UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedJune 29, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-08769

R.G. BARRY CORPORATION

(Exact name of Registrant as specified in its charter)

| | |

| Ohio | | 31-4362899 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| |

| 13405 Yarmouth Road N.W. | | |

| Pickerington, Ohio 43147 | | (614) 864-6400 |

| (Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Shares, Par Value $1.00 per share | | The NASDAQ Stock Market LLC (The NASDAQ Global Market) |

| |

Series II Junior Participating Class A Preferred Shares, Par Value $1.00 per share | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 ofRegulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of thisForm 10-K or any amendment to thisForm 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common shares (the only common equity of the Registrant) held by non-affiliates of the Registrant was $144,920,786 based on the closing price per common share of $13.92 on The NASDAQ Global Market on December 28, 2012 (the last business day of the most recently completed second fiscal quarter). For this purpose, executive officers and directors of the Registrant are considered affiliates.

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date: 11,418,837 common shares, $1.00 par value, as of September 11, 2013.

DOCUMENT INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement to be furnished to shareholders of the Registrant in connection with the 2013 Annual Meeting of Shareholders to be held on October 30, 2013, which definitive Proxy Statement will be filed not later than 120 days after June 29, 2013, are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent provided herein.

R.G. BARRY CORPORATION

FISCAL 2013

ANNUAL REPORT on FORM 10-K

TABLE OF CONTENTS

Exhibit 10.28

Exhibit 10.30

Exhibit 21.1

Exhibit 23.1

Exhibit 24.1

Exhibit 31.1

Exhibit 31.2

Exhibit 32.1

| * | The information required to be disclosed under each Item is incorporated by reference from the Registrant’s definitive Proxy Statement to be furnished to shareholders of the Registrant in connection with the 2013 Annual Meeting of Shareholders to be held on October 30, 2013, which definitive Proxy Statement will be filed no later than 120 days after June 29, 2013. |

2

FORWARD-LOOKING STATEMENTS

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995:

Some of the disclosures in this Annual Report on Form 10-K for the fiscal year ended June 29, 2013 (the “2013 Form 10-K”) contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by forward-looking words such as “may,” “expect,” “could,” “should,” “anticipate,” “believe,” “estimate,” or words with similar meanings. Any statements that refer to projections of our future performance, anticipated trends in our business and other characterizations of future events or circumstances are forward-looking statements. These statements, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995, are based upon our current plans and strategies and reflect our current assessment of the risks and uncertainties related to our business. These risks include, but are not limited to: our continuing ability to source products from third parties located within and outside North America; competitive cost pressures; the loss of retailer customers to competitors, consolidations, bankruptcies or liquidations; shifts in consumer preferences; the impact of the global financial crisis and general economic conditions on consumer spending; the impact of the highly seasonal nature of our footwear business upon our operations; inaccurate forecasting of consumer demand; difficulties liquidating excess inventory; disruption of our supply chain or distribution networks; our ability to secure and protect trademarks and other intellectual property; our ability to implement new enterprise resource information systems; a failure in or a breach of our operational or security systems or infrastructure, or those of our third-party suppliers and other service providers, including as a result of cyber-attacks; the unexpected loss of any of the skills and experience of any of our senior officers; our ability to successfully integrate any business acquisitions; and our investment of excess cash in variable rate demand note securities and other short-term investments. You should read this 2013 Form 10-K carefully, because the forward-looking statements contained in it (1) discuss our future expectations; (2) contain projections of our future results of operations or of our future financial condition; or (3) state other “forward-looking” information. The risk factors described in this 2013 Form 10-K and in our other filings with the Securities and Exchange Commission (the “SEC”), in particular “Item 1A. Risk Factors” of Part I of this 2013 Form 10-K, give examples of the types of uncertainties that may cause actual performance to differ materially from the expectations we describe in our forward-looking statements. If the events described in this “Safe Harbor” Statement or in “Item 1A. Risk Factors” of Part I of this 2013 Form 10-K occur, they could have a material adverse effect on our business, operating results and financial condition. You should also know that it is impossible to predict or identify all risks and uncertainties related to our business. Consequently, no one should consider any such list to be a complete set of all potential risks and uncertainties. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the statement is made to reflect unanticipated events. Any further disclosures in our filings with the SEC should also be considered.

DEFINITIONS

All references in this 2013 Form 10-K to “we”, “us”, “our”, and the “Company” refer to R.G. Barry Corporation, an Ohio corporation (the registrant) or, where appropriate, to R.G. Barry Corporation and its subsidiaries. The Company’s annual reporting period is either a fifty-two-week or fifty-three-week period (“fiscal year”) ending annually on the Saturday nearest June 30. For definitional purposes, as used herein, the terms listed below include the respective periods noted:

| | |

| Fiscal 2014 | | 52 weeks ending June 28, 2014 |

| Fiscal 2013 | | 52 weeks ended June 29, 2013 |

| Fiscal 2012 | | 52 weeks ended June 30, 2012 |

| Fiscal 2011 | | 52 weeks ended July 2, 2011 |

3

PART I

Item 1. Business

BUSINESS AND PRODUCTS

Overview

R.G. Barry Corporation develops consumer brands and markets consumer products in three areas of the retail accessories category. These products include: footwear, such as slippers and sandals; foot and shoe care products, such as cushioned insoles; and handbags, tote bags and travel items. Our products are primarily sold in North America by a broad cross-section of retailers of varying sizes and classifications.

Approximately 74% of the Company’s fiscal 2013 consolidated net sales was generated through the sale of accessories-type footwear, which has been the Company’s principal product line since our founding in 1947. The remaining consolidated net sales can principally be attributable to the Company’s newer, non-footwear accessories businesses.

R.G. Barry Corporation uses a flexible sourcing model for its operations. Approximately 70% of the costs and expenses related to product procurement and distribution are variable and expand and contract with our needs. Our products are primarily produced by contract manufacturers in the People’s Republic of China (“China”) with the exception of certain footwear products manufactured in Vietnam and certain foot and shoe care products manufactured in the United States of America (the “U.S.”). Most of our products are warehoused and shipped by third-party logistics providers located in the U.S.

During fiscal 2013, we formalized our initiatives to develop the international footprint of all Business Units through a combination of: (1) growth into new markets with our retailer customers who have existing international businesses; (2) strengthening of our existing international customer relationships; and (3) development of new foreign markets.

We are an Ohio corporation with executive offices located in a Company-owned facility at 13405 Yarmouth Road N.W., Pickerington, Ohio 43147. Our telephone number is 614.864.6400, and our corporate Internet website can be accessed at www.rgbarry.com (this uniform resource locator, or URL, is an inactive textual reference only and is not intended to incorporate our website into this 2013 Form 10-K). We have been a public company since 1962. Our common shares are traded on The NASDAQ Global Market (“NASDAQ-GM”) under the trading symbol DFZ, which is meant to evoke the name of our flagship slipper brand, Dearfoams*.

Reporting Segments

Our business is divided into two reportable segments: the Footwear segment, which includes slippers and sandals; and the Accessories segment, which includes foot and shoe care products, handbags, tote bags and travel products. The segments currently are comprised of three individual Business Units: (1) footwear; (2) Foot Petals (foot and shoe care products); and (3) Baggallini (handbags, tote bags and travel products). These Business Units are organized around specific accessories product categories and trademarked brand names that we own. We think our trademarks have significant commercial value. In general, trademarks remain valid and enforceable as long as they are used in connection with our products and services and the required registration renewals are filed. We intend to continue the use of each of our trademarks and renew each registered trademark accordingly.

