UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

December 31, 2006

SEALIFE CORPORATION

(Exact name of registrant as specified in its charter)

Delaware

0-13895

34-1444240

(State or other jurisdiction

(Commission

(IRS Employer

of incorporation)

File Number)

Identification No.)

5601 W. Slauson Ave., Culver City, California

90293

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:(310) 338-9757

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange ct (17 CFR 240.14d-2(B))

¨

Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4c))

SEALIFE CORPORATION

INDEX TO FORM 8K

Item 8.01 Other events

ANNUAL REPORT FOR YEAR ENDED DECEMBER 31, 2006

Issuer's Revenues for its most recent fiscal year were $72,016.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on May27, 2007 was an estimated $ 2,387367

As of December 31,2006 , the issuer had 47,266,851 shares of common stock, par value $.0001 per share, issued and outstanding.

2

SEALIFE CORPORATION

INDEX TO FORM 8K

PART I

PAGE

Item 1.

Description of Business

4

Item 2.

Description of Property

10

Item 3.

Legal Proceedings

10

Item 4.

Submission of Matters to a Vote of Security Holders

10

PART II

Item 5.

Market for Common Equity and Related Stockholder Matters

11

Item 6.

Management’s Discussion and Analysis or Plan of Operation

13

Item 7.

Financial Statements

Index to Consolidated Financial Statements

20

Report of Independent Registered Public Accounting Firm

_F-11

Consolidated Balance Sheet

F-1

Consolidated Statements of Income

F-2

Consolidated Statement of Changes in Stockholders’ Equity

F-1

Consolidated Statements of Cash Flows

F-3

Notes to Consolidated Financial Statements

F-4

Item 8.

Changes in and Disagreements with Accountants on Accounting

And Financial Disclosures

20

Item 8A.

Controls and Procedures

20

Item 8B.

Other Information

20

PART III

Item 9.

Directors, Executive Officers, Promoters and Control Persons;

Compliance with Section 16(A) of the Exchange Act

21

Item 10.

Executive Compensation

22

Item 11.

Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters

26

Item 12.

Certain Relationships and Related Transactions

28

Item 13.

Exhibits

28

Item 14

Principal Accountant Fees and Services

30

3

ITEM 8.01 OTHER EVENTS,: ( NON REPORTING REGISTRANT : SEALIFE CORPORATION IS A NON REPORTING ENTITY UNDER THE SECURTIES AND EXCHANGE ACT OF 1934, AS A RESULT OF ITS FILING OF FORM 15 WITH THE SEC ON AUGUST 7, 2006

SEALIFE CORPORATION ANNUAL REPORT FOR YEAR ENDED DECEMBER 31, 2006

PART I

ITEM 1.

DESCRIPTION OF BUSINESS.

The Company cautions readers that the discussion setout below and elsewhere herein; includes certain forward-looking statements and information that is based on Company Management’s projections, as well as on assumptions made by Management. When used in form, the words “anticipate,” “intend,” “plan,” “believe,” “estimate,” “future,” “expect” and similar expressions are intended to identify forward-looking statements. Such statements are not guarantees of future performance and involve many risks, uncertainties and assumptions, including, but not limited to, certain of many risk factors set forth herein, which could cause the Company’s future results to differ materially from those expressed or implied in any such forward-looking statements.

Overview

SeaLife Corporation is a development stage company, and was originally formed as a Delaware corporation in 1984 under the name Fraser Realty Group. We operated as a real estate investment trust until 1990, when we ceased operations and remained inactive until December, 2002.

On December 17, 2002, pursuant to an Exchange Agreement dated September 30, 2002, we acquired all of the issued and outstanding shares of SeaLife Corp., a Nevada Corporation (“SeaLife Nevada”), in exchange for a substantial majority of the shares of our common stock (the “Acquisition”), and we affected a 15-to-1 reverse stock split. The Acquisition was accounted for as a reverse merger, the accounting basis of SeaLife Nevada continued unchanged, and the pre-transaction financial statements of SeaLife Nevada became our historical financial statements.

Our Products

.

MARINE COATINGS

Antifouling paints are used to coat the bottoms of ships to prevent fouling. Fouling, such as barnacles, tubeworms, slime and algae, significantly reduces the speed and performance of any vessel, resulting in increased fuel consumption, extended dry-docking and higher maintenance costs. Traditional anti-fouling paints work by releasing toxic chemicals (biocides) contained in the paint into the water, killing fouling organisms in order to prevent them from attaching to any treated surface In response to the pollution and poisoning of marine life in oceans and waterways, the International Maritime Organization (IMO), a United Nations agency responsible for improving maritime safety and preventing pollutions from ships, adopted an assembl y resolution that called on the Marine Environment Protection Committee (MEPC), to develop an instrument, legally binding through out the world, to address the harmful effects of anti-fouling systems used on ships. As of January 1, 2003, it is illegal to apply or re-apply to any maritime vessel, anti-fouling paint containing the most commonly used anti-fouling agent, tributyltin (TBT).

We have developed and begun to manufacture, market and distribute a line of environmentally safe, anti-foul, anti-corrosive coatings for the commercial maritime industry, the military, and the recreational boat owner, under the name SeaLife Marine products, Inc. The coatings comply with the international prohibition on the use of TBT. SeaLife Marine's paint products have been specifically engineered not to leach any biocides, pesticides or other toxins into the marine environment and to be fully compliant with international law.

4

SeaLife 1000(TM), SeaLife’s antifouling marine paint products, currently in production, can be applied to hulls on any sized vessel, and any other surface, providing antifouling, anti-corrosive protection in both fresh and salt water. SeaLife 1000(TM) may be applied to steel, aluminum, fiberglass and wood. When SeaLife 1000(TM) comes in contact with water, reactive hydrolysis of its proprietary ingredients begins, which microscopically expands and smoothes the SeaLife coating over the ship's underwater hull surfaces. This results in an undersea hull surface that becomes more uniformly smooth than when it was painted. Field tests using SeaLife 1000(TM) have indicated that hulls and other submerged surfaces treated with SeaLife 1000(TM) coatings provide long-term resistance to algae, fungus, shell growth and rust without harming marine life. Management believes that SeaLife's marine coating technology has significant advantages over competing products.

SeaLife has also developed and is currently testing SeaLife 1000 XP(TM) and SeaLife 1000 Out-Drive(TM), which are specifically designed to meet the needs of commercial and recreational users, respectively. SeaLife 1000 XP(TM) is a commercial grade of SeaLife 1000(TM) with enhanced features. SeaLife 1000 OutDrive(TM) is specifically designed to reduce corrosion of outdrive units on recreational boats.

SeaLife ZMp(TM) is a variant of SeaLife1000(TM) developed and specifically marketed to resist the attachment of Zebra Mussels, which currently infest underwater surfaces and cause problems for marine vessels and underwater facilities in fresh water lakes and streams and rivers in many U.S. states.

Our anti-foul paint has been approved for sale by the United States Environmental Protection Agency (USEPA), the California Environmental Protection Agency (CAEPA), the Washington State Department of Agriculture (WADOA) and the Florida State Department of Agriculture and Consumer Services (FDACS).and the Swedish EPA.

The Company has had under development and is shipping a complete coating system for commercial ships. SeaLife Marine Products has recently began shipping its complete product line including, (SEALIFE MZP); a high build epoxy primer (SEALIFE HBE), and a high gloss finish, (SEALIFE HGF). The complete coating system developed by SeaLife is based on a Zero Volitle Organic Compounds (VOC) technology. “Zero” VOC coatings are environmentally safe and do not produce any volatile organic compounds (green house gas), now thought responsible for accelerated climate change and global warming. As a result, the U.S. and many foreign countries have either adopted or have pending, regulations to limit the application of paints in shipyards which release such damaging gases into the environment. Certain shipyards in the United States are already restricted to applying a limited amount of any high VOC formula co atings in a 24 hour period. SeaLife’s Zero Voc formulation has no such limitations. As a result, SeaLife’s new “zero” VOC properties can be applied by shipyards without restriction.

SeaLife’s new coatings have been developed as a colorless neutral base, allowing the coatings to be tinted at the application site for a perfect match. The paints can be tinted to match any custom color desired. This eliminates the problem and costs of stocking multiple colors that may not match a customer’s requirement. The new product line allows SeaLife to bid on any commercial ship or boat and then deliver the product in the same day.

The Market

The magnitude of world maritime usage of anti-foul paints is substantial. The toll that marine growth can take on a vessel's performance is considerable. A barely visible 10 micro/meter (1%) increase in average hull roughness for a large ship, such as a bulk carrier, may equate to as much as 1,700 tons of additional fuel use over the course of one year due to fouling and subsequent frictional surface resistance. Since fuel costs can amount to as much as 50% of the total operating costs for such ships, increasing fuel costs could increase the cost of operating such ships significantly.

5

Removing this growth is also a punishing procedure, as the fouling is typically bonded with a strong grip. Dry-docking for the purpose of cleaning and re-coating a hull with fresh anti-foul paint is costly because of the expenses associated with the work, and the loss of business due to the ship’s inactivity.

