholders:

The annual meeting of the shareholders of TRM Corporation, an Oregon corporation (the "Company"), will be held onTuesday, May 18, 2004, at 9:00 a.m. at the offices of TRM Corporation, 1521 Locust Street, 2nd Floor, Philadelphia, Pennsylvania 19102, for the following purposes:

- 1.

- To elect three members of the Board of Directors for three-year terms.

- 2.

- To ratify the selection of PricewaterhouseCoopers LLP as the Company's independent auditors for the 2004 fiscal year, and

- 3.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

All shareholders are invited to attend the meeting. Holders of record of the Company's Common Stock and Series A Preferred Stock at the close of business on March 12, 2004, are entitled to notice of and to vote at the meeting.

| | | By Order of the Board of Directors |

|

|

Kenneth L. Tepper

President & CEO |

Portland, Oregon

April 20, 2004 |

|

|

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the annual meeting, please promptly sign and date your enclosed proxy and return it in the postage paid envelope.

A shareholder who completes and returns the proxy and subsequently attends the meeting may elect to vote in person, since a proxy may be revoked at any time before it is exercised. Retention of the proxy is not necessary for admission to the meeting.

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of TRM Corporation (the "Company") for use at the 2004 Annual Meeting of Shareholders (the "Annual Meeting") to be held onTuesday, May 18, 2004, at 9:00 a.m. at the executive offices of TRM Corporation, 1521 Locust Street, 2nd Floor, Philadelphia, Pennsylvania 19102, and at any adjournments thereof.

The cost of soliciting proxies will be borne by the Company, including expenses in connection with the preparation and mailing of the proxy statement, form of proxy and any other material furnished to the shareholders by the Company in connection with the annual meeting. In addition to the solicitation of proxies by mail, employees of the Company may also solicit proxies by telephone and personal contact. The Company has retained Registrar and Transfer Company to assist in the solicitation of proxies from brokers and other nominees at an estimated cost of $1,500. The Company's Annual Report on Form 10-K covering the year ended December 31, 2003, which includes financial statements, is being mailed to shareholders together with these proxy materials on or about April 20, 2004.

Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before its exercise. The proxy may be revoked by filing with the Secretary of the Company an instrument of revocation or a duly executed proxy bearing a later date. The proxy may also be revoked by affirmatively electing to vote in person while attending the meeting. However, a shareholder who attends the meeting need not revoke the proxy and vote in person unless he or she wishes to do so. All valid proxies will be voted at the meeting in accordance with the instructions given. If no instructions are given, the proxies will be voted for (a) the election of the nominees for director and (b) the ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent auditors for the fiscal year ending December 31, 2004. At the meeting, the presence in person or by proxy of the holders of a majority of all shares of the Common Stock and Preferred Stock issued and outstanding, together as a single class, will constitute a quorum for the transaction of business.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

The Company's outstanding voting securities consist of Common Stock and Series A Preferred Stock. The record date for determining holders of Common Stock and Series A Preferred Stock entitled to vote at the Annual Meeting is March 12, 2004. On that date, there were 7,184,565 shares of Common Stock and 1,777,778 shares of Series A Preferred Stock outstanding, each entitled to one vote per share, voting together as one class on all matters except for those matters pertaining only to the specific class. Neither the Common Stock nor the Series A Preferred Stock has cumulative voting rights. Each share of Series A Preferred Stock is convertible into .7499997 shares of Common Stock.

The following table sets forth the number and percentage of shares of Common Stock and Series A Preferred Stock beneficially owned, as of April 5, 2004, by each of the Company's directors

1

and executive officers, all of its directors and executive officers as a group and other persons who beneficially own more than 5% of either class of outstanding voting securities.

Beneficial Owner

| | Shares of

Common

Stock assuming

no conversion

of Series A

Preferred

Stock(1)

| | Percent

of Class

| | Shares of

Series A

Preferred

Stock

| | Percent

of Class

| | Shares of

Common Stock

assuming full

conversion of

Series A

Preferred Stock

and exercise of

options and/or

warrants(2)

| | Percent

of class

| |

|---|

Lance Laifer(3)

450 Seventh Avenue, Suite 1605

New York, NY 10036 | | 1,140,634 | | 15.5 | % | 313,228 | | 17.6 | % | 1,433,411 | | 18.7 | % |

Daniel G. Cohen(4)

1818 Market Street, 28th Floor

Philadelphia, PA 19103 |

|

653,435 |

|

8.9 |

% |

529,280 |

|

29.8 |

% |

1,318,794 |

|

16.4 |

% |

Edward E. Cohen(5)

1845 Walnut Street, 10th Floor

Philadelphia, PA 19103 |

|

693,973 |

|

9.4 |

% |

61,714 |

|

3.5 |

% |

940,501 |

|

12.4 |

% |

Safeco Corporation(6)

SAFECO Plaza

Seattle, WA 98185 |

|

566,850 |

|

7.7 |

% |

— |

|

— |

|

556,850 |

|

7.7 |

% |

ReadyCash Investment Partners, L.P.(7)

1521 Locust Street, 4th Floor

Philadelphia, PA 19102 |

|

— |

|

— |

|

467,388 |

|

26.3 |

% |

390,541 |

|

5.0 |

% |

Friedman, Billings, Ramsey Group, Inc.(8)

1001 Nineteenth Street North

Arlington, VA 22209 |

|

— |

|

— |

|

423,280 |

|

23.8 |

% |

388,889 |

|

5.0 |

% |

Bay Pond Partners, L.P.

c/o Morgan Stanley & Co.

1221 Avenue of the Americas, 28th Floor

New York, NY 10020 |

|

— |

|

— |

|

263,134 |

|

14.8 |

% |

241,636 |

|

3.2 |

% |

Kenneth L. Tepper

5208 N.E. 122nd Avenue

Portland, OR 97230 |

|

26,800 |

|

* |

|

— |

|

— |

|

149,300 |

|

2.0 |

% |

Danial J. Tierney

5208 N.E. 122nd Avenue

Portland, OR 97230 |

|

4,131 |

|

* |

|

— |

|

— |

|

141,131 |

|

1.9 |

% |

Permal Investment Holdings N.V.

Permal Asset Management

900 Third Avenue, 28th Floor

New York, NY 10022 |

|

— |

|

— |

|

90,892 |

|

5.1 |

% |

83,169 |

|

1.1 |

% |

Thomas W. Mann

5208 N.E. 122nd Avenue

Portland, OR 97230 |

|

4,000 |

|

* |

|

— |

|

— |

|

49,870 |

|

* |

|

| | | | | | | | | | | | | | |

2

Alan D. Schreiber, M.D.

821 Westview Street

Philadelphia, PA 19119 |

|

30,800 |

|

* |

|

— |

|

— |

|

30,800 |

|

* |

|

Gary Cosmer

5208 N.E. 122nd Avenue

Portland, OR 97230 |

|

497 |

|

* |

|

— |

|

— |

|

30,497 |

|

* |

|

Hersh Kozlov

1940 Route 70 East, Suite 200

Cherry Hill, NJ 08003 |

|

14,500 |

|

* |

|

— |

|

— |

|

24,500 |

|

* |

|

Slavka B. Glaser

277 Park Avenue, 9th Floor

New York, NY 10172 |

|

— |

|

* |

|

— |

|

— |

|

15,000 |

|

* |

|

Harmon S. Spolan

1900 Market Street, 4th Floor

Philadelphia, PA 19103 |

|

1,000 |

|

* |

|

— |

|

— |

|

6,000 |

|

* |

|

Nancy Alperin

1736 Pine Street, Suite 100

Philadelphia, PA 19103 |

|

— |

|

* |

|

— |

|

— |

|

5,000 |

|

* |

|

Rebecca J. Demy

5208 N.E. 122nd Avenue

Portland, OR 97230 |

|

— |

|

* |

|

— |

|

— |

|

3,200 |

|

* |

|

Ashley S. Dean

1A Meadowbrook, Maxwell Way

Crawley, West Sussex RH10 95A |

|

— |

|

* |

|

— |

|

— |

|

3,000 |

|

* |

|

Amy B. Krallman

5208 N.E. 122nd Avenue

Portland, OR 97230 |

|

— |

|

* |

|

— |

|

— |

|

— |

|

* |

|

Directors and executive officers as a group (17 persons) |

|

2,569,770 |

|

34.9 |

% |

904,222 |

|

50.9 |

% |

3,916,083 |

|

39.0 |

% |

- *

- Represents less than 1 percent.