Our reporting segments were established using generally accepted aggregation criteria under which we analyzed each Business Unit’s products, brand names, distribution channels, customer bases, sourcing and production methods and anticipated performance. Our Foot Petals and Baggallini Business Units share similar qualitative and quantitative characteristics that lend themselves to aggregation and that differentiate

4

them from our Footwear Business Unit. We believe that utilizing these reporting segments allows us to fairly represent our business and its financial results.

See additional information on operating results, as well as total assets for each of our reporting segments, in “Note (17)—Segment Reporting” of the Notes to Consolidated Financial Statements included in “Item 8. Financial Statements and Supplementary Data.” in this 2013 Form 10-K.

Each Business Unit is managed by a Business Unit President, who reports to the Company’s President and Chief Executive Officer. Each Business Unit President is supported by a team of business professionals. In-house corporate administration, finance, human resources, information technology, logistics, creative services and brand strategy professionals (“shared services”) are used in varying degrees by all Business Unit Presidents. Shared sales offices and showrooms are maintained for all of our brands at 9 East 37th Street in New York City.

Many selling, general and administrative expenses (“SGA”) are charged directly to the individual Business Unit. Certain shared service expenses are incurred and allocated to the respective Business Unit based on estimated usage. Operating profit as measured for each segment includes sales, cost of sales, direct and allocated SGA expenses. This segment measure of operating profit or loss, as defined, is the primary indicator of internal financial performance used by management to evaluate the Business Unit.

Other corporate expenses incurred are deemed to be applicable to the Company as a whole and are not allocated to any specific Business Unit. These unallocated expenses primarily include areas such as the Company’s corporate and governance functions, including the Chief Executive Officer, the Chief Financial Officer and the Board of Directors, as well as expense areas including annual accrued incentive bonus, incentive stock compensation, pension, professional fees and similar corporate expenses.

Footwear

Our Footwear segment is a component of the overall accessories category and a subset of the highly competitive footwear industry. According to independent industry research, annual retail sales of accessories footwear total in the neighborhood of $1 billion. The category includes slippers, sandals, hybrid and active fashion footwear and slipper socks. We believe that we are one of the world’s largest marketers of accessories footwear products, and as such, estimate that we sell about 30% of the slippers purchased at retail in the U.S. annually.

We have sold nearly 1.3 billion pairs of accessories footwear under various brand names since our founding in 1947. Today, Dearfoams* is our principal footwear brand. Since its introduction in 1958, Dearfoams* has, according to our proprietary consumer research, become one of the most-recognized brand names in accessories footwear in the U.S. In addition to Dearfoams*, our current footwear brand names include Angel Treads*, DF by Dearfoams*, DF Sport by Dearfoams*, Signature by Dearfoams* and Utopia by Dearfoams*.

Most competitors in this segment are either privately-owned sourcing companies, producing products under various licensed brand names, or retailers sourcing their own private label goods. Companies engaged in marketing apparel, traditional footwear and other goods also periodically sell accessories footwear items. While some of these competitors have significantly greater financial, distribution and marketing resources than we do, they traditionally have not committed the necessary assets to effectively compete long-term within the category. In addition, some retailers have from time-to-time sought to source their own accessories footwear products directly from overseas manufacturers. We believe that these attempts at self-sourcing have generally resulted in products of inferior quality that have ultimately failed to achieve the retailers’ desired performance metrics.

| * | Denotes Company trademark registered in the United States Department Patent and Trademark Office |

5

Quality, innovation and comfort in our products; price; value; service to our customers; category marketing and merchandising expertise; and reputation within the trade are the primary bases upon which we compete. Our extensive experience in this category and the benefits of scale gained as the category leader give us tremendous advantages over most competitors. We believe that we are the only accessories footwear resource capable of providing the consistently high level of comprehensive service, quality and support that is recognized as a hallmark of our wholesale footwear business.

We debut new footwear collections each spring and fall in conjunction with national retail accessory buying markets and other national trade events. We plan to continue the seasonal introduction of updated or new products in response to fashion changes, consumer taste preferences and changes in the demographic makeup of our consumer base.

Several basic footwear profiles are standard in all of our footwear brand lines. Many of these classic footwear silhouettes are in demand throughout the year. The most significant changes to our traditional products are made in response to broadly-accepted fashion trends and can include elements such as slight variations in design, internal constructions, outsoles, ornamentations, fabrics and colors.

We currently license certain footwear brand names we own to Olivet International, Inc. (“Olivet”). The five-year exclusive agreement entered in July 2010 gives Olivet sole right to develop and market a variety of sleepwear, active wear and accessories products bearing the Dearfoams*, DF by Dearfoams*, DF Sport by Dearfoams* and Utopia by Dearfoams* trademarks in North and South American markets. We receive quarterly royalty payments under this agreement.

Although international sales today represent less than 4% of our consolidated net sales, we view foreign markets as potential drivers of future growth. We currently sell footwear in Canada, Mexico, Israel Central America, and Asia.

Our footwear products are sold through many retail channels including mass merchandisers, national chain stores, warehouse clubs, mid-tier department stores, specialty and independent stores, discount stores and e-commerce and catalog retailers. We utilize a product segmentation strategy that allows us to differentiate product among retail channels by design, quality and retail price. Suggested retail prices for our footwear products range from approximately $7-to-$60 per pair, depending upon the style, retail channel and retailer mark-up. Independent research tells us that most buyers and consumers of our footwear are adult females.

We do not finance customers’ purchases beyond granting traditional payment terms at the time shipments to the retailers are made. We do grant limited return privileges and allowances to fund advertising and in-season promotional activities to certain footwear customers. Our direct-to-consumer footwear sales are limited to those conducted through www.dearfoams.com (this uniform resource locator, or URL, is an inactive textual reference only and is not intended to incorporate our Dearfoams* e-commerce website into this 2013 Form 10-K).

Our footwear business is comprised of two components, replenishment and seasonal. In the replenishment component, retailers carry a relatively consistent, planned assortment of products on a year-round basis. These products generally are displayed in a hanging presentation and are purchased by consumers on a repeat basis. The in-store assortment is regularly replenished to ensure product availability for shoppers. The seasonal component is comprised of a variety of more fashion-forward and boxed items that generally are found in stores only during the key retail selling periods, such as the period around the Christmas holiday selling season. Many of the purchases made in the seasonal business are impulse buys. Approximately 70% of our annual net sales in the Footwear segment have historically occurred from July through December. We have identified the popularity of slippers as a holiday gift item as the main reason for this heavy seasonal selling content.

6

Our advertising/marketing initiatives in footwear generally are focused on increasing our dominance in accessories footwear and expanding the relevance of Dearfoams* to a broader consumer demographic. We utilize seasonal in-store merchandisers during the critical holiday period as a tool for managing the flow of our footwear to the retail selling floor. We believe that when combined with modern automatic demand-pull replenishment systems and various other merchandising and sales techniques, the use of temporary in-store merchandisers helps us optimize critical holiday sell-through of our footwear products.

Due to the seasonal nature of our Footwear segment, the backlogs of unfilled footwear sales orders as of fiscal August month-end periods that ended on August 31, 2013, September 1, 2012 and September 3, 2011 were $25.2 million, $32.5 million and $34.3 million, respectively. The backlogs of unfilled sales orders at the end of fiscal 2013, fiscal 2012 and fiscal 2011 were approximately $24.8 million, $31.8 million and $31.3 million, respectively; comparisons between years reflect differences in the timing of order receipts only and do not necessarily indicate a growth or decline in sales volume.