Potential customers include individual pleasure boat owners, shipping lines and cruise lines, commercial fishermen and their nets, boat and ship manufacturers, boat and ship maintenance facilities, shipping ports, marinas, and offshore drilling platforms. The United States military, including the Coast Guard and the United States Navy are part of the anticipated market, as are the hundreds of marine product distributors worldwide.

Competition

The marine coatings market is highly competitive, with the world's major paint manufacturers seeking to develop environmentally compatible products in order to meet the stringent requirements mandated by the IMO. Marine coating companies, such as Akzo-Nobel N.V. (owner of International Paints), Ciba Specialty Chemicals AG, Clariant AG, The Dow Chemical Company, and DuPont Corporation, among others, are well-established, have extensive research and development facilities, are well capitalized and command the majority of the multi-billion dollar chemical manufacturing industry. In addition, a number of these companies were early pioneers of chemical and coating products and enjoy significant brand recognition and market share .

Several smaller coating-and bio-tech companies, as well as researchers at universities around the world, are also in the process of developing environmentally safe marine coatings, using a variety of methods and ingredients.

Government Regulation

Anti-fouling marine paints are subject to both Federal and State environmental and safety regulations in the United States, and similar regulation in other countries. As stated above, SeaLife anti-foul paint has been approved by the USEPA, CAEPA, WADOA and FDACS. The approval by these agencies allows us to sell our anti-foul paint in every state except Virginia and Texas, where we intend to apply for approval in the near future. We have received approval to import our anti-foul paint into South Africa, and have applied for, but not yet received, approval for it in Canada and Sweden. Additional government approvals will generally be required to sell our anti-foul paint in other foreign jurisdictions.

Manufacturing & Distribution

SeaLife Marine out sources its manufacturing. As demand increases, SeaLife Marine intends to outsource its manufacturing to a variety of independent manufacturing facilities in the Untied States. The manufacturing process for our paint does not require significant retooling. Therefore, if necessary, suppliers could be replaced without a significant disruption in production.

We began shipping SeaLife 1000(TM) in June 2004.

In the United States, we have distributors engaged to market our anti-foul paint products on the east coast from Maine to Virginia, and in the south central United States, including Louisiana and Texas. We are now marketing SeaLife 1000(TM )in the United States, and in California, Washington, Oregon, Hawaii, and Louisiana, in particular. We are continuing to pursue distributor relationships throughout the world. However, due to limited funding the company has curtailed the bulk of its international marketing activities and is currently focusing primarily on the U.S. market. Because our products are new to the market, and shipyards are prone to test products for extended periods before carrying a line, our sales to date have been small.

6

Patents

We have not patented the manufacturing formula for our marine paint products. When a patent is filed it requires the disclosure of all processes and formulas required to manufacture the product. Due to the problems inherent with the ease of patent formula duplication by potential competitors worldwide if the formula is disclosed, we have elected to keep the formulas for its marine paint confidential as a trade secret. As a result, no patents have been filed for our marine paint products. Senior management has possession of all formulas and processes, and safeguards this proprietary intangible property.

AGRICULTURAL PRODUCTS

We have under development a line of products to meet what management perceives as a growing demand for environmentally safe soil conditioners. These products are manufactured and will be distributed under the name and label “ProTerra”. Damaged soils, the result of the overuse of fertilizers and pesticides, provide an active and growing market for environmentally safe soil conditioners.

ProTerra’s Soil ResQ(TM) is an environmentally safe soil conditioner developed and undergoing testing, which improves poor soil conditions, buffer toxic salts, maintain a well-balanced soil structure, and promote vigorous plant growth. The product is being developed to work with conventional fertilizers, optimizing the fertilizer benefit for large scale applications to agricultural and park properties.

Soil ResQ(TM) is being extensively tested and management views the results as promising. Testing on county golf courses located in Sacramento, California has demonstrated that Soil ResQ(TM) has repaired soil, returning grass damaged by chemical intrusion and brown areas to full health. The same tests indicated a substantial reduction in water requirements. Other tests conducted in India, on banana crops, have resulted in measurable yield increases. Tests conducted in Japan have also yielded positive results. Tests of Soil ResQ(TM) have also been conducted in Colombia, South America, Algeria, Walnut Creek and Sacramento, California, with excellent results.

The Company’s ProTerra Plant & Soil ResQ has recently been tested to determine is toxicity level. Laboratory testing has confirmed that ProTerra Plant & Soil ResQ is considered non toxic with an LD-50 rating of > 5000 mg/kg.

ProTerra’s NuLagoon(TM) is a treatment system developed and undergoing testing that can be applied to the surface of any waste lagoon as an alternative to dredging. NuLagoon(TM) combines many strains of microbes with agricultural science utilizing proprietary media culture and micro nutrients. The microbes break down the waste materials in lagoons by digesting the waste into water and carbon dioxide. Mechanical dredging is expensive and labor intensive, and involves noxious odors prevalent throughout the lagoon evaporation and dredging cycles. NuLagoon(TM) additives work 24 hours a day to keep lagoons more liquefied and deodorized, and to reduce heavy sludge layers. The treatment system reduces manure sludge buildup, reduces odors, reduces nitrate leaching into groundwater, reduces flies and insects around lagoons, works quickly, and is a fraction of the cost of mechanical dredging.

The Market

The intended market for ProTerra's products is the global agricultural market, golf courses and parks. Currently, we are focusing on marketing Proterra's products for agricultural use in the United States, particularly in California and Texas.

7

Competition

The Company is not aware of any product currently on the market similar or equivalent to SoilResQ(TM). However, several companies currently produce microbe-based products which are claimed to function similarly to NuLagoon(TM). No single manufacturer has emerged as a leader in the market.

Government Regulation

ProTerra products, and its competitors' equivalents are generally not subject to Federal or State environmental or safety regulations because the products do not contain any significant concentration of regulated materials. However, many foreign countries have import restrictions and our products may require approval in such countries prior to import.

Manufacturing And Distribution

�� ProTerra currently outsources its manufacturing. As demand increases, ProTerra intends to outsource its manufacturing to a variety of independent manufacturing facilities in the United States. The manufacturing process does not require significant retooling. Therefore, if necessary, suppliers could be replaced without significant disruption in production.

Patents

We have not patented the manufacturing formula for the ProTerra products. When a patent is filed it requires the disclosure of all processes and formulas required to manufacture the product. Due to the problems inherent with the ease of patent formula duplication by potential competitors worldwide if the formula is disclosed, we have elected to keep the formulas for our products as confidential trade secrets. As a result, no patents have been filed for our ProTerra products.

OTHER PRODUCTS:

SOIL REMEDIATION

Soil Remediation is the process of cleaning soil that has been contaminated with potentially dangerous toxins. ProTerra has under development, a line of soil remediation products focused on large scale commercial and municipal customers. Although the remediation products can be used on a small scale, the Company hopes to develop associations with companies already established in the highly regulated remediation business. Gas stations with leaking storage tanks have been the primary cause for soil contamination from coast to coast.

Soildtox(TM)

Toxins such as, diesel fuel, MTBE, gasoline, etc. can be removed from soil using SoilDtox(TM) bioremediation technology. The product is under development as a bio-remediation process to remediate soil contaminated with high concentrations of environmentally damaging hydrocarbons, commonly found beneath industrial sites such as gas stations, airports and oil fields. SoilDtox(TM) relies on a proprietary blend of microbials that function as an active agent to actually digest the contamination locked deep in the soil. Among the many benefits of using microbial agents to clean contaminated soils is that no toxic residue is left behind. The by-products of this natural process are water and carbon dio xide, which are absorbed by plants and trees to produce oxygen.

8

Government Regulation

Soil detoxification is heavily regulated. Products are regulated for their effectiveness in cleaning the soil and their individual formulations. The USEPA, State regulatory authorities and the respective city where the clean-up site is proposed often oversee contaminated sites. Testing for the effectiveness of a remediation product by the USEPA, state regulatory authorities and cities where a clean up site is proposed is a lengthy process. However, once a product is approved it can be used at any location. None of the ingredients used in SoilDtox(TM) are currently regulated by the USEPA and we do not expect that any of these ingredients will Be regulated in the future.

Patents

We have not patented the manufacturing formula for SoilDtox(TM). Due to the problems inherent with the ease of patent formula duplication by potential competitors worldwide if the formula is disclosed, we have elected to keep the formulas for SoilDtox(TM) as confidential trade secrets. As a result, no patents have been filed for SoilDtox(TM). The formulas and processes for the ProTerra products are fully documented trade secrets and under the custody of key management.

EMPLOYEES

At December 31, 2006, we had 6 employees, including three who are officers of SeaLife Corporation or SeaLife Marine.

ITEM 2. DESCRIPTION OF PROPERTY.

SeaLife maintains a small office in Culver City, California,, and maintains a storage facility in Northern California where it stores its paint inventory.

ITEM 3. LEGAL PROCEEDINGS.

Legal Proceedings Relating To Transactions in 2002 and early 2003.