- (1)

- Beneficial ownership is determined in accordance with Rule 13d-3 of the Securities and Exchange Commission (the "SEC"), and includes voting power and dispositive power with respect to shares. Shares are held with sole voting and dispositive power unless otherwise indicated. Shares of Common Stock subject to options currently exercisable or exercisable within 60 days are deemed outstanding for computing the percentage for the person holding such options, but are not deemed outstanding for computing the percentage for any other person. The numbers of shares that may be obtained upon exercise of options that are currently exercisable or exercisable within 60 days of April 5, 2004, are as follows: Mr. Daniel G. Cohen 225,000 shares; Mr. Edward E. Cohen 190,000

3

shares; Mr. Danial J. Tierney 137,000 shares; Mr. Kenneth L. Tepper 122,500 shares; Mr. Thomas W. Mann 45,870 shares; Mr. Gary M. Cosmer 30,000 shares; Ms. Slavka Glaser 15,000 shares; Mr. Hersh Kozlov 10,000 shares; Ms. Nancy Alperin 5,000 shares; Mr. Lance Laifer 5,000 shares; Mr. Harmon Spolan 5,000 shares; Ms. Rebecca J. Demy 3,200 shares; Mr. Ashley Dean 3,000 shares; and all executive officers and directors as a group, 796,570 shares.

- (2)

- Each beneficial owner's percentage of the Company's voting securities was calculated assuming that (a) such beneficial owner exercised all options described in footnote (1) of this table and warrants and converted into Common Stock all shares of Series A Preferred Stock for which such person is the beneficial owner, and (b) no other beneficial owner exercised any options and warrants or converted into Common Stock any shares of Series A Preferred Stock.

- (3)

- Based on information received from Mr. Lance Laifer, as sole director and principal stockholder of Laifer Capital Management, Inc., his ownership consists of 1,433,411 shares, comprised of: 1,140,634 shares of Common Stock, 313,228 shares of Series A Preferred Stock which are convertible into 234,921 shares of Common Stock (for which an irrevocable proxy has been granted to ReadyCash to vote the shares), warrants to purchase 52,856 shares of Common Stock, and 5,000 shares subject to options exercisable within 60 days of April 5, 2004. Mr. Laifer also serves as a director of the Company.

- (4)

- Based on information received from Mr. Daniel G. Cohen, his ownership consists of 1,318,794 shares, comprised of: 653,435 shares of Common Stock, 21,342 shares of Series A Preferred Stock which are convertible into 16,006 shares of Common Stock, warrants to purchase 3,400 shares of Common Stock, and 225,000 shares of Common Stock subject to options exercisable within 60 days of April 5, 2004. Mr. D. Cohen's ownership also includes 146,032 shares of Common Stock issuable upon conversion of 194,710 Series A Preferred Stock to Common Stock owned by ReadyCash Investment Partners, L.P. ("ReadyCash"), and warrants to purchase 40,000 shares of Common Stock exercisable within 60 days held by ReadyCash, as ReadyCash automatically dissolves and liquidates upon conversion. Finally, Mr. D. Cohen's ownership includes 234,921 shares of Common Stock issuable upon conversion of 313,228 Series A Preferred Stock held by third parties who have granted irrevocable proxies to ReadyCash. Such irrevocable proxies terminate upon conversion of the Series A Preferred Stock. Mr. D. Cohen is the majority shareholder and an officer and director of the general partner of ReadyCash. Under current SEC rules, Mr. D. Cohen may be deemed to be the beneficial owner of shares owned by ReadyCash. Mr. D. Cohen also serves as Chairman of the Company.

- (5)

- Based on information received from Mr. Edward E. Cohen, his ownership consists of 940,501 shares. Mr. E. Cohen's ownership is comprised of 426,245 shares of Common Stock owned by Mr. E. Cohen, 73,476 shares of Common Stock owned by individual retirement accounts for the benefit of Mr. E. Cohen and his spouse, 194,252 shares of Common Stock owned by a charitable foundation of which Mr. E. Cohen and his spouse are trustees, (with respect to which he disclaims beneficial ownership), 61,714 shares of Series A Preferred Stock which are convertible into 46,285 shares of Common Stock, warrants to purchase 10,243 shares of Common Stock, and 190,000 shares subject to options exercisable within 60 days of April 5, 2004. Mr. E. Cohen also serves as a director of the Company.

- (6)

- This information is based upon a Schedule 13G dated February 11, 2003, and filed with the SEC reporting that Safeco Corporation had (i) sole voting power with respect to no shares and shared voting with respect to 566,850 shares and (ii) sole dispositive with respect to no shares and shared dispositive power with respect to 566,850 shares. Safeco Corporation disclaims beneficial ownership of these shares. The shares are beneficially owned by registered investment companies for which a subsidiary of Safeco Corporation serves as an adviser. Because of its ownership or control of one

4

or more investment companies which directly own shares, Safeco Corporation may be considered an indirect beneficial owner of these shares.

- (7)

- This information is based in part on a Schedule 13D/A dated July 17, 2003, and filed with the SEC, reporting that ReadyCash had (i) sole voting power with respect to 40,000 shares of Common Stock issuable upon exercise of warrants and (ii) sole dispositive power with respect to 40,000 shares issuable upon the exercise of warrants held by ReadyCash. ReadyCash's ownership also includes 146,032 shares of Common Stock issuable upon the conversion of 194,710 Series A Preferred Stock to Common Stock (ReadyCash automatically dissolves and liquidates upon such conversion), and 234,921 shares of Common Stock issuable upon the conversion of 313,228 Series A Preferred Stock to Common Stock held by third parties, for which ReadyCash has been granted irrevocable proxies which terminate upon conversion of the Series A Preferred Stock.

- (8)

- This information is based upon a Schedule 13G/A dated February 17, 2004, and filed with the SEC, reporting that Friedman, Billings, Ramsey Group, Inc., ("Friedman") had (i) sole voting power with respect to no shares and shared voting power with respect to 423,280 shares of Series A Preferred Stock which are convertible into 317,460 shares of Common Stock and (ii) sole dispositive power with respect to no shares and shared dispositive power with respect to 423,280 shares of Series A Preferred Stock which are convertible into 317,460 shares of Common Stock. Friedman also owns warrants to purchase 71,429 shares of Common Stock.

Securities Authorized for Issuance under Equity Compensation Plans

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

| | Weighted-average exercise

price of outstanding options,

warrants and rights

(b)

| | Number of securities remaining

available for future issuance

under equity compensation

plans (excluding shares

reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders: | | | | | | | |

| | Stock option plans | | 1,935,500 | | $ | 4.89 | | 227,300 |

| | Employee stock purchase plan | | — | | | — | | — |

| Equity compensation plans not approved by security holders: | | | | | | | |

| | 2001 Nonqualified Stock Option Plan | | — | | | — | | 100,000 |

| | Total | | 1,935,500 | | $ | 4.89 | | 327,300 |

On October 26, 2001, the Company reserved 100,000 of its authorized common shares for issuance under a nonqualified stock option plan effective May 28, 2001 (the "2001 Nonqualified Stock Option Plan"). Nonqualified stock options under the 2001 Nonqualified Stock Option Plan are to be granted at prices determined by the Board of Directors, at no less than fair market value on the date of grant, with no longer than 10 year duration.

