UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-16179

Energy Partners, Ltd.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 72-1409562 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

201 St. Charles Avenue, Suite 3400 New Orleans, Louisiana | | 70170 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

504-569-1875

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of exchange on which registered |

| Common Stock, Par Value $0.001 Per Share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | x |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ¨ No x

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ¨

The aggregate market value of the common stock held by non-affiliates of the registrant at June 30, 2010 (the registrant’s most recently completed second fiscal quarter) based on the closing stock price as quoted on the New York Stock Exchange on that date was $353,060,074. As of February 25, 2011, there were 40,175,161 shares of the registrant’s common stock, par value $0.001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment”) amends the Annual Report on Form 10-K for Energy Partners, Ltd. (the “Company”), originally filed with the Securities and Exchange Commission (the “SEC”) on March 3, 2011 (the “Original Filing”), solely for the purpose of amending and restating Item 5 of Part II to include a stock performance graph and filing Item 10, Item 11, Item 12, Item 13 and Item 14 of Part III. Although the Company was a “smaller reporting company” under Rule 12b-2 of the Exchange Act for purposes of Form 10-K when the Original Filing was made, the Company plans to file a registration statement on Form S-3 under the Securities Act of 1933, as amended (the “Securities Act”) that will incorporate the Company’s Annual Report on Form 10-K (as amended) by reference. Because the “smaller reporting company” eligibility rules are different for purposes of initial filings under the Securities Act, the Company is filing this Amendment to add the information that was excluded from the Original Filing because of its “smaller reporting company” status.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and the Company has not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing other than as expressly indicated in this Amendment.

2

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Since September 23, 2009, the common stock of the reorganized Company (the “Successor Company”) has been listed on the New York Stock Exchange (the “NYSE”) under the symbol “EPL.” During the period from March 30, 2009 through September 21, 2009, our common stock was quoted for public trading on the Pink Sheets quotations system, an over-the-counter market, under the symbol “ERPLQ.PK.” Prior to March 30, 2009, the common stock of the pre-reorganized Company (the “Predecessor Company”) was listed on the NYSE under the symbol “EPL.” The following table sets forth, for the periods indicated, the range of the high and low sales prices of our common stock as reported by the NYSE (through the First Quarter 2009 and subsequent to September 22, 2009) and the Pink Sheets quotations system (subsequent to First Quarter 2009 through September 21, 2009).

| | | | | | | | |

| | | High | | | Low | |

| | | ($) | | | ($) | |

| Predecessor Company (See Note 1) | | | | | | | | |

2009 | | | | | | | | |

First Quarter | | | 2.34 | | | | 0.08 | |

Second Quarter | | | 0.45 | | | | 0.05 | |

Third Quarter (through September 21, 2009) | | | 0.47 | | | | 0.27 | |

| | |

| Successor Company | | | | | | | | |

| | |

2009 | | | | | | | | |

Third Quarter (from September 23 to September 30, 2009) | | | 11.73 | | | | 6.81 | |

Fourth Quarter | | | 9.39 | | | | 7.25 | |

| | |

2010 | | | | | | | | |

First Quarter | | | 12.35 | | | | 8.28 | |

Second Quarter | | | 14.62 | | | | 11.36 | |

Third Quarter | | | 13.22 | | | | 9.61 | |

Fourth Quarter | | | 15.00 | | | | 10.75 | |

| | |

2011 | | | | | | | | |

First Quarter (through March 17, 2011) | | | 16.88 | | | | 13.79 | |

Note 1: Under the terms of the Plan of Reorganization, each holder of shares of the Predecessor Company’s common stock received, in full satisfaction of and in exchange for such holder’s interest in the common stock of the Predecessor Company, such holder’s pro rata portion of approximately 5% of the Successor Company’s common stock.

On March 17, 2011, the last reported sales price of our common stock on the NYSE was $15.59 per share.

As of March 17, 2011, there were approximately 151 holders of record of our common stock.

We have not paid any cash dividends in the past on our common stock. The covenants in certain debt instruments to which we are a party, including our new credit facility and the Indenture related to our 8.25% Notes (as defined below), place certain restrictions and conditions on our ability to pay dividends. Any future cash dividends would depend on contractual limitations, future earnings, capital requirements, our financial condition and other factors determined by our board of directors.

3

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides information as of December 31, 2010 with respect to compensation plans under which our equity securities are authorized for issuance.

| | | | | | | | | | | | |

| | | Number of Securities to be

Issued upon Exercise of

Outstanding Options,

Warrants and Rights (1) | | | Weighted Average

Exercise Price of

Outstanding Options

Warrants and Rights (2) | | | Number of Securities

Remaining Available for

Future Issuance Under Equity

Compensation Plans | |

Equity compensation plans approved by stockholders | | | — | | | | — | | | | — | |

Equity compensation plans not approved by stockholders (3) | | | 509,986 | | | $ | 10.49 | | | | 630,737 | |

| | | | | | | | | | | | |

Total | | | 509,986 | | | $ | 10.49 | | | | 630,737 | |

| (1) | Comprised of 488,616 shares subject to issuance upon the exercise of options and 21,370 shares which will vest upon the lapsing of restrictions associated with restricted share awards. Although the restricted shares are issued and outstanding as a matter of corporate law, they are subject to forfeiture provisions, which provisions will vest in accordance with the terms of the 2009 Long Term Incentive Plan. If any of the restricted shares are forfeited, they can be reissued pursuant to options, restricted share awards or other stock-based awards permitted under the 2009 Long Term Incentive Plan. |

| (2) | Restricted share awards do not have an exercise price; therefore, this only reflects the weighted-average exercise price of options. |

| (3) | The form of the 2009 Long Term Incentive Plan was filed with the Plan Supplement and approved by the Bankruptcy Court prior to our emergence from Chapter 11 reorganization. Accordingly, no stockholder approval was required, and none was sought or obtained. |

See Note 15 “Employee Benefit Plans” of the consolidated financial statements in Part II, Item 8 of this Annual Report for further information regarding the significant features of the above plan.

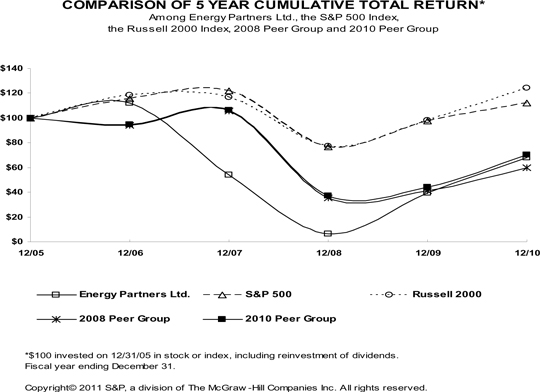

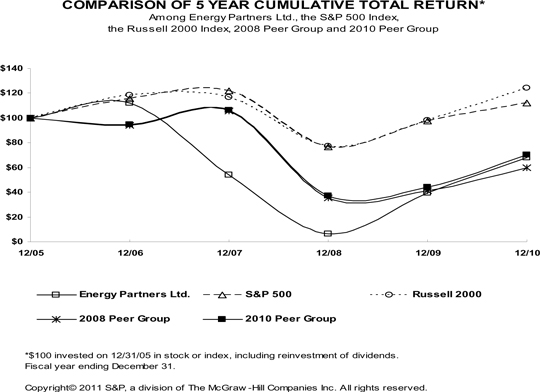

Stock Performance Graph

This information is being “furnished” to the SEC and is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Exchange Act or to the liabilities of Section 18 of the Exchange Act, and will not be deemed to be incorporated by reference into any filings we make under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent we specifically incorporate it by reference into such a filing.

The graph below compares our cumulative five-year total shareholder return on common stock with the cumulative total returns of the S&P 500 index, the Russell 2000 Index and the customized peer groups described below.

The graph tracks the performance of a $100 investment in our common stock, in the customized peer groups, and the index (with the reinvestment of all dividends) from December 31, 2005 to December 31, 2010. This historic price performance is not necessarily indicative of future stock performance.

