UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

|

ENERGY PARTNERS, LTD. |

| Name of Registrant as Specified in Its Charter |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | | | |

| | (2) | | Form, schedule or registration statement no.: |

| | | | |

| | (3) | | Filing party: |

| | | | |

| | (4) | | Date filed: |

| | | | |

201 St. Charles Avenue

Suite 3400

New Orleans, Louisiana 70170

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 26, 2011

To the Stockholders of Energy Partners, Ltd:

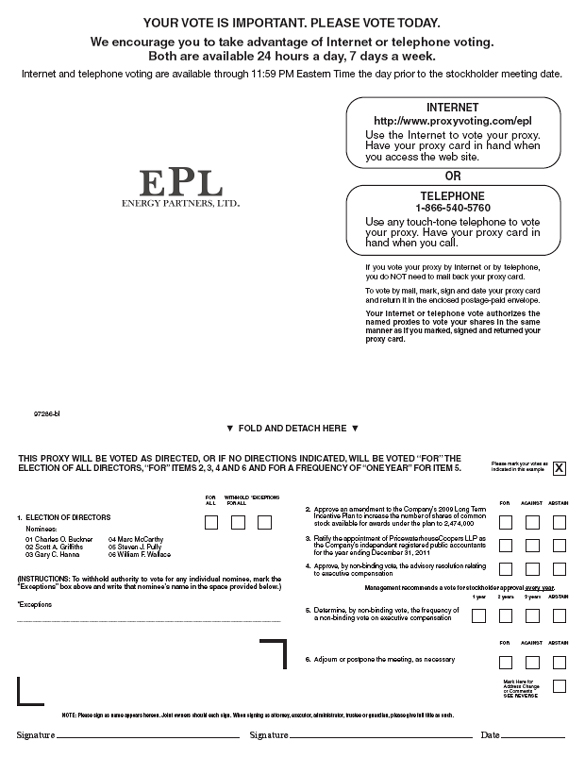

The 2011 Annual Meeting of Stockholders of Energy Partners, Ltd. (the “Company”), a Delaware corporation, will be held at the Company’s corporate offices at 201 St. Charles Avenue, Suite 3400, New Orleans, Louisiana 70170, on May 26, 2011, at 9:00 a.m., Central Daylight Time, for the following purposes:

(1) to elect six (6) directors to hold office until the Annual Meeting of Stockholders in the year 2012 and until their respective successors are duly elected and qualified;

(2) to approve an amendment to the Company’s 2009 Long Term Incentive Plan to increase the number of shares of Common Stock available for award under the plan from 1,237,000 to 2,474,000 shares;

(3) to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants for the year ending December 31, 2011;

(4) to approve, on a non-binding advisory basis, the Company’s executive compensation;

(5) to vote, on a non-binding advisory basis, on the frequency of future non-binding advisory votes to approve the Company’s executive compensation;

(6) to adjourn or postpone the meeting, as necessary; and

(7) to transact such other business as may properly come before the meeting.

Additional information regarding the meeting and the above proposals is set forth in the accompanying proxy statement. The Board of Directors has set the close of business on April 7, 2011 as the record date for the meeting (the “Record Date”), and only holders of common stock, par value $0.001 per share (the “Common Stock”) on the Record Date are entitled to notice of, and to vote at, the 2011 Annual Meeting, or any adjournment or postponement thereof.

You are cordially invited to attend the Annual Meeting in person.Even if you plan to attend the Annual Meeting, we urge you to vote your shares at your earliest convenience in order to ensure that your shares will be represented at the meeting.

As we did for the first time last year, we will be taking advantage of the Securities and Exchange Commission rules that allow us to furnish our proxy materials over the Internet. As a result, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders rather than a full paper set of the proxy materials. This Notice of Internet Availability of Proxy Materials contains instructions on how to access our proxy materials on the Internet, as well as instructions on how stockholders may obtain a paper copy of the proxy materials. This process will substantially reduce the costs associated with printing and distributing our proxy materials.

You can vote your shares via the Internet or by telephone. Furthermore, if you received paper proxy materials from the Company, you may sign, date and mail the proxy card in the envelope that was provided to you. If you hold your shares through a broker or other nominee, you should contact your broker to determine how to vote your shares.

By Order of the Board of Directors,

/s/ John H. Peper

JOHN H. PEPER

Executive Vice President, General Counsel

and Corporate Secretary

New Orleans, Louisiana

April 15, 2011

ENERGY PARTNERS, LTD.

201 St. Charles Avenue

Suite 3400

New Orleans, Louisiana 70170

PROXY STATEMENT

2011 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement and accompanying Notice and Proxy Form are being provided to the stockholders of Energy Partners, Ltd. (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board of Directors” or the “Board”) for use at the Annual Meeting of Stockholders of the Company to be held on May 26, 2011 at the Company’s corporate offices at 201 St. Charles Avenue, Suite 3400, New Orleans, Louisiana at 9:00 a.m., Central Daylight Time (the “2011 Annual Meeting” or the “Meeting”), or at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. As permitted by rules adopted by the Securities and Exchange Commission (the “SEC”), the Company has elected to provide stockholders with access to its proxy materials through the Internet rather than by providing them in paper form. Accordingly, the Company will send a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials via the Internet, rather than a printed copy of the proxy materials, to stockholders. The Company expects to send the Notice of Internet Availability of Proxy Materials to stockholders entitled to vote at the Meeting on or about April 15, 2011. Stockholders may also obtain a copy of these proxy materials in printed form by following the procedures set forth in the Notice of Internet Availability of Proxy Materials.

ABOUT THE 2011 ANNUAL MEETING

Voting Procedures

Stockholders of record at the close of business on April 7, 2010 (the “Record Date”) will be entitled to vote at the Meeting. On the Record Date, there were 40,192,255 shares of the Company’s common stock, par value $0.001 per share (the “Company Shares” or the “Common Stock”), issued and outstanding and entitled to vote. The holders of a majority of the Company Shares issued and outstanding and entitled to vote at the Meeting, present in person or represented by proxy, will constitute a quorum. The person(s) whom the Company appoints to act as inspector(s) of election will treat all Company Shares represented by a returned, properly executed proxy as present for purposes of determining the existence of a quorum at the Meeting. The Company Shares present at the Meeting, in person or by proxy, that are abstained from voting will be counted as present for determining the existence of a quorum. If such a quorum is not present or represented at the Meeting, the presiding officer of the Meeting will have the power to adjourn the Meeting from time to time, without notice other than announcement at the Meeting, until a quorum is present or represented.

Each of the Company Shares will entitle the holder thereof to one vote. Cumulative voting is not permitted. Other than with respect to the election of directors, an abstention has the effect of a vote against a matter to be presented at the Meeting. Votes cast at the Meeting will be counted by the inspector(s) of election.

If you hold shares in “street name,” you will receive instructions from your brokers or other nominees describing how to vote your shares. If you do not instruct your brokers or nominees how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the New York Stock Exchange (“NYSE”). There are also non-discretionary matters for which brokers do not have discretionary authority to vote if they do not receive timely instructions from you. When a broker or nominee does not have discretion to vote on a particular matter, or you have not given timely instructions on how the broker or nominee should vote your shares or the broker or nominee indicates that it does not have the authority to vote your shares on its proxy, a “broker non-vote” results. Although any broker non-vote would be counted as present at the Meeting for purposes of determining a quorum, it would be treated as not entitled to

1

vote with respect to non-discretionary matters. For Items 3 and 6 to be voted on at the Meeting, brokers or nominees will have discretionary authority in the absence of timely instructions from you. Items 1, 2, 4 and 5 are non-discretionary matters, and brokers will not have discretionary authority for Items 1, 2, 4 and 5 in the absence of timely instructions from you.