5

MATERIAL LEGAL PROCEEDINGS

On July 18, 2000, Frederick O. Paulsell, who was a director and shareholder of the Company, Frederick O. Paulsell III, Michael Paulsell, Leigh Ann Paulsell, and David Paulsell (collectively, "Paulsell") filed a lawsuit in the Multnomah County Circuit Court in the State of Oregon (the "Paulsell Litigation") against Edward E. Cohen and Daniel G. Cohen, each of whom is a director and shareholder of the Company (collectively, the "Cohens"), ReadyCash Investment Partners, LP, which was a $20 million investor in the preferred shares of the Company, and ReadyCash GP, Inc., the general partner of ReadyCash (collectively, with Resource America, Inc., which was later named as a defendant, "ReadyCash"). Paulsell alleged that ReadyCash agreed to purchase 1 million shares of the Company's common stock for $13 a share from Paulsell at or around the time ReadyCash invested in the Company in 1998. Paulsell further alleged that ReadyCash breached this agreement and is liable to Paulsell for damages of at least $12 million for breach of contract, common law fraud, securities fraud and promissory estoppel. The lawsuit was subsequently removed to the United States District Court for the District of Oregon. ReadyCash filed counterclaims against Paulsell. On February 22, 2002, the Company filed a lawsuit against Paulsell in the United States District Court for the District of Oregon (the "TRM Litigation"), alleging that if Paulsell made an agreement as alleged in the Paulsell Litigation, such an agreement usurped a corporate opportunity of the Company and constituted common law fraud and breach of fiduciary duty. The Company's suit alleged alternatively that if Paulsell's allegations in the Paulsell Litigation were untrue, then such litigation was initiated without foundation and with knowledge that it would damage the Company. The Company sought a constructive trust in favor of the Company on the recovery, if any, by Paulsell resulting from the Paulsell Litigation. Paulsell filed counterclaims against TRM.

Mr. Paulsell and Messrs. Cohen each requested that the Company provide certain indemnification with regard to the litigation. Subsequent to a vote of the Audit Committee, comprised of disinterested directors, the Company determined to reimburse the Cohens for certain legal expenses and at December 31, 2003 had paid $377,000 in total. On February 10 and 11, 2003, Paulsell and ReadyCash participated in a mediation, and a proposed settlement was reached. By a vote of disinterested directors, it was determined that the Company would participate with the other parties in this settlement. The Company's final participation was in the amount of $1,750,000 and was paid in full on April 17, 2003. Full and unconditional mutual releases were provided by all parties to the litigation in connection with the resolution. The Company has no remaining obligation to make any payments related to the litigation.

The Company is seeking payment of all or a portion of the settlement amount from its directors' and officers' liability insurance carrier. The Company believes it has a valid claim under its insurance policies; it is unable to provide an accurate assessment of the likelihood of recovery of all or a portion of the settlement amount.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors is divided into three classes serving staggered three-year terms. The terms of office of Ms. Nancy Alperin, Mr. Hersh Kozlov and Mr. Lance Laifer expire in 2004. The terms of office of Messrs. Daniel G. Cohen, Harmon Spolan and Kenneth Tepper expire in 2005. The terms of office of Mr. Edward E. Cohen, Ms. Slavka Glaser and Dr. Alan Schreiber expire in 2006.

Ms. Alperin, Mr. Kozlov and Mr. Laifer are each nominated for a three-year term to serve until the 2007 annual meeting of shareholders and until their successors are elected and have qualified. Descriptions of the three nominees for election follow. For a description of the continuing directors, see "Background Information About Continuing Directors."

6

It is the intention of the persons named in the accompanying form of proxy to vote for the three nominees, unless other instructions are given. Proxies cannot be voted for more than three nominees. Directors are elected by the vote of a plurality of the votes cast in person or by proxy at the meeting. Abstentions and broker non-votes will have no effect on the results of the vote. If any nominee is unable to stand for election for any reason, proxies will be voted for the election of a substitute proposed by the Board of Directors.

Director Nominees

| | Age

| | Director

Since

|

|---|

| Nancy Alperin was appointed to the Board of Directors in June 2002. For the last five years, she has been President and CEO of Maxwell Realty Company, Inc., a full service Real Estate and Mortgage Brokerage headquartered in Philadelphia, Pennsylvania. Prior to January 1999, she was a sales associate with Maxwell Realty Company. Ms. Alperin is a member of the Philadelphia Board of Realtors and a licensed mortgage broker in Pennsylvania. | | 36 | | 2002 |

Hersh Kozlov was elected a director in June 2001. He has been a partner in the law firm of Wolf, Block, Schorr and Solis-Cohen LLP since March 2001. From 1981 through March 2001, Mr. Kozlov was a partner with the law firm of Kozlov, Seaton, Romanini, Brooks & Greenberg. Mr. Kozlov formerly served as a director of each of JeffBanks Inc., and U.S. Healthcare Insurance Company. |

|

56 |

|

2001 |

Lance Laifer is the principal at Laifer Capital Management, Inc., a registered investment advisory firm that he formed in March 1992. Lance Laifer is also the founder, CEO and President of Bay9, Inc., a pay-for-click web search engine. Prior to forming Laifer Capital, and from February 1990 through March 1992, Mr. Laifer was a portfolio manager at Stonehill Investment Corp., a company that he helped form. From 1988 to February 1990, Mr. Laifer was a distressed credit analyst at an affiliate of Neuberger Berman. Prior to this, he was an Associate in the merchant banking group of Jamie Securities where he was employed from 1985 to 1988. |

|

39 |

|

2002 |

The Board of Directors recommends that you vote for the re-election of Ms. Nancy Alperin, Mr. Hersh Kozlov and Mr. Lance Laifer as directors.

Background Information About Continuing Directors

| | Age

| | Director

Since

|

|---|

| Daniel Gideon Cohen was elected a director and Chairman of the Executive Committee of the Board of Directors in June 1998, and Chairman of the Board of Directors in June 2003. He was elected Chairman of the Board of TheBancorp.com, a bank holding company, in September 2000. Mr. Cohen has been Chairman of the Executive Committee of TheBancorp Bank since 1999, and Chief Executive officer of TheBancorp.com from 1999 until September 2000. Mr. Cohen has been Chairman, CEO and President of Cohen Bros. & Co., a full-service brokerage firm, since 2001. From 1995 through 2000, Mr. Cohen was an officer and director of Resource America, Inc., a specialty finance company. Mr. Cohen is the son of Edward E. Cohen. | | 34 | | 1998 |

| | | | | |

7

Edward E. Cohen was elected Chairman of the Board in June 1998 and served in that capacity until June 2001. He currently serves as Chairman of the Executive Committee since June 2003. He has been the Chairman of the Board of Directors of Resource America, Inc., a specialty finance company, since 1990 and the Chief Executive Officer since 1988. Mr. Cohen has been the Chairman of the Board of Brandywine Construction & Management, Inc., a property management company, since 1994. Mr. Cohen is the father of Daniel G. Cohen. |

|

65 |

|

1998 |

Slavka B. Glaser was elected a director in June 2000. She has been employed with JP Morgan Securities, working in the European Cash Equities group since September 2000 as an Institutional Sales person responsible for research coverage of US investment institutions. Prior to joining JP Morgan, Ms. Glaser was employed with Brown Brothers Harriman, a private banking and brokerage services company, since 1996, serving as a member of its US Institutional Sales Group. |