4

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12/05 | | | 12/06 | | | 12/07 | | | 12/08 | | | 12/09 | | | 12/10 | |

| | | | | | |

Energy Partners Ltd. | | | 100.00 | | | | 112.07 | | | | 54.20 | | | | 6.20 | | | | 39.24 | | | | 68.20 | |

S&P 500 | | | 100.00 | | | | 115.80 | | | | 122.16 | | | | 76.96 | | | | 97.33 | | | | 111.99 | |

Russell 2000 | | | 100.00 | | | | 118.37 | | | | 116.51 | | | | 77.15 | | | | 98.11 | | | | 124.46 | |

2008 Peer Group | | | 100.00 | | | | 94.24 | | | | 105.69 | | | | 35.52 | | | | 41.02 | | | | 59.87 | |

2010 Peer Group | | | 100.00 | | | | 94.89 | | | | 106.59 | | | | 36.97 | | | | 44.06 | | | | 70.41 | |

The 2010 peer group includes: ATP Oil & Gas Corporation, Energy XXI (Bermuda) Limited, McMoRan Exploration Company, Stone Energy Corporation, and W&T Offshore, Inc. The 2008 peer group includes: ATP Oil & Gas Corporation, Callon Petroleum Company, Mariner Energy, Inc., McMoRan Exploration Company, Stone Energy Corporation, The Meridian Resource Corporation and W&T Offshore, Inc. In 2010, we removed Mariner Energy, Inc. because it was acquired by Apache Deepwater LLC during 2010. We also removed The Meridian Resource Corporation in 2010 because it was acquired by Alta Mesa Holdings, LP and subsidiaries during 2010. Callon Petroleum Company was removed from the peer group we used in our 2008 Form 10-K and replaced by Energy XXI (Bermuda) Limited in 2010 because we believe Energy XXI’s size and focus are more comparable to ours. We were not required to provide a performance graph in our Annual Report for the year ended December 31, 2009 on Form 10-K because we were a smaller reporting company for that filing. Therefore, we did not have a customized peer group for that year. We added the Russell 2000 Index in our 2010 Stock Performance graph because we believe the companies included in the Russell 2000 Index are more comparable to us in terms of size and market capitalization.

5

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance |

The names of our directors and executive officers, their ages as of March 1, 2011 and certain other information about them are set forth below:

| | | | | | |

| Name | | Age | | | Position Held |

Gary C. Hanna | | | 53 | | | Chief Executive Officer and Director |

John H. Peper | | | 58 | | | Executive Vice President, General Counsel and Corporate Secretary |

Tiffany J. Thom | | | 38 | | | Senior Vice President, Chief Financial Officer and Treasurer |

David P. Cedro | | | 43 | | | Senior Vice President, Controller and Chief Accounting Officer |

Chad E. Williams | | | 43 | | | Senior Vice President, Production |

Andre J. Broussard | | | 49 | | | Senior Vice President, Geosciences |

Charles O. Buckner | | | 66 | | | Director |

Scott A. Griffiths | | | 56 | | | Director |

Marc McCarthy | | | 40 | | | Chairman of the Board and Director |

Steven J. Pully | | | 51 | | | Director |

John F. Schwarz | | | 74 | | | Director |

Gary C. Hanna, age 53, joined the Company in September 2009 as Chief Executive Officer. He was elected as a director in June 2010. He has nearly 30 years of executive experience in the energy sector. From 2008 to 2009, Mr. Hanna served as President and Chief Executive Officer for Admiral Energy Services, a start-up company focused on the development of offshore energy services. From 1999 to 2007, Mr. Hanna served in various capacities at an international oil and gas services production company, Tetra Technologies, Inc., including serving as Senior Vice President from 2002 to 2007. Prior to 2002, Mr. Hanna served as President and Chief Executive Officer for Tetra’s affiliate, Maritech Resources, Inc., and as President of Tetra Applied Technologies, Inc., another Tetra affiliate. From 1996 to 1998, Mr. Hanna served as the President and Chief Executive Officer for Gulfport Energy Corporation, a public oil and gas exploration company. From 1995 to 1998, he also served as the Chief Operations Officer for DLB Oil & Gas, Inc., a mid-continent exploration public company. From 1982 to 1995, Mr. Hanna served as President and Chief Executive Officer of Hanna Oil Properties, Inc., a company engaged in the development of mid-continent oil and gas prospects. On April 6, 2009, Mr. Hanna and an ad hoc committee of the Company’s senior unsecured noteholders (the “Ad Hoc Committee”) entered into a consulting agreement whereby Mr. Hanna was retained to provide certain advisory services to the Ad Hoc Committee. On June 7, 2009, Mr. Hanna and the Ad Hoc Committee’s successor-in-interest, the Official Committee of Unsecured Noteholders (the “Noteholders Committee”), as the Bankruptcy Court’s appointed representative of the Company’s unsecured noteholders, entered into an amendment to Mr. Hanna’s consulting agreement (the “Amendment”) in which Mr. Hanna and the Noteholders Committee agreed to use a non-binding term sheet attached to the Amendment as the basis for the preparation of an employment agreement (the “Employment Agreement”) pursuant to which the Company would hire Mr. Hanna as Chief Executive Officer of the Company upon the Company’s exit from its Chapter 11 Reorganization. According to the terms of the Amendment, the Company’s hiring of Mr. Hanna as Chief Executive Officer of the Company was subject to the Bankruptcy Court’s approval of the Plan of Reorganization and the execution of a definitive Employment Agreement between the Company and Mr. Hanna. Mr. Hanna and the Company executed the Employment Agreement on October 1, 2009.

John H. Peper, age 58, joined the Company in January 2002 as Executive Vice President, General Counsel and Corporate Secretary. Prior to joining the Company, Mr. Peper was Senior Vice President, General Counsel and Secretary of Hall Houston Oil Company (“HHOC”) since February 1993. Mr. Peper also served as a director of HHOC from October 1991 until the Company acquired HHOC in January 2002. For more than five years prior to joining HHOC, Mr. Peper was a partner in the law firm of Jackson Walker, L.L.P., where he continued to serve in an of counsel capacity through 2001.

Tiffany J. Thom, age 38, joined the Company as a senior asset management engineer in October 2000, and has since held various positions with the Company: Director of Corporate Reserves (September 2001 to March 2006), Director of Investor Relations (April 2006 to June 2008) and Vice President, Treasurer and Director of Investor Relations (July 2008 to June 2009). In July 2009, she was designated as the Company’s principal financial officer, and, in September 2009, she was appointed to be a Senior Vice President. Ms. Thom was appointed Chief Financial Officer in June 2010. Prior to joining the Company, Ms. Thom was a senior reservoir engineer with Exxon Production Company and ExxonMobil Company and held operational roles, including reservoir engineering and subsurface completion engineering, for numerous offshore Gulf of Mexico properties. Ms. Thom holds a B.S. in Engineering from the University of Illinois and a M.B.A. in Management with a concentration in Finance from Tulane University.

6

David P. Cedro, age 43, joined the Company in October 2008 as its Vice President, Controller and principal accounting officer. In September 2009, Mr. Cedro was appointed to be a Senior Vice President of the Company and in June 2010 was appointed Chief Accounting Officer. Immediately prior to joining the Company, he was Corporate Controller for Bayou Steel, LLC, a steel manufacturing company acquired by ArcelorMittal, SA in 2008. From March 2003 to March 2008, Mr. Cedro held various positions with The Shaw Group Inc., a Fortune 500 public company and global provider of engineering and construction, procurement and construction management services to a broad range of industrial clients: Vice President — Financial Reporting (October 2004 to March 2007, August 2007 to March 2008); Vice President and Chief Financial Officer — Power Group (March 2007 to August 2007); and Vice President and Controller — Engineering, Construction and Maintenance Segment (March 2003 to October 2004). Prior to joining The Shaw Group Inc., Mr. Cedro was a Senior Manager with Ernst & Young LLP after serving in Big 4 audit practices from 1992 to 2003. He is a Certified Public Accountant in the State of Louisiana and holds a B.S. and M.S. in Accounting from the University of New Orleans.