We purchase our footwear products from approximately 12 different third-party manufacturers, most of whom are located in China. Our overall experience with third-party footwear manufacturers has been very good in terms of reliability, delivery times and product quality. All of our third-party purchases are conducted on an open account basis and in U.S. Dollars.

We operate a sourcing office in Dongguan City, China, and a quality control office in Nanjing, China, to facilitate the development and procurement of our products and help ensure their quality and timely delivery. Approximately 47 team members work out of these facilities.

We are dependent on third-party logistics providers to move our products from our third-party manufacturers to the distribution facilities we utilize, and from those facilities to our customers. In our Footwear segment, we warehouse and distribute nearly all goods from a third-party logistics facility in Fontana, California.

Accessories

The Foot Petals and Baggallini Business Units collectively comprise our Accessories segment. These Business Units compete in the comfort insert and handbag subcategories of the $35 billion-plus at retail accessories universe. The subcategories in which we compete represent approximately 3% and 26%, respectively, of total annual accessories sales at retail. We believe that these subcategories present us with opportunities for higher and more profitable growth than the opportunities presented by our Footwear segment.

Foot Petals

Foot Petals sells foot and shoe care products priced between $7 and $45. Its products, which include comfort inserts, primarily are targeted toward the foot comfort of women between the ages of 14 and 55. Many Foot Petals products are made from high-performance urethane or similar man-made materials and various fabrics. The products generally are sold at premium, non-promotional prices and yield higher margins than those earned in our Footwear segment.

Foot Petals products are sold under a variety of Company-owned brand names including Foot Petals*, Fab Feet*, Glamour Toez*, Heavenly Heelz*, Killer Kushionz*, Tip Toes* Pressure Points*, Amazing Arches* and Strappy Strips*. Sales to customers are handled by a combination of Company-employed and independent sales representatives. Products also are presented to retailers at various national markets and accessories trade shows. Foot Petals’ share of its market is nominal. Foot Petals emphasizes function coupled with fashion at a reasonable price; whereas, many competitors emphasize only function. We do not finance retailers’ purchases beyond granting traditional payment terms at the time shipments are made.

7

Foot Petals’ products are sold principally to consumers through mass-merchants, upper-tier department stores, independent retailers, internet and home shopping venues. We also sell direct-to-consumer via www.footpetals.com (this uniform resource locator, or URL, is an inactive textual reference only and is not intended to incorporate our Foot Petals e-commerce website into this 2013 Form 10-K). Due in part to its non-seasonal nature, the business has minimal exposure to obsolete inventory and net sales are relatively evenly distributed throughout the fiscal year. The replenishment nature of the Foot Petals’ business model contributes to making it a fast-turning, low inventory volume business.

A small portion of this Business Unit’s annual sales occur in foreign markets, including Canada, Japan, Singapore, Turkey and Australia. Foot Petals is part of our key strategic initiative to increase international sales through a variety of selling methods.

Foot Petals brand cushions are considered premium products within their category and carry the Seal of Acceptance of the American Podiatric Medical Association. Among Foot Petals’ major competitors are Dr. Scholl’s®, Implus® Footcare and Profoot®.

Products sold by this Business Unit are designed and developed by employees of the Company. Foot Petals’ products are primarily manufactured by a third-party supplier based in Ohio, and warehoused and distributed through a third-party logistics provider located adjacent to the supplier’s manufacturing plant. We rely on third-party transport to move Foot Petals products to our customers.

In addition to showroom and office space in our New York City location, Foot Petals operates a sales office in Glen Rock, New Jersey.

Baggallini

Products marketed by our Baggallini Business Unit consist of various styles of handbags, totes and travel accessories priced between $40 and $180 that primarily are targeted toward women between the ages of 34 and 55. The Baggallini Business Unit’s products are principally made from durable nylons, leathers and other man-made materials and are sold at premium, non-promotional prices. These products traditionally are recognized for their lightweight construction and intelligent, solution-oriented design. The Baggallini Business Unit generates higher margins than those earned in our Footwear segment.

The strategic acquisition of the principal assets of the KIVA* and Mosey* brands during fiscal 2013, added to the product offerings of the Baggallini Business Unit, (hand bag coalition). See “Note (15) – Acquisitions” of the Notes to the Consolidated Financial Statements included in “Item 8. Financial Statements and Supplementary Data.” In this 2013 Form 10-K. KIVA is a 20-year-old tote bag and luggage brand that primarily does business in the outdoor retail space; and Mosey is a 2-year-old fashion handbag brand that is principally sold on-line and through non-promotional department stores. Both businesses utilize materials and constructions similar to those used in baggallini products and both sell products that are produced in some of the same manufacturing plants used by the Baggallini Business Unit. These nominal businesses were acquired in January and April 2013, respectively.

Principal trademarks for this Business Unit include baggallini* and Le Bagg*; KIVA*; and Mosey*. Sales are handled by a combination of Company-employed and independent sales representatives. Products are presented to retailers at various gift and trade shows, conducted at various locations and at various times of the year. Each brand’s market share of the total retail handbag category is nominal.

The baggallini brand emphasizes function coupled with fashion elements at a reasonable price; whereas, many of its competitors primarily emphasize fashion. The baggallini products are sold to consumers through a network of several thousand independent retail locations, non-promotional department and chain stores, off-price channel customers and on-line retailers. We also sell direct-to-consumer via www.baggallini.com (this uniform resource locator, or URL, is an inactive textual reference only and is

8

not intended to incorporate our baggallini e-commerce website into this 2013 Form 10-K). Branded handbag competitors include Kipling® and LeSportsac®. Our Baggallini business is basically non-seasonal and evenly distributed throughout the fiscal year.

KIVA develops and markets outdoor and travel bags and travel accessories, which utilize eco-friendly materials and functional designs. KIVA products are primarily sold through independent and e-commerce retailers in the outdoor channel. The business is basically non-seasonal and evenly distributed throughout the fiscal year.

Mosey develops and markets handbags that, while similar in materials and constructions to those sold by Baggallini, feature more “fashion” elements and higher retail prices. Mosey products are sold through non-promotional department stores, independent stores and e-commerce retailers and are targeted toward a younger demographic than Baggallini. Mosey’s business is basically non-seasonal and evenly distributed throughout the fiscal year.

We do not finance retailers’ purchases in this Business Unit beyond, in some cases, granting traditional payment terms at the time of shipments to the retailers.

The Baggallini Business Unit has a modest international business in both the baggallini and Mosey brands, which we expect to expand as part of our Company-wide international growth strategy.

Products sold by this Business Unit are designed and developed by employees of the Company. They are then sourced through a network of contract manufacturers in China. All of the Business Unit’s third-party purchases are conducted on an open account basis and in U.S. Dollars. We are dependent on third-party logistics providers to move these products from our contract manufacturers to our leased, Company-operated distribution facilities in China and Oregon, and from our distribution centers to customers.

In conjunction with the purchase of the Mosey brand, the Company integrated the operations of its former China-based handbag sourcing agent, who was also the owner of Mosey, into our internal sourcing team. This integration added extensive expertise in all phases of handbag development and sourcing to the Company’s China-based operations, while reducing duplication and costs in our sourcing of these products.

Although some of the Baggallini Business Unit products contain elements of fashion, they focus more on function, thus lessening our exposure to obsolete inventory resulting from changing fashion trends. The various components of this Business Unit traditionally have operated with inventory levels that ensure quick customer order fulfillment and replenishment, while minimizing inventory risk.

