EPL Announces Initial 2014 Capital Budget and Provides Outlook

| · | | $360 million initial capital budget focused on low risk, shallow section development work within EPL’s core field areas |

| · | | Front-loaded program expected to drive significant oil growth in 2014 |

Houston, Texas, January 6, 2014…EPL Oil & Gas, Inc. (NYSE:EPL) (EPL or the Company) today announced its initial 2014 capital budget and outlook for the year.

2014 Capital Budget Overview

The Company currently plans to spend approximately $360 million on oil-dominated, lower-risk development activities in 2014. This initial budget will primarily fund the exploitation of the shallow section within EPL’s Ship Shoal, West Delta, South Timbalier, and Main Pass core field areas. Capital spending is expected to be front loaded, intended to drive production growth and organic reserve replacement. The Company has continued its active drilling program from the fourth quarter of 2013, with 5 rigs currently working within its core field areas. EPL plans to have up to 8 rigs running throughout 2014, mainly consisting of jack-up and hydraulic workover rigs necessary to execute its capital program.

Roughly 70% of the capital budget is expected to be spent on drillwells and sidetrack operations, 17% on major rig workovers and waterflood opportunities intended to drive oil production increases for select reservoirs within core field areas, and the remaining 13% of the budget is dominated by facility projects.

This initial budget has been conservatively designed to measure results in the first half of 2014, commodity prices, and free cash flow generation. Based on these factors, this initial budget could be modified up or down during 2014. Increases to the budget could include allocating capital to projects designed to test the deeper section of the Company’s core field areas as high-quality reprocessed and new seismic data becomes available throughout the coming year. In addition, the Company plans to spend approximately $50 million in 2014 on plugging and abandonment and other decommissioning activities. This initial budget does not include any future acquisitions or stock repurchases under EPL’s previously authorized program.