Chad E. Williams, age 43, joined the Company in November 2000 as our Production Superintendent. He was promoted to Production Manager in April 2002 and Vice President, Production in July 2008. He is currently serving as Senior Vice President, Production and is responsible for overseeing all aspects of the Company’s field production, construction, and plugging, abandonment and decommissioning activities. Prior to joining the Company, he worked with Chevron USA in positions of increasing responsibilities ranging from offshore drilling and workover supervisory roles to production and reservoir engineering leadership roles within offshore asset management teams. Mr. Williams holds a B.S. in Petroleum Engineering from Marietta College, Ohio.

Andre J. Broussard, age 49, joined the Company in February 2011 as Senior Vice President, Geosciences. Most recently he was with Probe Resources serving as Vice President, Exploration from March 2008 to February 2011. From April 2006 to October 2007, he served as Hydro GOM’s Exploration and Development Manager, GOM Shelf and from October 2007 to February 2008 he served as Shelf, Technology, and Eastern Gas Manager with StatoilHydro. Mr. Broussard was with Spinnaker Exploration Company from 1997 until April 2006 as an explorationist focused on their portfolio in the GOM shelf. He began his career in 1984 at CNG Producing Company working on a variety of GOM shelf exploration and development projects. Mr. Broussard worked at CNG Producing until he joined Spinnaker Exploration in 1997. Mr. Broussard earned a Bachelor’s degree in Geology from the University of Southwestern Louisiana.

Charles O. Buckner, age 66, has been a director since September 2009. Mr. Buckner, a private investor, retired from the public accounting firm of Ernst & Young LLP in 2002 after 35 years of service in a variety of client service and administrative roles, including chairmanship of Ernst & Young’s United States energy practice. Mr. Buckner is a director of Patterson-UTI Energy, Inc. and Global Industries, Ltd. Mr. Buckner also served on the board of directors of Gateway Energy Corporation from June 2008 to September 2010; Whittier Energy Inc. from June 2003 to December 2007; and Horizon Offshore Inc. from December 2003 to December 2007. Mr. Buckner is a Certified Public Accountant and holds a B.B.A. in Accounting from the University of Texas and an M.B.A. from the University of Houston.

Scott A. Griffiths, age 56, has been a director since September 2009. Mr. Griffiths has almost 30 years of experience in the energy sector. Mr. Griffiths served as Senior Vice President and Chief Operating Officer of Hydro Gulf of Mexico, L.L.C. from December 2005 to December 2006. Subsequent to leaving Hydro Gulf of Mexico, Mr. Griffiths has been involved in certain energy investments for his own account. From 2003 through December 2005, Mr. Griffiths served as Executive Vice President and Chief Operating Officer of Spinnaker Exploration Company. From 2002 to 2003, Mr. Griffiths served as Senior Vice President, Worldwide Exploration for Ocean Energy, Inc. Mr. Griffiths joined Ocean following the 1999 merger of Ocean and Seagull Energy Corporation, where he began working in 1997. At Seagull, Mr. Griffiths served as Vice President, Domestic Exploration. From 1984 to 1997, Mr. Griffiths was with Global Natural Resources, Inc. where he served in various capacities, including Vice President for Domestic Exploration, before Global merged with Seagull in 1997. Mr. Griffiths was also an Exploration Geologist with the Shell Oil Company from 1981 to 1984. Mr. Griffiths is a director of Copano Energy, LLC. He holds a B.S. in Geology from the University of New Mexico, an M.A. in Geology from Indiana University and completed the Advanced Management Program at Harvard Business School.

Marc McCarthy, age 40, has been a director since September 2009. Mr. McCarthy is a Vice President and Senior Analyst at Wexford Capital LP (“Wexford Capital”), having joined them in June 2008. Previously, Mr. McCarthy worked in the Global Equity Research Department of Bear Stearns & Co., Inc. and was responsible for coverage of the international oil and gas sector. Mr. McCarthy joined Bear Stearns & Co. in 1997 and held various positions of increasing responsibility until his departure in June 2008, at which time he was a Senior Managing Director. Prior to 1997, he worked in equity research at Prudential Securities, also following oil and gas. Mr. McCarthy is a Chartered Financial Analyst and received a B.A. in Economics from Tufts University.

Steven J. Pully, age 51, has been a director since April 2008. Mr. Pully has served since July 2008 as the General Counsel of Carlson Capital, L.P. (“Carlson Capital”), an asset management firm. From October 2007 until April 2008, Mr. Pully was a consultant, working primarily in the asset management industry. From December 2001 to October 2007, Mr. Pully worked for Newcastle Capital

7

Management, L.P., an investment partnership, where he served as President from January 2003 through October 2007. He also served as Chief Executive Officer of New Century Equity Holdings Corp. from June 2004 through October 2007. Prior to joining Newcastle Capital Management, from 2000 to 2001, Mr. Pully served as a managing director in the investment banking department of Banc of America Securities, Inc. From 1997 to 2000, he was a member of the investment banking department of Bear Stearns & Co., Inc., where he became a Senior Managing Director in 1999. Mr. Pully also serves as a director of Ember Resources, Inc. Mr. Pully is licensed as an attorney and Certified Public Accountant in the state of Texas and is also a Chartered Financial Analyst. He holds a B.S. with honors in Accounting from Georgetown University and a J.D. degree from the University of Texas.

John F. Schwarz, age 74, has been a director since September 2009. Mr. Schwarz is currently the sole director and President of Entech Enterprises, Inc., which holds investments and non-operated interests in producing crude oil and natural gas properties and leases domestically and internationally. Mr. Schwarz is also a director and President of Gopher Investments, LLC, a director and owner of Lantana Partners, Ltd. and a director and President of Lantana Operating Co., LLC. During the past five years, Mr. Schwarz’s principal occupation has been his involvement in various oil and gas related investments through private, family-owned entities. From 1989 through 1994, Mr. Schwarz served as director, President and Chief Executive Officer of Energy Development Corporation, a wholly-owned subsidiary of Public Service Enterprise Group Inc. From 1982 to 1989, he served as director, President and Chief Executive Officer of CSX Oil and Gas Corporation, a wholly owned subsidiary of CSX Corp. He has fifty years of experience in the oil and gas industry. He also formerly served as a member of the Board of Directors of Burlington Resources Inc. and NS Group, Inc. Mr. Schwarz has a B.S. in Petroleum Engineering from the University of Texas and is a Registered Professional Engineer in the state of Texas.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who beneficially own more than 10% of our outstanding common stock to file initial reports of ownership and changes in ownership of common stock with the SEC. Reporting persons are required by the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of reports we received and written representations from our directors and officers, we believe that all filings required to be made under Section 16(a) for the fiscal year ended December 31, 2010 were timely made.

CORPORATE GOVERNANCE

The Board of Directors

The Board’s leadership structure separates the Chief Executive Officer and Chairman of the Board of Directors positions, and the Chief Executive Officer reports to the Board. The Board does not have any policy with respect to the separation of the offices of the Chief Executive Officer and the Chairman of the Board. The Board believes that this issue is part of the succession planning process and that it is in the best interests of the Company for the Board to make a determination regarding this issue each time it elects a new Chief Executive Officer. The Board has determined that its current leadership structure provides an appropriate framework for the Board to provide independent, objective and effective oversight of management. The Board, however, may make changes to its leadership structure in the future as it deems appropriate.

The Board is responsible for the oversight of the Company and its business, including risk management. Together with the Board’s standing committees, the Board is responsible for ensuring that material risks are identified and managed appropriately. The Board and its committees regularly review material strategic, operational, financial, compensation and compliance risks with our senior management. The Audit Committee has oversight responsibility for financial risk (such as accounting and finance), and also oversees compliance with and enforcement of the Company’s Corporate Code of Business Conduct and Ethics (the “Code of Ethics”). The Compensation Committee oversees compliance with our compensation plans, and the Nominating & Governance Committee oversees compliance with our corporate governance practices. Each of the committees reports to the Board regarding the areas of risk it oversees.

