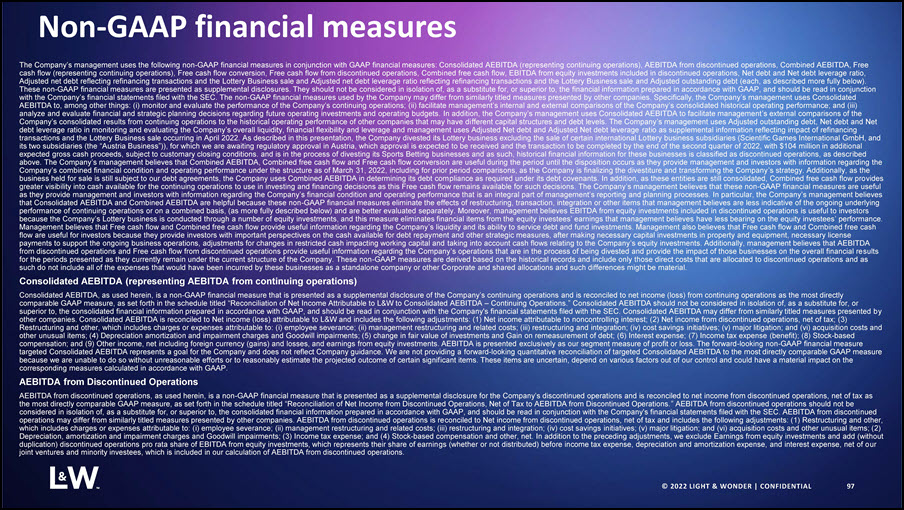

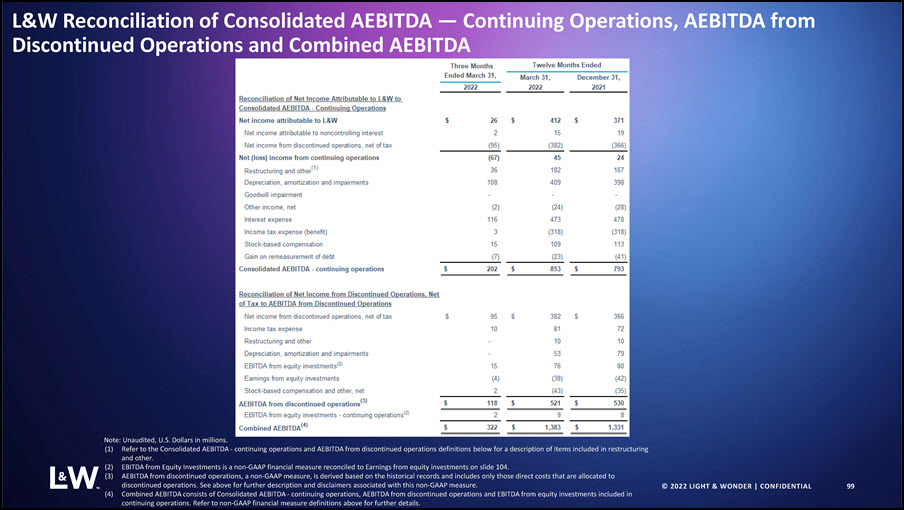

3 Forward-Looking Statements © 2022 LIGHT & WONDER | CONFIDENTIAL In this presentation, Light & Wonder, Inc. (“Light & Wonder,” “L&W” or the “Company”) makes “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements describe future expectations, plans, results or strategies and can often be identified by the use of terminology such as “may,” “will,” “estimate,” “intend,” “plan,” “continue,” “believe,” “expect,” “anticipate,” “target,” “should,” “could,” “potential,” “opportunity,” “goal,” or similar terminology. These statements are based upon management’s current expectations, assumptions and estimates and are not guarantees of timing, future results or performance. Therefore, you should not rely on any of these forward-looking statements as predictions of future events. Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties and other factors, including, among other things: the impact of the COVID-19 pandemic and any resulting unfavorable social, political, economic and financial conditions, including the temporary and potentially recurring closure of casinos and lottery operations on a jurisdiction-by-jurisdiction basis; risks relating to the intended sale of certain Lottery Business subsidiaries (Scientific Games International GmbH, and its two subsidiaries (the “Austrian Business”)), for which we are awaiting regulatory approval in Austria, which approval is expected to be received and the transaction to be completed by the end of the second quarter of 2022 and the sale of our Sports Betting business, which is expected to be completed in the third quarter of 2022, both subject to applicable regulatory approvals and in the case of the sale of our Sports Betting business, other customary closing conditions (“Pending Divestitures”), including lack of assurance regarding the timing of completion of the pending and proposed transactions and related risks associated with the ongoing operations and activities of the Sports Betting Business, that certain deferred tax assets may not be realized relative to the anticipated tax gain from these divestitures, that the transactions will yield additional value or will not adversely impact our business, financial results, results of operations, cash flows or stock price; our inability to successfully execute our new strategy and impending rebranding initiative; our inability to further de-lever and position the Company for enhanced growth with certain net proceeds from the completed Lottery business sale and the Pending Divestitures; slow growth of new gaming jurisdictions, slow addition of casinos in existing jurisdictions and declines in the replacement cycle of gaming machines; risks relating to foreign operations, including anti-corruption laws, fluctuations in currency rates, restrictions on the payment of dividends from earnings, restrictions on the import of products and financial instability, including the potential impact to our business resulting from the continuing uncertainty following the U.K.’s withdrawal from the European Union; difficulty predicting what impact, if any, new tariffs imposed by and other trade actions taken by the U.S. and foreign jurisdictions could have on our business; U.S. and international economic and industry conditions; level of our indebtedness, higher interest rates, availability or adequacy of cash flows and liquidity to satisfy indebtedness, other obligations or future cash needs; the transition from LIBOR to SOFR, which may adversely affect interest rates; inability to reduce or refinance our indebtedness; restrictions and covenants in debt agreements, including those that could result in acceleration of the maturity of our indebtedness; competition; inability to win, retain or renew, or unfavorable revisions of, existing contracts, and the inability to enter into new contracts; the impact of U.K. legislation approving the reduction of fixed-odds betting terminals maximum stakes limit on LBO operators, including the related closure of certain LBO shops; inability to adapt to, and offer products that keep pace with, evolving technology, including any failure of our investment of significant resources in our R&D efforts; changes in demand for our products and services; inability to benefit from, and risks associated with, strategic equity investments and relationships; inability to achieve some or all of the anticipated benefits of SciPlay being a standalone public company; dependence on suppliers and manufacturers; SciPlay’s dependence on certain key providers; ownership changes and consolidation in the gaming industry; fluctuations in our results due to seasonality and other factors; security and integrity of our products and systems, including the impact of any security breaches or cyber-attacks; protection of our intellectual property, inability to license third-party intellectual property and the intellectual property rights of others; reliance on or failures in information technology and other systems; litigation and other liabilities relating to our business, including litigation and liabilities relating to our contracts and licenses, our products and systems, our employees (including labor disputes), intellectual property, environmental laws and our strategic relationships; reliance on technological blocking systems; challenges