The Board of Directors is soliciting your proxy to provide you with an opportunity to vote on all matters to come before the Meeting, regardless of whether you attend in person. If you vote by proxy via the Internet or by telephone in accordance with the instructions found on the Notice of Internet Availability of Proxy Materials, your shares will be voted as you specify. Additionally, your shares will be voted as you specify if you request printed copies of proxy materials by mail and vote by proxy by filling out the proxy card. If you submit a proxy but do not specify how you would like your shares voted, your shares will be voted in accordance with the recommendations of the Board, as set forth below. After submitting a proxy, you may subsequently revoke your proxy by submitting a revised proxy or a written revocation at any time before your original proxy is voted. You may also attend the Meeting in person and vote in person by ballot, which would cancel any proxy you gave prior to the Meeting.

The Board of Directors urges you to vote, and solicits your proxy, as follows:

(1) FOR the election of six (6) nominees to the Company’s Board of Directors, Messrs. Hanna, Buckner, Griffiths, McCarthy, Pully and Wallace, to serve until the Annual Meeting of Stockholders in the year 2012 and until their respective successors are duly elected and qualified;

(2) FOR the approval of an amendment to the Company’s 2009 Long Term Incentive Plan to increase the number of shares of Common Stock available for award under the plan from 1,237,000 to 2,474,000 shares;

(3) FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants for the year ending December 31, 2011;

(4) FOR the approval, on a non-binding advisory basis, of the compensation of the Named Executive Officers, as disclosed in the Company’s proxy statement for the 2011 Annual Meeting;

(5) To hold a non-binding advisory vote on executive compensation EVERY YEAR;

(6) FOR the adjournment or postponement of the Meeting, as necessary; and

(7) At the discretion of the proxies designated through the Internet, by telephone or on the proxy card, on any other matter that may properly come before the 2011 Annual Meeting.

Proxy Solicitation

Your proxy is being solicited by and on behalf of the Board of Directors of the Company. The expense of preparing, furnishing through the Internet, printing and mailing proxy solicitation materials will be borne by the Company. In addition to solicitation of proxies by Internet and mail, certain directors, officers, representatives and employees of the Company may solicit proxies by telephone and personal interview. Such individuals will not receive additional compensation from the Company for solicitation of proxies, but may be reimbursed by the Company for reasonable out-of-pocket expenses in connection with such solicitation. Banks, brokers and other custodians, nominees and fiduciaries also will be reimbursed by the Company, as necessary, for their reasonable expenses for sending proxy solicitation materials to the beneficial owners of Common Stock.

Assistance

If you need assistance with completing your proxy card or voting via the Internet or telephone or have questions regarding the 2011 Annual Meeting, please contact John Peper, Executive Vice President, General Counsel and Corporate Secretary of the Company, at 201 St. Charles Avenue, Suite 3400, New Orleans, Louisiana 70170 or at (504) 569-1875.

2

MATTERS TO BE PRESENTED TO THE STOCKHOLDERS

AT THE 2011 ANNUAL MEETING

Item 1 —Election of Directors

At the 2011 Annual Meeting, six (6) directors are to be elected, each of whom will serve until the Annual Meeting of Stockholders in the year 2012 and until their respective successors are duly elected and qualified. The persons named as proxies on the proxy card intend to vote FOR the election of each of the six (6) nominees listed below, unless otherwise directed.

Currently, the Board is composed of the following six directors: Gary C. Hanna, Charles O. Buckner, Scott A. Griffiths, Marc McCarthy, Steven J. Pully and John F. Schwarz. Mr. Schwarz will not stand for re-election at the 2011 Annual Meeting, and the Nominating & Governance Committee has recommended to the Board to nominate Mr. William F. Wallace for election as a director of the Company.

The Board has nominated, and the proxies will vote to elect, the following individuals as members of the Board of Directors to serve for a period of one (1) year and until their respective successors are duly elected and qualified: Gary C. Hanna, Charles O. Buckner, Scott A. Griffiths, Marc McCarthy, Steven J. Pully and William F. Wallace. Each nominee has consented to be nominated and, if elected, to serve.

To be elected, each nominee for election as a director must receive the affirmative vote of a plurality of the votes of the shares of Common Stock cast at the 2011 Annual Meeting. This means that director nominees with the most votes are elected. Votes may be cast in favor of or withheld from the election of each nominee. Votes that are withheld from a director’s election will be counted toward a quorum but will not affect the outcome of the vote on this Item. Because a plurality of the vote is required to elect a director, broker non-votes will not be taken into account in determining the outcome of this Item 1.

The Board of Directors recommends that you vote “FOR” the election of the six (6) nominees: Messrs. Hanna, Buckner, Griffiths, McCarthy, Pully and Wallace.

Information About the Nominees

Set forth below are the names, ages, positions held and terms of office, as applicable, for the nominees that the Board has nominated to serve until the 2012 Annual Meeting of Stockholders. With the exception of Mr. Wallace, each of the nominees currently serves as a director of the Company.

| | | | | | | | |

Name | | Age | | | Position Held | | Term of Office |

Gary C. Hanna | | | 53 | | | Chief Executive Officer and Director | | June 2010 – Current |

Charles O. Buckner | | | 66 | | | Director | | September 2009 – Current |

Scott A. Griffiths | | | 56 | | | Director | | September 2009 – Current |

Marc McCarthy | | | 40 | | | Chairman of the Board and Director | | September 2009 – Current |

Steven J. Pully | | | 51 | | | Director | | April 2008 – Current |

William F. Wallace | | | 71 | | | n/a | | n/a |

Gary C. Hanna, age 53, joined the Company in September 2009 as Chief Executive Officer. He was elected as a director in June 2010. He has nearly 30 years of executive experience in the energy sector. From 2008 to 2009, Mr. Hanna served as President and Chief Executive Officer for Admiral Energy Services, a start-up company focused on the development of offshore energy services. From 1999 to 2007, Mr. Hanna served in various capacities at an international oil and gas services production company, Tetra Technologies, Inc., including serving as Senior Vice President from 2002 to 2007. Prior to 2002, Mr. Hanna served as President and Chief Executive Officer for Tetra’s affiliate, Maritech Resources, Inc., and as President of Tetra Applied Technologies, Inc., another Tetra affiliate. From 1996 to 1998, Mr. Hanna served as the President and Chief Executive Officer for Gulfport Energy Corporation, a public oil and gas exploration company. From 1995 to

3

1998, he also served as the Chief Operations Officer for DLB Oil & Gas, Inc., a mid-continent exploration public company. From 1982 to 1995, Mr. Hanna served as President and Chief Executive Officer of Hanna Oil Properties, Inc., a company engaged in the development of mid-continent oil and gas prospects. On April 6, 2009, Mr. Hanna and an ad hoc committee of the Company’s senior unsecured noteholders (the “Ad Hoc Committee”) entered into a consulting agreement whereby Mr. Hanna was retained to provide certain advisory services to the Ad Hoc Committee. On June 7, 2009, Mr. Hanna and the Ad Hoc Committee’s successor-in-interest, the Official Committee of Unsecured Noteholders (the “Noteholders Committee”), as the Bankruptcy Court’s appointed representative of the Company’s unsecured noteholders, entered into an amendment to Mr. Hanna’s consulting agreement (the “Amendment”) in which Mr. Hanna and the Noteholders Committee agreed to use a non-binding term sheet attached to the Amendment as the basis for the preparation of an employment agreement (the “Employment Agreement”) pursuant to which the Company would hire Mr. Hanna as Chief Executive Officer of the Company upon the Company’s exit from its Chapter 11 Reorganization. According to the terms of the Amendment, the Company’s hiring of Mr. Hanna as Chief Executive Officer of the Company was subject to the Bankruptcy Court’s approval of the Plan of Reorganization and the execution of a definitive Employment Agreement between the Company and Mr. Hanna. Mr. Hanna and the Company executed the Employment Agreement on October 1, 2009.