|

33 |

|

2000 |

Alan D. Schreiber, M.D. has held the position of Professor of Medicine for twenty years and Assistant Dean for Research for ten years at the University of Pennsylvania School of Medicine. In addition, Dr. Schreiber has been Scientific Founder and Chairman of the Scientific Advisory board of InKine Pharmaceutical Co. Inc., for five years. Before that, he had been Scientific Founder and Chief Scientific Officer at CorBec Pharmaceutical Co. Inc. for four years. He has been Founder and Scientific Chairman of ZaBeCor Pharmaceutical Co., LLC, for 1 year. Dr. Schreiber has also been a member of the Resource America, Inc., Board of Directors for ten years. |

|

62 |

|

2003 |

Harmon S. Spolan was elected a director in June 2002. He is a senior partner in the law firm of Cozen O'Connor, P.C., Philadelphia, Pennsylvania, which he joined in 1999, where he chairs the Financial Services practice group. Prior thereto, he was President, COO, and a director of JeffBanks, Inc., a commercial bank headquartered in Philadelphia, Pennsylvania, from 1977 to 1999, when he retired from the bank. He is a member of the Philadelphia, Pennsylvania, and American Bar Associations. |

|

68 |

|

2002 |

Kenneth L. Tepper was appointed President & Chief Executive Officer of the Company in June 2002. He has served on the Board of Directors of the Company since June 1998 and served as Chairman of the Board from June 2001 until June 2003. From 1995 to 2000, Mr. Tepper was President and CEO of USABancShares, a Federal Reserve bank holding company, and its FDIC-insured subsidiary. Prior to 1995, Mr. Tepper served in a number of senior positions within the financial institutions industry. He is currently a Director of the Pennsylvania Industrial Development Authority (PIDA) and served as Chairman of the Pennsylvania Republican Party Finance Committee during the gubernatorial campaign of the Honorable Thomas J. Ridge, Secretary of Homeland Security. |

|

42 |

|

1998 |

CORPORATE GOVERNANCE

Information Concerning the Board of Directors and Certain Committees

The Board of Directors held four formal meetings during 2003. Each of the directors attended at least 75% of all meetings of the Board of Directors and the committees on which they served. The Board of Directors currently consists of nine directors, six of whom are independent directors, as defined by Rule 4200 of the Nasdaq listing standards. The independent directors are Ms. Alperin, Ms. Glaser, and Messrs. Laifer, Kozlov, Schreiber and Spolan.

8

The Board of Directors does not have a formal policy governing Director attendance at its annual meeting of shareholders; nonetheless, the Company believes that all of its directors will attend the meeting. All directors attended the 2003 annual meeting either in person or telephonically.

Standing committees of the Board of Directors are the Audit Committee, Compensation Committee, Executive Committee and Investment Committee; the director candidate screening functions of the former Nominating Committee will be fulfilled by the entire Board of Directors, with final selection of director nominees being made by the independent Directors.

The Audit Committee reviews the scope and effectiveness of audits by the independent accountants, matters relating to the integrity of the Company's finances and financial statements, the adequacy of the Company's internal controls, and all related party transactions. The Audit Committee is also responsible for the engagement of the Company's independent accountants. The Audit Committee held four formal meetings during 2003. The members of the Audit Committee are Mr. Laifer (Chairman), Mr. Kozlov, and Ms. Alperin. Mr. Kozlov is not independent for Audit Committee purposes within the meaning of Rule 4350(d) of the Nasdaq listing standards. The Board has selected the following Directors as the new Audit Committee members effective as of the date of the Annual Meeting: Mr. Laifer (Chairman), Ms. Alperin and Dr. Schreiber, and all are independent directors as defined under the applicable Nasdaq listing standards. The Board of Directors has determined that: (i) none of the members of the Audit Committee has participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years, (ii) all of the members of the Audit Committee are able to read and understand fundamental financial statements, including a company's balance sheet, income statement, and cash flow statement, and (iii) Mr. Laifer is the "audit committee financial expert" as defined by SEC rules and Nasdaq listing standards. The Board made a qualitative assessment of Mr. Laifer's level of knowledge and experience based on a number of factors, including his formal education and past employment.

The Audit Committee operates under a written charter adopted by the Board, which charter was amended and restated in December 2003. Under the charter, the Audit Committee is required to pre-approve the audit and non-audit services to be performed by the independent auditor in order to assure that the provision of such services does not impair the auditor's independence.

Annually the independent auditors will present to the Audit Committee services expected to be performed by the independent auditor over the next 12 months. The Audit Committee will review and, as it deems appropriate, pre-approve those services, and has done so for the 2004 fiscal year. The services and estimated fees are to be presented to the Audit Committee for consideration in the following categories: Audit, Audit-Related, Tax and All Other (each as defined in Schedule 14A under the Securities Exchange Act of 1934). For each service listed in those categories, the committee is to receive documentation indicating the specific services to be provided. The term of any pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different period. The Audit Committee will review on at least a quarterly basis the services provided to date by the independent auditor and the fees incurred for those services. The Audit Committee may also revise the list of pre-approved services and related fees from time to time, based on subsequent determinations.

Under the auspices of the Audit Committee, the Board adopted a Code of Ethics that applies to the Board, senior financial officers, as well as all employees of the Company. The Audit Committee charter and the Code of Ethics are available on the Company's website atwww.trm.com. The Audit Committee will also provide oversight for the Company's corporate governance procedures. For additional information about the Audit Committee, see "Audit Committee Matters."

The Compensation Committee establishes and monitors executive officer compensation and administers the Company's 1996 Stock Option Plan and Employee Stock Purchase Plan. The committee

9

met formally twice during 2003. The current members of the committee are Dr. Schreiber (Chairman), Mr. E. Cohen and Ms. Glaser. The Board of Directors has selected the following Directors to comprise the Compensation Committee effective as of the date of the Annual Meeting, each of whom is independent: Dr. Schreiber (Chairman), Ms. Alperin, and Mr. Glaser.

The Executive Committee exercises all authority of the Board of Directors between meetings of the Board of Directors. The committee met quarterly during 2003. The members of the committee are Messrs. E. Cohen (Chairman), D. Cohen, and Tepper, each of whom will continue through 2004.

The Investment Committee evaluates and makes recommendations to the Board of Directors concerning potential merger and acquisition activities, significant capital investments and financial structuring. The Committee did not meet formally during 2003. The members of the committee are Ms. Glaser (Chairman), Mr. Laifer and Dr. Schreiber.

The Nominating Committee has historically served the function of recommending persons for nomination as directors of the Company. The committee held no formal meetings during 2003, although it met informally on numerous occasions. The current members of the committee are Messrs. Spolan (Chairman), D. Cohen and E. Cohen. Only Mr. Spolan is an independent director as defined under Nasdaq listing standards. Although Messrs. D. Cohen and E. Cohen are not deemed independent directors for this purpose, the Board values their perspective and participation in the nominations process and has therefore made the decision that, as of the date of the Annual Meeting, the full Board of Directors will perform the functions of a nominating committee going forward. The Board has determined that all of the directors, a majority of whom are independent directors as defined under Nasdaq listing requirements, have valuable insights into the functions of the Board and significant expertise in the operations of the Company to evaluate a director candidate in the event the need arises, and it has determined that the Company and its shareholders would be best served by having all directors, including Messrs. D. Cohen and E. Cohen, participate in the deliberative process of choosing director nominees for the Company, with the nominees being selected by the independent directors acting separately.

Because the Board will no longer have a separate nominating committee, it does not have a nominating committee charter; it has, however, adopted resolutions addressing the nominations process. In addition to shareholders' general nominating right provided in the Company's Bylaws, shareholders may recommend director candidates for consideration by the Board. The Board will consider director candidates recommended by shareholders if the recommendations are sent to the Board in accordance with the procedures for other shareholder proposals described elsewhere in this proxy statement under the heading "Shareholder Proposals." All director nominations submitted by shareholders to the Board for its consideration must include all of the required information set forth in the Company's Bylaws, as summarized above under the heading "Shareholder Proposals," and the following additional information:

- •

- Any information relevant to a determination of whether the nominee meets the criteria described below under the subheading "Director Qualifications";

- •

- Any information regarding the nominee relevant to a determination of whether the nominee would be barred from being considered independent under applicable Nasdaq or SEC rules or, alternatively, a statement that the nominee would not be so barred;

- •

- A statement, signed by the nominee, verifying the accuracy of the biographical and other information about the nominee that is submitted with the recommendation and consenting to serve as a director if so elected; and

- •

- If the recommending shareholder, or group of shareholders, has beneficially owned more than 5% of the Company's voting stock for at least one year as of the date of recommendation is made, evidence of such beneficial ownership.

