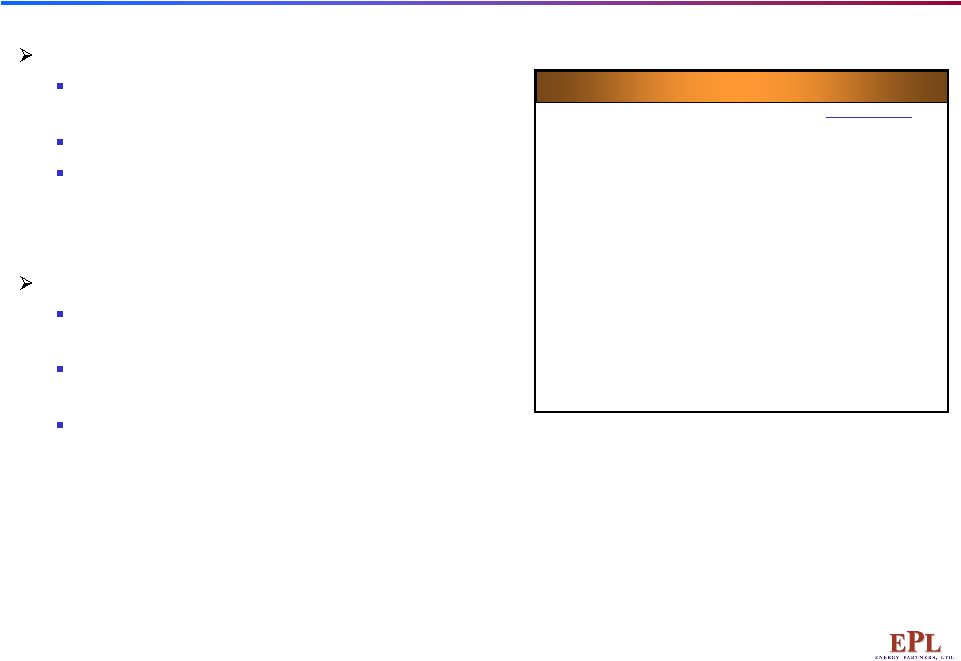

6 April 7 6 5 4 3 2 1 14 13 12 11 10 9 8 21 20 19 18 17 16 15 28 27 26 25 24 23 22 30 29 17 16 15 14 13 12 11 31 30 29 28 27 26 25 24 23 22 21 20 19 18 10 9 8 7 6 5 4 3 2 1 March Concurrent Self-Tender and Debt Tender Offers Commencement of self-tender and debt tender Scheduled expiration of self-tender and debt tender Board authorized self-tender offer for the repurchase of up to 8,700,000 common shares $23/share fixed price Represents ~22% of the current outstanding shares if fully subscribed Assuming more than 8,700,000 shares are tendered, EPL will purchase the shares tendered on a pro rata basis Refinance 8 3/4% Senior Notes through a concurrent debt tender and consent solicitation Financing plan: $300 Million bank credit facility (1) $300 Million senior fixed rate notes $150 Million senior floating rate notes - Callable after 2 years to allow for repayment flexibility Financing commitment from Banc of America LLC and affiliates ($ in millions) SOURCES OF FUNDS (3) USES OF FUNDS (3) New Revolving Credit Facility (1) $50 Share Repurchase $200 Senior Fixed Rate Notes $300 Refinance Revolving Credit Facility (2) $130 Senior Fixed Rate Notes $150 Refinance Senior Notes $150 Tender Premium $8 Fees & Expenses $12 Total Sources of Funds $500 Total Uses of Funds $500 (1) Initial borrowing base of $200 Million, increased to an initial availability of $225 Million pending asset sales (decreasing to $200 million at earlier of asset sale or 12 months from closing). (2) Based on balance of revolver at 2/23/07 of $195 million as disclosed in our 2006 10-K, net of insurance proceeds of $65 million anticipated to be collected. (3) As of 4/30/2007, assuming settlement on that date and does not reflect anticipated proceeds from contemplated asset sales |