In addition to office and showroom space in our New York City location, the Baggallini Business Unit operates a leased administrative office, showroom and distribution center in suburban Portland (Milwaukie), Oregon, and a leased bag sourcing office in Shenzhen, China.

BUSINESS ETHICS & SOCIAL RESPONSIBILITY

We strive to incorporate our core values of integrity, quality, innovation, leadership, teamwork and community into our business in a manner that will lead to the long-term success of the Company, our shareholders and our team members. We strive to achieve the highest business and personal ethical standards, as well as compliance with all applicable governmental laws, rules and regulations. We believe that it is the responsibility of a good corporate citizen to embrace social, environmental and governance factors as part of its overall business strategy.

9

Equal Employment Opportunities

We offer the opportunity of equal employment to all individuals without regard to disability, race, color, religion, sex, national origin or age and expect the same of all suppliers to our enterprise.

Fair Labor Practices

Our Code of Ethical Business Conduct details our intolerance of the use of forced labor, including but not limited to, slavery, indentured, bonded, child or prison labor and human trafficking — by anyone with whom we do business.

We require our suppliers to provide workers with a clean, safe and healthful work environment. Factories producing our merchandise must provide adequate medical facilities and ensure that all production and manufacturing processes are carried out in conditions that have proper considerations for the health and safety of the workers involved. Suppliers also must respect the rights of employees to associate with any group, so long as such groups are legal within their own country.

All of our suppliers and their contractors are randomly audited by independent third parties, both announced and unannounced, to help ensure adherence to our expectations related to forced labor and overall working conditions. We require that all vendors doing business with us fairly compensate their employees by: providing wages and benefits that meet or exceed applicable local and national laws; scheduling reasonable work hours; and providing reasonable days off, vacation and leave privileges. Each supplier also must display a signed Terms of Engagement document detailing this information in a location visible to all employees working at their facilities.

The Company is C-TPAT (Customs-Trade Partnership Against Terrorism) certified, which means we comply with the U.S. government’s standards to ensure that our shipments out of other countries are safe from tampering during the exporting process. A part of this certification process also includes periodic inspections of our foreign manufacturers’ factories.

Corporate Sustainability

The Company works to promote sustainable, environmentally healthy business practices by identifying and sharing practical, innovative conservation methods; adopting appropriate environmental policies; and encouraging all of our team members, vendors and customers to incorporate green wherever possible.

We have adopted recommendations from the ENERGY STAR program of the U.S. Environmental Protection Agency and the U.S. Department of Energy at our facilities and encourage and expect our suppliers to: reduce excess packaging and use recycled, nontoxic materials; follow guidelines that will prevent the future depletion of natural resources; and ensure the use of safe materials in manufacturing. We anticipate no material capital expenditures for environmental control facilities for the foreseeable future.

PRODUCT DESIGN AND DEVELOPMENT

Design and product development activities for all of our Business Unit’s product lines during fiscal 2013 were conducted in the U.S. and China.

The principal raw materials used in our footwear, foot care and handbag, tote bag and travel products are textile fabrics, threads, foams, nylons, other synthetic products, recycled micro fleece, mesh and high performance urethane. Raw materials also include organics such as leather, suede and cotton fibers; and various packaging materials. All of our raw materials are available from a wide range of suppliers. We have not experienced any significant difficulty in obtaining raw materials.

10

During fiscal 2013, fiscal 2012 and fiscal 2011, we spent approximately $1.2 million, $1.7 million and $1.9 million, respectively, to make improvements in existing products and refresh the look and feel of our product lines. These design and development activities were primarily supported by approximately 15 full-time team members.

SIGNIFICANT CUSTOMERS

The percentage of consolidated net sales made to our largest customers has declined in recent years due to the growth of our overall business and changes in customer mix. Walmart Stores, Inc. and its affiliates accounted for 26%, 29% and 32% of our consolidated net sales during fiscal 2013, fiscal 2012 and fiscal 2011, respectively. Our sales to Walmart Stores, Inc. and its affiliates are primarily in our Footwear segment and are less seasonal in nature than sales to many of our other footwear customers. No other customer accounted for 10% or more of our consolidated net sales during fiscal 2013, fiscal 2012, and fiscal 2011.

FACILITIES

Our owned and leased principal administrative, sales and distribution facilities are described above and more fully below under “Item 2. Properties.” of this 2013 Form 10-K.

EMPLOYEES

At the close of fiscal 2013, we employed 154 full-time team members. Approximately 71% of our team members are employed in the U.S.

AVAILABLE INFORMATION

We make available free of charge through our corporate Internet website all annual reports on Form 10-K, all quarterly reports on Form 10-Q, all current reports on Form 8-K, and all amendments to those reports, filed or furnished by the Company pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as our definitive annual meeting proxy materials as filed pursuant to Section 14 of the Exchange Act. These reports and proxy materials are available as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”).

Item 1A. Risk Factors.

There are certain risks and uncertainties in our business that could cause our actual results to differ materially from those anticipated. The following risk factors should be read carefully in connection with evaluating our business and in connection with the forward-looking statements contained in this 2013 Form 10-K. Any of these risks could materially adversely affect our business, our operating results, or our financial condition and the actual outcome of matters as to which forward-looking statements are made.

The global financial and general economic conditions that are largely out of our control may adversely affect our financial condition and results of operations.

Uncertainty about current and future global economic conditions may affect consumer spending or our customers’ buying habits, which would adversely affect demand for our products. Our customers may be impacted by the significant decrease in available credit. If credit pressures or other financial difficulties result in insolvency for these customers, it could adversely impact our overall financial results.

Furthermore, reduced traffic in retail stores or limitations on the prices we can charge for our products could reduce our sales and profit margins and have a material adverse effect on our financial condition and results of operations. Our business, financial condition, results of operations and access to credit as well as the trading price of our common shares could be materially and adversely affected if the economy fails to stabilize, or if current economic conditions do not improve or worsen.

11

Our North America business, which is our primary business, is dependent on our ability to continue sourcing products from third-party manufacturers primarily from outside North America, and to a lesser extent, sourcing products for foot and shoe care products from third-party manufacturers in North America.

We do not own or operate any manufacturing facilities and depend upon independent third parties to manufacture all of our products. During fiscal 2013, most of our products were manufactured in China. The inability of our third-party manufacturers to ship orders of our products in a timely manner or to meet our quality standards could cause us to miss customer delivery date requirements and could result in cancellation of orders, refusals to accept deliveries, returns or harm our ongoing business relationships. Furthermore, because quality is a leading factor when customers and retailers accept or reject goods, any decline in the quality of the products produced by our third-party manufacturers could be detrimental not only to a particular order but to future relationships with our customers.

We compete with other companies for the production capacity of our third-party manufacturers. Some of these competitors have greater financial and other resources than we have and may have an advantage in securing production from these manufacturers. If we experience a significant increase in demand for our products or if one of our existing third-party manufacturers must be replaced, we may have to find additional third-party manufacturing capacity. There can be no assurance that this additional capacity will be available when required or will be available on terms that are similar to the terms that we have with our existing third-party manufacturers or that are otherwise acceptable to us. If it is necessary for us to replace one or more of our third-party manufacturers, particularly one that we rely on for a substantial portion of our products, we may experience an adverse financial or operational impact, such as increased costs for replacement manufacturing capacity or delays in the distribution and delivery of our products to our customers, which could cause us to lose customers or revenues because of late shipments or customers being unwilling to absorb increased costs.