10

Director Qualifications. In selecting nominees for director, without regard to the source of the recommendation, the Board believes that each director nominee should be evaluated based on his or her individual merits, taking into account the needs of the Company and the composition of the Board. Members of the Board should have the highest professional and personal ethics, consistent with the values and standards of the Company. At a minimum, a nominee must possess integrity, skill, leadership ability, financial sophistication, and capacity to help guide the Company. Nominees should be committed to enhancing shareholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on their experiences. Their service on other boards of public companies should be limited to a number that permits them, given their individual circumstances, to responsibly perform all director duties. In addition, the Board considers all applicable statutory, regulatory, case law and Nasdaq requirements with regard thereto, including when appropriate, those applicable to membership on the Board.

Evaluation of Director Nominees. The Board will typically utilize a variety of methods for identifying and evaluating nominees for director. The Board regularly assesses the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Board will consider various potential candidates for director. Candidates may come to the attention of the Board through current directors, shareholders, or other companies or persons. The Board does not evaluate director candidates recommended by shareholders differently than director candidates recommended from other sources. Director candidates may be evaluated at regular or special meetings of the Board, and may be considered at any point during the year. In evaluating such nominations, the Board seeks to achieve a balance of knowledge, experience, and capability on the Board. In connection with this evaluation, the Board will make a determination whether to interview a prospective nominee based upon the Board's level of interest. If warranted, one or more members of the Board, and others as appropriate, will interview prospective nominees in person or by telephone. After completing this evaluation and any appropriate interviews, the Board will recommend the director nominees after consideration of all its directors' input. The director nominees are then selected by a majority of the independent directors on the Board, meeting in executive session and considering the Board's recommendations.

All of the director nominees included on the proxy card for election at the Annual Meeting were approved by a majority of the independent directors on the Board. No shareholder (or group of shareholders) beneficially owning more than 5% of the Company's voting common stock recommended a director nominee for election at the Annual Meeting.

Director Compensation

As Chairman of the Board of Directors with continuing responsibility in the areas of strategic planning and corporate governance, Mr. D. Cohen is paid a retainer of $150,000 per year, and received a bonus of $150,000 for 2003. Mr. E. Cohen, as Chairman of the Executive Committee of the Board of Directors, has the responsibility for Board oversight of the Company between meetings of the Board of Directors, and in connection with this responsibility is paid a retainer of $150,000 per year, and was paid a bonus of $75,000 for 2003. In addition, the Company leases automobiles for use by Mr. Tepper and Mr. D. Cohen.

The remaining directors are paid $500 for each formal meeting of the Board of Directors or Committee. In addition, members of the Board of Directors are paid an annual retainer of $12,000. In 2003, Mr. Laifer received an additional retainer of $5,000 as Chairman of the Audit Committee, Dr. Schreiber received an additional $5,000 as Chairman of the Compensation Committee, Mr. Spolan received an additional $5,000 as Chairman of the Nominating and Governance Committee, and Ms. Glaser received an additional retainer of $5,000 as Chairman of the Investment Committee.

11

Pursuant to the Company's 1996 Stock Option Plan, each non-employee director is automatically granted a nonstatutory stock option for 5,000 shares of the Company's Common Stock on the date of each annual shareholders meeting held during the time he or she serves as a non-employee director. Each non-employee director who is serving on the Executive Committee of the Board automatically is granted an additional nonstatutory stock option for 2,500 shares on the date of each annual shareholder meeting held during the time the director serves as a member of the Executive Committee, with the exercise price for all options granted to non-employee directors at fair market value as provided in the 1996 Stock Option Plan. Each such option has a 10-year term and becomes fully exercisable on the first anniversary of the option grant, provided the director is then serving on the Board and, if applicable, on the Executive Committee.

Compensation Committee Interlocks and Insider Participation

No executive officer of the Company is a director or executive officer of any entity of which any member of the Compensation Committee is a director or executive officer.

Certain Relationships and Related Transactions

In fiscal year 2003, the Company retained the law firm of Cozen O'Connor to perform services through such firm's London, England offices on behalf of the Company's UK subsidiaries. Mr. Harmon Spolan, a director of the Company, is a partner with the law firm of Cozen O'Connor, P.C., at the firm's offices in Philadelphia, Pennsylvania. Fees paid to the law firm were in an amount not greater than $200,000 or 5% of the firm's total revenues for its last fiscal year.

In fiscal year 2003, the Company retained the law firm of Wolf, Block, Schorr & Solis-Cohen LLP to perform services on behalf of the Company. Mr. Hersh Kozlov, a director of the Company, is a partner with the law firm of Wolf, Block, Schorr & Solis-Cohen LLP at the firm's offices in Philadelphia, Pennsylvania and Cherry Hill, New Jersey. Fees paid to the law firm were in an amount not greater than $200,000 or 5% of the firm's total revenues for its last fiscal year.

12

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the executive compensation paid by the Company during the years ended December 31, 2003, 2002, and 2001, respectively, to the Chief Executive Officer and the five most highly compensated executive officers of the Company during 2003. These amounts exclude certain perquisites that, in the aggregate, do not exceed ten percent of total annual salary and bonus as reported herein.

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| | Compensation

| |

|

|---|

Name and

Principal Position

| |

| | Securities

Underlying

Options

| | Other

Compensation

|

|---|

| | Year

| | Salary

| | Bonus

|

|---|

Kenneth L. Tepper(1)

President, Chief Executive Officer

and Chairman of the Board | | 2003

2002

2001 | | $

$

$ | 399,088(2)

285,847(2)

106,000(2) | | $

$

$ | 206,507

65,368

— | | 250,000

5,000

105,000 | | $

$

$ | —

—

— |

Danial J. Tierney

Executive Vice President |

|

2003

2002

2001 |

|

$

$

$ |

226,671

189,174

175,000 |

|

$

$

$ |

80,428

35,515

20,000 |

|

50,000

—

— |

|

$

$

$ |

—

—

— |

Thomas W. Mann(3)

Chief Operating Officer |

|

2003

2002

2001 |

|

$

$

$ |

196,674

93,843

— |

|

$

$

$ |

131,162

54,142

— |

|

25,000

75,000

— |

|

$

$

$ |

—

—

— |

Amy B. Krallman(4)

Senior Vice President and

Corporate Counsel |

|

2003

2002

2001 |

|

$

$

$ |

141,669

54,689

— |

|

$

$

$ |

32,485

21,656

— |

|

20,000

—

— |

|

$

$

$ |

—

—

— |

Ashley S. Dean

Managing Director, UK |

|

2003

2002

2001 |

|

$

$

$ |

118,859

86,806

76,750 |

|

$

$

$ |

47,372

12,863

15,286 |

|

2,500

—

— |

|

$

$

$ |

—

—

— |

- (1)

- Mr. Tepper was appointed President & Chief Executive Officer of the Company on June 4, 2002 and stepped down as Chairman on June 17, 2003.

- (2)

- Reflects fees paid to Mr. Tepper in his capacity as a Director of the Company in the amounts of $14,000 in 2003, $15,000 in 2002 and $76,000 in 2001.

- (3)

- Mr. Mann joined the Company in July 2002.

- (4)

- Ms. Krallman joined the Company in June 2002.