In 2005, the United States Securities and Exchange Commission (the “SEC”) filed a civil complaint in the United States District Court for the District of Colorado against SeaLife Corp, Robert McCaslin (its Chief Executive Officer and Chief Financial Officer), and several unrelated third parties long since disassociated from the Company, alleging violations of the Securities Act of 1933 and the Securities Exchange Act of 1934, in connection with events that occurred in 2002 and early 2003. The Commission sought permanent injunctions against all defendants, civil penalties against all defendants, and an officer-and-director bar against Mr. McCaslin. The Company and Mr. McCaslin have denied all allegations and are vigorously defending this lawsuit, which is in its discovery phase.

There are currently no other legal proceedings.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITIES HOLDERS.

No matters were submitted to a vote of security holders during the last three months of our fiscal year ended December 31, 2006.

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

SMALL BUSINESS ISSUER PURCHASES OF EQUITY SECURITIES.

9

COMMON STOCK

As of the date of this report, our common stock is traded on the Over-the-Counter Pink Sheet Market under the symbol "SLIF." As of May 15, 2006, the last sale of Common Stock, as quoted on the Over-the-Counter Pink Sheets Market, was $0.14. The following table reflects the high and low sales prices of our Common Stock for the periods indicated, as quoted in public markets.

COMMON STOCK*

HIGH

LOW

FISCAL YEAR ENDED DECEMBER 31, 2005

First Quarter 2005

$ .61

$ .19

Second Quarter 2005

.39 .15

Third Quarter 2005

.27 .11

Fourth Quarter 2005

.19 .07

FISCAL YEAR ENDED DECEMBER 31, 2006

First Quarter 2006

$ .19_

$ .07_

Second Quarter 2006

.27_ .05_

Third Quarter 2006

.13_ .07_

Fourth Quarter 2006

.14_ .09_

The Over-the-Counter Pink Sheets Market quotations in the table above reflect inter-dealer prices, without retail markups, markdowns or commissions and may not necessarily represent actual transactions.

As of March 31, 2007, there were approximately 128 holders of record of our outstanding Common Stock.

DIVIDENDS

The payment of dividends, if any, is within the discretion of the Board of Directors. We have not paid any dividends on our common stock in the past and the payment of dividends, if any, in the future will depend upon our earnings, capital requirements, financial condition and other relevant factors. Our Board of Directors does not presently intend to declare any dividends in the foreseeable future. Instead, our Board of Directors intends to retain all earnings, if any, for use in our business operations.

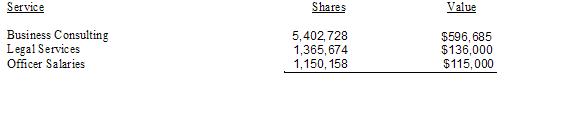

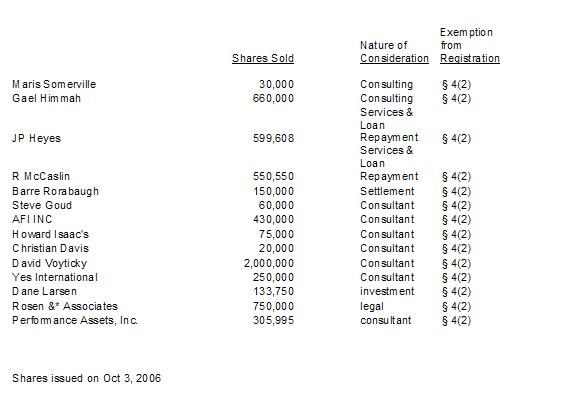

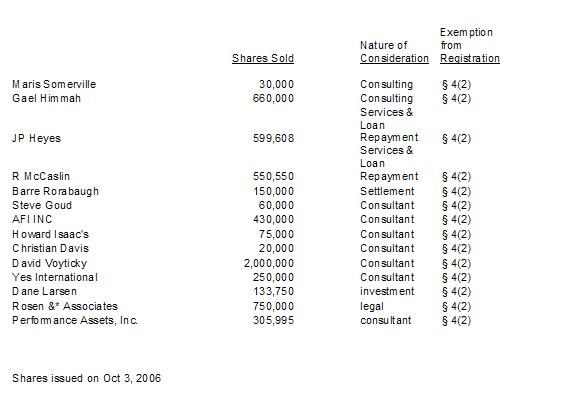

RECENT SALES OF UNREGISTERED SECURITIES

Unregistered Private Sales of Equity Securities and Use of Proceeds.

Shares issued on Nov 22, 2006

10

(1) Effective November 22nd 2006, the Company issued 599,608 restricted shares to director J.P. Heyes in satisfaction of amounts owed to her under her Employment Contract totaling $33,332_, and in payment of personal loans made to the Company by Ms. Heyes and accrued interest thereon totaling $38,621. The Company, additionally issued, 550,550 restricted shares to Robert McCaslin, CEO, in satisfaction of amounts owed to Mr. McCaslin under his Employment Agreement totaling $_66,600

ITEM 6. MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

This Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our consolidated financial statements and accompanying notes.

Overview

The 2007 Fiscal Year has seen an intensive effort in expanding marketing programs for SeaLife Marine Products, Inc. and ProTerra Technology, Inc., both. subsidiaries of the SeaLife Coproration. Both companies have been able to leverage prior successful tests into larger commercial applications in the target markets.we have sought to enter.

Zolatone, one of SeaLife’s primary distributors is actively promoting the paint and has negotiated to expand its territory to Alaska and Hawaii.

The ProTerra Technologies product line of soil conditioners are fully developed and are being tested on a variety of crops by actual customers. Crops under test include; corn for ethanol, soybeans, wheat, strawberries, almonds, rice, lemons, avocado’s, tomatoes, peppers, cantaloupes and lettuce. These tests are being conducted in California, Florida, South Dakota, Louisiana, Mexico, Turkey, China, and Japan. ProTerra is also being tested on several prominent golf courses in Florida, Pennsylvania and New York. So far, the results of such tests have been positive, and more and more potential customers are becoming excited about the prospects for use of ProTerra soil conditioners on their golf courses, parks and agricultural crops.

RESULTS OF OPERATIONS

COMPARING 12 MONTHS ENDED DECEMBER 31, 2006 TO 12 MONTHS DECEMBER 31, 2005.

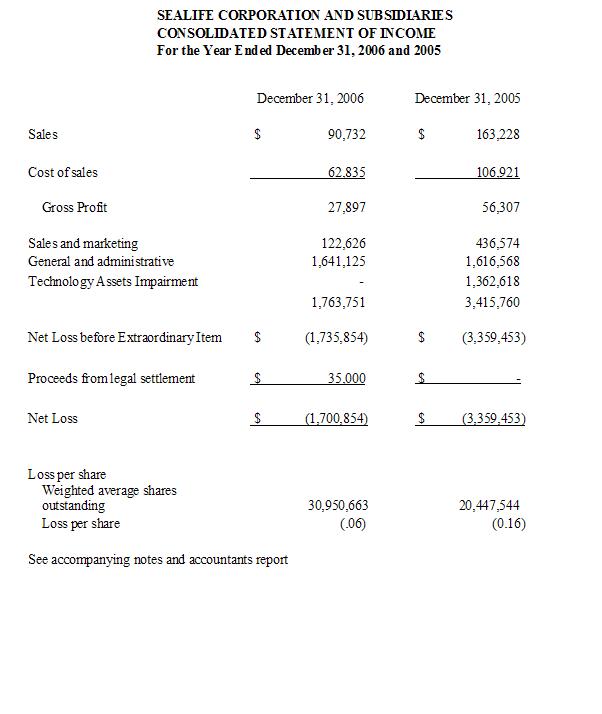

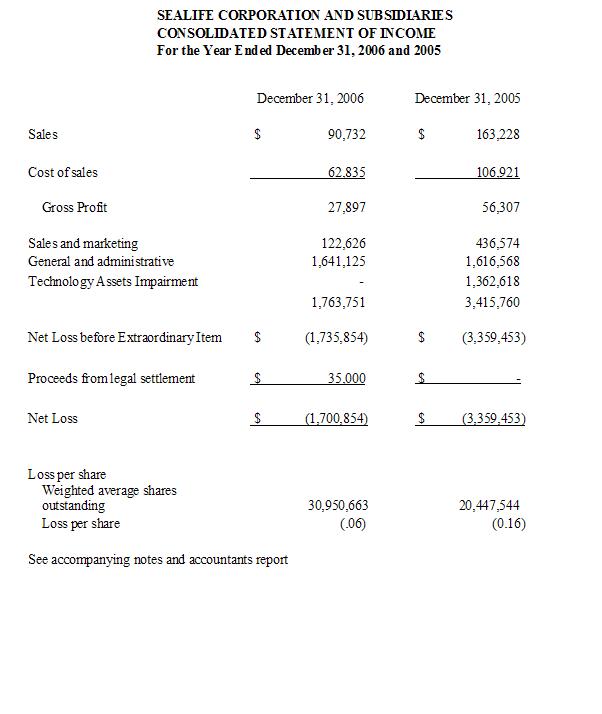

We incurred a net loss of ($_1,700,854) for the 12 months ended December 31, 2006 as compared to a net loss of ($3,359,453) for the twelve months ended December 31, 2005. This loss represents a loss from operations of ($1,700,854) and ($3,359,453) for the periods ended December 31, 2006 and December 31, 2005, respectively. In addition, the company incurred an extraordinary charge of $ 1,362,618 in connection with a reduction in the carrying value of certain acquired technology. Our net loss from operations (exclusive of the impairment charge) decreased by 48% between the 12 months ended December 31, 2006 and 2005, respectively, primarily due to eliminating S-8 stock and the legal cost required to issue S8 stock. Including the impairment char ge of $1,362,618 our net loss from operations decreased by 8% between the same periods.