Our international manufacturing operations are subject to the risks of doing business abroad.

We currently purchase most of our products from China. We expect to continue to purchase our products from China at approximately the same levels in the future. This international sourcing subjects us to the risks of doing business abroad. These risks include:

| | • | | the impact on product development, sourcing or manufacturing from public health and contamination risks in China or other countries where we obtain or market our products; |

| | • | | acts of war and terrorism; |

| | • | | the impact of disease pandemics; |

| | • | | social and political disturbances and instability and similar events; |

| | • | | strikes or other labor disputes; |

| | • | | export duties, import controls, tariffs, quotas and other trade barriers; |

| | • | | shipping and transport problems; |

| | • | | increased expenses, particularly those impacted by any increase in oil prices; |

| | • | | fluctuations in currency values; and |

| | • | | general economic conditions and regulatory environments in overseas markets. |

Because we rely primarily on Chinese third-party manufacturers for a substantial portion of our product needs, any disruption in our relationships with these manufacturers could adversely affect our operations. While we believe these relationships are strong, if trade relations or regulatory changes between the United States and China deteriorate or are threatened by instability, our business could be adversely affected. Although we believe that we could find alternative manufacturing sources, there can be no assurance that these sources would be available on terms that are favorable to us or comparable to those with our current

12

manufacturers. Furthermore, a material change in the valuation of the Chinese currency could adversely impact our product costs, resulting in a significant negative impact on our results of operations.

Our concentration of customers could have a material adverse effect on us, and our success is dependent on the success of our customers.

As a result of the continuing consolidation in the retail industry, our footwear customer base has decreased, thus increasing the concentration of our customers. Our largest customer, Wal-Mart Stores, Inc. and its affiliates, accounted for approximately 26%, 29% and 32% of our consolidated net sales in fiscal 2013, fiscal 2012 and fiscal 2011, respectively. If this customer reduced or discontinued its product purchases from us, it would adversely affect our results of operations. Additionally, in recent years, several major department stores have experienced consolidation and ownership changes. In the future, retailers may undergo additional changes that could decrease the number of stores that carry our products, which could adversely affect our results.

Our success is also impacted by the financial results and success of our customers. If any of our major customers, or a substantial portion of our customers, generally, experiences a significant downturn in business, fails to remain committed to our products or brands or realigns affiliations with suppliers or decides to purchase products directly from the manufacturer, then these customers may reduce or discontinue purchases from us, which could have a material adverse effect on our business, results of operations and financial condition. We are also subject to the buying plans of our customers, and if our customers do not inform us of changes in their buying plans until it is too late for us to make necessary adjustments to our product supply, we may be adversely affected. We do not have long-term contracts with our customers and sales normally occur on an order-by-order basis. As a result, customers can generally terminate their commercial relationship with us at any time.

Our business faces cost pressures, which could affect our business results.

While we rely on third-party manufacturers as the source of our products, the cost of these products depends, in part, on the manufacturers’ raw materials, labor and energy costs. Thus, our own costs are subject to fluctuations, particularly due to changes in the cost of raw materials and cost of labor in the locations where our products are manufactured, foreign exchange and interest rates.

The footwear and accessory product categories are highly competitive.

The product categories in which we do most of our business are highly competitive businesses. If we fail to compete effectively, we may lose market position. We operate in a relatively small segment of the overall footwear and accessory industries. We believe that we are among the world’s largest marketers of slipper footwear products. However, this category is a very small component of the overall footwear industry. In recent years, companies that are engaged in other areas of the footwear industry and apparel companies have begun to market slipper footwear and many of these competitors have substantially greater financial, distribution and marketing resources than we do. In addition, some of our retail customers for our products have sought to import competitive products directly from manufacturers in China and elsewhere for sale in their stores on a private label basis. The primary methods we use to compete in our industry include product design, product performance, quality, brand image, price, marketing and promotion and our ability to meet delivery commitments to retailers. A major marketing or promotional success or a technical innovation by one of our competitors could adversely impact our competitive position.

Our business is subject to consumer preferences, and unanticipated shifts in tastes or styles could adversely affect our sales and results of operations.

Our product categories can be subject to rapid changes in consumer preferences. Our performance may be hurt by our competitors’ product development, sourcing, pricing and innovation as well as general changes in consumer tastes and preferences. These categories are also subject to sudden shifts in consumer

13

spending, and a reduction in such spending could adversely affect our results of operations. Consumer spending may be influenced by the amount of consumer disposable income, which may fluctuate based on a number of factors, including general economic conditions, consumer confidence and business conditions. Further, consumer acceptance of new products may fall below expectations and may result in excess inventories or the delay of the launch of new product lines.

If we inaccurately forecast consumer demand, we may experience difficulties in handling consumer orders or liquidating excess inventories and results of operations may be adversely affected.

The slipper footwear business is highly seasonal and has relatively long lead times for the design and manufacture of products. Consequently, we must commit to production in advance of orders based on our forecast of consumer demands. If we fail to forecast consumer demand accurately, we may under- or over-source a product and encounter difficulty in handling customer orders or liquidating excess inventory, and we may have to sell excess inventory at a reduced cost. Further, due to the fashion-oriented nature of a portion of our products, rapid changes in consumer preferences lead to an increased risk of inventory obsolescence. While we believe we have successfully managed this risk in recent years and believe we can successfully manage it in the future, our operating results will be adversely affected if we are unable to do so.

We rely on distribution centers to store and distribute our products and if there is a natural disaster or other serious disruption affecting any of these facilities or our methods of transport, we may be unable to effectively deliver products to our customers.

We rely on our leased distribution centers as well as third-party logistics providers to store and distribute product to our customers. Significant disruptions affecting the flow of products to and from these facilities due to natural disasters, labor disputes such as dock strikes, or any other cause could delay receipt and shipment of a portion of our inventory. This could impair our ability to timely deliver our products to our customers and negatively impact our operating results. Although we have insured our finished goods inventory for the amount equal to its carrying cost plus normal profit expected in the sale of that inventory against losses due to fire, earthquake, tornado, flood and terrorist attacks, our insurance program does not protect us against losses due to delays in our receipt and distribution of products due to transport difficulties, cancelled orders or damaged customer relationships that could result from a major disruption affecting the flow of products to and from our distribution facilities.

Further, we are dependent on methods of third-party transport to move our products to and from these facilities. Circumstances may arise where we are unable to find available or reasonably priced shipping to the United States from our manufacturers in China and elsewhere or road and rail transport to our customers. If our methods of transport are disrupted or if costs increase sharply or suddenly, due to price increases of oil in the world markets or other inflationary pressures, we may not be able to affordably or timely deliver our products to our customers.

The seasonal nature of our footwear business makes management more difficult, and severely reduces cash flow and liquidity during certain parts of the year.

A significant portion of our footwear business is highly seasonal and much of the results of our operations are dependent on strong performance during the last six months of the calendar year, particularly the holiday selling season. The majority of our marketing and sales activities for our footwear business takes place at industry market week and trade shows in the spring and fall. Our inventory is largest in the early fall to support our customers’ requirements for the fall and holiday selling seasons. Historically, our cash position is strongest in the first six months of the calendar year. Unfavorable economic conditions affecting retailers during the fall and through the holiday season in any year could have a material adverse effect on the results of our operations for the year. Although our acquisitions during fiscal 2011 and fiscal 2013 have added businesses with year-round replenishment shipments, we can offer no assurance that the overall significant seasonal nature of our business will change in the future.

14

Our unsecured credit agreement includes financial and other covenants that impose restrictions on our financial and business operations.