Charles O. Buckner, age 66, has been a director since September 2009. Mr. Buckner, a private investor, retired from the public accounting firm of Ernst & Young LLP in 2002 after 35 years of service in a variety of client service and administrative roles, including chairmanship of Ernst & Young’s United States energy practice. Mr. Buckner is a director of Patterson-UTI Energy, Inc. and Global Industries, Ltd. Mr. Buckner also served on the board of directors of Gateway Energy Corporation from June 2008 to September 2010; Whittier Energy Inc. from June 2003 to December 2007; and Horizon Offshore Inc. from December 2003 to December 2007. Mr. Buckner is a Certified Public Accountant and holds a B.B.A. in Accounting from the University of Texas and an M.B.A. from the University of Houston.

Scott A. Griffiths, age 56, has been a director since September 2009. Mr. Griffiths has almost 30 years of experience in the energy sector. Mr. Griffiths served as Senior Vice President and Chief Operating Officer of Hydro Gulf of Mexico, L.L.C. from December 2005 to December 2006. Subsequent to leaving Hydro Gulf of Mexico, Mr. Griffiths has been involved in certain energy investments for his own account. From 2003 through December 2005, Mr. Griffiths served as Executive Vice President and Chief Operating Officer of Spinnaker Exploration Company. From 2002 to 2003, Mr. Griffiths served as Senior Vice President, Worldwide Exploration for Ocean Energy, Inc. Mr. Griffiths joined Ocean following the 1999 merger of Ocean and Seagull Energy Corporation, where he began working in 1997. At Seagull, Mr. Griffiths served as Vice President, Domestic Exploration. From 1984 to 1997, Mr. Griffiths was with Global Natural Resources, Inc. where he served in various capacities, including Vice President for Domestic Exploration, before Global merged with Seagull in 1997. Mr. Griffiths was also an Exploration Geologist with the Shell Oil Company from 1981 to 1984. Mr. Griffiths is a director of Copano Energy, LLC. He holds a B.S. in Geology from the University of New Mexico, an M.A. in Geology from Indiana University and completed the Advanced Management Program at Harvard Business School.

Marc McCarthy, age 40, has been a director since September 2009. Mr. McCarthy is a Vice President and Senior Analyst at Wexford Capital LP (“Wexford Capital”), having joined them in June 2008. Previously, Mr. McCarthy worked in the Global Equity Research Department of Bear Stearns & Co., Inc. and was responsible for coverage of the international oil and gas sector. Mr. McCarthy joined Bear Stearns & Co. in 1997 and held various positions of increasing responsibility until his departure in June 2008, at which time he was a Senior Managing Director. Prior to 1997, he worked in equity research at Prudential Securities, also following oil and gas. Mr. McCarthy is a Chartered Financial Analyst and received a B.A. in Economics from Tufts University.

Steven J. Pully, age 51, has been a director since April 2008. Mr. Pully has served since July 2008 as the General Counsel of Carlson Capital, L.P. (“Carlson Capital”), an asset management firm. From October 2007

4

until April 2008, Mr. Pully was a consultant, working primarily in the asset management industry. From December 2001 to October 2007, Mr. Pully worked for Newcastle Capital Management, L.P., an investment partnership, where he served as President from January 2003 through October 2007. He also served as Chief Executive Officer of New Century Equity Holdings Corp. from June 2004 through October 2007. Prior to joining Newcastle Capital Management, from 2000 to 2001, Mr. Pully served as a managing director in the investment banking department of Banc of America Securities, Inc. From 1997 to 2000, he was a member of the investment banking department of Bear Stearns & Co., Inc., where he became a Senior Managing Director in 1999. Mr. Pully also serves as a director of Ember Resources, Inc. Mr. Pully is licensed as an attorney and Certified Public Accountant in the state of Texas and is also a Chartered Financial Analyst. He holds a B.S. with honors in Accounting from Georgetown University and a J.D. degree from the University of Texas.

William F. Wallace,age 71, is a nominee for director of the Company and does not currently serve on the Board. Since 2008, Mr. Wallace has been a director of Western Zagros Resources Ltd., where he serves on the Health, Safety, Environment and Security Committee and Governance Committee. Since 2007, Mr. Wallace has been a director, as well as advisor to the Chairman and CEO, of Taylor Energy Company LLC. From 2004 through 2006, Mr. Wallace served as a director of Markwest Hydrocarbon, Inc. and the Kerr-McGee Corporation; he was a member of both the Audit Committee and the Compensation Committee of each board. From 1999 until its merger with the Kerr-McGee Corporation in 2004, Mr. Wallace served on the board of Westport Resources Corp., where he chaired both the Governance and Compensation Committees and was a member of the Audit Committee. Mr. Wallace has 47 years of experience in the oil and gas industry and has served on numerous boards of directors in addition to those mentioned above, including as a member of the board of directors of each of Khanty Mansiysk Oil Corporation, Input/Output, Inc., Vessels Energy Inc., Forcenergy Inc. and Barrett Resources Corporation/Plains Petroleum Company. Mr. Wallace has also worked as a consultant to The Beacon Group, an energy venture capital fund, where he advised on identifying energy investment opportunities. Prior to 1994, Mr. Wallace spent 23 years with Texaco Inc., an integrated oil and gas company, including six years as Vice President of Exploration for Texaco USA and as Regional Vice President of Texaco’s Eastern Region prior to his retirement. Mr. Wallace holds a B.A. in Geology from Middlebury College and a M.S. in Geology from Stanford University and completed the Advanced Management Program at the University of Illinois.

Item 2 —Amendment of 2009 Long Term Incentive Plan to Increase Number of Shares Available Under the Plan

The Board of Directors, subject to the approval of our stockholders as required under the NYSE’s rules, has approved an amendment that would increase the number of shares of Common Stock that may be issued pursuant to any and all awards under the 2009 Long Term Incentive Plan by 1,237,000 shares to a total of 2,474,000 shares. Our stockholders are being asked to approve this amendment to the 2009 Long Term Incentive Plan. As of December 31, 2010, the Company had granted employees and non-employee directors a total of 606,263 shares under the 2009 Long Term Incentive Plan and there were 630,737 shares available in the plan for grants. Approval of the amendment would allow the Company to continue to grant incentive awards and reward opportunities that are tied to performance of the Common Stock.

The proposed amendment to the 2009 Long Term Incentive Plan is attached hereto asAppendix A, and the 2009 Long Term Incentive Plan, prior to giving effect to this proposed amendment, is attached hereto asAppendix B.

Summary of 2009 Long Term Incentive Plan

The following summary provides a general description of the material features of the 2009 Long Term Incentive Plan (the “2009 LTIP”), and is qualified in its entirety by reference to the full text of the plan attached asAppendix B.

5

The purpose of the 2009 LTIP is to provide a means to enhance our profitable growth by attracting and retaining directors, officers and other key employees through affording such individuals a means to acquire and maintain stock ownership or awards the value of which is tied to the performance of our Common Stock. All directors, officers and other key employees providing services to the Company are potentially eligible to participate in the 2009 LTIP. There are approximately six directors, eight officers and 26 key employees eligible to participate in the 2009 LTIP. The 2009 LTIP provides for grants of (i) incentive stock options qualified as such under income tax rules and regulations, (ii) stock options that do not qualify as incentive stock options, (iii) restricted stock awards, (iv) restricted stock units, (v) stock appreciation rights, (vi) bonus stock and awards in lieu of Company obligations, (vii) dividend equivalents in connection with other awards, (viii) deferred shares, (ix) performance units or performance shares, or (x) any combination of such awards (collectively referred to as “Awards”).

Awards under the 2009 LTIP are made by the Board at the recommendation of the Compensation Committee, in the case of Mr. Hanna, and by the Compensation Committee, at the recommendation of Mr. Hanna, in the case of other executive officers. Awards typically fall into two categories: annual awards, which are made in January, and new hire and promotion awards, which are made on the date of hire or promotion. The Board or the Compensation Committee may make grants at other times, in its discretion, in connection with employee retention or otherwise. No grants may be made under the 2009 LTIP after September 21, 2019.

Before giving effect to the proposed amendment, the maximum aggregate number of shares of our Common Stock that may be issued pursuant to any and all Awards under the 2009 LTIP is currently limited to 1,237,000 shares, subject to adjustment due to recapitalization or reorganization, or related to forfeitures or the expiration of Awards, as provided under the 2009 LTIP. As of December 31, 2010, 630,737 shares remained available for future grants.