or disruptions relating to the completion of the domestic migration to our enterprise resource planning system; laws and government regulations, both foreign and domestic, including those relating to gaming, data privacy and security, including with respect to the collection, storage, use, transmission and protection of personal information and other consumer data, and environmental laws, and those laws and regulations that affect companies conducting business on the internet, including online gambling; legislative interpretation and enforcement, regulatory perception and regulatory risks with respect to gaming, especially internet wagering, social gaming and sports wagering; changes in tax laws or tax rulings, or the examination of our tax positions; opposition to legalized gaming or the expansion thereof and potential restrictions on internet wagering; significant opposition in some jurisdictions to interactive social gaming, including social casino gaming and how such opposition could lead these jurisdictions to adopt legislation or impose a regulatory framework to govern interactive social gaming or social casino gaming specifically, and how this could result in a prohibition on interactive social gaming or social casino gaming altogether, restrict our ability to advertise our games, or substantially increase our costs to comply with these regulations; expectations of shift to regulated digital gaming or sports wagering; inability to develop successful products and services and capitalize on trends and changes in our industries, including the expansion of internet and other forms of digital gaming; the continuing evolution of the scope of data privacy and security regulations, and our belief that the adoption of increasingly restrictive regulations in this area is likely within the U.S. and other jurisdictions; incurrence of restructuring costs; goodwill impairment charges including changes in estimates or judgments related to our impairment analysis of goodwill or other intangible assets; stock price volatility; failure to maintain adequate internal control over financial reporting; dependence on key executives; natural events that disrupt our operations, or those of our customers, suppliers or regulators; and expectations of growth in total consumer spending on social casino gaming.Additional information regarding risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated in forward-looking statements is included from time to time in our filings with the Securities and Exchange Commission (“SEC”), including the Company’s current reports on Form 8-K and quarterly reports on Form 10-Q and its latest Annual Report on Form 10-K filed with the SEC for the year ended December 31, 2021 on March 1, 2022 (including under the headings “Forward Looking Statements” and “Risk Factors”). Forward-looking statements speak only as of the date they are made and, except for our ongoing obligations under the U.S. federal securities laws, we undertake no and expressly disclaim any obligation to publicly update any forward-looking statements whether as a result of new information, future events or otherwise.Additional NotesThis presentation may contain references to industry market data and certain industry forecasts. Industry market data and industry forecasts are obtained from publicly available information and industry publications. Industry publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe industry information to be accurate, it is not independently verified by us and we do not make any representation as to the accuracy of that information. In general, we believe there is less publicly available information concerning the international gaming, social and digital gaming industries than the same industries in the U.S.Due to rounding, certain numbers presented herein may not precisely agree or total to the previously reported amounts.Discontinued OperationsOn September 27, 2021, we entered into a definitive agreement to sell our Sports Betting business to Endeavor Group Holdings, Inc. in a cash and stock transaction, subject to applicable regulatory approvals and other customary conditions. On October 27, 2021, we entered into a definitive agreement to sell our Lottery business to Brookfield Business Partners L.P. together with its institutional partners in a cash transaction, subject to applicable regulatory approvals and customary closing conditions. On April 4, 2022 we completed sale of the Lottery Business, with the exception of the Austria Business, to Brookfield Business Partners L.P. for $5.6 billion in gross cash proceeds with the sale of the Sports Betting Business expected to be completed in the third quarter of 2022, subject to applicable regulatory approvals and other customary conditions. Accordingly, the financial results for our Lottery business and the Sports Betting business presented herein have been reclassified to discontinued operations and prior period Lottery and Sports Betting balance sheet balances have been reclassified to the Asset and Liabilities held for sale lines on the Condensed Consolidated Balance Sheet presented herein in accordance with Accounting Standard Codification 205-20, Presentation of Financial Statements - Discontinued Operations. We report our operations in three business segments—Gaming, SciPlay and iGaming—representing our different products and services.