Our unsecured credit agreement signed in March 2011 contains financial covenants that require us to maintain minimum levels regarding our financial condition and operating performance. If we fail to comply with the covenants and are unable to obtain a waiver or amendment, an event of default would result, and the lender could declare outstanding borrowings immediately due and payable. If that should occur, we cannot guarantee that we would have sufficient liquidity at that time to repay or refinance borrowings under the unsecured credit agreement.

Modifications and/or upgrades to our information technology systems may disrupt our operations.

We regularly evaluate our information technology systems and requirements and are currently implementing modifications and/or upgrades to the information technology systems that support our business. Modifications include replacing legacy systems with successor systems, making changes to legacy systems, or acquiring new systems with new functionality. We are aware of the inherent risks associated with replacing and modifying these systems, including inaccurate system information, system disruptions and user acceptance and understanding. We believe we are taking appropriate action to mitigate the risks through disciplined adherence to methodology, program management, testing and user involvement, as well as securing appropriate commercial contracts with third-party vendors supplying the replacement technologies. Information technology system disruptions and inaccurate system information, if not anticipated and appropriately mitigated, could have a material adverse effect on our financial condition and results of operations. Additionally, there is no assurance that a successfully implemented system will deliver the anticipated value to us.

A failure in or a breach of our operational or security systems or infrastructure, or those of our third-party suppliers and other service providers, including as a result of cyber-attack may disrupt our operations.

Our success depends, in part, on the secure and uninterrupted performance of our information technology systems. Our information technology systems, as well as those of our service providers, are vulnerable to damage from a variety of sources, including telecommunication failures, malicious human acts and natural disasters. Moreover, despite network security measures, some of our servers and those of our service providers are potentially vulnerable to physical or electronic break-ins, computer viruses and similar disruptive problems. Despite the precautions we have taken, unanticipated problems may nevertheless cause failures in our information technology systems. Sustained or repeated system failures that interrupt our ability to process orders and deliver products to the stores or impact our consumer’s ability to access our websites in a timely manner or expose confidential customer information could have a material adverse effect on our results of operations, financial condition and cash flows.

We rely on the experience and skills of our senior executive officers, the loss of whom could have a material adverse effect on our business.

Our senior executive officers closely supervise all aspects of our business. Our senior executive officers have substantial experience and expertise in our business and have made significant contributions to the growth and success of our brands. If we were to lose the benefit of their involvement without adequate succession plans, our business could be adversely affected. Competition for such senior executive officers is intense, and we cannot be sure we will be able to attract, retain and develop a sufficient number of qualified senior executive officers in the future.

For any business acquisitions we undertake, we depend on our ability to successfully integrate and operate those newly acquired businesses.

We may be unable to consummate, integrate or manage our acquisitions. A portion of our recent sales and profitability growth has occurred through acquisitions. We may from time to time seek opportunities to acquire attractive businesses. There are no assurances, however, that any acquisition opportunities will

15

arise or, if they do, that they will be consummated, or that any needed additional financing for such opportunities will be available on satisfactory terms when required. In addition, acquisitions involve risks that the businesses acquired will not perform in accordance with expectations, and that business judgment concerning the value, strengths and weaknesses of businesses acquired will prove incorrect. The acquired businesses may not be integrated successfully and the acquisition may strain our management resources or divert management’s attention from other business concerns. Failure to successfully integrate any of our acquisitions may cause significant operating inefficiencies and could adversely affect our operations and financial condition.

We periodically invest funds in marketable securities, and the ultimate repayment of amounts invested depends on the financial capacity of the related financial institutions and corporations involved.

We periodically invest funds in marketable securities for which the ultimate repayment of invested amounts is dependent on the financial capacity of the related financial institutions and corporations involved. At June 29, 2013, as part of our cash management and investment program, we maintained a portfolio of $17.7 million in short-term investments, including $11.7 million in marketable investment securities consisting of variable rate demand notes and $6.0 million in other short-term investments. The marketable investment securities are classified as available-for-sale. These marketable investment securities are carried at cost, which approximates fair value. The other short-term investments are classified as held-to-maturity securities and include several commercial paper investments, which matured in August 2013.

Item 1B. Unresolved Staff Comments.

No response required.

Item 2. Properties.

The Company owns its corporate headquarters and executive offices located at 13405 Yarmouth Road N.W. in Pickerington, Ohio, a facility that contains approximately 55,000 square feet. The Company leases space aggregating approximately 89,500 square feet at an approximate total annual rent of $612,500. The following table describes the Company’s principal leased properties during fiscal 2013 and the operating status of those properties at June 29, 2013:

| | | | | | | | | | | | | | |

Location | | Use | | Approximate

Square Feet | | | Approximate

Annual Rental | | | Lease

Expires | | Renewals |

| 1887 SE Milport, Milwaukie, Oregon | | Office, Shipping, Distribution Center | | | 70,000 | | | $ | 294,500 | | | 2014 | | 1 year |

9 East 37th Street, 11th Floor

New York City, New York | | Sales Office/ Showroom | | | 5,000 | | | $ | 200,000 | | | 2015 | | None |

Room 1101, Huiye Building,

No. 17 Dongguan Ave.,

Dongcheng District,

Dongguan City, Guangdong

Province, China | | Sourcing Representative Office | | | 8,700 | | | $ | 62,800 | | | 2014 | | None |

194 Rock Road

Glen Rock, New Jersey | | Sales office | | | 1,500 | | | $ | 29,000 | | | 2014 | | None |

903 S.E. 28th Street Suite 7

Bentonville, Arkansas | | Sales Administration Office | | | 1,300 | | | $ | 19,500 | | | Month to

month | | Month to

month |

16

| | | | | | | | | | | | | | |

Room 106, Building No. 8

Tianzeyuan Block, No. 588

Zhushan Road, Jiangning

Science Area, Nanjing,

Jiangsu, China | | Sourcing Quality Control Office | | | 2,900 | | | $ | 6,600 | | | 2015 | | None |

Unit A, 21F

Shenmao Commercial Center,

JIngtian Sanlu, Futian

District, Shenzhen, China | | Sourcing Representative Office | | | 2,900 | | | $ | 41,200 | | | 2013 | | None |

The Company believes that all of our owned or leased buildings are well maintained, in good operating condition and suitable for their present uses.

Item 3. Legal Proceedings.

The Company is from time to time involved in claims and litigation considered normal in the ordinary course of our business. There are no significant legal proceedings pending for the Company. While it is not feasible to predict the ultimate outcome, in the opinion of management, the resolution of pending legal proceedings is not expected to have a material effect on the Company’s financial position, results of operations or cash flows.

Item 4. Mine Safety Disclosures.

Not applicable

Supplemental Item. Executive Officers of the Registrant.

The following table lists the names and ages of the executive officers of the Company as of September 11, 2013, the positions with the Company presently held by each executive officer and the business experience of each executive officer during the past five years. Unless otherwise indicated, each individual has had his or her principal occupation for more than five years. The executive officers serve at the discretion of the Board of Directors subject, when applicable, to their respective contractual rights with the Company and, in the case of Mr. Tunney and Mr. Eckols, pursuant to an employment agreement. There are no family relationships among any of the Company’s executive officers or directors.