The directors hold regular meetings, attend special meetings as required and spend such time on the affairs of the Company as their duties require. The Company’s Corporate Governance Guidelines provide that directors are expected to attend regular Board meetings and the Annual Meeting of Stockholders in person and to spend the time needed, and meet as frequently as necessary, to properly discharge their responsibilities. During calendar year 2010, the Board of Directors held a total of 13 meetings. All directors of the Company attended at least seventy-five percent (75%) of the meetings of the Board of Directors and of the committees on which they served during the period. As Chairman of the Board of Directors, Mr. McCarthy presides at regularly scheduled executive sessions at which the Board of Directors meets without management participation.

8

Director Independence

Under the Company’s Corporate Governance Guidelines, a majority of the Board must be comprised of directors who are independent under the listing standards of the NYSE. No director will be deemed to be independent unless the Board affirmatively determines that the director has no material relationship with the Company, either directly or as an officer, stockholder or partner of an organization that has a relationship with the Company. In its review of director independence, the Board considers all relevant facts and circumstances, including without limitation, all commercial, banking, consulting, legal, accounting, charitable or other business relationships any director may have with the Company. The Board has adopted categorical standards to assist it in making determinations of independence for directors, a copy of which is available on the Company’s website atwww.eplweb.com.

Under the standards adopted by the Board, it has determined that each of Messrs. Buckner, Griffiths, McCarthy, Pully and Schwarz is independent.

The Audit Committee

The Board has a standing Audit Committee established in accordance with Section (3)(a)(58)(A) of the Exchange Act, the current members of which are Messrs. Buckner (Chairman), Pully and Schwarz. The Board, in its business judgment, has determined that each Audit Committee member is “independent,” as defined by the Company’s categorical standards on independence as well as the listing standards of the NYSE and the rules of the SEC applicable to audit committee members. Further, the Board, in its business judgment, has determined that Mr. Buckner and Mr. Pully each qualifies as an “audit committee financial expert” as described in Item 407(d)(5) of Regulation S-K. During fiscal year 2010, the Audit Committee held five meetings.

Nominating & Governance Committee

The Board has a standing Nominating & Governance Committee, the current members of which are Messrs. Schwarz (Chairman), Griffiths and McCarthy. When seeking candidates for director, the Nominating & Governance Committee has a policy whereby it may solicit suggestions from incumbent directors, management, stockholders or others. The Nominating & Governance Committee treats recommendations for directors that are received from the Company’s stockholders equally with recommendations received from any other source as long as the recommendations comply with the procedures for stockholder recommendations outlined in the Company’s bylaws. In addition, the Nominating & Governance Committee has authority under its charter to retain a search firm for this. After conducting an initial evaluation of a potential candidate, the Nominating & Governance Committee will interview that candidate if it believes such candidate might be suitable to be a director. The Nominating & Governance Committee may also ask the candidate to meet with management. If the Nominating & Governance Committee believes a candidate would be a valuable addition to the Board, it will recommend to the full Board that candidate’s election.

The Nominating & Governance Committee selects each nominee based on the nominee’s skills, achievements and experience. The Nominating & Governance Committee considers a variety of factors in selecting candidates, including, but not limited to, the following: independence, wisdom, integrity, an understanding and general acceptance of the Company’s corporate philosophy, valid business or professional knowledge and experience, a proven record of accomplishment with excellent organizations, an inquiring mind, a willingness to speak one’s mind, an ability to challenge and stimulate management and a willingness to commit time and energy. As required by its charter, the Nominating & Governance Committee considers the diversity of, and the optimal enhancement of the current mix of talent and experience on the Board, when identifying director nominees. During fiscal year 2010, the Nominating & Governance Committee held two meetings.

The Compensation Committee

The Board has a standing Compensation Committee, the current members of which are Messrs. Pully (Chairman), Buckner and Griffiths. The Compensation Committee has a charter under which its responsibilities and authorities include reviewing the Company’s compensation strategy, reviewing the performance of and approving the compensation for the senior management (other than the Chief Executive Officer), evaluating the Chief Executive Officer’s performance and, either as a committee or together with the other independent directors, determining and approving the Chief Executive Officer’s compensation level. In addition, the Compensation Committee approves and administers employee benefit plans and takes such other action as may be appropriate or as directed by the Board of Directors to ensure that the compensation policies of the Company are reasonable and fair. The Compensation Committee has the authority to delegate to its Chairman, any of its members or any subcommittee it may form, the responsibility and authority for any particular matter, as it deems appropriate from time to time under the circumstances. Furthermore, the Compensation Committee’s decisions regarding the compensation of senior management (other than the Chief Executive Officer)

9

is made in consultation with the Chief Executive Officer. As described in “Executive Compensation—Compensation, Discussion and Analysis,” certain compensation decisions are made by the full Board of Directors, taking into account recommendations of the Compensation Committee. The Board of Directors has determined that each member of the Compensation Committee is “independent” as defined by NYSE listing standards. During fiscal year 2010, the Compensation Committee held four meetings.

Compensation Committee Interlocks and Insider Participation

The members of our Compensation Committee are set forth above. No member of the Compensation Committee is now, or at any time since the beginning of 2010 has been, employed by or served as an officer of the Company or any of its subsidiaries or had any relationships requiring disclosure with the Company or any of its subsidiaries. See the disclosures regarding the transactions between the Company and Carlson Capital, L.P., for which Mr. Pully serves as General Counsel, under “Transactions with Related Parties” in Part III, Item 13 of this Annual Report. Because of the nature of Mr. Pully’s position at Carlson Capital, L.P., the Company has made the determination that Mr. Pully does not have an indirect material interest in such transactions. In addition, none of the Company’s executive officers now serves, or at any time since the beginning of 2010 has served, as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Code of Ethics

The Company has adopted the Code of Ethics, which applies to all directors and employees, including the principal executive officer, principal financial officer and principal accounting officer. A copy of the Code of Ethics is available on the Company’s website atwww.eplweb.com. A copy of the Code of Ethics is also available, at no cost, by writing to the Company’s Secretary at 201 St. Charles Avenue, Suite 3400, New Orleans, Louisiana 70170. The Company will post on its website any waiver of the Code of Ethics granted to any of its directors or executive officers promptly following the date of the amendment or waiver. No such waiver has ever been sought or granted.

Website Access to Corporate Governance Documents

Copies of the charters for the Audit Committee, the Compensation Committee and the Nominating & Governance Committee, as well as the Company’s Corporate Governance Guidelines and the Code of Ethics, which applies, among others, to the Company’s principal executive officer, principal financial officer and principal accounting officer, are available free of charge on the Company’s website atwww.eplweb.com or by writing to Investor Relations, Energy Partners, Ltd., 201 St. Charles Avenue, Suite 3400, New Orleans, Louisiana 70170. The Company will also post on its website any amendment to the Code of Ethics and any waiver of the Code of Ethics granted to any of its directors or executive officers to the extent required by applicable rules.

10

| Item 11. | Executive Compensation |

DIRECTOR COMPENSATION

General

The following table sets forth a summary of the compensation the Company paid to its non-employee directors during the fiscal year ended December 31, 2010.