We had revenues of $ 90,732 for the 12 months ended December 31, 2006, compared to revenues of $163,228 for the twelve month period ending in December 31, 2005, a 44% decrease. Our ability to generate revenue in fiscal 2007 will depend on the success of our continuing marketing efforts and our ability to raise additional capital to support continued operations.

11

Our Gross profit for the 12 months ending December 31, 2006 was $ 27,897 versus $ 56, 307 for the twelve months ended December 31, 2005. The gross margin is 31% versus a gross margin of 34% for the respective comparable periods.

Our total operating expenses consist of general administrative, sales and marketing expenses. For the 12 months ended December 31, 2006, our total operating expenses were $1,763,751, versus $2,053,142 for the prior comparable period.

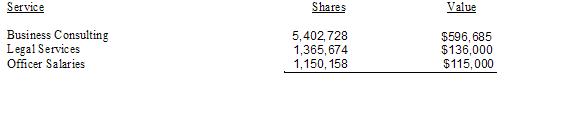

The major decrease in general and administrative expenses is due to the reduction in legal fees and reduction in salaries. The majority of our expenses are recorded as paid-in capital, since the large majority of our marketing, sales and administrative expenses were paid in the form of common stock.

For our fiscal year ended December 31, 2005, we conducted a valuation of our technology as required by SFAS 144, which resulted in an impairment charge of $1,362,618 with respect to certain of our SeaLife Marine and Proterra Technologies. This charge is in addition to the General Administration and Marketing/Sales expenses of $2,053,130 and together equals a total expense of $3,359,441. See Note 3 to our Financial Statements.

During the last 12 months, our distribution expansion for both ProTerra and SeaLife marine products was limited due to limited funding. Our ability to continue to expand our distribution of products will depend on our ability to raise capital to support the cost of adding distributors, advertising, product approvals, market collateral materials such as brochures and websites, and technical support. In addition, we do not have assurance that our consultants who have previously accepted our common stock in lieu of cash compensation will be willing to accept our equity securities in the future. Therefore, our ability to retain consultants and other service provi des may also depend on our ability to raise capital to support the compensation of such professionals.

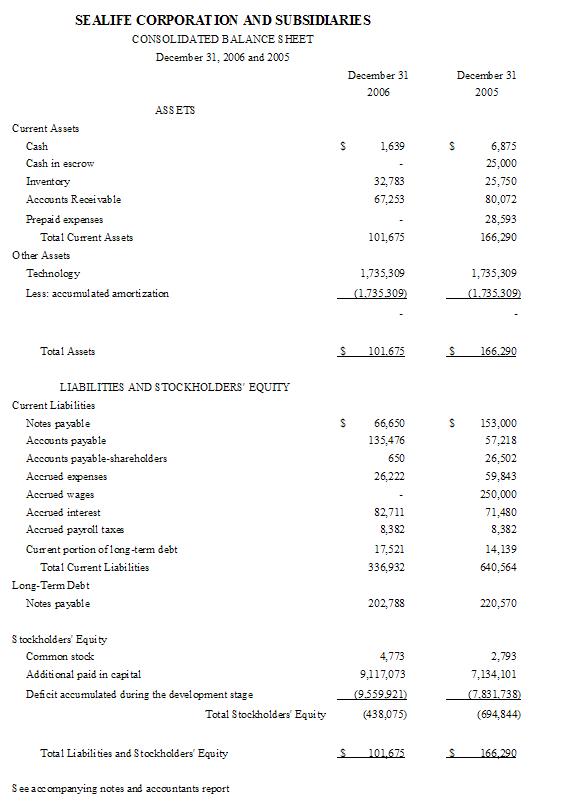

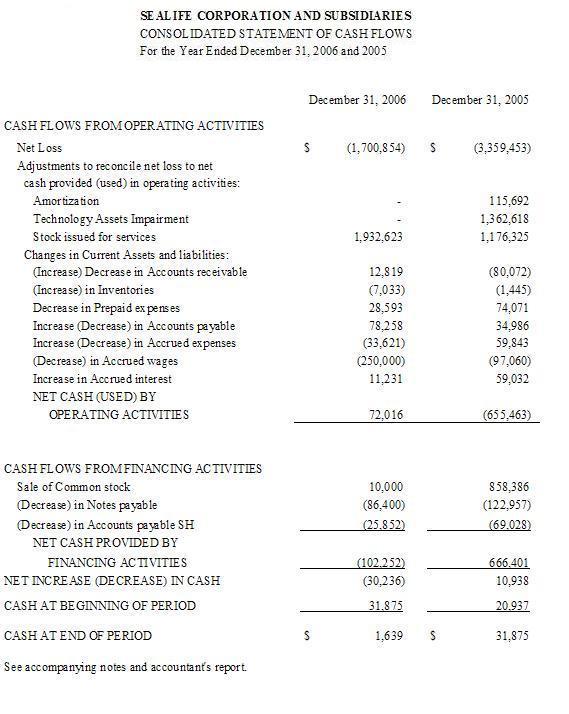

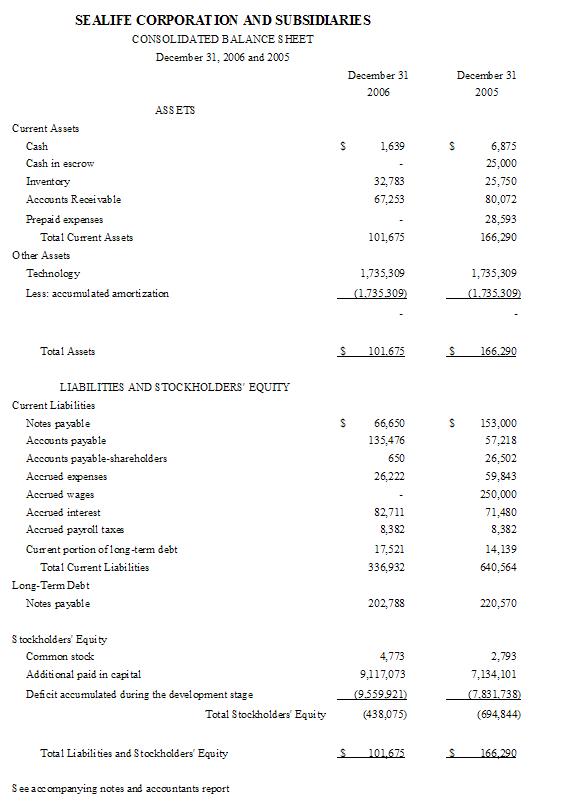

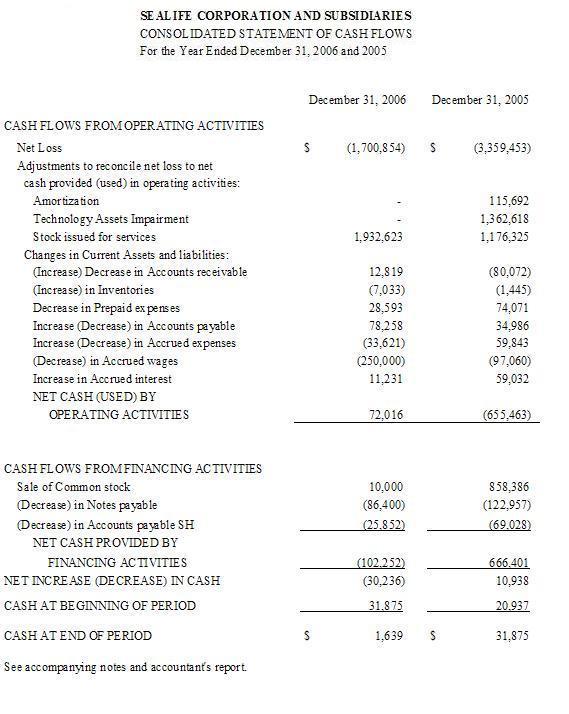

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2006, we had cash and cash equivalents of $1639 as compared to cash and cash equivalents of $31,875 as of December 31, 2005. At December 31, 2006 we had a working capital deficiency (total current liabilities in excess of total current assets) of ($453,075) as compared to a working capital deficiency (current liabilities in excess of total current assets) of ($694,844) as of December 31, 2005. Net cash from financing activities was $102,252 for the 12 months ended December 31, 2006, as compared to $ 666,401 for the 12 months ended December 31, 2005. The principal use of cash for the 12 months ended December 31, 2006 was to fund the net loss from operations for the period. We raised a total of $96,400 as follows : the issuance of common stock, $10,000 and loans totaling $86, 400 from private lenders during the 12 months ended December 31, 2006.