13

Stock Option Grants During the Year Ended December 31, 2003

Stock options were granted to the executive officers named in the Summary Compensation Table during the last fiscal year as follows:

| | Individual Grants

| |

| |

|

|---|

| | Number of

Shares

Underlying

Options

Granted

| | Percent of Total

Options Granted to

Employees and

Directors In

Fiscal Year

| |

| |

| | Potential Realizable Value at Assumed

Annual Rates of Stock Price

Appreciation for Option Term(1)

|

|---|

| | Exercise

Price

Per

Share

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Kenneth L. Tepper | | 27,780

222,220 | | 4.67

37.32 | %

% | $

$ | 1.80

1.80 | | 7/1/08

7/1/08 | | $

$ | 13,496

107,959 | | $

$ | 30,125

240,981 |

| Danial J. Tierney | | 50,000 | | 8.40 | % | $ | 1.80 | | 7/1/08 | | $ | 24,291 | | $ | 54,221 |

| Thomas W. Mann | | 25,000 | | 4.20 | % | $ | 1.80 | | 7/1/08 | | $ | 12,146 | | $ | 27,111 |

| Amy B. Krallman | | 20,000 | | 3.36 | % | $ | 1.80 | | 7/1/08 | | $ | 9,716 | | $ | 21,688 |

| Ashley S. Dean | | 2,500 | | 0.42 | % | $ | 1.80 | | 7/1/08 | | $ | 1,215 | | $ | 2,711 |

- (1)

- In accordance with rules of the Securities and Exchange Commission, these amounts are the hypothetical gains or "option spreads" that would exist for the respective options based on assumed rates of annual compound stock price appreciation of 5% and 10% from the date the options were granted over the full option term.

Option Exercises and Holdings

The following table indicates (i) stock options exercised by the executive officers named in the Summary Compensation Table during the last fiscal year, (ii) the number of shares subject to exercisable (vested) and unexercisable (unvested) stock options as of December 31, 2003, and (iii) the fiscal year-end value of "in-the-money" unexercised options.

| |

| |

| | Number of Unexercised

Options at Fiscal Year End

| | Value of Unexercised

In-The-Money Options

at Fiscal Year End(2)

|

|---|

Name

| | Shares

Acquired on

Exercise

| |

|

|---|

| | Realized(1)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Kenneth L. Tepper | | — | | — | | 122,499 | | 250,001 | | $ | 819,768 | | $ | 1,682,507 |

| Daniel J. Tierney | | — | | — | | 133,000 | | 54,000 | | $ | 470,115 | | $ | 338,620 |

| Thomas W. Mann | | — | | — | | 35,445 | | 64,555 | | $ | 258,040 | | $ | 456,210 |

| Amy B. Krallman | | — | | — | | — | | 20,000 | | $ | — | | $ | 134,600 |

| Ashley S. Dean | | — | | — | | 3,000 | | 4,500 | | $ | 10,590 | | $ | 23,885 |

- (1)

- Aggregate market value of the shares covered by the option, less the aggregate price to be paid by the executive.

- (2)

- Based on the fair market value of the Company's stock as of December 31, 2003. Values are stated on a pretax basis.

Employment Agreements and Severance Arrangements

Mr. Kenneth L. Tepper entered into an employment agreement as Chairman of the Board with the Company in December 2001. Under the terms of the employment agreement, Mr. Tepper is to be paid an initial annual salary of $275,000, to be reviewed annually, and is eligible for incentive compensation as the Board of Directors of the Company may approve from time-to-time in its discretion. Under the terms of the employment agreement, Mr. Tepper received options to purchase 100,000 shares of the Company's stock that vest monthly over a period of 24 months, and expire ten years from the date of grant. In the event Mr. Tepper is terminated by the Company other than "for cause", Mr. Tepper will

14

receive a severance payment equal to twelve month's salary plus one month's salary for each year of employment up to a maximum of 24 months' pay. In June 2002, Mr. Tepper agreed to serve as the Company's President & Chief Executive Officer.

Mr. Danial J. Tierney entered into an employment agreement as with the Company in January 2000. Under the terms of the employment agreement, Mr. Tierney is to be paid an initial annual salary of $165,000, to be reviewed annually, and is eligible for incentive compensation as the Board of Directors may approve from time to time in its discretion. In the event Mr. Tierney is terminated by the Company other than "for cause", Mr. Tierney will receive a severance payment equal to six months' pay plus an additional one month's pay for each year of employment by the Company, measured from January 1995, up to a maximum of 12 months pay, plus all incentive compensation earned but unpaid on or prior to the separation date, plus health insurance for up to a maximum of 12 months. In September 2003, Mr. Tierney agreed to serve as the Company's Executive Vice President.

Mr. Thomas W. Mann entered into an employment agreement as Senior Vice President with the Company in July 2002. Under the terms of the employment agreement, Mr. Mann is to be paid an initial annual salary of $190,000. Thereafter, his base salary shall be set at the start of each of the next two successive terms, but shall not be less than 110% of the prior year base salary. Thereafter, his base salary is to be reviewed annually. Mr. Mann is eligible for incentive compensation as the Board of Directors may approve from time to time in its discretion. Mr. Mann was granted a $25,000 bonus on the 30th day after the effective date of his contract, and given use of a Company-leased vehicle. Under the terms of the employment agreement, Mr. Mann received options to purchase 75,000 shares of the Company's stock at an exercise price of $1.25 that vest monthly over a period of 36 months, and expire ten years from the date of grant. In the event Mr. Mann is terminated by the Company other than "for cause", Mr. Mann will receive a severance payment equal to six month's pay plus one month's salary for each year of employment up to a maximum of 12 months' pay, plus all incentive compensation earned but unpaid on or prior to the separation date, plus health insurance for up to a maximum of 12 months. In September 2003, Mr. Mann agreed to serve as the Company's Chief Operating Officer.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION(1)

- (1)

- This section, the section entitled "Report of the Audit Committee" and the section entitled "Stock Performance Graph" are not "soliciting material," are not deemed "filed" with the Securities and Exchange Commission and are not to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Act of 1934, regardless of date or any general incorporation language in such filing.

Compensation Committee

All of the actions regarding compensation of executive officers of the Company during the year ended December 31, 2003, were taken in accordance with policies as established by the Compensation Committee of the Board of Directors (the "Committee"). The Committee is composed of three directors, each of whom is a "non-employee director", as defined under Rule 16b-3(b)(3) of the Securities Exchange Act of 1934, and an "outside director" as defined in Treasury Regulations Section 1.162-27, promulgated under the Internal Revenue Code of 1986, as amended. During the year ended December 31, 2003, the Committee also administered the Company's 1996 Stock Option Plan and the Company's Restated 1986 Stock Incentive Plan.

Section 162(m) of the Code limits to $1,000,000 per person the amount that the Company may deduct for compensation paid to any of its most highly compensated officers in any year. It is anticipated that the levels of salary and bonus to be paid by the Company will not exceed that limit.

15

Executive Officer Compensation

The Company's executive officer compensation is based on several general principles, which are summarized below:

- •

- Encourage long-term success and align shareholder interests with management interests by giving Company executives the opportunity to acquire stock in the Company

- •

- Reward initiative of the Company's executive officers

- •

- Link corporate and individual performance to compensation

- •

- Provide competitive total compensation which enables the Company to attract and retain key executives

The Company's executive compensation program consists of base salary, annual cash incentive compensation in the form of discretionary bonuses and discretionary long-term incentive compensation in the form of stock options. This program is designed to reflect pay for performance that is tied to the Company's, as well as the individual's, performance.

Base Salary. During the year ended December 31, 2003, the salaries established for executive officers other than the Chief Executive Officer were determined after considering the Company's size and complexities relative to other public companies, as well as job responsibilities, individual experience and individual performance. Each executive officer's salary is reviewed annually, and increases to base salary are made to reflect competitive market increases and the individual factors described above.