Director Compensation for the Year Ended December 31, 2010

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash | | | Stock

Awards(1) | | | Option

Awards | | | Non-Equity

Incentive Plan

Compensation | | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings | | | All Other

Compensation | | | Total | |

| | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| | | | | | | |

Charles O. Buckner | | | 74,500 | | | | 100,000 | | | | — | | | | — | | | | — | | | | — | | | | 174,500 | |

| | | | | | | |

Scott A. Griffiths | | | 55,000 | | | | 100,000 | | | | — | | | | — | | | | — | | | | — | | | | 155,000 | |

| | | | | | | |

Marc McCarthy(2) | | | 29,000 | | | | 120,000 | | | | — | | | | — | | | | — | | | | — | | | | 149,000 | |

| | | | | | | |

Steven J. Pully(3) | | | 72,500 | | | | 100,000 | | | | — | | | | — | | | | — | | | | — | | | | 172,500 | |

| | | | | | | |

John F. Schwarz(3) | | | 67,500 | | | | 100,000 | | | | — | | | | — | | | | — | | | | — | | | | 167,500 | |

| (1) | Amounts in this column reflect the aggregate grant date fair value of the awards computed in accordance with Accounting Standards Codification (“ASC”) Topic 718, Stock Compensation. The grant date fair value has been calculated using the assumptions disclosed in Note 15 in Part II, Item 8 of this Annual Report for the fiscal year ended December 31, 2010. These amounts reflect grant date fair values and do not correspond to the actual value that might be realized by the directors. These amounts include an equity award of 8,547 shares per director with a grant date fair value of $11.70 per share, of which 4,273 remained unvested as of December 31, 2010. These amounts also include 1,709 shares with a grant date fair value of $11.70 per share for Mr. McCarthy representing fees that he elected to receive in stock. See “Director Compensation Program” below for a description of the material features of these awards. |

| (2) | Mr. McCarthy’s cash fees and stock awards are paid to Wexford Capital. |

| (3) | Messrs. Pully and Schwarz have each elected to defer receipt of his stock awards pursuant to the Second Amended and Restated Stock and Deferral Plan for Non-Employee Directors. See “—Deferral Plan and Deferred Share Agreement” for a description of these provisions. |

Director Compensation Program

On November 6, 2009, the Compensation Committee of the Board of Directors approved a compensation program (the “Director Compensation Program”) for each non-employee director of the Company. The Director Compensation Program includes annual cash compensation in the amount of $20,000. Each director who is a member of the Audit Committee of the Board is entitled to receive an additional $5,000 each year, and the chairperson of the Audit Committee is entitled to receive an additional $15,000 each year, while the chairperson of any other Board committee is entitled to $10,000 per year. Each such annual fee shall be payable in cash, shares of common stock of the Company, or a combination thereof, at the election of each director.

11

The Director Compensation Program also provides for the annual grant of a stock award to each director with a market value of $100,000 (as measured on the date of the grant and prorated from the date of the grant, if applicable). Pursuant to the terms of the Director Compensation Program, one-half of each stock award vests immediately on the date of the grant, and the remaining one-half vests immediately prior to the next annual meeting of stockholders held after the grant date.

In addition to the annual fees described above, each non-employee director will be entitled to $2,000 paid in cash for each Board meeting that he attends, and each member of a Board committee will be entitled to $1,500 paid in cash for each meeting of such committee that he attends that is not held on the same day as a Board meeting. Each member of a Board committee is also entitled to $1,000 paid in cash for each meeting of such committee that he attends that is held on the same day as a Board meeting, provided that it lasts for a substantial period of time.

Deferral Plan and Deferred Share Agreement

On November 6, 2009, the Compensation Committee adopted the Second Amended and Restated Stock and Deferral Plan for Non-Employee Directors (the “Deferral Plan”), which Deferral Plan is administered by the Compensation Committee and is available to all eligible Board members. Under the Deferral Plan, each eligible director may defer all or a portion of such director’s compensation and fees to either a future date or the date the individual ceases to be a director for any reason, at the election of such director and in accordance with the form of Director Deferred Share Agreement adopted by the Compensation Committee in connection with the adoption of the Deferral Plan (the “Deferred Agreement”). Such compensation and fees may be deferred in the form of cash or in the form of shares of common stock of the Company, at the election of the director according to the deferral election options presented to the directors by the Compensation Committee on an annual basis. In the event that a director has elected to receive settlement of his or her account in the form of common stock of the Company, all shares shall be granted pursuant to the Company’s 2009 Long Term Incentive Plan (the “2009 LTIP”).

The Deferral Plan is an unfunded plan, and each director’s deferred compensation and fees is credited to a bookkeeping account in the name of such director. Pursuant to the Deferral Plan, any portion of a director’s account to be settled in cash is credited during the deferral period with interest equivalents at the end of each calendar quarter at an interest rate determined by the Compensation Committee in its sole discretion. Any portion of the director’s account to be settled in common stock is deemed to have been invested in common stock on the day that such fees or compensation would have otherwise been paid to the director, and the shares track the value of common stock throughout the deferral period.

The Deferred Agreement will be governed pursuant to the terms and conditions of the 2009 LTIP and the Deferral Plan, as applicable, including, but not limited to, the 2009 LTIP provisions regarding the Company’s repurchase rights and share adjustment provisions. The Deferred Agreement states the number of shares of common stock to be deferred, the treatment of dividend equivalents on such shares of common stock during the deferral period, the length of the deferral period and the vesting schedule for the shares of common stock, where applicable. The Deferred Agreement restricts the transfer of any deferred shares of common stock (other than by will or the laws of descent and distribution) to transactions between the director and the Company, or the director and an institutional investor of the Company that has designated the director to serve as a member of the Board.

EXECUTIVE COMPENSATION

Compensation, Discussion and Analysis

General. The Company’s compensation philosophy is to reward performance with competitive compensation in order to attract and retain highly qualified executives and to motivate them to maximize stockholder return. The Company’s executive compensation program is designed to provide overall competitive fixed and incentive-based pay levels that vary based on the achievement of company-wide performance objectives and individual performance.

In establishing corporate and individual performance objectives, the Company uses metrics that it believes investors use in determining whether to purchase the Company’s stock: discretionary cash flow, managing general and administrative expenses and lease operating expenses efficiently, growth of oil and gas reserves at economic finding and development costs, return on equity, and achievement of high standards in health, safety and environmental stewardship, among other things. As a result, compensation is driven by the achievement of the same or similar results the Company believes its investors are looking for.

12

Market Compensation Data. The Compensation Committee compares each element of total compensation against a group of publicly-traded energy companies (collectively, the “Peer Group”). The Peer Group, which is periodically reviewed and updated by the Compensation Committee, consists of companies that the Compensation Committee believes are reference points, primarily because the Company competes for employees and stockholder investment. However, the Compensation Committee recognizes that some of the companies in the Peer Group may be larger than the Company or have compensation philosophies tailored to those companies’ specific circumstances. Therefore, the Peer Group comparison is used by the Compensation Committee as a general guide to evaluate the competitiveness of the Company’s compensation policies, rather than as a benchmark according to which the Company establishes its varying levels of compensation.

The Company’s current Peer Group consists of the following companies:

| | • | | ATP Oil & Gas Corporation |

| | • | | Contango Oil & Gas Company |

| | • | | Energy XXI (Bermuda) Limited |

| | • | | McMoRan Exploration Company |

| | • | | PetroQuest Energy, Inc. |

| | • | | Stone Energy Corporation |

In accordance with the philosophy outlined above, a significant percentage of total compensation is allocated to incentives. However, there is no official policy or target for the allocation between either cash and non-cash or short-term and long-term incentive compensation. Income from incentive compensation is typically realized as a result of the performance of the Company and/or the individual, depending on the type of award, compared to established goals.

Senior Executive Review Process. The Board, including members of the Compensation Committee, retains responsibility for the selection, evaluation and determination of compensation of the Chief Executive Officer, as well as the other executive officers. Because of the importance of retaining a well-qualified Chief Executive Officer to lead the Company successfully after its recent emergence from its Chapter 11 Reorganization, the Board made the determination that the Company should enter into an employment agreement, dated October 1, 2009, with Mr. Hanna. The Board’s decisions relating to salary levels, bonus awards and equity grant amounts for Mr. Hanna in accordance with his Employment Agreement reflect the Board’s views as to the broad scope of responsibilities of Mr. Hanna and the Board’s subjective assessment of Mr. Hanna’s impact on the Company’s overall success.