Our paid-in capital increased from $7,134,101_ for the 12 month period ending December 31, 2005 to $9,117,073 for the twelve months ending December 31, 2006. This paid in capital was used to fund services from consultants, attorneys and executives of the company. These services will continue to be funded by paid in capital until we reach a sales level that can fund continued operations and/or outside investment occurs.

Our Stockholder's Equity (decreased) from $ 166,290 for the 12 months ending December 31, 2005 to $ 101,675 for the 12 months ending December 31, 2006.

GOING CONCERN

Our independent auditor has expressed substantial doubt as to our ability to continue as a going concern, in its report for the 12 months ended December 31, 2006, based on significant operating losses that we incurred and the fact that we do not have adequate working capital to finance our day-to-day

operations.

12

We currently plan to raise additional capital through the public or private placement of our common stock and/or private placement of debt or convertible debentures, in order to meet our ongoing cash needs. However, the additional funding we require may not be available on acceptable terms or at all, and, if obtained, could result in significant dilution. Management also hopes to begin to generate commercial orders for its SeaLife 1000(TM) marine paint product which would generate additional cash flow.

To date we have financed approximately 80% of our expenses by issuing shares of common stock in exchange for consulting services, legal services and the services of other professionals. The remaining 20% was financed through private placement stock offerings. In order to expand, we will be required to obtain additional financing either in the form of debt or equity.

If we cannot obtain adequate funding or achieve revenues from the sale of our products, we could be required to significantly curtail or even shutdown our operations.

CRITICAL ACCOUNTING POLICIES, JUDGMENTS AND ESTIMATES

Our discussion and analysis of our financial conditions and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States. The preparation of financial statements requires management to make estimates and judgments that affect the reported amounts of assets and liabilities, revenues and expenses and disclosures on the date of the financial statements. On an on-going basis, we evaluate our estimates, including, but not limited to, those related to revenue recognition. We use authoritative pronouncements, historical experience and other assumptions as the basis for making judgments. Actual results coul d differ from those estimates. We believe that the following critical accounting policies affect our more significant judgments and estimates in the preparation of our consolidated financial statements.

IMPAIRMENT OF GOODWILL. We adopted SFAS No. 142 for all goodwill and other intangible assets recognized in our statement of financial position as of May 31, 2004. This standard changes the accounting for goodwill from an amortization method to an impairment-only approach. Our technologies are being amortized over 15 years. This is management's best estimate of the technologies' life at this time.

REVENUE RECOGNITION. Revenue is recognized on the day a product is shipped and invoiced.

ACCOUNTS RECEIVABLE. Accounts receivable balances are evaluated on a continual basis and allowances, if any, are provided for potentially uncollectible accounts based on management's estimate of our ability to collect such accounts. If the financial condition of a customer deteriorates, resulting in an impairment of its ability to make payments, an additional allowance may be required. Allowance adjustments, if any, are charged to operations in the period in which the facts that give rise to the adjustments become known. To date, we have not had any customer whose payment was considered past due, and as such, have not recorded any reserves for doubtful collectability.

STOCK-BASED COMPENSATION. We account for stock-based compensation using Accounting Principles Board ("APB") Opinion No. 25, "ACCOUNTING FOR STOCK ISSUED TO EMPLOYEE."

LONG LIVED ASSETS. We periodically review the carrying values of our long lived assets in accordance with SFAS 144 "Long Lived Assets" when events or changes in circumstances would indicate that it is more likely than not that their carrying values may exceed their realizable value and records impairment charges when necessary. We have determined that an impairment charge of $1,362,618 is necessary for the year ended December 31, 2005 (see Note 3 to our consolidated financial statement).

ACCOUNTING PRONOUNCEMENTS

13

CERTAIN RISK FACTORS

YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISK FACTORS, AMONG OTHERS, AND ALL OTHER INFORMATION CONTAINED IN THIS REPORT, BEFORE PURCHASING SHARES OF OUR COMMON STOCK. INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK.

Risks Related to Our Business

We have incurred substantial losses from inception while realizing limited revenues.

For each fiscal year since our acquisition of SeaLife Nevada in 2002, we have generated net losses and we have accumulated losses totaling approximately $9,551,921 as of December 31, 2006. We are still a development stage company and have historically generated very limited revenues. We can provide no assurances that our operations will generate substantial revenues or be profitable in the future. We have just recently introduced some of our products into the marketplace and have shipped only small quantities to our distributors.

We will need to raise additional capital and it may not be available to us on favorable terms or at all.

We estimate that we may need to raise up to $1 million of additional capital over the next 24 months to support our operations, meet competitive pressures and/or respond to unanticipated requirements during and beyond that period. While there are no definitive arrangements with respect to sources of additional financing, management is optimistic that these funds can be raised through private offerings of our common stock. However, our inability to obtain additional financing, when needed or on favorable terms, could materially adversely affect our business, results of operations and financial condition and could cause us to curtail or cease operations.

Future revenues and quarterly operating results may fluctuate significantly.

We have a very limited operating history, and have very little revenue to date. We cannot predict future revenue, nor the consistency of our quarterly operating results. Factors which may cause our operating results to fluctuate significantly from quarter to quarter include:

•

our ability to arrange for additional capital to fund marketing efforts and the manufacture of inventory;

•

our ability to attract new customers;

•

our ability to protect our proprietary technology;

•

the ability of our competitors to offer new or enhanced products or services.

Because of these and other factors, we believe comparisons of our results of operations for our twelve months ended December 31, 2006 and December 31, 2005, are not good indicators of our future performance. If our operating results fall below the expectations of securities analysts and investors in some future periods, then our stock price may decline.

We expect our business to be seasonal which means that we anticipate having less revenue during certain portions of the year.

The practical application of our products, both in the case of SeaLife Marine paint products and ProTerra agriculture products, requires warmer weather conditions with little to no precipitation. As a result, management expects our business to be seasonal, with sales and earnings being relatively higher during the outdoor season (such as the spring and summer seasons) and lower during the indoor season (such as the fall and winter seasons). Accordingly, we may show lower revenues during portions of the year which could correspondingly adversely affect the price of our common stock.

We may rely in part on international sales, which are subject to additional risks.

14

International sales may account for a significant portion of our revenues in the future. International sales can be subject to many inherent risks that are difficult or impossible for us to predict or control, including:

•

unexpected changes in regulatory requirements and tariffs;

•

difficulties and costs associated with staffing and managing foreign operations, including foreign distributor relationships;

•

longer accounts receivable collection cycles in certain foreign countries;

•

adverse economic or political changes;

•

potential trade restrictions, exchange controls and import and export licensing requirements

•

foreign currency fluctuations.

We may not be able to adequately protect our intellectual property rights, and may be exposed to infringement claims from third parties.

The technologies upon which our products are based are protected only by laws governing the protection of trade secrets. Our success will depend in part on our ability to preserve our trade secrets and to operate without infringing on the proprietary rights of third parties. There can be no assurance that others will not independently develop similar technologies, duplicate our technologies or design around our technologies.

Certain of the processes and know-how of importance to our technology are dependent in part upon the skills, knowledge and experience of our technical personnel, consultants and advisors and such skills, knowledge and experience are not patentable. To help protect our rights, we require employees, significant consultants and advisors with access to confidential information to enter into confidentiality and proprietary rights agreements. There can be no assurance, however, that these agreements will provide adequate protection for our trade secrets, know-how or proprietary information in the event of any unauthorized use or disclosure.

From time to time, we may receive notices from third parties of potential infringement and claims of potential infringement. Defending these claims could be costly and time consuming and would divert the attention of management and key personnel from other business issues.

We do not believe that any of our technology infringes on the patent rights of third parties. However, there can be no assurance that certain aspects of our technology will not be challenged by the holders of patents.

We may be unable to compete effectively with competitors of perceived competing technologies or direct competitors that may enter our market with new technologies.

Our products may be subject to technological obsolescence.

We believe there is substantial research underway by competitors and potential future competitors into the causes of and solutions for marine, agricultural and other environmental pollution. Discovery of new technologies could replace or result in lower than anticipated demand for our products.

A change in the prices of, raw materials could materially adversely impact our results of operations.

We purchase certain raw materials such as Cuprous Oxide and other chemicals, biocides, pesticides or toxins, under short- and long-term supply contracts. The purchase prices are generally determined based on prevailing market conditions. If there is a shortage in these raw materials, or if our suppliers otherwise increase the costs of such materials, this could materially adversely impact our results of operations.

Our future success depends, in part, on our Key Personnel, Consultants and Principal Management’s continued participation.

Our ability to successfully develop our products, manage growth and maintain our competitive position will depend, in large part, on our ability to attract and retain highly qualified management and technologists. We are dependent upon our Chief Executive Officer Robert McCaslin, age 55 and Gael Himmah, age 75, an independent contractor that acts as our Chief Consulting Scientist, and other members of our management and consulting team. We do not maintain Key Man life insurance on any of these employees or consultants. Competition for such personnel is significant, and there can be no assurance that we will be able to continue to attract and retain such personnel. Our consultants may be affiliated or employed by others and some may have consulting or other advisory arrangements with other entities that may conflict or compete with their obligations to us. In the case of Mr. McCaslin, the SE is seeking to bar him from servin g as an officer or director of a public company, a suit which he is vigorously defending. We require that our consultants and independent contractors execute confidentiality agreements upon commencement of relationships with us.