Without stockholder or participant approval, the Board of Directors may amend, alter, suspend, discontinue or terminate the 2009 LTIP or the Committee’s authority to grant Awards under the 2009 LTIP, except that any amendment or alteration of the 2009 LTIP, including any increase in any share limitation, shall be subject to the approval of the stockholders not later than the next annual meeting if stockholder approval is required by any state or federal law or regulation or the rules of any stock exchange or automated quotation system on which Common Stock may then be listed or quoted.

The 2009 LTIP provides for the grant of stock options to purchase Common Stock for which the exercise price, set at the time of the grant, will not be less than the fair market value per share at the date of grant. Our outstanding stock options generally have a term of 10 years and vest ratably on an annual basis over a three-year period from the date of grant, with the exception of the stock option grant to our chief executive officer described in “Prior Issuances of Awards under the 2009 Long Term Incentive Plan,” below.

Transfers of Awards under our 2009 LTIP are limited to those by will or by the laws of descent and distribution, or further restrictions specified by the Compensation Committee, and option rights are exercisable only during the participant’s lifetime by the participant or the participant’s guardian or legal representative.

U.S. Federal Income Tax Consequences of the 2009 LTIP

The following is a summary of the United States federal income tax consequences that generally will arise with respect to awards under the 2009 LTIP and with respect to the Common Shares acquired under the plan. This summary is based on the federal tax laws in effect as of the date of this proxy statement. Changes to these laws could alter the tax consequences described below (possibly retroactively). This summary is not intended to be a complete discussion of all federal income tax consequences associated with the 2009 LTIP. Accordingly, for precise advice as to any specific transaction or set of circumstances, participants should consult their own tax and legal advisors. Participants should also consult their own tax and legal advisors regarding the application of any state, local and foreign taxes and any U.S. federal gift, estate and inheritance taxes.

6

Incentive Stock Options. The incentive stock options under the 2009 LTIP are intended to constitute “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code of 1986 (the “Code”). Incentive stock options are subject to special federal income tax treatment. No federal income tax is imposed on the optionee upon the grant or the exercise of an incentive stock option if the optionee does not dispose of the shares acquired pursuant to the exercise within the two-year period beginning on the date the option was granted or within the one-year period beginning on the date the option was exercised (collectively, the “holding period”). In such event, the Company would not be entitled to any deduction for federal income tax purposes in connection with the grant or exercise of the option or the disposition of the shares so acquired. With respect to an incentive stock option, the difference between the fair market value of the stock on the date of exercise and the exercise price must be included in the optionee’s alternative minimum taxable income. However, if the optionee exercises an incentive stock option and disposes of the shares received in the same year and the amount realized is less than the fair market value of the shares on the date of exercise, the amount included in alternative minimum taxable income will not exceed the amount realized over the adjusted basis of the shares.

Upon disposition of the shares received upon exercise of an incentive stock option after the holding period, any appreciation of the shares above the exercise price should constitute capital gain. If an optionee disposes of shares acquired pursuant to his or her exercise of an incentive stock option prior to the end of the holding period, the optionee will be treated as having received, at the time of disposition, compensation taxable as ordinary income. In such event, the Company may claim a deduction for compensation paid at the same time and in the same amount as compensation is treated as received by the optionee. The amount treated as compensation is the excess of the fair market value of the shares at the time of exercise (or in the case of a sale in which a loss would be recognized, the amount realized on the sale if less) over the exercise price; any amount realized in excess of the fair market value of the shares at the time of exercise would be treated as short-term or long-term capital gain, depending on the holding period of the shares.

Non-Statutory Stock Options and Stock Appreciation Rights. As a general rule, no federal income tax is imposed on the optionee upon the grant of a non-statutory stock option such as those under the 2009 LTIP (whether or not including a stock appreciation right) and the Company is not entitled to a tax deduction by reason of such a grant. Generally, upon the exercise of a non-statutory stock option, the optionee will be treated as receiving compensation taxable as ordinary income in the year of exercise in an amount equal to the excess of the fair market value of the shares on the date of exercise over the option price paid for such shares. In the case of the exercise of a stock appreciation right, the optionee will be treated as receiving compensation taxable as ordinary income in the year of exercise in an amount equal to the cash received plus the fair market value of the shares distributed to the optionee. Upon the exercise of a non-statutory stock option or a stock appreciation right, the Company may claim a deduction for compensation paid at the same time and in the same amount as compensation income is recognized by the optionee assuming any federal income tax reporting requirements are satisfied.

Upon a subsequent disposition of the shares received upon exercise of a non-statutory stock option or a stock appreciation right, any appreciation after the date of exercise should qualify as capital gain. If the shares received upon the exercise of an option or a stock appreciation right are transferred to the optionee subject to certain restrictions, then the taxable income realized by the optionee, unless the optionee elects otherwise, and the Company’s tax deduction (assuming any federal income tax reporting requirements are satisfied) should be deferred and should be measured at the fair market value of the shares at the time the restrictions lapse. The restrictions imposed on officers, directors and 10% stockholders by Section 16(b) of the Exchange Act is such a restriction during the period prescribed thereby if other shares have been purchased by such an individual within six months of the exercise of a non-statutory stock option or stock appreciation right.

Restricted Stock Awards. The recipient of a restricted stock award will not realize taxable income at the time of grant, and the Company will not be entitled to a deduction at that time, assuming that the restrictions constitute a substantial risk of forfeiture for federal income tax purposes. When the risk of forfeiture with respect to the stock subject to the award lapses, the holder will realize ordinary income in an amount equal to the fair

7

market value of the shares of common stock at such time, and the Company will be entitled to a corresponding deduction. All dividends and distributions (or the cash equivalent thereof) with respect to a restricted stock award paid to the holder before the risk of forfeiture lapses will also be compensation income to the holder when paid and deductible as such by the Company. Notwithstanding the foregoing, the holder of a restricted stock award may elect under Section 83(b) of the Code to be taxed at the time of grant of the restricted stock award based on the fair market value of the shares of common stock on the date of the award, in which case (a) the Company will be entitled to a deduction at the same time and in the same amount, (b) dividends paid to the recipient during the period the forfeiture restrictions apply will be taxable as dividends and will not be deductible by the Company and (c) there will be no further federal income tax consequences when the risk of forfeiture lapses. The Section 83(b) election must be made not later than 30 days after the grant of the restricted stock award and is irrevocable.

Restricted Stock Units. The tax consequences of restricted stock units are similar to the tax consequences of restricted stock, except that no Section 83(b) election may be made with respect to restricted stock units. A participant will not have taxable income at the time of grant of a restricted stock unit award, but rather, will generally recognize ordinary compensation income at the time he receives cash or shares of Common Stock in settlement of the restricted stock units in an amount equal to the cash or the fair market value of the shares of Common Stock received.

Stock Appreciation Rights.A participant will not recognize any income upon the grant of a stock appreciation right. A participant will have compensation income upon the exercise of a stock appreciation right equal to the appreciation in the value of the shares of Common Stock underlying the stock appreciation right. When the shares of Common Stock distributed in settlement of the stock appreciation right are sold, the participant will have capital gain or loss equal to the sales proceeds less the value of the shares of Common Stock on the exercise date. Any capital gain or loss will be long-term if the participant held the shares of Common Stock for more than one year.

Withholding and Dividends.A participant will be subject to withholding for federal, and generally for state and local, income taxes at the time he recognizes income under the rules described above with respect to shares of Common Stock or cash received. Dividends that are received by a participant prior to the time that the shares of Common Stock are taxed to the participant under the rules described above are taxed as additional compensation income, not dividend income.