2014 Outlook

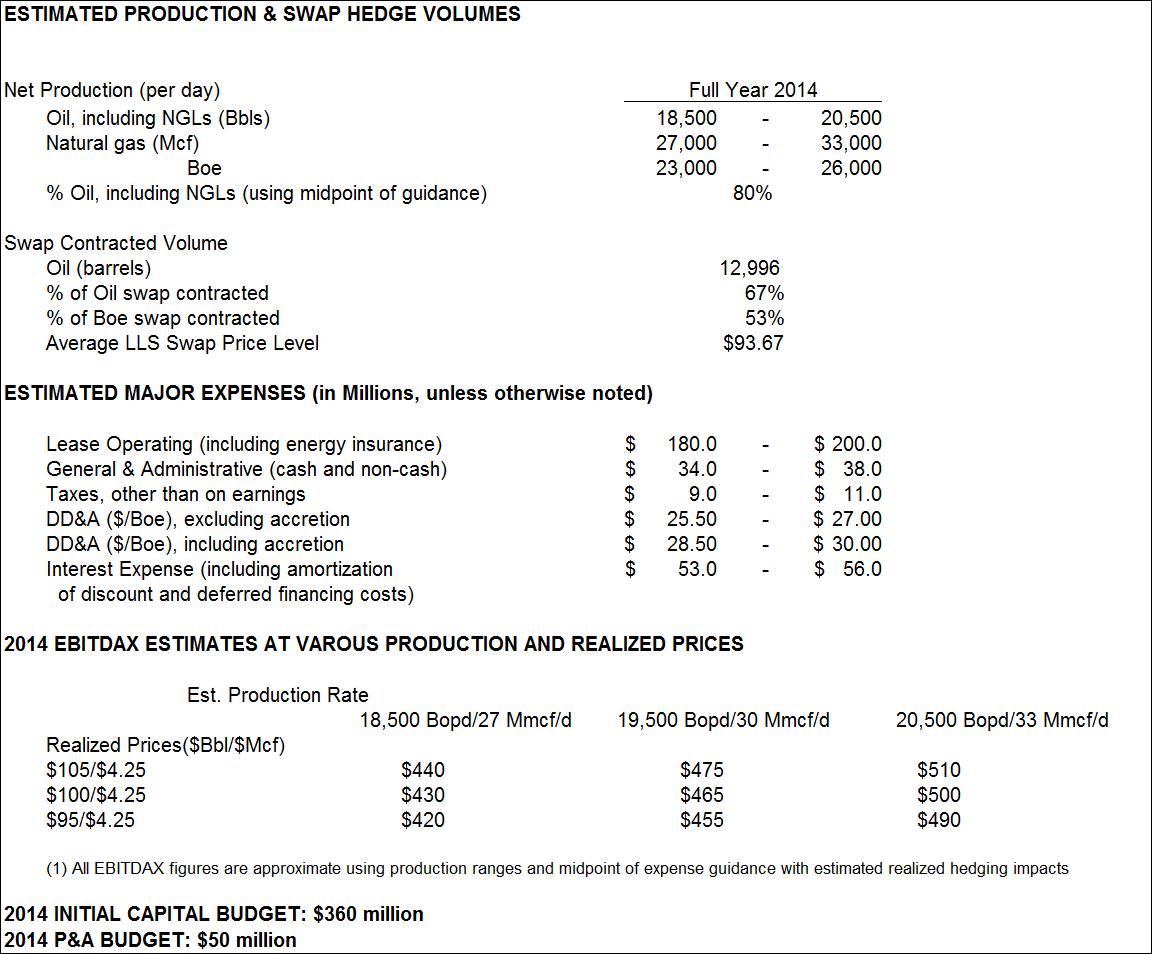

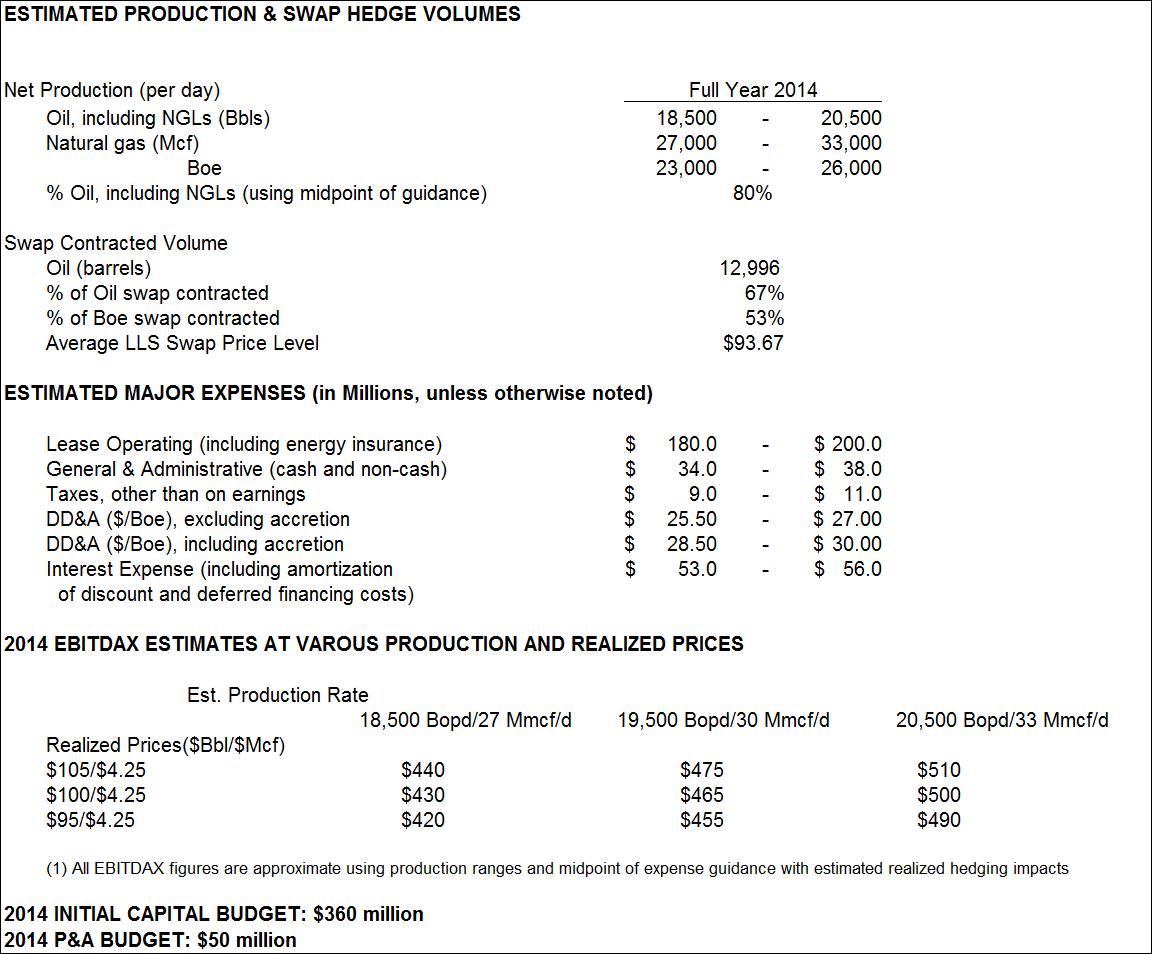

Based on this initial budget and the recently announced acquisition of oily assets within the Eugene Island 258/259 field expected to close late January, the midpoint of 2014 oil guidance is 19,500 barrels of oil (Bbls) per day, with the ability to see oil grow on the highside to 20,500 Bbls per day, representing approximately 15% to 21% growth respectively over 2013. Natural gas is forecast to essentially be flat to 2013 at approximately 30 million cubic feet per day at the midpoint of guidance. Overall, 2014 total Company production is expected to range from 23,000 to 26,000 barrels of oil equivalent (Boe) per day.

EPL expects to fund its initial capital budget through cash flow generation in 2014. Using the Company’s 2014 full year guidance and current hedge position, as well as current prevailing prices of $100 per barrel of oil, EBITDAX is expected to range from $465 million to $500 million, using the midpoint and highside of current guidance respectively.

The Company has layered in downside protection to protect its cash flow for 2014, in the form of Louisiana Light Sweet (LLS) swaps. EPL has a total of 12,996 Bbls of oil per day hedged, or 67% hedged using the midpoint of oil guidance at a fixed price averaging $93.67 per Bbl. For full year 2014, EPL has a total of 5,000 Mcf per day of gas hedged, all of which is hedged using swaps at a fixed price averaging $4.01 per Mcf.

Gary Hanna, EPL’s President and CEO commented, "This initial capital budget meets our commitment to maintain a disciplined approach to capital allocation. As demonstrated in the past, our approach is to balance our capital budget to efficiently drive significant growth in oil production and organic reserve replacement, all the while providing free cash flow generation. This front-loaded plan should deliver oil production for 2014 above our organic growth target of a minimum of 10% per year, while providing us the flexibility to modify the spend up or down depending upon market conditions. It is also important to keep in mind that this initial budget of $360 million is in addition to our recently announced $70 million acquisition within the prolific Eugene Island 258/259 field.”

2014 Initial Guidance

The guidance below includes the effects of the recently announced Eugene Island 258/259 asset acquisition which is expected to close late January 2014.