The Board makes its decisions regarding the compensation of executive officers based on the recommendations of the Compensation Committee. The Compensation Committee, at the recommendation of Mr. Hanna, conducts an annual review of the base salary, bonus and equity awards made to each executive officer other than Mr. Hanna. In each case, the Compensation Committee takes into account the executive’s scope of responsibilities and experience and balances these against competitive compensation levels, including retention requirements and succession planning with respect to each executive. Mr. Hanna makes recommendations regarding compensation for each executive officer other than Mr. Hanna based on an evaluation of each executive’s contribution and performance, strengths, weaknesses, development plans and succession potential.

Components of Senior Executive Compensation. The primary elements of annual compensation for senior executives are base salary, bonuses (which can be in the form of cash, stock or a combination of both) and equity awards. Each component is evaluated in the context of individual and Company performance, as well as competitive conditions. In determining competitive compensation levels, the Company analyzes data from the Peer Group, as well as other information regarding the general oil and gas exploration and production industry. Senior executives also receive other forms of compensation, including various benefit plans made available to all of the Company’s employees, but these are not independently evaluated in connection with the annual determination of senior executive compensation. With the exception of Mr. Hanna, none of the Company’s executive officers has an employment agreement.

Base Salary. The Compensation Committee, based on the recommendations of Mr. Hanna, determines base salaries for executive officers other than Mr. Hanna by evaluating the responsibilities of the position, the experience of the individual, the performance of the individual, and the competitive market for similar management talent. The Compensation Committee’s salary review process includes a comparison of base salaries for comparable positions at companies of similar type, size and financial performance.

13

Bonuses. All executives, including Mr. Hanna, are eligible to receive a bonus tied directly to the Company’s achievement of financial, operational, and strategic objectives and the executive’s personal performance. Bonuses are determined by the Compensation Committee on an annual basis, and individual target bonus potentials are established at the beginning of each fiscal year. For the fiscal year ended December 31, 2010, the Compensation Committee established a bonus program with (i) target bonuses based on a percentage of base salary, (ii) job-specific individual performance goals for the top five senior executives and (iii) a supplemental discretionary bonus of up to an additional 25% of the target bonus percentage if the Company’s discretionary cash flow exceeds $180 million. The bonus program for 2010 based executive bonuses on management’s achievement during the fiscal year, based on quantifiable metrics that are specific to the roles performed by the particular executive officer, such as health, safety and environmental metrics for operational officers. The determination of each executive officer’s bonus was also based upon the Company’s achievement of corporate objectives common in the oil and gas industry: (i) growth in discretionary cash flow, measured by the Company’s EBITDAX (earnings before interest, taxes, depreciation, amortization and exploration expenses), of at least $177 million, (ii) general and administrative expenses per barrel of oil equivalent (“BOE”) of not more than $3.05 per BOE, (iii) lease operating expenses of not more than $10.61 per BOE and (iv) growth of oil and gas reserves at finding and development costs of not more than $9.80 per BOE. The performance of each executive is discussed with such executive during semi-annual performance reviews.

The 2010 bonus program described above was established by the Compensation Committee for the first full fiscal year after the Company’s emergence from Chapter 11 reorganization. As part of the Company’s continued improvement and growth, for the fiscal year ending December 31, 2011, the Compensation Committee adjusted the bonus program for 2011 as follows. Fifty percent of an executive’s bonus will be based on such executive’s individual performance, as measured by role-specific metrics, and the remaining 50% of an executive’s bonus will be based on the Company’s achievement of the following weighted corporate objectives: (i) safety, measured by (a) total recordable incidents per 200,000 man hours (5%), (b) the ratio of Incidents of Non-Compliance issued by BOEMRE (5%) and (c) elimination of preventable significant events (5%), (ii) growth in average oil production (15%), (iii) growth in average oil and natural gas production (10%), (iv) target aggregate lease operating expenses (10%), (v) target aggregate general and administrative expenses (10%), (vi) growth in discretionary cash flow, measured by the Company’s EBITDAX (20%), (vii) reductions in capital expenditure overages, measured as a percentage of the applicable AFE (5%), (viii) growth in proved reserves (10%), (ix) relative stock performance, measured by the year-over-year performance of the Company’s 10-day average stock price as compared to the Russell US 2000 Energy Oil Companies Index for the same period (5%) and (x) target rates of return on acquisitions (10%). These metrics are set with minimum, target and stretch amounts that scale an executive’s bonus from 50%, 100% to 150% of such executive’s base salary.

Equity Awards. The Company’s equity compensation program for senior executive employees includes two forms of long-term incentives: restricted stock and stock options. Award size and frequency are based on each executive’s demonstrated level of performance and Company performance over time. The Compensation Committee annually reviews award levels to ensure their competitiveness. In making individual awards, the Compensation Committee, or the Board, in the case of Mr. Hanna’s equity awards, considers industry practices, the recent performance of each executive, the value of the executive’s previous awards and the Company’s views on executive retention and succession.

Equity Award Mechanics. Equity awards are granted pursuant to the 2009 LTIP. Awards are made by the Board, at the recommendation of the Compensation Committee, in the case of Mr. Hanna, and by the Compensation Committee, at the recommendation of Mr. Hanna, in the case of all other executive officers. Awards typically fall into two categories: annual awards, which are made in January, and new hire and promotion awards, which are made on the date of hire or promotion. The Board or the Compensation Committee may make grants at other times, in its discretion, in connection with employee retention or otherwise.

All stock option awards have a per share exercise price at least equal to the closing price of the common stock on the grant date. Stock option awards and restricted stock awards vest upon the passage of time.

Deferred Compensation and Retirement Plans. The Company does not have a deferred compensation program for its executive officers, pension benefits, a retirement plan, or any type of post-retirement healthcare plan.

14

Perquisites and Other Benefits. In general, the Company provides no benefits to its senior executives that are not otherwise available to all of its employees.

Severance Plan and Change of Control Plans. Our Change of Control Severance Plan for certain designated officers and employees of the Company, effective as of March 24, 2005 (as amended from time to time, the “COC Plan”), is designed to facilitate our ability to attract and retain executives as we compete for talented employees in a marketplace where such protections are commonly offered. We believe that providing consistent, competitive levels of severance protection to senior executives helps minimize distraction during times of uncertainty and helps to retain key employees. As explained more fully below in “—Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table,” the COC Plan provides certain cash payments and other benefits to eligible employees if, under certain circumstances, such employees’ employment is terminated following a change of control. The Compensation Committee is responsible for administering these policies and the COC Plan. The Company does not provide any executive officer with a gross-up payment for any taxes that may be assessed against any compensation paid to such executive officer, including any income taxes or any excise tax under Section 4999 of the Internal Revenue Code of 1986.

Regulatory Considerations. It is the Company’s policy to make reasonable efforts to cause executive compensation to be eligible for deductibility under Section 162(m) of the Internal Revenue Code of 1986. Under Section 162(m), the federal income tax deductibility of compensation paid to the Company’s Chief Executive Officer and to each of its four other most highly compensated executive officers may be limited to the extent that such compensation exceeds $1 million in any one year. Under Section 162(m), the Company may deduct compensation in excess of $1 million if it qualifies as “performance-based compensation,” as defined in Section 162(m). For fiscal year 2010, none of the Company’s executive officers received compensation in excess of $1 million.

Stock Ownership Guidelines.The Company’s Executive Stock Ownership Guidelines require executives to retain 50% of the “profit shares” acquired under equity compensation programs of the Company. “Profit shares” are defined as those shares of common stock held by an executive as a result of the exercise of options, the lapsing of restrictions on restricted stock and restricted stock units (but not including any shares that are awarded as unrestricted, fully vested shares) and the earning of performance shares, in each instance after shares are sold or netted to pay the exercise price of an option (for options) and tax withholding amounts (for all types of awards made under the Company’s equity compensation programs, such as withholding amounts associated with the exercise of stock options, the lapsing of restrictions on restricted stock and restricted stock units and the earning of performance shares). “Profit shares” do not include any equity based consideration received as acquisition consideration in connection with an acquisition made by the Company.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis included in this Annual Report with management. Based on the Compensation Committee’s review of and discussions with management with respect to the Compensation Discussion and Analysis, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in this Annual Report.

| | | | |

| | The Compensation Committee, | | |

| | |

| | Steven J. Pully, Chairman | | |

| | Charles O. Buckner | | |

| | Scott A. Griffiths | | |

15

Summary Compensation Table

The following table summarizes, with respect to the Company’s Named Executive Officers, information relating to the compensation earned for services rendered in all capacities.