Additional Considerations in Regard to Changes in Control.Where payments to certain employees that are contingent on a change in control exceed limits specified in the golden parachute payment rules under Section 280G of the Code, such employees generally are liable for a 20% excise tax on, and the Company or other entity making the payment generally is not entitled to any deduction for, a specified portion of such payments. The Compensation Committee may make awards under the 2009 LTIP as to which the vesting thereof is accelerated by a change in control of the Company. Such accelerated vesting would be relevant in determining whether the excise tax and deduction disallowance rules would be triggered with respect to certain employees of the Company and its subsidiaries.

Section 162(m) of the Code. Section 162(m) of the Code precludes a public corporation from taking a deduction for compensation in excess of $1 million paid in a taxable year to its principal executive officer and to each of its four other most highly compensated executive officers. However, compensation that qualifies under Section 162(m) of the Code as “performance based” is specifically exempt from the deduction limit. Based on Section 162(m) of the Code and the regulations issued thereunder, the Company’s ability to deduct compensation income generated in connection with performance units or performance stock or the exercise of stock options and stock appreciation rights granted by the Compensation Committee under the 2009 LTIP should not be limited by Section 162(m) of the Code. The 2009 LTIP has been designed to provide flexibility with respect to whether restricted stock awards granted by the Compensation Committee will qualify as performance-based compensation under Section 162(m) of the Code and, therefore, be exempt from the deduction limit. Assuming

8

no election is made under Section 83(b) of the Code, if the lapse of the forfeiture restrictions relating to a restricted stock award granted by the Compensation Committee is based solely upon the satisfaction of one of the performance criteria set forth in the 2009 LTIP, then the Company believes that the compensation expense deduction relating to such an award should not be limited by Section 162(m) of the Code if the restricted stock becomes vested. However, compensation expense deductions relating to restricted stock awards granted by the Compensation Committee will be subject to the Section 162(m) deduction limitation if the restricted stock becomes vested based upon any other criteria set forth in such award (such as the occurrence of a change of control or vesting based upon continued service with the Company). Compensation income generated in connection with bonus stock, awards in lieu of Company obligations, dividend equivalents in connection with other awards and deferred shares granted under the 2009 LTIP will generally not qualify as performance-based compensation and, accordingly, the Company’s deduction for such compensation may be limited by Section 162(m) of the Code. For fiscal year 2010, none of the Company’s executive officers received compensation in excess of $1 million.

The 2009 LTIP is not qualified under Section 401(a) of the Code.

The comments set forth in the above paragraphs are only a summary of certain of the United States federal income tax consequences relating to the 2009 LTIP. No consideration has been given to the effects of state, local, or other tax laws on the 2009 LTIP or on award recipients.

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides information as of December 31, 2010 with respect to compensation plans under which our equity securities are authorized for issuance.

| | | | | | | | | | | | |

| | | Number of Securities to be

Issued upon Exercise of

Outstanding Options,

Warrants and Rights(1) | | | Weighted Average

Exercise Price of

Outstanding Options

Warrants and Rights(2) | | | Number of Securities

Remaining Available for

Future Issuance Under Equity

Compensation Plans | |

Equity compensation plans approved by stockholders | | | — | | | | — | | | | — | |

Equity compensation plans not approved by stockholders (3) | | | 509,986 | | | $ | 10.49 | | | | 630,737 | |

| | | | | | | | | | | | |

Total | | | 509,986 | | | $ | 10.49 | | | | 630,737 | |

| (1) | Comprised of 488,616 shares subject to issuance upon the exercise of options and 21,370 shares which will vest upon the lapsing of restrictions associated with restricted share awards. Although the restricted shares are issued and outstanding as a matter of corporate law, they are subject to forfeiture provisions, which provisions will vest in accordance with the terms of the 2009 LTIP. If any of the restricted shares are forfeited, they can be reissued pursuant to options, restricted share awards or other stock-based awards permitted under the 2009 LTIP. |

| (2) | Restricted share awards do not have an exercise price; therefore, this only reflects the weighted-average exercise price of options. |

| (3) | The form of the 2009 LTIP was filed with the Plan Supplement and approved by the Bankruptcy Court prior to our emergence from Chapter 11 reorganization. Accordingly, no stockholder approval was required, and none was sought or obtained. |

Prior Issuances of Awards under the 2009 Long Term Incentive Plan

Pursuant to an employment agreement and the 2009 LTIP, on September 30, 2009, our new chief executive officer, Mr. Hanna, was granted an option to purchase 68,116 shares of successor Company common stock, which was memorialized in an option award agreement dated as of October 1, 2009 (the “Option Agreement”). The terms of the Option Agreement provide for an exercise price equal to $10.00 per share. The closing price of

9

our Common Stock on the NYSE on September 30, 2009 was $7.46 per share. The option vests ratably on a monthly basis over a 36-month period from the date of grant; provided, however, that the vesting for the first six months of the vesting period (the “Initial Period”) is deferred until the end of the Initial Period and any remaining unvested portion vests ratably on a monthly basis over the remainder of the 36-month vesting period, subject to the executive remaining continuously employed. Vested stock options under the Option Agreement expire 30 months following the applicable vesting date of such stock options. Upon a change in control as defined in the 2009 LTIP, all remaining unvested stock options under the Option Agreement automatically vest and remain exercisable for a period of not less than 30 months following the change in control.

Pursuant to the 2009 LTIP, on the date of the 2010 Annual Meeting of Stockholders, the five members of the Board of Directors were awarded, in the aggregate, a total of 42,735 shares of restricted stock, of which one-half vested immediately and one-half will vest on the day immediately preceding the date of the 2011 Annual Meeting of Stockholders. In connection with the appointment of the five members of the Board of Directors of the Successor Company and pursuant to the 2009 LTIP, the five directors were awarded, in the aggregate, a total of 43,460 shares of restricted stock, of which one-half vested immediately and one-half vested on the day immediately preceding the date of the 2010 Annual Meeting of Stockholders. Pursuant to elections applicable to the 2010 award made by two directors and applicable to the 2009 award made by one director, the receipt of such stock awards are deferred until such directors cease to serve on our Board of Directors.

Other than the option awards disclosed in the first two paragraphs under the heading “Prior Issuances of Awards under the 2009 Long Term Incentive Plan” above, options awarded to Messrs. Hanna, Peper, Williams and Cedro and Ms. Thom that are disclosed in the “Grants of Plan-Based Awards for the Year Ended December 31, 2010” table set forth on page 27 and “Summary Compensation Table for the Year Ended December 31, 2010” table set forth on page 26 of this proxy statement, we have not, since the inception of the 2009 Long Term Incentive Plan, granted any options thereunder to any (i) Named Executive Officer, (ii) current executive officer, (iii) current director who is not an executive officer, (iv) nominee for election as a director, (v) other employee or individual, or (vi) associate of any of the foregoing individuals. On March 30, 2011, the closing price of our Common Stock was $18.02 per share. The exercise price of the outstanding options awarded to Mr. Hanna under the 2009 LTIP is either $10.00 per share or $13.59 per share and the exercise price of the outstanding options awarded to Messrs. Peper, Williams and Cedro and Ms. Thom under the 2009 LTIP is $8.90 per share.

Pursuant to our Amended and Restated Bylaws and NYSE rules, the amendment to the Company’s 2009 LTIP to increase the number of shares available for issuance under the plan will become effective if there is an affirmative vote of the holders of a majority of the outstanding voting power of all classes of stock that are entitled to vote thereon, present in person, represented by proxy or by remote communication and entitled to vote at the Meeting and that have actually been voted. In addition, NYSE rules require that the total votes cast on this Item 2 must represent greater than 50% of all the shares entitled to vote on this Item 2. That is, the total number of votes cast “for” and “against” this Item 2 must exceed 50% of the outstanding shares of Common Stock if there is an affirmative vote of the holders of a majority of the votes of the shares of Common Stock cast on this Item 2 at the Meeting. Abstentions and broker non-votes will not be counted as votes cast and, accordingly, will not affect the outcome of these votes.

The Board of Directors recommends a vote FOR this Item 2 to approve the amendment to the Company’s 2009 Long Term Incentive Plan to increase the number of shares available for issuance under the plan, as described above.