15

We do not have a separate standing Audit Committee, Compensation Committee or Nominating and Corporate Governance Committee, so the duties customarily delegated to those committees are performed by the Board of Directors as a whole, and no director is an “audit committee financial expert” as defined by the rules and regulations of the Securities and Exchange Commission.

Our Board of Directors consists of three members, our Chief Executive Officer and Chief Financial Officer, and our Vice President and Secretary, and one outside and independent director. The Board of Directors as a whole performs the functions of an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Risks Related to Our Industry

Our industry is very competitive, and we may be unable to continue to compete effectively in this industry in the future. We are engaged in an industry that is highly competitive. We compete with many other suppliers and new competitors continue to enter the markets. Many of our competitors, both in the United States and elsewhere, are major chemical companies, and many of them have substantially greater capital resources, marketing experience, research and development staffs, and facilities than we do. Any of these companies could succeed in developing products that are more effective than the products that we have or may develop and may also be more successful than us in producing and marketing their products. We expect this competition to continue and intensify in the future. Competition in our markets is primarily driven by:

•

product performance, features and liability;

•

price;

•

timing of product introductions;

•

ability to develop, maintain and protect proprietary products and technologies;

•

sales and distribution capabilities;

•

technical support and service;

•

brand loyalty;

•

applications support; and

•

breadth of product line.

If a competitor develops superior technology or cost-effective alternatives to our products, our business, financial condition and results of operations could be materially adversely affected.

We are subject to a wide variety of local, state and federal rules and regulations, which could result in unintentional violations of such laws. Also, changes in such laws could result in loss of revenues.

As an environmental products manufacturer, we are subject to a wide variety of local, state and federal rules and regulations. While we believe that our operations are in compliance with all applicable rules and regulations, we can provide no assurances that from time to time unintentional violations of such rules and regulations will not occur. Certain of our products are regulated by the U. S. Environmental Protection Agency and the individual states where marketed. Government regulation results in added costs for compliance activities and increases the risk of losing revenues should regulations change. Also, from time to time we must expend resources to comply with newly adopted regulations, as well as changes in existing regulations. If we fail to comply with these regulations, we could be subject to disciplinary actions or administrative enforcement actions. These actions could result in penalties, including fines.

16

RISKS RELATED TO OUR COMMON STOCK

We have a limited trading volume and shares eligible for future sale by our current stockholders may adversely affect our stock price.

To date, we have had a very limited trading volume in our common stock. As long as this condition continues, the sale of a significant number of shares of common stock at any particular time could be difficult to achieve at the market prices prevailing immediately before such shares are offered. In addition, sales of substantial amounts of common stock, including shares under Rule 144 or otherwise could adversely affect the prevailing market price of our common stock. As a result of our limited cash, a number of our employees and consultants have elected to accept a portion or all of their compensation in shares of our common stock. In the past a portion of these were issued pursuant to effective registration statements or registered for resale to the public. The Board in April of 2006 adopted the policy of henceforth only issuing restricted private placement stock for services rendered by employees and consultants.

Our common stock price is highly volatile.

The market price of our common stock is likely to be highly volatile as the stock market in general, and the market for technology companies in particular, has been highly volatile.

Factors that could cause such volatility in our common stock may include, among other things:

•

actual or anticipated fluctuations in our quarterly operating results;

•

announcements of technological innovations;

•

changes in financial estimates by securities analysts;

•

conditions or trends in our industry; and

•

changes in the market valuations of other comparable companies.

The sale of our common stock on the Over-the-Counter Pink Sheets Market and the designation of our common stock as a “penny stock” may impact the trading market for our common stock.

Our securities, as traded on the Over-the-Counter Pink Sheets Market, will be subject to Securities and Exchange Commission rules that impose special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. For purposes of the rule, the phrase “accredited investors” means, in general terms, institutions with assets in excess of $5,000,000, or individuals having a net worth in excess of $1,000,000 or having an annual income that exceeds $200,000 (or that, when combined with a spouse’s income, exceeds $300,000). For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell our securities and also may affect the ability of pu rchasers to sell their securities in any market that might develop therefore.

In addition, the Securities and Exchange Commission has adopted a number of rules to regulate “penny stock.” Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities and Exchange Act of 1934, as amended. Because our securities constitute “penny stock” within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of our common stock to sell our securities in any market that might develop for them.

We do not foresee paying dividends in the near future.

17

We have not paid dividends on our common stock and do not anticipate paying such dividends in the foreseeable future.

Officers and directors own a significant portion of our common stock, which could limit our shareholders’ ability to influence the outcome of key transactions.

As of December 31, 2006 our officers and directors and their affiliates controls directly or indirectly approximately 61% of our outstanding voting shares. As a result, our officers and directors are able to exert considerable influence over the outcome of any matters submitted to a vote of the holders of our common stock, including the election of our Board of Directors. The voting power of these shareholders could also discourage others from seeking to acquire control of us through the purchase of our common stock, which might depress the price of our common stock.

ITEM 7. FINANCIAL STATEMENTS

The financial statements required to be provided pursuant to this item are presented beginning on

page F-1.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

AUDITED FINANCIAL STATEMENTS: PAGE

Consolidated Balance Sheets at December 31, 2006, December 31, 2005

F-1

Consolidated Statement of Income for the Twelve Months ended

December 31, 2006, and the Twelve Months ended December 31, 2005

F-2

Consolidated Statement of Changes in Stockholders' Equity for the

Twelve Months ended December 31, 2006, and the Twelve Months

ended December 31, 2005, and May 31, 2005

F-1

Consolidated Statement of Cash Flows for the

Twelve Months ended December 31, 2006, and the Twelve Months

ended December 31, 2005

F-2

Notes to the Consolidated Financial Statements

F-4

Report of Independent Registered Public Accounting Firm

F-11

ITEM 8:

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

ITEM 8A. CONTROLS AND PROCEDURES.

18

CONTROLS AND PROCEDURES

Members of our management, including Robert McCaslin, our Chief Executive Officer, President and Chief Financial Officer, have evaluated the effectiveness of our disclosure controls and procedures, as defined by paragraph (e) of Exchange Act Rules 13a-15 or 15d-15, as of December 31, 2005, the end of the period covered by this report. Based upon that evaluation, Mr. McCaslin concluded that our disclosure controls and procedures are effective.

INTERNAL CONTROL OVER FINANCIAL REPORTING.

There were no changes in our internal control over financial reporting or in other factors identified in connection with the evaluation required by paragraph (d) of Exchange Act Rules 13a-15 or 15d-15 that occurred during the fourth quarter ended December 31, 2005 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM 8B. OTHER INFORMATION.

None.

PART III

ITEM 9. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS; COMPLIANCE WITH SECTION 16(A) OF THE EXCHANGE ACT.

INFORMATION WITH RESPECT TO EACH DIRECTOR AND CERTAIN OFFICERS.

The following table sets forth certain information with respect to each of our directors, nominees, and executive officers as of March 31, 2007.

DIRECTOR/

OFFICER

NAME

AGE

POSITION____________

SINCE

Robert A. McCaslin 55

President, Chief Financial Officer, Director

2002

J.P. Heyes

79 Vice-President, Secretary, Director

2002

All officers are appointed by and serve at the discretion of the Board of Directors. There are no family relationships between any of our directors or officers.

ROBERT A. MCCASLIN

Mr. McCaslin owned, operated and served as a Director and President of the privately held electronics manufacturing company REMCorp from 1996 through 2000. The company was originally acquired to develop and manufacture several of Mr. McCaslin's inventions.

During 2001 Mr. McCaslin acted as a distributor for products invented by Gael Himmah and was engaged in the testing of such products internationally.

In early 2002, Mr. McCaslin formed SeaLife Nevada for the purpose of acquiring rights to certain products invented by Mr. Himmah and served as President and a director of that Company until it was acquired by SeaLife Corporation in December of 2002, at which point Mr. McCaslin became President and a director of SeaLife Corporation.

J. P. HEYES

Ms. Heyes served as a Senior Vice President at REMCorp from 1995-2000. Among Ms. Heyes's primary responsibilities were negotiating manufacturing contracts, business finance and developing a direct TV sales marketing program for the company's products. Ms. Heyes was also responsible for contract negotiations as well as implementing production and supervising off shore manufacturing.

19

During 2001 Ms. Heyes worked with Mr. McCaslin and acted as a distributor for products invented by Gael Himmah and was engaged in the testing of such products internationally.

In early 2002, Ms. Heyes assisted Mr. McCaslin in forming SeaLife Nevada for the purpose of acquiring rights to certain products invented by Mr. Himmah and served as Secretary and a director of that Company until it was acquired by SeaLife Corporation in December of 2002, at which point Ms. Heyes became Vice-President, Secretary and a director of SeaLife Corporation.