Cash Bonuses. In 2003, Company employees were eligible for payment of an annual cash bonus based upon the determination of the Compensation Committee for executive officers, and delegated by the Compensation Committee to management for less senior members of the Company. Consideration included individual performance, as well as contribution to Company performance and profitability among other criteria.

Long-Term Incentives-Stock Options. The Company's primary long-term incentive compensation is through stock options. The Company has a stock option plan in which key employees of the Company, including executive officers, are eligible to participate. The Board of Directors and the Committee believe that the availability of stock incentives is an important factor in the Company's ability to attract and retain key employees, to provide an incentive for them to exert their best efforts on behalf of the Company and to further align their interests with shareholders. Initial options granted to executive officers depend on the level of responsibility and position, and subsequent grants are made based on subjective assessment of performance, among other factors. Options granted to executive officers generally become exercisable in equal increments over a period of years. The Committee believes that stock options with these features provide an incentive for executives to remain in the employ of the Company and reward executive officers and other key employees for performance that results in increases in the market price of the Common Stock—which directly benefits all shareholders.

Chief Executive Officer Compensation

The 2003 compensation established for Kenneth L. Tepper was determined by the Committee based on the criteria described above after considering salaries offered by the Company's competitors, the Company's size and complexities relative to other public companies, and the Company's desire to retain a skilled senior executive. The Committee also considered the performance of the Company, in all respects, during Mr. Tepper's service as President & CEO.

| | | Compensation Committee Report Submitted By:

Alan Schreiber, Chairman

Edward Cohen

Slavka Glaser

|

16

AUDIT COMMITTEE MATTERS

Report of the Audit Committee

In accordance with its written charter adopted by the Board of Directors, as amended and restated in December 2003, the Audit Committee of the Board of Directors consists of three members, currently Lance Laifer, Chairman, Hersh Kozlov, and Nancy Alperin and operates under such written charter. Mr. Kozlov is not independent for Audit Committee purposes within the meaning of Rule 4350(d) of the Nasdaq listing standards. The Board has selected the following Directors as the new Audit Committee members effective as of the date of the Annual Meeting: Mr. Laifer (Chairman), Ms. Alperin and Dr. Schreiber, and all are independent directors as defined under the applicable Nasdaq listing standards.

In connection with the Company's audited financial statements for the year ended December 31, 2003, the Audit Committee:

- •

- reviewed and discussed the audited financial statements with management;

- •

- discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61; and

- •

- received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 and discussed with the independent auditors the independent auditors' independence.

Based upon these reviews and discussions, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2003 for filing with the Securities and Exchange Commission.

| | | Audit Committee Report Submitted By:

Lance Laifer, Chairman

Hersh Kozlov

Nancy Alperin

|

Principal Accounting Firm Fees

The Company incurred the following fees for services performed by the Company's principal accounting firm, PricewaterhouseCoopers LLP, in fiscal year 2003:

Audit Fees: The aggregate fees billed by PricewaterhouseCoopers LLP for professional services rendered for the audit of the Company's annual financial statements for the year ended December 31, 2003 and for the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q for 2003 were $371,000. Fees billed by PricewaterhouseCoopers LLP for the audit of the Company's annual financial statements and for the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q for 2002 were $334,000. Audit fees include fees billed in connection with the audit of the statutory financial statements of the Company's United Kingdom subsidiaries.

Audit-Related Fees: The aggregate fees billed by PricewaterhouseCoopers LLP for audit-related services were $187,000 in 2003 and $9,000 in 2002. Audit-related services include assistance in responding to SEC comment letters, audits of TRM Inventory Funding Trust, the audit of the Company's retirement plan, consultation on accounting matters and certain agreed-upon procedures relating to one of the Company's subsidiaries.

17

Tax Fees: The aggregate fees billed by PricewaterhouseCoopers LLP for professional tax services were $157,000 in 2003 and $183,000 in 2002. Professional tax services during 2003 and 2002 consisted of compliance, planning and advice relating to United States, United Kingdom and Canadian taxes.

All Other Fees: None.

The entirety of services provided by the Company's independent auditors for 2003 were provided by full-time employees of PricewaterhouseCoopers.

The Audit Committee has considered whether the provision of non-audit services by PricewaterhouseCoopers LLP is compatible with maintaining that firm's independence and has concluded that the independence of PricewaterhouseCoopers LLP is not compromised by the provision of such non-audit services.

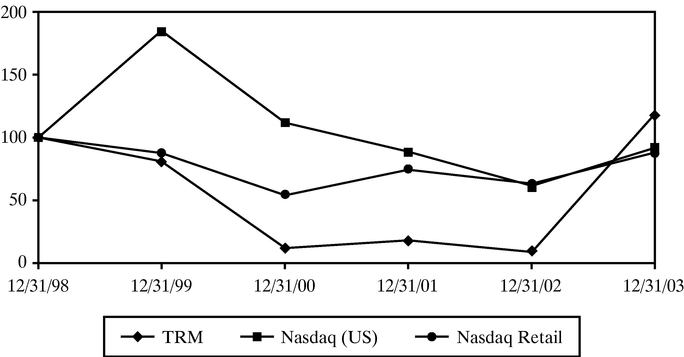

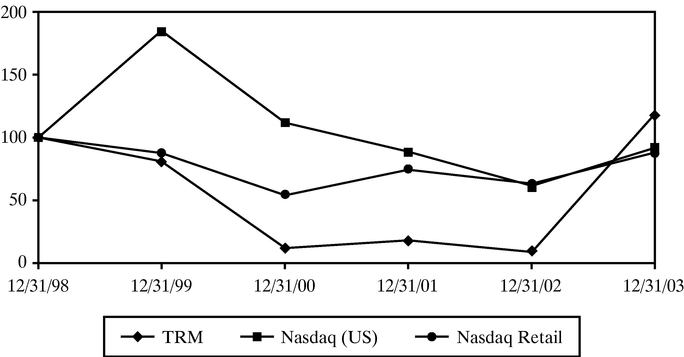

Stock Performance Graph

The following graph provides a comparison of the cumulative total shareholder return for the period December 31, 1998 through December 31, 2003 for (i) the Company's Common Stock, (ii) the Nasdaq Stock Market (US) and (iii) the Nasdaq Retail Trade Index, in each case assuming the investment of $100 on December 31, 1998 and the reinvestment of any dividends; the Company has never paid dividends on its Common Stock.

18

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee Board of Directors has selected PricewaterhouseCoopers LLP as our independent accountants for the year ending December 31, 2004. There is no requirement that the selection of PricewaterhouseCoopers LLP be submitted to our shareholders for ratification or approval. The Board, however, believes that the Company's shareholders should be given an opportunity to express their views on the selection. While the Audit Committee is not bound by a vote against ratifying PricewaterhouseCoopers LLP, it may take a vote against PricewaterhouseCoopers LLP into consideration in future years when selecting our independent accountants. PricewaterhouseCoopers LLP, an international firm of certified public accountants, has audited our financial statements since 1999. Representatives of PricewaterhouseCoopers LLP are expected to be present at the annual meeting, and will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

The Board of Directors recommends you vote for the ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent auditors.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Reports of all transactions in the Company's Common Stock by insiders are required to be filed with the SEC pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Based solely on its review of copies of these reports and presentations of such reporting persons, the Company believes that during 2003 such SEC filing requirements were satisfied.

SHAREHOLDER PROPOSALS

Shareholder Proposals to be Included in the Company's Proxy Statement

A shareholder proposal to be considered for inclusion in proxy materials for the Company's 2005 annual meeting must be received by the Company not later than December 20, 2004.