Summary Compensation Table for the Year Ended December 31, 2010

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary | | | Bonus | | | Stock

Awards | | | Option

Awards(1) | | | Non-Equity

Incentive Plan

Compensation | | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings | | | All Other

Compensation(2) | | | Total | |

| | | | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | | | ($) | |

| | | | | | | | | |

Gary C. Hanna(3)

Chief Executive Officer | | | 2010 | | | | 400,000 | | | | — | | | | — | | | | 866,250 | | | | 400,000 | | | | — | | | | 16,770 | | | | 1,683,020 | |

| | | 2009 | | | | 112,308 | | | | 117,780 | | | | — | | | | 168,900 | | | | — | | | | — | | | | 147,857 | | | | 546,845 | |

| | | 2008 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | |

Tiffany J. Thom(4)

Senior Vice President, Chief Financial Officer and Treasurer | | | 2010 | | | | 232,500 | | | | — | | | | — | | | | 112,750 | | | | 113,750 | | | | — | | | | 12,341 | | | | 471,341 | |

| | | 2009 | | | | 200,000 | | | | 37,000 | | | | — | | | | — | | | | — | | | | — | | | | 116,597 | | | | 353,597 | |

| | | 2008 | | | | 189,167 | | | | — | | | | 95,580 | | | | — | | | | 54,000 | | | | — | | | | 11,627 | | | | 350,374 | |

| | | | | | | | | |

John H. Peper(5)

Executive Vice President, General Counsel and Corporate Secretary | | | 2010 | | | | 275,000 | | | | — | | | | — | | | | 112,750 | | | | 100,000 | | | | — | | | | 18,720 | | | | 506,470 | |

| | | 2009 | | | | 275,000 | | | | 27,000 | | | | — | | | | — | | | | — | | | | — | | | | 295,440 | | | | 597,440 | |

| | | 2008 | | | | 275,000 | | | | — | | | | 668,561 | | | | 229,126 | | | | — | | | | — | | | | 17,700 | | | | 1,190,387 | |

| | | | | | | | | |

Chad E. Williams(6)

Senior Vice President, Production | | | 2010 | | | | 230,000 | | | | — | | | | — | | | | 112,750 | | | | 93,150 | | | | — | | | | 17,561 | | | | 453,461 | |

| | | 2009 | | | | 230,000 | | | | 22,000 | | | | — | | | | — | | | | — | | | | — | | | | 127,618 | | | | 379,618 | |

| | | 2008 | | | | 212,775 | | | | — | | | | 102,660 | | | | — | | | | 59,460 | | | | — | | | | 14,195 | | | | 389,090 | |

| | | | | | | | | |

David P. Cedro(7)

Senior Vice President, Controller and Chief Accounting Officer | | | 2010 | | | | 220,000 | | | | — | | | | — | | | | 112,750 | | | | 96,800 | | | | — | | | | 15,888 | | | | 445,438 | |

| | | 2009 | | | | 212,500 | | | | 27,000 | | | | — | | | | — | | | | — | | | | — | | | | 44,170 | | | | 283,670 | |

| | | 2008 | | | | 53,125 | | | | 75,000 | | | | 183,330 | | | | — | | | | — | | | | — | | | | 3,463 | | | | 314,918 | |

| (1) | Amounts in this column reflect the aggregate grant date fair value of the awards computed in accordance with ASC Topic 718, Stock Compensation. The grant date fair value was calculated using the assumptions disclosed in Note 15 in Part II, Item 8 of the this Annual Report for the fiscal year ended December 31, 2010. These amounts reflect grant date fair values and do not correspond to the actual value that might be realized by the Named Executive Officers. See “—Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table” below for a description of the material features of these awards. |

16

| (2) | Amounts reflected in this column represent the dollar value of term life insurance premiums paid by the Company for the benefit of the Named Executive Officers, the dollar value of the company match to the Company’s 401(k) Plan on the employees’ behalf and payments made to certain Named Executive Officers pursuant to severance or other arrangements (if applicable) or in connection with the Company’s Chapter 11 Reorganization as described in “—Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table” below. For 2010, (a) the life insurance premiums for Messrs. Hanna, Peper, Williams, and Cedro and Ms. Thom were $2,070, $2,580, $1,541, $468 and $893, respectively; and (b) the value of the 401(k) match for Messrs. Hanna, Peper, Williams and Cedro and Ms. Thom were $14,700, $14,700, $13,800, $13,200 and $10,008, respectively. For 2009, (a) the life insurance premiums for Messrs. Hanna, Peper, Williams and Cedro and Ms. Thom were $423, $2,580, $1,278, $450 and $714, respectively; and (b) the value of the 401(k) match for Messrs. Hanna, Peper, Williams and Cedro and Ms. Thom were $6,000, $16,500, $13,800, $12,750 and $10,008, respectively. For 2008, (a) the life insurance premiums for Messrs. Peper, Williams and Cedro and Ms. Thom were $2,580, $451, $113 and $432, respectively; and (b) the value of the 401(k) match for Messrs. Peper, Williams and Cedro and Ms. Thom were $13,800, $12,774, $3,188 and $10,000, respectively. See Notes (4) through (7) for amounts related to severance and other arrangements. |

| (3) | Mr. Hanna became Chief Executive Officer of the Company in September 2009. From March 26, 2009 until his election as Chief Executive Officer, Mr. Hanna served as a consultant to the Ad Hoc Committee and the Noteholders Committee. In Mr. Hanna’s role as a consultant, he received from the Company $140,954 in consulting fees, which are included in the “All Other Compensation” column. |

| (4) | Amounts reflected for fiscal year 2009 in the “All Other Compensation” column include $104,681 paid primarily in connection with the Company’s Chapter 11 Reorganization. Not included in the table is $4,820, the value realized on vesting in 2009 of 13,600 stock-settled restricted share units granted from 2005 through 2007, and a payment of $432 related to cash-settled restricted stock units granted in 2008. Not included in the table is $35,600, the value realized on vesting in 2008 of 3,500 stock-settled restricted share units granted from 2005 through 2007. |

| (5) | Amounts reflected for fiscal year 2009 in the “All Other Compensation” column include $275,000 paid in connection with the Company’s Chapter 11 Reorganization. Not included in the table is $6,709, the value realized on vesting in 2009 of 20,547 stock-settled restricted share units granted from 2006 through 2008, and payments totaling $2,490 related to cash-settled restricted stock units granted in 2007 and 2008. Not included in the table is $19,250, the value realized on vesting in 2008 of 2,009 stock-settled restricted share units granted in 2006 and a payment of $116,792 related to cash-settled restricted stock units granted in 2007. |

| (6) | Amounts reflected for fiscal year 2009 in the “All Other Compensation” column include $111,570 paid primarily in connection with the Company’s Chapter 11 Reorganization. Not included in the table is $6,933, the value realized on vesting in 2009 of 19,350 stock-settled restricted share units granted from 2005 through 2007, and a payment of $464 related to cash-settled restricted stock units granted in 2008. Not included in the table is $44,746, the value realized on vesting in 2008 of 4,400 stock-settled restricted share units granted from 2005 through 2007. |

| (7) | Amounts reflected for fiscal year 2009 in the “All Other Compensation” column include $30,000 paid in connection with the Company’s Chapter 11 Reorganization. |

17

Grants of Plan-Based Awards Table

The following table provides information concerning each grant of an award made to our Named Executive Officers under any plan, including awards, if any, that have been transferred during the fiscal year ended December 31, 2010.