Item 3 —Ratification of Appointment of Independent Registered Public Accountants

The Audit Committee of the Board of Directors is required by law and applicable rules of the NYSE to be directly responsible for the appointment, compensation and retention of the Company’s independent registered public accountants. The Audit Committee has appointed PricewaterhouseCoopers LLP as the independent

10

registered public accountants for the year ending December 31, 2011. While stockholder ratification is not required by the Company’s Amended and Restated Bylaws or otherwise, the Board of Directors is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as part of good corporate governance practices. If the stockholders fail to ratify the selection, the Audit Committee may, but is not required to, reconsider whether to retain PricewaterhouseCoopers LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent registered public accountants at any time during the year if it determines that such a change would be in the best interest of the Company and its stockholders.

Pursuant to our Amended and Restated Bylaws, the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants will be ratified if there is an affirmative vote of the holders of a majority of the outstanding voting power of all classes of stock that are entitled to vote thereon, present in person, represented by proxy or by remote communication and entitled to vote at the Meeting and that have actually been voted.

Representatives of PricewaterhouseCoopers LLP are expected to be present at the 2011 Annual Meeting, with the opportunity to make a statement should they choose to do so, and to be available to respond to questions, as appropriate.

The Board of Directors recommends a vote FOR the proposal to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accountants to audit the Company’s consolidated financial statements for the year ending December 31, 2011.

Item 4 — Advisory Vote on Executive Compensation

The Board recognizes that executive compensation is an important matter for our stockholders. As described in detail in the “Compensation Discussion and Analysis” (“CD&A”) section of this proxy statement, the Compensation Committee implements our executive compensation philosophy, which has been and continues to be to reward performance with competitive compensation in order to attract and retain highly qualified executives and to motivate them to maximize stockholder return. The Company’s executive compensation program is designed to provide overall competitive fixed and incentive-based pay levels that vary based on the achievement of company-wide performance objectives and individual performance. In accordance with SEC rules adopted in accordance with the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), our stockholders are being asked to approve an advisory resolution on the compensation of the Named Executive Officers, as reported in this proxy statement. This proposal, commonly known as a “say on pay” proposal, gives you the opportunity to endorse or not endorse our fiscal year 2010 executive compensation program and policies for the Named Executive Officers.

Accordingly, you may vote on the following resolution at the 2011 Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on a non-binding advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2011 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and related narrative discussion.”

As you consider this Item 4, we urge you to read the CD&A section of this proxy statement for additional details on executive compensation, including the more detailed information about our compensation philosophy and objectives and the past compensation of the Named Executive Officers, and to review the tabular disclosures regarding compensation of our Named Executive Officers together with the accompanying narrative disclosures in the “Executive Compensation” section of this proxy statement.

This vote is not intended to address any specific item of compensation, but rather our overall compensation policies and procedures relating to the Named Executive Officers. Accordingly, your vote will not directly affect

11

or otherwise limit any existing compensation or award arrangement of any of the Named Executive Officers. Because your vote is advisory, it will not be binding upon the Board of Directors. The Board of Directors and the Compensation Committee do, however, value the opinions of our stockholders, and will carefully consider the outcome of the vote when making future compensation decisions for executive officers. In particular, to the extent there is any significant vote against the compensation of our Named Executive Officers as disclosed in this proxy statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

Pursuant to our Amended and Restated Bylaws, the resolution described above will be approved if there is an affirmative vote of the holders of a majority of the outstanding voting power of all classes of stock that are entitled to vote thereon, present in person, represented by proxy or by remote communication and entitled to vote at the Meeting and that have actually been voted.

The Board of Directors recommends a vote FOR the approval, on a non-binding advisory basis, of the compensation of the Named Executive Officers.

Item 5 — Advisory Vote on the Frequency of an Advisory Vote on Executive Compensation

As described in Item 4, our stockholders are being asked to vote to approve the compensation of the Named Executive Officers, as reported in this proxy statement pursuant to the SEC’s compensation disclosure rules. In accordance with the Dodd-Frank Act, Item 5 gives you the opportunity to cast a non-binding vote on how often the Company should include an advisory vote on executive compensation in its proxy materials for future annual or other meetings for which the Company must include executive compensation information. Stockholders may vote to have the advisory vote on executive compensation on one of the following three schedules: every year, every two years, or every three years. Stockholders may also abstain from voting.

Although the Board of Directors understands that there are different views as to what is an appropriate frequency for advisory votes on executive compensation, it believes that an advisory vote on executive compensation that occurs every year would be best for the Company. Setting a one-year period for holding this stockholder vote will enhance stockholder communication by providing a clear, simple means for us to obtain information on stockholder opinions about our executive compensation philosophy. The Board believes that receiving annual feedback on the Company’s executive compensation program will assist it in making future executive compensation decisions.

Pursuant to our Amended and Restated Bylaws, the advisory vote on the frequency of the non-binding advisory vote on executive compensation will be determined by the affirmative vote of the holders of a majority of the outstanding voting power of all classes of stock that are entitled to vote thereon, present in person, represented by proxy or by remote communication and entitled to vote at the Meeting and that have actually been voted.

The Board of Directors recommends that stockholders vote to hold the non-binding advisory vote on executive compensation EVERY YEAR.

Item 6 — Adjournment or Postponement of the 2011 Annual Meeting, as Necessary

An adjournment or postponement of the 2011 Annual Meeting may be necessary for the Company to conduct the business of the Company that is before the Meeting or may properly come before the Meeting.

Pursuant to our Amended and Restated Bylaws, the adjournment or postponement of the 2011 Annual Meeting, as necessary, will be approved if there is an affirmative vote of the holders of a majority of the outstanding voting power of all classes of stock that are entitled to vote thereon, present in person, represented by proxy or by remote communication and entitled to vote at the Meeting and that have actually been voted.

The Board of Directors recommends a vote FOR the proposal to adjourn or postpone the 2011 Annual Meeting, as necessary.

12

OTHER MATTERS FOR 2011 ANNUAL MEETING

Management of the Company is not aware of any other matters that are to be presented for action at the 2011 Annual Meeting. However, if any other matters properly come before the 2011 Annual Meeting, it is the intention of the persons named in the accompanying proxy card to vote in accordance with their judgment on such matters.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of Common Stock as of March 1, 2011 by (1) each of the Company’s directors and nominees for election as a director, (2) each of the executive officers named in the Summary Compensation Table (the “Named Executive Officers”), (3) all current directors and executive officers as a group and (4) each person known by the Company to own beneficially more than 5% of the outstanding shares of the Common Stock. Except as otherwise noted below, the Company is not aware of any agreements among its stockholders that relate to voting or investment of shares of the Common Stock.

| | | | | | | | |

| | | Common Stock Beneficially Owned(1) | |

Name and Address of Beneficial Owner | | Number of Shares | | | Percent of Class(2) | |

Directors | | | | | | | | |

Charles O. Buckner (3) | | | 17,239 | | | | * | |

Scott A. Griffiths (4) | | | 17,239 | | | | * | |

Marc McCarthy (5) | | | 7,079,093 | | | | 17.6 | % |

Steven J. Pully (6) | | | 4,055,899 | | | | 10.1 | % |

John F. Schwarz (7) | | | 19,890 | | | | * | |

William F. Wallace | | | 0 | | | | 0 | % |

| | |

Named Executive Officers | | | | | | | | |

Gary C. Hanna (8) | | | 102,572 | | | | * | |

Tiffany J. Thom (9) | | | 19,102 | | | | * | |

John H. Peper (10) | | | 18,688 | | | | * | |

Chad E. Williams (11) | | | 16,528 | | | | * | |

David P. Cedro (12) | | | 15,340 | | | | * | |

All current directors and executive officers as a group (11 persons) (13) | | | 11,366,079 | | | | 28.2 | % |

| | |

Principal Holders | | | | | | | | |

Wexford Capital LP (14) 411 West Putnam Avenue Greenwich, CT 06830 | | | 7,079,093 | | | | 17.6 | % |