Shareholder Proposals Not in the Company's Proxy Statement

Shareholders wishing to present proposals for action at an annual meeting must do so in accordance with the Company's Bylaws. A shareholder must give timely notice of the proposed business to the Secretary. To be timely, a shareholder's notice must be in writing, delivered to or mailed and received at the principal executive offices of the Company not less than 30 days nor more than 60 days prior to that year's annual meeting; provided, however, that in the event less than 30 days' notice of the meeting is given or made to shareholders, notice by the shareholder, to be timely, must be received no later than the close of business on the tenth day following the date on which such notice of the annual meeting was mailed. For each matter the shareholder proposes to bring before the meeting, the notice to the Secretary must include (i) a brief description of the matter proposed to be brought before the meeting, (ii) the name and address, as they appear in the Company's books, of the shareholder proposing such business, (iii) the class and number of shares of the Company that are beneficially owned by the shareholder and (iv) any material interest of the shareholder in such matter. The presiding officer at the annual meeting may, if in the officer's opinion the facts warrant, determine that business was not properly brought before the meeting in accordance with the Company's Bylaws. If such officer does so, such officer shall so declare to the meeting and any such matter shall not be considered or acted upon. For purposes of the Company's 2004 annual meeting, such notice, to be timely, must be received by the Company between April 4, 2005 and May 5, 2005. In addition (assuming the Company gives shareholders 30 days' notice of the annual meeting and the date of the 2005 Annual Meeting is on a corresponding date to the 2004 Annual Meeting), if notice of any shareholder proposal to be raised at next year's annual meeting of shareholders is not received by the Company at its principal executive offices between April 4, 2005 and May 5, 2005, proxy voting on that proposal when and if raised at the 2005 annual meeting will be subject to the discretionary voting authority of the designated proxy holders.

19

Shareholders wishing to nominate directly candidates for election to the Board of Directors at an annual meeting must do so in accordance with the Company's Bylaws by giving timely notice in writing to the Secretary as described above. The notice shall set forth (i) the information described by Items 401(a), (e) and (f) and Item 403(b) of Regulation S-K under the Securities Act of 1933, as amended, (ii) the class and number of shares of the Company which are beneficially owned by the nominating shareholder, and (iii) any material interest of the shareholder or of the nominee in the Company. The presiding officer at the annual meeting shall determine whether any nomination was properly brought before the annual meeting in accordance with the Company's Bylaws. If such officer determines that any person has not been properly nominated, such officer shall so declare at the meeting and any such nominee shall not be considered in the election.

SHAREHOLDER COMMUNICATIONS

Shareholders who wish to communicate with the Board of Directors, or specific individual Directors, may do so by directing correspondence addressed to such Directors or Director in care of Amy B. Krallman, Esquire, Senior Vice President and Assistant Secretary, at the address of the Company. Such correspondence shall prominently display the fact that it is a shareholder-board communication. Such communications will be relayed to the intended Board member(s) except to the extent that it is deemed unnecessary or inappropriate to do so by the Senior Vice President and Assistant Secretary in accordance with a process that is approved by a majority of the independent Directors. At this time, no such process has been implemented. In the alternative, shareholder correspondence can be addressed to David Gitlin, Esq., Corporate Counsel, at Wolf, Block, Schorr & Solis-Cohen LLP, 1650 Arch Street, 22nd Floor, Philadelphia, PA 19103. Mr. Gitlin will follow the procedures described above with regard to any correspondence received.

OTHER MATTERS

The notice of annual meeting of shareholders provides for transaction of such other business as may properly come before the meeting. As of the date of this proxy statement, the Board of Directors has been advised of no matters to be presented for discussion at the meeting. However, the enclosed proxy gives discretionary authority to the persons named in the proxy in the event that any other matters should be properly presented to the shareholders.

SHAREHOLDERS SHARING AN ADDRESS

Shareholders sharing an address with another shareholder may receive only one set of proxy materials to that address unless they have provided contrary instructions. Any such shareholder who wishes to receive a separate set of proxy materials now or in the future may write or call the Company to request a separate copy of these materials from: Investor Relations 5208 NE 122d Avenue, Portland, Oregon 97230.

Similarly, shareholders sharing an address with another shareholder who have received multiple copies of the Company's proxy materials may write or call the above address and phone number to request delivery of a single copy of these materials.

ANNUAL REPORT ON FORM 10-K

The Company will provide without charge to each person solicited by this proxy statement, on the written request of any such person, a copy of the Company's Annual Report on Form 10-K including financial statements and the schedules thereto. Such written requests should be directed to the Company at 5208 NE 122d Avenue, Portland, Oregon 97230, Attention: Legal Department.

Portland, Oregon

April 20, 2004

20

REVOCABLE PROXY

| ý | | PLEASE MARK VOTES

AS IN THIS EXAMPLE | | |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR

THE 2004 ANNUAL MEETING OF SHAREHOLDERS—

May 18, 2004

The undersigned hereby appoints Kenneth L. Tepper and Harmon S. Spolan, and each of them, as proxies with full power of substitution, and authorizes them to represent and to vote on behalf of the undersigned all shares which the undersigned would be entitled to vote if personally present at the 2004 Annual Meeting of Shareholders of TRM CORPORATION to be held on May 18, 2004, and any adjournments thereof, with respect to the following:

1. | |

ELECTION OF DIRECTORS: | |

For | |

Withhold | | For All

Except |

| | | | | o | | o | | o |

| | | Nancy Alperin (3-year term)

Hersh Kozlov (3-year term)

Lance Laifer (3-year term) | | | | | | |

INSTRUCTION: To withhold authority to vote for any individual nominee, mark "For All Except" and write that nominee's name in the space provided below:

|

2. |

|

Ratification of selection of PricewaterhouseCoopers LLP as independent auditors. |

|

For

o |

|

Against

o |

|

Abstain

o |

3. |

|

Transaction of any business that properly comes before the meeting or any adjournment thereof. A majority of the proxies or substitutes at the meeting may exercise all the powers granted thereby. |

|

For

o |

|

Against

o |

|

Abstain

o |

|

|

Either or both of the proxies (or substitutes) present at the meeting may exercise all powers granted hereby.

|

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF DIRECTORS AND FOR THE RATIFICATION OF THE SELECTION OF PRICEWATERHOUSECOOPERS LLP AS INDEPENDENT AUDITORS. IN ADDITION, THE PROXIES MAY VOTE AT THEIR DISCRETION ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING.

Please date and sign exactly as your name or names appear hereon. If more than one name appears, all should sign. Joint owners should each sign personally. Corporate proxies should be signed in full corporate name by an authorized officer and attested. Persons signing in a fiduciary capacity should indicate their full title and authority. Detach above card, sign, date and mail in the postage paid envelope provided.

Please be sure to sign and date

this Proxy in the box below. | | Date

|

Shareholder sign above |

|

Co-holder (if any) sign above

|

Detach above card, sign, date and mail in the postage paid envelope provided. |

| | |  | | 5208 N.E. 122nd Avenue

Portland, Oregon 97230-1074 |

PLEASE ACT PROMPTLY

SIGN, DATE & MAIL YOUR PROXY CARD TODAY

|

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH THE PROXY IN THE ENVELOPE PROVIDED.

QuickLinks

Notice of Annual Meeting of Shareholders May 18, 2004PROXY STATEMENTVOTING SECURITIES AND PRINCIPAL SHAREHOLDERSMATERIAL LEGAL PROCEEDINGSPROPOSAL 1 ELECTION OF DIRECTORSCORPORATE GOVERNANCEEXECUTIVE COMPENSATIONCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION(1)AUDIT COMMITTEE MATTERSRATIFICATION OF SELECTION OF INDEPENDENT AUDITORSSECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCESHAREHOLDER PROPOSALSSHAREHOLDER COMMUNICATIONSOTHER MATTERSSHAREHOLDERS SHARING AN ADDRESSANNUAL REPORT ON FORM 10-KREVOCABLE PROXY