17

| | | | |

Name | | Age | | Position(s) Held with the Company and Principal Occupation (s) for Past Five or More Years |

| Greg A. Tunney | | 52 | | Chief Executive Officer of the Company since May 2006; President of the Company since February 2006; Director of the Company since August 2006; Chief Operating Officer of the Company from February 2006 to May 2006.; President, Chief Operating Officer and a Director of Phoenix Footwear Group Inc., a supplier of a diversified selection of men’s and women’s dress and casual footwear, belts, personal items, outdoor sportswear and travel apparel, from 1998 to February 2005. |

| Jose G. Ibarra | | 54 | | Senior Vice President – Finance and Chief Financial Officer of the Company since January 2009; Secretary of the Company from January 2009 to October 2009; Senior Vice President – Treasurer of the Company from July 2008 to January 2009; Vice President – Treasurer of the Company from December 2004 to June 2008. |

| Glenn D. Evans | | 52 | | Senior Vice President – Global Operations of the Company since July 2010; Senior Vice President-Supply Chain and Logistics of the Company from November 2006 to July 2010; Senior Vice President – Creative Services and Sourcing of the Company from November 2003 to November 2006. |

| Yvonne E. Kalucis | | 48 | | Senior Vice President – Human Resources of the Company since February 2008; Vice President – Human Resources of the Company from September 2007 to February 2008 |

| Lee F. Smith | | 51 | | Senior Vice President – Strategic Brand and Channel Services of the Company since 2012; Senior Vice President – Creative Services of the Company from January 2009 to November 2012; Senior Vice President – Design and Product Development of the Company from December 2006 to January 2009 |

| Nancy N. Coons | | 53 | | Business Unit President – Footwear since June 2011; President, Dearfoams, from July 2010 to June 2011; Principal of Coons Consulting Co., a company providing brand strategy, product development and merchandising consultant services, from April 2008 to June 2010 |

| Dennis D. Eckols | | 64 | | Business Unit President – Baggallini, Inc. since June 2011; President, Baggallini, Inc., from April 2011 to June 2011; Chief Operating Officer, Baggallini, Inc. (prior to its acquisition by the Company), January 2003 to April 2011. |

| Mark W. Zobel | | 46 | | Business Unit President – Foot Petals, Inc. since January 2012; Vice President of Marketing of the Company from August 2010 to January 2012; Director of Marketing of the Company from November 2009 to August 2010; Director of Business Development & Strategy, Blue Ribbon Digital, an interactive advertising agency based in New York, New York from June 2007 to February 2008. |

18

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

| | | | | | | | | | | | | | | | | | |

| | | | | Market and Dividend Information Sales Price Per Common Share | | | Dividends

Declared per | |

| | | Quarter | | High | | | Low | | | Close | | | Common Share | |

Fiscal 2013 | | First | | $ | 14.98 | | | $ | 12.49 | | | $ | 14.74 | | | $ | 0.08 | |

| | Second | | | 15.62 | | | | 12.50 | | | | 13.41 | | | | 0.17 | |

| | Third | | | 14.73 | | | | 11.24 | | | | 13.39 | | | | 0.00 | |

| | Fourth | | | 16.26 | | | | 12.88 | | | | 16.24 | | | | 0.09 | |

Fiscal 2012 | | First | | $ | 11.82 | | | $ | 8.15 | | | $ | 10.60 | | | $ | 0.07 | |

| | Second | | | 13.00 | | | | 9.58 | | | | 12.08 | | | | 0.07 | |

| | Third | | | 14.21 | | | | 11.30 | | | | 12.20 | | | | 0.08 | |

| | Fourth | | | 13.85 | | | | 11.23 | | | | 13.59 | | | | 0.08 | |

Since March 1, 2008, common shares of the Company have traded on NASDAQ-GM under the “DFZ” symbol. The high, low and close sales prices per common share shown above reflect the prices as reported in NASDAQ-GM.

Approximate Number of Registered Shareholders: 1,900 as of September 11, 2013.

The declaration and payment of future dividends with respect to the Company’s common shares will depend on the net earnings, financial condition, shareholders’ equity levels, cash flow and business requirements of the Company, as determined by the Board of Directors.

The unsecured Credit Agreement (the “New Facility”) between the Company and The Huntington National Bank (“Huntington”), as entered into on March 1, 2011, places no direct restrictions on the Company’s ability to pay cash dividends. See the discussion of the New Facility in “Note (6)—Short-term Notes Payable and Long-Term Debt” of the Notes to Consolidated Financial Statements included in “Item 8. Financial Statements and Supplementary Data.” and in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” in this 2013 Form 10-K.

Information Regarding Recent Sales of Unregistered Securities

No disclosure is required under Item 701 of SEC Regulation S-K.

Purchases of Equity Securities by Registrant

Neither the Company nor any “affiliated purchaser,” as defined in Rule 10b-18(a) (3) under the Securities Exchange Act of 1934, as amended, purchased any common shares of the Company during the fiscal quarter ended June 29, 2013. The Company does not currently have in effect a publicly-announced repurchase plan or program. However, with respect to stock awards granted to employees, the Company is authorized under the terms of its stock-based compensation plans to withhold common shares which would otherwise be issued in order to satisfy related individual tax liabilities upon issuance of common shares in accordance with the terms of restricted stock unit (“RSU”) agreements.

19

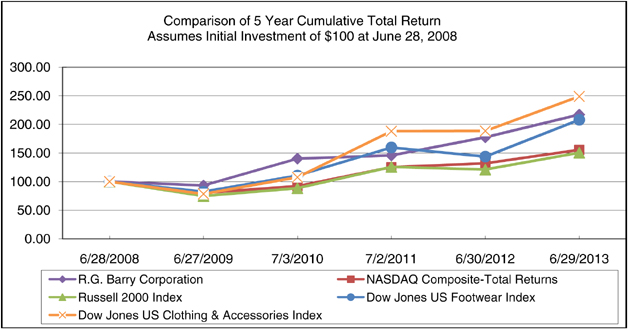

Stock Performance Graph and Cumulative Total Shareholder Return

The graph below shows the cumulative total shareholder return, assuming the investment of $100 on June 30, 2008 (and the reinvestment of dividends thereafter), on each of R.G. Barry Corporation’s common shares and the NASDAQ Composite-Total Returns, the Russell 2000, the Dow Jones U.S. Footwear and the Dow Jones U.S. Clothing & Accessories indices. With the acquisition of accessory product businesses during fiscal 2011, the Dow Jones U.S. Clothing &Accessories index has been added to reflect this new segment for the Company. The comparisons in the graph below are based upon historical data and are not indicative of, or intended to forecast, future performance of R.G. Barry Corporation’s common shares.

| | | | | | | | | | | | | | | | | | | | | | | | |

Company/Market/Peer Group | | 6/28/2008 | | | 6/27/2009 | | | 7/3/2010 | | | 7/2/2011 | | | 6/30/2012 | | | 6/29/2013 | |

R.G. Barry Corporation | | | 100.00 | | | | 93.17 | | | | 140.13 | | | | 145.68 | | | | 177.38 | | | | 217.10 | |

NASDAQ Composite-Total Returns | | | 100.00 | | | | 80.20 | | | | 92.09 | | | | 125.13 | | | | 131.93 | | | | 155.48 | |

Russell 2000 Index | | | 100.00 | | | | 74.79 | | | | 88.45 | | | | 125.54 | | | | 121.09 | | | | 150.45 | |

Dow Jones US Footwear Index | | | 100.00 | | | | 82.35 | | | | 110.54 | | | | 159.64 | | | | 143.70 | | | | 208.04 | |

Dow Jones US Clothing & Accessories Index | | | 100.00 | | | | 78.46 | | | | 107.64 | | | | 188.03 | | | | 188.54 | | | | 248.79 | |

20

Item 6. Selected Financial Data.