Description of the Company

Founded in 1998, EPL is an independent oil and natural gas exploration and production company headquartered in Houston, Texas with an office in New Orleans, Louisiana. The Company’s operations are concentrated in the U.S. Gulf of Mexico shelf, focusing on the state and federal waters offshore Louisiana. For more information, please visit www.eplweb.com.

Investors/Media

T.J. Thom, Chief Financial Officer

713-228-0711

tthom@eplweb.com

Forward-Looking Statements

This press release may contain forward-looking information and statements regarding EPL. Any statements included in this press release that address activities, events or developments that EPL “expects,” “believes,” “plans,” “projects,” “estimates” or “anticipates” will or may occur in the future are forward-looking statements. We believe these judgments are reasonable, but actual results may differ materially due to a variety of important factors. Among other items, such factors might include: hurricane and other weather-related interference with business operations; the effects of delays in completion of, or shut-ins of, gas gathering systems, pipelines and processing facilities; stock market conditions; the trading price of EPL’s common stock; cash demands caused by planned and unplanned capital expenditures;

changes in general economic conditions; uncertainties in reserve and production estimates, particularly with respect to internal estimates that are not prepared by independent reserve engineers; unanticipated recovery or production problems; the failure to complete the proposed Eugene Island 258/259 asset acquisition, as well as any delays in completing the acquisition; changes in legislative and regulatory requirements concerning safety and the environment as they relate to operations and to abandonment of wells and production facilities; oil and natural gas prices and competition; the impact of derivative positions; production expenses and expense estimates; cash flow and cash flow estimates; future financial performance; drilling and operating risks; our ability to replace oil and gas reserves; risks and liabilities associated with properties acquired in acquisitions; integration of acquired assets; volatility in the financial and credit markets or in oil and natural gas prices; and other matters that are discussed in EPL’s filings with the Securities and Exchange Commission. (http://www.sec.gov/)

### 14-002