COMMITTEES OF THE BOARD OF DIRECTORS

Our board does not have any committees, including an audit committee. The functions customarily delegated to an audit committee are performed by our full board of directors. As we do not maintain an audit committee, we do not have an audit committee "financial expert" within the meaning of Item 401(e) of Regulation S-B. The Board has determined that it is not feasible to recruit an audit committee financial expert at this time.

CODE OF ETHICS

We have adopted a Code of Ethics applicable to all of our Board members and to all of our employees, including our Chief Executive Officer and Chief Financial Officer. The Code of Ethics constitutes a "code of ethics" as defined by applicable SEC rules. The Code of Ethics has been publicly filed with the SEC as an exhibit to our Annual Report on Form 10-KSB for the transition period ending December 31, 2004. You may also request a copy of the Code of Ethics by writing or calling us at:

SeaLife Corporation

5601 W. Slauson Avenue

Culver City, California 90230

Attn: Robert McCaslin

Telephone: (310) 338-9757

Any waiver of the Code of Ethics pertaining to a member of our Board or one of our executive officers will be disclosed in a report on Form 8-K filed with the SEC.

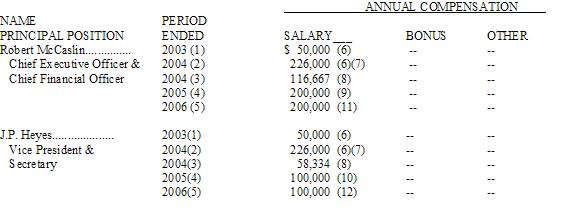

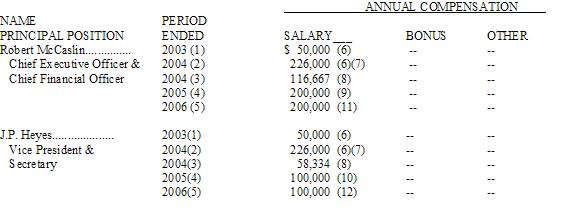

ITEM 10. EXECUTIVE COMPENSATION.

SUMMARY COMPENSATION TABLE

The following table sets forth information concerning all compensation paid for services to us by our Executive Officers in all capacities for our fiscal year ended May 31, 2004, the seven month period ended December 31, 2004 and our fiscal year ended December 31, 2005, and our Fiscal Year ended December 31, 2006. No other executive officer received total annual salary and bonus in excess of $100,000 during these periods.

*Columns in the Summary Compensation Table that were not relevant to the compensation paid to the named executive officers have been omitted.

(1) Fiscal Year ending May 31, 2003

(2) Fiscal Year ending May 31, 2004

(3) Seven Months ending December 31, 2004

(4) Fiscal Year ending December 31, 2005

(5) Fiscal Year Ending December 31, 2006

(6) Each of Mr. McCaslin and Ms. Heyes elected to receive their respective salaries for January 1, 2003 through May 31, 2003 ($50,000) and June 1, 2003 through September 30, 2003 ($40,000), in our common stock, which was issued to each executive officer at a price of $0.30 per share upon the filing of a Registration Statement on Form S-8 by us on October 17, 2003.

20

(7) Comprised of shares valued at $40,000 for services rendered from June 1, 2003 through September 30, 2003, as described in Note (1) above, shares valued at $60,000 as described below, shares valued at $93,750 as described below, and $32,250 of deferred compensation as described below.

Each of Mr. McCaslin and Ms. Heyes was issued 300,000 shares of our common stock on January 10, 2004, in payment of our debt to them for accrued salaries for October 1, 2003 through December 31, 2003, which were each valued at $60,000. The shares were issued to the executive officers at $0.20 per share, a 33% discount on the $0.56 closing price of the shares on the Over-the-Counter Bulletin Board on November 19, 2003, the date the officers agreed to accept our common shares in lieu of cash compensation. The closing price of the shares on the Over-the-Counter Bulletin Board on January 9, 2004 was $0.56 per share.

Each of Mr. McCaslin and Ms. Heyes was issued 206,044 shares of our common stock on March 26, 2004 in payment of our debt to them for accrued salaries under their Employment Agreements, which were valued at approximately $93,750. The shares were issued to Mr. McCaslin and Ms. Heyes at $0.455 per share. The closing price of the shares on the Over-the-Counter Bulletin Board on March 26, 2004 was $0.97 per share.

Each of Mr. McCaslin and Ms. Heyes also deferred, at their election, payment of $32,250 due under their respective Employment Agreements for our fiscal year ending May 31, 2004, which Employment Agreements are described under the heading "Employment Contracts and Change of Control Agreements" below.

(8) Comprised solely of deferred compensation due under Employment Agreements with Mr. McCaslin and Ms. Heyes.

(9) In 2005 Mr. McCaslin was issued 622,126 shares of our common stock, in payment of our debt to him for accrued salary under his Employment Agreement through September 30, 2004, which was valued at $98,918. The shares were issued to Mr. McCaslin at a price per share of $0.1590.

(10) In 2005 Ms. Heyes agreed to convert all her accrued compensation under her Employment Agreement through December 31, 2005, totaling $190,582, in shares of our common stock. Ms. Heyes received two blocks of shares, 202,830 shares on September 30, 2005 and 1,487,353 shares on December 31, 2005 of our common stock at a per share price of $0.1590 and $0.1069 respectively.

21

(11 In 2006 Mr. McCaslin was issued approximately 4,538,980 shares of our common stock, in payment of our debt to him for accrued salary, under his Employment Agreement, for services provided from March 2004 through Dec 2006, , which was valued at $492,121_The shares were issued to Mr. McCaslin at a price per share of $.12.

(12 In 2006 Ms. Heyes was issued approximately 857,666 shares of our common stock, in payment of our debt to her for accrued salary under her Employment Agreement through December 2006, which was valued at $_100,000. The shares were issued to Ms. Heyes at a price per share between $. 10 - $..15

OPTION GRANTS

We have not granted any options to purchase common stock since the beginning of our fiscal year ending May 31, 2003.

2004 STOCK AWARD PLAN

Our 2004 Stock Award Plan was adopted and became effective in November 2004 and was amended on March 25, June 30, November 4, and December 21, 2005. A total of 3,820,000, shares of common stock were reserved for issuance under the 2004 Stock Award Plan, as amended. Any shares of common stock subject to an award, which for any reason expires or terminates unexercised, are again available for issuance under the 2004 Stock Award Plan. The Board of Directors has indicated that it does not plan to issue any additional shares under the 2004 Stock Award Program

Our 2004 Stock Award Plan will terminate 10 years from the date on which our board approved the plan, unless it is terminated earlier by our board. The plan authorizes the award of common stock and derivative securities (which may include stock bonuses).

Our 2004 Stock Award Plan is administered by our full board of directors. Following the expansion of our board of directors, we intend to form a compensation committee, all of the members of which will be independent directors under applicable federal securities laws and outside directors as defined under applicable federal tax laws. Following its formation, the compensation committee will have the authority to construe and interpret the plan, grant awards and make all other determinations necessary or advisable for the administration of the plan.

Awards under the 2004 Stock Award Plan are not restricted to any specified form or structure and may include, but need not be limited to, sales, bonuses and other transfers of stock, restricted stock, stock options, reload stock options, stock purchase warrants, other rights to acquire stock or securities convertible into or redeemable for stock, stock appreciation rights, phantom stock, dividend equivalents, performance units or performance shares, or any other type of Award which the Board shall determine is consistent with the objectives and limitations of the Plan. An Award may consist of one such security or benefit, or two or more of them in tandem or in the alternative.

Our 2004 Stock Award Plan provides for the issuance of incentive stock options that qualify under

Section 422 of the Internal Revenue Code as well as nonqualified stock options. Incentive stock options may be granted only to employees of ours or any parent or subsidiary of ours. All awards other than

incentive stock options may be granted to our employees, officers, directors, consultants, independent contractors and advisors of ours or any parent or subsidiary of ours, provided the consultants, independent contractors and advisors render services not in connection with the offer and sale of securities in a capital-raising transaction. The exercise price of incentive stock options must be at least equal to the fair market value of our common stock on the date of grant. The exercise price of incentive stock options granted to 10% shareholders must be at least equal to 110% of that value. The exercise price of nonqualified stock options will be determined by our compensation committee when the options are granted. The purchase price for shares & nbsp;of common stock underlying any derivative securities issued under the plan will be determined by our Board of Directors at the time of the grant.

22

EMPLOYMENT CONTRACTS AND CHANGE OF CONTROL AGREEMENTS

Each of the named executive officers is party to an employment agreement with SeaLife Corporation or its subsidiary, SeaLife Marine Products, Inc.