Selected Financial Data (1) (2)

(Dollars in thousands, except per common share amounts)

| | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net sales | | $ | 147,013 | | | $ | 155,938 | | | $ | 129,568 | | | $ | 123,787 | | | $ | 113,817 | |

Gross profit | | | 63,944 | | | | 67,168 | | | | 48,163 | | | | 51,359 | | | | 43,467 | |

Gross profit as percent of net sales | | | 43.5 | % | | | 43.1 | % | | | 37.2 | % | | | 41.5 | % | | | 38.2 | % |

Selling, general and administrative expenses | | | 42,964 | | | | 43,795 | | | | 36,483 | | | | 36,623 | | | | 32,971 | |

Operating profit | | | 20,980 | | | | 23,373 | | | | 11,680 | | | | 14,736 | | | | 10,496 | |

Net earnings | | | 13,257 | | | | 14,549 | | | | 7,510 | | | | 9,400 | | | | 6,992 | |

Basic earnings per common share | | | 1.17 | | | | 1.30 | | | | 0.68 | | | | 0.86 | | | | 0.66 | |

Diluted earnings per common share | | | 1.15 | | | | 1.27 | | | | 0.67 | | | | 0.85 | | | | 0.65 | |

Dividends declared per common share | | | 0.34 | | | | 0.30 | | | | 0.28 | | | | 0.15 | | | | 0.25 | |

Long-term debt, excluding current installments | | | 16,071 | | | | 20,357 | | | | 24,643 | | | | — | | | | 97 | |

Total assets | | | 130,253 | | | | 128,266 | | | | 115,979 | | | | 83,369 | | | | 75,083 | |

Other Data | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | | 1,055 | | | | 1,834 | | | | 676 | | | | 1,181 | | | | 1,365 | |

Depreciation and amortization expense | | | 2,807 | | | | 3,045 | | | | 1,891 | | | | 867 | | | | 775 | |

| (1) | See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” for information regarding the factors that have affected the financial results of the Company. The Company’s annual reporting period is either a fifty-two-week or fifty-three-week period (“fiscal year”). Fiscal 2010 was a fifty-three-week period. For all periods, the selected financial data set forth above is derived from the Company’s audited consolidated financial statements. |

| (2) | Results for fiscal 2011 include those businesses acquired during fiscal 2011 (Foot Petals, LLC on January 27, 2011 and Baggallini, Inc. on March 31, 2011) starting from the date of the respective acquisitions. |

21

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide investors and others with information we believe is necessary to understand the Company’s financial condition, changes in financial condition, results of operations and cash flows. This MD&A should be read in conjunction with our Consolidated Financial Statements and related Notes to Consolidated Financial Statements and other information included in “Item 8. Financial Statements and Supplementary Data.” in this 2013 Form 10-K. All dollar amounts, except as stated on a per common share basis, are rounded and represent approximate amounts when cited in the text within this section.

Unless the context otherwise requires, references in this MD&A to “our”, “us”, “we” or the “Company” refer to R.G. Barry Corporation and its consolidated subsidiaries.

Our Company and its subsidiaries, Foot Petals, Inc. and Baggallini, Inc., are engaged in designing, sourcing, marketing and distributing footwear, foot and shoe care products and hand bags, tote bags and other travel accessories. We operate with three operating segments, two of which are aggregated into a single reportable segment. The two reportable segments include: Footwear that encompasses primarily slippers, sandals, hybrid and fashion footwear; and Accessories with products including foot and shoe care products, handbags, tote bags and other travel accessories. Our products are sold predominantly in North America through the accessory sections of department stores, national chain stores, warehouse clubs, specialty and independent stores, television shopping networks, e-tailing/internet based retailers, discount stores and mass merchandising channels of distribution.

All comments made herein relative to period over period comparisons refer to results reported for fiscal 2013 as compared to fiscal 2012 and for fiscal 2012 as compared to fiscal 2011, when applicable.

Summary of Results for Fiscal 2013

During fiscal 2013, we remained focused on achieving our principal goals:

| | • | | grow our business profitably by pursuing key initiatives based on innovation within our product lines and acquisition opportunities outside of our core footwear business; |

| | • | | continue efforts to strengthen the relationships with our retailing partners and open distribution of our products in new retail channels; and |

| | • | | further enhance the image of our brands through both customer and consumer advertising. |

During fiscal 2013, we accomplished the following:

| | • | | Achieved solid profitability in the Footwear segment despite a challenging fiscal 2013. |

| | • | | Successfully implemented and integrated new information technology systems. |

| | • | | Successfully continued to grow our accessory products businesses within multiple channels achieving the levels of profitability targets established for the Accessories segment for fiscal 2013. |

| | • | | Reported consolidated net earnings of $13.3 million, or 9.0% of net sales. |

| | • | | Reported cash, cash equivalents and short-term investments of $39.5 million at the end of fiscal 2013. |

Looking Ahead to Fiscal 2014 and Beyond

Looking ahead to fiscal 2014 and beyond, our strategy continues to center on growing our business through acquisitions; increasing our distribution channels within our footwear business; growing our accessory products businesses within their traditional as well as new channels, achieving levels of profitability that are at or above a top quartile performance within our peer group, and ultimately delivering financial performance that drives growth and long-term shareholder value.

See the discussion under the caption“Item 1A. Risk Factors” in this 2013 Form 10-K.

22

Summary of Consolidated Results of Operations – Fiscal 2013 Compared to Fiscal 2012

Effective with the first quarter of fiscal 2012, the Company implemented organizational changes in its reporting structure including the creation of a separate Business Unit President for each business unit, with each President reporting to the Chief Executive Officer (“CEO”) of R.G. Barry Corporation. Each Business Unit President has financial performance responsibility for the operating unit. The measure of such operating unit operating profit was redefined and our internal financial reporting structure changed accordingly.

Under this reporting structure, the operating profit or loss measure for an operating unit includes sales, cost of sales, direct SGA expenses and allocated SGA expenses from certain shared services for which expenses are incurred and are allocated to each operating unit based on estimated usage of such corporate support. Other corporate expenses are deemed applicable to the Company as a whole and are not allocated to any specific operating unit. Such unallocated expenses include costs associated with the Company’s corporate and governance functions, including the CEO, the Chief Financial Officer and the Board of Directors, as well as such expense areas as annual accrued incentive bonus, incentive stock compensation, pension, professional fees and similar corporate expense areas.

Our Footwear and Accessories segments’ results reported below for fiscal 2013, fiscal 2012 and fiscal 2011 have been presented based on this reporting approach.

Consolidated Results of Operations

Listed below are excerpts from our consolidated statements of income for fiscal 2013 and fiscal 2012:

| | | | | | | | | | | | | | | | | | | | |

| (all amounts in 000’s) | | Fiscal 2013 | | | % of

Net Sales | | | Fiscal 2012 | | | % of

Net Sales | | | Increase/

(Decrease) | |

Net sales | | $ | 147,013 | | | | 100.0 | | | $ | 155,938 | | | | 100.0 | | | $ | (8,925 | ) |

Gross profit | | | 63,944 | | | | 43.5 | | | | 67,168 | | | | 43.1 | | | | (3,224 | ) |

Selling, general and administrative expenses | | | 42,964 | | | | 29.2 | | | | 43,795 | | | | 28.1 | | | | (831 | ) |

Operating profit | | | 20,980 | | | | 14.3 | | | | 23,373 | | | | 15.0 | | | | (2,393 | ) |