Carlson Capital, L.P. (15) 2100 McKinney Avenue, Suite 1600 Dallas, TX 75201 | | | 4,038,221 | | | | 10.1 | % |

Donald Smith & Co. Inc. (16) 152 West 57th Street, 22nd Floor New York, NY 10019 | | | 2,405,476 | | | | 6.0 | % |

BlackRock Inc. (17) 40 East 52nd Street New York, NY 10022 | | | 2,406,510 | | | | 6.0 | % |

| (1) | Beneficial ownership is determined in accordance with the SEC’s rules and regulations and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options currently exercisable, or exercisable within 60 days, are deemed outstanding for purposes of computing the percentage of shares beneficially owned by the person holding such options (as well as for purposes of any group calculations for any group of which any such person is a member). However, no such option shares are deemed outstanding for computing the percentage of any other person. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table have sole voting and investment power with respect to all shares of the Common Stock shown as beneficially owned by them. |

13

| (2) | Based on total shares outstanding of 40,178,922 on March 1, 2011. Also based, where appropriate, on the number of shares owned and acquirable within 60 days of March 1, 2011. |

| (3) | Includes 4,274 shares of unvested restricted stock. |

| (4) | Includes 4,274 shares of unvested restricted stock. |

| (5) | Includes 12,965 shares of vested restricted stock, 4,274 shares of unvested restricted stock and 3,224 shares representing annual retainers, all of which Mr. McCarthy assigned to Wexford Capital and its affiliates. Mr. McCarthy is an employee of Wexford Capital and disclaims any beneficial ownership of shares of the Common Stock held by Wexford Capital or its affiliates. |

| (6) | Includes (i) 13,034 shares of Common Stock and (ii) 4,274 shares of unvested restricted stock, in each case the receipt of which Mr. Pully has deferred under the Company’s Stock and Deferral Plan for Non-Employee Directors. The deferred shares are not issued and outstanding shares of Common Stock until Mr. Pully’s deferral period expires, which will occur when Mr. Pully ceases to be a director of the Company. Also includes 4,038,221 shares owned by Carlson Capital. Mr. Pully is an employee of Carlson Capital and disclaims any beneficial ownership of shares of Common Stock held by Carlson Capital. |

| (7) | Includes (i) 4,273 shares of Common Stock and (ii) 4,274 shares of unvested restricted stock, in each case the receipt of which Mr. Schwarz has deferred under the Company’s Stock and Deferral Plan for Non-Employee Directors. |

| (8) | Includes (i) 20,834 shares of unvested restricted stock and (ii) 75,725 shares of Common Stock underlying options exercisable within 60 days of March 1, 2011 granted to Mr. Hanna under the 2009 LTIP. |

| (9) | Includes (i) 290 shares of Common Stock beneficially owned by Ms. Thom and held in trust by the Company’s 401(k) Plan, (ii) 9,167 shares of unvested restricted stock and (iii) 8,334 shares of Common Stock underlying options exercisable within 60 days of March 1, 2011 granted to Ms. Thom under the 2009 LTIP. |

| (10) | Includes (i) 346 shares of Common Stock beneficially owned by Mr. Peper and held in trust by the Company’s 401(k) Plan (ii) 6,666 shares of unvested restricted stock and (iii) 8,334 shares of Common Stock underlying options exercisable within 60 days of March 1, 2011 granted to Mr. Peper under the 2009 LTIP. |

| (11) | Includes (i) 383 shares of Common Stock beneficially owned by Mr. Williams and held in trust by the Company’s 401(k) Plan, (ii) 5,000 shares of unvested restricted stock and (iii) 8,334 shares of Common Stock underlying options exercisable within 60 days of March 1, 2011 granted to Mr. Williams under the 2009 LTIP. |

| (12) | Includes (i) 185 shares of Common Stock beneficially owned by Mr. Cedro and held in trust by the Company’s 401(k) Plan (ii) 5,000 shares of unvested restricted stock and (iii) 8,334 shares of Common Stock underlying options exercisable within 60 days of March 1, 2011 granted to Mr. Cedro under the 2009 LTIP. |

| (13) | Includes (i) 17,307 shares of Common Stock and 8,548 shares of unvested restricted stock, in each case the receipt of which has been deferred under the Company’s Stock and Deferral Plan for Non-Employee Directors, (ii) 1,204 shares held in trust by the Company’s 401(k) Plan, (iii) 62,822 shares of unvested restricted stock and (iv) 109,061 shares of Common Stock underlying options exercisable within 60 days of March 1, 2011. See notes 3 through 12 above. |

| (14) | Pursuant to a Schedule 13D/A filed by Debello Investors LLC (“Debello”), Wexford Catalyst Investors LLC (“Wexford Catalyst”), Wexford Catalyst Trading Limited (“Wexford Trading”), Wexford Spectrum Fund, L.P. (“Wexford Spectrum”), Spectrum Intermediate Fund Limited (“Spectrum Intermediate”), Wexford Capital, Wexford GP LLC (“Wexford GP”), Mr. Charles E. Davidson and Mr. Joseph M. Jacobs with the SEC on September 29, 2009, Debello has shared voting and dispositive power over 1,454,616 shares, Wexford Catalyst has shared voting and dispositive power over 1,539,353 shares, Wexford Trading has shared voting and dispositive power over 45,182 shares, Wexford Spectrum has shared voting and dispositive power over 2,028,295 shares, Spectrum Intermediate has shared voting and dispositive power over 1,991,185 shares, and each of Wexford Capital, Wexford GP, Mr. Charles E. Davidson and Mr. Joseph M. Jacobs have shared voting and dispositive power over 7,058,630 shares. Wexford Capital is the managing member, investment manager or sub advisor of each of Debello, Wexford Catalyst, Wexford Trading, Wexford Spectrum, and Spectrum Intermediate and by reason of its status as such may be deemed |

14

| | to own beneficially the interest in the shares of the Common Stock of which such entities possess beneficial ownership. Wexford GP is the general partner of Wexford Capital and, as such, may be deemed to own beneficially the shares of which Debello, Wexford Catalyst, Wexford Trading, Wexford Spectrum and Spectrum Intermediate possess beneficial ownership. Each of Messrs. Davidson and Jacobs is a controlling person of Wexford GP and may, by reason of his status as such, be deemed to own beneficially the interest in the shares of the Common Stock of which each of Debello, Wexford Catalyst, Wexford Trading, Wexford Spectrum and Spectrum Intermediate possess beneficial ownership. Each of Messrs. Davidson and Jacobs, Wexford GP and Wexford Capital shares the power to vote and to dispose of the shares beneficially owned by Debello, Wexford Catalyst, Wexford Trading, Wexford Spectrum and Spectrum Intermediate. Each of Wexford Capital, Wexford GP and Messrs Davidson and Jacobs disclaims beneficial ownership of the shares of Common Stock held by Debello, Wexford Catalyst, Wexford Trading, Wexford Spectrum and Spectrum Intermediate, respectively. In addition to the ownership disclosed on the September 29, 2009 Schedule 13D/A, Wexford Capital is the beneficial owner of 12,965 shares of vested restricted stock, 4,274 shares of unvested restricted stock and 3,224 shares representing annual retainers, all of which the Company issued to Mr. McCarthy and were assigned to Wexford Capital. |

| (15) | Pursuant to a Schedule 13D/A filed with the SEC on September 25, 2009, Carlson Capital, Double Black Diamond Offshore LDC (“DBDO”), Asgard Investment Corp. (“Asgard”), and Mr. Clint D. Carlson reported the following: Carlson Capital, Asgard and Mr. Carlson each have the sole power to vote and the sole power to dispose of 4,038,221 shares of Common Stock and DBDO has the sole power to vote and the sole power to dispose of 3,783,052 shares of Common Stock. Carlson Capital, as DBDO’s investment manager, may, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), be deemed to beneficially own 3,783,052 shares of Common Stock held by DBDO, and beneficially own Common Stock held by other private investment funds and managed accounts. As Carlson Capital’s general partner, Asgard, may, for purposes of Rule 13d-3 under the Exchange Act, be deemed to own beneficially 4,038,221 shares of Common Stock. As the President of Asgard and the Chief Executive Officer of Carlson Capital, Mr. Clint D. Carlson may, for purposes of Rule 13d-3 under the Exchange Act, be deemed to own beneficially 4,038,221 shares of Common Stock. Mr. Carlson, Asgard and Carlson Capital disclaim any beneficial ownership of shares of the Common Stock held by DBDO or by other investment funds and managed accounts. |