Grants of Plan-Based Awards for the Year Ended December 31, 2010

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards (1) | | | Estimated Future Payouts

Under Equity Incentive

Plan Awards (1) | | | All

Other

Stock

Awards:

Number

of

Shares

of Stock

or Units | | | All Other

Option

Awards:

Number

of

Securities

Underlying

Options | | | Exercise

or

Base

Price of

Option

Awards | | | Grant

Date

Fair

Value of

Stock

and

Option

Awards

(3) | |

Name | | Grant Date | | Threshold | | | Target | | | Maximum

(2) | | | Threshold | | | Target | | | Maximum | | | | | | | | | | | | | |

| | | | | ($) | | | ($) | | | ($) | | | (#) | | | (#) | | | (#) | | | (#) | | | (#) | | | ($/Sh) | | | ($) | |

Gary C. Hanna | | January 5, 2010 | | | 0 | | | | 500,000 | | | | N/A | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | April 5, 2010 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 125,000 | | | | 13.59 | | | | 866,250 | |

Tiffany J. Thom | | January 5, 2010 | | | 0 | | | | 125,000 | | | | N/A | | | | — | | | | — | | | | — | | | | — | | | | 25,000 | | | | 8.90 | | | | 112,750 | |

John H. Peper | | January 5, 2010 | | | 0 | | | | 137,500 | | | | N/A | | | | — | | | | — | | | | — | | | | — | | | | 25,000 | | | | 8.90 | | | | 112,750 | |

Chad E. Williams | | January 5, 2010 | | | 0 | | | | 115,000 | | | | N/A | | | | — | | | | — | | | | — | | | | — | | | | 25,000 | | | | 8.90 | | | | 112,750 | |

David P. Cedro | | January 5, 2010 | | | 0 | | | | 110,000 | | | | N/A | | | | — | | | | — | | | | — | | | | — | | | | 25,000 | | | | 8.90 | | | | 112,750 | |

| (1) | Amounts actually paid are reflected in the column titled “Non-Equity Incentive Plan Compensation” found on the “Summary Compensation Table” above. For additional information see “—Compensation Discussion and Analysis—Bonuses.” |

| (2) | While executive officers may earn up to a certain maximum percentage of each quantitative target under our annual incentive bonus program, the Committee retains discretion to award officers additional amounts based on external factors beyond the control of the officers as well as individual performance by the officers. |

| (3) | Amounts reflect the grant date fair value of the respective awards computed in accordance with ASC Topic 718, Stock Compensation. Please refer to Notes 2 and 15 in Part II, Item 8 of this Annual Report for a discussion of the assumptions used in computing the grant date fair value of stock based compensation awards. These amounts reflect our accounting expense for these awards and do not correspond to the actual value that might be realized by the Named Executive Officer. |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

The following is a discussion of material factors necessary to an understanding of the information disclosed in the “—Summary Compensation Table” and the “—Grants of Plan-Based Awards Table” above.

Bonuses

On January 21, 2011, Mr. Hanna received a bonus for fiscal year 2010 of $400,000 in cash. On April 5, 2010, Mr. Hanna received a bonus for fiscal year 2009 of $117,780, payable in 6,013 shares of the common stock (and $36,063.33 in cash as the amount required to satisfy applicable income tax withholding requirements on the shares of the common stock). Both bonuses were paid pursuant to the Employment Agreement dated October 1, 2009, between Mr. Hanna and the Company. Under the terms of the Employment Agreement, Mr. Hanna’s bonuses are specified as stock bonuses, but the Compensation Committee elected for Mr. Hanna’s bonus for 2010 to be paid fully in cash.

On January 21, 2011, Ms. Thom received a bonus for fiscal year 2010 of $113,750 in cash. On January 5, 2010, Ms. Thom received a bonus for fiscal year 2009 of $27,000, paid in 1,821 shares of the common stock and $10,793 in cash pursuant to the 2009 LTIP. During 2009, Ms. Thom also received an additional cash bonus of $10,000.

On January 21, 2011, Mr. Peper received a bonus for fiscal year 2010 of $100,000 in cash. On January 5, 2010, Mr. Peper received a bonus for fiscal year 2009 of $27,000, paid in 1,821 shares of the common stock and $10,793 in cash pursuant to the 2009 LTIP.

On January 21, 2011, Mr. Williams received a bonus for fiscal year 2010 of $93,150 in cash. On January 5, 2010, Mr. Williams received a bonus for fiscal year 2009 of $22,000, paid in 1,484 shares of the common stock and $8,792 in cash pursuant to the 2009 LTIP.

On January 21, 2011, Mr. Cedro received a bonus for fiscal year 2010 of $96,800 in cash. On January 5, 2010, Mr. Cedro received a bonus for fiscal year 2009 of $27,000, paid in 1,821 shares of common stock and $10,793 in cash pursuant to the 2009 LTIP. In 2008, Mr. Cedro received an employment bonus of $75,000, of which $35,000 was paid on October 15, 2008 and $40,000 was paid on March 31, 2009.

18

Stock Awards

In 2008, pursuant to the Company’s 2006 Long Term Incentive Plan (the “2006 LTIP”), the Company awarded stock-settled restricted share units and cash-settled restricted share units to the Company’s Named Executive Officers. The 2006 LTIP was terminated pursuant to the Company’s Chapter 11 Reorganization. In connection with the Chapter 11 Reorganization, the stock-settled restricted share units became fully vested and shares of Predecessor Company Common Stock were issued therefor. Pursuant to the Plan of Reorganization, 100% of the outstanding shares of Predecessor Company Common Stock were exchanged for an aggregate of approximately 5% of the Successor Company’s Common Stock. Each of the Named Executive Officers holding cash-settled restricted share unit awards issued pursuant to the 2006 LTIP surrendered any and all rights to such awards pursuant to a Settlement Agreement (as defined below).

Option Awards

In 2010 and 2009, pursuant to Mr. Hanna’s Employment Agreement and in accordance with the 2009 LTIP, the Company awarded stock options to Mr. Hanna. In 2010, pursuant to the 2009 LTIP, the Company also awarded stock options to Messrs. Peper, Williams, and Cedro and Ms. Thom.

Pursuant to the 2006 LTIP, the Company awarded stock options and stock appreciation rights to certain of the Company’s Named Executive Officers in 2008. As described above, all stock options outstanding under the 2006 LTIP were deemed fully vested and, unless exercised in accordance with the 2006 LTIP, were then cancelled pursuant to the Plan of Reorganization. Any holders of stock options that exercised such stock options in accordance with the 2006 LTIP received shares of Predecessor Company Common Stock upon such exercise. Pursuant to the Plan of Reorganization, 100% of the outstanding shares of Predecessor Company Common Stock were exchanged for an aggregate of approximately 5% of the Successor Company’s Common Stock.

Actions During 2009

Certain of the Company’s current and former executive officers, including Mr. Peper, previously entered into Change of Control Severance Agreements (each, a “Severance Agreement”) with the Company. Mr. Peper entered into his Severance Agreement in March 2005 and contained a termination date of March 28, 2010. Mr. Peper is no longer eligible for payments under his Severance Agreement. As part of the Company’s Chapter 11 Reorganization, and as approved by an order of the Bankruptcy Court, the Company entered into a settlement agreement with Mr. Peper in which he surrendered all rights, titles and benefits to and under his Severance Agreement in exchange for a general unsecured claim against the Company. Mr. Peper was awarded a claim for $275,000, which claim was treated as an unsecured claim and, like the Company’s other valid unsecured claims, was paid in full under the Plan of Reorganization.

As part of the Company’s Chapter 11 Reorganization, the Bankruptcy Court approved the Company’s entrance into various settlement agreements (together with the settlement agreement executed by Mr. Peper described above, the “Settlement Agreements”) with a number of the Company’s employees, including Ms. Thom, Mr. Williams and Mr. Cedro, who held outstanding equity compensation awards or unpaid bonus payments. The Settlement Agreements provided the individual with a cash retention payment in lieu of his or her outstanding equity or bonus awards, and cancelled the outstanding equity awards that the individual previously held, if any.

Employment Agreements