ROBERT MCCASLIN

In January 2004, we entered into an employment agreement with Mr. McCaslin as President and Chief Executive Officer, and entered into an amendment to such employment agreement in June 2004. Under his employment agreement, Mr. McCaslin is entitled to an initial salary of $200,000 per year, and may be awarded an annual bonus, in the sole discretion of SeaLife. Mr. McCaslin's compensation is reviewed annually by our Board at the beginning of each fiscal year. The term of Mr. McCaslin's employment is six years, however, under California law, we and Mr. McCaslin may terminate Mr. McCaslin's employment agreement at any time for any legal reason. Upon termination for reasons other than cause, Mr. McCaslin may be entitled to severance &n bsp;payments of up to eighteen (18) months of base salary if Mr. McCaslin is terminated as a result of a permanent disability, and severance payments of up to six (6) months if Mr. McCaslin is terminated for failure to fulfill job functions. As of March 31, 2006, we owed Mr. McCaslin a total of $300,000 in accrued salary.

J.P. HEYES

In January, 2004, we entered into an employment agreement with Ms. Heyes as Vice President, and entered into an amendment to such employment agreement in June, 2004. Under her employment agreement, Ms. Heyes is entitled to a salary of $100,000 per year, and may be awarded an annual bonus, in the sole discretion of SeaLife. Ms. Heyes's compensation is reviewed annually by our Board at the beginning of each fiscal year. The term of Ms. Heyes' employment is five years, however, under California law, we and Ms. Heyes may terminate Ms. Heyes's employment agreement at any time for any legal reason. Upon termination for reasons other than cause, Ms. Heyes may be entitled to severance payments of up to eighteen (18) months of base salary if Ms. Heyes is terminated as a result of a permanent disability, and severance payments of up to six (6) months if Ms. Heyes is terminated for failure to fulfill job functions. As of March 31, 2006, we owed Ms. Heyes a total of $25,000 in accrued salary.

GAEL HIMMAH, CHIEF CONSULTING SCIENTIST

We entered into a Consulting Agreement with Gael Himmah, our Chief Consulting Scientist, doing

business as Aspen Laboratories, Ecosys International and SeaLife Marine Coatings, on January 6, 2003, and amended the agreement in August 2004 (the "Original Consulting Agreement"). Pursuant to the consulting

agreement, as amended, Mr. Himmah is to be paid $12,500 per month in exchange for providing consulting services to us associated with the development, testing, and marketing of our products. In lieu of cash, Mr. Himmah has consistently elected to be paid in shares of our common stock. The consulting agreement terminates on January 1, 2008, unless earlier terminated.

On April 20, 2006, we and Gael Himmah entered into a Consulting Agreement, Settlement and General Release with respect to the settlement of Mr. Himmah's potential claims regarding certain technologies owned by the us and his continuing relationship with us. The agreement provides for certain payments to Mr. Himmah in the form of cash and shares of our common stock having an aggregate value of approximately $188,044 in payment of (a) certain amounts owed to Mr. Himmah under the Original Consulting Agreement, (b) royalty payments due on the sale of our SeaLife Marine products, (c) interest payments due under a our promissory note dated June 30, 2002, and (d) royalty payments due on the sale of certain of our ProTerra products. In additio n, the Agreement provides the terms of an ongoing additional consulting relationship with Mr. Himmah which prescribes his participation in supporting our capital-raising and research and development efforts necessary to maintain the our products' technological advantages. As consideration for these new consulting services, we have agreed to pay Mr. Himmah commission fees equal to ten percent (10%) of the net sales of products utilizing the Original ProTerra Technologies (defined below) up to $2.5 million, and thereafter commission fees equal to eight percent (8%) of such products up to a maximum of an additional $3.2 million. The maximum amount of commissions payable under the consulting agreement will not exceed $5.7 million. The "Original ProTerra Technologies" include the following formulas: Plant Rescue Formula 844, Soil Rescue F ormula 808, Odor Meister Formula 355, GreaseBeast Formula 398, MuniMix Formula 354 and Sterile Boost Formula 899. The new consulting arrangement with Mr. Himmah has a term of seven (7) years. Mr. Himmah will also continue to provide services under the Original Consulting Agreement.

23

INDEMNIFICATION OF DIRECTORS AND EXECUTIVE OFFICERS AND LIMITATION OF LIABILITY

Our Bylaws require us to indemnify our directors and officers to the fullest extent not prohibited by the Delaware General Corporation Law; provided, however, that we may modify the extent of such indemnification by individual contracts with our directors and officers; and, provided further, that we are not required to indemnify any director or officer in connection with any proceeding (or party thereof) initiated by such person unless (i) such indemnification is expressly required to be made by law, (ii) the proceeding was authorized by the Board of Directors of the corporation, or (iii) such indemnification is provided by us, in our discretion, pursuant to the po wers vested in us under the Delaware General Corporation Law.

A shareholder's investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers as required by these indemnification provisions. At present, there is no pending litigation or proceeding involving any of our directors, officers or employees regarding which indemnification by us is sought, nor are we aware of any threatened litigation that may result in claims for indemnification.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that, in the opinion of the SEC, this indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

ITEM 11. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

The following table presents information regarding the beneficial ownership of our common stock as of April 1, 2007 by:

o each of the executive officers listed in the summary compensation table;

o each of our directors;

o all of our directors and executive officers as a group; and

o each shareholder known by us to be the beneficial owner of more than 5% of our common stock.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Shares of our common stock that may be acquired upon exercise of warrants that are currently exercisable or exercisable within 60 days of March 15, 2005 are deemed to be outstanding and to be beneficially owned by the person holding the options for the purpose of computing the percentage ownership of that person but are not treated as outs tanding for the purpose of computing the percentage ownership of any other person.

24

The information presented in this table is based on 47,266, 815 shares of our common stock outstanding on 12/31/2006 Unless otherwise indicated, the address of each of the individuals and entities named below is c/o SeaLife Corporation, 5601 W. Slauson, Culver City, CA 90293.

NUMBER OF SHARES PERCENTAGE OF

NAME OF BENEFICIAL OWNER SHARES______________________________________

BENEFICIALLY OWNED OUTSTANDING

EXECUTIVE OFFICERS AND DIRECTORS:

Robert McCaslin.

8,125,621

18%

Director, President and

Chief Executive Officer and

Chief Financial Officer

J.P. Heyes

4,451,435

11%

Vice President and Secretary

All 2 directors and executive officers as a group

12,577,056

29%

5% SHAREHOLDERS:

Gael Himmah

3,879,000

8.0%

Dan Kubik

3,498,636

7.8%

David Voyticky 2,000, 000 5%

Bob Rosen

2,000,000 5%

Performance Assets, Inc.

2,474,321 5%

* Less than 1%

ITEM 12. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Other than the employment arrangements described above in "Executive Compensation" and the transactions described below, since January 30, 2003 (inception), there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or will be a

party:

o

in which the amount involved exceeds $60,000; and

o

in which any director, executive officer, shareholder who beneficially owns 5% or more of our common stock or any member of their immediate family had or will have a direct or indirect material interest.

TRANSACTIONS WITH OFFICERS AND DIRECTORS

Mr. McCaslin and Ms. Heyes advanced the Company an aggregate of $52,000 during our fiscal year ending December 31, 2006. Approximately $38,000 of such advances were converted into 321,000 shares of our common stock on November 22, 2006, at a price of $0.162/share.

TRANSACTIONS WITH 5% BENEFICIAL SHAREHOLDERS

On April 20, 2006, we and Gael Himmah entered into a Consulting Agreement, Settlement and General Release with respect to the settlement of certain potential claims of Mr. Himmah regarding certain technologies owned by the us and his continuing relationship with us. The agreement provides for certain payments to Mr. Himmah in the form of cash and shares of our common stock having an aggregate value of approximately $188,044 in payment of (a) certain amounts owed to Mr. Himmah under the Original Consulting Agreement, (b) royalty payments due on the sale of our SeaLife Marine products, (c) interest payments due under a our promissory note dated June 30, 2002, and (d) royalty pay ments due on the sale of certain of our ProTerra products. In addition, the Agreement provides the terms of an ongoing additional consulting relationship with Mr. Himmah which prescribes his participation in supporting our capital-raising and research and development efforts necessary to maintain the our products' technological advantages. As consideration for these new consulting services, we have agreed to pay Mr. Himmah commission fees equal to ten percent (10%) of the net sales of products utilizing the Original ProTerra Technologies (defined below) up to $2.5 million, and thereafter commission fees equal to eight percent (8%) of such products up to a maximum of an additional $3.2 million. The maximum amount of commissions payable under the consulting agreement w ill not exceed $5.7 million. The "Original ProTerra Technologies" include the following formulas: Plant Rescue Formula 844, Soil Rescue Formula 808, Odor Meister Formula 355, GreaseBeast Formula 398, MuniMix Formula 354 and Sterile Boost Formula 899. The new consulting arrangement with Mr. Himmah has a term of seven (7) years. Mr. Himmah will also continue to provide services under the Original Consulting Agreement.

25

During our fiscal year ended December 31, 2006 we issued 2,298,051 shares of our common stock to Gael Himmah as partial compensation for services rendered as a Chief Consulting Scientist pursuant to the terms of his consulting agreement with us dated January 1, 2003, described above under "Executive Compensation - EMPLOYMENT CONTRACTS AND CHANGE OF CONTROL AGREEMENTS." The