| (16) | Pursuant to a Schedule 13G filed on February 11, 2011 under Section 13(d) of the Exchange Act for Donald Smith & Co., Inc. (“Donald Smith”) and Donald Smith Long/Short Equities Fund, L.P. (“Donald Smith Fund”), Donald Smith, an investment advisor, has sole voting power over 1,902,322 shares of Common Stock and Donald Smith Fund has sole voting power over 8,154 shares of Common Stock. Each of Donald Smith and Donald Smith Fund has sole dispositive power over 2,405,476 shares of Common Stock and may, for purposes of Rule 13d-3 under the Exchange Act, be deemed to own beneficially 2,405,476 shares of Common Stock. |

| (17) | Pursuant to a Schedule 13G filed on February 4, 2011 under Section 13(d) of the Exchange Act for BlackRock, Inc. (“BlackRock”) and certain of its subsidiaries listed in such Schedule 13G, BlackRock has sole voting power over 2,406,510 shares of Common Stock and sole dispositive power over 2,406,510 shares of Common Stock. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who beneficially own more than 10% of our outstanding Common Stock to file initial reports of ownership and changes in ownership of common stock with the SEC. Reporting persons are required by the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of reports we received and written representations from our directors and officers, we believe that all filings required to be made under Section 16(a) for the fiscal year ended December 31, 2010 were timely made.

15

CORPORATE GOVERNANCE

The Board of Directors

The Board’s leadership structure separates the Chief Executive Officer and Chairman of the Board of Directors positions, and the Chief Executive Officer reports to the Board. The Board does not have any policy with respect to the separation of the offices of the Chief Executive Officer and the Chairman of the Board. The Board believes that this issue is part of the succession planning process and that it is in the best interests of the Company for the Board to make a determination regarding this issue each time it elects a new Chief Executive Officer. The Board has determined that its current leadership structure provides an appropriate framework for the Board to provide independent, objective and effective oversight of management. The Board, however, may make changes to its leadership structure in the future as it deems appropriate.

The Board is responsible for the oversight of the Company and its business, including risk management. Together with the Board’s standing committees, the Board is responsible for ensuring that material risks are identified and managed appropriately. The Board and its committees regularly review material strategic, operational, financial, compensation and compliance risks with our senior management. The Audit Committee has oversight responsibility for financial risk (such as accounting and finance), and also oversees compliance with and enforcement of the Company’s Corporate Code of Business Conduct and Ethics (the “Code of Ethics”). The Compensation Committee oversees compliance with our compensation plans, and the Nominating & Governance Committee oversees compliance with our corporate governance practices. Each of the committees reports to the Board regarding the areas of risk it oversees.

The directors hold regular meetings, attend special meetings as required and spend such time on the affairs of the Company as their duties require. The Company’s Corporate Governance Guidelines provide that directors are expected to attend regular Board meetings and the Annual Meeting of Stockholders in person and to spend the time needed, and meet as frequently as necessary, to properly discharge their responsibilities. During calendar year 2010, the Board of Directors held a total of 13 meetings. All directors of the Company attended at least seventy-five percent (75%) of the meetings of the Board of Directors and of the committees on which they served during the period. As Chairman of the Board of Directors, Mr. McCarthy presides at regularly scheduled executive sessions at which the Board of Directors meets without management participation.

Director Independence

Under the Company’s Corporate Governance Guidelines, a majority of the Board must be comprised of directors who are independent under the listing standards of the NYSE. No director will be deemed to be independent unless the Board affirmatively determines that the director has no material relationship with the Company, either directly or as an officer, stockholder or partner of an organization that has a relationship with the Company. In its review of director independence, the Board considers all relevant facts and circumstances, including without limitation, all commercial, banking, consulting, legal, accounting, charitable or other business relationships any director may have with the Company. The Board has adopted categorical standards to assist it in making determinations of independence for directors, a copy of which is available on the Company’s website at www.eplweb.com.

Under the standards adopted by the Board, it has determined that each of Messrs. Buckner, Griffiths, McCarthy, Pully, Wallace and Schwarz is independent.

The Audit Committee

The Board has a standing Audit Committee established in accordance with Section (3)(a)(58)(A) of the Exchange Act, the current members of which are Messrs. Buckner (Chairman), Pully and Schwarz. The Board, in its business judgment, has determined that each Audit Committee member is “independent,” as defined by the

16

Company’s categorical standards on independence as well as the listing standards of the NYSE and the rules of the SEC applicable to audit committee members. Further, the Board, in its business judgment, has determined that Mr. Buckner and Mr. Pully each qualifies as an “audit committee financial expert” as described in Item 407(d)(5) of Regulation S-K. During fiscal year 2010, the Audit Committee held five meetings.

Nominating & Governance Committee

The Board has a standing Nominating & Governance Committee, the current members of which are Messrs. Schwarz (Chairman), Griffiths and McCarthy. When seeking candidates for director, the Nominating & Governance Committee has a policy whereby it may solicit suggestions from incumbent directors, management, stockholders or others. The Nominating & Governance Committee treats recommendations for directors that are received from the Company’s stockholders equally with recommendations received from any other source as long as the recommendations comply with the procedures for stockholder recommendations outlined in the Company’s bylaws. In addition, the Nominating & Governance Committee has authority under its charter to retain a search firm for this. After conducting an initial evaluation of a potential candidate, the Nominating & Governance Committee will interview that candidate if it believes such candidate might be suitable to be a director. The Nominating & Governance Committee may also ask the candidate to meet with management. If the Nominating & Governance Committee believes a candidate would be a valuable addition to the Board, it will recommend to the full Board that candidate’s election.

The Nominating & Governance Committee selects each nominee based on the nominee’s skills, achievements and experience. The Nominating & Governance Committee considers a variety of factors in selecting candidates, including, but not limited to, the following: independence, wisdom, integrity, an understanding and general acceptance of the Company’s corporate philosophy, valid business or professional knowledge and experience, a proven record of accomplishment with excellent organizations, an inquiring mind, a willingness to speak one’s mind, an ability to challenge and stimulate management and a willingness to commit time and energy. As required by its charter, the Nominating & Governance Committee considers the diversity of, and the optimal enhancement of the current mix of talent and experience on the Board, when identifying director nominees. During fiscal year 2010, the Nominating & Governance Committee held two meetings.

The Compensation Committee

The Board has a standing Compensation Committee, the current members of which are Messrs. Pully (Chairman), Buckner and Griffiths. The Compensation Committee has a charter under which its responsibilities and authorities include reviewing the Company’s compensation strategy, reviewing the performance of and approving the compensation for the senior management (other than the Chief Executive Officer), evaluating the Chief Executive Officer’s performance and, either as a committee or together with the other independent directors, determining and approving the Chief Executive Officer’s compensation level. In addition, the Compensation Committee approves and administers employee benefit plans and takes such other action as may be appropriate or as directed by the Board of Directors to ensure that the compensation policies of the Company are reasonable and fair. The Compensation Committee has the authority to delegate to its Chairman, any of its members or any subcommittee it may form, the responsibility and authority for any particular matter, as it deems appropriate from time to time under the circumstances. Furthermore, the Compensation Committee’s decisions regarding the compensation of senior management (other than the Chief Executive Officer) is made in consultation with the Chief Executive Officer. The Board of Directors has determined that each member of the Compensation Committee is “independent” as defined by NYSE listing standards. During fiscal year 2010, the Compensation Committee held four meetings.

Compensation Committee Interlocks and Insider Participation